The EIA just released their Petroleum Supply Monthly where they give their estimates of US crude production as well as the crude production for all states and territories through August 2014.

There was not much movement from anyone in August. Here are the biggest movers:

Change

Total USA 61 kbd

Texas 46 kbd

GOM 21 kbd

North Dakota 18 kbd

Oklahoma -6 kbd

Colorado -9 kbd

Alaska -24 kbd

The data is in kbd with the last data point August 2014.

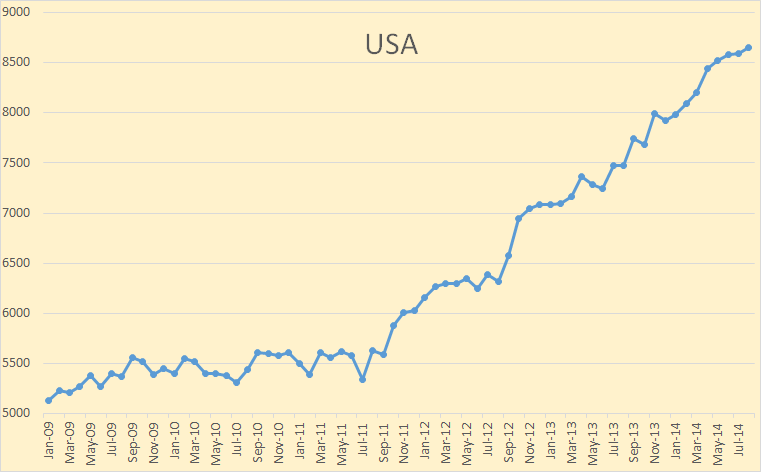

I have started the data in January 2009 in order to get a better picture of what is really happening.

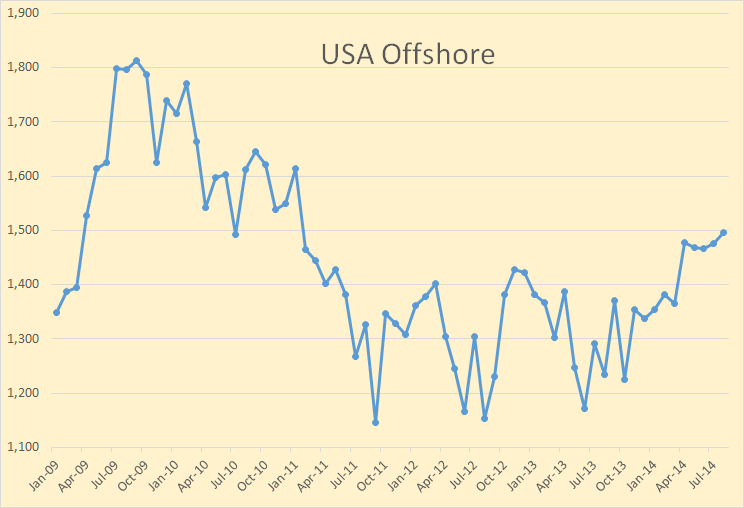

The above chart is the combined production of both GOM and Pacific offshore.

The EIA is predicting Offshore production to reach 2 million barrels per day by 2016, I really don’t think it is going to make it. They are counting on a lot of new offshore fields that are coming on line to bring it up to that level. While that is happening, what they have underestimated is the very high decline rate of these deep water fields.

While the Petroleum Supply Monthly only has data through August the EIA’s Montly Energy Review has data through September and has USA lower 48 crude production up 155 kbd and Alaska up another 65 kbd for a total of 220 kbd. Of course that is just an estimate as the states have not yet reported their September production numbers.

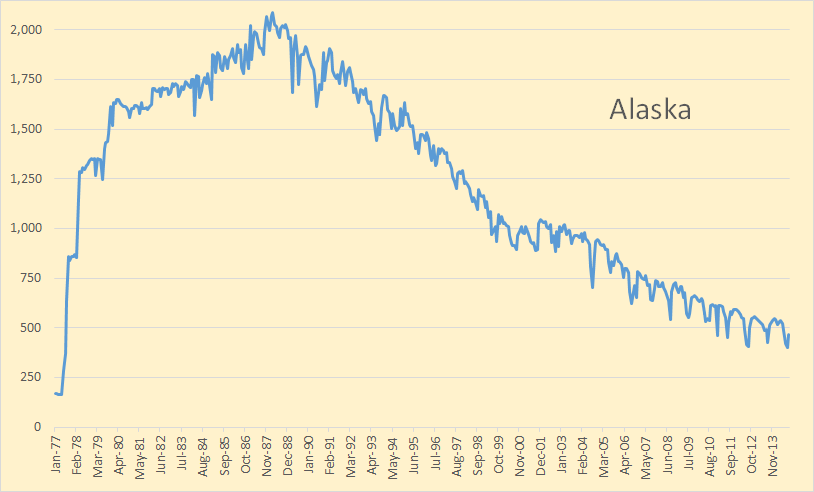

This is Alaska since the opening of the Trans-Alaska Pipeline in KBD, last data point is September 2014.

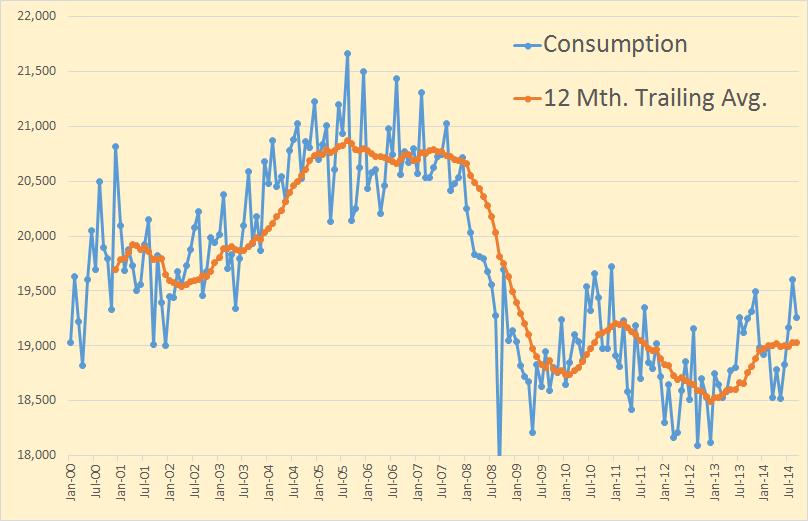

US total petroleum liquids consumption has been on a bumpy plateau since 2009 at around 19 million barrels per day. The last data point is September, 2014.

North Dakota publishes a Daily Activity Report Index of all oil patch activity. It looks like this:

You can click on any particular day and get a PDF file of everything that happened on that particular day. That includes permits issued, permits cancelled, wells released from “tight hole” (confidential) status, confidential wells plugged, wells approved for “tight hole” status and a lot of other information. But one important thing you do get is “Producing Wells Completed”.

Some days there are no producing wells completed but most days there is at least one or two, and on some days they list over twenty. Confidential wells are not included in producing wells completed and some months there are a few wells listed without giving production numbers. But every month there are about 100 wells listed, give or take a few. So note: This is not all wells. It is likely about 60 to 80% of all wells completed in any given month.

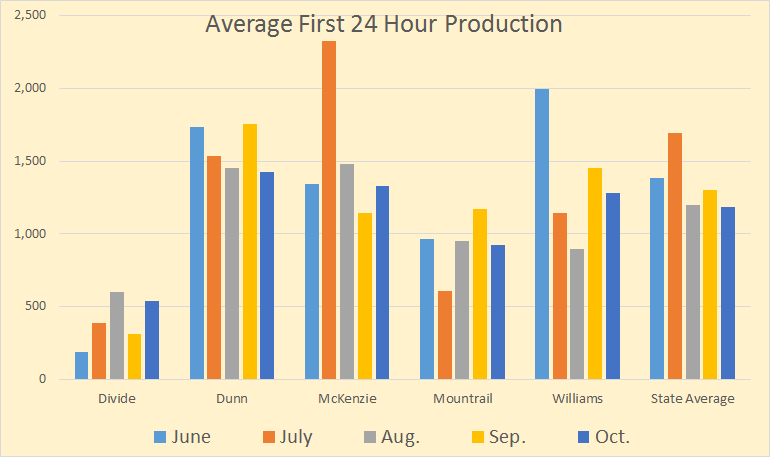

Copying and pasting the data into Excel and working it into a compliable spreadsheet is a very time consuming job but I did it for the past five months, June through October. Here are the results.

The actual average numbers for the first 24 hour barrels per day for all North Dakota:

June 1,382

July 1,695

Aug. 1,196

Sep. 1,301

Oct. 1,188

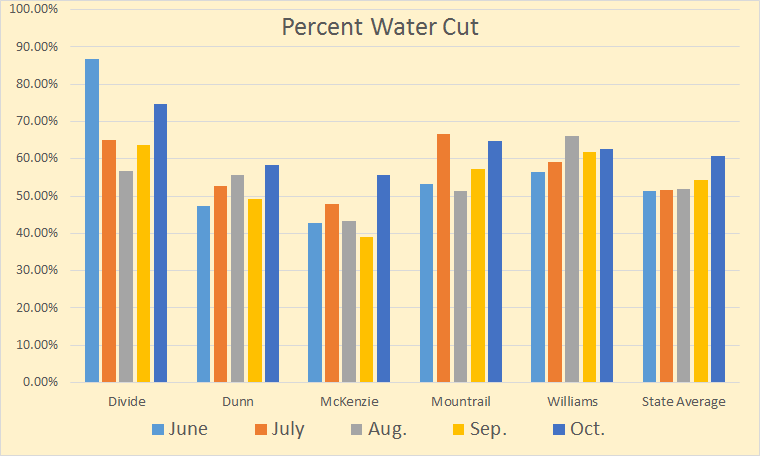

I think this chart is very important. Water cut was only increasing slightly until September and October. In those two months it has jumped significantly. The actual average water cut for all North Dakota is as follows:

June 51.38%

July 51.5%

Aug. 52.02%

Sep. 54.23%

Oct. 60.73%

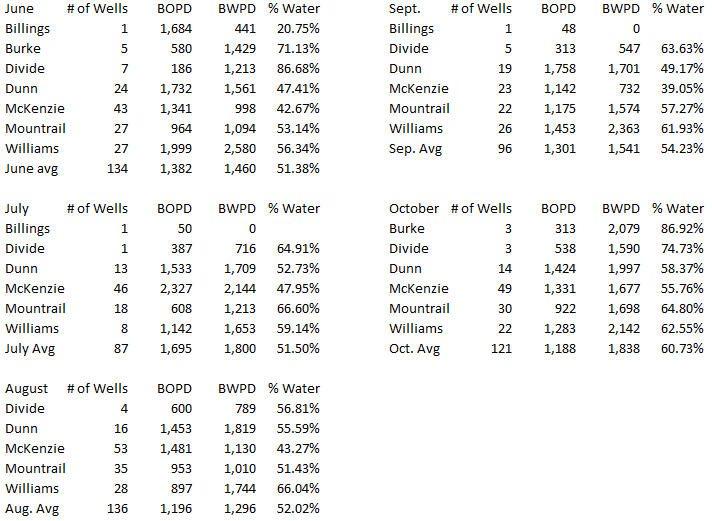

Or if you would like all the numbers:

This is all the wells reported in the five months examined. Billings and Burke were not included in the charts but were included in all averages.

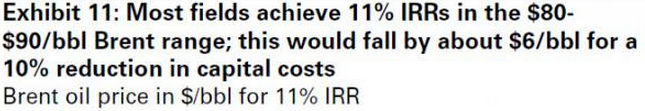

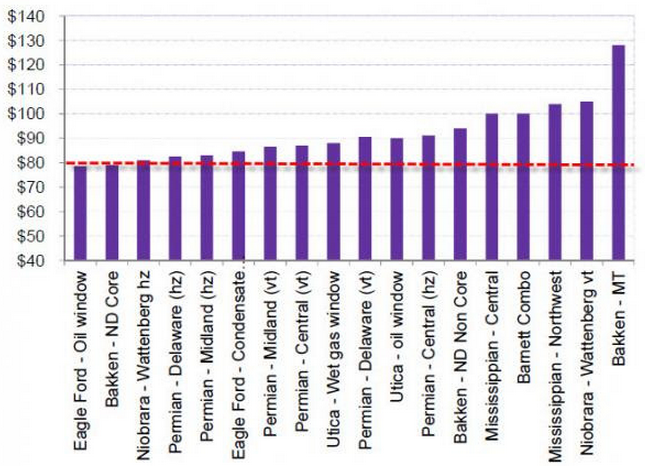

Via Goldman Sachs, ZeroHedge gives Goldman Sachs take on the marginal shale price. Bold theirs.

Our oil forecast calls for a slowdown in US shale oil production which our North American Energy equity research team led by Brian Singer estimates will occur at $75/bbl WTI prices.

They estimate that the WTI oil price at which average wells in the Eagle Ford, Bakken and Permian Basin plays achieve an 11% IRR ranges between $70-$80/bbl. More importantly, they believe that funding gap constraints below $80/bbl WTI will ultimately drive the slowdown in production. Specifically, balancing capex with cash flow is likely to be the key constraint for shale producers, which continue to outspend their cash flow. Historically, E&Ps under our equity research coverage have spent 120% of cash flow annually, with only 2012 above this threshold when several companies which have since changed strategy were large spenders. At our pre-oil price decline capex assumption for 2015, this 120% reinvestment rate would be reached at $80/bbl WTI prices.

Based on their analysis of key shale play production growth at various oil prices, we estimate that WTI prices will need to remain at $75/bbl in 2015 to achieve the required 200 kb/d slowdown in production growth. Given the lag of 4-6 months between when rigs are dropped and when there is an impact to production as well as the impact of hedging, this price forecast implies a larger slowdown in US production growth in 2H15 to 650kb/d yoy.

Though the Bakken rig count is still around 190 the total US oil rig count continues to decline.

U.S. Oil Rig Count Declines by 13, Baker Hughes Says

Rigs targeting oil in the U.S. dropped by 13 this week after crude futures traded below $80 a barrel for the third time in a month.

Rigs drilling for crude declined to 1,582, Baker Hughes said today.

“We’re seeing the impact of lower crude oil prices,” James Williams, president of WTRG Economics in London, Arkansas, said by telephone today. “Nobody’s going to drill to break even. I’m expecting us to be below 1,500 oil rigs by the end of the year.”

On October 10 the oil rig count stood at 1,609 so the rig count is down 27 since that date.

I found this article very interesting.

Venezuela, with world’s largest reserves, imports oil

For the first time in its 100-year history of oil production, Venezuela is importing crude — a new embarrassment for the country with the world’s largest oil reserves…

“The government has destroyed the rest of the economy, so why not the oil industry as well?” says Orlando Rivero, 50, a salesman in Caracas. “How much longer do we have to hear that the government’s economic policies are a success when all we see is one industry after another being affected?”

While Venezuela has more than 256 billion barrels of extra-heavy crude, the downside is that grade contains a lot of minerals and sulfur, along with the viscosity of molasses. To make it transportable and ready for traditional refining, the extra-heavy crude needs to have the minerals taken out in so-called upgraders, or have it diluted with lighter blends of oil.

The latter tactic is what state oil company Petroleos de Venezuela SA (PDVSA) is using since it doesn’t have the money to build upgraders, which perform a preliminary refining process, and its partners have been unwilling to pony up cash because of the risk of doing business in the country.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Global Oil and Other Liquid Fuels Production Update

Global conventional crude oil + condensate production (C+C) attained a value of 73 million barrels per day (Mbpd) in May 2005. Since then conventional C+C has been bumping along a jagged plateau with the all time high of 73.3 reached in July 2008, immediately prior to the Chinese Olympic Games and the financial crash. It seems possible that the peak in global conventional oil production is behind us (Figure 1).

All of the growth in global liquid fuels has come from non-conventional sources, shale oil and tar sands, that currently are only produced in N America, and from “other liquids” such as biofuel and natural gas liquids. These liquids are inferior to conventional crude oil in a number of ways such as 1) requiring the use of more energy in their production, 2) being less energy dense and 3) not usable as liquid transport fuel.

US oil production has risen about 4 Mbpd, about 2 Mbpd is from LTO. Where does the rest come from? EOR?

Ron your US consumption chart is also striking. Economic growth without oil consumption growth!?

Tight oil production pushes U.S. crude supply to over 10% of world total

U.S. tight oil production averaged 3.22 million barrels per day (MMbbl/d) in the fourth quarter of 2013, according to U.S. Energy Information Administration estimates.

However a lot of what the EIA counts as tight oil is actually conventional oil. Most of the Permian is actually conventional oil. The EIA’s “Other” catagory is mostly conventional oil.

I think those economic growth figures have been fudged a bit. However increased efficiency does allow for some growth without growth in oil consumption. However the help better efficiency gives is limited and can only help so much. Unless consumption starts to increase you can expect economic growth to slow to a crawl.

“Unless consumption starts to increase you can expect economic growth to slow to a crawl. ”

Yo, China! India! Read it. Know it. Live it.

If you want decent lives, burn oil. If you want social security, burn oil. If you want anything of the US lifestyle, get your per capita burn up.

And get more heroin, too.

Don’t forget to become morbidly obese, as well.

Correct.

That’s right! You can have horses haul food into NYC. They did it before. They can do it again!

Watcher, your forgot your smiley face. Never make really sarcastic comments without a smiley face. Someone may just think you are serious. Now you wouldn’t want that would you?

No. Not ever.

It looks like this: 😉

Ron, I only have Bakken and Eagle Ford in my chart so the Other US category accounts for a bit. That works towards the conventional C+C being a bit lower but as you say Other is mainly conventional. Need to wait another 10 years to find out what is going on 🙁

North Sea will grow between now and 2020.

Euan,

How much is the North Sea forecated to grow by 2020?

Steve

I caught you over at Zero Hedge with your cute little US map with an EROI superimposed icon. ^u^

Caelan,

So, you finally caught me “Foaming Out the Mouth” in Zerohedge. I don’t normally do that all that much, but once in a while it’s nice to get one’s feet wet.

By the way, that “lil cute icon, is also part of my logo from my website, which you can see in BRIGHT COLORS at this link: http://srsroccoreport.com/

steve

Some of us would do our fellow humans well/better by continuing to spout our particular foam here, there and elsewhere…

Oh hey, nice page, I’ve been there and recall it… More 3D-ish icon/logo, with table-reflections to boot! …Bookmarked! ^u^

The UK has a significant number of new largish projects that have already begun to come on beginning with Golden Eagle (50,000 bpd), Clair phase II (120,000 bpd), Mariner, Bentley and more. Most of it is heavy oil and has come as a result of prolonged high price.

The chart is not my own. But I agree in general with it.

Drowning in oil again

North Sea production has already stabilised. The lower production goes the easier it becomes to reverse declines. Stabilisation of the North Sea is one of the contributory factors to current price weakness.

From Drowning in Oil:

From Drowning in Oil. It looks like OPEC capacity may be rolling over.

Hi Euan,

Eyeballing your UK and North Sea charts it looks like UK North Sea output is expected to increase temporarily by about 0.5 Mb/d from 1 to 1.5 Mb/d (roughly I am estimating from your chart). Norway is expected to be flat, other countries we will assume are also flat so the expectation is that North Sea output will rise to 3.5 Mb/d by 2018 and then begin to decline again.

Do you know if these projects are on schedule? I assume once these projects begin they will go forward regardless of oil price and I believe they usually take about 5 years minimum to reach full output.

Euan,

Do you expect North Sea growth to be significant?

If you are reading this Rune it would be interesting to hear your perspective because you follow Norway’s oil output very closely.

Hi Dennis,

I have presented my view in the post

Norwegian Crude Oil Reserves and Production per 2013

As of now I do not expect much changes to my forecast. Perhaps 1% higher for 2014 than my forecast, but likely higher decline in 2015 and 2016.

This may change dependent on NPD’s reserves estimates at this year end, but as of now I do not expect much changes.

Hi Rune,

Thank you. Do you follow other countries North Sea output?

Euan Mearns is expecting an increase in North Sea output. but I suspect he means the UK portion.

I imagine any increase would be fairly small and followed by decline within a few years, but I don’t follow this as closely as Euan or you.

A bit off topic, but your most recent post on the Bakken had breakeven at $68/b, with an average well producing 320 kb over 23.5 years (shut down at 7 b/d), well cost of $9 million, royalties and taxes at 24.5% of wellhead revenue, transport costs of $12/b, OPEX at $4/b, other costs at $4/b and a discount rate of 7% I get a breakeven of $58/b rather than the $68 in your post. In the past you have used economic parameters similar to these and your average well was more productive than I had assumed. Have the economic parameters that you are using changed from what I am using above?

Hi Rune,

I was not very clear above, the $58/b that I calculated is the wellhead price breakeven, at the refinery gate the breakeven price is $70/b.

I believe the $68/b breakeven price in your post was at the wellhead, but I may have misunderstood your post.

Yes, economic growth really doesn’t need more oil.

Think about it: the majority of oil consumption is for personal transportation. A Prius (60% reduction in liquid fuel consumption), Volt (90% reduction) or a Leaf (100% reduction) gets people to work just as well as an SUV. The US could reduce fuel consumption by 40% with almost no effort, just by reducing passenger car fuel consumption. After all, a Leaf is the cheapest vehicle on the road to own.

Reductions in industrial/commercial liquid fuel consumption take a little longer: better aerodynamics and other design changes for truck can reduce fuel consumption by 40%, and freight can move to rail.

I agree entirely.

Nick G,

U.S. could do a lot of things. However, overall fuel economy is down since 2008.

Steve

Yeah, gasoline consumption has gone down by only about 1%, while Vehicle miles Traveled has gone down about 2.5% since 2008.

Which tells us that US consumers don’t think gas prices are very high, and they’re not worrying about fuel consumption. IOW, US consumers don’t feel significant pain from fuel prices.

I wish the US were taxing oil very heavily, and incentivizing more efficient vehicles: oil has very high external costs, which aren’t included in the price tag.

Oddly enough, industrial/commercial users are often more sensitive to energy/fuel efficiency: they’re big enough to have dedicated energy managers.

Finally, the point remains: the US has enormous room for easy reductions.

Nick G,

Your examination of the possibilities of growth without increased oil consumption is terribly over simplified. What do you think people do when they find driving is cheaper. Unless they take the money and hide it under their mattress it will ultimately be used for the consumption of something that involves energy and it is highly likely that energy will come from petroleum.

Not really. Manufactured goods require very little oil: factories run on electricity. Services, of course, require much less energy/oil per $.

The fact is that transportation uses most of our liquid fuels. Make transportation more efficient, and liquid fuel consumption will drop pretty much proportionately.

Finally, have you noticed that young people aren’t into cars that much (even affluent, employed young people). iPhones don’t use oil to operate, and manufacturing and transporting them takes very, very little oil.

There are a number of problems wrong with your argument. First I will concede that manufacturing runs on electricity, even though I really don’t know that it is true but it sounds plausible. That electricity is not simply zapped into existence. Even in the best case scenario where a good deal of that power is generated by solar power the infrastructure to install and maintain that power source relies on petroleum. Your second point, about making transportation more efficient and consumption will drop is a non-sequitor which says nothing about economic growth. Currently almost everyone’s waste is someone else’s income. So I can grant you that fuel consumption may fall but so may economic growth. Your last point is about I-phones not running on petroleum is even more irrelevant. So what? Horses don’t require petroleum to operate either, the point is what? I once too wish thought that if we just used the technology we had we could set everything right in the world, I still want to believe that. Unfortunately the evidence does not point in that direction.

Power generation infrastructure doesn’t use much oil. Generators, turbines, etc are manufactured, which gets us back to manufacturing using little oil. It’s true that construction uses a little oil, but it’s only a little (and of course, it doesn’t have to – work site can connect to the grid, and contractors can commute with Priuses and Leafs. They don’t, yet: it’s not in contractors culture not to drive a pickup, even when the only cargo is pretzels and beer. But, they can and they will). The Energy Return on Liquid Fuel invested is probably about 1000:1.

I agree: if the US uses less oil, countries like Saudi Arabia will lose income. So, what’s the problem again?

iPhones are an example of the answer to your question: “what will people do with all that money if they don’t waste it on oil?”. The answer is, a lot of things, like phones and videogames and Facebook and who knows what. But, whatever it is, it’s likely to use a lot less oil than cruising to the mall to try to pick up babes.

But as has been pointed out now about 15 zillion times, what’s the point of smashing in the skulls of Americans who want to burn oil if it means there is more for the Chinese and Indians to burn? What does an American have to gain by sending that oil to someone else?

Saving a ton of money

Reducing pollution

Fighting fewer oil wars

Having fewer oil recessions

And

Cutting down on bad ME war movies!!!

The US consumed about 6.89 bn barrels of oil in 2013. At $100/barrel that’s $689bn. GDP was 16.8 tr. So oil was about 4% of the economy.

There is some argument that a lack of oil is a show stopper in certain areas. But the economy does not depend on oil for the most part.

Nick

You’re completely neglecting supply chains in all this. The supply chains which feed all industry is pretty much entirely oil fuelled. Much of it by large cargo ships and aeroplane, both of which are oil only and are pushing maximum efficiency. Supply and transport is key to all industrial economies. Factories in Japan were shut down by the icelandic ash cloud a few years back, for example. You ignore the interdependence at your peril. And as for volts and leafs, yeah they’re great, but electric motors are simply not cut out for hauling freight on roads, which is where the real issues will come from.

Your point about vehicle miles travelled is also way off. Yes, it’s 2.5% since 2008, but it’s absolutely miles off where it would be had it followed the trend before 2008. That’s what’s significant, and suggest that US pocketbooks are hurting.

As for making cars more efficient, it’s been shown time and again that Jevons paradox applies here. More efficient cars = driving more miles with the same amount of fuel. Efficiency also follows a pattern of diminishing return.

I’m sorry but many of your arguments are pretty specious.

Hi Sam,

Jevons paradox does not apply very well to driving. First people buy more fuel efficient cars to save on fuel costs, clearly it is their choice whether to drive more miles with the fuel savings or to spend the savings on other things besides transportation. A rise in fuel costs will result in more long haul transport with railroads which are 4 times as fuel efficient per ton-mile as 18 wheelers. Over time the freight railroads can be electrified requiring no liquid petroleum.

Not that much freight is transported by air, mostly its people, there will be less air travel as fuel costs rise. Ships will continue to be powered by liquid petroleum at some point liquid fuel costs will rise to the point where there may be a switch to coal and if coal gets too expensive maybe nuclear. There will also be a tendency in the future to only transport what is absolutely necessary. It will be too expensive to manufacture cars in Japan and ship them to the US, the Japanese will build factories in the US and build the cars (including the parts) in the US. None of this will happen overnight, there will be a gradual transition as fossil fuel becomes more expensive.

Dennis,

In the long run I expect your right, but short term I think there will be lots of bumpy times. Production lines can fail when a single key component is no longer available. As I mentioned, a number of factories around the world were closed as a result of the icelandic air cloud. A number of bankruptcies in the airline industry could easily have a similar effect. The lack of resilience in the system could easily lead to some cascading effects if just a few key nodes were taken out.

Network failure speed tends to be a function of the speed of the network, and our global economy is faster and more tightly networked than ever. The 2009 financial crash itself nearly took out gobal trade, and that was without liquid fuel production declining.

A number of bankruptcies in the airline industry could easily have a similar effect. The lack of resilience in the system could easily lead to some cascading effects if just a few key nodes were taken out.

I don’t think we’re see the system come down as you describe. The recession continues to reduce activity. So the effects are happening already. Much economic activity may have been slowed down before the actual effects of oil reduction hits.

It’s probably not likely that all airlines will go bankrupt at the same time. And cutbacks to air travel will only truly impact relatively few people. Air travel is discretionary for most consumers.

Hi Sam,

I agree there will be bumps, I by no means expect the transition to be smooth.

I think part of what you are worried about is the JIT (just in time) nature of many manufacturing processes today.

The smart companies will take a look at the changing transportation landscape and will identify critical components that may shut down their production lines if unavailable and they will keep a couple of extra on hand. Those companies that do this well will have a competitive advantage.

They will not always do this perfectly and there will disruptions there is no doubt about it, especially over the short term.

D C,

Bulk freight does not go by air, of course–planes won’t take away from freighters.

I wonder about a lot of various supply chains, though; doesn’t UPS have one of the largest jet fleets in the world?

Not that UPS is insulated from problems of oil supply.

Hi Synapsid,

I expect fuel costs will increase and the UPS jet fleet will get smaller due to reduced demand, in fact documents will be sent over the internet, only things which cannot be produced elsewhere (rare earth metals comes to mind) will be transported and by ship and/or rail rather than plane and truck.

Again everyone thinks when I mention these possibilities that I think it will be simple. Is it possible? Yes. Will it be easy?Definitely not.

Oddly enough, fuel costs are only about 5% of the overall cost structure for companies like FedEx and UPS.

Freight transportation accounts for less than 25% of oil consumption. This kind of operation will first increase fuel efficiency, then it will reduce other costs, then it will outbid other users of the oil, easily.

That’s why passenger miles in US aviation haven’t fallen over the last 10 years, even though the price of oil has gone up by five times.

Now with the price of oil heading lower, you are going to see Americans purchase more SUV’s and BIG TRUCKS. As I stated before, overall fuel economy is about the same as it was in 2008. Interestingly, light vehicle fuel economy is even worse in 2102 than 2008.

Lastly, even the Heavy-Duty trucks show a decline in overall fuel economy since 2008.

steve

Yeah, this would be a good opportunity for the US to raise taxes on oil. Then maybe there’s be money to replenish the Highway Fund.

They could follow the lead of the Indians.

http://in.reuters.com/article/2014/10/18/india-diesel-prices-idINKCN0I70EK20141018

If the gax tax were easy to raise in America, the decade plus of nope-not-raised points to better odds of pulling four-of-a-kind in a five card draw. Worse, a quick news search turns up what looks like disapproval for linking the gax tax to inflation:

http://www.salemnews.com/news/local_news/polls-show-support-for-ending-automatic-gas-tax-hikes-is/article_4d03a8de-4d3a-5dae-b36b-6757b48f20d4.html

How about that?

Yes, decades of Koch brothers’ propaganda against government, taxes, and fuel taxes in particular, have succeeded.

Still, it’s useful to be clear on what the best public policy would be.

Nick G, your posts are really full of cornucopian bulls*&t.

You’ve constantly and deliberately understated many thing to accomodate whatever agenda you’ve got going on. For example you stated in one of your posts above that fuel costs for Fed-Ex was only 5% of their operating expenses, when in fact it’s double that.

http://www.bidnessetc.com/business/fedex-coasting-through-a-strong-period/

Then you made this outrageous statement that facilities have about a 1:1000 eroei. WTF?

I happen to build large facilities and I can tell you that the amount of diesel used to build a water treatment plant, or manufacturing plant, is absolutely staggering. The equipment involved in just building the roads to these places, to say nothing of the actual asphalt used to pave said roads, is unreal. A new 2 lane undivided road costs about $2-$3 million to build/mile. About 25% of that will be fuel related costs, so figure about $750k in fuel per mile just to build the roads to the plant. A litre of diesel is what, $1.20?..so, $750k/1.20/litre = 625,000 litres of fuel. Just for one mile of road. Concrete alone costs $210/m3 delivered, probably about $120 of that is fuel costs, if not more. So figure about 100 litres of fuel used to produce 1m3 of concrete, which is a very small amount. Even a tiny concrete pad measuring 5m x 5m x .1m deep takes over 500 litres of fuel, and thats not including digging down 2-3′ for the gravel layer or even delivering the gravel. Much less processing the gravel to make it suitable as fill. Then there’s the rebar, compaction, all the site trucks and other vehicles, and the fuel consumption soars.

Anyway this is rambling, but I came on here to say that mainly your arguments are pure BS – they very greatly understate true energy costs and are quite misleading, and I couldn’t take it any more.

Mike,

Put the keyboard down. Step away. Take a deep breath.

Ok.

Now, I took that 5% figure from FedEx disclosures, their annual statement I think. Still, let’s assume for the moment the articles correct. What happens if the price of oil doubles? Fedex costs go up by only 11%. And, according to the article their profit rises….

As for the highway construction costs, I suggest you do a little research, instead of just guessing off the top of your head.

Good grief. You guys are terrible at fuel economy! In the UK the average new car gets around 45mpg, and over 50 for diesel. That’s the positive effect of high fuel taxes for you right there.

Hi Sam,

Remember that US gallons are only 80% of a UK gallon, our fuel economy is terrible, I agree with you there. Are those averages for all UK cars on the road? Higher taxes on fuel would help, but the US is less enlightened than the UK with regard to carbon taxes.

Dennis,

Those figures are averages for all cars sold in 2013. At a rough guess, average on the road would probably be 10-15% lower than those figures.

Are the gallons UK gallons? If so and we take 10% off 45 we get 40 MPG and a US gallon is 80% of a UK gallon so that would get us to 32 MPG US.

There are lots of cars sold in the US that get good gas mileage, but we also buy a lot of SUVs amd pickup trucks that get about 20 MPG US.

We also only pay 49 pence per liter for petrol vs the 1.25 pound sterling that is common in the UK.

If petrol was $7.50/ US gal in the US, which is equivalent to the UK petrol price, then we would no doubt have better fuel economy for the average vehicle.

Have you checked out the latest EIA Weekly Report? Products supplied (Line 26) is over 20 mbod . That is the first time recently that I recall it to be over 20. Since inventories didn’t change much, usage must be going up.

http://ir.eia.gov/wpsr/overview.pdf

Your argument about the electric cars would be better if there were more of them on the road today. Do you have any numbers?

Euan

Looking at the numbers, USA GDP growth was predominantly driven by growth in exports (helped by cheaper energy and Europe’s malaise?), growth in investment in non residential assets (the rich buying assets) and a massive bump in defence spending by the government, (possibly in response to the Ebola epidemic). I suspect that this quarter might be a little bit of an outlier.

I think a lot can be explained by FED debt monetization. Check here:

http://research.stlouisfed.org/fred2/series/BASE/

would be nice to see FED monetary base and US oil/energy consumption in one graph!

Alex

Unless I missed something I think we got a little off topic. I have no doubt that there is plenty we can do in the way of greater efficiency and an over all reduction in consumption. In fact most of it will be good for us. Like we could simply eat less food or drive less and walk more or buy less stupid crap. These are all good things and it is because of these things that I hope we do reach peak oil soon. None of this however means that we can grow GDP with out in an increase in oil consumption. This is what scares me about the idea of peak oil how will we cope with a permanent contraction in so called economic growth. I live in Minot ND and when I talk to people about how nervous I am to see what happens when the oil riches future the citizens of this state have been promised doesn’t arrive I get the some line about how North Dakotans are strong and will be deal with whatever happens. I just don’t think that is true. Peak oil will be an opportunity for us to change the way we think about economics but first we have to admit that, that change will be required and rid ourselves of efficiency fairytales.

Efficiency is one part: US average MPG is twice what it was 40 years ago, and it can be doubled again. The increase in MPG over the last 40 years has been far more important then LTO.

But, just as importantly, there are better and cheaper substitutes. An electric leaf is the cheapest car on the road to own and operate.

Freight uses far less energy than trucks, and can be electrified. Ironically, if you eliminated all of the coal and oil being carried by rail in the US, that would free up more than enough room to replace all long-haul trucking.

I’d say the quickest way to grow the American economy would be to tax gas at the pump.

In money terms, the GDP is money spent on stuff made in America. That’s private consumption, government spending and net exports. (Note that Exports – Imports = Savings -Investment).

Taxing gas at the pump would cut our main import bill, which is crude oil. This is likely to be at least as effective as the LTO boom. In addition, the ban on exporting oil should be removed. It doesn’t make any sense at all.

There is more money is selling oil to people who are using it to grow their economies with it (like the Asians) than to waste it on toys. This is a point that Watcher seems to stumble on as well.

Reducing wasteful oil consumption oil will make the country richer, not poorer. It’s true in Saudi Arabia, and it’s true here as well.

Ron,

Thank you for the fine work that you publish.

John Hummel

Oil got clubbed today:

WTI: – $2/-2.47%/settle $78.57

Brent: -$1.33/-1.55%/settle $84.53

More Saudi price war and them saying they are willing to accept lower prices for some time.

Suddenly that “comforting” $75 number everyone has been quoting on shale isn’t so far away.

Sub 79, not just intraday. At the close.

They will be able to conceal the shale destruction for a few months via winter, and consequent GDP smash using the same method.

But the REAL measure will be hotel vacancies and payroll collapse, which should anecdotally be starting in about 3 weeks (the 100 day drill/completion time since the beginning of the price smackdown).

If I had a central bank of my very own (aka infinite money) I would short the big three Euro, GBP and Yen and smile as . . . as . . . I destroy an American industry . . . in retaliation for sanctions.

Has there been any talk about (any or the) connections between ebola, ISIS, Ukraine, the most recent IPCC climate change alarm, and the oil price dive (among other things) since I’ve been gone (past 3 weeks or so)?

Of course large scale centralized nation-states run on lots of oil… So what happens when the easy stuff starts to run out? What kind of reactions/responses/policies?

Ebola can scare consumption. ISIS and the Kurds are definitely selling below market price. Ukraine, not particularly oil relevant. Climate stuff similarly irrelevant to oil.

Dollar spike is the big deal. Yardstick change.

Hi Watcher,

The spike in the Dollar has been about 10%, over the June 30 to Nov 1 period, WTI has decreased by about 28% over the same period.

Exchange rates are a part of the story, but only explain about one third of the change. There has been a shift of supply and/or demand curves in the World oil market that has caused oil prices to fall 18% in real terms. The fall in prices will eventually slow down drilling for oil due to reduced profitability at the margin, the reduced output that results (probably a 6 to 9 month delay) will eventually drive oil prices higher.

There is no evidence of a supply or demand variation of powerful magnitude over the 3 relevant months. In fact we had a GDP report suggesting consumption increase.

It is amusing, though, to see such a profound confidence in the function of markets by the left wing.

Hi Watcher,

Your explanation for the change in price, as you do not seem to believe in markets? It is not just exchange rates as you keep saying, that is a part of the explanation (about 10%) of a 30% price move.

Please explain the remaining 20%.

The dollar index undercounts the yuan, and of course China is a big player in oil.

But I’m not quite sure how that addresses this sudden left wing worship of free markets.

Hi Watcher,

Yep left wing capitalist that thinks free markets are great with a little government intervention when the economy tanks and to regulate externalities.

The uneconomy seems in increasing chaos-mode as the fundamentals come home to roost and where ‘pundit’ discussions increasingly might as well be discussing the previous nights’ dreams, nightmares and drunken flights of fancy.

That nevertheless swept aside for artistic license, I seem to have caught something about Japan’s ‘war on currency’ as well as, some time ago, something about manufacturing an oil glut to spite Russia(‘s).

Whatever… 😉

Pre Asia futures (New Zealand and Australia) drop WTI another 55 cents, to $78.23.

This is getting fun.

Hello everyone,

US crude closer to $78 on Saudi’s US price cut

http://www.cnbc.com/id/102148210

U.S. crude lost 47 cents at $78.31 a barrel as of 0005 GMT. On Monday it settled down $1.76 at $78.78 after hitting a low of $78.14 per barrel, its lowest since June 2012.

Brent crude previously settled at $84.78 after falling as low as $84.18.

Top oil exporter Saudi Arabia has hiked the price of crude to customers in Asia and Europe in December, but deepened cuts to U.S. buyers in a sign it may be redoubling efforts to retain its share of the world’s biggest market.

It will be hard for it to fall further tonight. The big three currencies are reversing and depressing the dollar slightly.

North Dakota Active Rigs 03/11/2014: 186 (-7 from last week)

https://www.dmr.nd.gov/oilgas/riglist.asp

This has to be seasonally normalized. November is when everything slows.

Some curiosities from the data. Why would IPs be better June/July than the other months? Well, it’s one year’s months. Maybe they had some weather in August, which is still summer. Still, weather should only hit number of wells, not how strong the wells drilled happen to be.

Sept/Oct water cut elevation is also curious.

July, the highest month for initial barrels per well, had the fewest wells reported, 87. That is likely about half the wells actually brought on line in July. I think it likely that most of the very poor producers were put on the confidential well list.

The increasing water cut is the most interesting thing. Could have something to do with down spacing, or perhaps moving further away from the sweet spots.

I can’t see the mechanism for downspacing increasing water.

As for sweet spots, the theory would be that X% of pores hold oil and X% of pores hold this thin barely-oil, but I don’t think the imagery can tell the difference. That would be cool to know if it can, but I think it just finds pores and permeability, not what’s in the pore. So picking a sweet spot should have the same odds of water vs oil in the pores. Maybe an imaging guy will speak up.

Though let’s keep in mind those two months are the recent two months that show distinct and surprising production rollover long before winter. In that context, this month, November, for various reasons could prove to be the peak.

Or rather, last month, Oct.

Watcher, you always get something when you drill. The term “dry hole” is very misleading. If you drill in porous rock, you will never come up dry! There will always be something wet there. It may be 100%water or 100% oil or, usually, somewhere in between.

Downspacing, if you get less oil, you will get more water. As you move away from sweet spots, if you get less oil you will automatically get more water.

You will always see the water cut increase as production declines… well that is if enough pressure in the reservoir. If you have no pressure you will get nothing. But the water is there nevertheless. Pores in rock are never empty, they are always filled with either water oil or gas. And if they contain no oil or gas then they are filled with water.

You will get liquid, oil, or water, in direct porportion to the pressure in the reservoir. Except in gas wells of course but when the gas is released pressure forces water into the pores.

Hmm.

I guess this bears looking into, but I think this is not right. It is 100% right for a water driven well. You are washing the oil out of pores with water and after they are washed out the flow becomes more and more water.

But I don’t think it’s right for shale.

The pore has either water or oil in it, not from water injected but from 80 million years ago. You don’t know which before you drill (theoretically, but if the imagery can tell then clearly you don’t drill where the pores are filled with water.) So. . . . downspacing doesn’t change this. Cannibalization of wells from each other should equally cannibalize water and oil from the pores, just from the pressure difference between rock and wellbore.

But . . . interesting thought.

The pore has either water or oil in it, not from water injected but from 80 million years ago.

Not pore but pores, billions of them. And they have both oil and water. Look at the table of wells I posted. Only two wells had no water. One of those wells produced 48 barrels the first 24 hours and the other 50. The average of all the other wells were more than 50% water.

The county with the lowest production per well, Divide, had the highest water cut. And the county with the highest production per well, McKenzie, had the lowest water cut. And the county that was once North Dakota’s highest producer but is now second, Mountrail, has a very high water cut. I don’t know but I will bet that when it was North Dakota’s highest producer it has a low water cut like McKenzie now does.

I know Mountrail County is still increasing production but only slightly. However the two formally most productive fields in North Dakota, Sanish and Parshall Field, are now both in Mountrail County and both are in decline.

When oil production drops water cut rises. That’s the way it works in conventional fields as well as tight oil fields.

Interesting.

I wonder if this is even known information. Billions of pores. Well maybe millions but . . . is an individual pore filled partially with water and partially oil — or are some pores water and some oil?

If the latter, then interconnectedness aka permeability would flow them equally, some water and some oil. If the former then there’s nothing complex, each pore has a partial fill of water or oil. If water flows then so does oil.

Low production counties having a lot of water. Hmm. That might be what was in those pores. And vice versa.

I don’t even know where to find this out. In a non water driven field, why does water flow when oil peters out? Why should that be so? Should not the pores within range, as it were, of that well bore be equally emptied regardless of water or oil? If the pores are empty, why would anything at all flow?

Oooh, maybe it’s from deeper down, where the temperature didn’t allow oil to remain oil. Water from deeper down flows upwards to refill the pores. Then water cut will rise.

Maybe.

Murex Petroleum, a private company that operates mostly in Divide and northern Williams Counties (i.e. outside of the Bakken sweet spot) in North Dakota, has brought this up in the relatively infrequent instances that the company makes public statements. What they have stated is that a water zone seems to lie under the Three Forks formation within their acreage. Thus the deeper they drill into the Three Forks to downspace in that area, the greater the likelihood of the vertically-induced fractures from their horizontal wells penetrating into the water zone below and eventually bringing that water to the surface. This is a rather well-documented problem in Divide and Burke Counties at this point, but whether other areas of the Bakken might exhibit similar behavior hasn’t really been brought up anywhere that I have seen.

Here is a link to a presentation Murex gave at a conference earlier this year. Of particular relevance are the statements under “In some areas of Williston Basin, bigger is not better” on page 25.

Good data Wes, so water does flow up from lower to fill empty pores and the path of flow is the 3D frack around the horizontal bore.

Billions of pores. Well maybe millions but . . .

No, trillions of pores, or more accurately cracks, spaces between the grains of shale, which is almost a solid. They are so small you would need a microscope just to see one. A billion would not fill one barrel.

…is an individual pore filled partially with water and partially oil — or are some pores water and some oil?

Hell, you would need to talk to an oil geologist on that one but in any square foot of shale I would imagine there would be both.

Billions of pores. Well maybe millions but . . . is an individual pore filled partially with water and partially oil — or are some pores water and some oil?

The fields are all “pressure driven”. The well bore provides a relief valve for the pressure. Even when you have a down hole pump, or a nodding donkey pump, the pump creates an area of negative pressure and the pressure in the reservoir pushes the oil to the well bore.

So when you pump something out, or the pressure pushes something out, then something else must fill the void. That is never air or just empty space, it would be water.

Oilfields water out. That’s just what happens to them in their old age. Some oil fields are said to be producing “oil stained brine”.

I’ve gotten curious. All oil fields don’t have to have been underwater at one point. Here is the water source for US oil:

http://en.wikipedia.org/wiki/Western_Interior_Seaway

And that link pales in coolness to this next one:

[warning I got an avast virus warning from this next site, but hard to see how it would be a good place for a virus–I ignored it, no negative effects noticed]

http://cpgeosystems.com/paleomaps.html

I’ve gotten curious. All oil fields don’t have to have been underwater at one point.

Yes they do. Oil is formed from alga. Alga that formed in shallow seas, died and sank to the bottom where conditions did not allow it to decay. Then it was covered by sediment, and more sediment until it was so deep in the earth that the temperature rose high enough to cook it into oil.

My vague recall is the mechanism requires the microorganisms or algae to be shut off from oxygen. This doesn’t require water. A large earthquake can bury it under a few tons of rock somewhat suddenly.

I think (given California was not under the Seaway) that it was suggested Cali’s seismic history used quakes to make its oil those millions of years back. The organisms were living in lakes or streams and got buried very suddenly, or that would be the story.

But I’ll stand down in that I think you’re right in the majority. I recall an article about searching in Africa and what was desired was river inlets to the sea millions of years ago because major cataclysmic events would toss millions of tons of river sediment out over the organisms just barely offshore and bury them. The process requires a sudden oxygen shutoff, any way you can.

My vague recall is the mechanism requires the microorganisms or algae to be shut off from oxygen. This doesn’t require water.

Yes it does, alga doesn’t grow on dry land.

The organisms were living in lakes or streams and got buried very suddenly, or that would be the story.

No, that’s not the way it happens. Alga can grow in lakes but you would not get enough alga in a lake to make very much oil. And streams? Not likely because the water is cool and flowing. You wouldn’t get enough oil to fill a barrel. And if t were buried by rocks and dirt you would still have enough oxygen for decay. You would get nothing but organic rich dirt. But most importantly, your earthquake debris would not bury it deep enough. You need 7,500 feet, almost a mile and a half down, to get enough heat to turn the alga into oil. Alga, not buried deep enough becomes kerogen, a waxy solid.

There is some very ancient oil but most oil began to be formed 150 million years ago and again 90 million years ago during times of intense global warming.

Energy and Public Health: The Challenge of Peak Petroleum

Petroleum was formed by geologic processes dating from the Cretaceous and Jurassic periods, 90 to 150 million years ago, when vast amounts of zooplankton, algae, and other organic material were deposited on ocean floors. This material contained organic molecules with energy in carbon-hydrogen bonds, derived principally from photosynthesis. Over geologic time, some of these deposits were buried in sediment, pressurized by the overburden, and heated. At depths below 7,500 feet, heat and pressure decomposed large organic molecules into fragments of between five and 20 carbons, forming the liquid we know as petroleum.

I wasn’t clear. The avalanche of material would be the initial event, and it could be somewhat dry. Then you have millions of years to push it deeper and achieve the heat and pressures. The African article wanted river inlets. At some point there would be a cataclysm to send tons and tons of sediment offshore, and then time would push it deeper and deeper.

There is oxygen in water. You can slowly rot submerged material. You need a cataclysm to bury the material under lots of sediment, and then let time push it down deeper and deeper.

I remain intrigued by this perpetual water flow from an oil depleted well. It suggests permeability for water is different than for oil? If all the oil in pores “within range” of the bore’s pressure differential flows and empties, and then water flows into those pores, how does the concept of “range” work for water. Shouldn’t the well just stop flowing eventually? Anything at all?

Watcher,

Deeper ocean water can sometimes be anoxic, which allows for the organic meterial to be covered by sediment before it begins to decay.

Otherwise yeah, big cataclysms such as turbidite flows can quickly bury a large amount of organic material and give rise to a suitable environment for oil generation.

I would imagine that water can flow more easily than oil in a shale formation because it is a much smaller molecule, and can thus fit through gaps which the oil cannot.

Also, if I remember my petrophysics, the relative permeability of oil and water changes as the saturation fraction of the rock changes.

Oil formation requires a mile and half of sediment on top to form. Sediments do not build up on dry land, they only build up in the sea. Of course some sediment can build up in lakes but not very much for very long. It takes rivers draining into seas to form sediment.

If the alga were buried on land there would be enough oxygen to destroy the algae. Oil formation was never cataclysmic, oil is formed during times of intense global warming when algae blooms are prevalent in shallow warm seas. The algae dies and sinks to the bottom where it is covered by sediment, most of which is washed in by river water.

No, there is not always oxygen in water:

Petroleum Primer

Organic material is easily destroyed by exposure to air. Deposition of the material must be rapid in waters containing little or no oxygen due to water stagnation. Where water is oxygen deficient and chemical reactions take oxygen atoms away from molecules it is said to be a “reducing” condition, a requirement for the preservation of organic matter. Also, low-oxygen environments greatly decrease the number of scavengers that might otherwise consume and destroy the organic morsels. Usually the proper conditions occur in quiet marine basins, lagoons, and rapidly buried delta deposits, but similar conditions prevail in some lakes.

“I would imagine that water can flow more easily than oil in a shale formation because it is a much smaller molecule, and can thus fit through gaps which the oil cannot.”

Good discussion overall, but this probably goes back to the key issue. Permeability of rock is a number that means different things to different kinds of liquid.

Hmmm, this also can address how/why API rating in some wells / counties differ from others. Maybe sand is too small a particle to let larger molecular chains grow. Ceramic proppant might generate better quality oil.

err flow, not grow

Most oil comes from ocean life buried on the seabed…

On the definition of a “dry” well, I think 100% water would be considered dry, unless one is drilling a water well.

Basically if the amount of oil or gas produced is too low for the well to be profitable, it is called a dry hole and the well is capped.

Yes, “dry hole” and dry well” are used in exploration to describe a well where no significant reserves were found. This has been extended to business failures in general, I think.

Watcher,

I work in seismic. To my knowledge there is as yet no way to reliably image a sweet spot using imaging techniques. I’m not sure that the rock properties would change enough for that to show up. Some of the bigger processing shops are trying to figure out ways to image it but I don’t think they’re successful so far. Still flying blind AFAIK.

Sam, thanks for the information. We are always glad to have another oilman on our list. Please feel free to correct us when we get things screwed up in our oil field speculations.

+1

Thanks Sam.

Thanks Ron,

I mostly do work in marine seismic, so unconventional land isn’t really my area. I’m trying to keep abreast of the latest developments, but I have a feeling that most of the work on shale characterisation will be being done in-house at the big processing shops, and as such will likely be proprietary. Lots of them have big flashy webpages about how their various rock physics tools can help characterise frack zones, but I’m always skeptical about marketing claims, since no geophysicists get to write them.

There’s an interesting primer on seismic in shale plays here: http://www.cwp.mines.edu/images/newsevents/120201_DueyEandParticle.pdf

Thanx Sam. We often have imaging questions here. Most recently about developments enabling imaging past salt domes — which is a capability only recently possible?

But good data on it being impossible to characterize the content of pores re water vs oil prior to drill and observe cut.

Watcher,

Yes subsalt imaging is a relatively recent development, last few years maybe. It generally requires some pretty hefty compute power which has meant that it’s only really become feasible in the last few years. You generally need wide azimuth data as well, which is often more expensive to acquire. However if you have this, combined with a decent reverse time migration algorithm, you can image structural traps on the flanks of salt domes quite nicely.

Improved tomography algorithms and application of tools such as full waveform inversion are also helping. Which is useful given how appalling the geology that some of these plays are in.

The conversation about salt dome imaging was hmm I think it was about Gulf of Mexico plays, and that extended to offshore Brazil and I think offshore Saudi Arabia, which was a surprise.

Of course oil bordering salt domes is entirely different from subsalt oil. We have been drilling for oil next to salt domes for almost a century, subsalt only in the last few years.

The lube looks about right where it should be for the upward-thrusting salt dome.

I posted this yesterday, but as was very near the end of the post, I will repost as I feel it is very import article.

https://rbnenergy.com/the-battle-for-henry-hub-ominous-implications-of-natural-gas-oversupply

“More than 60 natural gas pipeline projects are in the process of reversing the continent’s gas flows to move gas out of the Northeast, and much of that production will be moved to the Gulf Coast.”

“Many producers in Northeast Pennsylvania can profitably produce gas at prices less than $2.50/MMbtu. Many wet (high BTU, high NGL content) gas producers in Southwest Pennsylvania, West Virginia and Ohio can operate profitably at prices well below $2.00/MMbtu by selling higher value NGLs (even at today’s lower NGL prices). “

That’s good data, toolguy.

The wet vs dry thing we discussed. I am always suspicious of “Many” this and “Many” that. Since this blog’s perspective is on seeing a decline, we are not interested in “many”. Or “some”. And only sometimes in “most”.

If 2/3 of wells are still just fine, but 1/3 aren’t, then the total goes down, all while there are sunny articles about Many and Most.

I look forward to articles over the next few days about how there are many wells in the Bakken that will operate just fine down to $20/barrel. And many others that will be drilled at $30.

There will be no articles covering companies shutting down, even if there are more of those than of any starting or even operating.

Watcher,

I feel you are missing a major point. You keep referring to the oil market, which is world wide and when someone stubs his toe on a rock in a sandy place, then the oil prices can change. The number of oil wells drilled in the US can then be effected.

On the other hand, the Nat gas market currently is internal to North America. It doesn’t really matter what the price of nat gas is, there will always be enough wells drilled to meet the market. Price goes up, drilled holes goes up, usage goes down. Supply goes up, price comes down, less holes drilled. Simple econ 101. Having said that, it appears your US nat gas market is about to be turned upside down. To me that is an important topic to discuss and not to be dismissed by “many” “most” and “some”.

The US had their coldest winter for a very long, and gas withdrawals were at all time records. The US gas industry has been able to make up that shortfall with increased production at $4 mcf, not a historically high price. If this winter is not as cold as last and normal levels of carry over occur, then with current production levels, I feel you are are going to see some very cheap Nat gas next summer, with the corresponding changes in drilling patterns.

One thing about the fast decline rates on all these shale wells, you don’t have to wait long to see a result, unlike the good old days where it take a decade to balance out, now we get near instant responses to market fluctuations. It is going to be an interesting show to watch.

Someone posts the occasional graph showing I think Canada nat gas storage WAY below previous norms for this time of the year. With such poor storage it seemed amazing that the price was still low.

But you would seem to have a legit point about the general speed of response of production to demand. Things will happen fast. On the oil side we happen to know pretty well that it takes 100 days from start of well to first flow. Do we know the equivalent gas number? This would inform us further about the response speed.

Any idea how many of those pipelines mentioned now and then are for NGL?

Break even cost estimates for tight oil seem to be all over the place. My own personal impression was that it took prices in the ninety dollar class to make tight oil profitable, this impression being the result of reading this forum and a couple of others and random articles in the business press.

Now it seems that maybe seventy to seventy five bucks is enough to keep the drillers working – but this may be because a good bit of the expense is sunk already and finishing up on land that has already serious money spent on it for siesmic, permitting, leasing,contracted rental of drilling rig etc is worthwhile even at say seventy bucks.

So – we won’t know what the approximate floor is until these sunk investments are worked thru and the people making the decisions are looking at whether to lease the rigs for another three months , pay for more seismic , contract with the trucking company for another few months, etc.

Is there any body here who really has a good idea how long this might take?My own wild ass guess is that it will not be less than six months or so.

And if the managers decide to cut back on new wells in a major way then what will be the feedbacks in terms of reducing the rental rates of drill rigs, the price of fracking sand, the hire of trucks, etc?

The owners of big cargo ships have been willing to hire them out for a song when the market was glutted with excess capacity. The rental rates on smaller machines such as backhoes and bulldozers also dipped quite a bit during the recent great recession.A little income is better than none if the expenses don’t change much and while I have never even seen a drill rig I am pretty sure these rigs are quite durable and that they don’t need a whole lot of maintenance or repairs until they have been used steadily for a good long while. So even a few thousand a month above routine maintenance costs coming in would probably be better than just parking a rig in a lay down yard someplace.

“Break even cost estimates for tight oil seem to be all over the place. ”

Not bad Farmerguy. Dead On. Nobody has a clue, other than me, and I already laid it out. They are in deep, deep trouble.

As best I can tell the critical parameter is just how much is the whole operative shebang as a % of GDP. Like the overall Apocalypse occurring just 6 months after $147 oil, it has been suspicious to me that the US logged winter -4% Q1 GDP as the Bakken got its winter smash and logged -58K bpd in one of those months.

If we see some sort of confirmation of tight GDP linkage to shale flow, then there WILL be subsidies and all the breakeven calculations will be crapola.

OFM

Exactly right!

I have stated the assumptions used and also pointed out they are on a point forward basis, that is, from the well is spudded and thus do not include acreage acquisition and some other listed items.

What may cause divergences are applied discount rates and those publishing the estimates seldom lists the assumptions put into the equation, so it becomes hard to make an independent verification of the estimates.

Further the well profiles for late life production are, call it scientific guesses (but I do think there is a lot of good experience put into this guessing).

The acreage acquisition costs are on the books of the companies so at some point they will kick in.

With regard to well costs, it appears that superfracks comes with a price tag

Continental Shares Fall On Higher Bakken Costs, Boardroom Shuffle

From your link:

The concern appears to stem from Continental’s disclosure that its well costs in the Bakken had climbed to $10 million per well, about $2.5 million than a year ago.

The article says they are more than making up for that in increased production per well. More sand, more oil. But there is just something wrong with this arithmetic:

Its 1.2 million net acres there hold about 11,000 more drilling spots, and the company is dedicated to figuring out how to make the most out of them.

That’s 109 acres per well or almost 6 wells per square mile. I really don’t think so.

1200 feet frack radius XY plane only X 1 mile would be 5280 ft X 1200 ft = 6.4 million square feet.

An acre is 43560 sq ft. So that well is draining 145 acres. This divides into their 1.2 million acres and gets 8,000 wells, nowhere near 11,000, but I’m sure they’ll hand wave their way in to Three Forks, sort of double dipping the same acre.

Hi Watcher,

Continental estimates their frack radius is only about 300 feet, see their most recent presentation. I have no evidence that this is anything more than hype. They also claim recovery will be 15% of OOIP if we assume 400 Gb OOIP that is 60 Gb, so there is quite a lot of BS in the investor presentation, I think 9 GB for all of the Bakken/Three Forks (including Montana) is somewhat reasonable if oil prices recover to $90/b or above, a very optimistic scenario (high prices, low well costs) might allow 11 Gb, 60 Gb is a fantasy in my humble opinion.

I frowned at 1200 when I typed it. It’s in my memory for some reason. 300 was the downspacing experiment and my recall is they declared “interference” with adjacent wells and were not going to embrace it.

600 either side would be 1200 I guess. I should not have said radius.

Mr. Likvern, I appreciate your work a great deal. If I may, an observation from 50 years of conventional oil and gas operations:

The shale oil industry is guilty of a number of creative accounting methods that I have never seen before; you are precisely correct regarding the convenient omission of leasehold acquisition in the term, “well costs.” For a typical thousand acre drilling unit I estimate bonus paid to mineral ownership, independent land work, or in-house land work allocations, curative title work and preparation of division order title opinions totals a minimum of 2,000 dollars an acre. Eventually there are multiple wells drilled in that unit. Nevertheless, leasehold costs are seemingly never included in “well costs.”

Neither, to my knowledge, is plugging and de-commissioning of the abandoned location costs, which I believe are upwards of 200,000 dollars per well with full surface restoration.

I agree with your estimates of incremental lift cost per barrel of 4.00 dollars. Most people guessing seem to want to use 3.00 dollars; yours is far more accurate. In fact, I think it could be as high as 5 dollars…and rising as the well declines and OWR decreases. Disposal of produced water in the Eagle Ford can often be as high as 5 dollars a barrel with trucking costs. Sometimes those trucks sit in line at the disposal facility for hours waiting to unload.

In the oil and gas business I am accustomed to, general acceptable accounting principles require each producing well be assessed a company “overhead” allocation, or an administrative overhead fee. That covers the cost of rent, copying, expense accounts; paper clips to jet fuel for the company jets, that sort of thing. I have no idea what that administrative overhead allocation is in the shale oil business and if it would say, I would not believe it anyway. Offshore, for instance on one producing platform, Exxon might charge BP and Anadarko, its two working interest partners in the platform, $45,000 dollars per month in administrative overhead costs. One might imagine what the overhead costs are for EOG or CHK, for instance, given the number of employees it has.

Which all brings me to the internal rate of return numbers shale oil companies publish in press releases and annual reports. I think those rates of return are the window into individual well economics and consequently, whether an entire shale play is going to work in the long term. And you are precisely correct, how do we know? How do companies risk 10 million dollars per shale well, borrowed money at that, for what appears to be the “hope” of 3% annual rate of return over 20 years? And for the record, that hope is based on the company’s EUR numbers. Are those reported internal rates of return numbers before depreciation and direct intangible drilling cost deductions, before depletion, or after? After, I suspect. And what about company overhead allocations, etc.?

I don’t think we get anywhere near the full skinny from the shale oil business. We sure didn’t from the shale gas business.

Mike

Mike,

Appreciate your feedback.

I have seen several numbers for acreage acquisition cited from a few hundred dollars/acre upwards to 10,000 dollars/acre.

1) With regard to acreage costs (acreage acquisition) I think this is also a hard one for the oil companies as this is a cost that has to be handled in time and space. By that I mean I do not know how the rules for depreciation for these costs are, how they become distributed (discounted) over time.

Further, what volumes (number of wells) will be allocated these costs. The final answer will not be known before the end of the day.

2) Unit operating costs should be expected to come up as the flow declines, and for a tight oil well the effect of this becomes watered down due to discount effects.

3) Produced water (brine) (water to oil ratio) has seen a steady increase and this needs to be disposed of at dedicated disposal sites. This will add to the operating costs and it is possible to make good estimates on it, but these will also be subject to uncertainties with regard to how waiting time etc. is accounted for.

4) Then there are General and Administration as you point out should be allocated each well (or each unit produced and sold).

The internal rate of return (IRR) is as good as the data used to produce them, in other words they are expectations/projections. The final number will not be known before the end of the day some years down the road.

Mr. Likvern, the point I wanted to make is that, for the reasons I explained, I believe that actual incremental lifts costs per barrel is higher than $4.00 for LTO wells. Based on Mr. Patterson’s OWR data I suggest produced water costs may be close to 3.00 dollars per oil barrel alone. There are then chemical costs, gas processing costs, surface maintenance costs, down hole maintenance costs (replacing a DHP at 9000 feet can cost 80,000 dollars; twice a year), gauging fees or gauging allocation, and the big unknown, administrative/overhead allocations per well.

You are correct, sir; down the road all these unknowns, or half truths, about costs and rates of return will sort themselves out and we will know. Not until then. Incremental lift costs are important to me only from the standpoint of decline curve analysis and EUR’s per well. Trying to determine the LTO “break even” price for oil, forgive me, a waste of time. Every company, for a host of reasons, is going to have its own internal cash flow requirements, depending largely on debt load and overhead; producing oil wells seldom, if ever, get shut in because of product price volatility.

Thank you again for your work.

Mike

Hi Mike,

Thank you for this comment.

I do my analysis in a similar way to Mr Likvern, in fact I learned it from him, though the errors in my analysis are my fault alone.

Along with $4/b for OPEX I include $4/b of “other costs” and because I do not include income from associated gas (about $3/b) the “other costs” would amount to $7/b if the natural gas were included in the analysis. I use a 7% real discount rate(calculations are done in real (or inflation adjusted) dollars which if we assume a 3% rate of inflation is equivalent to a nominal discount rate of 10%.

What are your land costs and G and A costs on a per barrel basis (approximately), would $7/b cover it?

Howdy from S. Texas, Dennis:

I could quote you my numbers, sir, but they would not be a representation of the numbers you should use in your LTO work. My company is small, my overhead allocations would represent that. Ernst and Young surveys the country for administrative overhead charges based on the depth of the well, but I think they are low.

Allow me to address just one part of the incremental lift cost per barrel of oil equation: produced water. If an average Bakken well makes 250 BOPD the first year of production I believe that well is also going to make 160 BWPD, first from flowback frac water, then a gradual transition to interstitial water. Including disposal fees of $0.50 and 4-5 hour turn arounds per load of water with vacuum trucks, at $ 125 dollars an hour, that is $2.82 per incremental barrel of oil.

I can make real life arguments for incremental lift costs possibly being as high as 10 dollars per barrel in some places in the country, but 7 dollars is more reasonable than 4 dollars, IMO.

Mike

We’re seeing water cuts in IP data up around 50%. The oil flow dies fast. I think the water does, too. Only Ron’s most recent work of the last two months in NoDak showed a water cut jump. Seemed less sharp an increase until recently.

Your 4-5 hour quote on truck turn around for water disposal is pretty powerful data. That’s to empty the onsite tank, of course, but that is a LOT of time on the road servicing just one well. Good data.

CLR’s Selling and General Admin expense as of Dec 31, 2013 was $472 million. This was a 37% increase from 2012. Projecting to the end of this year at the same rate would have 2014 G&A at 646 million.

I did that because CLR hype says they will hit 200,000 bpd company oil production by the end of this year. That would be all fields, not just the Bakken.

So G&A is 646 mill / (200K X 365) = $8.9/b

Hi Mike,

What about OPEX and other costs in the Eagle Ford? That’s right in your neighborhood, would the guesses you gave for the Bakken apply to the Eagle Ford as well? I understand you don’t necessarily have great estimates, but your experience would likely mean that your guesses would be much better than mine.

I have driven by a few oil wells, read some books, learned from people like Rockman and Doug Leighton, but my guess is that you have forgotten more than I know about oil.

Hi Mike,

Another point is that the average first year output of Bakken wells is about 240 b/d, since average water per b of oil is about 1/3 we would have 80 b/d of water for the first year, I don’t think the 24 hour IP gives a very good picture of water cuts.

So This would reduce water handling from $3/b to $1/b and OPEX would be $5/b including water handling.

Note that upon re-reading your comment I understand where you got the $7/b, that is your initial guess of $4/b plus $3/b for water.

Please correct me if I still have this wrong. Basically if the water cut is 1/1 water handling would be $3/b, but if it is 3 b oil to 1b of water it would be reduced to $1/b.

Hi all,

I made a mistake here. Mike used 160 BWPD to estimate an extra $2.80/b of costs for water disposal and I thought he was using 240 BWPD.

So if my estimate of about 80 BWPD for 240 BOPD is correct the water disposal costs would be about 1/2 of Mike’s estimate or about $1.50/BO.

This would raise OPEX to $5.50/b and other costs would be $3.50/b (this is really $6.50/b but I deduct the natural gas income of about $3/b), transport costs to Cushing are $11/b and royalties and taxes are 27.5% of wellhead revenue, assumed well cost is $10 million.

Hi Mike,

We are interested in average lift costs, in your response to Rune you said OPEX of $4/b was reasonable, looking at the Continental Resources(CLR) 2013 annual report G+A was about $4/b, OPEX was about $8/b (so Mike was conservative in his estimate of lift costs).

If we look at the income statement and deduct depreciation, impairments and taxes from the total operating costs we get about $14/b for OPEX and all other costs, interest expense was almost $7/b so total costs would be $21/b (not including production taxes) when these are added the total costs are $30/b. My calculations use OPEX plus other costs of $11/b and royalties and taxes of 27.5% (not including income tax which is only paid on income). In 2013 the average Bakken crude price received by CLR was $89.5/b, we will assume transport costs of $12/b and weelhead revenue of $77.5/b so royalties and taxes are $21/b for a total of $32/b which compares fairly well with the 2013 CLR annual report, where we got $30/b.

Clearly these numbers will fluctuate over time.

A drop in the oil price from $89.5/b to $75/b will cause gross income to drop by 16%, but net income by 25%, based on the simplified assumptions of my calculations (OPEX and other costs at $11/b, transport costs of $12/b, and royalties and taxes at 27.5% of wellhead revenue.)

On water cut, when we look at cumulative barrels of oil to cumulative barrels of water for wells which started producing from Jan 2008 to August 2013 the average is 4 b oil per 1 b water. For Sept 2011 to Aug 2013 (12 to 36 months of output data) the oil water ratio drops to about 3 b oil to 1 b water so the water cut may be increasing based on this view point.

A better way to look at it is to look at the first 12 months of oil and water output. This is very revealing.

For first 12 months of output(well start date range)

wells (1/2008 to 12/2011) — 48 b oil/ 1 b water(2892 wells)

wells (1/2012 to 8/2013)——3 b oil/ 1 b water(3080 wells)

That is a big difference.

Data from NDIC gathered by Enno Peters.

Any mistakes in analysis are by me, Enno just gave me some raw data.

Thank you Enno you are the man!

Hi Mike,

I now get where the $7/b estimate for lift costs comes from.

I think it is $4/b for the oil plus $3/b for the water see my comment above, I did them out of order somehow.

OK, I understand where you were going, Dennis. I know you want me to help you with incremental lift costs but it is not easy. Your deal is Bakken and I don’t know anything much about N.D except that it use to be pretty up there before they covered it in shale wells. Different companies in different counties with different reservoir characteristics are all going to have different costs. Nothing is fixed. After 50 years I can guess pretty well what those shale guys costs are, the truth of the matter is I would not operate a shale well if you gave me the damn thing. My produced water cost estimates per barrel of oil I feel reasonably confident in, though some of those bigger companies in sweet spots may have their own personal disposal systems. I was stunned by Ron’s OWR data; I knew Bakken wells made water but, yikes.

One other thing, in Texas, for instance, in the EF, 22.5% royalty burden is a good number. You know this; oil severance tax is 4.6%, natgas is 7%, though there may be some exemption for that if that gas is qualified as “tight” gas and anything from shale is tight as a tick. But I’ll say this, ad valorem taxes (property taxes) often gets left out left out of the economic equation, I’ll bet. I am paying mine for 2014 this very day: right at $1.00 per incremental barrel. It makes me what to start day drinking.

Mike

Thanks again Mike,

I realize that every well is different and am just trying to get average figures in the ballpark. So for oil royalties and taxes are about 27% and for natural gas about 30%? That is higher than I realized and property taxes tend to be $1/b on average?

Interesting. Would your earlier estimate (which I may not remember correctly) of roughly 7b/d being the average level for abandonment for a shale oil well be correct for the Eagle Ford (which I think is in your neighborhood so you may know someone who works those fields)?

Mike, that was the water cut from a partial list of wells. Confidential wells were not included and some wells did not report oil and water at all. And it was the water cut for the first 24 hours of operation.

Enno Peters’ data shows the Bakken water cut, through June, for wells drilled in 2014 at about 40%.

Also check out FreddyW.s post from yesterday.

Freddy’s Water Cut Post

Hi Rune,