Taking a closer look at OPEC. All OPEC and price data below is through December. All production data is in thousand barrels per day.

Iran and Libya have had serious political disruptions in their production numbers. Simply adding them to the OPEC numbers distorts the picture. To try to figure out what has been happening to OPEC we need to look at OPEC without Iran and Libya.

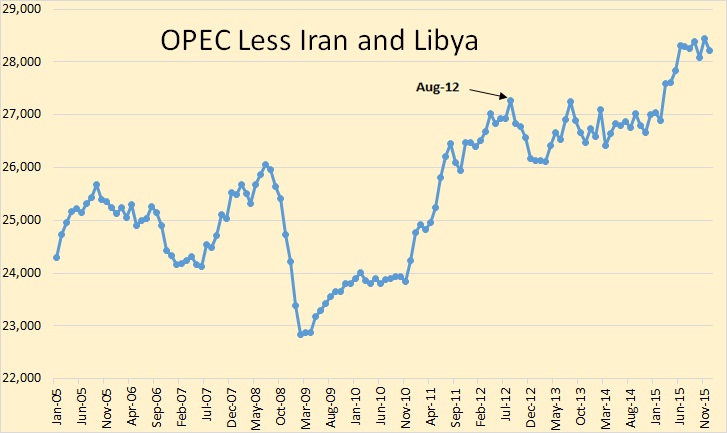

Here is OPEC less Iran and Libya, or the OPEC 10 if you will. I have marked August 2012 as what I call the “Price Peak”. Not the peak in oil prices but the production peak that was brought about by the increase in the price of oil. That price increase began in early 2009 and by March 2011 was well above $100 a barrel. And the price of oil did not drop below $100 a barrel until late August 2014.

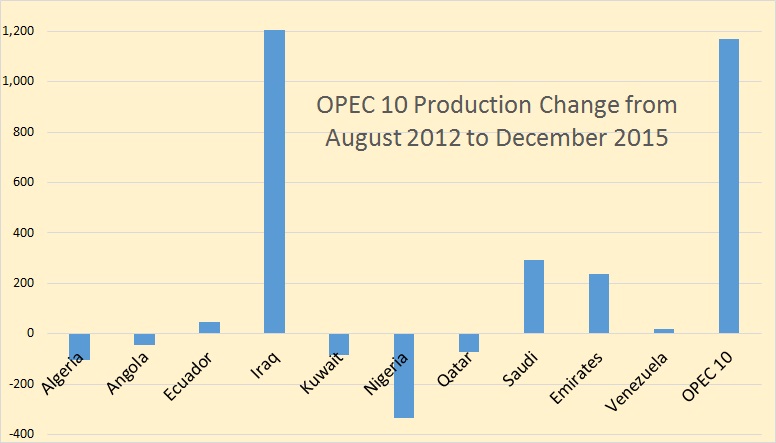

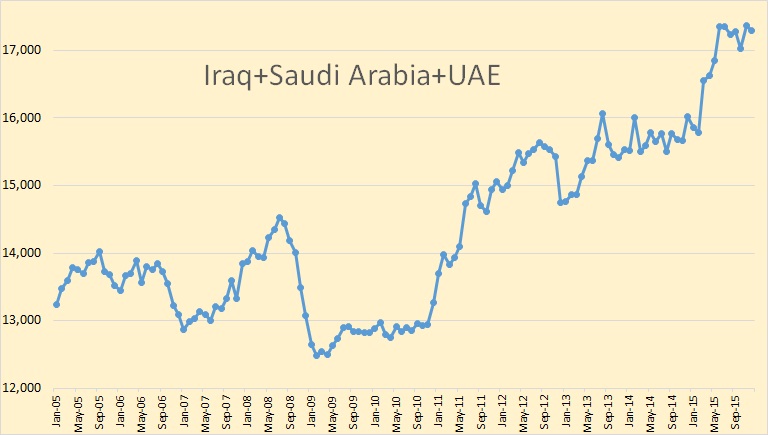

Here are is the production change from August 2012 to December 2015. As you can see the lions share of increase came from Iraq with a little help from Saudi Arabia and the UAE.

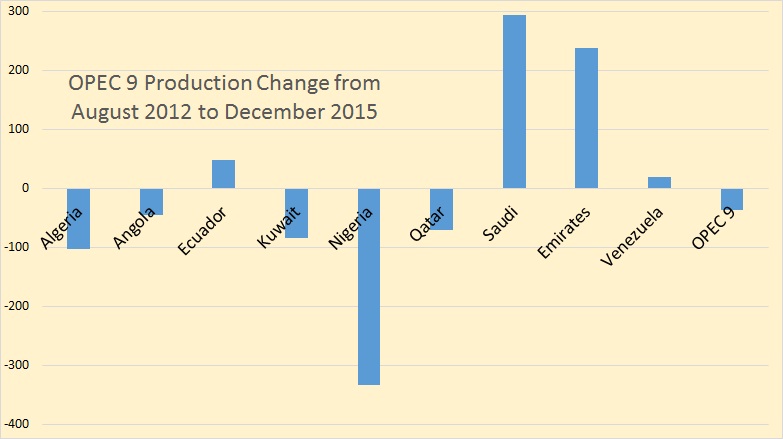

Removing Iraq from the mix and the remaining 9 OPEC nations were actually down during that period. Except for Iraq, OPEC production from August 2012 until the present, is actually down in spite of the price of oil being in excess of $100. And that is not even counting the huge decline from Libya during this period. The Iranian decline was prior to this period.

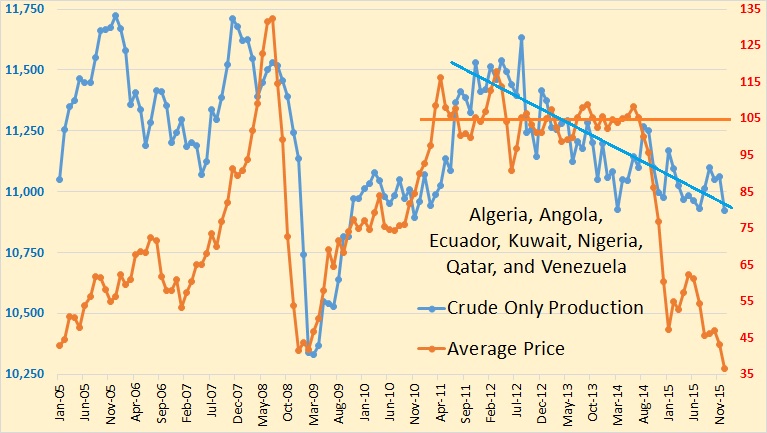

The price data in the chart below is from the Mundi Index and is the average of three spot prices; Dated Brent, West Texas Intermediate, and the Dubai Fateh, US Dollars per Barrel

This is a chart of the combined production of Algeria, Angola, Ecuador, Kuwait, Nigeria, Qatar and Venezuela, seven of the 12 OPEC nations. The point I am driving at is that oil, averaging about $105 a barrel, could not stop the decline in the combined production of these seven OPEC nations. These OPEC nations have peaked and a return of $100 plus oil will not change that simple fact.

Barring the collapse of the Arab Spring and peace breaking out in Libya, any further increase in OPEC production must come from Iran and/or Iraq, Saudi and the UAE. Saudi and the UAE, I believe are producing at or extremely close to their peak, and I am not so sure about Iraq. At any rate the OPEC 10, in my opinion, has peaked. Any possible increase in Iraqi production will be offset by the decline in production of the other 9.

Crude oil production charts of all 12 OPEC nations can be found at the page OPEC Charts.

Good points Ron.

When you subtract the human element (military-political instability) it looks like a lot more could be produced from Libya, Iran, and Venez.

When you add the human element, it all looks very fragile. I see the current output from Iraq and Saudi as certainly vulnerable.

I wonder why an organization of petroleum importing countries (OPIC) was never formed, to collective deal with OPEC on pricing and delivery issues.

A couple of links relevant to Saudi Arabia:

Amazon link to “On Saudi Arabia”

http://www.amazon.com/On-Saudi-Arabia-Religion-Lines/dp/0307473287

NYT: Surprising Saudi Rises as a Prince Among Princes (June, 2015)

http://www.nytimes.com/2015/06/07/world/middleeast/surprising-saudi-rises-as-a-prince-among-princes.html

https://en.wikipedia.org/wiki/International_Energy_Agency

Estimated Unplanned Crude Oil Production Outages in OPEC countries (mb/d)

Source: EIA Short-Term Energy Outlook, January 2016

Iran crude oil production and unplanned production outages (mb/d)

Source: EIA Short-Term Energy Outlook, January 2016

Libya crude oil production and unplanned production outages (mb/d)

Source: EIA Short-Term Energy Outlook, January 2016

Total OPEC crude oil production and unplanned production outages (excl. Indonesia) (mb/d)

Source: EIA Short-Term Energy Outlook, January 2016

According to the EIA estimates, if not for production outages, OPEC production would increase by almost 4 mb/d over the past 5 years, from 30.7 mb/d in January 2011 to 34.6 mb/d in December 2015

AlexS. What are the OPEC countries’ consumption statistics during that period?

I think you posted information re KSA oil consumption, but what is it for OPEC as a whole?

shallow sand

I do not have combined data for all OPEC members, only for some of them.

Oil consumption in Saudi Arabia and Iran (kb/d)

Source: BP

Oil consumption in several other OPEC countries (kb/d)

Source: BP

Hi Shallow sand,

Try

http://mazamascience.com/OilExport/

Roughly 4 Mb/d in 1990 and 8 Mb/d OPEC consumption in 2014, estimating from the chart.

Combined data for 8 OPEC members (Iran, Kuwait, Qatar, Saudi Arabia, UAE, Venezuela, Algeria, Ecuador):

1990: 3.4 mb/d; 2000: 4.6 mb/d; 2005: 5.8 mb/d; 2010: 7.2 mb/d;

2014: 8.4 mb/d. (from BP)

AlexS. Thanks again for the data.

Although somewhat conspiratorial on my part, I note Citi and Goldman Sachs are now turning bullish on crude oil.

I read that since the first of 2016, there has been extremely high correlation between the S & P 500 and WTI.

I wonder if maybe the money center banks have decided that further shorting of crude oil will torpedo the US stock market, and thus the economy, given the “wealth effect” confidence, or lack thereof, it creates.

Further, although not bank threatening, these banks stand to lose a lot if some bigger shale names implode.

Also, Mr. Kerry is in KSA again, supposedly trying to soothe over ther Iranian issue. I wonder if there is also some “crude overdone” talk going on? It would not surprise me if US is just as concerned about low prices, given the obvious correlation with US investor confidence.

Not like $45 or so is that great, but at least we could fight through that. Still in 20s in the field, which is still a money burner.

shallow sand,

I also noticed that GS, Citi and IHS’s Yergin have turned bullish. And I agree with them, current price is not justified by fundamentals and cannot stay at these levels for long.

$45 is quite possible in the second half, maybe by the end of the year, in my view.

I don’t know about Kerry, but Saudi Arabia has just said that “$30 oil is ‘irrational’

This is why they turned bullish:

http://www.reuters.com/article/citigroup-energy-idUSL2N1551W2

and trying to move it with this:

http://www.bloomberg.com/news/articles/2016-01-22/oil-is-trade-of-the-year-for-citigroup-after-iran-export-surge

Hi AlexS,

Unplanned outages are a fact of life. It is unlikely that all the “unplanned outages” will be resolved at the same time, and there is the ongoing decline from the OPEC9 (which has been relatively modest to date). I would agree that at some point OPEC output will increase as outages in Iran, Iraq, and Saudi Arabia are resolved. I doubt any problems in Nigeria, Venezuela, or Libya will be resolved in the near term. Total OPEC output might increase 3 to 4 Mb/d over the next 10 years, but there will be declines in non-OPEC output.

Total OPEC output might increase 3 to 4 Mb/d over the next 10 years,

Given that the OPEC nations that are in decline, will decline 3 to 4 Mb/d over the next 10 years, that means that OPEC nations that are not in decline must increase from 6 t 8 Mb/d over the next 10 years… for that to happen.

Would you care to name which OPEC nations will show such an increase?

Crickets chirping

Hi Ron,

Your chart with 7 declining OPEC nations has about a 600 kb/d decline from 11.5 Mb/d in late 2011. The decline rate is about 1.33% per year from Dec 2011 to Dec 2015.

If we assume this rate of decline continues for these 7 countries for 5 years then output declines by 700 kb/d over those 5 years.

So we would need only a 4.2 Mb/d increase from the rest of OPEC to get a 3.5 Mb/d increase.

My guess would be about 2 Mb/d from Iraq, 1 Mb/d from Iran, and 1 Mb/d from Saudi Arabia and 0.2 from elsewhere in OPEC.

Note that I suggested OPEC might increase output this much, it is intended as a maximum likely output. It may well be less, but not likely to be less than 2 Mb/d in my opinion.

Dennis, of course I disagree with you here. I think your estimate of future OPEC production here is way, way off the mark. However we are both just making our best guess.

It would be really stupid for us to argue about what is going to happen in the future since neither of us really know.

So I say you are wrong and you say I am wrong. So we will just have to leave it at that for the next five years or so. And that is the sorry state of affairs that we are just going to have to live with.

HI Ron

On this point we agree we don’t know the future.

Note that my best guess for all Opec is a 2 Mb/d increase over the next 3 to 5 years. I would think your best guess might be flat opec output if so we aren’t that far apart and reality may fall between these guesses.

A few years ago on the Oil Drum there was a lot of expert discussion on what might happen to decline rates on Ghawar. All the results were off because they had to use best guess data, but I think the analysis methods were fairly solid. One eye catching result indicated that the production could drop by over 50% in a matter of 2 or 3 years once water breakthrough hits horizontal producers (and then steadies out again to a slower decline rate). In one scenario this sudden drop was expected about now.

Hi Ron,

I said in my comment 10 years, the 7 declining OPEC nations would decline about 1.4 Mb/d if the 1.33% annual decline rate does not increase. So the rest of OPEC would need to increase by about 5 Mb/d over 10 years, so maybe 2 Mb/d from Iraq, 1.5 Mb/d from Iran, 1.25 Mb/d from Saudi Arabia, and 0.25 Mb/d from UAE, above 2015 average levels in 2025. So total OPEC output (from current OPEC members) would be about 3.5 Mb/d higher in 2025 in this scenario (which I believe is optimistic). A more realistic estimate would be about half this increase or 1.75 Mb/d higher OPEC output in 2025.

I assume oil prices will rise from $100/b in 2018 to $150/b in 2025 (2016$) and that demand for oil will not be reduced due to a severe recession between 2016 and 2025. If demand is low due to recession or War then oil prices and output will be lower than the “realistic” scenario and OPEC output would clearly decline if there was a major war in the middle east (say a Saudi Iran Iraq war with Nato on the side of KSA and Russia and China backing Iran and Iraq, or essentially a non-nuclear World War 3.)

Nuclear war is another can of worms which gets us to more serious doomer territory. Not sure how that plays out, but not well would be my guess.

I would not isolate OPEC from others. The better technique would be to identify nations with low potential, already declining. I believe their total forecasts can be prepared simply extrapolating an exponential decline for all of them lumped together.

The other nations, which include Saudi Arabia, Iraq, Iran, USA, Canada, Brazil, Russia, and possibly the Emirates, can be considered individually.

I ran so many models and excel workbooks in my life nowadays I can’t get too motivated to crank one up. But if you think this is worthwhile I’ll see,if I can give it a try.

I would appreciate if you cranked one up fernando.

Maybe a guest post?

Hi Fernando,

I would love to see that, probably a 2% decline rate would work (exponential decline) for the declining nations.

Not sure how the forecasts for the other nations would be done, but I don’t have nearly the knowledge that you have about the oil industry.

HI Alex

In your eia chart it looks like 3 Mb/d not 4.

Hi AlexS,

I misread your comment, you are talking about the increase for the past 5 years with no outages would have been about 4 Mb/d.

I was looking at your first EIA chart showing OPEC outages which is about 2.7 Mb/d, which was not what you said. My apologies.

If we assume the situation in Libya will not improve much over the next 3-5 years, but all other unplanned outages come back on line, we would see an increase of 1.7 Mb/d, then we subtract declines of 700 kb/d fro the 8 OPEC nations (including Indonesia) in decline and we would have about a 1 Mb/d increase, if Iraq, Iran, Saudi Arabia, and UAE cannot expand output any further. I think these 4 nations might increase output by 2 Mb/d over the next 5 years if oil prices rise to $100/b by 2018 and remain that level or higher through 2021, which would add up to about a 3 Mb/d OPEC crude oil increase between 2015 and 2021 (comparing yearly averages).

I think the relatively low oil prices of 2016 and 2017 will lead to oil scarcity by 2018 and $100/b or higher will be the average oil price in 2018.

This quote which I just hooked from Quora, by Richard Muller, was in response to questions from students as to why they should have to study subjects they did not expect to bear DIRECTLY on their careers.

It does bear directly on understanding the complexities of the oil industry, oil markets, international politics, future technologies, overshoot, and everything else we discuss in this forum.

“I was watching an interview with a well-known actress a few years ago. She was opposing nuclear power, and made some statements about the aftermath of 3-Mile Island. After she went on for a while, the interviewer pointed out that she got many of her facts wrong. She was indignant. “This is not about facts,” she said. “It’s about feelings!”

Many, maybe most people have a similar approach to life. There is a marvelous description of this attitude in the wonderful book, Uncommon Sense by Alan Cromer. Most of the world makes decisions based on feelings, not taking into account thoughtful analysis. Yet nothing conflicts with good decision making as much as giving in to this instinct.

In my mind, Shakespeare and Geometry teach the most essential lessons needed for a productive and successful life. Properly taught, they teach you to think, to take in the evidence, to analyze, and to deduce. My favorite Shakespeare course was taught by Prof. Hugh Richmond at Berkeley; I went to all the lectures (as an auditor) and did the readings while I was a graduate student earning my Ph.D. in physics at Berkeley, but this course was very important to me. Whenever I see Prof. Richmond, I thank him yet again for this course. No course gave me more insight into human behavior. Or about writing and persuasion — Shakespeare’s methods for convincing us of his insights.

Think of Antony’s great speech, “Friends, Romans, Countrymen …” and how he brings a hostile crowd to his own point of view. In what other course would you learn how to do that? Is that a skill that will prove useful in your future life? Let me ask that differently. Is there any more important skill?

And it is not just the way that Antony does it. It is the very fact that he does it. Recognize that, and you become aware of an aspect of life that you don’t get in a physics or engineering course.

About writing…. Shakespeare sets the standard, not in flowery language, but in vivid language, language that makes you understand what it is that Shakespeare wanted you to understand. That’s why you need to read (or better yet — watch) the originals, not the short study guides designed to give you the plot and help you with a pop quiz.

Think of what we learn about life and love from Much Ado About Nothing, about how two people who hate each other can change and feel deep and true love towards each other. I can go on and on, and if you had a good Shakespeare course, so can you. Many of the great books are comparably good; I particularly love the Russian novels, especially War and Peace. But I sometimes just sink into Moby Dick and read it again.

Geometry is the class that teaches us about logical thinking, about what it means to draw a conclusion, about the meaning of truth and how we can test it to see if it is correct or false. Most reality cannot be reduced to simple theorems in the way we do for geometry, but a study of that subject shows us that at least some truths really do exist; some speculation is definitely false, and with careful thought and analysis, you can (at least sometimes) tell the difference.

Of course, there is a limited amount you can learn from these courses. They are really meant to trigger a lifelong learning, of logic, of literature, of books and plays, of fact-based knowledge and knowledge of people and persuasion, a lifelong learning that informs and educates. Stick with it for a few decades and you will understand and be able to control and influence much of the world around you.

If the actress I was referring to had studied geometry, maybe she wouldn’t have been so cavalier about whether facts matter; if she had studied Shakespeare, maybe she wouldn’t have been so cavalier about total trust in the guidance of feelings.

If you are older, and feel that you don’t understand the world; if you feel powerless and cheated out of life, it just may be because you didn’t study Shakespeare or Geometry when you were younger, or because you just got through them, instead of getting into them.”

Muller has forgotten more science , and more about human nature too, apparently, than most people can ever dream of learning.

I will say it again, sound bites are for fools and people who want others to do their thinking for them.

Understanding any thing worth the trouble of understanding it invariably requires time and intellectual work.

“you will understand and be able to control and influence much of the world around you”

That sounds deranged.

“That sounds deranged.”

It sounds crystal clear to ME.

Are you saying YOU personally do not understand and control and influence SOME of the world around you?

The word “much” can mean a little or a lot of course.

I understand MOST of what goes on in the world which is of interest to me, and I believe that most people who make an honest effort to do so can come to understand those aspects of the world that are important to them.

Now as to how much CONTROL over the world I have is concerned, I have a LOT of control over a small portion of it. I am enjoying tropical level warmth, eating tropical fruit, and reclining in an easy chair, watching the birds outside at our feeders, while the wind howls and the snow blows, playing with my crystal ball, talking to people on the far side of the planet.

A man such as Muller trains a hundred or more capable scientists, personally, as their mentor, over the course of his career, and may make some important discoveries himself. He makes things happen. He has influence with powerful people.

The Henry Ford’s and Bill Gate’s of this world make things happen.

http://www.wired.com/2016/01/jeff-bezos-blue-origin-rocket-took-off-and-landed-again/

Now if a MAN is technically illiterate, and spends his time watching football, and playing cards, or drinking beer, and never studies the classical literature as Muller suggests, then HIS understanding of the world, compared to that of a man such as Muller, is as the understanding of a dog, compared to that man himself.

If I come off sounding like an elitist, I do not deny the description. I live on a daily basis among people who are intelligent enough, as intelligent as other folks, but IGNORANT as a fence post, when it comes to the sciences and history.

I do not look down on such people, they are MY OWN people, my OWN close blood kin in many instances. But otoh , my close blood kin includes medical doctors, engineers, teachers, professors, and other true professionals in various fields. I am a professional myself, in the true sense that I have devoted years of study to learning my profession, learning countless things I could NEVER hope to learn in one lifetime,on my own, except by learning them in a university environment, in an organized, structured environment created for that purpose.

There is a HELL of a difference between being a “professional truck driver” and a professional engineer, or a professional accountant, or a physician, etc.

Muller thinks very highly of himself but… Golden lads and girls all must, as chimney-sweepers, come to dust.

Actually considering his accomplishments, I should say he is quite justified in having a high opinion of himself, if in fact he does. Not everybody gets to be professor of physics at an elite university.

And he seldom talks about himself, if he ever does, to my knowledge. He talks about his WORK.

I will hazard a guess that he is satisfied that with his accomplishments, and with his status, and feels no need to brag about them.

People can speak like prisoners of the Matrix.

They can speak in the language of it; ‘professional’, ‘university education’, ‘corporation’, ‘cars’, ‘taxes’…

They can live under the wool of a culture pulled over their eyes to blind and curtail them from any other way to live; to make them think that there is no better way than what they know, existing within their own perceptual myths, slaves to their societal straightjackets.

To quote a piece of graffiti once read:

“You are not your job” ~ Anon

Caelan,

Speaking of Jobs. Are you still unemployed ? You could try HomeDepot. If that doesn’t happen for you. Lowe’s will hire anybody.

Good Luck

“You are not your job” ~ Maybe

‘Trump 1.0′? Really? LOL

But sure-sure, I could also huckster trucks and EV’s– even second-hand ones– and offer some complementary Kool Aid for the consumers– after my share of course.

Go Trump!

*fart/belch*

…How am I doin’?

Good post Mac.

If Saudi policy is to endure lower oil prices in favor of market share, then it is logical that the Saudis would pump at greatest ability in order to yield greatest share. Saudi production has declined each of the last 6 months. Certainly the Saudi’s won’t tell; but time will tell if the ongoing decline marks their greatest ability.

The decline of the past several months was due to supply disruptions from the Neutral Zone

(250 kb/d net to Saudi Arabia.)

From EIA STEO:

“Kuwait and Saudi Arabia continue to have a combined disruption of 0.5 million b/d at the Wafra and Khafji fields in the Neutral Zone that straddles the two countries.”

AlexS,

This is weird: I saw an announcement a few days ago that production would resume in the Neutral Zone, but now I can’t find it–ah, it was on Rigzone Thursday.

Production is to resume “soon.”

http://www.q8dailynews.com/story-z4351308

I thought I saw that on Rigzone also.

I’d love to see an ELM analysis of OPEC and various OPEC subsets i.e. OPEC 7, OPEC 10 etc. I understand times see turbulent and nothing that has happened is likely to continue in a linear fashion, but all the same, if Mr Jeffrey J. Brown would grace this fine blog with an ELM guest post of any sort I’d be ever so thankful.

2005 to 2013 total liquids consumption data for OPEC 12 (finally heard from an EIA contact in regard to missing 2014 global consumption data; he said he would look into it. ):

http://www.eia.gov/cfapps/ipdbproject/iedindex3.cfm?tid=5&pid=5&aid=2&cid=CG9,&syid=2005&eyid=2013&unit=TBPD

2005 & 2013 OPEC 12 EIA Data (rounded off):

2005:

Production: 35 million bpd (total petroleum liquids + other liquids)

Consumption: 7

Net Exports: 28

ECI (Production/Consumption): 5.2

2013:

Production: 36 million bpd

Consumption: 9

Net Exports: 27

ECI (Production/Consumption): 4.0

Estimated number of years to ECI Ratio of 1.0 (production = consumption, and thus zero net exports), based on above ECI decline: 50 years

Cowboy Integration Estimate of post-2005 CNE (Cumulative Net Exports):

10 Gb/year (at presumed net export peak) X 50 years X 0.5 (area under a triangle) less 10 Gb (annual net exports at peak) = 240 Gb

CNE shipped from 2006 to 2013 inclusive: Approx. 80 Gb

So, ballpark guess is that OPEC has already shipped about one-third of post-2005 CNE, through the year 2013.

Ratio of estimated (as of end of 2013) remaining post-2005 CNE divided by 2013 net exports: 24 years.

Note that this approach, using initial seven year rate of decline in Six Country ECI Ratio was too optimistic by 23%.

And note that the above extrapolation of the OPEC 12 data, in effect, assume an indefinite increase in both production and consumption.

As I noted on a prior thread, the ELM model, and the Six Country Case History, showed that a declining ECI Ratio corresponded to an accelerating rate of depletion in post-export peak CNE.

Link to my lengthy defense of the ELM on the prior thread, which, as noted, is just a set of mathematical observations:

http://peakoilbarrel.com/opec-except-iran-has-peaked/#comment-556981

And a link to the normalized charts for the ELM, Six Country Case History and (2005) Top 33 Net Exporters:

http://peakoilbarrel.com/opec-except-iran-has-peaked/#comment-556985

As best that I can tell the CC (Crazy Cornucopian) visitors from Fantasy Island so far have adamantly refused to acknowledge the mathematical facts inherent in the ELM, what I call “Net Export Math.”

Thanks Jeffrey! I hope you’re well.

An ELM for Algeria, Angola, Ecuador, Kuwait, Nigeria, Qatar and Venezuela, seven of the 12 OPEC nations clearly post peak that Ron discusses above would be an interesting eye opener.

It seems to me we’ll be running on fumes sooner than most folks think.

For the Export Land Model (ELM), I stipulated a production peak with an ECI Ratio (ratio of production to consumption) of 2.0 (consumption = half of production), with declining production and increasing consumption. My most recent graph shows a net export peak in the year 2000.

The Model

From 2000 to 2007, the Export Land ECI Ratio fell by 42%, which corresponded to a 95% decline in remaining post-2000 CNE (Cumulative Net Exports).

A Case History

From 1995 to 2002, the Six Country* ECI Ratio fell by 17%, which corresponded to an 84% decline in post-1995 CNE. An extrapolation of the initial seven year 1995 to 2002 rate of decline in the Six Country ECI Ratio resulted in an estimate of post-1995 CNE that was 23% too high.

Estimates of the Declines in Post-Export Peak Remaining CNE

(Based on initial rates of decline in the respective ECI Ratios)

From 2005 to 2013, the OPEC 12 ECI Ratio fell by 23%, which I estimate corresponded to about a 33% decline in remaining post-2005 CNE.

From 2005 to 2013, the (2005) Top 33 Net Exporters’ ECI Ratio fell by 17%, which I estimate corresponded to about a 26% decline in remaining post-2005 CNE.

*Major net exporters, excluding China, that hit or approached zero net exports from 1980 to 2010.

http://www.bbc.com/news/science-environment-35344664

Hawking weighs in on threats to the globe. I love Hawking, but he is missing the biggest threat IMO.

ELM.

It’s simple. Plug the actual net export data on the ELM chart starting in 2007. You ought to be able to do it through 2014.

The ELM Fantasy.

At the time that I posted my ELM essay 10 years ago this month (which predicted that we were on the verge of a global net export decline), the Top Five net exporters at the time were showing a 7.4%/year rate of increase in net exports, up from 19.4 million bpd in 2002 to 24.2 million bpd in 2005 (total petroleum liquids + other liquids, EIA data). At this rate of increase, they would have been up to about 44 million bpd in 2013.

Their net exports actually fell from 24.2 million bpd in 2005 to 21.3 million bpd in 2013. Granted, their combined net exports have not fallen as fast as our modeling suggests that it would. However, an extrapolation of the 2002 to 2005 rate of increase in would have shown about a 20 million bpd increase in net exports through 2013, whereas actual net exports fell by about 3 million bpd.

The Crazed Cornucopians are complaining that the Export Land Model, which is really just a set of objective mathematical observations, is wrong, because 10 years after I predicted, because of falling production and/or rising consumption, that we were on the verge of a net export decline, our subsequent modeling of (2005) Top Five net export numbers was not right on the mark.

It’s simple. Plug the actual net export data on the ELM chart through 2014. A nit. The 2007 upper confidence level should be below the 2006 actual data point. 2015 looks fine by eyeball.

The ELM FUD campaign – “ferocious decline” – was based on the reference case. Are you retracting it?

Troll alert

Not necessarily.

Models need to be able to withstand different forms of, say, scrutiny, which can help in hashing out and clarifying what the models are expressing as well making them more robust and expressive.

As I have periodically noted, we are dealing with mathematical certainties:

The ELM is a nothing burger, hence Brown’s reticence to post actual data to demonstrate empirical falsification.

KSA reafirmation of their market share strategy is about as clear a definition of insanity as I can think of. An OPEC reduction of 5 to 10% would deliver an immediate 100 to 150% price increase per barrel, keep the wolf away from the door , and may restore the Saudis stability. Non OPEC producers are ready to join in…what more do they want? If cutting off one’s nose to spite their face is a sound strategy then I guess they are on point. Meanwhile ISIS is knocking at KSA door and could possibly be heading in full force since they are being squeezed out of Syria and Iraq. House of Saud is in deep shit.

Are LTO producers ready to join in…?

Is Iran ready to join in after 3 years of underproducing due to the sanctions?

Hi AlexS,

Is the marginal Russian barrel profitable at $30/b?

I would think there is some production everywhere in the world where even the OPEX is not covered by this oil price (after taxes etc), so wells might be moved to smaller chokes or temporarily abandoned where possible and that completion of new wells would be slowed while waiting for the oil price environment to change. Several large IOCs have announced big layoffs, so I imagine fewer workers might slow down the process of implementing investment decisions to some degree, the smaller OCs have already made many cutbacks, within 6 months we will see these cutbacks start to reduce oil output. I doubt $40/b is going to stem this decline.

Behind WSJ’s paywall but available via Google, bold mine:

Russian Oil: Output Grows as Prospects Shrink

Without new investment, Russia’s oil future is less bright. In West Siberia, where some two thirds of the country’s oil is produced, companies battle declining production rates after decades of oil extraction. “It’s unlikely we can stabilize production in West Siberia,” said Mr. Alekperov of Lukoil. “We can only slow the decline.”

—-

Horizontal drilling last year made up about a third of all drilling in Russia, up from 11% in 2010, according to CDU TEK, the monitoring agency at Russia’s energy ministry. Such wells are drilled parallel to an oil or gas formation and can boost yields as much as five times that of a vertically drilled well. It is a technique that helped fuel the U.S. oil boom of the past few years.

“Russia was late to this,” said Sergei Alekseev, director of marketing at TMK, Russia’s largest manufacturer of steel pipes for the oil industry. “But now we see it everywhere.”

The technology has allowed Russia to squeeze more oil out of older fields across Russia and particularly in Siberia, where Lukoil is pumping at Imilor, but is only staving off the inevitable, executives said. Many of the big West Siberian oil fields have produced for more than five decades and yield less every year.

Output across the Khanty Mansiysk region, which includes Imilor and accounts for just under half of Russia’s output, fell 2.8% in the first 11 months of 2015 versus a 1.6% decline for 2014 overall, according to IHS Energy, a consulting firm.

At Rosneft’s Varyeganneftegaz division in West Siberia, oil production has fallen almost 6% in the first nine months of 2015 compared with the same period a year earlier. Rosneft posted a crude oil production decrease of 1% in the same nine-month period because of declines in older fields, despite new output from offshore projects and East Siberia.

It is just a matter of time before two thirds or Russian oil production starts showing some very serious declines.

Dennis,

There is indeed some production in non-OPEC countries where OPEX is not covered by $30 oil price.

But this is not the case of Russia (see the chart below, which I had already posted earlier).

I don’t think that at $30 currently producing wells in Russia would be idled, or development drilling will be significantly cut.

If prices remain at these levels for the whole year (which is not likely, in my view), there will be further cuts in investments in new project, but this should not affect near-term production levels.

For example, Lukoil’s $8.5 billion investment program for this year was based on $50 oil. Their CEO Vagit Alekperov said last week that he still expected Brent to reach $50 by the end of 2016, but the company now has 3 much lower oil price scenarios: base case @ $30 average for the year; optimistic @ $40; and “crisis scenario” @ $20/bbl. At $30 they would cut investment by $1.5bn to $7 bn, at $20 – to $5.5 bn. Note, that up to 90% of operating and capital costs in Russia are ruble-denominated. And given that the ruble/US$ rate is closely correlated with the oil price, the real capex in ruble terms would be reduced much less than in dollar terms. Capex cuts will primarily affect projects with long payback periods, some non-essential spending, investments in new infrastructure, etc.

Meanwhile, projects that were scheduled for 2016 continue to come onstream. Thus, last week Rosneft has started commercial oil production at Zapadno-Epasskoye field in Russia’s Tyumen Region.

( http://www.worldoil.com/news/2016/01/21/rosneft-subsidiary-brings-zapadno-epasskoye-field-onstream )

Median Total Cost of Oil Production per Barrel

Source: Rystad Energy

[ http://money.cnn.com/interactive/economy/the-cost-to-produce-a-barrel-of-oil/index.html?iid=EL

Hi AlexS,

The median cost doesn’t really tell us much, it is the cost to produce the most expensive barrels which is relevant. You seem to argue that the low oil prices are unlikely to affect output. If output is unchanged, it would stand to reason that oil prices would remain $30/b. Why won’t the oil price remain $30/b, if that price will have little affect on output in the near term?

Perhaps the median OPEX in the US is $15/b, but based on Shallow sand’s comments, this seems pretty low.

One has to realize there are costs besides OPEX and CAPEX, royalties and taxes (in the US) are usually about 30% of the wellhead price and there are transport costs to get the oil to a refinery ( we will assume the refinery pays WTI or Brent prices for simplicity). The transport cost varies but we will call it $5/b (often with pipeline access this is close to the low point, in some cases it is $12/b when crude is shipped by rail) So at a WTI of $30/b, the wellhead price might be $25/b, then $7.50 gets paid in royalties and taxes, so we would be down to $17.50/b and at least half of US output would be making $2.50/b more than OPEX in this scenario.

Maybe Shallow sand and others in the US oil industry can comment on whether the $15/b US median OPEX estimate seems correct. Seems too low to me.

What do they classify as “capital expenditure”? All of the CAPEX needed to produce a given oil reserve volume? As Denis says, lumping production units by country is a bit too coarse.

The question is more what’s the individual field/well limit, and the psychology of the operator.

I have audited operators who simply didn’t know what opex was for individual units, so they kept on producing them at a loss.

The real reason oil is rallying:

http://money.cnn.com/2016/01/22/news/russia-ukraine-sanctions-john-kerry-davos/

The downturn began with Kerry announcing sanctions

following your logic, oil should soon return to $100.

That was the level when sanctions were announced

“The downturn began with Kerry announcing sanctions”

This idea that the drop of oil price was Obama administration (in full cooperation with Saudis) declaration of an economic war on Russia is a recurrent theme of many posts. It is enhanced by the fact that talking about Saudis defending their market share does not align well with the facts. Gaining 11 billion (1 Mb/d, at $30 * 365 days) and losing 100 billion in budget is not a very apt strategy of defending market share. My impression is that Saudis wanted a “modest” drop, say, to $60 and were instead caught naked by Wall Street sharks.

Why they can’t just wait when the US shale production died with a natural death? Outside of sweet spots, it was not very profitable at $100 per barrel and actually profitability greatly improved due to oil slump (with all “redundant” expenses thrown under the bus and greatly increased danger of environment catastrophe ). Now people claim that it can survive at $60-$70 a barrel.

BTW this article has a pretty strange set of comments (for CNN website ). Looks like people start ignoring or, worse, questioning official propaganda line.

It s quite hilarious how the rats are changing their tune now:

http://www.pravdareport.com/news/business/22-01-2016/133132-soros_russia_international_reserves-0/

Soros is definitely a typical financial rat, GS-style rat to be exact — a financial hacker. No questions about it.

Soros is one of the greatest philanthropists of our times, a champion for democracy and human rights.

“George Soros has been a prominent international supporter of democratic ideals and causes for more than 30 years. His philanthropic organization, the Open Society Foundations, supports democracy and human rights in more than 100 countries.”

The infamous KOCH brothers support cancer research.

Of course that just might be because they are afraid of getting cancer THEMSELVES, lol.

What people do on the job, and what they do after they go home from the office is two different things.

Having said this much, Soros is a nice guy, compared to his peer group.

Is not he also a supporter of “color revolution” and “disaster capitalism”:

http://www.sott.net/article/295896-George-Soros-The-hidden-hand-behind-color-revolutions

Just asking.

Actually it is important that these do not shut down from a nat security pt of view:

http://www.wsj.com/articles/stripper-wells-are-wild-card-in-oil-rout-1441660049

Of course, I agree.

Are you the famous oil trader Andy Hall?

A new post from Aleklett

https://aleklett.wordpress.com/2016/01/22/what-will-happen-with-the-iranian-stored-40-million-barrels-of-oil/

He does not ask himself an important question, what all those tankers contain. Is this crude or condensate? Or some refined products like heating oil too.

For what it’s worth, Iranian sources say it’s condensate and fuel oil. I guess we will find out.

http://www.reuters.com/article/iran-oil-idUSL3N1021Z120150723

For comparison

US condensate production increased from 231 mb in 2011 (start of shale oil boom) to 326 mb in 2014

https://www.eia.gov/dnav/ng/hist/rl2r57nus_1a.htm

So IEA’s estimate of 36 mb x 0.67 = 24 mb would be 7.4 % of 2014 US condensate production

There are some reporting issues regarding “Lease condensate,” i.e., I suspect that a good deal of condensate production is reported as crude oil production. And in fact, the EIA refers to Crude + Condensate (C+C) as “Crude oil.”

A survey that the EIA did last year estimated that 22%, or about 2 million bpd, of US Lower 48 C+C production consists of condensate (45 API +). And about 40% of US Lower 48 C+C production exceeded the maximum API Gravity for WTI crude oil (42 API Gravity).

My “Condensate Con” comment:

http://econbrowser.com/archives/2016/01/world-oil-supply-and-demand#comment-194595

Hi Jeffrey,

One cannot know how that bar from 40 to 45 API is divided, it might be that 5% is 43 to 45 API or it might be more, we don’t really know, many people put the condensate dividing line at 50 API. Tapis is a high quality crude traded in Asia with an API of 43 to 45, it is notconsidered condensate.

https://en.wikipedia.org/wiki/Tapis_crude

The article below also puts the dividing line at 45 API or higher for condensates, so if the US output was 9.5 Mb/d and 22% was above 45 API, that is about 2.1 Mb/d of condensate, this can be exported to Canada where they need it to dilute the oil sands so it will flow in pipelines.

http://www.ogfj.com/articles/2012/10/fifty-shades.html

There is actually no exact definition of condensate and its API gravity threshold.

“On Oct. 3, the U.S. Energy Information Administration … held a closed-door “Condensate Workshop” for officials from several government agencies and experts from the industry in an effort to come up with a new and more consistent definition.”

“Some experts have suggested that the federal government define condensates as any hydrocarbons that are liquid at standard pressure and temperature and have an API gravity of more than 50 degrees.

Hexane has an API gravity over 80, pentane over 90 and butane over 110, which are all well above the suggested 50-degree threshold.”

http://www.reuters.com/article/us-condensate-usa-kemp-idUSKCN0HZ03220141011

[My comment: butane is certainly not included in condensate. Normally it would be pentane+]

———————————–

“The API gravity of condensate is typically 50 degrees to 120 degrees. ”

(from Schlumberger glossary)

http://www.glossary.oilfield.slb.com/en/Terms/c/condensate.aspx

———————————–

“Condensate gravities range between 50° and 70° API.

Light crude oils have an API greater than or equal to 45°.”

https://www.e-education.psu.edu/png520/m18_p6.html

——————————

“Refiner Phillips 66 and midstream giant Plains All American (PAA.N) have said condensate is oil with an API gravity of 45 or above. Meanwhile, Marathon Petroleum Corp’s top executive said in a recent interview he believed condensate should have an API gravity of 60 and above. ”

http://www.reuters.com/article/us-oil-condensate-idUSKCN0HX0BU20141008

———————————–

“Condensate is a very light hydrocarbon with an American Petroleum Institute (API) specific gravity of greater than 50 degrees and less than 80 degrees. ”

http://info.drillinginfo.com/what-exactly-is-condensate/

—————————————-

“Anything above 45 degrees API can be considered condensate, depending on who you ask. Some of the stuff pouring out of wells in Texas, North Dakota, and Colorado is coming in at a range of 50 to 60 degrees API.”

http://blogs.wsj.com/corporate-intelligence/2014/06/25/what-is-condensate-introducing-americas-new-oil-export/

———————————————

“The API gravity of lease condensate ranges between 45 and 75 degrees”

http://petrowiki.org/Gas_condensate_properties

———————————

Hi AlexS,

Thanks. So in summary, most industry observers would consider condensate as liquid with an API gravity above 45 degrees, though the choice of the low point varies from 45 to 60, with 50 often cited.

Above 50 is condensate with so very few exceptions they aren’t worth considering. Don’t fret so much over it, set it at 45.

Matt Mushalik,

I’m a little uncertain about the figures because your link takes you to a page, under the heading Natural Gas, titled Natural Gas Liquids Lease Condensate. To me, “lease condensate” means wellhead condensate and that is not associated with NGLs; condensate also comes out at the NGL-separation stage down the line. If it is the latter that the chart refers to, then the figure is not total production of condensate but only that recovered from the NGL stream.

Somebody help?

“At the end of November, roughly 36 mb of oil, of which 67% was condensates, was floating in 18 tankers.”

Source: IEA Oil Market Report, December 2015

Iranian oil in floating storage

source: http://money.cnn.com/2016/01/18/investing/iran-sanctions-hoarding-oil-prices/index.html

“With no clear timeline for a restart at petrochemicals producer Dragon Aromatics, one of Tehran’s key condensate buyers, after its April fire, Iran hoped new buyers in South Korea, Japan as well as in China would pick up the slack, traders said.

The CNOOC-Shell petrochemical plant in southeastern Guangdong province could also be a replacement buyer for condensate, they said. The plant was forced to drop a regular supply pact in mid-2012 when the European Union put an embargo on trading Iranian oil.”

http://www.reuters.com/article/2015/12/03/us-china-iran-oil-idUSKBN0TM0CN20151203

“Iran may roil global oil markets with plans to sell about 45 million barrels of fuel stored in tankers in the Persian Gulf within three months of the removal of sanctions on its economy, according to analysts.

Most of the stored oil is condensate that contains a sulfur compound, which complicates sales because many refineries can’t process it, said Victor Shum of IHS Inc. and Robin Mills at Dubai-based Manaar Energy Consulting. To market this large amount of oil within three months — the equivalent of about half a million barrels a day — Iran will have to resort to offering deep discounts, they said.”

The condensate … is pumped from the offshore South Pars natural gas deposit.

Iran may need to spur sales of its sulfur-heavy condensate by offering discounts of at least 10 to 15 percent, Shum said. Its main condensate customer, Dragon Aromatics Zhangzhou Co. of China, stopped buying after a fire at its plant in April and an Iranian refinery designed to use it won’t be ready until 2017, causing stockpiles to build, he said.

“There will have to be a major impact on the market of selling that condensate,” said Manaar Energy’s Mills, who worked for Royal Dutch Shell Plc on projects in Iran from 1998 to 2003. “If they’re already having difficulty shifting it, adding another half million barrels will be even more difficult,” he said by phone. “They’ll manage, but at what discount?”

http://www.bloomberg.com/news/articles/2015-10-29/iran-seen-jolting-oil-market-with-90-day-supply-after-sanctions

Petrobras is in pretty deep doo doo, and will likely fold, as a business enterprise, unless the price of oil rises sharply and soon.

http://www.usatoday.com/story/money/markets/2016/01/23/riskiest-oil-stock-in-world/79105742/

Can the Brazilian government bail’em out?

Maybe.

Maybe Fred Maygar will chip in on this question. He knows a lot about Brazilian politics.

They don’t have to fold. They simply have to shut in 700,00 BOPD. That will raise prices so they can go through the hoop.

API: Oil and natural gas drilling down by half in fourth quarter 2015

http://www.api.org/News-and-Media/News/NewsItems/2016/Jan-2016/API-Oil-and-natural-gas-drilling-down-by-half-in-fourth-quarter-2015

WASHINGTON, January 19, 2016 – Estimated total U.S. oil and natural gas well completions fell by 51 percent in the fourth quarter of 2015 compared to year-ago levels, according to API’s 2015 Quarterly Well Completion Report, Fourth Quarter.

Estimated development oil well completions in 2015 fourth quarter fell 55 percent compared to 2014 fourth quarter estimates. Estimated development gas completions decreased 37 percent over the same period.

For 2015, total well completions decreased 35 percent overall compared to 2014 levels. Oil completions were down 37 percent and natural gas completions were down 28 percent). Total footage drilled was down 27 percent overall.

From your link:

“We can’t expect that growth to continue if our own outdated energy polices stand in the way. Reducing unnecessary regulations and speeding up permitting on federal lands will help U.S. producers to compete effectively in the global market under the low-price environment.”

Typical. They are blaming it all on the federal government. If the government would just get out of the way and allow them free drilling on federal lands, that would fix the problem. Hell, if the government would just get out of the way and allow them free access to government lands then they could produce more and drive the price down further.

These right wing nut cases really piss me off sometimes. It is always the governments fault. All their problems would be solved if the government would just get out of the way and let them do as they please. Then all our nations problems would be solved. The rich would get richer and the poor could just go to hell.

“They are blaming it all on the federal government. If the government would just get out of the way and allow them free drilling on federal lands, that would fix the problem”

I agree. They are losing money on the private lands, but they hope to fix this if they are allowed to drill on the federal lands.

Yes, I wonder where all the US federal locations are that work at $26-32 WTI and $2 HH?

I read somewhere that there is enough federal lands open to drilling that it’d take a decade to get through it all. I guess the problem is they need a couple decades worth and they need it now not later. Typical right wing (which basically means big business these days) campaign to try and manipulate perception of current events to try get what they want.

The true irony is that right wing is almost totally small business. Long ago, big business became left wing because they had to get along with their unions. In general, big business is NOT right wing. Start by listing the biggest: Apple, Google, Facebook, almost the entirety of silicon valley. GE gives mostly to democrats. So do the Wall Street Banks (all of New York City has a special relationship. For example, while Jews are 3% of the population, they are over 60% of Wall Street Executives). What is Hollywood, which has the the movies to promote agendas? What are most of the Newspapers? NY Times, Washington Post, LA Times, Chicago Tribune, etc.? How about the mainstream media? All left. But, go ask the small businesses with 2 to 100 employees – they are mostly right wing. They want lower taxes and less government interference.

Hi Clueless,

Not sure there is actual evidence that most small businesses are right wing, a nice story though. Most small businesses set up their businesses so that profits are zero (if they are privately owned). Any profits are paid out to the business owners as bonuses and they are taxed on their personal income just like everyone else.

Perhaps these small business owners think that everyone but them should pay taxes or perhaps they think that capital gains and dividends should not get special tax treatment, I agree with that position and that tax shelters favoring the wealthy should be eliminated from the tax code.

Hi Ron,

I hear ya, loud and clear, and have NO DESIRE to argue this point.

BUT I hear the same sort of bullshit from hard core people on the left, who blame all our troubles on ” GRRREEEEDDDDYYY BISNESSMEN”.

It’s just a talking point handy for rallying the unthinking foot soldiers.

Come to think about it, the foot soldiers on either side are generally not capable of much thinking. If they were, they would not be true believers in socialism on the one hand, or unbridled capitalism on the other.

Mac, what you missed in the story was the irony! They are losing money because way too much oil and gas is being produced. But if the government would just get out of the way and allow them to produce more then that would fix the problem.

Do you not see the irony in that argument? And just when, from the left, have you ever heard such nonsense?

Another example of irony is you saying that you “have NO DESIRE to argue this point” then you proceed to argue the point.

Why do these silly ironic arguments always come from folks on the right? 😉

I think it is because they are not really arguments the way the average person thinks of arguments. The goal is always to erode the power and control of the government. They throw everything regardless of how non-sensical ironic or whatever at this issue and use this prescription because solving whatever problem they are supposedly addressing is only secondary to them. Damaging the governments ability to function is the objective. Undermining the government’s legitimacy is the goal.

From the left, it is generally a question of problem solving. There is a genuine effort to analyze the situation and arrive at a solution (I’m not talking about actresses here Mac but policy experts) and often, government is looked at as the logical perhaps the only tool capable of performing the necessary function.

The right, with their mindset assumes that the goal of the person on the left is to expand the government. THis is projection. Because their goal is the opposite. To hobble or delegitimize the government. But expanding the government is not the goal of most people on the left. It is simply a consequence of trying to problem solve since most of the problems that attract the attention of people on the left require collective action to solve and government is the primary tool with which a modern society achieves collective action.

I think this is why we are always talking past one another.

The left has a pretty wide range, they can include a centrist like Clinton all the way to hard core murderous thugs like Fidel Castro.

I guess in your view, a democratically elected Marxist socialist like Salvador Allende, is much worse than a hard core murderous right wing dictator and thug like Augusto Pinochet because Pinochet proclaimed himself anti communist?

Yes, Pinochet was much better than Allende. Once communists get in power they proceed to destroy democratic institutions, put in place a censorship, a system to repress the people, including concentration camps, mass murder and terror are used if needed, and on top of that they destroy the economy. The system decays, and entrenches a corrupt oligarchy which is incredibly hard to dislodge.

Pinochet types on the other hand give up power.

This is why you find people like me who have suffered horrors under communism, and are quite willing to decapitate communists and mount their heads on spikes if the need truly arises. I’m not prone to violence, but it should be clear that communism is a cancer which needs to be fought with resolution, and to the death if necessary.

Any one who can, with a straight face, claim that Pinochet was much better than a democratically elected president whether or not that president was a self identified Marxist, is simply not capable of rational thought because of purely idelogical blindness!

Ah yes, good old Pinochet. What, 35,000 victims: 28,000 tortured, over 2,000 executed, and over 1,000 missing plus 200,000 or so people who suffered exile and God only knows how many went through clandestine centers and illegal detention including my best friend and his wife. She was held and tortured for two years for the crime of being a university professor. What a sweat chap General Pinochet was. My friend is a mining engineer and could never figure out his “crime” other than being married to an academic.

State folks like Pinochet couldn’t have got anywhere without a whole lot of dupe, mindlessness, compliance and acquiescence. What a sorry lot.

That is indeed true Fernando, and in a healthy polity, the right would include a broad spectrum as well since is should be a healthy natural counter-balance to change initiated by folks on the left. But here in the U.S. the right, that is the conservative impulse has been co-opted by The Radical Right, Movement Conservatism, a fringe group in the time of Eisenhower et al. Perhaps this condition is temporary. Being taken to its logical extreme with the likes of Cruz and Palin maybe it will have to fail spectacularly before the portion of the population who gravitate towards a conservative world view can organize themselves around a rational set of principles. But we appear to be a long way from there right now.

Hi SW,

The reasonable Rebublicans got voted out of the Republican party and most of the reasonable Republican positions have been adopted by the majority of Democrats, there are a few Democrats out there on the fringes arguing for crazy policies such as a National Healthcare system (already adopted by almost the entire OECD, except the US). Only a few crazies though, most stick to the party line that change for the better is too divisive.

Hi Fernando,

Clinton would be on the right in Europe (or at least the center). She is arguing against a national healthcare system, which would hardly be on the left in most European nations.

Now if this were the 19th century, Clinton might be considered on the left.

She is arguing against a national healthcare system, which would hardly be on the left in most European nations.

No, she very strongly supports the so called “Obama care” program, which is a national healthcare program. What she does not support, and Sanders does support, is a “single payer”, system.

A single payer system is what Canada and almost every European nation has. It is what I favor also because it cuts out the middle men, the insurance companies.

The insurance company mark-up is what makes our current system so damn expensive. Did you know Medicare is not allowed to ask for bids for drugs as the Veterans Administration does. That is because the pharmaceutical company lobbyist wrote the damn bill. The insurance companies and Big Pharma has our congress bought and paid for.

Well, there is a few others who own a piece of our congress also, like the NRA.

A single payer system is what Canada and almost every European nation has. It is what I favor also because it cuts out the middle men, the insurance companies.

Ditto! Same in most civilized societies. In Brazil, basicl health care is considered a human right. Every one is entitled to basic health care if they need it, for free!

Obviously if you are wealthy you can purchase personal care as much as you like. But that, like checking into a five star hotel or flying first class are luxuries that you pay for…

Yeah, good point. I’m not sure if any current candidate other than Bernie Sanders even comes close to being left of center. In Europe Clinton would be considered right wing. As for the current crop of Republicans they are mostly just a bunch of ultra right wing neo fascists.

Kasich is nice. So is Paul.

No,I haven’t missed the irony. I said I hear ya, loud and clear. In the vernacular of the American common man, this means I AGREE WITH YOU.

I doubly pointed out that I agree by saying I have no desire to argue YOUR point.

My point, a different point, is that both sides display the same sort of hypocrisy.

You are very much like everybody else, and remember what pleases you, they call it confirmation bias. You overlook anything that tends to contradict your own bias. So do I .

I suppose you have forgotten the speeches made during the recent “occupation ” of Wall Street, etc?

You haven’t heard HRC rail about the big banks, and how she is going to put a whupping on them, and make them roll over on their backs, and pee themselves, when she gets to be prez? She uses somewhat more restrained language, but the message is more or less the same. Only the naive take it to heart, literally, in either case.

Ask a republican what he thinks about somebody putting a garage or machine shop down the street from HIS house, and you will find out INSTANTLY that he DOES INDEED believe in government. He also probably believes in locking up kids for smoking pot, unless they happen to be HIS kids.

I have wandered from one end of the political spectrum a couple of times, round trip, over the course of my life. I am pretty much in the middle now, and plan to vote for Bernie if he gets the nomination. I have said so before.

Could it be that I am ( gasp!) a liberal, going around posing as a conservative ? Maybe I just think of myself as a conservative as a matter of HABIT, this being evidence of cognitive dissonance on my part?

A Darwinian explanation ( the evolutionary theory of psychology) of human behavior works extraordinarily well in describing and understanding how and why we act.

We are born liars, evolved liars, HABITUAL LIARS, from the top of the heap right on down to the flies that look like wasps. Conservatives lie, liberals lie, preachers lie, environmentalists lie, the Koch brothers lie.

I tell a few myself from time to time but so far none today, unless I have forgotten them already. LOL.

Key point that no one has noted so far. The API release mentioned “unnecessary regulations AND federal….”

“Unnecessary regulations” is a separate issue from opening more federal lands for drilling. It’s about reducing regulatory requirements (and related COSTS) for fracking, produced water disposal, EIR’s, special off-shore BOP’s, spill-containment, new rail cars, pipe lines, etc. Regardless of how MUCH oil the API’s members produce and sell, if they can reduce COST per barrel, they are more profitable in the low-cost-oil environment. Their members don’t care about producing more OIL, just making more PROFIT (or at least losing less).

Google Venezuela news, and the state of that unfortunate country becomes clear , very quickly.

It seems very likely to me that there will be some sort of revolution there, within the year. Oil production may crash to very close to zero.

I have no idea how long it might take to recover. Even if the goverment stabilizes, and the country remains calm, it will take a good while before anybody much will risk his money in Venezuela, and a good while after that to get the oil flowing again.

The government owes several times what it is taking in. The only debts, apparently, that have been paid recently are those relating to government bonds, and default on those appears to be in the cards, within the year.

Nobody in his right mind ships anything to Venezuela these days expecting to be paid for it later.

Venezuela will be not unlike Syria, Iraq, Afghanistan or Somalia in very short order. Much of the region will soon follow.

The region is fine. Venezuela is highly unstable.

The news I hear late Saturday early Sunday:

1. they are shipping seven tons of gold to an airplane, extracted from the national bank vaults.

2. Cilia Flores, the president’s wife, and Diosdado Cabello, former National Assembly president, were visiting generals around the country. Bocaranda says the president told the defense minister to take away sidearms from army officers. I don’t know if the order was obeyed (note: it’s well known the Cubans have military embedded in the Venezuelan forces, they also have secret agents inside ready to murder officers as needed, thus a coup will take place executed by Cuban moles).

3. Several statements issued by Cabello, Maduro, and other communist leaders saying the National Assembly “isn’t needed”.

@Fernando

The region is fine?

44 of the top 50 cities for highest murder rates are in South and Central America. The region is a mess in so many ways I don’t know where to start.

https://en.wikipedia.org/wiki/List_of_cities_by_murder_rate

The region isn’t about to be like Somalia or Syria. Relax.

Saw an article over at insideevs.com a few hours ago, as sales data for December 2015 from various countries continues to trickle in and decided to do a little digging. Here are some titbits that some people might find interesting.

With the worldwide, year to date plug-in sales standing at 447,617 at the end of November, adding the December sales data from the US, the Netherlands, China (BYD only), France, Norway, Denmark and Australia, the 2015 total comes to 495,504. With no data yet from Japan, Germany, the UK, Canada and the rest of the world, the approximately 4,500 needed to take the total to over half a million should be easily reached. That would make the total plug-ins sold worldwide for 2015 more than 60% greater than the 320,713 total for 2014.

The amount of plug-in vehicles produced in China in 2015 of which, less than two thirds are passenger cars, exceeded the total amount of plug-in in vehicles sold worldwide in 2014.

Based on data from the Monthly Plug-In Sales Scorecard at insideevs.com it should be safe to say that cumulatively, over a million plug-in vehicles have been sold worldwide since the latest wave of plug-in vehicles went on sale starting in December 2010. Actually in looking for the answer to the question I pose in the next paragraph, I found that this number was passed last September:

Global Sales Of Plug-In Electric Cars Hit One Million

What I want to know is, how many of these plug-in vehicles will it take to reduce demand for oil by a million barrels per day? Except for China, I think it is safe to say that most plug-ins that are sold will be displacing an ICE powered vehicle. A quick search brought up the following:

How Will Growing EV Demand Affect Oil Demand?

Could mainstream electric vehicle adoption result in a significant drop in crude oil demand? While some impact would of course be expected with large-scale adoption, could the impact be larger than is currently supposed?

An interesting new article published over on Seeking Alpha explores these questions, and provides in-depth descriptions of some interesting possible scenarios.

According to the analysts over there, roughly 39 million electric vehicles (EVs) and plug-in hybrids (PHEVs) will be on the roads in the US by 2030. A fleet of this size would lower gasoline consumption by around 17.2 billion gallons a year (the electrics would use about 180 terawatt-hours of electricity a year instead).

So, based on that article, some simple arithmetic suggests that a million plug-ins could reduce oil demand by 1.2 million barrels per day. My gut tells me that figure is high. What do others think?

Below is the article that started me on this track:

Netherlands Shocks With Nearly 16,000 Plug-In Electric Car Sales In December!

The cause?

The surge of sales in late 2015 isn’t a natural phenomenon, but related to some tax rebate cuts beginning January 1, 2016,

All-electric cars remain at 4% tax (so no rush in sales here), but plug-in hybrids move from 7% to 15% (non-plug-in stand at 21-25%) – note the surge (pictured left) in extended range sales in December.

It’s also amplified by new models and new versions of existing models (like Mitsubishi Outlander PHEV).

Anyways, we are fairy confident that the year 2016 will begin badly in comparison to 2015’s end for plug-in car sales in the Netherlands.

I believe the typical auto here in the USA is driven enough that the average gasoline consumption per car is very roughly a gallon a day, being actually around seven to eight gallons a week.

So – It would take about forty cars to save a barrel of oil per day. It would take close to three barrels of crude to make that much gasoline, but we can assume the fraction of the crude that becomes gasoline can be used for other purposes, and ignore this factor, for purposes of this discussion. Forty million pure electrics and or plug in hybrids could easily save us a million barrels a day. The savings would probably be greater, because these would be new or at least newer cars, and the newer a car is, the more heavily it is used.

Let us suppose we subsidize the construction of forty million pure electric and or plug in hybrids to the tune of 5000 bucks each. That would be about 200,000, 000,000 bucks. Real money, even by the standards of Washington politicians!

BUT – if we assume oil goes to one hundred bucks, and stays there, which seems ENTIRELY possible from my pov, a few years down the road…………. well then …….. hmmm…..

A million barrels at a hundred bucks is a hundred million dollars A DAY that would STAY HOME, rather than line the pockets of people in oil exporting countries, people who are not really and truly our friends, in most cases.

We would save a billion dollars on imported oil every ten days. This billion could stay home, providing local jobs. This thought experiment looks at first glance as if it might be a pretty good deal, taken all around.

Any reduction in the consumption of a commodity tends to force the price of that commodity DOWN. There would be a huge additional savings as the result of gasoline selling for LESS.

If oil spikes up hard and sharp, it is not unreasonable to believe that Volts, Bolts, Leafs, Tesla Threes etc will all sell like ice water in hell within the decade- assuming the batteries give service comparable to the COMBINATION of IC engines AND automatic transmissions.

There will be many other pure electric and plug in hybrid models as well, because just about every large manufacturer is committed to building electric and plug in hybrid cars. These cars will be on virtually every new car lot all over the country within the decade.

Forty million electrified cars and light trucks within fifteen years ? It could happen.

Range anxiety is something the driving public will eventually forget about. People who need long range will buy plug in hybrids, or a Tesla pure electric, or rent a conventional car for a trip, if they don’t own both an electric AND a conventional car.

I believe that 60-65% of every barrel refined ends up as gasoline, not 33%.

In 2014 USA refineries produced an average of 46% gasoline per barrel of crude.

Crude from each different locale varies widely in the gasoline fraction.

It depends on the amount of gasoline consumed by these plug ins. The USA has vehicle efficiency goals which should increase fleet fuel efficiency, it’s fairly easy to assume this efficiency is reached, and compare that to today’s consumption rate. My conclusion is that refinery owners should be prepared to export refined products to countries with a growing population and increasing gasoline demand. I don’t expect there will be ANY refineries built in the OECD in the future.

US gasoline consumption was 137 bn gallons in 2014

https://www.eia.gov/tools/faqs/faq.cfm?id=23&t=10

39 million EVs in 2030?

But this 2011 study

http://www.cargroup.org/assets/files/ami.pdf

assumes that in 2025 there will be 44 million light vehicles more on the road than in 2009

So where is the reduction in gasoline consumption?

“So where is the reduction in gasoline consumption?”

Excellent point, Matt!

All such arguments should be stated with the caveat “everything else held equal”.

The saving of the million barrels would be real, but sight of it would be lost in the noise.

However high consumption is at that time, it would be ANOTHER or ADDITIONAL MILLION barrels per day HIGHER, without the hypothesized thirty million electrics in the fleet.

Hi Matt,

From

http://www.rita.dot.gov/bts/sites/rita.dot.gov.bts/files/publications/national_transportation_statistics/html/table_01_11.html

US 4 wheeled vehicles (passenger cars and other 4 wheeled vehicles(1970-2006), and long and short wheelbase light duty vehicles (2007-2013), remained relatively flat from 2006 to 2013, so the 2011 study looks to be wrong if the trend of the past 7 years continues.

We may have reached “peak 4 wheeled vehicle” in the US, if so the 39 million plugin cars replace ice vehicles. The European Union (especially the early 14 members) has also probably reached peak car. I will let someone more familiar with Eurostat dig up that data.

In addition, fuel economy in the US will move closer to European levels when fuel prices increase, so there will be a significant reduction of US oil demand from both of these trends.

This will not be enough to offset increased demand from emerging economies so oil demand will remain robust over at least the next 20 years and oil prices will be high by 2018 (back to $100/b or more). This might drive demand down a bit and speed the transition to non-oil transportation.

I believe the typical auto here in the USA is driven enough that the average gasoline consumption per car is very roughly a gallon a day, being actually around seven to eight gallons a week.

So – It would take about forty cars to save a barrel of oil per day. It would take close to three barrels of crude to make that much gasoline, but we can assume the fraction of the crude that becomes gasoline can be used for other purposes, and ignore this factor, for purposes of this discussion. Forty million pure electrics and or plug in hybrids could easily save us a million barrels a day. The savings would probably be greater, because these would be new or at least newer cars, and the newer a car is, the more heavily it is used.

Let us suppose we subsidize the construction of forty million pure electric and or plug in hybrids to the tune of 5000 bucks each. That would be about 200,000, 000,000 bucks. Real money, even by the standards of Washington politicians!

BUT – if we assume oil goes to one hundred bucks, and stays there, which seems ENTIRELY possible from my pov, a few years down the road…………. well then …….. hmmm…..

A million barrels at a hundred bucks is a hundred million dollars A DAY that would STAY HOME, rather than line the pockets of people in oil exporting countries, people who are not really and truly our friends, in most cases.

We would save a billion dollars on imported oil every ten days. This billion could stay home, providing local jobs. This thought experiment looks at first glance as if it might be a pretty good deal, taken all around.

Any reduction in the consumption of a commodity tends to force the price of that commodity DOWN. There would be a huge additional savings as the result of gasoline selling for LESS.

If oil spikes up hard and sharp, it is not unreasonable to believe that Volts, Bolts, Leafs, Tesla Threes etc will all sell like ice water in hell within the decade- assuming the batteries give service comparable to the COMBINATION of IC engines AND automatic transmissions.

There will be many other pure electric and plug in hybrid models as well, because just about every large manufacturer is committed to building electric and plug in hybrid cars. These cars will be on virtually every new car lot all over the country within the decade.

Forty million electrified cars and light trucks within fifteen years ? It could happen.

Range anxiety is something the driving public will eventually forget about. People who need long range will buy plug in hybrids, or a Tesla pure electric, or rent a conventional car for a trip, if they don’t own both an electric AND a conventional car.

Electrification of the personal auto is not going to save the life of Old Man Business As Usual, but it WILL keep him out of the cemetery for a few additional years, with a little luck.

My apologies to all for a major brain fart on my part. Looking over the article again, I realized that it said, “A fleet of this size would lower gasoline consumption by around 17.2 billion gallons a year.” I did my arithmetic without taking proper notice of that and came up with “a million plug-ins could reduce oil demand by 1.2 million barrels per day“, the error with units meaning my figure was of by a factor of 42. Now that I have realized my error, everything makes more sense and as said by OFM the average plug-in has the potential to save about a gallon a day.

According to the EIA, “Refineries in the United States produced an average of about 12 gallons of diesel fuel and 19 gallons of gasoline from one barrel (42 gallons) of crude oil in 2014.” So, it would take about 19 million plug-ins to reduce oil consumption by a million barrels per day, assuming consumption of diesel goes down by a similar amount.

I did a little extrapolation based on the worldwide growth rate between 2014 and 2015 and came up with a doubling period of 18 months so, if the fairly modest growth rate of about 4.37% per month continues, the 19 million figure should be achievable within 70 months, less than six years. So plug-in vehicles have the potential to reduce world crude oil consumption by a million barrels per day over the next six years.

I am fully aware that a black swan event could happen at any time and make that extrapolation hopelessly optimistic. On the other hand other developments could accelerate the pace of EV adoption and make the 19 million very conservative. Who knows? The thing is. as OFM points out every chance he gets, a very small oversupply of something for which no storage is available, can cause the price to fall dramatically.

“Who knows? The thing is. as OFM points out every chance he gets, a very small oversupply of something for which no storage is available, can cause the price to fall dramatically.”

Likewise, a small reduction in consumption, when supplies are tight, can prevent the price from RISING dramatically.

If fifteen or twenty years from now we are compelled to get by on domestic production, maybe supplemented by some coal to liquids, and some biofuels, forty million electric cars might keep the price of gasoline from shooting up from say six or eight bucks a gallon, to double that, by reducing consumption.

Personally I BELIEVE in peak oil, and I BELIEVE in EXPORT LAND. We may never be able to pay six or eight bucks, but otoh, maybe we WILL.

Hi OFM,

At 6 to 8 dollars per gallon we would see people move to European levels of fuel efficiency rather quickly, at 10 to 12 dollars per gallon we might see rapid adoption of EVs and plugin hybrids. The increased demand from developing economies and the eventual peak in output around 2023, is likely to result in oil prices being $150/b or more by 2025.

A price of $150/b would get us to $5/gallon (assuming no tax increase), and $200/b gets us to $6.40/gallon, assuming at $100/b the gasoline price was $4/gallon and that the non crude costs are fixed (probably not a realistic assumption). We don’t get to $9/gallon until crude oil is over $300/b (given the fixed refining, distribution, profits, and taxes assumption).