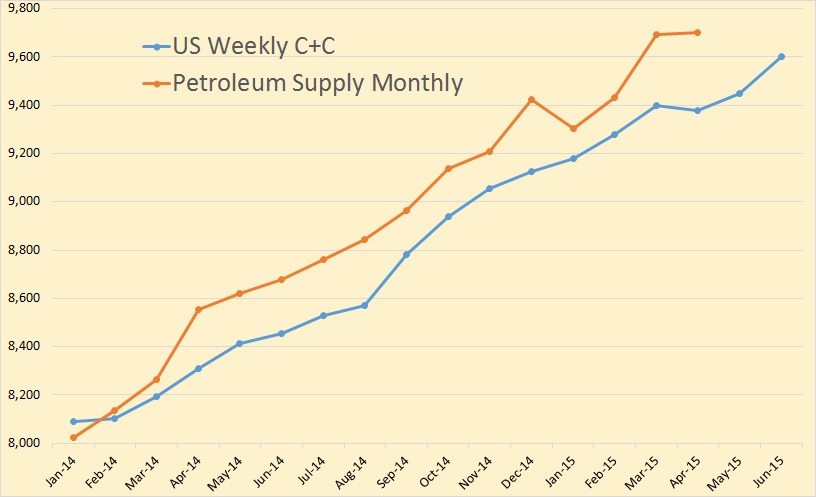

The EIA’s, on June 30th, published its Petroleum Supply Monthly. I Think their numbers are just way too high. I compared them with the EIA’s Weekly Petroleum Status Report. The chart below shows the Results.

I averaged the weekly numbers and converted them to monthly data. They were pretty close for the first three months of 2014 but then they begin to diverge. Of course they were much closer earlier but in the Petroleum Supply Monthly has, over several months, been revised upward. The Weekly Petroleum Status Report is never revised.

In April, the Petroleum Supply Monthly shows US C+C production 322,000 barrels per day above the weekly average of the Weekly Petroleum Status Report.

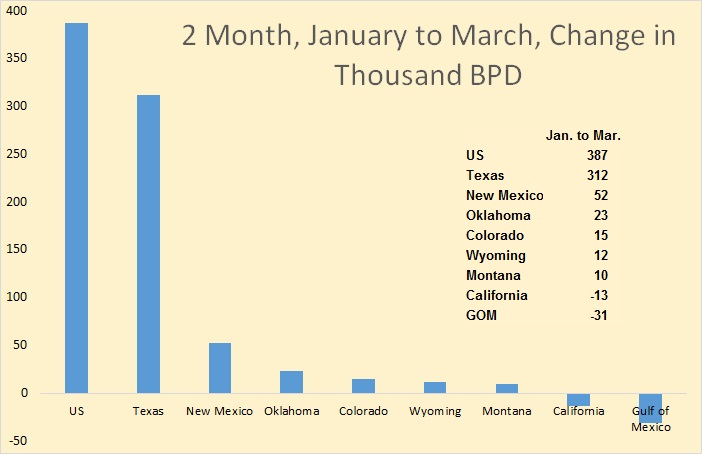

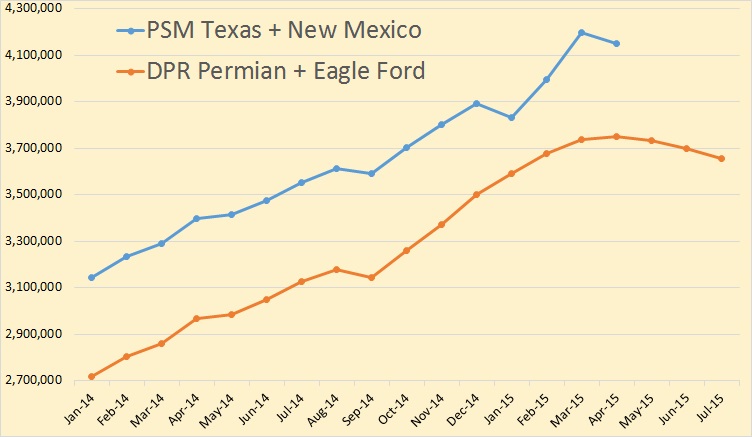

The Petroleum Supply Monthly shows US production increased 387,000 barrels per day in the two months January to March. That is an increase when oil rigs were being stacked by the dozens. They show Texas up 312,000 over those two months and New Mexico up 52,000 bpd. That means they think the Permian, which is mostly in Texas but partly in New Mexico, was really booming during those two months.

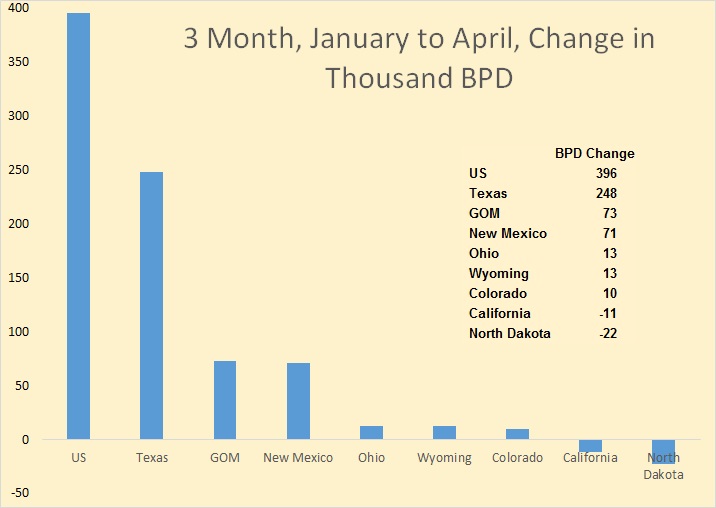

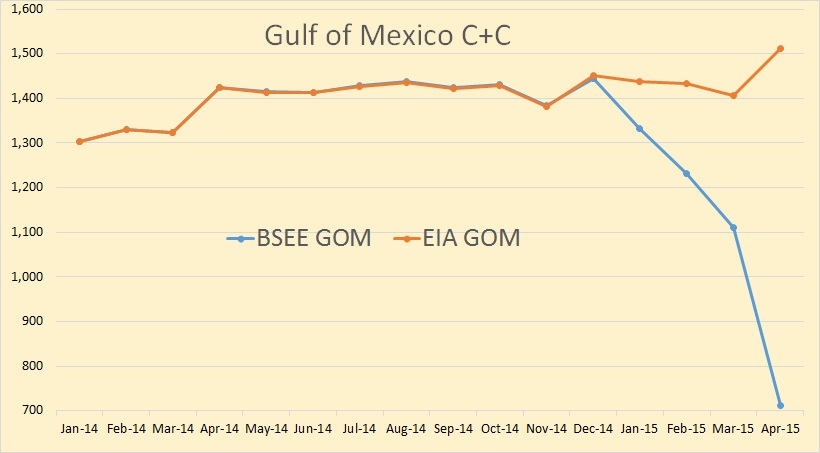

The EIA has crude production continuing to climb during April, up 396,000 bpd January to April. The Gulf of Mexico, which had been down slightly the previous three months, was shown up 104,000 in April, giving them a gain of 71,000 bpd over the three months.

But obviously Texas is where all the action is.

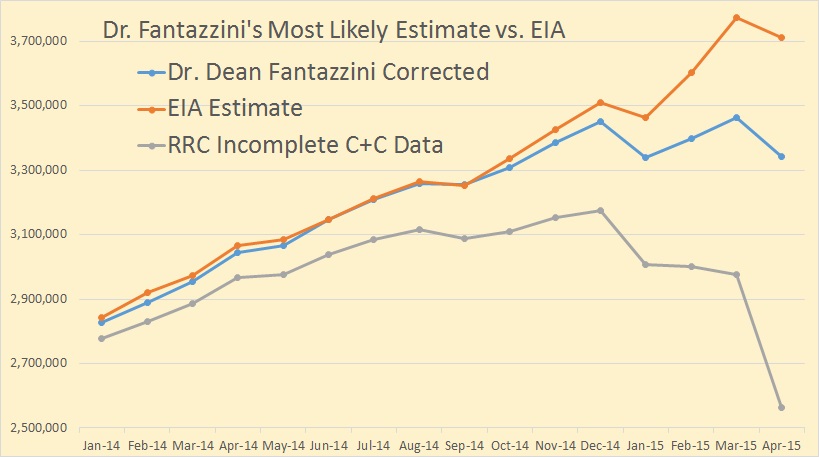

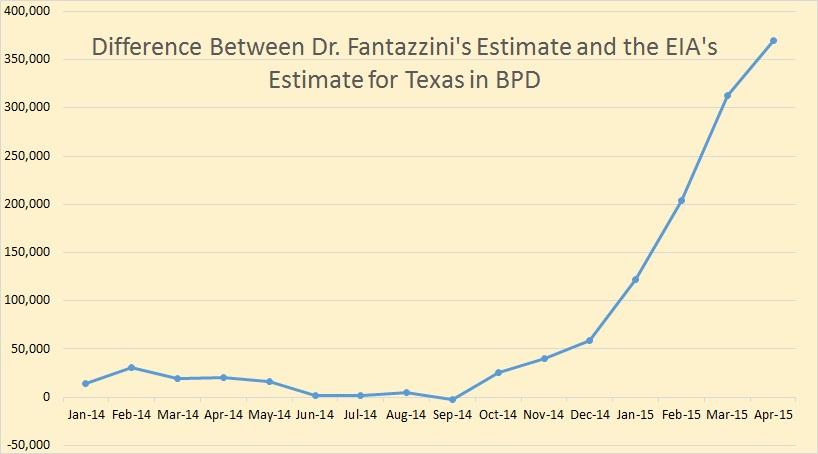

Dr. Dean Fantazzini, Moscow School of Economics, Moscow State University, has worked out an algorithm, described here, where, based on the data supplied by the RRC, he is able to predict, with some accuracy, what the final data will show.

Dr. Fantazzini publishes three estimates, High, Low and Corrected or what I call “Most Likely” which is in between his high and low estimates. I am here using only his corrected data. As you can see up through September 2014, he and the EIA were extremely close. But then they began to diverge.

The difference between the two estimates widens every month for seven months reaching almost 370,000 barrels per day in April.

The Drilling Productivity Report has the Permian + Eagle Ford peaking in April.

The EIA gets their Gulf of Mexico data from the US Bureau of Safety and Environmental Enforcement. The BSEE, like Texas, does not get their data on time. But after four months all the data is pretty much in. But here the April data is apparently only about half complete.

The EIA likely has the January, February and March GOM numbers estimated pretty close. But I think the 104,000 barrel per day increase they show in April is unlikely.

In Conclusion, I believe that the EIA’s crude oil production numbers since January are too high. And they get a little more out of kilter each month. However the EIA revises the Petroleum Supply Monthly every month. So the numbers will be revised, little by little, every month, until they get them them right.

___________________________________________________________

Note 1: Due to the long holiday weekend and a dearth of data this time of the month, this will likely be my last post until late Tuesday afternoon or Tuesday evening after the EIA’s Short Term Energy Outlook comes out. I am sure I can hammer out something from that.

Note 2: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Great read. When do you believe the actual data will be corrected?

They revise the numbers every month. So they revise the numbers piecemeal, little by little every month until they finally reflect what is reported to them by the states. The revisions will be so gradual few will notice.

The numbers are so wrong because many states, not just Texas, don’t report their final numbers until many months have passed. But eventually they get the numbers correct.

The WSJ has discovered “Net Export Math.”

WSJ: As Saudis Keep Pumping, Thirst for Domestic Oil Swells

Kingdom is poised to break records for crude output, but its ravenous energy needs threaten its ability to ramp up exports

http://www.wsj.com/articles/as-saudis-keep-pumping-thirst-for-domestic-oil-swells-1435786552

Link to my comment on BP + EIA data on Saudi Arabia’s net exports:

http://peakoilbarrel.com/bakken-april-production-data/comment-page-1/#comment-521843

Whilst the Saudi population in common with the rest of the middle east has grown substantially and its consumption with it in recent years I sometimes wonder if we are dealing with a case of Muhammad Saeed al-Sahhaf aka Baghdad Bob or Comical Ali.

What I mean by that is that hyping their production level is such an important part of their bragging rights that they are willing to do so even when it is clearly not in their interest. Well before the US shale boom they were apt to do this even when logic would dictate that they talk down their production (obviously the quota system also plays a significant role). When their production finally nose dives I think they will claim the same or higher production while increasing their consumption estimates more and more in fact this will likely be the message that all the last great net oil exporters will give us towards the end.

Interesting admission by Khalid al-Falih:

Reuters (January, 2015): Saudi Aramco to renegotiate some contracts on low oil price -CEO

http://www.reuters.com/article/2015/01/27/saudi-oil-aramco-idUSL6N0V60Z320150127

The politics of oil prices are complicated indeed.

While the Saudis have plenty of reasons to want to put the screws to the Russians they can’t trust the rest of OPEC to honor the cartel’s production sharing decisions.

But it appears they are willing to cut a deal with the Russians who do have at least ONE thing in common with them. They both want a higher price for their oil.

http://finance.yahoo.com/news/saudi-arabia-leaving-u-behind-215428719.html;_ylt=AwrC0F9wMJVVCHUA4SyTmYlQ;_ylu=X3oDMTByMDgyYjJiBGNvbG8DYmYxBHBvcwMyBHZ0aWQDBHNlYwNzYw–

By the way ” our” Jeff Brown and host Ron ought to be on the talking head shows. The fact that they aren’t proves that the MSM is not really competent , perhaps by choice, when it comes to energy.

I am an hopeless amateur when it comes to oil compared to the pros who hang out here but to the best of my knowledge the Russians have until recently always done what they promised in terms of delivering oil and gas.

I predict that if they cut a deal with the Saudis to cut production they will honor it.

Jeffrey, are the other Gulf OPEC states similar to KSA, in that their exported oil is also falling due to rising internal consumption?

I can shoot you the data base for the (2005) Top 33 net exporters. It’s only updated through 2013 (still waiting on EIA consumption data), and there have been some revisions since we compiled the data base.

My email: westexas AT aol Dot com.

As I have repeatedly pointed out, what almost everyone is missing is the enormous difference between rates of change in production and CNE (Cumulative Net Exports) depletion*. I estimate that we may have already burned through around 30% of post-2005 Global CNE.

*As combined production from the Six County Case History increased by 2% from 1995 to 1999, they had already shipped 54% of post-1995 CNE (major net exporters, excluding China, that hit or approached zero net exports from 1980 to 2010).

the decline in net exports was largely offset by the drop in US net imports

The decline in US net imports certainly affected the demand for Global Net Exports of oil (GNE*). But within OECD countries, we also had some countries with increasing net imports, e.g., the UK.

Of course, on the demand side, the key factor has been the ongoing decline in what I define as Available Net Exports (GNE less Chindia’s Net Imports, CNI). ANE fell from 41 MMBPD in 2005 to 34 MMBPD in 2013, and BP/EIA data indicate that the ANE decline probably continued in 2014.

Based on most recent EIA data, the US is still dependent on net crude oil imports for about 40% of the crude + condensate (C+C) processed daily in US refineries, and a plausible estimate is that our existing C+C production is declining at about 20%/year (we have to run very fast to stay in place production-wise). The US is one of about 157 net oil importing countries in the world.

Based on current trends (rate of decline in GNE/CNI Ratio), in about 16 years China & India alone would theoretically consume 100% of GNE, leaving no net exports available to about 155 net oil importing countries.

*Combined net exports from top 33 net exporters in 2005 (EIA)

So we have current trends saying that:

– Saudi Arabia will become a net importer in 15 years.

– China & India are to consume 100% of net exports in 16 years.

As those trends become unsustainable, we are going to have lots of interesting things happening during the next decade.

I am surprised that most people don’t seem to notice how things are taking a turn for the worse lately. At the same time the world is radicalizing, (Isis, Syriza, French National Front, Spanish Podemos, etc) and the world economy is worsening (Greek bankruptcy, fake recovery, world commerce diminishing, China growth reducing). To me is like seeing storm clouds approaching.

Terrific confirmation, Jeffrey. I have sent your comments on to others many times these past few years. Unfortunately, the confirmation by a major MSM publication is what John Q Public needs to see in order to accept reality. I have already sent it on!!

regards

Cherry-picking Brown circa 2005 is funny and real funny.

2015 net export math.

Ah, those trips to the archives.

Speaking of archives, here is a link to, and concluding paragraph from, my first article on net exports (January, 2006):

http://www.theoildrum.com/node/984

While it’s true that net exports have not fallen as much as I expected, it’s also true that my early 2006 article on net exports precisely nailed a major inflection point. The original draft of my article said these factors “will interact this year” (2006) to produce an unprecedented net oil export crisis (my article was edited by the Oil Drum editors).

Following is a Gap Chart showing Global Net Exports through 2012. At the 2002 to 2005 rate of increase we would have been up to about 71 MMBPD in 2013, versus the actual rate of 43 MMBPD.

Yes indeed, Jeffrey, and 10 years ago soon, too…

And of course I recognize marmico from ‘The Archives’ too. Hi marmico.

Hi Marmico,

Those charts are for Saudi Arabia, not the world. Net exports for Saudi Arabia did not drop as much as some people expected in 2005, Jeffrey Brown was not alone in this assessment. There were many who thought at that time that Saudi output would soon peak. The actual 2014 net exports are close to the high end of the confidence interval.

Marmico. Am I reading it incorrectly, or are exports down since 2005 per the chart you posted.

Long term oil predictions usually don’t look so good in hindsight. For example, look at the stuff put out by the EIA.

Further, I think Citi is in the camp that KSA becomes a net importer of oil by 2030. They recently predicted the 2014-15 oil price crash, which almost no one saw coming. However, they missed the bottom by over $25 WTI.

At the 2002 to 2005 rate of increase in Saudi net oil exports (7.1 MMBPD to 9.5 MMBPD), they would have been up to about 23 MMBPD in 2014, versus the actual (BP + EIA) rate of 8.4 MMBPD in 2014.

As Dennis noted, Saudi net exports in 2014, at 8.4 MMBPD in 2014 (versus 9.5 MMBPD in 2005), were at the top end of the 95% confidence interval in the paper that Sam Foucher and I coauthored on the (2005) Top Five Net Oil Exporters (Saudi Arabia, Russia, Iran, UAE & Norway):

http://www.resilience.org/stories/2008-01-08/quantitative-assessment-future-net-oil-exports-top-five-net-oil-exporters#

And the fact remains that Saudi net exports (as revised per EIA) rose from 7.1 MMBPD in 2002 to 9.5 MMBPD in 2005, but have been well below the 2005 rate for nine and almost certainly 10 straight years.

Sam Foucher’s specific projection, circa 2007, for Saudi Arabia was that their net exports would decline at a rate of between 0.7%/year and 8.7%/year. The actual observed 2005 to 2014 rate of decline n Saudi net exports was 1.4%/year, which is within Sam’s predicted decline rate boundaries.

Regarding the overall (2005) Top Five, their combined net exports fell from 24 MMBPD in 2005 to 21 MMBPD in 2013 (2014 data not yet compiled), which is below the upper end of the 95% confidence interval.

Jeff, I love your net export math analysis. I wish you’d do a blog where you update the numbers from time to time. I’ve been reading about KSA’s max production but what I’m not seeing big press attention on is their declining exports. I beg you to do a little blog page where you do a ‘live feed commentary’, so to speak, or a semi annual update on production/consumption/export data and talk us through the export land model as it plays out in real life on planet earth.

The problem is that consumption numbers are only updated on an annual basis, although the EIA revises their production and consumption numbers more frequently.

Hi Jeffrey,

One problem with your “Gap” chart was that 2002 to 2005 was an unusual period where OPEC tried to keep prices in check by raising output to full capacity, then they could raise output no further without further investment which takes some time. If you look at the trend of saudi net exports over a longer period it is clear that the 2002 to 2005 period was unusual so the gap chart is not very convincing to me. Saudi net exports from 1999 to 2013 using EIA data below.

I completely disagree. Comparing 2002 to 2005 to 2005 to 2013 makes enormous sense for the following reasons:

Annual Brent crude oil prices doubled from $25 in 2002 to $55 in 2005. They doubled again, from $55 in 2005 to an average of $110 for 2011 to 2013 inclusive (and they averaged about $99 in 2014).

So, we are looking at the production/export response to one price doubling (2002 to 2005), versus the production/export response to a second price doubling (2005 to 2013).

This seems so obvious to me that I don’t see how anyone could disagree with the approach.

But the real, and virtually ignored, problem is that I estimate that Saudi Arabia has already shipped close to half of their post-2005 CNE (Cumulative Net Exports). While everyone is lulled to sleep, focusing on production, almost no one is looking at catastrophically high CNE depletion rates (see Six County Case History down the thread).

And the hard fact of life is that given an ongoing, and inevitable decline in production in a net oil exporting country, unless they cut their consumption at the same rate as, or at a faster rate than, the rate of decline in production, it’s a mathematical certainty that the resulting net export decline rate will exceed the production decline rate and that the net export decline rate will accelerate with time.

This works for ANE too. Given an inevitable ongoing decline in GNE, unless China & India cut their net imports at the same rate as the rate of decline in GNE, or at a faster rate, it’s a mathematical certainty that the ANE decline rate will exceed the GNE decline rate and that the ANE decline rate will accelerate with time.

While the conventional wisdom is that there are no problems in sight, in regard to global oil supplies, there is the following chart.

Observed Rates of Decline 2005 to 2013:

ANE = GNE less CNI (Chindia’s Net Imports)

GNE: 0.8%/year

ANE: 2.3%/year

At a GNE/CNI Ratio of 1.0, China & India alone theoretically would consume 100% of GNE. Apparently the ANE decline continued in 2014.

Hell ,I am so impressed by the net export model that I want an autographed picture of Jeff and Sam. Gonna get it photoshopped and put myself in it too and hang it on the wall in the den so I can tell more colorful lies about being a real peak oiler ten or fifteen years from now. 😉

How about it JB??

Here are net exports in Millions of tonnes per year, relatively flat since 2004, down a little but not by much.

http://mazamascience.com/OilExport/

With the scale stretched to focus on 2000 to 2014, using paint on the image above, the World net exports for millions of tonnes per year are in the chart below.

So, Global Net Exports (GNE) showed a strong increase from 2002 to 2005, as annual Brent crude oil prices doubled from $25 in 2002 to $55 in 2005, but they declined as annual Brent crude oil prices doubled from $55 in 2005 to an average of $110 for 2011 to 2013 inclusive, and you really don’t see any warning signs on the horizon?

And in a similar fashion, everything was peachy for the Six Country Case History from 1995 to 1999. Their production was up by 2%, although they had shown a mild net export decline. But there was the fact that in only four years, they had already shipped 54% of their post-1995 CNE (Cumulative Net Exports).

In any case, I estimate that remaining post-2005 Global CNE are down by 30% of so, as of the end of 2014–about 30% depleted in only 9 years. Incidentally, this method of estimating CNE was too optimistic for the Six Country Case History (by 23%).

Hi Jeffrey,

Yes I think there will be problems. There a couple of problems with your analysis. One we do not know what either the ANE or CNE will be in the future. Why is it that we would naturally assume that all of China and India’s demand for oil will be satisfied and the rest of the World gets what is left over?

I explained why a doubling in price fro 2002 to 2005 did not have the same effect as a later doubling, in the first case there was excess capacity for OPEC to increase output and in the second case there was not. One cannot look at oil prices in isolation, in 1972-75 ($18/b to $61/b) and in 1978-80($53/b to $97/b) there were also substantial rises in oil prices and net exports grew relatively slowly in both of these periods. The better explanation for the difference between the rise in net exports in the early(2002-2005) vs late period(2006-2014) is the absence of substantial excess production capacity in Saudi Arabia and other countries after 2005 and OPEC’s decision that the World could live with oil prices above $60/b (in 2015$). In 2002, the thinking was that oil prices above $30/b (nominal dollars)would cause the World economy to crash and OPEC did all it could to avert such a crash by pumping as much oil as it could. By 2006 the spare capacity of OPEC was all gone.

The other thing is that consumer demand responds slowly to changes in the oil price. By 2011 when oil prices had stabilized at the next doubling in price (annual average prices) above the 2005 oil price level consumers had enough time to buy more fuel efficient cars so the long term demand response to higher oil prices had time to manifest. In addition, there was slower World growth due to the 2008 financial crisis which also reduced oil demand.

Bottom line, the World economy and oil demand can respond differently to a doubling of oil price depending on the circumstances. So I would not expect net oil exports for the World to be a simple function of the price of oil, it is more complex than that.

The concept of “available net exports” is also flawed, there is no way of knowing which countries will receive what quantities of oil. There will be a market price of oil determined by supply and demand of all countries for oil, China and India have no special claim on oil.

The concept of “available net exports” is also flawed, there is no way of knowing which countries will receive what quantities of oil.

I really don’t understand what “available net exports” have to do with “who will receive what imports“.

Hi Ron,

When one country exports oil there must be other countries that import oil. The Export land model assumes that as net exports fall, the amount of oil imported by India and China will be unaffected and that what is left over (available net exports) is shared by the rest of the importing nations. I do not think it will work this way, I believe supply and demand from all countries in the World will determine a market price and that price will determine how much oil will be imported given the net exports on the World market.

When one country exports oil there must be other countries that import oil. The Export land model assumes that as net exports fall, the amount of oil imported by India and China will be unaffected and that what is left over (available net exports) is shared by the rest of the importing nations.

Clearly Jeffery knows that will not happen like that. As he shows in his post below he was using that as an example to show what would happen if China and India did not cut their rate of imports. It was an example.

Oil is a fungible commodity. The only way China an India could keep their imports from declining, if net exports declined, is to simply outbid everyone else. I really don’t think they wil be in a position to do that.

Hi Ron,

I may just not understand Jeffrey’s terminology, it seems that the concept of available net exports (ANE) implicitly assumes that China and India get a certain share of net exports and everyone else gets what is left. I see no reason to single out certain countries the global net exports (GNE) are available to everyone willing to pay and I think the ANE category is unnecessary, it just seems very arbitrary to create a special grouping for China and India.

Most oil is sold on long term contracts as oil is used for feed stock for refineries. Price, some formula linked to the market pricing.

This gives exporters some assurance about income.

Hint, check out what countries opted for long term contracts (like 20 years) and with what suppliers.

As available net exports are adjusted for these volumes, it becomes easy to figure out who is most vulnerable as net exports tanks.

As noted below, following are the mathematical facts of life regarding Net Export Math, and as noted below, the observed rate of decline in ANE was about three times the observed rate of decline in GNE, from 2005 t0 2013, which resulted in ANE falling from 41 MMBPD in 2005 to 34 MMBPD in 2013 (with the decline apparently continuing in 2014).

As discussed below, given an ongoing and inevitable decline in GNE, the only way we will not see the ANE decline rate continuing to exceed the GNE decline rate is if China & India cut their net imports at the same rate as the GNE decline rate, or at a faster rate.

I continue to get qualitative objections to a quantitative analysis.

So far, the pattern has been that net oil exporting countries that subsidize petroleum consumption, e.g., Indonesia, continued to subsidize consumption, even as they become net importers, and the countries that heavily tax petroleum consumption, e.g., the UK, continued to tax consumption, even as they became net importers. But for the two examples cited, Indonesia & UK, both regions showed accelerating rates of decline in net exports.

Hi Rune,

Thank you for taking the time to educate me.

I was not aware of the long term contracts, as oil supplies tighten there will be all kinds of scrambling to get oil, but under these circumstances the oil exporters may be less likely to strike long term deals unless they are worried about “peak demand” as oil prices rise.

If debt becomes an issue (or more of a problem than it already is), then demand for oil may fall as fast as net exports fall and oil prices may stabilize. It is doubtful the World would stay on this knife’s edge for long and oil price volatility seems more likely. It really seems that a World Oil cartel would be better than the alternative, maybe Canada, Norway, and Russia should join OPEC so we could get oil price stability. We could have the TX RRC and NDIC work with this new “OPEC” and create some stability in the oil industry.

I guess that’s sort of my whole point, isn’t it? GNE rose sharply in response to the first price doubling, but fell in response to the second price doubling. This is so transparently obvious to me that I remain astonished that anyone disputes the validity of the approach.

What will happen is not clear, but what has happened is quite clear, and the same consumption trends (shown on chart below) continued in 2013 (and apparently in 2014).

In any case, as noted elsewhere and to paraphrase Heinlein, Net Export Math is a Harsh Mistress.

*The volume of Global Net Exports of oil (GNE) available to importers other than China & India (ANE) fell at 2.3%/year from 2005 to 2013, as GNE declined at 0.8%/year.

Yes Jeff, what you say is true. If your assumptions are correct (that the level of imports by China and India are unaffected by declining net exports) then the available net exports will decline very fast.

I think your assumption is not one I would make.

Also net exports will eventually decline and if oil exporting countries consumption is unaffected by rising oil prices and declining output then net exports will decline faster than overall output.

The faster this occurs the more that prices will rise which will lead to a faster transition to alternatives to oil (public transport, plug in hybrids, and EVs and more rail for transporting goods and possibly hybrid or natural gas driven trucks).

It could be that oil exporters will try to reduce domestic consumption so their source of revenue does not disappear as oil importing nations rapidly transition away from oil.

India and China have been growing rapidly relative to the OECD, it is expected that their share of global net exports would increase. We will all have to do with less oil in the future, the OECD should lead the way in transitioning away from oil for transport.

Dennis,

I don’t know how many ways I can say that we are talking about mathematical certainties.

Hi Jeff,

And I will repeat if your assumptions are correct, the analysis will be correct. It is not your math, it is the underlying assumption that China and India’s rate of increase of oil consumption will not change as oil exports decline.

As far as long term contracts, these will be broken when it becomes necessary. That is if the contract is to supply oil at a given price for 20 years, the contract will be renegotiated, the seller may decide the price they want is so high that the buyer fails to agree, then the seller can just sell to the highest bidder.

If most oil is locked up in long term contracts and output declines, contracts will need to be broken eventually.

Perhaps you could point out where I made this assertion?

I have shown an extrapolated decline in the GNE/CNI Ratio, but as I have repeatedly pointed out, given an inevitable ongoing decline in GNE, the rate of decline in ANE will exceed the rate of decline in GNE–unless Chindia cuts their net imports at the same rate as, or at a faster rate than the rate of decline in GNE.

In other words, given declining GNE, the GNE/CNI Ratio will decline, unless Chindia cuts their net imports at the same rate as GNE, or at a faster rate. This does not require China & India to maintain their recent rate of increase in oil consumption.

Let me put it this way. Given an inevitable ongoing decline in GNE, if Chindia’s net oil imports remain constant and never increase, the ANE decline rate will still exceed the GNE decline rate and the ANE decline rate will accelerate with time. I don’t know how many different ways I can say this.

As I have repeatedly said, we are dealing with hard mathematical certainties, and qualitative objections to basic math concepts will not make the math go away.

Dennis wrote;

”As far as long term contracts, these will be broken when it becomes necessary.”

From where do you take this? Any examples?

The Buyers have agreed to market price or some derivative of it.

Hi Jeff,

Why would China’s and India’s oil consumption never decrease? Those countries which are growing rapidly will have an increasing share of oil consumption. Based on IMF data China’s GDP has tripled since 2002 and India’s GDP has increased by a factor of 2.5 since 2002.

ANE as you define them, will no doubt decrease faster than global net exports, because China and India will continue to grow faster than the OECD.

Eventually as oil output declines everyone’s consumption will decline including China and India, how the oil is distributed will depend on demand.

Hi Rune,

No I do not have examples. I mistakenly thought the long term contract was at a specific price.

Let’s say 35 Mb/d of crude is under a 20 year supply contract and net exports drop to 30 Mb/d, there would be some contracts that would not be fulfilled if that occurs.

You suggested that most oil supply is under long term supply contacts, does this apply to 90% of net exports?

Hi Rune,

Finding the amount of oil traded on the spot market is difficult.

http://www.encharter.org/fileadmin/user_upload/document/Pricing_-_chapter_3.pdf

at the link above on page 72 they claim about 30% of oil is traded on the spot market, but the document is from 2007.

http://www.platts.com/IM.Platts.Content/InsightAnalysis/IndustrySolutionPapers/oilmarkets.pdf

The paper by Platts (2010) estimates 5 to 10% of oil is traded on spot markets. Also the “long term” contracts are typically 1 to 2 years with a renewal clause that gives each party the ability to not renew.

So there is unlikely to be the need to break any contracts, I had misunderstood how short these long term contracts were.

Hi Jeff,

There are a number of assumptions to the export land model:

1. Net Oil Exporting nations will generally increase their consumption of oil until their net exports decline to zero.

2. China and India’s oil consumption will probably grow and is unlikely to decrease.

These assumptions are likely to be correct, but beyond this we don’t know the rate that oil consumption will increase in net oil exporting nations and we don’t know how much future oil will be consumed by India and China.

This is on top of uncertainty about when peak oil will occur and how fast oil output will decline.

I agree that Available net exports are likely to decline faster than global net exports and that global net exports are likely to decline faster than oil output.

It is not clear to me how much faster these rates will be and I do not think the World case will be similar to the 6 country case.

In the 6 country case those countries could simply become oil importers, for the global case this will not be an option so things will play out differently.

Dennis,

Some years ago I saw reports of some South East Asian countries entering into long term contracts of 20? years with some Middle Eastern oil producers/exporters.

As the links you provided shows that most of the oil is on some contract of varying durations which may have some renewal clauses.

What could have been interesting, if feasible, was to draw a chart with time axis and volume axis, stacking the contracts according to their duration/expiration with the longest durations at the bottom.

This could visualize how much of the oil was somehow tied up in contracts and how this developed with time.

As net exports starts to tighten it will set up some dynamics that may be perceived. Several oil companies with strong national ties are likely to get whispered to take care of their (home) nation’s supplies first.

Oil may be sold to preferred customers (politics comes into play).

Importers with little or no long term contracts and little leverage (both political and economic) may find themselves with steep declines in supplies (imports).

The point is as net exports starts to decline there likely will not be a pro rationing of available exports.

The whole Net Export thing seems to hinge on the assumption that exporters can’t get more energy efficient, even though they tend on average to be the least energy efficient economies around.

If the Saudis, for example, would stop wasting so much energy, their consumption would fall rapidly.

Many things are possible, but given an ongoing, and inevitable decline in production in a net oil exporting country, unless they cut their consumption at the same rate as, or at a faster rate than, the rate of decline in production, it’s a mathematical certainty that the resulting net export decline rate will exceed the production decline rate and that the net export decline rate will accelerate with time.

This works for ANE too. Given an inevitable ongoing decline in GNE, unless China & India cut their net imports at the same rate as the rate of decline in GNE, or at a faster rate, it’s a mathematical certainty that the ANE decline rate will exceed the GNE decline rate and that the ANE decline rate will accelerate with time.

Hi Jeff,

The reason China and India’s net imports of oil rose so much from 2002 to 2014 is because they grew very rapidly. I used data from the IMF’s World Outlook to plot the normalized GDP of China, India, US and Germany.

http://www.imf.org/external/pubs/ft/weo/2015/01/weodata/index.aspx

Over that period real GDP grew to 114% in Germany (total over 12 years), 125% in the US, by 243% in India and 312% in China by 2014 (2002 value would be 100%. So it is not surprising that net imports went up in China and India relative to the US.

German oil from Energy Export Databrowser.

http://mazamascience.com/OilExport/

Mac,

I can shoot you a pic, but Sam seems to have vanished from the Internet.

A key question:

How much of KSA’s domestic oil consumption is used for electrical generation?

Okay, I’ll have to answer the question: about 20%, or around 600k bpd. The rest? Industry, and personal transportation. KSA uses about 3M bpd, which is more than Germany, a country with 3x the population and 5x the GDP. It makes no sense – most of it is wasted. Growing that number at all, let alone to 10M bpd, is economic insanity.

So, how smart is KSA?? I’m told they’re very smart about running Aramco. But, they’ve been talking about solar for years, and doing nothing. When will they start installing solar PV, which produces power for about 1/3 the cost even now, and whose cost is still falling like a rock? When will they raise gasoline prices, and reserve cheap/discounted fuel for the minority that truly needs it? When will they raise oil and gas prices, instead of wasting vast amounts of money and energy on a domestic industry that is set up for failure when the inevitable decontrol of fuel prices occurs?

How long will KSA shoot themselves in the foot??

Here is an article about Saudi refining.

http://www.reuters.com/article/2014/11/04/saudi-oil-refineries-idUSL5N0SQ3UH20141104

Solar panels may require water washing in the desert, and that’s a very expensive commodity. I’d love to see estimates of water use by a solar plant near Riyad.

The article about Saudi refining is interesting, but not relevant to this discussion: we’re talking about net exports, so refined products don’t change that.

Solar panels may require water washing in the desert

I’d be surprised. I think you need to provide evidence of this idea – otherwise, it’s just FUD (Fear, Uncertainty and Doubt – a misinformation and fear-mongering device).

Even as we speak, Jordan is in the process of buying PV at less than 7 cents per kWh – that’s nearby, and less than 1/3 the cost of generating power with oil.

Hi Nick G.

Refined products do have a connection with net exports though, don’t they? Every barrel of Saudi crude refined is a barrel not available for export.

Net exports include refined products.

Think of it this way: very few end-users actually consume crude oil. Generally, consumers use refined products. It doesn’t matter a whole lot who does the refining. Whether KSA does the refining or the US, what matters is the availability of refined products to end users.

Thanks Nick. I’d got it into my head that the topic was the Saudi situation.

What OFM calls a senior moment.

I’ve used the following example to illustrate the differences between gross and net exports:

Production Land (P) has 2.0 MMBPD of production, but no refining capacity. Refinery Land (R) has 2.0 MMBPD of refining capacity, but no production.

Ignoring refinery gains and other minor issues, P has consumption of 1.0 MMBPD, and R has consumption of 1.0 MMBPD.

P’s gross exports to R are 2.0 MMBPD. R’s gross imports from P are 2.0 MMBPD.

R refines 2.0 MMBPD, consumes 1.0 MMBPD, and exports 1.0 MMBPD of refined product to P.

P’s net exports are production (2.0) less consumption (1.0) = +1.0 MMBPD.

R’s net exports (actually net imports) are production (zero) less consumption (1.0) = -1.0 MMBPD.

Alternatively, you get the same answer if you define net exports as gross exports less gross imports.

Fernando stated: Solar panels may require water washing in the desert

Nick replied:

I’d be surprised. I think you need to provide evidence of this idea – otherwise, it’s just FUD (Fear, Uncertainty and Doubt – a misinformation and fear-mongering device).

Nick, now I realize you have not done your solar panel homework. I lived in the Saudi Desert for five years. Dust is a serious problem. The wind blowing across the desert picks up dust and everything gets dusty. Due at night makes the dust a serious problem. It makes the dust turn to a kind of goo. Trucks, with pulsating water spouts, must wash the high voltage power line insulators down periodically to prevent arcing. I have always been very skeptical of solar panels in the desert because I know what a serious problem the dust and dew will cause.

Solar in the MENA Desert

Problem: Dust build-up is the greatest technical challenge facing a viable, desert solar industry.

A 0.4-0.8% per DAY baseline yield loss caused by dust.

60% energy yield losses during and after sand storms are widely reported.

If left more than a day, dust particles from organics, dew and sulfur adhere to the panels.

Challenge: Current solutions in the market rely upon;

Expensive, unreliable, human labour in remote, desert conditions.

Water (desalinated, transported and wasted).

Complex, sensitive equipment, that will fail in harsh conditions.

Cleaning cycles of 4 days or longer, which allow dust to build up and adhere to the panels.

Is Anything Stopping a Truly Massive Build-Out of Desert Solar Power

In the desert near Abu Dhabi in the United Arab Emirates the Middle East’s first large CSP plant recently faced down the dust issue. In order to reach the 100-megawatt-capacity goal of the Shams 1 plant, developers had to add substantially more mirrors to the plant than planned due to dust in the atmosphere. Scott Burger, an analyst at Greentech Media’s GTM Research who focuses on the region, said the plant probably ended up costing three times the initial estimate, thanks in part to dealing with that dust. And now that it is built, Shams 1 sends a series of trucks up and down the lines of 250,000 mirrors every day, using robot arms to spray that precious water and clean away the dust.

Ron,

Those are interesting articles, and I appreciate your finding them. But:

Both of them state quite firmly that sand and dust aren’t showstoppers. Every location has its unique problems, but there is very little doubt that solar can massively replace KSA oil fired generation, and do it for much lower cost.

And,

You found them, not Fernando. If somebody is going to persistently throw doubt on something, they should do a little work and find some evidence for their ideas.

Ron, thanks for the thorough discussion. My experience is similar, I’ve worked in the Chalbi desert (Kenya), lived in Patagonia and SE Spain, and exchanged notes with friends over dust problems in other areas.

SE Spain is fairly close to the Sahara, we get their dust all the time, and the local newspaper reports the dust is a major cost issue for the owners. I’ve also read there’s a conflict over water use between the large solar plants and local agriculture. The two sides are having dogfights over water use rights.

When I worked in the Chalbi we had small dust devils every afternoon, these dumped so much sand I used to wear swim goggles and usually had a diaper stuck under my helmet. I remember one time a big Texan boy who flew in with me started laughing when he saw me put my swim goggles on my helmet, and made a joke about where the hell was I going to go swimming. The next day he found out what it was like.

And all of that kind’ve makes sense, except…you’re relying on personal (anecdotal) experience and popular news reports (which are often inaccurate or incomplete).

Here’s a counter-example: we often hear questions about water use for fracking, but when you really quantify and analyze the amounts used, you realize that they’re pretty trivial. Certainly not a showstopper (something that will prevent a significant number of wells from being drilled).

re: Soiling… anecdotes…

Just today, I was reading the May 2014 issue of IEEE Journal of Photovoltaics.

(Vol 4, number 3) (yes, I know – I’m behind, but that’s how it goes with technical journals…)

While my main focus was on Wolf et. al. “Modeling the Annealing of Dislocation Loops in Implanted c-Si Solar Cells” (p 851), there is an article by

Burton & King “Spectral Sensitivity of Simulated Photovoltaic Module Soiling for a Variety of Synthesized Soil Types” (p 890).

http://ieeexplore.ieee.org/stamp/stamp.jsp?arnumber=6732891

Abstract at:

http://ieeexplore.ieee.org/xpl/articleDetails.jsp?arnumber=6732891

It seems to be open access at the moment, though there may be some unexpected cookie left on my home machine allowing me access.

One of their references seems to be a nice review, but it is not open access.

T. Sarver, A. Al-Qaraghuli, and L. L. Kazmerski, “A comprehensive review of the impact of dust on the use of solar energy: History, investigations, results, literature, and mitigation approaches,” Renewable Sustainable Energy Rev., vol. 22, pp. 698–733, 2013.

http://www.sciencedirect.com/science/article/pii/S136403211300021X

Burton & King say in their introduction: “The study of soil accumulation on photovoltaic (PV) surfaces has been of interest for nearly 70 years” then give the reference to Sarver et. al.

Another reference, that I do have, is:

H. Qasem, T. R. Betts, H. Müllejans, H. AlBusairi, and R. Gottschalg, “Dust-induced shading on photovoltaic modules,” Progr. Photovoltaics: Res. Appl., vol. 22, pp. 218–226, 2012.

http://onlinelibrary.wiley.com/doi/10.1002/pip.2230/abstract

In Figure 1, for August 1982, a very exceptional month, but nevertheless an existence proof of real severe dust in the Kuwait International Airport area,

a bit more than 450 grams of dust were deposited per square meter.

That’s a pound of dust over a square meter in a month!

From their abstract, if amorphous silicon (a type of thin-film PV) loses 33% in photocurrent at 4.25 mg/cm^2, (that’s 42.5 g/m^2), what would more than 10 times that dust do?

Ron is right about dust in the desert.

It varies by desert, some has lots of nasty salts that are hygroscopic with the dew, and will form gnarly films that are hard to remove, and are conductive/corrosive when damp.

People think the deserts of the world must be wonderful places for solar, and some are. But a particular problem in most of the mid-East is the dust in the air – as alluded to with the Shams-1 concentrating solar thermal plant. All concentrating solar power (thermal or PV) needs good Direct Normal Insolation. Dust in the air (or on the surface of a mirror) scatters that direct-from-the-sun light. Flat plate PV can use that scattered light just fine, as long as the dust in the air/on the cover glass isn’t too thick.

Dust on mirrors is one reason GlassPoint Solar puts their concentrating mirrors (to make steam for Enhanced Oil Recovery) inside flat glass greenhouses. The flat glass is easy to clean (they use a robot on the roof, and collect the water in the gutter so much is reused) and cheaper than curved glass, and the mirrors are light weight aluminum honeycomb, protected from the wind (something else some deserts have a lot of).

http://www.glasspoint.com

Their presentation on the challenges of deserts, lots of nice pictures, recommended to all:

http://www.glasspoint.com/download/6236/

More details on building their plant in Oman:

http://www.glasspoint.com/download/3375/

edit: added this:

http://www.greentechmedia.com/articles/read/GlassPoint-Wins-53M-From-Oman-Shell-VCs-For-Solar-Enhanced-Oil-Recovery

flat PV panels on fixed mounts can use dry dusters.

Several are mentioned herein:

http://www.treehugger.com/solar-technology/rugged-robot-saudi-arabia-cleans-dusty-solar-panels-without-using-water.html

it’s the curved concentrating solar thermal mirrors with the intervening supports for the thermal tube that you end up paying some guys to drive trucks with water sprayers.

n.b. the NOMADD was developed with Saudi money hiring a bunch of outsiders at King Abdullah U.S.T.

http://www.nomaddesertsolar.com

Wow! Great info. I and my development team loved to work on that kind of problem. Lots and lots of top-of-head obvious ways to get a satisfactory solution. Just go to it, rake up a bunch of the most promising, do a quick and dirty first analysis, rank according to promise, make some prototypes, take ’em out in the desert, report back, iterate until done to taste.

I guess we would not have taken a year to get something quite satisfactory– given ,of course, an arms-race level of funding and support.

After all, the clean energy race is a damsight more important than the ICBM race.

And about that wind. Didn’t I hear somewhere that wind can be useful?

“How long…”

Looks like another 8 years…

http://www.bloomberg.com/news/articles/2015-01-20/saudi-arabia-delays-109-billion-solar-plant-by-8-years

They want to do it all with locally sourced material,

and right now they don’t have much in the way of local manufacturing.

They also don’t have a competitive power market or much in the way of interconnect policy for distributed energy.

They also have been pursuing nuclear power – air cooled one hopes…

Maybe you can get a flavor of the bureaucratic and academic approach that is a lot of talk, but not so much action yet.

http://www.kacare.gov.sa/en/

On top of that, a way different culture…

Hi Ron,

The Weekly data seems to under report output, so that data can mostly be ignored as it is a very rough guess.

Dean’s numbers match up pretty well with the EIA Petroleum supply monthly TX C+C data through December 2014 (only a difference of 60 kb/d).

After that we do not know whether it is the EIA’s estimate or Dean’s estimate which is incorrect.

I have used Dean’s data (thank you for sharing Dr Fantazzini) to estimate the percentage correction each month and used that rather than the absolute correction (in barrels), this gives a slightly higher estimate, I also used only the April 2014 to April 2015 data for both oil and condensate, where Dean uses Jan 2014 to April 2015 for oil and April 2014 to April 2015 for condensate (possibly due to missing data).

Below are the estimates in kb/d for Sept 2014 to April 2015 in kb/d for Texas C+C

(first # is EIA data, second is average of eia and my estimate, and the third# is my estimate using Dean’s data with % corrections)

Sep 2014, 3254, 3266, 3278

Oct 2014, 3335, 3335, 3335

Nov 2014, 3426, 3422, 3418

Dec 2014, 3510, 3500, 3490

Jan 2015, 3463, 3416, 3370

Feb 2015, 3603, 3518, 3434

Mar 2015, 3775, 3640, 3505

Apr 2015, 3711, 3540, 3368

Where we do not know which estimate is correct, I think the average of the two estimates would be better for Jan 2015 to April 2015. Just one person’s opinion, the EIA data from the petroleum supply monthly is not great, but through March it is high by no more than 8% and I think it will be more like 4% (135 kb/d). We will know in a couple of months.

Dennis,

You brought up a valid point in the comments to Ron’s previous post. That is that the explanation for US still rising since 9/14, while ND has not, is due to ND Bakken being earlier in time than both EFS and Permian unconventional.

Have you ever taken a close look at Elm Coulee in Montana? That, of course, is where the 21st century horizontal shale oil boom started.

I perused the MT state site last night for awhile. Of course, I am interested in long term production of these wells. It appears that most wells in Elm Coulee, most of which were completed between 2003 and 2008, settle out to around 10-30 barrels of oil per day. Interesting is how little water these wells produce. 30-300 barrels per month is very common, it appears.

In any event, do you think by taking a look at Elm Coulee, where it appears activity has pretty much stopped, could give us some clues about where the ND Bakken production is headed? Also, could it be a predictor for how other unconventional oil fields in the US will play out?

I also looked at 10K for both Continental and Whiting for the year ending 12/31/03, which was the year Bakken production commenced in Elm Coulee for Continental. I jotted down some things that were interesting, to me, at least. Will post later when have the time.

Hi Shallowsands,

I have a hard time figuring out the Montana data base so the most I have done is dig out annual output data for the whole Bakken/Three Forks play. For North Dakota I have Enno Peters excellent spreadsheet.

Short answer no I haven’t studied it. An excellent idea though. As to other LTO plays, I don’t know how similar the plays are, but based on stuff Mike and Fernando have said, probably not similar. I think it would help with the ND Bakken, but the way these older wells were completed is probably more like pre-2008 ND Bakken wells which may make for somewhat of an apples to orange comparison to the 2008-2014 wells in the ND Bakken/TF.

Hi Shallow sands,

Based on looking at about 10 wells (not really a big enough sample I admit), it looks like some of these old wells last a while, what is not clear is how many have been abandoned over the years, so we might only be seeing the “good” wells.

Dennis, contrary to some, I think Bakken wells will produce for many years. IMO, they will produce at rates of 5-20 bopd 20 years from now. Almost no water, probably rod pumped only a few hours a day.

As long as down hole failures are kept to a minimum, they might make decent stripper wells if oil prices are strong. One down hole failure per year would really hurt economics, though. Two or more would likely render them uneconomic. That is why I have wondered about vertical hole deviation given the huge rush to drill, apparently to save money.

We have a few wells that produce low volumes of both oil and water. They are on time clocks. OPEX is very low, we would be great even now if all of our production were like those. Some have had no down hole failures for over 5 years.

shallow sand

I think you are right

There were only 3 producing wells at the Elm Coulee / Bakken in Dec 2000 (one well wasn’t producing, probably, it was dry)

All three wells (!) are still producing at between 10 and 20 barrels per day

Look, for example at this well, which was initially drilled vertically and then re-drilled horizontally:

Permit to Drill 11/18/1988

Date Well Spudded 12/3/1988

Date Well Completed 2/14/1989

Intent to Horizontally Re-drill Existing Well 11/25/2003

Horizontal Re-entry, Date Well Spudded 12/8/2003

Horizontal Recompletion, Vertical Well 1/18/2004

Chg production by installing RHBM pump & rods 4/26/2013

Production history (b/d)

This well is 15 years old, was initially drilled horizontally and fracked. In 2008 converted to injection and in 2011 from injection back to production

Dennis. Good point about longer lateral length and more frac stages.

I wonder if, in the long run, the extra expense spent for these things will have been cost effective.

Hi Shallow sand,

The super fracks move production closer to the present where it is discounted less, at oil prices above $80/b it probably is worth it, at lower prices maybe not. Rune Likvern knows this best, I think for the Bakken in North Dakota he estimates a break even at about $70/b, but I may not be remembering correctly and that may be a point forward estimate.

Dennis, so do the big fracks increase EUR or just front load?

I guess that question cannot be answered definitively, but what is your opinion?

Hi Shallow Sands,

It may increase EUR a bit, bit it is difficult to say for sure.

In the ND Bakken there was a definite increase around 2008 when the super fracks were introduced with a likely doubling of EUR from about 150 kb to 350 kb (over a 30 year life), further increases in 2013 and 2014 seem to have just changed the shape of the well profile (more output in first 12 months) without a significant increase in cumulative output over the first 18 months, so either no increase in EUR or a marginal increase from 350 kb to 360 kb. So in my Bakken Model the wells from 2007 and earlier have a lower well profile than the 2008 and later wells. I have little data for the wells before 2007, so this early well profile is a guess on my part.

Hi shallow sand,

I took a closer look at August 2006 through Dec 2007 wells from Enno’s spreadsheet and the EUR for those wells is about 224 kb vs 348 kb for the average 2008 to 2012 well. It is possible that the lower well profile that I estimated (without much data at the time) was too low. When I substitute the higher well profile (EUR=224 kb) for 2005 to 2007 wells, it changes the Bakken model very little.

Dennis. 1198 wells in Elm Coulee field.

In April, 2015:

16% produced under 10 bopd

59% produced 10-30 bopd

16% produced 30-60 bopd.

9% produced over 60 bopd

Most of the top 25% completed since 2010.

Once the wells hit 10-30 range, most produce about one tank truck of water per month. These wells could be economic for 50 years or more.

Hi Dennis, which % did you use, the ones from March to April or some averages?

D.

Hi Dean,

I used corrected value in barrels for each month for T to T-23 for all months from April 2014 to April 2015 for both oil and condensate and divided each by your “corrected” value for each of those months. Then I took the average of those % corrections for all months from April 2014 to April 2015 for T to T-23 and finally multiplied those average % corrections by your corrected estimate, the difference is not that big in fact.

I also have realized it would be better to use the data value from the RRC rather than your estimate, so I will rethink it a bit.

Hi Dean,

So I have redone things with your correction factors and converting to percentages using the RRC data plus correction factor in the denominator where the RRC data is the most recent data downloaded. It turns out this gives a somewhat lower estimate for the correction factor than your method (with very small differences between the methods.

EIA, average, my estimate

Sep 2014, 3254, 3249, 3243

Oct 2014, 3335, 3315, 3295

Nov 2014, 3426, 3398, 3370

Dec 2014, 3510, 3472, 3435

Jan 2015, 3463, 3393, 3324

Feb 2015, 3603, 3493, 3384

Mar 2015, 3775, 3611, 3447

Apr 2015, 3711, 3516, 3322

I made a chart using the data Dennis posted.

How does the inventory data fit into all this? If indeed production is starting to fall then the latest inventory increase seems to be counter-intuative.

“If indeed production is starting to fall then the latest inventory increase seems to be counter-intuative” this could be explained by increased imports especially considering the high lease condensate content & lack of demand thereof of shale oil.

Production is just one thing affecting inventories. Imports and withdraws are two more. Refineries withdraw supplies from inventory according to demand which depends on the state of the economy.

Inventories, last Friday, were over one million barrels below where they were just over three months ago.

Date ………inventories in k barrels

3/20/15 … 466,678

6/26/15 … 465,379

Thanks. I must be too simple to understand this. But i thought imports are down and rafinery capacity is pretty much at limit. Which of those data is proven and which is assumed?

This is the kind of deep capture that rules markets today. The reason is because the real story on payroll numbers or many other measures would show that the world is in a depression with food stamps the new soup kitchen. Markets are no longer driven by a price signal but by Central Planners and their banks. Just look at the zerohedge link on JP Morgan and their massive commodity derivative exposure.

http://www.zerohedge.com/news/2015-06-29/jpm-just-cornered-commodity-derivative-market-and-time-we-have-proof

http://www.zerohedge.com/news/2015-07-02/americans-not-labor-force-soar-640000-record-936-million-participation-rate-drops-19

I have no idea who these “Central Planners” are. But I do know that they do not plan the price of oil. The price of oil does swing from day to day based on news and sentiment. But the long term price of oil is based on supply and demand.

Your first Zerohedge article is about derivatives. A derivative is something that derives its price from something else. The price of oil derivatives is derived from the price of oil, not vice versa.

Your second Zerohedge article is about unemployment. Now that does affect the price of oil. But “Central Planners”, whomever they are, have little control over that.

But the long term price of oil is based on supply and demand.

Unproven, and btw impossible. Dollars/barrel cannot be dependent on only barrels. It must be dependent on dollars, too, by definition.

Your second Zerohedge article is about unemployment. Now that does affect the price of oil. But “Central Planners”, whomever they are, have little control over that.

If the US central bank has no control over unemployment, then there would be no reason to assign unemployment to that central bank as one of the two criteria for monetary policy in the dual mandate — which is the law. Price stability and employment. Somebody thought they had control over it. In fact, they think that themselves.

As for the purity in general of the marketplace, with the system hanging by a thread no one rational would leave it to the essentially random fluctuations of free markets. You can make a good case for that being irresponsible.

Unproven, and btw impossible.

If the price of oil is dependent upon something other than supply and demand then the burden of proof is upon those who say it is dependent upon something else to describe what and exactly how the price is manipulated. So far I have heard a lot of theories but none of them makes any sense whatsoever. And you have supplied nothing in this post that gives any hint of how the price is controlled by “Central Planners” or anyone else.

Dollars/barrel cannot be dependent on only barrels. It must be dependent on dollars, too, by definition.

But of course. Price depends on supply and demand. Dollars are the price part of this equation. Did you not understand that Watcher?

If the price of oil is dependent upon something other than supply and demand then the burden of proof is upon those who say it is dependent upon something else to describe what and exactly how the price is manipulated.

Says who? Why isn’t the burden of proof on those who say price is supply and demand dependent, and as is so with any scientific hypothesis, evidence to the contrary requires one to reject the theory.

So there is that price on the shelf that doesn’t change as a function of the number of products on that shelf. You show up Monday, price is X. You show up Wednesday, fewer items on the shelf, but the price is still X.

Walk into McDs. Ask for a fish sandwich. “Sorry, sir, we have no more fish sandwiches.” “Oh, but the price up there is what it was last week when you had some.” “Uhm, what?”

2010, zillions of empty houses out there. Big supply. Price should fall. Banks refused to accept the lower price. Big supply, constant demand, no fall in price.

Done. You gotta toss that theory and work on another.

Hi Watcher,

Housing prices did fall in markets where there was oversupply.

The price is set by the market which is an aggregation of all those buying and selling.

If you own a store you can set all your prices at 2 times the level of all other stores, it is your choice.

Such a store owner finds that he sells very few items and either will reduce his prices or go out of business.

Have you ever had a McDonalds tell you they were out of something? It has never happened to me.

You have proven nothing. Especially for oil markets where none of your examples are applicable. The theory works well enough, though it is not perfect, exactly how equilibrium prices are established requires some strange constructs such as an “auctioneer” to establish market clearing prices in Walrasian theory. The fact is there is no auctioneer so there will be inefficiencies in the system as some goods will be sold above and below a market clearing price. Another problem with the theory is that consumer preferences are taken as given, exogenous to the market. Clearly if this were the case there would not be clever advertising schemes to try to create demand, so the theory falls down there as well. Nonetheless it is the best theory we have.

In order for a theory to be discarded, a better theory needs to be advanced, you have failed on that score.

Says who? Why isn’t the burden of proof on those who say price is supply and demand dependent, and as is so with any scientific hypothesis, evidence to the contrary requires one to reject the theory.

Yeah, what Dennis said plus common sense! Common sense should tell you that a seller wants to get the highest price he can so he sells to the highest bidder. Common sense should tell you that a buyer wants to buy at the lowest price possible so shops until he finds the lowest price.

Supply and demand is the default position. The market is just an auction, every seller getting every dollar he can and every buyer paying as little as he can. It is just common sense. It is not a theory.

Have you ever had a McDonalds tell you they were out of something?

Yup. Have. No change on the displayed item. The guy who bought the last one paid the same as the guy who bought the first one.

Done. Find another theory.

Oh and it’s not the default position. Victory is.

Notice how there are anti dumping regulations on the books? And Tarriffs?

Why are you guys doing this self delusion thing? You know perfectly well actions are taken to make the price of things whatever pursuit of victory suggests it needs to be.

Victory? Sometimes Watcher you make no sense at all. That last paragraph is about the silliest thing I have read in a long time.

Hi Watcher,

A store does not adjust the price based on the amount in stock. The market price of a good is determined by the market supply and market demand, nobody (except you) thinks this operates at the store level. So again you have only proven you understand very little about economics.

Hi Watcher,

If your theory that we can make prices whatever we wish, then all buyers would get their stuff for free and all sellers could charge an infinite price for their product.

You do see that this would not work well in practice, I would think. 🙂

Ron,

I think he means that, yes, while the supply and demand for oil determines its price, since it is bought in dollars the relative strength or weakness of the dollar can and does influence the price of oil.

edit: wrote this before reading any of the comments, so ignore it if necessary.

No Anonymous, that is not what he means at all. He completely denies that supply and demand determines the price. Obviously you have not been following Watcher’s post on this subject at all. He has hammered on this point for months. He thinks that somehow, somehow, others, somehow, cotrols the price of oil.

Of course he has never explained exactly how they do this.

Watcher. Maybe it is just me, but most of the time I do not have a clue as to what you are talking about. For example “with the ‘system’ hanging by a thread.?”

What “system?” The educational system? The political system? The religious system? The banking system? [If you are talking about the US banks, do not admit it, since it would indicate a total lack of understanding.] The socialist system? [Europe] The communist system [China, Cuba, Venezuela, etc.] The capitalist system? [US, Canada, Japan, Korea, etc.] The world trading system? The manufacturing system? The agriculture system? The construction system? The transportation system? The utility system?

Or is there a “Watcher system” that incorporates some or all of the world’s many integrated systems that is “hanging by a thread?”

A long, long time ago, I read a story. I think that it was titled “Chicken Little.”

The Watcher System rejects use of threads as a corruption of laissez faire.

That was a joke, where is the laughing.

The true price of anything is what somebody is willing to pay for it. It’s really just that simple.

s Haiti Relief Bounty Tournament will match all bounty money won and donate the

total relief efforts to Haiti up to $50,000 and also contribute

all tournament fees collected. In the long run sports like

soccer, cricket, volleyball and other exclusive sports events World Cup and Olympics are more enclosed

because of their ideal viewership in the world which furthermore captured a

large number of the dignified viewers. There is also a trend of many college students running

up debts on sports betting.

Nissan Leaf sales June 2014 — 2347. For first 6 months of 2014 — 12736.

Nissan Leaf sales June 2015 — 2074. For first 6 months of 2015 — 9816.

That’s down 23% year to date. Volt sales down 34%.

Total June car sales were down 3% at 676K. So the Leaf’s decline beat the average decline. Wow.

Light truck sales up 10% to 800,000. hahahahhahahahahaah

The electric revolution continues!

You’re just a plain old spoil sport Watcher. Now the EV Disciples will emerge, both of them.

Hi Doug,

With oil prices so low is anybody surprised? Oh wait, prices don’t matter in Watcher’s world, never mind. 🙂

Pretty much.

Those sales could increase sharply with no change in the price of the car OR in the price of oil.

Increases in US per capita real income would do it.

And thus, once again, price is proven less than compelling.

Why do I have to teach this stuff? How can y’all not figure this out?

BTW sales could fall, too. As income does. As it has been doing.

Yes watcher,

The idea is pretty simple. At a given level of income, a higher price for a good will result in less demand and a lower price more demand. Demand will also be affected for a single product by the introduction of other products that are better. Part of the reason for a fall in the Volt’s sales is that many buyers are waiting for the 2016 Volt which has many improvements over the old model. Prices will be reduced to sell off the older models. The price of oil will also affect car sales as will income.

Ahh, “many”.

If you can’t measure it, it’s not science.

Hi Watcher,

We will be able to measure the change in sales when the new Volt goes on sale, there are many variables that change in economics so the “science” is very difficult when you cannot control your variables as in a physics or chemistry experiment. So yes, social sciences are less “scientific” than some physical sciences, climate science also suffers from the inability to put the earth in a lab and to do controlled experiments which are repeatable.

As I said before we do the best we can with the theories that we have, come up with a better theory and you can win a Nobel Prize.

Hi Dennis,

Do you believe when Art Breman says that US oil producers at this moment loose $3.20 for every $1 of barrel that they make?

Let’s assume that that is the correct calc. My question is why there are 640 rigs still drilling in US? If supply is adequate why they are drilling? Shouldn’t supply and demand work there as well regarding to the number of the active rigs? I agree that for actual price of oil at any given moment it is quite hard determine how it is formed and where is equilibrium. But with rigs should be simpler especially if we look for the last 7 months since not all rigs can be stacked right away. Yes, number of rigs are halved, but at $57 does anybody in US make money? According to Art they are losing money. So why they are still drilling?

There are at least two good reasons ,from the pov of the people drilling, to keep drilling.

One is the hope of rising prices. The people who have been preaching dirt cheap oil indefinitely have already been shown up for incompetent price forecasters over the last few months. Oil is much closer to sixty than it is to twenty and with so many rigs parked depletion will most likely mean a rising price over the next year or two – in SOME peoples opinions at least.

The other is that it is sometimes the case that it is cheaper to run at a loss than it is to simply shut down.

For example suppose you own a restaurant in a rented building and are losing say three thousand bucks a month with all hired help including management. If the rent is four thousand bucks a month your are a thousand bucks better off to stay open- at least until the lease expires.

Plus there is generally a possibility that business will pick up and you can get your restaurant – or your oil wells – running in the black.

I know very little about oil except what I read but this explanation basically applies to any cyclical business.

And now we are at the end of ‘cyclical business mode’.

There is a lot of undrilled acreage plus a lot of leases likely have clauses requiring more than one well. Drill it, pay to extend or modify the lease, or lose it.

Also, almost all drilling at this point are public companies. Wall street will punish those with falling production, even though that does seem counterintuitive during low prices.

Some may have hedges to take advantage of yet this year.

Maybe don’t want to pay more termination penalties to drilling companies.

Just a few reasons, sure there are more, including a few may be ok at this price.

Shallow,

only hedges could be a valid reason but don’t they expiry in June for most of them.? I just read article about that few days ago.

All other reasons I don’t buy it because the drilling and making every barrel afterwards at loss is more expensive then all termination fees. I don’t buy that.

Ves. Don’t know that reasons I listed are smart or right thing to do. Just throwing out stuff.

Have discussed why you keep a water flood going. Do not want to lose the drive.

Also, on existing priduction, keep in mind all you have is a lease. It will expire if you leave it shut in too long.

Dumbest thing to me is pub co saying will return to drill at $65. Why would you put a lid on oil speculators in that manner?

Mac,

Hope is very good human trait. Same as Grace, Love and Faith. But I don’t think that businesses are run on Hope. Let’s forget the hope. And anyway my question was why do you keep drilling a NEW loss making wells from a get go? So that first reason is not good.

Second reason. again I did not ask why do you keep already producing wells running. There could be a reason if cost analysis is done that keeping them going is cheaper then shutting them down. My question is again why do you keep drilling a NEW wells when it is obviously cheaper option just NOT to drill. Isn’t the cheaper option not to drill? Make sense to me. So again that second reason with your example of restaurant is not valid because you are not opening a new restaurant down the block if the first one is not making profit.

I have known many small business men who ran at a loss at various times hoping for business to pick up. I used to be a small businessman myself and sometimes ran at a loss.

Some went broke. Some hung on to their crews and regular customers and made a ” killing” when business picked up again.We ran our orchards at a loss sometimes for years on end when the market price was below our production costs due to the industry over expanding. When the market EVENTUALLY turned we made VERY good money given that enough others gave up and there was then a short supply. One of my neighbors spent a lot of money establishing a new orchard and after three years of good production running in the red had a bulldozer in and converted it back to a hayfield. There was a short crop the following year. We did VERY well that year.

There are plenty of news accounts of large businesses hanging on for years losing money year after year. Sooner or later they get bought out or close.

You DO NOT KNOW for sure that it is cheaper for a given operator to quit drilling. It is obvious enough that a lot have quit or nearly quit , as evidenced by the stacked rig count.

But for the rigs still running, the people doing the paying are running on the basis of either straight dollars and cents accounting considerations or hope – most likely a combination of the two.

As others have pointed out, there are many substantial expenses you may have to pay even if you quit.You can lose your leases, your experienced crews scatter, getting the key people back could be very hard, you have to pay termination penalties, you may have to go straight to bankruptcy.

If you are drawing a good salary as and executive level employee or owner, even though your OVERALL business is losing borrowed money or market cap , you can keep paying the girls tuition at that snotty snooty private college. Your wife can keep the Benz and you can still play golf at the country club.

You can even be working on hiding some assets from the bankruptcy judge you may be expecting to meet a year or two down the road. 😉

My seat of the pants guess is that barring a really sick economy , oil will be closer to a hundred within eighteen months than it is to fifty five to sixty. Depletion never sleeps courtesy of Matt Simmons.

Mac,

Apple orchard as example does not apply. That is like “renewable” product, it grows every year 🙂

Oil on the other hand is like Slurpee that can not be mixed again. Once you suck that Slurpee out of the ground – no more.

I cannot reply down thread but the people who have wells already pumping are generating badly needed cash even if they are not actually making money.

They may be drilling new wells for the many other reasons mentioned in other comments.

It is true that an orchard is renewable over the long term and oil is not – but within the time frame that businessmen either orchardists or oil men make decisions, this makes no difference. The fact that any GIVEN well is not renewable does not matter short term so long as there are still plenty of places to drill new ones.

Orchards have a life span too, the same as an oil well. The only real difference is you can put a new orchard in the same spot.

Incidentally the life span of an orchard is not too far different from that of an oil well, ranging from a few years to a few decades.

“According to Art they are losing money. So why they are still drilling?”

For preventing production at least from declining maybe also. Could be that in several wells production is dropping like a rock.

If it would be the hope of rising oil prices, they better wait.

Hi Ves,

First, I do not know if Art Berman’s calculations are correct.

Has he assumed that oil prices will remain at $60/b forever?

Is that assumption correct? Maybe the drilling and completion continues only in areas where the best wells have been drilled previously and the oil companies need the output in order to keep the company operating. The oil companies may believe that oil prices will increase, I do not know exactly why they continue to drill, but it may be a combination of many factors, some of which I may not be aware of.

Hi Dennis,

I don’t know if Art’s calculation is correct but I wrote let’s assume it is correct in order to analyze what is happening in reality. To be honest we don’t know if EIA data is correct and we don’t know even if Baker Hughes data are correct with 640 active rigs in US. But that is data that we have so we have to make sense with what we have. So, so far nothing makes sense.

” Has he assumed that oil prices will remain at $60/b forever?”

Of course not. Price is always going up or down. But that is not my question. My question is why do you drill NOW when it is cheaper NOT to drill now?

Why do you assume that oil companies know when the price of oil will go up? They do not know. How they would know? If they know they would make a killing on the stock market and leave drilling and refining to someone else 🙂

Hi Ves,

The oil companies probably estimate what they think the future price will be. Every business has to make some estimate of what they think will happen in the future. It does not matter if they are correct in fact, their decisions will be affected by their expectations.

Let’s say you owned an oil company, what do you think the future trend of oil prices will be? If you think they will be lower in the future, then prospective wells will be less profitable based on that expectation, if you believe oil prices will be higher then those wells will seem more attractive.

Expectations make a big difference.