The EIA has released its latest Drilling Productivity Report. There were some interesting data presented in the report.

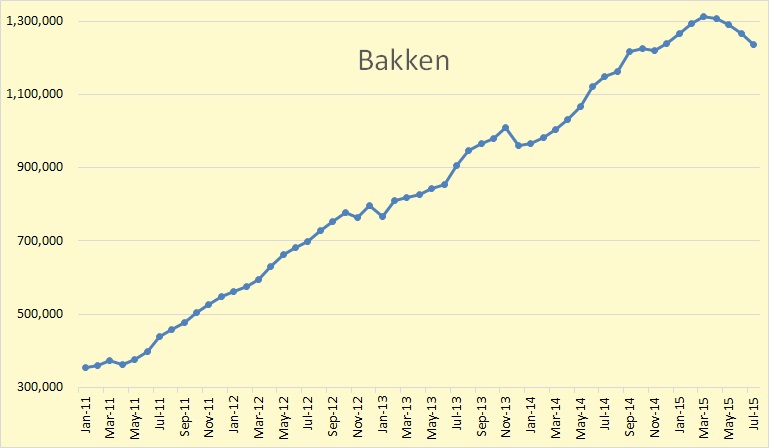

They say the Bakken peaked at 1,311,703 barrels per day in March and will have declined by 74,763 bpd in July.

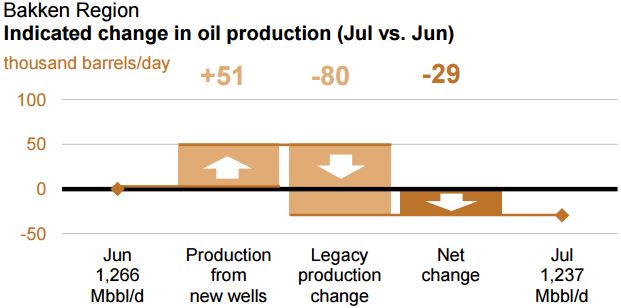

The EIA says the Bakken will get 51,000 barrels per day in July from new wells but legacy wells will decline by 80,000 barrels per day leaving a decline of 29,000 bpd.

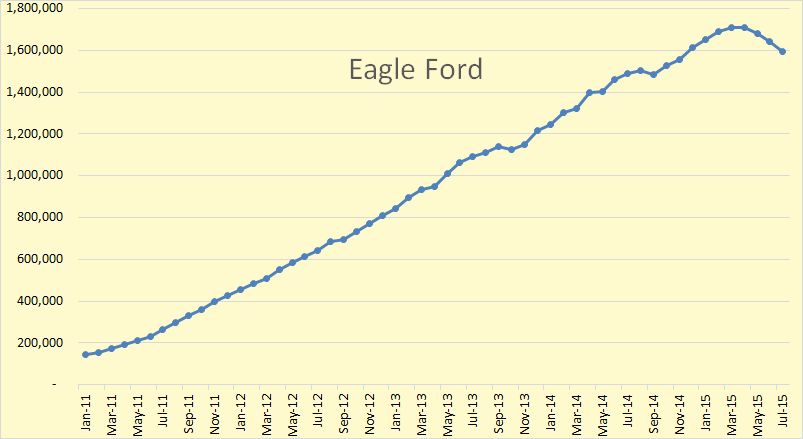

The EIA says Eagle Ford peaked in 1,711,376 barrels per day in March and will have declined by a total of 117,971 bpd in July.

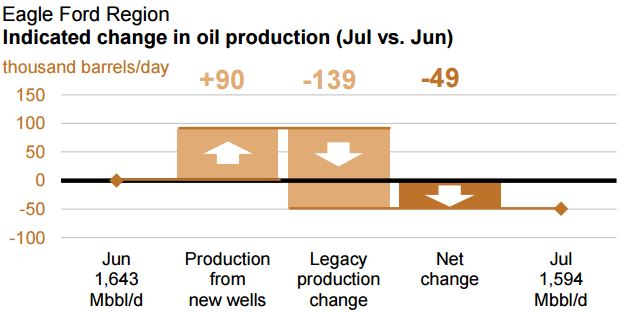

The EIA says Eagle Ford will get 90,000 bpd from new wells in July but the decline from legacy wells will be 139,000 bpd leaving a decline of 49,000 bpd.

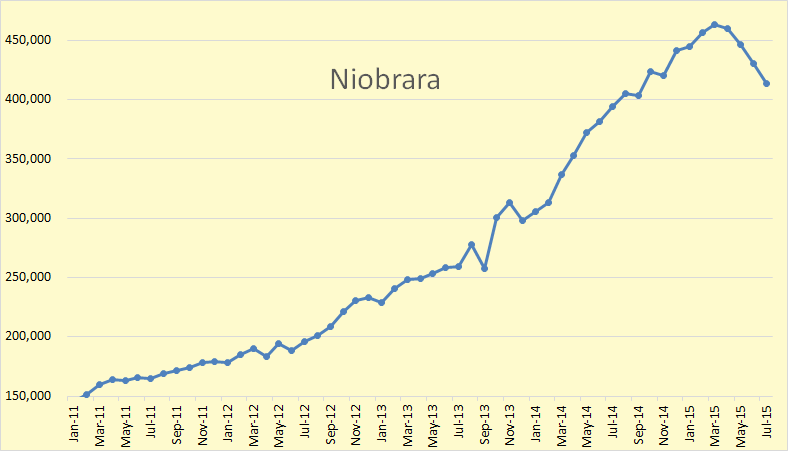

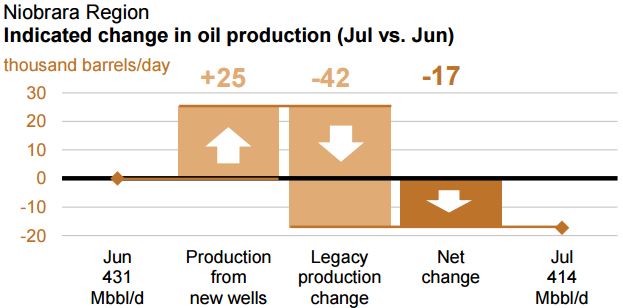

The EIA says Niobrara peaked in March at 459,861 bpd and will have declined by 49,712 bpd by July.

The EIA says Niobrara got 25,000 bpd from new wells but the legacy wells will decline by 42,000 bpd resulting in a decline of 17,000 bpd.

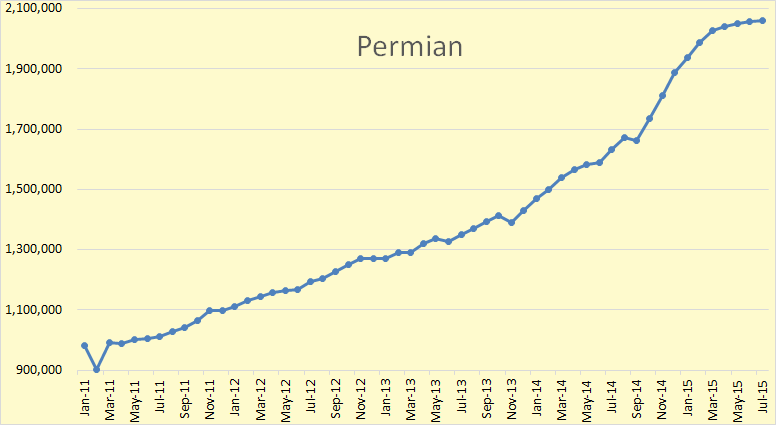

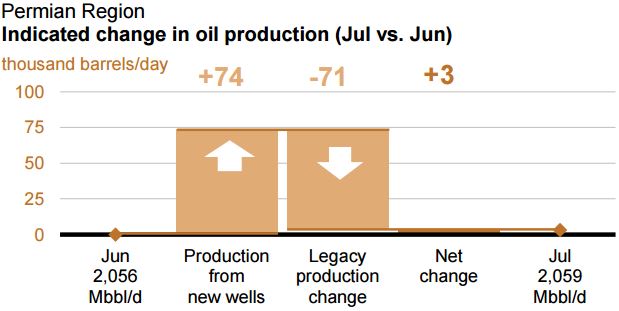

The EIA has the Permian not yet peaking but production leveling out. Production from the Permian in July, the EIA says, will be 2,059,851 bpd.

The EIA says production from new wells will equal 74,000 bpd in July and the decline from legacy wells will be 71,000 bpd leaving a net gain of 3,000 bpd. Almost half the Permian production comes from conventional wells therefore the legacy decline is not nearly as great as from pure LTO plays.

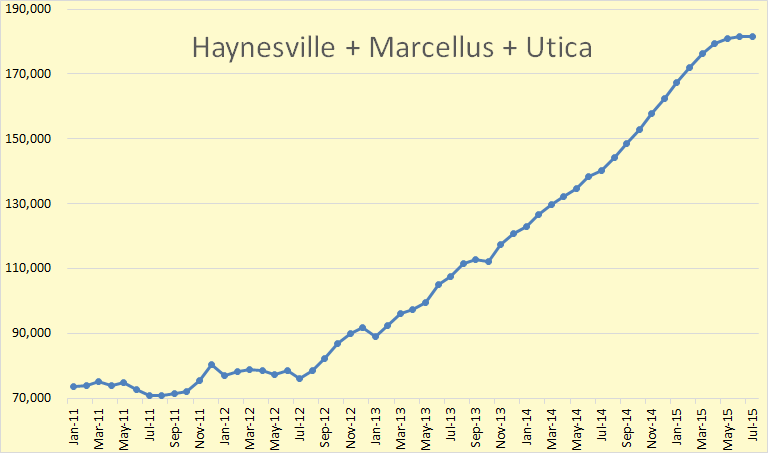

The other three shale plays are mostly gas plays and don’t contribute a lot to the total. Nevertheless the EIA says they will peak this month, June, at 181,538 bpd and will decline by 106 bpd in July.

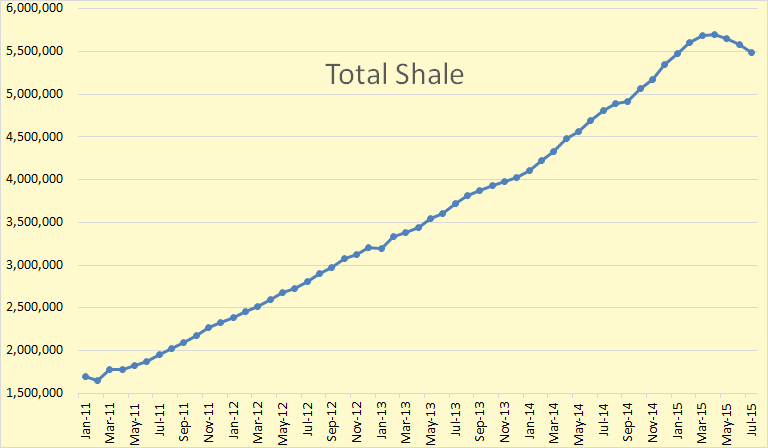

The EIA says the total of all seven shale plays peaked in April at 5,694,580 bpd and will have declined by 208,782 bpd in July. The one month decline, June to July, the EIA says, will be 93,027 bpd. These July numbers are still 142,720 bpd above the production numbers they have for December. However if the decline they they predict in July continues, then production in December 2015 will about 322,000 bpd below the December 2014 numbers.

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

“… if the decline they predict in July continues, then production in December 2015 will about 322,000 bpd below the December 2014 numbers. ”

The EIA in its May STEO had actually projected a 310kbd decline in the Lower 48 (ex GoM) production in December 2015 vs. December 2014

The G7 have released a statement in which they say the world by 2050 has to realize a reduction in use of fossil fuels 40à70%. And within “this century” has to fall back to zero. Let’s simulate that for a moment. I model falling back to 50% by 2050 (that is between 40 and 70, so that’s alllright.)

As the use of fossil fuels is still increasing now at 2.1%, globally, on an annual basis, I project a 1% increase for the next 5 years, and 5 years of status quo. This order not to shock too violently. From then onwards:

2025 -> 2030: -1%

2031 -> 2035: -2%

2036 -> 2040: -3%

2041 -> 2045: -4%

2046 -> 2050: -5% (and I’m almost at 50% reduction compared to now!)

and so to a decrease of -8% from 2060 onwards. A sharper decline does not seem feasible to me. And then I arrive at around 0 in AD 2100.

Meanwhile, nuclear also shrinks by 1% annually (the current trend is a sharper decline).

Hydro grows at 1%, continuing current trend. This until 2050, because each stream, worthy of the name, will have a turbine by then.

Sun, wind and geothermal grows at a blistering rate of 8% over the next 35 years and remains stable from then onwards. (That seems overly optimistic.)

Biomass I don’t touch. More forests felled is not really an option. And cultivate more bioethanol or biodiesel will bring agriculture (further) into trouble.

See the result of the exercise:

The left graph is the world energy consumption from 1830 to 2010. The right chart shows the already accomplished growth for the first 5 years (2010->2015). And then begins the simulation.

Have fun on the slide!

“Sun, wind and geothermal grows at a blistering rate of 8% over the next 35 years ..”

8% would be a massive slowdown from average growth for solar PV.

http://en.wikipedia.org/wiki/Growth_of_photovoltaics

This says 2014 growth was 14% vs. the 5 of the wiki article.

http://www.pv-tech.org/news/global_solar_demand_in_2015_to_hit_57gw_on_strong_30_growth_rate_ihs

More on exponential growth:

http://cleantechnica.com/2014/07/22/exponential-growth-global-solar-pv-production-installation/

Wind is capable of these kinds (40-50%/year) of growth too.

http://www.gwec.net/global-figures/wind-energy-global-status/

Now – the 64 trillion $ question – will people quit subsidizing fossil fuels and otherwise get behind renewables?

I hear you on hydropower.

Only 12.1 GW technical at non-powered dams, but that’s nothing to sneeze at:

http://nhaap.ornl.gov/content/non-powered-dam-potential

New stream reach is 65.5 GW giving 346 TWh/yr (excluding wild and scenic rivers…),

a 128% increase from existing hydro.

http://nhaap.ornl.gov/nsd

n.b. US uses 4,000 TWh/year currently, so we’d need massive efficiency and renewables growth to replace fossil fuels in transport, domestic heating, manufacturing, etc.

Geothermal needs “enhanced” (aka “hot dry rock”) and/or geopressurized systems to get way more widespread.

Otherwise conventional hydrothermal locations are fairly limited.

http://mitei.mit.edu/publications/reports-studies/future-geothermal-energy

Remember that Solar and Wind don’t have the thermal losses of fossil fuels, but to take care of intermittency the installed capacity needs to be higher unless there is hydro or some other form of backup, possibly thermal storage for heating and cooling needs.

I doubt we will get to zero fossil fuels by 2100, if equilibrium climate sensitivity is 3 C, we might be ok at 1200 Gt of total Carbon emissions from 1750 to 2150. It will be cutting close, the G7 plan is safer.

Not sure how much natural gas is used for heating in the US, maybe 50%? Using ground source heat pumps in colder climates and air source in warmer climates only about 33% to 40% of the energy is needed because we can get 2.5 to 3 J of heat for every 1J of electrical energy used by the heat pump.

Better building envelopes, more insulation and passive solar design will also help reduce heating needs.

I don’t pretend to know how long exponential growth of wind and solar power can continue. At some point we will hit a limit on how much can be built in any given year even if building it is undertaken on a wartime type of economic footing.

Beyond that as the amount that could be be usefully utilized IS built out, the manufacturing and construction industries doing wind and solar will have to stop expanding. Nobody is going to voluntarily build extensive new manufacturing facilities or train lots of new workers for an industry that is peaking..

For a wild ass guess I will say that significant additional new manufacturing capacity will not be built any less than five to ten years from the peak estimated deployment rate. Recovering the investment in any less time than that would probably be impossible.

But I can’t see any real reason why the wind and solar power cannot expand for a decade or more at an extremely fast rate, maybe as high as twenty five or more percent annually.

As a matter of fact I will not be surprised to see this to happen due to the combined effects of oil and gas and maybe even coal supply shocks.

Depletion and a lack of investment can bring on oil and gas shortage troubles as fast as a minor oversupply combined with a soft economy brought on a price collapse. War could bring on a gas , oil AND coal supply crisis given that all three must be shipped via blue water freighters. My retired buddies in the armed forces tell me that just about any gray haired old fighter jockey driving just about any obsolete old fighter equipped with air to ground rockets could easily sink just about any freighter afloat.

Such ships don’t have the fire fighting capacity necessary to deal with multiple fires started by rockets designed to penetrate armor – and …… they don’t HAVE any armor.

If freighters sail in time of war , they will necessarily sail with naval escorts. There are not very many escorts available and there would not be time to build them.We no longer have a robust ship building industry in the western countries.

With the costs of wind and solar continuing to fall and the price of oil and gas eventually spiking again, the NEXT BIG THING may very well be a BOOM in renewables comparable to the dot com boom or the housing booms of recent decades.

Every body will pile in with every dime they are currently throwing at other desperate attempts to earn more than one or two percent annually.

In addition the possibility of various national governments going flat out on renewables as a matter of national security policy is SUBSTANTIAL.

Some of these governments are going to find themselves frozen out of oil and gas markets for various reasons. When this comes to pass, they will necessarily go pedal to the metal on renewables and or nukes – to whatever extent they are capable of.

UNLESS -UNLESS just maybe they are strong enough to ” go a viking” in quest of some oil and gas.

Not many are going to be in a position to do so.

I doubt all the countries in Western Europe together could muster enough diesel fuel and uniformed troops and equipment to invade Russia- not that anybody is going to invade nuclear armed Russia for the foreseeable future.

IF -Repeat IF they were to start selling like ice water in hell, I wonder how fast the production of plug in hybrid cars could be ramped up.

I suppose a DUPLICATE of Musks giga battery factory could be built in not much more than half the time it is taking him given that the research and development has already been done and the supply chain is or will be in place for the machinery needed .

I say plug in hybrid because a car such as a VOLT needs a battery only a third or so the size of a LEAF battery, never mind a TESLA S battery.

Above I suggested 50% of US natural gas is used for heating. Only about 20% of natural gas use is residential use, most of this is space and water heating. Another 14% of natural gas is used for space and water heating in commercial buildings for a total of 34%, so the 50% estimate was not very good.

Another 34% of natural gas is used for power generation, and about 32% is used in industry for heating and as an input for fertilizer, plastic, fabric, anti-freeze, and other chemicals.

About 3 times less energy would be consumed by converting to heat pumps for space and water heating and roughly 2.5 times less energy would be needed by replacing natural gas power generation (40% efficiency) with wind and solar where these thermal losses are eliminated. So only 37% of the energy would be needed for the space and water heating needs currently provided by natural gas and the total energy needed would be reduced by 43%.

About 70% of US petroleum use is for transportation, the internal combustion engine and associated systems (friction in power train) are about 25% efficient, if we assume EVs and other electric transport (light rail, electrified rail) are about 75% efficient (including transmission and distribution losses in the grid), then the 70% of petroleum used for transport can be reduced by a factor of 3.

In total the energy currently provided by petroleum could be reduced by 47%.

For US coal about 87% is used for electric power, by switching to Wind and solar the thermal losses are eliminated and less energy would be needed by 40% of the 87% in the electric power sector, an overall reduction of 52.2% in needed energy.

For US fossil fuel consumption, about 22% is coal, 34% is natural gas, and 43.5% is petroleum. Fossil fuels are about 81% of all US energy consumption.

All of the reductions together would reduce fossil fuel use to 53% of the previous level and overall energy use would be reduced to 62% of the previous level (or a reduction of 38% in total energy). Fossil fuel use would be reduced by 47%.

Main point is that less wind and solar is needed to replace fossil fuels.

To deal with intermittency however the total capacity will need to be similar or maybe somewhat larger, excess capacity of 2 to 3 times average electric load tends to minimize system cost.

Note that there are a host of solutions not covered here such as better building codes, passive solar heat, demand management through peak pricing, better urban design, significantly less fuel use with better light rail, rail, and other public transportation systems. All of these strategies will reduce energy consumption and will be used as fossil energy prices rise.

There will however be great difficulty in accomplishing such a transition and no doubt severe economic disruption for 10 to 20 years (2030 to 2050).

Those are good thoughts. Here are a few more:

The average US car gets about 22MPG. That’s about 1.6 kWhs per mile. EVs get 3-4 miles per kWh. If we assume .33 kWh per mile, that’s a ratio of about 5 to 1. Even if we allocate transmission and conversion losses to electricity, but don’t allocate refining and transportation losses to oil, EVs would still reduce joules consumed by 75%.

We have one pretty good model that suggests that 2-3x overbuilding of wind and solar would be cost effective. I’d say that’s very preliminary. The model says that would work, but I’d say that a lower level of overbuilding (perhaps 1.5-2x) is much more likely to be the optimal level. Remember, they didn’t take into account the dramatic impact such overbuilding would have on the price of electricity. Very cheap power would shift the economics towards much cheaper (and less efficient) forms of storage.

Finally, keep in mind that our primary economic problem right now is lack of aggregate demand. Building wind, solar and EVs would help with that.

There’s another factor to think about- the ignorance of the average car buyer of the merits of EV’s.

Example. I have a couple of relatively young guys working for me in my gadget shop, one of whom is a real expert on all sorts of cars, bulldozers and anything related to an IC engine. The other is an average car lover and has an average knowledge of them, and never heard of an EV.

I overheard a conversation between them. The expert mentioned how incredibly simple an electric motor was in comparison to the engine in the other’s toyota.

The proud toyota owner then began to ask for details- “well, how often do you have to change the transmission oil?”

“Ain’t no oil, and no transmission, either” —

“What!”

And so on from there.

My point. When people began to realize the merit of EV’s, there might be a sudden and big demand for them.

Hey Wimbi,

Just want to say thanks for the links in your comment to the previous lead post, especially the second one. It lead me to look up pyrolysis, something I’ve heard about but not seriously looked into.

In another comment in this thread I wrote about a bush fire last year at my late father’s homestead and the need for a more efficient way of producing charcoal and bio-char from the waste biomass on the property.

My plan is to replace the felled trees with high value lumber trees like Spanish Elm, Mahogany, Spanish Cedar (Cedrela odorata) and even the very slow growing Lignum Vitae.

I recently discovered that Lignum Vitae, a tree indigenous to Jamaica, is the most dense wood known, so dense it will not float in water. While attending the Renewable Energy World trade show in Orlando in 2013, I ran into a company that makes bearings for hydroelectric turbine shafts, out of lignum vitae wood that, it claims are superior to bearings made from other materials! So, if you ever need really long lasting, water lubricated bearings, now you know where to look.

Hi Dennis,

You may find this study of interest:

100% clean and renewable wind, water, and sunlight (WWS) all-sector energy roadmaps for the 50 United States

web.stanford.edu/group/efmh/jacobson/Articles/I/USStatesWWS.pdf

For some time now on this blog I have noted that the issue with renewable energy is not technological. The issues are political and social. The intermittent problem of solar and wind energy is not as big as many claim. Of course battery technology is expanding fast, but I posit we do not need any new technological breakthroughs to solve this problem. On multiple occasions I have provided evidence of technologies and working companies that are using solar thermal to produce electricity 24/7. I have also pointed out that we can produce hydrogen from sunlight with 10 times the efficiency that plants convert sunlight to sugar; doing so with off the shelf technology–no fancy catalysts added.

I don’t know why we keep believing the coal and oil company’s propaganda about renewable energy, but believe we do.

Best,

Tom

Hi CaveBio (Tom),

I am an optimist, but try to be a bit of a pessimist in the sense that a transition may well be possible, but is by no means assured. Mr. Murphy always has his monkey wrench in hand, the best laid plans of mice and men and all that. It is nice to have Fernando telling us that it can’t be done, but when we suggest solutions I wish he would do more than say, I don’t think so.

Sam Taylor has an excellent suggestion that the cost minimized solution of Budischak should be run against a longer wind and electric load data set to see how it fares. I agree but don’t know how to get the data to try it, maybe I should see if the author would share some of his data.

That is the kind of criticism that is useful and necessary to move forward. Thanks Sam. I will read the paper you linked and comment later, I think there are many solutions to intermittent output. Widely dispersed wind turbines and overbuilding capacity by 2 to 3 times load, Vehicle to grid, thermal storage, demand management, fuel cells, and batteries.

Hi Dennis,

I completely agree that a transition is not assured, but what frustrates me is how so many seem to think it is impossible.

Let’s hope the pessimists won’t be in charge of trying to get us through the transition.

Best,

Tom

Let’s hope the pessimists won’t be in charge of trying to get us through the transition.

I don’t see any value in assuming a transition is impossible. It may well be, but what use is it to give up even before you have to? Might as well give it your best shot, even if you fail at it, than not to try at all.

For some time now on this blog I have noted that the issue with renewable energy is not technological. The issues are political and social.

You got that right!

“For some time now on this blog I have noted that the issue with renewable energy is not technological. The issues are political and social.”

It’s also an economical issue. Costs for renewables are substantially higher than fossil fuels. Few people can afford to replace thier fossil fuel consumption with renewable systems.

Once the cost of fossil fuels become expensive and they are rationed, investment in renewables will vanish as the economy tanks and collapses.

Costs for renewables are substantially higher than fossil fuels.

That’s just plain not so.

First of all, the primary solution to Peak Oil isn’t renewables (except for the 10% or so of oil that’s used for power generation), it’s EVs. And EVs are cheaper then ICEs, right now.

Second, wind and solar are in the same ballpark as fossil fuels, even before you include external costs like pollution and security of supply. Land-based wind is cheaper than new coal in the US, right now: it costs less than 4 cents per kWh in places like Iowa. Solar is at 6 cents per kWh in places with very good sunlight.

3rd, pollution and security of supply are real costs. Asthma is real. Mercury contamination is real, and has real costs. Climate Change is real. And, what about the two trillion dollars we spent on our recent oil war??

investment in renewables will vanish as the economy tanks”

The economy needs more spending, not less. Spending on renewable infrastructure and EVs would stimulate the economy, not harm it.

And, when the Great Depression hit (in part due to farmers buying tractors that threw people off the land and made food prices fall), farmers didn’t stop buying tractors: they bought more, to try to cope with their new economic troubles.

That last paragraph about excess of tractors causing great depression, where do you learn about that staff: in Ivy league schools?, some books?, CNN?

That’s a great question.

I can’t claim that I invented the idea – I’ve seen oblique references to the idea somewhere (though I partly put it together on my own).

Yet, I’ve looked through histories of the Great Depression and seen no reference to the fundamental causes. You see discussion of bank failures, and gold standard problems, and stock-market bubbles, but little discussion of farm labor productivity, labor surpluses, and falling farm commodity prices.

But, if you look at the statistics for farm automation: numbers of tractors bought, etc., it becomes very clear:

The Okies were moving to California because they were no longer needed on the farm.

“but little discussion of farm labor productivity, labor surpluses, and falling farm commodity prices.”

Nick,

That is also a symptom, not a cause. Cause has to be in inherent flaw of monetary system. and that is constant lack of sufficient purchasing power. Did you read anything from CH Douglas?

Cause has to be in inherent flaw of monetary system

Well, that’s part of it. It’s certainly an necessary part, but it’s not sufficient.

Rising farm labor productivity meant that many laborers lost income. At the same time, small farms were no longer viable: their owners had to go bankrupt, and the land combined with other properties to gain the necessary economies of scale.

A large volume of unemployment and farm bankruptcies stressed the banking system: Many banks failed, which reduced the money supply. And…we were off to the races…

It’s not sufficient but it is a foundation and you can not built house without good foundation. Technological advances that increase labour productivity are default in this life. They will always happen. It’s like sun always come out every day. You can not fight that.

the primary solution to Peak Oil is to use less oil

“the primary solution to Peak Oil is to use less oil”

Is that like the solution to running out of air in a sealed room? Breath less! OR, walking through a desert with no water: Sweat less!

No, it’s more like Pepsi gets expensive, so you switch to something cheaper and healthier, like water or fruit juice.

Once the cost of fossil fuels become expensive and they are rationed, investment in renewables will vanish as the economy tanks and collapses.

I doubt that will happen. The Silicon Valley folks are both interested in renewable energy and are very wealthy. They should be able to do renewable energy for themselves even if the rest of the world doesn’t have it.

As I have maintained, the increasing income inequality allows a small percentage of people to amass wealth and resources enough to sustain themselves. It would be easier for them to have renewable energy than to depend on coal, oil, and nuclear power because those are massive operations. Solar can work on whatever size they need for themselves.

Boomer Wrote:

“I doubt that will happen. The Silicon Valley folks are both interested in renewable energy and are very wealthy. They should be able to do renewable energy for themselves even if the rest of the world doesn’t have it.”

I am sure the Wealthly will take care of themselves. its the rest of the 99.9% that have to worry about it. Of course when the middle class can’t afford to buy Sillicon valley’s silly gadgets, they too will become poor.

http://www.mirror.co.uk/news/world-news/panicked-super-rich-buying-boltholes-5044084

http://www.theguardian.com/public-leaders-network/2015/jan/23/nervous-super-rich-planning-escapes-davos-2015

http://www.stuff.co.nz/business/industries/9223975/Surge-in-rich-gaining-NZ-residency

Of course when the middle class can’t afford to buy Sillicon valley’s silly gadgets, they too will become poor.

The smart ones are already changing those paper fortunes into real assets. Sell some stock, buy some farmable land.

If they have more useful stuff then the rest of us, they should do better than the rest of us. How is that poverty?

I think it might be comforting to think that if a collapse comes, the rich will suffer as much as the poor. But I don’t know why that should be the case. If they plan well, they should be able to much better than the average person.

You should start a business building and selling 50 mw self contained power plants able to deliver 5000 volt AC power 24 hours per day for 7 days in a row. If I can get electricity for 20 U.S. Cents per kWh at 3 % financing I’ll buy the first 300 plants.

You should start a business building and selling 50 mw self contained power plants able to deliver 5000 volt AC power 24 hours per day for 7 days in a row. If I can get electricity for 20 U.S. Cents per kWh at 3 % financing I’ll buy the first 300 plants.

I’m sure something like that is the goal for some folks. Remember when cellphones were big, heavy, and expensive? The fact that they weren’t practical for the mass population didn’t stop the industry from improving them.

High tech items go from expensive products for a small market, to commodities for the mass market. That’s the way it goes.

“I’m sure something like that is the goal for some folks. Remember when cellphones were big, heavy, and expensive?”

Unfortunately, you’re fooling yourself, believing that power consumption devices can be applied to power generation systems. It far more easily to build a cheaper consumption device than it to build a cheaper power source. The reason why electronics got cheaper is that the materials used in construction got a lot smaller.

Replacing Fossil Power systems with renewable power systems are the exact opposite. You are switching from a concentrated high energy resource (fossil fuel) to a low density energy source (Solar or Wind). Imagine if the size of consumer electronics grew every year. The cost for those devices would rise.

Nick G. Wrote:

“It’s far cheaper for the grid to provide that service.”

Bingo! Fossil fuels are considerably cheaper than renewables. When Fossil fuels become expensive the economy will collapse. When the economy collapse there will be no money to fund renewable projects.

Replacing Fossil Power systems with renewable power systems are the exact opposite. You are switching from a concentrated high energy resource (fossil fuel) to a low density energy source (Solar or Wind).

There is so much waste in the way we burn fossil fuels that we can get by with less energy use with better design and lifestyle changes. We don’t need renewable energy to replace how we use fossil fuels. So they don’t have to be the energy equivalent of fossil fuels.

You are switching from a concentrated high energy resource (fossil fuel) to a low density energy source (Solar or Wind).

Sunlight, at 1kW per meter, is far more concentrated than the 500,000 oil wells in the US>

Wind and solar produce electricity: what’s more concentrated?

Seriously, this whole “density” thing is unrealistic. The only thing that matters is cost, and the costs of renewables are affordable.

Fossil fuels are considerably cheaper than renewables.

Why keep saying that, when it’s not so?

When the economy collapse there will be no money to fund renewable projects.

Actually, this kind of investment increases in hard times.

Nah. The idea that wind and solar projects should deal 100% with their own variance is a red herring. That’s not demanded of any other source of generation.

It’s far cheaper for the grid to provide that service.

why ac power?

Because most appliances use low voltage AC. Do you think it’s practical to ship 5 kV DC into people’s homes?

Whenever I propose that solar and wind power fanatics put their money on the line they invent a run around. But 50 mw reliable power is very suitable for smallish islands. Jamaica is fairly large and uses about 600 to 700 mega Watts. For Jamaica I need about 800 mw so they can start driving Teslas.

they invent a run around.

Nothing new about the way the grid works. Every power source backs up every other power source.

That’s why nuclear works well in the US, and can’t be used in Ireland: the grid is big enough in the US, and not in Ireland.

Wind and solar, on the other hand, come in much smaller units, so they work nicely on small islands.

Heck, Guantanamo Bay base is using windpower. It’s saving them a lot of money on diesel bills.

I admit, my knowledge in the AC/DC issue is thin. I guess I was asking something more fundamental than well that’s what we have now, so that’s what we should use.

That being said, I am sure I am not the only one who is thinking that maybe DC is at least an option when thinking about smaller systems / microgrids / buildings, etc.

http://www.technologyreview.com/news/427504/edisons-revenge-the-rise-of-dc-power/

FWIW department…

Renewable Electricity

Futures Study – NREL

lots of stuff here. 4 big pdfs

http://www.nrel.gov/docs/fy12osti/52409-1.pdf

“That being said, I am sure I am not the only one who is thinking that maybe DC is at least an option when thinking about smaller systems / microgrids / buildings, etc.”

1. DC Can’t be easily stepped up/down (voltage). DC needs switching hardware which has reliability issues compared to transformers.

2. DC has arcing issues. Once a arc occurs with DC, not extinguished until the power is shutoff. AC is generally self extinguishing, since the voltage drops to zero every 120 times per second (for US 60 hz Grid). DC isn’t recommend except for low voltage inputs ( < 50VDC). Higher DC voltage have increased risks. Low voltage distribution has high losses (even in household wiring). Decreasing the voltage by 10 fold increases the power losses by 100 fold Ploss = I^2R. Older homes would need wiring retrofitting to replace the wiring with much heavier gauge wiring.

3. The majority of consumer electronics and appliances require AC power for input. Most would require retrofit or replacement. Currently there are very few DC consumer appliances (Refrigs, Washing machines, Kitchen appliances, etc), and the selection of models is very limited, compared to AC appliances.

FWIW: I looked into using just DC for an offgrid home. The issue is the cost of running extra heavy gauge wire ($$$) to compensate for the low voltage, and the lack of DC appliances (and their higher costs). In a long term grid down/economic collapse, it would far easier to acquire replacement AC appliances, than DC appliances, since virtually every abandoned home will have AC appliances and there will be virtually no abandoned working DC appliances. Most of the DC appliances are 12V/24V DC which means they are usually limited to small devices (no full sized DC Refrigs/Freezers/Washing Machines) and are not very power efficient because of large current input required.

well, see TechGuy, you are thinking about it.

http://www.news.pitt.edu/news/pitt-project-aims-turn-world-dc-power

http://www.mnn.com/green-tech/research-innovations/stories/the-home-of-tomorrow-will-run-on-direct-current

http://www.emergealliance.org/

In about two and a half weeks (June 26), the EIA’s next “Electric Power Monthly” should be out with the data for April. I will be updating my graph for Solabr PV and Thermal Monthly Energy Output with the April data but, the figure for March is already greater than the peak in June last year (1934 vs 1689 GWh).

This year the output should peak in June or July and it will be interesting to see what the peak production will be. Solar is approaching 1% of US electricity production (GWh) and may well produce more than 1% of the electricity used in 2015 with that doubling to 2% by the end of 2017. That would suggest less than six more doublings from 2017 to reach 100%!

I am not suggesting that any such thing will happen but, just pointing out how current growth trends suggest a disruption may be in the offing. If I were in the business of generating electricity using fossil fuels or nuclear, I would be busy planning my strategies to deal with the threat from new renewables. Otherwise I would be planning my exit strategy, from the electricity business that is.

Just in case there’s anybody out there who’s still wondering why I continue to post about electricity production from renewables on a Peak Oil site, take a look at the following stories:

Oil, Politics Pave Path Toward Default in Puerto Rico

Puerto Rico Gets $3.5 Billion Plan to Fix Teetering Utility

From the EIA

” Puerto Rico has few conventional energy resources, and shipped in petroleum products are the dominant energy source for the island. In 2013, 55% of Puerto Rico’s electricity came from petroleum, 28% from natural gas, 16% from coal, and 1% from renewable energy.”

Other articles I have read suggest that Puerto Rico faces similar challenges to where I live, among them, high levels of electricity theft and large numbers of delinquent customers. For all intents and purposes, I could have been posting from Puerto Rico but, I think Puerto Rico may have more electricity related indebtedness than Jamaica! The high price of oil since 2005 or thereabouts seems to have done a real number on them. For islands all over the world with zero fossil fuel resources, I see improvements in the affordability of renewable energy technology as a very positive development.

I will also add that EVs are far more practical for islands and the smaller they are the less EV range limitations are an issue. What’s the point of an EV with 200 miles (320km) of range when the island is 15 miles from end to end or even less? Cuba, Hispaniola, Jamaica, Puerto Rico are the only islands in the Caribbean on which, you could drive for over a hundred miles in a straight line without ending up in the ocean and for Trinidad, the longest distance you could drive in a straight line, is a little over 60 miles.

Rest assured that quite a lot of the regulars here look forward to your comments.

The various islands are ready made natural laboratories that are as good as deliberately designed experiments in helping us learn how the peak oil question is going to play out.

Hopefully the people of Jamaica will get their political act together and get control of their electrical grid by whatever means is necessary- maybe even nationalizing it if nothing else works.

It seems obvious to me that your little country has no real choice other than to bite the bullet and somehow pay the upfront cost of going renewable as soon as possible to the extent possible.

It is only a matter of luck that my own country has a larger window of opportunity to manage a successful transition.

What happens in the island nations is probably for better or worse going to be repeated within a decade or two , maybe much sooner, in many larger countries.

History doesn’t precisely repeat but it does rhyme.

Hey Mac, thanks for the assurance!

Speaking of natural laboratories, Wimbi posted some links in a comment he made on the previous lead post that, introduced me to pyrolysis, something I had not looked at before.

Last year during a particularly bad spate of bush fires, an idiot was negligent in starting a fire that damaged a portion of the land at my late father’s homestead. I have been felling the trees that did not survive the fire as well as some low value trees that did survive, as I am re-planting with high value lumber trees. My farm hand and his brother decided that they would use the felled trees to produce charcoal which I thought was a good idea. However, I have observed that their choice of using an earth mound kiln to produce the charcoal seems fraught with issues, produces a lot of smoke and seems a bit inefficient.

Wimbi’s link lead me to the discovery of this 55 gallon drum charcoal retort that, seems pretty easy to build and operate as well as being significantly more efficient, smoke free and movable, once the feedstock has been exhausted. I’ve told the guys to stop until I can get one of these things built.

One might say that burning biomass is unsustainable but, around here excessive amounts are often considered a problem. People light bush fires to clear land and the waste from clearing road and highway verges, vacant lots and agricultural plots as well as yard cuttings from trimming hedges and lawns, is considered a solid waste problem. I have often thought, why not gather all this biomass that might otherwise just go up in smoke and use it to produce electricity or charcoal for fuel or bio-char for soil enrichment? Some of this stuff grows really fast, to point of being a plague. I would love to be able to turn the Guinea Grass on my property into bio-char!

Gov. David Ige, D-Hawaii, signed a bill into law that mandates state utilities to procure 100% of their electricity from renewable energy sources, making Hawaii the first U.S. state to require such a mandate.

H.B.623, “Relating To Renewable Standards,” increases Hawaii’s renewable portfolio standard to 30% by 2020; 70% by 2040; and 100% by 2045.

http://www.solarindustrymag.com/e107_plugins/content/content.php?content.15363

This ought to trigger a boom in geothermal power. They are going to need 20 to 25 2000 hp rigs drilling non stop forever.

I know growth of solar has been much higher than 8%/y. Still in real numbers on a global scale we are talking about peanuts. When solar will (soon) represent substantial quantities, these double digit growth numbers will be over. In the model I let solar (+wind and geo) grow at 8% for 35 years. That means a ~twentifold increase! That is huge! We will run out of rooftops! There will be no more wind available to blow through our hairs! 🙂

You know: I am just guessing – starting from the knowledge I have. It is what is is.

Hi Verwimp,

I think your graphic is very interesting. My point was that in 1900 (the oil industry was about 40 years old in the US at the time) oil output grew at double digit rates until 1948, so such growth in a relatively new technology lasted for many years (oil growth was about 31%/year from 1900 to 1910 and over 10% in 1948.)

My understanding of the oil industry is that it is somewhat more complex than digging holes in the ground at random. Even if that is not the case, there has been some technological progress since 1900, no? Possibly we can match 1900 to 2005 growth rates with the technology of 2015 to 2100? The model seems too optimistic so I have modified it to 80% of oil industry growth rates below for something that looks reasonable, I have no illusions that this will be easy, there will no doubt be obstacles, many unforeseen. It does not look to be impossible, though you may not agree, do you have an alternative proposition?

Note that with efficiency improvements and a reduction of the Total fertility ratio worldwide and slower economic growth we may well be able to cut energy use below 300 Exajoules, but there are physical limits to efficiency improvements.

The modern wind industry is roughly 41 years old (took off with first oil crisis in 1974, a similar age to the US oil industry in 1900), though I used 1995 as the starting point for Wind at 1900 oil industry growth levels (modern wind industry only 23 years old). For the solar industry, growth took off around 1995 with output growth for the last decade at about 44%, and from 2005 to 2013 growth was 47% per year, so the 1900 oil industry growth was actually slower than present day growth in solar output.

If we assume wind and solar only grow at 80% of the 1900 to 2005 oil industry growth rate (wind starting at 80% of oil industry growth rate in 1996 and solar in 2008) then we get a more realistic scenario with wind and solar output at 340 Exajoules in 2100.

You know, given the cost of the mega batteries you’ll need I think I’m going to start sketching a geothermal renewable business line. We can use second hand rigs from North Dakota to get started. Let me see if I can invent some kind of “future technology improvement” I can peddle to get some r&d cash and future subsidies.

So, got any calculations on the batteries??

Fernando,

I single out wind and solar because they are growing rapidly, I am all for geothermal, tidal, wave, hydro, and pumped hydro storage, whatever works for the lowest cost (when all externalities are included in those costs). For nuclear, I would want the nuclear industry to cover all liability (repeal the Price Andersen Act in the US) and all cleanup and disposal of nuclear waste so that we see the true cost of nuclear power. If it is cheaper and the people who live near the reactors are comfortable with such reactors, we could go for nuclear, as long as it is not in my backyard (I would feel the same about a coal fired power plant).

A widely dispersed set of these technologies tied together with an HVDC grid and a capacity overbuild of a factor of 2, would require very little back up by a combination of vehicle to grid, fuel cells and batteries. Excess wind and solar can be used to produce hydrogen to fuel the fuel cells for backup, hydro, pumped hydro and geothermal can also be used to fill some of the gaps and a limited amount of natural gas can be used on rare occasions until the system can be optimized to run without natural gas spinning reserve.

There is also thermal storage and peak power pricing that can be used to shave the peaks in demand and fill the valleys.

In eighty-five years natural depletions and the growing global warming crises will have provided any needed impetus for change. Not a very aggressive or politically abrasive goal.

To look that far into the future gives no urgency to act today. Solid goals for near term of five year increments with annual checks need to be set to spur early action. The sooner action occurs the easier it is to implement further action and the less likely the effort will stagnate.

Thanks for the effort Verwimp. I hope you can update this on an annual basis, and maybe consider for example 2-3 scenarios.

Enno, thanks! Annual updates on world energy consumption are provided by BP. (Tomorrow is the release of the 2014 data!!!)

The reason why I made the post above was the G7 statement. The cool thing is: The G7 als a group of nations experiences a decline in energy consumption since 2007. They are post peak-consumption. And they are aware of it. And now they ask the rest of the world to limit their growth too, in the interest of the climate. That’s just politics. But it’s interesting.

The G7 als a group of nations experiences a decline in energy consumption since 2007. They are post peak-consumption. And they are aware of it.

Of course they’re aware of it. It’s what they want. It’s what they planned. It’s a good thing.

Fossil fuels (and other energy sources) have no inherent value. Their only value is what they can do for us. If we can get around, and deliver freight, with less energy, that’s a very good thing.

Hi Verwimp,

If we assume wind and solar grow at the oil growth rate from 1900 to 2000, with wind starting in 1996 at the 1900 oil rate of growth and solar starting in 2008 at the 1900 oil rate of growth (wind was at a similar growth rate, solar was actually growing faster), we would have the following electric output in Exajoules from wind and solar from 2020 to 2100. These are unrealistic, but the idea is to illustrate that similar rates of growth as oil experienced when it was a new technology would easily allow double the fossil fuel peak energy output, when we only need half that amount.

Fossil fuels peak at about 500 Exajoules, that amount can be reached in 2055, but 300 Exajoules would be enough (because of fewer thermal losses in engines and power plants, and the use of heat pumps for space and water heating) and could be attained by 2048.

Dennis! Why you do this to me? 😀

I know, I know. But solar PV is not oil. You don’t just make a hole in the ground to get Solar, like they used to do to get that first oil. I believe solar PV is a result of fossil fuels, not a substitute. Time will tell. I hope there is a really great future for solar PV and wind.

Hi Verwimp,

I replied to you in the wrong place. Your work is excellent, thanks.

See my reply at link below:

http://peakoilbarrel.com/the-eias-drilling-productivity-report/comment-page-1/#comment-520757

I believe solar PV is a result of fossil fuels, not a substitute.

Every energy source is built (at the start) using the energy source that came before.

Oil was originally transported with horses.

Coal was moved from the mines using wood.

A New Peak in Conventional Crude Oil Production

http://www.euanmearns.com/wp-content/uploads/2015/06/C-Cdec141.png

If shale’s decline will mirror it’s increase (in full percentages on a monthly (!!) base), future doesn’t look pretty good.

Can someone please inform the masses to stay calm and cool?

Rising prices will send people stampeding back into shale, which will provide something of a moderating factor on the way down. Erratic extraction of reserves makes Hubbert peak graphing inapplicable. Iraq is the best example of this.

Problem is that the US continuing to grow production is toast.

One would think that since the boom and bust cycle is harmful to society in general, that people would get tired of it and move to more stable endeavors. Real progress (and I do not mean infinite growth or increases in GDP) is difficult to make in unstable situations.

EIA says the above shale plays oil production peaked in April.

Didn’t I just read the EIA reported a large spike in May?

The spike in May had to do with revisions? Or are other oil plays, such as SCOOP really taking off?

Can someone explain this? I feel like I have been following this closely. I guess not, or the intelligence/memory is failing me.

Shallow, it is very easy to explain. Those guys who said we had a huge spike in May are a different group of guys from those that said we peaked in April. They work all the way over on the other side of the room. Different cubicles and everything.

Ron, I am sure I have posted this before, and you may already know this, but for the benefit of others, given what I find is a ridiculous system by the EIA of recording oil production data, here is what happens each month regarding our, and I assume every other oil producers’ oil in the United States:

1. Throughout the month, our oil is picked up by tanker trucks. At one time several of our leases were metered and went straight into the pipeline. Unfortunately, the pipeline company did not want to maintain the line and shut it down.

2. Each time a truck hauls a load of our oil, we are provided with a run ticket, which contains information such as top gauge, bottom gauge, % bs&w, oil gravity, date and time gauged and hauled, etc.

3. Around the 10th of the following month, the crude purchaser forwards us run statements, which show pretty much the same information as the run tickets, but also show the price per barrel. We match the run tickets with the run statements. If we find an error, we call the crude purchaser. I can remember 2 errors in 18 years, and they were minor and corrected immediately.

4. Around the 20th of the following month, we are paid for oil sold the previous month.

I presume 99.9% of all proceeds from oil sold in May, 2015 will be paid to the owners thereof between the 18th and 25th of June, 2015.

I again ask, why can’t the EIA require all US crude purchasers report their gross US crude purchases to the EIA? The information would be sent electronically.

Why would this be a bad thing to do? What problems am I not considering?

I do not think oil in storage would be an issue. Even if Exxon decides to store every drop of oil it produces in a year, I am sure it first sells same to a subsidiary pipeline, which pays the royalty and other working interest owners.

As I have said before, crude purchasers have to be meticulous record keepers and have advanced technology for record keeping purposes. They handle millions or billions of dollars paid to hundreds of thousands or maybe over a million different persons or entities each month.

We have leases where minerals were severed from the surface over 100 years ago. Some now have well over 100 royalty interest owners. This is common in many places all over the USA.

Think about the division of interest for SACROC, the Wasson Unit and the Yates Unit. If crude purchasers can keep these records accurate, seems sending a simple report of monthly gross purchases to EIA electronically would be a piece of cake.

We would know crude oil sold for May by June 20.

I invite criticism of my idea. Surely I am missing something here.

Also, they could report gravity information. That way Jeffrey J. Brown would be proven conclusively correct re his oil gravity assertions.

Shallow, you have explained basically the process in which oil is sold and how the income from that oil is disbursed. That happens every month, to the complete satisfaction of 28,000,000 Texans, in Texas anyway. Leases, counties, districts, regions; every barrel is accounted for. The problem (for some folks) is on the state level and how all that data is gathered up over time and presented to the public.

As I have said here, however,

http://peakoilbarrel.com/world-oil-output-last-3-years/comment-page-1/#comment-520543,

folks are not going to change how we do things down here in Texas very easily. Your idea is reasonable and a good one, but there must be an accounting relationship between producer and buyer to balance the oil check book.

Our process down here works fine. It causes some people angst, I understand. To me its much to do about not very much and my only complaint with all this hubbub is the misinformation being stated by some that creates doubt and mistrust in how barrels of oil are actually accounted for in Texas.

Mike

Hi Mike,

I apologize. My use of the “e” word was not intended to cause mistrust and I will try to refrain from using it in the future, occasionally it is actually mentioned by the RRC, as in the link below.

http://www.rrc.state.tx.us/all-news/052715b/

I am sure that all barrels produced are accounted for as accurately as is humanly possible in Texas and everywhere else in the US.

You probably don’t care what the statewide output is in Texas, but I do because it is more than a third of US output. Do you have access to better data for Statewide Texas output than what is reported in the PDQ?

Any uptick in Eagle Ford activity in April and May? I have read that there were more completions in April and May than in the first quarter. About 150 oil well completions per month in first quarter and 210 completions per month in April and May.

Edit: I just read your comment linked to above.

Mike you seem like a very smart man. If you really believe that the total output of oil is known exactly in Texas, I will just go with it.

In my world, no measurement is exact, every measurement is an estimate. Clearly you think of estimate in the sense of a guess, and most people seem to agree with your use of the word. These are just different meanings of the same word and for the most part I will avoid using that word as many find it offensive.

Texas has been at the oil game a lot longer than North Dakota, at some point Texas will improve its data systems, but i won’t hold my breath. Two years is a long time to wait to get all the data reported, but if it works for Texas, it’s all good, we will use statistics to guess at output in the meantime.

No need to apologize to me, Dennis. I understand its frustrating to you and a handful of others; I simply want to make sure that the rest of America does not think we are flying by the seat of our blue jeans down here. Texas operators must file timely, and accurately, and no regulatory agency or individual working in that agency has the ability to trade oil futures with data the rest of the world does not have. That’s dumb. You did not say that, I know. Production reporting is complex in Texas, with a workable system of checks and balances (absolutely imperative by Texas mineral law standards), but it serves the precise purpose for which it was intended when it was devised over 90 years ago. Things won’t change in Texas too much, no sir.

I just drove thru the guts of the EF today, Dennis; there is absolutely NO uptick occurring, I assure you. I saw only 3 drilling rigs running in the Karnes trough, near Cheapside (now called Richside by many), in the heart of EOG country and numerous CT heads on cranes indicating to me that EOG is frac’ing away, on multiwall pads, at that. I never bought into that drill and hold stuff and I sure don’t see it. If completions increased in April and May that was shale folks getting caught up on wells they drilled EOY 2014, under dedicated 2014 budgets. The drilling to completion lag time is decreasing with less stress on frac spreads; 2-3 months now, IMO. H&P has a new yard east of San Antonio that has 75 rigs stacked in it. There were 3 rigs sitting on 30 trucks waiting at the front entrance for the valet to show them where to park. I don’t see how they could squeeze a wheelbarrow in that yard anymore.

I have good friends, with 40 years of experience out of work. If we drop off in another swale with oil prices, it is even going to get worse, IMO.

Mike

Hi Mike,

I am releaved that you are still talking to me.

Thanks for the info. So maybe the fracking activity has picked up a little since March, but the drilling has not. I imagine if oil gets above $80/b for a month or so maybe the rigs will become active again.

Hopefully Kopits oil price forecast is correct ($85/b by end of 3rd quarter).

Is there anywhere that has more up to date statewide Texas output data than the RRC’s PDQ?

It may be that I just don’t know how the RRC’s online system works or maybe the info is in the State’s tax database (but that info may not be available to the public).

I am convinced that somebody follows this very closely (to the penny) in Texas, probably on a monthly (or maybe weekly) basis.

What seems strange is that it takes 2 years for all the data to flow to the PDQ, it may make sense to you. For example I understand for tax and royalty purposes everything has to balance like a checkbook.

For reporting purposes in the PDQ there is no such requirement, the data provided by producers could be posted in the PDQ with the proviso that all data is preliminary until 24 months have past and any discrepancies (and I believe you have said these are very few) can simply be taken care of by revising the data.

The only thing I would mess with is the way data is reported in the PDQ, I am pretty sure that nobody’s taxes or royalties are based on the PDQ (or a whole lot of Texans would be mad that their royalty payments were late).

Dennis, my assessment of activity in the Eagle Ford is based on physical observation, actual vested interest (and first hand knowledge) in the near term plans of several shale operators and heresay. New EF wells in S. Texas have slowed to a crawl. On a day to day basis I am too busy dealing with 149 of my own problem children to worry about what those shale knuckleheads will do tomorrow when and if oil prices improve. All the pundits and bloggers are essentially discounting price volatility in their desire to guess about the future of shale oil; LTO economics require high, stable oil prices for the business model to succeed and it didn’t, IMO. It won’t.

Texas oil producers do not report production to the EIA, nor IHS, nor DI, nor to NCAA; only to the TRRC. There is no other place to get the data.

I have tried to correct the misstatements made about Texas reporting practices. I don’t think “estimate” is a four letter word. I allocate individual well production under commingling permits and common tank batteries using a number of different methods; it is indeed estimating, but it’s accurate estimating. In the end, however, oil produced, and removed (sold) from under a mineral owner’s land must balance to the barrel. Stealing oil (by not reporting production accurately) will still get you strung up in Texas. Royalty and taxes are paid accurately on a lease by lease basis, each month, not off the PDQ, correct, but by individual reports, lease by lease, pooled unit by pooled unit. The PDQ exists for the benefit of people like yourself who think they need the exact data, immediately.

Admittedly, I don’t fully understand that.

In my opinion 80% of the oil producing countries in the world do not report their daily production accurately, intentionally, by very large amounts. Most remaining recoverable reserves throughout the world are grossly overstated by wide margins. For the peak oil community to get its panties in a bunch about Texas not making its production data accurately available to the public for several months down the road…well, I don’t much get it.

Mike

Mike: Do you do your own royalty accounting or does the crude oil purchaser do that for you?

The crude oil purchaser does that part for us, thankfully.

Mike,

A cold beer on a hot summer day, what a refreshing dose of realism. Thanks for that man.

Doug

Mike, many of us get the data prepackaged and massaged from IHS in a single contract. It includes well logs, maps, production and all sorts of goodies. That outfit makes a living taking state and private data and reselling it.

I think my idea is more efficient than what EIA is currently doing.

EIA apparently has many analysts who use various formulas to estimate production.

My idea would seem to require a very small team that would just need to be able to set up a simple online reporting system for crude purchases, gravity of crude purchased, monthly, and then total/compile the data.

My suggestion would not require any state to change anything they do. It would only require crude purchasers to electronically mail a simple report of total crude purchased for the month, and a breakdown of the crude by gravity, maybe in increments of 5 degrees, or whatever is deemed best.

It is too simple. Therefore, I assume, it will not happen.

Maybe too many government employee forecasters and private forecasting firms rely on the current system in order to make a living.

Hi Shallow sands,

I guess my point is that the oil companies already provide this information to their state agencies and would probably prefer not to have any extra paperwork.

As far as the different reports out of the EIA, none are great, but the monthy data from the Monthly energy review(MER) is much more reliable than the Drilling Productivity report, which is a model which needs some serious work. Given that the data the EIA gets from the states is incomplete, the MER is as good as it gets for US data, if we subtract Texas EIA guesses and substitute the much better guess by Dean, that is about as good as it gets for US C+C output data.

I like your idea even better, but like you said it is unlikely to happen.

Dennis. I agree that no business likes extra paperwork/record keeping. However, what I propose is a minimal amount of extra work concerning information I am sure the crude purchasers have already compiled. The form, which would be electronically submitted, would be one page. Crude oil purchased for the month would be broken down by state and by gravity. That is it. I think that could be fit on one page, or at least one page per state.

My comment above about forecasts is an exaggeration. However, I thought forecasts concern predicting future events, not what happened months ago.

It really is not a big deal to us. We don’t trade oil, just sell oill for the monthly average posted price plus a volume bonus. I just think EIA production data could be made more accurate and timely.

Agreed, we should put you in charge 🙂

Lol Dennis. No way. I am highly qualified at complaining though. I think I have demonstrated that well here! Lol!

Updated EIA chart showing estimated US C+C Production by gravity. The EIA is now showing virtually no increase in US 40 API and lower crude oil production from 2011 to 2014, with a minimal increase in 40 API and lower projected production in future years, in their Reference Case.

It would certainly be better data then we get now. It would be sales volumes as opposed to production volumes. For purposes of watching big trends, it would be close enough to the same thing. Perhaps it is because I have been mired in the minutiae of this very stuff for nearly 20 years, but it seems to me that it would probably harder to get it together than it seems at first glance. It depends on what level of detail you are after I suppose. The more useful, the harder it would be. That has been my experience anyway.

Hi Shallow sands,

I think this is a states rights issue. Recording this information is up to the states.

North Dakota probably does something like you suggest (but that it is a guess).

Other states seem to do that for their taxes and royalties etc, but the information does not seem to get to the part of the government agency that compiles and reports the output data publicly in a timely manner. There are states where it takes about 24 months for all of this output data to make it to the public database. The reasons for this delay are unclear, it is just a low priority I guess.

So the EIA is left to guess at output. The Drilling productivity report is a forecast and it has never been very good. The output from Jan to April in that forecast for the Bakken and Eagle Ford is too high. We have the real numbers through March for the Bakken from the NDIC (about 1130 kb/d) and in Feb the Eagle Ford was about 1400 kb/d (my last estimate based on RRC data and Dean’s estimate from April). The DPR does not take account of the frack log and bases its estimates on rigs and assumed completions per rig. So when the rig count goes down output goes down with a two month lag, the existence of thousands of wells waiting on completion is ignored and is a major flaw in the EIA’s model.

I think this is a states rights issue.

Dennis, I am sorry but I could not help but laugh when I saw that sentence. Do you really think this is a Tenth Amendment issue?

The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.

Hi Ron,

I am not a legal scholar. Generally the federal government lets the states decide how they should tax minerals. As some have pointed out a lot of this has to do with mineral rights and taxation.

The EIA has to be funded by congress, if the legislature wants the EIA to do a better job collecting data, they will put enough money in the EIA budget to accomplish the task. This choice has not been made, for what ever reason, mostly because many members of congress would prefer to reduce the scope of the Federal government as much as possible.

The suggestions of Shallow Sands could easily be done by the state agencies responsible for collecting oil data and the EIA could just collect the data from the various states. It is just not a high priority item as some people have pointed out.

So we are left with guesses.

I bet OPEC, the Chinese, and other outfits have this data, and the NSA and CIA grab it. This is used by fake CIA fronts to play in the market and get extra cash to pay for secret operations and the illegal alien welcome center in Area 41.

This is used by fake CIA fronts to play in the market and get extra cash to pay for secret operations and the illegal alien welcome center in Area 41.

Does this welcome center look anything like the extraterrestrial alien welcome center in Area 51? 😉

The welcome center is at McCarran for the weekly flights north, which is not all that comfortable.

I think $85 oil by end of year is pretty likely. Bakken new well production would just about equal out to legacy declines at that price, but it certainly won’t grow under $100. For production to actually continue to increase and go above it’s March peak, you’d need prices that the global economy couldn’t sustain for long.

Shale oil growth has matched the increase in global demand for half a decade now, but that’s over now. The ~1 to ~1.5 million more barrels per day that the world gobbles up per year will start to have an effect on prices.

Steven Kopits is predicting $85 oil by the end of the third quarter. Here’s the link to the recent interview with Steven on CNBC:

http://video.cnbc.com/gallery/?video=3000384466

It depends on the Chinese, I suppose. They must have a huge stock of cheap oil bought over the last few months. Being the largest crude buyer does give them an interesting monopsonish flavor. What’s the Saudi net cash flow at 80? Do they live from what they make at that price? Would it be possible for the Saudis and Chinese to fine tune the market? Just asking.

So, the EIA says the US shale plays will decline at 1.63% per month in June 2015.

Solar PV is good for the southern U.S.,

but for the northern areas and Canada, it seems Wind power is the best option.

Recent installations on vancouver island have shown an 8.1% return on investment, which means they are economic without subsidies.

Wind generation has massive issues with bird strikes & kills in northern US since that is in the migratory pathway. On the talk radio there is frequent mention of how the dead birds really pile up if not cleared away by people or predators in the heavy wind farm areas.

cats and windows kill several orders of magnitude more birds than wind farms

A Summary and Comparison of Bird Mortality from

Anthropogenic Causes with an Emphasis on Collisions

http://www.fs.fed.us/psw/publications/documents/psw_gtr191/Asilomar/pdfs/1029-1042.pdf

Wind turbines are responsible for 0.01% of bird fatalities from man made causes. The more important causes are buildings(58%), power lines(14%), cats (11%), and pesticides (7%). All other causes were less than 1%.

From table 2 in the document linked by ezridermike on p. 1036 of the document.

Killing 1,000 birds per day like a wind farm will? Don’t know about that. Chilling video at http://www.youtube.com/watch?v=CEersoJLtRw showing how our genius government is literally giving these wind farmers license to kill endangered and supposedly protected birds all in the name of keeping the greenies happy (and voting Democrat, no doubt).

If we don’t have energy….birds don’t stand a chance anyway.

We will be putting them on tacos and nachos when ELM peak oil bites.

We need thorium/nuclear and liquid fuels to have a chance.

I don’t think even that will work.

Ultimately, it is an exponential curve of population growth that is the problem. We have to stop the exponential doublings.

There is no escape from that, unfortunately.

”There is no escape from that, unfortunately.”

BB4 ,I used to believe the same thing but I am no longer SURE there is no escape.

Some possibilities come to mind.

One, Business As Usual, world wide, lasts longer than we expect – with women world wide getting some education sooner than we expect.A number of countries that I used to believe were doomed to famine and worse might turn the population corner simply because of rising general prosperity.

Two, priests of various stripes in some cases may and probably will come out in favor of family planning. This has happened before with dramatic results but I can’t remember the details well enough to post them.

Three, some super rich folks are donating megabucks to good causes. Somebody may figure out a way to make birth control free and unobtrusive. Suppose a woman could swallow a single pill that prevents her from getting pregnant for a year or longer?Or suppose a poor man is offered something priceless to HIM – such as a small pv system with batteries, some power tools, radio, and so forth in exchange for having a vasectomy?

Four, somebody impatient with more ethically acceptable approaches may decide to modify a common virus so that it sterilizes anybody who gets infected by it. Given that it would spread by itself but curing it would involve treating the victims- many or most of them in places where no treatment is available- this sort of approach could work wonders.

All this sort of thing used to be the province of wishful thinking or science fiction but things are changing so fast technologically that social change can and sometimes does come unexpectedly in an eye blink.

Consider the amazing drop in the birth rate in Brazil for instance. So far as I can tell the single most important factor in this coming about was the arrival of cheap television sets. Once the women there saw actresses on tv living a modern life without lots of kids they got the idea IMMEDIATELY. Note that Brazil is at least nominally a Catholic country.

Another thought that apparently has not yet blossomed in the eyes of the public is that as population falls-which it MUST eventually- wealth is going to be there for the inheritance of it rather than the purchase thereof. A new social paradigm could arise.

Just yesterday I was lamenting the fact that I don’t have a couple of hale and hearty sons to work their asses off for their old daddy on their days off for affection and in hopes of inheriting the farm.

People at one time did in PART raise large families to assure themselves of help and hopefully support in their old age. (Personally I have always believed half or more of the kids were the result of just having a little fun back in days when birth control was expensive, unreliable, and hard to come by due to law and religious custom.)

With modern medicine and the welfare state etc people no longer need lots of kids. People may come to FULLY understand that having one or two kids means having a HIGHER standard of living over the course of their lifetimes- PLUS having ASSETS to leave as inheritances which will ensure the prosperity of that same one or two kids.

Nevertheless you are probably right.

My own guess is that the Four Horsemen are going to solve the population problem in a lot more places than people solve it for themselves.

From Calhoun’s population studies on rats:

http://en.wikipedia.org/wiki/John_B._Calhoun

“After day 600, the social breakdown continued and the population declined toward extinction. During this period females ceased to reproduce. Their male counterparts withdrew completely, never engaging in courtship or fighting. They ate, drank, slept, and groomed themselves – all solitary pursuits. Sleek, healthy coats and an absence of scars characterized these males. They were dubbed “the beautiful ones.” Breeding never resumed and behavior patterns were permanently changed.

The conclusions drawn from this experiment were that when all available space is taken and all social roles filled, competition and the stresses experienced by the individuals will result in a total breakdown in complex social behaviors, ultimately resulting in the demise of the population.”

Do you find yourself spending more and more time alone at the computer, the TV and other isolating endeavors and less and less time procreating, raising and protecting young or otherwise being involved with females and children? It’s OK, you are now beautiful, at least according to John B. Calhoun’s labeling.

But unfortunately we’ve never been able to get of rats.

We won’t – or people either. A closed laboratory is not the same thing as large open spaces. In the real world , as opposed to a closed lab space, rats and people move and fight to the death and keep on making hanky panky.If a given suitable territory by chance becomes totally depopulated, wandering newcomers soon find it and repopulate it.

But the implications of this research are troublesome in the extreme. I think it should be repeated on a larger scale with more modern equipment. There might be a significant new insights gained.

The lack of predators seems to be a key to the results. I don’t know if ants or other scavengers were present and present in sufficient numbers to clean up the rat carcasses. Such factors would change the results, probably dramatically.

I remember hearing about it in various classes I took over the years. The professors generally referred to this phenomenon as part and parcel of the ”General Adaptation Syndrome.” You seldom hear it mentioned these days.

“we’ve never been able to get of rats.”

Rat knew that.

I ate simbiliki a long time ago. It’s a large African rat. Tastes ok with rice and mushroom soup.

showing how our genius government is literally giving these wind farmers license to kill endangered and supposedly protected birds all in the name of keeping the greenies happy (and voting Democrat, no doubt).

Yeah, maybe so! But your comment reeks of ignorant ideology! Why don’t you concern yourself with skyscrapers that symbolize the fossil fuel based BAU paradigm, infinite economic growth and right wing corporate monopolies? How about migrating waterfowl that are killed by waste ponds around the Tar Sands up in Canada or because of deforestation and and habitat loss in hundreds of places all around the world?!

http://www.bcnbirds.org/window.html

Window Collisions

Bright Lights, Big Cities: Lights & Windows are Deadly Hazards for Birds

At least 100,000,000 birds are killed and even more are injured every year across North America by collisions with windows. Ornithologists have been studying this phenomenon for decades and their findings are very conclusive: birds simply do not recognize glass as a barrier. During daytime, birds often fly head-on into windows, confused by the reflection of trees or sky. This is a common occurrence even in the suburbs at homes and glassy office campuses. Of the birds that suffer head trauma, over half die.

Additionally, scientists have observed that at night the bright lights of buildings seem to confuse birds, especially during cloudy, foggy or rainy weather. Large masses of birds have been photographed during the night at one of Chicago’s skyscrapers, the birds continually circling and battering the building lights. By dawn the birds are either dead or seriously injured. These birds were migrants on their twice-yearly, night-time migration. During some weather conditions and at certain “killer” buildings, the death toll can be in the hundreds per day.

Emphasis mine, BTW, NOTE: those hundreds of birds killed per day, that’s not caused by an entire wind farm, that’s just one fucking building on one street corner in one city.

The USA is placing these windmills in wild, natural ecosystems, causing an untold amount of ecological damage. In one desert ecosystem in California, the first Earth-death occurred while skinning the ecosystem with roads for access to install the wind turbines in the first place.

The turbine installers then killed a huge population of desert tortoises, a listed, protected, native species of biological diversity with the heavy, planet-skinning equipment. One of the reasons, this strand in the web of all life is headed toward extinction is, when they disturb the soil in an ecosystem, like skinning the plants and trees away to make room for the bird, eagle and bat killing windmills, more death to the strands in the web of all life — they plant weeds in the disturbed soil.

These weeds are not in the food chains with any biological diversity; bio means life. The endangered tortoise/biological diversity is starving today because the weeds aren’t in his ecological food chain.

A sliced and diced ecosystem falls under fragile island ecology, scientifically, “fragmentation”. A fragmented ecosystem is a heavily damaged ecosystem. It changes the roles of predators and prey species. Birds like to build their nests in the interior of ecosystems while fragmentation forces them to build their nests and nestlings at the exterior of the system. Predators have easier access to prey species at the exterior, just like windmills killing birds, the predators gain the advantage.

The reason they’re skinning and destroying these rural out of the way ecosystems/Earth is because people will no longer live with these noisy, gigantic monsters that take away serenity, beauty and peace and health due to all the noise and oscillations. Yes, the USA is killing Earth, the strands in the web of all life and the future to, maybe, somehow, help climate! Sickening.

Can we sign you up for the various environmental protection groups?

There are all sorts of projects we might want to kill to protect the environment.

I am concerned that those who protest wind turbines in the name of the environment wouldn’t also protest roads, housing developments, waste water disposal, and other projects because of their negative environmental impact.

But if there is true environmental concern for all of these projects I welcome the discussions. Let’s organize a massive campaign across the US to support environmental protection.

We’ll add people like yourself to show that the EPA does have widespread support.

The EPA? They’re skinning, deforesting, denaturing and scouring Earth’s ecosystems to make room for a green energy while they lap up the big green payola for themselves! Wind energy requires vast acreages of Earth’s wild, natural ecosystems for an inefficient, unproven energy source that slaughters millions of birds.