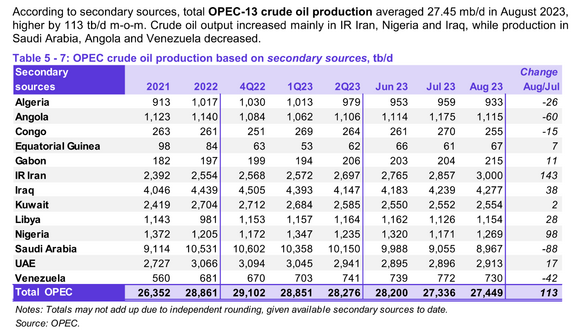

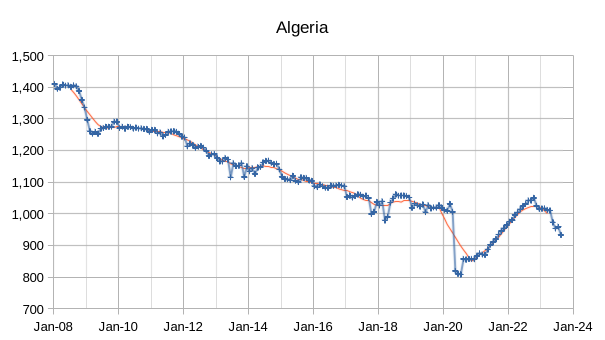

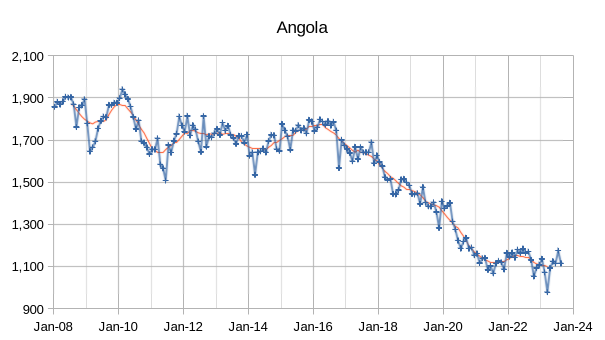

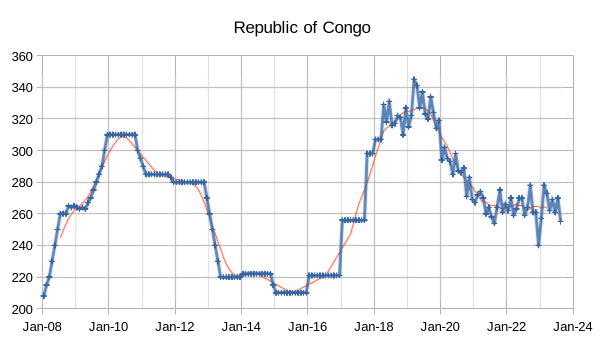

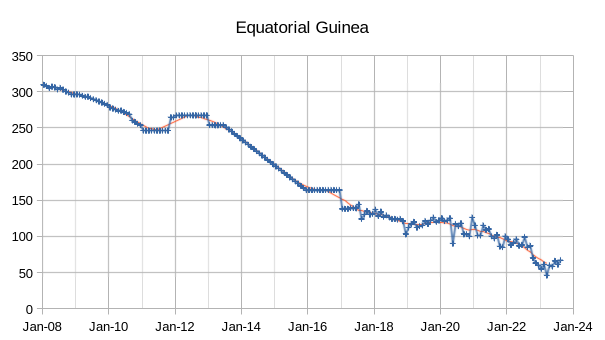

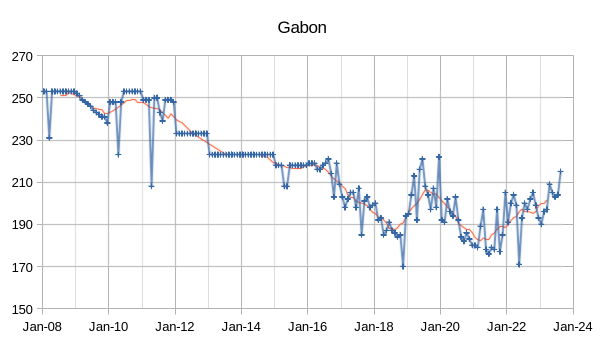

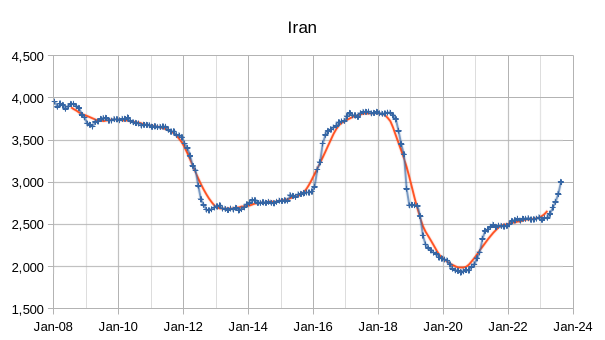

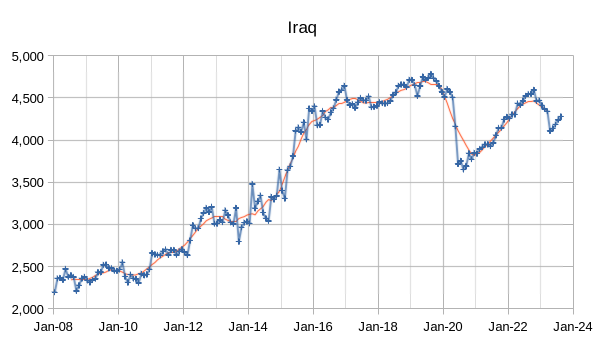

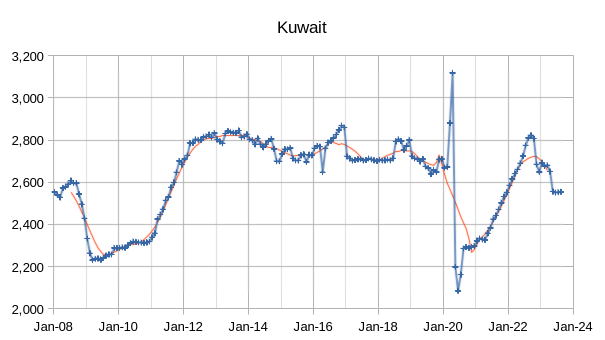

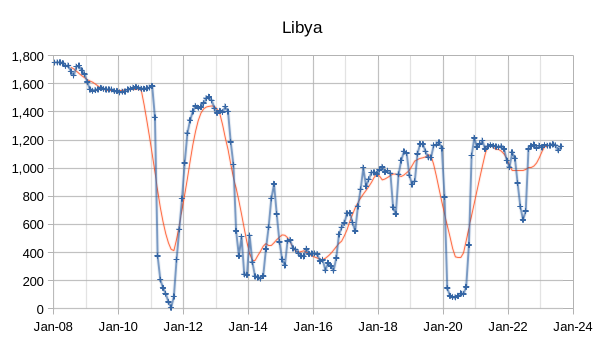

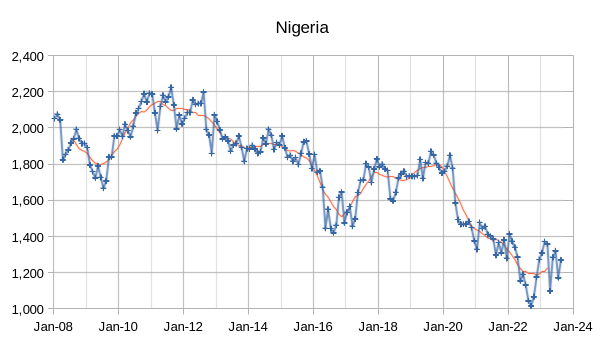

The OPEC Monthly Oil Market Report (MOMR) for September 2023 was published recently. The last month reported in most of the OPEC charts that follow is August 2023 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In many of the OPEC charts that follow the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

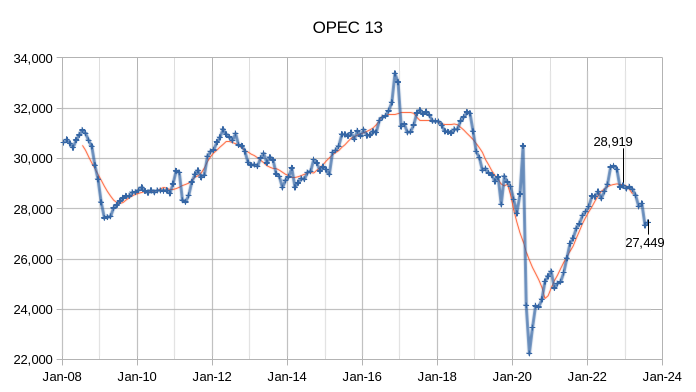

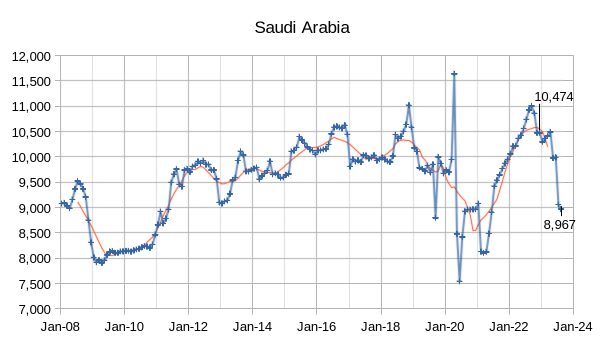

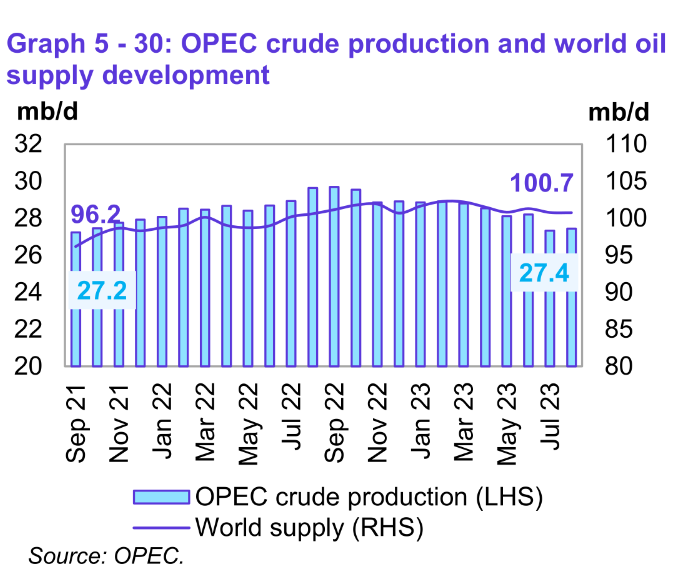

OPEC crude output was revised higher in July 2023 by 26 kb/d compared to last month’s report and June 2023 OPEC crude output was revised higher by 54 kb/d. When the World was at its CTMA peak for C+C output in 2018, OPEC crude output was about 31300 kb/d and by August 2023 OPEC crude output had fallen to roughly 3851 kb/d below the CTMA peak in 2018. The OPEC 13 crude output in December 2022 and August 2023 are noted on the chart, with OPEC 13 crude output falling by 1470 kb/d in the past 8 months. In the Saudi Arabia chart below we find that output fell from December 2022 to August 2023 by 1507 kb/d so that the OPEC 13 cuts during 2023 mirror the Saudi cuts (with the Saudi cuts actually being 37 kb/d more than the cuts by the rest of OPEC combined.)

Preliminary data indicates that global liquids production in August was unchanged from last month

and averaged 100.7 Mb/d. World liquids output increased about 3.5 Mb/d in the past 23 months (from 96.2 Mb/d in September 2021).

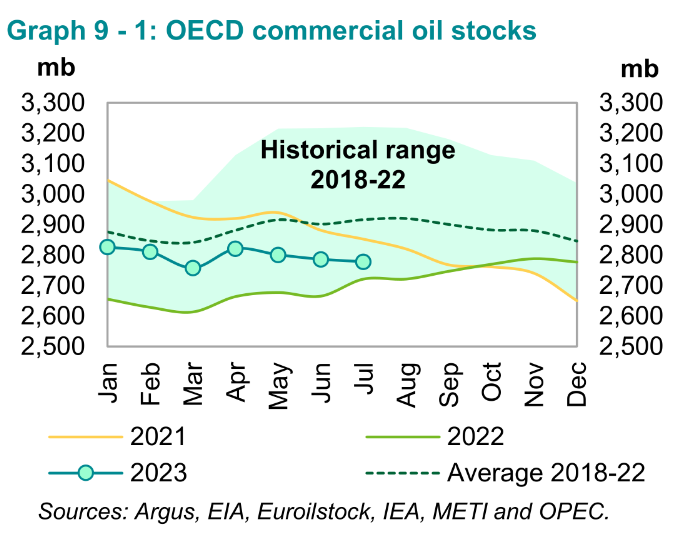

Preliminary July 2023 data sees total OECD commercial oil stocks down m-o-m by 7.9 Mb. At 2,779 mb, they were 57 mb higher than the same time one year ago but 138 mb lower than the latest five-year average and 190 mb below the 2015–2019 average. As OECD stocks come closer to the bottom of the 5 year range we may see oil price spike further.

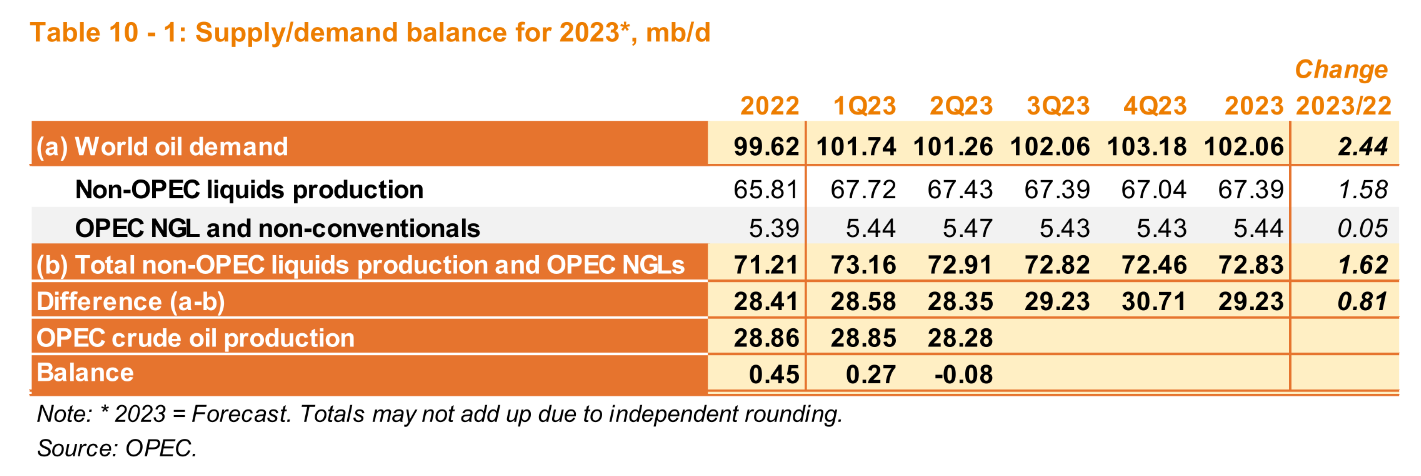

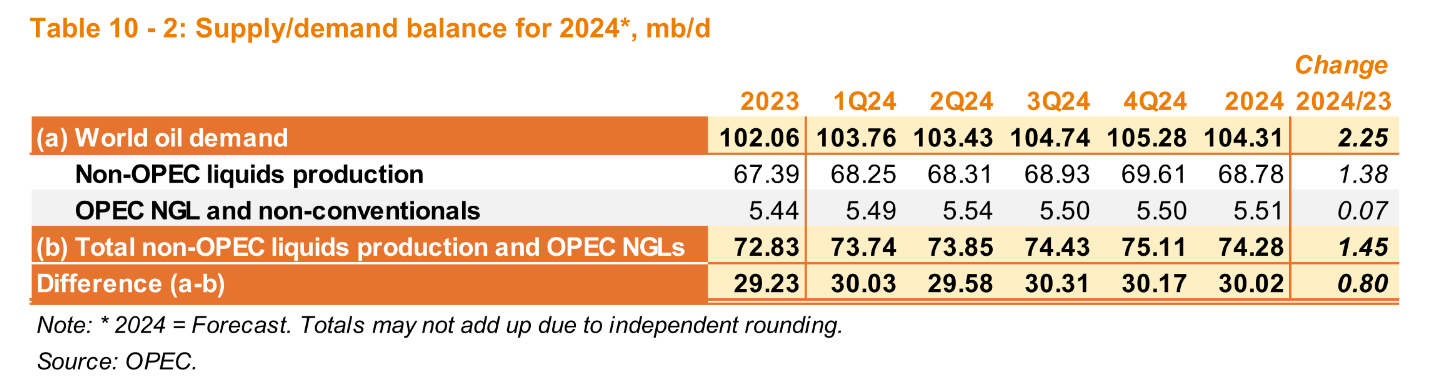

If OPEC continues to produce at the August 2023 level of about 27.4 Mb/d of crude oil, we will see a significant draw in World Oil stocks, assuming OPEC estimates for Non-OPEC Oil Supply and World Oil Demand are correct. My expectation is that the World Oil Market will become very tight and oil prices should rise, unless OPEC increases output to balance the OiI Market. It is also possible that OPEC is overestimating future demand for oil, higher oil prices might lead to slower growth in World demand and perhaps higher non-OPEC output which would reduce the call on OPEC.

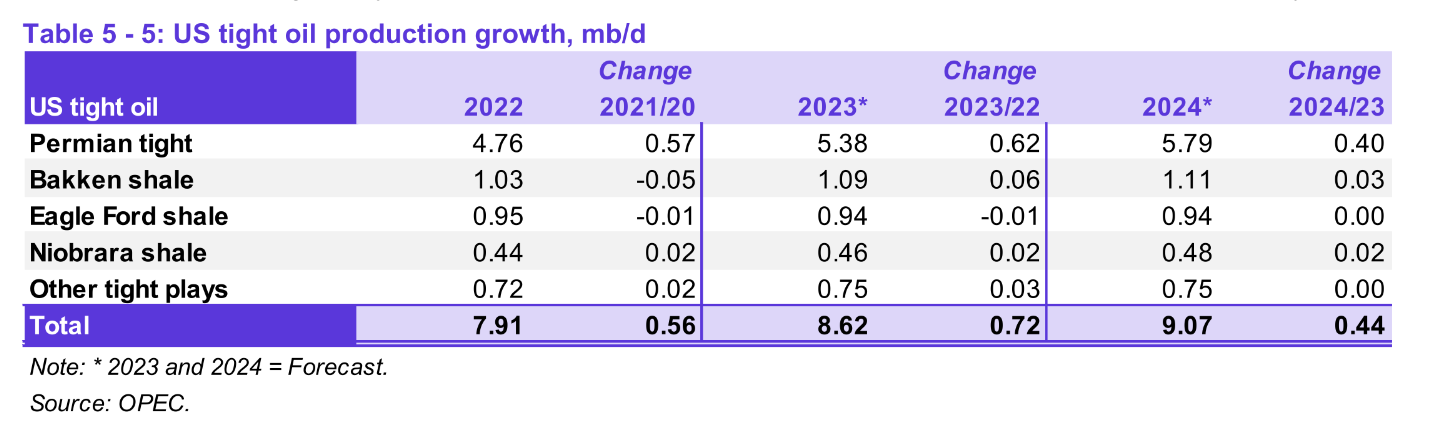

OPEC has reduced its estimate for US tight oil growth to 720 kb/d in 2023 and 440 kb/d in 2024 compared with last month’s estimate (760 kb/d in 2023 and 490 kb/d in 2024). The estimate for 2023 is similar to my scenario (723 kb/d increase in average annual tight oil output from 2022 to 2023), their estimate for 2024 remains a bit more optimistic than my scenario (with a 358 kb/d increase in annual tight oil output in 2024).

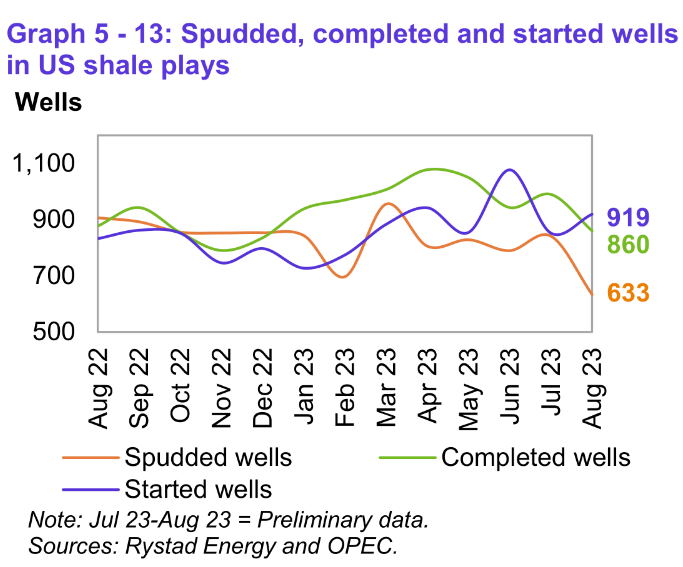

The numbers on the right are August 2023 preliminary estimates for Started, Completed, and Spudded wells in the EIA-DPR Shale regions. For July 2023 the preliminary estimates are 841 wells spudded (up 52 wells from June), 990 wells completed, and 852 wells started. Historically the preliminary data for the most recent two months has usually been revised higher in the future.

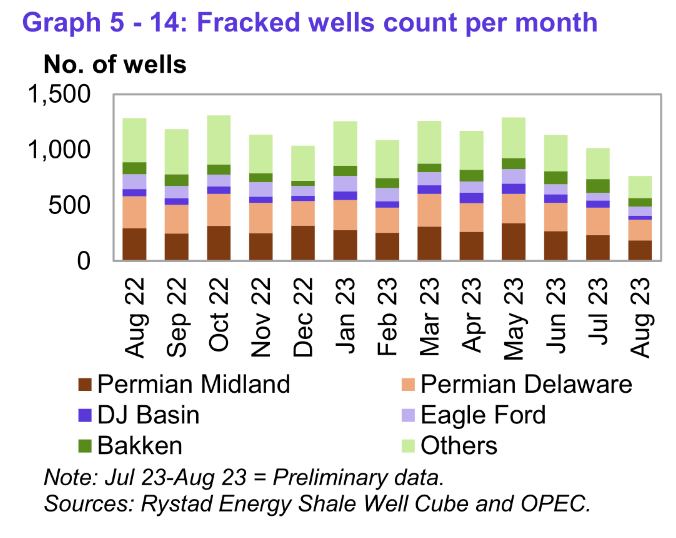

Again the most recent two months of data is usually on the low side for fracked wells. Rystad reported that 1133 oil and natural gas wells in shale regions were fracked in June 2023, 1017 wells fracked in July and 765 wells in August. The breakout by region was 482 wells fracked in July in Permian, 127 wells in Bakken, 67 in Eagle Ford, and 64 wells in DJ Basin (Niobrara). In June there were 523 wells fracked in the Permian.

Thanks for the post Dennis. Great work as usual.

(post 1/x)

Saudi Arabia oil production update.

Saudi Arabia (abbreviated to KSA) is one of the most important countries in terms of world oil

supply, and even more so in terms of exports. On the other hand, it is one of the most opaque when

it comes to oilfield figures. The URR of some of them, such as zuluf or khurais for example, can

vary according to estimates from simple to quadruple, and their proven reserves are in practice

worth very little. The purpose of this post is to try and shed some light on the Saudi situation and to

assess a long-term forecast (2050) of its oil production. I would like to point out that I personally

have no connection whatsoever with the oil industry. I therefore apologize in advance for any errors

I may have made, and would be happy to engage in a debate on the subject, provided that openmindedness

and respect are the order of the day.

Historical outlook of the production

During the 20th century, production was dominated almost entirely by Ghawar, Safaniyah and

Abqaiq (chart 2), who are, in the words of Matthew Simmons, the king, queen and queen dowager.

A turning point came in the 2000s, with a number of fields coming on stream or back into

production, making up the rest of the royal family.

Thanks for the info. Would it be possible to show the cumulative totals for each field and some indication of decline rates for the older fields?

yes it’s possible but since i cannot post more than one graph per post, it would be rather annoying and difficult to read. And as far as i know there are only two fields in decline : Abqaiq and Ghawar. I have planned to post a chart with the historical and forecasted production for the last one. The majority of others are in plateau and a very few have probably still a growth capacity (notably Zuluf, marjan and shaybah)

Your chart ends in 2017. As Ghawar production was reduced at 3000 kb/d in 2021, the whole chart should be contracted by now as the rest of the little oil fields have not probably increased their own production as you stated below. Am I wrong?

Je suppose que je peut vous parler en français (if not it would be an horrible mistake of my part). Le graphique se termine en réalité en 2018 (libreoffice n’avait pas la place pour charger la dernière année je suppose). Mon estimation personnelle (que j’ai posté plus bas) est que les autres gisements saoudiens seront en mesure de combler le déclin de Ghawar et Abqaiq pour quelques années de plus jusque vers le milieu de la décennie 2020. Dennis et Jean Laherrere ont une estimation plus optimiste et Mathew Simmons et de nombreux autres furent beaucoup plus pessimistes. Nous verront comment les choses vont évoluer mais la situation saoudienne n’est pas très réjouissante. Celle de la Russie est peut-être encore pire, donc je suppose que la décennie dans laquelle nous sommes sera (et est déjà) mouvementé en terme de production et du prix du pétrole.

J’espère avoir répondu à votre question 🙂

Merci de la réponse. Attention aux conjugaisons et aux accords pour les participes passés mais merci de l’aimable effort. Je pense, qu’à mon tour, mon expression en anglais n’est souvent pas très propre malgré mes efforts.

(post 2/x)

Table 1 : Major Saudi oil fields production, reserves (own estimation), depletion and crude oil quality

Thank you for the information. According to the table there is 94 Gb left (assuming no reserve growths), which is roughly 3 years of C C world consumption.

If they produce at an average of ~ 10 million bpd it will take ~26 years for their remaining reserves to finish.

Interesting. Great stuff.

26 years left for Saudi, but that was almost five years ago. On average that would imply about a 5% decline from now on. Typically fields come off plateau somewhere between 5 and 10%, so that kind of ties in with everything.

George,

Do you think there is anyway they could reduce and sustain a decline rate of < 5%

Probably yes for a few years, but at some time water break through is going to catch up with them and decline will be steeper. For horizontal wells decline can be dramatic for a couple of years and then will settle down to lower rates. I’m not saying that will happen but it may on some of the fields as they age, and when or if they get to less than 10 years R/P then they will simply have to accept fate and decline will be 10% or more.

Thanks, if you just post line curves for the declining fields on a single chart (i.e. not stacked) it would just need one extra chart, maybe use primary and secondary y-axis if there is a big gap from Ghawar to the others.

FRENCHFRIES,

Jean Laherrere sent me his most recent Chart for OPEC oil production & Forecast. According to Jean, the URR for OPEC is 125 km3, or 786 Gb with 85 km3 of cumulative production or 534 Gb.

Thus, the 534 Gb of cumulative OPEC production is 67% of the 786 Gb of URR. This fits nicely with your figures when we update the cumulative production over the past 5+ years.

steve

Here is Jean’s HL of OPEC’s oil production. It seems the 125 km3 URR is the more realistic trend-line.

Interestingly, due to advanced EOR, it has changed the HL trendline to become steeper. I believe the URR will likely trend even lower in the years ahead

steve

Steve,

OPEC reduced output a lot in response to the pandemic. If we use the 10 years from 2010 to 2019 we get an estimate very similar to the 20 and 30 year estimate for URR.

Steve and others here is mine, It is based on BP data so all liquids since we only get consumption data for that.

Its looks like peak export level for OPEC in this century was 2004, and will never be higher.

KSA….if vertical wells were used from 1975-2000 for 1P recovery and horizontal wells from 2000-2023 for 2P…and 3P is not possible is KSA empty or on last 10% of field ability…

I have seen nothing to suggest that the 2P estimates for reserves don’t still give the best number for final recovery. These would be something like 95% of proven, 50% probable, 5% possible and, maybe, a tiny amount for contingent. There is no theoretical reason these should add to the 2P number, but in practise they tend to do so. As fields get more mature the proportion from proven and probable go up (reaching 100% the day it shuts down) and those from possible and contingent go down. Rystad publish 2P numbers based on well by well analysis, which is about as good as you can get without having direct access to the operator’s full scope reservoir models.

Using EIA data from 1973-2022 and OPEC data for cumulative output to 1972, I get the following Hubbert Model based on an HL from 2001 to 2022. URR is 348 Gb, peak for model is 2024 at 10.2 Mb/d.

Dennis

What do you think Saudi Arabia maximum production is now and how long could they maintain that?

Charles,

I think they might be able to maintain 10.2 Mb/d for 5 years, but this is speculation on my part.

Hickory,

Cumulative production for Saudi C plus C was about 168 Gb at the end of 2022, the Hubbert model has cumulative output at 168 Gb at the end of 2022. Cumulative output was 17.5 Gb at the end of 1972, I have adjusted the Saudi crude cumuative output by assuming the ratio of C plus C to crude was similar to the 1973-1980 ratio prior to 1972.

Dennis

That’s probably not far off, perhaps they may produce 11 but for a shorter period of time.

And you think U.S oil will peak around 2028?

Charles,

Yes 2027 or 2028 is my best guess for US peak.

What has been the cumulative Saudi production thus far?

Hubbert linearisation doesn’t work if there are artificial limits imposed (Hubbert said so himself); the tighter the limits the worst the results and Saudi above all others has the most constraints imposed so will have the most inaccurate predictions when using HL.

George,

I agree.

Dennis, what do you use as the cumulative in 1970? Not that it matters much, for I get URR=350.8 and peak year 2023.5 with data from 1960 on, and starting cumulative of 6 Gb that I fixed so that it checks with Colin Cambell’s cumulative of 91.4 Gb in 1999.

Incidentally, Dennis Coyne, I met Kenneth Deffeyes at the Baker peace conference in 2003, and he mentioned there to me that he did not know anybody who initially rejected Hubbert’s analysis and later changed his or her mind. You are an exception to this, so kudos to you. https://www.ohio.edu/cas/contemporary-history/news-events/baker-peace/past

Professor Korpela,

I have cumulative C plus C output of 104.86 Gb at the end of 1972 for OPEC, for Saudi Arabia I have 17.55 Gb cumualtive C plus C output at the end of 1972 and 168.6 Gb at the end of 2022.

A problem with Hubbert Linearization is that the endpoints of the data chosen is subjective. So there are multiple answers depending on the endpoints chosen. For KSA if we choose a 20 year interval of data the result changes from 362 Gb before the pandemic to 329 Gb after the pandemic for the URR estimate. The average of the two would be 345 Gb, so perhaps 345 plus or minus 15 Gb would be a good rough guess based on this methodology. Laherrere guessed around 300 to 350 in 2018, call it 325 plus or minus 25 Gb. I think anything less than 325 Gb is likely too low for KSA URR and 345 Gb would be my guess.

Clarification of a prior discussion topic-

People have talked about peak oil demand.

Perhaps we will see peak light transport gasoline demand sometime soon,

but I am skeptical that we will see peak demand of all other oil derivatives

in the next couple decades.

My thinking on this takes into account the growing population and purchasing power of the global economy, especially in emerging markets countries where the energy and material per capita demand catchup process will continue with strong momentum. Also, all of the other oil derivatives, from diesel to aviation fuel to bunker fuel, are much more difficult to replace than is light transport fuel.

The king, the queen and the queen dowager.

Ghawar, truly the “king of all kings”, is an aging giant that long ago passed its peak production (exactly in 2004 at 5772 kb/d) and is now seriously depleted. Most URR values are between 80 and 120. 80 is far too low a value; it has already produced that amount. 120 seems too high given the actual decline rate of this field (almost -125 kb/d per year). A linearization gives a URR of 100 Gb with an r2 of 0.99. This is the value chosen for the following chart, who represent the historical (till in 2018) and forecasted production of Ghawar for an URR of 102 Gb and a subsequent decline rate of 5,5% per year.

Laherrere estimates about 123 Gb for Ghawar URR.

See pages 117 to 118 at link below

https://aspofrance.org/2018/10/03/updated-extrapolation-of-oil-past-production-to-forecast-future-production/

yes i think my estimation can be a bit low, it would be interesting to see the impact of the URR with 10 and 20 Gb more.

(post 4/7)

The rest of the royal family

The rest of the “royal family” includes numerous fields, most of which were only recently brought into production in the early 2000s, notably khurais and manifa. They are geologically complex and, in the case of manifa, the oil is of poor quality. Bringing them into production has required billions of dollars of investment and the installation of hundreds of wells, whose flow rates are much lower than those initially drilled in Abqaiq and the northern part of

Ghawar. They were developed progressively, theoretically enabling production at 12 mb/d, which has been much vaunted for years, but is doubted by many analysts.

The following chart represent the Saudi Aramco official targeted production level in kb/d for the 9 others major Saudi oil fields.

(post 5/7)

In practice, it is remarkable to note that they are all well below production targets, albeit with wide variations between fields (chart 8). The question is whether this underperformance is deliberate, as Saudi Aramco does not feel the need to exploit them to their full potential (despite repeated calls to do so or during their attempt to “kill” American shale), or whether it is a sign of difficulty in pushing production as well as maturation of the fields. I suppose that if, in the coming months/years, the oil market tightens up (and I think there’s a good chance it will) and prices soar, with the OECD countries calling on us to increase production, we’ll be able to see whether or not

these fields can deliver on their promises. In which case, their reserves are far greater than the estimated reserves on which the following forecasts are based. Moreover, it should be noted that their depletion rates are significantly higher than those of abqaiq and safaniyah. Perhaps this reflects Saudi Aramco’s need/willingness to push them as fast and as high as possible to maintain overall production for as long as possible. In any case, even with the official figures, Saudi Aramco doesn’t have much room for manoeuvre left, which implies that in the absence of major new projects, Saudi oil production is doomed to decline in the medium and long term.

Chart 8 : «The rest of the royal family» 2018 real production in kb/d in comparison of the official data.

French Fries

Great charts. Thanks for sharing.

Thank you for these charts. If you don’t mind me asking. but I would be delighted to know from where do you get the data?

sorry for the late reply. I have found a few months ago a paper made by a saudi geologist who assess the futur of the saudi oil production. But when i have used the data to explain why i think KSA is close to it’s peak of production, he have used them to prove that KSA can still produce a lot of oil (even at 15 mb/d) for the decades to come.

Thank you FRENCHFRIES for all the interesting charts and information, these would have made a awesome blog post IMO !

FRENCHFRIES: You posted a remarkable and illuminating series of graphs and charts. Thank you very kindly, sir!

FRENCHFRIES – Thank you for this contribution, I agree it would be a fantastic stand-alone post.

The take-home from my perspective is that all data points to a significantly lower URR than many/most expect. I believe it confirms what many have said here that OPEC managed to keep production relatively high well beyond the 50% URR mid point of ~2000-2010. Most likely OPEC is down to the last 25-30% of their oil supplies and production must fall as they keep overproducing their reserves. Their massive divesture of oil and investment in everything else confirms the view that they realize they only have ~10 years left before they run out/low.

We can narrow this entire assessment down to 4-5 countries, those with estimates of oil reserves (2P) of more than ~30 Gb: Saudi Arabia (70), Russia (60), US (50), Canada (50), and Iraq (40). They produce more than half the worlds oil.

This is very significant, it means that worldwide we can expect production to decline between 3-4 Mb/d each year.

About 4-5% annually.

Reality may be that we have even less remaining, a total URR between 1,750 and 2,000 Gb. 1P = ~250 Gb and 2P = ~500 Gb. If 1P is that low, we can expect decline rate >10%, which will be a very difficult pill to swallow.

Without any doubt, a 10-year plateau is simply not in the cards. If there is more oil to be found/grown, it will not change the next 5-10 years of decline.

Kengeo,

Note that the OPEC data excludes extra heavy oil from Orinoco, so this might add another 100 Gb to OPEC URR, in 2018 Laherrere estimated OPEC C plus C URR at about 1200 Gb. Generally Mr Laherrere is fairly conservative in his estimation of URR.

Can you remind us of your prediction for 2024? It seems you now are expecting 10% decline, so if you accept 81.5 Mb/d as a reasonable guess for 2023, you might expect 73.4 Mb/d for annual average output in 2024? Or maybe its 5% decline which would be about 77.5 Mb/d for World C plus C in 2024.

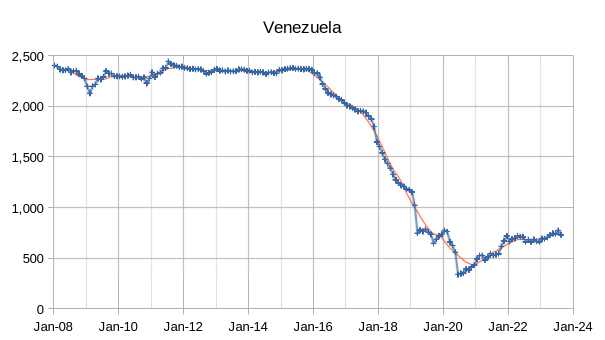

Dennis – Oil from Venezuela is getting produced at <1mb/d, even if they can return to ~2 mb/d, it will not matter in the greater context of global oil depletion. By the time they add ~1.5 mb/d, so many other countries will have depleted by a total amount 10 times that…it's certainly not an argument that it will add to global supplies, more likely they will use all or most of it for themselves, for example from 2012-2014 Venezuela used ~0.8 mb/d. All big ifs, but if they can produce more, it's unlikely much will go to world market (likely be 1-2 countries that benefit, most likely China)….

Kengeo,

Any oil used on planet Earth is part of the World oil market, oil sold by Venezuela to China is oil that China does not need to purchase elsewhere. I tend to agree Venezuela may not contribute much to future World output, my scenario has a very low estimate for extra heavy oil URR, about 100 Gb total from both Canada and Venezuela and about 72 Gb of LTO output from the US, total conventional C plus C output for the scenario is only 2500 Gb with total World C plus C URR of only 2670 Gb (830 Gb less than the 2022 estimate by Laherrere et al of 3500 Gb for World C plus C URR).

Dennis –

Since 2006, the rest of the world has been declining by 1.1% annually.

If we exclude N.A. from the equation, all others are declining by ~1 mb/d (~1.4%). Currently down ~4 mb/d since the 2018 peak.

With relatively short supply, U.S. will see considerable declines soon of at least 1 mb/d each year.

I expect that we will see annual decline of at least 2 mb/d.

Over the next decade or so the rate of decline may be moderate (~2.5 – 5%).

By the 2040s it will skyrocket above 5% and then hit 10% by 2050s.

Production will fall to essentially zero in the 2060s.

If you assume low decline rates of only 1-2%, that means relatively high continued production levels (>40 mb/d thru at least late 2050s) and in turn means we run out sooner (by the mid 2050s).

We are at the transition point from ~10-15 years of peak oil plateau. Now we are entering the decline phase, it will increase each year (as we are already starting to see).

See graph below in response to Frenchfries question…

Kengeo,

I think you need to check your data more carefully. Your OPEC plus CIS, plus US, plus Canada as big producers and resof world defined as World minus this big producers group has been declining at about 1% per year for C plus C production since 2006, about 245 kb/d per year, the big producers have been increasing at an average annual rate of 662 kb/d per year (this includes the years of pandemic oversupply where output was cut i response to oil glut).

If we look at the pre-pandemic period of 2003 to 2019 we find the big producer group increased at an annual rate of 951 kb/d per year and the rest of the World declined at about 220 kb/d per year, a net increase for the World of 731 kb/d per year. The future rate of increase will be lower than this probably on the order of 400 kb/d per year on average from 2023 to 2027, then I expect output to gradually decrease at an increasing annual rate over future years as the world weans itself from oil use.

Dennis – See below, your increasing production suggests a URR of ~3,200 Gb.

1P suggest URR of 1,850 Gb (maybe this is too low, but we don’t know for sure yet, likely 80-90% chance it’s too low).

2P suggest URR of 2,000 Gb (50-50 chance of being about right, therefore this is the “Best” guess based on a coin flip).

2PC suggest URR of 2,750 Gb (<10% chance of being correct, likely too high and doesn't seem to match production data). Your value of 3,200 Gb matches closest to 2PCX, I'm not sure what probability 2PCX has of being close to the actually figure (I would guess <1%).

The highest URR I'd support you on is ~2,400 Gb, this would imply world peak of ~2014 which generally matches for conventional oil.

But even if you want to use ~2,750 Gb, still peak was several years ago…so don't think there's a remote chance of growth of next several years…

Kengeo,

As I have mentioned several times, conventional and unconventional oil should be modeled separately, the peaks do not occur at the same time. For conventional the peak was 2016 (cumulative reached 50% of 2500 Gb URR in 2015), for uncunventional the URR is 170 Gb, peak is 2027 at cumulative of 72 Gb.

A single Hubbert curve doesn’t get the job done, you need two.

Venezuela is shipping a lot of water with the oil, and that is separated at the receiving port. That is what some refinery guys at the gulf claim.

Kengeo,

I agree with your assessment that a 10 year plateau seems to be quite unlikely assuming the relevant data supplied is an accurate reflection of whats on the ground.

Thanks Iron Mike, it seems the list of production losers is growing…I guess at this point it might be the only list there is…just scanned all the charts above, all losing production over the last 3-5 year period…

It would probably be interesting to make a forecast for each of the 10 majors oil producing countries since the world minus these “Big ten” is in decline since almost 20 years (Ron have post pretty nice graph about this in the past).

Thank you FF (fossil fuels or french fries). To add to your pots, there are only 22 countries in the world that export over 100 kb/d and of those 16 are past their production peak so that leaves only 6. Those beyond the peak lost 7 Mb/d of exports between 2008 and 2022. That is from 17 Mb/d to 10 Mb/d. The countries left are Saudi, Irak, UAE, Canada, Oman, and Kazakhstan, Kuwait peaked in 1972 and Iran in 1974. Mexico is joining the list of importers, and my guess is that Brazil will likewise as the domestic demand increases. Again the numbers are for all liquids because we only have consumption data for that.

We are already 9 years into the peak plateau phase…here that chart again.

Hickory,

I tend to (probably mistakenly) count the plateau from the peak onwards. So I dont think the plateau can be sustained to 2028 is what i meant. Of course the plateau is subjective and can include or exclude many data points.

Mathematically it probably makes more sense to have the peak in the middle

Iron Mike,

As Hickory defines the plateau (and it seems as good a guess as any to me, I agree most things are subjective) my best guess scenario has output remaining above the lower limit of Hickory’s plateau until 2033 (average output that year would be 80.4 Mb/d). The plateau would start in 2014 and end in 2033 with average output over that 20 year period at 81.3 Mb/d, the midpoint of that plateau would be 2023/2024, I have the peak at 2027, but any year from 2018 to 2029 is likely and we have the data through 2022 and know the current peak is 2018, my best guess is 2027, but it could be any year from 2025 to 2030 in my view, the specific year is of little importance in the grand scheme.

Dennis,

Yea that seems like a reasonable prediction to me also. One reason i like your prediction is that I think its entirely possible that a slowing global economy might possibly delay a second peak into the late 2020s.

On the other hand, if the global economy continues humming BAU, if the 2018 peak isn’t surpassed or equalled by 2025 we won’t see the 2018 peak beaten. And a terminal decline will start by around 2025 which has been my initial guess for peak oil.

My prediction is entirely dependent on the global economy and the global economy is entirely dependent on credit expansion. There is a lot of moving parts.

Iron Mike,

Your scenario also sounds quite reasonable, I agree there are many moving parts all of which are difficult to predict, also possible that we never reach the demand levels of 2018 due to a combination of higher oil prices, a slowing economy and the transition to electric land transport. I discount this last possibility in my scenarios, but my thinking is that this is the most likely reason that 2018 would remain the peak in World centered 12 month average output for all time.

Iron Mike- “My prediction (on oil production peak) is entirely dependent on the global economy and the global economy is entirely dependent on credit expansion.”

And credit expansion decisions by government/banking system is in part dependent on inflation considerations, which in turn is partly dependent on energy prices.

How does humanity spend a lot more money on energy systems (equipment and fuel) without escalating inflation, which in turn requires credit tightening?

Its a failing spiral scenario.

Repercussion of Overshoot in a finite world.

“… the specific year is of little importance in the grand scheme.”

I very much agree with Hickory’s definition of a plateau and that we’re more or less at the middle of it. Technically I also agree that the precise year of the peak is of minor importance (we might see two peaks, an absolute one in 2018 relates to monthly data, and another one in the near future related to running average). But my concern is, especially in these times of a not so cold war and the strategic importance of reserves, how markets will react. IMO the jigsaw of limited production and a resulting recession should soon show another ugly tooth.

By the way, where’s Ron? I didn’t read anything from him. Hope I’ll be able to check this post later, my connection is as weak as the battery …

“the specific year is of little importance in the grand scheme”, i completely agree with you, and i found sad that many economists or writers who talk about energy or the “demise of peak oil” focus only with a specific year who, if exceeded, would then prove that the whole peak oil debate is completely wrong (Forbes, NYT or Thefiscaltimes have many articles of this kind).

Iron Mike and others –

After looking more closely at production data, I think I’ve figured out what is going on…

Between late 1980s and 2008 oil production increased at a rate of ~1.4% annually.

By 2008 oil production plateaued and remained there until 2012 when US tight oil growth helped drive annual growth of 1.6%. Since 2018, there has been no additional growth (5 years).

In order to remove the US tight oil we can exclude US production from the overall picture.

Doing so confirms a plateau ranging 2009 to 2016.

The current production level excluding US is likely at it’s lowest level since ~2000.

Another way to think about this is that we had two waves, the first being the overall world oil production wave that crested in the early 2000s and a second wave that built up in 2010 and is cresting now (US shale). It’s tempting to combine them but they will both behave much differently (and one is 6 times bigger than the other). The big wave has a much longer period/timescale than the small wave. The small wave (US shale) has a much shorter period, it will also decline much faster.

Taking all of these factors into consideration, I would break this down into several segments/periods:

Pre-global peak – 2000 to 2007

Global peak – 2008

Global plateau – 2009 to 2016

US shale peak – 2018

Post-peak decline transition – 2019 to 2022

Post-peak decline – 2023

TBD but 2024 to 2030 will likely be decline of 1-2% annually.

So you can make the overall plateau as wide as you want, say 2001 to 2022 (21 years), or narrow it all the way down to the year in the center 2012, which marked the beginning of US shale growth.

Kengeo,

Interesting view.

In your thinking will the decline rate increase > 2% after 2030 ?

Iron Mike –

It’s difficult to say but we know that production managed a long term growth rate of ~1.5% for 30 plus years. I don’t think anyone here would argue that 4-5% decline rates are inevitable at some point.

I would say decline rate will on average be at least 3% per year over the next decade, it will be easily measurable since we are talking about a few key producers (Russia, OPEC, and US).

The longer we manage low decline rates 1-2%, the worse the drop will be later on.

At some point we should see a rate of decline greater than 10%, so the key is how quickly we decline in the meantime. Hopefully it’s a fairly steep decline over 12-18 months then a moderate decline of 2-3%, this would allow production to continue and be the least worse option, but I don’t see an orderly decline to be very likely.

The short answer is that we will not be so lucky to have 30-40 years of 1.5% decline, we would run out far too quickly. You can add up 20-30 mb/d that will be lost over the short term (next 15 years), so the next several years will be challenging to say the least.

It’s fascinating to me that this slow motion train wreck has been in progress for 15-20 years and somehow there are still cheerleaders talking about future growth and peaks…bewildering.

We are here to witness/document it.

Iron Mike,

My view for future annual decline rates for World C plus C for an Oil Shock Model with URR=2675 Gb.

Dennis – For the OPEC 13 chart above, what is the average OPEC decline rate from ~2017 to 2013? It appears to be at least 5-6 mb/d lower over that period, even with relatively high oil prices. Is the decline rate accelerating? Looks to be somewhere between 3% – 7% depending what time period you look at. Currently looks like ~7%, we will see if that tapers off or continues…

Kengeo,

Using an OLS fit to Jan 2017 to August 2023 the average annual decline rate is about 700 kb/d over that period. In percentage terms from Sept 2017 to August 2023 (this period was chosen to eliminate any seasonal effects) average annual decline was about 2% per year.

Over most of this period (Jan 2019 to August 2023) OPEC was cutting output because the World was oversupplied with oil. Prices were certainly not high relative to 2010 to 2014, particularly during the pandemic years of 2020 to 2021. We will see in 2024 how much OPEC is able to produce, my guess is 29 to 30 Mb/d, if oil prices remain over $90/bo OPEC may choose to develop resources more aggressively, especially the big 5 in the Middle East (Saudi Arabia, Iraq, UAE, Kuwait, and Iran).

Over the 2025 to 2030 time frame I expect relatively low average decline rates from OPEC 13, on the order of 1% per year or less.

(Post 6/7)

With the URR i have estimate in my second post, these 9 others fields have still probably a significant remaining growth potential but it’s worthy to note that’s it far below of the official Saudi Aramco production target (chart 9) and that beyond the mid-2020s (or even beyond 2030 with a higher assumed URR), these fields would probably begin to decline. In this scenario, KSA oil production from their 12 majors fields remains globally stable until the mid-2020s, before starting a relatively slow decline, and then a much steeper one from the 2030s onwards (chart 10 of the post 7/7).

Chart 9 : Historical (01/01/2019) and forecasted production in kb/d of the others 9 major fields and comparison of SA target

Which means that your (all of ours) window of opportunity for getting electric transportation system lined up and deployed is just about 5 years.

Better get to it!, or you and your region will be waiting in a long line for vehicles and chargers, batteries and transformers, and permits and electricians.

Relevant note- my wife charges up her mid-size AWD electric car at home. Our utility has a fixed price for retail electricity. Gasoline would have to be under $1.50/gallon to be cost competitive per mile. Current gasoline average price in our county [6th biggest GDP in the country] is $5.26/g

Where i live (France as my weird pseudo suggest) the price of gasoline is almost $7,8/gallon, which push serious difficulties above many peoples. Slowly (and much slower than the northern european countries) but surely the French government is starting to take action for reducing energy consumption and increase electrification. The question of the demand of electricity is another complex question and RTE (the gestionnary of the electricity transport reseau) have made a very interesting report about this.

Take care of you and of your family 🙂

Gas needs to be more expensive, not less. Electricity too, for that matter.

No one ever cut back because of cheap energy and better efficiency. You want to see people realise how precious these things are? Let them keep driving F-350 RAM Turbo MAXX ST mega trucks that do 10 MPG on a level. Then we’ll see how people value their energy slaves daily.

(post 7/7)

Conclusion

It is likely that, despite still considerable uncertainties, KSA’s oil production is close to its decline. I have not assessed the production potential of other fields (lords and peasants) such as Hawtah, Fadhili, Nu’ayyim, Abu Hadriyah or Dammam but their production capacity remains very limited compared with the super-giant fields studied. For this reason, they are unlikely to significantly alter the forecast made below (chart 10). My personal best case for KSA is a broadly flat production at 10 mb/d or so for a few more year before a decline. I let everyone make their own forecasts based on their personal estimates. We’ll see in a few years who will hit the nail:)

Chart 10 : Historical and forecasted production in kb/d of the 12 biggest Saudi oil fields for 1951-2050 (nota : the black line indicated the last available data and the red line indicate approximately the date of redaction of this post).

French Fries,

Great stuff, merci beaucoup.

Laherrere forecast from October 2018, see pages 117 and 118 at link below

https://aspofrance.files.wordpress.com/2018/10/35cooilforecast-oct.pdf

I superimposed my Hubbert Model on top of Laherrere’s chart shown above for easier comparison.

The post Covid rebound in OPEC rig numbers seems to have settled out at about 100 fewer than previously. I don’t now if this is due to labour shortages, supply chain issues, cost inflation etc., or there would have been fall of this period anyway because of decline in prospective sites. (Note – Iran not included by Baker-Hughes.)

https://www.barrons.com/articles/peak-oil-is-near-the-path-down-will-be-treacherous-730f2981

Everyone agrees with this headline.

But it pivots from peak supply to demand. Like we’re in control, we like playing with fire. It implies climate change is more treacherous than less FFs.

The real problem is over population with higher expectations , errrr but then again I guess this is just an opaque way of dealing with it.

Long time reader of TOD and POB, first post.

I have been thinking about Ghawar fields a long time, since the Satellites o’er the Desert days showed the water injection wells around the perimeter of the anticline.

Is it likely that the decline is slower now, and when water approaches the top of the production zone at the peak of the anticline large areas will water out and production will Seneca Cliff all at once, at least in that area of the field? If this is likely with USA depending on shale oil which drops off quickly and all the prime spots drilled first, this could cause the world production curve decline to be very steep.

I have taken PetE and Geology classes in my university days, but am not a professional in those areas, just a very interested observer.

You put it very well.

Most every known producer is in decline, for variable reasons.

And I think the Saudis are saying that–in their own quirky way.

If the oil extraction in Ghawar is stopped in various sections over time and is restarted, does that give time for the remaining oil in place time to “percolate” up above the flood level?

It seems, dear centex, the stock to flow ratio is up for a rather dramatic change. The stock owners are in charge. For now.

Saudi ARAMCO has been reiling for years about underinvestment in the oil patch. WHY? Underinvestment by other nations would only mean more money for Saudi Arabia. Why would they want other nations to invest more? Why would they want other nations to produce more oil?

Aramco CEO says underinvestment in hydrocarbons causing energy crisis

Warning about the lack of investments in the oil & gas sector, Saudi Aramco CEO Amin Nasser said taxing oil companies and capping energy bills are not solutions to the global energy crisis.

Speaking at a forum in Switzerland, Nasser said underinvestment in the hydrocarbons sector when alternatives to fossil fuels were still not readily available was among the root causes of the global energy crisis.

It is true that more and more capital expenditure for oil E & P is necessary if the world desires to try and keep up production for longer. And despite concerns about climate disruption from fossil fuel combustion, humanity is on the path to keep up with as much combustion as can be afforded….by and large.

Problem is diminishing returns on investment with each dollar spent on the effort leading to less and less net production, perhaps with rare exception.

Yeah, but you didn’t answer my question. Why is Saudi Aramco screaming for other countries to invest more in exploration?

We all know – or at least think we know – the answer: SA is peaking and can’t produce more so they want others to fill the gap.

But that and a subway token……

rgds

WP

I am in agreement but with a slightly different spin. My opinion is that the Saudis aren’t actually concerned with filling the gap: they would like others to produce more to allow them to hide the state of their fields. We all know there is no spare capacity, but if demand was met by other producers, they could continue to pretend there is.

Good point. Posturing probably is a strong motivation.

rgds

WP

The ruling elite in Saudi must be starting to feel a bit exposed. As the production declines they will be unable to afford the dane geld to all the drone princes and princelings. Add in a large “credentialed precariate” (as Turchin calls them), some Sunni-Shi’ite strife (internally and with Iran or Qatar), a climate that is becoming unliveable in places and all the foreign workers that do the dirty jobs, including much of the fighting, and the place is a bit of a powder keg. If earth in is overshoot because of fossil fuels then Saudi is the extreme example. The natural population is tens of thousands not millions. The emergency escape jet liners and super yachts are kept on hot standby. If trouble starts rolling then production could collapse quickly. This must influence how they think, act and speak. I don’t know what they would gain directly from highlighting others under investment, some of it may be a message to their fellow OPEC members, some just frustration with a continual “call on OPEC” and associated internal interference from the west.

Ron, “Why is Saudi Aramco screaming for other countries to invest more in exploration?

I don’t think it’s at all complicated but we are all just guessing. For a practical point of view and I would include myself and most oil and gas professionals in this view, I offer:

Despite all the hoopla regarding energy transition and electric vehicles, it aint happening, at least at a pace that will keep the world from having a significant energy crises in the near future for LACK of investment in oil and gas. The short cycle horizontal sector flooded the market and kept new investment in longer cycle projects from happening. With the increase of cost world wide, $50-$70 oil does not offer the needed returns required by investors and still have sufficient funds for new investments. Most major economies still think they are “entitled” to cheap oil. I think the Saudis are just stating the facts as they see it, the world will require oil and gas for decades and to get that oil and gas to market prior to a major energy crises new investment is needed now. Again that is just a guess but nobody I know professionally sees any differently and we are all in the same boat as the Saudis, that is we benefit greatly from higher oil and gas prices but still want the world to keep moving forward.

Thanks, Texasteattwo, I agree completely. The world will need more oil in ten years and even more in twenty years. And it will just not be there. Food is produced with the aid of fossil fuels. Less fossil fuel, less food. It is as simple as that—end of story.

https://twitter.com/Rory_Johnston/status/1705256288647631259

Ron interesting chart on the subject.

“Without increasing oil and gas capex, we risk energy deficits and acute inflation across the commodities complex. This may lead to multiple oil-led energy crises in this decade, potentially much more severe than the gas crisis seen in Europe in 2022.” – JPM

“we believe that the global economy is able to withstand triple-digit nominal oil prices, as in real terms such prices remain below the peak levels seen in 2008 and 2011 and also below the “demand destruction zone” (ie. oil share in world GDP >5%, vs c. 2.5% currently)” – JPM

“We forecast a 1.1mbd S/D gap in 2025 widening to 7.1mbd in 2030 driven by both a robust demand outlook and limited supply sources.”

TL/DR: oil deficit to hit 7mmb/d in 7 years.

Thank you greens

https://twitter.com/zerohedge

what has been very clear for now many months now is becoming mainstream…a oil and gas super-cycle is/may now be underway. domestic US producers will have another “boom” cycle. the greens had their time in the sun but its hard to sell fantasy and fairy-tails to starving, struggling or barely getting by working class people anywhere. now on with the show!

Saudis need to conserve their oil as long as possible in order to diversify their economy. Unfortunately they cannot make the desert bloom.

They are simply following the Dubai model and that is completely flawed.

Saudi’s at best have maybe 15 years of oil exports left. In reality probably 10 years left as they will choose to go to zero as production falls substantially. Which means they will no longer have income from oil sales.

Russia is facing same situation. Oil revenues go to zero. With no available oil exports prices on a global market won’t matter. The benchmark prices won’t matter. Since you can’t get it regardless of price.

Saudi’s will go broke with no oil income. Investment income isn’t likely to replace oil income as the value of assets fall in the environment of No oil exports.

Less oil is going to be highly deflationary everywhere.

Exactly why they are divesting and diversifying. Feel sorry for the scmucks that fall on that sword…

“ Saudi Arabia’s Aramco Considers Selling $50 Billion in Shares”

https://www.wsj.com/business/energy-oil/saudi-arabias-aramco-considers-selling-50-billion-in-shares-4d5e4dd1

@HHH & Kengeo

Aramco is just another Enron I guess (maybe the whole stock market for that matter). Peak oil collapse is going to be miserable but it wont be without some amusing situations. The third party certification companies could get their estimates/audits for Aramco and even shale inventories wrong by an order of magnitude and then what? Sue? In an energy collapsing world? What will there be to gain? Force majeure. Joke is on the investors for not doing any diligence. There will be less litigation during the energy cliff but plenty of conflict.

Much of Saudi oil is used on their own air conditioning.

“During the peak summer months, when temperatures soar past 120°F, Saudi Arabia burns about 700,000 barrels of oil a day for air conditioning.”

https://www.washingtonpost.com/news/energy-environment/wp/2018/03/28/why-saudi-arabia-is-trying-to-pull-off-an-utterly-massive-new-solar-project/

Hello Ron, good to read your lines. I started to miss your comments!

Well, I am slowly fading away. I will be posting less and less from now on. I am working on another book, my very last one. This one will cover the subjects more deeply than the other two. And the last chapter will cover the coming collapse of civilization as we know it. I will try to explain why it is inevitable. Also, I will try to explain why the average citizen of the world has no idea what is about to happen and wouldn’t believe it even if they were presented with overwhelming proof of the coming catastrophe.

I would be really interested to buy your new book 🙂 personnally i think we are at the twilight of our current civilizational model and i’m very curious to see what would be like the new one (if there’s one and i hope so). As Jean laherrere have said me a few years ago “vous les jeunes, vous aurez du pain sur la planche” (or in english “you young people will have your work cut out for you”). The new era who come are full of challenge but also of potential profits.

Take care of you

I hope you do read my new book, but it will not be out until next year, likely early summer. It will be the last thing I ever write for public distribution.

Keep us posted when you do get a release date finalised. I would like to send money to secure a copy of the book as soon as it comes out.

No need to send any money. The book will be available on Amazon.com, both Kindle and paperback when it is published.

Count on me as a reader! This looks to become an essential must read for the peak oil crowd and hopefully for many more.

Frenchfries,

Very cool that you have met Mr. Laherrere. I agree with his sentiment.

Keeping it simple- He could just be putting out a warning to world about the pending supply situation as he sees it.

Global oil production may or may not exceed the 2018 peak.

What will be different is from 2028 almost every country which has kept production at around 80 million barrels per day over the last 7 years will be in decline.

With Canada, Brazil flat, the U.S. Saudi, Russia in permanent decline it will be a different and difficult era.

Decline rates could be higher than expected due to horizontal wells declining far faster than vertical wells.

A study of hydrogen production show that all the renewable electricity infrastructure built so far would only be enough for half what aviation would need. The world would lose that amount of oil in 2 years.

We are in trouble

Charles,

Other forms of energy may ramp up to take the place of fossil fuels and energy may be used more efficiently, as is the case for EVs, heat pumps, LED lighting, many more efficient appliances and so forth.

In addition population will decline as the demographic transition proceeds worldwide. South Korea saw its total fertility ratio fall from 6 births per woman in 1965 to about 1 or less today, education is the key, particularly for girls and women along with better access to birth control and equal rights for women.

There has been a lot of change over the past 60 years, I expect there will be more changes over the next 60, the pace of change has been far higher than I would have guessed 40 years ago, hopefully the pace of positive change in the future will occur faster than many of us imagine, or not, many if us won’t be here to see.

In addition population will decline as the demographic transition proceeds worldwide.

Even if the world total fertility rate ramps down to zero over the next 60 years, the population will not decline by then, rather it would level off at over 10 billion and would be near that level by the end of this century. The demographic transition only slows the rate of increase and lowers the total population at the plateau. The only thing that will reduce world population this century is an increase in the death rate. To get the population to a reasonable level (1 or 2 billion) by the end of the century would require excess deaths per year that would make WW2 look like nothing.

This discussion about prospective declines in oil production glosses over the tight correlation between energy production and population. If oil really does decline per the modeling discussed here and coal-to-liquids or gas-to-liquids can’t replace it, the human population will decline accordingly. 2% of 8 billion is 160 million excess deaths per year. The deaths would come from lack of food.

Joe Clarkson,

Many nations have total fertility levels below replacement, in fact half of the population of the World lives in nations with total fertility levels below the replacement rate, with lower total fertility levels population can fall pretty quickly.

We are currently on a path to have global population at about 9.7 Billion by 2050.

Hard limitations, and the human reaction to those, may very change the picture to the downside before too long. As Joe said.

I don’t think the drop in global reproduction rates will come close to matching the decline in prospects for sustenance and habitability on any kind of timely or proactive basis. In fact, we a more than 50 years late for that.

Hickory,

Of course it will take time, but with good policy the transition can happen relatively quickly, in any case the sooner we begin the sooner population may begin to fall because people choose smaller families. Just one of a basket of possible policies that might improve the situation, there is no panacea.

Interesting paper on long run fertility and population.

https://sites.utexas.edu/pwi/files/2023/09/spike_site.pdf

This year the global TFR is 2.3118 and in 1992 the TFR was 3.04. TFR doesn’t change instantly. And note that, from the chart you posted, even with a TFR that rapidly approached 1.75 (by 2030 to 2050), the population decline doesn’t begin until 2060 or so. All I was pointing out is that it is not true that population will decline as the demographic transition progresses. Only after many decades of additional progression of the demographic transition, will the population then begin to decline. If you want population to decline starting right now, you need a lot of excess deaths.

My arguing over this may seem a little nit-picky, but given the situation the world is in now with human population overshoot and the need for that overshoot to be resolved as soon as possible, relying on the demographic transition is not going to save the day. If you want to rely on birth rates to be a significant part of overshoot resolution, only a worldwide ban on having babies will do much. And even that will take some time to work. The global death rate is now only 0.77% and although, as the population average age increases, the death rate will go up, it doesn’t get much above 1% until people are older than 60, so it will take some time for the population to “age out” and die. Admittedly, rich countries have a much older starting demographic profile, which would ensure much more rapid population declines with zero births.

But a real-world situation, like Korea, with a TFR of 0.8 and an older demographic profile is not going to have much of a decline in population until after 2040 (only 1.6 million down from its peak of 51.8 million in 2020) and will still have 37.7 million people in 2070.

Demographic transitions are very slow, especially when the only variable is birth rate.

Joe,

Yes such transitions take time, but population will fall as this occurs.

Dennis

EVs , heat pumps, trams, electric trains, hydrogen powered ships and planes will all demand more power from wind and solar.

This is not just about peak oil but addressing climate change. The amount of coal, oil and gas being burnt is now far higher than the maximum to prevent other feedbacks from making things worse.

https://www.pbs.org/newshour/science/driven-by-climate-change-thawing-permafrost-is-radically-changing-the-arctic-landscape

Anyone who believes politicians, that hitting net zero by 2050 will prevent catastrophe is deluded.

The degradation that is happening now, not tomorrow but today guarantees hundreds of millions excess deaths over the next 20 years.

Droughts, flooding and building on land has reduced the amount of land per person by half.

https://www.globalagriculture.org/report-topics/soil-fertility-and-erosion.html#:~:text=Each%20year%2C%20an%20estimated%2024,every%20person%20on%20the%20planet.

If million’s are already starving to death now what will things be like in 10 years time?

https://www.un.org/en/chronicle/article/losing-25000-hunger-every-day

Fact is the rich think they will be fine, once 3 or 4 of billion people perish there will be enough for the rest. However once the feedbacks of forest fires and soil erosion get to a certain point it won’t stop until the human population is so small as to no longer impact the world.

What population is required to allow the world to start to regenerate?

https://www.footprintnetwork.org/our-work/earth-overshoot-day/

Considering how much worse the environment is today than in 1970. The world probably can handle a maximum of 3 billion. Probably far fewer than that.

Charles,

I agree climate change needs to addressed, reducing fossil fuel use as quickly as is feasible is one way to address that problem, sequestering atmospheric carbon is another as is recycling, cradle to grave manufacturing, less leisure travel, producing and consuming locally as much as possible, better urban design so less travel is needed, producing quality products that can be repaired and that can last for decades or centuries rather than days or months, reducing or eliminating excess packaging, these are amongst the actions that might be taken along with lower family sizes, many nations have total fertility ratios less than 2 some below 1.5, in a single generation, my family has seen total fertility ratio fall from 5.5 to 1.27 in a single generation, similar to what happened in South Korea, education is a key to making this happen.

Empowering women is key to making this change.

Stephen,

I agree, some research suggests one way to accomplish that is through education, there are some very patriarchal societies (Korea and Iran for example) that may not be models for women’s rights but in spite of this have seen rapid decreases in TFR.

It may be that better educated women have greater opportunity and are better able to assert their rights.

All agrarian civilizations were built for women by men, which is why we are currently and exactly in this staggering jackpot of both population overshoot and progressive climate debasement.

As for this self-righteous call to ’empowerment’ – for what purpose exactly? To get even more of them to report to the cube farm for 8 hours a day? (Which is where the ’empowered’ end up) Most of them hate that life – according to the last survey, more than 70% hate their jobs and would prefer to stay home if they could afford to. So there’s that.

In what way does female ’empowerment’ abet the energy situation? The last time I looked, real men on real drill rigs had to work really hard to get oil out of the ground. Will female ’empowerment’ somehow change or replace that? With what, exactly?

Mike Sutherland,

This is about population growth and fertility rates, women having the rights to decide whether to have children or not makes a difference in the number of children they have.

If you don’t see that, there is nothing left to explain.

Empowered women don’t have babies they don’t want because they are allowed access to birth control and abortion. Having fewer babies means fewer humans. Fewer humans means less demand for energy and other scarce resources. Somebody is obviously having trouble getting laid lol. Maybe try tapping into your sensitive side and see if that helps

Dennis

The world food comes from the soil, how do you fix 24 billion tonnes washed and blown into the oceans this year and last year and the same for the last 20 years.

There is no reasonable scenario where global fertility rate drops to your hopeful level in time.

https://ourworldindata.org/births-and-deaths

Births exceeding deaths by 50 million in 2035, which means global overshoot will cause even further devastation.

Do you understand overshoot?

Charles,

There are many problems, better agricultural practices will help with the soil problem, also eating fewer animal products reduces energy use, soil loss, and likely results in better health. I expect there will be difficult times ahead but focus on how to ameliorate problems rather than focusing on the problems themselves.

As for the speed of the transition to lower fertility ratios, South Korea went from 6.2 births per woman in 1958 to 1.6 births per woman in 1988. Iran went from a TFR of 6.5 in 1983 to 1.77 in 2006. In 2021 the World was at 2.32 births per woman, S. Korea went from 2.44 to 1.6 births per woman in 5 years, and to 1.2 in another 15 years, in 2021 the TFR in S. Korea was only 0.88, in Japan it is 1.2, in China it is 1.16, Europe is 1.48, South America is 1.81, and North America 1.64, Africa is 4.31, Asia 1.94. Australia/New Zealand TRF is 1.63. Data for 2021 (most recent year from UN.

https://population.un.org/wpp/Download/Standard/MostUsed/

As I understand it, the UK has about 30 years of productive topsoil remaining. If correct, the effects of that should be starting to be noticed soon

Here’s a quick and dirty look, rest of world is losing 0.5 Mb/d every year since 2006.

What’s interesting, I believe URR of 2,250 Gb is a fairly realistic number (it’s essentially 2P plus 250 Gb growth/additions). That translates to 67% of available oil has been produced, which lines up well with estimates for Saudi Arabia…

– US has nothing left to give as far as growth goes (and certainly not more than the rest of the world is losing each year).

– OPEC + is also clearly tapped out, so down from here…

Kengeo,

Using EIA data

https://www.eia.gov/international/data/world/petroleum-and-other-liquids/annual-petroleum-and-other-liquids-production?pd=5&p=00000000000000000000000000000000002&u=0&f=A&v=mapbubble&a=-&i=none&vo=value&&t=C&g=0000000000000000000000000000000000000000000000000000004&l=249-00000010000000000000000000000000000000000000000201&l=176–176&l=271-00000000000000002000000a000800000000000000000g0g8&l=272-0000000000000000000000000000000000000004000000000000004&s=94694400000&e=1640995200000

I get a different result. Not clear where you are getting your data.

Longer term chart for 1973 to 2022, EIA data.

I wasn’t sure what CIS was, I had to look it up. Commonwealth of Independent States. I am still not sure which nations are members of the CIS. But their oil production is collapsing according to Statista.

Crude oil production volume in the Commonwealth of Independent States (CIS) from 2019 to 2050, by scenario

Crude oil production forecast in the CIS 2019-2050

Published by Statista Research Department, Apr 4, 2023

By 2050, the annual production volume of crude oil in the Commonwealth of Independent States (CIS) was forecast to decline to one exajoule under the Net Zero scenario. In 2019, the crude oil production in CIS amounted to 29 exajoules.

1 exajoule is equal to 163,455,763 barrels of oil equivalent (us)1. Alternatively, exajoule is equal to 174 million barrels of oil equivalent.

Ron –

CIS compared to North America and Middle East provides 20% of the combined production:

CIS – Russia + Kazakhstan = ~12 mb/d, they also have ~20% of the 2P oil reserves (75 Gb), assuming production doesn’t drop much more (bad assump.) they could produce for another 15 years or so. More likely production will drop to a sustainable level and they can run 20-25 more years.

North America has slightly more at ~100 Gb 2P oil reserves, however we are producing at ~20 mb/d so our fate is similar, run out in 14 years at current production levels.

Middle East has considerably more 2P oil reserves, ~170 Gb, producing them at ~25 mb/d, this results in a similar depletion timeframe as CIS.

Grouping these 3 regions we get the following:

Production of 57 mb/d.

2P reserves of 350 Gb. URR = 1,850 Gb.

Average of 2P and 2PC reserves of 650 Gb. URR = 2,150 Gb.

2PC reserves of 950 Gb. URR = 2,450 Gb.

Below is a graph which assumes peak production at 50% URR (2P = 975 Gb [2006]; Ave-2P-PC = 1,075 Gb [2010]; and 2PC = 1,225 Gb [2015]).

For all cases the peak is assumed to be ~80 mb/d.

For simplicity the decline rate is 1% for 10 years, 2% for 10-20 years, then 3% >20 years.

Graph below with actual production values (per Dennis’ link), and the different decline scenarios (2P, ave-2P-C, and 2PC).

As we can all see, doesn’t matter how much oil is there, the decline is the same, just shifts a couple years here a couple years there….US shale production has made it a bit blurry, but we are at the point of confirmed decline, there is no doubt about it…

Note – If you remove the US tight oil contribution, the decline is much closer to the 2P scenario, so we might expect that 2P is in fact the “Best” estimate of remaining oil reserves. This is a very important fact since focusing on the 2PC value overinflates remaining oil reserves by ~600 Gb. The question is, have we used >80% of conventional oil (2P)? Or have we only used >60% of conventional (2PC), or maybe somewhere in between? But without question, we are at least 10 years past peak conventional oil production, which likely occurred sometime between 2005 and 2015.

2018 was the point in time where peak production occurred, likely at a value between 54% of URR (2PC) and 72% of URR (2P).

The only debate left is decline rate, no future growth, no future plateau…

If we are lucky we will be in a controlled slide (but unfortunately something tells me it will be uncontrolled).

Dennis – Please prove me wrong!

Kengeo,

We have no proof of what will occur in the future, only speculation. Laherrere estimates 2500 Gb for conventional oil URR, this seems a bit low unless peak demand causes low oil prices around 2030-2035 as I expect. My best guess for unconventional oil is about 170 Gb (about 98 Gb of extra heavy and 72 Gb of tight oil).

For comparison see chart below and note the charts are not all that different. The main difference is that you expect decline to begin immediately, I think output increases for a few more years and decline starts in 2027, that is simply my best guess, based on a very conservative estimate of URR (more than 800 Gb less than that of Mr. Laherrere).

Also keep in mind that many believe 2P reserves should point to the best estimate, I think this is the best current estimate assuming no future discoveries, technological progress, or changes in expected future prices.

The problem is simply that the above assumptions always prove false.

1998- URR=1800 Gb

2005- URR=2000 Gb

2010- URR=2200 Gb

2015 URR=2400 Gb

2018 URR= 2700 Gb (including extra heavy oil)

2022 URR=3500 Gb (conventional plus unconventional)

this last estimate seems too high to me, probably 3000 Gb would be more reasonable, if we assume oil prices remain high indefinitely (no transition to electric transport).

Dennis – Thanks, added your model to the graph, notice the strong divergence in 2022, I would say this model is not matching current production values, but maybe you expect a big turnaround soon? Would like to see monthly actuals versus your model and how they might be correlating…

Kengeo,

The model is done on an annual basis. We will see when we have 2023 World output data how well it correlates. Currently my scenario is below EIA STEO projections through 2024.

Kengeo,

The model matches EIA data through 2022 (annual output data), 2023 is similar to STEO estimate for 2023 and slightly lower than STEO for 2024 (2025 output for shock model is similar to the 2024 STEO estimate.)

If Moore’s Law (doubling of chip density Q2 years) is still remotely operational mankind will figure this out and come up with a way to provide energy and electricity to the globe’s people without destroying the place. In my view, oil and gas will continue to play a large role, but oil will go for petrochemicals and gasoline while gas will produce the fertilizer and cement and also drive standby turbines in utility plants. Direct air carbon capture has been shown to work by Lehigh in its cement factory, and by LF in fertilizer production. An exceptionally dramatic turnabout would come from merely using LNG instead of coal, in conjunction with DAC.

I understand the limitation of NG feedstock in certain locales, such as China. But that’s quickly changing. The largest NG deposit by far is in the Qatar Peninsula, and they are gearing up their LNG facilities at warp speed. The biggest threat to Qatar is this massive deposit, as ME neighbors are jealous. Qatar is set to become, as strategic energy providers, what KSA was for years. They are so wealthy, well situated and autocratic that they can become the LNG capitol without getting approval by Congress, or a regulatory agency, and they have enough NG to drive the least painful transition from coal to LNG. Qatar will set the price.

It makes absolutely no sense for the U.S. to throw its economy to the dogs when China burns gargantuan quantities of low-quality bituminous coal. China has talked a good game while building dozens of new teapot utility plants that burn coal. They use 60% of all the coal used in the world. The air obviously gets mixed up in the troposphere. Germany and the UK have also increased coal burning while preaching the gospel about climate change.

The U.S. has at least decreased coal usage, but has been exporting coal while talking up climate change and imposing draconian bills that have raised the debt load awfully. But the U.S. pales compared to Australia–on both counts. Australia has built out huge lithium-ion-exchange battery dumps to store energy, while quietly exporting as much coal as China will take, which, lately, has been picking up incredibly since China ended its ban on Australian coal.

I’m optimistic about the future of the globe, because of Moore’s Law. I’m less enthusiastic about current climate change leadership which mandates one thing while doing just the opposite. Thank goodness for Qatar!

Err, how exactly does Moore’s law apply to geology?

I think you’ve got “direct air” capture mixed up with carbon capture and storage (which is much easier when from concentrated tail gases). And Moore’s Law is dying if not yet dead because of the phisical limit of the size of an atom, the difficulty of cooling and the exponentil growth in cost of chip manufacture as they get smaller (until quatum computing comes along anyway).

I’m not the one who perverted the terms, George. The Inflation Reduction Act credits $180/metric ton removed by DAC (direct air capture). Occidental paid $1.1B for Carbon Engineering with a plan to establish dozens of DAC units in dense CO2 “point” zones (close to refineries, etc) and then sequester the CO2 somewhere. I’m just guessing here but I would imagine that “somewhere” would be down dead oil wells, for stimulation and also to get the IRA carbon capture credits. The same will be true for fertilizer and cement manufacturing plants–to get the extra incentives. Perhaps I misused the terms, but I wasn’t referring to putting these things in the great outdoors, like in Switzerland, but in high CO2 density zones where tons of CO2 can be collected in a swift process. On the plains of Nebraska, it would take a while for DAC, but I would imagine Occidental has some locations in mind.

As to Moore’s Law, you’ve got me. I used it mainly as a tool to make a point that we’ve gotten to the place where I think we can get ourselves out of the carbon hole we’re in. And I did it only because the remarks had gotten so morbidly negative. Nothing was ever done in the spirit of pessimism, except suicide. And I somehow have to hold onto faith that the planet isn’t doomed. I probably should just quietly exit, because I do like oil and gas, and I think this carbon capture and sequestration concept has a lot of merit–even if it’s called something else in order to get the extra credits.

But you wrote “Direct air carbon capture has been shown to work …” It hasn’t. The carbon capture in cement and fertiliser plants is directly on the tail gas streams, which are not air. In fertiliser plants they come directly from the CO2 removal process (e.g. Selexol or amine unit) and, from memory, would be above 90% CO2. For cement works it comes from the kilns and is also very rich in CO2. The majority of such schemes have eventually failed and been shut down, but they are still doing better than DAC which has so far got no further then small pilot plants.

Gerry Maddoux wrote: If Moore’s Law (doubling of chip density Q2 years) is still remotely operational mankind will figure this out and come up with a way to provide energy and electricity to the globe’s people without destroying the place.

Thanks, Gerry, that’s a real keeper. I may use that one in my book. That is how most people rationalize things in order to deny the obvious coming collapse. This one is that scientists are so brilliant they will figure out something. After all, Moorre’s Law shows just how smart they are, and Moore’s Law proves that they can come up with some way to provide the energy needed to save humanity without destroying the place.

Hint: the place is already being destroyed. (“Place” meaning the ecosystem that provides nourishment to all living creatures on earth.) It is not completely destroyed yet, but it is getting there at breakneck speed.

I love Gerry’s posts. I hope he continues.

But we are all fallible apes.

Apes in the African Savannah didn’t need to understand exponential curves to survive.

Moore’s law is an exponential curve.

It was and has been very accurate. But an idiot like me can see it will not keep going.

A keeper, indeed, sort of like those who mis-apply subatomic physics to “spirituality.” Whatever that is.

I have no idea what you are talking about unless you mean “quantum entanglement”, or what Einstein called “spooky action at a distance”. Einstein hated it but Niles Bohr and Werner Heisenberg loved it. It was later proven a fact by the great physicist John Bell, who received the Nobel Prize for his work.

Or, you may be talking about the Double Slit Experiment as explained! by Jim Al-Khalili

Man, there is really some spooky shit going on there. It seems that some unknown entity has knowledge of when you are using a recording device and when you are not. Something non-human, something spiritual. But as Jim says in the video, if you can figure it out, then you, Mike B, will be awarded the Nobel Prize.

Note: If you have something to say, Mike, just say it. Your sarcasm stinks.

Cargo Cult is what William Catton Called it.

Seppo, what are you calling “it”? You lost me there.

Ron, I was referring to what William Catton described in his book Overshoot. He mentioned that during the WWII on some pacific island, US built a landing strip. When planes arrived, the airmen gave the natives goodies. After that the natives developed rituals to attract the passing plane high in the sky to land on their island. It sometimes worked not because of the ritual, of course. This came to be known as a cargo cult. Today people hope that engineers will come up with a new energy source. Did not John Kerry say that we need to solve the climate issue with technologies that have not yet been invented. Modern form of cargo cult.

Thanks Seppo. I am very familiar with the cargo cult story. I have Catton’s Overshoot. I read it cover to cover and refer to it frequently. I did not get the connection to the subject being discussed.

Mike B was trying to be sarcastic about the two-slit experiment that I discussed in my book. As usual, he had no clue as to what he was talking about.

Sorry Ron, I again answered to the wrong post. Here is what I referred to as Cargo Cult

“After all, Moorre’s Law shows just how smart they are, and Moore’s Law proves that they can come up with some way to provide the energy needed to save humanity without destroying the place.”

Mr. Patterson,

As per Carolyn Myss, regarding the misconflation with spirituality and religion, “Spirituality is an individual recognition of the existence of a non physical Reality. Religion is a cultural expression of that”.

One of the ironic aspects of secular humanists – in general – is that they are the most ardent worshippers of the godhead called Reason. No Torquemada ever was or will be more intolerant of the heresy of questioning the Supreme exaltedness of Reason, disregarding the fact that this status is entirely self-appointed. This, despite the uncontestable fact that we sentient humans – all of us, anywhere and everywhere – permanently exist in the state of pre-cognitive awareness.

Bell’s theorem should – at the very least – give pause to those who confidently disparage the myriad wonders of this universe.

(Personally, I think the concept of waves traveling in both directions may ‘answer’ a lot of uncertainties. So much that we do not ken.)

Thanks for the reply Coffeeguyzz. I had to look up “Torquemada”. I got: “Spanish Dominican monk”. I do not regard reason as the only tool in the toolbox, though it is a very important one. Logic is another tool. But what are we using reason on? What are using logic on? Evidence, that’s what. Nothing should be believed without supporting evidence. And nothing should be disbelieved when there is evidence to support it.

Most people have ideologies, or worldviews, that are not supported by evidence.

“Conclusion

US oil production is not surging, it’s flat. Please ignore the EIA weekly US oil production figure. It is not useful. As long as you know that and look at what we say US oil production is, you will have an edge over the rest of the market”

https://hfir.substack.com/p/public-is-us-oil-production-surging

Dennis – Since you love so much to refer to the 3,500 Gb value for URR, here’s what production might look like if that were a possibility, notice current production is much lower than it should be if 3,500 were realistic.

This assumes by 2120 there’s still ~500 Gb remaining in place. Could provide a longer tail or stay in place…

Peak is ~2032 at ~93 mb/d. I don’t believe this to be remotely possible, you may disagree, this would imply ~2,000 Gb of reserves, a value roughly 4 times 2P and almost double 2PC…

But wouldn’t that be great if production could continue to grow for another ~8-9 years to help transition to renewables? But wouldn’t be so great for GHGs.

I agree 3500 Gb is not likely realistic, which is why my best guess scenario is about 830 Gb less at 2670 Gb, roughly similar to the 2018 Laherrere estimate for World URR.

FRENCHFRIES – See a possible OPEC decline graph below, tried to match it to your Saudi Arabia decline rates, while it may be skewed it’s likely close enough, do you agree?