A guest post by Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs October Petroleum Supply monthly PSM which provides data up to August 2022.

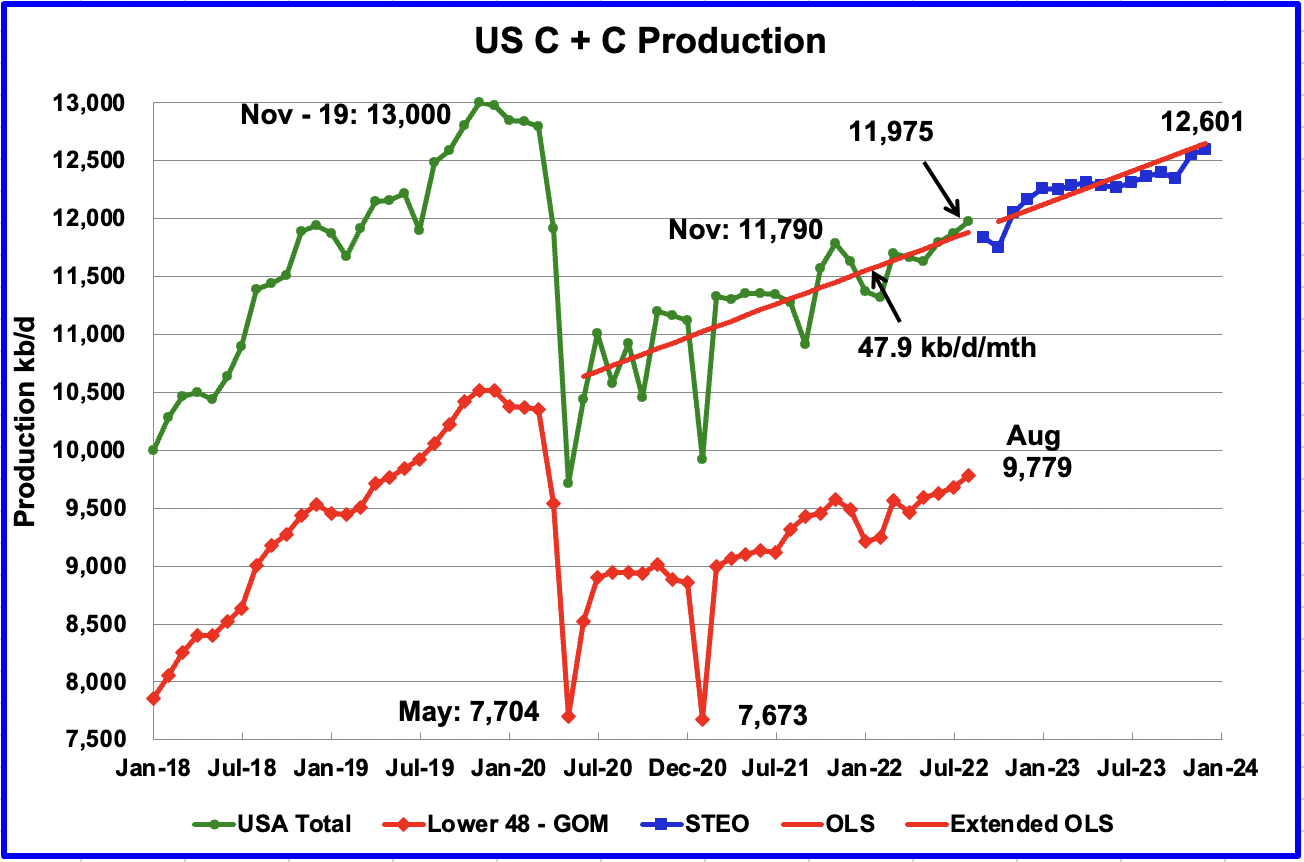

U.S. August production increased by 102 kb/d to 11,975 kb/d. It should also be noted that July’s oil production was revised up from 11,800 kb/d to 11,873 kb/d in the October report. So the total increase over the July report, including the revision, was 175 kb/d. For August, the state with the largest increase was Texas at 78 kb/d. August’s production was a new post pandemic high.

In general, the August report had a number of higher output revisions for many states. No explanation was provided. Could be just normal monthly revisions.

While overall US oil production increased, a clearer indication of the health of US production can be gleaned by looking more closely at the Onshore L48 states. In the Onshore L48, August production increased by 100 kb/d to 9,779 kb/d. This means that all of the increase in US production came from the Onshore L48.

The blue graph, taken from the October 2022 STEO, is the production forecast for the U.S. from September 2022 to December 2023. Output for December 2023 is expected to be 12,601 kb/d.

The red OLS line from June 2020 to August 2022 indicates a monthly production increase of 47.9 kb/d/mth over that period. The first portion of red line stops at August because that is the range covered by the OLS analysis. The second portion is the same OLS line extended to see how well it fits the STEO forecast. The OLS extension closely follows the STEO forecast and indicates a continued steady increase in production at close to the same rate out to December 2023.

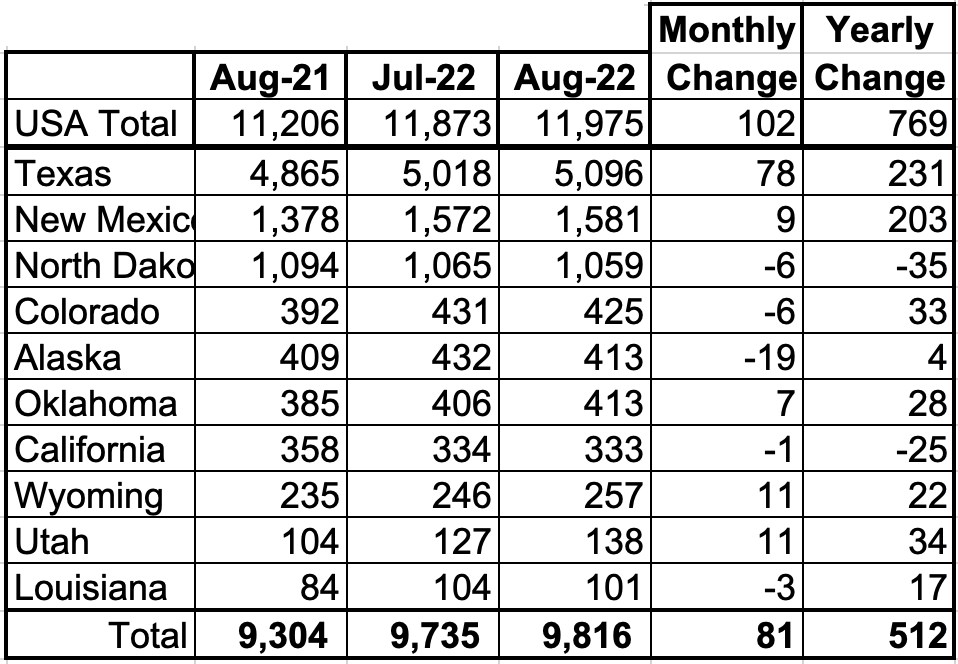

Oil Production Ranked by State

Listed above are the 10 states with the largest US production. These 10 accounted for 82.0% of all U.S. oil production out of a total production of 11,975 kb/d in August 2022.

On a YoY basis, US production increased by 769 kb/d with the majority having come from Texas and New Mexico. Note that only North Dakota and California are producing less crude this year than a year ago.

State Oil Production Charts

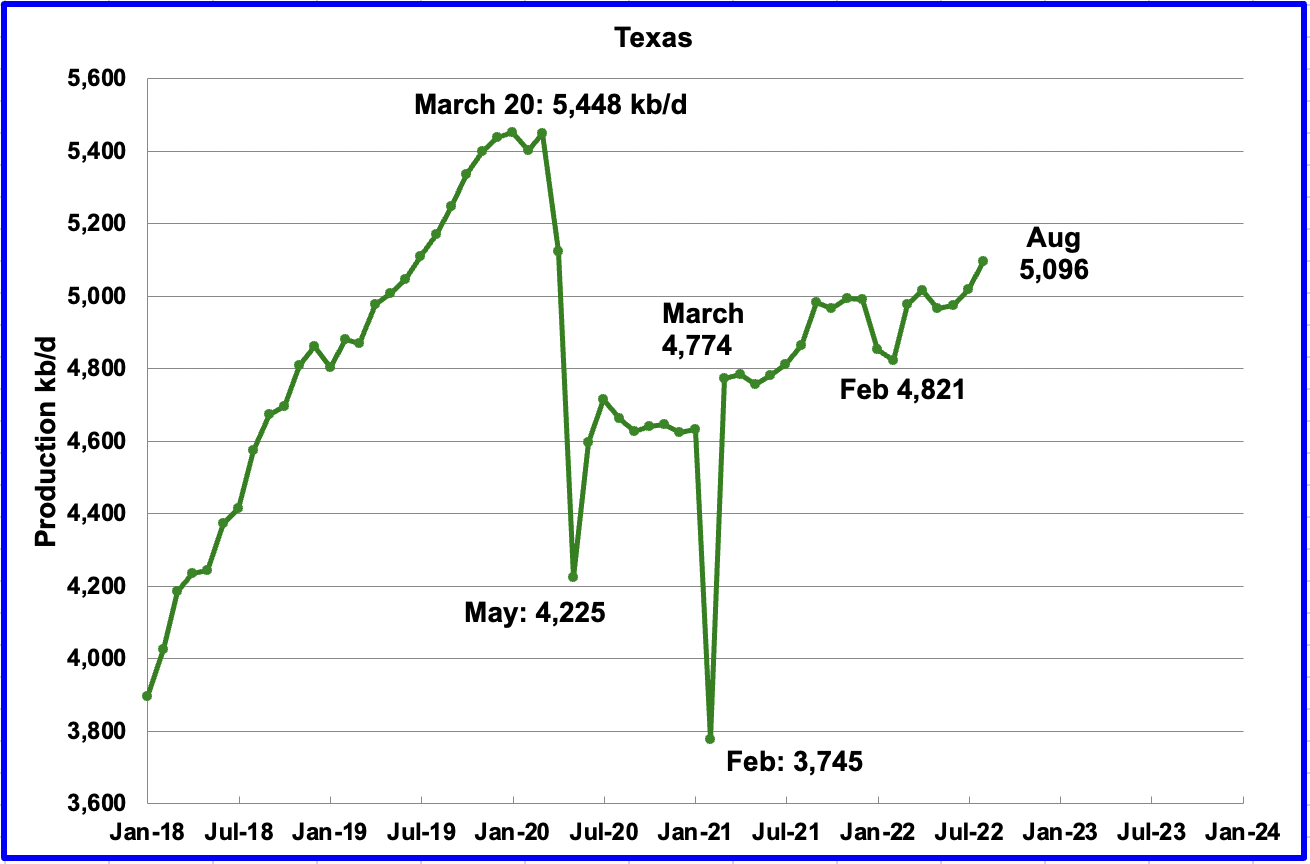

Texas production increased by 78 kb/d in August to 5,096 kb/d, a post pandemic high, from 5,018 kb/d in July. From March 2021 to August 2022, Texas production increased by 322 kb/d or at an average rate of 18.9 kb/d/mth.

In September 2021 there were 205 Hz oil rigs operating in Texas. By the last week of August 2022, 308 Hz oil rigs were operational, an increase of 103 rigs.

August’s New Mexico production increased by 9 kb/d to 1,581 kb/d to a new record high. From January 2022 to the end of May, close to 92 rigs were in operation in the New Mexico Permian. However by August operational rigs increased by four to total 96 which is consistent with New Mexico’s rising output. The recent production increase is due to more wells being drilled and more wells being completed than drilled.

North Dakota’s August output dropped to 1,059 kb/d, a decrease of 6 kb/d from July. Note that this latest report revised July’s output up by 31 kb/d to 1,065 kb/d.

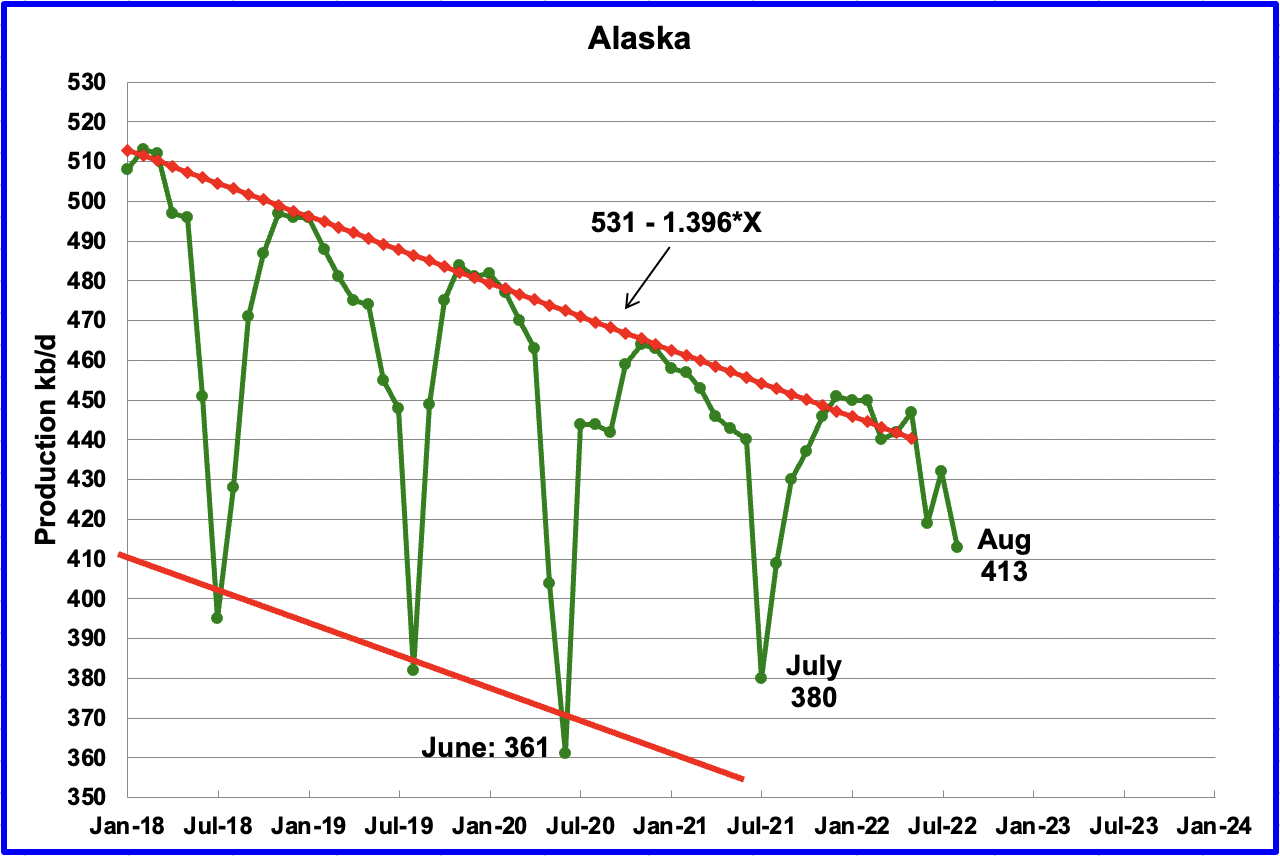

Alaskaʼs August output decreased by 19 kb/d to 413 kb/d. An unexpected drop since typically August output increases.

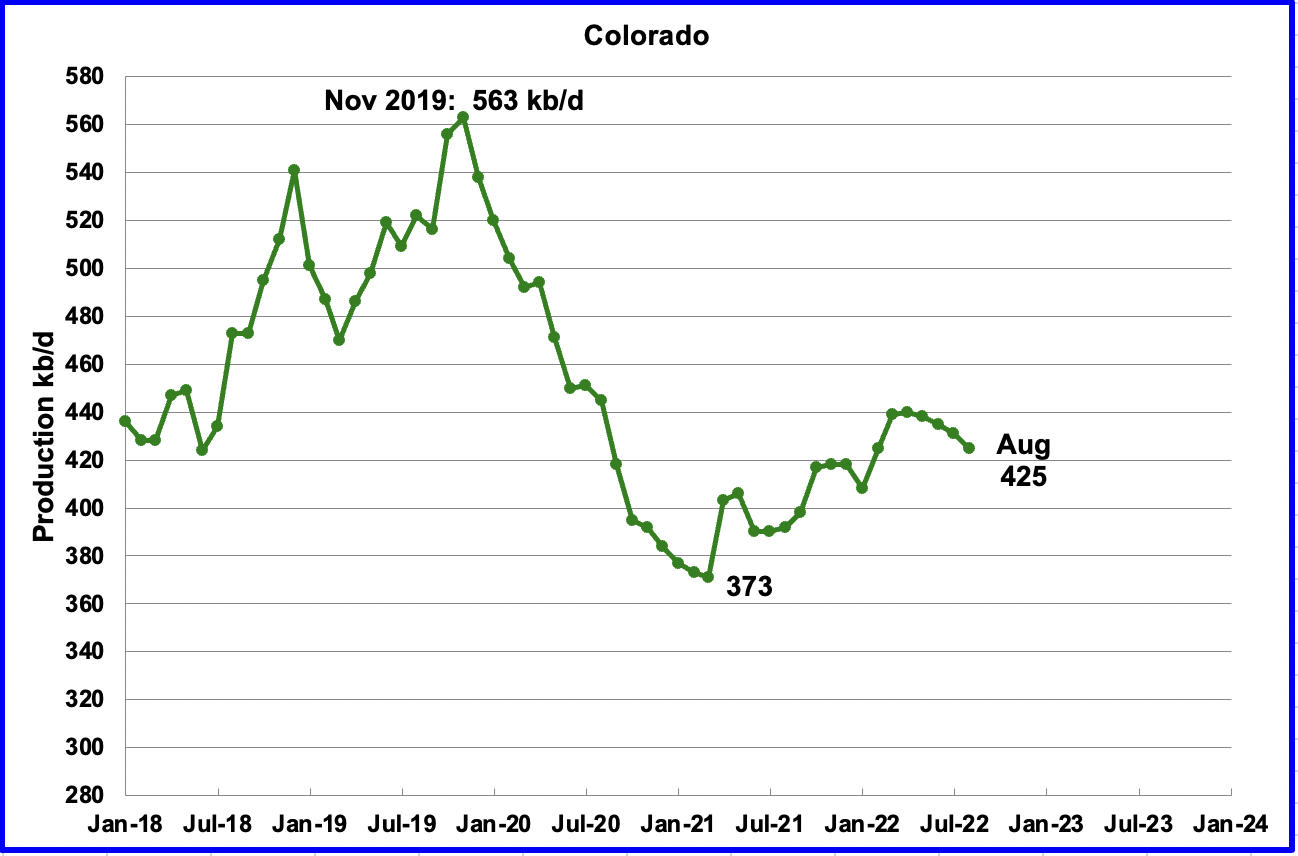

Coloradoʼs August production decreased by 6 kb/d to 425 kb/d. After production being flat in March and April, production has entered a slow decline phase. A recent Colorado report forecasts little oil growth is likely in Colorado for 2022.

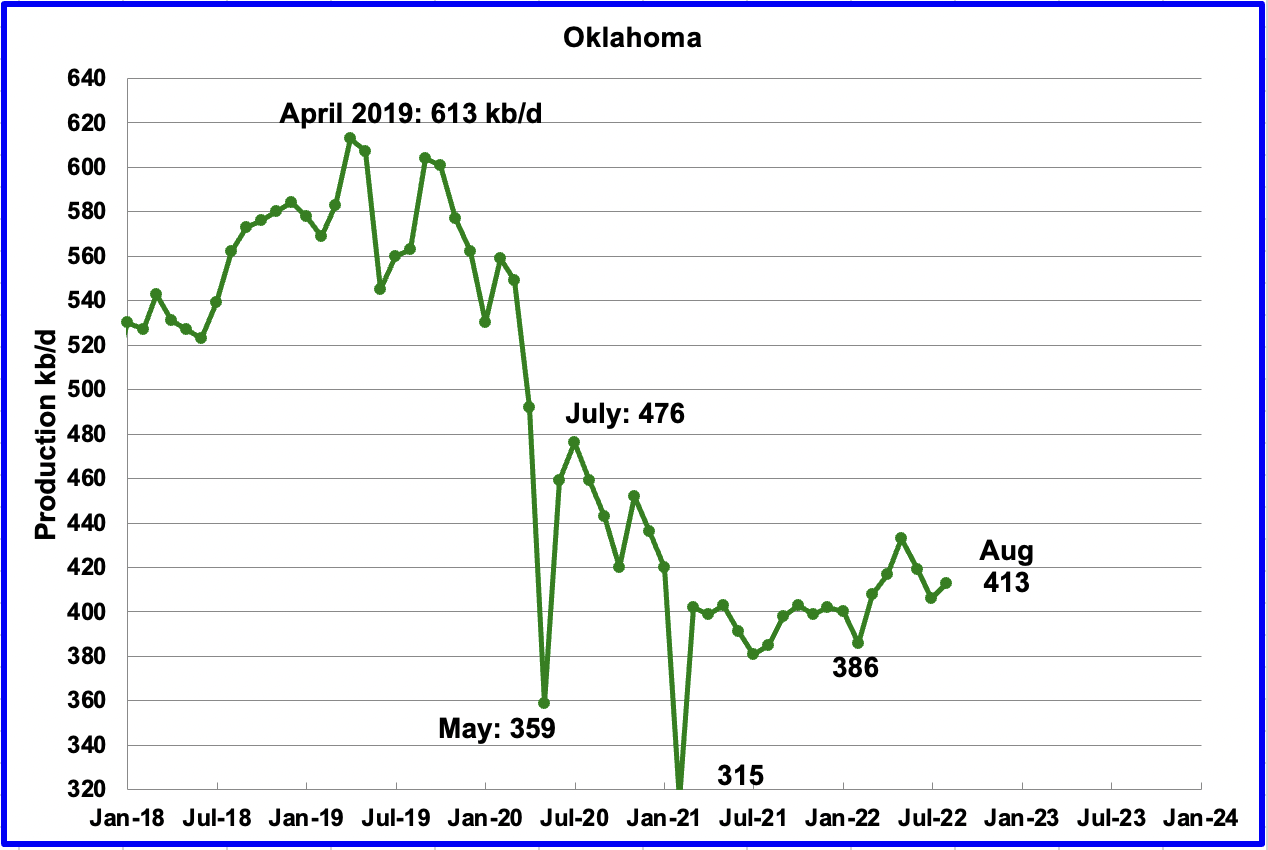

Oklahoma’s output in August increased by 7 kb/d to 413 kb/d. From January to April, close to fifty rigs were operating in Oklahoma. In July and August the rig count increased to between 57 and 59 which may lead to higher production.

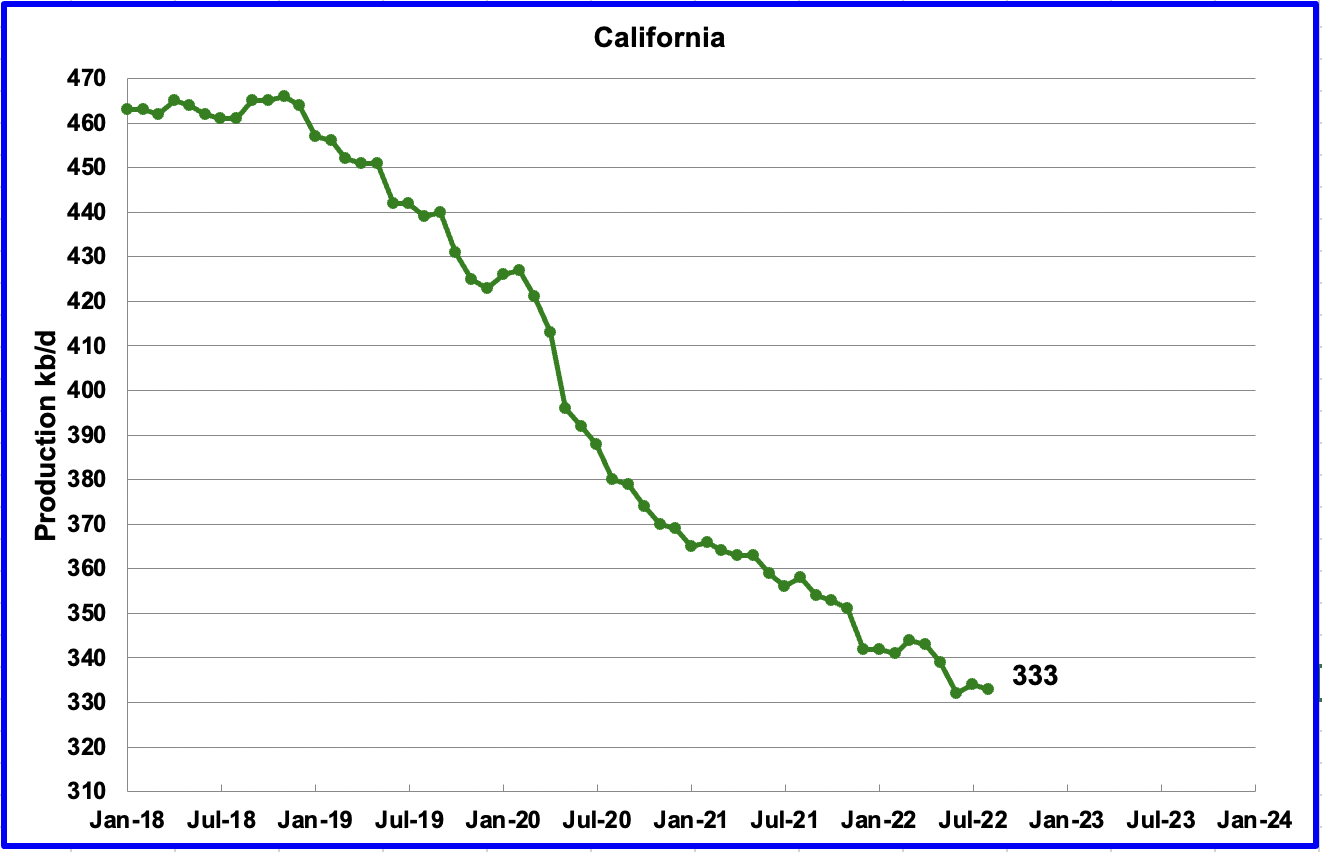

Californiaʼs slow output decline continued in August. Output decreased by 1 kb/d to 333 kb/d.

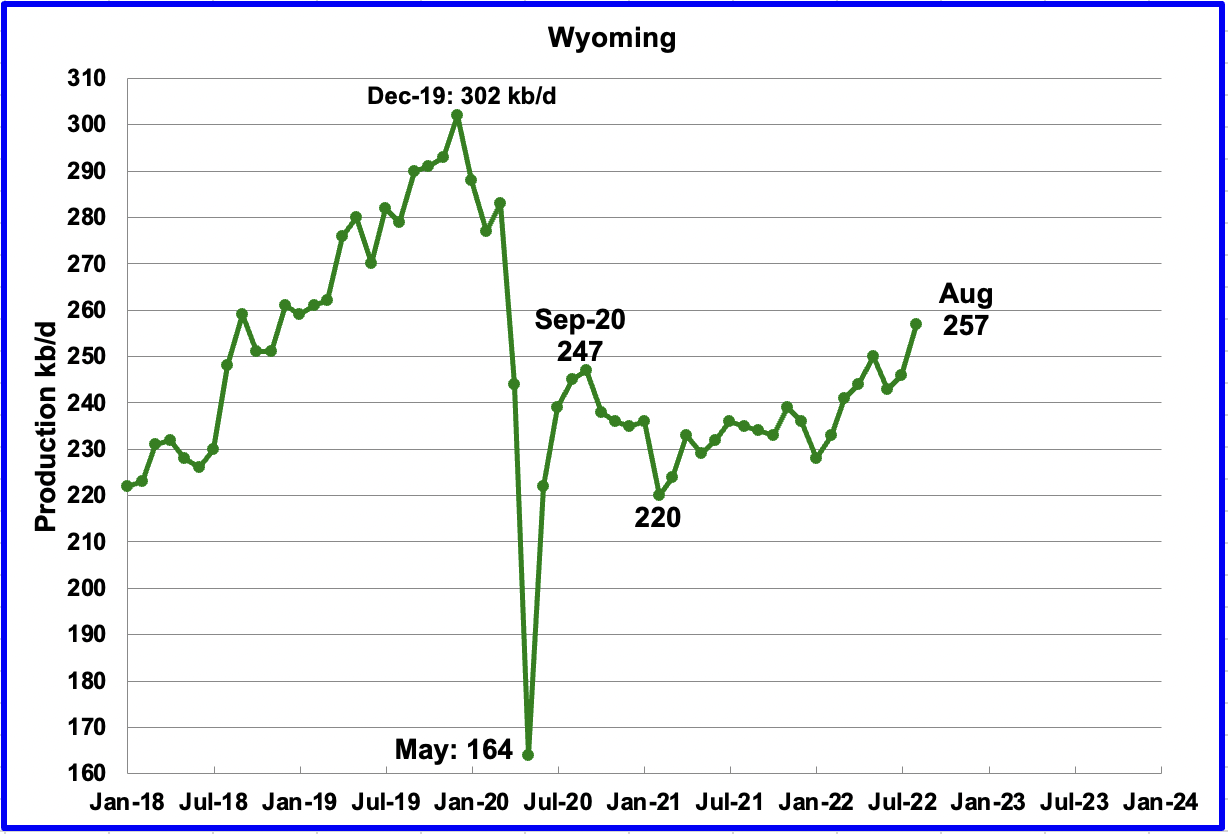

Wyoming’s oil production has been on a slow unsteady uptrend from the low of 220 kb/d in February 2021 due to increased drilling. August’s output reached a new post pandemic high of 257 kb/d.

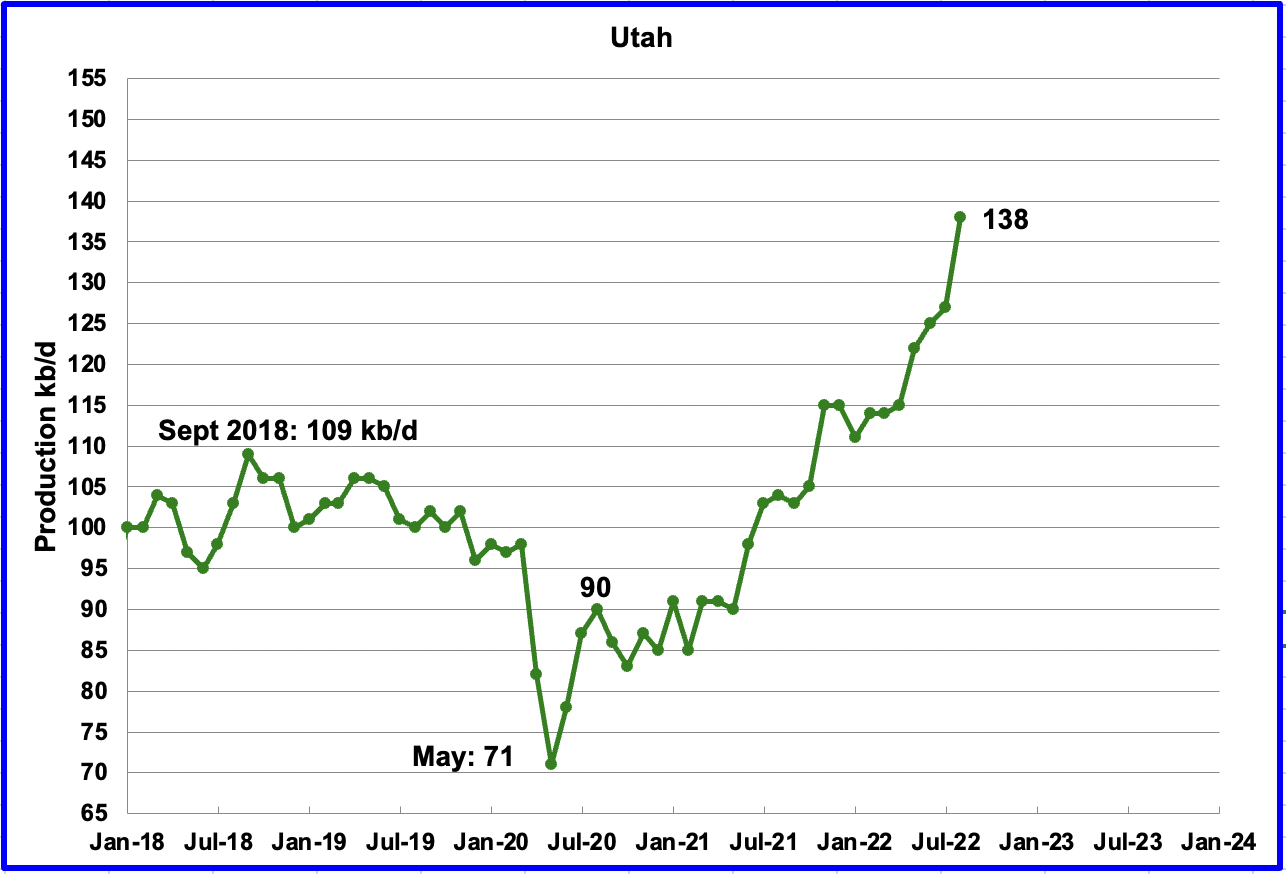

Utah’s production has been on a steady increase since January 2022. Production hit a new high in August of 138 kb/d after just adding 11 kb/d to June’s output. Utah had between 7 and 8 rigs operating in August.

The Biden Administration paves way for railway that will quadruple oil production in Utah’s Uinta Basin.

According to this source, a new railway, “The Uinta Basin Railway is expected to quadruple oil production in Utah’s Uinta Basin by linking its oil fields to national rail networks. Most of the crude will travel through the Colorado Rockies for 200 miles to Gulf Coast refineries.”

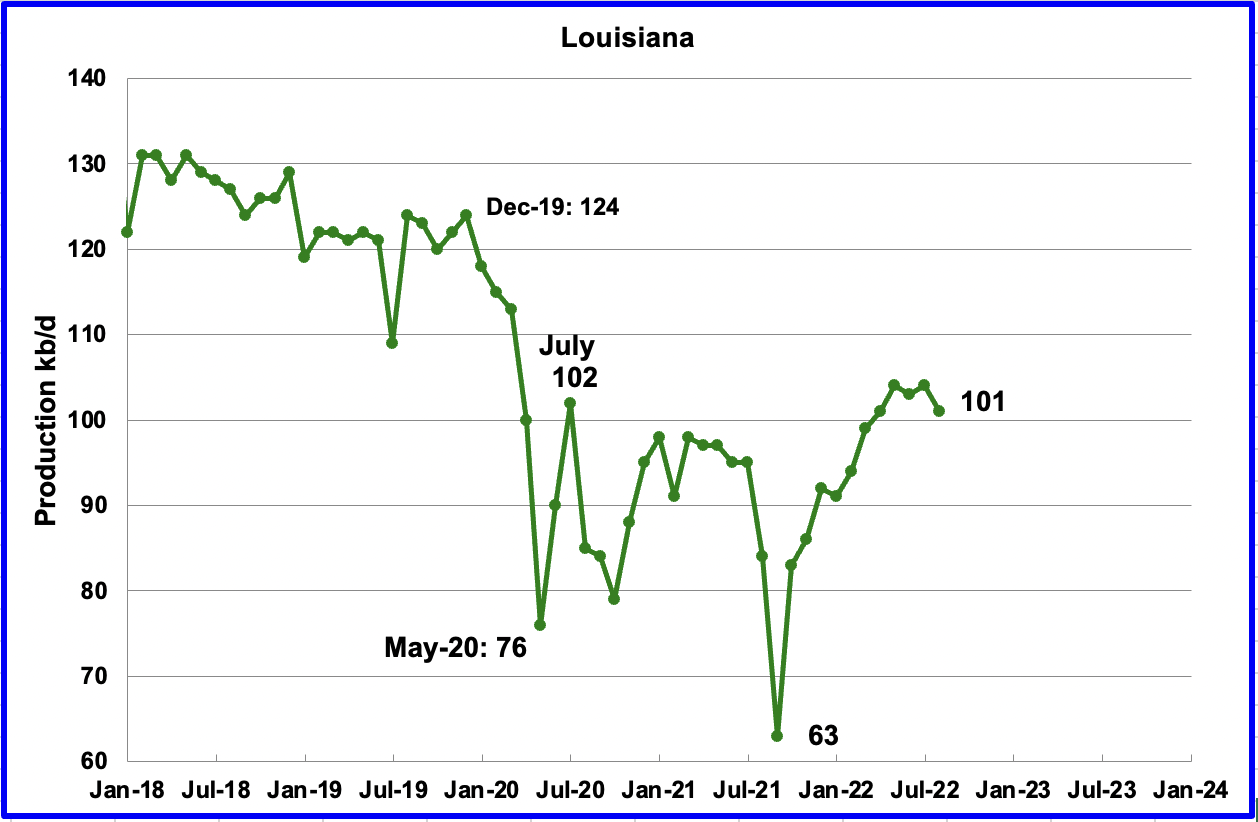

Louisiana’s output dropped in August to 101 kb/d.

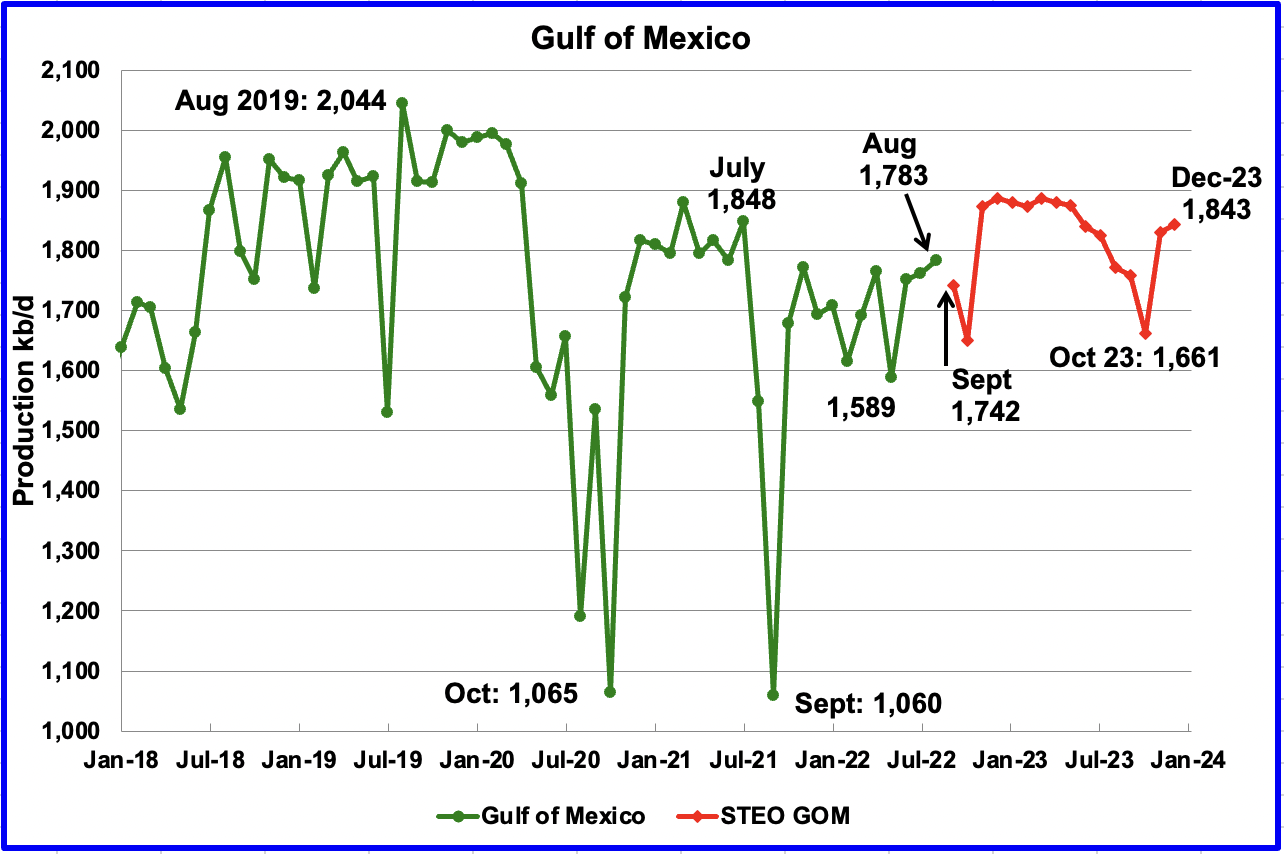

GOM production increased by 21 kb/d in August to 1,783 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The October 2022 STEO projection for the GOM output has been added to this chart and projects output will be 1,843 kb/d in December 2023, 60 kb/d higher than August 2022.

For September 2022, the STEO is projecting a decrease of 41 kb/d to 1,742 kb/d, possibly associated with Hurricane Ian which hit the GOM in late September. November is projected to have a sharp production increase of 224 kb/d to 1,874 kb/d.

A Different Perspective on US Oil Production

The Big Two states, combined oil output for Texas and New Mexico.

Oil production by The Rest

August’s production in the Big Two states increased by a combined 87 kb/d to a new high of 6,677 kb/d with Texas increasing by 77 kb/d and New Mexico adding 9 kb/d.

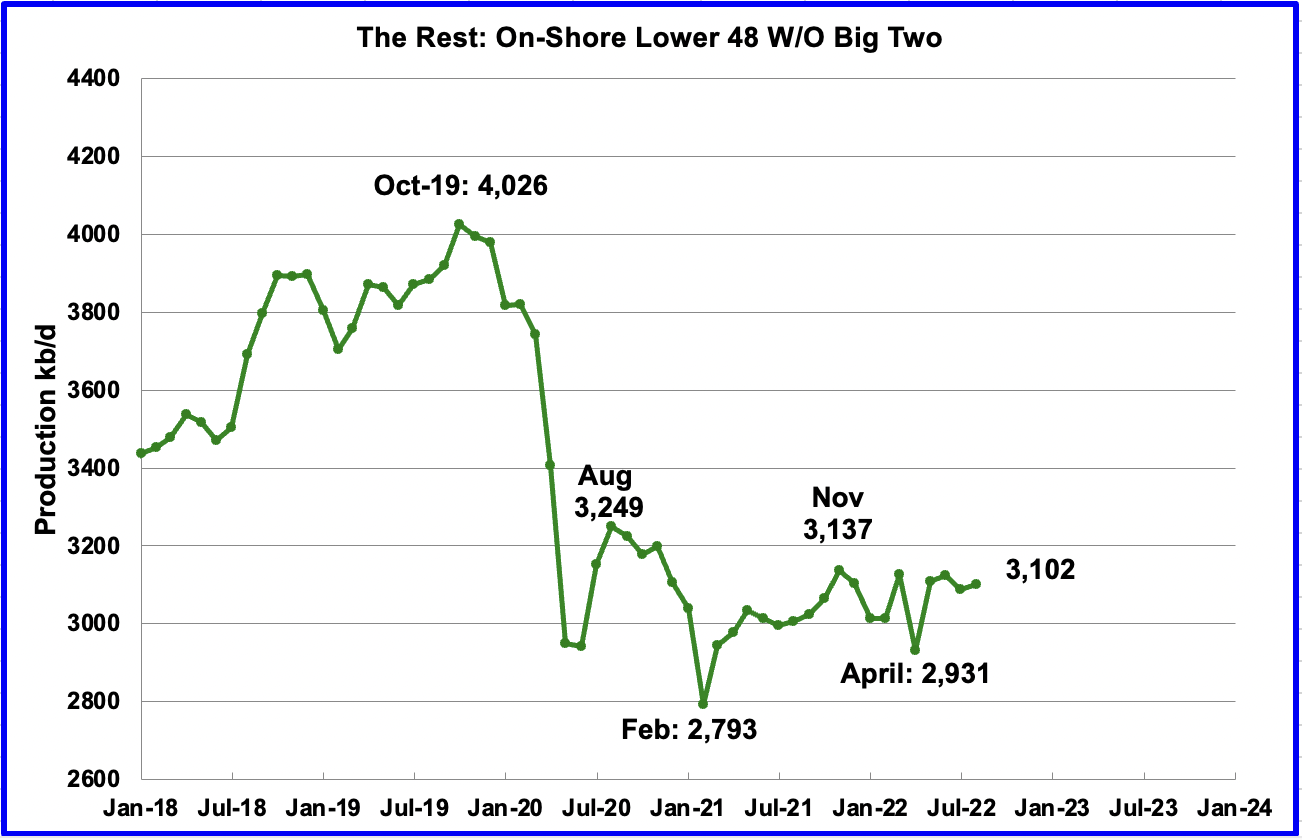

Over the past year, production in The Rest appears to be holding steady at close to 3,100 kb/d. In August The Rest increased output by 13 kb/d to 3,102 kb/d.

The main thing to notice in the Rest Chart is that current production is 900 kb/d below the high of October 2019. The question we need answered Is “Is this a permeant loss that will never be recovered?

Rigs and Fracs

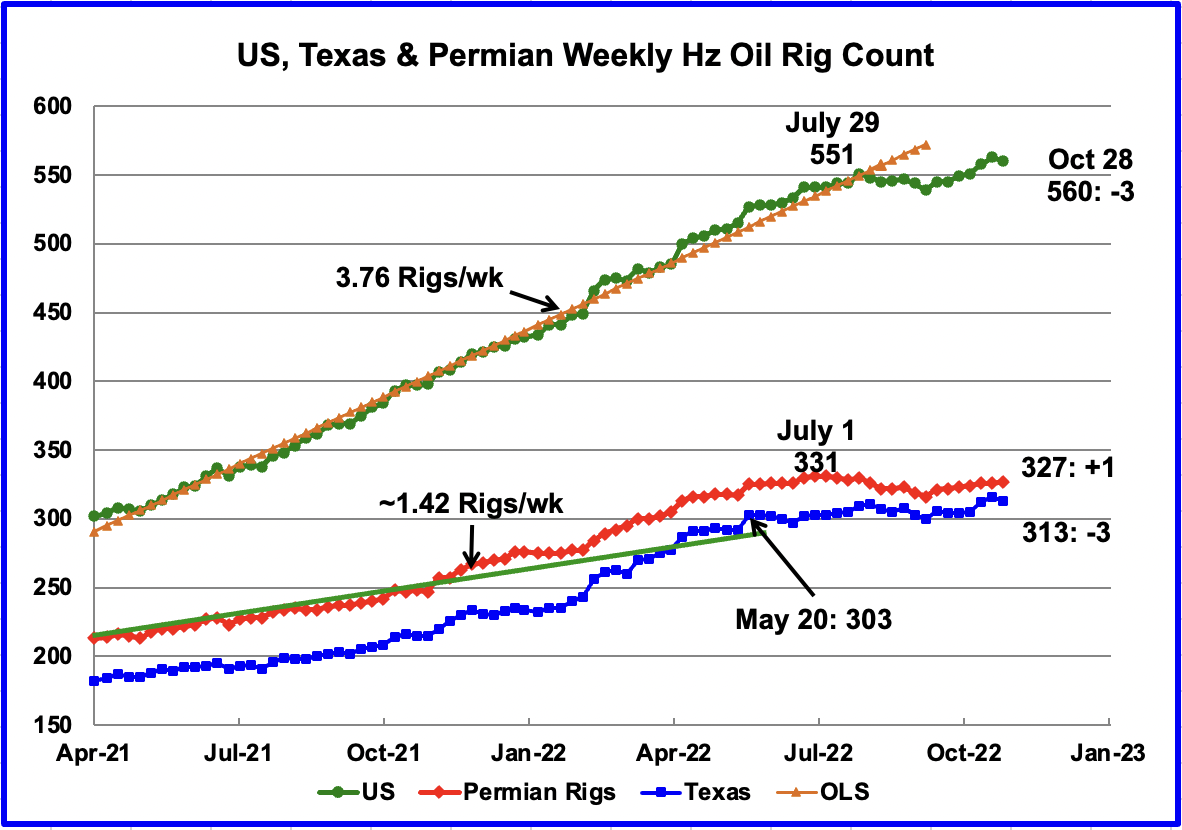

Since the beginning of April 2021 through to the week ending July 29, 2022, the US has been adding horizontal oil rigs at a rate of close to 3.82 rigs/wk, orange OLS line, and peaked at 551 rigs in the week ending July 29. However since then the number of operational rigs has been more or less steady at the 550 level. In the week ending October 28, the number of rigs decreased by 3 to 560.

In the Permian and Texas, the general trend for the number of operational rigs since July has been flat. Is this related to the recent drop in the price of WTI?

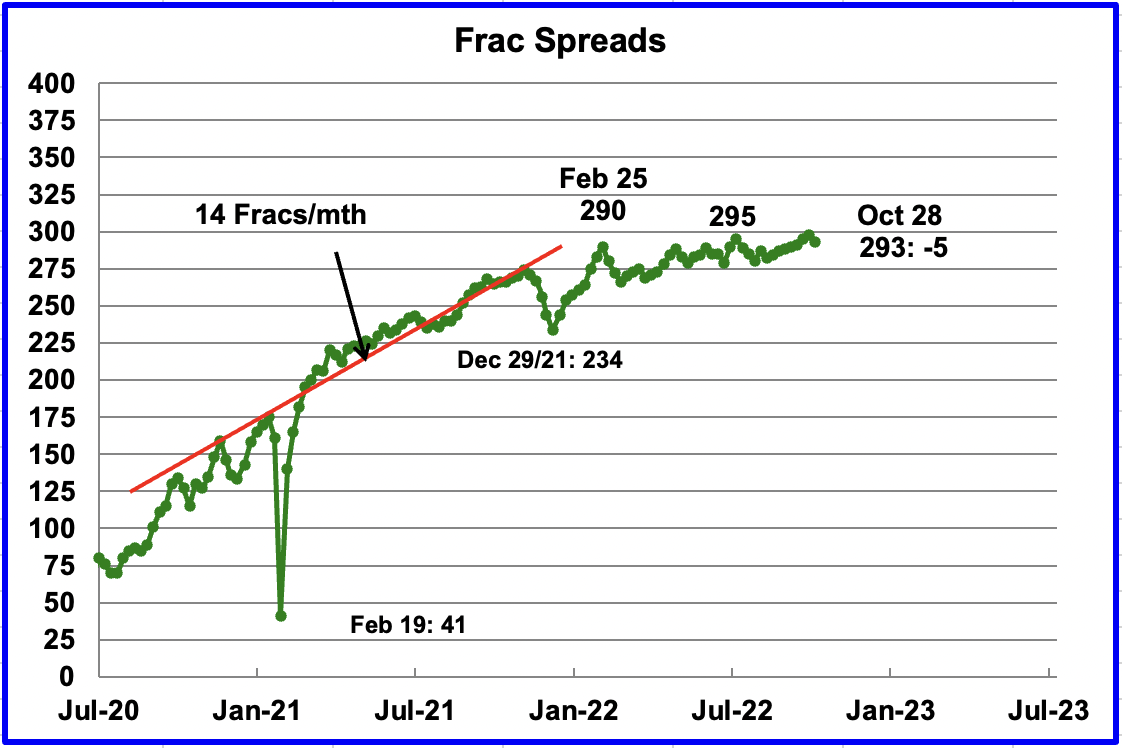

For frac spreads, the general trend since late February can best be described as essentially flat around the 290 level but with a hint of a slow increase toward 300 frac spreads.

The essentially flat rig count since June and the flat frac spread count since February hints at a possible equilibrium between rigs around 550 to 560 level and a frac spread count around the 300 level. This equilibrium could be driven by the new balance between drilling/completion expenses and return of capital and dividends to investors.

Note that these 293 frac spreads include both gas and oil spreads.

Drilling Productivity Report

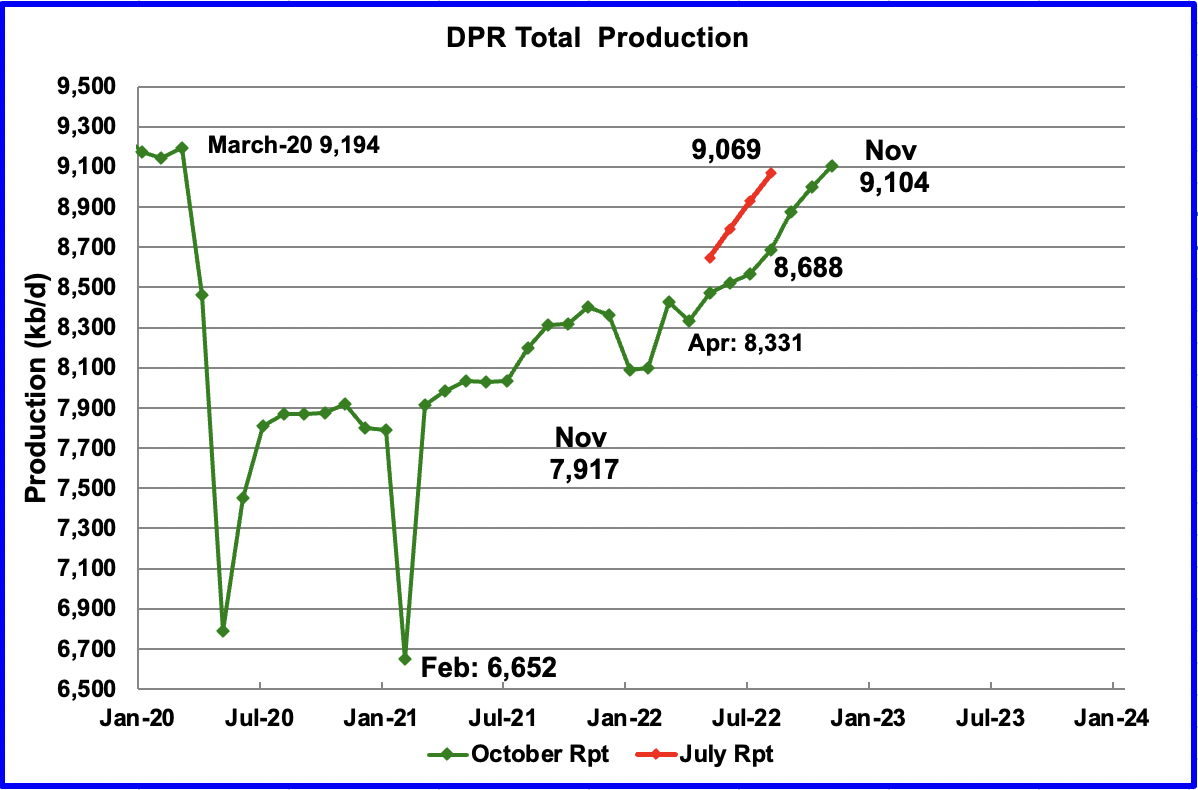

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The October DPR forecasts production to November 2022 and the following charts are updated to November 2022.

Above is the total oil production projected to November 2022 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The October DPR report has downwardly revised the April to October production forecast. The original production forecast for August 2022 was 9,069 kb/d, red markers. The revised estimate for August is 8,688 kb/d, a downward revision of 381 kb/d.

The DPR is projecting that oil output for November 2022 will increase by 103 kb/d to 9,104 kb/d. From April’s output of 8,331 kb/d to November’s 2022, output in the DPR basins is forecast to increase by 773 kb/d or by an average of 110.4 kb/d/mth.

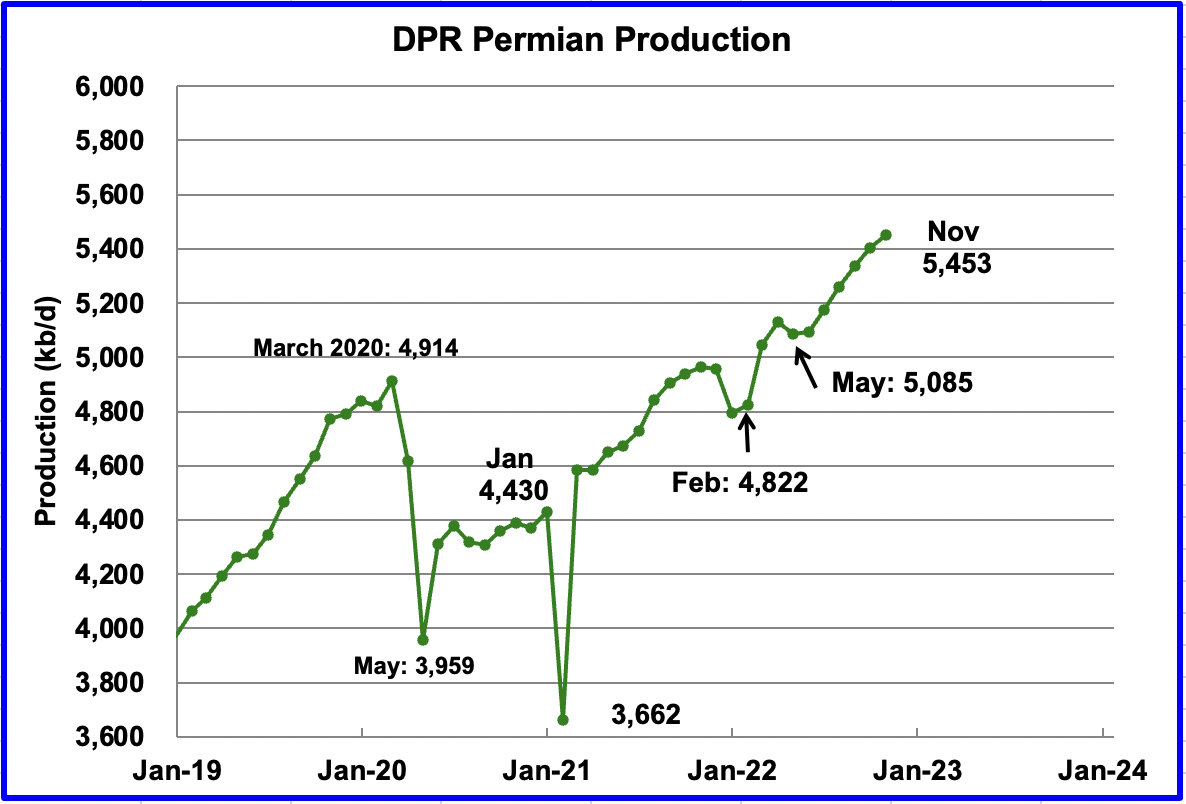

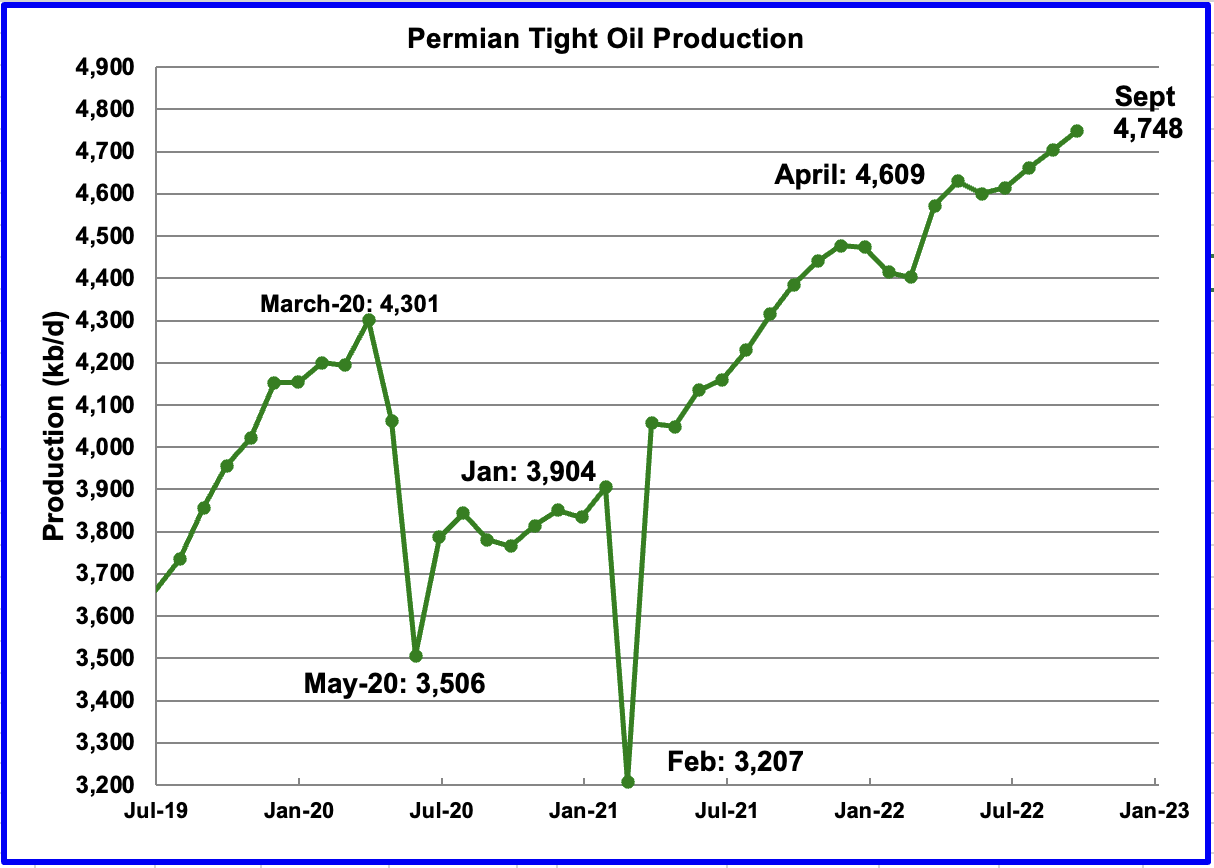

Permian output continues to increase in November. Production is expected to increase by 50 kb/d to a new high of 5,453 kb/d. From May to November, production is forecast to increase by 368 kb/d or at an average rate of 61.3 kb/d/mth. If the Permian were part of OPEC, at 5,453 kb/d it would be the second largest producer after Saudi Arabia.

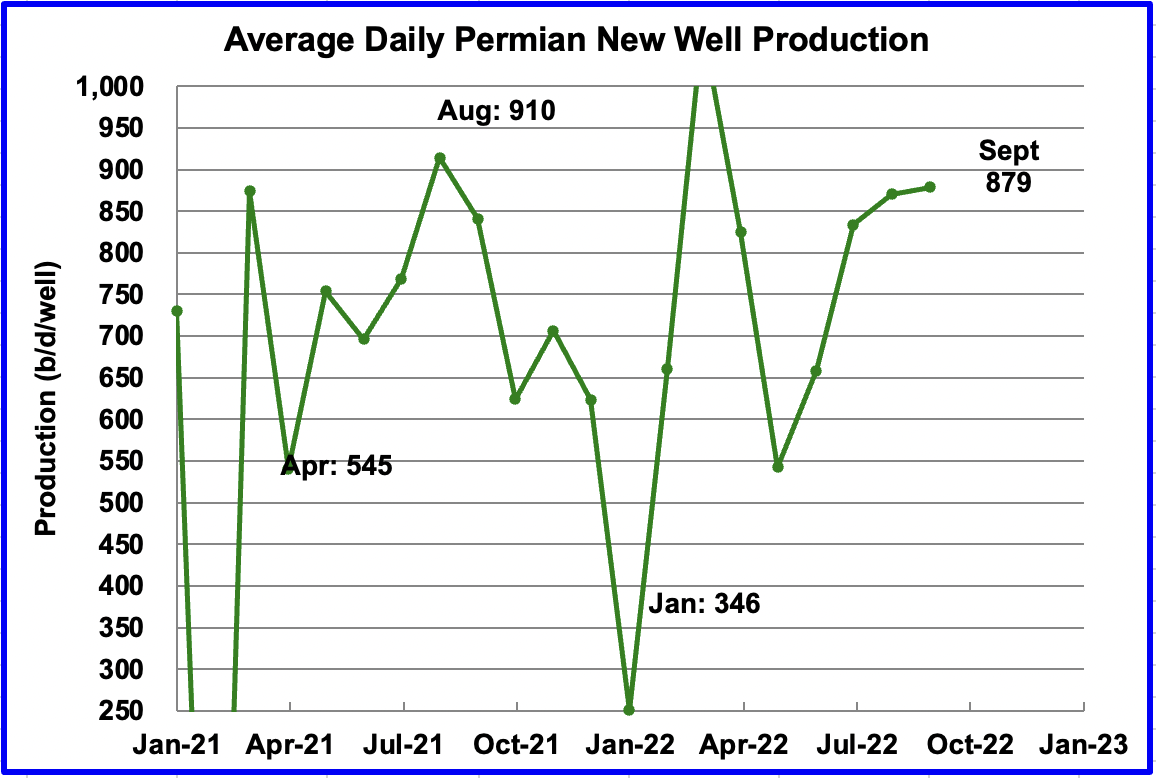

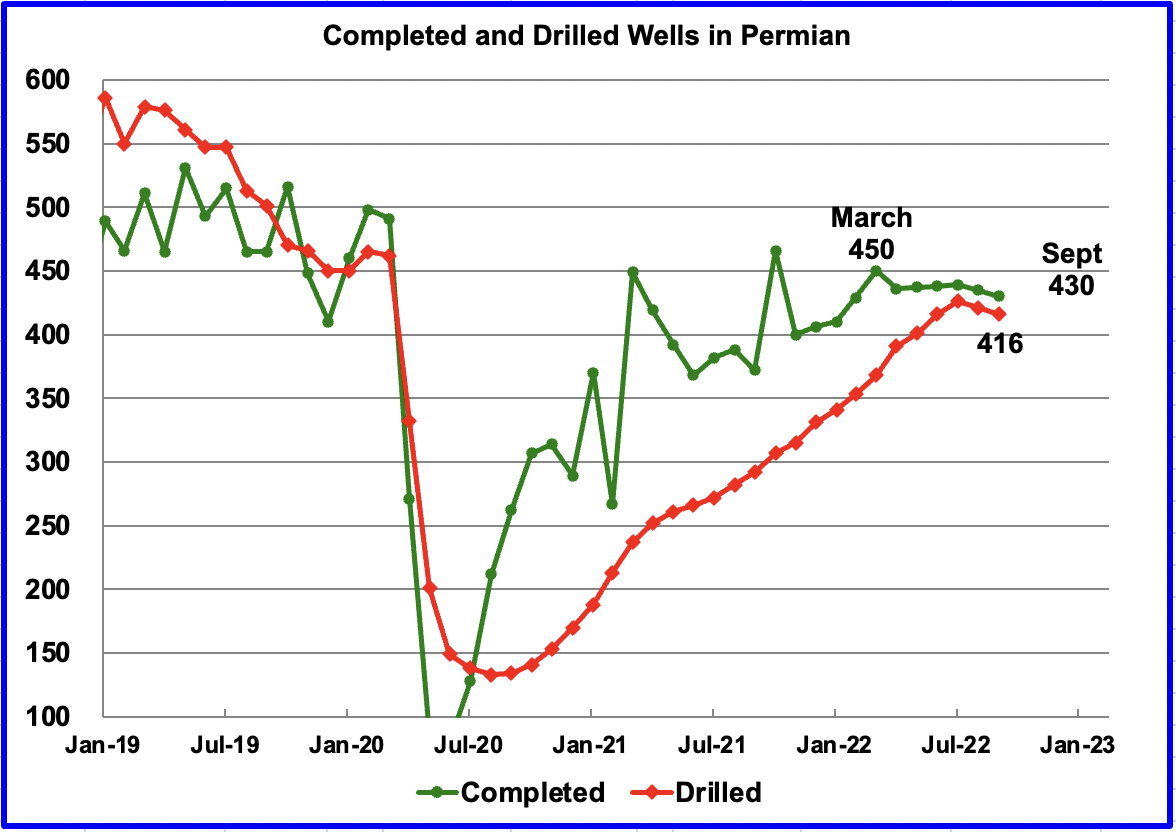

During September, 416 wells were drilled and 430 were completed in the Permian. (Note that September is the latest data for DUC info). The completed wells added 378 kb/d to September’s output for an average of 879 b/d/well. The overall decline was 300 kb/d which resulted in a net increase for Permian output of 78 kb/d. Of the 430 completed wells, 341 were required to offset the decline. The completion of 14 extra DUCs over the drilled wells contributed 12.3 kb/d of the overall 78 kb/d increase.

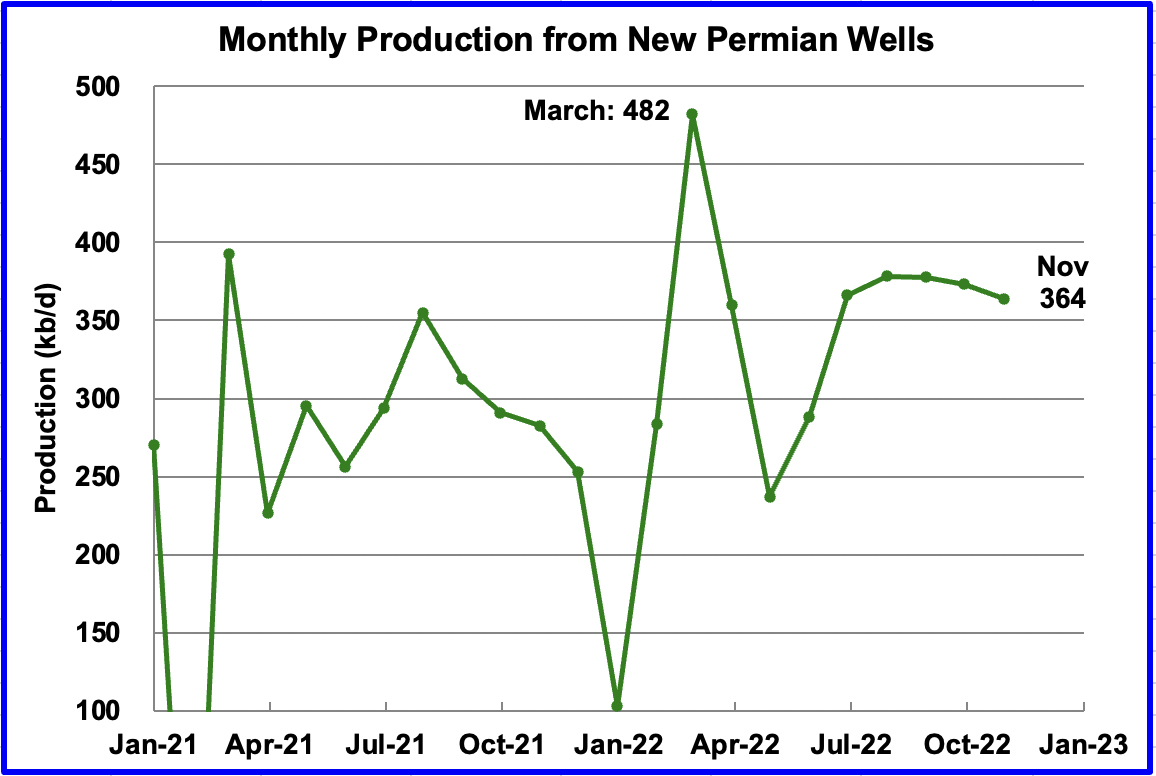

This chart shows the average total monthly production from first month Permian wells tracked on a monthly basis. Since July 2022, the volatility shown in prior months has stopped. While I cannot be certain for the reason for the reduced volatility, it may be related to the first upgraded LTO report released in September. Assuming the latest information is correct, total monthly production from the newest Permian wells may have peaked at 378 kb/d in August. Part of the decline shown is related to fewer wells being completed.

Average daily production for first month Permian wells is also volatile but the most recent data indicates average production is close to 879 b/d.

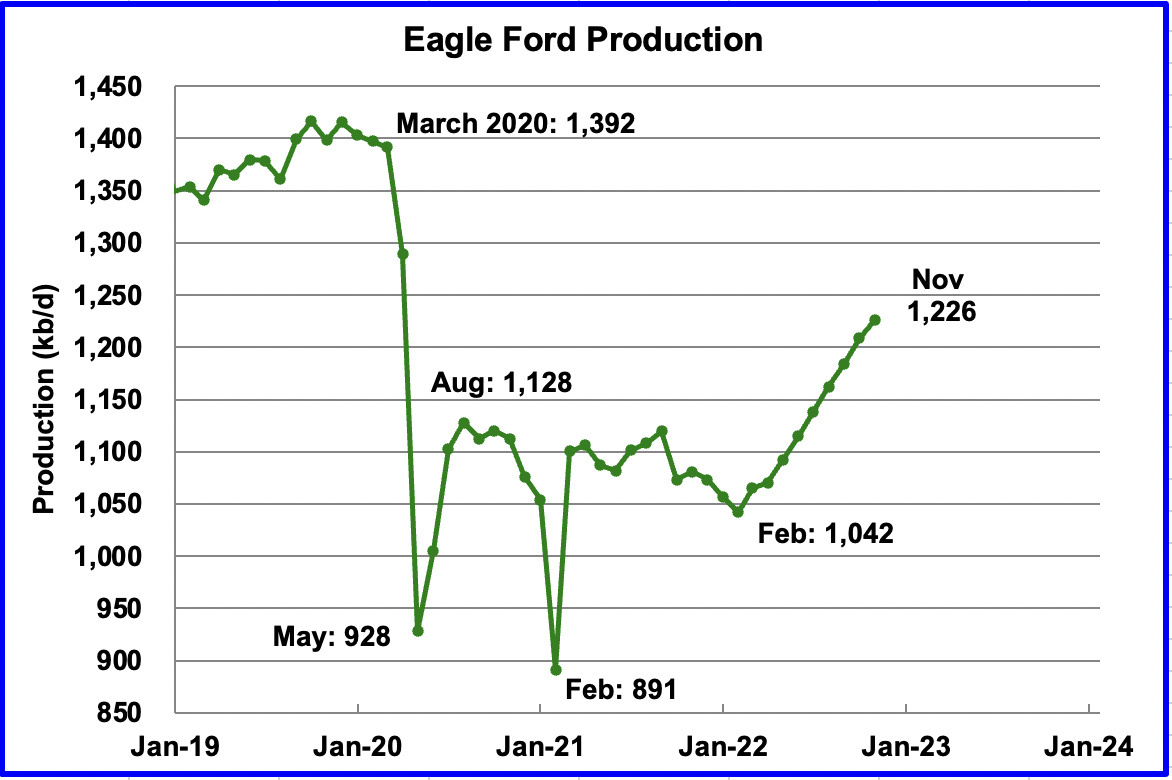

Output in the Eagle Ford basin has been showing an increasing trend since March 2022. For November, output is expected to increase by 18 kb/d to 1,226 kb/d. At the beginning of the year, 43 rigs were operating in the EF. As of October, 67 were are operational and account for the increasing production.

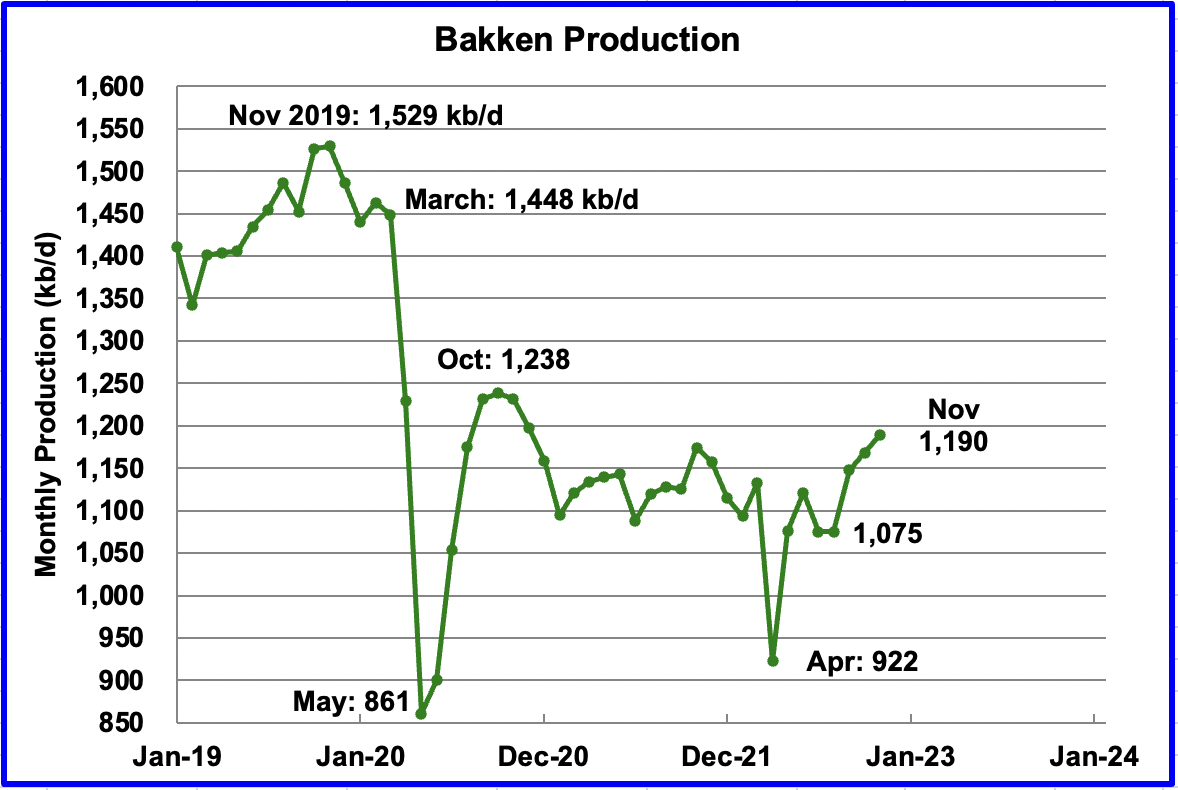

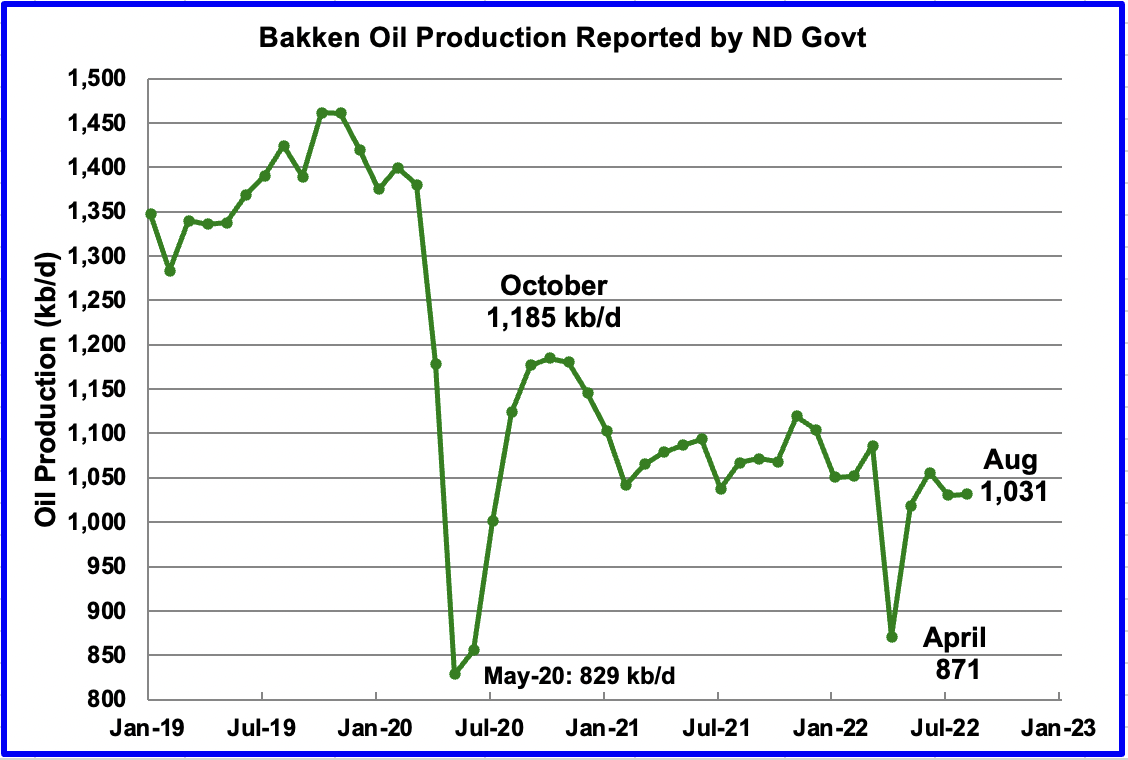

The DPR forecasts Bakken output in November to be 1,190 kb/d an increase of 22 kb/d over October.

This chart shows the Bakken’s output as reported by the North Dakota government. August production was unchanged at 1,031 kb/d and showing no sign of increasing production. The DPR Bakken chart above shows August production to be 1,075 kb/d, 44 kb/d higher due to the Permian basin in Montana. The trend in the two charts up to August is essentially the same. However, the DPR is forecasting increasing production in the coming months.

The projection for increased production may be due to this source indicating a steady stream of completed wells would increase production in September.

“There is a steady stream of newly completed wells, with a projection that September’s numbers will continue to increase.”

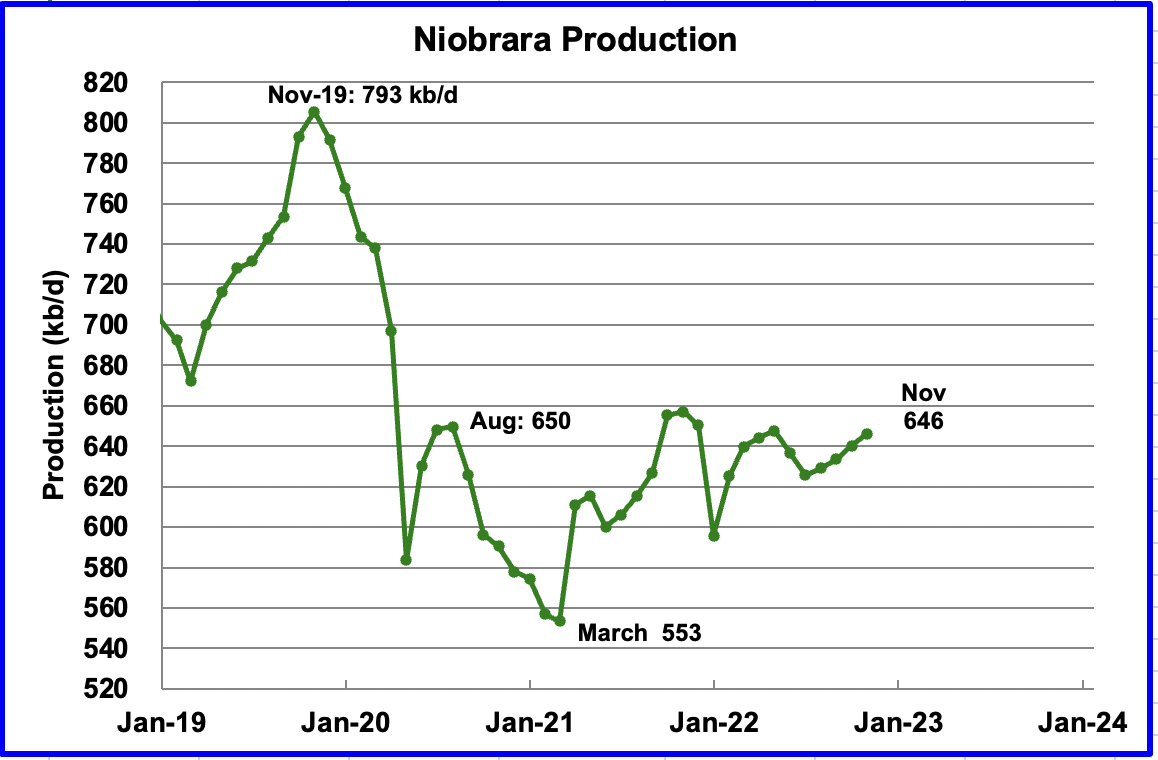

Output in the Niobrara continues to increase slowly. November output increased by 6 kb/d to 646 kb/d.

DUCs and Drilled Wells

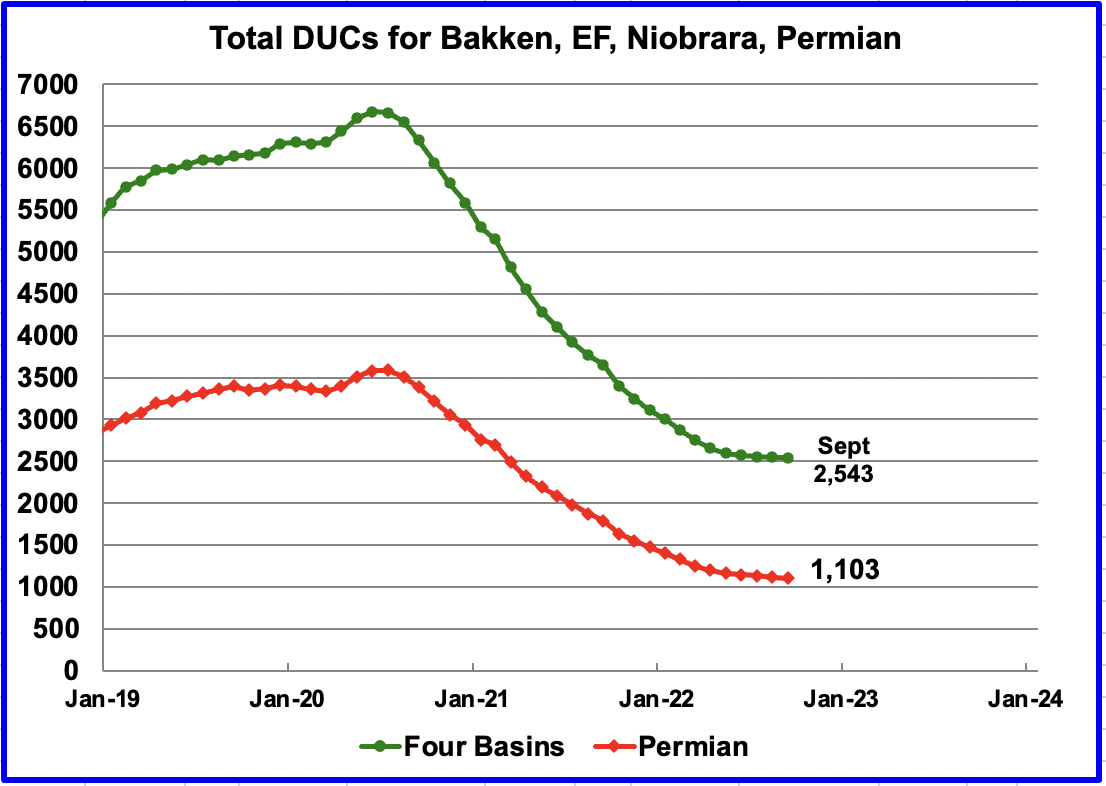

The number of DUCs available for completion in the Permian and the four major DPR oil basins has continued to fall every month since July 2020. Prior to July 2020 more wells were drilled than were completed. The last two data points show how the use of DUCs continues to slow and is further illustrated in the next chart.

According to this source, limitations on the ability to ship natural gas out of the Permian could affect crude oil production.

“From July 2020 to September 2022, the number of DUCs in the Permian region fell from to 1,103 from 3,590.

Meantime, because most natural gas from the Permian region is produced along with, and as a result of, crude oil production, limitations on the ability to ship natural gas out of the Permian region, known as takeaway capacity, could limit future crude oil production growth in the region, EIA said.“

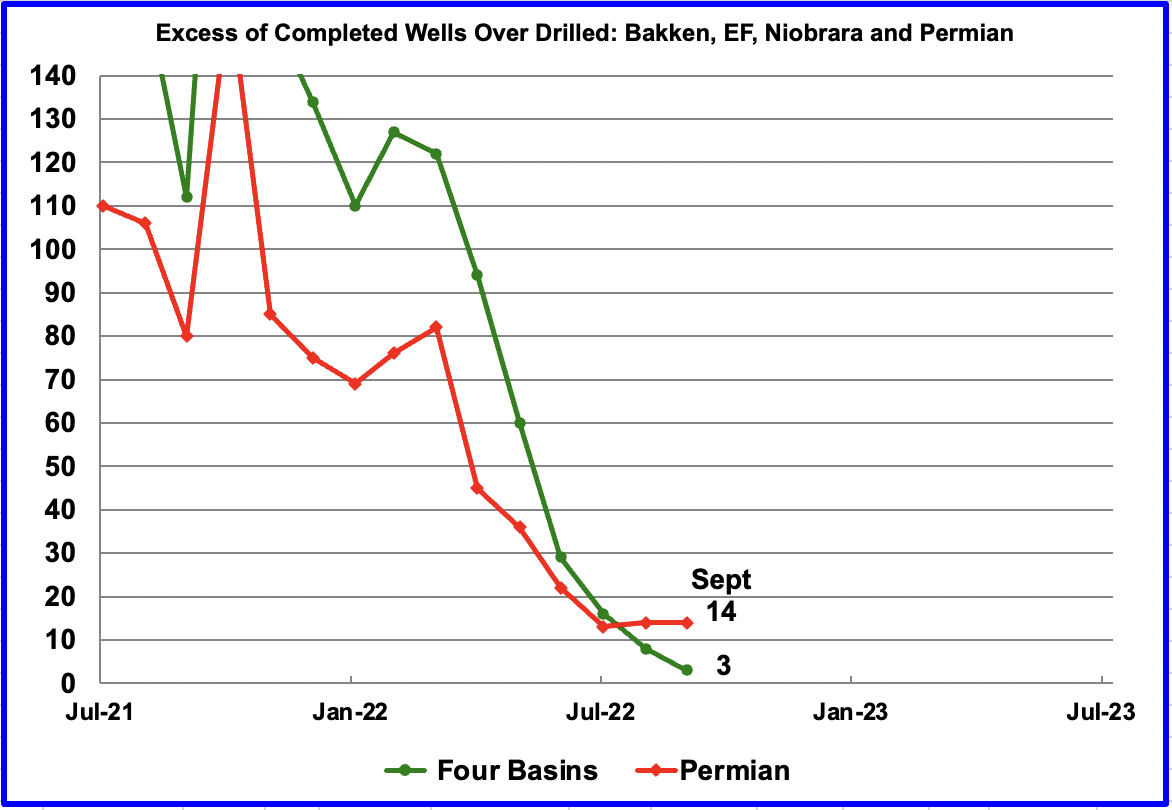

While this chart is titled “Excess of Completed Wells over Drilled”, it could also have been called “Monthly change in DUC completion rate” because the excess of completed wells in a given month is equal to the change in the DUC completion rate.

In these four primarily oil basins, the change in the monthly completion rate of DUCs started slowing after peaking in March 2021. In September 2022, there were 3 fewer DUCs (2,546 to 2,543 as shown in the previous chart) than in August. This means that the number of wells drilled and completed were essentially in balance in September in these four basins.

However in the Permian, the change in the monthly completion rate for DUCs has been unchanged for the last two months at 14. In September, the number of remaining DUCs fell by 14 (1,117 to 1,103 as shown in the previous chart). Note that since Permian excess well completions were greater than in all four basins combined, a few basins drilled more wells than were completed. For instance in the Niobrara, 126 wells were drilled and 111 were completed.

This chart shows that the completions of DUCs and the drilling of wells has stabilized in the Bakken, Eagle Ford and Niobrara basins while the inventory of DUCs continues to drop in the Permian.

In the Permian, the monthly completion rate has been showing signs of slowing since the recent March peak of 450. This is consistent with the frac spread chart shown above where there has been little to no growth in frac spreads since February.

In September 416 wells were completed, 5 fewer than in August and 10 fewer than in July. During September, 430 new wells were drilled, a decrease of 5 over August and 20 fewer than in March. This is the second time that there was a MoM drop in drilled and completed wells. The gap between drilled and completed wells in the Permian has reached a new current low of 14, which is the same as reported in the previous chart.

October Light Tight Oil Update

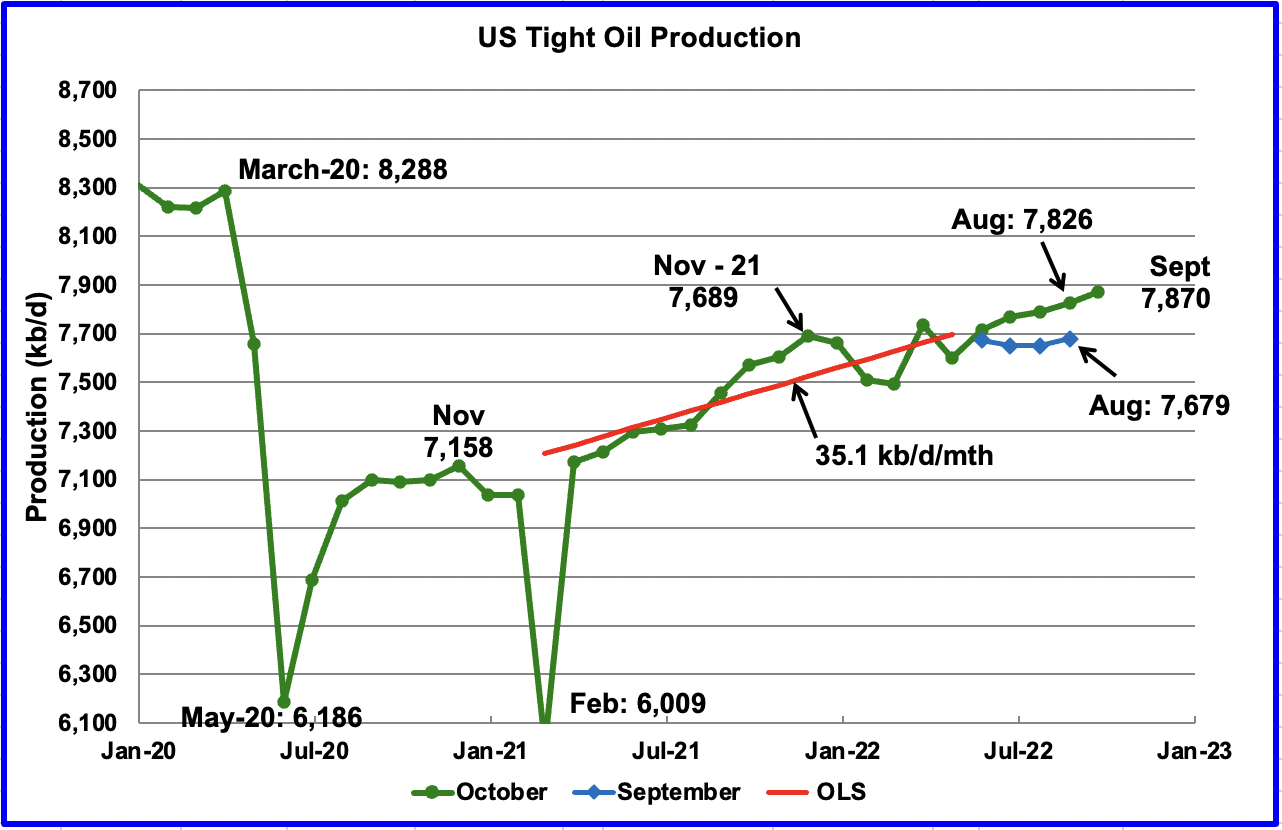

The EIA’s LTO database provides information on LTO production from seven tight oil basins and a few smaller ones. The October 2022 report updates tight oil production to September 2022.

This is the second LTO report published after it was updated because of operational issues. While the first report revised production down, a bit much it appears, this second report has revised production back up. It also appears to be more reflective of what is happening in the field because the latest monthly production increases/decreases appear to be in line with previous months.

September’s LTO output increased by 44 kb/d to 7,870 kb/d.

The EIA’s September LTO report made significant downward revisions to the production forecast published in the May report. The October report indicates the September downward revisions were overdone and have been revised upward. For instance the August production rate reported in the September report has been revised up by 147 kb/d, from 7,679 kb/d to 7,826 in the October report.

The red OLS line from March 2021 to September 2023 indicates a monthly production increase of close to 35.1 kb/d/mth. The red line stops at April because it masked the green line. The analysis covered the whole period March 2021 to September 2023.

September’s output increased by 44 kb/d to 4,748 kb/d and is 447 kb/d higher than the high of 4,301 kb/d recorded in March 2020. Interestingly the Permian increase is the same as the total for the LTO basin.

According to this source the Permian may have seen its best days. For Top U.S. Oil Producers, Permian Shale Output Is Losing Steam

The Bakken’s September LTO output increased by 6 kb/d to 1,038 kb/d.

According to this source there was a steady stream of completed wells that would increase September production.

“There was a “steady stream” of oil and gas drilling permit applications in August, he said. The drilling rig count continues to stall out in the mid-forties and is expected to do so for the rest of the year.

There is a steady stream of newly completed wells, with a projection that September’s numbers will continue to increase.”

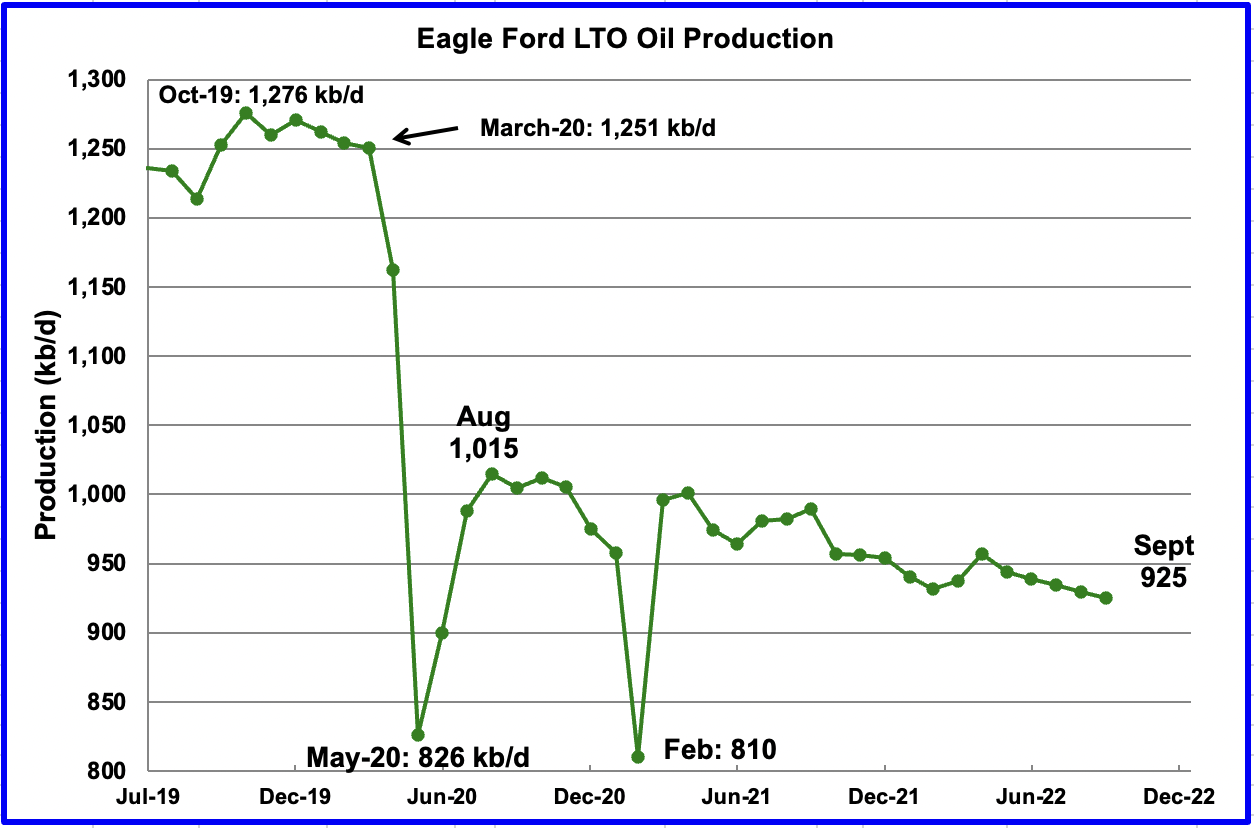

Production in the Eagle Ford basin decreased by 5 kb/d to 925 kb/d in September. Eagle Ford appears to have entered a slow decline phase.

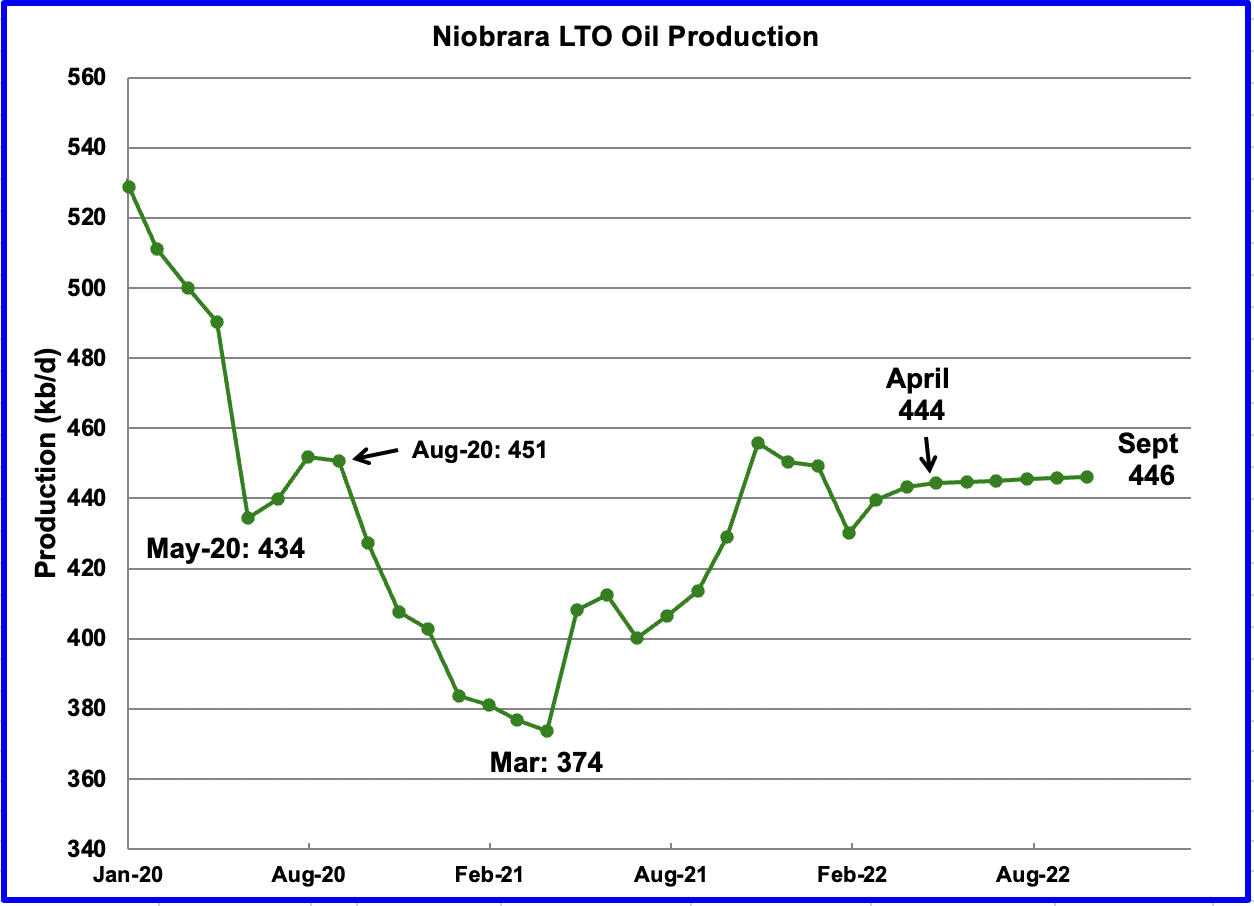

After increasing production from March 2021 to October 2021, output in the Niobrara began to drop in November 2021. Production since April has shown little growth. September’s output was unchanged at 446 kb/d and is up 2 kb/d from April.

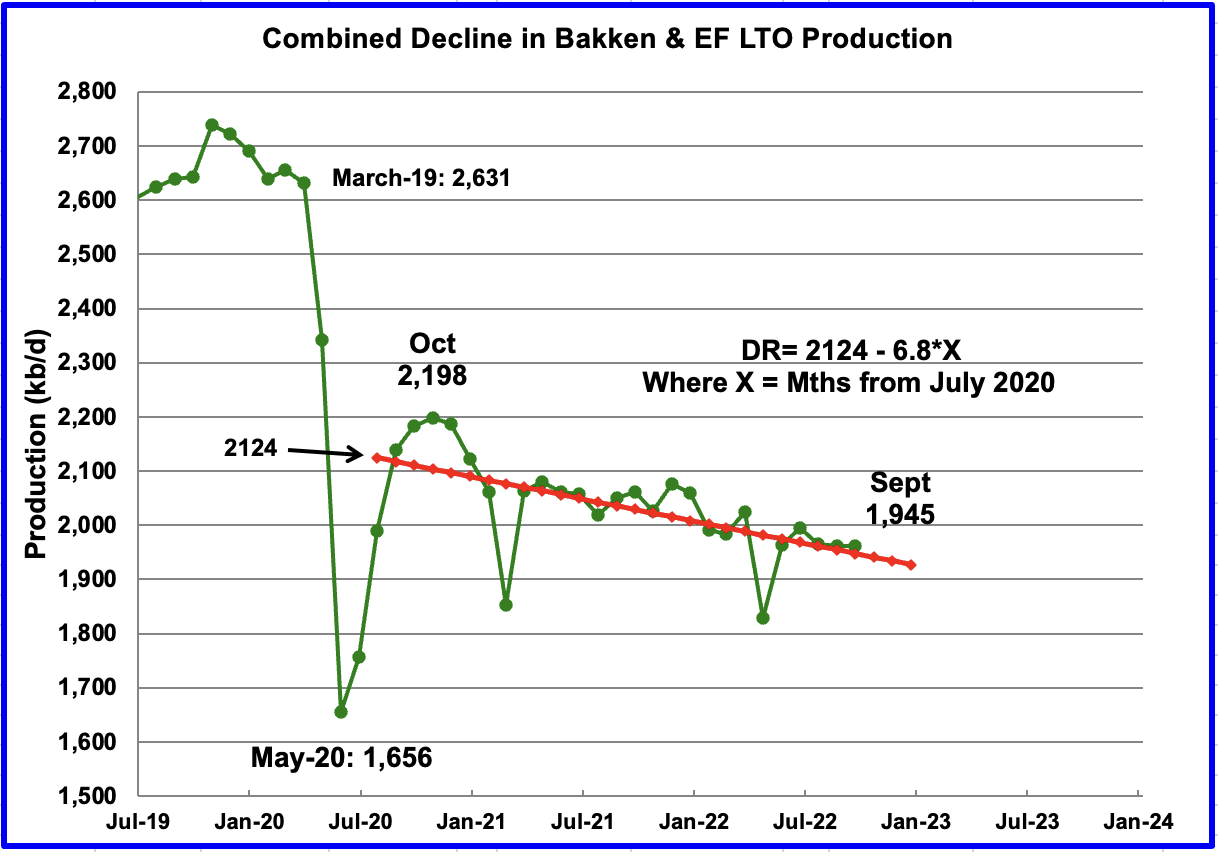

As noted above, monthly production in the Bakken and Eagle Ford basins since October 2020 has been in a slow decline. The decline being addressed here is not the rapid decline associated with LTO wells. Rather it is the decline associated with the lower productivity of new wells along with reduced investment in rigs and frac spreads.

The above chart is the combined output from the Bakken and Eagle Ford basins since they are so similar. Using data from July 2020 to September 2022, the OLS line gives a combined decline rate of 6.8 kb/d/mth.

On shore L48 Conventional Production

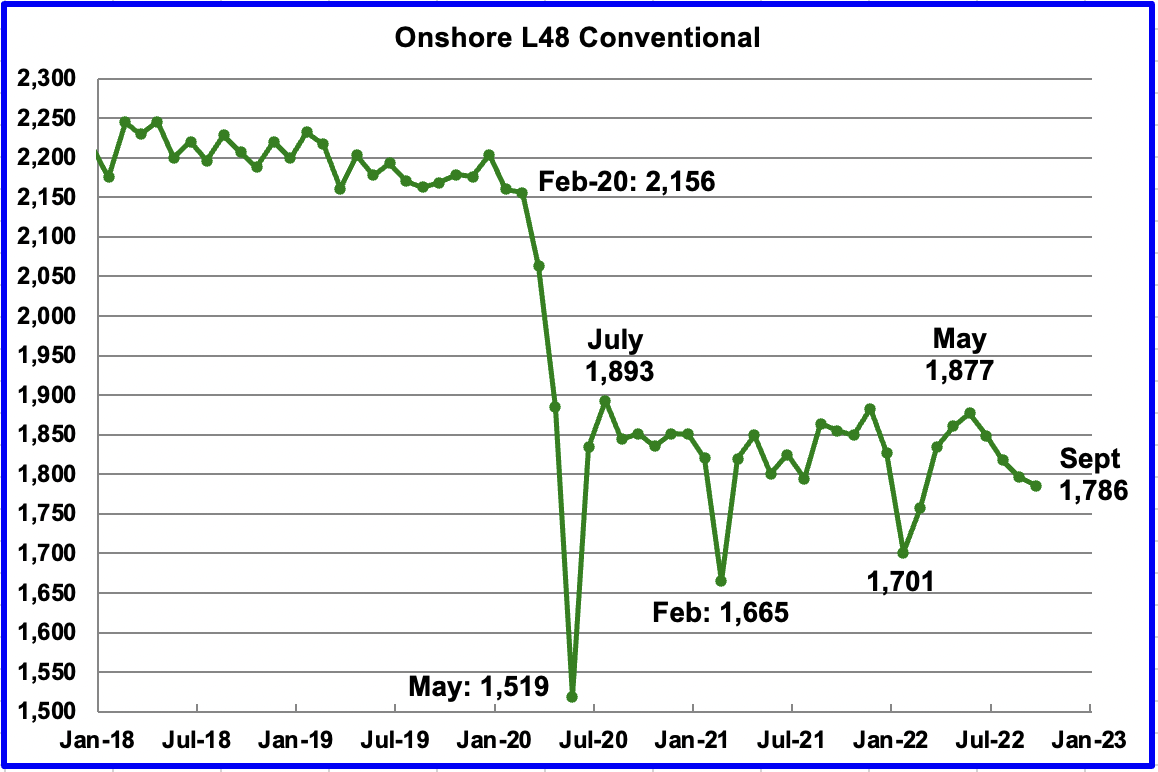

Conventional oil output in the Onshore L48 dropped by 10 kb/d in September to 1,786 kb/d and continued its decline from 1,877 kb/d which started in May. This estimate is based on a combination of the expected September LTO output and the October 2022 STEO report that has a September 2022 forecast for the US Onshore L48 output.

Production was essentially flat from June 2020 to June 2022. However since May 2022, a decline may have set in.

A note of caution is in order. This chart is derived by subtracting two large numbers which are subject to revision, particularly the last two months, August and September. Since there was an increase of close to 150 kb/d in LTO over the last four months, that has resulted in a similar drop in conventional crude.

Non-OPEC Production

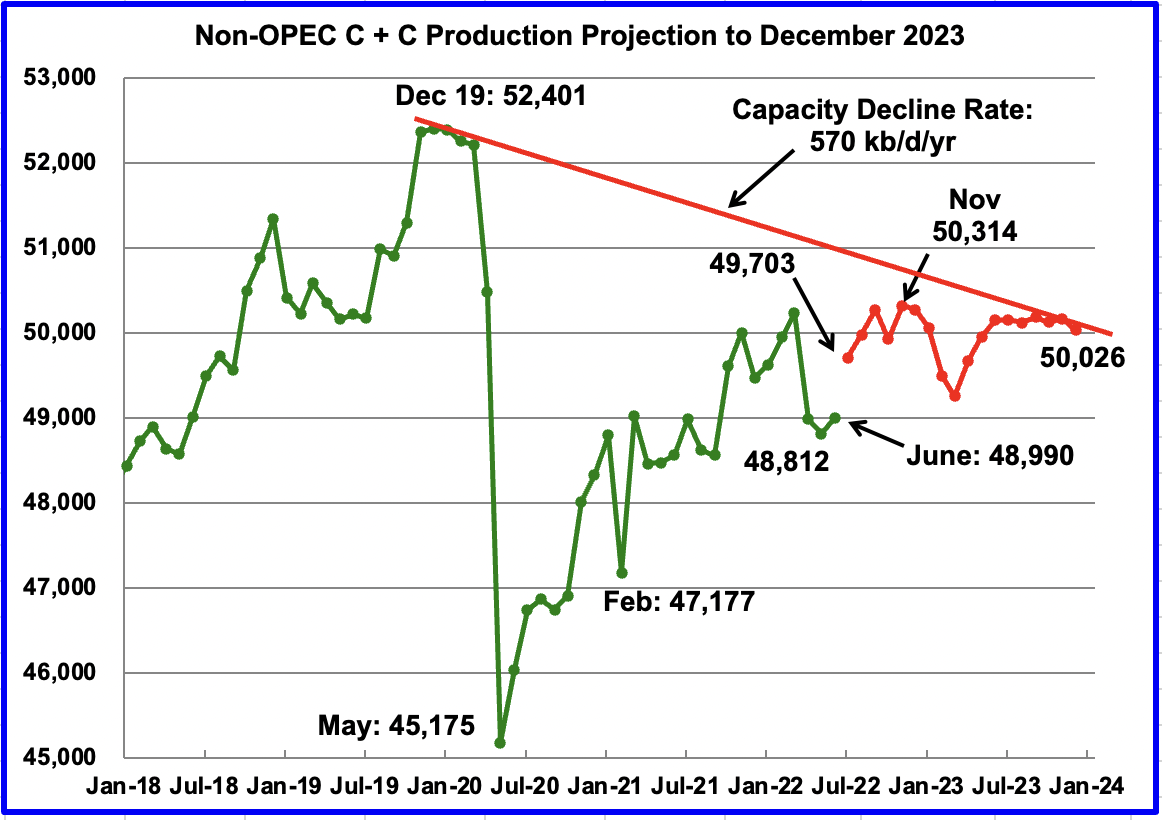

Non-OPEC oil production in June increased by 178 kb/d to 48,990 kb/d according to the EIA (Green graph).

Using data from the October 2022 STEO, a projection for Non-OPEC oil output was made for the time period July 2022 to December 2023. (Red graph). Output is expected to be 50,026 kb/d in December 2023. The July increase is expected to be 713 kb/d.

The projection shows that a post pandemic peak will be reached in the September to November time frame. Note that this high of close to 50,300 kb/d is the high for all of 2022 and 2023.

The red capacity decline line represents an average decline rate of 570 kb/d/yr for Non-OPEC countries over the four years since December 2019 and is combination of the natural decline rate plus possible reduction in exploration expenses and production/capacity investments.

Based on updated country data, the July increase of 713 kb/d will be provided by Brazil 155 kb/d, Canada 119 kb/d, Guyana 110 kb/d, Kazakhstan 214 kb/d and Norway 311 kb/d for a total of 909 kb/d. Offsetting this increase will be Russia with a drop of close to 217 kb/d, for an expected net increase of close to 700 kb/d. The EIA World report will be out with July crude production in about a week.

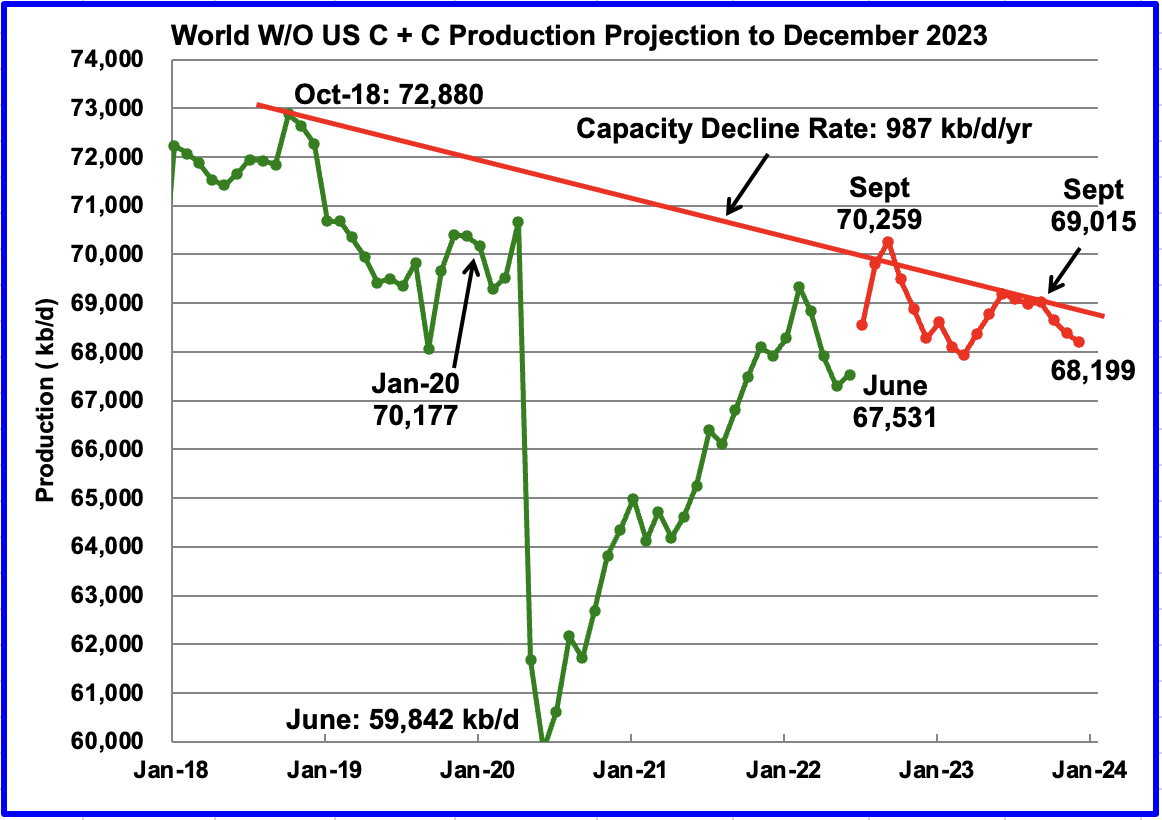

World Production W/O US

June World oil production W/O US increased by 234 kb/d to 67,531 kb/d according to the EIA (Green graph).

Using data from the October 2022 STEO, a projection for World oil output W/O US was made for the time period July 2022 to December 2023. (Red graph). Output is expected to be 68,199 kb/d in December 2023.

This chart also shows World production W/O the US with a post pandemic high occurring around September 2022.

The red capacity decline line represents an average two point decline rate of 987 kb/d/yr for World W/O US over the period October 2018 to September 2023. This is the highest decline rate seen over this period, provided the forecast is correct.

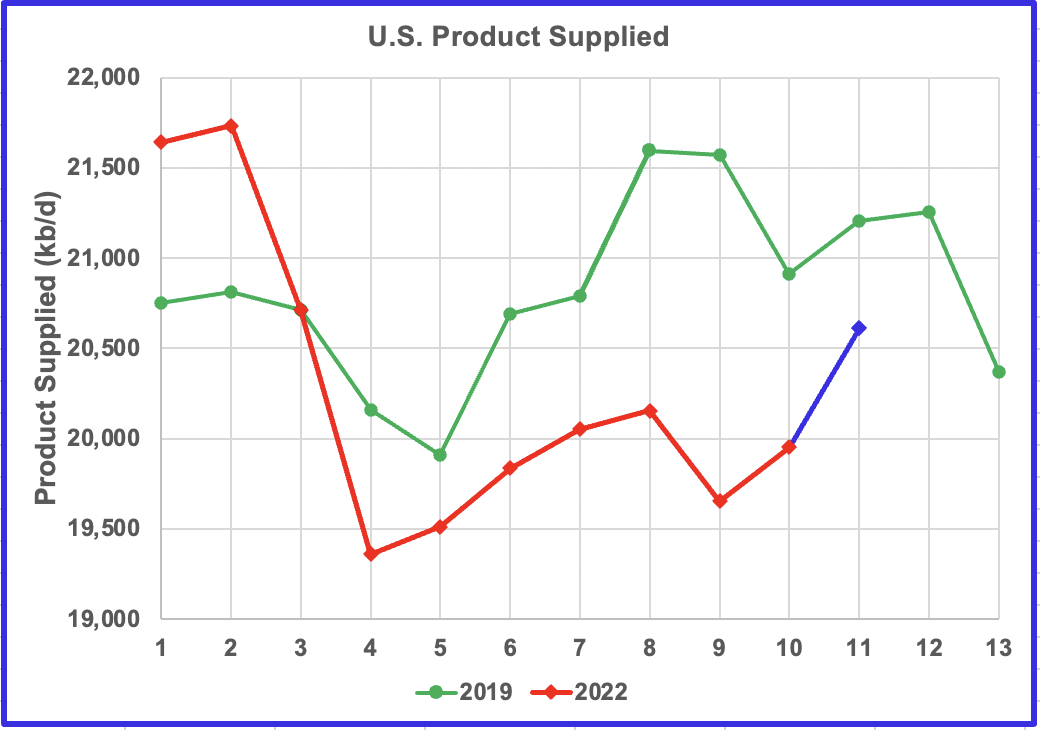

US Product Supplied

This chart shows product supplied in 2019 compared to 2022. The year has been divided into 13 four week segments. The last blue mark only represents the last three weeks. It does indicate that consumers are getting used to the currently higher oil product prices. Period nine shows an almost 2,000 kb/d decline in product supplied. The current period 11 is only down by 600 kb/d. Sounds like the US economy is on the mend.

Thank you Ovi.

As always, outstanding work.

Dennis

Thanks

Thanks Ovi, great charts.

The “On shore L48 Conventional Production” chart is very informative. Many thought the demand destruction in 2020 “saved oil in the ground” pushing the peak forward. That chart clearly shows that the demand destruction did not save oil, the opposite was the case. The shutdown of many marginal wells meant they would never be restarted again. So instead of “pushing the peak forward” it simply confirmed that the peak was in the past.

Ron

Thanks

I think “the Rest” chart under Alternative view of US production shows definite damage to the tune of 900 kb/d.

Yeah, and that’s just here in the USA. The same thing is happening in many other places in the world.

I have mentioned this before when I thought it was obvious in many other places. No one seemed to be paying attention, however.

Ovi,

A lot of that change in “the rest” comes from North Dakota and Colorado and perhaps some from some other tight oil basins. In fact if we look at US tight oil minus Permian basin tight oil and take the centered twelve month average(CTMA), we find that from the peak in October 2019 at 4452 kb/d to the most recent CTMA of 3127 kb/d (March 2022 CTMA), the difference is 924 kb/d.

Perhaps these other tight oil basins will never increase their output to the previous peak, it will depend in part on how high the completion rate rises in these other basins in the future.

Also if we look at the decline rate of “the rest” of US tight oil (excludes Permian Basin) from July 2020 to August 2022 the OLS regression suggests a monthly decline rate of about 4.75 kb/d per month.

Dennis, it doesn’t really matter where it came from, it happened. And it happened to 58 other nations, about 75% of the world’s oil producers. It appears that most of the wells shut down were marginal wells that will, very likely, never be restarted.

Click on the chart to enlarge it.

Ron,

For tight oil basins it is less about shutting down marginal wells and more about the rate that new wells are completed. If the completion rate decreases too much then output will decrease. It took over 15 years for the World to return to the centered 12 month peak of 63033 kb/d in October 1979 in Jan 1996. It is total World output that is the story. We ar likely to see continued increases in World output until 2030 unless the transition to electric transport reduces oil demand to less than available supply at prevailing oil prices so that we see falling oil prices, in that case we will have a peak demand scenario that keeps World output below the 2018 peak. If autonoumous vehicles start to be approved before 2026 and robotaxis take off shortly thereafter, we could see oil demand decimated by 2028 which would lead to falling prices and falling supply of oil. In this case you will be correct and I hope that you are, but I am not that optimistic, I expect we will have to wait until 2035 for oil prices to start falling due to lack of demand.

Link below to Tony Seba presentation (18 minutes)

https://www.youtube.com/watch?v=Vqs0_3M-18c

That’s all well and good Dennis, but how do you explain what about the other 58 producers?

Ron,

For some of those producers perhaps marginal wells have been shut down permanently and the oil may remain in the ground, also there may be some wells that have been temporarily shut in and will eventually be brought back online or redeveloped in the future.

If oil prices go up to $150/bo, different decisions might be made, if oil prices decrease due to lack of demand the scenario could be very different. The future will depend a lot on the balance of supply and demand which is difficult to predict.

Here are the gainers since January 2020. I think they have about reached their peak.

Click on chart to enlarge it.

I should have excluded both Permian and Eagle Ford to compare with US minus Texas and New Mexico, sorry for the mistake.

When we do that we get a 600 kb/d of the drop from CTMA peak to the March CTMA for US tight minus the sum of Permian and Eagle Ford, so about two thirds of the 900 kb/d drop in L48 onshore output comes from tight oil outside Texas and New Mexico, the rest may well be a drop in US L48 onshore conventional C plus C output of roughly 300 kb/d.

OPEC oil output falls by 20,000 bpd in October -Reuters survey

In October, the 10 OPEC members bound by the deal have a target to produce 26.689 million barrels per day (bpd), down about 64,000 bpd from September’s target.

According to the survey, they trimmed output by 20,000 bpd to 25.33 million bpd. Still, this was 1.36 million bpd less than called for by the agreement.

September output was revised down after a change to the estimate for Angola.

Did they really trim or are they at capacity?

https://www.reuters.com/business/energy/opec-oil-output-falls-by-20000-bpd-october-reuters-survey-2022-11-02/

Ovi,

We will know the answer when Brent oil prices are over $100/bo in 2022$ and the big OPEC oil producers (Saudi Arabia, UAE, Iraq, and Kuwait) can no longer increase output. Clearly the other OPEC producers (with the possible exception of Iran) are already at capacity, the others may already be very close to capacity unless they choose to expand existing capacity, but that will likely take 3 to 5 years.

Dennis

I assume you are implying that once Brent gets over $100, that OPEC will increase production to try to stop the increased possibility of entering a recession.

“The employment index decreased to 49.1%, from 53.0%. Note: Above 50 indicates expansion, below 50 in contraction.”

Ovi,

I think if oil prices are over $100/bo, OPEC will likely not have any production quotas, but if they do it will be obvious to all they are trying to hide their lack of capacity. So everyone will be expecting an OPEC increase, but it may not happen.

Oh, I’m sure the world isn’t heading into some mild turbulence.

Sure thing, Dennis, oil will go up $5/barrel and everyone will open the taps they’ve kept closed.

Stephen,

If oil prices remain well above $100/b, say $110 to $130 for a 12 month period (say a yearly average of about $120), OPEC will no longer be claiming the need to restrain output, whether they can actually produce higher output remains to be seen, my guess is it will not be significant in the short term, maybe in 5 years if they develop their resources more aggressively they could increase output a bit.

We will see.

Prolonged $120 oil might do something. $100 oil obviously won’t as we have seen earlier this year. Thanks for the clarification.

Stephen,

Earlier in the year oil was above $100/bo briefly, things might have been different if oil price had remained above $100/bo, we will know more if this does in fact occur in the future, it will probably take a year with oil prices above $100/bo to see the effect I expect.

Dennis, oil has averaged much higher this year than 2019, yet the rig count is much lower. Something fundamental has changed that your model is not picking up on.

https://oilprice.com/Energy/Energy-General/US-Rig-Count-Still-305-Below-Pre-Pandemic-Levels.html

Higher costs?

Labor supply, materials, and cost of capital

@STEPHEN HREN:

I am thinking it could be too things:

– Supply chain issues for rig components;

– No good spots to drill; shortage of spots

Stephen,

Tight oil producers are being much more cautious than in the past.

Stephen,

At the end of 2019 the oil rig count in the US was 677 and the most recent oil rig count was 613, about 10% below the end of 2019 level. I agree oil prices are higher, but tight oil producers have become less willing to invest since the pandemic, investors want high dividends and/or stock buybacks.

And likely they are running out of places to drill also.

Ovi,

I get a slightly different result for the OLS on US C plus C output from June 2020 to August 2022, with a monthly increase of about 48 kb/d (annual increase of 575.21 kb/d).

Dennis

Checked my data. Looks OK to me. If I plug in your constants into my analysis, the SS increases.

Not sure where the diff is. Will keep looking,

Ovi,

When I drop the Feb 2021 data point I get a slope similar to your analysis. It may be a coincidence?

For this second chart the slope at a monthly rate is 44.4 kb/d per month.

Dennis

When we were having a private off line discussion on how to deal with the Feb 20 low, I looked at the difference between leaving that data point out and using the average. In updating the latest three months I forgot that February contained the average of January and March.

I have updated the post with the correct slope of 47.9 kb/d/mth.

I am beginning to better understand why so many writers say away from numbers.

Thanks Ovi,

I figured it was something simple and likely my error rather than yours.

Sorry to be a pain, note that your idea about dropping the data point may be a good one in this case, I tried a very simple method of minimizing the absolute value of the residual rather than the square and go a slope of 40/kb/d per month. This is a simplistic way of doing so-called “robust regression”, that are resistant to outliers. There are better methods available in R, but I have not yet gotten up to speed in that language where there are much better regression tools than simple OLS.

In short your 44 kb/d per month estimate may indeed be the better estimate.

If I figure out the robust regression, I will let you know by email.

Dennis

There is not much difference between between 44 and 40 or 48. What was concerning to me in the earlier STEO reports was the sudden increase in slope starting in September 2022 from around 50 kb/d/mth in the previous months to 75 kb/d/mth after.

I think the revised LTO report has affected both the DPR and the STEO for the better.

As for better regression, I recall reading many years ago of using a moving average and then regressing. Not sure if the is discussed anymore.

Permian tight oil output using data from tight oil production estimates by play at link below

https://www.eia.gov/petroleum/data.php#crude

The OLS regression is on data from August 2020 to September 2022 for Permian basin tight oil output. Monthly rate of increase is about 45 kb/d per month.

Permian Basin tight oil output is the sum of the Spraberry, Wolfcamp, and Bonespring formations within the Midland subbasin in Texas and the Delaware subbasin of Texas and New Mexico. The Spraberry formation is in the Midland basin and the Bonespring formation is in the Delaware basin, the Wolfcamp formation is in both the Midland and Delaware basins.

Many have claimed this rate of increase cannot continue, but keep in mind that the annual rate of increase in percentage terms is about 13% over the Aug 2020 to Sept 2022 period. Over the July 2017 to June 2019 period the average annual rate of increase in Permian tight oil output was about 37.5%.

I think when Scott Sheffield and others try to tamp down expectations of future Permian tight oil growth, they are saying don’t expect 37% annual rates of increase in the future. My guess is that a 500 to 550 kb/d annual rate of increase can be maintained for 5 years or so for Permian basin tight oil with a gradual decrease in rate over time. This assumes that oil prices remain relatively high (over $90/bo for average annual oil prices from 2023 to 2028).

Dennis,

There is no way the increase you suggest will be happening. Did you notice the aggressive drawdown of DUC inventory in the last 18 months? Without the DUC completions, we would have seen little to no production growth in the Permian (including New Mexico) Prices need to be at least above $125 per barrel to expand drilling and completions taking into account current inflated costs. Furthermore, once we do start seeing production declines, they will be like falling off of a cliff. You will see a greater than a 100,000 BOPD each month.

Another real problem with the Permian is gas take away. The Producers are getting hammered with low Natural gas prices and Pipeline Midstream Companies are loathed to commit a tremendous amount of capital to build to this region when they know, the region will begin terminal decline very shortly.

LTO Survivor,

The recent drop in prices at Waha Hub is likely temporary due to maintenance and more pipeline capacity is scheduled to come online. Yes I have noticed the DUC inventory has decreased and also have noticed that it is decreasing more slowly of late, if completion rate comes down just a small amount and rig count rises just a bit the DUC count will start to rise in the Permian basin. Also costs may come down as commodity prices were sky high and are coming down, it will take 6 to 12 months to this to feed in to steel pipe and other input prices. I would think excess natural gas could be used to run frac equipment instead of diesel and if natural gas prices are low this would reduce cost.

I think $100/bo and $5/MCF are enough to see Permian output continue to expand at about 8.5% per year.

We will see.

Below is a more conservative Permian scenario with the monthly completion rate gradually increasing from 400 completed wells per month in Dec 2022 to 450 wells/month in Feb 2027 (an increase of one well each month over that 4 year period. I expect this scenario will be too conservative unless oil prices remain under $90/bo. The annual growth rate is about 5.7% for this scenario.

Forgot units on chart, vertical axis is in kbo/d, the annual rate of increase for this scenario is about 300 kb/d.

When do you expect the 100 kb/d monthly decrease in Permian output to begin? Notice what is happening in the Eagle Ford and Bakken, output is declining but at more like 5 kb/d month.

Terminal declines in the Permian very shortly??? In the greatest petroleum system on Earth? That’s silly vodka talk. Pipes will still be built, expanded and maintained for decades in the Permian.

Terminal declines in the Permian very shortly??? In the greatest petroleum system on Earth?

What a relief to know that we have a brilliant oil field geologist on this blog. Smart enough to know that the Permian makes Ghawar look puny.

No different than another person opining that terminal decline is imminent in the Permian. I just happen to disagree… opinions vary. We are all just staring into crystal balls anyway.

I never compared Permian to Ghawar… that’s your comment. However, given a choice of any spot on the planet to own acreage, Permian would be mine. It is still surprising us with world class new plays and rebirth of old plays… truly an amazing complex.

Ghawer is obviously an amazing beast too, but not really a clean comparison vs. Permian… A “single” field vs. a multi-basin and platform complex with thousands of fields. Not really fair to Ghawar.

But thanks for the warm wishes, Ron.

I was referring to “total barrels produced, or will be produced.” Ghawar began production in 1940 and has cumulative production of over 70 billion barrels. Approximately 60–65% of all Saudi oil produced between 1948 and 2000 came from Ghawar.

Anyway, what the hell do I know? I am not an oil man. But LTO Survivor is an oil man. He is an actual Texas oil driller. I was just taking his word for the situation. What are your credentials? Why do you think you know more about the Permian than he does?

Ron,

Scott Sheffield is CEO of the company with the highest oil output in the Permian basin (Pioneer Natural Resources). He says:

“With an inventory of more than 20 years of high-return wells, our improved 2023 development program is highly repeatable and will deliver affordable energy to the world…”

Sorry Dennis, but this man is obviously lying, perhaps to pump up his stock price. It is impossible to have 20 years of high return wells in the Permian. As you know Permian shale wells drop about 80% of their production in the first 2 years. But he is saying they will produce high returnes for 20 years? Bullshit!

Okay, quite obviously, he is talking about reserves, not actual producing wells. That’ tricks they play in order to pump up their stock. However he cannot know how much oil those reserves will produce.

LTO Survivor,

I found this article today, see link below, arlicle published November 3, 2022.

https://www.naturalgasintel.com/pioneer-aiming-to-limit-exposure-to-weak-waha-natural-gas-prices/

Excerpt:

Pioneer CEO Scott Sheffield has increasingly focused Pioneer’s operations on the Permian’s Midland sub-basin, citing what he said is superior inventory to that of the Delaware sub-basin.

Pioneer is targeting full-year 2022 capital expenditures (capex) of $3.6-3.8 billion, to be fully funded by cash flow.

Pioneer plans to operate an average of 22-24 horizontal drilling rigs and about six hydraulic fracturing fleets in the Midland for the year, and to place 475-505 wells on production.

The company is forecasting 2022 production of 623,000-648,000 boe/d, including oil output of 350,000-365,000 b/d.

“To further enhance our top-tier free cash flow generation and return of capital, we have increased the return thresholds for wells to be included in our future development programs, which is expected to improve our program well productivity in 2023 and subsequent years, surpassing 2021 productivity levels,” said Sheffield. “Additionally, our current 15,000-foot lateral program, which we plan to expand in 2023, is delivering improved returns through lower capital costs per lateral foot.

“With an inventory of more than 20 years of high-return wells, our improved 2023 development program is highly repeatable and will deliver affordable energy to the world, with some of the lowest emissions as a result of the company’s high environmental standards.”

Dennis do you have any idea of the technical geoscience and engineering work required to get 1 location ready for a drill bit much less the technical work required to count “drillable ready for the drill bit” locations for the next 20 years!

Do people really believe this nonsense? Are you all in Dennis, portfolio wise with PXD?

Scott Sheffield: “With an inventory of more than 20 years of high return well, our . . .program is highly repeatable . . as a result of the company’s high environmental standards.”

I get a really good laugh when I read someone citing Scott Sheffield. Scott isn’t talking to me or you Dennis. Scott is talking to PXD’s bond holders and Wall Street.

And the word on the street in Midland, Texas is that the internal discussions at PXD is “how do we shift PXD from a “pure play Permian” company to a different and preferably new basin?

And this discussion is not limited to PXD.

John

US economy is definitely not on the mends. GDP was 2.9% for the quarter. Of which 2.8% was exports. Mainly high priced natural gas to Europe.

Not really what you want to see. You want to see Imports going up because that means US consumers are buying lots of stuff.

US economy is decelerating. And will continue to. The recession is just getting started.

Diesel shortage that can’t be fixed in a speedy manner will equal mass layoffs.

HHH,

Note that a lot of the high price of natural gas in Europe goes to the middlemen transporting the LNG, see

https://www.forbes.com/sites/thebakersinstitute/2022/10/26/whos-to-blame-for-exorbitant-natural-gas-prices-in-europe-hint-maybe-not-who-you-think/?sh=6f42cb447fa9

Excerpt:

Currently, given high prices, Europe is one of the major markets for this gas but it is not the US LNG exporters or US gas producers who pocket the steep price difference between HH and European spot prices. It is the “middle men” companies who buy natural gas or LNG in the US and sell LNG in Europe that receive the windfall.

HHH,

The claims of a diesel shortage are overblown see

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WDIUPUS2&f=4

Dennis,

The reason for the higher Diesel & Natgas prices is due to Free Market Capitalism. The U.S. has been exporting on average, 1.2 mbd of Diesel and 10 Bcf/d of Natgas. If we kept some of this to fill our inventories to the normal 5-year average levels, we wouldn’t be seeing our diesel inventories at 106 million barrels when they should be closer to 140 million barrels.

Now, with the next round of EU Sanctions on Russia, to stop receiving Russian diesel imports, the U.S. will likely be EXPORTING MORE DIESEL to Europe.

So, we can thank EUROPE for even higher Diesel prices in the future… GO EUROPE… keep the hammer on Russia… LOL.

GOD HATH A SENSE OF HUMOR…

steve

Thanks Steve – So that’s why stocks are drawing down so much, producing 5, exporting ~1.2, and still consuming ~4.3, so net effect is every day distillate stocks are dropping 500k, only ~100,000k in the piggy bank so can’t keep this up for too much longer…

All the while high diesel prices here and abroad are causing major damage to global economy…

So, maybe the diesel shortage is real? Or maybe very soon it is going to be more real?

KENGEO,

The Diesel Shortage is tied to the problems stemming from Europe and will likely worsen if we export more diesel.

However, I see a continued structural diesel shortage in the world as global oil production declines.

steve

Dennis –

I think I agree with you about the diesel situation, but some of the trends are concerning, and if the Permian pulls back significantly like many of us think it will then things could change very quickly…

That’s curious why heating oil is double the price it was a year ago?

Also, distillate stocks a year ago were 127,000,000, as of 10/28/22 they are 107,000,000 (30 days supply vs 25 days). Dist. production stands at 5 MBpD, versus ~4.6 a year ago. This should result in a slow build as long as demand is not too high…refining margins are all time highs (diesel in Europe is $8-10 per gallon, about double US price), so refiners are producing at max capacity…but what is strange is that in past month overall distillate stock has dropped 5%, must be exports drawing supplies down…

New England and Central Atlantic are running at 52% from a year ago…

Demand doesn’t appear to be waning much (currently above levels from a year ago) – peak demand should hit in next 1-2 months… I guess most people fuel their trucks and heat their homes regardless of price, if they don’t drive then they have no income…if they don’t heat their homes they are dead…

Kengeo,

Fewer people are heating with fuel oil, many are switching to natural gas, propane, or installing heat pumps. Few people drive diesel passenger vehicles in the US. Stocks of diesel have decreased a bit, if supplies become short less will be exported.

There is not much sign of Permian output decreasing at present.

Kengeo,

Distillate exports are coming down of late.

Also worth noting that 25 days of diesel supply is a little bit misleading, because it includes product that is required to just keep the system running: such as, process inventory in refineries, volume required to fill pipelines, product trapped in tank bottoms, product in rail and truck transport etc.

PADD 1 distribution stress is already starting to show up, they are likely the bellweather for when the system disintegrates due to a lack of sufficient operating inventory.

Old Chemist , intelligent post . X number of days is not important , what is important is MOL ( Minimum Operating Level ) . A business does not shutdown because it has zero turnover , it shutdowns because sales are not enough to meet the expenses at the MOL ( also called breakeven ) . Kudos .

HHH . $ 1 trillion flew out of the emerging markets to USA . The Eurodollar problem is a bitch . India’s reserve one year ago were $ 640 billion now $ 525 billion . $ 115 billion gone in a year . Affordability of oil is now an issue for several countries .

Petrodollar is really just a myth. It doesn’t and has never really existed. It’s Eurodollars that are used to settle oil transactions. And no the FED and US government don’t control the currency that global settlements are done in.

HHH

After decades of running a trade deficit, a little export led growth can’t hurt America.

Ovi – Thanks for doing this update.

Your fingers must be sore from all the CTRL+C / CTRL+V just for the charts!

Thanks

WP

WeekendPeak

Thanks.

Yes it takes time but it also fills the time with a very interesting subject that most of the world is ignoring. My biggest problem is typing.

Ovi you do an outstanding job for this website. I for one am very thankful for everything you do.

LTO Survivor

Thanks. I am also thankful for Dennis and his contribution who does so much to keep the discussion going.

Thanks also for your hands on information.

In the discussion of oil production the focus on global production glosses over the unequal distribution energy among countries, and that effect on the economic prospects of most major countries of the world.

Up above it was stated ” It is total World output that is the story.”

As I see it- The big story is just how much crude oil and derived products are available for net export.

Consider that 8 of the top 10 biggest economy’s of the world are big net oil importers

[in order of GDP this includes China, Germany, Japan, UK, India, France, Italy, and S.Korea]

The other two on the list are Canada (clearly a long term net exporter), and USA. For the last 30 years the US has been a big net importer of oil (with the possible exception of the last couple years?).

Beyond the top ten biggest economies, there are over 100 other countries that are heavily dependent of oil imports.

Take S. Korea for example- A big industrialized economy in a country that has no domestic fossils. Oil contributes 43% of total energy consumption. The only current sizeable non-fossil energy is nuclear at 11% of total supply, and the output level has not grown in the past 35 years. Hydro, bio, wind and solar combined for less than 4% of total.

Their solar prospects are fair- annual insolation level on par with Toronto or Budapest.

Their onshore wind reserve is poor, the offshore wind prospects are not prime.

Transport use of crude is roughly 50% of total, with the other 50% being utilized for a wide range of industrial applications. Very little of that industrial use can be replaced by electricty. I don’t know if much can be offset by nat gas liquids or coal.

Consider that Naphtha as a petrochemical feedstock is 47% of total crude oil product consumption.

Clearly, if less oil is available for export then this country is going to experience big economic and social problems. And they are just one country of many. China, Japan, Germany have very similar problems.

https://ourworldindata.org/energy/country/south-korea

https://www.enerdata.net/estore/energy-market/south-korea/

Hickory,

Korea is expanding there sales of EVs

http://www.koreaherald.com/view.php?ud=20211115000649

and

https://www.seoulz.com/the-electric-vehicle-industry-in-korea-3-million-evs-by-2025/

I have no doubt that Korea will make a dramatic shift this decade toward electric vehicles, and will do a hard ramp up on solar.

That will help the situation from being quite as problematic/severe.

A big point of giving this example is that over a hundred countries are going to be competing for a dwindling supply of export oil. This competition for the products has always been a big issue, but will become an existential level competition as the next decade or three unfolds.

Some countries simply will not have the cash or credit to purchase what their economy needs for base operations and industries.

Efforts to replace demand with electric sources will help somewhat- much more in some countries than others.

Most countries are getting a very late start at those efforts.

But electricity can not replace some of the uses of oil, such as petrochemical feedstock.

D Coyne: “I think when Scott Sheffield and others try to tamp down expectations of future Permian tight oil growth, they are saying don’t expect 37% annual rates of increase in the future. My guess is that a 500 to 550 kb/d annual rate of increase can be maintained for 5 years or so for Permian basin tight oil with a gradual decrease in rate over time.”

Mr. Sheffield was the first person in the Permian Basin to warn that the GOR was rising inexplicably (2017). I’m sure his engineers and geologists informed him of the complex geologic physics involved.

In low permeability reservoirs (shale), solution gas separates from rock when the reservoir pressure drops lower than the bubble point of the gas. At that point, the gas emerges from solution, and also out of the rock. What causes the reservoir pressure to drop? Well, the removal of hydrocarbons, for one thing. Drilling an infill well too close is another. Sound familiar?

This point is marked by more than just gas coming out of solution. It is also the point where the oil cut falls. Necessarily, the GOR increases. By definition (of a light tight well), the bulk of the oil is of short-chain hydrocarbon molecules, but it is the longer chain (C6+) that cause all the problems. When the pressure falls, they get lodged in artificially fractured pores–billions of them.

By this point, the average Wolfcamp (both A & B benches) oil cut has dropped substantially, driven by aging wells hitting their bubble point. The GOR has to rise. It’s not talked about much.

This awful feature that Mr. Sheffield warned about was preceded by the same thing in the Bakken, the Niobrara, and the Eagle Ford. It happens in every shale basin. This interesting oil-gas-pressure interaction with the fracture spiderweb determines more than anything else the longevity of a shale oil well. The only thing keeping oil production rising in the Permian is the drilling of a great number of wells. When multiple thick benches were found in the NM part of the Permian, most of the rigs left the other basins. If the rig count doubled in the Bakken, the average production would rise dramatically and the GOR would fall. For a while.

Alas, a rising GOR is much more of a harbinger than was initially thought. This gets measurably worse when you try to crowd the field: two wells per 1280 acres is too few but twenty is too many. The only thing so far that will slow down decline is the injection of field gas to maintain reservoir pressure. The more ethane percentage in the NG the better because it is a superior solvent for naphthalenes and asphaltenes and even longer-chain hydrocarbons–it keeps the pores open longer. But eventually the inevitable will occur.

ALL shale oil fields are in decline. Enjoy the IP, because that’s where the money is. In fact, if you can’t reclaim 100% of your investment money from the IP, don’t participate. That’s my suggestion.

Different look at tight oil GOR for Permian, Bakken, Eagle Ford, and Niobrara Basins.

GOR data from EIA

Gerry,

You are correct on all points. More than one year payout of a well is just trading dollars. Pioneer is a bell weather major independent. When they signal they are looking for other zones, this tells the market a whole bunch about their drilling inventory.

The UK oil and gas reserves for 2021 were issued by the NSTA (ex OGA) in September. All areas, including one time frontier West of Shetland, are past mature and there are very few new discoveries or reserve revisions (actually P2 oil numbers have declined in the last four years showing negative revisions to existing discoveries). There is continuous trumpeting of the potential for multi billion barrel new developments but almost no sign of them, and as more and more main platforms are decommissioned the chances for developing small deposits, that would only have sufficient ERoI as tie-backs, fall away.

Oil has an R/P around nine and has been fairly stable. This equates to over 10% decline.

Natural Gas is in slightly worse shape, and the desire for increased draw in this and future winters is likely to increase decline. R/P is about seven, equivalent to about 14% decline without new additions.

(actually P2 oil numbers have declined in the last four years showing negative revisions to existing discoveries).

The official name for that phenomenon is “reserve shrinkage.” 🤣

Ron,

Note that the cumulative 2P reserve line is the one to pay attention to, this is the engineering best estimate, it has dipped a bit, especially when oil or natural gas prices fell, but the big dips are in the 3P reserves which include the possible P3 category which are more speculative.

Almost certainly because a number of largish start-ups from 2017/2018 have significantly underperformed: WIDP, Laggan (condensate), Scheihallion redevelopment, Clare Ridge and, especially, Mariner.

and

I like listening to Charles Hall, even when he’s repeating things I’ve heard before. I’d bet he’s great company over a beer: https://www.youtube.com/watch?v=6DABEN4slmo

Thank you! The Q&A portion is just a hoot!

Everyone is ignoring crude oil supply. Peak oil demand is all that anyone talks about. However, I believe the UAE’s Energy Minister Suhail Al-Mazrouei is obviously talking about the geology of peak oil supply here, not the economic concept of peak oil demand.

UAE Believes The Oil Industry Is In “Decline Mode”

Crude oil is in “decline mode” in the long term, OPEC heavyweight the United Arab Emirates (UAE) says.

“To assume oil is going to be there forever is wishful thinking,” the UAE’s Energy Minister Suhail Al-Mazrouei said at the ADIPEC energy conference, as carried by Bloomberg.

“No matter how much we defend it, it’s in decline mode,” said the official from the UAE, one of the most influential members of OPEC and a major crude oil exporter.

Ron,

The demand forecast by OPEC is what they are hoping for, in this case they are perhaps worse than the EIA. The IEA is closer to the truth in my opinion. If autonomous vehicles ever reach level 4 autonomy, then oil demand very quickly crashes. Lots of companies are working on this (Tesla, Google, Apple, and most major auto companies (Ford, GM, Audi, VW, Mercedes, Nissan, BMW, Honda, Toyota, Kia/Hyundai) it only take one company to break through and take over the market. I expect this may happen between 2025 and 2030 (regulatory approval in California), once it occurs it will spread rapidly in the US and then throughout the OECD.

I suspect that the impact of autonomous vehicles deployment on oil demand will take much longer to materialize than you Dennis. Maybe ten years later.

Perhaps I am just unimaginative on it, or perhaps just realistic.

I am certainly am not well educated on it, so take my comment with salt.

Hickory,

See following video, 19 minutes.

https://www.youtube.com/watch?v=Vqs0_3M-18c

Fleets discussed starting at minute 4, autonomous vehicles around 7 minutes,

Transportation as a service around 11:40, it will be ten times cheaper per mile than a new car, and 4 times cheaper than just the operating cost of a car that has already been paid for (say you were given an old car by your neighbor). The expectation is that oil demand falls to 70 Mb/d by 2030 and oil prices fall to $25/bo.

Also the point is made that hardware costs are decreasing exponentially while software improvements are progressing exponentially, making AI improvements increase at a double exponential rate, Machine learning is the key behind AV development, it might take much longer than Tony Seba believes, but his past projections from 2014 were pretty good (see first 7 minutes of video where he talks about EV costs and availability of 200 mile range EV for under 10k.) Also see link below.

https://www.greencarreports.com/news/1133768_volvo-parent-geely-reveals-9-000-geometry-ev-for-china-bullish-on-battery-swapping

Also I have long held the view that it would be 2035 before this happens, I am just suggesting that once AVs are approved, Lyft and Uber, and perhaps Tesla will go all in on robotaxis and will make the passenger vehicles owned by the middle class obsolete, wealthy people will still own their own vehicles, and trades people that need to carry their tools and supplies to jobsites. For many they will simply call Uber, Lyft, etc.

Seba [@ around 15:52] says they project that by 2030 Auotnomous EV with Transportation as a Service will account for 95% of global passenger miles.

I don’t buy it. Add 10 years and cut it to 50%. Maybe.

And I consider that very optimistic.

But then again I was born in the last century, and do see the world as having tough limitations to growth.

The transition from horse to car was very quick among those who had some cash/credit, but that was an incredibly compelling revolution in transport, cost, labor, and land use.

While the possibility of improvement in affordability and safety is considerable with electric autonomous transport, the degree of improvement over self-driven EV is not anywhere close in magnitude to the revolution of car over horse before WW1.

Most people who can afford to have their own vehicle will continue to do so.

Maybe people who live within dense cities, or in other countries, see this picture differently.

Hickory,

The key factor for Seba is that AVs will reduce the cost of transport by a factor of 10 relative to ownership of an ICEV, he also points out that an EV will last 500k to one million miles, the average car user drives about 10k per year, a personal vehicle that lasts for 100 years is not practical for most individuals, but for a fleet use where vehicles often travel 50 to 100k per year these vehicles make more sense.

I agree the forecast by Seba is optimistic. I also thought he was optimistic in 2014 when he suggested a 200 mile range EV for 10k by 2025, the Geometry EX3 was only sold in 2021 and was replaced by Geometry E in 2022 and the base price is 13K, for version with 200 miles of range, so we are not at 10k yet, but perhaps the 2014 estimate for a 200 mile range EV at around 10k might be met by 2025.

Generally these changes happen about 10 years sooner than I think. I know when I saw my first iphone, I thought, I have no use for that. Probably within 5 years I owned a smartphone.

Difficult to know how it will play out, but I think it will be slower than Seba thinks, but faster than your current belief. I hope I am wrong and that Seba is correct.

If AV is adopted in cities, but not in rural areas, it will just make cities more attractive. American cities suffer from poor land use and disastrous transportation, which is why they are smaller than European cities. It’s insane that people spend $10,000 a year just to get around town in America. AVs could be a partial solution to this, though the obvious solution is better land used and transportation systems.

My guess is that AV will happen, and have the effect Tony Seba predicts, but it is hard to say when. Seba is right that computing power is increasing exponentially, but AI is notorious for failing to deliver for decades, and then suddenly surprising everyone.

Alimbiquated,

I am not familar enough with AI to know what is possible, but I would imagine that more computing power helps. It might be 2 years or it might be 10 years before we have AVs, when they arrive things will change very quickly.

Dennis

You are right that more computing power helps. But look at neural networks, which got their start with perceptrons in the late 50s. They failed at everything, and neural networks were widely considered to be a joke until 2011, when good design and massive computing power put them into the spotlight. It took 50 years. Another key improvement was the availability of large collections of labeled data, data files identified by humans as being pictures of specific objects.

Or take expert systems, slated to change everything in the 80s. It never happened.

On the other hand, some applications like protein folding and image generation (like MidJourney or Dalle) just appeared unexpectedly, seemingly out of nowhere.

Computing power is a big plus, but massive amounts of data are also needed. The reason why games, language translation and image processing have been so successful is that there is so much data available online for training. Chinese English translation is amazingly good, but good luck getting a machine to translate Turkish into Vietnamese. Protein structures are also readily available, so protein folding is nearly solved. The best game engines train against each other, not against humans, because they need tens of millions of games to train on, more than humans have recorded in all history.

Self driving has a massive data problem. The data set is not growing as quickly as computing power is. Tesla’s solution is to use their fleet to record training data, which is very clever. Simulations are also heavily used. But my impression is that it currently isn’t going very well. Maybe we will see a revolution tomorrow, nobody knows. But maybe we won’t.

One day while driving at, let’s say 70mph on I 95. I looked in my rear view mirror as a Kenworth swerved into the full lane behind me forcing a woman driving a Town Car completely off the road. The Kenworth than moved out of the lane and the Town Car got back on the road just to have the Kenworth again forcing her halfway off the road. The truck then finally moved two lanes over ending the nightmare. There is no way in hell that computers could ever have saved the two people lives in that car. When it ended we were maybe 500 feet from a bridge.

Autonomous travel needs more kilometers than now – just because there are void drives, as a taxi owner has some empty drives to return from a suburb to the bar district for example.

And the electric grid is in no shape to support a huge increase in electric consumption – on the contrary, all the green agenda gives a lot of strain to the system.

Things will go much slower – gadgets like the smartphone could be provided much faster because they are so small.

Eulenspiegel,

No not really, in many cases the robotaxi could park and wait for next ride, it might be a kilometer down the road. Also robo taxis will allow pool service for lower cost so in many cases there will be several passengers, where today most trips are a single passenger in the car. There could be a decrease in miles travelled due to higher average occupancy in vehicles.

Outside of industrial use, AV’s will most likely just cannibalize an unknown percentage of Uber and Taxi’s which will be energy demand neutral in my opinion. AV’s are almost a novelty for individual use, much like the Lime and Bird scooter frenzy a few years back. Now I don’t see those scooters laying around everywhere… they’re almost gone.

Meanwhile, most of humanity outside of high dense population areas will still own their own car or motorcycle, whether EV or ICE. There are too many examples of why humans require independent transportation….. and I get a bit too long winded at times, so I am stopping here… But it’s likely that garages will be filled with private cars for the foreseeable future or until molecular transport is mainstream.

I’m with Dennis on this one, I think most people on this site badly underestimate how disruptive EVs and potentially AVs will be. Most EVs will easily last 500K miles and are 4-5 times as efficient as ICE. It will be easy to program them to charge when electricity is abundant and even feed back to the grid in times of low supply.

Already plug in cars are 18% of global car sales. It will not be an issue for this number to increase 10%/yr. There will be no more gas cars sold after 2030 except for hobbyists.

https://cleantechnica.com/2022/10/31/100-electric-vehicles-13-of-new-vehicle-sales-globally/amp/

And if you have a fleet of cars for delivery or your business, the economic incentive to switch to EVs will be truly overwhelming by 2025.

Agree.

A couple years ago when I said that 90% of light vehicle sales in US would have a plug I got the sense I was seen as outlandish on this.

I reaffirm that prediction.

I haven’t digested the possibilities of autonomous vehicles. I’ll probably just have to believe it when I see it.

Hickory,

Can you clarify?

90% plugins in US by what year? My guess would be 2032, if there were no AVs. If AVs get approved by 2025 in California, I expect 90% of passenger miles traveled on land will be with electricity by 2030.

Dennis- oops I forgot to indicate that I was talking about year 2030-

90% of global light vehicle new sales will have a plug

Thanks Hickory. I thought that was what you meant, but I often assume incorrectly, so thought it would be better to ask.

I have been on the same page, but think things may be moving more quickly.

Stephen

There is something wrong with your 18%. EV sales in China are 18%. EV sales in Europe are dropping according to the article below. US EV sales are at 7%.

Typically I don’t follow this trend but I went looking and this is what I found. Maybe you have better data,

“The share of electric car sales in Europe dropped to 11% for the first half of 2022, down from 13% in the second half of last year. Growing electric vehicle sales in the United States and China suggest that a lack of regulatory incentives, not a supply chain crunch, is the main cause of Europe’s sluggish electrification efforts, says T&E.”

https://www.transportenvironment.org/discover/europes-electric-car-sales-stagnating-as-china-gains-foothold/

Ovi, your China EV sales data must be out of date.

https://cleantechnica.com/2022/10/24/china-electric-car-sales-35-share-of-auto-sales-in-september/amp/

Fully electric 26% with a plug 35%. China is on track to stop selling gas cars around 2025-26.

China is also perfecting the car you have advocated for and that I also hope will become more popular, an EV with a range of 100-150 miles that still has a gas engine for range extension. These do no count as EVs but the vast majority of miles driven in these cars will be electric. They are still called plug-in hybrids and don’t show up in the EV numbers but are wildly popular in China.

The numbers in any given region is it nearly as significant as the total global EV sales and their percentage of all car sales.

Keep in mind that EVs will last several times as long as a conventional ICE car and so each EV sale will displace many ICE car sales down the line, just as a well built piece of furniture will last many generations and potentially displace many pieces of crap from IKEA. This is because there are only about 1% the number of moving parts in an EV compare to an ICE car and also because of the lack of constant vibrations that an ICE car produces that slowly wears on things and shakes things loose.

Stephen

The outliers here are China and Norway. China understands it’s Achilles heel is its need to import 10 Mb/d of crude so it is pushing EV sales. Norway has massive subsidies.

Not sure what is happening in South America and Africa, but I think the EV market there would just be starting.

I have no doubt that the PHEV market share will continue to grow and will be accelerated by the increased price of gasoline. I just think that today’s projections are a bit optimistic.

EV sales are down in Europe because nobody can deliver. There are serious supply chain problems, and waiting lists are months long.

After China maxes out at 100% in the 2025-26 timeframe the floodgates will open, the prices will come down significantly worldwide, and EVs will be everywhere.

I ordered a new Chevy Silverado ICE pickup truck in June. It’s estimated arrival is now April. The dealership tells me this is because of a chip shortage. The sales manager also made an interesting comment. He said he’s heard that GM is “hoarding chips” needed for its upcoming EV line, and this is slowing the manufacture of ICE vehicles.

Is this just urban legend? I haven’t been able to verify this.

I also read above in a post that the most popular vehicles in China are plug in hybrid. Those have always made the most sense to me for the driving my wife and I do. We have family that lives several hours away and I also have to make driving trips of over 250 miles for work at times.

We still have very few Tesla’s in my area, but we do have many hybrid vehicles and some are plug in.

SS, I haven’t heard that rumor and can’t comment on it. But hopefully the entry of sophisticated plug in hybrids from China which I suspect will be here by 2025 will drive growth in availability in this segment. These vehicles should be substantially less expensive than full EVs because of the smaller battery size but still run 90-95% on electricity. But I don’t see any movement at the present moment for this type of vehicle to be offered here in the US unfortunately.

Lets keep in mind that the landscape looks very different through the eyes of the vast majority of vehicles customers of the world, than those in a country like the US or Canada.

In these two N.American countries all are used to abundant domestic oil and have the sense of stability in supply.

In most countries of the world that is not the case. Many will shift eagerly to electricity if their grid has a history of reliability in supply and reasonable price.

In the last 10 years China has had 3.5 M EV vehicles sales

In the last 10 years US has had 0.63 M EV vehicles sales

China has reasons to be more motivated on this, with domestic supplies of oil much lower than demand (far into the depletion curve) , and all of the oil import cargo ships being tracked by the US 7th fleet.

Nonetheless, the US will be running hard to play catch up as the years unfold. We’ll have to see if the international supply chains hold up.

Hickory —

> In these two N.American countries all are used to abundant domestic oil and have the sense of stability in supply.

The US has been a net importer of oil since 1946.

There is a massive worldwide chip shortage that is squeezing the car industry hard. Basically chip manufacturers overestimated the effects of Covid and shut down. Now they are struggling to keep up with demand. GM is definitely not alone. I don’t know how they are allocating chips between models though.

One big problem is that car manufacturers aren’t interested in getting the latest and greatest chips, and chip manufacturers aren’t interested in selling old chips. For example, chip manufacturers are focused on energy savings for mobile devices and server farms. But cars have enough energy, and chips are a small part of the equation, so it isn’t worth it to car companies to redesign systems for the newest generation of low power chips. So car companies are low priority customers for chip manufacturers.

Dennis, when the UAE Minister says, “To assume oil is going to be there forever is wishful thinking,” it is blatantly obvious that he is not talking about demand not being there. He is talking about oil not being there to meet demand. How can you possibly spin that to mean he is talking about demand not being there?

Ron,

I read the article you linked, I was commenting on the OPEC World Oil outlook cited in the piece.

Excerpt:

Earlier this week, OPEC presented its annual World Oil Outlook at ADIPEC, in which it forecast that demand for oil would continue to grow all the way through 2045. Oil is expected to retain the largest share in the energy mix, accounting for almost a 29% share in 2045, the cartel said. In OPEC’s view, all major fuel types, with the exception of coal, will see demand growth through 2045. Moreover, OPEC also said that the global oil sector would need a cumulative investment of $12.1 trillion in the upstream, midstream, and downstream through to 2045, equating to over $500 billion each year.

OPEC’s rosier outlook on oil demand is in contrast with projections from other forecasters and analysts who see the early 2030s as the possible time of peak oil demand.

The International Energy Agency (IEA), an advocate of the energy transition and net-zero emissions by 2050, said in its own world energy outlook last week that fossil fuel consumption is expected to peak or plateau within this decade, accelerated by the policy and trade flow shifts following the Russian invasion of Ukraine. For the first time ever, a World Energy Outlook scenario from the IEA based on current government policies and settings has the global demand for every fossil fuel showing a peak or plateau, the agency said in its World Energy Outlook 2022.

Did you read the whole piece that you linked?

Autonomous vehicles is a total pipedream.

OPEC is basically 5 nations instead of 13 as usually stated. Those five are Saudi Arabia, Iran, Iraq, Kuwait, and the UAE. And that is with the consideration that sanctions will soon be lifted on Iran, allowing them to increase production by, hopefully, one million barrels per day.

The other eight are in terminal decline, just like most of the rest of the world.

the 2022 data below is through October.

Ron,

Much of the fall in the OPEC small 8 output is due to the crash in Venezuela’s output, which is likely to plateau around 600 kb/d, or at least decline more slowly than the 2012 to 2020 period. If we look at only the OPEC small 7 listed in the title of the chart below (your group of 8 minus venezuela), output declines at an annual rate of 226 kb/d on average from 2012 to 2021. I used EIA annual data through 2021.

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-petroleum-and-other-liquids-production?pd=5&p=00000000000000000000000000000000002&u=0&f=A&v=mapbubble&a=-&i=none&vo=value&&t=G&g=none&l=176-2000000040004000g0g000000400000400000000000000002&s=94694400000&e=1640995200000

Yes, of course I read the whole thing. The author of the piece first quotes the UAE Minister, then he talks about the OPEC presentation. Two entirely different things.

I thought what the UAE Minister had to say was a lot more interesting.

Chart below has OPEC other 7 and Venezuela from 2013 to 2020.

Over 60% of the decline of the OPEC other 8 was due to Venezuela.

Leaving Venezuela out of the mix doesn’t seem to help much.

Dennis, I believe your charts are designed to hide more than they reveal.

Ron,

Using EIA data (which we only have through 2021 (there is not 2022 OPEC annual output). The annual decline is 226 kb/d from 2008 to 2021. This is if we use an objective method to determine the slope of the average decline such as ordinary least squares (OLS) regression. This can be done by simply adding a trend line in excel and then displaying the linear equation on the chart. (right click on your data series then choose trendline from the pop up menu.

Dennis, we have the OPEC MOMR data through September, and I used this data for October; OPEC oil output falls by 20,000 bpd in October -Reuters survey. If you have the data, you should use it as I do. I stated that my 2022 data was only through October. And I expect OPEC November and December crude production will be even lower.

That being said, I still prefer my charts to yours. I think they are far more informative. I think you will find that I have a consensus of opinion on that point.

Ron,

Perhaps. Can you explaine where your straight line comes from? Are you just eyeballing it? Kind of subjective don’t you think?

Really Dennis, are you serious or just trying to be funny? I get my straight lines from the exact same place you get yours. Obviously, it’s just a trend line. But perhaps your straight lines are not trend lines, perhaps you have some complicated mathematical algorithm from which you derive your straight lines.🤣

Ron,

Looking at the lines on your charts it looks like you use the drawing tool as the lines are often not centered on the data points, also no equation is displayed. There is an objective algorithm for determining the best fit to a set of data called ordinary least squares (OLS) regression and there are more advanced statistical methods called robust regression that give a better fit when there are outliers or other problems with the data.

Excel uses OLS to fit a trendline to the data.

Well hell, I just use my eyeballs to fit the trendline to the data. If I am off a fraction, what the hell? I will continue to just draw trendlines to fit the data as best as I can. Sorry about that.

Dennis/Ron

Eyeballing Ron’s data, I get a difference of 2700 kb/d between the 2010 and 2022 data points. 2700/12 = 225 kb/d/yr. Same as what Dennis got using OLS. I would call this a DRAW.

Ovi,

Rons charts are more informative though, I think different perspectives are useful, my main pointvwas that most of the decline of the other 8 is Venezuela. Well over 50%. Let’s say Venezuela continues to decline at 300 Kb/d. They would then be at zero after 2.25 years and could decline no further.

Ovi, it is not my data at all. It came from the OPEC MOMR as well as the Reuters link you posted a few days ago. I don’t have any data that is mine. I always get it from another source. 😇

Ron

I am a bit sloppy sometimes when I write quickly. I think most of the participants here know that you are using OPEC data.

Dennis, I am replying below to have more room for my chart.

Dennis

I just found it it interesting that both charts gave the same slope. As for Venezuela, I think they are stuck on a plateau as long as they are under sanctions and should be left out of decline analysis.

Ovi,

I agree. Venezuela may be on plateau and the decline we witnessed as Venezuela fell into failed state status is not likely to be repeated so excluding Venezuela from the analysis makes sense to me.

so excluding Venezuela from the analysis makes sense to me.