There has been considerable dispute over how many new wells required to keep production flat in the Bakken and Eagle Ford. One college professor posted, over on Seeking Alpha, figures that it would take 114 rigs in the Bakken and 175 in Eagle Ford to keep production flat. He bases his analysis on David Hughes’ estimate that the legacy decline rate fir Bakken wells is 45% and 35% for Eagle Ford wells. And he says a rig can drill 18 wells a year, or about one well every 20.3 days.

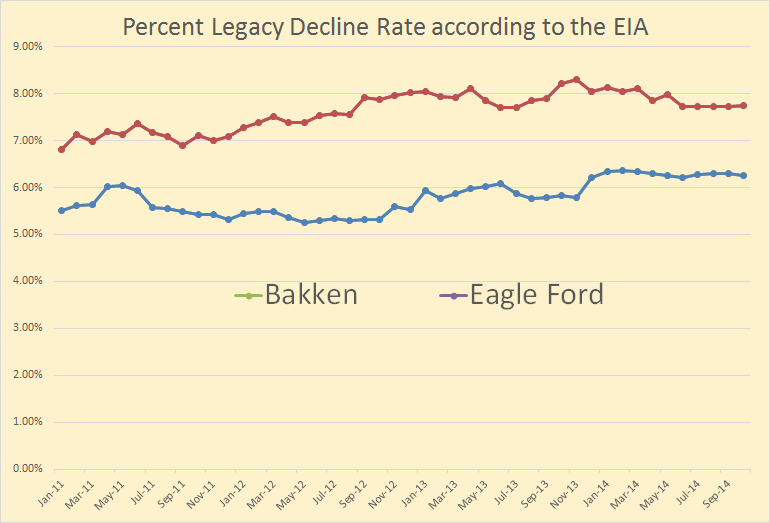

The EIA has comes up with different numbers. The data for the chart below was taken from the EIA’s Drilling Productivity Report.

The EIA has current legacy decline at about 6.3% per month for Bakken wells and about 7.7% per month for Eagle Ford wells. That works out to be about 54% per year for the Bakken and 62% per year for Eagle Ford. I believe the EIA’s estimate of legacy decline, in this case, is fairly accurate. For instance last month Mountrail County had over 30 new wells completed yet still declined by 6.4%. And in December 2013 North Dakota declined by 5.22% yet had 119 new well completions.

I have examined the last sixteen Directr’s Cuts and gleaned, I think, some important data… I think.

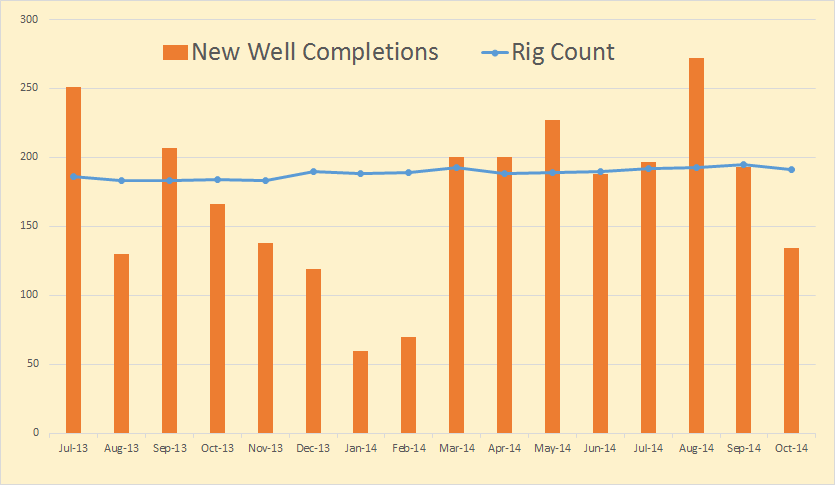

Rig count has averaged 189 rigs per mnth and has been fairly steady while new well completions has averaged 172 wells per month but has been highly erratic.

New well completions depends far more on weather and fracking crews than rigs. In October there was 650 wells awaiting fracking crews. At 172 wells per month that is almost a four months supply. And that is also what the average spud to completion is, 120 days.

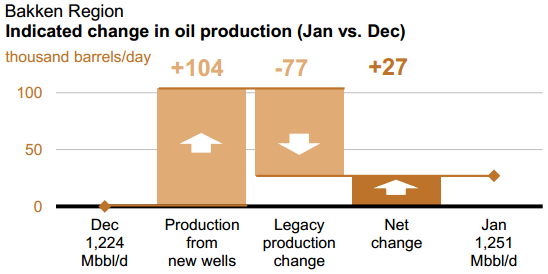

The Bakken part of the chart above says the Bakken legacy decline was 77,000 bpd but it was 77 bpd in Octber. This fits perfectly with what I found by looking at the 16 month Director’s Cut stats. They showed an average of 172 new wells per month, an average of 555 bpd per new well, (first month).

That is the 16 month average. Of course every month is different. But if we accept the EIA’s legacy decline data then everything fits perfectly. The legacy decline, in October, was 72,951 bpd. But they had a decline of 4,054 bpd in October. That means new production was 68,897 bpd, or 4,054 bpd less than the legacy decline. There were 134 new wells that averaged 514 barrels per day each.

It would have taken 142 new wells to keep production flat in October. They came up 8 wells short.

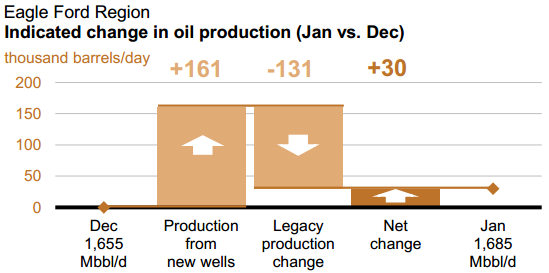

The situation in Eagle Ford is a little more dire.

Their legacy decline is 81% of current production. If their new well production declines by only 19% then their production will be flat.

What will light tight oil production look like in 2015? I can only guess. But I expect Bakken production to continue to increase, at least until mid year, but at a much lower rate. I think Eagle Ford will start to decline, slightly, by the second quarter.

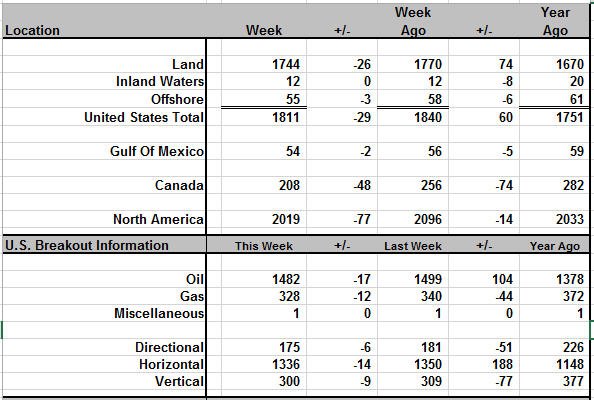

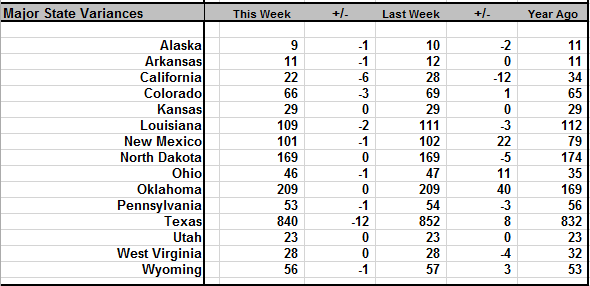

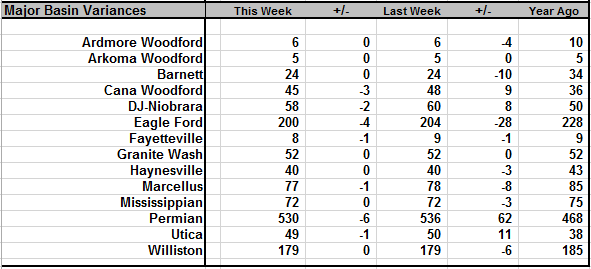

Rig Counts from Baker Hughes as of Friday January 2, 2015.

North Dakota at 169, flat for the week but down 28 from the most recent high of 197 in October. Williston Basin, which includes Montana, is at 179. Eagle Ford is dropping but not as fast as North Dakota.

If you don’t know about the web site Desdemona Despair, Blogging The End of the World, you should check it out.

The most surprising image of 2014 came with the discovery of large craters in the Yamal peninsula in Siberia, caused by sudden releases of methane as the permafrost thaws and collapses. This image captures a bit of the profound change that humans have precipitated in the great biogeochemical cycles of the planet, to the doom of all.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Good article as usual. I’m a lurker, but there was a small mistake at the end of the post, which was the week-over-week change in ND – it was flat and -5 yoy. the eagle ford is actually dropping rigs faster than Bakken. Keep up the good work, Ron.

Thanks, fixed it.

Didn’t we find already that completions don’t map to production? That fell apart early last year.

Hi Watcher,

The “completion” data by Helms in the directors cut is just a rough guess, after 6 months when most wells come off the confidential list we can get a better idea about how many wells were completed by looking at the NDIC data.

The model matches the data pretty closely, considering its approximate nature. Clearly the “average well” will be slightly different each month so there is no expectation of a perfect match between a simple model and real world data.

In short, no what we saw last winter was a bad estimate of the number of completions by Helms.

That crater is a thawed pingo.

A pingo is a frozen mound. If it thawed it would be smaller, perhaps level to the ground. But it most definitely would not be a huge crater in the ground. And it would not throw debris up around it. And it would not have methane settled at the bottom as this crater does.

What this is is a methane blowout. Ancient methane craters have been found at the bottom of the ocean in many places but to my knowledge this is the first time they have been found on land. Of course they could have many such ancient land craters but they would have weathered away thousands of years ago. The still ocean continental shelf floor does not weather nearly as fast.

The Arctic is undergoing thermal changes caused by warming associated with Holocene sea level rise and warm waters have flooded permafrost areas of the Arctic. A thermal pulse is propagating into submerged sediment which seems to be decomposing gas hydrate (as well as permafrost). Basically, what is happening is gas is venting on the seafloor and on the surrounding land from gas hydrate decomposition at depth. This takes the form of elevated methane concentrations as streams of gas bubbles emerge. Because hydrate deposits exist close to their pressure-temperature equilibrium, an increase, even a small increase, in rock formation temperature (or decrease in pressure), induces decomposition, gas-hydrate-bound methane is released and the gas migrates to the surface and ultimately to the atmosphere. As methane is an potent greenhouse gas, this story of decomposing gas hydrate is of concern. Of course it is an ongoing process and it has been well documented on the Beaufort Shelf and elsewhere, especially in the Russian Arctic, for decades. Yamal peninsula craters in Siberia are believed to be a dramatic example of these degassing phenomena.

Doug L,

I’ve seen collapsed pingos in Alaska and lots of views in the literature. They aren’t pits; this thing is a pit, and it sure does look like splash-out around it, and 9.6% methane is within the explosion range if I remember correctly so that’s a whopping level of methane.

More about this pingo

http://wattsupwiththat.com/2014/08/01/newly-discovered-siberian-craters-signify-end-times-or-maybe-just-global-warming-mystery-of-the-siberian-crater-deepens-scientists-left-baffled-after-two-new-holes-appear-in-russias-icy-wilderne/

Ted, for goodness sake, look at the page you posted. The “mystery crater” is a huge blown out crater with debris thrown all around. Your “thawed pingos” all look like small puddles on the ground, no crater and no debris. They do not remotely resemble each other.

Click on the link Desdemona Despair

(Nature) – A mystery crater spotted in the frozen Yamal peninsula in Siberia earlier this month was probably caused by methane released as permafrost thawed, researchers in Russia say.

Air near the bottom of the crater contained unusually high concentrations of methane — up to 9.6% — in tests conducted at the site on 16 July, says Andrei Plekhanov, an archaeologist at the Scientific Centre of Arctic Studies in Salekhard, Russia. Plekhanov, who led an expedition to the crater, says that air normally contains just 0.000179% methane.

Since the hole was spotted in mid-July by a helicopter pilot, conjecture has abounded about how the 30-metre-wide crater was formed — a gas or missile explosion, a meteorite impact and alien involvement have all been suggested.

But Plekhanov and his team believe that it is linked to the abnormally hot Yamal summers of 2012 and 2013, which were warmer than usual by an average of about 5°C. As temperatures rose, the researchers suggest, permafrost thawed and collapsed, releasing methane that had been trapped in the icy ground.

A company I worked for studied Yamal development possibilities for a while. The whole area is indeed getting warmer. What’s the orifice diameter?

“the 30-metre-wide crater”

Thanks. It could be a pingo crater.

But if one looks at a map where this methane eruption took place,

Yamal map

There are lots of lakes that have formed after similar eruptions.

It seems to be a fairly common occurrence.

Anybody who has ever seen or looked at photographs of bomb craters or craters produced by deliberate underground explosions such as set off by miners or highway builders etc will have seen some that look VERY MUCH like the picture.

The absolutely dead giveaway is that the debris is ON TOP of vegetation and the edges of the debris are pretty sharply delineated. The debris also shows only minor signs of slumping down- piles of soil that are subject to freeze thaw cycles for a few years slump down nice and smooth. These heaps are sharply defined.

Conclusion : Inescapable conclusion — explosion.

Nothing about this indicates a long drawn out gradual process being involved.

Beyond this what possible explanation could be offered for the crater not being full of water- or at least ice? This place is way the hell up north where the permafrost is DEEP. There is no reasonable expectation that such a crater could ever be empty in that sort of climate if it were created by a melted pingo.

It would necessarily have to be full of either water or ice. Else the permafrost would have to have melted somewhere down inside the crater to allow it to drain to – well WHERE could it drain to in a place with a couple of hundred feet of permafrost under it?

And if it WERE a melted ping- well the very fact that it melted fast enough that the vegetation has not had time to start to encroach on the mounds is SOMETHING WORTHY OF HARD THOUGHT.

That something would HAVE to be pretty fast and extremely localized warming.I am waiting to hear any theory as to where the heat could have come from – other than the whole area warming up.

When you make popcorn a few grains necessarily pop ahead of the others.

IF any skeptics want to lay a bet I am ready to mortgage the farm on the proposition that LOTS of ” melted pingos” will be found within the next couple of decades- and that at least a few of them will be found to have” melted” in the space of a few hours or days if enough satellite capacity is available to photograph the general area on a regular basis.

Astronomers find things by looking at pics taken at intervals- they have computer programs that spot a change for them in heartbeat. Cheap with ground based telescopes and automated cameras etc.

Unfortunately it seems unlikely anybody will be able to photograph Siberia at high resolution on a regular short term basis. Too expensive.

Hi Mac,

Pingos are lenses on (mostly) ice. I’ve stood on them when working in the Arctic. What’s wrong with the idea of Ron’s crater being a methane related explosion/sinkhole feature? Several of these beasts have been observed and they are being studied as we “speak”.

I have two main memories of my times in the Arctic: one wonderful the other horrible. Wonderful = Northern Lights displays (aurora borealis). Horrible = goddamned inescapable bugs. Many times I’ve stood on a pingo because a little extra breeze up there reduces the bug population SLIGHTLY. People assume cold is the main enemy in the far north but I disagree. You can dress for cold but if you need to breathe damn, bugs will penetrate any defense. So, pingos are nice.

Meant to say lenses “of” mainly ice: My kingdom (such as it is) for a text editor.

Recently I read a magazine article by Finnish nature photographer/writer who has been in Lapland for tens of years; he wrote that pingos are not forming anymore in the north and old ones are melting away…

Hi Doug,

Some how you seem to have gotten the idea that maybe I disagree with Ron. Absoulutely not so.

The only remotely reasonable explanation for this hole in the ground is an underground explosion. AND the only plausible thing I have seen mentioned as the explosive is decomposing methane hydrate.

I have seen beer bottles with beer capped too soon that exploded in like grenades – fortunately nobody was around.

And kids around here have found out that if Daddy has a he man air compressor in the garage – one capable of 180 psi or more – that you can make a mighty fine firecracker out of a plastic soda pop bottle by using a lot of tape and some ingenuity to secure the air line into the bottle and opening the line valve.

These firecrackers are potentially capable of seriously injuring or maybe even killing somebody but hardly anybody has such an air compressor handy except garages etc or otherwise I would not mention this ersatz firecracker. I have one of these machines because I got it the way I get almost everything expensive- buying one not running dirt cheap and fixing it up.

I have never been fortunate enough to see the Arctic but I spent a day or so reading up on pingos weeks ago when I first read about these craters. Being mostly stuck in the house looking after my old Daddy has a few bright sides the brightest of which is plenty of time to read anything I want.

I expect that most of the time there is no explosion as such because the gas probably LEAKS thru a CRACK in the overlying permafrost rather than blowing it out in one big blast so not very new empty craters will ever be found in relation to the number of small deep lakes that probably are the remains of pingos.

Having pronounced like a tenured professor on these matters well outside my own area of expertise I hereby admit that my only specific training in geology was one sophomore level course back in the dark ages. But I have alway spent my evenings reading history and science books.

When air tanks and other high pressure containers fail they usually fail – in my experience at least- by developing a crack which relieves the pressure gradually rather than explosively.

I have repaired a bunch of air and water tanks that split at a rusty spot or a seam rather than exploding.

Any old farmer will tell you that soil on top of vegetation didn’t get there via any drawn out process – otherwise the vegetation would be on top. 😉

The gas does leak slowly. To get an explosion we need an air filled cavity into which methane leaks, to eventually reach a high concentration. Therefore it appeas this was an ice mass which heaved the terrain. Did you notice it was a neat circle? This implies the cavity underneath was a dome. If the walls are nearly vertical and there’s smooth ice at the bottom then this was a type of pingo. I suppose methane could have leaked into the cavity, and eventually exploded. But I tend to doubt it.

I am probably going out on a limb and sawing it off by contradicting or at least questioning an engineer in this sort of thing but part of my experience on the farm in more innocent times involved ditching with dynamite.

In pre terrorism days we used it so routinely you could always borrow some from a neighbor in case you ran short. The hardware store kept it in stock but not a whole lot – the owner understood that a just a stick or two would destroy his building and kill every body in it – a risk he was willing to run. .

But he was not willing to keep enough to kill a bunch of people in neighboring stores so he didn’t keep MUCH dynamite on hand.

We used to punch holes in boggy ground we wanted to drain and put in half sticks about three feet apart three feet deep down the desired ditch line. If you watched very carefully you could see the explosion travel the line. Plus I have watched a lot of ” shots” on excavation jobs.

We got beautiful ditches in places too boggy to run any sort of excavator- and far cheaper to boot. Plus we got to have some serious fun doing something dangerous. 😉

Rocks and soil flew as far as fifty yards. Now the usual thing in construction is to use just enough to break up the soil or stone. A proper shot heaves the ground up some but nearly all or all of the loosened material remains in the crater.

That soil did not get deposited the way it is by any slow gradual process of ice heaving up and melting. IT was TOSSED. THROWN.

And so far as methane exploding- English is a poor language in some respects. I it would be better to say the methane was RELEASED in explosive fashion when the overlying ice and soil capping the crater failed SUDDENLY like the beer bottle exploding due to excessive CO2 being manufactured by the yeast.

If you look again at the crater the sides slope inward as they slope down in precisely the fashion that a sharp hammer blow will knock out a conical plug from a sheet of brittle material such as glass if the entire sheet doesn’t fail.

Bullets punch tapered holes shaped precisely this way in glass.

Now I must admit that a serious grasp of the chemistry or physics of methane hydrate structure is beyond my modest level of training in chemistry – and that training has been mostly forgotten in the last forty years.

BUT- Everything I read about methane hydrate describes it as an unstable substance that disaccoiates with a rise in temperature resulting in free methane -so if there is hydrate in the permafrost and it is slowly warming up then you have your source of free methane. The pressure would rise steadily until vented.

The air is often (usually) colder during winter than the underlying permafrost ( which freezes only so deep due to heat rising from deeper levels of the earth ) so there could be a very hard frozen layer of ice and soil over a methane pocket.

I believe the overlying layer failed in EXPLOSIVE FASHION just like the aforementioned beer bottle or plastic soda bottle firecracker.The methane need not have exploded in the usual sense of the word of releasing energy from chemical bonds in milliseconds.

There may very well have been a pingo where the crater is NOW.But it didn’t melt. It blew out with a BANG.

Hi Mac,

Mac, Well I’m an engineer (Engineering Physics) and I agree with you. Plus, the arctic is filled with pingos and something called “pingo like structures” (PLS) and these were formed by methane release. The PLS have been studied in great detail by the Canadian Coastguard, and others, including shallow drilling and geochemical work. So, its quite likely that the structure in Ron’s photo corresponds to a methane discharge perhaps with some version of sinkhole erosion. “Explosion” is a relative term.

You would have to derive an equation whereby methane, which is lighter than air, would remain trapped in a perfectly circular cavity and blow a perfectly circular hole at the top. Don’t forget this is supposed to be Yamal. I assume you realize that’s permafrost terrain? To be honest, I don’t really think it matters either way, but I’m having a bit of a difficult time visualizing an underground methane explosion.

Methane is combustible and mixtures of about 5-15 percent (in air) are explosive. When air contains 9.5 percent methane it reaches a perfect oxidation point, meaning the correct quantity of fuel is mixing with exactly the right amount of O2 and this produces water, CaO2 and heat. It doesn’t require much heat to ignite and methane explosion accelerate fast. Heat generated by this process raise the temp. of air (esp. in coal mines) causing expansion. Since hot air cannot really expand underground, pressure builds and if this pressure is high enough, it can cause the air ahead of the combustion zone to compress and cause a shock wave. Ventilation is used to avoid explosions in coal mines but EVERY miner understands this perfectly. No engineering required.

There’s no hot air in Yamal permafrost. I assume you do realize the terrain in Yamal is frozen? These shafts must be caused by really weird geometry, and water flow must have a role to play. I just happen to think the simple minded “methane explosions” aren’t the real story.

Fernando, why are you being so bone headed about this? Methane hydrates (clathrates) are extremely common in shallow marine and near shore environments where they’re continually degassing and creating voids. But if you want to be a prima donna and have the last word, go for it.

Leighton, I have serious doubts a crater like that would be created by a “methane explosion”. It seems you are focused on only one cause, while I´m more curious about the full process.

By the way, I lived in Russia, and my job description included working on Arctic projects in the Russian north. I´m not a permafrost expert, but I spent quite a bit of time working on issues such as pad, well drilling, pipeline, port and infrastructure construction over permafrost terrain. Given what I was taught in those years, I have serious doubts the overall structure was caused by a methane explosion. It sure looks to me like there must have been some sort of thaw bulb in the area if those holes are as deep as reported. Since we lack the full amount of information this is getting a bit silly.

It could be a pingo that melted, and the water ran off. The bottom is probably smooth ice.

Ted,

Just out of interest, do you ever have doubts about any of the articles published on watt’s up with that? I mean, that would be the,er, skeptical position to take wouldn’t it?

By the way I use the word “skeptical” in its traditional sense of “withholding judgement in the absence of sufficient evidence” as opposed to the modern sense of “hostile”

For instance, take the “sea ice” page:

http://wattsupwiththat.com/reference-pages/sea-ice-page/

It seems the 2012-2013 winter was the worst, and that there has been some recovery.

All trends have noisy data. Is the sea ice cover trending, or is it oscillating about a mean?

I suppose only time will tell.

The death spiral…

Here’s the latest version to November 2014… http://haveland.com/share/arctic-death-spiral.png

Nothing in nature moves in straight lines.

WattsUpWithThat is an active propaganda site and shouldn’t be cited for anything.

I’m curious what exactly you would say was propaganda on the “sea ice” page? I didn’t read it all, but it only seemed to contain raw data, with some analysis.

Do you claim the data to be biased, or the analysis of the data?

Of course, it’s all made up by those thousands of scientists sending millions of secret e-mails back and forth all designed to trick the honest God fearing folk into believing a climate change fantasy. Or maybe I’ve got that backward: Need more coffee.

I’m just asking that a theory explain all of the data. The data shows that sea ice cover and volume have decreased in the last 15 years in the Arctic. And that sea ice cover (and volume?) has increased in the antarctic.

Are these trends related? Is it just an oscillation?

One needs to not be passionate about a theory in order to properly test it against the data.

The antarctic sea ice anomaly.

canabuck, the Antarctic sea ice anomaly doesn’t help the cause, therefore it gets very little coverage. But these trends take time. We could see a reversal in both trends, with increased Arctic sea ice, decreased Antarctic sea ice, and so on.

Antarctic ice is all first year ice. Melts in summer and forms in winter. A different beast than Arctic Ice. Look at what happens to Antarctic ice sheets mass . And if you think you will find real science discussion at WattsUpWithThat you are as deluded as the “abundant-tight-oil-will-make-US-energy-independent-forever” and “oil-is-renewable-and-regenerates-in-deep-earth” folks

Antarctic Ice is all 2st year ice??????

Antarctica Ice is 80% of the ice on the entire planet – miles thick in places. Antarctic Ice that melts (land ice) is on the penisula that goes will north of the south pole. It’s lattitude is somewhat similar to Alaska or Canada.

sea ice… Antarctic sea ice ( the graph above…) pay attention

Nice overview. I’m not sure why we are discussing ice, but while we are at it: the way I see it, the extent is important because it changes albedo. The amount of ice being formed can impact thermohaline circulation, and the overall thickness and age impact heat transfer as well as the ability to navigate. Did I forget anything?

The enormous quantity of fresh water being deposited from the ice sheet may well be reducing the salinity of surrounding surface water enough to result in it freezing faster. Less saline water tends to float on top until mixed by wind tide thermohaline circulation etc which all take time.

The geography of the far southern part of the earth is such that there is nothing to impede circumpolar winds and currents there.This makes it a different animal than the Arctic pole.

The key thing that you may be missing about Arctic sea ice is that it is VERY CONSISTENTLY MUCH thinner in recent times as well as being less extensive ON AVERAGE than formerly.

I don’t keep track of numbers personally but if I remember correctly the quantity of Arctic sea ice is only about half or even less NOW with the same surface area as it was a couple of decades ago.

Old farmer, I worked in the arctic and I used to develop computer models for ship navigation through ice infested waters as a personal hobby (I’m a bit nerdy). I saw the thinning ice data before most of these arctic experts were out of high school (we got a hold of usa military data). I summarized the ice issues. Thinning ice isn’t the only important item if you are worried about a bit of warming.

I understand that someone does not want to argue the same point over and over again. And at some point it is easier to just dismiss a website and move onto serious discussion.

I am not at this point (yet) with this website. And am willing to look at other points of view, for when you disagree with someone, then there is real opportunity to learn.

A good article! Thanks. It seems like fresh water due to land ice-mass melt could cause more sea ice.

It does. But the fact that sea water is mighty cold and getting colder sure seems to help. Don’t forget antarctica is a continent. It can have variable climates and circumstances.

WTI at $49.94, Brent at $52.93, Euro at $1.1946.

At these oil prices wich producer is still in profit? Shale oil at ~$34 head well…

I am curious to see production for December 2014.

By the way, anyone has a clue why the WTI/Brent spread has narrowed so much of late?

Greek tanker getting bombed?

Better pipeline capacity out of Cushing to the Gulf coast where most of the US refining capacity is located, several new pipelines have opened over the past 12 months.

There’s a lot of talk about the US lifting the export ban. That might do it.

I just talked to my neighbor who works in the Bakken. He tells me that rigs are being laid down as soon as they finish a well, but insists that this is only a short-term problem, caused by the fact that ISIS is dumping oil on the market, and that prices will recover when that oil is gone. (Well, that’s what they’re saying in Williston, anyway.)

this is only a short-term problem, caused by the fact that ISIS is dumping oil on the market,

I believe that is the most absurd explanation I have ever heard. If ISIS is dumping oil it is oil they stole, oil that would have gotten to the market anyway. So it just went through ISIS’s hands. It would be a wash anyway. But they could not be stealing and selling, daily, that much oil.

Ron,

Be gentle on the man. He is just a messenger, as he is reporting what people are saying, not what he believes. I agree with you that it is an absurd reason, but when nothing else makes sense people try to come up with their own explanations to justify.

I think it says a lot, that nothing normal is making sense, and people need to go these lengths to justify what has happened.

Toolpush, my comment was directed at the worker using that logic, not at Don. I knew anyone on this blog would know that was faulty logic.

On one of the BBC’s flagship current affairs radio programmes this morning there was some “energy analyst” burbling on about the price crash being due to a surge in world oil production. Curiously, he highlighted “all time high” production in Russia”. Well, I suppose it’s a little less deluded than the ISIS theory.

Of course it’s absurd. That was my entire point in reporting on it. I guess I should have used my sarcastic voice.

What is ISIS breakeven price? 🙂

This better then Sainfield 🙂

The statement about ISIS oil is just desperation. When you are getting a pink slip what else are you going to blame it on?

We are at a point where a big chunk of production is underwater on an operating basis, not just new projects not making economic sense. I guess at least 3-4 million bopd of current production. Just a guess.

All you can say is WOW!!

Blaming somebody else or yourself will just aggravate your situation. Blaming is fighting, resistance. It’s like throwing hot coal at somebody. And whose hands would burn first? We can’t change anything regarding the price since it is beyond our abilities. So the right way is just to accept it and let it go.

I agree w you Ves. Just saying why they are saying that. Don’t know why re the crash this far but afraid will go much farther.

3-4 sounds good globally.

I am sort of okay with the ISIS story, in terms of mechanization. The oil they sell is certainly discounted, because buying it is illegal, so to entice people to buy illegally the price is discounted. They aren’t “dumping”. That’s silly. But they probably are priced under market rates and that will drag things a tad.

But a tad ain’t 60% in 6 months.

Some 20-40% of coal extraction is now also “under water”, and coal gives our civilization only little less energy than oil. Is this the ‘this is it” moment?

Don Wrote:

” just talked to my neighbor who works in the Bakken. He tells me that rigs are being laid down as soon as they finish a well, but insists that this is only a short-term problem, caused by the fact that ISIS is dumping oil on the market”

The most likely answer is that the global economy is slowing down. It probably does not take very much excess production to send prices falling. Its likely that falling oil prices is creating a economic feedback loop causing the economy to fall even more since a lot of money was invested into Oil production.

On the economic data side, we definitely see a slow down in China and the US. China raw material imports are way down. The Baltic dry index (loosely tracks raw material shipments) has collapsed to near the 2008 lows. US factory orders are falling and companies are starting to idle Plants. US home sales have also started to tumble and home prices now appear to be falling. Another key indicator is falling Gov’t Bonds in the US and Europe. Usually bond prices fall when investors withdraw money and buy Gov’t bonds for safety.

I doubt the Shale will bounce back. I think Investors are pulling away money. There are a lot of over leveraged drillers that are going to be in trouble and once the bad news starts to leak out, investors are not going to be eager to jump back in. With out investor financing its unlikely that boom will continue. It will likely be many years or never before the shale boom resumes. Sorry for the disappointing information, but its best to be prepared for the worst.

“I doubt the Shale will bounce back. I think Investors are pulling away money. There are a lot of over leveraged drillers that are going to be in trouble and once the bad news starts to leak out, investors are not going to be eager to jump back in. ”

Behold, permanent destruction of shale. This is edging towards genius.

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother

Rig Count

Canada still dropping. Down 48 after a 100 plus drop last week. I would have though if it was a Christmas break, that this would have been flat at worst?

US down 29 split fairly evenly between oil and gas

Permian down 6

Eagle Ford down 4

California down 6 after a big fall last week

Bakken steady

So what is going on, the Canadians are responding to normal economics, and the US drillers are on drugs? I think our Watcher would say the drug dealer was the Fed, and he maybe correct.

I see Don’s comment above, the word on the street is for rigs to be laid down as they finish their wells. At 20 days a well and 170 rigs, about 8 rigs a day have the opportunity to be laid down. So things can happen fast once the decisions are made. January is going to be a very interesting month. The quarterly reports are really going to be the test. what ever media hype gets put out until then, can be just hype. The music stops at the end of the month, and then we will see who speaks the truth.

Quoting from a news article published a week or two ago:

“On the Canadian side, it’s determinately the curtailment of capital budgets that’s affecting the drilling programs,” Dinara Millington, the vice president of research at Canadian Energy Research Institute in Calgary, said by phone Monday. “The wells are more costly to drill than the U.S.” because of the remote locations and higher labour costs, she said.”

So Canada is down for the count, and not just on holidays? Oops!

http://www.bloomberg.com/news/2015-01-06/biggest-oil-rig-drop-since-2009-spells-tough-year-ahead.html

The rig count fell by 93 in the three months through Dec. 26, and lost another 17 last week, Baker Hughes Inc. (BHI) data show. About 200 more will be idled over the next quarter as U.S. oil explorers make good on their promises to curb spending, according to Moody’s Corp.

Some how I think I am on a different wave length. I see OPEC and the Shale playing school boy games, and seeing who can piss the highest or should I say who can produce at the lowest price, and the market makers are shorting the hell out of things until someone capitulates.

That capitulation to me will be a 100 to 200 drop in drilling rigs in a week, not a quarter! We do live in an unreal world.

Hi Toolpush.

I see OPEC and the Shale playing school boy games, and seeing who can piss the highest [.]

Okay, let’s say you’re the Saudis. You see that the market is overstocked- let’s guess at 3 million barrels a day.

You could cut your production back by that much- and if that supported the price, lose half of your foreign oil income.

Or you could let the price drop- and maybe lose less. But make every body else lose, too. Doesn’t cost you a cent to share the burden out. Might even save you some money.

There is a third option, however.

What if the Saudis decided that they couldn’t stop it, even if they wanted to?

What if they think that supporting the price would just backstop more shale drilling, offshore projects and tar sand developments, and they’d be faced with this problem again 3 years from now, having lost half of 3 years income?

They’re not the bully pushing your fist into your face and saying “Stop hitting yourself.”

More like the guy looking over and saying “You seem to have some kind of nervous tick causing you to hit yourself in the face, and it’s contagious…but if the rest of you want to keep hitting yourselves in the face, who am I to stop it?”

-Lloyd

Why crash it all the way to $50, or $40 (if it happened) if breakeven is $70-$100 for the rest of the producers? Why leave money on the table?

1) They don’t know where the pain infliction point is for the rest?

2) The need to be done in blitzkrieg so they go all the way to the absolute world breakeven price as fast as they can?

3) or herd of the market shaved that additional $20-$30 more than it was needed?

Lloyd/Ves,

My money is definitely on the side of the Saudis. It is just a matter of time before the shale plays cry uncle. I also feel the Saudis started the price fall to flush out the weak hands, but it is the traders and shorters in the market that are pushing the down now. They don’t care about what is economic to produce, just following the trend, until it bends.

I feel it will bend when the shales put up there hand and have a massive cut back. In 2008 Devon Energy, drilling in the Haynesville paid $40mil in penalties to rig owners not to drill holes. It is going to be a few announcements like these that will get the markets attention and reality will set in that any surplus of oil will only be a short term event.

Now getting production back on track after that is going to be difficult, but that is not the traders worry, and will make Saudi happy.

BTW, where is all the conversation about market manipulators, now the price is going down, rather than up?

As soon as the narrative gets molded to be “foreign influence is inflicting harm on a US industry” then patriotic defense will be offered up.

Y’all still just don’t realize money has lost its meaning in the most macro of aspects. The breakeven can be redefined at a whim.

This is what I am talking about. The way to stop it is to have a capitulation from the shales. Or someone, but I believe the shales will be the weak link. The good news it once the free fall stops and the shorts cover, we should have a short covering rally to out back to reality. But not before a lot of damage will have been done.

http://www.cnbc.com/id/102315032

“We’re divorced from the economics, from the rig economics, so now fear and greed are in the market. Low prices are becoming the excuse for lower prices,” Schork said Tuesday on CNBC’s “Futures Now.” “Trying to pick a bottom here is akin to the old adage of catching a falling knife. So don’t try to pick the bottom, just ride the wave lower.”

toolpush,

I’m not clear about the Saudis starting the price fall. What did they do?

Synapsid,

The Saudis didn’t do as they were expected to do.

They were expected to cut production, they didn’t. So by doing nothing, they did something.

Which turns out to have been a lot.

toolpush,

The Saudis have been burned badly in the past when cutting production to raise prices because the rest of OPEC kept right on producing. This time they said “No more of that.”

That was in response to falling prices though, right? They were asked to cut production because prices were falling.

We’ve all seen the graphs showing that world oil production hasn’t climbed much over the past few years, except for oil from the US and Canada. The Saudis, and some of the smaller Gulf producers, point to that and say There’s where oversupply is coming from so that’s where cuts should be made. That looks a lot like Jeff’s suggestion that the Saudis are taking advantage of a development that has come along that they figure they can ride out but that is going to hit their competitors hard.

All in all, it looks to me like the Saudis are adapting to a situation they didn’t start but that works to their benefit. Canny rascals.

The Saudis didn’t do anything. Aggressive producers elsewhere invested too much and increased production to such an extent it flooded the market.

You are assuming the Saudis knew when this spiral began how far it would go down. The price may have decreased faster and farther than they were projecting. I think a lot of supposed experts have been caught with their pants down with this massive and quick increase. It may be that the Saudis believe there is not much they can do to control the market and so they are just going to try to ride this out. Further, why is it their responsible to protect the U.S. oil industry for over producing?

Perhaps it is time for U.S. producers to revisit whether or not they truly believe in a free market. Right now they are free to produce as much as they want restrained only by certain regulations that might be enforced from time to time.

Perhaps it is time for U.S. producers to revisit whether or not they truly believe in a free market.

I was waiting for someone else to say this.

Toolpush, though he couches his language, obviously believes there is- er, was– a visible hand in the market: the Saudis.

The question is no longer “Will the Saudis step in?”

The new question is “What are we going to do instead?

-Lloyd

Hi Ron,

The 114 rigs would only need to drill about 130 wells per month, it is possible that rig efficiency might increase in this low price environment as only the best rig crews will continue to work. If new wells added decrease to 130 new wells per month by spring and remain at that level then in the Bakken we would have fairly flat output, with a small drop at first, but with output rising back to Oct levels within 24 months. I agree that if wells drilled per rig is unchanged, then 114 rigs will not get the job done, about 140 rigs would be needed.

For the scenario above the legacy decline in kb/d is shown in the chart below.

Jeez, not these charts again O_o

Dennis, one thing we are all forgetting is “production per well”. Fewer and fewer wells in fringe areas will be drilled. The wells that will still be drilled are “sweet spot” wells and it will take fewer of them to keep production flat. I really expect the Bakken to keep increasing production until about mid year, if prices stay low. They know where the sweet spots are and there is still some wiggle room there.

I agree that there could be some increase in new well EUR, it depends on how much room is left in the sweet spots and whether higher density drilling can maintain the current average new well EUR.

Rune Likvern thinks there will be an increase, Mike is doubtful, I have simply assumed the new well EUR will remain the same in the model above until June 2016. That assumption may be incorrect.

I would expect an increase in well quality, decrease in well drlling costs, more wells drilled away from water, and very hard ball negotiations with contractors, transport companies and others to cut costs to the bone.

I expect that lower prices would lead to fewer wells drilled everywhere, including the sweet spots. Of course the drop in wells drilled would be greater away from the sweet spots.

Hi Frugal,

Not sure if that is correct, I believe that Ron has this right. Only the sweet spots will be profitable to drill so there may be little change in wells drilled there. The less productive areas is where most of the drilling will decrease.

The effect will be that the average new well will produce more since the poorer prospects will no longer be part of the mix.

Someone with actual oil field experience will hopefully correct me if I have this wrong.

Dennis, it depends on available well slots in existing pads in high graded areas. A well slot in an existing pad could be as simple as having the ability to rig up and drill a well somewhere in an existing pad, having a feasible connection to a manifold, and fluid handling capacity in the existing system. I just don’t know how these guys lay out their surface systems. I got the feeling it must be very adhoc and there’s poor coordination between operators?

Who will pay the, say, $10Million for getting a well online? Investors look at the oil price and calculate when the initial cost will be amortized, let alone profit. Not for a long time. Investors will shy away seeing all the market turbulence. And in the meantime another well has to be drilled since the production of the first one will decline rapidly.

Weren’t there discussions that all sweet spots are drilled first? Why going to lesser spots and leave sweep spots for rainy days or what. Why infill later when there is much more profit right now.

Dennis, as I have suggested before, there will be no marked increase in individual rig efficiency. They have it down to a science now, about 13-14 wells per year per rig, IMO. Because of the primary focus on sweet spots, as Ron suggests, there won’t be as much RDMO/MIRU; they’ll walk those rigs on multi slot pads but I don’t think they can get much faster. There is actually little difference in A team and B team rig hands. Its the toolpusher that counts, uh Toolpusher?

If they can get caught up in frac’ing, that will help get wells on line much quicker.

Mike

Mike,

RDMO/MIRU?

I have a suggestion for the pros: The first time you use an acronym in a post, unless it’s one that we’ve seen over and over here, spell it out in brackets as well. Even Google didn’t help with this one.

MIRU = Move in rig up

RDMO=Rig Down Move Off

Don’t Worry Synapsid, these are land rig acronyms, and they don’t come easy to me either, but if Mike had of said Code 1, ( as on the IADC drilling report), then I would have known exactly what he meant , but very few other would, lol.

Mike,

As to your earlier comment, it is all about planning and having things ready, but the amount of paper work required offshore these days, would make you cry.

Codes? What’s the oilfield coming to? Can you guys still swim in the moon pool like we use to be able to?

Errrggg, paper work!!

Thanks, Push; keep a bind on it!

Mike

Mike,

Funny you should mention swimming in the moon pool. I do just have some footage of me recovering a MRT (marine riser tensioner) The water was slightly over my head, it was 2700m deep, and you could say a little rough.

I am not sure if the corporates would like to see it, but I am sure they were happy they didn’t suffer any down time.

Thanks toolpush.

Rig down, move out, move in, rig up. I thought everyone knew that, (lol); sorry. It takes a good bit of time to break down a 15,000 drilling rig, load it, make multiple trips to move it down the highway, and put it all back together again. In sweet spots the focus will be on walking rigs fully erected, 40 feet, to spud another well on the same pad, saves money and time. I never get tired of watching this:

http://eaglefordshale.com/news/typical-eagle-ford-well-start-to-finish-video-marathon-oil/

Mike

Hi Mike,

What is the diameter of that casing/pipe that is being used. How much steel ends up underground?

In the Eagle Ford, a short tin cellar, no conductor pipe, 8 5/8ths or 9 5/8ths surface to 3400 feet, 5 1/2 inch OD 23 pound per foot production casing from surface to the lateral toe. 2 7/8ths production tubing. I guess about 400 tons per shale well, tax, title and license. There will be enough 5 1/2 in shale wells someday to go around the world 9 times; they can recover some of that. For what I don’t know. Maybe they’ll melt it all down and make EV’s out it.

Mike, I’ve used 8 meter spacing with large 2000 and 3000 hp rigs. We put the wells in a tight row, put all the piping and electric lines underground, pave over, and when the rig is over a well the offset wells are shut in and protected with steel cages. It allows for rather small multiwell pads. The biggest I saw had 24 horizontal wells.

Hi Mike,

If there is more focus on the sweet spots at lower oil prices, would you expect MIRU/RDMO time to be reduced?

Dennis, I think there will be far fewer rig moves and more rig skids (walks) on already existing pads, yes. Providing, however, there are that many locations left to drill in very sweet spots; when I look at well numbers being permitted in existing units in the Eagle Ford, I have my doubts. I do not believe those shale guys will be doing anything that does not essentially guarantee them success. Experimenting with new toys, or down spacing, that’s all gone for awhile unless it is 100% proven to make money. BTW, moving one of those big mama jamma rigs down the highway can add a half mil to costs, all the more reason to stay on a short leash.

I stand by my 13-14 wells per rig per year. Twenty days per well happens, about as often as 30-40 days per well. Murphy likes to practice law in the oilfield.

I’ve lost some credibility lately, lol, but rig counts will not come down significantly until mid March, IMO. I am hearing a lot of “one or two more” from hands. The only permits being filed anymore here are by the big 5, EOG, COP, CHK, those guys. Even some strong ones, so I thought, like Penn, are slashing budgets. Landmen doing what little leasing is left and curative title work before units can be formed, one of the leading indicators of things to come, are all going to the house out of work.

I hope this helps, Dennis.

Mike

ROFL.

Mike, do you have any good references, especially video, of rig walking/skids for us non-oil people to get an appreciation of what is involved?

Thanks

NAOM

NAOM,

A couple of quick references.

http://www.patenergy.com/drilling/technology/apexxk1500/

https://www.google.com.sg/search?q=walking+rig&es_sm=93&tbm=isch&tbo=u&source=univ&sa=X&ei=ZditVL3LLomLuATV4YGgDQ&ved=0CCgQ7Ak

That is so cool. I use to have to skid them away from blowing wells with a dozer, a couple of traveling blocks, 18 lines and a deadman buried to China, but we could do it.

That’s amazing technology. H&P Flex rigs can walk just about as fast as I can these days.

Mike

Thanks, that really does walk! Quite a versatile beasty.

NAOM

The key to a smooth skid is to have the pad laid out to allow the rig to move, drill the next well, and have the ability to (eventually) work on the prior wells with a workover rig and a coil tubing unit. In large developments these pads can have two dozen wells. For example a Bakken pad could be built for three different zones, using a fork pattern, three tines, two sides, total 18 wells. These don’t have to be drilled at the same time, but it’s important to remember that wells require workovers. And I’ve seen engineers design pad layouts which precluded doing a workover unless the offsets had their trees removed. I prefer 8 meter centers to give us more room, with the wellheads recessed to allow all the casing spools to be covered by a metal hatch if required. It’s just a personal preference.

Thanks Mike.

Yes that helps a lot. Where I misinterpreted your earlier comment was that you suggested there might be less MIRU/RDMO, but no difference in rig crews. I thought less time spent moving rigs might lead to more wells drilled per rig per year.

I think in your comments you are suggesting that companies are already focusing on sweet spots for the most part and that any such changes will be marginal.

If that is correct (and your guesses would be far better than my own), then we may not see much change in new well productivity,except in those cases where rigs are stacked because they were working in the less sweet areas.

Hi Mike,

Thanks. What is RDMO/MIRU? I would think some toolpushers are better than others, but you would know better than me. So you would agree that we should expect an uptick in average new well 6 month cumulative output?

Sorry, question answered. So more holes will be drilled per rig, if I understand correctly. And the focus on sweet spots should increase average new well EUR as Ron (and Rune Likvern) suggested.

dood, no one said that. Mike specifically said technique was at its best and shift A was no better than shift B and there was explicitly no reason to think rigs could drill more holes than they have been.

Hi Watcher,

He also said the focus on the sweet spots would mean there would be less MIRU/RDMO (move in rig up/rig down move out) so that the natural conclusion would be greater rig efficiency as in more holes drilled because the rig would not be put up and taken down as much, but just walked from one location to the next. You are correct that he said there is little difference between crews and that is not an important effect. The fact that MIRU/RDMO time may be reduced is the important effect and a focus on the sweet spots will tend to reduce that. Or I misinterpreted Mike’s comment and there will be no change in the number of wells drilled per rig even though the companies are likely to focus on the sweet spots due to low oil prices.

I don’t know about the USA industry, but in other countries I’ve seen improvements. For example, if we have six rigs under contract and have to drop two, we drop the worst performers. The drilling companies will keep more experienced hands. Our company engineers have more time to chase little details, service companies use their better operators, the mud company keeps guys who know how to make really good mud, and on and on. But that’s in areas where we have higher prices and personnel isn’t as good as it is in the USA. So who knows, I may be wrong.

It seems that maybe the six months to a year guesses about how long it would take oil companies to cut back on drilling were a little on the long side at least in respect to tight oil.

Does anybody have any good info on how much drilling is being curtailed NOW in conventional oil fields? I am guessing that the bigger companies operating in conventional fields are not able to reverse course so quickly as the small tight oil companies.

Another question- given that it is just now hitting the hardest and toughest part of the winter season how long might it be until the fracking crews either catch up and work out their backlog – assuming the well owners are willing and able to pay them?

With drilling slowing down so fast it looks as if the Fracking guys ought to catch up pretty quick if the weather cooperates. Does fracking usually come to a near halt in January in ND?

With about half the total cost of a well being the Fracking expense some well owners just won’t be able to raise the money – or might choose not to until oil prices recover.

Anybody with the cash to buy up distressed leases will probably also have the cash to wait out the worst of the price slump.

But maybe anybody buying up such leases with wells already drilled ( or not) will be compelled to complete at least a few of them in order to meet the terms of the lease?

I am finding it hard to believe that the production increases are going to continue in the Bakken. The high here in Minot on Sunday was -10. No matter what you are doing things slow down at that temp. In the last couple of weeks we have had a major blow out and some large Enbridge oil tanks caught fire. So I think it is reasonable to think that you may see a slow down for the rest of the winter and then a slight bump in the spring. Also, does anybody know if there is any well degradation if a drilled well in not fracked right away. Other than financial motivations I can’t see a reason all those drilled wells need to be finished anytime soon. I also wondering how many companies have wells listed as waiting for completion that they don’t ever really intend to complete.

Nick,

If the well is drilled, cased and cemented, then it can live there unaffected for a very long time. I cannot give you a complete answer as, I do not have a good handle on there fracing methods on land. I hear stories 10 to 20 stages being fraced in a day. Now that is nothing that I have experienced, impossible to perforate and then frac at that rate. So they obviously use different methods. Slotted liners, bare foot completions, open hole packers and the like. All I can say is if the completion fluid is in contact with the formation for any length of time, then the shale could swell, but as for the time scale, it would depend on the shale and how much inhibition is afforded by the completion fluid.

Push, there are Bottom Hole Assembly Tools like those from Baker Hughes (Opti Port) and NCS Multistage that are deployed on coiled tubing and open pre-set sleeves on production liner and can frac stages in under an hour and set up in ten minutes for the next stage. NCS touts a world record 40 stages frac’d in 24 hours. Demo videos are viewable online.

Of much more significance, however, is the out put from those wells as Whiting – in the Bakken – had the two highest 24HR IPs there @7,100 and 7,800 boe. Those two wells produced 55k and 60k their first month production.

As a former diver, I did more working dives in moonpools than I can count. Hope you had your union card handy when you were splashing around that tensioner.

Thanks Coffee,

I must admit we were only doing double and triple frac packs in Africa. They were fairly long drawn out affairs, Heaps of rig up, and it was only one frac at a time. Pull it all out and clean up and run it all down there again. Screen outs were the plan, and it got exciting when the sand did not want to move. Cost? Once we took the hose from the frac boat, it was $250k per day. Needless to say people wanted things done in a hurry. Two wells at most out of an Annular element, as our “sliding sleeve” was functioned by stripping through the element.

They obviously have there act together a lot better these days.

Just to get things clear, the liner is cemented, the sliding sleeves are opened exposing pre-set perforations in the liner, and sand is pumped per program. Stop pump, unseat packer, pull out to next sleeve, set packer pump, etc?

I find it interesting, that they pump sand down the annulus, and only if they sand out do they pump down the coil tubing. where as we pumped sand down drill pipe, and on sand out we pumped down the annulus. and reversed out.

As for my little moonpool job. No I didn’t have my union card, and I got most of the job done when my head was underwater, which I suppose would have got me into trouble. But offshore Brasil it is real hard to find the union rep to pay. Insert Smiley face here.

Hey, push, we had a Canadian toolpusher inspecting the pontoons in the Campos field off Brazil one time. He slipped off and quickly went towards Africa in the swift current. Miraculously, the Zapata boat found/rescued him bout ten miles off almost an hour later. We were in the mess when he came splohing in, still bug-eyed and in a state of shock. Like Mike has said, stay safe.

There is a huge technological push to enable the frac sand to be more expeditiously placed far from the well bore while avoiding all the ‘guar/gumming’ issues. One promising route is Resin Covered Sand (RCS) that makes the sand more ‘bouyan’ . Lottsa rapid, ongoing developments continuously arising.

I hear another thing continuously arising is demand for repayment of loans.

Thanks for attempting to answer. This article from CNN, http://money.cnn.com/2015/01/06/news/economy/oil-jobs-gas-prices/index.html, seems to confirm what I thought I was hearing and that is that fracking companies are laying off workers pretty fast. That leads me to think that these wells that are waiting completion will be waiting for a long time.

Maybe this might be of interest. It carries no weight, but maybe some of you can read something into it.

http://dealbook.nytimes.com/2015/01/05/right-price-for-oil-not-the-current-one/

Quote from the article: The price could be much lower if more production came from the most efficient fields. No one really knows how much lower, because Saudi Arabia and some other producers with low-cost unused resources have decided not to exploit or explore them aggressively. Still, there is no good reason to think that more than $30 a barrel is needed.

No good reason? Think again. Even if SA can produce $30 oil, they need a $90 per barrel to pay for public spending programs. Where are the few fields that can do it? Are they able to supply the 93Mbd world consumption. This show how simple-minded this article is.

If people weren’t willing to spend that $90, the Saudis would just have to do without their social programs. The Times is right. There is a huge gap between production costs and the price consumers are willing to pay.

If a replacement for oil is found in the near future, the price will certainly fall.

There is no doubt that there is plenty of room in the Saudi economy to absorb some pretty steep declines in oil income. The royal family isn’t referred to as ROYAL for nothing.

If it comes down to losing their kingdom or keeping it the royals may find it expedient to cut back a bit on the personal jets and yachts and so forth rather than flee the country.

That would likely be enough to tide things over for a while. Not that they are worried about the short term- they have PLENTY of money in the bank.

I wonder if they are smart enough to realize that all those pieces of paper real or electronic facsimiles are subject to being inflated right up the chimney- or that they may just be ignored when they present them for payment some day.

I am not a gold bug but it is very easy to see why a LOT of people believe in gold.

I wouldn’t be reading the ny times to learn about the oil industry. Their writers are lost in this field.

I posted it because Watcher is always saying that the government will do what it can to protect the US oil industry. So I thought this guy’s ideas fit with that.

What the Obama administration will do for the oil industry will be identical to what the Reagan administration did in 1986. Or maybe he will do even worse. Obama is now pandering to groups he thinks will help the democrats in 2016. This explains his deal for illegal aliens, the weak knees approach towards Cuba, delays on approval of oil pipelines, rather stupid hostility towards Russia and the rather silly approach to reducing co2 emissions via a 2000 page EPA document we know won’t get very far in really reducing worldwide co2 emissions. He’s almost as bad as bush.

Obama is now pandering to groups he thinks will help the democrats in 2016.

Actually Obama is finally doing many of the things those who voted for him wanted him to do all along. He was more conservative before the midterm elections and it didn’t help. So he now seems to be following an agenda many in his party have wanted him to do. Rather than caving, they are giving him credit for showing his backbone.

If this will help the Democrats in 2016, so much the better.

Time will tell. I voted for Obama, but I don’t like his current emphasis on pleasing the left. I guess he risks having the middle of the road types like me vote Republican. But in general I tend to dislike most politicians.

What the hell is a self-described Libertarian doing voting for Obama? Do our semantics for Libertarian jive?

Because he’s a so-called ‘lame duck’, yes?

But whatever… this whole government/state nonsense is just that- nonsense. We are a tribal species grossly out of scale, out of synch, and out of touch.

Obama doesn’t know us and we don’t know him. It’s all a mirage.

Perhaps the kingdom knows what it’s doing. A comment of Extreme Interest from the Seeking Alpha article.

“Exactly saratogahawk, I keep seeing these “little picture” analyses, but the reality is the world has a 2% oversupply problem with a 50% price response that is going to result in a 20% supply reduction, followed by a 300% price response.” Now that’s a casino even the TBTF Banks can envy. Economic whiplash ?

The ” imbalance” between current supply and current demand might be a lot less than two percent and still result in a fifty percent crash in price..

I doubt we will ever have good enough figures to know for sure just how INELASTIC oil demand is in the very short term – weeks to months. There is too much noise in the supply data to be sure with real precision exactly what the supply actually is. Hell we don’t even have a well accepted definition of what OIL ITSELF IS anymore.

The guys with hands on experience want to define it as less than some specific arbitrary value on a scale but they aren’t in charge of the media or the banks or the bureaucrats or even the companies they work for.

After following the peak oil issue on an almost daily basis for years now I am still not sure what oil really is in terms of the difference between crude and condensates and ngl liquids and so forth in terms of what they are good for with any real degree of confidence..I know the technical definitions but with a little processing… things that were not called oil a few years ago can come out of the delivery end of a refinery as unquestioned oil products.

With these things being interchangeable to a large extent depending on how they are processed at the refinery HOW COULD any definition of oil be anything but ARBITRARY?

A good case can even be made for calling soybean oil OIL and palm oil OIL since both can be used in the place of ordinary crude.

Trucks Triumph in the Year of Filling Up Cheaply

By David Welch and Mark Clothier, Bloomberg, Jan 2, 2015 12:01 AM ET

I wonder how many of them will come back to the dealership once fuel prices go back up to previous levels?

Or maybe we should look at where the sales were. If they were in energy boom areas, maybe the trucks will be going back to the dealership as layoffs happen.

Given 6 of the 12 months didn’t have that cheap gas, and the trucks were still bought, no reason to bring them back.

Make that 9. WTI was still 94 at the end of last quarter. Declining – yes but wasn’t crashing yet. The Mayhem started in the first week of October.

This said sales surged in December.

http://www.npr.org/2015/01/05/375201451/car-sales-surged-in-december-capping-a-good-year-for-the-industry

And this one said lower gas prices did influence purchases.

http://www.latimes.com/business/la-fi-auto-sales-20141104-story.html

Another attributed sales increases to lower gas prices.

http://www.cnbc.com/id/102309096

I won’t bother to check more, but sales of everything (including Leafs) seemed to be up in December.

FWIW: Car Sales are up because Subprime auto loans are back.

http://www.slate.com/articles/business/moneybox/2014/09/the_return_of_the_subprime_loan_believe_it_or_not_it_s_a_good_thing.html

“Five years after the worst of the financial crisis, subprime loans are creeping back, this time primarily in the form of auto loans. As U.S. auto sales have surged, credit standards have moved lower, with more than a quarter of all auto financing now classified as subprime.”

Its very unlikely falling oil prices have much to do with increase vehicle purchases.

Yes, I said maybe people would be turning in their cars/trucks if gas prices rise again. They may be doing that, but not for the reason I thought.

http://www.post-gazette.com/business/money/2014/12/12/Americans-car-payment-delinquency-rate-rises-with-subprime-loans/stories/201412120017

An increasing number of Americans are falling behind on their car payments following a jump in lending to borrowers with poor credit, according to two credit tracking companies.

Do we know that the trucks were bought in months with high gas prices?

“Consumers bought more pickups, minivans and sport utility vehicles than cars in every month of 2014. “

10,556 oil tank cars were shipped by BNSF in week 52.

http://www.bnsf.com/about-bnsf/financial-information/weekly-carload-reports/pdf/20141227.pdf

Must be buyers of some of the Bakken oil out there somewhere and I’ll bet they are buying all they can. Buyers might even pay a premium just to insure that the oil will be there in the future, which would mean more business for the BNSF. It is a buyers market if there ever was one.

At 49.50, Bakken producers are probably capturing even more market share, more demand for oil that is a day away from the refinery, higher ipo numbers translates to fewer wells drilled and just as much oil. It probably can be done at even forty dollars. At thirty dollars it might be a catastrophe, by then the investors or whoever is throwing the money at the Bakken developments will be heading for the exits and to the Fed’s doorstep with hat in hand. JP Morgan and Goldman Sachs won’t be holding the bag.

At this point in time, 25 dollars for one barrel looks like a real possibility. Buy ten barrels, get one free. Might as well give it away. Aliens from the Orion Belt will be flying fleets of spacecraft with cargo bays to fill up on earth. The least expensive oil across the universe right here on earth.

There is nothing new under the sun.

I did an Eraserhead thing kind of dedicated to or inspired by you, but I’m on a different computer so I can’t retrieve it just yet.

Oil Below $60 Tests Economics of U.S. Shale Boom

http://www.bloomberg.com/news/2015-01-05/oil-below-60-tests-u-s-drive-for-energy-independence.html

I thought this comment at the end of this article was interesting:

”I live on the Bakken. Outside the 4 core counties the breakeven is $76 according to the ND Dept of Mineral Resources (DMR). Of the 4 core counties nearly half the lease acres have already been drilled. All remaining rigs have poured in to these 4 counties. The third “tranche”,ie, the next 25% of the lease acres will be drilled in 2015 and the final 25% of the lease acres drilled in 2016. Using a 75% first year depletion rate that means within 3 years virtually all drilling and the vast majority of fracked oil will have been produced.

The Bakken is over. ”

Source article: http://seekingalpha.com/article/2798525-shale-oil-boom-uncertain-in-wake-of-falling-oil-prices

From Argentina:

In May there was this:

Exxon Mobil Corporation (NYSE:XOM) announced today that its affiliate, ExxonMobil Exploration Argentina jointly with Gas y Petróleo del Neuquén, has discovered oil and gas in an unconventional shale well in Neuquén Province of Argentina.

Located in the liquids-rich area of the Vaca Muerta play, the Bajo del Choique X-2 well was drilled to a total measured depth of approximately 15,000 feet (4,570 meters). The horizontal leg of the well extends for 3,280 feet (1,000 meters).

The well was completed in the Vaca Muerta formation and flowed at an average rate of 770 barrels of oil a day on a 12/64 inch choke in its first flow test. Data analysis and additional studies are being conducted to fully evaluate this discovery. Appraisal wells will also need to be drilled before a commerciality decision can be made.

2 weeks ago, this

http://latino.foxnews.com/latino/news/2014/12/18/exxonmobil-makes-new-shale-oil-gas-find-in-argentina-vaca-muerta/

U.S. energy super-major ExxonMobil said Thursday it has made a new shale oil and gas discovery in the massive Vaca Muerta formation in southwestern Argentina.

Exxon said in a statement that it made the find with the La Invernada X-3 well, which was drilled to a depth of 4,686 meters (15,364 feet).

The well, operated by ExxonMobil Exploration Argentina and drilled at the La Invernada block in the southwestern Argentine province of Neuquen, produced a flow rate of 448 barrels of oil and 1 million cubic feet of gas per day in an initial test.

“Analysis of additional information and studies is being conducted to completely evaluate the discovery,” the company said, adding that “more wells must be drilled before decisions can be made” on commercial viability.

After 60 days of output, the well has produced a total of 31,400 barrels of oil equivalent.

This latest find was made at a spot 20 kilometers (12 miles) from an earlier Exxon discovery, announced in May, at the Bajo del Choique block.

That don’t look like much.

Watcher, those production numbers are not particularly high, but the fact that they have drilled and successfully produced a 12,000 foot deep well is what is significant. In the early days of these new shale plays, the laterals are always short – relatively speaking – as that is where the most trouble can arise. As successful wells are repeatably drilled/completed, an entire array of enhancements start to incrementally appear, such as the precise (as within one to five feet) placement of the lateral in the payzone), increasing length of lateral, number of stages/placement of same, number of perforations, type of fracturing process to apply, and many other ongoing components.

Sinopec is just past this phase now in Fuling with over 100 producing wells and is ramping up with pad/batch drilling.

The Tuscaloosa Marine Shale is probably near this stage of development with 55 or so VERY difficult wells drilled these past couple years and the last dozen showing repeatable success, even at a relatively low output as is the case in Argentina. The TMS guys, which right now is almost exclusively Goodrich, are absolutely screwed at low WTI pricing. However, the proven process/technology is there for whoever in the future chooses to run with it.

Process matters a lot less than financing. The defaults are coming and that spigot will be closed forever to avoid being burned again.

It took only five years for the free and easy money to return to the personal auto market.

Forever may mean anywhere from a year or two to five or six in the tight oil business. It seems pretty likely that SOME tight oil is profitable at a hundred bucks or less- I think we can accept this as a fact.

The lenders will be more careful and insist on more equity money or maybe a profit share but tight oil WILL be financed again – some of it anyway.

The lenders will also insist on a faster repayment schedule so as to minimize their risk from another price crash as well as declining output.

I wouldn’t consider 700 bopd in a 1000 meter lateral a low output. The Gas to Oil ratio does look very high, and they didn’t report the oil density. I worked in Argentina and they will require significant NGL infrastructure if this is a fairly large extra light oil or a very rich condensate.

so the devil will be in the details, but Gov Brown isn’t a moonbeam any more…

“Toward that end, I propose three ambitious goals to be accomplished within the next 15 years:

Increase from one-third to 50 percent our electricity derived from renewable sources;

Reduce today’s petroleum use in cars and trucks by up to 50 percent;

Double the efficiency of existing buildings and make heating fuels cleaner.

We must also reduce the relentless release of methane, black carbon and other potent pollutants across industries. And we must manage farm and rangelands, forests and wetlands so they can store carbon. All of this is a very tall order. It means that we continue to transform our electrical grid, our transportation system and even our communities.

I envision a wide range of initiatives: more distributed power, expanded rooftop solar, micro-grids, an energy imbalance market, battery storage, the full integration of information technology and electrical distribution and millions of electric and low-carbon vehicles. How we achieve these goals and at what pace will take great thought and imagination mixed with pragmatic caution. It will require enormous innovation, research and investment. And we will need active collaboration at every stage with our scientists, engineers, entrepreneurs, businesses and officials at all levels.”

http://www.latimes.com/local/political/la-me-pc-brown-speech-text-20150105-story.html#page=1

If Moonbeam succeeds at this (and I suspect he may), it will blow a big hole in the oil market.

I think the renewable part will be achieved. Arnold already started that with 33% by 2020.

I’m not sure how we will achieve the reduction in oil use

although we did start on the 1st leg of the high speed rail today

Reduction in oil use?

Two hints:

1) ‘Best car we ever tested”–AN ELECTRIC CAL

2) “Lowest cost car to operate”–AN ELECTRIC CAR.

may be true, but people have to buy them as replacements for ICEs. We do that in CA a bit, but not to meaningful scale yet. I wonder what Brown has up his sleeve to promote a huge change in car sales and/or operations.

http://www.greencarcongress.com/2015/01/20150106-umtri.html

The average fuel economy (window-sticker value) of new vehicles sold in the US in December was 25.1 mpg (9.36 l/100 km)—down 0.2 mpg from November and down 0.7 mpg from the peak reached in August,

We all knew that was coming, didn’t we?

http://www.greencarcongress.com/2015/01/20150106-leaf.html

Nissan sold 30,200 LEAF electric vehicles in the US in 2014—the first time any plug-in has sold more than 30,000 units in a single year. The LEAF results also represented a 33.6% increase over 2013 LEAF sales (22,610 units).

Now we will have to wait and see if the sales can hold up with cheaper fuel?

I was in San Francisco the last couple of weeks and I think higher density living arrangements will be one way forward. I remember when I 80 was 4-6 lanes. Now it’s 10 lanes, overcrowded and there’s no room to expand. So they are investing in higher density, not to save oil but to reduce commute times.

I live in an european city, and I agree. I retired here because life is actually less complicated, everything is closer, and one gets to talk to neighbours in the morning when we hang around the bakery or the coffee shop.

I read someplace Moonbeam started disbursing money for the long delayed super fast commuter train yesterday or maybe the day before.

This is going to be one of the biggest boondoggles ever – the most expensive single public works job in American history that will so thoroughly piss off working class people who can’t afford to ride it- and don’t live or work near the stations anyway- that it will probably cost the Democrats a couple of decades worth of elections.

Keystone ”déjà vue all over again.”

I am all for mass transit and energy efficiency but such projects have to make financial sense to at least some degree. This one is a solid gold turkey in terms of costs versus utility.

Now FAST trains that could be built at reasonable cost and go places where people really need to go on an every day basis just don’t seem to be sexy enough for anybody right or left.

I doubt if any body really knows but I would bet that ninety percent of the trips between cities three or four hundred miles apart in this country are of highly questionable value to put it mildly.

There must be a hundred ways that the money could be better spent to improve the lives of Californians while silmantaneously safeguarding the environment.