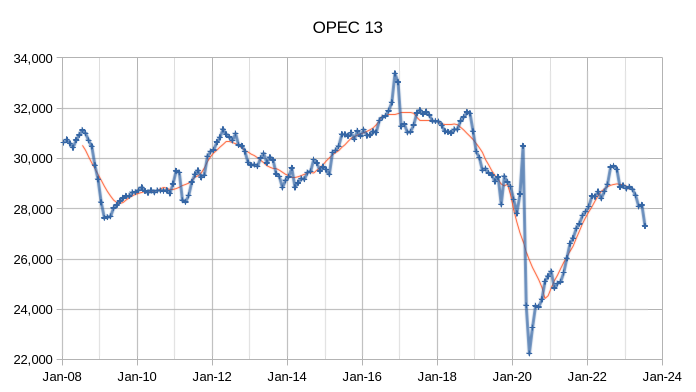

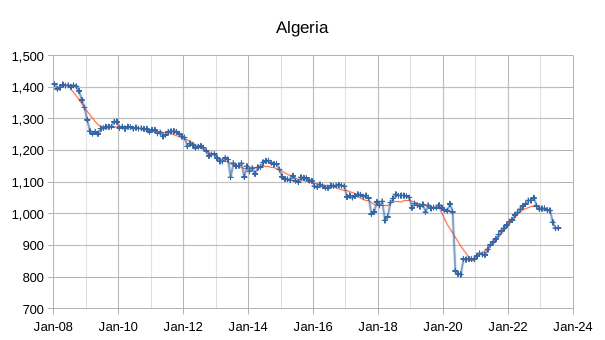

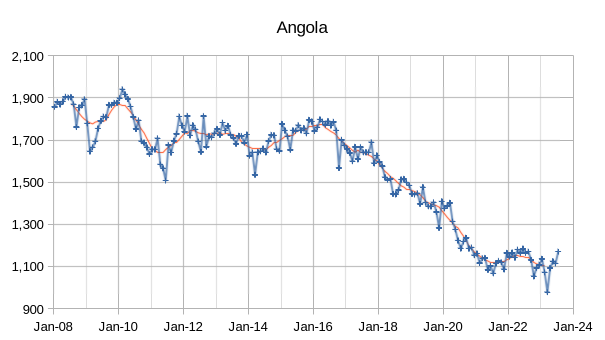

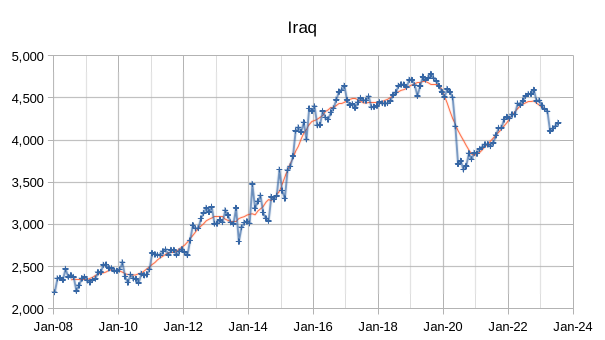

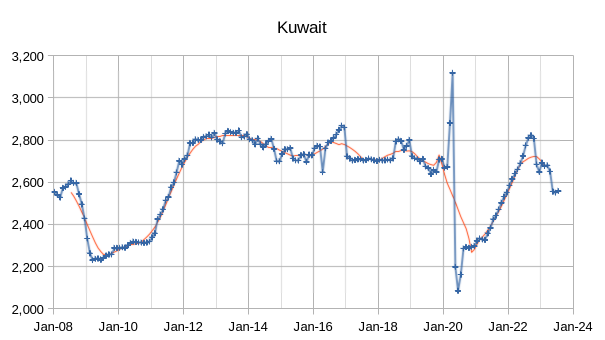

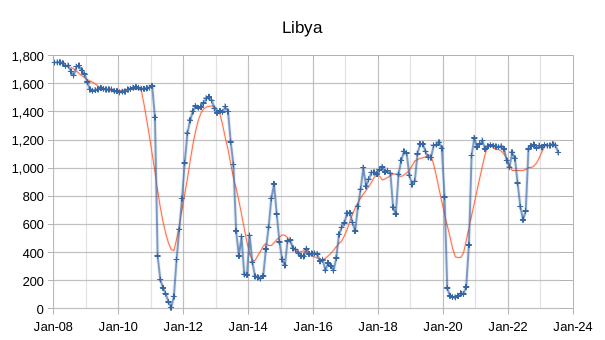

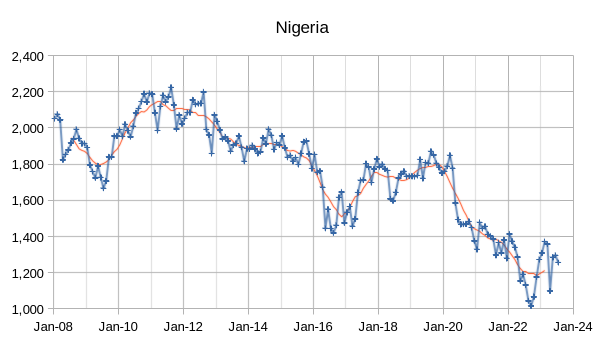

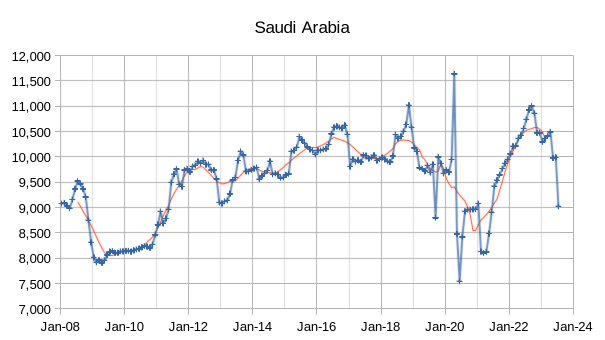

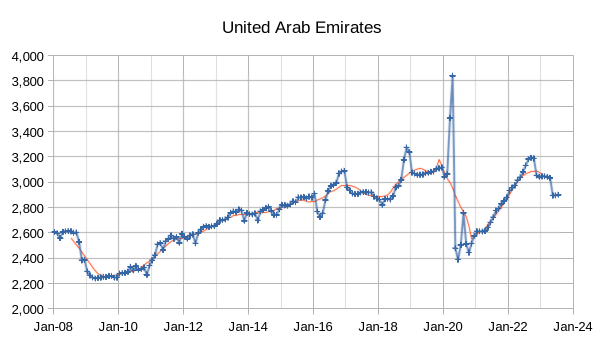

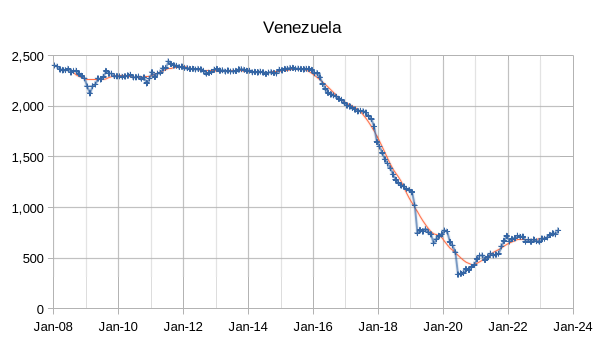

The OPEC Monthly Oil Market Report (MOMR) for August 2023 was published recently. The last month reported in most of the OPEC charts that follow is July 2023 and output reported for OPEC nations is crude oil output in thousands of barrels per day (kb/d). In many of the OPEC charts that follow the blue line with markers is monthly output and the thin red line is the centered twelve month average (CTMA) output.

OPEC crude output was revised lower in May 2023 by 15 kb/d compared to last month’s report and June 2023 OPEC crude output was revised lower by 43 kb/d. When the World was at its CTMA peak for C+C output in 2018, OPEC crude output was about 31300 kb/d and by July 2023 OPEC crude output had fallen to roughly 3990 kb/d below the 12 month average peak in 2018.

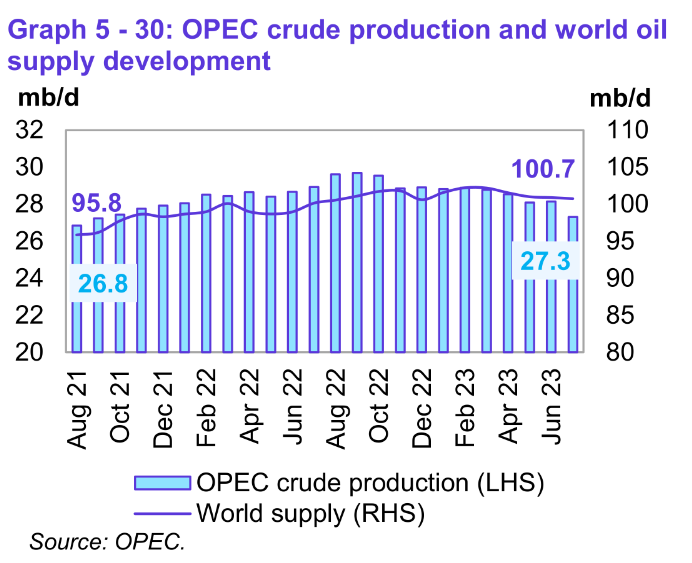

Preliminary data indicates that global liquids production in July decreased by 0.2 mb/d to average

100.7 mb/d compared with the previous month. World liquids output increased about 3.9 Mb/d in the past 23 months (from 95.8 Mb/d in August 2023).

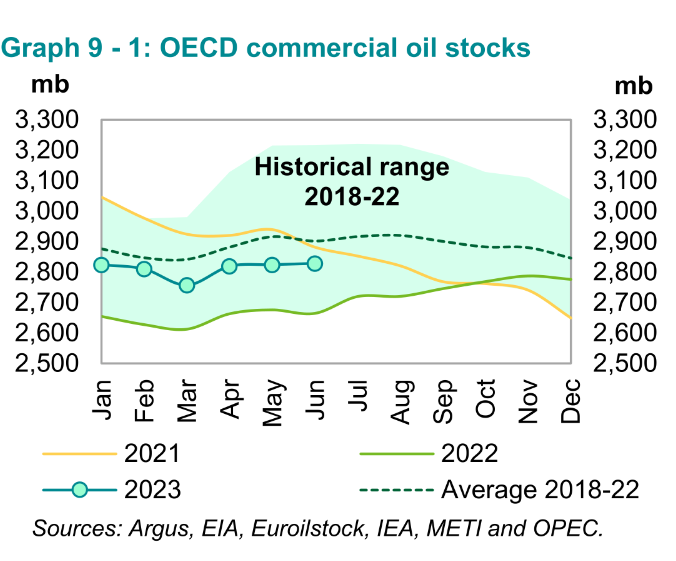

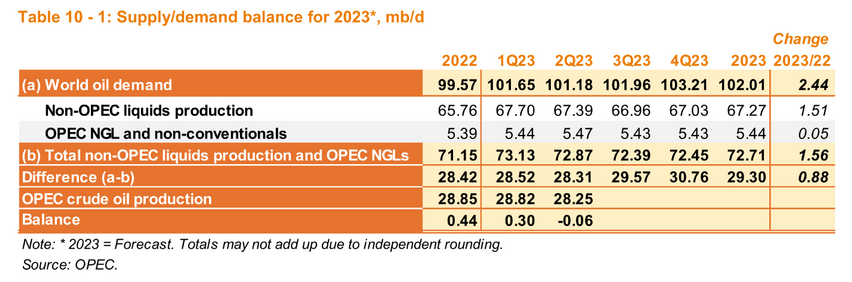

OECD commercial oil stocks increase by 4.2 Mb in June 2023, at 2828 Mb, they were 74 Mb lower than the latest five-year average. World Oil stocks are likely decreasing with the recent OPEC cuts, also note that this chart looks at commercial stocks only, in the first half of 2023 OECD SPR stocks have decreased by 30 Mb after decreasing by 270 Mb in 2022.

If OPEC continues to produce at the July 2023 level of about 27 Mb/d of crude oil, we will see a significant draw in World Oil stocks, assuming OPEC estimates for Non-OPEC Oil Supply and World Oil Demand are correct. My expectation is that the World Oil Market will become very tight and oil prices should rise, unless OPEC increases output to balance the OiI Market.

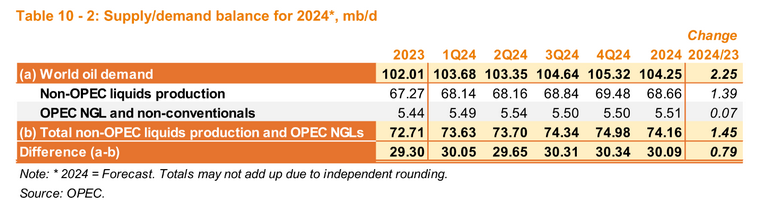

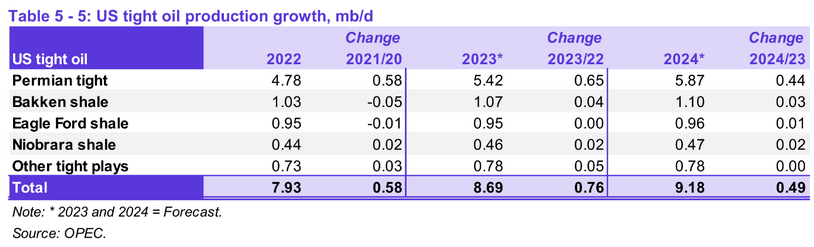

OPEC expects US tight oil output to increase by 760 kb/d in 2023 compared to 2022 (annual average output) with 650 kb/d from increased Permian basin output. In 2024 OPEC projects an increase in annual average US tight oil output of 490 kb/d with 440 kb/d coming from the Permian basin.

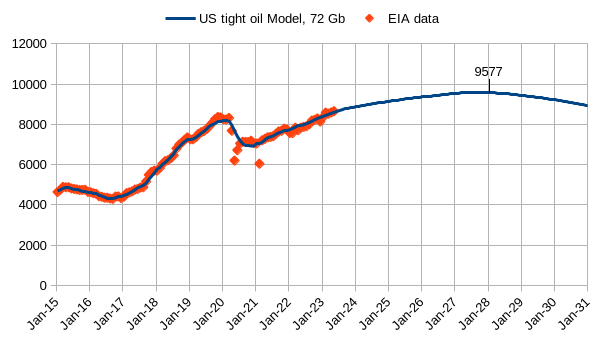

The OPEC estimates are optimistic in my opinion, my best guess is an increase of 723 Kb/d in US tight oil output in 2023 and an increase of 358 kb/d in 2024.

The estimate above assumes average well productivity does not change in the future as a model simplification. As the most productive areas of tight oil plays become fully developed, less productive areas will need to be developed and this will likely lead to falling average new well productivity though we do not know when this will begin or how rapidly it will progress.

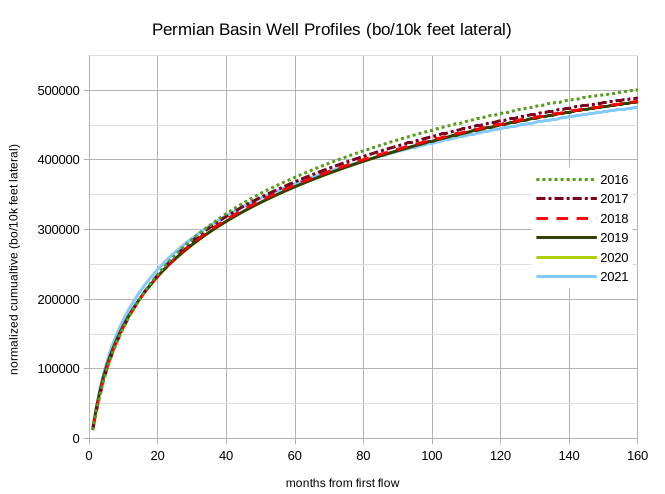

The chart above considers well profiles for the Permian Basin from 2016 to 2021 with EUR normalized for 10 thousand feet of lateral length, these well profiles are barrels of C+C and do not include natural gas or NGL output. I do not show the well profiles from 2013 to 2015, over this period EUR per 10k feet was increasing, but by 2016 it seems proppant loads and frack stages per 1000 feet of lateral were close to optimal. Increasing lateral length over the 2016 to 2021 period reduced output per foot of lateral for the average Permian well.

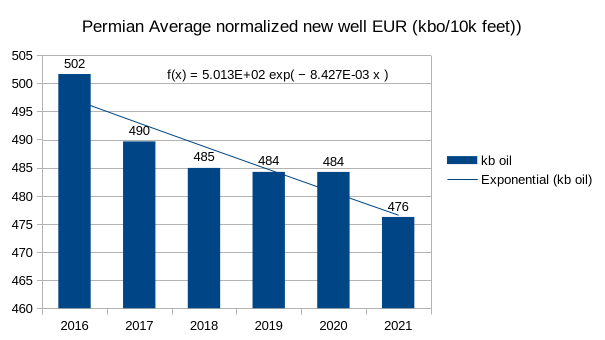

EUR normalized for a 10k lateral length (the approximate average lateral length in 2022) fell from 502 kbo in 2016 to 476 kbo in 2021. The average annual rate of decrease was about 0.84% per year over that 5 year period. It is unclear if this decrease is due to increased lateral length which would increase frictional losses along the the length of the well especially when the well has been placed on artificial lift and tend to reduce normalized EUR or due to fewer high quality areas to develop new wells. It may be a combination of the two factors.

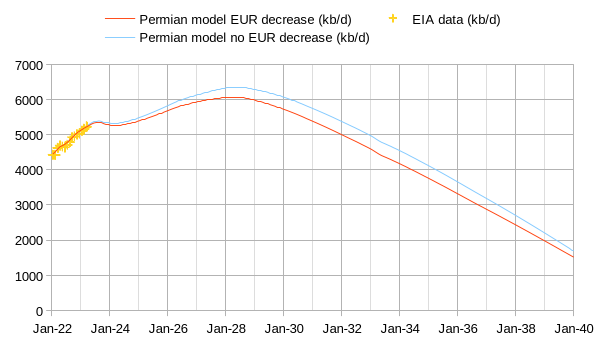

For the Permian basin there have been about 25000 new wells completed from the end of 2015 to the end of 2021, if we assume all of the decrease in normalized productivity per 10k of lateral length has occured due to lack of quality areas to drill new wells we can adjust future productivity so that for each well developed, the productivity falls by 5% for every 25000 wells completed as was the case from 2016 to 2021. The chart below compares two scenarios for the Permian basin where the EUR remains at the 2020 productivity level in the future for the no EUR decrease scenario and a second scenario where productivity decreases by 5% for every 25k new wells completed. About 63000 wells are completed for the two scenarios after December 2021.

The scenario with the EUR decrease is about 2 Gb less than the no EUR decrease scenario (40 Gb vs 42 Gb). Note that some of the 5% decrease in EUR from 2016 to 2021 may have been due to the increasing average lateral length over that period, though we do not know what proportion is due to this effect rather than decreasing high quality areas for development. Reality is likely somewhere between the scenarios shown above if average lateral length eventually stops increasing due to diminishing returns to increased lateral length.

Above is my best guess for US tight oil output, this scenario assumes no average EUR decrease in the Permian Basin, other tight oil plays are assumed to see some decrease in new well EUR. An assumption that Permian EUR decreases at 5% per 25000 wells completed would reduce URR by roughly 2 Gb and the peak would be about 200 kb/d lower, roughly 9400 kb/d.

Thanks, Dennis. Great post. Interesting to note from Graph 5-30 above that world total liquids hit a post-pandemic high around January of this year and have been declining ever since. July’s level was 100.2 million barrels per day, according to the MOMR. The all-time high was in November 2018 at 102.3 million barrels per day.

Ron,

What matters is C plus C as you know. The peak in 2018 remains the peak so far.

I know that Dennis. I was just pointing out that total liquids also peaked in 2018 and is now in decline. Though it is obvious that C+C has a greater hill to climb in order to reach the 2018 peak. It is my opinion that It will never happen.

But then, that is just my opinion. I could be wrong.

Ron,

Total liquids includes NGLs which have been increasing, but as you have stated before and I agree with, bottled gas is not that important. Perhaps you will be correct, but I think we will see a new peak around 2026 to 2028.

Hello Ron,

I just took a look at the MOMR archives (https://www.opec.org/opec_web/en/publications/7107.htm) and struggled to find this 102.3 Mb/d value. December 2018 MOMR states “Preliminary data indicates that global oil supply increased by 0.50 mb/d to average 100.64 mb/d in November 2018, compared with the previous

month.”

It seems that OPEC agrees with IEA in finding that world total liquids supply reached slightly higher levels in 2022 and 2023 (up to 101.5 Mb/d) than in late-2018 (100,6 Mb/d).

Only EIA finds a 102.3 Mb/d value for November 2018 (https://www.eia.gov/international/data/world/petroleum-and-other-liquids/monthly-petroleum-and-other-liquids-production?pd=5&p=0000000000000000000000000000000000g&u=0&f=M&v=line&a=-&i=none&vo=value&t=C&g=none&l=249–249&s=725846400000&e=1680307200000&vb=170&ev=true).

In fact, only EIA finds an all-liquids peak in late-2018.

Yeah, but only the EIA tracks every nation and posts their production numbers. The OPEC MOMR is just a shotgun guess. So I am going with the EIA because they are watching it closer than anyone else. The peak total liquids and C+C were in November 2018. But the total liquids do not really matter. Who cares when bottled gas peaked? C+C peaked in November 2018, according to everybody. End of story.

OVI ,Dennis you might find the twitter thread useful

https://twitter.com/EIAgov/status/1692251780900422031

TexasTeaTwo

I don’t do Twitter. The accounting/adjustment issue was a problem earlier this year when they were over 2 M barrels for many weeks. More recently they are closer to 0.5 M barrels.

The adjustment factor is required to balance the difference in the change in oil inventory vs what the EIA calculates from the difference between import and export numbers and refinery input.

Several rears ago I did this post, together with Art Berman:

8/10/2016

U.S. Storage Filling Up with Unaccounted-For Oil

http://crudeoilpeak.info/u-s-storage-filling-up-with-unaccounted-for-oil

Again, when will I be included in the email list notifying us of new articles?

Matt,

An email is no longer sent out, just check in every 7 to 9 dys for a new post, we do 4 per month.

Dennis, good report

“If OPEC continues to produce at the July 2023 level of about 27 Mb/d of crude oil, we will see a significant draw in World Oil stocks, assuming OPEC estimates for Non-OPEC Oil Supply and World Oil Demand are correct. My expectation is that the World Oil Market will become very tight and oil prices should rise, unless OPEC increases output to balance the OiI Market.”

As a thought experiment, what if OPEC plus wants the market to “balance” using price rather than increasing production? You have two of the largest members, the Saudi’s and Russians that have every reason to do so.

They can’t do that, because it would make the American car lover sad, as well as Joe Biden. Don’t they know they have an obligation to keep?

TexasTeaTwo

SA wants $85 to $90 Brent. Watch what happens when Brent gets above $90. If SA reverses it’s 1 b/d cut using two 0.5 Mb/d cuts over three to four months that will tell what price they want.

What if SA cuts are just natural that they cannot produce more?

Exactly how much Saudi can produce is a deep dark secret. However, there is no doubt their oil production is in decline. And I do think that much of their recent cuts are due to their declining production. That July cut, however, was not due to decline. That one was just too big to be natural.

Just guessing, but I would estimate their current level of production, which they can hold for a few months, is somewhere between 10 and 10.5 million barrels per day.

There were some article on TOD back then that showed that the way SA is using water to take the oil out sometimes giving the field a break helps with the oil just coming on top, the way if you mix water and oil and then give it a break to separate on the column …

Svaya, naw, that’s not how it works. The water injection is to increase the pressure and sweep the oil toward the center. They have been doing that for many decades now. There is always water in the oil, and the Saudi oil-to-water ratio has been increasing for some time now. In some places, it is just oil-stained brine.

Hi Ron! As they are trying to keep production levels using water injection, could it be that the production is dropping very steep at the very end of the reservoir ? Kind of a switch where within a few months there is very big drop in production ? It could have happened in one of there fields.

I am not an expert on this domain, so I will reply on experts on this forum to clarify 🙂

Svaya,

Declines are involuntary and cuts are voluntary. Even with declining production one is still going to adjust production according to consumptive conditions. The scale of these Saudi cuts are big but don’t appear to be about preserving oil due to declining production. I’ll believe the headlines for now that they’re about market, and of course, budget considerations.

Preservationary cuts are coming not too far out in the future imo. When that point approaches, we readers here at pob will know ahead of everyone else what’s going on and will see right through the headlines if they pretend otherwise. I think Mr. Shellman is going to get his wish relatively soon and the US is going to ban exports, at which point, given shale’s extreme decline rates, won’t matter by much.

That is also my thinking, They now cut by million barrels and later increase by half as much to give the appearance that they are in control. But, since most of the Saudi oil comes from the super-giant and mega-giant fields, that are in decline, this is a game that cannot last for a long.

…

Here is a map of Saudi Oil Fields with estimates of the field sizes. It has about half of the fields in Simmons’s book and some, such as Khafji is not on the map (probably because it is counted as being in the Neutral Zone). If I add the estimated URR for these fields, I get about 320 Gb, indicating that the estimates are generous. I stress, that these are estimates as many are listed exactly as having 500 Mb of oil.

….

https://www.cccarto.com/oil/saudiarabiaoil/#3/43.83/70.84

Dennis

I think OPEC is purposely overstating their expectations of US shale production so that if inventories start dropping rapidly, they can come in and save the day, while blaming the shale producers for failure to perform.

High prices and a convenient fall guy to blame! Welcome to the world of oil price control by OPEC ( until they run out of spare capacity).

Very good report.

Old Chemist,

That is possible, but my guess is they believe their forecast, we all realize such forecasts are rarely correct.

So I was reading the article: https://oilprice.com/Energy/Energy-General/Net-Zero-Goals-Wont-Slow-Down-Oil-Exploration.html

While reading this article I thought to my self what a great opportunity to 1) solidly my position as the biggest bullshitter on the POB and 2) remind those who questioned my earlier bits of wisdom just how dumb they now look. Its twofer😎For those who are easily offended by the ramblings of a highly successful, but barely literate business man, you might just want to ignore.

“The recovery in exploration spending is taking place amid a double-down on the transition.”

Well color me shocked, you mean the numb-nuts who want to end oil and gas production don’t realize that it’s the oil and gas production that allows for the entire chain of of events from mining to transportation to manufacturing to installation any green transition to even be remotely possible.

“The expected rise in hydrocarbons demand and the relative importance of energy security are two reasons why oil companies are spending more on exploration.”

Ah yes, as Coffee pointed out in a response to Dennis in the last thread, what libs love to do is claim one thing and behind the scenes be doing something else. Coffee pointed out how California uses out of state coal power rather than just admit that the green transition, at best has limits. Germany the same story using cheap Russian gas for the industrial base while “pretending” to be a leader in the green energy movement. Let’s not forget about the NE US whose grid was stabilized by burning OIL. It was not windmills that came to the rescue last winter, it was fossil fuels. Hypocrisy has its risk and those risks have come home to roost. I spend a lot of time in Alaska, lot of folks up there grow a garden every year and then store the produce unit the next years harvest. Not one Alaskan ever throws away the remains of last years crop before this year crop as been harvested. That kind of reasoning escape the green fool. They promote throwing away known provable energy systems before a replacement has been developed. Yea that’s the ticket.

“Indeed, one campaign group dubbed Oil Change International slammed the Inflation Reduction Act as being “one of the biggest handouts to the fossil fuel industry in US history.”

“According to that group, “With tens of billions dollars in giveaways for the oil and gas industry, provisions expanding fossil fuel leasing, and incentives for dangerous and unproven technologies designed to keep the fossil fuel industry in business like Carbon Capture and Storage (CCS), hydrogen, and Direct Air Capture (DAC), this law will not accomplish what we need to have a livable future”

Now I don’t have a deep understanding if the above statement is true, what I do know is this, I would be shocked if it is not. People who truly understand how to keep our society stable and competitive know to do so will require fossil fuels while they openly lie to their base to get their votes. Hope you guy are comfortable with that.

“The gas squeeze that pushed European prices sky-high last year reminded a lot of people embracing the transition that it does not really enhance energy security. It could, at some point, but that would take time, a lot more money and solving several major problems with wind, solar, and EVs. Right now, however, the only sources of energy that do provide energy security are the hydrocarbon sort.

The transition advocates were not the only ones reminded of that fact of life. The oil and gas industry itself may have temporarily forgotten it and got a wake up call last year. So now, spending is on the rise. And the industry is tying it to achieving transition goals ”

I pointed this out over a decade ago (as did others) on this forum only to be banned.

“Continued investments in oil and gas will be needed to make sure that the energy transition happens in a balanced way with a secure supply of affordable and increasingly lower-carbon energy. We will contribute to this balanced transition by focusing our investments on the most profitable and carbon-competitive projects,” Shell’s Integrated Gas and Upstream Director, Zoe Yujnovich, said last month.

Indeed, a fact not often voiced by the transition advocates, both in political circles and outside them, is the fact that the transition away from hydrocarbons depends strongly on those same hydrocarbons.”

Just a polite thank you for doing my part is all I require, I have already received plenty of renumeration for my rather large bets against you goobers.

Which balance? The balance which matters is the Earth’s energy balance with space. We know that we are out of balance and why. And we get the first evidence that society is being destabilized by climate change.

Where is the legislation which says that fuels refined from oil coming from new discoveries should only be used for renewable energy projects? The untruthfulness of governments comes from not telling the public we will have to adapt to much more modest lifestyles in order to reduce emissions. At present we seem to wait for declining oil production to do that job.

Matt, indeed. As Colin Campbell never tired to say that politician cannot tell the truth as they would be voted out of office. Here is a thought that came to me. What if, at least, some of the leaders know what is happening and reason that the only way to prevent a huge crash is to push for renewables as a camouflage and to de-industrialize, and thus make the crash come earlier so that it is a bit less severe as letting the show go on. I may be giving too much credit to them, as they live in their own bubbles. But it is quite clear to most on this discussion group that we are in a collision course with declining output and rising consumption in oil producing countries, which means that soon there is nothing to export, and after that there is not enough for even for the citizens of the exporting country.

TTwit –

The constant dribble you excrete is impressive! Keep it up!

KENGEO,

You know what they say…

CAN’T FIX STUPID.

steve

TexasTeaTwo

““Continued investments in oil and gas will be needed to make sure that the energy transition happens in a balanced way with a secure supply of affordable and increasingly lower-carbon energy.”

+10

This landed in my inbox . WEO outlook 2022 . All energy sources defined including Net Zero etc . Spanish so use Google translate .

https://crashoil.blogspot.com/

Saudi Arabia is currently in a recession. Their balance of trade is falling fast. How many quarters of negative GDP growth can they take?

Only a matter of time before they reverse course and are back producing all they can.

You know they know to when they do this, they’ll earn less. Oil price will fall more than 10% fast, and they will have the extra cost for pumping more (wear of equipment, chemicals, fuel, … all this stuff ) and gain NOTHING.

Pumping more into falling prices is a loosers game. The Russians are holding, back, too, so they will pump more, too when SA abandons their pledge.

Longer term 50-60$ oil will help them again by killing off pesky shale companies in times where the cheap OPM isn’t available in huge quantities anymore.

The democratic US government wants to have 50-60$ oil, both to punish Russia an Iran while calming their car owners for the next election. They still think US shale can run on 30$ oil because of all the marketing BS the companies published in all media.

Thanks Dennis for the report and info.

I have a question, you stated:

My expectation is that the World Oil Market will become very tight and oil prices should rise, unless OPEC increases output to balance the OiI Market.

Why is that expected of OPEC, can’t the non-OPEC countries which are producing ~ 70% of total liquid fuels ramp up production ? Or are we to assume non-OPEC countries are producing at full capacity while OPEC are not ?

Iron Mike,

OPEC MOMR already has non-OPEC increasing output and the forecast is already optimistic in my view. OPEC has cut about 2100 kb/d over the last 3 quarters, if these cuts are maintained I think it unlikely that non-OPEC nations will be able to pick up the slack, instead we will see oil prices rise enough to reduce oil demand so that the market becomes balanced. That’s what I expect, but it is likely that I will be incorrect, as has often been true in the past.

Note that I focus on crude plus condensate output, OPEC produces about 37.5% of World C plus C output.

Dennis,

I think OPEC is overestimating non-OPEC output so they don’t have to increase their production.

I think OPEC can increase production but they just don’t want to, since their main export is C plus C, they want to get the most money out of their export which makes economic sense.

I still think a severe recession is needed reduce oil demand. It seems to me that credit availability hasn’t really been hampered by the interest rate rises. For a recession banks need to stop lending, which is not what is happening at the moment. And as long as credit is available so will the strong demand for oil.

Iron Mike,

I agree with your comment except the part about OPEC purposely overestimating non-OPEC output. I think they believe their forecast and also think they believe that World Oil stocks are too high and are trying to reduce those to increase oil price.

another scorcher here in Texas and like much of the last few days ERCOT once again announces voluntary electrical demand reductions. This is likely to go on for another 10 days to two weeks.

you can follow along with this failed experiment at:

https://www.ercot.com/gridmktinfo/dashboards

If you are talking about solar, than don’t call it a failure until the state has installed about 10-fold more of it. That would be a decent first inning effort,

and yes…Texas will get there. I’m confident of the capability to eventually grow up into the big shoes.

btw-don’t be so fearful. Oil and Gas will still be in demand in a big way indefinitely, so you will still be making your money.

I am impressed that TX gets such a huge chunk of its power from renewables. Many days it’s around 25-30% and it is increasing as time goes on. Far from perfect but a move in the right direction.

Rgds

WP

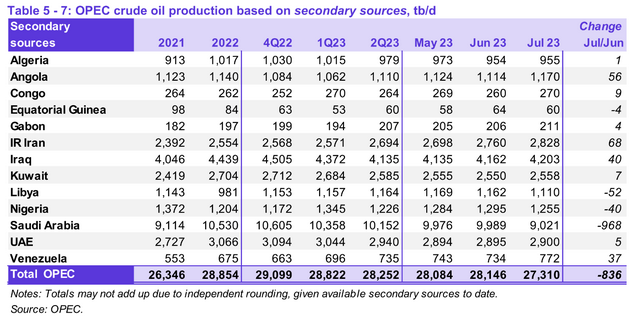

How Much Crude is OPEC 13 Really Producing

Attached is a table which shows OPEC 13 crude production according to OPEC MOMR, IEA and Argus.

According to the IEA, OPEC 13 is over producing by 550 kb/d. The main difference is with the UAE producing 340 kb/d more than the MOMR reports and Iran is at + 210 kb/d. The IEA has Nigeria below the MOMR estimate.

I think the IEA has it about right because from May to the end of June WTIC bounced around $70/b because of the over production by the UAE and Iran. SA wants at least $80/b WTIC or the extra $4/b Brent and they tried to get the other members to cut but Iran and UAE would not agree. In the end, SA announced their lollipop cut for July to September and immediately at the end of June the oil market went from a 500 kb/d oversupply to a 500 kb/d shortage and inventory started to drop and WTIC slowly rose by $12/b through July in to August. Do the math. 10 Mb/d @ $70/b vs 9Mb/d @$80/b. Everybody in OPEC 13 wins.

Argus also has the OPEC 13 over producing by 390 kb/d. The biggest over supplier is Iran with an extra 210 kb/d, which is in agreement with the IEA. Argus also has a number of smaller over production increments such as Iraq with +90 kb/d.

It will be interesting to see how and when SA decides to increase its production. Will it happen at $90/b WTIC, i.e. $94/b Brent?

The units in the table are in Mb/d.

EIA STEO estimate for July 2023 for OPEC 13 crude oil in Mb/d:

Algeria 0.96

Angola 1.18

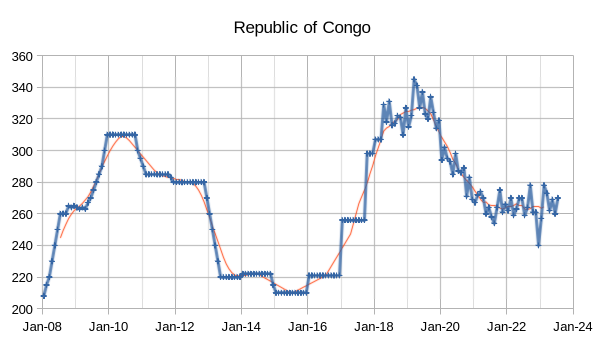

Congo (Brazzaville) 0.26

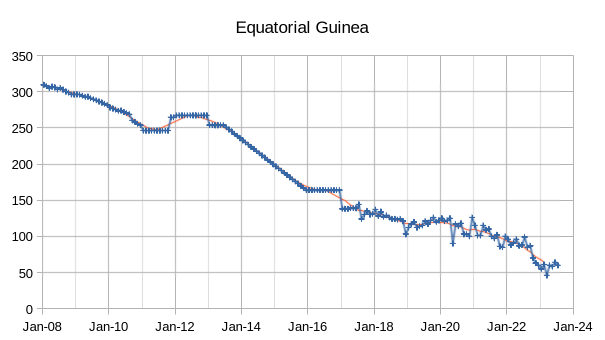

Equatorial Guinea 0.06

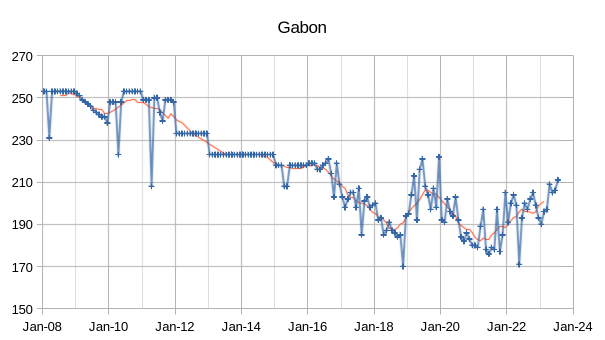

Gabon 0.21

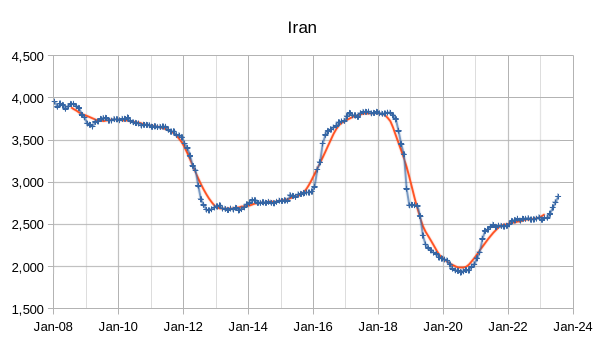

Iran 2.81

Iraq 4.28

Kuwait 2.55

Libya 1.13

Nigeria 1.19

Saudi Arabia 9.3

United Arab Emirates 2.9

Venezuela 0.79

OPEC Total 27.62

The Average of the three estimates presented by Ovi and the EIA STEO estimate is 27.62 Mb/d for Total OPEC 13 crude oil output for July 2023. I agree we don’t know exact OPEC crude oil output, but it is likely in the range of 27.31 to 27.86 Mb/d for July 2023.

Dennis

Whether the OPEC production reports are 500 kb/d too high or too low makes little difference to us.

However a surplus or shortage of 500 kb/d in the real market has a major impact on the price of oil. All of the OPEC + 2 Mb/d cuts did little to stabilize the price and could not get it back to $80/b because there still was an oversupply. That was a clear indication to the Saudi’s that they needed another cut to bring the market in to balance. They are the ones that really need to know whether the market is short or oversupplied.

Ovi,

I agree, the fact is that nobody knows the correct numbers.

I imagine the Saudis might believe the OPEC MOMR estimates (as they play a major role in producing those reports). Base on OPEC estimates the market was oversupplied with oil and that is the reason for OPEC cuts. There are various estimates out there, it is impossible to know which estimate is closer to the truth, we can only speculate. This fact is part of the reason for market volatility, basically everybody is guessing at what the market clearing oil price actually is. It is a mystery.

Giovanni Staunovo🛢

@staunovo

·

3h

#Iran’s Booming Oil Flows Surge Above 2 Million Barrels a Day

TankerTrackers says satellite images show new surge in flows

https://www.bloomberg.com/news/articles/2023-08-21/iran-s-booming-oil-flows-surge-above-2-million-barrels-a-day

If we look at EUR vs lateral length we find about 4% of the 5% decrease in normalized EUR from 2016 to 2021 was due to increasing lateral length, so that once average lateral length stops increasing when an optimtum length is determined we might see EUR decrease slow to 1% per 25k wells completed. That would be closer to the no EUR decrease scenario presented in the post for the 100k total wells completed scenario for the Permian basin, roughly 42 Gb URR.

What a joke .

https://www.bnnbloomberg.ca/argentina-fixes-oil-price-at-56-a-barrel-to-put-inflation-in-check-1.1960712

https://oilprice.com/Energy/Natural-Gas/US-To-Remain-Dominant-In-Global-LNG-Markets.html

This is a pretty comprehensive article on the growth of LNG over the next few years with the USA leading. The article also give much evidence to my thesis that that gas will be the bridge to a nuclear future. I may have mentioned I am long (very) midstream to reap the rewards of the now fully built in future growth.

TTT,

Re natgas …

I was just going over some Pennsylvania wells’ production history.

Impressive, to say the least.

Expressed in both oil equivalent numbers and actual natgas priduction,

about 150 wells have produced over 3 million boe (3 MMboe/17.4 Bcf) with leader Deremer 2HC at ~5 MMboe/28.5 Bcf in 3 1/2 years online.

With average US residential natgas usage at 75,000 cubic feet per year, the 8 well Carpenter pad could supply all of Philadelphia’s and Cleveland’s households’ natgas needs for the past 3 1/2 years’ production (~30 MMboe/174 Bcf). Thattsa heckuva return for ~$100 million development cost.

The recently turned in line 5 well King Hippo pad is on track to produce ~7 MMboe/40 Bcf in its first year … enough to provide all of Pittsburgh’s, Cincinnati’s, Buffalo’s and St. Louis’ residential natgas needs for the year.

Cummins’ X15N natgas engine is being positively received in China and is set to be rolled out in the US in a few months’ time.

With the ongoing buildout of LNG plants that you referenced (near doubling current capacity in just a few years … and do not forget Mexico’s Pacific coast projects), demand for natty should remain strong – along with supply – for many years to come.

That Cummins NG engine looks impressive.

Good to have an alternative to diesel.

This past week I took a big ferry (BC to Vancouver Island) that was NG powered.

https://www.cummins.com/engines/x15n-2024

“PACCAR will work with Cummins Inc. (NYSE:CMI) to offer the new Cummins X15N natural gas engine in Kenworth and Peterbilt trucks. The X15N is the first natural gas engine to be specifically designed for heavy-duty truck applications with up to 500 horsepower output.”

Hickory,

Awhile back, an online trade magazine quoted a large, unidentified west coast distributor (sounded like Walmart) as saying that it would immediately replace all 4,000 of its diesel trucks with the X15N power plants when they became available.

Re LNG-fueled ferries, both ISO type containers (as used by the Tasmanian ferries) and larger bulk-fuel type storage (used in the Baltic area) are becoming more widely adopted throughout the world, remote and/or island communities especially making the switch from diesel.

One of the world’s biggest aluminum smelters in Brazil is switching to LNG from diesel as its primary fuel source.

Expressed in financial/energy terms, oil is about 5 times more expensive than natgas for the same heat content. (~6,000 cubic feet of natty – currently under 17 bucks – equates to one barrel of $80 earl.)

This swift, ongoing transformation towards natgas will catch many people unawares.

Coffee….T.Boone Pickens is looking down smiling.

==================================================

Liquefied Natural Gas .. stored in huge steel concrete tanks

==================================================

Step back and marvel at that ridiculous achievement of mankind.

Yes…Walmart w Cummins NG engines

Quite possible that a large scale conversion to natural gas from oil will lead to higher natural gas prices and will tend to reduce the price of oil, it may also pull the peak in World natural gas output to an earlier date.

Hickory

I managed a group that worked with Cummins to develop the first NG powered engines for 40 ft city buses. The research on how to covert a heavy duty diesel engine to spark ignition mode was started at the Ontario Research Foundation in cooperation with Cummins Engine around 1986. Developing the NG fuel delivery system that would let the engine run lean was the big issue along with meeting engine emission standards. As I recall it took about 3 years and then Cummins took the engine in-house to ruggedize it for heavy road use.

We then launched a City bus development program with Orion Bus industries for 50 CNG buses. The big issue was where to put the CNG tanks to get the 400 mile range. The answer was obvious, on the roof. We put 4 20 ft long tanks on the roof that each stored 4000 ft^3 at 3,000 psi.

Attached is a picture of I think one of the first Orion NG buses. The Ontario buses were put into service around 1990 with 25 in Toronto, 15 in Hamilton, 6 in Kitchener and 4 in Mississauga. Orion also had a factory in New York.

Cummins went on from there to develop bigger bus engines and eventually put them into trucks.

Ovi,

That 3,000 psi storage has long been obsolete/unnecessary with the ongoing advances in adsorption (with a ‘d’) technology.

1,000 psi containers filled with activated carbon are now widely used.

A few years back, a research team from Texas A&M produced an inexpensive polymer with adsorbtion characteristics that enable a 22 GGE (Gallon of Gasoline Equivalent) fuel tank to hold CNG at 500 psi.

That low a pressure could come from stepped up residential natgas allowing homeowners to fuel up right in their own driveways.

CoffeeGuyzz

One of my team members was working on adsorption of NG, again in the 1985 to 1990 time frame. As best as I can recall he started working with a professor at Queens University and looked at Zeolites and polymers. I think in the end they decided that polymers were the way to go and selected Saran.

They made pucks, similar in size to a hockey puck and then slowly pyrolyzed them. What kept happening was that the pucks could not maintain their nice uniform shape. If the pucks could maintain their shape they would nicely pack into a cylinder. I don’t recall how efficient those pucks were in adsorping the CH4.

I would be curious to know if the Texas A&M team were able to commercial their work. Are there commercially available CNG tanks which contain adsorption material?

From about 1980 to 1990 we had vehicles running and being tested on methanol, ethanol, gasoline/ethanol blends (15/85 and 85/15), propane, NG, ammonia and a battery powered van that shuttled Ministry Staff between HQ and downtown. Its range was six miles. The ammonia vehicle emitted unburnt ammonia.

It was a very exciting and fascinating time.

OVI,

The September 4, 2019 issue of online magazine ‘Asian Scientist’ contains the short article ‘Flexible Polymers for Natural Gas Storage’. I have heard of no recent info on this development.

This entire field of Covalent Organic Frameworks is exploding in global interest as the convergence of several disciplines (3D printing, nanotechnology, supercomputing) seems to be enabling a dizzyingly rapid introduction – and manufacturing – of an asston of new storage/filtration products targeting various gasses and liquids.

World record, IIRC, is a grape-sized polymer with internal surface area of 10,000 square meters … about 10 football fields.

There are several companies worldwide that manufacture cylinders for CNG storage. (3,000 psi + seems to be normal, to my surprise.)

A company called Ingevity is one that uses adsorbtion and facilitates ‘virtual pipelines’, i.e., trucks shipping CNG (usually to large commercial customers).

If, as I expect, use of natgas will increase dramatically, many more innovations in techniques and hardware are likely to emerge.

Interesting work.

OVI, good to get a glimpse into your professional life, gives me(us) some context for your ideas and contribution.

TexasTeaTwo

I started life as an aeronautical engineer and worked at Dehavilland aircraft. Out of university I was the wiz kid who knew how to use computers, (punch card Fortran on an IBM 1492 with as I recall 64 k of memory), and was tasked with automating processes onto computers. In the end I specialized in the new and upcoming field, at that time, of computational aerodynamics for 3D bodies so that we could reduce tunnel test times and increase the probability of success with modifications.

I then left to take on a whole new challenge. See above.

Hickory

Did you happen to notice that when the ferry docked, they immediately plugged in to shore power (hydroelectric), and shut down the onboard generator?

That was a conversion done about 25 years ago to the complete ferry system in the province. It was complex and expensive with more than 40 ferries of varying vintages, sizes, and countries of origin ; a similar number of docking facilities with minimal electrical capacity and had to be done without impacting the ferry schedules.

People have been doing the right things and moving in the right direction for a long time, but those efforts have been overwhelmed by population and consumption growth.

I didn’t see that. My view was limited at the dock since I was a bike passenger.

The one I was on was a new conversion-

“The two ferries are the first vessels in the BC Ferries fleet to undergo a conversion from marine diesel fuel to LNG. The newer, Salish Class ships introduced last year were purpose-built to run on natural gas. Deborah Marshall, BC Ferries media spokesperson, says the Spirit class vessels will run on both LNG and diesel, with the intent to operate on gas most of the time. The Spirit of British Columbia started its refit last September after sailing to Poland, where the work was done.”

Hickory

Yes , they were all diesel when we did the conversion engineering.

Hmm looks like I am right once again, “one small step for me one giant leap for mankind” . Don’t take it so hard boys nat gas to nuclear was always the path forward, hop in…. the waters fine.

https://www.zerohedge.com/commodities/soaring-number-americans-want-nuclear-power

We can put a bunch of nuclear power stations near the people that think it’s a good idea, it is better than coal or natural gas, but not as good as wind, solar, or hydro in my opinion. It is an expensive option, wind and solar power are far cheaper, natural gas can be used as backup power and eventually there will be enough excess wind and solar power that synthetic fuels produced using the excess wind and solar power will displace most or all of the natural gas backup and nuclear power will no longer be needed and will become a stranded asset.

Time will tell if Texas tea is right, he may be right short term and wrong long term. We will see in 5 to 10 years.

Nuclear will require many Dems in gov’t positions — they may not advocate nuclear power if they have their choice, but they do know how to govern, regulate, oversee, and enforce a public utility.

To that point, “The U.S. Nuclear Regulatory Commission (NRC) issued its final rule in the Federal Register to certify NuScale Power’s small modular reactor.

The company’s power module becomes the first SMR design certified by the NRC and just the seventh reactor design cleared for use in the United States.”

This action came under the chairmanship of the NRC appointed by Biden. Effective Feb 2023

https://www.energy.gov/ne/articles/nrc-certifies-first-us-small-modular-reactor-design

The bigger issue with nuclear deployments in the US going forward , even more than turning everything into a partisan issue, will be funding. No company in the country or the world can fund these on their own, without huge government funding and loan guarantees because of the upfront costs and history of massive cost overruns with the long planning/construction times. Some utilities and their customers have been very badly burned with projects previously.

High interest rates won’t help with funding of any type of big and long project.

That funding bit I overlooked (perhaps because it’s a given). Also consider end-of-life costs for nuclear plants, which need to be added to the funding. Repubs would just hand it over to the free-market and obviously all the EOL costs would be ignored — not my problem, we’ll be long dead, etc.

I think to recycle the old nuclear installations to install in them new kind of reactor just as the scientists did during the 1960s by replacing the ARE by the MSRE in the Oak Ridge National Laboratory. Ok, that’s not the same scale but the reactor building is what it costs the most in a nuclear power plant.

HFI Research

@HFI_Research

·

2h

“Global onshore crude inventory data is so bullish that it’s making people do a double take.

The same double take I did when I saw how much Saudi and Russia decreased crude exports this month.

We will know soon enough.”

ALSO Both HFI and Eric Nuttall have commentary out regarding the shrinking OIL on water inventory, this despite the implied data from IRAN showing higher exports.

https://youtu.be/Zk11vI-7czE

https://consciousnessofsheep.co.uk/2023/07/19/our-predicament-re-stated/

Predicaments only have outcomes not solutions.

There are some smart people on this site, so maybe one of them will know the answer to this conundrum. There are a few whales buying blocks of wells in mature shale basins. Not the Uinta with its waxy crude, or the Powder River, but Bakken, Niobrara, Stack, Eagle Ford, and even the Texas Permian.

Why?

Usually when something like that happens, the private equity company knows something we don’t. Is a new methodology of getting above 15% recovery coming down the pike? Is oil really going to get scarce? These are not penny-ante folks, but those with a billion and up to spend. And they’re buying.

I have a guess. I think carbon capture–for all it has been decried and castigated on these hallowed pages–is about to go mainstream, upscaled, with vast amounts of carbon dioxide being blown down dead and dying oil wells. And I think that CO2 has a collateral benefit: miscible with oil, dense, capable of raising the reservoir pressure, it could conceivably produce an extra million dollars worth of oil from each borehole as it is blown in. Additionally, there is the fabled halo effect, whereby neighboring wells receive a new frack job.

Anybody with knowledge out there care to edify us?

Mr. Maddoux,

Intriguing to hear of interest in the acquisition of older assets in mature basins, especially if by ‘blocks’ you specifically mean contiguous acreage.

Pure speculation – albeit informed – on my part, but here goes …

1. There have been several dozen EOR projects underway for many years now. With the exception of EOG’s publicized Eagle Ford operation, virtually NO info is being publcly disseminated on results.

Hmmm …

The last thing operators would want is for widespread knowledge of an additional 25%+ oil to economically come from US ‘shale’. (That 25% figure came from ND’s EERC in describing the result’s of Liberty’s truncated Stomping Horse EOR project).

2. When Hamm bought the unsolicited Parsley acreage it caught many people by surprise (including, seemingly, then owner Pioneer. In addition to purchasing mostly contiguous Permian land – a pre-requisite for large EOR via gas/water injection – Continental hired Doug Lawler – former CEO of Chesapeake. Just prior to the Covid-inspired shutdowns, Chesapeake was about to embark upon an extraordinarily sophisticated – and large – EOR project in its Eagle Ford operations. Hamm now owns CLR completely, which would benefit him enormously if/when it becomes known rhat OOIP recovery may be in the 30% range.

3. A guy touting his own EOR consulting firm is adamant that high volume, high pressure, short time soak periods are optimal for gas-injection EOR. This dovetails nicely with the very strong demand for the expensive, high volume, high pressure compressor packages that have neen rolling out these past few years.

4. There seems to be ongoing innovations with solvent material transported via water (the SAGD boys seem to be leading in this technology) whereby not only miscible formulations are pumped downhole, but – being liquid – formation pressure can be significantly increased.

5. At lest one outfit – Hess, in the Bakken, I believe, has been experimenting with supercritical gasses (methane or field gas, I think) to better control injection placement.

6. EOG’s seemingly bizarre massive entree into the Ohio Utica (and the ‘fringe’ area, at that) could be explained if they have developed a method of economically high recovery in that notoriously low pressure region. (EOG continues to add acreage in this area, also).

Overall, I would not be surprised to learn in the not-too-distant future of successful EOR processes which would make the early ‘shale’ wells productive once again.

Just my two and a half cents.

Great analysis. I figure something is up. It’s going to be interesting to see how this unfolds.

The Smackover wells are being purchased for their high lithium borehole concentration. Some of the Mississippi Lime wells are valued for their helium content. When you think about it, there are hundreds of thousands of old shale wells.

Something is afoot. Thank you for your informative comment.

Regarding your comments above, Coffee, I’m sure you’re aware that Crescent Point just sold their U.S. Bakken acreage (which was some of the finest) for $500M, and has bought Montney Shale in its place. The Montney is Big Gas, providing the government lets them harvest it, as much of it is over indigenous lands. It was probably a good move for Crescent Point, but that’s not the purpose for my thinking.

The buyer of CPUSA North Dakota acreage is important. That would be Kraken, which is already a great (aggressive) driller in the Bakken. In terms of excellence, though, there was no one better than CPUSA.

The intrigue of the purchase is doubled by the knowledge that the same buyer purchased the eastern fringe of the Eagle Ford, a comma-shaped swath of the Brazos Valley, with Austin chalk on top and a complex multilayered shale down below.

That buyer is both is Kayne Anderson, an LA private equity outfit, which in conjunction with Pincus bought the east Eagle Ford from Chesapeake through Wildfire (which developed a cluster of very fine horizontal wells in that area (I have minerals under one, in Madison County).

Kayne Anderson got nearly 24,000 boe in the Bakken, and nearly 27,000 boe in the Eagle Ford (which we call the Eaglebine–part Eagle Ford, part Woodbine in characteristics). 50,000 boe in the two. But that’s not nearly enough to cash-flow that stuff. Something else is afoot.

The concept of DAC of CO2 has been decried, but when a collector is put in a high-ambient zone the yield is high. Years ago EOG injected CO2 down a horizontal well in Mountrail County North Dakota and guess what? The CO2 broke through into a separate well over a mile away. All shale basins are interbedded with some sort of carbonate. In the Bakken it’s most usually strontium carbonate. CO2 follows not only frack lines but carbonate interbedding seams. Under pressure, it will probably travel for miles, over time.

That unintentional recipient well woke up and produced more oil, which was the CO2 equivalent to the “Halo Effect” of remote fracking. The point here is that injected CO2 down a dead well in the midst of a dying field “finds” other wells in addition to its injection well–the entire reservoir pressure could eventually rise.. CC and CS are coming on a large scale. There’s a reason why Kayne Anderson paid $2B for shale acreage that’s not normally thought to be the shiny penny in the shale world.

I am quite sure that EOG hasn’t forgotten that accidental well interference a mile away from CO2 injection. Low pressure zones like the Ohio Utica don’t have to remain low pressure–that can be adjusted measurably by oil-miscible gas which remains in the reservoir. As you know, EOG is buying the farm over in Ohio–it won’t make a tinker’s dam to them if they cause a Halo Effect five miles over, because they’ll own it. I think we’re likely to see a pretty exciting series of experiments from CC (which is heavily subsidized) and CS (also subsidized), with economical oil recovery.

CO2 flooding has been used on conventional oil wells for decades, of course. But now it’s impossible to build an interstate CO2 pipeline. Enter in-field DAC, CC and CS down unconventional wells that have struggled to get past 10% recovery. This could be exciting.

Mr. Maddoux,

Just got back from some travels and I see your comment.

When Crescent Point entered the Bakken, I believe that stated that they ultimately were looking to do water injections to raise formation pressure like they had been doing in Canada. One pre-requisite was needing to have large contiguous acreage so as to have more operational control of the below ground fluid movements.

Do you remember that colorful outfit that used gelled propane instead of water to frac years ago?

Gasfrac was the company. Went bust. However, they frac’d 2 shallow (~6,000 foot, IIRC) wells in the Eaglebine that had 2 or 3 strong months’ of production before falling off a cliff.

Same thing happened in one shallow well in Ohio (Equinor was the operator). The first few months, people thought the code had finally been cracked in order to profitably produce from these shallow, low pressure formations.

It didn’t work, but the idea of boosting formation pressure has been shown – over and over – to enable liquid hydrocarbons to effectively flow topside IF the pressure boost can be done effectively and profitably.

I would not be surprised if some outfits (Continental and EOG come to mind) already have processes that are bona fide EOR mechanisms.

There seems to be a strong collective sense that if it was feasible and affordable then carbon capture would be a good thing, worth spending large amounts of money on.

Here is a good summary the state of the things and two projects getting funded- Texas and Louisiana.

https://www.science.org/content/article/us-unveils-plans-for-large-facilities-to-capture-carbon-directly-from-air

I remain in a skeptical stance..how I approach everything in this human world. Proof in the pudding. Perhaps if there are a series of technical advances then there will be some feasibility.

I do think it is remarkable that there has been a gradual but definite change in the stance of large swaths of the population, who now seem to acknowledge that the ‘crazy scientists’ who from the 1970’s have been warning about climate warming from combustion were correct in proclaiming this very inconvenient truth.

From decades ago-

“Yes, the vast majority of actively publishing climate scientists – 97 percent – agree that humans are causing global warming and climate change.”-

https://climate.nasa.gov/faq/17/do-scientists-agree-on-climate-change/

Many observers think it is far too late to stabilize this phenomena…that progressive disruption is already baked in the cake. I am one who falls into that category.

All carbon capture schemes pale beside agroecology. See https://kisstheground.com/.

The term “agroecology” is an oxymoron. “Agriculture” is the opposite of “ecology.” Agriculture is “the greatest mistake in the history of the human race.”

You are wrong. Agroecology aka regenerative agriculture aka restorative agriculture respects holobionts (by my definition) and has been practiced for tens of thousands of years (by people we frequently call hunter-gatherers). See https://theproudholobionts.blogspot.com/2022/07/why-agroecology-is-future-of-food.html

Understanding holobionts is the key to understanding life on earth. See https://theproudholobionts.blogspot.com/2022/06/survival-of-fittest-or-non-survival-of.html

You might want to watch Ugo Bardi explain the significance of the holobiont here: https://www.youtube.com/watch?v=oF0nkauaNj4&t=332s

I agree-

Guns germ and Steel

HFI Research

@HFI_Research

For much of this year, EIA monthly US oil production has outpaced the weekly figures.

Following this week’s revision to ~12.8 million b/d for the weekly, we will now see weekly outpace monthly production into year-end.

EIA STEO is too aggressive, so adjustment will narrow.

with several charts: https://twitter.com/HFI_Research/status/1694411386070478869

Canada steps up pace of oil production growth, seen rising 8% in two years

Aug 23 (Reuters) – A busy oil sands maintenance season and early summer wildfires put a dent in Canadian crude production in the second quarter, but oil companies are ramping up growth over the next two years and will add nearly 8% to Canada’s total output, analysts estimate.

The roughly 375,000 barrel per day (bpd) increase in two years would be more than Canada, the world’s fourth-largest oil producer, has managed to add over the last five years combined, even after promising European allies it would boost crude output in the wake of Russia’s invasion of Ukraine in early 2022.

Much of the growth will come from oil sands producers like Cenovus Energy (CVE.TO) and Canadian Natural Resources Ltd (CNRL) (CNQ.TO) tweaking operations to boost efficiency.

Companies are also moving forward on so-called “step-out” or “tie-back” oil sands thermal projects, where instead of building an entirely new facility to steam bitumen deposits, they are linking new areas with existing plants to speed up development and lower costs.

RBN expects total Canadian crude output to increase 175,000 bpd this year and another 200,000 bpd in 2024, while S&P Global Commodity Insights analyst Kevin Birn said annual oil sands production alone will rise around 350,000 bpd by 2025.

Two-thirds of Canada’s crude comes from northern Alberta’s oil sands.

https://www.reuters.com/markets/commodities/canada-steps-up-pace-oil-production-growth-seen-rising-8-two-years-2023-08-23/#:~:text=According%20to%20Canada%20Energy%20Regulator,4.61%20million%20bpd%20in%202018.&text=Much%20of%20the%20growth%20will,tweaking%20operations%20to%20boost%20efficiency.

There is going to be a lot more egress with the opening of the TMX pipeline starting early next year.

“Commodity experts at Standard Chartered have predicted that global oil markets will register a supply deficit of 2.81 million barrels per day in August; 2.43mb/d in September and more than 2mb/d in November and December. The analysts have also projected that global inventories will fall by 310mb by end-2023 and another 94mb in the first quarter of 2024 thus pushing oil prices higher. According to the experts, Brent prices will climb to $93/bbl in the fourth quarter.”

https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-Likely-To-Extend-Production-Cuts-To-October.html

https://www.energyintel.com/0000018a-18b7-d633-a7de-9abf5b520000

“Elevated oil and gasoline prices have put the Biden administration on “alert” mode, but it is hoping that seasonality and bearish sentiment over China’s economic troubles will not push prices higher, he said.

“What would really flip them into true panic mode is where oil prices kept rising,” with WTI at $90-$100/bbl and gasoline consistently at or above $4/gallon, McNally added.”

This article touches on the geopolitics of energy. While OVI speculates upthread on the Saudi intentions I am not so sure they do not have a a bigger goal in mind, that is just getting Brent oil to $85-90 may be the tip of the iceberg. If you caught the news on the BRICS meeting and how a new energy alliance surrounding the BRICS et al is being established to counter the US previous influence, it points to a much greater control for OPEC + control and in my opinion is not a temporary phenomenon. Of course that is speculation on my part, but with the now failed efforts by the US and EU to rid the world of fossil fuels, those with most at stake have an opportunity to drive out of office those pushing that agenda, higher oil prices will do just that, as both the US and EU have dug themselves a very deep hole and yet continue to keep digging. All they have to do is push a little via higher oil prices and it s a win win. US and EU lose power, influence and esteem while the new BRICS trading bloc goes on their merry way.

Texas tea,

What might occur with higher oil prices is an acceleration in the transition to electric transport, OPEC plus might be satisfied with $90/bo for oil prices and is likely to increase output in response to higher oil prices, in addition higher oil prices might also spur higher output levels from non OPEC plus producers also putting downward pressure on oil prices. My guess is that the price of oil will settle in the 85 to 95 dollar per barrel range.

Dennis I cant argue with those conclusion regarding oil price at this time. As OVI pointed out time will tell and if OPEC begins to add incremental oil production to cap prices at or below $100, then yes, my ideas will be wrong.

With respect to any energy transition, its just not happening. The data is clear,

green energy takes a portion of NEW ENERGY DEMAND, it is not replacing anything. I don’t post much of my research on this here because its not really oil/ nat gas related but a green energy transition is a mirage.

Last I looked electric vehicles are selling like hot coffee in the desert in the US, lack of infrastructure and high interest rates are a real barrier.

News alert- according to Texas Tea there is no longer any oil depletion, and therefore

“With respect to any energy transition, its just not happening”

There is a reason that China is far ahead of the US on the transition attempt- electric vehicles, batteries and photovoltaics.

It is not because they are more concerned about carbon emission… it is because they import large amounts of their oil consumption.

When you are at the whim of geopolitical turbulence and see global oil depletion in big letters written on the wall, it can be a big motivation if you happen to have any focus of mind.

The Chicoms will do what ever it takes to avoid the importing of oil and natural gas. Hickory aced it with this comment. The world can count on an ample supply of carbon dioxide from them for many years.

China’s efforts on building up domestic energy that does not rely on oil and gas is just an example of what all countries will be confronting as depletion sets in.

Its not a tough concept.

Everyone is starting out late on the attempt.

Texastea,

A large proportion (more than half) of World Energy consumption added in recent years has come from renewable energy, I disagree that there won’t be an energy transition, wind and solar consumption have been growing at about 25% per year at the World level, we will likely see 15% to 20% growth on average until most energy use is satisfied by wind and solar, the balance will be supllied by hydro, nuclear, amd synthetic fuels produced by excess solar and wind capacity. This will be the reality by 2050, perhaps sooner.

Wouldn’t it be worthwhile to use renewables to cover that new demand? Save a little ffs, which will still be in high demand as long as they’re available. It seems like all you care about is making money off an energy crisis anyway. No lie the greens have told will ever be as damaging as the notion promoted by the ff industry that we don’t need to worry about depletion, that oil and coal and gas will always be cheap and plentiful, etc.

well look what we have here, a dose of reality.

https://oilprice.com/Energy/Natural-Gas/Natural-Gas-Fills-The-Gap-As-Renewable-Power-Falters.html

also to Dennis’s point here in Texas solar as been doing its part for at least the daylight hours at about 13% of total generating capacity or about equal to coal does except coal works 24/7. As we look forward a warning as El NINO may take out much solar generation across the southern US.

https://www.zerohedge.com/weather/el-nino-threat-puts-us-solar-power-output-risk-winter

Right NOW it’s really a wind story or lack thereof. Now for weeks, the large heat high which covers several states is keeping the wind generation at a standstill. Again today, is “action day” to limit electrical use as wind is suppling about 8%. Every day is a race as the sun goes down to keep the lights on state wide.

15 years ago if you had said “don’t bother building wind power because the jet stream is going to collapse” people would have said you were insane. Whoops.

I have opined here on POB that we are living a repeat (at a minimum) of the 1970’s. At this link you will find an inflation chart that looks like I am right again…at least thus far. Now add in the potential for an energy shock/ geopolitical realignment and bingo front row it’s the 70’s show.

https://twitter.com/KobeissiLetter/status/1694706863454187877

and there is more

BREAKING: BRICS announces new members as:

🇦🇷 Argentina

🇪🇬 Egypt

🇪🇹 Ethiopia

🇮🇷 Iran

🇸🇦 Saudi Arabia

🇦🇪 UAE

https://www.zerohedge.com/geopolitical/xi-putin-hail-first-brics-expansion-over-decade-two-gulf-oil-powers-join

In the end all these countries will continue trading in dollars. Eurodollars that is.

None of the BRICS are going to be willing to give up control of their currency in exchange for a gold backed currency. When the local currency is the biggest lever or tool most governments have. They’re not going to give up that power.

There is way more leverage in the offshore Eurodollar market that the world outside the US uses to trade and finance everything between each other than there is leverage in the onshore US dollar market. You’ll see currencies implode if they try leaving the global monetary system. But it won’t be the dollar that is imploding.

The entire world has a synthetic short on the dollar. Because the dollar is what is borrowed to do everything with.

BRICS are going to drive the dollar to all time highs. And it’s going to be very destructive everywhere.

Those Eurodollars that originated outside the US. If you default on them you not defaulting on the US. You’re defaulting on Japan and Europe. Your defaulting on any bank that is a dollar provider outside the US.

Crescent Point Energy signs deal to sell assets in North Dakota for $675M in cash

CALGARY — Crescent Point Energy Corp. (CPG: NYSE) has signed a deal to sell its North Dakota assets to a private operator for about $675 million in cash.

The Calgary-based company announced the sale Thursday, saying in a news release that the limited drilling inventory associated with the assets means oil production from the area is expected to decline over time.

“This (North Dakota asset sale) allows us to realize future value for an area with limited scalability while immediately enhancing our financial position and increasing our focus on our core operating areas.”

Crescent Point’s North Dakota production was about 23,500 barrels of oil equivalent per day (boe/d) in the second quarter of this year.

But the company said that is expected to decrease to 18,000 boe/d by 2027 and decline further in future years.

Italics mine

This implies a decline rate of close to 1,400 b/d/yr, 6%/yr, with regular infill drilling I assume. More evidence that the Bakken is at best on plateau before decline sets in, in a year or two.

https://financialpost.com/pmn/business-pmn/crescent-point-energy-signs-deal-to-sell-assets-in-north-dakota-for-675m-in-cash#:~:text=CALGARY — Crescent Point Energy Corp,about $675 million in cash.

I hate like the dickens to see Crescent Point exit ND—they are a first-class operator, just tops.

But they got a little over their skis, buying the Kaybob Dubernay from Shell and then the Montney shale from Spartan. Plus, the bulk of their operations are in western Canada.

As usual, this was a smart move, to pay down debt and transition to their home base. They had a good position in the Bakken but not nearly as fresh as in the Montney shale, which seems to be a great play. These two acquisitions, along with their other inventory, should fix Crescent Point for the next twenty years or so.

The $675M price for their Bakken holdings was almost a fire sale, which reflects their need to raise some cash. One of the great strengths of Crescent Point is the ability to drill and complete wells at a good price. I just looked over their 2021 data. In the North Dakota Bakken, they drilled their wells for just over $7.5M each, and they were the best in the business for productivity. Interestingly, they were growing their ND Bakken production (23,500 doe/d, up from 19,000 in 2021), and as far as I can tell, their per well productivity has steadily increased, not decreased.

Whoever bought their assets will likely drill the snot out of it. Crescent Point was exceptionally careful with spacing and choke management, treating each well with great interest. People talk all the time about “Tier-One” acreage. Tier-One operators are just as important.

You don’t sell a class 1 asset to fire sale prices – at least not in the current oil price scenario.

There has to be a flaw with these assets, perhaps already almost drilled out locations or other things.

At 60 or 50$ oil fire sales would be more plausible, raising cash.

EULEN_SPIEGEL

BMO seems to agree with you.

09:39 AM EDT, 08/25/2023 (MT Newswires) — BMO Capital Markets on Friday reiterated its outperform rating on the shares of Crescent Point Energy (CPG.TO, CPG) and its C$13.00 price target after the company sold its North Dakota oil and gas assets for US$500 million.

“Crescent Point announced the sale of its North Dakota assets for a cash consideration of ~$675 million (US$500 million). While the sale price is less than expected and reduces near-term cash flow, we believe that the transaction aligns well with the company’s strategy and is expected to accelerate debt reduction. We believe that the shares remain attractively valued and are maintaining our Outperform rating and target price of $13 for Crescent Point,” analyst Randy Ollenberger wrote.

Eulen_Spiegel:

I think Crescent Point was cash-strapped. Relatively speaking.

But there is an obvious flaw with these Bakken assets: they don’t have as many targets for a spacing-particular company like Crescent Point as the acreage they bought. I thought I made that pretty clear, maybe not.

I own quite a bit of Bakken shale mineral rights and heavy overrides (for a small investor), but I’m not blind to the fact that it’s a mature field. Whoever bought CPUSA assets got some good stuff but it’s not wide-open spaces. If the government allows them to develop it to its fullest, the Montney shale is a much better place for them–and the 2X price (over Bakken) they paid for it reflects that.

In a whole sea of tight-spacing, open-choke, ruin-a-well-up-front companies in the shale basins, I simply hate to see best of show leave a basin where I have a stake, that’s all. But there are quite a few very good operators up in the Bakken–on balance more careful than in the Permian. Crescent Point is just a great steward of the mineral resources.

“I think Crescent Point was cash-strapped”

Didn’t they just pay a special dividend?

despite the tremendous expanse of solar and wind power in texas as of this moment nat gas coal and nuclear are producing 88.9% of the electrical generation and we are once again being ask to conserves electricity, since texas is bright red politically and each of got the sound alert on our smart phones I expect the next legislative session to produce better result, you can flow this failed green energy experiment at

https://www.ercot.com/gridmktinfo/dashboards

Last Updated: Aug 24, 2023 19:54 CT

CURRENT GENERATION

Solar306 MW(0.4%)

Wind6,496 MW(8.6%)

Hydro249 MW(0.3%)

Power Storage852 MW(1.1%)

Other105 MW(0.1%)

Natural Gas50,584 MW(67.0%)

Coal and Lignite11,972 MW(15.9%)

Nuclear4,939 MW(6.5%)

Texas tea,

Not surprising that solar output would be low at 8 PM, at about 2:30 PM on Aug 26, about 22.5% of ERCOT power output was from wind and solar combined. This is at roughly the peak for daily demand in Texas.

https://dailycaller.com/2023/08/27/opinion-wind-and-solar-keep-failing-texans-at-the-worst-possible-times-david-blackmon/

Pretty optimistic take on the Vaca Muerta-

“Such solid production growth has triggered considerable speculation that the Vaca Muerta could be pumping as much as one million barrels of oil by 2030, or more than triple the average of 291,377 barrels per day lifted during the first six months of 2023. If that occurs, it will see Argentina become a major regional and global oil producer which will give the troubled economy as well as government coffers a solid boost.

The light sweet oil being produced from the Vaca Muerta, which is light with an API gravity of 39 degrees to 42 degrees and sweet with a sulfur content of less than 0.5%, is cheaper and easier to refine into high grade fuels. This makes it particularly appealing in a world where fuel emission standards are continuously being tightened. According to consultancy McKinsey, as quoted in LatAm Investor, the carbon intensity for extracting the oil in the Vaca Muerta, which is 15.8 kilograms of carbon per barrel of oil equivalent produced, is one of the lowest globally and below the industry average of 23 kilograms. This enhances the appeal of the Vaca Muerta for foreign energy companies, especially with considerable pressure being placed on the global oil industry to reduce greenhouse emissions and become carbon neutral.

The quality of the Vaca Muerta play is underscored by this statement from industry consultancy Rystad Energy:

“. . . there are no issues with the quality of Vaca Muerta’s shale oil or its capacity to produce hydrocarbons at scale (after proper stimulation). Its shale is distinguished by its high pressures and substantial thickness. Its oil yield per foot is demonstrably superior to similar horizontal wells in major US shale plays.”

There are also the geological formation’s low breakeven costs to consider. Drilling, lifting and other operational costs have fallen considerably in recent years as the Vaca Muerta has been developed. The geological body has a low average breakeven cost of $35 to $40 per barrel, with consultancy McKinsey & Company claiming the Vaca Muerta technically breaks even at $36 per barrel, which is competitive with other drilling locations in Latin America and lower than most U.S. shale basins. This further underscores the attractiveness of investing in the Vaca Muerta for foreign energy companies that are seeking high-quality, low-cost plays that produce light, sweet crude oil with a low carbon footprint.”

https://oilprice.com/Energy/Crude-Oil/Vaca-Muertas-Sweet-Crude-Attracts-Global-Energy-Giants.html

HFI Research

@HFI_Research

·

11m

In the years I’ve followed the oil market, I have never seen the Saudis this determined to push oil prices up.” with chart

https://twitter.com/HFI_Research

Giovanni Staunovo🛢

@staunovo

As of August the implied crude shortfall has really accelerated with the latest 4-week average showing draws of close to 5mbd. About 2mbd come from onshore tanks, with China having shifted from a stockbuilding to a stockdrawing pattern. And an even bigger figure is emerging for crude oil at sea. #oott…with chart

https://twitter.com/staunovo/status/1695048151831318906

https://www.vortexa.com/insights/crude/on-and-offshore-crude-oil-inventory-drop-reflects-fundamental-market-tightening/

August 25 Rig and Frac Report

New Recent low for Rigs and Fracs

US Hz rigs down 4 to 463.

Permian down 3, with New Mexico Permian down 4 and Texas up 1

Eagle Ford down 1

NG down 1 to 103

New recent low for Fracs

Fracs down 10 to 246.

How long can production increase while frac spreads decrease?

Ovi perhaps this is the explanation. There is no sign of stabilization of rig count now in the middle of the 3rd quarter and as we move into the 4th quarter. Looks to me like it will be next year and at much higher prices to get industry to begin to “kick it up a notch”. I find it curious, we have completed the ducs we drilled last summer and I am seeing a quite a bit of permitting activity in Central Okla, but if industry was wanting to front run the possible price increases relating to the Saudi/OPEC + cuts, I would have thought we would see the rig count stabilize.

“Earlier this year the EIA revised the number of drilled but uncompleted wells in the top U.S. shale basin, adding several years’ worth of unreported DUCs,” said Phil Flynn, energy analyst at Chicago brokerage Price Futures Group.

Flynn said the revisions imply that drilling-rig productivity has been higher than past estimates despite the U.S. oil rig count having fallen by more than 15% this year.

The EIA “believes active drilling rigs were about 10% more productive in 2021–2022 than previously estimated”, Flynn added.

https://www.investing.com/news/commodities-news/oil-us-stocks-down-6m-barrels-output-at-new-3year-high-3159981

Two Opposing Views on Peak Oil Demand

IEA & Oilprice.Com See Peak Oil Happening This Decade

In June, the IEA took another look into the future and announced “peak oil” was in fact on the horizon. Here’s what its latest prognostications had to say.

“Growth in the world’s demand for oil is set to slow almost to a halt in the coming years, with the high prices and security of supply concerns highlighted by the global energy crisis hastening the shift towards cleaner energy technologies, according to a new IEA report released today.

“The Oil 2023 medium-term market report forecasts that based on current government policies and market trends, global oil demand will rise by 6% between 2022 and 2028 to reach 105.7 million barrels per day (mb/d) — supported by robust demand from the petrochemical and aviation sectors. Despite this cumulative increase, annual demand growth is expected to shrivel from 2.4 mb/d this year to just 0.4 mb/d in 2028, putting a peak in demand in sight.

“In particular, the use of oil for transport fuels is set to go into decline after 2026 as the expansion of electric vehicles, the growth of biofuels and improving fuel economy reduce consumption.”

The case against imminent peak oil demand

A few stats from prominent analyst Arjun Murti offer a sobering case for why a global peak in oil demand may be very far away.

The big picture: In a compelling analysis, he notes the 1 billion who live in the U.S., Canada, western Europe, Japan, Australia and New Zealand averaged 13 barrels per capita annually last year.

The rest of the globe’s roughly 7 billion people? A mere three barrels, Murti’s writes in the latest of several recent posts on the topic.

“Even as attempts are made to reduce rich-country oil demand, the upside potential in the developing world we believe is magnitudes greater,” writes Murti, a Goldman Sachs veteran who’s now a partner at Veriten LLC.

In a video, he argues demand increases are inevitable for at least the next decade, “and frankly I think it is going to be much longer than that.” Murti likes renewables and electric vehicles but describes himself as a realist. “I am not advocating for fossil fuels. What I am doing is applying analysis.”

My take: They are both wrong. Peak oil supply happened in 2018. There is a very small chance that the peak may be breached, but only slightly if it happens. The first article is wildly optimistic that demand will fall while supply is still plentiful. It won’t. The second article is wildly optimistic that there will be plenty of oil to meet demand as demand keeps rising and rising. Wrong and wrong.

Why the holy hell is no one talking about peak supply? These folks are in for a real shock, and pretty damn soon at that. Bu soon I mean this decade.

“By soon I mean this decade.”

https://www.oilystuffblog.com/forumstuff/forum-stuff/why-do-you-suppose-this-is-happening

I might be the least qualified person that posts on the board about oil.

I started pumping AdBlue into my car the other day as the gas station put that next to the regular fuels (which is a dangerous design).

DO NOT MAKE THAT MISTAKE, it corrodes your cars fuel system.

I would love the oil pros and more talented posters to discuss this article by Mike Shellman.

This looks ominous to me.

Sooner in the decade rather than later in the decade?

This is up there with the most important questions in human history.

Interest rates here in US went from 0.25% to 5.25% in about 18 months. Mortgage rates at 7.23%.

There is a wall that the economy is heading towards that it hasn’t hit yet. Not many have had to roll over or refinance existing debt yet. Because it’s only been 18 months.

Obviously I’m talking about the economy in its entirety not just shale producers.

Yield curves aren’t wrong. They won’t tell you exactly when the bottom falls out of the economy. Just that it’s coming.

There is an absolutely enormous amount of debt that won’t get rolled over or refinanced. Nothing inflationary about the next few years.

what would you say about a stagflationary situation, where prices of things you own and things needed to live go up but the economy isn’t growing much or even shrinking. could this lead to feedback loop where commodities like energy and related equities catch significant bids as they accelerate while tech, bonds, and retail decelerate?

I think you need bank credit that is growing that allows consumers to pay the higher price to get stagflation.

There was no shortage of credit creation in the 1970’s it was legit inflation.

Ultimately it comes down to what consumers can pay. Banks decide not to extend credit because of an inverted yield curve. Credit dries up.

Banks are looking at China and saying no thanks. China has had to resort to their huge commercial banks going into swap markets and borrowing dollars and providing those dollars within their economy since Eurodollar banks are saying no thanks. As bad as things appear in China. It actually worse than the data indicates.

I see demand going down faster than supply. Economies are imploding. Just because it hasn’t reached the US yet doesn’t mean it’s not going to.

Consumers in the US. Those with students loans. Come October they will have anywhere from $200-$400 less to spend each month on average.

Commercial real estate is going to hit bank’s ability to extend new loans in a big way.

Interest rates ultimately go back to zero but that don’t mean they can’t go higher first.

When the central banks start cutting again things will be so bad oil prices are falling in big chunks. Like 6%-8% moves down in a day or weeks time.

What happens to US crude production when credit dries out and junk bonds need to be rolled?

I would guess production will fall faster than comsumption.

HHH

Is not Stagflation a very real prospect?

https://en.wikipedia.org/wiki/Stagflation