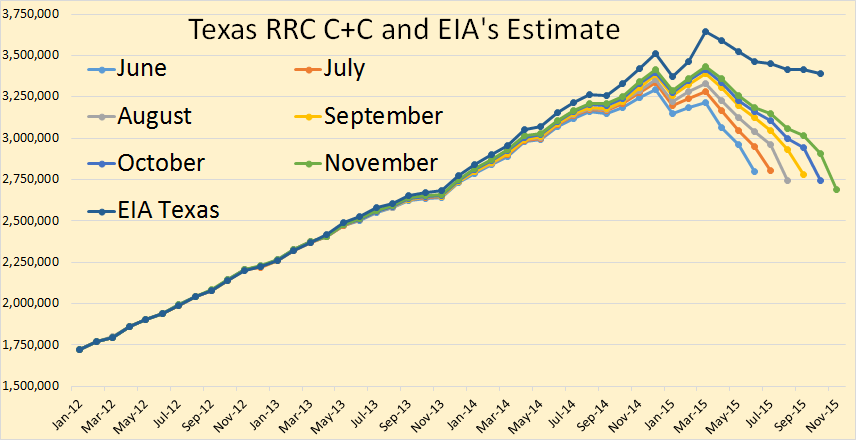

The Texas RRC Oil and Gas Production Data is out. This data is always incomplete. But we can get some idea of what the trend is by comparing it with previous months. This is what I have done in the charts below. If the latest months data is below the previous months data then the trend is down. But if the latest months (incomplete) data is above the previous months (incomplete) data the trend is up.

All RRC data is through November 2015 but the EIA data is only through October. The oil data is in barrels per day.

The trend is definitely down. The scale makes it difficult to gauge the month to month change but I have the exact month to month change here in barrels per day. Of course this only gives you a general idea of what is happening. The final change could be either less or greater than the numbers indicate here. But the EIA data should be very close.

Jun. to Jul. 7,245

Jul. to Aug. -63,827

Aug. to Sep. 34,507

Sep. to Oct. -33,486

Oct. to Nov. -52,802

Jun. to Nov. -108,363

EIA Dec. to Oct. -121,000

Dr. Dean Fantazzini has developed an algorithm that gives a very close estimate of what the final data will look like. His data and the EIA data track each other pretty close.

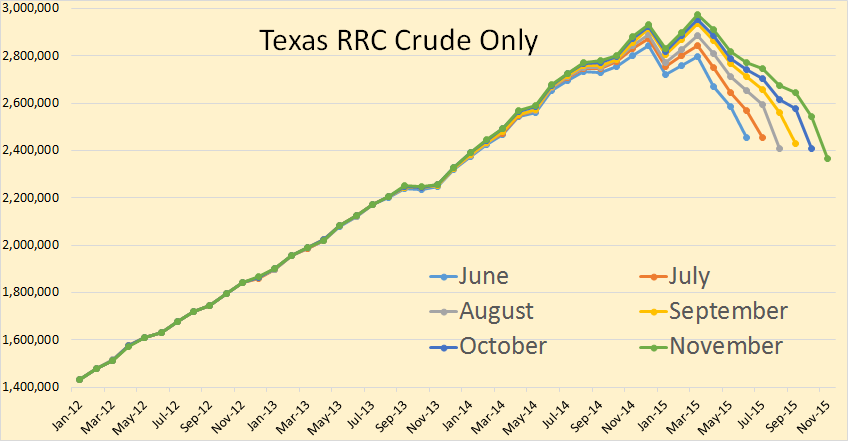

Crude only has had the lions share of the decline, the incomplete data is down 91,000 bpd since June.

Dr. Dean Fantazzini’s corrected data indicates that crude only will actually be down about what the incomplete data indicates.

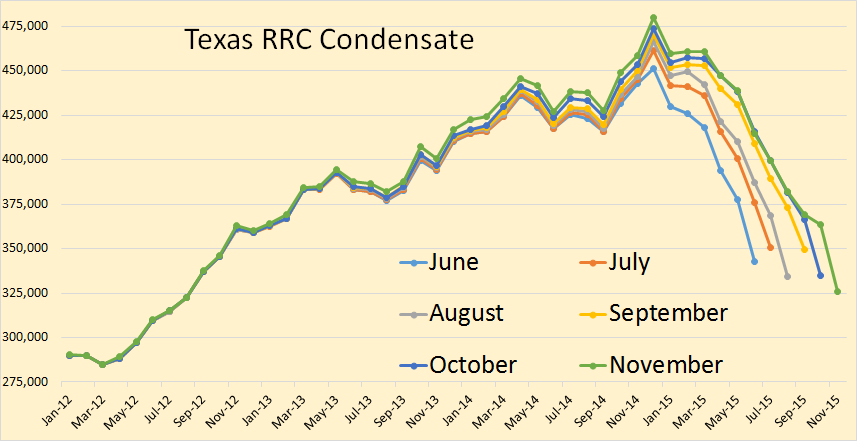

Condensate shows a slightly more erratic decline, down 17,000 bpd since June.

And Dean’s condensate chart disagrees slightly with what I would estimate. He has condensate up in October where the RRC incomplete data has it down.

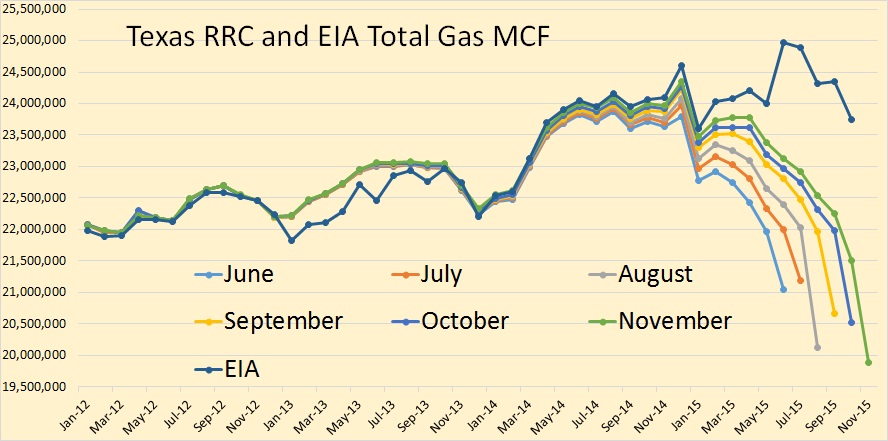

The EIA has dramatically revised their estimate of Texas natural gas production since last month. I think they have it pretty close this time. The EIA data is only through October but the ups and downs pretty much agree with the ups and downs of the RRC incomplete data.

Dean’s expectations for Texas total gas production is slightly different from the EIA’s. It does show a big drop in November as the Texas RRC data indicates.

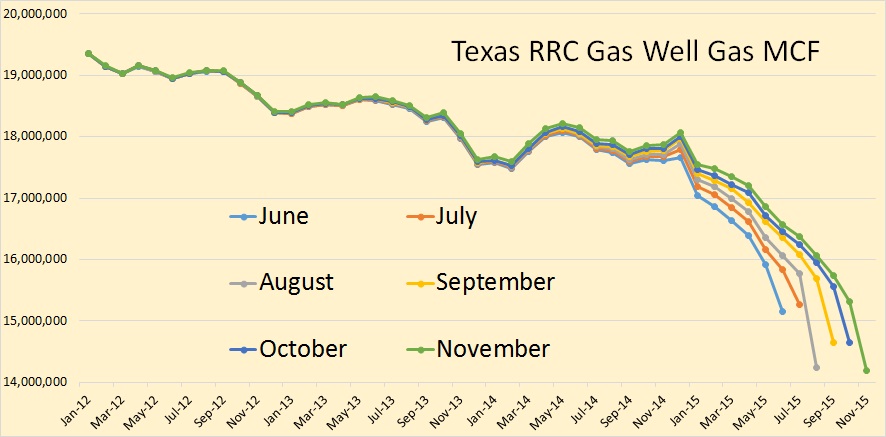

Texas gas well gas shows a drop in November though it was up in September and October.

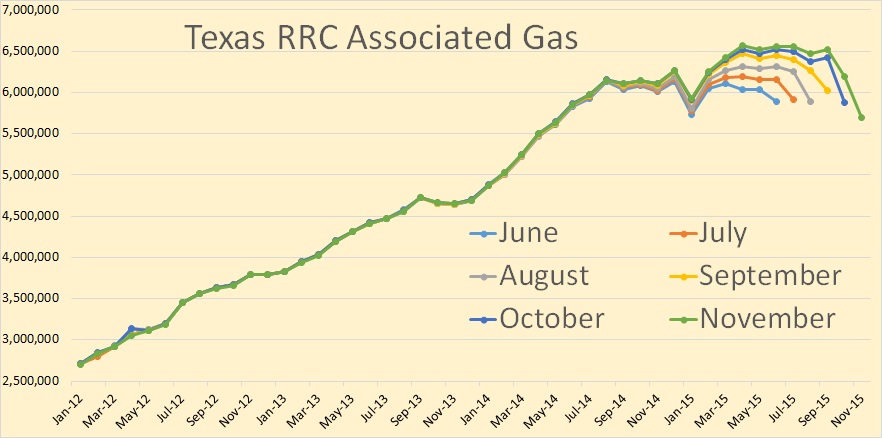

Texas associated gas should show a considerable decline in November when the final data is in.

An off the immediate topic tidbit copied from the Gaurdian site:

Jowett named a number of other technologies that were making vehicles more efficient. Among them were grille shutters to improve aerodynamics and more efficient air conditioning systems. He also explained that the 2025 fuel economy number that’s most often quoted – 54.5mpg – is misleading. The real number, the Corporate Average Fuel Economy standards that include more real-world driving parameters, is about 49mpg.

“The EPA number is based upon two-cycle testing that came about 30 years ago, when the national speed limit was 55 miles per hour,” he said. “It doesn’t take cold weather testing, air conditioning use and other factors into account.”

Bold is mine.

This of course means a LOT of emphasis on pure electrics and plug in hybrids to get the CAFE of a manufacturer up to snuff.

Texas is closer to the money, but still . . . . .

btw ZH on a roll. Big article that goes like this . . . . oil sellers funded sovereign wealth funds. Big numbers 800+ billion for norway.

When those SWFs grow, they gotta put the money somewhere and drive up stock markets. When oil revs are too low to fund govt spending, they gotta sell those stocks to raise cash to spend. It’s like reverse QE.

Didn’t zh just put up a thing saying mark to market wavers out for some oil loans? Thoughts?

They just took it a step further and watcher… you are becoming more scrutable by the minute;

“With the oil fallout quickly spreading, the Fed is resorting to behind-the-scenes manipulation of energy debt, and now, that apparently includes oil ETNs as well.”

http://www.zerohedge.com/news/2016-01-17/what-just-happened-oil

What am I missing here?

From 2011 to late 2014 rig count in US was floating around 1800–1900. Kicking up US production to latest peak (or final, depending on your view) to 9,56 thousand barrels in May. In a year 2015 rigs has dropped to 650. Production has only dropped to 9,22 in the same time.

The question is: did the crazy drilling between 2011–14 generate that many holes that were DUC or are we in for some massive skydiving in production? If so I takes a lot of time for that to show up on EIA’s reports. Not even there drilling report makes sense with the knowledge of rigs in use.

Sorry if I the question is stupid, well then I am.

Think not only about DUC. Think about the choke and desperation.

They drilled in the areas that mostly made over 200k barrels the first year, and less in areas that only generated 50k to 75k the first year. However, there is only so much of that. In Nov and Dec wells completed dropped from an average of over 1000 a month to less than 700 month. Plans by EOG is to not drill much and finish the DUC wells the first of the year. However, all I can say for sure about is Atascosa County, but those DUCs were not in very good areas.

Amatoori,

There is a time lag of six months for shale and 18 months for conventional projects from drilling towards production. The real decline is coming over the next months.

Texas C+C fell approx 190 kb/d from its peak in March 2015 according to my corrected data. The fall in natural gas since September 2015 (particularly associated gas) makes me think that C+C will accelerate its fall in the coming months. Let’s see.

Hi Dean,

The low natural gas prices have reduced investment in natural gas in Texas, the money has moved to the Marcellus and Utica plays which may be more profitable.

If the oil price forecast of the EIA in the Jan 2016 Short term energy outlook is correct we might see a steep drop in Texas output eventually.

I am surprised the Texas C+C output has declined so slowly, only about 20 kb/d each month on average since March 2015. Considering the price of oil and the steep drop in rigs, I thought we would see a lower well completion rate. So far the drilled wells that have not been completed (DUC wells) seems to keep output relatively flat as they are gradually completed. In fact, so far much of the decline may be from conventional stripper wells that have been temporarily abandoned due to low prices based on comments from Shallow sand.

It would be interesting to hear comments from Rockman, or Mike on whether they think a decline of 20 kb/d could be accounted for by decline in conventional oil output in Texas.

Very roughly there is about 2.5 Mb/d of LTO output in Texas (split between the Eagle Ford and Permian basin). This would leave about 900 kb/d of conventional output.

If there was a 10% decline in conventional output over a year that would be 90 kb/d or about 7.5 kb/d each month, so decline in conventional output might explain a third of the decline in Texas output.

Another question I have is the RRC’s reports on the “oil wells on schedule” on the Eagle Ford information page (upper right). In November and December there were over 400 oil wells added to the schedule in the Eagle Ford, when a well has been drilled, but it still waiting for fracking does it get added to the “schedule”, or does this only happen when the well has started production?

See http://www.rrc.state.tx.us/oil-gas/major-oil-gas-formations/eagle-ford-shale/

On Nov 1 the oil wells on schedule were 9,655, Dec 1 there were 9,887 oil wells, and Jan 1, 2016 there were 10,140 oil wells on schedule. That is 232 new wells in November and 253 new well in December, but whether all these wells are producing wells is not clear (at least to me). The completion numbers seem too high.

Thanks in advance for any clarifications from those who might know.

I am sorry but I do not know the situation with “oil wells on schedule”. I suggest you to contact the RRC data help center , since they are very polite and reply quickly.

Marcellus and Utica are DOA. Basically it’s totally impossible to make money fracking for dry gas below $3 — the dry-gas breakeven prices mostly start at $4 and are upwards of $8 through most of the region — and there’s very little liquids in the Marcellus and Utica. They’ve mostly been fracked by land-flipping scam artists who cut corners, which has been really bad for the local environment.

The few liquid-heavy sections of the Marcellus will continue being drilled, but there aren’t very many of them.

You have to remember that Bakken makes its money on liquids, not on gas. Fracking for gas is basically unprofitable everywhere. It remains to be seen when gas production will drop, and whether gas fracking will revive because of that (I hope not, given what an environmental disaster it is).

There’s a cap on natgas prices set by the point where it’s cheaper to use wind and solar to generate electricity (declining every year as wind and solar get cheaper) and another cap set by the point where it’s cheaper to use electricity to heat houses (declining every year as heat pumps get better); that leaves a fairly narrow window for natgas prices where fracking could be genuinely profitable. It’s never stayed in that window for long.

RRC had it posted yesterday. EIA is on track about the drop, I just don’t think they are close as far as the total drop will be. Art Berman seems to think most of the Permian shale wells will be folded down at below 30 price. EOG contacted the mineral right owners on a 6000 acre parcel they were starting to drill on that I own a small piece in, and asked if they would sign an extension on drilling while the price is so low. As I know all of the mineral right owners, I know the general consensus was: air mail the agreement.

Oil in the teens forever -because Kazakhstan

http://www.marketwatch.com/story/fund-manager-whos-been-right-on-oil-has-a-depressing-new-prediction-2016-01-15?page=2

This guy is always right, so he must be right, right?

Stock market CRASH: £27 BILLION wiped off investments as Iran sparks oil price war

STOCK markets across the Middle East COLLAPSED today as the lifting of sanctions on Iran prompted fears of a huge oil price war.

Yeah, a lot of interest in Iranian oil interests. To pour mega millions in their sorry infrastructure, and then make pennies on the dollar for capex. Maybe Lukoil with their heavy pockets?

I hear that the OCC finally had some wells shut down due to Deep Waste Water Injection issues. There seems to be studies now being looked at seriously by the OCC – Oklahoma Corporation Commission on Deep Water Injection and its impact on Earthquake activity. If a precedent is shown to exist… WATCH THE F*CK OUT.

From what I understand, there are huge lawsuits in the pipeline if (once) a precedent is found. I also hear that the TRRC is watching closely the OCC hearings and meetings. If a precedent is found to exist and is made official by the OCC, the TRRC will likely follow.

This could shut in a lot of Resource Oil & Gas Wells due to the liability and deep water injection issues. I have been doing some reading on Earthquake damage to homes, buildings and infrastructure and it is much worse than MSM has reported. There’s one hell of a lot of very angry and pissed off people in Oklahoma and Texas that have suffered damage from earthquakes.

You add this to the recent Dallas Fed decision to keep the Banks from MARK TO MARKET their energy assets (LOL… Liabilities), and looks like we are going to see one hell of a BLOOD BATH in the U.S. energy industry this year.

Prof MudFlap

My brother is having a problem with that around Edmond, Okla. 50% of the wells in Texas, they just use surface ponds to allow them to dry OU. The better alternative they are starting to use is centralized wastewater treatment plants that they can reuse the water from. If it becomes a huge issue, then I hope they gravitate that way.

Guy Minton,

This requires an huge transportation infrastructure for waste water, which will require a lot of time. Obviously everybody wants to extinct the oil industry as there is the strong (mistaken) belief that the economy can do it with renewable resources. The same what happened with coal is now happening with oil.

Heinrich Leopold says:

And obviously you don’t believe in magic.

The Lovin’ Spoonful has the cure for you:

Obviously everybody wants to extinct the oil industry as there is the strong (mistaken) belief that the economy can do it with renewable resources.

Not really, nobody I know, who has even half a brain thinks that renewables alone can sustain the kind of global industrial economy that still exists today. And to say everybody wants to extinct the oil industry is just beyond ridiculous!

The strong mistaken belief, I call it denial, is the idea that we don’t need a plan B! Pretending that fossil fuels can continue to sustain the global economy at current levels of consumption for the long term just isn’t going to end well.

Arguing that renewables won’t work is like refusing to get into a life boat when the Titanic was sinking. In the life boats you won’t be sitting down to a nice dinner served by elegantly dressed waiters while listening to the live band… but it sure as hell beats drowning in the freezing water. Oh and let’s not forget that there weren’t enough lifeboats for everyone. Not everyone got to survive but a few lived to tell the story.

BTW, Attacking the messenger is a rather pointless exercise in futility!

The strong mistaken belief, I call it denial, is the idea that we don’t need a plan B!

Ahhh yes, we definitely need one. But we don’t have one. And very likely will never have a drawn out plan. Things will just evolve. That is there will be some renewable infrastructure built, electric cars, solar panels, wind turbines, but not nearly enough to make the huge difference needed.

The world moves according to the will of 7 billion people, and they definitely do not have a plan.

Arguing that renewables won’t work is like refusing to get into a life boat when the Titanic was sinking.

That statement does not make a lot of sense to me. Arguing what will work or wont work is not the point. The point is: “What will actually happen?” There will definitely be a lot of renewables built. But not nearly enough. And most of those folks will not make it into the lifeboat. That lifeboat is just not nearly big enough. Most of those folks will drown.

There will definitely be a lot of renewables built. But not nearly enough. And most of those folks will not make it into the lifeboat. That lifeboat is just not nearly big enough. Most of those folks will drown.

That is probably correct if we are talking about the people trying to maintain BAU living in the so called first world. But that still isn’t quite the same as:

Obviously everybody wants to extinct the oil industry as there is the strong (mistaken) belief that the economy can do it with renewable resources.

Not to mention that there are also about 1.3 billion people living in abject poverty, without any sanitation or electricity who will probably get access to some very limited electricity and communications technology via small local off grid solar. To them that would still be a huge step up!

As to: “What will actually happen?”

I guess we’ll all just have to wait and see, won’t we?

Though for what it is worth there are some people who are still trying to steer the big avalanches away from the village by setting off a few smaller ones here and there. But most of the people are still sound asleep in their little cottages down in the valley oblivious to the possibility of being buried under tons of snow and ice…

Just because some of us are trying to find other ways of doing things does not mean we are as stupid or naive as we are being made out to be by those who seem to be absolutely sure that they are right. Truth is none of us knows and we could probably all use a dose of humility.

But a little electricity is not going to make food appear.

Is there an “export land model” for food? What will Egypt (for instance) do when there is no food available on the international market? Or KSA? (Of course, it probably won’t be called ‘KSA’ much longer.)

However, I do agree that in an environment with sufficient arable land, sufficient clean water, and sufficiently low population density that a little electricity is better than none.

The people of Egypt are mostly going to starve, except for the ones who manage to emigrate, barring miracles.

There just aren’t any agricultural technologies that can be brought to bear to allow Egypt to feed herself, and they aren’t going to be invented, in time to help, and if they were invented, Egypt could not pay for the implementation thereof anyway.

Who believes the rest of the world will feed Egypt, on a charitable basis, indefinitely? Egypt has nothing to export.

The only very slim hope for Egypt is a cultural revolution involving a birth rate that falls way below replacement level VERY soon.

What are the odds of THAT coming to pass?

Egypt is my chosen poster child of collapse.

The people of Egypt are mostly going to starve, excepting the ones who manage to emigrate, barring miracles.

There just aren’t any scalable agricultural technologies that can be brought to bear to allow Egypt to feed herself, and they aren’t going to be invented, in time to help, and if they were invented, Egypt could not pay for the implementation thereof anyway.

Who believes the rest of the world will feed Egypt, on a charitable basis, indefinitely? Egypt has nothing to export.

The only very slim hope for Egypt is a cultural revolution involving a birth rate that falls way below replacement level VERY soon.

What are the odds of THAT coming to pass?

Egypt is my chosen poster child of collapse.

Hi Old Farmer Mac,

I think they have a lot of sunshine there. Invest in solar panels and produce enough electricity to export to Europe by undersea HVDC cable.

This is not an original idea, but it seems like a good one, it would help solve the problem of shorter days in Northern Europe during winter, dust storms may be a problem, but perhaps wind power would be adequate when dust storms are a problem.

Egypt could feed itself better if they knocked that damn dam down and restored their natural agricultural cycle (which was ULTRA productive).

Yeah, population needs to stabilize so that we stop overrunning our food supply. We can’t keep “juicing” it with artificial fertilizers — we’re already seeing mineral-deficient food.

Luckily we know how to stabilize the population. Give women equal rights, educate them, and provide them with birth control. Wait 1 generation.

This involves breaking up deranged fundamentalist cults which enslave women and force them to have dozens of babies, of course.

Pfffft, renewables can easily cover the energy needs for a much larger population wasting much more energy than we are. Just look up the calculations regarding how large an array of solar panels is needed to power the world — laughably small numbers.

That’s not to say that that’s what will happen, of course. Our governments are too stupid to actually *build* that solar array, so we’ll get much uglier results.

“Arguing that renewables won’t work is like refusing to get into a life boat when the Titanic was sinking.”

A very ignorant analogy fred. Apples and oranges. More accurate;

Arguing that renewables won’t work is like refusing to gather a group in the dinning hall to design and discuss a method of construction of a life boat when the Titanic was sinking.

Jef. On plan B for the titanic. I wrote it all out in plain anglosaxon long ago on good ol’TOD.

Captain gets news from designer that ship has received fatal wound. Cap immediately calls crew and gives order

“organize the passengers to tear up everything that floats and toss it all over the side. And I mean EVERYTHING.

get the lifeboats over asap with enough crew and ropes to make rafts out of the floating stuff.

Pull rafts alongside and chute the passengers down, feeble workers first. As each raft fills, pull it away and lash it to the next.

Keep it up. And keep those radios working, and the rockets.”

So, when the Carpathia shows, it finds lotsa miserable but alive people on rafts, cursing their fate and the dumbass designers.

So, on this titanic we’re on, do the same Thing. Sure, renewables won’t provide the servants and the band, but might keep us afloat.

I stick with my guess of 10% of present energy as ok for a reasonable life. Assuming of course, a moderate level of wit and wisdom.

Doubtful, but not impossible.

regarding:

I stick with my guess of 10% of present energy as ok for a reasonable life. Assuming of course, a moderate level of wit and wisdom.

Doubtful, but not impossible.

I just want to add to that if I may. How well you make out:

It depends on where you live.

It depends on your skills and intelligence, including abilities to build and solve problems.

It depends on your health and willingness to work hard.

It depends on your preps made now.

Finally, a dose of luck and good fortune will help.

Sure. All you say.

I’m assuming most folk don’t need to know it all. The goat shows how to eat thorns and the sheep just follow.

Im with ya Wim – I just hate it when people imply that all we need do is switch to something else or even, to beat the Titanic metaphor some more, not worry because we have lifeboats. We NEED to worry big time because, again like on the Titanic we don’t have anywhere near enough lifeboats.

Hi Jef,

Keep in mind that on a blog, one cannot write a treatise or people will not read it.

When someone says we can use EVs, public transportation, biking, walking, roller skates, etc. instead of ICE vehicles for transportation, that does not mean the writer believes that all problems of the World have been solved.

It is one of many possible solutions to the problem of peak oil.

Natural gas and coal may also peak (coal by 2030 and natural gas by 2035, roughly give or take 5 years plus or minus). Solar and wind are a potential solution to that problem, again we take the problems one at a time.

Does anybody suggest these are the only problems?

Not that I have read. YMMV.

http://www.techinsider.io/map-shows-solar-panels-to-power-the-earth-2015-9

This is an overestimate. Electric cars are far more efficient than gasoline cars; insulating our houses properly reduces heating and cooling costs massively; LEDs are eliminating massive waste of energy in incandescent lights; etc. So we don’t actually need to generate as much energy as this site shows.

However, this site shows how easy it would be to generate the energy from solar. Trivial really.

So the implicit suggestion is that renewables are like lifeboats? And are they even renewable?

So the implicit suggestion is that renewables are like lifeboats?

Yep, in a way that is correct! What seems to get lost in the discussion is that since there is no way to rebuild the ship we were on, we will have to find ways to live with what we still have. One option, of course, is to choose to go down with the ship.

And are they even renewable?

By definition, yes! Is the definition correct? It guess it depends.

Some of us will eventually find out. One thing we know for sure, fossil fuels are NOT renewable.

Hi Fred,

Renewables– yes– by definition, but whose? Team Greenwash’s? (waves in Glenn’s direction ‘u^)

Now that was of course half-joking, but also half-serious. I am unsure we have really thought out so-called renewables long enough.

For example, someone hereon has related their manufacturing, etc., to ‘BAU Lite’. That’s not good in and of itself, is it? Nor is it if you, yourself, are all about transcending BAU, is it?

I also hear that the rush to their manufacture will further the C02 in the air and, through Jevon’s Paradox (potential bugs and loopholes aside), not really slow down the uptake and release of C02 from other sources/places anyway, will they? Chindia?

What kind of so-called renewables do we want; how dispersed/affordable will they be (in a world of increasing job-cuts, economic-cum-oil-energy-industry-surrealism, and social unrest, etcetera); will they be integrated (on or off-grid or both?) and what will their scales be (home/low/wimbiTech/democraTech or large-scale centralized/eliTech)?

What kind of post-sales, local and accessible support will they have, such as in an era of decline/collapse, such as of international shipping, and of relocalization?

Have ‘we’ really considered other, say, competing, options, and as vigorously as we have considered BAU Lite-based options? What about passive solar, low-tech wind, and maybe some kinds if wimbiTech approaches? Here, I am perhaps feeling a little more confident that wimbi has achieved a certain level of wisdom, even though I am unsure about their ‘biochar’ thing (assuming it is understood as such), but that’s another can o’ worms for another day.

Don’t let the perfect be the enemy of the good.

We can use PV, wind, passive solar, and better efficiency to reduce carbon emissions.

Things will change, maybe not as quickly as you would like or the way you would like.

As I have pointed out before there are a lot of people in the World and not all people behave well.

You seem to think we can take 8 billion people and divide ourselves into 8 million small democracies of 1000. Seems there is a lot of potential for conflict among those 8 million non-governments.

Now for every project that such a community does in common people will need to voluntarily donate time or money to accomplish the task.

Perhaps this might work for a community of 1000, but probably not for 10,000 and definitely not for 100,000 or more.

Why might community sizes become larger?

If there is conflict among communities (and it is naïve to think there won’t be), who wins between a community of 1000 and another that is 100,000?

This is possibly the reason that nation states developed.

In general, 8 billion humans and anarchy are not a good mix, given human nature.

Have ‘we’ really considered other, say, competing, options, and as vigorously as we have considered BAU Lite-based options? What about passive solar, low-tech wind, and maybe some kinds if wimbiTech approaches?

Not sure what exactly you mean by BAU Lite but as far as passive solar, low-tech wind etc… those are no brainers. I worked for a while with PV installations the first thing we always suggested was that customers do their homework. Focus on the low hanging fruit first. Things like LED lighting, attic insulation, attic fans, etc…

Superinsulation is a bit more complicated than mere attic fans, but has a humungous payback, cutting heating/cooling costs by 80% compared to a typical poorly insulated house.

BAU Lite = BAU Greenwash I guess. It’s just that I’ve read BAU Lite before and it seems to sound about right– that BAU hasn’t really gone away like it should.

I like low-tech responses better. They are, by nature, closer to democracy and community/ individual empowerment and resilience. I’ve quoted Ivan Illich about that before.

Unsure about attic fans, but whatever.

In a comment to Ron’s previous top post, I outlined how a 6kW PV array could power a typical 2015-2016 BEV (Volkswagen eGolf) for 605,900 miles of driving over a twenty year period. The actual math is a good deal more complicated than my back of the napkin calculations but, even if the results are way too optimistic, they are still quite revealing.

Let’s just look at the first year. The 6kW PV array could provide enough energy to drive the eGolf about 30,000 miles. A regular 25 mpg VW Golf would consume 1,200 gallons of fuel to cover the same distance. The PV array will be able to repeat this feat for twenty five years and probably more with an expected 20% decrease in output by year 25. The car with the ICE will need 1,200 gallons of fuel every year if it is to cover the same distance. Which is more sustainable?

The economics of renewables, batteries and EVs are such that, at the moment they do not compare favorably with fossil fuels but, if they follow their respective historical cost reduction curves, as Tony Seba speculates they will, they will be less costly than FF powered options at some point in the next fifteen years.

I remember HereinHalifax over at TOD, giving us examples of huge savings he was achieving in the field of commercial lighting in Canada and at the time the doors were closed over at TOD, he had just started to look at using LED based lighting. There is huge potential for energy savings in North America from just switching to LED based lighting alone (80% reduction in power consumption for the same level of light, compared to incandescent lighting).

The prospect of the proliferation of renewable energy and energy efficiency must be keeping team Koch up at nights. The question is, does the world have fifteen years of anything remotely resembling BAU ahead of us?

A couple of elaborations to add to your comments I.B., when I tried to determine the net equivalent petrol energy investment required to manufacture 1kW capacity of solar PV, I came up with 660 gallons petrol/kWc.

So in your scenario of a 6kW array, burning the fuel directly would yield 118,800 miles of travel @ 30/mpg. Compare with your 605,900 of travel the PV would yield over its lifetime: five times as much!

I think it is important to note however that the average U.S. EV will need only 10kWh/day, which a mere 2kWc can provide.

You also wrote: “The economics of renewables, batteries and EVs are such that, at the moment they do not compare favorably with fossil fuels.”

I question this. Hasn’t the Edmunds’ data been posted multiple times demonstrating that in total cost of ownership, the Nissan Leaf is the least expensive new car to own over its lifetime?

Internet debates won’t change the adoption rates of PV+EV though. What will influence it is people like Wimbi demonstrating for their family, friends and neighbors what personal energy security looks like.

The other question is, is that the right question?

Remember my previous quip to you last year regarding running around nude all day in the sun on your island, and, if recalled, you suggesting something along the lines that BAU doesn’t really care about that (thus applying itself to everywhere and everything, irrespective of its appropriateness.)?

Also, you, along with whoever else, seem to be approaching your tech from an odd kind of internal logic; like well the costs are going to go down and bla bla bla, etc., which doesn’t really address the big pic of appropriateness, does it? Systems/Holistic thinking?

Would you rather jerk around with your planet, while feeding the elites’ BAU setup, than run around nude all day, body-surfing, hiking. eating bananas and papayas and making love when you feel up to it? There’s no real reason to be doing much of anything else is there? Like pushing paper in an office cubicle breathing sick building syndrome canned-air on the best hours of the day while the sun shines outside?

I’m here in Halifax, myself, incidentally, and could always try to look up TOD’s Hereinhalifax and if successful, try to coax them hereon. Can we get some leads? It was Paul? Anything else to go on?

Would you rather jerk around with your planet, while feeding the elites’ BAU setup, than run around nude all day, body-surfing, hiking. eating bananas and papayas and making love when you feel up to it?

How’s this for Systems/Holistic thinking?It is “making love when you feel up to it” that sort of got us into this pickle in the first place. As it stands, there are way too many people on this little island for us to be “eating bananas and papayas” and just about anything we could grow locally so, we depend a lot on imported rice and flour and even locally produced chicken meat, depends on imported grain for chicken feed.

The thing is, evolution or if you are so inclined, your favorite deity, made sure that the act that results in procreation is a highly pleasurable one so, if naked apes don’t have enough to otherwise occupy their time, a lot of procreation happens. It would appear that lack of material resources doesn’t seem to hamper the tendency to procreate, as witnessed in the places in the world with the highest population growth.

My attitude stems from an acceptance that we have a “bag of goods” to start with and that has to be our starting point. I’m totally there with Fred and his stuff about the circular economy and think that ought to be the ultimate goal, regardless of whether it his high tech or low tech.

I am very disheartened when I drive across some of the bridges that span the storm channels (think Los Angeles) in the capital city, where I spend most of my time. Low income folks have taken to squatting along the land immediately adjacent to these channels and just throw their trash into the “gully” as they are called. I’m gonna take a picture of the mess and show it to you guys when I get an opportunity. There is definitely some “jerk around with your planet” going on. When I’ve posted the pic, I’ll invite you to get back to me about the running “around nude all day, body-surfing, hiking. eating bananas and papayas and making love when you feel up to it”.

Hey guys, I am just heading out, but managed to skim your stuff and will be back again later today or tomorrow, but some off-the-cuffs for now to chew on:

– Where exactly will we be going in our EV’s as this thing unwinds (and roadway infrastructure further degrades and remains neglected and as jobs are cut, [un]government salaries get frozen, and transnational shipping diminishes) and when will we all get one and charging stations and spare ‘just-in-time’ parts for them and in the face of Richard Duncan’s rolling blackout/aging grid Olduvai stuff?

– Wimbi’s Titanic analogy seems to have presupposed that we haven’t dilly-dallied and, if so, won’t continue to do so and that the ship is not already listing and sliding everything and everyone to one end of it.

– Given some of our concerns hereon with regard to a possible exponential unraveling, how sunk is the Titanic already and can the time left be used in different ways than what some on here seem to think it should be used (i.e., EV’s and PV’s and assorted BAU-lite)?

Later…

Sure. My little story started with captain getting off the dime soon as he heard the ship was doomed.

We didn’t, so now we have all those other things to think about.

The sad fact is, we have to start early, and earliest is always now.

So, starting now, what best to do? Maybe PV not the best, so what is better? Actually, I prefer little heat engines instead of PV. Reason is, I know how to make damn good little engines that will run great on sun or biomass, and I don’t know how to make PV.

Anyhow, what is better is sure as hell NOT just standing around pointing out that x is not the best.

Can you do a good little heat engine from local materials– say, from scrap yards and neighbors’ collections and whatnot– and are they easy to learn for others, even the young, to reproduce on their own? Then we like it more, yes?

What I am unsure I like is relying on BAU’s vast cold hard large-scale international just-in-time infrastructure while twilight-in-the-desert oil and its related uneconomics increasingly takes on a twilight zone.

I think I prefer basic ‘quick-and-dirty’ local tech. That’s where real survival and comfort, such as in being self-sufficient and surrounding oneself with real community– that which has been gutted by the crony-capitalist plutarchy dynamic– seems to be. And it helps nurture that kind of smarts so that we are less left with repetitive overspecialized drudge jobs working for The Man.

Some summers ago, I made insanely-delicious cold-milk-brewed tea frosties out of a local ‘weed’ here. It grows all over the forest floor and the locals in-the-know call it teaberry. It’s also called wintergreen. Imagine a beautiful pastel-emerald-colored wintergreen milkshake made with semi-frozen milk, a dollop of homemade custard and some pulverized and sieved wintergreen leaves in the middle of July. I should have taken a pic of that, but below’s a pic I did take of the plant in the wilds of Liverpool, NS.

Don’t talk to me about big box corporate (grocery, etc.) stores. Visiting them and their general locations can give me a bad case of suburbarrhea. We have a far healthier and tastier green banquet growing right under our noses that often get mindlessly weed-whacked or poisoned.

Tule Mulle Kaissu (translation)

can you make good little engines from local materials?

Yes. That’s what I was talking about. Have one in the shop as I speak made of nothing but steel pipe of the ordinary kind you find anywhere. No machining.

Yes, I am remiss in not putting it on the web. Working on that.

What I am unsure I like is relying on BAU’s vast cold hard large-scale international just-in-time infrastructure while twilight-in-the-desert oil and its related uneconomics increasingly takes on a twilight zone.

I think that model has already proved itself as being unsustainable so probably sooner than later it will go the way of the Dodo.

There is a better model. It’s known as the ‘Circular Economy’ and it is happening right now. Of course the people who are poo poing this concept are the same people who are telling us things like, alternative energy can’t ever substitute fossil fuels while they show us charts of how great sales of SUVs are doing in China…

WHAT IS A CIRCULAR ECONOMY ?

The best way to explain what a circular economy is, is to compare it to our current linear economy. In our current economic system, we extract resources from our planet at an ever-increasing pace, and turn them into a product that we mostly dispose after use. From the perspective of an individual or organization, that seems efficient. However, zooming out to a global level shows how unsustainable this approach is.

In order for those same individuals and organizations to thrive, we need an economic system that operates within our planetary boundaries. A circular economy is one that is waste-free and resilient by design. It is a new economic model that is ambitious as well as practical. Designing the economy in a way that is restorative of ecosystems, ambitious with its innovation, and impactful for society, is a bold challenge but one that is achievable when guided by the below principles of the circular economy

http://goo.gl/vO3mGj

Checkout this as well:

http://www.ellenmacarthurfoundation.org/

I get criticized when I talk about disruption and the people who do the criticizing get stuck as if they can’t get past the One Note Samba of Solar powered EVs and driverless Uber transportation models. That is actually just the tiny tiny tip of one of many of the gigantic disruption icebergs floating around out there.

My personal favorites are in the realm of biomimicry, I’d much rather listen to people like Janine Benyus then to the GSs of the world…. watch her video at this link.

http://biomimicry.org/janine-benyus/#.Vp47JiorLIU

But again, this too is just another one of those many many icebergs, Check out the next Disruption Innovation Festival:

The next DIF takes place from 7 to 25 November 2016.

https://www.thinkdif.co/

Cheers!

Fred,

I know you’re on a crusade to save the world, and to spare mankind of the mayhem and destruction which now stare him in the face.

Nevertheless, economic, political and engineering decisions are best left in the realm of the pracitical, the material, and the possible. When they move into the realm of the mystical, what we get are disasters like Energiewende and Caliwende, which stand in stark contrast to the highly efficient and well administered rollout of renewables in Texas.

This is not in any way to downplay the importance of the mystical. It is merely to state that the mystical needs to be kept in its appropriate place.

In Texas we have places where the mystical is practiced. They’re called churches.

Fred,

I know you’re on a crusade to save the world, and to spare mankind of the mayhem and destruction which now stare him in the face.

Sorry Glen, you know absolutely nothing about me! Your portrait of me is a strawman. But for what it is worth, I’m definitely NOT part of any crusade.

Nevertheless, economic, political and engineering decisions are best left in the realm of the pracitical, the material, and the possible.

Despite your constant implications to the contrary, I only deal in the realm of the practical, the material and the possible.

Case in point:

http://www.asknature.org/article/view/why_asknature#whats_biomimicry

If you can propose scientific evidence why any of these ideas are impossible or impractical I’d love to hear them.

I do know one thing, the world built by engineers like yourself just isn’t working anymore. So I’m trying to work with people who actually understand the 3.8 billion years of life on this planet and the systems that have made it possible. I haven’t yet met too many economists, politicians or engineers, who can demonstrate a mastery of that body of knowledge so, IMHO they are not even remotely qualified to say what is or isn’t possible!

When they move into the realm of the mystical, what we get are disasters like Energiewende and Caliwende, which stand in stark contrast to the highly efficient and well administered rollout of renewables in Texas.

I do agree with you that Texas seems to be doing a lot of things right.

I don’t agree that Energiewend is the disaster you claim it to be. Even if it were a complete failure it would still be a success because at least in my way of thinking F.A.I.L. stands for First Attempt In Learning. Anyone who has ever succeeded at anything knows that mistakes are a part of the learning process and I highly doubt the Germans are done learning.

When all is said and done I’ll bet they will have a thing or two to teach the rest of us.

Methinks, you are throwing the baby out with the bath water.

In Texas we have places where the mystical is practiced. They’re called churches.

Since those are places I never frequent, let’s do each other a favor and leave them out of the discussion.

Caelan,

Grammar: An Introduction

Meaning should flow from one sentence to the next, carrying the argument or point of view forward in a clear and concise manner. If you do not use correct grammar and punctuation, or your sentences are too long and complex, what you are trying to say will become unclear and the reader will be unable to follow the text because the flow of meaning is interrupted.

And don’t forget your Twitter feeds too (as well as examples and illustrations to support what you are talking about [such as from your own work], as well as indications that you’ve actually read what you are critiquing, such as those with qualifications, such as ‘off-the-cuff’ or those that may claim ‘artistic license’.).

^u^

” Imagine a beautiful pastel-emerald-colored wintergreen milkshake made with semi-frozen milk, a dollop of homemade custard and some pulverized and sieved wintergreen leaves in the middle of July.” ~ Caelan MacIntyre

(You can almost taste it. Go on, admit it.)

;D

Hollywood Dream Bubble

Fred

I have been reading your welcome take on resource depletion for a good number of years, but am glad to see you re-state it.

Regarding Plan B it will at a minumum need Renewable electricity generation that can build and maintain its own sufficient industry over the decades of dwindling fossil fuel deployment. I am assuming that fossil fuels will be less and less energetically affordable as time goes by. How significant affordability will be (is there such a thing as net-affordability?) I cannot guess but it is interesting to see lower US demand for diesel now being ascribed to the lower fracking activity and its associated trades!

best

Phil

I am with Fred Maygar all the way. Whatever gets built, whatever gets done, in the way of renewables, means we and following generations are better off to some extent.

Now as to what WILL happen, nobody can say. Even old farmers don’t know EVERYTHING, lol.

BUT I know that SOMETIMES when a LEVIATHAN is aroused from a long slumber, and gets thoroughly pissed off, the reaction can be astounding, in terms of old LEVIATHAN getting furiously busy.

Half of what happens might make things worse, but the other half might make things IMMENSELY better.

Suppose a country sees the handwriting on the wall, finally, after getting a few Pearl Harbor Wake Up Bricks upside it’s collective head.

Such a country might immediately forbid the sale of oversized pickup trucks for use as personal transportation as a FIRST single step. A hundred other war time footing economic policies could be put in place within a matter of days or months, as far as setting up the rules, and put into actual effect, starting within a few months.

If the usual projections for the decline of oil and gas production over the next few decades are even in the NEIGHBORHOOD of the ballpark, it would be possible to divert PLENTY of energy currently more or less WASTED to building out renewables.

We might not WANT to burn coal- BUT speaking as a person committed to renewable energy, I would be PERFECTLY happy to see ANY AMOUNT of coal burnt, IF the juice generated is used to mine the materials needed, and to manufacture SOLAR PANELS.

Hey guys, the price of JUST ONE typical car is going to be more than enough to cover the cost of a six thousand personal pv system, installed turnkey, pretty soon.

The winning strategy is is not to go renewable overnight, but to go renewable as quickly as we can, as a practical matter, while at the same time EXTENDING the life of our depleting fossil fuel endowment.

It was about fifteen F this morning here, and not a whole lot warmer now, with a stiff wind, but I am sitting toasty warm, and have been all day, in a sun room, which is not at all hard to cool even in high summer, because it is WELL SHADED by maples , and has the right sort of roof overhangs. Energy costs to heat our house today, during daylight hours, zero. And this is an old farmhouse, built back in the fifties. It has been upgraded,yes, but it is a mile from being REALLY energy efficient.

Humanity as a whole does NOT have a plan, Ron is dead on right about that. But when the shit is finally well and truly getting spattered all around, by the proverbial fan, we will find that nation states are capable of creating and implementing plans.

Note that I have often and continue to predict than a hard crash is baked in, and that a large portion of humanity is going to die hard, probably within this century.

But some of us have a shot at living decently, maybe even quite well, on a sustainable basis, long term.

Old Man Business As Usual is a dead man walking, but he has children and grandchildren, and some of them will survive. There will be a NEW generation BAU.

It won’t be much like the one living today, but it might not be all that bad.It could even turn out to be pretty good, for SOME people.

Is this Saudi announced that OPEC and Russia will cut soon?

Saudi Oil Minister Ali al-Naimi said crude prices will rise and foresees that market forces and cooperation among producing nations will lead in time to renewed stability.

http://www.bloomberg.com/news/articles/2016-01-17/saudi-oil-minister-says-he-s-optimistic-crude-prices-will-rise

Boy, that’s a safe country for the Saudis to cooperate with. Mexico will not raise their oil production more than the Saudis. That oughta raise oil futures.

Sarko,

In my understanding his comments hint at a dramatic reduction in US supply.

History doesn’t exactly repeat as a regular thing , but it DOES have a tendency to rhyme as a many a wag has noticed.

Here is something for SS and the other hands on guys to cheer them up.

http://www.cnbc.com/2016/01/15/oil-about-to-get-bullish-but-stocks-another-story-analyst.html

From the link:

“On Friday, U.S. Brent crude hit a fresh 12-year low as fears that the lifting of Iranian sanctions could flood an already oversupplied market for crude.

In spite of the sell-off, the man who correctly saw the steep market correction in August told CNBC that investors would be smart to buy oil at these levels — and short the stock market.

“Markets estimate the probability of a spike in oil, and a bear market at about 3 percent,” JPMorgan’s Marko Kolanovic, told the “Fast Money” last week. “But we think it’s actually much higher.”

Kolanovic’s theory comes from looking at past instances of when crude has dramatically underperformed the equities market, as it is on Friday. In each of the 10 instances in the last 30 years this happened, oil eventually came back with a vengeance.”

Bold is mine.

By the end of the year, the Global Head of Derivative and Quantitative strategy says $45-$50 oil is fully reasonable to expect while “the doubling of oil prices to $60 is actually quite possible.”

My gut feeling, backed up by my modest training in basic economics, plus a lifetime of watching farm commodity markets, is that UNLESS the world economy goes to hell in a hand basket, oil will be going up soon.

Now as far as future traders, and speculators, and computerized stock trades , and all that sort of stuff goes, I just DO NOT BUY IT.

Now it is reasonable to say that EXPECTATIONS of future oil price changes, up or down, might have SOME MINOR INFLUENCE on the DAY TO DAY ECONOMIC AFFAIRS of the world.

BUT a huge influence?

So far as I can see, that is a bullshit proposition, pure and simple, because people that buy and burn oil buy and burn it IN REAL TIME, not six months or two or three years down the road, or five or ten years down the road.

And while oil producers may make decisions about FUTURE PRODUCTION, today, many months or even years down the road, based to some extent on futures prices, they actually PRODUCE OIL, day after day, in REAL TIME. Production decisions made today are not going to have an impact on the market for a year or longer, in most cases, except maybe small operators at the end of their rope finally going bankrupt. Even then, their wells will be kept in production, if they are generating some cash flow.

Power politics can trump the basic rules of supply and demand, for a while, as in the case of Saudi Arabia arguably maintaining production so as to put a hurt on Russia and Iran, rather than cutting production and getting MUCH more money for a lot LESS oil.

But most producers are not trying to wage a defacto war on anybody, they are trying to just stay in business and make a profit.

And it is now painfully obvious that the oil industry is such a slow moving behemoth that it takes a YEAR for the people in it to go from full speed ahead to full speed reverse, even in the case of the most nimble operators. AFTER letting off the throttle, and shifting to REVERSE, it has STILL TAKEN months and months for production to start falling noticeably, as the current charts indicate.It will take MORE months for production to bottom out, maybe a year or longer. Maybe even two years, who knows?

But since the quantity coming to market APPEARS to be falling, and some of the oil in storage is used up, it is totally reasonable to expect the price of oil to start going up, so long as the world economy doesn’t roll over and DIE.

Supply and demand can be expected to work only so fast. When an industry is as slow to change as the oil industry, then the laws of supply and demand will work EQUALLY SLOWLY.

These are my personal beliefs. Other folks are free to believe as they please.

I think the facts are on my side, and that Occam’s Razor is on my side.

Oh, I can see his point if oil was a widget sold over the Internet (one location), and could be mass produced, at will, in time. Then, yes, we have to wait til the entire over supply is eradicated. However, the traders, with absolutely perfect foresight that they have, will see a cliff before they fall over it. On second thought, maybe not, this time.

Here is one scenario, perhaps coming to a globe near you-

We have achieved ‘peak globalization’, not because of a shortage of energy (yet), but because of a slow motion grinding down of the global macro economic growth factors at play over the last 150 years. [Most of the good soils have been plowed, virgin forests sent to the mill, easy to minerals been dug, etc]. A majority of the worlds population now live in countries who are past their peak growth rates, growth rates that have been extended and jazzed up over the years by taking on massive debt and essentially borrowing potential growth from the future.

Between massive debt and just getting older, the growths rates are declining in the ‘developed’ world, and now China is clearly starting to slow. Germany’s big export economy will likely start to show big cracks this year. A few countries are still on the upward trajectory of growth, like India and some African countries, but the majority of the population is starting to round the top of the global growth curve.

And so while we probably have not reached peak demand for energy, the global populations ability to afford more energy consumption may be leveling off ( or at least slowing). In this scenario, depending on the relative rates of change that pan out, it is possible that fossil fuel production will outrun demand to some degree for longer than many of us have expected. Especially when you add on factors such ‘artificial’ brakes on fossil fuel use due to concerns over carbon, increasing deployment of renewables over the next decade, and the progressive aging of the big consuming countries.

I hope that this comes across as coherent, it is a scenario that is slowly crystallizing in my mind as a possibility.

Deutsche Bank’s Peak Oil Report a few years ago predicted massive swings: high oil prices cause demand for oil to drop, low oil prices cause oil exploration to drop, high oil prices cause demand for oil to drop… and so on until oil becomes a niche product like anthracite.

http://www.wsj.com/articles/spacexstumbles-as-booster-suffers-hard-barge-landing-1453062105

We may just have to let the Russians handle this– they are the pro’s.

The Valley Boy’s and Girls are better at smaller projects, and

meetingcreating consumer demand.Duncan Idaho,

The Russians have never tried doing such a thing, that I’ve heard of. Neither has NASA.

The previous one did land successfully, the first such landing ever. There’s a long way to go, of course. The payload was launched successfully, so consumer demand is satisfied. And SpaceX has sent six cargoes at least to the space station now, and brought back trash as well. (Keepin’ Space Tidy) Costs are way below the government launches; I hope to see the whole enterprise become more commercial.

They’re having a lot of trouble with those barges. Maybe they need a marine expert. The land landing went fine….

Not information but a scenario:

Good chance that Ron is right about 2015 being peak, as low price cripples forward investment, reducing production in years ahead. And perpetual insipid demand keeps a ceiling on price rise; so perhaps a volatile price environment that is very difficult to plan future in investment under: creating a virtuous circle for transition from oil dependency. Price is set by the marginal barrel and there is little interest in that at any almost price now, and good reason to see that continuing.

Insipid demand? Yes:

1. Neither China nor India will drive like Americans, it is simply impossible both spatially and for air quality reasons, neither will get anywhere near it, and certainly not with ICE vehicles. Their urbanisation will continue but will follow Japan/Hong kong/Singapore model of density and Transit. This article, despite a silly title, is a good description of the set-up, especially for people only used to a drive-everywhere urban form: https://nextcity.org/features/view/war-on-cars-winnable

The laws of spatial geometry are permanent, and cars are the most spatially inefficient ordering device for cities. Chinese new car growth is softening and this is likely permanent, they will settle for a much much lower level of vehicles per capita than the rest of the OCED.

2. OCED countries will continue to exhibit flat to falling VMT per capita, plus accelerating average fleet fuel efficiency. Thus the demand response to cheaper oil will remain muted, even in North America, and fall everywhere else, especially Europe. EVs, PHEVs, and simply more efficient ICE vehicles will increase penetration of market. Again it is the marginal change, and the change in rate of uptake that matters. Ironically perhaps booming new car sales means more economical vehicles in the fleet sooner. That and of course continued urbanisation and increase in walkable, bikeable, and Transit focussed living are strong trends this century. My household of five, for example, has just gone from two cars to one, and that new car, not an EV, is startlingly efficient yet responsive. And we are all driving less, due to improving Transit. We also own and use five bikes. This what city living enables.

3. And continued urbanisation is unstoppable: http://www.citylab.com/work/2015/12/mapping-65-years-of-explosive-urban-growth/419931/

All cities in China over 500k pop are connected by high speed rail [and have metro systems/BRT/LRT], over 2 billion journeys a year, very safely [cf 30 000 US citizens killed by car ‘freedom’ annually] http://www.china.org.cn/business/2016-01/10/content_37542438.htm

4. Increasing likelihood of real Carbon Taxes or other pricing measures to implemented globally, and even if the US tries to pretend it’s still last century, and keeps subsidising oil use, these will still impact on global demand, adding to demand suppression. The Carbon-club is shrinking, not only is China now in a new phase politically [especially because of air quality and other wider pollution issues] and political and market changes in the anglophone big polluter club [Australia, Canada, US] will also bite. See here for a fascinating view on Australia’s situation: http://www.canberratimes.com.au/comment/climate-change-and-confusing-economic-activity-with-economic-prosperity-20160114-gm6ess#ixzz3xJt3o6zk

Sorry about the length of this, just wanted to add a perspective from outside the tight circle of the US auto-dependency and the oil patch itself. However these are views I value highly: I love this site and lurk here often, love the contributions of so many, especially Ron, DC, AlexS, Dr Dean, Nick G etc, and even the ones I often disagree with like the view from Watcher’s paranoid silo.

Am not in the oil patch so my apologies for seeing the decline of this mega industry’s vice like grip on our fortunes as anything but good; especially for the continued habitability of the planet, and I do not see at all why this means TEOTW. Signs are clear that oil’s role as the master commodity are on the way out, but that this will take a very long time, [especially as coal is too], and I do not see any signs that this process will follow Gail-like catastrophising. Keep up the great contribs, all.

Great to hear from our very own NZ Patrick. Good on ya, mate.

Thanks Doug + Fred, should have included you and OFM on the always keen to read list. Plus of course Jeffrey B, Island, wimbi, and shallow, and others; it is a great space you curate here, Ron.

Shorter version of above post: signs of peak demand as well as peak supply; could well be a strange little tango of these two down the back of the slope… oil left in the ground, especially in the Arctic etc.

Agree I didn’t see this coming at USD100 oil, seemed like supply tightness and persistent demand would result, as ever, in robust price. However this variation seems quite plausible now. See how coal is now plateauing on low price. I can’t see coal going anywhere but down; every renewable installation adds supply at zero marginal cost, and installations are increasing faster and faster. And what matters is the cost of the marginal electron, not the current supply source.

emissions: http://gregor.us/uncategorized/the-peak-in-oecd-emissions-is-starting-to-look-more-secure/

‘It’s common to see confusion over this point. Dependency, to the casual observer, looks alot like growth. But it’s not. The US oil adoption phase ended over a decade ago. Today, US oil consumption remains below levels seen in the year 2000 (in fact it’s barely above 1995 levels). In Japan and Europe, the classic cycle of economic growth begetting more oil consumption terminated even further back in time. But as you fly into London or Paris, you will still see strong evidence of the terrible dependency on oil the West has never fully shaken off, as the great motorway circulars pulse with vehicle lights’. – See more at: http://gregor.us/uncategorized/the-peak-in-oecd-emissions-is-starting-to-look-more-secure/#sthash.8G9HJPHY.dpuf

coal: http://gregor.us/coal/after-great-pain-a-formal-feeling-comes-for-coal/

Soooooo, the weird part about oil is that the cheapest production-cost source (Saudi) is still going, and is outlasting several of the more expensive production-cost sources.

This is *not* what happened with anthracite (the cheapest production-cost sources were depleted first), or steam coal, or bituminous, or sub-bituminous, or lignite. In all these cases the cheapest production-cost sources were depleted first.

So that will cause some really weird dynamics in the oil market near the end of the oil age.

Direct-production natural gas follows the same dynamics (cheapest production depleted first), but a lot of natural gas comes as a side effect of oil production, so that’ll make it weird too. Renewable methane (biogas) has an odd role to play in this market too.

The path to the end for coal is pretty clear. The path to the end for “market driven” oil production is quite clear to me too; it’s the same pattern. But the surviving cheap Saudi oil throws a wrench in my predictions. When oil demand drops to the level where the marginal barrel can be supplied entirely by the ultra-cheap Saudi oil (with every other oil company driven out of the market permanently) there will probably be a weird plateau.

Hey Patrick,

I think the scenario you describe is quite likely!

BTW, Despite having a couple of folk on this site painting me as a member of an imaginary ‘Team Green’ I actually have a pretty eclectic background and like most here have greatly enjoyed the benefits of our fossil fueled global economy. Heck I even worked on oil rigs as a deep sea diver as a subcontractor for Petrobras and Pemex waaaay back in the day. But life goes on. I almost ended up in academia at one point, thought I wanted to get a doctorate in biological oceanography, then I had a few businesses and I’m working on another one right now. I’ve dabbled in art, still do. I do not now, nor have I ever, belonged to any clubs that would have me as a member and have managed to remain free of any particular ideology. I have lived in different parts of the world and do not see things in simple black and white.

But, try as I might, I just can’t see fossil fuels continuing to be the driving force in the global economy going forward. Sure, like a huge oil tanker the global economy takes time to change course. The old ways don’t die overnight but they are dying. Anyone who frequents this site has to be seeing the writing on the wall.

I suggest anyone still expecting the good old days coming back watch this movie.

Who Moved my cheese?!

https://goo.gl/argEhv

Cheese! 🙂

Hi Fred,

There could be a sequel to that (maybe there is), where Haw goes again back to Hem to let him know of the new-found cheese and notices that Hem has managed to scale the wall with some rope he spun (‘hemmed’?) out of the growing unmowed grass and has transcended the maze, itself, and the reliance on the-powers-that-be to place the cheese in assorted locations, according to their own game.

@Patrick R:

NZ is its own silo/maze of sorts for various reasons, and what might work there may not work elsewhere and vice-versa. It is also important to keep in mind the context by which technology of various sorts (like electric vehicles) is arrived at (hint: undemocratically). NZ is a bit antithetical to a maze like China, for example. I’ve been to both mazes.

Back to the maze analogy, I think we would do well to transcend/smash our own mental/physical silos/mazes that contain and indoctrinate us to see the world through the nation-state lens and to transcend those very geopolitical borders. That appears really hard and I am not getting much in the way of that from even those ‘in-the-know’, say, like James H. ‘I-Voted-For-Obama-Twice’ Kunstler; Nicole Foss; John Michael Greer, Dmitry Orlov (who seems to have a bit of a thing for Vlad P.) or Gail Tverberg. (To be fair, I haven’t, and cannot, catch all their words, and Nicole did mention governments as crowds, and ignoring them [easier said than done, babes]… Now that I think about it, she also relocated to NZ if recalled… perhaps along with some of the sociopathic elite who can afford to do so, since NZ’s governpimp allows immigration also under the ‘Lots’o’Money’ category. Ironically, I imagine that some of those, say, with Maori anscestry living on welfare, wouldn’t be able to immigrate into their own country… Of course, then again, last I looked, if I got it right; immigration-speaking, China was [maybe still is] a glorified lobster-trap in that if one from there received another governpimp maze-membership [AKA, citizenship], they would automatically lose their Chinese-maze-membership.)

Many would seem to do well to peruse a few notable thoughts and passages from anarchist thinking and then apply them.

*Game over. Please Try Again.*

I like a good gruyere. Anyone like a good gruyere?

Mouse In A Maze

Nearly every government has a “lots of money” immigration category. Exceptions include Canada and… drumroll… New Zealand, which got rid of its category a few years back.

Well said, well reasoned Patrick R.

I believe that with some luck, with the cards of chance falling favorably, your scenario is not only possible but might actually even be PROBABLE. MIGHT.

Let us hope you ARE right.

You can bet I will be copying this comment into my book notes, verbatim, to be mined for the gold in it later on. Thank you!

If I paraphrase you, I will link to this comment, so as to give you credit.

Patrick R said:

Nah.

Glen, Patrick said sales were softening, he didn’t say they had stopped. They are softening because the entire Chinese economy is slowing down. Do you really expect a 7% growth rate year over year to continue? You do realize that such a growth rate means a doubling of the Chinese economy every decade. As the late Professor Albert Bartlett used to say: “The greatest shortcoming of the human race is our inability to understand the exponential function.”

Fred,

Just check out the latest December car sales figure for China http://www.tradingeconomics.com/china/total-vehicle-sales. Sales were soaring to an all time high of 2785500 cars per month, which is at least 50% higher than in the US. Also other economic numbers in China are staggering strong: House prices are up again, oil, iron and copper ore at all time highs… Low oil prices trigger already high economic growth worldwide.

Heinrich,

Here’s what Scotiabank has to say in its most recent Global Auto Report:

Heinrich,

I think the latest figure I have seen is that China’s economy is still growing at 6.9% so almost 7%. Sure that is a phenomenal growth rate but I don’t see any way that that can be sustained. As for car sales, in a country with 1.3 billion people I don’t find those numbers all that impressive and I’m willing to bet that won’t continue growing either. I guess time will tell.

IMHO the entire Chinese Economy is one gigantic bubble just waiting to burst. Anyone who thinks the Chinese Economy can continue to double every decade should sit down with a chess board and place a grain of rice on the first square and the progressively double the number of grains for each subsequent square until they get to the 64th square…

For those wondering… On the entire chessboard there would be:

2^64 − 1 = 18,446,744,073,709,551,615 grains of rice, weighing 461,168,602,000 metric tons, which would be a heap of rice larger than Mount Everest. This is around 1,000 times the global production of rice in 2010 (464,000,000 metric tons)

I guess people just really don’t understand the exponential function!

Doubling the Chinese economy in the next ten years would certainly require quite a bit of magic, to say the least!

Hi Glenn,

Cars sold have increased by 3.8%/year from 2013 to 2015, based on your graphic (I will ignore the 2016 forecast).

Also see http://www.statista.com/statistics/233743/vehicle-sales-in-china/

I copied the graphic below from the link above. Passenger vehicle sales grew by about 8.6%/year from 2010 to 2015, but this is slower than 2008 to 2010 when growth in passenger vehicle sales was 35%/year.

Dennis,

Patrick R’s claim is that “Chinese new car growth is softening” (emphasis mine).

Can you marshall any empricial, factual evidence to demonstrate that claim to be true?

And why should you “ignore the 2016 forecast”?

It’s based on something which I have heard you mentioning ad nauseaum on these comment threads. To wit:

You’ve consistently argued the mainstream prediction. Does this mean you are now reversing your previous position?

Hi Glenn,

I think we interpret what PatrickR said differently.

He said new car growth was softening, I interpret that as a slow down in the rate of growth which I have found empirical evidence to demonstrate.

I ignore the forecast because scenarios of the future, including my own, are usually incorrect.

Also note that the quote of mine that you found is in response to those predicting a Worldwide recession.

Slower growth (such as what has happened to new passenger vehicle sales in China) is perfectly consistent with no recession.

If China grows at 4%/year that is slower than 7% growth, but it does not necessarily imply a World recession.

You may believe that fiscal and monetary policy are ineffective in all cases and believe that the market should be left alone to determine how resources are allocated.

I do not, I think government interference in the economy should be minimized, but during a severe recession fiscal and monetary policy should be used. The time for fiscal austerity is when the economy is booming.

China has issued a diktat that new cars are to be electric, thanks to their local air pollution problems. They haven’t quite required it, but they have all kinds of stuff which massively benefits electric cars over gasmobiles. Like a license plate lottery (you have to wait for your “ticket to come up” to get a license plate) for gasmobiles, but electric cars get registered automatically.

China now has the *three* largest-volume electric car manufacturers in the world, and has more electric buses on the road than any other country. They’re utterly serious about this. They’ve more than doubled production of both in the last year and intend to continue doubling production every year.

Patrick R said,

This is untrue of the United States, which is by far the OCED’s largest oil market.

http://www.umich.edu/~umtriswt/EDI_sales-weighted-CAFE.html

Hi Glenn,

I see increasing fuel economy in the US on your chart.

What might explain the flattening of the curve in 2015?

Hint: What has happened to gasoline prices in the US?

What do you think might happen when gasoline prices return to $3/gallon and continue to rise from there.

Note that if you think PatrickR’s scenario is too optimistic I agree, I doubt in the near term (next 15 years) we will see low oil prices due to a lack of demand for oil. Perhaps we will in 25 or 30 years, probably because high energy prices have caused a serious recession (from 2030 to 2040) which reduces demand. By then, people may realize that there won’t be enough oil unless oil prices are very high and alternative forms of transportation (public transport in cities and EVs and plugin hybrids in the suburbs and rural areas) will take off.

Dennis:

Simple extrapolation of the exponential solar power installation trend (a trend back 30 years now) has solar power producing all the electricity in the United States sometime around 2030-2035. (Obviously it will hit a bit of a wall when it’s producing 100% of daytime electricity, and the price of batteries will then be important, but you get my point: daytime usage is something like 2/3 of total usage, so this is a big deal.)

Simple extrapolation of the exponential growth of electric car sales has them replacing all new gasmobile sales sometime around 2040. Electric cars are a demonstrably superior driving experience and are killing the high end of the gasoline car market. This means they’re being adopted even though there’s a price premium for them.

Electricity usage is actually going *down* thanks to the implementation of obvious efficiency moves such as insulation and LEDs.

Oil has *already* priced itself out of the heating market, and permanently (even the current oil price is too high to compete with gas *or* electric heat). Oil has already priced itself out of most of the industrial markets in favor of natgas. Oil’s been relegated to a transportation-fuel niche.

Low oil prices due to a lack of demand for oil? It’ll happen. I’m not sure when, but remarkably soon — definitely within the next 15 years.

The MODEL YEAR average fuel economy HAS declined a little.

But the model year overall TREND is up, and will continue up,because higher fuel economy, as measured by CAFE, is mandated.

By way of example, a typical early nineties F150 pickup truck gets substantially worse mileage than a 2016 F150, even though the newer truck is physically larger.Ditto the Chevy’s and Dodges, even though they are not yet built with a lot of aluminum.Ditto just about any comparably sized car, capable of comparable acceleration etc.

The question is how fast are owners of really old cars and trucks scrapping them in favor of newer ones that get better fuel economy?

We know that newer vehicles are driven far more miles, per vehicle, per year, than older ones. Really old cars and trucks are generally not used much at all.

My guess is that for every ten new cars and pickups sold in the USA, at least eight or nine old ones are scrapped.

I found links to tables with this data in them, but cannot get them to display properly for some reason.

According to “Scarcity” – C. Clugston, The U.S. imports 100% of bauxite, mostly from Australia and Jamaica. The global peak extraction year is forecasted as 2038. Clugston analyses 89 ores and minerals necessary to grow/maintain industrial society and finds 69 of them have “almost certainly” reached permanent domestic (U.S.) extraction levels.

Mineral recycling is critically important, for aluminum, copper, etc. etc. etc. I expect we’ll start to see landfill mining after a while.

Patrick R says:

Maybe so, but according to the latest Short-term Energy Outlook from the EIA, oil consumption will continue to grow at its previous clip in the United States.

https://www.eia.gov/forecasts/steo/report/global_oil.cfm

Hi Glenn,

That forecast is based on very low oil prices through 2017, the forecast for prices will probably be too low because there will not be adequate oil supply at that price, unless there is a recession. If there is a recession consumption will decrease rather than increase.

Well Dennis, it sounds like you need to take it up with the EIA.

Hi Glenn,

Do you think the EIA’s forecast is correct? The EIA has not posted anything here, but you have, I think the EIA’s AEO 2015 reference case oil prices seem reasonable, but their recent short term forecast based on the oil futures market is likely to be incorrect. Just double checked AEO 2015 ref scenario, 2016 may be a little high, probably $50/b for an average 2016 price is more reasonable.

Patrick R said:

Not according to the latest Oil Market Report from the IEA.

https://www.iea.org/oilmarketreport/omrpublic/currentreport/

Glenn,

It is obvious there is no slowing down in terms of oil usage for transportation. What it is slowing down is the amount of disposable income due to built in price inflation. So that is manifesting in decrease of spending in non-essentials goods and services. So as the result Baltic dry index is way down. But amount of oil used for driving back and forth like in bumper cars in Amusement Park is the same in OECD or increased in Asia.

Ves,

Nevertheless, overall global oil demand continues to march inexorably higher according to the IEA’s latest Oil Market Report.

Well actually they say demand was down in the 4th quarter 2015 and will be down further in the 1st quarter 2016. And the 2nd quater of 2016 quarter will still be below the 3rd quarter of 2015. Only in the third quarter of 2016 do they predict that it will start to rise again.

Ron,

these are normal seasonal variations in demand.

To determine the trends in demand, we should compare the quarterly number with the same quarter of the previous year, not with the previous quarter

The IEA provides a calendar quarter to calendar quarter comparison.

Hi Glenn,

Thanks for that chart.