A guest post by Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to February 2023.

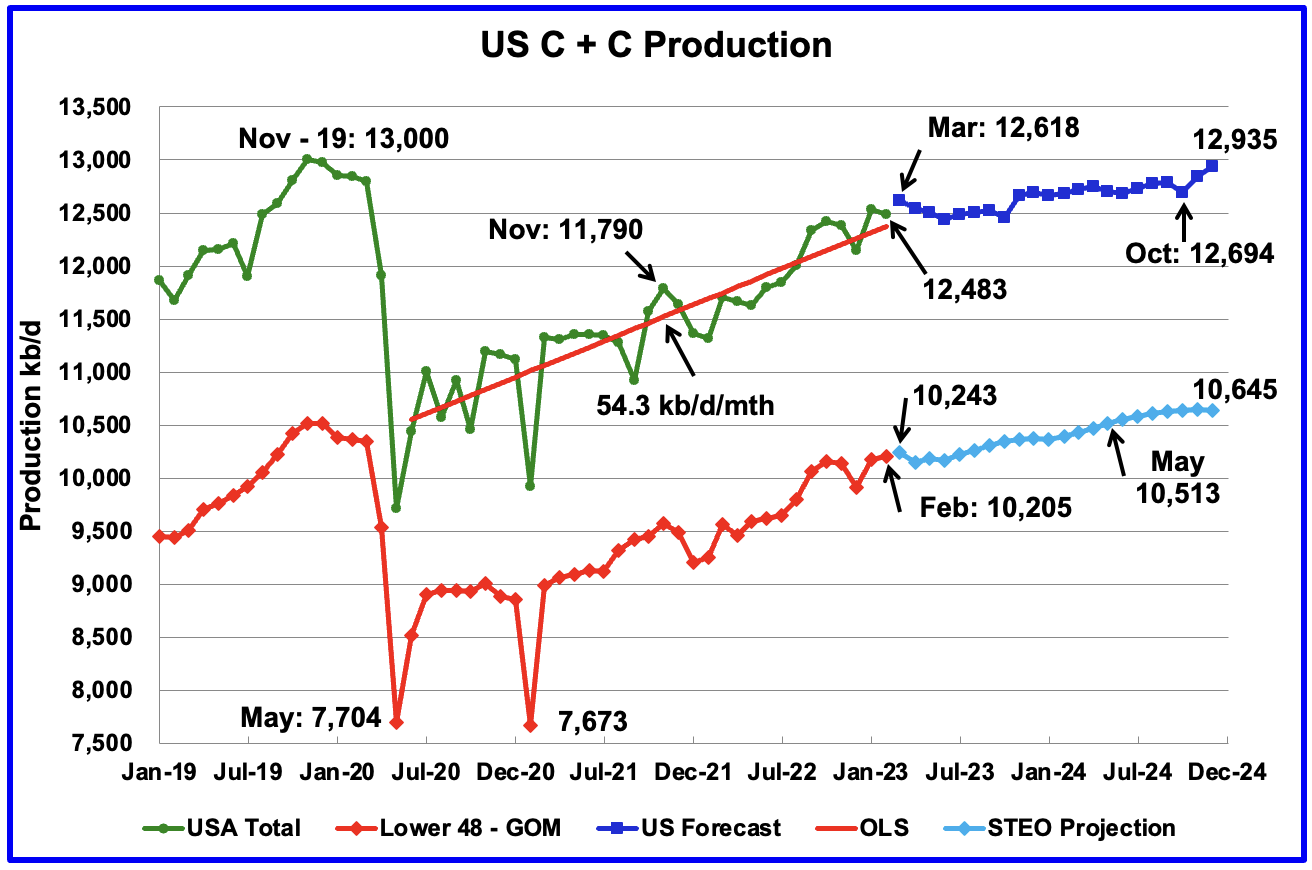

U.S. February oil production decreased by 53 kb/d to 12,483 kb/d. Of the 53 kb/d drop, part of it is due to the upward revision of January production from 12,462 kb/d to 12,536 kb/d, an increase of 74 kb/d.

Most of the states had a small drop except North Dakota which increased production by 77 kb/d.

The dark blue graph, taken from the April 2023 STEO, is the forecast for U.S. oil production from March 2023 to December 2024. Output for December 2024 is expected to be 12,935 kb/d which is 65 kb/d lower than the November 2019 peak of 13,000 kb/d. From March 2023 to October 2024, production is forecast to increase by 76 kb/d.

The red OLS line from June 2020 to February 2023 indicates a monthly production growth rate of 54.3 kb/d/mth, unchanged from last month. Clearly the growth rate going forward into 2023 and 2024, shown in the dark blue graph, is projected to be lower than the 54.3 kb/d/mth seen in the previous July 2020 to February 2023 period.

While overall US oil production decreased by 53 kb/d, the Onshore L48 had a production increase of 28 kb/d to 10,205 kb/d in February. The light blue graph is the STEO projection for output to December 2024 for the Onshore L48. From March 2023, to December 2024, output is expected to increase by 402 kb/d. Note that the last six months of 2024 are showing a hint of plateauing. From May 2024 to December 2024, production increases by just 132 kb/d.

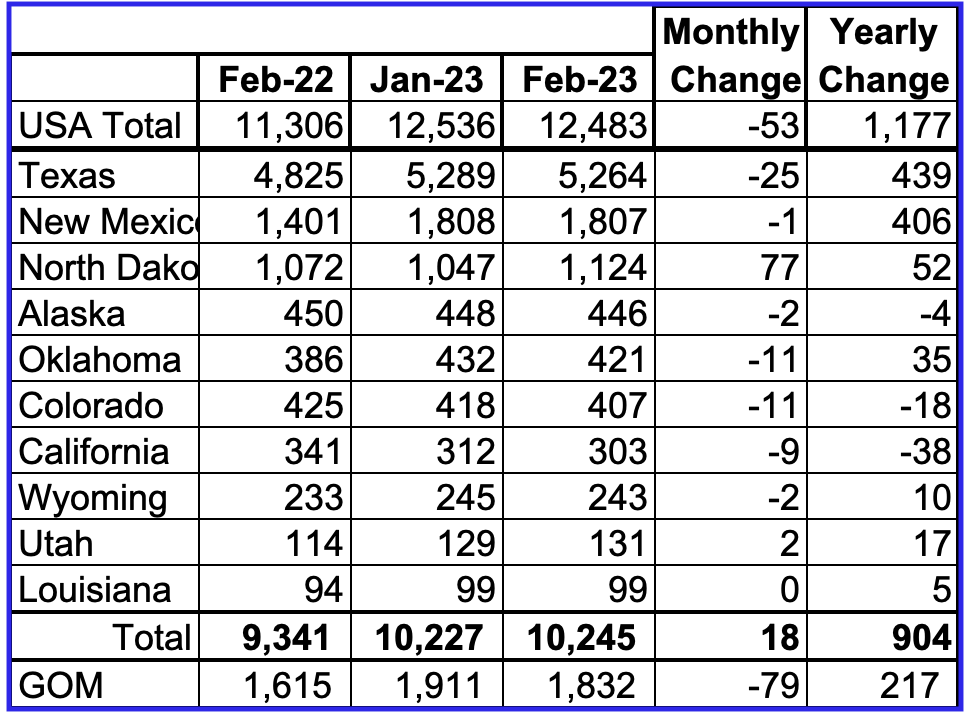

Oil Production Ranked by State

Listed above are the 10 states with the largest US oil production along with the Gulf of Mexico. These 10 states accounted for 82.1% of all U.S. oil production out of a total production of 12,483 kb/d in February 2023. Note that New Mexico production, if it keeps increasing as it did over this past year, could surpass the GOM in the near future.

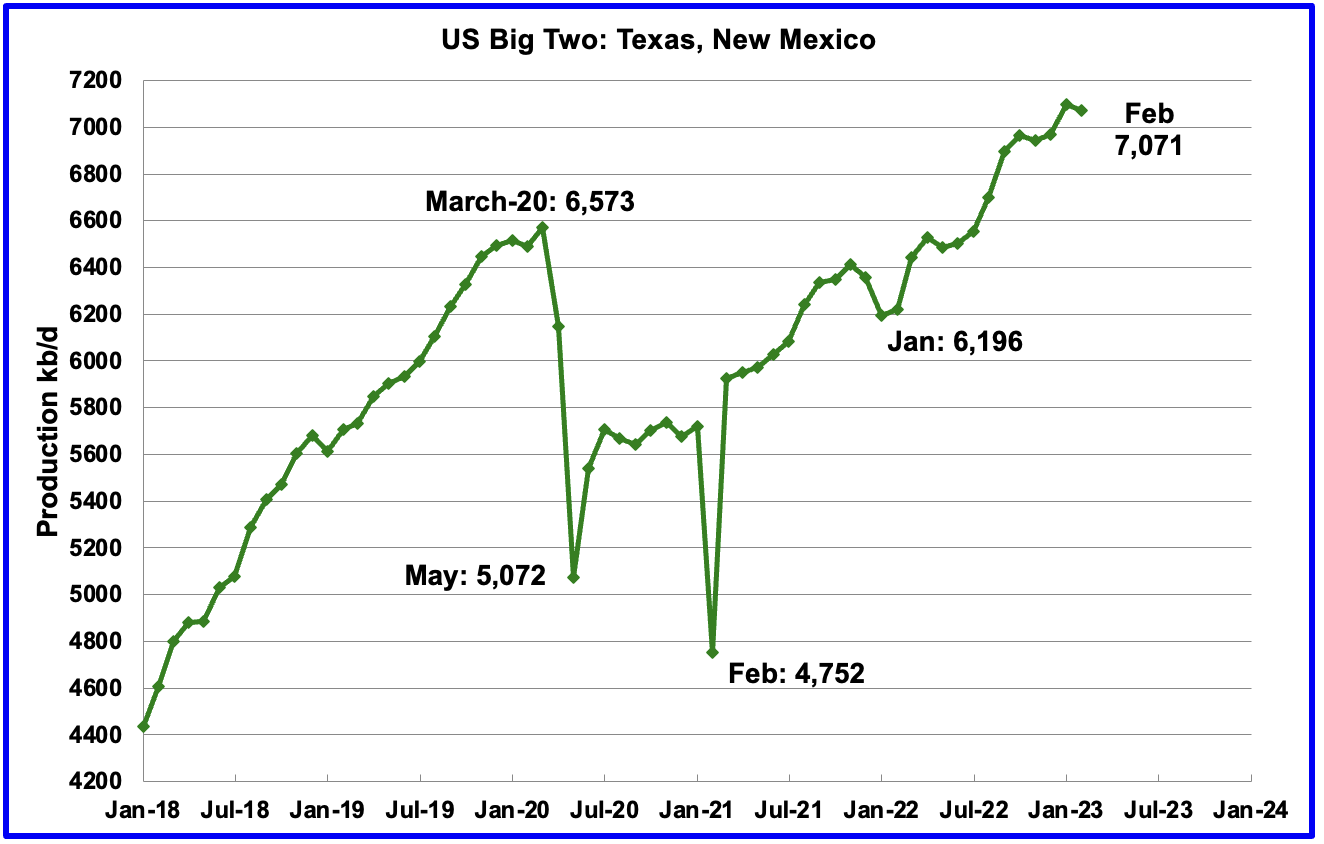

On a YoY basis, US production increased by 1,177 kb/d with the majority, 845 kb/d having come from Texas and New Mexico.

State Oil Production Charts

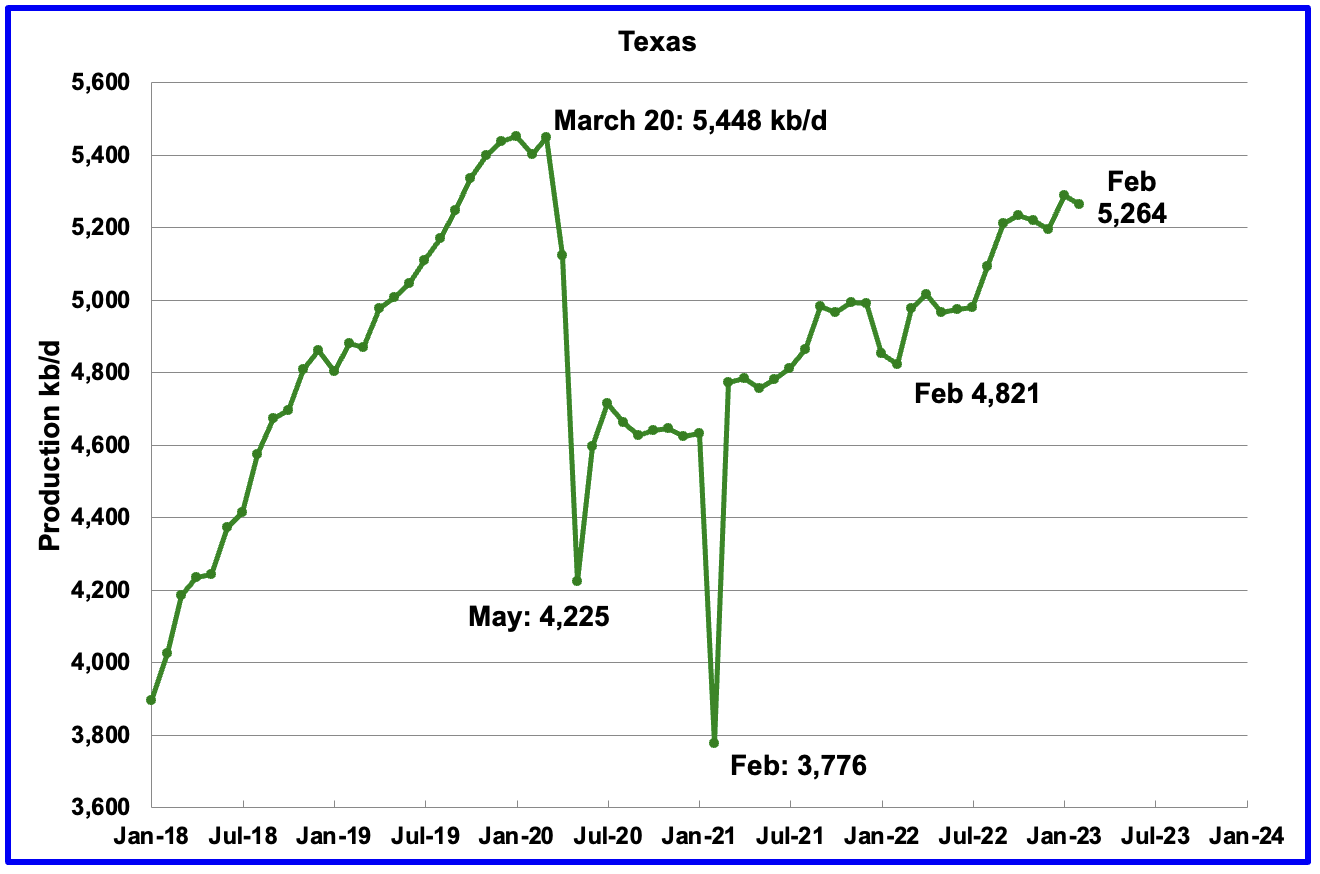

Texas production decreased by 25 kb/d in February to 5,264 kb/d, a drop from January’s post pandemic high of 5,289 kb/d.

In January 2023 there were 324 Hz oil rigs operating in Texas. By late April 2023, the rig count had fallen to 311 Hz oil rigs, a drop 13 rigs. Will this drop in rigs manifest itself in a slowing or flat oil production rate going forward?

New Mexico’s February production continues at a high level but was little changed from January. February’s production dropped by 1 kb/d to 1,807 kb/d, close to the January record high of, 1,808 kb/d

The red OLS line from May 2020 to January 2022 indicates a production growth rate of 27.4 kb/d/mth and shows no sign of rolling over. However in the DPR section below, production in the Permian basin in April and May is showing sign of starting to roll over.

Since August 2022, the rig count has been steady in the high 90s, 97 ±4.

North Dakota’s February’s oil production has recovered from December’s extreme cold weather impacted production. Output increased to 1,124 kb/d, an increase of 77 kb/d over January.

The rig count in North Dakota has been holding steady at 40 since the beginning of the year.

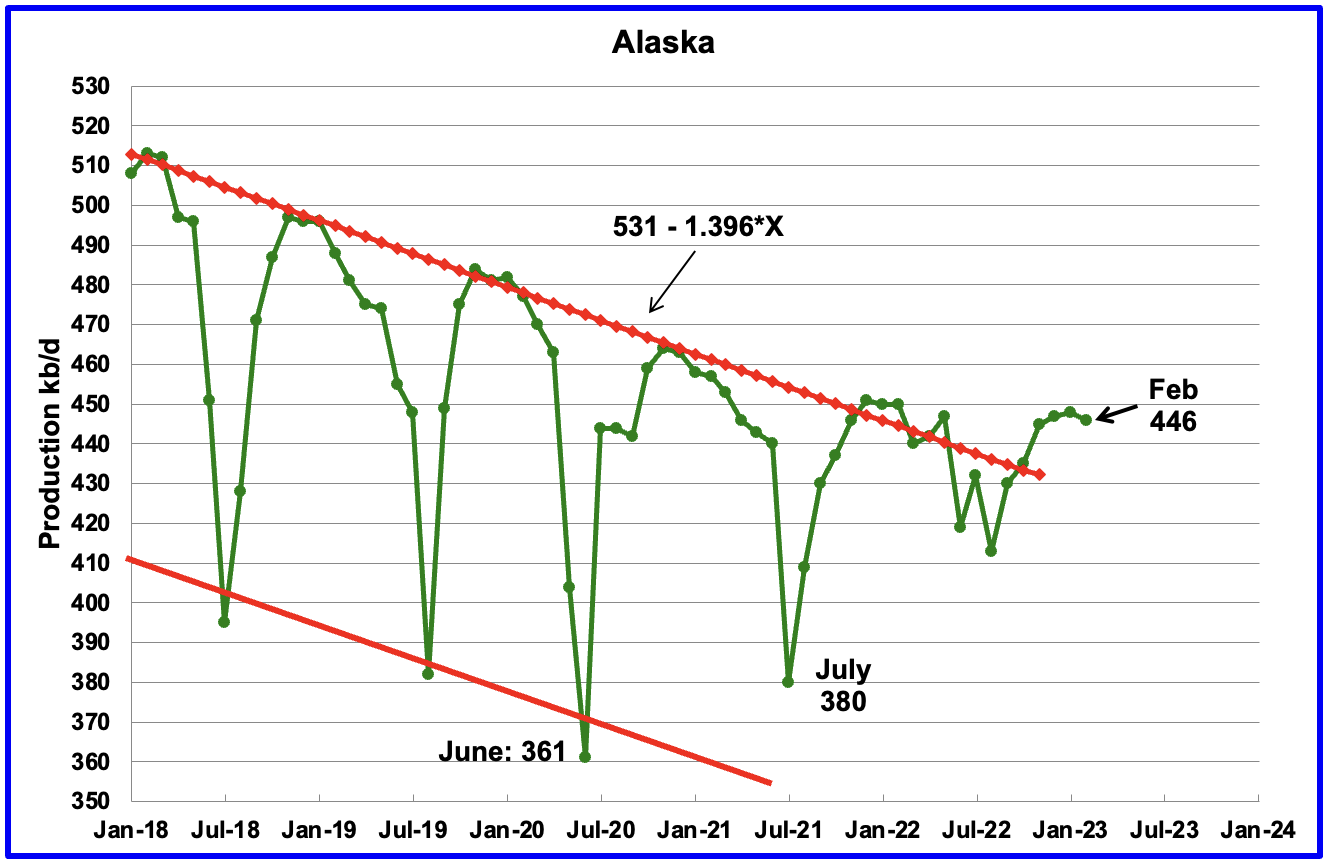

Alaskaʼs February output decreased by 2 kb/d to 446 kb/d and was 4 kb/d lower than January 2022. February is the beginning of Alaska’s annual production declining phase.

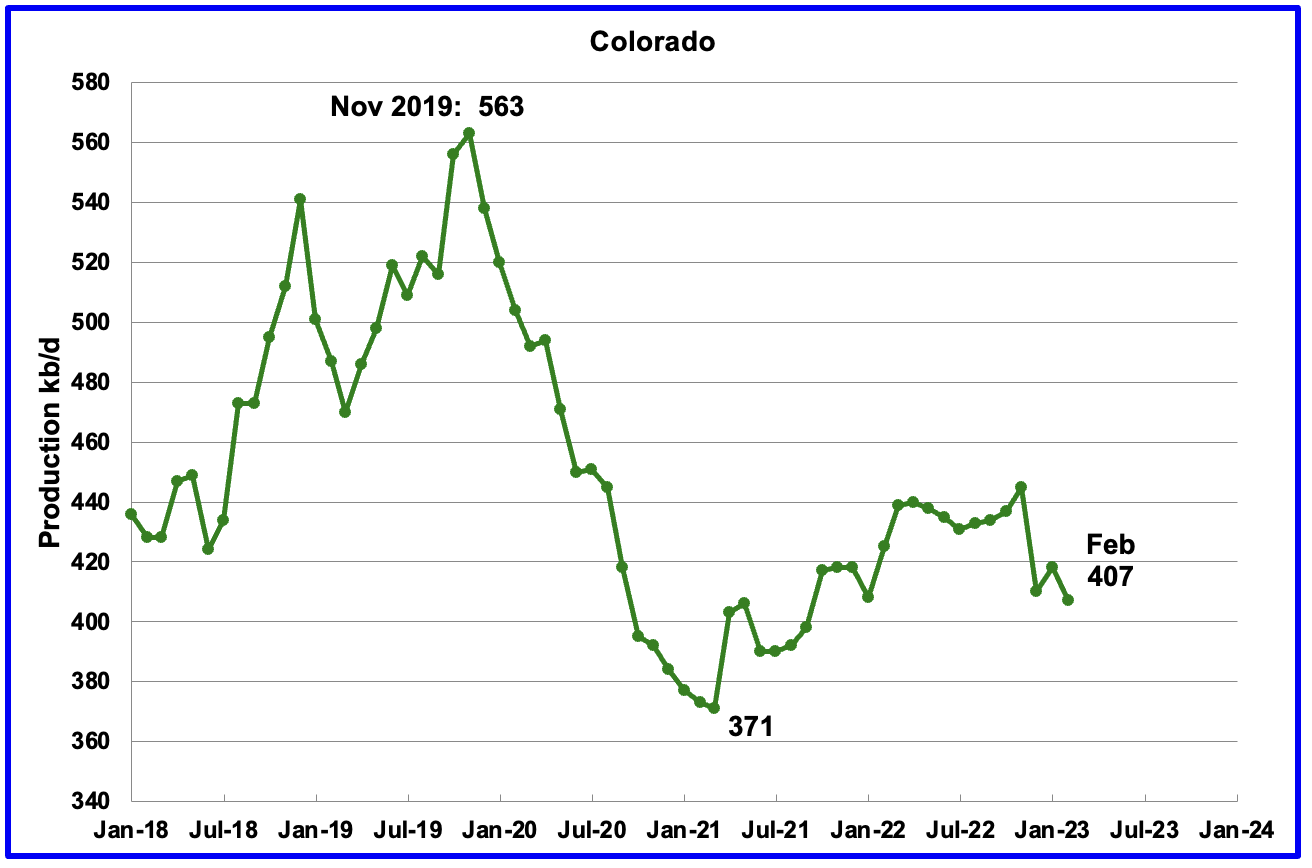

Coloradoʼs February production decreased by 11 kb/d to 407 kb/d.

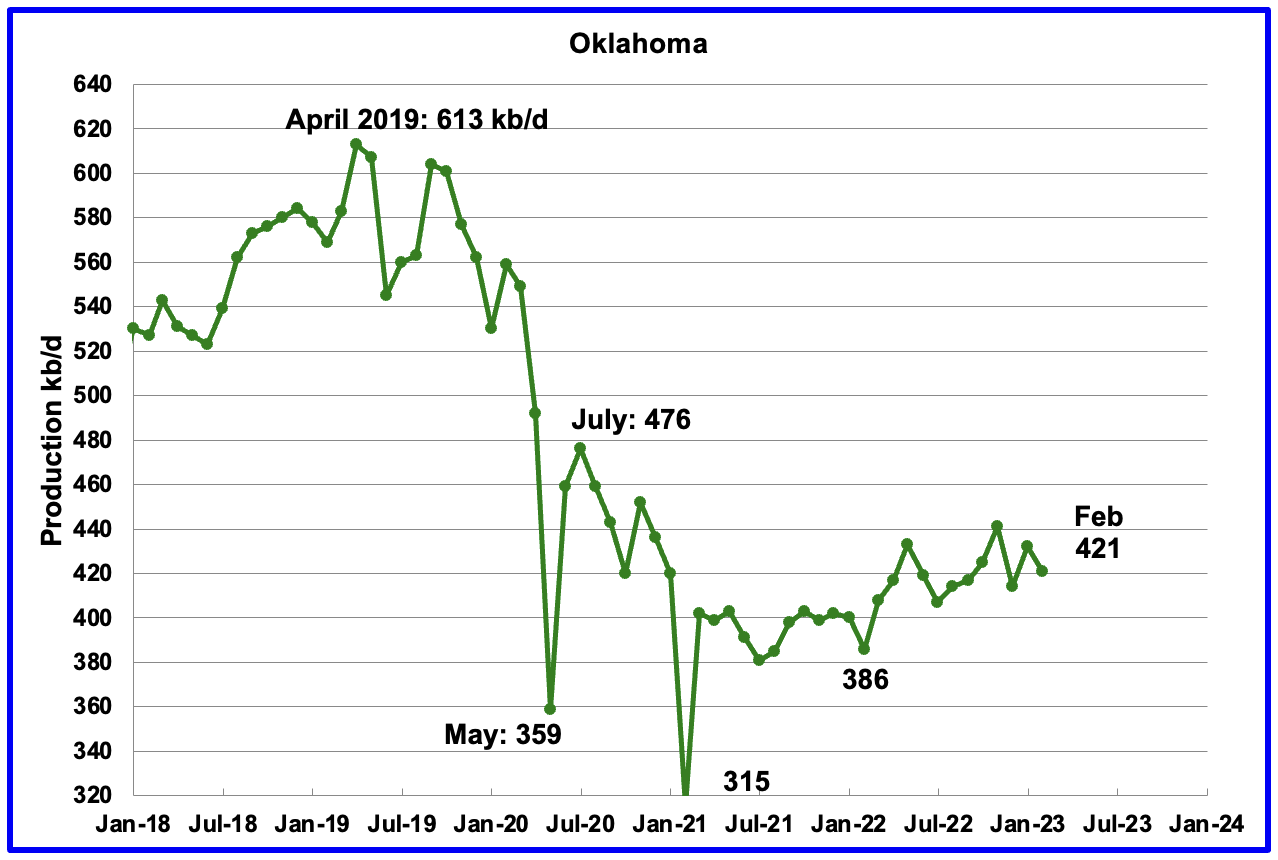

Oklahoma’s output in February dropped by 11 kb/d to 421 kb/d. Production remains 55 kb/d below the post pandemic July 2020 high of 476 kb/d.

From January 2023 to March 2023 close to 60 rigs were in operation in Oklahoma. During April 2023 the average rig count fell to 53.

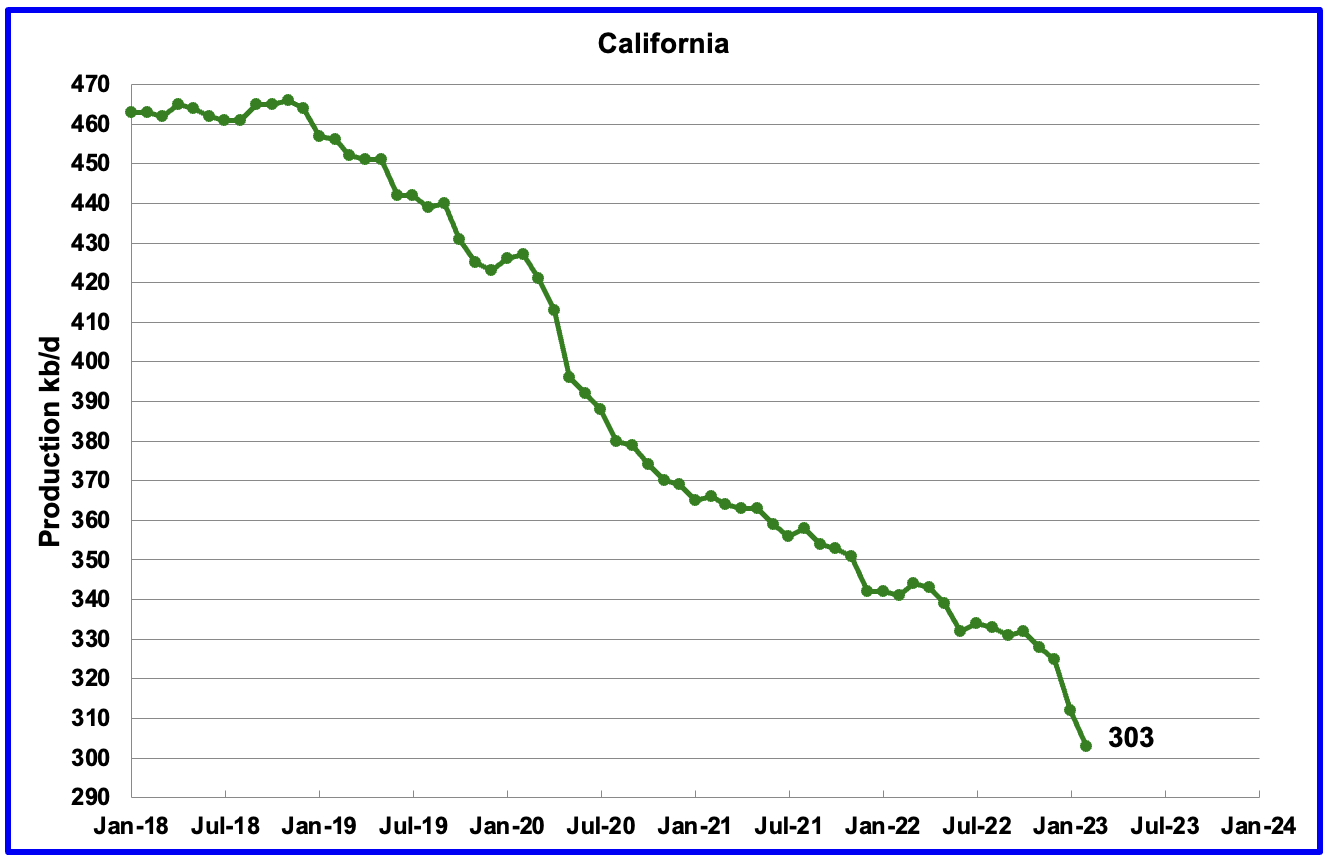

Californiaʼs overall slow output decline trend continues but appears to have accelerated in the last two months. February, along with January, also had a larger than normal drop. February dropped by 9 kb/d to 303 kb/d while January dropped by 11 kb/d.

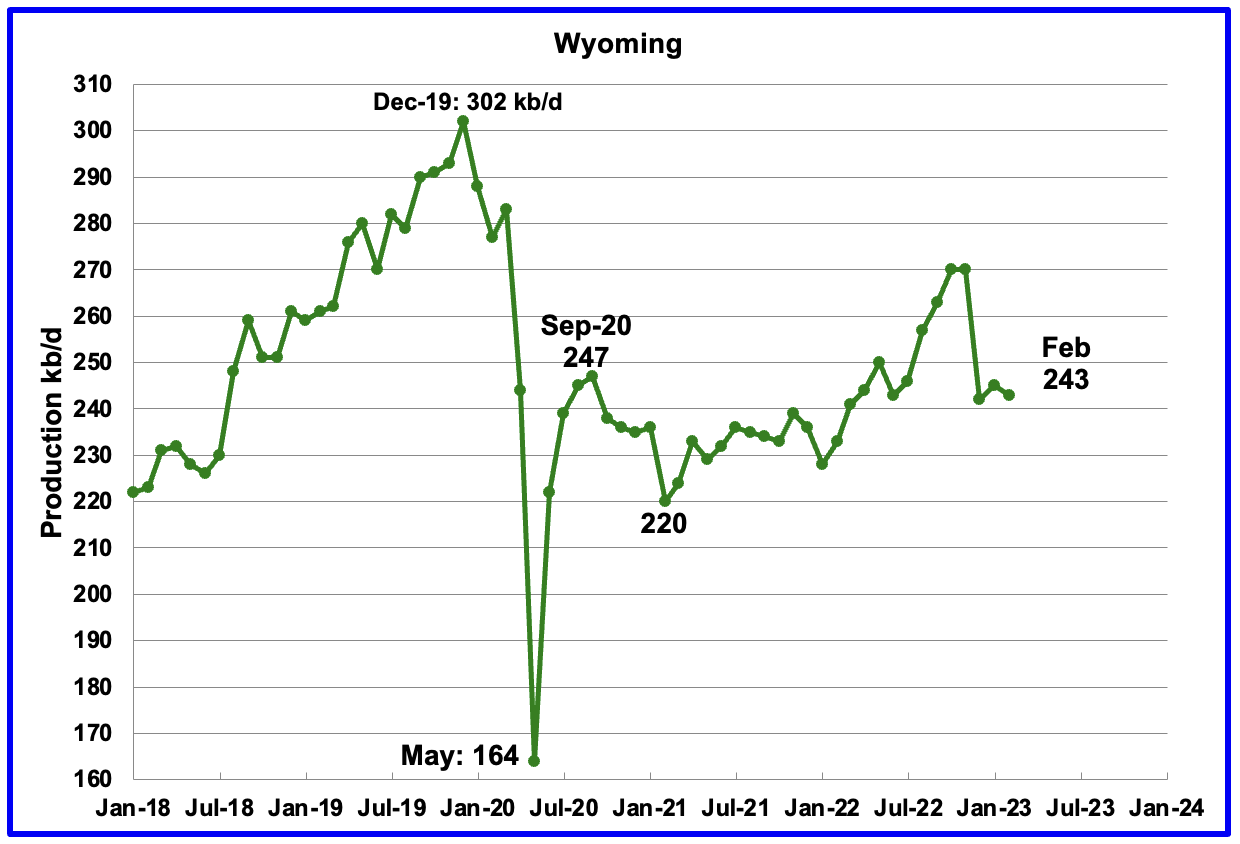

Wyoming’s oil production has been on a slow unsteady uptrend from the low of 220 kb/d in February 2021 due to increased drilling. October and November 2022 output reached a post pandemic high of 270 kb/d. Weather affected December production and February’s production is largely unchanged from January. February’s oil production dropped by 2 kb/d to 243 kb/d.

In late 2022, Wyoming had 18 rigs operating which dropped to 15 in January and dropped further to 12 in February.

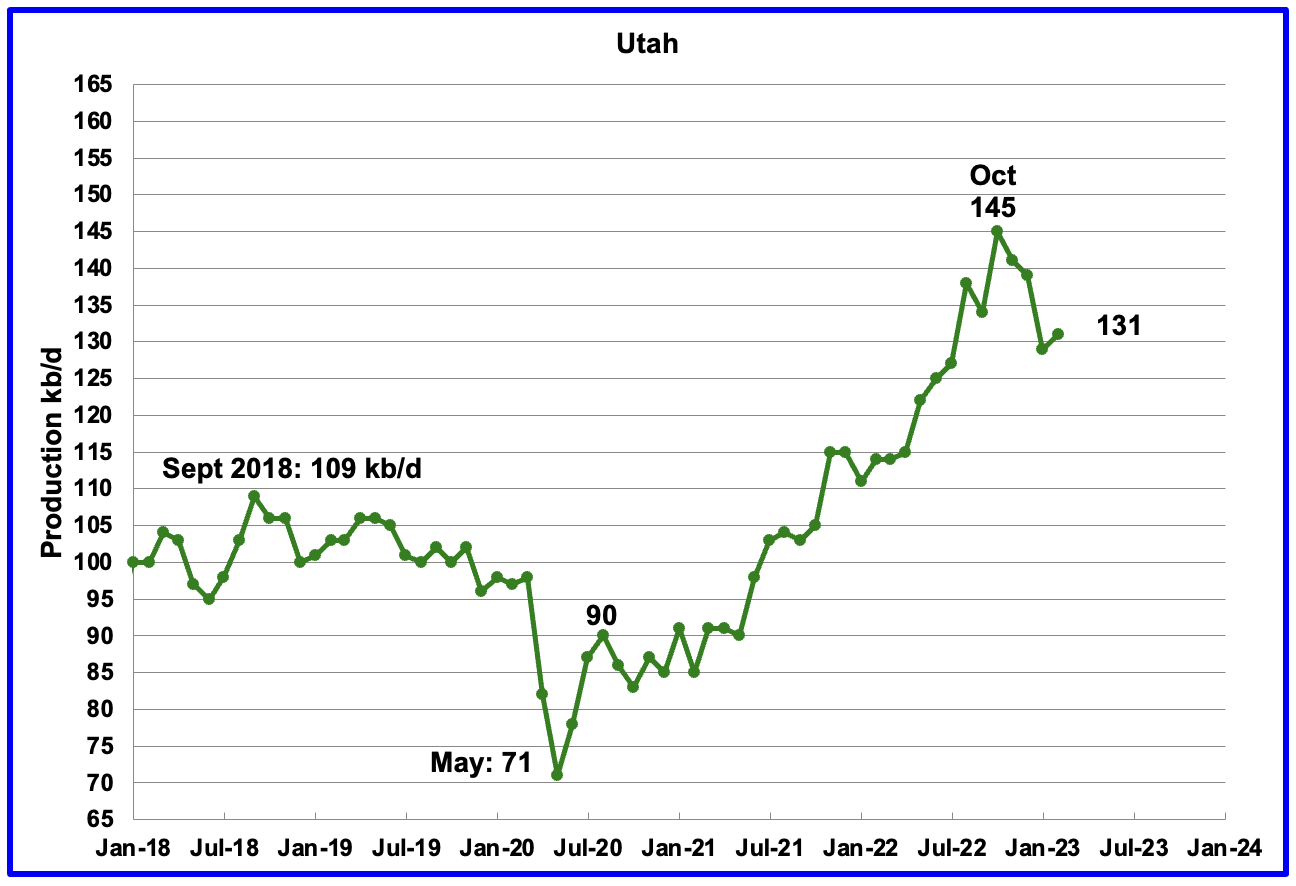

Utah’s oil production increased steadily since early 2021 and reached a new high of 145 kb/d in October 2022. However since then, production has declined by 14 kb/d to 131 kb/d in February.

Utah had 7 Hz rigs operating in January and February 2023, up from 5 in January 2022.

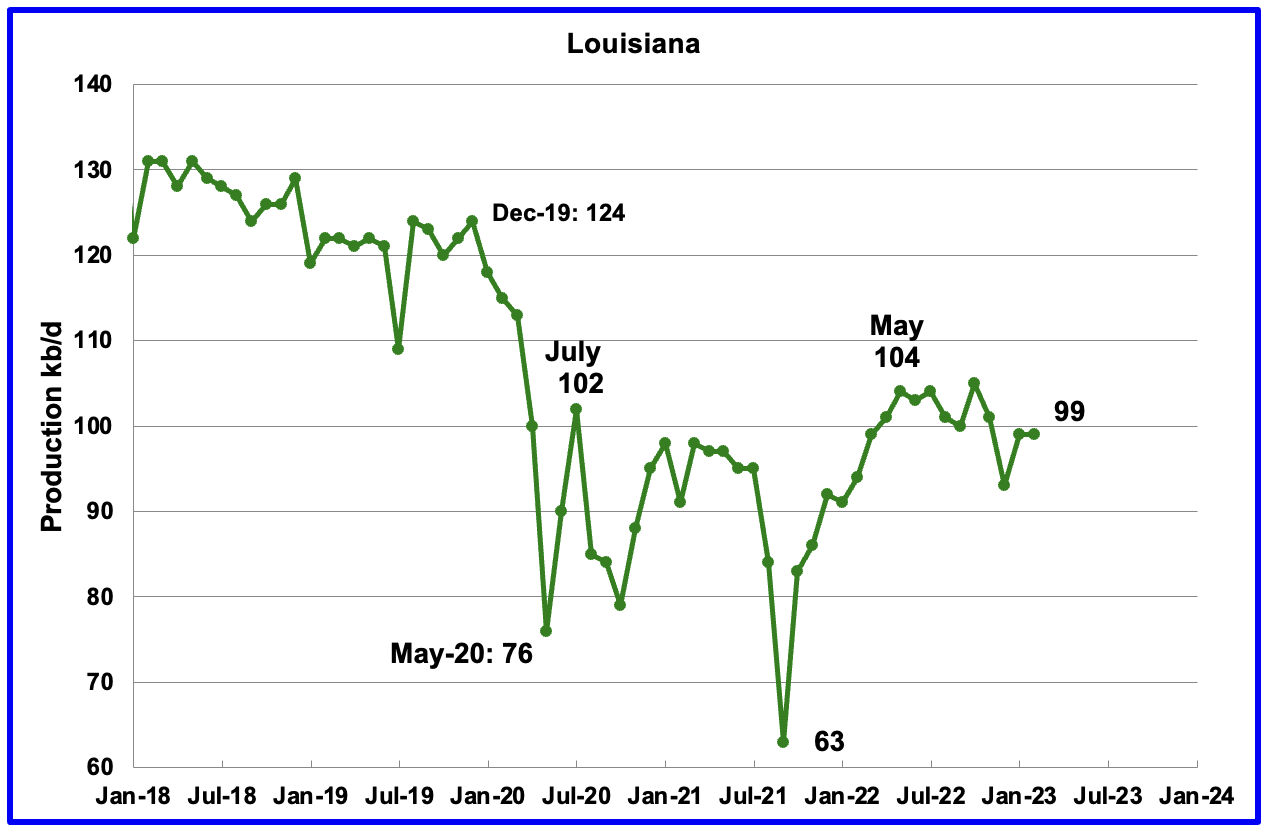

Louisiana’s output rose from the low of 63 kb/d in September 2021 to 104 kb/d in May 2022. Since then output has plateaued. February’s production was unchanged at 99 kb/d and is 5 kb/d lower than May 2022.

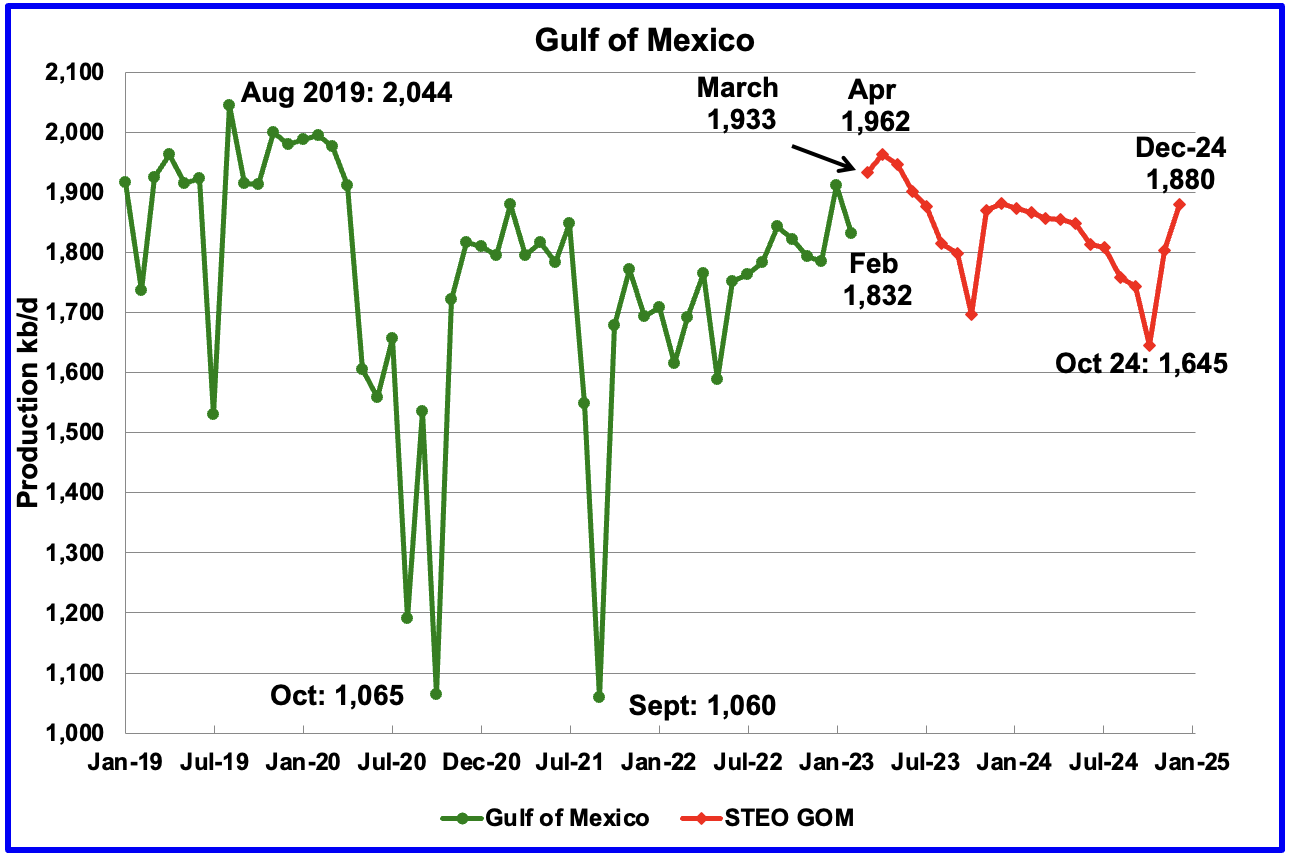

GOM production decreased by 79 kb/d in February to 1,832 kb/d. If the GOM was a state, its production would normally rank second behind Texas.

The March 2023 STEO projected GOM output for February 2023 would drop to 1,828 kb/d. Amazingly, it just missed by 4 kb/d.

The April 2023 STEO projection for the GOM output has been added to this chart and projects that output in March 2023 will rise to 1,933 kb/d.

This could be a reasonable estimate since Shell announced that the Vito platform had begun production on February 15, 2023.

It is not known if the GOM decline after March 2023 is related to extensive maintenance.

A Different Perspective on US Oil Production

The Big Two states’ combined oil output for Texas and New Mexico.

February’s production in the Big Two states decreased by a combined 26 kb/d to 7,071 kb/d with Texas contributing 25 kb/d while New Mexico dropped 1 kb/d.

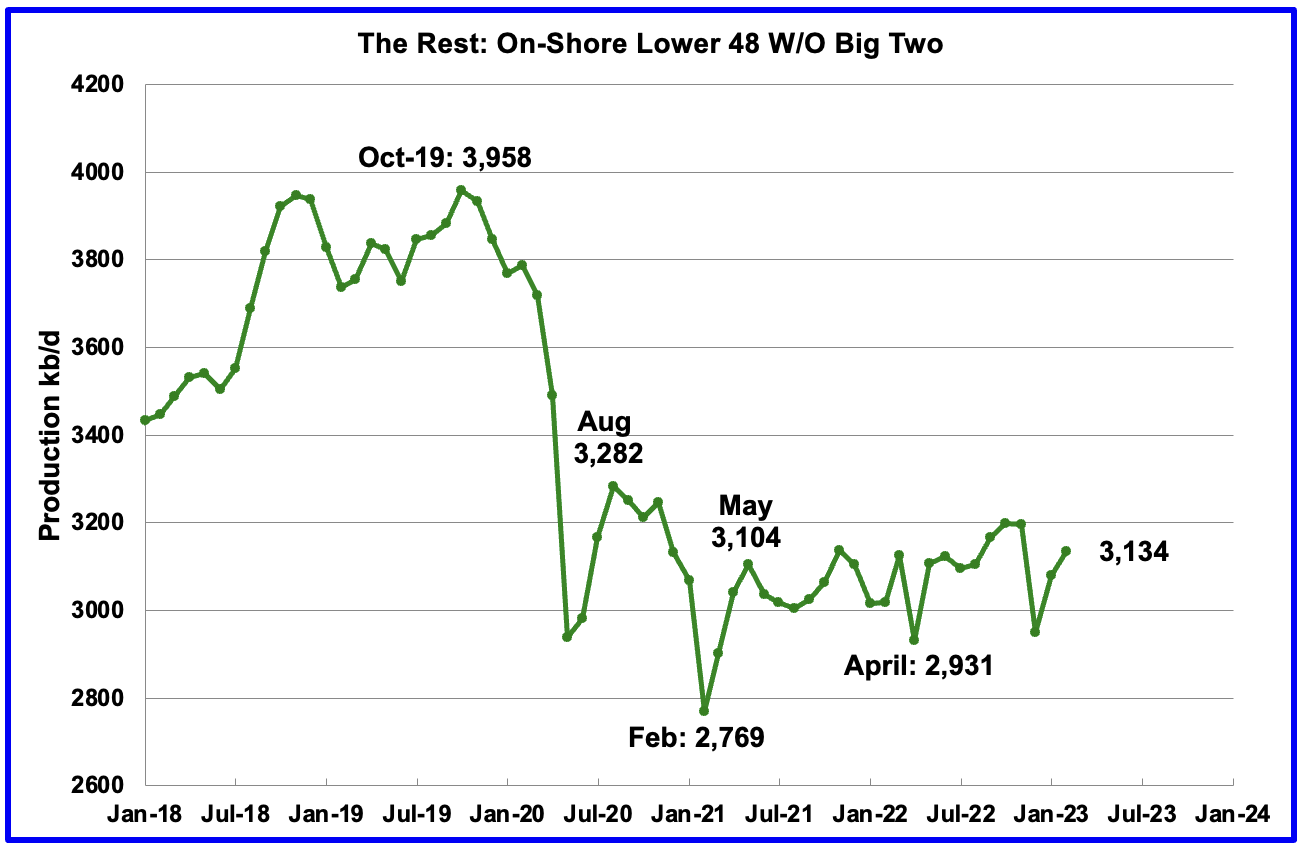

Oil production by The Rest

In February production in The Rest rose by 54 kb/d to 3,134 kb/d. From May 2021, oil production in The Rest has been range bound between 3,000 kb/d and 3,200 kb/d and has not given any clear indication of being in decline or rising.

The main takeaway from The Rest chart is that current production is 824 kb/d below the high of October 2019. The question we need answered is “Is this a permanent loss that will never be recovered?” All indications continue to be that this is a permanent loss.

Rigs and Fracs

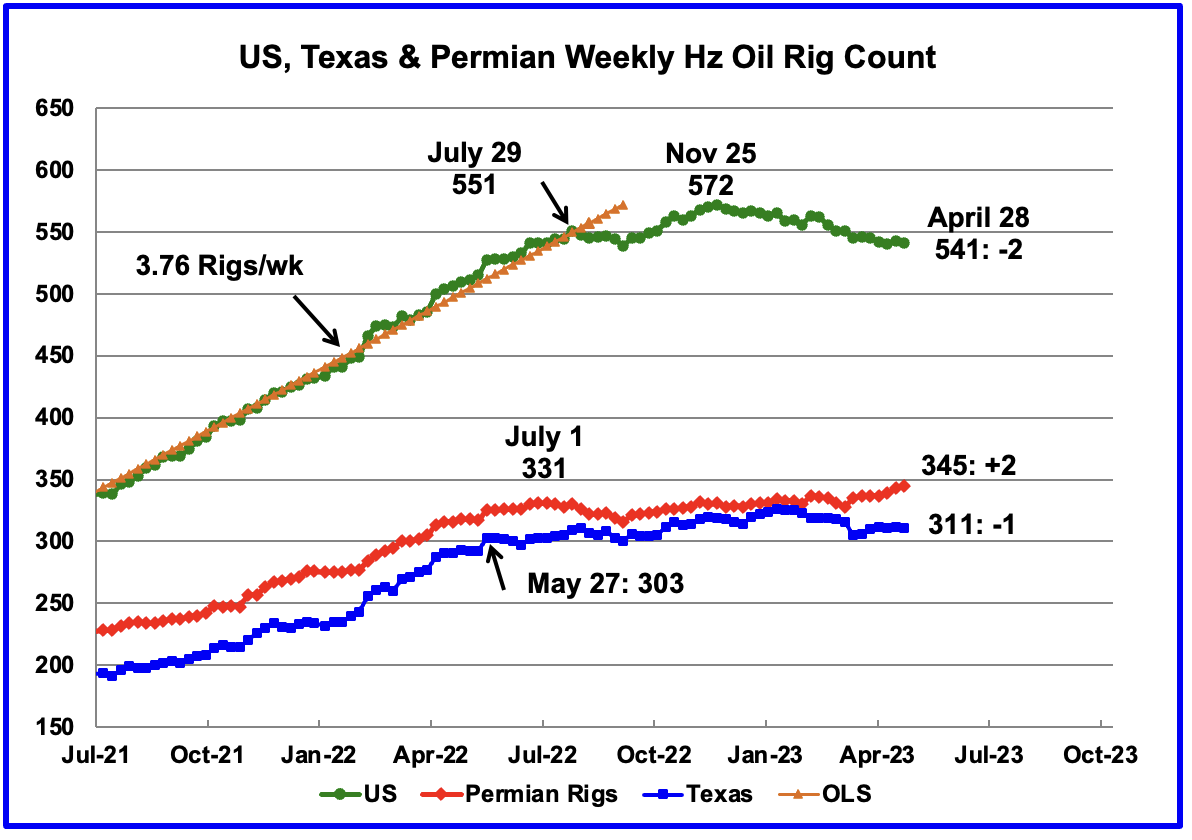

Since the beginning of April 2021 through to the week ending July 29, 2022, the US added horizontal oil rigs at a rate of close to 3.76 rigs/wk, orange OLS line, and peaked at 551 rigs in the week ending July 29. However since then the number of operational rigs has wondered primarily sideways.

A high of 572 rigs was reached in the week ending November 25, 2022. In the week ending April 28, 2023 the number of rigs decreased by 2 to 541 and are down 31 from the recent high of 572.

In the week ending April 28, Permian rigs increased by 2 to 345 and Texas rigs dropped by 1 to 311. Note that the trend for rigs in the Permian is showing a slow increase from September 2022 and is currently 14 above the high of 331 on July 1, 2022.

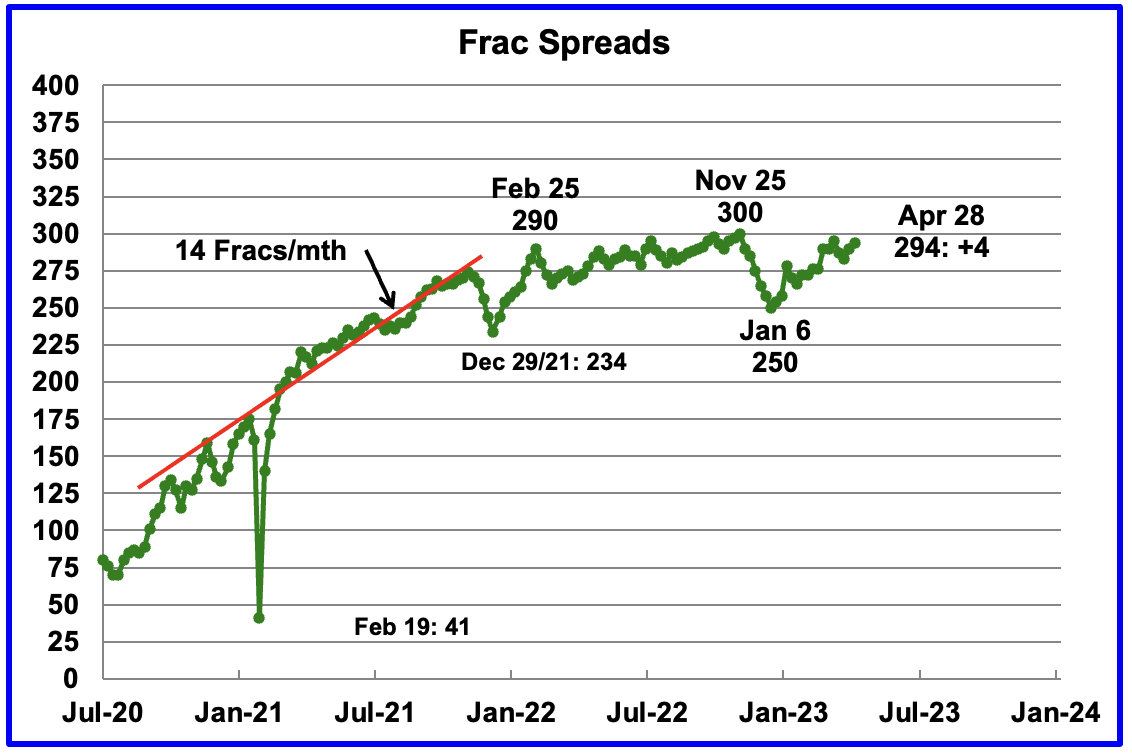

For frac spreads, the general trend since the week of January 6, 2023 can best be described as recovering from the slow down associated with the 2022 Thanksgiving and Christmas holidays. This trend is a repeat of what happened last year. However there is one difference. Last year the recovery took place over 9 weeks while this year it has taken 13 weeks so far.

For the week ending April 28, the Frac count increased by 4 to 294. How far above 300 will the Frac count get in 2023?

Note that these 294 frac spreads include both gas and oil spreads.

This interesting comment appeared in this North Dakota source regarding the availability of Frac crews: “Well completions rose in February and dropped in March due to volatility in the availability of fracking crews, Helms added.” Is this a North Dakota issue or does it also apply in the Permian?

Frac Spread Count Detail

The Frac Spread Count, provided by energy consultancy Primary Vision, measures how many crews across the U.S. are drilling wells in preparation for hydraulic fracturing of shale, and serves as a simultaneous indicator of the number of wells being drilled, as well as a leading indicator of crude oil production.

I have been working recently with the Frac Spread count database to try to understand how to use it. Some progress has been made and some initial results are provided. This is some of the typical information provided in their database, OperatorName, WellName, the vertical distance from a point in the well (usually the current or final depth) to a point at the surface, the total oil volume.

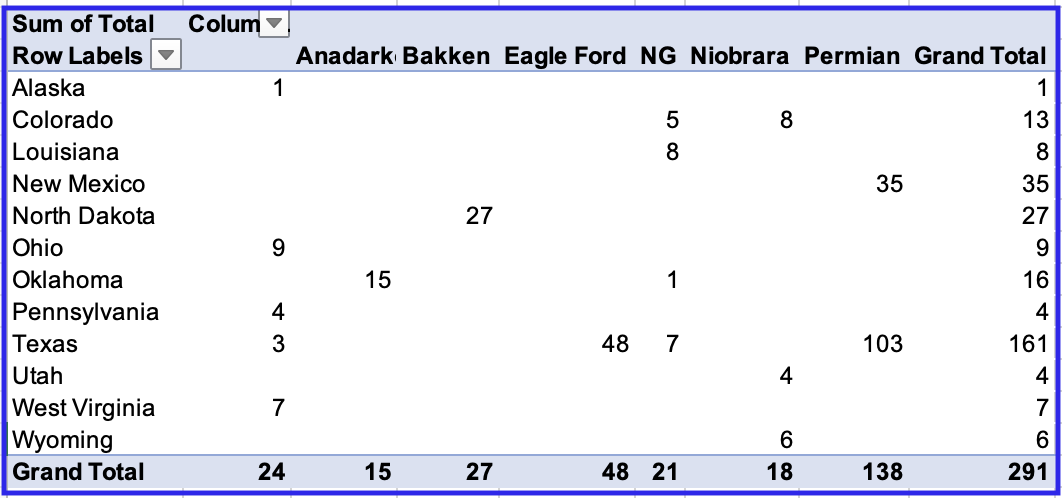

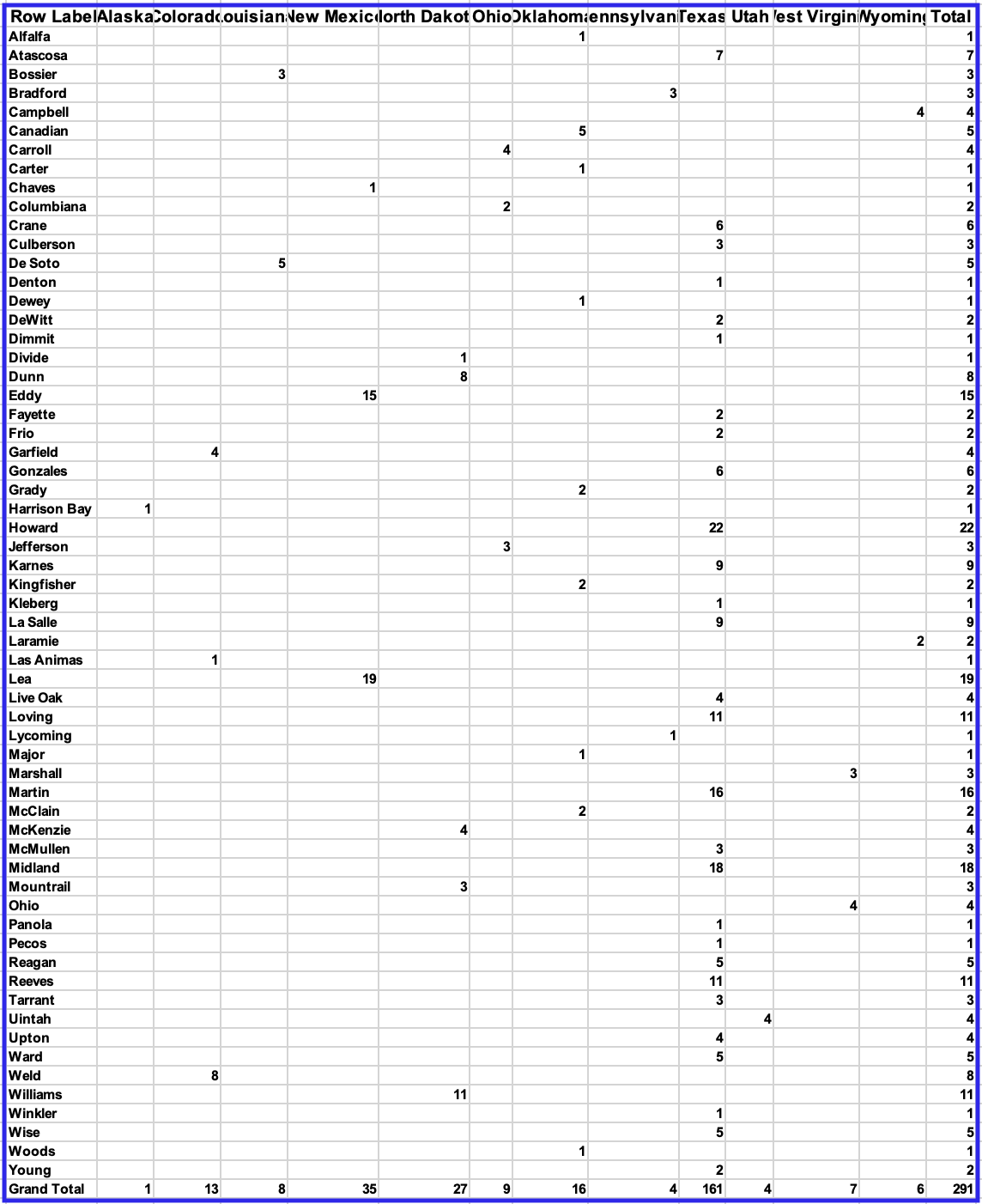

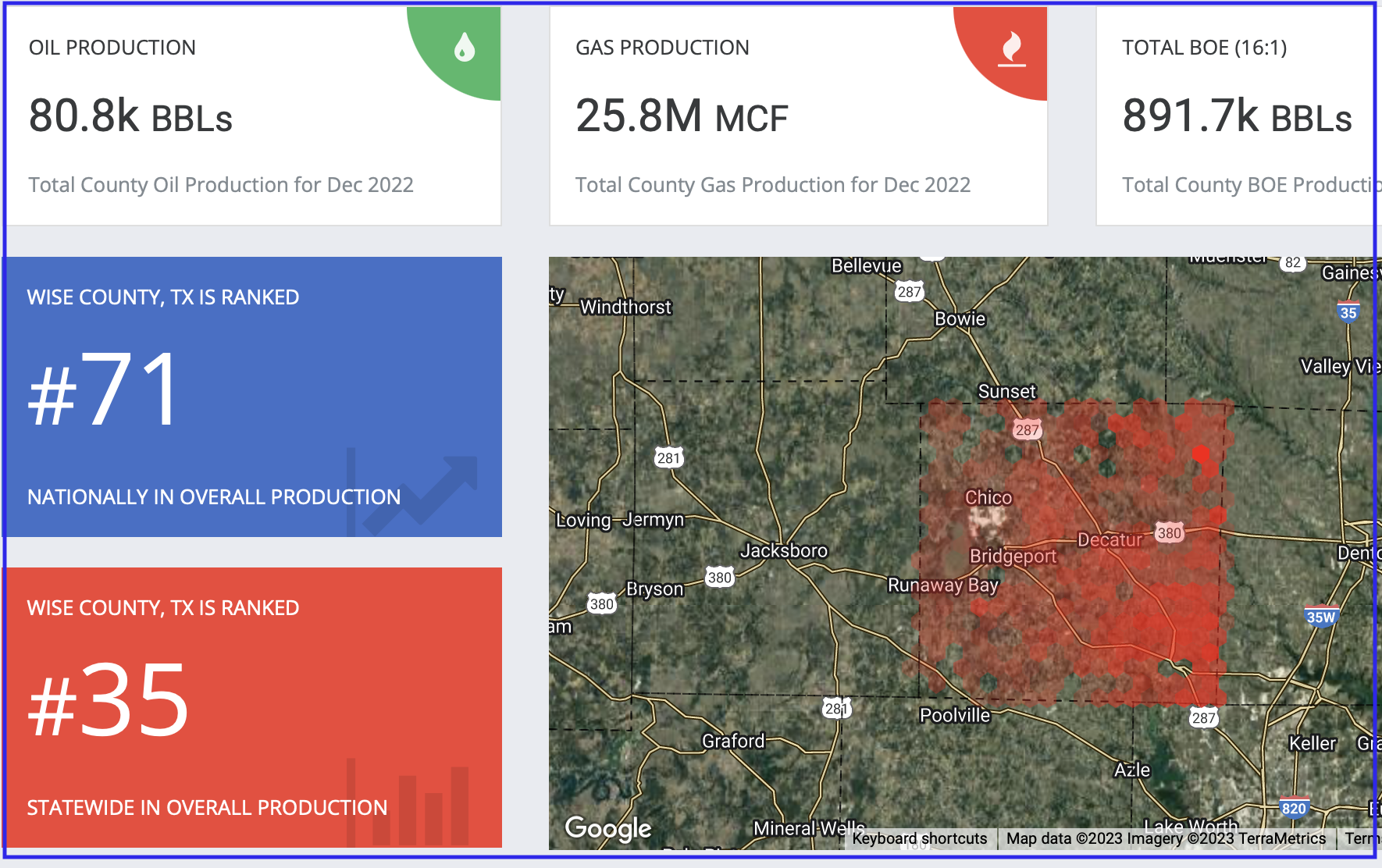

This above table shows the distribution of Frac spreads by Basin and State. The column NG was added to indicate which counties were primarily NG producers in places such as Texas and Colorado. Note that Pennsylvania and Ohio have no Frac spreads because they were left “Blank” in the spreadsheet since I think they are mostly natural gas plays.

The above results are for the week March 25 to March 31. According to the official Frac Spread site that week had 290 frac spreads operating. The table is showing 291. Of the 270 oil Frac Spreads, 138 or 51% are located in the Permian.

That date was chosen since the Frac data file is not fully up to date for later weeks.

This table shows the distribution of Frac spreads by State and County. Lea and Eddy counties are the hot spots in New Mexico while Howard, Midland, Loving, Martin, Midland and Reeves are the most active counties in Texas.

I would be interested in hearing whether there are any Gems in the two pivot tables or any additional info I should look at.

The info for many the lesser known counties came from this source. Information at this site and other similar ones indicate whether it is primarily an oil county or gas county.

Drilling Productivity Report

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The April DPR forecasts production to May 2023 and the following charts are updated to May 2023. The DUC charts are updated to March.

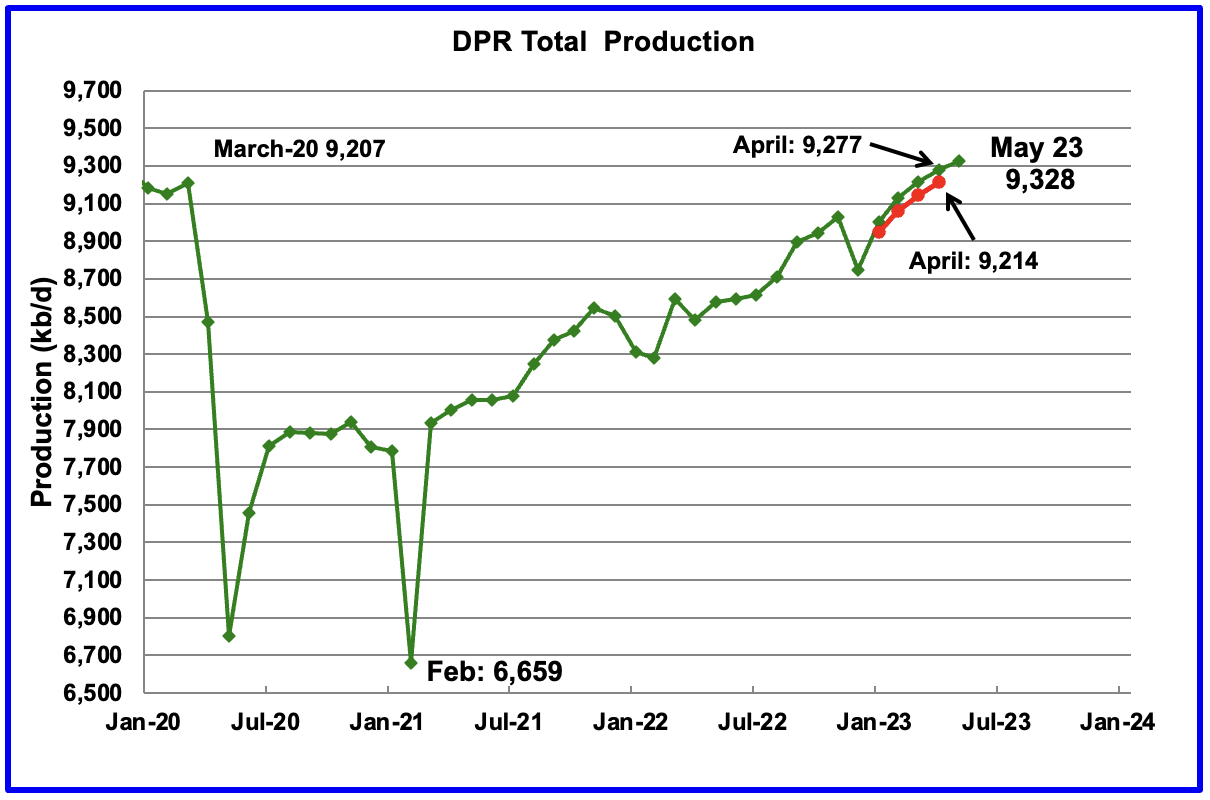

Above is the total oil production projected to May 2023 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The April DPR report made a modest upward revision to the March report. For instance, April output was revised up by 63 kb/d from 9,214 kb/d to 9,277 kb/d. The DPR is projecting that oil output for May 2023 will increase by 50 kb/d to 9,328 kb/d, a new all time high. The pre-pandemic high was 9,288 kb/d in December 2019.

Note the rolling over production trend over the past five months. See next chart.

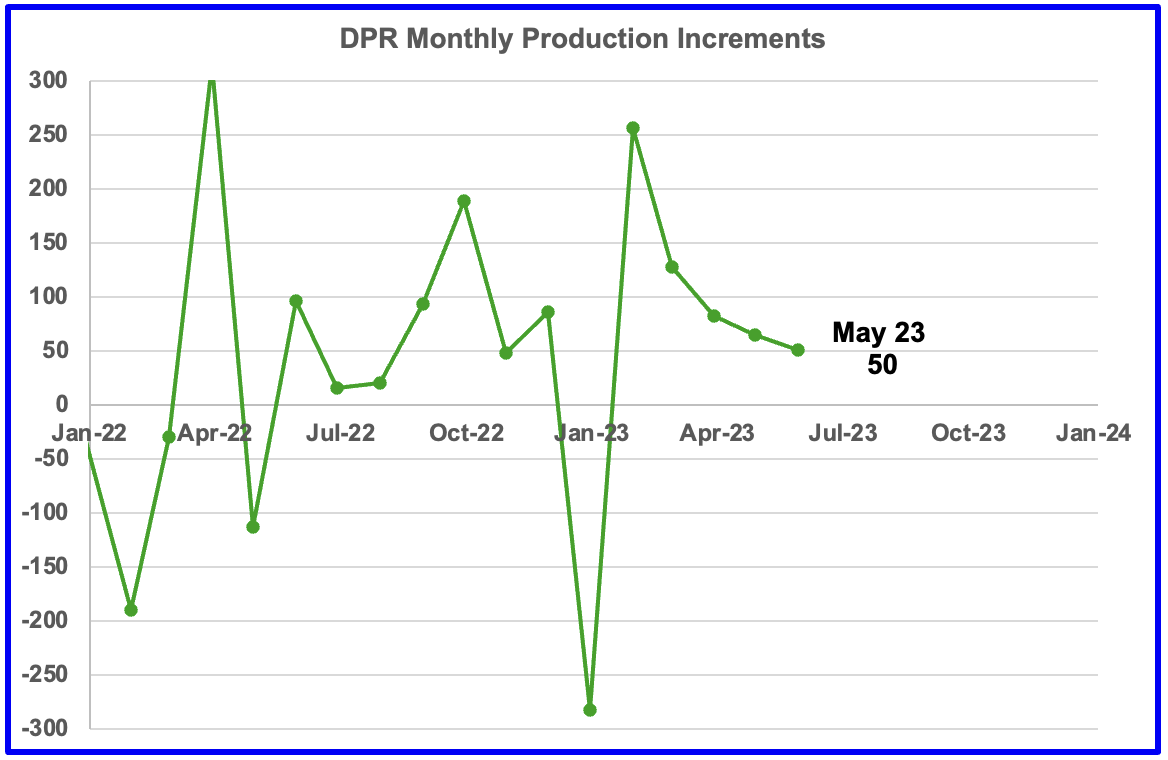

This chart shows the monthly DPR production increments. What is notable is the reduced month to month volatility since January 2023. The January 2023 spike is due to the weather related December oil production drop.

The more interesting trend to notice is the declining monthly changes in the production rate. March’s production increase was 82 kb/d while May’s increase dropped by 32 to 50 kb/d. This short term trend is hinting at an upcoming plateau in Permian production, since it is the dominant producer.

The issue is whether this trend is the result of management’s decision on how to deploy its revenue, investors vs production, or is it related to geology, fewer Tier 1 locations along with the Permian gassing out?

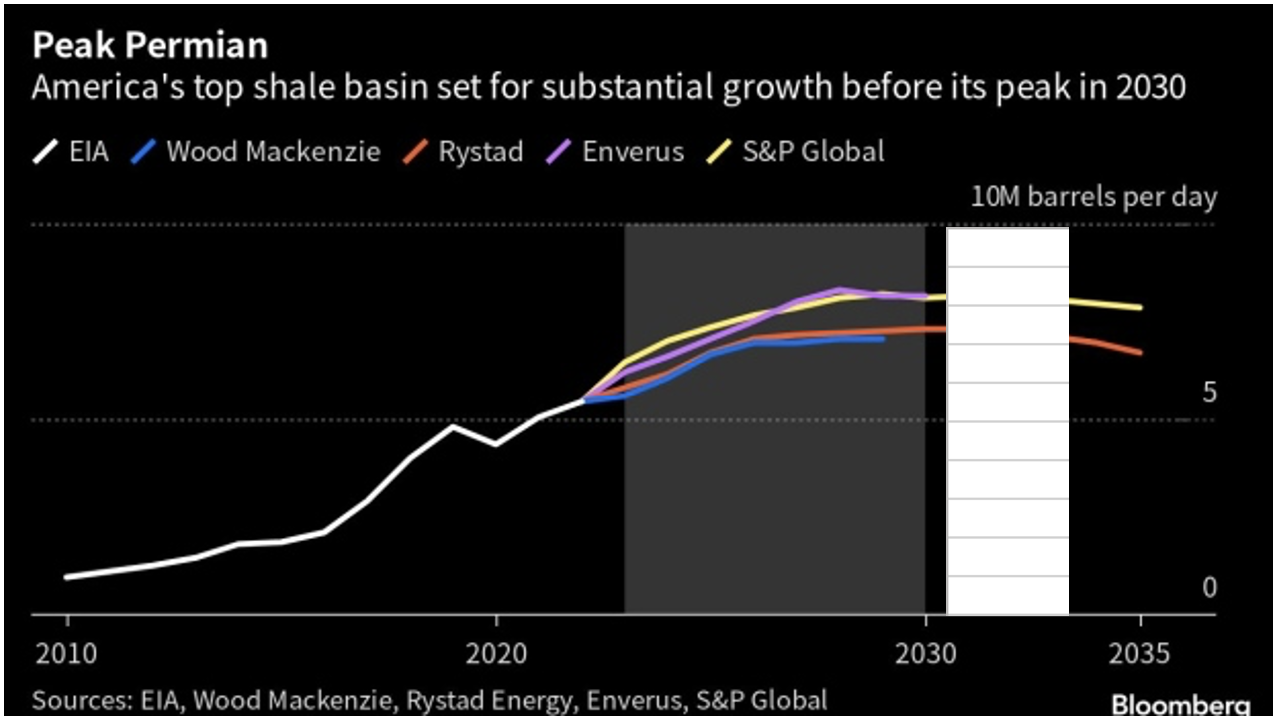

However this source‘s longer term forecast is that the Permian will continue to grow till 2030 and peak at close to 7,860 kb/d in 2030. See next chart.

In this chart, Rystad and Wood Mackenzie are forecasting peak production in 2030 of 7,000 kb/d to 7,200 kb/d. On the other hand Enverus and S & P Global are forecasting peak production of 8,100 kb/d in 2030. The white graph is the EIA Permian projection showing close to 5,500 kb/d in early 2023. The white scale has been added to read the chart for 2030.

In January 2025, Rystad and Wood Mackenzie are indicating production of 7,100 kb/d to 7,250 kb/d while Enverus and S & P Global are showing production at 6,900 kb/d.

Looking at the lower estimate of 6,900 kb/d in January 2025 and current production of 5,700 kb/d (See next chart), and the slowing production in the Permian, it is difficult to see 1,200 kb/d being added over the next 19 months, based on the latest DPR info.

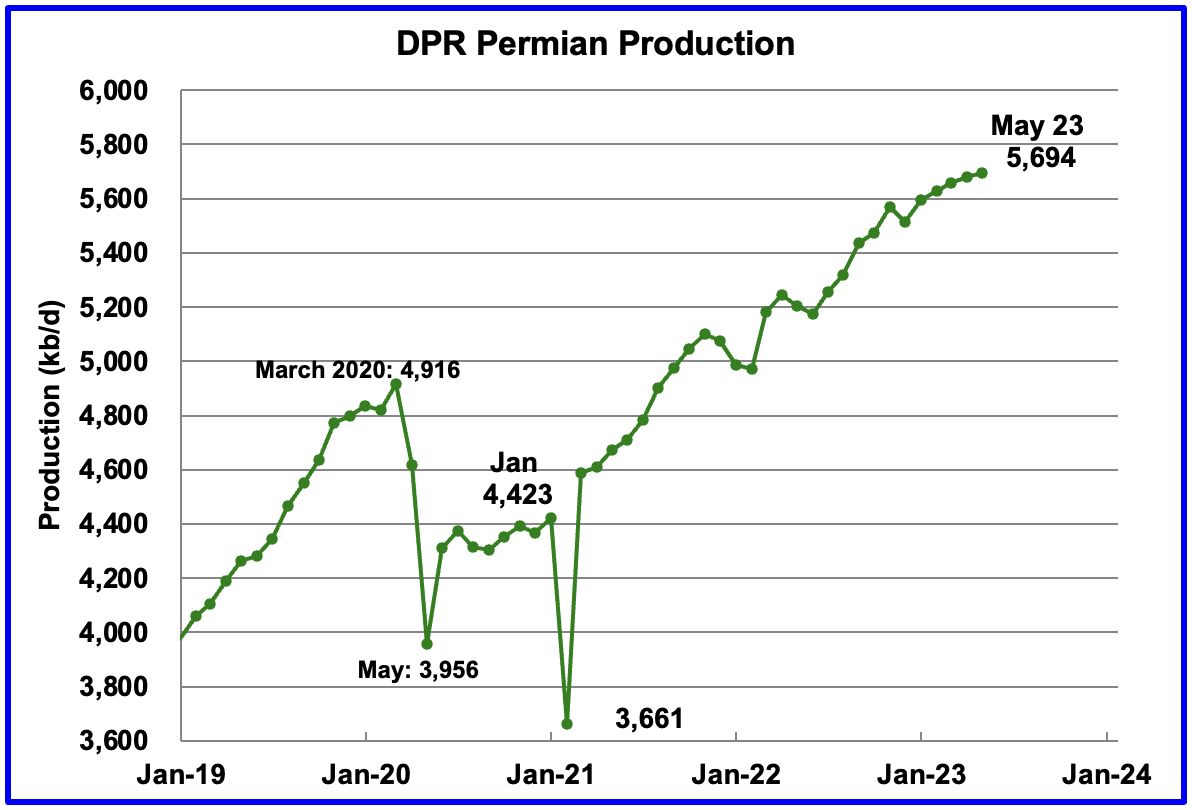

Permian output continues to rise in May. It is expected to increase by 13 kb/d to 5,694 kb/d.

If the Permian were part of OPEC, at 5,694 kb/d it would be the second largest producer after Saudi Arabia. April’s output is 778 kb/d higher than the pre-pandemic high 4,916 kb/d.

In February, the monthly production increase was 32 kb/d. In May it drops to 13 kb/d. This plateauing trend in the chart is very visible over the last four months, which is similar to the overall trend for the combined production in all of the LTO basins.

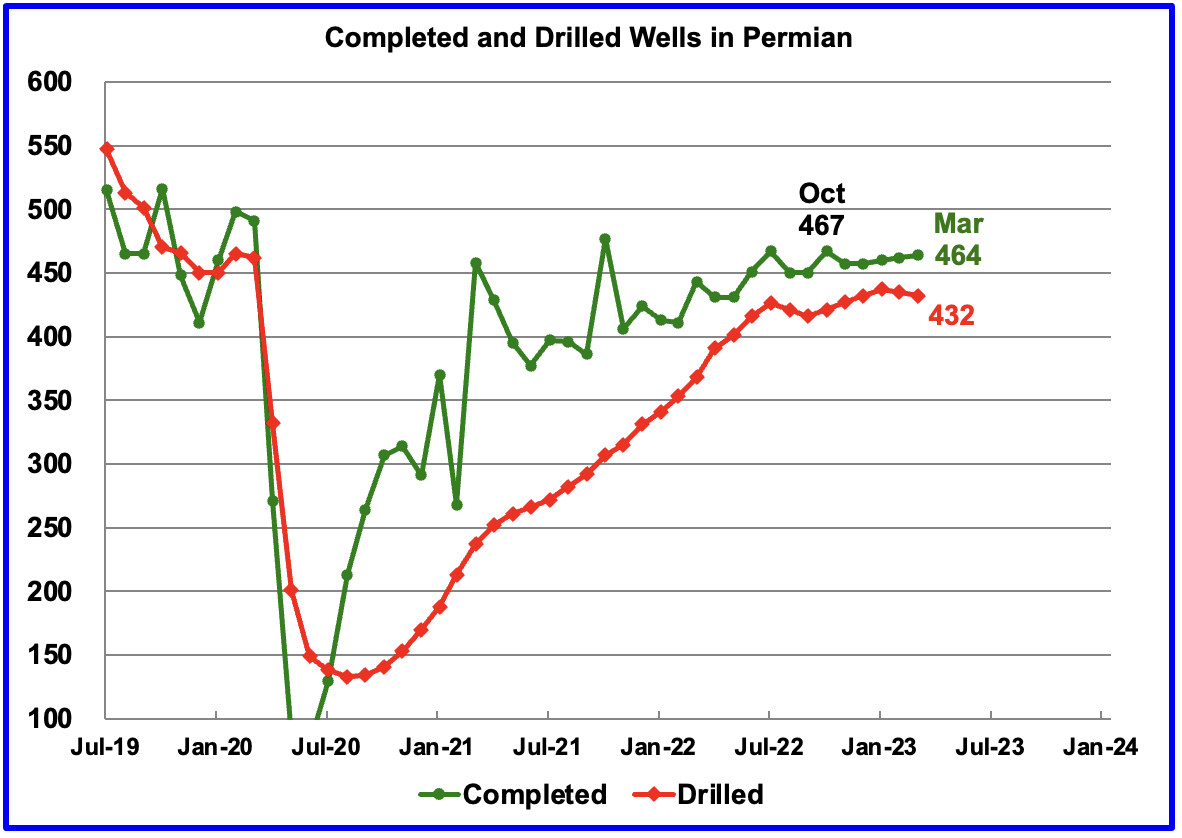

During March, 432 wells were drilled and 464 were completed in the Permian. (Note that March is the latest month for DUC information). The completed wells added 376 kb/d to March’s output for an average of 809 b/d/well. The overall decline was 345 kb/d which resulted in a net increase for Permian output of 31 kb/d. Of the 464 completed wells, 425 were required to offset the decline.

Note that the increased use of DUCs is a reversal of what occurred in the previous months where drilled and completed wells were essentially the same. For May, well competitions exceeded drilled wells by 32.

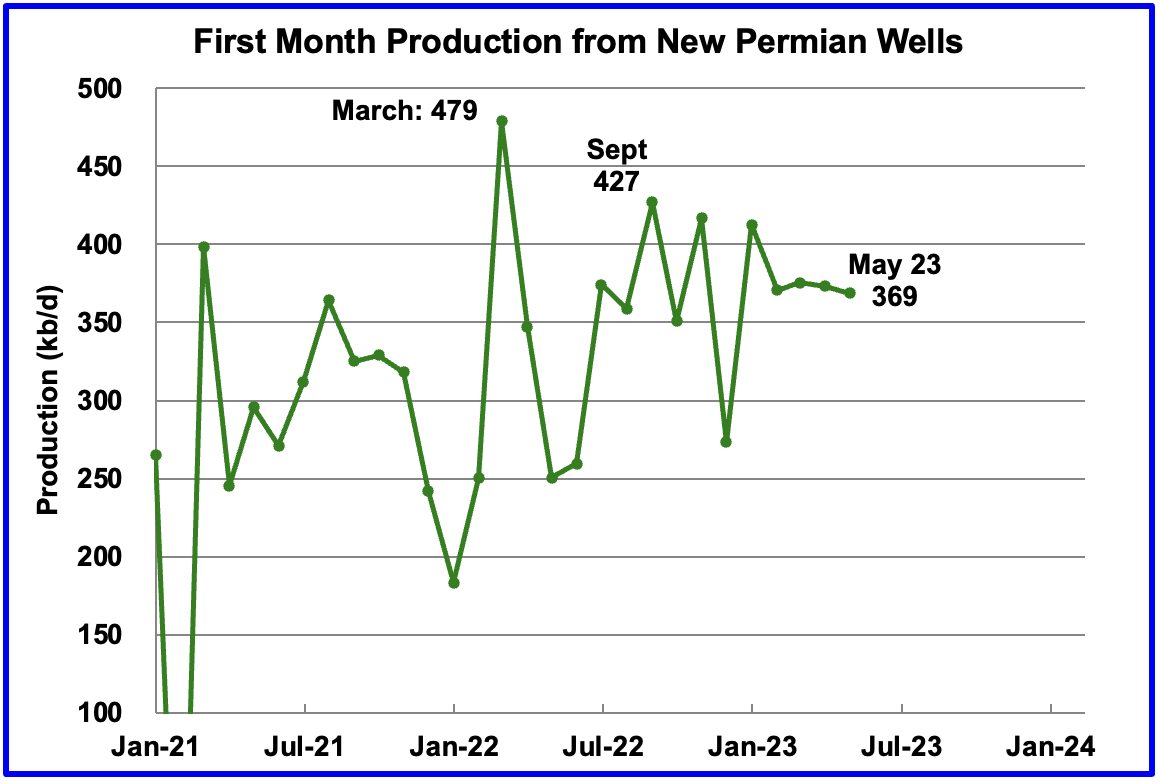

This chart shows the average first month total production from Permian wells tracked on a monthly basis. The total monthly production from the newest Permian wells in May continues to be at the 370 kb/d level. To achieve that production level in May, drillers completed 32 more wells than were drilled. In other words the Permian DUC count dropped by 32.

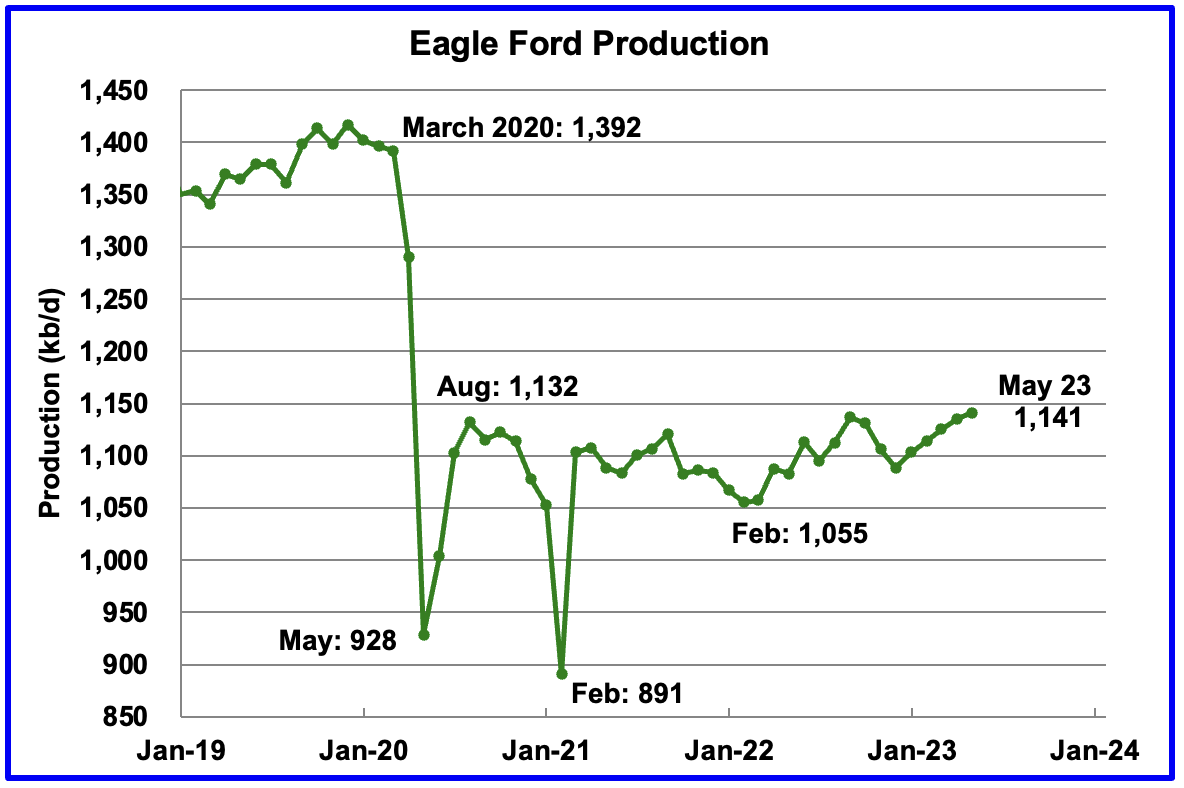

Output in the Eagle Ford basin has been in a generally flat trend since March 2021. However since the December 2022 weather induced production drop, production has been increasing. May’s output is expected to increase by 6 kb/d to 1,141 kb/d and now exceeds the August 2020 output of 1,132 kb/d.

At the beginning of the year 2023, 68 rigs were operating in the Eagle Ford basin. The rig count began to drop in mid March to 60 and dropped further to 57 in the last week of April.

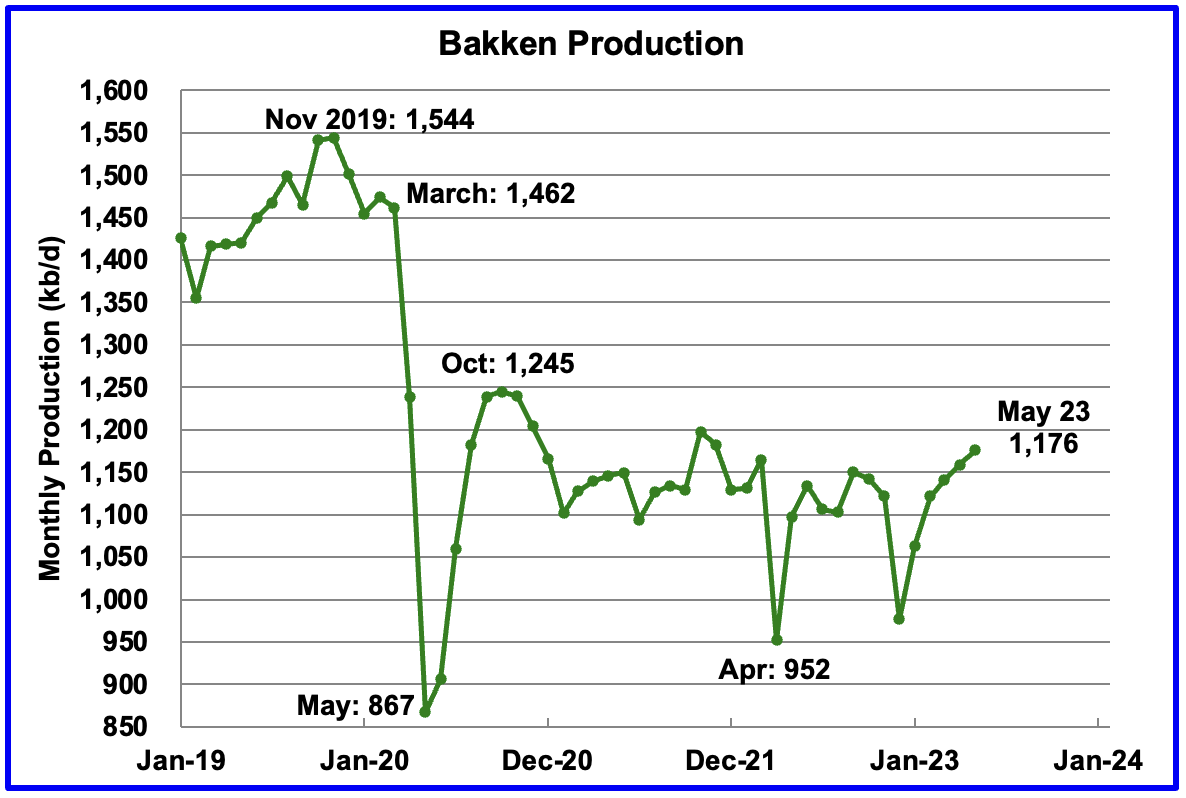

The DPR forecasts Bakken output in May will be 1,176 kb/d an increase of 17 kb/d over April.

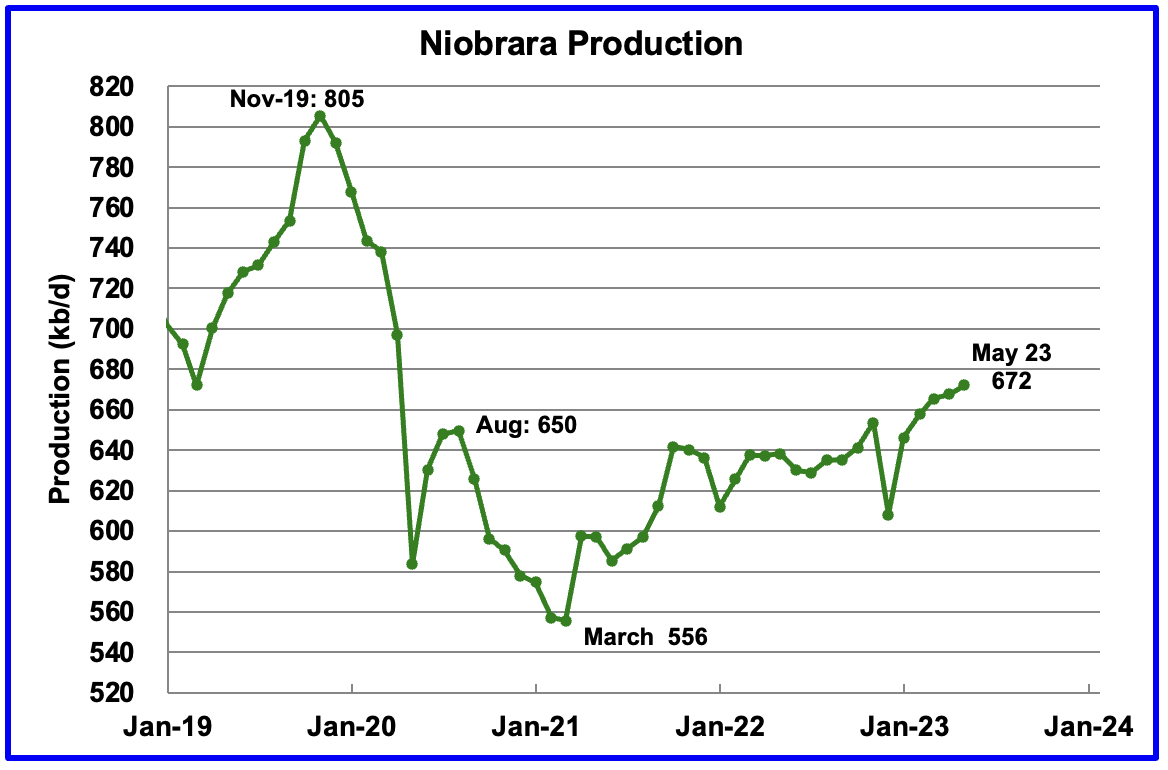

Output in the Niobrara continues to increase slowly. May’s output increased by 4 kb/d and set a post pandemic high of 672 kb/d.

Production increased due to the addition of more rigs into the basin. The Niobrara had 16 ± 1 rigs operating from January 2023 to April 2023.

DUCs and Drilled Wells

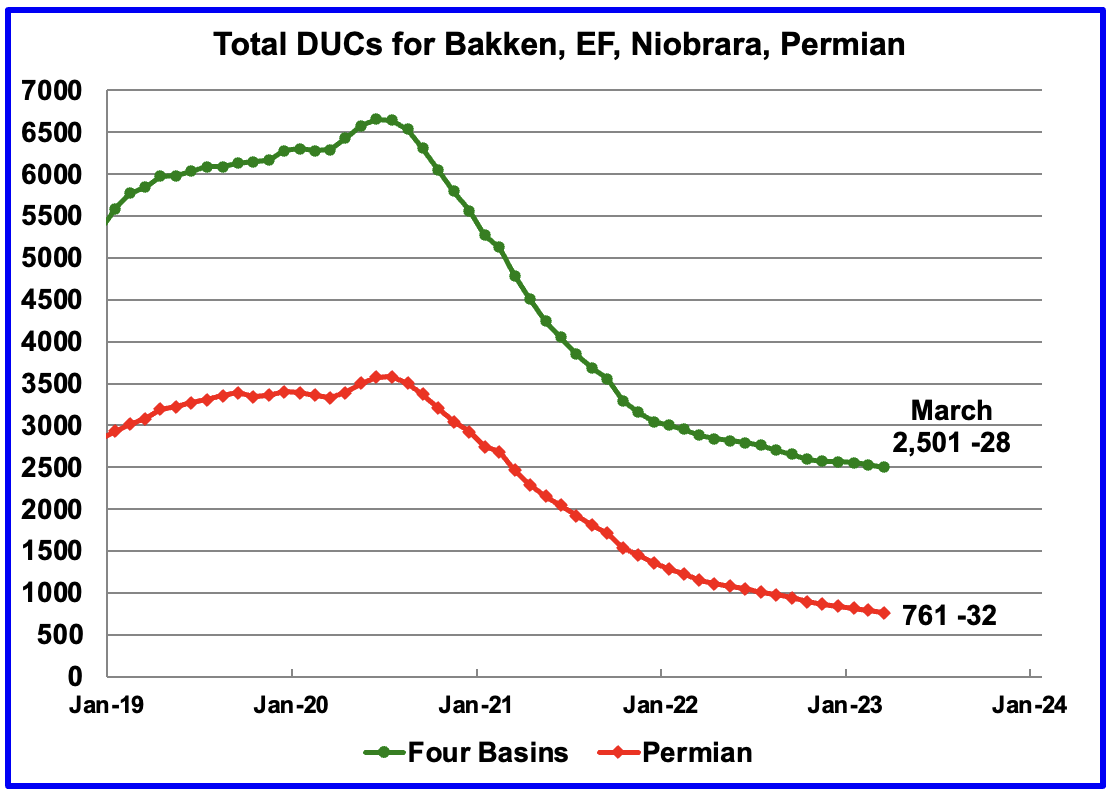

There has been a significant revision to the DUC data in the April report. First the total number of DUCs over the last five months has been reduced by approximately 200. Secondly the trend has changed from increasing back to decreasing.

The number of DUCs available for completion in the Permian and the four major DPR oil basins has fallen every month since July 2020 and continued to decrease in March. March DUCs decreased by 28. The biggest decrease came from the Permian where DUCs decreased by 32 while Eagle Ford DUCs dropped by 10 and the Niobrara added 15, for a net of 27. The Bakken DUCs decreased by 1.

The Permian basinalso had the same revisions as the four basins. Permian DUCs were revised down by over 300 and the trend reverted to decreasing. May Permian DUCs decreased by 32 to 761 because 432 wells were drilled and 464 were completed.

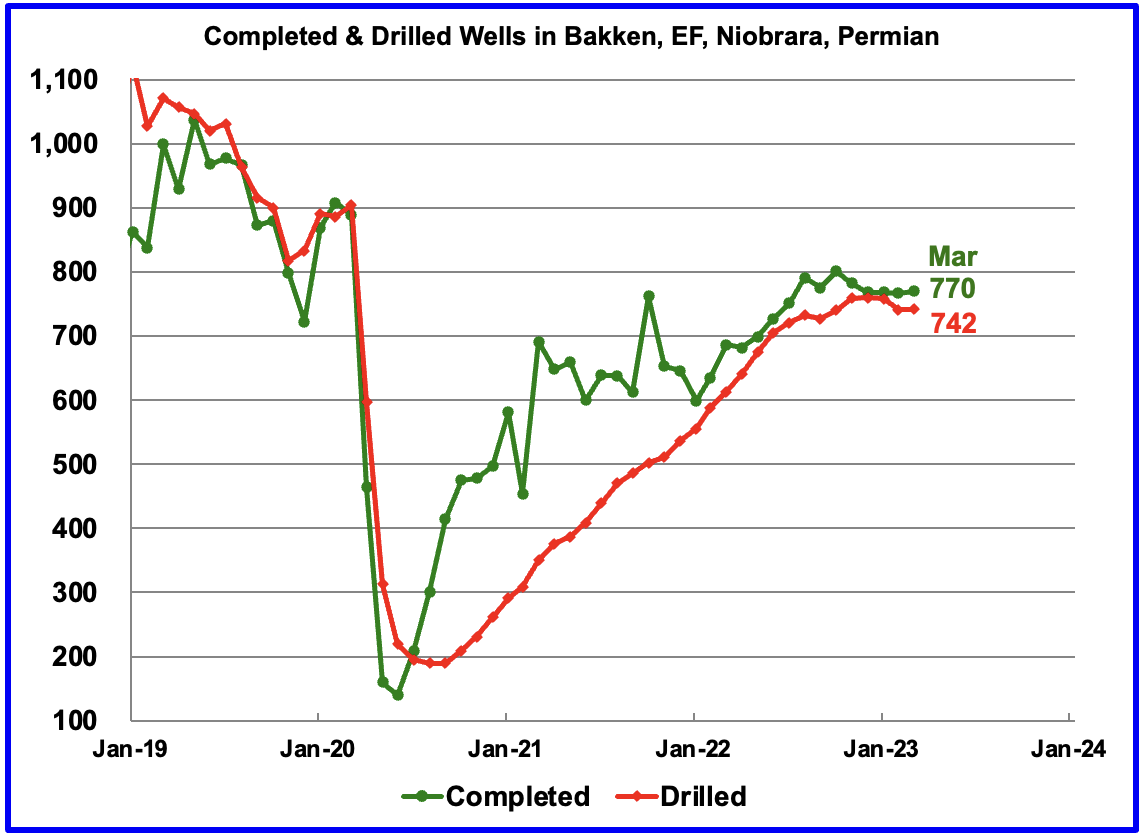

In these 4 basins, 742 wells were drilled while 770 were completed for a net decrease of 28 DUCs in March.

In the Permian, the monthly completion rate has been showing signs of stabilizing since the October high of 467. This is consistent with the frac spread chart shown above where there has been slow growth in frac spreads since February 2022. The number of wells drilled in the Permian is now showing signs of plateauing at the 435 level.

In March 464 wells were completed, an increase of 2 over February. During March, 432 new wells were drilled, a decrease 3 from February. The gap between completed and drilled wells in the Permian has now opened up to 32.

The Permian, as of March has 761 DUCs and the current completion rate is 464 wells/mth. This means that the current cycle time between drilling and completions is 1.64 months or 50 days.

The Peak Permian graph with all of the future projections is interesting. I suspect it’s not too different from Dennis’s? Is Permian production going to rise from the current 5+ to 7-8 mmbopd in the 2026-2028 timeframe?

Bob,

I agree, that chart was interesting. My best guess is a Permian peak at about 6600 kb/d in late 2028, this scenario assumes a maximum completion rate of 500 wells per month, recent EIA estimates have the Permian completion rate at about 464 wells completed in March 2023. My scenario assumed 429 wells completed from August 2022 to July 2023 with the completion rate increasing at about 4 wells per month on average from July 2023 to Jan 2025 when a completion rate of 500 wells per month is reached (464 wells/month is reached in April 2024 for the scenario). Below the data points called out are for December of 2021 to 2029 in kb/d. Note that it is assumed that completion rate starts to fall after July 2027 and reaches 472 wells per month in August 2028 (at peak monthly output for the scenario). By Jan 2034 (end of the part of the scenario shown), the completion rate has fallen to 150 wells per month and reaches zero in April 2035. Also note the URR for the scenario is 38.5 Gb with cumulative production from Jan 2010 to March 2023 at 10 Gb. At peak in mid 2028 cumulative output is about 22 Gb for the scenario.

Obviously if the completion rate were higher or lower than I have assumed output would be higher or lower. I also have not accounted for future decreases in new well EUR, though higher completion rates could compensate for falling productivity as long as prices are high enough to ensure profitability.

An alternative Permian scenario with completion rate reaching 500 wells per month by 2024 and growing slowly to 550 wells per month by late 2026 and then gradually decreasing from late 2027 to Nov 2035 by one well per month (550, 549,…,453,452.) In Jan 2036 the completion rate starts to fall more rapidly by 10 wells per month and reaches zero in August 2039. Peak is about 7350 kb/d in late 2030, URR is 54 Gb. This scenario is similar to the lower scenario in the chart in Ovi’s post.

I seriously doubt there are that many viable locations left to drill.

Lightsout,

About 41699 horizontal wells have been drilled in the Permian basin as of March 2023. You may be correct that there are not that many viable locations left to drill, it depends in part on optimal spacing as well as the price of oil and natural gas. The scenario below assumes a faster decrease in the completion rate than the earlier scenario. URR is reduced to 44 Gb (this is close the the USGS low TRR estimate, 95% probability the TRR is higher) and 22k fewer wells are completed than the 54 GB scenario above. This may also be incorrect.

See

https://www.mdpi.com/1996-1073/15/1/43

In that paper they project 155k well locations after 2021, at the end of 2021 for my scenario about 35k wells had been drilled, so this paper implies that there are about 190k potential well locations. The URR for the scenario in that paper was about 54 Gb.

A final scenario below that assumes 464 wells are completed at most after March 2023 (same as EIA estimate for March 2023). Completion rate starts to fall in Jan 2030 by 5 wells per month up to Jan 2034, and then by 10 wells per month.

Is that in line with refinery capacity (~18 MBpD currently and nearly 100% utilized)?

As others have mentioned, it’s a shame we are trying to burn thru the Permian so quickly, would be better if we kept it for reserves and imported more oil…specially at these relatively low prices (today’s prices are equivalent to $50 per barrel in 2009 pricing)…

Thanks both Ovi and Dennis for taking time out of your day to post these great updates, much appreciated!

Kengeo,

Much of the tight oil would be exported, US refineries can process about 4 kbpd of of tight oil the rest is exported.

I agree that exporting oil from the US is a bad idea, many do not agree which is why the crude export ban ended in 2015.

Exporting oil from America is an excellent idea, for several reasons:

First, America is a huge cumulative net importer of oil since 1945, so net exports would help pay off our vast foreign debt, whether measured in dollar or gallons.

Second, America waste oil more flagrantly than almost all out trading partners. So exporting oil would mean a net reduction in waste.

Third, the bast way to do it would be to tax oil at the pump to cut domestic consumption. that would send a signal to markets that demand is set to fall in America, which would push down prices. That would also discourage drillers in the Permian from drilling too fast. After all, shale oil is expensive oil, so keeping oil prices low is the best way to conserve it.

Alimbiquated,

I do not agree that exporting US resources is a good idea. I do agree that a carbon tax on all fossil fuel is an excellent idea, but in the US that is a minority position, so no action is likely. The inflation reduction act is the best we can do for now.

typo, rax should be tax in comment above.

Fixed it for you Dennis. You should learn how to do this. 🤣

For wide-ranging discussions, I’m finding that GitHub and Gist for GitHub is very nice. You can drop an image into a comment just by doing a screengrab copy&paste. Anyone that has a GitHub account can contribute with equivalent privileges. Check it out: https://gist.github.com/pukpr/

Paul,

Very cool stuff you have been working on of late. For those interested in a sample see

https://geoenergymath.com/2023/04/26/wobble-perturbation/

and

https://geoenergymath.com/2023/03/26/does-gpt-understand-geophysics/

Dennis, thanks. If you have any ideas for neural net analysis of data I could try it out. Noticed some research applied to fracking production.

https://seekingalpha.com/article/4584624-goehring-and-rozencwajg-q4-2022-natural-resource-market-commentary

Russia’s oil and gas budget revenue drops sharply in April

MOSCOW, May 4 (Reuters) – Russia’s federal budget revenues from oil and gas, the lifeblood of its economy, fell 64% in April from the year-earlier period and declined by 5.9% from March, the finance ministry said on Thursday, as a result of higher subsidies to oil refineries.

Budget income from oil and gas sales reached 647.5 billion roubles ($8.3 billion) last month, compared to 688.2 billion in March and 1.798 trillion roubles in April 2022, it said.

April, while the same payments to oil refineries under the “damping mechanism” rose to 107.2 billion roubles from 96.7 billion roubles in March.

At the same time, profit-based tax revenues from oil producers fell last month to 185.4 billion roubles, from 220.6 billion roubles in March.

The Russian finance ministry plans to halve subsidies to oil refiners from July 2023, and is aiming to cut payments from the budget under the damping mechanism by 30 billion roubles.

Any projection on crude oil production growth in the Permian is pure speculation at this point. This has to do with the fact that the GOR in new wells is higher than in the past, but also the older wells–say from 2016 to 2020–are now at higher GOR too. Each day, another dozen or so wells drop below the bubble point, with gas coming out of the rock and longer-chain hydrocarbons remaining trapped in the rock. Basin-wide, that amounts to massive amounts of gas in the future.

And it’s not the greatest gas in the world. The Western Haynesville/Eastern Woodbine NG is “certified” of low methane density, whereas the Permian is medium to high. This is very important going forward–in terms of ESG concerns. In fact, there is likely going to be a special trade for certified NG.

With increasing NG production in the Permian, it is entirely possible that greater than expected natural gas production might outstrip takeaway. And when a high-production field “gasses out,” it is no easy thing to convert crude oil pipelines to NG pipelines, because crude pipes are generally of lower diameter and not designed for higher tangential wall stresses.

This was not a concern when there were seemingly no guidelines for flaring or venting. But now, that’s mostly in the past, thank God. Personally, I suspect this fear was one of the reasons Scott Sheffield didn’t want Pioneer to “grow” production. If you look at comparison studies (Mike Shellman has a nice chart on his website), Pioneer’s gas production has gone ballistic. Enough that they might overwhelm their pipeline reservation.

Parenthetically, this issue is going to limit every shale oil basin. Texas is lucky; they are “on the water,” and can build pipelines without violating interstate pipeline regulations. North Dakota, not so much. They have no significant takeaway, and NG production has kept the rig count down fully as much as a scarcity of drilling sites.

Gerry,

As gas production increases, more pipelines will be built. I agree all scenarios of the future are guesses. There are no future facts.

I would note that my scenario, which is about 6 months old has been repeatedly called too optimistic, but current reported output is more than the model by about 200 kbpd.

Twilight in the sunset. The beginning of the end of Permian Dominance.

Gerry Maddoux,

I have been looking at Pioneer’s Natgas production and the PROOF is in the pudding.

By looking only at Pioneer’s 2021 and 2022 Oil & Gas Production… SEPARATELY:

When we compare Pioneer’s Permian Q1 2022 Oil to Natgas production to Feb 2023, oil has declined 65% while Natgas is up 1%.

This is a RED FLAG because when we compare Pioneer Q1 2021 to Feb 2022 production, Natgas actually declined 27% over the same period.

Thus, completing (100) 3-mile laterals will only make this situation worse in 2023.

steve

Not necessarily. The 100 new 3-mile laterals may target a separate, independent shale zone that is relatively underdeveloped and thus not exhibiting increasing GOR. Overall GOR may actually stabilize or decrease depending on the pace of development of a low GOR reservoir.

How many horizontal shale wells in the Permian Basin completed since 2006 produced 25 BOPD (not BOEPD) or less in the most recently reported month? Same with Bakken?

Also, if the above can be answered, what percentage are those wells of the total drilled and completed?

Shallow Sand,

Info available at Novilabs.

About 14k of 42k Permian wells at 25 bopd or less as of Jan 2023 based on Novilabs data. Roughly 33%. This number includes inactive and plugged wells from Jan 2007 to Jan 2023 only horizontal wells are included.

For North Dakota Bakken, 53% of 17775 horizontal oil wells completed since 2001produced less than 25 bopd as of December 2022 (data from Novi labs). Of these 13.34% were either plugged or inactive wells (zero output in Jan 2023).

Shallow sand,

The last report from shaleprofile for all of the US (that is available for free) was in April 2022 and had data through December 2021. For December 2021 at that time (data has likely been revised since then, but I do not have access) for all US horizontal tight oil wells covered by shaleprofile.com, 68.9% of completed wells had output of less than 25 bopd, this includes 37.3% of wells that had zero output. Of this 37.3% of wells with zero output about 15.7% were either plugged or inactive. About 5.5% of all completed wells from 2001 to 2021 had been plugged by December 2021. The total horizontal wells completed (in the areas covered by shaleprofile in April 2022) was 153,659 (includes both tight oil and shale gas wells) as of December 2021.

https://novilabs.com/blog/us-update-through-december-2021/

Is Russia Really Cutting Oil Production? Please read the last paragraph, bolded by me. That is exactly what I think is happening.

Earlier this year, Russia said it would reduce its oil production rate by half a million barrels daily in response to Western sanctions and as part of OPEC+ efforts to prop up international oil prices.

Yet export data is creating confusion: based on that data, Russia is producing as much oil as before. At the same time, the number of idled wells in the country has gone up, Bloomberg reported this week. And Russia has stopped reporting official production figures. The situation has all the markings of a good mystery.

A mystery is the one thing this isn’t. According to Bloomberg, the number of idled oil wells in Russia rose to 18.1% of the total in March. This, according to the report, suggests that Russian producers are indeed cutting production.

What seems to be tripping some observers is the fact that while production is declining—at least in terms of the number of wells—exports remain strong. In fact, they even returned to levels before the invasion of Ukraine.

It appears that there is no space for suggesting that Russia can produce less but export more, perhaps because there is uncertainty about its local demand and storage capacity to do so. Whether this is the case or not remains unclear because of the limited availability of production information.

Still, Bloomberg notes, Russian refineries—and there are a lot of these—are currently in maintenance season, which means lower domestic demand for crude, which could provide a possible explanation for the seemingly conflicting information from export data and official idled wells figures.

In its report, Bloomberg also notes that the portion of oil wells idled carries limited information because it does not tell us anything about changes in the productivity of the ones that remain pumping.

But then, there was an argument being made in Western news outlets that Russia would be forced to curtail production because it cannot handle the technology of oil production without Western experts on call. Given the history of oil production in Russia, not everyone with knowledge in the energy industry field supported this argument, but it made the rounds repeatedly.

Some have suggested Russia is hiding the worst: the author of this GIS Reports article argues that Russia is suffering more damage to its oil industry than officially disclosed and is simply not talking about it. As evidence, Carole Nakhle, CEO of energy advisory Crystol Energy, points to the sharp drop in oil revenues during the first quarter: it declined by as much as 40% from last year.

Bear in mind a lot of oil is sold at a decent discount to India, where it is refined and sold to the EU (mainly).

Also, as Russia now owns almost all the oil companies at 51% or 50% plus 1 share, it has upped the ‘social contribution’ required to be paid to public development projects. This might perhaps affect ‘nett’ revenue, depending how it is accounted.

Loz , from where I belong we have a saying ” income is 50 cents and expenditure is a dollar you are in trouble and vice versa then nothing to worry ” . Russia does not have this problem . Russians live within their means . The Russian budget calculates that the minimum receipt for their oil will be $ 40 . They get about $ 60 so no worry . Does this look like an economy or people under stress ?

https://www.youtube.com/watch?v=94KPrOpXzto

https://www.youtube.com/watch?v=YseIsUAYLic

Loz, the article was not about what Russia can sell. It is known that Russia can find buyers for about all the oil they can produce. The article was about the fact that Russia is trying to hide the destruction to their production ability.

Some have suggested Russia is hiding the worst: the author of this GIS Reports article argues that Russia is suffering more damage to its oil industry than officially disclosed and is simply not talking about it.

Let’s see, Russia operated a technically proficient and highly respected oil industry totally independent of the West for 70 years in the Soviet era, but now we are supposed to believe they have suddenly become incapable of doing so without western technology? Sorry, that doesn’t even pass the smell test. I don’t understand why so many people are determined to believe that Russia is a technologically backward basket case that can’t function without the West. As the late but not missed John McCain described Russia, “Spain with a gas station.” The evidence does not support that stereotype and people need to stop deluding themselves. Perhaps this is all just war propaganda from the same people who brought us previous misadventures in Kosovo, Afghanistan, Iraq, Syria, and Libya. The media have certainly been “all in” on the war messaging just as they were in those other interventions until they were deemed “mission accomplished.”

https://www.abc.net.au/news/2023-05-03/nt-government-fracking-decision-beetaloo-basin-gas/102295762

Fracking in Australia’s Beetaloo Basin gets the go ahead!

Gosh Golly, where is Australia going to get workers and technology to Frac (USA! USA! USA!)

Look for six figure salaries, free lodging and citizenship/visa offers for those with the appropriate skills….I would reckon.

“The Beetaloo Basin is an enormous shale gas reserve about 500 kilimetres sout-east of Darwin. (Supplied: Empire Energy)”

https://www.abc.net.au/news/2022-05-06/beetaloo-basin-potential-katherine-oil-gas-conference-fracking/101043884

Beetaloo Basin’s ‘absolutely immense’ potential spruiked at oil and gas conference, but big fracking tests loom.

https://www.youtube.com/watch?v=PsY9ZWjKxQc

This is quite a technical review of the Beetaloo (well if you are a couch potato interested in energy like me).

They are trying to fill the gap for Europe natural gas insecurity.

Before I get flambasted…I realize that this is an Energy CEO pumping his company on Australian Media.

However, do any of the oil pros have any thoughts?

Calling Matt Mushalik . He is the real pro on Australian oil and gas matters .

Andre – thank you for posting on this. Anyone who would quickly dismiss fracking in another country (especially a somewhat developed one) after the past 15 years in the US and how it blew apart old-school pre-2008 peak oil estimates is really playing fast and loose with their credibility.

Twocats,

In addition to the US, Canada, Argentina, China, and Russia (Gazprom Neft’s Bazhenov output) currently producing ‘shale’ oil and gas, several other countries are tentatively engaging in unconventional hydrocarbon development, India being just one.

A UK company – IGas – had somewhat flamboyantly claimed that it could produce desperately needed ‘shale’ gas in under 2 years if the British government lifted restrictions.

(Several decades of gaseous hydrocarbons lie within the Bowland and Weald Basins alone).

The decade-old (2013) EIA report declared 137 formations in 41 countries contained Technically Recoverable Resources of oil and gas hydrocarbons.

While that 76 page report may be TMI, the 20 page Executive Summary is a fascinating read for anyone interested in this stuff, especially newbies).

Political/economic/social constraints are the biggest impediments to an expanded embrace of a global ‘shale’ program.

Andre,

The Beetaloo has enormous potential if the topside obstacles – specifically the political – do not curtail development.

The productive area is large, multi layered, and the initial flow rates project to be about 15 Million cubic feet per day for a 10,000 foot lateral. (About a dozen horizontals have been drilled/frac’d at ~2,000/4,500 foot lengths.) This is very promising so early on in the programs.

A Super Flex rig has arrived in country and should lower drilling time/costs dramatically. (Antero just drilled a world record 12,340 foot lateral feet in 24 hours).

While some American shale veterans are involved – particularly in the completion phase – Australia actually has quite a robust oil/gas industry. In fact, this site had a great Aussie commentator- Toolpush – who once supervised operations at Sakhalin … absolutely global top tier expertise.

Should the Beetaloo operators continue, they will benefit from the ~25 year history of American and Canadian unconventional hydrocarbon production – recycling water being but one prominent aspect.

Right after the announcement that Australia is training on US Nuclear submarines and buying Virginia Class Nuke Subs….hmmmmmm…..

This is gas not oil right?

What is the oil potential?

I am guessing this is not good news if you are a natural gas producer? Its going to flood the market

I am obviously not an oil pro.

Andre,

There was a highly detailed, yet concise, article on the Beetaloo posted on the Seeking Alpha site a few weeks back. (Laurentian Research author?).

The basin is huge, stacked, ~6,000′ to 10,000′ depth and largely natgas.

The remoteness and – currently – lack of pipelines are some of the challenges.

That said, Australia – particularly in the populated southeast, is actully very short of natgas.

Much more to the Beetaloo/Australia story, but a global abundance of natgas is a given, even as wildly disparate circumstances (largely political, including infrastructure availability) continue to manifest on the global stage.

Increasing pressure on Russia’s oil industry

he West’s attempts to curtail the Kremlin’s ability to finance its war on Ukraine are starting to bear fruit. Russia’s oil and gas revenues are dropping, along with its overall economy, while its budget deficits are growing. The early results of 2023 show that a combination of price caps, import bans and lower market prices is working even as Russia’s energy exports flow.

The EU embargo on refined products of Russian origin, with associated price caps, came into force on February 5, 2023. The measures are aligned with those adopted by the Group of Seven (G7) nations and Australia. They follow sanctions on crude oil, which went into effect on December 5, 2022. Together they ban the sale within the EU of seaborne Russian crude oil and oil products, except for pipeline oil, and a temporary exemption given to Hungary, Bulgaria and Croatia because of their limited alternatives.

Any third party willing to buy such products using enabling services provided by an EU entity – such as insurance and shipping – can only do so if the price they pay for the Russian products is at or below the price cap imposed by the EU. The price cap is set at $60 per barrel for crude oil and $45 per barrel for discounted petroleum products (such as fuel oil and naphtha) and $100 per barrel for premium petroleum products (such as diesel, kerosene and gasoline).

Recently, the market has been doing a better job than the price cap, with Russian crude oil selling below the $60 per barrel cap, at least before the 1.1 million barrels per day production cut that was announced on April 2 by OPEC+ nations, including Saudi Arabia and Russia.

The upshot is that Russia’s revenues from oil and gas exports tumbled by nearly 40 percent in January 2023 ($18.5 billion) compared to January 2022 ($30 billion). The revenue decline will be even steeper in the coming months, the International Energy Agency (IEA) has predicted.

Targeting Russian energy makes sense because it accounts for roughly 18 percent of Russia’s gross domestic product (GDP) and at least a third of its state budget revenues. Yet despite the loss of revenue, the damage to the overall economy remains surprisingly slight, at least according to official numbers, which some question.

Russia’s GDP shrank to an estimated $1.5 trillion, or 2.1 percent, in 2022. The 2023 forecast ranges from no growth (+0.3 percent), according to International Monetary Fund projections, to a 5.6 percent decline, based on the estimate from the Organisation for Economic Co-operation and Development. But some critics say that the Russian government’s concealment of official data is masking deeper problems.

The big problem with stories like this is that we have been supplied a never ending river of them since Feb 2022, and most of them have been lies, distortions, and selective reporting. We can’t trust any mainstream media source for the duration of the conflict. I have taken to relying exclusively on a number of independent investigative sources, some of them independent journalists and some persons with expertise in relevant fields, who have been getting the factual information largely correct since the commencement of hostilities. “Mainstream” media sources might as well be NATO employees, or worse, Zelensky’s employees! (You know, the new Churchill who always dresses like he just flew in from the front in Bakhmut. That is bound to be a CIA/State Dept. idea after conferring with some Hollywood or Madison Avenue consultants. No one does Narrative Control like America, at that we have no peer!) This has been the most shameless, one sided narrative spinning by the media that I have ever seen.

D Coyne: “As gas production increases, more pipelines will be built. I agree all scenarios of the future are guesses. There are no future facts.”

Very true, and I didn’t mean my comment as an attack on your projections. There is a certain nonchalance about the capacity of the Permian to go on for several more years, growing all the while–and it could. But Pioneer is probably the canary in the coal mine. If Pioneer’s oil production is falling, and its gas production rising, it’s time to look behind to see what’s coming.

If the price of natural gas rebounds strongly, then everything will probably be okay for awhile. But if the price for NG bifurcates–with a strong preference for third-party “certified” gas–then the higher quality product from the Haynesville-Woodbine might well bring a premium price and Permian gas a low market price. I guess I didn’t make that clear: there is a difference in the “methane density” in natural gas, and that difference is quickly being differentiated and commoditized. Where is Coffeeguyzz when you need him?–he’d know about this.

Additionally, when the GOR goes up for an entire basin, it doesn’t mean that the basin is just “gassing out.” It might equally mean that gas production is static and oil production is waning. In the Permian, unfortunately, both are happening. Not at warp speed, because only because about 500 new wells are coming on line each month. Still, there are thousands of wells on the same trajectory, and it’s going to be hard to outrun them.

I don’t think that trajectory is what we’ve been told. I’ve participated in enough of them to know that when the pressure falls, the longer-chain hydrocarbons disappear from the mix. That’s because the pressure isn’t capable of flowing those complex molecules out. That’s roughly at the bubble point.

I never would have thought to construct a graph with the entire basin on a bubble point, but Mr. Shellman did, and I’m telling you, when a well hits the bubble point, church is very close to being out. As a basin, that bubble point was some ways back.

Mr. Maddoux,

As always, great to read your comments/contributions.

Regarding Permian natgas takeaway … within 18 months, there should be an additional 4 Billion plus cubic feet capacity by way of one newbuild and 3 expansions.

In addition, the Puerto Libertad LNG plant seems to be a go.

That should consume over 1 1/2 Billion cubic feet more.

Amazing just how prodigious is the Permian.

Re ‘certified’ natgas … yeah, it is comical at how several players are engaging in the chest thumping, touting that their gas is just so much more pristine than the other guys’.

Like many other marketing approaches (think ‘organic’ foods), various ‘certifying’ companies have sprung up with wildly varying criteria on just what ‘good/’clean’ natgas actually is. The European LNG market seems especially sensitive to not wanting to be consuming that ebil natty.

Regarding bubble point, I am still confident that effective field repressurization will take hold.

Indeed, every nearby frac must be handled so as to not cause blowouts in nearby producers (like Oasis experienced in the Bakken a few years back).

Bruce Oksol has – for years – routinely been reporting increased production from older wells subsequent to newer, nearby wells being fractured. He has called this the ‘halo’ effect.

Combined with purposeful solvent/dilutent, controlled injected water and natgas might just provide the increased formation pressure by which the liquids – especially the ‘big’ molecules – may flow to the surface.

We shall see.

Today’s Rig and Frac Report.

Something is changing. Maybe $70 WTI just is not profitable or are there fewer profitable wells?

Rig count down 6. Permian rigs down 4

I know that lending standards are tightening in the wake of the developing banking crises. I would imagine some of these companies are borrowing at high-yield rates. High yield bonds fell about 16% in value last year. I’m assuming most of those yield rates would not come even CLOSE to making up the difference. So why would anyone be piling into high yield bonds? Could it be a funding issue? I’m honestly asking, I don’t actually know the answer.

Another, I think less likely, reason could be that these oil companies are actually seeing the slowdown in demand and are adjusting accordingly. I say unlikely because I was working in the housing industry in 2006 & 2007 in California and had family working housing in Ohio and NO ONE was discussing the housing bubble as something that could ever actually end.

But I think Gerry Maddoux talking about Natural Gas prices are probably the real answer. If Natural Gas is a large fraction of the end product, drilling just isn’t worth it.

Twocats

Yes, funding costs are rising.

Calgary, Alberta–(Newsfile Corp. – April 27, 2023) – Baytex Energy Corp. (TSX: BTE) (NYSE: BTE) (“Baytex”) announced today the closing of its private offering (the “offering”) of US$800 million aggregate principal amount of senior unsecured notes due 2030 (the “Notes”). The Notes bear interest at a rate of 8.5% per annum and mature on April 30, 2030. The Notes were priced at 98.709% of par to yield 8.75% per annum.

The gross proceeds of the offering have been deposited into escrow pending satisfaction of certain escrow release conditions, including the consummation of the previously announced merger (the “Merger”) with Ranger Oil Corporation (“Ranger”). Upon satisfaction of the escrow release conditions, Baytex intends to use the net proceeds from the offering, together with borrowings under its credit facilities, to fund the cash portion of the consideration for the Merger, to repay certain outstanding indebtedness of Ranger and Baytex and to pay fees and expenses in connection with the Merger. The Merger is expected to close in the second quarter of 2023, subject to the satisfaction of customary closing conditions. Closing of the Merger is not conditioned upon completion of the offering.

if Baytex wants to start reducing its debt in a few years and rates fall, they will have to buy them back above par.

An analyst report I read made the following comments on their EF buy; “Thereafter, activity could increasingly shift south (into the Eagle Ford) given: 1) ample runway (741 net drilling locations/12-15 years sustaining development) and 2) competitive asset economics (second only to Peavine and non-operated Eagle Ford in Karnes County).

Peavine is a Clearwater play in Alberta. The analyst stated the following: “The 12 wells produced at an average 30-day IP rate of 661bbl/d, and BTE now holds 19/20 top wells in the play.”

Fracs DOWN 12

I don’t have to tell anyone who does this for a living that there is a major difference between $90 oil and $10 gas as compared to $70 oil and $2 gas.

The sea change was in the price of gas, not oil.

As these new wells came in with a higher GOR, the high price of NG covered a multitude of sins–like a falling per well oil production.

But now that NG is selling for $1.50 at the wellhead, many of these new wells won’t break even.

That’s to be compared to NG in the Bakken, which is bringing exactly zero.

The Haynesville needs $2 gas to break even. The Marcellus needs $3 gas.

Like the point I tried to make earlier, it’s the gas that is the Achilles heel in the Permian.

PIONEER NATURAL RESOURCES COMPANY- FORM 10-Q

Oil and Gas Industry Considerations

Demand for oil throughout the world remains volatile since improving from the COVID-19 pandemic in mid-2020. Worldwide oil inventories have consistently been lower due to limited capital investments directed towards developing incremental oil supplies over the past few years. Sanctions, import bans and price caps on Russian crude oil and petroleum products have been implemented by various countries in response to the war in Ukraine, further impacting global oil supply. In addition, the lingering impacts from the pandemic, combined with the Russia/Ukraine conflict, have resulted in global supply chain disruptions, which have led to significant cost inflation and the potential for a global recession. This uncertainty led OPEC to reduce its oil demand outlook, which led to multiple cuts to its production quotas. As a result of the current global supply and demand uncertainties, average NYMEX oil and NYMEX gas prices for the three months ended March 31, 2023 were $76.21 per Bbl and $3.44 per Mcf, respectively, as compared to $94.29 per Bbl and $4.96 per Mcf, respectively, for the same period in 2022.

Global oil price levels and inflationary pressures will ultimately depend on various factors that are beyond the Company’s control, such as (i) the ability of OPEC and other oil producing nations to manage the global oil supply, (ii) the impact of sanctions and import bans on production from Russia, (iii) the timing and supply impact of any Iranian sanction relief on their ability to export oil, (iv) the global supply chain constraints associated with manufacturing and distribution delays, (v) oilfield service demand and cost inflation, (vi) political stability of oil consuming countries and (vii) increasing expectations that the world may be heading into a global recession. The Company continues to assess and monitor the impact of these factors and consequences on the Company and its operations.

Financial and Operating Performance

The Company’s financial and operating performance for the three months ended March 31, 2023 included the following highlights:

•Net income attributable to common stockholders for the three months ended March 31, 2023 was $1.2 billion ($5.00 per diluted share), as compared to net income of $2.0 billion ($7.85 per diluted share) for the same period in 2022. The primary components of the decrease in earnings attributable to common stockholders include:

•a $764 million decrease in oil and gas revenues, primarily due to a 25 percent decrease in average realized commodity prices per BOE in 2023 due to the aforementioned instability in worldwide oil, NGL and gas demand, partially offset by a seven percent increase in daily sales volumes due to the Company’s successful Spraberry/Wolfcamp horizontal drilling program;

•a $163 million decrease in net interest and other income primarily due to a decrease in the fair value of the Company’s investment in affiliate; and

•a $119 million decrease in net sales of purchased commodities due to a decline in margins on the Company’s downstream Gulf Coast refinery and export oil sales.

partially offset by:

•a $217 million decrease in income taxes, primarily due to the decrease in earnings in 2023 compared to 2022; and

•a $91 million decrease in derivative losses, primarily due to a reduction in the Company’s commodity derivative positions.

•During the three months ended March 31, 2023, average daily sales volumes increased on a BOE basis by seven percent to 680,440 BOEPD, as compared to 637,756 BOEPD during the same period in 2022.

•Average oil and NGL prices per Bbl and average gas prices per Mcf decreased to $75.15, $27.30 and $3.79, respectively, during the three months ended March 31, 2023, as compared to $94.60, $41.37 and $4.81, respectively, for the same period in 2022.

•Net cash provided by operating activities decreased during the three months ended March 31, 2023 to $2.3 billion, as compared to $2.6 billion for the same period in 2022. The decrease in net cash provided by operating activities during the three months ended March 31, 2023, as compared to the same period in 2022, is primarily due to (i) the aforementioned decrease in oil and gas revenues and (ii) an increase in the current income tax provision, partially offset by a decrease in cash used in derivative activities.

•During the three months ended March 31, 2023, the Company declared a base and variable dividend of $1.10 per share and $4.48 per share, respectively, and paid dividends of $1.3 billion, as compared to a declared base and variable dividend of $0.78 per share and $3.00 per share, respectively, and dividend payments of $1.1 billion during the same period in 2022.

•During the three months ended March 31, 2023, the Company repurchased 2.4 million shares for $500 million under the Company’s stock repurchase program, as compared to repurchases of 1.1 million shares for $250 million during the same period in 2022.

•As of March 31, 2023 and December 31, 2022, the Company’s net debt to book capitalization was 18 percent and 15 percent, respectively.

I haven’t been following this for awhile, but did skim PXD’s earnings release. LOE nearing $12 per BOE and DD&A also nearing $12.

680k BOEPD, with 361k being oil.

I suspect that DD&A more than likely will wind up being $20-25 per BOE, based on the graphs I have recently seen here comparing projections against actual well performance.

When gas is selling for $6-12 per BOE, $32-37 per BOE to drill and produce it doesn’t compute. It really drags down the oil profitability.

Anyone have a chart on PXD’s oil, gas and NGL production over time? I assume it shows oil flattening, with gas and NGL’s increasing.

And as I asked above, wonder how many and what percentage of PXD’s wells produce under 25 BOPD (not BOEPD).

SS – Correct, I think. The increase in 2020 was the purchase of Parsley Engineering.

Shallow sand,

Info at https://novilabs.com/blog/permian-update-through-january-2023-1/

You can select Pioneer only for Permian and show output by production level see

https://public.tableau.com/shared/467K85NP4?:toolbar=n&:display_count=n&:origin=viz_share_link&:embed=y

Of 3624 horizontal wells completed as of Jan 2023, 238 wells were producing less than 10 bopd and 439 wells were between 10 and 25 bopd, so a total of 677 wells of 3624 total at 25 bopd or less or 18.7%. Total crude output was 486 kbopd in Jan 2023, natural gas output was 1697 BCF/d in Jan 2023 so the overall GOR was 3.49 MCF/bo based on preliminary data for Jan 2023. If we go back to April 2022 (where the data is likely more complete) the GOR for April 2022 was about 3.26 MCF/bo. In Jan 2022 the GOR was 2.97 MCF/bo and in April 2021 the GOR was 2.67. So GOR seems to be rising fairly steeply for Pioneer.

When we compare to all producers in the Midland subbasin of the Permian the GOR was 3.17 in April 2021 and 3.28 in April 2022, so less of a GOR increase in the rest of the producers over the April 2021 to April 2022 period compared to Pioneer.

I absolutely LOVE this line:

•a $91 million decrease in derivative losses, primarily due to a reduction in the Company’s commodity derivative positions.

jeez, I guess if you’re pulling in 1.2 billion, what’s 100 million amongst friends.

John at Mike S website has an excellent post on PXD . The hustle and the shuffle . Smell the coffee .

https://www.oilystuffblog.com/forumstuff/forum-stuff/the-crude-chronicles-and-the-history-of-pioneer?origin=notification

Oil and gas producers use derivative instruments as a form of insurance to lock in prices for their future output.

“I absolutely LOVE this line”

Speaking of LOVE sharing friends. Pioneer will be sharing those 91 million love buddies thanks to and with Joe Biden in taxes. If the federal government wants to buy 200 million barrels to fill the SPR at around $65 to $70. Who needs to buy crude oil options to protect the down side ? Right HHH, you know. Just in case oil goes to $25 in March (of what 2040).

Yield curves are indicating that FED will be cutting interest rates aggressively somewhere around July or August of this year.

How bad do things have to get for FED to do a complete 180 in other direction?

$25 might be too high. Bank reserves from the FED are no substitute for bank deposits at the small and mid size regional banks. There is no mechanism that will bailout all these banks. So regardless of what FED does these banks will have to fire sale assets to meet customer withdrawals.

We aren’t heading into a global recession. We are heading into a global depression.

BlackRock and Blackstone aren’t banks but their exposure to commercial real estate is huge. What’s the FED going to do? Bail them out? They aren’t banks. Even if they were bank reserves don’t solve the problem.

Charles Schwab, many might think of them as an investment firm. But they are also like the 8th or 9th largest bank in the US. They are also in trouble.

We are in a systemic banking crisis that the FED and government won’t even acknowledge is happening.

When collateral gets repriced things break.

Oil price just happens to be one of the many things that are going to break.

FDIC insurance can’t cover all these bank deposits without a government bailout. Things are really going to get messy.

“FED will be cutting interest rates aggressively somewhere around July or August of this year”

I will not argue that the FED is not out in front of it’s skis on rates. But you and your choice to continue to pick future dates only discounts your voice. You don’t seem to learn. Most people don’t stick their finger in the light socket twice. You like to play hero ball.

HHH , “We are in a systemic banking crisis that the FED and government won’t even acknowledge is happening. ” This is the problem . I mentioned the risk of a Synchronized System Failure as defined by David Korowitz in an earlier post .

https://peakoilbarrel.com/short-term-energy-outlook-april-2023/#comment-756593

HHH , “BlackRock and Blackstone aren’t banks but their exposure to commercial real estate is huge. What’s the FED going to do? Bail them out? They aren’t banks. Even if they were bank reserves don’t solve the problem. ”

Well the FED could give them a banking license and convert them into commercial banks instead of investment banks . Heck they could even designate them as GSIB ( Globally System Important Banks) then we have bailouts to infinity . Problem solved . 🙂

“The fundamental cause of the trouble is that in the modern world the stupid are cocksure while the intelligent are full of doubt”

HB – 4 of the top 8 biggest bank failures in US history happened within the past two months. I thought you said you were in Finance? That is genuinely terrifying if you were.

HB, again bank reserves aren’t the problem. FED can create all the bank reserves they want. There is no shortage of bank reserves.

Bank reserves are no substitute for bank deposits. Customer withdrawals can’t be met with bank reserves. There would be no bank failures if bank reserves created by FED were actual money.

FED doesn’t have the power or tools to bailout banks. I know we are all told they have a printing press.

No money was printed over the duration of Covid. March 2020 to present day.

Government borrowed trillions not from the FED though. Government borrowing is money redistribution not money printing.Which created bank deposits in a massive amount. Which banks are required by law to back those deposits with assets. Mainly US treasuries.

Well the value of those treasuries fell as FED raised rates. Banks don’t have enough collateral to sell to service customers withdrawals.

You can put money in a money market fund and earn 4.8 % while banks are paying 0.5% on deposits.

Over 80% of commercial mortgages are on the balance sheets of these small and mid sized regional banks. They are illiquid as crap. $14 trillion in illiquid mortgages.

So bank deposits are leaving these banks to get better returns. And FED has no tools that matter.

The real credit spigot. These banks. Are going to turn the taps off. Not because the necessarily want to but because they are balance sheet constrained.

Again the yield curves have been warning us for over a year. The probability of a deflationary monetary outbreak is extremely high.

And it will spill over into real economy in the form massive job cuts in a relatively short amount of time.

Oil prices are agreeing with yield curves. That’s why oil prices are tanking.

HHH, again if you want respect- it’s a problem

Doctor, my eyes have seen the years

And the slow parade of fears without crying

Now I want to understand

I have done all that I could

To see the evil and the good without hiding

You must help me if you can

Doctor, my eyes

Tell me what is wrong

Was I unwise to leave them open for so long?

‘Cause I have wandered through this world

And as each moment has unfurled

I’ve been waiting to awaken from these dreams

People go just where they will

I never noticed them until I got this feeling

That it’s later than it seems

Doctor, my eyes

Tell me what you see

I hear their cries

Just say if it’s too late for me

Doctor, my eyes

They cannot see the sky

Is this the prize

For having learned how not to cry?

https://www.youtube.com/watch?v=qKGTaplzmV4&list=RDEMdsEJJDdz8w4itU1r_Sxp_Q&start_radio=1&rv=SqRvJLH_-vU

Lyrics are for HIckory and Mac

HHH,

Care to speculate on when the World economy goes into a Depression and how does one distinquish between a Recession and Depression?

At link below there is a discussion of Recessions and Depressions. Often a peak to trough change in real GDP of 10% or more is considered a depression. Even the severe recession in 2020 due to the pandemic only saw World real GDP fall by 3.2%.

So am I correct in thinking you expect to see World real GDP decrease by 10% or more at some point in the medium term (next 5 years)?

I think a recession is likely, but a Depression is not likely.

https://www.imf.org/external/pubs/ft/fandd/basics/recess.htm

A bear will always be right eventually as long as they consistently predict bad times ahead.

Dennis , your question to HHH on recession and depression . Who will decide ? The data or the referees ? What do you do if the referees are paid up ? No referees were needed that Vietnam , Iraq and Afghanistan were lost causes in spite of what was reported by Westmoreland . Petraeus etc and company , Data ,physics and math’s prevail . See my post on the German situation ( as goes Germany , so goes Europe) . There is no comeback in China and US is all paper shuffling GDP . Recession is already here . Just because no referee ( paid up ) said so is immaterial . OPEC keeps on cutting production to maintain a high price . Pull up your socks for the depression . KSA has a deficit they need high prices and they will cut to oblivion . Don’t wait for an official announcement .

https://english.alarabiya.net/News/saudi-arabia/2023/05/07/Saudi-Arabia-budget-slips-into-deficit-as-spending-accelerates

Just

Hole in head,

The question is what does HHH consider a Depression, it is mostly not defined very well. What is your definition? Without a definition, we don’t know. Which data do we look at, in the US the NBER looks at real GDP, employment, and consumption to assess the business cycle.

https://www.nber.org/research/business-cycle-dating

Dennis , read the link below . This is what happens when the referees go AWOL . ” Prolonged global recession ” = a depression , but no one will announce it . This revolution will not be televised . The language is the medium . Participants here are all intelligent and can arrive at the conclusions without the referees .

https://www.japantimes.co.jp/opinion/2023/05/08/commentary/world-commentary/sleepwalking-prolonged-global-recession/

The China story is over .

https://www.reuters.com/markets/asia/chinas-imports-shrink-april-exports-grow-slower-pace-2023-05-09/

The Chinese also know that globalization is over . There is no cure for denial .

https://www.sinification.com/p/yan-xuetong-warns-chinese-businesses

M2 is negative year over year for the first time since the start of the Great Depression. Private bank lending, the real source of money growth, not the Fed, has virtually dried up. Penn State’s less lagging ACY version of the CPI shows inflation down to zero and poised to go negative. So, yeah, I will not be surprised at all if the Fed starts slashing rates like mad, but they will probably need a Lehman Brothers moment to get them moving. Once prices (and employment) start falling, even zero rates will be positive in real terms.

“Oil and gas producers use derivative instruments as a form of insurance to lock in prices for their future output.”

wow HB you’re so smart – I want to be YOUR friend.

Pioneer is down 18% over 6 months. I know you like your love rough, but that’s gotta hurt. And I know its tough to type while holding all those bags, so don’t bother.

“wow HB you’re so smart – I want to be YOUR friend”

If you want to play with the Big Dogs. You need to toughen-up and grow a pair. PXD is up 120 percent over the last three years. Cherry pickers earn minimum wage.

If You Can’t Take It, You Sure Can’t Make It

https://www.youtube.com/watch?v=ziDsVm-3k9s

Think HB is on drugs lol. I’m here trying to educate. I don’t need or care for respect. But people are clearly in the dark. If you don’t want to listen to or agree with what I’m saying I’m fine with that.

Oil is going $25 if not lower. And that has major implications on the oil industry. Also has major implications on the so called energy transition.

Energy might be the economy but without monetary liquidity which central banks can’t provide. We don’t have an economy or energy.

WTI futures has been experiencing illiquidity. Price basically crashed last week all the down to $63. Not because oil markets aren’t tight on supply but because there is no liquidity.

“Think HB is on drugs”

The lyrics were not intended for yourself because I expected you wouldn’t understand. Clearly I was right again.

“Oil is going $25 if not lower” “but without monetary liquidity which central banks can’t provide”

You do realize the only real end user of oil are refineries, right ? It’s the reason WTI went negative three years ago. All you paper guys had no place to take delivery. Refineries are swimming in profits and liquidity for the last 18 months. Their currently doing buy backs, debt reduction and increasing dividends. Their capex needs are only regular maintenance turnarounds during tight times. Their a money machine.

James Taylor – Money Machine

When I was just a child (hey baby)

My life seemed oh, so simple

And the ways of the great world

Seemed strange and funny

Then when I was a young man

Babe I learned of that machine

Turns out all those bails of precious money

Money, money money, money, money

Money, money money, money, money, money

Now you can measure your manhood by it

You can get your little children to try it

You can bring your enemies to their knees

With the possible exception of the North Vietnamese

It takes a strong a hit from the money machine

Feelin’ on top, on top of the goddamn world

Strong hit, baby from the money machine

Feelin’ on top, on top of the world

Oh, General Motors and IBM

AFL-CIO and all the king’s men

When I began the game

See me singing about fire and rain

Let me just say it again

I’ve seen fives and I’ve seen tens

It was strong hit from the money machine

Sitting on top, on top of goddamn world

Strong hit baby from that money machine

Sitting on top, on top of the world

https://www.youtube.com/watch?v=DFe8flSEzBk

HHH – agreed – he thinks because he picked a stock that’s up from after the Covid collapse he’s smart. literally every small cap stock went up, some more some less. why don’t we just say that the US economy has gone up since the 1950’s. It’s unintelligible gibberish. I actually preferred Texas Two Teas and I think a lot of other posters do as well. I’m pretty sure HB is considered the “special needs” addition on the thread.

Once bubble point is reached in boundary defined, solution gas driven shale containers, like those found in the Permian, ultimately GOR goes down and associated gas is depleted, same as liquids. More takeaway, or LNG exports for associated gas will become expensive (leveraged) overbuilds left with no product to handle.

Exporting US tight oil and tight associated gas at current, and proposed levels, will make money for people who put money before country and long term energy security, but when we start drilling the flank stuff for 250K BOE EUR’w will ultimately prove to be the worse hydrocarbon policy in American history. We banned exports in 1975 for a reason; today the same reasons exist x 10.

Gerry is correct …when 50 % of ones revenue stream in a tight oil basin is related to associated gas and NGL’s, and both are down 40-50%, economics are in the toilet.

Past results have NEVER in the history of the oil and gas business been indicative of future performance.

Shallow, nationwide over 50% of tight oil wells make less than 25 BOPD; don’t know about the Permian but I’d guess over 30%. Decline rates at <50 BOPD are still accelerating. Economic limits are being reached much sooner than 10-12 BOPD because of declining gas/NGL prices, increased WOR, rising lift costs and ever increasing PA&D costs.

Gerry,

Much depends on price, if oil and natural gas prices are low, less than 70 per bo and less than 2 per MCF NG, profits will be low and few wells will be completed in Permian basin. I assume 80 per bo and 3 per MCF or higher for my scenario. This is likely incorrect, future unknown.

JUST IN – German factory orders slump 10.7% month-on-month in March — one of the largest declines in history.

. Energy is the economy .

Retail sales just had a YoY decline of -8.6%, largest decline since 1954. But all of Europe has been in a recession since January, more or less. Not sure what it has to do with “energy” but its certainly a policy mistake that ECB is tightening into a slowdown. But the ECB has done that 100% of the time since 2008, so they aren’t very good at capitalism.

Chinese demand for German machinery just isn’t there. South Korean trade with China is also way down.

4 week T-bills yields went from about 4.5 to 5.5 in one day. Money markets selling T-bills due to debt ceiling. 100 basis point move.

Which means borrowers will need more collateral to borrow via REPO. When the leveraged longs are forced to sell due to lack of collateral. Prices take the elevator down.

Oil prices take the elevator down.

Goldman’s CTA’s are also starting to take profits on their longs because nobody is coming behind them to bid prices higher.

Twocats , Germany used 20% less energy to avoid blackouts . 15 % was industrial only 5% was domestic .

https://cepr.org/voxeu/columns/energy-crisis-and-german-manufacturing-sector-structural-change-no-broad

good responses from both HHH and HiH – thank you. There is such a swirl here of peak oil and an economic downturn at the same time, with each feeding into each other or mitigating each other at various points. I believe economics (as I believe HHH does as well) will “take over” here and drive economic activity so low that supply issues won’t be a factor for the next year or so. we’ve seen this a couple of times – 2008, 2020, where oil demand plummets and gives production a reprieve and a chance to develop new sources. at some point depletion and lack of new sources will short circuit this cycle – though coffeeguyzz et al would disagree – you have to imagine the global economy will be able to develop shale resources in at least a few countries before the global economy completely unravels. so unfortunately I’m betting we get another decade of this slowly decaying pile of dog-poo.

Twocats , an excerpt from Tim Morgan’s latest post . You can read the whole at the link provided . EcoE cannot be ignored .

” The really big problem, though, isn’t the volumetric supply of energy, but its cost. The Energy Cost of Energy – that proportion of accessed energy which is consumed in the access process – has been rising relentlessly, climbing from 2% in 1980, and 6% in 2010, to over 10% now. This, of course, has largely reflected depletion effects in the supply of oil, natural gas and coal, but there are no solid reasons to believe that the less dense energy alternatives offered by renewables can do much to blunt the rise in ECoEs, let alone start pushing them back down again.

If economic output stagnates or declines, whilst ECoEs continue to rise, prosperity decreases. This isn’t necessarily going to happen rapidly, and might, in that limited sense, be manageable. But there are two huge complicating factors.

Meanwhile, the financial system can’t, for much longer, cope with the invalidation of its core predicate of infinite economic expansion. It is, in a way, surprising that it has survived for as long as it has. As of 2022, the underlying ‘real’ or material economy of products and services was already 43% smaller than the ‘financial’, representational or proxy economy of money and credit.

Third, of course, we need to have plans in place for the moment when the penny drops – the moment, that is, at which it becomes clear, beyond the possibility of further self-deception, that the financial system of assets and commitments comprises a body of monetary claims that cannot be honoured ‘for value’ by a contracting material economy. ”

https://surplusenergyeconomics.wordpress.com/2023/04/12/253-how-has-it-come-to-this/

That last paragraph of Morgans that you quote bears rereading 10 or 20 times.

‘we need to have plans in place’….hah. Good luck with that. It will be like swimming upstream in a mile wide whirlpool

The EcoE is just too high for EU . Tweet from Art Berman

Gas cost Europe more than 3x the cost in 2021

$390 bn vs $120 bn & that’s just for electric power generation.

And Russian gas was a big part of Europe’s supply in 2022–only 10% less than in 2021.

The issue of the dying wells . Hope the US taxpayer has deep pockets of course they can buy gas masks .

https://www.oilystuffblog.com/news-stuff

Hole in head,

Great piece. Thank you Mr Shellman.

https://www.bloomberg.com/features/diversified-energy-natural-gas-wells-methane-leaks-2021/

HIH/Dennis,

I simply could not avoid commenting on these hit pieces on a company that I admire greatly – Diversified Energy – and its founder/CEO, 4th generation West Virginian energy worker Rusty Hutson. (His ~75 year old father still works every day).

These calumnies COULD offer an outstanding example of just how you good folks have been bullshitted for years, continuously being fed half truths (at best) from which you all consistently draw erroneous conclusions.

“Great piece”, sez Dennis. Indeed.

Did you carefully read that 2 year old tripe, Dennis?

Shellman’s post linked by HIH is 3 years old.

The part where notorious short seller Loughrey poo poos wells throwing off 15,000 cubic feet per day.

Using his own math, at $3/mmbtu (Diversified is heavily hedged), those 18,000 ‘dogs” throw off over $24 million Per. Month.

And the remaining ~23,000 wells (at that time, now about 50,000 additional) are, by clown Loughrey’s own admission, far better.

Did that ‘great piece’ say how many are Coal Bed Methane wells?

Do you have any idea how low maintenance – and long lived – conventional gas wells can be? (Hint, some are nearing 100 years old and still producing). If you were truly interested, you could find out how incredibly low cost these wells can be.

Did you notice that ‘journalist’ Rachel Adams-Heard wrote both the Bloomberg knee capper as well as the linked FLOW article in HIH’s link extolling clown Loughrey’s ‘model’ that is a blatant attempt to destroy DEG? (Blackrock took a 5% ownership stake in Diversified just after Adams-Heard’s wildly defamatory article was published. Hmmm.)

Rather than smugly applauding slander since it reinforces your prejudiced ignorance, one could learn about DEG’s spending millions of dollars on cutting edge methane detectors – both drone operated and hand held – as they continue to implement the most effective emission controls available today.

Did you know, HIH and Dennis, that Diversified is likely now that largest ‘plugger’ of wells in the country as they have acquired several ‘little guy’ plugging operations and are way ahead of state-regulated programs on well restoration?

No, you all have – in good faith and ignorance – regurgitated just more vile, erroneous bullshit rather than spending a bit of time doing your own research which could actually show a completely different picture than what the detractors and reputaion/business destroyers would have you believe.