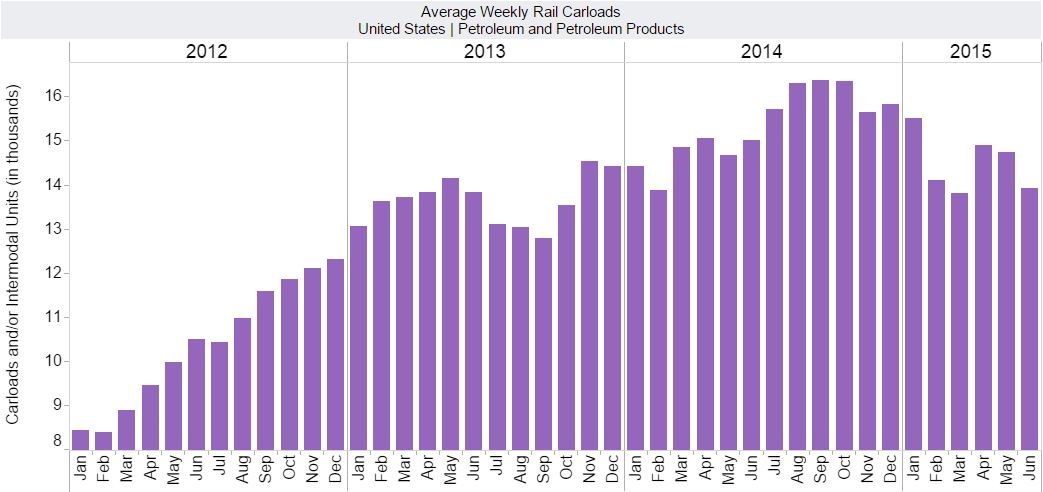

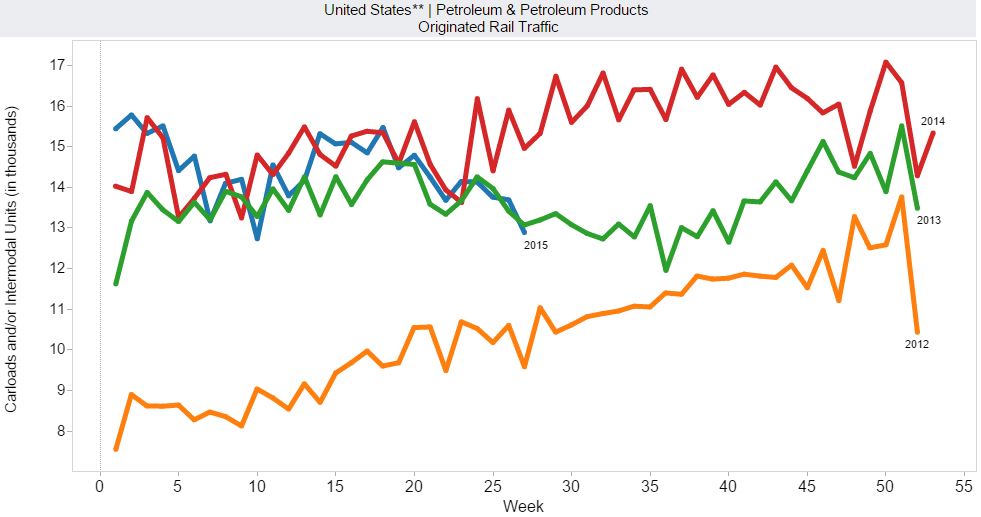

Weekly oil shipments by rail can be found on the web at Weekly Carload Reports. And a summation of that data with charts can be found at Association of American Railroads Freight Rail Traffic Data.

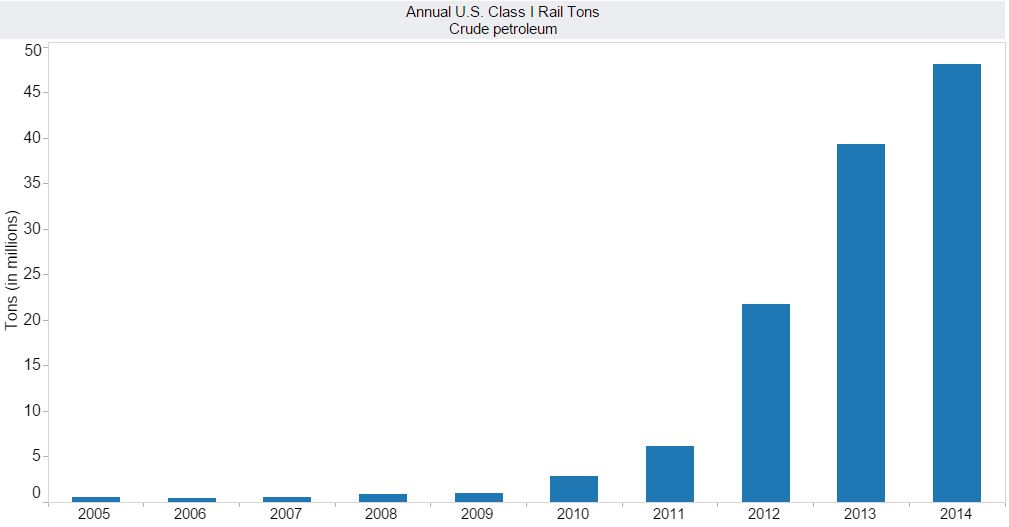

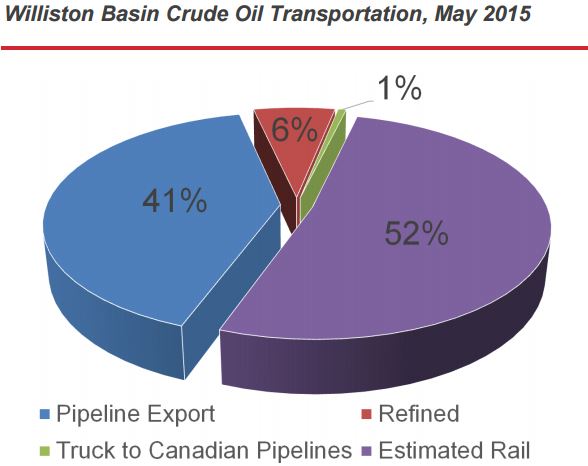

Crude oil by rail basically started with the shale boom. Prior to that almost all oil was shipped by pipeline. Of course a lot of oil was trucked to the pipelines. The EIA says in the first seven months of 2014 8 percent of all us crude and refined products was shipped by rail. It looks like that percentage was increased somewhat in the second half of 2014.

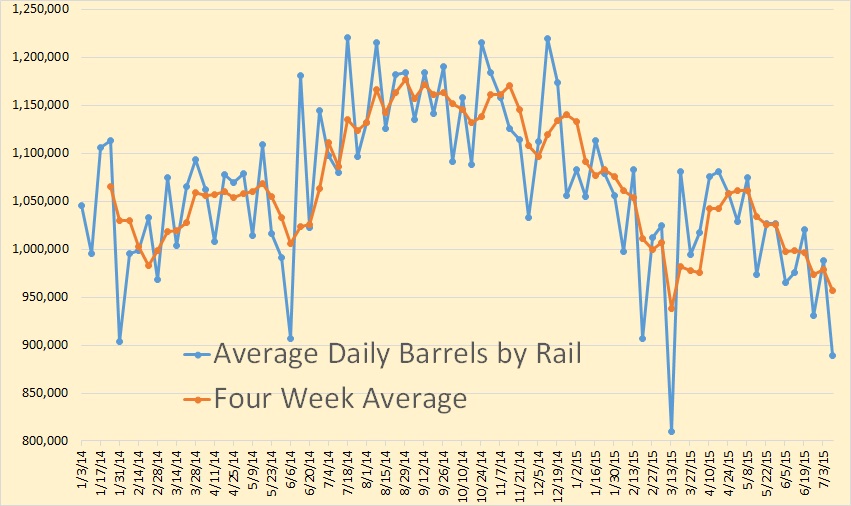

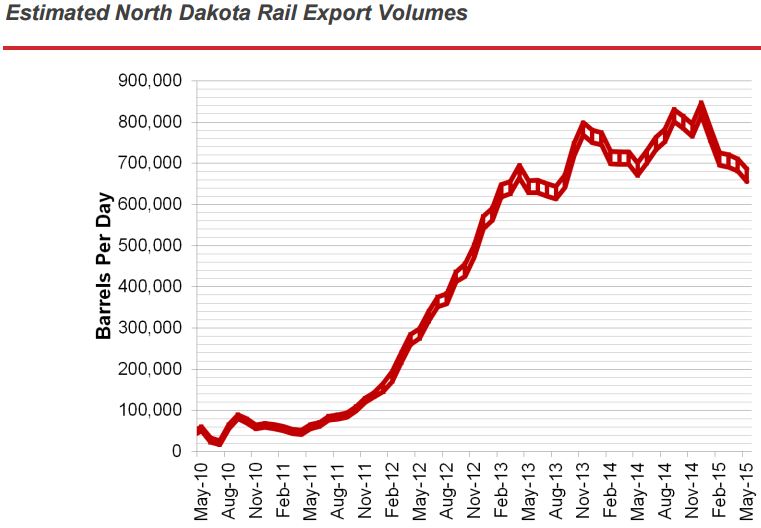

Oil by rail, for the entire USA, peaked in August, September and October of 2014 and has declined since.

I have converted the weekly carloads to daily then converted carloads to barrels. There are about 700 barrels per carload. That gives us the average barrels per day by rail.

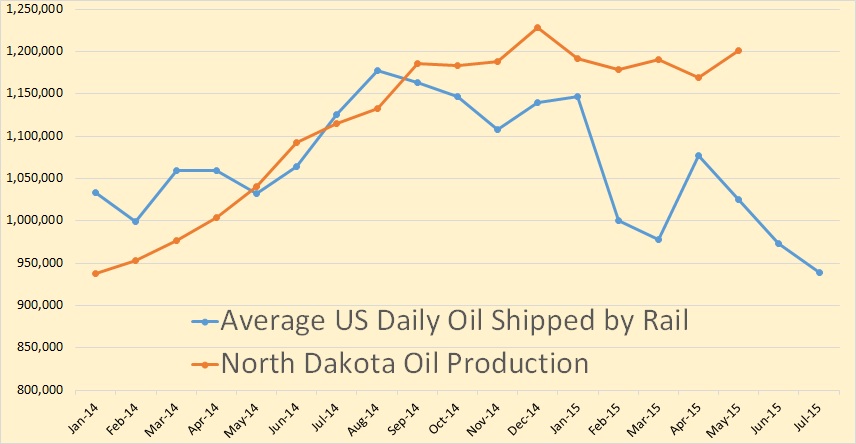

I have converted the weekly “daily average” to monthly “daily average” and plotted it against the North Dakota production. The EIA says: Between 60% and 70% of the more than 1 million barrels per day of oil produced in the state has been transported to refineries by rail each month in the first half of 2014, according to the North Dakota Pipeline Authority.

As we can see from this chart the volume of oil shipped by rail changes from month to month. The chart is barrels per day per month. The peak, for North Dakota, is December 2014. Oil by rail for the USA peaked about three months earlier.

Also the percentage of oil shipped by rail drops as production drop. This is because the pipelines are usually at max capacity so as production drops rail traffic takes the blunt of the decline.

The following is Art Berman’s take on the matter.

- The AAR data is for Petroleum & Petroleum Products whereas EIA data is for crude oil.

- The AAR data goes through June whereas EIA data only includes April.

- AAR data is in carloads or international units (whatever international units is) whereas EIA data is in barrels.

__________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Remarkable story out of Delaware about the Delaware City refinery now owned by PBF Energy. This used to be Getty then Texaco then Motiva then Valero.

This refinery was close to being mothballed but the new owners made a switch to getting most of their feedstock via rail and now they are booming.

However, the train traffic is insane. These trains are 90-100 cars each and I think the DCR gets 2 per day now. I am in awe of how well they have mastered the logistics of moving and unloading these trains.

Still, there are many other issues.

http://www.delawareonline.com/story/news/local/2015/05/01/delaware-rail-crude/26711265/

Those big trains are unit trains, only carry one product. They offer cost advantages of scale over mixed freight. The mainline near me runs about 25 trains per day, I have seen trains with 200 cars.

Although pipeline operating costs run at about 1/3 the cost of rail, rail transport can come on line much more quickly and it is far easier to get regulatory approval for transport. It costs about $3 a barrel more to transport oil by rail than pipeline from the Bakken region.

If a forty two gallon barrel yields thirty gallons of salable liquids that is only about ten cents a gallon difference. This small amount will obviously add up over time but it is not enough to make or break the business of selling gasoline and diesel.

Plus the rail lines , the tracks and equipment, are going to be kept up better due to having enough traffic and revenue to justify the upkeep. I can see rail taking more and more business over the very long haul from pipelines as the amount of oil available to be sold declines and thus building and maintaining pipelines becomes uneconomic. Railroads are multipurpose transportation.

A LOT of gasoline and diesel fuel in my part of the country is hauled quite a long way from the closest tank farms to retailers. If / when rail comes back strong as expected some of this truck traffic can be switched to rail and the truck routes can be shortened substantially. I don’t see any reason why delivery trucks can’t be loaded directly from a rail tanker, other than petty bureaucratic rules.

Since the shale oil boom will be fairly short lived it doesn’t make economic sense to build large pipelines. Building pipelines to take a portion of the peak production would probably make better economic sense. The pipeline will be kept filled and the railroad will get the variable trade.

The Baker Hughes Rig Count is out. The decline in oil rigs picked up again this week. Oil rigs declined by 7, gas rigs up 1. Eagle Ford down 4, Williston down 2, Permian up 3.

Re the rig count, late in last Ronpost comment thread:

Semi curious question:

There is talk of time constraints on getting wells completed lest, I guess, there are fines.

But there is also talk about not just cheaper but more efficient drilling that is getting more than expected numbers of holes drilled with a declining number of rigs.

I am suspicious of technological miracles that arrive at just the right time. And so:

Question: Is there some tiered layout of development timing requirements. Like so many days after lease signature that you must drill a hole and then on top of that another requirement for oil flow so many days after that.

Meaning, these increased numbers of holes drilled with fewer rigs . . . because companies have gotten efficient . . . is there a definition of “hole” in play? Can they satisfy tier 1 requirement with a 200 foot hole, and call the remaining 1.5 miles “completion”? Versus 2 years ago drilling the hole meant the entire 30 stage length.

Watcher,

As I understand things, the oil company signs a lease with the mineral rights holder.

Within that contract will have a term in which the oil company must drill and produce oil on the first well of that lease to convert it into “Held by production”. The term usually ranges from 3 to 5 years.

On the other hand, the ND govt says that once the oil company drills a well, it has 12 months to complete it. Or penalties apply. Not sure if the 12 months starts at spud or total depth, but I would guess the spud date would the one.

Helms has stated that it is possible to extend this another year, with the correct paper work, and no doubt fees.

Good man. You do see the mechanism I am speculating on. There is an avalanche of absurd stories of total wells drilled seeing no particular decline as drill rig count falls. If you change the definition of well, you can do that.

The vertical rig count is up again by 2 to 123, 24 more than the low point of 99. Horizontal wells are at low point of 650 after dropping another 4. The Lowest since Jan 2010. Any increase in the oil rig that has taken place in the last month has been in vertical wells, not horizontal.

It sounds like conventional oil to me rather than a come back in the shales? Shallow, Mike are you drill a few wells on the quiet?

Toolpush. No. We will wait till price recovers. Everything is HBP.

I don’t have a rig running at the moment, Push. Still on track for 4th quarter. I am, however, thinking of shutting all my production down for a day to throw worldwide oil markets into a panic, kind of a symbolic protest if you will, and I have advised my receptionist to accept calls from anyone with funny accents claiming to represent OPEC. I’ll get back with you on how that goes.

We think down here that BH has the rig count in the EF much higher than it actually is. I have never seen in a half century the number of rigs cold stacked, not even in the early 80’s. Little blips in rig counts are, as you know, not very meaningful, IMO. Conventional/vertical guys I believe are just trying to time the bottom and there are HBP issues, replacement wells, flood maintenance wells and all that to be drilled. Some of those vertical rigs may actually be setting surface casing for shale wells, but permit applications are way down, as someone as already suggested.

Forrest had crap EF acreage and Sabine’s demise is of no surprise. There is more of those coming very soon. Penn Virginia is next on the merger list but the issue I have with mergers are willing buyers, with willing funders. Buyers are going to have to be very strong. For those that did not see this, as I have said many times, the shale oil industry has not made a nickel yet:

https://btuanalytics.com/will-outside-capital-continue-to-prop-up-oil-and-gas-activity/

Mike

Shallow/Mike,

I didn’t expect you fellas to be drilling, just seeing ig if you were awake, smiles.

I realize little blips don’t mean too much, but it annoys me when the MSN catches onto the little blips eg “oil rig going up”, and miss the point that it is in the “low productive” rigs, that are on the increase, and their fabled “high productive” horizontals, read shales, are actually still on the decline.

I really get the impression that a lot of people want to tell a story, and they are not too interested in the facts!

I agree, Push. The domestic oil industry here in the US, especially the shale oil industry, has become like fantasy football to many.

By the way, I drove 2 hours to watch Olympus being towed to sea; man that mama jama was huge!! Too big to keep leashed, I guess, tee hee. What a nightmare that is.

Mike

Here are the Olympus, Lucius, Big Foot, and Jack/St Malo hulls in Kiewit a few years ago.”

Mike-

In an earlier post, I mentioned the failed debt raise by Swift Energy. I think we are at the point where the spigot is turning off for these shale guys. If these guys couldn’t raise senior first lien debt to replace their credit lines, that tells me that the bond world has woken up to the fact that many of these assets are worth close to zero at current prices and probably at much higher prices as well. I will be interested to see what happens in bankruptcy. I think the banks and bond investors will be shocked when they see what the assets are really worth. The banks and bondholders have been relying on Ponzi financing hoping that they will be taken out by a greater fool as the assets will never be able to pay back the debt through production and cash flow. The Swift debacle tells me that the music has stopped.

Ron or others,

The BH rig count for Utica is 22 an increase of 1 from the prior week. However, I recall that the count from the July EIA Drilling Productivity Report was only 11 for June in Utica. This was a sharply declining rig count from prior months: May 13, Apr 14, Mar 18, Feb 21, Jan 26 rigs. Did they actually double the rig count in Utica since the last DPR or is there a screwy inconsistency in what is being counted?

Don, you can pay no attention to the Drilling Productivity Report for the last four or five months of that report. Everything after March for production, rigs and decline rate are totally a guess. The Baker Hughes report has the correct data for rig count and pay no attention to what the DPR says for July for rigs or production.

Note: The data for the chart below for the “NDIC Bakken” is for the entire Bakken, North Dakota and Montana. The data I have labeled “NDIC Bakken” below is for all North Dakota.

Thanks for the reply Ron. This is mind boggling. I went back to the EIA DPR and they said in the footnotes, “3. The monthly average rig count used in this report is calculated from weekly data on total oil and gas rigs reported by Baker Hughes.” The BH data for June was out far before the release of the July DPR. This is just simple minded incompetence. There is no reason for them to be guessing. They should just do what they are claiming to be doing in the footnotes.

In the past I have tried to explain why there is opposition in Nebraska from a group of farmers/ranchers who don’t want the Keystone pipeline to run on their property. This is why.

They believe with pipelines come damaging leaks and they don’t want those leaks on their property.

Pipeline Spill In The Heart Of Canada's Tar Sands Industry Leaks 1.3 Million Gallons Of Oily Emulsion

That is a doubled casing line with leak detection – built a year ago. State of the art leak!

Interesting mention on last post of Swift Energy. Company around since 1979. Looks like they are in trouble. Stock below $1, bond issue failed.

Looks like they got burned in EFS. Anyone know what caused their downfall? Looks like at end of 2014 long term debt of $1 billion, standard measure PV10 $1.6 billion. I’ve seen worse.

Yes, borrowing money to drill shale wells that were not economic at 90 dollar oil, then having prices fall to 45 dollar oil. That will do it every time.

Another long term company that bit the dust was Forest Oil Corporation. They were bought recently by Sabine, who just declared bankruptcy.

Forest was incorporated in 1916 and pioneered waterflooding. We operate some acreage they first flooded around WW2.

How many drill permits did Sabine and Forest have pending?

Don’t know that. Had $2.5 billion of assets and $2.9 billion of debts. Largest oil BK thus far. Mistake appears to be agreeing to buy Forest in March 2014, who had high debt, and then price tanking of course. Bank cut borrowing base, they could not refinance debt, so BK. Read story on fuel fix, which says they have over 1000 well sites, not sure if that means wells or drilling locations.

Bank cut borrowing base

Reserves impairment. haha

Relevant: http://seekingalpha.com/article/3334955-eia-global-supply-demand-forecast-overestimates-production

Back to CHK.

From what I saw on 2014 10K, standard measure PV 10 all categories $17.1 billion.

From 2015 Q1 10Q long term debt at $10.6 billion.

Notice any similarities between ratios for CHK and Swift Energy?

shallow sand,

Considering cash and ST debt, CHK net debt was $8563 mn at the end of 1Q15 vs. $7389 mn in Dec 2014

AlexS. True. I note the 90 day cash burn you mention. Also, net debt is a valid metric, but most of these companies are spending the cash drilling and have no intention of using it to pay down debt principal.

Interesting to look at Chesapeake debt to PV10. Numbers are year end. PV10 is standard measure, effect of income taxes included.

2013. Long term debt. $12.88 billion. PV10. $17.3 billion.

2012. Long term debt. $12.16 billion. PV10. $14.66 billion.

2011. Long term debt. $10.63 billion. PV10 $15.63 billion.

2010. Long term debt. $12.64 billion. PV10 $13.18 billion.

2009. Long term debt. $12.30 billion. PV10 $8.20 billion.

2009, of course, had very low oil and natural gas prices utilized in calculating PV10.

Chesapeake is more gas weighted, and gas has been low for the most part since 2008.

I will say they are a much more complicated company than Continental Resources. Many transactions. Many drilling partnerships and other transactions. They had the Founders Well Participation program, where former CEO received a carried interest on every well drilled.

I note they recently lost about 250K acres and production via a short sale with private equity funding partner. Have read that will cause a $1 billion hit to PV10, but it released them from some major drilling commitments that are presently underwater.

Went back and looked at year end 2002. Long term debt $1.7 billion. PV10. $3.7 billion. They have and will have considerable debt for a long time.

Redundant statement warning. Without all the debt, US shale oil and gas booms never happen. As Mike always says, they have not paid for themselves.

If anyone can suggest a shale oil or gas company that does not have significant debt, that has been able to grow primarily through cash flow, please point the company out and I will look at 10K.

SS: “please point the company out and I will look at 10K”

Could you do for Crescent Point, please? 🙂

In your opinion what their “palm reading” says? 🙂

I’ll look but I have trouble with non US based companies. Haven’t looked at their reports, so I will try when get a chance.

Ves. As I said, not as familiar with Canadian reporting, but on their website I looked at 2014 year end. In Canadian $$, looks like 12/31/14 PV10 for proved all categories was $8,891,498,000

12/31/14 Long term debt. $2,943,074,000

12/31/13 Long term debt. $1,734,114,000

Debt numbers also in Canadian $$, it is based in Canada after all.

Absolutely nothing magic about company info I am pointing out here or elsewhere. It is all public information.

Just pointing out because PV10 has been a common way to value oil and gas reserves. Understand PV10 can be flawed, oil and gas prices utilized make a big difference. Assume data on expenses and production is accurate, companies have liability there.

Also, understand point about net debt, but I do not see companies paying down debt with cash. They are also cash flow negative so not building cash balances. So I just have been looking at long term debt.

I see so many different charts used and metrics used to describe oil company profitability. I readily admit I cannot understand many of them.

I just try to keep it simple and look at long term debt to PV10 and look at whether the company is cash flow positive or negative.

Not giving any investment advice, definitely not one to listen to about stocks or bonds. I’m not good at that.

Just trying to get a sense of shale boom, whether it has been profitable and what will happen to it given it partially brought on much lower oil and natural gas prices.

Due to investment in conventional working interests, have a reason to follow this stuff. Also find it interesting that there is little to no mention of PV10, let alone long term debt to PV10 ratio. After all, valuation of reserves is how banks value company assets for collateral purposes. Also how bank regulators grade loans to upstream companies.

Given the capital intensive nature of oil and gas extraction, think it deserves more attention. Looks like companies will take a hit similar to 2007 to 2008, will be cut in half. However quick rebound appears less likely.

Thanks Shallow.

It is the same story everywhere. So called growth fuelled by Mastercard. The word on street was that they were buying left and right in the oil patch in the last 2 years. There is no secret to that when I talk to oil truck drivers and that they are even “deeply concern” about their extending itself by buying with debt. When even people who don’t know inside-out about the numbers know that something is not right than it is time for reflection. Anyway, was last weekend at oil patch golf gathering, situation in one word: Bleak. Half of the people laid off and layoffs started in other indirect business. So honestly I don’t know where and why these 90 odd rigs in Canada are drilling for. and 640 in US that is even bigger mystery.

Ves Wrote:

“So called growth fuelled by Mastercard.”

LOL! Awsome summariation and perfect assement!

As Mastercard Advertisements alwasy end with the word “Priceless”

Greetings

Now that we have Ron, CrisNelder, and ASPO on record for a 2015 peak, I wonder if someone can help me on decline rates. I’ve seen estimates of 5 – 8%, but Dennis uses a much lower number in his modelling. Can someone help me out?

Thanks

Walter

Geeezus Walter, ain’t that asking a lot? Picking the year is not enough? 😉 Where did you see those estimates of 5 to 8 percent? I would like to have a look at them myself.

Actually I am guessing about 1 million barrels per day by the end of 2016, that’s just over 1 percent. Then I think it will pick up a bit in 2017 and 2018 to 2 to 3 percent. Then there is just no telling what will happen after that. Things might get pretty bad.

Thanks Ron

I doubt I’ve seen anything that would be news to you. I can see that near the peak, wells that are increasing would counterbalance declining wells, so the total decline rate would low. But it seems that as more and more wells went past peak, the total decline rate should increase.

Here’s an interesting paper from 2009, I think.

http://www.postpeakliving.com/files/shared/Hook-GOF_decline_Article.pdf

Land based fields which plateaued in the 1960’s declined at -4.2%, in each succeeding decade the decline rate increased, and by the 2000’s the rate was -10.7%.. see Table 4 The off shore fields were even more dramatic. see Table 5

see also http://surfthepeak.blogspot.com/2015/02/trouble-with-curve.html

(my blog)

Chris nelder uses 5% here: http://www.smartplanet.com/blog/the-take/peak-oil-isnt-dead-it-just-smells-that-way/

“The IEA’s World Energy Outlook 2008 included, for the first time, a study of the depletion rates of the world’s top 800 oil fields. It found rates of 6.7% for past-peak fields, increasing to 8.6% by 2030 (the end date of the report’s “reference scenario”). Averaged across all fields, the rate is 5.1%. Against such high decline rates-up from a generally accepted 4.5% estimate only a few years ago–the agency calculates that the world would need to add a whopping 64 million barrels per day (mbpd) of new capacitybetween 2007 and 2030 in order to meet an anticipated demand growing at 1.6% per year. That’s like adding six new Saudi Arabias.”

from

http://peak-oil.org/peak-oil-reference/peak-oil-data/oil-depletion/

Thanks

Walter

Thanks. Very interesting links. The paper by Höök I have seen before and it contains some really good information. I agree that it seems as if the production curve will be more cliff like. See for example the new big oil field johan Sverdrup in Norway. With a planned production of about 600.000 barrels of oil equivalents per day the yearly depletion rate will be nearly 10%. Smaller oil fields have even higher numbers. It looks like the smaller the oil field, the higher the depletion rate. As we find less oil every year, I just can´t see how Dennis Coyne´s model with 1-2% decline rates will come true. Perhaps we can keep up the production for many more years by using more and more energy for extraction. But that will only make the cliff steeper when it happens.

“I just can´t see how Dennis Coyne´s model with 1-2% decline rates will come true.” You’re forgetting something quite important. Dennis lives in Fantasy Land. 🙂

Haha ok. But it´s allways good to hear other people’s opinions, even if you do not agree with them.

Dennis Coyne doesn’t model anything. Scientific modeling involves developing physical, conceptual, or computer-based representations of systems. Dennis just picks his favorite URR and makes a graph.

Hi Futilitist,

Try reading up on the oil shock model. I use oil discovery data from Jean Laherrere, oil production data and estimates of URR from Jean Laherrere, the USGS, and Hubbert Linearization, my best estimate is essentially the average of the HL estimate and the USGS estimate.

The graph is based on assumed future extraction rates, I use past extraction rates as a guide.

As I do not know what future oil prices will be I cannot predict future ROI. The implicit assumption of the model is that market forces will adjust the oil price so that in the long run oil production will be profitable.

If we assume that oil production will not be profitable at any oil price and any level of production, then clearly oil output will fall to zero.

You think that the assumption of oil production not being profitable long term is reasonable, I do not.

As Mike has said ROI is everything, I agree.

He has not said that he thinks ROI will be negative permanantly and he would not be in the oil business if he believed so. Though I will let Mike speak for himself, as all he has said is that ROI is the most important thing.

If Mike would just tell me what future oil prices will be, I might be able to figure out ROI. It would be rather difficult for the World as a whole, so the model (which is based on the work of Paul Pukite and Jean Laherrere) is far from perfect.

Hi Dennis.

“The graph is based on assumed future extraction rates, I use past extraction rates as a guide.”

So you admit that your “model” is really just an extrapolation of past extraction rates. Okay. But that is not very scientific at all. It certainly doesn’t rise to the level where your graph could be called a model of anything.

“As I do not know what future oil prices will be I cannot predict future ROI.”

Okay, here is where your so called “model” really falls apart. You blindly extrapolate the best estimates of historical extraction rates to estimate future extraction rates. Then you turn around and intentionally ignore exact historical oil prices and refuse to use them to estimate future prices. Why? It makes no sense.

Extraction rates have always been tied to oil prices. A large percentage of current oil production is not economically feasible at the current price. We certainly know that extraction costs are not falling. So, logically, oil prices must rise very significantly to allow your future extraction rate estimate to be even remotely possible.

What happens if you extrapolate rising historical oil prices along with historical extraction rates?

Please make a graph showing this. If you do, you will immediately see the problem. It will be very obvious to everyone.

In order to justify your future extraction rate estimate, future oil prices would have to be so high that they could obviously never be supported by the economy.

In 2008, oil prices collapsed when they briefly spiked close to $150/barrel. Only with extensive bailouts, QE1, QE2, ZIRP, and NIRP were oil prices were able to recover to around $126/barrel. Even with an additional QE and operation twist, by 2014 oil prices had weakened to around $105/barrel. Then, suddenly, they collapsed again to reach today’s price of around $56.50/barrel. So we have a pretty good idea of what maximum oil price the economy is currently capable of supporting. How will the future economy be able to support prices in excess of $200/barrel?! If that is not possible, then your silly extraction rate extrapolation is also impossible.

The basic concept of peak oil theory is that oil prices will eventually rise until they can no longer be afforded. Your “model” completely violates this basic, common sense notion. You have some serious explaining to do there, Dennis.

“As Mike has said ROI is everything, I agree.

He has not said that he thinks ROI will be negative permanantly and he would not be in the oil business if he believed so.”

Wow, Dennis, that is very tacky. Is that the best answer you can come up with? If I think that ROI will remain negative, I am not insulting Mike’s honor or intelligence in any way. This is between you and me. You have to justify your “model” on it’s own merits (or total lack thereof). I don’t think Mike would defend your silly “model” anyway.

Please don’t continue further with this cheap line of unreasoning in your next answer to me. I brought up some very obvious weaknesses in your “model” for you to address. Please concentrate on those points instead of trying to pointlessly bring other people into the discussion.

It’s your stupid “model”. Defend it yourself.

“The implicit assumption of the model is that market forces will adjust the oil price so that in the long run oil production will be profitable.”

How could that ever happen? Your implicit assumption is clearly false. Oil affordability must be essentially infinite in order for your implicit assumption to be true. Therefore, your so called “model” stands in open denial of the most basic precepts of peak oil theory and the laws of thermodynamics. You should just admit you are wrong. That is what a good scientist would do when faced with such basic problems with a hypothesis. I’ll bet it doesn’t stop you, though.

Relax Futilitist, we know no model will be perfect.

Perhaps you should construct your own model?

Hi Futilitist,

Extractionrates tend to follow economic activity more than oil price. In fact oil price doesn’t help predict much of anything. I have actually looked at oil consumption vs oil price and there is little correlation.

My models do not have extraction rates increasing forever, they level off or decline.

The oil price does not predict much of anything it is determined by supply and demand which have too many variables to predict the future oil price.

The oil price has never been infinite and I have never proposed that it will be.

You should read some introductory economics. This is very basic microeconomics. Do a search on perfectly competitive markets and read up so you can ask intelligent questions.

On thermodymamics, the price of oil is not related directly to thermodynamics. Energy can flow from coal, natural gas, nuclear, hydro, solar, wind, and geothermal to the oil industry. A single industry is not isolated thermodynamically from the rest of the economic system. The net energy of the entire economy must be analyzed for a sensible analysis.

Hi Futilitist,

Extraction rates tend to follow economic activity more than oil price. In fact oil price doesn’t help predict much of anything. I have actually looked at oil consumption vs oil price and there is little correlation.

My models do not have extraction rates increasing forever, they level off or decline.

The oil price does not predict much of anything it is determined by supply and demand which have too many variables to predict the future oil price.

The oil price has never been infinite and I have never proposed that it will be.

You should read some introductory economics. This is very basic microeconomics. Do a search on perfectly competitive markets and read up so you can ask intelligent questions.

On thermodymamics, the price of oil is not related directly to thermodynamics. Energy can flow from coal, natural gas, nuclear, hydro, solar, wind, and geothermal to the oil industry. A single industry is not isolated thermodynamically from the rest of the economic system. The net energy of the entire economy must be analyzed for a sensible analysis.

Peak oil theory says oil output will peak and decline. As the supply becomes smaller price will go up to the point that it can be afforded. When it can rise no further the amount will be supplied that is profitable.

I think we actually agree on that.

Your starting premise that extraction rates are tied to oil prices is wrong, extraction rates are determined by GDP and its effect on the supply and demand for oil.

The extraction is influenced by producing reserves and the quantity of oil that will balance supply and demand.

Read up on the oil shock model.

http://oilpeakclimate.blogspot.com/2015/02/the-oil-shock-model-with-dispersive.html

or try

http://www.theoildrum.com/node/2376

“…extraction rates are determined by GDP and its effect on the supply and demand for oil.”

Earlier, you said that the most important thing was ROI.

So what determines GDP? Does it have anything to do with the physics of energy?

Hi Futilitist,

For oil demand, GDP is most important. For oil supply the profitability (annualized ROI) is the most important metric. The two interact through supply and demand to determine the oil price. There are complex feedbacks in the economic system.

Yes physics influences everything, but EROEI is not the sole determinant of oil price and it is not very well measured. One can claim that it is decreasing, but we do not have good data on the EROEI of the oil industry and how it has changed over time.

A more important metric for the oil industry is the cost to produce the oil and the revenue generated by selling the oil (determined by output and price). Then we can determine profitability. If it is profitable to produce the oil, it will be produced, even if the oil produced has an EROEI of 1.

As long as the net energy produced by society from all sources of energy is sufficient to keep the economy functioning there is not a problem.

As energy resources become constrained, prices will rise and less energy will be used and what is used will be used more efficiently. There are huge resources of wind, solar, and nuclear energy that can be tapped as prices of fossil fuel energy rise and alternative forms of energy become more competitive.

The transition will be difficult, but not impossible

Nice cut and paste belief statement. You have said exactly the same thing about a thousand times. It is like a mantra.

You cannot see the forest for the trees, Dennis.

Have you ever heard of the Maximum Power Principle?

“That theory, as it is expressed by the maximum power principle, addresses the empirical question of why systems of any type or size organize themselves into the patterns observed. Such a question assumes that physical laws govern system function. It does not assume, for example, that the system comprising economic production is driven by consumers; rather that the whole cycle of production-consumption is structured and driven by physical laws.”

~Howard T. Odem

Hi Futilitist,

The oil shock model is a physical model based on the discovery of oil, the time it takes to develop the average oil discovery, the physical production of oil to date, and then reasonable projections of future extraction rates based on history.

I do not project very high oil prices, I think price will increase as supply becomes tight and the amount produced will decrease as prices rise due to less demand.

If prices rise gradually to $110/b a lot of oil could be produced, the World economy operated with oil prices around $110/b from 2011 to 2013. As output from LTO plays in the US decreases due to low oil prices, oil price will rise by 2016 to 2017 to $100/b. If peak oil occurs in 2017 or 2018, oil prices may rise to $130/b, but this is likely to slow economic growth which might reduce oil prices. The future extraction rates could decrease, increase, or remain the same, several scenarios have been presented.

You seem to think that oil prices are determined by net energy. If that were true, why did oil prices increase from 2002 to 2008, drop sharply, then rise, plateau(2011-2013) and then fall in 2014.

Was this due to changes in the net energy of the marginal barrel of oil or was it because of changes in demand and supply in the oil market?

I assert that the latter explanation is best, I do not think net energy is a useful concept for the oil market.

Most oil professionals (Fernando, Mike, Shallow Sand, and Rune Likvern) would likely agree with me.

“If that were true, why did oil prices increase from 2002 to 2008, drop sharply, then rise, plateau(2011-2013) and then fall in 2014.

Was this due to changes in the net energy of the marginal barrel of oil or was it because of changes in demand and supply in the oil market?”

Take a step back. The price curve of oil is noisy, but it is not random. If you followed the yearly average oil price, it would show a smooth, exponential rise from 1960-2014. That doesn’t seem quite so random, does it? How do you explain such a consistent rising price pattern if the price was only due to changes in supply and demand? Why did such a longstanding rising pattern change so suddenly after June of 2014? Could it be that the maximum price had been reached and could no longer be sustained by the economy? Is there a maximum possible sustainable oil price? If supply and demand don’t determine the maximum possible sustainable oil price, what does? (Hint–now we are back to the physics of energy)

“Most oil professionals (Fernando, Mike, Shallow Sand, and Rune Likvern) would likely agree with me.”

Yet I’ll bet they won’t defend your “model”.

Hi Futilitist,

No one needs to defend the model, I have not seen many reasonable objections. Most people think it is too complicated to be bothered with, which is why I attempted to simplify so people could raise reasonable objections.

Clearly physics applies, but the physics needs to be done properly. When applying entropy to a system the boundries are important and all energy flows must be accounted for. Net energy concepts must be applied to all forms of energy in the economy, not only oil. Net energy applied to a single energy industry is a flawed thermodynamic analysis.

Here are Real Oil Prices (using CPI data from the Bureau of Labor Statistics and Oil Price Data from BP Statistical Review of World Energy) from 1920 to 2014.

Bullshit. The old adjusting for inflation ploy. The raw oil prices are far more real than prices adjusted using the CPI. Adjusting for inflation is not proper. It is redundant and the CPI is hardly a real measure of anything. You are intentionally distorting the only real data we have. If you look at raw prices, a definite pattern becomes visible. Adjusting for inflation conveniently obscures this. Peak oil deniers have been using this stupid (trick) argument for years.

I have brought up several reasonable objections to your model. You are simply ignoring them.

You object to the application of any physics or physics principles on the grounds that it is hard to do with absolute perfection since the system is so complex. But that is what models are for: To simplify the problem enough to get some useful information. Your model disregards any physics at all. It pretty much disregards common sense.

You can’t even tell that you are losing the argument. I almost feel sorry for you.

Some questions for anyone reading this:

1. Do you think that Dennis’ Oil Shock Model has any validity?

2. Do you think that Dennis has satisfactorily answered my objections to his “model”?

3. Do you think I am being mean to Dennis?

Futilitist, you are badgering Dennis.

Give it a rest! Okay?

Hi Futilitist,

You can claim that I am losing the argument, I disagree. Adjusting for inflation makes sense, not doing so is contrary to mainstream economic thinking.

Yes physics matters, but if you do not do it correctly you can get nonsense.

The boundries of the system are important when doing a thermodynamic analysis.

Future oil prices and the profitability of the oil industry are difficult to predict.

I try to model what has happened to World oil output from 1870 to 2014 based on discovery data, output data, reserve growth, and estimates of 2P reserves through 2010.

What extraction rates will be after 2014 is unknown and I have presented different scenarios for future extraction rates from producing reserves (which peak in 2006 and then decline). The URR for C+C output is also unknown and I have presented different scenarios for different levels of C+C URR (3100 Gb to 3700 GB).

Jean Laherrere’s most recent estimate is 2700 Gb for World C+C URR.

I believe that over time oil prices will rise, you believe they will fall. Time will tell who is correct.

Hi Futilitist,

Graph below shows extraction rate vs real oil price (2014$) from 1960 to 2014. The correlation is very low, R squared is 0.12.

The extraction rate averaged 6% from 1982 to 2014.

We could easily do a model with extraction rates at 6%, but the trend from 2009 to 2014 was an increase in extraction rates of 0.08% per year.

Hi Dennis,

I don’t care about extraction rates and you don’t have a model to explain them anyway.

Please plot the average annual oil price trajectory from 1960-2014. Explain how this pattern could be due only to supply and demand. It seems like it might have something to do with the declining EROEI of a barrel of oil over that time period, doesn’t it?

Thus, the price of oil is determined primarily by physics.

The extraction rates are based on the discovery data, oil production data, proved plus probable reserve data, and US producing reserve and proved reserve data, together with the oil shock model developed by Paul Pukite.

I have attempted to simplify the original model, but I guess some people still do not understand it.

So first you claim extraction rates follow the oil price, and when I refute that, then extraction rates don’t matter. How about oil output, do you care about that?

Here are real oil prices vs World C+C output from 1975 to 2014. R squared is 0.15, still not much of a correlation.

Hi Futilitist,

The real oil price is in a chart up thread, it is a much better metric than nominal oil prices when considering the economy, because it is the percent of income spent on energy that is important, using nominal oil prices doesn’t really tell us much.

We need to differentiate between gross decline rates (the rate of decline from existing wells) and the net decline rate (the rate of decline after new wells are added).

Also, the depletion rate is the rate of consumption of remaining recoverable reserves. Production can increase, stay the same or decline, but depletion is a one way street.

Hi all,

Fernando seems to think the URR I have estimated for my best guess is reasonable. On matters of oil production he is fairly conservative, though not as conservative as Mike.

The USGS estimates a URR for crude plus condensate less extra heavy oil of about 3100 Gb and 1000 Gb for oil sands from Canada and Venezuela (they estimate about 50 Gb of light tight oil(LTO) from the US and I have only seen World estimates from the EIA). For now we will ignore LTO and call the USGS estimate 4100 Gb for World C+C.

My “fantasy land” estimate (thanks Doug) is 3400 Gb of C+C for the World (600 Gb of the 3400 Gb is extra heavy oil).

I have proposed many different scenarios, if there is a major war in the middle east, or a severe depression, decline rates will be much higher during these crises (from 3 to 5%). Only if there are no “above ground” problems in the World from now until eternity would decline rates be 1 to 2% per year. So such a scenario is indeed a fantasy land prediction, the best (or worse for the environment) of all possible worlds.

As several others have said, future oil production rates will depend on the state of the World economy and this is either very difficult or impossible to predict. The low annual decline rate scenarios of under 2% through 2100 are based on an assumption of a growing World economy (maybe 1% real GDP per capita) for the foreseeable future.

In practice, such an assumption seems absurd to any realist.

The Hubbert Linearization method that many defended valiantly in 2005-2008 would suggest that World C+C less extra heavy oil URR will be about 2500 Gb, Jean Laherrere forecasts 500 Gb of extra Heavy oil, so the combination of these two would be 3000 Gb of C+C output.

In the past Hubbert Linearization has tended to underestimate the URR, so my 3100 Gb low end estimate would be a likely minimum World URR for C+C output.

If things turn out very badly (collapse of civilization by 2050 for example) or very well (a rapid ramp up of alternatives for fossil fuels and a move towards sustainability of the World economy), then demand for oil will collapse and the World URR of C+C might be much lower than 3100 Gb.

I do not think either this very pessimistic or very optimistic scenario are realistic, not even in fantasy land.

Dennis I think that you should consider separating the USGS “conventional” oil estimate of 3100 Gb from the “oil sands”. Oil sands production is fairly flat and not subject to decline rates. It is not subject to falling pressures or horizontal vs vertical wells. It may be better described as a production line operation. It is strictly a question of the rate that a company decides to produce each year and how much that are prepared to spend.

One good example I am aware of is Syncrude in Canada, which is note, “a mining operation”. They can mine and process so much each year and plan accordingly. Below is their annual production and daily rate since 2007.

Production Daily Rate

Yr Mbbls kb/d

2007 111.3 305.0

2008 105.8 289.1

2009 102.2 280.0

2010 107.0 288.4

2011 105.2 288.3

2012 104.9 286.5

2013 97.5 267.0

2014 94.2 258.0

2015 103.0 282.0 This year’s target

Their target is slightly over 100 M barrels each year and a daily rate 280 kb/d. There were significant operational problems in 2013 and 2014. Their product is a synthetic crude which is sweet and is formulated to have a higher distillate fraction than WTI. Their plan is to produce at this rate for at least the next 35 years.

At some point their oil sands will run out a probably then shut down.

Below is the projected production rate from current Canadian oil sands operations plus those in construction. Note how flat it is from 2020 to 2030.

Yr Mb/d

2014 2.16

2015 2.29

2020 3.07

2025 3.08

2030 2.97

Hi Ovi,

If you read the posts I have done on the Oil Shock model, you will see that I do what you suggest already.

I have two separate models, one for oil sands and the other for “conventional” oil (I call this C+C less extra heavy oil).

My extra heavy oil model is based on the CAPP (Canadian Association of Petroleum Producers) forecast for Canadian oil sands and the EIA’s AEO forecast for Orinoco.

See

http://peakoilbarrel.com/oil-shock-models-with-different-ultimately-recoverable-resources-of-crude-plus-condensate-3100-gb-to-3700-gb/

OK Dennis. I saw your shock post but did not work thru the details.

The Alberta extra heavy crude oil reservoirs do decline. Not all that extra heavy is mined, a lot is produced using horizontal wells and steam injection.

As a general rule, the projects are designed to have a well stock which uses the steam the boilers can produce, and delivers a liquid volume sufficient to keep the processing plant full. As the wells decline, additional well pairs are steamed and put on production.

I suspect that, in the future, as locations for new well pairs are exhausted , we will see individual projects start to decline. When they do, they’ll decline very fast.

Hi Dennis,

I agree that HL underestimates the URR for a bell curve. But if the curve is more Seneca cliff like, then it may instead overestimate it.

I also want to add that the EROEI for oil sands in Canada is not high enough to support a functional society. I bet that the same is true for at least some of the conventional oil production. So what the curve will look like depends alot on the EROEI of the other energy sources and if they can keep up the average. It´s a very complicated system with lots of dependencies. So it would of course be best with a model that does not look at oil production separately.

Hi FreddyW,

The EROEI is probably not going to be an important effect for oil. The energy necessary can be supplied by natural gas, coal, nuclear, and alternative energy. The energy density of petroleum makes it very desirable and even low EROEI oil will be produced if it is profitable to do so.

The Oil shock model is not the same as a Hubbert curve, the extraction rate is variable, not fixed.

A Seneca curve is possible, but requires unrealistic extraction rates in my view. Possible, but not likely long term.

The EROEI is probably not going to be an important effect for oil.

I don’t know about EROEI but I do know ROI will have a dramatic effect on oil. ROI is what it is all about, especially with shale oil. The ROI, for many companies right now, is negative. It is just a matter of time before they must file for bankruptcy.

A Seneca curve is possible, but requires unrealistic extraction rates in my view.

Err…. I don’t quite understand what you are trying to say here Dennis. I was under the impression that a Seneca curve was all about decline rates, not extraction rates. And if extraction rates are kept level, or near level, via massive infill drilling, for many years, then a Seneca decline curve is very likely. In fact, under those conditions, it is almost a lead pipe cinch.

For instance most old Saudi fields, as well as those in Russia and most other old giant and super giant fields, have been undergoing massive infill drilling for many years now. They have managed to keep the decline rate in these fields to from between zero and three percent or so. It is just a matter of time before these fields hit the Seneca curve. Daqing will likely hit it in 2016. I suspect a lot of other fields will hit it in the next year or so also.

Hi Ron,

I agree ROI is important, LTO is a pretty small part of the story when we look at the big picture, roughly 100 Gb of a total of 3400 Gb of C+C. Note that 100 Gb of LTO is optimistic in my view.

Dennis, actually ROI is everything. And it most certainly does not only pertain to LTO extraction. From 800 foot stripper wells in Kansas to DW wells in 8,000 feet of water off the coast of Brazil, return on investment, profitability, is ALL that matters, period. Extraction costs can not exceed gross income during any prolonged period in the life of a well or it gets the ‘ol cement tombstone.

You seem to have a hard time accepting that. I suspect many other peak oil enthusiasts do as well as their only basis for observation about the oil and natural gas business, in general, is the shale oil business. I understand; it has been hammering away for 9 years and has not made a nickle of profit yet. It is still drilling wells and still losing money. Folks with questionable cranial capacity are still loaning the shale oil industry money. It must be terribly confusing.

Its actually not. Oil exploration and production is a business, even for countries who have nationalized their hydrocarbon resources. Any oil well anywhere in the world must be profitable to drill and complete, then produce. Never in 50 years had I ever heard the ridiculous term “break even” before some people in the peak oil community began playing fantasy football with shale oil extraction.

Its not about breaking even. Its about profitability. Profitability is not just “important,” its everything.

Mike

Hi Mike,

I agree. The LTO is not very profitable and it is what Ron mentioned. My guess is that there are many places where oil is profitable, if not it will not be produced, it is very simple.

Oh and break even includes whatever ROI is required by the investor, it is part of the calculation. The breakeven oil price is the price that will allow some given ROI over the life of the well if prices remain at that level for the entire life of the well.

You can make ROI whatever you want, profits are included.

Mike, your business view has clouded your scientific view of what is happening. The scientific view is of a statistical distribution of reservoirs and a statistical distribution of extractors. There are AVERAGE rates of extraction that we can apply to estimate the historical and projected levels. Why you keep thinking that your anecdotal view means something is beyond me.

Mr. Scope, you are a pompous ass. I have known people like you my whole life; they think they have life figured out thru science, but can’t tie two pieces of rope together to save their life. Reality is that predicting the future of oil extraction without considering if it is profitable or not, without understanding the “business” ramifications of it all, is absurdity. You don’t respect what I do to feed my family, nor do I, you. Lets leave it at that. Your boy, Dennis can take care of himself.

Dennis, I did not know ROI was part of the break even manipulation exercise. Wow. That’s the first I’ve heard of that. What rate of return? I assume you are using EUR and not actual UR. Whatever. It is indeed very much become a game of fantasy shale oil around here.

Mike

Mike

Hi Mike,

Lately I have been using a nominal ROI of 15%, based on your input. I am surprised you were not aware of this.

I was introduced to the idea of a break even oil price by Rune Likvern in his famous Red Queen series. I had always assumed this was a standard metric.

For an LTO well I have to estimate the EUR, I have shown these estimates on many occasions, for the Bakken/Three Forks the EUR is about 370 kb with an assumption that the well is plugged at 7 b/d. We only have actual data for the massively fracked wells (starting in 2008) for about 6 to 7 years.

The average Bakken Three Forks well has a break even oil price of $79/b with a nominal ROI of 15%(inflation rate is assumed to average 3% over the life of the well). This price is at the refinery gate, the ATW oil price is $67/b (transport costs are$12/b).

I do not understand why the drilling continues and agree that at current oil prices it will stop eventually, maybe by September, perhaps sooner.

For the Eagle Ford average well break even oil prices (at refinery gate) are $72/b with a nominal ROI of 15%. The well life is 12.83 years and EUR is 250 kb. We have less data on the Eagle Ford wells, but using oil wells on schedule from the RRC as a guide for the number of producing wells and this well profile, the model matches the output data fairly well, but these wells have only been producing since about 2010, so we do not really know what the tails will look like.

Again, I am just trying to estimate what may happen in the future, it is not clear why more wells are drilled at current prices.

Could it be that each oil company is trying to hold on in hopes that other companies will go bankrupt? You would know better than me.

Dennis, thanks; I was not aware of your definition of “break even,” no. Again, I still don’t truly get the significance of that. The question I believe was the importance of ROI and profitability, which is significant. Your buddy, Paul, pisses me off. He is right, however; for me its all about business. About making money, not posting on a peak oil blog, which I clearly need to stop doing.

Predicting the future is important. I understand that. Predicting reservoir performance and recovery has historically been much different than it is today. To me reservoir recovery in conventional plays use to be credible, and trustworthy. The era immediately following WWII was a time of tremendous growth in world reserves. That growth came from conventional reservoirs where calculations of OOIP were reasonable and extraction rates were not price driven. Conservation practices made predicting easier. Thirty years of stable oil prices made predicting the future a lot easier.

Now, accounting rules have changed, as have definitions. Nobody in the world tells the truth about it’s reserve inventory, not even in North Dakota (Texas either). Unconventional resources are not so predictable, in my opinion. Their development is very much financially constrained. I think in the next 10 months, when bankruptcies occur on every street corner and the money the shale oil company needs to survive becomes very scarce people will understand that better. It is just business.

We all hope for better times. I do. Making business decisions, borrowing money, however based on the hope that prices will go up is stupid. Loaning money to shale companies is even stupider. I am a broken record on that dribble.

Good luck, Dennis.

Mike

Hi Mike,

My main point is that I agree that ROI is the most important metric and was just trying to make clear that when I say the discount rate is 15%, that is the same as saying that the ROI is 15%.

So when someone looks for a break even oil price they are asking the question,

“What does the oil price need to be over the expected life of this well in order for me to turn a X% profit?”

If for Mike’s Oil Company X=15% then we set the nominal discount rate in our NPV (net present value) calculation to 15% and then find the oil price that results in the discounted cash flow being equal to the initial investment.

My guess is that when you have decided that an investment is worth doing at $65/b, that you have essentially done this, you just have a different name for it.

What you must be thinking for break even is the same calculation with the nominal discount rate set to 3% (equal to the average long term rate of inflation) or possibly 0%, where you would be losing money to inflation.

Clearly nobody stays in business for long if they are investing in wells with either a -3% ROI or a 0% ROI.

Does the “Seneca Cliff” scenario for World output seem reasonable to you?

Chart below of a Seneca cliff.

From http://srsroccoreport.com/wp-content/uploads/Seneca-Cliff.png

Hi Ron,

The extraction rate (similar to the depletion rate except it is from producing reserves or developed reserves that have started producing rather than from proved plus probable reserves) determines the decline rate. Below is a shock model for my medium World C+C URR case of 3400 Gb with extraction rates decreasing by 5% each year after 2035. The decline rates are high in this scenario, but it is not clear why extraction rates would decrease unless there is a major war or major economic depression.

This scenario is not realistic in my view unless we explain why extraction rates should decrease.

When I say extraction rates decrease by 5%, that means if the extraction rate is 10% in year 1 it decreases to 9.5% =0.1*0.95 in year 2.

Also Ron,

The fields that start declining are off set by other fields that are on plateau and others that may be increasing output. The all hit the rapid decline phase at different points of time. When they are added together, we do not get the Seneca cliff you anticipate.

Only if extraction rates far above their present level or fall very rapidly below their present level (in the case of an oil shock from a war or recession), will we get the kind of decline rate for World output that you think is realistic (4 to 5% by 2030).

DC Wrote:

“but it is not clear why extraction rates would decrease unless there is a major war or major economic depression.”

You’ve answered your own question!

1. All gov’ts of major industrialized nations have over promised liabilities and have huge unsustainable debt levels. Its why the worlds central banks have pressed for ZIRP and used QE to avoid a fast economic collapse back in 2008. There should be no doubt that without QE and ZIRP the global economy would already been in a severe depression. However QE and ZIRP can only delay a crisis, it can’t solve systemic problems decades in the making.

2. The US/EU has shifted their economies from high wage manufacturing production to low wage service jobs and have outsourced manufacturing\production to Asia. Finacial Gimmicks and massive trade deficits had delayed some of the economic problems, temporarily.

3. US/EU had have declining populations offset by low skill immigrants, who unfortunately do not posse the education and skills need to replace aging skilled workers. For every engineer/craftsmen that retires, he or she is replaced wth 4 to 6 low skill immigrants working low wage service jobs.

4. Increase global competition for depleting strategic resources. The US has mobilized its Armed forces to control the middle east. China is making moves in Africa, South America and the Pacific. The US/EU has sanctioned Russia, which is going have some impact on its Energy Exports. Cold War 2.0 has been created between the US, Russia and China.

4. We seen widespread riots in the EU and through the developing world. We’ve seen the Middle east collapse into anarchy and civil war. Civil ware and foreign troop occupation will continue to grow as the economic problems worsen. I think the next major region to struggle will be Asia, or perhaps the EU as Italy, Spain, Portugal fall in the same situation as Greece has. Should either region get hit with a financial crisis, so will the US and the rest of the industrialize world. I think the US will lose another 20+ million jobs over the next ten years or less.

Its likely that when the Shale Drilled debt problem becomes first page news, its going to be a long time before bankers and investors are likely to loan money to the oil/gas industry. Its taken about 10 years for the Tech Bubble to reappear, so probably about 10 years for another Driller Bubble. By then it likely be too late. Perhaps gov’t’s will step in to bailout the drillers as energy shortages unfold.

Hi TechGuy.

Great post.

Dennis thinks wars and depressions are random events that are unrelated to economic conditions, which are also random and unrelated to energy use.

Hi Futilitist,

No that is not correct. I actually have predicted that a depression might occur around 2035 in response to peak oil, War is also a distinct possibility and the first is more related to economics (with some politics mixed in) and the second is more related to international politics (with economics also having an influence).

I do not have a model that can predict future political and/or economic events with any degree of certainty. So while I have proposed the possiblilty of a major War or major depression and decreasing extraction rates as a result, the point is that peak oil won’t necessarily cause either of these. I do agree that either is likely and think that a depression is more likely.

I am hopeful that the lessons of World War 2 may prevent World War 3, but that might be wishful thinking.

Peak oil would be a minor problem by comparison.

Dennis,

A Seneca curve is possible, but requires unrealistic extraction rates in my view.

I can find two effects which will cause a seneca cliff curve.

-First the massive infill drilling which Ron has written about many times. When you go back to old fields and increase extraction rates it will cause the curve to be asymmetrical. That is more seneca cliff like.

-Second, in the Höök paper we can see that the decline rates have increased over time which is the same as the extraction rates have increased over time. This will also make the curve more seneca cliff like.

If the extraction rate would not have changed over time then the curve would have looked like the curve for discoveries, which is bell curve like. It’s very likely that it will be seneca cliff like as far as I can see.

The EROEI is probably not going to be an important effect for oil. The energy necessary can be supplied by natural gas, coal, nuclear, and alternative energy.

That is the question. The EROEI of coal and natural gas will also decrease over time. Maybe it´s not a problem now, but it will be more so in the future. Perhaps not directly related to EROEI but I was actually quite surprised to that the oil/coal price ratio has stayed about the same even when the oil price sky rocketed. In 2011 when the coal price started to decline you could read about coal companies in economic problems. So it looks like oil and coal will peak together. That is actually not that strange as coal is used to make things and oil to transport them.

It is hard sometimes to get in a comment in the best spot. This time I cannot.

Dennis is right about ” break-even” in the sense the word is used by economists. My old textbooks say that every stable business and industry basically operates at ” break-even” meaning that the people in the industry are making just enough on average to STAY in that industry rather than LEAVE IT and put their capital and expertise into some other business or industry. In this sense the term DOES include a return on investment with the assumption being that this return is roughly constant through out the economy.

This definition of break even involves ”opportunity costs” and has little to do with bookkeeping profits but the bookkeeper WILL be recording some ”profit” in good times.

In a recession or depression a company might actually be losing money according to the bookkeeper but still breaking even in this economist’s narrow theoretical sense if the owner has no better opportunity to employ his capital and expertise elsewhere.

Now when my neighbors talk about breaking even for the year they mean they got back what they spent but nothing for the years labor.

Mike is the sort of guy who would be a well liked neighbor and that is the way HE uses the word and the way BOOK KEEPERS use the word.

Both definitions are commonly accepted depending on context but small businessmen who have not had a college level course in economics have mostly never run across the first definition that includes a profit in ” break-even”.

A lot of the discussion going on is a lost cause based on people using the same word to mean different things.

Mr Telescope may or may not be getting good results with all his modeling but it is possible for him to model the industry without knowing how to tie two ropes together . He is not drilling for oil and selling it.He is a spectator in the high bleachers where he can see the whole playing field. He does not have to possess any expertise in any particular players position to watch the game. He will never be able to hit a home run but after watching lots of games he can tell you almost exactly how many home runs will be hit in the next one hundred games.

All the things that matter so much to Mike , the things that make or break him on a day to day and year to year basis, AVERAGE OUT over all the people in the industry.

Mr. T is not concerned at all with any given company but with the AVERAGE results of ALL the companies in the industry.

In Mike’s world if he loses money for a few years, too many years, he goes out of business.

In Mr. T’s world if the industry loses money for a few years it shrinks as projects are delayed and some companies go broke . The individual companies don’t matter from his perspective.

It is all a matter of where one sits and his point of view.

Thank you, OFM. I don’t like “scientists” looking down their nose at me. I have spent my entire life doing the work that engineers and scientists don’t know how to do, or are too afraid to do. Ten years ago most of the people that now consider themselves experts on oily matters did not even give the subject, or the process a second thought. The internet fixed all that, for sure.

I think you and I are old enough that we know that life is actually very “anecdotal.” Not very much I thought would happen in my life, actually happened, sometimes for the good, often for the bad. Its just life. And to get through it one better be able to roll with the punches and have a sense of humor about it, in my opinion.

Take care, mate.

Mike

Hi FreddyW,

As the prices of fossil fuels increase, other energy supplies will be used such as nuclear, hydro, wind, solar, and geothermal. In addition energy will become more expensive and will be used more efficiently. Eventually growth will need to stop, hopefully population will have peaked before this happens, if not we will need to get by with less stuff. A different economic paradigm will be needed to make this work. I do not know what this would look like.

Wimbi has it right, we really need to focus on finding alternatives to fossil fuels. It will not be easy, but it may be possible.

DC wrote:

“As the prices of fossil fuels increase, other energy supplies will be used such as nuclear, hydro, wind, solar, and geothermal. In addition energy will become more expensive and will be used more efficiently.”

And so will the Jobs become more “efficient” (ie a lot fewer of them). The US has lost about 20 Million jobs since 1999. No need to substitute production when there is no demand growth. As Energy costs rise, consumers will cut consumption leading to fewer workers. Less workers means less people buying stuff, thus a feedback loop. Industrialization was built on cheap and abundant energy.

Nuclear is dead in the West. the US has two new Plants under construction which will be completed in 2019-2022 (depending on delays), yet is closing about 2 nukes every year. Germany isn’t building new Nukes and I think Sweden announced is closing two nukes in the next 12 months. I think France is building 1, and decommissioning 1.

Nuclear appears to be only growing in Asia and parts of the Middle East.

Hydro is pretty much maxed out in the US, and probably is in decline as the drought in the West is impacting output. I believe there are numerous dams in the US that need to be rebuilt due to structure problems, and there is no money to replace them.

Wind and Solar: DOA without a substantial breakthrough in energy storage tech.

FWIW: the time to mitigate for fossil fuel depletion was 30 to 40 years ago. At this point we are in the bottom of 9th, down 50 home runs.

Hi Ron,

Here is the World C+C URR=3400 Gb with extraction rates remaining constant after 2017,

extraction rates rise to 1.9% above 2014 extraction rates from 2015 to 2017. Annual decline rates remain below 1% until 2035,remain under 1.5% until 2055 and reach 1.85% in 2091.

Hi Dennis.

“Fernando seems to think the URR I have estimated for my best guess is reasonable.”

If Fernando didn’t think your estimate was reasonable, would you change your estimate? How did Fernando arrive at his estimate?

“I have proposed many different scenarios, if there is a major war in the middle east, or a severe depression, decline rates will be much higher during these crises (from 3 to 5%).”

How did you arrive at the 3-5% number? What if we have WWIII?

“Only if there are no “above ground” problems in the World from now until eternity would decline rates be 1 to 2% per year.”

How did you come up with that estimate? The IEA is pretty conservative and they think we will see a considerably higher depletion rate.

http://peak-oil.org/peak-oil-reference/peak-oil-data/oil-depletion/

“The IEA’s World Energy Outlook 2008 included, for the first time, a study of the depletion rates of the world’s top 800 oil fields. It found rates of 6.7% for past-peak fields, increasing to 8.6% by 2030.”

“If things turn out very badly (collapse of civilization by 2050 for example)…”

2050? Is that your worst case scenario? Is it even conceivable to you that a collapse could happen a lot sooner than 2050?

“I do not think…this very pessimistic…scenario (is) realistic, not even in fantasy land.”

Wow. Putting off the inevitable collapse of industrial civilization till 2050 sounds hopelessly optimistic to me. But I think that the health of the economy is based on available net energy, while you think the health of the economy is totally arbitrary and not subject to the laws of physics in any way at all.

Hey Ron.

I just tried to edit my comment above and was refused. It said I do not have permission to edit this comment. Why?

—EDIT—

But this current comment is editable.

You have 60 minutes to edit a comment. After that you are shut out. If it had not been 60 minutes then I have no idea why.

Shit happens.

Ron Wrote:

“You have 60 minutes to edit a comment. After that you are shut out. If it had not been 60 minutes then I have no idea why.”

Question: Is it possible to change the timer display to just display the “minutes” left instead of both minutes and seconds.? As the seconds count down it shifts all of the text below up and down a line when the seconds wraps back and forth with a new line. Not a complaint.

Thanks

Question: Is it possible to change the timer display to just display the “minutes” left instead of both minutes and seconds.?

No, I have no control over that. Sorry.

The laws of physics have to be applied to the entire system, thermodynamics has to be applied to the entire economy, not simply to the oil industry. When looking at EROEI, you have to consider all energy flows in the economy.

Whether oil is produced depends on ROI not EROEI.

“Whether oil is produced depends on ROI not EROEI.”

I’m not sure what your point is, Dennis. The only way that ROI can be positive is with a sufficiently high oil price.

The problem with the current situation is that in order for the price of oil to return to a level that that will be more generally favorable to positive ROI, production must fall, causing grave economic damage. That will temporarily raise the price of oil, but lower available net energy to society. The net result will be reduced economic activity, which makes the higher oil price impossible to sustain. Catch-22.

My problem with your so called “model” is that you do not explain exactly how market forces can ever fix the situation I describe above. You just claim they will.

You don’t seem to able to grasp or accept the most basic physics premise that the level of economic activity is completely dependent on available net energy. Thus, the price of oil is not arbitrary. It is indirectly determined by the laws of physics.

There must be an upper limit to the price of oil. This is based on it’s energy content and the amount of economic activity a barrel of oil can produce. It must produce a positive return on consumer’s investments. Duh.

Anyway, I don’t need to know the exact physics formula or all of the energy flows in the economy to know that there is upper limit on the price of oil. We have already experienced this limit. The oil price seems to be physically constrained to a maximum yearly average of a little over $100/barrel.

“The implicit assumption of the model is that market forces will adjust the oil price so that in the long run oil production will be profitable.”

Please present a plausible scenario describing exactly how market forces will produce a situation in which consumers will be able to sustainably afford oil over $100/barrel any time soon. Or any time, for that matter.

If you cannot do this, your “model” is completely invalid (and you should honestly admit it).

Hi Futilitist,

The economy will adjust to higher oil prices over time, just as it has adjusdted to higher prices in the past. The net energy in oil is not of consequence, it is the net energy of all forms of energy used by society that matters.

You assume the world cannot operate on oil that is $100/b, it did so for a couple of years and price came down due to too much oil being produced. When the supply adjusts to demand, the oil price will rise to a level that oil is profitable to produce. Read some microeconomics to understand how this works, generally it works pretty well, though for the oil industry price volatility is a problem and a cartel would allow the system to operate with more stability. This is the reason that the RRC controlled oil output in Texas from 1930 to 1970 and OPEC controlled output from 1975 to 2014. The volatility may result in chaos, if so the EIA, IEA, or RRC may step in to try to balance supply and demand if the free market is unworkable.

The upper limit on the price of oil has very little to do with its net energy, it is determined by the balance of supply and demand. There is no doubt an upper limit, Ron has guessed $145/b or so (I think), this seems reasonable over the medium term (next 10 years). As the economy gets used to oil at $125/b (maybe from 2017 to 2025) and substitute forms of transportation are developed (rail, light rail, buses, plug-in hybrids, and EVs, and generally better fuel economy) higher prices may be feasible.

Oil use per unit of GDP produced has been decreasing and will continue to do so.

“The economy will adjust to higher oil prices over time, just as it has adjusdted to higher prices in the past.”

You keep repeating the same vague invisible hand argument. But market forces are currently lined up to produce low oil prices. The only current way to raise oil prices is to destroy production. I am asking you to describe (in microeconomic terms) specifically how that situation can change in the future so that oil prices can sustainably rise.

In the past, we could count on rising GDP to support higher oil prices. GDP cannot rise if available net energy is falling. Are you trying to claim that GDP is completely independent of available net energy?

“The net energy in oil is not of consequence, it is the net energy of all forms of energy used by society that matters.”

Bullshit, Dennis. The net energy of oil matters because it is our primary energy source. When the net energy of oil declines, the net energy of civilization declines with it.

“The upper limit on the price of oil has very little to do with its net energy, it is determined by the balance of supply and demand.”

You sound like an economist and your position is basically indistinguishable from that of a peak oil denier.

For a good example of what a potentially valid forecasting model looks like, please check out my Futilitist Oil Price Forecast Model down the page.

Hi Futilitist,

The economic analysis is straight forward.

Lower oil prices due to excess supply will have two effects, the quantity of oil consumed will increase (if income remains unchanged), and the quantity of oil produced will decrease because the lower prices make oil production less profitable.

On a traditional supply and demand diagram this can be thought of as a shift of the supply curve to the left, the amount of oil produced will decrease and oil prices will rise, there will also be a lower quantity of demand for oil at the higher prices.

Why would oil supply decrease? Oil companies that are operating at a loss will eventually go bankrupt, these bankruptcies will reduce the supply of oil.

For a “peak oil denier” I tend to create a lot of scenarios that show a peak in oil production. I suppose you could call me a “Seneca cliff denier” as I find that scenario to be implausible unless we assume economic collapse or World War 3 to cause the Seneca cliff. I agree either of those scenarios are possible, but disagree that they are inevitable.

DC wrote:

“You assume the world cannot operate on oil that is $100/b, it did so for a couple of years and price came down due to too much oil being produced.”

FYI:Sorry, not trying to gang up on you, but here is my thoughts: