A Guest Post by George Kaplan

Introduction

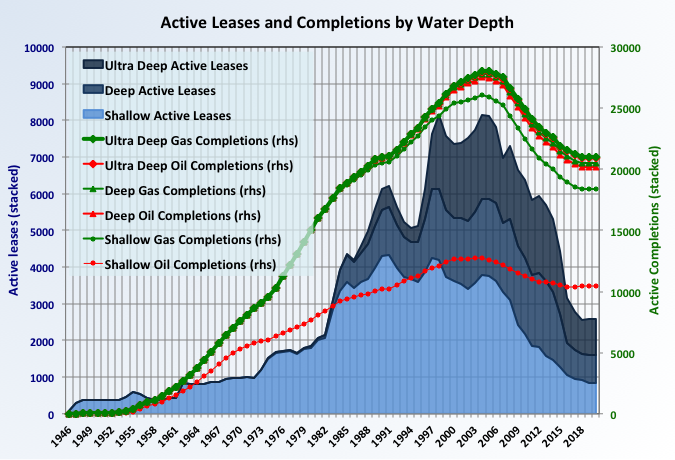

In many ways the US side of the Gulf of Mexico shows signs of a production basin at the end of life. Most of the sort historic of charts that would normally plotted – discoveries, drilling, active wells, active leases, leasing activity, natural gas production – show classic bell shapes, with current conditions on the tail; and yet oil production is still just about increasing, and the fall in remaining reserves has been reversed in recent years. Examples for some parameters are shown in the chart, and others in subsequent sections. (Note the units used for production, it was the only way to get everything on the same axis.)

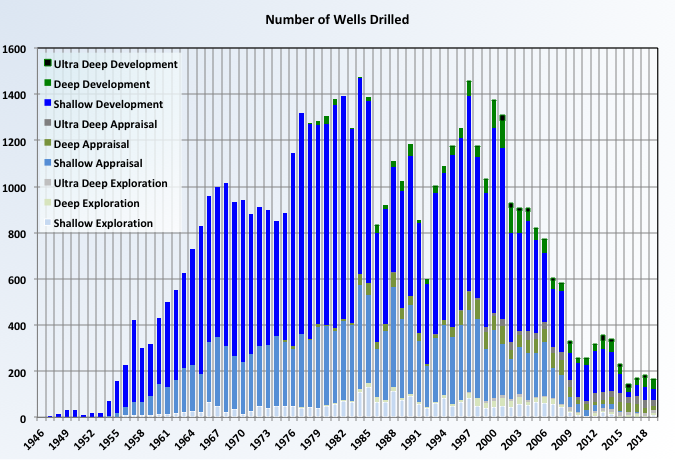

I think the main reason for this is that there are really several different plays which have come and are now mostly gone or going. Without getting into the complicated geology, which I am incapable of anyway, the main divisions have been a move from shallow water (<1000ft) to deep, and now to ultra-deep (>5000ft) as newer generation drilling rigs and production facilities became available. These can be further divided: the initial shallow production was more natural gas and condensate than oil; and recently technology has moved from 10ksi, to 15ksi and soon to be 20ksi completions. Seismic technology improvements have also opened up other resources, most recently sub- (or pre-, I’ve never got the hang of the difference) salt, although the gains from that may not be as evident as initially expected. Exploration and production has further been disrupted by some big hurricane seasons, a couple of oil price collapses, the drilling hiatus after the BP Deep Horizon disaster, and some major equipment failures and delays. Reserve and production histories look like a series of overlapping bell curves, from four to maybe up to eight or ten. I’ve tried fitting these (see later posts) but I don’t know they have much predictive power, which is what seems to interest people the most.

I’ll concentrate on exploration, drilling and discoveries in this post, which are really just presenting BOEM (and some EIA and company) data in different ways, with a bit of conjecture as to what is happening, but nothing particularly startling or revelatory. Later (putative at the moment) posts would cover production, reserves and decline rates.

It also gives me a chance for a tirade against Trump, whom I consider a greater threat to the earth’s, and our, wellbeing than peak oil ever was, so if your sensibilities are going to be offended close your eyes after scrolling through about a dozen screens (or now if you like). This might be regular therapy for me especially if, god help us, he wins a second term – which, one good thing from it seems increasingly unlikely given how the virus (not him the other one) is revealing his shortcomings, despite what I see of the Democrat and democratic chaos in the USA. Nevertheless it’s a catharsis of some kind for me after seeing his odious visage, and that of his fawning and baying cult who has now pretty well given up any pretence of suppressing their various bigotries.

Oil and Gas Leasing Activity

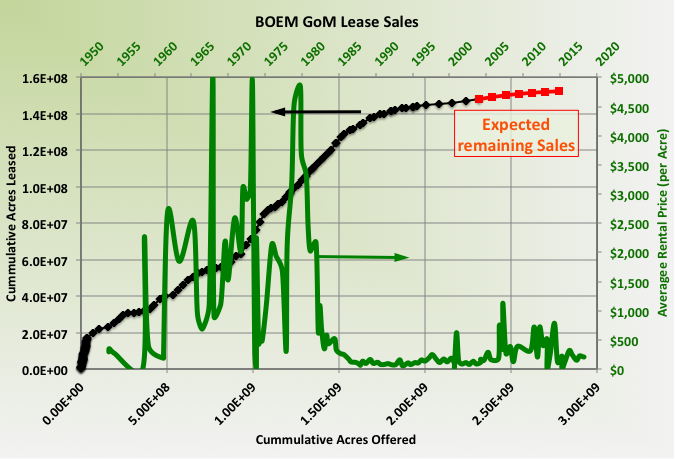

Lease sales are at the tail end of a creaming curve and recently haven’t engendered much interest with only about one to one and a half percent of the acreage sold; generally there isn’t much competitive bidding and the lease prices are relatively low.

There are six more lease sales planned, each of about the same size: two this year, three next and the last in 2022. If normal leasing behaviour has been followed then there will have been industry input into deciding the order of leasing with the best tracts offered early, and those remaining are the dregs (in fact the GoM, more than anywhere, set this as the standard procedure).

There were suggestions from the White House that further eastern acreage would be opened up, but there’s plenty of evidence that those areas are not very prospective and there would have been, and were, objections from the Florida fishing and tourism industries (a key Trump state in 2016, and arguably more marginal now with demographic changes and an influx from Puerto Rico after hurricane Maria). I think there is a valid question as to whether Trump understands that there needs to be recoverable oil in place for it to be produced. He sees everything as conspiracies and politics and probably thinks only regulations and environmentalists have prevented more growth in oil from GoM – he also only gets ‘oil’ as a single economic idea, the nuances of natural gas, condensate, or differences between exploration and production have no place in his world.

New Discoveries and Developments

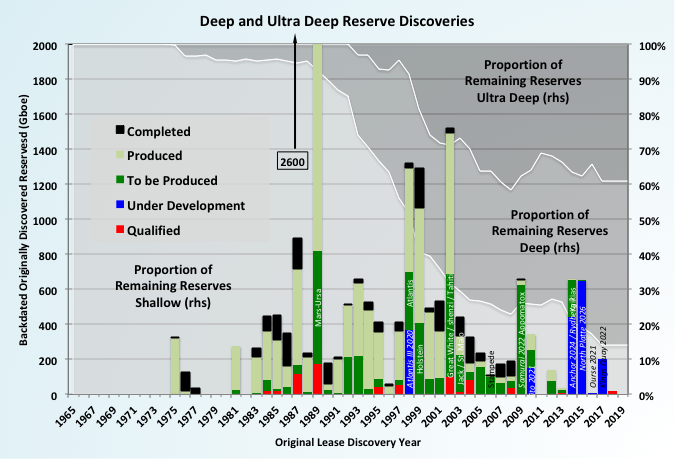

This chart shows the deep (>1000ft water depth) leases with the 2017 BOEM estimates for reserves. The background shows the proportion of total reserves in shallow, deep and ultra deep water, and how then resource base has been moving to deeper blocks.

The estimates for the fields under development (in blue) are from the trade magazines or company press releases so will be the very high end of equivalent oil totals; some don’t jibe with other reports, e.g. a very high reserve number being considered only as a tieback opportunity. There have been many examples of deep-water fields having downward reserve revisions soon after start-up (to be covered in later post).

The almost illegible writing in each year show the major projects based on that year’s discoveries. All the reserves are backdated against the year of original discovery in the lease – this carries the usual confusion in that there can be more than one field per lease, or fields extending over several leases, so actual field discovery does not match lease discovery.

The reserves shown for non-qualified fields are really just placeholders. They are for leases that are attached to existing fields in production and I just pro-rated based on total reserves and number of leases. In fact as these leases are the last to be developed their reserves are likely to be low, possibly zero. There are a dwindling number of other non-qualified leases (see first chart above) but their reserves are also likely low.

That said BOEM reserve numbers, although nominally 2P) have proved to be quite conservative in the past. They are far from scraping the bottom of the barrel for new developments, but what’s a bit odd is that most of the backlog of smaller, near field tie back and brownfield developments have been used up. I think this was a result of a fairly unusual confluence of technology, geology, the prior Deep Horizon drilling hiatus, low interest rates and oil price that stopped major developments but then hoovered up all the low cost, near field prospects.

What are being developed are major stand-alone projects, and what are being considered are also recent, putatively large discoveries like Whale, Ballymore and Dover. But two cautions about this: 1) many previously hyped discoveries subsequently turned out to be duds – Moccasin, Kaskida, Phobos, Shenandoah (not a dud, but not so good); as above at the same time as hinting at them as major, these new discoveries have all been mainly discussed as tie backs to maintain capacities in existing facilities. I saw one puff piece about Whale being the first of a new wave of developments – removed within hours.

It looks like developments now will be limited by the pace of discoveries, and could now slow to trickle given the oversupply in the market, the cost and risk of GoM activities and the already obvious geological limits.

Drilling Activity

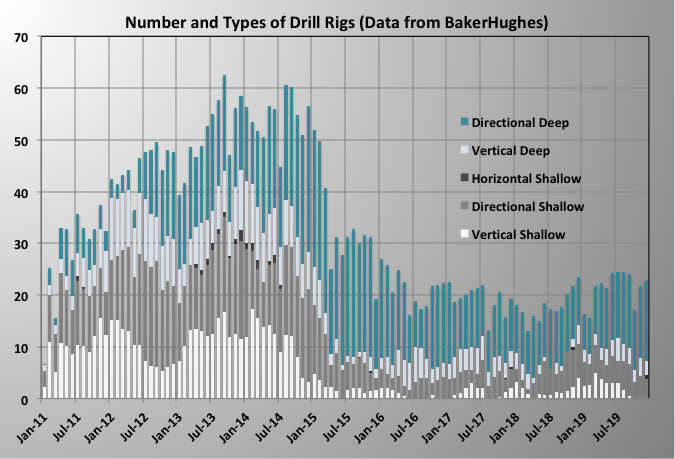

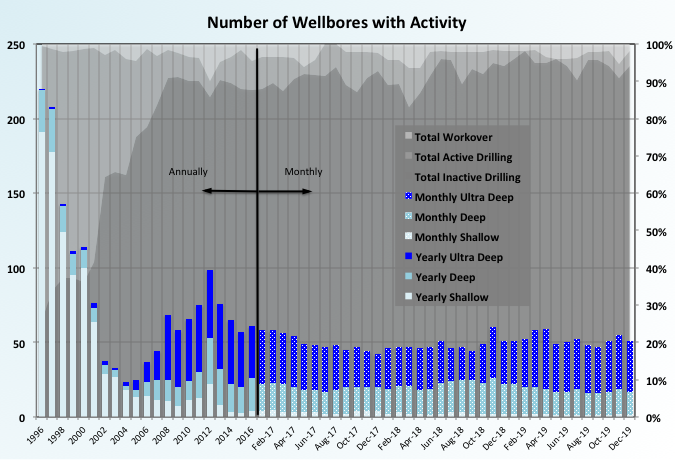

The number of drill rigs, now virtually all deep water, and the number of boreholes with drilling activity (active drilling, inactive drilling and work overs) has been fairly constant since a big drop after the number of prospective shallow water sites disappeared, though there may be signs of a fall, mainly from inactive drilling boreholes recently. However this may be illusory as these are numbers that tend to get revised – additionally I’m not sure how this gets estimated: counting in whole months for such work, as BOEM does, seems far too granular.

There don’t appear to be any pure gas prospects in ultra-deep leases and the shallow gas fields are at end-of-life run down, so the number of active gas rigs has dropped to one or two.

There is little or no apparent correlation between oil and natural gas prices and drilling rig activity, if you squint and apply some putative time delays something could be conjured up but given the short data set you’d have to be rather desperate.

There have been a few horizontal wells – all in shallow water – and shallow water wells have mostly been vertical, more so in the years prior to those shown on the chart, but now almost all drilling in the Gulf is directional.

The drilling activity reported by BOEM is consistent with the steady number of rigs reported by BakerHughes.

I don’t know why the ratio of active to inactive wells drops so low for deep water drilling; it too could have something to do with the way the figures are reported.

Drilling Technology

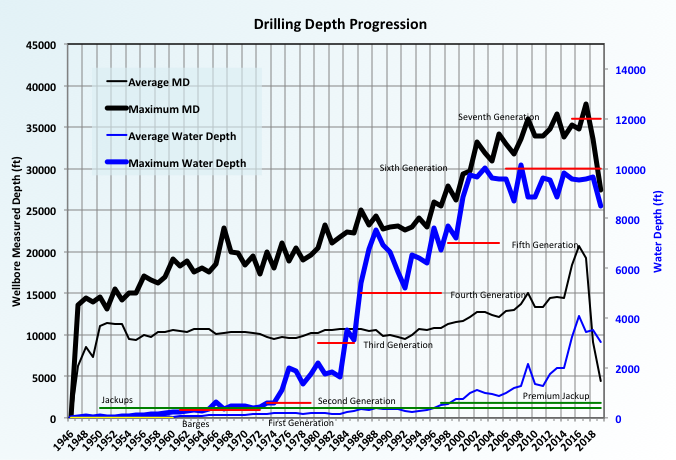

The measured depth of wellbores (MD), which is basically the length of the drill string, has been gradually increasing as technology has improved. The water depth for the lease has increased more in step changes as new drilling rigs become available. The chart shows the years that particular types of rigs were manufactured and the approximate maximum depth GoM crews apparently pushed the limits in the80s and 90s. Technology progressed from barges through jack-ups to the seven generations of MODUs (semi-subs and drilling ships); I think the early ones of these could be grounded while drilling. Recently there has been a gradual move from deep to ultra deep, but that may be reversing in the last couple of years, although much of that drop off may be just delayed reporting.

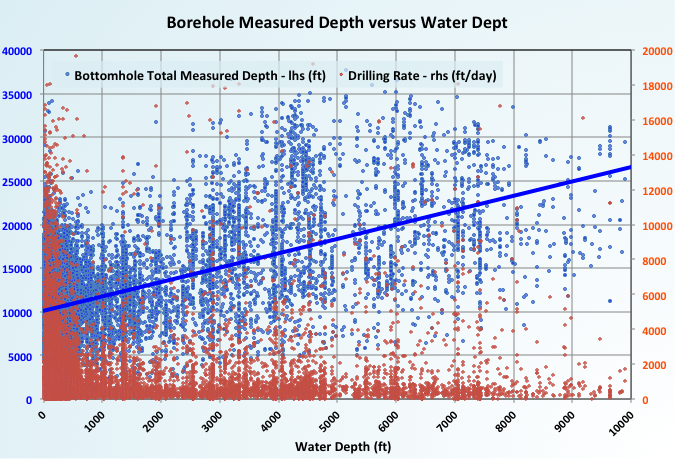

Well measured-depth (MD) gradually increases with water depth. I found this a bit surprising, as I had thought that the GoM geology was a bit reversed from normal (i.e. with gas nearer to shore and something odd about the geothermal gradient); but I’m not surprised to be wrong and it would take a proper geologist to explain it (did somebody say SouLaGeo?).

Overall drilling rate seems to decline rapidly with water depth up to about 500ft and then stays pretty constant or slowly increases a bit. This is probably due to different drilling technologies used at different depths, with possible additional effects from the relative times for MIRU and RDMO compared to actual drilling (although I think I take the time from spud date to completion, so maybe not).

Active Wellbores and Leases

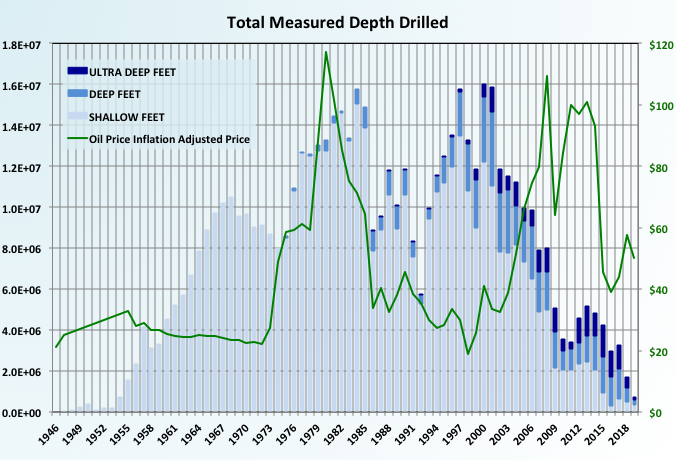

The number and length of wellbores drilled, if not the cost, has been dominated by shallow fields. For better clarity the deep and ultra-deep wellbore numbers are shown separately in the first chart above (but have all been lumped together as ‘deep’).

The big drop in activity in the late eighties almost certainly was a result of the preceding collapse in prices, I’m not sure if there’s much correlation in other years, which is not to way the current collapse won’t have a similar effect.

The number of active leases fell quickly from about 2000, many of those rescinded, especially in deep water, were blocks that had never produced rather than ones that had become exhausted.

The number of active completions, which is a balance between new wells and old ones being abandoned, has plateaued for all water depths over the past two years, though for shallow fields this was after a period of decline. It seems likely the numbers active will now decline, but may not necessarily impact production numbers.

Most wells end up as sidetracks and, interestingly (or not) the proportion of sidetracked wells in all water depths tends to level off at about 70 to 80%

Future GoM Posts

Future GoM posts (both viruses allowing – three if you include the human sort, and with unknown schedule):

Probable: Part II – Reserves

Probable: Part III – Production: Past and Present

Possible: Part IV – Company Activities

Tentative: Part V – Future Projections

Off Topic Finish: MAGA, a Rant

A lot of baggage has become attached to the phrase ‘make America great again’ since Trump starting using it as a moronic clarion call. In non-sentence order: firstly, among the vapid, pharmaceutically-addled reptile brains of his cultists ‘great’ is now taken to mean ‘greatest’, and not just any old greatest, but clearly and chest-thumpingly greatest; and not just at some things, but everything.

Secondly (or fourthly) ‘again’ implies it is not great at things now. In fact it is great at many things, not all of them necessarily good from all points of view, but those that they could be considered great at and, from normal ethical, moral or humanitarian standpoint, would be considered generally good are exactly the ones that the odious one feels threatened by, and that his toadies are allowing him to systematically destroy: lead positions in apolitical, cutting edge and often cross border science; generally humanitarian and incorruptible career professionals in government (both federal and state) – mainly the middle and upper middle positions, and less so the front of house DoT tellers, immigration officers and embassy staff, and certainly not the political appointees, whether the shifty chancers under most regimes or the moronic yes-men the fat boy favours now; a certain type of literature; some of the best of modern art; the more enlightened of their military (compared to the Neanderthal thugs his orangeness seems to worship); liberal professors in the arts – many of the best of whom are also pretty good authors of various sorts, etc. (I’m sure I’ve omitted many).

‘Make’ is also interesting, implying that it should just be a question of picking the right thought processes, mixing them together and – hey presto – we’re great. In fact America had a lot of externalities going for it: a huge resource base (coal, oil & gas, soil, land, water, benign climate, plenty of ideal sites for cities), which could be readily exploited with emerging technologies as the country grew; plenty of available and willing immigrants (there’s a theory that the majority came from pastoralist backgrounds, which tend to promote thrusting, pioneering entrepreneurship); a decline in rival states just at the right time (WW I and WW II, and before that the collapse of the French and Spanish empires, and a disinterested, kind of lap dog partnership from the British); pretty good politicians with real skill and integrity coming along at the right time; an inheritance of property rights and fairly open government through the enlightenments etc. (though obviously not for all).

It also, really by accident, led the way in universal education with the concomitant head start that gave them in having a skilled workforce as societies industrialised, with increased technological and cultural complexities. Accidentally because the prevailing believe was, incorrectly as it turned out, that all behaviour came from cultural learning, so all people are capable of all things. The reality, considered taboo in many quarters in America, but prevalent in Europe, is that heredity and psychological evolution have significant impacts on all behaviour and abilities. The lead America had has now fallen to a significant lag, at least as far as the ‘universal’ part is concerned, the decline started years before the repugnant slug’s first bankruptcy but he is certainly not going to make any effort to reverse things. I don’t hold with conspiracy theories but can believe that the elites came to feel threatened by purely merit based advancement and started intuitively to take whatever decisions would most thwart it. They did it tacitly; the golf cheat in chief is pretty open that he considers his base is stupid and needs to be kept that way (they probably are more ignorant on average, and seem to take some pride in this, but not lacking in native wit).

Much of those advantages have gone, although there is still a (decelerating) momentum carry things along from early growth spurts. It’s now kind of middle aged and staid – or at least more so now. There’s still plenty of some kinds of resources but they are not virtually free now, with plenty externalities. There is still a kind of economic empire, but it’s getting increasingly expensive to maintain; and with globalization and deregulation, it’s no longer ‘America[n]’, although the costs to maintain it are American taxpayer liabilities. And no one but the rabid core support can maintain with a straight face that exceptional politicians are coming along to sort things out. So the future will be a bigger challenge than the putative great times of the past.

Lastly ‘America’ implies the whole country, but really everything is aimed at red flyover states that, in many places and on average, only achieved ‘not quite completely awful’ in the past. Part of his delusion is to try and convince his base there of how great things were supposed to be. Trumpa the Gutt will ostentatiously dump them at the least hint of anything less than undying sycophancy as his promises are shown up as vapid, pandering nonsense.

The Cheeto doesn’t have any principles, he’ll just do and say whatever satisfies his narcissism the most, its just that he finds this easier with the more unpleasant side of human nature; and MAGA allows him to get away with barely acceptable bigotry.

Like his recent attempt at film criticism (concerning which, if he’d ever heard of them, he’d consider himself greater than Godard, Kael or Ebert, though he probably can understand no further than the Rotten Tomatoes audience score); I doubt Trump has seen Gone With the Wind, or really knows what it’s about, probably less so than most of the ignoramuses in his ‘base’. He could well believe it to be a frat boy comedy about bean eating contests (and, to be fair, many of those types of film were more deserving of an Oscar than the odd, turgid mix of racism, rom-com, psycho-drama and war apologetic of the actual winner). What he does know is that pushing the boundaries of racism and xenophobia as far as possible – and each time he is testing the limits a little further – while dressing it up in MAGA-speak, manages to get his (basically fear driven) cultist toadies a bit more fired up, and lets them come a bit further out of the bigots closets from which they’ve been wanting to escape for so long. Each time makes it so much more difficult to push them back in again. It’s not going to stop until something significantly more awful happens than just having to watch his slavering, gurning, hate and drivel-spewing orangeness in front of the baying hordes (all of whom seem to be vying with him for the ridiculous haircut Oscars).

The Fatman and COVID-19

I wrote the above a couple of weeks ago and the latest events mean we live in a different world; but the MAGA mind set hasn’t gone away and is likely to become more polarising as events unfold.

It’s hard to see much going right if the contagion really gets a hold in the US: an inept and ineffectual administration with no chance of forming any kind of popular, central leadership, and that has recently been alienating all it’s former allies; the nominal leaders being not only blind to science but actively against it; a divided country along class, race, age and geographical lines dominated by detached oligarchs and CEOs; an economy dependent on distant transport and commuting; a pretty awful health service controlled by for-profit-pharma and insurers rather than medical services; a huge number of people living day to day with needing two or three jobs to survive with no savings and no support; a high proportion of young but weakened people because of diabetes, obesity, addiction problems; large populations of incarcerated and homeless;, general libertarian outlook which is loath to accept any government controls; a business environment anathema to mortgage or rent holidays; a recent hollowing out of various federal departments like EPA and CDC; a kind of ingrained feeling that violence is often the best way to address problems; lot’s of guns if it comes to “me first”; etc. In flyover states especially the deniers will be out in force and quarantine measures will be very hard to impose. It will be a short step to unrest, riots, the National Guard, and, maybe, a bunch of people suddenly finding that socialism isn’t so bad anyway. The only positive is that it’s pretty warm and quickly getting hotter.

Until now Trump and his ever changing cadre of incompetent toadies have been pretty lucky in not having to face too many problems that can’t be dumped on future generations either by completely ignoring them (e.g. climate change and environmental damage) or just by loading up on debt (everything else).

Trump currently is just flailing around hoping something accidentally works, he is the very worst kind of buffoon. Really he just wants somebody to make it all go away (but his father is not around anymore). The virus has never read “The Art of the Deal” and doesn’t respond to threats of being sued by a billionaire, and he can’t declare bankruptcy and start again – so he’s out of ammo. In speeches he has to constantly remind himself to keep saying what a great job he’s done. There’s been a subtle shift so he’s talking more about “we” as if suddenly he has been listening to anyone who can make it all go away. His two or three policy mantras – the wall, cheap oil, and high stock markets – are biting him in the backside. He has no hint of humanitarianism in him so really has nothing to give in times of hardship.

To the extent he does anything it is whatever he thinks will appease his MAGA base, or his old pals on Wall Street, or that boosts his narcissism. The MAGA lot are virulently against any imposition of overt controls on personal freedom (despite being almost wholly susceptible to more subtle forms of media propaganda for political or other life choices), and keen on isolationism (a way for them to hide their racism and bigotry. The Wall Street boys know that Trump will primarily do anything to protect their assets, so this will just be another chance for the giant wealth transfer to continue, even as on average the country is further impoverished.

Trying to satisfy these forces is making him jump around at random like a desktop pendulum magnetic toy. He surely knows how far out of his depth he is, and that his normal repetitive, loud bluffing won’t work; every obvious blunder is going to be a body blow to his narcissism.

Hopefully he just goes into his twitter safe space and does not take any real action, he’s had plenty of practice, because another possibility is that the Republicans through action and others through inaction, allow this crisis to be the opportunity that allows him to become the Dictator he has always sought to be.

If he does fade away I don’t see too many of his toadies that can step up either. I haven’t seen that much of her but Pelosi looks like a natural leader with real ethical standards and natural authority (she’s a woman, so Trump hates her more than the usual loathing he has for any non-sycophant and it will be interesting to see how much influence she can finesse). Let’s hope the excellent career professionals in the US federal and state government departments, and some of the better-elected officials, can find ways to bypass the Trump appointees and get through this without too much damage and that this is the last major issue he faces. The probability and consequences of these crises are only going to increase, if he gets a second term, which looks almost impossible at the moment if the election proceeds, but there are worse possibilities, we should all be very afraid (except maybe Putin, MbS, Erdogan, Bolsonaro and the like).

The opinions expressed in this post are those of the author. They do not purport to reflect the opinions or views of PeakOilBarrel owners or other contributors, or those on any of the other sites that may choose to download and repeat this post, whether with or, as always, without permission (please feel free, but only if you take all of it).

Mr Kaplan , first let me acknowledge I am not an oilman ,so the first part of your post is ^ is above my pay scale ^ . I do not live in USA but do follow politics there because it effects the whole world . So all I can say is that the second part of your analysis on Mr Trump and the coming events is kudos . Thanks for your analysis . Of course your work on offshore is as they say ^Top of the Pops ^ .

George, great to have you back. Thanks for the informative no nonsense post.

Doug, it’s nice to see you still here, and carrying on the struggle. I normally look for your comments if I visit this site (plus a few others including Survivalist, who may also have disappeared, like a few old faithfuls on both sides of the aisle, and Jeff and Schinzy, below). We all need an occasional digital detox, an internet interregnum, a peak oil purge, some doom and gloom downtime, a shale oil … er … shabbatical (that’s enough meaningless alliterations, Ed.).

Thanks for the great post George. I hope you’re well. I’ve been running a handful as of late, and have had to resign myself to lurking. I will return to my usual shitposting self by mid-spring I’d imagine. Best comments on the net around here, if you can stand it. I was very pleased to see George back at POB with a piece; above my pay grade of course; I’ll be chewing on it for weeks.

Thanks George,

I always learn from your posts, good to hear from you again.

Nice and infomative, your posts are much appriciated and fun to (hope not only 3P but also tentative resource materialise)

https://www.click2houston.com/news/local/2020/03/19/report-texas-regulators-contemplating-a-reduction-in-oil-production-amid-coronavirus-crisis/

If this is correct it would be big news. I would think low oil prices might lead to a fall in the rate of new well completion.

There is a longer Wall street journal piece but its behind a paywall.

I wrote yesterday that my thought was that there would eventually be a summit resulting in a global version of the Texas Railroad Commission.

I still think so, because my next guess is that demand destruction will be able to swallow total US production whole, burp, spit on the ground, and not raise prices.

This is going to be bigger than the Texas RRC can handle.

Lloyd,

Agree in full.

D C,

North Dakota is considering similar actions. There was an article on it yesterday at s and p global; I read it through ASPO USA.

Synapsid,

Had not heard that, thanks for the heads up. It would be good for state agencies to attempt to limit production, they could take their cues from RRC and follow their lead, much like oligopoly pricing in the auto industry.

One of the suggested ideas to get oil prices back up is to sanction Russia if it continues to engage in a price war.

But given that the global economy is tanking, are sanctions much of a threat? If no one is buying or trading much, how much leverage is there in saying we won’t buy or trade with a country?

Boomer,

A $50/b import tax on C+C (or petroleum products in general perhaps) might give some relief to the oil industry as it would raise WTI to profitable levels. Potentially Canada and Mexico might be exempted from these tariffs.

Dennis

If the US placed such a tariff, other countries would follow with equally damaging tariffs.

The US sells a great deal of equipment to Russia and Saudi Arabia.

https://www.ustradenumbers.com/country/russia/

They could simply buy what they need from Europe, Japan and South Korea.

I do not think making another half a million Americans unemployed would help very much.

Wayne,

You may be right, generally I am an advocate of free trade, it usually is the best policy.

Anecdotal.

I drove on a major interstate today and both the light auto and semi truck traffic was heavy.

In the city the traffic was like Sunday. Light. In the burbs the traffic was also like Sunday. Lots of cars at the stores. Lots of cars in restaurant drive throughs.

Wal-Mart had over thirty semis parked in its delivery area, unloading.

The shale desperation begging the TRRC to make them stop drilling made me chuckle, but then I remembered all the good people in the field who will once again be laid off, like 2015-16.

We are hanging tight. One month of this won’t sink us. Nor will a few. A year, different story. Figure many will shut in before that. Maybe worldwide.

On the regulatory front, the state offices are all closed and no one is answering phones. The field personnel are still out there as of now, but thinking they may be sent home soon too.

Can shale wells be shut off and restarted later or do they risk damage that may need reaming out and in bad cases abandoning?

NAOM

Mike could answer better than me, but I think they can be shut down for a fairly long time with little problem.

Many older shale wells pump periodically.

We have reactivated conventional wells that were abandoned for decades. Those were economic until this most recent collapse

Shallow sand,

I remember differently, I thought Mike had said there is damage to the wells if they are shut in, this may only apply to tight oil wells in their first 36 to 48 months of operation, or I may not be remembering correctly.

The older tight oil wells (under 20 b/d of output) probably can be shut in as you say. You would know more than me, does that sound roughly correct?

It depends. Early in the well’s life, subject to liquid flow states, shut ins are not good because of proppant embedment and the possibility of induced frac closure. There is near wellbore skin damage to cope with; paraffin, scale, etc., and all of that threatens the wells ability to be brought back on line. As the well gets older they are less subject to harm from shut in. In the Permian, however, shut in periods might prove harmful with regard to ESP and gas lift systems for reasons I’ve described above.

They’ll sort this out. The TRRC is good at this stuff and it knows what it’s doing; it did it successfully, to the great benefit of worldwide price stability, for over 40 years. I still believe given the extreme decline rates of HZ LTO wells it is better to let Mother Nature do Her thing and focus instead on regulating the rate of shale oil development (slowing drilling) thru spacing requirements between wells and the density of wells per acre of land. That will be much easier, and safer to implement; this will reduce oversupply and associated gas waste much more cost effectively. We can always go back in between wells later. The TRRC can do that, as well, thru existing statutory laws, it does not need the permission or authority of the Federal government.

Depending on proration schedules there is little to no threat to leasehold issues. This will piss lenders and PE assholes off with drilling commitments and development covenants in their loans but they can all eat fish heads. I am hopeful that if this gains momentum the KSA and RU will take heed and come back to the table, quicker.

For me personally, this TRRC news is a big deal and I am hopeful.

https://www.oilystuffblog.com/single-post/2020/03/19/BREAKING-NEWS

Mike,

Thanks. You know this stuff better than most, makes sense that controlling completion rates through spacing rules and other regulations is the way to accomplish this. I would think that other State agencies would be able to regulate just as the RRC has done in the past as their has been precedent set by Texas. I am not a lawyer, so I may well be wrong on that.

Having trouble getting to Mr. Shellman’s post?

Here it is:

I have been working tirelessly the past four years, and relentlessly the past three weeks on social media, etc. for the Texas Railroad Commission to re-implement conservation laws in Texas and to stop the flaring of natural gas and the producing, and selling of Texas resource below extraction costs. Texas is the 3rd largest oil producing country on the planet, any effort to remove excess production from the market and/or to slow the rate of shale oil growth in America sends a strong message of cooperation to the rest of the world that we too want to raise and stabilize oil prices. That is good for the American oilfield worker and that is vitally important to America’s long term energy security. This is American strength.

This is huge and this will help bring the KSA and RU back to the negotiating table much, much faster. Watch.

God Bless Texas

Mike if you would like me to take this down, let me know.

I agree with your position (in your post above) 100%.

Link to Mike’s blog

https://www.oilystuffblog.com/

I would add, God bless Texans.

Thanks for the information guys, much appreciated.

NAOM

Mike,

“…but they can all eat fish heads.”

Thank you for this. It’s a new one to me.

(Life enrichment goes on.)

Unfortunately not all on the RRC are in agreement see

https://twitter.com/ChristianForTX/status/1241059333921738752

also look at the comments this Christian guy is going to keep the RRC from doing the right thing. It is a shame.

Also see

https://www.rrc.state.tx.us/about-us/commissioners/christian/news/032020a-rrc-chairman-wayne-christian-comments-on-oil-markets/

From the letter there is this (bold added by me):

None of this is temporary, as the U.S. Geologic Survey assessed a recent oil discovery in the West Texas to be 46 billion barrels of oil. RS Energy Group estimates this find could actually be as large as 230 billion barrels. This is the largest oil find in the history of the world.

The “recent discovery” is not recent at all, he is referring to the Permian basin assessment for “continuous oil resources” by the USGS, the mean TRR assessment is actually about 75 Gb and when economics are considered, the URR might be 60 Gb if oil prices eventually rise to $90/b by 2035 (in 2020$) and the mean USGS TRR estimate is correct, the range is roughly 40 Gb to 110 Gb (90% probability is is in this range for TRR by USGS estimates). Note also that real oilmen like Mr Shellman believe these estimates are ridiculous (I think perhaps the low end might be considered believable by Mike at high oil price levels, but I am guessing as he has only said they are not good estimates).

In any case, I am no expert, but based on comments by those more knowledgeable than me, the 230 Gb estimate seems patently absurd. Nearly 4 times higher (at minimum) than the most likely scenario (about 50 to 60 Gb of URR for the Permian basin, by my estimate.)

It is too bad they have a knucklehead as chairman of the RRC.

Dennis.

I wish people like this would quit using phrases like “energy dominance” when discussing shale.

I guess if one wants to be easily identified as a complete fool, one could continue to use such phrases.

The largest operator in our field and the largest operator in the adjoining field shut in combined around 1,000 wells this week and laid off about 80% of the workforce including all rig employees. That means wells that fail will be left shut in.

Stripper well operating break evens have a wide range, but I suspect $35-40 is average “all in” operating expense excluding income taxes and debt service.

Most operators are getting between $8-18 per barrel in the field from 3/20-3/22. Of course, most are on a monthly average, which will likely wind up being in the low $20s for March.

shallow sand,

Yes the energy dominance thing is silly. Not much can be done unless the US government decides to restrict imports of oil as it once did with exports, generally such policies back fire though.

I’m afraid I must ask a dumb question now, so as not to make it obvious later.

Will somebody take a few minutes and explain some of the techno speak in this thread?

I can’t make much sense of it.

Thanks.

As far as the rant at the end goes, it’s pretty much on the money.

Not me, there are a few sites with petroleum dictionaries you could try, but it’s not the work of a few minutes. I don’t know why I write this stuff – partly to get it straight in my head, partly to see how colourful and complicated I can make a chart while still keeping it almost legible, partly to fill up a lot of sleepless periods because of arthritic pain and muscle spasms; it’s certainly not as an educational service for the layman. There are probably hundreds of PhDs, extant and to be written, on why so much barely read gumpf is spewed out every day. When I do occasionally check the comments section here I take one look at your screeds with RANDOM capitalisation spooling off the page and don’t bother reading even the first sentence. I assume most people have a similar approach to anything I write, including this comment, so I’ll stop there.

Nothing anyone writes here will affect by even one day the day the trucks stop rolling and we all start starving.

But it still gets written. Not really cathartic, but there is a sense of thought organizing.

We’re all “blind men” trying to figure out the elephant under ground. some are better than others in describing what’s going on.

Me, I take a back seat to you all and try to educate myself and understand what you all are saying. I often come away as the grade school kid in a high school algebra class.

You’re much appreciated and respected.

I NEVER randomly capitalize anything, lol.

In other places I post, there are easy ways of underlining, italicizing, etc, that take one or two key strokes. In this forum, the only really fast way to emphasize a word is to cap it.

Two keystrokes.

But technical jargon is something else altogether. I could pepper my comments about the technical end of my own field so that hardly anybody here , excepting maybe a biologist or two, could make sense of them, but I learned long ago as a teacher, my secondary profession, that you can best get the message across to laymen, meaning anybody outside your professional field, using as little jargon and as much everyday language as possible.

It wouldn’t be hard at all to at least include the words indicated by acronyms in parentheses the first time they’re used, which would help a lot in deciphering the meanings of the same.

But you have my thanks and appreciation anyway for doing so much unpaid work, and I can still decipher some of it.

If you don’t like my comments, you can turn them off. THAT’S easily accomplished here, lol. Just click on the little box with the x in it beside my handle.

What do the initial rhs & lhs stand for? I assume that they are data sources.

They refer to the Y axis of a chart, Right Hand Scale and Left Hand Scale for all charts that have two vertical scales.

[Head slap]!! Of course. Thank you!!

Thanks for the informative post George, glad to see you back bud.

George,

Great to hear from you again, my friend, and another great post on the GOM! And looking forward to future posts.

I was referenced in your comments about well depth, gas v. oil, shallow water v. deep water, and geothermal gradients. I’ll comment on the shelf gas v. deepwater oil issue now.

The shelf has definitely been much more gas prone than deepwater. At it’s peak, the GOM was producing upwards of 13-15 bcf per day from the late 70s to the mid 90s. Now it’s producing only a few bcf/day largely because of the depletion of the shelf gas fields. There have been very few pure gas fields in deep water.

Why is this? It’s for one of two reasons – either the source rocks on the shelf are more gas prone (which is definitely the case offshore Texas shelf), or, the source rocks are more deeply buried on the shelf and are now in the gas zone, which is deeper than the oil zone. (Note that the thickest sediment packages in the northern gulf are about midway across the Louisiana shelf). Another reason for more shelf gas production is because of an abundance of shallow biogenic gas.

Picking up on shelf v. deep water well depth,, One of the reasons deepwater wells are typically deeper than shelf wells is because many of the deepwater fields are subsalt – the reservoirs are below an allochthonous salt canopy. The wells have to be deeper just to drill through the canopies to get to the reservoirs. These canopies also are present over much of the shelf, but virtually all shelf production is from above the canopies.

Regarding subsalt v. presalt – subsalt is in reference to reservoirs that are below salt that is out of place, v. presalt refers to reservoirs that are below in-situ salt. In the Gulf of Mexico deepwater, many of the reservoirs are below a salt layer that has been mobilized from a deeper salt layer. This mobilization process requires the in-place salt to forms diapirs or ridges in places, and then salt canopies develop from these diapirs or ridges. These salt canopies are “allochthonous” or “out-of-place”. The reservoirs are younger than the salt. To date, there have been no presalt wells in the Gulf of Mexico, although there is some exploration interest in testing the presalt. The best place for this would be in the east central GOM.

The prolife reservoirs offshore Brazil are presalt. This salt is in-place, or autochthonous, and therefore the reservoirs are older than the salt.

SouthLaGeo,

Economics may not be your thing, but do you expect the low oil price will slow down any further development in the GOM? It is not clear to me that future projects are economically viable at current oil price levels. You may have a better handle on this than many of us, with the possible exception of Mr. Kaplan.

Projects are at least getting deferred. I’m familiar with some development wells getting deferred, as well as some small facility projects. A few operators pulled their bids a day or two before last week’s GOM lease sale. There has been some talk about seeing if BOEM will grant an across-the-board one year lease extension to give operators one more year to drill exploration wells before their leases expire. As of last week, almost all operators have their staff working from home – it will probably be everyone this week.

Regarding those projects that have new facilities being fabricated in Korea – I’m sure there has been some delays, but, things may be getting back on track. Not sure though.

Historically, GOM projects that include the fabrication of new facilities have been somewhat immune to short term price cycles. Operators can’t keep starting and stopping these projects. Once the FID (Final Investment Decision) is made, it’s full speed ahead. This time may be different. Those projects that are within 2 years or so of first oil, where facility fabrication is well on track, are likely to proceed. Those include projects like Mad Dog 2 and Vito. Not so clear with other projects. This might make Chevron’s decision on Ballymore easier – tie it back to Blind Faith rather than build a new facility.

SouthLaGeo,

Thanks. So short term (next 24 months), this may have little effect on anticipated GOM output, after that it will depend on oil price over the next 24 months, if it remains under $50/bo (in 2020$) perhaps we see fewer new projects reach an FID and output might drop sharply in 24 months (in a low oil price scenario). Is that roughly a correct interpretation?

I think that’s right. Deferring development wells this year won’t have a much impact on this year’s production, but will impact production for the next couple of years. If the well eventually gets drilled, that production just gets delayed, assuming no EUR hits. I think it’s unlikely any projects get the green light for a while – maybe up to 2 years.

SouthLaGeo,

Thank you again. I appreciate you sharing your expertise here.

I appreciate Mr Kaplan’s work as well. Thanks for the excellent post.

The headline says it all. Oil just tanked to below $20. June is too far away. Will Russia come?

https://www.investing.com/news/commodities-news/breakingtexas-oil-regulator-had-great-talks-with-opec-invited-to-june-meet-2117128

I have just returned from holidays in the US.

News from Ron that he said I could share from an email.

Dennis it’s a long story. I checked into the hospital Friday noon in anticipation of a routine colonoscopy. I went into the operating room at about two and out at about 3. I was engulfed in horrible pain. The pain persisted and I was swelled up like a balloon. The doctor said he hit some kind of blockage and jut could not get around the corner in my colon. He told me he would do a CT scan next week. But I was still engulfed in horrible pain. He said it was just gas in my colon and he had to blow it up. He then told me to go home and walk a lot and the gas would go away.

I did buy the pain got no better. Bu 9 that night I could stand the pain no longer. I went back to the emergency room. They did a CT scan right then. They came back and told me I had a ruptured colon. I was having an emergency operation before midnight. I was in the ICU until Tuesday and was just discharged today, March 19th at about 6 PM. I now have a colostomy bag and will have to wear it for the rest of my life.

Of course, I had no internet access in the hospital.I could not call you because I did not have your phone number. Longtimber, whom I know personally from Pensacola, was the only number I had. So I called him and let him know what was happening. I explained my problem to him and thought he would post it on the blog. Instead, he just posted that I had a problem. I did not care that anyone knew what my problem was but apparently he thought I might. However, you may share this info with anyone you wish.

In a followup email he said:

Oh, the reason I had a ruptured colon was the doctor poked a hole it trying to make the corner in my colon.

Ron

He said he is doing ok, been out of the hospital for about 24 hours.

@Ron

Best of wishes, hope all goes well.

NAOM

Damn. And it is such a shame this was caused by the doctor.

300,000 deaths a year from the medical/pharmaceutical industry in the US. Who knows how much other damage short of death?

1 in 350 colonoscopies have serious complications and thousands die each year. That is more than 54,000 serious complications per year due to a single test type that detects about 3/4 of cancers present.

Can it be that hard to provide a link to these statistics?Well, here’s one I dug up on colonoscopies:

https://www.ncbi.nlm.nih.gov/pubmed/23373100

Unless you are remembering these numbers from the top of your head, you are likely referring to something in front of you, so the link is right there that you can copy & paste.

edited:

(of course I wrote the above before realizing it was in the context of Ron’s predicament, so we should just be happy that he pulled through. My mom had her last colonoscopy at ~82 years of age and the doctor told her that it was the last one she would ever need to get)

My best wishes, Ron. It never rains, but it pours.

Jonathan

Well, sometimes a little humor helps. I was talking to my son on the phone today. He asked, “But this is only temporary right, they will go in and fix it later?” I replied, no, this is permanent. I will never have another normal crap as long as I live. He replied, “Well, look on the bright side dad, just think of all that money you will save on toilet paper.”

In the spirit of humor-

Some people will do anything to get out of a Pandemic!

_______________________

Very sorry to hear what you had to/have to endure.

Best luck on healing up, and hunkering down.

Anesthesiologist a good friend of decades. He has talked of colostomies. There is some relative good news of a recent sort.

The nurses will teach you how to care for the opening. That used to be perpetually infected. No longer.

Ron,

Thank you for your transparency. Shit happens. As we get older, shit happens with greater frequency. I admire someone who tells it like it is regardless of what people might think. I appreciated your straight speak back in the oil drum days, and I still do. That’s a big reason I spend more time on this blog than on any other site.

Glad to have you back, take care.

I’m sorry to hear about – I hope you heal well.

Any idea why it can’t be repaired? I’m not sure I’d take that answer as the final word…

Fifty thumbs up!

Your son is lucky he was on the phone!! I don’t think he’s ever been hit up the side of the head with a colostomy bag!!

My son lost 18″ of his colon due to C-Diff and almost his life. We still have him and we are glad that he and you are still with us!!!

I pray your healing goes well.

Peter

Peter, it was a joke. Even though laughing caused me pain at the time, I laughed anyway. I desperately needed a little humor at the time.

Best whishes of quick recovery to Ron!

Ron,

Sorry to hear that story. But as usual you are keeping it real and strong. Hope you heal up well bud.

Ron, I’m sorry to hear about your hospitalization. My thoughts are with you. Remain strong.

You’re an inspiration Ron, and we all know we’re lucky to have you.

Thank you for the POB and best of luck in healing. You’re at the top of the Tough Old Bird list and that’s a genuine compliment.

Looks like frack spreads just took a dive.

https://twitter.com/PrimaryVision/status/1241157823817560071?s=20

Lightsout,

Not surprising. I think if oil prices remain under $30/b for the next 3 or 4 months we may see the frac spread count fall to less than 75, one thing that is unclear is how the frac spreads are split between oil and gas, there might be a few that remain in operation fraccing natural gas wells, but the frac spreads involved with tight oil focused production could drop close to zero at current oil price levels.

It is quite possible we will see tight oil output drop by 3000 to 4000 kb/d over the next 15 months if we see the tight oil completion rate drop to zero by May or June. As always we do not know future oil prices or future tight oil completion rates so this is speculative. At some point the economic crisis unfolding because of the covid 19 pandemic may be resolved (I am guessing by 2022). If that assumption is correct, demand for oil will eventually recover, oil prices will rise and eventually tight oil wells may begin to be completed again in the future perhaps a gradual increase starting in early 2022. Again speculation based on speculative assumptions. Crystal ball has never worked well.

My crystal ball can’t even tell me if I will survive to see prices recover.

Loved the rant – but you seemed to forget that everything which now exists depends upon the Third Central Bank of the United States – which produces a purely Fiat Currency.

FIAT : (1) a command or act of will that creates something without or as if without further effort

https://www.merriam-webster.com/dictionary/fiat

If tangible assets are used as currency vs. the now abstract assest – paper money created out of thin air – then Overshoot might be eliminated – and reality would be limited to what could actually be produced on time – and future demand would not be redeemed in present time.

“The probability and consequences of these crises are only going to increase, if he gets a second term, which looks almost impossible at the moment if the election proceeds, but there are worse possibilities, we should all be very afraid”.

Since we are already deeply into Overshoot – how should we proceed? Does it matter who is President?

CIRCUMSTANCE: The Age of Exuberance is over, population has already overshot carrying capacity, and prodigal Homo sapiens has drawn down the world’s savings deposits.

CONSEQUENCE: All forms of human organization and behavior that are based on the assumption of limitlessness must change to forms that accord with finite limits.

http://www.jayhanson.org/page15.htm

Tim E,

Perhaps leaders that choose advisers who recognize well established science would be a step in the right direction toward better policy.

“Perhaps leaders that choose advisers who recognize well established science would be a step in the right direction toward better policy”.

I agree – and M.King Hubbert was a leading member of Technocracy – or how the rich resources of this Planet would be appropriated/handled.

M. King Hubbert offered two different scenarios – one which was the status quo – the other afforded by an unimaginable limitless resource source – and that did not occur.

Technocracy is a necessary & and needed Government Organization when resources such as Oil are discovered and which can allow Overshoot – at least in Human Populations – to occur.

I fear it is too late.

Thank you for your kind and thoughtful reply.

“CONSEQUENCE: All forms of human organization and behavior that are based on the assumption of limitlessness must change to forms that accord with finite limits.”

Yep. Its a matter of timing and pathway. Choose well, or the path will be chosen for you.

“Choose well, or the path will be chosen for you”.

Choose well – lead your Sons and Daughters – and vote for the best & brightest.

A big thank you to Ron Patterson for allowing these discussions – and all the frequeny Contributors.

Thank you for the thoughts – contributions – and meanderings.

Hickory,choose well ,what ? Between a conman or a dementia man? . Surprising that in a population of 300 million this the choice . Of course if the dementia man fails,then the witch is there . Between a rock and a hard place .

P.S ; I am not a US citizen ,resident or anyway connected to the US ,but to a rational thinking individual the choice is disgusting .

try to choose everything well.

your thoughts, your friends, your food, what you spend money on, and what you tolerate from from your leaders.

etc.

Wrapping my mind around all this – I come back to my Pilgrimage to the Georgia Guidestones – whose tenets I can agree with:

From the Georgia Guidestones:

A message consisting of a set of ten guidelines or principles is engraved on the Georgia Guidestones in eight different languages, one language on each face of the four large upright stones. Moving clockwise around the structure from due north, these languages are: English, Spanish, Swahili, Hindi, Hebrew, Arabic, Chinese, and Russian.

Maintain humanity under 500,000,000 in perpetual balance with nature.

Guide reproduction wisely — improving fitness and diversity.

Unite humanity with a living new language.

Rule passion — faith — tradition — and all things with tempered reason.

Protect people and nations with fair laws and just courts.

Let all nations rule internally resolving external disputes in a world court.

Avoid petty laws and useless officials.

Balance personal rights with social duties.

Truth — beauty — love — seeking harmony with the infinite.

Be not a cancer on the earth — Leave room for nature — Leave room for nature.

Dying with the most toys….. well…. it is not sustainable. And oil is a finite and depleting resource.

Dennis produces some very beautiful charts and data – but when the oil is unavailable – what then?

Tim,

Better efficiency in use of energy, wind, solar, hydro, geothermal, and perhaps a bit of nuclear. Also better education should be a focus as it leads to lower total fertility ratios and human population decline eventually. It will not be easy, but nothing worth doing ever is.

Dennis – I agree with your comment – but I am not sure that the majority of Humanity can accept and come up to the level of the challenge to sustain and maintain “Industrial Civilization “Light” “.

At this point in time – numerous wheels are coming off of the Bus – and outside forces are coming into play which are leading to the end of Industrial Civilization and the ever increasing load of Humanity upon the Earth.

When the artificial lights go out – so does the sanitation system which most Urban Humans take for granted.

From The Plumber:

“The first epidemic of a waterborne disease probably was caused by an infected caveman relieving himself in waters upstream of his neighbors.

Perhaps the entire clan was decimated, or maybe the panicky survivors packed up their gourds and fled from the “evil spirits” inhabiting their camp to some other place.

As long as people lived in small groups, isolated from each other, such incidents were sporadic. But as civilization progressed, people began clustering into cities. They shared communal water, handled unwashed food, stepped in excrement from casual discharge or spread as manure, used urine for dyes, bleaches, and even as an antiseptic.

As cities became crowded, they also became the nesting places of waterborne, insect borne, and skin -to-skin infectious diseases that spurted out unchecked and seemingly at will. Typhus was most common, reported Thomas Sydenham, England’s first great physician, who lived in the 17th century and studied early history. Next came typhoid and relapsing fever, plague and other pestilential fever, smallpox and dysentery’s-the latter a generic class of disease that includes what’s known as dysentery, as well as cholera”.

https://theplumber.com/plagues-epidemics/

Those diseases, unknown in recent times – will return with a vengeance.

Ron,

I am very sorry to hear about this terrible medical injury.

I have read your fascinating site with its many interesting commentators for years. Thank you for all the work you’ve put into maintaining it.

I hope your recovery goes well, though it is dismaying that there is no surgical remedy for the damaged colon.

with warm wishes,

Brian

And is blaming Trump – who I am ambivalent about – the answer to which is neither a D or R reply.

From Dr. William Catton:

“In precisely Mills’s sense, the conversion of a marvelous carrying capacity surplus into a competition-aggravating and crash-inflicting deficit was a matter of fate. No compact group of leaders ever decided knowingly to take incautious advantage of enlargment of the scope of applicability of Liebig’s law, or subsequently to reduce that scope and leave a swollen load inadequately supported. No one decided deliberately to terminate the Age of Exuberance. No group of leaders conspired knowingly to turn us into detritovores. Using the ecological paradigm to think about human history, we can see instead that the end of exuberance was the summary result of all our separate and innocent decisions to have a baby, to trade a horse for a tractor, to avoid illness by getting vaccinated, to move from a farm to a city, to live in a heated home, to buy a family automobile and not depend on public transit, to specialize, exchange, and thereby prosper”.

http://www.jayhanson.org/page15.htm

RIP Jay Hanson.

Jay was a very interesting guy, but he greatly overestimated the importance of fossil fuels.

We don’t need fossil fuels, except for the short run. They were extremely useful in their time, and I have great respect for those who kill themselves to produce it, but…it’s time for something else.

As Dennis noted, there are superior substitutes, when you consider all of the costs and benefits. We need to move to them ASAP. This doesn’t require sophistication on the part of most users: the lights will continue to go on when people flick the switch. Good leadership is important, but fortunately FF interests (Republicans in the US) have only been partly successful in slowing down the transition away from FF. We have succeeded in developing wind and solar which is cheaper than FF; EVs which are as cheap or cheaper than comparable ICE vehicles; and plans for transitioning the grid away from FF. The only real question is whether we’ll do it as fast as we need to, to mitigate the worst of climate change.

Catton nailed it but so help me Sky Daddy, ninety percent of the people in this country couldn’t decipher what he is saying in this quote to save their soul. It’s university level English.

Here’s a plain language translation, for those who are minimally acquainted with evolutionary theory. :

Mother Nature doesn’t give a shit. She just continually stirs the pot, and whatever lives, and whatever dies, is of no consequence to her at all. She’s not sentient, she’s incapable of caring. She doesn’t keep score, except via the fossil record, and she doesn’t read it. She just creates it.

He probably does think that. But, what he said in the reference was different. He said something like this: “Humanity has become dependent on fossil fuels, and when they run out humanity will necessarily crash”.

Here’s a sample quote: “The human family, even if it were soon to stop growing, had committed itself to living beyond its means. Homo sapiens, as we saw in Chapter 9, was capable of transforming himself into new “quasi-species.” By the Industrial Revolution humans had turned themselves into “detritovores,” dependent on ravenous consumption of long-since accumulated organic remains, especially petroleum.” In other words, he’s talking about fossil fuels. (The whole thing is about fossil fuels and nuthin but – it reminds me of the song “Nothing but the bass”: no treble, it’s all about the bass, the bass, nothing but the bass…”)

Which is unrealistic. Humanity could crash, of course, and a transition away from FF could cause enormous trouble if mishandled. But, basically, Catton was wrong: humanity does not have to have fossil fuels: they can be replaced with substitutes that are as good or better: cheaper, cleaner, more equally distributed and far more abundant.

How did he get it so wrong? Basically, he was writing a long time ago, when biomass seemed to be the only renewable form of energy. We’re well past that idea, now.

Sorry Nick, but that is just a lot of baloney. Yes, humanity can live without fossil fuel but 7.8 million people cannot live without fossil fuel. Catton hit the nail squarly on the head. Less than half that number could not possibly live without fossil fuel.

The so-called Green Revolution has taken on the air of a mass movement.

A world powered entirely by renewable energy has become an ideology with a dogma all it’s own. They qualify for what Eric Hoffer wold call “True Believers”.

It is the true believer’s ability to “shut his eyes and stop his ears” to the facts that do not deserve to be either seen or heard which is the source of his unequaled fortitude and constancy. He cannot be frightened by danger nor disheartened by obstacle nor baffled by contradictions because he denies their existence.

Eric Hoffer: The True Believer.

Oh, my. We’ve had this discussion so many times. Each time I think we’re getting somewhere and then the discussion gets sidetracked to something else, and we don’t get that sense of finality, of agreeing on something. Well, we can try again.

Perhaps a good place to begin would be scalability. Do you agree that solar power, at 100,000 terawatts of continous 24×7 power (somewhere on the planet, of course, not 24×7 at any one spot) is more than enough to power civilization?

Enough? I have not done the math but that whole concept is absurd. The sun shining in South Africa will in no way power New York City in the middle of the night.

I would need to look at your model of this happening first. Then we could discuss it.

In 1920, world population was 1.8 billion and oil consumption was 450 million barrels.

Oil is mostly a luxury, we can go back to walking and reduce today’s healthcare costs. The world can transform to a better standard of living on 25 percent of today’s oil consumption.

Yep – there’s a lot of room for greater efficiency and conservation.

You know this just blows my mind. If we did it in 1920 then we can do the same thing in 2020. No we cannot! Since 1920 the world population has increased by four and one third times. In 1920 the vast majority of the world’s 1.8 billion people lived an agrarian lifestyle. Today the vast majority of the world’s population live and work in urban areas.

In 1920, one farmer produced enough food and fiber to feed and clothes one other family other than his own. Horsepower with real horses. But with the aid of fossil fuel today one farmer an feed at least 100 other families.

The world is today dramatically overpopulated. We are totally dependent on fossil fuel to produce the food, clothing, and all the other consumer products necessary for the survival of 7.8 billion people.

Every morning I take about a 10 minute shower at 2.5 gallons per minute and the water cost is about 1/4 of a cent per gallon(a luxury). If starting tomorrow the city raised the price of water to a $1 per gallons. I would learn to take a shower on less than 2 gallons over night.

Life goes on

I’m not arguing earth isn’t over populated with humans. It was also over populated in 1920.

Yes, New York City only gets sunlight for part of the day. The point is that I’m talking about averages, not peak power.

So…the average world generation of electricity is about 3 terawatts (an average of very roughly 400 watts per person, 24×7). You can compare that 3 TW to the 100,000 TW received by the planet as a whole in the form of sunshine.

If we assume 20% efficiency for PV, that means 20,000 TW available. Divide 3 TW into 20,000 TW, and we find that we’d need to cover .015% of the earth’s surface with PV.

Humans have already covered about 900,000 square km of the earth’s land surface with structures or paving of various sorts*. With 1 KW per square meter of insolation, those structures now receive 900 TW of sunlight. If all of that was covered by PV with an efficiency of 20%, and an average capacity factor of 15%, we’d get 27 TW of power. If we need 3 TW, then we’d need to cover about 11% of human structures with PV.

*http://www.curiousmeerkat.co.uk/questions/much-land-earth-inhabited/

Or, a country the size of the US could have one big PV farm about 80 miles x 80 miles, just to illustrate the scale needed.

Now, that’s just current electricity consumption: if we wanted to cover heating and transportation etc., we’d need about 2.5x as much electricity (assuming no improvements in efficiency and conservation).

So: do we agree that solar power can scale up to provide enough power for human civilization?

Nick, that is some pretty good math. But no, you haven’t proven a damn thing. New York probably averages, year around, about 6 hours of sunlight per day. (They don’t get a lot of sunshine in the winter.) You are going to need a pretty big battery bank. Where are your battery figures?

Yeah, I haven’t shown in this conversation that we can solve the problems you’ve raised, which are often called diurnal (daily) intermittency and seasonal intermittency. There are other problems, including weather-related intermittency and cost viability and probably other possible objections I’m not thinking of this second.

I’ll be delighted to discuss those.

But…in the name of actually making progress in this discussion, can we agree on this first point, that the total energy available from solar power is adequate for human purposes? In other words, that solar can scale up?

No Nick, solar power, alone, cannot possibly power the world. We cannot have half a conversation about replacing fossil fuels. Solar power must be able to power 24 hours a day in the dead of winter. You have not even made an attempt to tackle that problem. Simply to say that we could build enough solar panels to power everything is glaringly inadequate.

Ron, I’m sticking on this point because…well, this is how our conversations often go. I argue one point, and you move on to another. If we have a long discussion about fossil fuels, we suddenly move sideways to a discussion about loss of biodiversity, or soil, etc, and we don’t finish the conversation about fossil fuels. So, we never make progress.

Of course, we’d have to address intermittency in order to come to an overall conclusion that solar power could work. I’m not going to play games with you, and say that you’ve agreed that solar will work, when you haven’t.

I just want to finish one part of the discussion before we move on to intermittency.

So, if I stipulate that we’ve only had half the conversation (or less!), and that you’re not agreeing to the overall viability of solar power, can we agree on this one point: that solar can scale up?

Here’s a proposal: I’m going to assume you agree. If you don’t agree that solar can scale up, just say so, and give a reason, any reason, and we’ll discuss it. But, if you don’t say so, I’m going to assume you agree and the point is settled. Fair enough?

Okay, now, next question: daily intermittency. In the first step in this discussion, let’s examine the distribution of consumption over the day. In the US, power usage is higher during the day than during the night. I’d estimate that day time (roughly 9 to 5) power usage is twice as high as Night time (roughly 10 PM to 6 AM). Does that make sense?

Nick, I can very well understand why you wish to stick to solar panel production, deployment, and how much acreage they would cover. Those are the points you can cover with mathematics and so on.

But we both know that storage is achilleas heel of the renewal power problem. That problem has simply not been solved by scientific engineering yet. They may one day solve that problem. But not with the current demand and definitely not if all transportation ran on electrical power.

So you want to discuss the easy part, the part you can prove with mathematics. Well, I am not interested in talking about that. I want to discuss the difficult part, the part that is currently impossible. I want to hear how you think that part will be solved by scientists and when.

Until then, we have nothing to talk about.

Ron, I’m glad we agree. We agree that producing enough solar power isn’t hard to do. And, we agree that we also have to solve the storage problem. If you re-read the last paragraph of my last comment, you’ll see that I’m starting to answer the storage question, and I start by discussing intermittency.

The storage problem is all about solving intermittency: the fact that solar power is available only part of the time. Does that make sense?

I’d estimate that day time (roughly 9 to 5) power usage is twice as high as Night time (roughly 10 PM to 6 AM). Does that make sense?

No, that makes no sense whatsoever. Nighttime is not 10 PM till 6 AM. Nighttime is 6 PM till 6 AM (average). And the early evening hours, when the lights are turned on all over the nation, is at least as high as noon consumption. Also, the early morning and late afternoon sun will not produce a lot of electricity.And there are days, many days, when the skies are totally overcast for many days consecutively. Intermittent is not the word to describe that situation.

Also, just look at the traffic, anywhere in the world. A billion vehicles that you wish to convert to electrical vehicles. They will demand a charge throughout the day and night, mostly from your storage facility, that you haven’t even invented yet.

The storage problem is all about solving intermittency: the fact that solar power is available only part of the time.

Nick, that is dramatically underestimating the situation. Intermittency is something that happens occasionally. We are talking about something, that in the winter months, is present only about 25 to 30% of the time. Intermittency is not the word to describe that situation. You need a system that can be charged in with 6 hours of sunlight and then power every home, every industry, every business, and every vehicle on the road for a full 24 hours.

And as I said Nick, that system has not been invented yet.

Okay, deal with them apples.

The storage facility for pure solar energy is already invented, and partly build.

“only” the filling / discharging technic is more experimental.

Hydrogen, stored in huge caverns where today natural gas reserves are stored.

For creating electricity again you need hydrogen fuel cells, or with somewhat worse efficence reworked gas power plant (one experimenal gas plant runs on hydrogen here in Germany).

Oh, and big batteries for the day / night cycle – and reworked gas tankers transporting hydrogen around the world.

Chile can get the new Saudi Arabia, their Atacama high land desert is the best solar location on earth. They only need water and billions of $ – but I think the billions of $ can pump desalinated water from the coast.

Their current solar power plants are already under 3 cents / kwh – so there is a lot more possible there.

The storage facility for pure solar energy is already invented, and partly build.

Oh we are back to “the hydrogen economy.” We are, or will be, converting electricity to hydrogen, then converting the hydrogen back to electricity, and lose 80% of the original energy in the process. It is all explained here:

The Hydrogen Hoax

Yes, hope springs eternal but occasionally we just have to return to reality.

Ron, I don’t speak about cars where you have lot’s of additional compression losses and tranportation losses from transportation with trucks.

Best electrolysis methods have an efficiency of 80%, and modern gas plants get 60%. And you store at low pressure if you do it nation wide, like natural gas. You’ll get some losses with storing in caverns first, but this will taper out when saturation sets in.

It’s used for seasonal storage only, you build as much solar to cover 3 seasons, and store the surplus you always have with alternative energies since you have to overbuild. In Winter, you don’t get enough so you have to add from seasonal storage.

From the waste energy you can heat metropols in the winter with distance heating (implemented in Germany for some metropol areas, feed is from big coal and gas power plants).

It’s not perfect, but the best available non fossile since cheap fusion energy is so far away.

A strong nation wide mega volt power net is necessary to avoid storing as much as possible. So wind energy can be added from good places.

I think with a good balance 80-90% of the energy doesn’t need to be seasonal stored, only daily in batteries with much better efficiency. So a loss from round about 60% for seasonal storage is in sum not as bad as it looks first.

It’s all known technic that has to be scaled, not unknown stuff still to be developed. Power plants can be build for natural gas first and converted to hydrogen peak plants later.

Best electrolysis methods have an efficiency of 80%, and modern gas plants get 60%.

Eulenspiegel, We are talking about converting electricity to hydrogen via electrolysis, storing the hydrogen, then converting the hydrogen back into electricity. And you say you can recover 80% of the original electricity.

Eulenspiegel, what the hell are you smoking?

Seriously, the link I posted showed the step by step process from electricity, to hydrogen, then back to electricity again. The fact that the final electricity was to power an electric motor that powered an automobile, made no difference whatsoever. The math was there, explained in every detail. Now the least you should do is post the link that shows your statement to be correct. That is electricity to hydrogen then back to electricity with only a 20% loss. I just don’t think that is too much to ask.

If you really believe in your theory, you should have the links and math to back it up.

Intermittency is something that happens occasionally.

Well, “intermittency” is the word that the utility industry uses to refer to the fact that sunlight is only available part of the day; that winter reduces sunlight; and that clouds sometime block sunlight.

Can you stand the idea of using the standard word, or would you prefer a different word to refer to this kind of energy production variation?

Ron, I’m not smoking anything,

I said 80% for the electrolysis (to create H2), and 60% for converting back. That is, as you can think, multiplicative and results in a ball park number of 40% accounting for some more losses.

Plus the part for the pumps into the caverns – which is much less than the hydrogen handling for hydrogen cars. With hydrogen cars you get 80% loss. Filling 800 bar car tanks costs lot of pumping energy, as filling truck with cyro or high pressure hydrogen to drive it to the gas station.

No compressing, transporting and other steps involved.

And it’s for seasonal storage only – most will be used as produced or stored in much more efficient batteries or pumped hydro.

So if you only need to store 10% of the created energy in such storage, the overall effiency is not 40%, but 94%.

Example (sorry in German, perhaps a translater works):

https://www.zeit.de/2017/26/architektur-energieeffizienz-walter-schmid

It’s a Swizz zero enery house (no grid connection) with a seasonal hydrogen storage. Round about 10% of the yearly energy usage is stored there, most during surplus time in the summer. While discharging, the waste heat of the fuel cell is fully used for heating.

The nice thing: It works with today tech you can buy – no fusion energy and no yet to be invented super batteries. And in a not really good solar country.

When you build everything bigger (and cheaper with mass production), you can make a whole town independend. Scale effects can and will be used then.

How is this working out for Germany so far? Are they on the brink of 100% renewable power by now?

If not where are they?

How much time and money have they put into their current result?

If Germany is struggling, will it be harder or easier on a global scale? For poorer people and countries, countries with worse “location” then Germany?

Some times i think these global fantasies are based on the neighborhood where the creator of the fantasy lives.

+1

Germany is about 55% renewable electricity so far in 2020.

https://www.energy-charts.de/energy_pie.htm

The switch to electrified cars hasn’t really started yet, but oil consumption should be way down this year due to the (hopefully) one off pandemic. VW say it will release the first wave 30K of its new EV platform vehicles in August. They are presold.