A guest post by Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to April 2023.

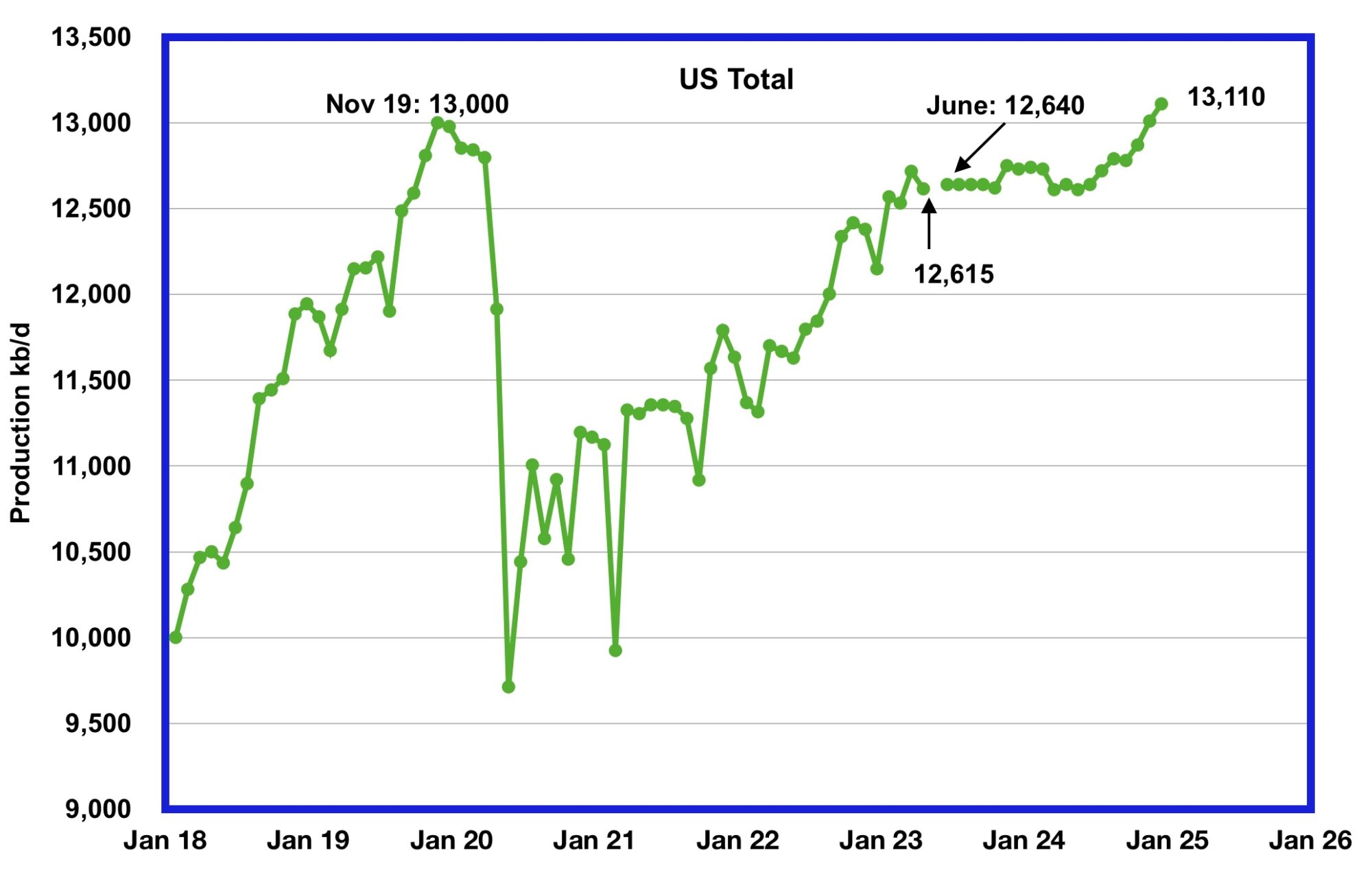

U.S. April oil production decreased by 102 kb/d to 12,615 kb/d, a drop from last month’s post pandemic high of 12,717 kb/d. Note that March’s output was revised up by 21 kb/d from 12,696 to 12,717 kb/d.

Onshore production increased by 37 kb/d to 10,447 kb/d.

The green graph from June 2023 onward is taken from the June 2023 STEO and is the forecast for U.S. oil production from June 2023 to December 2024. Output for December 2024 is expected to be 13,110 kb/d which is 170 kb/d higher than forcast in the previous post. Also it is 110 kb/d higher than the November 2019 peak of 13,000 kb/d. Production will be essentially flat from May 2023 to May 2024 before production begins to rise.

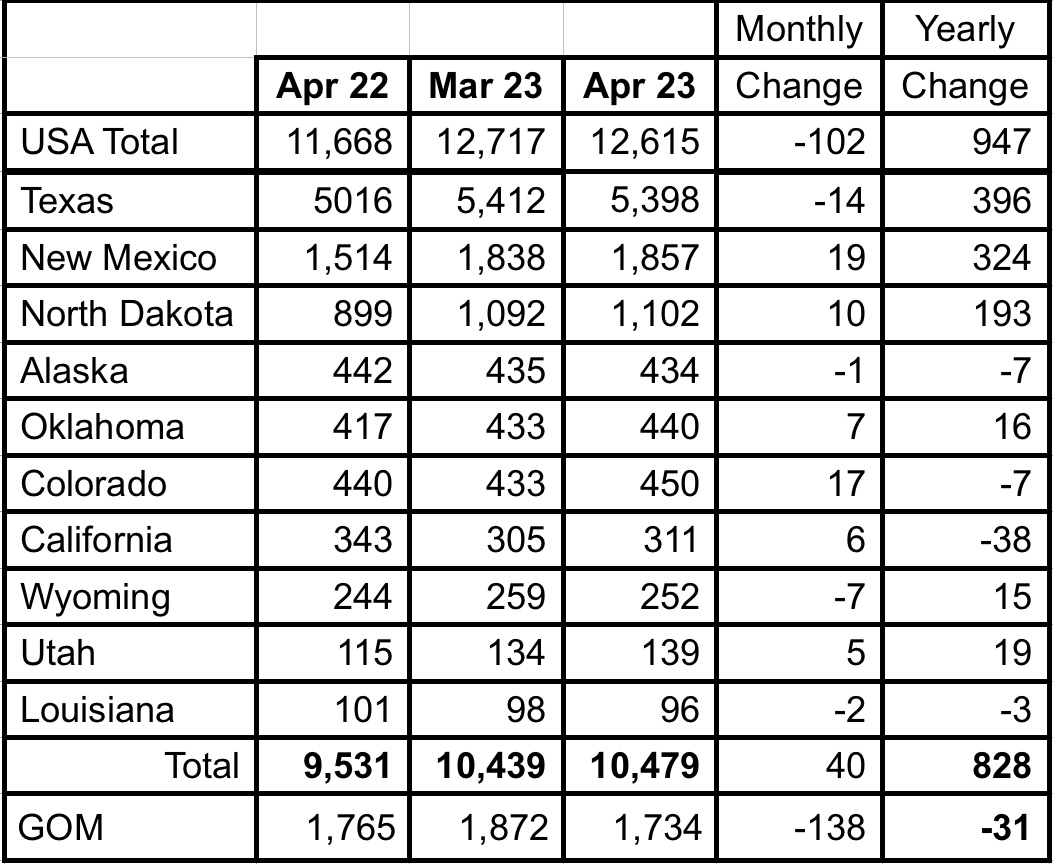

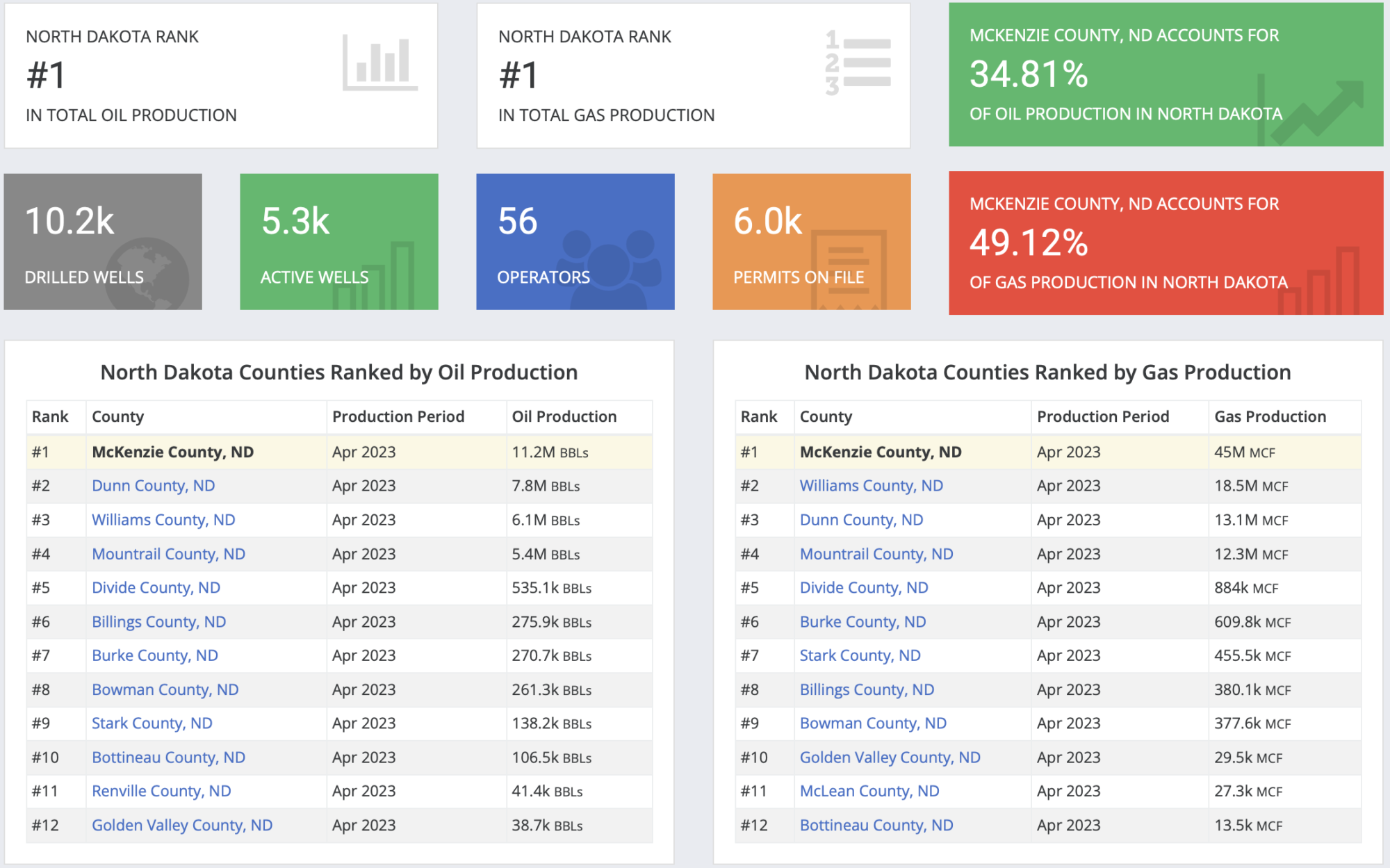

Oil Production Ranked by State

Listed above are the 10 states with the largest US oil production along with the Gulf of Mexico. These 10 states accounted for 83.0% of all U.S. oil production out of a total production of 12,615 kb/d in April 2023. Note that GOM MoM production is down more than overall U.S. production.

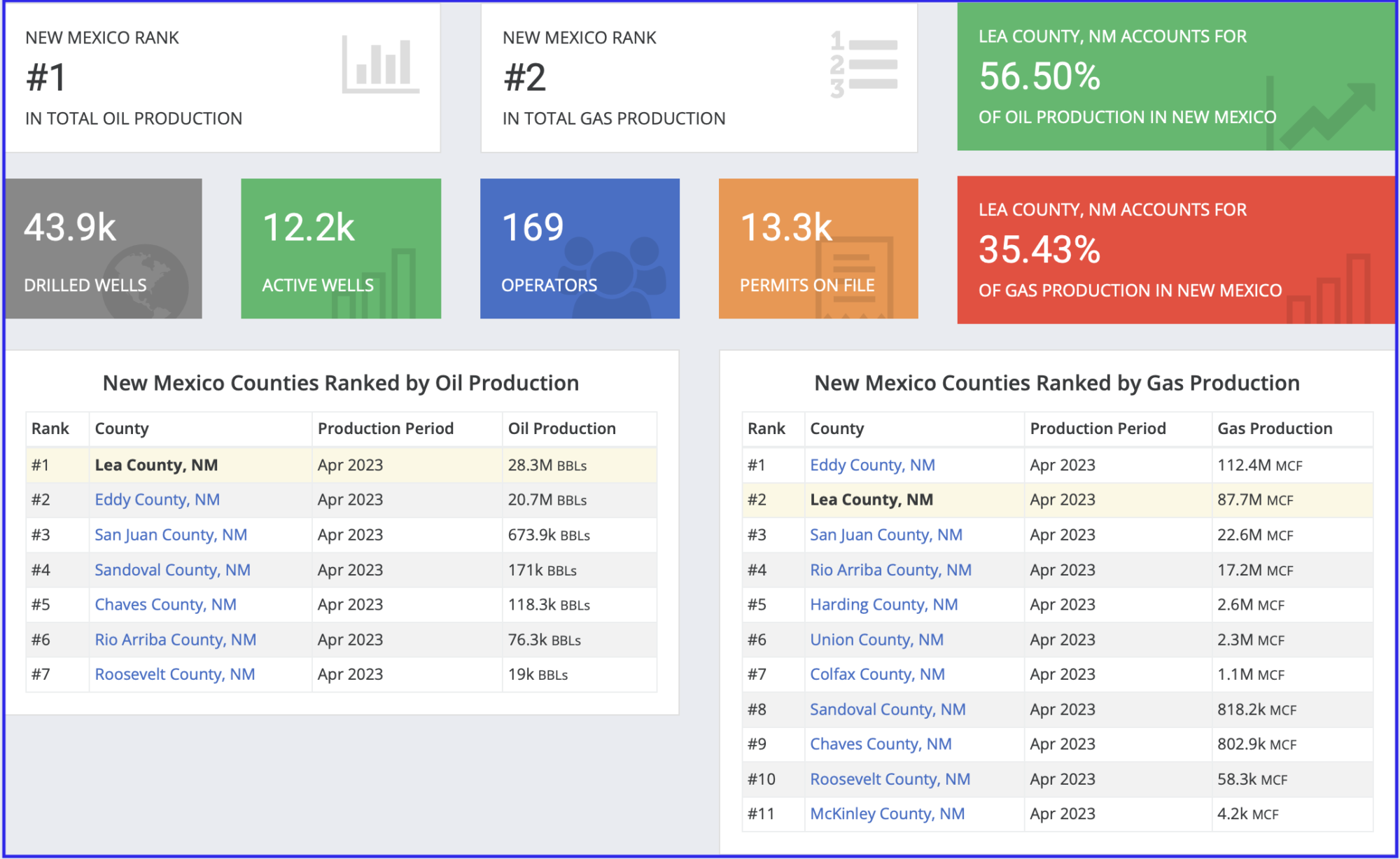

Note that New Mexico’s oil production, for this month, has passed the GOM’s production.

On a YoY basis, US production increased by 947 kb/d with the majority, 720 kb/d coming from Texas and New Mexico.

State Oil Production Charts

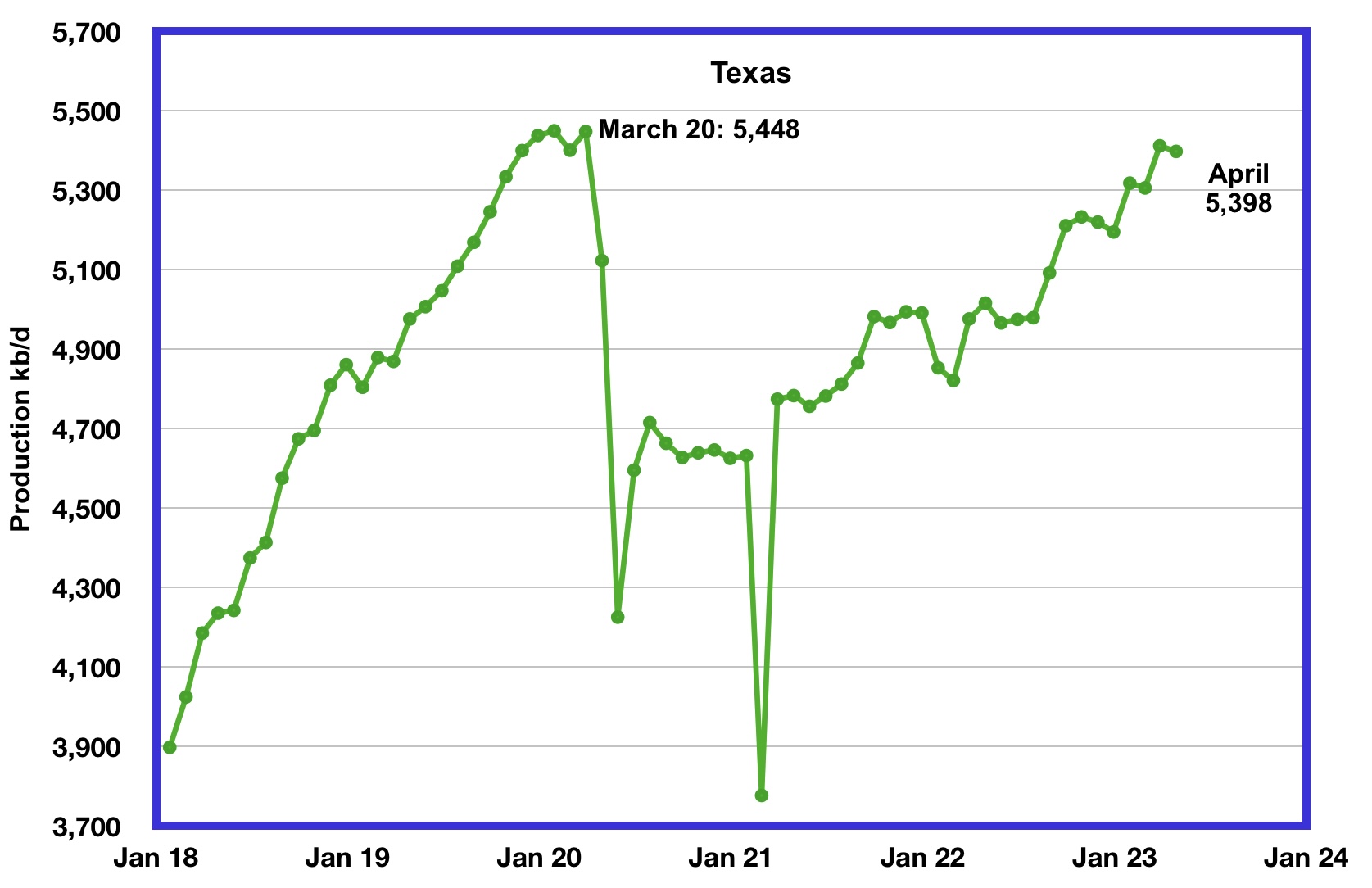

Texas production decreased by 14 kb/d in April to 5,398 kb/d. April’s output is 50 kb/d short of the March 2020 high of 5,448 kb/d.

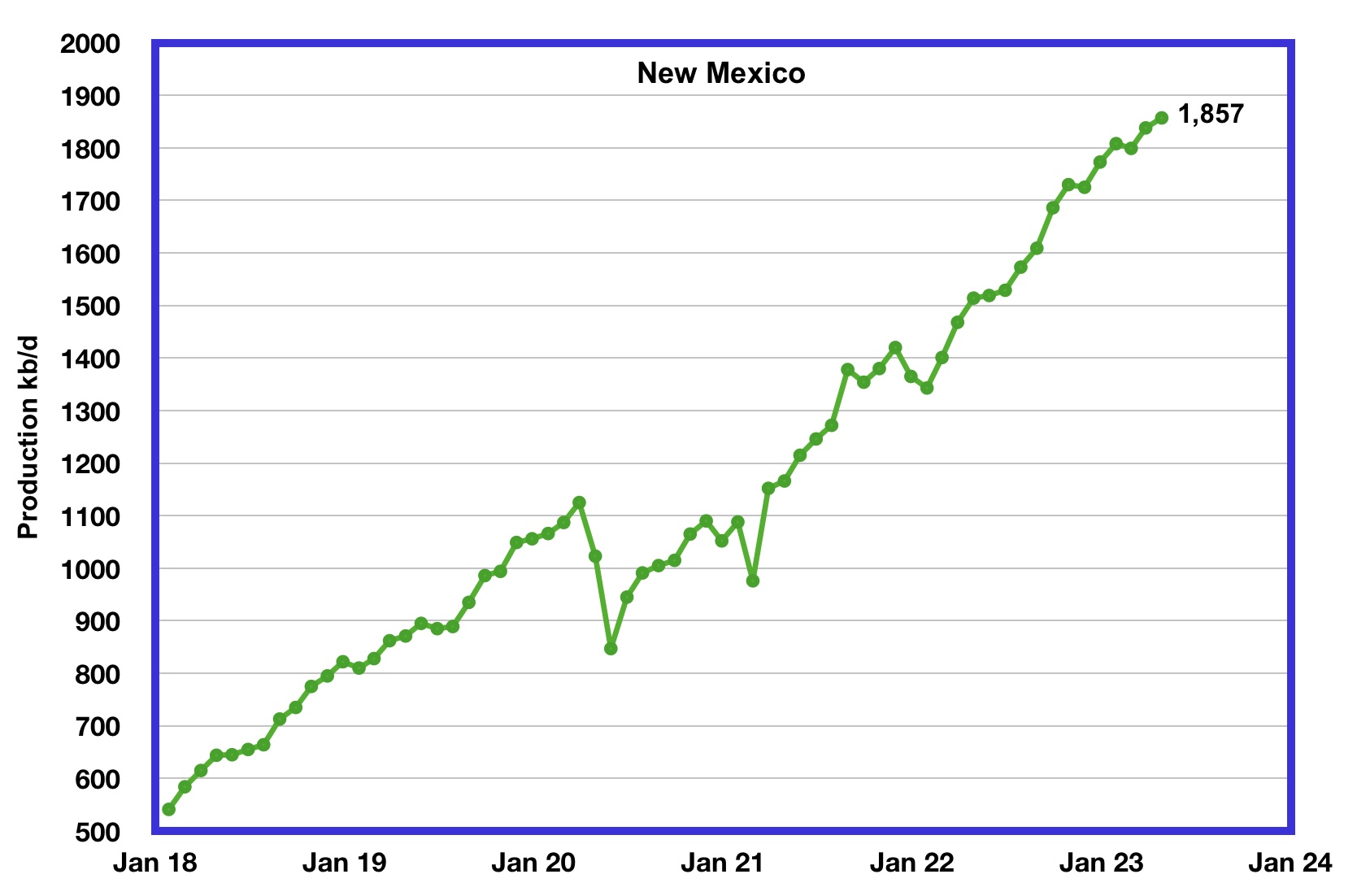

New Mexico’s April production continued at a record level but was little changed from March. April’s production increased by 19 kb/d to 1,857 kb/d.

Of the 1,857 kb/d, 1,633 kb/d came from the Lea and Eddy counties, according to this source. More production information from these two counties is reviewed in the Goehring and Rozencwajg section further down.

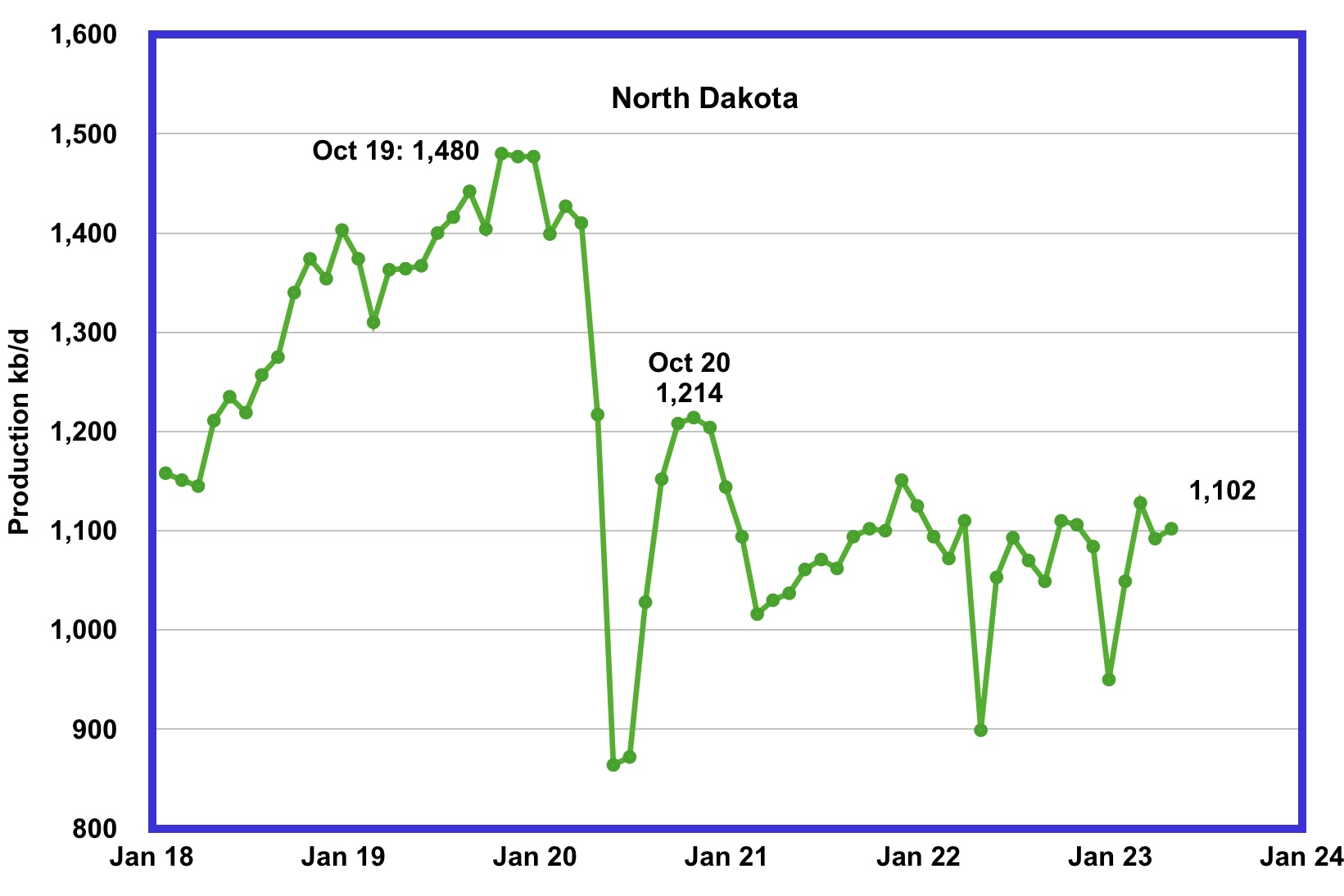

North Dakota’s April oil production has recovered from December’s extreme cold weather impacted production. However April’s increase was essentially flat. Output increased by 10 kb/d to 1,102 kb/d. Current production is unchanged from January 2021, 1,094 kb/d, and production over the past two years has been on a plateau.

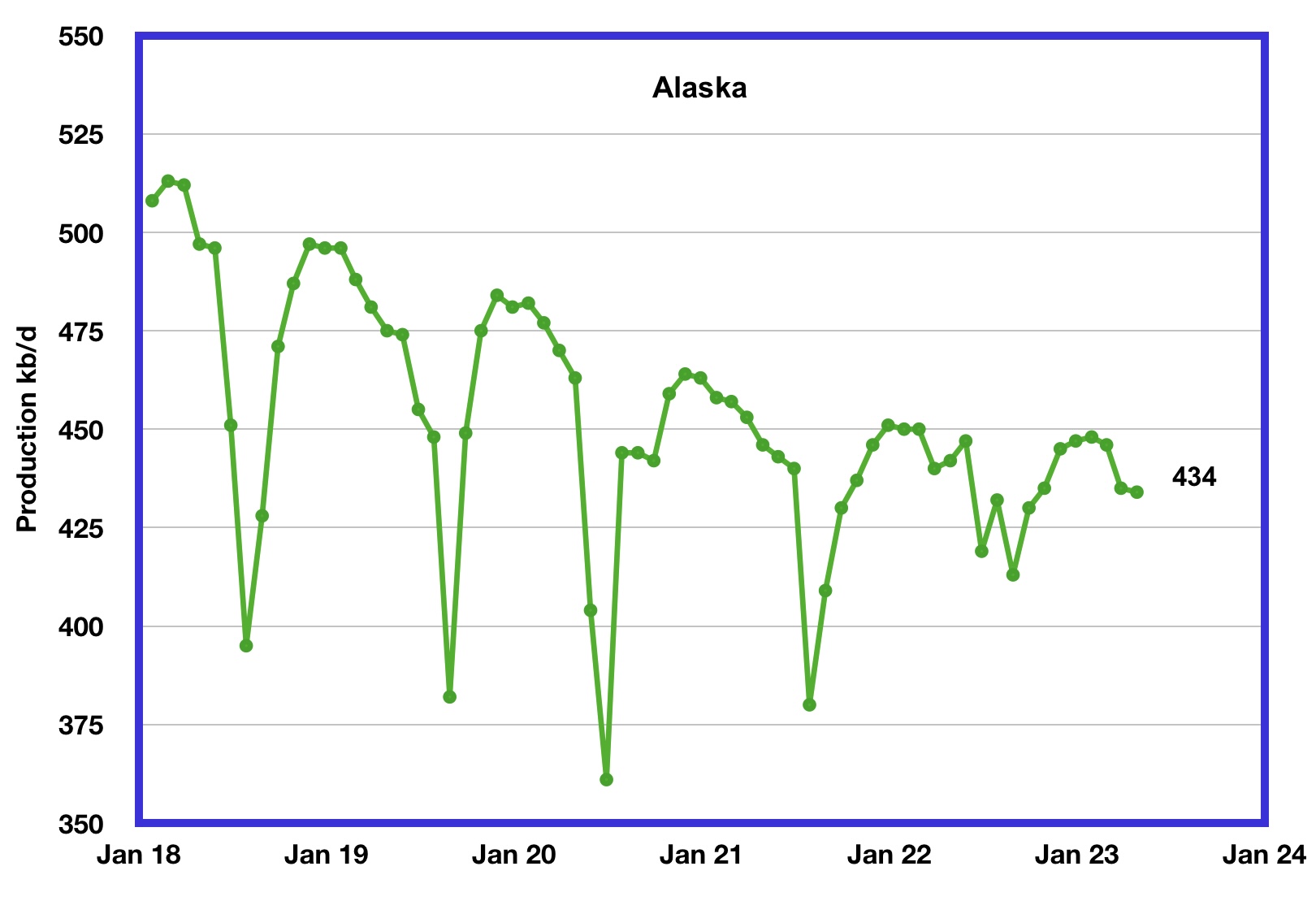

Alaskaʼs April output decreased by 1 kb/d to 434 kb/d. February/March is the beginning of Alaska’s annual production declining phase. However note how the low summer production points in the last two years have been rising.

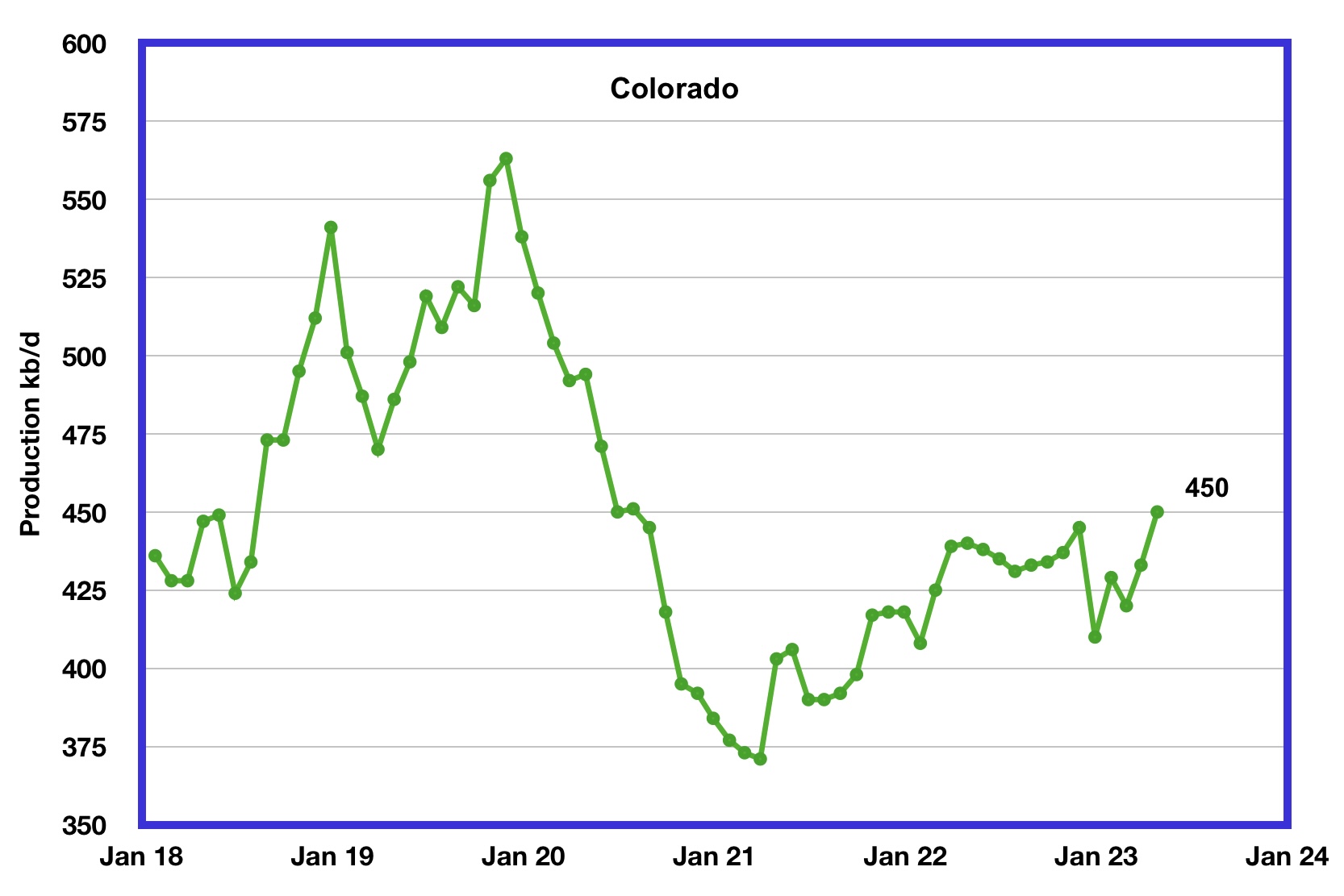

Coloradoʼs April production increased by 17 kb/d to 450 kb/d, a new post pandemic high.

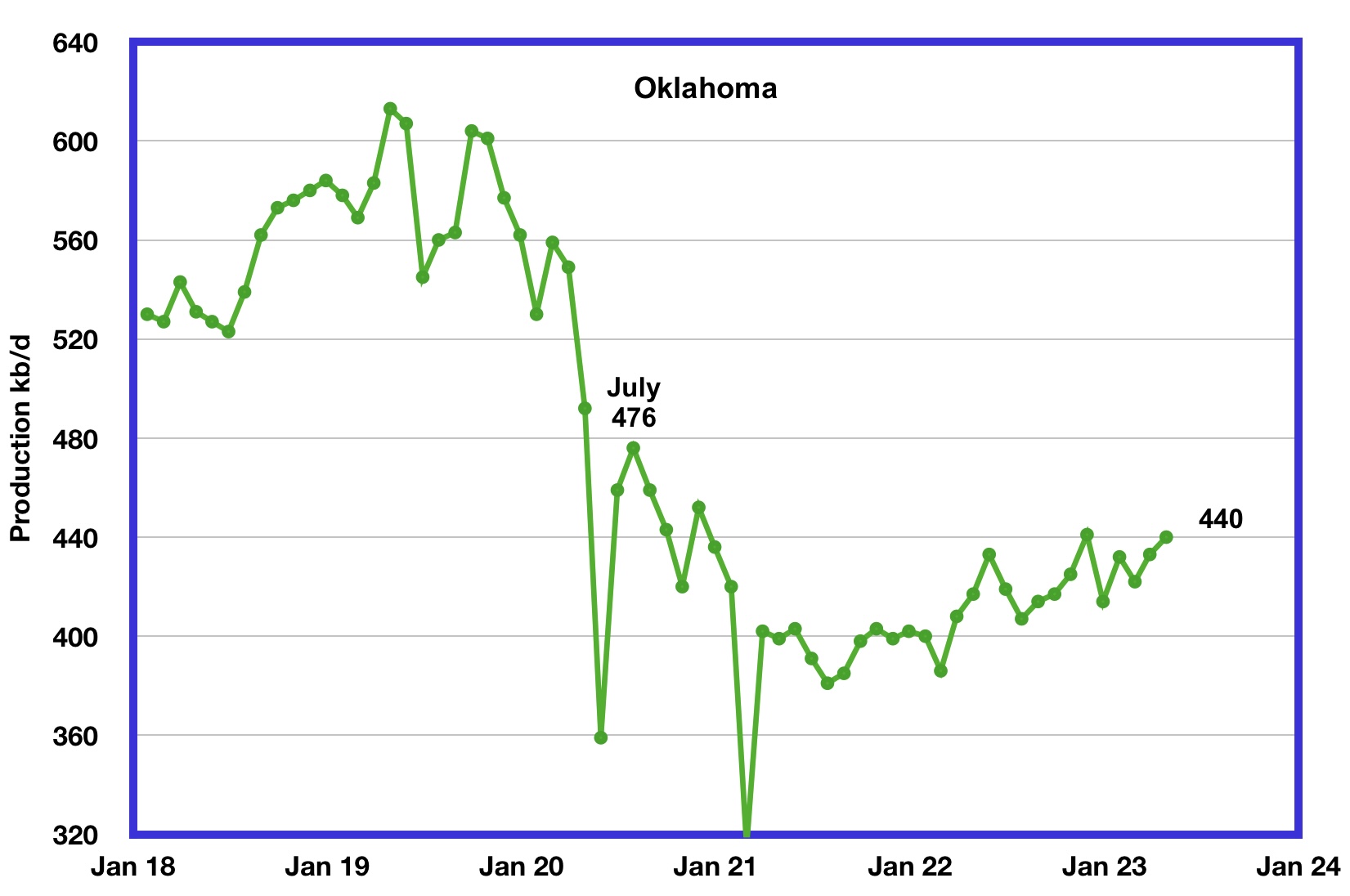

Oklahoma’s output in April rose by 7 kb/d to 440 kb/d. Production remains 36 kb/d below the post pandemic July 2020 high of 476 kb/d.

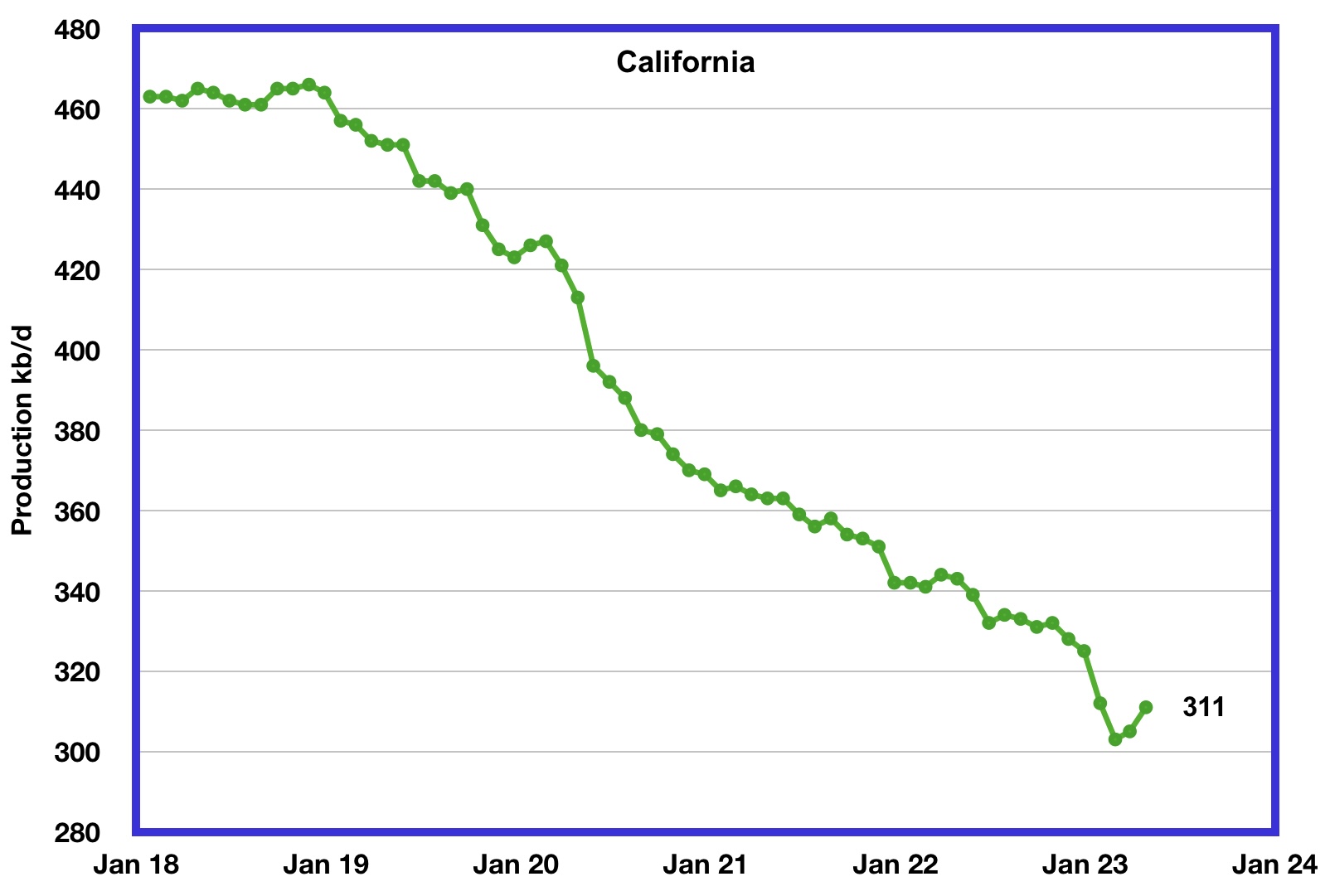

Californiaʼs overall slow output decline trend accelerated in January and February. However for March and April production rose. April output increased by 6 kb/d to 311 kb/d.

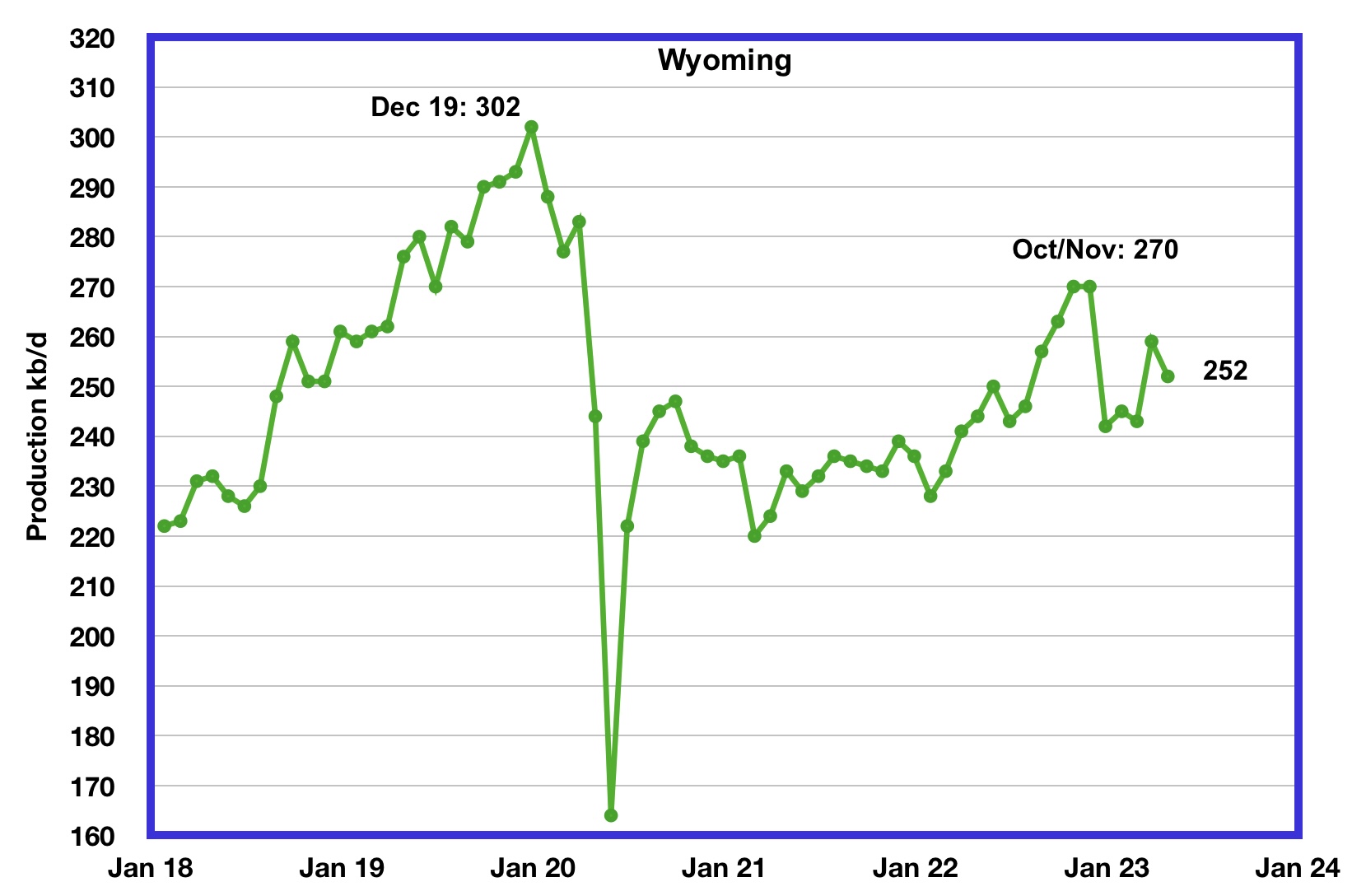

Wyoming’s oil production has been on a slow unsteady uptrend from the low of 220 kb/d in February 2021 due to increased drilling. In October and November 2022 output reached a post pandemic high of 270 kb/d. April’s oil production decreased by 7 kb/d to 252 kb/d.

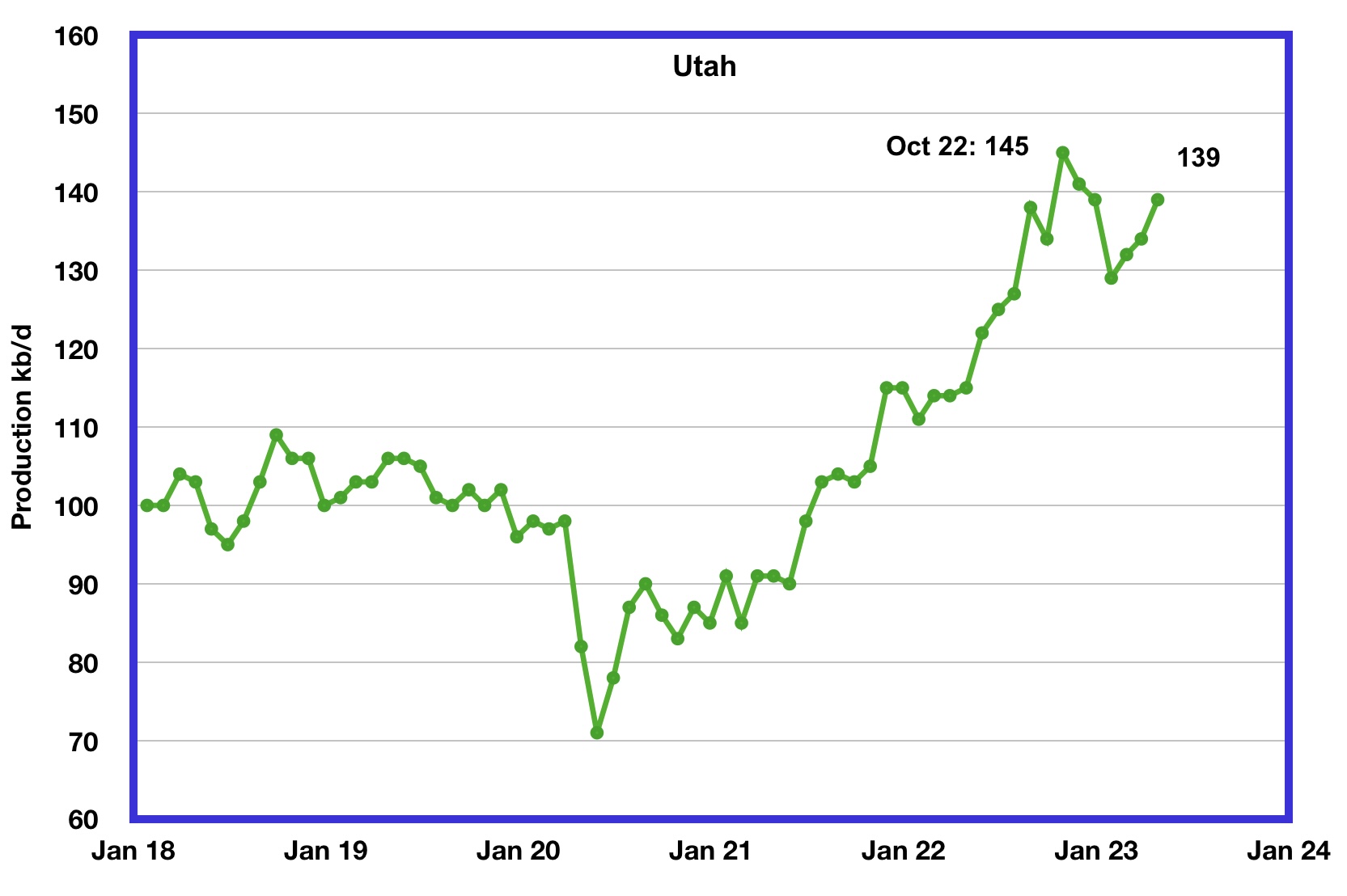

Utah’s oil production reversed its declining trend in February 2023. April’s production increased by 5 kb/d to 139 kb/d and is down 6 kb/d from the October high of 145 kb/d.

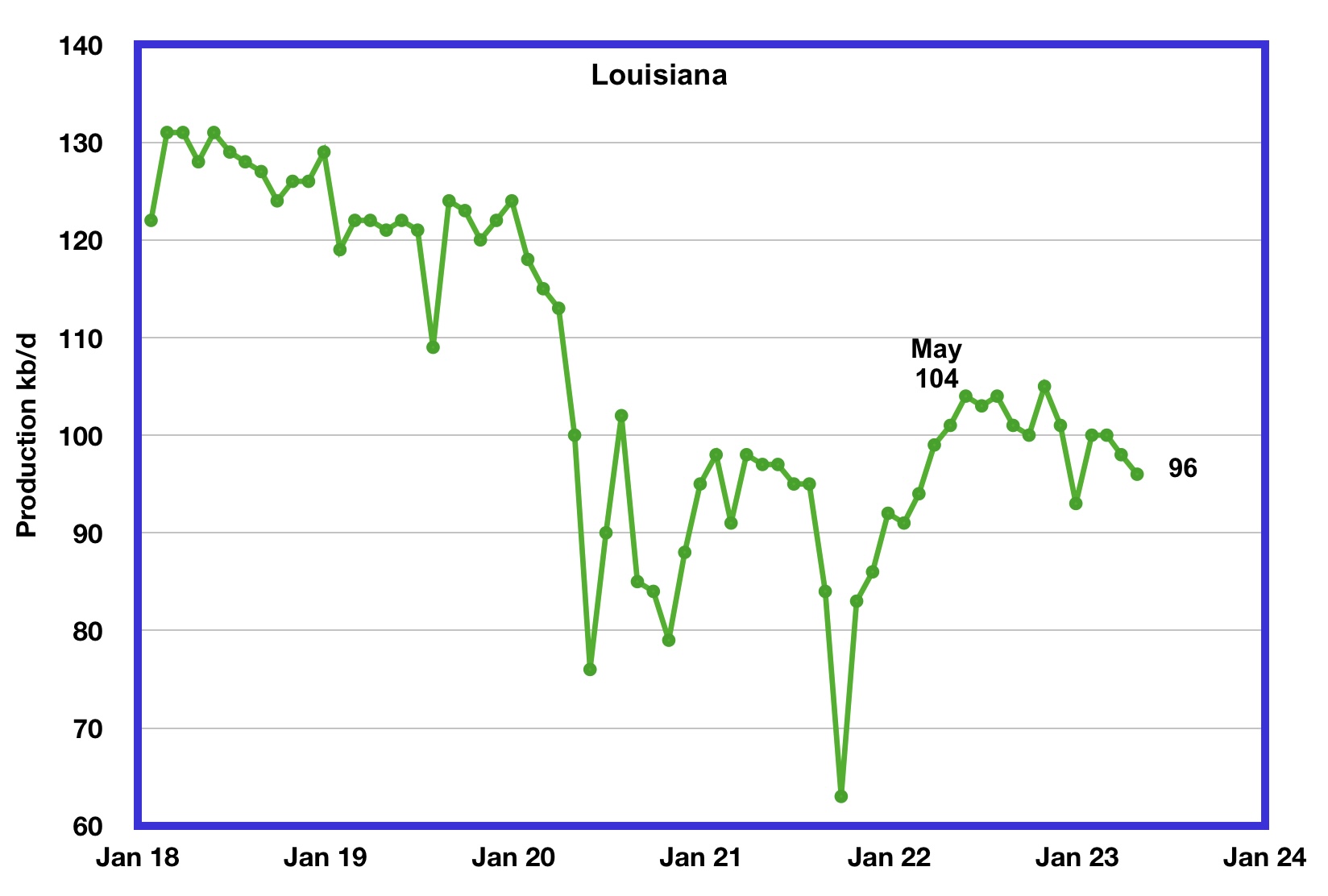

Louisiana’s output rose from the low of 63 kb/d in September 2021 to 104 kb/d in May 2022. Since then output has entered a slow declining phase. April’s production dropped by 2 kb/d to 96 kb/d and is 8 kb/d lower than May 2022.

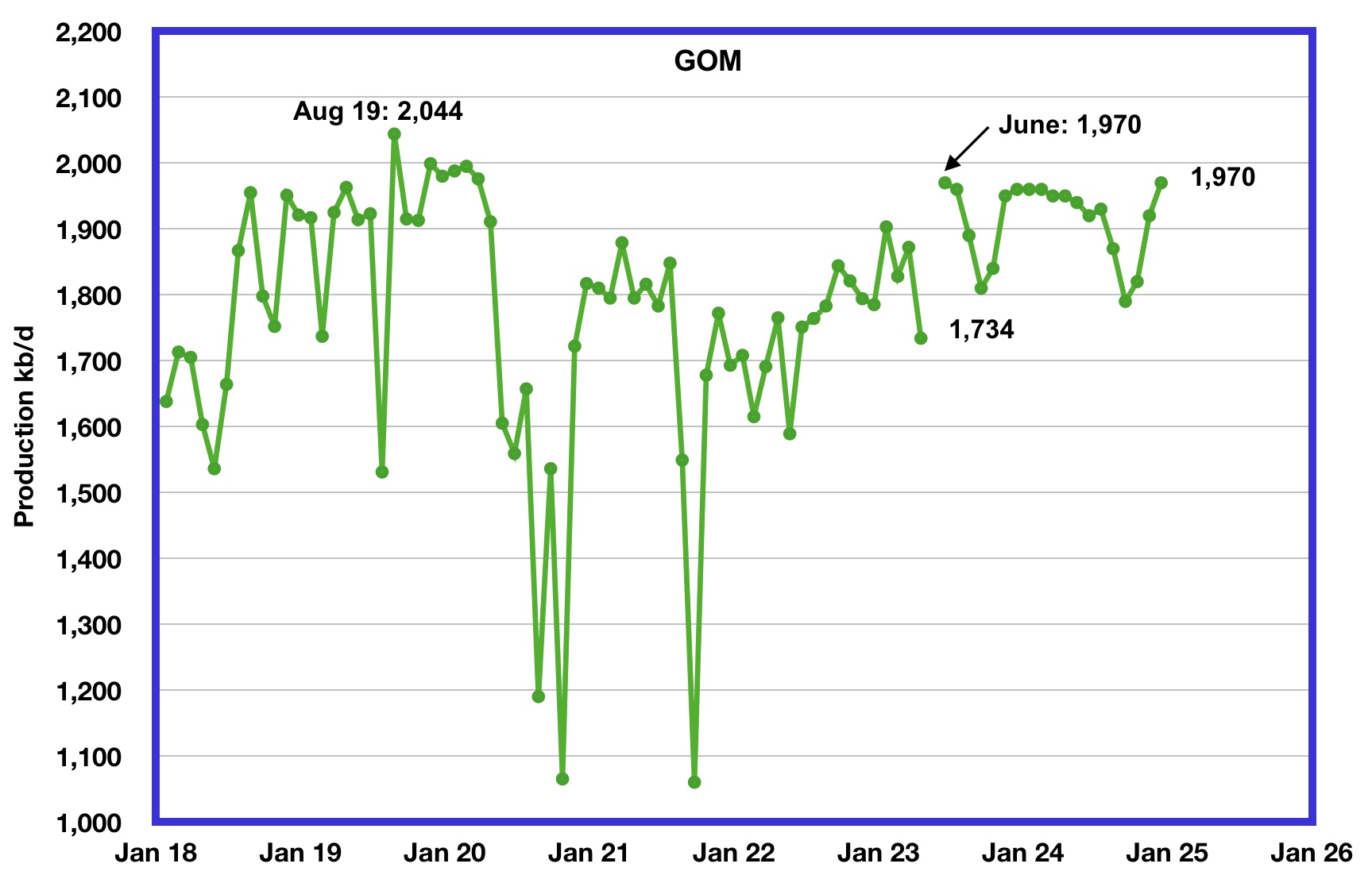

GOM production dropped by 138 kb/d in April to 1,734 kb/d.

The June 2023 STEO projection for the GOM output has been added to this chart and it projects that output in June 2023 will rise to 1,970 kb/d, down by 30 kb/d projected in the May STEO. This could be a reasonable estimate since Shell announced that the Vito platform had begun production on February 15, 2023.

According to this source, GOM production is expected to reach 2,000 kb/d in 2023. However since February , production has dropped and it could be related to problems bringing the Vito platform online.

It is not known if the GOM decline shown after June 2023 is related to extensive maintenance.

A Different Perspective on US Oil Production

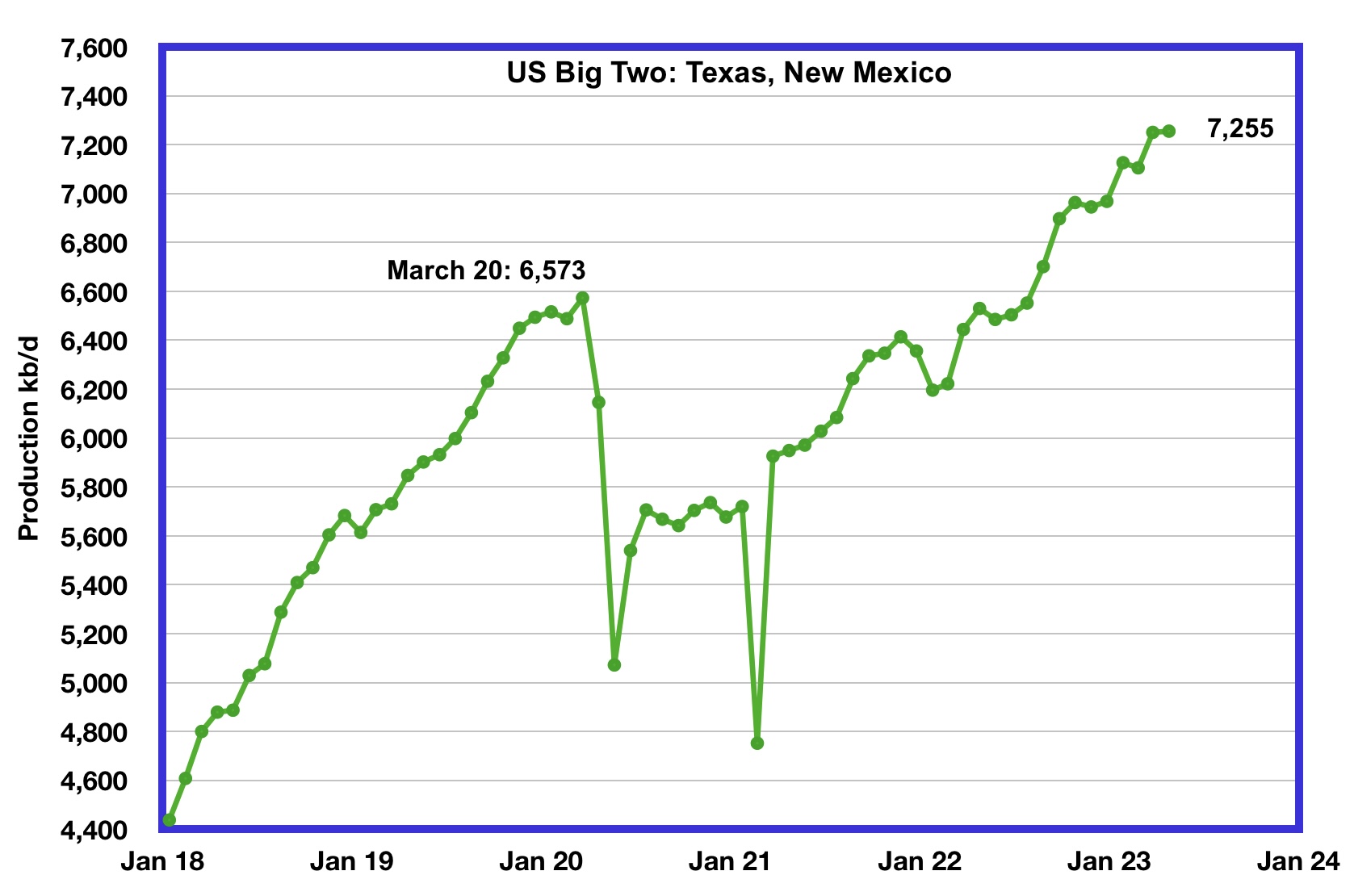

The Big Two states’ combined oil output for Texas and New Mexico.

April’s production in the Big Two states increased by a combined 5 kb/d to 7,255 kb/d with New Mexico contributing 19 kb/d while Texas dropped by 14 kb/d.

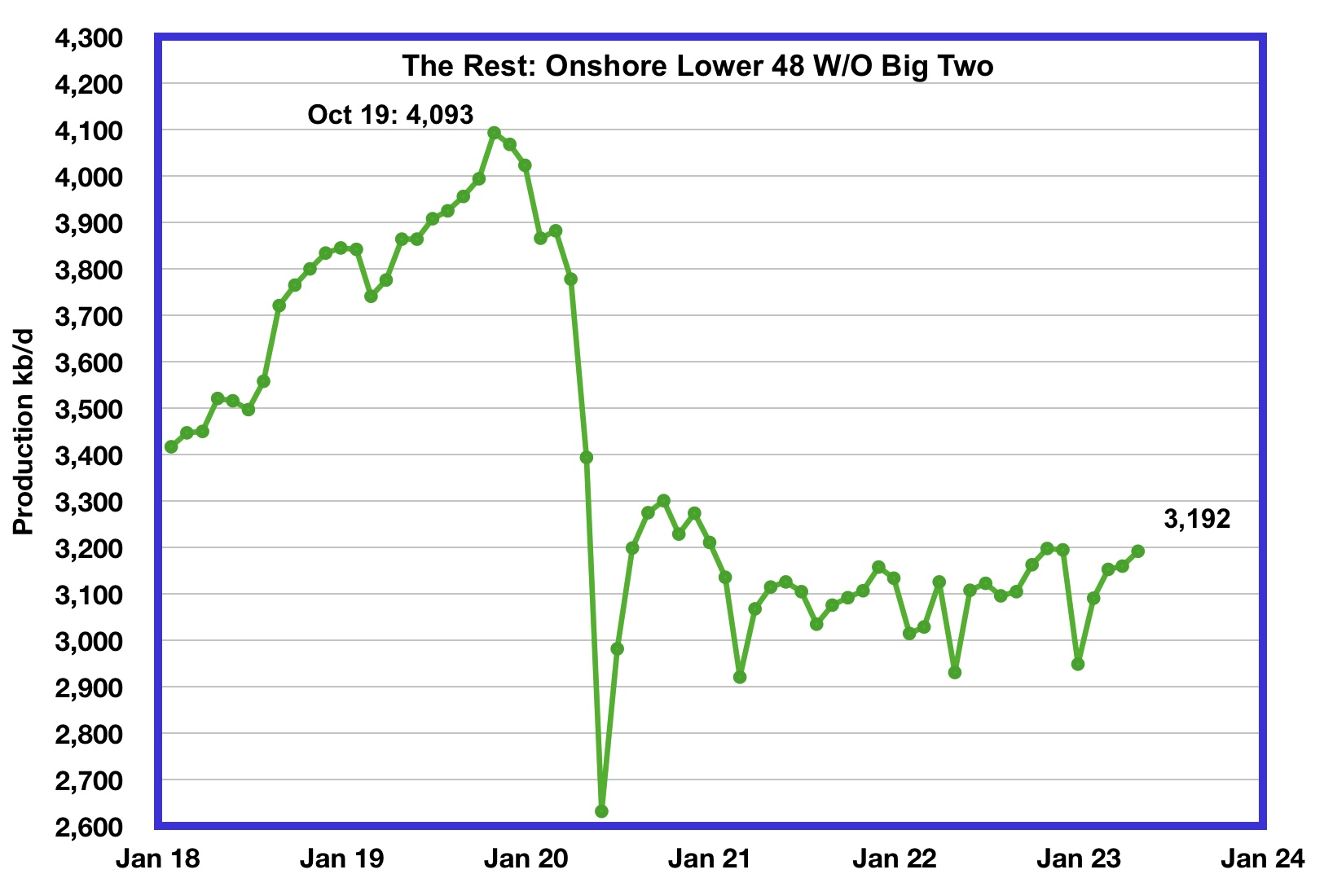

Oil production by The Rest

April production in The Rest rose by 32 kb/d to 3,192 kb/d. From May 2021, oil production in The Rest has been range bound between 3,000 kb/d and 3,200 kb/d and has not given any clear indication of being in decline or rising.

The main takeaway from The Rest chart is that current production is 901 kb/d below the high of October 2019. The question that needs answering is “Is this a permanent loss that will never be recovered?” All indications continue to be that this is a permanent loss.

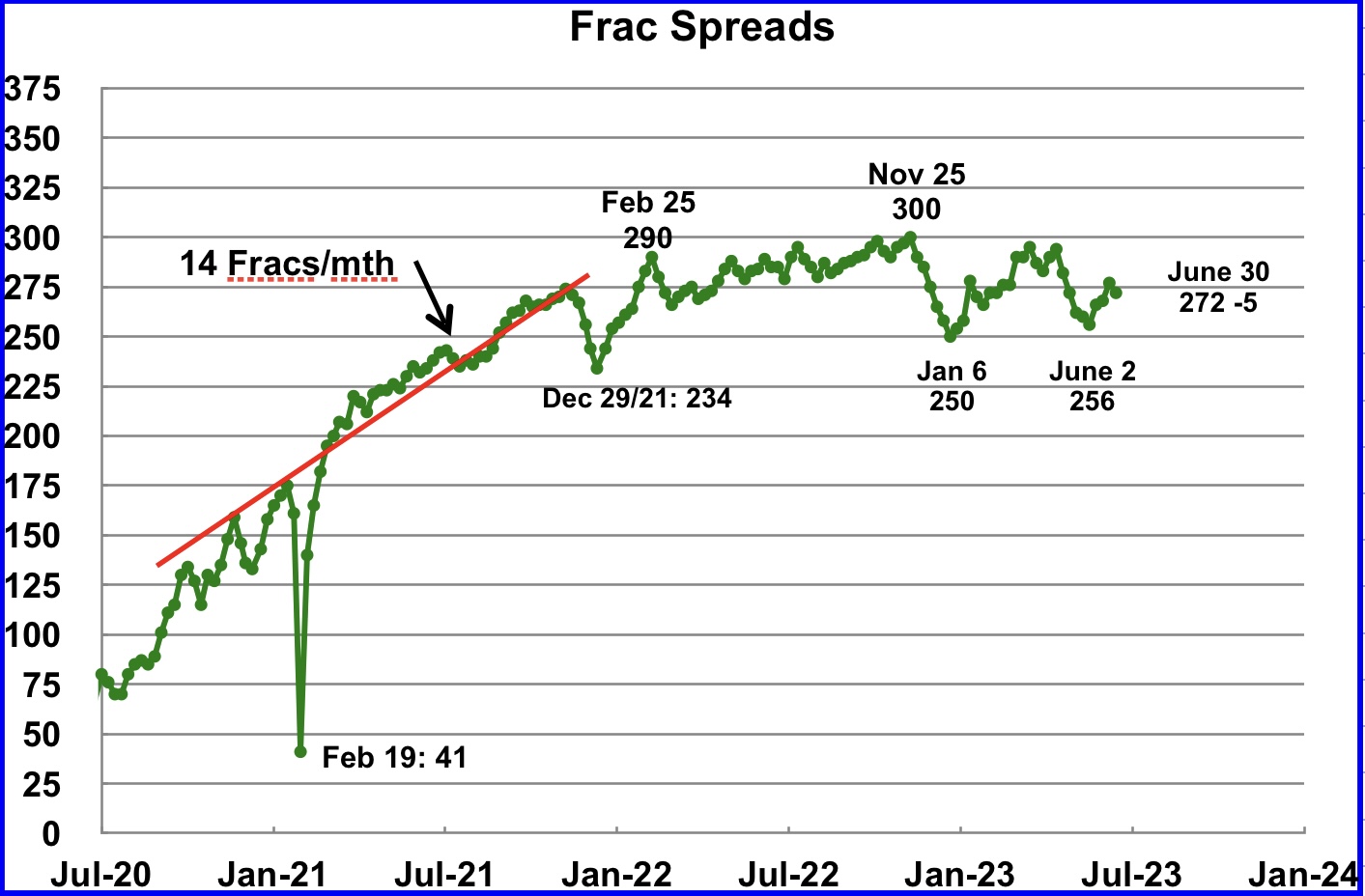

Weekly Frac Spread Count

Since January 2022, the frac spread count has wandered between 250 and 300 fracs per week. For all of 2022 the average weekly frac count was 280.

Frac spreads have been rising from the low of 256 in the week ending June 2 and rose to 277 in the week ending June 23. For the week ending June 30, the frac count dropped by 5 to 272 and is down 28 from the high of 300 in November 2022. The current count is slightly lower than the 2022 average of 280 frac spreads per week.

Note that these 272 frac spreads include both gas and oil spreads.

Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The June DPR report forecasts production to July 2023 and the following charts are updated to July 2023. The DUC charts and Drilled Wells charts are updated to May 2023.

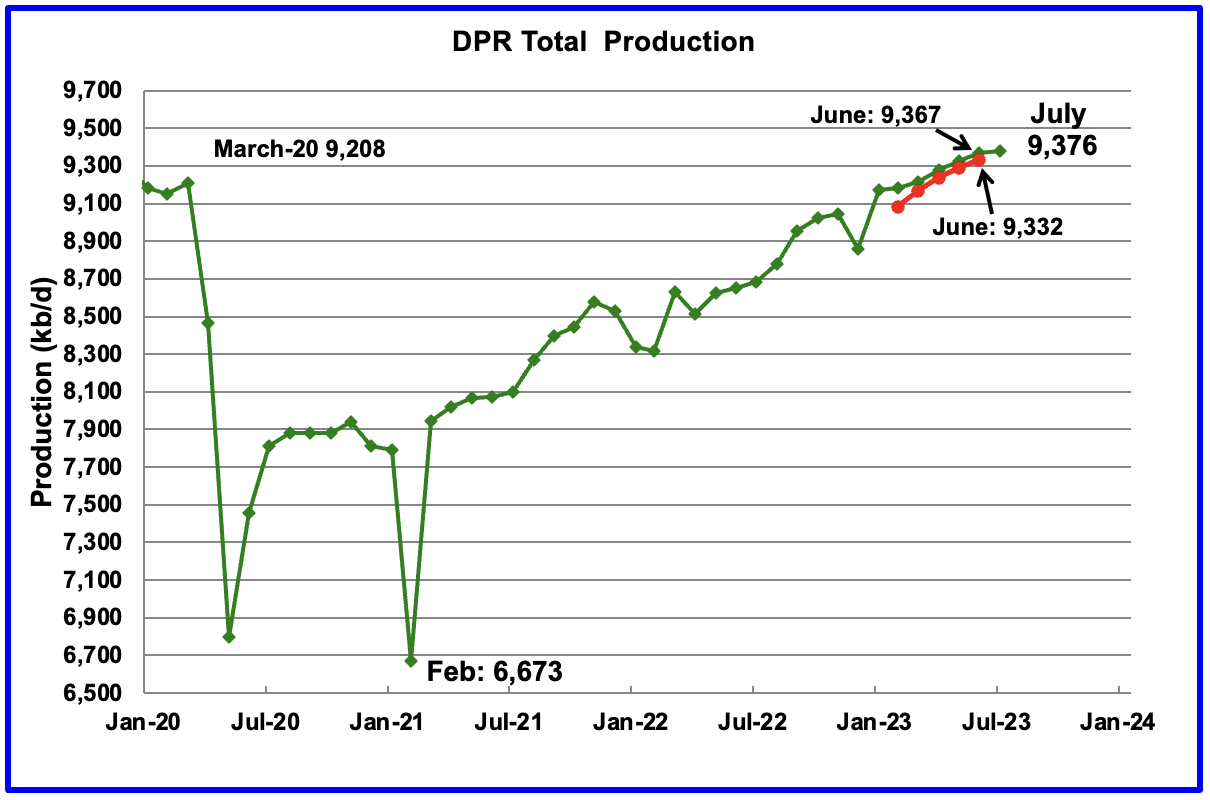

Above is the total oil production projected to July 2023 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The June DPR production report increased/revised production over the last few months by roughly 35 kb/d to 45 kb/d over the May report. For instance, June output in the May report, red markers, was revised up by 35 kb/d from 9,332 kb/d to 9,367 kb/d. The DPR is projecting that oil output for July 2023 will increase by 9 kb/d to 9,337 kb/d, a new all time high. However the monthly increase was the smallest since last February when production increased by 13 kb/d and continues the rolling over/plateauing production trend that began six months ago. Also see next chart.

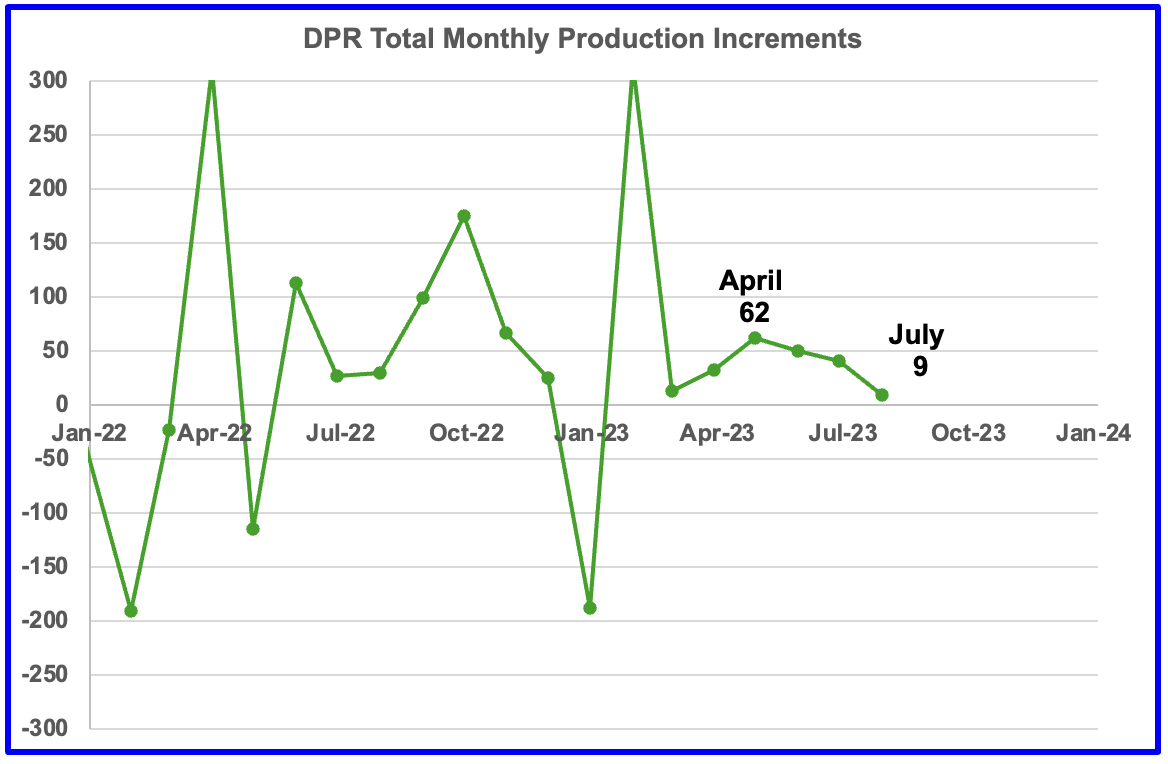

This chart shows the DPR total production increments tracked on a monthly basis. What is notable is the reduced month to month volatility since February 2023. The January 2023 spike is due to the weather related December oil production drop.

The more interesting trend to notice is the declining monthly changes in the production rate. April’s production increase was 62 kb/d while July’s increase dropped by 53 kb/d to 9 kb/d. This short term production rate trend is hinting at an upcoming plateau in Permian production, since it is the dominant producer.

The issue is whether this slowing trend is the result of management’s decision on how to deploy its revenue, investors vs production increase, or is it related to geology, fewer Tier 1 locations along with the Permian gassing out and last but not least the current price of WTI, bouncing around $70/b?

This source suggests that management has decided on how best to deploy its revenue, i.e. less drilling:

“Muted increases in U.S. oil production and cuts by the OPEC+ producing-nations group will limit crude supply in the months ahead, pushing up prices, an executive at U.S. shale producer EOG Resources (EOG.N) said on Wednesday.

U.S. energy firms have cut domestic oil and gas drilling activity to the lowest level since April 2022 with declines from Texas to Pennsylvania. Analysts expect further cuts this year with oil and gas prices off from last year’s strong levels.”

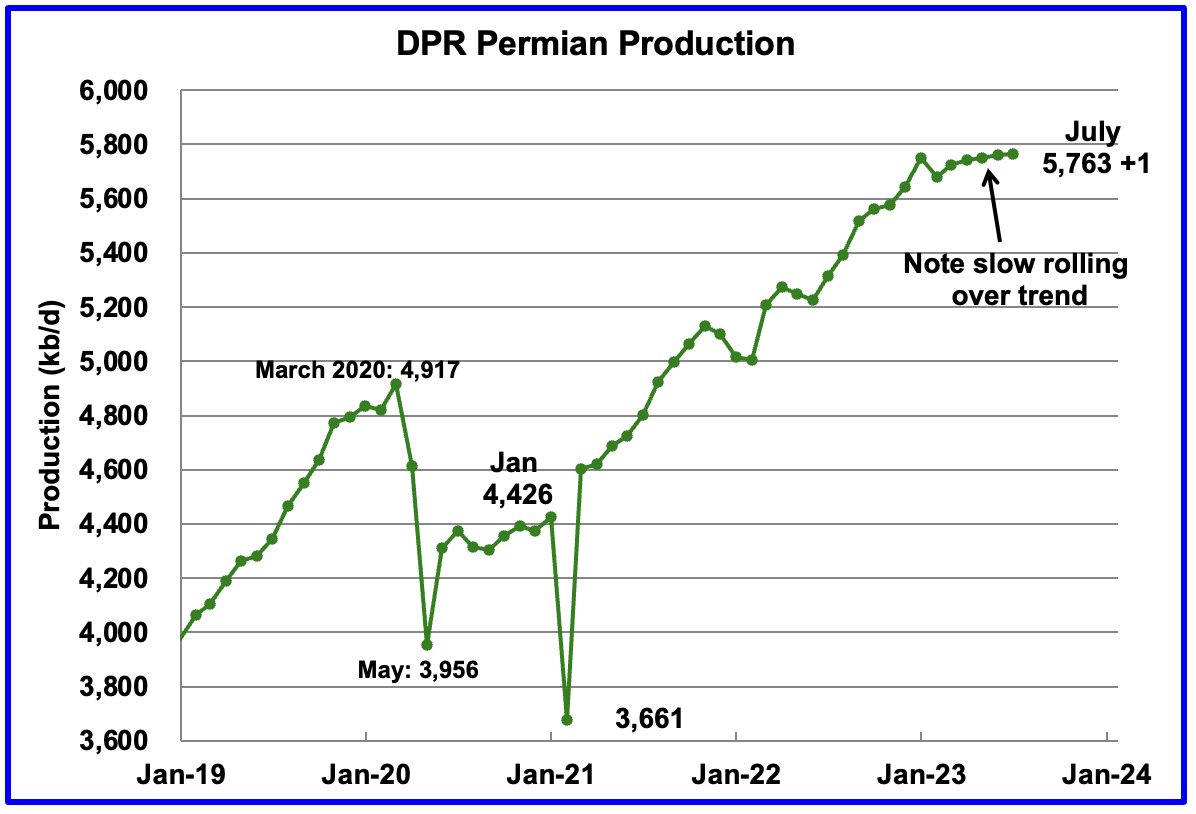

Permian output continues to rise in July. It is expected to increase by 1 kb/d to 5,763 kb/d. The last six months of production data clearly shows a slowing in monthly production increases, similar to the trend noted above for the total production for the DPR regions.

July’s output is 846 kb/d higher than the pre-pandemic high 4,917 kb/d.

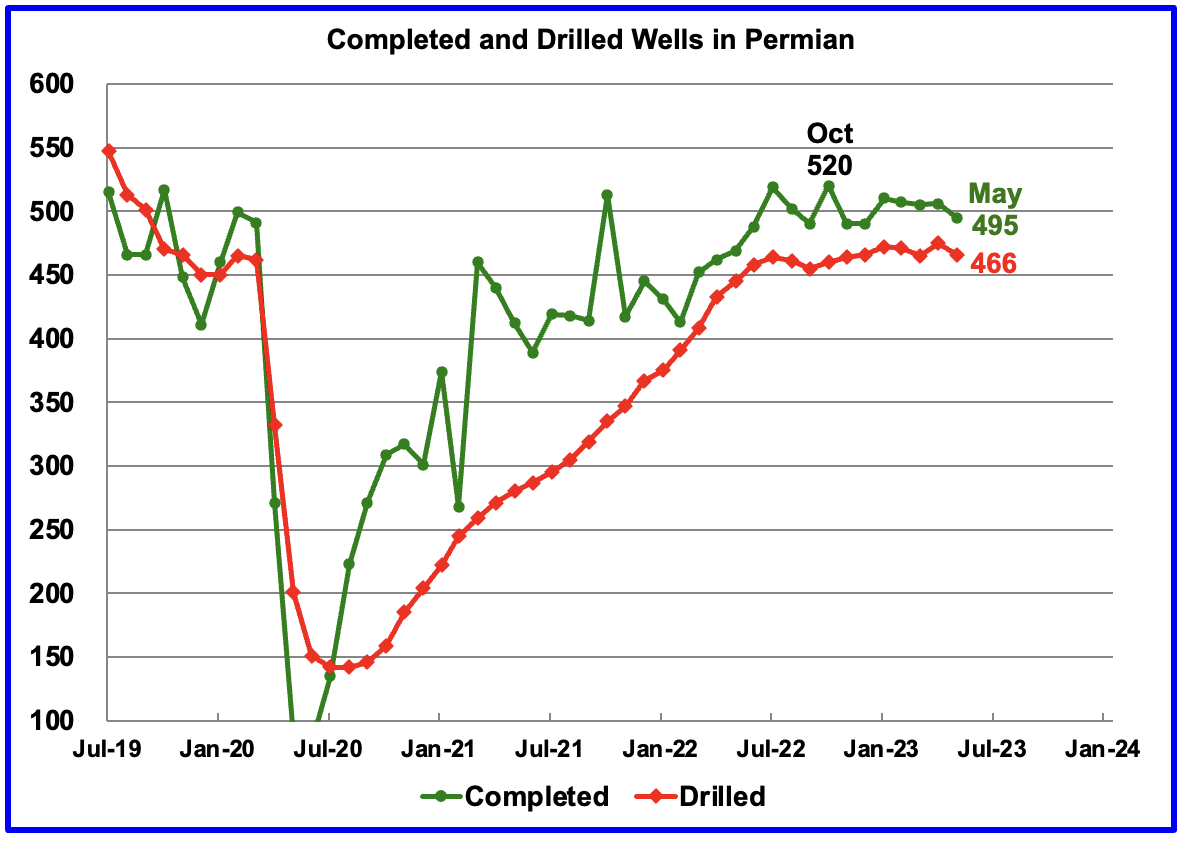

During May, 466 wells were drilled and 495 were completed in the Permian. (Note that May is the latest month for DUC information). The completed wells added 368 kb/d to May’s output for an average of 744 b/d/well. The overall decline was 359 kb/d which resulted in a net increase for Permian output of 9 kb/d. Of the 495 completed wells, 483 were required to offset the decline.

Note: The additional 12 wells over those required to offset decline only added 9 kb/d to overall production in May, less than 1 kb/d per well.

A more detailed review of production in the Permian is included in the Goehring and Rozencwajg section further down.

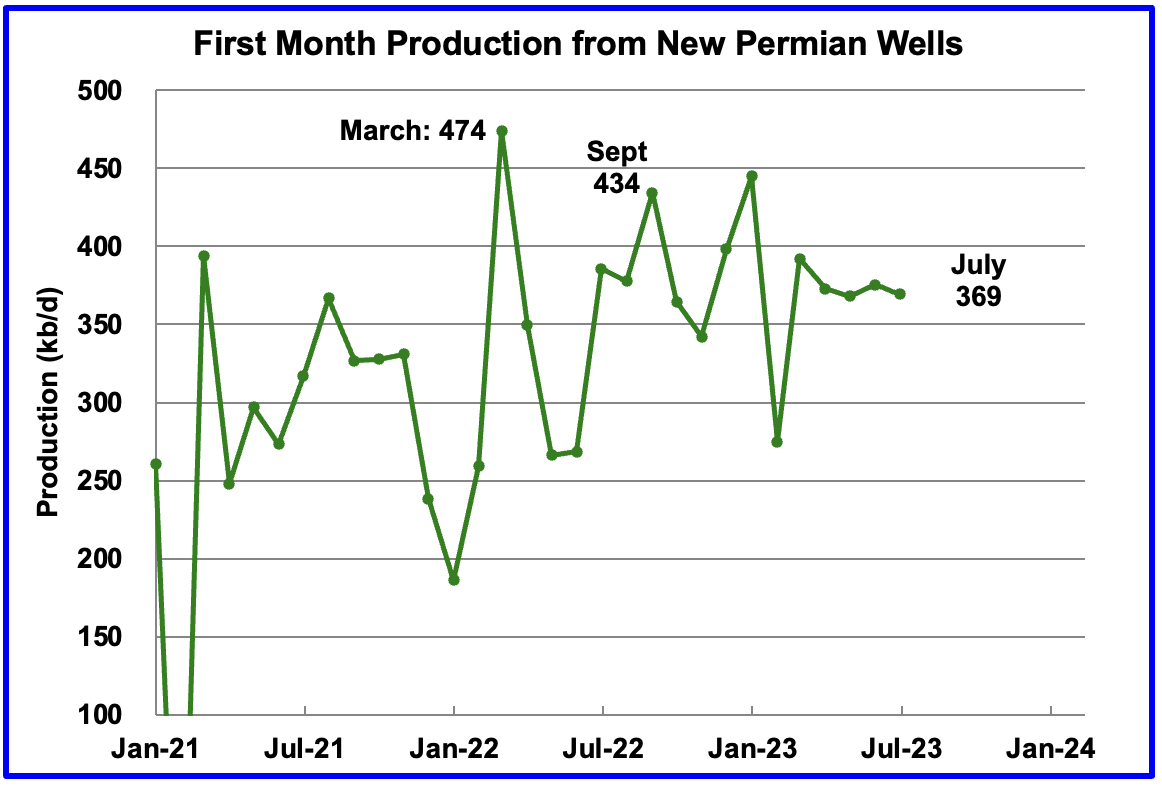

This chart shows the average first month total production from Permian wells tracked on a monthly basis. The total monthly production from the newest Permian wells in July continues to be at the 370 kb/d level. Production has bounced around 370 kb/d for the last four months. To achieve that production level in July, drillers probably completed a few more wells than were drilled, based on historical drilling and completion data up to May 2023.

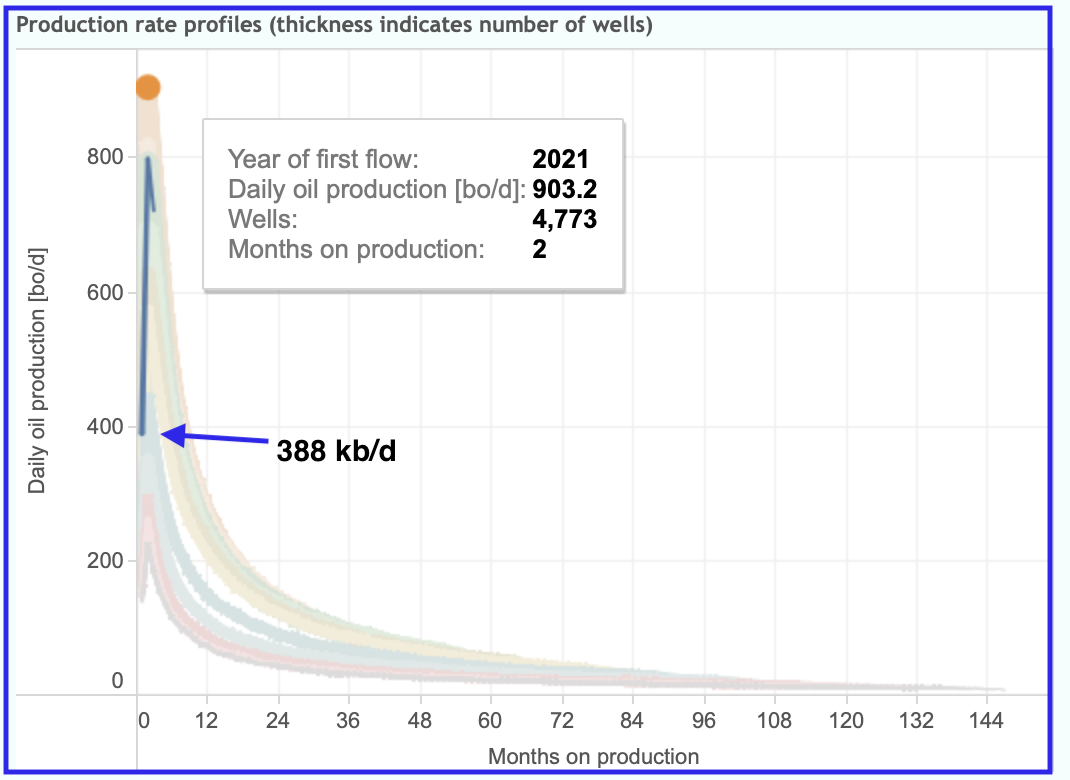

The first month DPR production rate of 369 kb/d is very close to that published by Novi Labs in the April 2023 Permian production update. See next chart.

This chart taken from Novi Labs shows that the average first month flow rate of 2023 Permian wells is 388 kb/d, blue graph, which compares well with the DPR July estimate of 369 kb/d shown in the previous chart.

Of greater interest may be the peak production rate for the 2021 wells, 903.2 kb/d, orange marker, compared to the high point of the blue graph. Peak production in the second month for the 2023 wells is 797 kb/d vs 903 kb/d for the 2021 wells, a drop of 106 kb/d.

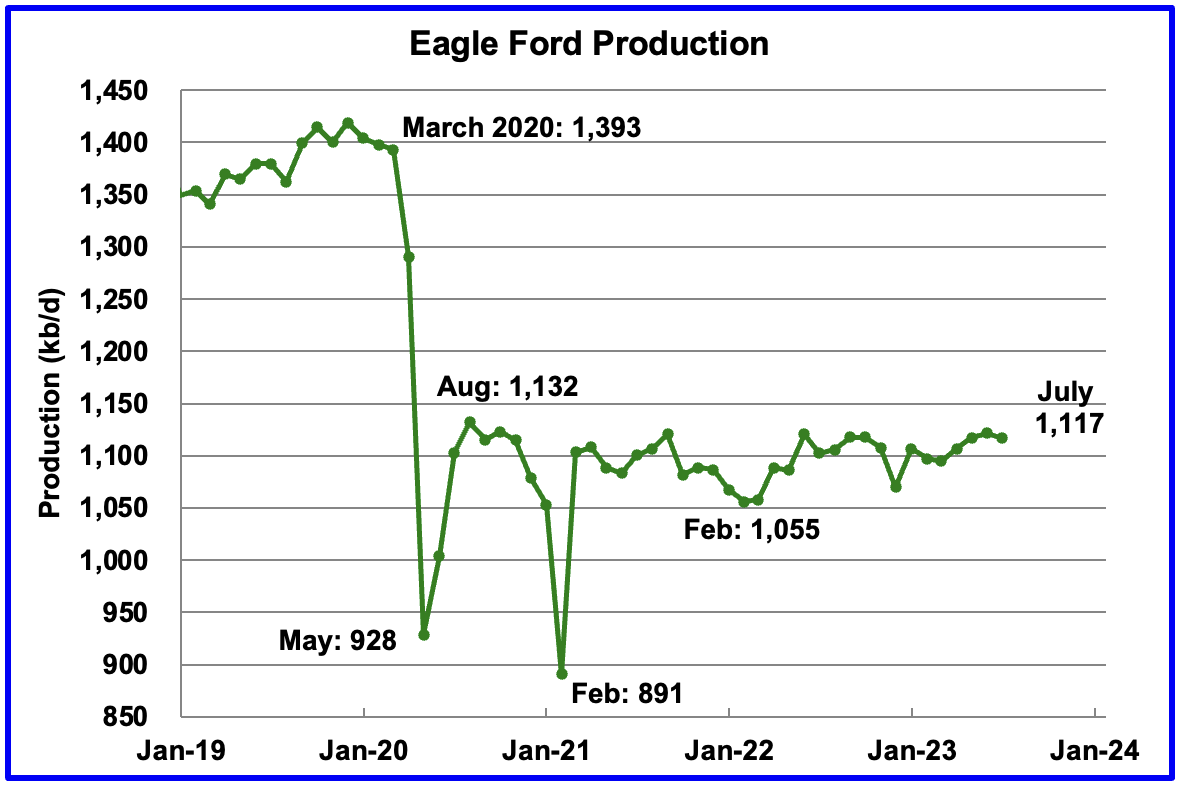

Output in the Eagle Ford basin has been in a generally flat trend since March 2021, fluctuating over a range of between 1,050 kb/d to 1,150 kb/d. July’s forecast output is little changed and is expected to decrease by 5 kb/d to 1,117 kb/d.

At the beginning of the year 2023, 68 rigs were operating in the Eagle Ford basin. The rig count began to drop in mid March to 60 and dropped further to 58 in Mid June.

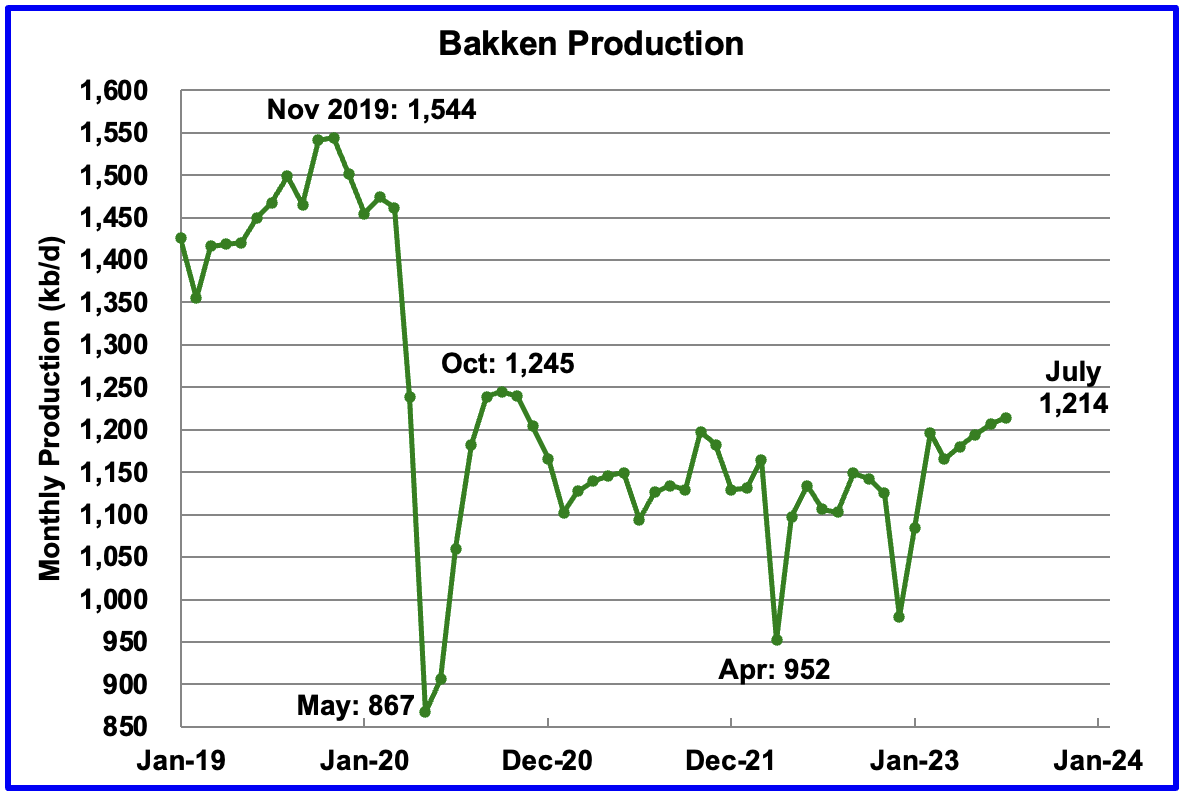

The DPR forecasts Bakken output in July will be 1,214 kb/d an increase of 7 kb/d over June.

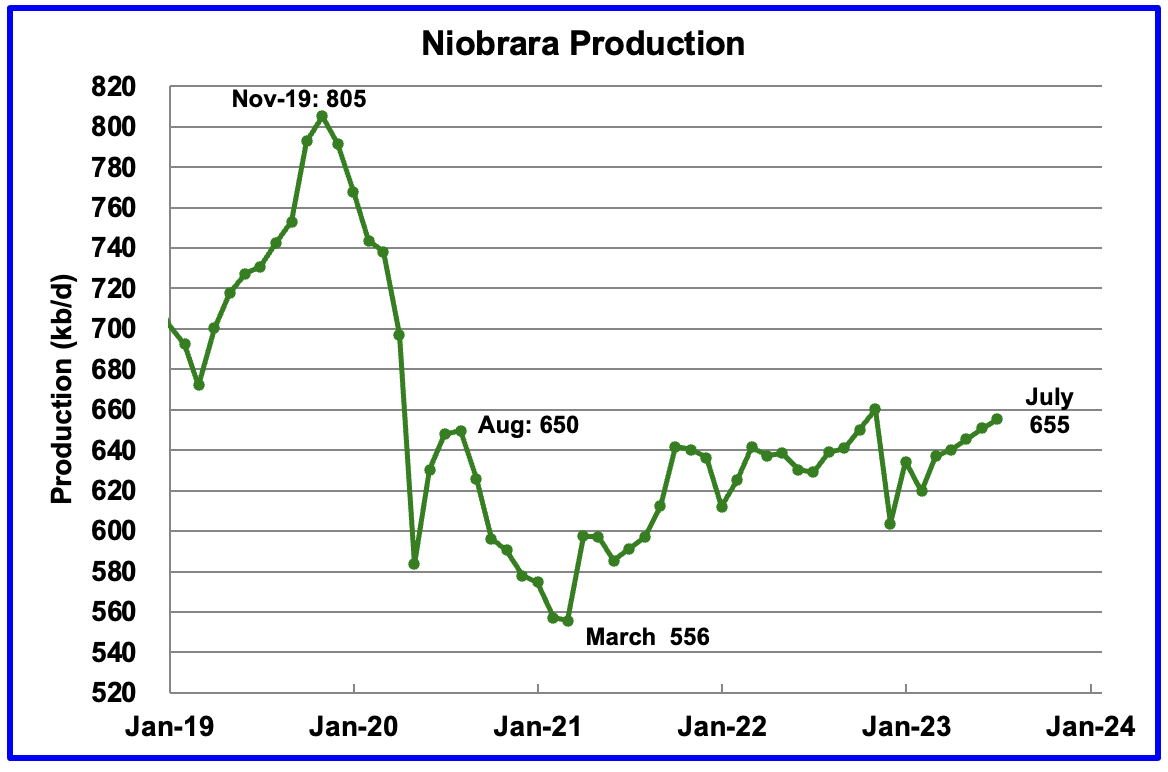

Output in the Niobrara continues to increase slowly. July’s output increased by 4 kb/d to 655 kb/d.

Production increased due to the addition of rigs into the basin but stabilized at 16 ± 1 rigs in March and April. However in May and June the rig count dropped to 13.

DUCs and Drilled Wells

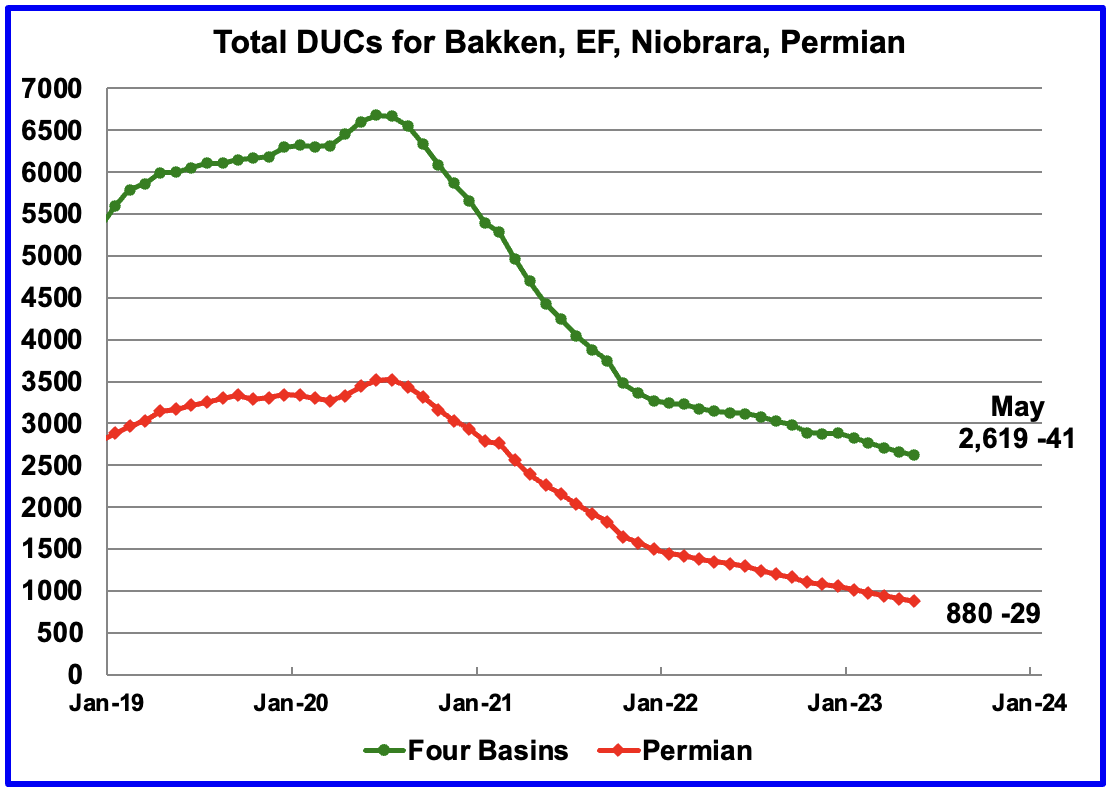

The number of DUCs available for completion in the Permian and the four major DPR oil basins has fallen every month since July 2020 and continued to decrease in May. May DUCs decreased by 41 to 2,619. The biggest decrease came from the Permian where DUCs decreased by 29 while Bakken DUCs dropped by 10, Eagle Ford by 8 and the Niobrara added 6.

May Permian DUCs decreased by 29 to 880 because 466 wells were drilled and 495 were completed.

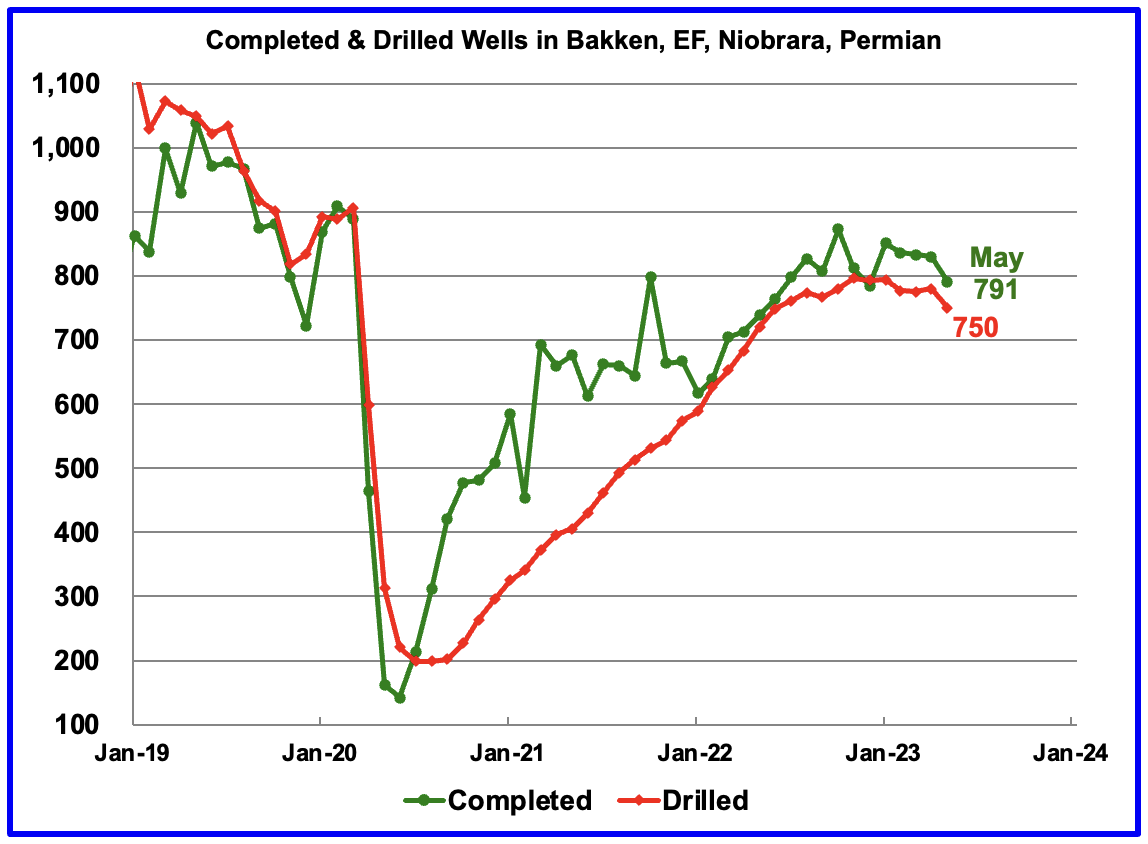

In these 4 basins, 750 wells were drilled while 791 were completed for a net decrease of 41 DUCs in May. Both drilled wells and completions are down from higher levels in late 2022.

In the Permian, the monthly completion rate has been showing signs of slowing since the October high of 520 but May showed a large drop. This is consistent with the frac spread chart shown above where there has been slow growth in frac spreads since February 2022 and then a sharp drop starting in April. The number of wells drilled in the Permian is now showing signs of plateauing in the 465 to 470 range.

In May 495 wells were completed, a decrease of 11 since April. During May, 466 new wells were drilled, a decrease 9. The gap between completed and drilled wells in the Permian has now opened up by 29.

The Permian, as of May, had 880 DUCs remaining and the completion rate was 495 wells/mth. This means that the current cycle time between drilling and completions is 1.77 months or 54 days.

Comment on 2023.Q1 Goehring and Rozencwajg Report

This report starts with the following two paragraphs which is a summary of what the authors believe.

“Conventional oil production has now unequivocally rolled over. Unconventional production, the only source of growth in global oil supply over the last 12 years, has also significantly slowed. The only growing non-OPEC basin is the Permian in West Texas. Never before has oil supply growth been so geographically concentrated. Six counties in West Texas are now 100% responsible for all global production growth.

Conventional non-OPEC oil production peaked in 2007 at 46.2 mm b/d and now stands at 44.2 mm b/d – 4% below its peak. Including OPEC, conventional global output peaked in 2016 at 84.5 mm b/d and now stands at 81.3 m b/d – 5% below its peak. Even if OPEC has its alleged 4 mm b/d of unused production capacity (something we do not believe), conventional production would barely regain its 2016 peak.”

The authors of the G & R report clearly distinguish between the peaking of “Conventional oil” and the slowing in the growth of “Unconventional oil”, such as LTO and deep offshore, in the above two statements. Below are production charts for six counties that are powering production growth in the Permian and provide some insight on whether they are close to peaking/plateauing.

What is perplexing in the second paragraph is that the authors do not believe that OPEC has 4 Mb/d of unused capacity. They do not state what level of spare capacity OPEC has, 2Mb/d, maybe?

Permian Basin

The authors have a major section regarding the Permian in the report. Charts and data from another source are presented below to show the source and state of Permian production today.

“Our models tell us the Permian will ultimately recover 34 bn barrels of oil, of which 14 bn or 41% have already been produced. At current production levels, the Permian will have produced half its recoverable reserves sometime in late 2024; at this point, it will most likely stop growing, just like the other two basins.

The authors believe that Hubbert’s theory can be applied to the LTO basins and that once the Permian has produced half of its recoverable resources by late 2024, production will have peaked and begin to roll over.

Below are charts for six Permian counties which have the highest oil production along with strong gas production. Two are in New Mexico and the other four are in Texas .

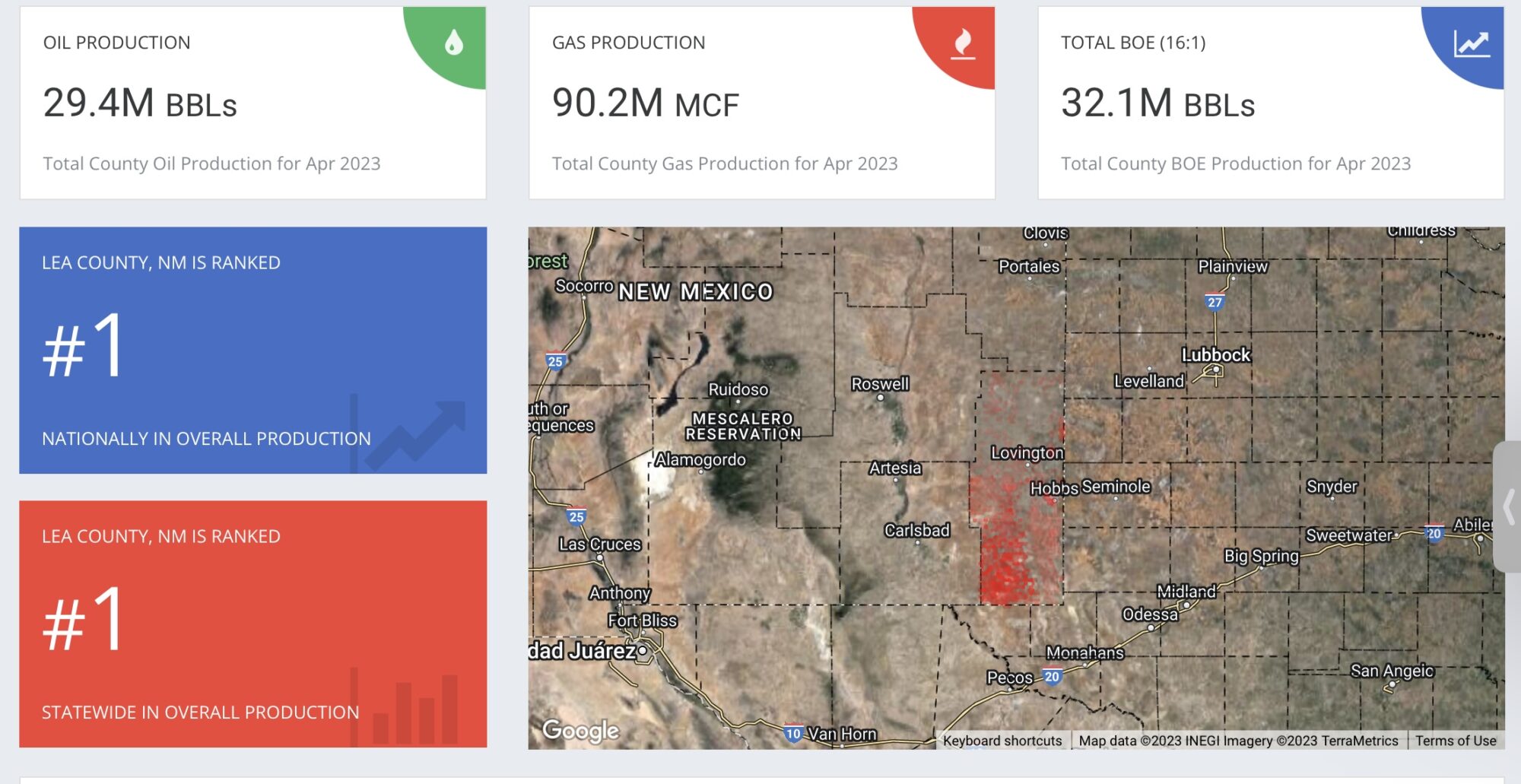

This table was taken from Shalexperts and it lists the top oil producing counties in New Mexico in April 2023. Lea and Eddy are the two largest oil producing counties in the Permian. According to the table, the daily production rate for Lea county in April was 943 kb/d. Novi Labs shows a production rate of 924 kb/d for March.

The combined production rate for the Lea and Eddy counties is 1,633 kb/d. As shown in the New Mexico production chart above, C + C production in April was 1,857 kb/d. It is not clear if the crude production numbers in this table include condensate, which may account for the difference of 224 kb/d between the two estimates. These two counties account for 98% of New Mexico’s oil production. Note the production gap between Eddy county, #2, and San Juan county, #3.

To clarify the condensate question, this picture from the same source above shows an equivalent BOE of 32.1 M barrels. The normal conversion for NG to BOEs is 6000 ft^3 equals 1 BOE. So the 90.2 MCF equals 1,500,000 barrel of oil for a total of 30.9 M barrels, which is 1.3 M barrels lower than shown above. Can someone clarify.

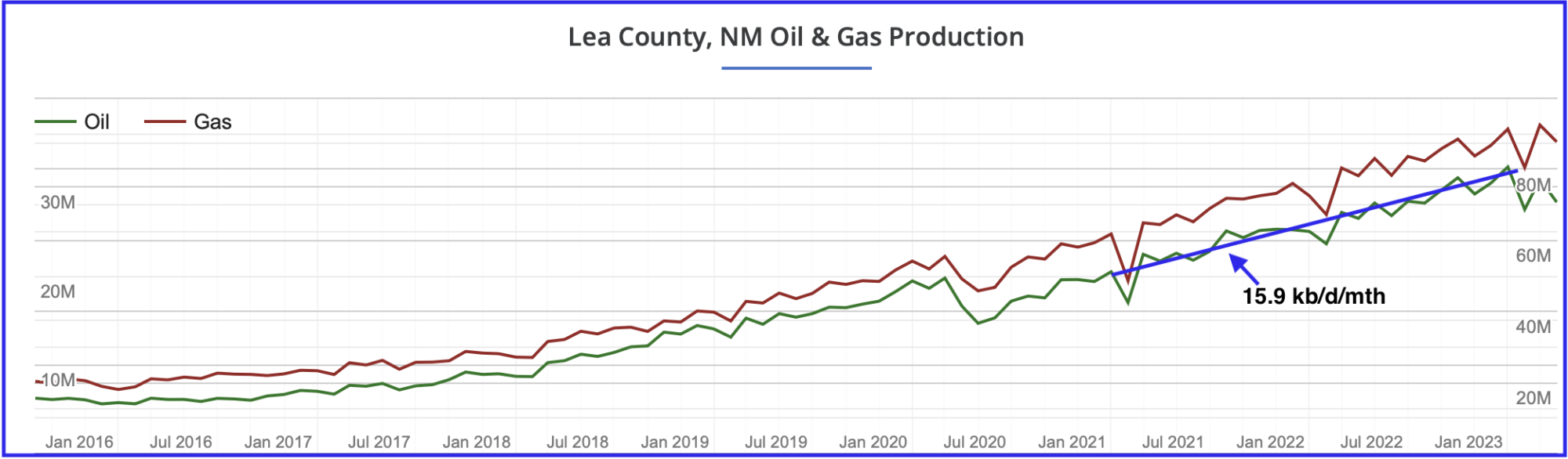

Lea County oil and NG production profile. No sign of peaking up to January 2023 and oil and NG production are rising in parallel. A two point analysis was used to estimate the rate of production increase from January 2021 to January 2023. Over that period production increased at an average rate of 15.9 kb/d/mth.

Comparing the last four oil and gas data points in the chart, January to April, there is a hint that Lea county oil production may have crossed into the bubble point phase because gas output made a new high while oil production dropped. A few more months of data will be required to confirm the production uptrend has stopped and production has entered the bubble point phase.

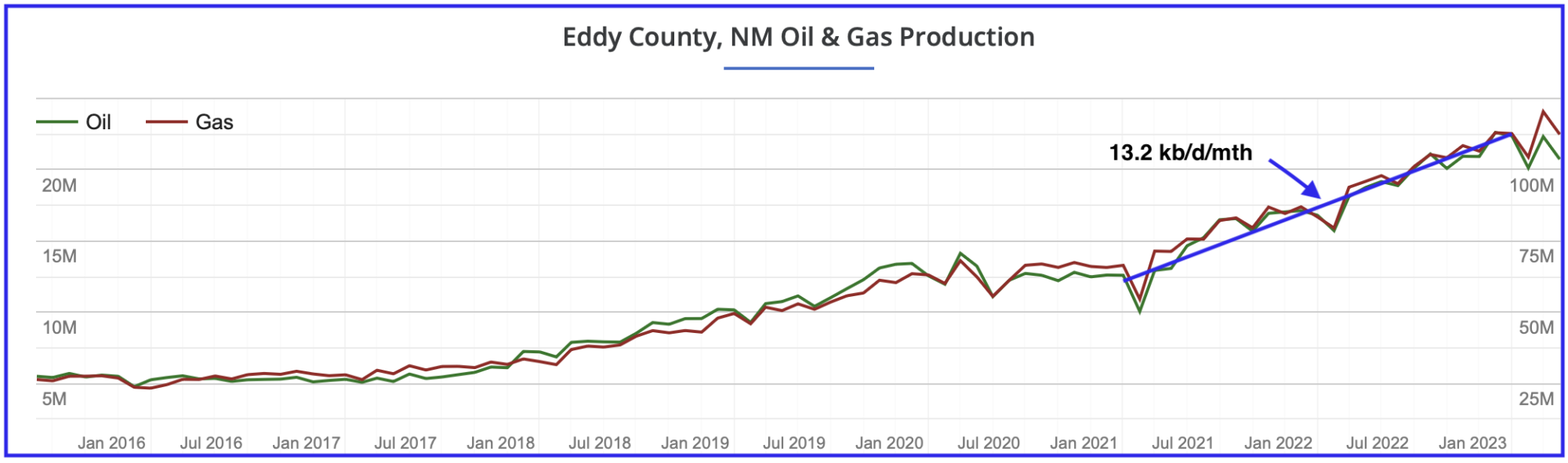

Eddy County oil and NG production profile. No sign of peaking up to January 2023 and oil and NG production are essentially overlapping. A two point analysis was used to estimate the rate of production increase from January 2021 to January 2023. Over that period production increased at an average rate of 13.2kb/d/mth.

As with Lea county, the last four data points in the Eddy chart, January to April, indicate that it may also have crossed into the bubble point phase because gas output made a new high while oil production dropped a bit.

Putting an OLS line through the same period, January 2021 to January 2023, for New Mexico production gives a slope of 29.4 kb/d/mth. Adding the two slopes for Lea county and Eddy county gives a slope 29.1 kb/d/mth. Essentially these two counties account for all of the production growth in New Mexico.

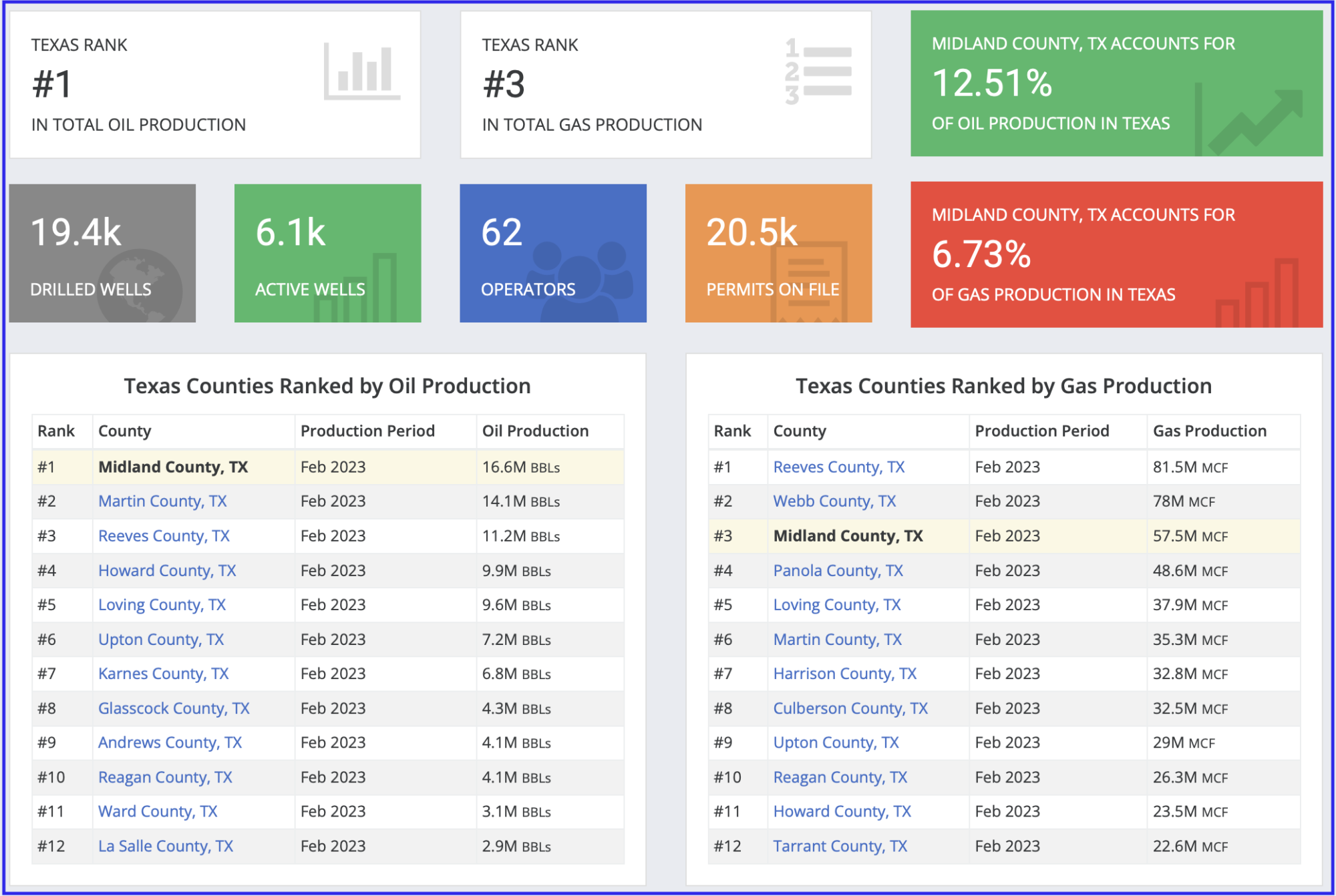

This table was taken from Shalexperts and it lists the top oil producing counties in Texas in February 2023. Midland is the largest producing county in the Texas Permian and is ranked number 3 nationally. According to the table, the daily production rate for Midland county in February was 593 kb/d. Cross checking this February production rate with Novi Labs yields a similar rate of 587 kb/d.

Comparing the production rates in the top two New Mexico counties with those in Texas, it is clear that the Lea and Eddy counties are the Ghawars of the tight oil fields. Essentially that means the first clue for Permian peaking will come from noticing when New Mexico’s oil production starts to slowly roll over.

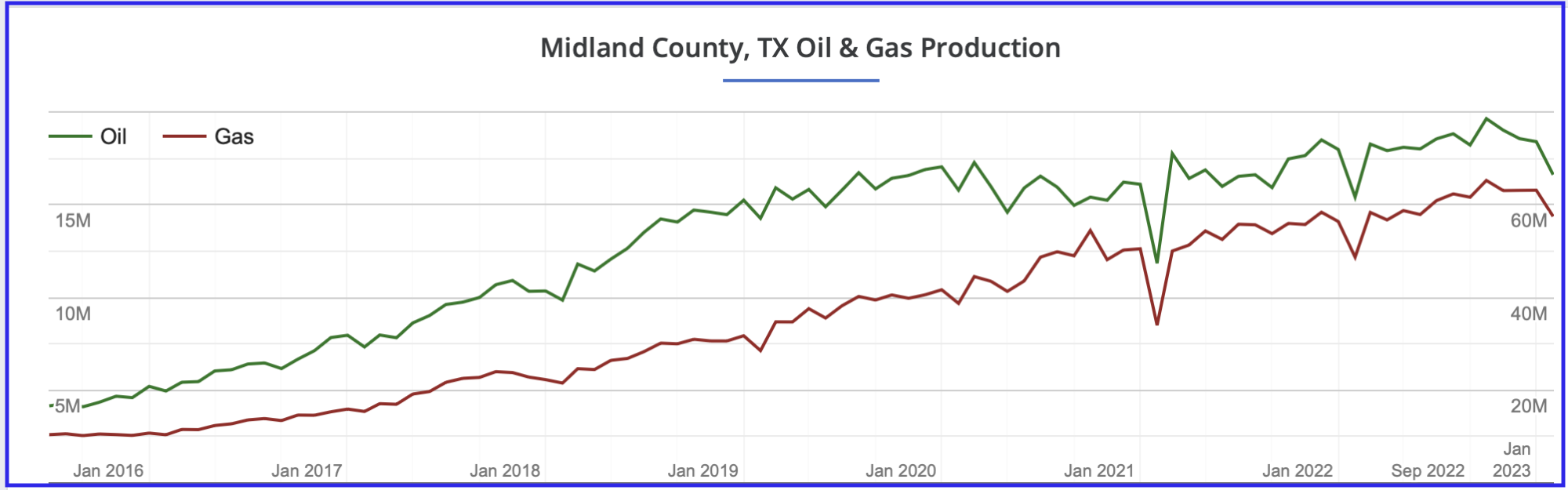

Midland county oil and NG production profile. Comparing the production increase before and after January 2020, it appears that Midland production may be entering a plateau phase starting in 2022. NG’s monthly production appears to increase linearly over the whole period shown.

Note the big drop in oil production over the last four months. This could be mostly due to slow reporting in Texas.

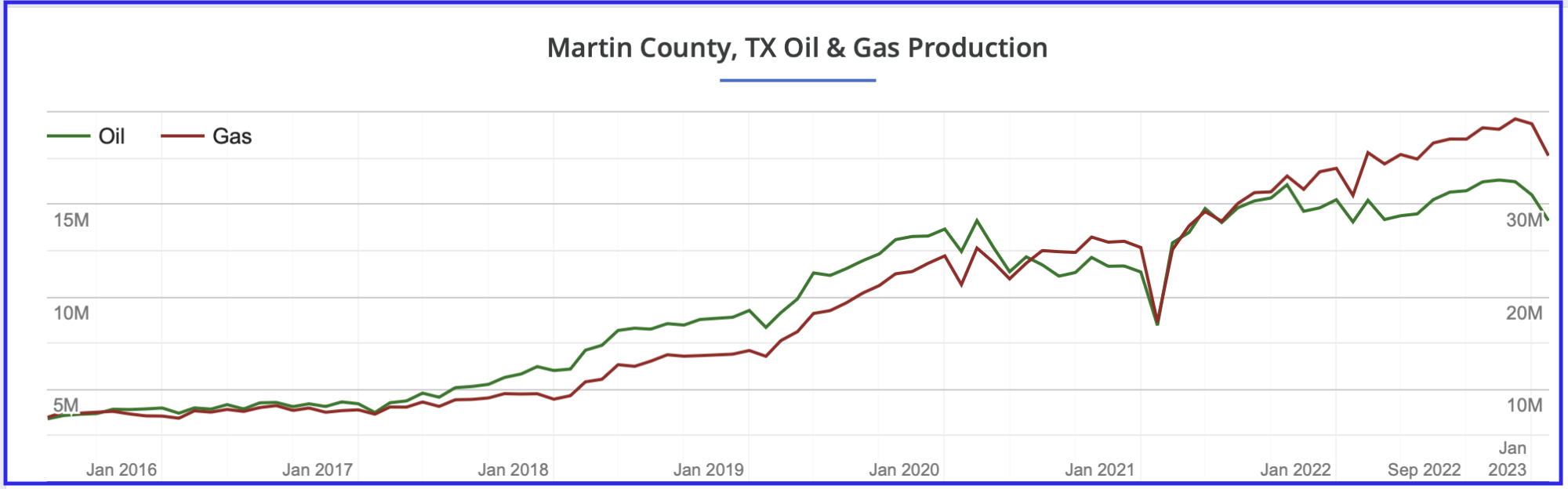

Martin county oil and NG production profile. Since January 2022, oil production has been flat while gas production continues to rise, a clear sign that Martin county is gassing out. Note that the oil graph crossed the NG graph in mid 2020.

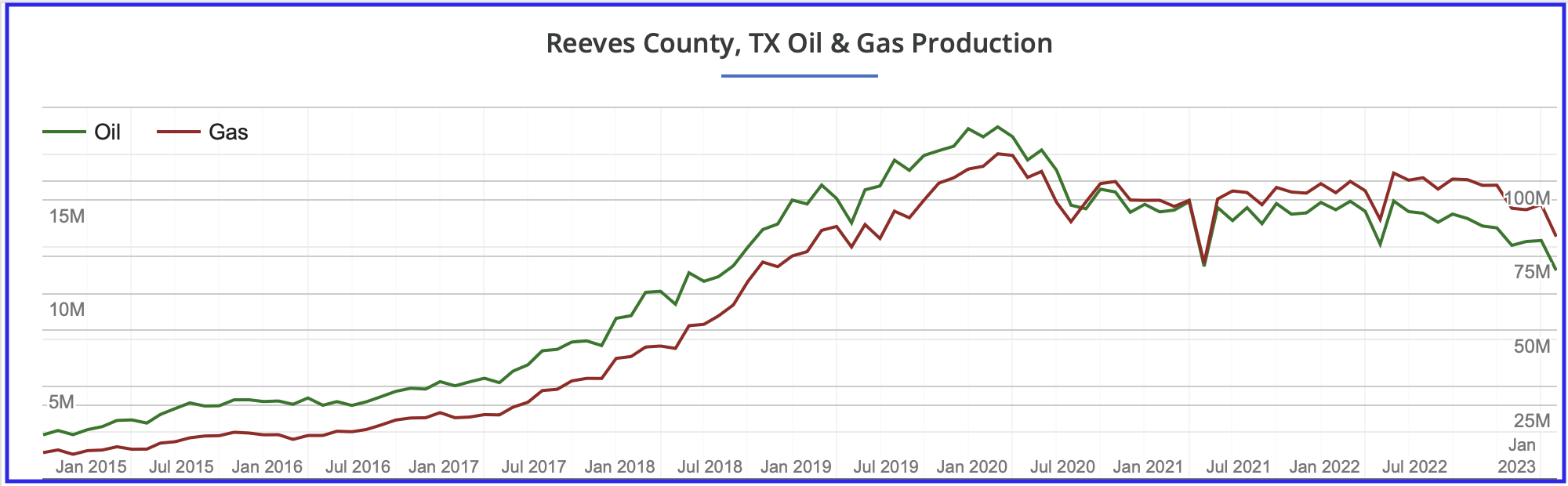

Reeves county oil and NG production profile. Reeves’ county oil production has been in decline since early 2020.

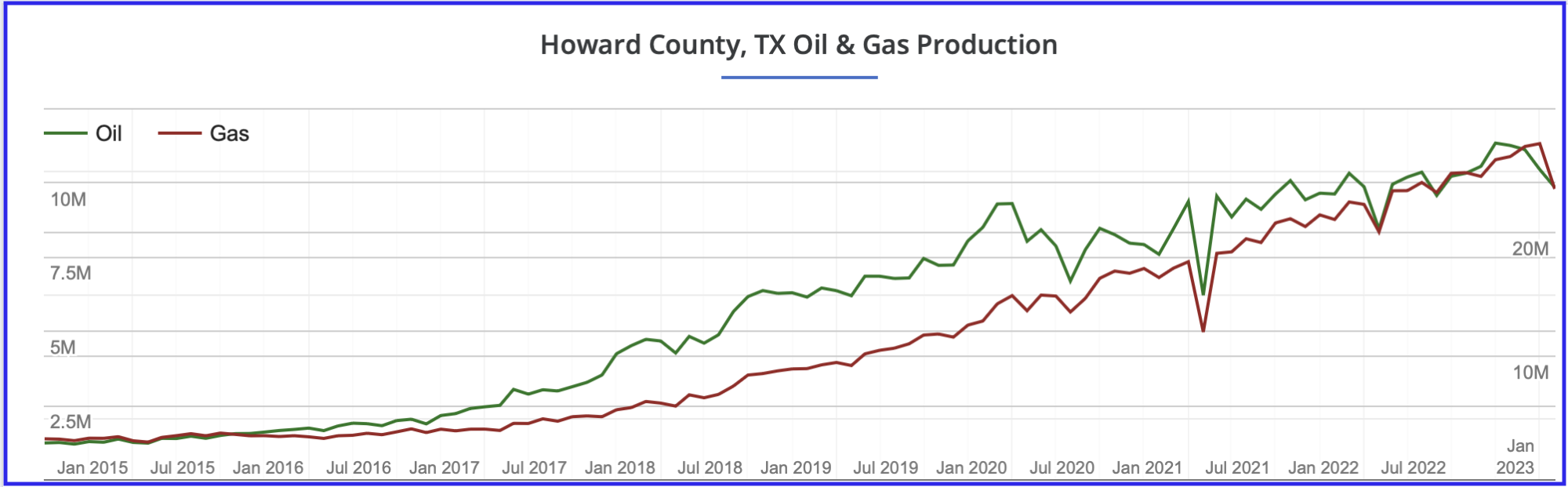

Howard county oil and NG production profile. Howard county’s oil production continues to be on a rising trend.

Permian Summary

The two largest producing counties in the Permian, Lea and Eddy, may be entering a production phase characterized by crossing into the bubble point of an oil field. In Texas, Midland production growth rate is slowing, Martin county is on a plateau, Reeves county is in decline and Howard county’s production continues to rise. Based on the production profile of these six counties, it appears that the Goehring and Rozencwajg report’s forecast that the Permian may peak in the next twelve months has merit.

In addition, it should be noted that in the DPR section above, Permian production growth is slowing and approaching no growth.

Bakken Basin

The G & R report focuses primarily on peaking in the Permian and comments that the Bakken has peaked. For comparison purposes, information similar to that posted above is presented for the Bakken.

This table was taken from Shalexperts and it lists the top oil producing counties in North Dakota in April 2023. The top four counties account for 1,017 kb/d of North Dakota’s 1,102 kb/d production in April.

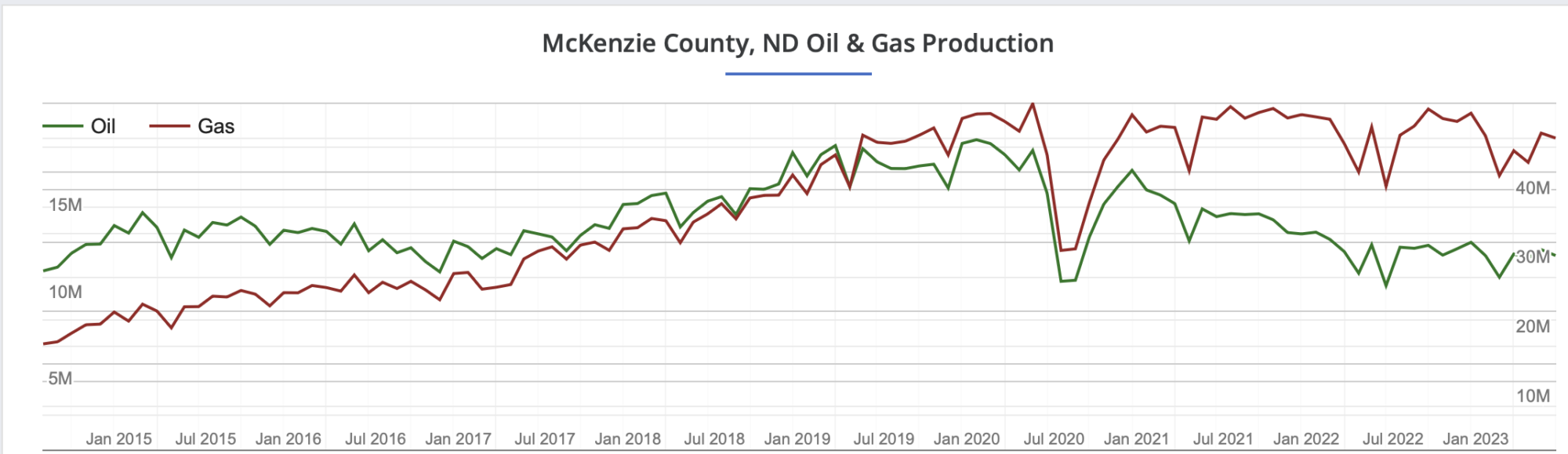

McKenzie county oil and NG production profile. McKenzie county, the number one county in North Dakota, is in decline and appears to be gassing out.

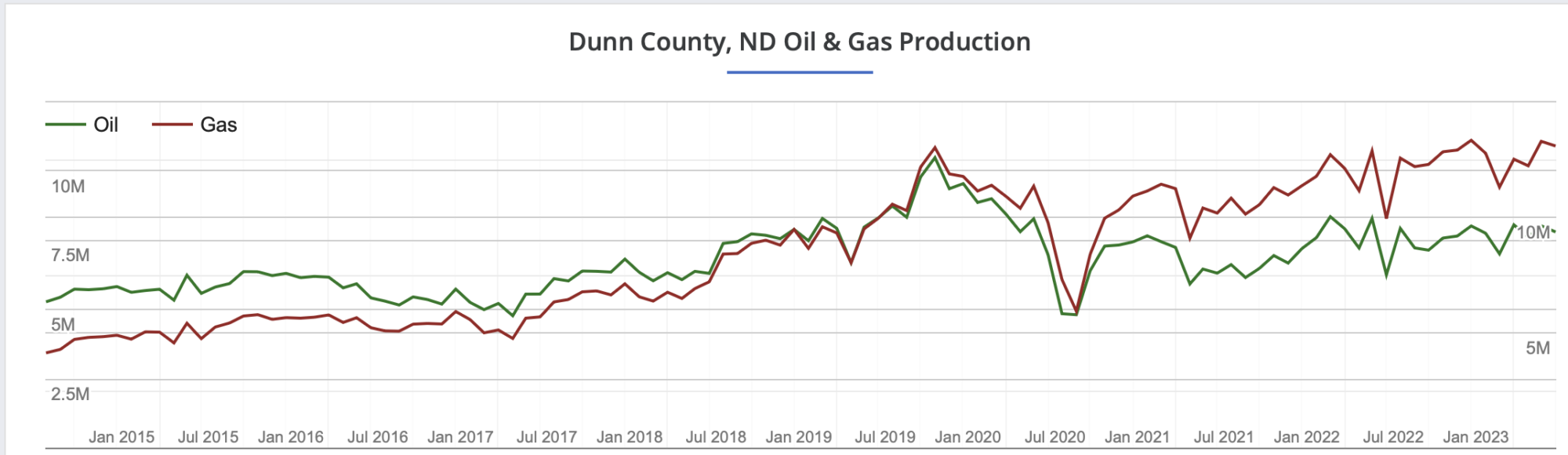

Dunn county oil and NG production profile. Dunn county’s oil production is down from its high in August 2019 and now appears to be on lower production plateau.

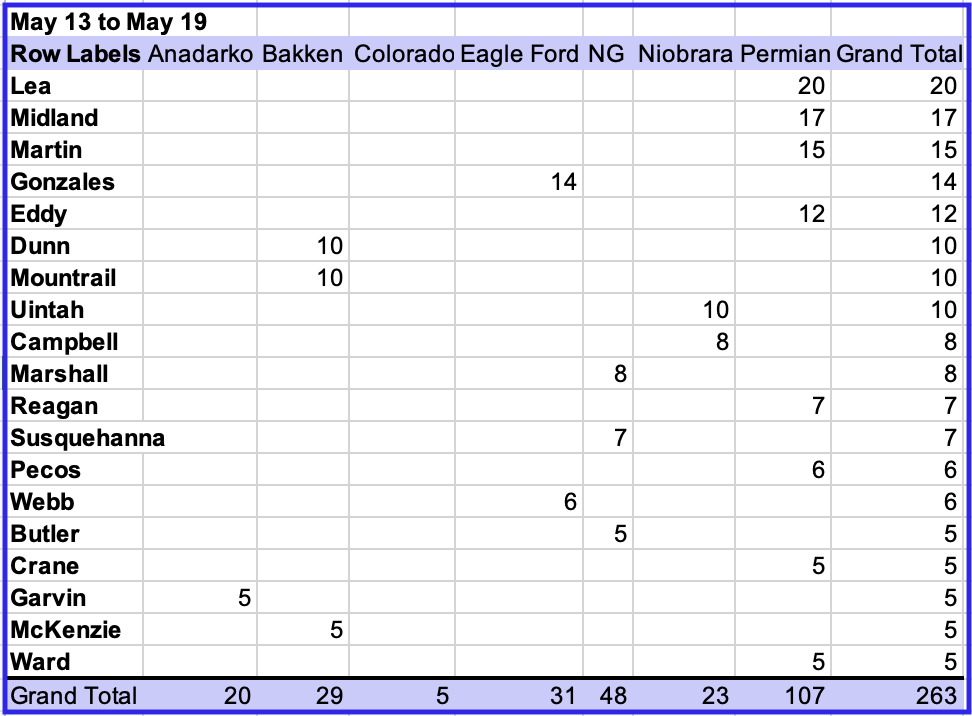

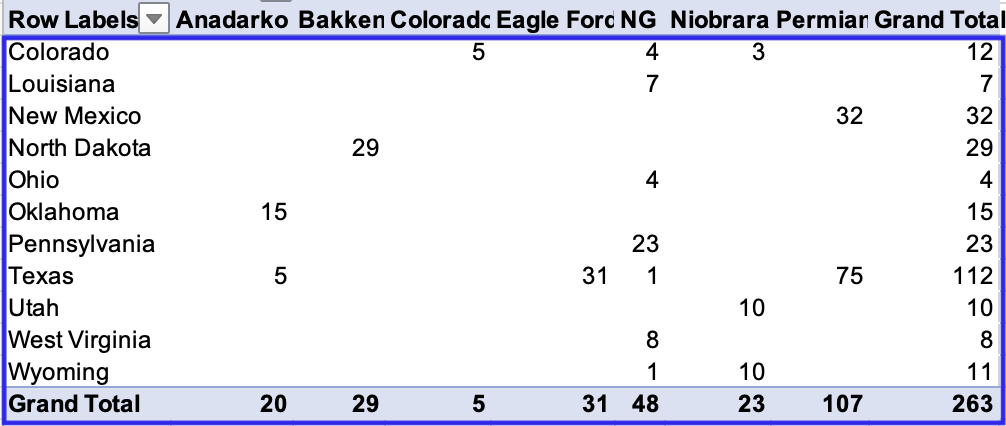

Frac Spread Count by State and County

Below is a breakdown of the frac spread count for the week May 13 to May 19 taken from this source. That is the most complete data set for that week. While information is provided up to the current week, it is incomplete and is updated in subsequent weeks.

This table shows in which counties the most activity was taking place. The table was cut off at 5 frac spreads. The official frac spread count for the week May 13 to May 19 according to this source was 262, while the above table shows 263.

Four of the five top counties are in the Permian. What is different in this table vs a few months ago is that the Permian frac spread count is less than half of the total. Earlier it was more than half. This is another indicator that the production rate in the Permian may be slowing.

It is not clear if the drop in frac count is due to the $70/b price for WTI or the reduced number of Tier 1 sites or management decision to return more cash to investors.

This table shows the distribution of frac spreads between basins and States. The most completion activity is happening in Texas, New Mexico and North Dakota.

298 responses to “GOM Drop Drops US April Oil Production”

As always, most excellent work!

My only, very minor, point would be to have the STEO projections in the first graph in another colour, to not confuse the ones not reading the details so they realize it´s an estimate/guess/projection.

But again, great work!

Laplander

Thanks. Much appreciated.

I agree with you on the colour issue. The problem is that for the last two posts, I have been away from home and have limited capability.

I will be home for the next post and will return to the format I used in the February report which will be consistent with your request.

https://peakoilbarrel.com/small-drop-in-us-february-oil-production/#more-42760

Agree – fantastic post. I particularly liked the link that you had where one can download the Goehring & Rozencwajg pdf

https://info.gorozen.com/2023-q1-hubberts-peak-is-here

Thanks for putting all of this together!

Rgds

WP

WeekendPeak

Thanks. Much appreciated.

Saudi Arabia and Russia to Extend Oil Cuts

Saudi Arabia said Monday that it would extend a cut in oil production of one million barrels a day that it announced in June through at least August, trying to push up what officials view as stubbornly weak oil prices. The Saudis were joined by Russia, whose deputy prime minister Alexander Novak said Moscow would cut supplies by 500,000 barrels in August.

Together, these trims could amount to 1.5 percent of global supplies. Oil prices initially jumped on news of the cuts but later faded.

Oil prices have been under pressure in recent months because of uncertainty about the strength of the global economy as many central banks continue to raise interest rates to stem inflation. There are also doubts about oil’s longer-term future as electric vehicles and other alternatives to consuming oil continue to grow. The Saudis and other members of the producers’ group known as OPEC Plus have been gradually dialing back production since last fall.

There is a lot more to this article. Plus, there are many other articles out there announcing this duel Saudi-Russian cut in production.

Great job Ovi.

The Recent Novilabs report on the Permian sees things a little differently.

https://novilabs.com/blog/permian-update-through-april-2023/

Some excerpts:

Permian tight oil production grew to just below 5.3 million b/d in April (after upcoming revisions, horizontal wells only). However, April production has only been reported for a little over 70% (this is about 85% on the Texas side), which explains the drop you’re seeing for that month.

This lack of data completeness seems to be worse for New Mexico than for Texas based on the comment above indicating the New Mexico data is less than 70% complete (as Texas data is 85% complete based on Enno’s comment).

Also:

This number of active rigs (333) is however more than sufficient to maintain current output, assuming no changes in rig & well productivity. The following overview, from our Supply Projection dashboard (available to subscribers), reveals that if one assumes a drop 100 rigs from now until September 1st (top chart), Permian production will plateau at the existing level (bottom chart).

This comment was followed by chart below with 233 rigs from Sept 2023 to Dec 2029, at April completion rates of about 500 wells, this would be 1.5 wells completed per rig and at 233 rigs this would be 350 wells per month (roughly a 30% drop in the completion rate from April’s level). Not clear we will see a 30% drop in the completion rate in the Permian basin.

My analysis has very similar results for a 350 well scenario. Also shown are scenarios with 450 wells, 500 wells (current completion rate) and 550 wells.

Ovi – you are too kind with Dennis …50 Gb of plateau??? Really? That’s a looooooooong shoooooot, Dennis – thought your best guess was for growth?

Kengeo

Most of us here have accepted peak oil Dennis is still at the bargaining stage.

There is peak oil as a faith based concept (the majority opinion) and then the analytic one. I believe Dennis falls on the analytic side, and his estimates are reasonable because of the information he uses for URR. If he had better resource estimates (not necessarily smaller mind you, but improved by better delineation of individual formation performance) his numbers might be more in line with what the more faith based side would agree with. Which is to say, smaller, and with sooner peaks. To the faithful, those are always the more correct answers.

Without higher resolution/quality resource estimates, Dennis is stuck with resource base size as is. He could use data similar to what NoviLabs provides to change the underlying USGS inputs parameters and plug that into their published monte carlo simulator, but I don’t know if he has explored that option yet.

Reservgrowthrulz,

I do reduce the USGS TRR estimates by considering only the highest productivity assessment units (Lower Spraberry, Wolfcamp A and B, and second and Third Bonespring Formations). I could do a better analysis that does separate well profiles for each of these formations (earlier iterations of shaleprofile data did not divide out the formations in as great detail, I only had access to Wolfcamp, Spraberry, and Bonespring formations and they were divided no further). I did an analysis utilizing separate well profiles for Wolfcamp Delaware, Wolfcamp Midland, Spraberry and Bonespring and the results were not significantly different from using a single well profile for the entire basin. Thus I have chosen to use a single well profile for entire basin for wells starting 2010-2012, 2013, …, 2018, 2019, and 2020. After 2020 I simply assume well profiles beyond that date are similar to the average 2020 wells, it is a bit early to fit a well profile for 2021 wells (only 16 months of complete data for the 4773 horizontal wells completed in the Permian in 2021 so the fit would be pretty rough).

I have not used the full Novi data suite and machine learning tools as I cannot afford the subscription.

World c+c production happened in Nov 2018 on Earth.

Don’t know about the planets you are living on?

It could be surpassed, if that is the argument, but that is an argument.

Hightrekker,

Reservegrowthrulz points out there have been many peaks in the past, whether 2018 will be the final peak is not known as the future is unknown. Seems a fairly logical argument from my perspective.

To Dennis:

Your level of resolution for particular formations wasn’t what I was referring to. Lowering the USGS estimates seems reasonable to me off the top of my head, but I can’t say by how much or where for another 2 weeks or so. I was referring to the way the USGS method works, and something I’ve bumped into over the past 6 months that might negate their method entirely. Doesn’t mean a change in method wouldn’t deliver similar answers, after all they still do area/productivity analysis, the issue is more how the productive areas are calculated.

For a entire sector of the oil industry (and its registered, professional reservoir engineers, sworn to tell the truth by moral obligations set forth in the Society of Petroleum Engineers) to NOT be able to get reasonable close to accurate EUR’s for INDIVIDUAL wells, it is ridiculous to focus on ultimate recoverable resource (URR) for an entire, vast basin like the Permian. URR is wild ass guesses of the worse kind. Check that, an E always goes before URR; there is nothing remotely ultimate about URR.

Most of the tight oil sectors EUR’s have been proven, beyond doubt, to be exaggerated by 30-40%. So we are now suppose to believe in EURR’s ?

You guys are nuts. And desperate, clearly.

But to be clear, and for the record…the analyst would be able to make better analysis if the EURR was better? So he could work DOWN using EURR, and certain oil prices, that would enable extraction of a probability percentage of EURR and make a better prediction of the future? Is that correct?

Well, no shit.

It’s dark down there and hard to see. Welcome to the real, non corporate, non home-basement world of the real oil business.

Over 60% of the areal extent of the USGS assessment of the Midland Basin has been tested, and abandoned, forever, short of $200 oil, or will NEVER be tested.

Analyse that.

“Sometimes what people believe is the truth is not the truth at all.”

Copy that.

Reservegrowthrulz,

The USGS estimate for the Bakken/Three Forks in North Dakota seemed to be pretty good with ERR about 80% of TRR which seems reasonable, was there something very different about the Midland Wolfcamp and Spraberry and Delaware basin assessments, it seemed the methodology was similar. Note that I throw out about 20 of 50 million prospective acres covered by these three assessments and reduce the TRR from about 75 Gb to about 50 Gb in the highest productivity assessment units. My 40 Gb scenario is in line with the ND Bakken/TF in that about 80% of the 50 Gb TRR that I utilize in my analysis is economically recoverable at $80/bo in 2022$ at current costs.

Mike,

The EUR I use is about 430 kbo for the average 2020 well over 157 months with the assumption that the well is shut in at 19 bopd.

The EUR is based on a fit to Novilabs data where exponential decline at 12.5%/year is assumed after the hyperbolic profile reaches an annual decline rate of 12.5%.

The low scenario with URR=37 Gb and a 350 well per month completion rate is consistent with the scenario presented by Enno Peters in his recent Permian post and not far from the G &R estimate of 34 Gb, in fact the scenario can easily be modified after 2030 to be consistent with a 34 Gb URR assumption. The 17 Gb cumulative output point is reached in Dec 2026 for the 350 well scenario, if one likes the assumption that peak occurs at cumualtive output that is 50% of URR. In this case the scenario is a plateau at about 5150 kb/d that starts in Jan 2023 and might end in Dec 2030 with the midpoint of the plateau occurring at cumulative output at 50% of 34 Gb (17 Gb).

Reservegrowthrulz,

It seems you are suggesting the TRR estimates by the USGS are far too large. Is that correct?

To Dennis:

I was not implying large or small as much as the particulars of the method itself. As just one example, without involving costs in a model, there is no explicit way to factor in price effects other than as guesswork. As opposed to how a resource cost curve based method would work, as just one example.

The USGS method is based on geologic area, and a distribution of productivity across that area, assuming they have wells drilled and production. They discount area for previously drilled wells, leaving area yet to be developed, and apply a productivity distribution. Relatively simple at the end of the day.

What happens when additional data at the play level demonstrates that the shape of those distributions are fundamentally different than those assumed by their method? We aren’t talking about new plays anymore, with small samples of wells to substantiate the productive, we are talking about manufacturing, one of those stages in that graphic I emailed you some time ago. And with manufacturing comes distributions that don’t match what the USGS assumes. Does that make their esimates high or low? I don’t know yet. But there is plenty of data to figure it out now.

Reservegrowthrulz,

It seems to me that by looking at actual well productivity data over time as I do, with a separate well profile for each year from 2013 to 2020, I capture much of the technological and geologic data over time. The model to data match is pretty good, future will always be unknown.

whether 2018 will be the final peak is not known as the future is unknown.

It is the peak, the highest production of c+c.

Reality over ideology.

It may be surpassed, but embrace reality.

Lightsout,

Perhaps peak oil will remain 2018, or it may be 2028 as I guess, it makes little difference we will roughly be on an undulating plateau between 79 and 84 Mb/d from 2015 to 2033 in my view, if there is a new peak it will be within 1 Mb/d of the 2018 peak, if not it matters not output will be in the 79 to 84 Mb/d range from 2023 to 2033. I will believe the future decline asserted by others when I see it. I don’t think we see annual decline rates for World C plus C over 2% until 2034 or later.

I agree, except for the decline rate. I think it will be greater than 2%. The decline rate will not be linear. It may start off at 2% or less but will then accelerate because of the export land model. Producing nations will start to hoard their production, just like the US is starting to do. The non-producing nations will be left in a world of shit.

Producers hoarding their residual production capacity is certainly to be expected, and/or directing the products to their ‘most favored nations’ list in the post peak/decline phase.

Also, there will very likely be an acceleration of decline in the economic prospects of marginal countries who find themselves on the outside of the declining oil trade market. Lack of basic oil products and derivatives will likely tip countries into failed state status and that will be an extremely tumultuous series of episodes for humanity.

When does an episode turn into the main story?

Its hard to imagine how a globalized interconnected world will continue to function on all cylinders as we have all come to expect over this long growth spurt, which added billions to both the overall population and to the rolls of those in world with purchasing power (demand). Globalization has depended on oil energy and products greasing the skids and powering the engines. In a world with a contraction in globalization, many previously prosperous countries, including your own, may have to undergo some earthshaking adjustments to settle at new and lower level of economic function. Think of supply chains that never recover from a one or two year wait, or hardware stores with shelves of goods and tools poorly stocked, for example. Many have no idea how dependent all the vehicles and the grid and the hospitals and the communication networks of the country and the world are on a smoothly functioning interconnected semiconductor industry. Or minerals industry, for example.

We are approaching the Global Peak Combustion Day [all fuels]. The decline rate will indeed be interesting to observe, from a safe place I hope for you.

” I don’t think we see annual decline rates for World C plus C over 2% until 2034 or later.”

And don’t forget nefarious characters realizing that world oil is declining.

And being excited to destroy oil infrastructure which is a sitting duck militarily.

A recent example is the Nordstream pipeline.

Pakistan (a borderline failed state) nuking the Strait of Hormuz to realize an apocalyptic prophecy may be another.

And if you think the US Navy is going sit back and watch Oil Tankers float by destined for other countries…

think again!

Ron,

I agree it will be more than 2%. As tight oil declines rapidly from 2032 to 2040 the World decline rate will be over 3% for a few years, but the average annual rate of decline for World C plus C over the 2034 to 2070 period will be about 2.8% for my best guess scenario.

Keep in mind that after 2035 supply will fall as fast as demand for oil, perhaps demand decline will accelerate, I hope that is the case, but I am not that optimistic.

I see little evidence that the US is hoarding its energy output.

Some advocate this approach including me, but I see zero evidence of this affecting anyone.

This is a hypothetical.

Back in 2005, there was a “Peak Oil” that petrogeologists more or less correctly predicted. Along came the fracking business, that extended the due date for another “Peak Oil”. Exxon seems to confirm that in their View to 2050 Annual Reports with a known peak in 2018 and a possible final peak around 2032.

USGS estimates we have 3 trillion barrels of oil equivalent in the Shale Oil basins of Colorado and Utah of which 1 trillion may be accessible but not easy to mine and process. To process any mineable ore, a Shell manager estimated they would need 2.5 barrels of water to create a barrel of “crude” that could be pumped through a pipeline. The manager was thinking that they could get the amount of water needed down to 2 barrels.

Niagara Falls has a flow rate of about 85,000 cu ft/sec. This equates to a little over 15,000 barrels of water/sec. If the USA needs, 15 million barrels of oil per day and we could mine that much from the above basins, we would need 30 million barrels of water for processing/day. We would need 2,000 seconds of water flow from Niagara Falls or about 33 minutes of that flow per day.

To divert that much water to that basin, we would need about 20 Alaskan Pipelines based on 1.5 million barrels/day/pipe and 10 Alaskan Pipelines to transport that “crude” to a refinery.

To me, it puts things into perspective about our energy situation.

Peterev,

Pretty sure that nobody is arguing that Kerogen from the Green River Shale is likely to ever be extracted, definitely not me in any case. I often refer to a 3 Tb resource estimate by the USGS, but that is for World Conventional Oil Resources (study was published in 2000). Possibly another 500 Gb of unconventional oil resources, but my guess is there won’t be enough demand and the the amount of unconventional oil extracted will be less than 200 Gb, likewise I expect less than 2500 Gb of conventional oil will be extracted also due to lack of oil demand.

Hi Dennis,

The USGS estimates there are 6 trillion BOE of shale oil worldwide; 3 trillion in the Colorado and Utah area.

The question comes down to whether we would be technologically able to try to extract that resources and would we be desperate enough to do so? I think the answer is no because of the difficulty in extracting the resource and the absence of political will to run up to 30 Alaskan Pipelines through the central part of the US. But I don’t have a good feel for what we can or would do when times get desperate.

Peterev,

I agree the kerogen is not likely to extracted as it is too expensive to produce and cannot compete with normal oil resouces (both conventional and unconventional. Coal or gas to liquids would probably be cheaper than using Kerogen. It is a resource that is unlikely to ever be exploited in my opinion, some of the very high oil resource estimates over 4 Tb include this as a viable resource which is a mistake.

https://www.reuters.com/business/energy/norway-oil-safety-regulator-warns-threats-unidentified-drones-2022-09-26/

“The warning came after the country’s largest oil and gas firm Equinor (EQNR.OL) recently said it had notified authorities of sightings of drones of unknown origin flying near some of its platforms.”

In returning to the 2% decline rate discussion.

I would like to point out that shortly after the explosion of the Nordstream pipeline.

An almost untalked about event occurred that does not bode well for the future oil security..

Unidentified Drones were caught buzzing Norway’s OIL rigs. Probably Russian…but who knows.

Drones allow organisation’s/terrorist groups other than National Governments to get into the oil infrastructure attack game as they are much cheaper than a Naval Vessel.

Kengeo,

My best guess is the 40 Gb scenario with a completion rate of 450 wells per month, that scenario has Permian output increasing from about 5300 kb/d in April 2023 to about 6300 kb/d in late 2029. The lower scenario was to compare with Enno Peters scenario and through Dec 2029 where Mr. Peters scenario ends the scenario is very similar to my scenario.

Kangeo

Eh! That’s Canadian.

An alternative 350 well scenario with about 68.9k wells completed after December 2015, roughly 20 million of 50 million prospective acres or 40% of prospective net acres covered by 3 USGS Permian assessments. URR is 32 Gb, slightly lower than the G&R recent estimate for Permian URR, my guess remains that there is at least a 90% probability that the URR for the Permian will be higher than this scenario.

Note that I believe G&R may be mistaken in their estimate of 14 Gb of tight oil extracted so far from Permian basin, the EIA data suggests about 10.7 Gb of tight oil extracted from Permian from Jan 2000 to April 2023. Not clear what the basis of their 14 Gb estimate is. Perhaps G&R are mistakenly using DPR data to estimate cumulative production, from Jan 2007 to April 2023 the cumulative Permian production for the DPR is about 14 Gb, but this includes about 4 Gb of conventional oil from the Permian region.

It occurs to me the G&R may believe there are only 20 Gb of remaining recoverable resources in the Permian and if we use the correct estimate for cumulative tight oil production for the Permian Basin (10.7 Gb), their URR estimate would be reduced to 30.7 Gb, slightly lower than my scenario above, I am skeptical of this estimate, it is likely about 9 to 10 Gb too low.

Mr Coyne , still dreaming of a white Christmas ?

Excess DUC wells, which were responsible for a significant portion of 🇺🇸 oil production rebound since 2021, are now at critically low levels!

With frac spread count ⬇️ 5% YoY and rigs dropping every week, all signs are pointing towards continued shale activity deceleration

Hole in head,

I will believe the dead DUC Meme when we see output start to decrease significantly, in the mean time I use the DUC count at Novilabs and focus on the Permian, about 2200 DUCs in Permian as of March 2023 with roughly 490 completions, about a 4.5 month supply.

https://novilabs.com/blog/permian-update-through-april-2023/

So Mr Coyne .

Decreasing DUC’s don’t matter ( they are a meme).

Increasing GOR don’t matter .

Exhausted Tier 1 locations don’t matter .

Increased OPEX don’t matter .

Higher interest ( financing costs) rates don’t matter .

Waste water removal and the cost don’t matter .

Earthquake’s don’t matter .

Plugging old oil wells and the cost involved don’t matter .

Question ? If the above don’t matter , what does ? Did you study economics under Prof Milton Friedman ? Your thinking is like his illustrious student Ben Bernanke . 🙂

Because of the time difference I get posts by Mike S when the American continent is asleep . Here is his latest .

https://www.oilystuffblog.com/single-post/map-of-the-month?postId=2d6426c7-6f03-4ebe-95be-43f5b91be507&utm_campaign=e6bdc598-e080-4d28-9a1d-c7a5ca8358cc&utm_source=so&utm_medium=mail&utm_content=f30d54ce-8ce0-4425-84b5-66371ca61d8f&cid=fa335351-37bb-44a6-9899-f8c34b4a0f81

Hole in head,

DUCs aren’t decreasing, profits matter, costs have been decreasing of late, I use OPEX and Capex levels that Mike Shellmen occasionally mentions, including costs for plugging wells in the analysis. My expectation is that as natural gas pipeline projects come online (there are several under construction) in West Texas that natural gas prices will rise at WAHA. Much of the financing can be done with cash flow so interest rates are not that important. I never said waste water removal is not a problem, that problem can be solved with waste water recycling (it also reduces water use and solves the shartage of water in West Texas). Many large producers in the Permian have said they have 10 years inventory of tier one locations, other producers may only have 3 to 4 years pf tier one locations, when I see a consistent decrease in average well productivity I will believe this is important. Only in 2022 did well productivity fall back to the 2020 level (the highest productivity year besides 2021).

GOR rising is expected, that is what happens to older tight oil wells and the proportion of output from older wells rises as completion rate stabilizes.

Hole in Head,

Chart below looks at Horizontal Wells drilled in Lea and Eddy Counties in Wolfcamp A and B formations and 2nd and 3rd Bonespring Formations (where most of the tight oil wells are drilled). The Data is from Novi Labs. GOR has been pretty steady since recovery from pandemic in June 2020 with average GOR about 3.73 from June 2020 to Jan 2023. Note that data beyond Jan 2023 is likely incomplete for now.

Another scenario that tries to maintain a plateau, Well completion rate in wells completed per month on right hand axis. This is an attempt to match a “rollover scenario” to a plateau. Well completion rate stabilizes around 360 wells per month from 2027 to 2029, URR=38 Gb.

Another set of scenarios for Permian Basin. The highest is my best guess with about 475 wells completed per month, URR=41.5 Gb. Other scenarios have URRs of 16, 28 and 38 Gb. The wells completed from Jan 2010 to December 2040 are 42k, 69k, 93k, and 105k wells. Note that 42k wells have been completed as of March 2023, so for future wells after March 2023 we have 0, 27k, 51k, or 63k wells completed for each of the 4 different scenarios.

A slight variation on 28 Gb scenario above (blue dashed line), in this case I show completion rate on right axis. My expectation is that the odds are low (1 in 25) that output will be this low or lower for the Permian Basin.

Dennis

Thanks. Much appreciated.

The G & R report makes reference to the work they have been doing in cooperation with Novi labs and I felt that they must have investigated the Permian in depth to come to their conclusions. See comment below.

I must admit that the G & R report caused me some conflict between the great work you do with your models, Permian and World, vs Novi Labs and G & R. It is that conflict that caused me to look into the production in the 6 biggest counties in the Permian and present it to the POB participants.

A couple of our participants have mentioned that the pressure in the Permian is dropping and how the GOR ratio is going up. It is the last 4 months of the Lea and Eddy counties that makes me think those counties may be close to rolling over and possibly moving into the bubble point phase. Will this cause production growth from these two counties to slow? As I mentioned in the post we will need information from a few more months of data to see if those two counties are moving into a plateau phase.

The initial data I retrieved from shale experts was for March. Last Wednesday when I checked for more info, their NM data had been updated to April. Interestingly, the data for January 2023 I used to get the two point production growth average had not changed. Next month I will check to see if their April data gets updated.

You note that the number of rigs, 333, is sufficient to maintain production in the Permian. Maybe the frac spread count is more critical than rigs. Recall that in the DPR section, July production, if correct, increased by 1 kb/d. It will be interesting to see how many DUCs they used to increase production by 1 kb/d.

Bottom line, based on what I found is that I think their projection has some merit but I do not consider it conclusive.

I will try to update the Permian section, possibly three months from now to see if some of observations made still have merit.

The big outlier continues to be the price of WTI.

“We have spent the last several months completing and updating our machine-learning models. We owe a debt of gratitude to both the data and analytical insights provided by NoviLabs (formerly ShaleProfile), our data providers. Since we first built our neural network in 2018, NoviLabs has dramatically enhanced its database. Whereas our original models relied upon geographical data (i.e., where a company drilled a well) and completion data (i.e., how a well was drilled and completed), our latest model incorporates actual subsurface geological data. Our original models inferred the best Tier 1 acreage based on nearby well results. Our new model adds geological parameters such as thickness, thermal maturity, organic content, oil in place, porosity, and permeability to make accurate well-quality predic- tions.”

That G & R report is excellent, they have access to far more data than I have. I would caution about reading too much into recent data as it often changes as it becomes more complete. Not sure about wells reaching bubble point, I think we need individual well data to make that determination which I do not have access to, I also do not have the knowledge to make that determination in any case. Enno Peters seems pretty knowlegable and has access to all of the Novilab data.

I would also note that G&R have an estimate for the North Dakota Bakken URR of about 9 Gb, which is very similar to my estimate. The USGS mean TRR estimate is about 11 Gb for the North Dakota Bakken/Three Forks. The F95 TRR estimate for ND Bakken/Three Forks is about 8 Gb. For the Permian Basin the USGS mean TRR estimate is 75 Gb witht the F95 TRR estimate about 44 Gb. My guess is that the G&R estimate of 34 Gb for the Permian is too low by at least 6 and more likely by 10 Gb, note that the ND Bakken/Three Forks URR is about 82 % of the mean TRR estimate. A similar level for the Permian would be a URR of 60 Gb, I don’t think it will be that high, but 34 Gb seems low to me. My guess is that Permian 2P reserves plus cumulative production at the end of 2021 were about 36 Gb, my expectation is that as reserves are developed there may be an increase in 2P reserves. From 2020 to 2021 Permian 2P reserves increased by about 6.4 Gb.

I don’t believe the DPR model is very reliable, I think the EIA official tight oil estimate is slightly better, but even those last few months of data are not all that good as they make a statistical estimate to fill in missing state data and these often need revision. I trust Enno Peter’s analysis, he does excellent work.

Dennis.

When there is discussion of conventional versus unconventional, I think about oil gravity.

I’m not in the camp that claims unconventional oil is junk, it all has a use or it wouldn’t be sold.

However, we continue to receive a strong price for our 31-36 API light sweet, even with its relatively high iron content. I feel we receive a strong price, despite being a very, very small producer in a very, very small field and basin, because there isn’t a lot of this grade of crude produced and it must be desirable compared to lighter shale and heavier tar sand.

Also, I have read Mike’s articles which I think point out the shale grades are becoming lighter. More 50+ API, which, in my uneducated mind is really more NGL than oil.

Do you ascribe any relevance to this issue?

Shallow sand,

The light oil may be less useful, though back in the day the ultra light oil say 45 to 50 API used to trade at a premium as it is easy to refine into diesel, gasoline, and jet fuel. Today most of the Gulf coast refineries are designed to refine heavy oil, it may be that your oil is perfect for any refinery, but I speculate, I know very little about the details of refineries.

The short answer, I don’t know how important the issue is, but it is the reason a lot of tight oil is exported. We would need to reduce tight oil output to 4.6 to 4.9 Mb/d in order not to export any crude from North America. I doubt we could find enough votes in Congress for such a policy, what do oil industry folks in your area think of such a policy? Would they be in support of a ban on crude exports outside of North America?

Percentage of Texas Crude with API Gravity from 40 to 50 degrees, EIA data 2016-2023

Shallow Sand,

There is not a lot of 50 API gravity liquids being produced. EIA data in chart below for

% US L48 Crude with API Gravity more than 50 degrees. Maybe this is a lot more than historically, we only have data from 2015 to 2023, over that period the percentage of US crude with high API gravity more than 50 degrees has actually decreased.

Sometimes what people think is true, isn’t.

I should note Mike’s gravity comments are in reference to the Permian Basin, and in particular Lea County and Eddy County, NM, where most of the oil produced is greater than 40 API gravity.

Shallow Sand,

For New Mexico the average % of crude with API Gravity more than 50 degrees from Jan 2018 to March 2023 was 3.97%. This is actually lower than the Nation as a whole and most of the crude produced is from Lea and Eddy Counties in New Mexico. So this chart is basically output from Lea and Eddy Counties.

Most of the output is indeed 40 to 50 degrees from New Mexico. from Jan 2018 to March 2023 about 84% and close to 90% over the past several months.

Oil from 40 to 50 is pretty good stuff for the right refinery.

Consider that Tapis Crude trades at a premium.

https://en.wikipedia.org/wiki/Tapis_crude

Ovi,

I was thinking about your comment on frack spreads being more important than rig counts. I agree.

Consider the EIA’s DUC spreadsheet which estimates about 495 Permian completions in May 2023 and your Frac Focus based estimate for about 107 frac spreads operating in the Permian Basin for week ending May 19, as a simplifying assumption I will assume 107 frac speads were operating for all of May. The wells competed per frack spread under that assumption would be 495/107=4.63 wells completed per frac spread for May. If that is a roughly accurate average in the future (not known), a scenario with 350 wells competed per month would require 350/4.63=76 frack spreads for the month. It will be interesting to see if the frack spread count in the Permian basin drops by that much.

If we look at the OLS trend for Permian completions from Oct 2022 to May 2023, the trend is decreasing at about 7.6 per year over that period, so if the trend does not get steeper, it will take 19 years for the completion rate to fall to 350 completions per month, even to fall to just 450 completions per month would take about 6 years at the average rate from October 2022 to May 2023. It will be interesting to see how things play out, trends often change.

Ovi, Mike S sheds a light on the GOR etc issue .

https://www.oilystuffblog.com/forumstuff/forum-stuff/wish-america-luck

Stephen Bowers has a comment on OSB regarding the GOR issue .

Mike,

I am not a fan of the drilling productivity report. Looking that the June report makes for an interesting view. Page 9 bottom. Permian oil and gas production Oil +1000 b/d Gas +60 million cu ft. That is a big gas increase, obviously not all from the 1000 b/d oil but a hint of what you have been saying- it is getting gassier.

Dividing the gas production by the oil production gives 3.95 thousand cu/ft per bbl oil. that is a lot of boe’s being produced. “

This is the link to Art Bergman’s critique of the Goehring and Rozencwajg Report.

Permian Production Will Not Peak Because of Depletion

https://www.artberman.com/2023/07/03/permian-production-will-not-peak-because-of-depletion/

You need to be registered to read it. Anybody registered?

Hole in head,

There have been roughly 10.7 Gb of tight oil extracted for the Permian basin as of April 2023. I have the URR of Permian between 37 Gb abd 47 Gb with a best guess of 40 to 43 Gb, call it 41.5 Gb, that would leave about 30.8 Gb of remaining resources that might be extracted, with the 50% cumulative mark at 20.75 Gb (this occurs in Dec 2027 for my 500 well scenario). Note that I don’t think the peak happens at the 50% cumulative mark, except by chance as output rarely follows a Hubbert type curve historically, I do not expect the future will be different.

Dennis –

Could you give a guess at future 1P growth over next 5 -10 years?

2023 – 285 Gb

Maybe you see it leveling off around 250 Gb?

Presumably 2P will level off too as reserves shift from 3P to 2P and so on? I imagine you see 1P growth from high oil price? Although one could argue that we should have seen high growth from prices 6 months ago?

Happy 4th to those who celebrate it!

Kengeo,

1P reserves for the World grew by about 17 Gb in 2022, based on Rystad estimates. 2P reseves fell by about 13 Gb. 2PC resources grew by about 95 Gb in 2022, the 2PC number most closely matches my URR estimate of 2600 Gb. The Rystad 2PC estimate plus cumulative production is about 2756 Gb. So my scenario, if correct would require 2PC resources to decrease by 144 Gb in future years, URR of my scenario is 2612 Gb.

HIH

Thanks. Good catch. I think he agrees with me.

He does, 100%.

HIH

I don’t do twitter. Apparently in Mike’s blog there is mention of Art Berman doing critic of the G & R report. Could someone do a summary.

Art states “less than half of commercial Permian locations have been drilled.” as well as “Permian weighted average EUR is 835 kboe & breakeven price is $37. How is that a dying play”

I feel Art is worth following on Twitter. There’s quite a few interesting talking heads on the platform. It’s worth a scan.

Dennis

Is there a way of comparing your info on the Permian with the above comment.

Further up you state: “There have been roughly 10.7 Gb of tight oil extracted for the Permian basin as of April 2023. I have the URR of Permian between 37 Gb abd 47 Gb with a best guess of 40 to 43 Gb, call it 41.5 Gb”

Based on Gb, the statement implies only a quarter of the Permian oil has been recovered. What about the average EUR per well?

Ovi,

Yes the 10.7 Gb extracted is based on the official EIA tight oil estimates from Jan 2000 to April 2023, if we take 41.5 Gb for URR as my best Permian basin guess, this would be about 26% of eventual URR has been extracted to date (I do not have an estimate of Permian tight oil extracted prior to Jan 2000). For the average 2020 well, my estimate of EUR is about 473 kbo per well. The 835 kboe from Art Berman includes natural gas and NGL, my estimate for that is about 964 kboe, which includes 328 kboe of natural gas (1967 MMCF) and 163 kboe of NGL.

I get a breakeven crude price (where discounted net revenue at an annual discount rate of 10% is equal to a CAPEX of 12.5 million for the well when the well is shut in at 159 months) at $65/bo at wellhead assuming Natural gas sells at 2.50/MCF and NGL sells at 30% of the crude price. The well pays out under these assumptions at 67 months. For a 60 month payout the wellhead crude price needs to be $66.50 (same NG and NGL price assumptions as above) and for a 36 month payout a wellhead crude price of $77/bo would be needed. So Art’s breakeven price is very different from my estimate. I think sometimes these “breakeven oil prices” just cover LOE and do not consider the price needed for a decent ROI. I believe Shallow Sand looks to have his wells payout in 60 months minimum and Mr Shellman aims for 36 months minimum.

Dennis

Thanks for the clarification. Sounds like we are all going to have to stand by and see how it plays out.

Dennis

I can’t comment on the reserve estimates since I have not tracked that data but appreciate that you need that info for your models to determine the peak.

As for the bubble point, I just looked at the charts and figured that when the oil chart falls below the gas chart that the GOR is getting bigger and that if the field is not at the bubble point it is getting closer. The Reeves county chart is interesting. After mid 2021, gas output is almost constant while oil production slowly declines. When the latest data is updated, I think that the currently reported GOR would not change that much after being updated.

Maybe some of our oil experts could say a few words on the bubble point. While it is temperature and pressure related, can one get a clue from the GOR.

Always something to look forward to.

Any comments on the rapidly falling DUC count?

Shallow sand,

As DUCs fall too low, I expect drilling rate will increase to stabilize the DUC count at the level considered best for the operators. Also note the DUC count at Novilabs is very different than what is reported by the EIA. I personally trust the Novilabs data more than the EIA data. For March 2023 Novi Labs has the DUC count at 2208, down from 3197 in March 2022. In October 2022 Novilabs has 529 first flow wells in Permian and the DUC count was 2901 that month. That would be over a 5 month inventory of DUCs. In Jan 2020 about 500 wells were competed and the DUC count was 3190, just over a 6 month inventory. The data after October 2022 may not be complete so DUC count might be inaccurate after October 2022.

Based on the Novilabs data DUCs are not an issue.

Chart below from Novi labs Permian report linked below

https://novilabs.com/blog/permian-update-through-april-2023/

Ovi,

No for the Permian model I do not use URR to determine the peak, I use the prospective area (about 30 million acres) and area per well (a 10k lateral well spaced at 1320 feet as suggested by LTO Survivor which is about 295 acres per well). That is about 100k wells. For the USGS scenario there are a total of 50 million prospective acres to be developed, I take the most productive 30 million acres which have a TRR of about 50 Gb. That is the basis of the model. I use well profiles developed with data from Novilabs. I am just pointing out reserves based on the assumption that 2P reserves are about 1.7 times 1P reserves as I found by looking at UK data. The 1P data for the Permian can be found at link below.

https://www.eia.gov/naturalgas/crudeoilreserves/excel/Table2.xlsx

Note that for recent Rystad estimate for World Reserves (June 2023) for Non-OPEC reserves the ratio of 2P to 1P reserves is 1.67, so the 1.7 I used is pretty close for non-OPEC reserves Worldwide if the Rystad estimate is correct.

If I use the 1.67 ratio for Permian 2P to 1P ratio, then cumulative output plus 2P reserves is 35 Gb and 2P reserves increased by 6.3 Gb from 2020 to 2021.

Most of the GoM drop came from maintenance at Appomattox (maybe including brownfield work for Dover and Rydberg tie-ins), Thunder Horse and Horn Mountain.

George

Thanks for explaining the GOM drop.

Wonderful work, with lot’s of important details and observations, thank you.

Although I would admit that Goehring and Rozencwajg maybe missed some – still ongoing – major growth outside Opec from Brazil (currently around 3,3m bpd, still adding FPSO’s) or Argentina (projected to reach 1m bpd from Vaca Muerta shale next year)

https://tradingeconomics.com/brazil/crude-oil-production

Envison

I have production data up to April. It is lower than January 2020. I keep reading that Brazil will be increasing production but so far it is slow and unsteady.

Happy Independence Day America

🎇🎇🎇🎇🎆🎆🎆🎆

Gerry – Thank you for this wisdom, fascinating too!

Don’t drink the water!

Mr Maddoux , you just hit the ball out of the park . Hopefully it will hit a zombie who has his eyes or ears glued to his smartphone . 🙂

Gerry,

Thanks for this information, I was not aware of the use of PFAS chemicals in fracking.

Large companies would simply declare bankruptcy to avoid litigation, the fracking would continue and they would stop using the PFAS chemicals. I am not a lawyer, but usually companies have lawyers that can find ways around these problems. As to Carlsbad formations, I imagine the geologists and geophysicists are well aware of this.

I agree models will often be incorrect as I will make assumptions that are incorrect. I do not know all, nor have I claimed omniscience, I do the best I can with the information I have, which is limited. My best guess scenario has roughly 60k more wells drilled in the Permian basin, with about 30 Gb more oil extracted (about 11 Gb has been extracted from Jan 2000 to April 2023). Care to make a more educated guess on future extraction of tight oil from the Permian basin?

Article on PFAS in fracking

https://www.ehn.org/pfas-fracking-2657471451/pfas-in-fracking-fluid

also see

https://psr.org/new-report-fracking-with-forever-chemicals/

INTERESTING…

What happened to Gerry Maddoux’s comment? I read it on another computer about an hour ago and now it’s gone.

Gerry… did you delete it?

steve

Steve,

He must have decided to delete it. People have about 3 hours to change their mind and delete a comment they have made, I respect their decision to do so.

I deleted my post because I have consistently found it impossible to articulate the fragility of the limestone karst underlying what is now known as the Delaware Basin. And also, Mr. Coyne, because I was sure that you would provide a couple of reassuring articles showing that my concerns were hysterical screeching of some old curmudgeon lost to the times.

The story here is not so much the use of polyfluoroalkyl substances in the fracking solution, but rather the fact that that particular area was gone over with a geological microscope during WIPP (the nuclear Waste Isolation Project), but somewhat after the fact, when Congress finally ordered a study that should have been done at the front. After a substantial deposit of uranium waste was interred there, with the thinking that salt creep would entomb it, a discovery was made that not only was there a high radioactive level in the area aboveground, but that there was a lot of oil nearby. This WIPP deposit is on the eastern edge of Eddy County, almost to the border with Lea County, the area that is written about as the future of American domestic oil known popularly as the Delaware Basin.

And lo and behold, into this limestone karst that was built long ago from carbonate evaporates like the Carlsbad Caverns, the area that has breccia pipes and moisture-seeking conduits that eventually hook into the largest underground aquifer in the U.S.–the Oglala–was apparently injected the forever chemicals that have a habit of getting through fissures and infiltrating the water supply. So now, this fragile area that appears so desolate but holds geologic hands with the water supply is not only contaminated with radioactive waste but these chemicals. And in a state with a Trade Secrets Act that allows a company not to divulge the chemicals they used until after the fact.

I find this alarming, that on arguably the biggest oil blog, everyone is so damn busy constructing charts on the “future growth” of the Permian Basin (which is, at this time, basically the Delaware because that’s the only part that’s growing) no one ever mentions the fact that this is also an area of unusual karstification, and that the Oglala Reservoir is nearby, and that this is a geological/chemical/nuclear disaster cleverly hidden by greed and oversight. I am not sparing New Mexico, which wears the ecology hat while raking in the money. I’m not even sparing myself–as I make a good portion of my income from unconventional oil. and gas.

What I was trying to do was bring attention to the VERY FRAGILE nature of the area. It is a karst unlike any in the world. When you go underground in Carlsbad Caverns, and notice that it’s sort of damp, and that evaporates have hollowed out the earth and that stalactites and stalactites have formed, this is what it is like on a smaller scale in much of the Delaware Basin. I deleted my post because I can’t transmit that concern without being whacked over the knuckles by the teacher who knows better. Well, the crack WIPP team knew better than the geologists from Sandia Labs too, until they had put a bunch of low level radioactive waste underground. The salt creep didn’t take care of the stuff, because that takes many years.

Color me crazy, just an old fart with too much worry in my head, but this was a piss-poor area to put radioactive waste and it’s also a piss-poor area to allow the injection of “trade secret” chemicals down holes. It might be okay if they stayed there, but like the uranium, they don’t. Instead, waste water is taken by truck into Texas, where it is deposited into deep, well-sequestered disposal wells, only now those are full, and the pressure is high, and Mother Nature is really pissed off, and there are almost daily earthquakes, and when a large enough earthquake hits, this crap is going to get into the fissures of the earth, and go wherever the fissure goes.

All I’m saying is there are some things that can’t be shared in a graph. Go look at the geology and the nature of these chemicals before you tell me that I worry too much, it’ll be okay. After my time, at some future date, this fragile, beaten-to-death place where wells are being spliced into the ground like a quilt, very close to the old WIPP site stands to put some very large oil and gas companies out of business. Because New Mexico gets almost 90% of its drinking water from the ground. And I fear that we’re contaminating it. Thank you for letting me take the space to scratch the surface of a topic that has been poorly exposed. I’m quite sure that I’ve lost my way, addled beyond help.

Gerry,

I for one appreciate your comments and your expertise. A few of us on this blog, live outside the U.S. And don’t know the details of whats going on in the Delaware basin.

I think i can speak on behalf of most other people on this blog that your views and knowledge in the field is invaluable and much appreciated.

Gerry, bravo for this.

MORAL: Apes will do ANYTHING to continue BAU.

Gerry, to quote Lyle Lovett, ‘your not from Texas but Texas loves you anyway.’

I often refer to the Delaware Basin as the Sacrifice Zone. What exactly do Texans and New Mexicans sacrifice so that over 85% of the tight oil extracted underneath them can be exported to foreign countries?

Pretty much everything. Groundwater and groundwater quality, mostly. A way of life. Family traditions of raising what scrawny cattle will live in this country, that the earth trembles under their feet constantly; 8 earthquakes today, Wednesday, alone. That the air reeks from H2S, particularly in the area you mention in New Mexico.

All of that. I drive thru this country frequently. My friend from Midland now calls it Waste Texas. He is IN the oil business, BTW, just like you and I are.

How does one predict the end of usable quality water in an arid part of the West? You don’t. And therefore ALL predictions of the future of oil from this region is a big ‘ol fat assumption, with total disregard for extenuating circumstances that negatively affect real people. It’s the Sacrifice Zone. No amount of lawyers, or pseudo increases in recycling produced water is going to fix this easily. No ifs, ands and buts apply to this problem. Its real.

And you are precisely correct. 1701 N. Congress Avenue in Austin now allows New Mexico, tired of fouling their water, to send it to Texas to ruin our groundwater. There is nothing we won’t do in Texas to ensure we are draining ourselves of fucking everything, for the sake of oil exports. Nothing.

Thanks again.

Mike,

Do the fracking fluids mix with the ground water? It seems the Ogallala Aquifier is generally between 50 and 500 feet from the surface on average, though there are a few places where the bottom of the Aquifier might be as deep as 1500 feet in parts of Nebraska. Are there a lot of problems with fracking chemicals mixing with groundwater? The Second Bonespring to Wolfcamp B formations are at around 4500 to 9000 feet below the surface.

Article below talks about PFAS chemical use in New Mexico Oil and Gas Operations.

https://www.currentargus.com/story/news/2023/04/12/toxic-forever-chemicals-found-new-mexico-oil-gas-wells-pfas-fossil-fuel-permian-san-juan-basin/70100118007/

Also see

https://www.nytimes.com/2021/07/12/climate/epa-pfas-fracking-forever-chemicals.html

Perhaps these chemical should be banned from use in fracking. I guess Colorado has already done so.

https://www.ehn.org/pfas-fracking-2657471451.html

On a short-term and superficial basis upon which we consider most things…hydraulic fracturing has been ‘safe’ to this date,

however groundwaters are not some simple uniform pocket of water. And diffusion of chemical in liquids is not a fast process.

Study Links Fracking, Drinking Water Pollution, and Infant Health-

Apr 11, 2022 — “Our research reveals that fracking increases regulated contaminants found in drinking water, but not enough to trigger regulatory violations.”

Univ of Rochester

Are you confident that regulations are strong enough, or enforced with enough vigor and extent to protect the groundwater? Nothing stands in the way of producing a field as big as the Marcellus or Permian. Lets be honest about that.

“Both flowback and produced water may contain (PDF) heavy metals such as barium and lead (PDF), hydrocarbons, naturally occurring radioactive material, and incredibly high levels of salinity. Flowback and produced wastewater can also include chemical additive formulas, with volatile organic compounds (VOCs) such as benzene, ethylene glycol, methanol, and toluene. Between 2005 and 2013, the EPA identified 1,084 chemicals reported in fracking formulas.”

To put it simply, I wouldn’t want my kids or other people I care about, drinking water or eating food produced with that groundwater or surface waters in the watershed.

Wouldn’t want to live anywhere near a refinery either.

Hickory,

It seems to me that PFAS chemicals should be outlawed. But I am no expert on these matters. Humans create lots of bad stuff with both intended and unintended consequences.

No I am not at all confident that these processes or chemicals are safe. People from the oil industry might have a different perspective.

Most of us have made the choice to look the other way on just about all of these issues.

Apparently its the the human method-

to Pretend/Pray that the repercussions come far behind you.

Rarely do frac fluids communicate with groundwater; almost never. In the Scoop/Stack those OK idiots could not keep a frac in zone if they wanted to and they WERE destroying shallower conventional production AND groundwater.

Shit happens. It happens a lot in the oilfield. Its NOT just about numbers.

The bigger issue, as Gerry lays forth, is injection of contaminated frac fluids/produced water into groundwater sources from SWD communication, poor cement, etc. THAT happens. In New Mexico it happens a lot. You have to understand the geology of that region to understand.

It’s not something you can fix, Dennis Coyne. You can’t dismiss the impact of this on real people in the Sacrifice Zone. Your comment about lawsuits being resolved, no big deal, is callous; it pissed me off, and, clearly, Gerry. You can’t make real life problems go away with a click of your mouse.

EURR is bull shit in analyzing tight oil plays unless you understand the extenuating circumstances that affect extraction. Water going into the Permian and particularly water coming out, is a disaster.

You seem to think that this will all sort itself out some day. Well, that is not rational. The Permian has been dealing with water issues for 8 years now because of the tight oil play and the tight oil sector has basically done nothing, or not much, not near fast enough.

If they had, why are we even discussing this? They’ve run the spectrum of oil and gas prices, they KNOW what the problems are. They had the money to begin resolving this issue, they didn’t. Now, they’re running out of water. They are causing earthquakes, man. Ever felt one?

What makes you think somethings is going to change so your models work?

Mike,

Often big companies get away with doing the wrong thing. I don’t support that, I was trying to state things as they are, production of oil and gas seems likely to continue in New Mexico and in Texas.

Perhaps all extraction of oil and gas in the Delaware basin will cease. This seems unlikely to me. As to my models being correct, you may not have gotten the memo.

They won’t be. The chance that anyone predicts the future correctly has a probability of exactly zero. I say this over and over. The model makes many assumptions about the future such as wells being completed at about 450 per month in the Permian basin (or 350 per month, 500 per month etc). If no wells at all are completed in the Permian basin after March 2023 we get the scenario below. The correlation coefficient between Jan 2010 and March 2023 from Model to data is 0.9982. I doubt this is what we see, but it is what we get if we assume no wells are completed in the Permian basin in the future.