A post by Ovi at peakoilbarrel

As I wrote in my previous post, preparing these last two has been a surrealistic exercise. The oil market environment for this post has been even more surrealistic than the previous one and the associated futures contract prices have been extremely volatile this week. The May WTI front month contract went negative on April 20 for the first time ever and closed at negative $37.63/bbl while the June contract closed at $20.43. Today’s settled price, April 24, for the June contract is $16.94.

On April 7th, OPEC + finalized a record oil production cut of 9.7 Mb/d after days of discussion. The 9.7 million bpd cut will begin on May 1 and will extend through the end of June. The cuts will then taper to 7.7 million bpd from July through the end of 2020, and 5.8 million bpd from January 2021 through April 2022. The 23-nation group will meet again on June 10 to determine if further action is needed.

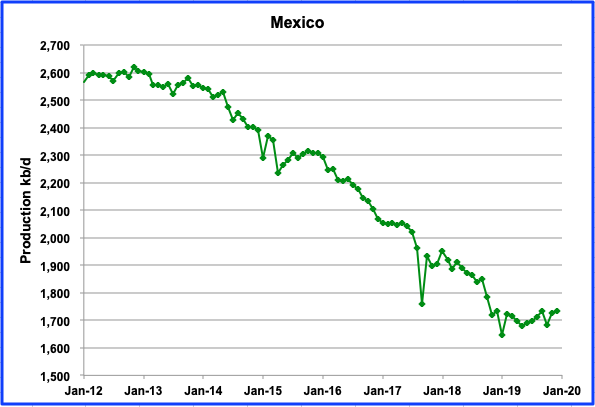

The lone hold out to the deal was Mexico which was expected to cut 400 kb/d but would only agree to 100 kb/d. This was a real Mexican standoff and Mexico won because they had hedged their oil output and the more the price dropped, the more they made on their hedges. According to this report, they hedged their oil at $49/bbl in January. It was unclear how many barrels were hedged or how much was spent.

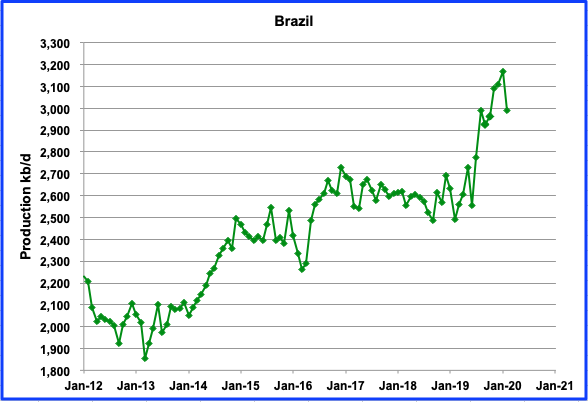

Below are a number of oil (C + C) production charts for Non-OPEC countries, created from data provided by the EIA’s International Energy Statistics and updated to December 2019. Information from other sources such as OPEC and recent news reports is used to provide a short term outlook for future output and direction.

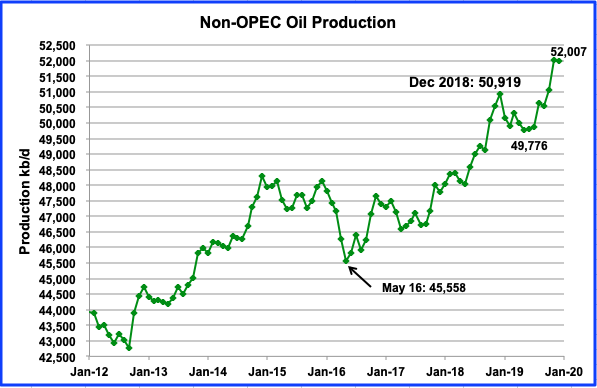

Non-OPEC production was essentially flat from November to December at 52,007 kb/d and continued at this near record production level for a second month in a row. Officially, according to the EIA December report, output fell by 5 kb/d in December and most likely will be revised in the January update.

December’s 2019 production exceeded the previous high of 50,919 kb/d reached in December 2018 by 1,088 kb/d. Of this increase the US contributed 742 kb/d. Smaller gains were provided by Norway, Brazil and Canada to overcame declines from other countries to post a second monthly record.

At some point later this year, the EIA will let us know what is happening today, April, and in May. It will be a dramatically different picture from the one above.

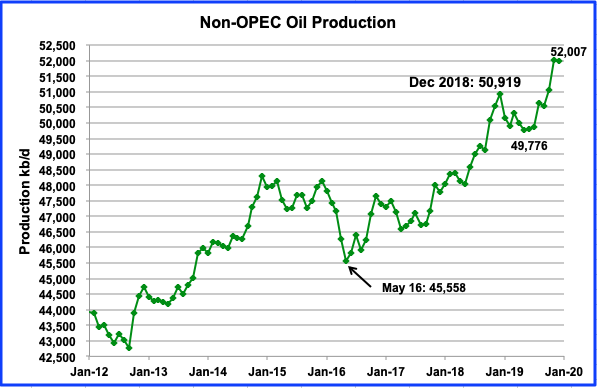

Above are listed the world’s 14th largest Non-OPEC producers. They produced 87.1% of the Non-OPEC output in December. What stands out in this table is how the declines and increases from these countries only resulted in a 38 kb/d month over month increase and overall there was a monthly decrease of 5 kb/d. The yearly increase was 1,088 kb/d. Will it ever see such a large increase again?

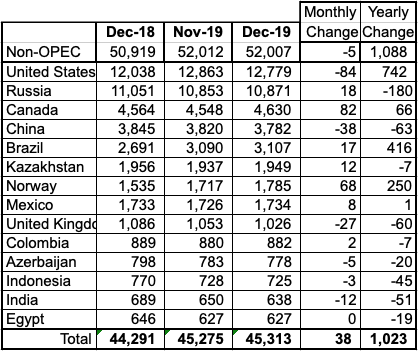

In January, Brazil reached a new record production level of 3,170 kb/d. The April OPEC report states that production fell by 180 kb/d in February, the last data point.

According to OPEC, “Brazilian production in the current lower oil price environment is faced with high operating costs, in some areas close to $30/b. It will be a big challenge for Petrobras to come up with production ramp ups in pre-salt unless the company decides to have fewer wells interconnected; if so, the expected production growth for this year will be affected. Another challenge is the heavy declines reported from fields located in post-salt reservoirs in the Campos Basin, particularly the Roncador field, according to the Agência Nacional do Petróleo (ANP).”

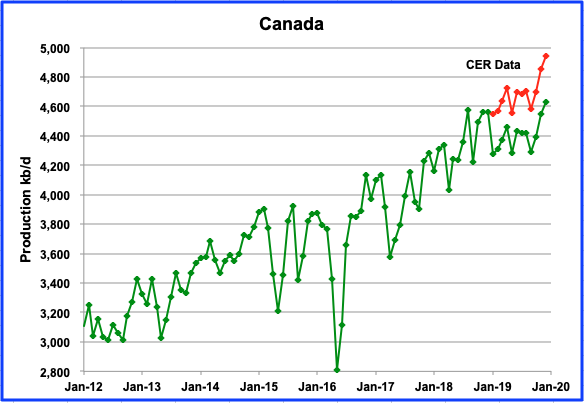

According to the EIA, Canada increased its production by 82 kb/d in December to 4,630 kb/d and it closely corresponds to the 90 kb/d increase reported by the Canada Energy Regulator (CER). Output from Alberta continues to be limited by the curtailment rules imposed by the government. In January, rail shipments of crude to the US reached a new high of 403,767 b/d from 347,136 b/d in November.

With increasing rail shipments and the Keystone pipeline returning to normal operations, inventories in Western Canada started to fall before the pandemic started. More recently, the WCS to WTI discount has shrunk from a typical $16/bbl to $9/bbl and WCS is selling close to $8.25/bbl. An almost identical low price regime applies to Syncrude Sweet blend, currently priced at $11/bbl, which normally is priced close to WTI.

In Minnesota, the PUC regulators voted to approve the replacement of Enbridge’s aging Line 3 pipeline with a new route and new pipes. However hurdles remain and before construction can commence a number of permits will be required. These were supposed to be issued in April after hearing were held but are on hold due to the virus.

According to a Minnesota paper, “Enbridge still needs a water quality certificate from the MN Pollution Control Agency (Section 401 of the Clean Water Act), which will include a public input process, so stay tuned for calls to action. They also need permits from the US Army Corps of Engineers, which will also require a public input process. However, given the current federal administration, we expect relatively quick approvals from the Army Corps. Then Enbridge will still need about 20 other, more minor permits from Minnesota agencies, but it’s safe to assume those are on the way.”

Keystone XL Pipeline: More Delays

On April 16, 2020, a U.S. judge canceled a key permit for the Keystone XL oil pipeline that will stretch from Canada to Nebraska. This is another setback for the disputed project that got underway less than three weeks ago following years of delays.

Judge Brian Morris said the U.S. Army Corps of Engineers failed to adequately consider effects on endangered species such as pallid sturgeon, a massive, dinosaur-like fish that lives in rivers the pipeline would cross.

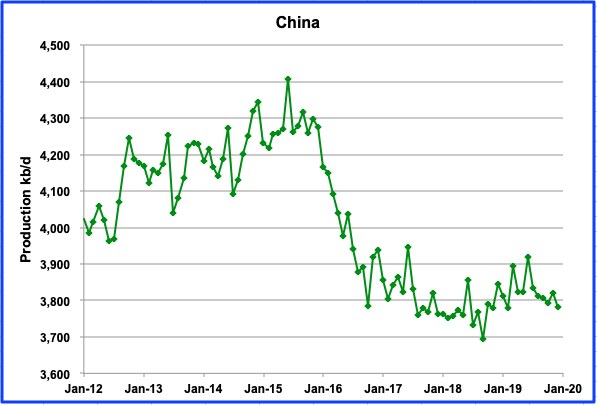

China’s production continues its slow decline which started in July 2019. Since July, it has declined by 136 kb/d to 3,782 kb/d. China’s oil companies are increasing spending and drilling to maintain output at its current level. According to OPEC, “Three major companies — China National Petroleum Corp., Sinopec and China National Offshore Oil Corp. — have increased investment in domestic oil and gas E&P in 2019 by 22%, or around $48 billion, compared with a year earlier.”

Mexico resumed it slow output increase in November and December after recovering from the drop in October. December output was up by 8 kb/d to 1,734 kb/d in December.

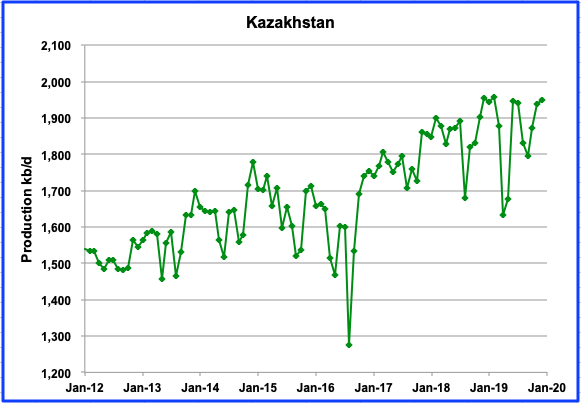

Since December 2018, Kazakhstan output has kept topping out close to 1,950 kb/d. Output increased by 12 kb/d in December to 1,937 kb/d after completing field maintenance. Output is expected remain at this level until the new OPEC + cutbacks are implemented in May.

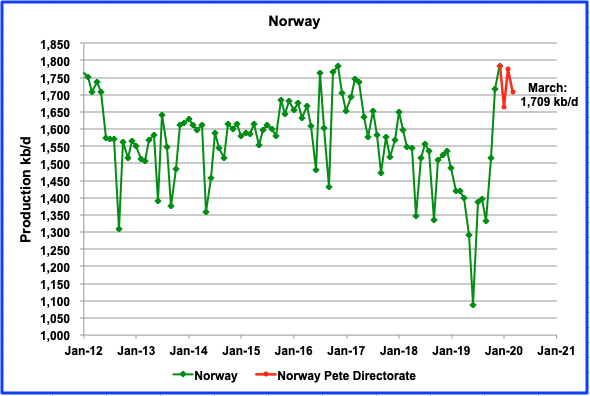

Oil (C + C) production data for Norway is published monthly by the Norway Petroleum Directorate and is shown in red. For March, the NPD reported preliminary output of 1,709 kb/d. It dropped by 67 kb/d from 1776 kb/d in February. Since the the addition of new oil from the Johan Sverdrup field in December, Norway’s output has been very volatile. It is not clear if it is associated with JS or other fields. Below is a statement from the NPD:

“What we’re seeing now, is both exploration wells being postponed and delays/cancellations of geophysical mapping. As of today, it appears that around 10 exploration wells will be postponed, meaning that there will be about 40 exploration wells in 2020. However, we can’t rule out further changes in this area in the future,” the Director General says.

There was speculation that Norway would reduce their output as part of the overall OPEC + cut back. However no formal statement has been made.

According to Reuters, OSLO (Reuters) – Norway, Western Europe’s largest oil producer, said on Saturday the country was still considering cutting oil production if the OPEC+ group implemented its plan.

“How any potential output cut will be carried out by Norway, and the size of it, we will have to come back to,” Minister of Petroleum and Energy Tina Bru said in an emailed statement to Reuters.”

Russian production increased by 35 kb/d from October to December to 10,871 kb/d according to the EIA. Also shown in red is a modified version of the oil output as reported by the Russian Ministry of Energy. It is higher than the EIA data because it includes condensate from NGPLs. The Russian data has been reduced by 350 kb/d to show how closely it parallels the EIA data. It shows a decrease of 26 kb/d from 11,320 kb/d in January to 11,294 in March 2020.

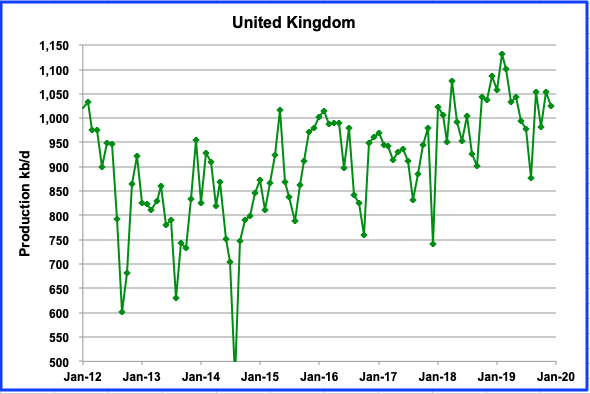

Recently UK output has been running close to 77 kb/d lower than the peak of 1,131 kb/d in February 2019. In December 2019 production dropped a further 27 kb/d to 1,026 kb/d from 1,053 kb/d in November.

According to OPEC: “For 2020, despite expected growth from new projects, UK oil production is forecast to decline significantly from April to September due to planned maintenance. Therefore, minor growth of 0.02 mb/d y-o-y is anticipated, with a yearly average of 1.17 mb/d.” (Note the 1.17 mb/d, which is close to 0.15 mb/d higher than the EIA February output, includes NGPLs while the EIA numbers only report (C + C)).

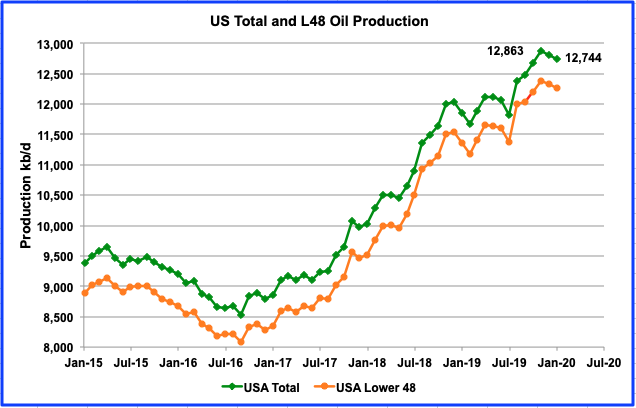

The March EIA report shows US production dropped from November to January by 119 kb/d to 12,744 kb/d. Note it has dropped for two successive months. The January drop from December was 60 kb/d. From June to November 2019, the US increased output by an average of 150 kb/d/mth.

These two successive output drops are the beginning of slowing LTO growth going into 2020. For the lower 48 states, production from December to January decreased by 61 kb/d. Today’s extra low oil prices are forcing a decrease in drilling activity. Lowering capex and expenses are the new mantra.

According to this Reuters report, “Continental Resources Inc (CLR.N), the company controlled by billionaire Harold Hamm, stopped all drilling and shut in most of its wells in the state’s Bakken shale field, three people familiar with production in the state said on Thursday.”

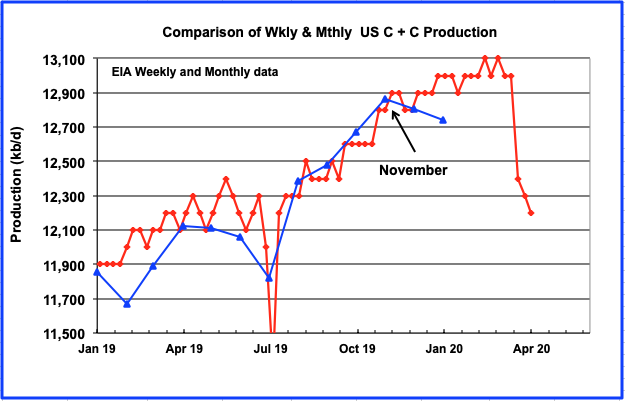

This is the latest guesstimate by the EIA on US production for the week ending April 17. After the initial drop of 600 kb/d three weeks ago, the EIA has dropped output by 100 kb/d in the last two weeks and may be headed for the 11,900 kb/d rate being estimated by the STEO for May 2020. Note that the EIA does not revise the weekly numbers. The monthly numbers, blue line, made a definite break from the weekly data in January.

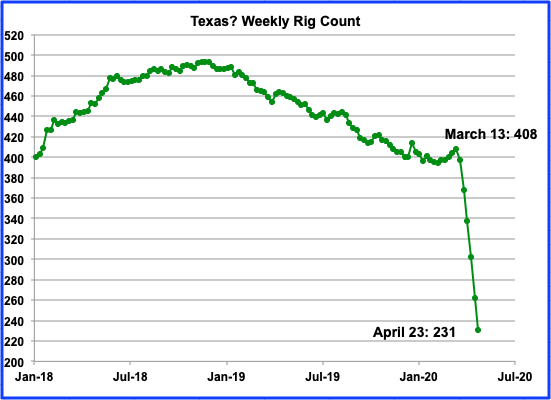

Above is the Baker Hughes Texas rig count for the week ending April 23. This looks like your classic Seneca Cliff. How will oil output follow? From March 13 to April 23, the number of rigs dropped by 177 to 231. For the week, rigs we down 31, 12% based on last weeks number of 262. At this average rate of 30 rigs per week, the count will be close to zero in close to 7 to 8 weeks. In the same week, New Mexico cut 14 rigs to 70 and North Dakota cut 7 to 27.

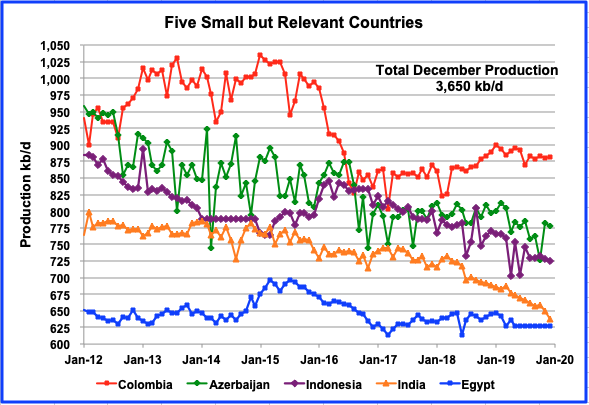

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. All five are in overall decline. Their combined December production is 3,650 kb/d down 18 kb/d from November’s output of 3,668 kb/d. Looking back one year, December 2018 to December 2019, production has dropped from 3,792 kb/d to 3,650 kb/d, a drop of 142 kb/d, or 3.74%. The average drop over the last 5 years has been 84 kb/y, closer to 1.2%. Note that Columbia’s production has been essentially flat since August. Azerbaijan, Indonesia and India appear to be in a slow steady decline phase.

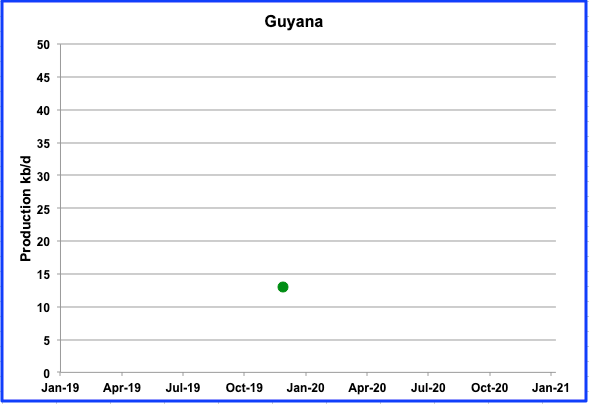

Welcome a new member to the oil market

When was the last time you saw a one point chart? I thought I should add this chart so that we can see how fast production grows in Guyana, not that the world needs their oil right now. Production started on December 20, 2019. Based on this report, the first two weeks of production produced 500,000 barrels of oil or roughly 36 kb/d, which is almost three times the rate of 13 kb/d shown in the chart.

“Production from the first phase of the Liza field is expected to reach full capacity of 120,000 barrels of oil per day in the coming months, and the first cargo is set to be sold within weeks.”

“ExxonMobil has said that by 2025, at least five FPSOs will be producing more than 750,000 barrels per day from the Stabroek Block.”

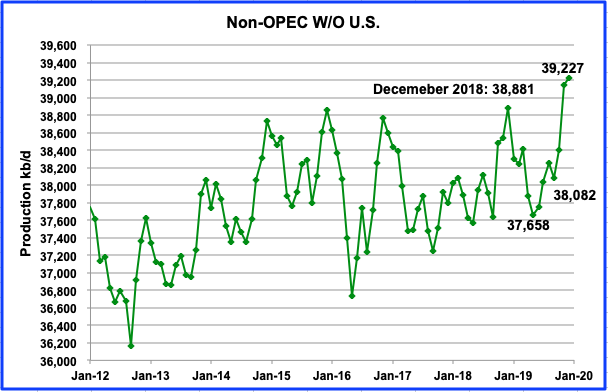

This chart, which shows production from Non-OPEC countries without the US, is one of the more critical charts that bears watching. It is providing an early indication that the Non-OPEC oil producing countries, excluding the US, are currently on a plateau. From December 2015 to December 2018, output remained in the range 38,800 kb/d to 39,000 kb/d. However with the current proposed supply constraints for Non-OPEC countries, we might see a new low output level below the low of May 2016 before we see a new high, if ever.

In November, the Non-OPEC countries, excluding the US, added 748 kb/d to push output above the previous high of 38,881 kb/d which occurred in December 2018. It is 346 kb/d higher than the previous high due to the arrival of new oil fields coming on line. Primary contributors were Norway, Brazil, Canada and the US. December 2019 output added another another 78 kb/d for a new high of 39,227 kb/d.

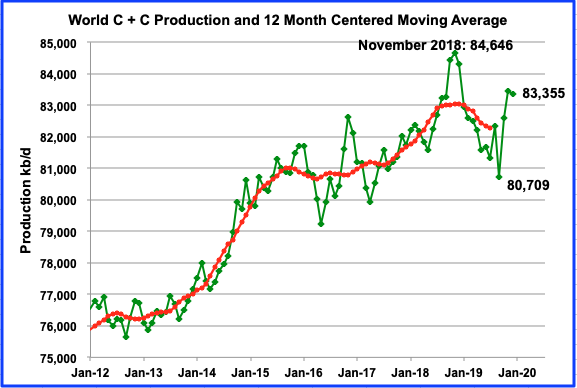

World oil production dropped by 109 kb/d to 83,335 kb/d in December 2019 from 83,464 kb/d in November. From September 2019 to November 2019 2,755 kb/d were restored to world production. Of the 2,755 kb/d increase, 1,400 kb/d was contributed by Saudi Arabia after recovering from the attack on its Abqaiq processing plant, one of the world’s most important oil production facilities. In addition, large contributions came from Brazil, Canada, Norway and the US.

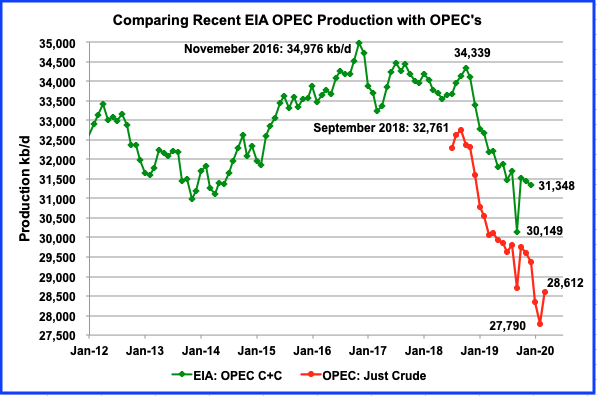

This is a comparison of the EIA’s estimate of OPEC’s C +C production vs OPEC’s crude output. The EIA’s estimate is roughly 2,000 kb/d higher, due to the inclusion of condensate. The EIA’s big production increase in October is 1,364 kb/d. However OPEC shows a smaller increase of 1,037 kb/d. According to OPEC, March 2020 OPEC crude production is 28,612 kb/d and is now down by 4,149 kb/d from the peak in September 2018. According to the EIA, C + C output is down by 2,991 b/d.

Supply side stats:

Frac spread down 62 to 85

Total rigs down 64 to 465

Oil rigs down 60 to 378

Demand side:

Total products came in at 14.1 MBPD, up 300K BPD from the week before at 13.8 MBPD.

Total products supplied for the week ending 24th April has strongly recovered to 15.763 MBPD. 2 MBPD off the lows.

WTI today: $16.

Maybe this is a way to general remark but sometimes a radical solution to a problem that doesn’t completely fix the problem changes the problem. Shale was that kind of solution. And after shale solution the problem of peak oil is totally different now.

True. It’s now peak demand. The peak oil is past us. 2019 was that year. We are never going to see 100 MBPD demand ever again.

T Shyam,

How long do you expect the economic down turn to last?

I tend to focus on C+C output as that tracks more closely with liquid fuel consumption (where I define a liquid as being a liquid at 20 C and 1 ATM of pressure.) For World C+C the 12 month peak output thus far is about 83 Mb/d, I expect that by 2024 demand for C+C will have returned to the previous peak and storage levels will be back to “normal levels”, Brent oil prices will have increased to above $70/bo.

I think some of the Tony Seba type projections do not take account of the difficulty of replacing a World vehicle fleet of well over 1 billion vehicles, this will take some time, at minimum 10 years and probably 20 years is more realistic, just to get manufacturing ramped up and overcoming material constraints (cobalt is one, and there may be others). I expect that perhaps by 2037 we might see demand fall to less than supply (2035 to 2040, for my 70% confidence interval).

Also the estimate for demand falling below supply was done prior to covid19 pandemic, this might be pushed forward due to coming recession/depression by 3 to 5 years.

The scenario below does not account for fall in demand after 2040-2042 below supply which would lead to a fall in prices to match supply with demand.

I am not sure of the economic downturn but I predict peak oil based on a confluence of factors some of which has been hastened by the pandemic

1. Jet travel that too international travel is going to be suppressed for a long time not least because people have found out they can conduct most business without meeting face to face. There will also be a permanent component in demand destruction due to behavioral changes towards work from home. Many of the jobs actually can be done without the long daily commutes and the pandemic has proven that.

2. Battery capacity is being built out at huge rates. China went from 0 to 400000 buses in 4 years flat. That capacity is now going to do something else. Will it replace trucks, diesel machinery, buses in other countries? I dont know but I know it’s going someplace which will suppress diesel demand.

3. Rapid electrification of Indian railways. Now this is not reported anywhere in global cleantech pages but it is a big deal. Already 57% of route KM responsible for more than 70% of passenger and freight transport is electrified and the management is hoping to complete electrification by 2024. The network uses 3 billion litres of diesel per annum (India uses 100 billion litres of diesel per annum) which is going to go away.

4. Europe has entered the steep part of the S curve in electric vehicle adoption. Most large countries are now reporting sales of vehicle with a plug of atleast 10%. Some like Norway has crossed 60%.

Same with China and infact the whole world. The adoption of electric vehicles is very rapid. It is now becoming increasingly apparent that the peak ICE sales was in 2018.

5. Delivery fleets are going to shift swiftly to BEV. Rivian will supply 100000 delivery vans for Amazon from 2021 to 2024. Imagine that. 100k vans for just 1 company in 1 geography.

6. Other commercial vehicles which have high running or repeated predictable circuits (example: dump trucks, school buses) will quickly change to electric powertrain as soon as the battery capacity becomes available. Decision making will be based on economics and will happen very quickly.

6. Electric 2 wheelers and 3 wheelers are booming in Asia. They are very easy to manufacture and need only 1 to 5 KWh of batteries per vehicle. An American may not understand this but 2 wheelers and 3 wheelers are the most important means of transport for vast populations in Asia and Africa. Almost all of them run on petrol now. Huge disruption waiting to happen.

7. A speculative point but lot of companies particularly Asian ones are growing very wary of stretched supply lines particularly involving China. More localization may reduce shipping needs and hence consumption of bunker oil. Copper ore need not be shipped from Australia to China to be smelted into copper, made into wire and then be shipped to Japan. Japan might just smelt it themselves or import wires from Australia.

8. Aging boomer population in OECD. This is a huge demography which have fuel in their veins. Fortunately or unfortunately, they are retiring and pretty soon will start dying (the oldest boomer is now 74). In any case they will commute way less, become increasingly incapacitated and immobile even if they are not dying. The demography (millenials) and geography (non OECD) replacing them are not as enthusiastic about driving or vehicle ownership. Over the next decade, the demand from this voracious group is going to fall off the cliff.

9. MENA countries are going big on solar for electricity generation. Most of their current electricity comes from oil and natural gas.

10. There are also other long term trends like increasing energy efficiency of GDP and declining population in countries like Japan, Italy, Russia and others which have much higher per capital oil consumption than world average. These trends secularly reduces the oil demand and are not disruptive in nature. So I am not going to delve deeply into those.

And ofcourse the obvious reaction on the supply side:

https://oilprice.com/Energy/Energy-General/Covid-19-Set-To-Wipe-Out-1-Trillion-In-Oil-Production-Revenues.html

“Covid-19 Set To Wipe Out $1 Trillion In Oil Production Revenues.

E&P revenues are set to plummet by around US$1 trillion in 2020, a drop of 40 percent, and stand at just to US$1.47 trillion this year, compared to last year’s combined annual revenues of US$2.47 trillion.”

This is $1 Trillion less that will go to the industry this year and it will be a vicious cycle. Less money to payout to shareholders. Less money to unsecured debt holders when a company declares bankruptcy. Reduced attractiveness of the industry to potential investors.

This means less money to reinvest for future production. And any attempt to raise prices to increase production will be quickly used by alternative energy to fill the gap reducing the demand and the price.

As I have said, vicious cycle.

T Shyam,

Your arguments are all very good.

Some counterarguments, production of crude plus consensate (and consequently over the long run consumption of the same) has grown at an average annual rate of 800 kb/d from 1982 to 2018, clearly there will be a temporary oil shock due to the current pandemic. The question is, will the economy recover?

My answer is yes it will, after about 6 years.

Countering all the trends reducing demand is very rapid economic growth in Asia and potential future rapid growth in less developed nations in South America and Africa (here the population is very young relative to Europe).

How much time does it take to ramp up battery and vehicle manufacturing to replace the existing fleet of ICE vehicles, or some percentage of the existing fleet if you believe it will be reduced despite growing population? I have run the numbers and if we assume very limited growth of the vehicle fleet initially and then a reduction due to AV, it would be no sooner than 2035 under any reasonable scenario, that was before the pandemic occured. I expect the economic recession will slow the transition due to reduced economic activity, so 2038-2042 is a more reasonable scenario.

I think Tony Seba is great, but nobody makes money on a vehicle today at 35k and 200 mile range, that is why Tesla is not producing that car.

About 80 million light vehicles were sold in 2017 worldwide, if Tesla grows by 40% per year over the next 10 years they will reach 10 million vehicles sold, the rest of the auto industry is moving pretty slowly, perhaps they get to 30 million in 10 years for EVs from a very low base (I doubt they will grow as quickly as Tesla and the 40% estimate for Tesla seems unrealistic).

Perhaps there will be less air, sea and land transport due to telecommuting and teleconferencing, but note that there will still be a need to move goods (which uses a large proportion of fuel) and there will likely be some driving of ICEVs. The 1982 to 2018 trajectory would have taken demand to over 88.5 Mb/d, my model has output at essentially zero growth from 2018 to 2027, about 5.6 lower than we otherwise would have expected without the current oil shock.

To be honest, I hope you are correct and I am wrong, but I am just a bit less optimistic than you.

I hope Tony Seba’s vision comes to pass.

Hi Dennis,

Regarding your 1st question, my answer is also yes. It will bounce back. Dont know about the timeline but the oil density of GDP will be invariably down. If as you say it takes 6 years, it may need say only 95 MBPD to generate the same GDP as 2019 which needed 100 MBPD. While I am not sure about the timeline, I dont think it will take 6 years. It will be much sooner than that.

Whether battery capacity can ramp up? We can’t predict the future with certainty but the past has been very promising. The capacity has zoomed up from 50 GWh to 2200 GWh in just 6 years! That’s 44 times and as I have said, China went from 0 to 400000 buses in 4 years.

The whole fleet need not be replaced for the oil consumption to go down from 100 MBPD to say 80 MBPD. You just need conversion of high consumption commercial vehicles to do that. Private vehicle conversion is just a bonus.

Regarding 35k, 200 mile vehicles: There are plenty in every geography except in USA. Renault Zoe, Hyundai Kona, MG Hector and a whole bunch of Chinese EVs have range much more than 200 miles and retail for as little as 20k. Tesla need not build a 35k car simply because it can make much more profit selling higher priced cars. Kind of like BMW or Mercedes. To give a general sense, any compact or small car like Kona or Zoe needs only 40 KWh battery to reach 200 mile range and these small cars are already sporting that in their base models. The top ends of these cars have batteries in the 50 to 65KWh range and go past 300 miles of range. Even these top end variants now cost 35k or less.

I recommend following sites like Insideevs, Cleantechnica, electrek to follow this space. It is very exciting and fast paced. Sure the Tesla fanboyism of the comment section can put you off but you also learn a lot. I mean if the doomerism in POB comments is 7/10, then the tesla and EV fanboyism there would be 11/10. You just need to look past it and get what you need to improve your knowledge. The comment sections are gold mine just like POB if you know what you are looking for: facts. You will also be surprised to know the range of EVs available throughout the world if you are thinking there are no 35k, 200 mile EVs.

For example, Tata Motors the Indian owner of Jaguar Land Rover released the electric version of their popular compact SUV called Nexon for 1.4 million Rupees late last year which is less than $19k. It has a 30 KWh battery, has a claimed range just short of 200 miles and practically gives around 140-150 miles according to user reports.

Regarding Tony Seba, what can I say? He has been spot on till now and the skepticism I had about his predictions 5 years back is turning into admiration. But the remarkable thing is, even he underestimated the pace of fall in battery cost. He predicted only 16% fall per annum. The actual figure is 20%!!!

TShyam,

Yes there are some other EVs out there, I do follow inside EVs, sales of Tesla vehicles were 2/3 of all US sales of plugin vehicles in 2019.

Kona is 37k before rebate, eventually those will expire.

It will take quite a bit of time for either heavy or light vehicles to get replaced. So far there are not a lot of heavy EVs on the road, I agree this may be more important than light vehicles.

Also note that real GDP grows by about 2.9% per year on average from 1983 to 2018, and it will be faster than this during a recovery from a depression. The previous trajectory of real GDP, if we reach that level eventually will be considerably higher than 2018 real GDP (about 30% higher by 2027). My model takes account of falling oil use per unit of real GDP and estimates both commercial vehicle and light vehicle transition, an eventual transition to AVs and TaaS will accelerate the transition, but I doubt we get Worldwide regulatory approval and widespread adoption before 2035. That will be game changing, but we have a long way to go on that front.

My point on the 35k car with 200 mile range that Seba predicts for 2020, there are not a lot of those cars out there. So far not profitable to produce. As far as his prediction for a 200 mile range EV at 22k in 2023, I doubt we will see this that early, perhaps by 2025 or 2026. Chevy Bolt also 36.6 for 259 miles of range. The Kia Niro EV, 239 mile range starts at 38.5k, again rebate will go away. Only about 3000 of the Kona/Niro were sold in US in 2019 with about 1500 in 2019 Q4 (so about a 6000 per year sales rate in Q4), if we add Bolt, Kona and Niro Q4 sales we get about 4600 in the US vs 47k for Model 3.

For class 8 tractor trailers, though they are being developed, there are only prototypes on the road in the US to date (Tesla semi pushed to 2021) and Nikola Semi also expected in 2021. Agree 100% this will be important, but will take time to ramp output. In 2017 medium and heavy truck sales in the World were over 3.7 million per year, total registered commercial vehicles worldwide in 2015 were about 335 million and light vehicles about 947 million in 2015. Commercial vehicles use about half of gasoline and diesel fuel consumed in the US, in less developed nations the proportion used by commercial vehicles is likely higher, perhaps as much as 65%.

Checked price of Renault Zoe (without 3000 pound rebate available in UK), it is about $36k, range 245 miles.

Traffic in Dhaka

https://www.youtube.com/watch?v=Kyk2pfEt_w4

Thanks Matt.

Video from April 2014, it may be much the same today.

Opinion piece on Dhaka traffic, considered the worst in the world.

https://www.dhakatribune.com/opinion/op-ed/2019/05/23/how-can-we-fix-the-world-s-worst-traffic

https://twitter.com/USCGLosAngeles/status/1253570343815442432?s=20

One gets a *FREE* tank of gas with $25 in store purchase.

What could be better? (s)

Horizontal Oil Rig counts in US from Baker Hughes

https://rigcount.bakerhughes.com/na-rig-count

Frac count from

https://twitter.com/PrimaryVision/status/1253808048654528512

Frac spread discussion starts around 12:50, I don’t agree with his view of debt doom, but I have been wrong about many things in the past and the future may be no different. In an economic crisis, government debt is ok, but I tend to agree that business bailouts are a bad idea, allow bankruptcy to eliminate poorly run businesses, that is the way capitalism is supposed to work. Seems buying high yield debt by the Fed is also a bad idea at least to me.

I have attempted to estimate oil frac spreads by assuming frac spreads are proportional to horizontal oil to gas rig ratio over the flat portion of the chart from Jan 31 to March 6. I then assume the total horizontal rig to frac spread ratio (2.23 rigs per frac spread) can be used for the gas focused frac spreads from March 20 to April 24 to estimate gas frac spreads and the oil frac spread count is estimated by taking the total frac spread count and subtracting the gas frac spread count.

Average total rig count for Jan 31 to March 6 was 711 rigs.

^In an economic crisis, government debt is ok,^

I agree ,but not when it is + 100% of GDP already . In such a case it is better to follow the route you have enumerated in the rest of your post directly , on which I am in total agreement . Of course as per our arrangement ^ we agree to disagree^ .:-).Last but not least the work you put on the forum is greatly appreciated .

hole in head,

In the crisis, government debt increases, then it gets paid back as economy improves. Or that is the theory, politicians seem reluctant to pay down the debt during good times, 1995 to 2001 was the last time this occurred in the US

See

https://fred.stlouisfed.org/series/FYPUGDA188S

and

https://fred.stlouisfed.org/series/DEBTTLJPA188A

Correction,

US Federal Debt to GDP ratio mostly decreased From 1946 to 1974, after that has mostly increased with the exception of 1994-2001.

’46-74 was the boom economic time after WWll which paid for the increase in govt spending for the war, which in turn took care of the Great Depression.

’46-’74 was the second (and last) TRUE economic expansion of US – first being 1865-1907, which was the rapid development and industrial growth after the Civil War. It ended with the panic of 1907 (some say the Fed creation 1913, and the beginning of WWl – the end of the classical gold standard).

’46-’74 expansion ended for 3 reasons:

1. US oil peak (free flowing – not LTO/fracking crap) in Dec 1971,

2. Johnson’s Great society and pointless Vietnam war,

3.End of Breton-Woods (aka dollar-linked gold standard).

These are the real reasons – not the StLouis fed crap!

1994-2001 was NOT a true expansion. Was the selling of America and the West to the ding-dongs and CCP by Bill Clinton, Rubin, Summers and other chosen ones.

The elimination of Glass-Steagall and awarding China the status of Most Favoured Nation in trade during that period (which utterly devastated american industry), was a nice gift that Clinton gave us and the real reason why we beg the Ding Xi fucks for respiratory masks and ppe today, among other things.

You’re welcome!

Be well,

Petro

“The elimination of Glass-Steagall”

yep Clinton signed it, but it was a Republican congressional bill-

“Republicans Phil Gramm of Texas and James Leach of Iowa co-sponsored the bill that ultimately was passed by both Republican-controlled houses and signed by Clinton in 1999, under a threat of overriding his veto if he did not.”

Realism is based on facts.

Ha, ha, ha

you think that I am a republican and, what’s truly sad/funny, you think there’s a difference between Republicrats and Democlicans…

A proud member of herd you are!

http://files.abovetopsecret.com/images/member/8e5074454fcc.jpg

Keep it up.

be well,

Petro

you think there’s a difference between Republicrats and Democlicans…

Think hell! Anyone who doesn’t know there is a difference between Donald Trump and the average Democrat is as dumb as fucking dirt.

Simply saying, and drawing cartoons, that implies there is no difference between the right and the left does not make it so. Right-wing idiots, now realizing their leader is a blooming idiot, are now trying to say that the left is just as stupid. This attempted trick only proves how stupid they are.

Observe the obvious difference between the press conferences of Andrew Cuomo and Donald Trump. Cuomo obviously knows his job and is very meticulous with his every word and comment. Trump, on the other hand, is obviously a blooming idiot suggesting that injections of Lysol might kill the virus in us.

And you have the fucking audacity to tell us that there is no difference? Get a life!

O

Hi sirs,thank you for the report I’m looking for opportunity myself .

The US will have a debt to GDP ratio of about 145% with GDP at 17T and debt at 25T end of 2020, assuming no cure nor more stimulus.

The all time high for this before the virus was 113% WWII. This is a crushing reality.

Recovery from WWII can be found in oil. US exported oil at about 1.5 million barrels/month in 1950. Burned the rest domestically. No cash outflow to pay for any.

Watcher,

US GDP was 21 trillion at end of 2019, not clear that it will fall by 4 trillion by 2020Q4. For 2019Q4 total federal debt was 23 trillion. No reason debt cannot be higher, when economy recovers, taxes can increase and debt can be paid down, Japan’s Government debt to GDP was around 200% for 2019Q4.

Hi Dennis,

The current debt is about 24.7 T$. Maybe Watcher was only taking “Debt Held by the Public” which is at 18.8 currently (https://treasurydirect.gov/NP/debt/current).

Now the difference with Japan is that Japanese debt is about 95% internal, it is ~70% for US debt.

The intergov’t debt still counts as it was money set aside to pay for federal pensions & entitlements (Social Security & medicare). We now reached the demographics cliff as Boomers are retiring: stop paying into entitlements and start drawing down entitlements. The only way the intergov’t bonds can be *redeemed* is increased revenue (ie much hire taxes & money printing). Seems likely its going to be a lot of money printing with soaring unemployment (at least 16% currently and probably increasing to 30% later this year).

Or the government could raise taxes and cut pointless defense spending.

Also getting rid of america’s bizarre zoning laws that prevent people from living in cities would be a good idea, because it would make vastly better use of existing infrastructure.

“and debt can be paid down”

Theorectically, but lets be honest- we don’t do that.

We’ll have to find a method of default, gradual hopefully.

Hickory,

For Federal Debt we did it from 1946 to 1974 and from 1994 to 2001. No reason debt cannot be paid down, it is relatively simple, reduce government spending or increase taxes or a bit of both as a compromise, just a matter of political will.

Dennis Wrote:

” No reason debt cannot be paid down, it is relatively simple, reduce government spending or increase taxes or a bit of both as a compromise”

Unlikely, $24T (on the books) and probably another $4T in 2020. By 2021, Interest Payments & costs for Welfare & entitlements will exceed every tax dollar collected. You can close every gov’t office, close the US Military and still not be able to balance the budget. Good luck taking away Welfare & entitlements!

Do you *really* believe the Federal gov’t will ever cut spending? The most likely outcome, is a whole lot of money printing to keep the lights on until the US is the next Weimer Republic!

Dennis Wrote: “Debt we did it from 1946 to 1974 and from 1994 to 2001”

from 1946 to 1974 the US dominated the global manufacturing economy as the rest of the world’s infrastructure was largely destroyed by WW2. The US was also a net creditor up (trade wise) until the 1980s. But starting in the 1980’s the US started financializing its economy using debt to fund the economy, it also started shipping manfacturing overseas.

US never had a balance budget between 1994 & 2001 because it stole from the SS Surplus. All of the SS surplus was applied to the general fund. If the US gov’t had left the SS surplus untouched (not spent) than it would a big budget deficit.

No, neither happens. The national debt is always inflated away.

I haven’t been following this thread, been too busy. But I assume you were talking about the national debt. If not just ignore my comment.

Ron,

The charts show Debt to GDP ratios, so it adjusts for inflation. Basically the economy grows and yes there is some inflation, but inflation rates were relatively low for most of the 1946 to 1972 period, a bit of inflation during the first oil shock. Yes Federal debt is essentially the national debt. What is important is the level of debt relative to GDP, the US economy was growing rapidly for most of the 1946 to 1972 period which brought the debt to GDP ratio down.

You are correct that the total level of federal debt has rarely gone down (1946 to 1948 is one exception), mostly the level of Federal debt expansion was slower than the growth of GDP for most of the 1948 to 1974 period.

The USA prints money for the whole world and gives out loans. This is a big advantage. I could be wrong, but the US debt is not as big as it seems. The thing is that loan bonds

buys mainly Fed

the share of non-residents is not large. Fed buyback

-This can be called a dollar issue.

The only inconvenience of a large debt to the Fed is the inability to raise interest rates.

In this case, debt servicing will be expensive, which will lead to strong inflation.

Yes, right now the FED is the central banker to the world with all the swap lines to other Central bankers . These are never going to be squared and are used to keep kicking the can down the road .

Simple answer: either the hierarchy changes in some way, or civilization collapses.

You are always saying it’s only ones and zeros, or paper, or whatever (I’m paraphrasing).

Soon enough we are going to have a chance to prove it.

And if you still have Republicans in power in January, it will not be pleasant.

To understand what $25T of debt means on a personal level, I divide the $25T of Debt by the Presidential Budget. Trump’s budget was around $5T. So there is approximately $5 of debt for every $1 of income tax the government wants to collect from us. I simply multiply what I pay in income tax to realize that I am paying for another mortgage **and** an ever increasing one while the people who “earn” the big bucks are asking for hand outs. I’m pissed off.

I finished watching Michael Moore’s Planet of the Humans and I feel slightly devastated but not all that surprised.

I would argue that you also can’t really inflate that debt way either. When you increase the money supply in a fiat monetary system all your doing is inflating the amount of debt. Now if there was no debt attached to the creation of money you might be able to actually get out of debt by increasing the money supply. Money disappears when you pay debts down in a fiat monetary system. Leading to a contraction of GDP.

Negative interest rates don’t make the debt go away.

If they worked Europe and Japan would be soon out of debt.

There is only one way forward here and it’s an exponential growth in debt. Problem is you have to have a growing economy for this to work. It takes growing energy production or you can buy energy production from your neighbor.

I’m in the opinion that there will be no real recovery. What happens when debt goes to 50T and underlying economy is still the same size or slightly less. Remember when debts are paid off or even cancelled money disappears leading to contraction of GDP. There is no way out. There is just an endgame.

Some believe the endgame is loss of faith in the currency. I believe debts will be walked away from. Hyper-deflation as money or credit disappears.

HHH,

We are making a distinction between government and private debt here. Yes increasing the money supply increases total private and public debt, but not necessarily public debt, that depends on fiscal rather than monetary policy.

I agree lots of private debt will be defaulted on. Those are debts owed by poorly run businesses and were a poor bet by the lenders. That’s capitalism, not all businesses are a success and some debt will be written off (in the current crisis it will be a large portion of private debt perhaps).

Dennis. I normally would agree with your statement, but in this instance, there are many well run businesses that are in jeopardy of failure. Many with little to no debt.

Also, many new businesses that might have succeeded will now fail. I know most new businesses fail, but the shut down due to the virus makes things way, way worse.

You must be doing a good job self-isolating if you don’t see this happening in your community.

There is a lot of disconnect I am afraid. Many who are able to go to work or work from home are viewing this state of affairs as more of an inconvenience. They need to become more aware of the scale of economic failure that is growing each day this goes on.

I might add anyone with a government pension better not count on it, given the remarks made by Mitch McConnell.

Shallow sand,

Yes these are exceptional times and perhaps small businesses should be bailed out, the large businesses that do not have the ability to borrow should fail, in my opinion. Or perhaps one could look at pre-crisis debt to equity ratios and those with ratios above some cutoff should be allowed to fail.

I agree this is a disaster, it is unclear the best solution, but it seems likely that there are some poorly run businesses that should be allowed to fail (many of the tight oil producers for example and many of the shale gas producers as well.)

I see the economic damage, but it seems to me that bailouts of all businesses is not the solution.

Any ideas?

Note that states aren’t allowed to declare bankruptcy, Cuomo challenged McConnell to pass a law that allowed it.

It is a stupid idea that would be a financial disaster, it would create a lack of confidence in US fiscal management and likely slow he recovery from the economic crisis.

Nobel laureate Paul Krugman’s thoughts on McConnell’s proposal at link below.

https://www.sltrib.com/opinion/commentary/2020/04/24/paul-krugman-mcconnell/

I’d say the WWII approach makes sense: increase government spending dramatically to support individuals and some businesses, and pay for that with a combination of tax increases on the wealthy and borrowing.

An increase in income tax brackets for the wealthy should be obvious: if you’re hurt by the economy and your income is low, then it won’t affect you.

Similarly, corporate bailouts should be partly paid for by an increase in corporate income taxes: the high income companies (who are mostly saving their profits) should pay for part of the bailout of suffering companies.

Dennis.

No, I don’t have ideas.

I was just pointing out these are exceptional times and there are a lot of small businesses with little or no debt that are hurting, either because they were required to close, and/or because of the shock to the whole economy.

Bailouts are very difficult. They tend to help the larger and stronger more.

shallow sand,

I agree PPP may help a bit, but they may have defined “small” a bit too loosely and most of the money probably went to medium sized businesses rather than “small” businesses. It seems to me that “small” should have been defined as businesses with revenue below some figure maybe $10 million or perhaps even $5 million.

Also so the money could be shared they should have taken all of the annual revenue for the small businesses say it was 1 trillion dollars (I have no idea what the right figure is, but I bet the IRS could do an estimate based on 2018 tax returns) and if 300 billion was in the PPP program, then loans for any individual business would be limited to 30% of their 2018 revenue. This has the problem of not accounting for rapidly growing businesses or recent start ups, but may be better than the legislation as it was written. Seems most of the money went to larger firms, though oversight was not really done so we don’t know where the money went.

Perhaps to those who gave the biggest donations to their Congressmen or Senators. 🙂

Dennis wrote: “I see the economic damage, but it seems to me that bailouts of all businesses is not the solution. Any ideas?”

Your basically asking how can I save my home that burned down to the ground. The simple answer is: You cannot!

FWIW: I suspect we’ll see the gov’t buy a lot of the debt, trying to prevent a deflation death spiral. But all this debt buying is likely going to trigger inflation. Perhaps slowly, but it will gain steam over time. Once the inflation Jeannie is out, it will be impossible to stop.

With the Tit-for-Tat war between the US and China, I think its going to lead to higher prices. China is the worlds Manufacturer, and everything sold or made requires something from China: Parts, assemblies, finished goods, and materials. It took about 40 years to outsource US manufacturing to China, so presuming it would take considerable time to bring it all back. Then there is also an issue finding a workforce willing to do those jobs. Boomer are retiring, Gen-X is already *fully* employeed, and millennials don’t want to do Manuf. & industrial jobs. the US would need to import a lot of immigrants to full manuf. & ind. jobs. Also Asia is facing its only demographics cliff, especially China & Japan.

Tech guy,

Nope, the question is either whether to rebuild the home and how best to do it.

Sure we know how to stop inflation, there are levers to control the growth of the money supply so hyperinflation is not likely.

Lots of people in the World willing to do manufacturing and much of it is done by machines these days in any case, that will continue so the labor issue is likely to be a non-issue.

HHH, one could agree globally to reset the system at zero. That would mean a lot of losses for many financial institutions that hold debt, but in the end there‘s one single truth: money isn‘t real, it‘s based on mutual agreement. Oil on the other hand is real and so is any other form of energy. So resetting the debt to zero, you don‘t erradicate real wealth (energy). In fact you free it for an adequate and new valuation.

IMO we should skip all that fiat money sistem when a reset happens and try something new, something that doesn‘t oblige the world to grow ruthlessly.

If they were to go ahead with a debt jubilee I believe it is called the repercussions are unknown. I mean just off the top of my head, rating agencies like standards and poors or moodies would be completely useless and who is going to lend to governments or banks etc? It will be a strange scenario.

Totally agree – except we already are in a strange scenario. And we might not find our way out with the old formulas. We have to get off that doomed growth waggon, it‘s heading to a cliff anyway. If this virus is anything good for, then for doing exactly this: stopping that wreck called growth oriented economy. And fiat money practically obliges us to grow like mad.

But if we can predict the amount of energy we are going to have in the near future, let‘s say the next ten years, we know what amount of wealth we are going to create and can define the amount of money equivalent. I think that‘s a totally different approach than creating money out of nothing and let the „market“ do the rest. I know this is not perfect, we‘re here on a site where we try to predict the impossible – but at least one should HAVE IN ACCOUNT the limits of energy growth creating money. Lending money with a fictive wealth is doomed to fail very soon.

One thing we can count on, regardless of which party has the congress, is that in order to put bandaids on the huge fiscal mess

-capital gains taxes will be raised much higher

-estate tax will be much higher

-real estate capital gains will no longer be so heavily exempted from tax

-and a value added tax will likely come into being

and they will be here to stay.

And this will not even begin to address debt. Currency devaluation will be the tool used to achieve a stealth default on debt, I suspect.

Greece was the prototype. Recall Greece imported about 400K bpd and that slashed when the triad of IMF, ECB and EU got involved to force more debt onto Greece and crush their economy, with most of it used to service already existing debt. This was in the 2012/2013 time frame. Their oil requirement was a powerful obstacle for Greece in their negotiations with that trio.

But Greece was the prototype. A declaration of default means NOTHING for sovereign debt. There is no international bankruptcy court to expunge debt a country owes to others. If you declare default, any assets you ever have outside your borders in the future are subject to seizure.

This absence of a bankruptcy court sort of makes jubilee impossible. People who default are doing so with only themselves caring what they have to say. You default? Go ahead. The interest will keep compounding and creditors will wait for chances to collect via asset seizure.

This is not rocket science and it’s also not new. Countries have always wanted to default. The answer was conquest. Either the debtor conquers the creditor and seizes assets and repays the loan with them, or they find and tear up the relevant pieces of paper in some finance ministry building, or they seize the country’s gold and use it to repay. Regardless, when you have conquered your creditor, you pretty much won’t owe the money anymore. The reverse would be the creditor conquers the debtor. That nearly always turns into loss of territory, to go with some raping and pillage.

The US has so many different creditors the armed forces will be very busy. But odds seem pretty good that’s how this will be dealt with.

Oh, don’t be silly. Sovereign defaults happen all the time. Greece has been defaulting every 25 years, for the last 200 years. Loans get renegotiated, lenders take a haircut, after a few years they start lending again (at profitable terms, even with the likelihood of eventual default), a few years later the loans get into trouble, rinse and repeat. Unfortunately for Greece, this time around they made the mistake of joining the Euro-zone, so they couldn’t devalue their currency, and were held at metaphorical gunpoint by European lenders.

Almost every country in the world has defaulted at some time, and very few have been invaded because of it – it’s just business as usual (I have some 100,000 Deutche Mark notes issued by Germany during it’s last big default, executed via deliberate hyperinflation). The US is unique: it has never defaulted in it’s 200 year history (the Continental Congress doesn’t count, apparently). That’s why it’s debt is where people flee to when they’re scared.

Greece devalued their currency by a quarter when the joined the EU. Devaluing it even more simply makes no sense.

The problem in Greece was bad governance, though it has improved. You can’t fix that in the long run be destroying your currency.

Well, there’s no question that Greece has structural, long term problems – you don’t default regularly for 200 years otherwise. But Greece’s membership in the Eurozone created more problems. Here’s one discussion:

“ Greece did indeed run up too much debt (with a lot of help from irresponsible lenders). But its debt, while high, wasn’t that high by historical standards. What turned Greek debt troubles into catastrophe was Greece’s inability, thanks to the euro, to do what countries with large debts usually do: impose fiscal austerity, yes, but offset it with easy money.”

https://www.nytimes.com/2015/07/10/opinion/paul-krugman-greeces-economy-is-a-lesson-for-republicans-in-the-us.html

I heard the following story at a presentation of the Deutsche Bundesbank, but I have never been able to find the details.

While the Greek and German governments were arguing about a bailout, one German parliamentarian remembered that he had never paid property taxes on his vacation home on a Greek island. Fearing political embarrassment, he immediately contacted a lawyer in Greece to figure out how to do it. But the local authority wasn’t interested in collecting the tax. After a few months of wrangling he ended up suing the Greek authorities to force them to take the back taxes he owed and giving him a receipt.

I don’t think the problem goes back thousands or even hundreds of years. It is a problem all small linguistically isolated countries in Europe have. Politics is local and dominated by a few personalities or families.

In the case of Greece, you have the Papandreou family on the left and Mitsotakis and Karamanlis families on the right. In the decades since the wave of reform after Papandreou ousted the military, nobody really felt the urgent need to clean up the Augean stables of Greek government. Getting into office was about political patronage, not rocking the boat.

EDIT: It’s a bit like the good old boy networks that stifle American state governments and allow Jesus freaks, Ayn Rand acolytes, child molesters and anti-vaxxers to run the place, but even worse because these countries are mass media islands cut off from the wider world by language.

Letting people like that run their own central bank is not a recipe for success.

That’s interesting – linguistic isolation makes government more corrupt or less responsible? I hear people arguing to save small endangered languages. This suggests that’s a bad idea.

On the other hand, here’s a comment on Quora that suggests that language is unrelated (unless Kentucky English is unique…):

“ Is Mitch McConnell throwing his own home state under the bus by suggesting states should file for bankruptcy?

Here is the thing that you need to understand about Mitch McConnell and the State of Kentucky. Nobody there actually likes him.

He is the least popular Senator in his home state ever elected and has remained so for his entire political career. Kentucky is a state ruled by old fashioned political machine politics. He can never be primaried, because the Repulican Party will never allow it. The Democrats pretty much totally forgot everything they’d ever known about running a real campaign in Kentucky sometime around 1976.

So, Mitch McConnell remains a Senator in spite of the electorate. He is simply the only name on the ballot in a state which will not vote for the other party.

He does not care about Kentucky. He does not care about the people of Kentucky. He rules the Republican political machine in his state with an iron fist and that is all that matters to him.

So, yes. He is perfectly willing to throw the people of Kentucky under the bus. He’s been doing so for decades. I see no reason why he would change now.”. By Ben Skirvin

Linguistic isolation allows a small elite to control the press. Berlusconi, who controlled Italy for years thanks to his control of Italian TV, showed the world how it is done. You see imitators in Poland, Czechia, Hungary, Turkey and Israel now.

Actually Israel is a special case, a small country whose political system has been upended by rich crazy outsiders. Israel is America’s Belarus. But the point is the same — you don’t need 1984 style total control, media manipulation is just as effective.

As is well known by Roger Ailes (of Fox Opinion), Rupert Murdoch and the Kochs.

Seen any good articles about the situation you described in Israel?

Mostly just bits picked up from reading Haaretz. According to them a vote in an Israeli parliamentary election costs just under 10 shekels, so buying elections isn’t a big deal. Netanyahu gets most of his money from three American families — the Falics, the Books and the Schottensteins.

But the Las Vegas casino owner Sheldon Adelson is the kingmaker in Israel. He owns Israel’s most read newspaper, and another he gives away for free, and spends huge sums on politics through various channels. He really wants to nuke Iran, and is behind a lot of Netayahu’s aggressive behavior and rhetoric towards the country. He also bankrolled Trump for $25m, presumably on the condition he abrogate the treaty Obama and the rest of the world negotiated with the country.

Nick,

The interesting thing is that McConnell may lose his position as majority leader with his new concern over the deficit. If he gets his way, economic recovery is unlikely before November and a lot of Republican Senators may be replaced by Democrats or left of center independents.

It will be interesting to watch.

Nick Wrote:

“It’s just business as usual (I have some 100,000 Deutche Mark notes issued by Germany during it’s last big default, executed via deliberate hyperinflation”

As I really the events of an economic depression (triggered by defaults) led to WW2 When People start starving or getting desperate, they select the worse possible leaders, who obtain promises by stealing it from others. I don’t believe civilization will survive WW3.

WWII was a continuation of WWI. WWI was started by Germany, which felt that it’s industrial and economic strength entitled it to a colonial empire and more power in Europe, and that continued to be the German goal in WWII. Another factor was the rise of the USSR after WWI: Hitler (and his party) was supported by a class of industrialists (including many outside Germany, such as Henry Ford, and King Edward VIII) who built the Nazi party as a weapon aimed at the USSR.

It’s true that the pain of hyperinflation and depression made it easier for Hitler to gain power and destroy democracy under the Weimar Republic. But that’s secondary.

Nick, I dare to disagree with fundamental parts of your post.

First: It is a proven historic fact, that Germany did not start WW1. The war was a result of a general hubris of ALL european powers.

Second: Economic misery and political inestability was the main reason Hitler came to power. For several years after the war, Germany was flagellated by permanent and violent insurrections from the right and the left, followed by injust and unproportional reparations paid to France that sucked the lifeblood out of the country and caused hyperinflation, which was followed almost immediately by the big global depression starting in 1927 – precisely this mixture of misery and humiliation was Hitler‘s fertile ground.

Well, this is a mighty complex historical event, which a short discussion can’t possibly do justice. But we don’t have to decide who was responsible for WWI. The real issue that we’re discussion is: which came first for Germany: hyperinflation, or war? I’d say that war came first.

Germany wanted war in 1914. WWI was a continuation of a long conflict between Germany and France, and that Germany’s part was fueled by an underlying sense that it was “due”: that it came late to the colonial party, and that it’s industrial power should be accompanied by political power. France tried to punish Germany with reparations, and Germany evaded them by hyperinflation: as Eulenspiegel put it, they turned war bonds into colored pieces of paper.

And, WWII was fueled by similar ambitions – remember the 1,000 year Reich.

Now, the misery of hyperinflation and depression certainly made the German people vulnerable to cries for vengeance. But…who stood to benefit? Who wanted the war in the first place? Perhaps war profiteers and those who wanted to destroy the USSR?

The big stock crash and the following deflation was global and hit Germany very hard. They tried to reduce budget deficit during the crisis instead of Keyne spending – and that got Hitler. He thrived on high unemployment filling his ranks of rowdies of the SA.

With a big “New Deal” program I think the Nazis would have stayed a counterpart of the communists, zeroing out each others. No calm times, but no dictatorship.

For WW1: Every european power was ready for war, there was only a match needed to ignite this situation. The book “Sleepwalkers” is a good overview of this time. The biggest error of everyone was a war would be short and could be won – it was long and there was no real winner. Everyone lost.

I’m not looking to judge Germany for WWI. My question is about the cause of dictatorship: did economic chaos cause it, or were there other more fundamental causes, which took advantage of the situation?

Watcher, if we stick to BAU, I’m afraid this is very probable.

So now we create an extreme chasm between debtors and creditors – followed by a second wave when Peak Oil hits in less than a decade – and the creditors want all that non existing money back from debtors that won‘t be able to pay ist back not in a thousand years. And debt jubilee is off the table by principle. For me that‘s just another definition of insanity. And the worst: yes, Watcher, you‘re probably right …

To some extent the debt can be inflated away. I recall buying ice cream cones for 5 cents.

It can be done.

Germany paid the dept of lost World War 1 and 2 with a debt reset. First time with an hyperinflation that converted all war bonds into colored paper, and the second time in 1949 as a reset with fixed starting money and not much conversion of the old money.

Franz Pick – Currency/ hyperinflation expert. https://reason.com/1982/06/01/interview-with-franz-pick/

I don’t like to scroll on this tablet so some of the stuff above winds up here.

First of all, GDP. In late March, Goldman Sachs estimated a -24% Q2. The stimulus package was passed on the 23rd and I’m pretty sure GS offered up their number pre stimulus. But Deutsche Bank held up a -13% estimate for Q2 in early April, and that was clearly post stimulus.

Given no cure, I’ll offer up a – 6% for Q3 Q4. That sums to 19% and that will leave us at right about 17T. Reopening the economy is not something government has any control over. All those planning on booking a cruise this fall raise your hands. If you know anybody in university administration you might want to ask them if they expect the usual number of students to want to come and sit in a room and get infected this fall. The point being, negative GDP growth seems likely for the remainder of this year, excluding cure.

The US bankruptcy code is interesting and somebody up above said that states are prohibited from declaring bankruptcy. I know that the code provides for municipalities to declare bankruptcy but that section of the code is very careful to say that any such power does not obstruct the prerogatives of the state within which that municipality resides. I do not think the code prohibits states from declaring bankruptcy, but I don’t think there is any provision for it within the code.

Now let’s be clear here. States can default on their debt. The uproar and upheaval would be extreme, but if they do not make payments on their bonds that is a credit event and they have defaulted. And a reminder here, a default on any bond is a default on all bonds. It would be interesting to see how state assets that reside in another state could be seized. Now that I think about it California’s pension funds don’t reside in California. Holy crap. Probably true of Illinois, too. Maybe there with Fidelity. That would be hilarious.

SS is very much correct above as regards state or local government retirees and their pensions. Scare words of this sort have floated around before but this is a brand new world and there is no history. There is lots of precedent for slashing pensions in a bankruptcy and the PBGC steps in and covers pensions that cannot be paid, at perhaps 40% their previous level.

As for the hyperinflation clique, best to be reminded since the financial crisis central banks around the world have longed for inflation. They have created money in quantities no one would ever have imagined and they can’t get a lousy 2% inflation. You got people who cannot leave their house to do much of anything and it’s real hard to imagine how such a scenario is anything but deflationary.

Oil is down over 2 bucks in Asia right now. More deflationary fuel for the fire.

Will be interesting to see if and how Trump responds to the OK governor’s request to declare a national “Act if God.”

I read that North Dakota is up to over 400,000 BOPD shut in.

$14 WTI means single digits for most and negative for some.

If you don’t have leasehold debt and such an “Act of God” we’re declared, allowing for temporary shut in without penalty, things could be manageable.

There are still some fixed costs, minimum utilities, insurance, taxes and fees as they come due.

Also, the longer equipment is idle the more issues will arise to restart.

An “Act of God” for May and June would not be the end of the world for a producer with no debt. Definitely a tough pill, but can be survived.

Question is, how much US oil production is not leveraged? 20% maybe?

shallow sand,

I imagine there will be a lot of bankruptcies both chapter 7 and chapter 11 in the petroleum industry.

Much of the debt may be written off and assets will be on the market at fire sale prices, the majors and any other large producers that can survive may find some great deals, the consolidation that might occur will be interesting to watch. Mr Shellman believes tight oil may be gone for good, or implied as much in a comment at oil price, though he did not use those specific words, he said he would advise an investor to stay away from tight oil or something to that effect.

He would obviously know better than me. Your thoughts?

Could a tight oil company starting from scratch with say 10 million to invest and oil industry experience similar to yours make a go of it by buying up cheap assets up for sale in due to chapter 11 and developing those assets carefully as oil prices eventually rise. I expect oil prices will rise to above $60/b by the end of 2022 and will probably reach $80/bo by 2030, unfortunately there is likely to be a lot of volatility along the way, though a vaccine in 18 months may help to settle things down, continuing waves of pandemic seem likely between now and release of a vaccine, otherwise we will need to attain herd immunity.

SS, what exactly is an act of God declaration going to do contractually? What costs are suspended? Or is it just obligated barrels that will not be provided, and thus the loss per barrel avoided? Isn’t that Force Majuere? Why does there need to be any additional declaration?

From the perspective of bankruptcy, since the land and minerals are largely owned by independent parties, the presumption that there will be cheap assets to be purchased in a bankruptcy doesn’t seem to me all that clear. Maybe the lease is an asset, but one wonders if the lease documents declare it all null and void in a bankruptcy. Regardless the asset of value is the oil underground and often doesn’t belong to the companies declaring bankruptcy.

It’s probably a good time to remind folks shutting in production means oil doesn’t exist at refineries nor gasoline at gas stations. The disaster scenario that would result will be something less than 100%. Some oil is going to flow to refineries.

And that oil will be from the SPR. The usual criticism of this reliance has to do with the limited rate of flow possible from the SPR. As I recall 4 to 5 million bpd. With what other limited flow is possible from conventional wells with hedges, it may sum to sufficient given a declined consumption.

Watcher,

I imagine there is oil and petroleum products stored in many places and the pipelines will probably continue to work, as storage levels fall, prices will increase and production will gradually restart, it will likely take a while for the economy to get restarted. Purchasing the wells from a bankrupt company would be complicated as an agreement with the landowner would need to be negotiated at the same time, perhaps one could make both transactions contingent on the other, there is likely some legal mechanism that has been devised to accomplish this. That’s one way lawyers make money.

Almost all oil and gas leases have a primary term, within which a well(s) must be drilled.

Next there is what is called the habendum clause, which provides the lease continues indefinitely so long as oil and/or gas is produced.

If production ceases, anyone with standing can file suit to have the lease declared forfeited.

This is why you may hear of operators pumping a well here and there on each lease for a short period of time to try to keep the leases valid.

Temporary cessation of production is ok, but there are many gray areas as to what is temporary and what isn’t, and each case is fact specific.

Possibly, such a declaration would end the risk of lease forfeiture for lack of production, however one wonders if either state or federal have the ability to supersede a contract.

Shallow sand,

Great info thanks. You said most operators in your area are shutting things down, does that mean you have to get an agreement with the land owner that it is ok to suspend production? Or do you just pump a barrel on each lease each month to keep the terms of the lease?

Dennis. Case law is all over the map as to what is considered temporary cessation of production.

One could try to reach an agreement with surface and mineral owners (both typically have standing to seek to cancel a lease) but in stripper fields many times the minerals have been severed, and the landowner and mineral owner may have differing viewpoints. Further, if the minerals were severed from the surface decades ago, there could be tens, if not hundreds of mineral owners.

Almost all lease documents contain a force majeure provision. The question is whether extremely low/negative prices would qualify, unlike a storm, fire, flood or some other type of an “Act of God”. Maybe a pandemic would qualify?

The landowner/mineral owner(s) would need to file a complaint in state court seeking cancellation of the lease.

In the past, operators would top lease the existing lease, and would then file suit with the cooperation of the surface/mineral owners.

I wonder who would want to top lease right now and spend a few years and maybe tens of thousands of $$ or more to cancel a lease?

I have litigated lease cancellation cases, as many arose after the 1998-99 crash. They can be costly and take 2-5 years, especially if there is an appeal of the trial courts decision.

The other issue is the various state agencies. They have rules that require wells to be produced, plugged or TA’d. Each state has different rules.

Thanks Shallow sand,

I thought it would be complicated, as usual it is even more complex than I imagined. Great concise summary of a subject that sounds like a book would be required to cover it. 🙂 Or perhaps several books.

Oil plummeted 30% to under $13 a barrel today. Ho hum. Not interesting enough to elicit a comment from anyone.

Most producers are getting less than that, anywhere from negative up to about $11 per barrel.

shallow sand,

April 27 prices at plains crude bulletin were -5 to 9 per barrel

https://www.plainsallamerican.com/getattachment/aebd21b1-ed4a-420d-9295-42c8cd0e1f01/2020-080-April-27-2020.pdf?lang=en-US&ext=.pdf

So, anyone know if the USA corn ethanol production is projected to undergo change in production levels this year?

Last year- Fuel ethanol production capacity in the United States totaled 16.9 billion gallons per year (gal/year) or 1.1 million barrels per day (b/d), as of January 2019, according to the U.S. Energy Information Administration’s (EIA) 2019 https://www.eia.gov/todayinenergy/detail.php?id=41393

..”In other words, the U.S. devotes enough land to corn-ethanol production to feed 150 million people.”

The RFS (renewable fuel standard) is an indirect subsidy to this industry, requiring that a certain amount of ethanol be added to all gasoline by refiners.

https://www.theatlantic.com/ideas/archive/2019/11/ethanol-has-forsaken-us/602191/

Ethanol production had been averaging about 1 million BOPD, and the last reported figure for the week ended 4/17/20 was 563,000 BOPD, which is the lowest amount since EIA began reporting ethanol supply in 2010.

Cash corn is below $3.00 at most grain elevators in the United States.

The hits just keep on coming for rural commodity industries.

shallow sand,

As you know most of the ethanol goes into gasoline at about a 10% level, gasoline consumption has gone from roughly 9 Mb/d to 5 Mb/d, so ethanol consumption has gone from 900 kb/d to 500 kb/d, when the economy recovers demand for ethanol goes back to 900 kb/d and corn prices go back up to $3.75.

I agree, terrible for farmers, though looking at historical prices these dips in the spring seem to happen every couple of years since Match 2014. Doesn’t make it better, but not as bad as the drop in price for oil that you have seen recently.

Correction March 2014 in comment above rather than Match 2014.

Hickory,

It will be difficult to change production level unless farmers decide to plant less, which may not be viable. Perhaps some of the corn can be exported, certainly the demand for ethanol will be down which will hurt farmers.

Looks like a setup for a huge glut of corn, unless the growers scale back production strongly. I know of no coordinated approach to achieve that market-responsive strategy. Just thousands of individual decisions. Correct me if I’m wrong on this.

Hickory,

Correct, just individual farmers making decisions, typically the decision is to plant all the corn that is feasible to grow, one never knows whether there will be flooding or some other event that might reduce the harvest, so you grow it and sell it at the market price. I imagine there may be an export market, but shallow sand would know more as I believe he lives in farm country. Mostly potatoes in my region and organic farms growing local vegetables, not a lot of corn these days, maybe a bit for grocery stores and farmers markets.

Exact SPR extraction rate 4.4 mbpd. Refiners will make a lot of money on that. One presumes they will pay only the going price, or the govt might just zero that for stimulus purposes. Where it gets interesting is distribution. Customers near the refineries get it first, and refineries near the SPR also get it first.

BTW those numbers above computing stimulus, deficit/GDP, debt to GDP . . . . odds look at least 50/50 of more stimulus this year, and big numbers. Probably worth also noting the $1.1T organic deficit projected pre virus/stimulus . . . that’s going up because tax revs are going to crash. And going up big.

$5T is a pretty credible total deficit this year. And make that $26.5T debt.

Soc Sec insolvency date is moving closer. A lot. Unemployment is not going to go away very fast.

“…Mexico won because they had hedged their oil output and the more the price dropped, the more they made on their hedges. According to this report, they hedged their oil at $49/bbl in January…”

The South Korean refiners were not as astute as Mexico. S-Oil (which is Saudi owned) just reported the largest quarterly operating loss ever. – http://koreajoongangdaily.joins.com/news/article/article.aspx?aid=3076546

With all storage for oil in the country full, the refiners must be hoping that the return to normal usage goes well.

….Jeju braces for surge in incoming holiday tourists amid easing pandemic restrictions ….

https://en.yna.co.kr/view/AEN20200428007000315?section=national/national#none

And then there are the 100+ tankers now anchored off California and Texas.

Including the 200+ oil tankers sitting off Singapore, the Oil Market will become even more interesting over the next 1-2 months.

steve

It’s common for about 3 to 6 tankers to be parked off the coast of Long Beach Harbor and they only sit there for a day or two with about half of them empty. I was near the coast two days ago to see what was there but it was overcast and couldn’t see anything. All the regular working pump jack along the cliffs in HB were all operating.

There is only one thing to do, which, in first view, seems very obvious : reinject the oil already extracted into the different oil wells. That seems extravagant but I am sure that this absurdity will become an obvious fact in the next months.

Simpler and cheaper to just shut down production, there is still 60 Mb/d of oil used currently, stock levels will fall at a rate of 60 Mb/d with zero output.

Here’s a helicopter video of some of the oil tankers anchored off Long Beach, California.

https://www.youtube.com/watch?v=yD0W0oFdQhY

If I’m seeing correctly, some of the tankers are floating high, i.e., are empty.