A Guest post by Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs March Petroleum Supply monthly PSM which provides updated information up to January 2023.

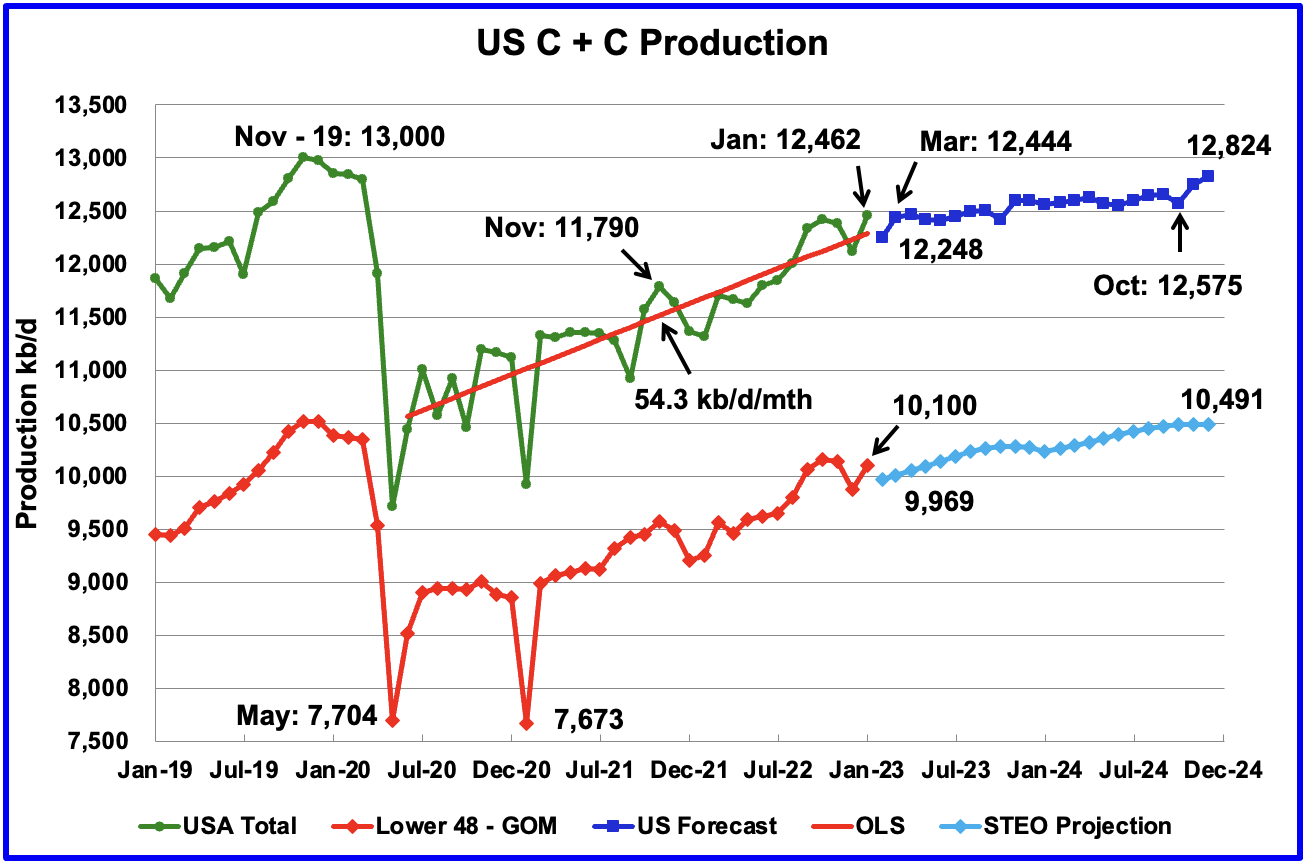

U.S. oil production increased by 437 kb/d to 12,462 kb/d, a post pandemic high. For January, the GOM contributed 125 kb/d to this high. The states with the largest increase were North Dakota with 97 kb/d followed by Texas with 76 kb/d.

The dark blue graph, taken from the March 2023 STEO, is the forecast for U.S. oil production from February 2023 to December 2024. Output for December 2024 is expected to be 12,824 kb/d which is 166 kb/d lower than the November 2019 peak of 13,000 kb/d. From March 2023 to October 2024, production is forecast to increase by 131 kb/d. February’s production is expected to drop by 214 kb/d to 12,248 kb/d.

The red OLS line from June 2020 to January 2023 indicates a monthly production increase of 54.3 kb/d/mth over that period. Clearly the growth rate going forward for 2023 and 2024, shown in the dark blue graph, will be lower than the 54.3 kb/d/mth seen in the previous July 2020 to January 2023 period.

While overall US oil production decreased by 347 kb/d, the Onshore L48 had a smaller but similar sized increase of 221 kb/d to 10,100 kb/d in January. The light blue graph is the STEO projection for output to December 2024 for the Onshore L48. From February 2023, to December 2024, output is expected to increase by 522 kb/d. Note that the last six months of 2023 are showing a hint of plateauing.

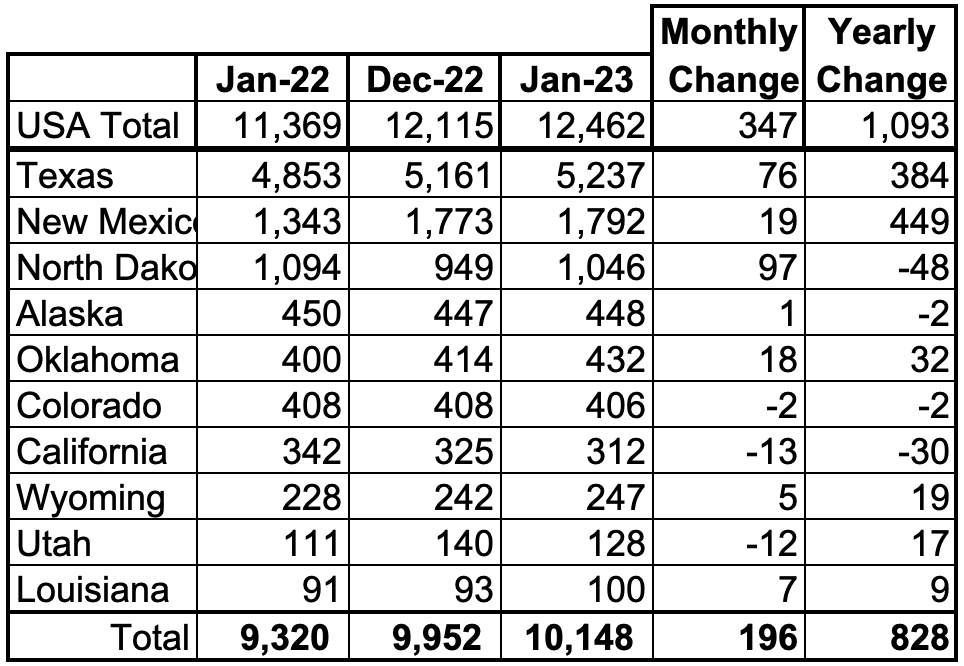

Oil Production Ranked by State

Listed above are the 10 states with the largest US oil production. These 10 accounted for 81.4% of all U.S. oil production out of a total production of 12,462 kb/d in January 2023.

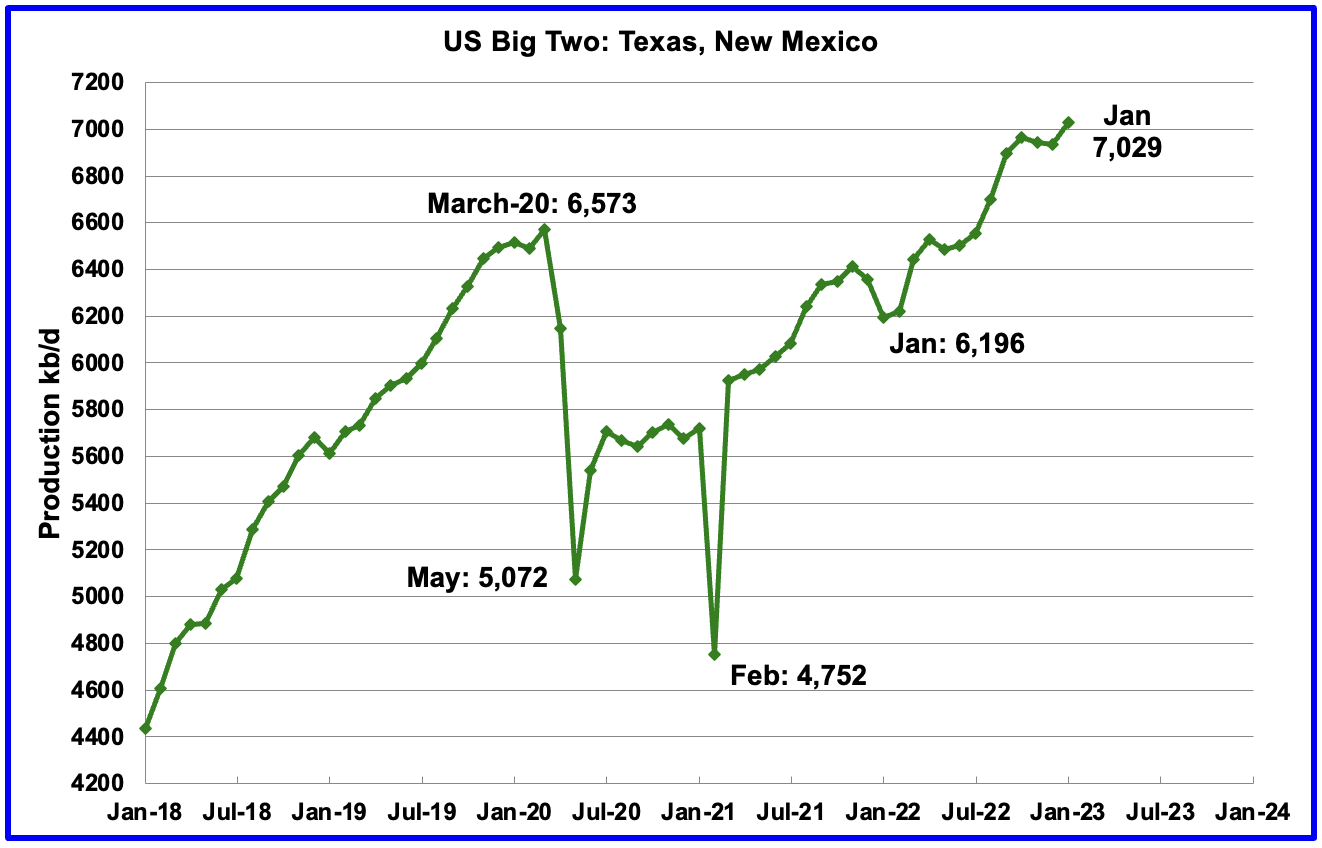

On a YoY basis, US production increased by 1,093 kb/d with the majority, 833 kb/d having come from Texas and New Mexico.

State Oil Production Charts

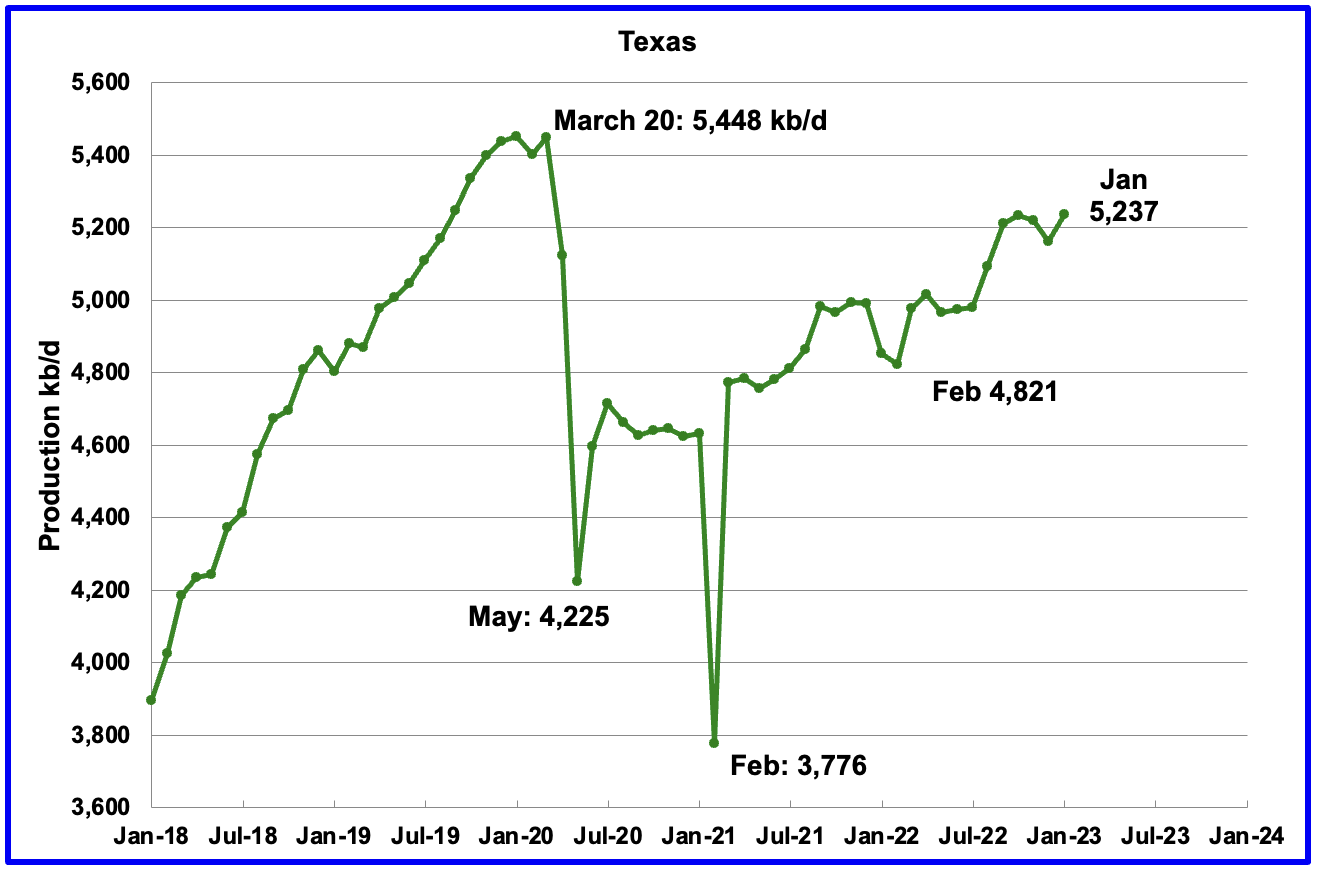

Texas production increased by 76 kb/d in January to 5,237 kb/d, a post pandemic high.

In January 2022 there were 235 Hz oil rigs operating in Texas. By January 2023, 325 Hz oil rigs were operational, an increase of 90 rigs. On a YoY basis, production increased by 384 kb/d.

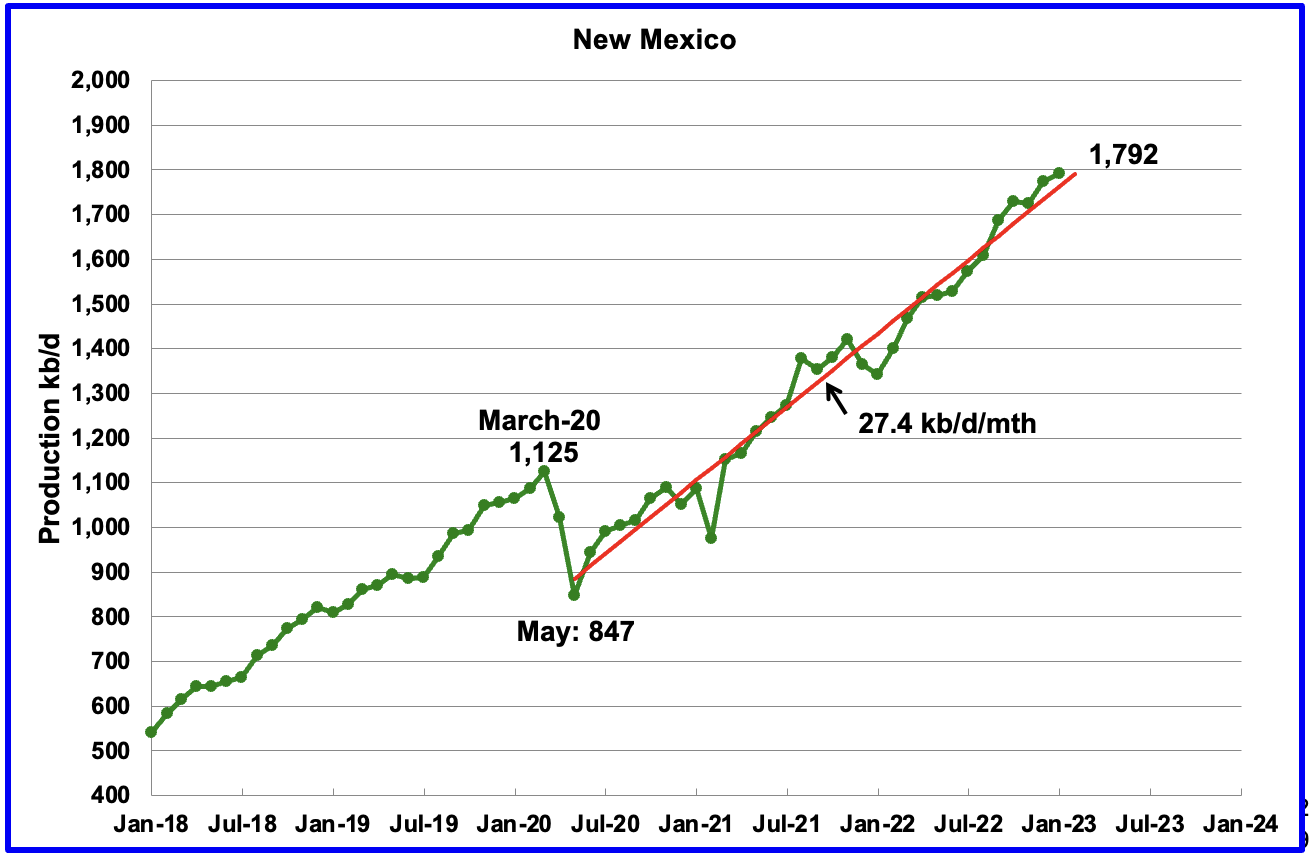

New Mexico’s production continues to make new highs. January’s production added 19 kb/d to 1,792 kb/d, another record high.

The red OLS line from May 2020 to January 2022 indicates a production growth rate of 27.4 kb/d/mth and shows no sign of rolling over. Since August, the rig count has been steady in the high 90s, 97 ±4.

North Dakota’s January oil production has partially recovered from December’s extreme cold weather impacted production. Output increased to 1,046 kb/d, an increase of 97 kb/d over December.

Alaskaʼs January output increased by 1 kb/d to 448 kb/d and was 2 kb/d lower than January 2022. This is an early indication that Alaska’s oil production may be breaking out from the red declining downtrend line.

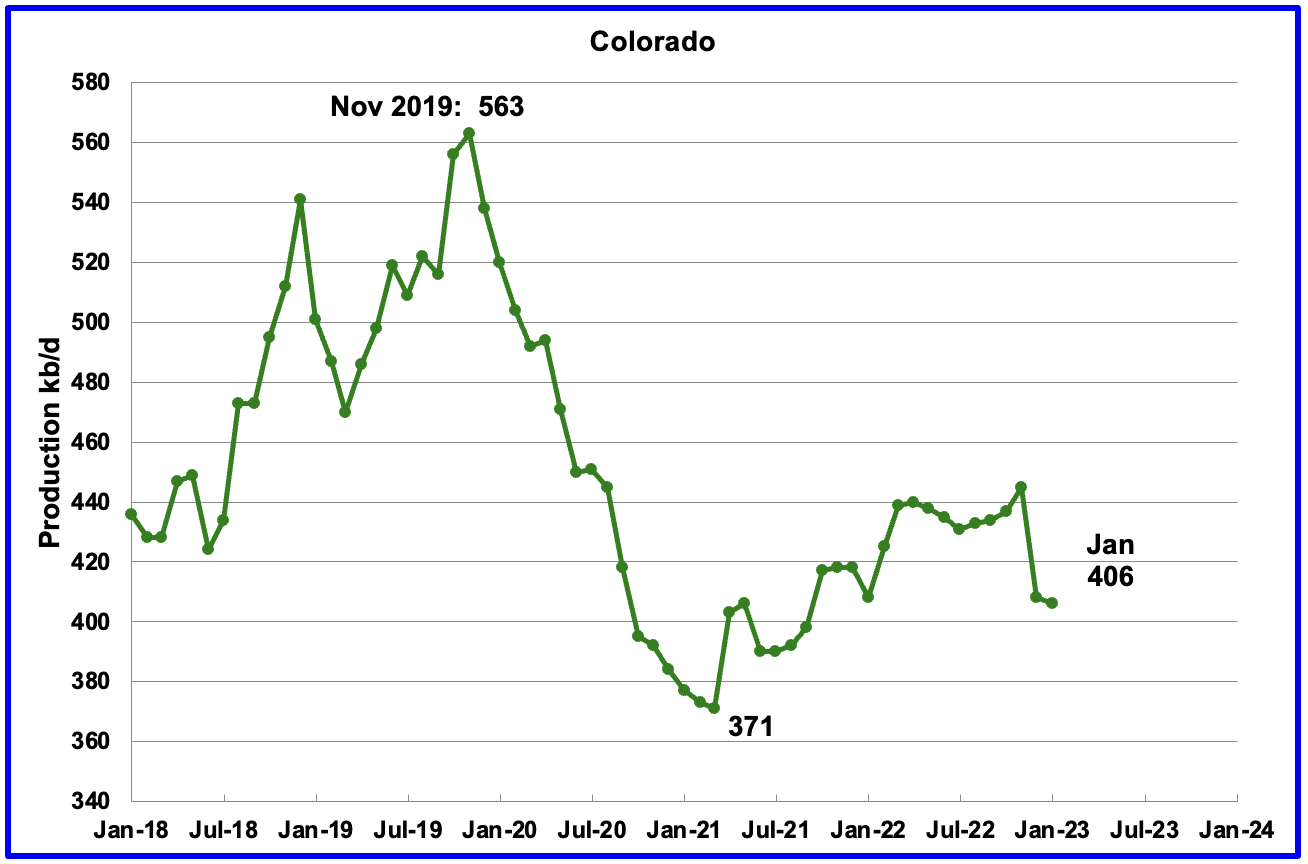

Coloradoʼs January production decreased by 2 kb/d to 406 kb/d.

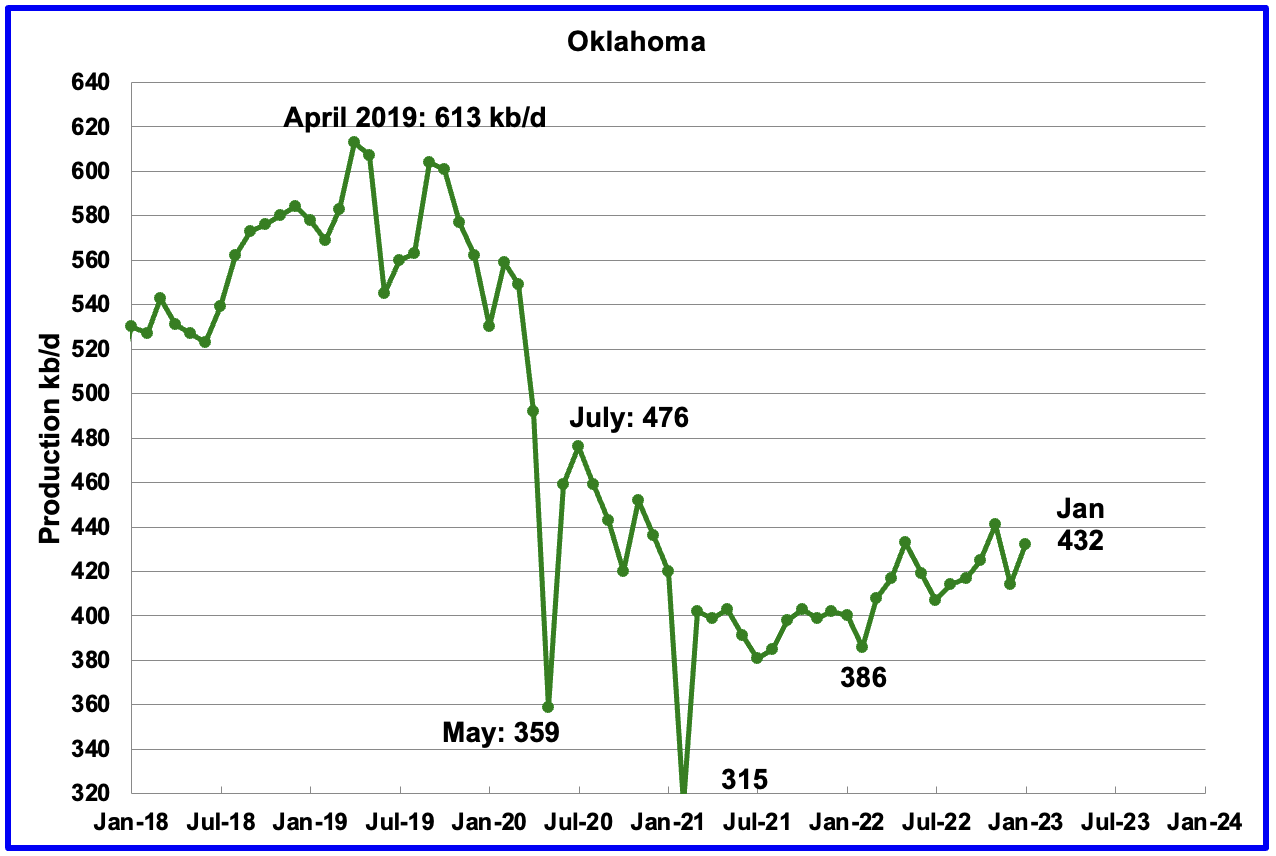

Oklahoma’s output in January increased by 18 kb/d to 432 kb/d. Production remains 44 kb/d below the post pandemic July 2020 high of 476 kb/d.

From January 2022 to April 2022, close to 50 rigs were operating in Oklahoma. By January 2023 the rig count had increased to 60.

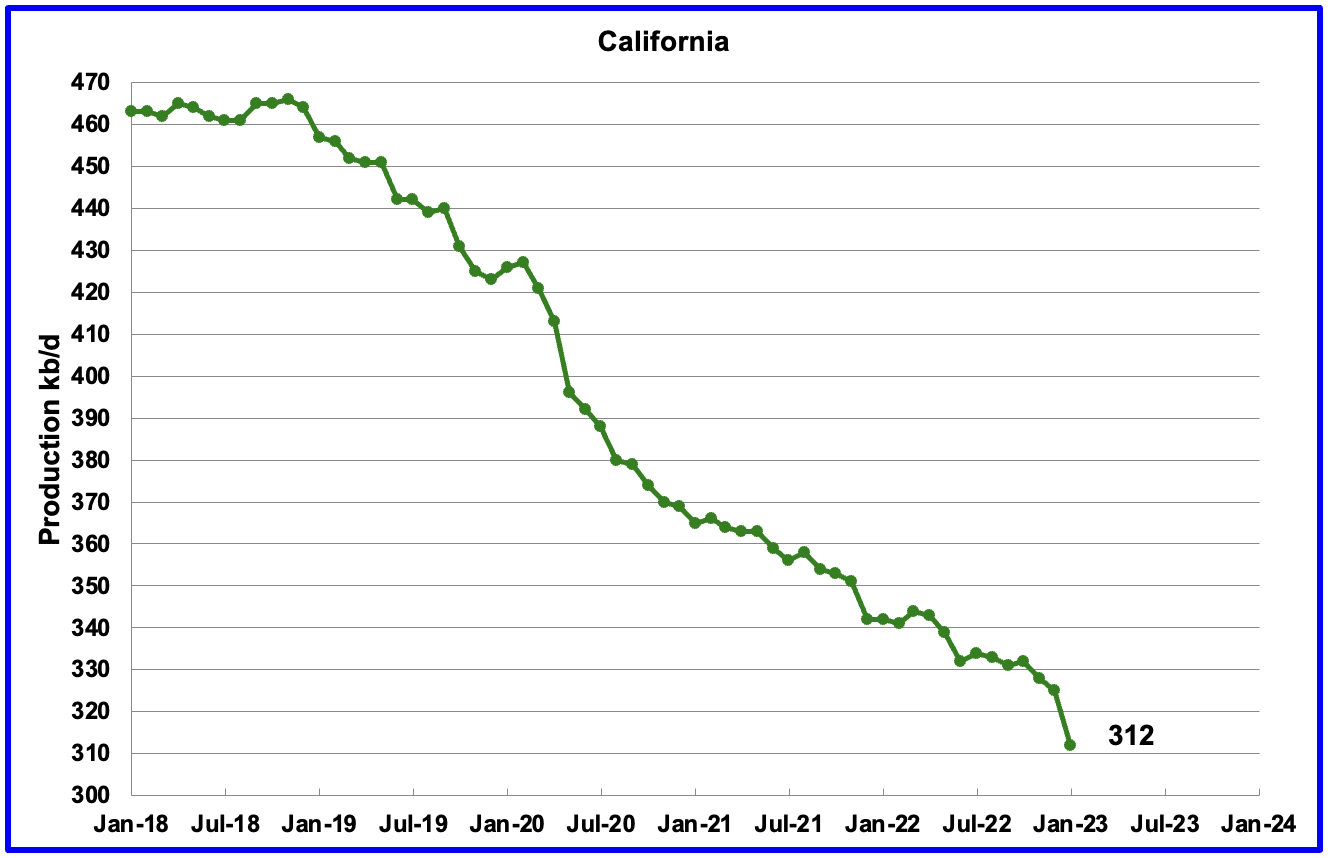

Californiaʼs overall slow output decline trend continues. However there was a larger than normal drop of 13 kb/d in January to 312 kb/d.

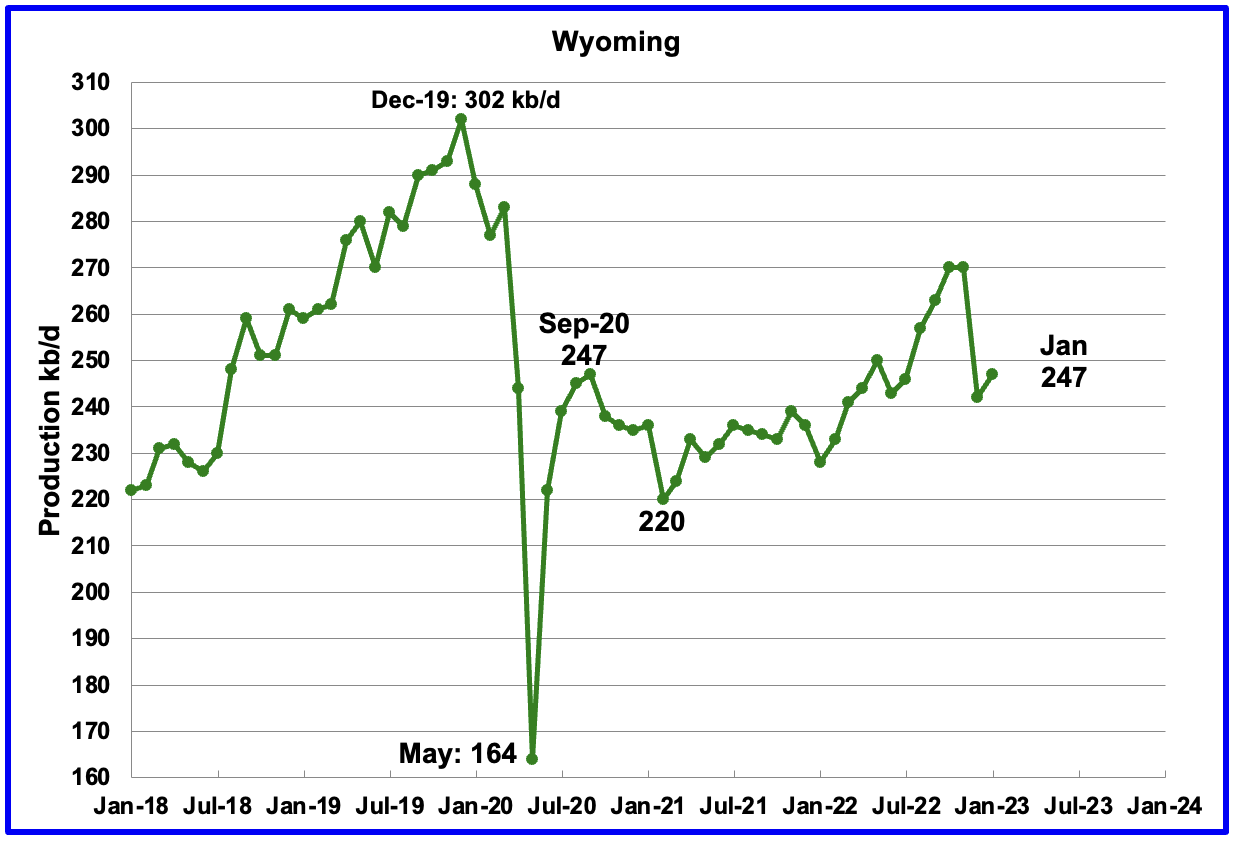

Wyoming’s oil production has been on a slow unsteady uptrend from the low of 220 kb/d in February 2021 due to increased drilling. October and November 2022 output reached a post pandemic high of 270 kb/d. Weather affected December production but January’s production recovered by 5 kb/d to 247 kb/d.

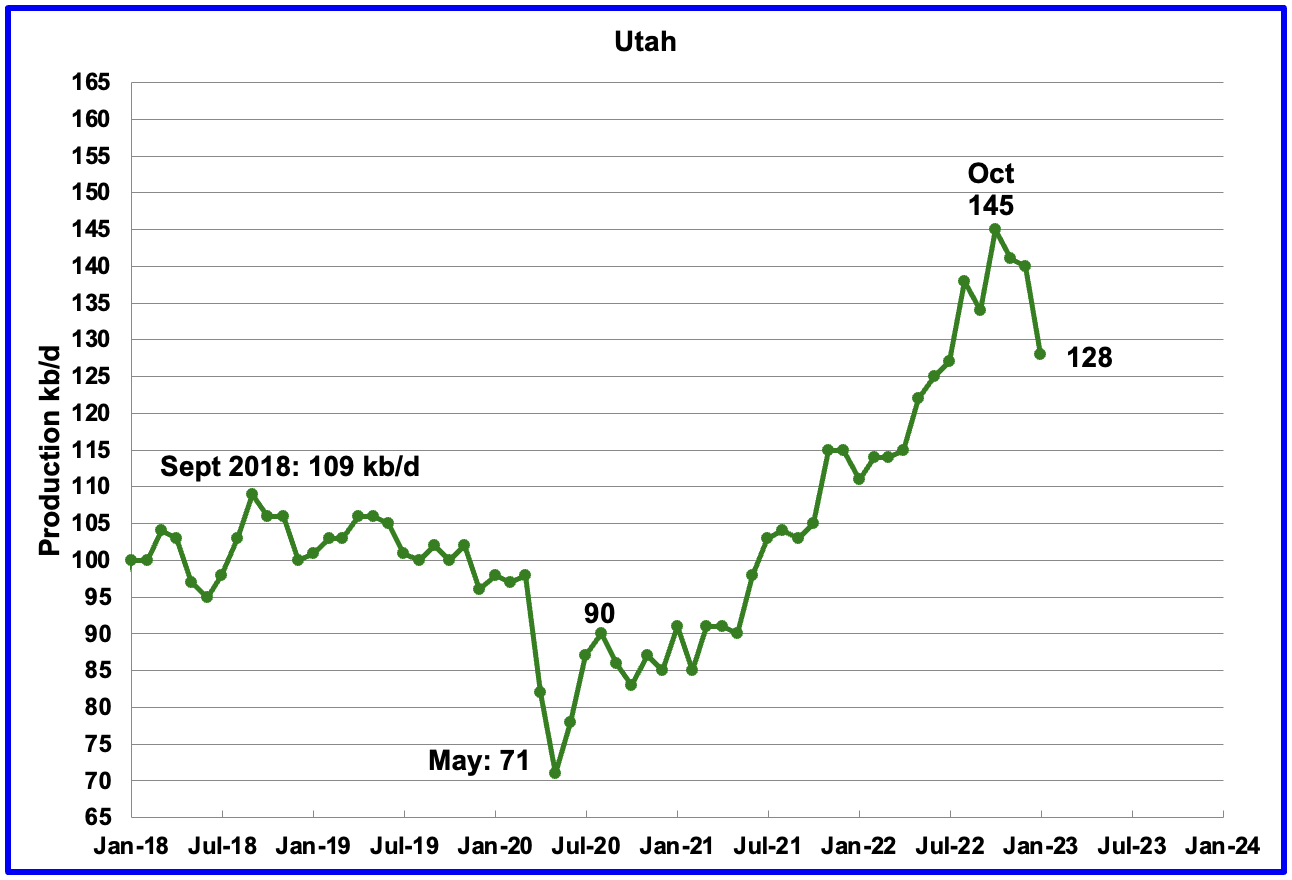

Utah’s oil production had been increasing steadily since early 2021 and reached a new high of 145 kb/d in October 2022. However since then, production has declined by 17 kb/d to 128 kb/d in January.

Utah had 7 Hz rigs operating in January 2023, up from 5 in January 2022.

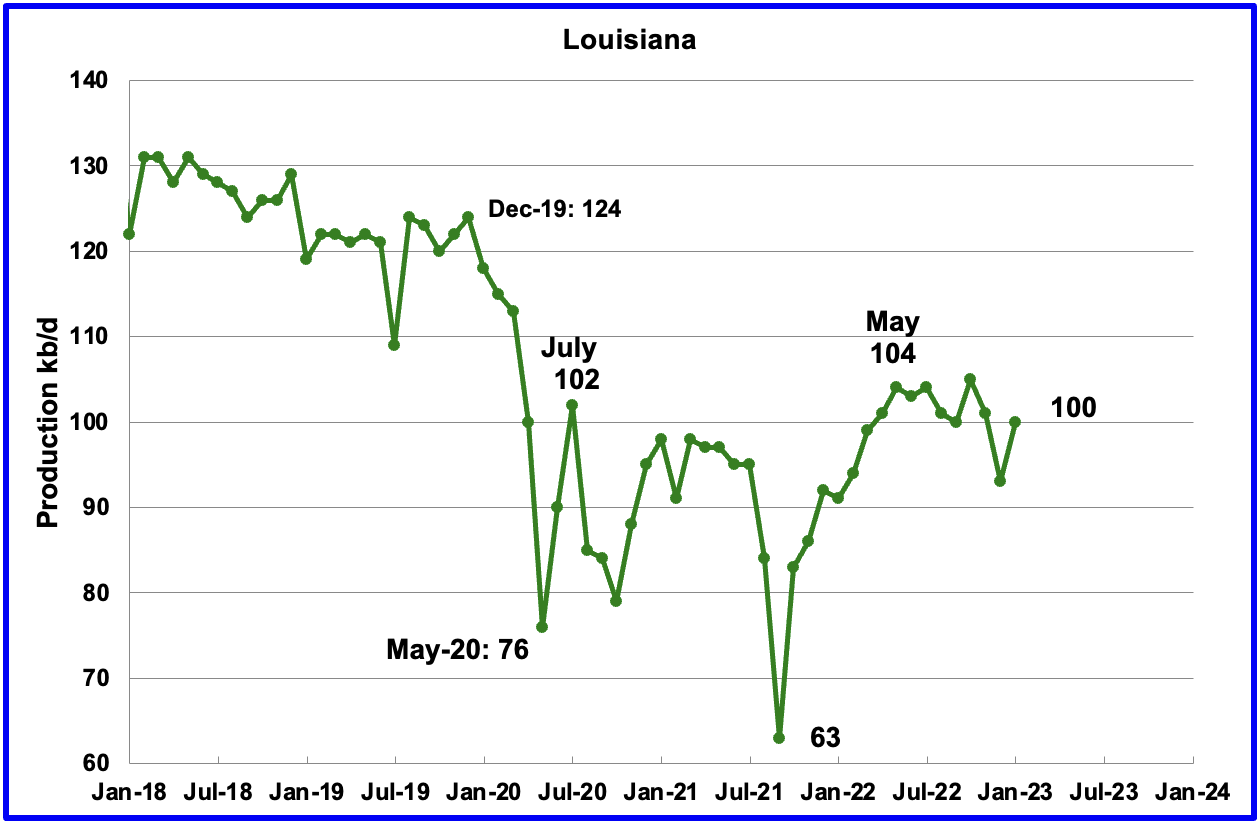

Louisiana’s output rose from the low of 63 kb/d in September 2021 to 104 kb/d in May 2022. Since then output has plateaued. January’s production was 100 kb/d, 4 kb/d lower than May 2022.

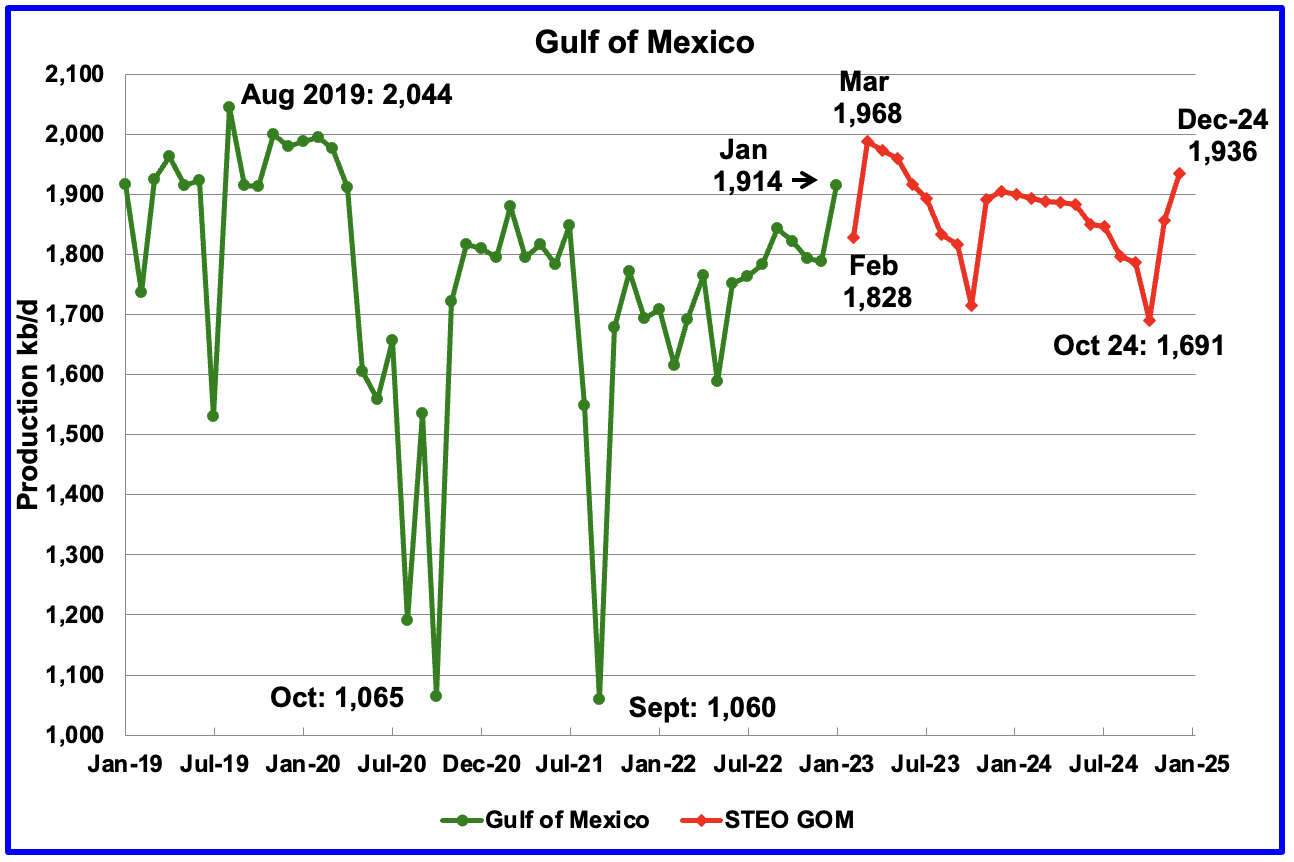

GOM production increased by 125 kb/d in January to 1,914 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The February 2023 STEO projection for the GOM output has been added to this chart and projects that output in February 2023 will drop to 1,828 kb/d. This is an unexpected surprise since Shell announced that the Vito platform had begun production on February 15, 2023. This production drop implies that the startup may have encountered problems and the Vito platform had to be shutdown.

Note that March production, estimated at 1,968 kb/d, could mean that the EIA expects that Vito’s estimated peak production of 100,000 barrels of oil equivalent per day, will be fully online during March.

It is not known if the GOM decline after March 2023 is related to extensive maintenance.

A Different Perspective on US Oil Production

The Big Two states, combined oil output for Texas and New Mexico.

January’s production in the Big Two states increased by a combined 95 kb/d to 7,029 kb/d with Texas contributing 76 kb/d while New Mexico added 19 kb/d.

If the data in the DPR section below is accurate, 25 kb/d of the Texas increase came from the Eagle Ford basin. That would imply that the increase from the Permian was 70 kb/d in January. The DPR data shows that the January Permian output was 65 kb/d, which is fairly close. This may also imply that the slightly older DPR data has been updated and is more accurate than the latest data.

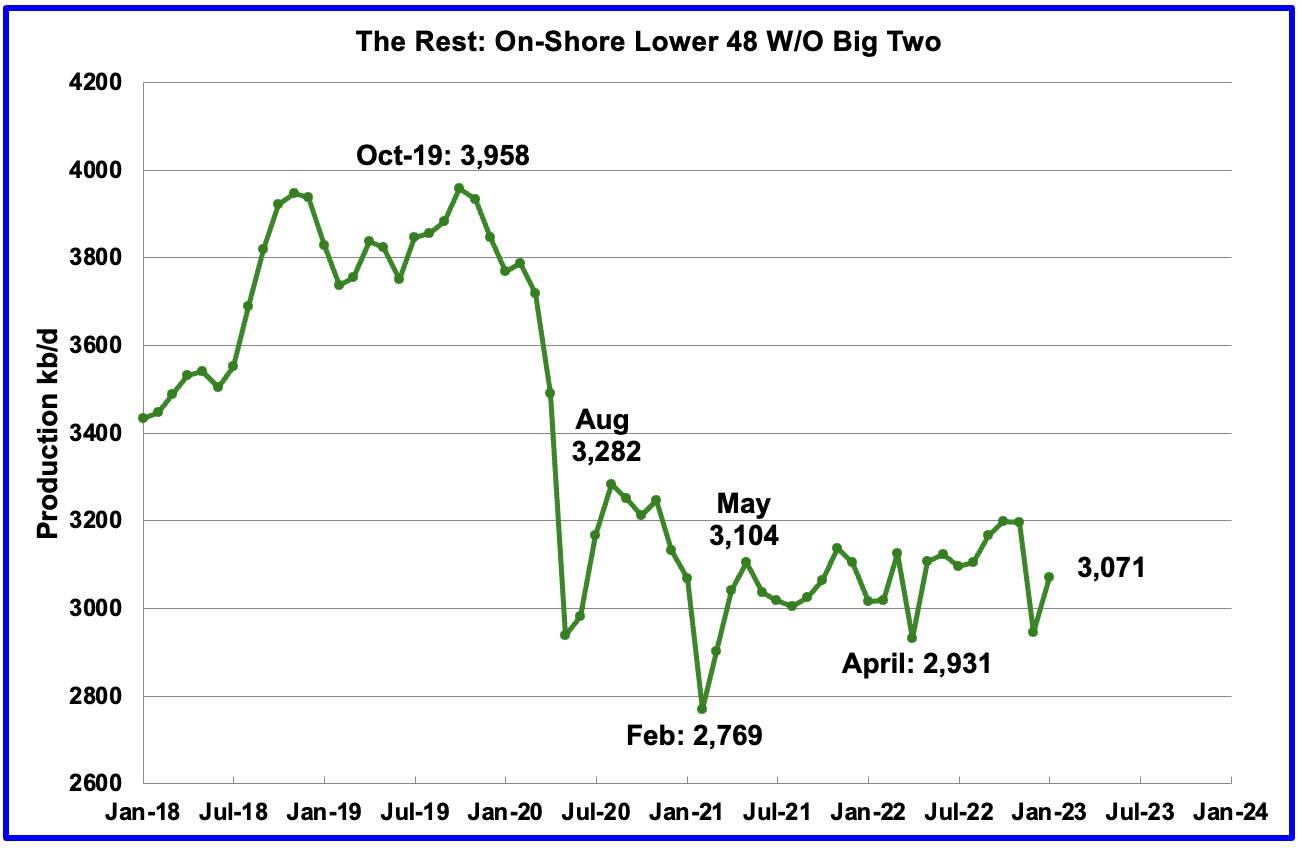

Oil production by The Rest

In January production in The Rest rose by 126 kb/d to 3,071 kb/d. From May 2021, oil production in The Rest has primarily stayed in the range of 3,000 kb/d to 3,200 kb/d and has not given any clear indication of being in decline or rising.

The main takeaway from The Rest chart is that current production is 881 kb/d below the high of October 2019. The question we need answered is “Is this a permanent loss that will never be recovered?” All indications continue to be that this is a permanent loss.

Rigs and Fracs

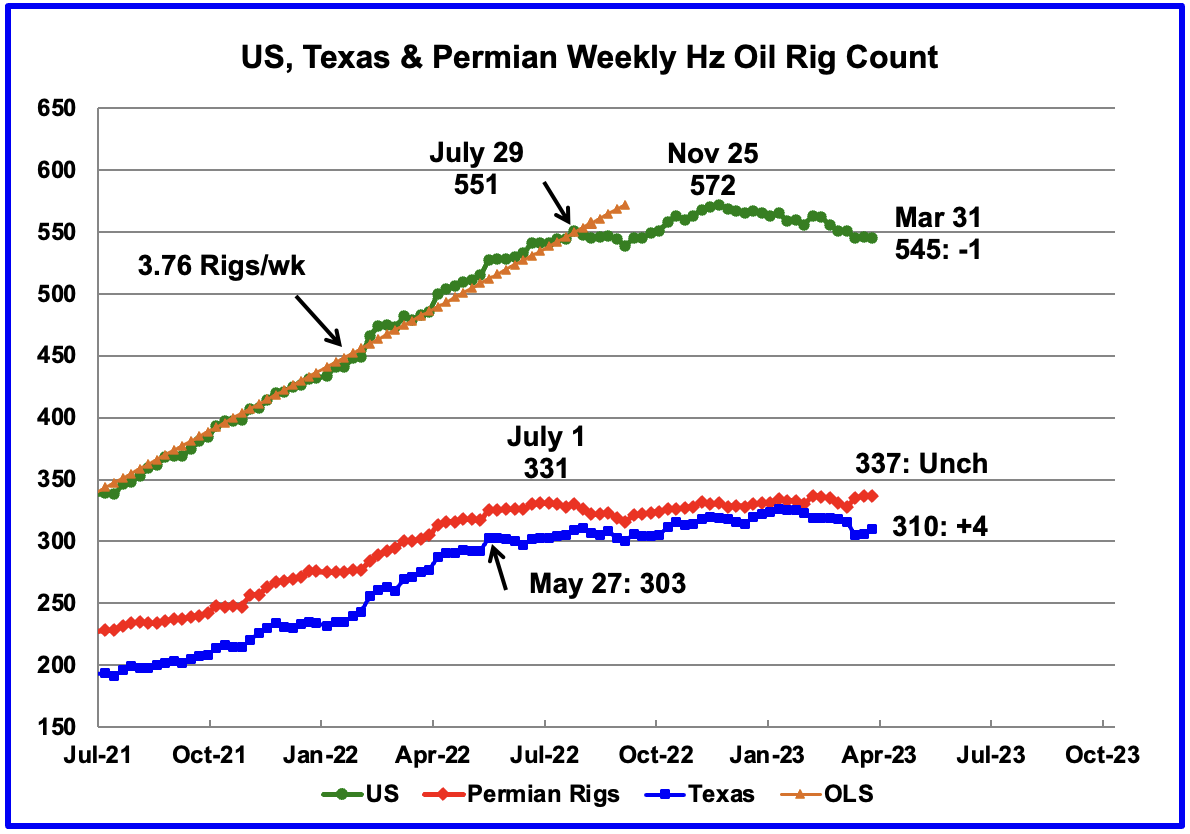

Since the beginning of April 2021 through to the week ending July 29, 2022, the US added horizontal oil rigs at a rate of close to 3.76 rigs/wk, orange OLS line, and peaked at 551 rigs in the week ending July 29. However since then the number of operational rigs has wondered primarily sideways.

A high of 572 rigs was reached in the week ending November 25, 2022. In the week ending March 31, 2023 the number of rigs decreased by 1 to 545 and are down 26 from the recent high of 572.

In the week ending March 31, Permian rigs were unchanged at 337 and Texas rigs increased by 4 to 310. Note that the trend for rigs in the Permian is showing a slow increase from September 2022 and is currently 6 above the high of 331 on July 1, 2022.

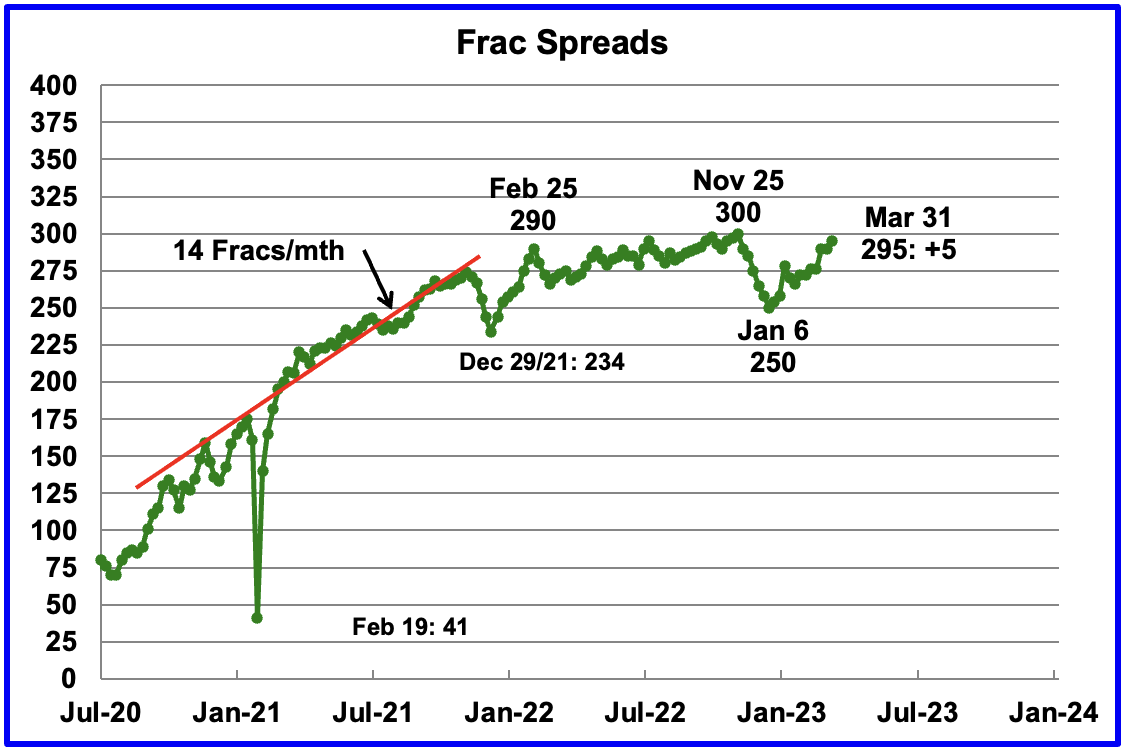

For frac spreads, the general trend since the week of January 6, 2023 can best be described as recovering from the slow down associated with the 2022 Thanksgiving and Christmas holidays. This trend is a repeat of what happened last year. However there is one difference. Last year the recovery took place over 9 weeks while this year it has taken 13 weeks so far. How far above 300 will the Frac count get in 2023?

For the week ending March 31, the Frac count increased by 5 to 295.

Note that these 295 frac spreads include both gas and oil spreads.

Frac Spread Count

The Frac Spread Count, provided by energy consultancy Primary Vision, measures how many crews across the U.S. are drilling wells in preparation for hydraulic fracturing of shale, and serves as a simultaneous indicator of the number of wells being drilled, as well as a leading indicator of crude oil production.

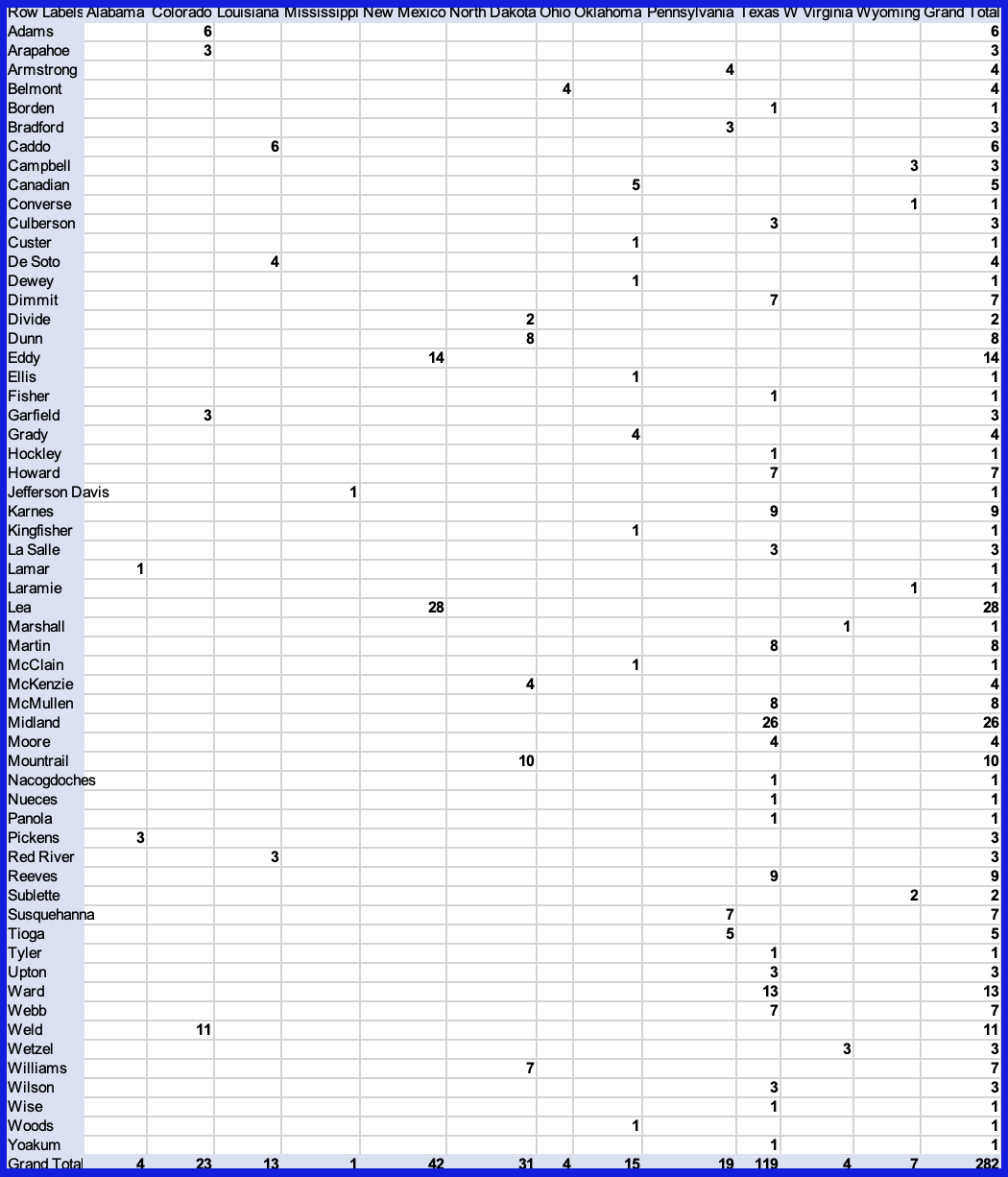

Frac spread count for the week February 11 to February 17.

Frac spread count for the week February 25 to March 3.

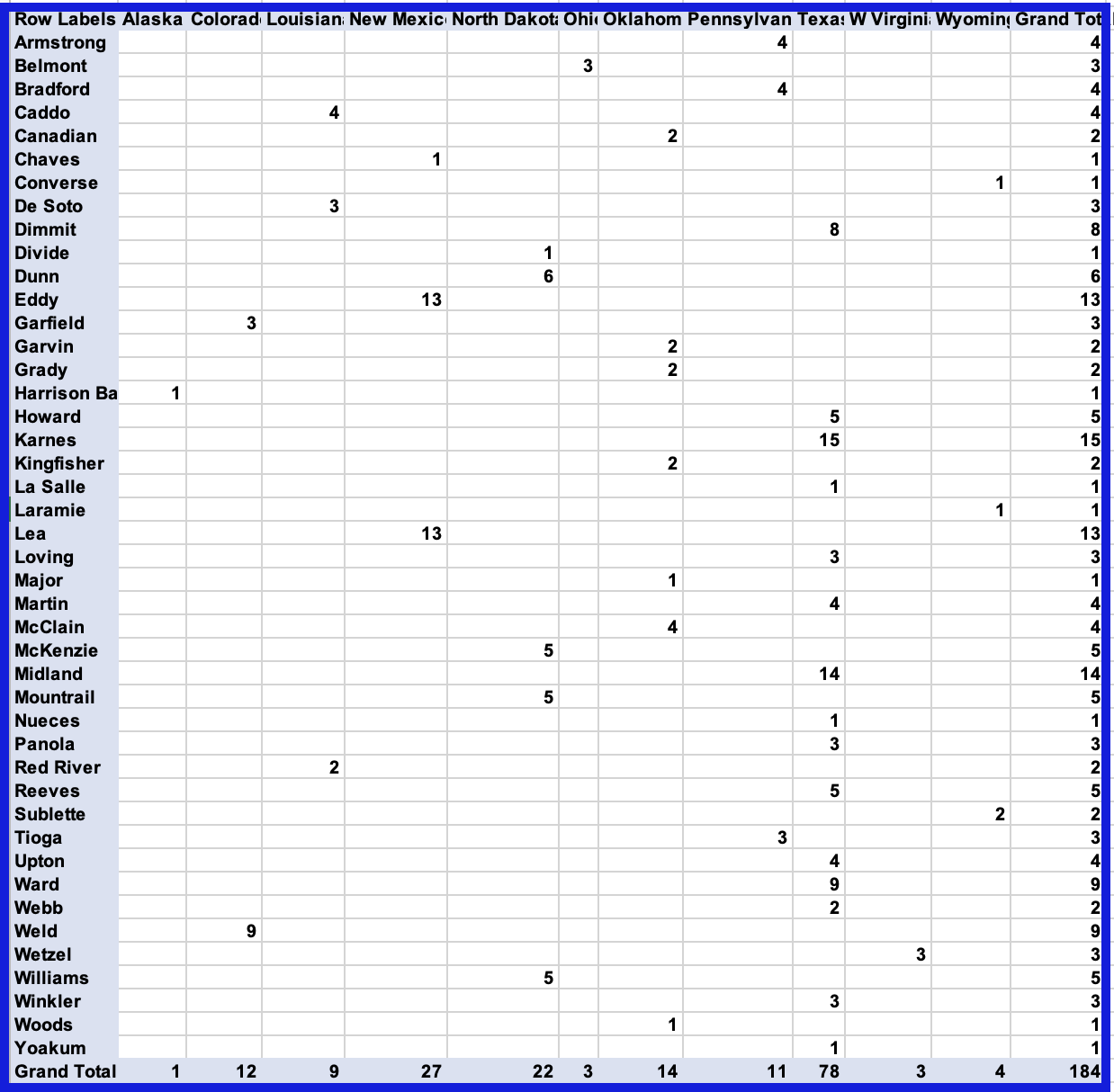

I have been working with the Frac Spread count database recently to try to understand how to use it. Some progress has been made and some initial results are provided in the above two tables. Not sure how useful they are since I think most of the oil experts out there already know what these two tables are showing.

Here is some of the typical information provided in their database, OperatorName, WellName, the vertical distance from a point in the well (usually the current or final depth) to a point at the surface, the total volume of water used as a carrier fluid for the hydraulic fracturing job, etc. Unfortunately I cannot find any information that identifies an oil spread vs a gas spread. Any information to sort that out would be helpful.

The first table above shows results for the week February 11 to February 17. The total Frac count is 282, 10 higher than reported officially by Primary Vision. This could be due to double counting or more updated information. Texas and New Mexico had 161 frac spreads crews operating during that period. The 161 spreads accounted for 59% of all Frac crews. Eddy and Lea counties are the hot spots in New Mexico while Midland and Ward are the most active counties in Texas.

The second table shows the results for the week February 25 to March 3. The total count is 184 and is 92 spreads below the officially reported 276. I assume this is due to late reporting in the database and will update next week to see if the count increases. One of the issues is that the database does not show Frac spreads in progress. It only reports Fracs that have been started and completed.

As in the previous table, Eddy and Lea counties are the hot spots in New Mexico while Midland, Ward and Barnes (new) are the most active counties in Texas.

I would be interested in hearing whether there are any other Gems in the two pivot tables.

This morning it was reported that Ovintiv bought EnCap’s Permian basin oil assets in a $4.3 billion deal. Interestingly the article states “The assets being bought are located in the Midland portion of the Permian Basin in Texas”. At least they are buying in the right county.

Drilling Productivity Report

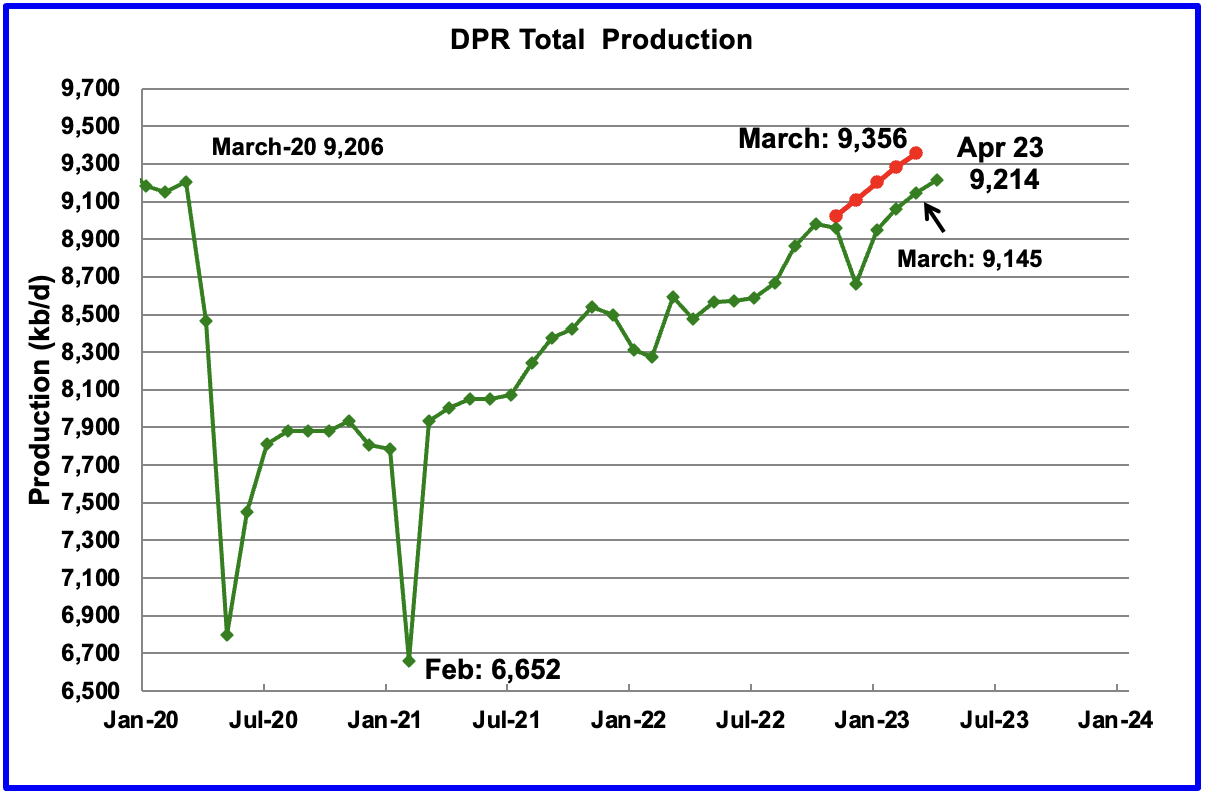

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The March DPR forecasts production to April 2023 and the following charts are updated to April 2023. The DUC charts are updated to February.

Above is the total oil production projected to April 2023 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The March DPR report made significant Downward revisions to the the February report, which had already made downward revisions to the January report. For instance, March output was revised down by 211 kb/d from 9,356 kb/d to 9,145 kb/d. The DPR is projecting that oil output for April 2023 will increase by 69 kb/d to 9,214 kb/d, a post pandemic high. April’s output is projected to barely exceed the March 2020 output of 9,206 kb/d by 8 kb/d. The pre-pandemic high was 9,292 kb/d in December 2019.

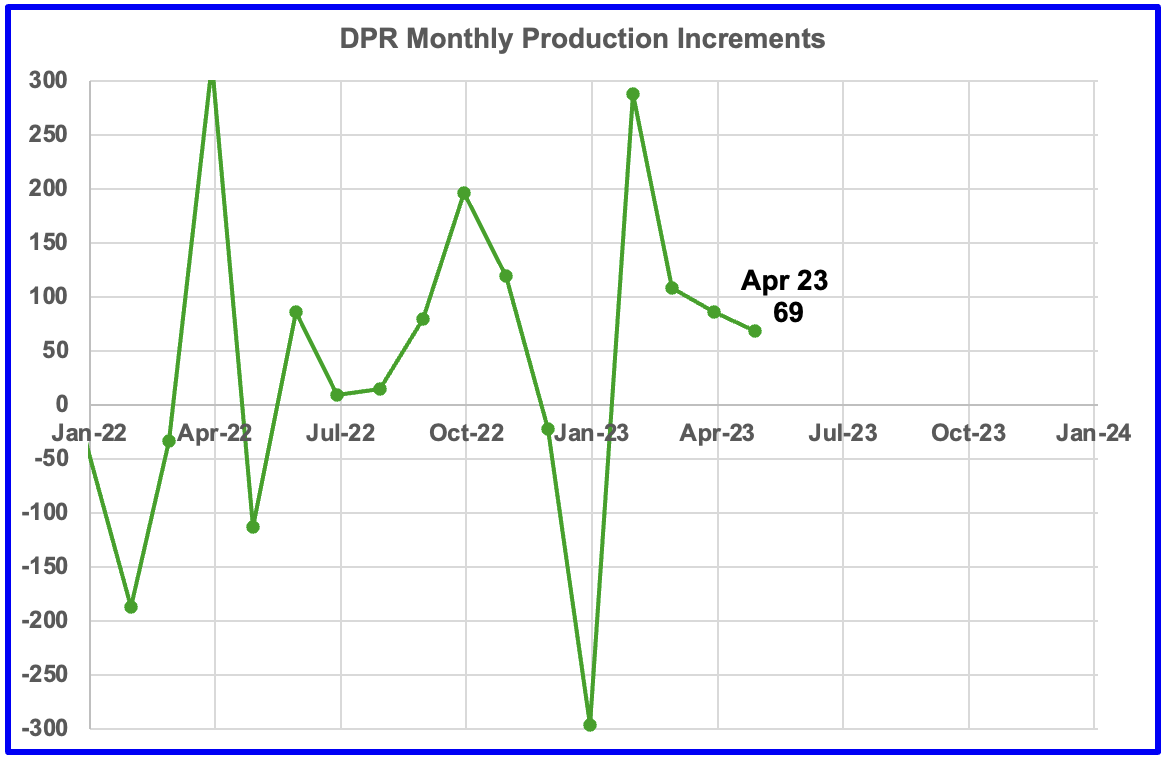

This chart shows the monthly DPR production increments. What is notable is the reduced month to month volatility since January 2022. The January spike is due to the weather related December oil production drop.

The other thing to notice is the declining monthly increases in the production rate. March’s production increase was 86 kb/d while April’s increase dropped by 17 to 69 kb/d.

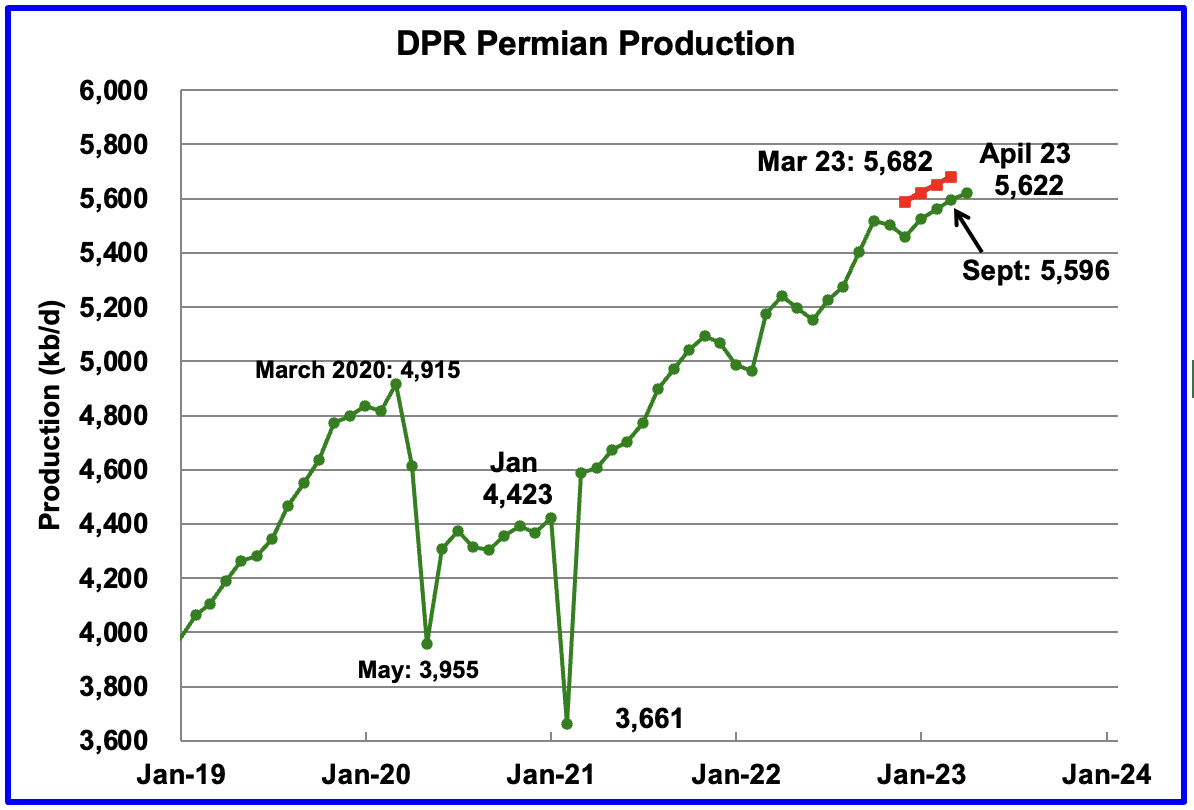

Permian output continues to rise in April. However the rise is really a drop after incorporating a large downward production revision to the previous post. The April report report has downwardly revised March output from 5,682 kb/d to 5,596 kb/d, a drop of 86 kb/d. Note that April’s production is lower than the March estimate (red markers) from the previous post.

If the Permian were part of OPEC, at 5,596 kb/d it would be the second largest producer after Saudi Arabia. April’s output is 707 higher than the pre-pandemic high 4,915 kb/d.

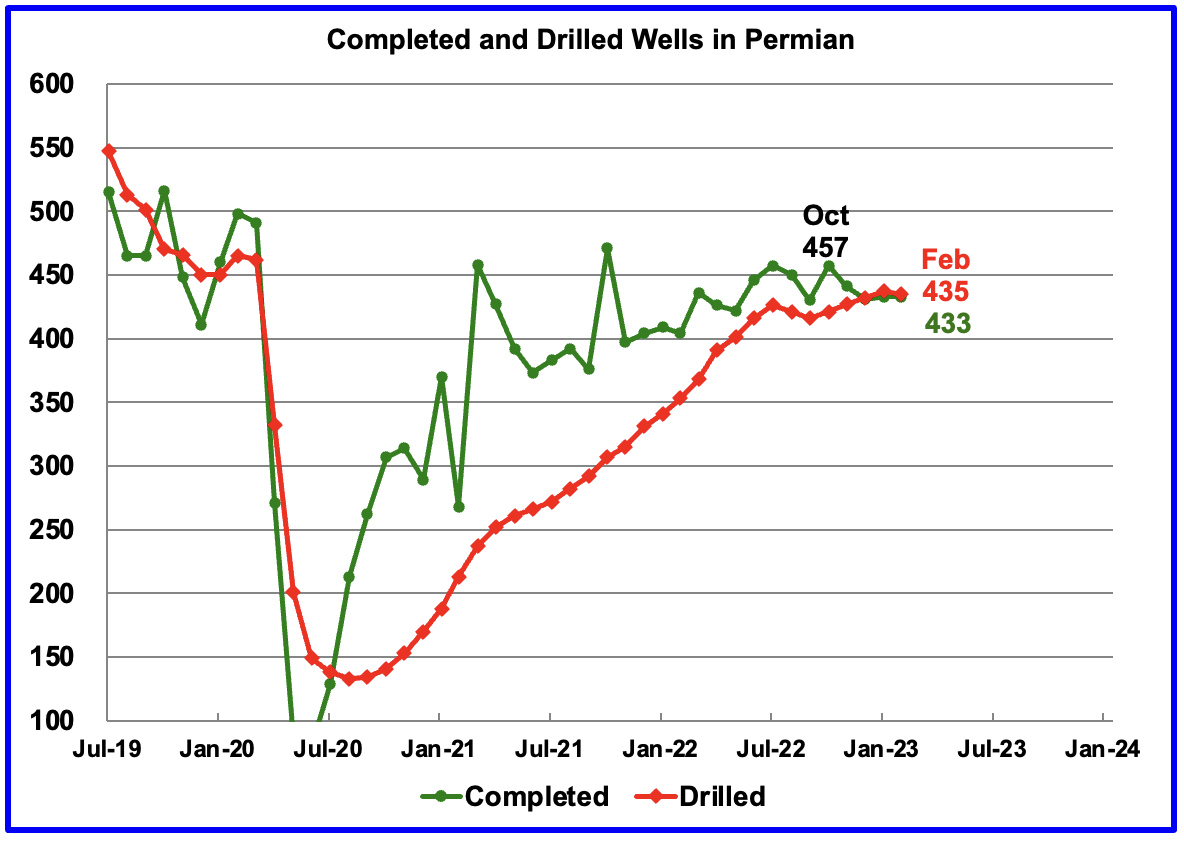

During February, 435 wells were drilled and 433 were completed in the Permian. (Note that February is the latest month for DUC information). The completed wells added 370 kb/d/well to February’s output for an average of 855 b/d/well. The overall decline was 335 kb/d which resulted in a net increase for Permian output of 35 kb/d. Of the 433 completed wells, 391 were required to offset the decline.

Note, this is the second month in which no DUCs were used in the Permian, actually two were added.

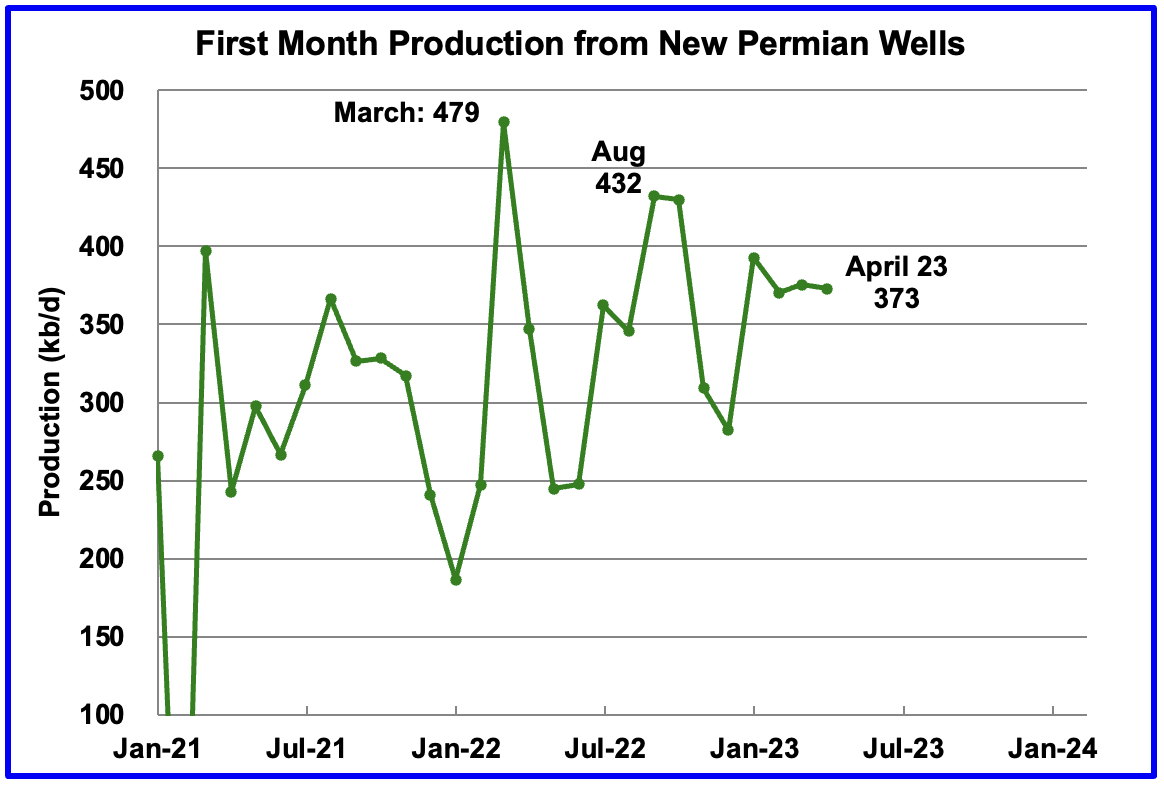

This chart shows the average first month total production from Permian wells tracked on a monthly basis. Assuming the latest information is correct, total monthly production from the newest Permian wells in April continues to be at the 370 kb/d level. Part of the flat production shown is related to an essentially unchanging number of wells being completed, currently hovering slightly over 430 for the last 4 months.

This production level could drop over the coming months if oil prices stay close to $70/b, according to this source.

“The US shale patch may lose as much as 20% of its activity over the next year if energy prices hold at current levels, according to one of the biggest private equity players in the industry.

Crude would need to rise by about 15% to $80 a barrel, and gas would have to climb by more than a third to $3 per million British thermal units for drilling and frack work to maintain its current pace, Quantum Energy Partners Chief Executive Officer Wil VanLoh said in an interview Tuesday. Oil and natural gas prices have slid since mid-2022 on fears of a global economic slowdown.”

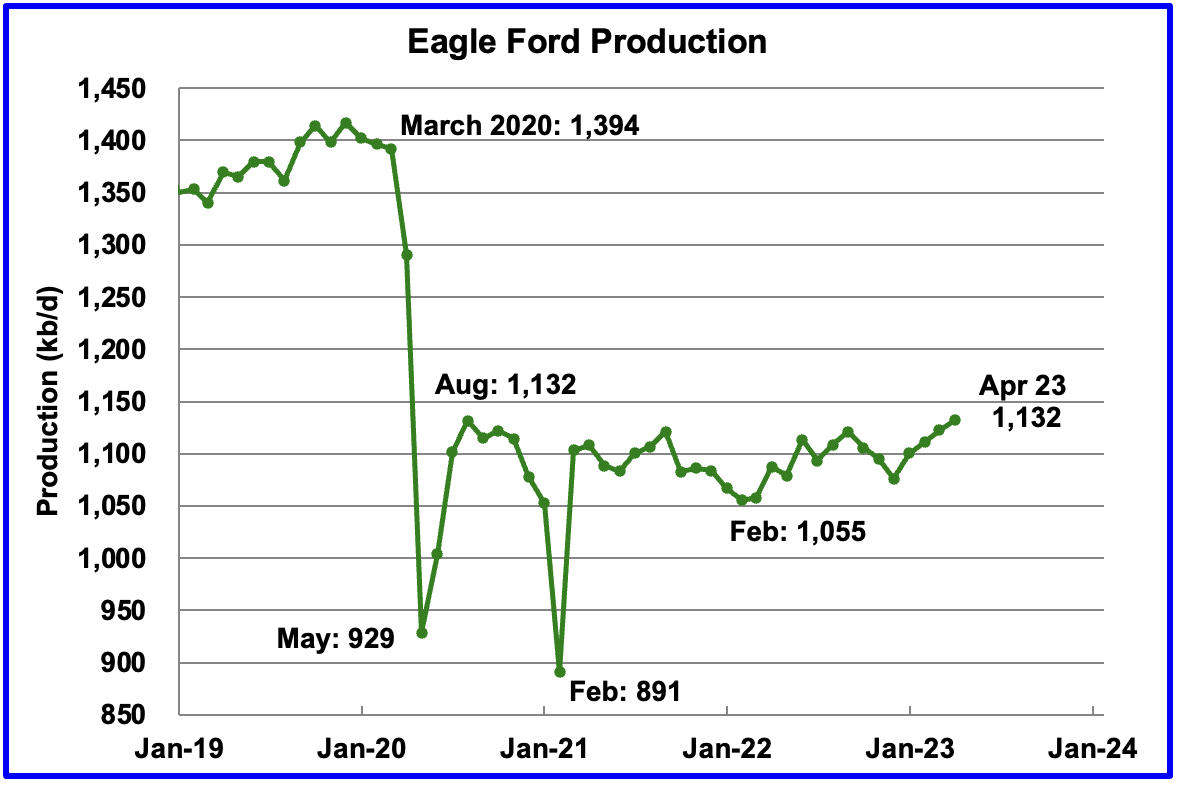

Output in the Eagle Ford basin has been in a generally flat trend since March 2021. However since the December 2022 weather induced drop, production has been increasing. April output is expected to increase by 9 kb/d to 1,132 kb/d and is back to the same output as in August 2020.

At the beginning of the year 2023, 68 rigs were operating in the Eagle Ford basin and continued at 68 in March.

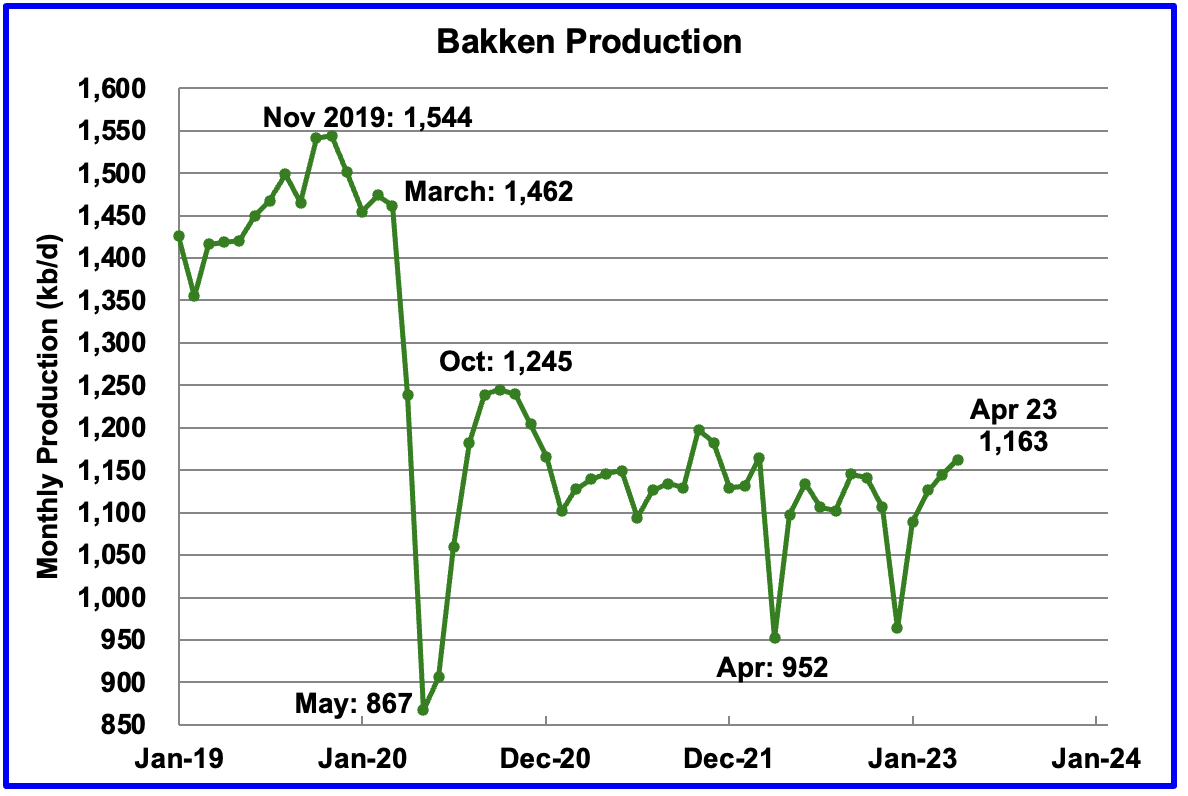

The DPR forecasts Bakken output in April will be 1,163 kb/d an increase of 18 kb/d over March. Production from January onward looks optimistic/wrong and increasing linearly.

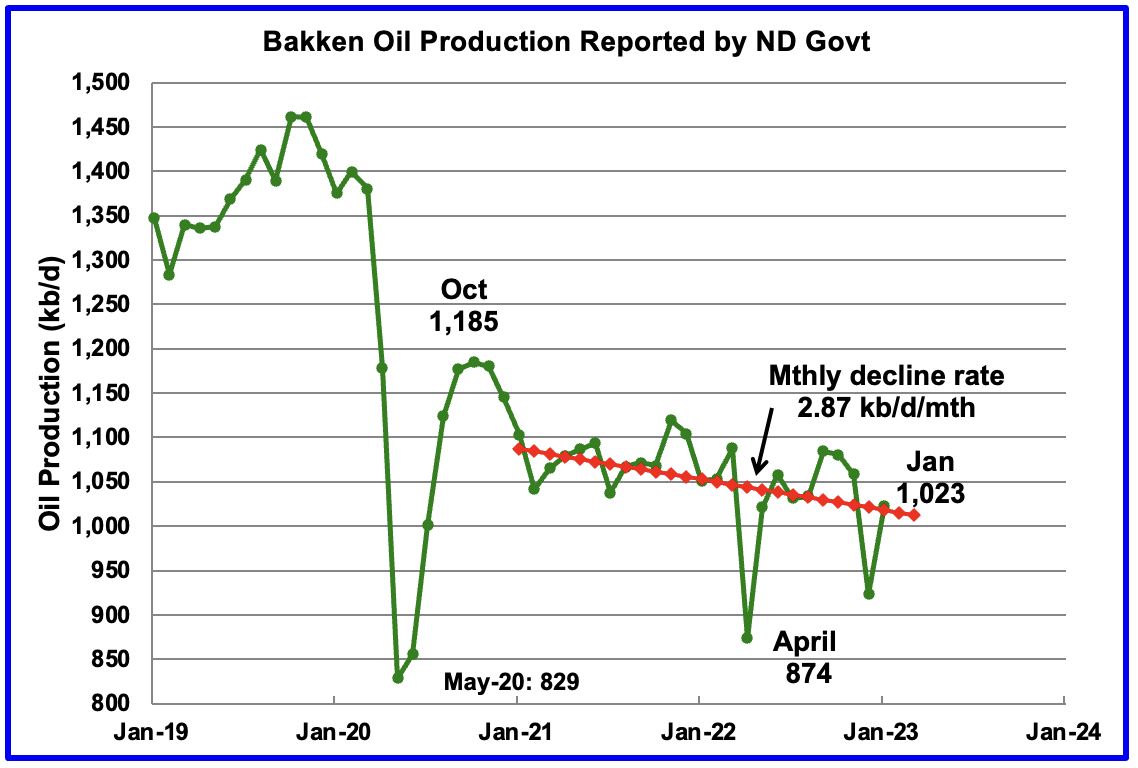

The North Dakota Department of Mineral resources is reporting January Bakken production as 1,023 kb/d while the DPR is reporting 1,089 kb/d. See next chart

North Dakota Bakken production rebounded by 99 kb/d to 1,023 kb/d in January.

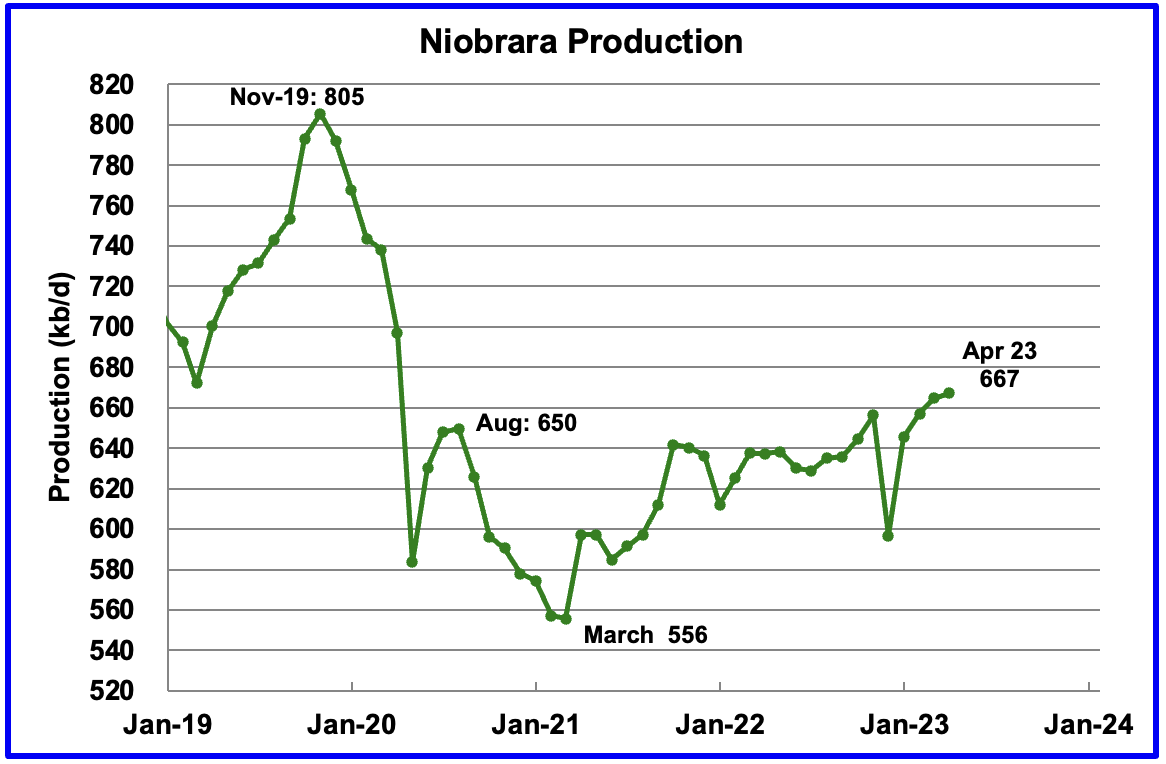

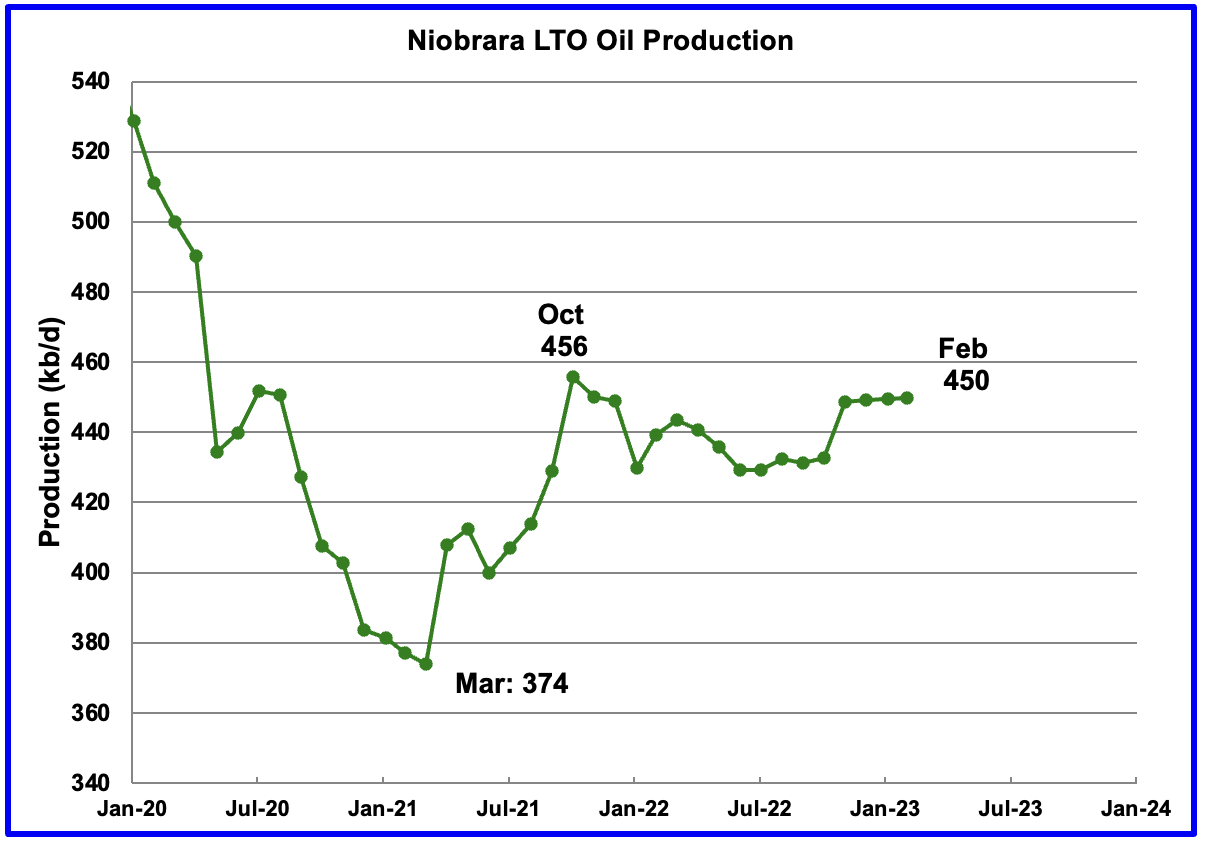

Output in the Niobrara continues to increase slowly. April output increased by 2 kb/d and set a post pandemic high of 667 kb/d. It should be noted that the LTO report in the next section indicates no LTO growth in output over the last three months in the Niobrara basin.

Production increased due to the addition of more rigs into the basin. The Niobrara had a peak of 19 rigs operating in November 2022. In March 2023, the count had decreased to 15.

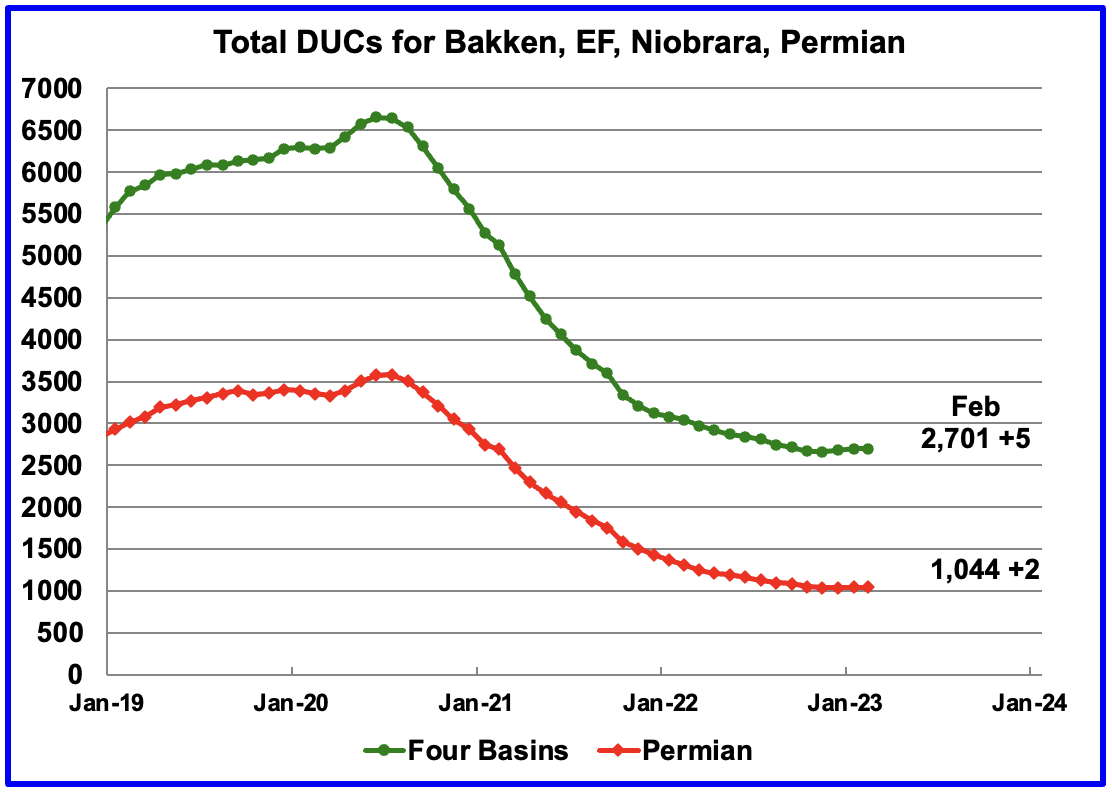

DUCs and Drilled Wells

The number of DUCs available for completion in the Permian and the four major DPR oil basins has fallen every month since July 2020 but that trend has now reversed. In December 2022 the trend for total DUCs changed from decreasing to increasing. February added 5 DUCs. The biggest increase came from the Niobrara where DUCs increased by 10 while Eagle Ford DUCs dropped by 8.

In the Permian, the falling trend in DUCs has also changed. December was the first month since mid 2020 when the number of DUCs increased. February Permian DUCs increased by 2 to 1,044 because 435 wells were drilled and 433 were completed. Since the low of 1,037 DUCs in November 2022, the Permian DUC count has increased by 7 to 1,044.

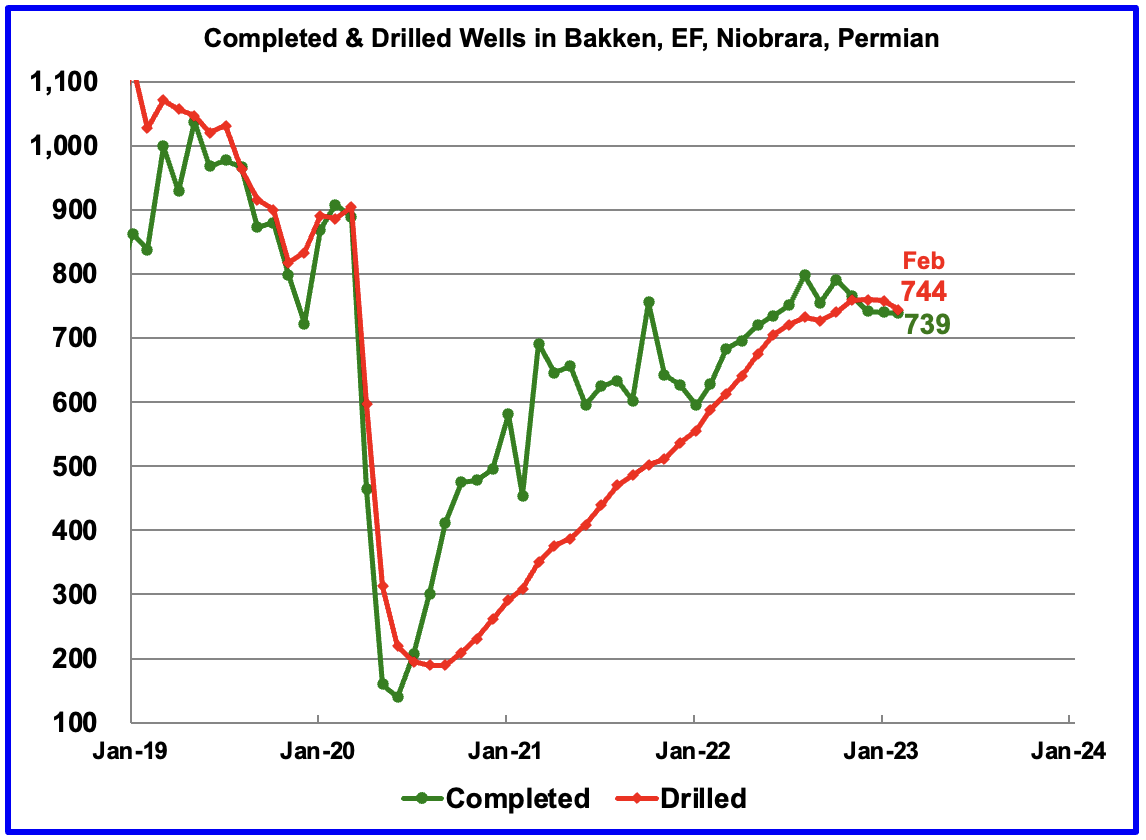

In these 4 basins, 744 wells were drilled while 739 were completed for a net increase of 5 DUCs in February.

In the Permian, the monthly completion rate has been showing signs of slowing since the October high of 457. This is consistent with the frac spread chart shown above where there has been little growth in frac spreads since February 2022. The number of wells drilled in the Permian has been showing a slightly increasing trend since October but is now showing signs of plateauing at the 435 level.

In February 433 wells were completed, unchanged from January and 22 fewer than in October. During February, 435 new wells were drilled, a decrease 2 From January. The gap between drilled and completed wells in the Permian has now essentially vanished. This raises a question. Since the producers would be completing the best wells, does this imply that most of the remaining 1,044 Permian DUCs are Dead DUCs?

It also raises another question. Were those extra 2 wells that were drilled, DUDs that became dead DUCs?

February Light Tight Oil Update

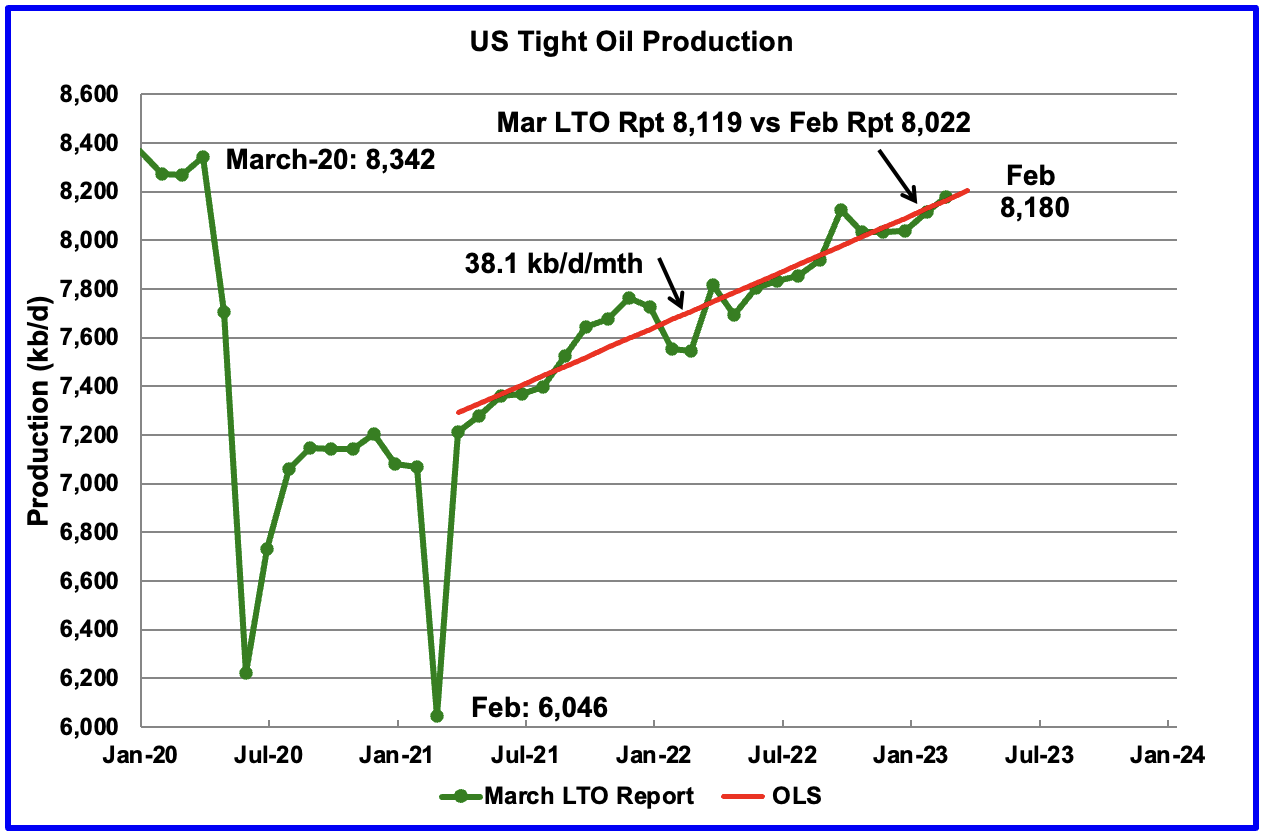

The EIA’s LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The March 2023 report updates tight oil production to February 2023.

This is the seventh LTO report published since it was updated due operational issues. The current update has made significant Upward revisions to production reported in the previous February LTO report.

According to the March LTO report, February’s LTO output increased by 61 kb/d to 8,180 kb/d. However the January 2023 output in the March LTO report was revised up to 8,119 kb/d from 8,022 kb/d reported in the February report, an upward revision of 97 kb/d.

The red OLS line from March 2022 to January 2023 indicates a monthly production increase of 38.1 kb/d/mth.

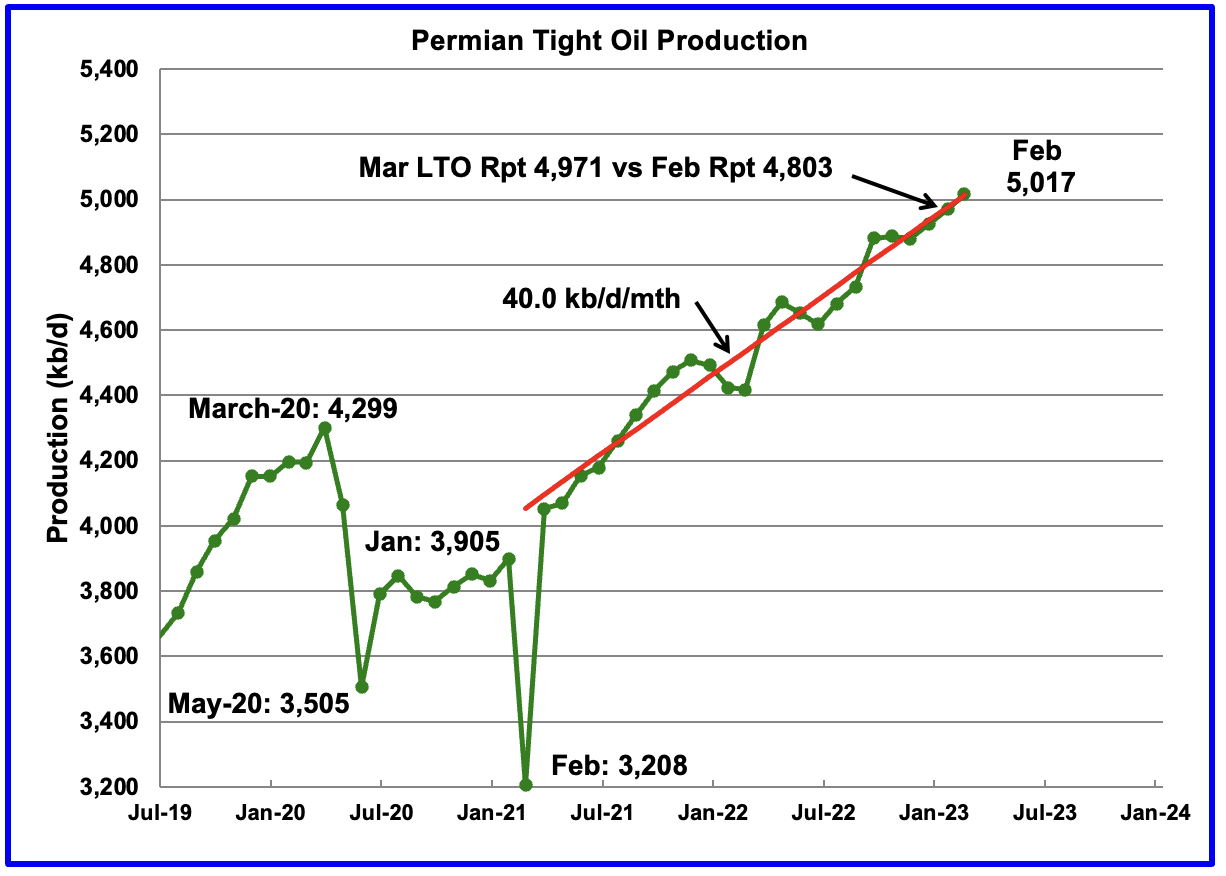

February’s Permian output increased by 46 kb/d to 5,017 kb/d and is 718 kb/d higher than the high of 4,299 kb/d recorded in March 2020. The January 2023 output of 4,803 kb/d in the February LTO report was revised up to 4,971 kb/d in the March LTO report, an upward revision of 168 kb/d. Most of the revision noted above for the LTO Total output is due to the Permian revision.

The red OLS line from March 2022 to February 2023 indicates a monthly production increase of 40.0 kb/d/mth.

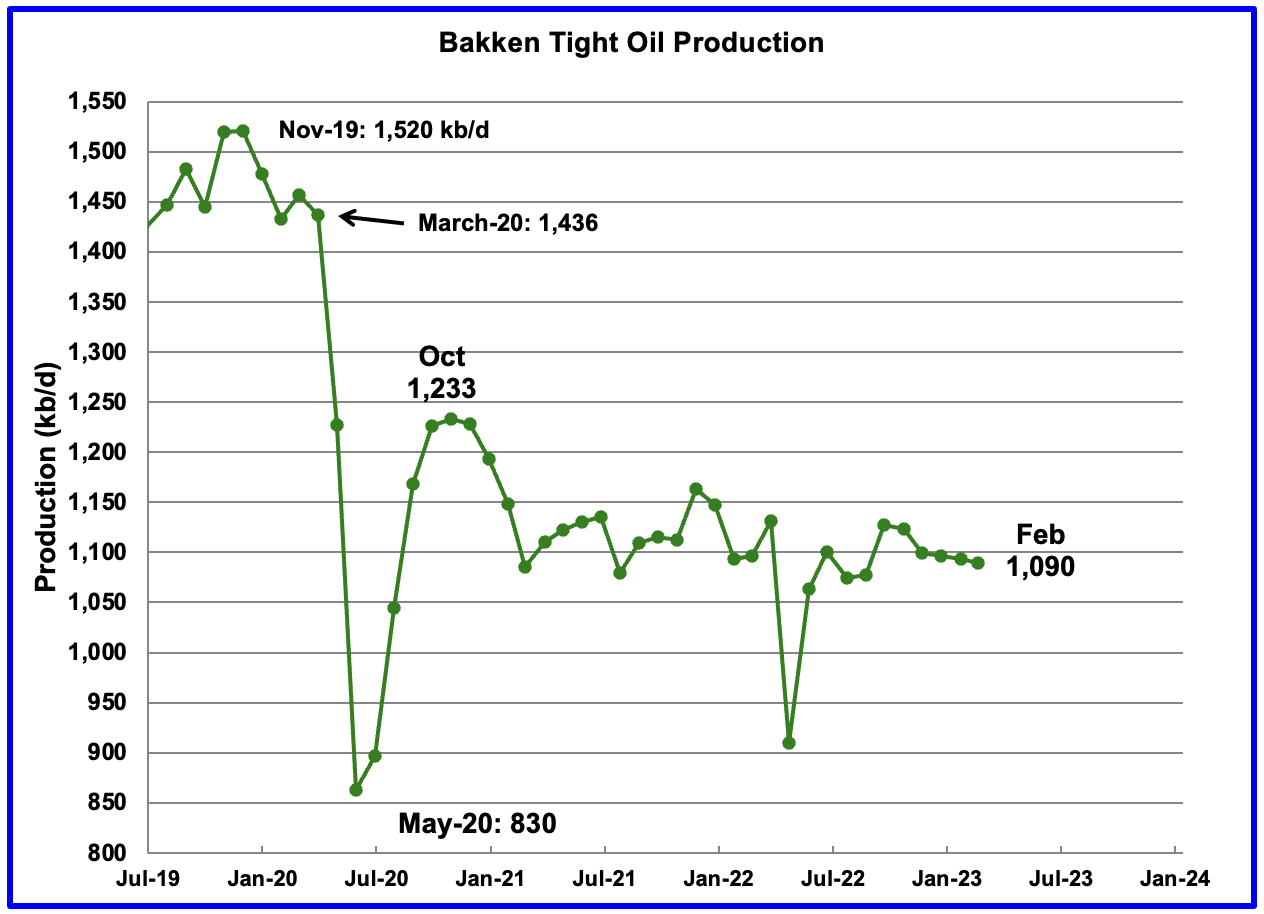

The Bakken’s February LTO output decreased by 3 kb/d to 1,090 kb/d. Consistent with the Permian basin’s output, last month’s January output was revised up by 40 kb/d.

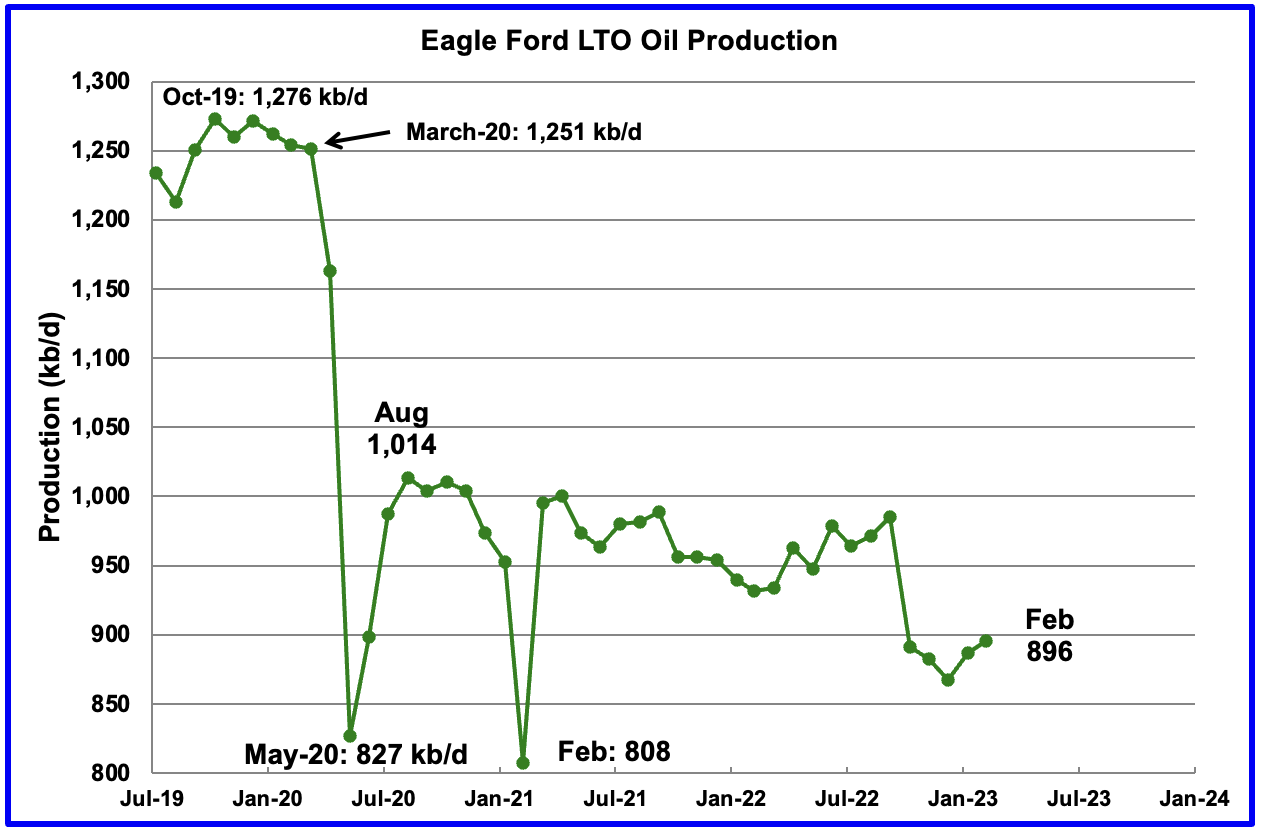

Production in the Eagle Ford basin increased by 9 kb/d in February to 896 kb/d and is now 118 kb/d lower than the post pandemic August 2020 high of 1,014 kb/d.

In February 2022, 45 rigs were operational in the Eagle Ford basin. By February 2023, the rig count had risen to 68.

Production in the Niobrara since November has shown little growth. Output has been essentially flat at 450 kb/d.

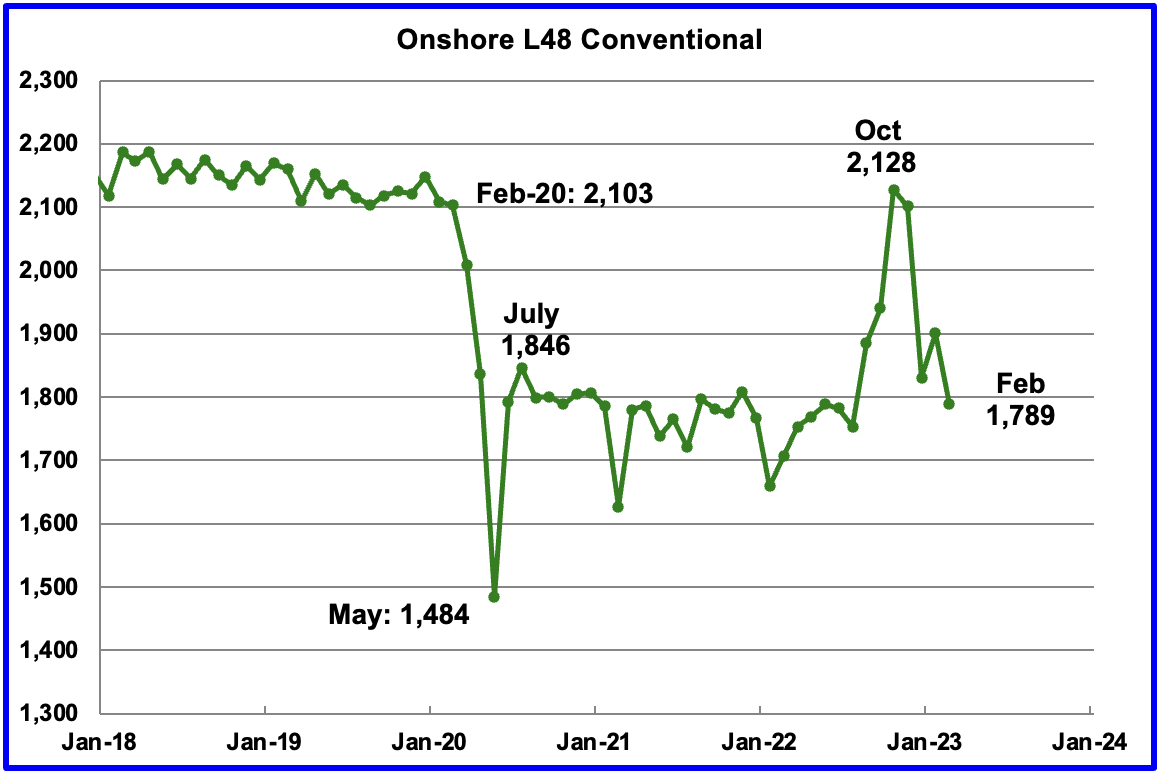

Onshore L48 Conventional Production

Conventional oil output in the Onshore L48 dropped by 112 kb/d in February to 1,789 kb/d and is more in line with estimates prior to July 2022. This estimate is based on a combination of the expected February LTO output and the expected February Onshore L48 output reported by the STEO.

The big production drop from October is due to ongoing major revisions to the monthly LTO report. Note that the conventional oil estimate comes from subtracting two large numbers and is quite volatile month to month due to revisions.

WTI

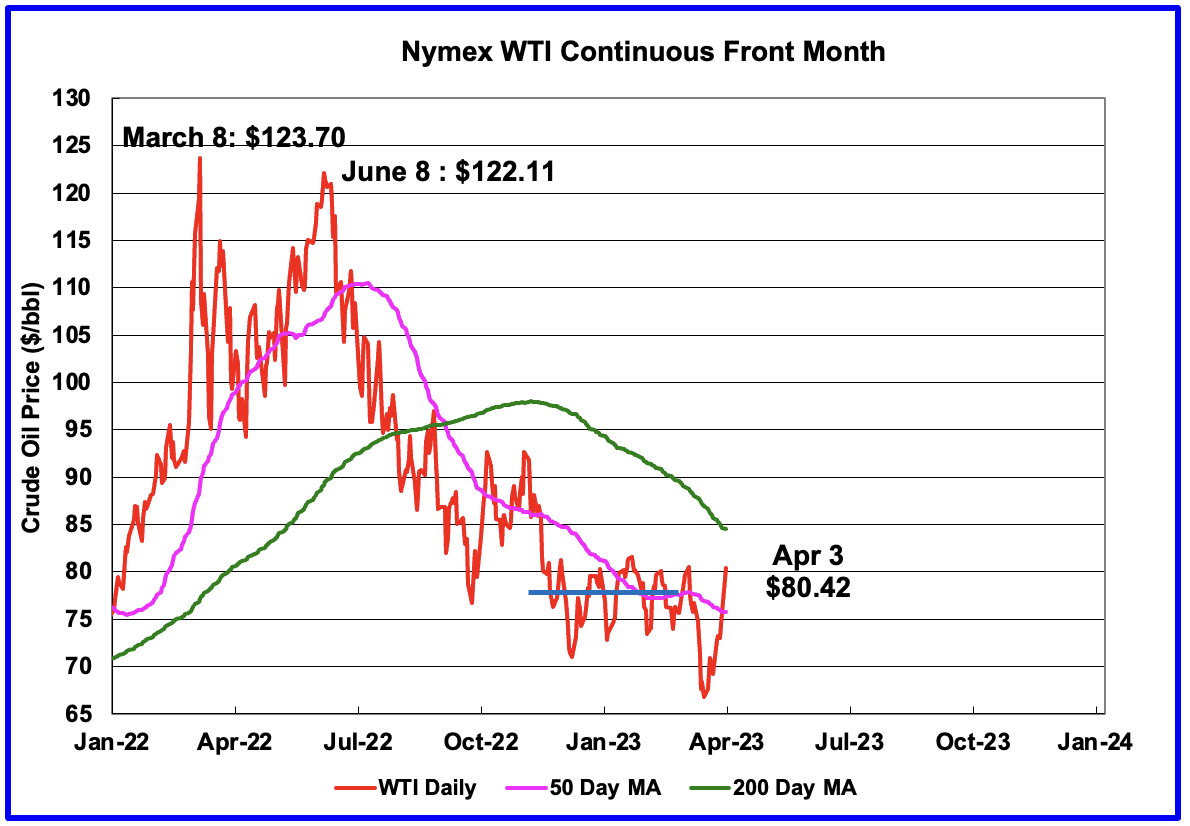

In the last post the following statement was made, “WTI appears to be making a strong bottom since the low of $71.02/b on December 9, 2022”. Then the Banking Crisis hit and a new low was established within a few days. On May 17th WTI settled at $66.74/b.

Following the banking crisis and oil price drop, OPEC +, over the April 1, 2023 weekend, shocked markets by announcing further production cuts of about 1.16 Mb/d. On Monday April 3, WTI settled at $80.42/b after adding a one day rise of $4.75/b. Is it a coincidence that the close to 1 Mb/d cut was set to offset the supposed 1 Mb/d buyback for the SPR which the administration had promised but then Energy Secretary Jennifer Granholm announced it would take years to happen.

The big question appears to be why did they do it now? If demand is strong, they wouldn’t need to cut. On the other hand, some think the financial side of the oil trade caused the price to drop due to fear of recession which led to traders creating a large short position. The production cut forced the shorts to cover.

It should be noted that OPEC’s current production of 28.9 Mb/d is 0.15 Mb/d above world demand for Q1 and 0.3 Mb/d above world demand for Q2. These are two typical week quarters. In Q4-23, OPEC is projecting demand of 30.1 Mb/d, 1.2 Mb/d above current reported February production. Maybe these estimates will be revised next month.

OPEC’s cut is likely going to backfire on them. You have an economy that wasn’t doing well before the cuts. An economy teetering on recession.

The cuts and added price might be enough to tip the economy right on into recession. I’d fade the hell out of this momentum driven rally. CTA’s exiting their shorts by buying doesn’t mean economy is doing well. It’s doesn’t mean any of the banking issues are fixed. It’s doesn’t mean China is fixed and coming to the rescue.

All this rally is, is some hedge funds being short squeezed.

For Goldman being all bullish on oil their CTA’s have about $30 billion in shorts. That they will be unwinding.

So what happens when you take out the shorts and everybody is long? Then some shock hits the economy or banking?

Oil goes to $25 when the longs are forced to exit their positions.

HHH

John Kemp

“The spreads imply traders were not anticipating a significant oversupply or a large increase in inventories prior to the OPEC⁺ cut. Following the cut, however, traders expect the market to become very tight later in 2023:”

https://mobile.twitter.com/JKempEnergy

That is the current view, for you to be right things are going to have to get much worse. While that is certainly not impossible right now that scenario is not being priced in. You’ve been on the oil price collapse wagon for some time, care to put a date on that $25 oil call so we can judge your accuracy?

Texasteatwo,

The only date HHH has been willing to give was March 2023, he has become a little gunshy about a specific date. Now it is “the future”, I expect that guess will be correct. My WAG would be 2040 for $25/bo WTI in 2022 US dollars (monthly average price), but it depends on many factors and I would put a 10 year window around that (2035 to 2045).

The front two contracts in WTI are still a few pennies in contango. How is that possible?

Why am I the only one that had to put a date on it? $25 is just a number. Maybe the real number is $35 or $45 or $55 or perhaps $15.

What’s your number? And date?

HHH,

I would guess $85/bo or higher for nominal Brent crude (monthly average price) by September 2023, about $80 for WTI, for Sept 2023.

Interesting, just a number, so you have revised your forecast, there will be a positive price for WTI in the future (25, 35, …, 500), I think you may have nailed it.

No I think the macro backdrop is bad enough to put oil at $25 dollars. Stop asking me when. Macro can take months to play out.

Absolutely everything is lined up to have another 2008 like recession. Bad economy plus bad monetary conditions. If it was just one or the other I wouldn’t be so bearish. But it’s both.

HHH,

I won’t ask again, the future is a long time, I agree at some point oil might get to $25/bo.

The when is where we might disagree, probably a 10 to 20 year difference.

I realize you said months and not years so maybe you’re with Hole in Head who expects $25/bo by 2025, I think this is nominal WTI and interpret this as a monthly average WTI price by December 2025, we could even give it to him in $2022 US$ (I think he made that prediction in 2022.) I would put the odds at less than 1 in 100 this guess will be correct.

I rarely get future oil prices right though.

Dennis – your prediction is a call based on huge economic shifts happening over a decade. HHH’s call was a much more short term call based on deteriorating economic conditions having very little to do with supply and demand. as HHH has been saying Macro conditions can take a long time to play out. In addition, we are talking about the largest bubble in human history. forever is a long time, even by your over-drawn standards.

Oil is down 32% from its June 22 high. It’s down 18.5% over the past year. If I recall, the “price” conversations with HHH took place last August, when oil was around $90, so a mere 11% drop from that. I’m old enough to remember a month ago when the banking system had a huge seismic jolt that sent oil from $80 to $65 – a drop of 19%. I could go on, but clearly few here will be convinced until well after this process has COMPLETELY played out. Economic data be damned! 🙂

Twocats.

The call HHH has made was for $25/bo. I don’t think this is very likely in the short term, now he is saying 25 is just a number, it could be some other number. I agree, the likely number is about $80/b, a recession might take us down to $60, continued growth perhaps $100. My point is that $25/bo is very very unlikely before 2035.

What is your expectation of what time period is needed for this to completely play out? From your comment it seems a decade is too long, is it 2 years, 5 years? I don’t need an exact date, give me a year or a couple of years window. It is not 2033, how about 2025 or 2027, a hint, thanks as I am not a reader of minds.

Dennis, commercial real estate is in deep shit. Most of the loans are on the balance sheets of the mid size banks that are already in trouble because of collateral issues.

There is a reason why Blackstone had $4.5 billion in withdrawal requests but only let $660 million be withdrawn.

Mostly likely scenario is $25 oil as this plays out. And let me make it clear. This isn’t what I want to happen. Based on all the info it’s just what is most likely.

HHH,

There are always potential problems, I just don’t think the macroeconomics will play out as you believe they will, we will know more in the future.

HHH,

What makes you think that when a recession comes, OPEC won’t cut production further and further. Oil is not just demand driven, there is also a supply side in economics. OPEC is not as dumb as you think, they are obviously putting a floor on oil prices as they don’t want a repeat of what happened during the pandemic.

If they don’t cut production during a recession or a depression, then we’ll see < $25 oil. And i agree with you. But i just don't see them letting that happen. OPEC+ is at war with the west.

HHH, I don’t know who will be right, I just follow the data. But I think there are several differences in the energy markets now as compared to previous economic cycles. Usually late in the cycle inventories begin to build, SPR’s have been filled, and production is high. That is just not the case at the current time. The Saudis just said you are NOT going to be getting any of our oil for less that $70 and many analyst think they mean north of $90 Brent. Now it is certainly a question as to their veracity but as I noted before they are in the drivers seat and we (and our allies) have few policy responses left. TO paraphrase Jeff Curry with goldman , OPEC has never had so much pricing power over the markets as they do now. I am betting we have seen the lows for the year outside of a major economic event. .

https://www.cnbc.com/video/2023/04/03/opecs-pricing-power-is-higher-than-it-has-ever-been-says-goldman-sachs-jeff-currie.html

to add a bit more commentary the metals are on fire this morning and the $ has broke below the support for a very clear head and shoulders topping pattern. While I like the action as it reinforces my world view I will wait a couple of week before saying I told ya so🖖

CHART OF THE DAY: OPEC is cutting oil production to defend much higher prices than ever before. The chart below, from

@GoldmanSachs

, shows the (nominal) price of Brent crude the Friday before any output cut announcement (collective or voluntary) #OOTT

https://mobile.twitter.com/JavierBlas/status/1643267338894974976?cxt=HHwWgICx3Ya8h84tAAAA

Texasteatwo,

Looking at real oil price data we haven’t seen the real price of oil (monthly average) fall below $25/b since Dec 1998 (except for the pandemic crash in April 2020), I think the odds of seeing a nominal monthly average oil price of $25/bo for WTI in the next 10 years are vanishingly small, Great Depression 2 might do it or WW3. I am hopeful we do not see either of these events in the next 10 years and preferably never.

I fully expect them to cut production again this year and probably 1-2 times next year. But in a deleveraging event. Which is my base case scenario. Going by what all the yield curves are telling us. It’s not going to matter. It didn’t matter in 2008.

they cut 2.2 million barrels in early 2009 and oil did start to go up right on those screws. but that was AFTER oil price had fallen, and the fed was also slashing interest rates and firing up the QE printing presses.

https://money.cnn.com/2008/12/17/markets/oil/#:~:text=OPEC cuts 2.2 million barrels,17, 2008

the landscape is much different now with inflation still so high and the fed still raising rates. i do agree that cutting production too much would be akin to warfare.

According to this link, sales of combustion engine passenger vehicles has probably peaked.

https://www.visualcapitalist.com/combustion-vehicle-sales-peak/

More interestingly, the sales numbers are currently at about 69m vehicles. The question is whether the number of combustion engine vehicles on the road has peaked.

I don’t know the exact numbers, but there are roughly a billion vehicles on the road, and their life is roughly 14 years. So roughly 70 million are taken off the road each year. That is about the same as the number of new combustion vehicles.

This suggests that the number of combustion engine passenger vehicles on the road has peaked. So it looks like oil demand from them has probably peaked as well.

Of course, EVs are taken off the road each year as well, and make up part of that 70 m. But only small numbers of EVs are taken off the road, because they currently make up a tiny minority of the vehicles on the road.

These numbers may seem odd in rural America. A third of the new car market is China, and the Chinese are paddling as fast as they can to switch to EVs. This will cut their oil imports and increase their car exports. Since China is probably the world’s biggest oil importer, the Saudis will have noticed.

HHH

Where did you get the info that GS has $30 billion in shorts that they will be unwinding.

As of this morning the Trend line for oil was $82.70. I think TTT also mentioned $82 as a number he was seeing as a “break out” type number. As of 6:15pm the price stands at $80.88. I typically like to see “confirmation” of 2-3 days, but certainly if oil closed ABOVE $82, I would imagine anyone shorting anything oil / energy related would hasten their unwind.

I still whole-heartedly agree with HHH about pretty much everything related to current economic conditions, but if I’ve learned one thing from 15+ years of watching markets – do not fight the signal no matter how much an asset class “should” do something. I imagine TTT will be celebrating with something stronger than tea if that happens and I will admit I was wrong and that he called it should oil recapture bullish trend. Let’s do this! 🙂

When oil prices really start heading down it won’t be because hedge funds and some CTA’s are shorting it. It will be because the longs are selling.

And why will the longs sell? Because they will be forced to. In illiquid markets. Again these markets are bought up with leverage.

When the credit gets turned off it’s lights out. OPEC can cut all it wants and prices will still fall.

Credit comes from commercial banks not the FED or other central banks btw.

I wouldn’t make money short selling unless there are these bear rallies where everyone thinks the “bottom is in” or whatever bullshit they are selling on CNBC, Fox Business, Bloomberg or whatever. there’s been no relief rally in Russell 2000, or financials, or REITS. 7 companies are responsible for 90% YTD gains in markets. so I could really care less what dennis thinks. I’m posting because this shit is so obvious it’s a weird perverse pleasure in frolicking in this knowledge while most people here are like “But OPEC cut!!” please please please buy energy so I can sell it to you!

More commentary on Opec cut, I don’t wish to beat a dead horse, but since it parallels my “rant” in part that shows the comments were not entirely political but rather sober analysis.

“Or maybe the market is a lot stronger, and China was merely masking its economic recovery precisely to inflict the most damage not only on shorts, but the Biden white house. In a time when the multi-polar world order is breaking down and virtually every nascent superpower (or just plain old “power”) is taking on the senile 80-year-old in the White House, this is certainly a credible scenario.”

https://www.zerohedge.com/commodities/opec-succeeds-nuking-crude-oil-shorts-puts-100-brent-horizon

The myth of the “dead DUC”.

The drilling and completion of tight oil wells should be thought of as a production line with drilled but uncompleted wells as what could be termed work in progress on a production line. It takes time to complete a well after the drilling phase is finished so tight oil producers want an inventory of drilled wells to be ready for the completion process when completion crews become available. Typically this is in the range of 4 to 5 months of inventory for the current completion rate, so the roughly 1000 DUCs in inventory for Permian producers represents between 2 and 3 months of the current completion rate (2.4 months). In short, there are either no “dead DUCs”, or likely very few. Note that people were claiming there were 3500 dead DUCs in the Permian basin back in June 2020, obviously that was wrong by about 2500 DUCs. If there are “dead DUCs”, the count might be 0 to 100 rather than 1000. Note that if producers want 4 months of DUC inventory, recent completion rates of around 430 wells per month implies a build in the DUC inventory is necessary to 1720 DUCs in the Permian basin an increase of 676 in the DUC count. I am not going to claim that the “dead DUC” count is negative 676.

Real oil men that have actually worked on these types of wells can correct me as I might be wrong.

Dennis, I must disagree. Dry holes, or just “not enough oil to be profitable” has happened thousands of times in the history of the oil industry. Do you really believe that shale wells are an exception?

‘DUCs’ Are Goosing Oil Companies’ Booming Profits. What Happens When They Run Out? Bold mine.

In late October, U.S. oil and gas producers posted some of their best quarterly results in years.

ExxonMobilXOM +5.9%, for example, posted a third-quarter profit of $6.8 billion, and Chevron earned $6.1 billion — a stunning turnaround from losses of $680 million and $207 million, respectively, a year ago.

They didn’t accomplish the blow-out earnings by drilling more. In fact, they spent less on new drilling in the third quarter. Exxon’s capital spending fell to $3.9 billion from $4.1 billion.

SNIP

U.S. producers are completing DUCs at record rates, outpacing new wells by almost 250 a month, according to an analysis by Raymond James & Associates. In July 2020, companies had about 9,000 DUCs on their books. Today, that number is about 3,300. The 6,000-well drawdown in 16 months is the largest in history.

But not all DUCs are created equal. Many of the wells drilled before 2019 are now classified as “dead DUCs” because their contributions are irregular. DUCs that are still viewed as viable candidates was just 2,370 in September, which was the smallest inventory since early 2013.

That’s 930 Dead Ducs. Hey, if most of them were drilled before 2019 and are still Ducs, there has to be a reason. But let’s look at pure reason. There is no reason that some drilled wells were deemed not profitable to complete. Why would that not be the case? In the history of the oil industry, there have been thousands of dry holes drilled. There is absolutely no reason that this should not be the case for shale wells.

Ron,

Lets look at the Permian basin specifically and keep in mind that we do not know the drilling date of the wells that have been completed. Lets say for simplicity that producers follow a first in first out type of mentality when drilling and completing wells, so the first wells drilled are the next in line to be completed, in the past 3 months there were 1304 wells drilled in the Permian basin. I would suggest that most of the 1044 DUCs in the Permian were drilled in the past 3 months. There may be a few wells that have been drilled that will be low performing wells, but most of those have been completed and either have been producing at low rates or they have been shut in because they are no longer profitable to produce.

One can casually look at other plays besides the Permian and consider the ratio of DUCs to completion rate and find that the DUC inventory in all plays minus Permian basin is about 6.93 months at the Feb 2023 completion rate, for the Permian basin the ratio is 2.41 months. There are not 1044 “dead DUCs” in the Permian basin, that is nonsense in my view. There might be 5 or 10, difficult to know, probably the number is close to zero.

Ron also keep in mind the people who wrote that article were not oil men they were journalists. Perhaps there might be a few dead DUCs in other shale plays, but the very low ratio of DUCs to completed wells in the Permian basin suggests there are fewer dead DUCs there.

Of all 38199 horizontal wells drilled in the Permian basin as of Aug 2022 (from Jan 2007) only 632 of the wells had been plugged (1.65%), a few of these may have been “dry holes”, but most of the 632 likely produced oil for some period and perhaps were poor performers and were not worth continuing to produce when there was a pump failure or other downhole repair needed and were plugged after 5 or 10 years.

Also during the early period of the Permian tight oil play there were a much higher percentage of wells that were poor producers. By about the end of 2014 the play had been better defined and a far lower percentage of wells drilled were poor performers.

See

https://novilabs.com/blog/permian-update-through-august-2022/

Lets say for simplicity that producers follow a first in first out type of mentality when drilling and completing wells, so the first wells drilled are the next in line to be completed,…

There is no reason to make such an assumption. In fact there is every reason to believe that would not be the case. It just makes sense that drillers would complete the most promising wells first and leave the least promising wells for last.

At any rate, I am not an oil man. Therefore I must take the word of what the industry is telling me. Like in the following article.

EIA: Number Of DUCs Falls To Lowest On Record Bold mine.

With more than 4,000 DUCs still active, it may seem like there is little cause for concern, even with losing nearly 50% of the DUC inventory since the beginning of last year. But that DUC count has long been debated. Not due to the accuracy of the figure itself, but because wells that remain in the uncompleted phase for more than two years are considered dead DUCs.

Most analysts agree that 95% of all wells drilled are completed during the first two years. That means any wells still left uncompleted after that time are extremely unlikely to be completed—ever.

Back in June of last year, Rystad Energy estimated that the total number of live DUCs was just 2,380—that was when the EIA had estimated the overall DUC count was more than 6,100. Since then, the total DUC count, per the EIA, has dropped by 1,827, or 30%. Assuming that the majority of those that were completed were live, that leaves U.S. shale with precious little to frack.

The method with which the EIA calculates DUC wells has been called into question well before the dwindling fracklog.

Ron,

You can believe what you wish. I think the dead DUC meme is nonsense. If we take the numbers from the Oil Price article (again, I think Geiger is a journalist not an oil person) it suggests that in Feb 2023 there would be a total of 1115 DUCs that are “live” in all US shale plays. with a Feb 2023 completion rate of 971 so an inventory of 1.15 months for DUCs for all US shale plays. If you believe that, I have a bridge to sell you in Brooklyn…

Also it occurred to me that if the Permian DUC count is accurate at 1044 (and a 2.4 month inventory based on Feb 2023 completion rate) and we deduct this from the 1115 DUC estimate based on the Oil Price article you linked for all shale plays in Feb 2023 we are left with 71 DUCs for all plays minus the Permian basin in Feb 2023 for a completion rate in those other plays of 538 wells in Feb 2023. That implies an inventory of 71 DUCs for 538 completed wells or 0.13 months.

A simpler explanation is the 2 year rule for Dead DUCs is simply wrong and the Rystad estimate from June 2021 is wrong.

I would suggest that anything that you read in OilPrice.com you do so with great care. Few of the posters have any real world experience and much of their work is copy and paste from elsewhere. Whether that is journalism is open to debate. There are a number of posters who do there own work, David Messler for one, but the majority are just would be hacks with sod all idea. The usual suspects are widely quoted. EIA, IEA, Rystad, WoodMac etc are mentioned as if they were the gospel. Like some others on this blog I am extremely cautious about about these entities because first they are out to sell their wares, the IEA is now effectively behinds a paywall, and the likes of S&P, Argus, WoodMac and Rystad are out to sell reports for $ zillions, and secondly they dare not rock the boat with bad news – it is all dumbed down. The worst people to believe are the management consultants – truly clueless and stuffed full of MBA’ s who simply read all the consultant reports and make ever more wild asummptions. ( Show us your watch and we can tell you the time. )

Stephen Bowers,

Do you have an opinion on the “dead DUC” claims made by Rystad and others? I think it is not well founded based on comments Mr. Shellman has made, but I might be remembering incorrectly.

Dennis, I do not think there is one sinlge explanation here. Some holes will have been drilled and that on logging may indicate a poor prospect. The shale reservoir is not homogenous and will vary. The logging will identify the best locations of a cluster frac. Adjacent wells may be indicative of productivity. The oil business is based upon cash flows, always has done, and always will do. Looking at some of the published data on ROI is rather eye-wateringly lousy ( in my business we would not accept this). I suspect the DUC’s are therefore graded working on the best first principle, as is always the case. The lower grade wells will be graded as to the likely return on investment $, and may never be completed. What the cut off point is will be much down to the well owner and what assetts he will have at his disposal and what money is available to pay for the completion. Completion costs will vary in terms of number of cluster fracs, amount of sand, flow back water disposal, expected oil and gas production and the cost of marketing the oil and gas. There are so many variables that you just cannot generalise. Remember cube drilling? That was supposed to save costs and boost productivity – where is it now? Rystad will not be completely wrong and will not be completely right either. This is why I hate consultants.

Stephen Bowers,

Thanks for the reply, I agree with most of what you said. No doubt the operators estimate what a drilled well will produce when completed and I understand that there is wide variability within any tight oil play as far as individual well productivity. My guess is that since 2016 or so the prospective acreage (or rock volume as there are many horizons in most plays) has been fairly well defined and would expect that very few wells have been drilled since 2016 that will not be worth completing at $80/bo and $3.50/MCF at the wellhead. Also consider that the options are a 3.5 million loss on a drilled well that is never completed vs breaking even by spending another 4.5 million to complete the well and at least get your 8 million back, once you have the sunk cost on the drilled well the choice is between zero profit and negative 3.5 million ($8 million D&C assumed for the example). I think this may be why Mr Shellman once commented that the dead DUC meme seems kind of silly.

You mention frac clusters helping to decide on completion, but the fracs happen during the completion process, so we wouldn’t have much information on fracs, unless you are talking about adjacent wells. As Mike often says it is dark down there and much is not known, if the wells are properly spaced (at least 600 feet from the nearest lateral) fracs from adjacent wells might not tell us much, though productivity of nearby wells would certainly influence the decision on whether to complete the well.

Though one might ask, if the nearby wells were dogs, why drill another well nearby?

Stephen…I agree with your comment about OilPrice postings.

Same applies to many other sources of info quoted here on energy and political matters.

Zero Hedge for example.

One of the most important skills that people can have these days, and that most perform miserably at, is the ability to identify factual information and the ability to separate fact from opinion, from speculation, and from politically or financially motivated biased analysis.

You can’t trust anyone to do this mental sorting for you- not the editor, not the producer, not the preacher, the newscaster, the lawyer, the CEO, the AI program or your friends.

Can you find reality? Can you spot when you are simply being manipulated to someone elses agenda.

I thank Dennis for working hard to keep this site focused toward the search for reality in the energy sphere.

Hickory,

Thanks. I have biases as well, difficult for humans to be objective as we all have a point of view which influences how we understand what we read. That is why a variety of viewpoints is useful from my perspective.

Ron,

Chart below from

https://novilabs.com/blog/permian-update-through-august-2022/

Nice chart Dennis. But I do not understand the connection to ducs, especially dead ducs. The article is all about completed wells. Ducs are not mentioned anywhere in the article. I found the below chart, from Pioneer Wells, interesting.

Ron,

We assume a DUC is a dead DUC because if completed it won’t produce enough to be profitable, the chart shows the percentage of completed wells with different levels of production. Note also that nobody knows what a DUC will produce until it is completed. Mike Shellman has mentioned in the past that no sane oilman would drill a well and not complete it eventually (and sooner would be better).

Note also that nobody knows what a DUC will produce until it is completed

No Dennis, that is simply not the case. Damn Dennis, you know better than that. We have been over and over this for a decade now. You know they take samples before they frack. And you tell me they simply ignore them even if they tell the driller he will get very little if he completes the well?

When the well is drilled, before it is fracked, the driller has samples from the well. He can tell from the samples of the the rock just how much oil he can expect to get from the well if fracked.

Mike Shellman has mentioned in the past that no sane oilman would drill a well and not complete it eventually (and sooner would be better).

Well, I don’t remember ever reading that. But then I don’t read all the posts anymore. I would love to hear Mike S explain his reasoning here. I simply cannot believe any man would complete a well if his samples showed he would get hardly any oil if completed.

Ron,

I think there is more to tight oil wells than you understand. Many of these wells have 10 thousand foot laterals, 2 miles. There are no dry holes, they always hit some oil in the rock. How well the oil will flow depends on the fracture network, both already existing and future fractures that happen during the completion process, these can not be predicted accurately in advance, this is not the simple poke a hole in a pool exercise you are familar with, it is 100 to 10,000 times more complicated than that. So what you think you know about this is very far from reality.

No samples show there will be no oil, there are no dry holes, especially today when the sweet spots are well defined, in the early days when the sweet spots were being delineated there might have been some. Nobody spends 3 to 4 million drilling a dry hole, there are more and less productive wells and that is only determined once the well is fracked.

Dennis, let’s call a truce here. Ducs are just not that important. US production, if it has not already peaked, will peak soon. The US, as I have said befoe, is now just a bit player in this peak oil story. Sure, it was very important in the last decade because of the shale boom. But that is over now and US production will likely plateau for about a decade now. Either that or decline.

World peak is my primary interest.

Ron,

Tight oil will play a small role in determining the World peak, I am just correcting the record on the “dead DUC” meme, there probably are few dead DUCs, its an arbitrary category created by journalists looking for clicks on the pieces they write, there is nothing special about 2 years, especially when a pandemic intervenes. In the Permian the drilling inventory is at historically low levels (2.4 months) and the number of dead DUCs is likely zero to 5. In other basins there might be a few, I tend to focus on the Permian because that’s where most of the growth is happening.

Dennis, we must agree to disagree on this point. Throughout all shale basins, there are several hundred DUCs that will never be completed unless the price of oil goes above $150 or so. But neither of us can prove our case, so we will just have to leave it there.

Thanks for the interesting exchange.

Yes Ron I agree we do not know the number, but we have very different estimates on how large the number of dead DUCs is. There are no doubt a few, but keep in mind that it takes typically 3 to 6 months from drilling to first flow for a tight oil well. In some setups with multiple wells on a pad the process waits on a set of 4 to 6 wells to be fracked so that they come online at nearly the same time which can extend the lag time.

A large inventory of DUCs is needed to keep the process moving forward. In the Permian basin in particular there are about 1000 DUCs with a Feb 2023 completion rate of 430, about 2.4 months of inventory. It is doubtful that many of these Permian DUCs are “dead DUCS”, and certainly not 100 of them. Note that a typical well inventory from Jan 2016 to Sept 2018 was about 4 to 6 months more than the most recent monthly completion rate, today’s level is less than half that inventory. Perhaps there are 100 dead DUCs in the rest of the shale plays, impossible to determine. My expectation is that at $100/bo the number is in the single digits for all shale plays.

Hi Ron,

I was wrong, I had misinterpreted what Mr. Shellman had said in the past. He let me know that dead DUCs are not a myth and that there may well be a 1000 or more dead DUCs out there.

I am surprised the number would be that high. There are about 3400 total DUCs in the 5 major tight oil plays (EIA estimate) so if 1000 of these are dead, then the DUC inventory is quite thin, a level of about 3 months for the 5 major tight oil basins.

Dennis, thanks for the info. I am not at all surprised.

Another way to look at DUCs is to consider the ratio of DUCs to current completion rate which I call DUC inventory in months of current completion rate. The chart below looks at the historic inventory levels from Jan 2016 to Feb 2023, currently we are near historic lows for that period (low was 4.47 months in Oct 2022.) Currently we are at 4.92 months as operators have chosen to increase the drilling rate perhaps because the DUC inventory was getting too low. The Permian basin is at 2.41 months of DUC inventory a very low level, if the count is accurate.

WAHT THE HECK DENNIS AND RON, I will give you my two cents.

Early in the resource plays the big operators often using minor players as front operators would drill a vertical well, case it and complete it in several zones that had potential horizontal applications. I know this because I watched it happen in real time in Okla. They would make a “crappy well” but they would produce it and evaluate over time. that is how they mapped out the play if there were not sufficient previously drilled wells. IN the mean time they were building their lease positions again often using other names so to not draw attention.

To be clear in the early days, could some of the operators drill a well and case it knowing that it might not produce, sure that could happen, although I have never seen that myself in any of my work. What is more likely is that a company has a contracted drilling rig and wants to keep it, either they have a favorable cost agreement OR perhaps they are afraid they can not get another rig on a time frame they want. Other factors may be their cap ex budgets. Lets say you have X money to spend and that will drill and complete 10 wells or 25 DUCS. Let’s also say you guided the street to a certain production level and you can use your DUC inventory to increase or keep steady your production to meet your guidance. There is a lot going on in this area. It is not black and white. I know for a fact that these companies manage their businesses using DUCS. I would put the idea that these companies drilled a well and cased it and thought it might NOT produce on the lowest possible rung of the reason why there are DUCs in the business.

To those who might disagree, a sports analogy might be appropriate. Let’s say you got a guy who played two years high school football and he believes that gives him the knowledge to call into a sports talk show and tell the world a head coach in the NFL doesn’t know what he is doing. It happens all the time, the question for you guys is who do you believe.

Just my 2 cents.

Texasteatwo,

The DUCs referenced by the EIA are horizontal wells only rather than vertical wells. Let’s try a straightforward question, do you believe there are hundreds or thousands of horizontal DUCs that are so-called “dead DUCs” that will never be completed? I believe Mike Shellman has said in the past that not many businessmen would spend 3 to 4 million to drill a well and then leave it to rot. I believe Mr Shellman is likely correct.

Dennis,

“The DUCs referenced by the EIA are horizontal wells only rather than vertical wells.” yes I realize that Dennis, the point I was making is the the industry was evaluating the extent of the plays using vertical wells. That is when they would run a full whole core, evaluate the thickness the brittleness, the oil or gas content etc. They did not do that with the way more expensive horizontal wells.

“Let’s try a straightforward question, do you believe there are hundreds or thousands of horizontal DUCs that are so-called “dead DUCs” that will never be completed?

to your question not I do not. but i have not evaluated every play out there but I do not believed anyone would drill and case any well without the intent to complete it. hope that helps.

I almost left out another very important reason for a DUC’s. Sometimes industry will drill a well but does not have the immediate ability to transport the the products, ie pipelines. Or they have pipelines but do not like there terms of use and may build their own pipeline. Like a say it’s a bit more complicated, but I cannot imagine a reason where after drilling you would case the well if you were not going to complete it. If it did not come out like you hoped, you would just Plug it.

not many businessmen would spend 3 to 4 million to drill a well and then leave it to rot.

This reminds me of what Alan Greenspan said about the crash of 2007. He couldn’t believe that banks would expose themselves to so much risk.

“Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief,” [Greenspan] told the House Committee on Oversight and Government Reform.

https://www.nytimes.com/2008/10/24/business/economy/24panel.html

The assumption that all businessmen always know what they are doing is doubtful at best. Maybe it’s just me, but I can’t remember a single project in my career where nobody made a mistake. In my experience, mistakes are so common in business that managers spend most of their time fixing stuff.

Considering the frenzied drilling and the incomplete information about geology and the market, abandoned wells don’t seem all that unlikely.

Alimibiquated,

Perhaps there will be a couple of DUCs that do not get completed, 100s or 1000s is quite unlikely. Typically these operators have maintained a 3 to 6 month inventory of DUCs, during the pandemic the inventory ballooned temporarily as completion rates plummeted, but now inventory levels are inline with historic levels and in Texas and New Mexico the levels are well below historic levels at about 3 months or less. Probably not very many dead DUCs in those two states especially if oil and natural gas prices rise as I expect they will to $80/bo and $3/MCF at wellhead.

Dennis

Something has changed regarding the use of DUCs. Looking at the DUC charts in the post, in January 2020 there were 3400 DUCs in the Permian and the completion rate was 500/mth, or roughly 7 months of backlog. Looking at the latest February data, there are 1,044 DUCs and the completion rate is 433/mth for a cycle time of 2.4 months.

One possible explanation is OPM. There may have been a lot of that back in January 2020 and it was used to drill extra wells giving false hope to investors. In today’s environment where cost control and returning cash to investors is the new norm, the supply of OPM is tighter and requires a more disciplined use of cash resources.

The only oily basin where DUCs are increasing is the Niobrara. Something is unique there.

As noted in the post, the gap between drilled and completed wells in the Permian has now essentially vanished. We need some info from some Drillers or Framers on the typical time between completions and drilling.

Ovi,

Yes things have changed at lot especially in the Permian see chart below, in 2016 to mid 2018 the inventory of DUCs hovered around 5 months completion rate. Lately it has been about 2.4 months, that is a big change.

Permian DUC inventory with pandemic values off scale (high of 45 months).

Ovi,

I found the following from Jan 2023 on lag times between drilling and completion

https://www.spglobal.com/commodityinsights/en/ci/research-analysis/drilled-but-uncompleted-wells.html

Befor the pandemic the average time beween drilling and completion was about 6 months, but during the pandemic the average lag rose to about 10 months, recently the lag time has fallen to about 8 months (data from Jan 2022 through August 2022.) see first figure in blog post linked above.

There is also this older article from the EIA (June 2021.)

https://www.eia.gov/todayinenergy/detail.php?id=48537

Dennis

As noted above something has really changed in the Permian. With 2.4 months of DUCs, the cycle time must be down to less than 2.4 months, assuming a few of those DUCs are dead.

Ovi,

It may be that they are doing just in time well manufacturing to save on costs, I would note that the Eagle Ford also has a low inventory of about 3.6 months. Maybe there are a lot of frack crews available in Texas and New Mexico and the companies in those two states don’t feel the need to maintain a large inventory of DUCs. Note that this is not the case for the Haynesville (in Texas and Louisiana) where the DUC inventory is about 10 months, and also in the Niobrara (about 6 months inventory) and the Bakken (7 months of inventory). My guess is that there are fewer dead DUCs in the Permian and Eagle Ford, but it would be interesting to hear from people who know more than me.

https://www.worldoil.com/news/2023/4/3/u-s-shale-unlikely-to-fill-gap-left-by-surprise-opec-production-cuts/

“There’s not a coordinated response that comes out of here,” said Brendan McCracken, Chief Executive Officer of Permian basin producer Ovintiv Inc. “We’re now into several years of players like us running these businesses for returns and free cash flow, and that’s not going to change in the short term or the long term.”

The golden age for small producers with legacy production may have arrived. Shallow and Mike should be happy, it will come with higher societal cost such inflation, but I think that is where we are at.

Texasteatwo,

Supply from non-OPEC producers that are not a part of OPEC plus may increase if oil prices remain at $80/bo for WTI for an extended period, especially if natural gas prices follow the futures curve and get back to $3.50/MCF we might see higher completion rates in US tight oil plays. Lately completion rates in Haynesville, Marcellus, and Utica plays have plateaued so we may see shale gas output increase more slowly at current low natural gas prices ($2/MCF).

Ovi,

Thanks, great work.

The frac spread data is very interesting, do you have a link to where you found it, or are you a subscriber to Primary Vision?

Note that on the Bakken January estimate for the DPR this is total output from the Bakken region in both North Dakota and Montana, nearly all output in those two states comes from the Bakken region (Williston Basin), and total C+C output in January 2023 from those two states (ND and MT) was 1110 kb/d fairly close to the DPR estimate of 1089 kb/d for the Bakken region (about 2% too low, which is not bad for a model). Looking at historical DPR estimates vs PSM data it looks like about 22 to 23 kb/d on average comes from outside the Williston basin in North Dakota and Montana so the DPR may be quite close to the PSM estimate for Jan 2023 for the Bakken (1110-22=1088 vs 1089 in DPR).

Dennis

Thanks

As I mentioned in the post, I wasn’t sure how useful the results would be since most of the participating oil experts already know what is happening in the main counties that are shown in the two tables. So no, I am not paying for info that may not be useful to me.

I meant to link Primary Vision to their database in the post. I forgot and have updated the post so that Primary Vision is now linked. Scroll to the bottom of the page and download the SQL or CSV version. I used the CSV version. After looking at many of the files I finally got to one that I thought would be useful, registryupload_3.csv.

Thanks Ovi.

I will check it out.

Ovi,

This seems useful for determining completions in various plays, but after October 2022 the data seems incomplete at least compared to the DUC spreadsheet estimates for completion rates. I focused on the Permian basin for completion rates.

Dennis

I agree that the DUC sheet is more up to date and more useful. The most useful info out of this table is that it shows that 50% of the Fracs occur in the Permian. I was hoping there would be info showing primarily Oil fracs vs NG fracs

The data in the attached tables covers the period Feb 25 to March 3, same as in the post. I don’t understand your October 22 comment. The database is incomplete because it only shows completion Start and End dates. I downloaded another data folder yesterday and the number of frac spreads increased. Not sure on the extent of the time lag.

It is unfortunate that the database does not include the basin. However by doing an internet search, a column for Basin was added to the file for a few of the bigger basins. Attached are two tables showing the break down by the bigger basins.

Table 1: Basin vs County

Ovi,

I looked at the data by month for Permian basin completions (this can be done by sorting on state and county) and we know the counties for the Permian basin from novilabs Permian posts. For the Permian basin the numbers match for Sept 2022 and Oct 2022, but for Nov and Dec 2022, and Jan and Feb 2023 the completions for the Permian are less than the DUC spreadsheet. To me, monthly data is more natural than weekly data and I wanted to compare completions with DUC spreadsheet. I think the EIA might be using a model for the most recent few months of data, but there may be proprietary databases that have this information.

Sept 2022-431 completions in Permian vs DUC 430

Oct 2022-468 completions Permian vs DUC 457

Nov 2022-388 completions Permian vs DUC 441

Dec 2022-368 completions Permian vs DUC 431

Jan 2023-362 completions Permian vs DUC 433

Feb 2023-207 completions Permian vs DUC 433

This is what I mean by incomplete data after October 2022, also possible the DUC spreadsheet is wrong for data after Sept 2022.

I will check back in a month to see how the data has changed.

Dennis

I have sent you an email.

Table 2: State vs Basin

Ovi,

I think you might mean Montana for Bakken (rather than Colorado), for Pennsylvania, Ohio, and W Virginia (Marcellus and Utica) they would be natural gas and the unknown in Texas plus Louisiana would be Natural gas (Haynesville shale). Wyoming and Colorado would be the Niobrara (oil) and Oklahoma (Anadarko) might be a mix of oil and natural gas frac crews. No Permian basin in Oklahoma, New Mexico and Texas only. See DPR spreadsheet that lists states and counties for various shale plays.

Garfield County in Colorado is in the Niobrara play, Major County in Oklahoma is in the Anadarko play, Yoakum County in Texas is part of the Permian Basin, Webb County in Texas is part of Eagle Ford, Divide and Dunn Counties in North Dakota are part of Bakken. The Colorado and Wyoming Counties would all be in the Niobrara, Counties in Pennsylvannia, W, Virginia, and Ohio would be part of Appalachia shale gas plays, Oklahoma would be Anadarko, other Texas and Louisiana counties would be Haynesville shale gas play. Everything else would be other plays (Powder river, Fayetteville, etc).

Dennis

Thanks

I will look at focussing on the oil plays. However that is getting tricky because many of the oil plays are getting gassier.

There is a Garfield County in Montana also. When I saw Garfield I added Permian. I failed to notice the Colorado next to it.

Ovi,

Yes that is a problem, in many cases there is both oil and gas produced, but some plays such as Marcellus, Utica, and Haynesville are almost exclusively natural gas (with some NGL and condensate). Other plays such as Eagle ford, Permian, Niobrara, and Anadarko are indeed quite gassy and becoming more gassy as time goes on (as the region suffers from pressure depletion).

The truth behind the curtain on the DUC calculation on a basin basis .

https://www.oilystuffblog.com/forumstuff/forum-stuff/quack?origin=notification

On refilling the SPR, I think there are limitations for withdrawing and filling, when the administration promised to refill, they may have believed that Congress would be ok with not selling another 26 million barrels from the SPR, but they were incorrect. They might not be able to refill until the withdrawals are complete at the end of June 2023. It was a dumb policy to drain the SPR in the first place in my opinion and also dumb policy to drain another 26 million as Congress has mandated.

Perhaps the rest will be held for a true emergency as was originally intended.

I agree it was a stupid policy to use the reserve when there was no emergency condition.

Another huge American error has been to drill the hell out the Bakken and Permian over the past decade.

That action should have been spread over 3 decades, but we generally have no plan or coordinated action

when it comes to developing the nations natural resources.

So often this country runs around like a chicken with it head cut off.

Hickory,

Yes there is a strong belief in the US of the magic of the market and general distrust of government intervention in markets, though the release of oil from the SPR was exactly that a government intervention.

It is not clear that government planning of oil production would yield better results than private enterprise. Though perhaps better enforcement of spacing rules and restriction of natural gas flaring might have led to less waste. Also not having changed the rules on crude oil exports in 2015 might have led to a more gradual development of tight oil resources, this may have been another government blunder (but one that was fully supported by many in the oil and natural gas industry.)

I would like to point out that Elinor Ostrom won the 2009 economic prize in honor of Alfred Nobel for empirically showing that solutions other than those usually promoted by economists (that is to say private ownership and government regulation) frequently solved the so called “tragedy of the commons” problem in a superior fashion than the commonly promoted solutions. The better solutions were not unique but followed two general rules in order to attain success:

1. Those exploiting the resource made the rules.

2. Those exploiting the resource were in charge of enforcing the rules.

Schinzy,

I think market solutions are imperfect and need government oversight to take account of externalities, but I am not familiar with that work as I have been out of the economics game for a long time, sometimes better social policy is difficult to institute under existing institutions which are often slow to change (particularly in the US, perhaps in Europe such policy might be more easily instituted). Unfortunately the US constitution was written in a way that makes significant change nearly impossible, we have a system that is conservative by design, it is why we are stuck with 19th century policy in the US.

Hickory and Dennis,

Hindsight is 2020. A year ago, the West was applying sanctions, oil was sky rocking and no one knew what was going to happen to Russian production. After April of 2020, one could make a case it would be heathier for the oil industry to have an extra 100 million barrels of spare storage. America could in force a 55mph speed limit and save a million barrels a day. But we don’t. America is going to produce records amounts of oil for the next 10 years. What kind of emergency are you looking for that the SPR is going to make a real difference. It’s not. We have 10 years to change our ways and the Biden administration is trying to point the ship in that direction.

Huntingtonbeach,

I respectfully disagree, selling the oil from the SPR was a dumb move, I believed it at the time and believe it now. Much of the oil produced by the US (the 8 Mb/d from tight oil) cannot be utilized by US refineries, we have the capacity t handle about 5 Mb/d, that is it, any excess is simply exported. Most of the US refinery capacity was designed to handle heavy grades of crude oil (most of World output is heavy oil or extra heavy oil). US C plus C is likely to peak in 2028 and then decline rapidly as tight oil plays run out of profitable drilling locations, so we have more like 5 years not 10 years. Perhaps a drained SPR will not be a problem, but it is nice insurance to have and dumb to have drained it when not necessary.

“If you give a man a fish, you feed him for a day. If you teach a man to fish, you feed him for a lifetime.”

“but it is nice insurance” Not really, it’s like buying a $1000 life insurance policy for your young children’s college education on yourself. Do you think if it was a $600 policy it would make a difference?

“likely to peak in 2028 and then decline rapidly as tight oil plays run out of profitable drilling locations, so we have more like 5 years not 10 years.” Now your sounding more like most of the doomers here. The world is not going to come to an end the day after peak. It will most likely take 5 years for everyone to agree the tight play has peaked.

“(the 8 Mb/d from tight oil) cannot be utilized by US refineries, we have the capacity t handle about 5 Mb/d, that is it, any excess is simply exported. Most of the US refinery capacity was designed to handle heavy grades of crude oil (most of World output is heavy oil or extra heavy oil).” This statement just doesn’t even seem relevant. Instead of saying “simply exported” you could have said simply exchanged. Not sure your point.

California has one of the largest reserves for heavy oil in the world, second only to Venezuela.

https://www.researchgate.net/figure/General-map-of-California-showing-the-location-of-the-oil-and-gas-fields-and-of-the-major_fig1_273693761

If commenting to SPR releases helped unite the West against Russian tyranny. It was well used.

Huntingtonbeach,

The release from the SPR was not needed, only a small portion of the 200 milion barrels sold (about 30 million barrels) was part of a coordinated release with other nations, that’s fine, the other 170 million barrels was stupid.

You claim we produce plenty of oil, but much of it cannot be used in our refineries. In a situation where we need the SPR for whatever reason, selling crude oil exports only helps us if we can find imports to replace those barrels, you assume they can be found, in a situation where the SPR is needed, that may be a bad assumption.

Here is what the decline in the tight oil plays may look like.

After 3 years output would be down by 1000 kb/d and down by 2000 kb/d after about 5 years, the decline will likely be evident after 1 year, 2 at most.

I agree the peak won’t be the end of the World, but claims that we have plenty of oil for several decades are wrong in my opinion.

California proved crude oil reserves are 1.7 Gb, US input to refineries is about 5.8 Gb each year, so California proved reserves would take us about 3.5 months. Of course CA output is much lower at about 122 million barrels per year, about 2% of the typical yearly crude input to refineries (122/5800). The SPR is at 371 million barrels and we import about 6 million barrels of crude per day, so we have enough oil in the SPR to last for 62 days.

“California proved crude oil reserves are 1.7 Gb, US input to refineries is about 5.8 Gb each year, so California proved reserves would take us about 3.5 months.”

You make my point for me, the SPR is a false sense of security. Also, you make the same mistake Ron does. There is a lot of oil out there that are not proven reserves. California has more oil than Texas. 20 years ago tight oil wasn’t a reserve either.

I also see 10 years of production as high as today in your graph.

The real answer is getting off the addiction.

Huntingtonbeach,

Only the oil that is profitable to produce counts, there is a difference between resources and reserves. You are correct that there might be 10 years of tight oil at today’s level or higher, but we still can only refine about 5 Mb/d of the tight oil and that probably won’t change, as Mike Shellman has pointed out it would be better to conserve our resources and not export them. The SPR is nice to have for the 62 days we might need it, saving tight oil resources for use in the US might also be sensible.

I agree using less oil is the best approach, but it will take some time to achieve, probably more than 10 years.

HB –

CA Proven Reserves were 5.0 GB in 1990, 3.0 GB in 2010, 1.5 GB in 2020…the peak was 1985

What’s your point….? CA oil production will continue it’s decline, not sure what the heavy oil is going to do for anyone…CA oil production nears zero around 2030 (+/- a couple years).

Anyone who actually thinks the SPR get’s refilled….geez not sure what planet they are living on, we likely tapped into because we had no other options to meet national demand. As we’ve discussed refineries need a certain balance to the quality of crude product input…we are starting/continuing to scrape the bottom of the barrel…

Dennis,

“nice to have for the 62 days we might need it”

Well we all know what 62 days of a college education gets you, flipping burgers. Monday night this week Tucker Carlson went on a rant about how the SPR is arguably the most valuable asset the United States has. At the time, mine first thought was that’s why TTT bought up the subject last week. Then the next morning you bring the subject back up. I wasn’t going to let it go without posting. Then later in the day TTT admits below he watches Tucker. No surprise for myself from someone who links to Zero Hedge.

“Only the oil that is profitable to produce counts”

Regarding proven reserves, what is profitable changes by the day. Unproven resources are the feed stock for proven reserves. Know one knows exactly what’s out there, but for sure there is a lot. Making your above comment is kind of a type of tunnel vision.

Not exporting or the masses driving 55mph just isn’t realistic today. The truth is oil is just to cheap today to take conservation serious. I’m actually pleasantly surprised how much of the world is moving toward decarbonization. I tried to bring to your attention last week that maybe we have reached peak demand, but your canned response seemed like you were blowing me off. I think we’re closer to it than you think. Thanks for the Tesla link on the non oil side.

Huntingtonbeach,