A guest post by Ovi

All of the oil (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM. After the production charts, an analysis of three EIA monthly reports that project future production is provided. The charts below are updated to June 2021 for the 10 largest US oil producing states.

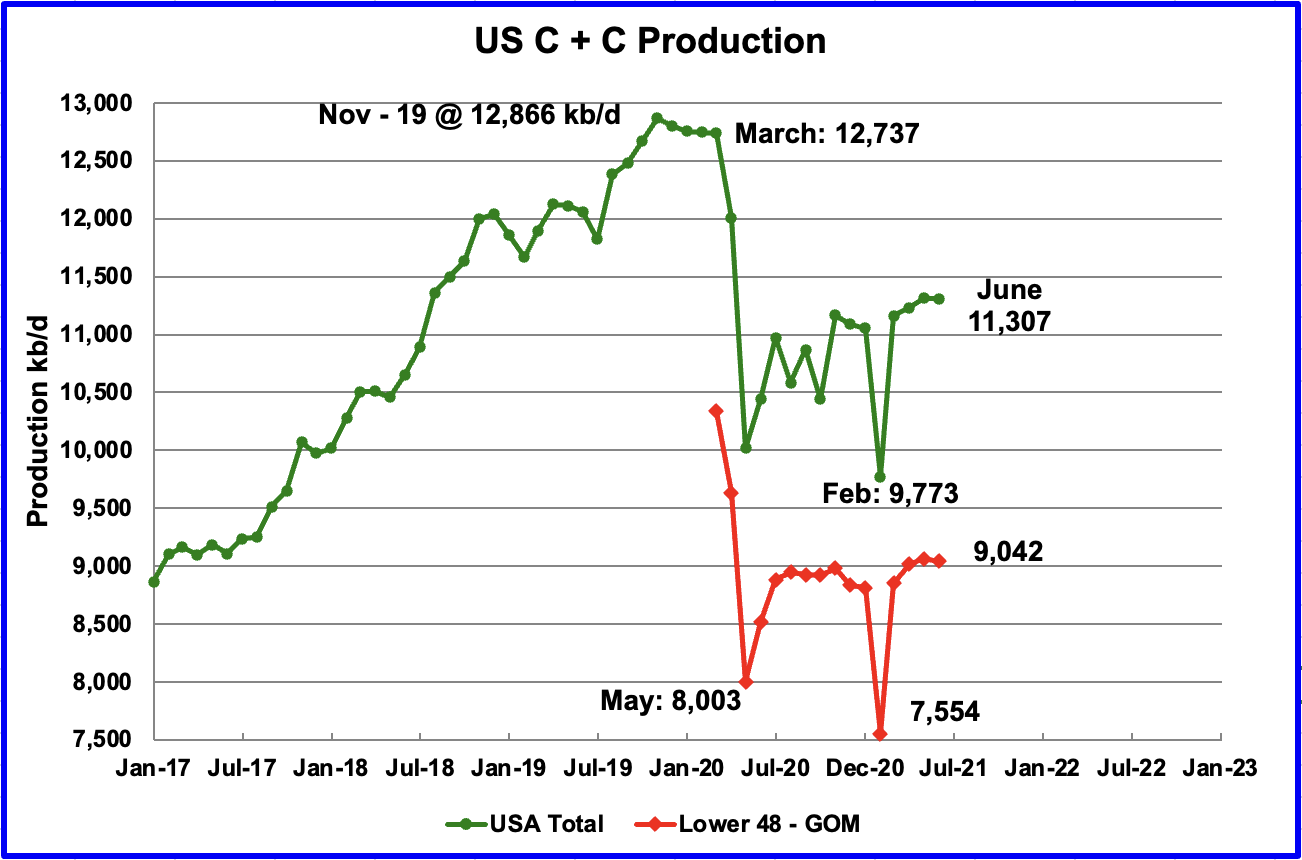

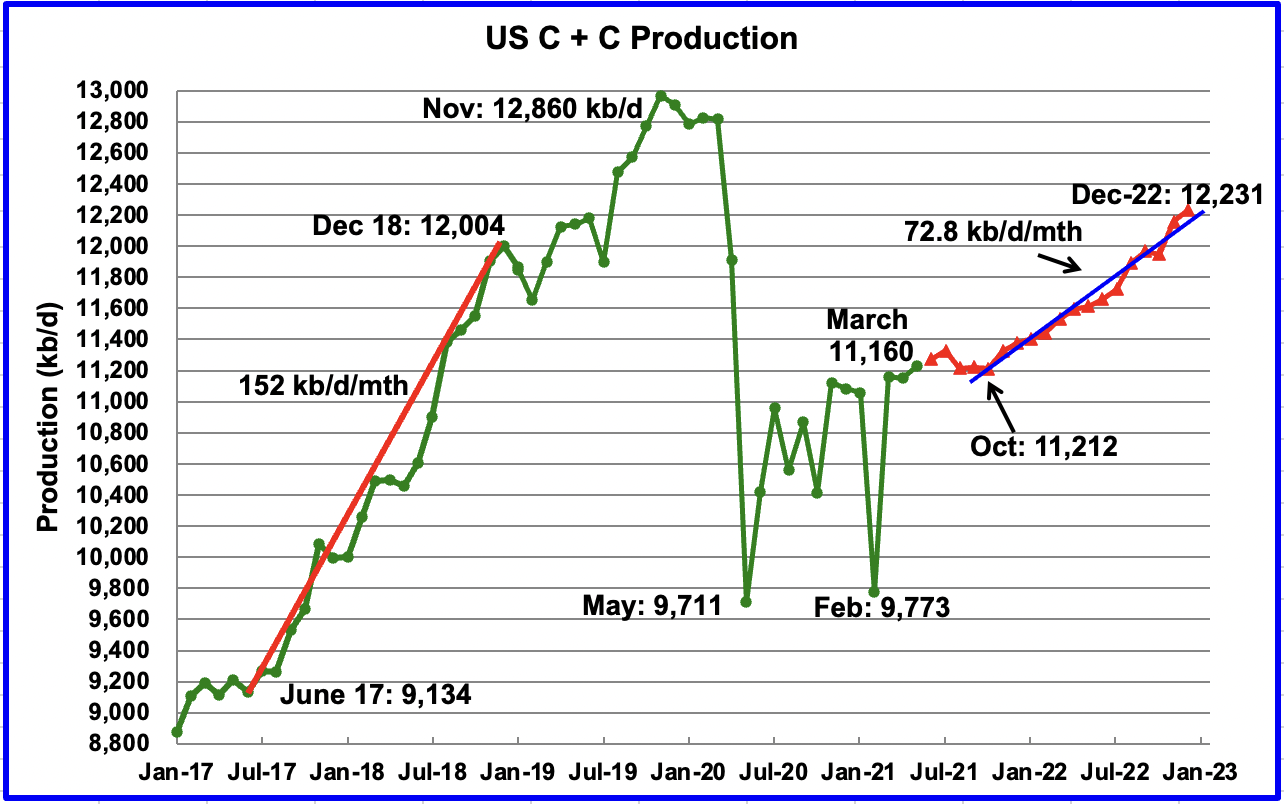

U.S. June production was essentially flat, only down by 5 kb/d from May. The revision to May was a surprise. May was revised up by 81 kb/d to 11,312 kb/d. From March to June, production increased by 147 kb/d or 49 kb/d/mth on average. June has now exceeded November’s previous high of 11,168 kb/d.

The August STEO report forecast US June output would be 11,270 kb/d, a reasonable forecast, low by just 37 kb/d.

In the onshore lower 48, June production decreased by 20 kb/d to 9,042 kb/d, red graph. Overall, production was little changed in the three US regions, US L48 onshore, GOM and Alaska.

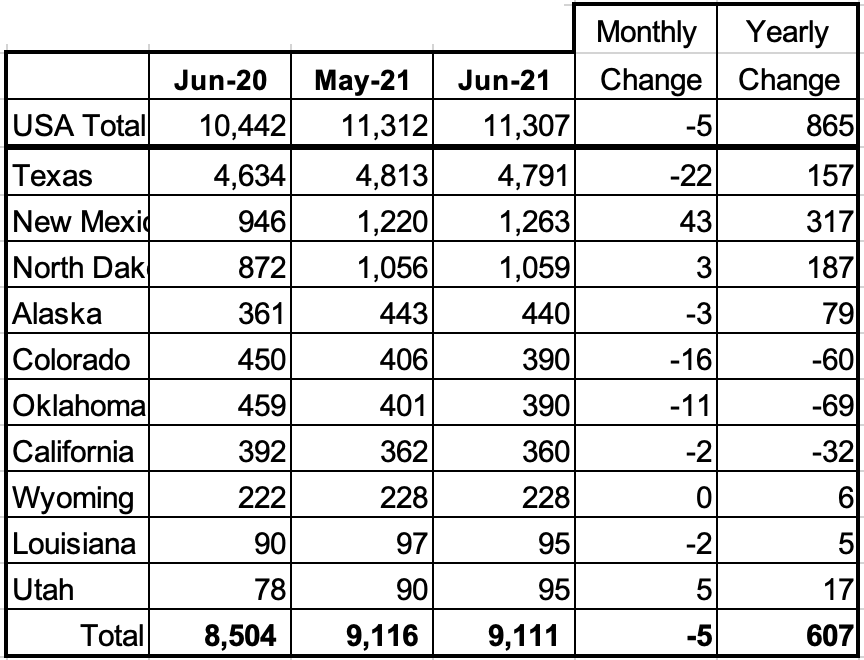

Ranking Production from US States

Listed above are the 10 states with the largest US production. These 10 accounted for 80.6% of US production out of a total production of 11,307 kb/d in June 2021.

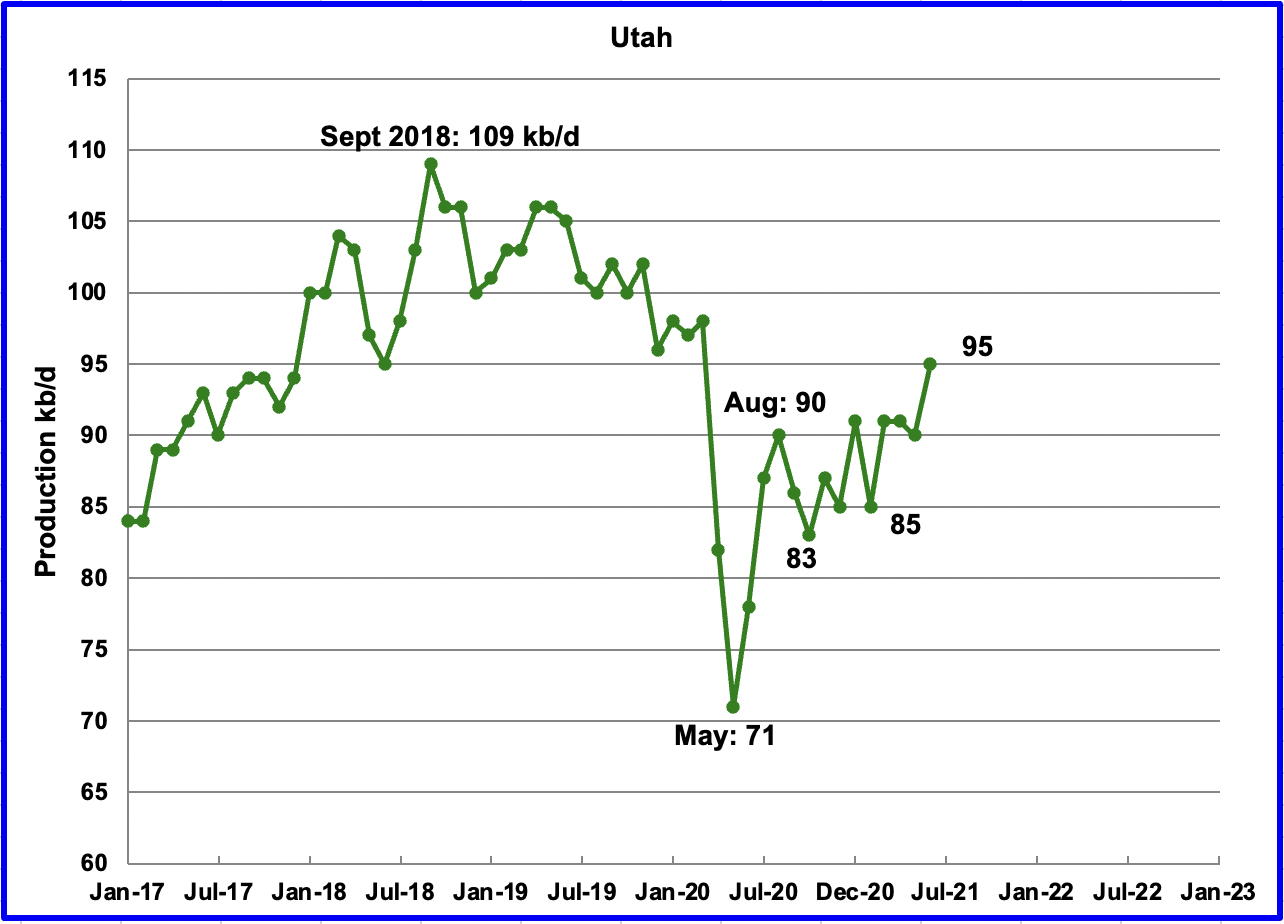

On a MoM basis, again the largest increase came from New Mexico, 43 kb/d. Surprisingly, Texas dropped 22 kb/d in both May and June. On a MoM basis, only New Mexico, North Dakota and Utah were able to increase production.

Production by State

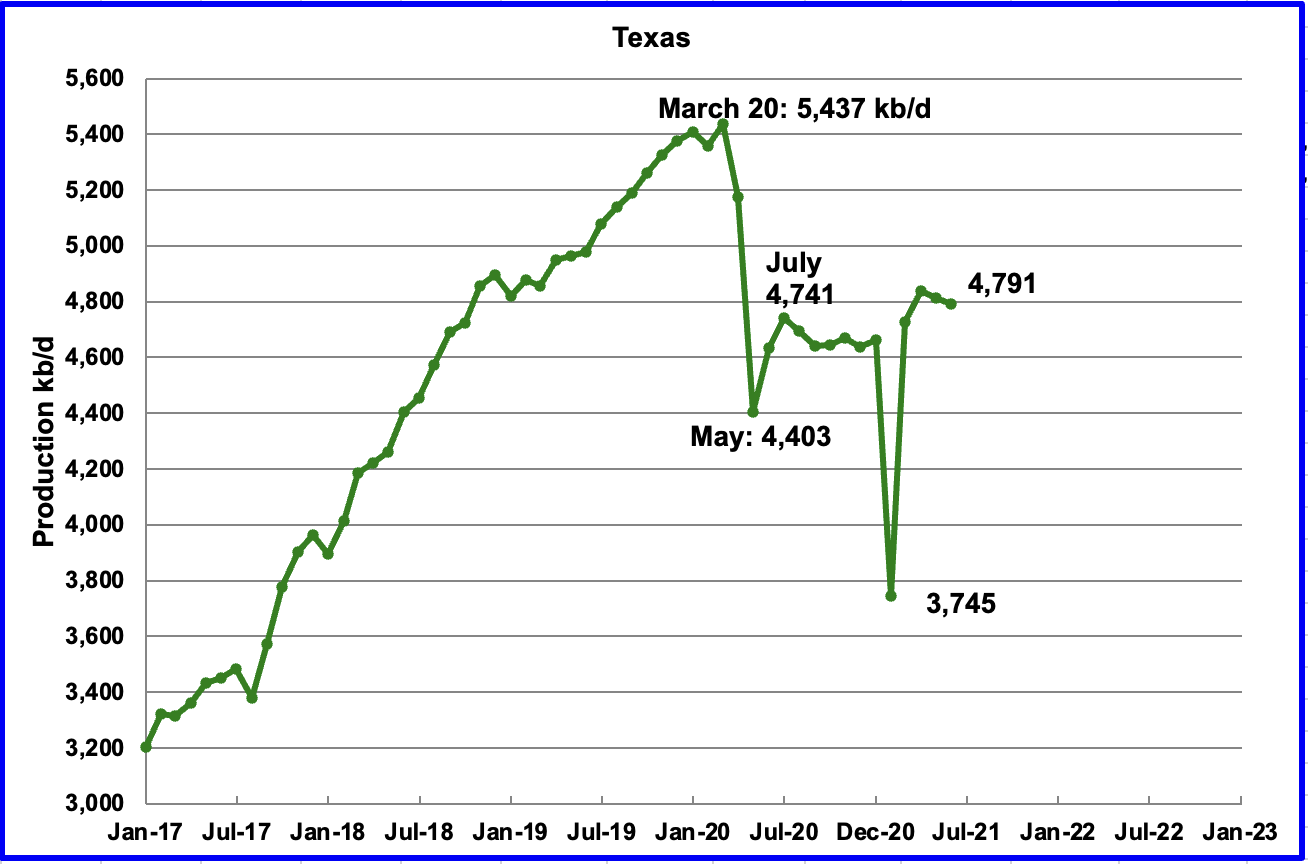

Texas production decreased by 22 kb/d in June to 4,791 kb/d. In the EIA’s August report, May’s output was revised up by 81 kb/d from 4,741 kb/d to 4,813 kb/d. Note that Texas production decreased for two consecutive months.

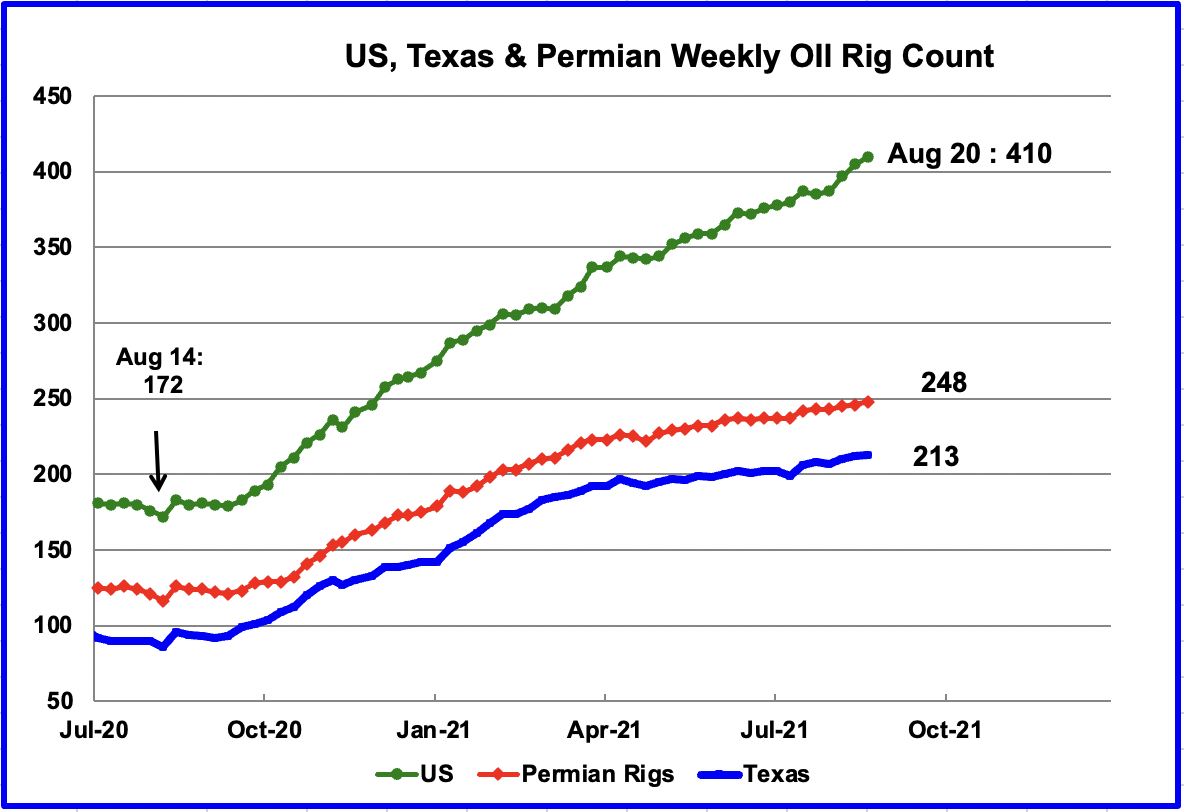

In June there were close to 200 oil rigs operation in Texas. By the week of August 27, 213 were operating.

June’s New Mexico production increased by 43 kb/d to 1,263kb/d. June’s output is another new record. New Mexico had 75 rigs operating in the Permian in June and they increased to 78 in the week of August 27.

According to this source: “New Mexico’s rising status as a key supplier reflects its cost advantage. U.S. oil and gas companies have been judicious in raising output after many producers pledged to cap spending and focus on returning more capital to shareholders. To that end, the Permian’s New Mexico is being favored over North Dakota, where higher production costs have historically curbed profits.”

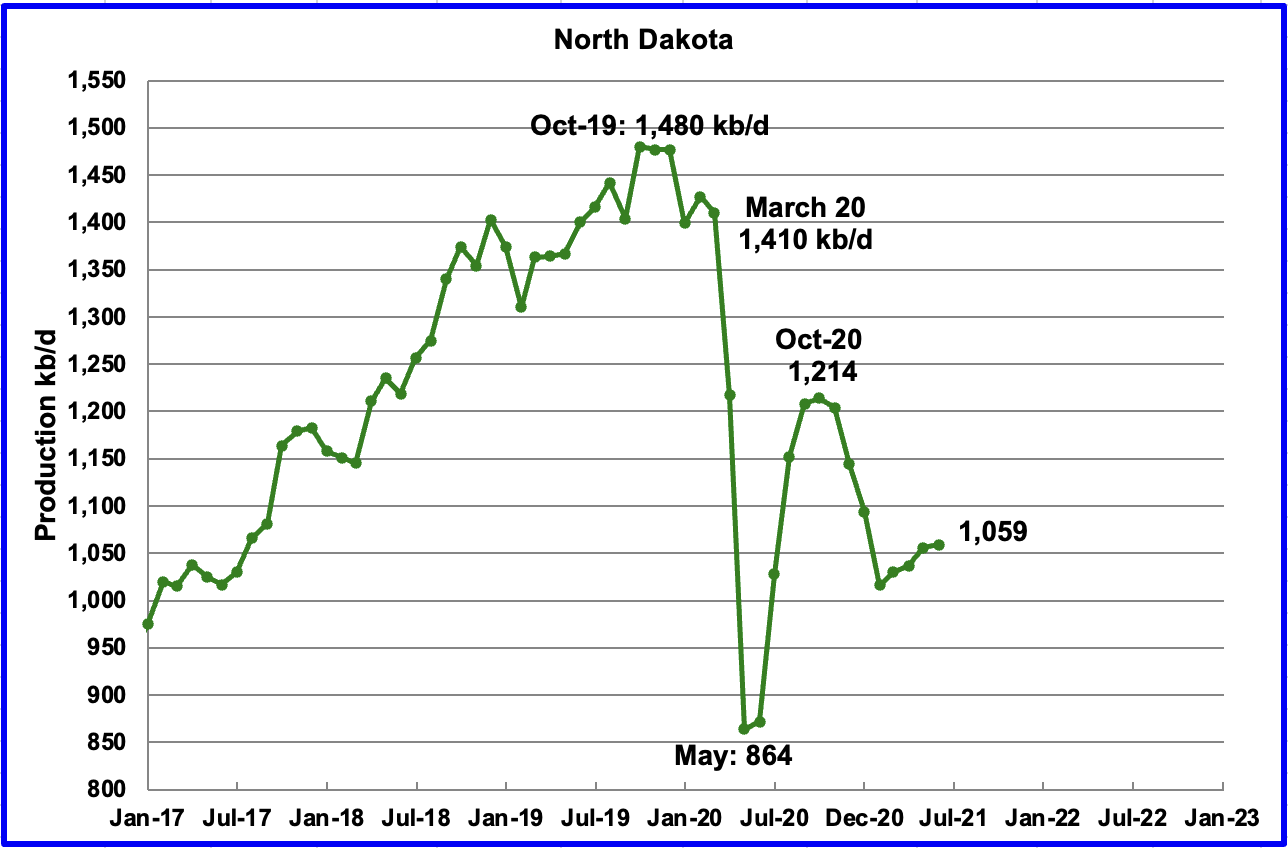

According to the EIA, June’s output was 1,059 kb/d, an increase of 3 kb/d over May. The June report revised up May’s output from 1,029 kb/d to 1,056 kb/d.

According to this source, fracking crews are hard to come by in North Dakota.

North Dakota’s Bakken Shale oil production under-performed in its most recent monthly statistics, reflecting a “serious shortage of hydraulic fracturing (fracking) crews,” the state’s chief oil/natural gas regulator Lynn Helms reported Tuesday.

Helms told a webinar with reporters that he expects to see improvement in the summer months, but the May statistics — 34.9 million bbls (1.127 million b/d) compared to 33.6 million bbls (1.123 million b/d in April) — come with eight fracking crews in the field compared to the usual 20-25 such crews at the current level of prices around $60/bbl.

“Operators are trying with all their resources to hire, but they are not finding employees who want to come back to the industry and come back to North Dakota, ” said Helms, director of the Department of Mineral Resources. “Pre-Covid-19 pandemic we had 25 frack crews, and during the deepest part of the pandemic we went down to one crew.”

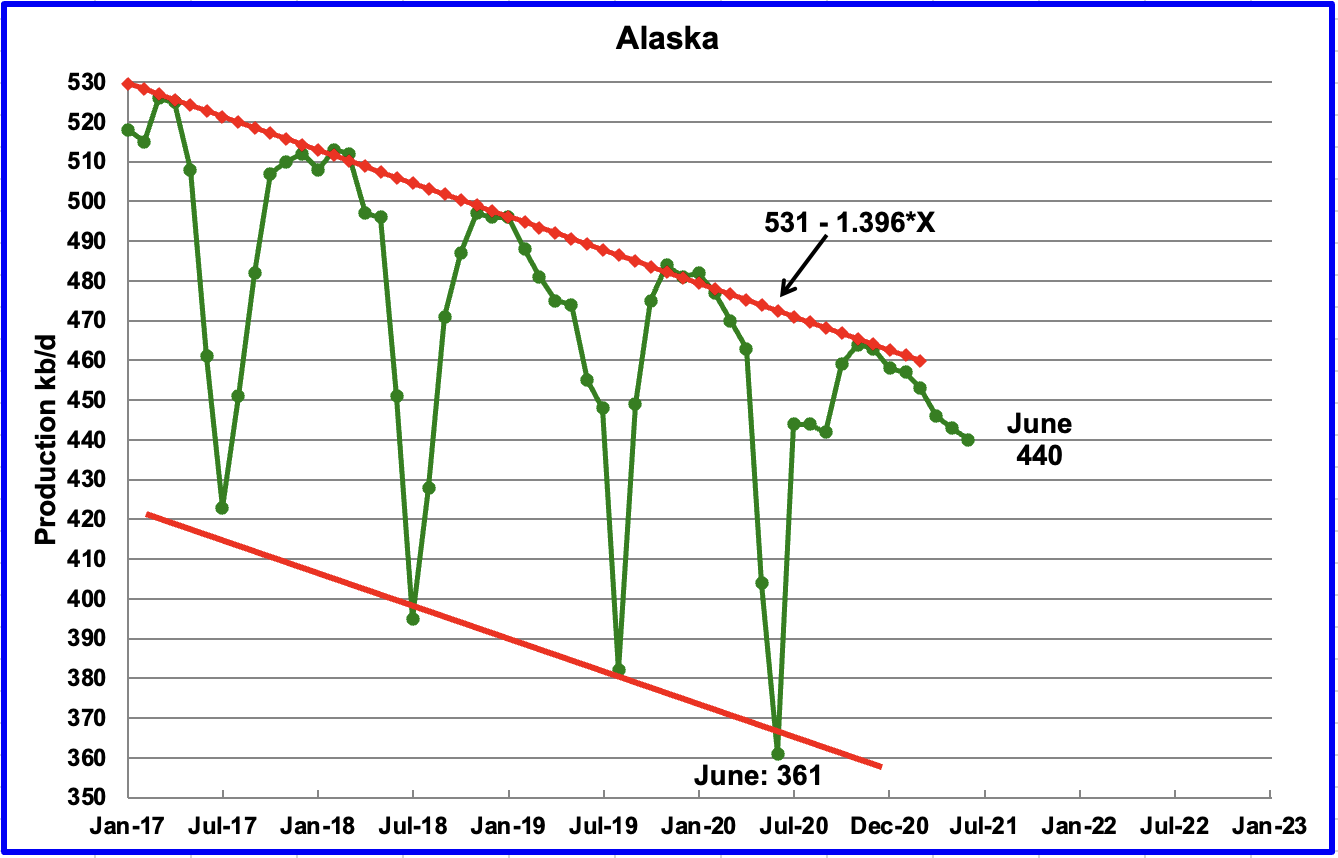

Alaskaʼs June output decreased by 3 kb/d to 440 kb/d.

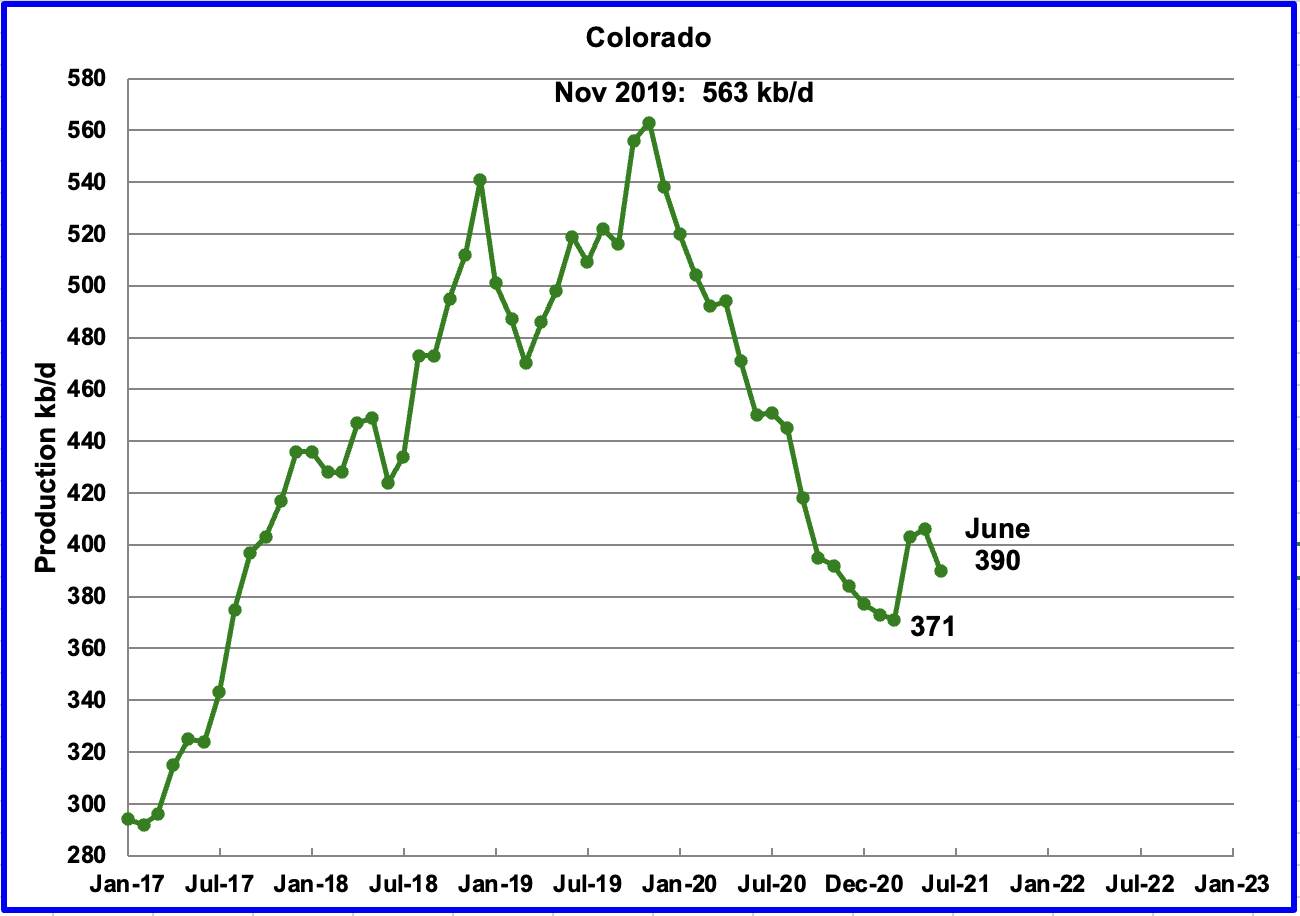

Coloradoʼs June output decreased by 16 kb/d to 390 kb/d.

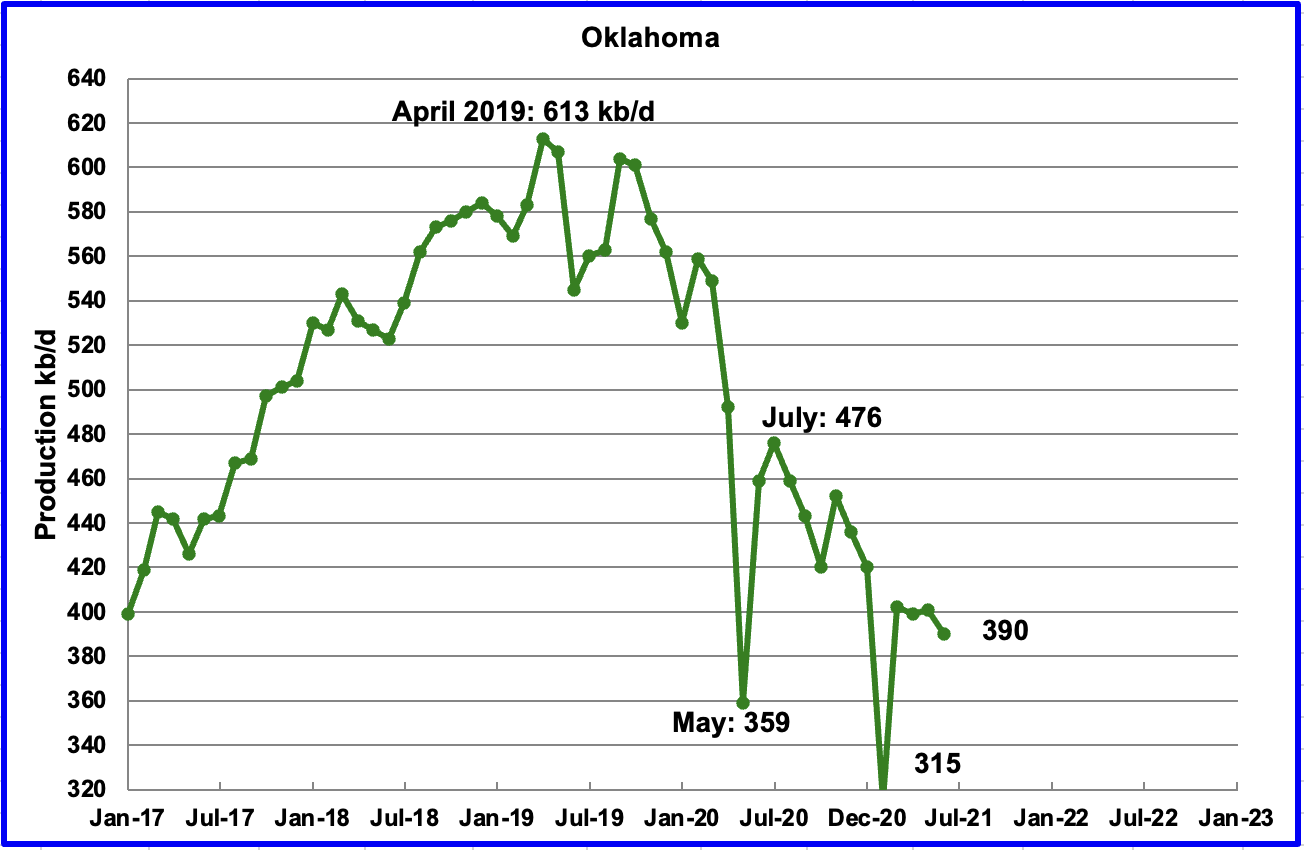

Oklahoma’s output in June declined by 11 kb/d to 390 kb/d. At the end of June, 27 rigs were operating. From the beginning of May to the end of June, the rig count increased from 21 to 27. Increasing rigs and decreasing production?

By the week of August 27 the rig count had increased to 31.

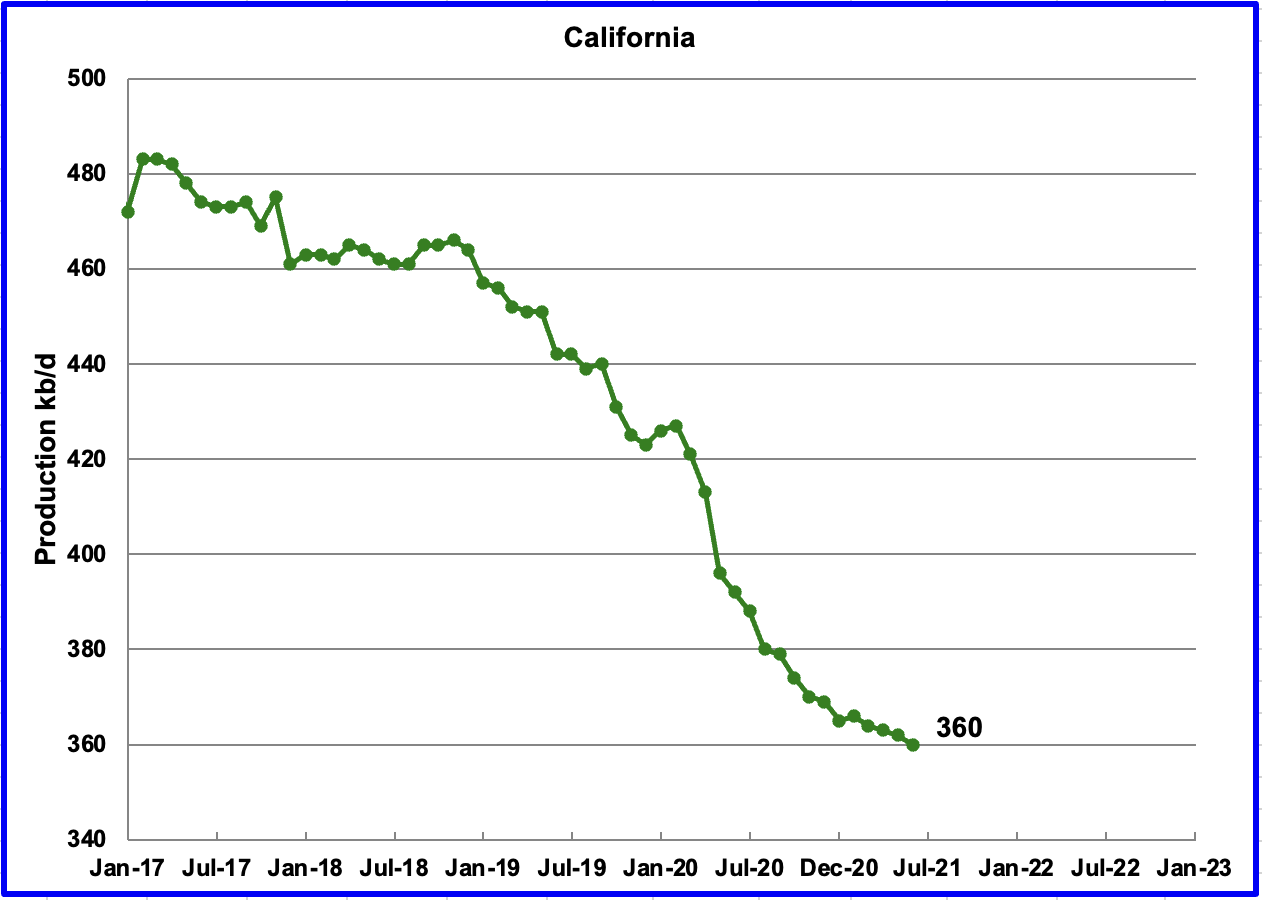

Californiaʼs slow output decline continued in June. Its production decreased by 2 kb/d to 360 kb/d.

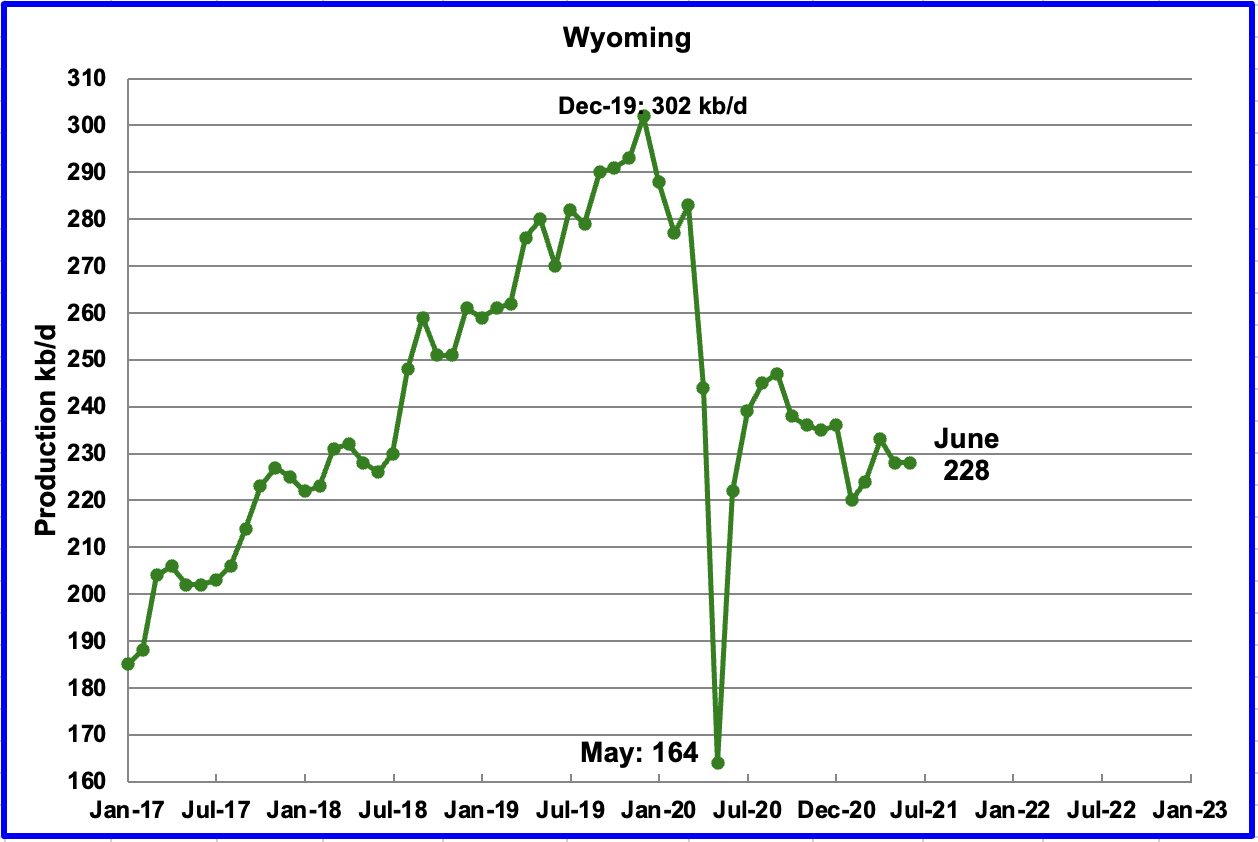

Wyomingʼs production in June was unchanged at 228kb/d. Wyoming had 3 oil rigs operating in May and they increased to 17 by late August.

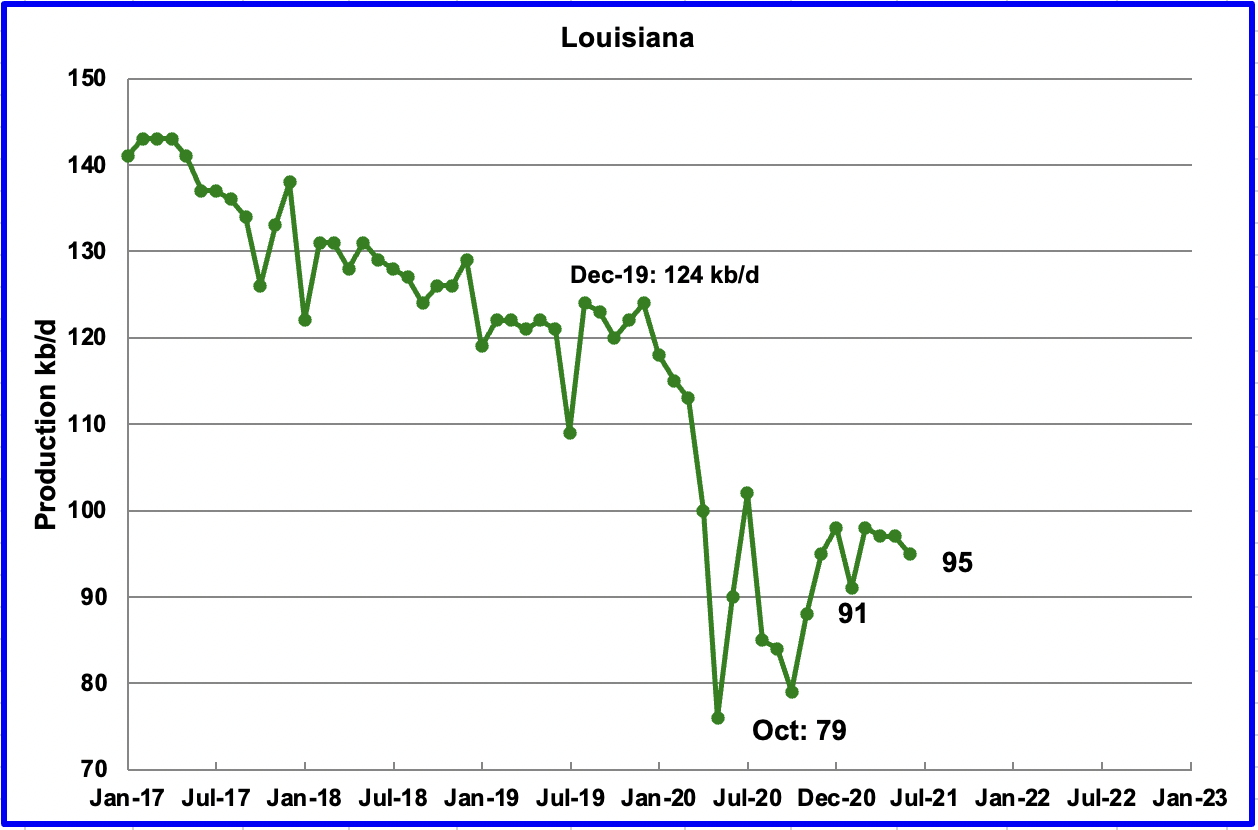

Louisianaʼs output was down 2 kb/d in June to 95 kb/d.

June’s production increased by 5 kb/d to 95 kb/d. Ten oil rigs were operational in June and were increased to 11 by the fourth week of August.

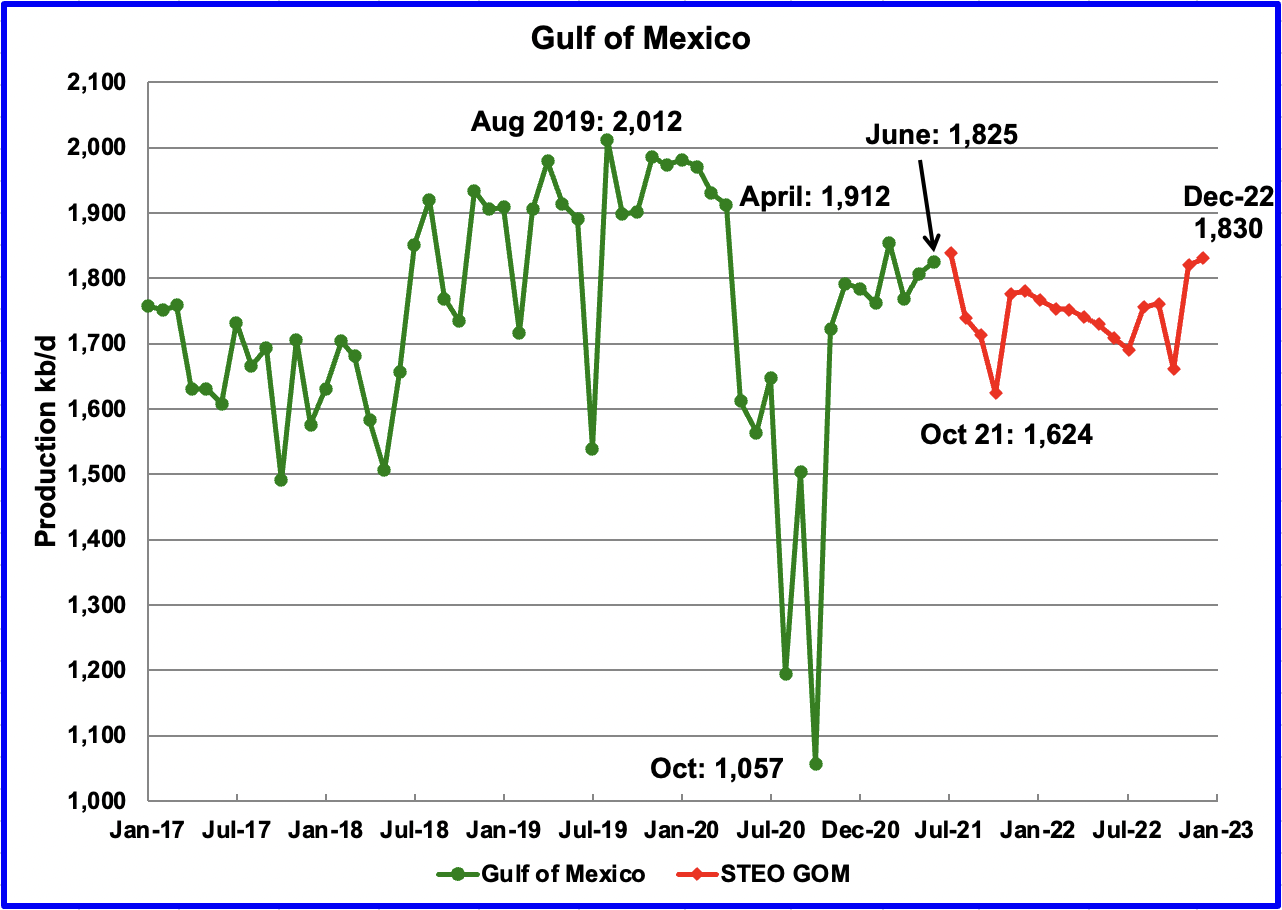

Production from the GOM increased in June by 18 kb/d to 1,825kb/d. If the GOM was a state, its production would rank second behind Texas.

The August STEO projection for the GOM output has been added to this chart and projects output to be 1,830 kb/d in December 2022, little changed from the current August output level.

From July 2021 to October 2021, production drops by over 200 kb/d. Is this due to maintenance or an expected high hurricane season? Ida just hit Louisiana hard in late August taking most of the Gulf platforms off line. Also, why does output drop from December 2021 to July 2022? Is this natural decline?

1) Short Term Energy Outlook

The STEO provides projections for the next 13 – 24 months for US C + C and NGPLs production. The August 2021 report presents EIAʼs updated oil output and price projections to December 2022.

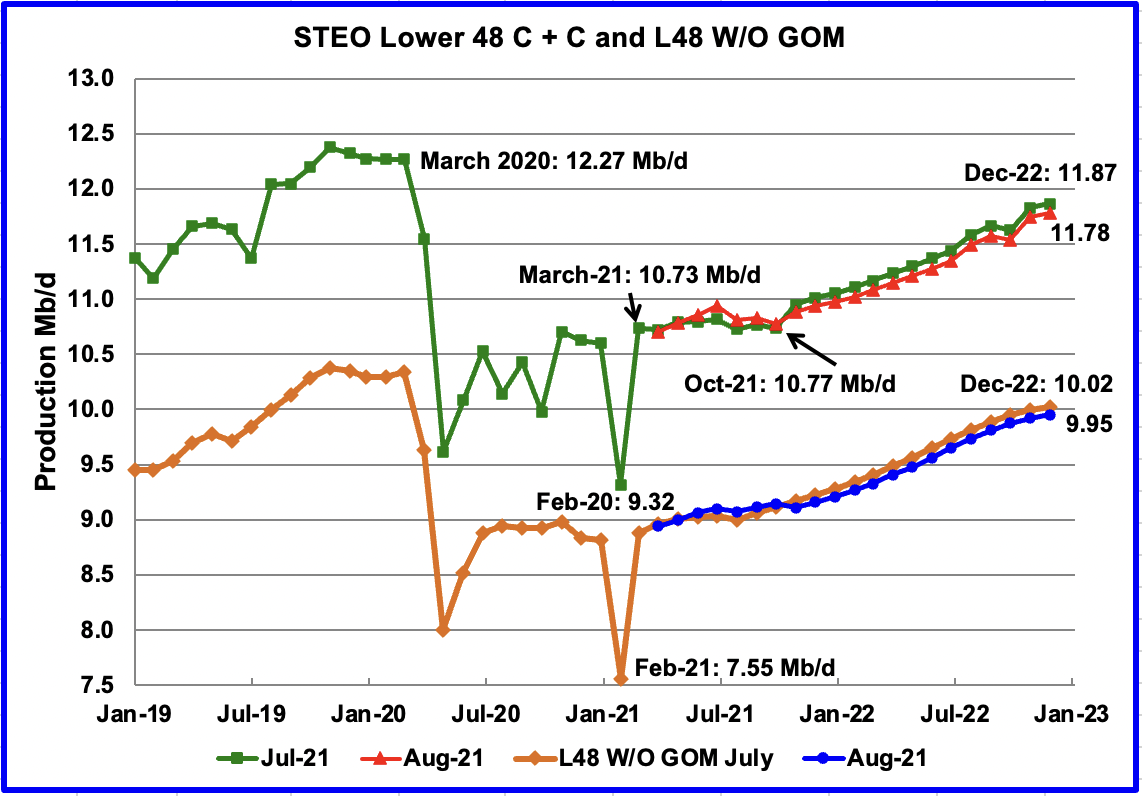

There has been a small revision in the August STEO outlook. The December 2022 output has been reduced by close to 80 kb/d and there is a small output increase in July before it drops back to 11,200 kb/d in August 2021. Production then begins to climb in an almost linear manner from November 2021 to December 2022 at an average rate of 72.8 kb/d/mth. It is not clear why output begins to climb almost linearly after November.

The August STEO output projection for the L48 states is very similar the one provided in the July report except for the output decrease of roughly 90 kb/d from late 2021 to 2022. Similarly for the lower 48, the August projection is close to 80 kb/d lower than the July estimate.

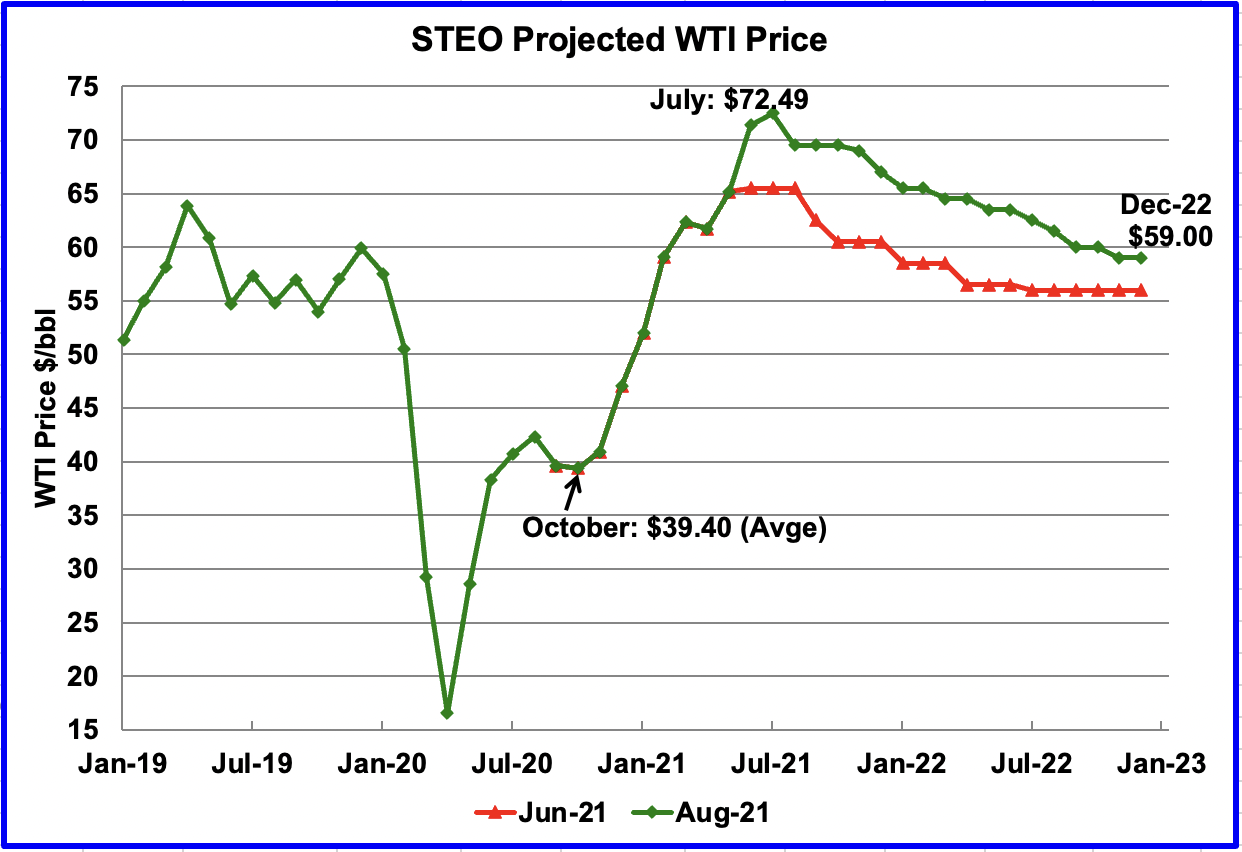

The August 2021 STEO oil price forecast shows a steady decline from the peak in July $72.49 to $59 in December 2022. The December 2022 price projection is down $2 from $61 in the July report

The October WTI contract settled at $68.50 on August 31, slightly lower and reasonably close to the EIA projection of $69.50.

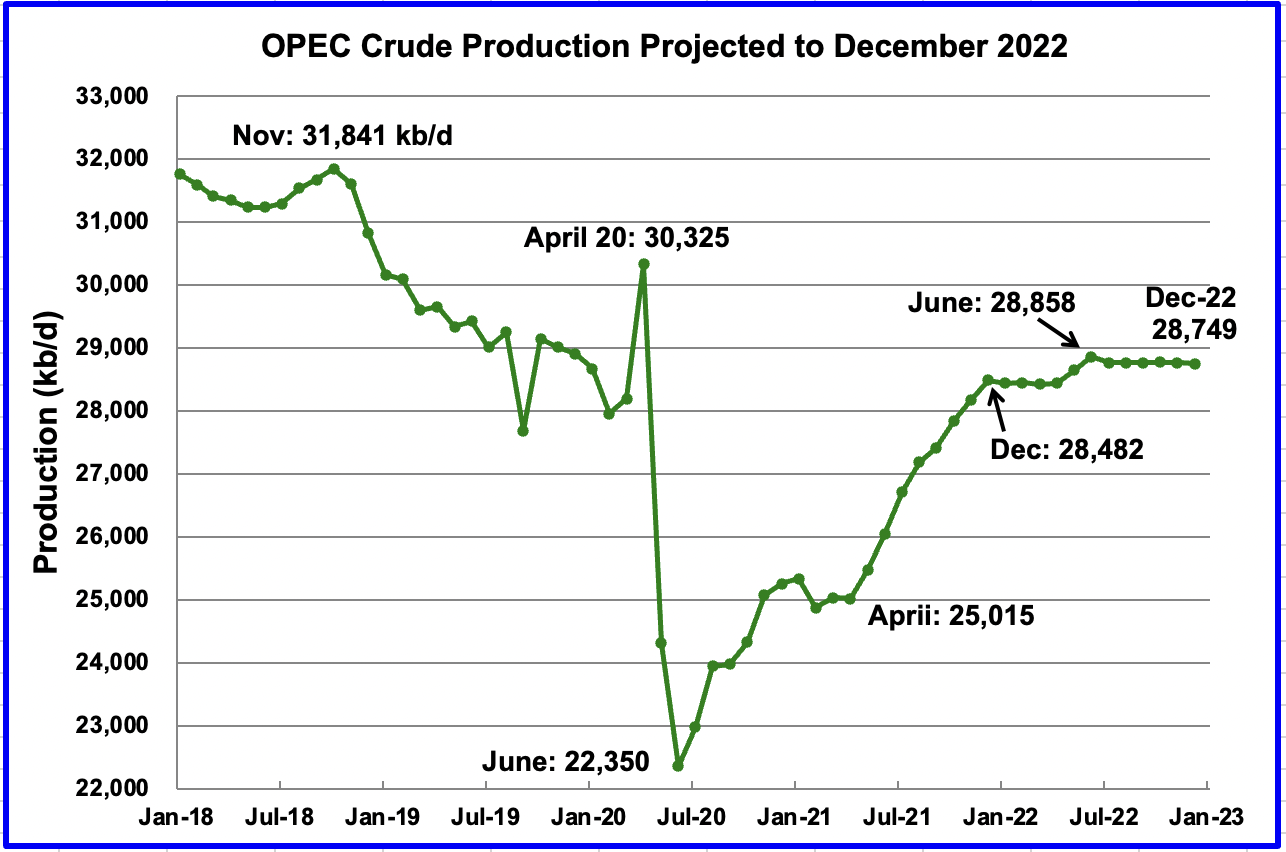

This chart shows the STEO’s August forecast for OPEC crude output to December 2022. OPEC’s output is projected to increase from April 2020 to December 2020 by close to 3,450 kb/d. For July 2020, EIA forecast production to be 26,710 kb/d. Actual production as reported by OPEC was 26,657 kb/d.

In July, OPEC + announced they will add 400 kb/d/mth from August to December for a total of 2,000 kb/d. Of the 2,000 kb/d, OPEC will add 1,772 kb/d, or 88.6%, according to the EIA. The EIA’s projected OPEC monthly increases for August to December are, 470, 230, 425, 329, and 319, respectively.

OPEC’s production for the second half of 2022 is projected to be flat and virtually the same as OPEC’s output on January 2020, just prior to the onset of the pandemic.

According to this preliminary report: The Organization of the Petroleum Exporting Countries has pumped 26.93 million barrels per day (bpd), the survey found, up 210,000 bpd from July’s estimate. Output has risen every month since June 2020, apart from in February.

The EIA August STEO report estimated that OPEC would produce 27,180 kb/d in August, 250 kb/d higher than the preliminary report.

2) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The following charts are updated to September 2021.

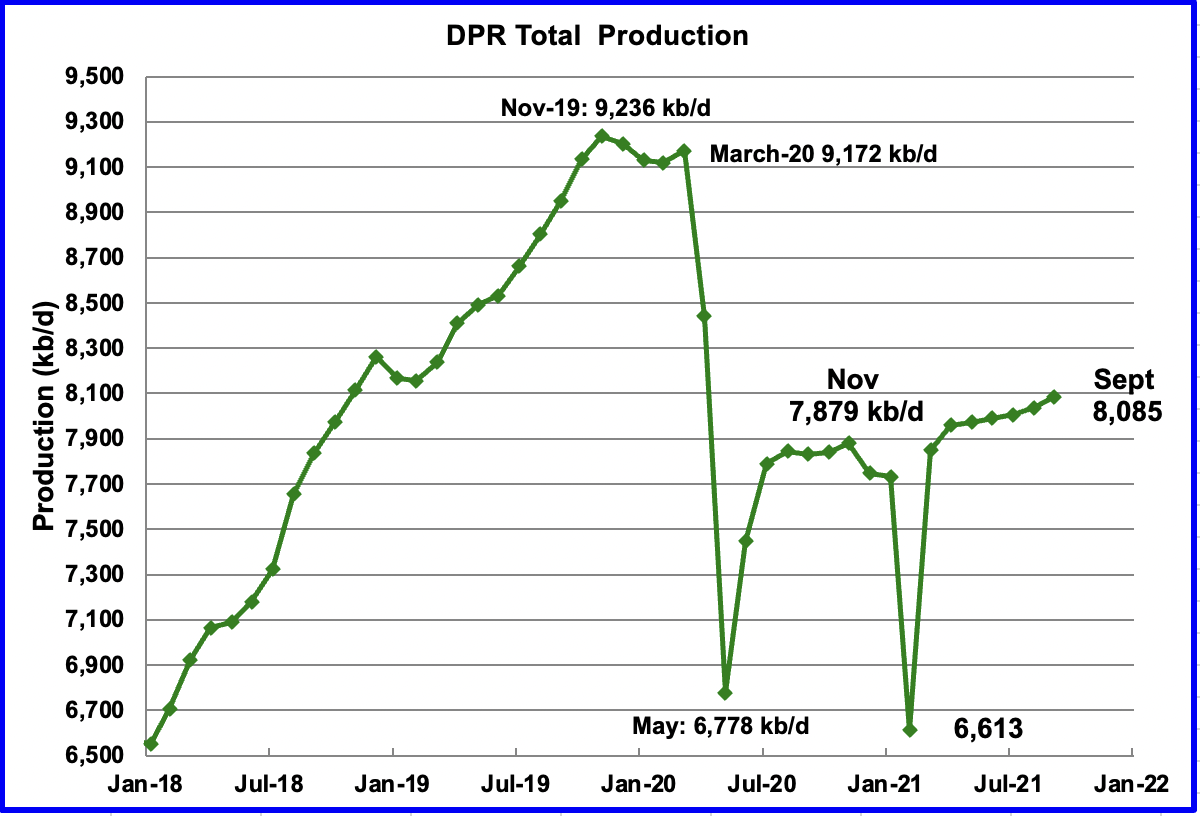

Above is the total oil production from the 7 DPR basins that the EIA tracks. Note that the DPR production includes both LTO oil and oil from conventional fields

The DPR is projecting output for September 2021 to increase by 48 kb/d over August to 8,085 kb/d. From March to September, output in the DPR is forecast to increase by 235 kb/d or close to 40 kb/d/mth and appears to be accelerating.

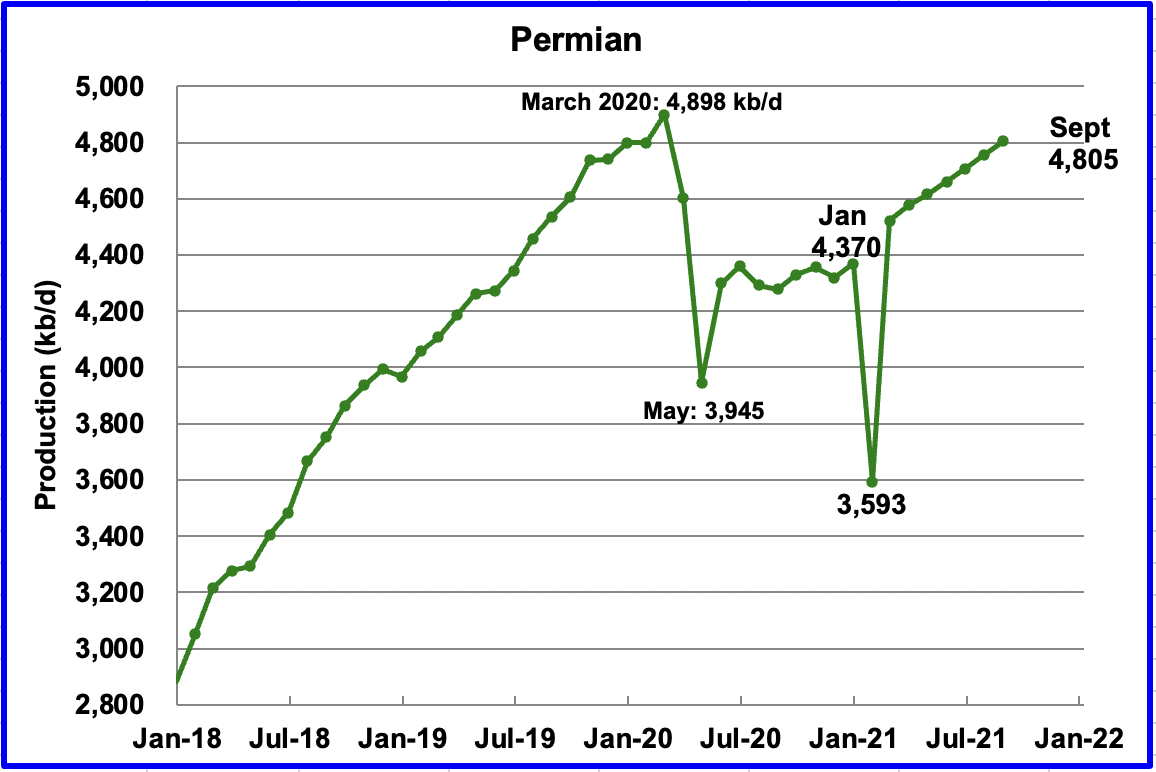

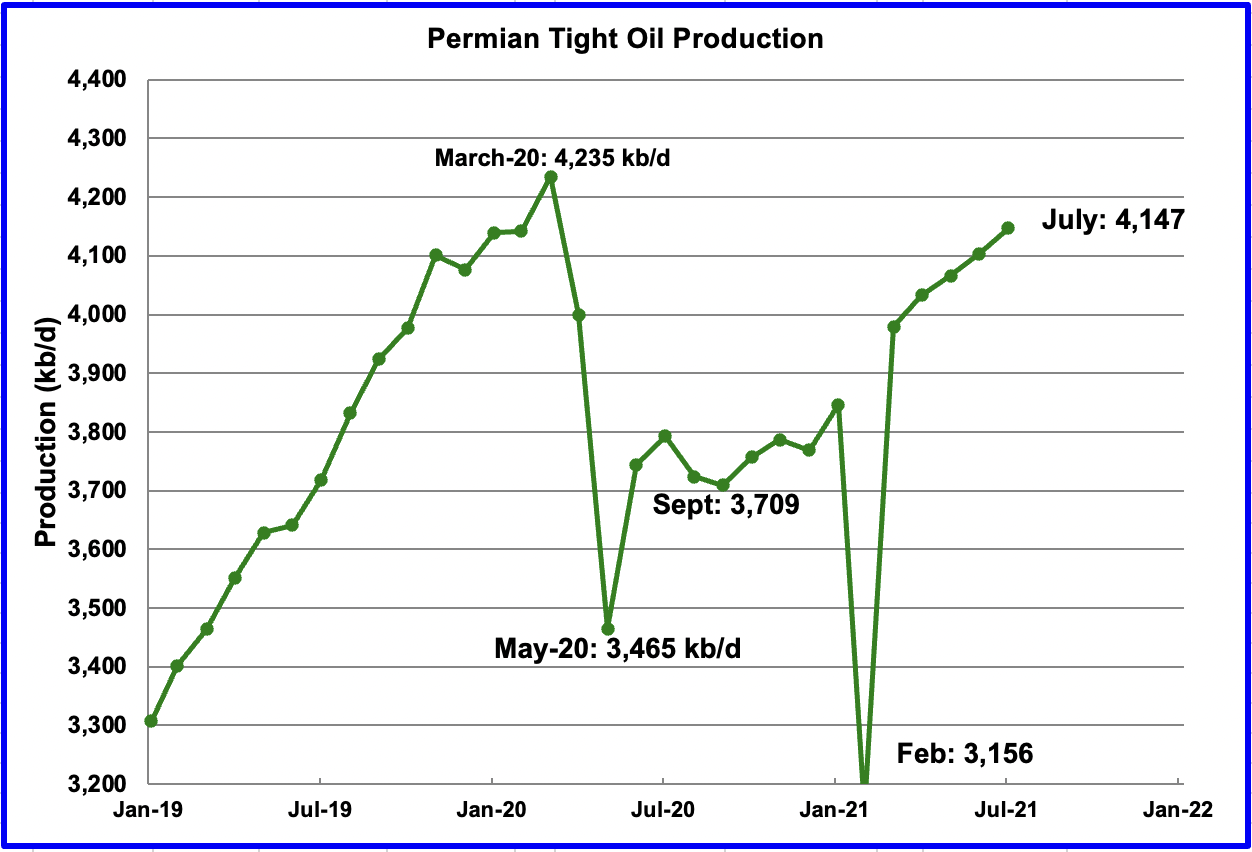

Permian output in September 2021 is projected to be 4,805 kb/d, up by 49 kb/d from August. From March to September production increased by 284 kb/d or approximately 47.3 kb/d/mth. At this rate, Permian production will exceed the March 2020 peak of 4,898 kb/d in November .

During July, close to 239 rigs were operating in the Permian, up from 100 in November. These were increased to 244 in August and are more than sufficient to increase production in the Permian.

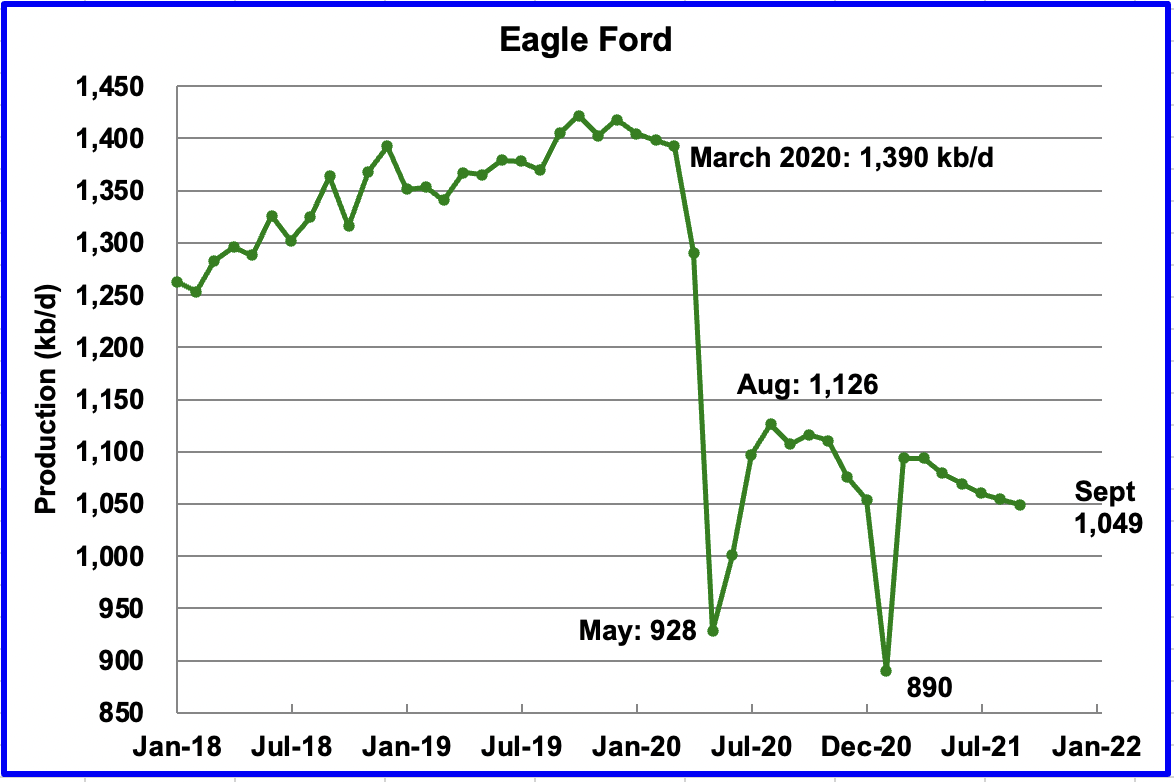

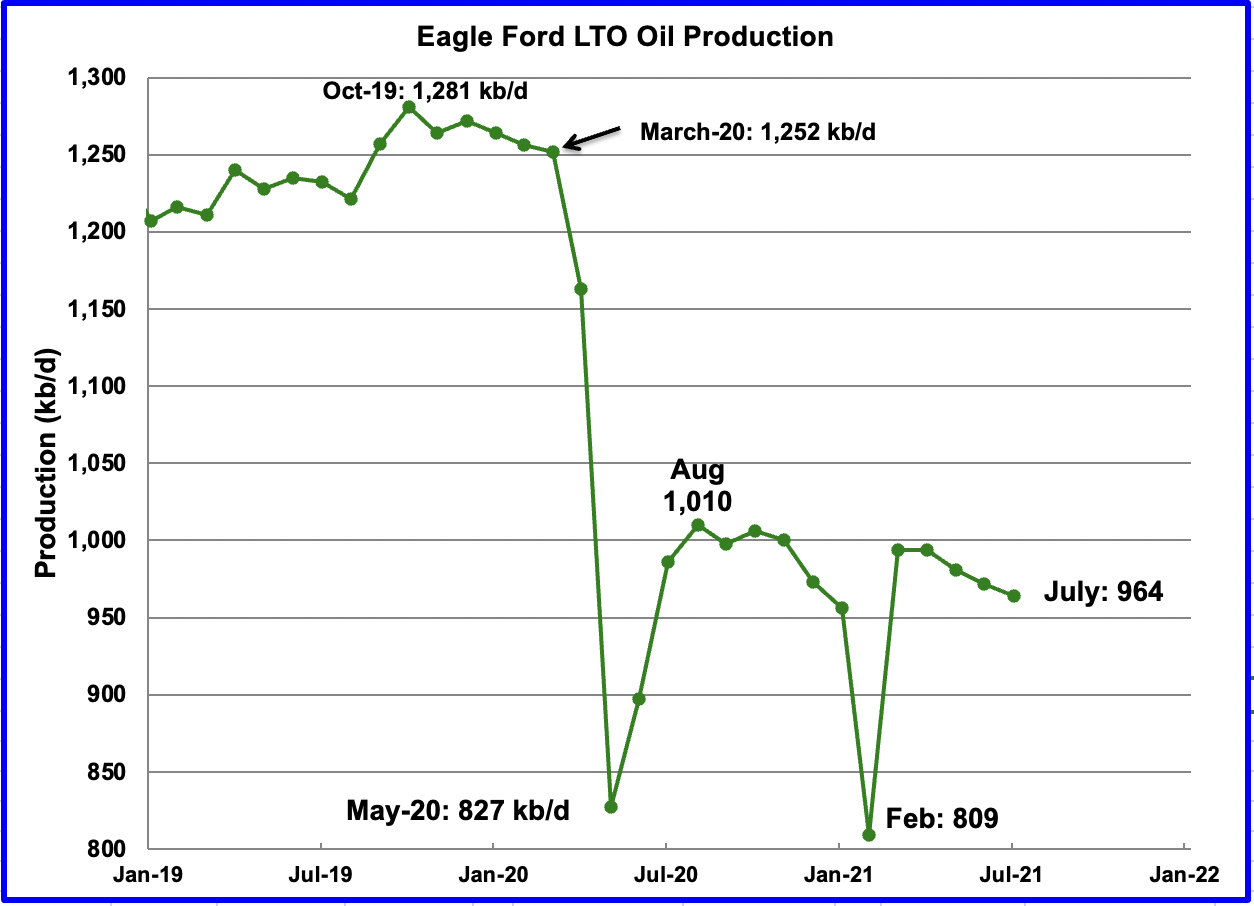

The forecast for the Eagle Ford basin has shown a dropping but slowing output for six consecutive months. Output is expected to drop by 5 kb/d in September to 1,049 kk/d.

It should be noted that the August update has revised last month’s August output from 1,039 kb/d to 1,054 kb/d. The DPR forecasts continue to under estimate production from the LTO basins.

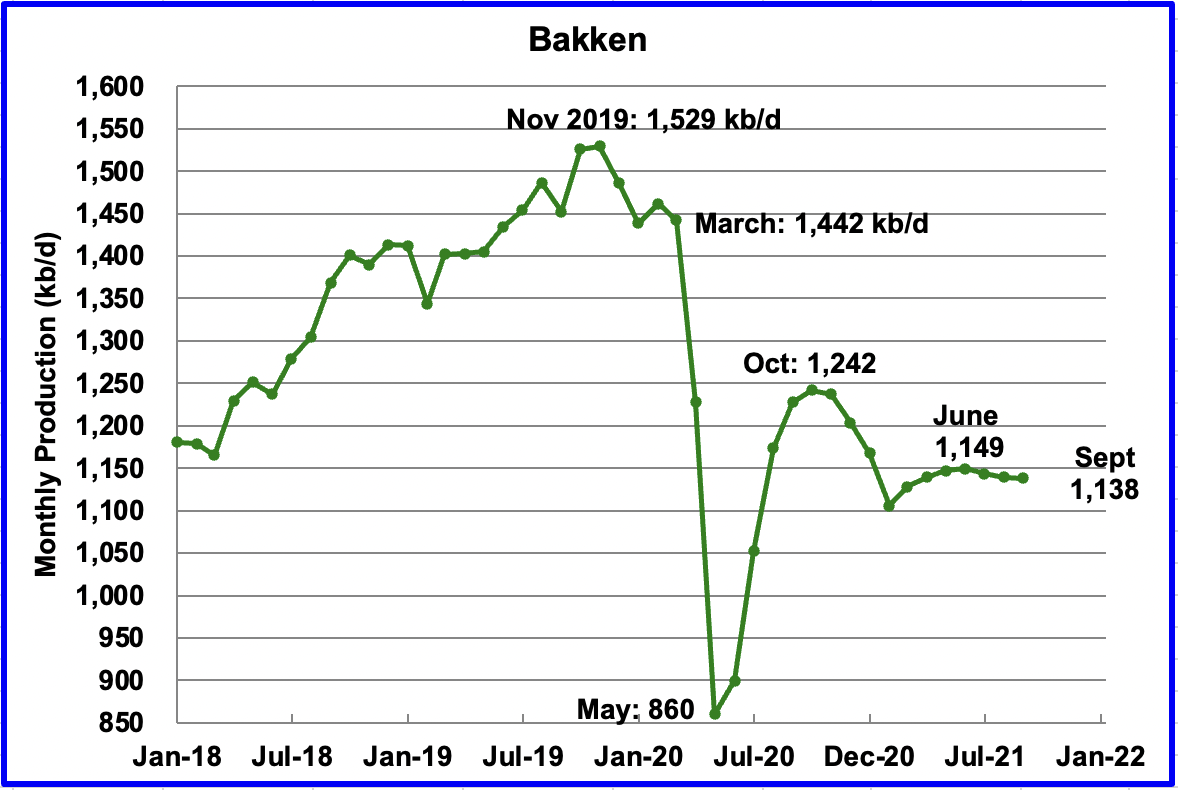

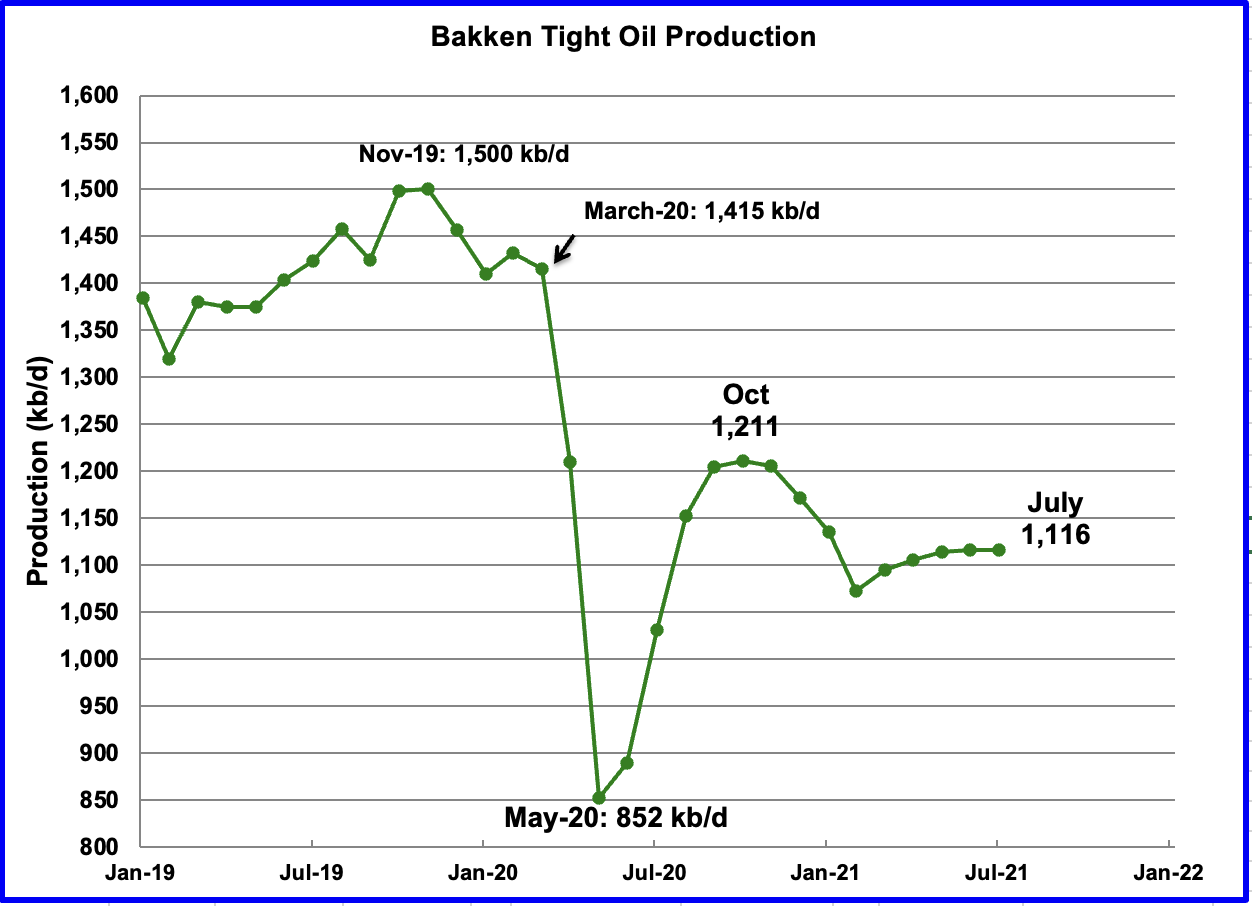

The DPR forecasts Bakken output in September to be 1,138 kb/d a decrease of 1 kb/d from August.

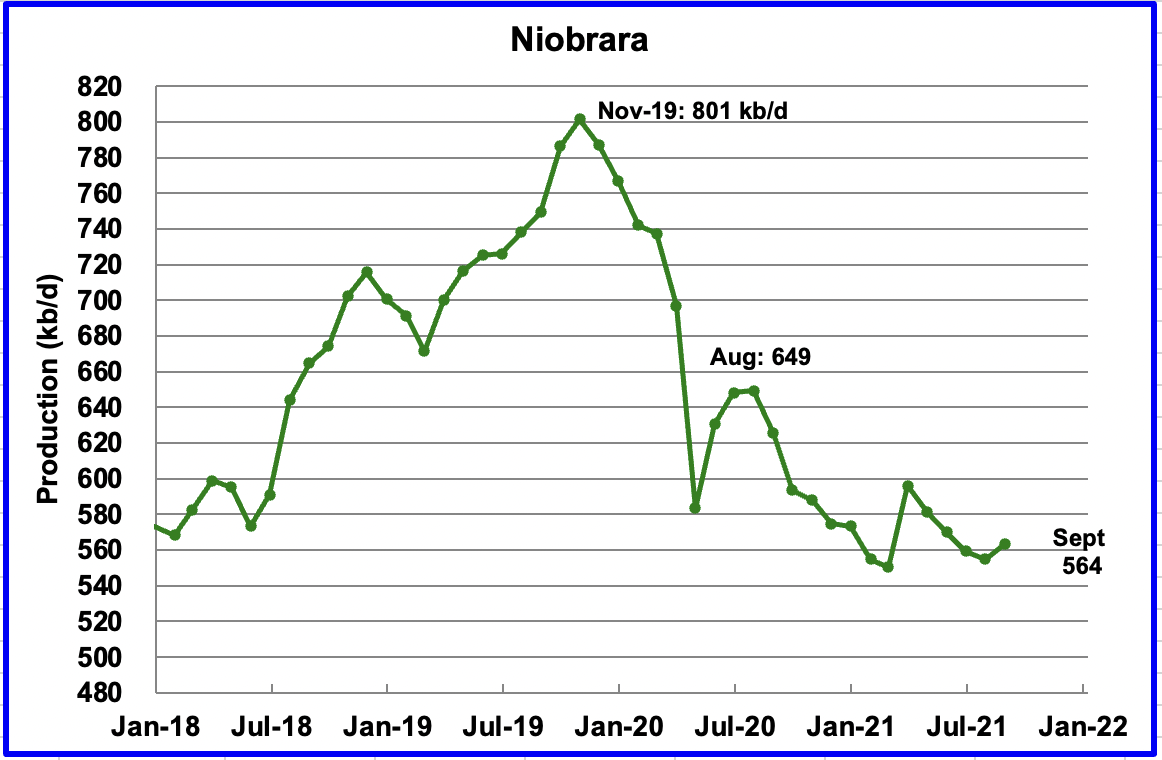

Output in the Niobrara reached a new low in August 2021, 555 kb/d. However, September is forecast to increase by 9 kb/d to 564 kb/d.

The Niobrara is spread over Wyoming and Colorado. In June 7 oil rigs were operating in the Niobrara. By August, they had increased to 12.

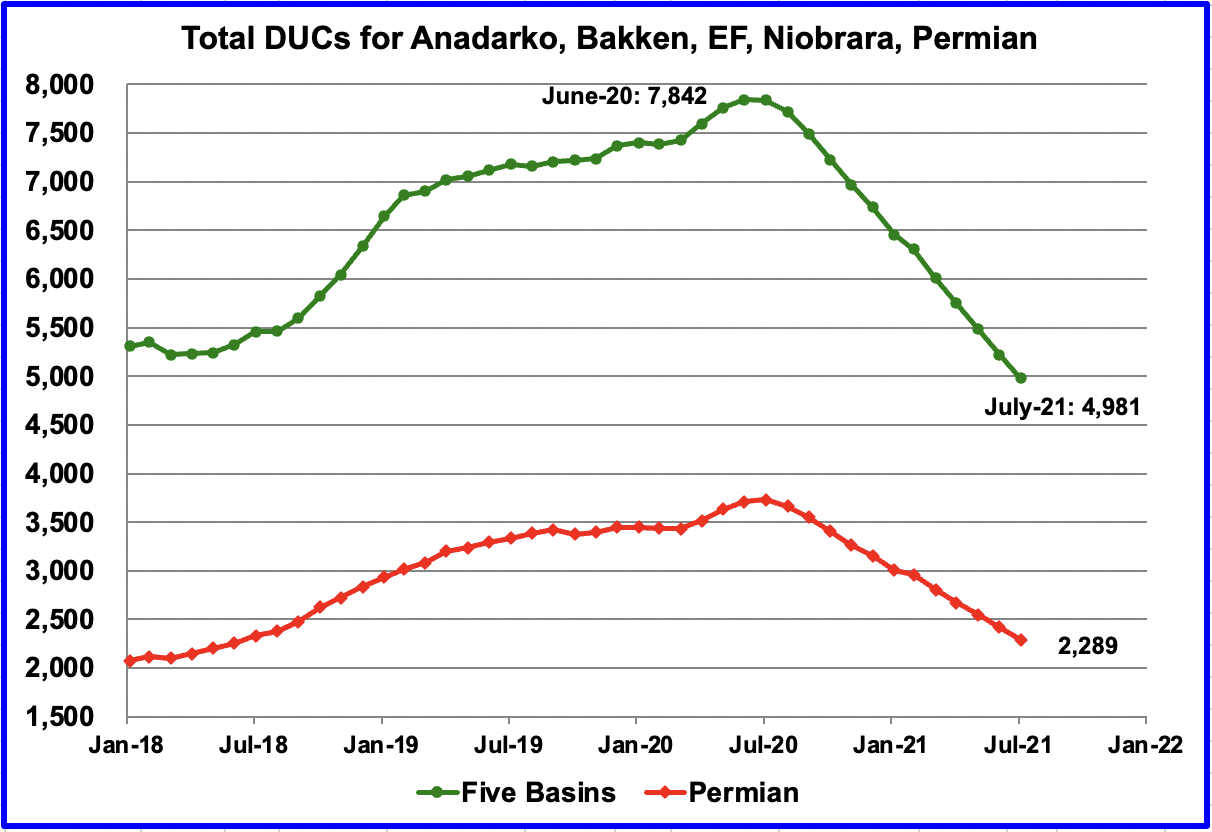

In these five primarily oil basins, DUCs are being completed at an average rate of close to 235 DUCs/mth. In total 258 were completed in July, according to the EIA. In the Permian, the completion rate is close to 125 DUCs per month. In July, 130 were completed in the Permian.

The monthly completion of DUCs accounts for the increase in production in the Permian.

3) LIGHT TIGHT OIL (LTO) REPORT

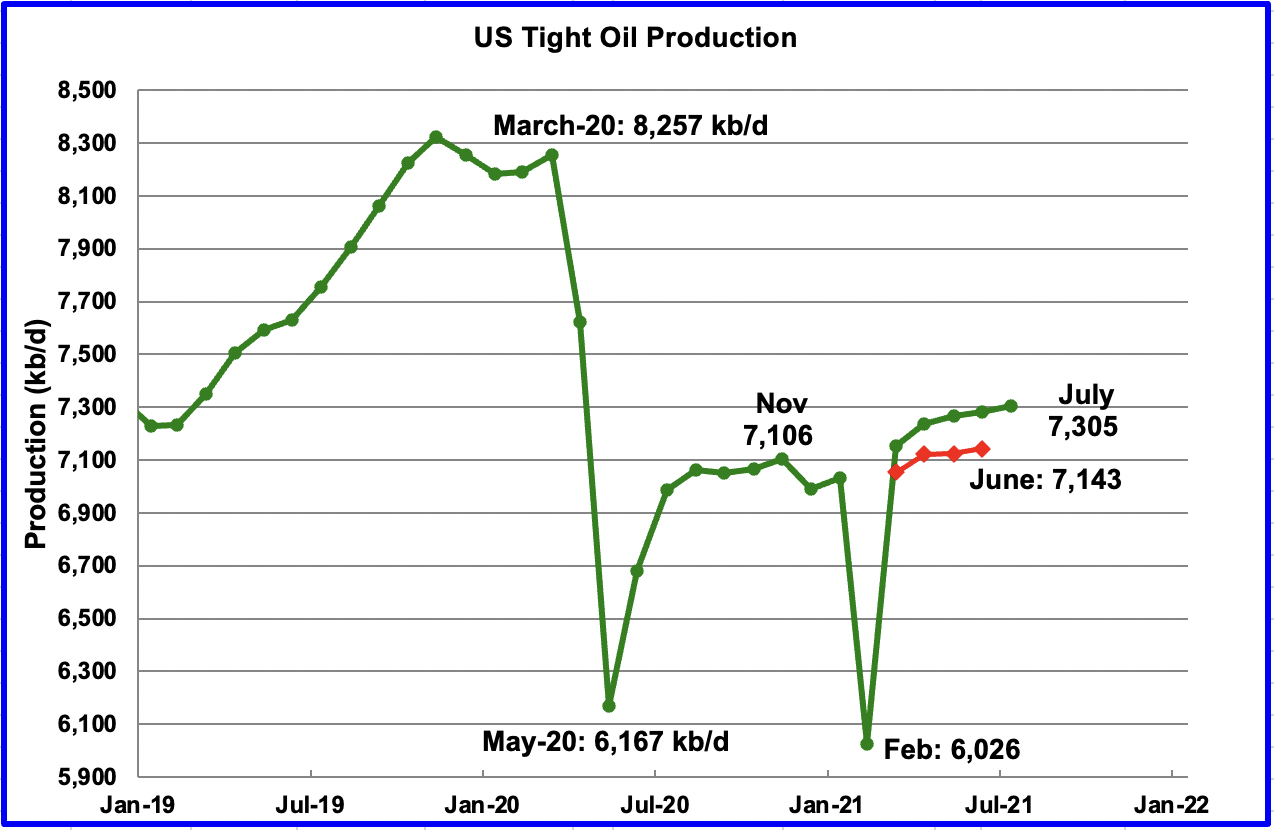

The LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The August report projects the tight oil production to July 2021.

July’s LTO output is expected to increase by 21 kb/d to 7,305 kb/d.

In the August LTO report, July’s forecast output was increased from March to June by close to 120 kb/d to 150 kb/d. It appears that the early estimates are always on the low side. The red markers represent LTO output as reported in the July report.

Permian LTO output in July is projected to increase to 4,147 kb/d, an increase of 43 kb/d. Production in the Permian continues to rise at an average rate of 42 kb/d/mth since April. At this rate, it could almost equal the March 20 high of 4,235 kb/d by September.

It should be noted that Permian DUCs are being completed at an average rate of close to 125 DUCs per month and contribute to the rising production.

The Bakkenʼs July output is forecast to remain unchanged at 1,116 kb/d.

The Eagle Ford basin is expected to produce 964 kb/d in July, a decrease of 8 kb/d from June.

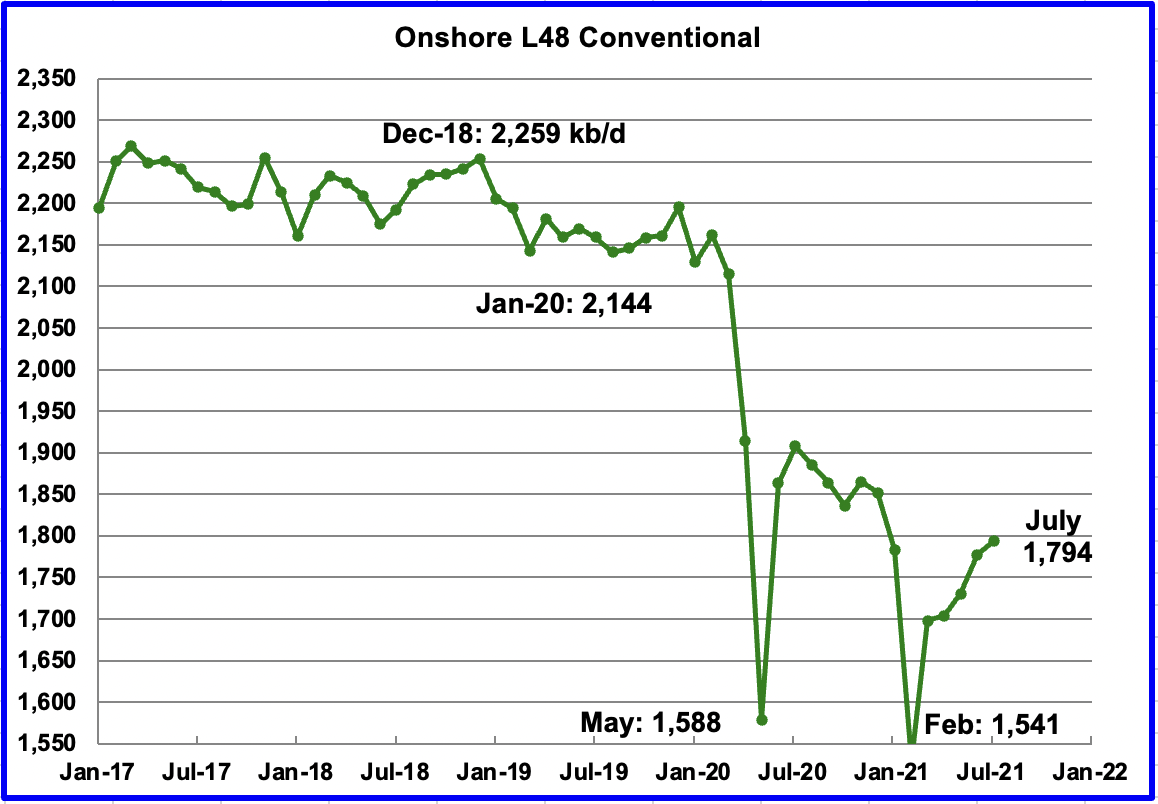

Conventional oil output in the On-shore L-48 is expected to increase in July by 17 kb/d to 1,794 kb/d from June 2021. This estimate is based on a combination of the July LTO output and the August STEO report that projects US on-shore L48 out to July 2021.

In the August LTO report, LTO output was revised up by 120 kb/d to 140 kb/d. This revised output resulted in a decrease in conventional oil output. The June conventional output of 1,881 kb/d in the July report has been revised down by 104 kb/d to 1,777 kb/d in the August LTO report.

4) Rigs and Fracs

Since the end of July, the US added 25 oil rigs during August for an average rate of 6/wk. Of the 25, 5 were added in each of Wyoming and Texas and 6 in New Mexico.

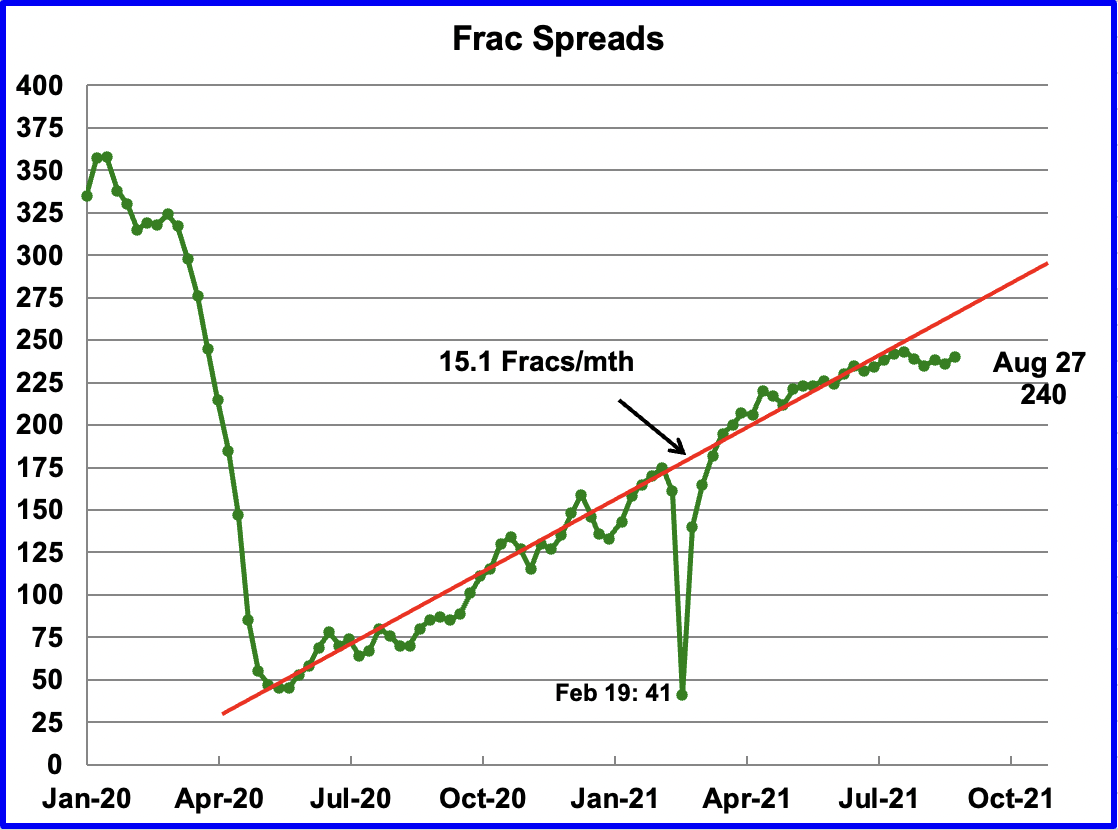

Since the week of July 23, frac spreads have not been added at the previous rate of approximately 15 spreads per month. During the week of July 23, there were 243 operating frac spreads. In the week ending August 27, 4 frac spread was added for a total of 240, fewer than in July 23.

Note that these 240 frac spreads include both gas and oil spreads.

5) World Oil Production

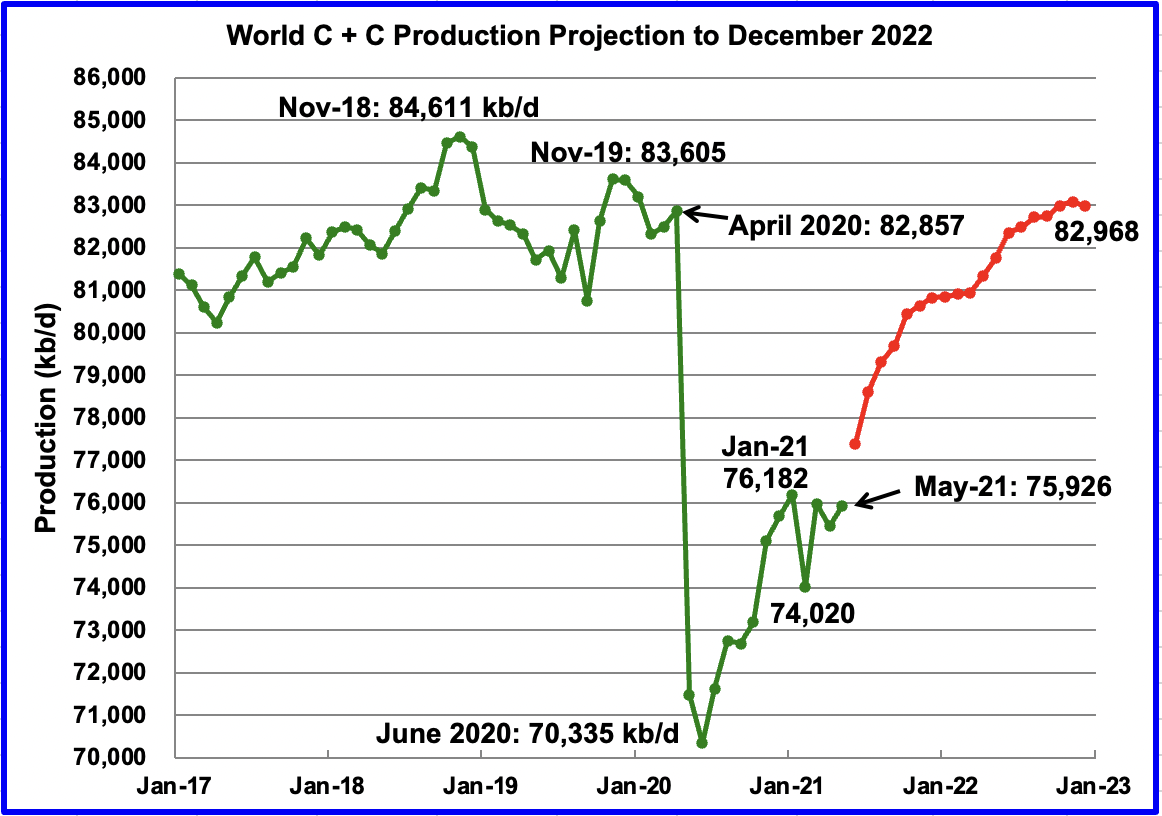

World oil production in May increased by 485 kb/d to 75,926 kb/d according to the EIA. Of the 485 kb/d increase, the biggest contributor was Saudi Arabia, 385 kb/d. There were a number of countries that had smaller increases of less than 100 kb/d, offset by countries with similar decreases.

This chart also projects world production out to December 2022. It uses the August STEO report along with the International Energy Statistics to make the projection, red graph. It projects that world crude production in December 2022 will be close to 82,968 kb/d, little changed from the April report. The December 2022 output is 1,643 kb/d lower than the November 2018 peak of 84,611 kb/d.

You express your uncomprehension for the linear trend of oil production starting from october for US STEO. So do I. I don’t understand also why EIA start an almost linear and flat trend for OPEC oil production starting from december 2021. Indeed, the group of the lesser oil producers of OPEC (Angola, Algeria, Nigeria, Venezuela, Gabon, Equatorial Guinea, Congo, Libya) experienced a decrease of daily production of 67 kb/month between december 2017 and march 2020. There is no reason that these decline will not continue. Furthermore, the Ghawar field experienced between 2008 and 2018 a decrease of daily production of 60 kb/month. So, if there is trend for OPEC it is one of decline.

Jean Francois,

Let’s look closely at your group of declining OPEC producers which includes Venezuela. Venezuela had an average monthly rate of decrease of about 36.5 kb/d over the Dec 2017 to March 2020 period. Currently Venezuela’s output has stabilized at about 500 kb/d, but even if it continued to decrease at the previous rate (the most recent rate of decrease has been about 9 kb/d per month over the past 16 months).

Bottom line is the 67 kb/d per month decline estimate is unlikely to continue at such a high rate, it is likely to fall to 30 to 35 kb/d per month.

Now to increasing OPEC nations (leaving off Iran that was hit with sanctions and is unlikely to decline as it dis over the Dec 2017 to Mar 2020 period). The big 4 (Saudi Arabia, Iraq, UAE, and Kuwait) increased output over the Dec 2017 to March 2020 period by 36 kb/d.

So it looks like OPEC output would be flat from a high output level (as was the case in Dec 2017 and March 2020). Note however that currently OPEC output is far below the March 2020 level by about 1922 kb/d.

The Dec 2021 STEO estimate looks reasonable, but the increases they forecast in 2022 are likely optimistic unless an agreement on the JCPOA (Iran nuclear deal) is reached between the US and Iran. If that is accomplished prior to the end of 2021 (seems unlikely at present), then the STEO forecast for OPEC output in 2022 might be an underestimate.

Thanks for the work Ovi!

The Russian propaganda news outlet says Iran is fixing to increase production by 1 mb/d:

https://www.rt.com/business/533596-iran-further-million-barrels-oil/

JFF

Not sure if their is a typo or a misunderstanding with what is happening in Ghawar.

Its current decline rate us close to 2% annually or approximately 75 kb/d/yr. This would translate to a number closer to 6 kb/d/mth.

Yes, it was a typo!

Thanks Ovi,

Great job!

Chart below has Permian basin horizontal oil rig count from Baker Hughes (using pivot table).

https://rigcount.bakerhughes.com/na-rig-count

The trend from Oct 23, 2020 to Aug 27, 2021 is about a 120 rig annual rate of increase over that 10 month period.

The early part of the data (Oct 23, 2020 to Mar 26, 2021) has an annual rate of increase of 174, and the later part has the rate of increase lower at 62 rigs per year (Mar 26, 2021 to Aug 27, 2021).

For comparison 2 years ago the horizontal oil rig count was 399, one year ago it was 121 and the most recent data point (week ending Aug 27, 2021) has the horizontal oil rig count in the Permian basin at 236.

Are you sure that a linear regression is correct to describe the curve? A logarithmic regression would fit more to the data.

Jean Francois,

Just showing the linear trend, not looking for best fit using arbitrary functions, as I stated in my comment the trend was higher, now it is lower, what happens next is not known.

Ovi.

I think shale well location numbers in the Permian are the key to the future. LTO argues those are far less than has been advertised.

The other issue is labor and materials to drill those wells. Helms in ND points to that.

The cost of steel pipe has skyrocketed. It is to the point where I am getting quotes on plugging some marginal wells, because the value of the both the surface and down hole equipment is worth more than what the well could be sold for as a producer.

Lease values are depressed, in part because of labor and equipment shortages. In part because of the fear of government regulations.

Now, not sure about all of this yet. I am getting some quotes, just to see. Would be interesting if right now one can come out with a positive cash flow P & A ones own wells.

COVID has resulted in a lot of weird stuff.

Shallow sand,

The issue in North Dakota may in part be companies moving their capital to New Mexico and Texas where costs are cheaper and there is a higher ROI.

The inventory problem in the Permian basin is an interesting one.

LTO survivor has said there are 5 to 6 years of drilling inventory left, though he never tells us at what rate of drilling he is assuming. If we take the maximum 12 month average completion rate in the permian basin (about 458 completions per month), that would be about 30000 wells completed over 66 months. If we assume oil prices do not increase in the future and that no other drilling locations are added in the future, we get a very conservative scenario for Permian output with ERR of 22.5 Gb. It is assumed rigs are added at the rate of the last 10 months (120 rig increase per year) until 425 new wells can be drilled per month, I assume at this point DUCs are steady state (little change month to month until drilling rate decreases). Total wells drilled are about 63000 (30000 inventory, plus 31000 completed to date, plus DUCs). I assume a maximum wellhead price of $67/bo for this scenario, well cost is $10.5 million, P and A is 500k, OPEX is $17.33/bo. Debt reaches a maximum of $130 billion in early 2021 and all debt is paid back by late 2026 for this scenario. If debt was at $160 billion in early 2021, debt would be paid back in full one year later in late 2027. It is assumed that 25% of net revenue is paid out as dividends, annual interest rate assumed to be 7.5%.

Higher oil prices and greater drilling inventory would allow for higher ERR. I expect that both will be higher in the future than assumed in this scenario and my guess is there is about an 85% probability that ERR will be higher than 22.5 Gb for the Permian basin. My best guess remains 46 Gb.

Leaving my other scenarios for Bakken, Eagle Ford, Niobrara, and rest of US tight oil unchanged with the Permian conservative scenario above, the US tight oil scenario looks like the chart below with ERR=54 Gb and peak in Feb 2026 at 8621 kb/d. I expect this scenario is too low by 20 Gb or so and peak will likely be later (2027/2028) at about 9500 kb/d.

This actually looks realistic.

Stephen,

I know to people here it does, but as I have suggested probably 65% of the USGS mean TRR will be produced in the Permian basin under a reasonable oil price scenario (one that has oil prices rising to $100/bo by 2028 in 2020$). Mean TRR for Permian basin by USGS estimate is about 75 GB, 65% of that is about 49 Gb, for comparison North Dakota Bakken/Three Forks mean TRR estimate by USGS is 11 Gb, 65% of that would be 7.15 Gb, cumulative production through Dec 31, 2019 plus proved reserves is about 8 Gb for North Dakota Bakken Three Forks.

I would put the minimum for Permian ERR at about 37 Gb with perhaps a 90% probability that ERR will be higher than 37 Gb. I have revised my thinking on the probability that the ERR will be 22 Gb or less to less than a 5% probability, it would require oil prices to remain at current levels or less for all future time. I doubt this will be the case until some time after 2032.

No, I’m more thinking this graph is a good representation of your idealized lab-grown model and how it might perform in the real oil world (based on the more sobering views of oil men on this blog), given price volatility, debt loads, spiking materials costs, lack of investment interest in fossil fuels, economic uncertainty in the next few years due to Covid variants, and a more rapid rise in EV adoption in high-use oil countries than expected because of the high oil prices, etc.

The real world .

https://tomluongo.me/2021/09/02/breaking-empire-means-breaking-with-saudis/

Stephen , your response to Dennis is one word ” bulls eye ” . The real world is different .

Your post is appreciated . Separate’s the wheat from the chaff . Kudos .

Stephen,

Perhaps you will be correct, I expect it will be 2033 befor demand for oil falls faster than the supply of oil. I also expect that eventually the World will get past covid, perhaps by 2023. There is likely to be a lot of pent up demand for travel new cars etc, working from home is nice, but people are social beings and many will want to return to work for more social interaction. There may be some reduced demand for oil due to work from home, perhaps it will result in a significant decrease in demand for oil.

Note the high oil prices will tend to overcome the economic uncertainty, rising costs, and lack of investment. The sobering views of the oil men have been input into the model with higher well costs, higher operating costs, lower new well EUR, etc.

I hope the transition to EVs happens as quickly as you imagine, but a more realistic view is that it will take 15 years for EVs and plugin hybrids to make a significant dent in oil demand. I wish it were not so, but I have modelled this and even 15 years may be too optimistic for a realistic EV transition scenario.

LTO survivor has said the oil is there, just not at $75/bo, he said $150/bo, but I think he may have been exaggerating, $100/bo will do it and by 2025 we will be there (perhaps higher) in 2020$.

As I am sure you are aware, no model represents reality with perfection all of them make simplifying assumptions, but rather than hand wave we have a set of assumptions and physically based well profiles, completion rates, prospective earth volumes that are likely to contain oil based on geology and geophysics and I run the numbers, subject to expert estimates from the USGS.

Note that the USGS estimate from 2013 for the Bakken/Three Forks yields a very reasonable ERR estimate using the same methodology I apply to the Permian basin.

North Dakota Bakken/Three Forks mean TRR=11 Gb and ERR=7 Gb, 7/11=0.64

Permian Basin mean TRR=75 Gb and ERR is probably 48 Gb, rather than 22 Gb, 48/75=0.64

Also note the assumptions of the Permian basin 22 Gb scenario, only 63k wells of a likely prospective number of wells closer to 125k and oil prices no higher than $70/bo for Brent in 2020$ ($67/bo at wellhead). These are not very realistic assumptions and would not be likely to lead to a fast transition to EVs.

Dennis,

6 years with the current rig count.

SS

Thanks.

I kept hearing how the price of Steel was going up. Did not make the link to drilling wells. Any idea if the increase is related to tariffs or just higher demand?

Ovi.

I don’t know.

I do know there isn’t a lot of 2 3/8” tubing around. Not long ago it was around $2.50 per foot. Recently paid $6.69 per foot.

We are scrounging around trying to find used, tested. But not a lot around.

Heck, I’d like to buy a new riding mower too. John Deere dealers say it will be at least November.

Lots of shortages.

Shallow sand,

Don’t these prices go up and down?

During the height of the pandemic there was a big drop in steel prices? What is the most you have paid for 2 3/8″ tubing in the past, maybe during 2011-2014 when oil prices were $110/bo and demand may have been quite high would be my guess?

Chart below is for steel rebar (couldnt find chart for tubing) from

https://tradingeconomics.com/commodity/steel

Dennis.

Yes of course they go up and down.

We keep some tubing in inventory, but not that much.

Same for sucker rods and down hole pumps.

When a well goes down, if you don’t have any on hand, you have to buy it.

The $6.69 happened because we were out and couldn’t find any used, tested. Why we might go ahead and plug out a few of our worst wells. We are also searching for cheaper over a wider area.

Another issue is likely that one of the supply stores in our area closed up shop a couple years ago during this most recent bust.

There could also be regional bottlenecks. We will find some cheaper somewhere hopefully.

Commodities are volatile. We contracted some corn earlier this year for $5.91 per bushel. Look at the price of corn the past few years. Then take that times 200 bushels per acre times a few thousand acres. That’s what farmers deal with too.

Just part of it.

Shallow sand,

Commodity prices are volatile and perhaps more so during a Worldwide pandemic.

For steel producers they may be happy right now, yes farmers are at the mercy of the market, more so than steel or oil producers because their product can spoil. I suppose steel can rust as well but shelf life is probably longer than corn.

For those interested in corn see link below

https://markets.businessinsider.com/commodities/corn-price?op=1

Up and down from $3 to $8 per bushel, but most of the time around $4/bushel (long term average).

What is the long term average steel tubing price for 2 3/8″?

This is why changes in investment measured in dollars are damped relative to changes in actual infrastructure. According to this paper: https://doi.org/10.2516/ogst/2019061

upstream investment in 2018 was 40% less than that of 2014 measured in dollar terms, but that translated into a 12% drop in terms of actual infrastructure. I believe that the damping will be even more significant in terms of ramping up for reasons that have been brought up by the invaluable comments of those who are actually in the business: labor and talent shortages combined with more expensive parts.

Total global upstream capex in 2020 and 2021 has fallen a further 40% from 2018 levels. Latest estimates are around $310bn (nominal) for both years. It also looks likely to continue for 2022 given current trends.

Much more interesting is the capex reduction by OPEC. There was a chart a couple of weeks ago with Saudi rigs at 27, lows since 2005. The total upstream capex by OPEC has come down to $13bn in 2021 compared to $40bn in 2017 – declining by 2/3 over the period.

chart here:

https://www.opec.org/opec_web/en/647.htm

Ancient archer,

There is a lag in investment, not clear that 2022 will be similar to 2021.

If investment is low oil prices are likely to be high and high oil prices will attract more capital the following year.

Schinzy,

How is “actual infrastructure” measured? Do you mean rig counts, offshore platforms?

Seems difficult to add this stuff up, probably an oil industry dollar index (reflecting overall oil industry costs) would be the way to go.

Dennis,

Good point. I don’t know how actual infrastructure is measured. But when you cut costs, you get rid of the least productive workers and you are buying fewer parts. Cost per well will tend to decrease. When you are expanding CAPEX, you hire new workers that probably won’t be as productive on average as the ones already working, you are buying more material so costs per well tend to rise.

Ancientarcher,

Thanks for the link.

Dennis,

Sure, 2022 investment in upstream might improve but the ridiculously low capex in 2020 and 2021 will have an impact on production going forward. And of course, as mentioned above, capex has been declining since 2014 – that will also have an impact.

Brace for lower supply going forward.

Your answer to that is – as prices increase, investment will increase.

My response to that:

1) will it? given all the hoo-haa about ESG and climate change?

and

2) even if investment goes up, which it will eventually, it will take 3-4 years for that to flow through to supply. It’s not as if you increase capex now and tomorrow you will be producing in new fields.

So, brace for a period of supply deficit.

Ancient Archer,

Yes I expect the market will be short of oil, perhaps oil prices go to $120/bo for 3 to 4 years, investment increases, then possilbly oversupply or adequate supply depending upon speed of transition to non-oil land transport. After 4 to 6 years the transistion may have proceeded to the point that oil prices start to fall as demand falls faster than supply. Potentially OPEC falls apart and we see a market share war with oil prices quickly dropping to $30/bo (in 2020 $). Of course this is one of an infinite number of possible future scenarios, only one will be correct, unlikely that it will be my scenario that is correct.

Schinzy,

Yes that makes sense. Keep in mind that on top of this there is technological change along with learning by doing that tends to gradually bring costs lower, though the rate of decrease in costs from this effect will fall over time. Also costs for materials and services may have fallen during the period of slack demand so these rising costs may just bring costs back to a “normal” level.

Steel Prices are up but the most important costs are completion costs which have been relatively flat for the first 5 months of the year but due to labor shortages, those costs are starting to climb again.

Steel tubing is a big business where I live, and 2020 was one of the worst years in decades. Production crashed. Now they are scrambling to get production back up to pre-pandemic levels.

Dennis,

Pressure depletion is real. Each successive year we will see lower and lower yields per well. I assume the current drilling rate because there is no new money coming into the industry. Companies with stronger balance sheets will: (1) continue to buy other companies/ producing barrels (2) pay down debt (3) attempt to make dividend payments.

It has been my experience that at current product prices, companies cannot pay down debt, pay dividends and grow production. The price prediction of $59 per barrel is not high enough to make LTO sustainable. This is a fact and now with steel shortages and labor shortages and cost push inflation the economics are getting worse. There will be a point in time where the locations and pressure are gone. It won’t be this year or next but its coming.

LTO

I need some clarification on your statement “Pressure depletion is real”.

If you are referring to a completed well with laterals, then the pressure will drop as the oil and water come out. Basic physics.

Is it possible that you are also saying/implying that there is a general pressure drop across a whole basin/field. My understanding is that LTO basins consist of a large number relatively small pockets of oil that are not connected. Hence fracking is required to connect them with small passages to bring the oil to the well bore.

If you are saying/implying that there is a general pressure drop across a whole basin/field, then that implies that there may be small connecting passages between a number of the small pockets of oil. Can’t think of another explanation.

Ovi,

We are seeing significant connection between wells spaced 1400 feet apart. Our original shut in pressure was 2400# at the surface as opposed to the child wells with 1600# shut in at the surface. Our IPs are only about 71.428% of the average flowing parent wells. I only expect this to get worse over time. Everything is interconnected and in some cases with wells 1420 feet apart we are seeing the production in the parent well being effected in a positive way with more water and hydrocarbon being produced. Despite the fact we have horrible permeability in the shale, the efficient nature of the frac complexes being propped open are creating pathways between wells.

Good analysis from Mike Shellman on interconnectivity in the Permian:

https://www.oilystuffblog.com/single-post/four-seasons-spraberry

Presumably the water flows better through the fractures than the hydrocarbons, as water molecules are smaller than most hydrocarbon molecules, though not methane I guess.

So if you are fracking and pumping in a lot of water, I would expect that you might be able to maintain total pressure, but not the partial pressure of the hydrocarbons. In other words you may be able to maintain total pressure, but if so you are unlikely to do anything about the increasing water cut.

LTO Survivor,

Current drilling rate is around 275 wells per month in the Permian, so 60 months of inventory would be 16500 well locations in the entire Permian basin if we assume 5 years of inventory at current drilling rate. Is that the number you have in mind?

The price assumptions of my scenario is $67/bo for crude oil at wellhead, NGL sold at 35% of crude wellhead price and Natural gas sold at 1.80/MCF. I assume a well cost of $10.5 million. The steel and labor shortages will be temporary, the market will adjust.

The model assumes average new well EUR starts to decrease starting in Jan 2020. The model uses an average EUR of 406 kbo per well. I have also increased OPEX for model to $17/bo.

I understand the pressure depletion is real, note that my expectation is that oil prices will increase, it is under that higher oil price scenario (with oil prices rising to $90/bo by 2025 and perhaps to $110/bo by 2028) that I expect a higher number of wells to be completed.

Does this 22 Gb scenario seem unrealistic to you? Even the USGS F5 scenario has a Permian TRR of 44 Gb, I would find any scenario with less than 60k wells completed in total (about double the number completed to date) difficult to believe.

How many total wells completed in the Permian basin do you expect by 2040? Are you thinking 45k? In the ND Baken we are likely to see about 25k wells completed minimum for a play with a mean USGS TRR estimate of about 11 Gb (ERR will be 7.5 to 8 Gb). Permian has a mean TRR estimate of about 75 Gb with a 90% condidence interval of 44 to 114 Gb. Permian cumulative production plus proved reserves at the end of 2019 were about 17 Gb, if we add probable reserves the total is about 25 Gb for the Permian basin. I expect we will see reserve growth in the future.

To everybody,

Yesterday the President of Mexico announced that Mexico will no longer sell oil abroad. All oil produced will be used in working at home toward Mexico becoming energy independent.

I just looked over Oil Price and Rigzone and there’s no mention of this. US refineries will be depending on Canada for a greater percentage of crude supply than has been the case, with Mexico (and Venezuela) no longer contributing.

Mexico ” resource nationalism” . Which country is next ?

Hih,

All of them.

I guess it is net exports right? Then this makes no difference, they are a net importer nowadays. Would be strange to ban exports completely as they need to trade to get the right grades.

Jeff,

Mexico is a net exporter of C plus C plus NGL, about 781 kb/d in 2020 and 425 kb/d in 2019, for the World net imports were about 20294 kb/d in 2020, so Mexico is about 4% of the total for 2020. Note that Mexico’s output will continue to decline, if it does so at the recent rate of past 15 years, Mexico will be a net importer of crude in 4 years.

From where did you get the numbers? It differs from eia, perhaps cc only? https://www.eia.gov/international/analysis/country/MEX

Best,

J

Jeff,

The numbers are from BP statistical review of World energy, I used production and consumption of oil in metric tonnes.

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Part of the difference is how the data is reported, best to do it in tonnes.

If mexico exports 100 barrels of heavy crude and it get refined in the US (and often we get 105 barrels of product as it is lighter after refining process), then Mexico exports those products it looks like they have imported 5 barrels. When we do it in tonnes we have more of a one to one comparison. This is a problem with EIA data.

Thank you. I know the difference between volume-weight-energy but it seems there must be something else that is more important here. Processing gains alone do not explain 781kb/d.

Jeff,

I guess you could ask BP and the EIA, there are many different data sources and each place chooses what they think is best, in the grand scheme 781 kb/d is not a huge amount in a World market consuming roughly 100,000 kb/d of liquid fuel (about 0.78%).

If we use Mexico’s oil consumption minus oil production in barrels for 2020 using BP data we get 598 kb/d more oil produced than consumed, it is possible this oil was stored in Mexico and not exported, I assume all oil produced and not consumed becomes a part of net exports.

Maybe they should just tax oil to reduce waste. It’s cheap by European standards.

Port Fourchon update. Getting GOM production back online will likely take weeks…

“Port Commission executive chairman Chett Chiasson said in an interview with National Public Radio that the damage to Port Fourchon was “extensive” and “far-reaching”.

https://www.upstreamonline.com/production/far-reaching-hurricane-ida-effects-linger-for-oil-and-gas/2-1-1060345

Details on oil and gas shut ins for the Gulf:

https://www.rigzone.com/news/wire/usa_oil_sector_examines_ida_damage-31-aug-2021-166305-article/

Oil spill now occurring near Port Fourchon:

https://www.cbsnews.com/news/hurricane-ida-photos-oil-chemical-spill-gulf-of-mexico-federal-response/

Invest 91L could develop into a tropical system affecting So La by end of this week:

https://weather.com/storms/hurricane/video/watching-system-that-could-impact-the-gulf-of-mexico

Thought of Shallow Sand when I saw this

https://oilprice.com/Energy/Energy-General/The-US-Oil-Industry-Is-Facing-A-Talent-Crunch.html

The EIA predicted that Russia’s oil production would be up 120,000 barrels per day in August. Rystad energy had a similar prediction. Russia’s oil production was down 30,000 barrels per day in August. They only missed their guess by 150,000 barrels per day.

Bold mine

Russia’s August oil, gas condensate output fell to 10.43 mln bpd

MOSCOW, Sept 2 (Reuters) – Russian oil and gas condensate output decreased to 10.43 million barrels per day (bpd) in August from 10.46 million bpd in July, according to Reuters calculations based on an Interfax report citing energy ministry data on Thursday.

Total oil and gas condensate production was 44.09 million tonnes, Interfax reported, versus 44.24 million tonnes in July. The ministry does not provide a breakdown for the production of oil and condensate, a type of light oil.

The Organization of the Petroleum Exporting Countries and other producers including Russia, known as OPEC+, agreed on Wednesday to continue a policy of phasing out record production cuts by adding 400,000 bpd each month to the market.

It was not immediately clear why Russian oil and condensate production fell last month.

Nikolai Shulginov, Russian energy minister, told reporters that monthly fluctuations were not significant and Russia would reach a pre-pandemic level of oil output next May.

Russia plans to pump a total of 506 million tonnes of oil only this year, he said, a 1% decline from 2020.

In 2020 Russia pumped an average of 10,274,000 barrels per day. 506 million tons would be about 1% less than that or about 10,170,000 million barrels per day. Through the first 8 months of 2021, Russia has produced an average of 10,350,000 barrels per day. They are expecting production to drop further this year.

Oh, I believed that they were up to reach almost pre pandemic level (11,3 Mb/d) of 2019 in 2030 as it was said from a document of the Energy Ministry in April. As you mentioned, the recent statements are inconsistent. https://www.themoscowtimes.com/2021/04/12/russia-may-have-passed-peak-oil-output-government-a73558

“Nikolai Shulginov, Russian energy minister, told reporters that monthly fluctuations were not significant and Russia would reach a pre-pandemic level of oil output next May. ”

Next May is 9 -10 months away . Makes me go hmm—-mmm .

Ron,

The two comments by the Russian oil minister are contradictory, either he misspoke or was misquoted. Russian output is unlikely to be as low as 506 million tonnes in 2021, probably more like 524 million tonnes. Note that a 30 kb/d drop is pretty small, essentially statistical noise. Forecasts are often wrong, so no surprise.

Dennis, I did the math. He said:

“Russia plans to pump a total of 506 million tonnes of oil only this year, he said, a 1% decline from 2020.”

As I said, I did the math. 506 million tons is 1% below 2020 production. Do you think he misspoke twice or was misquoted twice?

Yes, a 30 kb/d decline is not very much. But it was 150 kb/d below what the EIA predicted. That is significant. And their production has been basically flat for five months when OPEC+ production was supposed to be increasing. That is very significant.

Also, the link posted by Jean-Francois Fleury is very significant:

Russia May Have Passed Peak Oil Output – Government Russia’s oil production is unlikely to recover to pre-coronavirus levels, according to a government strategy document cited by Kommersant.

Dennis, I think you fail to see what is really happening in Russia. Either that or you are simply in denial. Russia’s five very old supergiant fields, historically responsible for 60 to 70 % of Russian oil production, are in steep decline. They hope that new Eastern Siberian and Arctic oil production will replace that decline. It will help but come far short of making up for the steep decline in their old supergiant fields.

Ron Russian energy minister also said output would increase to pre-pandemic level by May 2022.

Perhaps that was the misquote, I was not there to hear what he said. My point was the comment saying output will decrease for the rest of 2021 seems inconsistent with output returning to pre-pandemic level 5 months later. I do not know what future output in Russia will be. My guess is they will return to about 11000 kb/d by June 2022 and then maintain that level for 3 to 5 years and then decline slowly (2%/ year for first 5 years and accelerating later to 3 or 4% per year).

Oh, that was the contradiction you were speaking of. In that case, I agree with you. And that is a very absurd contradiction. However….

My guess is they will return to about 11000 kb/d by June 2022 and then maintain that level for 3 to 5 years and then decline slowly (2%/ year for first 5 years and accelerating later to 3 or 4% per year).

No, no, and no again. Their production will not return to 11,000 kb/d, it will not hold steady for 3 to 5 years, and it will not decline at a mere 2% for 5 years.

The decline has already begun. And it will be far greater than 2% per year. Oh, there will still be ups and downs. That is, there will not be a decline every month. But the trend will be down at… at least 5% per year.

Ron,

Obviously you know more than the Russian energy ministry.

I stand by my best guess, time will tell us whose best guess proves more accurate, yours or the Russian Energy ministry.

Denis news from Russia:

RF at the beginning of September increased the average daily production of oil with condensate by 2.3%

08 September / 06:56

Moscow. The average daily production of oil with condensate in Russia in the first days of September is 1,455.3 thousand tons / day, which is 32.9 thousand tons more than in August (2.3% more). This is evidenced by statistics.

In August, condensate production in Russia was greatly reduced, as the Sakhalin-2 liquefied natural gas (LNG) plant, as well as one of the lines of the Yamal LNG plant, did not work for almost the entire month. In addition, on August 5, a fire broke out at the Surgut condensate stabilization plant of Gazprom.

In the first days of September, oil companies increased production of oil with condensate by 0.9% – up to 1,161 thousand tons / day, Interfax reports.

Thus, Rosneft increased production of oil with condensate by 0.1% versus August, LUKOIL – by 1%, Surgutneftegaz – by 0.9%, Tatneft – by 0.5%, Slavneft – by 3%, Gazprom Neft – by 0.1%, Bashneft – by 13.2%, Russneft – by 1.3%.

Among oil companies, production at NOC fell by 0.9%, to 104.1 thousand tons / day. A decrease was recorded in the subsidiary structure NNK-Nizhnevartovskoe oil and gas production enterprise – by 1.5%, NNK-Saratovneftegazdobycha – by 2.7%, Gusikhinskoe – by 2.1%, NNK-Pechoraneft – by 1 , 2%, NNK Severo-Varyoganskoe – by 0.8%, Tatnefteotdacha and Varyoganneftegaz – by 0.5%.

NOVATEK increased production by 4.5%. Other subsoil users, where Gazprom, which produces condensate, is also taken into account, increased production by 10.7% (by 22.2 thousand tons / day) – up to 230.2 thousand tons.

The PSA operators reduced the production of oil with condensate (by 1.6%): the production of Sakhalin-2 (operator Sakhalin Energy) fell by 11.4% – to 7.5 thousand tons / day, Sakhalin-1 (operator ExxonMobil) – by 0.8%, to 30.6 thousand tons / day.

In the very first days of September, everyone ramped up an average of 2.3%? That’s 237,000 barrels per day in just a couple of days. All they had to do was open the taps a little wider? Why didn’t they do that in August?

Well, if they can do that they sure as hell aren’t going to get those tax breaks now?

I have no idea how this is happening. This is partly due to the commissioning of capacity at the Surgut condensate stabilization plant of OJSC Gazprom.

Almost half of the oil produced in Russia has benefits for the mineral extraction tax (MET),

There are places where tax breaks (Mineral Tax Exemption) are important and apply:

– The Yamal LNG plant still has it, this tax was canceled for a long time (such a condition was at the beginning of its construction).

-Lukoil enterprises in the Khanty-Mansiysk District, where viscous oil is produced. After the government refuses to extend the privilege, Lukoil is holding a tender for the conservation of production capacities.

-Enterprises in Tatarstan, which produce viscous oil.

-Another number of companies with similar capacities.

I’m not ready now to talk in detail about the tax on oil production. There, except for the Mineral Extraction Tax (MET) (If the standard profit tax is 20% of profit before tax. For example, MET payments accounted for about 27.4% of Rosneft’s revenue or 347.9% of net profit for the entire 2018. For Tatneft, the share of MET in revenue at the end of 2018 amounted to 31% of revenue or 134.3% of net profit.) There is also an Export duty. According to the calculations of the Ministry of Finance of Russia, the export duty on oil in the Russian Federation from September 1, 2021 amounted to $ 64.6 per ton.

Your assumption about the peak production in the Russian Federation is close to the truth. But I think the decline will not be sharp and the plateau will probably last for another 2-3 years. Hopes for this are associated with Vostok-oil, production on the shelf of the Caspian Sea and in Eastern Siberia. In addition, trying to start production in the arctic basin, but this is a matter for the distant future …

Construction of the North Pole ice-resistant self-propelled platform is 85% complete

08 September / 12:06

Moscow. The construction of the North Pole ice-resistant self-propelled platform is 85% complete. The unique research vessel is being built at the Admiralty Shipyards in St. Petersburg.

“In all respects, the platform has no analogues in the world. The North Pole will open a new page in the research of the Russian Arctic and in international cooperation in the study of northern latitudes. Such a floating observatory will allow monitoring most of the Arctic basin, and timely obtaining reliable scientific data on natural processes. in the northern polar regions of the Earth, “said Alexander Kozlov, Minister of Natural Resources and Ecology of Russia.

The platform is a self-propelled displacement steel vessel. At the same time, the strength of the hull along the sides and bottom will withstand the compression of perennial ice. In total, the duration of the platform drift in terms of fuel reserves can be up to two years when restocking. It is assumed that the personnel will work on a rotational basis. The platform has a helipad for receiving Mi-38 helicopters.

The decision to build the ship was made in 2017 by the government of the Russian Federation, the department clarified.

We add that the North Pole is a whole scientific complex for carrying out various types of research and observation. There are 16 scientific laboratories on board with built-in modern equipment. For work on the ice, a mobile field ice camp is provided, as well as various transport equipment.

Along with the traditional complex of studies, the creation of an ice-resistant self-propelled platform will expand the range of studies and observations in the field of ionospheric observations, geological, chemical and environmental studies, acoustic tomography, studies of ice loads and ice breakdown mechanics, studies of the boundary layer and free atmosphere in the central Arctic, magnetic and gravity research.

Thanks Alex, your post makes perfect sense. I have never met a person who knows more about their countries oil production than you.

Alex , second Ron . You always come out with nuggets that we would never find .

Russia says that they have enough oil reserves to last 59 years – 19 years at current level of technology. gas reserves enough for 103 years.

Interview with head of ministry of natural resources (held in May 2021) published here:

https://www.rbc.ru/business/11/05/2021/609971fe9a7947e065f63cd4?from=from_main_1

In Russian, but easily translated to English in Chrome.

“He recalled that there was not a single year when Rosnedra had not been informed that the increase in oil and gas reserves was greater than the volume of production.”

So, reserve replacement is running at < 1 for a while now.

That Russia is investing heavily in its Arctic fields is enough to tell me that they are seeing and expecting significant declines from the resources (mostly in Western Siberia) they have been exploiting in the last few decades.

Dennis, I have posted this link before but it is worth posting again:

Alex Burgansky: Russian Oil and Gas Industry Surprises Analysts Sep. 25, 2009

There are plenty of projects in Russia, both, new projects and existing brownfield projects. Russia is a very mature producer. If you exclude all the drilling activity taking place every year, then Russian organic decline in production is close to 19%. To compensate for that organic decline, Russia drills somewhere between 5,000 and 6,000 wells every year.

And then there are two important questions. One, is there enough oil in Russia for 5,000 or 6,000 wells to penetrate? In my view, the answer is yes. As I explained, we are dealing with a very large reserve base. And the second question: is there enough money in Russia to do that, and can it be done economically? The answer to this question is not so obvious.

That was posted 12 years ago. 5,000 to 6,000 infill wells per year for 12 years, in those old supergiant fields, with a natural decline rate of 19%, have finally taken their toll. Did you really think they could continue doing that forever?

Ron,

No not forever, but certainly until 2019 as history shows. For the future of Russian output I assume thr Russian energy minister knows more than me about potential future Russian output.

Dennis, I would not dare question what the Russian Minister of Energy really knows. But I most definitely question what the Russian Minister of Energy says.

Are you implying that you would not?

Dennis, concerning the Russian Minister of Energy, I think there is a pretty good rule of thumb you can go by. Whatever he says concerning the short run, that is the near future, you can take to the bank. But the more distant future, a year or more out, he has an out when his predictions are nowhere near the mark: “But we did not get the tax breaks we were counting on.”

Remember, the Minister has been campaigning for tax breaks for the petroleum energy for a couple of years now. However, to my knowledge, no tax breaks have been forthcoming.

Ron,

May 2022 is only 10 months from now, I agree predictions further in the future are more likely to be wrong, no matter who makes those predictions.

In the mean time there seems to be mixed messages coming from the energy ministry, both are unlikely to be correct. Personally I doubt Russian output will be as low as 506 miilion tonnes in 2021. I also doubt output will reach prepandemic level in May 2022, the truth will be somewhere between these, my guess is about 11 Mbpd for Russian C+C output in May 2022.

Ron, the comment about 506 million tonnes of oil only may be output of crude oil only and not include condensate. 506 miilion tonnes for 2020 would be an average output of about 10.1 Mb/d. Just a thought, Russia was allowed 9500 kb/d of crude output in July inder OPEC plus agreement, but their crude plus condensate output was 10418 kb/d. This suggests condensate output was about 900 kb/d (roughly as the density is different than crude) in July. For an entire year this would add up to about 42 million tonnes of condensate (guessing it is 7.8 barrels per tonne for condensate). Add this tho the Energy minister’s “oil only” estimate of 506 million tonnes of crude and we get about 548 million tonnes of crude plus condensate for 2021.

Ron, the comment about 506 million tonnes of oil only may be output of crude oil only and not include condensate. 506 miilion tonnes for 2020 would be an average output of about 10.1 Mb/d.

No, for two reasons. One, only OPEC uses crude only. Every Russian estimate or stat is always C+C. And two, I told you I did the math. Do you doubt me?

506 million tons comes out to 10,162 kb/d. Their production in 2020 was 10,274 Kb/d. 1% less than that would be 10,171 kb/d. That is only a 9,000 difference. That is almost exact.

So yes, the Minister of Energy was spot on and was talking about C+C, not crude only.

Dennis, as I said, I did the math!

A second thought. When the Minister of Energy said 2021 production would be 1% less than 2020, did you really think he meant that 2021 crude only would be 1% less than 2020 C+C? Dennis, that makes no sense whatsoever.

Ron,

I don’t doubt your math. I am trying to reconcile contradictory statements by Russian Energy Ministry, the OPEC plus agreement is for crude only. It is likely that the ministry can estimate condensate output. I reallize that C plus C is what they report at the Energy ministry website.

Your assumption that “oil only” means C plus C may be incorrect, possibly oil only should have been translated as crude only.

Dennis, did you read my second reply that started with: “A second thought”? Obviously, the ministry was comparing apples to apples. When he said 2021 production would be 1% below 2020 production, he either meant C+C or crude only in both cases. So it really makes no difference.

However I know he was talking about C+C because his website:

Statistics clearly states: “Production (including gas condensate).

And if you had read the link that started this whole conversation:

Russia’s August oil, gas condensate output fell to 10.43 mln bpd you would have found this paragraph, bold mine:

Total oil and gas condensate production was 44.09 million tonnes, Interfax reported, versus 44.24 million tonnes in July. The ministry does not provide a breakdown for the production of oil and condensate, a type of light oil.

Dennis, the ministry never gives statistics in crude only, never!

Ron,

Yes I said they do not report crude only, but the quota agreements for OPEC plus are in crude only. So internally they must have estimates for crude only that are not reported.

Note that the OPEC plus quota for Russia is about 9500 kb/d of crude for July, which is about 40.34 million tonnes, output in July of C plus C was about 44.24 million tonnes for Russia. This suggests about 3.9 million tonnes of condensate output, if Russia met its quota for July. The 506 million tonne estimate for 2020 seems inconsistent with OPEC plus increasing their quota levels from August to Dec 2020. The average level of output for the first 7 months of 2021 is an annual rate of 514 million tonnes of C plus C. I am highly skeptical that Russian C plus C output for 2021 will be less than 514 million tonnes and my best guess is about 524 million tonnes of C plus C output for Russia in 2021.

Perhaps the Russia energy minister was trying to drive up oil prices by understating future output, or he misspoke or has since revised his estimate. In 2019 average Russian C C output was about 560 million tonnes, I doubt Russia gets to that level by May 2022, though much depends on oil prices, tax policy, etc.

Of course, they do. They exactly how much of each, crude and/or condensate, they produce. But you must know they don’t pay a lot of attention to their OPEC+ quota. However:

OPEC+ hikes crude output 750,000 b/d in July, slightly shy of target: Platts survey

The OPEC+ group’s largest producer Russia pumped 9.64 million b/d in July, above its 9.50 million b/d quota. Its compliance rate in July slipped to 90% from 97% the previous month.

Russia produced 10,461 kb/d of C+C in July. That means they produced 821 kb/d of condensate.

However, they report only C+C. But I am sure they report the correct crude only numbers to OPEC.

Ron,

It is likely more difficult for Russia to control output precisely as there are several companies and all may not comply with government output targets. It is not clear how compliant they have been with the qoutas as that information is not easily found.

Ron

Russia also encountered production difficulties last month. Its total oil output — consisting of crude and a light oil called condensate — fell about 0.5% to 10.43 million barrels a day after a fire at a Gazprom PJSC processing plant in West Siberia, according to data from the Energy Ministry.

Ovi, the fire was quickly extinguished but condensate production was cut off for about a week. They still produced condensate for domestic consumption but decided not to export any condensate for August. They had planned on exporting 100,000 barrels for the entire month. That works out to be about 23,000 barrels per day if that much condensate was indeed not produced. That is about three fourth the total decline for August. They would still have declined even if they had no fire. They were supposed to be up 120,000 barrels per day.

Gazprom cancels Aug condensate exports after Urengoy fire, sources say

net: exports – imports

Top steel exporters in 2018[1]

Rank Country Mt

1 China 51.4

2 Russia 31.5

3 Japan 29.8

4 South Korea 27.6

– European Union[24] 22.6

5 Germany 21.2

6 Turkey 18.5

7 India 17.1

8 Ukraine 15.2

9 Italy 14.9

10 Belgium 12.9

11 Brazil 10.6

12 France 10.2

13 Taiwan 10.0

Top steel net exporters in 2018[1] (Exports – imports)

Rank Country Mt

1 Russia 26.4

2 Japan 24.8

3 South Korea 16.1

4 Ukraine 13.9

5 China 13.5

6 India 12.1

7 Brazil 8.7

8 Turkey 6.0

9 Egypt 4.4

10 Germany 3.0

USA is a spectator as far as steel is concerned . It is not in a position to control prices . It can only apply tarriff ( which Trump did ) to save it’s own steel industry .

Shallow Sand,

Here is the most recent steel pricing we received last month.

NEW US ROD ¾ $2.12/FT

NEW US ROD 7/8 $2.55/FT

NEW 2-3/8 MW-55 4.7# $3.95/FT

NEW 2-7/8 MW-55 6.5# $4.70/FT

NEW 5-1/2 15.5# MW-55 $9.50/FT

NEW LS 8-5/8 23# $17.75/FT

We do try to keep a decent amount of tbg/rods on hand. For one thing we don’t have a lot of outside WI in our wells, and our production man is almost always on site babysittying the pulling units to make sure things go as they are supposed to. If you have to toss out 6 or 8 joints of tubing and get it on a whim from the supply shop, well, you know how costly that can get.

Kansas Oil.

Thanks.

The four joints at $6.69 per foot were from the supply store on a Saturday without seeing what we had in the yard.

But we are very low in inventory and that is our fault. We probably need to truck in a semi load and bite the bullet.

I’m no oil man, but do software in industrial enviroment.

We had once a customer who told quite a story. He has a big conveyor belt system, to supply machinery and out/ingoing trucks. He bought it from a big company, paying big, to avoid being stranded with a system from a gone company.

One day a motor burned out. No problem they thought, just have a call and emergeny order a new one.

They got told a new batch of these motors will start production in 3!!! months…

Now they have spare parts of everything in their warehouse, just because…

Other thing – got to a hardware store to buy a few shelves for a cupboard. Nearly tumbled back out when I saw the price tags. 200€ for a few boards. I’m only happy I don’t have to build something at the moment – if this continues they’ll steel old sheds…

Kansas Oil,

Are those prices fairly typical? I guess my question is, was the $2.50 per foot price quoted by shallow sand a somewhat low price for 2 3/8″ tubing by historical standards (perhaps this was the price in late 2015/early 2016 when things were pretty slow in the US oil industry)?

Thanks.

Article on tight oil today

https://oilprice.com/Energy/Crude-Oil/US-Shale-Ramps-Up-Drilling-But-Maintains-Spending-Restraint.html

Excerpt:

… the expected higher activity will not eat up more expenditure than companies have budgeted for this year, executives say. Shale producers have decreased drill times and achieved operational efficiencies. All of these allow them to do more with less investment, leaving a larger share of record cash flows to return to shareholders.

Supermajor ExxonMobil’s frack rates are now around 50 percent faster, which has led to a reduction in drilling and completion costs of more than 40 percent, Jack Williams, Senior Vice President, Overseeing Downstream and Chemical, said on the Q2 earnings call.

Diamondback Energy is decreasing the number of rigs and crews that it needs to execute the 2021 capital plan and reduced its full-year capital guidance by $100 million.

“On the production side, our wells have outperformed expectations this year,” Diamondback Energy CEO Travis Stice said on the earnings call.

“As a result, we are slightly increasing our Permian oil production guidance, which should not be taken as a conscious decision to grow,” Stice added.

The step-change in Diamondback’s drilling times is going to be permanent, CFO Kaes Van’t Hof added.

“And basically, we can do what we once had to do with 10 rigs, with eight now in the Midland Basin,” Van’t Hof noted.

Rick Muncrief, president and CEO at Devon Energy, said on the company’s call:

“We have no intention of adding incremental barrels into the market until demand side fundamentals sustainably recover and it becomes evident that OPEC+ spare oil capacity is effectively absorbed by the world markets.”

“The bottom line is we are unwavering in our commitment to lead the industry with disciplined capital allocation and higher dividends,” Muncrief added.

““On the production side, our wells have outperformed expectations this year,” Diamondback Energy CEO Travis Stice said on the earnings call. ”

Yeah , but we still loose money .

” “As a result, we are slightly increasing our Permian oil production guidance, which should not be taken as a conscious decision to grow,” Stice added. ”

We can’t grow because we can’t , but I must put lipstick on the pig .

” “The bottom line is we are unwavering in our commitment to lead the industry with disciplined capital allocation and higher dividends,” Muncrief added. ”

We are FUBAR .

World Production has been updated above.

World oil production in May increased by 485 kb/d to 75,296 kb/d according to the EIA. Of the 485 kb/d increase, the biggest contributor was Saudi Arabia, 385 kb/d. There were a number of countries that had smaller increases of less than 100 kb/d, offset by countries with similar decreases.

This chart also projects world production out to December 2022. It uses the August STEO report along with the International Energy Statistics to make the projection, red markers. It projects that world crude production in December 2022 will be close to 82,968 kb/d, little changed from the April report. This is 1,643 kb/d lower than the November 2018 peak of 84,611 kb/d.

83 mbpd in Dec 2022 . No way . What are these guys smoking ???

Hole in Head

Massive jump from May to August, a jump of 3,300 kb/d. Not clear where it all comes from.

Ovi ,doesn’t make sense . Numbers not adding up . Your post below indicates no such activity that would justify the figure of 3.3mbpd additional .

OPEC plus Russia increased output by 1200 kb/d from May to July. Norway up about 175 kb/d from May to July. That would leave 1925 kb/d, if OPEC plus increases output by 400 kb/d in August we would be 1525 kb/d short of the STEO estimate (note the estimate could be wrong if the assumptions made in making the estimate are incorrect for World C plus C, STEO gives a total liquids estimate which includes a considerable NGL and biofuels estimate). Natural gas output has been growing and NGL output would also grow, biofuels output may be higher in NH summer, though this might be offset by winter in Brazil. If OPEC plus continues to add 400 kb/d each month from Sept to Dec then we get the 3300 kb/d by Dec 2021. Declining output in some nations might be offset by increased output from Canada, Brazil, Norway, and US.

The 3300 increase by August 2021 is likely wrong, it may be more like a 1500 to 2000 kb/d increase from May 2021 to Aug 2021.

In the last post, Reuters reported the following

OPEC August oil output rises, but outages limit gain – Reuters survey

The Organization of the Petroleum Exporting Countries has pumped 26.93 million barrels per day (bpd), the survey found, up 210,000 bpd from July’s estimate. Output has risen every month since June 2020, apart from in February.

https://www.reuters.com/business/energy/opec-august-oil-output-rises-outages-limit-gain-reuters-survey-2021-08-31/?rpc=401&

This morning there is an update from Bloomberg.

OPEC Boosted Output Last Month Even as Some Members Left Behind

Bloomberg reports an extra 180 kb/d of OPEC output over the Reuters report. Summary below.

(Bloomberg) — OPEC boosted crude production last month as it continued the revival of supplies halted during the pandemic, but some members struggled to keep up.

The Organization of Petroleum Exporting Countries lifted output by 290,000 barrels a day, slightly more than stipulated by its road map for restoring output, according to a Bloomberg survey. Saudi Arabia and Iraq were the main drivers of the increase.

Despite the gains, the group is actually pumping about 10% below its overall quota as some members — notably Angola and Nigeria — suffer from deteriorating production capacity and technical disruptions.

Output from OPEC’s 13 members averaged 27.11 million barrels a day in August, according to the survey. Saudi Arabia increased by 200,000 barrels a day to 9.63 million, while Iraq ramped up by 110,000 a day to 4.08 million. Both countries were roughly in line with their new, higher targets.

The survey is based on ship-tracking data, information from officials and estimates from consultants including Rystad Energy AS and JBC Energy GmbH.

Nigeria’s production dropped again in August, by 90,000 barrels a day to a five-year low of 1.43 million a day. Royal Dutch Shell Plc has announced a disruption at the country’s key Forcados loading facility following signs of a leak.

Angola, which was able to keep output steady last month at 1.11 million barrels a day, is producing several hundred thousand barrels below its permitted amount. The country is reckoning with an exodus of foreign investment, and declines in capacity at deep-water oil fields.

In the broader OPEC coalition, Russia also encountered production difficulties last month. Its total oil output — consisting of crude and a light oil called condensate — fell about 0.5% to 10.43 million barrels a day after a fire at a Gazprom PJSC processing plant in West Siberia, according to data from the Energy Ministry.

https://www.bnnbloomberg.ca/opec-boosted-output-last-month-even-as-some-members-left-behind-1.1647168

”Russia also encountered production difficulties last month. Its total oil output – consisting of crude and light oil called condensate – fell about 0,5% to 10,43 million barrels a day…” Yes and the production will continue to decline according to the data of Energy Ministry. They are saying that in 2021 Russia will produce 506 million tons of oil. Given that they have produced on average 10,325 million oil barrel a day during the past eight months, that means they have already produced around 339 million tons of oil, leaving 167 million tons of oil to be produced untill the end of the year or 10,2 million oil barrel a day, give or take. Thus, their production will continue to decline.

Jean Francois,

If we take Russian Energy Misistry statements at face value (and also assume they do not change policy after making a statement). We would see output decline a bit by the end of 2021 and then ramp up sharply by May 2022 to reach the pre-pandemic level.

I doubt this is what we see. You guys tend to believ statements that support what you believe and discount statements that do not support your story, I guess we all do this. Supposedly Russian quota levels will increase by about 100 kb/d each month from August to December based on OPEC plus agreements. They could choose to produce less, but I do not think they will make that choice.

Good interview with Jeff Currie – Goldman’s head of commodities.

https://www.bloomberg.com/news/videos/2021-09-02/goldman-s-currie-says-jury-is-still-out-on-new-oil-equilibrium-video

Amrita Sen talking about OPEC and the demand supply situation going forward

https://www.bloomberg.com/news/videos/2021-09-02/oil-prices-should-be-higher-into-year-end-sen-video

Nice stuff Ancient archer, thanks.

Jobs numbers was awful this morning. Economy is rolling over due to inflation. Yet people believe that FED will push back any tapering of QE. And actually they probably will push it back. But that doesn’t stop inflation and the economy from rolling over. FED’s market put is going to be tested. And since FED doesn’t actually print money. Market will sell off anyway. Good luck with higher priced oil. My timeline is 12-18 months before major blow up or financial crisis.

HHH

I think the fourth wave of CV is forcing companies to delay their rehiring plans.

Yes and that is not going to go away. And that’s global. There will more variants right behind delta. And while vaccines may keep some people out of the hospital. The big picture is the vaccine hasn’t been a game changer.

HHH

I disagree. Where would we be without the vaccine. The world would be in a much worse condition.

Ovi is correct.

One example- I live in a county with a very big economy (#6 in the country- MLKing Co, WA)

It was the first big county in the US to achieve 70% vaccination rate months ago.

Businesses and roads have gone from very quiet back to very busy status.

Worse variants could set us back to square one. We would be in poor shape like those communities that have not embraced vaccination.

Ovi and Hickory,

I agree.

I also think the full approval of the Pfizer vaccine in the US will lead to more vaccine mandates from local governments and private businesses, so we may see vaccination rates increase. Hopefully a vaccine for 5 to 12 year old children will be approved by December in the US.

What is the status of vaccine approvals in Canada?

For Europeans, what is the status there? Full approval, children, etc?

Closing of economy was always a choice vaccine or no vaccine. Reality is this vaccine isn’t a sterile vaccine. And by the numbers things really aren’t that much different than when cases and deaths per day were at peak. We are just choosing to push on regardless.

And worlds economy goes into deep freeze not because of virus or vaccine. It goes into freeze because the response to the virus can’t be repeated in 2022. If you believe that governments can in someway do equal to the stimulus and spending that was done during 2020-2021 every year until end of time then things keep going. If your like me and know that doesn’t happen you know economic crisis is dead ahead

“And by the numbers things really aren’t that much different than when cases and deaths per day were at peak. We are just choosing to push on regardless.”

A massive difference is that now the people being hospitalized, and dying, are almost entirely doing so by choice. Those who have been vaccinated have lowered their risk enough to have a confidence in participating in public life. as you know- sentiment has a big impact on economic decisions and activity.

And yes- the Pfizer and Moderna and J/J vaccines are sterile.

-regarding J/J -‘The Johnson & Johnson vaccine uses what’s known as “viral vector” technology, which uses a harmless, inactivated cold virus to activate your body’s immune response to COVID-19. Because the Johnson & Johnson vaccine does not contain a live virus, you cannot get COVID-19 from the vaccine’

Factual knowledge is useful to a healthy economy

A sterile vaccine is where the virus stops with you after being vaccinated. Sterile mean you can’t transmit it to others.

None of these vaccines stop the spread of COVID. They might keep you out of the hospital but you can still spread the virus.

Ahhh… you are using the term incorrectly.

The vaccines are indeed ‘sterile’

‘Sterilizing immunity’ is what you are referring to, and it is true that like many other vaccines this one is not 100% effective.

“For example, the inactivated poliovirus vaccine does not produce sterilizing immunity and is 90 percent or more effective. A vaccine can lessen the ability of a pathogen to produce a disease response without sterilizing it. If it does sterilize against a pathogen, it can prevent infection. For example, the human papillomavirus vaccine induces sterilizing immunity.”

Nonetheless, almost everyone who is severely sick or dying with Covid-19 in the US are unvaccinated- and that is now an entirely voluntary situation. And bad for the economy.

Dennis

Pfizer, Moderna, Johnson and AZ are approved. AZ was only used early on. Second shot was recommended to be Pfizer, if first was AZ.

Also most Canadians got their second shot after 12 weeks. Apparently this gave a better antibody response than the US policy of 3 and 4 weeks for the second shot.

I have posted this earlier so just a repeat .

1. It is impossible for the FED to raise interest rates .

2. It is impossible for the FED to taper .

Both actions will crash Wall Street overnight , crash the dollar and have repcursions beyond the shores of USA . Having a reserve currency status has it’s advantages and disadvantages .The only option for Powell is to ” kick the can ” down the road and pray that the crash does not happen under his watch . The result of this inaction will be inflation , next stop stagflation and then deflation which will be for eternity . The final destination is deflation whether he acts now or delays . Last minute , the FED serves itself first , Wall street second and the rest can go to hell .

The common sense in the financial press is they can’t taper (much) when there is a recession. No way to let long duration bond interrest rate rise during a recession, making credit unaffordable.

Who will buy 10 years without the FED put? Getting paid 1% during 5% inflation? At 5% inflation bonds need at least 6% interrest (for AAA) to cover the risk. That’s an epic bond crash.

The FED has printed itself into a corner, they won’t be able to come out. In my opinion the only way out is only a currency reform – and to avoid this they can only print + pretend.

Yes, they can taper a bit, perhaps 20-30% less than now. And they should. But that’s it. When things get crashy they have to speed up again.

For the really long trend:

US interrest rate is sinking the last 40 years. And when they hit 0, they had to start QE as replacement for negative interrest rates. With a complete digital currency (no escaping) we would be at -3 – 4% interrest, with no need to QE.

https://www.bbc.com/news/business-35105299

You can see at this curve the year 2000 and 2008 crash correlates with increasing the interrest rate. So a QE taper will likely trigger a crash, followed by even lower interrest rats (even more QE …).

And they can’t afford a big crash now – in a everything bubble everything will crash, leaving a crater. Bonds, stocks, real estate, even gold and coins will crash. Banks will be annihilated.

So in a stock crash I give the FED a maximum of 2 weeks until they will QE the crash – stronger than 2020 when they stopped the corona crash.