All charts are updated through March 2016

The latest OPEC Monthly Oil Market Report is out out. The charts are “Crude Only” production and do not reflect condensate production.

Also the charts, except for Libya, are not zero based. I chose to amplify the change rather than the total. OPEC is now 13 nations with the the addition of Indonesia.

All Data is in thousand barrels per day.

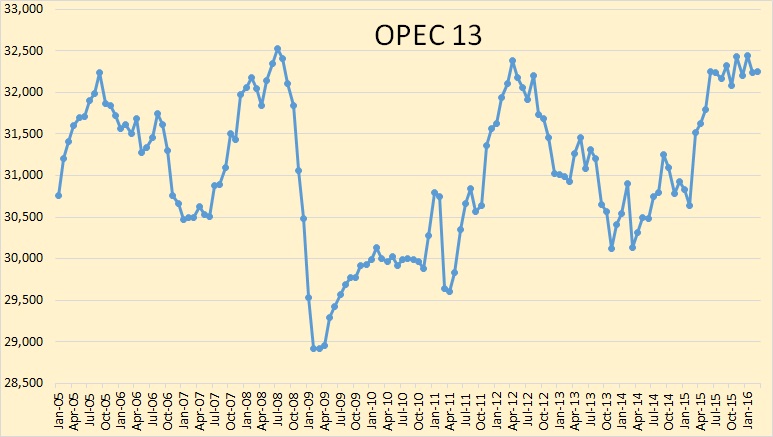

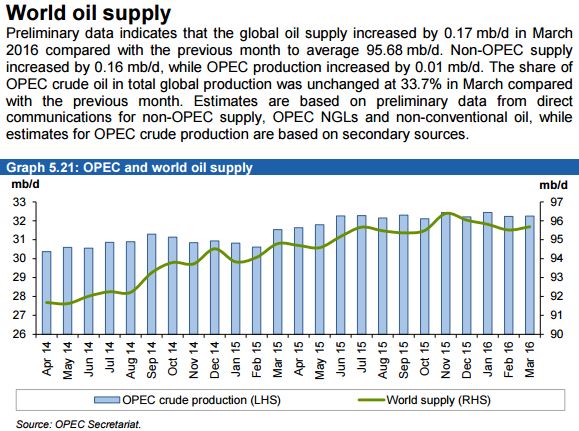

OPEC production was up 15,000 barrels per day in March. But there has really been very little change since June of 2015.

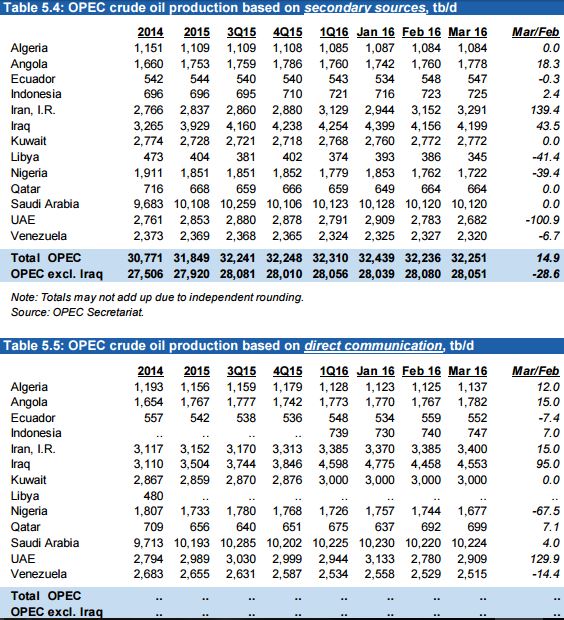

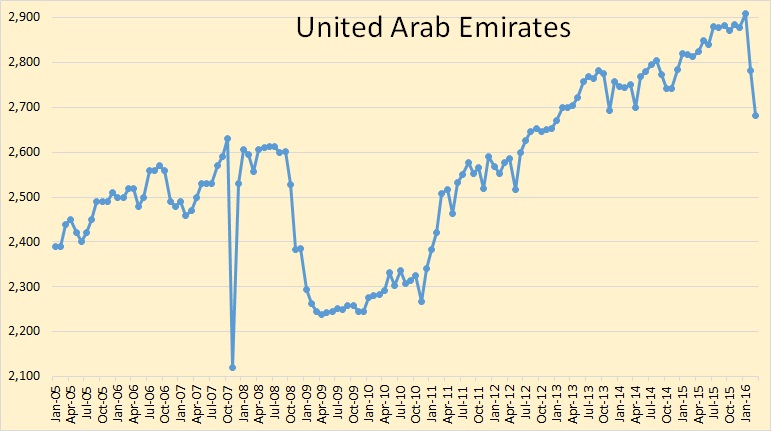

OPEC uses secondary sources such as Platts and other agencies to report their production numbers. These numbers are pretty accurate and usually have only slight revisions month to month. The big gainer in March was Iran while the biggest loser was the UAE. Notice that the UAE says their production recovered in March, from their big drop in February. But OPEC’s “Secondary Sources” says they did not, they fell another 100,000 barrels per day.

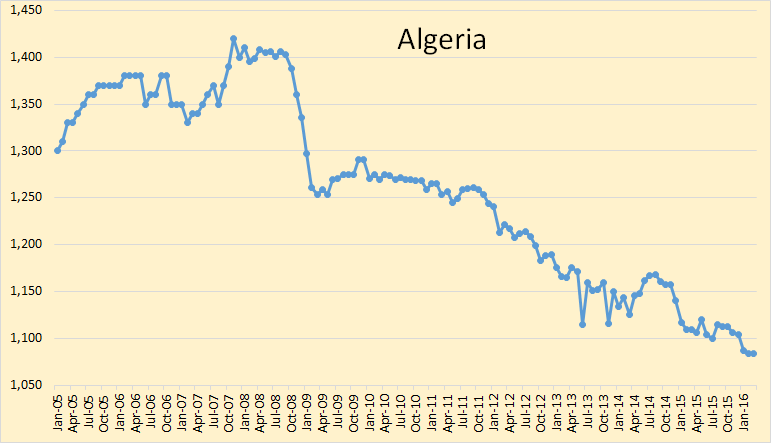

Algeria peaked in November 2007 and has been in a steady decline since that point.

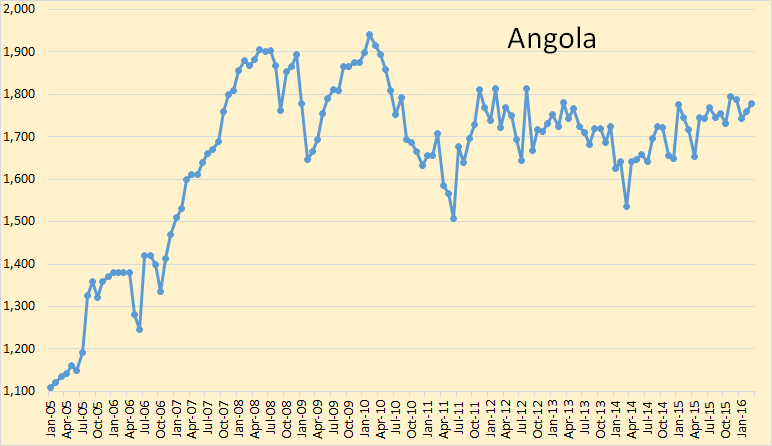

Angola has been holding steady since peaking in 2008 and 2010.

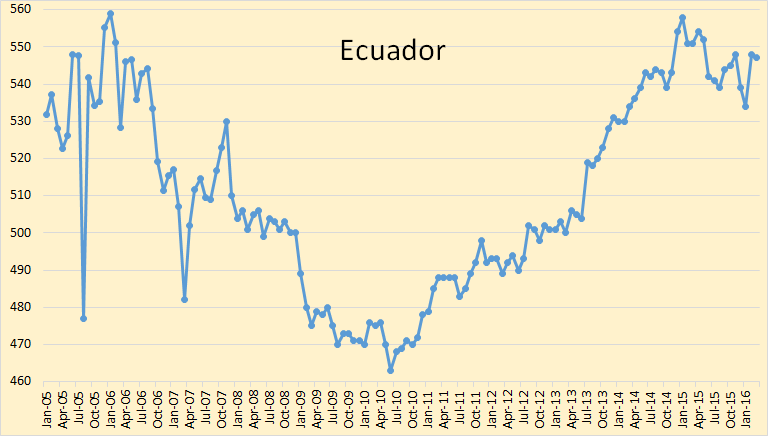

Ecuador appears to have peaked last year. It is likely production will be down, but only slightly, in 2016.

Indonesia has shown an increase in recent months but their oil rig count has dropped from 35 in December f 2014 to 10 today. That does not bode well for their future oil production.

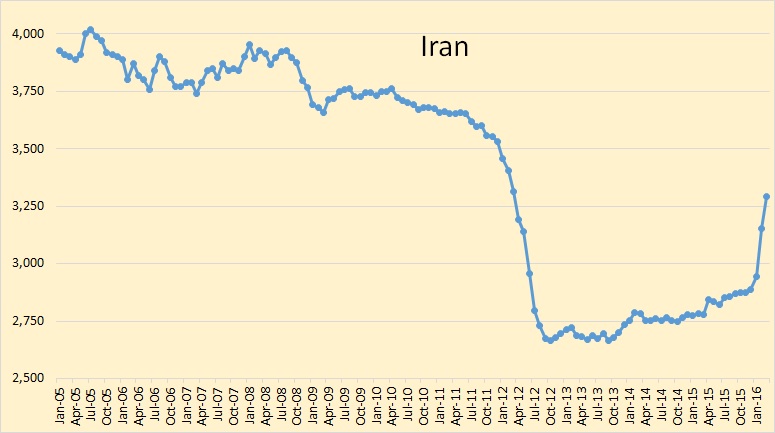

Sanctions were just lifted, in the middle of January, on Iran. Their production was up 208,000 barrels per day in February and another 139,000 bpd in March. I expect their production to be up by from 500 to 600 thousand barrels per day by year’s end. However I believe Iran will be the only OPEC nation with any significant production increase in 2016. Most other OPEC countries will, I believe, be flat to down slightly.

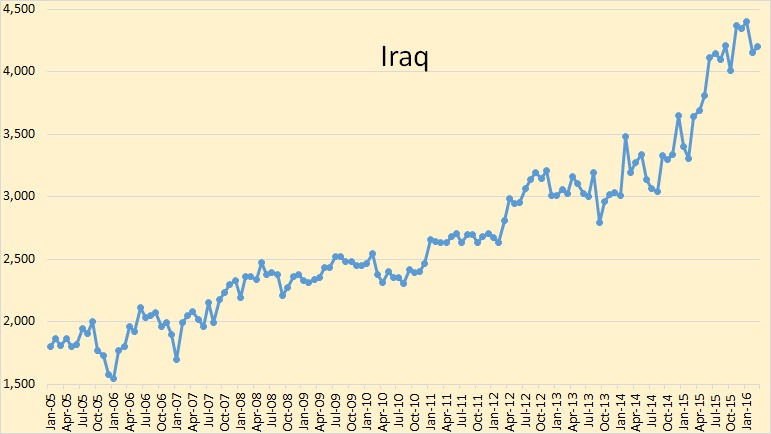

Iraq, after first going over 4 million barrels per day in June 2015, has struggled to hole that level. I think it is very likely that Iraq has peaked, or at least peaked for several years. Iraq still depends on foreign investment to increase production and that seems to be drying up.

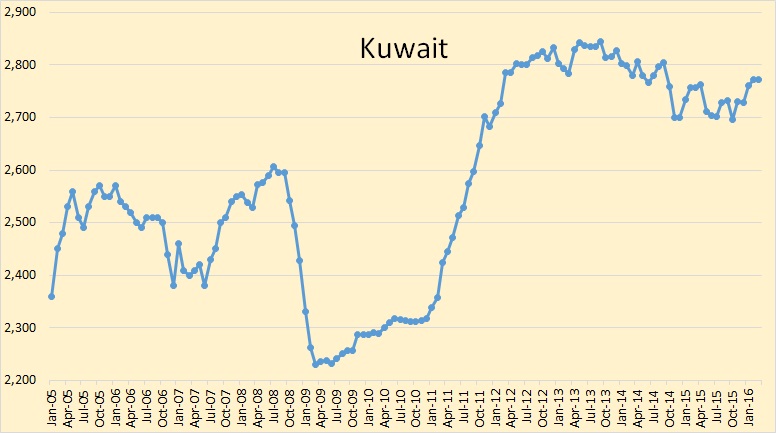

Kuwait has increased production slightly in the last three months but I don’t expect that trend to continue. Kuwait will take a huge hit in April due to the strike.

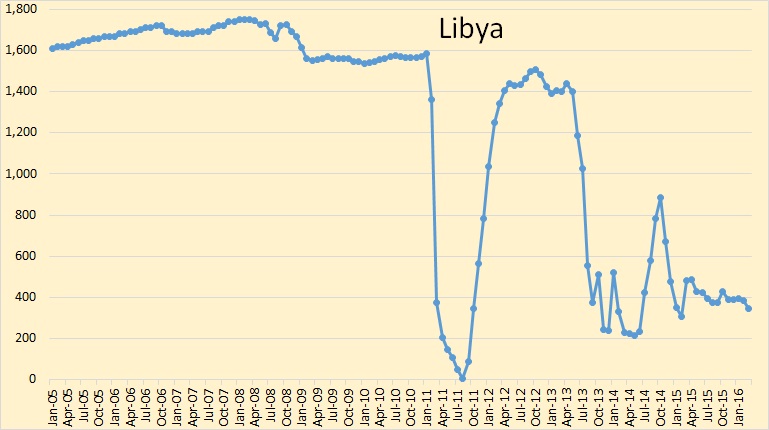

Libya is struggling. Their political problems are getting worse, not better.

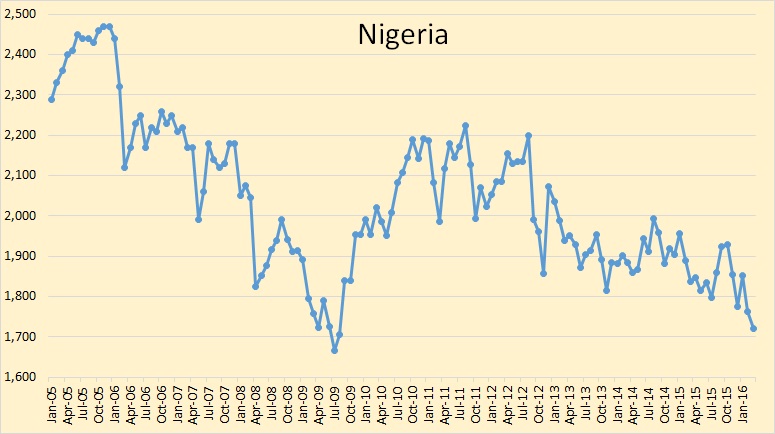

Nigeria’s problems continue to increase. Their production dropped to 1,722,000 in March, their lowest level since August 2009.

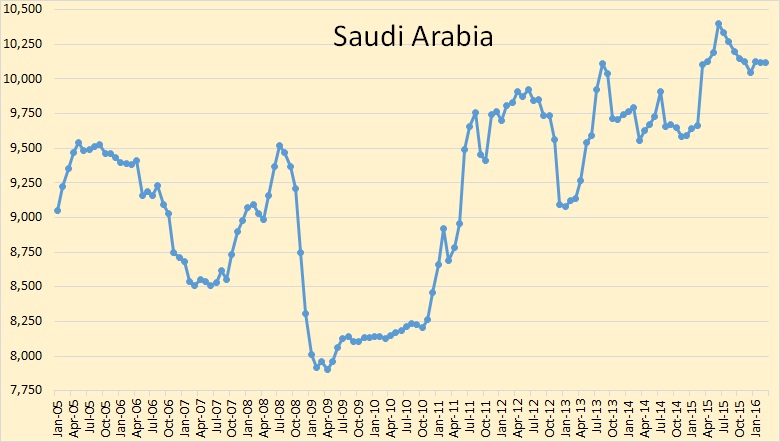

I believe Saudi is producing every barrel they possibly can. They will be lucky to hold this level for much longer.

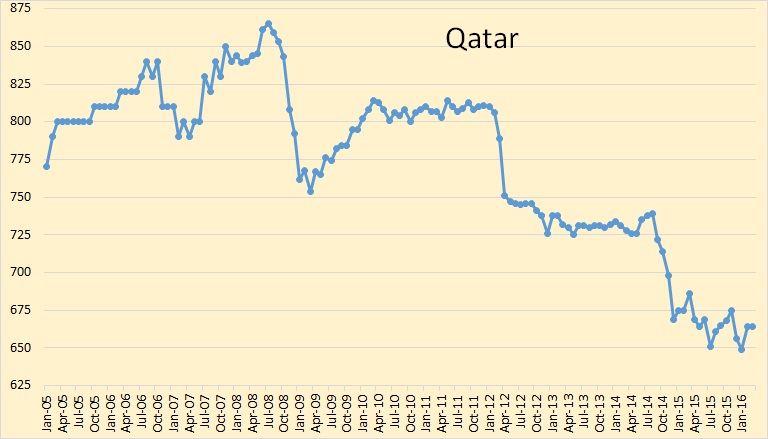

Qatar has lots of natural gas but their oil production has clearly peaked and is now in decline. Their production was unchanged in March.

I have no idea what is going on in the UAE. After peaking in January they have since dropped 227,000 barrels per day.

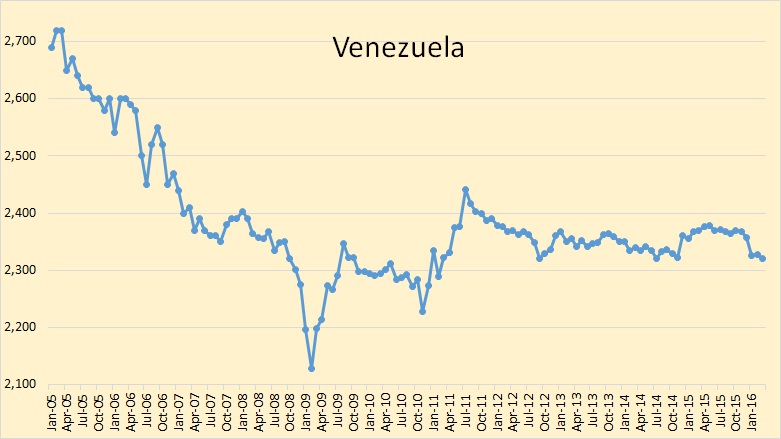

Not much can be said about Venezuela. Their conventional oil is in decline but their bitumen production is keeping production relatively flat. But their political and economic problems are getting worse. I look for them to suffer serious declines in the next year or so.

According to OPEC, World oil production peaked, so far, in November of 2015. I look for this downward trend to continue for at least the next two years.

Carryover from previous discussion.

From RW – Once upon a time, $2 oil was a good price.

When in hell was that??

http://inflationdata.com/Inflation/Inflation_Rate/Historical_Oil_Prices_Chart.asp

Clueless. It would have to be prior to WW2 that $2 was a good price. I have read some publications from the 1930s which indicate prices under $1 (I think during the East Texas field discovery in 1930-1931 prices got as low as 10 cents). In fact, I have a publication from the mid 1930s which indicates average prices in the particular field (ours) were 83 cents, and that producers were just able to cover expenses, possibly an early reference to dreaded BREAKEVEN!! Note in the mid 1930s our field was already what would be considered a “stripper” field. In fact, I would say that was pretty much the case by 1915.

In Yergin’s book THE PRIZE, there is an account of oil in the early days in the Texas oil fields being cheaper than water.

This was because oil had to be HAULED OUT, and there was more oil handy than there was a sale for it, and transportation for it, but water had to be HAULED IN.

I might be wrong about the highest price of petroleum oil ever, but I have read that the all time peak price, adjusted for inflation, occurred during the American Civil War years, when the usual way of getting some petroleum oil was to skim it off the top of water emerging from springs in areas with lots of oil near the surface.

That extremely limited supply was apparently in extraordinary demand as a lubricant. Trains were just getting to be common at that time.

I believe this to be true, but I am not sure.

Looks from your chat that nominal price in 40’s and 50’s was 2-4 dollars

You guys all miss the point. Nominal prices mean nothing. OFM says it used to be cheaper than water. Okay, 2 months ago at $27 bbl, it was equal to 16 cents a quart. I know you cannot buy a quart of water for 16 cents. So, it was cheaper than water in 2016.

ONLY at well sites before roads and pipelines were built, lol.

Water, in large volume, goes for less than a tenth of a penny per gallon.

Quoting the price of “spring” water in a plastic liter container isn’t really realistic.

In 1942, circa, oil was at about $1.60 per barrel.

Gold had a fire sale price at $35.07, when you divide 35 by 1.60 you have a quotient of 21.875.

An ounce of gold bought 22 barrels of oil.

Today gold is priced at 1267 USD. Oil is just over 44 USD.

1267/44=28.7 barrels of oil gold can buy at today’s prices.

Oil at $1.60 in 1942 was is worth about 60 USD in 2016 dollars.

1267/60=21.116 barrels of oil

When oil was bought at $1.60 in 1942 it is about the same as oil selling for 60 USD today.

The US dollar is worth about 0.04 USD today.

2 dollar oil way back when is equivalent to 75 dollar today.

22 dollar oil a few weeks ago is 80 cent per barrel oil in 1942 dollars.

Just the way it is in the real world.

Thank you!

Ron. Thank you very much for this OPEC post. I hope you are able to keep doing them each month!

Thanks Ron, I’ve been wondering how anyone is disaggregating Iranian “Exports” (of stored crude) vs “Production”? Thanks, bb

Looks like an ongoing OPEC shortage …

(Glut? What glut?)

Ron, thanks for your update.

Since Libya is mentioned, below and FWIIW a link to an analysis from GEFIRA (Global Analysis from the European Perspective.)

”Europe is planning on recolonizing Libya, and so it will send in armed forces in the coming months to restore order and stem the flow of migrants coming from Africa. If this expedition army succeeds in securing parts of the country and restoring law and order, Italian and German engineers from ENI and Wintershall will follow suit to help resume the country’s oil production, which will add 1.3 million barrels per day (Libya produced 1.7 million barrels per day before Muammar Gaddafi was toppled in 2011) to the world oil glut 1).2

http://gefira.org/en/2016/04/18/europe-inevitable-intervention-in-libya-will-add-1-3-million-barrels-to-the-world-oil-glut/

well I’d posit thats one way to unite the country …..

Forbin

Any discussion of this link should probably be taken over to the last open thread non petroleum as far as the POLITICS of Venezuela are concerned.

I think anybody who reads it will agree that Venezuelan oil production is apt to fall rather than rise, at least for the next year or two.

Warning, it is pretty long, but length is necessary for detail and nuance. You can’t learn much from sound bites. Depending on sound bites means you are letting other people do your thinking for you.

http://www.businessinsider.com.au/venezuela-implosion-2016-4

Hi Old Farmer Mac.

To me, the politics of Venezuela is relevant to OPEC output and belongs here.

Warning, it is pretty long, but length is necessary for detail and nuance.

But once you start reading it you will be unable to stop. I read every word and I am shocked. I had no idea Venezuela was in this kind of condition. Venezuela is definitely the world’s next failed state.

Hey people, read this article.

‘BODIES PILING UP’: All you need to know about Venezuela’s looming implosion

Hi Ron,

I agree 100%.

Thanks Old Farmer Mac, great article.

Wow. It’s hard to believe, but like a person who wins the lottery, a country with huge oil reserves is actually worse off than not. An excess of bounty is its own punishment. Lessons to be learned.

Clueless, previous thread, re KSA threats to liquidate US paper.

Liquidate means sell. It doesn’t happen without a buyer.

Analagous to cart before the horse stuff with increased storage meaning the price fall is due to “over supply”. Storage was bought. A purchase is demand. That looks like demand above consumption. blah blah That looks like justification for price increase, not decrease, and you gotta find someone who, over a 2 yr period, decided to keep buying on the way down without having a customer waiting. Don’t look credible.

Hi Watcher,

Only someone who has never sold anything would thing that too much supply has no effect on the price of the good.

I have asked you this question before. If you had a truck full of apples and no money and you could not find a buyer at a price of $15/bushel, what do you think you might do about your selling price?

Pemex seems to have a chronic fire safety problem.

http://www.bbc.com/news/world-latin-america-36098260

Hi Ron, I posted this about Saudi Arabia (from Bloomberg) in the last thread:

“world’s largest oil exporter could increase output to 11.5 million barrels a day immediately and go to 12.5 million in six to nine months “if we wanted to,”

What is your disagreement with it?

The Deputy Crown Prince says this. Saudi also says they have 266 billion barrels of proven reserves, almost as much as all non-OPEC nations combined.

Many of them also say they will receive 72 virgins in paradise if they die a martyr while killing a lot of infidels with a suicide bombing .

Why do you think I should express an opinion on the very stupid things they say?

So, has it been proven that they cannot physically produce the extra oil and me being the big dummy that I am, missed it?

P.S.- 72 would represent a huge reduction in the amount of virgins available to the Saudi royals compared to what they have now in their harems.

I don’t believe it’s been proven, physical or otherwise, that they can. I tend to think that if they could do it then they would have by now. If KSA says they can do it I don’t believe it’s up to their critics to prove that they can’t. How would you recommend that be achieved anyway, ask for a look at the geological and engineering data sets? It’s up to KSA to prove that they can. I suppose we could take the Deputy Crown Prince at his word but I don’t see any good reasons to take that approach either.

PS- that’s probably why a Saudi royal has never died a martyr.

If somebody, anybody at all, were to bring another two or three million barrels of oil to market right now on a daily basis, without other producers reducing their own production to compensate, the price of oil WOULD go to zero for some producers.

It seems reasonable to me to assume that the Saudis are willing to tolerate the current low price in order to put a hurting on their enemies, and maybe to also make DAMNED SURE that if and when they do cut, the rest of their OPEC buddies play fair and share in the cutting, not just in the increased revenue.

Maybe the Saudis could stand a near zero price longer than Russia and Iran, but something tells me the Russians and the Iranians would still be around long after the Saudi royal family found it highly desirable to move en mass to their second homes in western countries.

I understand that the yankee tight oil industry is in intensive care, and will remain there, so long as the price of oil stays in the pits, but the tight oil industry IS NOT DEAD, and it will make a remarkable recovery, once prices go up again.

Sure it will take a while for burnt lenders to lend on tight oil again, but the BIG big boys will be able to get financing, or pay as they go, and buy up the tight oil fields from the busted little guys.

There are plenty of big sharks out there in the investment world, with big teeth, and big appetites, and with the land already surveyed, the exploration already done, the roads and pipelines mostly already in place, etc, and the cost of drilling a dozen or so wells being a piddly hundred million or so…………. a hundred million is hardly any more than pocket change to people with access to ” sure thing” investment money.

Tight oil will be back within a year or two of the time the price of oil goes up again,

Tight oil is a pig in a lot of ways, but it’s not a pig in a poke, the oil is KNOWN to be there, and the costs of extracting it are known, the decline rates are known, etc.

There won’t be many surprises from here on out in the tight oil industry from the “production in the field” point of view.

Hi Old Farmer Mac,

I agree that if the oil supply increased by 2 Mb/d in a few months time, that the oil price would decrease, but to zero, I don’t agree with that estimate. The oil price might decrease to $15/b and the higher cost producers would shut in their wells because the price for some producers would fall below operating costs.

Remember that the “market price” is at the refinery gate.

For some producers, transport and operating costs are about $19/b. So those producers are out of the game at any price below $19/b (that is for Bakken /Three Forks output shipped by rail, and I haven’t included royalties and taxes of about 30% of the wellhead price, or capital costs, G+A, land and development costs). In reality $25/b or lower would probably shut down a lot of US output, but shallow sand or Mike can correct me, the price might be higher than $25/b.

Hi OFM,

On rereading your comment, you said,

“..for some producers…”

So wellhead price minus cost would go to zero, but the price is likely to remain above zero. When wellhead price reaches the level of lease operating expense plus royalty and tax payments then production may be shut in.

Hi Dennis,

Yes, thanks for clarifying my comment, I should have composed it more carefully.

Being a hands on guy in ANOTHER industry, I tend to think of the ” out the gate” price producers get, rather than quoted commodity prices from some market hub or another.

Every body parks his machine when the costs of running it for a day exceeds the cost of parking it, ALL things considered.

For now, the Saudis and Russians and Iranians and lots more folks can still afford to consider MORE things than just their bottom line when making production decisions. But if prices stay low long enough, fewer and fewer things will matter more than the bottom line.

Personally I believe the large majority of the people who REALLY run the automobile industry, the ones who set corporate policy, believe in peak oil, and peak oil having a huge influence on the auto industry within the next decade or two. If they didn’t , they would put up a far bigger fight about fuel economy mandates, etc.

Anybody interested can read this for insight.

http://www.motortrend.com/news/2017-honda-accord-hybrid-clarity-series-show-ev-commitment/

“Personally I believe the large majority of the people who REALLY run the automobile industry, the ones who set corporate policy, believe in peak oil”

99+% are Clueless. Clueless to ELM’s future hammer impact on the North American Auto Industry. Elon’s going to be even a bigger Rock Star.

“Tight oil is a pig in a lot of ways, but it’s not a pig in a poke, the oil is KNOWN to be there, and the costs of extracting it are known, the decline rates are known, etc. ”

If it was generally a money loser in the first go round, why would it be a winner in the second? Especially, since they have the knowledge now.

It’s either a con game or someone has to figure out how to reduce the costs.

Greenbub,

The most interesting part of that paragraph from Bloomberg is not the actual content – if SA can or cannot produce 12.5 mil within 6-9 months. The ability to produce 12.5 in 6 months is irrelevant because it is self defeating measure for Saudis as well. What is relevant to me is that kind of statement is actually allowed to be published in high profile US business paper. Because that is not a simple statement but a threat. That shows you that there is some deep split how this petrodollar relationship should continue within US itself.

You get to paradise, and then the 72 virgins would last for about three months. Then you have all eternity to live. What do you do for the rest of the trillions of years? Sort of Peak Virgin situation, really.

They remain virgins. Like Promoteus liver regrows every day after the eagle picked it out.

Also, they get 5000 widows, which is far less known. We in the west only know about the virgins.

Do people actually believe they have bodies after they die? Do they really believe they have sex organs, glands and urges to procreate among the dead?

I just saw the movie, ‘Spring’; a love story, maybe even chick-flick (for those chicks that like this kind of genre) with a light horror twist.

We live on through our children.

An almost 1/4 million barrels per day difference between UAE secondary sources and UAE direct communication. That’s gotta be some kind of record. If secondary is correct UAE is dropping like a stone. Does anybody have any insight? I understand UAE had a lot of drilling rigs on the go for the last little while. I believe BH states up from 30 to 50 or so in the last two years. Are those 50 rigs discernible between oil or gas?

UAE rigs are 40 oil, 8 gas. The production difference could still be a statistical blip, it only represents one large production or processing centre off-line, and we don’t know storage changes. They are upgrading Upper Zakum which will add 90 kbpd to give 750 kbpd by 2017 with 25 year plateau (one of ExxonMobil’s biggest project involvements at the moment), there may need to be some shutdowns for tie-ins for this or just general maintenance. Alternatively maybe they are getting early water breakthrough in Lower or Upper Zakum, each has been on operating for over 35 years and should be about half way through reserves (depending on what numbers you believe).

Actually 42 oil if Dubai is included with Abu Dhabi.

Purely as a thought experiment If we take the current world production of 95.68 Mbd and grow this by 3% per year we would churn through the next trillion barrels of oil in less than 20 years. Most on this site will understand that we will not have 3% growth because it is getting harder to recover the oil. But those who base their thinking purely on economics and not on the hard environmental facts, might argue that we still have half the recoverable oil left, or even more.

If one assumes that there are 2 trillion barrels left to recover, then at 3% annual growth we would only make it to just over 30 years. Our daily production would have to be 232 Mbd in 30 years if we assume 3% growth.

It seems our politicians are powering the Titanic at full steam towards the bergs.

Nothing Matters Until It Collapses Completely

Partial collapse is for those who lack conviction in the impossible…

Stavros says we have an expanding Empire going here…surely it can’t be based on oil any longer.

Ponzi Borrowing–>Mass Outsourcing–>Printing Money to Buy Stocks (we are here).

Looks like a Madoff to me.

It doesn’t take much fossil fuels to power the Algorithmic Fabrication of Value Empire.

Just requires a lot of Idiots…hence the Idiocracy.

Always suspected that Star Trek had it right about everything in the future…

1. Juvenile Free Energy Hoaxes (Dilithium crystals or “Renewables” or Nuclear whatever)

2. Computer wars replacing conventional warfare. (Fed Ponzi Computational Machine vs World)

3. Building the Ultimate A.I. Computer being the desired economic goal. (Google and IBM)

4. The social paradise of the United Federation of Something or Other (Collective aka The Borg)

Or at a steady 3% decline we’d produce another trillion barrels over a 100 years (most of what is left that isn’t in Canada and Venezuela), so at the moment adding any capacity while discoveries and reserve additions are declining fast will inevitably lead to a rapid collapse sometime later.

Ron, thanks so much for the update. As a retired transportation engineer I am trying to gain knowledge in the area of energy, in particular oil. Your website has been most helpful, especially with the loss of The Oil Drum.

Ron – thanks for the update, I thought we might have lost it. One piece of pedantry from me – Venezuela don’t strictly produce bitumen, which is normally defined to have viscosity above 10000 cP, but rather extra heavy oil (API less than 10, but viscosity 1000 to 5000 cP).

Is it not possible that U.A.E. is voluntarily reducing production rather than sell oil at currently low prices? They don’t have the budget deficit issues or social unrest issues that keep KSA pumping for every last barrel they can produce.

Also, I believe KSA could produce more than they currently are for a little while, but that doing so would create long term harm and reduce ultimate recovery. So they say they can, and maybe they can, but I don’t think they will.

US C+C production is likely to drop to about 8,200,000 to 8,300,000 bpd by the end of 2016 unless higher prices bring a lot of fracking crews back to work.

The top chart is from the Weekly Petroleum Status Report and the bottom chart is from the Petroleum Supply Monthly. The projection is mine based on the weekly data.

The average decline, from the April peak, is just over 60,000 barrels per day per month.

Ron, thanks again for all you do. Do you have any explanation for the hiatus in the drop from Sept 15 to Feb 16? After the bottom fell out in the middle of last year things started to stabilize and move upwards before falling off a new cliff. I wonder if the “recovery” period was fueled by false hopes of a price rise.

It is mostly an anomaly of the weekly reporting data. They do not measure actual production but use an algorithm. They often get it wrong but they never revise their previous data.

I have inserted monthly corrected data for the same time period. This production data is far more accurate than the weekly data. But now we have almost the same thing except two months earlier. But for this I have no explanation. Perhaps someone else does.

Hi Ron,

I only see one chart not two. Do I need new glasses? 🙂

Hi Ron,

Below is a chart for US C+C from Feb 2015 to Jan 2016 (12 months of monthly data from the EIA). Average output was 9146.5 kb/d, average decline rate was 4.2%. If that decline rate continues we would see 384 kb/d of decline in the next 12 months.

The weekly chart is not very useful because the data is very bad and as you pointed out is never revised. Also the EIA may be underestimating US output based on Dean Fantazzini’s estimate for Texas output.

Looks like a pretty linear and steeper decline since last september

Dennis, you are drawing your line in the wrong place, starting it at a point where US production was still on the upswing. If you would just start your line one year earlier and project it forward then you could predict that US production would increase this year.

It matters where you start the decline. You cannot just pick any arbitrary point and start it there, which is what you did. Decline has to be measured from the peak.

Dennis drew a best fit line through your points which is what I would have done. I don’t think he can be faulted for this: tons of stuff but not this. Strictly (mathematically) speaking there should have been some qualifications attached but, given the context, I don’t fault him for this.

Dennis drew a best fit line through your points which is what I would have done.

No he did not. My points started in December 2014, his “best fit” chart started in February 2015. If he had used all my points then the decline rate would have been much smaller.

True Ron, that’s why I said there should properly have been some qualifications attached. But, the fact is, it’s hard to determine a trend in noisy time series data. I’d guess the trend line, in this case, should be determined from April 15 and should be a best fit line up to the most recent data point. Maybe not.

Hi Doug,

Due to the noisy data it seems to me that picking the high point is similar to what some “skeptics” do with temperature data. I then accuse them of cherry picking. To avoid this, I think it is better to take a little wider data grab, I started with two months more, went to one month extra, going to the peak seems unsound from a statistics perspective.

I also prefer to use more data rather than less, as it tends to give a more robust estimate.

Hi Ron,

One does not have to pick the peak point as that data point may have been an anomaly, I chose the previous 12 months, if we use 11 months instead and do a best fit through those 11 points we get a decrease of 490 kb/d over 12 months, the average output over those 11 months was 9413 kb/d so the average decline rate would be 490/9413=5.2%. If that rate of decline continues for the next 12 months, output would fall by 480 kb/d by Jan 2017 to 8700 kb/d.

Hi denis. From a statistics point of view this might make sense, but when one considers that we have lost 300 kb/d in the last 5 months then it is hard to imagine how we should not have a bigger decline (unless oil prices recover significantly).

Hi Daniel,

Rates can change, decline tends to be steep at first and then tends to moderate, it usually is not linear but tends to be hyperbolic in shape. I am using linear trendlines because people get all bent out of shape if I use a logarithm. Before the steep section the previous 4 months had very little decline. This is due to changes in offshore and Alaskan output.

For US lower 48 onshore (L48OS) C+C and replacing the EIA Texas C+C estimate with that of Dean Fantazzini we get the following if we fit an exponential trend line to the March 2015 to Jan 2016 data, the decline rate is 7.6%, this will be offset to some degree from increased output from the Gulf of Mexico (about a 250 kb/d increase is expected).

Dennis, my point is simple. You just cannot pick a number of months to average the decline if some of those months are well before the decline even set in. The decline rate starts when the decline starts, not when production is still increasing.

Production increased for several years until it peaked in April 2016. Before April 2016 US production was on the increase. If you pick your “Start Decline Rate Here” point, well before the decline actually started, while production is still surging upward, then your numbers will be worthless.

That’s all I am saying. And I think that point should be quite obvious. It just seems so damn simple. I don’t understand what the problem is.

Hi Ron,

And I don’t understand why someone who follows the data so closely does not recognize that the data can be noisy so picking a high point that could be anomalous can lead to suggestions of cherry picking, I chose a point two months before the peak, and one month before the peak. If I use the data from one month after the peak to Jan 2016, I also get a 5.2% decline rate. I don’t hang my hat on a single data point.

Dennis, the average decline for the last seven months has been just over 71,000 barrels per day per month. If that seven month trend continues we will reach your 8,700,000 bpd level by mid July. Seven months is definitely a trend and the decline is just as likely to be greater than that as less than that.

The last three months data in the chart above, Feb, March and April 2016, was taken from the EIA’s weekly data.

Hi Ron,

I don’t trust the weekly data, it is often very far from the mark.

April to Jan, the least squares fit indicates a decline rate of 5.2 % and based on Dean’s estimate, the EIA estimate may be too low, it might be as low as 3.1% for US C+C output from April 2015 to Dec 2015 (I throw out the Jan data point because Dean thought that point might be anomalous, the decline rate is 3% if January 2016 is included.)

Hi Ron,

We don’t have data for all of April yet, so that should definitely be dropped. Feb and March are also suspect because weekly data is so bad.

New glasses, no Dennis, stick with your rose-colored pair, we wouldn’t recognize you otherwise. 🙂

Hi Doug,

Glad your back 😉

No, you should see two. Is anyone else only seeing one chart?

No Ron, I see two, thanks.

There are two now, I guess I just needed to refresh the page.

I would ignore the weekly data, it is very bad, for example in Sept 2015 the monthly data was 9452 kb/d, the weekly average over that month was about 9126 kb/d, or 300 kb/d too low, in other cases such as June 2015 the monthly data was 9315 kb/d and the weekly data was 9600 kb/d for that month (average) so 300 kb/d too high in that case. So the error can be as much as 3% for the weekly data.

Corelabs comments from earnings release…

https://www.webcaster4.com/Webcast/ListenPage?companyId=1000&webcastId=14289

The net decline curve has stepped up to 3.30%

The Company continues to anticipate a “V-shaped” worldwide commodity recovery in 2016, with upticks expected to start in the third quarter. Global demand for hydrocarbon-based energy continues to improve, while worldwide crude oil supply peaked in the second half of 2015 beginning a decline that Core believes will continue through all of 2016 and 2017. The Company has observed that U.S. onshore oil production peaked in March 2015 and has fallen since then by over 600,000 barrels of oil per day (“BOPD”), some of which was offset by new additions to production in the Gulf of Mexico (“GOM”) as a result of eight deepwater legacy-field developments coming on-line in 2015. This new production, from deepwater fields that includes Anadarko’s Lucius and Heidelberg and Shell’s Stones, offset significant declines in existing GOM fields.

At current U.S. activity levels, Core predicts 2016 U.S. onshore oil production will fall approximately 1,100,000 BOPD, somewhat offset by GOM gains of approximately 200,000 BOPD, yielding a U.S. net decline of 900,000 BOPD and net decline curve rate of 10.1%. Based on currently available worldwide crude oil production data, coupled with internal Core Lab data, Core has increased its estimate of the net worldwide annual crude oil production decline rate to 3.3%, as supported by recent International Energy Agency (“IEA”) reports that worldwide crude oil production fell 300,000 BOPD in March from February 2016 levels. March was the third consecutive month of global oil production decreases.

The increase in the net worldwide decline rate is predicated on sharper decline curve rates for tight-oil reservoirs and the significant decline in maintenance capital expenditures for the existing crude oil production base. This, coupled with the continuing decline in global production and the continuing increase in global energy consumption, should create a tight crude oil supply market for the second half of 2016, and that should lead to increased crude prices and industry activity levels worldwide.

Interesting piece, thanks Don.

Hi Don,

Perhaps decline has accelerated. Using Dean Fantazzini’s estimate for Texas C+C output rather than the EIA estimate, I get a decline rate for US lower 48 onshore output of 7.6% from March 2015 to Jan 2016, if that rate continues for the next 12 months L48 onshore C+C falls by 546 kb/d and C+C output in Jan 2017 for L48 onshore would be 6635 kb/d. The average C+C output for the past 11 months was 7379 kb/d (L48 OS) and the trendline has a slope of 562 kb/d, 562/7380=7.6%.

There is a significant difference between Dean’s TX estimate and the EIA’s Texas estimate for C+C in Dec 2015 and Jan 2016. Core Labs perhaps used the EIA estimate which for L48 onshore (OS) gives a 9.9% decline rate over the past 11 months (March to January), the average of the two estimates is about an 8.7% decline rate, which would be about a 620 kb/d decline from Feb 2016 to Jan 2017 and about a 1.2 Mb/d decline from the peak in March 2015 to Jan 2017 (if the rate of decline does not change from Feb 2016 to Jan 2017).

I am wondering if there is good data for oil export trends, rather than for overall oil production?

It seems that it is the global trade in crude that is so critical to the volatility, and is so important for the economy of the big consumers of crude, such as the EU, USA, Japan, China, rather than the overall production numbers of the producing countries.

We have been presented info previously that crude export has peaked in year 2005 (Jeffrey Brown?).

Is that still the case, and if so how far down the export curve are we?

Thanks to anyone who has that kind of info.

Hickory,

There is an excellent article at crudeoilpeak.com about net exports:

http://crudeoilpeak.info/net-crude-oil-exports-the-shrinking-commodity

However, the article is from 2011. You probably can contact the author if he has an update.

That’s a great article! An update on that would be a great read!!

Hi Hickory,

http://peakoilbarrel.com/world-crude-oil-exports/

Thanks Heinrich and Dennis.

Looks like the data is considerable delayed.

This will remain very interesting to track.

Hickory,

In my view net exports did not change very much over the last five years. However, net imports declined considerably. Especially net imports from the US declined from 12 mill b/d towards 6 mill b/d. As the increase of net imports from China and India could not compensate for the US decline, the oil price fell and the surplus went into inventory.

Nevertheless, this is about to change as US net imports increase again and China and India have combined 1 mill b/d more net imports per year. The balance reverses quite slowly and this is the main reason, prices are slow to recover.

On April 25 the prince is scheduled to unveil his “Vision for the Kingdom of Saudi Arabia,”

……

“We’ve been screaming for alternatives to oil for 46 years, but nothing happened,”

…….

“Last year there was near-panic among the prince’s advisers as they discovered Saudi Arabia was burning through its foreign reserves faster than anyone knew, with insolvency only two years away. Plummeting oil revenue had resulted in an almost $200 billion budget shortfall”

……

‘If women were allowed to ride camels [in the time of the Prophet Muhammad], perhaps we should let them drive cars, the modern-day camels,’ ”

……

http://www.bloomberg.com/news/features/2016-04-21/the-2-trillion-project-to-get-saudi-arabia-s-economy-off-oil

Where should one start measuring the decline when trying to figure out what the decline rate actually is. Should you start five months before the peak, four months before the peak, two months before the peak or at the peak? Dennis’ example starts two months before the peak. I am of the very strange opinion that the decline rate should be measured from the peak. 😉

A first order trend won’t work when second order derivatives are dominating, as at a peak. That is partly why logistics curves are used.

Hi George,

Often hyperbolics are used or an exponential can be used for a simple fit.

The fit is not very useful as the curve will change when the price changes and as demand changes over time due to changes in economic output and changes in the structure of the economy.

There is no particular reason for using a logistic, it is simply a functional form which gives the approximate shape that Hubbert was looking for.

Hi Ron,

If we substitute Dean’s Texas estimate for the EIA Texas estimate we get a different result.

In the chart below the blue line is EIA data and the Red line uses EIA for everywhere in the US except Texas where I substitute Dean’s TX estimate for the EIA TX estimate.

The trend line is an exponential fit from April 2015 to Jan 2016 (the weekly data should be ignored in my view). For the EIA data the decline rate is 5.2% and for EIA+ Dean TX it is 3%.

Ron,

Your above chart tells me that the rate of decline gets faster at the tail end of the curve. This is a classical case of a differentiation equation. It is the same situation as a stone falls and the longer it falls it picks up more and more speed.

You could call it also the process of a self feeding move like a stock market crash (self full-filling prophecy). This happens very often in nature and makes the anticipation of future trends so difficult, as moves go very seldom in a linear fashion.

Hi Heinrich,

Only until it hits the earth or reaches terminal velocity due to friction from the air.

If we removed the Earth’s atmosphere, your example would match reality, until the rock hit the ground. Also note that the line would never become vertical as the velocity is limited by physical laws. The rock is not going to go faster than light. If we think of the slope of the curve as velocity, a vertical slope implies a velocity of infinity.

The decline in production is driven by the decline in prices. If prices rebound, the trend in production will also reverse, with a several-months lag.

Therefore, any extrapolation of the current trend does not make sense

Hi AlexS,

I agree. Let’s assume oil prices remain low for the next 2 years. (Note that I think that is a bad assumption, but it is not far from the EIA oil price scenario.) In that case the decline may continue as it has for the past 11 months.

Dennis,

If prices stay low over the next two years, the production decline will almost for sure accelerate as all the hype, which still exists, is coming out of the oil and gas market. There will be no expectation of ten fold increases for investments gains anymore.

Capital will flee the oil and gas companies as they did not earn anyway a lot of money and even the expectations for future profits will evaporate.

The longer the oil price stays low, the more hot air is coming out of the bubble.

Hi Heinrich,

There may be increased decline for a few months, but drilling will not stop completely. If North Dakota Bakken/Three Forks completions fall from 65 to 40 over the next 9 months, the average Bakken/Decline from July 2015 to July 2016 will be about 20% at most, then it will moderate to about 10% if completions remain at 40/month.

Remember there are about 1000 SPUCs (spudded but uncompleted wells) in the ND Bakken/TF, of the rig count falls to 20 rigs, they can drill 25 wells per month, so only 15 SPUCs are needed to get to 40 wells per month, let’s say they use 20 SPUCs per month (cheaper to complete), that means there are 50 months worth.

L48 onshore decline is already 10%, it might temporarily reach 15% during the first half of 2016, but then is will return to 10% or less.

I think you are being fooled by the RRC data, look at Dean’s estimates or the EIA estimates for Texas output and decline rates are not as high as you believe. So far the decline rate in Texas (since the peak in March 2015) has been about 8% (using the average of the EIA and Dean’s estimate from March 2015 to Dec 2015). Possibly this will accelerate, but Texas LTO is closer to refineries and has lower transport costs as well as better infrastructure than North Dakota so decline in Texas may not reach the 20% level of the ND Bakken/TF.

Dennis,

The falling stone has been just an example for how the process works. Nature very often works on a self feeding mechanism – on the upside or the downside. Linear processes or ‘undulating plateaus’ are very seldom. Any trend cannot go on forever and ends like a stone by crashing on the floor – or topping out on the top.

In the case of shale oil and gas, the downward spiral could work like this:

1. As companies drill less, they add less reserves, thus have less collateral and get less money for new drilling.

2. The consequence of less drilling is less production, less added reserves, lower capital expenditures……

This is exactly the opposite what we have seen when shale went into an upward spiral over the last several years.

In my view there is probably also a political element here. Bernie Sanders has promised to ban fracking – if elected. Who knows, maybe he is really elected and bans fracking. Who in earth wants to spent capital when the company is not allowed to exist anymore by next year? So, it is better to wait until the political situation is resolved.

This all contributes in my opinion to a veritable crash in shale production. In my view the chances are high that the decline accelerates even more in the fall of 2016 and production will crash through 7 mill b/d in 2016 as I have already envisioned last year.

The writing is already on the wall:

http://oilpro.com/post/23930/non-opec-production-to-see-largest-annual-decline-since-1992-iea

Hi Heinrich,

Prices can only go so low, as the weaker players go bankrupt, stronger players with deep pockets (XTO and Statoil come to mind) will buy up assets on the cheap. They will be able to complete the SPUCs and maybe drill a few wells if they think the economics works in certain locations.

You said above:

This all contributes in my opinion to a veritable crash in shale production. In my view the chances are high that the decline accelerates even more in the fall of 2016 and production will crash through 7 mill b/d in 2016 as I have already envisioned last year.

What “production” do you mean? USL48 onshore is likely to fall below 7 Mb/d in 2016, you don’t mean US C+C output, I hope.

At the end of 2015 US C+C was 9.2 Mb/d, so a drop to 7 Mb/d by Dec 2016 would be 2.2 Mb/d lower or a 27% annual decline rate.

Is that your prediction?

Dennis,

We had this discussion already last year.

Yes, I mean US C+C and I mean the production will be down around 30% from its peak last year.

I cannot see any reason why the decline should stop in September 2016, as there is no price recovery yet and drilling did not go up and it will take at least half a year until production can go up again after drilling went up.

US C+C production will crash through 7 mill b/d by the end of this year and could fall even much further in 2017.

Hi Heinrich,

And how low do you expect US output to go in 2017?

I do not think the decline will stop. I have pointed out to you that even if drilling stops completely in all the US LTO plays, the decline rate for the US will not approach the level that you are forecasting.

There is a chance that the EIA’s forecast of 8.1 Mb/d in Sept 2016 might be correct (I think this forecast is too low). US C+C output of under 7 million barrels per day in 2016 is not going to happen, even pessimistic observers might agree with me.

USL48 onshore is likely to fall below 7 Mb/d in 2016, you don’t mean US C+C output, I hope.

Dennis, this statement… or question… is confusing. Are you saying US lower 48 onshore is likely to fall below 7 mb/d… or not?

Please clarify.

The US lower 48 onshore is already well belw 7 mb/d and is very likely to go below 6 mb/d.

Hi Ron,

Rather than eyeballing it you can use excel to put a trendline which automatically does a least squares fit on the data in the series. Us math types prefer to use statistics to fit a line to the data.

We can use March to Jan, April to Jan, or May to Jan, for all three the best fit to the data has a decline rate of about 5.2%. So the point is not worth arguing April to Jan is fine with me, the weekly data tells us very little. The weekly numbers can be off by up to 300 kb/d.

Dennis, I would bet that the EIA also has some of them “math types” working for them. Anyway, the EIA’s “math types” comes to the same conclusion as I did, that US production will reach 8.7 million barrels per day in July 2016, not January 2017 as you project.

Edit: Sorry I made a mistake. The EIA has US C+C production at 8.7 million barrels per day in June 2016, not July as I predicted. It seems the EIA’s math types are a bit better at math than I. The EIA says June 2016 C+C production will be 8.62 million barrels per day.

Look at the drop they are predicting for August 2016, over a quarter of a million barrels per day.

EIA Short Term Energy Outlook. Click on “All Tables” then on “Table 4a”.

Hi Ron,

Interesting. An exponential trendline on April 2015 to March 2016 has a decline rate of about 5.7% per year. The change in trend after March is mostly due to Alaskan summer maintenance and the GOM hurricane season (August and Sept).

The trendline almost meets the STEO in 2018.

Hi Ron,

For the US Lower 48 onshore (L48OS) C+C output in the EIA STEO the annual decline rate steepens from 10.4% in 2015 to 18% in 2016. I think a combination of too low an estimate for TX C+C through Jan 2016, poor weekly C+C estimates, and a flawed DPR model are leading to a poor forecast by the EIA.

Time will tell.

EIA’s US C+C output projections for 2016-17.

The numbers are from the April STEO, but with some additional details.

Source: http://www.eia.gov/todayinenergy/detail.cfm?id=25892

In response to continued low oil prices, onshore crude oil production in the Lower 48 states is expected to decline from an average of 7.41 million barrels per day (b/d) in 2015 to 6.46 million b/d in 2016 and to 5.76 million b/d in 2017.

The number of active onshore drilling rigs in the Lower 48 states fell 78% (from 1,876 to 412) between the weeks ending on October 31, 2014, and April 15, 2016. The decline in active rigs and well completions is projected to result in month-over-month onshore oil production declines of 120,000 b/d through September 2016.

EIA projects that the number of operating rigs in the Lower 48 states will continue to decrease through mid-2016 before beginning to slowly increase. However, expected Lower 48 production will continue to decline—although at a slowing rate—throughout 2017.

EIA’s April STEO forecasts Brent crude oil prices averaging $35/b in 2016 and $41/b in 2017, with the December 2017 price averaging $45/b.

continued

In contrast to the forecast of declining Lower 48 onshore production through 2017, federal Gulf of Mexico oil production is projected to increase from 1.54 million b/d in 2015 to 1.66 million b/d and to 1.82 million b/d in 2016 and 2017, respectively. Alaska’s oil production is projected to slightly decrease from 0.48 million b/d in 2015 to 0.47 million b/d in 2016 and to 0.46 million b/d in 2017.

Increased production from the federal Gulf of Mexico (GOM) is not enough to offset those declines, with total projected U.S. production falling from 9.43 million b/d in 2015 to 8.04 million b/d in 2017.

Great intel Alex, thanks for posting.

Eyeballing the decline of Q1 2015, onshore : it appears to drop from about 7.5 to 5.0 in 1 year time (33%). That’s an even higher decline rate than I expected. Looks like not only the production I’m tracking is declining at a rapid rate.

I’m curious to see if we indeed will see the projected pick up in rig count this summer already.

Enno,

Your charts for the Bakken and some other sources show that LTO output drops by some 35% in 12 months if no new wells are completed.

Given that the EIA chart for Lower 48 onshore includes conventional production and still assumes that new wells are drilled and completed, a 33% decline indeed looks too big.

Apparently, they assume continuing decline in conventional output, primarily due to shut-down of the stripper wells. BTW, according to the EIA, between April 2015 and January 2016, US conventional onshore production was down 300 kb/d (bigger in relative terms than the drop in LTO output).

In addition, the EIA’s oil projections are too low, in my view. Therefore, they may assume a small number of well completions

AlexS,

In my view we will see actually a massive decline in wells due to plugging of wells. The latest RRC report for March 2016:

http://www.rrc.state.tx.us/oil-gas/research-and-statistics/well-information/monthly-drilling-completion-and-plugging-summaries/

shows already a net decline of 1000 wells per month.

So, a 33% decline of production is realistic and probably even too conservative.

Hi Heinrich,

The plugged wells are stripper wells with output of 5 b/d or less.

So if 1000 of these wells are plugged each month that’s 5 kb/d lower output each month or a 60 kb/d total decrease over 12 months. Not really much of a factor.

Dennis,

It is difficult for me to check how big these wells are. However, the main point here is about a huge sea change (see below chart) in net wells. Add the dramatic decline in use of proppant, the drop in rig counts (natural gas rigs are just at 88 versus 1600 in 2008)….. I can see the writing on the wall.

US production will be declining dramatically over the next months. Even the CEO of Pioneer and the IEA admit the decline. The only difference is that I think the decline will last much farther than Sep 2016 and will last well into 2017.

Hi Heinrich,

Everyone agrees there will be some decline.

Some estimates are more reasonable than others.

So far decline in Texas has been relatively modest at an annual decline rate of 8%.

There are still a lot of horizontal oil rigs operating in the Texas Permian Basin (over 100), and the horizontal wells produce much more oil than the vertical wells in that Basin.

I am talking about oil only here, I don’t follow natural gas as closely, at some point gas output will fall and natural gas prices will rise, no idea when that will happen though.

The permits minus plugged is not really very useful. Oil wells completed relative to wells plugged is of greater interest. Every well completed (average of about 250 kb/d for first year) covers about 50 plugged stripper wells (with an average of under 5 b/d). So about 20 completed wells will make up for 1000 plugged wells.

The first 3 months of 2016 there were 2482 new drill oil completions in Texas and 1453 oil wells plugged. The plugged wells are equivalent to taking away 29 of the new wells drilled, so the net new wells would be 2453 new wells or about 818 new wells per month for the first 3 months of the year. In March about 300 of these wells were in districts 1 and 2 (Eagle Ford most likely) and about 450 wells in Districts 7C, 8 and 8A (Permian Basin).

There has continued to be quite a lot of activity in Texas at least through March 2016.

Hi Heinrich,

You suggested in an earlier comment that US C+C output would fall to 7 Mb/d in 2016 and “much lower” in 2017. I asked what your 2017 estimate was, but you didn’t answer. Seeing as 2016 decline is expected to be 2.2 Mb/d, I assume much lower means at least as much as 2016, so would 4.8 Mb/d be about right for the low point of US production in 2016?

Note that I expect US output will remain above 8 Mb/d until 2020, or possibly even 2022 (if oil prices remain above $90/b from 2020 to 2022.)

Hi Enno,

Are you accounting for possible incomplete data in Texas?

Are you seeing 33% decline rates outside of Texas?

I am talking at the field level, rather than individual wells or counties. So for the Niobrara, or New Mexico Permian, the decline is certainly not 33% in the north Dakota Bakken, or not through February at least. Based on Dean’s data for Texas and even the EIA data for Texas, the statewide decline rate is not anywhere close to 33% per year.

Using EIA data, TX decline rate is 9% from March to Jan 2015. Using Dean’s data from March 2015 to Dec 2015 the decline is 6.1% (Jan was anomalous so I threw it out, if it is included the decline rate is 4.2%)

Looking at the Bakken, the decline rate from June 2015 to July 2016 will be close to 20% per year if the completed wells fall to 50 new wells per month on average for the rest of 2016, so decline is pretty steep, just not 33%/year. After July 2016 if the completion rate levels off at about 40 completions per month the decline rate moderates to about 10% per year for July 2016 to July 2017.

Hi AlexS,

I think the EIA is overestimating the decline because they are underestimating the oil price. With the DUCs available, the decline for the rest of 2016 in the LTO plays could be as little as 350 kb/d. The EIA is estimating almost a 1 Mb/d drop for the rest of 2016,

the conventional L48 onshore was about 3300 kb/d in Jan 2016, a 650 kb/d drop in output from L48 onshore conventional would be a 20% drop, if we assume an 8% drop, that would be about 270 kb/d, for a total of 620 Kb. The EIA is also underestimating Texas output, if Dean’s estimates are correct. If we assume no acceleration in the decline rate for L48 onshore, we get the following, with 2017 output about 6200 kb/d for L48 onshore.

Dennis,

The EIA has a long record of underestimating US oil production, not only during the shale boom, but also during the current downturn.

In particular, they have been underestimating volumes produced in Texas.

But I think that the most recent Dean’s estimate for Texas may be too high.

TRRC is now receiving production data from operators in electronic form, which may have shortened the reporting time. Hence, the underreported volumes for the most recent months are probably less in relative terms than previously.

My conclusion is that historical numbers are somewhere in between Dean’s and the EIA’s estimates.

As regards projections for the rest of this year and 2017, I agree that the EIA’s price assumptions are too low. Higher prices may result in higher volumes.

That said, I do not expect a quick rebound in drilling/completion activity as most shale companies are in a difficult financial situation and will not rush to increase capex. And even in the shale industry, with its short investment cycle, there is a time lag between a decision to increase capex and first production.

The EIA’s projections may be too low, but I still do not expect a quick rebound in the US C+C output.

AlexS. Although maybe not moving the needle much, I think US stripper well production may not decline as much as it has recently because of:

A. If prices continue to stay above $40 WTI, wells shut in may be put back on production.

B. As winter is over, it is more likely that low volume wells will be returned to production.

Actually many times both A. & B. apply. We have some wells that must be shut in when the temperature drops below a certain level. Shutting in requires some work, as does resumption of production. When oil prices were high, we would only shut in during the cold weather. This past winter, we just shut in at the first sign of cold weather, and did not start up until winter was over.

I do think, however, US conventional will continue to drop because there are very few vertical oil rigs running, far lower than even in 1998-1999. Also, I do not think a price increase will result in many conventional rigs coming back to the field this year. Balance sheets must be healed first. Conventional producers do not have a shocking decline like the LTO companies, so skipping another year of new wells is not as big of a problem.

Thank you shallow sand,

I actually wanted to ask you if you expect a return of shut-in stripper wells with higher oil prices

Hi Shallow sand,

What would you guess is the average output of stripper wells being shut in in Texas. I have suggested 5 b/d, but in reality it is probably more like 2 b/d.

For the wells that you run that you might consider for shutting in (or those you have shut in recently) what is their average daily output over an average month.

Hi AlexS,

Agree with all you have said above, I like the average of the EIA and Dean’s estimate for TX C+C and think the rebound in LTO output will take 12 months or so maybe mid 2018 there will be a gradual ramp up in LTO output. It will depend on many factors, especially the price of oil.

When oil hits $85/b or higher and remains there for 6 months (maybe we get there in Jan 2019), LTO may ramp up more aggressively.

The folks who predicted dirt cheap oil at The ECONOMIST don’t look quite as dumb as they did a few years ago, lol.

There is an old saying that the alarmists , pessimists, optimists, who ever, are always right, if you give them time enough.

This link may or may not reflect well on the judgement of the authors and editors of the Economist, but it is worth reading for insight if nothing else.

http://www.economist.com/news/leaders/21697221-impetuous-prince-rattling-middle-east-may-also-bring-bold-reform-new-oil

The biggest takeaway for me is that the pressure is rising in the Saudi pressure cooker, and that there is a significant chance the lid will fly off within the next few years, or maybe even the next few weeks or months.

The kid seems to be reckless sure enough, but he also seems to UNDERSTAND that the Saudi economy must be diversified before the oil runs out. I think maybe he DOES believe the oil will run out, or that the world will move away from oil, or both, otherwise he would not be pushing so hard for change.

Some commenters will disagree with me, but I don’t think all people in positions of great power are short sighted, ignorant, or stupid. Many people, maybe most people , are wise in some respects but stupid or ignorant in other respects.

I will not argue ( for instance ) that the engineers who design automobiles are much interested in the environment, but it is very hard for me to believe that they don’t understand such a simple proposition as peak oil. They know it comes out of holes in the ground, and that it does not rain oil on this planet.

The fact that EVERY major manufacturer is working feverishly on alternatives to the ice cannot be laid ENTIRELY at the feet of the environmental movement in my estimation.

( Of course expecting auto companies or their senior management to say much if anything at all about unobtainium oil is absurd. Some of the engineers and executives will have some things to say after they retire, but for now………. expect zipped lips. )

I sort of doubt they were smart enough to get thru engineering school and yet too stupid draw the correct conclusion in respect to the long term future of the petroleum burning internal combustion engine, lol.

The bean counters have enormous power in modern corporations. I doubt that the ones at the top of the heap at GM,FORD, NISSAN, HONDA , etc overlooked the fact (as Jeffrey Brown has so often pointed out ) that oil prices went up about five times over a decade without the production of REAL oil going up more than a pittance.

One of this kid’s top goals will be to cut back as fast as he can on the export of crude,in favor of processing it at home and exporting finished products. It might take him a good while to consolidate his power and put such plans into effect, and he might not succeed.

Yogi sez predictin’ is hard.

But I wouldn’t want to have much money invested in an oil company dependent on importing crude a few years down the road. All the larger exporting countries are likely to go this same “process it at home ” route so as to provide local employment and stability. A man is more grateful for a job than he is for a welfare check.

Ron, am I reading this right. Would OPEC be down 700,000 bpd if Indonesia wasn’t added to the club?

I guess OPEC-13 includes Indonesia for the full period

No, that is not right at all. Without Indonesia OPEC production would be 725,000 barrels per day less but not down by 725,000 barrels per day. Indonesian production is added to the entire history of OPEC production.

Actually OPEC production is down about 200,000 barrels per day because of Indonesia. That is because back in 2005 Indonesian production was averaging about 200,000 barrels per day higher than it is averaging today.

Look at that first peak in September 2005. Today OPEC production is at about that same level. But OPEC less Indonesian production, current production is about 200,000 bpd above that point.

OPEC 13 peaked in July of 2008 at 32,525,000 bpd. OPEC less Indonesia peaked in November 2015 at 31,724,000 bpd.

still no mention of “if” any partial float would include reserves ?

potentially – this could enable the game to be played a little longer ?

Saudi Aramco IPO Could Be 5% of Value

22/04/2016 03:05AM AEST

PARIS—Saudi Arabian Oil Co., the largest energy firm in the world, is considering listing up to 5% of its value on a stock exchange in New York within the next year, a top Saudi oil official said Thursday.

By listing even a tiny fraction of the company, known as Saudi Aramco, the offering would create one of the world’s most valuable energy firms. Estimates of Saudi Aramco’s value have varied, but using a conservative number of $2.5 trillion, a 5% listing would give it a potential value of $125 billion—bigger than BP PLC and French oil titan Total SA.

The Saudis are considering listing Aramco at a time when the kingdom is trying to raise cash during a period of sharply lower oil prices and transition to a world that is less dependent on oil. Deputy Crown Prince Mohammed bin Salman is overseeing a “National Transformation Plan” to promote private-sector growth and reduce government reliance on petroleum revenues.

New York has emerged as the leading place for an Aramco listing, but London and Hong Kong are also being considered, said Ibrahim Muhanna, a top adviser at the Saudi oil ministry. Mr. Muhanna said the kingdom wouldn’t list the company only on Saudi Arabia’s bourse, the Tadawul, because it was too small.

“The Saudi market cannot take a company like this,” Mr. Muhanna said on the sidelines of a conference in Paris.

He didn’t disclose which firms were working on the listing for Aramco. He said a price for the stock was still being determined and that it may take another year for a listing to be completed.

Pricing “has to be decided by international markets,” Mr. Muhanna said. “It has to be competitive.”

An unresolved question remains whether a listing will include the division of Aramco that includes its vast reserves of crude oil. It manages, but doesn’t own, the kingdom’s 260 billion barrels of reserves, the most in the world.

Saudi Aramco Chairman Khalid al-Falih has sent conflicting signals about whether the reserves will be include. Mr. Muhanna didn’t address the issue.

A number of Saudi experts and insiders have said Saudi Arabia wouldn’t include its production assets in any listing. Aramco is essentially an instrument of state policy, and its methods and reserves tantamount to state secrets.

The company produces more than 10% of the world’s oil supply every day and controls a large chain of refineries and petrochemical facilities to complement its exploration and production operations.

Summer Said in Dubai contributed to this article.

Write to Benoit Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

April 21, 2016 13:05 ET (17:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

I don’t think it will ever happen, not even 5%. 5% of ARAMCO would have to include 5% of reserves. And there would have to be confirmation that those reserves actually exist. And of course they do not exist, not 266 billion barrels of reserves anyway.

Therefore it will never happen.

Ron Wrote:

“I don’t think it will ever happen, not even 5%. 5% of ARAMCO would have to include 5% of reserves. And there would have to be confirmation that those reserves actually exist. And of course they do not exist, not 266 billion barrels of reserves anyway.”

I think they will fangle a way around the reserve reporting problem. Didn’t Brazil’s Petrobras over state its reserves, yet was able to raise over $100 billions in capital.

Petrobras slashes oil reserves to lowest level in 14 year

http://www.reuters.com/article/brazil-petrobras-reserves-idUSL2N15D165

Jan 29, 2016:

“Brazil’s state-controlled oil producer Petrobras slashed its oil and natural gas reserves 20 percent on Friday, hit by a plunge in energy prices, a heavy debt load, high costs and a corruption scandal.”

if Petrobras can lie, so can SA.

I have had exactly the same thought. How can KSA “cash in” on ARAMCO without the public disclosure required? But maybe they will find a way. Maybe they can sucker investors into believing their reserve numbers? Maybe they can do their offering in a country with less stringent regulations? I don’t know much about how that works and I could be way off base, but I do know that where there’s a will (and tons of money) there often is a way. And KSA has a BIG TIME desire to cash in, which should tell anyone all they need to know about the state of their economy.

There are people with money willing to believe just about anything.

SVO wrote:

“There are people with money willing to believe just about anything.”

I think you meant to say there are people with other peoples money to invest, willing to believe anything. 🙂 For the most part, investments these days are institutional investors and hedge funds. The retail investor left stocks back in 2008.

“The retail investor left stocks back in 2008.”

Not all of us.

The retail investor left stocks back in 2008.”, “Not all of us” –clueless

Ha! With the S&P500 PE ration at about 27? Its at the third all time high, behind 1929 and 1999. The odds are better at a casino, and at least the drinks are free at the casinos.

Clueless asked:

“I would also add, what type of investor would want to own a minority stake in that asset?”

The same investors that bought Continental Resources (CLR) & and the rest of the Shale companies now in or near bankruptcy. Investors been doing stupid investments for a very long time: Pets.com @1999 , Chipotle ($442), Panera Bread ($215), twitter, and the rest of the ridiculous investments.

Most of it it is driven up by hedge funds and institutional investors using OPM (Other peoples money). The managers collect huge fees as well as profits, but they don’t give back the money when their investments collapse. Its a “heads I win”, “tails you lose” con game.

Do you know what most fund mangers invest in: Cash and US treasuries. It’s odd that they don’t put their own money into the same investments included in their funds. I wonder why!/sarc.

As far as investing in SA. The majority of people think they have an unlimited supply of Oil. People will gladly hand over money to SA. We (Peak Oilers) are a tiny minority. The rest of the world thinks we are nothing but a bunch of mad tinfoil hat wearers.

“The majority of people think they have an unlimited supply of Oil.”

This is why their threat to pump a gazillion extra barrels is nothing to scoff at. It would lend credence to the idea that they have unlimited supply right before the IPO. Would it damage their wells? I don’t doubt it, but does that mean they won’t do it?

Ron – I think that you are 100% right. I would also add, what type of investor would want to own a minority stake in that asset? I know that I would not. And, I expect most would rebel if they owned a mutual fund that invested.

To give an example: Would anyone want to own a 5% interest in Buckingham Palace? You could go there and, from a distance, take a picture of it and say “I own 5% of that.” But, that would probably be the extent of your benefit. You could probably go to SA and take pictures of oil wells also – just be careful not to pack a bible, or a crucifix, or a copy of Playboy, etc. And definitely do not talk about 911.

Ron,

The article mentions that the question of whether or not any of the reserves will be included in the offering is still not settled. The initial announcement a couple of months ago said that only midstream and downstream assets would be included. The story has bounced around since then.

“The initial announcement a couple of months ago said that only midstream and downstream assets would be included.”

This is one of the options to not disclose oil reserves number.

They can also list the company on the local exchange where disclosure rules are not the same as in the western countries. I am sure a lot of local wealthy individuals, as well as people from other GCC countries, from Asia, and risky investors from the West would be willing to buy shares in Aramco even if its reserves are not disclosed.

Finally, they can separate the listed subsidiary from the parent (100% state-owned) company. Similar model was used during the privatization of the oil industry in China (CNPC/Petrochina and Sinopec parent/Sinopec listed).

The listed company may own some upstream assets, while most of the fields (including Gwahar) will be owned by the parent company.

Ron

Colin Campbell always used to say he believed the 266 billion was total discovered taking no account of historic production.

Prudent to expose other skin in the game.. A few stray Bullets can make a mess out of an operating Petro-Chem Complex. The HCC Disaster was one of the Top 10 Global Insurance claims of all time for many years. https://en.wikipedia.org/wiki/Phillips_disaster_of_1989

The dependency on petroleum revenues makes it exceedingly difficult for petro-states, even ones with progressive governments, to transition to a post carbon economy.

Many Canadian politicians that talk up their plans for reducing emissions have no real sense of how fast and how soon the transition has to happen. There isn’t the time, capital, or carbon budget available to be squandered on building out petroleum infrastructure.

The federal NDP’s ‘Leap’ of faith advocates and Alberta’s right-wing opposition: strange bedfellows?

albertapolitics.ca, David Climenhaga 1 week ago

The Leap: Time for a reality check

By Naomi Klein, Rabble, April 14, 2016

Alberta wildfires on the rise amid hot, dry spring weather

By Robson Fletcher, CBC News Posted: Apr 19, 2016 3:16 PM MT

The $2 Trillion Project to Get Saudi Arabia’s Economy Off Oil

Eight unprecedented hours with “Mr. Everything,” Prince Mohammed bin Salman.

Peter Waldman, Bloomberg, April 21, 2016

VERY interesting, aws.

from your link: “The likely future king of Saudi Arabia says he doesn’t care if oil prices rise or fall. If they go up, that means more money for nonoil investments, he says. If they go down, Saudi Arabia, as the world’s lowest-cost producer, can expand in the growing Asian market.”

Bloomberg does seem rather cozy with the Saudis lately.

Smoke and mirrors … they are burning massive amounts of money today, they have about 3-4 years left at the current burn rate.

And Saudi invests have been such great things as growing wheat in the desert, destroying their aquifers.

I try to think about things, everything, at the very most basic level, so as to UNDERSTAND why they might work or not work, whether they will last or fail.

Take the German industrial export model economy for instance.

As I see it, it COULD last and MIGHT last so long as the world wide “business as usual ” economy lasts. But if it does last, one essential condition is that Germany must maintain that country’s current front runner status in terms of the skill and knowledge of the German people, not just for a year, or a decade, but PERMANENTLY.

There is no real reason, other than LACK OF human capital and built industrial capital, that the people of Bangladesh can’t build luxury automobiles just as good as the ones in Germany.

What I am trying to say is that the whole world cannot forever continue to exist on the imported ( exported ) raw materials, exported ( imported ) business model, for a couple of basic reasons.

One, wannabe exporters can win the export game by undercutting the wages and environmental standards of the winners, for example China.

Two, the raw materials are going to become increasingly scarce, so that the exporters of the same cannot obtain enough finished goods in exchange for their exports.

Importers that don’t exercise sufficient foresight in planning for the time when they CAN’T import sufficient raw materials at affordable prices must cease to export. You can’t export what you can’t build at all, and you can’t export stuff so expensive only one percenters can afford it, at least not on a nation sustaining scale.

Hardly anybody ever says so in so many words, but I am personally convinced that Germany is pedal to the metal on the renewable electricity front for two entirely sufficient reasons that have little to do with the environment in DIRECT fashion. One, sufficient and affordable fossil fuels will not always be available, TWO , with changing conditions, old markets die and new ones are born, the new one being renewables. Germany hopes to export renewables expertise and hardware.

Now with this background in mind, WHAT can Saudi Arabia export once the oil is gone? I just can’t see the people of that country ever competing in the way Germany competes.

They are starting from TOO FAR BEHIND to have a snowball’s chance on a red hot stove of catching up, and they are handicapped by too many other shortcomings. Germany does not have an IDEAL climate, or LOTS of good farmland, etc, but compared to Saudi Arabia, Germany is a physical paradise.

It’s extremely hard to come up with an even remotely realistic scenario wherein the Saudi PEOPLE aren’t up shit creek without a paddle.

At some point in the not far distant future, the elite will start emigrating by the tens of thousands, and life for who ever can’t get out is going to be extraordinarily hard and dangerous.

The country is basically a powder key with a fuse hanging out, and there are lots of characters in the wings with matches in hand.

The regulars here who own oil in the ground WILL find themselves in cotton so tall they can’t see over the top when the keg inevitably,finally, blows. Oil will go way past a hundred bucks when that happens.

When? Any year now.

Dilbit Dogma? The Myth of Tidewater Access

Pipeline cheerleaders often employ this rationale. But it no longer applies.

By Eugene Kung, Yesterday, TheTyee.ca

Times are hard for almost everybody in the oil biz but I think the people who are preaching the industry’s funeral are, as Twain put it, exaggerating.

I am about as big a techocopian as anybody who posts regularly in this forum, except NICK who seems to have dropped out recently. But I can’t see us breaking our oil addiction in less than two or three decades, and that’s with the best of luck and steady work.

Unless somebody finds a few new supergiant fields, oil HAS to go up, unless the economy goes down. Matt Simmons was a man a little ahead of his time, but he knew a thing or two.

“Rust and depletion never sleep.”

If we are VERY lucky, the oil endowment will last long enough that we can learn to live with less and less of it from one year to the next.

And it could be that we WILL learn how to do that.

Researchers at the University of California have apparently discovered a way to construct a battery using gold nanowires and a gel electrolyte that can be cycled over a hundred thousand times. It seems there is hope of using nickel and possibly some other metals for the wires, meaning that there is at least a theoritical possibility such a battery could be a practical undertaking.

The only way we will learn to live with less is to have less to live with. Oil is just too good, too easy, too essential to give up voluntarily. I don’t expect that technology will fill that gap in any way that will avoid mass suffering around the world — less so in the United States perhaps.

Ten years ago the graphs that were making the rounds showed a sharp peak and steep decline. According to Ron’s graph of World C+C Annual Production, the upward trend has been solidly in place since 1983. Will that continue? I don’t think so. But if Dennis is correct, the fall will not be so steep. I have my doubts. But regardless, even a small downward trend will be sufficient to send the world into economic trouble. Anything exceeding 2% a year decline will be catastrophic after five years in my opinion. I don’t see how it could be otherwise.

On the other hand if the decline is as steep as the growth over the past 30 years has been, then we are in deep deep trouble. So those are the choices. Bad or worse. I just don’t see technology coming to the rescue, though I know that many here do. For some, like many here in Silicon Valley, life will go on relatively unchanged. But for the vast majority, both in the U.S. and the world, I see only pain.

Hi Silicon Valley Observer,

The scenario I think most likely is and undulating plateau in C+C output to about 2021 and then gradual decline of under 1.5% though about 2027 and by 2030 that declining output will cause an economic crisis and a World recession.

By that time it will be clear that peak oil has been reached and perhaps policy measures will be aggressively implemented to alleviate the problem.

Oil prices will be high and this will help make alternative forms of energy for transport more attractive. Perhaps it will be clear to the cornucopian crowd that coal and natural gas will also peak and that aggressive policy should be followed to address those problems as well.

An economic crisis (such as the 1930s in some parts of the World) can lead to positive social changes, they can also be very negative.

Hopefully we will not forget our history.