By Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated production information up to October 2025.

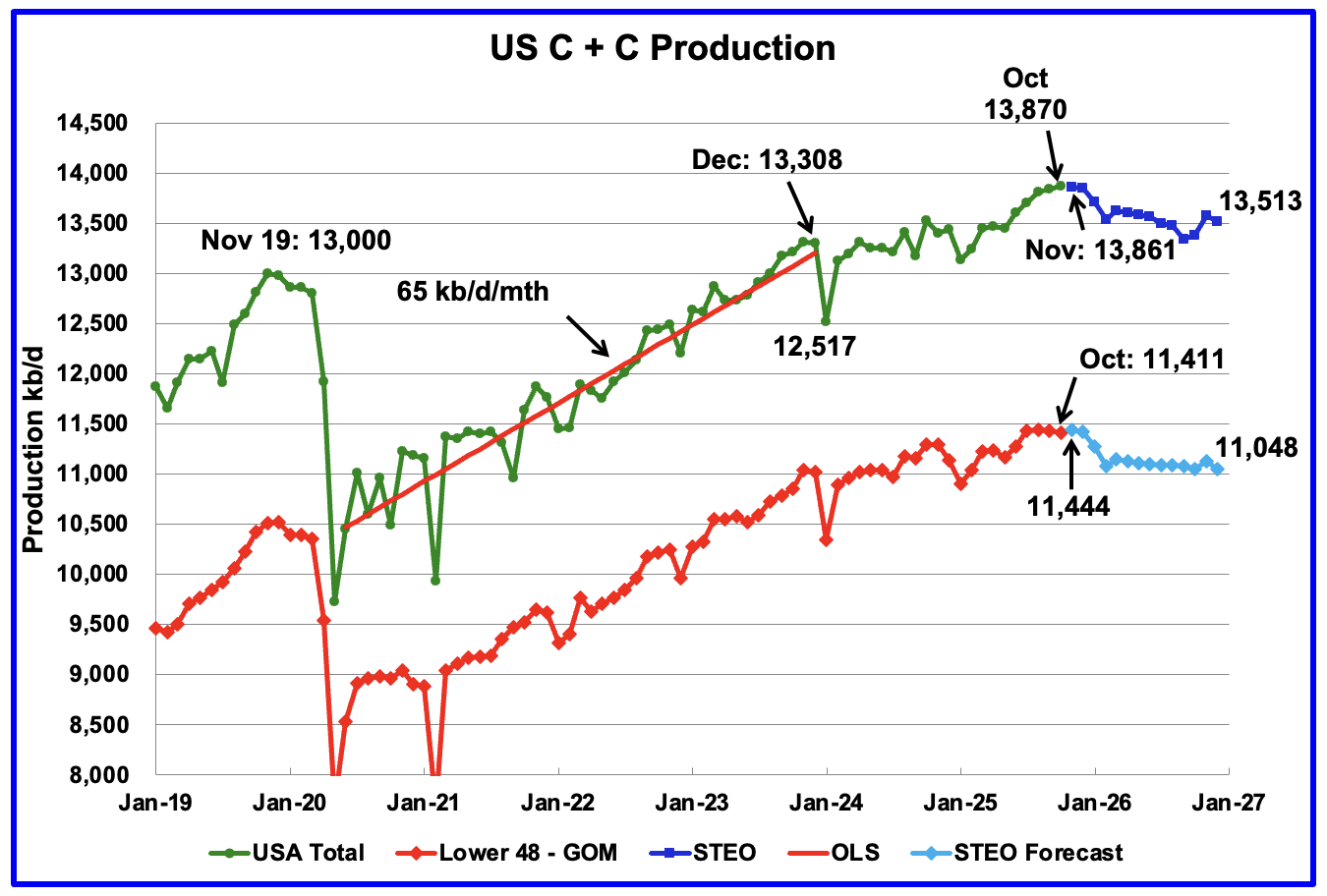

U.S. October oil production increased by 31 kb/d to 13,870 kb/d, another new record high. The largest increases came from the GOM and New Mexico offset by a Texas drop. November production is expected to drop by 9 kb/d to 13,861 kb/d according to the December STEO.

The dark blue graph, taken from the December 2025 STEO, is the U.S. oil production forecast from November 2025 to December 2026. Output for December 2026 is expected to drop to 13,513 kb/d. From October 2025 to December 2026 U.S. oil production is expected to drop by 357 kb/d.

Note the almost flat production in the Onshore L48 from July 2025 to December 2025, 11,436 kb/d to 11,420 kb/d, respectively, red/blue graph. The October Onshore L48 oil production dropped by 25 kb/d from September’s 11,436 kb/d to 11,411 kb/d. The difference between the 31 kb/d increase in the overall US production vs the 25 kb/d production drop in the Onshore L48 is largely due to the 46 kb/d increase from the GOM.

US production will peak between October 2025 and December 2025. October has a chance. Onshore L48 almost guaranteed.

The light blue graph is the STEO’s forecast for the Onshore L48 output to December 2026. From October 2025 to December 2026 production is expected to decrease by 363 kb/d to 11,048 kb/d.

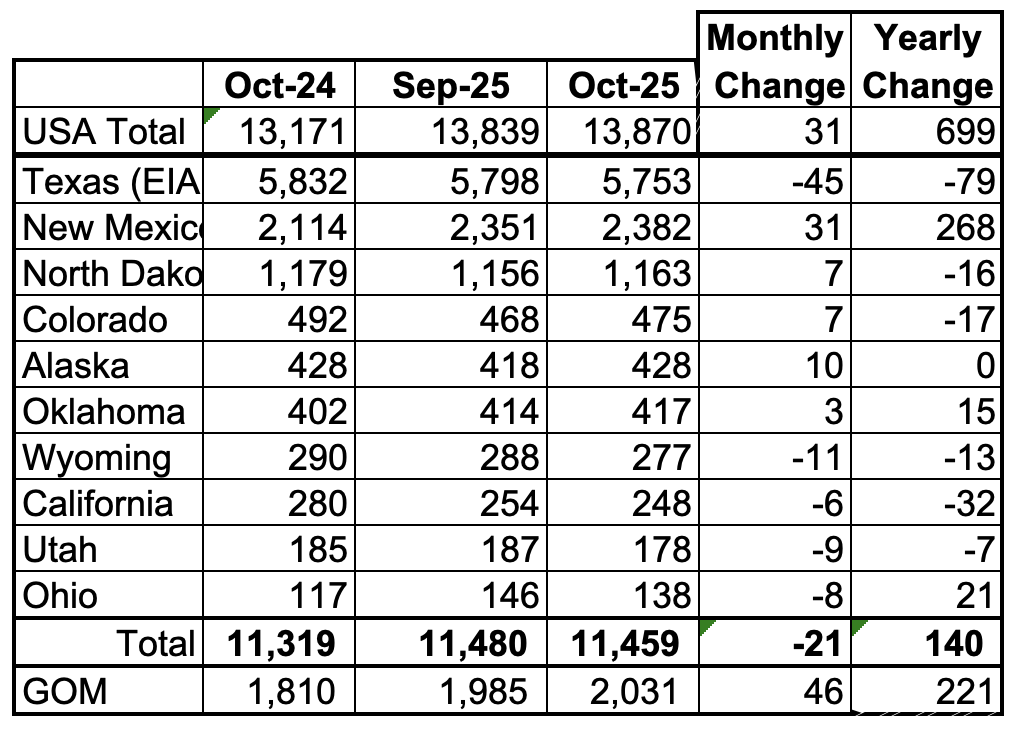

U.S. Oil Production Ranked by State

Listed above are the 10 US states with the largest oil production along with the Gulf of Mexico.

These 10 states accounted for 82.6% of all U.S. oil production out of a total production of 13,870 kb/d in October 2025. On a MoM basis, October oil production in these 10 states dropped by 21 kb/d. On a YoY basis, US production increased by 699 kb/d with the largest contributors being New Mexico and the GOM.

State Oil Production Charts

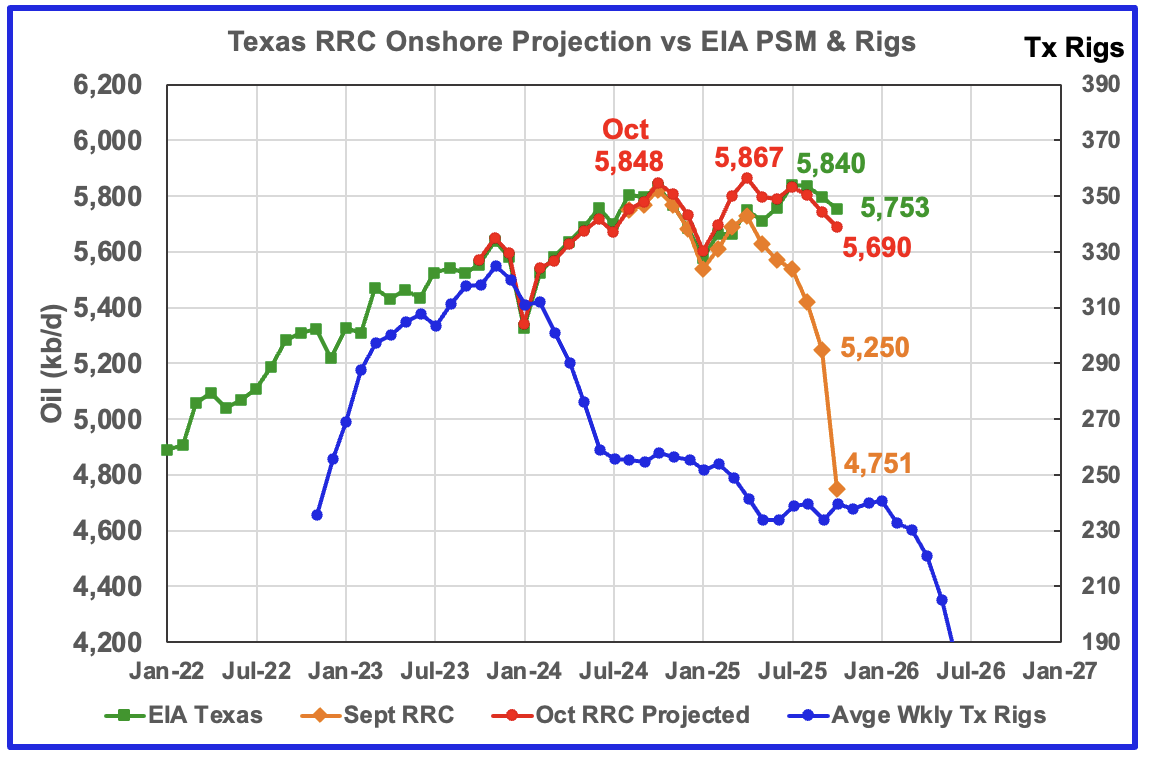

Texas’ October production decreased by 45 kb/d to 5,753 kb/d according to the EIA and is 87 kb/d lower than July 2025.

Texas’ production rebounded from January 2025 to July 2025 to 5,840 kb/d. However since July 2025, production has dropped for three consecutive months. The point to note here is both the production projection and the EIA’s production are going in the same direction from January 2025 to October 2025 and both are indicating that Texas is entering a declining phase.

The Texas’ RRC initial production for October dropped by 499 kb/d from September to 4,751 kb/d. The projection added 939 kb/d to raise October’s production to 5,690 kb/d, 63 kb/d lower than the EIA’s estimate.

The red graph is a production projection using the September and October Texas RRC data.

The blue graph shows the average number of weekly rigs reported for each month shifted forward by 10 months. So the 276 rigs operating in July 2023 have been shifted forward to May 2024. From February 2024 to July 2024, the rig count dropped from 312 in time shifted February 2024 to 256 in July 2024. That drop of 56 rigs had no impact on production up to July 2025. August 2025 appears to be the first month when the impact of the rig count drop on oil production started to show up.

According to the EIA, New Mexico’s October production rose by 31 kb/d to 2,382 kb/d, a new high. YoY production rose by 268 kb/d, the biggest contributor to overall rising US production.

The blue graph shows the projected output up to October. October’s production projection increased by 24 kb/d over September to 2,341 kb/d, of which 22 kb/d came from the OCD’s preliminary production.

Eddy County added 34 kb/d of production to the overall New Mexico increase and is discussed further in the Permian section below.

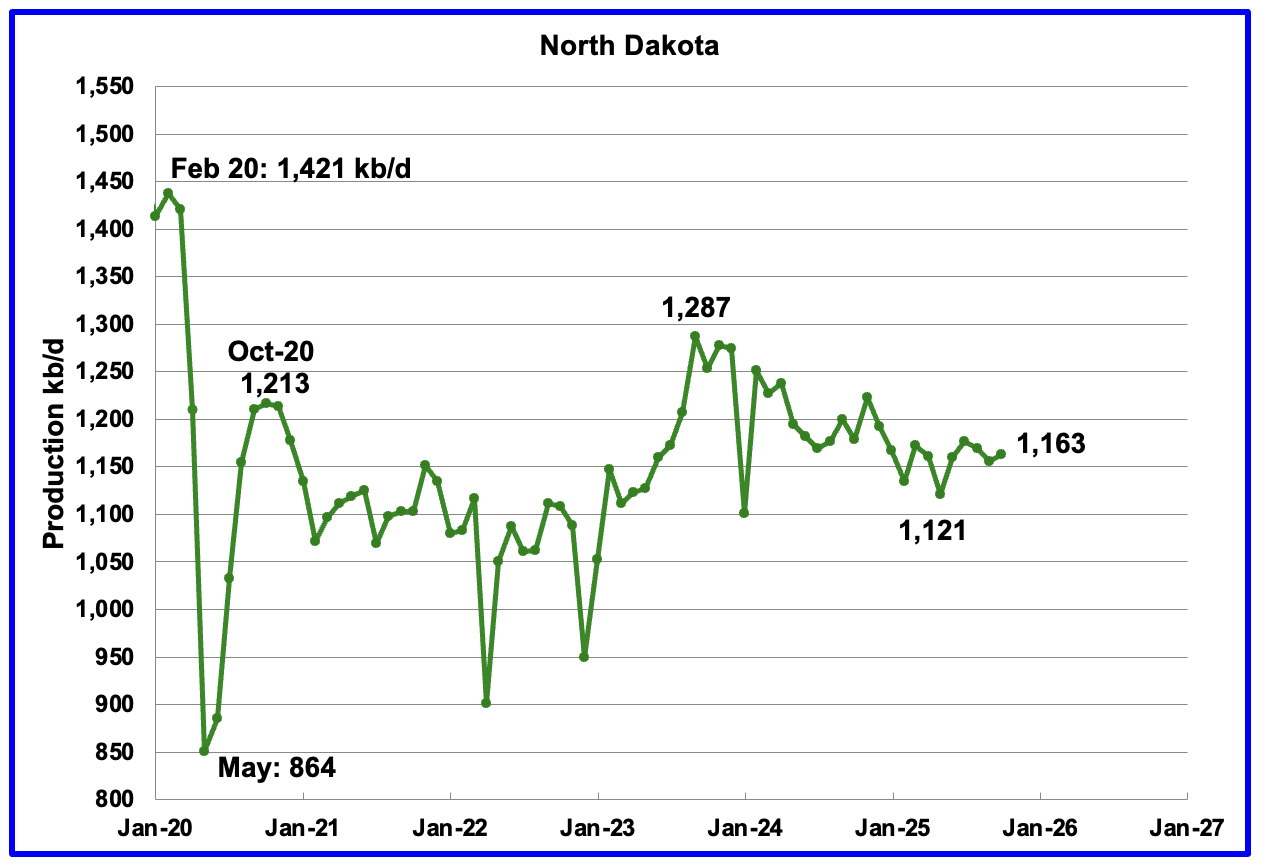

October’s output rose by 7 kb/d to 1,163 kb/d. Production is down 124 kb/d from the post pandemic peak of 1,287 kb/d.

The North Dakota Department of Mineral resources reported October production increased by 1 kb/d to 1,169 kb/d, which is close to the EIA’s estimate.

According to this Article, some North Dakota drillers are drilling 4 mile horizontal wells.

North Dakota’s top oil regulator is pessimistic about oil prices for 2026 but says oil production should hold steady, due in part to new drilling technology companies are using to remain profitable.

“Every time somebody thinks that the industry is essentially kind of maxed out on their technical capabilities, they usually come through with some type of innovation,” said Nathan Anderson, director of the North Dakota Department of Mineral Resources.

One reason North Dakota oil production is stable, despite the dip in oil activity, is companies are drilling longer horizontal wells. Oil wells drilled in the Bakken typically drill vertically until they hit the Bakken rock formation about 2 miles underground, then curve horizontally for 2 miles. The surrounding rock is then fractured, or fracked, to release the oil.

But companies are now drilling farther horizontally. More than 1,000 permits have been issued for wells that are drilled horizontally for 3 miles instead of 2. That accounts for 30% of all wells being completed, according to Department of Mineral Resources data.

Some companies took it a step further in 2024 and began drilling horizontally for 4 miles. There have been 105 permits awarded for wells of that length, a fifth of which have been drilled and completed.

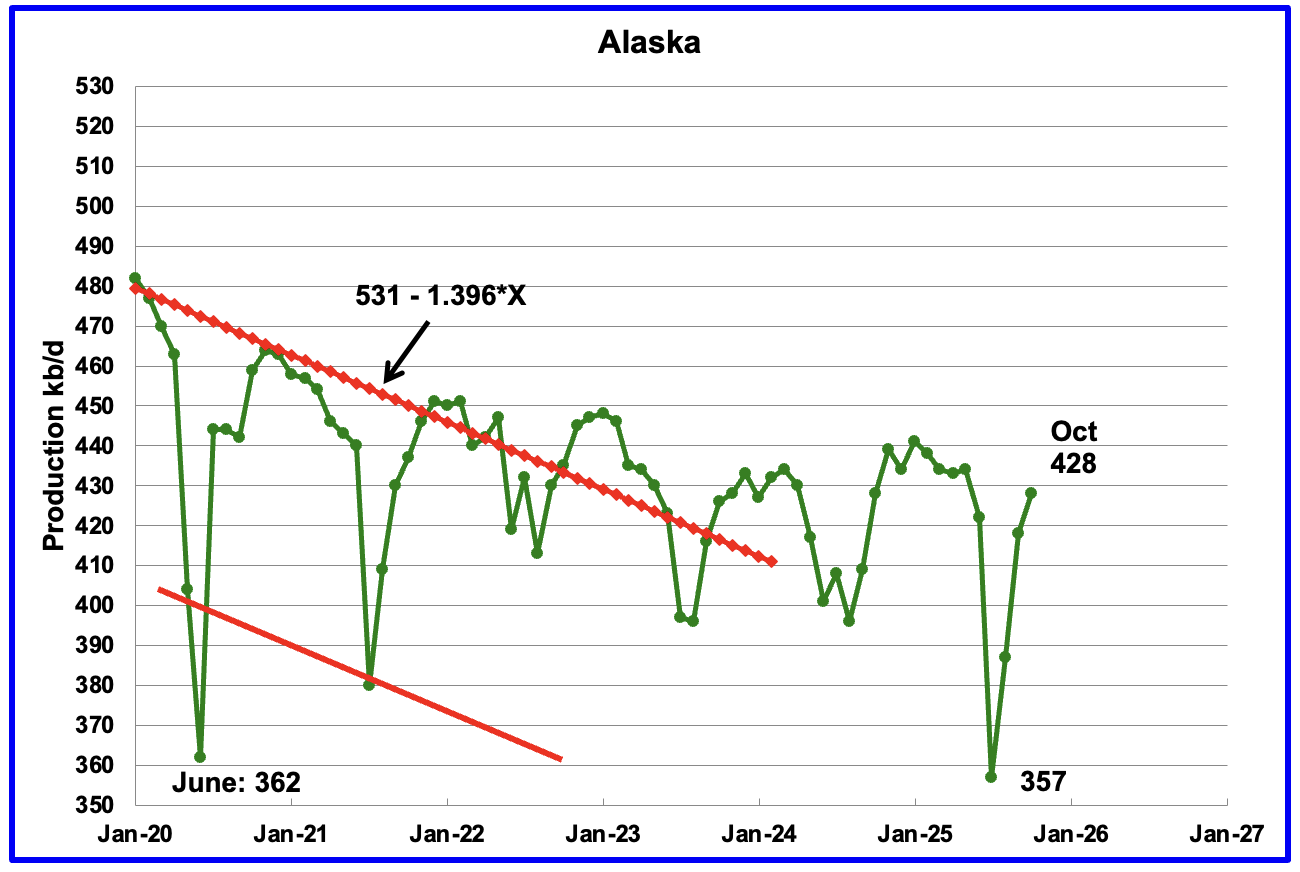

Alaskaʼs October output rose by 10 kb/d to 428 kb/d while YoY production was flat. The EIA’s weekly October reports indicated that October production would rise and would average close to 430 kb/d. Production from the weekly reports for October and November continues to be in the 430 kb/d to 435 kb/d range, showing little growth beyond October.

Alaska has recently brought new fields online to consistently have flat YoY and monthly production gains which have broken away from the earlier dropping production red trend lines. New production is expected to come online from the Picca field in early 2026.

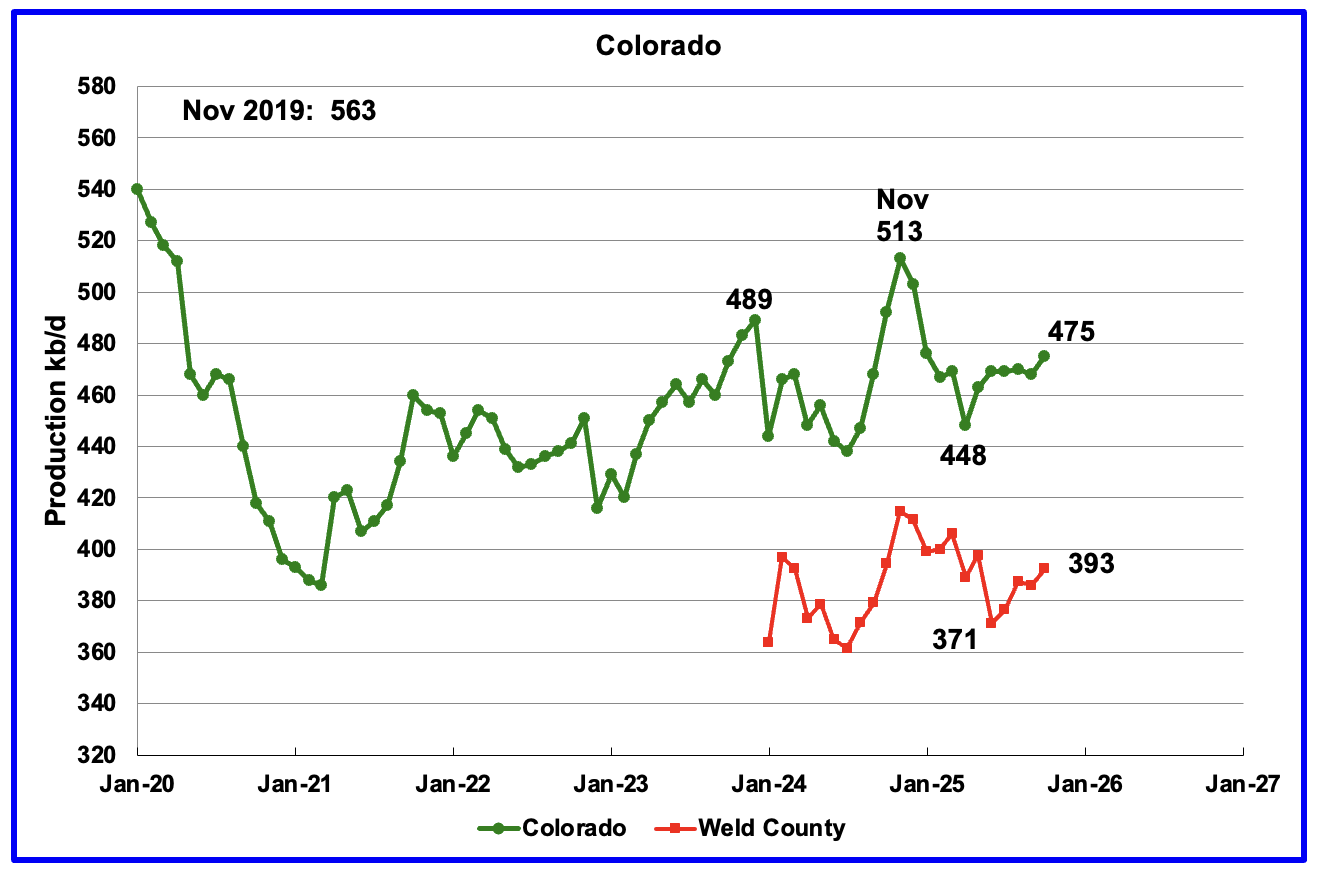

Coloradoʼs October oil production rose by 7 kb/d to 475 kb/d.

The biggest oil producing county in Colorado is Weld County and its production has been added to the chart. The two graphs have been almost parallel since January 2024 but diverged over the last few months. Weld’s production also rose by 7 kb/d in October to 393 kb/d.

Colorado began 2025 with 6 rigs in January and February and peaked at 11 in October. At the end of December 7 rigs were operational..

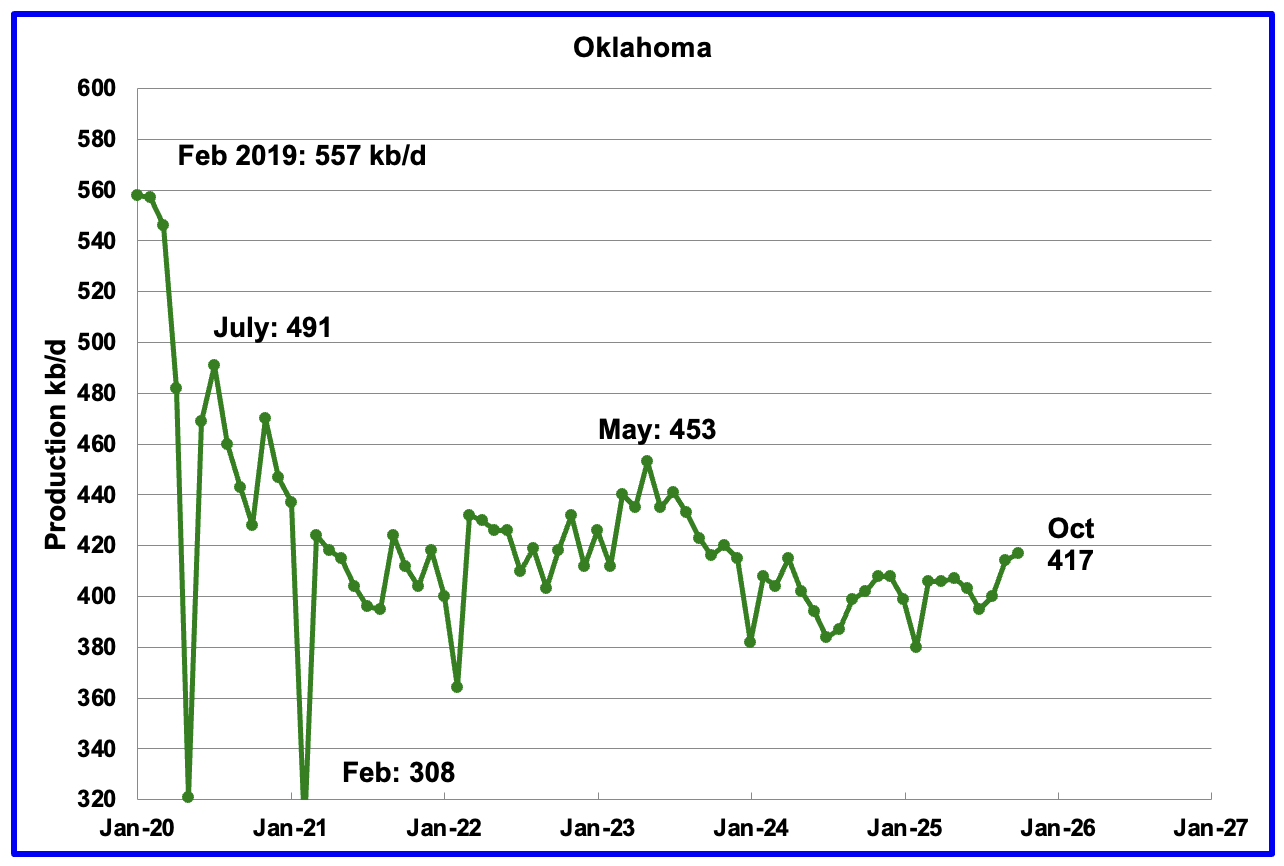

Oklahoma’s output in October rose by 3 kb/d to 417 kb/d. Production remains below the post pandemic July 2020 high of 491 kb/d and is down by 36 kb/d since May 2023. Output entered a slow declining phase in June 2023 and now appears to be range bound around 400 kb/d ± 20 kb/d.

Oklahoma had 51 operational rigs May which slowly dropped to 39 rigs in December. The impact of the dropping rig count after May should begin to show up in a few months, allowing for a 6 month time shift between rig count and oil production.

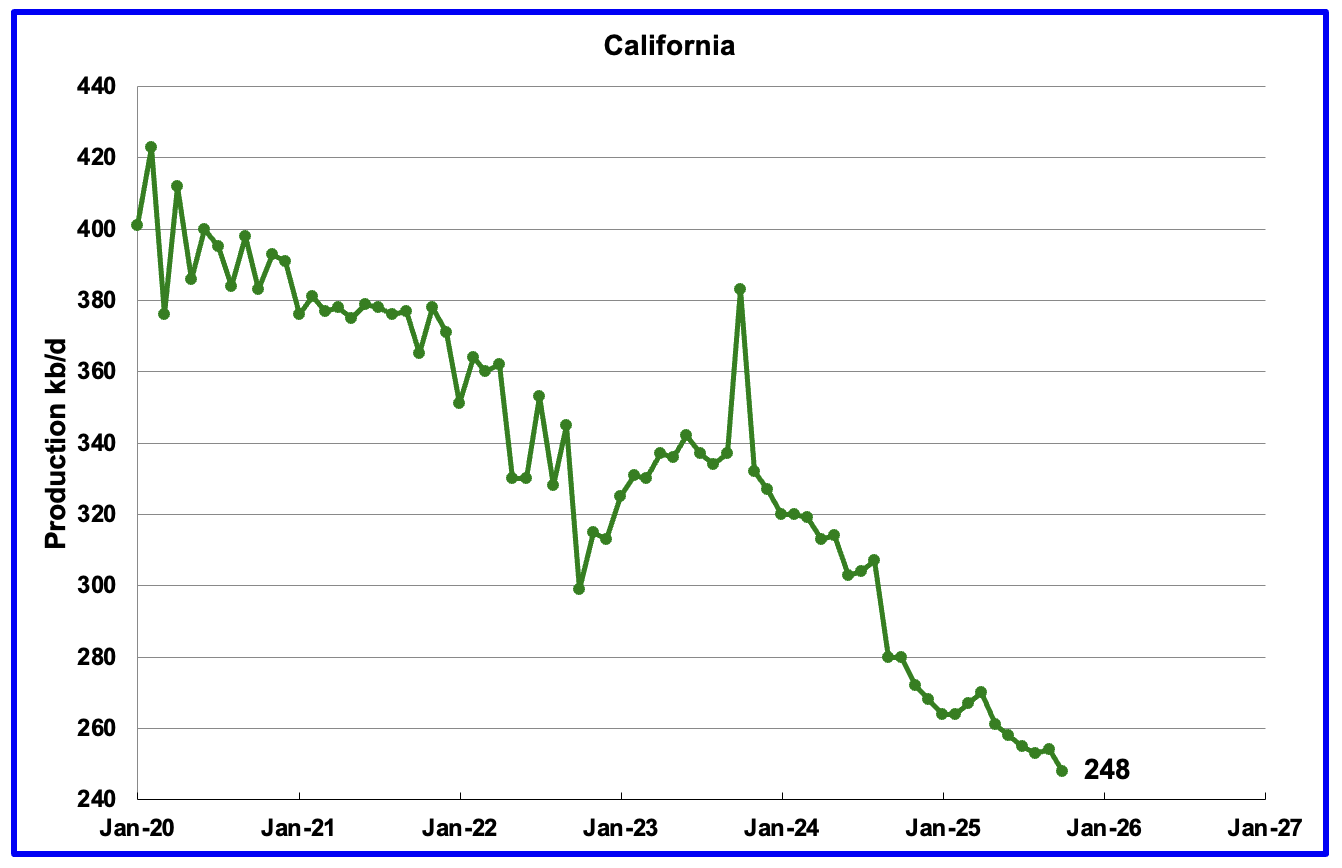

California’s overall declining production trend continues. October’s production dropped by 6 kb/d to 248 kb/d. YoY production dropped by 32 kb/d.

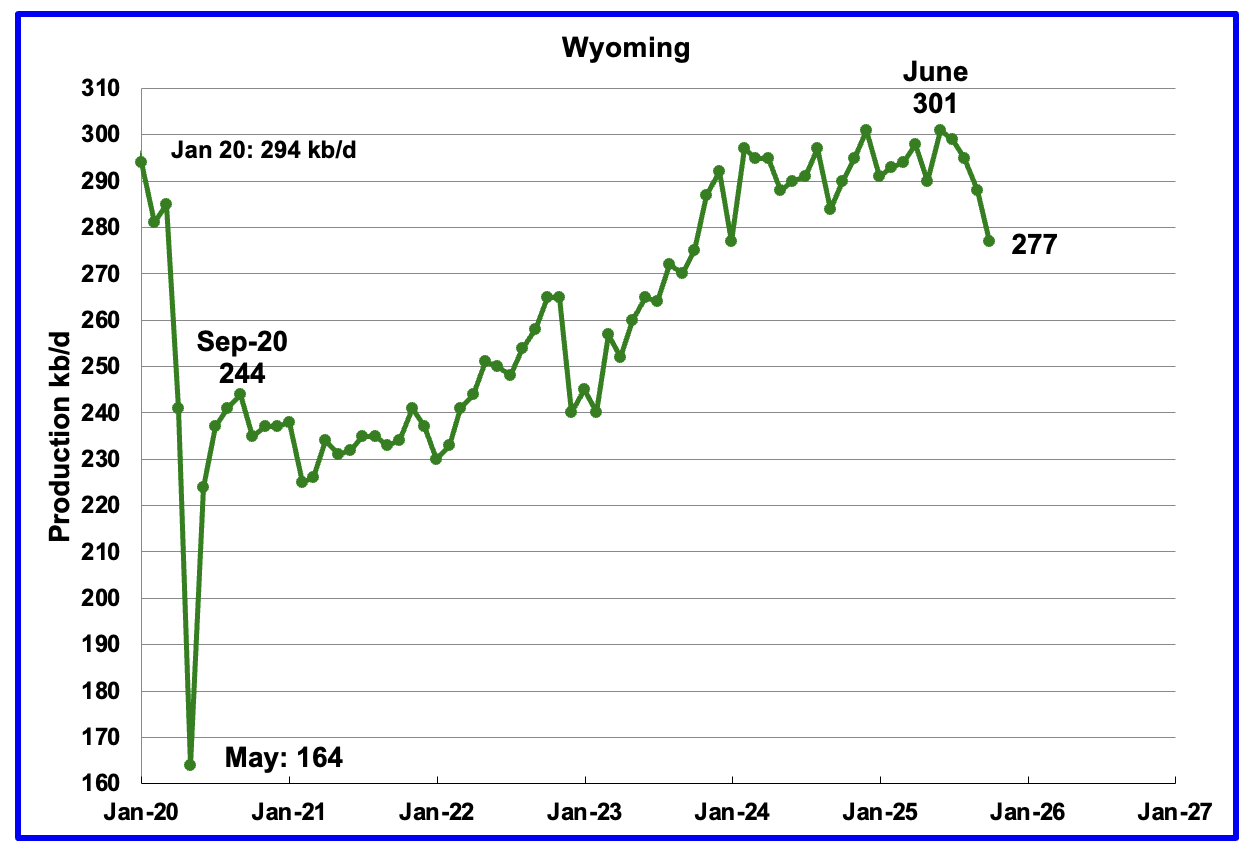

Wyoming’s oil production reached a post pandemic high in December 2024 and again in June 2025. Production has dropped in each of the last 4 months. October productions dropped by 11 kb/d to 277 kb/d and Wyoming appears to have entered a declining phase.

At the beginning of 2025 Wyoming had 14 operational rigs and rose to 16 in March and April. At the end of November 10 rigs were operational. In December 3 rigs were added for a total of 13.

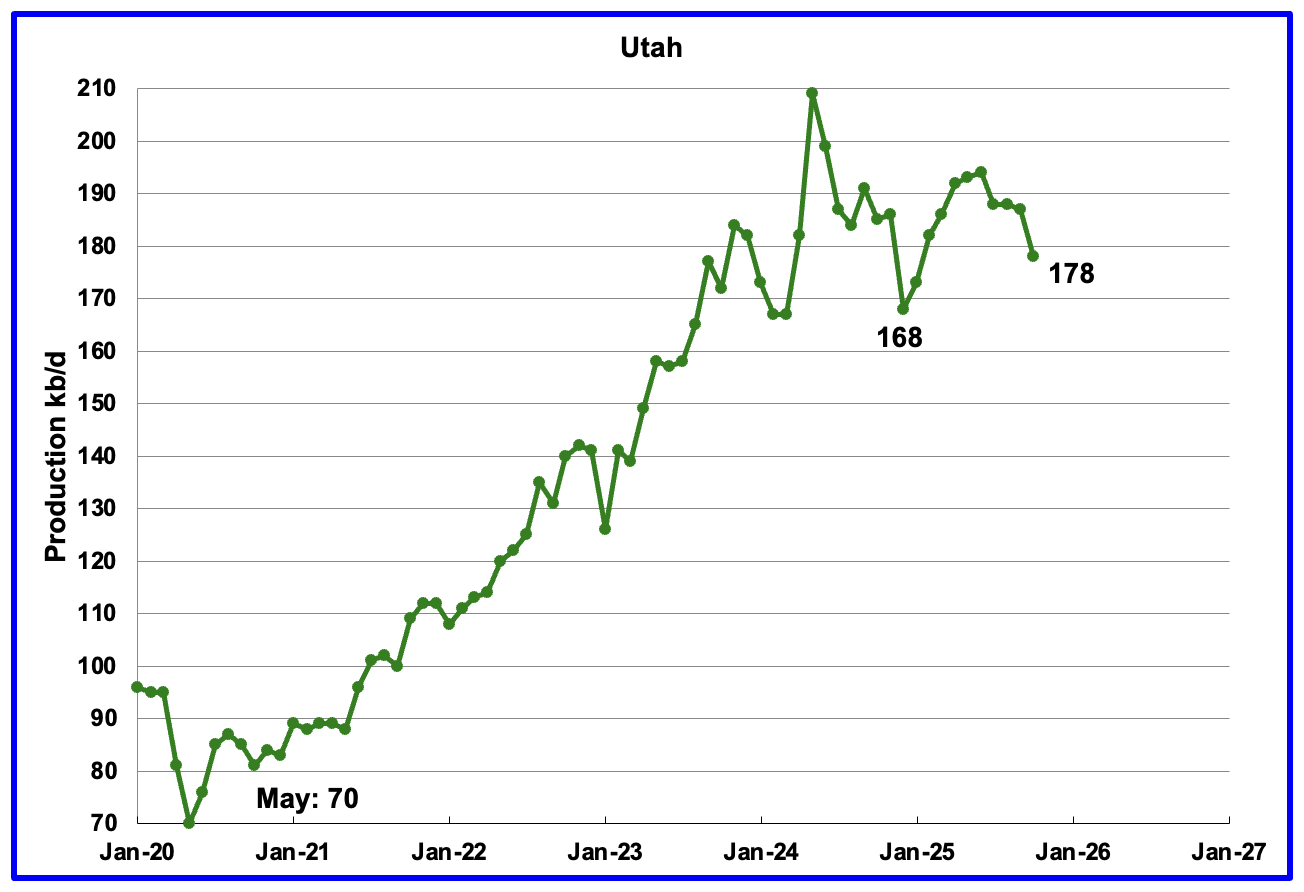

October’s production dropped by 9 kb/d to 178 kb/d. Utah had 8 rigs operating from October 2024 through May 2025 but dropped to 6 in early June but returned to 10 at the end of December.

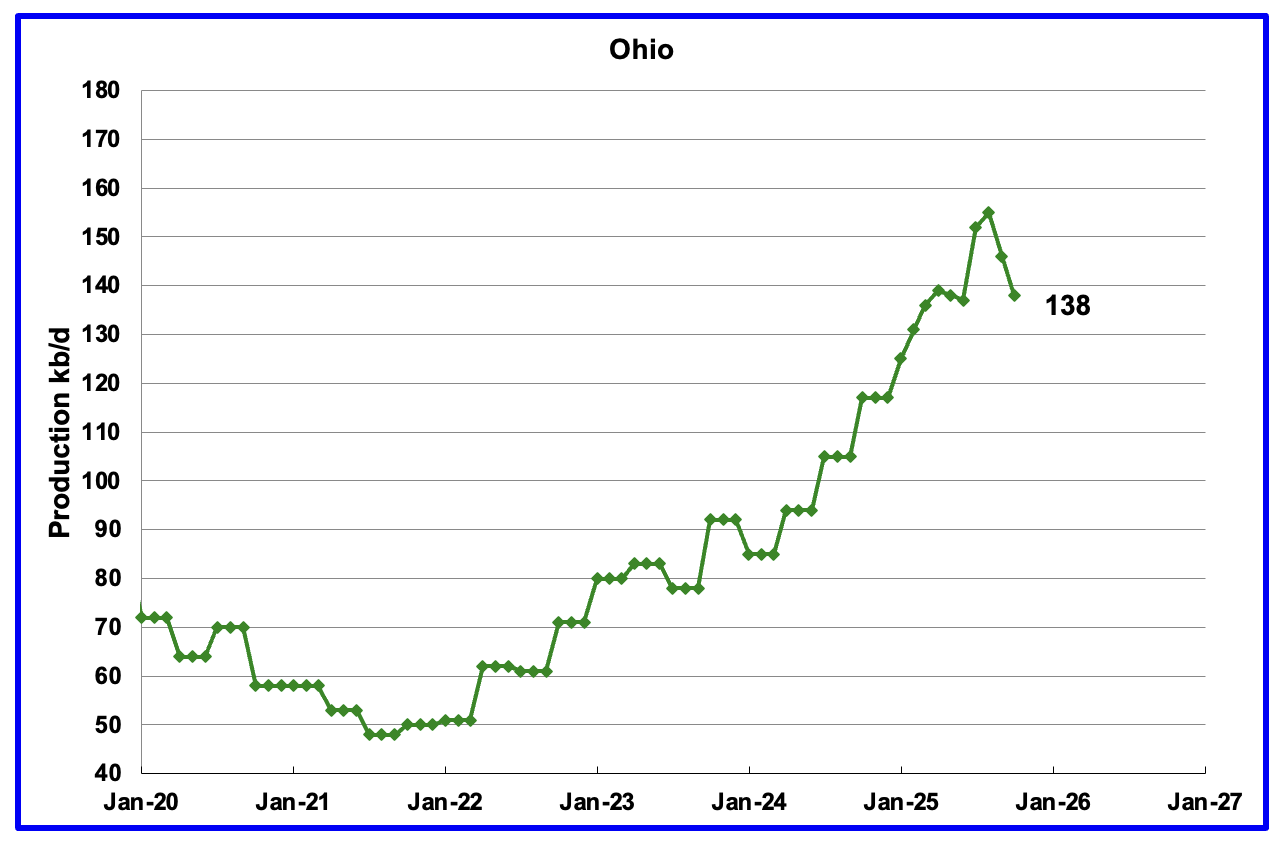

Ohio’s October oil production decreased by 8 kb/d to 138 kb/d. Ohio started the year with 6 NG rigs, In late December Ohio had 12 NG rigs and 1 oil rig operating.

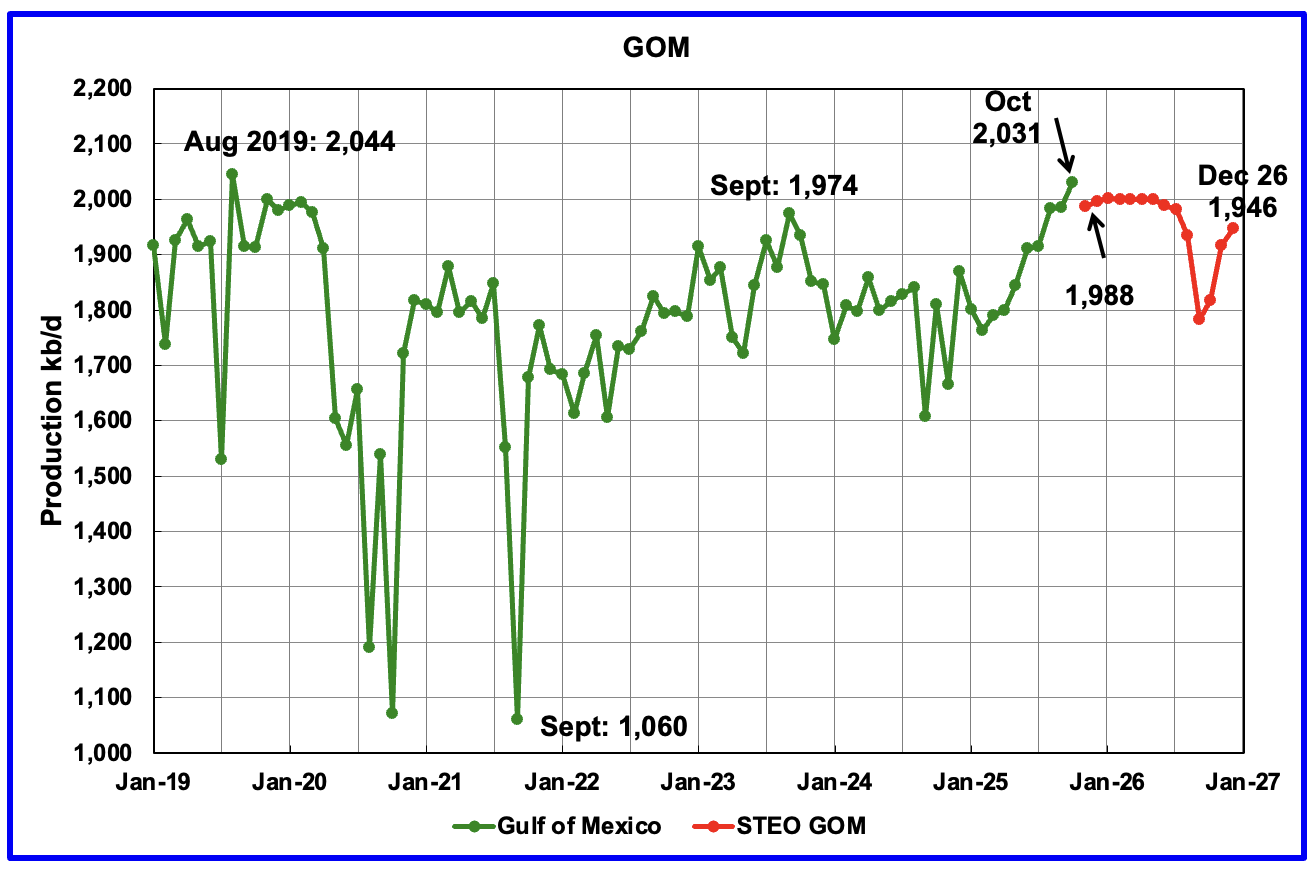

GOM production rose by 46 kb/d in October to 2,031 kb/d. The large increase may be related to the July startup of the Shenandoah floating production system. It reached its 100 kb/d production target in October. (See comment below) November’s production is projected to decrease by 43 kb/d to 1,988 kb/d. Surprised with the projected drop. Could be revised in the January 2026 STEO.

The December 2025 STEO GOM projection has been added to this chart. It projects production in December 2026 will be 85 kb/d lower than October 2025 at 1,946 kb/d.

According to this Article, Three new projects have helped boost US Gulf of Mexico output since mid-2025 and will continue to add to supply.

“Beacon Offshore Energy’s 120,000 b/d Shenandoah floating production system started delivering oil into Genesis’ SYNC pipeline in July. The line connects to the Cameron Highway Oil Pipeline System (Chops), which feeds the SGC crude stream. Beacon said in October that Shenandoah had reached its 100,000 b/d target.

Elsewhere, BP recently started up the Argos Southwest Extension project, adding 20,000 b/d of oil equivalent (boe/d) to the existing platform. Argos output also goes into Chops to feed the SGC stream. And LLOG Exploration’s Salamanca project, which achieved first oil in the third quarter, is expected to ramp up to its design capacity of 50,000 b/d by mid-2026 and flow into the medium sour Poseidon stream.

Additionally, BP’s Atlantis Drill Center 1 oil field expansion project started up two months ahead of schedule, the company reported on 11 December, and is expected to add peak production of around 15,000 boe/d. Atlantis’ gross oil production capacity is 200,000 b/d and feeds into the Chops stream.”

A Different Perspective on US Oil Production

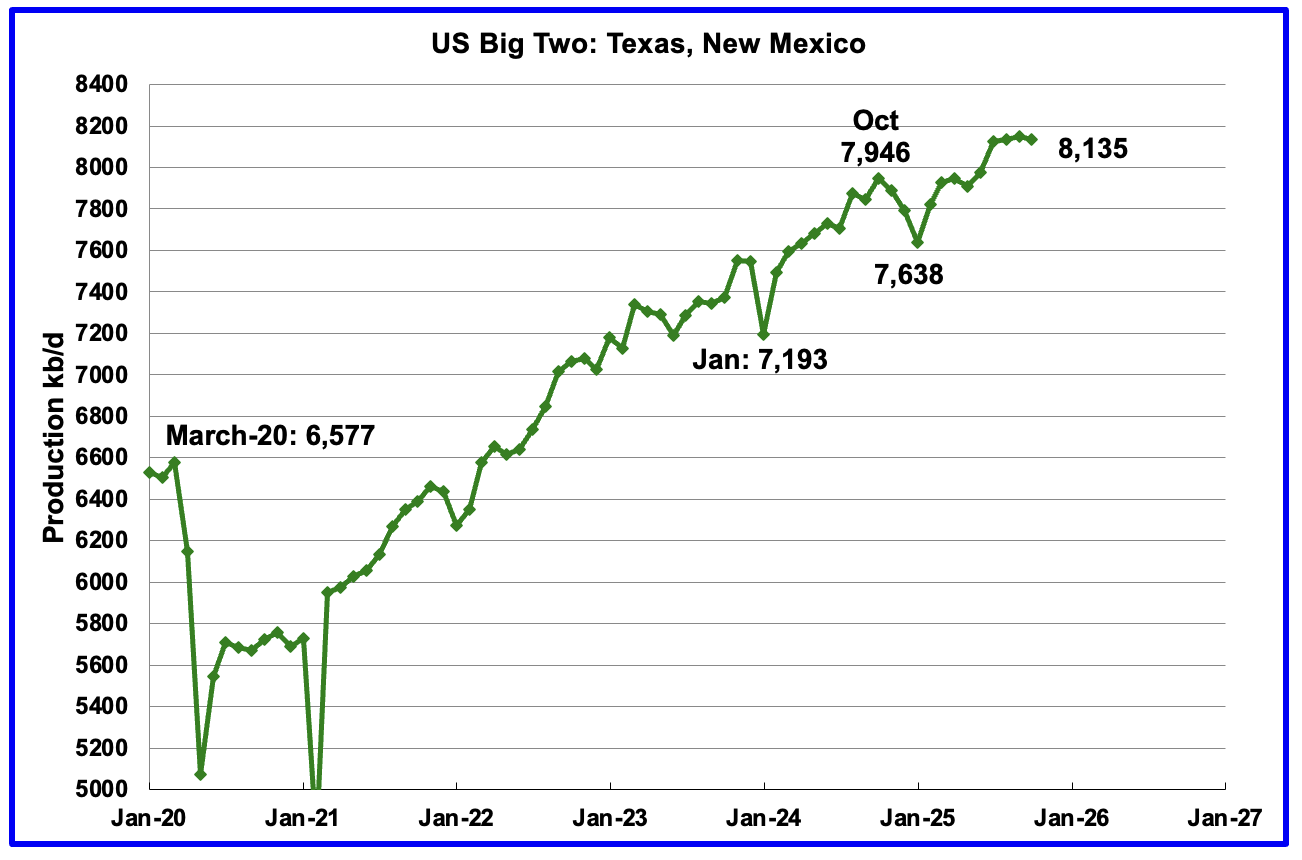

Combined oil output for the Big Two states Texas and New Mexico.

October’s production in the Big Two states decreased by a combined 14 kb/d to 8,135 kb/d. Clearly these two states were the drivers of US oil production growth up to September 2025. Is the October decline the first sign that production in these two states is close to peaking?

Oil Production by The Rest

October’s oil production by The Rest dropped by 11 kb/d to 3,276 kb/d and is 210 kb/d lower than November 2023.

Permian Basin Report for Main Counties and a District

This special monthly Permian section was added to the US report because of a range of views on whether Permian production will continue to grow or will peak over the next year or two. The issue was brought into focus many months back by two Goehring and Rozencwajg Reports and Report2 which indicated that a few of the biggest Permian oil producing counties were close to peaking or past peak.

A more recent report was issued and can be reviewed Here. In this report they state:

“For years now, we have outlined with what we hoped was clarity, and what we now submit was prescience, the view that U.S. shale oil, that great source of modern supply, could not grow forever. It would mature, crest, and begin its long descent. That moment, by our models and measures, has arrived: shale has plateaued, and 2024 appears to be its high-water mark. And yet, investor sentiment has scarcely been more downbeat.”

This section will focus on the four largest oil producing counties in the Permian, Lea, Eddy, Midland and Martin. It will track the oil and natural gas production and the associated Gas Oil Ratio (GOR) on a monthly basis. The data is taken from the state’s government agencies for Texas and New Mexico. Typically the data for the latest two or three months is not complete and is revised upward as companies submit their updated information. Note the natural gas production shown in the charts that is used to calculate the GOR is the gas coming from both the gas and oil wells.

Of particular interest will be the charts which plot oil production vs GOR for a county to see if a particular characteristic develops that indicates the field is close to entering or in the bubble point phase. While the GOR metric is best suited for characterizing individual wells, counties with closely spaced horizontal wells may display a behaviour similar to individual wells due to pressure cross talking . For further information on the bubble point and GOR, there are a few good thoughts on the intricacies of the GOR in an earlier POB comment and here. Also check this EIA topic on GOR.

New Mexico Permian

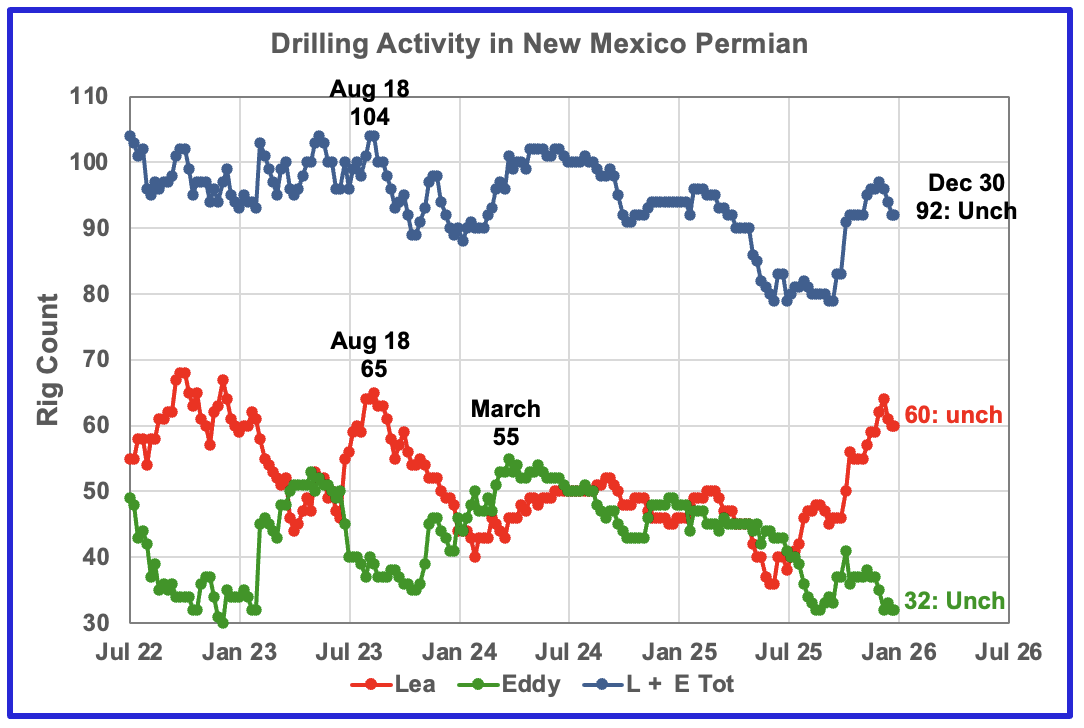

The current rig counts in Lea and Eddy counties are moving in different ways. Lea County has been dropping rigs while Eddy is holding steady. Over the past month Lea County dropped 4 rigs to 60 while Eddy has held steady at 32. Overall NM dropped 4 rigs in December to 92.

Oil Production in New Mexico’s Primary Permian Counties

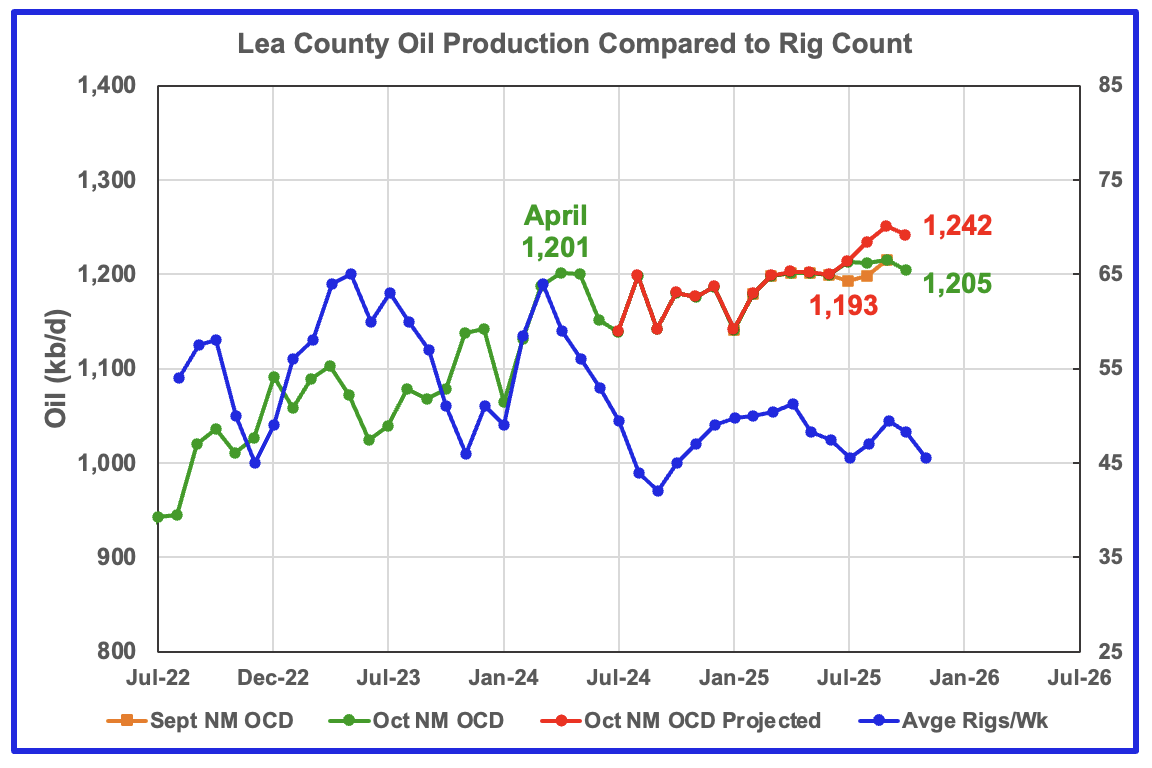

Lea County’s oil production started its plateau phase in April 2024 at 1,201 kb/d and the plateau continues to October 2025 but with a small drop of 9 kb/d to 1,242 kb/d. This month’s projected production is a bit optimistic. The gap between the green and orange graph for July and August, i.e. two to three months before the end of the month, is bit unusual since increments/revisions of the order of 16 kb/d between months rarely appear this far back and biases the projection toward being a bit optimistic. Note how there is no gap for September. For this report a better estimate for September’s and October’s projected production is 1,220 kb/d and 1,210 kb/d, respectively, a decrease of close to 30 kb/d for each month.

Preliminary October data from New Mexico’s Oil Conservation Division (OCD) indicates Lea County’s oil production dropped by 10 kb/d to 1,205 kb/d, green graph, and is a second indictor that production is on a plateau in Lea County. The October production drop could be associated with the dropping rig count that starts in time shifted October 2025.

A few months back I had the impression that Lea county was on the verge of entering a slowly declining phase. However after looking at the data over the past months showing very flat production from April 2024 to August 2025 and a rise in September followed by a drop in October, one cannot infer/see a start to slowing production. A plateau is a better call at this time. However looking at the time shifted rig graph, Lea county could be entering a temporary slowly declining phase before rebounding in February 2026.

The blue graph shows the average number of weekly rigs operating during a given month as taken from the weekly rig data. The rig graph has been shifted forward by 7 months. So the 64 Rigs/wk operating in August 2023 have been time shifted forward to March 2024 to show the possible correlation and time delay between rig count, completion and oil production.

Note that rig counts are being used to project production as opposed to completions because state completion data is not available. However completion data from the Drilling Productivity report below indicates that extra DUCs are being completed in the Permian at this time.

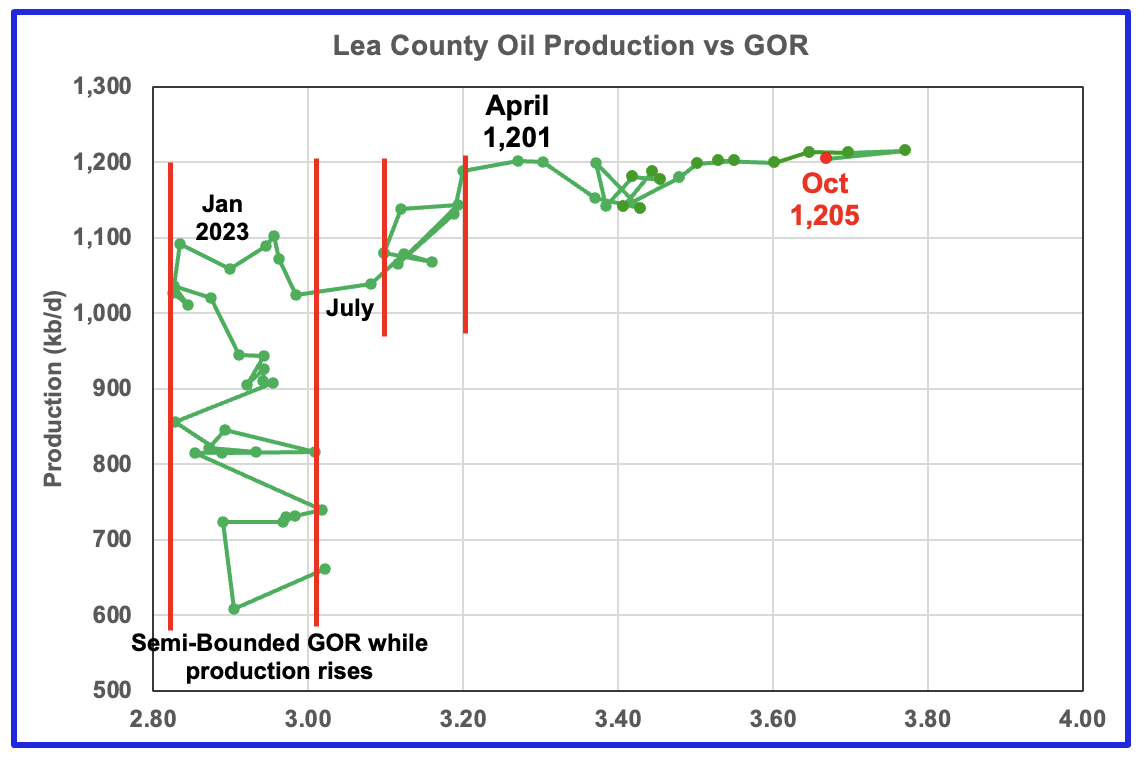

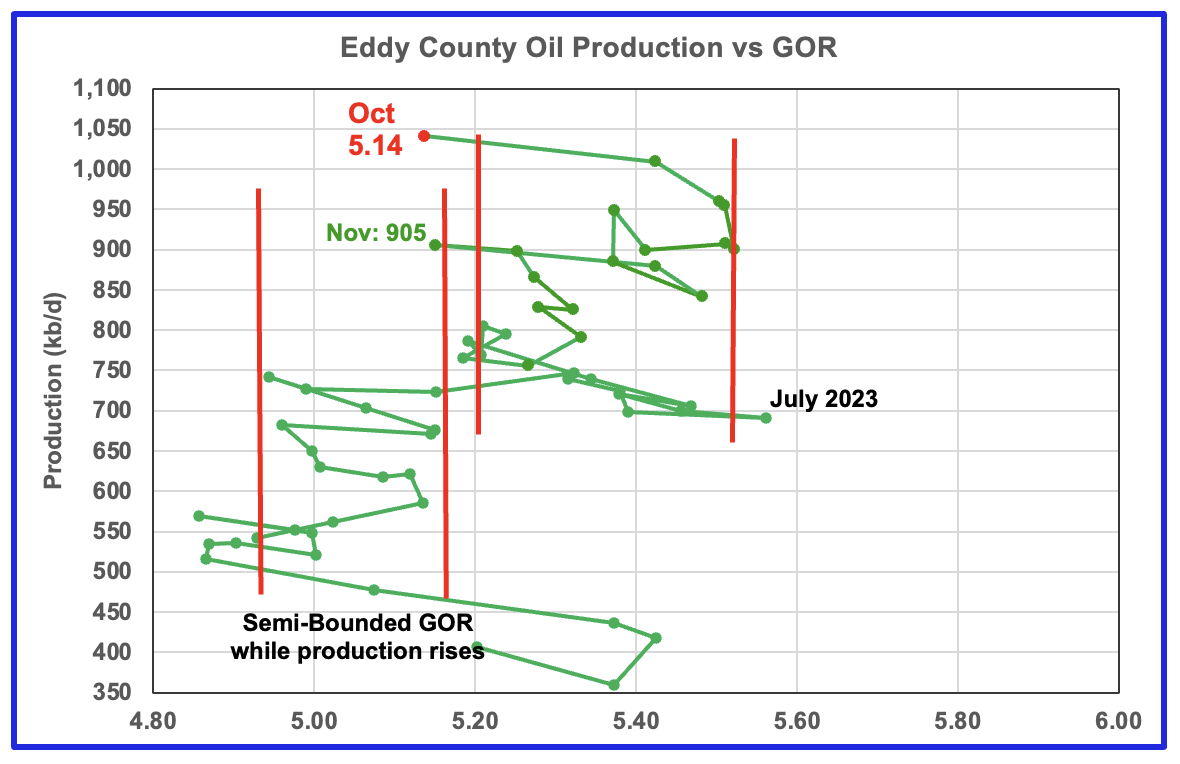

After much zigging and zagging, oil production in Lea county stabilized just below 1,100 kb/d in early 2023. Once production reached a new high in January 2023, production appeared to be on a plateau while the GOR started to increase rapidly to the right and first entered the bubble point phase in July 2023.

Since July 2023 Lea County’s production continued to increase as the GOR remained within a second semi-bounded region. This may indicate that additional production was coming from an oilier part of a layer since the GOR’s behaviour since August 2023 to March 2024 time frame appears once again to be in a second semi bounded GOR phase accompanied with rising production.

The GOR moved out of the second semi-bounded GOR region in April 2024 as production hit a new high of 1,201 kb/d. From July 2024 to February 2025 the GOR was range bound between 3.43 and 3.48 but from March 2025 to September 2025 the GOR has risen every month to hit new highs. September’s GOR was 3.77 while preliminary production increased to a new high of 1,215 kb/d. October saw both a small production drop to 1,295 kb/d and a GOR drop to 3.67.

This zigging and zagging GOR pattern within a semi-bounded GOR while oil production increases to some stable level and then moves out to a higher GOR to the right has shown up in a number of counties. See a few additional cases below. The rising GOR to new highs and flat oil production in Lea county is an early indicator that production may be close to entering a declining phase.

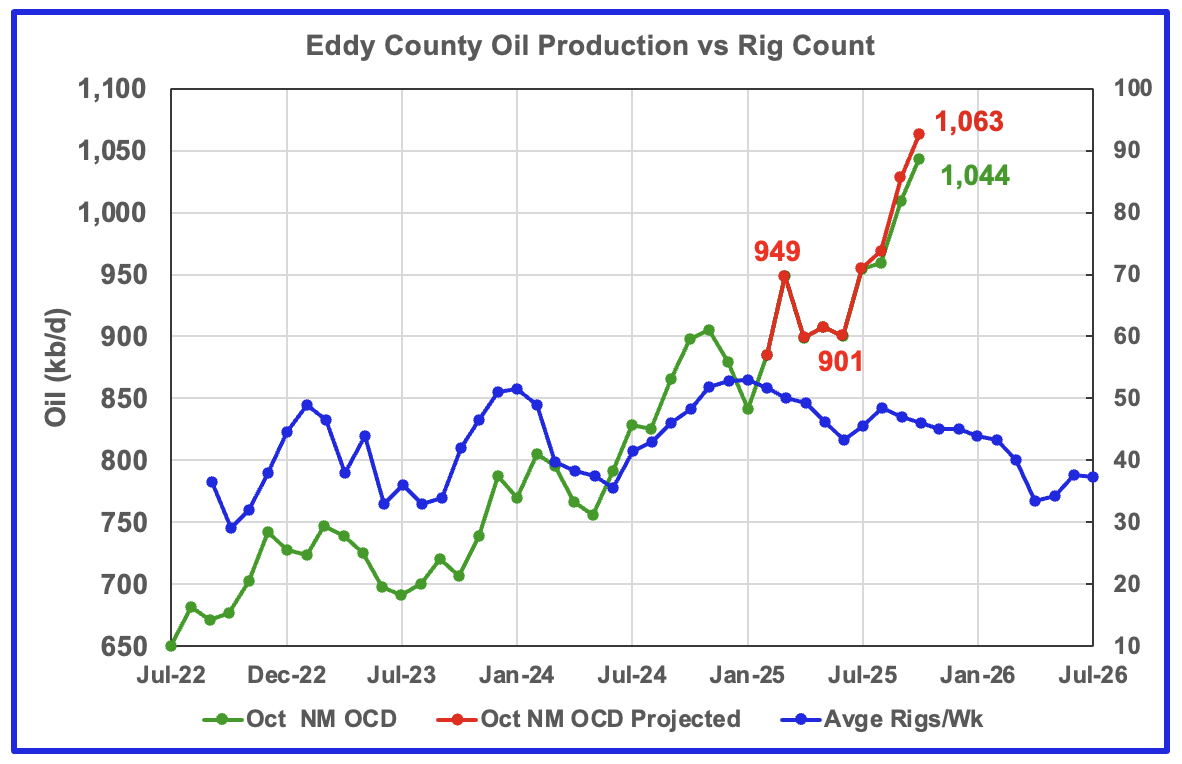

October’s projected oil production increased by 35 kb/d to 1,063 kb/d, a new high while preliminary production from the NM OCD also increased by 35 kb/d to 1,044 kb/d. Eddy county’s month over month production updates are very few and small and primarily occur in the last two or three months which indicates their preliminary production is very close to final. This month’s updates/revisions again were minimal.

Note that from June 2025 to October 2025, projected production in Eddy County increased by 162 kb/d. Over the same period, preliminary production reported by the OCD is up by 144 kb/d.

The rising production could be linked to the increasing rig count starting in time shifted June 2025. However the rig count for September and October and going forward is dropping while production continues to rise. This implies that Eddy County has been drilling in some very productive areas or been completing extra DUCs or drilling longer laterals beyond three miles.

Unfortunately an article by Mike Shellman, which I quickly scanned and hoped to quote is not available any more. As I recall he indicated that Lea County is on a plateau and that the best drilling areas remained in Eddy County. This month’s charts for Lea and Eddy counties show he is bang on. I hope I have not misinterpreted him.

In a newer Post Mike says this: New Mexico is mostly Federal BLM lands and a 1/16th reduction in royalty burdens can amount to $2MM in additional cash flow; New Mexico, Eddy County anyway, has got some room to roll, the Midland Basin, not.”

The blue graph shows the average number of weekly rigs operating during a given month as taken from the above weekly drilling chart. The rig graph has been shifted forward by 8 months to roughly coincide with the increase in the production graph starting in November 2023.

Clearly the production rise up to November 2024 is closely associated with the rise in the rig count and associated well completions delayed by roughly eight months. After November difficult to provide the primary reason for increasing production.

The Eddy county GOR pattern is similar to Lea county except that Eddy broke out from the first semi bounded range earlier and then added a second wider semi-bounded GOR phase. For October New Mexico’s Oil Conservation Division (OCD) reported preliminary oil production increased by 35 kb/d to 1,044 kb/d while the GOR dropped to 5.14 and dropped back into the first Semi-Bounded GOR range.

Texas Permian

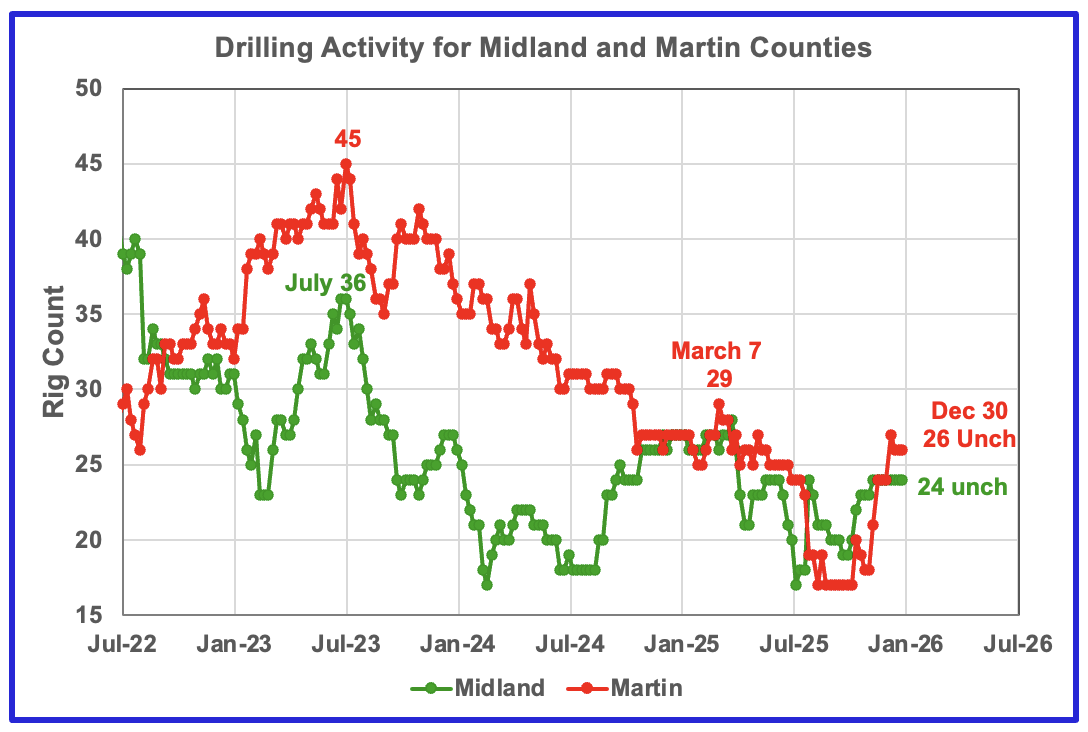

The rig count in both Midland and Martin counties has increased over the past few months. Martin dropped 1 rig to 26 in December after adding rigs in October and November while Martin held steady at 24 in November and December.

Oil Production in Primary Permian Texas’ Counties

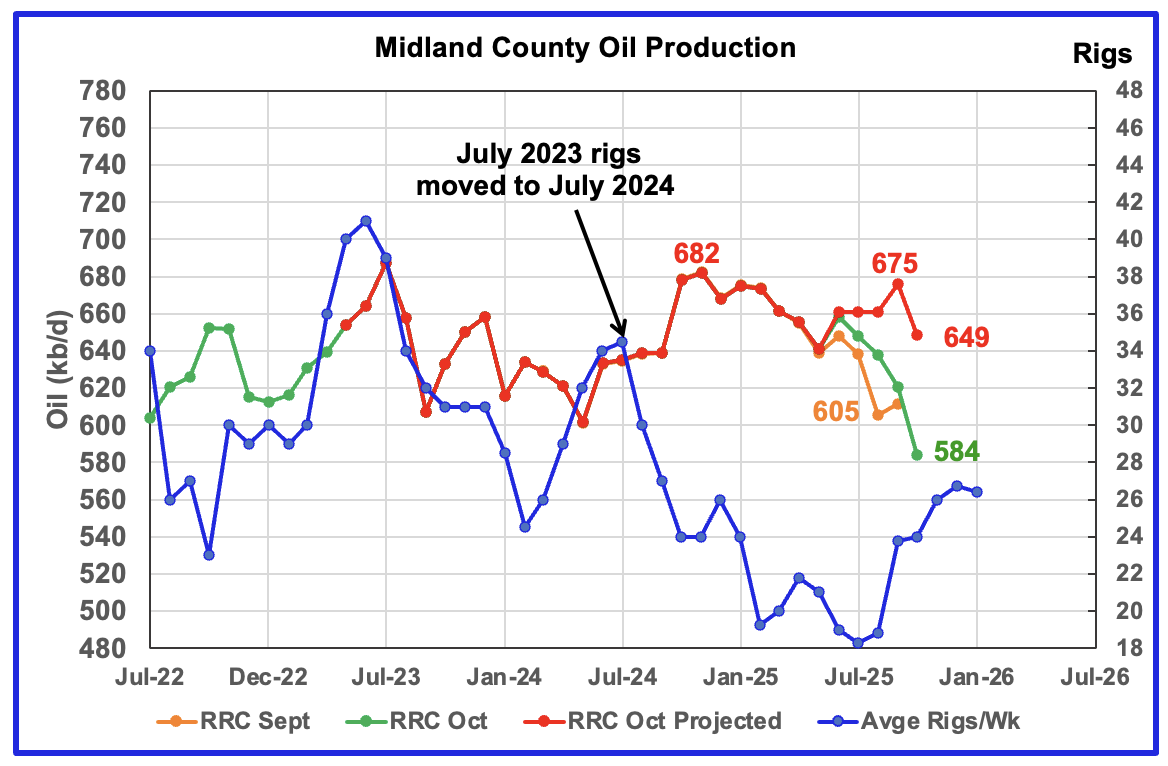

Comparison Chart: Midland chart posted in the September report.

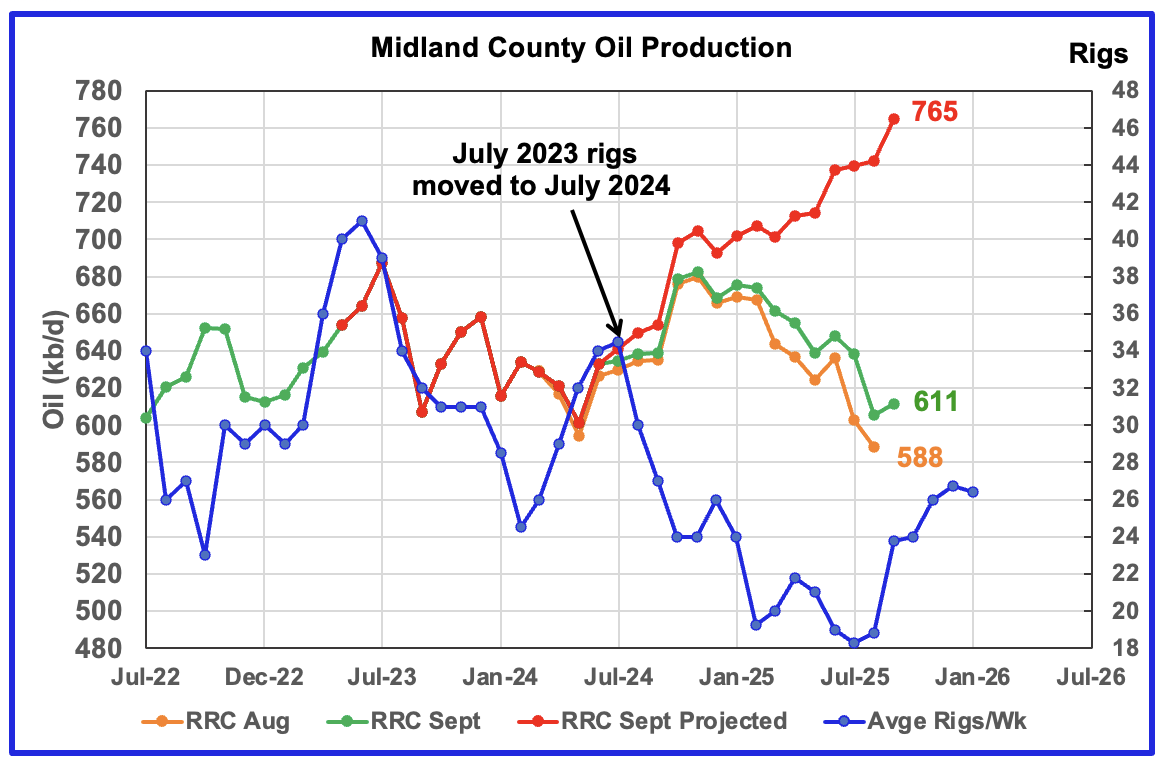

October’s projected production dropped by 26 kb/d to 649 b/d. In the previous report I noted that September’s projected production looked optimistic (See comparison chart above) and a “more realistic production projection for September was in the 710 kb/d to 720 kb/d range”. Even that estimate was too high by about 35 kb/d. September came in at 675 kb/d.

Compare the gap between the orange and green graphs in this chart with the previous comparison chart. Production revisions don’t start till June 2025 in the current chart, increasing the probability that the projection may be more realistic/accurate. The projection is indicting that at best, Midland may be in a plateau phase. The large October drop could be the beginning of a declining phase.

The orange and green graphs show preliminary oil production for Midland County as reported by the Texas RRC for September and October. The red graph uses the September and October data to project production as it would look after being updated over many months.

The blue graph shows the average number of weekly rigs operating during a given month as taken from the weekly drilling chart. The rig graph has been shifted forward by 12 months to better align with production. So the average 34.5 Rigs/wk operating in July 2023 have been moved forward to July 2024 to show the possible correlation and time delay between rig count, completions and oil production.

The 12 month rig time shift is much larger than the typical six to eight months used in other counties. It is not clear why there should be such a difference. It is surprising how the large jump of 6 rigs/wk from time shifted July 2025 to October 2025 only manages to keep production flat.

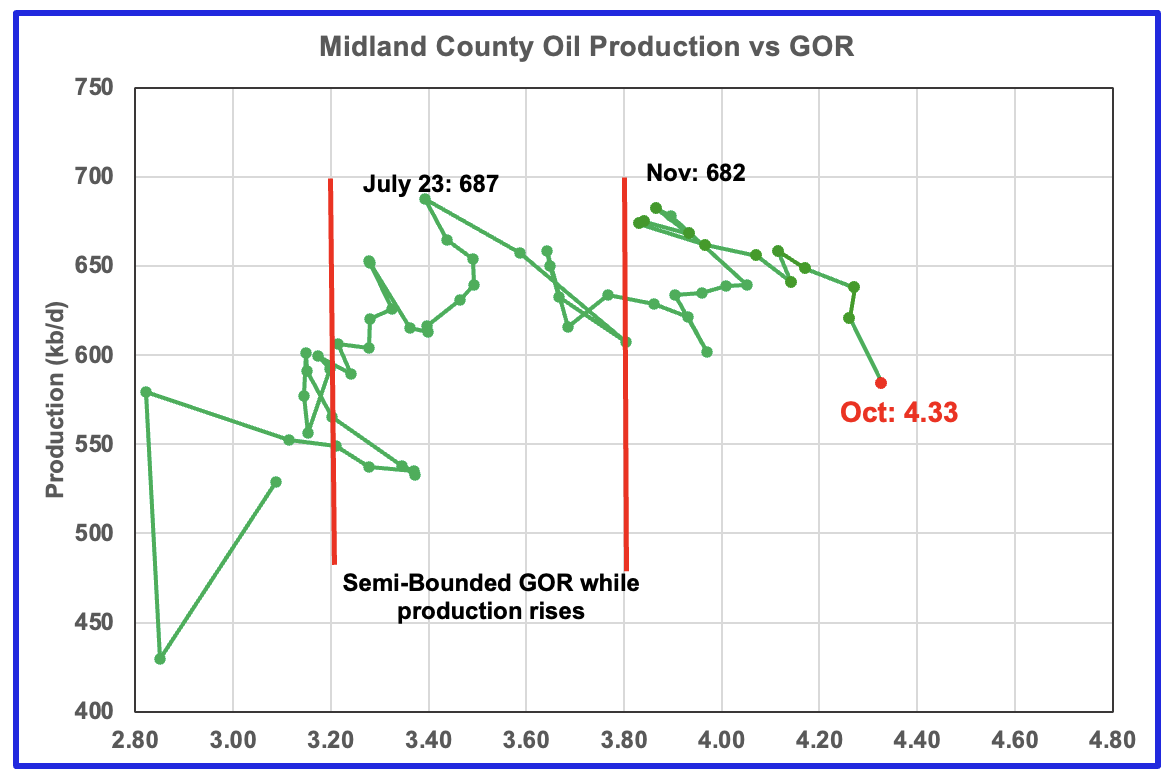

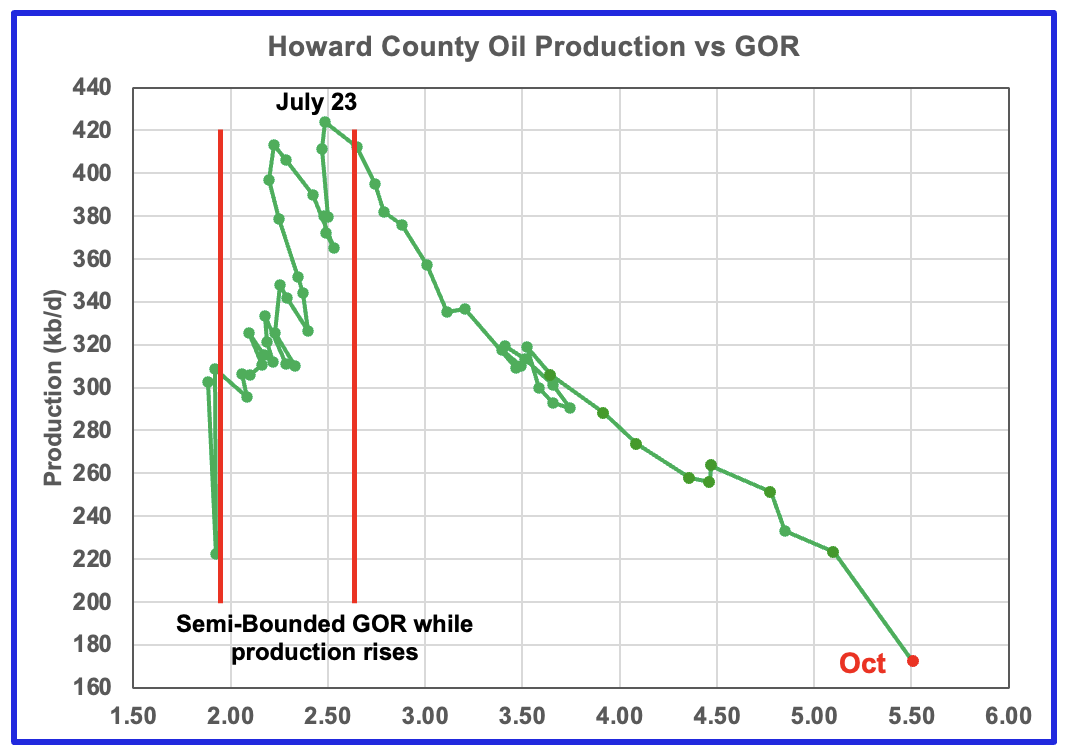

For October the Midland GOR ratio rose to 4.33 from 4.26 in September while the reported preliminary oil production dropped by 37 kb/d to 584 kb/d.

When Midland county GOR initially moved into the bubble point phase, oil production and the GOR stayed within a narrow GOR range of 3.8 to 4.0 outside of the initial Semi-Bounded GOR region from March 2024 to March 2025. However after March, the April to October 2025 GORs broke out to new highs. The October GOR rose to a new high of 4.33.

The oil production and GOR data shown in this chart are based on the RRC’s October preliminary production report.

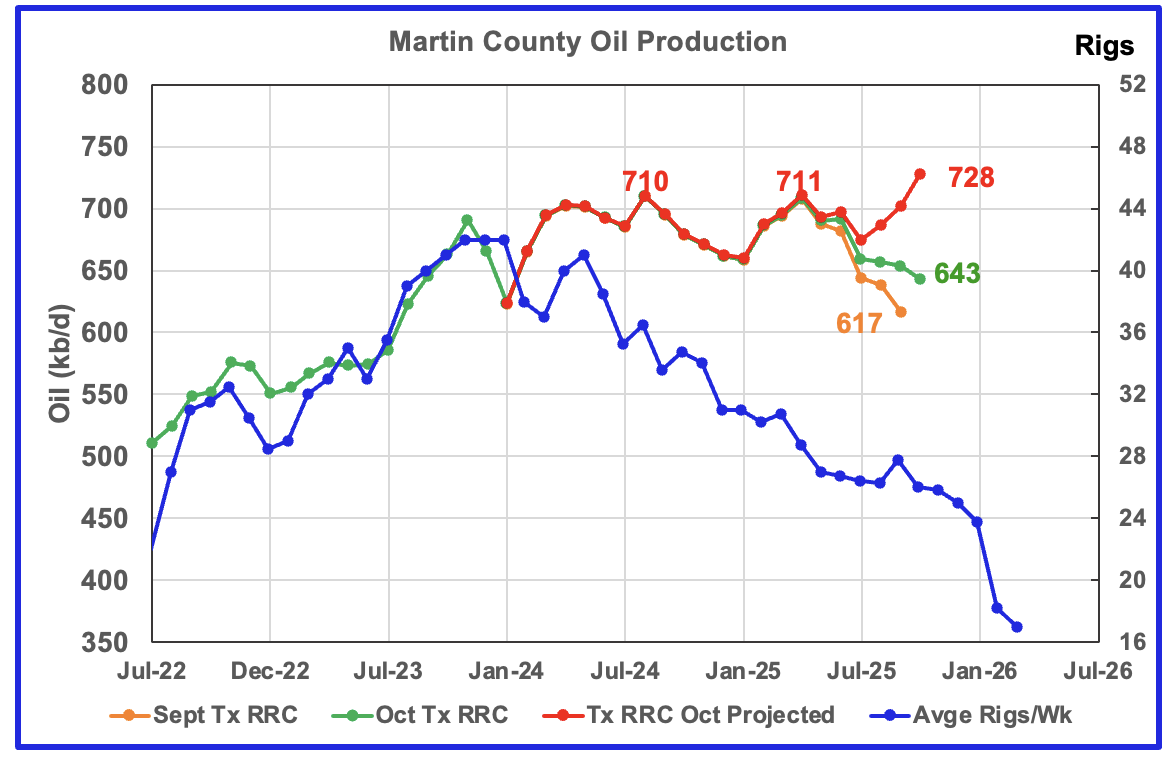

Martin county’s projected October oil production rose by 26 kb/d to 728 kb/d. I think October’s projected production is a bit optimistic and a more realistic level would be somewhere between 700 kb/d and 710 kb/d. The October projected production is slightly optimistic because the MoM updates, the gap between the orange and green graphs, are larger than in previous months over the last three months.

The August 2024 and April 2025 peaks are close to 710 kb/d. Using a better estimate of 705 kb/d for October’s projected production and combining it with the falling rig count may indicate that Martin county may be in its oil production plateau phase.

The red graph is a projection for oil production as it would look after being updated over many months. This projection is based on a methodology that uses preliminary September and October production data.

The orange and green graphs show production for Martin County as reported by the Texas RRC for September and October. The blue rig graph time shifts the rig count forward by 6 months.

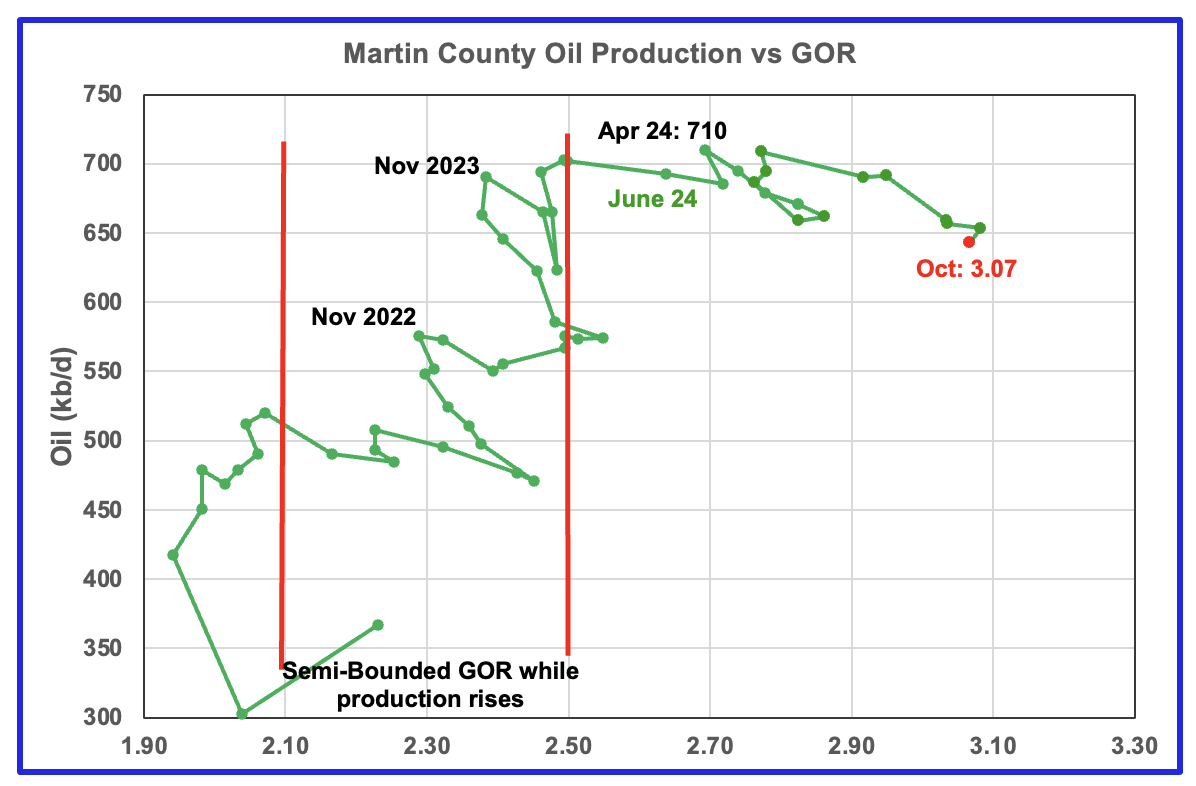

Martin county’s oil production after November 2022 increased and at the same time drifted to slightly higher GORs within the semi bounded range. However the June 2024 GOR saw its first move out of the semi bounded region. The RRC’s preliminary October 2025 production for Martin County shows a 11 kb/d decrease accompanied by a small decrease to the GOR to 3.07.

Martin county has the lowest semi-bounded GOR boundary of the four counties at a GOR of close to 2.50. The October GOR is now clearly out of the semi-bounded region. Martin County has now entered the bubble point phase that should result in oil production staying in a plateau phase before entering a slowly declining phase.

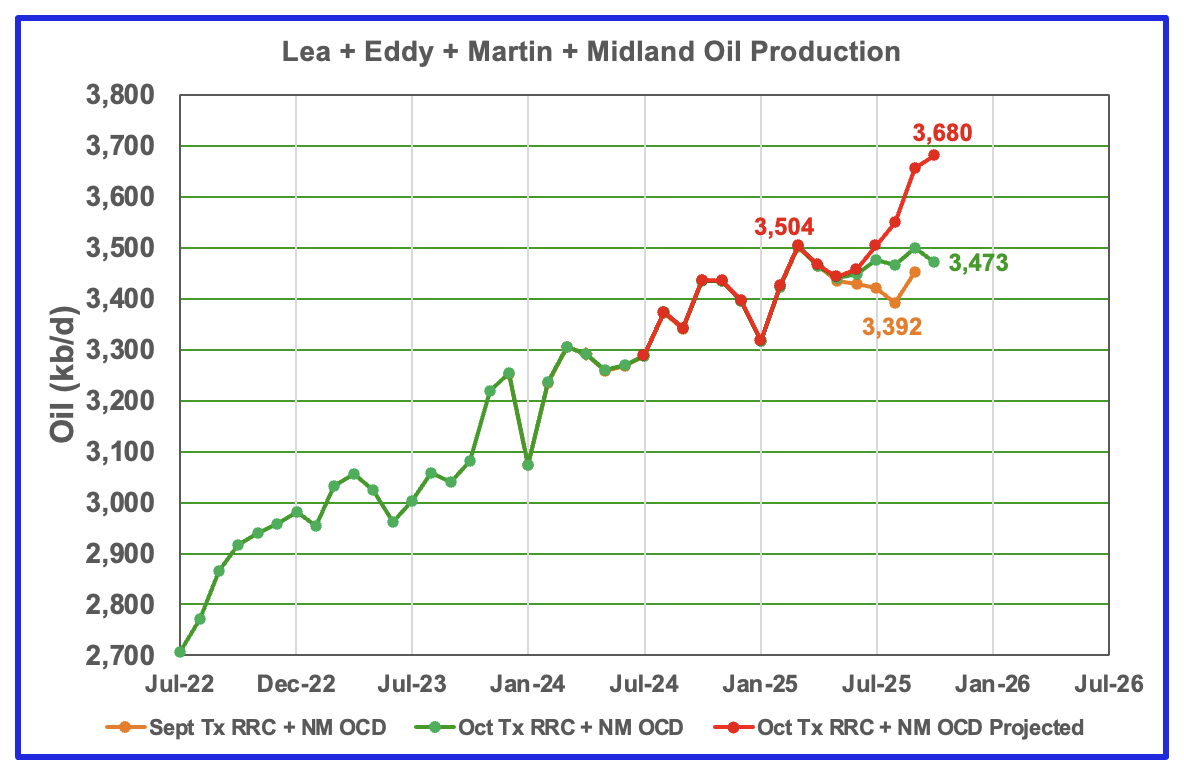

This chart shows the total oil production from the four largest Permian counties. Assuming current Permian production is close to 6,600 kb/d, these four counties account for 56% of the total. October’s projected production increased by 24 kb/d to 3,680 kb/d and is the fifth consecutive month showing increasing production.

The production projection is too optimistic by orders of 70 kb/d to 90 kb/d. October’s production should be closer to 3,600 kb/d. It is too optimistic due the under reported production of 74 kb/d for August 2025 in the last report, the gap between the green and orange graphs. Note also that March 2025 production has been revised down by 90 kb/d from 3,594 kb/d in the Sptemeber report to 3,504 kb/d in this report. The main source for production growth has been Eddy County.

The September and October initial production data are shown in the orange and green graphs respectively. The red graph uses the September and October production data to project a more realistic estimate for the final updated October production.

Findings

– The preliminary October production data for New Mexico is OK. The Texas RRC production data had MoM revisions that resulted in slightly optimistic projections.

– Lea county entered its plateau phase in May 2024. While oil production is not following the rig count graph directly, the dropping rig count has resulted in Lea County production being in a steady flat plateau phase up to August 2025. However September had a 17 kb/d production increase followed by a 9 kb/d decrease. Lea is still in its plateau phase.

– July to October production in Eddy County saw a steady increase to a record high of 1,063 kb/d and is possibly signalling the beginning of a short increasing production phase.

– Updated October Texas RRC production indicates that Midland County’s production may be in a plateau phase. The addition of six new rigs to Midland county in real August 2025 to 24 from 18 was an unexpected surprise and makes one wonder what it implies for Midland county oil production going forward after allowing for a rig count/production delay.

– Martin County appears to be in a plateau phase that started in May 2025.

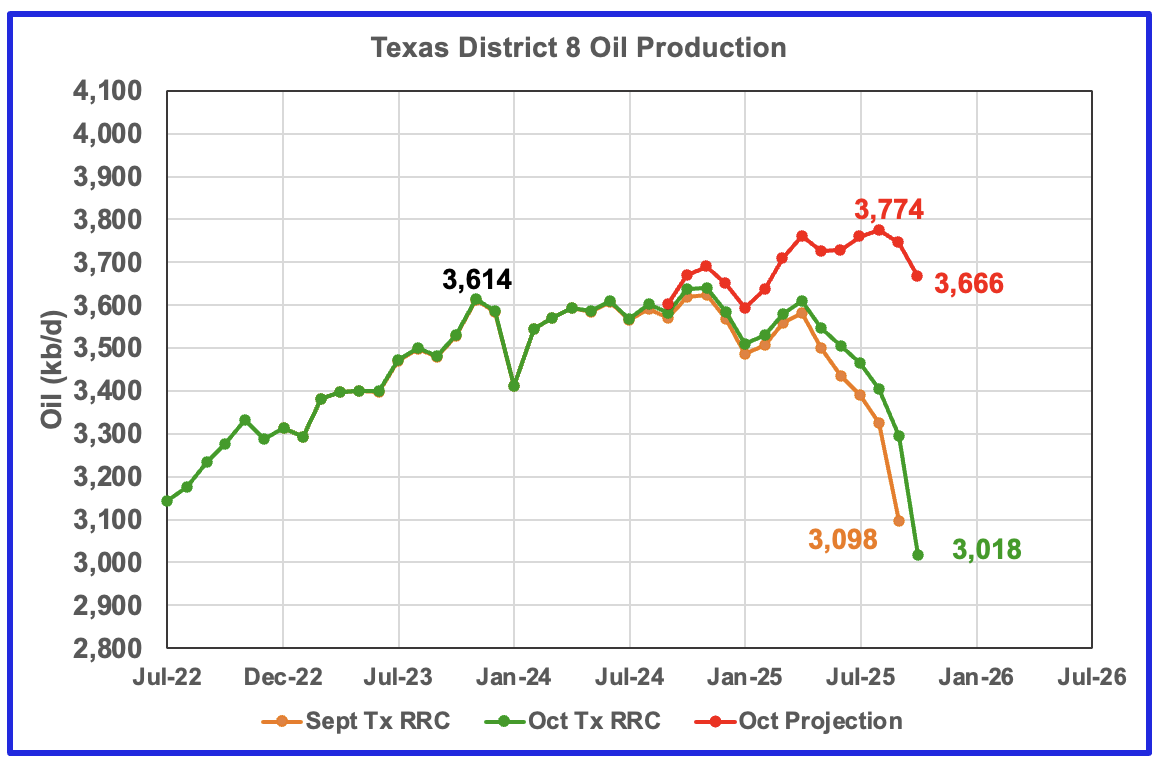

Texas District 8

The District 8 projected production chart is now showing a plateau phase followed by dropping production. In last month’s post, I wrote: “A more realistic production level for April to July is 3,700 kb/d and 3,800 kb/d for September.” Notice that the three green peaks are close to 3,600 kb/d which maybe indicating an upcoming plateau phase.

October saw a projected production drop of 79 kb/d to 3,666 kb/d.

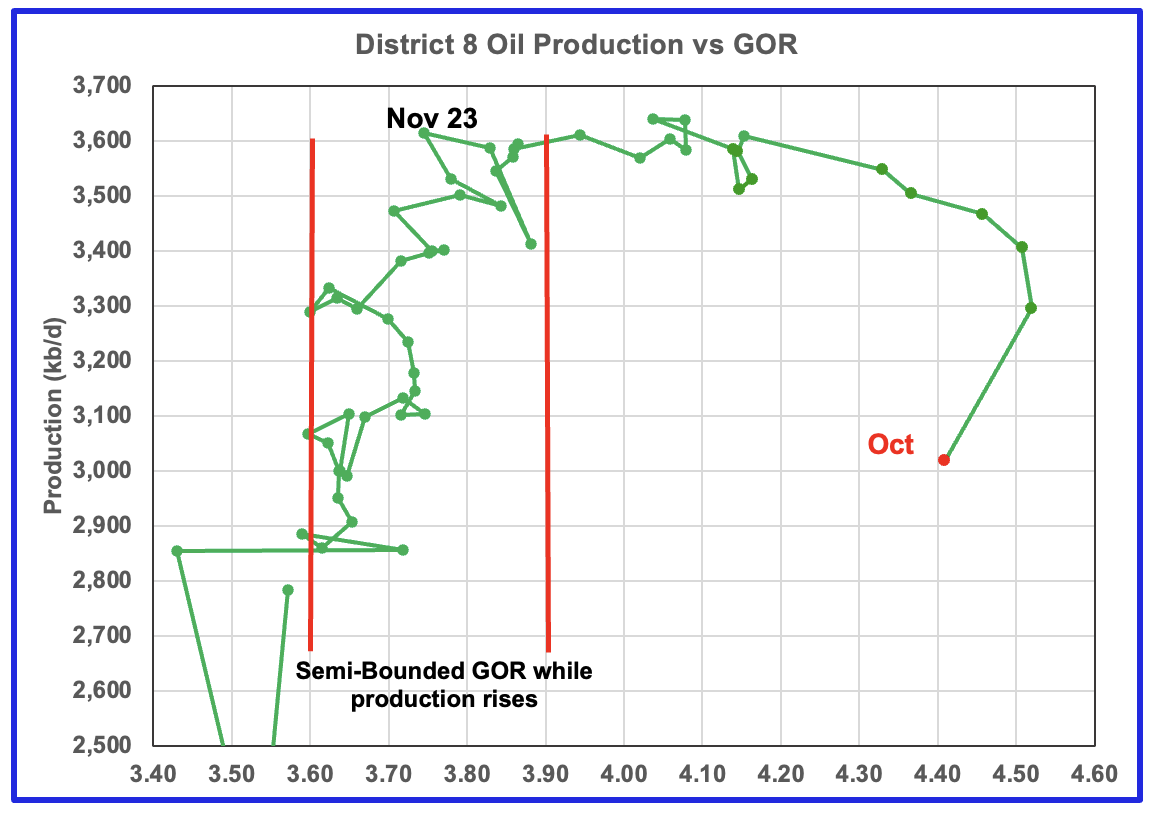

Plotting an oil production vs GOR graph for a district may be a bit of a stretch. Regardless here it is and it seems to indicate many District 8 counties may well be into the bubble point. The October GOR decreased slightly to 4.41 as the preliminary RRC production took a large drop of 277 kb/d.

Oil Production and GOR Charts for Three of the Larger Texas Oil Counties

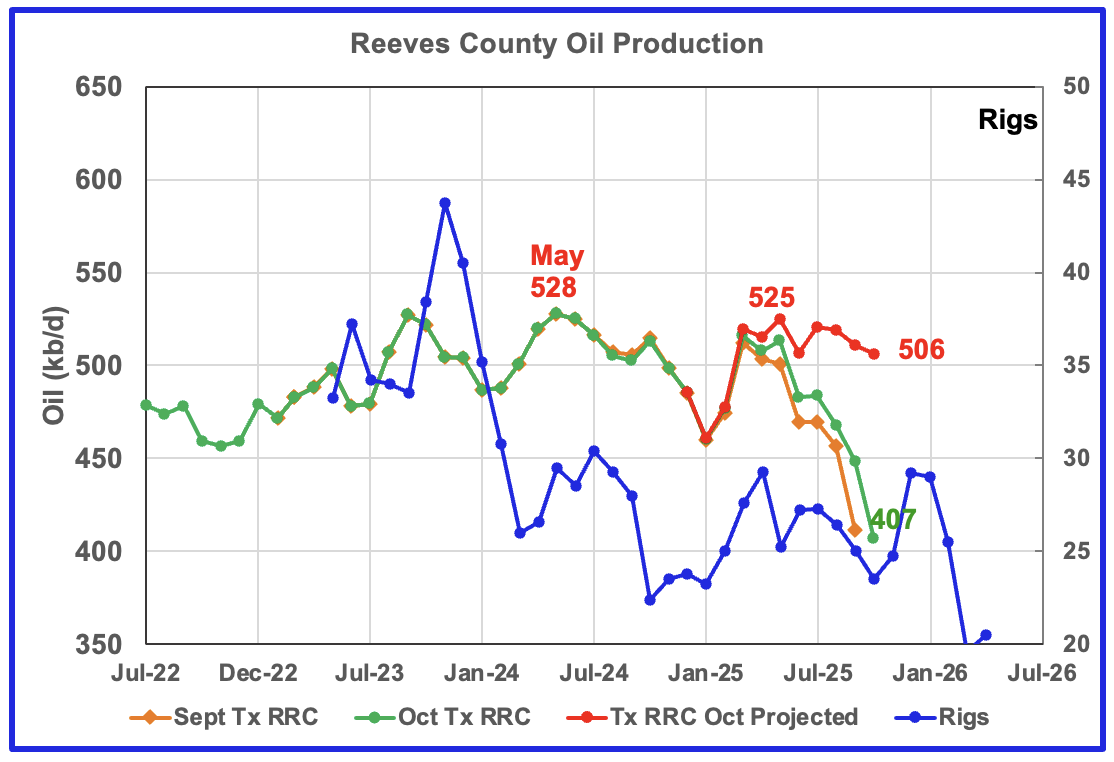

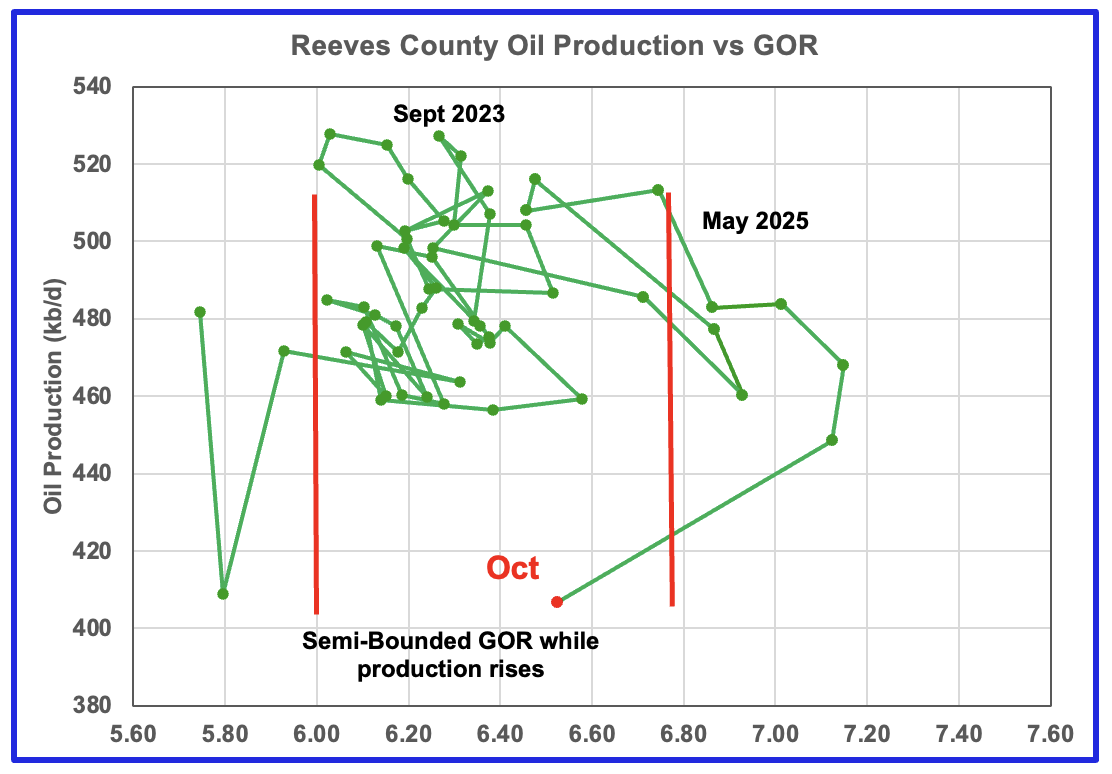

Reeves county GOR is high because it is the number one Texas county ranked by gas production. The current C + C production is almost split between crude and condensate, with concentrate about 15% higher than crude. October projected production dropped by 5 kb/d to 506 kb/d.

The rig count is time shifted forward by 7 months.

In Real June 2025, 29 rigs were operational in Reeves county. By late December the rig count had dropped to 13.

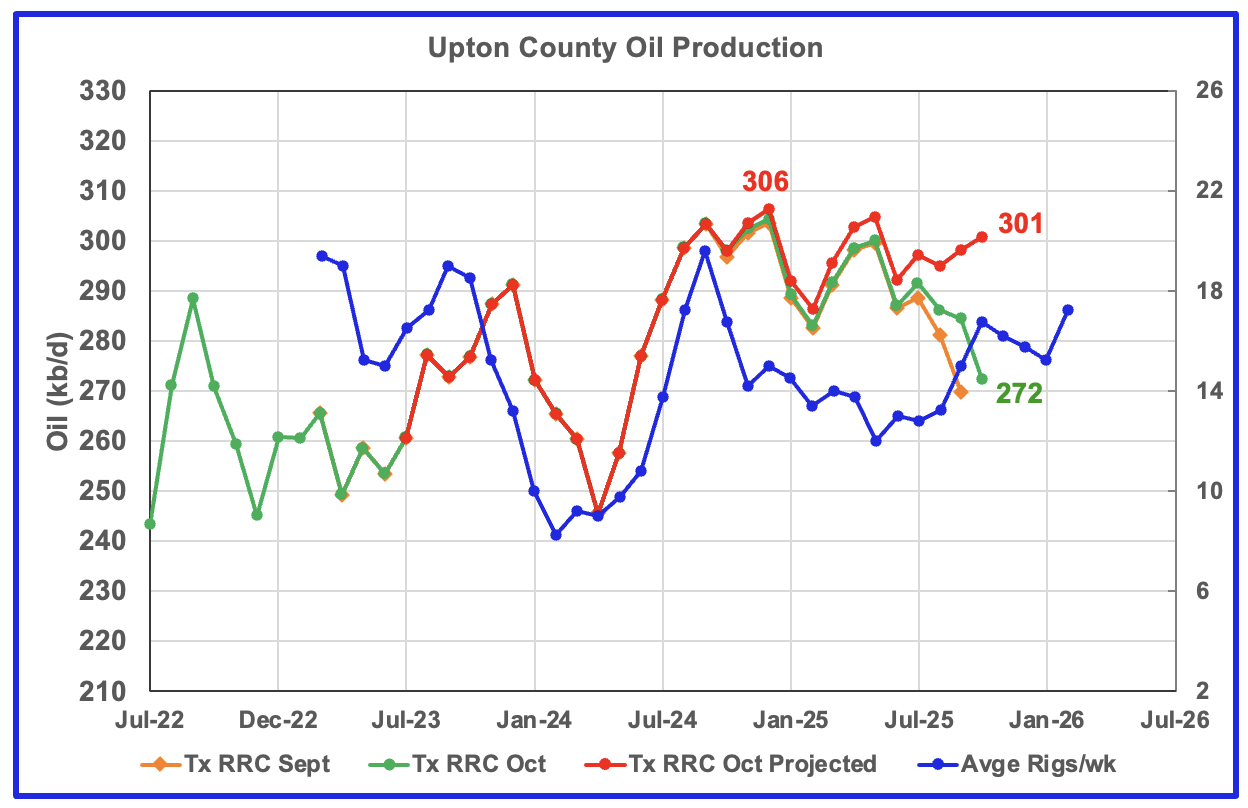

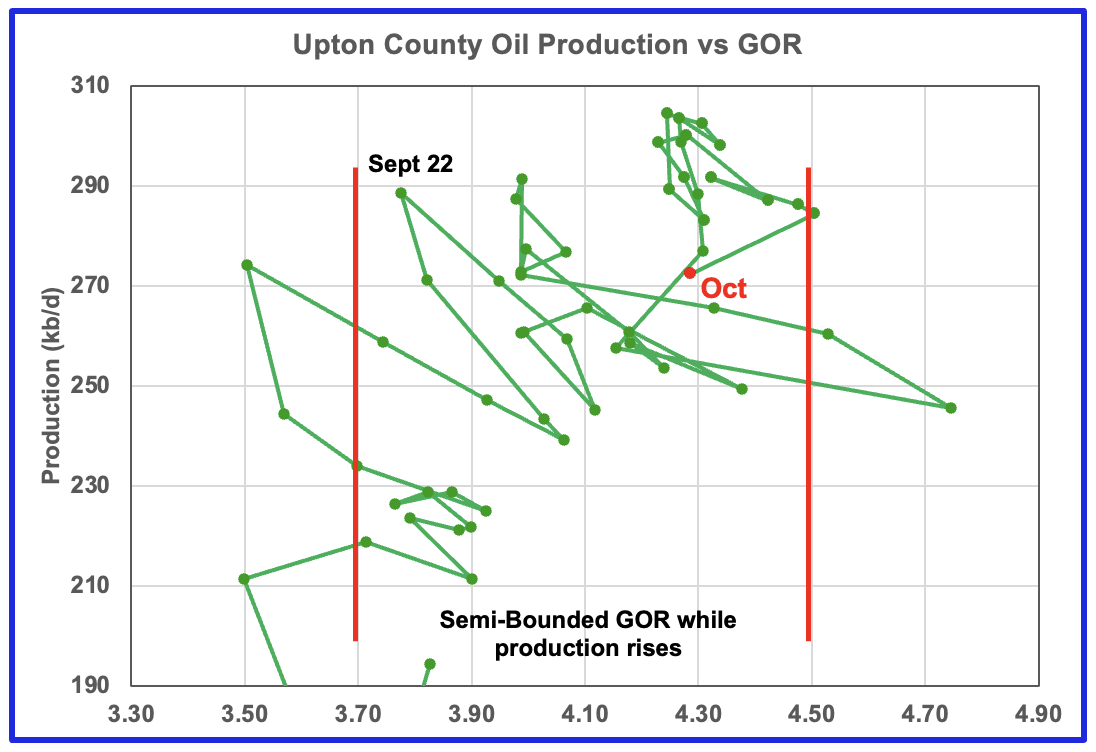

Upton County entered its slowly declining phase in January 2025. October’s projected production rose by 3 kb/d to 301 kb/d. For the next few months Upton County may see a production increase associated with the rising rig count which started in time shifted August 2025. A decline may begin in November/December.

Upton’s oil production may be on the verge of entering the bubble phase since it barely popped out of the Semi- Bounded region in September and then re-entered it in October.

Upton’s rig chart has been time shifted forward by six months. Upton began the year with 13 rigs. In real December 2025, 7 rigs were operating.

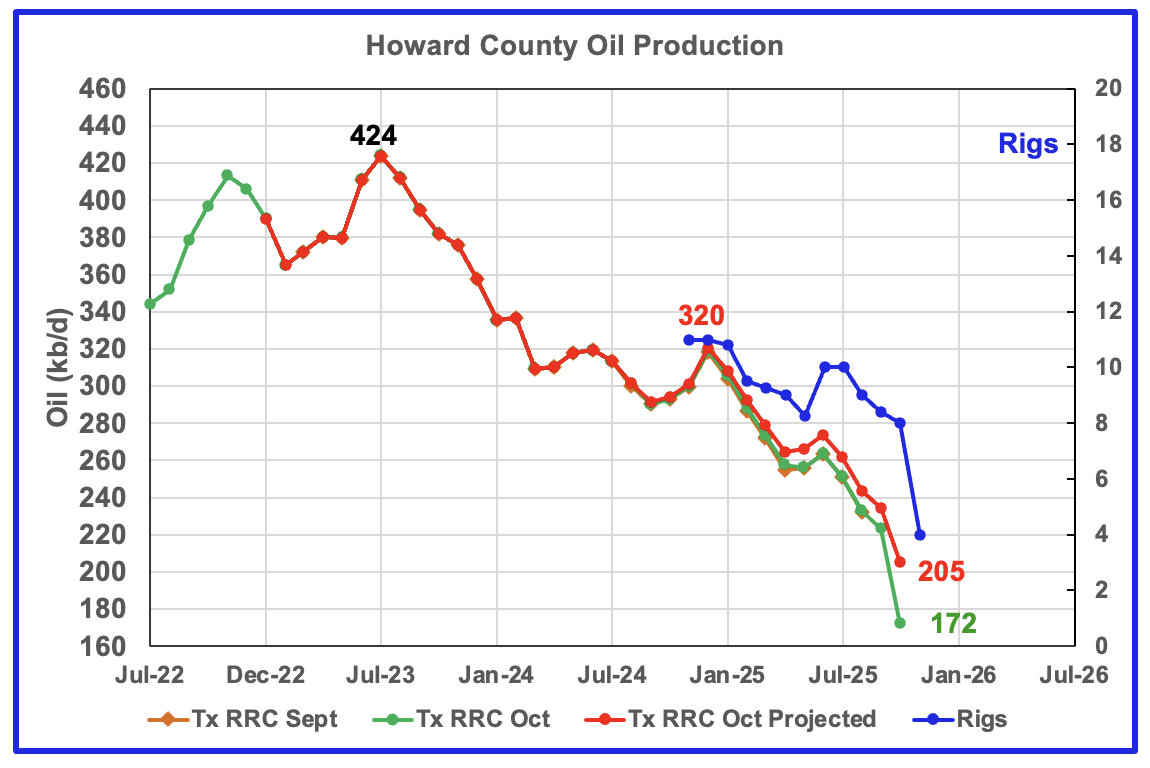

Howard County oil production peaked in July 2023 and has been in a slow decline ever since. The falling production has been falling along with the dropping rig count. In October the projected production dropped by 30 kb/d to 205 kb/d.

The rig graph is time shifted forward by 5 months.

The GOR continues to increase as production drops. The GOR ratio reached a new high of 5.51 in October.

Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The new DPR report in the STEO provides production up to November 2025. The report also projects output to December 2026 for a number of basins. The DUC charts and Drilled Wells charts are also updated to November 2025.

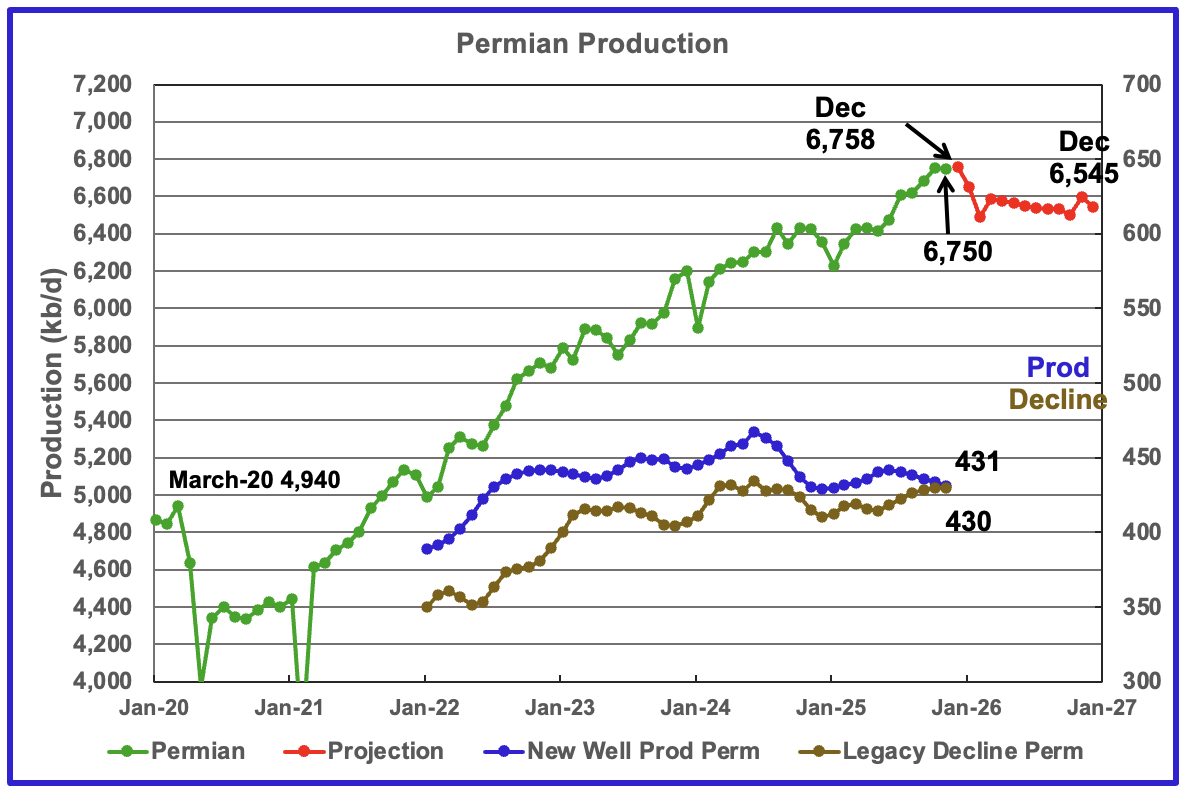

The EIA’s November STEO/DPR report shows Permian November output dropped by 4 kb/d to 6,750 kb/d. December is expected to add 8 kb/d to 6,758 kb/d and then begin dropping in January. From November 2025 to December 2026 output is expected to drop by 245 kb/d to 6,545 kb/d. Note that December 2026 production has been revised down by 26 kb/d from 6,571 kb/d to 6,545 kb/d.

Production from new wells and legacy decline, right scale, have been added to this chart to show the difference between new production and legacy decline. The gap has been getting smaller every month for the last six months and is now essentially gone.. If this trend were to continue, it portends peak Permian production.

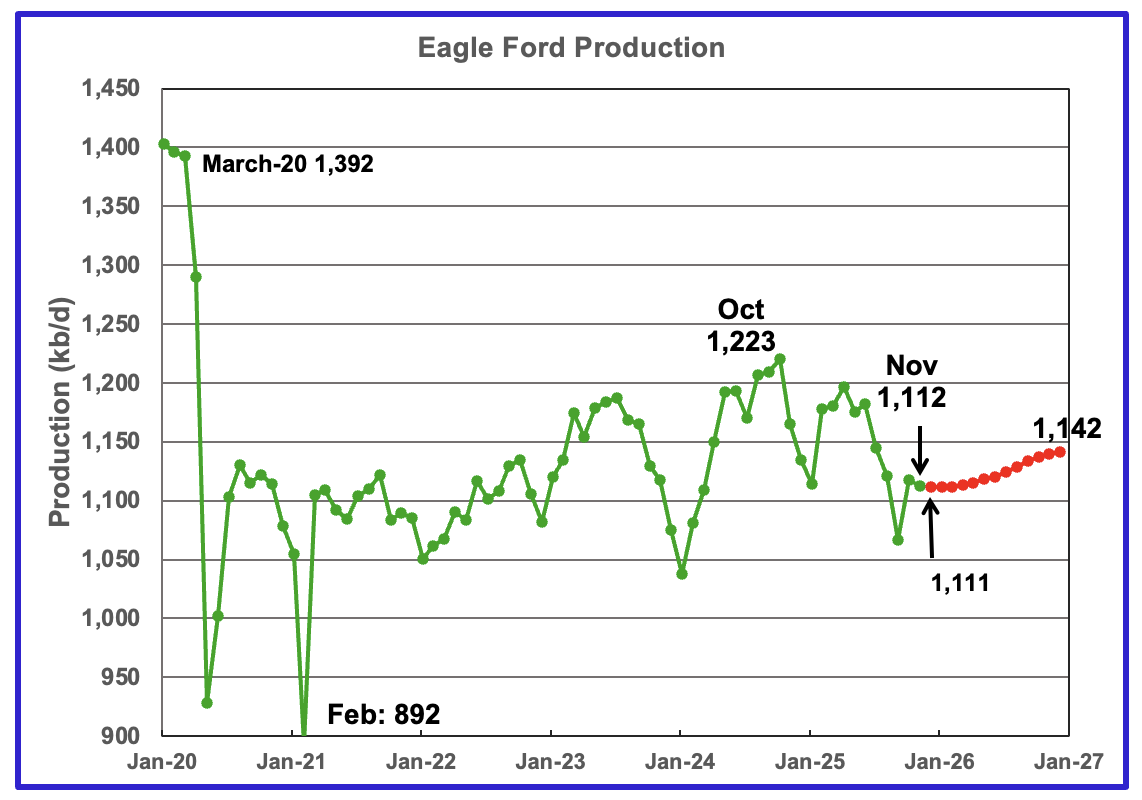

November’s output in the Eagle Ford basin decreased by 6 kb/d to 1,112 kb/d. December’s 2025 production is forecast to drop by 1 kb/d to 1,111 kb/d.

Output in December 2026 expected to be 1,142 kb/d, an increase of 7 kb/d from the previous report of 1,135 kb/d.

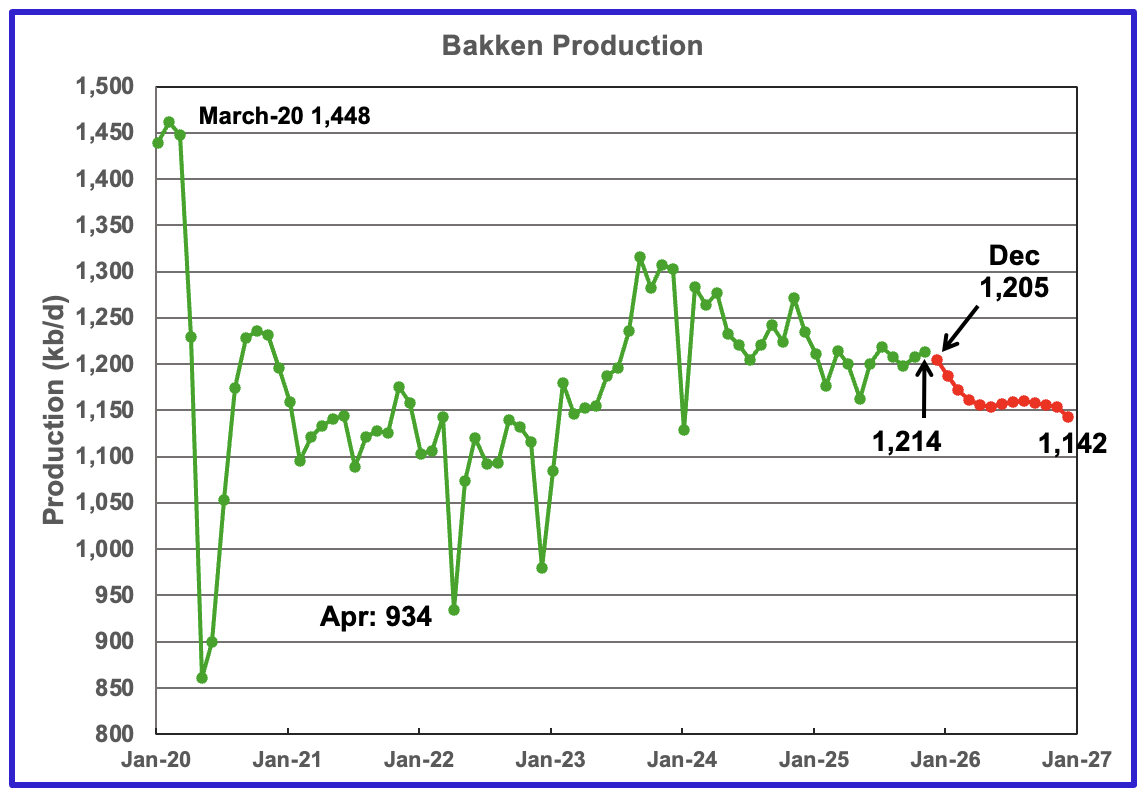

The DPR/STEO reported that Bakken’s November output rose by 6 kb/d to 1,214 kb/d. December production is expected to decrease by 9 kb/d to 1,205 kb/d. The STEO/DPR projection, red markers, shows output dropping to 1,142 kb/d in December 2026.

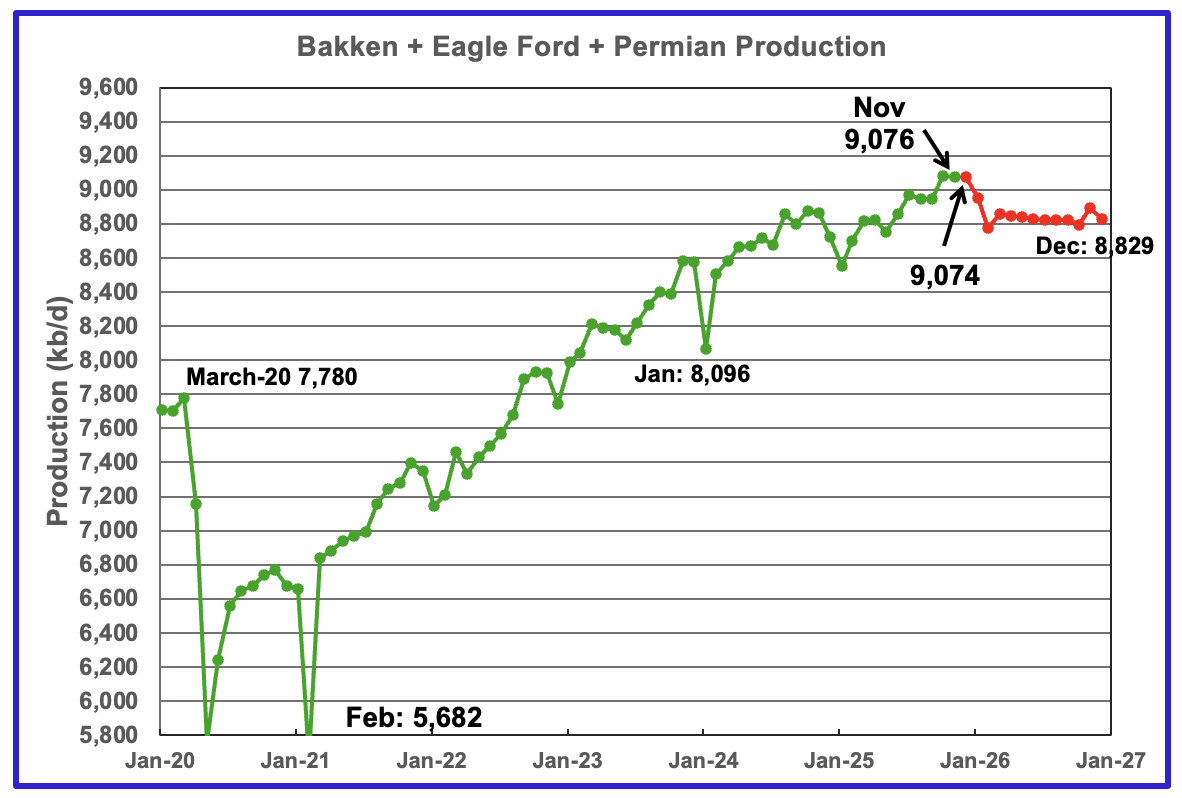

This chart plots the combined production from the three main LTO regions. For November output decreased by 3 kb/d to 9,076 kb/d. Production for December 2026 is forecast to be 8,829 kb/d, revised down by 43 kb/d from 8,872 kb/d to 8,829 kb/d.

DUCs and Drilled Wells

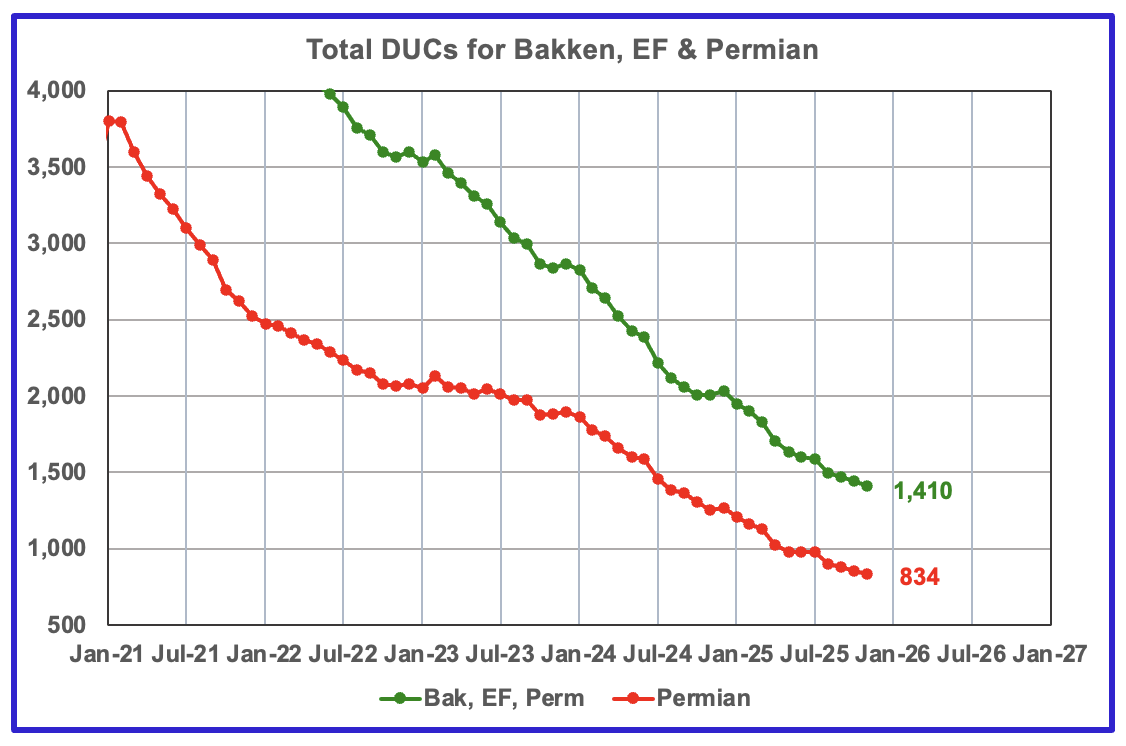

The number of DUCs available for completion in the Permian and the three major DPR regions has returned to a dropping trend. November’s DUC count for the three basins dropped by 34 to 1,410. In the Permian the DUC count dropped by 23 to 834.

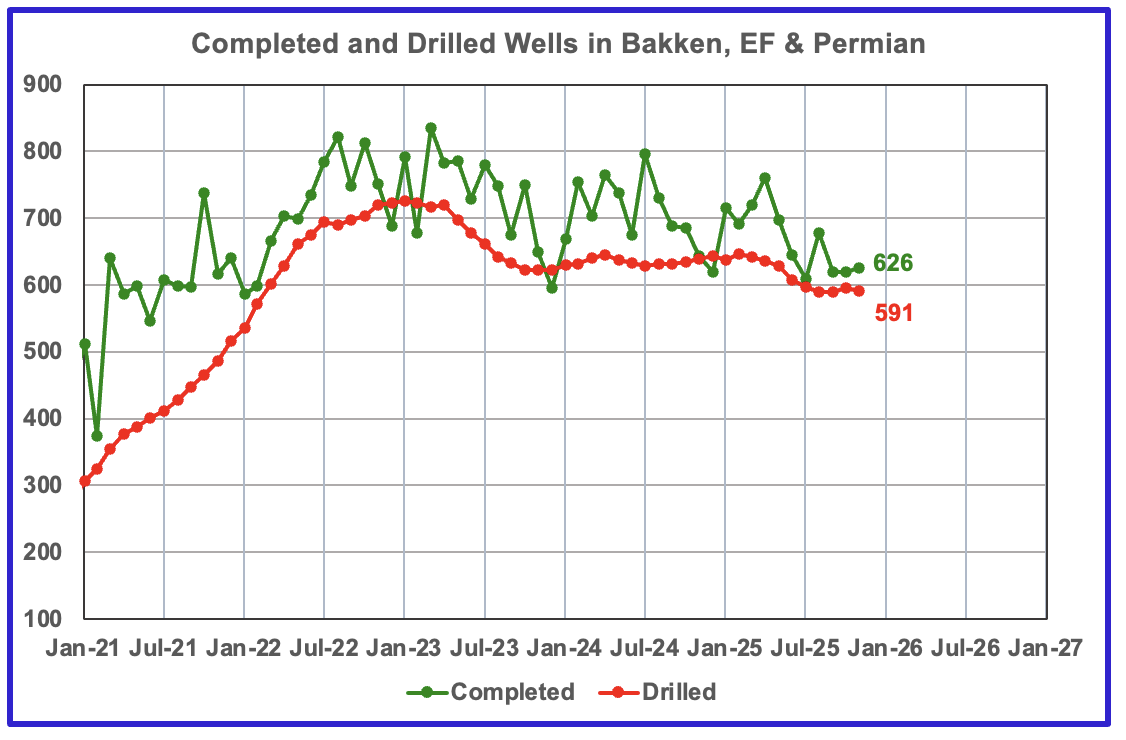

In the three primary regions, a total of 626 wells were completed in November, six more than in October. There were 591 wells drilled in November, 4 fewer than in October. For comparison, In January 2023, 722 wells were drilled.

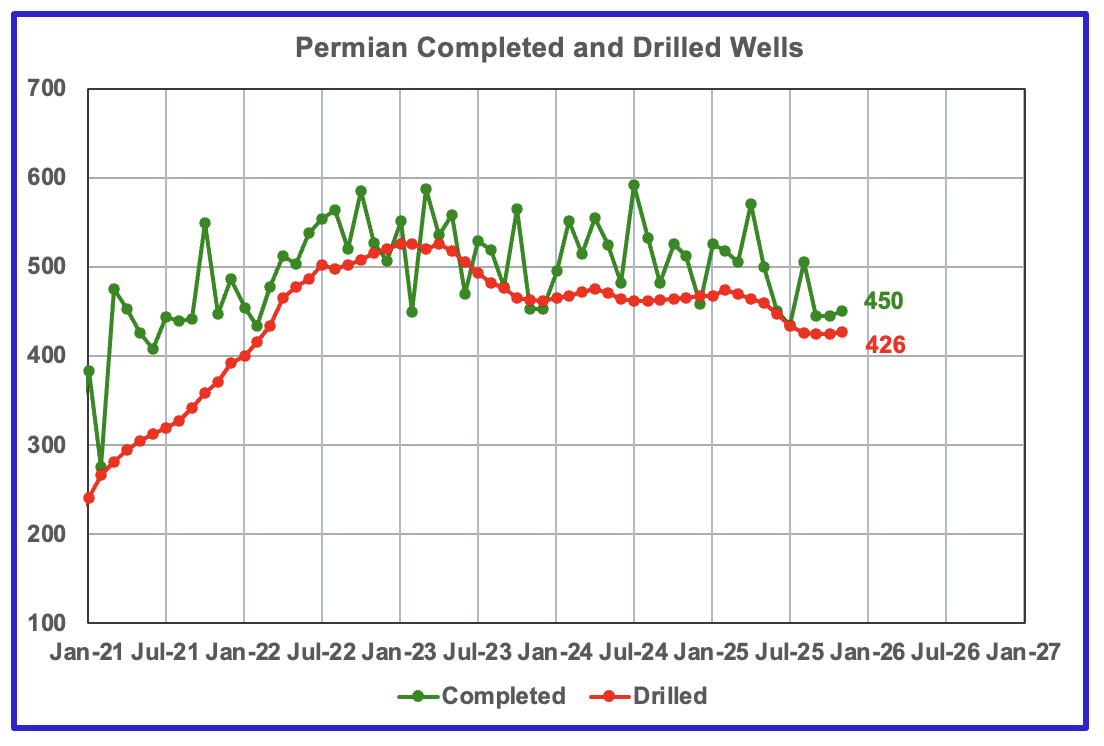

In the Permian, the monthly drilling rates have stabilized around 425 for the last 4 months.

In November 2025, 450 wells were completed and 426 new wells were drilled.

239 responses to “Record US October Oil Production”

If GOM production exceeds 2 MMBOPD for November and December, 2025 will be a record oil production year exceeding the old record of 1.90 MMBOPD set in 2019. Both years had no, or very limited, storm-related down time.

2026 should exceed 2025, again, assuming no or little storm down time.

While new fields are contributing a lot of new production, as Ovi has mentioned, there are 5 legacy fields/field complexes that continue to hang in there contributing around 700 KBOPD, or about 35% of the total GOM production.

These fields are:

Shell’s Mars-Ursa complex – 154 KBOPD – 1.8 BBO cum

BP’s Thunderhorse/Thunderhorse North complex – 153 KBOPD – 770 MMBO cum

BP’s Mad Dog – 133 KBOPD – 420 MMBO cum

Chevron and Oxy’s Tahiti/Caesar Tonga complex – 120 KBOPD – 696 MMBO cum

Chevron and Exxon’s Jack/St.Malo/Julia complex – 119 KBOPD – 509 MMBO cum.

Thanks Bob,

Do you expect GOM production can be maintained at 2000 kb/d for several years?

I think annual GOM production will hover around 2 MMBOPD through the early 2030s, and then start a terminal decline. This will be bolstered by the current new projects (Whale, Shenandoah, Anchor, Salamanca, Ballymore), the legacy projects I mentioned, and future projects including Kaskida, Tiber, Sparta and Daenerys (Talos’s 2025 discovery).

Some have thought GOM production could get as high as 2.4 MMBOPD,, but I don’t see that on an annualized basis, though there may be some months when it gets that high.

Note that GOM production will never be high enough to offset the eventual decline in the resource plays. The variability in GOM production is in the hundreds of thousands of barrels a day while the eventual decline in the resource play production will be in the millions of barrels a day.

Yeah…it’s not the Permian.* But it has done better than some of the articles on this site predicted. I still remember someone (not you), who had a great command of field names and did super detailed stacked area charts, predicting decline to 1.5 from 1.7ish (pre Covid). He laughed at EIA predicting 2.0. Then 2.0 happened. He disappeared for a few years after.

I’d also say that looking out to 2035, there are possibilities we learn something new, find something new. That area has been called dead for decades, but ended up coming back. And it has favorable geopolitics. And sort of has been a technology incubator, for ultra deep water and seismic.

P.s. Thank you for your insights and gentlemanliness.

*Then again a lot of people didn’t expect the Permian to be the Permian. Not just here, but even Mark Papa made comments about U.S. shale just being the Bakken and EF. So, there’s always some uncertainty to the upside. (The downside, depletion/decline, is easier to predict.)

Thank you Bob.

I made my first predictions of GOM oil production back in 2016. At that time, by L-M-H ranges for 2025 GOM production were 1.2 – 1.5 – 1.6 mmbopd. So even my high range estimate has been exceeded. I also thought that some of the EIA estimates were too high at that time. I made the mistake of having too narrow of a range – a common one, thinking I knew more than I did.

My 2016 EUR ranges were 30-37-47 BBO. My latest EUR range is 33-37-42 BBO. The current cumulative oil, estimated through 2025, is 26 BBO. I may be making the same mistake about EUR – too narrow of a range?

Hi Bob,

When making these estimates there is always much more room to the high side. Currently we know the minimum cannot be less than 29 Gb when we add proved reserves to cumulative output (assuming output will at least be equal to proved reserves), often there is reserve growth and 2P reserves are typically 1.5 times proved which gets is close to your low number. Medium case would often be 30% higher than my low estimate and high case about 30% higher than medium case. Even 40 or 50% might work. Taking your recent low case of 33 Gb, maybe 43 Gb for mid case and 55 Gb for high case (using 30% increments). You actually know a lot (as a former industry pro) so the narrow range may be more appropriate.

From AEO 2025, 5 cases for US L48 Federal Offshore (most will be GOM) see link below.

chart(114)

Bob

Have you seen any estimates for the decline rates for the GOM fields?

Ovi,

I have trouble uploading a BOEM decline curve analysis for oil and gas in OCS GOM/A after 2020, the upload never end up ok.

so, I managed to find the link,

https://www.boem.gov/sites/default/files/documents/oil-gas-energy/2022-2031%20Oil%20and%20Gas%20Production%20Forecast%20Review_0.pdf

see figure5,6 and table 4,5 for the legacy DCA.

Obviously, actual oil decline is slower than forecast which is based on marine sourced higher API&GOR oil.

Sheng wu,

What the data seem to indicate is that the forecasts have been more than actual output, which suggests that decline is in fact higher than estimated.

Also see this quote

“Note: the OCS, GOM Oil Production in Figure 5 excludes completions made on or after August 30th, 2021 as these did not exist at the time that the Auto-DCA algorithm was run.”

DC,

Please help me when I try to upload a file, what is the reason that I ended up unable to post or upload? the file size is under 1MB, and do I need to uncheck some pop-up?

About the DCA in figure 5 — it is for wells made before August 30, 2021, and the “green actual line” is actually higher than the “forecast black line”; but for gas, it is the opposite in figure 6.

What happened? my conjecture is that they used marine based higher API&GOR model for GOR increase, and ended up with way higher GOR estimate.

Figure 1-4 has shown forecast higher than actual production, but those are because the slower deployment of newer projects.

Ovi, thanks.

I put stuff up, and take stuff down because I am subject to plagiarism and the stealing of expensive charts all the time. People that want, desperately to be oil and gas analysts are too cheap to buy, or update their old “free” data; I have my resources and I don’t wish to be taken advantage of. I can go all the way to the top on that, like Bloomberg/Reuters and have the proof.

You don’t do that, thank you.

I will try and re-publish all the really CURRENT stuff I have on New Mexico, but you are spot on…and were two years ago: there are little to NO Tier 3/4 level drilling locations left in Lea County; EOG hammered it to oblivion. You saw where we were going two years ago. It is the first time that I’ve seen where county wide GOR was actually used as a look-see into the future, except for Midland County, which you also predicted. Lea County IS done. Thank ‘ol EOG for that. You should be commended.

Eddy is all there is left for the entire U.S. tight oil…hope.

One third of a county in S.W New Mexico, that has no frac source water, that sends all of its produced water to Texas for disposal, that will require 4-5 mile laterals to develop because of potash set asides, that with current prices at WaHa has to to flare its associated gas, or send its gas to Texas to flare. That is in deep in doo-doo already because of pressure depletion in the Bone Springs interval.

Every foreign recipient of 3.7 MM BOPD of Permian tight oil exports should be scared to death.

Jesus, how did so many Americans, like Annoying, get so stupid about one little lousy oil play? Why is it SO important to make predictions that never come to fruition?

It was the internet, and the need to be…entertained. Like video games. The internet made stupid people, stupider.

Oh Boy! Now we’ve got AI to look forward to. Hot diggity dog.

Scared to death why?

Only if you believe that OPEC has peaked which it has not.

Then there are electric vehicles, not as great a game changer as some people here think. But electric cars, vans and trucks are giving people a real alternative that they did not have before.

https://www.fleetnews.co.uk/news/global-electric-vehicle-sales-up-but-stall-in-the-us

Great stuff at Oily Stuff.

Thank you Mr Shellman.

Make sure to read the comments, lots of great charts and explanations by experts.

https://www.oilystuff.com/group/oily-stuff/discussion

To me, those wells look pretty similar.

Are the newer one slightly worse (normalized)? Sure. But on the scale of looking at different plays or the like, it’s more a story of similarity. Not some falling off a cliff.

For that matter, if you watch the 32 minute Novi webinar (I recently linked it and rewatched it), the takeaway is that even with the anti Permian hype, there’s still 5+ years of inventory, even if only T1 rock were drilled. That’s not some Hubbert dream of things falling off the cliff. At least not in the next half decade (likely much longer, as they will drill T2 and some of the T3/4 also).

Nony,

More recent analysis by Jorge Garzon suggests 52,000 tier 1 and tier 2 locations (in terms of economics when accounting for parent/child interaction, aka pressure depletion) with about 20k of those locations being tier 1, lately there have been roughly 5400 completions per year in the Permian and if we assume lateral length remains at the 2024 level EUR per well will likely decrease at about 2% per year. At $60/bo we are not likely to see many locations lower than tier 2 utilized as they won’t be profitable. We may see completions fall to about 400 per month due to the drop in rigs that started 8 month ago, there tends to be a 6 to 10 month delay between rig count changes and completion rate changes, that might extend the number of years a slow decrease can be maintained, but the longer it is maintained the steeper the decline when tier 1/2 locations run out. Also note how much 2025 normalized cumulative production decreased relative to 2024 (about 6%), this was during a period where there would have been incentive to high grade due to low oil prices, so your hope for a bump higher for EUR us not shown in the data. My 2% assumption for the decrease in new well EUR looks to be 3 times too conservative.

Steiner will just drill longer laterals und wird das alles in ordnung machen. 😉

https://www.youtube.com/watch?v=Ag4gup01QBk

Nony,

I realize you are joking, but the reality is that longer laterals tend to reduce EUR per foot, but it also reduces cost per foot and perhaps cost per barrel, at some point diminishing returns may result in higher cost per barrel and we might have reached that point especially as EUR per foot continues to fall.

Mike

Thanks. Much appreciated.

Thanks also for your deeper insight into what’s happening in Texas and NM.

Great stuff Mike

“Oh Boy! Now we’ve got AI to look forward to. Hot diggity dog.”

AI is in a massive bubble. Spent 100s of billions and make 45 billion across this industry a year.

The Data Centers are cash furnaces. They require continuous exponential investment because the equipment depreciates so fast, and we all know the electricity bill is insane.

Now using debt financing to stay afloat.

https://www.nbcnews.com/business/business-news/openais-sam-altman-backtracks-cfos-government-backstop-talk-rcna242447

OpenAI has admitted that processing more data is making things worse and they have hit a limit to what they can do and diversifyng into industries….like PORN.

https://www.forbes.com/sites/jaimecatmull/2025/08/22/mit-says-95-of-enterprise-ai-failsheres-what-the-5-are-doing-right/

MIT says 95% of AI projects fail with no return on investment.

https://www.msn.com/en-us/money/news/the-big-short-investor-michael-burry-bet-10-million-that-ai-stocks-will-crash-by-2027/ar-AA1TeclS

https://www.msn.com/en-us/money/top-stocks/michael-burry-bets-billions-against-the-ai-boom/ar-AA1TmEZP

Michael Burry who famously shorted the US housing market in 2007 and has a book and hit movie “The Big Short”

just shorted the AI industry for a BILLION dollars.

GPUs (special CPUs for AI ) depreciate in 3 years and NVIDIA are accounting for them on a 6 year scale (lieing). Burry says this is accounting fraud and overvalues their company.

Do research all these articles are out there

https://fortune.com/article/warren-buffett-cash-pile-berkshire-hathaway-earnings-q1-2025-insurance-losses/

Me and Warren Buffet are in CASH and 13 week T-bills (cash equivalents) because US stock market growth is AI

Uncle Warren and Berkshire Hathaway are going to pounce on these assets for pennies on the dollar.

https://www.planetearthandbeyond.co/p/ai-will-destroy-everything

AI will destroy the world, not with sentient robots, but by being 10x worse than the Dot Com bubble.

Unlike the Dot Com…..you can’t fix this and recover.

Don’t say Andre didn’t warn you.

Thanks, Ovi. Agreed on US peak this month probably or next (less likely). DEC had some colder than normal weather in the US, so I expect there will be a decent seasonal drop for ND, and overall US will also be down as a result. I really doubt DEC is up.

We are probably entering the slow down/plateau stage. I do not expect a Hubbert style plunge. Too much drilling going on, even if not enough to quite match decline (but pretty close). Superimposed on that will be some seasonality. But I doubt we get back what we lose in the winter, so OCT/NOV will be the peak. It’s gonna be boring.

Note: GOM has definitely outperformed what the resident peak oil expert here predicted, from several years ago. Something wrong with his method, despite the incredible knowledge of field names and the like.

interesting observation about deep water GOM/A, Venezuela and China Bohai Bay saline lacustrine,

Several very large to giant oilfields (>1~10 Billion BO) in the Bohai Sea are shallow heavy and viscous oil reservoirs similar to those in Venezuela. This includes Penglai 19-3 (4B BO), the largest discovery led by the U.S. oil company ConocoPhillips, which to this day remains the most profitable asset in ConocoPhillips’ portfolio, as well as the Luda oilfield discovered by Chevron but abandoned because the oil was considered too heavy. These oilfields are now the backbone of Bohai production, and their development costs are much lower than those for light crude. They are likely also naphthenic-rich oils formed from the decomposition residues of oils similar to those in Venezuela’s saline lake environments, transported to shallow reservoir, became separated into gas and heavy oil.

Somehow, Bohai has PDP reserve GOR even lower only 1:18, while Venezuela Orinoco has PDP reserve GOR at about 1:9.

Today, China’s capability to produce heavy oil—especially Bohai heavy oil—has improved dramatically to a level comparable to Venezuela’s, making it possible to develop Venezuela’s extra-heavy oil efficiently at lower cost, effectively reversing and intensifying the outflow of resources from what is often referred to as the United States’ “backyard.”

Based on isotope, API and GOR data, Ultra-Deep GOM/A probably is also saline lacustrine sourced oil with extra heavier oil and lower GOR than medium depth fluids, but certainly way lighter than the Bohai/Orinoco belt heavy at really shallow reservoirs, and yet they could produce at much higher rate and EUR with slower decline rate than forecast due to the extra lower API and GOR.

This is quite counter-intuitive to main stream, geologists to public media, they all originate from the conventional perception that lower API and GOR fluid can not flow effectively.

The OCS Report BOEM 2022-022, figure 1 clearly forecast continuously drop in GOR and yet higher BOPD rate, and probably even this underestimates the power of saline lacustrine sourced oil.

Nony

I agree that the US production will start with a slow decline and no Hubert plunge.

I keep wondering how many companies keep drilling to try to maintain production so that their stock price does not get hit. There are too many accounting tricks to make the books look better than reality.

All heavy oil is due to bacteria chewing the light ends of the oil molecules. The process needs oxygen.

David,

I agree that most heavy oil is due to bacteria chewing the light ends and also the long chain HCs, leaving only the heavier naphthelene, tar/asphaltene and resin.

However, there is the kinda mainstream view:

The earlier less mature or immature oil also has lots of heavier asphaltene(with oxygen), resin and naphthelene, and the oil is also heavy. This assumption is often validated by the biomarkers in heavy oils, which indicate lower maturity. But, isotope of methane, ethane and propane often give over matured fluids readings. This is why I started to suspect this “immature” heavy oil model, instead all are over-mature fluids migrated to shallow reservoirs, and biodegraded rendering biomarkers also reads incorrect values. Such heavy oil often have asphaltene levels above 5% and API below 15deg.

However, there is also the saline lacustrine shale oil that could generate close to heavy oil at mature stage.

Such heavy shale oil often have API 15 to 20deg, but they have very little asphaltene (with little oxygen in shale). Such oil when migrated to neaby reservoir, also have diagenesis conditions that preserve the heavier components, and making it possible to see quite heavy oil in quite deep formations, e.g. API20 at 4km, and maybe in the case of ultra-deep GOM, we are still seeing API<25 oil at over 9km depth.

For marine sourced oil, drilling in or close to shale indicate that even just at oil mature stage, i.e. Bakken, the oil already has API above 40deg.

Suppose Trump can “run Venezuela”: what will that mean for Gulf Coast refineries? How much Naphtha would be needed for 1 mb/d of Orinoco bitumen? Which US refineries exactly would take that diluted extra heavy oil? This would increase diesel production by how much?

Russia is soon toast.

https://youtu.be/WuTITvz4rMU

Matt, Trump will not and cannot run Venezuela. Don’t fall for his bragging. However consumption of Vz heavy for blend stock is as simple as taking off the sanctions.

I’m not sure how much would flow to the US. The market would sort it out. After all Canada is also a supplier. And somewhat captive, because they have not built enough pipes to water.

There would probably also be some market for US ultralight for Vz blend stock to export elsewhere.

Thanks OVI

About the projections. Is it really so that those are calculated based on two previous months’ data (RRC/OCD), only. So just one data update/revision. It means, if the the update is larger, the projection is high, and if the update is smaller, the projection is also low.

I am still looking for EIA Texas 2024 figures, some months are 10-50k bpd higher than Texas RRC figures. Last month RRC updated the figures slightly downwards rather than upwards. I don’t know, if the numbers can be left so that EIA and RRC have different figures or will they be made equal at some point.

Month | RRC | EIA

Jan-24 | 5,340 | 5,327

Feb-24 | 5,542 | 5,524

Mar-24 | 5,569 | 5,583

Apr-24 | 5,627 | 5,637

May-24 | 5,675 | 5,688

Jun-24 | 5,717 | 5,756

Jul-24 | 5,670 | 5,7

Aug-24 | 5,751 | 5,805

Sep-24 | 5,767 | 5,798

Oct-24 | 5,824 | 5,832

Nov-24 | 5,769 | 5,768

Dec-24 | 5,682 | 5,685

Juha

You are correct in saying: “if the update is larger, the projection is high, and if the update is smaller, the projection is also low.”

You can see the effects of that in the two Midland production charts posted above. On many charts I have to make an estimate for the over correction and provide a revised guesstimate.

It’s the nature of the beast, bad data makes for bad projections.

However this month’s Texas data was better than average and the gap between the Tx projection and the EIA is only 63 kb/d.

If you go to the 914 site, which unfortunately is not being updated any more, you can download the Comp-Stat-oil file. Click on “Crude oil comparisons with other estimates” It has tabs at the bottom for each state.

Select the Texas tab at the bottom and it will show you the latest EIA estimate and the Texas RRC estimate. I think it is late by one month. See attached picture,

You will see that that EIA and RRC data are different starting in July 2023. So basically the EIA does not update Texas before 2 1/2 years. For New Mexico the delay is one year.

Screenshot

Thanks Ovi, very nice of you 🙂

From Maryland, USA.

My nephew had a solar installation of 17 kw plus two 11.5 kw Powerwall units, which went online on December 21, 2024. The system cost $76,200 and was ground based for perfect orientation to the compass and to the horizon. I asked myself, in a world without free money and feed in tariffs, could this system produce enough electricity to earn enough money to repay the loan at a modest 5% time value of money over 20 years. I did not take into account the reduction of solar cell efficiency and the cost of the inverters which the installer said had a life expectancy of 10 years.

The principal and the interest cost over 20 years would be $120,800 and using the current cost of a kwh of $0.22 which includes all fees and charges. The system would need to generate 27,200 kwh a year to cover the suggested loan. The actual generation in 2025 was 22,700 kwh or 80% of what was needed to cover the costs.

As for my nephew, he was able to take a $23,000 tax credit off of his 2024 Federal taxes and the Tesla software operating the solar installation, feeds the grid Monday through Friday whether it needs the power or not., at the highest time of day billing rate.

My conclusion is that the solar installation, on its own, will not and cannot pay for itself but my nephew is smiling all the way to the bank.

In my work, a nearby military base offered space so we could set up two buildings to operate a long-term research facility.

As we started planning the construction, the military facilities team at the base contacted us and said that because we were going to be within a short distance of the ‘air-side’, the power line would have to be underground and that would take some time to accomplish.

The military asked us what the overall power consumption would be for all the electronics, computers, lighting, motors etc. When we gave them the numbers they proposed that we look at a solar-powered facility, and provided recommendations for solar panels, batteries, inverter, etc. Our construction group took their recommendations and built our facility on the original timetable.

It’s worked perfectly well for seven years so far.

I’ve since seen many other examples of facilities and equipment that are off-grid, and that wouldn’t have been possible in an earlier era.

Meanwhile, in the wider world-

Globally the utilities of world electrical generation capacity additions in year 2025 was

over 70% photovoltaic.

Collectively, the global electricity utility industry knows the economics of electricity generation better than any other entity. Even Ervin.

I’ve been hearing the badmouthing of NM for quite a while now. But it was up more than a quarter million bopd for the year and is up over a million bopd since Covid.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFPNM2&f=M

Score. Board.

Will it last forever? No. But it has done pretty damn well.

Nony,

Doubtful that it will more than offset the decrease in output from the Texas Permian Basin. The STEO expects a peak soon in the Permian region for tight oil (Dec 2025 to Jan 2025). Low oil prices might reduce the completion rate as oil rig counts continue to fall.

Yeah, agreed. I’m just saying it’s done well.

A low oil price scenario with EUR decrease starting in July 2029 with 75k total wells completed, after Nov 2025 it is assumed only tier 1 ond tier 2 wells are completed (tier 1 locations run out at 75k wells). I think this scenario is very optimistic for oil prices assumed at $60/bo in 2025$. URR about 43.5 Gb total wells completed for scenario about 108k. Number of new wells on right axis is new wells completed per month. Chart at link below.

permian lowprice2601

On an unrelated matter, but one dear to my heart as an environmentalist, it should be noted that the Carlsbad Caverns was formed by sulfuric acid eating away at the limestone karst in that area of Eddy county. The primary reason Eddy county has become a tremendous sweet spot in the Delaware LTO sub-basin is due to extensive interbedding of the shale with limestone and dolomite (which is just limestone carbonate with a little more magnesium added to it). This interbedding with just the right amount of fragile carbonate gives the shale in that area its “brittleness.” When you exert fracking pressure on it, the fracture lines extend horizontally (laterally), not vertically. So the fractures merely open up more of the porous matrix of the oil-dense shale in that area.

It bears pointing out that the Carlsbad Caverns is massive, and the far reaches of it have never been explored. Most sane people won’t push their body into fissures that are barely larger than they are, but seismography will tell you where the larger voids exist. However, it is a certainty that smaller fissures run for miles. To extrapolate logic, it is damned near a certainty that at some point in the future, the oilfield is going to communicate with Carlsbad Caverns, the eighth wonder of the world.

What is happening in Eddy county is a national disgrace. I’m no geologist but even I can figure out that the more brittle the karst, the more an intrusion is likely to keep going until it meets a millions-year-old fissure extending out from the massive Carlsbad Caverns. And then it’s remediation time. In twenty years time, Eddy county will be pockmarked by a few old wells still cripping along, but thousands of cement jobs. The wellbores will still be down there, the maze from hell, collecting water and sulfuric acid, eating its way into the cavern. And that’s all she wrote, boys.

The potash mines were risk enough, though they didn’t form communications through shattered limestone-interbedded shale. Then the WIPP project was put in, which contains radioactive waste storage for much of our country. And now we are filling this area full of horizontal wellbores and blasting the limestone karst to smithereens with fracking? This is truly madness on a crazier scale.

Correction: limestone is chemically weathered, not by sulphuric acid, but by rain and soil water, which is simple water containing comparatively small amounts of dissolved carbon dioxide. Also, soil water may be acidic due to percolation through regolith and soil charged with decaying organic matter.

Northern Eddy and Lea have lots of conventional carbonate reservoirs, quite shallow, but they have lots of left-over oil, called ROZ (Residual Oil Zone) and some could be tapped by laterals with modern water fracking.

Oil markets very slightly up, after Vz raid. (The change is on the scale of normal daily variation.)

https://www.reuters.com/business/energy/oil-prices-slip-ample-supply-despite-political-turmoil-venezuela-2026-01-04/

I think markets don’t see some colossal loss (or gain) of bbls. OPEC seems to think similar as they are not adjusting loosening policy either.

I have to think Trump is dreaming with the idea of Chevron taking over the Vz industry. Look how those types of hopes worked out in Iraq. It is interesting though to see the new president backing down now.

https://www.reuters.com/world/americas/venezuelas-maduro-appear-us-court-trump-says-further-strikes-possible-2026-01-05/

TBD. TBD.

Pretty evenhanded, and decent, for MSM, article on the Vz oil industry going forward.

https://www.cnn.com/2026/01/03/business/oil-gas-venezuela-maduro

“The prospect is then how quickly could a Venezuela that is pro-US increase its production. That will be the parlor game. Perception may race ahead of reality. People will assume Venezuela can add oil faster than they actually can,” he said.

“Venezuela can be a huge deal but not for 5 to 10 years,” McNally said.”

Significant uncertainty, and even if Vz is rehabilitated, it will take a while. I guess the one plus is it was already such a small player that even if destabilization hurts production, it will not be momentous.

According to Rystad Energy, oil resources 2CPX are only 27 Gb, not 300 Gb as repeated endlessly by the media

https://www.rystadenergy.com/news/discovered-recoverable-oil-resources-increased-by-5-billion-barrels-despite-produ

Thanks Matt.

Don’t just find a strange number you like better and just run with it. Figure out what the story is.

If everyone was saying 27 and Rystad was an outlier at 300, would you take that as gospel? Or would you try to learn more?

Nony,

The Venezuela proved reserve numbers have always been suspect in my mind, ever since they added the Orinoco resources. In 1984 Venezuela’s proved reserves were 28 Gb, in 1987 the proved reserves doubled to 58 Gb (this was the OPEC nations fighting for quotas by artificially raising their reserves). Then in 2005 to 2010 they added about 220 Gb of proved reserves from the Orinoco Belt. In Rystad’s estimation the true estimate of 2PCX resources for Venezuela is 27 Gb. Likewise the Canadians claim 161 Gb of proved reserves in oil sands, but only about 19 Gb is in active development as of 2020 according to Energy Institutes Statistical Review of World Energy.

This is not news to me, I just am thanking Matt for reminding people that the 300 Gb number typically quoted for Venezuela’s “reserves” is very unrealistic.

Surprised you find this surprising. This is part of the reason that US oil companies (aside from Chevron) are not all that interested in Venezuela, along with the lack of any plan by the Trump administration for what happens after Maduro was kidnapped. The Maduro government remains in place minus Maduro, unclear that there will be significant change, oil companies realize this and the potential for political chaos. Low oil prices make it less likely the Orinoco Belt will be developed as it is expensive oil from a cost of production perspective.

That Nony is the story as I see it, generally I find Rystad’s analysis excellent.

There are also even larger 2000 GB estimate for Vz when you ask Chatbot.

There was a general oil-price driven asset bubble when oil price bubble formed from 2002 to 2014.

There is also the technology development, like shale, heavy oil now could be tapped at much lower cost per barrel than before. Especially heavy sour crude, like Canadian Oil sands and Vz heavy crude, which was much harder to produce, and only advanced countries like US could process it.

The Bohai bay heavy oil with high acid level from the largest oil field, Penglai 19-3, discovered by Conoco-Philips led operators, was not processed in China till after 2008/2009, almost 10 years after production started. Now, China Bohai bay has more than 65% crude coming from several large heavy crude fields there, all close to Vz heavy grade, maybe lower asphaltene and sulfur level, but still quite much higher than shale oil. The same refineries that process Bohai heavy crude now process Vz heavy crude.

The majority 65% of newly discovered crude in Bohai continue to be heavy crude like PL19-3 or close. The local tea-pot refineries also tuned up for such crude because of the higher naphthelene levels, could have high yield in JP8 kerosene, diesel and products that operate under extra low temperatures and yet high flash point.

So, the Vz heavy crude could only be tapped and processed by US big companies before 2008, i.e. monopoly. BTW, some of the catalyst to process such sour heavy acidic crude need large amount of rare earth. In fact, the last company that actively mining and use rare earth in US was Unocal. In 2011, CNOOC offered to buy UNOCAL, and was rejected by US congress security committee, citing rare earth. But, after merged with BP/ARCO?, UNOCAL rare earth operation was eventually shut down.

Sheng Wu,

2 TB would likely be an oil in place estimate, USGS has TRR estimate of about 500 Gb, ERR might be as high as 300 Gb, but will depend on oil prices. The 220 Gb reserve estimate for Orinoco belt was based on very high oil prices of about $118/b in 2025 $ in 2010. Maybe 20 to 30 Gb of Orinoco belt oil will eventually be produced if Venezuela get back on track which is by no means certain. I do not expect oil price to rise higher than $75/b in 2025$ in the future and prices may remain around $60/b (futures curve out to 2032), this would be lower in 2025$ as futures prices are in nominal dollars. Not clear that much of the Orinoco belt resource will be profitable to produce at the futures strip price. Time will reveal the answer.

DC,

https://tse4.mm.bing.net/th/id/OIP.-7FiPjmVgUzsl4NnlFu3nwHaDN?rs=1&pid=ImgDetMain&o=7&rm=3

The above link is the historic production figure for Venezuela since 1970, and you could see that even at the low price 90s’, Vz could produce 1.5MBOPD, and so it is not that cost is as high as Canadian Oil sands, and US companies already had the technology to tap them efficiently, and more over, there is monopoly from well-site to refineries that maximize the profit in the end.

Vz socialist government is worse than China in this respect, that they just yank the monopoly for good. The Bohai bay still have COP operating there sharing the same profit contract signed more than 30 years ago, and only changing the operator from COP to CNOOC after 15 years following the contract.

In terms of cost per barrel or profit, some sources claim that Guyana still lags behind Vz, and Exxon was forced to tap Guyana after Vz nationalized US major assets.

Sheng Wu,

Not much Orinoco oil was being produced in the 90s, Venezuela’s oil output was primarily from conventional resources before 2000.

DC,

you are right, the Orinoco Belt did not produce much in earlier 90s, but it did get to 100K BOPD in 1999 when price was very low, and now already 55% in 2024, according to link below (table of production from 2008 to 2024),

https://grokipedia.com/page/Orinoco_Belt

This means that the cost or challenges to produce is probably lower for the Ultra-heavy Orinoco Belt?

Or, just the lighter oil from the conventional Maracaibo lake legacy declined much faster after 2013 peak?

I am curious when US gulf-coast refineries tuned up for such ultra-heavy Orinoco crude, as such ultra-heavy grade did not kick in until after 2008? The Canadian oil sands got scared of the US take-over in Vz, implicating lower cost in Vz Orinoco belt?

Also interesting is that Chevron discovered the similar heavy oil in Bohai before 2000, and they had to abandon it due to low viscosity, but it is one of the major fields in production now. Obviously, the heavy oil production also got improved due to higher oil price and improved recovery technology.

“About three-quarters (around 75%) of Venezuela’s massive oil reserves, estimated at 300+ billion barrels, are in the form of extra-heavy crude and bitumen (tar sands) concentrated in the Orinoco Belt, making most of it very challenging and viscous to extract compared to conventional oil.”

Breakeven price for production? Expensive asphalt.

Make friends with neighbors- Buy Canadian.

the commons and differences between Canadian oil sand (COs)and Venezuela extra heavy OIl (VzH)

Commons:

1. API<10, or heavier than water 1.0g/cc

2. high in sulfur over 3%~8%

Differences:

1. COs: high in oxygen (2~8%) or asphaltene and bitumen, a result of even shallower depth than VzH which has oxygen level below 1%

2. a result of 1, COs viscosity is 20K~40K cp, VzH is usually below 10K cp (4~5K cp typical )

so, VzH actually don't need on-site upgrade plant to flow, just add some light diluents, but COs needs upgrade before adding diluents.

Article describing Venezuela’s oil industry at link below.

https://www.msn.com/en-us/money/markets/how-much-oil-does-venezuela-really-have-for-chevron-the-truth-matters/ar-AA1TF7qY

Article concludes with:

“If oil prices shot up to $100, producers might not be deterred by any of this. With Brent in the high $50s, Venezuelan oil may be far more trouble than it’s worth.”

Michael Ghirelli

01/05/2026

Correction: limestone is chemically weathered, not by sulphuric acid, but by rain and soil water, which is simple water containing comparatively small amounts of dissolved carbon dioxide. Also, soil water may be acidic due to percolation through regolith and soil charged with decaying organic matter.

My response: I don’t know who you are and you may know a lot about limestone, but for some strange reason the limestone karst that became Carlsbad Caverns was eroded out into giant spaces that send “nature’s wellbores” far into the surrounding area. That strange reason was due to the hydrogen sulfide in petroleum–the main reason I wrote the little article. The entire area used to be the Permian Sea, a place of deposition for millions of years. Like in most areas of high petroleum manufacture in the deep earth, there were parts that contained hydrogen sulfite, which will kill you if you drill into it without a ventilator on. There’s plenty of that in the western part of Eddy county and it rose from the deep until it met ground water, which is fairly well oxygenated. The resulting sulfuric acid eroded a massive network of caves. It’s not like there’s usually just a pocket of hydrogen sulfide and the surrounding area is clear of it. The cave network goes on and on, and many tributaries have never been explored. The oilfield is encroaching upon those tributaries, and at some point, due to tangential movement of fluids under pressure, the cavern itself is in danger of being breached. The process that created the magnificent Carlsbad Caverns was not some trickle down rainwater process; it had some help from the hydrogen sulfide present in some areas of intense hydrocarbon synthesis. My point, which I possibly didn’t make sufficiently, was that the caverns were hollowed out by a component of the rich petroleum system that we are tapping at a furious rate with two, three and four-mile laterals. I am a huge fan of oil and gas, but also of nature’s wonders, and surely to God we can find enough oil and gas to glut the market without encroaching upon one of the most marvelous structures in the world.

Gerry, oil keeps us alive. and access to power. The Caverns don’t.

Leeg,

At least 15% of oil consumption is really low value: there’s really very little value to the fuel consumption of one person in a large SUV or pickup. On average US passenger vehicles only have 1.2 people! US fleet average fuel MPG is only 23.

European light vehicle fuel consumption is only 18% of the US.

Excellent example Nick, access to power.. The power to command 1000’s of pounds of mobility on a whim. It is our birthright. Straight six pumping out 95 hp to the drive in. You and your date eating popcorn under the stars and bugs. Power to waste. Power to drain aquifers.

Sure we have a lot of room to increase efficiency. My point is that natural wonders, like the Caverns or Cedars of Lebanon, cannot compete for what is most valued.

Leeg,

I hope that’s irony or satire. I know that there are people who would say that and mean it – I’d argue that they don’t know what’s important in life.

Research tells us that’s a common problem: people buy stuff (houses, cars, etc) that don’t make them happier and often make them actually less happy. It’s really a massive social problem: for most of human history the way to make things better was to get more and better “stuff”.

That’s no longer true. Most people have enough stuff: their houses and cars are “good enough”. Bigger houses often bring under-utilized space, longer commutes, bigger mortgages, tedious maintenance, more isolation, more neighbor envy & competition. Cars are the same way: bigger isn’t better.

They need to find better ways to be happy than buying stuff: better relations with people, better work, better physical and emotional health and so on.

https://www.washingtonpost.com/climate-environment/2026/01/06/smaller-houses-happier-lives/

——————————

Not to mention that EVs are more powerful than ICEs.

Nick, oil gives people access to power. I’m speaking of watts. The ability to shoot yourself down the road at speeds way beyond what muscles can give. Also the power to pull farm equipment or bend steel.

Natural wonders do not. Homo saps will strip natural wonders in their land or across the globe for that power. Hell, a tar seep is a natural wonder.

I was responding to Gerry’s worry that the Caverns are at risk. They’re at risk like everything else in the biosphere.

Leeg,

Well, if power and speed are the important things, then EVs will take over the world very soon, because…they’re faster and more powerful than ICEs.

And then we can fuel them with solar panels, that coexist with the natural world far better than oil production and combustion.

Dennis,

USGS had a TRR of 513 BBO in 2009.

https://pubs.usgs.gov/publication/fs20093028https://pubs.usgs.gov/publication/fs20093028

Is it possible that 27 is right and 300 is wrong? Yes. Is it certain? No. Based on the TRR, I’d opt for the 300 more than the 27.

Do a little better and a little more. And keep a more open mind. Just jumping on the one of two wildly different estimates that you like better is not intellectually serious. Do more.

And no…the OPEC quota growth is not some massive inight. It’s a feather of evidence, well known to BP and the like. A very starter level of peak oil argument. Fesharaki says he made them up for some OPEC members, but he thinks the numbers are low, not high. And he knows a lot about OPEC oil. And even he is not so confident…one way or the other. (But he laughs at fuzzy logic Matt Simmons.) For that matter, I remember all the sturm and drang about Saudi Arabia…and when there finally WAS a very professional, top notch reserves auditing firm that said ~270…you all still didn’t like it…despite saying that was what you were waiting for.

Honestly, if this were something I was actually doing professionally, I would just reach out to someone at Rystad (their PR line…or just get a link of a link on LinkedIn) and get their explanation. Heck…if it really is 27, maybe the explanation adds extra insight. Or maybe they explain how there’s an apples and oranges situation. Who knows? But don’t just jump on the one (of two widely different estimates) and assume it is right AND you know FOR SURE why it is right. Go…ask questions and learn! Yes…even of the things that are “going your way”.

Isn’t the very likely explanation simply price? I’d guess that 300 is for oil at $200, and $27 is for oil at $70.

Nick, maybe. That’s probably one of several reasons to explain why each number makes sense in out’s own right. Could also be a definitional thing. Or maybe they are just competing estimates.

But, let’s find out! This is why I advocate, taking the unusual number as an opportunity for learning. Not just for “you go, girl” style cheerleading.

Heck, even if the 27 stands…you learned something. And there are many times in oil, business, military, politics, etc. where jumping on the report you “like” is a mistake. Pressure test.

Yep – we should all try to do a bit of research before we comment.

OTOH, in this case I don’t see much value in investing time: IMO Venezuela is way too chaotic for IOCs to invest much time, energy or money any time soon. I really think this whole thing is just theatre to distract from the President’s serious domestic problems.

I suppose there is a small possibility that he thinks Venezuelan oil production can be expanded quickly – he may not understand how unrealistic this is. Based on his very limited business experience running a very small real estate organization (with most major components of his RE projects outsourced), he seems to believe that countries are generally run by a single person at the top. This has been described as a “neo-royalist” approach. Thus, he thinks that making friends with Putin makes some kind of real difference, and perhaps he thinks that he can kidnap Maduro and change the whole Venezuelan government. That, of course, would be remarkably unrealistic, but then this president appears to be remarkably out of touch with the real world.

Anon

Do you actually know what Matt said about Saudi Production?

From an interview I saw he said (from memory) Saudi Arabia, 12 million yeah but various people say it should never try and produce more than that.

How much is Saudi producing?

It has not had to test if it can produce 12 million per day for a year or more. Do you know it can produce 11m/d, no you don’t, so shut up misquoting people.

Nony,

I am not doing this professionally, perhaps 300 Gb will be recovered by 2500 CE, do you believe that Rystad doesn’t do serious analysis? Yes USGS estimates 513 Gb for Venezuela’s TRR as of 2009. The estimate may not be correct and the important number is economically recoverable resources. I don’t have access to anything but the publicly available Rystad data.

Nothing about the future is certain, so expecting certainty is silly.

This older article from 2016 at link below discusses differences between Rystad estimates and the national oil estimates by Venezuela (which are esssentially resource estimates.)

https://www.fairfieldsuntimes.com/business/study-us-holds-more-oil-reserves-than-saudi-arabia-venezuela/article_1033e489-bb54-5991-98a3-4bb211887d27.html

Another article from July 2017 discussing the difference between the estimates for Venezuela’s reserves between the Statistical Review of World Energy and Rystad at link below.

https://www.spglobal.com/energy/en/news-research/blog/crude-oil/071017-venezuelas-oil-reserves-kick-into-reverse-fuel-for-thought

Dennis:

I think Rystad does serious research. So does BP. So does USGS.

The two articles are helpful, thanks.

I don’t think it is just an issue of Vz juicing the estimates, but of the economic challenges of extracting the heavy oil. For example differing hurdle at $100 oil prices and half that. There are likely also local control/political hurdles that are implicit too (non-physical constraints). If all that oil were magically transported to the USA or Canada, I suspect that solutions could be brought to bear…after all look at the development of Alberta. (Note, I’m NOT expecting local control issues to go away…look how we screwed up Iraq and Libya, rather than helping them! But I do think it’s important on a long range blog like this to consider the difference between physical constraints and societal ones.)

Again, thank you for the articles.

Nony,

Rystad CEO is a physicist, the number reported for 2PCX is based on the same set of criteria (SPE guidelines) for every nation assessed. My guess is they use the long dated futures curve to estimate future oil prices and on that basis the remaining resource for Venezuela as of Jan 1, 2025 is about 27 Gb and for World C+C the best estimate (F50) for ERR is about 3100 Gb based on Rystad’s analysis (about 1519 Gb of remaining World C+C resources in 2PCX category).

https://www.rystadenergy.com/news/discovered-recoverable-oil-resources-increased-by-5-billion-barrels-despite-produ

Count me as a small US oil producer who will be extremely pissed if US taxpayer dollars go towards funding Venezuelan oil production.

We have weathered OPEC’s opening the spigots in 1986, the Asian Flu of the late 1990’s, the GFC, 2016 and COVID. No bailouts. Just percentage depletion, which we cannot even take on leases that are in the negative during the tax year.