In this life nothing is certain. Therefore I am not declaring, absolutely, that we are at peak oil, only that it is a near certainty. But I am putting my reputation on the line in making the claim that the period, September 2014 through August 2015 will be the year of Peak Oil. Below are my reasons for making this claim.

First of all, Peak Oil is not a theory. The claim that Peak Oil is a theory is more than a little absurd. Fossil hydrocarbons were created from buried alga millions of years ago and they are finite in quantity. And as long as we keep extracting them in the millions of barrels per day, it is only common sense that one day we will reach a point where their extraction starts to decline. In fact most countries where oil is extracted are already in decline. So obviously if individual countries can experience peak oil then the world as a whole can also experience peak oil.

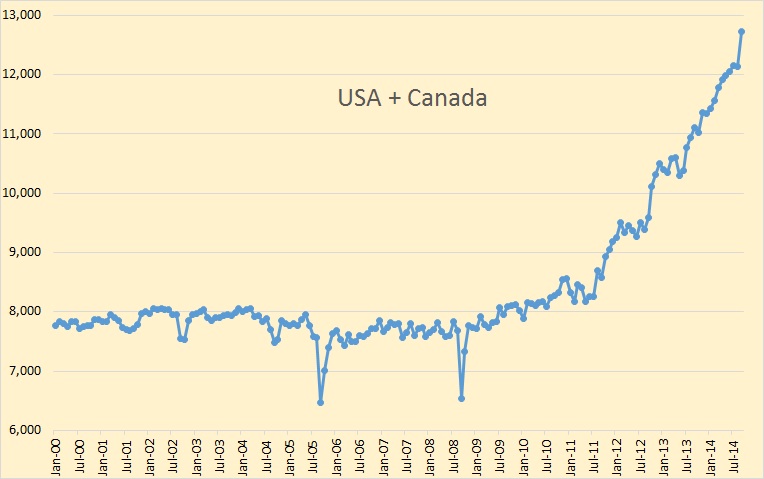

All charts below are in thousand barrels per day of Crude + Condensate with the last data point September 2014.

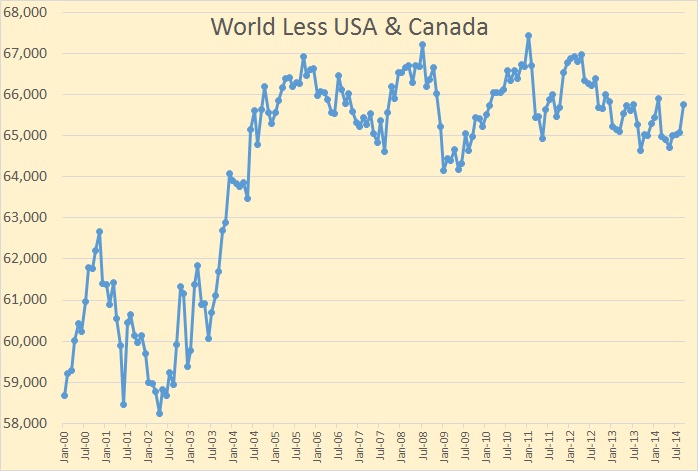

First I want to deal with the portion of the world that reached peak oil about four years ago, in January 2011. That is everywhere else in the world except the US and Canada. I am not saying that every country outside the US and Canada has reached peak oil, but combined they have reached peak oil

The world outside the United States and Canada has been on a bumpy plateau for ten years now and now, even with that last September 2014 surge, is still 1,670,000 barrels below the peak of January 2011. However only a few countries is responsible for this plateau.

The bumpy plateau actually began back in 2005 where the peak was in July. Since them, outside the USA and Canada, there have been 15 countries with production increases and 21 countries with production declines. Here is a look at the 15 winners outside the US and Canada.

Dealing with the winners one at a time:

Iraq: The EIA has data only through September but Iraq has actually increased production by about 300 kbd to December. but word is they are slightly down in January. That puts Iraq up almost 1.5 million barrels per day since they started their massive infill drilling program in 2009. Iraq still has some upside potential but their downside risk now even greater.

Russia: Russia has peaked, even according to Russian analyst. They will decline only slightly in 2015 but their decline will accelerate after that.

Brazil: Brazil has some upside potential and a lot of downside potential. The finances of Petrobras are a damn mess. Moody’s has downgraded them to Baa3, just one notch above junk status and further downgrades is expected soon. To increase their pre-salt production much more will require a lot more borrowed money. That is not very likely.

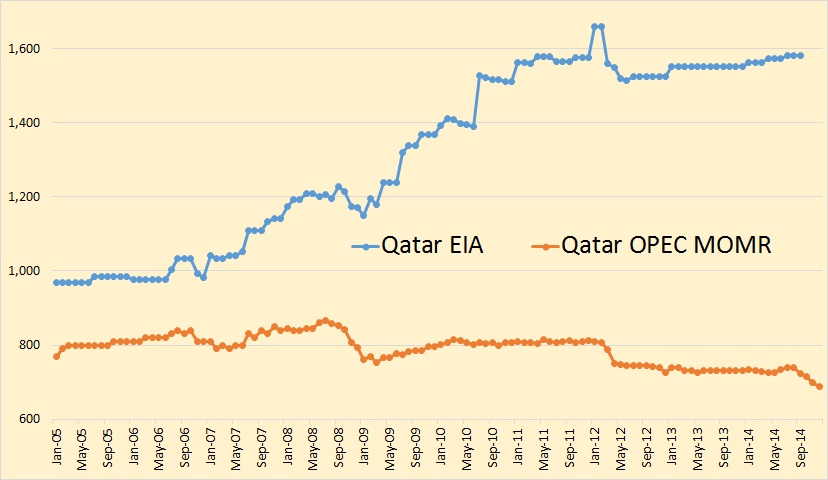

Qatar: The EIA says Qatar C+C production increased by 598,000 barrels per day between July 2005 and September 2014. The OPEC Monthly Oil Market Report says their crude only production declined by 78,000 barrels per day during that time span. The chart above was made with EIA data which counts condensate as oil. OPEC reports only crude. On the char below the EIA data is through September, the OPEC data is through December 2014.

The EIA says Qatar has increased condensate production from her massive natural gas fields. Qatar crude oil production is in decline and has been since 2008. Qatar crude will continue to decline and their condensate is likely at a peak also.

Angola: Angola peaked in 2009 and 2010 and is now in decline. However some of the decline is caused by political problems. Those problems will likely get worse.

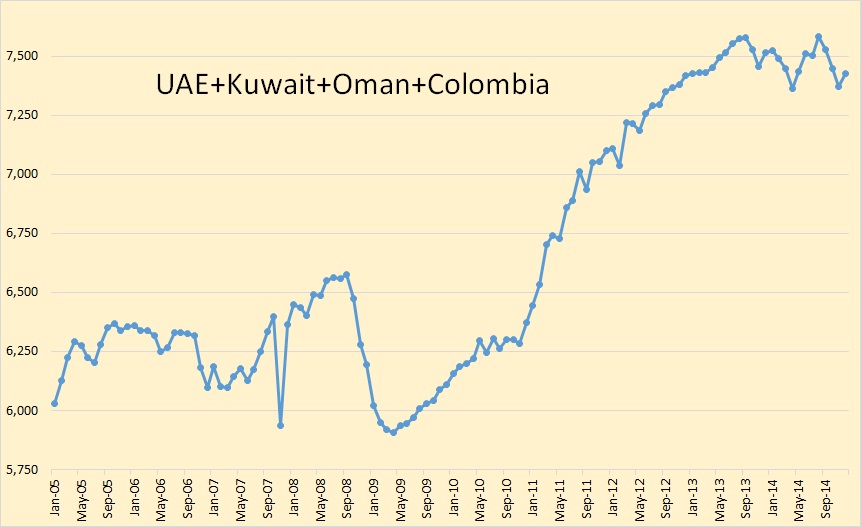

Colombia: Colombia’s production has doubled in the last 8 years but they reached their peak in 2013 and have held almost flat for the last two years. Colombia has peaked and will decline, though that decline will likely be very slow. I have included Colombia in the chart below that shows four countries that have recently peaked.

Kazakhstan: Kazakhstan is at peak of currently producing fields. Production will likely decline until Kashagan comes on line sometime in 2017. This field that once promised to produce over a million barrels per day is now expected to barely produce 300,000 barrels per day… if it ever manages to come on line. But nothing spectacular is expected out of Kazakhstan, especially since its old fields are expected to start to decline soon.

China: China peaked in 2010 and has held pretty well steady since then. I expect China will start to decline soon.

Azerbaijan: Azerbaijan peaked in 2010 and has been in steady decline since.

UAE, Oman and Kuwait: All three of these Middle East countries have implemented massive infill drilling programs in the last decade or so. But all three have now peaked. These three nations, along with Colombia, show a beautiful increase in production then a rounding peak at the top.

These four countries are responsible for 1.5 million barrels per day of the increase since 2005. They have all four now peaked, or at least very near their peak.

Saudi Arabia: Saudi has brought their last mothballed field on line, Manifa. Now they have none. Saudi is producing flat out. They might, with great effort, produce a few more barrels per day, but basically they are at peak right now.

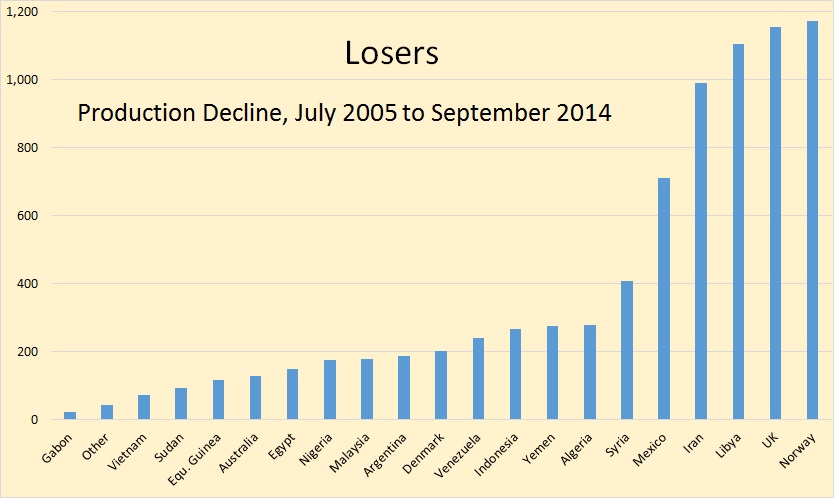

And a look at the 21 losers.

I have changed the negative numbers to absolute numbers in order to make it easier to read. But basically these are the nations that have peaked and are now in decline. A couple, Iran and Libya, because of political problems, have declined a lot more than they would have without that conflict. However neither is likely to recover very soon. And even when they do, it will be to a point lower than they were before their problems. Syria and Sudan, including South Sudan, and Yemen are others that will not recover in this decade, or until long after we are on the down-slope of peak oil.

That brings to the US and Canada.

The USA and Canada are responsible for about 120% of the increase in world oil production since 2005, even though they did not begin their grand ascent until 2009. Canada’s over 400,000 bpd increase in September is responsible for that last spike upward. But can this continue?

In a word… no. The gain has been almost all LTO and oil sands. And low prices are killing both. If prices stay low both Canada and the USA will begin to decline by the second half of this year. But even if prices return to the $70 ti $80 range, (it is not likely they are going higher than that), their production will still not increase fast enough to offset the decline in the rest of the world.

But what about those massive reserves still in the ground? Many say we have not yet produced half the URR, the Ultimate Recoverable reserves, and until we are at least that half way point, we cannot be at peak oil. Well, there are a few really serious problems with that logic. First, what is meant by the word “recoverable”? And at what price? Let’s look at really important chart.

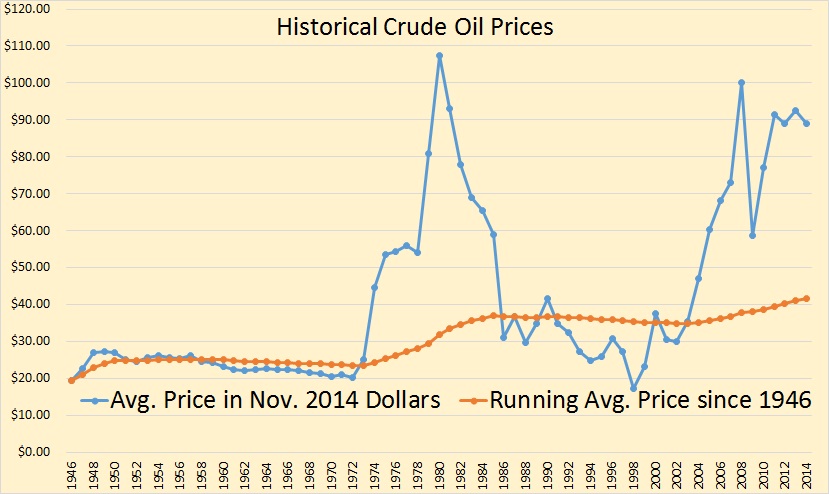

The 2014 data point on the chart below is the average January through November.

Here is a chart of Historical Crude Oil Prices. The average price, the blue line, is the average price of oil for that year. The orange line is the average price from 1946 to any point on that line. For instance the average price of oil for the 34 years from 1946 through 1973 was $23.68. And that in today’s dollars. From 1946 through 1973 oil companies were getting an average of $23.68 a barrel for their oil, and they were making a pile of money at that price. Today, the price is more than twice that amount, and many of them are losing a pile of money.

So let’s get back to reserves. The reserves produced in 1973 and prior years was very profitable at less than $24 a barrel. Then all hell broke loose in the Middle East and prices skyrocketed. Then for the next dozen years oil companies made windfall profits. But in 1986 oil prices came down to normal. Between 1986 and 2002 oil prices averaged $30.42 a barrel. (Not shown on the chart.) Even at that price oil companies still made huge profits. But today they are losing money at $50 a barrel.

The problem is with those “reserves”. Today’s reserves are just not the same as those earlier reserves. All the good cheap stuff has already been sucked up. We are now left with dredges at the bottom of the barrel. All today’s new oil is harder to find, depletes a whole lot faster, and cost many times as much to produce. None of the cheap stuff is left except in a few old super giant fields that are undergoing infill drilling like there is no tomorrow.

Once again, we are at peak oil right now. The peak will straddle the 2014 and 2015 time line. 2016 will be the first full post peak calendar year. It really doesn’t matter how many barrels of oil is left in the ground. The point is we will never again pull it out of the ground at the same rate we are pulling it out right now.

_______________________________________

I usually have a new post every three or four days though that may vary. If you would like to receive an email notice when I have a new post please email me at DarwinianOne@gmail.com

I wouldn’t bet so hard on a peak just yet. Assuming oil (C&C) production will start declining by mid to late 2015 is reasonable. But this decline will trigger renewed activity. The low interest loans to usa independents will bear a higher interest, the drlling and completion costs will be slightly lower. The sum of these effects should be a much lower decline, or even an increase in production.

So the key is price expectations, and the response time. And this is really hard to model. As you know, I already bet that oil prices will rebound. This implies tight supply, which leads to more investment. I’m not sure we can be sure such investment won’t allow production to increase slightly.

Stepping out of the real crude oil realm, If prices rise beyond $100 per barrel, I also expect the biofuels industry to go bananas increasing production. And refineries will shift to making more light products, swelling the “refinery gain” (this is the reason why I had asked how you planned to handle refinery gain, I think there’s a slight potential to increase yields by adding hydrogen).

I think the problem with that analysis is that North American production has to increase more than slightly to off-set declines elsewhere. It is pretty tough to see enough increases in North America, if they happen to offset production declines in the rest of the world anymore.

You are assuming the sum total of all nations other than Canada and the USA can’t hold production flat. That’s the big unknown, I suppose.

Recall that I also mentioned refinery gains and biofuels? If these take up the slack then we have reached peak crude and condensate for sure.

I guess the big question is whether oil companies anticipate what Ron predicts. If they do we should see a fairly steady deep water drilling pace.

One other comment: the typical reaction by companies in dire straits (such as Petrobras) is to give up shares in their projects. Sometimes they also give up operatorship. I wouldn’t expect the Brazilians to sit still and wait for lawsuits to unfold. They will react. And I expect this will lead to really large companies with quality technical capability, cash flow, and credit to step in. I wouldn’t be surprised to see something big happen in Brazil.

Well the internets have been around long enough now that we all remember the posts at TOD about how we are now at peak oil. No one was talking than about a few states and a shale play that would produce 4 million additional barrels a day.

“The problem is with those “reserves”. Today’s reserves are just not the same as those earlier reserves. All the good cheap stuff has already been sucked up. We are now left with dredges at the bottom of the barrel.”

Ron, you sound like Gail Tvarberg on a bad day. Very short sighted and the prospective of time of a teen age boy finding is manhood his first time.

I’m with Fernando and think your premature gett’en your peak on .

I recall several predictions from TOD that claimed oil production would go up so long as price could go up.

It seems that is exactly how it played out.

So if we’re not at peak now then oil prices must be headed north here pretty quickly. How do you suppose that will happen, and when?

“You are assuming the sum total of all nations other than Canada and the USA can’t hold production flat. That’s the big unknown, I suppose.”

That is a known. If the rest of the world could keep production flat we would have seen it happen while oil prices were sitting comfortably at $100 per barrel.

If high prices didn’t get the oil out of the rest of the world then how do you expect low prices to do it?

You are assuming the sum total of all nations other than Canada and the USA can’t hold production flat. That’s the big unknown, I suppose.

Universe, you are correct. The sum to total of all other nations other than Canada and the USA have not held production flat. It is no great assumption to assume that this trend will continue.

Thanks!

I greatly appreciate your work on this issue. Resource depletion is even more misunderstood than climate science and your work does a good job of trying to correct that.

Timing. Projects take time to engineer and execute. The high price environment kicked in around 2007, there was a hiccup in 2008, then it regained ground. Oil companies don’t usually change their internal price forecasts to a high side unless they are really convinced it’s going to last.

I have seen this lag really mess with projects. But let’s face it, I don’t get an insight on how many projects were launched in 2009 through 2014 and are just now getting ready to start production.

The question always comes down to expectations. Keep an eye on large solid companies to see how many people they layoff. That should be an indicator.

I would hope that the U.S. drillers have learned their lesson and suck on the straw a little slower and enjoy the associated higher prices longer.

I recall a phrase in “Blade Runner” along the lines of “The brighter it burns, the shorter it lives”.

Actual quote

Tyrell: The light that burns twice as bright burns half as long – and you have burned so very, very brightly, Roy.

My candle burns at both ends

It will not last the night.

But oh my friends and ah my foes

It gives a lovely light.

I wouldn’t bet so hard on a peak just yet.

Yeah, but this is not your bet, it’s mine.

The biggest threat to your whole theory is a black swan event. The most probable cause of this is technology. I know of 2 techs being tested that have the ability to render the whole production curve as we know it wrong.

Just like a prediction of peak oil was valid right up until horizontal drilling took off.

Nick Hail, What are the two techs?

Cannot say as it is in testing. May or may not prove out but if it does it’s gonna be ugly for non US companies.

Why ugly for non US companies? For example, is this newfangled technology forbidden to Total, ENI or BHP?

Beyond legitimate use by western companies any new tech will also be used by Russian and Chinese companies probably without even bothering with asking for a license.

So, you are arguing that the finite sum of the output from high decline rate tight/shale oil wells will show a perpetual rate of increase in production?

Horizontal drilling just didn’t take off, it has been around for decades. Saudi Arabia started horizontal drilling as infill drilling projects well over a decade ago.

What took off was the fracking of source rock. That is source rock that was so tight that the oil could not escape. Fracking source rock is very expensive and the production from tight source rock declines extremely fast. In other words, it is scraping the bottom of the barrel.

Oh, and fracking was not a black swan event, it was a price event. The price of oil rose high enough to make tight oil fracking economical.

Ron,

Black Swan Events are likely to help than hurt your cause. I see the likelihood of countries like Venezuela and Russia declining by 4-8% plus as very high considering that they have NO money to drill.

I am not sure about Venezuela, but as regards Russia, it seems that you are only reading Westerm mainstream media, and do not know nothing about the Russian oil industry.

“do not know nothing about the Russian oil industry.”

So I DO know something?

Look at the investments made in the last 3 years to achieve the growth they did.

Calculate the amount of Inflation adjusted roubles at current price.

Subtract amount to pay debt in USD coming due

See how much is left.

Extrapolate decline based on how much is spent.

Not too complicated.

Each year since mid-2000s I’ve seen forecasts that Russian oil production is about to decline. I’m not saying that it will continue to increase at tyhe current oil price levels, but a decline of 4-8% p.a. is absolutely out of reality.

Read, for example, this article to understand why:

Goldman Sachs Busts Myth Of Impending Russian Oil Collapse

By ZeroHedge

Posted on Tue, 27 January 2015

http://oilprice.com/Energy/Crude-Oil/Goldman-Sachs-Busts-Myth-Of-Impending-Russian-Oil-Collapse.html

Two Russian, state sponsored, think tanks predicts Russia oil peak by 2016.

GLOBAL AND RUSSIAN ENERGY OUTLOOK TO 2040

Or read My Blog on the subject.

Sorry, posted the wrong link. This one is to my Russian blog.

Like BP, OPEC, the EIA and the IEA Russia also publishes an annual energy outlook. It is called the Global and Russian Energy Outlook to 2040. It is published by The Energy Research Institute of The Russian Academy of Sciences and The Analytical Center for The Government of The Russian Federation. I have no idea who these guys are but their titles sound impressive and they seem to be Russian think tanks funded by the Russian Government. But that is just an assumption of mine.

It is a very large 175 page PDF file that appears to be very scholarly and well researched. However they appear to be very optimistic in their prediction of the future oil supply out to 2040. In one scenario they are not optimistic at all for coal production however.

Great article Alex. Thanks for sharing.

I think one point here that Goldmann Missed is that Inflation is over 30% in Russia. They are delusional if they think finding costs in Roubles will remain static.

Huckleberry Finn,

CPI (consumer price) inflation in Russia has risen above 11% in Dec14 and Jan 2015, but is likely to moderate by the end of the year.

PPI (producer price) inflation if much lower (5.9% as of Dec 2014).

(Official data from Goskomstat).

Oil services costs may have risen slightly in ruble terms, but they are certainly sharply down in dollar terms due to the ruble devaluation. Meanwhile, the large part of the revenue base is dollar-denominated. Coupled with the Russian oil tax system this supports company margins and cashflows.

The article below is not about Russian oil companies. But it mentions two of them as having the best Free-cash-flow yield among global oil producers:

“Free-cash-flow yield, a measure of how much cash from operations a business generates relative to its share price, is another way to compare producers, Hubbard said. By that measure, Woodside and ONGC rank behind only OAO Rosneft, Valero Energy Corp. and OAO Tatneft.”

http://www.bloomberg.com/news/2015-01-19/woodside-ongc-among-world-s-best-protected-from-oil-s-plunge.html

Hey AlexS,

Do you have any idea/guess what would be price to income ratio of real estate in the second/third tier cities in Russia?

Ves,

Sorry, I don’t have this data

I never said fracking was the black swan event. You implied that all by yourself.

Oil taxes Russia:

“Oh, and fracking was not a black swan event, it was a price event. The price of oil rose high enough to make tight oil fracking economical.”

And cheap and easy credit to finance it. If interest rates were normal (ie 5%) it would not have been as easy for frack drillers to obtain the capital they needed. The costs to drill would have been higher if the borrowing costs were higher. Most of the frack drillers are deep in debt, and borrowed almost every penny needed to fund drilling operations.

Even if oil prices move back up, frack drillers will also need low borrowing costs to continue to drill.

You know, lending at 5 % may be justifiable if the entity receiving the loan is locked to say 50 % equity (the hurdle discount rate for this type of investment could be as low as 10 %). You guys seem to know quite a bit about finances. I wonder what such a deal would look like to a lender who also asks for 70 % of the first year’s oil production to be covered in the futures market?

I haven’t run the numbers, but it seems to me such lending could make sense. What do you guys think?

Just look at the way the Linn deal was structured with DrillCo. They’re getting a far cry more than one year’s coverage in the futures market.

The points you folks make regarding LTO extraction, profitability or lack thereof, capital structure, recoverable reserves etc. are fundamentally distorted by the generality of your assumptions regarding the business model. Unconventional reservoirs have no more heterogeneity than the operators who currently control them. In other words, not all companies are created equal. It’s true in all other sectors of the economy, certainly no different here. To say the shale “revolution” is only made possible by cheap credit is just stupid. Oil and gas bidness is the most capital intensive business outside of space exploration- so ,of course, access to capital is critical for innovations in production to occur. Incentives for investment in energy have always existed in one form or another. Commodity prices, in this case, were the catalyst for the initial development of shale fields and infrastructure. High prices will not be as necessary going forward. The operators who secured the commercial acreage are not relying as heavily on high-yield financing as are the small fries who came to the party late. Economies of scale make LTO work and unfortunately the access to cheap credit and high commodity prices let a bunch of diluted, second rate operators in the marginal areas of the plays. These guys will be wiped out by the credit crunch and lack of overall commerciality of there positions. Who gives a shit. This is the nature of the beast. If anything, it did the EOG’s of the world a favor by delineating the economic windows of the play. Most of this was done during times of unusually high prices so the in-ground assets of the failed operators are probably close to neutral in terms of NPV (if you factor in some salvage value). The chain of M&A’s will be kicking off soon and the rest of the commercial acreage will be absorbed by those with the lowest cost structure and ability to continue without being levered up out the eyeballs. Public companies will use a mix of equity, debt, and free cash flow to develop their leasehold at a reasonable pace and will earn an adequate (not huge) return. In the interim, service companies will capitulate and overall prices will moderate. The real unknown lies in the performance of in-fill wells and the ability to successfully down-space. IMO, no conclusive data is being presented in the major plays to make the case one way or the other. The long-term profit driver for these companies is the ability to manufacture repeatability at minimum spacing after the infrastructure build out and common lease facilities have been largely paid off. In the grand scheme, US shale reserves are small potatoes. The chicken littles screaming the I told you so’s about the shale biz aren’t saying much. It is what it is. It will work as a moderately profitable model for a decent period of time for SOME and others it won’t. It will not make the US energy independent and it won’t change the world. It’s not a black swan or a revolution or anything that dramatic really. It’s a nice tale of dedication, perseverance and American ingenuity but its net neutral at best in terms of economic plus or minus.

Ryan, please learn how to use paragraph brakes. Your post is very hard to read without them. And indicate who you are replying to?

To say the shale “revolution” is only made possible by cheap credit is just stupid.

Who wrote that? I did not. However I would not argue with that logic. A lot of small drillers would not be in business without the money from low yield junk bonds. Now junk bonds are yielding a lot more, it will be a lot harder for them to borrow money.

US shale reserves are small potatoes.

I don’t know about reserves but US shale production is definitely not small potatoes, it is the one thing that has kept the world from hitting peak oil way back in 2005 or 2006.

Ron,

Apologies. And thanks for the advice on forum etiquette. Paragraph breaks dually noted!

My response was supposed to be directed at this post by Northwest resident which was a carry-over argument from a post SRSrocco made. I am new to this forum and am having trouble following the spider web of comments which seems to pile up at a precipitous rate.

“We couldn’t afford it. It was a “boom” charged to credit with no way to repay. It was like somebody who knows he’s going to file for bankruptcy anyway, so why not go out and max the credit cards before filing. If you ask me, the whole shale revolution was an engineered event to buy a little more time, to throw one last really wild party before the lights go out. Now here we are, no more credit, buried in debt, and no more time. Lights out!”

Anyway, my point is that most successful LTO producers are major, public companies who do not rely solely on bonds to finance their drilling efforts. I can’t cite credit ratings for individual entities but I doubt most of them are junk status. The high yield financing is more symptom than cause. Like any market segment, you have winners and losers. Most drillers who relied on high yield debt to finance operations were late establishing positions in commercial areas of the plays which has been and will continue to be the only way to earn a decent ROI and ROE in the unconventional realm. The others simply did it because it could be done and people would lend them the money to do it. Because shale is somehow viewed as a revolution or phenomena, we tend to extrapolate the notion that it is either a success or an abject failure. The correct conceptualization is more akin to conventional production in that capital investment may work for one company and not for another depending on the result of operations. The only difference is conventional development is mainly subject to geological risk and unconventional subject to economic risk. In this sense, there is very little significance to North American LTO production outside of the confluence of factors that allowed for many incapable and unsustainable entrants to the plays which ,in turn, caused a significant production spike from the US. On a go forward basis, high commodity prices ($85-$100+) are not necessary for good operators to succeed.

“I don’t know about reserves but US shale production is definitely not small potatoes”

The “sweet spots” in the two major plays (Bakken & EF) are limited in scope. The Permian still has questions surrounding economic recovery rates and thus proven reserves. Given decline rates and the correlation between commodity prices and CAPEX, US proven reserves are very small in comparison to SA, Venezuela and other low cost, high reserve countries. Correct me if wrong, but I believe EIA estimates US proven reserves around 40 billion. IEA estimates put SA and Vend at nearly 200 billion MORE THAN US! When you put it in perspective, there is nothing all that significant about US unconventional production aside from how quickly it ramped up. We should stop viewing it in the light that its some exceptional, world-altering discovery. It’s more comparable to tech companies in the late 90’s. A bunch sprung up. A bunch failed. The good ones consolidated and are still around today. The major difference being that eventually commercial shale fields will deplete and the companies still standing will have to look elsewhere.

Most of Venezuela’s oil resource is in the Orinoco oil belt. That oil is similar to Alberta’s “bitumen”, but it has a lower viscosity. Under current circumstances a lot of those booked reserves can’t be produced. And even if one tries to move ahead it would take years to turn things around.

The way I see it they got the brazilian fields, ITT in Ecuador, Vaca Muerta in Argentina. I can think of a few other places, but the other reserves they have will require lots, lots of wells. It’s going to get busy in a couple of years.

Unless the technology they have created can produce oil over an extended period of time at an affordable price, then it probably isn’t going to change anything.

Nick Hail > The biggest threat to your whole theory is a black swan event. The most probable cause of this is technology. I know of 2 techs being tested that have the ability to render the whole production curve as we know it wrong.

“Sustainable Energy – without the hot air”

http://www.withouthotair.com/Videos.html

I linked this post at Judy Curry’s “week in review”. I think you’ll have some new visitors.

Ron, excellent presentation. I believe you are correct in calling peak oil in the near future. The fact that the Saudis are investing billions for fracking their shale oil deposits is an indicator that even they see the end of their enhanced oil recovery in historical fields

But just to play devil’s advocate, I do not see a huge plunge in oil production worldwide. As it starts to fall, the Russians, Chinese and Saudis will push shale oil production. This will slow the fall in production and might even cause a second hump or plateau. Further development of North American shale and tar sands as well as some EOR will ease the drop on this side of the world.

As price rises, exploration will increase and some new finds will come on line.

All in all though, this does look like the top. One does have to be wary of new “accounting” methods for oil that might make things look better than they are.

We can always hope the new method for low temperature conversion of CO2 to methanol comes out of hiding again. That and some other methods will ease the change. It will be quite interesting to see the response when oil descent becomes obvious.

Storage solutions:

http://www.vtnews.vt.edu/articles/2013/04/040413-cals-hydrogen.html

http://www.technologyreview.com/view/512996/a-cheaper-way-to-make-hydrogen-from-water/

http://cleantechnica.com/2015/01/31/citigroup-predicts-battery-storage-will-hasten-demise-fossil-fuels/

Fern Wrote:

“This implies tight supply, which leads to more investment…Stepping out of the real crude oil realm, If prices rise beyond $100 per barrel, I also expect the biofuels industry to go bananas increasing production. ”

Its very likely that this dip in price, even if short lived will have a more lasting effect on CapEx spending. Investors and Oil majors will be reluctant to jump back in with both feet, fearing another price collapse. It very unlikely the global economy can sustain $100 oil. As prices creep up, consumers will cut consumption causing demand destruction. This cycle will repeat until the economy finally collapses or World War 3 breaks out. The primary reason why oil prices have fall is because demand has fallen. It appears to me that the massive amount of Central banking has been able to prop up the global economy. The first round of QE implemented ZIRP (Zero Interest Rate Policy) has come to its conclusion. To keep the economy afloat, Central banks will need to implement NIRP (Negative Interest Rate Policy). However I don’t expect NIRP to last as long as ZIRP, and there once NIRP is done, there is not else left to prop up the global economy. ZIRP and NIRP are the equivent of eat ones seed corn. Once all of the capital savings are gone the economy will die. ZIRP was an attempt to get savings spent to keep the economy running. NIRP is designed to force the reaming capital to be spend (either spend it or lose it).

Biofuels are not an energy source, and need other energy resources for the conversion. Plants require petrochemicals for productive yields. It takes energy to harvest and process the crop and even more energy to convert it into a usable fuel. The cost of biofuels is considerably more expensive than fossil fuels.

The beauty of fossil fuels is that they all originate under-ground and allowing the surface of the planet to be utilized for other uses. For instance. land can be used to raise crops for human and animal consumption, and grow trees for lumber. With the exception of fracking, Water is not required to extract and process fossil fuels. If the economy was to switch to biofuels. Land, water and other resources must be diverted from other productivity (ie growing food) to fuel production. Large scale biofuel production to preserve BAU is walking dead man. Biofuels are also a disaster for the environment as it cases massive deforestation and farmers cut down forests to make room for biofuel crops. The World needs more trees since the are a natural carbon sink and also absorb air and water pollution. Trees are nature’s all purpose cleaning system.

In conclusion. Not only have we reached Peak Oil, Peak Energy Extraction, we also reached Peak CapEx for Energy resources.

Once all of the capital savings are gone the economy will die. ZIRP was an attempt to get savings spent to keep the economy running. NIRP is designed to force the reaming capital to be spend (either spend it or lose it).

I think another issue we have to deal with is that even if oil were cheap and plentiful, these financial tricks haven’t encouraged the rich to invest that money in activities that benefit the middle and lower classes.

So even if we had cheap plentiful oil, if most of the world’s population has little money to spend on it, then demand goes down.

There’s enough income inequality that I don’t think cheap oil alone can drive economic growth these days. If you want to pay the poor to buy the cheap oil, then you can keep things running. But if they have no money to buy, then it doesn’t matter how cheap it gets.

Or you could pay the oil producers to generate cheap oil and then they can give it away. However, in order to pay those producers, the governments either have charge the rich more taxes, or the governments have to create more debt.

So we have a combination of economic and resource problems.

The point about the underground source of fossil fuels is beautiful. I’ve been looking at this problem (peak whatever) for over a decade and did not encounter it. A simple mental construct that should immediately impress upon a reader the unlikelihood of using alternate sources to completely replace fossil fuels.

Thanks.

Stu, I guess the idea is fairly simple: fossil fuels do run out, as they do we must have replacements, if replacements don’t compete on price with fossil fuels the cost of energy increases, this leads to either population reductions and/or a less energy intensive lifestyle.

My concern arises because I read unrealistic assessments about renewables, way too optimistic and utopian.

I also see the USA president is being advised by people who advocated de-development 40 years ago. De-development can be a Troyan Horse used by communists who realize their system leads to poverty. This introduces a political factor into the equation I don’t like at all. After seeing what communism does close up I’d rather be dead than red.

“After seeing what communism does close up I’d rather be dead than red.”

Given that communism has never been implemented (not even by so-called “communist” regimes), I do wonder how you managed to see it.

Yes, that is my thought, too. I don’t know any “communists” other than a few hippies who used to live on communes.

Call them what you please but the people who controlled Russia and the twentieth century Russian empire called themselves communists.

And while they were not quite as evil and bad as bad as Hitler they certainly gave him a run for the money when it comes to being bad characters.

And Chairman Mao called himself a commie too. He isn’t usually mentioned in the same breath with Jesus or Gandhi or other famous good guys.

One reason I will never think of myself as a liberal is that back when I was at university in the dark ages the liberal establishment had its head out of sight up Soviet Russia’s ass. This was such an obvious crock of shit that I just about puked for many years even thinking about it..

We were supposedly the bad guys but just about anybody could come to or leave the US back in those days. The lefties who controlled the intellectual debate on American campuses were for some reason unable to acknowledge the existence of the Iron Curtain.

There have been religious fundamentalists that would never call themselves communists but who have been known to rape, kill, and oppress. So I don’t think economic labels tell us much. There are evil people who may call themselves whatever they want, but what they have in common is the willingness to use power to serve their ends.

I think any of the “it’s a communist conspiracy” comments in this forum tell us nothing. As I have said before, they might as well say it is Satan who is doing this.

We’ve got people saying the “communists” are behind the bike riding movement: Bike paths are a plot to take away our cars.

Of course, roof top solar must be a communist plot to lessen the influence of utilities. It is more American to give your money to oil companies, coal companies, and electric power plants than to have roof top solar. Yeah, right.

It is certain that roses no matter the name smell the same.

I agree that labels are of limited use but where would we be without them?

People who think of renewable energy and especially user owned renewable energy as a commie plot are just reflexively shooting off their partisan mouths.

People of that sort are too ignorant to talk to as a general rule but some of them have brains. The ones with brains are just cynically manipulating public opinion in favor of their own political faction to the extent they can.

Brings to mind the last sentences of a well-known book…

“Twelve voices were shouting in anger, and they were all alike. No question, now, what had happened to the faces of the pigs. The creatures outside looked from pig to man, and from man to pig, and from pig to man again; but already it was impossible to say which was which.”

FWIW: The concept of Communist (or Marxism). Is completely flawed. In human nature, no body is going to work there butt off if they can’t keep the fruits of their labor. Venezuela is a classic example of the failure of Communism. When production is taken away from the producers to share with the poor, the producers simply stop working and the whole system collapses. Why should I work my Butt off, if I get nothing out of it? why work hard when you can do nothing and someone else will provide for me?

The majority of people believe that capitalism is evil, and don’t even understand it. No where in the world at this time is there pure capitalism. Its all manipulated by the politicians that have set up a system of deep inequality. Its the manipulated system that causes deep inequality and politicians use propaganda to blame capitalism for inequality.

Karl Marx was a horrible, horrible person, and in no circumstance should he be a role model for human society and development. Karl was clearly mentally disturbed.

https://www.youtube.com/watch?v=yA2lCBJu2Gg

No where in the world at this time is there pure capitalism. Its all manipulated by the politicians that have set up a system of deep inequality. Its the manipulated system that causes deep inequality and politicians use propaganda to blame capitalism for inequality.

Karl Marx was a horrible, horrible person, and in no circumstance should he be a role model for human society and development. Karl was clearly mentally disturbed.

And nowhere in the world is there pure communism.

What we do see is a power grab by people at the top, no matter what they system. Pointing to “communists” as the problem isn’t helpful because there are no “communists” in power in any country. There may be dictators and there may be a power elite, but they aren’t “communists.”

What about socialists that are just commie light for people like Marx. It’s a stepping stone. To the Utopia that ends up killing millions.

What about socialists that are just commie light for people like Marx. It’s a stepping stone. To the Utopia that ends up killing millions.

Oh, God, please. Can we hit the delete button?

What about farm co-ops? Are they commie fronts?

What about babysitting co-ops? Are they commie fronts?

Are homeowners associations commie fronts?

People form groups and share ownership all the time. Is that commie light?

I suppose the sharing movement, where people rent cars, tools, bicycles, and such, rather than own them is the first step toward the slippery slope of sharing ownership.

not to mention the impurification of our precious bodily fluids

Alexis Tsipras is a communist. Nicolas Maduro is a communist.

The Chinese Communist Party is run by people who were raised in a communist dictatorship but realized communism sucks. They want to keep the repressive machine alive but are tuning to a dirigiste form of fascism.

The same applies to the Cuban dictatorship, which has a very strong personality worship culture tied to a very repressive regime. In their case, they hope, with Obama’s and corporate interests, to morph into a fascist regime, with emphasis on links with foreign multinationals which use Cuban slave labour.

Don’t forget I was trained in Cuba as an “internationalist”. This means I know communist dogma, methods, and practices. And I also know they are quite willing to murder and commit terrorism to achieve their ends.

So when you deal with me you do have a problem. I have lived inside the monster, and I know its entrails. And I know you are a naive follower of a system you really know nothing about.

And I know you are a naive follower of a system you really know nothing about.

And what system am I a follower of?

It appears your training has made you very dogmatic in some areas. Whenever we get on certain topics (e.g., alternative energy), you shoot them down. You see plots where there aren’t plots. Maybe because of your background you don’t realize, for example, that there are private property owners in Nebraska who don’t want a pipeline across their land. They aren’t funded by Venezuelans. These are people who have owned the land for generations. PRIVATE PROPERTY. They don’t want a Canadian company to come in and legally force them to allow a pipeline (which may leak) across their land.

The landowners aren’t funded by the venezuelan dictatorship. But the other hangers on sure are. Look, it’s fairly easy to track the relationships. Just this morning I read a very reliable source naming names and discussing cash flowing from Venezuela’s dictatorship to Tsipras. I sure wish you guys could speak Spanish to listen to material like this

http://dieta-politica-religion.blogspot.com.es/2015/02/pte-de-la-asamblea-nacional-de.html

But if you don’t understand why the landowners are fighting the pipeline, then you don’t understand the issues on the ground. There have been enough pipeline accidents that farmers and ranchers don’t want the possibility of oil leaking on their property. And they definitely don’t want a foreign company to use US laws to FORCE them to have pipelines on their property.

The idea That this is a farmer movimiento is bogus. Its driven by watermelon politics and financed by the venezuelan dictatorship because it wants to avoid competition to the oil it ships by tanker.

Fernando, you should like these people know where they can get some of that venezualan cash

http://boldnebraska.org/about/

Fernando-The Ted Cruz campaign has hereby requested you personally. Pleaase pack your bags and leave this evening. Amen!

Who is Ted Cruz?

TechGuy have you frequented an US school, maybe in the Deep South?

Boomer II, the farmers’ coops, babysitter/homeowner coops can and do show the strength of collective efforts. They are voluntary.

Involuntary collective action, entailing necessaties such as food, have had horrific historic consequences … as the millions of dead Ukrainians from the 1930’s can attest.

So, how is it that allowing people to own/lease roof top solar is “communist” but forcing them to get their power from a monopolistic utility isn’t?

“TechGuy have you frequented an US school, maybe in the Deep South?”

No, unfortunately, the exact opposite. Fortunately, I avoid taking the socialism pill and developed critical thinking to cut through all of the propaganda and BS.

“FWIW: The concept of Communist (or Marxism). Is completely flawed. In human nature, no body is going to work there butt off if they can’t keep the fruits of their labor. Venezuela is a classic example of the failure of Communism. When production is taken away from the producers to share with the poor, the producers simply stop working and the whole system collapses. Why should I work my Butt off, if I get nothing out of it? why work hard when you can do nothing and someone else will provide for me? ”

——-

Yes of course

Main.

in order to all work.

and to

factory owner

shared money

with society

it does not matter as it will be called

though communism

“When production is taken away from the producers to share with the poor”

So the “poor” are not producers? And “producers” are only the top 1% or 5%?

Before you criticize Marxism, if would be helpful if you know about what Marxism is about.

“So the “poor” are not producers? And “producers” are only the top 1% or 5%?’

Perhaps I should have used “non-productive portion of the population”. There are indeed some poor people that are hardworking, in most causes their efforts eventually remove them from poverty. Lots of people are stay poor because they don’t want to work or are manipulated to believe they can’t get out.

On the other extreme, there are people in top 5% that manipulate the system and built their “empire” on the backs of the productive workers and preying on the poor. These are generally, but not limited politicians that obtain power and use it to enrich themselves. There are extremes on both ends of the spectrum.

Handing out money blindly to the poor never works. I rather see resources be directed to making the poor productive, whether through education, and motivation that gets then interested in doing some productive. Creating a generation of people utterly depend on gov’t handouts is self-destructive and creates feedback loops. The politicians that promise the most handouts always win elections. The US has followed a path of wealthfare for 50 years, since then, poverty has increased substantially. We now have multigenerations of broken families (single mother families) that survive on wealthfare. Its become the so ingrained in their lives that its become a prison from which they are unable to escape. I am deeply sadden that these people are trapped in a system of dependency that is designed to prevent them from ever escaping.

Creating a generation of people utterly depend on gov’t handouts is self-destructive and creates feedback loops. The politicians that promise the most handouts always win elections. The US has followed a path of wealthfare for 50 years, since then, poverty has increased substantially. We now have multigenerations of broken families (single mother families) that survive on wealthfare. Its become the so ingrained in their lives that its become a prison from which they are unable to escape. I am deeply sadden that these people are trapped in a system of dependency that is designed to prevent them from ever escaping.

Politicians aren’t really going to cut government spending. There are a lot of people depending on Social Security, Medicare, military jobs and retirement, and so on. If the government stopped all its payments to people, the US economy would collapse. I doubt you’ll see it happen.

A lot of people don’t realize that the conservative states are the most dependent on Federal money. They tend to be the states that pay less in taxes to the Federal government than they get back in government money. So the ones where people most bitch about Federal handouts are often the ones benefiting most from them.

You can see a map of states that get a higher percentage of money here:

Boomer II, I don’t see any map.

Did the link to the article not work? Here is a link to the map image.

http://voices.washingtonpost.com/ezra-klein/mapstatestaxes.gif

And here is the link to the article again.

http://www.ussc.edu.au/blogs/Are-red-states-addicted-to-government-spending

Sorry. I didn’t realize I hadn’t posted the link. However, in my previous message I posted a link both to the article and directly to the map.

We’ve got a whole lot of states that benefit from government money. Interestingly, these are the states that tend to vote for politicians who say they want to cut government spending. However, if government spending does go down and these states see less money coming to them, I would expect the states would change their tune.

It’s like comment or placard attributed to a Tea Party protester, “Keep the government hands off my Medicare.”

Oh Christ. Another self taught expert on human nature. It’s either bootstraps or the folly of failing to choose the right parents. Spare the world your sermons. From the dawn of civilized society there have been two means by which the human species advances. Individual effort and collective action. Only a fool or a mouthpiece for self interest denies the necessity of both components. Ideologues and charlatans have been making hay out of our inability to see both of these things simultaneously. So you want to add your voice to that madness? Knock yourself out.

From the dawn of civilized society there have been two means by which the human species advances. Individual effort and collective action. Only a fool or a mouthpiece for self interest denies the necessity of both components.

A same comment, for once. As the world gets tougher, I think you will find that people will form groups precisely because it is in their self-interest to do so. Pooling talents and resources has always been important.

And if people here think humans only listen to themselves, then they are discounting the centuries of religion, kings, leaders, and so on.

From the dawn of civilized society there have been two means by which the human species advances. Individual effort and collective action. Only a fool or a mouthpiece for self interest denies the necessity of both components.

I meant to say a SANE comment in reference to the above quote.

I disagree thoroughly. Marx was an oddball of course but he was a man to be reckoned with as a philosopher.

There is even today a good bit of insight to be gained from study of his writing.

People who don’t understand Marx generally lack an understanding of the world as it existed in his time.

Capitalism today is a far kinder and far gentler animal than it was in his day- having been mostly tamed and domesticated by government.

But as smart as he was he didn’t understand some key facts about human nature and his overall vision was fatally flawed.

Several years back, I spent some time reading some Marx. And I also read Adam Smith’s The Wealth Of Nations. After reading, talking, and pondering, I found that my suspicions were correct: a lot of people who revile Marx and revere Smith have read neither.

Someone once observed that while Marx was exactly right about capitalism, he was exactly wrong about communism. I’ve always liked that observation.

Tech Guy, are you exhuming Karl Marx? Gott im Himmel! If you really think that all this garbage about the “invisible hand” is anything more than a talking point for the Chicago School than you are the kind of fool that Marx wrote so eloquently about. Put down your copy of Atlas Shrugged, better yet throw it into the fire.

Only a blind fool who has not actually read ATLAS SHRUGGED would ever suggest throwing it in a fire. Or throwing ANY book in a fire.

Of course a lot of fools are incapable of reading a novel as philosophy and commentary rather than as a blueprint- the socialist leftist element has demonized Rand as thoroughly as the laissez faire crowd has demonized Marx.

And of course a lot of fools on the right wing have put Rand on a pedestal that is built out of mud and sand with no mortar.

Rand sucks as far as her prose style is concerned but she was a pioneer – maybe even THE PIONEER in writing a widely read book that had a woman as the key character – a woman who crashed thru the glass ( concrete in those days) ceiling to the very top and proudly proclaimed her personal freedom as a human being to be her own person in every respect including who she chose to sleep with.

The socialist leftist element in American politics has so thoroughly crapped on Rand that I have found it necessary to introduce her as a writer to a number of sharp liberal young women who had no idea AT ALL what the book is actually about.

Now as far as her political vision as expressed in this novel is concerned – let us remember THREE things.

ONE- she knew communism first hand thru her family as it was practiced then.It wasn’t pretty. Having seen it she understood it was a capture of government by big business interests – that government and business morphed into one. Call it the capture of business by government if you please it amounts to basically the same thing. Power concentrated in the hands of a very few people concerned with their own problems and desires and to hell with everybody else for the most part.

TWO – She missed the way just about any businessman or big business AS SUCH can and gladly will fuck over anybody and everybody.But it is only a novel and within the constraints of her plot and her own background she did ok.

THREE – SHE ABSOLUTELY NAILED IT DEAD CENTER in the TEN RING when she wrote the book the way she did with BUSINESSMEN AND GOVERNMENT COLLUDING TO FUCK OVER THE COMPETITION WITH ZERO CONCERN FOR THE CONSUMER OR THE COUNTRY.

All together now children- can we say GOLD IN SACKS and TREASURY or FED in the same sentence without acknowledging they are getting pretty damned close to one and the same?

Can we say ” teacher” and NEA and monopoly in the same breath?

Do we have a law enforcement judicial prison industry that exists in large part for the benefit of the business people involved in it? ( Pot being against the law etc )

Incidentally Fernando is absolutely and one hundred percent correct in his general description of Venezuelan and Cuban politics. He may or may not be correct in terms of any specific detail but I am more than willing to give him the benefit of the doubt.

I have been reading what has been published by PEOPLE who LIVED in communist countries as it became available for fifty plus years.

I strongly recommend that anybody who wants real insight into economic and political reality read both Marx and Rand as well as serious history a couple of evenings a week instead of watching football.

I saw what commnists achieve in real life. You see, the system can’t be implemented. When communists try to do it, they botch it. Because many of them think like you, they try to tweak things. This usually leads to torture, murder, and other unspeakable human rights abuses. So I can vouch for it. It’s evil. It floats psychopaths and other individuals with very sick minds right to the top echelons.

“Because many of them think like you, they try to tweak things. This usually leads to torture, murder, and other unspeakable human rights abuses.”

sounds disturbingly similar to the MIC in the USA

Well he was a Communist Party supported candidate. Although they were smart enough to change their name to the “New Party”.

In practice there are only 2 forms of government. Democracies, and Oligarchies. No 1 person can run a country, it takes a group. Dictatorships are actually Oligarchies.

Certainly Democracies are the lessor of evils. However, when the Plebs decide to start voting themselves free stuff, the country is pretty much doomed. E.g. Greece.

I suppose it’s only fitting that the world’s oldest Democracy, would be the first to destroy themselves at the ballot box.

“In practice there are only 2 forms of government. Democracies, and Oligarchies. No 1 person can run a country, it takes a group. Dictatorships are actually Oligarchies.”

Unfortunately, democracies don’t exist in the real world. All of the “democracies” are representive gov’ts where the people “allegedly” elect bureaucrats to make all of the decisions for them. In just about all instance elected officials drop their campaign promises and act to benefit the oligachs and themselves.

In some “democracies” there is only one ruling party as the other parties never obtain significant control. Japan is an example, since the end of WW2 the “Democratic party of Japan” has ruled the country.

The US has a two party system which locks voters into two extreme views. For the most part, US candidates are selected by oligarchs by supporting selected candidates with campaign contributions and control of the media. I don’t believe in all of American history that the US elected an independent president or that one of the independent party held any significant number of seats. It very like that American democracy or free elections is just an illusion, deluding the public that they have some input into the decision process. Notice the Bankers and wall street still largely written the laws, and they also appear to be above the law. They allegedly pay a fine when caught with fraud, that is appeal in the courts for decades and later dismissed. Very rarely has a banking executive ended up in jail. the same is true with all of the mega-corporations.

I don’t know what MIC means. However, there’s a huge distance between the hardcore communists (Castro, Ho Chi Minh, Pol Pot, Maduro, Mao, Stalin), and USA government leaders. I suppose by now you realize I don’t exactly like US policies in many areas. I consider Bush II to be a war criminal, and I had better leave it at that because I may get censored.

But the naive comparisons just show those who defend commnist regimes or advocate communism are mostly naive and unaware of what really goes on.

The USA does have committed communists who work actively and openly to defend these horrible regimes.

Some are more covert, and others are wide open reds (for example there’s a very active communist cell active in the University of Michigan which seems to be financed by the vnezuelan regime).

military industrial complex – MIC

Fernando is pretty much dead on when it comes to communist regimes. The history books are there for anybody willing to read them.I have been reading them for decades.

This is not to say communists have not gotten some things done in certain respects in some instances. Just about everybody in Cuba for instance gets a basic education and basic medical care.

This is certainly not true of a lot of countries that were at about the same level of development as Cuba when the commies took over there.

The USA does have committed communists who work actively and openly to defend these horrible regimes.

The US has had small groups of communists since the Russian Revolution. But they haven’t ever been taken seriously by the country as a whole. They are seen more as a religious cult.

I’ll also point out that concern about Communists has certainly encouraged politicians to make war and monitor activities within the US because of this Communist threat.

That’s been a question in the US since the Russian Revolution. To what extent should the US wipe-out other countries and to what extent should it monitor all communication and activities within the US to protect against “Communists” or other enemies.

The more people play up the “Communist threat,” the more armed and the more of a surveillance society the US is likely to get.

One has to keep things in perspective here. If you start trying to accuse people of being “Communist sympathizers” you are falling into the McCarthyism trap that made life in the US ugly for awhile.

There are definitely evil people in the world. And in some cases we can go to war and wipe them out. But in other cases, it is beyond the capability of the US to control what happens elsewhere. While we seem to have been in a state of perpetual war since 9/11, channeling American money and American lives into fighting a never-ending war takes its toll.

I’ve got more to say about this whole “communist” issue in the US.

Usually when a politician talks about “communists,” it means giving the US government MORE power. In order to stop “communists” we get more military spending, more wars, more surveillance, and these days, more local police power.

If stopping “Communists” means turning the US into a constant war machine and police state, not everyone wants to do that.

So when people try to say solar is a communist plot, I just want to roll my eyes. As if allowing consumers some little opportunity for some energy independence is a communist plot that then justifies even more government control, I think the fears are much worse than the reality.

De-development can be a Troyan Horse used by communists who realize their system leads to poverty. This introduces a political factor into the equation I don’t like at all. After seeing what communism does close up I’d rather be dead than red.

I live in a very affluence community with lots of renewable energy supporters.

I don’t see any “communists” around me.

That’s probably right. Hogweed, this doesn’t mean there aren’t people out there who are unlike your neighbours. You write like a pretty normal fella. What I found is that idealists like you are the first ones to get shot. You are too honest. But I’ve been around the merry go round way too many times, I’ve seen them in action. More than once. Trust me, you really don’t want me to ruin this blog describing what I have seen.

My stupid spell checker called you Hogweed. It was supposed to read however.

Fernando, glad you clarified the ‘Hogweed’ bit. I was just startin’ to Google thinking it was some Harry Potter reference.

That sure sounds like a really unusual insult, doesn’t it?

Gawd! How many times have I heard all this commie chatter identical to all of above.

ENOUGH! We know that and all other systems are bad, all we have to do is look around and see the results. All over bad bad, like everyone keeps pointing out in numerical detail after detail.

START OVER FROM SCRATCH. First, lay down the general characteristics of an economic structure we would want. I will start it right here:

1) Makes the world better, not worse

2) Gives everybody enough

3) Everybody has immediate daily access to employment that they can feel proud of doing, is good for everybody, and makes them want to get up in the morning.

Said employment doesn’t have to be anything glorious, anything satisfying those criteria is good enough, it’s just gotta be there.

Etc. You fill in the rest, and if you draw a blank, hire an economist to do it for you. After all, those people gotta do something to justify their oatmeal.

North Carolina – a state often ridiculed for being bright red – is a leader in solar energy and if the state had a good wind resource- which it does not compared to the plains states – it would no doubt be a leader in wind too.

This reply intended to Boomer’s two forty six pm comment:

Well said and dead on !!!!!

These things are never simple but most people are unable to bring themselves to think enough to see beyond the first layer of the onion.

And the people who are in control of our government- being IN CONTROL- naturally just use any opportunity to gain ever more control and power.

Darwinian evolution may not explain everything but it doesn’t miss much!!!

We are no more and no less than NEKKID APES under our clothes and the nature of the alpha ape is to gather in as much power as possible.

About the only real difference I can see is that in chimps the bands are smaller and the alpha usually stands alone.

Chimps HAVE however evolved the technique of two or three second tier chimps banding together to kick the alpha’s ass if necessary.

In humans the alphas have learned to band together and share power collectively each having a great power concentrated in one area (ownership of money maybe etc ) and sharing in overall control.

“The primary reason why oil prices have fall is because demand has fallen. ”

How come when the graph shows that demand is rising.

OECD demand has gone down. Graph in this post

2/2/2015

Peak affordable oil

http://crudeoilpeak.info/?p=6817

Because “demand” means one thing to economists, and another thing to everyone else. To an economist, a man with no money and dying from thirst has no “demand” for water. To everyone else, he does.

Ignoring the relatively small factor of storage, “demand” for oil is equal to production of oil. The ability of consumers to pay for it is something else altogether.

Gerry, you hit the nail on the head. Demand equals consumption. The two terms are totally interchangeable.

Hi Ron,

They are interchangeable to people smart enough to see thru the smoke and mirrors.

Unfortunately the evidence seems to indicate there are not very many who can.

Of course this is just to elegant and beautiful and simple a truth to be comprehensible to people who want to believe shadowy characters control the price of things such as oil day to day.

Your ski boat analogy is the best one I have ever come across.

Americans consumers (USA) spend about 400 billion dollars on entertainment and entertainment related services every year. They spend about 829 billion dollars per year on food. However they spend 1.1 trillion dollars per year on transportation.

The only expenditure category that trumps transportation (Bureau of Labor and Statistics) is housing.

This is just consumer spending, not business or government.

Transport in the US is so big and is fueled mostly by oil. Oil prices are very volatile toward the high side and vehicle prices keep rising.

Gerry,

The ability to pay for it exists in FIAT system. The problem is that in the process you devalue units of purchasing power not only for average Joe but also Mr. Buffet. And there are only so many “farms on New Zealand” or “Oil Wells in North Dakota” for everyone with substantial purchasing power to have it if you know what I mean 🙂

My analysis shows sugar cane biofuels are pretty good. I’m trying to lobby the USA government to allow me to ship ethanol from Colombia. But I can’t find the right congressman willing to receive my campaign donations.

Do you know anything about Cerrejón and the $2 billion new infrastructure project being completed to increase coal exports ?

I sure don’t. I’m not from Colombia. But several years ago I worked with a guy who was researching biofuels for a large multinational. He focused on a South American target area, and showed me how biofuels were produced in Brazil.

I concluded they were very viable, and I suggested a graduate thesis for a student at a Venezuelan University. The thesis work outlined a systems analysis for biofuels (a model using I Think software) and it concluded biofuels in the USA were losers because they used corn, but that biofuels in Latin America were winners using sugar cane.

It also concluded they helped reduce poverty, and emphasized the land use should be regulated to switch zones used for cattle grazing into sugar cane growing areas.

If the FARC are defeated in Colombia it may be viable to plant sugar cane in the Llanos, but this is only a concept.

Fernando-please go back to trolling the Drudge Report.

Whats the Druge Report?

“The beauty of fossil fuels is that they all originate under-ground and allowing the surface of the planet to be utilized for other uses.”

That would be nice if it were true. Just in the western US the government has leased and offered the equivalent land area of Colorado for oil and gas development. This does not include pipeline areas, storage or refinery areas.

If that amount of area was covered with solar panels at 15% efficiency they would produce 15 times the amount of electricity produced by all sources in the US (4 kwh/ day/ m2 insolation assumed).

The Marcellus in Pennsylvania has new gas wells being fracked at better than 2000 per year. From what I recall, the sites take up about 4 acres each. That is 8000 acres lost (11.5 square miles) per year and that does not include the roads leading into the site, the pipeline areas, pumping or storage facilities.

Pennsylvania law does not allow a building or residence within 500 feet of a well. That is 20 acres minimum off limits right there for every well pad.

Surface mining for coal alone has disturbed (means mountain tops blown off, streams buried, etc.) 8.4 million acres of land. New land “disturbed” each year amounts to 104,ooo acres. Just mountain top removal has “disturbed” 1.2 million acres and 774 miles or streams destroyed.

Solar thermal is estimated to need 84% of the land “disturbed” by coal and wind would power would use only 4% of the land “disturbed” by coal to produce equivalent energy. Of course, those two could not produce equivalent pollution that coal does or destruction of streams.

Yes, both solar and wind are often put into areas that haven’t been fully utilized (e.g., roofs) or in areas that allow multiple uses (e.g., farming around turbines).

Biofuel is a waste if crops are growing to burn rather than to eat, but if biofuel involves utilizing waste products, it might free up more land (e.g, landfills).

Also incinerating waste eliminates the need for landfills.

“That would be nice if it were true. Just in the western US the government has leased and offered the equivalent land area of Colorado for oil and gas development. This does not include pipeline areas, storage or refinery areas.”

Oh Please! your nit-picking. In the early 20th century, most of the developed regions of the world had been denuded of trees in order to support the demand for firewood for fuel. After Oil production and coal mining (at the time most of it mined underground not open pits) the woods regrew since it was no longer been striped for firewood. Just about all of the open pit coal mines are in undeveloped land that would be very marginal to grow crops. In the context of biofuels (in response to Fern’s comments about biofuels), Biofuels need the same high yield farm land used to grow crops. Switching to biofuels will need to complete with land currently being used to grow crops.

Solar PV systems are a low density energy resource. It takes many square miles of PV panels to equal the output of a single baseload fossil plant that occupies less than a 100 acres of land.

In the case of of Nat Gas drilling. The top side of the land is still available for farming (presuming the soil and ground water has not been contaminated).

“Solar thermal is estimated to need 84% of the land “disturbed” by coal and wind would power would use only 4% of the land “disturbed” by coal to produce equivalent energy.”

That state is completely wrong. PV and Wind which are intermittent power sources can’t make up more than 7% of grid output. Any further increase would destabilize the grid.

PV and Wind which are intermittent power sources can’t make up more than 7% of grid output. Any further increase would destabilize the grid.

Putting solar in where it doesn’t plug into the grid is a good use of the technology. There are lots of places where that can be done.

I gotta ask this: Why are you and the others that believe PV and wind can replace fossil fuels here? I figure if you really believe PO can be solved with renewables, you have nothing to worry about. Why waste your time reading and commenting about PO when there is nothing to fear? Why not just go about BAU and forget the whole mess?

Why are you and the others that believe PV and wind can replace fossil fuels here? I figure if you really believe PO can be solved with renewables, you have nothing to worry about. Why waste your time reading and commenting about PO when there is nothing to fear? Why not just go about BAU and forget the whole mess?

I believe a greater use of renewables can reduce the amount of fossil fuels we use, thus postponing their decline.

As for why I am here. I live in an area where fracking has been moving into heavily populated areas, and some of those communities have been trying to block it.

I have wanted to understand the economics of fracking to know whether this will be a boom-and-bust situation. If so, then I believe communities are wise to think twice about disruptive practices by companies that might go bankrupt and then not be able to pay any damages they might create.

You can hire me pro bono to help you tame the lion. There are options galore to minimize social and environmental impact. But you will need state government cooperation.

That is why so many new companies are forming to provide storage solutions.

Seems that somebody always says it can’t be done, and then it is.

Sometimes we say something can’t be done. And then it can’t. Those tend to be buried. Take fusion using the Tokamak. Or the USA space shuttle achieving low launching costs. Or Thomas Gold finding oil in Sweden. Or building the giant gas pipeline from Alaska. Or finding dark matter.

That state is completely wrong. PV and Wind which are intermittent power sources can’t make up more than 7% of grid output. Any further increase would destabilize the grid.

I have mentioned this company/technology here before and of course it was completely ignored. This is not the only company claiming to have solar thermal technology that allows a solar plant to produce energy 24/7. I am trying to convince a buddy of mine that works for a major American power company to give them a look.

So far he has been dismissive because, like so many here, he has a preconceived notion of what is true and so he refuses to even look at the data.

http://www.bren-energy.com/

There are enough people who want to have their own solar power and there are enough off-grid uses for it that right now it doesn’t matter the extent it dovetails with the grid.

In fact, I am guessing that with the people objecting to solar as an entire category, there must be some worry that it is actually threatening utilities. If solar is such a minor consequence and will never amount to anything, then let it develop on its own, without the protests. If solar is nothing more than a hobby, then let the hobbyists continue to play around with it.

And what can be less “communist” than allowing people to develop their own power? Seems to me that forcing people to buy from a monopolistic power company is closer to “communism” than having lots of people own or lease their own systems.

Your guess is wrong. If you want to have a solar panel farm and use it in an isolated power system you are helping those of us who don’t. If you want to sell the electricity or have the grid back you up then you are impacting my costs and freeloading, and I object to it. I sense this difference escapes many solar panel advocates.

If you want to sell the electricity or have the grid back you up then you are impacting my costs and freeloading, and I object to it. I sense this difference escapes many solar panel advocates.

If I want to generate electricity and not sell it to the grid or get off the grid entirely, that shouldn’t be a problem for you.

It’s not. Just don’t expect backup when it rains. Or when you get sand blowing in from the Sahara and it covers your panels.

Just don’t expect backup when it rains. Or when you get sand blowing in from the Sahara and it covers your panels.

If I make arrangements to purchase additional power when I need it, I should very well be able to get it. It is entirely possible to have solar not feed into the grid, but to still be connected to the grid for occasional use.

But I assume you mean that if solar results in the demise of the grid, there won’t be a grid for backup. Fair enough. People will do without when there isn’t enough solar, or they will have their own backup systems. And it could be a community-wide backup system rather than a per-house system. These are problems that can be dealt with in on way or another.

People have snow days when it becomes too snowy to get around. They have blackouts when storms knock out the power lines. They take those days off. It can actually be fun when the world stops and you can’t do anything for a few days. If you anticipate this happening a lot, you put up enough supplies to get through it. You have a supply of saved water. You have a supply of dry food and canned food. You don’t keep too much in your refrigerator, so that if your power goes out for several days, you won’t lose anything. And so on.

Its posible for you to self generate, and parchase excess electricity the grid has available for you. But you will have to stand in line. You see, if a lot of people put up solar panels and start demanding electricity in cloudy weather the grid could collapse.

And we really can’t afford to keep generators turning just in case you happen to demand your juice.

Those who insist on getting electricity on demand are freeloading. This is the real conflict. A conflict I see gets ignored by all those chinese agents who sell solar power