A post by Ovi at peakoilbarrel.

This post updates Non-OPEC production to February 2020. However we are now in late June 2020 and the effects of the plunge in the price of WTI which began on January 6 and ended in the negative low of $-37.63/bbl on April 20 is showing up in plunging production numbers in US and other oil producing countries that post more recent output numbers. However WTI has now recovered to close to $40/b and weekly US production numbers are indicating that output may have bottomed.

OPEC, in response to the reduced worldwide demand associated with the outbreak of the CV pandemic, arranged a production reduction agreement through a Declaration of Cooperation (DoC) with OPEC and Non OPEC countries. At this time, the output reduction is only being seen in those Non-OPEC countries that provide one month lagged production numbers, i.e., Russia, Norway and Brazil.

Bloomberg reported that OPEC and its partners have tentatively agreed to extend their initial production curtailments for another two months. The group planned to curb its combined output by 9.7 million barrels per day (BPD) in May, the reduction to taper off to 8 million BPD through the end of this year. However, it now plans to maintain the reduction of 9.7 million BPD through the end of July. That will provide the global economy with more time to recover and burn off excess inventory.

Below are a number of oil (C + C) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to February 2020. Information from other sources, such as OPEC and recent news reports and country specific sites, is used to provide future output for a few countries for a month or two.

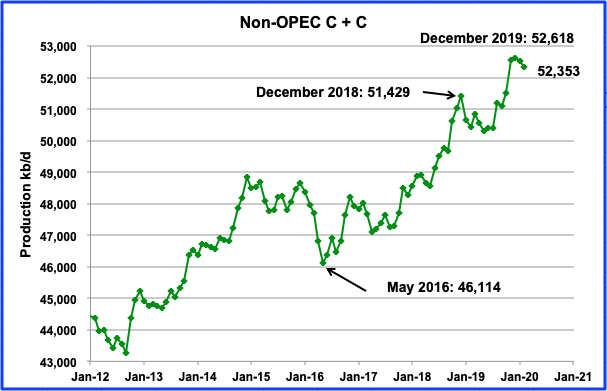

Non-OPEC production dropped from a high of 52,618 kb/d in December 2019 to 52,353 kb/d in February 2020. February’s output of 52,353 kb/d, was down by 164 kb/d from January.

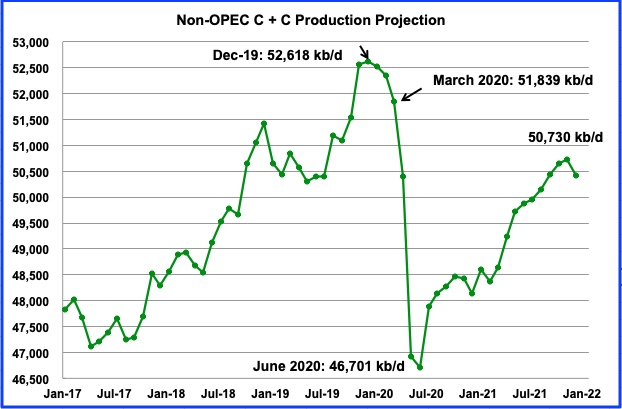

This Non-OPEC output projection was made using information from the June STEO and the EIA’s monthly C + C International Energy Statistics. If correct, Non-OPEC production will bottom in June 2020 at 46,701 kb/d and then begin to recover. From March to June, production dropped by 5,138 kb/d. Output is projected to be down by 1,888 kb/d in November 2021 from the high of December 2019. Of the 1,888 kb/d, 1,740 kb/d are primarily from declines in US tight oil fields.

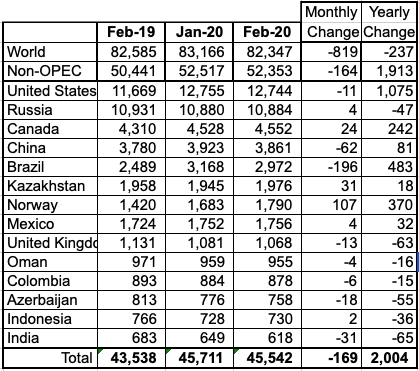

Above are listed the worldʼs 14th largest Non-OPEC producers. They produced 86.9% of the Non-OPEC output in February. On a YoY basis, Non-OPEC production was up by 1,913 kb/d while world oil demand was down by close to 1,250 kb/d in Q1- 2020. In February 2020 Non-OPEC output accounted for 63.6% of world oil supply and Non-OPEC W/O US accounted for 48.1% of world supply.

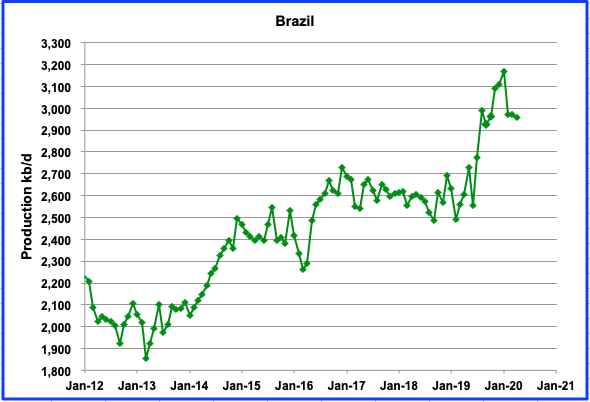

Brazil’s production peaked in January 2020 at 3,168 kb/d. The EIA reported February output of 2,972 kb/d. March and April data, the last two points, were obtained from this source where it was reported that April output was 2,958 kb/d, down by 15 kb/d from March. Petrobras had planned to reduce production by 200 kb/d in May but reversed those cuts amid resilient Chinese demand.

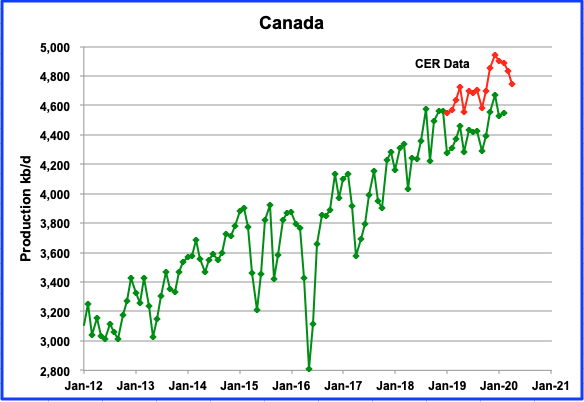

According to the Canada Energy Regulator, Canadian production will drop by 108 kb/d from December 2019 to March 2020 as shown by the separate red graph. The EIA shows production was up in February by 24 kb/d. The CER data is higher because it includes NGPLs in their estimates.

Alberta’s monthly production limits for raw crude and bitumen are currently set at 3.81 Mb/d from December 2019 to August 2020.

Alberta has also introduced a special production allowance provision. Effective December 2019, operators can apply, on a monthly basis, to increase oil production – if the additional product is moved by new rail capacity – in order to meet increasing demand. In April Canadian crude exports to the US by rail were 156,242 b/d, down by 194,325 b/d from March exports of 350,567 b/d.

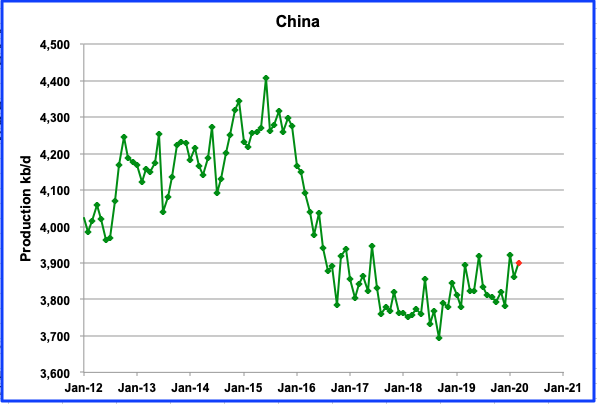

China’s production decreased by 62 kb/d in February. Chinese companies are increasing capex to maintain production. According to OPEC’s May report, China’s production in March increased by 39 kb/d to get back to 3,900 kb/d (Red dot).

Mexico continues its slow steady output increase. In February, Mexico’s production increased by 4 kb/d to 1,756 kb/d. Data from Pemex shows that production increase by 15 kb/d in March and dropped by 25 kb/d in April, red dot, to 1,746 kb/d. Under the DoC, Mexico has committed to reduce output by 100 kb/d in May.

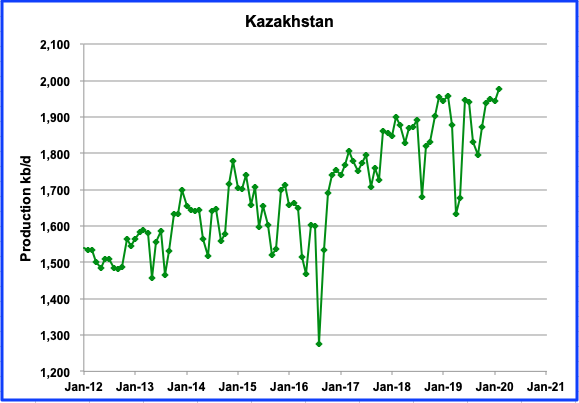

Kazakhstan production hit a new output high in February, 1,976 kb/d, 31 kb/d higher than January.

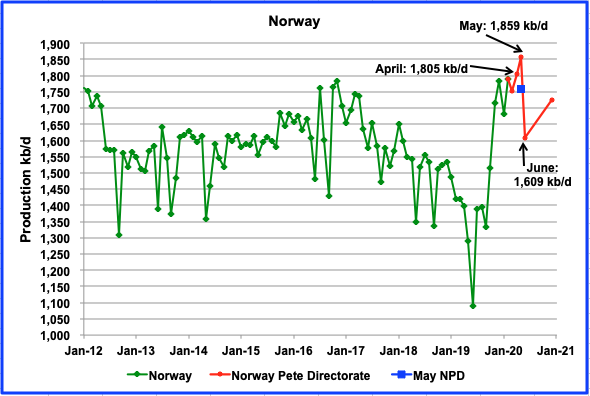

Norway’s output rebounded by 107 kb/d in February to 1,790 kb/d according to the EIA which agreed with the NPD report. The red lines indicate production going forward as outlined by the NPD. In January’s post, an NPD press release indicated that Norway’s output for May would 1,859 kb/d. It also noted that it would cut production by 100 kb/d as part of the OPEC + DoC. The blue dot shows May production came in at 1,760 kb/d which indicates that Norway is in compliance with the DoC.

This is the first sign of how the principal countries that have signed onto the OPEC + Declaration of Cooperation (DoC) are responding to their commitments.

Shown in red is a modified version of Russian oil output as reported by the Russian Ministry of Energy. It is higher than the EIA numbers because it includes NGPLs. According to the Russian Ministry of energy, Russian production dropped by 1,951 kb/d in May to 9,388 kb/d.

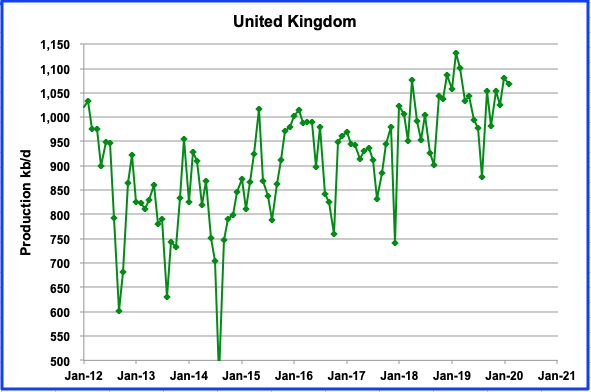

UK’s production dropped by 13 kb/d in February to 1,068 kb/d.

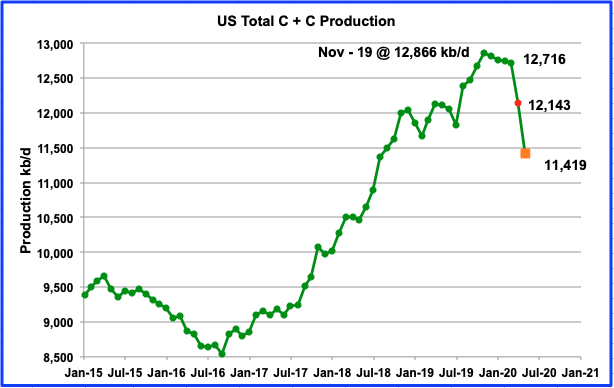

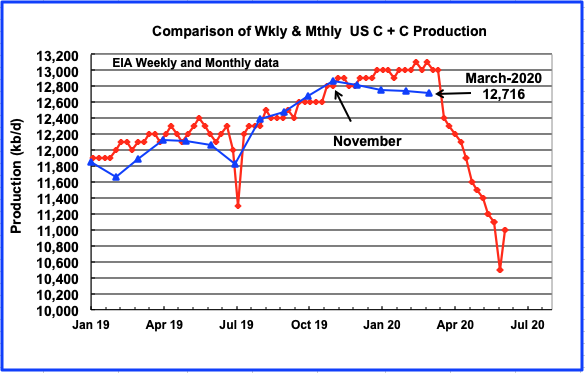

This US production chart is tentatively updated to May and shows the continuous slow decline in oil output from US oil fields from November 2019 to May 2020. March output was 12,716 kb/d, down by 28 kb/d from February’s 12,744 kb/d. Also it should be noted that February’s output estimate from the EIA’s earlier May report, 12,833 kb/d, has been revised down to 12,744 kb/d, a downward revision of 89 kb/d.

The Red dot is the projected April output, 12,143 kb/d, taken from the June Monthly Energy Review. The June STEO is projecting April output of 12,380 kb/d for the US, much higher than the MER. Averaging the latest EIA weekly data gives 12,160 kb/d for April, close to the June MER. Using the EIA weekly data, May drops to 11,419 kb/d, orange dot. The June MER estimates May output at 11,394 kb/d, 25 kb/d lower than the weekly average.

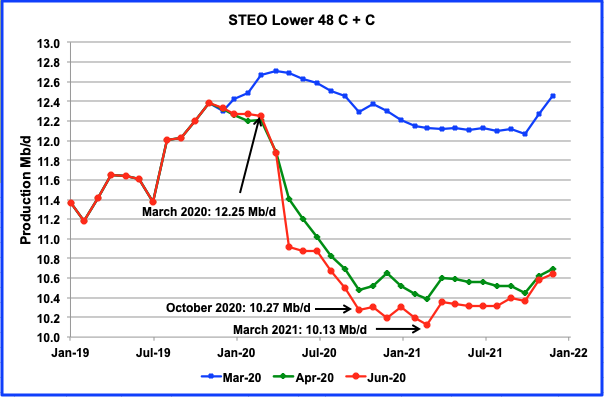

The STEO is projecting a major drop of 2.12 Mb/d in US L-48 production from March 2020 to October 2020. Note how the June STEO output projection has dropped by a further 200 kb/d in the October 2020 to March 2021 time frame compared to April’s estimate. While the STEO is showing fairly steady drop from March to October, the projection from October to March 2021 appears to be more tentative and further revisions should be expected over that time. Comparing March 2020 output with December 2021, the decrease is reduced to 1.61 Mb/d as production slowly begins to rise, starting in early 2021.

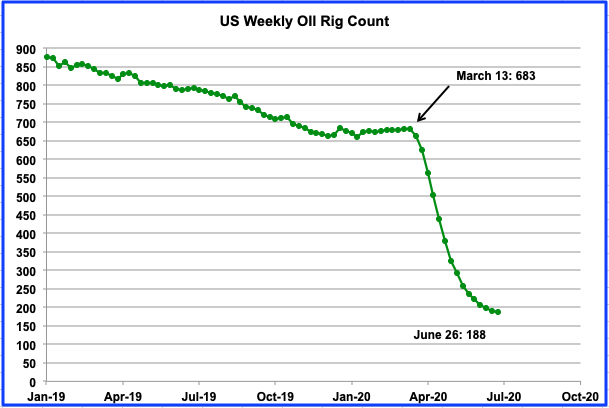

The weekly drop in US operational oil rigs is slowing and appears to be heading for a minimum in July. For the week of June 26, US oil rigs just dropped by one from the previous week. Interestingly, Texas oil rigs were up by one to 98.

According to the EIA weekly inventory report, US production reversed its production slide in the week of June 19. However with the number of virus cases soaring again in Texas, this reversal may take a pause or reverse again over the next few weeks.

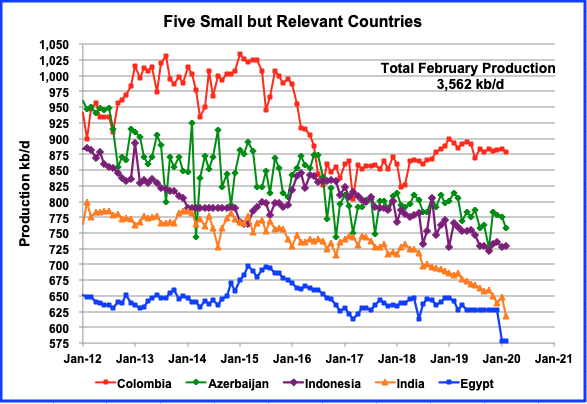

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. All five are in overall decline. Their combined February production was 3,562 kb/d down 54 kb/d from January’s output of 3,616 kb/d. Note that Columbiaʼs production has been essentially flat since August but showing signs of declining. Azerbaijan, Indonesia and India appear to be in a slow steady decline phase.

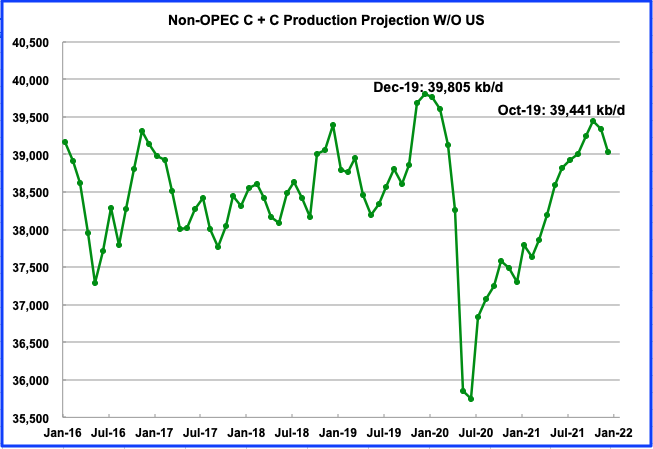

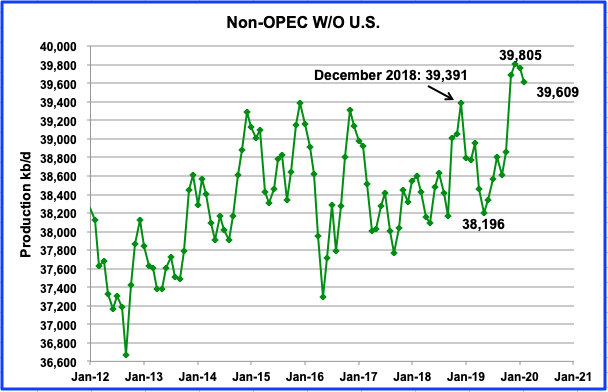

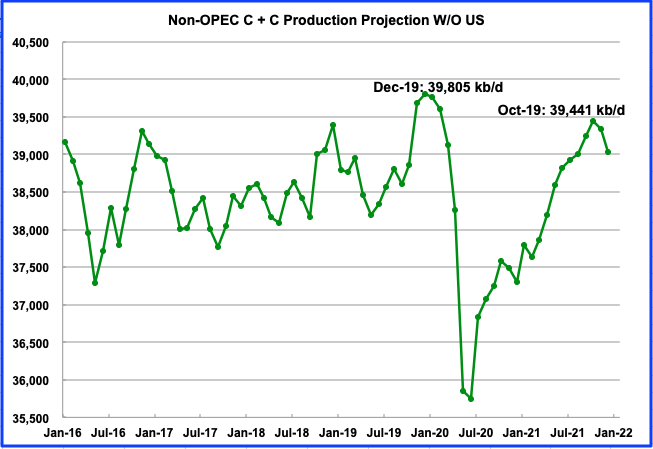

Non OPEC W/O U.S. Production on a Seven Year Plateau

This is one of the more critical charts that bears watching when investigating the expected timing for the plateauing/peaking of oil production because these countries currently supply close to one half of the world’s oil. As noted above, the Non-OPEC W/O US countries accounted for 48.1% of world oil supply. Note that this chart is addressing the question of the timing for the next attempt to unseat the current November 2018 peak.

Looking at the chart, it is clearly providing an early indication that Non-OPEC countries, excluding the US, are very close to an output plateau. From December 2014 to December 2018, yearly peak output remained in the range 39,300 kb/d to 39,400 kb/d, essentially an output plateau. However in December 2019 production reached a new high of 39,805 kb/d.

This group of countries will be the first to be on a production plateau before going into slow decline. As world demand then begins to increase, it will be up to the other countries, OPEC and the US, to meet that increase in demand. This will then begin to stress the world oil supply chain, as happened during 2005 to 2008, and will again begin to manifest itself in increasing gasoline and crude prices.

This chart, which extends the previous chart to December 2021, shows oil production reaching slightly less than 39,500 kb/d in October 2021. The projection was made using information from the June STEO and the EIA’s monthly C + C International Energy Statistics.

If the projection is correct, it means that from December 2014 to October 2021, oil output from these countries will have wandered between 39,300 kb/d and 39,500 kb/d, except for 2019. For all intents and purposes, these Non-OPEC countries are currently on a Seven Year production plateau and are not in a position to meet increasing world oil demand.

World Oil Production

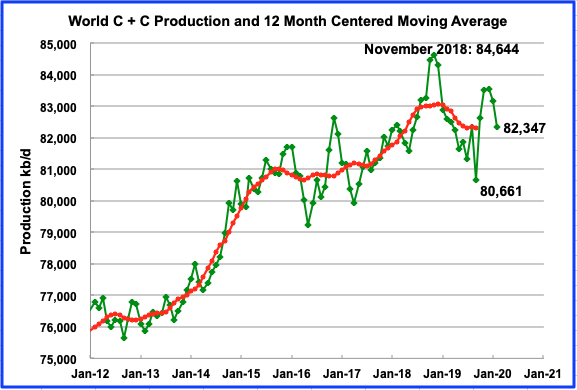

World oil production dropped in February by 819 kb/d to 82,347 kb/d from 83,166 kb/d in January. This puts February output 2,297 kb/d below the previous November 2018 high of 84,644 kb/d. The questions now are “How low will it go before bottoming” and “to what level will it recover?” An indication is provided below to the first question.

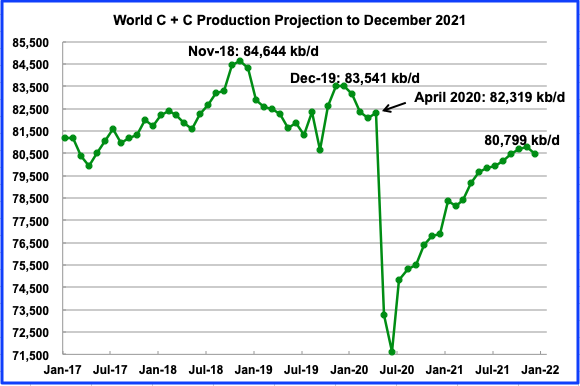

This is an expanded and shortened view of world oil production projected from April 2020 to December 2021. According to this projection using data from the STEO and the EIA’s International Energy Statistics, the production low will occur in June 2020 and will be close to 71,500 kb/d, a drop of close to 12,000 kb/d from December 2019. November 2021 output is projected to recover to 80,799 kb/d and will be 2,742 kb/d lower than December 2019 and 3,843 kb/d lower than November 2018.

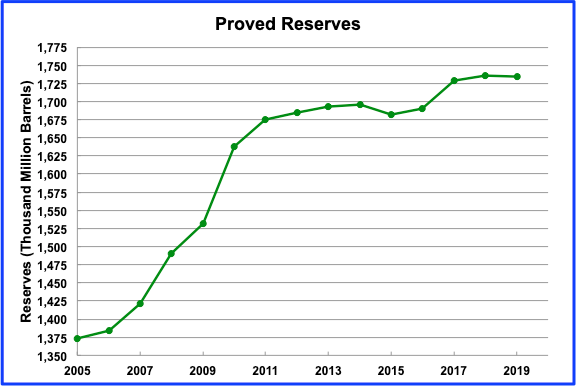

BP World Oil Reserves

This is BP’s world oil reserves updated to 2019. From 2007 to 2011, 254 B barrels were added to the world’s reserves. Of the 254, contributions came from Venezuela (198), Iran (16) and Iraq (28) for total of 242. Believable?? More critically from 2011 to 2019, only 58 B barrels were added or roughly an average of 7.25 Bb/yr. It is the slowing yearly rate of increase that is more critical over the last eight years rather than the absolute level of the proven reserves.

The only significant reserves addition between 2011 and 2019 occurred in 2017. This increase was due to the US adding 11.3 B barrels and Saudi Arabia adding 29.8 B barrels for a total of 41 B barrels. Note that these additions may be updated reserves in known fields, as opposed to new discoveries or a combination of both.

The actual 2017 reserves increase was 38.5 B barrels due to reserve depletions in other countries. Over the last two years, 7.7 B barrels were added in 2018 and there was a decrease of 2 B barrels in 2019 for a net increase of 5.6 B barrels.

Clearly the world’s oil reserves are in the peaking/plateauing phase. Over the last two years, the world consumed 70 B barrels of oil (using BP numbers) and yet the world’s reserves have not materially changed. For example, the US average daily production was 17.04 Mb/d in 2019, (BP data) for a total of 6.22 B barrels for the year. BP shows reserves for the US are unchanged from 2018 at 68.9 B barrels.

Denise, your optimism is misplaced . Should have been in the earlier post ,but now their is a new post . There is no going back to normal ,normal has left the station .

https://oilprice.com/Energy/Crude-Oil/Oil-Market-Optimism-Is-Entirely-Misplaced.html

hole in head,

I agree with that article, basically it says don’t expect high oil prices (above $40/bo) in 2020, but likely oil prices will rise in 2021, I agree.

A scenario from May, where tight no new tight oil wells are completed and extra heavy oil output is flat, tight oil output falls to 1.5 Mb/d in 2026 in this scenario. World oil output reaches 84 Mb/d in 2026 and 2027. Scenario produced May 17, 2020.

The extraction rate is for conventional producing oil reserves. Note that in 2019 for the US 4.465 million barrels of oil were produced and producing reserves at the end of 2018 were 28.5 million barrels, extraction rate 4.465/28.5=15.7% for US C C.

So the World average extraction rate may be able to increase from the 5.6% rate in 2018, the scenario has the extraction rate for World conventional oil rising to 6.1% in 2026, close to the level of 2005.

hole in head,

Dennis Coyne’s name is Dennis, not Denise. Denise is a female name.

Dennis has pointed this out to you. It would be common courtesy to use his correct name. It would be boorish to continue not to.

U.S. Shale Oil Industry May Never Regain Peak

The biggest-ever shutdown of U.S. shale oil production sets the stage for another historic feat: turning it back on again. But for battered oil stocks, reopening the taps is the tricky part.

Shut-ins, or the closing off of wells, will hit U.S. production for years to come. So will recent halts in new drilling. The immediate fallout is clear. After hitting a record high of 13.1 million barrels per day as recently as mid-March, total U.S. crude oil production has tumbled to 11 million bpd.

Some shale oil industry leaders warn of permanent damage. Geology and Wall Street may determine the long-term effects.

SNIP

Most of the damage during a well shut-in occurs between 30 and 60 days, he says. The geology of U.S. shale fields makes the wells especially susceptible to damage after prolonged shut-ins.

Shale is a fine-grained sedimentary rock with very low permeability. That means the liquids and so-called proppants, like sand or ceramics, that are used to crack open shale will remain stuck in the well, causing damage to the rock fractures from which oil normally would flow.

But EOG’s CEO says that is bullshit.

“On these shale wells, there’s absolutely no damage when you shut them in and bring them back on for — whether it’s two weeks or two months,” Thomas said. “We feel very confident about that.”

Well, we shall see. However, I do not believe that the “shut-ins” are the major problem. It’s the new wells or lack thereof, that is the problem. Investors have been burned and they will not make that mistake again. There will be far fewer new wells in the future.

Ron.

EOG ceo really doesn’t know. That is because every well is different.

There are operational issues out there that predate COVID that will cause more problems restarting shut in wells.

One is the widespread use of submersible pumps. Another has to do with highly corrosive waters.

There are many more we have been discussing that are above my pay grade to explain.

Shallow sand,

From what you have said in the past, many of the shutins will be temporary. Also tight oil wells are often shut in when nearby wells are fracked or for well repairs so there is experience with temporary shut ins. No doubt the EOG ceo is talking about the average well. Most wells will not have problems when they are shut in from what I have read, as long as the shut in period is less than 2 months or so. With proper well prep it could probably be done safely for longer.

Don’t you shut in some low flow wells each winter?

Dennis.

I didn’t say all shale wells will have issues.

We do not use submersible pumps. Those are more likely to have costly issues after shut in than rod pumped wells.

Also, the wells we shut in do not have highly corrosive water. Thankfully we generally do not have highly corrosive water on any lease. Note, I say generally.

A well that has highly corrosive water will have issues if it is shut in, with the longer time shut in being worse. The down hole equipment is standing in same for a long time.

Our wells produce from a highly porous sandstone. Not from a tight shale. I understand that makes a difference also.

Again, much of this is above my paygrade.

I will say I have a very good source who says EOG has many down hole issues in the EFS with highly corrosive water and holes where the vertical portion is not very straight. This results in a lot of rod wear and failures.

Leaving rod worn tubing idle in corrosive water for a few months isn’t a good thing, IMO.

How long shut in can be a major factor. In 1998-99 a good sized company in our field went under. Many wells were shut in 6 months to over one year. Most experienced down hole failures soon after being re-activated.

Shallow sand,

Did you say in an earlier comment that a lot of shut in wells have come back online? I might have misunderstood. My guess is that much of the tight oil wells that have been shut in, are unlikely to remain so. This would be particularly true for those wells that have highly corrosive water.

Based on comments by you and Mr. Shellman, oil production companies are run by highly intelligent individuals. Again I am guessing that they will figure this stuff out. I am not saying there will not be problems, only that they will be managed.

I am often wrong and know much less than you.

Is it your expectation that most (say 60% or more) of the shut in tight oil wells will have down hole failures after being shut in for 2 to 3 months?

Not what I expect, but I would defer to your experience.

Dennis. I wouldn’t say 60%. I don’t have a good estimate. Too many variables. But 60% is likely too high.

Keep in mind, however, that a failure of a submersible pump down a 7-10,000’ vertical can cost over $100,000 to repair.

I think North Dakota put out some $$ estimates on what it costs to restart a hz well there.

In contrast, we started up 28 wells that are on contiguous leases. The wells were shut in four weeks. 4 failed within the first week. About $3,000 to repair them, including down hole equipment. 2 were tubing holes. Two were stuck on the upstroke, and came loose without pulling.

Of course, our wells are 1 barrel a day or less of oil, and generally less than 1,000’.

I suppose we will see what happens if oil doesn’t trend back lower.

Freddy also brings up and issue I have read about and discussed. But I just don’t know enough to comment.

I read some place the propant used in Permian was from local sourses and had low quality. I believe the fractions might get stuck, but that might be solved with refracking I guess.

Ron,

When oil prices rise to $60/bo or more tight oil might return to 8 Mbpd, my guess is 5 to 6 Mbpd and US output maybe 9.5 Mbpd in 2026 to 2028.

Denis, no doubt things can be fixed and oil production can recover to, say, somewhere near the 2018 peak. I think in these terms even Ron and you could agree.

But while oil is the single most important foundation of the economy, the economy is not oil. How will all this mess finally play out?

For now, we can only watch into a very opaque cristal ball. We mitght know a little more in a few months …

Westtexasfanclub,

I agree we can only guess how the economy will fare in the future. Not sure Ron would agree that production could return to previous peak. I believe he has given me 10:1 odds that the trailing 12 month World C+C peak reached in May 2019 will not be surpassed before Jan 2031. My best guess is about 2028 for the final peak in trailing 12 month World C+C output.

Not sure Ron would agree that production could return to previous peak.

No, that is just not going to happen. And I am a little shocked that you would based on this statement by you:

…and US output maybe 9.5 Mbpd in 2026 to 2028.

Really now? It has been mainly the US that has kept the world from decline. Brazil was up over half a million barrels per day from January 2019 to January 2020. But that surge will not be repeated. OPEC peaked in 2016. Russia has admitted that they are post-peak. And there is little doubt that the vast majority of other producers are in decline. That decline will increase between now and 2028. So where will this huge increase come from Dennis?

Ron,

Brazil, Canada, OPEC, Norway. Not a huge increase, just a bit more than 2018. Eventually the World economy will recover, oil prices will rise and output will increase, up to about 2030 or so, after that we may be beyond the peak, peak could occur any time between 2026 and 2033 in my opinion, I think 2026 to 2029 is the best bet, probably 50/50 chance it will be in that Jan 2026 to Dec 2029 time frame, with 25% probability it will be before that interval and a 25% probability it will be later. Depends on a huge number of variables that are not possible for me to predict.

Ron,

My scenario near the top of the comments has US tight oil falling from 8 Mb/d at the end of 2019 to about 1.5 Mb/d in 2026. So an estimate that has tight oil at say 6 Mb/d would make it easier to get to a new peak.

My scenario near the top of the comments has US tight oil falling from 8 Mb/d at the end of 2019 to about 1.5 Mb/d in 2026.

Jesus H. Christ Dennis, with that kind of a drop on the one nation that has held off peak oil for a decade, you still believe that we are not post-peak.

So an estimate that has tight oil at say 6 Mb/d would make it easier to get to a new peak.

Easier but not easy at all. If US production falls by 2 million barrels per day there is no way in holy hell with the majority of nations way past peak can make up that difference.

Dennis, from 8mb to 1.6 mb would blow the ship out of the water . It was only the major increase in LTO that had kept the Titanic afloat . Lo and behold ,the ship is taking water and very few noticing it . Tks for this info , missed it in my read earlier .

Ron and hole in head,

There is a lot of OPEC oil that has come out of the market from Venezuela, Libya, and Iran. I doubt Venezuela will come back by 2028, but Iran certainly could (just end sanctions) and Libya might resolve at some point before 2028 (probably 50/50 chance imo), Canada can increase, Brazil can increase, and OPEC/Russia cuts can end. Also OPEC has the potential to increase extraction rates.

The very conservative tight oil scenario used for my oil shock scenario assumed no new tight oil wells are completed from May 2020 to Jan 2040, not realistic at all in other words.

Even in that case a slight increase in World average extraction rates from “conventional” (defined here as C C that is not tight oil or extra heavy oil) producing oil reserves from the 2018 World average level of 5.6% allows a new peak in 2026.

The world average extraction rate rises to 6.1% in 2026 in the scenario, note that the US extraction rate in 2019 was 15.7%, and that the World average extraction rate for conventional oil was higher than 6.1% for all years from 1946 to 2001. The lowest annual extraction rate from 1958 to 1987 was 7.8%, the high World conventional oil extraction rate was in 1973 at 12.1% over the 1945 to 2019 time frame.

Ron,

OPEC has cut output by 2 Mb/d since the end of 2018, I imagine they can increase output back to that level when oil demand increases after the economic crisis resolves.

Canadian output can also increase with higher oil prices, as can Brazilian output. Norway also expects output to increase as Johan Sverdrup ramps up, this may be delayed until oil demand increases, original plan (pre covid19) was to reach their 2009 level of C+C output by 2024.

Dennis, I said somewhere near the peak.

Let me suggest a window of +– 2mb/d around the 2018 peak.

Would that be comfortable for both of you?

Westtexasfanclub,

I think it will be in that window, but believe it highly likely that the current 12 month trailing average peak (about 83.06 Mb/d) will be exceeded in the future, odds about 3:1.

You are correct that whether a secondary peak is 82.5 Mb/d or 83.5 Mb/d will make little difference in the grand scheme. Your suggestion of a secondary peak somewhere between 81 and 85 Mb/d sounds reasonable to me. I do not presume to know Ron’s position, except that he does not expect future 12 month average output above the recent peak in 2019 (for trailing 12 month average World C+C output).

For most, the important consideration with oil supply is

‘how long can supply stay high enough to avoid fuel based cost restriction on economic activity?’.

I don’t pretend to know what that supply level is. Maybe over 80Mb/d [2014 level] ?

And secondly, what do we do with that time to prepare for shortfall in affordable supply?

Hickory,

In my view a shortage of supply, when it occurs, will lead to higher oil prices and this will accelerate the transition to EVs as EV cost continues to fall, while ICEVs become more expensive to own and operate.

If self driving vehicles are ever perfected (10 years away in my view), then costs for TaaS falls and fewer people will choose to own vehicles, most of the miles travelled will be covered by EV robotaxis which drive 80,000 miles per year, so fewer vehicles will be needed to replace the ICE fleet.

By 2037 I expect demand for oil to fall below supply due to this effect and oil prices will fall and much of the remaining oil will not be extracted due to lack of demand.

Good public policy helps to speed the transition, but even without it economics and the free market may make it happen (though likely less effectively).

Thanks for the report is their any reports about oil leases.

Horace

I do not have access to oil lease data. Perhaps some other participant on this board could provide a source for oil lease info.

Check Texas Railroad Commission production database query for Texas. Other states also have data.

Link to RRC PDQ

http://webapps.rrc.texas.gov/PDQ/home.do;jsessionid=U9P4OOiTy0AyszCucFkXFrMNmZbw4ELhWo79UUbOexifhH-til6M!-888046471

Hi Im from Argentina

How are you?

The 1P reserves of Venezuela are 300.000 millon of barrels?

Whats are real reserves of venezuela according to you?

Laherrere said XH and covecntional oil are diferent, his projection are depende on U

Mariana,

Jean Laherrere estimated 175 billion barrels for Venezuala for the URR in October 2018, 75 billion conventional and 100 billion barrels for Orinoco belt (Faja).

Note that only about 106 billion barrels of 2P reserves remained at the end of 2017, with only 11 billion barrels of conventional and 95 billion barrels of extra heavy Orinoco oil.

I think Laherrere’s estimate is the best we have.

See page 134 of link below (35cooilforecast-Oct)

https://aspofrance.org/2018/10/03/updated-extrapolation-of-oil-past-production-to-forecast-future-production/

Mariana

Attached is a chart which shows how Venezuela’s reserves grew between 2010 to 2013. I think the growth from 2010 to 2013 were driven by Hugo Chavez’ desire to have the largest reserves. The reserves for 2010 are probably correct. Beyond that? You may want to check this reference for some background.

https://en.wikipedia.org/wiki/Oil_reserves_in_Venezuela

The short story on Venezulan reserves is the jump from 75 Gb to 300 Gb was due to Orinoco extra heavy oil reserves. These are likely overstated by about a factor of 3 for proved reserves, 2P reserves might be about 100 Gb, my expectation is that at most 75 Gb will ever be produced from the Orinoco reserves.

I’m long oil. We got the opportunity to by oil as cheap as it’s ever been. I can hold my position 5-6 years or more if needed. I also realize the lows can be revisited. I don’t believe the crash has happened yet. All we’ve seen so far is the panic followed by the response. Then the hope rally.

When the hope rally has run it’s course. And reality sets in. It’s going to be sell everything. Including US treasuries, and gold.

And of course the Central Banks will go crazy. But it doesn’t matter what they do or how much they buy. This is and insolvency event that can’t be fixed by more liquidity or more loans. Understand that when a central bank buys a loan or asset backed security. Those loans are just own by the CB’s. The entities that must repay these loans are insolvent without cash flow.

Because of the way the plumbing of the monetary system works. There has to be economic growth or nobody in the system is solvent. Soon as the first person pays his loan off plus interest there isn’t enough money in the system for anybody else to repay their debt. The constant need for credit creation.

But it’s not that simple. You can create all the credit and loans you want. But if there is not enough economic activity nobody has the cash flow to service their debts. That is why Covid-19 is the blackest of black swans. It shuts economies down.

I dunno. Japan over the last 20 years seems to be a counter-example: no economic growth, lots of zombie companies, but very few companies taken into bankruptcy.

If interest rates are zero, there’s no need for the borrower to make interest payments. Companies can keep borrowing to cover expenses, and central banks can continue to buy those loans.

Perhaps eventually the loans are moved to shell companies with no employees, taken into bankruptcy, the CB writes off the loans (or just keeps it on it’s books without recognizing the loss), and the economy moves forward?

HHH,

The covid19 crisis will not last forever.

It is going to last one hell of a lot longer than you seem to think it will. And when we recover, if we ever do, it will be a different world.

This Covid-19 is one hell of a game-changer. And that simple fact has just not sank into the psyche of the average citizen of the world. But it will… it will.

Ron, I have the same gripe with Denise . his forecasts go into 2025 . My question has been how do you get thru 2021,2022,2023,2024 before you arrive at 2025 without witnessing a financial crash that is now baked in with all the wild money printing going on? I am more than sure that Denise is aware of this ( if he wasn^t it would be our miscalculation ) , but he discounts and underestimates the effects of Covid on the worldwide economy which pushes him in the wrong direction . Example let us look at India . Today actual is 50000 infections per day . By September 200000 infections per day . 1% fatality rate is 2000 deaths per day . I am reporting from ground zero . There is now a waiting list at the crematoriums (conventional) where wood is used in New Delhi . What will it be by September ? Now on top off this is the Indo-Chinese border clashes . All resources are being diverted to defense. This is a 2.5 trillion dollar economy that cannot pay the wages of it^s front line healthcare workers that the Supreme Court had to issue directions to settle their dues on threat of imprisonment of senior bureaucrats. This is the 7th largest economy in the world . By the way the top 6 are in an equally big s^^^ . The music is playing ,but the party is over . Ignore this at your peril .

https://www.youtube.com/watch?v=NKvSDYJbNQg

Why India is in trouble with the Covid virus .

Why Europe is at a dead end .

https://www.unz.com/gdurocher/corona-depression-southern-europe-will-never-recover/

Hole in the head. The 2nd article you posted talks about chances of ‘race war’ and refers to some European economies being ‘hobbled’ by thier non-white populations. As a long term lurker on here you finally got me to post.

I think that article falls so far below the quality of content folks expect on here it should be removed. It’s depressing to see such idiocy spreading in today’s world.

Olive oil,regret you find the article offensive ,but I did not write it and my objective is to illustrate the structural slowdown in Europe and why growth is not coming back to the world . Too late to delete by me . You can ask the moderators ,if they feel it is inappropriate they are at liberty to delete .

I appreciate your reply, I mean my offence really isn’t here nor there. I agree that growth is looking extremely questionable in Europe, if you can call what we’ve had since ’08 growth. For many europeans real per capita terms growth has been over for some time. The problem with using that article to illustrate the point is that it eschews an analysis of the problem with cheap scapegoating and explicit racism. It derails conversations about energy (which is why we’re here presumably) into something else entirely.

Olive ,growth in EU is looking questionable ? Give me break . With negative growth forecast by the ECB and the IMF ,what are you smoking ? Of course this forum is not about race,color etc and I have an impeccable

record of decent behavior . This forum is not about Energy alone . We are in a new world where one has to connect the 3 E which are Energy,Economics and Ecology . Not only that, with the current money printing a new equation is now in play ,this is 3D which is Debt,Deficits and Demographics . All narratives of race,color fail on an empty stomach . Get this straight ^There are no volunteers for starvation^ .

Be well and take care ,all of us are in for a tough time ahead .

Hole in the Head

Denise? Who is Denise? You are either ignorant or provocatively rude. The name is Dennis. Show some respect.

Its been pointed out to him at least 4 times now.

Its intentional.

Yes, it’s really easy to insult someone behind a keyboard or an I phone.

Bet he wouldn’t do that to someone’s face.

Is it hole in head, or head in hole?

hole in head,

I expect a severe economic downturn, followed by a recovery. Also the health crisis can be handled with appropriate government action. People around the World just need to look at examples of where things have been done appropriately and where they have been done poorly and demand that their governments take appropriate action.

Obviously this is easier said than done. The United States is an interesting example where there are essentially 50 different experiments on how to handle this health crisis.

Smart countries would follow the example of New York State or Germany.

Ron,

My expectation is 2 to 3 years until World real GDP returns to tne 2019 level. Yes it is different from your expectation and neither of us knows the future.

I will point out that on oil output most of my estimates of the past have missed the mark on the low side. Perhaps things will be different this time.

Time will answer the question.

Personally I believe Ron is dead center in the ten ring.

“This Covid-19 is one hell of a game-changer. And that simple fact has just not sank into the psyche of the average citizen of the world. But it will… it will.”

But there’s at least some silver lining in every cloud.

The likelihood of an oil supply shortfall strangling the world economy is now substantially reduced for at least the next two or three years, maybe five or ten years.

And even though this reprieve is going to be the result of hard times, it won’t stop the electric vehicle industry from growing like grass after heavy spring rains.

In five years, or ten years for sure, I’m thinking batteries will be cheap enough that for most folks buying an electric car will be a no brainer decision.

Ditto for a lot of businesses that run light to medium duty trucks and some companies that run heavy duty trucks too.

We might be able to get along just fine for at least a decade or longer without having to deal with oil prices going well over a hundred bucks and staying there.

I’m presuming of course that demand doesn’t out run supply before the electric vehicle industry grows up.

One scenario is that virus treatments (monoclonal antibodies, and medications), and effective vaccinations will be available within a year. By the end of 2021, viral drag on the global economy will be much lower, and by the end of 2022 global GDP will be back at 2019 levels (that is 2 1/2 years from now).

I am not a generally optimistic person when it comes to the affairs of humanity, but this scenario possibility/probability is at least 50% in my guess.

Until then, mask up if you need to go out in the world.

There will be multiple monoclonal antibody products available later in this year, and multiple vaccines in the next 6-12 months. It will take time to see which ones work best, and longest.

For an example of one of more than a dozen monoclonal antibody projects that are under development-

https://medicalxpress.com/news/2020-06-potent-antibody-cocktail-potential-covid-.html

Non-OPEC C+C output minus US C+C output, trailing 12 month average.

Plateau from Jan 2016 to Mar 2020 (about 5.25 years). From Jan 2012 to Mar 2020 an increasing trend line of about 132 kb/d per year.

Forgot chart

Note the plateau period was a period of relatively low oil prices on average, the average Brent Price for Jan 2016 to March 2020 was about $58/bo. The Average Brent oil price from Jan 2012 to Dec 2015 was about $93/bo. The price of oil affects output.

Naw… See a better chart below.

Dennis

To get a better idea of the current plateau, one needs to look at a longer production history. Below is the same chart that was posted in the original post but extended back to 2002. My data actually goes back to 1998. The major break in the growth rate of Non-OPEC W/O US occurred in December 2003 at close to 37,650 kb/d. Production rose slowly from there to a new peak in February 2007 as the price of WTI increased. The next peak occurred in Jan-11 at 38, 918 kb/d. Companies had a lot of cash to invest in E&P after WTI went to $140/b in July 2008. I think this was the beginning of the plateau phase of Non-OPEC W/O US. It is interesting to note that December 2021, 39,036 kb/d, is only projected to be 118 kb/d higher than Jan-11, ten years later..

While I believe we are essentially on a plateau, one could draw a line connecting the peak from Jan 11 to Dec 19. The increase over those 9 years is 900 kb/d or 100 kb/d/yr. However that peak is the result of a confluence of new oil coming on line. Of the 900, contributions from Brazil (126), Canada (163). Norway (202), and the UK (72) totalled 563 in November 2019, which then lead to the peak in December, which was 400 kb/d higher than December 2018

A more realistic comparison would be to compare Jan 11 to Oct 2021, 39,441 kb/d, essentially 11 years, where the increase is 525 kb/d or closer to 50 kb/d/yr. Regardless how you look at it, Non-OPEC W/O the US is struggling to increase production and as noted above is not in a position to meet increasing world demand, whether demand increases by 500 kb/d/yr or gets back to its more normal 1,000 kb/d/yr.

Thanks Ovi, great chart. I don’t have a lot of faith in the EIA forecasts (nor do I expect any of my scenarios are likely to match the future) so the only change I would make is to leave off the part after March 2020.

I agree non-OPEC w/o US has been quite flat for at least a decade.

For Jan 2010 to March 2020 the trend line slope is 98 kb/d/year and for Jan 2004 to March 2020 it is 103 kb/d/year, so yes quite flat.

We can also look at World w/o US and that slope from Jan 2010 to March 2020 is about 246 kb/d/year, which implies OPEC slope for same period would be 148 kb/d/year.

For the World over the Jan 2010 to March 2020 period the trend line slope is 964 kb/d/year which implies the slope for the US C+C output trend line would be 718 kb/d/year over the past decade plus 3 months.

Chart below is zero scaled to show how flat non-OPEC w/o US has been.

Dennis

While my headline was a bit bold, the line inside the text was a little more nuanced, “For all intents and purposes, these Non-OPEC countries are currently on a Seven Year production plateau and are not in a position to meet increasing world oil demand.”

I think my main point is that when we get back to our new normal and yearly demand begins to increase in the 500 kb/d/yr to 1,000 kb/d/yr range, these non-OPEC countries will not be able to contribute anything or very little to the increasing yearly world demand. At best they may contribute 100 kb/d/yr for a few more years. Hopefully the US and OPEC can share in meeting that demand so that both sides can prosper.

What is interesting is that there have been significant increases since 2004 from many Non-OPEC countries that have been nullified by decling countries. Using the EIA C+C data, below is a list of countries that have added more than 200 kb/d and declined more than 200 kb/d from 2004 to 2020. These 18 countries net out to adding 2,600 kb/d, which is close to the 2400 kb/d that can be estimated from the posted chart above.

Over those 16 years, the net additions from the positive countries is 8,725 kb/d. Since the net addition was 2,600 kb/d, the net decline was close to 6,100 kbbls or an average decline rate of 380 kb/d/yr.

In my January 2020 post, using more detailed analysis, I estimated the decline rate from Non-Opec countries which were in decline to be close to 360 kb/d/yr. Using a steeper part of the same data on the chart, a more recent decline rate of 580 kb/d/yr was estimated. That decline is working 24/7 and the results shown in the above chart confirm how difficult it is to increase production with that level of decline working against increasing production.

Well, again, we have no idea what historical output from non-US countries would have been under “counter-factual” scenarios (like the US not being part of the mix). If the US had not ramped up it’s production, prices would have been much higher and other countries might have done very different things.

For instance, both Mexico and Venezuela allocate oil revenue first to the government. Low oil prices mean much lower investment in E&P. Oily guys on POB in the past have argued that Mexico has a lot of untapped potential. Also, I read stories about China suggesting that low oil prices have greatly lowered production.

So, if prices stayed high for a sustained period we might see substantially higher production from some of these laggards.

Nick g

I agree that if the US had continued on it slow decline, we would be in a different world now. I think that we would be in a high price scenario with oil around $125/b. We would know if SA could pump at 12 Mb/d. The world might even be pleading with the US to let those Cdn pipelines be built so Canada could help world supply. Many more possibilities to ponder to take up our time while we reduce our outings to stay safe.

I think that we would be in a high price scenario with oil around $125/b.

Yeah. Around 2007 I predicted prices would stay indefinitely in a range of about $100-120 (in 2007 dollars). Boy was I wrong…

You are not the only one wrong on the price .Many on TOD were of the same opinion including me .Matt Simmons was talking of $200 per barrel in those years .

Ovi, Nick, hole in head,

I also thought oil prices would remain high back in 2012, I did not really think tight oil could expand as much as it has done.

Hard to predict this oil stuff so although I present many oil scenarios for the future, I doubt any of them will be correct, best I might accomplish is to bracket potential future reality with high and low scenarios, though when I tried this in 2012, all scenarios were too low, except a high scenario at 2795 Gb URR (should have called it 2800 Gb), I threw out because I thought it was too optimistic (that was the only scenario a bit higher than reality of 8 total scenarios. See

http://oilpeakclimate.blogspot.com/2012/07/further-modeling-for-world-crude-plus.html

chart from post below, click on it and a bigger view pops up.

Ovi see my chart down thread where I look at non-OPEC minus Russia, US, Canada, Brazil, and Norway and for Jan 2011 to March 2020 the trend in output is -175 kb/d per year, note that the rate of decline seems correlated with oil prices to some degree with a lag of about a year. I expect in a high oil price environment the decline rate will be lower and in a low oil price environment the rate of decline will be higher.

Comment at link below

http://peakoilbarrel.com/non-opec-w-o-u-s-on-production-plateau/#comment-705076

Dennis, your chart is deceptive. Here is the actual chart. The data is through March 2020. Without Brazil the data is way down. And Norway is the other nation that added to the Non-OPEC total. They, like Brazil, will not have the surge they had in the last few months of this chart. But just remove Brazil from the chart and the 12 month average is declining.

As I said,, just remove Brazil from the mix and the trend is down. And that is including the 250 thousand barrel per day from Norway’s Johan Sverdrup which just came online last year.

If the USA is now in decline, and I believe it is, then non-OPEC is in decline and will decline by several million barrels per day between the high of 2019 and 2028.

Ron,

Bullshit.

My chart simply charts the 12 month trailing average output over the period indicated.

I chose the same period presented in Ovi’ chart Jan 2012 to March 2020. You can cherry pick some other period to get a chart to your liking.

Neither of us knows what future output from Brazil, Norway, or Canada will be.

Dennis,

Reply below to get a wider post for my chart.

Denise ,you may not know but Ron and me know . Brazil,Norway,Canada and all others are over the hill as far as ^economical^ output of oil is concerned . All countries can pump themselves into bankruptcy just like LTO has done . Welcome to the new future.

hole in head,

Let’s say for a moment that you are correct and that output is too low at $40/bo to meet World demand for oil.

What do you think will happen to the price of oil?

If you have the correct answer, what do you believe would happen to output at the new oil price level?

What is economical to produce is oil that earns a profit for the company producing it.

My take . I don^t see oil going above $60 per barrel at least in 2020/2021

on a sustained basis . Spikes like the one we had at minus $37 are possible,

oil traders have their own formulas to which I am not privy. A spike can be $ 80-90 but that will be a spike only . Oil production will remain curtailed because of a tanking economy worldwide and supply will be controlled by agreements like we have now . Economical price ?? My opinion is $80/90 if we want an increase in output and bring the now marginal oil online .

Hole in head,

See 2018, C+C output rose a lot, Brent oil price averaged $71.43/bo that year. I agree prices will be low in 2020, they might rise close to $50 in 2021 which might get oil sands output up. Tight oil needs $60/bo to be profitable imo, perhaps even $65/bo.

2018 cannot be the study case .2018 the economies of the world were still chugging and there was no Covid 19 . We are in a world ^ upside down^ where past situations and experiences have become irrelevant .

hole in head,

I agree during the covid crisis demand for oil will be lower, oil prices will be low, and output will fall to match demand.

Where we differ is that you seem to believe this will last forever (or maybe 10 years you have not really been clear), I think by 2025 the crisis will be resolved and the World economy will be back to 2019 output levels (or higher). That is the comparison to 2018, demand is likely to be pushing oil prices higher and tight oil, extra heavy oil, and ultra deep offshore oil will all be profitable to produce.

The one thing likely to prevent this is OPEC falling apart and Russia and OPEC producing all out to maximize their shares of the market, in that case oil prices remain low because the market may be oversupplied and in that case the expensive oil might never be produced, or it will be produced later (after 2030).

Unclear which scenario will prevail, my guess is $70-$80/bo oil until the World peak in 2027-2029 is apparent (a few years after the peak so maybe in early 2030s). Then oil prices rise to $120/bo until transition to EVs takes pressure off oil market (around 2037).

Dennis,

We also have no idea what historical output from non-US countries would have been under “counter-factual” scenarios (like the US not being part of the mix). If the US had not ramped up it’s production, prices would have been much higher and other countries might have done very different things.

Dennis/H i H

Canada is not over the hill. SU and CNQ have oil sands production costs in the $25/b range, when producing at unconstrained levels.

Canadian output has the potential to keep increasing production if the world/US needs it because oil sands production is a mining operation or a production operation like LTO, except that they don’t have a decline rate. They primarily have a depletion rate. Here is a summary taken from the Canadian Association of Petroleum Producers.

“The report projects a constrained outlook for Canadian oil production from 2019 to 2035. Although production will increase by 1.27 million barrels per day (b/d) by 2035, that growth rate is about 6% less than CAPP’s 2018 forecast.

Total annual production is expected to increase by an average of 3% until 2021, then slow to an average growth rate of 1% annually. Oil sands production is expected to reach 4.25 million b/d by 2035 from 2.9 million b/d in 2018 – a growth rate decline of 12% from last year’s forecast.”

As mentioned in the post, Alberta is currently operating under output constraint orders.

Denise ,incorrect once again . If the oil in Alberta is not finally ending into the gas tank of Laurel and Hardy in Miami its value is nul,nada,shunya,zero (take your pick ) . All on this forum know of the regulatory and political problems that exist regarding the pipelines from Canada to USA . Nothing new . One can wish them away ,but as they say ^ If wishes were horses ,beggars would ride ^ .

Or…they’d take the train. CSX, for example, which has transported quite a lot of Canadian oil…

Nick g , yes it can go by train,but it is an added expense to an already uneconomical oil .Also added insurance costs due to added risk compared to pipelines . We are discussing economic output.

Hole in head,

North Dakota tight oil has been shipped by rail for years, some goes by pipe, but when output is near the maximum some of it goes by rail, especially when oil prices are above $60/bo.

That is what I have indicated to Nickg also , however I also remember that there were many explosions in the rail cars and that is why a pipeline is the preferred mode of transport . We are in agreement that pipeline is cheaper than rail .

hole in head,

I agree pipelines are safer than rail, but if governments do not allow pipelines, then rail will be used, and it will be more expensive to transport oil in that case. I also agree it takes a long time to construct a new pipeline, high oil prices make such construction more likely.

hole in head,

If there is a demand for the oil it will be produced, if the US runs short on oil pipelines will be built or the crude will be shipped by rail. The Canadian crude could be shipped to BC and exported to Asia. It is not only Americans that use oil.

It is you who is incorrect… again. 🙂

Of course oil can be produced but economical oil that is the question . Pipelines will be built ?There does not seem to be any enthusiasm for them right now and since laying a pipeline is a long term project ,well when will they start . My contention is that pipelines will not be built for political and environmental concerns . As to shipping US or Canadian oil to Asia , are the refineries there designed to handle LTO or the heavy tar sands oil ? I don^t know ,but I haven^t heard of any big shipments out of North America destined for Asia . If it has to be produced but production is a lose making operation ,will the USG nationalise the oil industry ? What do you think ?

US lto already goes to Asia pretty sure they can handle extra heavy oil. Pipelines may or may not be built, they are actually safer than rail, but that is up to Canadians and or US citizens.

I do not know what will happen, but expect if oil is in short supply then oil prices increase and more expensive oil will be produced.

I think it highly unlikely that the World recession lasts more than 2 years and that World read GDP recovers to the 2019 level by 2025 at the latest, about 75% probability.

Yes, I know that LTO goes to Asia but not huge quantities . I am aware that India purchased a tanker load in January but that was a political buy to please Trump who was on a visit . Nothing big after that . The promised off take by China under the now dead trade deal has not materialised . Just thinking , if the price levels continue to be in the below $ 45 for let us say till 2022 ,will not the industry disintegrate or let us say unravel ? Then if and when supply is short we may not have enough support industries or skilled and experienced personel around to ramp up production . What is your view on this ?

hole in head,

That could potentially be a problem, it depends on how long oil prices remain low. The oil industry has been through many booms and busts, things may proceed as in the past, or not, we just do not know. Eventually if oil prices rise high enough, somebody finds a way to produce the stuff to satisfy as much demand as possible at the prevailing price of oil. I do not expect that basic mechanism to change. The details of how much is produced at any point in the future is impossible to predict precisely imo.

DC,

China has refineries that are built to handle sour heavy crude. I believe this stems from China’s former policy of lending Venezuela lots of money with the loans to be paid back in crude.

Synapsid,

They might have some capacity to refine tight oil, note that I said Asia, which is more than just China, pretty sure the Chinese refineries will be able to handle Canada’s extra heavy oil as the US Gulf coast refineries had been using Venezuelan oil, but can refine the Canadian extra heavy as well. If US tight remains at about 5 Mb/d instead of 8 Mb/d, most of it can be refined in the US and very little would need to be exported.

Denise? You need to go to the ophthalmologist. Or brain surgeon.

It is Dennis.

Advice taken . 😉

Ovi,

Does the 2019 forecast (if covid19 crisis had not occurred) from Canadian Association of Petroleum Producers seem reasonable to you?

https://www.capp.ca/resources/crude-oil-forecast/

Dennis, it sounds reasonable to me. And honestly, it wasn’t all that great.

The report projects a constrained outlook for Canadian oil production from 2019 to 2035. Although production will increase by 1.27 million barrels per day (b/d) by 2035, that growth rate is about 6% less than CAPP’s 2018 forecast.

An increase of 1.77 million barrels per day over 16 years is nothing to write home about. But the virus crisis has thrown a monkey wrench into even that. We know the rest of the world, with the possible exception of Brazil, will decline many times that number…. over those 16 years.

So now we know. Canada will not save us from peak oil.

Ron,

We could just remove all the nations with increasing output. Then we get declining output. 😉

Dennis, we don’t need to do that, we have a declining output.

Ron,

Yes over a very short two year period that is true. Over 7 years, not so much. But if we take out all nations that have had increasing output over those 7 years, we increase the chance that the remaining nations will, as a group have a decline in output.

Ron,

Chart below has non-OPEC minus US, Russia, Canada, Brazil, and Norway. Trend line from right click on data in chart in excel then choose trendline and show equation on chart in options. From Jan 2011 to March 2020 the trend is a decrease of 175 kb/d per year.

3 charts below for non-OPEC C+C minus US, Russia, Canada, Brazil, and Norway C+C output, the first period is the mostly rising/and/or high oil price period from 2004 to 2014, the second is the period of mostly falling/and or low oil prices from 2015 to 2017 and the third is the period of somewhat high prices (relative to 2015 to 2017) from 2018 to March 2020. The decline rates change with the general change in the oil price environment.

second chart

third chart

A lot of change in decline rate from -85 kb/d per year in first chart to -636 kb/d per year in second, to -52 kb/d per year in third chart.

Average Brent price from Jan 2004 to Dec 2014 (first chart) was $81.70/bo for the average monthly price. For the period from Jan 2015 to Dec 2017 the average monthly Brent price was $50.05/bo. The average monthly Brent price was $65.79/bo for the Jan 2018 to March 2020 period. Price may have influence the decline rate to some degree, though this is one of many factors and perhaps not the major reason for the change in the slope of the decline curve for this group of non-OPEC nations.

What would it take to stop the economic effects of the virus?

A vaccine? It’s going to have to be something as effective as smallpox’s vaccine. Some 30 or 40% effective vaccine is not going to close the deal and most flu vaccines are about 30 to 40% effective, even when there’s a good match to the current virus mutation. If the mutation departs the match effectiveness drops to 10%. That’s not going to persuade anybody to get on airplanes. It’s going to take a smallpox level of effectiveness.

A treatment? HIV is controlled with the current treatment. People generally don’t die. That would be an acceptable treatment. Even if it’s an ongoing requirement like a pill per week, people would accept that and old folks would start spending again. But if you don’t have that, and have that within the next year, it’s hard to see how wars don’t start getting underway.

Way too many people extrapolate money and trading and interest rates to extremes. The world does not work that way. When the situation gets truly extreme bullets start to enter skulls. If a price of something is unacceptable, kill whoever has the item and take it, and then devote 10 or 15 minutes to deciding how it was a moral thing to do and sleep just fine.

The same will evolve with oil. It will be made to flow with bullets if that’s what’s required.

Flu and corona virus are a comparison of apples and oranges, the corona virus hits an immunologically naive population, there is no pressure to change, in case of flu it is different.

ATM a vaccine seems possible, but will be available in larger amounts in summer 2021 earliest.

Ron, Bullshit.

My chart simply charts the 12 month trailing average output over the period indicated.

I have no problem with your chart Dennis, it’s your trend-line that is totally deceptive.

I chose the same period presented in Ovi’ chart Jan 2012 to March 2020. You can cherry pick some other period to get a chart to your liking.

Dennis, Deeper bullshit! If you go back far enough then every nation on earth has an increasing average. The last seven years, 2013 through 2019 is the best fit to get an idea of what a nation is doing right now. That is not cherry picking.

Neither of us knows what future output from Brazil, Norway, or Canada will be.

We may not know exactly what their output will be but we can make a very educated guess. We know that the vast majority of nations already in decline will continue to decline. I just did a quick count using the EIA’s world production data. 99 nations are currently producing any oil. Of those 99 nations, looking at December 2015 March 2020, 58 nations are in decline, 16 showed no change, (less than 500 bpd change), and 25 increased production. So declining nations outnumber increasing nations 2.3 to 1. Those 16 that held steady will soon slip into decline.

What we do know Dennis is that the declining nations will continue to decline and every year more nations will slip into decline.

The below chart is Norway for the last 7 years. (The data is through March.) They were in steep decline before Johan Sverdrup came online late last year. But obviously they will soon slip back into decline. You say we do not know that. Bullshit. We do know that.

Ron,

You know what will happen (due to clairvoyance no doubt), I make no such claim.

We are in agreement that World oil output will peak at some point in time. The timing of that peak we do not agree on, perhaps we can agree on that.

On the 7 year thing, nothing magic about 7 years in my opinion, I simply chose 8 years, as Ovi had done and fit a trend line. I think it unlikely that the trend will continue, it is clear from the chart that the 12 month trailing average has not followed the trend line.

I try not to state the obvious.

Ron,

Here is the chart for trailing 12 month average output for non-OPEC C+C minus US C+C for April 2013 to March 2020 (exactly 7 years). Hopefully this is not too “deceptive”.

About a 127 kb/d per year average increase in output over that 7 year period.

No Dennis, it is totally deceptive to anyone who does not know what you are trying to do. Oil production, from the world or from any nation or group of nations, does not follow a seven-year trend line. Can you imagine anyone asking: What does Norway’s production look like? Answer: I have no idea until I look at their seven-year trend line.

Even a one-year trend line can turn immediately. But a seven-year trend line?

Really Dennis, give me a break.

Ron

I guess I give the readers of this blog more credit for their intelligence.

It is obvious to any intelligent reader that the trend line is not likely to continue.

I often leave the obvious unstated. It might deceive a 5 year old, of below average intelligence. 😉

I think I give them far more credit than you do. I know and they know trend lines are always deceptive so I never draw them. What’s the point?

Ron,

You miss the point. To an intelligent observer they are not deceptive at all in my opinion. How do we know output is “flat”? I look at the slope of the trend line, that is the best way to evaluate the “flatness” of any period of output, end of story. If you think not, just ignore the “deceptive” trend line.

I really don’t think I am the one that misses the point. A trend line depends on how many years you include in the trend. That Dennis, is what makes it totally fucking useless. You can show almost any trend you wish by including or excluding years of production from your trend line.

You accused me of cherry-picking when I wished to show only five years in my trend. Well now, just what the heck were you doing by picking eight years for your trend line?

Dennis, the people can see the trend without any straight line whatsoever. Give people a little credit if you will.

Ron,

You said in an earlier comment it should be 7 years, I had chosen 8 years, Ovi actually prefers a longer trend of 8 years from 2011 to 2020 or perhaps even longer from 2004 to 2020, now you seem to like 5 years.

Whatever.

Chart below has non-OPEC w/o US,

output trend is an increase of 107 kb/d each year over the most recent 5 years.

Chart is zero scaled so trend line slope does not appear very steep.

Click on chart for larger view.

Ron,

One cannot determine the trend very well from just looking at the chart, it will depend on the vertical scale, and so forth. It is much easier in my view to simply note the slope of the trend line. The trend line just does a simple least squares fit through a set of data points and gives us the slope and y-intercept of the line. Of course it depends on what data set is chosen, just as the chart only shows the data you decide to include. Whatever is the deception you imagine, I cannot fathom.

Maybe posting a chart is deceptive?

On the cherry picking, one can pick the data that gives the appearance they like. Why did you choose only 5 years, what is special about 5 years? I could now claim that if 8 years is too long, maybe 5 years is also too long as well, maybe we should use 3 years so we can see the recent trend.

You said in an earlier comment it should be 7 years,…

Well, I checked back and I cannot find anywhere where I said it should be seven years. I currently use charts for OPEC going back 15 years. But otherwise, I use 7-year charts. I do not use trendlines at all. So I have no recommendation whatsoever for the number of years for trendlines.

Trendlines are a total waste of time. They are only used to give the trendline drawers bias of what is happening. It is far better just to show the monthly numbers and sometimes a 12-month average. That way the reader can draw his/her own conclusions. Most are capable of doing that.

Ron,

Quote from an earlier comment (the deeper bullshit comment):

If you go back far enough then every nation on earth has an increasing average. The last seven years, 2013 through 2019 is the best fit to get an idea of what a nation is doing right now. That is not cherry picking.

You also seem to misunderstand that I do not draw the trend line, it is done by excel and is simply based on the data set chosen.

There is no more bias than the choice of data set, which occurs every time you post a chart. So that’s why I don’t understand how it could be deceptive, but it may be a lack of understanding on your part about what an ordinary least squares linear fit is.

See https://en.wikipedia.org/wiki/Linear_least_squares

A nice property of ordinary least squares estimates is that they are unbiased as long as errors in the estimates are random. In short, in most cases the ordinary least squares estimate (which is what the trend line is) will be unbiased.

Ron,

Here is a nonOPEC w/o US for past 3 years.

Also Ovi claimed output for nonOPEC wo US had been flat for many years, maybe almost a decade. So the trend line was a test of that claim, a rise of only 130 kb/d is indeed pretty flat a rise of only 0.3% per year.

Just as you prefer the chart was not zero based to better show changes in output. A zero based chart would be quite flat.

Zero based charts make almost never any sense.

If you really want to be “pure” it should then also go on the X axis from either 0 BC or the start of the universe. Every chart would be a dot.

The idea behind a chart is to tease information out of data and zero basing may or may not add, but most of it time it won’t.

Weekend peak,

On the vertical axis, it shows the “flatness” more, if that is what wants to demonstrate, everyone is different, rather than subjectively determining the trend over the period shown in a chart, I prefer an OLS estimate of the linear trend in the data shown. Generally an infinite range on either axis is not very useful.

We are in agreement that World oil output will peak at some point in time.

Am I missing something, but isn’t that in the rear view mirror, fading fast?

November 2018

High trekker

There have been many peaks in the past that have been exceeded in future years.

In 2026 to 2032 the May 2019 peak for trailing 12 month World C+C output is very likely to be exceeded imo.

Perhaps the peak has been passed permanently, I would not bet on that. It is essentially a bet that the World economy will not recover to the 2019 level of real GDP in the next 15 years. A bet that has very long odds.

A bet that has very long odds.

That is where we differ.

We shall see.

Yes we will.

If you are confident you could make a lot of money shorting the S&P 500. My guess is that you are not that confident, or prefer to not be shirtless. 🙂

I’m in my 70’s, and quite comfortable economically.

Got some lucky rolls of the dice, I guess.

No need to do anything with the S&P 500.

I’m just interested —

But, good luck

No bets by me either, though I do think if one is invested in the stock market, long on either S&P 500 or total stock market index is probably the safest long term strategy.

If one expects a long term crash, perhaps land or real estate 400 feet or more above sea level would be a better investment.

Hightrekker,

World C C trailing 12 month average Jan 1974 to Jan 2020, I count 11 peaks over that period nearly one every 4 years on average, though 8 of 11 were from 1998 to 2019(one every 2.75 years on average.) There may be more peaks in the future.

I don’t know what oil prices will be in the future Ron, that will affect every nation’s output and the timing of when their output declines, in addition war, disease, political developments, and natural disasters will also affect oil output.

I do not know the extent or timing of any of these future events.

Let me know what they are and I will develop a scenario. 😉

Shale oil production may take years to recover, despite a short-term uptick

HOUSTON (Bloomberg) –As oil prices tick up to $40 a barrel following a pandemic-induced plunge, there’s a sense the shale industry is snapping back to life with Continental Resources Inc., EOG Resources Inc. and Parsley Energy Inc. all saying they’re restarting closed wells.

But top industry forecasters are painting a far darker picture. The reopenings, they say, will do little to bring new growth to an industry being increasingly starved of cash by Wall Street after a decade of excess. Even before the pandemic, investors were demanding companies spend no more than they earn. Now, that’s become a major barrier to future growth.

Looking out 18 months, U.S. output will still be around 16% below its peak in February, according to an average of surveys from the IEA, Genscape, Enervus, Rystad and IHS Markit. It will probably be at least 2023 before the U.S. again hits its record close to 13 million barrels a day.

“Nothing is going to be in the money,” said Bernadette Johnson, vice president of strategic analytics at Enverus, a data and research firm. At current crude prices in New York, she added, “very few new wells are being brought on line.”

That’s about one-fourth of the article. Very good read.

Ron I agree, the article is pretty good. Some parts are a bit overly optimistic as in this last part of the piece:

Even at $40 a barrel, the outlook for new wells is not good. While costs for the best parts of the Permian Basin break even below this level, the bulk of U.S. shale does not. In any case, most shale producers are busy conserving cash to repay their debts.

The big unknown, of course, is the price of oil. If prices rise to $50 a barrel, producers may be encouraged to start adding rigs again and drilling new wells, according to IHS. At that point, output could gain quickly, but even Rystad, the most bullish forecaster, doesn’t see the U.S. returning to the February peak before 2023.

The next level would be the big one. At $60 to $65 a barrel, the U.S. still has the capacity to add 1 million barrels a day for “a very long time,” said Johnson at Enverus.

The big question is how shale producers win back the trust of Wall Street to provide them with the money to do so. “They have the firepower to grow again but not the financing,” said Raoul LeBlanc, an analyst at IHS. “That trust will take some time to win back.”

Especially the send to last paragraph is not correct. At $60-$65, tight oil might return to 8 Mb/d in 2028, but I doubt they will find the cash financing needed at that price. I think that price level might get them to 5 or 6 Mb/d by 2026 or so, but I doubt they get back to 8 Mb/d for US tight oil at $65/bo or less.

Chesapeake Energy, a Shale Pioneer, Files for Bankruptcy Protection

The company helped turn the United States into a gas exporter but became known for an illegal scheme to suppress the price of oil and gas leases.

HOUSTON — Chesapeake Energy, a pioneer in extracting natural gas from shale rock across the country, filed for bankruptcy protection on Sunday, unable to overcome a mountain of debt that became unsustainable after a decade of stubbornly low gas prices.

The company helped convert the United States from a natural gas importer into a major exporter under the swashbuckling leadership of Aubrey McClendon, a company co-founder and former chief executive.

https://www.nytimes.com/2020/06/28/business/economy/chesapeake-energy-bankruptcy.html

Nat gas price @ historical lows and inventory close to 5 year high for this time of year.

https://americanoilman.homestead.com/GasStorageGraph.html

I don’t understand why everyone is bickering about absolute production numbers. Isn’t what really matter the “net energy” produced, meaning energy out per unit of energy in, or similar type of measure? I suppose if we assume that the ratio is constant then production numbers matter, but hypothetically a world desperate for oil could keep production levels at all time high as long as the ratio is >1. Yet we’d be in trouble long before then. What am I missing?

Peak aware,

Net energy is really only important on a societal level, so we need to look at net energy for all forms of energy, there are not very good numbers for net energy, it is a complex measurement problem, and different authors get different answers in their analyses.

Basically net energy is unknown, it is and interesting theoretical discussion, but the data is lacking.

makes sense, thank you.

Yeah, I can’t think of any cases where net energy analysis has really given new information.

One of the most commonly discussed cases is ethanol, but your comment applies to that as well. Another way of putting it in the case of ethanol: what’s important is liquid fuel return on liquid fuel invested, which is about 5:1.

Nick,

But the fact remains if one is concerned with a shortage of energy, corn ethanol does very little except line the pockets of large agribusiness, it is very poor policy to subsidize or mandate ethanol production imo.

Dennis is dead on.

If we were to spend even half of what we spend on moonshine on improving the fuel efficiency of new cars and trucks, we would be way better off……. without even stopping to consider the unnecessary faster destruction of our one time gift of nature farm lands.

Peak aware, yes, net energy is vital. Right now we boost end use energy by using several sources of energy input in the case of oil. Oil products are really a composite of all our forms of energy. As long as we have an excess of energy sources, that works nicely. Bio-ethanol is another composite energy source. They all depend on each other, some more than others, just to get to be produced and to market. Once the demand for energy outstrips the rate of energy accumulation it reduces energy reserves. That can be fatal if allowed to continue. The complacency instilled by the fact that humans have more tools than other animals to acquire food and energy can also be fatal. Complex systems tend to hide their problems and are highly interdependent (weakest link and critical system problem). This means the likelihood of unseen or ignored realities can produce catastrophic failures.

It is obvious that global energy is on a downslope of net energy. None of the energy systems can operate without large subsidies, both physical and financial. The energy system would collapse without all those subsidies, thus a large portion of the population would not have much access.

Dr. Charles Hall did a lot of work, produced papers and books on the subject. He covered systems down to their sources, not just at the end use or the particular product.

Also try this one: http://www.roperld.com/science/minerals/EROEIFossilFuels.htm

Dr. Hall giving a lecture on the subject:

https://www.youtube.com/watch?v=teDqDyvnTxc&feature=emb_logo

Great, thanks for the links. Bookmarked for later.

It is obvious that global energy is on a downslope of net energy.

Well, it does look like fossil fuel is getting more expensive and it’s EROEI (net energy) is falling. On the other hand, your link at roperld.com provides a chart near the bottom that says that renewable have much higher EROEI than FF, and that their EROEI is only getting better with time. The chart dates from 2011: renewables are much cheaper now, so they got that right.

So…FF is declining in value. Renewables are improving…

Well Nick, those bars have arrows in them. Appears to be a gradient over time, in other words possible future projections much as we see a lot of on this site. I would take those with a grain of salt.

Hall has shown that in order to have a high level of civilization (some disgressionary spending, art, culture, etc.) there needs to be a minimum of 14:1 real EROI. For comparison, primitive agriculture has an EROI of 10:1 to 50:1. Modern industrial agriculture is a huge energy sink <<1.

The other fallacy in energy considerations is the time factor. All of what we do is supported by past energy expenditures, some from over a century ago. That confounds the calculations, giving them and artificial boost. What is the energy cost of new energy and production sources? How much of our energy do we have to invest in obtaining and using energy minus the energy of the past (very important in when energy growth is slowing and energy quality is reducing).

A real EROI takes into account all the support systems needed to produce energy, not just the energy from mine to production/installation. The best paper I found for PV showed an EROI of about 10:1. However that did not include all the energies outside of the industry needed to support, build, maintain etc. Once those systems are included, the EROI drops even further. So even an improvement of 50 percent would not be enough.