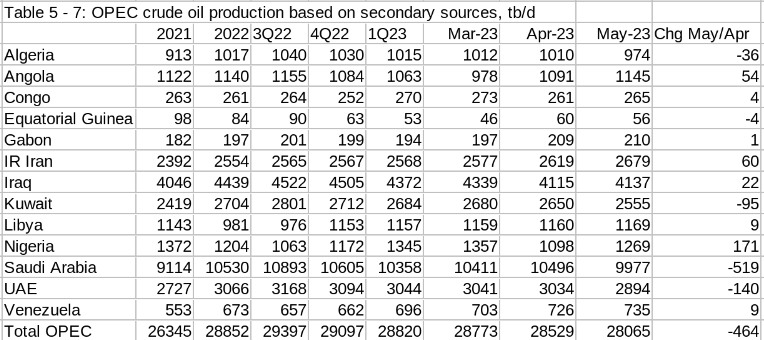

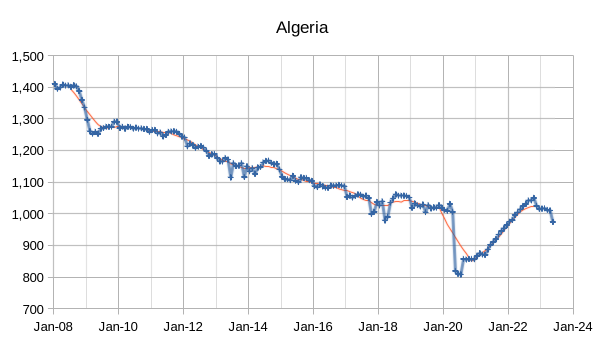

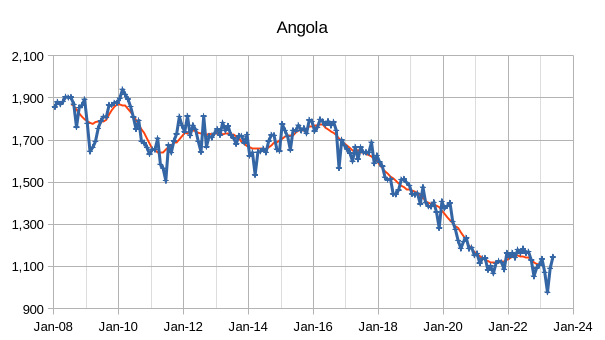

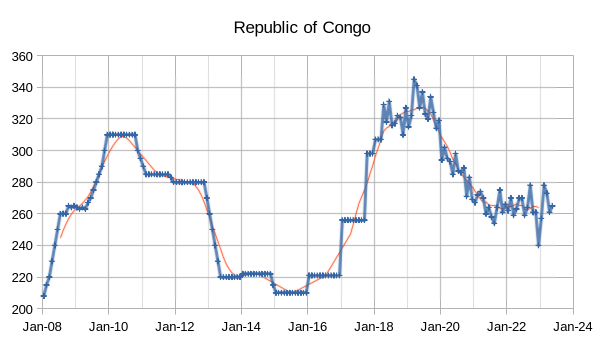

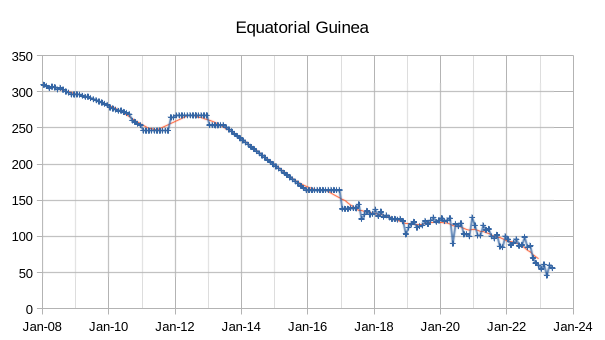

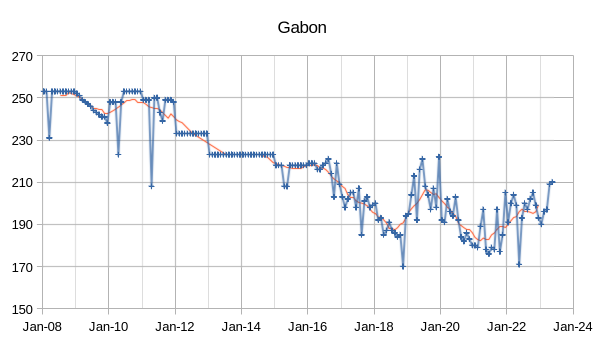

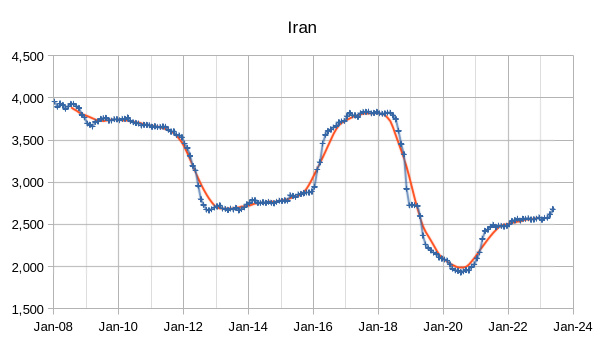

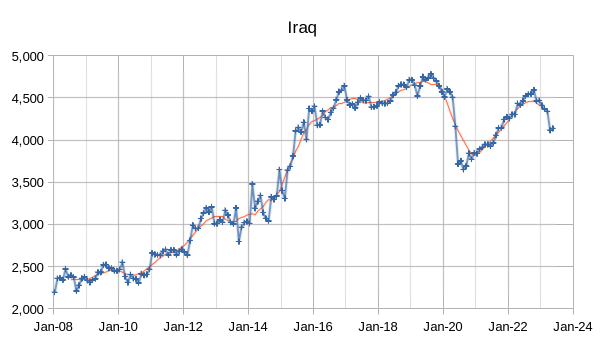

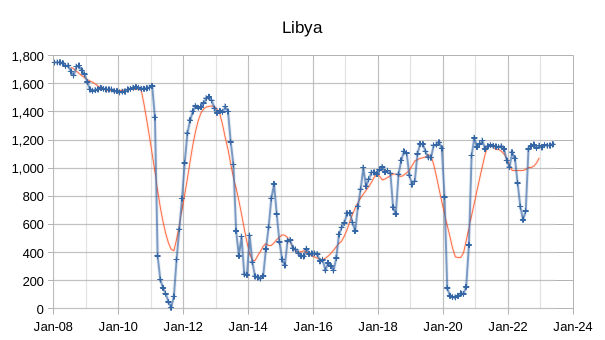

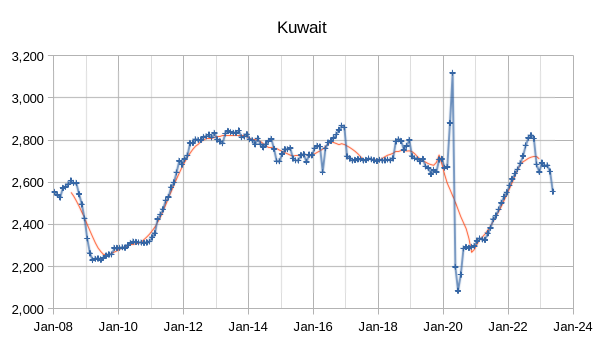

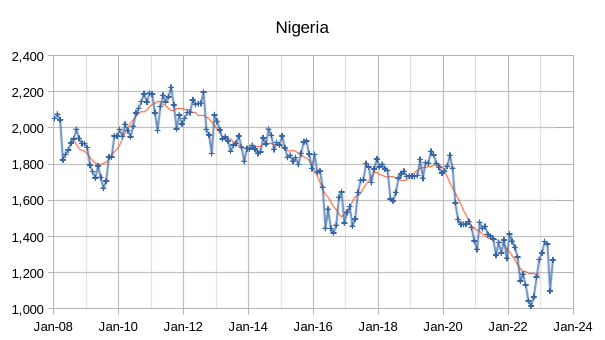

The OPEC Monthly Oil Market Report (MOMR) for June 2023 was published recently. The last month reported in most of the OPEC charts that follow is May 2023 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In many of the OPEC charts that follow the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

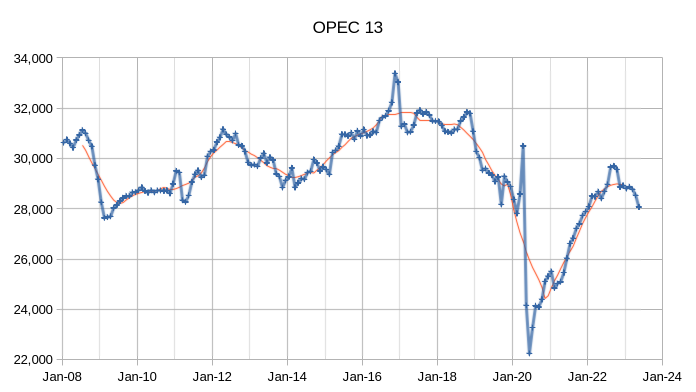

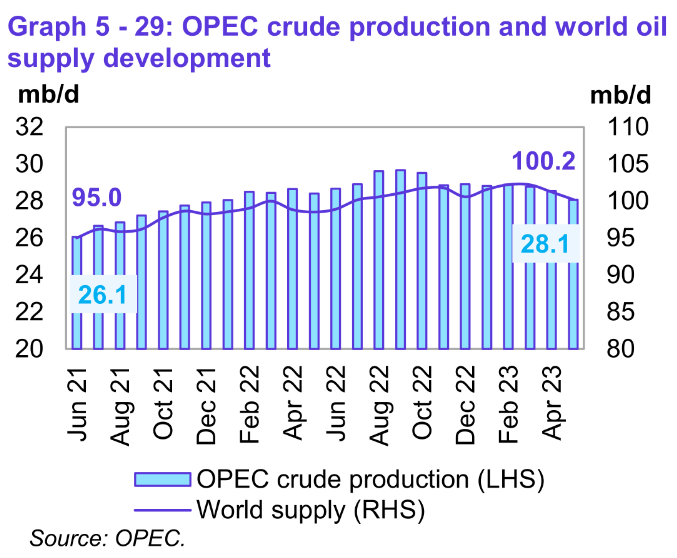

OPEC crude output was revised lower in April 2023 by 74 kb/d compared to last month’s report and March 2023 OPEC crude output was revised lower by 21 kb/d. When the World was at its CTMA peak for C+C output in 2018, OPEC crude output was about 31300 kb/d and by April 2023 OPEC crude output had fallen to roughly 3240 kb/d below that 2018 average level.

Preliminary data indicates that global liquids production in May decreased by 1.02 mb/d to average

100.2 mb/d compared with the previous month.

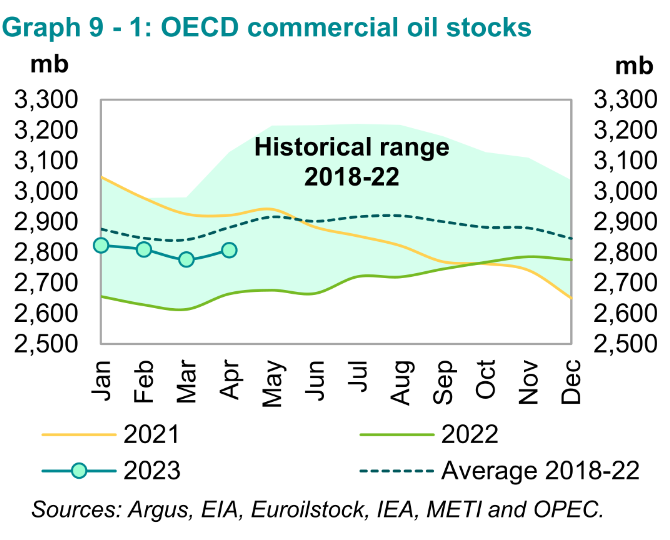

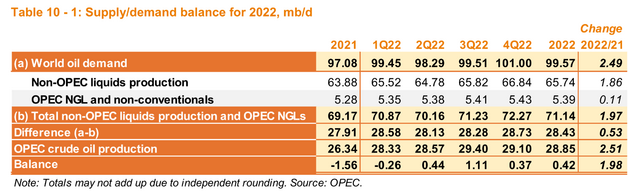

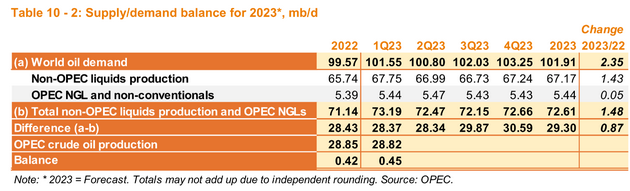

OECD stocks increased in April 2023 by 30.2 Mb and were 74 Mb below the 5 year average. Through April 2023 the World oil market looks fairly balanced with OECD stocks slowly rising. Looking at OPEC’s estimates for future supply and demand and considering recent OPEC quotas, it looks like the World Oil Market will be tight the second half of 2023, see figures 5 and 6 below.

The call on OPEC for 2023 has risen by 40 kb from last month’s OPEC estimate due to a reduced estimate for non-OPEC liquids output plus OPEC NGL and non-conventional output and an increase in the estimate for oil demand in 2023. We have avoided a default on US Treasury Securities and assuming no major changes in the Ukrainian War or increased tensions between the US and China, we might avoid a severe recession. This rosy scenario also assumes that central bankers don’t overdo the fight against inflation, which could be incorrect. If OPEC continues with cuts as currently planned and if OPEC supply and demand estimates are roughly correct, oil prices should rise by the middle of 2023Q3 (only 8 weeks away).

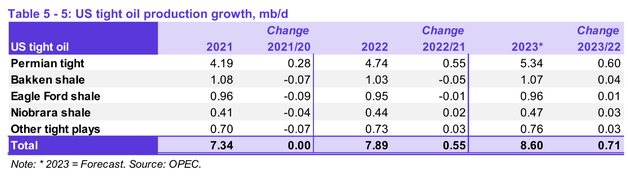

OPEC has increased its estimate for US tight oil in 2023 by 20 kb/d from last month. This breaks down to a 10 kb/d increase for the Permian basin compared to last month, a 20 kb/d increase in Bakken shale output from last month, and a 10 kb/d decrease in Eagle Ford output in 2023 compared to last month’s estimate. My estimate for the US tight oil increase in 2023 is 640 kb/d, about 70 kb/d less than OPEC’s estimate.

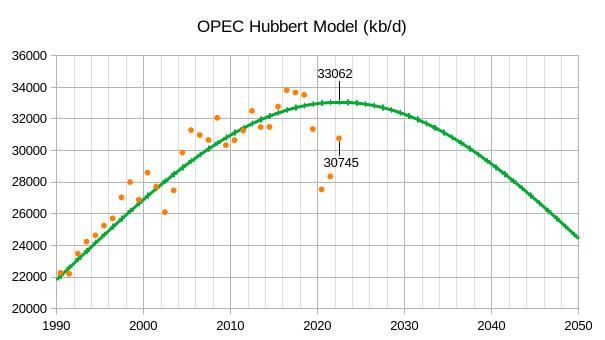

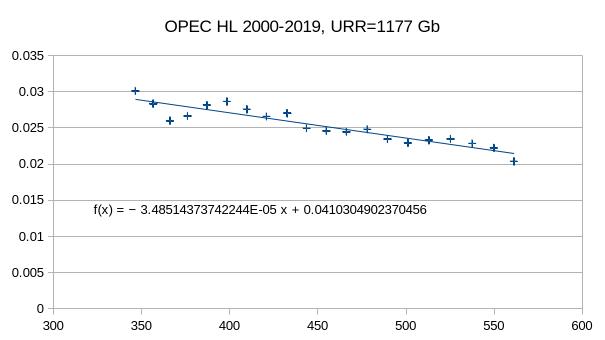

The Hubbert model above is based on a Hubbert linearization on OPEC data from 2000 to 2019, cumulative output through 2022 for the model match the data well through 2022 (model cumulative is 595 Gb at the end of 2022 vs 592 Gb for the data). The terminal decline rate for the model is about 4.1% per year, but the model does not reach this level of decline until 2146, the decline rate is zero in 2022 and gradually increases over time (1%/y in 2035, 2% in 2049, 3% in 2068, and 4% in 2129.) Hubbert linearization in chart below. For figure 9 below, the horizontal axis is cumulative output in Gb and the vertical axis is annual production divided by cumulative production. URR=-b/m for f(x)=mx+b on chart below.

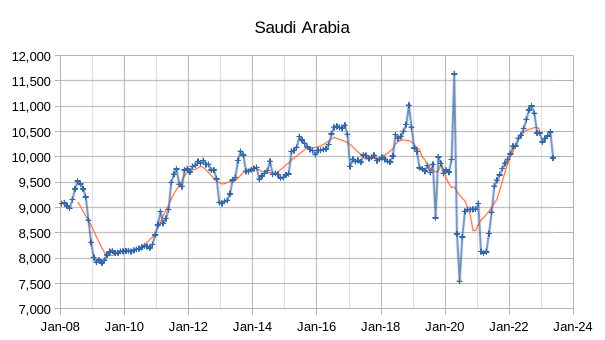

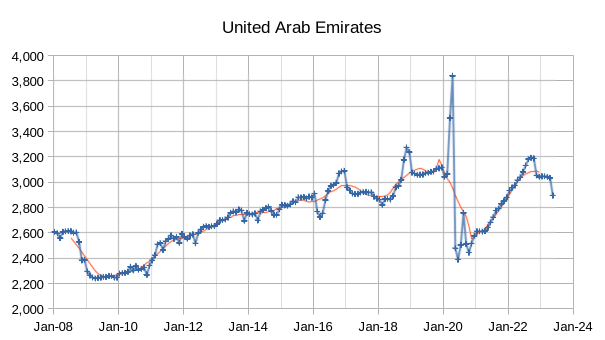

The OPEC Big 5, in May, was down 1,881,000 barrels per day from their post-pandemic high in September.

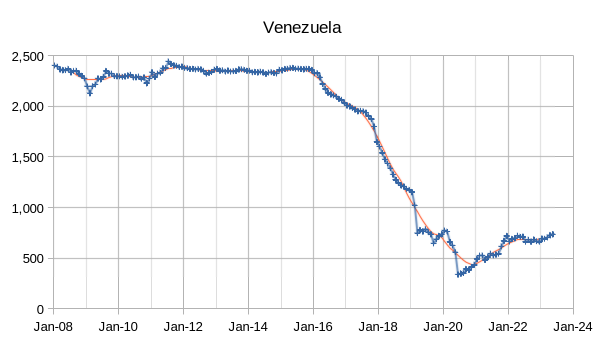

For OPEC 13 output is 1631 kb/d lower in May than the recent Sept 2022 peak of 29,696 kb/d.

The rest of OPEC, the Other 8, production was up 108,000 barrels per day in May. This was all Nigeria which was up 171,000 barrels per day. So, without Nigeria, the Other 8 was down 63,000 barrels per day in May.

Production stands where it would have been expected to be without the COVID-bump.

Saudi oil production forecast analysis.

According to my estimates, taking up old theoildrum publications updated with data from 2022, in 2031 the terminal decline of Arabia begins.

https://futurocienciaficcionymatrix.blogspot.com/2023/06/arabia-saudi-analisis-de-produccion-y.html

Thanks for the update Dennis.

Schinzy,

You’re welcome.

Thanks for the post and update Dennis. Barring a recession it seems there is going to be a supply demand imbalance by 3rd quarter of this year. Which might push up oil prices.

Iron Mike,

My pleasure. I agree, looks like oil prices may be higher in second half of 2023.

If we aren’t in recession already then a fuel price spike would likely push ys into one.

Legacy shale requires 10k bbl/d of fresh production every single day just to make up for its natural decline.

2022 was the last hurrah fueled by higher prices and complete drawdown of DUC’s. 2023 declines will be hard and fast 😈

60% of those are dead DUC’s (spud in 2019 or earlier) and shale generally requires a working stock of ~2-3 DUC’s per active rig (usually can’t frack wells when pad drilling and there’s a lag between drill and completions either way).

The dead DUC meme is likely wrong, notice that the DUC count seems to be approaching level in early 2023, it could be that the completin process has become more efficient and that there are plenty of frack spreads to service existing activity so less need for a big DUC inventory. DUC count for US tight oil and shale gas plays from DPR.

The ducks are lined in a row regarding the Permian by Mr Shellman .

https://www.oilystuffblog.com/single-post/what-s-declining-what-s-not-in-the-permian?postId=c081b387-6d62-429a-aa2a-d61842d9ae6c&utm_campaign=84625de6-86a8-4236-a535-f252736ecaaa&utm_source=so&utm_medium=mail&utm_content=f8646a23-57a4-4260-8a92-ae38ad32e760&cid=fa335351-37bb-44a6-9899-f8c34b4a0f81

that post should be pinned at the top somewhere on POB since its one of the better “the reported death of peak oil has been greatly exaggerated” explainers we’ve seen in a while. I’m assuming there is nothing in there that D. Coyne doesn’t already know – it’s interesting that Mike and Dennis still disagree on LTO production over the next two years.

Twocats,

Mike rarely agrees with me, but he knows infinitely more than me about the oil business. I expect oil and natural gas prices will probably rise in late 2023 and beyond (up to about 2030).

Mike maight think prices will remain where they are or decrease. I also think that as water and water disposal costs increase, that more water will be recycled and water and water disposal may become less of a constraint. Also note that recently shallow sand suggested that perhaps tight oil output might not see a big drop in the Permian for the next 7 years. LTO Survivor thought the 350 well scenario shown below might be realistic for the next 18 months, when I asked what he thought would happen beyond 18 months there was not any answer, perhaps no guess is feasible.

The 400 and 450 well scenarios are both about 40 Gb URR because the 450 well scenario sees the completion rate fall earlier than the 400 well scenario (2029 vs 2031), the 350 well scenario has a URR of 37 Gb, the 450 well scenario has 97k wells completed from Jan 2010 to March 2035 (no wells completed after that date). Cumulative Permian tight oil output from Jan 2000 to April 2023 is 10.7 Gb with about 42,300 wells completed.

Dennis , the number of wells is now immaterial . What matters is the location . You can sink 1000 wells in tier 2 & 3 location they will be uneconomical at today’s prices , then ??? . You are nixing quantity over quality or for better words ” Missing the woods for the trees ” .

Hole in head,

Note that longer wells have slightly lower productivity per foot, but costs per foot are also lower so producers go for the longer lateral lengths, because cost per barrel is what matters to an oil producer, they aim to minimize the cost per barrel produced. Productivity per foot of lateral is less important to an oil company than barrels produced per dollar spent. The CEOs are saying they don’t expect output will increase much in the Permian and peak will be around 2029 or 2030. That might coincide with about 375 new wells per month as in scenario below, in April 2023 tere were about 500 wells completed in the Permian basin (EIA estimate), the scenario assumes the completion rate falls by 20 wells per month until reaching 375 wells per month after about 7 months (Nov 2023) and then remaining at that level until 2031 and then fallin after that, URR for scenario is 38 Gb, and 93400 wells completed. There are likely to be this many tier one and tier two locations in the Permian basin in my opinion.

The annual decline rate for the scenario from 2035 to 2039 is about 27% per year, output is 1174 kb/d in December 2039, decline rate becomes even steeper after 2039, output is zero in December 2048.

Note also that many of the CEOs claim to have 10 years of premier drilling locations at current rates of completion, my scenario with 450 wells per month is about 12% below current rates of competion (510 wells per month) and the 400 well scenario is 22% below current rates of completion and the 350 well scenario is 31% below current rates of completion (375 well scenario about 26% below current rates of completion). Perhaps the CEOs are not being truthful, though in the past I think Mike S has suggested Sheffield is a straight shooter, perhaps I am remembering incorrectly.

Note that longer wells have slightly lower productivity per foot,…

Why would that be? Long or short, if production per foot is falling, then that means they are moving into less and less productive territory. Well, that is exactly what we would expect. We just didn’t know when it would happen. Okay, so it is happening right now. And it will, quite obviously, continue to happen. We can expect that production per foot will continue to do what it is doing right now, we can expect it to decline.

Or do you disagree?

excellent response – thanks dennis. It will be very interesting to see the oil production response once demand makes a call.

Ron,

The optimum is determined by cost per foot. I imagine you can see why cost per foot would decrease as lateral length increases. As wells get longer it is difficult to keep productivity per foot at the same level at the toe of a 15 k lateral.

As wells get longer it is difficult to keep productivity per foot at the same level at the toe of a 15 k lateral.

No, that is not the case. There is no reason that productivity per foot should decline unless the oil in the rock declines. Why would it?

Ron,

See the following

https://jpt.spe.org/the-trend-in-drilling-horizontal-wells-is-longer-faster-cheaper

Especially this snippet:

When the Norwegian data and consulting firm compared the results of companies doing 2- and 3-mile-long laterals in comparable rock with similar completions, they found the production per foot for longer laterals sometimes falls short.

“Our conclusion so far was that many of them were able to maintain productivity per foot, but we also recorded some cases with 10 to 20% degradation in productivity per foot for 3-mile laterals,” Abramov said.

Those estimates were based on the first 3 to 6 months of production. He said that “most likely, degradation in EUR [estimated ultimate recovery] will be less pronounced as 3-mile laterals exhibit even longer flowback period and shallower decline rates.”

Even if the lower rate has a lingering effect, the 15 to 20% reduction in drilling and completion costs offers an economic argument for going longer.

The entire article is worth reading, but this gives you a flavor of why I believe 15k horizontal tight oil wells might have lower output per well than a tight oil well with a 10k lateral, perhaps by as much as 15% lower productivity per foot, but with 17.5% lower costs per foot gives the company higher profits. Profits are how companies keep score.

Ron,

As to the why of lower productivity for longer length horizontal tight oil wells, the paper below suggests frictional losses along the horizontal well bore.

https://onepetro.org/JCPT/article-abstract/doi/10.2118/02-05-03/30357/Optimization-of-Well-Length-for-Horizontal?redirectedFrom=fulltext

It also may be difficult to get consistent fracking results towards the far end of the lateral (near the “toe” of the well). No doubt there are other considerations I am not aware of, but regardless of the reason, the data show the productivity of the very long laterals on a per foot basis is lower than for shorter laterals. For a long time (2008-2018 roughly) the “sweet spot” of cost vs productivity was considered to be 10,000 feet for the horizontal lateral of a tight oil well (this length was used for many years in the Bakken). Now companies are going longer, to 15k when possible, often the leases are not large enough to accomplish this, so presently in the Permian only a small percentage of wells are over 11k for the horizontal section (about 20% of wells in 2021, see link below).

https://www.eia.gov/todayinenergy/detail.php?id=50016

“Our conclusion so far was that many of them were able to maintain productivity per foot, but we also recorded some cases with 10 to 20% degradation in productivity per foot for 3-mile laterals,”

Dennis, this article explains nothing except for the fact that, in some cases, production per foot productivity dropped by 10 to 20%. There was no attempt in the article to explain why productivity per foot dropped. Otherwise, everything was the same.

Everything had to be the same because, in some cases, there was no decline per foot. From all that, we can come only to one conclusion. Available oil per foot of shale is declining in those new wells. That should be expected as they move further and further away from the sweetest spots.

The article said nothing about frictional losses. Why would some wells have frictional losses and others have none?

Ron,

The frictional losses are mentioned in a different piece, not all information can be gleaned from reading a single piece as you are no doubt aware.

The following piece reveals some of the challenges in modern horizontal fractured shale wells. An assumption that increasing the horizontal length of the well from 5000 to 15000 feet will yield 3 times more oil is likely not a valid assumption due to the complexities of such an endeavor, an art rather than a science (see end of piece linked below).

https://jpt.spe.org/optimizing-well-productivity-horizontal-logs-unlock-critical-geologic-knowledge

There are always inconsistencies in the rock from well to well. no two wells are ever the same, what is important is what happened on average and the average productivity decreased in areas where the expectation was that productivity should have remained constant.

I will leave you to your impression that it must be lower quality rock, I am open to other explanations such as longer laterals may not optimize productivity when normalized for lateral length.

I don’t think we know the answer, but a petroleum engineer might enlighten us on the general principles. Certainly there would be a pressure drop along the pipe, this is a very general physical principle. As the well becomes longer and longer eventually this affects productivity and there would be more of an affect for oil than for natural gas as the frictional losses may be greater.

Other problems are that landing zones may thin out as the lateral is extended to 15k and this reduce productivity and it may be more difficult to hit the intended target as the lateral is extended.

There may be a reason that most wells top out at about 8000 to 10000 feet, that may be the optimum size from an economics point of view.

See article below from May 2021

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/052121-us-upstream-industry-relying-on-longer-lateral-drilling-to-boost-cash-flows

Dennis, that was a very interesting article. However, I couldn’t find anything in the article that referred to lateral length or what increasing the length from two to three miles would have on production.

The word “lateral” is mentioned five times in the article. But not one of those five referred to any effects increased lateral length would have on production. I could find no mention of that subject anywhere in the article.

Ron,

The article is about the challenges of optimizing wells and getting uniform reservoir stimulation along the lateral. As wells become longer and have more frack stages this becomes more challenging. Also there is a second article which talks quite a bit about increasing lateral lengths and the effects, see especially the Diminishing returns section of that piece. Excerpt:

But even as more oil and gas is procured per well with plus-sized laterals, output increases come at diminishing returns, Rene Santos, manager of North American supply for S&P Global Platts Analytics, said.

Using a hypothetical example, Santos explained that between a 7,000 foot and a 10,000 foot lateral, the production increase might be around 400 b/d of oil or 0.133 b/d per each additional foot drilled.

However, the increased production from taking a lateral to 13,0000 feet versus 10,000 feet may be only about 275 b/d or 0.092 b/d per each additional foot.

“The 13,000 foot lateral is more economical than a 10,000 foot lateral, but you get less incremental production for each additional foot drilled,” Santos said.

I am just going by what the experts say, perhaps they don’t understand this as well as you.

Ron,

The bottom line is that if we have two wells in similar quality rock, and one well has a 10k lateral and the second well has a 15k lateral, on average experts would expect the longer well will have lower output per foot of lateral, one explanation might be frictional losses over the extra 5000 feet of lateral, another might be that the fracking of the well over the extra 5000 feet of lateral is more difficult to do properly relative to the first 10000 feet. There are no doubt about 10 other better answers (at least) that an oil pro could give us.

Thanks Hole in head. Nice post by Mr Shellman.

For Nov 2022 Novi Labs has GOR for Midland county at 3.3 MCF/bo, in Nov 2019 it was 2.37 MCF/bo, GOR has increased quite a bit (39% increase over past 3 years).

At $2.50/MCF and $70/bo, I get $70 for oil stream and $8.25 for gas stream, plus one tenth of a barrel of NGL for each MCF of NG so 0.3 barrels od NGL at $20/b so that adds $6 for NGL, so $70 revenue for oil and $14.25 NG sream (including NGL extracted). Oil is 70 of 84.25 or 83% of the revenue stream. Not sure where the 50% of revenue coming from oil estimate comes from, when natural gas prices were sky high back in August 2022 ($8/MCF) and NGL was at $35/b the revenue stream might have been close to 50/50, oil was at $85/bo back in Aug 2022, so 85 to 18.5 is still 82% of revenue stream from oil. I must be missing something with different tax rates or royalties on natural gas vs oil. If we take things on a boe basis 3.3 MCF would be 0.55 boe, so the gas would be about 35% of output on an energy basis, but revenue/unit energy for natural gas is typically lower than for oil.

Europe expects to receive US LNG for a long time; it will be short or at best medium [term].”

–Jean LaHerrere

“Beware of graphs that plunge dramatically just past the present moment”. How many graphs like this did we see on The Oil Drum? Hundreds, or thousands?

Things are about to go off a cliff, any day!

No editorial comment on the content, just the fact that these graphs have been wrong – every single time.

No editorial comment on the content, just the fact that these graphs have been wrong – every single time.

No, they were not! All graphs posted that showed a dramatic plunge in early 2020 were spot on!

The other trick is to add other forms of liquid fuel, or of unconventional sources of oil to the charts. It’s evident that the inertia of the worldwide economy will keep going in the short term as it adapts to other fuel sources, and excepting for a plunge as due to the pandemic, the curves will follow a dead-reckoning slope from current levels.

Consider the crash of 2008. As part of the recovery effort, Obama admin offered incentives for green energy, which the oil companies siphoned off and used for funding fracked shale oil production. It was a smooth adaptation to unconventional oil that was barely noticed in the curves.

At the risk of getting hammered by Mike , I am posting this . The lying just does not end , Lies . lies and more lies . This is why Dennis and me are in disagreement . The data source is contaminated . GIGO rule .

https://www.oilystuffblog.com/forumstuff/forum-stuff/energy-inaccuracy-agency?origin=notification

“It is likely that EIA forecasts to 2050…[are] unrealistic by assuming an increase by 50% of the drilled wells, when most shale plays are almost completely drilled.”

–Jean LaHerrere

Source of article?

Svaya , the first two slides Shubham Garg at White Thunder , the latter two slides Art Berman , Dependable sources .

yes, I know, I thought there is an article, Jean LaHerrere is pretty old school, old school as in good

“Art Berman , Dependable sources.”

October 2011

Art Berman….”my professional opinion….when I look at the volumes of oil I don’t see enough to make a difference”…. referring to US shale oil development.

The U.S. last year posted the biggest increase in oil production in the world and largest increase in U.S. history. – June 12, 2013 (referring to 2012)

https://www.wsj.com/articles/SB10001424127887324049504578541601909939628

Dependable sources indeed.

@RGR, best not feed the cult with facts outside their short-term memory. Best case you’ll only get an error message in return and will need repair. Worse case, their error message will get stuck in a continuous loop.

HB, even a damn fool knows the increase in US oil production last year was due to recovery from the covid-19 deep cuts. To believe that this was just a normal increase in production could only be done by an imbecile. But then…??? 🤣

Yes Ron, there has been a lot of fools in the past. There have been those who for almost 50 years thought the USA peaked in 1971. Then there was also the glory days of The Oil Drum. Where thousands of fools gathered counting the end of civilization. Thinking humanity was past peak oil. Only to find out The Oil Drum was past it’s peak as record prices brought on an economic technological flood of oil. So much oil that the price of oil collapsed to half of it’s price in a few months in early 2015. This is when the great oil man Ron Patterson called peak oil himself.

What happened next ? That’s right, humanity just keep figuring out how to keep producing more of that black gold by the day. Until there was a world pandemic and within 3 months the world was floating in so much oil that for a few days. People had to pay to get someone to take the oil assets off of their hands. Well you know what happened next, Ron The Great with his oily crystal ball called peak oil again. Honestly, I don’t know how many times one gets to call wolf before everyone stops listening. Maybe you do. But I do know a broken clock is right twice a day. So all hope is not lost.

Personally my money is in the Dennis camp. He is a student of history, economics, forecasting, data, doesn’t get distracted by one time events, doesn’t speak of certainty but of probability of the future and most of all is open minded to technological advancements. He even drives an electric car. It really doesn’t matter any more if humanity has reached peak. The world has changed from the days of your father’s Oldsmobile. There are alternatives now to liquid fuel transportation and oil will see the days of buggy whips in your grandchildren life time.

I’d say if someone called peak oil to be in 2015, and then it didn’t happen until say 2025…. that’s close enough for me man. A decadal error bar is quite fine for personal planning and prepping for this kinda shit to happen in one’s lifetime. The difference between Ron and Dennis, and his “rosy glasses”, is a rounding error.

FWIW- I think G Kaplan makes great forecasts with those charts…. 50 by 2050 is how I remember them. Approx 50 million barrels a day by 2050. Help your loved ones get prepared for that.

I like hearing from knowledgeable people who stick their neck out to make predictions and take some heat from the crowd. They got some balls, so to speak.

Agree Survivalist.

To survivalist: You said:

“I’d say if someone called peak oil to be in 2015, and then it didn’t happen until say 2025…. that’s close enough for me man”

I agree wholeheartedly. Now go back, starting with say Colin Campbell’s claim of global peak oil in 1990 or so, and check every written claim of peak oil for someone mentioning a given level of temporal uncertainty into their result. There were a few, including the EIA. But of all the ones I am aware of, everyone EXCEPT the EIA has already outrun both their initial claim, as well as any big error bar they dropped around it.

Ron himself, who in 2014 gleefully declared the blessed event, but gee, if not 2014 than FUR SURE!!! in 2015. You will notice that Dennis substitutes scenarios, which are better than nothing, but allow all sorts of testing. However, until those who have built their models with the appropriate independent variable, it is testing without the critical piece of information necessary to say ANYTHING about future production. But with the CORRECT independent variable, even scenarios are wildly useful and uncertainty around the independent variable can be quantified appropriately, including with a temporal component, should the user so desire to develop sceanrio down the road, for example, modeling global oil production balancing off against claimed climate change mitigation scenarios. Geopolitical risk. Etc etc.

One thing that I have learned studying the Earth is that geologists and geophysicists are really not that good at applied math. Or at least that’s what it seems. Maybe they don’t actually want to do the work. Perhaps it’s not in their best interests? In any event, what you get instead is some bloggers interested in doing the work independently, applying the math that they have learned from other scientific and engineering disciplines.

So for people like RESERVEGROWTHRULZ, this is what you get. Best-that-we-can-do estimates based on half-assed data from bureacratic organizations such as the Texas Railroad Commission, fundamental religious tribes such as Saudi Aramco, pirate plunderers operating in west Africa, and crazed warlord despots such as Putin and company, Only a few places like Norway and the UK and NoDak doing a decent job.

Or we can work on other earth sciences disciplines that the Earth pro’s are equally inept at, such as predicting the next El Nino …. Well, as it turns out it’s entirely possible that every El Nino could have been predicted from data as early as 1932 based on freaking TIDES!

https://geoenergymath.com/2023/06/17/canonical-cross-validation/

So RGRZZ can keep on taking shots from their pseudonymous armchair perch.

https://aspofrance.org/2023/06/

US tight Oil scenario using scale similar to Laherrere, note this is tight C plus C rather than all liquids as in Laherrere’s scenario which includes C plus C, NGL, and biofuels. Also his right hand scale is in Mb per year which for my scenario would translate to 3285 Mb/year at peak (9 times 365).

And renewable energy gets accused of intermittency lol

Dennis should replot that with the x-axis starting in the year 0 AD. Example of a delta function

I like this chart

LTO Survivor,

Thanks. Same chart with different scale below, most people at this blog do not like this chart. It kind of matches what many tight oil CEOs are saying with a peak around 2030 and slow growth between 2022 and 2030 (average annual growth rate is about 2.3% per year). The annual decline rate from 2035 to 2040 is about 16.5% per year.

Dennis –

I think your graph is a bit misleading…

Kengeo,

I disagree, Permian resources are about 75 Gb based on Mean USGS estimate, my scenario has about 52 Gb for Permian, 17.5 Gb for Bakken/ and Eagle Ford, 3.5 Gb for Niobrara and 8 Gb for other plays (including condensate from shale gas plays). The USGS assessed plays have about 100 Gb for mean TRR and other plays likely add another 20 Gb to total. The 81 Gb estimate is reasonable in my opinion. Tight oil proved reserves plus cumulative production are 45.5 Gb at the end of 2021, this would be the minimum we would expect. There are likely about 17 Gb of tight probable reserves which increased the likely estimate to 62.5 Gb, then there are possible reserves and contingent resources which are likely to become part of 2P reserves over time. In 2021 6.6 Gb were added to proved tight oil reserves, more will be added to proved reserves in the future especially as oil and natural gas prices rise. If we take 81 minus 45.5 thats about 36.5 Gb, so another 6 years of reserves being added to tight oil reserves at 6 Gb per year gets us pretty close. If oil price start to fall in 2031 rather than 2035 as in the model I used, then the ERR might be reduced to 70 Gb.

Ok, so let me get this straight.

You’re of the opinion that tight oil is growing ~1.2 mb/d annually (~15% annual growth)?

Yet, in the past 12 months, there has been virtually no growth – which for 6 of those 12 months had been a very high price environment. Tight oil production possibly grew at ~3% over past 12 months, hard to tell…

Bottom line is the industry experts are not anticipating any measurable growth in tight oil – but somehow you are? What makes it even worse is that you expect that tight oil growth will offset conventional crude oil decline rates…

Your position gets curiouser and curiouser!

Note that scenario has far higher peak in 2016, for the URR they use 3000 Gb from USGS which is for conventional resources only. Actual output increased by less than 1% rather than 2% and decline might also be similar rates.

Like I said, I’m no expert, but the little I have familiarized myself with shale your graph looks way too optimistic. My impression is that we’re on the cusp of sustained declines from shale.

Anon,

Consider

https://www.eia.gov/petroleum/data.php#crude

and

https://www.eia.gov/energyexplained/oil-and-petroleum-products/data/US-tight-oil-production.xlsx

My model has US output increasing from 8562 kb/d in April 2023 to about 9500 kb/d in June 2030, so about 950 kb/d over 7 plus years, an average annual rate of increase of 136 kb/d per year or roughly 1.5% per year (136/9000). Just does not seem that unrealistic to me.

https://www.rigzone.com/news/wire/pioneer_cuts_long_term_permian_basin_oil_production_forecast-06-jan-2023-171642-article/

Pioneer is forecasting Permian output at 7 Mb/d in 2030 as of last January, my model has Permian output at 6.5 Mb/d in 2030, current (April 2023) Permian output is 5291 kb/d.

Dennis,

How much untapped tier 1 acreage do you think is left to support your projections?

Anon,

I don’t have access to how various acres are graded. The scenario has about 62k wells completed after April 2022, at about 300 acres per well this is about 18.6 million acres, but note this is in about 3 benches so the surface acres would be about 6 million acres. Total wells completed about 104 k with 42k wells completed so far. Note this assumes 9500 foot laterals spaced 1320 feet apart, as laterals get longer fewer wells can be drilled. The most prospective areas will be drilled first and over time average well productivity will decrease, this has not been factored in and will either lead to more wells being drilled if prices are high enough or less output especially in the tail. Difficult to predict exactly how it plays out, it will be more complex than I can model.

Anon,

While not specifically addressing your question regarding remaining Tier 1 shale drilling locations, today’s (dated June 21) RBN Energy post – dealing with the massive expansion of Corpus Christi’s export terminal capacities – might provide a clue as to the direction – and duration – of oil production from the Permian over the next several decades.

The actions of people investing multiple billions in infrastructure for large, long term hydrocarbon output, might warrant serious consideration from outsiders as their ‘skin in the game’, aka money, is no trifling matter.

Jes’ sayin”.

Ken Geo,

From 2021 to 2022 annual average tight oil did increase from 7.3 to 7.9 Mb/d and from June 2022 to April 2023 US monthly average tight oil increased from 7830 kb/d to 8562 kb/d, over 12 months this would be about 878 kb/d if the rate of the past 10 months continues for the next 2 months.

It is unclear how you come up with 1.2 Mb/d annually or 15%. Let’s do some simple math from 7.9 Mb/d in 2022 on my chart at a 15% growth rate to 2030 (where my model has tight oil output at 9.5 Mb/d.) The result in 2030 would be roughly 24 Mb/d almost 3 times larger than my estimate. We can also use your 1.2 Mb/d annual increase which would result in 17.5 Mb/d in 2030.

To the math challenged my scenario might seem curious. The correct numbers are about an average annual increase in tight oil output of 2.4% per year or an average annual increase of 0.2 Mb/d. So you were only off by a factor of 6.

Border Collies are some of the smartest dogs on earth. But their intelligence is not measured entirely by the work they do. They herd sheep. Sheep are stupid, they simply follow each other around and, for instance, are so stupid will follow the ass of another sheep in front of them, in the squeeze chute, straight to a firing pin point blank in the noggin. Bingo, lamb chops.

The “nobody would invest money unless they knew it was going to be profitable or long lasting” meme is truly a stupid one. Its sheepful. First of all, it’s not their “skin” in the game, it’s somebody else’s. Its OPM.

Herding sheep has led to 150 billion, and counting, of bankruptcies in tight oil E&P, countless other bankruptcies in mid and downstream.

All tight oil exports from the US of A, 95% of them, come straight from the Permian Basin…the last refuge of American oil independence, of remaining affordable liquid hydrocarbons. 1Q2023 we averaged 85% of all Permian HS tight oil production exported to foreign countries.

That is our kid’s oil, their hope for their future. Electricity is a long time coming answer and your life in the US will NOT be as good without oil. Mox nix, let our kids have the option to decide for THEMSELVES.

Don’t buy the other people are smarter than you bull shit. Enormously large corporations that invest in mid stream pipe and downstream export terminals have NOTHING invested in that. Hope is not a plan.

Draining America First, for exports, is not very American. Forget what other people do, or don’t do, think for yourselves. Trust your instincts about remaining hydrocarbons in America.

Mike, No, No, No

That shit coming out of Texas now is so bad we’re lucky to be able to sell it at a discount. We have to import the good stuff to keep our refineries running. It’s why they have to keep draining the SPR because Texas is letting us down.

Mike, indeed. From the book Economics of Good and Evil, by Tomas Sedlacek, the fundamental problem we have is that rather than attempting to maximize moderation, the economic theory we have maximizes utility, which is to say the insatiable human wants. The reason is simple, we do not know how to calculate the former, but we have a way of calculating the latter by simply adding all that contributes to the GDP. In short, our economies are based on Hedonistic ideas, rather than following the Stoic school of philosophy, or something resembling that. Incidentally Adam Smith belonged to the latter, as his theory of Moral Sentiments shows.

Dr. Korpela, you are very kind, sir. Thank you.

I appear only to be capable of embracing those theories up to a point. With regard to our country’s natural resources, their plundering, for the sake of utility, escapes my comprehension completely.

I am a big fan, by the way. I still have a comment or two you made to me years ago.

Beach, take it up with Mama Nature.

In the meantime, see if you can talk some of these kids out of this, will ‘ya? On one hand I’d want to flee that dump and never go back… but Texas? Tell them we’re averaging 120 F back here right now, running out of water, and everybody is now carrying a gun.

I’m for a 10 foot fence around the entire State, with razor wire on top, but Austin is Austin. Austin belongs in California. Wanna buy it? You can sell some of your cattle and get it pretty cheap.

https://www.zerohedge.com/personal-finance/millennials-lead-way-great-migration-california-texas

Mike, I don’t need to sell my cattle. I can do better than that. I’ll give you two for one. You can have Riverside and San Bernardino counties for Austin. The two of them will be like big cousins to Flatonia. Those Austin guys will love running around in the sun, sand and surf.

Ya, no water, 120F and guns doesn’t exactly help real estate values

Seppo, Nature of Human Wants- All the desires and aspirations and motives of humans are known as human wants in economics. And the wants that can be satisfied with goods and services of any kind are economic wants. Like for example food, shelter, clothing, etc are economic human wants.

Mike,

No disrespect intended, but do you ever think not developing the Permian Shale and keeping it in the ground would have ever been a viable option? You keep reverting back to this thesis that this oil should have been preserved in the ground for the next generation. However, it would have been impossible to realistically do…. unless we socialized all mineral rights and oil & gas development to be released for drilling with perfect timing. Private mineral and land ownership, contracts, leases, variations in lease language… all would have made making shutting the Permian Shale down for future generations impossible. The lawsuits alone would have filled a thousand courts.

Meanwhile, the current real benefits of developing the Permian Shale currently flow nicely into worker salaries, local property taxes, state severance taxes, mineral/royalty owner payments, etc… so, these benefits would have suffered under your scenario.

So, why do you persist pushing a point that had almost no realistic chance of actually happening and would actually have direct offsetting negative effects?

Thanks,

Huntingtonbeach,

The point is that we should produce less tight oil, this would be the case if the export ban on crude had not been lifted in 2015. We can utilize roughly 4.5 Mb/d of tight oil output in existing US refineries, that’s the amount the US should be producing rather than draining our resources and exporting them. This makes perfect sense to me.

Gungalonga,

Mike can correct me, as I likely have this wrong. The basic idea is that the US banned crude exports from Dec 22, 1975 (a law signed by Gerald Ford) to Dec 2015 (roughly 40 years). Since 2015 we have basically exportaing any tight oil output over roughly 4500 kb/d. To Mr Shellman and me this seems a dumb policy, the crude export ban should never have been lifted, the resources which cannot be utilized by US refineries should remain in the ground for later use.

One thing Mike jas mentioned in the past is that he’s ok with exports to Canada and Mexico, that seems perfectly reasonable, though his views may have changed on this point, I am unsure.

Dennis, Gungalonga makes excellent arguments above for trading shale. But I can think of a couple more. First it doesn’t solve the problem of resource depletion. It only gives the US a few extra years of economic longevity. The real answer is to stop burning oil for transportation and transform. The only long term solution to the limited supply side is to address the demand side. Part of that process means changing Americans and the world expectations about transportation. We can move to it or have it forced on us. If you think about, if you slow down the speed of transportation. You kind of make planet earth larger for the 8 billion of us.

It will be to future generations advantage to move expeditiously from ICE and it’s damage to the environment. One example- tomorrow new vehicles could be governed some were around 50 to 60mph and in a very short time save mbpd’s worldwide. In a lot of areas it will force older vehicles to slow down also. It would also make electrifying transportation quicker and easier. Until we move to an optimum efficiency speed we really aren’t serious about the problem. We have to learn how to live off renewables. There is no reason we need to travel at 75 to 80 mph with a car load of people. It’s a combination of selfishness and ignorance.

Second, from an ethical point of view. Who are we to burn up other poorer nations resources to save ours for ourselves. This is the kind of attitude wars are made of. America has been sucking the nipples of other nations oil reserves for over 50 years. An now you want to say not from my nipple you don’t. That’s not right and you know it. Just because America has been more advanced over the last 100 years. Doesn’t mean we have the right to others resources and deprive them of their future. For what ? To drive our vehicles at 80mph. I don’t draw lines around my immediate family. Mine is a family of 8 billion and that includes Mike and Dennis. Maybe HIH not so much. Have a great day !

Mike, thank you for your kind words, as I with tentative steps stumble to understand the predicament we humans have gotten into. We will be forced back into economies that are local, and this is likely to temper our “insatiable wants”.

Guga, I’ve heard from you before several times, you mean to be very disrespectful to me. Quit the shit.

I don’t even truly understand your argument. You seem to be implying that slowing the rate of Permian production down to coincide with US refinery absorption would eventually lead to nationalization of all minerals in the US and, in… TEXAS? Gimme a break. Thats dumb, and clearly spoken from the ORRI or RI camp. No such thing would occur.

But to be clear, you are good with private mineral ownership dictating when the very last of our nations minerals are produced. THAT comes before long term national security and the future well being of the nations children. You voted I am sure for all three of the TRRC Commissioners. all of whom believe more is better, two of them appear to benefit directly from that theory, certainly Craddock, and are no longer willing to uphold Texas law.

I absolutely cannot believe people have become so far removed from history, the purpose of the TRRC, and what is best for our entire nation. How my industry was regulated the past 100 years was beneficial to the State, to employment, to mineral ownership, to the American consumer and to my nation’s energy security. All that historically has occurred, cooperatively, for the greater good of all Texans and all Americans. It is not either/or, that is fear porn kinda stuff.

If you don’t like what I write, don’t read it. I don’t give a shit. Don’t feel threatened by my words of caution and conservation, my concern for the long term… relish in the fact that you are just like every other fucking American these days. The future is now.

And congratulations. You, like Beach, are life time members of the Drain America First Club. You both have different reasons for wanting America drained of all fossil fuels ASAP, that is the beauty of the club. Its all encompassing. And that is exactly why exports of vital America resources will go on until there is nothing left.

A Love Hate Marriage

Hi Mike, you do realize your beloved state of Texas is the leader of your fictitious make believe club. You should rename it Drain Texas First. Texas is the number one contributor to producing and shipping America’s oil resources to China. I would suggest you take your F250 and drive up to Austin. Then explain to Governor Abbot the mismanagement of Texas. He is wasting America’s resources and that you want your children to be able to have the joy of driving an F250 also.

California denies most fracking permits ahead of 2024 ban- https://apnews.com/article/climate-business-environment-and-nature-california-gavin-newsom-1671bce1013b33ba9013b8c06ac2c645

I can’t help but to believe you have a hard time getting a good night sleep with your beloved Texas. On the bright side, Texas loves to put out. I mean output.

Looks like it’s going to be in the low to mid 70’s here according to the next 10 day weather forecast. https://weather.com/weather/tenday/l/dce0083169b639a7b248fe29153cd5ac9530713836224028be9537946084462c

Did you know Flatonia has Tesla super chargers right next to the Valero ? You could buy an F150 lighting with your money and help save Texas resourses.

It’s great to see you have a sense of humor. Enjoy your road trip and have a great day.

Mike,

No disrespect intended… just a healthy debate. You are the one firing back with aggression.

Not sure where you are going with this and what you didn’t understand… my point was and is …. What you propose would be impossible to have implemented in our fee country. All private owners of the Permian/Shale mineral interests would have had to agree to keep their oil & gas in the ground and sacrifice life supporting royalty revenue. All this sacrifice simply to support keeping reserves in the ground for unknown conditions in the far future. It would never have happened… too many different mineral owner cash flow needs and too many significant private and public benefits would have been lost.

… this includes massive lost royalty revenue to individual mineral owners from small to large, The University of Texas System and many other large Institutions, countless charities of all sizes (the Catholic Diocese is a huge mineral owner for example), someone’s grandma and grandpa, my neighbors who get $500/month that helps pay their mortgage. All of these benefits would have been left in the ground and all that capital that came from production would never have made it into the Private Sector hands to do the good that it did, or to just have been spent on Gatorade and wine… a free choice. The Government would have been in control and we all know how that would have ended up… think SPR times 1,000.

I am not threatened by anything you write, just entertained and sometimes you have some compelling points, so keep on posting. I am just pointing out that, in my opinion, the notion that U.S. reserves should be left in the ground for future generations is a philosophical and conceptual discussion only and not useful in practical terms…. unless all the Mineral Rights were socialized and controlled by the Gov to control keeping the reserves in the ground.

Further, much of the past and current huge royalty driven financial gains for the private/public mineral owners are pumped into lasting benefits that would not have been created and supported had shale been magically shut-in and preserved for the future. I know countless universities, charitable foundations and institutions that were born and/or are continuously supported by monthly shale royalty from developing and producing private mineral rights in the US.

Thanks for inclusion into the DAFC, not sure I agree with your statement… seems a bit extreme. But, maybe I will order a couple sleeves of styro cups with that on it… increase polystyrene demand a bit!

If having the freedom to develop your property and resources when and how you see fit under the guidelines of reasonably established protocols, then I am a proud and Free American. If the nations needs more oil security for the future, then build a bigger SPR and fill it.

Gungalonga,

Mike is proposing that the crude export ban that was in place from Dec 1975 to Dec 2015 be reinstated. That is pretty much it. Mineral owners are free to develop their resources as they see fit, they just have to sell their crude in the US (or possibly North America, Mike’s position on this is a bit unclear to me). The TRRC has been regulating oil production in Texas since 1919, Mike Shellman is more familiar with Texas laws regarding oil and natural gas and states that the RRC is not following the law in the way it is allowing Texas oil and Natural Gas to be developed.

I think reimposing the crude export ban in the US (or change to allow exports only to Mexico and Canada) that was removed in 2015 is a good idea. It would be interesting to hear the views of oil pros on this idea.

Dennis, respectfully, Mike wrote…”But to be clear, you are good with private mineral ownership dictating when the very last of our nations minerals are produced. THAT comes before long term national security and the future well being of the nations children. “… and several other times he writes that producing the Permian Shale is “draining our children’s future”. Whether it’s exported or not, it is still draining.

I may be missing something, but sounds to me like Mike wants to keep the Permian Shale in the ground for the future when apparently the global crude supply is tight. Whether our shale production is exported or consumed internally doesn’t make a difference to me. If things get lean in the future… we will adapt and slow down exports to keep more oil supply domestic. Meanwhile it’s time to make hay.

As for the TRRC, if Mike knows Craddick or someone else at the TRRC did something illegal, he should report them. In my opinion, the TRRC isn’t in the business of acting outside the law, they are there to promote and govern safe, fair and balanced production. Not saying they are perfect…. but pulling ~5 million BOPD out of the Permian is a wonderful thing and supports countless businesses, county tax rolls, salaries, charities and personal consumption budgets…. so the TRRC system is working fine by me overall.

Anyway, a nutty discussion all around. Done with it.

At this time I’m not seeing a big drop in US shale this decade, unless prices collapse again.

North Dakota seems to be good example. It’s the most mature large shale basin. There aren’t many rigs running there. But there are enough to keep production over 1 million BOPD.

In Enno Peters’ recent Permian post, he notes that even with the drop in rigs in the Permian, there are still more than enough running to maintain current production rates.

Production might not grow a lot more, but it won’t collapse unless we go through something like GFC, COVID, and government stimulus doesn’t happen or doesn’t work next time.

However, once the good shale locations are used up, then what?

Shallow sand,

If prices for petroleum and nat gas remain where they are now, output will fall, at higher prices output may fall a bit more slowly. After 10 years output of tight oil is very likely to fall, sooner perhaps.

So peak oil has arrived.

Anon,

Not in my opinion. Peak in about 5 years at 84 to 85 Mb/d is my guess. If oil and natural gas prices remain at current level then yes peak remains 2018, but I think it unlikely that oil and natural gas prices remain low beyond 2023.

Isn’t Powell trying to prevent that? The 2008 recession smacked the price of oil down 5 fold.

If energy gets more expensive from here on out, it will do the work of Powell for him and throw cold water on economic activity.

@anon – no – powell is not trying to prevent a recession – falls into “not my job” category.

https://www.pbs.org/newshour/economy/federal-reserve-rate-hikes-likely-to-cause-a-recession-research-says

https://www.bloomberg.com/features/2022-federal-reserve-recession-inflation-response/#xj4y7vzkg

fed focuses on two things – inflation and jobs. job market is still sizzling. target for inflation is 2%. Last print was about 4%. so inflation reduction is the priority. Consensus Estimates are as follows: 2Q23 – 4.2%, 3Q23 – 3.5%, 4Q23 – 3.2%, 1Q24 – 2.8%. And a lot of the drop in the last monthly was due to energy prices.

https://www.nytimes.com/live/2023/06/13/business/cpi-inflation-fed

so if energy goes higher then the fed will have no choice but to do WHAT IT JUST SAID IT WOULD DO in any event – which is raise rates 2 more times. No where in that equation does “high oil prices = doing fed job for it” leading to rate cuts and stronger economy. Operation Break Shit is still on.

the nasdaq just went on a 50% run. that’s crazy. very little of that flow went to oil. if the fed reverses course and cuts a portion of that flow will go towards oil and push about $100 in short order. powell can’t risk it.

Anon,

When Oil prices were highr from 2011 to 2014 the World economy grew about 3% per year on average in constant US $. There may indeed be a recession, then central banks will ease rates and growth will continue. Higher oil prices up to $100/bo are not likely to be a problem and it will be good for oil producing regions.

Powell can do nothing . The recession is here . Leading indicator .

” Apple saw its sales tumble 27.5 percent to 53.3 million units from the year-ago quarter. The iPhone 14 family made up 78 percent of that number.

This was the worst quarter since 2014 for smartphone shipments with total sales of 250 million units. Compared to last year, sales declined by 19.5 percent and this could be attributed to the gloomy global economic environment. In contrast, 301 million smartphones were shipped in Q4 2022

Finally the Eurozone concedes it is in a recession . Can’t keep lying all the time .

https://www.dlacalle.com/en/global-economic-surprise-plummets-as-eurozone-enters-recession/

It’s not just Powell that has no power. All these rate cuts in China are having absolutely no effect.

Interest rates cuts are really just signals to the markets/banks to do their job and lend money.

Banks aren’t going to lend just because central banks want them to. Rates go to zero globally.

Money will be cheap but not plentiful. Oil will be cheap but not plentiful. It’s what a global recession/depression looks like.

Despite Hole in Head proclamation of terminal economic decline of India a few years back, that country has grown, and then grown.

“India’s GDP touched the US$ 3.75 trillion mark in 2023: Union Finance Minister, Ms. Nirmala Sitharaman informed on June 12, 2023, that the gross domestic product (GDP) of India has touched the US$ 3.75 trillion mark in 2023, up from around US$ 2 trillion in 2014.”…”lifting the economy’s uptick in 2022-23 to 7.2% from the 7% estimated earlier”

And just “13 hours ago — India’s largest airline IndiGo has announced a 500-aircraft deal with Airbus, a record in aviation history. The agreement has topped the …”

Looks like they have considerable confidence in domestic demand, and the ability to find fuel. Either confidence or simple wishful thinking.

There never will be a pre covid 2019 economy . Nett surplus energy is declining . Aviation still behind the clock .

https://www.energyintel.com/00000187-e82b-d9d3-a7b7-e8efe1270000

I’d like to see all (or 99%) air flight permanently disappear in short order.

I am aware that this would be devastating for certain sectors of the economy, but it is all optional consumption of energy and of the biosphere…civilization would continue on.

I certainly do not expect this sector closure to happen. People will use up whatever they can until its all gone.

The India air order of 500 new planes is an indication that despite global slowing growth or even recession, that certain sectors of heavy energy consumption are and will continue to be funded and expanded, in this world of 8 billion soon to be 9 billion.

Even as billions hover at the level of bare subsistence, there are other billions with purchasing power to consume ever more energy, and energy derived products and services.

In short, I wouldn’t be holding your breathe for the time when demand/consumption for energy declines. If not whale oil, then kerosene. If not wood then coal. If not jet fuel then bunker fuel. In fact…all of it.

The IMF in its April 2023 World outlook has World real GDP growing quite slowly over the 2023 to 2028 period, an average annual rate of only 2.56%. For comparison from 2010 to 2019 the average annual growth rate for World real GDP was about 3%. No depression forecast, but growth may not be very robust.

Again? So peak oil #6 of this century in 2018 has been dispatched by yet another? When is it going to end!!!! The horror!!

Again? Peak oil was predicted in the past, and it didn’t happen!

So this means it just ain’t ever going to happen!!!!

When will these damn fools stop predicting oil production will begin to decline. When any damn fool should know oil production will continue to increase forever! The horror!!! 😫

To Ron:

Oh please. I am making fun of the incessant claims since Colin Campbell’s 1990 global peak oil claim, I accept Hubbert’s math on the profiles of extraction of non-renewable resources published in 1956 without question.

I simply note, as McPeaksters tend to forget, that if peak oilers aren’t lamenting the last peak that didn’t happen, they then eagerly await the opportunity to claim the next.

And the irony that we’ve been post peak globally (#6 claimed or occurred) for 5 years now doesn’t slow down their illogical Peak = Doom routine for a nanosecond. “The horror!!!” indeed.

RGR stated: Oh please. I am making fun of the incessant claims since Colin Campbell’s 1990 global peak oil claim,…

Bullshit Your snarky comment was in reply to someone who simply stated: So peak oil has arrived. They were not predicting a future peak but simply acknowledging the peak that happened five years ago.

But it’s not your fault. You cannot help the fact that you are a helpless cynic without any knowledge of how to make an argument without snarky, cynical comments. No, it’s not your fault. It could be because a child, you were bullied on the playground. 🤣

It’s actually Peak Bookkeeping that we should be monitoring. At some point, new bookkeeping tricks will cease to have an impact and the reality of the constraints will hit everyone. There’s also the related concept of Peak Smokescreen, where the utility of mentioning climate change as a mitigation carrot stops working. Not clear how soon the smoke will clear, but as long as climate scientists and geophysicists can’t figure out the patterns of change people will follow along.

BTW, example of near-Peak Bookkeeping: The USA only extracts 12 million barrels of crude oil per day from its territory, while USA also consumes 20 million barrels/day. Always cooking the books when it comes to crude.

Paul,

Not quite right on the bookkeeping. We extract about 12 Mb/d (11.88 in 2022) and we input about 16 Mb/d of crude oil to refineries (15.93 in 2022), net imports of crude are about 4 Mb/d. Actual imports are about 8 Mb/d because we export about 4 Mb/d (3.6 Mb/d in 2022) of tight oil that we do not have refinery capacity to utilize. The refineries were designed to handle mostly heavier grades of oil rather than tight oil. A lot of the 20 Mb/d consumption is propane, ethane and butane (so called LPG) about 4 Mb/d.

Above my pay scale , but here is a tweet on inventory adjustment and oil book keeping . Please analyze and comment .

https://twitter.com/ALikhodedov/status/1672010207436718082

Dennis, That’s my point. Lots of detailed bookkeeping tricks go into the numbers which make it look like the USA is net exporter of crude oil on first glance, that is without diving deep as you show.

“At this time I’m not seeing a big drop in US shale this decade, unless prices collapse again. ”

Shallow,

I love your comments. Have learned much from your thinking.

Just when I am convinced Peak Oil is about to bite. An oil pro thinks US Shale has a plateau of another decade.

I have an a**hole and an opinion like everyone else. Mine is just a far less qualified butth*le……LOL!

With shale there appears to be no moderation or steadiness. Shale production climbs rapidly and then declines rapidly. (Famous “sharkfin” production profile of shale). I don’t buy that shale production will plateau and I don’t see anything making up for a decline in U.S. shale production, which is coming soon.

**I’m an enthusiast and not a pro like some of these guys here.**

Anon,

See chart below from

https://novilabs.com/blog/permian-update-through-april-2023/

In the post above Enno Peters says of the chart below for potential Permian Basin tight oil supply:

This number of active rigs (333) is however more than sufficient to maintain current output, assuming no changes in rig & well productivity. The following overview, from our Supply Projection dashboard (available to subscribers), reveals that if one assumes a drop 100 rigs from now until September 1st (top chart), Permian production will plateau at the existing level (bottom chart).

I do agree that tight oil output will decline rapidly after 2030 or so, demand for oil may be waning at that point as the land transport fleet moves to electric over the next couple of decades.

I dont understand how he thinks. How does he reconcile a very vertical decline thats empirically observed with his prediction of a nearly perfect flatlining of production? It seems like fantasy/fiction.

I agree the history hasn’t necessarily shown this, but investor / bank discipline seems to have been instilling this more moderated strategy for several years now. Like you said, the experts on the thread can probably speak better to this, but the industry could certainly organize itself to maintain flat production if that were the goal – it’s just math.

it’s really a question of investor sentiment and the slide deck pitch. if you’re pitching “forever and exponentially rising production” and can show that increase over 3 quarters then sit back and watch the hot venture capital money flow in. if your slide deck shows a nearly guaranteed 15% return over 7 years, then the Warren Buffet money will flow in.

Anon,

See

http://oilpeakclimate.blogspot.com/2014/06/oil-field-models-decline-rates-and.html

Unfortunately I have lost the charts for this post, but a simple Bakken Model Can be found here.

https://docs.google.com/spreadsheets/d/1o30YdXx5zNZOV-bpcKEHU8uAZIF8Wym7/edit?usp=sharing&ouid=105320434049434900507&rtpof=true&sd=true

Bakken well profile below for model above, note that the average well actually becomae more productive from 2014 to 2018 and remains more productive in 2022 relative to 2014.

See

https://public.tableau.com/shared/7G7D67544?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Anon,

The average well profile is convolved with the wells added per month over time as shown in chart below for bakken model on spreadsheet, note that this model was from June 2014, I only had data through April 2014 at that time, wells added after April 2014 is a guess, the wells added are constant from April 2015 to December 2020 for this model at 95 new wells completed each month over that period.

The resulting model when the well profile (assumed not to change from April 2014 to December 2020) is convolved with the number of wells completed per month is shown below.

This is basically what Enno Peters has done in his supply projection for the Permian basin (the well profile is different and the number of wells completed per month, but the technique is the same.)

I wonder what folks make of this, according to Goehring & Rozencwajg – Hubbert’s peak is finally here

https://blog.gorozen.com/blog/hubberts-peak-is-finally-here

I’m not a pro regarding shale. I don’t think companies are making much money now either, at current oil and natural gas prices.

Companies didn’t make much 2017-19 either. But it seems that they keep plugging away unless prices collapse to where they are really losing a lot of money.

I’m just noting what I read in the most recent Enno Peters post about the Permian. There have been about 5,500 shale wells completed there every year for the past few years, except in 2020. I assume they have a few more years of locations at that rate, although it does appear issues are forming, and have been for awhile. GOR, WOR, and other issues which Mike, LTO point out.

But I see the Bakken is hanging in there without many rigs, and has for awhile.

I’m not saying there will be growth, but that there isn’t going to be a big fall off a cliff. Not until the locations have ran out. Then production will really fall. Easy to see that in the charts. Majority of oil comes from wells drilled in last 2-3 years.

I’m just assuming the drilling won’t stop, or even slow much, until we run out.

I do see it’s going to be close to 110 in Midland, TX this week.

I do wonder about whether the water be there to frac the remaining inventory.

Shallow sand,

Thanks for your comments, I know tight oil is not what you produce, but you are an oil producer and know much more than most of us (except Mike S. and LTO Survivor perhaps) about US oil production. I expect there may be more recycling of frack water and produced water as water becomes more scarce in West Texas.

Article below discusses some of this for Texas

https://abc13.com/hydraulic-fracking-wastewater-recycling-texas-earthquakes-oil-companies/12591057/

My exectation is a slow rise in tight oil output to about 9 Mb/d by 2028 or so, then a brief plateau until about 2032, followed by fairly steep decline as the Permian runs low on profitable locations (tier one and tier 2) to drill new wells. Potentially high oil prices might extend the plateau to 2035, but I expect we may see falling oil prices after 2030 so output may fall rapidly as completion rate slows due to lack of profits.

With regard to oil prices, it seems like they are dependent upon the world economy, at least somewhat.

I don’t have a good idea of how the transition from oil will occur. I think you are predicting a price collapse due to lack of demand resulting from transition.

That could very well happen, but the timing is key. Demand is still rising and the renewable build out will require a lot of oil.

My oil price prediction continues to be a range of $35-$150 WTI. Which means I have no idea, but feel both of those numbers will cause a major supply response.

shallow sand,

I also don’t know what will happen to the price of oil in the future, but my expectation (aka guess) is that oil prices will rise to $90/bo or higher over the 2024 to 2030 period, over this time there will be a gradual shift to EVs and plugin hybrids from ICEVs, eventually we will reach a point where demand for oil may be falling faster than the supply of oil at the market oil price in 2030 or so (perhaps $95/bo in 2023$) and oil prices will gradually fall so that supply and demand match. I don’t expect a sudden crash in oil prices, prices will gradually adjust lower so that more expensive oil is priced out of the market (mostly tight oil and perhaps some ulta deep water projects and Arctic oil projects). I expect tight oil output may fall pretty rapidy in such a scenario and new offshore projects may also cease and higher cost offshore platforms may be shut in. My oil price scenario used for my Permian basin scenarios below, oil prices fall after 2035 from $80/bo in 2022$ to $35/bo by 2040.

Dennis,

Do you have any thoughts on net energy? Declining EROI. The oil industry using more and more of its own oil to keep going looks like it can be a rapidly approaching problem with depletion.

Anon,

I don’t think it wise to evaluate net energy at an industry level, the Oil industry uses many energy inputs besides just oil, electricity, natural gas, NGL, etc. All that matters at the industry level is profits, nobody considers net energy, it is not evaluated. On a society wide level for all types of energy it is an important consideration.

I use papers such as the following as my guide.

https://www.mdpi.com/2071-1050/14/12/7098

I met with a surface landman last week working for XOM in the Delaware basin.

Water is selling for $0.85 a barrel.

How much water are they using to frac these Delaware Basin wells?

An alternative Hubbert Linearization using 2009-2018 data gives a URR that is closer to reported OPEC reserves excluding Orinoco Belt Oil, URR=1490 Gb, remaining resources 919 Gb at end of 2020, BP reported conventional OPEC reserves at the end of 2020 were 953 Gb, about 34 Gb more than indicated by my HL estimate. Chart below has revised OPEC HL.

Hubbert model for OPEC matching HL chart above, peak year is 2034 at 36.2 Mb/d, seems quite optimistic at current oil prices, but if oil prices increase to $90/bo or more perhaps the rate of resource development in OPEC nations will increase (especially big 5 producers). Previous peak was 2016 at 33.8 Mb/d, currently OPEC can probably produce about 32.5 Mb/d (with no OPEC cuts), with sanctions relief for Iran, perhaps 33.7 Mb/d within 6 months. So we would need to see a 250 kb/d on average each year over the next 10 years for the 36 Mb/d peak to be realized, even at $90/bo probably a stretch, who knows how high oil prices might go over the next 7 years, not me. A more likely scenario is a plateau around 31 to 34 Mb/d for the next 10-15 years for OPEC, if demand for oil holds up.

Denis, how much do horizontal drilling and water injection skew the peak to the right? And how much would we need a perfect world scenario to make such a clean curb come true? I would guess that sanctions and political struggle will take a toll on the peak, which will stay well below 35.000 kb/d. And then there will be a much steeper downturn:

West Texas Fan Club,

I agree OPEC output is likely to remain below 34 Mb/d, I believe I said that in my initial comment, I also agree it is unlikely the Hubbert curve will be followed for many reasons, chief among them may be a lack of demand for oil after 2035, though this might not affect OPEC as they likely have the lowest cost oil in the World. The low demand for oil will hit higher cost producers first.

My preferred model is the Shock Model. The Hubbert linearization favored by some points to a URR of 1490 Gb for OPEC, note that I have excluded the 260 Gb of Orinoco Oil Resources from the BP Reserves estimate. There has been 571 Gb of cumulative OPEC C plus C output up to Dec 31, 2020. So URR minus cumulative production=remaining resources=1490-571=919 Gb. If the peak gets pushed to the right as you suggest then it might occur at 900 Gb rather than 745 Gb as in Hubbert model. If we assume a plateau at 32 Mb/d=11.68 Gb per year, then from cumulative production at the end of 2022 (593 Gb) we would have 900-593=307 Gb/11.68=26 years plus 2022=2048 for end of plateau. Note that the Hubbert Curve reaches 900 Gb in 2045.

In any case I don’t think the HL method gives a reliable estimate. For the World I expect something like chart below. Not sure specifically how it will break out between OPEC and non-OPEC.

If I’m reading Laherrere‘s recent work right, He expects sharp decline (>7%) to start by 2025, losing almost 1 mb/d annually. Also, based on his chart, it appears the plateau phase will be 5/6 years (which means we are right in the middle of the plateau).

Covid likely made it trickier to see the plateau phase and also likely flattened the peak to some degree…

Kengeo,

Laherrere assumes the curves will be symmetric, just look at the Alaska curve to convince yourself this is a poor assumption. Also consider the centered 12 month average of UK C plus C output in chart below. Most oil output curves are not symmetric. My tight oil scenario has an average annual decline rate of about 12%/year from 2030 to 2040, so pretty steep.

Dennis

Those bumps up in Alaska are new fields. Using a few extra logistics accounts for the new fields and would give a slightly better result.

As for logistics, I think that was a reasonable assumption by Hubbert back in the 50s when wells were vertical and the reservoir pressure dropped as more wells were drilled and oil was removed.

I think that horizontal wells, along with pumping water into the well to maintain pressure along with other enhanced oil recovery methods cannot be modelled using the logistic function, IMO.

Ovi,

I tend to agree. Only presenting it as an alternative to the shock model which some don’t like, the geological analyses suggest a World URR on the order of 3500 to 4000 Gb for technically recoverable resources, if we had good cost curves we could evaluate how much of the oil might be produced under different oil price scenarios, but most of the cost curves I have seen severely underestimate actual production cost in the case of tight oil.

The Hubbert type analysis points to a URR in the right ballpark in some cases, but depending upon the choices one makes for data to include in and HL one can get very different results, in the case of OPEC between 950 and 1500 Gb so the method is not all that reliable. For non-OPEC including or excluding tight oil can change the result by a factor of nearly 2 for URR and likewise the choice of data to include can change the analysis to a large degree.

Overall the results are very subjective, though the choice of URR for a shock model is also subjective, I use the average of a 2500 Gb HL estimate and the USGS conventional oil estimate of 3000 Gb as a starting point and take a number in the middle (2750 which I round up to 2800 Gb). This is also subjective, but note that my overall URR for my best guess shock model is 2650 Gb with conventional oil at about 2470 Gb in line with the conventional HL oil URR estimate.

On Alaska there was one very large field that dominated output, what I am referring to is the slope of the curve when output was increasing vs the downslope which is far less steep. Using multiple logistics would seem to introduce more subjectivity into the analysis from my perspective. Also it seems the point of such an analysis is to simplify, there are a lot of fields in the World, fitting a logistic to each one would be pretty time consuming.

Found an interesting graph in Laherrere’s May 2023 paper:

Apparently, he sees a very sharp decline eminent.

I believe his URR works out to 2,600 Gb, which I believe also matches your shock model.

Dennis – For your shock model, the bulge from present to ~2035 doesn’t look real, I don’t think a world production curve would have any way to fit that arc you have shown.

My low estimate is slightly higher than Laherrere’s, if his graph turns out to be right, by 2028 that will put world production down 10 mb/d over ~10 year period.

Decline would be right about 1 mb/d…

Kengeo,

That chart for Laherrere is for conventional crude oil only, he also has unconventional at 135 Gb, though this is likely an underestimate, his estimate for tight oil URR is 35 Gb. Proved tight oil reserves at the end of 2021 for the US were 24 Gb and cumulative tight oil output from Jan 2000 to Dec 2021 was 21.6 Gb, so we would expect a minimum URR of 45.6 Gb, but note that 2P reserves tend to be about 1.7 times proved so 2P reserves are about 41 Gb plus cumulative production would be 65 Gb, the USGS estimates the mean TRR at about 100 Gb, my URR estimate bsed on well profiles and area left to be developed is about 80 Gb with a conservative oil price estimate, in short Laherrere’s URR estimate for US tight oil is far too low in my opinion.

Laherrere’s estimate is for conventional oil my estimate is for all C C. In chart below I have World C plus C and World C plus C minus US tight oil. This scenario assumes the rate that oil is developed continues at the pace of the past 104 years and that extraction rates for conventional oil increase from 5.1% in 2022 to 5.3% in 2028, note that in 2018 the World extraction rate for conventional producing reserves was about 5.4%, extraction rates decreased during the pandemic due to lack of demand, they can certainly increase as OPEC nations are currently cutting back on output. Producing conventional reserves from 2018 listed below for my model (multiply by extraction rate for conventional output):

490.34

491.28

493.66

495.32

495.49

495.01

493.90

492.19

489.92

487.11

483.78

480.03

475.92

Extra heavy output from 2018 (Mb/d):

3.76

3.86

3.39

3.82

3.94

4.04

4.12

4.16

4.21

4.30

4.35

4.39

4.41

CHART OF THE DAY: Deflation in the American oil patch.

The cost of benchmark oil country tubular goods (aka, drilling pipe) is down ~40% from the all-time high set in late 2022, easing pressure on US shale companies . —- Javier Bias

I don’t know if I’d call that chart deflation.

Let me know when it gets back to 2019 levels.

Shallow sand,

Deflation=falling price.

Dennis.

Hasn’t fallen below pre-pandemic. Still way above.

I actually pay for tubing. It has stabilized for us at $6.06 per foot for used, tested gas storage well pipe. It was $2.50-$2.80 pre-pandemic. 2 3/8”.

So it all has to do with your frame of reference. Yes, it has dropped since 2022.

I could go on and on about how much more everything costs compared to 2019 and prior. But I think you and everyone else here are aware of that.

Shallow sand,

Yes costs are much higher now than before the pandemic, hopefully prices will continue to fall for steel tubing, a pretty steep drop from the end of 2022, is this apparent in the used market, might be different and I do not buy steel tubes so would not know.

My apologies for offending you, not intended, I just say dumb stuff sometimes. I will try to be better or not comment at all.

Thats tubular steel, still double the recent times.

Other components of the cost equation not looking so ‘favorable’.

Labor costs for example.

Median real wages for adults over 16 full time in the US

2019Q4=362 1982-84 dollars, and 2023Q1=363

I believe the problem is finding workers in the oil field. Also lots of other costs have increased along with steel tubing.

Chart from

https://fred.stlouisfed.org/series/LES1252881600Q#

Remove 20-22 Data (Noise do to Pandemic)