A post by Ovi at peakoilbarrel

Preparing this March post has been a surrealistic exercise. Here I am providing a January US production update when at a time, January, the world had no clue that it was going to be hit with a double Black Swan event in early March . There was a hint in January on the coming pandemic for those who were listening. However, there was no clue of the Shock and Awe attack that would be launched by SA after Putin and his Oily Oligarch friend Sechin made the wrong move in the world’s Oil Chess Game. Russia thought that they had SA in Check, instead Russia and the rest of world were End Played. Now, a way must be found out of this mess. Reports are circulating that Trump and Putin have been talking and that an OPEC + meeting will be convened shortly. Let’s hope adult’s come to the table.

The silver lining, if there is one, is that the world will need lower oil prices to come out of the current economic slowdown. The question is, if an agreement can be brokered between US, Russia and OPEC, “What will be the right price for oil for both the producers and the economy?

The irony here is that Trump will be holding meetings with oil company executives shortly to see how the US can help. In the meantime the NOPEC (No Oil Producing and Exporting Cartels Act) bill keeps circulating within Congress. Interesting how the world, US positions and thinking, can be flipped upside down over night.

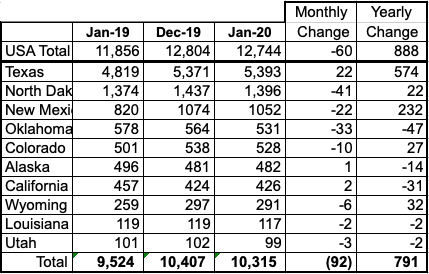

All of the oil production data for the US states comes from the EIAʼs Petroleum Supply Monthly. At the end, an analysis of a three different EIA reports is provided.

The charts below are updated to January 2020 for the 10 largest US oil producing states (Production > 100 kb/d).

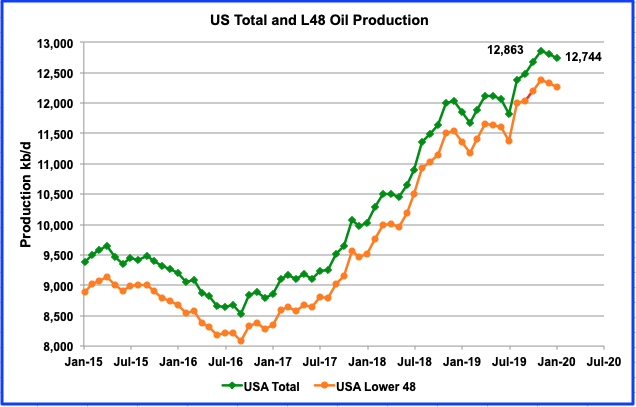

The March EIA report shows US production dropped from November to January by 119 kb/d to 12,744 kb/d. Note it dropped for two successive months. The January drop from December was 60 kb/d. From June to November, the US increased output by an average of 150 kb/d/mth. Are these two successive drops the beginning of slowing LTO growth going into 2020? For the lower 48 states, production from December to January decreased by 61 kb/d. Today’s extra low oil prices are not providing any incentive to increase drilling activity. Lowering capex and expenses are the new mantra.

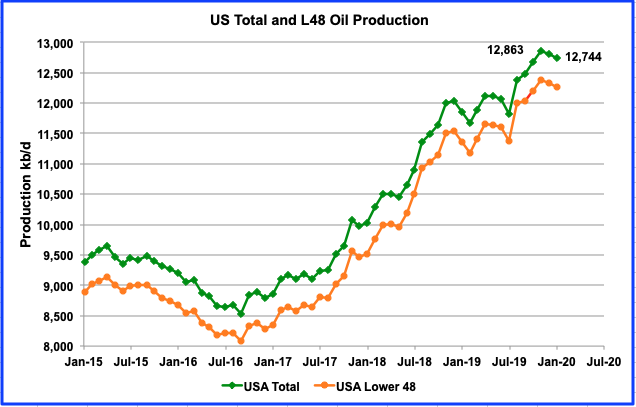

In an attempt to provide the latest production estimates for the US, above is a comparison of the EIA’s weekly and monthly production numbers updated to April 1. While the weekly and monthly numbers are in reasonable agreement from August 2019 to November 2019, there is major divergence after that. Clearly there is a lot of uncorroborated data coming out of the EIA’s oil production offices.

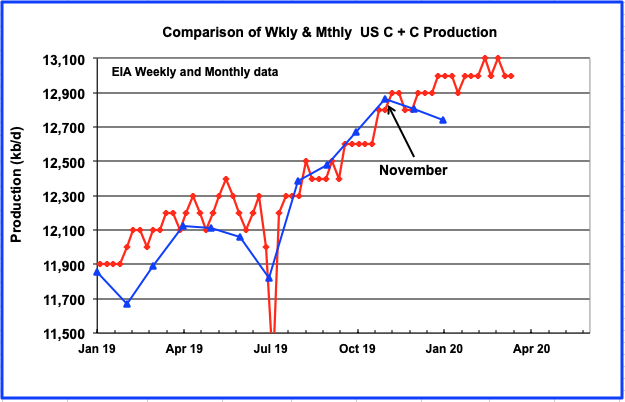

Oil State’s Production Ranking

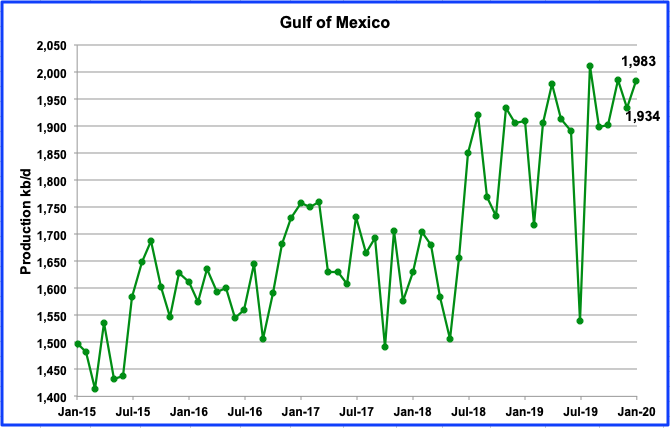

Listed above are the 10 states with production greater than 100 kb/d. These 10 account for 10,315 kb/d (81%) of total US production of 12,744 kb/d in January 2020. US year over year production is now down below 1,000 kb/d to 888 kb/d. Not shown in the table is the GOM which produced 1,983 kb/d in January and would rank it between Texas and North Dakota.

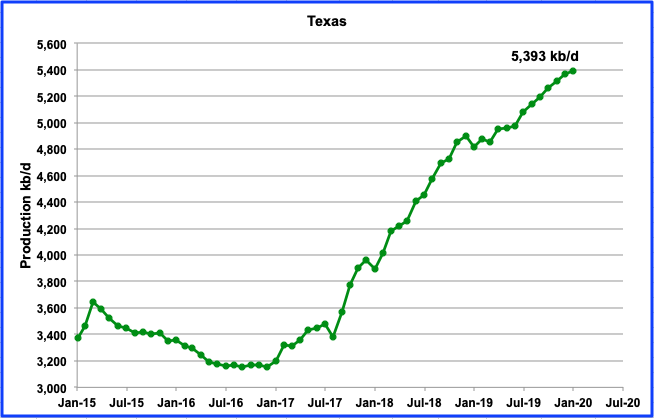

January production in Texas grew by 22 kb/d to 5,393 kb/d from a revised 5,371 kb/d in December. There is a hint of slowing in the graph.

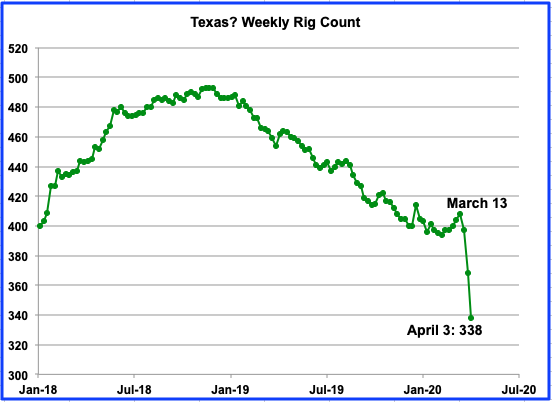

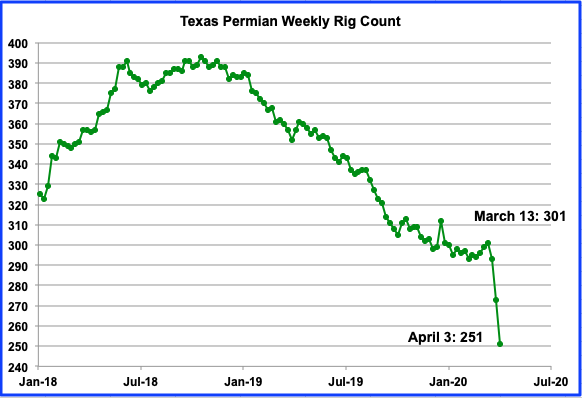

This chart provides an early indication of what to expect from Texas output over the next several months. From March 13 to April 3, the Baker Hughes (BH) Rig report showed a drop of 40 rigs from 378 to 338.

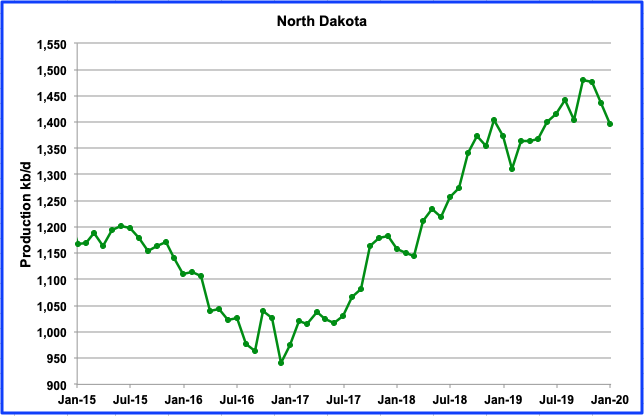

North Dakota’s oil production has been dropping since October 2019 from 1,481 kb/d to 1,396 kb/d in January. In January, the drop was 41 kb/d from December’s 1,437 kb/d. Since January the number of rigs operating each week has almost remained almost constant as it wandered between 51 and 53 and only dropped to 42 in the week ending April 3.

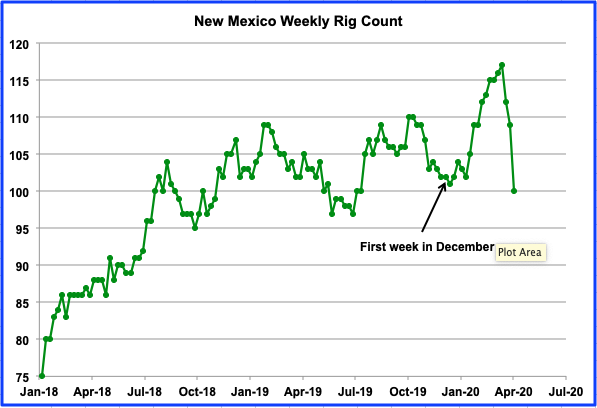

January is the first month that has shown a production decrease in New Mexico since June. Output fell from 1,074 kb/d in December to 1,052 kb/d in January. While Texas has been getting all of the attention regarding its production growth, New Mexico has also increased its output and recently has exceeded 1 Mb/d. On a YoY basis, New Mexico has increased its output by 232 kb/d.

Above is the weekly BH rig count for New Mexico. The rig count increased steadily from 101 in December to a peak of 117 in the week of March 13. In the week of March 20, the first drop, 5, in rig count occurred down to 112. A second drop of 3 occurred down to 109 in the week March 27 and down to 100 on April 3. This is an early indicator of further production drops in the coming months.

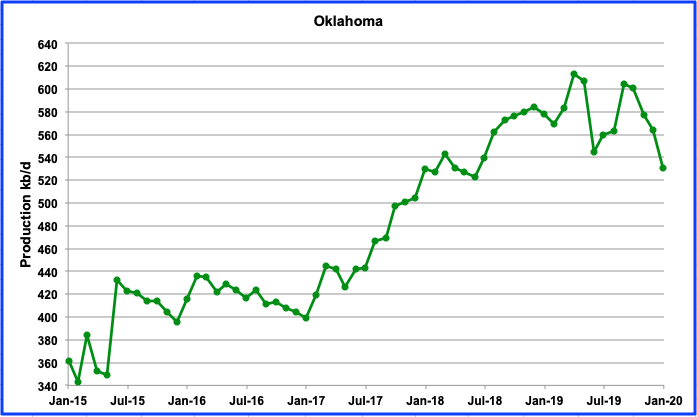

January marked the fourth month in a row that Oklahoma output was down. Output was down by 33 kb/d to 531 kb/d. Oklahoma appears to have entered a decline phase. Its highest production occurred in April 2019 with output of 613 kb/d. The complex Louisiana geology has stymied hopes for a “Permian Jr”. In the last week of 2018, Oklahoma has 140 rigs in operation. In the week of April 3, there were 29, a drop of ten from the previous week.

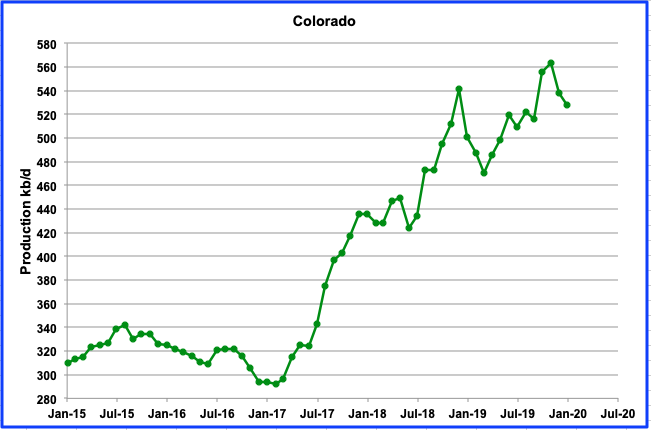

Colorado production declined by 10 kb/d in January to 528 kb/d from 538 kb/d in December. From the peak of 563 kb/d in November, output has dropped 35 kb/d. New environmental regulations may be beginning to take their toll on drilling activity and the associated oil output decline. The current low oil price can only add to the drilling industry’s difficulties.

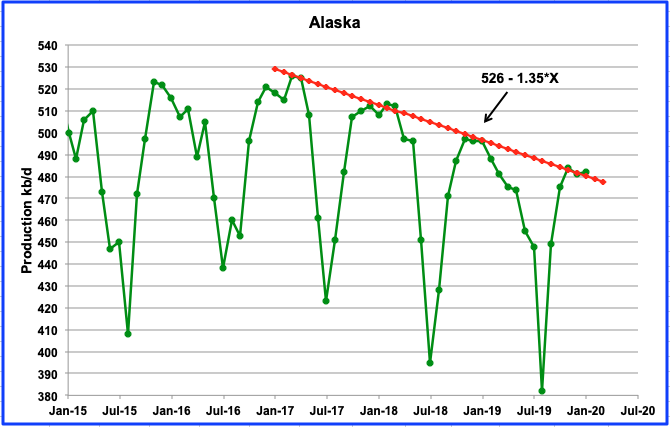

Alaska output continues its slow decline as shown by its annual peak production months of November, December and January touching the downtrend line. January was up by 1 kb/d to 482 kb/d. The line continues to show a decline rate of 1.35 kb/d/mth or 16.2 kb/d/yr.

The trend of gradually declining output is expected to continue until several new future projects now in development come on line. An expected 20 kb/d increment near the end of the year will mostly be offset by the estimated yearly decline of 16.2 kb/d.

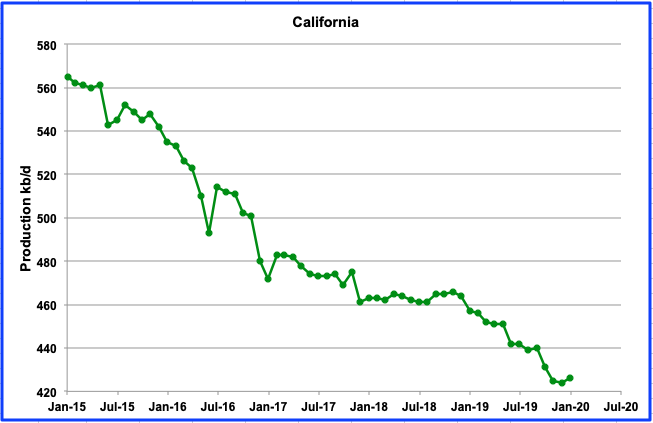

California continues its slow decline. However January production was up by 2 kb/d to 426 kb/d

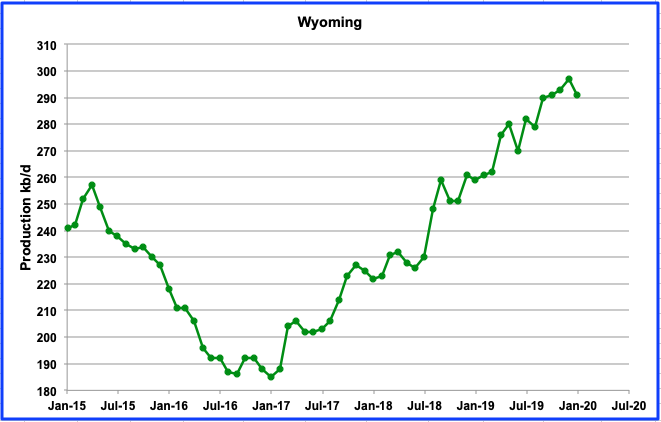

Wyoming increased its output from January 2017 to December 2019 and reached a new high of 297 kb/d in December 2019. However in January 2020 it had a small drop of 6 kb/d to 291 kb/d. Is this the beginning of a production drop associated with lower oil prices and a slow reduction in the number of rigs operating. Wyoming currently has 14 rigs in operation, down from a high of 25 in the third week of January. The week of April 3rd drop was 5 from 19 the previous week.

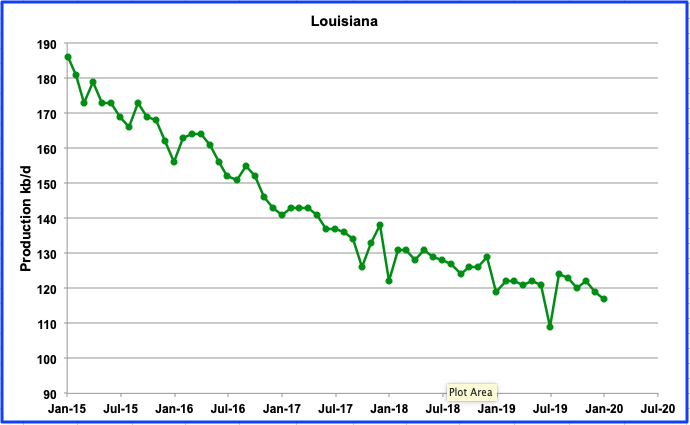

Louisiana continues is slow steady decline. After rebounding from a new low output of 109 kb/d in July 2019, the decline has begun again. January output was down by 2 kb/d from December to 117 kb/d.

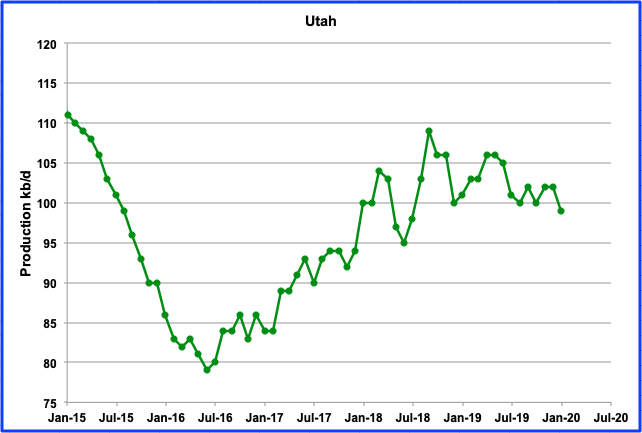

Utah’s output was holding steady since July 2019 at slightly over 100 kb/d due to its new conventional field but is now giving indications of entering a new slow decline phase. January production fell below 100 kb/d to 99 kb/d, a drop of 3 kb/d from December 2020. The last peak occurred in September 2018 at 109 kb/d.

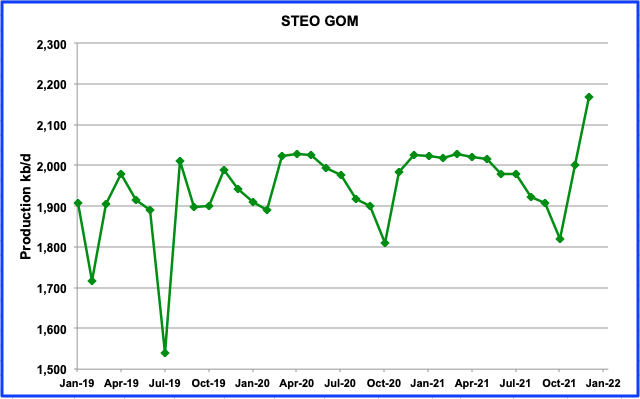

The GOM’s output rebounded by 49 kb/d in January to 1,983 kb/d.

Updating EIA’s DIFFERENT oil growth perspectives

1) Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the five key tight oil regions.

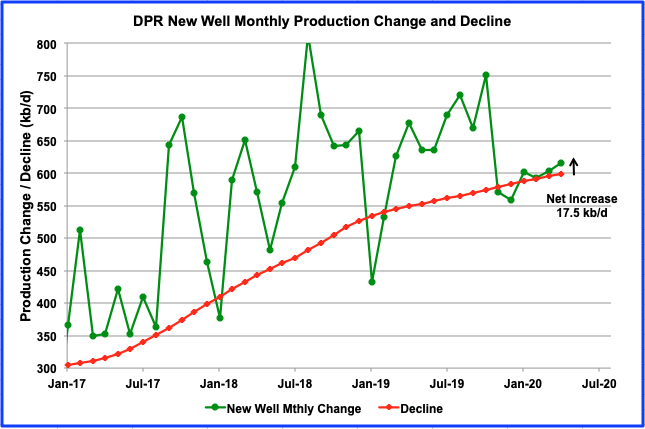

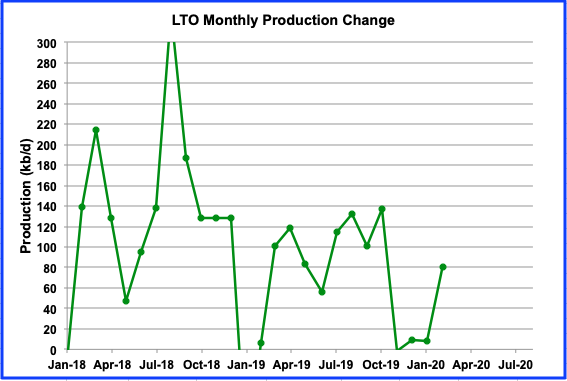

This chart shows the monthly change in new well oil production and the decline from all previous producing wells for the onshore L48 states. The difference between the two gives the projected output increase for all tight oil basins. For April 2020, the projected increase is 17.5 kb/d. What is clear is that since November the difference between production increase and decline is very small and has gone negative for a few months.

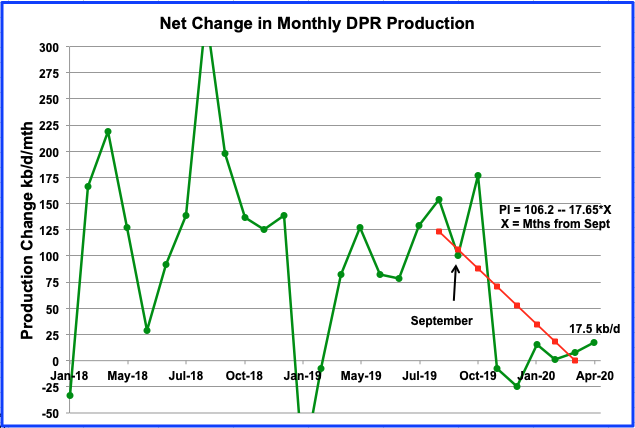

Above is the DPR net growth chart updated to April 2020 and shows the difference between the monthly change in new well oil production and the decline from all previous producing wells for the onshore L48 states. The March update indicates that there has been further revisions to the 2019 data. The March report now shows that production decreased in both November and December 2019 and February’s net growth was only 1 kb/d. March and April are showing small increases. However I expect the March and April data to be revised in the April report when the new oil price environment is factored into the DPR models.

The linear model in the chart is left over from the March post. Clearly it did its job when it was first posted four months ago indicating that LTO oil production in the US was going to slow down.

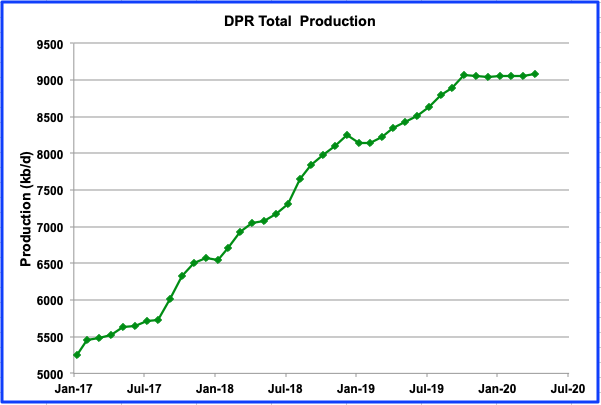

Above is the total oil production from the 7 basins that the DPR tracks. Note that the DPR production includes both LTO oil and oil from conventional wells.

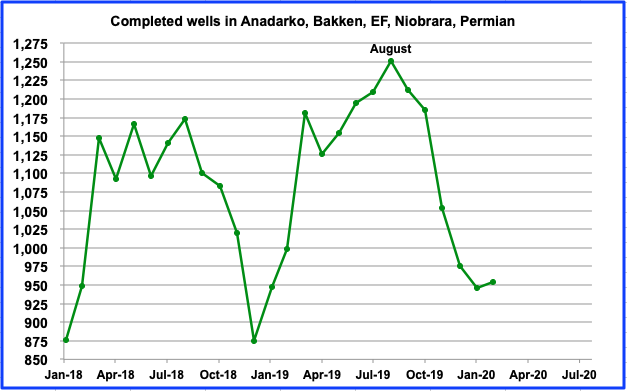

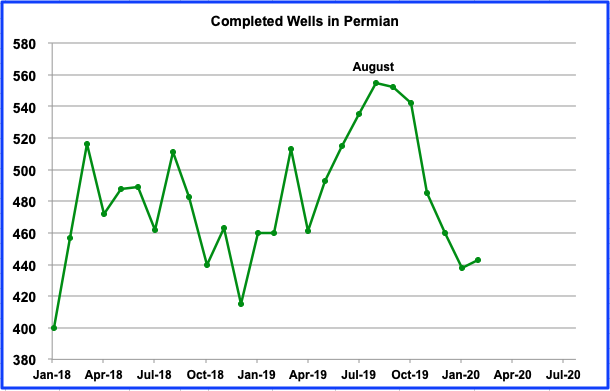

From February 2019 to October 2019, output grew at an average rate of 116 kb/d/mth. However starting in November 2019, there has been virtually no growth. The reduced output rate is associated/consistent with the rapid monthly decline in the number of well completions shown below.

As can be seen, the number of completed wells from August 2019 to January 2020 dropped from 1,251 to close to 950 in January and February, a drop of close to 300 wells. Not clear if the 950 completions in January and February are an indication of a new base level for completions to just maintain a constant level of production and reduce expenses.

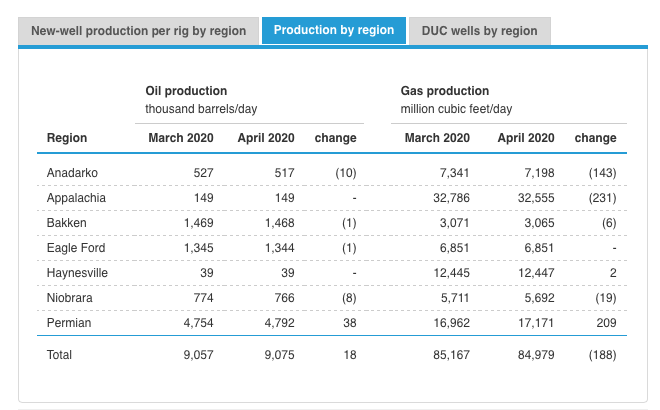

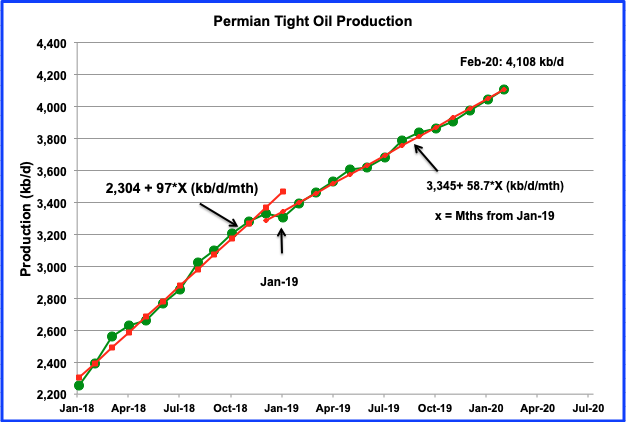

Of the 300 decrease in well completions since August, 117 are from the Permian. Interestingly, while completions are decreasing, the Permian was the only basin that indicated growing production out to April.

According to this DPR table, all basins except for the Permian will be in decline by April. With the new low prices for WTI, the Permian could also be in decline by April,

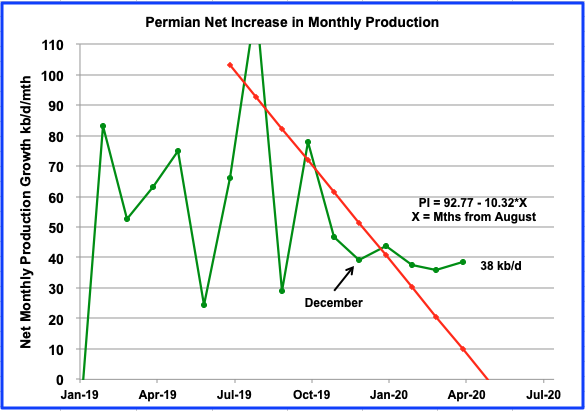

According to the DPR, Permian production growth from February to April will wander around 37 kb/d/mth. As noted above, there should be a significant change to the March to May numbers in the next report.

During the week of March 13th 301 rigs were operating in the Texas portion of the Permian,. By the week of April 3, it had dropped to 251, a drop of 50 rigs. Production decline should follow shortly.

Light Tight Oil (LTO) Report

The LTO database provides information only on LTO production from seven tight oil basins and a few smaller ones.

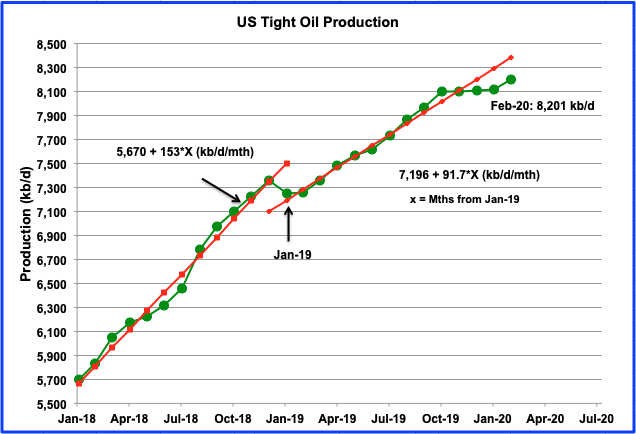

There was a significant downward revision to the LTO data in the March 2020 report. The revisions show up as a slowing/flattening in LTO monthly production growth, especially from October to January at approximately a constant 8,100 kb/d. January production was revised down from 8,232 kb/d to 8,121 kb/d, a reduction of 111 kb/d.

Estimated output from all LTO basins for February was 8,201 kb/d, an increase of 80 kb/d from a revised 8,121 kb/d in January. I expect the February increase of 80 kb/d will be revised down in the April report.

This chart shows the monthly addition to LTO output and its shape is similar to the DPR chart above. The production increase in February was 80 kb/d and indicates a significant increase over January. The current March LTO report confirms the DPR trend of slowing growth starting in November to January 2020. However while the LTO report is projecting an increase of 80 kb/d in February 2020, the DPR is estimating a smaller growth rate of 1 kb/d. This difference should be resolved in the April report and should also reflect the new oil price regime..

The Permian is the largest contributor to US tight oil growth. As can be seen in this chart, the average growth rate for 2019 is lower than 2018. While the average monthly growth rate for 2018 was 97 kb/d/mth, the average rate for 2019+ is lower at 58.7 kb/d/mth, a 40% reduction. The average LTO growth rate from November 2019 to February 2020 is slightly higher at 67 kb/d/mth. However as noted above, the current February increase of does not seem realistic.

3) Short Term Energy Outlook (STEO) Report

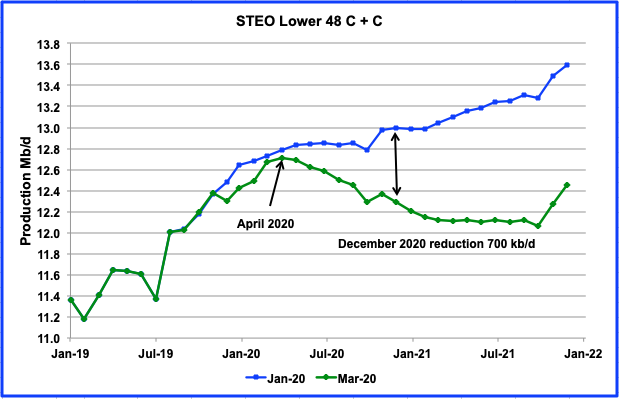

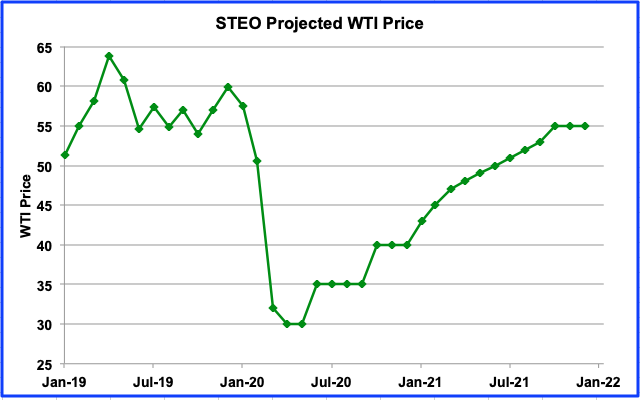

The STEO provides projections for the next 13–24 months for US C + C and NGPLs production. The March report presents EIA’s oil output projections out to December 2021

The chart compares the March 2020 STEO C + C projection with the January 2020 report. In the March STEO report, the estimated output for December 2020 has been reduced by 700 kb/d.

The March STEO was published on March 11. By then, the Shock and Awe oil production announcement by SA had been heard around the world and was felt on Monday March 9 when WTI dropped by $10 from $41.28/bbl to $31/bbl. So on Monday and Tuesday the EIA made drastic changes to its production outlook for December 2020 and 2021, as can be seen in the chart above.

Note that production continues to increase from December 2019 to April 2020 before beginning to decline. From April 2020 to December 2020, output falls from 12.71 kb/d to 12.3 kb/d, a decline of 410 kb/d.

There are two factors affecting the decline, the price of oil and the need for physical distancing during the pandemic crisis. For both the January and March update, production begins to increase in October 2021 due to new oil output coming from the GOM. See below.

Output in the GOM begins to increase in November 2021.

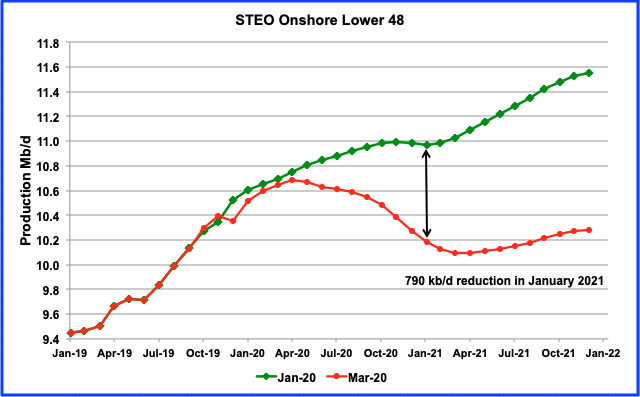

This chart compares the March 2020 STEO projection with the January 2020 report for the Onshore L48. The revisions in March STEO project that the onshore L48 output will be down by 1,280 kb/d in December 2021 as compared to the January report. The March report estimates that by December 2020 output is expected to be down by 410 kb/d from April 2020. The price environment projected by the STEO over the next two years is shown below.

Above is the STEO WTI price projection for 2020 and 2021.

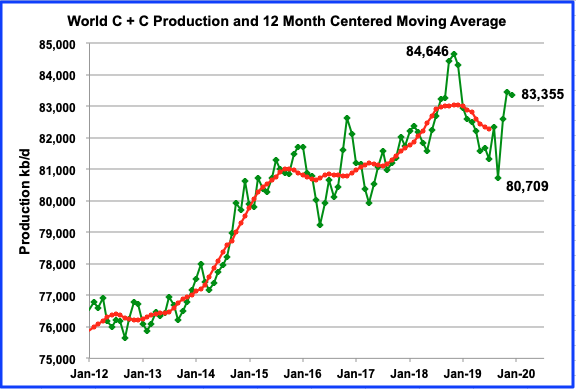

This is the world C + C production to December 2020. In December production dropped by 109 kb/d to 83,555 kb/d from 83,464 kb/d in November. The large increase of 2,646 kb/d from September to December was due to large contributions from Brazil, Norway and recovering production in Saudi Arabia after the September attack.

Thanks for the great post Ovi!

Here’s an interesting article I came across:

Saudi-Russia oil war is a game theory masterstroke

https://energypolicy.columbia.edu/research/op-ed/saudi-russia-oil-war-game-theory-masterstroke

I hope others here find it so too

Survivalist

Thanks. I found this interesting:

“Game theory shows how the ‘competing fringe’ passively benefits from Opec supply cuts for as long as they last. Since becoming the world’s top producer, however, the US is discovering that being a free-rider may no longer be an option.”

Its market interests, game theory suggests, have effectively converged with those of Russia and Saudi Arabia. By threatening to open the floodgates, the latter can compel it to join their club.

It will be interesting to see if and how the US joins. I have read that XOM and CVX are opposed since they want to pick up cheap acreage from the drillers that go bankrupt.

I don’t see why the US would care about the price of oil, as a national interest, at least in the short term. It’s no longer a significant net importer, but it’s not a net exporter, either. High prices help Texas, but low prices help California, Michigan, Ohio, Florida and Maine.

You could argue that stability is good for a large US industry, but the oil industry does not have a good image. It’s hard to imagine that voters would have a lot of enthusiasm for significant financial support for the industry.

You can argue that low prices now set the stage for higher prices later, but that requires a lot of trust in crystal balls which have been pretty cloudy in the past.

The USA has cared about the price of oil in the past. The reasons it did so and why can be read about and perhaps understood by others. Perhaps, for similar and evolving reasons, the USA will continue to care about the price of oil in the present, and into the future.

In 1986 Vice President George Bush traveled to Saudi Arabia with a warning- record low oil prices of $10 a barrel threatened the U.S. oil industry and U.S. national security. If prices don’t rise, he warned, a U.S. tariff on imported oil would do the job.

I wonder what all that was about eh? What a mystery!

One of the things about game theory (aka strategic decision making in the context of mixed motive actors) is, imho, that it helps if you can try to understand the motives of others (see theory of mind), even if you don’t share their motives, agree with them, or see why they would care. I will admit it gets a bit dicey when actors have inconsistent preferences and beliefs (see democracy), and that often, in real life, actions result inconsistently from those inconsistent preferences and beliefs. But hey, that’s the world we live in. It might help with your crystal ball.

Things have changed since 1986. Not enough, of course: we still have a president who’s political party is a captive of the oil industry. But the president himself cares only about himself, and his re-election.

The oil industry isn’t monolothic. Bush, an oil guy, could confidently speak for the whole industry in 1986. Now, look at how angry “Shallowsand” is at the LTO industry. And if the oil majors are waiting to buy the LTO independents after they collapse, they’re not going to want intervention.

This kind of chaos is extraordinarily painful for people in the industry. This is no way to run things. But…this country just isn’t all that good at planning ahead. The country is a bit more distracted than usual right now, and again, this industry isn’t popular – it’s hard to see a big bailout. And, of course, when the collapse in consumption is 10x as large as any likely production cuts, how well would it work?

My comment above was about national interests, and security. In the long run the oil industry is no longer essential to national security – it’s needed in the short run while we transition away from it, but that’s different. It would be great to help people who are losing jobs, but that’s different.

Arguably oil has been an enormous liability to national security since WWII. For instance, the US intervened in Iran in 1954 to protect British Petroleum, and as a *direct* result Iran now wants nuclear weapons. 9/11 was a direct result of our dependence on oil. We’re spending trillions already to protect this industry…

I’m as far from an expert in oil production as any regular here, most likely, but I do understand the workings of the industry to a certain extent.

What I’m getting at is that “the collapse in consumption is 10x as large as any likely production cuts” may apply in the very short term, but within a matter of a few weeks or months, production WILL BE CUT to the extent necessary, because the oil going INTO pipelines and refineries will back up until such storage facilities as are available are full the brim full, and the refineries will be unable to accept any further deliveries until they can ship out their own inventory……. and there simply isn’t any place for huge quantities of gasoline and diesel fuel TO go, other than into the fuel tanks of machinery from lawn mowers to tractors to cars and trucks and airplanes.

PERIOD.

Production WILL fall to match consumption, after a few weeks or months.

But it does occur to me that an oil importing nation with an authoritarian government or one with a great deal of central planning and money available might take advantage of this opportunity to stock up at fire sale prices.

I wonder for instance how long it would take the Chinese to build some storage facilities, even more or less makeshift facilities, to store dirt cheap crude by the millions of barrels.

In their shoes, as a person in charge of national security issues, etc, I would think about using explosives to create a reservoir in a dry canyon and pumping it full of crude. Whatever leaked thru the improvised dam of such a reservoir could be pumped right back into it.

Sure it would be an environmental disaster in some respects such as evaporation …… but it would be a grand slam home run, as an investment, if the price of crude goes up by a factor of four within the next two or three years.

Of course ‘the USA’ would care about the price of oil.

Many millions of people and their families earn their living in this industry.

Extreme chaos in any big industry is a human tragedy.

Not complicated.

Yeah, I absolutely agree.

I was talking about national interests, vs normal humanitarian interest in helping people in a terrible situation. Russia and KSA have compelling national interests in oil: they’re deeply dependent on oil exports. The US is not.

Secondarily, I just don’t see any rational planning process happening right now, at the national level. We’ve got Texas politicians willing to say that we should sacrifice 100’s of thousands of deaths to COVID-19, to help the economy. The car industry bailout was opposed by Republicans. Things are crazy.

In a sensible world we would be less dependent on oil, and could find a way to help the industry when it happens to have a temporary problem.

We just don’t have any kind of sensible planning process…

True.

We have the corn ethanol industry subsidized and pitted against the oil industry.

We have not had a coherent national energy policy, ever.

I guess a ‘partisan above all else’ culture guarantees that.

Yeah.

One quibble: the US doesn’t have a problem with partisanship, it has a problem with the Republican party, which has been taken over by crazy people, with the Kochs in the lead (how crazy are the Koch family? The father of the two brothers founded the John Birch society…).

I agree. Intelligent progress is dependent upon both the liberal and conservative impulses in human nature. The liberal impulse looks at the flaws in what is and through novel thought seeks to improve things, to expand the reach of justice the quality of life etc. The conservative impulse is the steady hand that values tradition and continuity. Scrutiny. Security. Holds up its hand and says wait a second partner, slow down a second, don’t throw the baby out with the bathwater.

Both impulses are equally important for wise progress. And it is perfectly fine to have two political parties that embody those two impulses.

But movement conservatism is something different. It is like a disease that has taken over one of the great American political parties. I fear it is beyond saving. I think we need a new conservative party in this country.

The Texas RRC did a pretty good job of keeping things sane from approximately 1930-1970.

Well, it protected the oil industry from low prices. But it missed many things needed in a coherent, comprehensive energy policy.

For instance, the US has no consistent policy on oil imports. It just allowed imports to expand from WWII to 1980, while suppressing domestic production with price caps on domestic oil. When imports were interrupted it resorted to military intervention in the M.E., which has cost many lives and trillions of dollars, and destabilized the world.

It has allowed excessive oil consumption by not charging consumers for all of the hidden costs of oil. Fuel taxes are way, way too low. Proper taxation would fund road work, reduce imports, reduce pollution, promote efficiency in vehicles, etc.

That’s just two examples…

Agreed.

Schinzy- I was indicating the failure at a national level. And sure, if you want to start the clock ticking at 1970, fine with me.

OK

Plenty of US Oil companies will now go bankrupt. Lots of debt will be unpaid. Are banks going bankrupt as well?

Tom,

Not all the debt is held by banks, a lot of it is corporate bonds held by wealthy investors. They should have done their homework, they didn’t and they will get 50 cents on the dollar if they are fortunate (it may be half of my guess). Also the publicly traded companies will see their stock value get cut by 90%, so again wealthy investors that were not paying attention will take a loss.

I am not worried about the wealthy, they have taken more than their fair share for decades (since 1981), about time they got a haircut. 🙂

Fed is going to buy that debt Dennis. They have already stated that they would. The debt is a non-issue now.

They didn’t really have a choice as a lot of that HY credit is held by pension funds.

I’ll repeat this. The FED is going to kill the dollar here. They are bailing out everything and everybody. Just watch where the FED’s balance sheet goes. And it’s going to carry the price of oil with it. Much higher! I bought WTI at $19.87 Trade never went against me either. I’ll add to the position on pull backs. Target is somewhere between $160-$170. WTI

And of coarse i have a stop loss at break even just in case i’m not right. So until price reaches $19.87 again i just let the trade run it’s coarse. I believe the bottom is in though.

HHH,

Doubtful Fed will buy all bad debt. Many of these companies will simply go bankrupt, the largest of them might be bailed out by Fed.

The oil industry has been the fundamental economic stimulus program for the state’s for over the last five years. It’s created millions of jobs, reduced the trade deficit, reduced inflation, headed America towards energy independence and put extra money in the consumers pocket. At the same time the American oil industry has been selling it’s product below cost.

The industry is a national security issue and needs to be saved for defense and economic reasons. The states are still an import nation and under attack from adversaries for it’s effort. An import tariff needs to be put in place of 90 percent of anything under 60 dollars and can be off set by exports credits.

Trump will fail to do the right thing.

Huntington beach,

The tariffs won’t allow the excess tight oil to be exported, we do not have the refinery capacity to utilize 8 Mb/d of tight oil.

We can utilize perhaps 5 Mb/d, with 3 Mb/d needing to be exported.

Now I suppose we can subsidize oil companies to refit their refineries, but it is not a good investment because we only will need that capacity for a few years as tight oil cannot remain at 8 Mb/d before it will decline (perhaps 5 to 10 years). So it will be a poor use of capital and a classic case of why government interference in the market leads to a poor allocation of capital.

A better approach would be a carbon tax on all fossil fuel to speed the transition too alternatives, that would be a much better policy than a tax on oil imports to support an industry that has allocated capital very poorly. Better to reward efficient use of capital rather than the reverse, in my humble opinion.

That’s why I said there should be an export credit(which could be applied towards imports).

The word “can’t” is for losers

Agree, this is a short term fix. Transition is the real fix, but this is a life line to the producers and economy. EV’s should be a near term mandate, 2030.

Huntington beach,

It is still not clear how the “export credits” would work. Do you mean we would subsidize exports of C+C? That is if, the World price of oil is $25/b and we want a price of $60/b0, we would put a $35/bo tariff on imports and pay exporters $35/bo for any oil exported? As long as imports are greater than exports, it would be a transfer of money from importers to exporters and the tariffs on net exports would be collected by the government.

Possibly that could work, but many American would not be happy about the government raising their gasoline prices.

I missed the export credit part of your plan, let me know if I understood it correctly the second time. Your brief statement may not have made it clear.

Small question:

What instrument did you use to buy oil? Just long future, or others?

Yes Dennis, with respect to the haircut the ‘wealthy’ were long overdue. And then some. None of these guys could fit through the ‘the eye of the needle’…

None of what they did was capitalism. It was all financialism, which is not capitalism.

“It was all financialism, which is not capitalism.”

Interesting point.

We should be taxing the hell out of ‘financialism’.

Dennis, Thanks! So, in some months time it’s time to buy very cheap stocks which will boom when the supply and storage gets lower, and demand becomes normalised?

Tom,

Not a bet I would make, but if you like to play low odds bets, you might win big, but more likely it is a losing bet. Kind of like buying a lottery ticket.

A more sensible bet is to buy the market (Vanguard Total Stock Market ETF) when you think it is close to its bottom, then hold for the long run, a much safer bet (probably about 7% annual real rate of return over 20 years).

Timber on the stump has matched the stock market, so they tell me, historically, up until recently.

If you’re not afraid to manage your own money, and willing to learn the business, and run it, real estate can and often does pay better than the stock market, long term, but it DOES require a hell of a lot of work just to learn the business. You won’t learn it taking a few classes, or attending a few seminars.

But consider the best investment, although people in the business of managing money deny it’s an investment, most people can possibly ever hope to make…… home ownership.

I know a ton of people who have made over a hundred times their initial investment in tax free equity within ten years who have CONSISTENTLY made this kind of return…. while living better for substantially less while doing so, in their own home.

Of course you may lose if you just jump in and buy. It’s sort of like shooting at a duck. You don’t shoot at the duck where it IS. You shoot where it’s GOING TO BE when the bullet has time to get THERE…. where the duck will be.

Of course this is not the forum, or at least not the right part of it, to debate investment strategies, and unless you are willing to WORK at learning the biz, you might as well just buy such funds as Dennis suggests.

The best bet: home ownership with an income unit that’s on the property. Real estate needs a lot of hands on management (you’ll lose your shirt if you pay trades to do all of the maintenance), so close is better.

Putin says Russia ready to cooperate on cutting oil production

Moscow (AFP) – Russia is ready to cooperate with Saudi Arabia and the United States to cut oil production, President Vladimir Putin said Friday.

Putin said Russia was willing to make agreements within the framework of the OPEC+ group and that “we are ready for cooperation with the United States of America on this issue,” according to a statement published by the Kremlin.

“I believe that it is necessary to combine efforts in order to balance the market and reduce production.”

The problem facing major oil producers in the short term is that demand has fallen much farther than they are likely to be willing to reduce supply to shore up the market.

When Putin and the Saudis started the price war, they did so by bumping up supply by a few percent. But since then, demand has fallen by ten times that. Cutting output will not get the industry out of the red before the pandemic ends.

Has Russia Reached Its Limit In The Oil Price War?

Russia is now preparing to ramp up spending to support millions of citizens and thousands of companies affected by quarantines and shutdowns. The Kremlin has thus far announced an increase of spending by $17.5 billion to counter the outbreak.

But according to Kudrin, the country may need to spend 5 percent of gross domestic product — or about $70 billion — to combat the impact of the coronavirus, which Russia has officially said has infected more than 3,500 people, but which skeptics suggest is a low-ball figure.

Those costs will be difficult to cover if oil prices are low — but on April 2, the price of Russia’s Urals crude blend fell below $11 a barrel, the lowest since Putin came to power two decades ago. The international benchmark Brent crude, meanwhile, was going for just over $26 a barrel on April 2, whereas Russia depends on a price of about $40 a barrel to balance its budget.

Russia as of March 20 had $551 billion in foreign-currency reserves at its disposal, although economists suggested that Putin would prefer not to tap into them. In just one week,

Russia oil production through March 2020. Russian did not increase production in March. It was pretty well flat, down 7,000 barrels per day at 11,248,000 barrels per day. This is the level Russia said they hope to be able to hold through 2023. However they may now decide to cut that a bit.

https://www.axios.com/coronavirus-fuels-historic-drop-in-gasoline-demand-cde75e40-f70d-4cca-9a16-f27e00f2168b.html

The amount of gasoline American drivers are consuming dropped to levels not seen in more than 25 years, government data shows.

We are finally at true energy independence at these consumption levels.

Russia has proposed spending additional domestically about 15 billion dollars over a period of two years, not one. Their Reserve Fund and National Wealth Fund combined have about $160B.

So they’ve got 20 years of this stimulus spending in those funds. Note that is not the entire Russian government expenditure. And note that Russia has income from other sources. They sell about $6 billion in weapons per year.

Watcher —

According to ZH today, since about 2013 your government debt-to-GDP ratio has stabilized somewhat, but now with the CARES Act (Coronavirus Aid, Relief, and Economic Security Act), some estimates place the deficit for 2020 alone will be $4 trillion. This will lead to at least an 18 percent increase in the government debt-to-GDP ratio in one year alone. Last time I looked, the US Federal Debt to GDP Ratio was 109.40%. My question is this: do you see this as a problem, or do you think the US can simply keep printing money indefinitely? My dad programmed me to believe debt is a bad thing and 80-ish years later I still live with a debt dread phobia, perhaps misplaced?

BTW, I managed to get through uni (geophysics and geology) debt free because there were tons of well-paying summer jobs in the oil and mining industries back then. I pity those modern students who must shoulder an enormous debt load.

Douglas,

Non dynamic math would say you’re correct. But the spending is supposed to be stimulus, the the item stimulated might be tax revenue as much as sheer economic activity.

Yesterday’s jobs report was -700K, which was worse than “expected”. But this is out of an employed workforce of 130 million. Most still are working, and paying taxes. A big part of the stimulus is given to small business and they are told those “loans” are forgiven if the business proves the loan was spent nearly all on payroll.

So, tax revenues appear to me better this year than expected. The money will be loaned to business and the forgiveness of that loan may not finalize until next year or the year after.

No question the $4T will be borrowed money and drive debt to $24T. But GDP is an equation and government spending is in that equation. If it doesn’t fall a huge amount, Debt / GDP will not depart from current curves too very much.

As for how long can you print — I would suspect the limit is determined more by oligarch fear of eliminating their source of power than by inflation. If money becomes too overtly meaningless, their power becomes unjustified. So . . . too visible a procedure of printing money will be discouraged.

Watcher,

The March employment report is based on surveys through March 12, in the subsequent 2 weeks 10 million people applied for unemployment benefits, non-farm payrolls are about 152 million. So 10/152= 6% over a two week period. In March 2008 US non-farm employment was 138 million. If we lose another 10 million over the next 2 weeks we would be at 132 million, less than 12 years ago and an unemployment rate of about 16.7% (labor force is about 162 million in March 2020, includes employed plus unemployed of 27 million).

Hopefully the stimulus will bring people back to work when covid19 crisis ends.

Doug ,you are on the right side of the equation . Even the US cannot flout the laws of Physics and Mathematics ( I don’t consider economics a science , it is only their to provide respectability to astrology ) . This mad money printing will blowup , the question is not ^if ^ but ^ when ^ . My best guess is any time between June and Sept this year . Why ? The stimulus money for the big corporations will reach them , but it will only fill in the black hole they are already in ,on the other end the SME’s will not get anything or at least not a lot , it will be used by the banks to fill their own black hole . This is my WAG .

Watcher and hole in head —

Thanks for responding. Economics has always been, and remains, a mystery to me. I do miss the good old days of running surveys and exploration programs but that was eons ago, a different life.

Cheers and good luck dodging the bug.

Doug

In your original post above you said:

“I pity those modern students who must shoulder an enormous debt load.”

You could also have added “and don’t want to work for the dying oil industry.”

Doug,

Too much debt for individuals is a problem. For governments in the face of a severe economic down turn, too little debt is a problem. Hoover chose to forgo government debt from 1929 to 1933, Roosevelt reversed this policy, but was too timid and still worried about debt, this delayed recovery from the Great Depression. Only high levels of government debt to fund WW2 ended the Great Depression.

In short, worrying about government debt is a mistake during an economic recession, in fact Europe’s concern (especially Germany’s) about too much government debt is the reason their recovery from the GFC was so much slower than in the US and China where more aggressive fiscal and monetary stimulus was used.

Read the following for an introduction,

https://www.amazon.com/General-Theory-Employment-Interest-Money/dp/198781780X

The kindle edition (free app available) is 99 cents, or at your local library for free.

Dennis, a quibble.

As you note in your second paragraph, fiscal stimulus is important. To be clear, that means government spending. Spending on WWII (in combination with borrowing) is what ended the Depression. You can just cut taxes alone, but that’s a big gift to the wealthy. They get to pay for a treasury note, which is an entitlement to interest income, rather pay a tax bill.

The key is to create demand in an environment where consumers are afraid to spend their money. The simple way to do that is for the government to spend money. Debt is secondary: you don’t want to raise taxes and reduce the effectiveness of your new spending. But that’s very different from just cutting taxes.

Much of the debt we’ve created recently has been ineffective, simply a gift to the wealthy.

Nick,

It can be either cutting taxes or government spending. If the tax cuts are targeted to the non-wealthy, it is nearly as effective as government spending as most extra money in the pockets of less wealthy individuals will be spent. I agree that a tax cut that mainly goes to the wealthy is poor policy and far less effective than government spending.

You are correct that in the case of World War 2 the fiscal stimulus was mostly a matter of increased government spending, that is indisputable.

I agree. Tax cuts targeted to low income folks would work just fine – sadly, that’s not what we’re getting lately.

Why is this important? Because one criticism of debt is that it seems to be less effective lately in stimulating the economy. I’d say that the fact that the tax cuts are going to the wealthy is the explanation.

Fortunately, that’s easy to fix (at least with the right people in office…).

Also, the US had a glorious opportunity this decade to raise taxes and cut government debt, but didn’t take it. Instead, they ran up the debt even further with the Trump gift to the 1%.

Now America desperately needs the government to go into debt. but deficit spending is already sky high.

This idea of giving the rich tax cuts to “prime the pump” as Keynes put it, is not very good, because the rich tend to have high savings rates anyway. Put another way, they don’t spend it. The money from Trump’s tax cut mostly went into pumping up the stock market or being squirreled away in tax shelters.

Another bit idea is blowing $2 trillion on infrastructure, which both Clinton and Trump promised in the election. The problem with that is that America makes such terrible choices on infrastructure spending that it probably isn’t a good way to spend money. The best idea here would be attempts to ameliorate the damage done by the poor decisions made in recent decades, like sound barriers for urban highways to increase land values.

The correct solution is to spend more on labor intensive and chronically underfunded areas of the American economy — public schools, not only for children but also vocational schools, driving schools, schools for police (Germany requires a two year course before you can join the police force), basic health care (including dentristry, where America has fallen far behind the rich world, and some efforts to reduce obesity) public transportation, social services etc.

I’m not holding my breath.

Alimbiquated , your solution is not going to be implemented . The corporates will get all the stimulus money . This money will then be piped out

to both the political parties for the next election cycle . After that rinse and repeat . That is how US politics has operated over the ages and nothing will change this except a revolt, as for the common man ,he can take a long walk on a short pier .

Concerning an agreement that would include the United States.

One would anticipate an absolutely outrageous manifestation of the United States reneging on any agreed quota. The cause would be the obvious thing to hide behind — that the producers are private and cannot be commanded by the US government. OPEC individual country production quotas have always been exceeded. Why would we presume that the US would comply with quota any more than individual OPEC countries have complied in the past?

What this means is a bit inevitable. KSA and Russia are going to have to stand back and produce at maximum and wait to see the United States comply with any agreement. There is no way imaginable that this will be found acceptable by the US oil industry, and therefore the quote by Vladimir Putin that the US must participate is a deal-breaker.

Besides which, Russia and KSA can proceed as planned currently and a reduction in US production should take place by itself, unless there is a bailout, which is likely.

Seems to me that the TRRC can set quota. That’s half of US production right there. Maybe Mike can speak to how long it would take to stop the flow: I assume there is some kind of legal instrument that allows one to drill and sell, and he might know what’s in the fine print.

Every one of the oil-producing states has a similar board…I saw an article yesterday where the producers in one state were asking the authorities to cut production.

So a US delegation would have to have 10 reps for the major oil producing states, and some cell phones to talk to their bosses.

So I say take away their legal right to produce and cut like the rest of the world.

Survive together, or all go bankrupt together.

“Why would we presume that the US would comply with quota any more than individual OPEC countries have complied in the past?”

Historic move to cooperate with Moscow in energy market management already happened last week. Objectively speaking, the oil crisis needs a joined-up international response, and, arguably, the solution lies in looking beyond OPEC (and OPEC+) at a wider coalition — OPEC++ that includes the US. In principle, Saudi Arabia and Russia would favour the idea that the high-cost producers outside the OPEC+ group must finally share the burden of balancing the oil market.

It will be up to US oil industry to figure out its own energy market management and it will happen very fast, maybe even this weekend.

In general everyone is trying to wrap their minds around various circumstances from the perspective of current legal mechanisms. Forget that stuff. It isn’t going to fly.

For example, if US oil producers were in fact inclined to agree to some production reduction arrangement among themselves — well, that is the somewhat explicit definition of anti trust behavior and collusion.

Someone, somewhere, will sue. If all companies get together and agree to a procedure intending to raise price and harm the consumer, the fines will be enormous for the obvious collusion anti competitive violation.

Forget the norm. Forget capitalism. It died once already and is dying once more. Just accept it. Government will have to put guns to the heads of various parties and force them to do things — and those things will be suddenly legal because government will have to overtly change laws to make it possible.

Just think, it’s going to have to become legal for oil companies to collude on raising prices. And it has to get through both houses and get signed.

There’s no way in hell any country selling oil into international markets will continue to produce at max rates for more than a few more weeks or months.

Oil is sort of like MILK. You can’t stockpile the damned stuff. It goes out from the farm and ends up in consumer refrigerators. When people quit buying, farmers have to sell dairy cows for stew beef.

The one big difference is that crude is not perishable, at least not short term. ( I suppose it does lose some volatile components in long term storage, thereby lowering the value of it somewhat. ) But the point is that once existing storage facilities, pipelines, and refineries are fully stocked up, where do you put gasoline and diesel fuel?

I will be buying some extra so as to play with my one big yellow machine but for every farmer like me, there will be a hundred people who won’t be going to the lake with a boat that burns three or four times as much in a day as my machine.

Maybe somebody here can provide us with a reasonable estimate of the cost and time frame involved in constructing a tank farm, or laying a pipe line to an old salt mine or something of that nature, so as to be able to store let us say an extra ten million barrels a day.

Now that would be one HELL of a tank farm, would it not?

Maybe some of the orangutan’s ” best people” can figure out a way to drain a major lake someplace, and dump all that dirt cheap crude in it, thereby allowing it to promise cheap gas for years to come, lol.

OFM

Here is a story about temporary oil storage you will enjoy>

https://www.roadsideamerica.com/story/23157

Finished motor gasoline supplied fell off the shelf in the last few weeks from 9459 to 6659 thousand barrel per day in the US (March 6 to March 27). Probably still falling.

Gonefishing,

For all petroleum products and crude, stock levels went up by about 8% in the week ending 3/27/20. Agree this will get worse.

Matt Taibbi on money creation: https://www.rollingstone.com/politics/political-commentary/coronavirus-fed-bank-bailout-disaster-976086/.

Debt and money creation always ends in hyper inflation. The inflation starts where the money is injected. We will see what happens to oil prices and the cost of extraction.

Schinzy,

Can you define hyperinflation?

Not a lot of hyperinflation (as I define it) evident in the US from 2008 to 2020.

https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA

or

https://fred.stlouisfed.org/graph/?g=8dGq&utm_source=series_page&utm_medium=related_content&utm_term=related_resources&utm_campaign=fredblog

first link used for chart below

I define inflation as a decrease in living standards at constant salary. With this definition the official inflation rate understates inflation because it does not include financial assets.

But I said it ends in hyperinflation. It hasn’t ended yet. We will check the inflation rate in 2025 to see if we are nearing the end. First there will be shortages, the shortages are followed by hyperinflation. Currently there are shortages in ventilators and surgical masks so you can find inflation there. You find inflation where the money is injected, it becomes hyperinflation when there are shortages that the injection of money does not solve. You can find hyperinflation today in Venezuela for example. I am predicting the shortages will spread to other areas of the economy in the US and Europe.

MMT doesn’t care about debt. And they will print their way out of any financial crisis. The repercussions of such activity is yet to be seen. (Other than asset price inflation and bailouts)

We have several competing components, increased mechanization and scale has made products cheaper. Increased efficiency has reduced material demand and energy use. This is countered by increasing population/demand and increasing debt. Too much debt gets balanced by lower demand but upsets the system sending it in a new direction.

Taibbi doesn’t make any claim on the inevitability of hyperinflation. The article is great – focusing on the preservation of unprofitable companies (hmmm, sound familiar?) with trillions of dollars of public debt. There was a conversation earlier in the thread about oil companies going bankrupt – and this would suggest that “the reported death of the [oil industry] has been greatly exaggerated”.

There is inflation in the sense that the stock market and most housing markets are not worth their asking price. They are inflated at many PE levels beyond any reasonable rates of profit. Since 2008 pensions, 401K accounts, etc have had a “choice” between holding dollars or buying into ever- and over-inflated markets to chase returns, and most institutions are going to take that gamble. And any that did have been proven correct – when things got bad the Fed has stepped in to be buyer-of-last-resort.

but little of that wealth filters to the average person – which is why you will never see hyperinflation of basic food items, etc from this mechanism.

That’s correct except that basic food items are no longer included in inflation statistics. Neither is energy. So they took out the most important items and had the nerve to call it “core inflation”.

Is it any wonder I can’t make heads nor tails of Economics? Change definitions at will and they still call Economics a science!

Schinzy,

Following chart has US CPI including food and energy. Data from

https://fred.stlouisfed.org/series/CPIAUCSL

Generally inflation does not include assets, that’s a strange definition from my perspective. Venezuela is very poorly run, in poorly run nations, hyperinflation is not uncommon.

Very nice graph.

In fact I think inflation is too low. Deflation is much more dangerous. In 2015 I thought malinvestment was increasing the probability of a deflationary debt spiral https://www.tse-fr.eu/article/dysfunction-oil-markets-increases-probability-deflationary-debt-spiral. In hindsight, I underestimated the importance of money creation by central banks, though the price of oil dropped about 13% in 2019 even though production was flat to down. I think we were heading into a recession when COVID 19 hit. I think the virus will be an excuse to push through a lot of arbitrary monetary policy in the name of saving the economy. We will see how long this pandemic shuts down the economy and to what level the economy comes back once the mortality rate stabilizes.

Venezuela is indeed a poorly run economy. I do not think the US economy is particularly well run. I do not think the US economy particularly robust in the face of the challenges it will be facing in the next few years.

I agree US is imperfect, but I bet a lot of Venezelans would choose the US over Venezuela.

I agree deflation is more of a problem than inflation. You mentioned hyperinflation, that’s a tough call, probably a toss up in my view.

A recession is always around the corner. It is policy used to deal with it that’s important.

A recession is always around the corner. It is policy used to deal with it that’s important.

Yea the policy being privatising profits, socialising losses. Great policy.

Iron Mike,

We get the policies of those we elect, elect poor leaders and you get poor policy. It is that simple.

“We get the policies of those we elect, elect poor leaders and you get poor policy. It is that simple.”

China has known 82,000 cases

USA has known 324,000 cases (despite a huge heads up on the outbreak)

Why the absolutely miserable showing for the USA?

Its Grade F leadership at the very top.

Sorry if you find the truth bitter, but you did vote for it.

Hickory,

Nope not my vote, but that of my fellow citizens.

I know Dennis, no doubt.

I was referring to those who would find the acknowledgement of the miserable performance of their choice to be a bitter pill.

+2

Schinzy,

You cannot look at output alone, oil plus petroleum product stocks have to be considered as well. Output was too high in 2018 leading to high stock levels, output was not cut back enough to bring stock levels down quickly so oil prices fell from 2018 levels. Output alone gives an incomplete picture of the dynamics of the oil market.

Hickory,

It is impossible to compare China with the U.S.

Authoritarian countries such as China can impose stricter controls on movement and more intrusive means of surveillance, such as house-to-house fever checks, tracing and enforcement of quarantines, and are less vulnerable to pressure from businesses and popular opinion. That gives them powerful tools to keep the virus in check, so long as they are vigilant against imported cases. That’s a more difficult proposition for other nations. The poorest countries can less easily afford the economic losses caused by prolonged restrictions, and often don’t have the health infrastructure for extensive surveillance.

https://www.bloomberg.com/news/articles/2020-04-03/when-and-how-does-the-coronavirus-pandemic-end-quicktake

Fine Hans,

then compare the death rate to date of USA at 29/million (and just now entering a steep phase),

with Taiwan with rate of 0.2 death/million.

Taiwans top leadership got a grip, didn’t deny, and rallied the country to get on board with measures to hit this challenge early and hard.

No excuse for the leadership in this country. Short term political expediency and ignorance are no excuse for failure on this scale.

A good point.

Another indicator is that central banks became worried in September 2019 and began injecting money into the system. The stimulus managed to bring oil prices up about $5/barrel by the end of the year, but prices started to fall again in January. Difficult to say when COVID 19 started killing demand. The Chinese lockdown began January 23rd.

Schinzy,

Unclear what moves oil prices some of it may have been chatter between Russia and Saudi Arabia and whether a new agreement would be reached also China epidemic was becoming apparent by January. In addition the visibility of stock levels beyond OECD is not good so there is a significant lag between changes in stock levels and changes in price probably 3 to 6 months.

“Venezuela is very poorly run, in poorly run nations, hyperinflation is not uncommon.”

Dennis, I’m VERY interested, NO sarcasm intended, in your estimate of how well the USA is being run these days, and how long you think it continue to be run as at present.

You don’t have to answer the first part, you’ve made it clear already.

If you were a betting man, what kind of odds would you want to bet on the D’s winning all three branches in November? THAT’s what I would really like to know.

OFM.

All three branches will be tough, I doubt the Senate will go Democratic, so for both houses of congress and executive, I would say maybe 20% probability+/-10%. A highly speculative and subjective probability, mind you.

In layman’s language, a 5 gallon bucket of salt needed with that guess.

OFM and Dennis , don’t sweat too much on this . The Reps and the Dems are as George Galloway says ^ Cheeks of the same bottom ^ . 😉

Bullshit! Such nonsense rolls easily off the tongue HH, but that don’t make it so. Donald Trump, a Republican, is the worst man ever to occupy the White House. He is a wannabe dictator. And most Republicans just line up to kiss his ass.

To say that Democrats are just as bad as Trump is an insult to the intelligence of every thinking American.

There is reason that over 9 out of every 10 college professors are Democrats.

Democratic professors outnumber Republicans 10 to 1, study shows

The higher the intelligence of a person, the greater the chance that person is a Democrat. But the really dumb-ass good-old-boys, those who want to Make America White Again, are almost to the man, Republicans.

I apologize for the rant but to insinuate that there is no difference between a Democrat, like myself, and the average Trumpite, just makes my blood boil.

Some people who argue that there’s no difference are embarrassed by their support of Trump, and want to claim a false equivalence.

Some don’t understand the nature of a two-party system, which drives candidates to the center. Such systems pull the two sides together to get votes, but the two parties are under tension, pulled to the edge by their more enthusiastic members, pulled to the center by the need to claim voters who are near the center. In such a system, the center needs to be moved by education. But activists tend to want to preach not to the uncommitted center, but to the choir…

> The Reps and the Dems

What you are saying is that you want Trump to be dictator, because democracy is a bad idea.

This is the line the Republicans have been pushing since Nixon. The American press plays along with it with an unending stream of abuse poured on “congress”, instead of assigning blame to the party that made the decision.

Oh heavens. Core inflation is a number that’s used by the Fed to determine whether or not inflation targets have been hit, which is one of the dual mandates they have as their raison d’etre — inflation and unemployment. Note that unemployment was added as an item the Fed should manage only in the 1970s

Core inflation excludes food and energy because food and energy tend to be volatile. You could use the word noisy for volatile in terms of signal processing.

In recent years, PCE has become the Fed’s inflation measure of choice. It is measured differently than core inflation.

The overall message to take from this is that it is all whimsical. There is no oversight. The Fed, and other central banks, lean on their independence from the rest of government and do whatever the hell they want. The Fed chairman goes before Congress and testifies now and then and tells them what he is doing and then sits back and lets them perform for the cameras and has no legal obligation to do anything they say.

“Core inflation excludes food and energy because food and energy tend to be volatile. You could use the word noisy for volatile in terms of signal processing.”

Hold on a sec my friend. Are you suggesting the cost of food and energy are (just) noise in the cost of living equation simply because they are volatile? Noise, by definition, is a generic name for a relatively persistent component, due to a multitude of causes, that is a non-interpretable or unwanted component of a signal. The cost of energy (or food) is NOT noise in the cost of living. No, the cost of food and energy are not “unwanted” or “non-interpretable”. You can’t legitimately argue in terms of signal processing that way. Errors in the data would qualify.

BTW, if I had walked away from every complex seismic signal I encountered simply because the information looked “noisy” it would have resulted in a very short career indeed. ?

+1

Noise does have frequency. You can apply a digital low pass filter to it and reduce its amplitude . . . the high frequency portion of its amplitude by 3 or 6 or 9 or whatever db. The nature of food and energy price motion does have a frequency component, which could be determined by FFT, or you can wave a hand at it (as Bureau of Labor Stats does) and instead announce seasonal adjustments and pretend you actually know something of that signal (or noise).

Douglas, nearly all of this stuff is whimsy, enshrouded in complex gobbledygook that can make sense once every few years and justify a thesis or dissertation, subjects for which can get scarce.

For this convo the reality is food and energy are volatile. So they are extracted because they obscure what is hoped to be a detectable trend. The BLS website describes how they measure inflation and what categories dominate the proportions. For the US . . . housing at 42%. I think food and energy add to 25-30% which is big enough that volatility screws up the overall number.

Here is the proportion of various categories for total consumer spending. It all comes from surveys:

https://www.bls.gov/cpi/tables/relative-importance/2019.txt

The Fed uses inflation statistics to decide on policy. They have decided that a sharp rise (or fall) in oil prices tend to not bleed into price changes elsewhere in the economy. OTOH, oil prices can affect the overall inflation number, so using the overall inflation number to decide on rate or QE policy would be a mistake.

IOW, oil prices can go up or down, but the Fed thinks it’s a mistake to change monetary policy based on those changes: they’re ignoring oil shocks, which actually makes sense. If Paulsen had done so in 1979, that would have reduced the damage done by the Fed to the economy.

Core inflation is not the primary measure of inflation. The primary measure, used for things like Social Security cost-of-living adjustments, absolutely includes food and energy.

It’s completely insane to worry about inflation right now. The NYSE alone just lost $10-$15 trillion dollars in value. Stock isn’t cash, of course, but it is pretty liquid. That liquidity just vanished into thin air.

Meanwhile corporate debt in large areas of the economy has just become basically worthless. Just look at the situation of holders of oil industry debt. I doubt they are about to go on an inflationary spending spree.

Demand is collapsing across the economy. Just about every company on the planet is facing a cash crunch, as are probably 1-2 billion households.

Worrying about inflation in the current situation is like falling off a ladder and worrying as you fall that you might bump your head against the ceiling. That may have been an issue when you were standing on the ladder, but it isn’t right now.

Japan still has everyone beat on printing money.

Sashay over there and find me some hyperinflation.

Watcher,

On that point we agree.

https://fred.stlouisfed.org/series/FPCPITOTLZGJPN

https://fred.stlouisfed.org/series/JPNCPALTT01CTGYM

Your observation doesn’t fit the narrative so it should be ignored. / s

WeekendPeak

As noted above, anti-collusion laws or antitrust laws are very much likely to prevent the United States from participating in an oil production reduction agreement, and because the United States chooses (yes, chooses) not to participate, Russia and KSA will likely not have any agreement to reduce production.

They very properly would insist that the United States change its laws to enable it to participate in such an agreement. This will never get through Congress and probably would not be signed by the president if it did. And so there probably will be no production reduction agreement. It would presumably require an outright payment of money to KSA and Russia to get them to reduce production regardless of US behavior.

So shale will continue to produce and as financial pressures mount, begin to reduce production, or more importantly, employment. The president will intervene. Executive orders can impose tariffs without Congressional approval and that is what he would do.

The president can probably also arrange for interpretation of the stimulus money pointed at financial institutions to substantially focus on those institutions involved with financing shale. If a lender is going to be backstopped by the government, and can still collect origination fees and commissions, hell yes he will lend more money to shale.

This won’t be the only industry requiring it. Remember all the sneering that was done about China having built empty cities? Real estate and construction employ a lot of people. Expect there to be a great many zombie subdivisions around and don’t expect your house to hold its price. Property tax rates are going up as house prices fall. Government employees who are funded by prop taxes won’t be taking a salary cut.

If the Government chooses to deny producers quota, it does not fall under collusion or anti-trust. It is not the business players themselves agreeing to reduce production: it is those same players being forced to do so.

Watcher,

The RRC still has the authority to limit production just as they did from 1935 to 1970, you may be correct that they choose not to act.

Watcher,

There are other ways….

“The Trump administration has considered a mandated shutdown of oil production in the Gulf of Mexico due to the coronavirus spreading among workers, WSJ reports.

Shuttering Gulf platforms over health concerns also would have the effect of curtailing U.S. oil production amid a worldwide glut of oil that has sent prices plunging, and possibly assisting a potential truce in the Saudi-Russian oil price war. If the U.S. shuts all Gulf of Mexico production, it would cut ~2M bbl/day from overall U.S. production of 13M bbl/day.”

The main insight of the current situation is to finally see that this ‘Energy Dominance’ policy with now crippled, U.S. fracking industry, has failed miserably.

What needs to happen is to cut the production immediately, make a deal with OPEC+Russia and avoid making energy policy based on financial fraud that fracking is in the future.

2 mbpd isn’t enough. Russia and KSA cut a great deal prior to all of this. The US has to catch down.

This is going to be phrased like that. If 10 mbpd is to cut, then that is to evenly distribute, but the starting level for the 3.3 mbpd from the US is not today’s level. it would need to be the level when the first OPEC+ deal was tried.

It’s going to be hard to shut down oil for health reasons if the health based stimulus is denied them.

Watcher,

Russia cut almost nothing to date, maybe 500 kb/d at most below what they are capable of producing. KSA has cut some, but when they have been at maximum output it has never been sustained for long, KSA capacity is probably only 10.5 Mb/d and they may have cut 1 to 1.5 Mb/d.

Ves, in my opinion, fracking is not a fraud… fracking is an engineering marvel. It did what George Mitchell and previous/subsequent developers over many years designed it to do… allow commercial production from source rock that was bypassed for decades as a dead zone. Fracking allowed production from this bypassed tight rock, creating production that flourished. The economic abuse by some lower level operators over the years certainly caused financial failures, but fracking worked.

Perhaps a fraud was committed when these weaker hands entered the industry and attempted to capitalize on this same technology by using other people’s money and targeting inferior rock. But, it’s no different than McDonalds dominating every corner with burger shops and other speculative burger shops coming in with the same model only to fail because they could only set up shop on a bad corner. For Shale and fracking, billions in profits have been made from tier 1 and perhaps some tier 2 rock…. a well that was drilled and completed for $12-$15,000,000 is generally profitable in the basins where most wells produce 300,000-400,000 BO in the first 3-4 years and still have decent production left over. At reasonable price assumptions, fracking is profitable in Tier 1 and many tier 2 regions. Low quality speculator companies bleeding out into tier 2 and tier 3 areas and attempting to capitalize caused most of the negativity.

So, in my opinion, a sweeping statement that fracking has failed is not true. Like all industry sectors, there are those that succeed and those that do not, even when they apply the same technology and methodology. Location choice and bad financial judgment failed, not the technology.

I know I said I wasn’t going to post for awhile, but I couldn’t let this post pass.

Where are these basins where most shale wells produce 300,000-400,000 BO in the first 3-4 years with decent production left over?

Make sure and let Enno Peters know of these basins, unknown to the rest of us, so he can include them on his shaleprofile.com.

For the hundredth time at least, ALL of the US shale basins only work at very high prices. Once again, the companies have amassed HUGE net operating losses since the 2014 crash. Once again, the almighty ExxonMobil cannot help but lose massive amounts of money in the Permian Basin at $56 WTI in 2019. Kind of like Tim the enchanter said, “Look at the bones!” in the classic Monty Python’s The Holy Grail, I say, “Look at the 10K!”

The 10K scream that shale doesn’t work at low ($50s and below WTI) the same way the pumping unit screams at me squeaking away if the pumper doesn’t give it regular gear oil and grease.

Since 2014 the almighty PXD has amassed a $5 BILLION net operating loss in its (almost) pure Permian Basin shale play. This is the norm, not the exception. PXD was smart, they funded the cash burn with much more equity than debt. But they still have burned cash.

Shale can only make money when we can make money hand over fist in our 114 year old high LOE stripper well field.

And right now, they are all begging for help because they know a few months of $20 or less WTI means they are screwed. They cannot cut corners and shut in a few wells for awhile like us grimy old shale people who have little to no leasehold DE͏B͏T.

I will not argue against the tech being amazing.

But to say billions in profits have been made and that there are basins as prolific as you claim in the post is just false.

Two groups have made money on shale since 2014. First, royalty owners. Too bad they have only made about 2/3 of what they should have, but they have made money.

Second, upper management. Management that has burned billions in the shale furnace since 2014. See the most recent fraud, Whiting. Right before BK, management pays itself a $14.6 million bonus. In the plan, management gets 8% of the company’s newco stock.

Why do the US BK laws reward public company management that completely fails?

If I were OPEC , I would insist of the US, among other things, that all failing management of shalecos be prohibited from “retention” bonuses and stock in Chapter 11 BK.

I would also insist on a 120 day drilling and completion moratorium for all US lower 48 onshore. It should just be applied to shale, but I would include conventional just to be fair. Trump can come up with a plan to pay the service workers during the shut down.

Third, I would insist on no waivers of spacing rules, as Mike has written on his oilystuff blog.

Last, I would insist on no more flaring, at least after a reasonable initial period of time following completion of a well.

Let’s look at shaleprofile in the future before we post well productivity. I am sure you can cherry pick and “prove me wrong” like NONY on SA. But that’s also false.

Thanks shallow sand.

Agree in full.

Hello Shallow Sand,

Yes, much of what you write does have merit on classic bad wall street management (The Whiting execs do need to be publicly shamed a bit!), however…. my distinction here is to defend fracking as a profitable venture, not to defend the poor financial structure used by many of the operating oil companies that were exposed when the winds changed against them. I believe shale fracking very much has been and can be profitable, but location and sound management are key. Like all oil and gas exploration activities, it’s a statistical play with winners, losers and a full spectrum in between. This could also apply to other industries… restaurants, real estate, retail, hospitals, etc….

To your point, many of the companies with poor financial structure, poor management and those who chased lower quality acreage could be labeled as a “fraud” (whether malicious or not) due to their inability to service debt in a lower price environment. But, leverage, development velocity and unfortunate commodity prices are what brought it down, not bad rock or technology.

So, from a bookend perspective…. Would shale fracking be a fraud if all the operating companies developed their acreage without debt? My opinion is, no, it would be profitable and legitimate in most cases on average…. just much slower to develop. So, in classic oil and gas, and many other human endeavors… the industry got way ahead of itself too fast and accelerated growth at a pace that was unsustainable…. this is just another classic boom/bust cycle we all know and love in our industry. I think this is my 3rd or 4th bust!

On to your other question of what basins are profitable? I am a small budget mineral buyer guy for the past 20+ years, so I have seen lots of activity in the major US basins. My opinion is that the following oily shale basins and counties are the premium (I also like lots of the gassy basins/plays, but we’ll save that for another time):

Williston Basin (ND): Mountrail, McKenzie, Dunn, Williams

Delaware Basin (TX & NM): Loving, Winkler, Ward, Reeves, Pecos and Lea (NM)

Midland Basin (TX): Upton, Reagan, Midland, Martin, Howard, Glasscock

I would also add certain areas of the Anadarko Basin in OK, DJ Basin in CO, Powder River Basin (WY) among others too numerous to list here.

I am not making the sweeping statement that all acreage works well in the above areas, but simply that statistically, a well run company with low debt can make good money fracking rock in the above areas, even at sub $40/Bbl in certain sweet spot fairways.

An example of this (only slightly cherry picked at random!) is the following three well pad:

Operator: Felix Energy

Lease name: Snowmass 2920-27 (1H, 3H & 4H)

Location: Winkler County, TX

Zone: Wolfcamp

# Wells: 3

First production: March 2018

Cumulative oil through Jan 2020 (23 months): 1,159,934 BO

Current daily production (Jan 2020): 1,217 BOPD

The example above is probably close to paying out and is still making 1,217 BOPD after almost 2 years. This assumes a 25% royalty and standard severance tax but no LOE. However, no value is assigned to the cumulative 1.5 BCF of nat gas which could be a partial offset to some LOE. details, details….

I can try to post a PDF of the decline curve chart on the monthly production from my data source, but not sure if third party data is allowed here for copyright issues? Let me know if someone knows…

I will agree with you that the Royalty owner is the best performer in this industry. They are profitable quickly after barrel #1, unless the mineral asset was purchased recently for too much/net acre with high leverage.

My point here is to defend fracking shale rock as a profitable venture, if approached with good management, sound economics and good acreage. Good timing helps too. Fraud is too negative of a description against a sound and financially viable process in my opinion. Maybe against some of the people, but not the process.

Apologies, I kinda rambled on here….

Thanks for your response.

I did indicate mineral owners have made money. They and shale management.

Dennis noted roughly 5% of wells produce what you initially stated were, “most wells.”

As I posted on here years ago, we operate some wells that are profitable at very low prices. Any operator that has more than a few wells does. Those are running right now. They make more oil than average for the field. They fail less than average for the field.

We have leases that have LOE under $10. But, they are not the norm by any stretch. They are our top 5% in the way the well productivity you initially mentioned are shale’s top 5%.

Shale needs high oil prices. No reason to add 2 million BOPD at $65 WTI in 2018 and 1 million more at $56 WTI 2019 and it wouldn’t have happened if shale management had more at risk.

In the early 1980s there were many “oil promoters” who showed up in our field, with no intention of doing anything but making money off investors, who tended to be wealthy people from urban areas. When the 1986 bust hit, these promoters walked away from everything, they filed BK and stuck the state with a lot of orphan wells and a lot of environmental messes. The investors’ non-operated WI was worthless and they ended up with $0.00.

See any similarities between shale management and the oil promoters?

I agree with you, shale would be ok if it were developed responsibly. But it wasn’t. The regulators let things slide in the name of more jobs and more tax revenues.

Think a few here have been posting this for 5 years or more.

gunga- “My point here is to defend fracking shale rock as a profitable venture, if approached with good management, sound economics…”

Sound economics is indeed a key ingredient, and that includes operating when the price paid for your product is enough to cover all costs. That price number has been insufficient since 2014.

Gungagalonga

One needs to look at the output of the average well.

Only 5% of all tight oil wells drilled have produced 300 kb to 400 kb over their first 36 to 48 months of production.

When all is said and done it will be billions of dollars lost as these tight oil companies go belly up and billions in debt is written off.

Agree it is an engineering marvel, but it only works at $75/bo or more for WTI.