Where did all the oil go? The peak is back

An extensive new scientific analysis published in Wiley Interdisciplinary Reviews: Energy & Environment says that proved conventional oil reserves as detailed in industry sources are likely “overstated” by half.

According to standard sources like the Oil & Gas Journal, BP’s Annual Statistical Review of World Energy, and the US Energy Information Administration, the world contains 1.7 trillion barrels of proved conventional reserves.

However, according to the new study by Professor Michael Jefferson of the ESCP Europe Business School, a former chief economist at oil major Royal Dutch/Shell Group, this official figure which has helped justify massive investments in new exploration and development, is almost double the real size of world reserves.

Wiley Interdisciplinary Reviews (WIRES) is a series of high-quality peer-reviewed publications which runs authoritative reviews of the literature across relevant academic disciplines.

According to Professor Michael Jefferson, who spent nearly 20 years at Shell in various senior roles from head of planning in Europe to director of oil supply and trading, “the five major Middle East oil exporters altered the basis of their definition of ‘proved’ conventional oil reserves from a 90 percent probability down to a 50 percent probability from 1984. The result has been an apparent (but not real) increase in their ‘proved’ conventional oil reserves of some 435 billion barrels.”

Global reserves have been further inflated, he wrote in his study, by adding reserve figures from Venezuelan heavy oil and Canadian tar sands – despite the fact that they are “more difficult and costly to extract” and generally of “poorer quality” than conventional oil. This has brought up global reserve estimates by a further 440 billion barrels.

Jefferson’s conclusion is stark: “Put bluntly, the standard claim that the world has proved conventional oil reserves of nearly 1.7 trillion barrels is overstated by about 875 billion barrels. Thus, despite the fall in crude oil prices from a new peak in June, 2014, after that of July, 2008, the ‘peak oil’ issue remains with us.”

The study referred to here is: Overview A global energy assessment,

Michael Jefferson

Against the background of IIASA’s massive (their word) ‘global energy assessment’ (GEA), this paper takes a closer look at the challenges posed by population growth, energy poverty, the fossil fuels and carbon storage, renewable energy, energy efficiency, natural catastrophes, and potential climatic change to offer a somber, although arguably more realistic, overview of what the future may hold than the GEA achieved. © 2015 John Wiley & Sons, Ltd

I thought the above article worth a post of its own. After all it is a vindication of what many of us have been saying for years now. And I especially call your attention to the line: “the standard claim that the world has proved conventional oil reserves of nearly 1.7 trillion barrels is overstated by about 875 billion barrels.”

That puts conventional reserves at about 825 billion barrels. That is OPEC + Non-OPEC, that is everything, well, everything conventional. That is almost exactly the amount of reserves I have been claiming for years. I have been thrashing this straw for over a decade and it feels good to get some vindication.

Here are a couple of other peak oil articles in the news this week:

On March 29th, the Government Accountability Office (GAO), also referred to as the ‘congressional watchdog’, released a much-anticipated report called Crude Oil:Uncertainty about future oil supply makes it important to develop a strategy for addressing a peak and decline in oil production.

This report was initiated by a request, just over a year ago, from Congressman Roscoe Bartlet, a very vocal proponent of the peak oil theory in the US Congress.

The significance of this report cannot be under-stated. For the first time in North America, an independent and nonpartisan agency that works for Congress and the American people has gone on record stating that peak oil is a real and pressing concern that the government should be preparing for.

Timing of the peak all-important

Strange new economic phenomena will kick in the moment oil production peaks, turning normal national finance ministry policies on their heads

The reason there is such heated debate over when exactly peak oil is due to arrive is because, at the point of the peak, the fundamental laws of economics governing oil production, consumption, and prices, will flip over to a whole new paradigm. And because oil is very much the key commodity at the root of all economic activity in the modern industrial world, the flip-over of economic laws governing oil will deeply affect, and even potentially flip over, the fundamental economic laws governing all the world’s industrial activity.

And… I thought I would just add a couple of charts taken from the EIA’s latest <a href=”http://www.eia.gov/forecasts/steo/”>Short-Term Energy Outlook</a>.

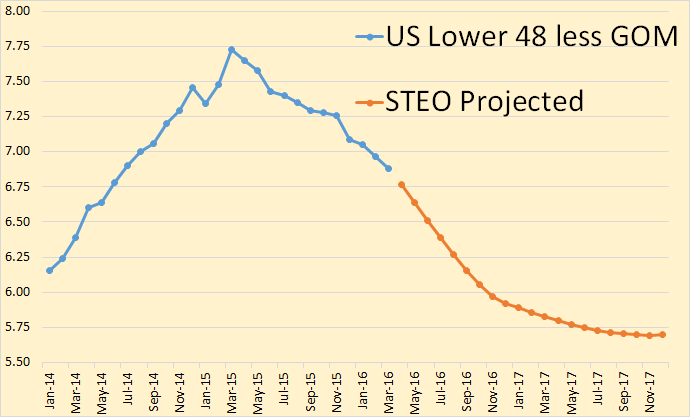

The EIA expects shale oil and the rest of the lower 48 states to continue to decline but slow the decline next year and plateau in the last quarter of 2017 at 5.7 million barrels per day.

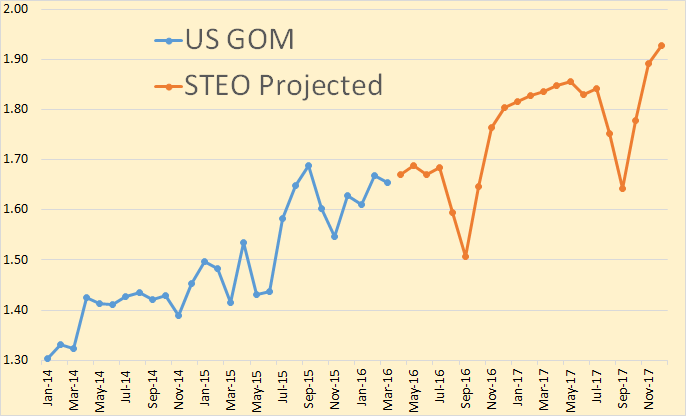

The saving grace, the EIA believes, will come from the Gulf of Mexico. They have GOM production reaching 1.93 million barrels per day in December of 2017. The spikes downward in August, September and October of 2017 and 2017 are obviously the EIA trying to anticipate the hurricane season. I think they are being overly cautious here. It is unlikely that disruptions of this magnitude will occour.

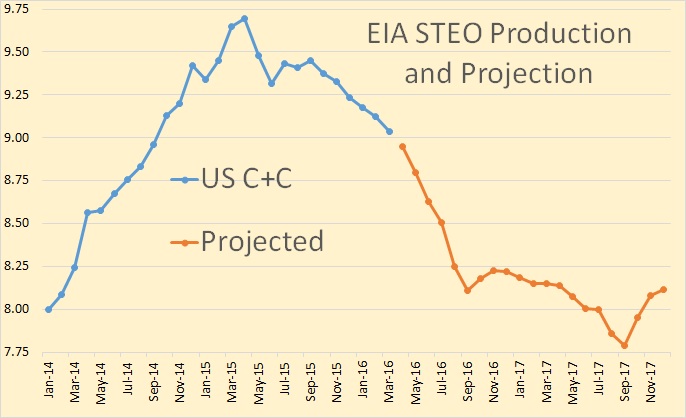

And, after you combine the two above charts then add in Alaska you get the above production numbers and projection.

Jean Laherrere posted me all the below: It is good to see that he is also in agreement with the above article.

Jefferson in this 2016 paper writes page 9:

put bluntly, the standard claim that the world has proved conventional oil reserves of nearly 1.7 trillion barrels is overstated by about 875 billion barrels.”

quoting his 2014 paper: 16. Jefferson M. Closing the gap between energy research andmodelling, the social sciences, and modern realities. Energy Res Soc Sci 2014, 4:42–52.

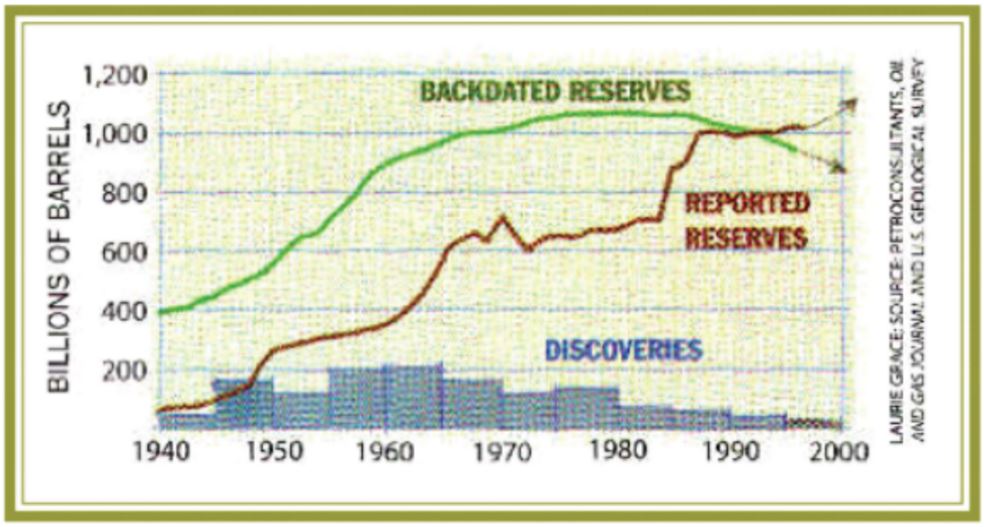

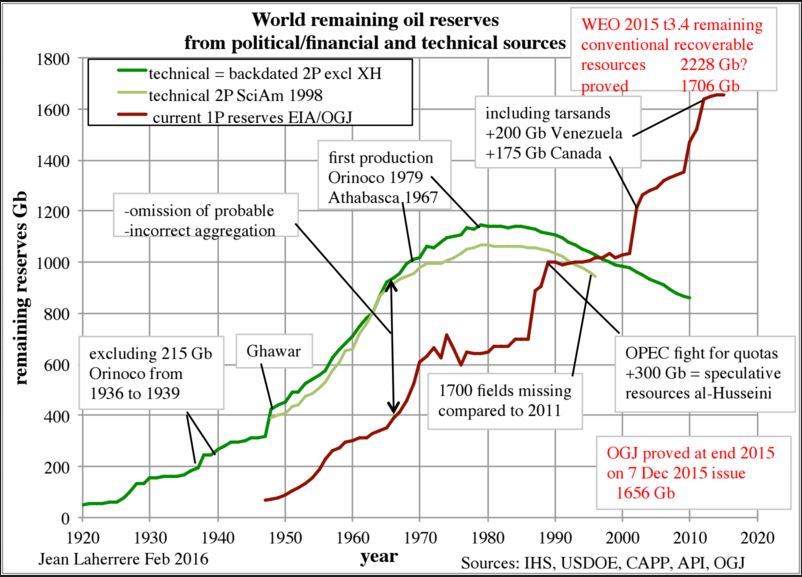

Since my graph of political current proved and 2P backdated remaining reserves in 1998 Scientific American (with 1700 missing fields) I have updated often in many paper this very important graph (the most in my opinion) because it explains the huge discrepancy between the economists relying on official data and the technicians relying on confidential data

You can see in my graph the conventional oil remaining reserves is at end 2015 about 1700 Gb for IEA and OGJ (EIA) but about 800 Gb for the backdated confidential technical sources, in line with Michael Jefferson

I am glad to see IIASA (which designed the very optimistic energy scenarios for the IPCC reports, in particular with the crazy CRP 8.5) showing more realistic assessments.

Hi Ron,

I have gone from being a peak oil doomer to being somewhat hopeful that some people and some countries have a decent shot at coming thru the coming natural resources bottleneck more or less whole, if a hell of a lot SKINNIER, with LOTS of notches taken up in the collective belt of society.

This move from the doomer camp to the cautiously hopeful camp on my part is based on fast falling birth rates in most of the world, along with the fast falling cost of renewable energy, and the resulting fast growth of the renewable energy industries.

But I have never doubted that you are dead on about the actual facts when it comes to oil in the ground.

If I am still able to drive ten years from now, I will probably be the proud owner of two old Chevy VOLTS or similar cars, and be charging one while driving the other, using my own pv system. That ought to just about take care of my PERSONAL oil consumption. 😉

There’s just no way oil can STAY cheap in the face of depletion over the middle term, meaning four or five to twenty years or more, other than that the world economy goes to hell in a hand basket. It will take that long, twenty years, at the best, for us to get away from oil, even with the best of luck on the technology and leadership fronts.

Hey OFM, I’ve been right there with you in your shifting from the “doomer” camp to the “cautiously optimistic” camp. Here is some of my reasoning.

At the end of 2007, when I first became aware of Peak Oil, there was less than 10 GW (7.8 GW) of solar PV generating capacity world wide according to data pulled from the Wikipedia page Growth of photovoltaics while at the end of 2015 worldwide PV capacity stood at 227 GW (IEA PVPS Snapshot of Global Photovoltaic Markets 2015), almost 30 times as much as the 2007 figure in just eight years!

Over the same period, according to data from the EIA’s Electric Power Monthly the contribution of PV to US electricity generation grew from 0.015% to 0.94%, more than 62 times greater! Electricity generation from wind also grew from 34.5 TWh to 190 TWh or from 0.83% to 4.67% of the total electricity generated.

Wind has become the least cost source of electricity in the world, not accounting for it’s intermittentcy with solar plus storage projected to become the lowest cost source of electricity within the next ten to fifteen years, according to Tony Seba.

In 2007 there were zero series production, highway capable, battery electric vehicles available for purchase anywhere in the world, while there are currently some 12 different models available in the state of California, out of a total of 33 plug-in (including hybrids), highway capable vehicles.

Electric Vehicle Sales Continue To Be Unstoppable In China – Up 170%

There are at least two models of 40 foot, battery operated buses available in the US, with one of them coming from a Chinese outfit that has orders for and is building thousands of theses buses, most for the Chinese market.

In summary, when I first became aware of Peak Oil the world was absolutely not ready for a permanent decline in global crude oil production but a lot has changed in the ensuing eight years. IMHO most pundits, including Ron are underestimating the rate at which the transition away from fossil fuels, towards renewable technologies is taking place. Even though the transition to electrically driven road transportation is in it’s nascent stages, the transition is definitely underway as is the transition from fossil fuel generated electricity to electricity generated from renewable sources.

As I have opined on this site before, I believe it is going to be a race between the transition away from fossil fuels and the decline of world oil production. In my best case scenario, Tony Seba’s prognosis will turn out to be right or slightly conservative and the talk will be about how the oil age did not end for the want of oil. In the worst case scenario, the doomers are right and we all go to hell in a hand basket.

That is one of the things I like about Bernie Sanders. He dares to dream and talks big on energy efficiency and the transition away from fossil fuels, in his usual style, in a revolutionary way. If he ever gets to influence US energy policy, the transition would likely accelerate.

Despite my optimism, I do not rule out a sudden collapse in production at Ghawar (a la Cantarell) that throws the world into disarray and results in the “hell in a hand basket” scenario. I’m just hoping, that does not happen.

Please excuse me, but electric cars mostly run on fossil fuels such as coal or natural gas. There is some hydro in some places and nuclear, but good luck with new nuclear fisson reactor build outs to replace declining coal and natural gas.

So don’t forget where your “clean” electricity comes from. It’s mostly from dirty fossil fuels.

Please excuse me, but electric cars mostly run on fossil fuels such as coal or natural gas.

Ok, but there is nothing stopping a transition from that to more wind and solar as as they are already cheaper than coal and gas.

correct. With transportation, as well as home heating via heat pumps, increasing electrification breaks the “hard-wired” (or piped) connection between energy source and final energy use. Electricity is an energy currency, not an energy source. Various generating sources convert their energy to the common currency – electricity – and the various energy demands tap that currency to convert the electricity to transportation, heating, cooling, light, water (via electric pumps), cooking, refrigeration, lawn mowing, etc. etc.

By electrifying as many energy uses as possible, it allows the greater community and the market to DECIDE what mix of energy sources to meet the load, including natural gas, hydro, wind, solar, geothermal, bio-mass, coal, or bicycle trainers.

Hey Fred, I’m tempted to think that “Dr.Doom” is a “drive by” poster. If he had bothered to try and understand my post or to check anything put out by Tony Seba, he should have realized that I was hinting at renewables eventually replacing FF for electricity generation in addition to a transition to electrified personal transportation.

Yes, I think the same. Dr. D is more than likely a paid drive by poster.

Cheers!

Umm, what? You think Dr. Doom is a paid astroturfer?

What possible interest group would pay for Dr. Doom’s post? I’m very watchful for such astroturfing, and in this case that accusation seems silly.

Dr. Doom’s post was just a reminder of basic factual information. There is a common DELUSION that renewables can replace fossil fuels. I’m well aware it’s taboo among environmentalists to say so, but it’s utter nonsense to claim that renewables can replace fossil fuels. Renewables can correctly be thought of as fossil fuel EXTENDERS, but not as a possible replacement.

Was the thought that anyone reminding us of this unpleasant FACT must be a paid shill for the fossil fuel lobby? If so, then I must be one, too, and I want a raise. That way lies madness.

P.s. The nuclear industry truthfully claims that renewables can not replace fossil fuels. That industry’s lie is claiming that nuclear power CAN replace fossil fuels. It can’t.

Instead, as the fossil fuels fade we will have less net energy for industrial civilization. Whether that will lead to a fast-collapse or a slow-collapse situation we can’t tell, but collapse we shall.

Bruce S.

Hmmm, with 14545 kWh per acre per day, you think that solar energy can’t replace an inefficient, limited and difficult to find resource?

The energy density of oil is about 1 kwh per acre.

No need to find sunlight, it’s there, every day. No searching the hills, the shoreline or under the deep ocean. No sun wars. It’s right there. It’s abundant and it’s source will outlast any need we have for it. Oil on the other hand is not and will be gone soon anyway.

Watcha gonna do then? What is your plan?

“energy density of oil is about 1 kwh per acre”

What does that mean? A barrel of crude has an energy density (by definition) of 37 MJ/L (where 1.0 MJ ≈ 0.28 kWh). How do you come up with oil (volume unspecified) = 1 kwh per acre?

Doug, it’s the production of oil spread across the earth’s surface to make a direct comparison to sunlight. The whole earth production of oil energy is almost nothing compared to solar energy. It’s pitifully small.

Volume = 90 million barrels per day for the whole earth production – and falling.

Sunlight is ubiquitous and highly dependable. Oil must be sought, drilled, produced, gathered, transported, refined into components, transported, sold at retail and finally put in the storage tank of a vehicle. A lot of energy and infrastructure goes into doing that, so the energy is even less, since a lot of energy had to go into those activities. Then the useful energy is about 20 percent of that. A giant, expensive system to collect a small amount of useful energy.

People complain that it’s hard to collect solar energy because it’s distributed. Oil is distributed around the world and must be collected, stored, transported, etc. before it is even converted to a useful form.

That kind of logic is illogical.

I’m well aware it’s taboo among environmentalists to say so, but it’s utter nonsense to claim that renewables can replace fossil fuels.

I contended that it is utter nonsense to claim the exact opposite or that renewables can not replace fossil fuels.

First, what the hell do environmentalist taboos assuming they exist, have anything to do with how energy can or can not be produced and used? Those are engineering problems subject to the laws of physics and chemistry.

Instead, as the fossil fuels fade we will have less net energy for industrial civilization. Whether that will lead to a fast-collapse or a slow-collapse situation we can’t tell, but collapse we shall.

Once you have gone through Tony Seba’s lecture on clean energy disruption and grasped the basics then you might want to get into a bit of a reality check on the chemistry and materials science front coupled with the global availability of lithium. Currently there are 1 billion ICE automobiles in the world.

The current global lithium reserves would allow us to build energy storage for the entire grid and produce enough for a lot more than a billion Tesla model Ss/ But if Tony is right we won’t need even a fraction of that number.

Great talk at MIT by Dr. Yi Cui, an Associate Professor in the Department of Materials Science and Engineering at Stanford University

https://goo.gl/BC59Px

Hope you enjoy chemistry lectures, He does provide some numbers and hints at some geopolitical implications near the end in the Q&A

My personal hunch is that fossil fuels will be irrelevant to the global economy in a very short time frame.

Oh BTW there are a number of red and brown marine algae that accumulate lithium in high concentrations so I’m sure we can bioengineer those organisms to help us produce lithium from sea water in case our reserves on land run out and we can’t find ways to recycle lithium from our used batteries. Though that will be a dissertation for another day!

Cheers!

Interesting how some people can casually dismiss, through technology, most any problem, while its detrimental effects are dismissed, if not ignored, with equal aplomb.

Caelan,

I don’t think you really get my synergistic points of view about what I see happening.

I’m just reporting what is already out there.

BTW, Humans already have this technology and we are already using it. The genie has been out of the bottle for a while you just have to make your three wishes wisely… remember this word ‘Lifecode’

https://goo.gl/iRf6Rk

For four billion years, what lived and died on Earth depended on two principles: natural selection and random mutation. Then humans came along and changed everything — hybridizing plants, breeding animals, altering the environment and even purposefully evolving ourselves. Juan Enriquez provides five guidelines for a future where this ability to program life rapidly accelerates. “This is the single most exciting adventure human beings have been on,” Enriquez says. “This is the single greatest superpower humans have ever had.”

So I’m pretty sure that sooner or later someone somewhere is probably going to bio engineer organisms to increase their propensity for accumulating elements such as lithium. Is that better for all life on earth than mining coal and burning it in power plants to generate electricity, I don’t know, but I think the possibility that it will happen is a number far greater than zero.

Just to keep things somewhat in perspective 3.5 billion years ago cyanobacteria started producing oxygen and changed the atmosphere destroying the habitat for anaerobic bacteria on earth.

Was that a good or a bad thing? Don’t bother trying to answer, it is a trick question. 🙂

Before I forget, Fred, one thing thought of today, and something we might sometimes forget, is that previous civilizations didn’t collapse or decline because they ran out of oil. They declined and/or collapsed for other reasons.

Cyanobacteria weren’t/aren’t conscious nor do they possess conscience. I suspect that the universe does, though– possibly the latter, too– and that it knows I am writing this.

Gartenn (Garden)

Excellent paper, Caelan. Saved.

I’ve been looking at the inequality dynamic and the boom-bust cycle in ecology as aspects of our current social crisis, and this neatly combines the two analytically. Thank you. I think this paper is very important.

It’s a common DELUSION that renewables cannot replace fossil fuels.

Renewables already *are* replacing fossil fuels. It’s not going to take very long, either. If you’d bothered to do the math, you’d see just how ludicrously much sunlight we can capture for power. The ingredients of silicon solar panels are all extremely common and are refined using electricity, which can be generated by (naturally) silicon solar panels.

This is the first true “closed fuel cycle”, something the nuclear proponents advertised and never achieved.

The problem for solar panels has always, and only, been upfront price. Fossils have been cheaper. The moment solar gets cheaper than fossils — which is happening RIGHT NOW — solar will take over world energy production, very very fast.

Please excuse me, but my two electric cars (Leaf and Volt) run on solar and wind.

12 KW of PV solar on my roof gives us net-zero energy for both house and cars.

One electric provider in Texas has so much surplus wind power that they give away free electricity after 9 PM. Perfect time to charge your electric car while you sleep.

I wish someone would pay me to do these “drive by” posts! You guys are delusional. Wind and solar PV are still minor players most places, they take fossil fuels to make and maintain, and they will go away just about when the fossil fuels that support their use goes away. Meanwhile, there are severe problems with interfacing these energy sources to the grid, because of intermitencies.

My day job is a professor and a scientist. I don’t always get to post and read all the comments, but you can ask Ron if he’s ever heard of me. I go back to The Oil Drum (TOD) days.

Look, even Chris Matenson knows the score on alternate energy. The big problem is there is no alternative to what we’re burning up right now, not at the SCALE we’re running things, like western and most eastern civilization. Google King Hubbert, for Christ’s sake. He knew we were fooked about 40+ years ago when he wrote the energy resources chapter in the classic book “Resources and Man” (1972).

We needed a fusion or even a fission nuclear build out and it simply didn’t happen. Enjoy our final days, for they are numbered. Meanwhile, I’ll be happy to take your questions.

Wind and solar PV are still minor players most places, they take fossil fuels to make and maintain, and they will go away just about when the fossil fuels that support their use goes away.

Really now?! Oh well, I guess you are right since we haven’t managed a fission reactor build out solar and wind are doomed and so are we.

Well given the state of my local coral reefs we may indeed be doomed but it certainly isn’t because fossil fuel use is going away.

BTW, I really do not understand this notion that because solar and wind are supposedly STILL minor players they will always be so. How many people were driving ICE powered automobiles in 1900? That was only 116 years ago

The big problem is there is no alternative to what we’re burning up right now, not at the SCALE we’re running things, like western and most eastern civilization.

Yeah, and so what? That only means that our current form of civilization is not sustainable, I think most people here already knew that. So we must be headed for some major changes which could include collapse of the current economic system, that could lead to massive dieoff of human populations but I very highly doubt that nothing will remain and that assuming some pockets of humanity remain that they will not be using alternatives instead of fossil fuels.

I’m a bit tired of all doom and gloom and will continue to hold out some limited hope because there are some bright spots in the world.

https://goo.gl/kxvoTq

Live conversation between UN Secretary-General Ban Ki-moon and Bertrand Piccard

Cheers!

So we must be headed for some major changes which could include collapse of the current economic system, that could lead to massive dieoff of human populations but I very highly doubt that nothing will remain and that assuming some pockets of humanity remain that they will not be using alternatives instead of fossil fuels.

I’m a bit tired of all doom and gloom and will continue to hold out some limited hope because there are some bright spots in the world.

Really Fred? You are tired of all this doom and gloom yet you hope some pockets of civilization just might survive the dieoff? Well hell, I hope so too.

Your position on this is about as doomy and gloomy as they come Fred. And you are tired of all this doom and gloom?

That is called “cognitive dissonance” Fred: the state of having inconsistent thoughts, beliefs, or attitudes, especially as relating to behavioral decisions and attitude change. 😉

I know, Ron ! I know! What do you suggest as an alternative? Suicide? I guess that is always an option, right? If I recall correctly you have a daughter what do you tell her? I have a son what should I tell him?

“Alice laughed. ‘There’s no use trying,’ she said. ‘One can’t believe impossible things.’

I daresay you haven’t had much practice,’ said the Queen. ‘When I was your age, I always did it for half-an-hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast. There goes the shawl again!”

― Lewis Carroll

Anyways, when Bertrand Piccard and Andre Borschberg embarked on the Solar Impulse project over a decade ago how many people do you think told them that what they were planning was completely impossible. Yet somehow they are flying around the world in a solar powered airplane today.

So forgive my daily cognitive dissonance it’s still better than ODing on opiates or hanging myself… 🙂

Wanna buy my latest T Shirt?

If I recall correctly you have a daughter what do you tell her? I have a son what should I tell him?

You do not recall correctly. I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed.

“I’ll be happy to take your questions.”

Have you looked at anything put out by Tony Seba?

As someone who is scientifically inclined, I am interested in what more learned people think about his prognostications and I ask the above question with complete sincerity. I have a Google search for him which I sort by upload date to try and catch the most recent of his presentations. here is the URL for that search but, if the URL does not preserve the sort order you may have to click on “filters” and sort by upload date:

https://www.youtube.com/results?q=tony+seba&sp=CAI%253D

The most recent full presentation available as of today (April 25, 2016) is:

Clean Disruption – Why Energy & Transportation will be Obsolete by 2030 – Oslo, March 2016

An excerpt from the above full presentation that cuts to the chase, as far as this particular discussion goes is:

The Energy Storage Disruption – End Of Peakers by 2020 and Baseload by 2030

My take away from his presentations is that solar PV is going to increase exponentially and eventually overwhelm all other sources of electricity, both in terms of scale and cost. He claims that the cost/performance trajectories of solar PV technology along with the cost/performance trajectories for batteries (lithium ion) all but guarantees this outcome. He does not rule out other battery technology but, makes the observation that, any new electricity storage technology that comes along, will have to compete on this basis of the ongoing cost/performance trajectory of lithium ion.

I would welcome any well thought out criticism of Seba’s projections since, it appears to me that the longer BAU can be drawn out, the more likely it is that, his projections will turn out to be reasonably accurate. He actually is on record saying that the end of the age of oil will come about because, the alternatives will turn out to be better.

I would prefer if people comment on Seba’s projections after they have actually watched one of his presentations or read his book (Clean Disruption).

Hi Islandboy,

Seba is very convincing in his recent presentation.

I encourage skeptics who have an hour to spend, to watch the video. I plan to buy the book.

Seems too good to be true. If he is correct, peak fossil fuels will not be a problem. I think the fast trends in adopting these new technologies are unlikely to happen as quickly as Seba believes.

He is predicting about 15 years, I think 35 is more reasonable, but agree that it will happen.

It is interesting to think back 35 years (around 1980) and think about changes in technology since that time.

Probably reality will be somewhere between Seba’s forecast and my “realistic” forecast, maybe 25 years or 2041. I plan to buy a Tesla Model 3 by 2020, by that time the cost may be 30K or less.

You guys missed this new electric car in your discussion. (Just to cheer you up)

https://onedrive.live.com/?authkey=!AFDbbgX8yqCnkXY&cid=841C36C60BF92CC5&id=841C36C60BF92CC5!1342&parId=root&o=OneUp

Thanks Paulo, I’ll take my next new ride with double D’s.

Thanks Paulo,

Very funny.

The page says it’s not available.

Seems too good to be true. If he is correct, peak fossil fuels will not be a problem.

I don’t think that quickly transitioning away from fossil fuels will not cause major disruption and severe problems in many parts of the world.

I fully expect peak fossil fuels to cause some deep pain, look at Venezuela or Egypt. I certainly don’t think I’d want to be living in Saudi Arabia in five years time either but I do think things will happen at a faster rate than most expect.

I agree Fred, the market for EV’s and batteries is too huge for investors to ignore. Things will change faster than expected. This is one of the biggest business and work opportunities in modern times. It involves transportation, technology and energy production worldwide. This is not an energy problem, it’s a manufacturing problem.

Every time the price of oil rises, it will be a big boost for EV’s and the renewables that will power them.

If we have problems in the world it will mostly be in places that depend upon oil as major income that have not planned ahead.

Fred,

Yes, it will be a problem, but if Seba is correct a lack of energy may not be the problem, it will be the rapid transition, and people’s inability to foresee the coming changes. For those who depend on the fossil fuel industry for their income it would be a big problem indeed.

Too rapid a transition will be very difficult.

Hi Fred,

It was less than 10 years ago the discussion on TOD was that politicians wouldn’t talk about the crisis at hand. Today, one American political party considers climate change the number one priority man needs to address. EV’s are now just a few years from becoming the standard. Solar panels prices are dropping almost as fast as data storage. Almost 10% of the homes in Southern California now have solar panels. World governments understand the dangers of climate change and have come to agreement to roll back emissions.

Hopefully you have educated your children on the importance of minimizing our impact on the environment and controlling reproduction activities.

My projections keep putting 100% solar sometime in the 2030-2040 range. Also 100% of new cars electric, same time range. Heating takes longer because peope are dumb about replacing heating.

If I had to bet I’d bet on the beginning of that time range, more like 2032. I think solar dominance comes before electric car dominance because it’s easier to ramp up solar factories than car factories., but I could be wrong.

Hi Nathaneal,

I would think there would be some wind in that mix, it might make sense to have a little natural gas backup (2% or so) as that may be cheaper than battery storage. The plants have already been built and natural gas prices might be low if demand is low.

If you mean 100% of new power plant additions, then we agree.

Dr. D said

“The big problem is there is no alternative to what we’re burning up right now, not at the SCALE we’re running things”

I agree there is no alternative AT the scale we are running things now. Solar energy is over 20,000 times the scale we are running things now.

Only a bunch of numbheads would allow us to become dependent upon a scarce, limited, inefficient and polluting resource such as oil. Only those who can’t even do simple math could believe petroleum is the major source of energy available on earth.

See that bright thing up in the sky, that is the sun. I live in a cloudy, northern area and still get an average of 4 kWh per m2 per day. Doesn’t take much area to provide all the energy I need. Add to that the fact that electric motors are far more efficient than ICE engines and it’s an easy winner. Makes me wonder about the time and money and deadly wars humanity has wasted on oil.

Nobody is paying me to do any of my posts.

And my day job is also as a professor and scientist.

Most of my colleagues are in denial. They actually discuss 10-20-30 year plans for the university. If it’s still occupied by then, the buildings will probably be used to house the homeless, assuming the water and power are still supplied, not to mention sanitation services, and the homeless are still being cared for by whatever passes for a society here.

The problem is well recognised, but not widely discussed except on lists and blogs like this one. Hindsight is always 20-20. Think of the opportunities lost, especially to the winners of the last world war. We chose capitalism, a market economy, and allowed a population boom to fuel demand. The liquid fuels then looked limitless, but some, like King Hubbert knew otherwise. In 1956, he gave one of his first public warnings, widely ridiculed at that time by those who failed to understand the math.

Now, we have painted ourselves into a corner, continue to saw on the support limb, etc. It was a collective decision. The financial aspect of our economy will be the first to implode, then will follow all sorts of related disasters, lack of supplies, grid failures, plagues, etc. That is how the system is gamed. Google Richard Duncan. Read Gail Tverberg’s blog, “Our Finite World”. The Limits to Growth folks look increasingly accurate in their models and predictions made 40+ years ago. Mostly, we don’t have much time left to turn anything around. Check the subject of this post by Ron.

It’s nice to dream of electric cars and solar PV, wind farms all over the place, replacing our fossil fuels. To remain somewhat sane, I can also dream dreams of fusion-powered civilization and the things we could do with abundant cheap energy (once again), but we all know that we’ve already polluted the atmosphere and ocean so badly that Earth, our only home, will be a difficult place to live on in the all-to-near future. Reality bites hard.

Hi Dr Doom,

Well there are other professors and scientists who do not agree with you. That does not mean they are correct, but things have changed very fast in technology. When costs of Batteries and Solar fall to a certain point, the demand for EVs and plugin hybrids will increase quickly and energy production by solar will also increase dramatically.

Solar-powered civilization IS fusion-powered civilization.

Look, I study this stuff professionally from an investment persepective.

— The exponential growth of solar power is just a fact and it’s not going to stop until the market is saturated. Google Swanson’s Law. Solar panels provide a startlingly large amount of independence from the supply chain, and as a result, they are being installed all over the place: they provide resilience.

— Wind is folliowing the same trajectory but slower.

— Electric cars are following the same trajectory but slower.

— Batteries are following the same trajectory though slower.

— Heat pumps are following the same trajectory…

I’ve actually plotted out all these trajectories,and critically, the price points where people switch to alternatives.

— When natgas exceeds $4-$6 (not sure) people switch heating to air-source electric heat pumps. Geothermal may be adopted at lower prices for large buildings.

— When grid electricity prices exceed 14 cents/kwh, rooftop solar is installed. (Varies by region but this is close enough.) Price continues to drop.

— When grid electricity prices exceed 29 cents/kwh, solar + batteries are installed. Price of both is still dropping.

— When wholesale electricity exceeds 5 cents/kwh, utility-scale solar is installed.

— When oil prices exceed $40/bbl, it’s cheaper to operate an electric car (at typical grid electricity prices), so anyone who has the upfront cash switches. Upfront cash prices are dropping.

— Wind is being installed as fast as the NIMBYs can be overcome because it is cheaper than anything.

This is a lot of demand-destruction for fossil fuels.

Yes, we’ve already baked in a dangerous and horrible amount of global warming and ocean acidification, which will cause mass famines, as well as flooding. But we’re going to actually get off of fossil fuels and we’re going to do it fast. The laggards who still depend on fossil fuels will suffer the second most. (The greatest suffering will be those who live in countries which will be entirely flooded.)

Peak oil is like peak anthracite (which Hubbert modeled his theory on) or peak whale. We switch to an alternative. The weird thing is how long it’s taken for the alternatives to oil to become cheaper than oil… I would have expected it to happen in the 1980s… but it’s happened now.

Does anyone consider the long supply chain that is dependent on fossil fuel? How does anyone think they can get the neodymium from the ground in China? EVs? Electric Excavators? (that is if China is still capable of supplying it). How about the Indium for the microchip or the tantalum for the capacitor? How about anyone get 99.99% purity arsenic for making semiconductor that is required for the chips. How about other rare earths like cerium, dysprosium or any rare earths that are required for the magnets in wind turbines or even electric motor in EV? Who is going to make the chips, the casing, the high strength steel that is required? How are they going to mine these minerals and how it is going to be transported 5000 miles? The parts of EVs are made by companies scattered across the world and many of them are protected by patents. No one knows what is inside and replicating it is impossible. There is an EEPROM or Flash and no one knows what is inside the software.

When the supply chain is down, you cannot even get the food on your table (i.e. all supermarkets are supplied by trucks).

So, can anyone tell me how EVs will work when things go south? Who has the skills and raw materials to make the parts and assemble them ? Be it EV or wind turbines, just because of a missing high strength screw, the whole EV may not run and the whole wind turbine may just fall apart (vibration). Nothing in the EV/Wind turbine can be produced locally.

p.s. I am an engineer working in a high tech firm that is in charge of sourcing parts for the machines. At times, we have to wait for a few days (with the machine down) due to a special part that no one in the world knows how to do except for a small company in Europe and they are having difficulties producing it (as their supplier has problem supplying them some parts). We are that precarious in the supply chain when everyone depends on someone else for their end product.

Witness the breakdown of JIT in the recent Japan earthquake.

How does anyone think they can get the neodymium from the ground in China?

There was trade of rare substances thousands of years ago without the use of fossil fuels!

Kerala had established itself as a major spice trade centre from as early as 3000 B.P, which marked the beginning of Spice Trade…

I’m pretty sure we will have sailboats and camels for a long time to come…

Cheers!

camels horses and donkeys will go extinct directly after the grocery shelves go bare.

The camels and donkeys I have known run around in places so hot, dry, high, thorny and all around inhospitable that nobody dependent on grocery shelves will have the skills to get anywhere near them.

Hi CTG,

Fossil fuels will not disappear overnight. The supply will fall and prices will rise and substitutes, such as EVs, wind and solar will become more competitive. As production of these new technologies ramps up costs fall further and the transition will accelerate.

But by your logic we could never have gotten to where we now are in the first place.

Fossil fuels are not the only way to do things. We are rapidly creating an industrial base of renewable energy. Electricity can power transport (electric trains and trucks are standard technology) and presently is used to smelt metals (e.g. steel and aluminum).

“How does anyone think they can get the neodymium from the ground in China?”

How do the Germans get their lignite from the ground?

Exactly!

Using Electric Excavators! Which they’ve been using for decades!

https://en.wikipedia.org/wiki/Bucket-wheel_excavator#Lignite_mining

You may need to use Google Translate for this:

https://de.wikipedia.org/wiki/Schaufelradbagger#Verlegung_in_andere_Tagebaue

“[…] how it is going to be transported 5000 miles?”

By using electrically powered trains perhaps?

Which, sensationally, can even travel below ground!

https://en.wikipedia.org/wiki/Gotthard_Base_Tunnel

And do you know how the Swiss built that tunnel?

By using plain old explosives (in parts) and ELECTRICALLY powered tunnel boring machines (in other parts of the tunnel, depending on the rock)

And do you know how non-trans-continental transport can be done without burning fossil fuel?

Let me give you a hint: http://www.auto.de/magazin/customs/uploads/auto/2014/08/Siemens-testet-elektrische-Autobahn-Oberleitungen-f-r-emissionsfreie-Brummis-sp9w-600×400.jpg

Seriously, you call yourself an engineer and don’t know half the shit that’s been accomplished since Werner von Siemens invented modern electrical engineering?

Gerry,

Don’t you know that mechanical engineers don’t believe in electrons? If you can’t see them, they’re just “theoretical”. 🙂

Elon Musk is deliberately shortening his supply chain — he wants to source everything for Tesla from North America specifically to shorten the supply chain.

I anticipate more actions of this sort. In-sourcing, avoiding long supply chains.

Dr.Doom, you really really really need to get a clue, so I’ll explain it slowly.

1 — every single thing in the solar panel factory process, from the sand mining through the silicon refining through the cell construction through the module construction through the transportation of modules, can be run off electricity. Most of it already IS run off electricity.

2 — All electricity can be generated using solar panels.

3 — Every single thing in the battery factory process, from the cobalt mining and the lithium refining onward, can be powered using electricity. Most of it already IS powered using electricity.

4 — Electricity for use at night can be stored in batteries

5 — With the sole exception of steelmaking, everything in a wind turbine can be made using electricity. Most of it IS made using electricity.

6 — All steelmaking from recycled-steel sources can be done with electricity TOO, and the problem of steelmaking from raw iron ore using electricity is being worked on.

7 — there is so much sunlight that we have enough power to run 100 times our current industrial civilization, if we just *use it*.

Like all new technologies, solar growth is *exponential*. On average, over a long time period, solar installs double every two years. Do the projections.

Swanson’s Law tells us that each time this doubling happens — every two years — the price of solar modules drops about 20%.

At some point this growth rate will slow down, but given the huge world demand for cheap power, I think we will have replaced nearly all fossil fuels well before the growth rate slows down.

There are still some annoying problems: airplanes need high energy density; steelmaking needs carbon; concrete needs to be replaced with Novacem or Ferrock to avoid CO2 emissions; but these are quite minor compared to the burning of fossil fuels in general.

I’ll be happy to take your questions.

“steelmaking needs carbon”

This is not essential, only conviniet, you provide energy and reduction agent with the same stuff. However, it can be substituted.

Fossil fuel for planes is more tricky or expensive.

The important point is that electric motors are roughly 99% efficient, with batteries about 90% efficient. Gasoline and diesel engines are less than *20%* efficient.

Using electric power to operate a car uses less than 1/5 as much energy as using gasoline directly. In fact, if the electric power were entirely generated by *coal*, it swould still generate less CO2 emissions than a gasoline car, because the electric motor is so much more efficient.

In fact, solar and wind are taking over the electric market with exponential growth, so your car will not run on coal in a few years.

Hi Nathanael,

It was my understanding that EV’s energy use was more in the 1/3 to 1/4 range compared to gasoline or diesel. But you could be correct.

More important, I think this is a fact that those who think solar or renewables can’t replace oil don’t understand.

An efficient small ICE car (40 mpg) uses 0.9 kwh/mile. Electric cars use 0.3 kwh/mile (some less). Both figures can be improved, in fact the technology to bring EV’s to 0.2 kwh/mile or less already exists and that is without going to ultra-light bodies. That means that the ICE wastes about 78 percent of it’s energy use compared to an EV.

An average ICE car uses 1.5 kwh/mile.

Where does the energy go? https://www.fueleconomy.gov/feg/atv.shtml

No water pump, alternator, fan to run is a big advantage in lower parasitic losses in EV’s. The ability to recover braking energy is another area of efficiency gain. No need for a radiator up front allows lower wind resistance.

My experience with both Nissan Leaf and Chevy Volt is 4+ miles/kwh, or 140 miles/gallon equivalent vs. gasoline. This is mostly in-town driving, but with quite a few hills.

the problem with private cars is not solely with their fuel source. It is with the huge resources required including asphalt from, guess what? Oil, with the waste of 10 x the land which could be used for growing food or preserving green space, with the iron, steel, glass and huge amounts of materials for private cars. Then there are all the ancillary costs of the 30,000 Auto addiction deaths, the hundreds of thousands of injuries, the need to pay for traffic cops, traffic courts, ambulances and ER rooms for the casualties of Auto Addiction. There is the vast waste of materials for the “Geography of Nowhere” of Auto addicted sprawl described so well by James Kunstler. There is the rampant obesity caused by driving instead of walking. One researcher found a 90% correlation between hours spent driving and obesity.

(NOTE: this is not saying that 90% of obesity is directly due to Auto Addiction but that Auto Addiction is correlated 90% with increases in obesity)

Auto Addiction is not sustainable even if it were possible to provide the fuel from solar electricity nor is it desirable as a way to live.

On the other hand, I am hopeful because by simply running and restoring public transit over Auto Addiction as was done from 1942-45 the USA could easily reduce its oil usage and greenhouse emissions by 10% a year.

Asphalt prices are actually rising already. I expct asphalt to go away. It’ll be replaced with concrete, but concrete is a CO2 emissions problem too. We need to commercialize Ferrock and Novacem…

Nathanael,

So many ways to tackle this.

What is the price difference between an equivalent area of concrete vs. asphalt?

What is the relative cost to “pave” concrete vs. asphalt?

For future expansions which is more costly to adjust?

I don’t know much. I really don’t. I am always learning, and will be learning to the day I die.

Why do we use concrete for projects like bridges , and asphalt for roadways? Why, when it comes to cost analysis, maintenance, and potential modifications, do engineers universally settle on concrete for a bridge, but find re-paving asphalt a more effective solution for roadways?

I do not have the answer.

If you can produce an answer that leaves the world’s engineers flabbergasted you will be a billionaire. If you provide a legitimate answer, and it is not patented I will become a billionaire, so be careful!

I guess we could use wooden roads for EVs made from wood and cow horns.

1 million barrel per day drop in 6 months – wow

Is there any study available how much extra electricity in the grid would be required to switch from fossil fuel to electric cars?

3000 to 4000 TWh annually worldwide needed for full conversion to EV use of 1 billion vehicles. That is compared to a current (2012) worldwide use of electricity of 20,900 TWh.

That’s about right, but probably a bit high. I did a US calculation and came up with an increase in electricity usage of 10% — not sure why the world number would come out to 15%, maybe they have more “cars per electric socket” than the US does.

Maybe the US uses a relatively higher amount of electricity than other countries so the percentage change would be lower.

daniel,

It is quite easy to calculate:

1 barrel equals 1500 kWh oil equivalent

1 mill barrels eaquals 1.5 billion kWh

As electricity consumption in the US stands around 10 billion kWh per day, a replacement of 1 mill barrels of gasoline per day (out of roughly 9 mill bbl/) means an increase of 15 % of electricity consumption.

If all of the gasoline consumption would be replaced by electric cars, this would be roughly a doubling of electricity consumption.

Electric cars would require much less electricity consumption as the oil equivalent, yet the conversion factor for natgas to electricity is at a maximum of 50%.

An electric car gets 3-5 miles/KWh from the batteries. (my Nissan leaf, real world

figures). The most efficient diesels get about 1.5 miles/KWh. (My car, 1.2l engine) The latest designs of combined cycle gas turbine power station are over 60% efficient. There are transmission and battery charging losses. The higher mileage figures for the electric are partly thermodynamics, partly aerodynamics, partly regenerative braking and partly driving style to maximise range . The latter will decline as electric car ranges increase and drivers lose range anxiety and start racing the lights again.

USA VMT is 3 * 10e12 miles per year so full electric conversion would require about

10e12 / 365 ~= 3 billion KWh (excluding heavy trucks and buses, etc). a 30% increase, not a doubling.

Ralph,

Did you also consider that electric cars have up to ten times less milage during the winter? In addition, the average car has much more weight than the average electric car. Then there are also transmission losses and you have to calculate electricity generated from the utility.

I guess doubling electricity demand is still a good estimate.

As most electricity is generated by 60% with fossil fuels at a conversion factor of 50%, it is probably better to use natgas or NGL for cars rather than produce more electricity. To use electric cars in a grand scale would make sense only if the complete electric supply is in wind and solar and hydro pumping storage. Yet this may take a few decades and requires enormous capital.

No Heinrich,

A doubling is not a good estimate at all.

10 times worse mileage in winter, I am doubtful that is a good estimate, sounds like someone from a warm climate driving in winter with the heat on maximum.

The ice gets about 20% of the energy to the wheels, the EV about 90%.

If we use natural gas to produce electricity and get 50% efficiency and 8% is list in transmission and distribution and another 8% charging losses. then we have 0.5*.92*.92*.9=38% of the energy goes to the wheels. We still get twice as much energy to the Wheels in an EV as we do using natural gas to power an ice where efficiency would be no greater than 20% gas tank to wheels. We would also need to build out a lot of infrastructure for natural gas or propane fueling.

Dennis,

another 8% charging losses

We have to convert from AC to DC using a charger. Let’s assume that it is 95% efficient.

But not all energy from changer is stored in the battery. We need to consider leakage of energy during conversion of electrical energy into chemical energy first and then back converting chemical energy into electricity. Battery also have some ohmic resistance, so part of the energy is converted to heat. I do not have real figures by I think a typical loss here is 10 to 15%.

Depending on the chosen drive train technology, the DC power is converted to frequency-modulated AC or to voltage-adjusted DC, before motors can provide motion for the wheels. There are losses here too.

Also high efficiency of electrical motor is possible only when it directly rotates the wheels. If there is a mechanical component in between like a differential it is less.

By multiplying the efficiency numbers one obtains for the maximum possible efficiency of EV car. It is much less then claimed.

http://www.plugincars.com/belgians-measure-ev-efficiency-129078.html

Heinrich, you’re wrong because electric cars are so much more efficient (90%) than gasoline cars (about 20%).

Calculating based on actual real-world mileage rates of the Tesla Model S, replacing all gasoline consumption in the US with EVs would add about 1 billion kwh/day. About 10% of US electrical demand. A bit less actually.

Not 90%. More like 60% See

http://peakoilbarrel.com/peak-oil-back/#comment-568106

Hi Likbez,

One would have to do the same analysis for the ICEV. The engine itself has about a 20% efficiency, the electric motor is about 90% efficient. The power for lights and other systems have to be provided by either vehicle.

Air conditioning will be no better for the ICEV than the EV, lights will be the same, the only advantage would be in heating and that can be reduced with heated seats and dressing warmly in winter.

Bottom line, the ICE engine has 20% efficiency, the power to the wheels is considerably less, about 15%. So the comparison is 60% for a well designed EV to at best 19% for a well designed ICE (non hybrid) so a factor of 3 better for the EV. Also note that if we are going to include charging, distribution, and transmission losses as well as thermal losses at the power plant, then we might need to include the energy used to refine the oil and then distribute it and pump it from underground tanks. These lines quickly become very blurry. The simplest analysis starts at the tank or battery and looks at how energy is converted to power at the wheels.

Or we could look at oil from refinery gate to energy produced at the wheel and compare that to natural gas at the electric power station gate and how much of that gets converted to energy at the wheel in an EV.

See

https://matter2energy.wordpress.com/2013/02/22/wells-to-wheels-electric-car-efficiency/

Bottom line in a Well to wheels comparison the EV is at least twice as efficient as an ICEV.

I think that is the wrong question to be asking. The answer might actually be very little if any at all. EVs might end up working as a battery storage system for the grid.

http://www.scientificamerican.com/article/how-to-sell-power-from-electric-cars-back-to-the-grid/

…”[The cars] essentially act as batteries for the grid,” he said. During periods of low demand, the batteries charge on low-cost electricity, and they can later sell that power back to the grid when prices rise during periods of high demand, making a profit, he said.

The grid benefits from the arrangement as well. It is cheaper than cycling on and off thermal power plants and can be deployed more quickly, said Michael Kormos, senior vice president of operations at PJM.

Do we need a functioning ‘economy’ and/or ‘government’ to make EV’s viable? What kind of economy/government is it, and is it actually functioning? If so, how is it functioning and can renewables support it and EV’s? If so, how soon and for how long? Lastly, do people want or need EV’s? What if they don’t? What if, for the most part, people are unhappy in this so-called economy/with this so-called government? Are EV’s and PV’s going to solve this?

Lastly, do people want or need EV’s? What if they don’t?

EVs will probably not be individually owned, more likely they will be driverless and shared.

People do need transportation and the model of how they get it is definitely changing.

Governments and economies are changing as well.

Fair enough… Well, we may see things shake out increasingly faster as time moves forward.

And the lot of us here all seem to have front-row seats; positions on-stage and/or back-stage passes.

Caelan,

The Chevy Volt has the highest customer satisfaction rating of any GM vehicle ever produced. Suffice to say, once people experience what EVs have to offer they do indeed say they need them.

There’s a reason that Tesla has 400,000 reservations for its Model 3.

A Prius is a sacrifice to feel “green”. An EV is an upgrade from an ICE, but so happens to also be “green”.

Then why the quotes around ‘green’?

Manufactured needs; need-creation; propaganda; public-opinion-shaping; cooked-/misleading-/obscured-statistics-leveraging?

You can have a 400 000-sized population, or, alternatively, a ~ 7 000 000 000-sized population undermine its very survival, and you can call it collapse or decline, or Tesla pre-orders.

The lunatic claims about lithium shortages appear to be spread by FUDsters and oil promoters.

The fact is that there are ludicrously large lithium deposits and they’re extraordinarily cheap to produce even with current technology. Whic is improving every year.

Tesla receives no government subsidies.

Would I rather people took public transportation? Absolutely. But the priority is to get rid of those gasoline cars. There are three electric bus manufacturers in the US, selling very well because the electric buses are cheaper to operate than diesel buses.

I am interested in lithium mining.

Could you post some facts and or links about it relative to mass production of battery powered vehicles and homes?

How is it mined? Where are the deposits located? What is the cost range per unit to mine it in various locales? That kind of info.

Hi Shallow,

I’ve had hands on experience with lithium exploration (not development). Most reserves are in Bolivia (70% of the world’s reserves), plus Chile and Argentina. Apart from local government participation, German and Chinese companies are the big players at least in the South American plays. These are all brines in salt basins where lithium is concentrated by evaporation. There are significant reserves in Australia as well. I could write a book on the subject but recommend Google for through studies by numerous writers.

Check out my post and video link

http://peakoilbarrel.com/peak-oil-back/#comment-567651

BTW Major Lithium deposits are in Chile, Argentina, China and Australia but there are smaller ones in quite a few other places.

http://www.statista.com/statistics/268790/countries-with-the-largest-lithium-reserves-worldwide/

Doug and Fred. Thanks for the info.

Lithium doesn’t just jump out of the ground on its own and climb into batteries and then into EV’s, as much as some seem to make it appear with their cavalier commentary.

EV’s, among a massive number of assorted techoindustrial vomit, require a vast layered global infrastructure of crony-capitalist plutarchic industrial processes; individual, community and environmental demands, destructions and ‘externalities’; roadways, and wage and tax slaves, and so on.

I bet that the addition to the ff grid will be zero or negative as EV’s start to take over. Reasons abound in the present trends toward lower cost of wind and solar, and for example, to EV owners realizing, like I and many others did, that the additional cost of PV to run them is quite acceptable, so the purchase is not just EV, but (EV + PV), meaning zero or negative additional load on grid.

I am puzzled by this bunch’s resistance to the inevitably of EV replacing ICE. Looks like mighty simple arithmetic to me.

Of course I have the advantage of so many hours fixing trivial but incapacitating illnesses in ICE’s, while the electric motors just went on and on for generations, ignored.

And now the PV driving the electric motor just goes on and on, too, equally ignored.

The great thing about PV is that the horizontal surface area of a car is about equal to the amount of PV needed to move an EV the average miles per day in the US. So if we put PV on top of the EV’s themselves, they could produce enough power on average to run themselves if left out in the sunlight.

It will be more complex than that, where some will supply the grid and others will use power from home or grid supply. But on average the EV may need little or no power from the grid. People like me would be suppliers to the grid or to my house from their EV’s since I drive well below the average miles per day.

In other parts of the world, cars are not used as much and will have little impact on grids or actually be suppliers of energy.

Making cars lighter and more efficient while keeping the top surface area large will be key design factors. Improvements in battery design and PV will make EV’s the prime mover worldwide.

The overall market for EV’s and the related battery systems is so huge that it is a no brainer for companies to jump into the market. The first company to do a “Volkswagon Bug” or “Toyota Corolla” type will be the first to make massive inroads. Remember what happened when the cheap, low power imports started coming to this country?

The autonomous driving and all the high end tech is just a distraction at this point. The big market is in a low priced electric that will get 400 miles on a charge, something practical.

Agree with all that. I wonder why some Chinese company hasn’t started selling that low priced EV already. My leaf is good and serves us just fine, but way too fancy and heavy for my tastes.

I was the first guy at NACA in Cleveland to come in with a crazy little bug-looking car after my junky studebaker got shot out from under me.

My buddies joked that it was a roller skate, not a car, but in a few years, they were as common in the parking lot as fleas on a dog.

Some of the kids who’ve worked on this Dutch electric car “Stella Lux” with PV panels on it ought to be out of school, looking for jobs – so start a company, hire them, and out-Elon Elon…

http://www.solarteameindhoven.nl

For technical reasons, Tesla doesn’t think it’s worth putting solar panels on the car roof, and recommends putting them on the *garage* or *carport* roof instead. This is typically enough to power the car.

Hi Wimbi,

For many of us, we agree with the inevitability of EVs and plugin hybrids replacing ICEV, it is a question of the rate of change.

What do you think of Tony Seba’s predictions? All new vehicles sold will be EVs or plugin hybrids by 2025, according to Seba and fossil fuels will be obsolete by 2030.

I agree with him that both of these will be true at some point, but 2035 for all new vehicles sold being at least partially electric (min 50 mile range) and 2050 for fossil fuels being obsolete for transportation and electric power (99% worldwide electricity production by non-fossil fuels) seems more reasonable imo.

Dennis, my projections are based on how fast Tesla can ramp up.

I’m figuring they introduce the pickup truck in 2020, and by 2022 every market segment has an electric variant. There are about 7.8 million new cars sold in the US each year. Tesla is currently set up to produce about 250K for the US in 2018 (250K for overseas). They know they have to increase that, so figure that they multiply it by 4 over the next 2 years, and produce 1 million by ~2020. There will be at least 3 competitors working hard on competing with them withi the US by then, so call it 4 million for the industry as a whole in 2020. Double in the next two years and that’s the new car market.

It’ll be hard to reach a price point to replace the bottom half of the ICE market, but I think that there will be a combination of fewer people buying cars (already happening) and people buying *used* electric cars which will displace that.

I figure by 2022 the majority of new cars are pure electric. I think Tony Seba’s estimates are too *conservative*.

I think used cars will take longer, though. Some fools will buy new ICE cars in 2022 and some will still be on the road in 2032. And then there’s fossil fuels for airplanes… so they won’t be fully obsolete. Still, eliminating car & truck & bus usage is a big deal.

My thinking is simple. “Tis the gift to be simple, tis the gift to be free–“.

It’a based on my wife’s remark, re her leaf ” this is the best car I have ever had, and I would not think of going back to a gas car”.

So, flash forward a few years. A customer comes into the chevy dealer and asks for an EV. Dealer says he’s out of EV’s. Customer walks out and buys one from Honda right next door.

Dealer goes to his convention and hears the same story from all the other dealers. They gripe to chevy that they need more EV’s. Chevy cranks up makng them, after all, one car is mighty like another car on an assembly line. And if there is a demand for batteries, there will be batteries. From wherever. After all, money is to be made.

So, bottom line, I go with Seba. Reason – people really LIKE EV’s. Simple.

It’s enough demand we can’t cover it with natural gas. This is why those long term fiction stories from the IPCC assume the world has extra humongous coal reserves.

Even if we could nature gas is no panacea either. http://thinkprogress.org/climate/2016/02/17/3750240/methane-leaks-erase-climate-fracked-gas/

Think progress doesn’t exactly contain quality information. I’m in the oil and gas industry, and most of their points are bullshit.

I know the work of the Cornell profs who did the first set of studies, backued up by the Harvard studies, and they’re entirely right about the methane leaks.

From what I can tell, a lot of it has to do with the frackers being “wild west” operations who don’t do their well casings right and make no effort to prevent leakage. Another part has to do with terrible irresponsibility by the utilities, who don’t fix leaks.

Your position in the industry prevents you from seeing reality. The fracking companies are mostly in business to scam the conventional oil & gas guys.

Neither Cornell nor Harvard impress me when it comes to this topic. One reason why they are wrong is precisely because they know so little about it.

I can see you are a greenhorn, so let me explain where I come from: the gas industry is way way more extensive and heterogeneous than discussed or measured by your “Cornel perfessors”. To understand the issue you would have to understand the balance for all large producers.

This means one has to range from say Trinidad and Tobago to the USA Gulf of Mexico to Pennsylvania to Canada to Western Siberia to Australia to Algeria to Afghanistan and on and on.

Once you understand the system layout, and where the potential leak points, then you would have to measure representative points, estimate losses, and figure out a means to reduce such losses.

I have actually done it, in several countries, for diverse reasons. The answer is highly variable, the cost to reduce losses depends on the site details, etc. These Cornell perfessors are like Neanderthals trying to understand a nuclear sub. They don’t even know where to look, where the worst emission points are, and of course they don’t have the foggiest idea of how to fix it.

Here’s one approach.

US 2014 Light duty vehicle, short wheel-base Vehicle Miles Traveled – 2,072,071 million miles (Source US DOT BTS)

Worst case EV power consumption 340 Wh/mile (Tesla Model S)

So if all VMT for the US in 2014 were traveled in EVs with the consumption of a Tesla Model S, the total electricity required would be:

2,072,071 x 1,000,000 x 340 = 704,504,140,000,000 Wh = 704.5 TWh

Total Generation at Utility Scale Facilities in the US for 2014 – 4,093,606 GWh (Source EIA EPM)

Increase required on top of 2014 total generation to power all Light Vehicle VMT in 2014 if traveled by EVs nwith the consumption of a Tesla Model S:

704.5 x 100 ÷ 4,093.606 = 17.2%

So, according to the above calculations, if all VMT by light vehicles in the US in 2014, had been using EVs with the power consumption of a Tesla Model S it would have required the production of 17% more electricity. This assumes that there is no reduction in electricity use to refine the needed motor fuels from crude oil.

Have I made any glaring errors?

IB – Numbers look good. +1.002:)

And the magic of PHEV’s like the Volt is that you can get up to 90% of that electricity/gasoline substitution with batteries sized for just 53 miles of range and home 115 volt charging, so long as the EV part of the car is paired with a backup ICE engine. You don’t need a 200+ mile EV with a complex new fast-charging network, etc. etc.

Volt sales are quietly growing and growing, especially with the new generation version with more space, more comfort, more range, more gas MPG, and lower price. People and sales staff finally understand the concept, no “flammable Volt” political rhetoric.

HVAC,

I can back you up here.

I’ve had my Volt a little over a year.

I’ve done ~11,000 miles and used 12.5 gallons of gas.

I basically drove 10,000 miles on 1 tank of gas., and most of that was due to a single road trip.

I also charge for free at work, so my fuel costs are exceptionally close to $0.00.

Looks good but are we not overlooking the FF input to make the EV mining lithium to manufacture batteries raw materials for tyres etc also maintaining roads and the like.

Hi Lights out,

Recycled Steel can be made with an electric arc furnace, a lot of mining equipment can also be electric, rail transport can be electrified. Ships will probably require fossil fuels or biofuel, though they could be nuclear powered or possibly wind powered. There may continue to be some need for fossil fuels, but if wind and solar continue their 20% growth rate as fossil fuels rise in price due to peak fossil fuels, the electricity produced with fossil fuels will quickly diminish.

Tony Seba points out if the cost curve for solar continues on its present trajectory (20% reduction in costs each year), that the price of rooftop solar electricity will fall below transmission costs, the falling cost of battery storage (15% /year reduced cost) will make backup electricity storage reasonably priced. The grid would be used to move power from sunny areas to cloudy areas and to lower latitudes in winter, when days are relatively short.

The combination of Wind, Solar, hydro, and nuclear power widely dispersed, along with EVs and self driving cars will make fossil fuels obsolete as a source of energy. Tony Seba believes this will happen by 2030, my guess is 2050.

Dennis, one thing that ships are good at doing efficiently is carrying weight. I wonder if anyone has done the calculations as to how much battery storage a ship would need to cross the Pacific. Additional power could be had from those spinning wind column generators devised for ships, or decks covered with PV. Battery weight would not be much of a problem on ship since they need ballast anyway.

I also wonder if this would be a good use for hydrogen fuel cell technology.

For example, a large Panamax ship must carry about 12,500 tons of ballast.

The Panamax freighter uses 729,600 kWh per day traveling at 20 knots. That is 7.6 GWh across the Pacific. Considering the engine used is about 30 percent efficient, that would be 2.28 GWhr actual.

If the battery/motor system is 85% efficient overall then 2.85 GWh of storage would be needed. Round that up to 3 GWh. That would be 25,000 tons of lithium batteries or 78,000 tons of lead-acid batteries. That is more than the ballast needed.

A Panamax can carry 60,000 to 80,000 tons of freight, so that would reduce the amount of freight by 12,000 tons or 65,500 tons depending on the batteries.

Obviously there is a need to improve battery energy density by at least a factor of 2 to make the crossing practical.

More efficient ship designs would also assist in moving to electric ships.

The new grapheme batteries might just be the answer.

A ship can use a lot less energy simply by going slower.

Hi Techsan,

I agree. Also a hybrid biodiesel battery powered ship is a possibility, or wind/electric hybrid.

That only works if there is no time factor involved. It’s a measure used when demand is low or fuel costs very high.

If you halve the speed, you need to double the amount of ships to achieve the same rate of tonnage or volume transport. Probably use more energy overall, since bigger ships are more efficient at carrying cargo.

Better to change hull design and use weather info to reduce energy use.

That’s a bit incorrect. A ship’s fuel consumption isn’t a linear function of distance covered.

I have prepared dynamic models for ice capable ships navigating to and from the Russian Arctic to a transfer point on the Kola Peninsula. Fuel consumption in open water can be optimized by the hull shape and the design speed.

I worked a bit with ship parameters, including the fact that a high horsepower ship designed to move through ice has spare to move at high speed. Also changed cases, assumed a ship to ship transfer from ice capable to a simple ice strengthened Baltic class, in conclusion, the ship design can be changed to optimum depending on fuel cost. In our case the optimum was 12 knots in the Barents, open water, which is a rather slow speed.

The battery/motor system is more like 92% efficient. Nothing you can do about the inefficiency of the turbine.

So, OK, a battery ship would carry somewhat less tonnage due to the batteries. But technically speaking they’re entirely practical (carrying 60000 – 12500 = 47500 tons is perfectly respectable) and it’s just a matter of price.

Government action could switch us to battery ships with minimal increase in shipping prices.

Makes more sense to use biofuel and wood chips.

Well, 340 Wh/mile is a bit high, but your calculation is pretty good apart from that.

“Electrical consumption of Tesla Model S 2014 variant

In early March 2016, a report by stuff.tv emerged that VICOM Ltd, a subsidiary of ComfortDelgro Corporation Limited and Singapore’s Land Transport Authority authorised inspection centre, ran a test on a used 2014 Tesla Model S. The test was performed under the United Nations Economic Commission for Europe (UNECE) R101 standards. The results from VICOM states that the car was consuming 444 watt hour per kilometre (Wh/km). However, a check on the U.S Environmental Protection Agency (EPA) states that the 2014 Tesla Model S consumes about 38 kilowatts hour per 100 miles.[420] This is equivalent to 236.12 (Wh/km), a marginally large electrical consumption difference for a 2 year old car. As of 5 March, no explanation was made as to why the results varied so much.” ~ Wikipedia

” If you’d bothered to do the math, you’d see just how ludicrously much sunlight we can capture for power.” ~ Nathanael

“The simple answer is that the 1% creating 50% of the all global greenhouse gas emissions must use a radically less amount of everything. Of course this reality is far less exciting than the dream of a consumerist green utopia. Impressing this green utopia as delusional upon the masses is even more difficult when collectively, your target audience has been spoon-fed entitlement, narcissism and privilege, since birth. The necessity to radically and drastically cut back all forms of consumption (which by default reduces demand for energy) flies in the face of a global economy intermarried and dependent upon infinite growth. Under the industrialized capitalist economy – no solutions outside of market solutions will be pursued or campaigned upon. Thus society… is fed a lie – which is voraciously consumed. The path to ‘sustainability’ is to follow the oligarchs yellow brick road to the ‘new’ economy— paved in foundation dollars. The necessity for a radical contraction of consumption by the privileged is replaced with ‘solutions’ comprised of more infrastructures, more technology, ‘green’ consumption, more mining, more burning of fossil fuels, more growth—all of which will benefit (only in the short-term) the same 1% who have created and continue to accelerate the nightmare. Ask us for the moon. Even for Mars. But don’t ask us to change.” Cory Morningstar