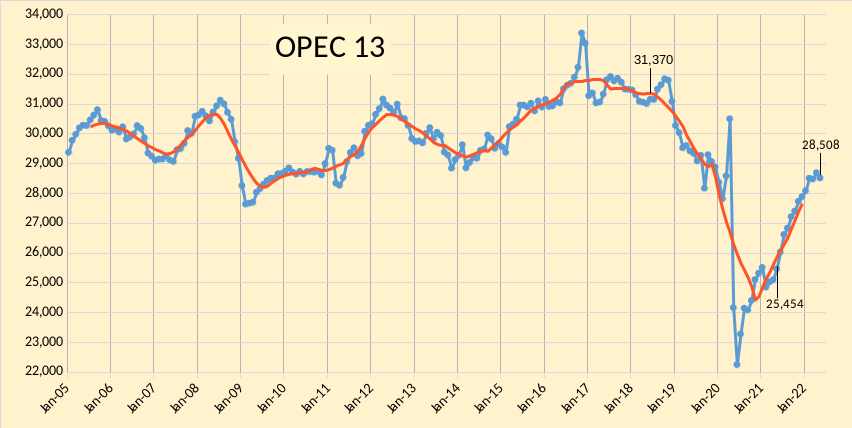

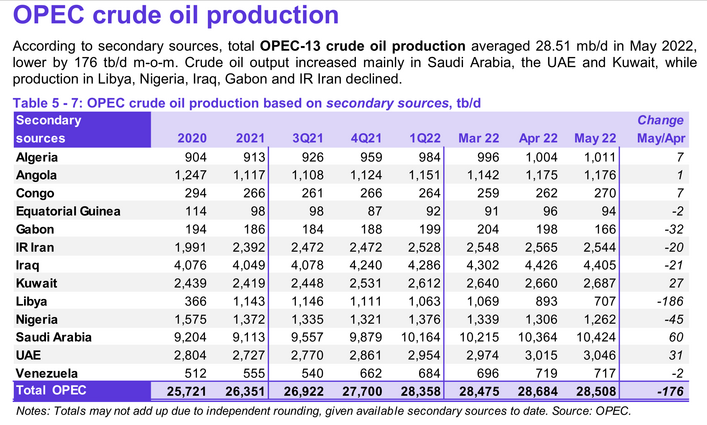

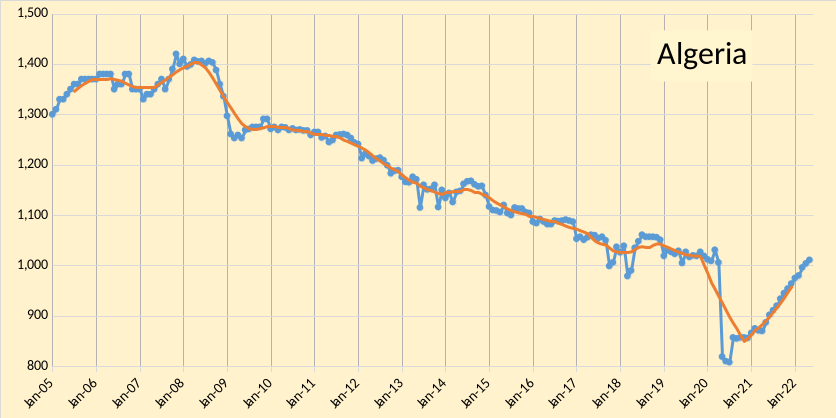

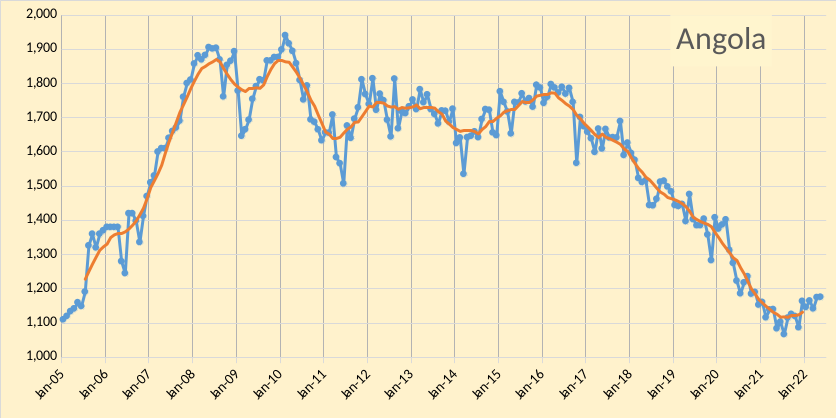

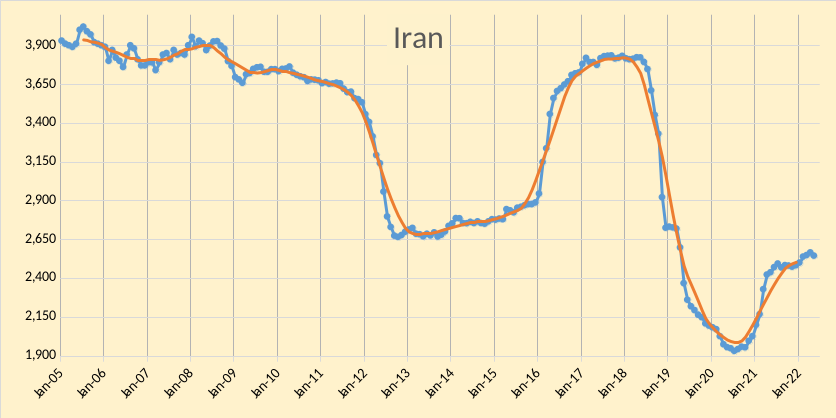

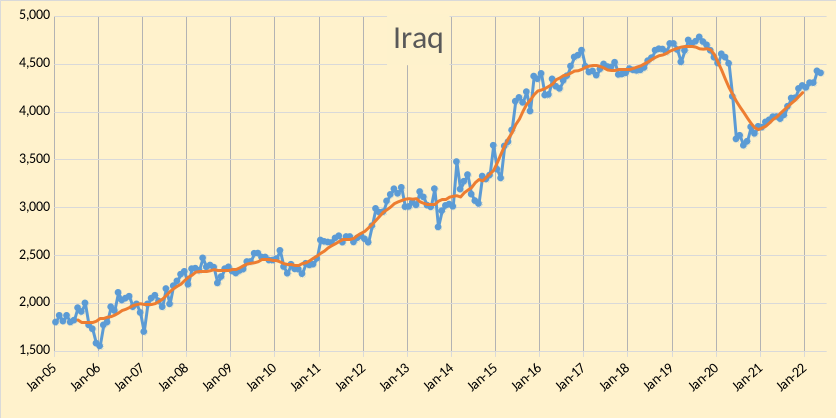

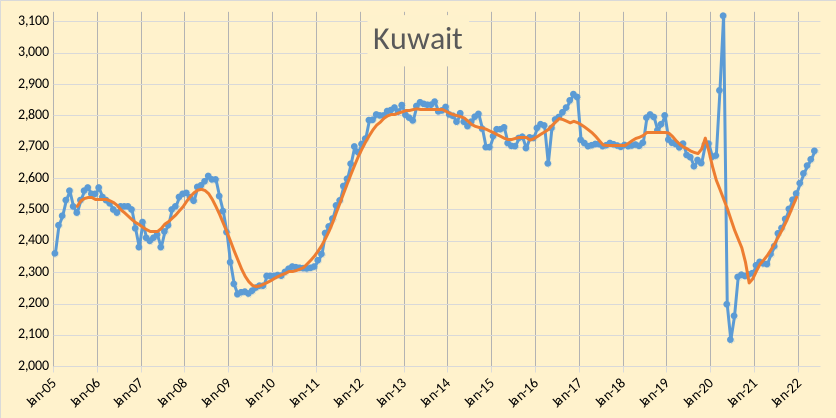

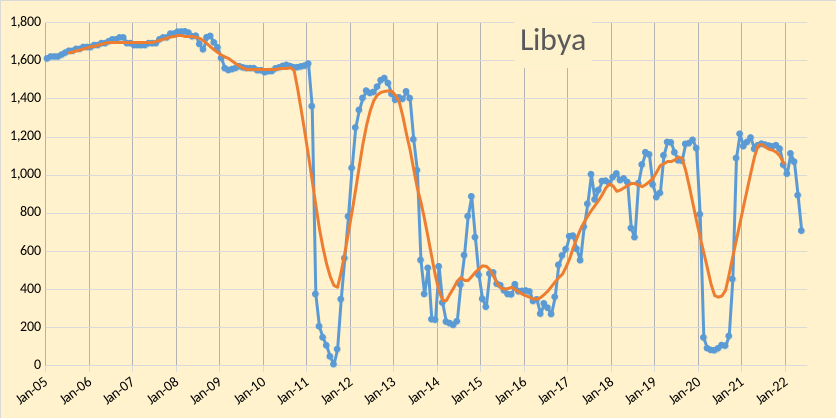

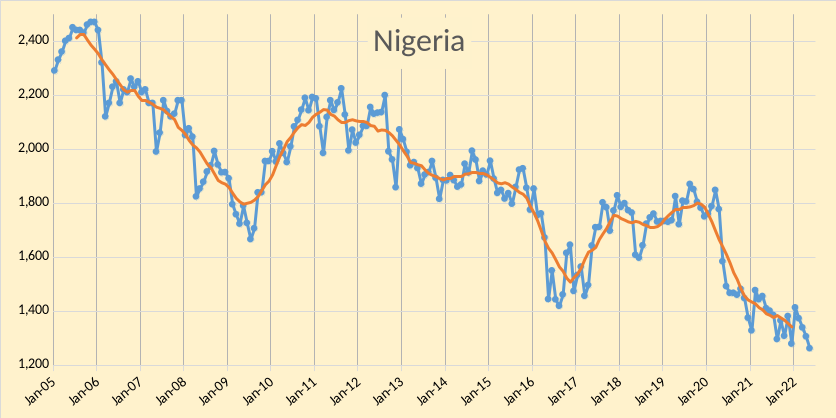

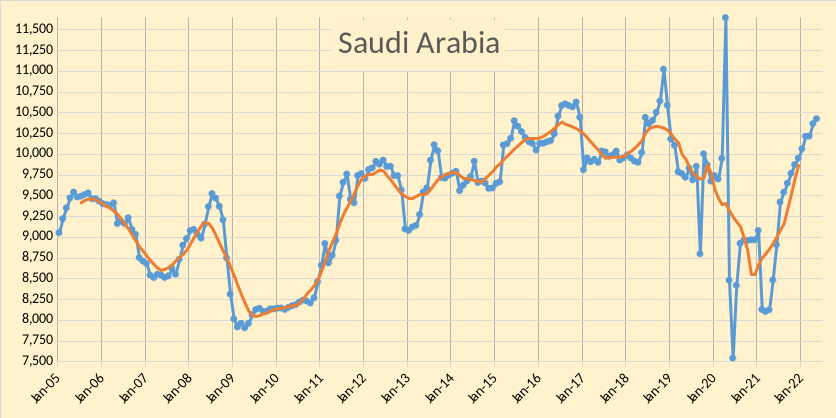

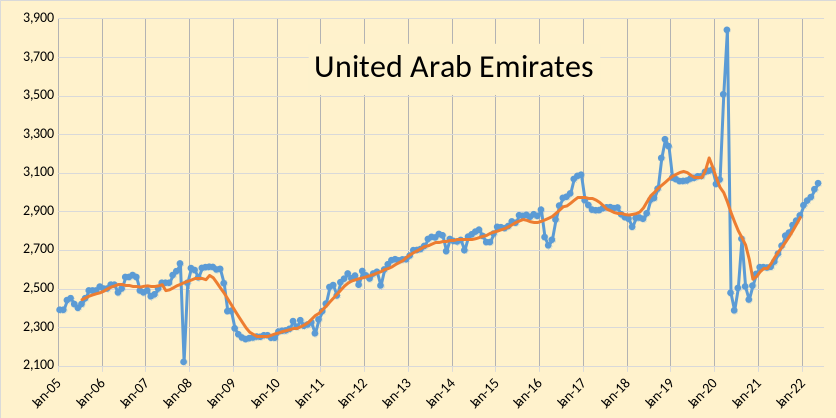

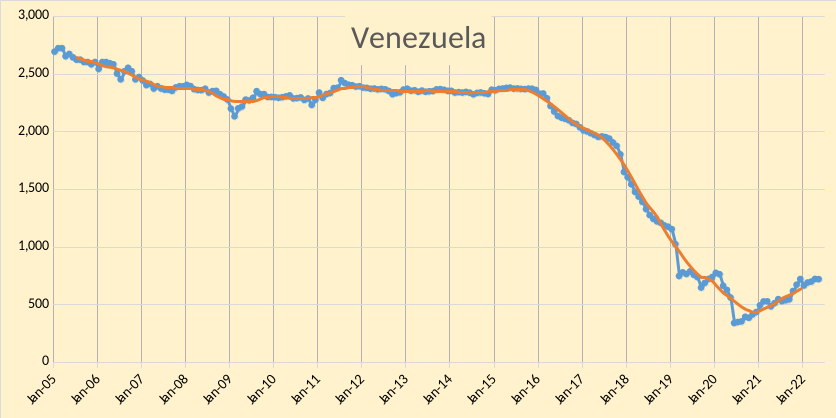

The OPEC Monthly Oil Market Report (MOMR) for June 2022 was published last week. The last month reported in most of the charts that follow is May 2022 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In most of the charts that follow the blue line is monthly output and the red line is the centered twelve month average (CTMA) output.

OPEC output decreased by 176 kb/d according to secondary souces in May 2022. March 2022 output was revised down by 20 kb/d from what was reported last month and April 2022 output was revised higher by 36 kb/d compared to the May 2022 MOMR. All of the decrease in OPEC output was from Libya(-186 kb/d) and for the other OPEC nations increases more than offset decreases by 10 kb/d. Six OPEC nations had higher output and 7 had lower output with Libya’s decrease about four times the next biggest decrease (Nigeria at -45 kb/d).

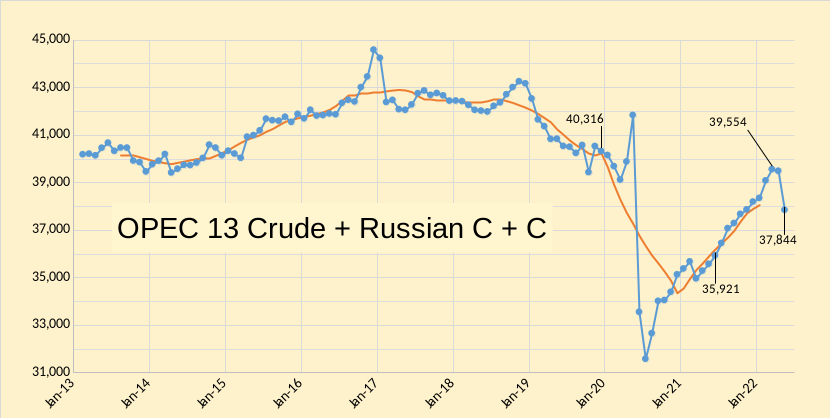

In the chart below we have Russian C + C and OPEC crude oil output. It is doubtful that any OPEC increase in the future (mostly from Libya if they recover from the recent decrease in output plus a small increase from Iraq and UAE of perhaps 200 kb/d combined, with most of this from Iraq) will offset future decline from Russia. I expect OPEC plus Russian output to continue to decrease by as much as 750 kb/d from the May 2022 level over the near term (next 18 months) or to approximately 37,090 kb/d. It is doubtful that this 2500 kb/d decrease in World output can be replaced by increases in the US, Canada, Brazil, China, Norway, and Guyana over the near term which suggests high oil prices unless the coming World recession is severe (1% annual real World GDP growth rates or less.)

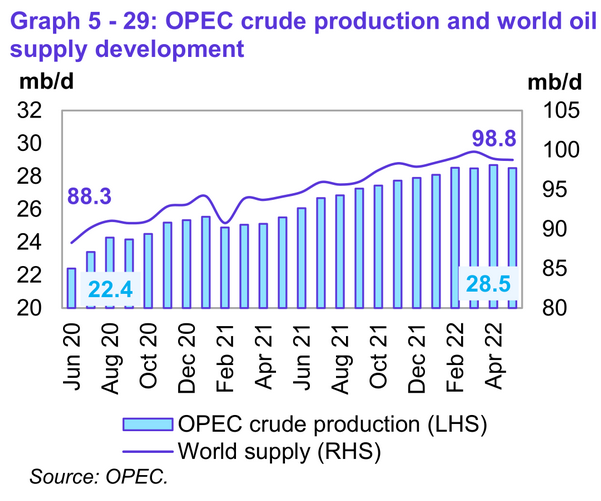

Global liquids output decreased about 150 kb/d in May, note that Libyan output decreased by 186 kb/d in May.

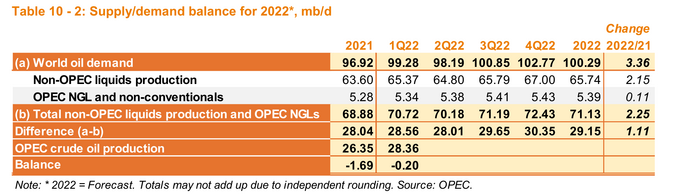

Based on OPEC’s estimate for the balance of World supply and demand, World oil stocks would have decreased by 617 million barrels in 2021 (1.69 Mb/d times 365 days). The forecast in Figure 5 above for non-OPEC liquids output looks very optimistic and it is doubtful that the demand forecast is correct (high oil prices and a World recession are likely to lead to lower oil demand than this forecast.) If the forecast were correct, it is highly unlikely that OPEC would be able to meet the call on OPEC crude for 3Q22 and 4Q22 and we could see World oil stocks fall by another 300 million barrels in the second half of 2022. For 2021 and 2022 we would see a decrease in World oil stocks of about 900 million barrels (this includes non-OECD oil stocks).

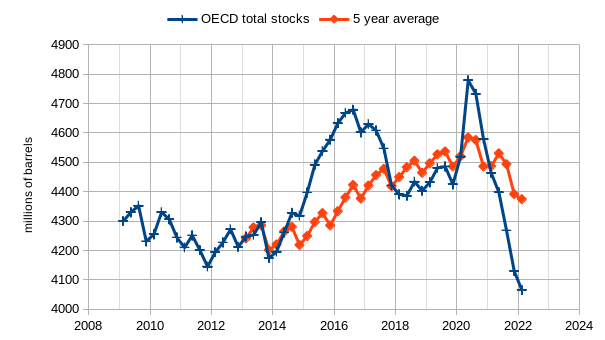

The chart above shows quarterly OECD total oil stocks (both commercial and SPR) from 1Q2009 to 1Q2022 and also the trailing 5 year average for OECD total oil stocks. The low point for the 5 year average was 4Q2013 at 4201 million barrels, 1Q2022 OECD total stocks were 4065 million barrels about 136 million barrels lower than the lowest 5 year average of the last 9 years. Also note that OECD total oil stocks fell by 449 Mb in 2021 out of an OPEC World estimate of 617 Mb, about 73% of the total stock decrease. Unfortunately we do not have very good data for non-OECD oil stocks. Typically the low level of OECD stocks that we currently see, results in very high oil prices in the absence of an economic crisis (similar to 2008/2009 or worse). Based what I see now, I would expect oil prices in the range of $100 to $150/bo for Brent crude over the next 12 months, but the odds are very low that this guess is correct.

As you can see from Dennis’ top graph, OPEC 13 is almost equal to their pre-covid level. The OPEC big 5, Saudi, UAE, Iran, Iraq, and Kuwait are almost one million barrels above their pre-covid level. The other 8 however, are over one million barrels below their pre-pre covid level… and falling. The non-OPEC part of OPEC+ is not helping. They are declining as well… big time.

Prices are high but a recession is almost definitely coming. But production and demand will likely fall. Things just don’t look good for the world economy.

Ron,

I agree the World economy does not look good, how severe the recession will be is unknown. A combination of higher output due to high oil prices and lower demand due to high prices and the coming recession may cause World output to continue to fall over the near term, difficult to predict when economic recovery begins, but my expectation is a short mild recession with recovery starting in 4Q2022 or 1Q2023.

“Bot production … will likely fall.”

I wish! Great typo!

Ron,

From Jan 2008 to May 2022 the average annual decline rate of the “other 8” OPEC producers is about 340 kb/d per year. Most of this decline comes from Venezuela and Libya over that period (2008 to the present). The other 8 minus Venezuela and Libya has an average annual decline rate of about 141 kb/d per year over the period starting at Jan 2008. Venezuela and Libya are likely to stabilize at around their current combined output level (current annual average level) over the next 7 or 8 years, and future decline for the other 8 OPEC nations may be about 140 kb/d, if I am correct.

Libya will not likely ever stabilize, I don’t know about Venezuela. Anyway, these are bit players in the big picture and any significant increase, if there is any, will still have to come from the big 5. I think all the big 5 are producing at their limits and have far more downside potential than upside potential.

I ran across this article, a wondered if people here agree or disagree with it and why. Any comments are appreciated.

“Eric Nuttall: OPEC running out of spare capacity confirms our multi-year bull case for oil

We have for more than a year argued the world was hurtling into an energy crisis of epic proportions that would result in a multi-year bull market for oil. Our bullish thesis had four basic tenets: persistent demand growth for at least the next 10 years, the end of shale hyper-growth in the United States, defined as shale production growth rates that no longer exceed global demand growth, stagnant production growth from the global super-majors resulting from eight years of insufficient investment and, finally, the exhaustion of OPEC’s spare capacity.

The hardest of these four core assumptions to prove by far was the last one. U.S. shale growth rates could be forecasted by talking with oil executives and modelling corporate cash flows. One could easily see that spending by the super-majors had peaked in 2014, falling to half of those levels today, while also being burdened by increasing pressures to decarbonize, so we could predict and model stagnant growth for years to come. And demand growth was boosted in the short term by the emergence from global lockdown, and is supported over the medium-to-long term by the realities that limit alternatives from reaching enough critical mass to meaningfully displace oil in the next several decades.

OPEC’s spare capacity, however, was the tricky one. Monthly data released by several different sources can vary wildly. Given the strategic importance of oil revenue to many Gulf States, hard data on productive capacity has at times been viewed as state secrets and either difficult to get or taken with some skepticism. How then can we be so confident that OPEC’s spare capacity is nearing exhaustion? Because they just told us so.

In his keynote speech, Barkindo warned that “OPEC is running out of capacity,” and that “with the exception of two or three members, all are maxed out.” Further, “the world needs to come to terms with this brutal fact” and that it is a “global challenge.”

Full article here:

https://financialpost.com/commodities/energy/oil-gas/opec-exhausting-spare-capacity-confirms-oil-bull-case

CB,

I think the part you quoted looks right, didn’t read full article.

Thanks for posting this CB. It is a fantastic article. I did read the whole thing. In fact, I found it hard to stop reading. And the article is only four days old. Here is one paragraph I found especially interesting, bold mine.

OPEC’s spare capacity, however, was the tricky one. Monthly data released by several different sources can vary wildly. Given the strategic importance of oil revenue to many Gulf States, hard data on productive capacity has at times been viewed as state secrets and either difficult to get or taken with some skepticism. How then can we be so confident that OPEC’s spare capacity is nearing exhaustion? Because they just told us so.

Last week, the Royal Bank of Canada hosted a spectacular energy conference in New York with the highlight being a keynote speech by Mohammed Barkindo, the secretary general of OPEC. That same night, I had the good fortune to have dinner with him, which to an energy enthusiast was the equivalent of a tech investor getting to hang out with Elon Musk. I found him to be a warm, insightful, soft-spoken and, surprisingly, straight-talking gentleman.

In his keynote speech, Barkindo warned that “OPEC is running out of capacity,” and that “with the exception of two or three members, all are maxed out.” Further, “the world needs to come to terms with this brutal fact” and that it is a “global challenge.”

It is difficult to describe the immense satisfaction that came on that day, to have one of the core underpinnings of our thesis, still wildly underappreciated by investors and the oil market alike, be affirmed by the head of OPEC.

Hey, wake up and smell the coffee people. OPEC is out of spare capacity, the US shale boom is almost over, and the world is on the downhill side of peak oil. Either oil will hit $180 a barrel soon or the world will go into a serious recession, possibly even a depression.

Putin’s timing a coincidence? I think not

He knows as much or more than Barkindo.

Ron,

I agree that OPEC is close to capacity at present, I disagree that the tight oil boom is over.

Dennis, simplify your very optimistic graph in terms like “we’re approaching the plateau phase” and you certainly could agree that the tight oil boom is, if not over, at least nearing its end. Whatever our perspective may be, peak oil is there or very close. IMO the war in Ucrania and the embargo against Russia finally tipped the balance towards the post-peak-fraction, future US tight growth will do nothing but compensate losses somewhere else.

Westtexasfanclub,

I believe my tight oil scenario is actually quite conservative, but agree the tight oil boom may end over the next 5 years and we will be at peak oil. I also agree this might only be enough to offset decreases in Russian output and we might struggle to reach a new peak in World output.

Much will depend on future oil investment levels in response to a high oil price environment.

If my view that the transition to electric transport will result in falling oil prices by 2030 or so were to become the mainstream view (this seems highly unlikely imo) then it would make investments in ultra deep offshore oil and artic oil and new oil sands projects less attractive and most new long term oil investment might cease. In that case the peak for World C plus C output might remain at the 12 months centered on Oct/Nov 2018, rather than 2028 which remains for now my best guess. I would change my view if I started hearing most pundits on CNBC repeating my thesis that peak oil demand is likely to occur around 2030, that will be the death knell for most new long term capital investment in oil production.

Sounds coherent to me, Dennis.

I don’t have so much of a problem with a second peak itself (even if it would be slightly higher than the one of 2018), but with the cornucopian interpretation of it: Everything is fine, there’s still plenty of oil, no need for mitigation … even if – as you wrote – this could boost oil production because it’s directing cash flow towards the oil industry.

To me this sounds like horizontal drilling of cash reserves: once the debt infill reaches a certain level, all money flow ceases and from thereon we will go down a steep cliff.

Something is telling me we’re in for a rough ride.

Westtexasfanclub,

I try to find a balance between “peak oil is the end of the world” and “there is plenty of oil, everything will be fine”. Reality is somewhere between these two views. Oil will peak (along with coal and natural gas over the 2028 to 2035 time frame with oil first, followed by coal, and natural gas last), the peaks will be due to a combination of geology and technology affecting both the supply and demand sides of the equation.

The transition will not be easy, but it will have to be done despite the many likely bumps in the road (including a potential economic depression due to financial panic when peak fossil fuels is finally acknowledged by mainstream analysts).

As always I have no special foresight about how this plays out, it could be very ugly, but some recognition of the problem and planning by governments might lessen the pain.

“Either oil will hit $180 a barrel soon or the world will go into a serious recession, possibly even a depression.” Never heard of high oil prices saving the world from a depression. But I think you mean that high energy cashflow would indicate a booming economy. IMO the crisis is already baked in and high oil prices will do nothing but accelerate its downfall.

In a sense, the reserve capacity of OPEC is not overwhelmingly important, what is key, is that they can now comfortably modulate their production to prevent any significant downslide in oil prices and nobody can do anything about it. If they are truly out of capacity financial pain will define the upper limit.

Old Chemist,

The biggest problem with OPEC reaching their capacity limit is that the mainstream economists still are under the impression that OPEC has 2 Mbpd of spare capacity, which is false. When most people catch on we may see a severe spike in oil prices, especially as 2 to 3 Mbpd of Russian oil may be removed from the market due to sanctions. For OPEC this could be a problem due to an acceleration of the EV transition that may result from very high oil prices (say $150/bo or higher). Under that scenario we might see demand for oil start to fall faster than supply by 2029 to 2031, oil prices start to fall, but supply only falls as fast as supply if oil prices continue to fall. OPEC then falls apart as middle east producers start to compete for market share and develop resources as quickly as possible, prices may fall to as low as $30/bo and a lot of oil may become a stranded asset due to lack of demand for oil. All of this takes place over about 35 or 45 years as World oil demand falls to about 30 Mbopd by 2078 or so.

I agree with you that when (not if) the world realizes we are past peak oil there will be a sharp increase in oil prices. If I look at the real price of oil from 1861 to present, I see the supply/demand curve from the old ECON 101 textbook. Not smooth ( we live in the real world where wars, pandemics and manic development of oil shale can bounce the price around) but we are really into the interesting part of the curve.

https://data.nasdaq.com/data/BP/CRUDE_OIL_PRICES-crude-oil-prices-from-1861

I think the use and price of oil after that spike will be far more nuanced than the scenario you outline above.

The jump in the price of natural gas in the last year has been a surprise, driven, as best as I can tell by demand from China to alleviate the air pollution in their major cities, and by Europe to compensate for an extended period of weak performance from their wind farms. The Ukraine war is now exacerbating the shortage, and fertilizer plants and other industries have been curtailed or closed to try and ‘get by’. During the winter, some Scandinavian power facilities switched to oil.

What is clear, is that standby fossil fuel generating capacity will be needed in substantial quantities for the forseeable future. A gas turbine is just a repurposed jet engine and can run on diesel or jet fuel instead of natural gas if the price is right. The engineering firm I worked for installed a 225 megawatt unit in a process industry, but only an interruptible gas supply was available, so we had to include a large diesel storage tank as part of the project (the turbine supplier was picky about the quality of the diesel).

Industrial boilers, lime kilns, cement kilns and other industrial applications are easily converted from one fuel to the other and when I first started working in industry, often came equipped to use either, depending on the competitive price of the fuel.

Cracking of high viscosity oil requires a lot of hydrogen, currently generated from natural gas but if natural gas prices go high, other hydrocarbons from the gasoline fraction can be the source of that hydrogen.

The energy values of oil fractions will largely determine where they go and the price they command in an energy constrained world .

Old Chemist,

Your scenario is likely more realistic than my more general outline which focused more on oil, there may be shortages of natural gas, though i think high natural gas prices are likely to lead to lower demand for natural gas as wind and solar investment will be far more attractive at the current price levels for nataural gas, coal, and oil. I agree fossil fuel backup will be needed over the medium term, eventually as the total quantity of wind and solar power rises and is widely dispersed and highly interconnected the amount of fossil fuel backup required will be diminished (this would be 30 to 40 years in the future). There are other types of backup such as batteries, synthetic fuel, or pumped hydro which can utilize excess power production during high wind or high solar periods which will provide low cost power, potentially vehicle to grid systems could provide some short term backup.

If it weren’t true, it would be funny in a way-

Just how narrowly focused so many tend to be on specific sources of energy.

Ex-

In response to the statement “we need to invest quickly and heavily in wind and solar”

so many times we hear- “they will never ‘save the world’, or they ‘won’t work because they are intermittent”

Thanks Old Chemist for helping to describe how it is standard practice in this world to use a mix of energy sources to get by. Changing sources as the supply, and costs, change.

We are in the early phase of a massive time of change now.

C8

Eric Nuttal has been an oil Fund Manager since I can remember, about 15 years. He has had a tough time over the last five years but has hit a four bagger over the last two years. I think I heard him say that his oil stock fund was number 1 in the world in 2021.

My only concern with his scenario continues to be his US outlook. He thinks, along with many others on this board, that growth in US shale will slow. On the other hand, the DPR keeps putting out monthly reports that the DPR basins will increase production at a rate of 140 kb/d/mth. (See chart. Note April decline from ND does not show up in this latest DPR chart)

Hopefully in six moths we will know who is right on LTO output.

Here is a quote from an article that agrees with Eric’s position on share holder return: “One thing Henke and his team will not be doing with that free cash flow is implementing major increases in the company’s drilling program. “We haven’t had shareholders on our doorstep demanding we grow our production and out-spend our cash flow like the industry did for many years,” he told me. “That’s certainly not what is being rewarded in the market now.”

https://www.forbes.com/sites/davidblackmon/2022/05/04/how-one-eagle-ford-shale-producer-illustrates-the-new-model-for-success/?sh=13307bd9752d

OPEC output from 2021 IEO from EIA, reference and high price scenarios, it seems likely the high price scenario will be closer to reality, note that this is C plus C rather than crude only as reported in MOMR.

Brent Oil Prices in 2020 $/b for reference and high oil price cases (reference case is lower than high price case).

A wider view of Dennis’ OPEC oil production prediction to 2030. Data is in thousand barrels per day.

I dunno why that has any credibility as literally all his predictions have been wrong in the same direction, while everything mustang and hubbert said has been true for 70 years.

Everything Hubbert said has been true? Which parts? Ohio production peaking early in the 20th century rather than early in the 21st? The world making 12 billion a year at peak in the mid 90’s, rather than 30+ in 2018? The US peaking in the early 70’s? Natural gas as well? Pick a volume and rate that Hubbert called that was RIGHT. You aren’t ShortOnOil in disguise are you? Otherwise known as Mustang19 over at peakoil.com?

Hubbert famously won a bet with the USGS that production would peak in the 70s, and now they have to pretend shale matters.

Dennis tried a little harder, he noted that the 1900 trend was wrong, because spraberry. Absolutely every country has followed the hubbert curve, I can provide a excel containing a hubbert curve for every country on earth.

Most of my scenarios have been lower than actual output.

Though I did miss the coming pandemic in 2019 and the Russian invasion of Ukraine, so some of my World scenarios were incorrect because I did not anticipate these in advance. Nor did anyone else.

Below is a fairly conservative scenario with low World extraction rates for conventional crude after 2021. My guess is that actual World C plus C output will be somewhat higher than this (extraction rates for World conventional crude will be higher than this scenario due to high oil prices from 2022 to 2030. LTO=light tight oil, XH=extra heavy oil with API gravity 10 or less.

Dennis , somebody said this ” As to your posts and predictions, I just love them. Don’t you dare stop. If you do, then who the hell am I going to argue with. And God how I love arguing. 🤣 ” .

I agree with somebody . 🙂

Dennis, World C+C stood in February, at 80,621 Kbp/d. Your chart shows it over 3 million bp/d below that figure for today. I know you often get the future figures horribly wrong but how could get historical figures also so horribly wrong? 😂

Click on graph to enlarge.

Ron,

The Chart uses annual data not monthly data note that your 12 month average is about 78 Mb/d at present and my estimate for 2022 is about 77.6 Mb/d. Russian output has decreased and we are likely to see Feb 2022 as a high point for the year. The future is unknown and my predictions about future output are wrong 100% of the time. We do not know what annual average World C plus C output will be for 2022, we will have our first estimate in March 2023 from the EIA. The scenario above has the following from 2021 to 2029 in Mb/d:

77.02

77.64

78.53

79.49

80.67

81.75

82.52

82.88

83.27

The extraction rate for World conventional producing reserves is 5.25% in 2029, less than in 2019 (5.47%). Note also that this is about as low as I would expect World C plus C output to be from 2022 to 2030, interesting to have you suggest for the first time ever that my scenario is too conservative.

interesting to have you suggest for the first time ever that my scenario is too conservative.

Don’t get too excited about that. I was talking about your historical data, not your future predictions. 😁

Ron,

The World C plus C scenario uses the annual average output centered on June/July of the year, we do not yet have that data for 2021 so you have misunderstood the chart, as always I am uninterested in individual monthly datapoints, in my view it is the 12 month average that is important and for a scenario that covers 1871 to 2294, I only use annual data, not individual months. The URR of 3000 Gb for the scenario above is World C plus C output from 1871 to 2294 CE.

Unbelievable .

Ron,

It is the EIA’s projection from the 2021 International Energy Outlook, the high oil price scenario is more realistic, but I would agree that might be too optimistic. I also have often underestimated future output.

Ron, is 2930 a typo or irony? It would fit that graph.

Dennis, your chart has OPEC 5 million barrels per day below your 2030 level. All that must come from just 5 nations, Saudi, UAE, Iran, Iraq, and Kuwait. Also, the other 8 will be down by at least another 1 million bp/d by then, more likely 2. That means the big 5 will need to increase production by at least 6 million bp/d. They are currently at about 23 million bp/d. They will need to go to 29 million bp/d. And they are currently out of spare capacity. They need a miracle.

Ron,

My chart is simply showing the EIA’s 2021 International Energy Outlook for OPEC crude plus condensate.

OPEC is currently out of spare capacity, I agree. They can invest and add to current capacity, just as they dis from 2010 to 2018 to increase their capacity from 31 to 34 Mb/d. Can they do this again? Time will tell, if oil prices are near $150/bo in 2022 $ for the next 8 years (average price level) then we might see OPEC capacity increase from 30 to about 32 Mb/d. February OPEC C plus C output was 30.7 Mb/d according to EIA. Capacity may currently be about 31 Mb/d for OPEC C plus C.

Dennis, what OPEC did was bring two old mothballed fields online at a great expense. Mantifa cost them a mint. But they have no more mothballed fields to bring on line. Since early this century they have also relied on massive infill drilling to keep production up. They are about to suck that cow dry.

No, Dennis, just throwing more money at the problem will not work this time.

A great read: The Mantifa Story: A triumph of engineering, nature and human spiri

Ron,

We will see. Note that OPEC is more than just KSA. Some new capacity may come from UAE and Iraq.

Dennis “Some new capacity may come from UAE and Iraq. ”

Reminds me of the popular Boy George hit ” Sweet dreams are made of this , who am I to disagree ” . 🙂 . Sweet dreams .

Hole in head,

Since 2011 Iraq and UAE have increased their capacity by about 2600 kb/d, you imply further increases are not possible. I would have said the same in 2011 (and probably did), I try not to make the same mistakes over and over. You may be right, nobody can predict the future, I think it remains a possibility that the OPEC big 5 (KSA, Iraq, UAE, Iran, and Kuwait) might increase their capacity in the future.

My guess is that OPEC might increase capacity to 32 Mb/d, but I doubt they will return to their previous peak. In the past I have underestimated future increases in OPEC capacity and perhaps I am repeating that mistake (meaning that maybe they could exceed their previous peak, if Iranian and Venezuelan sanctions were removed, Libya settled its civil war and the big 5 expanded capacity, but it seems the odds are low that all of these things will occur.)

Hey Ron, I got a good book for you to read – My Big Toe. You’re a science guy like me that wants to understand the universe and seeks insight into its inner workings. The author – Tom Campbell shows how the proven discoveries of quantum science provides a new view of the universe. One that we live in a universe that is an approximation of an objective universe and that consciousness is highly involved in the mechanism. Check out the book website – https://www.my-big-toe.com/

Thanks Izzy, I will check it out. However please post these subjects on the non-petroleum thread. Anyway, I have heard of this before but never bought the book. There are several YouTube videow on the subject if you search on that title. I will check them out also.

Why would production be less for the high oil price scenario?

Joe Clarkson,

The EIA must be assuming that OPEC restricts output in order to keep oil prices high in the high oil price scenario, also when oil prices are higher (all else being equal) demand for oil will tend to be lower (assuming the same level of real GDP). So in the high oil price scenario consumers have moved to substitutes for oil, perhaps higher sales of plugin vehicles, etc.

Mr Clarkson . Sometimes the simplest route is the best route . My take .

1. All OPEC reserves are overinflated and do not exist . Cannot pump what does not exist .

2 . Whatever oil they have they are better off stringing it out for as long as possible . Applies specially for countries where oil is the ” single trick pony ” . End of oil is end of the nation state .

3. Geology is not kind to the old oilfields ( pressure , water etc ) . They cannot be pushed too hard to avoid damage . Just like old age in humans . Having a fracture at 70 takes a lot of time to heal .

4 . This is of recent and as per the real oilmen who comment here is manpower . Not enough trained and competent men to run the operations efficiently .

Better to pump less and keep prices high . No loss of revenue to Russia in 118 days of war due to high prices .

Dennis, can you comment on why Saudi production is still following the hubbert curve, and when that will end?

https://i.postimg.cc/C12vnCsC/C92861-FD-BB45-4523-A7-BD-1789-C5-FF08-FD.jpg

You didn’t post an image of SA following a Hubbert curve ShortOnOil. Make up another one maybe? Change all the data first perhaps, because otherwise it won’t work.

As you can see, and I’ll post again, Saudi production is broken down into each part of ghawar. Shedgum, haradh, permian and tertiary. Each followed the curve and we’re at the end.

https://i.postimg.cc/P5NFPW2T/Saudi-combined-e.png

You need to learn how to model field level production then, if that is what you want to do, rather than the initial claim that SA followed a bell shaped curve. Because it doesn’t. Like I said Short, you’d do better if you just changed all the raw data to your liking and then drew your conclusions, otherwise you just confuse people with conclusions that don’t match the data. Maybe if you had engineered rather than becoming a web page designer you would know something about…anything?

Peak oil,

Perhaps you forgot a wave? Also keep in mind there are other fields in Saudi Arabia besides Ghawar.

I wouldn’t be surprised if the long-term nature of bringing non-shale oil on line is going to lead to de-globalization. The correlation between energy and economic growth is very high – mid 90% or so. Granted – it has been shrinking somewhat but it seems clear that without energy inputs economic growth is very hard to accomplish.

North America, and the Americas in general, is in a pretty good position from that point of view. It has still lots of resources and a relatively young population in comparison to the rest of the world. The rest of the world not so much.

As the ROW is essentially in a corner between squeezed between an aging population and resource constraints war seems to be an outcome that can reasonably expected. And although Russia has tons of resources it has pretty terrible geography and, more importantly, an aging and skewed population.

Rgds

WP

But engineers are making great strides in renewable energy production and storage, are they not? This is what I read at least. How true is it?

Thank you

Things are going to Coal to Liquids.

I remember reading Ron P (Darwinian) on the Oil Drum years ago.

“How do you become one of the survivors” – paraphrased and thankful/grateful for his advice of course…

My opinion is live in USA or Australia or Canada.

Hitler proved Coal to Liquids was possible. But did not prove it was scalable.

Australia and the USA own 40% of the world’s coal reserves.

And the USA has the military muscle to pull it off.

It’s the new OPEC.

Peak etc , forget CTL and GTL and H2 and XYZ . TINA is the acronym for the black goo . They also call it crude oil . Some people learn the hard way .

https://mishtalk.com/economics/the-harsh-reality-of-energy-tina-strikes-the-us-and-europe

Why are you so certain that CTL won’t work when it has proven to work before?

It might be slightly uneconomical compared to what we are paying today (125 a barrel compared to 150-200 CTL?).

The political and economical barriers that are causing it not to be used today, will get flushed down the toilet when the alternative is starvation.

And yes, I think Climate Change is a devastating problem, I just don’t think humans will sacrifice their own comfort and survival to attempt to get to Net Zero emissions.

Peak , hope this will clarify .

https://energyskeptic.com/2022/gas-to-liquids-gtl-coal-to-liquids-ctl-can-not-compensate-for-declining-oil-production/

A full scale CTL plant, say 150 kbpd diesel, would cost around 20 billion dollars and be a giant global, multiyear project (probably the biggest global project around while it is built.) I doubt if there are resources available, whether human or equipment supply, to support more than two such projects at any time at the moment and the capacity that exists is gradually falling. If the global industrial society collapses as it seems to be going I think mega projects like this will prove increasingly difficult to execute and, even if completed, to maintain.

From memory about 40% of the energy in the coal feedstock comes out as fairly low grade heat. To be anything like economic against just burning the coal for power that heat has to be used for something. In the Pearl GTL last I think it is for desalinisation, but most such plants would have to use it for steam raising and then power generation, which would likely add to the cost and complexity.

That said the compact, transportable and flexible nature of liquid fuels gives them huge local advantages over electricity, e.g. I can’t really see EV vehicles providing emergency services following major disasters like a hurricane that takes the grid down for three weeks, so there may be increasing pressure for manufactured diesel as oil decline really bites.

Just need some elbow grease and a positive attitude

Git ‘Er Done!

Peak Avocado,

Below is a chart from the EIA’s 2021 International Energy Outlook for coal to liquids output. They expect about 340 kb/d in 2028 and 400 kb/d in 2040, this does not help very much for World consumption of 80,000 kb/d or more.

Thanks Dennis.

That chart isn’t factoring in Peak Oil.

When South Africa got embargoed, they immediately went to CTL. And it worked!

Peak Avocado,

CTL can work, but it is very expensive and not likely to be a major source for Worldwide liquids. If it were competitive there would be more of it, in 2019 it provided about 0.3% of World Liquids output (0.3 of about 100 Mb/d). CTL really doesn’t move the needle, and there are much cheaper ways to go. Coal prices are currently very high, making this a high cost option at present.

Thanks Dennis.

Don’t disagree with you.

I just think the incentive will be there to make it work.

Starvation is a great motivator.

Botswana is building a plant that will serve a considerable portion of their needs-

Botswana plans to build $2.5bn facility to convert coal into liquid fuels-

The plant will have the capacity to produce 12,000 barrels of diesel and gasoline per day.

https://www.offshore-technology.com/news/botswana-coal-into-liquid/

Peak avocado,

There are likely less environmentally damaging and lower cost options than coal to liquids. It is not obvious that there will be a shortage of energy, keep in mind that roughly 60 to 70% of the primary energy in fossil fuel produces no useful heat or work, it essentially is simply waste heat. Producing energy with wind and solar has far fewer losses.

@Hickory

Based on my calculations and brilliant mathematical mind

100,000 barrels / 12,000 @ 2.5 billion = ~21 billion

Australia could service its own needs for ~100 – ~120 billion @ 600,000 barrels per day

The USA could do 6 million barrels for a trillion ( FED )

Yes, this is completely over simplification

C8

One thing engineering runs into is physics. Tesla has just raised their average car price by $6000 according to Bloomberg because of the higher cost of battery materials. Lower and lower cost per KWh in batteries is over. In the UK with the summer solstice and what should be peak solar electric production they are experiencing very cloudy weather, just like last year. The wind industry is now building 12 MW behemoths but where on earth do you get constant 30 mph winds that makes the investment worthwhile?

Ervin,

Tesla may have raised prices because of overwhelming demand for their products, people ordering a Tesla Model Y today have a 10 to 13 month wait (long range AWD) to get their new Tesla. I was lucky and only had to wait about 8 months to get mine.

D Coyne

I don’t disagree that the demand is there and Elon raises the list price of Teslas because he can, but it does not change the fact that since Jan1, 2021 the price of lithium carbonate is up 700%, cobalt by 230% and nickel by 58%. I just looked it up.

Ervin,

Yes prices are up for many inputs for batteries, often this leads to more investment in mining and producing thos materials, an increase in the supply of those goods and then lower oil prices. Car prices in general have been increasing.

Dennis , demand is useless if you have no capacity to supply . This is a boggy . Rivian has an order book for 100 K vehicles but they produce not more than 5 K in a year . So their waiting time is more than Tesla . Waiting time is a useless parameter . Musk has to increase the price because inputs costs are going up . Tesla is not fenced off from the general economy .

P.S : Waiting time is not important . What is the price of a can of beans that is not on the shelf ??

Hole in head,

Tesla is producing a lot of cars, just not as fast as the demand for them is increasing. Lots of car companies are raising prices, perhaps due to higher costs and in part because people are willing to pay the higher price.

Dennis , as usual high prices lead to new investments to produce lithium and cobalt . This is not true . No new investments in the oil industry inspite of high prices . There are too many external factors at play that you don’t take into consideration . Try lateral thinking ( Edward De Bono) instead of linear thinking .

Dennis , what is a lot ? Get things in perspective . Total cars produced in 2021 is 79.1 million worldwide . Total Tesla deliveries in 2021 is 934,000 . If this is a lot what is ” not a lot ” . All manufacturers are increasing prices ? Of course they have too , if all inputs (steel, aluminum, chips ,copper , oil etc. ) are skyrocketing . This is also called inflation in economics . Peak cars 2018 = peak oil (all liquids ) 2018 . Coincidence ??

Hole in head,

Here is what I expect for future, if plugin vehicle sales growth rates of the past 7 years continues. Perhaps oil companies see a lack of demand ahead or are only thinking short term and making poor decisions, we are seeing a lot of investment in batteries and EVs as businesses see an opportunity for future profit.

“where on earth do you get constant 30 mph winds that makes the investment worthwhile?”

silly thinking,

average wind speed at hub height over 17 mph is plenty for worthwhile investment

average is different than constant, in the real world

every amount of energy that wind or solar or hydro, for example, produces is less scarce fossil fuel that a country needs to keep running.

“In 2020, 57% of Iowa’s total electricity net generation came from wind” EIA

Ervin,

Did you expect that energy would so easily available… indefinitely?

Did you expect that bananas form the subtropics could always magically appear on your grocery shelves, or that an individually packaged sterile plastic syringe could be afforded by your health care system or funded by your taxes or insurance payment, indefinitely?

Did you think that it would pencil out to drive your petrol car to work more than 5 miles, even as fossil oil depletion was ticking away every second?

Did you think that a new replacement refrigerator or clothes washer would be affordable, or even available, in this current century?

Lets be clear- when the supply of an item becomes less/person than before

at first the price goes up

and then the products derived become less available, or restricted.

Now its said been plainly.

Just what is the response?

Hickory

I have often wondered if using any form of (renewable) energy has the benefit of conserving fossil fuel for some future generation. But in my opinion from decades of reading and just seeing how the world is evolving I see no evidence that carbon dioxide is now or will ever harm our world. I hate the lie that solar and wind energy will save us from a life ending catastrophe. Europe is now a test case of dealing with a real catastrophe. Next winter the possibility of people dying from cold is very real.

Ervin…where to start

-“wondered if using any form of (renewable) energy has the benefit of conserving fossil fuel for some future generation”

I don’t know about future generations…but it certainly helps in the here and now, and the next decade or two.

-“I see no evidence that carbon dioxide is now or will ever harm our world”

great example of how a person won’t see what they don’t want to.

Another example- the world is flat.

– “I hate the lie that solar and wind energy will save us from a life ending catastrophe”

I can’t help you with the hate, but I agree with the notion that no energy will ‘save the world’.

-“Next winter the possibility of people dying from cold is very real.”

Yep, just as it always has been, and will be.

Your going to need all sorts of energy, just like before.

Except now there are more people and less big chunks of coal to dig.

C8,

Much of this will depend on energy prices and government policy, costs for wind and solar are very competitive at current fossil fuel prices so the ramp up in these technologies may accelerate in the future.

On current price trends synthetic liquid fuel based on carbon capture and solar energy will soon be competitive. But I wouldn’t hold my breath waiting for it to happen.

It’s an insanely inefficient way to power a vehicle (well over 90% of the electricity is lost in the synthesis and subsequent burning) and the infrastructure simply isn’t there.

The choice is between dumping the huge fleet of combustion engines for electric vehicles or building a complete new system for making fuel.

Most of the world’s car industry is betting the farm on EVs right now. The car industry is the middleman between the oil industry and consumers. Their choices will likely decide what technology is used in the future.

There is more than enough viable oil to wear off the current car fleet, and a lot of new ones without doing stunts like this.

Alternative and additional energy can be used first for better things – first common electric consumpion, and then stationary demands like heating, industrial heat and processing energy.

If you go green, green steel, green cement – all needs before creating artificial gas in the most inefficieant way. If going this way, a hydrogen system would be much better. You need it anyway for green steel and seasonal/emergency storage – and it’s less efficient than batteries, but about twice as efficient as synthetic fuel. Round about 25% of the raw input arrive at the wheel.

The energy crisis shouldn’t be that strong if we wouldn’t be ideologic restrained.

Additional to wind/solar we could push fusion deveolpment in a Apollo program like mode: All components are there – even the in build ITER is already technologically old. It uses low temperature superconductors instead of high temperature which are able to deliver much stronger fields (= cheaper + better results). And then build a middle size factory mounted model – produced like Boeing jets and only installed in site.

This will take 20 years, especially the ramping up, but we have that much oil gas and coal left. Additional solar for the sunny countries, and wind where it is. It’s good to have more than one shot, you can do many things the same time.

Europe would need a freight railway system, build in a war like effort (otherwise NIMBYs would sue it into oblivion) to reduce Diesel demand.

Percent of global energy that is contributed by oil for road transport is 19.6% of total.

That energy will start to decline, and so it will be time to drive less and/or switch to electricity.

Voluntarily, or be forced by pricing and rationing- these mechanisms will serve to prioritize consumption.

Except for the very wealthy who don’t play by the market (or legal) rules like everyone else does.

Hickory, I thought you were banned.

Like you were Short?

“Hickory, I thought you were banned.”

No, that was you before you changed your name.

We must bring ” grades of oil” into discussion .

HOLE IN HEAD

IGNORED

06/18/2022 at 4:17 am

85% of…SPR [sales] have been medium-sour…By …October…only 179 mmb of [it will remain]..

Biden is not going tp KSA go on Haj or eat kebabs . He needs the to replace the medium sour in the SPR that he has been selling .

Hole in head,

Not surprising as US Gulf coast refineries are optimized for heavier grades of crude, it is a dumb plan to sell oil from the SPR, but unfortunately Biden is not getting good advice, I don’t think he has any oil industry experts in his administration or if he does he is not listening to them.

Dennis , ” not surprising ” , but also not my problem . Not getting good advice ?? Are you implying his advisors don’t know about grades of oil , blending and limitation of refineries to refine specific blends ? Not much even the experts can do if the refineries are not getting the correct blend . If medium sour is needed , then medium sour is needed . TINA . He better get to replenishing this draw down or WCS is going to be useless .

Hole in head,

The SPR should not be used until absolutely necessary, this is just stupid political short term thinking.

Dennis , but this is reality . What you and I think is immaterial . TINA is TINA . If medium sour is needed then medium sour is needed . QED .

Weekend peak,

Note that correlation does not tell us anything about causation, perhaps real GDP determines demand for oil which then influences the supply of oil through market prices. You may have the causation arrow reversed from reality.

Dennis:

That is possible but unlikely. In order to create widgets you need inputs – and oil is one of those inputs. If oil were an output rather than an input we would be surrounded by oil in storage. And we are not (and it makes absolutely no sense). How much oil does your Tesla produce? (still waiting for my model Y btw).

Oil is an input, not an output.

I think…

rgds

WP

WP, “Oil is an input, not an output.

I think… ”

Correct . Oil is the master resource and Diesel is king . Just for info , there is are now worries in Austria , Slovakia and Hungary regarding diesel . These countries are at the fag end of the Druzba pipeline and the stupid EU sanctions are creating problems . Rationing ???

Weekendpeak,

Energy is a necessary input, oil not so much, the amount of input consumed is in part dependent on the amount of output produced. This is a chicken egg argument, I go for chicken, you seem to think it is the egg that matters most. Here is my viewpoint in a nutshell, oil is not the master resource, there is no master resource, there is a set of resources that are necessary and the proportions change over time with changes in technology and consumer tastes.

Dennis , understand the three legs of the stool called IC . Oil , electricity and metals . No oil (diesel ) means no mining = no coal and NG = no electricity = no metals . Game over .

P.S : Don’t come back to me with nuclear/ hydro/wind/ solar etc as replacements for diesel . That argument is already buried .

Hole in head,

You are just not correct, electricity or natural gas can replace most uses for oil and coal. There are other fuels besides diesel, and al lot of diesel is wasted on uses such as personal transport. Lots of mining is done with electricity, which covers metals and coal.

Just because you make a claim does not mean it is proven. QED, means something has been demonstrated. Your “proofs” amount to I said it therefore it has been proven, I’m not buying it.

Oil can be replaced as it was in the 80s, it does not have to happen overnight, in the mean time high diesel prices with both increase output of diesel and reduce consumption of diesel.

Mr Coyne , ” electricity or natural gas can replace most uses for oil and coal. . other fuels than diesel ” . Please enlighten . How will you produce coal + NG= electricity without the Caterpillars /Komatsu’s mining and the Volvo HD dumpers hauling the coal without diesel or the gen sets ( diesel ) in remote locations drilling for NG . Your “Lots of mining is done with electricity, which covers metals and coal. ” . Can you give me an exact / approx figure of the diesel vs electricity used for mining worldwide ? It will be miniscule , not even worth discussing . I don’t claim anything but the facts . Since 2020 I have said peak oil (all liquids ) is 2018 , US peak is 2019 , OPEC + has no spare capacity , Russia has peaked , KSA has peaked , Covid will lead to a worldwide recession ( my take a depression ) . Always early to the party , but no regrets . I would rather be at the airport an hour before my flight then a minute late . 🙂

Hole in head,

I did not say it has replaced diesel, I said that it can, and likely will see link below, it estimates in Sept 2021 that about 1% of global mining, but with current technology and high diesel prices the electric option is cheaper and is likely to expand rapidly.

https://www.newscientist.com/article/2290944-how-electrification-is-changing-mining/

It’s been a long time since I’ve seen any estimate at all about the cost of doing coal to liquid, but the energy cost is high as a kite.

We would be far better off to burn coal to generate electricity and then run our vehicles and machinery on electricity to the extent we can, while reserving whatever oil we can produce for ESSENTIAL use such as in military vehicles, heavy construction equipment, farm machinery, etc, in cases where batteries just can’t get the job done….. unless……..

Unless the highly speculative green hydrogen revolution actually comes to pass.

I’m willing to believe it will happen, given that I also believe that we will have wind and solar power out the ying yang so that we can AFFORD to manufacture hydrogen via electrolysis of water and use it to run fuel cells so as to avoid needing super batteries.

Hydrogen has some very real problems, but it’s also the ultimate trump card in one respect…….. it can be stored indefinitely, by pumping it down an old oil well or into a salt cavern or even into tanks, if tanks can be built cheaply enough. This has the potential to more or less WIPE OUT the wind and solar intermittency problem.It could even wipe out the SEASONAL supply problem.

In the past I’ve mostly thought and argued that batteries will rule, due to the lack of any infrastructure system to distribute hydrogen to retail outlets, and the energy cost of producing and handling it.

But I also think if oil is expensive enough, hydrogen WILL find it’s way to truck stops and school bus fleets and city bus fleets, and just about any sort of truck fleet operation where one refueling installation can service a lot of vehicles.

From there it might actually eventually be possible to sell it at retail stores so people can run cars on it…… but my guess is that won’t happen, and that batteries will indefinitely out compete hydrogen for cars and small trucks.Let’s not forget that batteries might keep on getting cheaper too, lol.

Battery swapping hasn’t worked, and most likely never will work, imo, because it’s just going to be easier an cheaper to wait a few minutes to charge up.

But standardized H2 tanks are a real possibility. An eighteen wheeler load of them could be parked at a good location, and people could potentially swap out an empty one for a full one in as little as five minutes, and go three or four hundred miles on one tank. Dual tanks wouldn’t be a problem for larger vehicles, thereby doubling the range.

Tanks could or can work because they’re small enough, and can be swapped out without worrying about getting an old one while trading in a new one, when swapping batteries.

Toyota has made a LOT of progress lately with small hydrogen tanks big enough for three to four hundred miles range in an automobile.

Shale itself is already marginal, it’s condensate, and you realize that coal gas cannot be turned into any longer chain. So it’s physically impossible. Note that the countries that do it (China) are collapsing anyway.

Libs will say all kinds of physically impossible things but you can’t transform a gas back into a liquid and gain energy, that would be a perpetual motion machine.

Light tight oil sourced and reservoired in shales is primarily medium to light grade sweet crude Short. Now run along and create another Hill’s Group report so we can all have another good giggle at how engineers who never engineered get laughed out of technical review when they try to do something they have no experience with.

Ok well how is your argument even physically possible?

You cannot make diesel from condensate. That’s like making oil from styrofoam. Even if you were able to you can’t make chains longer in any useful way, it’s physically impossible, the point of entropy is to make the chains shorter.

This is why- surprise- it isn’t done and diesel is declining.

Mustang,

Light tight oil is not condensate despite your claims which are not supported by any evidence. The API averages about 42 degrees, it is light crude oil which once commanded a premium on World markets, but refineries in much of the world have been set up for heavier crude which dominates World crude supply.

Information on tight oil here (see Working with Tight Oil download at link below)

https://www.emersonautomationexperts.com/2015/industry/downstream-hydrocarbons/challenges-in-refining-tight-oil/

Chart from “Working with tight oil” referenced above presented below

plenty of gasoline and diesel from tight oil, low residual oil yield. making it more profitable, but US refineries have been optimized for heavier grades of crude.

I didn’t make an argument Short. I just happen to know the API gravity of various oil types by the formation they are produced from. You’ve made this claim before, been told it was wrong before, and it still is.

I recommend learning. Otherwise you just make Happy McPeaksters look bad, and that is saying something.

Oligomerisation. You can do want you want with hydrocarbons but if the feedstock prices are near the product price there is no driver:

Peak, I wish you would quit trying to blame everything on the libs. It is the conservatives who, in general, are the cornucopians. They are the ones who believe we have enough oil to last us for 100 more years, at least, if we would only allow drilling and pipelines everywhere. A liberal is far more likely to be pessimistic than a conservative about the state of the world,s oil supply than a liberal.

So please knock this “libs” shit off. You are 180 degrees off as to who to blame for “saying impossible things”. It is the conservatives who, in general, are the idiots concerning the world’s oil supply.

I second Ron. As a self proclaimed leftist, here is how I see it:

Liberals think we can just cut out oil and gas out completely and fly battery powered planes to Catalina to enjoy a nice brunch of organic avocado toast and free range champagne. The laws of physics do not matter. Elon is a nutty conservative, but he will save us. Just apply Moore’s Law to everything. On the way home in our 5,000 pound hybrid SUV, we can drop off the kids’ old scool clothes to fix income and social inequality and then pick up Mom’s mood stabilizers and Dad’s blood pressure meds. I miss Obama. BAU continues.

Conservatives think we can apply good ol’ American ingenuity and, because we are exceptional, drill our way through the future. The laws of physics do not matter. Elon is a nutty lib, but he will save us. The company will always take care of me, so I just used my bonus to lift my Yukon and put 30 inch mudders on it. Can you believe what Brandon did to gas prices? Anyway the unfettered free market will steer us when the time is right. Until then we just need to work hard and pray. BAU continues.

In the grand scheme of things, there isn’t much difference in what libs and cons DO. Nobody is taking the future seriously.

At least they both like Elon!

The Dim-Repug paradigm is a stage set for idiots to argue upon about how they should best starve to death.

Let me say this about hydrogen. Under no circumstances, no mater what process is used, the energy in a kilogram of hydrogen is less than the process used in its production. So, how in the hell can spending $1.00 to get $.50 worth of energy going to save us. Do the math !!!

So, how in the hell can spending $1.00 to get $.50 worth of energy going to save us.

Naw, it is $.30 worth of energy for each $1.00 spent producing hydrogen.

Scam Alert: Hydrogen Hoax – The Next Great ‘Renewable’ Energy Fraud

Here they come again for your money. Firstly, it was wind, then it was solar. Now they’ve put the two together and it’s hydrogen. And what they’re trying to do is to skin us alive forever. Now your previous segment on education reminded me of politicians, but totally and absolutely scientifically illiterate. It’s equivalent to a politician not being able to read or write. So let me say a few things for an illiterate politician. You need electricity to make hydrogen and you have losses when you do that. And then with the hydrogen, you need to make electricity, again you have losses. And so you get about 30% of the energy by that process, the rest gets dispersed. Unless legislation can change the laws of thermodynamics, you are in a loss, loss, loss situation. Loss because we taxpayers get skinned alive, loss because we redistribute energy, and loss because we cannot replace that energy.

I have read other reports that put the energy from water electrosis produced hydrogen at 20%. I think 30% is really quite optimistic.

Electric power at $0.05/kWh produces hydrogen at $7.00/kg. That power is more likely to come from nuclear reactors than wind turbines.

Hydrogen is not renewable energy.

It is a form of energy storage.

All forms of energy storage lose energy in the round trip process.

Some more than others, and some at much more expense than others.

I am not convinced that hydrogen energy storage is a worthwhile pursuit from what i have read,

but I am no expert on it.

Some very big companies, and countries (Japan for example) have decided it is a mechanism worth pursuing.

It seems to me that there are some much more solid, affordable, and reliable mechanisms available.

But these mechanisms are not at all ideal for heavy and long distance transport (batteries are heavy).

Don’t forget that poor energy efficiency is our civilizations baseline condition- less than 25% of the refined energy in crude oil transport fuel is converted to forward propulsion at the level of the wheel.

Hydrogen, currently, is not renewable because, once it comes out of the ground, it rises in the atmosphere and is lost in space. By using hydrogen from natural hydrogen sources, we will turn it into water, which will at some point in the future return to the earth’s mantle and be broken down again into hydrogen and oxygen. Then the hydrogen from these sources will become renewable.

Hydrogen is the “jack of all trades”. It can have a number of applications, but is a high cost solution.

The only reason why investments in hydrogen are popular is to make the most out of intermittent wind and solar energy resources. How can the solar (or wind) resources in Saudi Arabia or Morocco be converted into something useful where people live or where industry is located?

Two projects illustrate proposed solutions for this. One is the underwater interconnector cable from Morocco to the UK and second one is the hydrogen project between Germany and Saudi Arabia, where where hydrogen (based on solar power) is to be shipped from Saudi to the industry in Germany.

There is some viability for small scale hydrogen production used for transportation also. The idea is that the grid can be tapped for hydrogen production when electricity is cheap, that the energy loss of compression is not too high and that just enough can be produced to serve a hydrogen refueling station (or a back-up power generator).

Here is some promotion material from for example NEL:

“With advanced heat recovery, recent NEL electrolysers have reached up to 80%-85% efficiency. The mass produced containerized units would be ideal for smaller distributed clean H2 production for FCEVs, fixed standby power units etc”

https://nelhydrogen.com/water-electrolysers-hydrogen-generators/

Good point Kolbeinih.

And that is exactly why Hydrogen as energy storage has drawn very wide attention from many big energy companies and countries.

And if small scale “Water electrolysers / hydrogen generators” do indeed become widely available at good cost, one can foresee many useful applications. For example, many large scale farm operations could be fueled by hydrogen produced on-site by PV or wind.

Hickory,

You are correct in your thinking in your last sentence. It would be a relief if a cluster of large scale farms could run on renewables, including probably both battery and a hydrogen set up. In principle able to operate off grid. Maybe something to think about for the great plain states in the US.

Best of luck Prof Bardi .He got sick of the bureaucrats .

https://thesenecaeffect.blogspot.com/2022/06/bye-bye-university-how-to-leave.html

For those who may not know Dr Bardi is the one who coined “The Seneca effect ” .

A comment on the above link regarding EROEI .

AnonymousJune 15, 2022 at 12:35 PM

“And you may have asked yourself (but never dared to ask) what is the value of the EROI at “peak oil”?”

EROI is smoke and mirrors….

EROEI is the real deal:

The energy invested, measured in barrels of crude oil, say, is always millions of times more than the barrel extracted.

And that is when a newly drilled oil well comes gushing – creating lakes of crude around the well (actually, that what has happened in Baba Gurger in Iraq, 1927, and many others).

Not when water injected, gas injected, magical liquids injected to force the oil out

Coal didn’t take over wood – only after 60 years from its mass production in America.

But that didn’t stop the relentless deforestation of America to date.

When oil started its mass extraction in Pennsylvania, wood and coal were produced like no tomorrow – just to produce hundreds of barrels of Pennsylvania oil a day.

Only after 60+ years, Ghawar has come in 1937 online – and that’s is after Iran, Iraq, Azerbaijan, American, Canadian, Romanian and S. American oils were produced in millions and millions of tonnes per annum.

No matter how Ghawar has been massive and productive, all what it has produced was a subproduct of what energy has come before it.

Ghawar will dry out before Iraq, Iran, Azeribidjan’s oil – like Alaska and North Sea oils?

Whatever oil fields have come last – they will disappear first:

This is simply a testimony on there was never something like flying-carpet positive EROEI – as our Western Civilisation has claimed all the last 120+ years.

“No energy store holds enough energy to extract an amount of energy equal to the total energy it stores”

Wailing.

I googled “What is the history of the Ghawar oil field?” Here is what I received.

Ghawar was discovered in 1948, and put on stream in 1951. Some sources claim that Ghawar peaked in 2005, though this is denied by the field operators. Saudi Aramco reported in mid-2008 that Ghawar had produced 48% of its proven reserves. Approximately 60–65% of all Saudi oil produced between 1948 and 2000, came from Ghawar.

There is no doubt that Ghawar is way past peak and, I believe, is now in steep decline.

As goes Ghawar , so goes the world .— Matt Simmons .

Hole in head,

It seems Simmons was wrong, based on what has happened since twilight in the desert was published. Interesting book, though, it got me interested in peak oil.

And nukes are needed to fix blowouts in the Gulf. There is a reason I suppose why I never ran into accountants drilling wells in the GOM, they were apparently too busy selling horseshit to the peak oilers.

“If I want to understand something about an oil field you ask a reservoir engineer, not an accountant”….paraphrasing Mike Lynch circa first decade of this century.

In the half century I have been an oil and gas operator (and a worldwide well control hand for the biggest well control company in the world), I’ve only met five fingers of reservoir engineers that had the courage to put their money where their big mouths were. , They always worked for somebody else, on a salary, were pompous and arrogant, and quick to blame somebody else, like other engineers, or geologists, for their hypothetical BS.

Man, given what we now know about reservoir engineer induced EUR exaggerations in the tight oil and gas biz; yikes! THATS embarrassing.

In the well control business, engineers always stood back 500 yards and watched us fix their mistakes, reservoir engineers never left the office. Bad analogy there, big boy,

If you want to understand something about an oil field, avoid engineers (and Mike Lynch, good grief!) and ask somebody with their own money invested in it. They’ll shot straight with you every time.

And by the way, if there is SOOOOOO much oil everywhere in the world, so much tight oil in the US, if reserve growth actually “rules…”

…why is the price of oil so high?

Read something the new this morning, a magic wand to solve all oil problems.

The west wants to limit oil prices – that would solve all problems: Less to pay at the pump, and more supply since then all countries would pump more.

Easy – why didn’t they invented it before?

— They should try other pills, these are bad —

Eulenspiegel,

Not clear why everyone would pump more at lower prices, perhaps the thinking here is that when profits are negative you make it up by increasing sales? Pretty sure when in a hole a ladder is a better option than a shovel.

Ron

Why do you think that Ghawar is in steep decline. I assume that you don’t believe Obaids’ comment that continuous drilling and water flood has reduced Ghawar’s decline rate to 2% annually.

Guys , I pulled this out of the archives . It is a post on POB in 2019 regarding Northern Ghawar .

https://aktiertips.se/northern-ghawar-water-and-production/#more-214

Another post by the same gentleman on Ghawar .

https://aktiertips.se/saudiarabien-ghawar-och-i-told-you-so/

Ovi, of course, I believe that. But you seem to completely miss the gist of my argument. Decline and depletion are two different things. It would have been clearer if I had stated that the depletion of Ghawar is steep and will soon hit the Seneca Cliff. If you have a natural decline of 8%, which OPEC stated in 2006, and you, via the use of massive infill drilling, you reduce that decline rate to 2%, all you are doing is pulling the oil out much faster. Yes, you do get some oil out that would otherwise be left behind, but that is minimal. You are not creating more oil, only getting it out of the ground much faster.

William Catton, in “Overshoot”, compared that to being able to write withdrawal slips from your bank much faster. You are getting your money much faster but also depleting your bank account much faster. That is exactly what is happening to Ghawar. They are getting their oil out much faster but also drawing their reserves down much faster.

I hope my argument is clearer to you now. Anyway, that has been my argument all along.

Ron

I did not realize you were comparing 2% vs 8%.

What we really need to know is the water cut ratio to get a better idea of how close Ghawar is to the cliff. A few years back an article I read claimed that 7 Mb/d of water was being pumped into Ghawar and that they were recovering 4.6 Mb/d of oil or close to a 34% water cut ratio. If they are still pumping 7 Mb/d into Ghawar and with oil output today being close to 3.5 M b/d, then the water cut ratio is now close to 50%. At what point do the water columns leave stranded oil behind.

It is my understanding that by resting a well, the initial water columns will settle and oil will float up and a water oil mix will then come out again if the well is restarted. Apparently at some point the settling stops and oil is left stranded behind. I once read that the maximum amount of recoverable oil for Ghawar was around 70%. Not sure if new technology today would change that percentage.

“Whatever oil fields have come last – they will disappear first”

I do not understand this comment- can you kindly explain?

HiH will have to explain exactly what he meant, but there is the fact that all the super-giant fields, all the giant fields, and even all the medium size fields have already been found and many are close to exhaustion. However, what is left are the tiny fields. They are the last to be discovered and because of their size, they will not last very long nor will they produce a lot of oil. We are down to picking up the crumbs. Many will dry up years before the giants and super giants discovered half a century ago stop producing.

The Anonymous comment makes no sense at all. Somehow he thinks that all energy extracted is just a fraction of the energy devoted to the extraction process, i.e., all EROIs are negative. This is just silly. I hope a good laugh was your intention in quoting his comment.

Thanks, Dennis, I didn’t realize this was the same guy. Let’s get rid of him.

As to your posts and predictions, I just love them. Don’t you dare stop. If you do, then who the hell am I going to argue with. And God how I love arguing. 🤣

Edit: The guy who called himself “PeakOil” is gone. As a result all replies to his nonsense are gone also. That is just the way the system works and is unavoidable. Sorry about that.

Dennis

The CEO of Ford recently said that it costs $25,000 more to build a Mustang Mach 1 than a gas powered Ford Edge. The high cost of battery materials has ended any hope of profits from our EV,s. The average EV cost now exceeds $60,000 and the overall average auto purchase cost is $43,000. $17,000 difference at $5 / Gal. Will get you a 15 gal fill up once a week for 4.5 years. I just don’t see EV,s taking over the future.

Ervin,

Many EVs are priced around 43k with 300 miles of range, some still have the federal tax credit of 7500 which reduces the net price to under 36k. If we assume 30 mpg for the average ICEV and $5/gal for gasoline that is about 16.7 cents per mile, an EV can travel about 4 miles on 1 kWh of electricity input at a typical 13 cents per kWh that is about 3.25 cents per mile for the EV. So we have a difference in cost per mile of 13.417 cents per mile. Lets assume the car is driven 150,000 miles (note that an EV will likely go 250k, but many ICEVs will be junk before this).

So 150,000 miles times 13.417 cents per mile is $20,125 dollars, subtract that from the net cost of the car (35500 minus 20,125) and we get a comparative cost of $15,375 for the EV vs $43,000 for the ICEV.

I think we can see why many people would prefer to buy an electric vehicle. Note the price of the Mustang EV is 44k, so that would be 16375 vs 43000. There is also a Hyundai for 44k with 300 miles of range, the VW Id4 (275 miles range) is 42.5k, all of these EVs qualify for the 7500 Fed tax credit and in many cases there are state incentives as well (in Maine it is a 2000 rebate for these cars as well, so net cost after energy savings would be 14375 over the 150,000 miles assumed life of the car.)

Dennis/Erwin/Others

I have said it before and I will say it again. The concept of BEVs is totally crazy at this point in time. The main objective should be to reduce gasoline consumption over the next 10 to 15 years by 50% to 75%.

The most economic and quickest way to do this is thru PHEVs with a range of 125 miles. The battery cost for that vehicle would be close to 1/3 of the cost the battery in a BEV. Lower cost means better market penetration. Also the gasoline engine as a backup would remove a lot of potential buyers from the “skeptical” group to the “Maybe” group of potential buyers.

Places like California which are pushing for BEVs are not being helpful to the CC issue.

Ovi- “The most economic and quickest way to do this is thru PHEVs with a range of 125 miles. ”

That would indeed be an excellent combination of capability.

From what I’ve read, the reason that manufacturers have struggled to come up with passenger vehicle PHEV with over 30-40 miles electric range is that the combined battery weight plus ICE weight creates a heavy vehicle with need for heavy duty suspension/structure, and poorer energy efficiency performance.

Maybe there are other reasons, but I agree these vehicles would be very useful.

You can be certain that the legacy auto manufacturers like Ford, Toyota, VW etc have had great incentive to make the PHEV system work with longer ranges, but up to the current time have been unsuccessful.

Hickory,

It might also be a cost factor as well as weight.

I know quite a few people driving a PHEV here. There is one main problem of these things –

electric range and consumption. Due to the dual structure and additional moving parts, they use much more electricity than a pure EV.

Most times they are around 30 Kwh/100 km – which limits electric range to 30 miles. And they have limited trunk size due to the place of the battery there.

No easy way here. Many companies are looking at the sodium battery already – to get rid of these sky high raw material prices.

Cars are the problem. No car is a solution, even boondoggles like a fully EV fleet (which literally cannot happen with current resources and prices).

If only there was some other mode of mass transit that didn’t rely on the dumb American disease of carbrain…

Mass transit works in towns, together with a fleet of commercial trucks.

On the wide country in the USA it doesn’t work – no sense to drive around lot’s of air in a bus when there are only few passengers.

The next problem: To be very efficient, mass transit has to be unconfortable. Busses / trams have to be filled to be efficient.

Eulen , I see this ” driving of air ” all the time between 9 am and 4pm in the trains and buses in Belgium . Some pensioners just sit in the bus and ride spending time . In Belgium bus was free for +65 a few years ago . Now it is a small sum . I think Euro 100 per year or something for unlimited travel .

The wide country is irrelevant, because not many people live there anyway.

Anyway mass transit works fine in low density countries like Sweden.

Mass transit and crime are locked together in the public mind. People are very vulnerable on mass transit and you will have a hard time convincing them to ride when thugs with 15 prior arrests are constantly released to prey on the weak. The media feasts on these type of stories and the fear is real. Paying extra for gas is like paying for life insurance- its viewed as a necessity.

The left does not see the link between crime and cars- the current soft on crime policies of DA’s are defeating green energy goals.

Norway and Finland are soft on crime, have low incarceration rates, low crime rates, and low recidivism. If putting people in jail made life safer, the US would be the safest place in the world. It is not. Crime rates have been falling for decades in the US and the prison population keeps rising.

The USA has one of the most ineffective criminal justice systems in the world. Read Judge Jed Rakoff’s book “Why the Innocent Plead Guilty and the Guilty go Free”.

I attended my sister’s trial in 2018. What stood out was ignorance and poorly designed economic incentives.

Actually in the USA light transport is directly involved in many arrests.

Typical scenario. Driver who is addicted to drugs drives vehicle. Driver is pulled over for minor traffic violation. Expired registration, no turn signal, or some other “fine only” violation. Driver who is addicted to drugs usually has no license or is driving while suspended/revoked. So driver is arrested. Search of driver/vehicle incident to arrest usually results in discovery of felony drug possession/with intent to deliver.

Other unfortunate scenarios which result include driver attempting to flee in vehicle, driver fighting officer, etc.

Of course, many shootings are from vehicles in the USA “drive-by.”

In some left leaning jurisdictions, police are discouraged from making traffic stops.

The bottom line is that USA has a very significant drug problem and has for many decades. No easy answers to it.

Oregon is trying a new approach, but the approach seems to be failing early on.

Proponents of decriminalization have a point, as incarceration doesn’t seem to work. However, “offering treatment” rarely works either. Oregon has an “offer treatment” regime. Thus far less than one percent have sought treatment after ticketed for low level possession, even though just one treatment session attendance results in automatic dismissal of ticket. 70% of the drug possession tickets in Oregon are simply ignored.

I sometimes think we are just going to have to accept a certain level of drug abuse and the crime and child abuse and neglect that accompanies it.