A guest post by Ovi

Below are a number of Crude oil plus Condensate (C + C ) production charts for Non-OPEC countries created from data provided by the EIA’s International Energy Statistics and updated to May 2022. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few countries and the world. The US report has an expanded view beyond production by adding rig and frac charts.

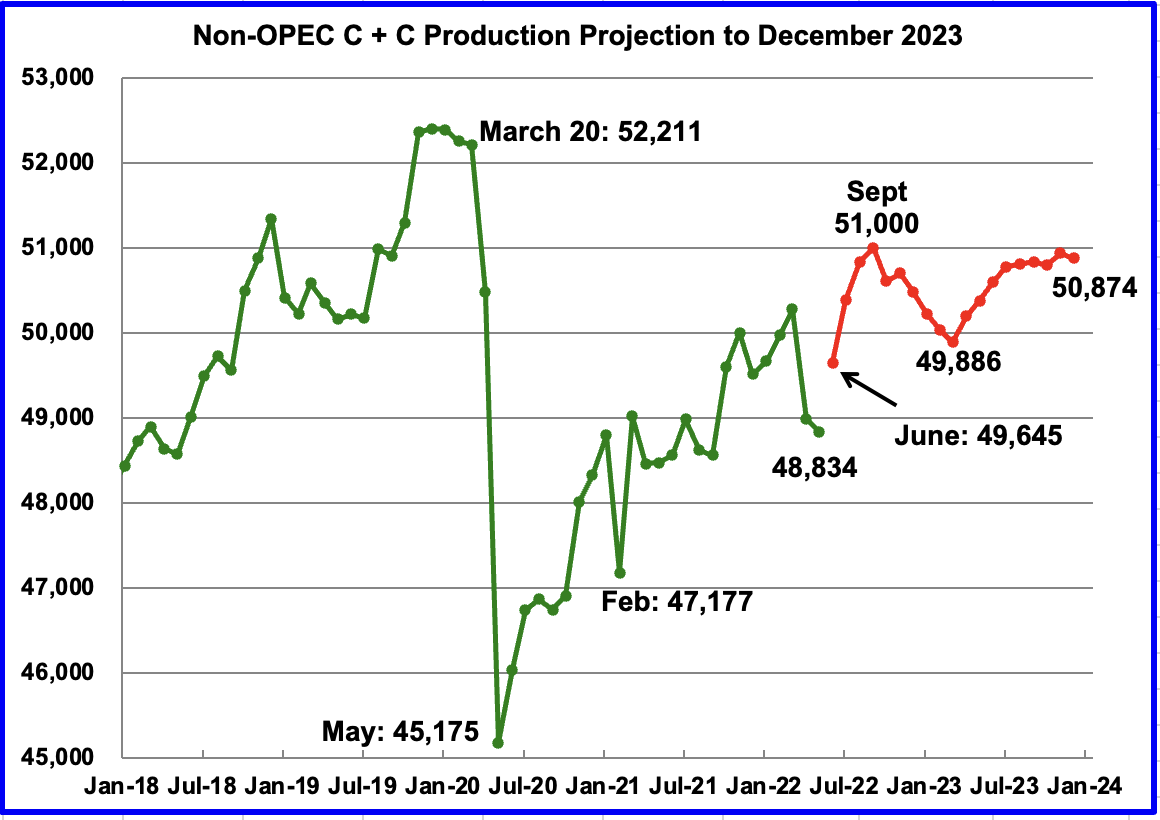

May Non-OPEC production decreased by 148 kb/d to 48,834 kb/d. The biggest decliners were Canada 193 kb/d, Brazil 120 kb/d, US 56 kb/d and Norway 38 kb/d. The biggest offsetting increases came from from Kazakhstan 148 kb/d and Russia 145 kb/d.

The May output of 48,834 kb/d is 3,377 kb/d lower than the March pre-covid rate of 52,211 kb/d.

Using data from the September 2022 STEO, a projection for Non-OPEC oil output was made for the time period June 2022 to December 2023. (Red graph). Output is expected to reach 50,874 kb/d in December 2023. This forecast is 33 kb/d higher than predicted in August. The production rise to 51,000 kb/d by September 2022 is due to projected increases by OPEC + and the U.S. Note that the September 2022 high is the high for all of 2022 and 2023.

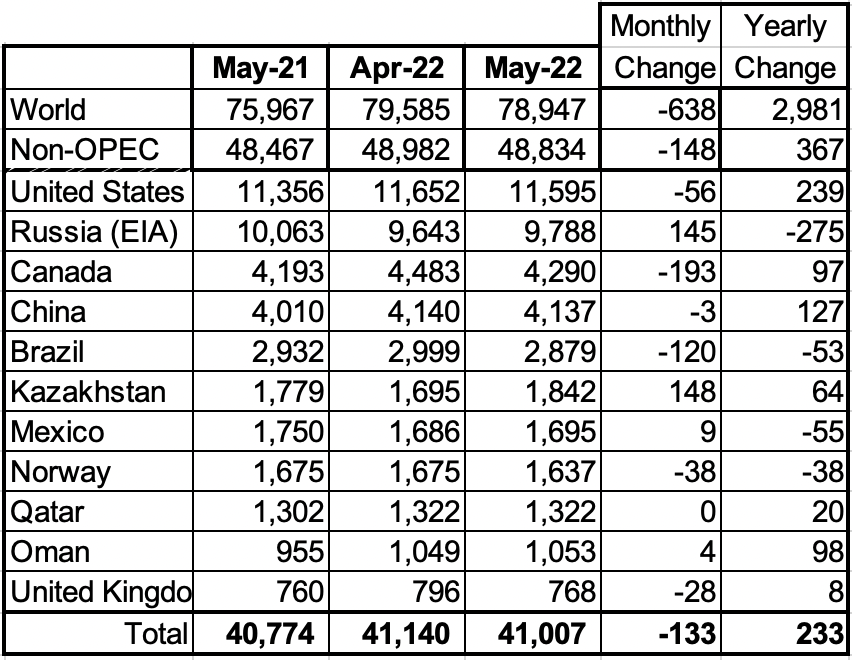

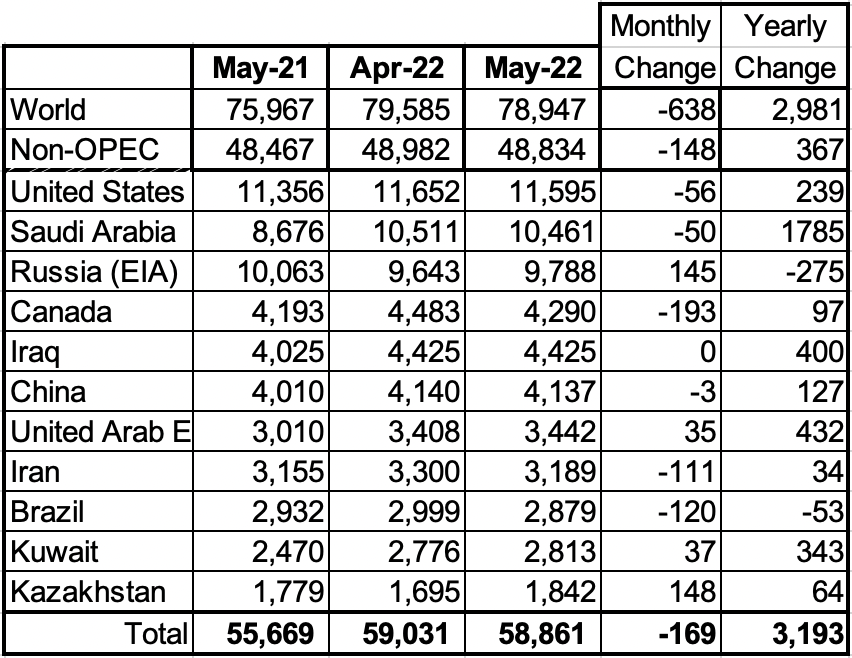

Non-OPEC Oil Production Ranked by Country

Listed above are the world’s 11th largest Non-OPEC producers. The original criteria for inclusion in the table was that all of the countries produced more than 1,000 kb/d. The UK has been below 1,000 kb/d since January 2021.

Note the Non-OPEC drop of 148 kb/d was much smaller than World decline due to large production drops in Libya, Nigeria and Iran.

In May 2022, these 11 countries produced 84.0% of the Non-OPEC oil. On a YoY basis, Non-OPEC production increased by 367 kb/d. World YoY May output increased by 2,981 kb/d.

Production by Non-OPEC Countries

The EIA reported Brazil’s May production decreased by 120 kb/d to 2,879 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that June’s output experienced another drop of 51 kb/d to 2,828 kb/d.

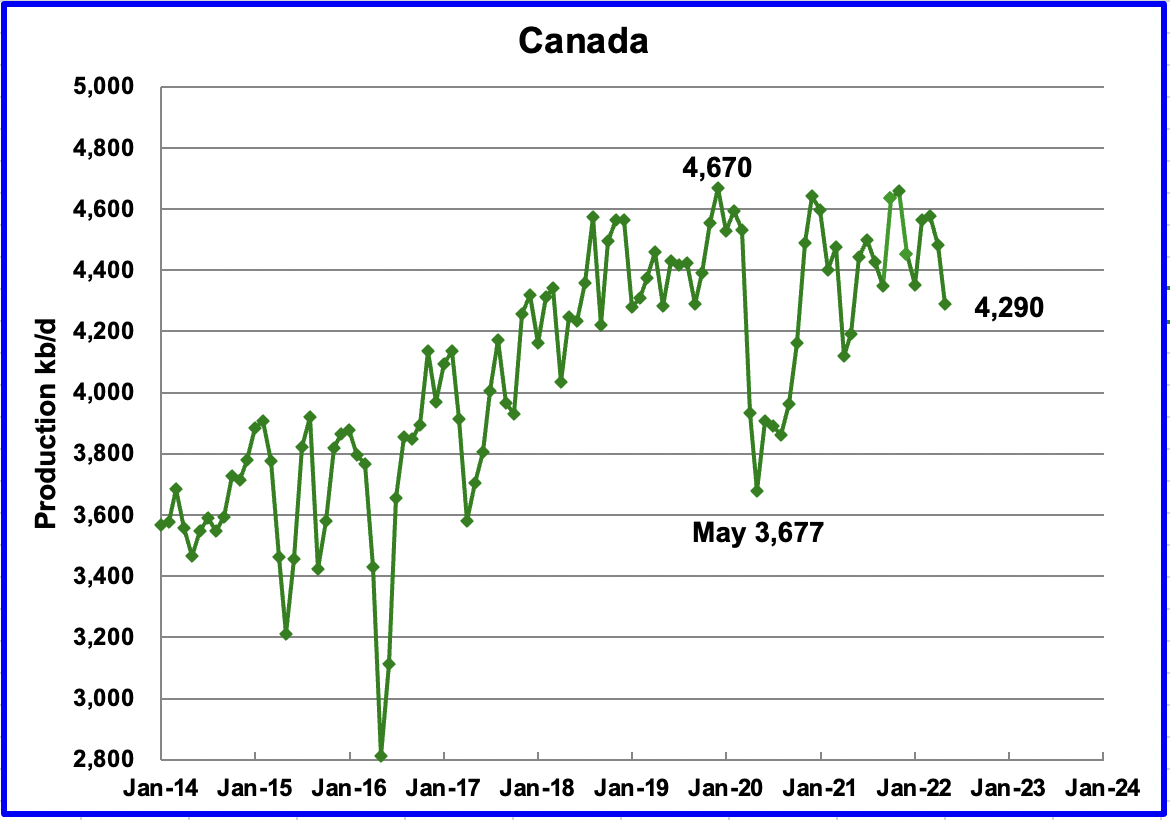

According to the EIA, Canada’s May output decreased by 193 kb/d to 4,290 kb/d. Preliminary data from the Canadian Energy Regulator indicates that synthetic crude production was down again in May.

Rail shipments to the US in May and June were slightly above 170 kb/d, up from 144 kb/d in April.

The EIA reported China’s output decreased by 3 kb/d to 4,137 kb/d in May. China reported that its output increased in June to 4,183 kb/d and then dropped to 4,034 kb/d in July. (Red markers).

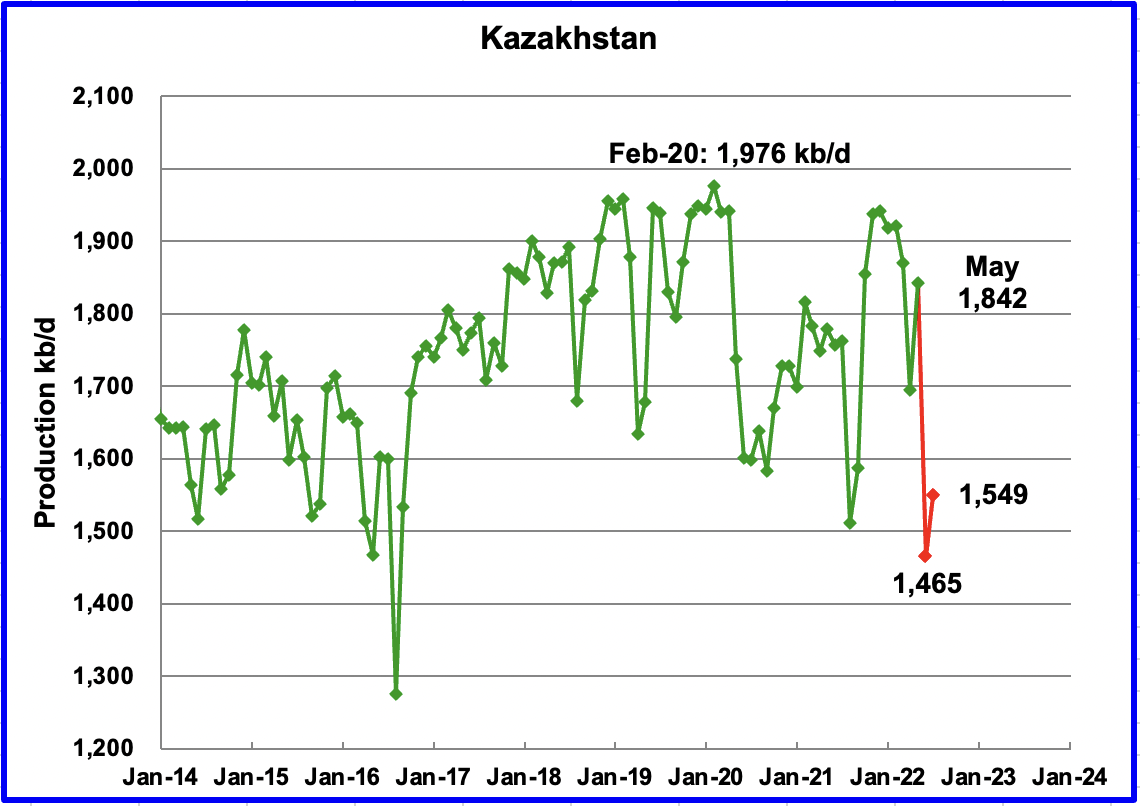

Kazakhstan’s output increased by 148 kb/d in May to 1,842 kb/d. June output was projected to drop due to required repairs at a damaged loading terminal in a Black Sea port in Russia, according to this source. The projected drop was 320 kb/d but actually came in at 377 kb/d. July output rebounded to 1,549 kb/d.

Mexico’s production as reported by the EIA for May increased by 9 kb/d to 1,695 kb/d.

Data from Pemex showed that June’s output was 1,787 kb/d. However, the EIA is expected to reduce Pemex’s June oil production by close to 70 kb/d due to a different definition for crude plus condensate.

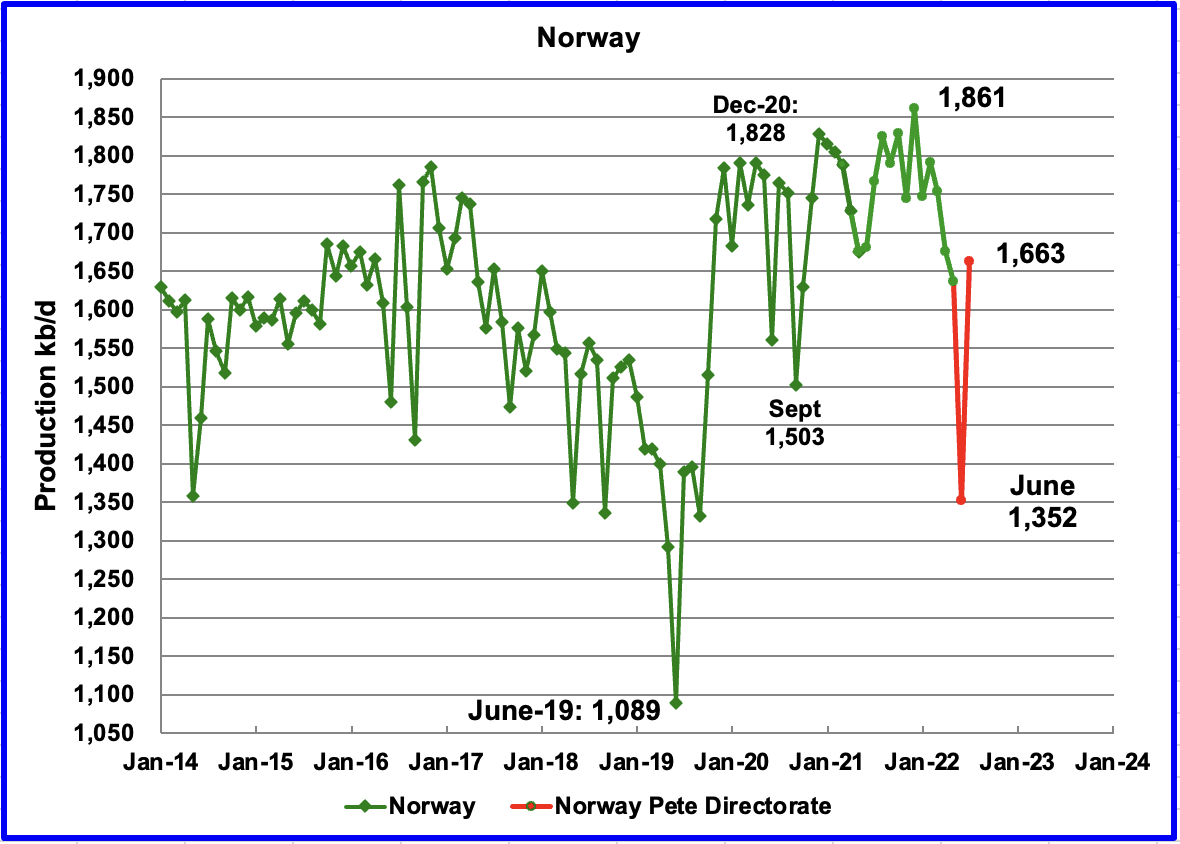

The EIA reported that Norway’s May’s production decreased by 38 kb/d to 1,637 kb/d.

The Norway Petroleum Directorate (NPD) reported that production decreased from May to June to 1,352 and then rebounded to 1,663 kb/d in July. (Red markers.). According to the NPD: “Oil production in July was 10.9 percent lower than the NPD’s forecast and 5.0 percent lower than the forecast so far this year.”

According to OPEC, the continuing drop was due to summer maintenance in offshore platforms and some operators prioritizing gas production.

Growth is expected in late 2022 and into 2023 when the second phase of the Johan Sverdrup field development starts production and other small fields come on line. According to OPEC “The Johan Sverdrup is projected to be the main source of increased output for the year. Neptune has also completed drilling at Fenja with the first oil on track for 1Q23. Fenja is expected to produce about 24 tb/d at peak production.”

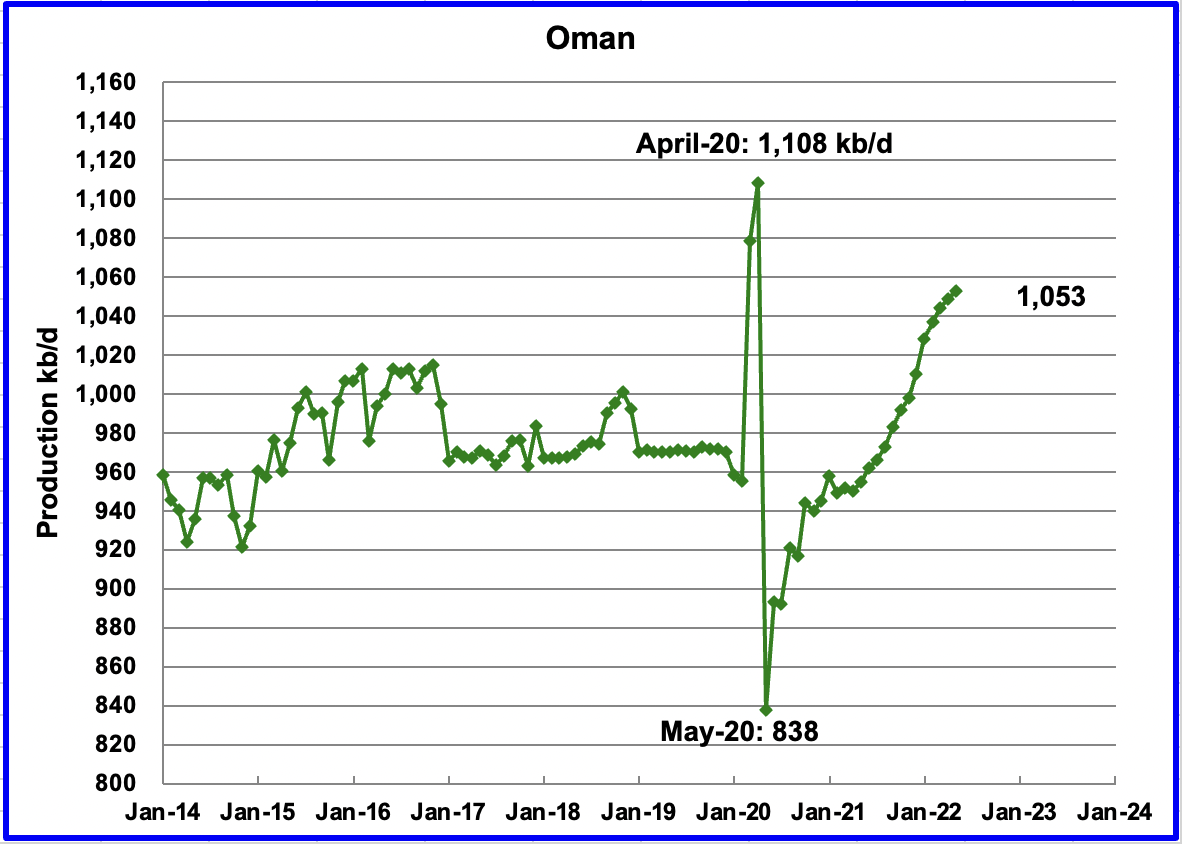

Oman’s May production increased by 4 kb/d to 1,053 kb/d.

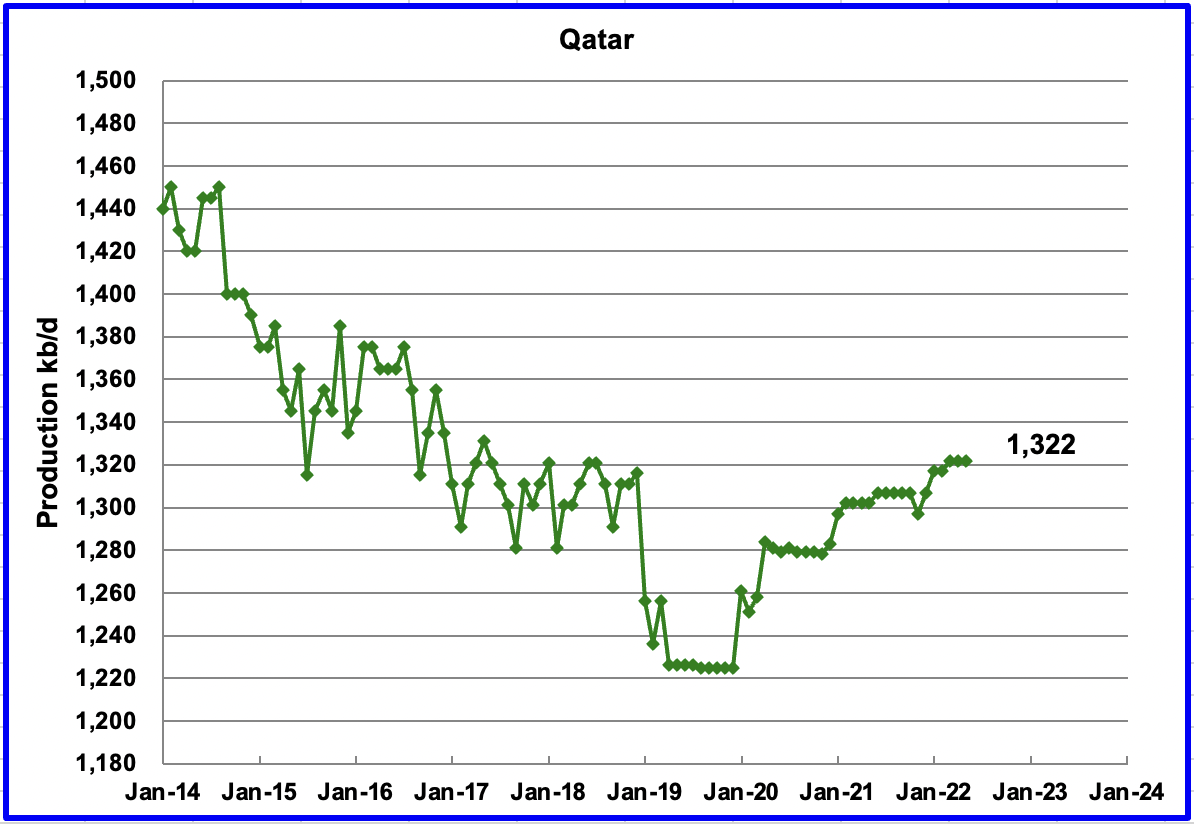

May’s output was unchanged at 1,322 kb/d.

The EIA reported that Russian output increased by 145 kb/d in May to 9,788 kb/d. According to this source August’s (first 3 week estimate) production decreased by 200 kb/d to 10,560 kb/d.

In the previous post, this source, based on August’s first week estimate, reported August production decreased by close to 300 kb/d.

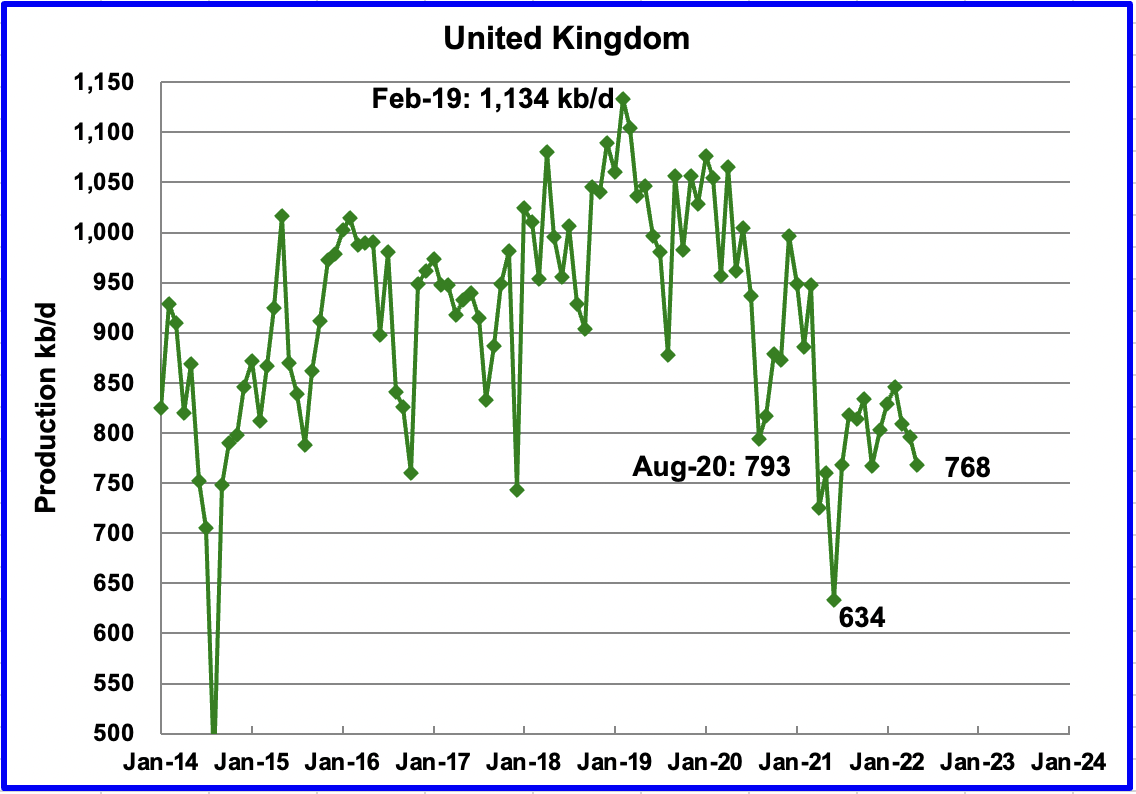

UK’s production decreased by 28 kb/d in May to 768 kb/d. The chart indicates UK oil production entered a steep decline phase starting in February 2019. On a YoY basis production is up 8 kb/d.

June output is expected to be essentially unchanged according to OPEC.

U.S. June production increased by 201 kb/d to 11,816 kb/d. The gain was partly due to production recovery from bad weather in May.

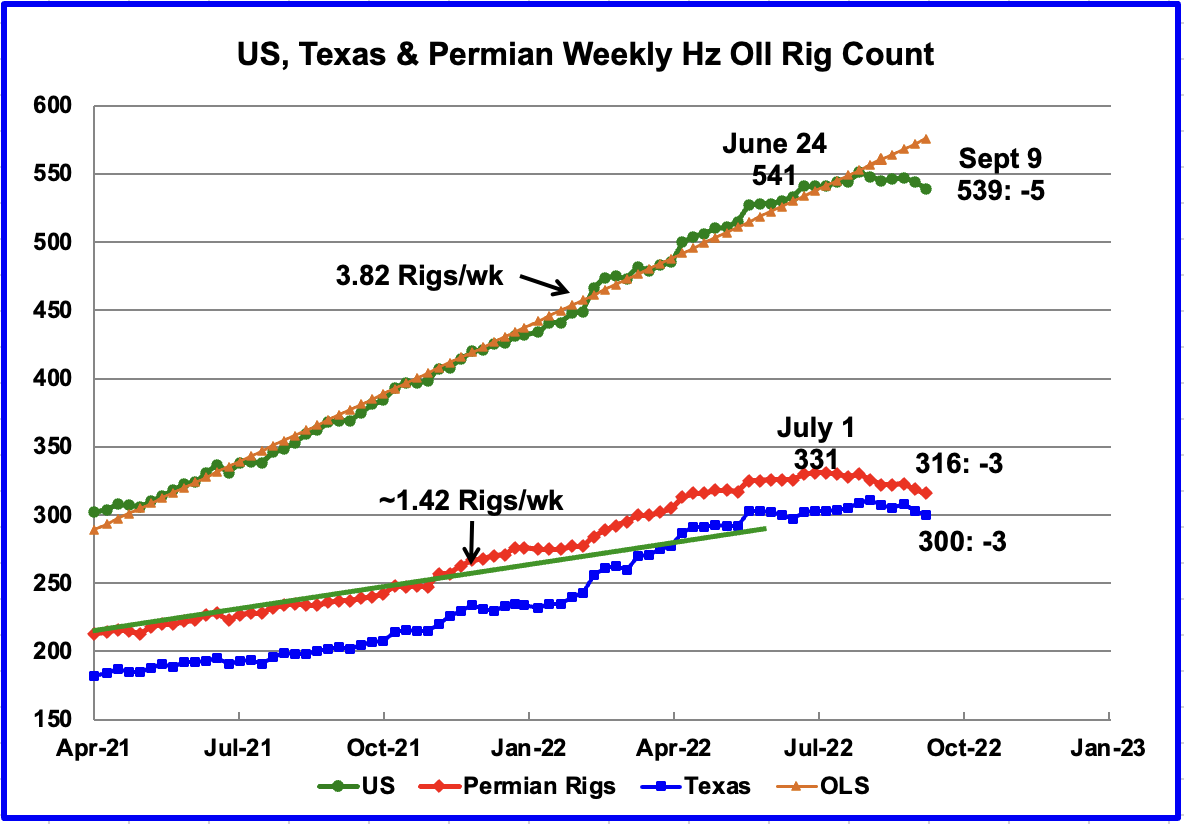

The big rig story continues to be the US Rig count continues to drop across the board. In the week ending September 9, there was a drop of 5 operating rigs in the US. The Permian dropped 3 to 316 and is down 15 rigs from a high of 331 on July 1.

Texas dropped by 3 to 300 and is down 11 rigs from a high of 311 on August 5.

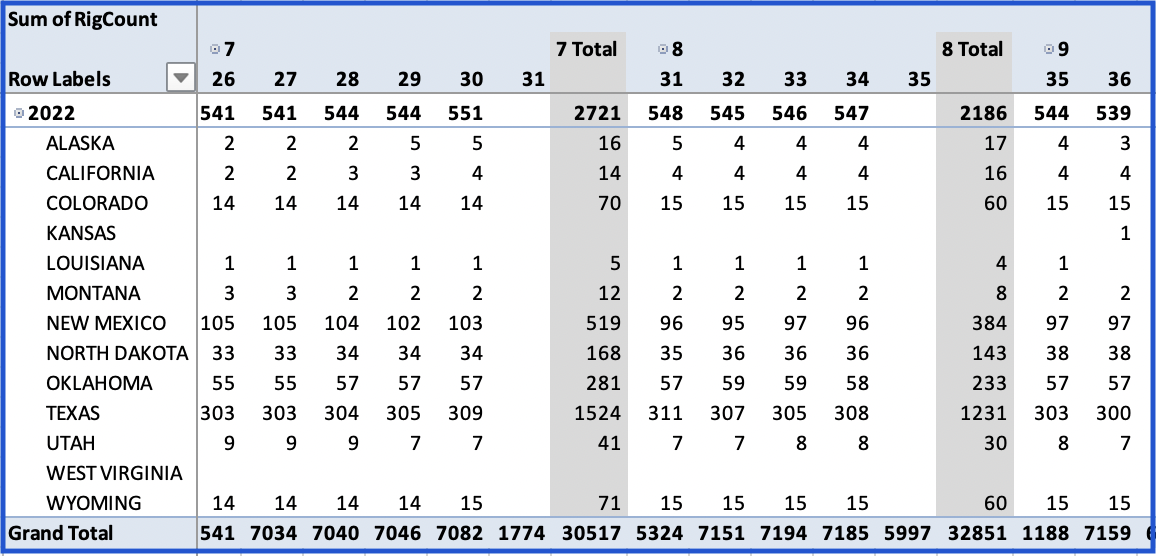

North Dakota is the only state showing a significant increase in the rig count since early July, left column. North Dakota has added 5 rigs since the beginning of July.

For the past 6 months up to late July, the growth in frac spreads has not been keeping up with the growth in rigs. Since then, Frac spreads have dropped from 295 in the week ending July 29 to 282 in the week ending September 2. Over the same period, the US Hz rig count dropped from 551 to 544. For the week ending September 9, two frac spreads were added for a total of 284 while five rigs were deactivated, down to 539.

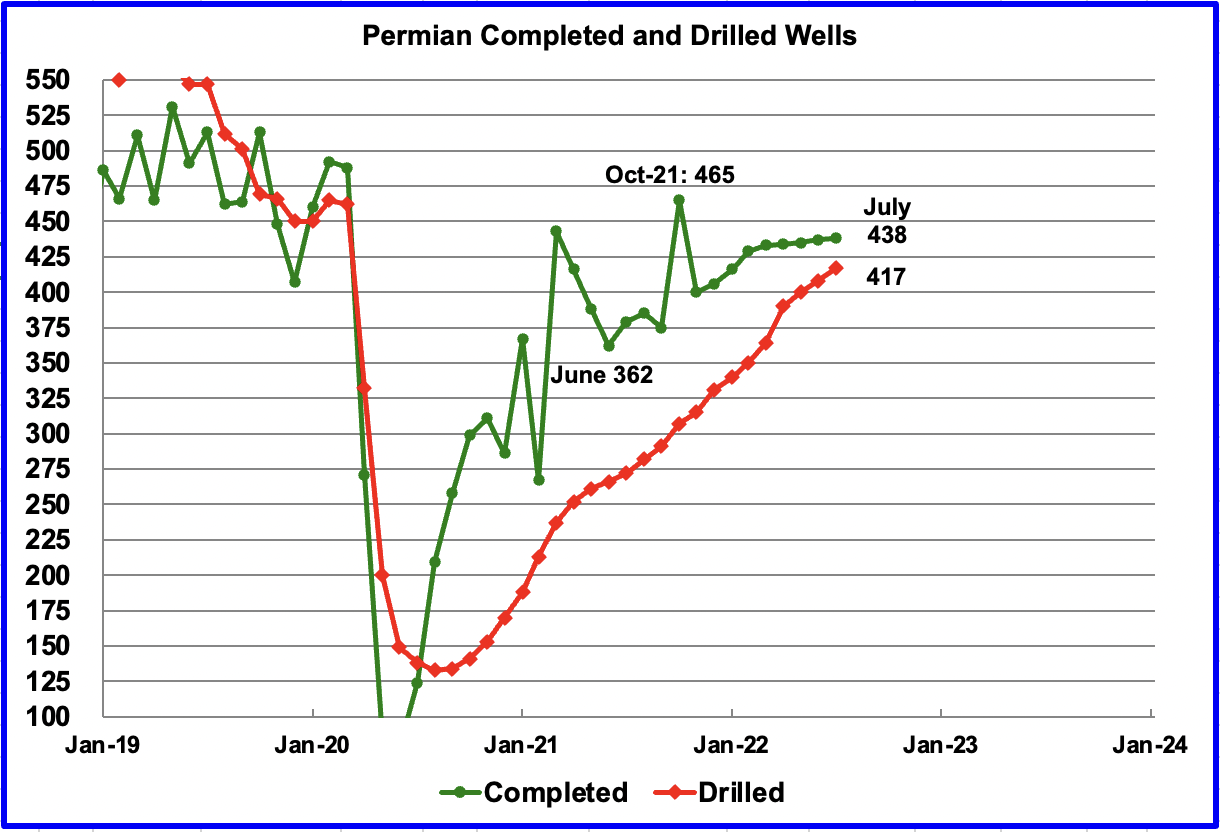

In the Permian, the monthly completion rate of wells has been showing signs of slowing since March. This confirms the lack of growth in the frac spread count shown in the previous chart.

In July 438 wells were completed, 1 more than in April and 8 more than February. During July, 417 new wells were drilled, an increase of 9 over June. Drilling continues to increase to replace the additional DUCs that were completed. The gap between drilled and completed wells in the Permian has reached a new current low of 21 DUCs and is expected to continue to decrease.

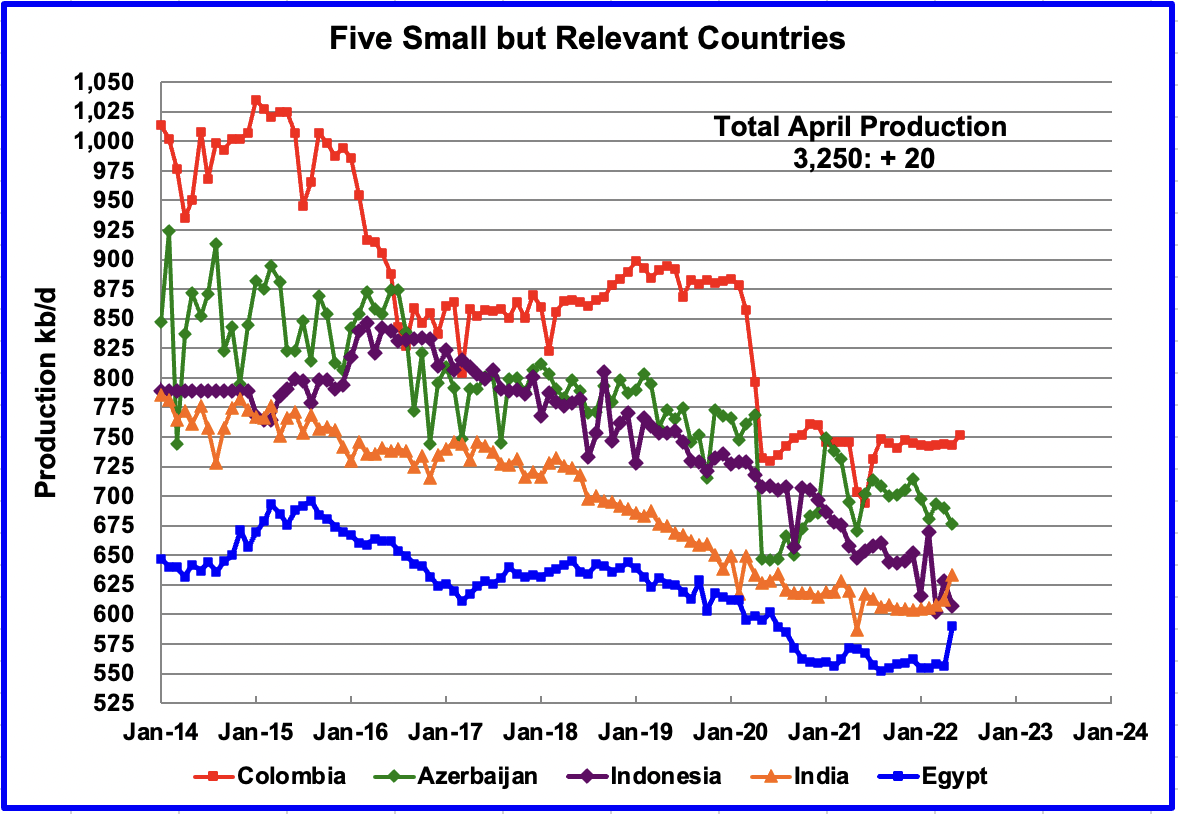

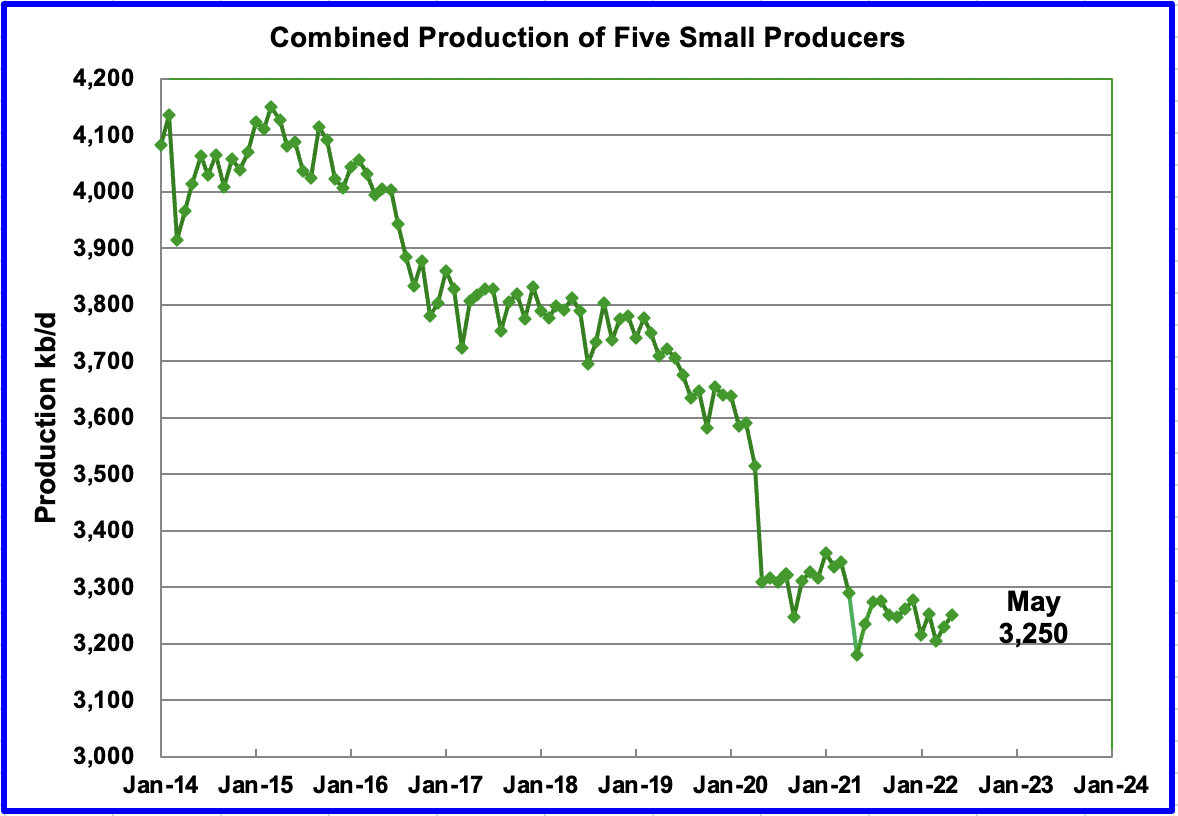

These five countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Their combined May production was 3,250 kb/d, up 20 kb/d from April’s 3,230 kb/d.

The overall output from the above five countries has been in a slow steady decline since 2015 and the decline continues.

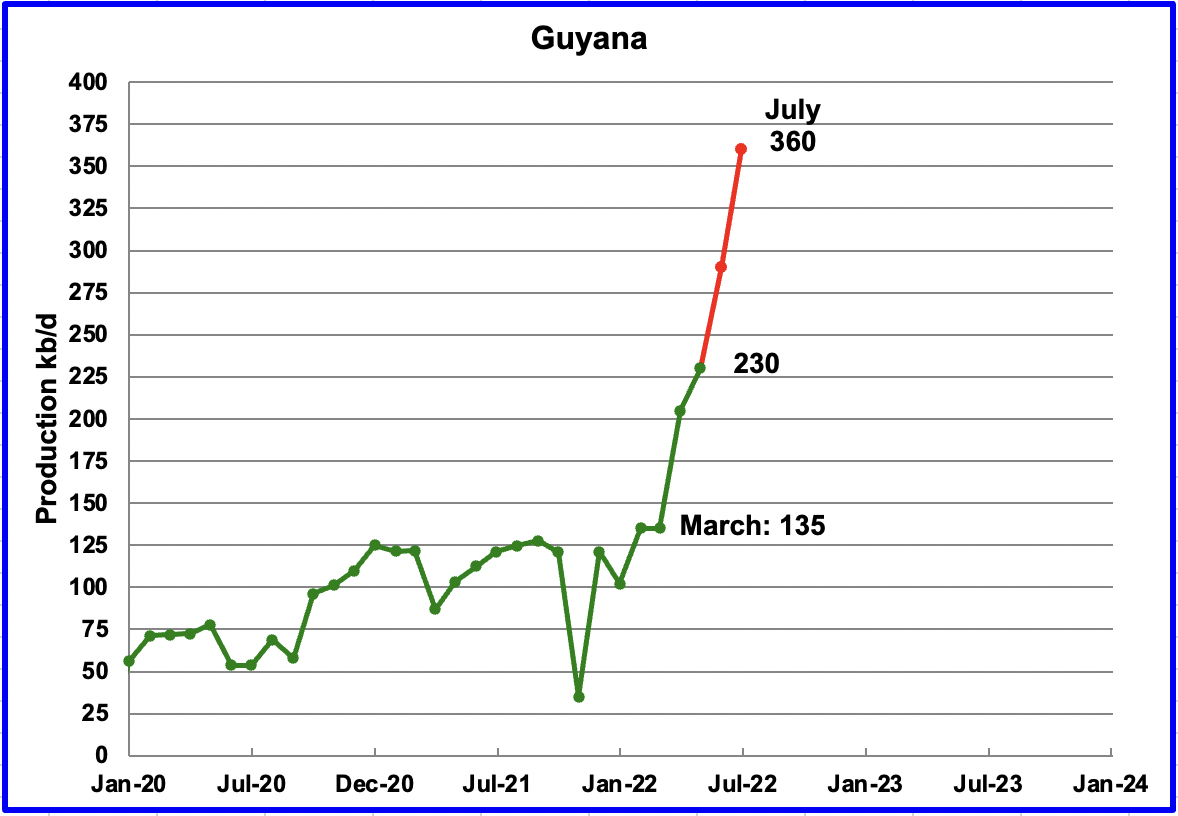

Guyana is starting to increase its production according to this source. Since March, production has increased by 225 kb/d to 360 kb/d in July. The EIA reported May production was 230 kb/d.

“Exxon’s partner Hess said in a follow up statement the group’s current production has reached 360,000 boepd. The increase was possible after optimization works that expanded capacity of the consortium’s first platform Liza Destiny by 20,000 boepd to 140,000 boepd, Hess said.

The second platform, Liza Unity, started in February and ramped-up to 220,000 boepd in five months.

Guyana amounts (Sic) for one third of the crude discovered in the World since Exxon first hit oil in the country in 2015, according to Rystad consultancy firm. The about 11 billion barrels of recoverable oil discovered to date should make the country a global oil power in the coming years, Rystad says.”

World Oil Production

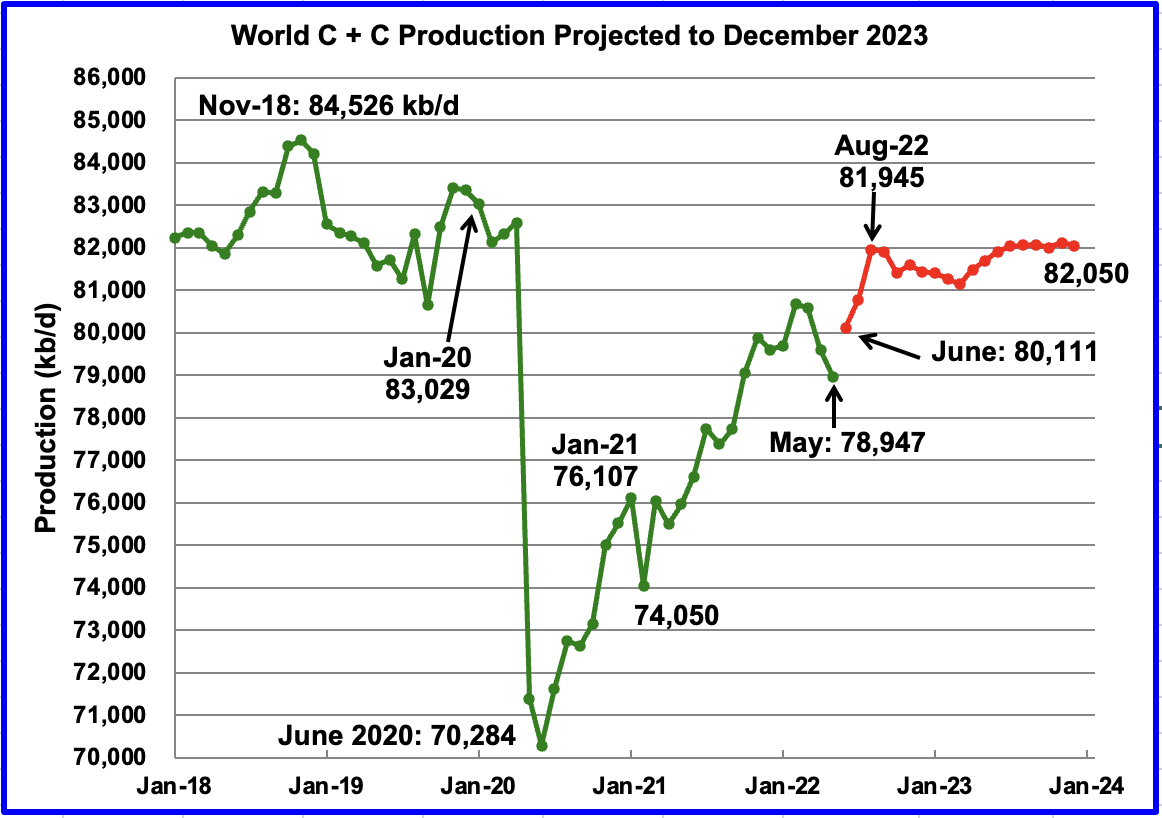

World oil production in May decreased by 638 kb/d to 78,947 kb/d according to the EIA (Green graph). As a side note, the November 2018 peak was revised up by 1 kb/d to 84,526 kb/d.

The biggest decliners were Canada 193 kb/d, Libya 180 kb/d and Brazil 120 kb/d. The biggest offsetting increases came from from Kazakhstan 148 kb/d and Russia 145 kb/d.

This chart also projects World C + C production out to December 2023. It uses the September 2022 STEO report along with the International Energy Statistics to make the projection. (Red markers).

It projects that World crude production in December 2023 will be 82,050 kb/d, little changed from the projection in the August report. The rise of close to 3,000 kb/d from May to September has increased since the August report and seems aggressive. However, it is associated with projected US and OPEC + production increases. After August 2022, World production is essentially flat at close to 82,000 kb/d out to December 2023.

Considering the upcoming June production losses shown above in the Kazakhstan and Norway charts, the smooth production increase from June to August appears to be optimistic.

World Oil Production Ranked by Country

Above are listed the World’s 11th largest oil producers.

In May 2022, these 11 countries produced 74.6% of the world’s oil. On a YoY basis, production from these 11 countries increased by 3,212 kb/d.

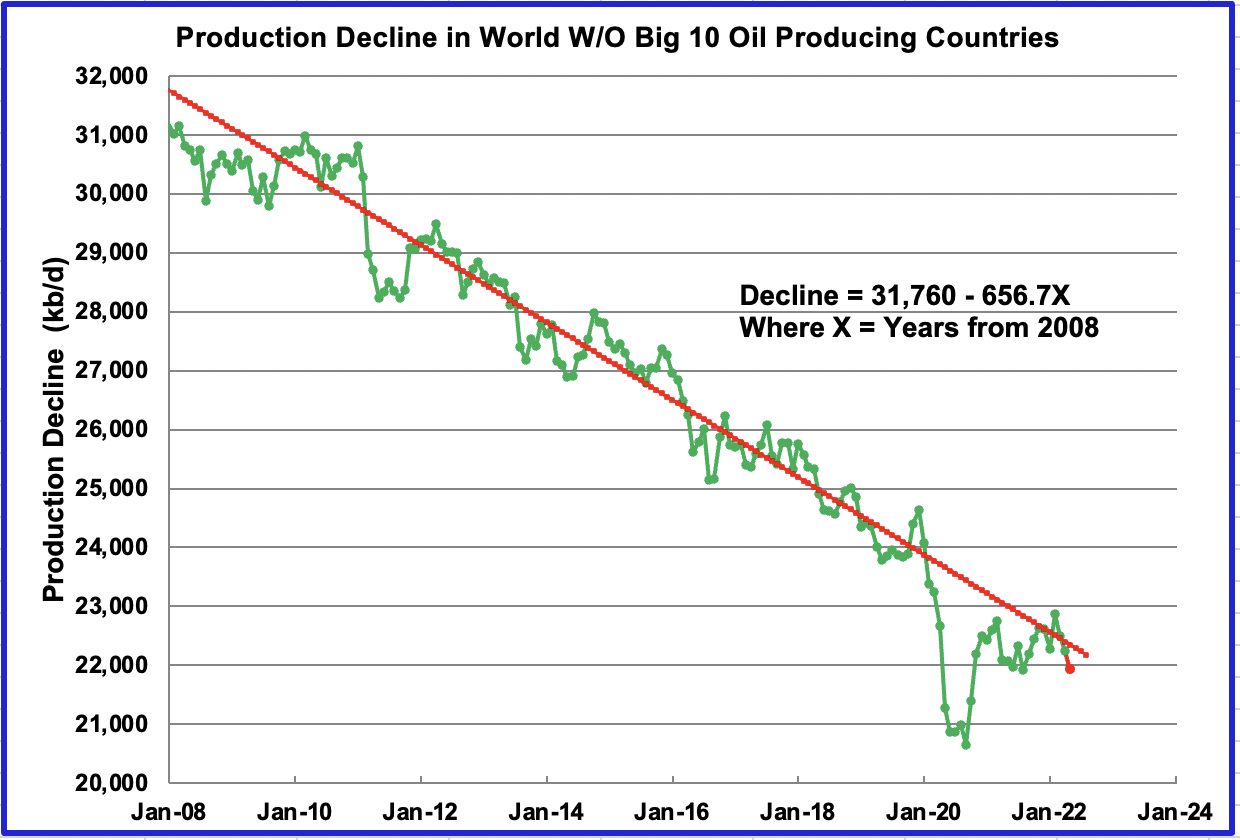

This chart shows the decline rate of World oil production, not including the World’s 10 biggest oil producers. The OLS line covers December 2009 to April 2022. The analysis does not include the data points during the big covid drop but does add in the latest 3 months up to April since production in most of these countries has returned to normal. The decline rate continues to be close to 650 kb/d/yr and has remained unchanged for the last 12 years.

This chart is the same as posted in the August update. Only the last red marker has been added and the OLS line has NOT been recalculated. Encouraging to see the May marker below the OLS line.

1) Short Term Energy Outlook

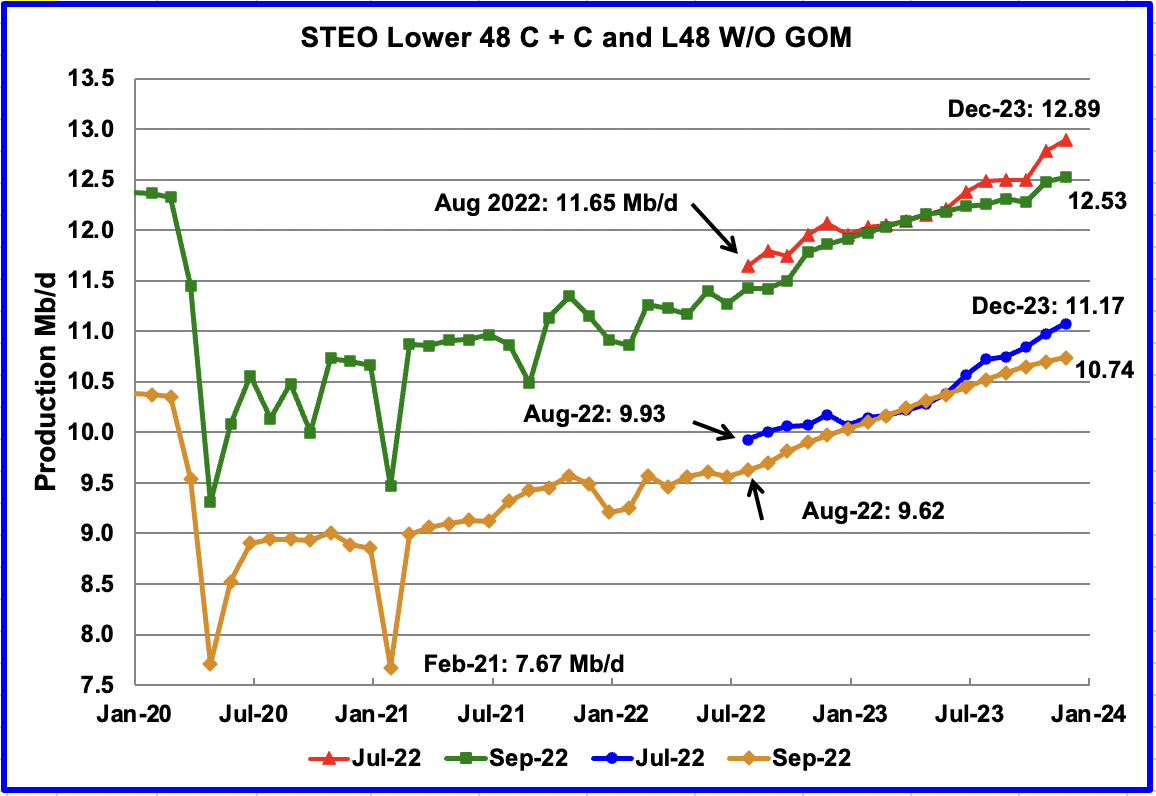

The September STEO provides projections for the next 18 months, starting with July 2022 to December 2023, for U.S. C + C and All Liquids for other countries.

The September 2022 STEO revised down its projected US oil output from July 2022 to December 2023. In December 2023 output is expected to reach 12,986 kb/d, 287 kb/d lower than reported in the August report.

In their August report, the STEO projected US June production to be 11,814 kb/d. They nailed it since it came in at 11,816 kb/d. However the average June weekly EIA production numbers were 12,033 kb/d. Clearly this indicates that the STEO has their own independent sources.

Using only the projected data from July 2022 to December 2023 to fit an OLS line, the STEO is forecasting production will increase at an average rate of 67.2 kb/d/mth. If the December 2023 output is achieved, it will be 20 kb/d higher than the November 2019 record.

This chart compares the STEO forecast for the L48 from the July report with the current September report to better illustrate how the output forecast for September 2022 changed. For the Lower 48, the December 2023 output has been revised down by 360 kb/d to 12.53 Mb/d over a period of two months.

The September output projection for the Onshore L48 states, blue and orange graphs, has also been revised down from the July forecast. For December 2023, output was lowered by 430 kb/d to 10.74 Mb/d.

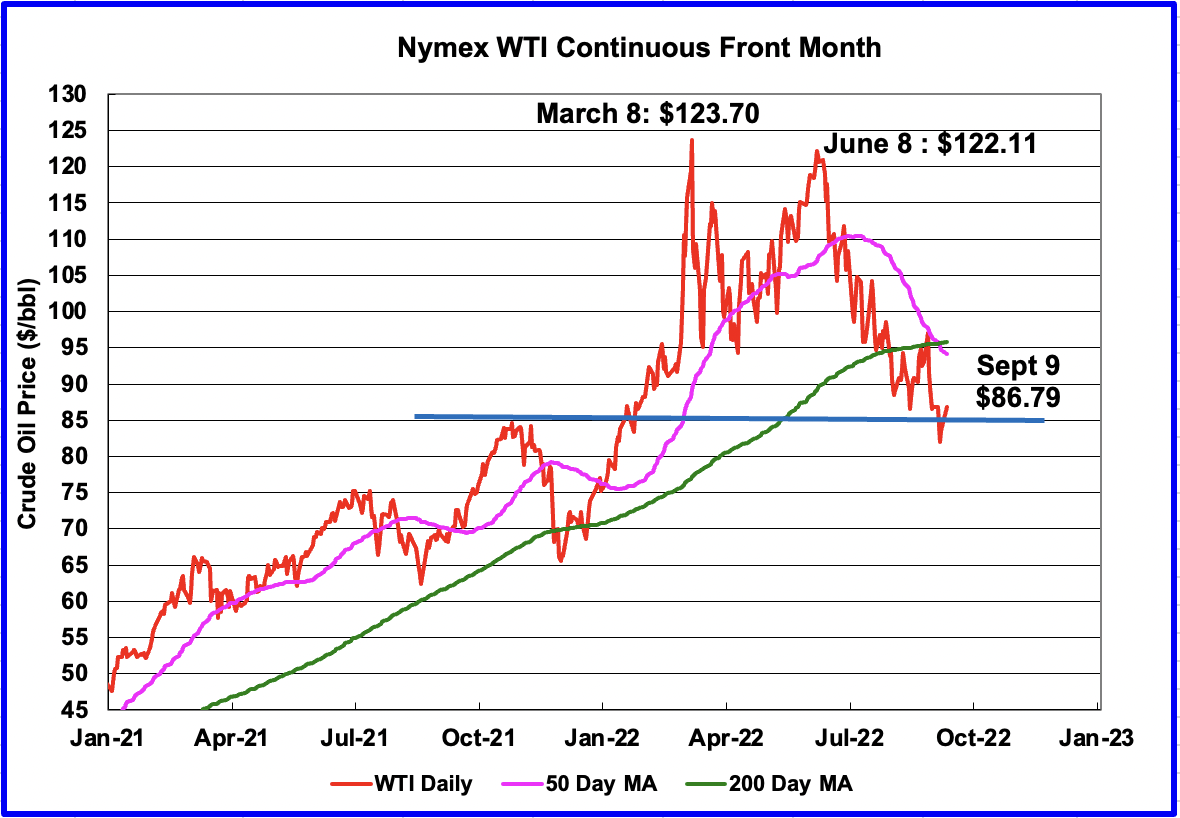

The September 2022 STEO oil price forecast continues to show a steady decline from the EIA’s March peak of $108.50/bbl to $89/bbl in December 2023, blue markers. Essentially the EIA is continuing to forecast that the only direction for the price of WTI going forward is down to the $90/b range. However what is different with their latest forecast is that the price of oil stabilizes in the $90/b area during the later half of 2023 as opposed to the April forecast which continued to trend down.

The September forecast shows how the STEO WTI forecasts from April to September have converged on a year end 2023 WTI price in the $90/b range.

The October WTI contract settled at $86.79 on September 9, $10.11/b lower than the EIA’s forecast average price of $97.00/b for the October contract.

During the week of September 9, WTI hit a low of $81.20/b on September 8 and broke threw resistance at $85/b. On September 7, the 50 day MA crossed the 200 day MA on the downside to form a death cross chart pattern. While this pattern portends short term downside, it also portends longer term higher prices when/if the pattern reverses.

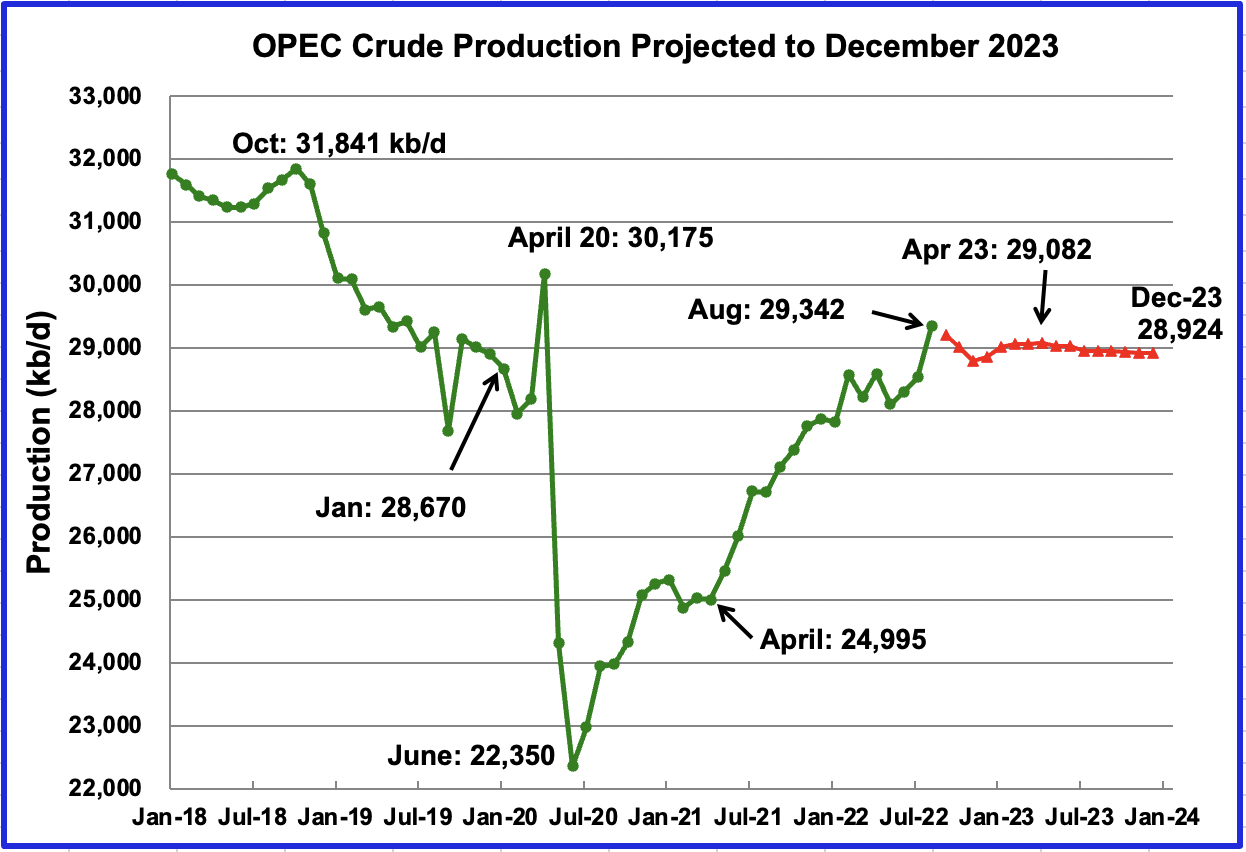

This chart shows the STEO’s September forecast for OPEC crude output from September 2022 to December 2023. OPEC’s output is projected to be essentially unchanged at close to 29,000 kb/d from September 2022 to December 2023. The September STEO forecast for July production of 28,530 kb/d is actually 369 kb/d lower than the crude production reported by OPEC.

The August OPEC report states that the call on OPEC in Q4-22 will be 29.79 Mb/d, which is 0.93 Mb/d higher than the 28.86 Mb/d production the STEO is forecasting for December 2022.

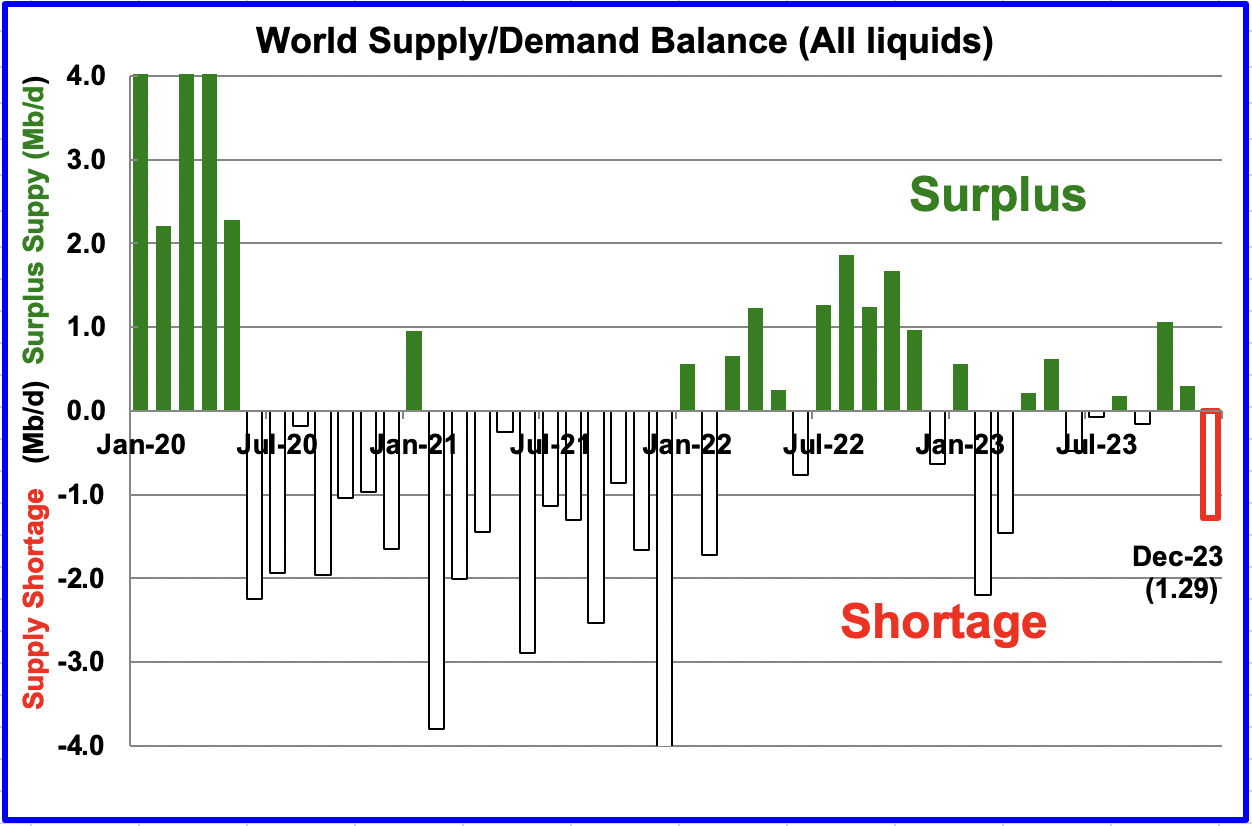

This chart shows the historical world supply/demand balance up to July 2022 and after that, the EIA’s forecast out to December 2023. The surplus of over 1,000 kb/d between August and December may be the reason for the current weakness in WTI, which is sitting close to its lowest level of $86/b on September 9 since the high of $122/b on June 8th. The supply demand situation for 2023 is expected to be very tight with February 2023 showing a shortage of over 2,000 kb/d and March and December 2023 showing a shortage of over 1,000 kb/d.

I picked a date, November 2017, one year before the peak in world oil production in November 2018. For all oil producing nations, I subtracted their production in May 2022 from that data, Nov. 2017. There were 23 who had gained production from Nov. 2017 to May 2022 and 65 who had lost production during that period.

The below graph is the combined production of the 23 nations that increased production between November 2017 and May 2022. In January 2013 they were 49% of world oil production. Today they are 60% of world oil production.

An entire thread about Non-OPEC and not one comment about fracking…

The below graph is the combined production of the 65 nations that declined production between November 2017 and May 2022. In January 2013 they were 51% of world oil production. Today they are 40% of world oil production.

Notice that this group had already declined by over 1.9 million barrels per day from their previous peak in Nov. 2016 by the time the world peaked in Nov. 2018.

These 65 nations were, in May 2022, down 7,091,000 barrels per day from their previous peak and down 5,170,000 barrels per day from the World peak month of Nov. 2018.

The data in both charts is through May 2022.

Hey guys, from July 2017 to May 2022, the combined production of the 65 countries in the loser’s category has declined a total of 6,857,000 barrels. Divide that by the 58 months from July 2017 to May 2022 you get an average decline rate of 118,000 barrels per month or an average decline rate of 1,418,696 barrels per year. This group will continue to decline. Perhaps not at this rate but very likely at about one million barrels per day per year.

The gainers have almost petered out. They will not even come close to making up for what the losers have lost. People, nothing could possibly be more obvious than the fact that the peak in world oil production happened four years ago. Why has the mainstream media or the oil world not recognized this fact? Why do we even have doubters on this blog? This baffles me!

Ron,

There have been many times that peak oil has been declared and every time so far that peak has been breached. This is likely to be the case for the centered 12 month peak in August 2018 of roughly 83 million barrels per day, we will see in a couple of years if this peak holds, my expectation is that it will not, but perhaps the peak in 2028/2029 of about 85 to 86 Mb/d for the centered 12 month peak (likely in the July 2028 to July 2029 time frame) will be the final peak in World crude plus condensate output.

Dennis, just look at the data. There has never been a time in the past where half the world’s oil production declined by over 1.4 million barrels per day per year for five years.

But, I will give you the benefit of the doubt. If you can show me where such a decline has happened before, then I will kiss your ass on the courthouse square and give you 30 minutes to draw a crowd. 🤣

I really don’t mean to be so sarcastic Dennis, but you just acting like this has happened many times in the past when I know damn well it has not bothers me just a tad.

Ron,

We will see how the future plays out. Peaks have occurred before. In 1979 five nations produced more than half the World’s Oil (Soviet Union, Saudi Arabia, United States, Iran and Iraq), it was actually 63.7% of the total. Five years later in 1984, those five nations produced 7.3 Mb/d less than they did in 1979 (an average annual decline of 1465 kb/d.) The world managed to muddle through. You want to be careful with “never”. I will forego the kiss.

In that case there was a major war between Iran and Iraq, recently there has been a pandemic which reduced demand and messed up supply chains, this may pass.

Dennis, the decline for these 65 nations, more than 50% of world oil production at the time, started about two and one-half years before the pandemic. And their combined production had declined by over three million barrels per day before the pandemic.

No, I use the word never with absolute confidence. This has never happened before.

Ron,

You said:

“There has never been a time in the past where half the world’s oil production declined by over 1.4 million barrels per day per year for five years.”

In 1977 five nations (Saudi Arabia, US, Iran, Iraq, and Kuwait) produced 51% of World C plus C. In 1979 those 5 nations produced 27.23 Mb/d of World output and in 1984 they produced 18.08 Mb/d or 9.15 Mb/d less than 5 years earlier which is an average annual decline of 1.83 Mb/d. So there was a time indeed when half the World’s oil production fell by more than 1.4 Mb/d per year for 5 years.

well thanks for cheering me up this sunday morning !

Agree Ron! Dennis – A new high doesn’t materialize out of thin air at some future date, there needs to be steady incremental progress. You have yet to provide any meaningful data or chart that shows how such a future scenario occurs. On the other hand, we now have countless charts of just the opposite. The data doesn’t lie…as for natural gas peaking in 2030-35, somehow that doesn’t make sense. Peak oil means peak everything, that’s a big reason so many issues around the world currently. The strangest part of Dennis’ position is that he believes the EVs will have a significant impact yet world oil will reach a new production peak, those 2 issues seem they can’t coexist…

Kengeo,

Consider World C plus C output in the chart below. For nearly two years the trend in World C plus C output has been an annual increase of about 4.8 Mb/d. The bottom line is that World output has recovered strongly since June 2020. Output in the US, Canada, Brazil, Norway, Guyana, Suriname, and Argentina will increase output by more than output will fall elsewhere up to 2028, potentially Saudi Arabia, Iraq, and UAE may also increase output by more aggressive resource development.

I expect the future annual growth rate will be around 800 kb/d for World C plus C output.

Of course, World production has been recovering since June 2020. That was the bottom of the largest demand hit that has ever happened. However, the recovery is now petering out. May 2022 production was below October 2021 production seven months ago. It will recover somewhat through August and then begin, at first, a slow decline. I expect the decline will speed up in two or three years. August will be the post-pandemic peak.

World oil production for 2023 will be below 2022 production.

Dennis – Thanks for giving more detail. This is useful. Assuming 2021 global prod. was ~89.9 MBpD, then by 2028 the previous peak would be surpassed if net annual increase was 0.8 MBpD.

It also sounds like you believe all of this increase in production will come from US LTO.

Note in Ovi’s post above he has US annual increase of 0.24 MBpD, significantly less than the 0.8 needed.

I’m not sure how your analysis treats Ron’s Loser65 group, but they lose more than 1 MBpD annually.

It sounds like a truly optimistic stance is that Loser65 might be offset by potential gains from a couple major players (US-Canada-MiddleEast+Russia)…If you were making the argument that there is no net oil production growth for the next 5-6 years, while I wouldn’t agree, I don’t think I would push back too much, as it’s feasible (yet unlikely as we should continue to see net annual decreases in production, as Ron believes/points out). For your scenario, do you believe the Loser65 group stabilizes or at least it loses less annually in the future?

I know you’ve made so many past estimates that have proven to incorrect, but I think it’s clouding your perception/judgment. I actually think your chart from 10 years ago is spot on, and remember that additional URR won’t have a significant change in the production curve from a timewise perspective…

If prices stay this high I’m sure we will see (continue to) demand destruction, that’s another factor that doesn’t support annual increases in production…but at least we have a metric to test your hypothesis (World growth quarterly in oil production of approx. 0.2 MBpD). On the other hand, I believe the losing hypothesis is that annually loses of at least 1.0 MBpD will be seen (-0.25 MBpD). Either of these should be very easy to tell apart…

Kengeo,

Nearly all of the decrease in output since 2017 has been from OPEC, some of this has been from the 10 OPEC nations subject to quotas since Jan 2019 and a large part has come from Venezuela and Iran. Basically a lot of the 65 losers decline was simply due to sanctions on Iran and Venezuela and OPEC cuts due to oversupply since Jan 2018. If we take OPEC and Russia out of the picture, the decline is not very large.

Kengeo,

I don’t think the analysis from 2012 is accurate, it did not account for unconventional oil output which has proven to be much larger than I anticipated in 2012. Chart below has my current best guess for unconventional and conventional C plus C. Unconventional is extra heavy oil (API gravity less than 10 degrees from Canada and Venezuela) plus light tight oil.

Kengeo,

Much of the increase in World output comes from US tight oil. For a high oil price scenario (where brent oil price remains above $90/b in 2022$) I get a scenario with a URR of about 90 Gb with an output peak at 12 Mb/d in 2030. In 2018 average annual tight oil output was about 5 Mb/d so this would be about a 7 Mb/d increase from 2018.

Average annual output in kb/d for US tight oil for scenario starting with 2018

4967

6528

7791

7338

7634

8332

9176

10116

10908

11387

11675

11845

11927

11839

11477

10966

10258

9487

Ron,

Excellent charts. The 65 Losers should put the FEAR OF GOD into the public, but it won’t. When I continue to debate peak oil on Twitter Spaces, the rebuttal I get all the time is that Peak Oil is just an issue of Under-Investment. Furthermore, they suggest we should be tapping into every barrel of oil we can to continue this wonderful experiment I call…

DESTROY THE NATURAL SYSTEMS of the planet to an even greater level to make even more impossible to support 8 billion souls.

Homo Sapiens… Very Smart & Intelligent, but also quite Stupid and Unwise.

GOD HATH A SENSE OF HUMOR…

steve

Steve, many of the same people think that Peak Oil is 10 years in the future and cheer the the discovery of the few fields that were in the category of yet to find. I wonder if they have thought about whether the world will be better off if they are right (which they are not) as the world population will then be 8.5 billion.

A lot of group think going on with the narratives in the news and in politics. No one wants to address the “elephant in the room” which is we are running out of scarce natural resources. It would be wonderful if someone actually clearly described what the energy transition is transitioning to and how it will impact life in the future.

In the mean time I have meet with several of my friends who run large PE firms that were mostly dedicated to Upstream Oil & Gas Investments. They related to me that they can only raise capital if it is for green transition or technology related to the green transition. Without capital, the charts above will look very different. Invested financial capital is a huge component of oil and gas reserve replacement and production. Just sayin.

Ron

A very interesting analysis and a rather startling result. However the very startling result makes one wonder from were did such a high annual decline rate come.

To answer that question, it was necessary to replicate your analysis to better understand from where the high decline rate arose. Looking at the countries with the biggest drop from November 2017 and May 2021, two countries stood out, Russia and Iran.

I don’t think that these two countries can be considered to be in decline. The EIA’s Russian production for May is just a fluke of a four month delay in reporting. It will go up since we already have preliminary results for August. Iran’s production has been slowly increasing back to its sanctions limiting level of 2,550 kb/d. While production is down from November 2017, it is not due to geology.

As such, I think that these two countries need to be added back into the analysis to get a more realistic decline rate.

I track three decline scenarios. The World W/O big ten scenario includes Russia and Iran and that chart is included in the World Oil Production section in the above post. I bookend that analysis with a “52 small countries in decline” scenario. Many of these countries may not be investing much in drilling to counteract decline. The other scenario is World W/O US and using the STEO forecast out to December 2023. Both of these bookends have been posted previously.

These scenarios, along with “Ron 23 plus Russia and Iran” are shown in the charts below. The decline rate for “Ron’s 23 plus Russia and Iran” is 569 kb/d/yr. The production beyond the covid discontinuity was not included in the OLS analysis. The 52 countries decline rate is 527 kb/d/yr while World W/O US is 756 kb/d/yr. I think that 525 kb/d/yr to 756 kb/d/yr is a reasonable range for the “net decline” rate. Ron Plus Russia and Iran falls in that range.

Note how the chart in the post, World W/O big 10, along with the 52 countries and World W/O US shown below have all recovered from the covid discontinuity.

See charts below.

I don’t understand how you can add Russian and Iran to Ron’s 23 gainers and start your chart at 27,000kbd and end up at 19,000, whereas Ron’s chart of the 23 gainers starts at 37 and ends at 47. How does taking into account more equal less?

Ovi, I agree with Mike. How can you add two nations and wind up with much less? Anyway, I did add Russia and Iran to my chart and got a totally different result than you.

No, Iran is not technically in decline, but politically they are. There are three things that affect a country’s production rate, geology, politics, and economics. All three affect every nation on earth. So, I just have to take the data as it is presented and use it. I cannot fudge it because I think if it weren’t for those damn sanctions’ things would be different. At any rate the total decline from May 2017 was 7,091,000 barrels per day. Removing Iran would only change that number by about one million barrels per day.

But as to Russia, you are dead wrong. There is no doubt that Russia is in geological decline. Of course, the sanctions just make it a lot worse. But if you remember Russia, before the invasion, admitted they were in decline. The Minister said he hoped to get back to within 200 K barrels per day of their pre covid production. He hoped to plateau around that point. But every analysist who commented on that probability said, “no” Russia would decline because their brownfields in the Urals and Western Siberia, where over 60% of their production came from, was about to go into steep decline.

I have added Russia and Iran to my chart of 23 gainers and got a totally different result than you did.

Ovi subtracted Russia and Iran plus Ron’s 23 from the World total to find the decline rate for the rest of the World (World minus these 25 nations). The title on the chart does not reflect the data plotted.

If we take Ron’s chart above and subtract rom World C plus C we get the chart that Ovi posted.

Oh, I get it now. He meant “Ron’s 65 losers less Russia + Iran.

Well, like I said, I will not fudge the data because of politics. I cannot predict politics. But as I also said, he is wrong about Russia. Russia is in a very serious geological decline. The sanctions will only make that decline much worse. Russia must be included in any chart of the world’s decliners because, in barrels per day, they will likely be the world’s largest decliner for the rest of this decade.

Thanks Dennis

That is exactly what I did and I did put the wrong title on the chart.

Corrected chart added.

52 Small Countries

Notice how the Covid discontinuity is just a small hiccup.

World W/O US and the STEO projection out to December 2023.

It will take until September 2022 for EIA data to appear and for the remaining countries to fully recover to the pre-covid trend line. This is the highest net decline rate I have seen, 756 kb/d/yr.

Another great post. Thank you Ovi. Would it be fair to say that, without the release from US SPR, the five-month surplus in world oil projected for this fall, would be non-existent?

Paoil

Thanks

The supply balance chart is the difference between actual production and demand. The SPR release is extra supply into the market. So the surplus, considering the SPR release, would be an additional ~1.0 Mb/d over and above what is shown.

Hi Ovi , long time no see . Only popped in to say that you are terrific also Dennis ( although he is on the wrong track ) . As someone who discovered ” peak oil ” in 2003 and has been following it from about 20 years , I now realize the subject should be ” peak electricity ” . I have oft commented that the 3 legs of the stool called IC are ” oil , electricity and metals ” . I have posted links on ” The Olduvai theory ” by Richard Duncan . Well , UK and Europe will be the first to learn the lesson . I will not respond to any comments . I only popped in to appreciate your effort and more important grace and manners . Some should read “Letters to my son ” by Lord Chamberlain on how a discourse should be made . With respects and be well .

Hole in head,

Everyone will believe I am wrong until 2029 arrives when my scenarios will again be proven too pessimistic (as has happened many times in the past).

Dennis, you forgot your smiley face after that comment. 😊 But to compensate I will add my laughing-out-loud face. 🤣

Ron,

We will see. In 2012 I expected the following for my best guess (between these low and high URR estimates). See

https://oilpeakclimate.blogspot.com/2012/07/further-modeling-for-world-crude-plus.html

In the chart below I updated the EIA data through 2021 using latest EIA estimates. The scenarios were created in 2012 when I only had World EIA data through 2011.

Dennis, so you got it wrong in 2011. Well, don’t feel bad, that was before the shale revolution. But, in 2011, where were all the nations that were in deep decline like they are today. It looks like you were just guessing. Well, back then I was just guessing also. And I also got it wrong. I was, like you, just guessing. But today we have the data. The data does not lie. The decliners outnumber the gainers, both in the number of nations and in barrels per day.

Arby’s says “We have the meat.” Well, I say “We have the data.” And the data does not lie.

I really don’t understand you when you make the claim that this has happened before. Yes, we have just guessed before and got it wrong. But this many nations declining has never happened before. And they are declining by the millions of barrels per day over just a few years. This has never happened before!

About the 65 declining nations. Russia will move out of the decliners in June, remain there through July and August, then back into the losers in September…and remain there forever.

Ron,

Fewer nations were producing oil in the past based on EIA reporting. Some nations have seen output decline and others have seen output rise. When the World reached its recent centered 12 month average peak in August 2018, OPEC plus was not restricting output, in 2019 they cut back, followed by pandemic. Since June 2020 World C plus C output has increased at an average annual rate of over 4.4 Mb/d. You are being fooled by your choice of dates for looking at declining nations, I use the same data and see things very differently. Any scenario of the future is always a guess, my point was that my guesses in the past have tended to underestimate future output using data available at the time. Whether my current scenarios are too high or too low cannot be known until we have more data.

Well, production level for my 65 losers was, in May, below their production level for February 2021, fifteen months ago. I would say they have recovered from the pandemic about all they will recover.

Hey, I made a bold statement. I said World oil production in 2023 would be below World oil production in 2022. Aren’t you going to dispute that? I know it will be close, but still, 2023 will be lower.

Ron,

I expect you will be wrong, 2023 output will likely be more than 2022 (annual average output for World C plus C).

Impressive Dennis!, from 10 years ago.

Nobody has been closer to the mark, despite LTO, pandemic, all the other things going on in the world.

Thanks Hickory,

Just a lucky guess really, at the time I badly underestimated how much unconventional oil would be produced, I had not developed any model for tight oil or extra heavy oil at that time, in a sense my overestimation of conventional oil was almost equal to my underestimation of unconventional oil. In any case my scenario was wrong in 2012 and my current best guess will also be wrong. Whether it is too low or too high, time will tell, much depends on future prices of oil, lithium, cobalt, and the state of the World economy, along with wars and other political conflict, nothing about the future is known and the number of possible futures is infinite. Any single scenario has exactly a zero probability of being correct.

Indeed.

And I very much appreciate your level headed approach, which is a desperately needed counterbalance to the rest of us all.

Nobody, I repeat NOBODY, that has ever invested in the oil and natural gas business, owned working interest in wells, paid lease operating expenses, or prepaid for the cost of drilling and completing of an actual well and then had to cover overages, NOBODY that ever worked out of a checkbook… and lost money, would EVER say something as asinine as this comment by Dennis Coyne.

Or this by whathisname: “Recoverable resources – at economical cost – will be available far off into the future. Gar. Own. Teed.”

Who “guarantees” anything they can’t see, miles below the surface, deep down in the dark?

Because they read about it on the internet? Because EQT says its true?

This is nothing more than narcissistic need to be different than others, to go against the flow, to draw attention to yourself by making bold, stupid statements with nothing at stake if you are wrong.

What’s the common denominator of a proverbial, eternal optimist, who ALWAYS finds a way to refute legitimate, fact based concern for the future?

They’ve got no real life experience in the subject matter. They’ve got nothing invested in it; they’ve not put their money where their mouths are. When they are wrong they sort of… slink off into the sunset.

Nothing about the oil business lasts very long. NEVER are past results an assurance of future performance. That is particularly true of this latest fad…tight oil and tight gas. It’s entire future depends on how much money private enterprise (debt), or governments (more debt) are willing to throw at it.

Mike,

I may well be wrong. The future is difficult to predict. Nearly everyone who comments here seems sure that oil output has peaked, my expectation is different. Below is my current best guess scenario for World C plus C, peak is 2029 at about 88 Mb/d, the extraction rate on the tight axis is annual output divided by proved developed producing (PDP) reserves for conventional C plus C which excludes extra heavy oil production (API Gravity under 10 degrees) from Canadian oil sands and Orinoco belt in Venezuela. The scenario assumes Brent oil prices remain above $90/bo in 2022 US$ on average from 2023 to 2040. The URR is about 2900 Gb through 2150 with about 2700 Gb of conventional oil URR and 200 Gb of unconventional oil URR.

I am concerned about the future, oil and natural gas output is likely to decline at some point in the near future and the World will need to find ways to use less fossil fuel. One option is to ride horses, but this is an expensive option, another is to walk or ride a bicycle which doesn’t work well in many cases, another is to transition to some other form of transport that uses less oil as a fuel source. Coal and natural gas are also likely to peak in output in the near future (coal may have already passed its peak in 2014) so alternatives to coal and natural gas will need to be ramped up in the near future.

If something doesn’t change soon the World will be very short on energy, another option is to try to waste less energy and utilize it more efficiently.

Mr. Roughneck,

From your very first posts on this site, many years ago, you and I have been at loggerheads.

I suspect that observers may have been exposed to data which – should they so choose to engage – has provided a basis for a wider ‘education’ as my view has been one of the few contrarian stances (vis a vis peak oil) on this site since its inception.

However, your openly calling me a liar regarding the ridiculous topic of EOG using 153,000 barrels of water to frac a Riverview well (a fact easily corroborated by anyone spending 1 minute on FracFocus) was both ungentlemanly and – as is frequently the case in your statements – 100% wrong.

Despite your making more exits from this site than James Brown starring in ‘Groundhog Day’, I generally appreciate your input while rarely giving much credence to your bombastic proclamations.

To the point of my referenced comment regarding abundant recoverable resources from the Appalachian Basin … yes, absolutely.

I spent some time reading G&R’s presentation that Doc Rich noted and a huge flaw leaped right up off the screen.

G&R claims only ~16,000 Marcellus drilling locations exist, while ~12,000 have already been brought online.

This is preposterous.

One can believe/disbelieve as one so chooses, but thinking that both the AB is turning over and that the US natgas prices will converge with global pricing is pure fantasy.

Gar. Own. Teed.

Coffeeguyzz,

Note that there will be a differential between the World natural gas price and prices in North America due to the cost for liquifying, transporting then conversion back to the gaseous state for natural gas which will probably be about $5/MCF.

Note that since mid 2020 dry Natural gas output has been growing at an annual rate of about 4 BCF/d and natural gas exports have been growing at an annual rate of about 2.3 BCF/d. If the rate of natural gas exports accelerates and natural gas output does not do the same we could see US natural gas prices approach to within $5/MCF of the World natural gas price level. Europe may no longer rely on Russian gas as they have in the past. It will be interesting to see how it plays out, but shale gas might not be as plentiful as you suspect.

From blog post at link below

https://novilabs.com/blog/pennsylvania-update-through-march-2022/

I get the following chart which suggests the average well profile for pennsylvannia shale gas has deteriorated since 2020.

Dennis,

Those charts from Enno’s excellent site actually strongly buttress my reply to Doc Rich regarding having familiarity with the WHYs behind presented data as being crucial to analyzing (or, at least, better ability to understand) just what the heck is going on.

Well profile deteriorated since 2020?

Really?

Cum is better for ’21 which is better than ’20

Likewise for production rate for ’21’s first 12 months.

Noticing anything about the line thickness after first 12 months for ’21 cohort?

Could this be wells going offline as adjacent wells are frac’d?

(Note, Enno uses calendar month production, NOT actual days online).

Regarding 2022 wells .. interesting exercise for you if you are interested …

Check 2022 production for Bradford, Sullivan, Susquehannah and Wyoming counties (NEPA … Northeast Pennsylvania). 41 wells, over 600 million cfd production.

Now, do the same for Allegheny, Armstrong, Beaver, Butler, Elk, Greene, Lycoming, Tioga, Washington, and Westmorland counties (SWPA and Northern Tier). 45 wells and just over 300 million cubic feet per day.

What your 2 charts show, Dennis, in depicting 2022 Pennsylvania horizontal wells is WAY fewer wells drilled that – proportionally – diminished impact of high output/dry gas NEPA wells while enhancing the impact of the lower producing ‘wetter’ SWPA wells (which captured higher value NGLs) along with the Tier 2 type profiles of ‘off the fairway’ locations.

Your charts provide an excellent display of how accurate data can be susceptible to a wide array of interpretations/analysis that might not capture the essence of what is actually going on.

(The various companies and their individual conditions/positions also play a big role in all of this).

Coffeguyzz,

The calendar month makes the most sense when looking at a well and its economics, so that’s a specious comment, Enno Peter’s data is excellent. The thickness of the line changes because each month in 2020 (Jan, Feb, …, Nov, Dec) new wells are completed, this has nothing to do with adjacent wells being fracked. Basically for wells completed in May 2021 or later we have fewer than 12 months of data (11 months for wells completed in May, 10 months for wells completed in April, etc).

The 2021 wells look perhaps marginally better than 2020, I am looking at the first 12 months that we have all wells producing which we only have data for 2020, for 2021we only have complete data for first 4 months (557 wells). When we compare the 565 wells completed in the first 4 months of 2020 with the 557 wells completed in the first 4 months of 2021 the cumulative production at 4 months in 2020 was 1534 MMcf vs 1599 MMcf for the 2021 wells or about a 4% increase. I do not have information on the increase in average lateral length for the first 4 months of 2021 compared to the first 4 months of 2020, if it was more than 4% then output per acre would have decreased. You like to tout the increase in lateral lengths achieved in Pennsylvannia, but I would note that the state is not getting any bigger in area, the longer the lateral, the fewer potential wells that can be completed profitably and also note that often output per acre decreases as the lateral length increases so overall URR could decrease as a result of increasing lateral length. I agree that the economics for longer lateral wells may be better up to a point, but there may be a premium leasing cost associated with putting together leases that allow very long laterals, so the returns to going longer may be minimal in many cases.

Coffee, “loggerheads” is an understatement. I don’t remember calling you a liar over a 153,000 barrel frac; we, not you, were using three times that water a decade ago and now we’re using 3 times that water again. I’ve set them. Sadly, I’ve even paid for a few. Have you?

I can’t stand guys like you, sorry. There are a number of you here on AOB. You THINK you are smarter standing on the sidelines that those playing the actual game. You won’t go in the game. Too scary, too risky. You have diminished my 65 years of hard manual labor in the oilfield, thousands of sleepless nights standing in the cold rain, putting good men into body bags then having to explain to their wives what happened, having my checking account down to three digits …to nothing more than a bunch of internet dribble, To stupid numbers and investor presentations. To fucking charts. You and people like you have forgone 150 years of history, of incredible hardships, loss, and heartache over a bunch of horseshit you read on the internet. I resent it, deeply. Always have. I consider you, and many people like you, and embarrassment to my industry and what it stands for.

I think the AB IS turning over; 100%. It was drilled practically to death to earn 65 cents per MMBTU. Its well productivity IS falling; I can prove it with data but it would be like talking to a fence post. Moreover, the people IN it, like the companies you admire so much and hang around, like a groupie, they are selling America out with LNG exports. Or others that you so admire, like anybody in the tired old Bakken, they simply burn their gas, a BCF a day, waste it, like it was nothing. Who, in God’s name, could EVER feel pride, or accomplishment, over that?

Nobody IN the oil business, or that respects it, appreciates it, and honors its incredible history, or the fickleness of Mother Nature, EVER “guarantees” anything. They are humbled by it all and the failures they have endured. Indeed I resent guys like you very much. Nothing personal; have a nice, laborless day.

That is the best comment I have read here, ever. I’d have to revisit TOD to find something that honest genuine and heartfelt, if even there. And it followed the first zero-scaled graph to ever appear on POB. Glad I stopped by. Thanks.

Thanks Mike,

I agree it looks like productivity may be decreasing in Pennsylvannia shale gas. In June 2022 ND captured 94% of 3061 MMcf/d of gas produced so about 177 million cubic feet of natural gas flared according to last month’s Directors Cut.

https://www.dmr.nd.gov/dmr/oilgas/directorscut

Texas does a much better job with only 0.65% of all natural gas flared which is amazing, this is down from 2.29% in June 2019. North Dakota (and all of the US oil industry) should follow the lead of Texas on this.

See

https://www.texansfornaturalgas.com/flaring_in_texas_falls_by_over_70_percent

Thanks Mike for pointing this out.

Found the following at Novilabs blog which suggests productivity normalized for lateral length has been fairly flat lately fro most tight oil basins. See first chart in the blog post.

https://novilabs.com/blog/can-unconventional-well-productivity-predict-peak-oil-production/

Hole In Head:

You are completely accurate. It should be peak electricity. This is the Achilles heel.

It would surprise a lot of people to realize just how much of California’s electricity comes from coal-fired utility plants in Wyoming and Nevada—especially during the summer months.

And this year, in Europe, there is going to be a lot of coal burned to generate electricity.

According to the EIA, it doesn’t look like that much coal really, and soon to be none.

“Although coal-fired power plants supplied about 9% of imports, coal’s total contribution to the state’s electricity supply from imports and in-state generation in 2020 was less than 3%. A state law enacted in 2006 requires California utilities to limit new long-term financial investments in baseload generation to power plants that meet California emissions performance standards, and essentially all imports of coal-fired generation are projected to end by 2026.”

https://www.eia.gov/state/analysis.php?sid=CA

China’s commitment to building 270 Gigawatts of new coal fueled power plants during the coming 5 years would seem to … offset … efforts by others in the ‘reducing emissions’ crusade.

That is one huge (1,000 Megawatt) plant coming online Every. Single. Week for the next 5+ years.

Much of the coal will come from the world’s largest open pit mines in Inner Mongolia and be shipped via the brand new $30 billion Haoji railway.

Mebbe someone outta tell Greta.

Australia + USA = 40% of worlds coal reserves

See military investments that are consistent with this.

COFFEEGUYZZ,

Indeed… China will continue to push its High-Tech Metropolis Economy to a higher peak; thus the COLLAPSE will be even more breathtaking.

China is now blowing through a staggering 4.5 billion tons of coal per year vs. 500 million tons in the USA. While China will likely increase its coal production & consumption for a bit, all bets are off when global oil production begins to decline, and with it, the very diesel that runs the World Coal Industry.

The INSANITY I get all the time is that if we get into trouble with oil, we have 1,000 years of coal reserves. I gather these EINSTEINS believe that Coal will be mined, extracted, and transported with the ENERGY TOOTH FAIRY. 🙂

steve

SRSROCCO,

I enjoy your posts. But you seem to be rooting for collapse.

This Einstein thinks,

The USA will have enough fuel to build a coal – to – liquids infrastructure.

Adding Australia’s resources in exchange for military protection will be a JACKPOT

PEAK AVOCADO.

No… I’m not rooting for Collapse, but I did stay awake in History class when I read about how ALL Ancient Civilizations Collapsed.

Thus, if we are looking at Homo Sapiens as a BATTING AVERAGE, they have struck out every time when we decided to Grow Exponentially.

So, it’s not a matter of ROOTING; rather, it’s a matter of LOGIC and DEDUCTIVE REASONING instead of HOPIUM.

I hope (LOL) you see the logic in my response.

steve

Gerry Maddoux,

Using BP Statistical Review of World Energy for World Electricity generation a peak is not evident.

See chart below.

Hole In Head,

Glad to hear from you. I always enjoy your comments. It seems to me that the natural gas situation will bite us sooner than declining oil. From what I have read the giant Marcellus basin is starting to roll over. The Utica formation still has some growth but then what. Our conventional natural gas fields have been in deep decline for some time now. I think natural gas prices in the US will really rise in the next 1 year especially with our increasing LNG exports.

Docrich,

The observation that the Marcellus might be rolling over is questionable.

While it is true that the current ~35 Billion cubic feet per day Appalachian Basin output may not increase, this is due – primarily – to maxing out the takeaway pipe limits.

In fact, the recent EQT acquisition of Tug Hill (after purchasing Alta) will enable EQT to drill longer (thus, cheaper per lateral foot) wells which will improve the economics.

Chesapeake’s purchase of Chief will have the same impact on its operations in NEPA.

The Utica indeed holds future promise as the step outs continue accross the northern tier.

XTO (although trying to exit the App Basin) just brought online a Utica well northeast of Pittsburgh.

In 6 1/2 months production, this well – the Trilogy 5HU – has produced almost 7 1/2 Bcf … the energy equivalent of 1,250,000 barrels of earl.

Long, long ways to go in extracting the available hydrocarbons … not even counting the 100+ Trillion cubic feet from the Upper Devonians.

Coffeeguyzz,

The World consumed 142.5 trillion cubic feet of natural gas in 2021. 100 trillion cubic feet is peanuts.

Natural gas is also likely to peak in 2030 to 2035, coal may have also have peaked by that time (at this time peak coal was back in 2014.)

Coffeeguyzz,

The US consumed about 30 trillion cubic feet of natural gas in 2021 and exported 6.6 trillion cubic feet of natural gas and imported 2.8 TCF for a net export total of 3.8 TCF, so about 34 TCF of natural gas per year, so 100 TCF is enough supply for less than 3 years, if there is no increase in consumption or net exports.

Coffeguyzz,

According to Goerhring & Rozenswajg(Commodity investment firm), US natural gas prices will start raising to more like world prices in the next 6 months. If it wasn’t for the explosion at the Freeport LNG export facility in June, Henry Hub prices would already been higher. Our natural gas storage in the past 2 months would have been near zero as Freeport is 20% of US LNG exports which are now going in to storage instead of being exported. We shall see what happens in the next year.

Doc,

Yeah, I need to read more of G&R’s work as I keep reading pretty much of what you just described.

When I started reading some of their stuff awhile back, I was unimpressed, frankly, and I believe (from memory) it was becsuse the G&R folks compile tons of data and make prognostications with seemingly minimal understanding/knowledge of the ‘WHYs’ behind the data.

I try to use first order info, that is, actual production numbers, locations, wells, information from the companies (mindful of the ever present chest thumping tone).

In the Appalachian Basin, the number of new wells is way down, productivity is up, decline rate is relatively low, and the efficiencies have become astonishing.

That said, in basin pricing was still ~3$/$4 per mmbtu right up until a few months ago.

Like all things hydrocarbon, Doc, future pathways for the AB will be determined as much by politics as anything else.

Recoverable resources – at economical cost – will be available far off into the future.

Gar. Own. Teed.

Coffeguyzz,

The average Marcellus well in Pennsylvannia produced about 4.2 BCF in its first 12 months of production, based on 515 wells completed in 2020. This is a more relevant metric than cherry picking one outstanding well.

Dennis,

You crack me up in so many ways … and that is not said with any type of derogatory tone.

Do you remember the brief back and forth that you and I had regarding Marcellus’ EURs a few years ago? Something about a ‘report’ that claimed the ‘average’ Marcellus well EUR was expected to hit 4 Billion TOTAL over a few decades’ production?

I had then referred to Cabot’s numerous wells that had ALREADY produced several Billion cubic feet.

… and, you are absolutely correct in noting that the Trilogy 5 HU is an uncommonly spectacular well.

Thing is, Dennis, there are about 30 or more wells in Pennsylvania and Ohio that have produced near or above 10 Billion cubic feet in their first year online.

As acreage continues to consolidate along with operational efficiencies, high output per well is apt to increase.

BTW, that 4.2 Bcf at $8/mmbtu throws off almost $34 million. First. Year.

Coffeeguyzz,

Just pointing out that first 12 months EUR is about 4.2 BCF. I am not sure about capex and OPEX in the Marcellus. Lets say OPEX is $13/boe, that would be about 9.1 million for OPEX, perhaps with current inflation the CAPEX is about 14 million per well (a guess based on tight oil costs per well). In 2021 the average price for natural gas was $3.89/MCF so gross revenue would have been about 16.3 million and net revenue about $7 million, so another year would be needed for the well to pay out.

It is surprising that the completion rate has not picked up more than it has with the higher natural gas prices.

Dennis,

Capital expense (D&C) and LOE vary significantly depending upon different factors … lengths of laterals and amounts of liquids being two of the more prominent.

An illustrative 10,000 foot lateral well cost ~$8 million prior to the recent inflationary runup. (Said by many to be ~25% increase).

The operating costs are largely gathering (local pipe), processing (fractionating liquids and removing impurities), and transportation (long distance delivery). Costs of $1/ thousand cubic foot have been cited as a rough average.

Overall, the big AB companies claim an ‘all in’ cost of ~$2.50/$2.75 per mmbtu to drill, complete, and deliver one thousand cubic feet. This has undoubtedly increased somewhat this calendar year.

FWIW, the in basin pricing is typically 80 cents below Henry Hub.

Regarding your comment about ~100 AB completions per month … as the takeaway pipes are about 100% utilized, expect no more growth out of the Marcellus/Utica with the present constraints.

Those 100 completions – if representative of WV, OH, and PA output – are bringing to market ~35/36 Billion cfd of natgas … over 6 million barrels of oil equivalent energy … larger than the Permian’s oil output.

Coffeeguyzz,

We need to look at all costs for CAPEX, not just D and C, land and other overhead should be included, I am pretty sure $8 million doesn’t cover it.

Also if we look at total boe for Appalachia as reported in DPR it was 6.18 Mboe/d in July 2022 vs 8.74 Mboe/d for Permian in July 2022 using 5.8 Mcf=1 boe. The Permian produces both natural gas (20 BCF/d=3.5 Mboe/d) and C plus C (5.24 Mb/d).

HHH

Glad to hear from you. I have been wondering to where you have vanished. I know that looking at these charts is almost as exciting as watching grass grow. The odd month some surprise does appear. Make sure you are back for the January issue since that is when the EIA issues it’s 2024 forecast.

FYI. Just thought I would post the chart of World C+C production less the World’s three largest producers, Russia, Saudi Arabia, and the USA. Right now, the World less those three is about four million barrels per day below their peak 12-month average. Obviously, the World less these three are in decline and I can see no reason this decline will not continue. It will be up to Saudi and the USA to make up this difference. Russia will only add to their burden.

Ron

Glad to see that you have included Russia in this chart.

I think the issue with Russian production is: “What will the future decline rate be?”. Will it be in the order or 100 kb/d/yr or say greater than 500 kb/d/yr.

The only pre-covid hint on Russian decline rate is from December 2018, 11,051 kb/d to April 2020, 10,935 kb/d, a drop 116 kb/d over 28 months (EIA). Not a big decline but definitely not showing any signs of growth. Then covid hit and they shut down a number of wells. How much well damage did this do?

As for oil sanctions it is not clear what this will do to their ability to export production. The impact of access to technology on production is another issue.

China, India plus a few others will buy all that that Russia can export via the Black Sea. According to the article below, Russia can export up to 6 Mb/d through the Black Sea. Internal use could be between 2.5 Mb/d to 3.0 Mb/d. OPEC says 3.5 Mb/d of all liquids. That leaves 2 Mb/d to 3 Mb/d to export to Europe, which Europe will readily take. I assume they get more $/b from Europe than China.

Bottom line is we will have to wait for about a year to see what is really happening with Russian production.

I have placed on OLS line through world W/O Big 3. Used data from January 2017 to January 2020 and the data from December 2021 to May 2022, the last seven data points. The decline rate is back in the ball park, 751 kb/d/yr.

https://markets.businessinsider.com/news/commodities/russian-oil-exports-august-record-china-india-sanctions-ukraine-energy-2022-8

“The August figure was down from the roughly 180 million barrels exported in May but is unusually high for the month, the IIF data showed. It is the most recent indication of the strength of Russia’s energy exports.”

Ovi, the decline will be fast at first, then slow down. I expect 2023 production will average between 9 and 9.5 million barrels per day. Then the decline will be much slower, on the order of 200 K barrels per day per year.

Russian domestic consumption has dropped dramatically. Nothing is happening in Russia so not much consumption. That gives them more oil to export.

Ovi, from that chart it is blatantly obvious what is happening. The World less the big three peaked in November 2016 and has declined by over 5 million barrels per day since then. The Covid recovery is over. Russia will be down two million barrels daily from its pre-covid production level. The US is slowing down, and Saudi will have reached a post-covid peak in August or very nearly so.

It’s over. It really doesn’t take a genius to figure that out.

Ron

It is unfortunate that the EIA data is four months late. I think we have to wait until the October EIA report is out to see if the post covid recovery is over.

The August OPEC report shows that in July, OPEC added 500 kb/d over May. That is why I think we have to wait till we get October data and then see if decline sets in. I am looking forward to the January STEO to see what they have to say about 2024. The September OPEC report should also be interesting as SA, UAE and Kuwait push into new highs.

I think we will see a lower third peak in late 2022 or sometime in 2023. The second lower peak was November 2019.

Ron,

All of the decline was due to OPEC less Saudi Arabia, this was due to OPEC cuts in 2019, pandemic, and sanctions on Iran and Venezuela starting in 2017, we will see what happens in the future. Iran and Venezuela (especially the latter) may not recover, but they will also not decline at the pace of 2017 to 2020 in the future.

Ovi,

Note that much of that decline was OPEC cutting output in 2019 as well as sanctions on Venezuela and Iran that started in 2017. If you looked at World minus OPEC minus Russia minus US and used same months that you used for OLS on that set of nations we get the following (months not used in OLS are not included on chart (Feb 2020 to Nov 2021). In this case we get a slight increase in output, all of the decline was due to OPEC.

Chart below is for crude plus condensate output.

Dennis

Missed your response. I agree Non-OPEC + US + Russia shows a big decline rate after Nov 2018. I also think Non-OPEC W/O Russia could be in a slow decline. It all depends on where you start. Starting in Oct 2014 to Jan 2020. Adding in Nov 2020 to May 2022 to the least squares shows a low decline rate of 118 kb/d/yr.

Decline in OPEC + US + Russia

1005 kb/d/yr

Ovi,

For that OLS decline rate did you exclude April 2020 to October 2021? Also we have data for OPEC and Russia through August and if we start in Jan 2019 and end in Aug 2022 (leaving out the late 2018 increase by OPEC and Russia to increase their quotas in 2019 and the Pandemic months of May 2020 to Oct 2021) I get an annual decline rate of 470 kb/d. Much changes with different starting points of course. Quite a lot of OPEC decline is due to Venezuela which seems to have stabilized around 650 kb/d.

If we look at OPEC plus Russia plus US for the same months you looked at for World less these nations (starting in Oct 2014 and ending in June 2022 and leaving out same months as your analysis (OPEC is crude only in this case) we get an average annual decline rate of 211 kb/d.

The data can be sliced and diced in many ways, if we drop more of the pandemic crash and recovery (Feb 2020 to Sept 2021) we get an annual increase for OPEC plus Russia plus US (crude only data for OPEC) of 158 kb/d.

Yes Dennis – We should cherry pick such data which indicate a sharp downward trajectory since 2018 and then focus on a thin slice of data pointing to a completely unsustainable upward trend…right? Whatever gets us to a new world production peak in say…7 years😲😲😲😲

who needs geological/other constraints anyway….

Dennis

The answer to your first question is yes.

I don’t think that that you can start OPEC plus US plus Russia at October 2014. The analysis has to start after the peak. We really need to see if the increasing OPEC output from UAE, SA and Kuwait offsets the OPEC decliners. I still think a more over all decline rate is in the range of 550 kb/d/yr to 750 kb/d/yr.

Dennis

A additional thought. Going forward, I think the more relevant data for assessing decline rate for OPEC + US + Russia will be post October 2021.

Ovi,

I think it makes more sense to look at top 15 producers from 2010 to 2020, rather than OPEC, Russia and US and World minus top 15. Many in the OPEC 13 are not very significant oil producers with about 5 OPEC nations producing under 500 kbpd.

Kengeo,

Oversupply, pandemic and sanctions are the better explanation for decline since 2018 rather than geological factors. The decline you expect may be delayed if oil prices remain high.

Russia

D. Coyne: “Using BP Statistical Review of World Energy for World Electricity generation a peak is not evident.”

“Peak Electricity” was probably the wrong way to phrase it, though anything else would be clumsy. Affordable electricity is perhaps the better concept. Or relatively clean electricity.

In point of fact, the price of electricity is going up rapidly. This is most obvious in the U.K. and Germany, but it’s spreading almost in lockstep with the determination to go green. California has used large amounts of electricity imported from the coal-burning Jim Bridger Utility plant, which was built ten-times too large to supply Wyoming’s needs in order to sell electricity-on-demand to the California grid. The previous commenter was right, California has sharply reduced that importation–for now–but time will tell. If the California grid shows signs of failing there will be a lot of electricity flowing from Wyoming to California–it’s a governor-to-governor phone-call option. The price of electricity in California is going up fairly dramatically. It’s a rich state and can subsidize its users. But it’s premature to say that they’ve stopped using coal-generated electricity, just as it was premature to declare the Diablo Canyon nuclear power plant a goner. As an emergency, it was kept on-line. More natural gas plants were added in the LA area this year too.

What’s the right term? “Affordable electricity for the masses,” which sounds socialistic, has peaked for a lot of places–just take a survey in London sometime. The U.K. is making contingency plans to subsidize the cost of electricity. When the Navajo coal-fired plant in northern Arizona was decommissioned, environmentalists cheered. However, before the year was up, China had added the bituminous coal-burning capacity of 27 Navajo plants to generate electricity. And they didn’t stop there. All for affordable electricity.

Peak electricity is not upon us–technically. Affordable electricity for the masses peaked out sometime during this last year. We are entering the age of governmentally-subsidized electricity. And to subsidize electricity at increasing levels in more and more places is going to be a tremendous economic drag.

I didn’t plan on going into such a long diatribe about this. But like the true environmental burden of producing electric vehicles, this is the dark underbelly of the transition to a cleaner form of energy. Ironically, carbon capture on a grand scale is advancing at roughly the same speed as the wind and solar projects. We–the world community–is going to wind up (hopefully) with some sort of happy mix of energy sources to allow civilization to advance.

Gerry , you understand the problem of electricity . ” peak electricity ” or ” peak affordable electricity ” . Does it matter ? ” A rose is a rose and it would still smell sweet even if called by another name ” Shakespeare . I am posting a link specially for you and anybody who is in UK and EU . ” Since when did banks produce energy ? ” Little Lizzie ” just f****d the British public twice over and they don’t even realize it . One of my friends opined about the Brits ” So ignorant and yet so happy ” . All who are from UK and the EU read this .

https://consciousnessofsheep.co.uk/2022/09/09/since-when-did-banks-produce-energy/

Groot Lizzie is dood aged 96 years .

Gerry Maddoux,

High prices for electricity may lead to a rapid expansion of non-fossil fuel energy which a current World price levels for fossil fuel is a far cheaper way to produce electricity. As this transition occurs we may see electricity prices drop eventually. Not clear how we measure “affordable electricity”.

Dennis , enjoy it while it lasts . 50 % of steel , aluminium and zinc production in EU is shutdown . My friendly neighborhood baker shutdown ( a husband and wife operation ) because they cannot pay their new electricity bill . Unaffordable . I can go on and on but it is futile . Some here think North America is the world . Well it is Eurasia that is the name of the game . Read Mackinder and Brzezinski and you will understand what I am talking about i think I will sign out just to avoid an unnecessary bout . From tubelight to candlelight .

Hole in head,

Do you have a link to a better copy of that graphic? It is impossible to read, but looks to be far from the mark through 2022. Or a link to the original source or where you found it.

Hole in head,

I found this by Duncan

https://web.archive.org/web/20060524051136/http://www.thesocialcontract.com/pdf/sixteen-two/xvi-2-93.pdf

Updated chart from 2005 or 2006 below from paper above.

Note that the chart has World energy production per capita in barrels of oil equivalent per capita, in 2021 the chart predicts about 6 boe per person when in fact energy output was about 12.9 boe per capita in 2021, slightly higher than 2008 when output was 12.4 boe per capita. The peak was 2018 at 13.01 boe per capita for World primary energy consumption using BP Statistical Review of World Energy 2022.

Data can be downloaded in a spreadsheet at page linked below

https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/primary-energy.html

Dennis , search ” the Olduvai Theory ” on Google ” Images ” . You will get a slew of updated and better graphics and images . Yours is the original image but it has been updated . By the way I learnt about ” the Olduvai ” from the website of Jay Hanson (RIP) . Rgds

D Coyne: “Not clear how we measure ‘affordable electricity’.”

Affordable electricity: that which can be purchased without requiring governmental subsidies.

Gerry Maddoux,

Measuring government subsidies Worldwide for electricity is not a small task. Can you point me to such a measure? Without it “affordable electricity” as you define it remains a philsophical concept without any real data behind it at the World level. Simpler to measure electricity produced, just as we measure C plus C output and do not look at the many ways the oil industry is supported by governments Worldwide (tax breaks, subsidies, public support of transportation infrastructure, etc).

In response to D Coyne:

Price of war: UK and EU throw $500 billion at energy subsidies

Gerry Maddoux,

I assume that is for all types of energy. One would need to assess what percentage of subsidies goes to different types of fuel, some would be for transport, some for heating directly (gas boilers heating homes and water) and some would subsidize electricity, and of course the EU and UK are not the World.

High prices may lead to more efficient use of energy and replacement of high priced sources of energy (natural gas, oil, and coal) with less costly non-fossil fuel sources of energy. This will clearly take time, but it is a badly needed step which North America and Asia will need to follow.

Ethiopia is about twice as populace as the UK, and is growing about 4 times faster.

The new hydroelectric dam dramatically improves electricity/capita and affordability of electricity.

And yes, government funding was certainly involved.

It always is with big hydro, and many other big infrastructure projects.

Large scale electricity requires large scale infrastructure investment.

For most countries the economic payback of electricity system and generation is huge.

Graph

Data

Lightsout, thanks for this chart. I think the top line reads Jan 22 through Aug 22, then % difference. But I know virtually no Russian. Can you, or anyone else, tell us what the legend on the left reads?

I think it’s:

Total oil and gas production

Taxable (and something else)

Oil

Gas Condensate

Exports (and something else)

Oil

Gas

Products

Thanks, George. But that makes things really confusing. That chart shows April as the highest oil production month. April was the month of total collapse according to all other sources.

March …………….. 11,010

April ………………… 9,693

Monthly Decline -1,317

Click on graph to enlarge.

Ron,

I found a source with Russian C plus C output at 10042 kb/d in April, 968 kb/d less than March.

From Jan 2022 to July 2022 I have the following estimates for Russian C plus C in kb/d:

11,002

10,461

11,010

10,042

10,225

10,710

10,800

Chart below has Russian output of C plus C in kb/d fo monthly data and the Centered Twelve Month Average (CTMA). For CTMA the peak was about 11.3 Mb/d and the most recent CTMA (Feb 2022) is about 10.7 Mb/d.

Well, you didn’t give us your source. I don’t understand that dip in Feb. 22. I see no reason to disagree with your average, it is the same as mine. At any rate, there is not much to argue about. In the long run, it will make no difference whatsoever. It is what happens from here on out that matters.

Ron,

You are correct on Feb 2022 output.

from following

https://www.reuters.com/business/energy/russias-feb-oil-output-rises-trading-paralysed-by-sanctions-2022-03-02/

Russian C plus C output was 11.06 Mb/d in Feb 2021, I must have been using a source giving crude only data, I have corrected this in the spreadsheet, thank you.

For April output of C plus C I used the link below which has May’s output at 10.2 Mb/d (43.1 million tonnes), and 5% higher than April (41.05 million tonnes). April has one fewer days than May so output is 41.05 times 7.33 b/t divided by 30 days or 10.03 Mb/d.

https://oilprice.com/Energy/Energy-General/Russia-Oil-Output-Rose-5-In-May-Report.html

Russia to cut oil, condensate output 2% m/m in Aug – Kommersant

MOSCOW, Aug 30 (Reuters) – Russia is set to reduce oil and gas condensate production by 2% month on month in August, the Kommersant newspaper said on Tuesday, citing sources familiar with the data, as Gazprom GAZP.MM cuts output.

Production in Russia is set to fall to 1.445 million tonnes per day (10.59 million barrels per day) after rising every month since May, the paper added.

Russian oil production has proved resilient and has defied predictions of a steep decline following sweeping restrictions introduced by the West after Moscow sent its troops into Ukraine on Feb. 24.

Russia has managed to boost sales of oil to Asia, notably to India and China.

Oil and gas condensate fell by 11.5% in April from March to just above 10 million bpd and had been on a recovery path since then. In July, it rose to 10.76 million bpd.

https://www.nasdaq.com/articles/russia-to-cut-oil-condensate-output-2-m-m-in-aug-kommersant

The 10.59 Mb/d is very close to the three week average of 10.56 Mb/d posted earlier.

Ron please see my earlier post up thread.

Finally some August oil production data out of Russia.

OPEC+ crude oil output rises but quota shortfall hits record high: Platts survey

Libya’s recovery, along with growth by core Gulf members, drove OPEC+ crude production in August to its highest since April 2020’s price war, according to the latest Platts survey by S&P Global Commodity insights.

Even so, the group underachieved yet again in delivering its promised production increase for the month and remains far below its declared output ceiling, as sharp losses in Kazakhstan and Nigeria tempered August’s gains.

OPEC’s 13 members pumped 29.56 million b/d in August, up 480,000 b/d from July, the survey found. Russia and eight other non-OPEC allies fell by 220,000 b/d in the month, producing a collective 13.28 million b/d.

SNIP

Growing shortfalls have led to swirling questions about how much more crude the group will be able to add in a tight physical market facing ratcheting sanctions on Russia over the war in Ukraine.

Leaving aside Russia, which pumped 9.77 million b/d in August, the rest of the members have increased production by just 440,000 b/d since February, while quotas have risen by 2.96 million b/d, survey data shows.

Only Saudi Arabia and the UAE have any significant upside potential, according to many analysts, with the majority of OPEC+ producers already at maximum volumes or are hamstrung by technical problems, a lack of investment, or internal unrest.

Perhaps in recognition of their limits, OPEC+ ministers agreed at their latest meeting Sept. 5 to claw back quotas by 100,000 b/d for October.

But first, they have committed to a 648,000 b/d hike for September—the same aggressive increase they were supposed to deliver in August.

The problem is I don’t know whether that 9.77 million b/d represents crude only or C+C. But I am pretty sure it is crude only. Russian C+C averages 8% condensate. That would put Russian August C+C at 10,551,000 barrels per day in August. That is pretty close to what we had expected.

Lets consider the list of countries with big geopolitical or managerial constraints to their oil production and/or exportation of crude oil products currently,

including Libya, Iran, Venezuela, Nigeria, and Russia. Who am I forgetting?

This is serious production curtailment.

And then consider that in this decade there is a pretty strong chance that the Chinese will move on Taiwan.

Militarily… unless Taiwan simply surrenders in the interim.