A guest post by Ovi

Below are a number of crude oil plus condensate (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to March 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world.

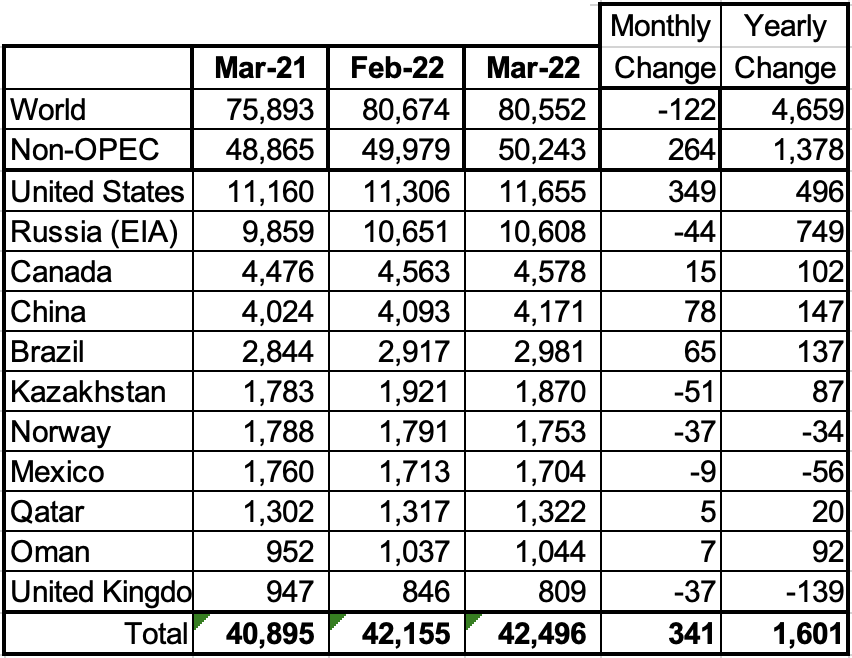

March Non-OPEC production increased by 264 kb/d to 50,243 kb/d. Of the 264 kb/d increase, the biggest increases came from the U.S., 349 kb/d and China, 78 kb/d. Offsetting the increases were decreases from Kazakhstan, Russia and Norway. The March 2022 output of 50,243 kb/d is 1,975 kb/d lower than the March pre-covid rate of 52,218 kb/d.

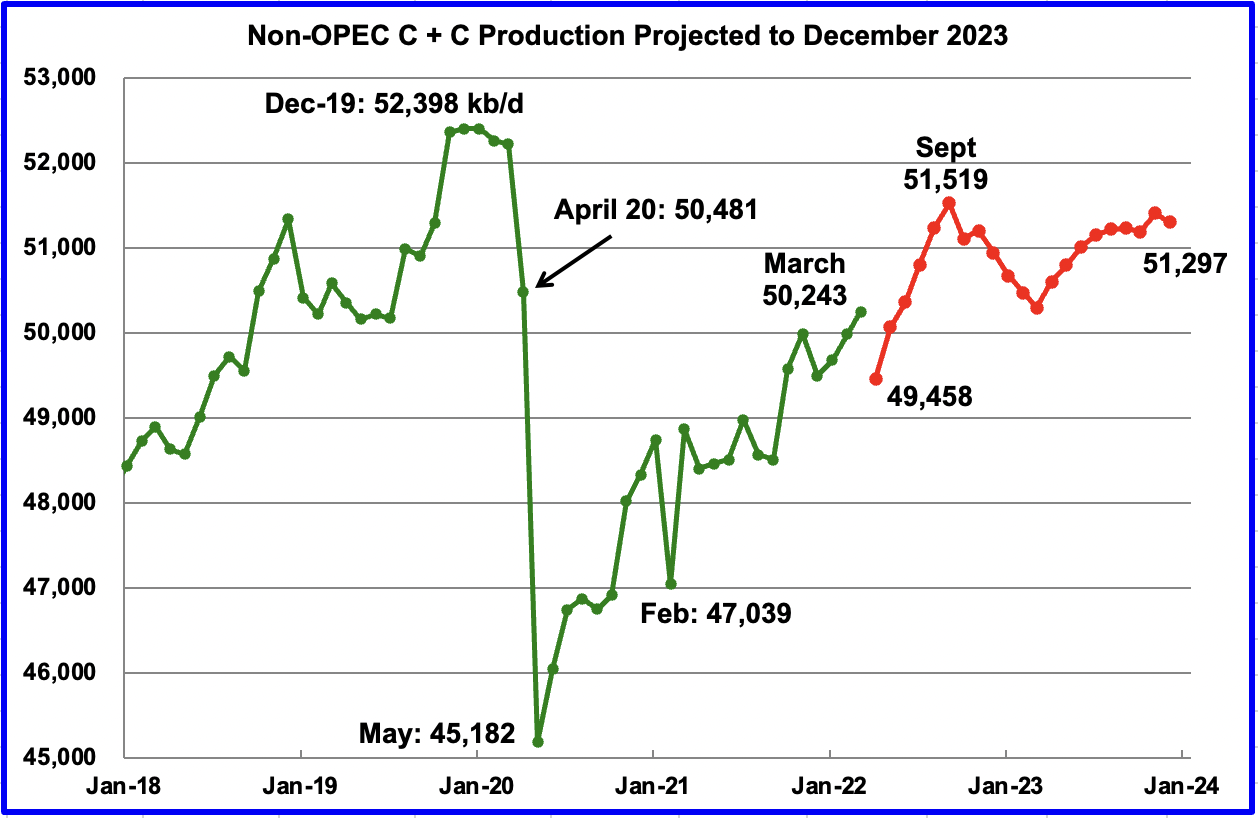

Using data from the July 2022 STEO, a projection for Non-OPEC oil output was made for the time period April 2022 to December 2023. (Red graph). Output is expected to reach 51,297 kb/d in December 2023. Note the April production drop of 785 kb/d to 49,458 kb/d in the red graph is associated with a projected output drop in Russia. The production rise to 51,519 kb/d by September is related to projected increases by OPEC + and the U.S.

The April 785 kb/d production drop may be realistic since according to this source, April Non-OPEC all liquids production dropped: “Non-OPEC production saw a decrease of 810,000 bpd to 64.92 million bpd in April”.

Above are listed the world’s 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The UK has been below 1,000 kb/d since January 2021.

In March 2022, these 11 countries produced 84.6% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 1,378 kb/d while on a MoM basis production, it increased by 264 kb/d. World YoY March output increased by 4,659 kb/d.

Production by Country

The EIA reported Brazil’s March production increased by 65 kb/d to 2,981 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that May’s output decreased by 123 kb/d to 2,879 kb/d, reversing April’s increase of 18 kb/d. (Red Markers). On a YoY basis, May production is down 53 kb/d. May’s output drop was mainly due to interruptions in offshore maintenance at the Tupi field, according to OPEC.

On July 20, 2022, the BNPA reported that June production dropped again. No information on the June drop to 2,828 kb/d is available. However, a new field came on line on May 1, 2022 and it is surprising that no production increase was reported for June.

Petrobras did announce that “Second quarter production was also affected by an increase in maintenance stoppages”. Are pre-salt fields proving to be more difficult to produce than anticipated?

On May 1, MODEC’s FPSO Guanabara MV31 for Brazilian presalt achieved first oil.

TOKYO, Japan — MODEC Inc.’s FPSO Guanabara MV31 deployed for operations at the Mero Field in the giant presalt region of the Santos Basin off the coast of Brazil, achieved first oil production and started charter services on May 1. It is the largest FPSO built by the company to date.

Moored some 180 km off the coast of Rio de Janeiro at a water depth of approximately 2,100 m, the FPSO is capable of processing 180,000 bbl of crude oil, 424 MMscf of gas and 225,000 bbl of water injection per day, and it has storage capacity of 1.4 MMbbl of crude oil.

Is water injection becoming standard practise for Deep Water wells/basins?

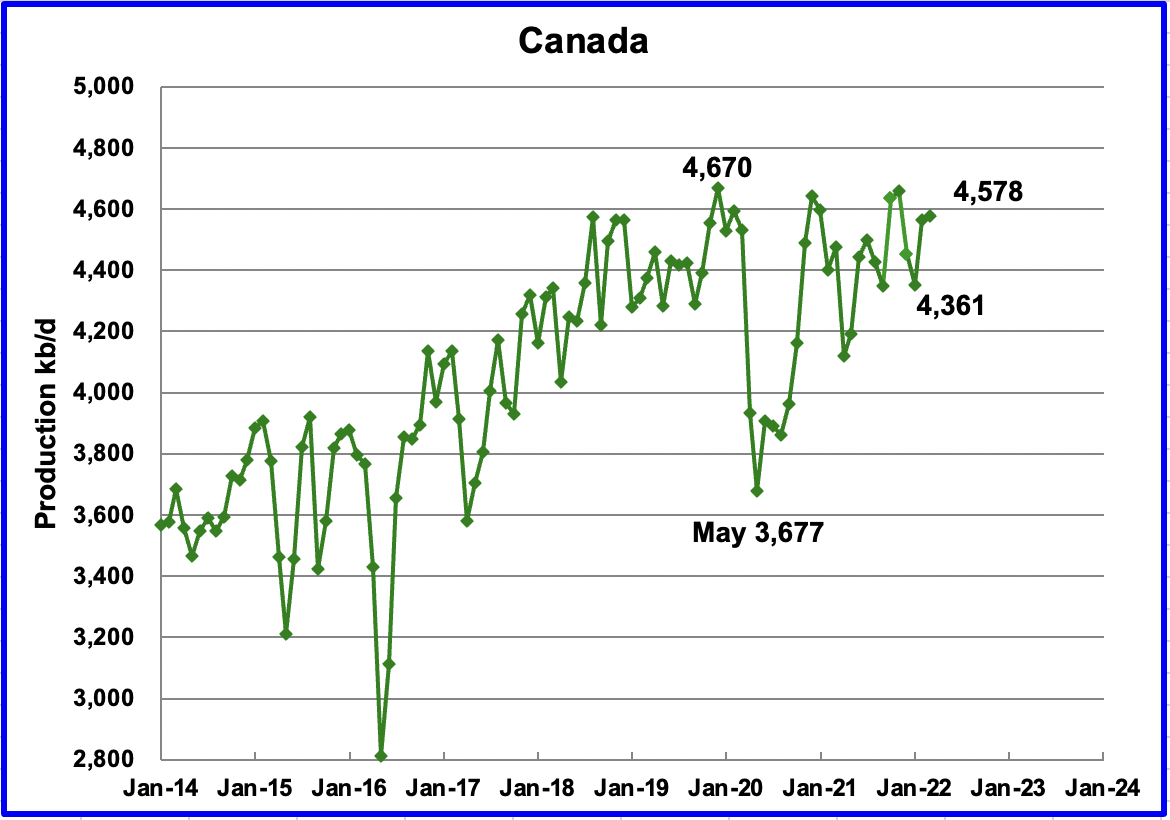

According to the EIA, Canada’s March output increased by 15 kb/d to 4,578 kb/d. Preliminary data from the Canadian Energy Regulator indicates that synthetic crude production was down by 100 kb/d in April.

The EIA reported China’s output increased by 78 kb/d to 4,171 kb/d in March. China reported that its output dropped in April and May and increased in June by 46 kb/d to 4,183 kb/d. (Red markers).

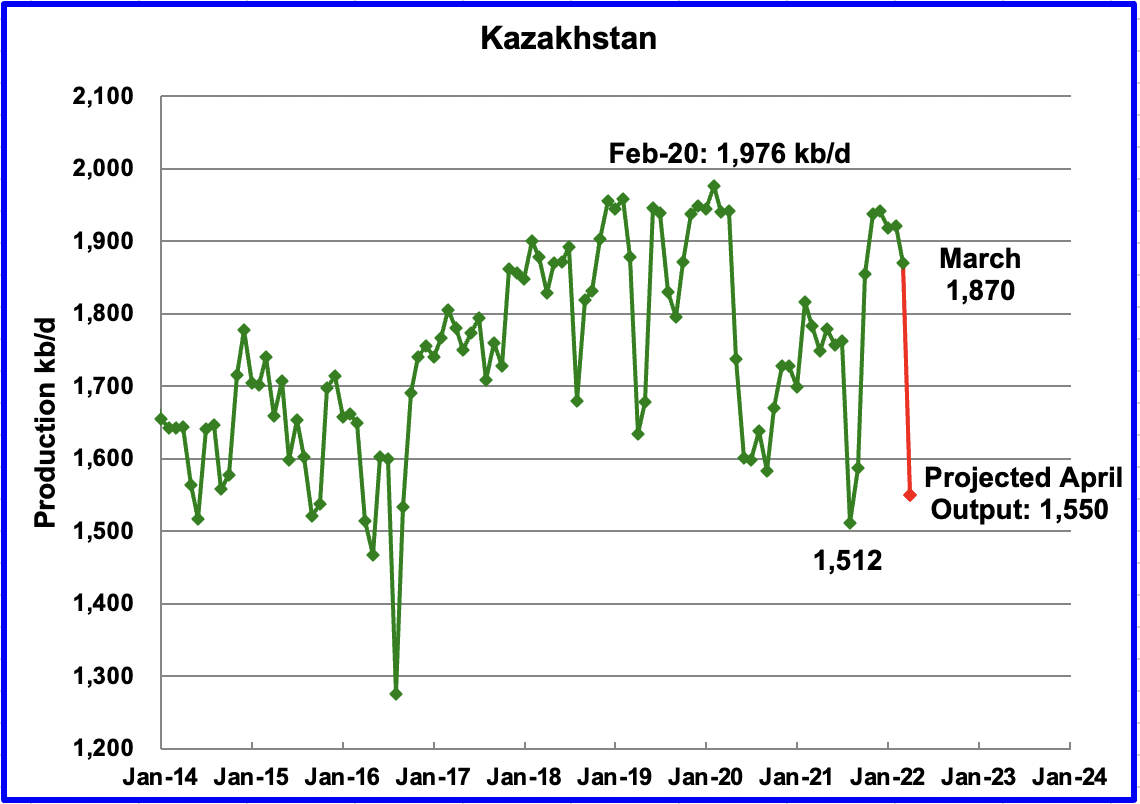

Kazakhstan’s output decreased by 51 kb/d in March to 1,870 kb/d. April output is projected to drop further due to required repairs at a damaged loading terminal in a Black Sea port in Russia, according to this source. The projected drop is 320 kb/d.

“Although energy market observers are bound to link the cutback to the loading terminal incident, Kazakh officials are selling this development as a planned measure to bring the country in compliance with OPEC commitments.”

OPEC reported that Kazakhstan crude production dropped to 1,400 kb/d in April. According to this source: “The data shows output running between 1.5 million and 1.57 million barrels per day on April 4 and 5.”

Mexico’s production as reported by the EIA for March dropped by 9 kb/d to 1,704 kb/d.

Data from Pemex showed that May’s output was 1,775 kb/d. However, the EIA reduces Mexico’s official oil production by close to 70 kb/d each month. Note that March was revised down from 1,777 kb/d to 1,701 kb/d. A possible explanation is that Mexico’s definition of condensate may be different than the EIA’s.

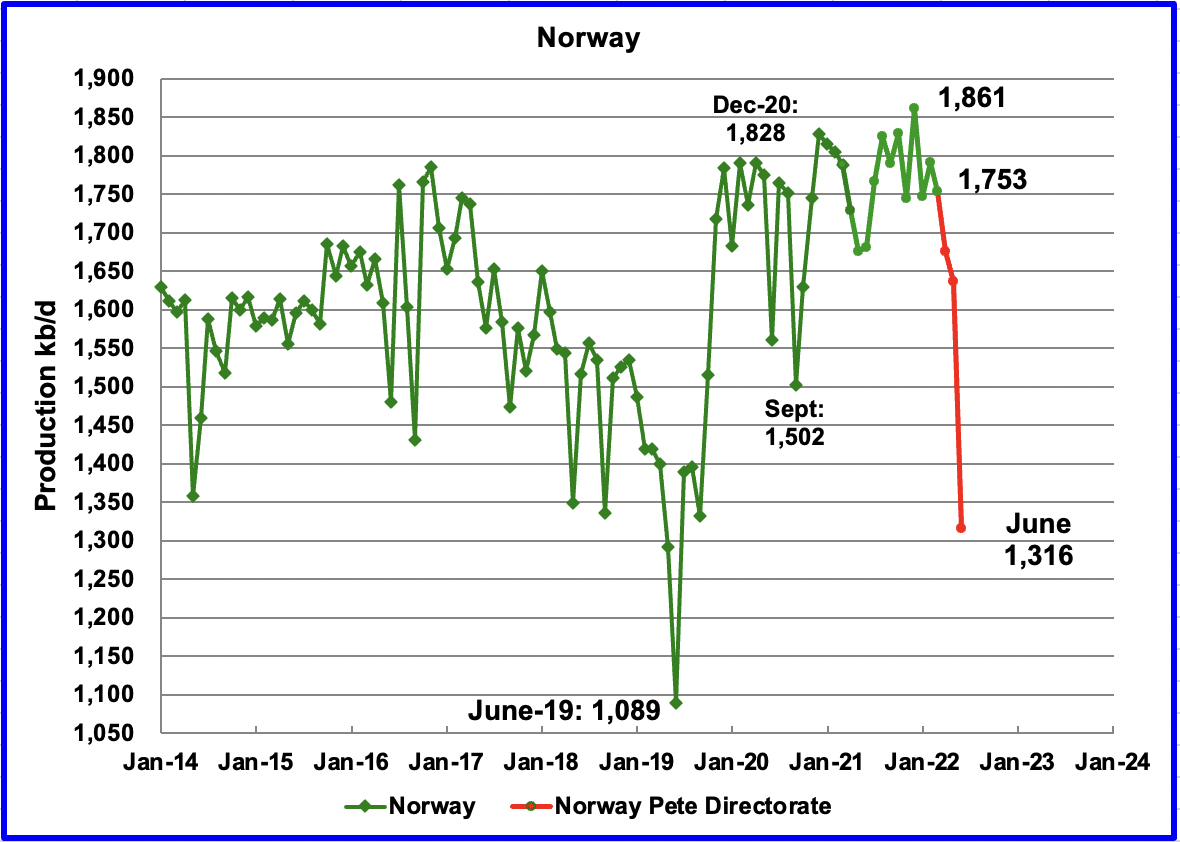

The EIA reported that Norway’s March production decreased by 37 kb/d to 1,753 kb/d.

The Norway Petroleum Directorate (NPD) reported that production decreased from April to June to 1,316 kb/d. (Red markers.). According to the NPD: “: Oil production in June is 0.2 percent lower than the NPD’s forecast and 4.2 percent lower than the forecast so far this year.

According to OPEC, the continuing drop was due to summer maintenance in offshore platforms and some operators prioritizing gas production.

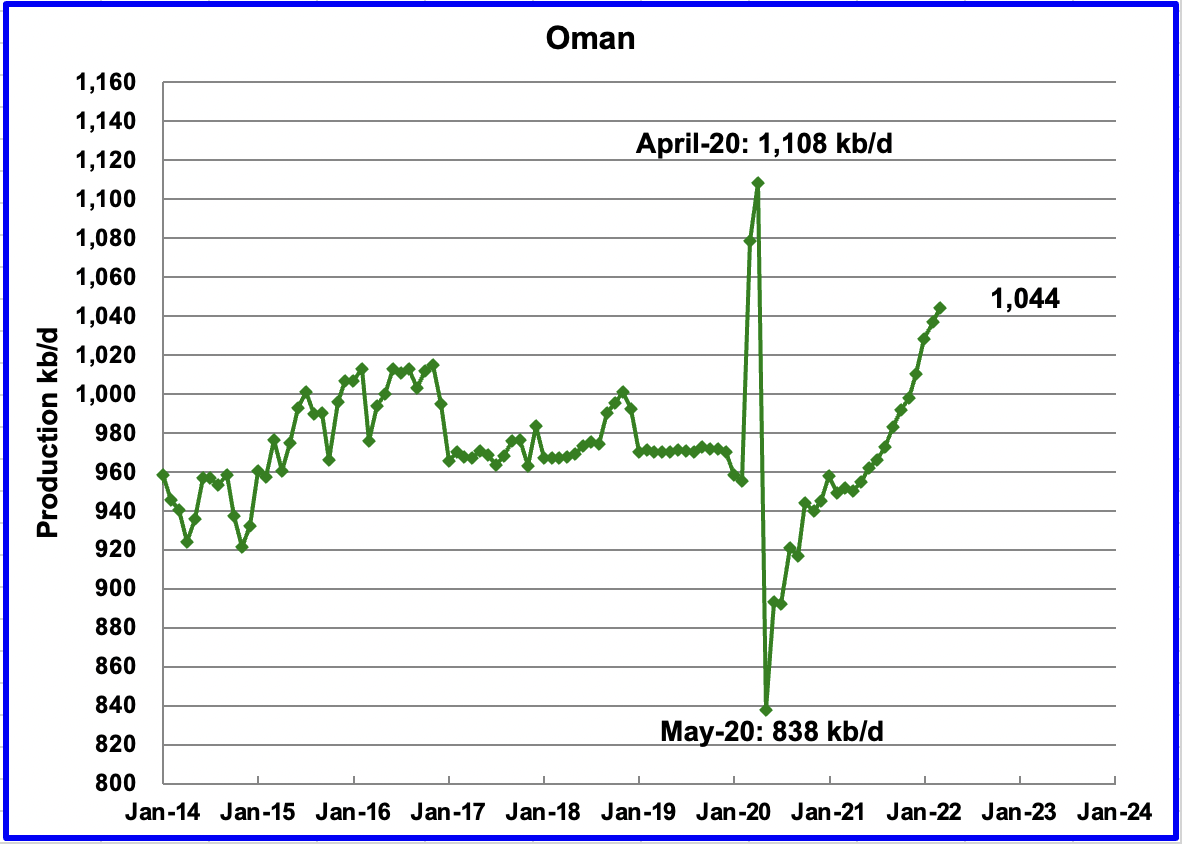

Oman’s March production increased by 7 kb/d to 1,044 kb/d.

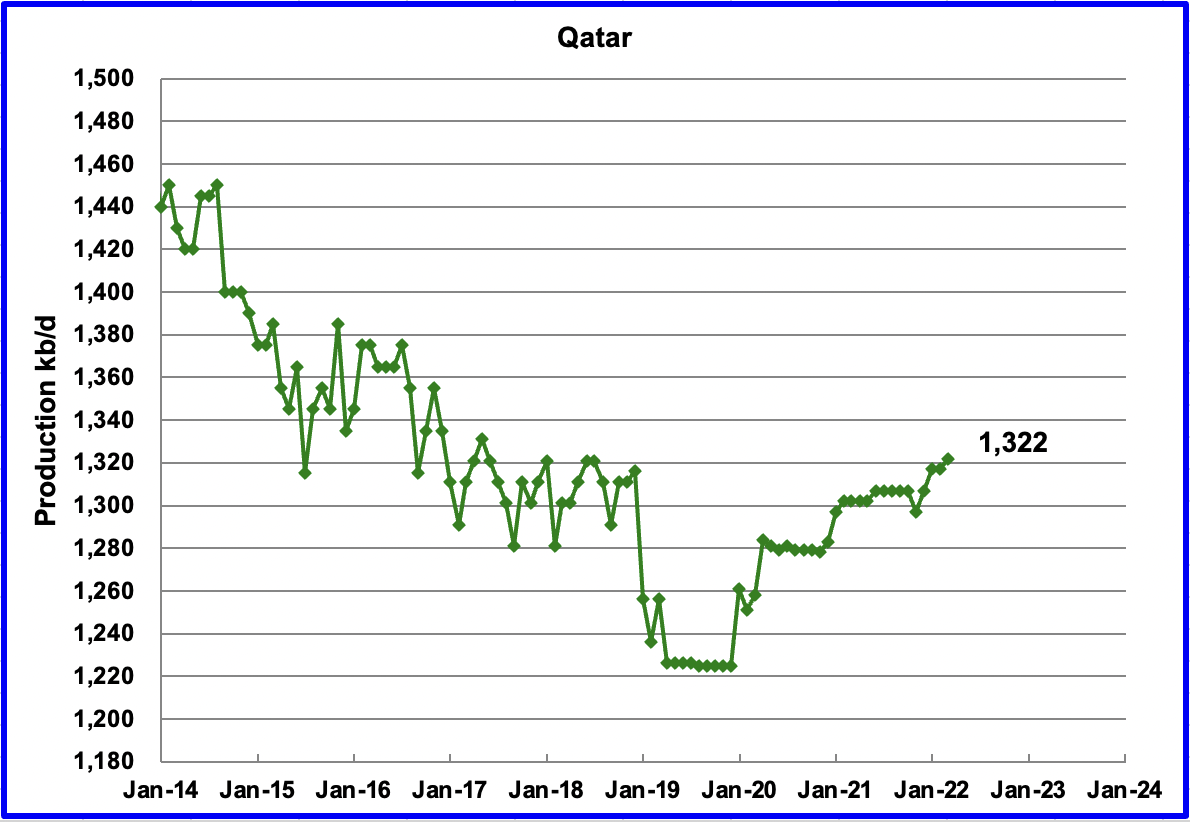

March’s output increased by 5 kb/d to 1,322 kb/d.

The EIA reported that Russian output decreased by 44 kb/d in March to 10,608 kb/d. According to this source July’s (initial 1/2 month estimate) production increased by 65 lb/d to 10,780 kb/d.

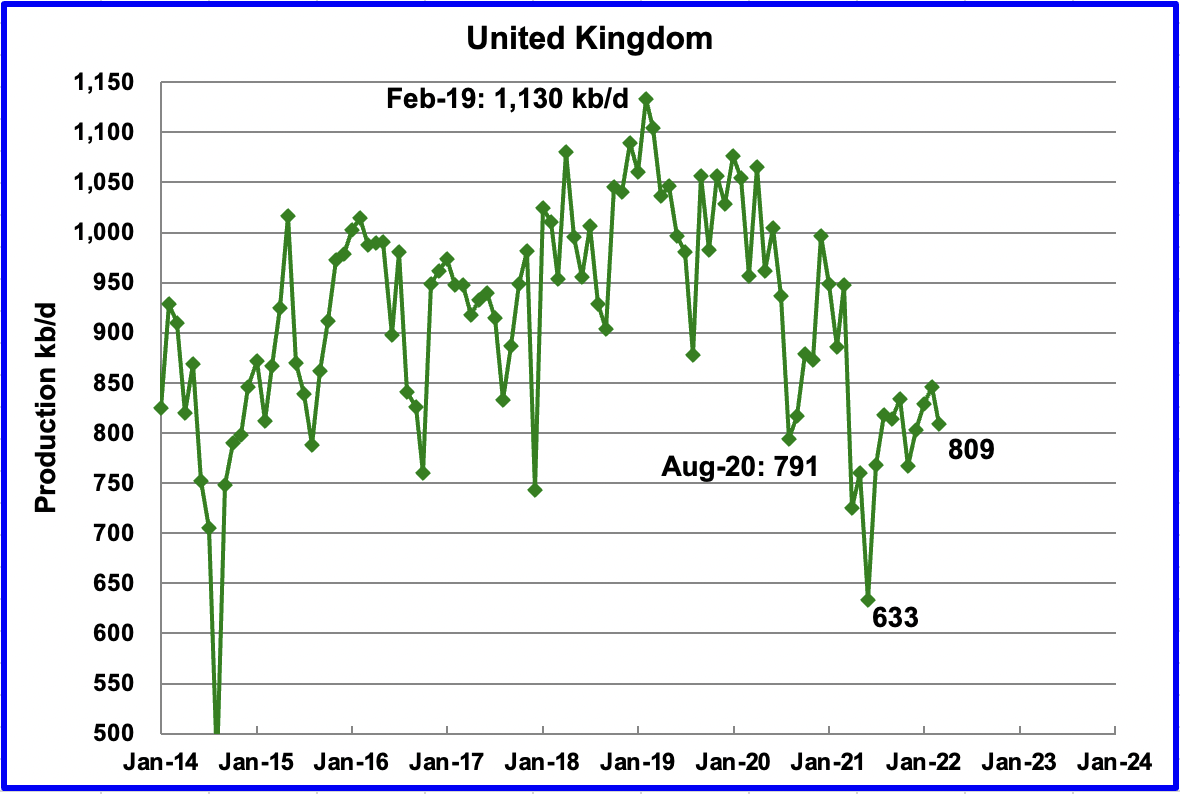

UK’s production decreased by 37 kb/d in March to 809 kb/d. The chart indicates that UK oil production entered a steep decline phase starting in February 2019. On a YoY basis production is down 138 kb/d. April output is expected to increase by close to 80 kb/d according to OPEC.

U.S. April production decreased by 60 kb/d to 11,628 kb/d. The largest production increase came from the GOM but North Dakota’s drop of 214 kb/d overcame the GOM increase.

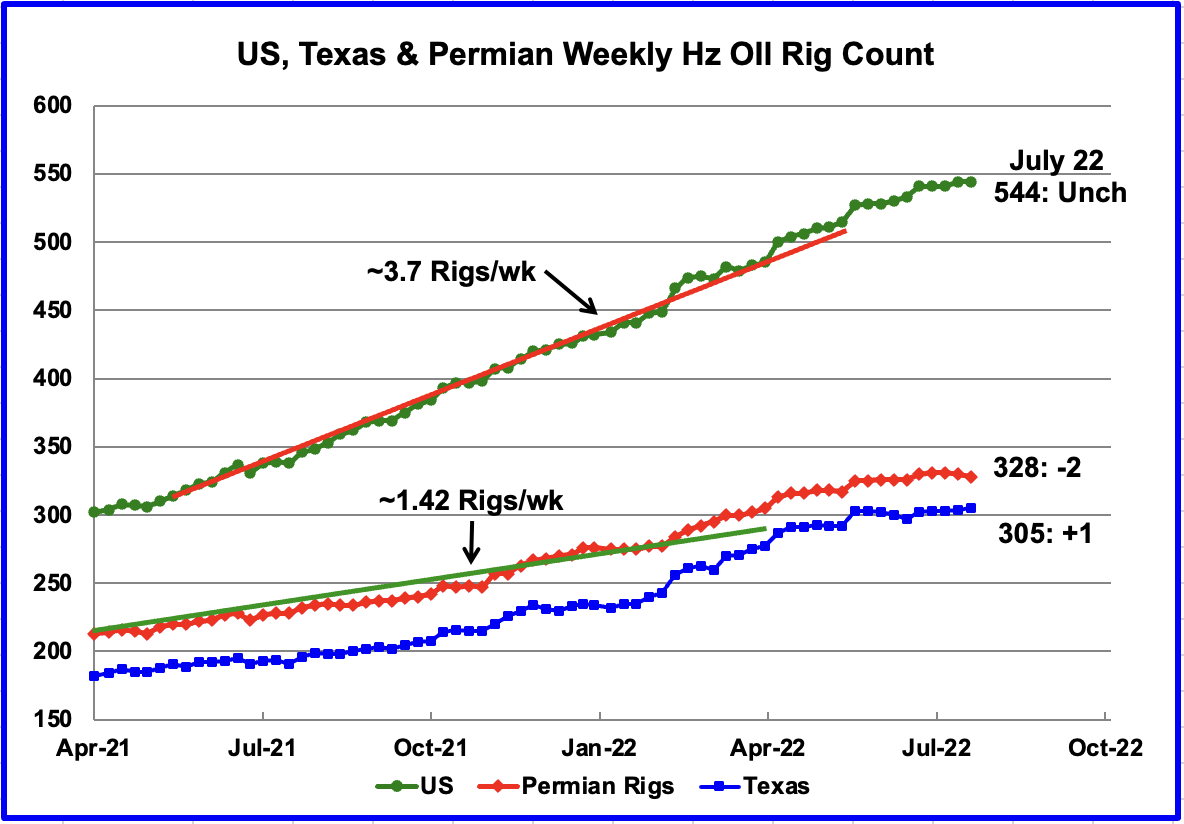

From the beginning of May 2021 to the end of April 2022, the US has been adding horizontal oil rigs at an average rate of close to 3.7 rigs/wk. The primary destination for rig additions appears to have been the Permian and Texas. However recent data for the last 10 weeks indicates that the rig counts in the Permian and Texas has been essentially unchanged.

For the week ending July 22, the US horizontal oil rig count was unchanged at 544. The Permian dropped 2 while Texas added 1.

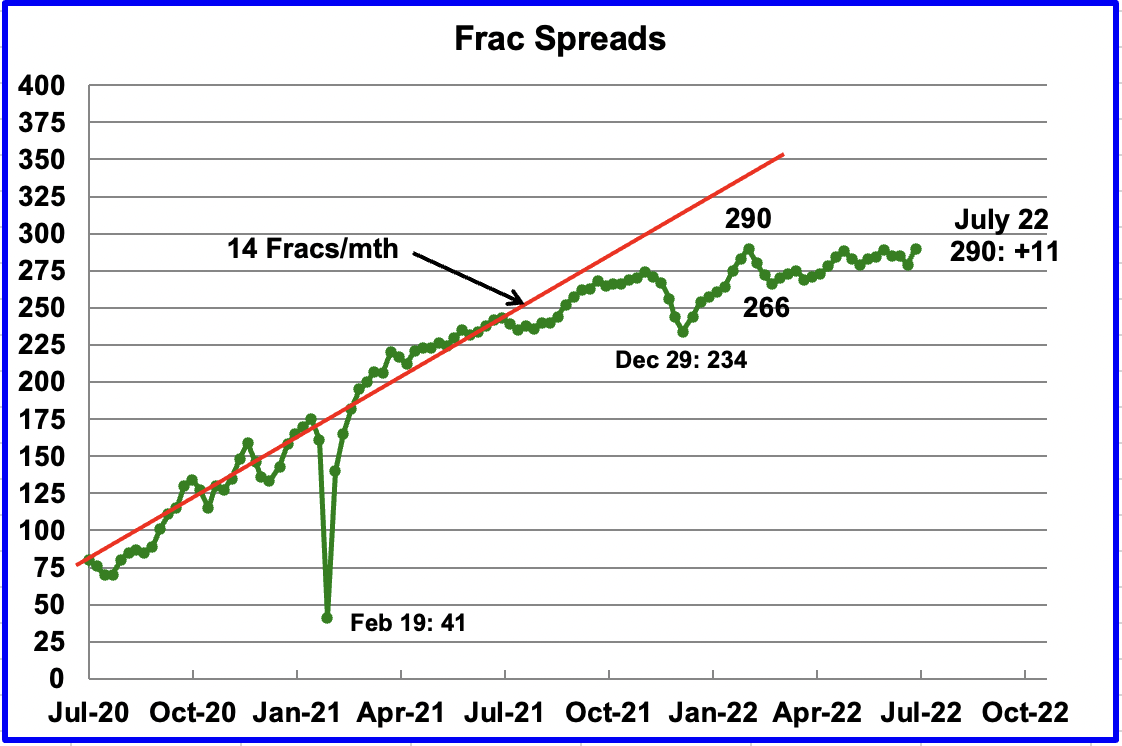

For the past few months, the growth in frac spreads has not been keeping up with the growth in rigs. In the week ending July 22, 11 Frac Spreads were added for a total of 290. The 290 matches the number of Frac Spreads operating in the week of February 25. It is not clear if last week’s increase of 11 Frac Spreads reflects a return to work of personnel after the Independence day holiday or just a correction of an incorrect count for the previous week.

Note that these 290 Frac Spreads include both gas and oil spreads, whereas the rig information is strictly for horizontal oil rigs.

One of the reasons for the slow growth of Frac Spreads is consolidation within the fracking industry according to this source. The effect of slowing growth in Frac Spreads is shown in the next chart.

“Nearly 360 spreads were active in early 2020 but the oil service industry has since consolidated, cutting capacity. “Two years of supply attrition and cannibalisation, plus limitations from labour shortages and a secular shift toward next-generation frac fleet technologies, have led to tightening in the frac space,” Liberty Oilfield Services chief executive Chris Wright says”.

“Rising costs, supply chain bottlenecks and a lack of investor capital are impeding a faster recovery in US tight oil production despite very high oil prices and government pleas for firms to boost supply. “I understand the desire to find a quick fix for the recent spike in gasoline prices,” Pioneer Natural Resources chief executive Scott Sheffield told the House of Representatives Energy and Commerce Committee on 6 April. “But neither Pioneer nor any other US producer can increase production overnight by turning on a tap.”

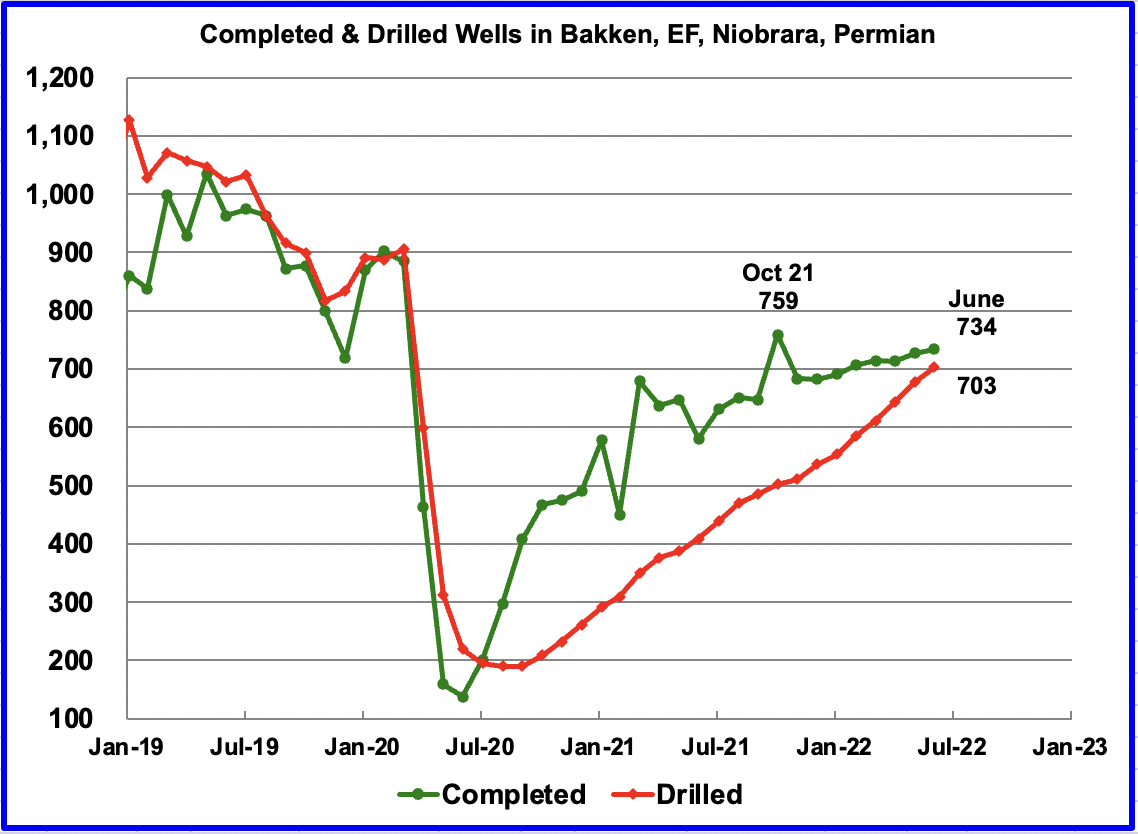

The impact of the slowing growth in Frac Spreads since last November can be seen in this chart. From November 2021 to June 2022, the monthly completion rate of wells/DUCs has slowed relative the rate in 2021. More wells were completed in October 2021 than in June 2022, 759 vs 734.

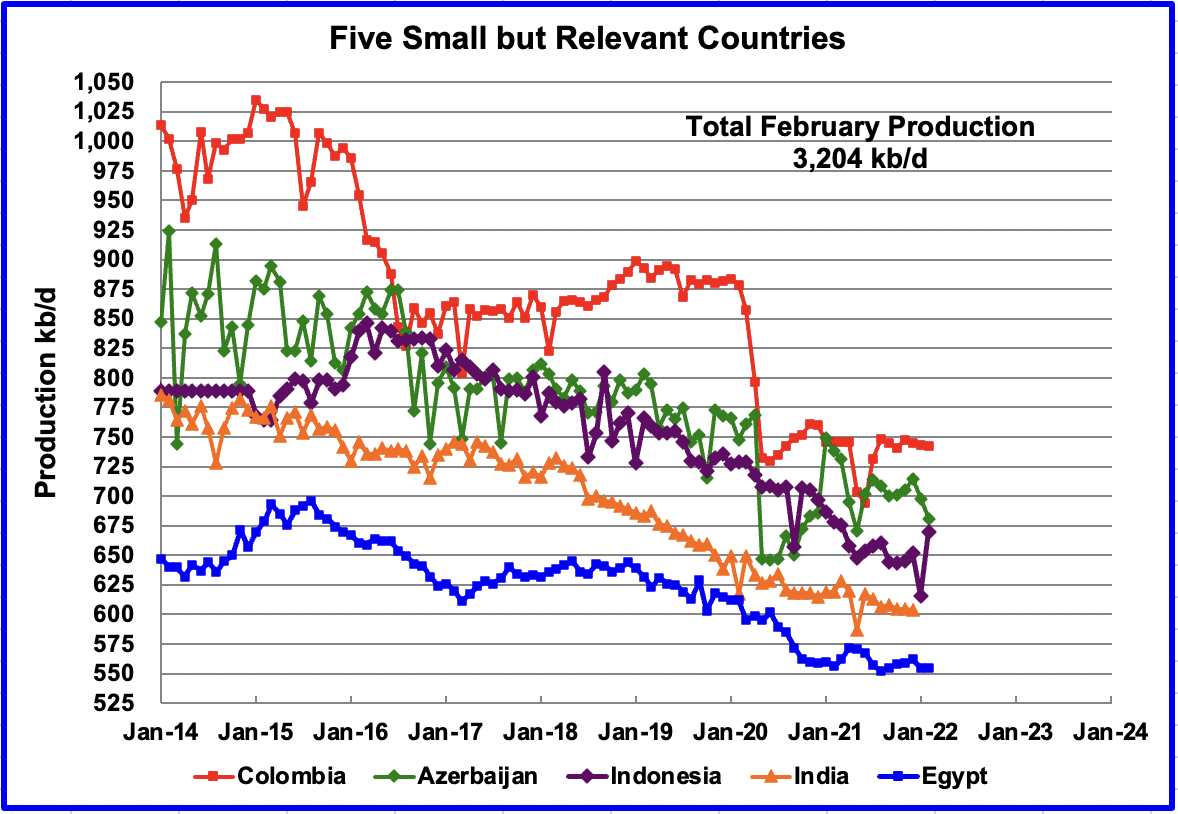

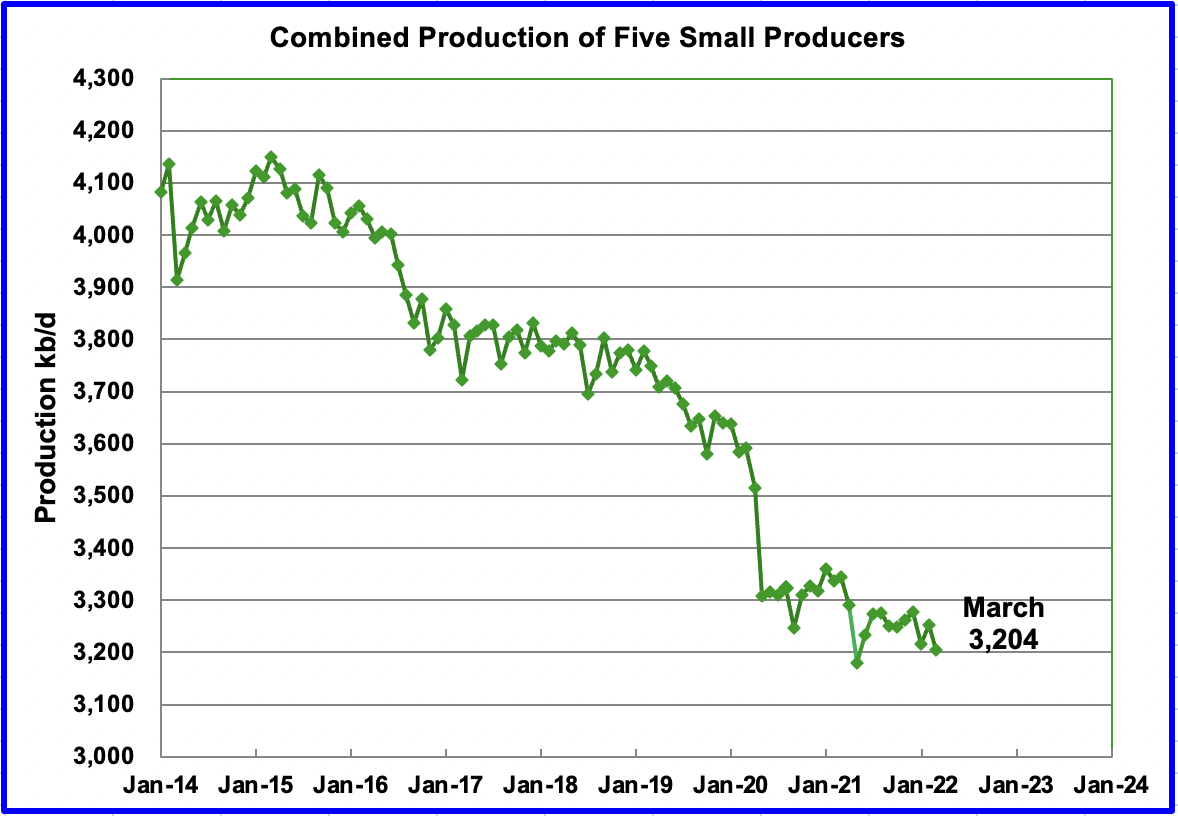

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined March production was 3,204 kb/d, down 49 kb/d from February’s 3,253 kb/d.

The overall output from the above five countries has been in a slow steady decline since 2015.

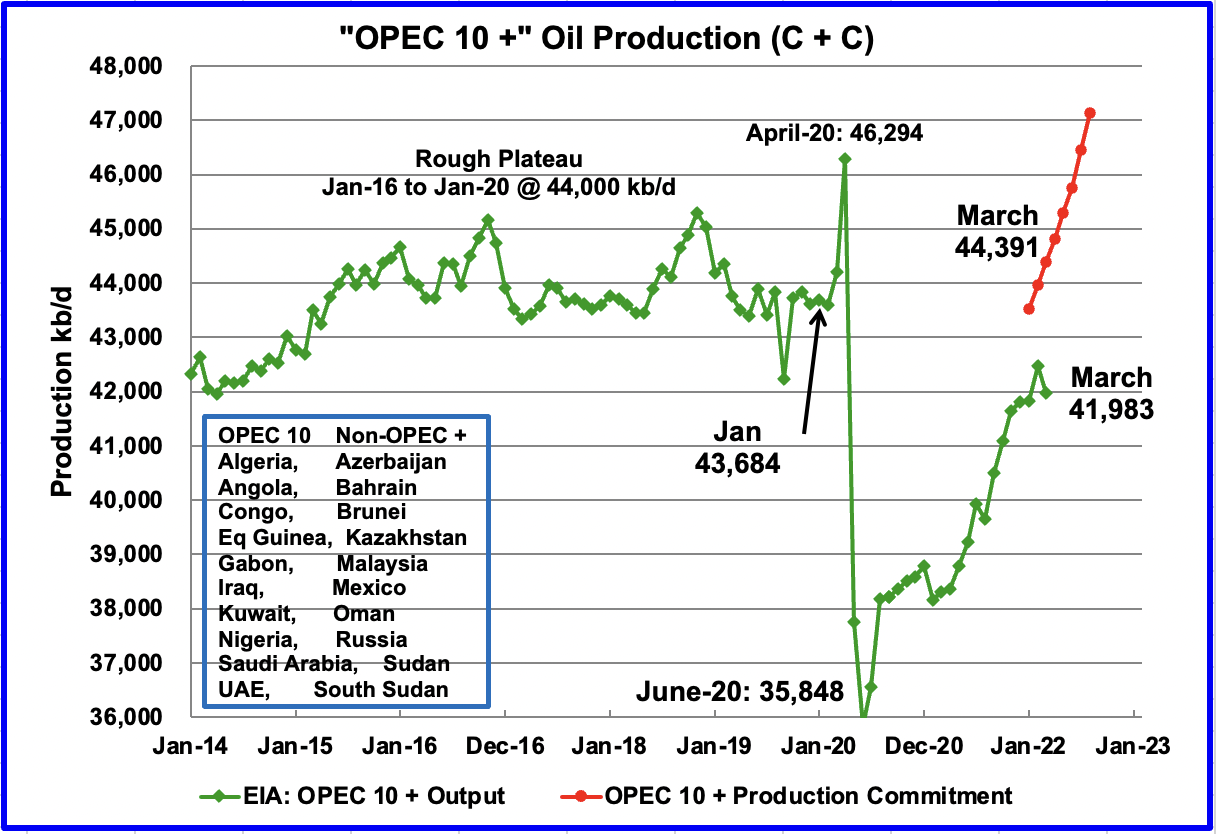

OPEC 10 + Production vs Commitment

This chart compares OPEC 10 + production with their commitment. For March, the gap between production and commitments is approximately 2,408 kb/d of C + C.

To develop this chart some assumptions had to be made. The OPEC 10 + commitments are for only crude oil production, no condensate. While that information is available for the OPEC countries from the OPEC report, it is not readily available for the Non-OPEC participants. On the other hand, the EIA monthly production information is available for those countries for both crude plus condensate. To get an estimate for the OPEC 10 + commitments in terms of C + C, OPEC crude production was compared with EIA’s C + C production for the OPEC countries.

For the last six months, October 2021 to March 2022, the ratio of EIA C + C OPEC production data to the OPEC crude data was calculated. Over that period, the EIA C+C production was close to 7.5% higher on average than the OPEC crude values. The OPEC 10 + commitments have been increased by 7.5%.

World Oil Production

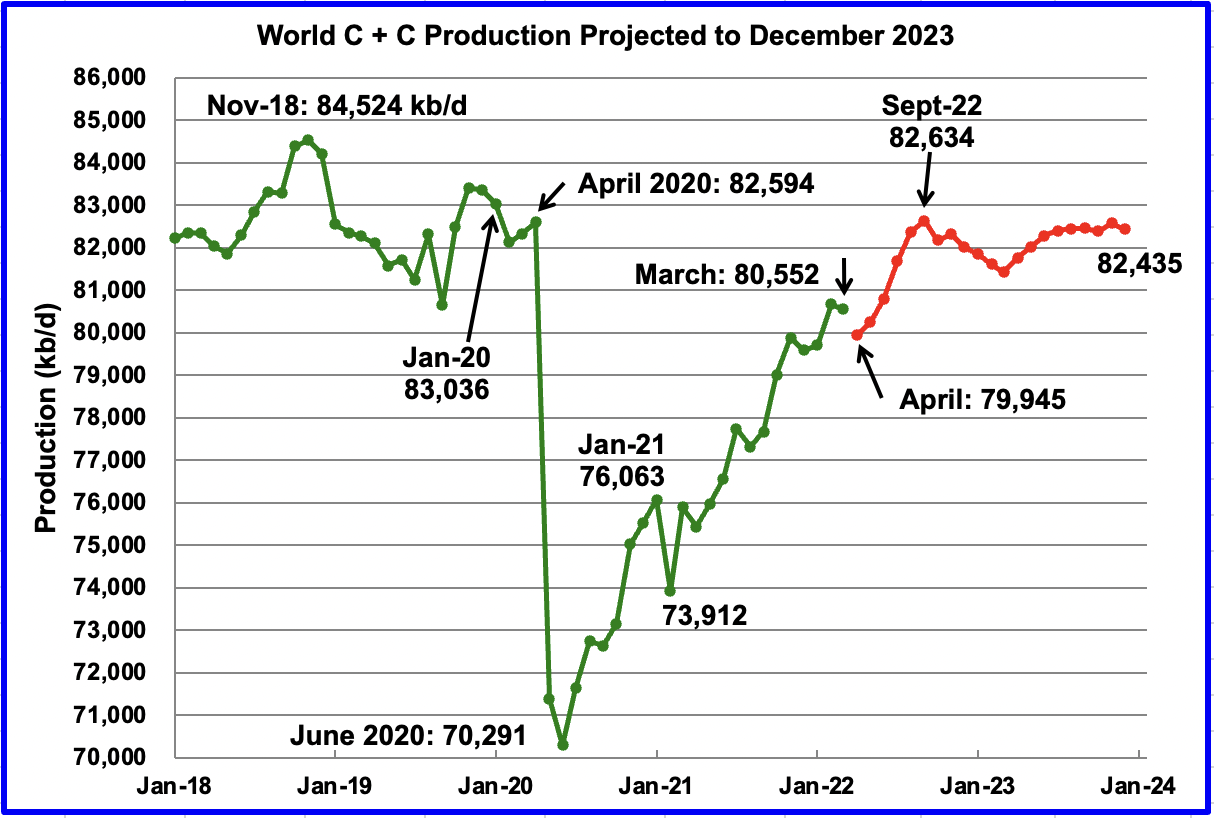

March’s world oil production decreased by 122 kb/d to 80,552 kb/d according to the EIA (Green graph).

This chart also projects world C + C production out to December 2023. It uses the July 2022 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that world crude production in December 2023 will be 82,435 kb/d, 164 kb/d higher than projected in the June report. The rise of close to 2,700 kb/d from April to September seems aggressive but is related to US and OPEC + forecast production increases.

Considering the upcoming production losses shown above in Brazil, Kazakhstan and Norway, the smooth production increase from April to September appears to be optimistic.

Thanks Ovi,

Note that the OPEC plus data for Russia is crude oil and does not include condensate. I cannot find an estimate for April 2022, but source below

https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Production-Jumps-By-5-In-June.html

Has June C plus C for Russia at 10.7 Mb/d about 5% higher than May which suggests 10.2 Mb/d for May 2022 (10.7 divided by 1.05). I have Russian output at 10 Mb/d in April 2022 for C plus C, but I cannot find my source.

Russian crude oil production was up 5% according to Russian daily Kommersant. However Russian exports were down 3.3% over the same period. That sounds a little strange.

Ron

Thanks. I found a more updated link with partial July production. I have updated the Russian chart and the link is there.

Dennis

Thanks for the info. I have found an updated July number for Russia and updated the chart and comments in the original post.

I have June production at 10,715 kb/d since the source says that July is 0.6% higher than June.

I have increased the OPEC 10 commitments by 7.5% to account for the missing condensate in the OPEC 10 list that OPEC publishes.

I got the April production estimate, 9,160 kb/d, from this source.

https://www.reuters.com/business/energy/russian-crude-production-plunges-by-nearly-9-april-opec-data-shows-2022-05-17/

Thanks Ovi,

Yes I looked t that source (linked in the post). I could not find any better estimate, but note that the source says the estimate is from OPEC and it specifically says crude oil rather than crude plus condensate.

Unfortunately in some places crude only is reported, in some crude plus condensate, in others it is C plus C plus NGL and in others it is all liquids (including refinery gain, CT, GTL, and biofuel.) We use to be able to get C pluc C output from the Russian Ministry of Energy, but that is no longer possible since the invasion of Ukraine.

See

https://www.reuters.com/business/energy/russia-delays-publication-monthly-oil-gas-output-data-sources-2022-04-04/

Ovi,

I found this other source for April data for Russia, in April output fell by 900 kb/d from the March level for crude only from 10.04 Mb/d to 9.14 Mb/d.

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/050922-opec-april-crude-oil-output-tumbles-as-sanctions-hit-russian-output-platts-survey

Your chart (and several sources) shows March Russian output at about 11 Mb/d which suggests condensate output is about 900 kb/d. This suggests at least 9.9 Mb/d for Russian crude plus condensate in April 2022 (this assumes 750 kb/d of condensate output).

Ovi,

Excellent update. While the world was able to increase production by 12 mbd since 2008, it is having difficulty getting back up to the same level just three years ago. Without oil production growth, there is no GDP growth. Soon, the world will realize this critical relationship.

Here is an interesting chart showing the lack of interest in the Oil Industry, even with much higher oil prices. The market cap of the top 48 U.S. E & P companies was higher in Q3 2018, even though the oil price was 27% lower.

Thus, the FALLING EROI is wreaking havoc throughout the oil industry, and investors subconsciously realize this by their lack of interest in the oil stocks.

Also, both Halliburton and Schlumberger came out with ROSY financials reporting much higher net incomes in Q2 2022. However, even with Schlumberger reporting a whopping $1.5 billion net income profit 1H 2022, the company is still paying a LOUSY 13 cents per share dividend vs 50 cents a share a few years ago.

Lastly, why has Schlumberger’s outstanding shares increased from 1.2 billion to 1.4 billion from 2009 to 2021, while long term debt has also increased from $4 billion to $13 billion over the same period with lots of positive FREE CASH FLOW??

steve

Steve

“Without oil production growth, there is no GDP growth. Soon, the world will realize this critical relationship.”

So true. The ESG groups and the environmental NGOs don’t realize this. Until the world realizes that the transition to Green has to be planned, the oil producers and Enviro groups will be talking at cross purposes.

Nothing like a crisis to wake people up. Gas crisis spurs Germany to mull extending life of nuclear plants.

https://www.reuters.com/business/energy/gas-crisis-prompts-germany-consider-extending-life-three-remaining-nuclear-2022-07-18/

In Canada we have a Prime Minister and Environmental Minister that are bent and bound on shutting down the oil sands. The US SEC is on a similar track to cut oil production by making oil refiners account for downstream emissions.

https://www.cbc.ca/news/canada/calgary/oil-carbon-emission-disclosure-1.6470117

It is pretty clear that most advisors these days will not recommend oil stocks or natural resources. While oil stocks are holding up, but down 10% to 15%, copper stocks have fallen more. Surprising with EV demand increasing.

I wonder what Buffet’s experts have figured out. He continues to buy OXY.

https://finance.yahoo.com/news/warren-buffett-morning-brief-july-23-110012203.html

Ovi,

Agreed… 100%. However, while the ESG and Anti-Oil & Gas policies have been a bit of a BUMMER for Global Upstream Investment, the data suggests problems were already beginning to occur before ESG became much of an issue.

In looking at the Rystad & BP Statistical data for these two periods:

2010-2014 Global Oil Investment = $3.6 trillion

2010-2014 Global Oil Discoveries = 51 billion barrels

2010-2014 Global Oil Demand = 140 billion barrels

2010-2014 Demand vs Discoveries = 2.7 to 1 (barrels)

2015-2021 Global Oil Investment = $3.4 trillion

2015-2021 Global Oil Discoveries = 38 billion barrels

2015-2021 Global Oil Demand = 207 billion barrels.

2015-2021 Demand vs Discoveries = 5.4 to 1 (barrels)

The takeaway from this data set shows that even with significant global oil investment, we aren’t finding that much oil. Sure, the global oil investment from 2015-2021 was less than 2010-2014, but oil companies aren’t too stupid to realize they’re just isn’t that much good quality out there remaining.

For example, Offshore oil exploration has been a complete mess in the past 5-10 years with DRY HOLE percentages surging. The only Outlier has been Offshore Guyana. But, that Sweet spot won’t last forever and will not offset the declines coming.

Furthermore, the Demand for oil versus Discoveries has doubled from 2.7 barrels during 2010-2014, to 5.4 barrels from 2015-2021. Thus, the issue isn’t that we aren’t spending enough money on finding new oil… THE LORD GOD & MOTHER NATURE only provided us with a certain amount of high-quality oil, and we had a great deal of fun burning most of it in the past 100 years.

Lastly, with the Coming Collapse of the Global Debt Market, that will also pop the Global Assets. The collapse of the Global Asset Market will destroy the ability to produce oil in the future.

Thus, we have the ENERGY CLIFF.

steve

That pesky shark again!

Steve

You and I have discussed the declining discovery trend as presented by Rystad. 2021 was pretty bad year.

Could you please explain “the Coming Collapse of the Global Debt Market,”

Ovi,

With global debt increasing from $97 trillion in 1997 to over $300 trillion currently (International Institute of Finance data), the world has to service this debt. Servicing debt becomes increasingly difficult when interest rates rise, either the Fed Funds rate, or the Real market rates.

Increasing debt only works in an environment of rising oil production. The Fed & Central banks have lowered interest rates to offset the Falling EROI of Oil (Energy), which has been propped up by the massive debt. Thus, the massive increase in global debt, as well as lowering interest rates, were used to OFFSET the Falling EROI of oil.

But, again… that only works in a rising oil supply environment. When global oil production peaks and begins to decline, it becomes increasingly impossible to service this debt or to roll it over. Thus, the Global Debt Bubble begins to burst.

However, someone’s DEBT is another POOR SLOB’S ASSET. Thus, the collapse of debt means the collapse of assets, especially, pension plans, 401ks, retirement plans, insurance funds, and so on and so forth. This leads to the collapse of BUYING POWER as assets collapse.

Hence, the collapse in the ability to fund and produce future oil production.

steve

Decade of Deficit: https://reason.com/2020/01/10/in-the-2020s-dealing-with-the-national-debt-will-no-longer-be-optional/

Defaults affecting >1 billion people coming (or already here for Russia and Sri Lanka…): https://www.bloomberg.com/news/articles/2022-07-07/why-developing-countries-are-facing-a-debt-default-crisis

Next up:

Argentina, Egypt, El Salvador, Ghana, Kenya, Pakistan, Tunisia…

The number of countries doubled in past 6 months…no doubt the 2022 oil-shock played a major role…

You can also look at this issue from another standpoint- demographics.

A growing population is related to growing gdp, growing worker pool, and ability to service debt.

Some countries are rounding the top on population such as Italy and Japan, with many others on their heels.

Even China soon- with a new internal report suggesting peak population for China in 2023.

This population peak and then decline is necessary since the population has grown to far exceed the longterm carrying capacity in every country on earth.

But a consequence is that for most countries the ability to service the debt will become more difficult as the population ages- less workers.

Just as with global warming, this population quandary is a very inconvenient truth.

Why will there be no access to debt? This seems a rather far fetched scenario.

I think that the easy/cheap credit might indeed have “deformed” a more traditionally expected shape of extraction levels, since it has enabled drilling of more expensive sources, e.g. shale, before the oilprice, regulating supply/demand, has reached a high enough price to motivate it, so to say. Thereby pulling forward extraction that otherwise would have been done later, smoothening the curve.

(Haven´t studied Steves work in detail, will do. Seems to be a slightly different angle, but same result)

Edit: come to think of it, cheap credit has also heavily affected the demand side.

The diagram says no debt vs access to debt, that seems farfetched. Perhaps more debt and less debt would be believable, but I doubt the curve is affected very much, unless there is a severe economic crisis, which I think is only about one in 5 probability over the next 8 years or so (I am talking about a Depression level event, with Worldwide GDP dropping by more than 15% in real terms.)

A 20% chance of a Depression level event with Worldwide GDP dropping by more than 15% in real terms seems kinda like a potential shit storm to me; perhaps a risk worth preparing for. A Depression level event on the back of a climate induced global harvest disruption, is sure to break a lot of porcelain.

A 20% probability of an event occurring that would cause catastrophic losses, injury or death is considered extremely high risk.

Those that lend all the real money into the economy are saying the probability is more like 95% instead of 20%

Okay, this video is just hours old. It covers Middle East oil, Russian oil, Former Soviet Union oil, Mexican oil, Canadian oil, and US oil including the shale revolution. It will cover a lot of stuff you already know but also a lot of stuff about which you had no idea. You will not regret watching it. It is just a tad over 18 minutes in length.

The Real Map of Oil – Peter Zeihan Oil Update

Ron – Great video, I also found this one really informative WRT to the EV/renewables debate…

https://youtu.be/CNn5T0rNzOw

Thanks Ron, PZ is just so lucid, he knows how to connect the dots.

Most of Zeihan’s videos are worth watching. Although I don’t agree with all of his conclusions because some of his conclusions are based on the abundance of shale oil and gas.

But for those who think a global transition to renewables is in the cards I’d recommend watching his video on solar and wind energy and look at his breakdown global map where there is enough solar intensity where solar makes sense and where wind makes sense.

Majority of EV will be powered by burning fossil fuels and nuclear.

He believes higher prices are coming. Which I don’t agree with.

I really like Zeihan. I don’t agree with him however, that China is going to go away quietly in the night.

They are likely to have hundreds of millions of starving lunatics running around and they are well armed.

Nuclear ICBMs and Submarines.

He believes higher prices are coming. Which I don’t agree with.

I do agree with him on that….. in spades!

His line of thought on price is Russian oil being shut in. Which hasn’t happened. And prices going high enough that the US also stops exports to contain domestic prices.

Sanctions more or less have no teeth and are or have been for more or less media consumption so it looks like the west is doing something.

Eurodollar market didn’t cut Russia off of dollar funding. Banks don’t give a shit. And will gladly fund for a profit oil coming out of Russia.

It’s pretty clear by the exchange rate USD/RUB that banks have no problem with this.

As oil prices fall though it will be less attractive for those banks to engage in lending dollars to move oil out of Russia.

I think the bigger problem though is Japanese banks that lend dollar funding into China are in trouble. Without explaining in detail why this is other than it being a collateral issue. Just watch the USD/CNY exchange rate. As dollar funding becomes scarce.

USD/RUB is strong because Russia is receiving rubles but the sanctions make it very hard for them to actually spend them so they are accumulating. In a way they are running their balance sheet through their income (and cashflow) statement.

rgds

WP

Banks know how to swap dollars for rubles. That is why USD/RUB is where it is. Without the actual swaps RUB doesn’t have a bid.

Eurodollar system doing exactly what it is suppose to do. In this regard.

US banks are not trading Rubles. Bloomberg doesn’t even quote it anymore – it has been frozen. EU banks are trading RUB in limited quantities to pay for gas purchases. The quotes you’re seeing are largely indicative but it is unlikely that you can trade in any meaningful quantity.

Rgds

WP

Nobody said anything about US banks. Banks outside US can swap Dollars for Rubles or whatever currency they want to swap for.

And we aren’t talking trading USD/RUB in spot market. We are talking large mega banks outside US swapping large amounts of dollars for Rubles with other large mega banks that have access to rubles.

We are talking the actual purchasing of oil not paper trading currencies.

Using US dollars to buy rubles to buy oil. It’s happening and on a rather large scale judging by the move in the value of the RUB against the USD.

Banks on behalf of their clients take US dollars swap with other banks at a fee of course for rubles or whatever they need. These swaps do require collateral. But the client gets what is needed to buy the oil from Russia.

Russia gets paid in rubles. Client can turn around sell the oil for a profit and in dollars. Bank gets paid back in dollars.

Since Russian oil is discounted at the moment this is working well making money hand over fist.

But when price oil collapses as we head into recession this won’t be so profitable and USD/RUB will head the other direction.

I’ve heard various rumors that the Ruble has been pegged to the price of gold since May. Can anybody confirm or debunk this?

It appears to have been a temporary move:

https://theconversation.com/why-russia-has-put-the-rouble-on-a-gold-standard-but-its-unlikely-to-last-180632

Rgds

WP

The Western service companies leaving Russia will have a far greater effect than any economic sanctions. The production problems will become apparent gradually then all at once.

the higher prices are here for me atleast

gas + leccy , from £1170 to £2800 in one year . predicted further 20-40% on top in October.

there is no consumer society when there’s no money to spend on goods and services.

Forbin

I looked it up for those like me unfamiliar-

‘Leccy’ is short for electricity

Hickory, it’s a Brit thing 🙂

British pound is down about 13% from its peak on Jan 13 (vs the USD I imagine, but we’ll let HHH elaborate). So everything is getting more expensive if you are in England. And Nat Gas is one of the few commodities left in the world trading bullish. So its a double whammy.

This is read almost verbatim from his new book, “The End if the World is Just the Beginning.”

The section on energy is pretty good, but he is under the opinion that the shale oil and gas is in such abundance that it will forever shape geopolitical hegemony.

exchange Coal-to-Liquids for shale oil and adding in other resources from Canada ( Tar Sands )

and Australia ( Coal, Rare Earths, Gas, others).

And Zeihan is on to something IMO.

America can largely detach from the Gobal World and have a future to look forward to relative to others.

Only if they also build their own dome to separate themselves from the fallout from that move. Climate change knows no borders, even if you can power your A/C in summer and boilers in winter, you’ll be having to deal with everything that scenario throws your way.

There’s no getting away from consequences. Just alternative paths.

I think Zeihan often overplays the US’ cohesion and resilience to the same extent he downplays China’s.

“relative to others”

I prefer my collapses slow and drawn out vs ABRUPT

Yeah, but that’s boring. You’re boring.

Beat the rush, collapse now.

Further to your comment below, I wrote that up: https://www.spectator.com.au/2022/07/we-will-win-chinas-war/

Zeihan’s rants can all be reduced to “People I hate will fail”. It’s an exercise in wishful thinking gone wild.

I agree, Zeihan finds interesting facts and figures & brings interesting points to the discussion, often ones I like to look into further, but his conclusions are very America-centric, likely because his analysis is very ethnocentric, and lacks balance. He is “objective” in that his analysis is devoid of Democrat & Republican talking points.

Yes, he has an extremely strong view on China…is he correct? If I had to guess, I’d say prob. so…

https://www.barrons.com/amp/articles/china-xi-jinping-economics-rise-51655929850

My biggest issue with him is he thinks US has >100 years of oil/energy…

@KenGeo

Australia and the US have 40% of the worlds coal reserves. Throw in the Canadian Tar Sands that is a lot of energy.

No one is going to sit on an energy abundance of that nature hoping to get to Net Zero carbon emissions.

Without the American Military (or the British? French?) Australia will be turned into dog food by the Chinese.

Resources for Military.

And it is a win-win for both parties.

Americans and Aussies like to have sex with each other.

And the military relationship has been there for decades…….

Peak avocado,

The coal and oil sands are expensive sources of energy relative to alternatives, perhaps if my guess that $15/MMBtu gas becomes the norm in North America and Australia those resources will make a comeback, but wind and solar are far cheaper and are likely to replace most coal fired power as well as natural gas. By 2042 at the latest and perhaps 2028 at the earliest oil prices will start to fall due to lack of demand as EVs replace ICEVs over time.

@Dennis

They are expensive to produce, yet are being produced today.

100 dollars a barrel vs 150 – 200 barrel…is Granny knitting you a sweater instead of getting you the latest “fashion du jour”.

When we get to 500 a barrel, then I’m listening.

I want meat, taters and water where I live.

Peak Avocado,

Yes they are being produced (coal and oil sands) and will continue to be produced, but less and less over time as they are expensive relative to alternatives. I expect coal will be replaced first and oil sands will no longer be developed after 2042 as conventional oil resources will be the only profitable oil resources as oil prices start to fall (2030-2040 for start date depending upon the speed of the transition to electric transport). By 2050 there will be far less oil sands development an coal production is likely to be far lower.

@Dennis

Good ideas.

If I am investor, and have to make an investment over a multi-decadal timescale.

I want something that works.

Liquid fuels work. CTL works.

South Aftirca immediately went to CTL when they got oil embargoed.

That is the blueprint for what countries with coal reserves will do.

The political roadblocks to using it (environmental – climate change) will end abrubtly when gas rationing and long waits in line to get fuel start happening.

“The key to a successful invasion, is an invitation from the country you want to invade”

Peak Avocado

Australia has a population smaller than Florida and a hydrocarbon resource that would make Texans blush. Rare Earths, Farmland, etc, etc ,etc

Australians do not want to become communists or give up the fun loving culture of the “Lucky Country”.

Military is the only way to sustain it.

I often pointed to China as a case study in how fast one can lose approx 14%, ish, of your oil production rather quickly; see 2016 to 2018, ish.

Now they seem to be a little bit on the upswing; any thoughts about the details of that here; how, at what cost?

Survivalist, here is a partial answer.

China’s Big Oil to pour cash into boosting domestic output

China’s big three state-owned oil and gas companies are raising their capital investment budgets this year to the highest level seen since 2014 amid an energy security push from Beijing to boost domestic production.

In his annual address to the National People’s Congress last month, Premier Li Keqiang put “enhancing domestic resource production capabilities and expediting exploration and production of oil, gas, and minerals” as a key element of the government’s “stability” agenda for the year. He barely mentioned the sector in his 2021 speech.

The agency set a domestic production target for the year of at least 200 million tons of crude oil. This would be the highest output since 2015 and compares with last year’s 198.98 million tons. (200 MT/yr is 4,000 kb/d which is lower than June production of 4,183 kb/d)

Big Oil quickly showed it had gotten the message from Beijing.

JUMP. HOW HIGH.

Maybe Biden should try the same message. 🤣🤣🤣🤣

https://asia.nikkei.com/Business/Energy/China-s-Big-Oil-to-pour-cash-into-boosting-domestic-output

Ovi, thanks so much for your time. China seems quite opaque. I appreciate all the work you and others do here.

Energy rationing.

Coming soon to countries you may be familiar with-

https://www.ft.com/content/619946ac-94b9-4d93-bc7f-d458dfc8b39a

https://www.iea.org/commentaries/coordinated-actions-across-europe-are-essential-to-prevent-a-major-gas-crunch-here-are-5-immediate-measures

https://foreignpolicy.com/2022/07/11/europe-energy-crisis-natural-gas-russia-nord-stream-1/

Currently, gas storage facilities in the European Union are 64% full. 0.4% daily up. At least last week. Poland and Portugal are almost 100% filled. The disaster is in Ukraine (22%). They will have a very hard winter. They also have problems with coal. Especially with anthracite. But this is not a surprise.

https://agsi.gie.eu/

The storages are not able to cover the full consumption – they are sized for the continous streaming of russian gas the whole winter long.

And most storages in Europe are small, only a buffer for a few days. The exception here is mostly Netherlands, Germany and Austria.

Yeah, the UK’s Rough facility before it got decommissioned held barely a week’s worth of gas, hence it closing wasn’t a case of the Tories fucking the nation with high prices: it would have changed nothing.

Europe’s storage being near full just means rationing will be less pronounced to start with. For the first month.

Opec+ compliance surges to 320pc in June: delegates

Several members of the coalition are struggling to meet their targets, hampered by years of underinvestment, infrastructure issues and sabotage. The compliance figures are also skewed by the impact of sanctions and custom boycotts on Russian production. Although Russia managed to raise its output by over 550,000 b/d last month, it was still 880,000 b/d below quota, according to Argus estimates. Moscow, the de facto leader of the non-Opec contingent, has not requested an exemption from its Opec+ commitments.

https://www.argusmedia.com/en/news/2354203-opec-compliance-surges-to-320pc-in-june-delegates

GUYANA POISED TO BREAK $1 BILLION IN OIL AND GAS REVENUE THIS YEAR

“Guyana is the global leader in total offshore discoveries since 2015, with 11.2 billion barrels of oil equivalent, amounting to 18% of discovered resources and 32% of discovered oil. Of the total, a whopping 9.6 billion barrels are oil, far outpacing the US in second place with a comparatively small 2.8 billion barrels. The Stabroek block accounts for all of these finds, but recent discoveries in other areas show the potential for growth elsewhere. “

https://oilprice.com/Energy/Crude-Oil/Guyana-Poised-To-Break-1-Billion-In-Oil-And-Gas-Revenue-This-Year.html

And, from today’s New York Times

CONGO TO AUCTION LAND TO OIL COMPANIES: ‘OUR PRIORITY IS NOT TO SAVE THE PLANET’

“The Democratic Republic of Congo, home to one of the largest old-growth rainforests on earth, is auctioning off vast amounts of land in a push to become “the new destination for oil investments,” part of a global shift as the world retreats on fighting climate change in a scramble for fossil fuels.

The oil and gas blocks, which will be auctioned in late July, extend into Virunga National Park, the world’s most important gorilla sanctuary, as well as tropical peatlands that store vast amounts of carbon, keeping it out of the atmosphere and from contributing to global warming.

“If oil exploitation takes place in these areas, we must expect a global climate catastrophe, and we will all just have to watch helplessly,” said Irene Wabiwa, who oversees the Congo Basin forest campaign for Greenpeace in Kinshasa.”

NB Not sure if this should be here or in non-oil thread (or both).

https://www.nytimes.com/2022/07/24/world/africa/congo-oil-gas-auction.html

we will all just have to watch helplessly

I thought we already were.

I’m well passed the “oh my god everything is fucked” phase of my life & long ago entering the “oh my god everything is fucked lol” phase. But hey, I’m cynical.

Pretty much.

Can’t change fate. Might as well grab popcorn.

Oil Flat as New Questions about SA Spare Capacity vie with Demand Worries.

WSJ report says Saudi Arabia can’t pump much more.

“People familiar with the operations say Riyadh would struggle to produce 11 million barrels a day for more than a few months at a stretch and 12 million barrels a day for more than a few weeks,” the report says.

They cite field maintenance requirements, declining production at some fields and technical issues involving pressure levels. During the pandemic, when oil demand fell, state oil company Aramco reduced drilling rates. Boosting them up again too quickly or injecting wells with fluids, a common practice to boost production rates, could cause longer-term damage.

Saudi Arabia hit 12 million barrels a day in April 2020, according to people familiar with its oil field operations, amid a pre-Covid-19 battle for market share with Russia. Engineers at Aramco, formally called the Saudi Arabian Oil Co., say the kingdom can’t sustain that level for longer than a few weeks.

This link references a WSJ report.

https://www.forexlive.com/news/oil-flat-as-new-questions-about-saudi-spare-capacity-vie-with-demand-worries-20220722/

Brazil offshore projects don’t appear to use predrilled subsea wells so it can take up to a year for the big FPSOs to ramp up to full production.

Nigeria will add some production now as a shallow field Total project has just started with 50kbpd capacity.

The big Mad Dog II (aka Argos) project start-up is delayed in the GoM because of equipment problems (so 120 to 140 maybe early next year – I think there have been a number of predrilled wells so a large chunk will come on quickly). The King’s Quay project is ramping up too through the remainder of the year.

Hi George – Wondering if you might be able to update your post from a little over a year ago:

“Annual Reserve Revisions Part IV: Shale Producers”

I think it might be a good time to revisit…

It’s a lot of work to go through all the annual reports. It was OK during various lockdowns and when the information was new to me but at the moment I have other things I’d rather be doing. I might look at something when winter comes especially if, as seems likely, the UK economy continues to deteriorate and society starts to unravel, but it would probably be something simpler like GoM reserves or Brazil production.

I don’t kid myself that these posts make much difference; if the presented data agrees with a readers preset ideas they’ll skim through it and maybe give you a “nice post”, if not it will be either dismissed or, at best, a couple of straw men picked out. So mostly I just do posts for my own interest. Getting the data originally showed up some interesting things, incrementing it gets a bit tedious.

No problem, just found the info particularly interesting and wanted to point out that it’d be great to see another post that does a “deep dive”. Understand that it takes a lot of time to compile and present the info…thanks for all the hard work!

From Oil & Gas Journal

ExxonMobil has made two new discoveries offshore Guyana to the southeast of the Liza and Payara developments in the Stabroek block. Discoveries at Seabob and Kiru-Kiru are the sixth and seventh in Guyana this year, with the total number of discoveries in Guyana at more than 25, the operator said in a July 26 release.

The Seabob-1 well encountered about 131 ft (40 m) of high-quality hydrocarbon-bearing sandstone and was drilled in 4,660 ft (1,421 m) of water by the Stena Carron drillship. The Kiru-Kiru-1 well encountered about 98 ft (30 m) of high-quality hydrocarbon-bearing sandstone and was drilled by the Stena DrillMAX in 5,760 ft (1,756 m) of water. Drilling operations at Kiru-Kiru are ongoing.

ExxonMobil’s 2022 investment plans include further exploration drilling and resource development in Guyana, where it is already increasing production at an accelerated pace, the company said in the release.

Two floating production storage and offloading (FPSO) vessels operating offshore Guyana—Liza Destiny and Liza Unity—have exceeded their initial combined production target of 340,000 boe/d, the company said.

A third project, Payara, is expected to produce 220,000 b/d. Construction on its production vessel, the Prosperity FPSO, is about 5 months ahead of schedule with start-up likely before yearend 2023. The fourth project, Yellowtail, is expected to produce 250,000 b/d when the ONE GUYANA FPSO comes online in 2025.

Guyana’s Stabroek block is 6.6 million acres (26,800 sq km). ExxonMobil affiliate Esso Exploration and Production Guyana Ltd. is operator with 45% interest. Hess Guyana Exploration Ltd. holds 30% interest, and CNOOC Petroleum Guyana Ltd. holds 25% interest.

ESG concerns and the resultant restriction of the fast burn (quick peak, then rapid decline) of fossil fuels.

Examples of imposed restrictions on fossil fuel sales-

Venezuela- Governance and Social [G/S] concern. This is by and large not a partisan issue in the US.

Iran- Governance and Social [G/S] concern. This is by and large not a partisan issue in the US.

Russia- Governance and Social [G/S] concern. This is by and large not a partisan issue in the US.

Whatever the reason (including concerns over global warming [E]), its only a matter time that fossil fuel production is less than demand.

We have terms describing the problem- finite resource, resource depletion, population overshoot.

Might as well get on with the adjustments now even if

a little late considering the graffiti has been on the wall front and center for the past 50 years.

The upside of Covid – knocked a couple years off demand increases. Just need a few more of those in the next ten years and… oh wait, did I say that out loud?

Cheeky monkey….pox

CAPEX in energy

Article on global energy sector capex here, with some detailed chart projections by sector

from IHS Markit-

“Fossil fuel capex took the largest hit in 2020 and upstream capex is unlikely to reach 2019 levels until 2023.”

“Global energy sector capex was over $1.5 trillion in 2021 as economic activity increased following the global downturn in 2020. Energy spend was directed mostly toward transmission and distribution at $363 billion, upstream oil and gas at $341 billion, and renewable energy at $315 billion. Over the five-year period from 2021-2025, cumulative global energy sector capex is projected to increase by 18% compared to the 2016-2020 period. In 2021-2025, transmission and distribution spending is projected to increase by $433 billion, followed by renewables at $367 billion and oil and gas spending at $209 billion.”

https://ihsmarkit.com/research-analysis/global-energy-sector-capex-strong-rebound.html

note- no comment in the article about whether the current data and projections take into account the new global energy situation after Putins withdrawal from the ‘western’ economic sphere.

This article was posted March 4,2022 and therefore likely does not reflect the new scenario.

I suspect that global energy sector capex will be much higher than they projected over the 2021-2025 period, as a result of the new landscape which highlights the great energy vulnerability to a wide swath of the population who had been sleepwalking in perceived energy bliss state.

Maybe this will lead to less oil extraction going forward…?

Cash flow would otherwise be quite good currently, with these prices, nést pas?

Natural gas prices are back over $9 this morning, with Europe almost certain to have shortages this winter. Once the Freeport LNG terminal opens back up in September or October expect major increases from this level for US this winter, possibly 50-100%.

I finally got around to reading the entire peak oil report that has been discussed here for the last week or so:

How much oil remains for the world to produce?

I think the report is far more pessimistic than many realize. Less Canadian oil sands and Orinoco heavy oil, they say the peak is right now, or rather 2019.

By contrast, production of conventional oil including LTO (blue line) has been increasing, but even if we exploit this oil fully, it is forecast here to reach a peak roughly about now. If we assume in addition that we can rapidly and fully exploit the extra 500 Gb or so of heavy oil from Canada and Venezuela (green line), this delays the global peak to about 2030.

So, if we assume everything except heavy oil from Canada and Venezuela has peaked, and if we assume, as I do, that this oil has begun to decline, then the question is can Canadian and Venezuelan heavy oil be ramped up fast enough to stave off the peak until 2030? Really now? That is laughable!

But, if you wish to count natural gas liquids as oil, which it ain’t, then that delays the peak a bit longer. Obviously natural gas has a bit longer to before it peaks.

I mean, hey, I am not going to argue with Jean Laherrère, Charles A.S. Hall, and Roger Bentley. I think they have done their homework. If anyone else feels they are all full of crap, then that is your prerogative. 🤣

Hi Ron,

it would not suprise me if they classified coal as ” super heavy oil”…..

Hi Ron, it is a shocking report, with shocking implications. I wonder what the downslope will look like.

Peak Oil: Its Impact on Food Systems and Public Health

“The resultant escalation in both oil and food prices could have impacts from widespread food insecurity to famine. The level of crisis will be determined by the extent of preparedness and food system resilience, as well as the speed of price rises and other factors.”

https://clf.jhsph.edu/about-us/news/news-2011/peak-oil-its-impact-food-systems-and-public-health-0

Google search for “Peak oil (plus) public health”:

https://tinyurl.com/3hxnbhcc

Cue the famine

For those on this site still minimally open minded about ‘how stuff works’ regarding unconventional hydrocarbon development, news coming out regarding EOG’s re-engaging in Ohio’s Utica oil production offers several intriguing data points.

The Rose well – located in Carroll county (fringe of Utica oil) – produced ~700 bbld and ~3 million cfd gas its first 15 days online.

The fact that EOG is building a takeaway pipeline and – reportedly – accelerating land acquisition, indicates that EOG may have ‘cracked the code’ in optimally extracting liquid hydrocarbons in this area.

Ohio is sitting atop huge, huge amounts of OOIP. The biggest hurdle has been finding a way to economically accomplish the recovery of this resource.

$100/barrel pricing certainly helps.

This approach applies to numerous other under developed, hydrocarbon-rich basins as well as expanding viable acreage (Tier 1/2/3, etc.) in the more well known ‘shale’ formations.

Estimate of Utica recoverable percentage gas vs oil content?

Thanks for the updates.

Hickory,

I am not sure that I understand your question.

The Ohio Utica covers a big area with several varying characteristics.

The so called Deep(er) Utica in Belmont and Monroe counties is ~100% dry gas.

Extending west/north/northwest, the rock contains more liquids with ‘condensate’ (high api oil) making up a high percentage of produced hydrocarbons.

This Rose well is shallow (7,000 feet) and was frac’d with a relatively modest ~350,000 bbls of water and all sand proppant.

Essentially, a ‘cheap’ well to D&C.

If some online rumors prove accurate – that EOG is using high pressure gas lift for recovery purposes – the ramifications could be far ranging beyond Ohio.

I was wondering what the rough split between oil and gas potential is for the Utica shale zone.

Seems like an answer ‘to be determined’, considering all the various layers and evolving recovery techniques.

Coffeeguyzz,

EOG was once focused on the Eagle Ford. A new focus on the Utica may simply mean they have run out of good areas for further investment in the Eagle Ford, much of the “liquid” from the Utica may be ethane, propane, and butane and of little help with land transport, but useful in industry and for drying crops, heating. and cooking.

Dennis,

LOL.

Ohio reports all NGLs as Natural Gas.

No sense in engaging in idle speculation.

Next week EOG has their Quarterly Presentation.

If the attendant analysts are half way astute (constant crap shoot there), more pertinent info may emerge.

I will leave you with this. However …

EOG has been widely mocked for labelling their promising acreage as Super Duper, Double Premium, yada yada.

Essentially, for EOG to invest ANY substantive funding in projects, the company expects very high rate of returns.

Whatever the hydrocarbon composition mix may be with this new Utica venture, its economic viability is pretty much pre-ordained.

Much more important issues are just how ‘big’ EOG will push this, if other operators can mimic the process, and – of highest significance – if their procedures can be implemented in other areas of the country.

Coffeeguyzz,

Looking at Ohio’s C plus C output so far, it is not really a big deal for oil. Perhaps there will be a lot of natural gas, but I focus less on that because supply has been relatively ample in the US. As more and more LNG export capacity comes online this may be less the case because US prices will move closer to World natural gas prices (less costs to liquify, transport and convert back to gas). That is in part why we see Henry Hub futures at about $9/MMBtu. Currently the spread between European Natural Gas (TTF) and Henry Hub in the US is about $50/ MMBtu. The futures curve shows this spread falling to about $10/MMBtu by Dec 2025, with TTF falling to $15/MMBtu by Dec 2025 and Henry Hub falling to $5/MMBtu.

Note for comparison that the futures market expects WTI to fall to $70/bo by Dec 2025, so it seems to be very optimistic. This is likely too low by at least 50% imho. If we assume the futures spread for TTF and Henry Hub is correct, but the overall price level is too low by 50%, this would imply natural gas prices of about $15/MMBtu at Henry Hub and $25/ MMBtu at TTF in Dec 2025. This might make solar, wind, hydro, and nuclear power much more attractive going forward and we will see fewer new natural gas electric power facilities and their replacement with non-fossil fuel sources as these other sources will be far more profitable by comparison.

“That is in part why we see Henry Hub futures at about $9/MMBtu.”

That nat gas price level makes utility scale Photovoltaic Energy look cheap, except perhaps in the cloudiest parts of the country.

btw- in 2021 the US added the equivalent energy output from over (3) 1000MW nuclear power plants in the form of utility scale PV, and almost another one in smaller scale installations.

Hickory,

Yes the high natural gas prices may make new natural gas power plants a thing of the past and may lead to the shut down of many less efficient peaker natural gas power plants. Solar will take care of much of the daytime peaks, and wind, solar, hydro, geothermal, and nuclear power will handle 90% of electricity output over time, the balance may be handles by batteries, synthetic fuel, biofuel, waste burning, and maybe a bit of natural gas. We may see long term natural gas prices at $15/MMBtu in the US and other exporters and $25/MMBtu for importers of LNG, this will be a boon for solar and wind power througout the World.

reply below (so i can post a chart)

Lots of coal. Cheap and reliable. Texas is sorry they gave it up for windmills. Store it on site in piles.

Price predictions always seem to be based on short term thinking. When oil was at -$38 there was plenty of gloom and doom about how prices would never recover. In fact it was a short term event mostly caused by the pandemic. Now we have a spike caused by a war, and the herd can only imagine higher prices.

The cost of producing oil hasn’t changed much and its value to the economy (i.e. the price consumers are willing to pay in a pinch) is if anything slowly decreasing, as alternatives and efficiencies spread. Prices will continue to be volatile, but its hard to see why the there should be a long term trend in price.

Alimibiquated,

The long term trend in crude plus condensate demand has been an annual rate of increase of about 800 kb/d from 1983 to 2019 (37 years). It is possible this rate of growth will not continue beyond 2021 (with growth interrupted by the pandemic in 2020 and 2021). World oil supply will have difficulty keeping up with increased World demand as the World economy continues to recover from the pandemic. The fall in OECD oil stocks gives a clue as to the state of supply and demand, unfortunately we do not have very good non_OECD storage data so World stock levels are unknown.

My expectation is taht oil prices will remain in the $100 to $120/bo range for the next 2 to 3 years, what happens to supply and demand for crude plus condensate beyond 3 years is impossible to guess accurately, but my expectation is that until there is a severe World economic downturn (-2% annual real GDP or worse) that the World oil market will remain tight with real oil prices at $100/b or more in 2021 US$ until 2030 and perhaps until 2040 (with the later date due to a slow transition to electric land transport and the earlier date corresponding to a fast transition to EVs).

Hickory,

Yes, exactly.

Way back in 2008, Questerre brought online a handful of successful dry gas Utica wells 60 south of Montral, Canada.

It is a gigantic, discontinuos formation containing the entire spectrum of hydrocarbons.

In Ohio, specifically, the low realized price for oil has been a big impediment for vigorous drilling. (This, despite numerous refineries in the general vicinity).

Somewhat similar to the Eagle Ford, there are regions where dry gas, liquids rich, or primarily oil are predominate underground.

Ohio jumped from 47 BOPD in 2/22 to 61 BOPD in 4/22.

To really have an oil price impact that needs to get to what level, 500k BOPD?

Ohio C plus C output using EIA data.

Great article by Richard Heinberg. It discusses the recent research paper by Jean Laherrère, Charles Hall, and Roger Bentley. I only quote the first paragraph.

Will civilization collapse because it’s running out of oil?

Will civilization collapse because it’s running out of oil? That question was debated hotly almost 20 years ago; today, not so much. Judging by Google searches, interest in “peak oil” surged around 2003 (the year my book The Party’s Over was published), peaked around 2005, and drifted until around 2010 before dropping off dramatically.

And now that peak oil is upon up, no one seems to notice. Ironic! Anyway, read the article, it is great.

Yea, read it.

Heinberg is always insightful.

When living in Santa Rosa, frequently saw him on the trail.

Ron,

I agree, a well written article.

I went back and looked at the USGS World Oil Assessment from 2000 and an update in 2012. The USGS expects conventional oil to have a URR of 3000 Gb, rather than the estimate of 2500 Gb by Laherrere et al. Laherrere has about 1000 Gb for unconventional resources, my guess is about 200 Gb for unconventional crude plus condensate. So combining the USGS conventional estimate of 3000 Gb and my unconventional estimate of 200 Gb results in about 3200 Gb for C plus C vs the Laherrere et al estimate of 3500 Gb.

Currently there are 22 basis points between the 3 months T-bills and the 10 year treasuries.

FED will likely raise FED’s funds rate by 0.75% later today. We really aren’t that far from the entire treasury yield curve being inverted.

Not far from monetary plumbing breaking down.

And oil prices will head lower as a result.

I genuinely cannot wait for cheap oil I cannot buy with my increasingly worthless paycheque.

Nippon Steel inked an annual deal for thermal coal through March at $375/ton

https://www.bloomberg.com/news/articles/2022-07-27/glencore-strikes-one-of-japan-s-most-expensive-ever-coal-deals#xj4y7vzkg

Any news as to why the Brent/WTI spread has grown to over $10?

Is this due to US Admin discussion of reinstating the crude oil export ban?

Can’t think of any other reasons, given we are drawing 5 million plus per week BO from SPR and most weeks are commercial draws as well.

There was actually a negative WTI reaction to the EIA weekly despite over a 10 million BO combined crude draw from commercial and SPR.

Games on the paper market I think.

Some recession expections, big players going in or out of shorts.

They played dead the aluminium market at the moment – prices falling because of recession expectation, but you can’t fill your order sometimes because of disruption of russian deliveries and high energy prices forcing cutting production. These ends will connect soon again, most times one of the paper players sit’s on a huge pile of losses then. Wouldn’t be the last hedge fond going bust.

A fast export ban would be a disaster for US oil companies. LTO will get unsellable until they cut down production by round about 40% (full drilling stop for almost a year) – and on the world market prices will moonshot because of the 3 mbpd light oil are missing.

An adjustment need to be done slowly by giving deadlines and declining quantities, or regulation of drilling permits. Adjusting the reffineries will take time. Otherwise upstream and service companies will take huge damage.

Well, WTI reversed itself some, now back to $97.

Always lots of volatility in the crude market.

Shallow sand,

It is fairly clear that an exprt ban is not very likely. Such a move would ensure Democrats would lose both houses of Congress in the fall as the result would be higher World crude oil prices due to lower output in the US in response. As you know we don’t have refining capacity in the US for more than about 4600 kb/d of tight oil, so a ban on US exports of crude oil will take about 3000 kb/d off the World market. leading to a significant spike in oil prices. Any Democrat that thinks this is a good idea has never taken an introductory course in economics, or should have gotten an F if they did.

Hey maybe some Republicans will join with the Democrats as Biden would be blamed by voters and the Democrats will take the hit.

Export restriction will come later in the decade.

Swaps for refining mix optimization will be spared.

Dennis. I’m just speculating on the reason for the widening spread.

I don’t like that our hard to find 31-36 API light sweet and our heavier sweet 25-29 API gets priced off more abundant US shale.

We probably need to negotiate harder?

There is a 7/25 Reuters article that blames easing gasoline demand in the US for the increasing the WTI/Brent spread.

Not sure about this. US gasoline demand seems like a 20 year old metric in terms of importance. That demand peaked in 2006.

Yet we just drew 10.1 million BO last week from US inventories despite this weak demand.

Dennis, have you ever given thought to the idea that conversion to EV’s isn’t going to solve the crude oil supply problem? I’m sure we have discussed that?

So, by 2050, gasoline demand might be very low historically yet there will still be a crude oil shortage?

“have you ever given thought to the idea that conversion to EV’s isn’t going to solve the crude oil supply problem? I’m sure we have discussed that?”

“So, by 2050, gasoline demand might be very low historically yet there will still be a crude oil shortage?”

I know you directed this Dennis, but here is my two cents-

Until proven wrong, I assume that conversion of transport fleet from ICE to EV will serve to partially offset the depletion of crude oil derived transport fuels.

How much is partially?…that depends on how aggressively a transition is pursued.

And yes, crude oil will still also be needed for all the other things it is used for and will be in short supply, for just about all countries.

Hickory,

It may be in short supply until 2030 or so, but if the EV transition is quick, it will not be in short supply after that point. Oil prices will start to fall because supply will be higher than demand at $100/bo after 2030 (possibly as late as 2035 if the EV transition is slow).

Below is a slow EV transition scenario where the supply curve shows what is possible with no EV transition at all where oil prices remain very high (and we assume a severe recession is somehow avoided).

I sure you could be right Dennis, but I’m not confident of a few key components of that recipe working out in a timely manner, or at scale.

I am swayed by the magnitude of the transition required, and the lack of unified sense of purpose and urgency. Not to mention the blinding effect of partisanship.

It sounds good on paper. I share your reservations. There are currently close to 1.5 billion cars on the planet. So we need to crank out about a billion cars, pronto! That’s gonna take some oil, putting all that together, moving all that stuff around.

Then we’ll need more. Will technology make cars obsolete, or undesirable? Not looking good on that front. Pandemics don’t help, who wants to die from carpooling? I see oil demand sticking around.

Hickory,

The scenario below updates the supply scenario (the older chart was done before the pandemic). In this slow transition scenario demand falls below supply in 2042, upt to that point oil prices would be high in order to destroy some demand to balance the oil market. In this scenario the World Plugin light vehicle fleet grows to 624 million by 2038 (this does not include 2 or 3 wheeled light vehicles) and it is assumed that the World light vehicle fleet is about 1.3 billion and does not increase, it is also assumed that no autonomous vehicles get approved (or not on a widespread basis).

I appreciate your efforts at looking over the horizon, and doing an admirable job of it.

I admit that I just can’t see the future of these interrelated trends very clearly at all, and it is helpful to see your attempts.

It is always challenging to remain open to all sorts of various possibilities playing out.

Most of us take what we see in our neighborhood and we assume that this applies to whole world. Take electric vehicles for example- the story thus far is 90% China and Europe, with the US being a small sideshow.

Hickory,

I appreciate the pushback. It is possible that EVs will not help much, but gasoline at 4 to 5 dollars per gallon might change the attitude in the US toward EVs, if they have little effect then oil prices will remain high for even longer than 2042 and eventually it might lead to a global depression. Possibly a 50/50 chance it would occur before/after 2054, based on last 3 major Worldwide economic crises in 1873, 1929, and 2008 with average time between crises of 67.5 years and using a maximum entropy probability distribution to evaluate probability of years to next major economic crisis with P50 at 46 years.

Shallow sand,

Clearly I do not know what the future will bring. The possibility exists that more and more EVs might be sold in the US and throughout the World, the growth rate in sales of EVs from 2015 to 2021 was about 40% per year on average. This growth rate will likely slow down over time, by how much I don’t know. Also supply chain bottle necks may ease and prices of EVs may come down while oil prices remain high which could lead to continued fast increases in EV sales growth.

In any case, if EV transition is slow, then oil prices will be higher and oil supply will also be higher, if oil supply is inadequate oil prices rise to a high enough level that demand is destroyed to a level that balances the market. There is plenty of oil to meet demand for other uses besides land transport (which currently is about 50 Mb/d for the World). Note that my expectation is that heavy duty trucking also gets replaced with a combination of EVs and electrified trains. I haven’t included any changes to farm use, air transport or water transport, but climate concerns will eventually lead to changes there as well (though I am not clear what those will be, nuclear or wind for ships perhaps and much less air transport or possibly synthetic fuel.)

I do not expect a crude oil shortage by 2050, by 2050 ICEVs will be like horses in 1950, rich folks may have them and perhaps some collectors and enthusiasts. Same will be true for heavy duty trucks, especially short haul, they may figure out ways to use BEVs for long haul trucking as well, or much of the freight may move to rail for long haul.

So the solution to oil supply is EVs and high oil prices, at least through about 2080, by then I think we will have figured out how to replace most of the other uses of oil where it is burned for fuel.

On the oil prices, I don’t know how that all works, a lot of it is just bets on paper barrels or so it seems.

Not sure if any of you pay attention to these forecasts, but they seem interesting:

https://glenlochenergy.com/resources/Forecasts/2022/OMFJul22/

“Oil Market Forecast – July 2022

Summary

There has been a notable deterioration in economic sentiment over the last month, with some commentators, Nomura for example, now putting the chance of US recession by year end at more than 50%. While this has certainly impacted oil prices, oil demand expectations for the year have held fairly steady and OPEC was the latest institution to come out with a surprisingly bullish 2023 demand forecast. The supply picture remains clouded by uncertainty over Russian production, and the growing gap between what OPEC+ says and what OPEC+ does. Meanwhile, in the US, rigs are steadily being put back to work.

A few key points:

The EIA and OPEC held their 2022 oil demand estimates steady, while the IEA downgraded their estimate by 200,000 bbl/day.

OPEC published its first estimate for 2023 demand, they expect it to rise by 3% year on year to 103 MMbbl/day.

We estimate oil supply reached 99.7 MMbbl/day in June.

Crude oil dipped below $100/bbl, both Brent and WTI futures dipped sharply and remain inverted.

The US land oil rig count continued to grow, hitting 577 on July 15th.”

Kangeo

In the post, under US, there is a chart for horizontal oil rig count for all of the US, Texas and the Permian, up to July 22. Also a Frac chart.

The chart just reports on Horizontal rigs because we think that is most relevant for tracking tight oil activity. Some of the vertical rigs are used to start a multi hole horizontal well.

Ovi,

I believe an oil pro commented that there is a single vertical section for each horizontal tight oil well the Multiple lateral wells are used in Saudi Arabia and perhaps in some deepwater offshore drilling, but not for tight oil wells. If you look at the number of vertical rigs vs horizontal rigs operating in the Permian basin and keep in mind that vertical rigs are used for most conventional oil wells, the logistics make it pretty clear that the horizontal rigs do pretty much all of the drilling for horizontal tight oil wells, or that was the impression the oil pro gave in his comment.

For Week ending July 22, 2022 in the Permian basin there were 328 horizontal rigs operating and 16 vertical rigs, does it not seem like a logistical nightmare for 1 vertical rig to be drilling holes for more than 20 horizontal rigs?

There may have been a time when vertical rigs drilled a starter hole and then a horizontal rig finished the job, but I doubt that is still the case for most horizontal tight oil wells currently drilled in the Permian basin.

Dennis

I guess I was thinking that one rig sitting at one location drilled all of the laterals associated with the main well and that the laterals were counted as wells.

I understood it took roughly 20 days to drill a 2 to 3 mile well. I find it difficult to believe that would also include possibly 6 laterals.

Maybe I just have it all wrong.

Ovi,

It may be me that has it wrong, I will let any oil men correct us that cares to comment.

My understanding is that for tight oil wells each producing well has a single surface point where the oil and gas are collected,a single well bore starts out roughly vertically then there is a radius (or bendm I do not know the typical radius, maybe 800 feet plus or minus 200 feet, but maybe an oil pro can correct this guess) and then a long horizontal lateral (7000 to 10,000 feet typically in Permian Basin in 2021). It is often correctly pointed out that I am not an oil man, so I will leave it to those who know to explain how it works if they care to share their knowledge.

Regarding deepwater wells using a single vertical wellbore for multiple laterals : What is common is to perform alot of sidetracks out of a single wellbore. A well may have 2 or 3 sidetracks over the course of its life, but at any time, production is only coming from the most recent sidetrack. If a producing sidetrack develops mechanical problems, or the well waters out, or depletes, the operator will plug that off and sidetrack out of the mother well.

Thanks Bob.

Bob

Does your comment “but at any time, production is only coming from the most recent sidetrack” also apply to the laterals in the LTO basins. In other words, is only one lateral producing at a time?

Ovi,

See my question to El Dano in an earlier post and his answer. He seems to be a person knowledgeable about tight oil wells, if someone knows more I would love to hear it.

https://peakoilbarrel.com/north-dakota-sinks-us-april-oil-production/#comment-742650

I interpret his answer as the horizontal drilling rig does the whole job except the top 100 feet which is done by a separate “tool” (I am unsure of the distinction between a tool and a rig) and he also says the multi lateral design is not used in tight oil plays, these are used offshore and in some of the giant reservoirs in the Middle East.

Ovi.

The vertical rig count isn’t accurate anyway. There are more rigs running in Kansas than reported by Baker Hughes. Same for Illinois and Indiana.

SS

OK. So the vertical rig count is too low.

Ovi. Not trying to be a pain by posting that.

Those vertical rigs aren’t a huge deal in terms of adding US oil production, as they are merely maintaining production in states that don’t produce a lot of oil.

Probably more to the point, I’m not sure how accurate Baker’s rig count stats are generally. Seems North Dakota state data differs from Baker’s at times, for example.

A likely source for differences is that BH just reports rigs actively drilling on the Friday whereas most jurisdiction reports give rigs on station.

Shallow sand,

That is an interesting fact. Do the states you mention divide up the rigs into oil, gas, and other categories? For Kansas the last date reported is May 6, 2022 and only one vertical rig was reported as active. For Illinois the vertical rigs are reported as 1 (all types)for week ending 7/22/22, and for Indiana for week ending 6/4/22 (last week reported) also one vertical rig was reported.

For North Dakota Baker Hughes reports 34 active horizontal rigs and 2 active vertical rigs. If we exclude the one rig MIRU the count on 7/22 was 42 rigs according to NDIC.

What was the rig active rig count in Illinois for April 29 ? Baker Hughes shows one active rig for all weeks from 10/20/2017 to 7/22/2022 for Illinois (all types of rigs, oil, gas, or other) Since Oct 20, 2017 the one rig has been a vertical rig, but back in 2017 there were horizontal and directional rigs active (only 1 or 2) this is based on Baker Hughes data.

Dennis.

I am just going by the recent quarterly Illinois Oil & Gas Association newsletter, which said 10-12 rigs were drilling in the Illinois Basin; which includes Indiana and Western Kentucky. I know most rigs are in White County, Illinois and across the Wabash River in Posey County, Indiana, near Griffin.

I will also note most of the Illinois Basin wells are horizontal wells, but TVD is under 5,000’. There is one rig running in our shallow field, hasn’t drilled many wells, maybe a dozen or so this summer. Can drill one in 1-3 days depending on if things go smooth and have enough hands.

As for Kansas, that data quoted earlier came from the Independent Oil & Gas Service, Inc. Go to iogsi.com

Thanks Shallow sand,

I hadn’t realized the Baker Hughes data was inaccurate, good to know. Perhaps the way an active rig is defined is different in different places and if so that might explain some of the difference. In the case of Kansas the difference seems too large to explain in this way, strange that Baker Hughes would be off by so much, but good to know. Good data is hard to find.

The most recent Kentucky data at Baker Hughes is from February 2018.

So right now bond yields are crashing lower.

FED’s funds rate which is the overnight lending rate is at 2.50% while 10 year is at 2.65%

Just 15 basis points.

There likely won’t be another rate hike. Not that it really matters what they do at this point.

Ship is going to sink regardless of what they do.

Bonds are collapsing—-

When reading financial news they expect the FED has to turn back to negative interest rates and lot’s of new QE soon to fight recession.

So stocks are already soaring and interrest rates crashing to the lows.

Oil is still undecided – is the recession stronger or the hope of enough FED support for cheap credit.

Good summary of Powell’s speech. If Wall Street thinks the Fed is lowering rates before mid 2023 they are not paying attention to what they are being told. CPI at 9% and fed rate at less than 3% right now, so real interest rate is about negative six.

https://wolfstreet.com/2022/07/27/powell-puts-75-basis-point-hike-on-table-for-sept-fed-determined-to-get-inflation-down-come-heck-or-high-water-most-hawkish-fomc-press-conference-i-ever-watched/

QE is a big part of the problem. If you put collateral onto FED’s balance sheet it leaves little collateral for market to function properly.

Not enough collateral to meet everyone’s needs in REPO market. Which is why we are see a spike in REPO fails to tune of a 1/2 trillion dollars.

T-bills yielding less than the FED’s fund rate is a sign of collateral shortage.

We are experiencing a dollar shortage due to collateral shortage. Only treasury can fix this by issuing more T-bills and make damn sure the FED doesn’t put them on its balance sheet.

What can be done?

The FED can fasten QT and dumping a few trillion hoarded bills on the market to provide collateral.

Problem: Buyers need the have the bank reserves to buy them, since these bank reserves will be destroyed in the move. The monetary base will shrink fast – these dumped bills have to create new money fast or we get a severe recession.

As you suggested, the government can start a spending binge and finance it with T-Bills while spending the money on their favourite political projects. Free health care for everyone, social security for everyone free, free education and so on, no problem to dump a few trillion into the market while creating new economic impulses.

Without QE, long term interrest rates will soar then due to the rising indebtness. Even when the rating stays – when the debt of the US government nears 200%, it’s more an Italy or Greece situation. And Greece is only stable at the moment because everyone knows the ECB has it’s fingers 2 mm over the “buy a lot” button.

So, for solving the just now problems, new longer term problems will be created. There is a crossroad now, all actions now will have much future impact.

Did you see that he reconciliation bill that was put forward?

Things have to breakdown vastly further for us to see any meaningful government spending.

Heck the bill that was put forward even talked about paying down some of the debt which is the most laughable thing I’ve heard in a really long time.