The EIA has published International Energy Statistics with Crude + Condensate numbers for September 2014. As most of you know I only follow Crude + Condensate because I believe that biofuels and natural gas liquids should not be part of the peak oil equation.

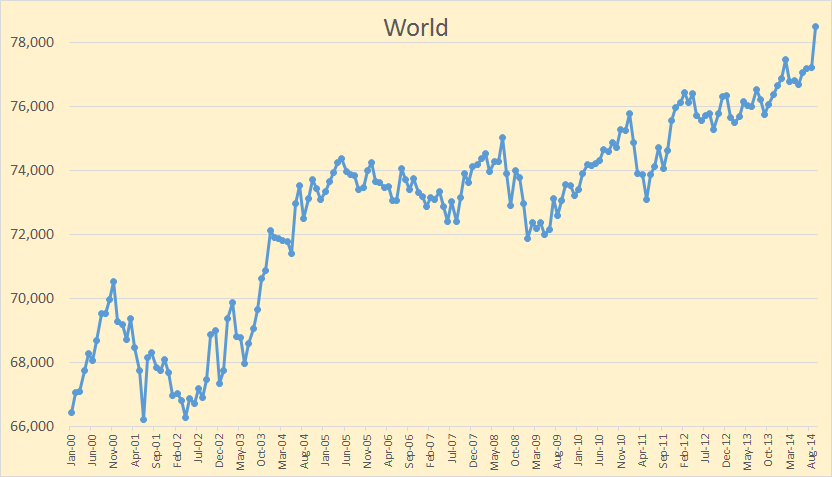

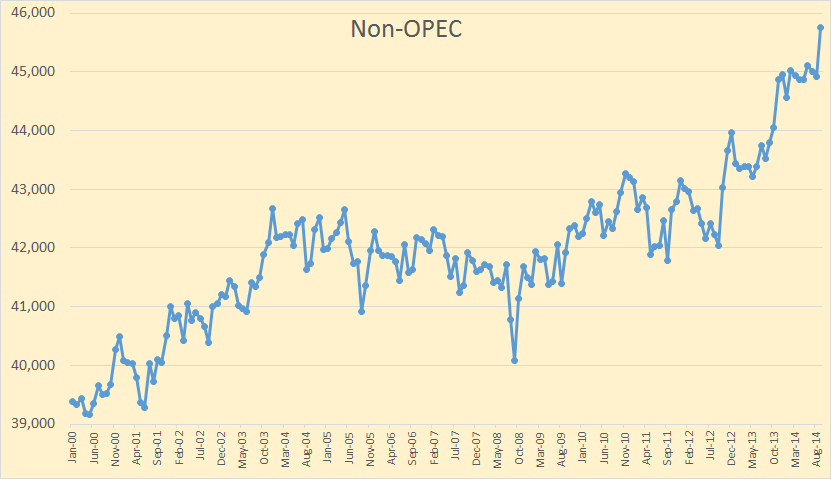

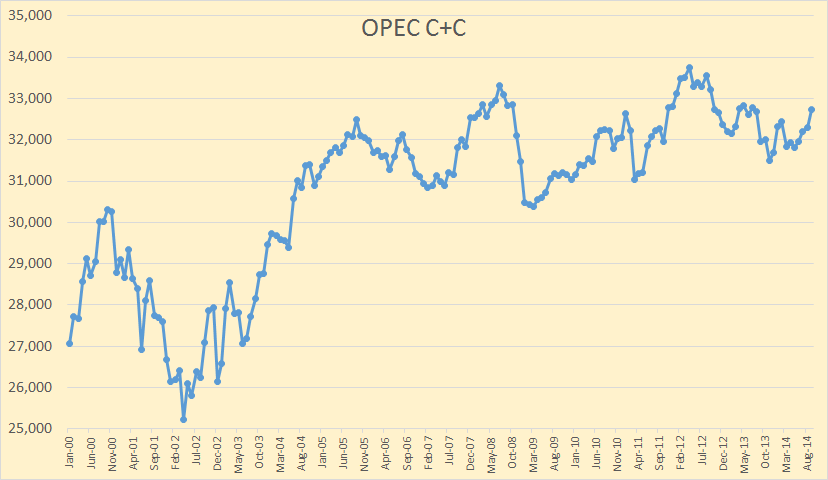

The data in all charts is thousand barrels per day with the last data point September 2014.

World oil production was up 1,270,000 barrels per day in September. This was somewhat of a shocker. I had expected production to be up about .9 mbd but not this much.

Non-OPEC nations accounted for 833,000 bp/d of the increase.

And OPEC nations accounted for 438,000 bpd of the increase. The EIA said OPEC produced 32,734,000 barrels per day of C+C in September. OPEC’s “secondary sources” said OPEC produced 30,560,000 barrels of Crude Only in September. OPEC’s crude only production had dropped to 30,053,000 bpd in November, or over half a million barrels per day lower.

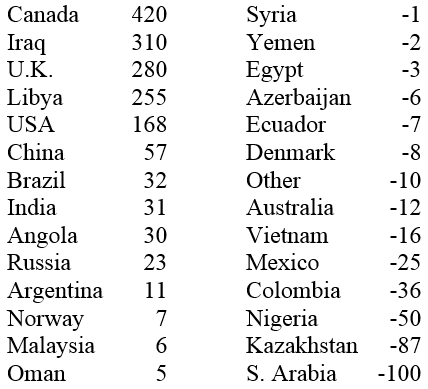

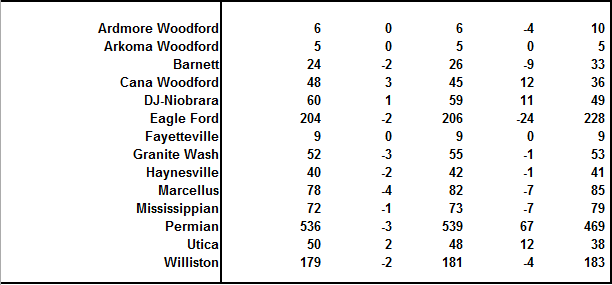

Just who were the big gainers and losers in September? They are listed below in thousand barrels per day. All others had no change. “Other” is the combined production of all small producers.

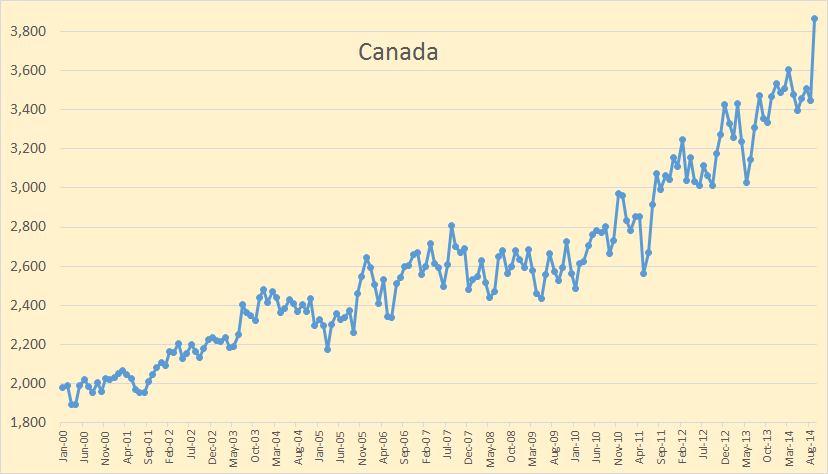

Canada was the big gainer, up 420,000 bpd. I have no idea how the EIA came up with such an increase from Canada. Perhaps someone can enlighten us with a comment.

That huge spike upward just looks strange. I am not yet ready to accept it and I expect it to be revised downward in the next report.

The number 2 gainer, Iraq was up in September but according to the OPEC MOMR they showed little change in October and November.

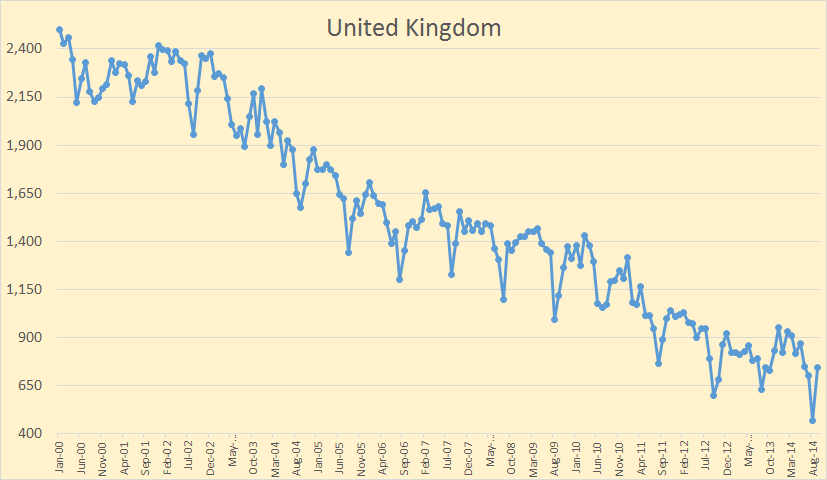

The huge gain in UK production was just a return from a lot of maintenance downtime.

The number 4 gainer, Libya, according to the OPEC MOMR was up in September and up a little more in October but dropped 250,000 bpd in November.

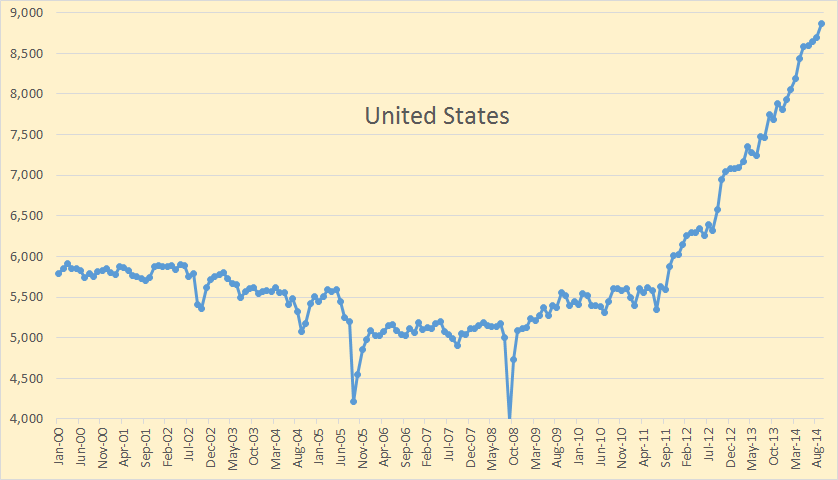

The number 5 big gainer in September was the USA, up 168 bpd in September. I believe the US still has some increase in production to come but this will be the last big gainer. That is the last increase of over 100,000 barrels per day for a long while…if ever.

For what it’s worth, JODI also has the US up by 170,000 bpd in September, but JODI has the US down by 155,000 bpd in October. The EIA’s Petroleum Supply Monthly is due out Tuesday December 30th with the USA’s October production numbers. However the EIA’s Monthly Energy Review is already out with November production numbers. There they have US production up by 91,000 bpd in October and up another 108,000 bpd in November. So they are already trying to make a liar out of me.

However the Monthly Energy Review is notorious for over estimating US production numbers. Their data is revised every month, usually downward. The Petroleum Supply Monthly is always far more accurate as they count production from each individual state. Though their numbers are also often revised.

China’s slight increase was nothing out of the ordinary, just up and down noise that can be expected from a mature producer. Daqing, China’s super giant is in decline.

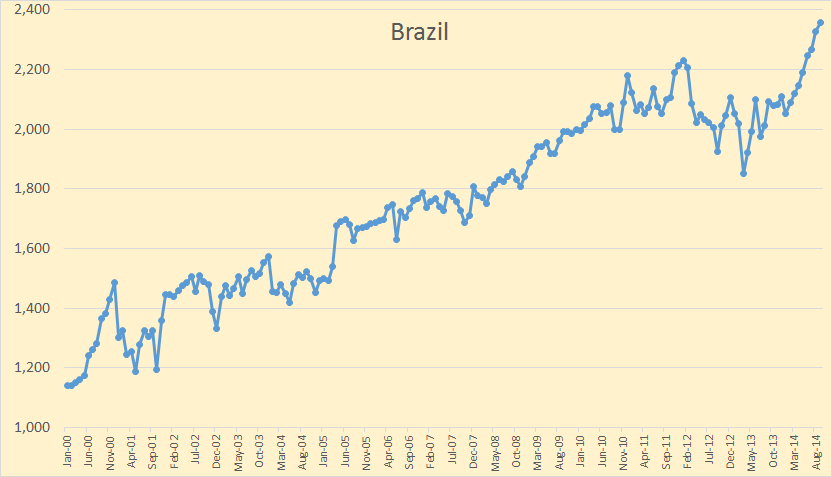

Brazil is one nation that has been showing a steady increase for the last few months. But expect them to level out at just a bit above their current production in the next few months.

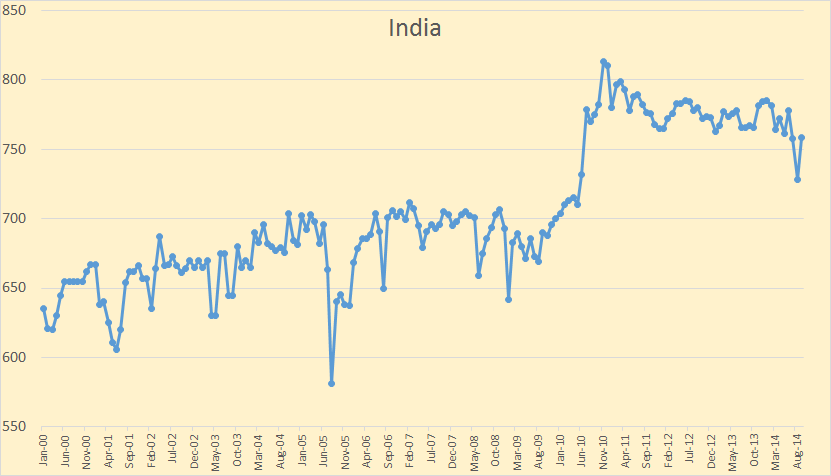

India’s gain was just a recovery from August’s huge decline. It still looks like they are in a slow decline.

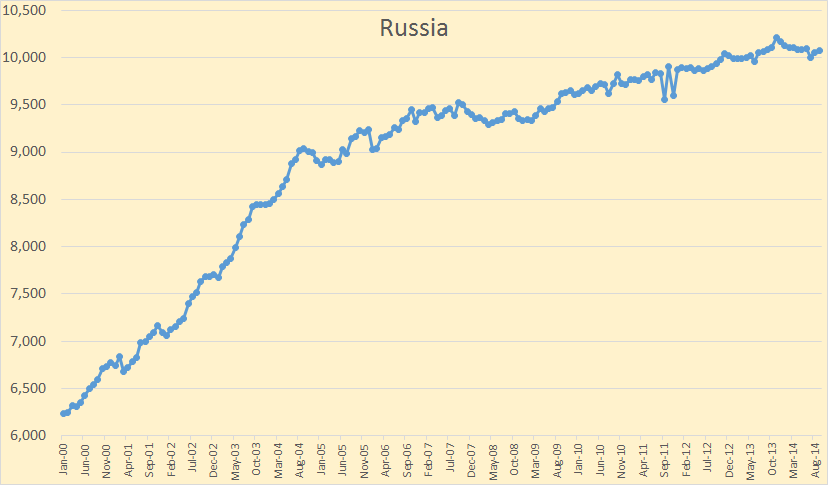

Russia, up slightly in September but headed lower in 2015, or so everyone believes, including Russia.

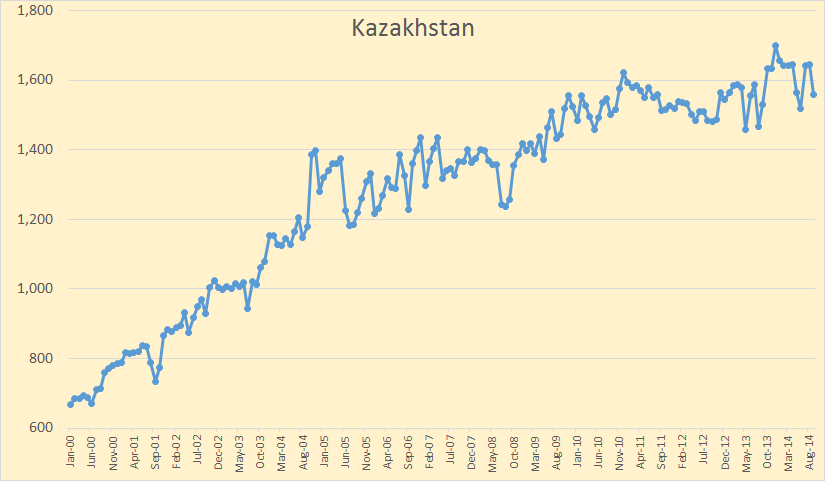

Kazakhstan has again fallen below 1.6 million bpd. They will be lucky to hold their current production level until Kashagan comes on line sometime in 2017.

Total: Kashagan Oil Project Will Resume Production by 2017

Is this the last hurrah for world oil production? Will we look back and see September 2014 as the all time peak in world oil production? Perhaps but the IEA has world total liquids up slightly in October but down by 340,000 bpd in November.

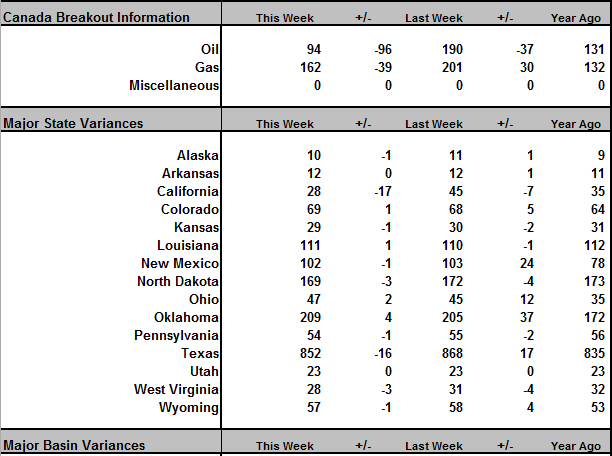

Baker Hughes North American Rig Count

Rig count: US rig count dwn 35. Canadian rig count down 135.

The Non-OPEC Charts page has been updated along with the page World Crude Oil Production by Geographical Area with September data.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Ron & Jeff,

I find this interesting. According to the IEA’s Monthly OMR report, In September, Saudi Arabia produced 10.1 mbd of total oil products, while consuming 3.5 mbd, exporting a net 6.6 mbd. Russia, on the other hand, produced 10.95 mbd in September, while consuming 3.8 mbd, leaving a net 7.15 mbd of net exports.

Russia with a population of 146 million is exporting a little more than a 0.5 mbd than Saudi Arabia, whose population is 29.6 million.

Saudi Arabia actually hit a new peak of consumption in July at 3.6 mbd. The one aspect of the oil market that most analysts fail to understand is the decline of NET OIL EXPORTS as explained by Jeff Brown.

steve

Interesting. They must not rely much on oil for heating in Russia. A little cursory browsing didn’t turn up any useful info. Anybody got any stats on Russian fuel use for anything – transportation, home heating, etc. I imagine there’s district heating in the cities, but do they burn coal, gas, wood, what else for all the heat they obviously need?

In any event, you make an interesting comparison, Steve.

They mostly use natural gas for heating, AFAIK. Gazprom also supplies much of the natural gas used throughout Eastern Europe, as well as Germany and even Italy.

The EIA shows Saudi total petroleum liquids production (+ other liquids, EIA) at 11.6 mbpd for September, 2014, which is the same number that they show for 2013 annual Saudi production. The EIA put their 2013 annual consumption at 2.9 mbpd, putting 2013 annual net exports at 8.7 mbpd (versus 9.1 mbpd in 2005).

The 2013 annual numbers for Russia are 10.5 mbpd production and 3.3 mbpd consumption, putting 2013 net exports at 7.2 mbpd. Russia has been at or below 7.2 mbpd of net exports since 2007.

The only thing more overlooked than net exports in my opinion is CNE (Cumulative Net Exports) depletion.

I estimate that Saudi Arabia has already shipped, through 2013, about 40% of their post-2005 CNE, and I estimate that Russia has already shipped, through 2013, about 22% of their post-2007 CNE. (CNE estimates based on the rates of decline in their ECI Ratios, the ratio of production to consumption.)

I thought the Saudis are still using oil for a substantial part of their electricity generation, but are trying to slowly replace it by natural gas and solar – apparently so far with limited results (?).

Maybe you can put it that Saudis are using that oil to extract more of the oil.

Red Queen Syndrome.

Oil is the biggest industry they have.

Saudi Arabia has officially recognized the necessity and cost effectiveness of solar electricity, for quite some time. They’ve had big plans for quite some time.

They seem to be having a very hard time actually building it. Perhaps the oil industry just can’t stand the idea of internal competition, despite it clearly being in the country’s best interest.

Their close neighbors seems to be doing a bit better…

Perhaps the lower cost to use natural gas rather than solar power is driving them, possibly because the desert dust covers the panels, and they lack water to wash them. These conspiracy theories about the oil industry merit a paper in a Psychlogy Journal. Maybe I’ll write one next week.

Actually, it looks like they plan to use both:

http://www.arabnews.com/featured/news/682436

Not bad, 550 MW using natural gas, 50 mw using solar. I bet they are laying km of black hose in the desert to preheat the water before they go to boiler feed pumps. I doubt they would use solar panels.

These conspiracy theories about the oil industry merit a paper in a Psychlogy Journal.

And, yes, there’s quite a lot of research on the topic:

“Why do some nations, such as the United States, become wealthy and powerful, while others remain stuck in poverty? And why do some of those powers, from ancient Rome to the modern Soviet Union, expand and then collapse?

… Countries that have what they call “inclusive” political governments — those extending political and property rights as broadly as possible, while enforcing laws and providing some public infrastructure — experience the greatest growth over the long run. By contrast, Acemoglu and Robinson assert, countries with “extractive” political systems — in which power is wielded by a small elite — either fail to grow broadly or wither away after short bursts of economic expansion.

Elites resist innovation because they have a vested interest in resisting change — and new technologies that create growth can alter the balance of economic or political assets in a country.

“Technological innovation makes human societies prosperous, but also involves the replacement of the old with the new, and the destruction of the economic privileges and political power of certain people,” Acemoglu and Robinson write. Yet when elites temporarily preserve power by preventing innovation, they ultimately impoverish their own states.

… “Most consequential ‘policy mistakes’ are by design,” Acemoglu says. “These leaders are choosing policies that don’t maximize economic prosperity, because their objective is different: to hold onto power or simply enrich themselves.”

http://web.mit.edu/newsoffice/2012/why-nations-fail-0323.html

A case in point: Fox News is doing it’s best to kill the Chevy Volt in it’s cradle with relentless attacks, filled with misinformation and cues to it’s followers that “we” don’t drive EVs.

This despite the fact that Fox News pretends to be patriotic, and the Chevy Volt has a dramatic potential to help the US car industry and reduce US dependence on oil imports.

A wealthy elite is willing to hurt the economy and forego general growth (by preventing a transition away from Fossil Fuels) to preserve it’s privileges.

There are newer wealthy who have no vested interest in fossil fuel-related products. But they haven’t done a lot so far to influence politicians on energy and environmental matters.

While Musk seems to be a prickly fellow, I hope Tesla expands its influence to start swaying more folks to alternative energy technology.

Also, although some of the folks in the “sharing” economy aren’t particularly nice either (e.g., Uber, Airbnb), their business models might encourage a breakdown of centralized energy generation and production.

The tipping point hasn’t yet hit DC, and many politicians there are doing their best to protect old business models, but hopefully at some point the money will shift to something else.

I meant a breakdown of centralized energy generation and transmission.

Musk is also connected to Solarcity.

Musk has said many times he’s more interested in accelerating the trend to EVs and renewable than he is in making money…

So far I see nothing to back these conspiracy theories. Fox isnt an oil company. I don’t live in the USA, and I’m not up to date with the electric vehicle direct subsidies. Here in Spain they aren’t worth buying. Hybrids seem ok, but the battery performance has to be given time to prove itself.

Re: EVs

If you take a look at Edmunds.com, you’ll see that the Nissan leaf is the cheapest vehicle on the road to own over five years, even excluding the tax credit/subsidy.

The Prius, and it’s NIMH battery, has been on the road for 15 years, so I think the battery has proven itself.

Fox isn’t company, it’s just a wholly owned subsidiary. By that I mean, that it’s an arm of the US Republican Party (Google Roger Ailes), and the US Republican Party is owned by the oil industry.

Re: conspiracy theories,

It’s not really a theory – if you follow the history of the Koch brothers, it’s right up there in the open. I’ll add another comment or two with additional information when I have the time.

“The Republican Party is owned by the oil industry” sure sounds like a conspiracy theory.

If you like.

So, let’s ask a question that tells us whether someone is listening to reason, or listening to Fossil Fuel investors (or works in the industry).

Line up all of the politicians who identify themselves as US Republicans. Ask them if Climate Change is a serious risk. These days about 1 in a thousand will agree.

Q.E.D.

Of Interest: Unconventional gas in USA – The Big Fix debated. “Natural gas now produces 27 percent of the electricity generated in the United States, and the percentage is rising.”

http://www.nytimes.com/2014/12/23/science/natural-gas-abundance-of-supply-and-debate-.html?_r=0

We largely abandoned oil for electric generation after the 70’s shock, now we’re going out on a different limb, while of course busily chopping it off behind us.

100 years of supply indeed. And even if it were true, what then?

Hydrogen can use some of the same infrastructure as gas. I suspect the “what then” will be Hydrogen. Natural Gas is mostly Hydrogen anyway.

Today’s hydrogen is obtained from natural gas with about 80% efficiency according to Wikipedia. Hydrogen Production

It makes no sense to produce hydrogen from natural gas since it would be more efficient just to burn the gas.

The alternative is to produce hydrogen from water. That is a big loser. It takes more energy to separate the hydrogen from water than you get when you burn the hydrogen, turning it back into water. But even after you get it separated from the water you still have to compress it, transport it, store it, pump it into a car or whatever, then use it in a fuel cell. After the whole trip is over you get about 20 percent of the electricity to turn the axle as you spent way back at the source to turn the water into hydrogen.

The question proposed by clifman, was what happens in 100 years after the gas runs out. So obviously, we wouldn’t be making hydrogen out of gas.

I suspect it will be some new technology such as this:

http://newsoffice.mit.edu/2011/artificial-leaf-0930

However there are some “demonstration” projects, and others planned that use excess wind power to produce hydrogen. As this energy would be wasted anyway, I don’t think the efficiencies really matter that much.

http://www.hydrogenics.com/about-the-company/news-updates/2014/02/18/excess-wind-power-turned-into-gas-in-denmark-using-hydrogenics-technology

These demonstration projects don’t demonstrate feasibility. The cost is extraordinarily high, and the technology isn’t applicable. I live in Spain, where the government ran a huge debt encouraging renewables, and there is a huge infrastructure. The grid is fed about 35 % by nuclear and coal, 25 % wind and solar, and the rest is hydropower or natural gas turbines. The key is to have sufficient standby gas turbines to back up the wind, because it’s intermittent. Electricity is very expensive, and this discourages industry, thus it’s one of the causes for high unemployment (although the main cause is the convoluted labor laws and the asphyxia of high taxes and an incredible bureaucracy).

Clearly, Spain has had a bad experience from solar & wind. But why?

As far as I can tell, both Spain & Germany (and Italy, to some extent) invested a lot of money into subsidizing solar. They spent more money than they expected to. Why?

Because the cost of PV fell more quickly than expected, investors piled into the market faster then expected, and (at least in Spain) there was substantial fraud and mismanagement.

But, many Germans are happy with the project because they understood that this investment was intended to bring down the cost of PV. The fact that it worked better than expected is good, not bad.

Germany, of course, can afford a large investment into PV much better than Spain.

Finally, in Germany the increase in electricity price has as much to do with unrelated taxes as renewable charges. I don’t know about Spain.

So, the bottom line is that you shouldn’t over-generalize from Spain’s bad experience.

That’s my understanding of Spain’s experience with solar – if you have other info in the form of links/sources, that would be interesting.

The Germans who are happy with the solar performance just lack the proper education and know how. However, german publications are gradually opening the eyes of the public. I saw an interview in a left wing german paper the other day, very critical of their solar program. Spain’s program was absolutely and incredibly stupid. They copied the german program.

No, pretty much the whole country, including the engineering and scientific a leader of Germany, are committed to this program.

Do you happen have a link/source for the article? I often see references to articles in Der Spiegel in this context. They seem to have a vendetta against wind and solar – they’ve published a series of articles with a great deal of misinformation. You may have been misinformed by them.

“A leader” should be “elite”.

Gotta proof read.

Gotta proof…

There are plenty of Germans proud to have led the world into a PV age.

Spain did not copy the German program exactly. They made several huge mistakes.

(1) they didn’t have a reservation system or planned reductions in the feed-in tariff (FIT).

The bureaucrats assumed it would be years before PV was at their goals (and fiscal limit) of 400 MW. When the PV industry blew past this limits, the government was slow to cut off the FIT, so Spain got 3,500 MW of PV in 2 years (2007 & 2008) instead of 400 MW in 5 or 6 years.

n.b. 2008 was the big crash.

(2) when they realized things were way larger than they wanted, the government shut things down abruptly, leaving many Spanish PV companies broke.

(3) the Spanish govt set their FIT levels higher than Germany, even though they have as much as twice the sun. With such crazy high tariffs, all kinds of con artists and incompetents got into the action.

Please explain. I understand that hydrogen, being such a small element, isn’t easily contained and escapes existing seals; also makes metals brittle. How would you produce (liberate) hydrogen? The majority is now made using an energy-intensive process to liberate it from the fossil fuel natural gas, no?

Google “hydrogen production” and you’ll be an instant expert or recall a grade 10 project in electrolysis. Remember: H2O and salt and two wires from a battery = hydrogen + Cl2)? However, most hydrogen (∼95%) is produced from fossil fuels by steam reforming or partial oxidation of methane. As far as I can see a so-called “hydrogen economy” goes with warp drive, right Scotty?

You put a dollar’s worth of energy in and get 20 cents worth of energy back. That is Why a hydrogen economy doesn’t make sense.

Cost is not always the deciding factor.

Let’s take cars as an example. Let’s assume that in the future there is a businessman that is required to travel several hundred miles in a day. He has the choice of using a battery electric car, or a hydrogen car. The hydrogen car gives him the advantage of longer range, and quicker refueling times. So even though the battery electric car is cheaper, and more energy efficient, the hydrogen car may still be a better benefit to his business, despite the higher cost.

One can always dream up scenarios where the cost is not the important thing but a few possible cases will not influence the overall market. The big picture, the overall economic picture, will be what determines whether the hydrogen car is built or not. And the big picture says it is a lousy idea. There will never be a so-called hydrogen economy. It is just a very bad, very uneconomical idea.

I agree with Ron overall. It may be possible to build fuel cell cars for a while- until natural gas gets to be scarce and expensive.

The only way there will ever be a hydrogen economy is if there were to be enough surplus wind and solar or other intermittent renewable power to dump it into industrial plants designed to electrolyze water.It is rather unlikely to extremely unlikely so much wind and solar capacity would be built that there would be enough surplus electricity to manufacture free hydrogen in quantities large enough to REALLY matter.

Somebody upthread pointed out that hydrogen is hard to handle and store. This is true. It leaks right thru steel pipe. Building out a hydrogen distribution system would cost a fortune by any measure.

And given that we already have an electrical grid….. my bet is on batteries eventually being the all around cheaper alternative storage mechanism.

Fuel cells imo are destined to be a niche technology. It may be a pretty big niche but they are unlikely to compete with batteries head to head. Heavy trucks can be built to run efficiently directly on lp gas. So can larger farm tractors and larger construction machines such as bulldozers.

This is off the shelf and on the market technology that actually already makes sense dollar wise if you live in a place where lp gas is readily available and bring your big truck home every night.

If natural gas stays cheap in comparison to diesel compressed natural gas may well be the fuel of choice for truckers wherever it is available in a few more years.

With diesel at four bucks ( not right now of course) compressed natural gas would be competitive today if the trucking industry would adopt it. But apparently most truckers have been afraid to spend the bucks for fear diesel would come down again.

Sure enough diesel DID come down.

Being somewhat of a gear head I like to keep up with such stuff and it appears that a year ago you could have recouped the extra cost of a new heavy truck built to run on either cng or diesel within three years max assuming diesel and natural gas prices had held about steady.

This is enough of an advantage that trucking companies are going to be unable to ignore it depending on the relative price of natural gas and diesel going forward.

Lots of tractors used to be sold in the midwest ready to run on lp gas but they went out of fashion when lp went up in comparison to the much more convenient diesel fuel three or four decades ago.

“The only way there will ever be a hydrogen economy is if there were to be enough surplus wind and solar or other intermittent renewable power to dump it into industrial plants designed to electrolyze water.”

Well maybe but hydrogen isn’t generally made by electrolysis. You might be recalling some old high school science experiments? Not that hydrogen has a hope in hell in creating a “new economy” in any reasonable time frame: Well, maybe along with fusion and warp drive. Ask Scotty (or Data) for an informed opinion in 3014/15-ish.

Mac, if you care, check out “steam reforming” which, as I recall, yields ammonia, as well and hence, possibly fertilizer??? You’d know all about that I’d imagine.

Hi Doug,

I am familiar with the basic processes involved in manufacturing ammonia and such of course – not the details but the basic reactions and the stuff going in and coming out.

I should have made it clear that I was thinking about a time far enough into the future that input materials such as coal and natural gas would be very expensive relative to today’ s prices.

I am under the impression that steam reformation of coal is nowadays an obsolete process or nearly so. I know it was once used extensively to manufacture so called town gas.Dangerous stuff with a hell of a lot of CO in it.

This would have the effect of substantially lowering the relative price of hydrogen produced by electrolysis compared to getting it by steam reformation or stripping it out of any material such as wood or crop residues.

The thing about stripping out hydrogen is that it consumes a lot of energy while at the same time it consumes something that can just be fed directly into a furnace or a boiler.I expect such materials as so called waste wood to be rather valuable within the fore seeable future.

It has been years since I looked into the specific way the chemical industry manufactures nitrates etc but to the best of my knowledge these days the process uses natural gas as both the energy source and primary feedstock.

At one time iIrc electrolysis was commercially used to get the hydrogen needed to manufacture ammonia. This was way on back there and other processes soon proved to be more economic.In those days the ammonia went into manufacturing explosives for military use mostly rather than fertilizers.

When it comes to industrial chemistry I (used to at least ) know the basic outlines of the processes involved in manufacturing all the important agricultural inputs.Probably about as much as the average baker knows about growing wheat. In other words not very much but at least what was needed and where the plants were in a broad way.

I don’t bother keeping up any more being retired now.

A working farmer needs to know at least the bare outlines of the industrial chemical industry in order to understand his supply problems. Knowing that natural gas is going up is reason enough to buy your nitrates early if you have the cash. Nitrate prices lag the natural gas market but nitrates always go up when gas goes up.

Knowing the plants are overseas ( some manufacture has returned stateside recently ) and supply is therefore vulnerable to disruption due to war or embargoes etc is pretty important. You could get caught short if don’t stock up early.

Coal to liquids, to make syndiesel is more practical, if they get around the co2 emissions problem.

Exactly: CTL is very practical except for the CO2 problem. Sequestration is somewhat expensive, but it would work. Of course, that’s still using fossil fuels, and people like to ask the theoretical questions about what to do when FF runs out.

It’s a pretty theoretical question, given the enormous amounts of FF in the ground, and how long they would last if they were used in much smaller amounts.

What you said is true, but the question proposed by clifman is what happens when the gas runs out? No natural gas, no LP gas, no oil. That day will certainly come.

So we have 3 basic working technologies now:

1. Hydrogen

2. Batteries

3. Biofuel

Biofuel works fine. The problem is trying to scale up to the current levels of liquid fuel consumption. E.g. , you would have to plant every arable acre (500 million) in the US with corn in order to produce 140 billion gallons of Ethanol.

Batteries work fine too. The drawback is the limited range, and relatively long recharging times. Imagine a battery powered big rig delivering goods across country. It would have to make many multiple stops, and spend many hours recharging.

Hydrogen vehicles solve both problems. The supply of hydrogen from water is virtually unlimited. And Hydrogen vehicles have longer range, and shorter refueling times than battery vehicles.

No doubt in the future, there will be better batteries. And perhaps genetically engineered plants that yield huge quantities of Biofuel, that solve the respective problems. Time will tell.

I just re-watched this “documentary” recently, and wondered what you all thought about it:

https://www.youtube.com/watch?v=S56y0AzwdVk&list=PLPRaak5gqMIj0zN7pDN-0PfBwyb6P-ypZ

Here is the playlist on youtube

http://www.graphenea.com/blogs/graphene-news/7915653-graphene-batteries-and-supercapacitors-to-power-our-world

whos to say betterys wont get more efficent

the biggest breakthrough today in technology i think is graphene it may end up being one of the greatest tools used to lesson the impact of peak oil

but of course its not gonna fix all the problems we are gonna have and its still many years off im betting

Jeez! Has everybody forgot that there are lots of thermal machines that run on just HEAT? You don’t need any hocus-pocus. Take any old biomass whatsoever and just burn it. To hell with the corn and alcohol and all that. Use weeds.

Then you take that heat and run it into, for example, a closed cycle gas turbine. Very powerful, very efficient, very well understood and proven. If you prefer a stirling, use that, or lots of other things, like combined cycles.

Or, if you are timid, take your pile of weeds, pyrolyze it, and run that gas into your diesel.

And put the carbon back into the ground where it belongs.

It’s a nice film. But I disagree strongly with the happy ending. And the start of the problem won’t be as fast as the say, ofcourse. High speed trains and large container vessels in a post oil world, running on algae? Don’t think so.

Working technologies? Four, the foot, five wind for sailboats and six water though some areas lacking these might be screwed, but so these things go. No more carboning London Bridges off to Arizona like they did during the age of affluenza, for example.

“Imagine a big rig delivering goods across the country.”

Meh. Why bother? Buy local, keep that wealth local.

“The supply of hydrogen from water is virtually unlimited”

And nuclear power is too cheap to meter, and there’s more sunshine than some marketing drone could blow up your aHEY HEY KIDS!!! but you know that pesky reality thing just won’t go away. And, hey, look, humanity is plunging like a pricked bull right along the path outlined by the limits to growth folks a few years ago. Good fun!

John,

Fuel cell vehicles are EVs. They just have a small battery.

Well, H2 will always be much more expensive than electricity, so it seems inevitable that fuel cell vehicles will eventually have larger batteries and be chargeable.

So, you have an Extended Range EV, and the only question is: which makes more sense, an ICE (with biofuels, residual oil or synthetic fuel) or a fuel cell? Given that it won’t be used for more than 10-15% of miles driven and that fuel cells have very large capital costs, I think the answer is clear.

No need to build out an expensive hydrogen distribution system because hydrogen could be generated on site were needed- you just need power and water.

But, I agree there are lots of problems with making a hydrogen economy work.

Hydrogen is an energy storage mechanism that has a storage problem.

Someone must have been able to store it, or they wouldn’t have been selling these all over the world for the past year:

https://www.hyundaiusa.com/tucsonfuelcell/

It’s not impossible. Its just tricky, and the real issue is the point of use. The ‘gas tank’. A big carbon block etc. There are solutions. They are just something of a kludge.

Future EV’s may likely have a longer Range than H2. kWh density per unit of volume of Hydrogen is not exciting unless it’s liquid or under extreme pressure. Then it’s really exciting. You can add more batteries to get range, so it’s likely to get back to economics and future battery costs. Liquids fuels at room temperature such as Ethanol or Ammonia may be a competitor.

I dont think hydrogen can use any methane infrastructure. Wrong metallurgy, wrong seals, wrong compressor parameters.

I think you are wrong.

http://www.sciencedirect.com/science/article/pii/S0360319906004940

This is the abstract which is all I can get of the article on using hydrogen in existing gas infrastructure.

xxxxx

In this paper, the transport and distribution aspects of hydrogen during the transition period towards a possible full-blown hydrogen economy are carefully looked at. Firstly, the energetic and material aspects of hydrogen transport through the existing natural-gas (NG) pipeline infrastructure is discussed. Hereby, only the use of centrifugal compressors and the short-term security of supply seem to constitute a problem for the NG to hydrogen transition. Subsequently, the possibility of percentwise mixing of hydrogen into the NG bulk is dealt with. Mixtures containing up to 17 vol% of hydrogen should not cause difficulties. As soon as more hydrogen is injected, replacement of end-use applications and some pipelines will be necessary. Finally, the transition towards full-blown hydrogen transport in (previously carrying) NG pipelines is treated. Some policy guidelines are offered, both in a regulated and a liberalised energy (gas) market. As a conclusion, it can be stated that the use of hydrogen-natural gas mixtures seems well suited for the transition from natural gas to hydrogen on a distribution (low pressure) level. However, getting the hydrogen gas to the distribution grid, by means of the transport grid, remains a major issue. In the end, the structure of the market, regulated or liberalised, turns out not to be important.

xxxx

Reading the abstract alone tends to incline me to believe than hydrogen is never going to be transported in existing natural gas pipelines or used as a straight up substitute for natural gas in very many situations.

Seventeen percent is enough of a blend to distribute a lot of hydrogen but so long as you still have to have eighty three percent or more ng…. what is the point except to get any odd amounts of H2 to market as a blend?

H2 is troublesome even at low pressures. Compress it enough to store it or transport it in quantity and it goes right thru any kind of affordable pipes and tanks like water thru a screen.

A lot of people are working on storage though and there might be breakthroughs in terms of affordable storage within the next few years.

John B, here’s a quote from the paper you cited:

“Mixtures containing up to 17 vol% of hydrogen should not cause difficulties. As soon as more hydrogen is injected, replacement of end-use applications and some pipelines will be necessary. Finally, the transition towards full-blown hydrogen transport in (previously carrying) NG pipelines is treated. Some policy guidelines are offered”.

In real life a paper doesn’t really mean much to people like me. I’m retired now, but I used to sign off on designs and documents for industrial projects, and my training included a keen awareness of the critical need to avoid explosions and setting people on fire.

Thus I write his as a prior authority who had to think a lot about these things, and I can assure you it will take a lot more than a Mickey mouse paper to convince me to feed 15 % hydrogen into a 30 year old 30 inch diameter gas pipeline working at 1000 psi. Senior engineers who are responsible citizens don’t sign off on things that easy, and thank God we exist to keep your behinds fairly safe.

Here’s another quote:

“only the use of centrifugal compressors and the short-term security of supply seem to constitute a problem for the NG to hydrogen transition”

A transition to 2 % hydrogen, John. That’s not worth much. Hydrogen is a tricky molecule. So tricky many companies prefer to buy it from others, this way they reduce the amount of hydrogen gear they have to put inside their plant fence line. It’s much safer to ship electricity using a high voltage line.

John B – kinda, sorta.

But saying natural gas is mostly hydrogen is like saying table salt is half chlorine, a toxic/corrosive gas – so completely avoid salt.

The “Power to Gas” movement in Europe is checking into adding some hydrogen (or methane from CO2+H2) to the natural gas “grid”, to use the existing gas pipelines, etc.

http://en.wikipedia.org/wiki/Power_to_gas

This is an old idea, that never quite seems to pan out.

Some issues:

* hydrogen embrittlement of metals – not a showstopper, but any given pipeline/compressor/tank/etc. must be verified as resistant or replaced.

But in Germany, their old gas systems were built for “town gas” (manufactured gas, using the water-gas shift reaction from coal, so it had 50% H2 in it).

* the Wobbe index – measures how similar things burn, put too much H2 in nat gas and people’s stoves… act funny.

* underground porous rock storage – you’re feeding H2 to bacteria in the rock, they make H2S (hydrogen sulfide), H2S is toxic and corrosive. And your gas disappears.

* the lightweight steel tanks in current nat gas vehicles are limited to 2% H2, and they are embrittlement susceptible.

Some articles:

http://www.gerg.eu/public/uploads/files/publications/GERGpapers/HIPS_-_the_paper_-_FINAL.pdf

http://www.nrel.gov/docs/fy13osti/51995.pdf

Bottom line, you’re limited to replacing 10% +/- of the methane with hydrogen before things get a bit weird –> more costly.

And in a world soon to hit peak gas, why invest in a “renewables” solution that declines as fossil fuels decline?

I don’t get it….

I would like to get a (used) Tesla Roadster and the new 400 mile range battery/aero/tyres upgrade.

http://www.treehugger.com/cars/elon-musks-xmas-gift-roadster-30-upgrade-400-mile-range-model-s-upgrade-come-eventually.html

I am getting a near-passivehouse place for myself,

(backup heater required by code),

but even in the UK one can get by without a furnace:

http://www.treehugger.com/green-architecture/cropthorne-autonomous-house-survives-english-winter-without-furnace.html

“I don’t get it…”

I think the Hydrogen proponents are anticipating a solid state direct solar water splitting device (artificial leaf). Something like this:

http://pubs.acs.org/doi/abs/10.1021/nn5051954

So that in the future, Hydrogen production is as cheap and scalable as electricity from PV.

And this looks like it might be more fun than the Roadster:

https://www.youtube.com/watch?v=FrGFjAlawmg#t=239

In the future our descendants will be riding antigravity belts.

searching for the group at Berkeley, I find their fancy new device is 0.12% efficient. “about as efficient as most plants”.

Hopefully you’ve followed the biomass saga – biomass just isn’t efficient enough vis-a-vis available land area –> sufficient enough to sustain modern levels of civilization. PV and wind are technically sufficient.

Every 5 years or so, someone else reinvents the direct solar cell to hydrogen… doodad. The earliest I know of is Roger Kilby of Texas Instruments has a patent filed in 1975 to split hydrogen bromide with a solar cell made of spherical silicon and store the hydrogen and bromine for later use.

http://www.google.com/patents/US4021323

All these combined photovoltaic (PV) and electrochemical cells have the same two big issues:

(1) when you put a bunch of extra junk in the solar cell, efficiency goes down – so you’re better off having a plain/mass-produced–>cheap PV panel feeding an optimized electrolyzer that can also suck up excess wind, hydro, … power.

(2) PV modules last 20-30-40 years, and need to last that long to have good economics. Electrochemistry electrodes have all kinds of side processes going on, and they don’t last near that long. (e.g. how long do most batteries last?)

Putting things in the sunlight is brutal – UV has enough energy to break chemical bonds. Fancy structures are going to break down. Plant leaves repair themselves on an ongoing basis.

Commodity PV panels benefit from economies of scale and the learning curve. Specialized PV does not.

Witness Soitec, a concentrating PV maker, is in trouble.

http://www.greentechmedia.com/articles/read/CPV-Hopeful-Soitec-Latest-Victim-of-the-Economics-of-Silicon-Photovoltaics

List of the dear departed CPV makers at end of that article.

I have no doubt that a fair bit of hydrogen will be produced in the future from solar and wind, etc., but mostly for industrial chemistry, like the Vemork ammonia (for fertilizer) plant from 1911.

http://en.wikipedia.org/wiki/Vemork

But as an energy carrier, hydrogen is pretty inefficient and troublesome.

The answer is fairly straightforward:

Fossil fuels will be gradually replaced by wind and solar, with nuclear probably staying roughly level.

Batteries will gradually replace the bulk of liquid fuel for transportation, with niches supplied by biofuels and a very, very long tail of oil production. Eventually synthetic fuels will be produced using surplus electricity – they’ll be expensive compared to oil but affordable because they’ll just used used for niches.

Hydrogen could be used for niches, like seasonal grid backup. Seasonal grid backup could be provided by electrolysis, with the H2 stored cheaply underground. The round-trip efficiency would be low, but it wouldn’t matter much because the input power would be cheap, and such a solution would have a very low capital cost – far lower than something like pumped storage or chemical batteries (which rely on use over many daily cycles to amortize their high capital cost). Seasonal backup would only be needed rarely, as an overbuild grid would mostly be in surplus (except that power would be much cheaper during periods of surplus because of the zero marginal cost of renewable power).

17 moving parts for a Tesla P85. vs thousands for a ICE. efficiency is a big advantage

David Hughes just sent me the chart below. Converting the monthly Canadian crude oil production, using 6.2898 barrels per ton, we get the following production for Canada, in kb/d:

Jan-14 Feb-14 Mar-14 Apr-14 Canada Crude Oil 3,436 3,462 3,55 3,431 May-14 Jun-14 Jul-14 Aug-14 Sep-14 3,338 3,402 3,448 3,389 3,489The EIA has Canada at 3,867,000 barrels per day, 378,000 bp/d higher than Canada has them.

I’m guessing it’s a data entry error.

When would we know that for sure?

Would they admit it was an error or just “revise” down?

Okay, could not get the data formatted correctly but here is the chart:

Unlike just about everywhere else, Canada has known, no crap, no interpretation, no doubt HUGE reserves. It is there. A time will come when it doesn’t matter how much it costs to get it. They have it and if they MUST have it, they WILL have it.

Which is why Suncor is different from Exxon. They HAVE reserves. Exxon is eating theirs up.

Not if it requires more energy to extract/process than you get out. What is the EROEI now, about 3? Is that enough surplus to maintain/replace the infrastructure and maintain society at BAU levels?

Don’t matter. Not a bit.

If you can’t get food to NYC, you drill the oil no matter what its cost in anything. No government could possibly get re-elected if they let cities starve rather than get oil that is there. Hell, they’ll have guys with shovels out there paid with printed money if that’s what it takes to get food to the cities.

This is not a calm, aloof scenario with sophisticated analysis. If people are going to starve without oil, then you get the oil, even if the energy required is calories from sugar.

Watcher ought to use a sarcasm indicator sometimes. EROEI does matter and he knows it.

But it is true that so long as the oil can be extracted and shipped at just about any price it will be done if necessary to avoid collapse.

I do not know what the eroei for tar sands oil is but so long as it can be marketed using only tar sands oil itself as the basic energy input it won’t really matter. ALL that will matter is that the process can be kept running at a monetary profit or that society can afford the necessary subsidy.

It seems to be the case right now that most of the energy used in the mining and processing of tar sands oil is gotten by burning local natural gas which is dirt cheap compared to oil on an energy content basis.

I could be as wrong as wrong can be but I nevertheless believe that the estimates of the required ereoi ratio of five or nine or whatever that you hear coming from different sources is based not on physics or physical laws but on the ASSUMPTIONS used in the calculation of the necessary ration.

The process of mining tar sands requires only a little in the way of NEW steel to maintain production since the old machinery in the mines can be recycled. The percent of the energy input that goes into the mining devoted to steel and manufacturing machinery to use in the mines is actually rather small compared to the energy content of the oil produced.

. If the process is highly automated and the machinery lasts a long time ( and mining machinery is quite durable) then if it takes the energy in one barrel to produce THREE – well you still have the two barrels out of three net on a rough basis and if it sells for more than the cost of operating the mine it will continue to go to market for as long as the price and the cost structure continue to hold.

The amount of energy that goes into the miners shoes and housing and food is obviously trivial in relation to the amount of oil produced per worker.

The amount of energy that goes into manufacturing a two hundred ton truck is trivial in relation to the amount of energy in the oil in the sand that truck will haul over the next fifty years.And it will be kept in service someplace or another that long.

A good agriculture shop teacher way back when I was a student in high school wrote ASS U ME on the chalkboard and left it there permanently. The idea was that you never assume the gun is empty or the gas tank full or the wheels chocked or the antifreeze in the radiator or that the wind will not start blowing right in the middle of cutting down a tree.

Never assume the cop is not in his favorite spot behind the bill board before you floor the gas to show a buddy how good your car accelerates.

Never assume that your girlfriend won’t go thru your phone and your email sooner or later.

Never assume that clever and persistent engineers won’t figure out ways to do things cheaper. Those mine trucks will be operating autonomously a long time before cars on the road are driving themselves and once the tech is perfected and installed- it will run for a tenth the cost of a driver. Maybe a hundredth. The auto driver system will not need breakfast or supper or a hot bath or a bed to sleep in.And it won’t have an accident due to fatigue either.No medical insurance no pension no paid holidays. No safety meetings. Never oversleeps. Calls in sick a lot less often than an obsolete flesh and blood trucker.

The factory of the future will have only two employees on hand on a regular basis. One will be a man to watch the gauges and look for troubler and call the mechanics if needed. The other will be a dog whose job is to make sure the man doesn’t touch anything.

I just don’t think anybody knows how high eroei has to be for any given energy industry to be viable.

Assume can and does make asses of u and me. Dead asses sometimes.

Believe it or not, a company I worked for had a feasibility study done to use nuclear power to generate steam for heavy oil production and process needs. If the emissions issue gets in the way I believe we will see nuclear plants built next to the upgraders.

Syncrude in the past reported that it used 1/6 boe of natural gas to produce 1 barrel of Synthetic Crude Oil (SCO). That puts the EROEI in the 4.5 to 5.0 range, after accounting for some diesel fuel to truck the oil sands around and electricity to run the plant.

The natural gas is used in the coker units to reduce the carbon content of the bitumen feed by about 16%. I barrel of bitumen produce 0.84 barrels of SCO. According to Canadian Oil Sands, the largest partner in Syncrude, a barrel of SCO contains 48% distillate vs 37% for WTI. Also it only has 1% bottoms vs 8% for WTI. On an energy basis, a barrel of SCO may contain slightly more energy than a barrel WTI, judging by the larger fraction of distillate.

As an aside, SCO from mining operations are on average only 8% to 9% more GHG intensive than average barrel refined in the U.S. according to an November 2012 IHS CERA report,

The mines are quite efficient compared to SAGD, but I’ve yet to see the fuel cost to haul the sand and replace the surface back to initial conditions.

As regards oil upgrading, there are processes which allow the heavy ends to be upgraded (ie they don’t make coke). I would love to lead a small team to design a combination nuclear plant and full upgrader to make a really nice 38 degrees API syncrude. We would get more syncrude barrels than bitumen feed barrels. Call it upgrader gain. Neat, isn’t it?

Well there’s your overshoot on global production estimates.

Probably should include rendered pig fat and duck fat in the crude inventories. Lard and duck sauce are just as important and maybe even more than crude oil. lol

The CNE, cumulative net export model, the extrapolation, is the number one indicator of a ineluctable reduction in future production/supply. Paints a bleak picture.

When the oil was a crisis during Jimmah Carter’s administration, coal consumption was advocated to reduce dependence on foreign oil, now coal is the dirty dog in the fight. Funny ol’ ride in this world.

Have to blame President Carter for the increase in the use of coal for an energy source. Hypocrites and double standards are the cause of cognitive dissonance.

You are blaming Pres. Carter for the USA’s-current use of coal? I’ll bet it all that your main news sources are Alex Jones, Limbaugh & The Blaze.

$53.xx. But you know, the large established companies will buy the small ones, because they are going to want even more unprofitable wells than they already have.

“Hello, Janet? Hi. How’s the weather in Washington? Great. That’s great. Hey, we have an idea to present to you. Do you have a minute?”

“Yes, that’s right, Janet. Greece. They cost us another $1 on WTI today. What? No, we don’t want you to bail them out. But there are some true blue Americans up there in North Dakota who’d like to see some fresh green ink. What d’ya say?”

Is this the end ?

Looks like Christmas to me. Give it time.

They did drill a few holes on Christmas Day, though…

The boarding of flights out of Williston are filled with oil workers who aren’t coming back. Boom is over for now. Workforce to decline by 20,000 by June, imo.

Good deals on furniture on the boulevards and alley ways I hear. Happened in the mid-eighties and it is happening again, however, this time, there are going to be 9300 more wells that need to be worked one way or the other, shut them down or keep them pumping. The infrastructure is there, so there will be a workforce in place.

Williston has an airport?

http://www.flywilliston.net/

Sloulin International

Yup. identifier ISN. Longest runway 6600 feet. Plenty for Gulfstream IV or CRJs, American and United have service there.

What would be cool is fracking a well right under that runway. There are wells pumping at OKC.

Well, you’re in luck because Statoil has a well whose horizontal leg runs directly underneath the runways at the Williston airport. It was drilled in 2011: File # 20282, WILLISTON AIRPORT 2-11 1-H.

Note that work has been ongoing for the last few years now to build a big, new Williston airport somewhere a little farther out of city limits. 2015 is supposed to be the year when plans are finalized. Aside from being too small to accommodate the dozens of daily flights, commercial and private, now coming into and leaving Willistion, the land the current airport sits on has become too valuable to use for an airport. Plus, the city really likes the idea of building a big convention center and hotel within close proximity of a new airport. They are tired of Bakken-related economic development conferences going to Bismarck, Minot, or Denver due to lack of meeting space in Williston.

Satellite view of the airport terminal from this past September.

Hey, is that a trucker urinating on the ground there under that Bombardier starboard horizontal stabilizer?

Black Sunday May 2, 1982

http://www.coloradoindependent.com/119367/black-sunday-lessons-from-30-years-ago-coloring-colorado-oil-shale-debate-today

I think they are talking about something entirely different here. This is the “Green River Shale” they seem to be talking about. This not the same kind of shale they are drilling in North Dakota and Texas. This Colorado stuff is not oil at all but kerogen. And they don’t drill it, they mine it.

Though the Shell operation, abandoned just a few years ago, did produce some oil but it was totally uneconomical. They put electric heaters down holes in the ground and heated the kerogen for three of four years, then they could drill it for oil and gas.

I had lunch with Shell’s heater guy a few years ago, and jokingly asked him if he was planning on using nuclear power to generate the electricity for his electrodes…he looked at me, held up two fingers, smiled, and said “I think we’ll need two”.

There are still some companies working on extracting oil shale. I wouldn’t write it off just yet.

http://www.redleafinc.com/about-red-leaf

I can’t make any sense out of this chart. I can’t even reproduce the handle of the person that posted it without hunting up a new alphabet. Any enlightenment will be appreciated.

None of the labels make any sense at all without additional context or explanation – at least not to me.

MAYBE the dates are days in dec 2014 ? Maybe the up top label that reads Bakken start drilling should read Bakken wells started by date ? Maybe ”count wells” is not a command but should read in ENGLISH ”well count”?

Mac, they are the number of drilling starts on those particular days. On the 15th of December 12 rigs started drilling a new well, on the 16th of December 8 rigs started drilling new wells and so on. The data comes from here Current Active Drilling Rig List.

He just searched on the dates and counted the starts on that particular day. The format is European, day before month.

Миша = Misha, in Latin script.

Baker Hughes Rig counts are in. They are posted above at the bottom of the post. Or you can go to the link.

Rig count: US rig count down 35. Canadian rig count down 135 to 256 from 391 one week ago. That is a drop of 35% in one week.

US Oil rig count down 37, gas rig count up 2. Oil rig count 1499 down from 1609 about two months ago.

Baker Hughes North American Rig Count

“Lower oil prices are UNABIGUOUSLY POSITIVE for American and it is Russia who will be the only one hurt.” — Lawrence Kudlow, PB, 2014 (Professional Buffoon)

Hang on to your ass then…

I keep telling y’all. Economic apocalypse is forbidden for all time in the future.

2008 was a precedent of unequaled magnitude. If numbers on a screen say people are about to die, the numbers will be changed. If the recent articles are true and the shale industry’s destruction is about to re-smash the entire economy, it won’t be allowed. Simply that.

You’ll have to dig to see what is done, because media won’t understand it or report it as such, but something will be done and wagons will be circled around normalcy as everyone declares normal still persists, despite the measures just taken.

Williston Light Sweet posting on Plains Marketing site today $37.19.

Light sweet on Flint Hills Resources is $35.25. I noticed on both sites there are sour prices that are in the low $20s or teens and one price on Flint Hills that was around $8. Can someone explain what wells produce that crude? Is it old conventional wells? Are some wells in ND back to producing $8 oil? If so, WOW!!

Flint Hills Resources 12/29/2014 bulletin

North Dakota Light Sour $32.86

Light Sweet 35.25

Medium Sour 28.86

Northern Area 18.50

Sour 8.50

Southern Area 45.50

Plains Marketing LP Bulletin 12/29/2014

Williston Basin Light Sweet 37.19

Sour 25.08

Anyone able to shed any light on the above?

The light sought would be Lynn Helms filing his retirement papers soon. Cushy state govt pension.

Sour gas contains too much hydrogen sulfide which makes it corrosive. In addition to being corrosive it can kill you if you breathe in too much: Nobody wants the stuff. That’s not really true, of course, but it requires special treatment and ‘sour’ is a relative term. Sour oil is oil containing a high amount of sulfur; when the sulfur level is more than 0.5% the oil is called “sour”. From my limited experience, some areas in producing fields are sour and avoided, if possible; any “real” oil guy would know.

Doug,

Unless you are being sarcastic, it sounds as you are trying to pick a fight with Shallow Sands, who by all accounts very well knows what sour crude is. I suspect he is interested in the outlyer of $8 per bbl.

To me it looks who ever is posting the prices is trying to send the message they really don’t want the stuff, or they left a digit of the front and it is a typo.

No, not trying to pick a fight, more like not understanding the comment. Maybe I ate too much turkey for Christmas.

No. Not offended. Have some wells that have big time H2S around here. Wear monitors.

I know only what I have read about ND production and would like some reliable info. Go to Flint Hills crude price bulletin. It isn’t a typo IMO. There is a sour crude who’s posting has consistently been around $45 below WTI and therefore is at $8.50 as of 12/29/14.

Just wonder what formations ND sour comes from. Readily admit my background is financial plus self-educated. No pet. engineer/geologist/chemist, etc here.

And I thought I’d never see $8 oil again. Check that one off the list!!

Doug. My background is owning WI since 1997 in wells 800′-2,500′ deep in a field discovered prior to WWI. I would not say I am as much of an “oil guy” as are several people who post. I do not have the education nor professional training. The more technical knowledge I can acquire the better.

I’d share more but this is the internet after all. I will say I never envisioned the ride I was getting on when I started with 6bbl per day 17 1/2 years ago. That 6 bbl is still at 5 bbl BTW.

$17 to $8 to $30 to $13 to $140 to $26 to $111 to $48. Geez.

Some sour grades are heavy crudes with metals and high acid content. I worked on a case many years ago, in which these contaminants were so harmful we were told the oil could not be put in the plant, period. So we kept that oil shut in.

Howdy, Doug.

I am not real but I snorted some H2S today, in fact. It is prevalent in some Cretaceous age carbonates in S. Texas and I also believe in the PB. MBP knows more about the PB than me. I was on a job once in Mississippi, we had to wear masks it was so bad. When you can smell it, it won’t kill you, When you can’t, your dead and don’t know it yet. Most of the hands working in the Eagle Ford wear sensors on their coveralls. H2S seems to increase in concentration from east to west in the EF and in McMullen County in the dry gas to condensate window it is upwards of 6-8%. If you get a whiff of that it will give you a bad headache and make you not want to drink beer for a week. H2S is indeed very corrosive and will eat holes plumb thru 35#/ft. casing. Some places in the world they have to run stainless casing and about 5000 dollars a linear foot. The Smackover in East Texas and south of Little Rock, Ark is deadly H2S; so sour you can’t hardly treat it, +15-18%. It’ll peel the paint off a barn 6 miles downwind.

One of the biggest blowouts, or one of the most infamous for deaths to well control personal, was actually in the Lodgepole formation right above N. Dakota in Canada many years ago (1980?). That well was so sour it was intentional set on fire to help burn the H2S off, and was actually capped still burning. I believe 6 people were poisoned on that well.

Nasty stuff, H2S. Smells like rotten eggs on a July afternoon.

Mike

What I am getting at is how much production in ND is at each of those grades? All I ever hear about is light sweet re ND shale, so wonder if any of the new $10 million wells in Bakken or Three Forks produce sour crude?

Better turn quick for the folks up there. I am upset with them for going crazy w the debt there and in EFS and PB, but yet also feel bad too.

$35.25 x 80,000 bbl oil = $2,820,000

$1.75 x 120,000 gas = 210,000

Gross income 3,030,000

Taxes 278,760

LOE (OPEX) 400,000

G&A 400,000

20% RI/ORRI. 606,000

Net for year one production. $1,345,240. On a $10 million well.

I don’t think any of the more than 11,000 wells drilled up there could pay out in 12 months at $35 oil.

I do not recall anyone foreseeing this. No one.

Yet Bakken driller stocks have bounced off their lows. Either a new math or a lot of inside info out there re oil price that us small fries don’t have access to.

Crazy times.

Some of it is the rising tide of the market itself lifting all boats.

Or some of it is confidence in a bailout of some kind.

Who remembers how fast prices came back up the last time they crashed?

I don’t have a good memory for numbers but it was only a three or four months IIRC before prices were well above the low again.

I am thinking now that the big boys at the super majors maybe saw this price crash coming a year ago when they started cutting so deep into capex.

The real Mc Coy top dog insiders- the guys with the big computers and access to all the data a super major is privy too – may KNOW just about how long it is going to take prices to go up again.

The banking people seem to have made fools out of themselves loaning money to the tight oil industry but we need to remember a loan officer is not loaning his own money. He just approves loans according to guidelines established by higher management.And it is not management’s own money either.

Maybe a lot of top dog insiders at the bigger banks pretty much KNOW how long it will be until prices go up again.

Personally I do not believe it is truly possible for anybody in the oil industry to truly conceal from other top dog insiders what is going on in any given company or any given country except for the minor details.

Any fool who has ever kept books at a furniture plant can tell you about how many bedroom suites are going to come out the shipping end if you tell him how many truck loads of lumber are being unloaded in receiving.

Saudia Arabia may be able to keep a lot of data more or less secret but there is no way the country can keep the companies that supply them with pipe or pumps or electric motors from revealing this information to another big customer that has a proven record of keeping such info confidential.

Professional people go in there and do work. Pros work for money and when they quit or retire nobody is ever going to convince me that half or more of them won’t spill their guts for a few thousand more bucks so long as they are confident they will not suffer any ill consequences.

There is no way anybody can keep the travels of ships secret anymore. A few hundred bucks spent on professional spying is probably enough to find out just how much of some particular specialty chemical some particular company shipped to some particular Saudi address last month.

Commercial satellite services are probably cheap enough now for a big bank to keep an eye on every truck load of pipe and concrete in the entire country.

If you have a fairly good assortment of pieces of the puzzle you can figure out what it looks like if your are a pro in the same business and are sufficiently motivated to do so.

You can have higher prices any time you want, as long as there is fuel for a single fighter jet with ordnance on the wings flying over KSA.

Shutting down high EROEI oil will only lower the price in medium-long term.

Doug,

The new unconventional production in the Permian Basin is generally light sweet crude. Older production, from conventional waterflooded fields, tends to have H2S. The upper Permian especially, since there was a large amount of Gypsum (CaSO4.2H20) in the Sabkha facies that was altered and released the Sulfur. Then the anaerobic bacteria that live in the water munch on the hydrocarbons and use the sulfur as their “oxygen.” So you get this:

CaSO4 (gypsum converts to anhydrite at depth) + H.C. –> CaCO3 + H2O + H2S

There is actually so much sulfur that there are sulfur mines near the Yates field at the southern extent of the Permian Basin. If you back calculate the amount of hydrocarbons that would have needed to move through the area and lost to the surface to deposit the sulfur in place, it is about 3 billion barrels of oil.

I just got back in town from vacation and am not sure if anyone will read such an old post, so I’ll post it again on the newest page.

So they will bailout the shale and let conventional crash? Figures.

The biggest hit seems to have come from California, down to 28 by -17 from last week 45. Not sure if this is all of one area, or spread across several basins, as it doesn’t show up in the basin breakdown.

Plus Texas is down 16, but across several basins.

Canada it the shocker, down 135 or 34%. This is their drilling season. Spring break is when they are suppose to shut down. It is going to a long cold winter for the drilling hands up there.

@Toolpush

My buddy’s son is an experienced driller in Sask. He has now been logging on BC coast since Sept. and will probably never go back to drilling, even if it improves. Logging doesn’t pay as well but working on the coast with one or two guys on the ‘rigging’ is better than working in Sask or Alta on a drill rig as far as he is concerned. My son seems to have quit electrical maint/construction just in time. He hated working in the oil sands for the most part for many reasons. He is actually doing better contracting electrical and drywall for a large company, and for local construction. I have never seen him happier, to be honest. He just got back from Mexico and started in on a new project within one day. He is ambitious and a hard worker so I think he will do well. Working for others doesn’t seem to have any security anymore, anyway, so I guess he might as well sink or swim on his own.

regards

Paulo,

I gather this is your son, that looked at working in Iraq? Strange how he went from being the wild adventurer, to installing dry wall at home. So it definitely sounds like he is better off at home, especially with the current events in Iraq. When I first started working on the rigs in the North Sea, I remember my old Irish crane driver saying, working in the oil field is just a long term casual job. The point being there is no job security in any one company. Within the industry, yes. Us oilfield workers, tend to move around a fair bit. Between companies and between places. So it is not a job for the same person who wants to spend their working life, working local and one employer for life. Just any one of the Canadian hands that was working one of those 100 plus rigs that got laid down last week.

I wish him well.

Hi again Toolpush

Yeah…the same ‘kid’…30 years young. Funny, he reminds me of myself in many ways. When he landed a steady maint job with a steady shift he went crazy with boredom. Couldn’t take it. The longest I have ever been able to take one job was 6 years.

I have an old school buddy who worked at the same pulp mill in the steam plant for 40 years. Thinking back….in my same 40 year work history I worked for 25 organizations in 4 provinces. Home base was always within a few km on the BC coast, though. I got itchy feet every spring and simply had to move on once in awhile.

We are what we are, I guess. Son heads back to Alberta in a week or two, but doing construction building apartments.

Who knows where events take us? I have always contended that being flexible with a solid work ethic is the key to success, and that security does not really exist. Look at municipal pensions these days. What was once gold plated now seems to have been written in smoke for many.

Thanks for your past words of advice. That advice was why my son did not go to Iraq….plus Dad was upset about it. I didn’t know he listened.

Paulo,

I hope I didn’t scare him too much, lol. I don’t like saying to people don’t do things, especially young people, but if you can give people the facts of a situation, they usually come to the correct solution and then it is was their idea of what not to do, and not someone eases.

Good to hear you are happy with what he decided anyway.

Yep, you never know where life will take you. Keep an open mind and go with it, I say.

Here Are The Most And Least Expensive Ways To Drill For Oil

Onshore drilling is the cheapest, benefiting many Middle East suppliers, while fracking and oil sands are most expensive, pressuring US and Canadian producers.

I have the impression, everytime I see bakken (shale) cost in analyses like this one, bakken cost is lower than in the previous analysis.

These analyses are too broad. Each of those classes has its own internal populations, and then there’s the tax and government imposed cost load variables, which tend to be quite rigid in many cases. Some countries such as Angola and Azerbaijan have flexible taxation. This will lead to tax reductions and also net reserve booking increases by oil companies operating in those countries. On the other hand we have Argentina, Venezuela, and others using inflexible tax and royalty type tax regimes coupled to really hstile operating environments. Those two in particular should see their production drop fast in 2015.

Just for laughs, topped off my tank with $5 worth of gasoline at $1.86.9/gallon on the way home from work.

Just for fun, to get the receipt to keep and show grand kids someday.

Methane…waste not, want not.

New Mexico Methane plume:

http://www.washingtonpost.com/national/health-science/delaware-sized-gas-plume-over-west-illustrates-the-cost-of-leaking-methane/2014/12/29/d34c3e6e-8d1f-11e4-a085-34e9b9f09a58_story.html?hpid=z1

Methane flaring nightime pics for many of the World’s oil=producing areas (absent Russia):

http://geology.com/articles/oil-fields-from-space/

A nice nightime pic of NorthAm from space: The Baaken and the Eagle Ford areas are clear as day:

http://upload.wikimedia.org/wikipedia/commons/3/3c/North_America_night.jpg

All that methane would have come in useful down the road…

Yes, it seams like a tremendous waste of resources to flare all that gas. Perhaps something can be done to utilize it.

http://www.wellservicingmagazine.com/featured-articles/2014/05/art-capturing-valuable-flared-gas/

And so:

Greece looms, as most focused knew it would. Snap elections req’d Jan 25. The Euro got slapped hard when the vote in Parliament failed this morning. If Greece is going to gut the Euro all year long 2015, the dollar will stay up.

Similarly, perversely, headlines are all over the place about the UK’s oil industry in collapse. This isn’t helping sterling, and presto, up goes the dollar.

More generically, 10 yr T paper is laughing at last week’s GDP and the yield is down just about 10 basis points from Wednesday. That’s a lot. It means, yup, stronger dollar. It also means (“the bond guys usually get it correct”) rampant deflationary pressures — which means eroding activity and that don’t mean consumption spike.

One more time, sportsfans. “It ain’t the drillers who are going to decide to drill. It’s the lenders. It’s all borrowed money. If the wallet gets closed, people are going home.”

http://www.usatoday.com/story/news/nation/2014/12/30/vermont-yankee-nuclear-plant-winds-down-operations/21037371/

I am not sure which I am most afraid of- having nukes or not having them.

But every one that shuts is sure going to be good for the natural gas market.If you are a seller rather than a buyer.

Since it has been almost 10 years since I first came up with the Oil Shock Model, the passage of time has been a good gauge as to how well it has modeled outcomes.

The significant finding is that it really only works well if estimates of past discoveries can be projected forward. So that the past estimates of discoveries that neglected to include the Bakken oil and Canadian tar sands oil will clearly not hit the target. As it turns out, the Shell Oil estimates of discoveries have worked out better than those of Laherrere — Shell included barrels of oil equivalent (boe) whereas Laherrere only estimated conventional crude discoveries.

For places like the UK and Mexico where the discovery estimates have been tracked accurately, the oil shock model has worked out pretty well. Just look at the decline of UK North Sea oil production that Ron plotted above and compare to what I predicted back in 2005 The Oil Conundrum

This is about as close as we can come being oil-patch outsiders, since as Fernando Leanme recently asserted “Also, I suppose you realize when we muscle up for this type of analysis we gather a lot of privately held information, which even if I had I can’t share?”.

WebHubTelescope, I find your model very fascinating, i wish i had time and math skills to dig in deeper. It amazes me what can be constructed from maximum entropy principle.

So what does your model look like if you were to revise for large shale discoveries? How much further might the peak be shifted?

The shale discoveries are a drop in the bucket, maybe 30 Gb at most out of 3000 Gb of C+C. I am including Jean Laherrere’s 500 Gb estimate of extra heavy oil fro Canada and Venezuela (oil sands) and 2500 Gb of C+C less extra heavy (XH) oil (Jean Laherrere’s latest estimate is 2200 Gb of C+C-XH).

I used Paul Pukite’s oil shock model (any mistakes are by me) to create the following scenario. Extra heavy oil is modelled with a separate oil shock model and the extraction rate shown on the chart is for C+C-XH oil (about 96% of World output in 2013). Peak is roughly 2014 to 2016, though if extraction rate is higher than I guessed in the future, the plateau might be extended.

Came across an interesting site on global water issues…

The Stream: ‘Virtual Water’ Responsible for Roman Empire Fall

The Stream, Circle of Blue, Friday, 12 December 2014 06:00

Over-reliance on traded grain and ‘virtual water’ is apparently what led to the rise and demise of the Roman Empire. Meanwhile, Saudi Arabia has recently announced that it will rely completely on imported grain by 2016.

oooh – interesting indeed.

the actual paper is at:

http://www.hydrol-earth-syst-sci.net/18/5025/2014/hess-18-5025-2014.pdf

open access, cool.

For our time, virtual petroleum exports in the context of agriculture are also important.

There is a lot of “virtual water” in the petroleum produced in North America, some of which is exported. Lots of water needed to frack shale or to wash/steam bitumen out of the tar sands.

Fracking seems to require about 1 barrel of water per barrel of oil produced.

Water, even the most expensive water from desalination, costs less than $.40 per barrel, while oil costs at least 100x as much. Usually 10,000 as much.

That doesn’t really seem like much water to me.

You are mixing up your units… Comparing volume with price when discussing water misses out on the value of water. It’ s easy to think water has little value when our perception is that it is abundant.

I’m not sure what you mean by confusing units.

I think the confusion here comes from differing ideas of “expensive”. For a farmer, paying one tenth of a penny for water is prohibitively expensive. But, that’s all it costs to create all the clean water you might want out of seawater, using reverse osmosis or even simple distillation. The oil industry obviously would laugh at the idea that 4 cents per barrel for water is “expensive”. The costs of trucking it to the drill site are infinitely larger.

Further, agriculture uses vast amount of water – thousands of times as much as oil drilling. The oil patch’s demand on water is trivial, in comparison.

That should be “For a farmer, paying one tenth of a penny per gallon for water is prohibitively expensive”

I think we will see more use of salty water for fracking operations. The systems are there to be used, but the viscosifiers are less efficient. I’m surprised we haven’t seen a shift to salty water over time.

Fernando,

You maybe my man. Everyone harps on about fracing requiring fresh water, but I have never heard why. The two main polymers that I know of in frac fluids are, Guar and PHPA. Both of these produces I have personally mixed in Salt solutions.

Guar Gum we used to use for top hole and mix direct with sew water, of which we would cross linked as well. Amazing stuff, it had a meniscus of about 3″ in the pit.

PHPA mixes in fine with KCL muds, and I can’t imagine being a problem in NaCL?

Please enlighten me. Thanks

Tool push, the viscosifiers have a lower ability to viscosify the fluids as salt concentration increases. Around 2004 I started looking into this issue (wanted to have the ability to use salt water if I had to). So, being in a large oil company we participated in research projects to investigate which viscosifiers fit which type of water, and so on. By 2008 the work had matured enough to give me the confidence that we could use very salty water if we had to. It’s just a cost and optimization issue. Bottom line: if you have a sea water supply it’s fairly easy to make the frac fluid. It can also be used to viscosify water in a polymer flood. Call one of the large service companies, by now they ought to be aware and be selling all sorts of mixes.

Fernando, thanks for this. You said: “It’s just a cost and optimization issue.” I could not agree with you more. The Eagle Ford shale play in S. Texas exists under the 2nd largest groundwater aquifer in Texas, the Carrizo Wilcox. It is vast in areal extent and subject to updip recharge. It is the largest source of human water in S. Texas.