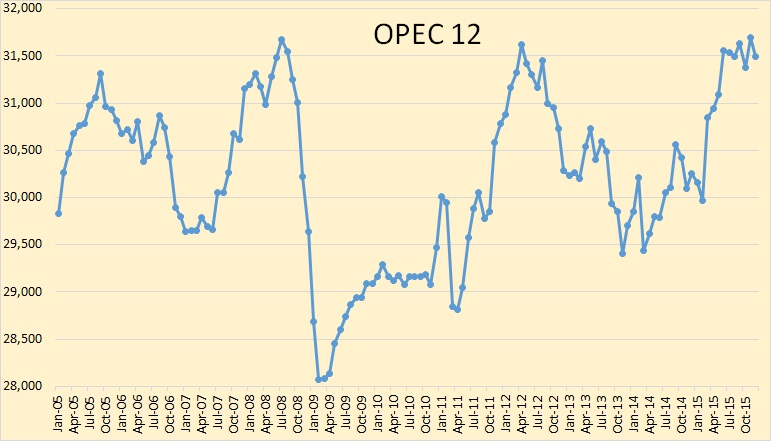

The OPEC Monthly Oil Market Report is out. OPEC took a hit in December, down 205,000 barrels per day. After examining the past and present production numbers, I believe that OPEC, except Iran, has peaked. That is, the combined production from all the other OPEC nations, has peaked. And any additional production from Libya is likely to be in tiny increments that won’t make much difference in the big picture. Other OPEC nations may show a slight increase from their current level. But the combined production from all the other 11 OPEC nations, 12 if you count Indonesia, has peaked.

Of course there will be some small increases from the other 11 OPEC countries from time to time but overall, in 2016 and beyond, I believe it will OPEC will be from flat to down, with a greater chance of being down. That is we are at, or near, the peak right now. There might be a slight uptick of their combined production in the coming months but not enough to get excited abut.

All Data in the charts below is through December and is in thousand barrels per day.

OPEC production, in the chart above does not include Indonesia. OPEC 12 was down 204,000 barrels per day.

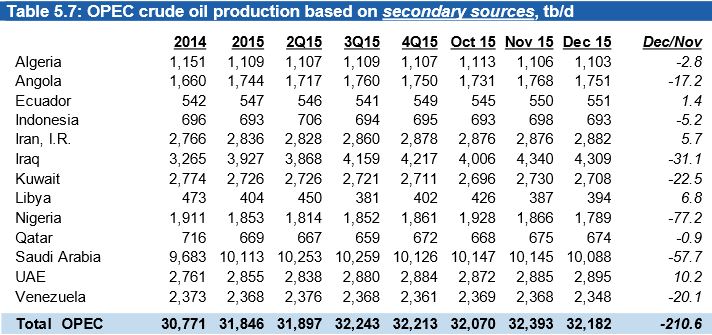

OPEC uses secondary sources such as Platts and other agencies to report their production numbers. These numbers are pretty accurate and usually have only slight revisions month to month. The biggest changes were from Iraq, Nigeria and Saudi Arabia, all down.

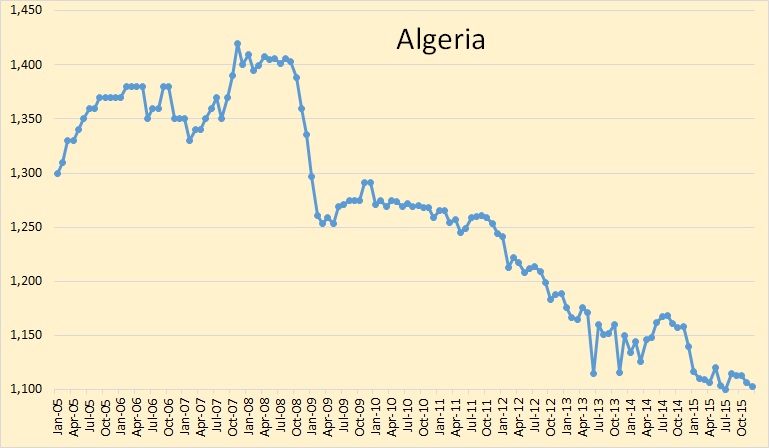

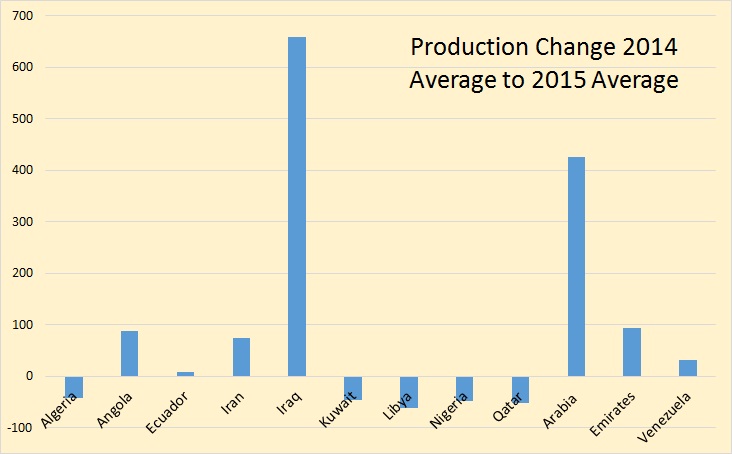

Algeria peaked in November 2007 and has been in a steady decline since that point.

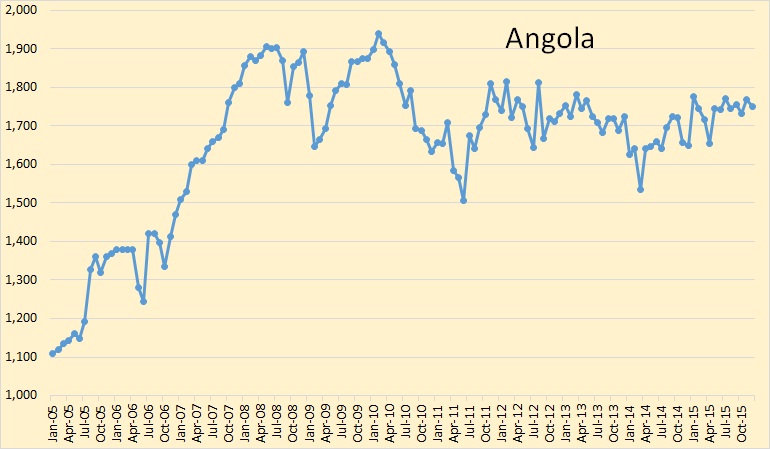

Angola has been holding steady since peaking in 2008 and 2010.

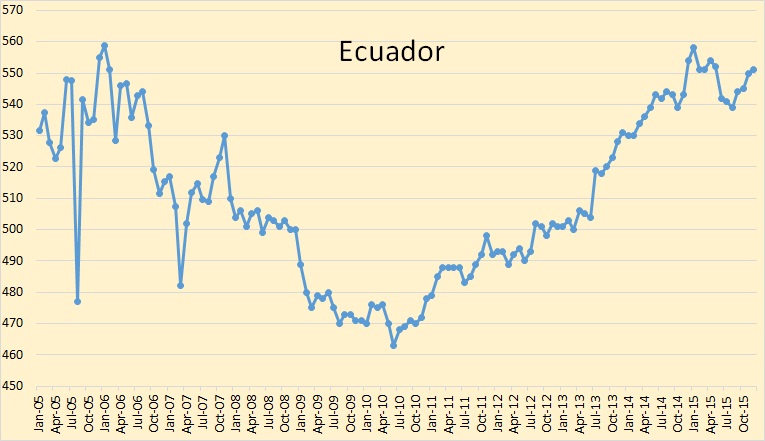

Ecuador appears to have peaked this year. It is likely production will be down, but only slightly, next year.

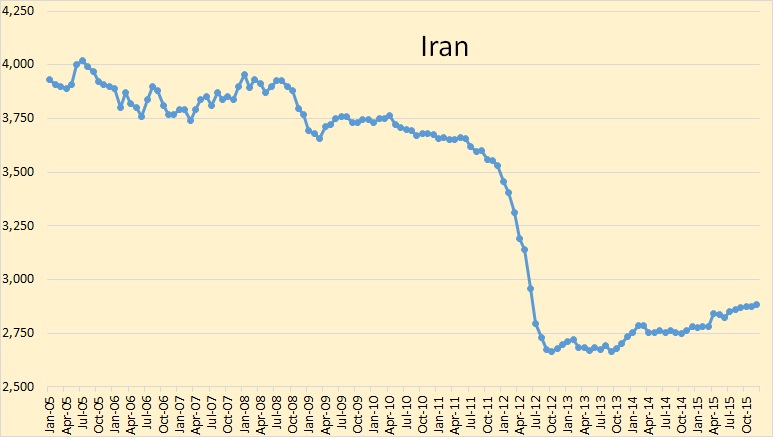

Sanctions were just lifted, in the middle of January, on Iran. I expect their production to be up by about half a million barrels per day, or slightly more, by year’s end. However I believe Iran will be the only OPEC nation with any significant production increase in 2016.

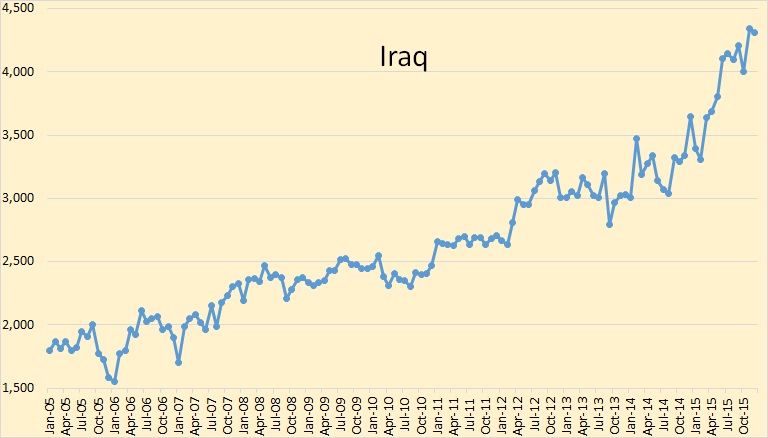

Iraq increased production more than any other OPEC nation in 2015.

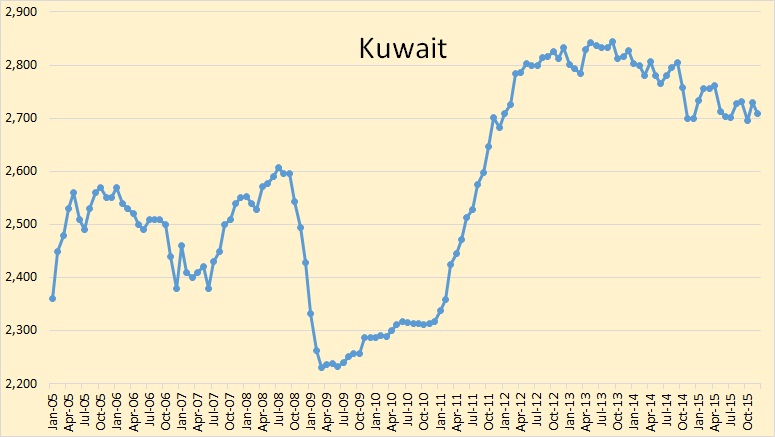

I expect Kuwait will continue its slow decline from its peak in 2013.

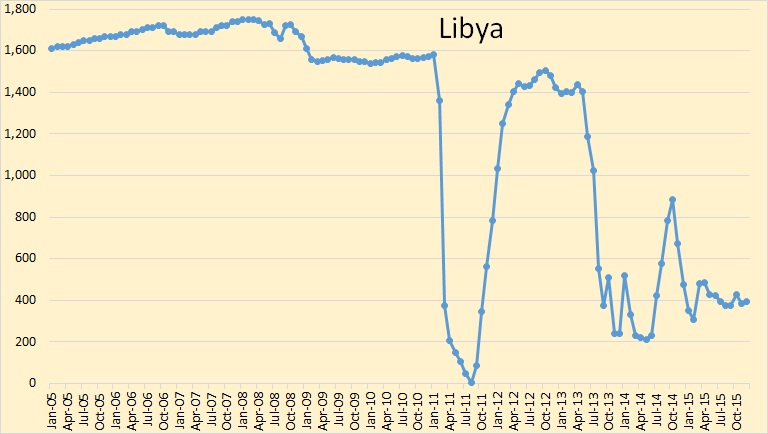

Libya is struggling with their own Arab Spring. There is no way of knowing when, if ever, peace will break out there. I think it extremely unlikely they will produce as much as 1,000,000 bpd within the next 5 years or so.

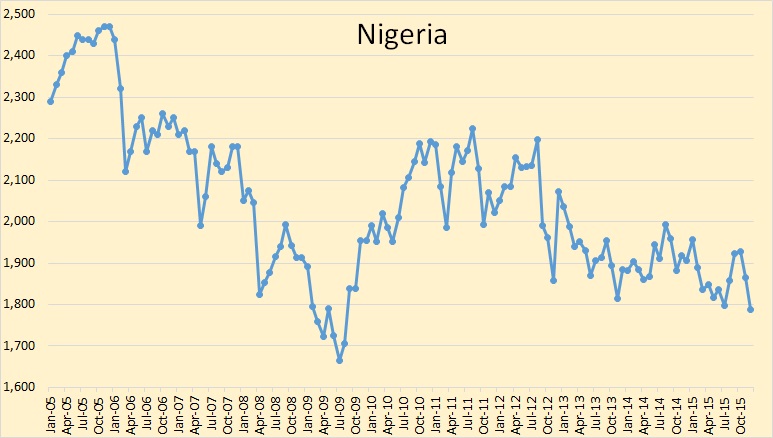

Nigeria is struggling with their own political revolution. But it appears they are in decline regardless of their political problems.

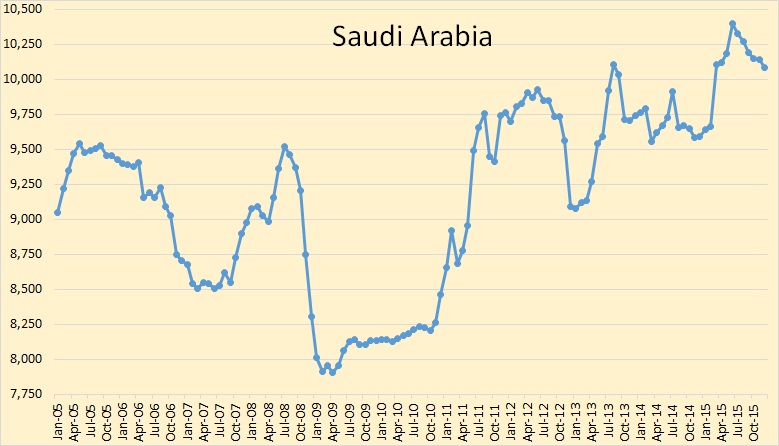

I believe Saudi is producing every barrel they possibly can. They will be lucky to hold this level for much longer.

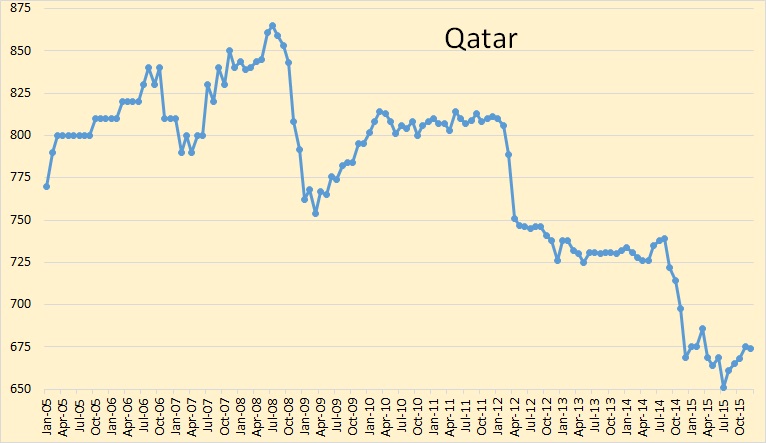

Qatar has lots of natural gas but their oil production has clearly peaked and is now in decline.

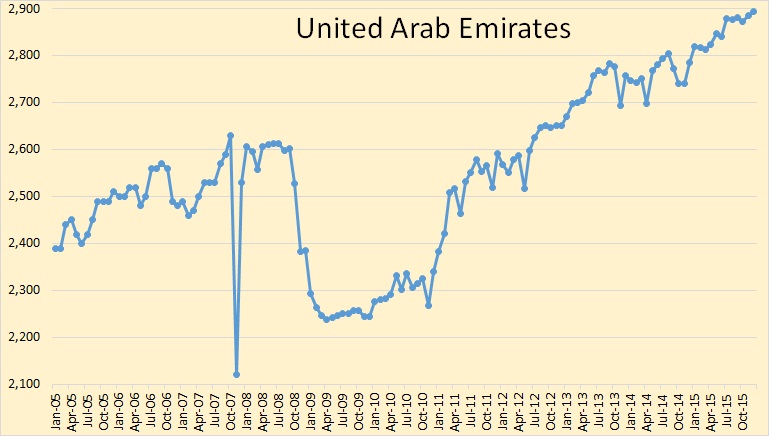

From 2005 through 2010 the oil rig count in the UAE averaged around 12. In November their oil rig count stood at 48, 4 times their average. They have managed to increase their production about 11% above their 2008 peak. I believe UAE production is about to follow Kuwait’s lead and rollover. The UAE’s rig count dropped by 4 in December.

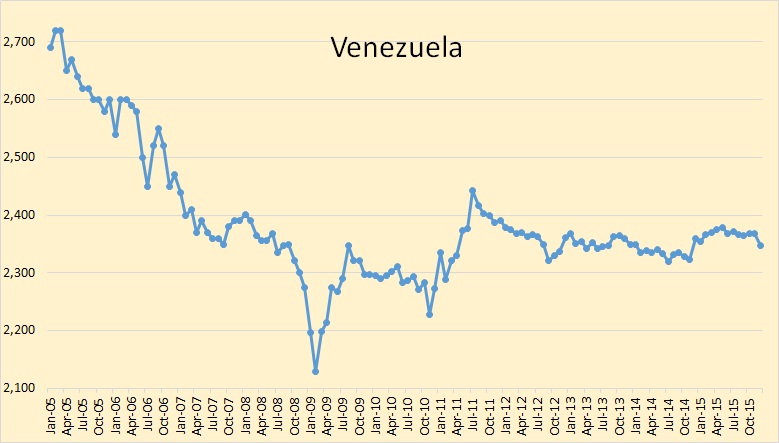

Not much can be said about Venezuela. Their conventional oil is in decline but their bitumen production is keeping production relatively flat.

The below chart is in thousand barrels per day.

This is where the OPEC action was in 2105. This chart will look entirely different in 12 months. Only Iran is likely to show any significant increase. Well, that’s my opinion anyway.

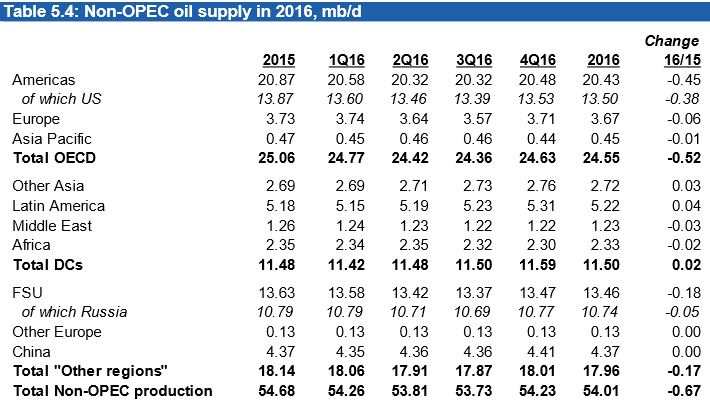

Here is what OPEC is expecting Non-OPEC countries to produce in 2016. They are expecting total Non-OPEC total liquids production to decline by 670,000 barrels per day. I expect the C+C decline will be closer to one million barrels per day. And I think it is likely that the total liquids decline will be close to that mark also.

Notice that they are predicting US total liquids to drop by only 380,000 barrels per day in 2016. I think this is overly optimistic. I am predicting a Non-OPEC production decline of at least one million barrels per day.

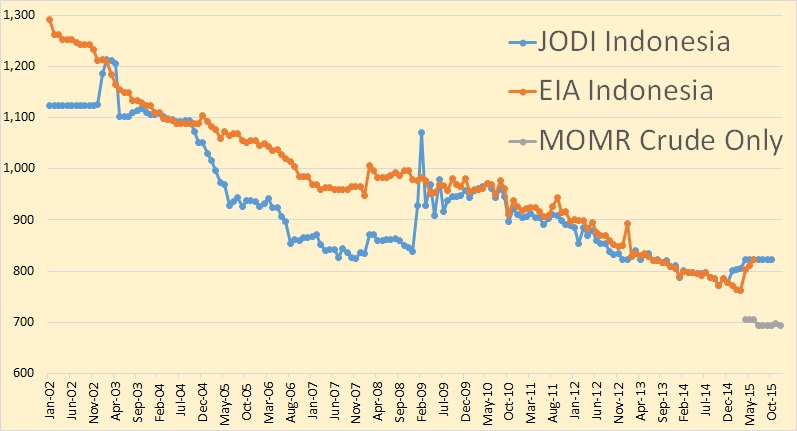

Indonesia, though they are a net importer and in decline, became an OPEC member this month. They have no “crude only” history so I will have to take their EIA chart and subtract their estimated percentage of condensate production and go from there.

Here the EIA data is through June, the JODI data is through October and the OPEC MOMR data is through December. Again, the MOMR data does not include condensate while the JODI and EIA data does. It looks like condensate is about 12 percent of Indonesia’s production.

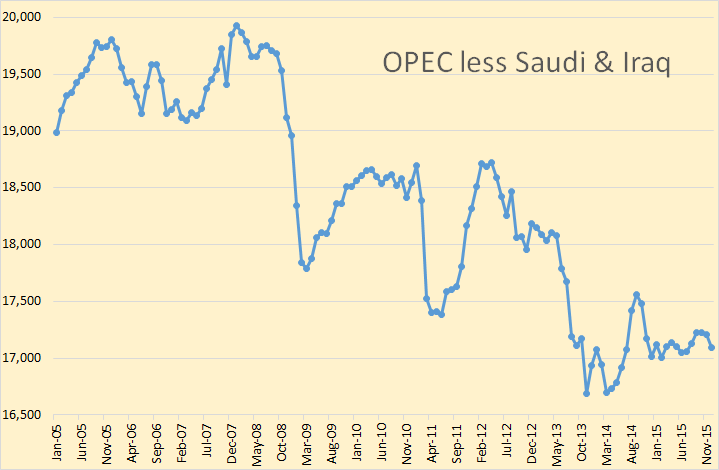

And I just had t add this for those who think there is little chance of OPEC peaking. OPEC less Saudi and Iraq peaked in 2008 and is down over 2,800,000 barrels per day since that point.

Just in: The Highlights of the IEA’s Oil Marker Report came out Tuesday. Normally the highlights gives the IEA’s estimate on Non-OPEC oil production. However this month they failed to do so. But all is not lost, Canada’s Financial Post was kind enough to give us the IEA’s estimate of December Non-OPEC production. Bold mine.

As OPEC pursues its policy of gaining market share and driving down prices, most non-OPEC producers have curtailed spending to weather the prolonged downturn. Non-OPEC production in December declined sharply by nearly 650,000 bpd to 57.4 million bpd— its lowest level since September 2012, according to an International Energy Agency report published Tuesday.

That is alarming. Perhaps my estimate of Non-OPEC production decrease of one million barrels per day is too low. “its lowest level since September 2012” is obviously a typo. What they meant was “its largest single month decline since September of 2102”.

Thanks for the post Ron.

I hope the ones who still think that KSA has millions of barrels in spare capacity read it and read it well…and let us hope they understand it in the first place.

…wow:

stock futures this morning way off;

10 year note yield below 2%:

oil below $28/brl;

We are in for rough times ahead…

Be well,

Petro

Based on EIA/BP data, Saudi total petroleum liquids + other liquids production was 11.5 million bpd in 2005 and 11.6 million bpd in 2014. Because of rising domestic consumption*, Saudi net exports fell from 9.5 million bpd in 2005 to 8.4 million bpd in 2014.

EIA data put Saudi production at 11.9 million bpd for the first half of 2015. If we assume 2015 annual production of 12 million bpd and no change in consumption, Saudi net exports in 2015 would be at about 8.8 million bpd in 2015, versus 9.5 million bpd in 2005. In other words, it’s almost certainly true that Saudi net exports have been below their 2005 rate for 10 straight years.

*EIA shows 2005 Saudi consumption at 2.0 million bpd; BP puts 2014 consumption at 3.2 million bpd (EIA consumption data for 2014 not yet available for Saudi Arabia)

And a link to some comments about the current situation in Saudi Arabia, in regard to the royal family:

http://peakoilbarrel.com/bakken-up-in-november-plus-steo/#comment-556202

Jeffrey,

Your link shows comment 556202, but I think your comment about KSA (which was timely – thank you) is 556001.

I have a graph on Saudi exports in my latest post

21/1/2016

The myth of US self-sufficiency in crude oil

http://crudeoilpeak.info/the-myth-of-us-self-sufficiency-in-crude-oil

It’s very hard to be sure about anything in Saudi Arabia because:

(1) it is generally believed that they conceal their best data on their oil as state secrets;

(2) they have a consistent history of manipulating production levels for political purposes.

I would go so far as to say that Saudi Arabia is a black box. Maybe they’ll run out tomorrow. Maybe they have millions of barrels in spare capacity. The secretive nature of the dictatorship/aristocracy in Saudi Arabia means we are very uncertain. By contrast we really do have pretty good data on everyone else.

Personally I believe that there are no real secrets when it comes to Saudi capabilities, at least not when it comes to well informed industry insiders, and to intelligence agencies.

There are too many outside contractors, too many outside suppliers, too many people tracking international trade, too many people staring at satellite photographs.

Now as to who has access to all this data-I should say for instance Exon has access to enough of it, considering that Exon buys so much in the way of goods and services, and a salesman finds it necessary to accomodate his BEST customer , especially one that buys by the tens of millions over and over.

For sure outfits like the CIA, etc have enough data to figure it out.

I have never heard that the Saudis have anything much in the way of a native IT industry.Some of what they are using is sure to have back doors allowing the people that created it, and spy agencies, to take a look.

And there are always turncoats, for one reason or another. A denied promotion, a personal vendetta, a man is out on his ass with no money, and blackballed in the industry within his home country…………. SOMEBODY will be very glad to provide such a man with a living in exchange for what he knows.

Spot on, Nathaneal!

As I was reading the article, I was thinking, every time he said “I think” this or that, how fuc*ing absurd, as all you really know is something you heard/read from someone else who said “I think…” If you ain’t been there–EVERYWHERE–fully armed with the technical knowledge to assess EVERYTHING then you don’t “know” shit. In fact, nobody knows shit: there are just too many variables–and a few of Rumsfeld’s unknown unknowns to boot.

We live in a virtual reality world, and our understanding of reality is what “they” want it to be.

As I was reading the article, I was thinking, every time he said “I think” this or that,

So your thinking (“I was thinking,”) is valid, but anyone else’s thinking (‘he said “I think”’)is invalid.

I’ll let the meta-stupidity of your comment sink in.

A direct reading of your text seems to advocate for a world with no discourse or commentary (’cause it requires thought, eh? (Though we would have to ignore your comment, of course, as very little thought seems to have gone into it.)) I suspect that you merely want a world where no one posts anything you disagree with, as a world with no commentary would, by definition, not allow your comments…perhaps you propose some sort of mental telepathy, so we can avoid thinking, writing, or publishing anything you disagree with.

Thank you Ron.

Below is a summary of the recent (January 2016) global GDP growth and global oil demand projections

Oil price forecasts (January 2016 revisions)

Hi AlexS,

I prefer the World GDP based on market exchange rates rather than PPP from the IMF.

These are 2.5% in 2015, 3% in 2016, and 3.2% in 2017.

From 2011 to 2014 GDP growth was between 2.4% and 3% (3%, 2.5%, 2.4%, and 2.7%).

The lack of oil affordability at over $90/b is somewhat of a myth based on World growth rates from 2011 to 2014. The hypothesis that low oil prices will boost the World economy also seems to be incorrect based on 2015 data and the 2016 forecast (which may be too optimistic).

“The lack of oil affordability at over $90/b is somewhat of a myth based on World growth rates from 2011 to 2014. The hypothesis that low oil prices will boost the World economy also seems to be incorrect based on 2015 data and the 2016 forecast ”

I agree with both assertions.

Interestingly, OPEC and IEA expect global demand growth to decelerate in 2016, despite higher economic growth and lower oil prices.

And this table from Goldman Sachs research shows that demand has been weakening in 2H15:

(source: http://oilprice.com/Latest-Energy-News/World-News/Iran-To-Drive-Oil-Prices-Lower-Still.html )

Hi AlexS,

They may believe that greater fuel efficiency and the cut backs in subsidies in some nations will reduce oil demand, forecasts of oil supply and demand are difficult, probably the average of several forecasts is the best guess. One could also extrapolate the recent trends for GDP vs oil consumption to get some idea, but trends often change.

Or we could have some monkeys throw darts at a board, probably just as accurate. 🙂

“I prefer the World GDP based on market exchange rates rather than PPP from the IMF.

These are 2.5% in 2015, 3% in 2016, and 3.2% in 2017.”

Dennis, what are those GDP numbers if stimulus i.e. QE and other fiscal policies to generate GDP are subtracted out?

Hi Stiglar Wilcox,

The short answer, probably lower.

I don’t know by how much.

Let’s say most governments reacted to the global financial crisis in the way Herbert Hoover dealt with the stock market crash of 1929.

No fiscal or monetary policy, let the economy heal itself.

I do not have data for the World, but for the US real gross domestic product fell by 25% from 1929 to 1932, so perhaps if the World as a whole had tightened their belts and balanced government budgets we might still have had lower real GDP than in 2008 by 2014 (it took 7 years for US GDP to reach 1929 levels, and this was only with 4 years of fiscal stimulus from 1933 to 1936), it is hard to know how much longer growth would have been negative without the New Deal.

I for one am glad some nations have the good sense to pay attention to what Keynes taught us long ago. If not the GFC would have become Great Depression 2.

Now we may still see another Great Depression as the World tries to adjust to peak oil (from 2025 to 2030), some think it is inevitable and will begin very soon. I think the 2015 peak will be temporary and will be surpassed by 2020, with the final peak around 2025+/-2 years. Decline will be gradual at first, but by 2030 or so we may see a severe recession or GFC 2, this could become Great Depression 2, if the poor economic policies that Europe chose in response to the GFC are followed Worldwide.

I agree Dennis that lessons were learned from the Great Depression and the resulting fiscal policies were important in avoiding a similar scenario. We both agree GDP would have been less (than listed in your post I was replying to), and once taking that into account, does it not reduce estimates of URR? Regardless of how much it may be reduced, I agree with your projections for a higher peak by 2020.

Hi Stiglar Wilcox,

No the URR would not really be affected, it is assumed that oil not produced today because GDP was lower will be produced later when the economy grows.

In addition I expect nations will behave in a rational manner and learn from past mistakes so I expect fiscal and monetary policy will be used appropriately to increase aggregate demand where possible.

It is possible that URR will be lower due to a transition to alternative transportation and energy. For example a recent model has C+C output at 2500 Gb by 2060, it is conceivable under optimistic assumptions that the 900 Gb that are still technically able to be produced (under a high oil price scenario) will be far lower because demand falls due to more wind, solar, nuclear, EVs, public transportation, plug-in hybrids, etc., maybe the URR falls to 3000 Gb or less in this scenario.

I am not sure if that is what you mean, but if so I agree URR would be lower if oil prices are limited to $80/b (2015$) long term due to a reduction in oil demand for whatever reason.

It is difficult to estimate how much lower the URR would be. A rough guess would be extra heavy oil URR falls from 600 Gb to 300 Gb and C+C less extra heavy oil falls from 2800 Gb to 2600 Gb for a total URR of 3100 Gb under a low oil price scenario ($100/b or less in 2015$ after 2060).

I personally believe there is a high probability that the world population will be falling by 2060, and that most countries that are well to do now, and manage to remain well to do, will have LOWER populations than expected, and that demand per capita will also be lower than expected , in such countries, due to adoption of alternate technologies, and changing lifestyles.

Now as to whether the people in currently poor countries are going to continue to get richer, on average, as they are NOW, that is an open question. I expect some countries will do ok , while others will implode or collapse due to (LOCAL ) overpopulation, lack of domestic natural resources, and lack of any thing that can be exported to pay for imported essential goods.

I am a LONG WAY from a cornucopian, but only a fool can possibly refuse to recognize that WE CAN COLLECTIVELY get double or triple the ESSENTIAL ECONOMIC BANG from a barrel of oil, as compared to today.

Electric cars WORK, there are already hundreds of thousands on the road, giving good service. They may be, they still are more expensive to buy, but they are unquestionably superior to open to the weather bicycles or STANLEY STEAMERS.

I can remember myself when it was a rare thing for an older car to last a hundred thousand miles without making numerous major repairs, such as overhauling the engine, replacing the clutch, rebuilding the differential and drive shaft, replacing wheel bearings and ALL the components of the brakes, putting on new tires every ten thousand miles max, etc etc, as a matter of course.

ELECTRIC CARS ARE GOOD ENOUGH NOW for the world to get by with them.

Get rid of most or nearly all the oil burning personal transportation, and there will be plenty of oil to run essential trucks, farm equipment, etc , for the rest of this century, more than likely.

It really is possible that a good bit of heavy oil will never be produced. OR it could turn out that due to the need for it to run trucks and farm machinery, it will be economical to produce it even at a current day dollar cost of two hundred dollars or even more.

A substantial part of what gets hauled these days is of negligible value. You can put twenty tons of potatoes in a big truck, in burlap bags, on pallets, or four or five tons of potato chips in card board boxes and plastic bags, on pallets, in the same truck. Potatoes are arguably an essential staple food. Potato chips are NOT.

We can afford to pay double or triple the current price of diesel fuel , if it is burnt wisely, without breaking our collective economic back.

The bottom line is that any prediction about the amount of oil we will be using,and the amount we use ultimately, and for what, decades down the road, is hardly any better than outright guesswork.

There are simply too many variables. The one thing that is for sure is that there is less in the ground every year, and so it is going to cost more, on average, to get it out and to market.

Got me to thinking, OFM, there are an awful of things like shipping potato chips that we could surely get by without, that require liquid fuel. Here is a few just off the cuff- nascar, all the sports teams that fly/drive all around the country and their fans, all the driving to entertainment venues (from movie theaters to amusement parks, and even disney), and certainly a large bulk of the various consumer goods we hoard.

Got to keep in mind that a consequence of cutting down on all these discretionary forms of liquid fuel use would result in an economic depression if the transition was quick.

BTW, the new Chevy Bolt looks promising if someone is looking for a small commuter car-

http://www.cnet.com/roadshow/news/chevy-confirms-chevy-bolt-ev-in-testing/

Hi Stiglar,

If oil prices are lower after 2060 (under $100/b in 2015$) due to a transition to a different energy and transportation system, URR would be lower.

My recent model has about 2400 Gb of cumulative C+C produced through 2060. Low oil prices in the future might reduce extra heavy oil to 300 Gb (from 600 Gb) and C+C less extra heavy from 2800 Gb to 2600 Gb for a total URR of 2900 Gb.

Such a scenario is very optimistic, the eventual URR will be somewhere between 2900 Gb and 3400 Gb depending upon the speed of the transition.

Model has about 150 Gb of cumulative extra heavy oil produced through 2060.

DC Wrote:

“The lack of oil affordability at over $90/b is somewhat of a myth based on World growth rates from 2011 to 2014.”

Back then (2011-2014) the Fed was doing QE and the Emerging market economics were gorging themselves with debt. Its easy to buy expensive things using cheap and abundant credit. However, at some point the creditor will start knocking and demand you pay them back.

My guess is that the Fed will soon return to QE, and commodities prices will start rising again. But this has nothing to do with afforability and everything to do with treating the patient (debtors) with heroin (cheap credit) to prop the system up. Its completely unsustainable. Like a heroin addict, it will take increasingly larger dosages to keep the financial pain away.

The Fed raised interest rates by a tiny 25bps and the market almost immediately began tanking. While I don’t believe the tiny increase is the direct cause, it was likely the straw the broke the camels back.

“These are 2.5% in 2015, 3% in 2016, and 3.2% in 2017.”

Fantasy, No way will the world GDP be 3% in 2016 or 3.2% in 2017. At best the Central banks will print money and buy worthless assets giving the appears of growth, when its really a slo-mo collapse.

The Fed reserve “Velocity of Money” shows that the US economy has been in a long term recession since about 2000. If the economy had any real growth we would have seen it increase, but it shows nearly continuous decline for more than 15 years. It only temporary reversed during the Fed induced global real estate bubble, and rapid accelerated lower after the bubble popped.

https://research.stlouisfed.org/fred2/series/M2V

Hi Techguy,

The decrease in the velocity of money is simply due to an excess supply of money sitting in banks. This is what happens when monetary policy runs up against the zero lower bound and further increases in the money supply no longer boosts aggregate demand. Under these conditions the velocity of money tells us very little about GDP growth. Real GDP growth hasn’t been great in the US, but better than Europe because of better fiscal policy.

Dennis,

Countries that do not have the world’s leading reserve currency don’t have the same luxury of fiscal profligacy the way the US does.

Hi Glenn,

Any country with its own currency can use monetary and fiscal policy. Possibly you are referring to Japan where the problem there is the demographic transition which is a conundrum which economists are struggling with.

The UK chose a silly policy of fiscal austerity simply because of free market ideology, it had nothing to do with the British Pound.

For those nations that are part of the Eurozone, they gave up their control over monetary and fiscal policy to the Germans, an unwise decision at best.

At some point either Europe will become a single nation along the lines of the United States where areas that are doing badly economically (think savings and loan crisis in Texas) receive help from the central government with no strings attached or the Euro project will be abandoned.

The current system is unlikely to remain stable over the long term in my opinion.

Dennis,

The United States has been a chronic debtor nation since the 1970s. In the past 40+ years the US has not experienced a single year in which the US has not ran a trade deficit.

The question thus becomes: How has the United States been able to do this for so long? What has contributed to the US’s seeming immunity to debt-trap dynamics?

On the last thread someone posted an answer to this question that sounds quite plausible:

…

Hi Glenn,

The US current account deficit is not very large as a percentage of GDP, a high of 6%.

As the US weans itself from oil use as oil prices increase, this will become smaller, in any case if others are willing to lend, we can continue to run current account deficits, by using less oil and importing fewer goods in general (or exporting more) the problem can be solved.

The following paper suggests it is not much of a problem:

https://www.stlouisfed.org/publications/regional-economist/april-2006/how-dangerous-is-the-us-current-account-deficit

An excerpt:

Other industrialized economies have incurred much larger external obligations as a percent of GDP without precipitating crises. For example, Australia’s negative net investment position reached 60 percent of GDP in the mid-1990s, Ireland’s exceeded 70 percent in the 1980s and New Zealand’s hit nearly 90 percent of GDP in the late 1990s. Notably, these economies have recently been among the most successful—in terms of economic growth—in the industrialized world. The combination of rising external obligations and prospects for robust growth is entirely consistent: Capital flows toward countries that can make productive use of it.

DC wrote:

“The decrease in the velocity of money is simply due to an excess supply of money sitting in banks. ”

Money Velocity started falling well before the banks were parking money. The US and the rest of the West has implemented ZIRP for the past 8 years. If there was any real growth since then, then rates would have normalized a long time ago.

Bank reserves Peaked in Early 2014 and plateau’d until the Fall in 2015 when Bank Reserves declined by about $800B. Yet Money volocity continued to steadly decline.

https://research.stlouisfed.org/fred2/series/WRESBAL

https://research.stlouisfed.org/fred2/series/M2V

“Real GDP growth hasn’t been great in the US, but better than Europe because of better fiscal policy.’

I disagree. The issue is that the US printed and borrowed a heck lot more money than Europe did. The US has a very poor fiscal policy. Since 2008, the US Debt (on the books) as doubled. This isn’t by an measure “better fiscal policy”. Its simply postponing an even bigger crisis in the future. The US will need to return to QE very soon to

avoidpostpone another major crisis.Hi Techguy,

Money velocity is not very important. Low interest rates have been in place since the GFC.

You understand very little about macroeconomic policy if you think the solution to a recession is a balanced government budget.

Try reading the General Theory of Employment, Interest, and Money by John Maynard Keynes.

The reason Europe has done so poorly is a misguided attempt to reduce budget deficits in the face of a severe recession.

The “printing of money” doesn’t matter as long as inflation is low, which it has been in the US.

Yes the US government has borrowed money at very low interest rates, exactly what it should have done in the face of a recession.

At this point the US economy is doing well, balancing the budget by raising taxes (preferably on income over $200,000 per year) and cutting military spending (or something else, maybe congressional salaries) would be fine with me.

Personally I think a carbon tax would be the best policy of all, maybe combined with all forms of income being taxed at the same rates (dividends and capital gains receive no special treatment) as wages and reducing corporate tax rates to zero. Such a policy would include things that both liberals and conservatives hate and might serve as a compromise, not sure where the best place is to cut spending, maybe just level fund everything and any increases on one category have to be met with reductions in other areas.

Ron, my latest:

Oil Price Crash: How low will the oil price go?

Re your post, what would happen to OPEC production if oil went to $150 and stayed there for 5 years?

Re your post, what would happen to OPEC production if oil went to $150 and stayed there for 5 years?

I have no idea. What would happen to OPEC is oil went to $10 and stayed there for 5 years? I cannot answer hypothetical questions that have no chance of actually happening.

Don’t know what to make of your answer Ron. Have you convinced yourself that Peak Oil is now at a time of glut followed by permanently low price? Scarcity will return towards the end of this year, price will recover strongly and the industry will begin a new cycle that could include a doubling of operational rigs in the ME.

Not likely. Of course prices will recover. But the deep investment in exploration and production will not return. They were burned once and lost billions. Do you think they are stupid or something?

Some investment will obviously return, but the wild and almost free money will never return. And other things are happening. China is slowing down and there has been no recovery, so far, of the recession that is gripping many European countries.

And more investment will not necessarily mean more oil. Only in the US and Canada has massive investment led to a massive increase in oil. And that party is likely over.

Euan, I simply do not believe prices are not going to go to $150 a barrel and stay there.

Ron Patterson: “But the deep investment in exploration and production will not return. They were burned once and lost billions. Do you think they are stupid or something?”

Once bitten, twice shy. But the third time, they won’t be able to help themselves. Eventually, high prices will tempt people into the drilling game The question is how high and for how long does it have to stay there before greed outweighs fear?

The US tight oil industry has been built on false assumptions, but it could become viable at $150/barrel. The viability price for US tight oil looks, for the time being, to be a ceiling on the oil price.

It’s a little difficult to imagine $150 a barrel and an absence of exploratory investment.

Ron:

“I simply do not believe prices are not going to go to $150 a barrel and stay there.”

What would bring the price back down?

Hi Greenbub,

Two things could bring down the price, either an oversupply of oil relative to demand (like the present situation) or a recession which reduces demand relative to the available supply.

I suppose these amount to the same thing too much supply relative to demand.

The only difference is that in one case supply grows too quickly and in the second case demand contracts (assuming supply is unchanged).

Once we have reached peak output price only falls if demand falls faster than the decline in output.

If Ron is correct that we have already reached the peak a recession is the likely reason that demand would fall faster than supply.

The optimist might say demand falls due to a rapid transition to more fuel efficient transportation, I think this is unlikely before 2050 ( and 2060 would be a more reasonable guess).

Ablokeimet wrote:

“The US tight oil industry has been built on false assumptions, but it could become viable at $150/barrel. ”

Its unlikely that Oil prices can be sustained anywhere near $150 bbl (adjusting for inflation of-course). The issue is that consumers & business can not afford to spend that much for Oil. Probably the max the global economy can afford without QE and other financial shenanigans is about $60. As soon as the US began tapering QE Oil prices began falling. If the US returns to QE again at the same levels as the 2009-2014, the max Oil prices can be sustained is likely about $100.

In additional the current LTO/shale oil sweet spots have been largely exploited. Unless there is are other untapped sweet spots (ie places outside of Permian, Bakken, Eagle-ford, etc) , its unlikely LTO/Shale will have any significant impact in future production.

Ablokeimet wrote:

“Once bitten, twice shy. But the third time, they won’t be able to help themselves.”

Very rarely do bubble re-inflate after they pop. In the late 1990’s it was the DotCom bubble, in 2004-2008 it housing bubble. Neither of these bubbles re-inflated. Investors moved on to other investments bubbles, such as energy and emerging market debt markets (2010-2015). These two investments will pop and investors will find some other bubble to chase after. That is, if they have any money left.

I suspect that at lot of the investor money was being sourced from retirement funds, either pensions, 401k’s, etc. Boomers are in the process of mass retiring now. I think they’ll start hording what ever capital they have left, rather than risk it chasing after returns. Taxes are also likely to rise significantly soon, as broke gov’ts will need more revenue to pay for the promised retirement entitlements. In the US, I expect the payroll tax to increase by 2% next year, and US states will also raise taxes to cover soaring pension outlays as state workers (boomers) are retiring. In the US, consumer and Business are struggling with the soaring costs of Obamacare (Healthcare). The business I work with, are in the process of switching to automation and outsourcing overseas to reduce labor. These are large multi-billion companies.

I think the next thing in Oil & Gas industry is that the remaining sound companies will buy up the assets of the failed companies at pennies on the dollar instead of investing in CapEx. When that is done, I expect the remaining sound companies merge, as they seek reserve replacements instead of pouring money in expensive CapEx projects. I doubt we will see any grand CapEx projects going forward unless they are subsided by a gov’t. The only remaining Oil resources left will be incredibly expensive (ie +$50Billion USD)

On the Global economic front, I expect long term weakness as the Boomers retire and go from paying taxes to consuming entitlements. We will like see much more turmoil in Europe and Asia as high youth unemployment takes its toll and unsustainable debt load prevent any recovery. The World now has turned 100% Japanese, which has been in a state of deflation for over 25 years. Too much debt, severe demographic problems, and depletion of cheap and abundant resources will force the unsustainable conditions to revert into a long term crisis. This is will be an economic environment that will not support long term expensive CapEx projects.

Tech Guy: “Its unlikely that Oil prices can be sustained anywhere near $150 bbl (adjusting for inflation of-course). The issue is that consumers & business can not afford to spend that much for Oil.”

People in industrialised countries have been becoming more efficient in their use of oil over the last few years. It would take quite a few years of very low prices to reverse that. In the Third World, oil consumption is increasing, off a very low base. In particular, the number of cars on the road has been expanding rapidly. This has been taking up the slack caused by declining consumption in industrialised countries.

You’d be surprised how people would adjust to $150/barrel oil.

Tech guy: “In additional the current LTO/shale oil sweet spots have been largely exploited.”

This has been a significant and open question in my mind – how much longer the LTO industry can keep finding sweet spots. I don’t know the answer and I’m far from convinced Tech Guy has it either. I hope he’s right, but I haven’t seen any evidence of it yet.

Tech Guy: “I think the next thing in Oil & Gas industry is that the remaining sound companies will buy up the assets of the failed companies at pennies on the dollar instead of investing in CapEx. When that is done, I expect the remaining sound companies merge, as they seek reserve replacements instead of pouring money in expensive CapEx projects.”

It all depends on the oil price. At present prices, you get a lot more bang for your buck if you do your drilling on Wall St. When the price recovers, however, so will the share prices of oil companies with substantial reserves and/or prospective acreage. This will create the incentive to go out and drill somewhere new. Because people got burnt badly in shale oil, there will be a more or less prolonged pause before the gold rush starts, but it will start eventually, with investors taking whatever precautions they feel necessary against repeating their previous mistakes. If the the incentive to drill is insufficient at $150/barrel, falling production because of depletion of existing fields will cause the price to rise further – until such time as CapEx levels rise again.

Ablokeimet says:

What shale demonstrated is that, if the global capitalist system can withstand $150+ oil and $8+ natural gas without collapsing, then there are vast quantities of oil and natural gas out there which can be exploited at that price.

Hi Glenn,

All that has been demonstrated is that at $110/b over three years about 80 Mb/d of C+C can be produced. We do not know how much more can be produced at $150/b, it might be more than 80 Mb/d, maybe 3 or 5 Mb/d, but old fields continue to deplete.

Would you care to guess how vast the quantities of oil might be at $150/b (2016$)? My guess remains 3400 Gb for the URR of C+C (about 1300 Gb of C+C has already been produced, leaving about 2100 Gb (590 Gb of this is extra heavy oil with API less than 10). Scenario below shows one possible way this could play out (if there is no GFC2, and oil prices rise to $150/b by 2023 and remain at that level (say $140 to 160/b) until 2040.

Sorry for small chart (not very readable). I’ll try elsewhere.

Dennis Coyne said:

Would you care to guess how vast the quantities of oil might be at $150/b (2016$)?

I really don’t know.

The EIA’s most recent estimate (updated September 2015) for technically recoverble shale oil and gas uses figures from a May, 2013 study. At that time it came up with a little bit more than 400 billion barrels of oil and 7,500 TCF of natural gas worldwide.

https://www.eia.gov/analysis/studies/worldshalegas/

Then there’s the Orinoco.

And there are Canadian sands.

But perhaps the biggest unknown is that there’s a real dearth of knowledge when it comes to the world’s conventional oil fields. How many fields have secondary recovery been implemented in? Tertiary recovery? Secondary and tertiary reserves can dwarf primary reserves.

Most of the world’s oil and gas reserves are in the hands of national oil companies, which complicates getting reliable information.

Many things become possible with $150+ oil and $8+ natural gas.

Secondary and tertiary reserves can dwarf primary reserves.

1. What are you calling secondary and tertiary recovery methods?

2. What evidence do you have that the reserves left in the world’s giant fields can be dwarfed by any recovery methods that have not already been implemented?

Edit: For some reason I thought it was Dennis who posted this truly absurd statement: Secondary and tertiary reserves can dwarf primary reserves. It was not Dennis but Glenn. My apologies to Dennis. Sorry.

Ron Patterson says:

What are you calling secondary and tertiary recovery methods?

Secondary recovery would be waterflooding.

Tertiary would be something like CO2 or polymer flooding.

Below, for example, is a graph of the Denver Unit in the Permian Basin.

It looks like oil production was about 13,000 BOPD in 1965 when waterflooding began.

By 1975 oil production had increased to 150,000 BOPD.

CO2 injection began in 1984, at which time oil production had declined to about 50,000 BOPD.

Production from the Denver Unit is currently about 25,000 BOPD.

Ron Patterson said:

What evidence do you have that the reserves left in the world’s giant fields can be dwarfed by any recovery methods that have not already been implemented?

None.

Let me reiterate what I said:

But perhaps the biggest unknown is that there’s a real dearth of knowledge when it comes to the world’s conventional oil fields. How many fields have secondary recovery been implemented in? Tertiary recovery? Secondary and tertiary reserves can dwarf primary reserves.

Most of the world’s oil and gas reserves are in the hands of national oil companies, which complicates getting reliable information.

Do you have information as to what stage of recovery the world’s major oil fields are in?

Hi Glenn,

The EIA does not estimate TRR very well, the 400 Gb of LTO worldwide, is not going to happen, at best it will be 100 Gb (maybe 40-50 Gb from the US and optimistically 50 Gb from the rest of the World).

I have included 350 Gb from Canadian oil sands and 250 Gb from the Orinoco belt (Fernando believes this is too optimistic and he is very familiar with Venezuela’s oil industry).

I don’t know what URR will be, it is an estimate roughly midway between the HL estimate(2500 Gb) and USGS estimate (3100 GB) for C+C less extra heavy oil (Canada’s oil sands and Orinoco.)

You sound a lot like Sergeant Shultz (I know nothing.)

Glenn, I know what secondary and tertiary recovery is. I just wanted to know what Dennis was referring to. But to be honest I have no idea what you mean by polymer flooding. Hydrocarbons are polymers, polymer strings. So…..

Oh we may not have much information on the production of most national fields but we have plenty of information on their water injection, when it started and how many million barrels per day they inject. Saudi has actually publishes that information from time to time.

And almost every old giant field in the world, many years ago, began waterflooding. Russia has done it in their tired old giants, starting with the very oldest one.

Russia’s Oldest Oil Producing Field Marks 65th Anniversary

First discovered in 1943, Tatneft’s Romashkinskoye oilfield was the first of Russia’s mega fields of platform type geology to be produced using contour waterflooding.

My point was, to Dennis, that he is way off in his estimate that secondary and tertiary could dwarf primary reserves.

No, there is not a dearth of knowledge concerning the world’s very old giant fields. We know that they all are now undergoing waterflooding and infill drilling. And that in spite of that almost every one of them are in decline.

Dennis Coyne said:

You sound a lot like Sergeant Shultz (I know nothing.)

But you do?

Ron,

I really didn’t know what the recovery status of the world’s major oil fields is.

Iran and Iraq’s oil fields, for instance, are reputedly stuck in some time warp due to political factors and haven’t had much investment for years.

Saudi Arabia, on the other hand, like the United States probably employs the most advanced methods and technology in the world.

It sounds like Russia is no slouch.

Ron Patterson says:

“to be honest I have no idea what you mean by polymer flooding.”

From U.S. DOE website:

Chemical injection, which can involve the use of long-chained molecules called polymers to increase the effectiveness of waterfloods, or the use of detergent-like surfactants to help lower the surface tension that often prevents oil droplets from moving through a reservoir. Chemical techniques account for about one percent of U.S. EOR production.

http://energy.gov/fe/science-innovation/oil-gas-research/enhanced-oil-recovery

Chemical methods focus mainly on alkaline-surfactant-polymer (ASP) processes that involve the injection of micellar-polymers into the reservoir. Chemical flooding reduces the interfacial tension between the in-place crude oil and the injected water, allowing the oil to be produced. Micellar fluids are composed largely of surfactants mixed with water. Goals of polymer floods are to shut off excess water in producing wells, and to improve sweep efficiency to produce more oil. Chemical field trials by industry indicate that surfactants can recover up to an additional 28% of reservoir oil; however the economics have not been favorable when the price of oil is factored against the cost of surfactants and polymers. Chemical flooding technologies are subdivided into alkaline-surfactant-polymer processes, polymer flooding, profile modification, and water shut off methods.

http://www.netl.doe.gov/research/oil-and-gas/enhanced-oil-recovery/chemical_methods

Ron Patterson says:

“almost every old giant field in the world, many years ago, began waterflooding. Russia has done it in their tired old giants, starting with the very oldest one.”

Ron, there is nothing wrong with waterflooding, if it used properly. The example of the Romashkinskoye field shows it. Tatneft, the company-operator, was able to stabilize production there at around 15 million tons/year (~300 kb/d) since the 90-s.

Oil production at Romashkinskoye field, kb/d

(Volga-Urals oil province, Russia, discovered in 1943)

Ron, there is nothing wrong with waterflooding, if it used properly.

Errr… did I even hint that there may be something wrong with waterflooding? Are you trying to read something into my replies that is not there?

Of course there is nothing wrong with waterflooding. Without waterflooding Khurais, in Saudi Arabia, was producing less than 80,000 bpd. So they shut it down. But then they started injecting about 2 million barrels of water per day and now Khurais is producing about 1.2 million bpd.

No, waterflooding is the saving grace of every tired old giant field. It works beautifully. But the point is, everybody has already done it. Today’s very high production from OPEC, Russia, and a lot of other places, is the result of waterflooding that began at least a decade ago. Decades ago in the case of Saudi Arabia.

We will not get more oil due to waterflooding, the high oil production we are getting today is the result of waterflooding. It is not something that will save us from peak oil in the future, it is something that has already saved us from peak oil in the past.

Hi Glenn,

No I do not know the future, but I am willing to estimate what I think might happen. Let’s try this,

Do you think the URR of C+C will be more than 2700 Gb? How about 3100 Gb? 3400 Gb? 3700 Gb? 4100 Gb?

How about what you believe to be a reasonable range?

Nobody knows the answer, my guess is the C+C URR will be between 3100 Gb and 3700 Gb, does that seem to be a reasonable range to you? Note Jean Laherrere’s estimate is 2700 Gb and the USGS about 4100 Gb.

I’m going to write this because the comments are too skinny: EOR can add reserves, but it doesn’t add as much to rate.

When a field has been water flooded and water cut is above 90 %, adding junk to the water can help, but it’s better to do it at a lower water cut.

If a field is depleted below bubble point and gas to oil ratio is high (say triple the initial GOR), water flooding it never achieves the results we get if its started before bubble point is reached.

CO2 injection makes produced fluids very corrosive.

Polymers are simply a rate acceleration add on, but the economic limit can change things to make them add real reserves.

There are fairly low tech EOR techniques we can apply outside the USA but the politics make project implementation very difficult. Lack of co2 is a problem.

Chart for scenario with prices going to $150/b by 2023 and remaining there (140 to 160/b in 2016$) until 2040. This is for World C+C rather than OPEC only.

See comment above in reply to Glenn for more explanation on the underlying URR (includes 600 Gb of extra heavy oil).

Hi Euan,

I do not think that Ron believes oil prices will remain low forever. I think he believes the World economy will not support oil prices at $150/b (2015$) in the near term. If you had proposed $120/b in 2019 (2015$), he might think that is reasonable (or at least I do).

I believe oil (C+C only) will peak between 2020 and 2030 at between 80 and 85 Mb/d, even if oil prices rise to $190/b (2015$) (which I believe is about as high as the World economy will support).

That estimate is based on a URR estimate for all C+C (including oil sands) of 3400 Gb.

“…what would happen to OPEC production if oil went to $150 and stayed there for 5 years?”

Well as an economist I would say this…first assume everyone in the world is rich and getting richer…

A large proportion of global population in India, China and SE Asia are getting richer.

I guess richer is a relative thing. Going from making a dollar a day to ten dollars a day doesn’t mean you can easily roll with $150 a barrel oil.

Point being oil over $75 a barrel and global economy crashes, demand falls and 80mbd becomes a glut so price falls. Even if this doesn’t happen as I say EVERYONE who matters is afraid that it will happen and acts accordingly.

Hi Jef,

Oil price was over $90/b from 2011 and 2013 and world real GDP growth was around 2.5% on average. That is not much of a crash, the GFC was not caused by high oil prices, it was due to poor banking regulation which lead to a housing bubble.

To be fair most GDP ‘growth’ in the western world (and probably eastern) has been driven by borrowing more debt. I don’t specifically know about the USA but in my own country we have borrowed around $2.20 dollars for every $1 of supposed GDP growth over the last few years.

GDP ain’t what it used to be.

best quote of the month on this site-

” don’t specifically know about the USA but in my own country we have borrowed around $2.20 dollars for every $1 of supposed GDP growth over the last few years.

GDP ain’t what it used to be.”

Thanks Dave P

Euan Wrote:

“A large proportion of global population in India, China and SE Asia are getting richer.”

Were getting richer (past tense). That trend is now reversing. A lot of the growth was fueled by debt that poured in from the West as Investors chased yield, due to the ZIRP (Zero Interest rate Policy) in the West. Now, the debt levels have become unsustainable in the emerging markets.

Most of the economic development was built to sell good and services to the West, as China & India were never able to switch over to a domestic consumption model to consume all of the production built (ie Factories). In the case of China, the gov’t tried to build new cities and lots of high rise apartment buildings, but the workers can’t afford them. Its seems unlikely that China construction boom will continue. Without the West to buy their production, China and other EM countries are doomed to the same faith as the Japanese: Permanent contraction & deflation.

A Reuters article on Chinese liquids consumption and car sales:

China’s oil demand likely rose 2.5 percent last year, but 2016 looks weaker

http://www.reuters.com/article/us-china-economy-oil-demand-idUSKCN0UX0MS

http://cleantechnica.com/2016/01/19/china-electricity-demand-slows-coal-consumption-drops-hits-australia-hard/

http://www.enerdata.net/enerdatauk/press-and-publication/energy-news-001/chinas-power-generation-fell-2015-first-time-1968_35800.html

http://www.cnbc.com/2016/01/17/reuters-america-chinas-2015-power-consumption-up-05-pct-year-on-year.html

http://www.cnbc.com/2016/01/19/what-is-chinas-actual-gdp-experts-weigh-in.html

As annual Brent crude oil prices doubled from $55 in 2005 to an average of $110 for 2011 to 2013 inclusive, OPEC 12 net exports of oil fell from 29 million bpd in 2005* to 27 million bpd in 2013 (total petroleum liquids + other liquids, 2014 EIA consumption data not yet available).

*Incorporating revised 2005 EIA Saudi production number, but otherwise based on EIA data compiled in late 2014

Jeffrey

That is because the United States production went from 8.3 million barrels per day to 14 million. If one of the biggest importers does far less oil, this leaves spare production all over the world and many countries had to cut exports.

Cut exports when oil was selling for over $100/barrel for 3 years running? Wow.

OPEC really must have been running a tight ship.

Ralph

The United States increased production of C&C by 4.3 million barrels per day. Also Europe consumption declined, taking all countries that increased imports. OPEC had no choice but to cut production, there was no one to buy the that spare oil.

This is something Jeffrey seams determined not to understand, yet it is not too difficult to follow, it is simply export land model in reverse!

And you are arguing that annual Brent crude oil prices doubling from $55 in 2005 to $110 for 2011 to 2013 inclusive reflects weak demand for global net exports of oil? So, a doubling in the price of commodity reflects weak demand? And a doubling in the price of a stock reflects weak demand for the stock?

I guess this makes sense to residents of Fantasy Island.

Note that the volume of GNE* available to importers other than China & India fell from 41 million bpd in 2005 to 34 million bpd in 2013.

*Global Net Exports of oil, combined net exports from (2005) Top 33 net exporters (total petroleum liquids + other liquids)

Jeffrey

Your argument does not hold any oil.

Global demand for oil today has never been higher. Yet the price of oil has fallen to as low as $27.

So your argument that price is an indicator of demand is simply wrong.

Your stupid comments about fantasy island is fit for a junior school and should be beneath you.

Unfortunately too many people resort to childish put downs instead of presenting clear logical thinking.

The price of oil is determined by various factors, financial sentiment being a very big factor.

When oil was $100 OPEC was not trying to destroy US shale production, they were happy to maintain the price. Now they have adopted a different policy of flooding the market. Your ELM simply does not work when countries are manipulating production. Unfortunately you obviously have given little thought to what happens when an importer like the US rapidly increases production and requires much less imported oil. Perhaps you need to go away and think about it.

Less childish put downs and more logic is required.

Always nice to have visitors from Fantasy Island.

In any case, the fact remains that the volume of GNE available to importers other than China & India fell from 41 million bpd in 2005 to 34 million bpd in 2013, as annual Brent crude oil prices doubled from $55 in 2005 to $110 for 2011 to 2013.

So, the other importers had to divide up a declining supply of what I call Available Net Exports (GNE less Chindia’s Net Imports). Some importers, like the US, showed a large decline in net imports (due to rising production and due to declining consumption, mostly rising production). Some of the other importers, e.g., the UK and Indonesia, showed rising net imports.

None of that negates the fact that the supply of GNE available to importers other than China & India fell by 17% in 8 years.

Jeffrey

You are exactly what happens to a person who only focuses on one thing. Utterly blinkered to any other evidence and hence totally incapable of reassessing your position. Resorting to childish insults to cover up you shortcomings.

So I will say this real slow again just for you.

Europe oil demand declined, therefore the exporters who exported that oil had to cut production.

The US increased production by over 4,000,000 per day. The exporters had to try and find new markets for that oil. Not all of them could do that, so many cut production in order to maintain price.

Exports fell because demand fell. It really is not that difficult.

Global demand for oil today has never been higher. Yet the price of oil has fallen to as low as $27.

So your argument that price is an indicator of demand is simply wrong.

Peter, the price of oil is a reflection of supply and demand. That is not only economics 101 it is also just common sense.

Only in a market economy.

Hi Peter, and anybody else who does not believe in supply,consumption, and cost of production , etc, determining price:

Although I am not an economist, or a big time banker, etc, I have some basic courses in the field, and a lifetime of experience observing commodity prices, having been involved with selling commodity goods as a producer since I was a CHILD.

Now there are MANY factors that interfere with the workings of what we refer to as supply and demand, and these factors often trump the workings of supply and demand, for a while, forcing prices up or down, temporarily.

But in the end, prices simply cannot be supported at “high” levels without SOMEBODY having a way to withhold product from the market, and doing so.

Likewise , prices cannot be forced to remain at ” low ” levels, except by rationing , or by subsidizing the production and distribution of the product.

A LOT of things are so SIMPLE , in the end, if you once understand them, that you want to smack yourself upside the head, and say why did it take me so long to understand something so SIMPLE?

When producers bring more of their product to market than the end user wants, under prevailing circumstances, the price FALLS.

In the case of a product such as oil, which is desperately needed in the USUAL quantity by a given end user, but nearly worthless to that same user in LARGER THAN USUAL quantities, the price falls LIKE A ROCK.

If apples get cheap enough, at retail, people will buy more apples, and less pears, grapes, oranges etc. In the case of oil, they cannot easily substitute oil for other fuels, as they can apples for other foods. So the price of oil REALLY crashes.

Joe Sixpack needs a certain amount of gasoline every week, and has a hard time getting by with less, and will pay anything his purse will stand for THAT much gasoline.

But Joe has VERY LITTLE USE for MORE gasoline, than usual, to put it bluntly , because he just has NO USE for it. He can slip in an extra weekend at the lake, with his boat, maybe, if he has one, but Joe just does not have TIME or opportunity to use a lot of extra gasoline, in the short term, or even in the near to medium term.

It is as simple as falling off a log, the oil industry as a whole is producing more than the world WANTS at any price higher than the current price. In order for the world to consume as much as it is consuming NOW, the price had to fall to what it IS NOW.

The why’s of over production are a separate question. Producers of any commodity tend to expand production when prices are high, and profits are also high, until they “oversupply ” their customers. The customers respond by buying from whichever producer offers them the lowest price.

I have personally had to lower the price of my own production of apples and peaches to zero a few times, without being able to find anybody to take my production at ANY PRICE.

Shutting in an orchard is as hard as shutting in an oil field. So you keep producing, even when you are losing your ass, hoping for the price to go up again.

The price ALWAYS goes up, eventually, when enough producers lose their ass long enough, and quit. There is NOTHING fundamentally wrong with classical economic theory when it comes to supply, consumption, cost of production, and prices, etc.

A lot of oil producers are losing their ass right now, and doing what they can to cut back on production, but this is a slow process, due to the nature of the industry.

Now is it possible that some producers are deliberately selling at very low prices in order to achieve goals OTHER than making a profit?

This is very possible. This sort of thing happens all the time, and many people will argue that it is happening at this minute.

No one cut exports deliberately. If they cut exports it was because their production declined, or their domestic consumption increased, or both.

I assume you mean domestic consumption.

Hoarding and embargoes happen under special circumstances.

I’ve never understood why Saudi Arabia doesn’t hoard.

I would think someone in the royal family cares about the future?

I am sure I am missing something though.

Ron

I refer you to my answer above

I suggest you exclude NGL and refinery gains.

That is because the United States production went from 8.3 million barrels per day to 14 million. If one of the biggest importers does far less oil, this leaves spare production all over the world and many countries had to cut exports.

Peter, that is just bullshit. Damn, you should know better than that. No country in their right mind would cut exports when oil was selling for over $100 a barrel.

And watch your insults, especially where Jeffrey is concerned. He is the most knowledgeable oil geologist on this blog.

I would recommend people refrain from insults in general, except Ron, it is his blog, he can insult anyone, including me (though he usually saves that for when I say really outrageous stuff.) 🙂

Denis, if you suck up to Ron like that he will start behaving like Hugo Chavez, change the blog to “The Peak Oil REVOLUTIONARY barrel” and name Watcher chief editor when he’s out touring the world. Imagine the results.

Hey, it’s Ron’s blog. That’s all I’m saying

You fucking aye! 😉

Since Peter is a visitor from Fantasy Island, he appears to believe that all production and/or net export declines are voluntary.

As I noted down the thread, he therefore appears to believe that the (2005) Top 33 net exporters voluntarily increased (at about 6%/year) their net exports from 2002 to 2005, in response to one doubling in annual crude oil prices, but voluntarily cut their net exports from 2005 to 2013, in response to the second doubling in annual crude oil prices. And he asserts that three years of annual triple digit oil prices, 2011 to 2013, reflect weak demand for Global Net Exports of oil.

Insults

You mean like telling people what they say is bullshit.

You need to learn manners yourself.

Telling someone they cannot see the obvious is not rude. Especially when their predictions have been utterly proved wrong.

So you think exporters to the US would force the US to take their oil.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mcrimus1&f=a

So you think exporters to the US would force the US to take their oil.

You need to learn manners yourself.

Hey, fuck off asshole. Where the hell are your predictions? How good were they? Any prediction would be one hell of a lot better than yours. It is so goddamn easy to criticize other peoples predictions when they cannot examine yours.

I will pay you a visit soon. You can say that to my face.

Just who in the hell do you think you are?

What? Are you some sort of disciple or somethun?

I could write words like ‘hey, now look, goddammit’ or ‘hey, fuckface, get off his back’ or ‘quit being a dumbfuck, shithead’ or ‘kiss my ass, motherfucker’ or ‘hey dumbass, go fuck yourself’ or just a plain old ‘fuck you, asshole’, that one always works.

I could write it all down in words, use invective, expletives, all insults and ad hominem, do it all with reckless abandon.

If I were to tell it like it is, it might not be all that nice, might not be mannerly, but then, you’d know, wouldntcha? That would be just too bad.

Just another waste of time, so I won’t.

Except for this time.

Euan, when we use empirical evidence from previous crashes we do need to factor in the real increase in the cost to produce the marginal barrels. Since 1998 those marginal barrels are much more expensive.

I’ve also learned that oil prices don’t necessarily drive all producers, they seem to be driven by oil price forecasts. Thus the key is to see producers think that oil prices next month will be below production cost enough to make shut in worthwhile (operators have fixed costs which don’t disappear simply because the wells were shut in).

But prices have dropped enough that shutting in for a couple of months may be worthwhile. Plus we have Venezuela’s looming problem. As long as Iran doesn’t start tossing barrels into the market we may see enough supply reductions over the next four weeks for the oil price to bottom out. Maybe.

WTI down 7% today to $26.76. Dennis tried to make the cost of marginal barrel to me which in the circumstances I just don’t get. Its relevant when prices are rising and companies are evaluating prospects and investments. I just don’t see the relevance on the way down. Companies will sell all they can for whatever they can get because xbbls*$20 is better than 0bbls*$20.

Oil is caught in an over-supply broad market crash vortex.

Hi Euan,

Eventually companies realize that when you are in a hole, the first rule is to stop digging.

In other words, cost matters because at a higher cost of production (say $50/b) you are losing $25/b on every barrel you sell at $25/b. If the cost of production is $30/b, you are only losing $5/b on each barrel produced.

The more money you lose, the less likely you are to invest more, this eventually reduces supply due to depletion.

So yes, the cost of the marginal barrel matters. If it did not, oil would have a price of zero.

The cost of the marginal barrel is relevant only to the cost of new production. Operating costs are the only limitation to production from existing wells. As Euan notes, oil produced at prices above operating costs produces revenue. Shut in wells do not. This means that existing wells can produce oil at prices far lower than those needed to justify drilling new wells. When the world needs new oil wells, the price will rise enough to allow them to be drilled at a profit. That price may be very high indeed.

Hi Joe,

Yes you are correct that producing wells might not get shut in, although some older wells may not be profitable to maintain at low prices and will be shut in and producing oil fields decline in output at an average rate of 6.5% per year if no new wells are drilled.

My point is this, very few new wells will be completed at very low oil prices and oil supply will decrease. That is why cost matters, it affects investment in new wells.

As I said before, if the cost to produce oil is zero, then the price will be zero, otherwise it will be a positive number which will approach the marginal cost in the long run.

The higher the cost of producing the marginal barrel, the more money one loses producing it at any given price below the cost of production. The bigger the monetary loss the less likely it is that more wells will be drilled.

Dennis,

You have a rather simplistic view on the interaction of prices, costs, investments and production.

At $35-40/bbl, the vast majority of the current global oil production remains profitable.

At $25-30/bbl, there are indeed fields in various parts of the world, where operating costs are above those levels. But companies do not take decisions based on daily or weekly fluctuations in oil prices. Only after several months of oil price staying below $30/bbl operators may decide to shut in non-economic wells. Despite headlines in the MSM with projection of $25, $20, $15 and even $10 per barrel, none of institutions such as IEA, EIA and OPEC, investment banks, energy consultancies and individual experts is projecting annual oil price below $30. The lowest existing forecast is from J.P. Morgan at $31.5/bbl. The majority is in the range between $37 and $50. Goldman Sachs which was mentioned as forecasting $20 oil, is actually projecting $40 by mid-year as the base case scenario. They say that under certain conditions prices may drop to $20, but only for a short term. Ed Morse from Citigroup and Daniel Yergin from IHS have also recently said that current prices are unsustainable and that there will be an upward correction in the second half of the year. Not to $75, as you are or were projecting, but to $40-50, which would support all of the current production.

There are well shut-ins and there will be more, but these are mostly wells with very low daily output, especially stripper wells in the U.S. And that will not have significant impact on global oil production. Also note that shutting current oil production may prove more costly than producing at a loss due to high decommissioning costs and potential damage to the reservoirs.

Investments also will not drop to zero levels even at $25-30, as there are a lot of projects at final stages of development, which will be completed with relatively modest additional investments and will be generating cash.

As I have said earlier, it is important to take into account a significant cost deflation, which lowers breakeven prices for new projects.

We have already seen this in the 80-s. In 1980 it was estimated that the most costly new projects, such as the North Sea and Alaska, had breakeven costs at $25-30 ($70-85 in today’s money). But as prices started to decline from 1981 and dropped to $10-12 lows in summer of 1986 ($23-27 in today’s dollars), all of the new projects in the North Sea, Alaska, Canada, Mexico (Cantarel) continued to increase output for at least 2-3 year more. This was largely due to declining costs. Non-OPEC production started to decline only by the end of the 80-s, after several years of low oil prices.

Non-OPEC production (mb/d) vs. oil price ($/bbl), 1970-1990

Hi AlexS,

Thanks. Your view is indeed quite sophisticated.

I believe that you may think that my argument is that no new wells will be drilled. It is not, my point is that if Euan Mearns forecast for oil price is correct, oil investment is likely to be lower.

Mearns oil price forecast is that Brent remains under $37/b until Dec 2016 with a bottom of around $15/b and oil prices remaining under $20/b at mid year, he does not give an estimate for an average oil price for the year, but it would be somewhere between $20/b and $37/b [maybe $29/b (2014$) for 2016.]

Under the scenario above I would expect some wells might be temporarily abandoned because the oil price might not cover OPEX, I would also expect that investment in new wells would be lower than at higher oil prices, rather than zero.

Thank you for pointing out how simple minded I am. 🙂

(Although in fact I knew all that, and I agree that it is quite unlikely to be the case that all investment in new wells will be discontinued.)

I think it equally unlikely that there will be no change in oil investment if oil prices remain under $40/b for the first 6 months of 2016 (average oil price over those 6 months), but I would never accuse you of such simplistic thinking. 🙂

On falling costs. Do you think the cost of the marginal barrel has fallen from about $70/b in 2012 to $40/b in 2016 (nominal dollars)?

Is there any evidence to back that up?

http://www.cnbc.com/2015/01/12/

The article above suggests about 1.5 Mb/d of output becomes unprofitable at $40/b or less.

http://www.reuters.com/article/us-oil-prices-kemp-idUSKCN0QI29320150814

The article above suggests also that under $40/b will be problematic for sustaining output.

At one point I was estimating $75/b by years end, but I have been convinced that may be too high. I think $50/b for an average 2016 oil price with a December level of about $65/b or higher is reasonable, I think at average prices matching the EIA’s short term outlook World liquids output will be lower than the EIA forecast for World liquids output.

Dennis,

Your powerful mind brilliantly covers a broad range of issues, many of which are too complicated for me given my limited intellectual capabilities. But in some cases we have to consider so many industry-specific details that a broader top down approach doesn’t work properly.

Hi AlexS,

You are the brilliant one, and I appreciate what you have taught me about the oil industry which you understand far better than I.

The top down approach I use is intended to be a rough approximation, I do not have access to enough data or the time to put together a detailed bottom up analysis of the oil industry.

Not sure how well it would work, because the EIA, IEA, and OPEC already do this and somehow they seem to create oil supply out of nowhere to fill the oil demand they expect to see. So I rely on a combination of Hubbert linearization and USGS estimates along with guidance from people in the know like Fernando, Doug, Ron, Shallow sand, and AlexS to create scenarios using Webhubbletelescope’s oil shock model.

I agree 100% with your analysis, except I am a little more pessimistic about oil supply at $40-50 per barrel than you are and believe oil prices may be a little higher than you do.

In the end you will probably be correct, I have consistently underestimated how resilient the LTO output would be and oil supply keeps surprising me on the upside.

Perhaps the EIA’s AEO 2015 with C+C output of 99 Mb/d, will even be correct, but my guess is that will be about 25 Mb/d higher than actual C+C output in 2040, the peak will be 85 Mb/d at most between 2020 and 2030 (probably closer to 2021 if it is that high and closer to 2030 if the peak is only 81 Mb/d.)

Do you have an estimate of URR for C+C, I assume you believe 3400 Gb(including 600 Gb of extra heavy oil) is too low?

Hi AlexS,

Another difference between today and in the 1985 to 1990 period is that the non-OPEC output increases were primarily coming from various mega projects which were ramping up at the time. Today about 5 Mb/d of World output is from very flexible LTO projects which are pretty near the breaking point at under $30/b. If there is turmoil in the LTO plays due to lack of funding we could see a 20% drop in LTO output (1 Mb/d), along with decreased output elsewhere in the World as higher cost output is reduced (maybe 500 kb/d from US stripper wells and 500 kb/d from other high cost areas throughout the World) for possibly a 2 Mb/d reduction in output.

This might be offset by a 600 kb/d increase in Iranian output, but we would be left with a 1.4 Mb/d decrease in World output. Possibly increases in the Gulf of Mexico and North Sea offset these declines partially and we are left with only a 500 kb/d decline in World output.

My guess is that this could happen at $50/b for an average 2016 oil price, but at $40/b it does not happen and decline is 1 Mb/d.

Hi Dennis,

Anybody who thinks investment in oil production is going to continue at the usual level at current prices must also believe that oil companies have or have access to two things I have not YET heard about.

ONE, awesome amounts of cash of their own, or access to similar amounts of cash on the easy never never plan.

Two , whole SHIPLOADS of them there new ROBOTS we keep reading about in the sci fi section of the business press, the ones that are smart enough to take over the world. Their assigned task of course is to take the place of all the oil men who have been laid off, and continue to be laid off, by oil producers.

THEIR PLAN, meaning the robots, is to take over the world by taking over the oil industry, as their first step.

Incidentally, as a serious matter, I do believe there is a significant possibility there WILL BE mobile robots capable of doing most kinds of trade work, eventually, maybe another forty or fifty years from now, assuming Old Man Business As Usual continues to stagger along, and Luddites don’t manage to burn down the robot factories and outlaw the manufacture of them.

“Operating costs are the only limitation to production from existing wells.”

This is true when the need for current cash income is overwhelming and most oil companies are in that position these days.

But suppose you are making only five bucks on a barrel, in net cash, at say thirty five bucks a barrel.

If the price goes to forty, you DOUBLE your net cash income.

Anybody who can AFFORD to shut in production ought to be doing so, unless I am a complete dunce. No industry can run in the hole forever, not even the oil industry.

Oil will go up again.

So, the question is, who has money enough in the bank to cut back now, so as to make a substantially larger profit, later on?

The Saudi’s, and maybe a couple of their good tight buddies come to mind. Is there anybody else big enough to matter?

The Russians have an authoritarian government that will remain in power if the Putin regime were to decide to cut production.

So take out the Russians, and THEN who is left?

Euan, I went through this in the 1985-86 crash. We had dozens of field operations, each of them was studied carefully, and I learned a lot seeing what we did, as well as the results.

As I wrote, behavior is dictated by what we see and forecast. An operator who knows opex breakdown can segregate it into “fixed” and variable. Even fixed isn’t that fixed as we expand the time horizon. So the analysis should look at options such as contract term changes, salary cuts, dividends suspensions, and tax cuts (that’s fairly common in some countries, where the government will cut taxes to help people stayed employed).

Thus when we look at say, the $22 opex in a faja field in Venezuela, we have to factor in what’s the actual cost reduction from shutting in, how fast can further cuts be made by cancelling contracts, laying off people, etc.

In many cases the decision is made to keep producing at a loss because shutting in causes even bigger losses. What we do is avoid work overs, pump changes, or any expenses we can cut. In shoddy operations maintenance goes to hell. Some contractors are called in and told to share the pain or else. And all of this is dictated by price forecasts. Evidently producing at a loss can’t go on forever.

Thus say you think prices will stay at $25 for a year, but will increase to $50 in 2017, then you produce even if this generates a $5 loss. You do need to have the $5 to stay alive. I look at it as an investment in the future. And I bet that’s the way most operators are looking at this current debacle.

“Companies will sell all they can for whatever they can get because xbbls*$20 is better than 0bbls*$20.”

When you are broke, this makes sense. You eat the seed corn, and burn the furniture, last thing before you freeze and starve to death in a mid winter famine.

But my neighbors keep hay in the barn, and beans in the silo, and beef cows in the pasture, for sale next year, to the extent they can, when prices crash this year.

The ones who make it long term are the ones with a barn full of hay, beans in the silo, and a pasture full of cows when prices go back up.

I have never sold a single load of logs in a down market, except a couple of times the trees were in the way, preventing me from using that particular spot of ground as a building site.

Unfortunately, apples don’t store well, which is a primary reason I have recently been switching to cows, although mostly retired.