A post by Ovi at peakoilbarrel

Below are a number of oil (C + C ) production charts for Non-OPEC countries created from data provided by the EIAʼs International Energy Statistics and updated to September 2020. Information from other sources such as OPEC, the STEO and country specific sites such as Russia and Norway is used to provide a short term outlook for future output and direction for a few countries.

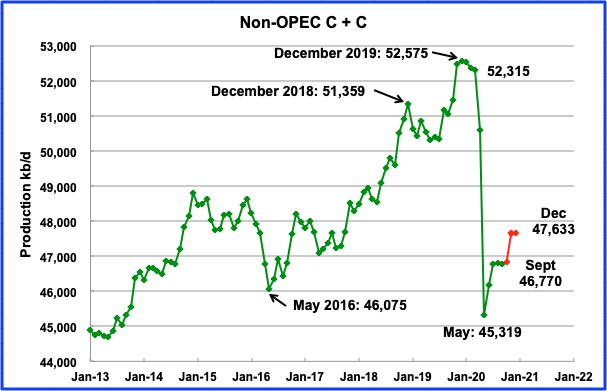

Non-OPEC production reached its current lowest production rate of 45,319 kb/d in May. According to the EIA, September output dropped 41 kb/d to 46,770 kb/d from August’s output of 46,811 kb/d.

Using data from the January 2021 STEO, a projection for Non OPEC output was made to December 2020. December output is expected to be essentially the same as November at 47,633 kb/d.

Ranking Production from NON-OPEC Countries

Above are listed the worldʼs 15th largest Non-OPEC producers. They produced 88% of the Non-OPEC output in September. On a YoY basis, Non-OPEC production decreased by 4,299 kb/d while on a MoM basis, production was down by 41 kb/d to 46,770 kb/d.

The EIA reported Brazilʼs September production was 2,907 kb/d, a drop of 180 kb/d from August due to maintenance and the presence of Covid on their sea platforms. According to this source, October’s output dropped by 28 kb/d to 2,879 kb/d and then continued to drop to 2,755 in November. (Red markers).

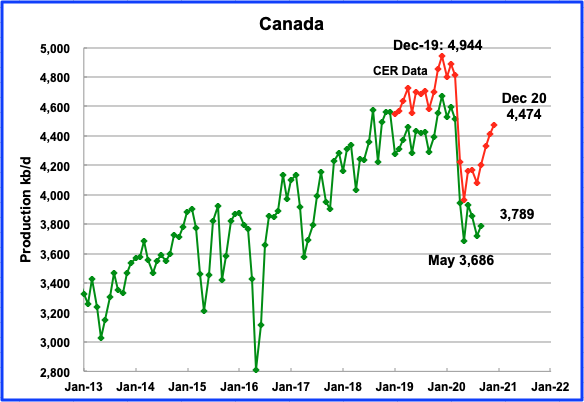

The EIA and the Canada Energy Regulator (CER) are is sync for September in that they are both showing an increase in output. The EIA is reporting that September output increased by 71 kb/d to 3,789 kb/d. The CER data is higher because it includes NGPLs in their estimates and is close to 6% of total output.

Exports by rail to the US in October were 92.8 kb/d, down from 94.4 kb/d in September and up from a low of 38.9 kb/d in July.

President Biden revoked the Keystone XL presidential permit on January 6, 2021. As the demand for Canadian heavy oil increases, the conventional and oil sands crude from Canada will be delivered by train rather than rail. However, transportation by rail is more polluting than transportation by pipeline but that doesn’t seem to be an issue.

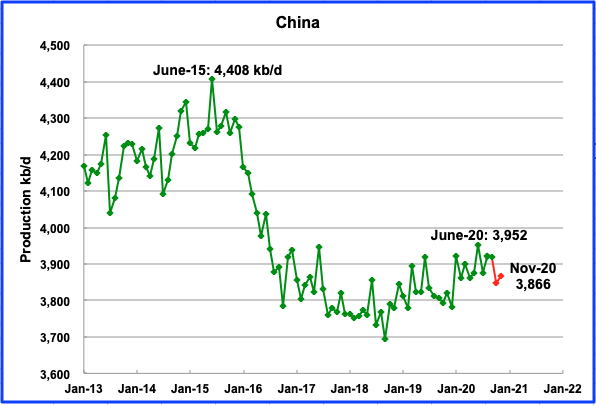

The EIA reports that Chinaʼs September output decreased by 3 kb/d to 3,918 kb/d from August. This source reported crude output for October dropped by 71 kb/d and increased by 19 kb/d in November to 3,866 kb/d. (Red markers).

Mexicoʼs production increased in September by 9 kb/d to 1,699 kb/d, according to the EIA. Data from Pemex shows that production in November was 1,689 kb/d, down 10 kb/d from September (Red markers).

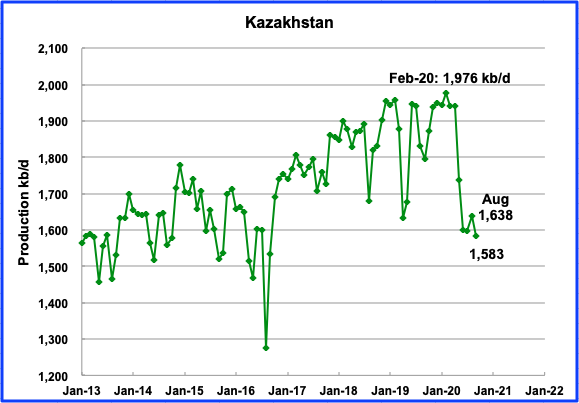

Kazakhstan’s September output dropped by 55 kb/d to 1,583 kb/d. The big drops in May and June are associated with their commitment to reduce output to the members of the OPEC + pact.

The EIA reported that Norwayʼs September production was 1,503 kb/d, a drop of 248 kb/d from August due to annual maintenance.

According to the Norwegian Petroleum Directorate (NPD), oil output increased by 121 kb/d to 1,624 kb/d in October and a further 113 kb/d in 1,737 kb/d in November.

Omanʼs September production dropped by 4 kb/d to 917 kb/d.

According to the Russian Ministry of energy, Russian production increased by 13 kb/d in December to 10,039 kb/d. The EIA reports that Russia’s September production was 9,562 kb/d.

UKʼs production recovered by 95 kb/d in September to 889 kb/d. The recovery is due the the completion of some of the planned summer maintenance. According to OPEC, UK production is expected to stay essentially flat for 2020 and 2021 at slightly over 1,000 kb/d.

Octoberʼs US production decreased by 442 kb/d to 10,419 kb/d from Septemberʼs output of 10,861 kb/d. Octoberʼs decrease was largely due to the GOM being shut due to hurricanes. This can be seen in the October onshore L48 production graph which has been essentially flat since July at 8,903 kb/d. According to the STEO, November production is expected to rebound by close to 600 kb/d to 11,000 kb/d.

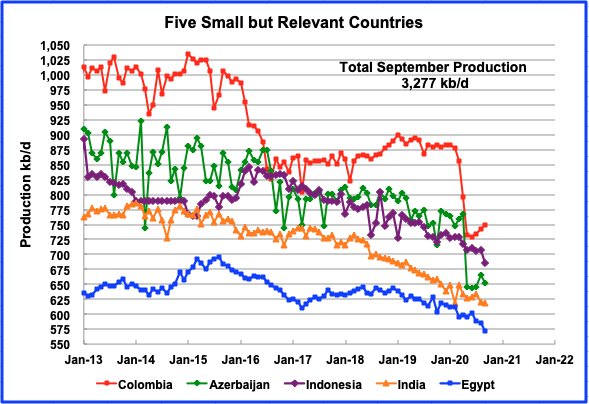

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. All five are in overall decline. Their combined September production was 3,277 kb/d down by 43 kb/d from Augustʼs output of 3,320 kb/d. Columbia is recovering from its big production drop in April and reported production increased to 761 kb/d in November, according to this source

Guyana has been added as an extra this month since it will become a significant oil producer over the next 5 years, reaching 750 kb/d.

According to this source, crude oil production from the ExxonMobil-operated Stabroek block off Guyana has climbed to 105,000 b/d, while repairs to a natural gas injection system that suppressed output will be completed by end-November.

“The US major is projecting output from Stabroek to reach 750,000 b/d by 2026, a year later than originally planned following a protracted political impasse in Guyana and pandemic restrictions.

ExxonMobil announced new discoveries in September, and now says these have increased its estimated recoverable resources on Stabroek by 1bn barrels of oil equivalent (boe) to 9bn bl.

The second phase of the Liza project is scheduled to start up in 2022, delivering 220,000 b/d. This will be followed by the $9bn Payara project that will be commissioned in 2024 and will deliver another 220,000 b/d.”

World Oil Production

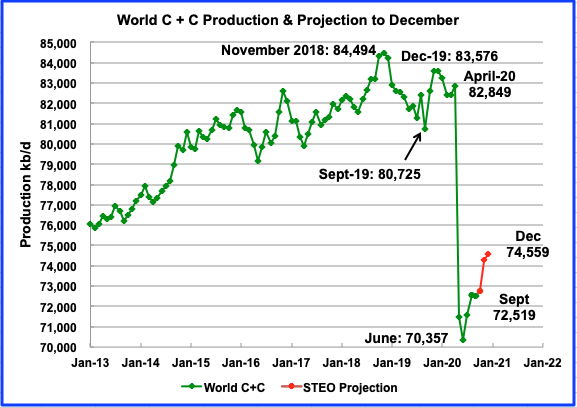

World oil production in September decreased by 53 kb/d to 72,519 kb/d according to the EIA.

This chart also projects world production out to December 2020. It uses the January STEO along with the International Energy Statistics to make the projection. It projects that world crude production growth will slow between August and October and then will recover to 74,559 kb/d in December from Juneʼs low of 70,357 kb/d, an increase of 4,202 kb/d.

I think I’ve seen enough graphing of oil to make an assessment of where the countries on this post stand:

Growers:

Canada, for how long? unknown, but in the past I’ve read that 5mmbls is about the natural limit. Factors for limit? secondary sources of energy such as NG, and possibly coal and nuclear used to boil water for separation of oil from sand. Other factor? water.

Brazil: Maybe there is more growth in offshore. Kaplan predicted they were exhausting their last offshore field, but they keep surprising to the upside. Wait and see I guess. But by 2025 growth will be over with.

Kazakhstan: tons of obstacles to growth. But over time, the Kazakhs and their oil partners seem to overcome the environmentally problems. More growth from them, but slow.

The stagnations:

Russia: I remember going to an ASPO conference in 2011 where experts in Russia saw more growth til the end of the decade. Mostly in Siberia. Now that growth is over. I think they’ll be happy to maintain what level they can produce now.

China: They’re struggling to maintain production at the shoulder of their peak. But throwing bodies and money at secondary EOR techniques can only go so far. They’ll start falling by 2023.

North Sea: The Brits and Norwegians have done what they can to stall production by producing smaller secondary tie-ins and fields. But those days are near an end. More dropping by 2025. Guaranteed.

The US: I think its a fight between the gains of the New Mexico part of the Permian and the rest. The Bakken may slow drop while Eagle Ford, Niobara (Colorado), Andarko (Okie) hemorrhage oil at a decent pace. Plus the continually drop by conventional oil in California, Texas and Alaska that is quickening will at the very at least put the US on a flatline to small decrease. Or at worst 1/2 million a year rate loss.

The Losers: everyone else, Mexico, the small 5, etc will have continual loss each year. If Canada, Brazil and the Kazakhs can’t grow supplies fast enough, the losers may overwhelm them.

Guyana: Makes up for some of the Shale loss. But in the long run, an bump in the road that will last til the end of the decade.

Biden just pulled the rug out from under New Mexico so the Permian will struggle to grow. If he follows up with gas flare limits then it’s game over for all but a few.

Alaska also.

https://www.lse.co.uk/rns/88E/operations-update-ff6zk01i3agb8ci.html

Lights out,

Producers knew this was Biden’s plan, so the smart producers stocked up on drilling permits before Jan 20, 2021. It may have an effect down the road, but Biden might change course in return for support for a carbon tax or cap and trade or some other type of legislation to fight climate change more effectively, the fear of fracking for its own sake has little scientific basis, if climate change is the aim, there are better approaches (tax carbon emissions directly) than going after oil producers.

This is the thin edge of the wedge Dennis, expect more to come!

Dennis,

I saw a headline to this effect recently and it occurred to me that drilling permits have time limits to spud in some states. I have no clue about federal lands. Also, some states have extension mechanisms. If politics are played out, perhaps the time limits or extensions may be enforced.

Additionally, as I believe this has been done regarding pipelines; if the permits have been approved but there is an objection after the fact, might the permit be invalidated to be resubmitted thus nullified?

Rasputin,

I am unfamiliar with the legal matters in this regard. I found this

https://www.blm.gov/programs/energy-and-minerals/oil-and-gas/operations-and-production#:~:text=An%20approved%20APD%20is%20valid,operator%20more%20time%20to%20drill.

From link above:

Once a leaseholder, operator, or designated agent identifies an oil and gas deposit on a Federal lease, they can file an application for permit to drill (APD). The BLM posts these APDs on its 30 Day Federal Public Posting Report Page. The BLM governs the APD process under Onshore Order #1 and its 2017 amendment, which is codified under 43 CFR §3160.

…

An approved APD is valid for two years or until the lease expires, whichever occurs first, but the BLM may grant a two-year extension to allow the operator more time to drill.

It seems they have two years to start drilling after the permit is approved or until lease expires which ever occurs first. Also extensions can be granted by the BLM.

SPOA_GUY

As it stands now, drilling activity in the LTO basins is not sufficient to offset the decline. However, even if drilling is ramped up and production does increase, the bigger question is “What will that rate of increase be?”. Dennis, did an analysis of the Permian a few posts earlier and the highest rate of yearly increase was in the order of 300 kb/d/yr. This is a long way from the 1000 kb/d/yr a few years back. That means that if yearly world demand increase returns to a more typical 800 kb/d/yr to 1,000 kb/d/yr, after we get CV under control, OPEC will regain full control of the world oil market and we will find out if they can meet that increasing demand.

Ovi,

Thank you for another great post!

Could you give us the annual average World C C output for 2018, 2019 and 2020 (based on your estimates for Oct, Nov, and Dec 2020).

I do expect US tight oil will peak by 2027 or 2028, and OPEC will likely gain control of the World oil market unless demand falls due to more working from home/telecommuting, etc as well as increased output of electric transport from trains, EVs, plugin hybrids, etc.

Scenario below is a slight modification of my medium scenario from the previous Permian post where the Permian scenario is assumed to have a maximum completion rate of 600 wells per month (the original post assumed 724 wells per month for the Medium TRR scenario and 600 wells per month maximum for the low TRR scenarios). This scenario assumed the mean USGS TRR estimate for all basins that have estimates and uses the $75/bo maximum Brent price in 2019 US$ from 2030 to 2040 with a linear rise in oil price from 2020 to 2030 and a linear fall (at the same rate with opposite sign) after 2040.

Note that the highest annual rate of increase for tight oil output for this scenario (using change in average annual tight oil output) after 2019 is 840 kbo/d from 2022 to 2023, also note the scenario is quite conservative in the assumed ramp up in completion rate and increase in oil prices. For comparison the highest annual rate of increase from 2010 to 2019 was 1569 kb/d from 2017 to 2018. There is a lot of OPEC output that can be brought back online and the bigger problem may be oversupply and low oil prices as higher oil prices bring OPEC and non-OPEC output back online, if sanctions for Iran are removed, this will also tend to lead to oversupply especially if oil prices rise above $75/bo in 2019$ for Brent.

Using tight oil scenario above with a conventional oil shock model with a 3200 Gb URR and extra heavy oil model with a URR of 130 Gb (World C plus C URR of 3400 Gb), I get the scenario below.

Note that extraction rate is for conventional oil only (which I define as C plus C that is not tight oil and has an API gravity of more than 10 degrees and thus excludes extra heavy oil from Alberta oil sands and Orinoco belt). There is a plateau at 87 Mb/d from 2028 to 2036 for this scenario, the annual peak in oil output might fall anywhere in that 8 year period, with perhaps 2031-2034 being a best guess and about a 50% probability it falls in that range of years.

Dennis

Thanks. Attached is the average world output up to December 2022. The red graph is a centred 12 month MA. The STEO projection shows a jump of 2.4 Mb/d in April 2021. Of that, 2.1 Mb/d comes from OPEC. I would expect the OPEC increase in April to change, depending on the state of the world economy.

I guess we will have to see if the Permian will get to those high yearly rate increases starting in 2023.

Ovi,

It will depend in part on the price of oil, if supply is adequate relative to demand then oil prices may remain subdued, if the vaccine rollout improves, the World economy might recover fairly quickly and demand might ramp up more quickly than supply. In that case, oil prices rise more quickly and my Permian scenario may well prove conservative, consider what happened in 2018 when oil prices rose to over $80/bo, this could easily be repeated in the Permian basin if the oil price path was similar in 2021 to 2023 as it was from 2017 to 2019. Difficult to predict.

I hadn’t looked at my subscription oil and gas production database in months, but decided to horse around with it some on a slow winter day with not much else to do.

The service purchases data from crude oil purchasers in the USA, such as Plains Marketing, LP. Lease name identifies each property, so there are many that are reported that have more than one well. Likewise many report production per well. It appears in the case of almost all horizontal shale wells that the service has used an algorithm to show the production by well in States such as Texas where multi-well lease reporting has been common.

The service allows the user to do queries. So I input production status ACTIVE, which means the well or lease has sold product in the past 12 months, and then for product code I input CRUDE OIL, which appears to mean that crude oil was sold in the past 12 months.

412,172 records or “leases” were found.

I next limited the search to “leases” that have sold 10,000 barrels of oil or more in 2020. It appears that reporting for most states is through either 10/31/20 or 11/30/20, so almost a full year. So for oil volume, I input greater than or equal to 10,000 BO YTD.

49,245 records or “leases” were found.

I next changed oil volume input to greater than or equal to 30,000 BO YTD.

21,835 records or “leases” were found.

Bump it up to 60,000 BO YTD.

11,201 records or “leases” were found.

Bump it up to 200,000 BO YTD.

1,125 records or “leases” were found.

This number was small enough to allow me to peruse where these “leases” or wells are located.

Of the 1,125 with 200,000 BO or more YTD 2020:

391 are in the Permian Basin.

354 are in the Deep Water Gulf of Mexico Basin.

144 are in the North Slope Basin (Alaska).

144 are in the Williston Basin.

92 are in many diverse miscellaneous basins throughout the United States.

Now, the other interesting thing I did was reversed it and input oil volume at less than or equal to 3,000 YTD.

309,451 records or “leases” were found.

So, over 3/4 of the “leases” in the USA produce less than 10 BOPD it appears.

Just thought maybe some here would find this interesting.

A good chunk of USA oil comes from just a few wells, and most of those are very new (less than 2 years online).

I wonder how much of this kind of data gets to those in the high level policy positions of the Federal Government?

I know many are astonished when I give them stripper well stats. Many cannot believe how many oil wells there are that make less than 15, 10, 5 and even less than 1 barrel per day.

I sure hope those making energy decisions are aware of the data, not only for oil, but all other types of energy. I worry in this era where BIG DATA is key, the Feds aren’t utilizing it, or at least do not know what they are looking at.

I like to hammer on the fact that oil is produced in the USA by companies and people from ExxonMobil all the way down to rural homeowners producing less than 1 BOPD from a well in their backyard. Few realize that, unfortunately.

This post again got me to thinking about how the US EPA is going to regulate methane from every wellbore in the lower 48, Alaska and offshore.

The DOE study measured methane emissions in terms of square cubic feet per hour.

So, there will need to be a FLIR camera trained on every one of over 2 million oil and gas wells plus facilities for two hours per year (bi-annual reporting is what has been proposed).

4 million hours divided by 2,080 work hours per year means almost 2,000 people needed to monitor, each with an $85,000 FLIR camera. Add in travel time between wells, I suspect that number of people doubles or triples.

We operate about 250 wells plus have about 40 more facilities (tank batteries). So we will need to allocate 700-800 man hours to monitoring, not counting the paperwork.

Per DOE preliminary findings, 75% of the stripper wells monitored had zero detectable methane emissions, and 90% had 13 scf per hour or less.

Sorry I keep going back to this, just trying to think through the logistics. I don’t think State well inspectors will be able to do this work. It will have to be self-monitored. Which to me means most will take their chances on spot checks.

Maybe Rasputin could give us an idea of how Colorado is handling methane detection? I could be missing something.

SS

Just to clarify, scf stands for Standard Cubic Feet. Usually that means the volume occupied by the gas at 68º F (20º C).

Yes, I believe so.

Gas prices are quoted in MCF, which is per thousand cubic feet, I believe. We don’t sell gas because we don’t have it to sell.

I stand to be corrected, of course.

In the Obama era regulations, I believe any existing source measured to be emitting 300 scf or less would become permanently exempt from future monitoring. So, it could be that many wells will just need to be measured once if this remains the rule for existing sources?

Shallow Sand,

In CO all of the costs fall on the operators with small outfits using contractors. The state FLIR equipment is used to investigate. They did the same thing in CO when they necessitated GPS coordinates for existing wells and we employed contractors. In OK, as you know, the state inspectors retrieved and uploaded the coordinates at their annual inspections. No contractors, no forms, no OCC data entry. Effective governance.

Please forgive my attitude but it never ends in CO and now I suspect that we will have dual emissions oversight unlike UIC primacy at the state level under federal guidelines.

Rasputin, yes, the State well inspectors doing the GPS has been very much appreciated. It also was a great way to get any errors in the State records cleared up. We found a few legal description typos from bygone eras due to the GPS work.

Rasputin. Didn’t think about having dual regulation of methane emissions in CO. Ugh.

Funny you should mention UIC. For the life of me, I cannot figure out how the Maximum Injection Rate (MIR) and Maximum Injection Pressure (MIP) we’re arrived at. They seem very arbitrary. Luckily the rules provide for other evidence. We have had to do some step-rate tests over the years, which have always supported a higher MIP than we needed. Since our wells are so shallow, the formula MIP is always too low.

As for the MIR, fortunately we are usually good there. However, I have the darndest time getting anyone to even give us the formula for MIR. I have asked the State Office for it and they act like it’s a state secret. Do you know where we could find that?

Shallow Sand,

I do not know where to find the MIR formula. Fortunately, I have not operated an injection well for years but that is just about to change in a big way. It would stand to reason, which makes my premise foolish in the real world, that the MIR is coupled with injection “reservoir” volume and permeability. However, low permeability is accounted for by MIP in my opinion leaving only the volume factor. The radius of investigation of surrounding wells should be based largely upon reservoir volume and injection rate and not arbitrarily set. Cumulative injection volumes and, if possible, offset well pressure data could be used to tailor injection parameters.

The upshot of my responses so far have been that broad brushed regulations have been accepted and applied at the expense of engineering/geological solutions which are more effective and transparent. This practice has allowed for over regulation, waste, under development, some level of cheating and, of course, substantial problems. Perhaps, northern OK seismicity problems are a by-product of such generic regulation. While my responses seem off topic, they are part and parcel of future production projections as somewhat exemplified by the slope of the oil production curve in CO and possibly in other regions of the US going forward. The several hundred thousand wells in TX, OK, CA, OH, WY, MT, IL, KS, CO, PA, KY, WV, NE, LA, AR, MS you noted above are not throwaway wells and merit rational regulation even in the realm of emissions.

It is so hard to keep quiet having sat on both sides of the regulatory table over the years. Thank you for allowing me to post and feel free to direct me to the other threads as appropriate.

Shallow Sand.

Just finished a Zoom conference with the OEPA and the UIC issues you bring up and most of the others that I addressed in my first response are being considered in response to currently huge issues in the state. It would appear that circumstances have driven the regulators to more effectively manage UIC issues; perhaps applying more case specific data including engineering and geologic parameters. That looks like better governance.

Methane monitoring and regulation is and will be a mess until clearer heads prevail. That mess will lead to more, not less, emissions. This is new territory for all upstream members of the industry.

Additionally, there is a legislative move to male the Marginal Well Commission a freestanding body again. For the outside observers here, the MWC helps small producers, let’s say, navigate the increasing complexity of the industry, not the least of which is a labyrinth of regulation. Please note that it is virtually impossible to implement (rules) which you don’t understand which leads to poor stewardship.

Taking that good news into consideration, perhaps there is a move, in at least one state, to “make sense” of governmental authority which should balance revenue streams with primary environmental stewardship. Of course, secondary stewardship, IMO, relates to the larger issues of climate change and sustainability. Not being too myopic but first things first.

I hope this helps you in your pursuits.

Shallow Sand,

That was an excellent post. Thank you so much for painting a clear picture of “us”.

Great stuff, thx shallow sand.

More news from Bloomberg on Biden’s plans for drilling on Federal Lands.

https://www.bnnbloomberg.ca/oil-industry-reels-as-biden-targets-fossil-fuels-in-first-days-1.1552861

Thanks for the post Ovi.

This is pretty much what I have been posting about for quite awhile.

Owning oil wells could be good or bad in the future, depending on the regulation. Looks like prices will surely increase?

If gasoline is $4 nationwide average in the fall of 2022, who wins the House and Senate? Or am I putting too much emphasis on that?

Shallow sand,

There is plenty of oil Worldwide, I doubt we will see very high oil prices by 2022, perhaps $65/bo for WTI, maybe $70/bo at most. The EIA STEO (which is often incorrect) predicts nominal WTI oil prices at $50/bo in Dec 2022. I think that is probably a bit low, we will see. The gasoline price is predicted at about $2.35 per gallon in Dec 2022 for the recent STEO. The highest monthly gasoline price in 2018 was about $2.89/gallon for regular unleaded, WTI was about $70.75/ barrel in that month (Oct 2018). In short, $4/gallon gas is not in the cards for Nov 2022.

Dennis.

You are assuming demand does not spike by several million barrels per day worldwide in 2021-22, and that money printing has no effect.

I look at what happened to the price of oil post GFC, when demand increased by a record amount YOY in 2010, with monetary stimulus playing a big part.

The demand spike post – COVID will likely be larger than GFC. The COVID stimulus makes the GFC stimulus look like child’s play.

Add in a major difference between post GFC v post COVID. Post COVID, Western governments are actively trying to stop oil exploration. That was not the case post GFC. This includes the one Western government (USA) whose overproduction has kept a lid on prices 2014-2020. What other oil producer of any magnitude has the desire to keep a lid on oil prices, besides USA? Now that USA doesn’t seek to keep a lid on oil prices, where will they go in the future?

Unless I have missed an update, the expectation is 18 million ICE light vehicles in USA will be replaced by EV light vehicles by 2030. That is a long time and not a big dent in a 250 million plus fleet, not to mention all other petroleum uses.

I am stating a contrarian case, I could be dead wrong.

However, when the moderator of a Peak Oil website believes there will be an abundance of oil for a long time, I take notice. Likewise, it seems posting on this blog has really dropped off. Another huge contrarian indicator.

As Jeffrey Brown liked to point out, when oil was $10 in 1998, the Economist predicted a long term price of $5, with never ending cheap supply. By the summer of 2008, oil topped out at $147, and was sustained $90+ 2011-14. Only shale drove down the price. Shale growth appears to be over.

We will see. Just happy our stripper wells are cash flowing again with no worries.

Shallow sand,

I am also happy things are going better for you. I may well be wrong, it happens pretty much 100% of the time (just ask my wife 🙂 ). My expectation is that 223 million plugin vehicles will be on the road Worldwide by 2030 and one billion by 2045 under a conservative EV scenario. Besides EVs there is also a lot more telecommuting that has happened during the pandemic, more home deliveries of goods and many of these changes may be permanent and are likely to reduce demand for oil.

Keep in mind that OPEC has taken 6 Mb/d off the market and World output is down by 8 Mb/d from March 2020.

US has 30% of production (as of 2017) coming from federal lands and waters, much of the increase in output has come from private land where the Federal government has little ability to affect output from tight oil wells (where most of the increased US output has come from).

Demand might increase by 1 to 2 million barrels per day, but it takes 4 years at that rate just to get us back to 2018 levels of World output. Note that I am not saying oil prices remain low forever, I just see a gradual rise in Brent oil prices in 2019$ from $53/bo today to $75/bo in 2030, roughly a $2.32/bo increase each year for 9.5 years on average.

Obviously prices will be volatile and will not follow a straight line increase as that has never happened historically for the past 40 years.

After 2030, supply might become short and oil prices might rise to $100/bo, that will depend on World demand for oil, I think demand growth will gradually slow down to zero by 2035 as EVs and telecommuting and online shopping reduce oil demand from land transport. I see oil prices falling after 2040 as demand starts to fall faster than oil supply. Obviously that is speculative.

As to shale growth being over, in the short term, through June 2021, I agree, after that I expect US tight oil grows to 9.5 Mb/d by 2028.

Chart below has average annual US tight oil output for my medium ERR scenarios with brent oil price rising to no more than $75/bo in 2019$ (for 2030 to 2040 period). Tight oil growth is not likely to be over, unless we see oil prices permanently below $50/b in the future.

Chart for US LTO referred to in comment above. Click on chart for larger view.

Dennis.

Of course I am throwing out a contrarian scenario.

If I could predict the future, I would have sold out in 2013 and put the net proceeds in FAANG stocks and TSLA stock, then sold them all recently, putting those vast sums in safe assets, retired on my private island in the Caribbean, never posting here! Lol!!

Note my number for light EV for 2020 was USA only.

Shallow sand,

You may well be right, you certainly know the oil industry better than me.

I appreciate alternative perspectives, generally if oil prices spike we will see higher output than a scenario with low oil prices.

Chart below suggests how US tight oil output change with low oil prices vs higher oil prices. The completion rate assumptions are somewhat different which accounts for different shape, but whatever completion rate assumptions are made the URR will be lower under a lower oil price scenario with similar production cost and other economic assumptions.

Things have really changed IMO.

Check out BP, production is going to drop by 1 million BOEPD for the company by 2030, with the exploration Department now employing less than 100 people.

Banks aren’t lending for oil & gas like they were either.

Shallow sand,

Nonopec output might fall due to lack of investment and low oil prices. OPEC likely has the capacity to keep oil prices in check if they choose.

If they become concerned about an EV transition they may get into a market share war and increase supply leading to low oil prices.

Slightly different scenarios with low price scenario roughly matching medium price scenario through 2023, after that the different oil price scenarios result in different completion rates.

Not sure if this goes in the oil thread. Just read a story over lunch hour that Elon Musk owns an upstream energy company and is in a title dispute in Texas about ownership of some leases.

Appears he wants to drill wells to supply rocket fuel.

Great stuff, thx shallow sand.

More on B’s oil and gas plans.

WASHINGTON — President Biden on Wednesday will direct federal agencies to determine how expansive a ban on new oil and gas leasing on federal land should be, part of a suite of executive orders that will effectively launch his agenda to combat climate change, two people with knowledge of the president’s plans said Monday.

An eventual ban on new drilling leases would fulfill a campaign promise that infuriated the oil industry and became a central theme in the fight for the critical battleground state of Pennsylvania, where the natural gas extraction method known as hydraulic fracturing, or fracking, has become big business.

The move is the most prominent of several that Mr. Biden with announce Wednesday, the two people said. The president also will direct the government to conserve 30 percent of all federal land and water by 2030, create a task force to assemble a governmentwide action plan for reducing greenhouse gas emissions, issue a memorandum elevating climate change to a national security priority. Mr. Biden will also create several new commissions and positions within the government focused on environmental justice and environmentally friendly job creation, including one to help displaced coal communities.

https://www.nytimes.com/2021/01/25/climate/biden-climate-change.html?action=click&module=Top%20Stories&pgtype=Homepage

There’s a plan to stop selling ICE by 2030 and remove them all from the road by 2040. Figure that into your demand projections.

Also figure in world population growth estimates between now and 2050.

Also figure estimates for non-light vehicle petroleum demand between now and 2050.

If USA policies are able to permanently stop USA petroleum production growth (13 million +/- being the all-time high) it appears to me very bullish for oil prices from now to 2050.

The remaining large producers (OPEC and Russia) have little incentive to keep oil prices low in this scenario.

Majors are projecting flat to significantly less future production (BP 1 million less in ten years – 6/7 of exploration staff laid off/reassigned).

I read charts here every month which show few countries can grow production significantly.

Being a niche producer (very shallow, very small footprint, very low decline) supplying primarily non-light transport petroleum markets might very well work out just fine. Really nobody knows.

Think of all the petroleum needed to transform the light fleet to electric (plastics, mining). More petroleum needed for more road repair (EV’s much heavier, more road wear). Petroleum needed to build the worldwide EV charging infrastructure. I could go on.

Hopefully less ff will be burned in the future. Burning ff is the primary problem. Will be interesting to see the petroleum substitutes for air shipping and travel, all other forms of shipping. Also, substitutes for non-burning petroleum uses, such as plastics, etc.

Going green fast could include natural gas.

You can pyro-frac it into graphite and hydrogen, for losing a part of it’s energy but when you deposit the graphite you go CO2-free. With fossil gas , for a faster transformation. There are pilot projects running here already.

The technic could be used to decarbonize air and ship travel faster, before there are enough sources of green hydrogen. It’s called blue hydrogene here , in opposite to gray hydrogen generated by steam fracking natural gas. With steam fracking the C-part is blown out as C02.

If you have enough cheap natural gas in the USA, it would be a possibility to do a faster transformation.

If the economy gets back on its feet and I expect it will over the next couple of years. I would expect another global oil peak from about 2025 to 2030. I will be looking for opportunities to divest and diversify

Shallow Sand- “Burning ff is the primary problem”

I have trouble with the relative ranking of that problem with the other big one-

Depletion of energy, in the setting of a 7.8B population not ready for a big contraction in civilization.

Hickory,

Even with a very conservative transition to electric land transport, oil demand is unlikely to outstrip oil supply. Chart below outlines oil supply (assuming BAU) vs oil demand for the very conservative electric transport transition scenario.

Thank you Dennis.

And cheers to a stable world with smooth trends.

I prefer it that way.

I am still looking for a way to buy a guarantee on that [insert smiling irony/sarc emoji here]

I keep a watch on the trends and innovations in the electric vehicle industry. It looks to me like the ball has reached critical mass, like a snowball going downhill just now big enough to gather speed. I think petrol demand will be dropping quicker after 2030, despite a bigger population.

Hickory,

I would agree the future is unlikely to see the smooth output graph of my future scenarios, but a three year average output line might fall within +/-10% of my scenario. That would roughly correspond to my estimate of an 80% confidence interval.

I also agree my demand scenario is very conservative, I think we could see oil demand fall quite a bit faster as the man on the street starts to understand how much better EVs are than ICEVs and charging infrastucture is built out further.

Huntingtonbeach,

Such a plan would ensure a Republican executive in 2025 and would never pass the US Senate over the next 4 years (or perhaps ever). Talk is cheap, as are executive orders which are easily reversed.

Says the guy who owns an EV. I pulled the statement from yesterday’s interview of Chuck Schumer. We all know it’s the direction of the future. The actual dates may be a little different. Plan accordingly.

This is a win/win situation. We want to keep the oil price high to keep our domestic oil industry in tact, while simultaneously encouraging drivers to transition to EVs. Let’s do this by gradually reducing the amount of oil drilling we do, whether by federal land restrictions, a carbon tax, whatever. Dennis has outlined scenarios where EV adaptation happens quickly leaving a failed OPEC and a glut of oil. It’s best to get out ahead of this by starting to limit supply now and sending a strong price signal to switch. I’m driving an 8yo Leaf and it’s still a nicer car to drive by far than brand new ICE cars in the $30-40K range. The smoothness, the acceleration, the lack of vibration and noise, it’s just so much better. If there are any oil guys on here who haven’t been in an EV I highly recommend a drive in one, you will understand viscerally how archaic ICE cars are even today. My guess is there will be almost zero ICE cars for sale by 2030 except in developing countries even without any incentives.

Stephen Hren,

I agree there will be a transition to EVs, but it does not need to be mandated, a tax on carbon emissions or a cap and trade arrangement is likely to lead to more efficient outcomes.

A conservative scenario for EV transition has World demand for C plus C falling below World supply by 2035 to 2040, at that point oil prices start to fall to balance supply and demand and it likely doesn’t stop until Brent oil prices fall to $30/bo (in 2019$). At that price no more development of tight oil, Arctic oil, extra heavy oil from Alberta, or ultra deep water offshore oil will occur. There will continue to be some uses for World C+C output for air transport and some water transport, but it is possible excess renewable energy output in the future will be used to produce synthetic fuel (the excess electrical energy output would be very low cost) which might have a price that is competitive with fuels refined from oil at $30/bo. This would happen some time from 2050 to 2070.

Magic Carpets

Stephen, the problem with the supposed ‘wonderfulness’ of EV’s now (what kind in our minds? One-person-per-car? Public transit?), buoyed by FF’s and the current, if nevertheless cracked and cracking, system (let’s also add, as a niche market with a ‘privileged, gated-community-and-perspective’ set’) is that they appear viewed, perhaps by you too, in a different context with the way the world is elsewhere and for whom and what it will be going forward and into the future.

We should all understand the notion of, and inherent problems with, short-term and blindered thinking, right?

IOW, we shouldn’t get too starry-eyed about EV’s, and as they are currently driven around by the relative (global) well-to-do (whose relative privileges are often funded/supported by ‘the rest’).

Hey, ICE cars were likely seen as fabulous, too, compared with walking, bicycles or horses and carriages, but look where/how that got us?

EV’s aren’t Tonkas or Hot Wheels in the sandbox… where, instead of going ‘Vroom’ with your voice as you push it over the sand (thus creating the roadway as you go), you say something like, ‘Shshsh’, cuz it’s electric.

How about only the car-drivers pay for all their roadways? As the economy unwinds, funding for that might slowly evaporate, such that it already appears to be doing. But maybe roadway infrastructure could be the beneficiaries, too, of Universal Basic Income. Magic carpets.

Speaking of/in tongue-in-cheek, WRT a recent comment elsewhere in these wacky threads; the rising economic tide will float HuntingtonBeach’s yacht and they will hit the shoal of pay dirt.

G.M. Will Sell Only Zero-Emission Vehicles by 2035

Expect most other automakers to follow suit with their own announcements over the next 6-18 months. And don’t be surprised if it happens a few years early:

https://www.nytimes.com/2021/01/28/business/gm-zero-emission-vehicles.html

And to answer Caelan’s question: the statement about EV’s is simply about the reality that if there is a better product and it suits their lifestyles better, people will buy it. Buying an ICE car after 2023-4 will be a similar move to investing in landlines in 1998. And no, folks in India or other developing countries won’t buy an EV. But they will choose to ride in an electric rickshaw instead of a diesel one if presented with the choice, and avoid the fumes in the 45C summer heat.

Stephen, I’m unsure where a few billion-and-counting people are supposed to get the minerals, etc., for batteries, etc., for their, often engineered/manufactured, lifestyles; their electric Teslas, mobile home park golf carts, electric rickshaws/mototaxis, electric bikes, electric scooters, electric this and that, and electric laptops and assorted personal gizmos, etc..

Ya, sure, in a cute little personal anecdote, it sounds nice about someone in India or wherever riding an electric rickshaw/mototaxi, minus the fumes, or transcending landlines, messenger-by-horse, carrier pigeon messaging, or smoke-signalling, but it helps to back up a little from the pointillist paintings to see the pictures emerge.

Insofar as we abandon and have abandoned things like technology, so we can do it again.

We do it all the time, maybe in part because we don’t think hard enough about it in the first place, and/or we let others, like the techno or lifestyle elites, do our thinking/doing for us.

EV’s and other newer stuff don’t appear immune to abandonment, and in fact appear even less so than usual.

And sometimes what is old– even very old– is new again, and maybe unexpected.

By 2035, that, or if, ICE cars will not be sold anymore by government decree might be kind of moot if the minerals, ecology, lifestyles and populations won’t support them anyway.

In a similar vein, if EV’s take over, so to speak, after 2035, it will be interesting to see for how long, who’s selling them, what they actually are, to whom they are sold, how they are used (i.e., what jobs they are going to in a collapsing economy and on collapsing roadway infrastructure, etc.), how many of them will be sold and where and what the socioeconomic, ecological and other contexts will be, etc..

Hi Caelan,

Agreed collapse is a possibility. For urban traffic, ICE vehicles get about 8-10mpg. EVs are ten times as efficient if not 15. The same number of trips, 1/10th the amount of energy used. If autonomous vehicles pan out, it could be the same number of trips with 1/10th the number of vehicles, as cars are parked 95% or more of the time. The same pressures that make collapse seem possible also make a change in behavior possible before collapse happens. I agree the future is not written and it will be interesting to watch.

Huntingtonbeach,

What Mr Schumer wants and what is passed as legislation are two very different things. It might happen in California and some European nations, for the US as a whole perhaps such legislation gets passed in 2040 or later.

I am trying to set realistic expectations. The US is pretty backward on climate action, this is likely to continue, probability greater than 80%.

I agree Dennis—-

The US will let Darwin sort it out.

I lived in Huntington Beach in 1967.

Realistic expectations predicting oil prices in 2050 to 2070? Can’t is the vocabulary of backward climate change deniers. Wake up and understand the believers in science have their hands on the levers of power in the White House and both houses of Congress. The filibuster is going to be kicked to the side in a heartbeat and Biden is going to call a climate change emergency to save the planet and democracy. This is the last opportunity to right the ship and the Trump’s insurrection sacred the crap out of the Dem’s. McConnell’s obstruction isn’t going to fly this time.

If you where hit on the side of the head with a brick. Would you realize it?

Dennis.

Is there a future for petroleum for any use, long term?

I have seen two opinions on this here. One is that oil is too useful to be burned as a fuel. Another is that all oil is inherently bad, and hopefully there will be substitutes for all non-fuel uses of petroleum.

If we are operating wells that are emitting minimal methane, powered by wind and solar generated electric, and transported to market by electric powered tankers, what is the problem?

I assume the posters here are aware of the vast uses of oil besides as a fuel?

Or does oil equal tobacco, no redeeming quality?

Huntington Beach,

Your viewpoint strikes me as naive, I hope there is change, but too much change is likely to result in Republican control of the Senate and house in 2023 and without a filibuster, any legislative changes will be reversed. Things move very slowly in the US, it is the way our system of government was conceived, perhaps the Constitution will be amended to change things, but that is also a very slow process.

Shallow sand,

Most petroleum is burned as fuel, releasing carbon into the atmosphere where it remains for many thousands of years. Eventually all petroleum production may cease, but I doubt that occurs this century.

Chart below has a long term oil shock model assuming BAU (no rush to convert to electric transport), URR=3400 Gb. Some uses, such as asphalt paving, airline travel and water transport will need petroleum for many years, and there is some non-fuel petroleum demand as well, as I have suggested the problem will be oversupply, low oil prices and many resources becoming stranded as oil price falls below cost of production for some oil resources. A lot of the resource may be left in the ground as demand falls below supply and cheaper substitutes replace many uses of petroleum. Click on chart for larger view (true for all charts posted in the comments).

Dennis.

I will be more direct. And keep economics out of the equation. If the future oil price is too low, it’s too low. However, we ended up not losing much in 2020 despite some extremely challenging times. So let’s agree, if the prices are too low for too long, we will plug the wells and call it a day. My inquiry is more about what is best for the environment, moral, or whatever, and what isn’t, at least in the opinion of posters here, and yours, as moderator.

If oil wells like ours, which emit little to no methane, are operated by electric pumps and motors, with either off grid wind and/or solar or on grid wind and/or solar, and are transported to market by EV tankers AND used for non-fuel applications, is what we are doing still bad?

Shallow sand,

No that would be fine, but in my opinion producing oil is not bad, burning it contributes to climate change, but we all do it. As a producer of oil you have no control over how that oil is used. I am agreeing with you that oil production is unlikely to stop, I am not in a position (nor is anyone in my opinion) to sit in judgement of what is moral or not.

As to petroleum having any use, it has many, that much is obvious, but economics is always an issue, at some point if the oil is not profitable to produce, it won’t be. I doubt that occurs in this century worldwide. I do expect Brent oil price will fall to $30/bo in 2019$ by 2062 and to $50/bo by 2053, Brent would be at $55/b by 2050 (that’s $50/bo for WTI in 2019$). Of course my guesses for future oil prices are very likely to be wrong (probability 100%).

The most sensible approach is to limit carbon emissions from all sources through some policy that is as fair as is feasible. It can be a carbon tax, a fee and dividend approach, or a cap and trade approach, or some other method.

That is the best way to combat climate change that also maximizes personal freedom to choose what one thinks is the best approach. Let the market decide once clear policy has been put in place.

The problem is not solved by ignoring it. Our children and grand children will thank us for finally taking some action to address a clear and present danger.

I don’t think climate issues should be ignored and never have.

I also think it is very difficult to predict the future. I am sure you agree.

When I read future projections I think about the reverse, so if you predict to 2060, for example, I think back to 1980. It’s just a tough thing to do. Look at oil prices 1980 to 2020. Those would have been tough to predict accurately.

But there is no law against trying. I don’t know how old you are, but I will be lucky to make it to 2060.

Shallow sand,

I agree predicting the future is impossible, a scenario is subtly different. It makes a set of assumptions and sees how things play out. You will note I have a range of different assumptions, anyone can suggest alternative assumptions, in fact much of what I have learned from you Mike Shellman and others are built into my future scenarios. Every suggestion made by oil pros improves the future scenarios, but they will still be wrong as the possibilities are infinite and the scenarios are limited to some number n. Unless n is close to infinity the probability of creating a correct scenario is appoximately zero. Of course if n is very large, choosing the correct future scenario of the n created is also a low probability exercise.

I also am unlikely to see 2060, might make it to 2050 at best.

Dennis. I see the Biden Administration is going to end “tax breaks” for fossil fuel companies.

If percentage depletion ends, it ends. I would appreciate the truth being told that it is not a tax break for “big oil” but that it only applies to the first 1,000 BOEPD of a producer’s production.

Hopefully that will occur, unlike when President Obama billed same as ending “tax breaks for big oil.”

Note my post above that there are over 300K oil leases that produce less than 10 BOPD in the USA. There are almost as many gas leases that produce less than 90 MCFPD.

Also note that there are hundreds of thousands of taxpayers that own small royalties in oil and gas leases throughout the United States.

A common example would be my wife’s great-great grandparents, who had an oil strike on their farm in 1907. The minerals passed down generation to generation and are now owned by her mother, uncle and many distant relatives. They receive anywhere from $200-$2,000 per year at $50 WTI. They also take a percentage depletion deduction.

Just tell the truth. Our country really needs that now.

Shallow sand,

The case is best made by those who know, that would be oil pros.

I agree ending the percentage depletion allowance is a bad idea.

Perhaps producers that produce less than 1000 barrels per day for average annual output could be exempt from changes in the percentage depletion allowance?

If 1000 bopd is too low, what number would leave 95% of small oil producers unaffected?

Right now the first 1000 BOEPD for all non-integrated producers (XOM, CVX, BP, RDS) may utilize percentage depletion, only to the extent of net income per property.

So, PXD and EOG may take the deduction on up to 1,000 BOEPD. These companies produce 500,000 BOEPD plus. So it doesn’t make a big difference.

I don’t know what cutoff should be used and I am not even arguing against elimination.

I just want President Biden to explain that the percentage depletion deduction affects smaller producers and royalty owners the most, and that there are thousands of small producers and hundreds of thousands of small royalty owners. Maybe also throw in all other non-ff miners, including gravel, dirt, etc., will still be permitted to claim the percentage depletion deduction.

This is not complex. I hope most voters could understand.

Just please don’t say it is a “big oil” tax break. Heck that might be enough to satisfy me.

I read a study that elimination of percentage depletion would decrease investment in oil and gas, which would eventually lead to higher prices, resulting in a wash for small producers and royalty owners.

I guess I was not clear, my suggestion is that small producers should be exempt from the change. In other words, if a company produces more than 1000 boepd they get no depletion allowance at all, small producers (who produce less than 1000 boepd for their annual average output or 365 kboe for the year) continue to get the percentage depletion allowance.

Nobody is interested in hurting small businesses.

WTI chart printed a bearish engulfing candlestick on daily chart 10 days ago that still hasn’t played out one way or the other. Dollar is finishing up the turn and we are in the beginning of a short squeeze. The record shorts on long dated 10 and 30 year treasuries are going to get squeezed also.

I think near term oil goes lower. The whole Game-stop situation. It’s not good at all for markets in a very broad sense. Margin calls went to a few hedge funds. This situation isn’t even remotely over. These hedge funds were short using leveraged money. On Game-stop in particular there was more open shorts than actual shares. They either have to post more collateral which they might not have and borrow their way through this or they have to sell assets to meet these margin calls or hope someone comes to the rescue with a bailout. They also have to pray that Game-stop will issue them more shares. This can most certainly cascade into something much bigger than it currently appears to be.

OIL and markets as a whole face a rocky start to 2021.

I never understood how you could be so stupid to short something with an short ratio above 50%. The hedgefonds should know these numbers. And with > 100% they should have known the door is very narrow when only a small thing goes wrong.

Now it are the Robin Hoodlers – but even in the time before it would be easy money for other Hedge fonds, creating a short squeeze by buying the stock and even cheaper do an additional gamma squeeze.

Even part of the Tesla rally has been a long running short squeeze. When old shorts have been squeezed out new jumped in, only to make a +10% day out of a +5% day. Some people never learn.

This week the earthquake for stock and oil prices could be felt – the market movement was dictated by fonds needing more margin for the GME, AMC …. stock battles. The word is around of 70 billion $ losses from short sellers so far this month.

Ovi, Thanks for the post. Appreciate your excellent work.

Regarding the Biden revocation of the TMX pipeline permit I have a couple of thoughts. First, I think it was purely political, as it reversed one of tRumps first actions. Second, I think it was wrong, as we will eventually need the Canadian oil it could transport. Third, I believe the effect is vastly overstated. Overstated because thankfully Line 3 replacement is finally approved and in progress, and TMX is also approved and under construction. Additional delays to either of these lines would be horrible, but if they are both completed the resulting increase in takeaway should allow for reasonable increases in Canadian activity for several years. I do have worries that the line 5 repair could cause big problems if it is not completed. But, if revoking TMX satisfies the anti line group without hitting the more essential needs, then so be it. Eventually, I think the line or something similar will be desperately needed and will be built, but I also believe the switch to renewables will not be so easy.

I hope that the methane regulations Shallow Sand worries about are changed. Stupid overregulation is as bad as the denial of climate change.

DC. Good to hear from you.

The methane thing could work in our favor in the event we are below the threshold and a lot of production that above has to be P&A. Who knows.

We operate a lease across from a turkey barn. Believe me, when we get our hands on a FLIR camera, we will point it across the road at that barn and compare it to our operations. Sometimes you about need a gas mask. Funny thing, that is the lease where the people put up the big solar array, only to run an extension cord from one of our electric boxes to their home in the winter. Lol!

They sold the home, but must have taken the solar panels.

So many hot button environmental issues around that little 60 acre 3 barrel lease. Lol!

DC

Yes Keystone XL was a political call. So much for “Decisions will be based on science” The original State Dept assessment was based on the concept that the oil would be coming to the US. The only question was, “Does it arrive by train or pipeline?” Their logical answer was that the pipeline was less polluting than trains. It is interesting that Obama approved the link from Cushing to the Gulf to create jobs as part of his re-election. After that the story changed.

With regard to the more recent decision I wonder how much influence the train lobby had in this decision. Any idea which railroad the oil would travel on?

With regard to Line 3, it is not out of the woods yet. I understand that tribes and several environmental groups have filed a lawsuit to the Minnesota Court of Appeals challenging the MPCA’s 401 Certification, the major water pollution permit issued in December.

I have read cancellation of Keystone nets Berkshire Hathaway about $2 billion annually.

Shallow, I suppose its human nature to want to “borrow” a little electricity from your neighbor when it’s cold. Thankfully, most of us know right from wrong.

I hope someone responsible for implementing those methane rules has a practical side. I deal with the state version of epa on some of my business stuff and have found that they are usually practical with small businesses such as mine. Unfortunately, there are hot button issues where everything gets polarized and practicality goes away. I hope the methane regs on stripper wells don’t go that way. People don’t appreciate what the small operators collectively do in terms of energy produced, folks employed, or how much the industry supports our rural economy.

DC. One small example.

Several stripper operators here are big fair boosters. When oil prices are high, you should see the bidding wars at the livestock auction.

In the 1980s, there were still some larger companies operating in the conventional fields, as well as a lot of fly by night promoters. That is now over, and has been for decades.

During the last drilling boom (2005-14) almost all of the new wells were drilled by people who either live in the county or in an adjoining one. There isn’t presently an operator in the county who isn’t local, or very close to local. I receive an annual production report, I know all of the operators.

Oil production in our field is operated by “family farm” type companies. The worry is the next generations have been pretty much scared off from being involved. Too much uncertainty.

Actually several families both operate oil wells and farm. Many of the wells are located on land they own and/or lease for farming.

I always give anecdotal examples, so bear with me.

We operate a lease on a farm owned by a widow. Her farm is 240 acres. Some of that 240 acres is non-tillable. My estimate is she receives about $30,000 net income from the grain farm. At $50 WTI oil she also nets around $30,000 from the 1/8 royalty due to her also owning all of the minerals. The wells were drilled on her and her husband’s farm in the early 1980s. The cumulative oil production from these wells is nearing 300,000 BO. She is now 89. Her retirement income has been very good because of both the surface and the minerals of this 240 acres, which she and her husband bought in the 1960s. The farm had oil wells on it from the first boom in 1905-11. It was water flooded in the 1950s, and plugged out in the late 1960s, around the time they bought the farm. So the nearly 300K cumulative isn’t from those old plugged wells, just the present ones.

There are thousands of people in similar circumstances. It has been a good thing that the USA has been one of the few countries that permit private ownership of minerals, at least in my view.

So many people receive royalty income in the USA, a lot of them rural people. A national association that represents royalty owners estimates 12 million. That seems high to me, but we do operate more than one lease that has over 100 separate royalty owners.

Wonder how BP is going to square owning 19.75% of Rosneft with BP’s move to Green Energy.

Rosneft is going forward with Arctic drilling.

No offense intended . Funny and tragic at the same time .

https://www.zerohedge.com/markets/saturday-sarcasm-9-great-new-jobs-laid-oil-and-gas-workers

A new thread on US November production has been posted.

http://peakoilbarrel.com/us-november-production-rebounds-after-hurricane/

A new Open Thread Non-Petroleum has been posted.

http://peakoilbarrel.com/open-thread-non-petroleum-january-30-2020/