By Ovi

Below are a number of Crude plus Condensate (C + C) production charts, usually shortened to “oil”, for Non-OPEC countries. The charts are created from data provided by the EIA’s International Energy Statistics and are updated to April 2023. This is the latest and most detailed world oil production information available. Information from other sources such as OPEC, the STEO and country specific sites such as Russia, Brazil, Norway and China is used to provide a short term outlook for future output and direction for a few of these countries and the world. The US report has an expanded view beyond production by adding rig and frac spread charts.

Where STEO data was used, the ratio of C + C to All Liquids was calculated. The average for the last six months was used to project the May and June production numbers in a few cases.

World oil production and projection charts are presented at the end of this post.

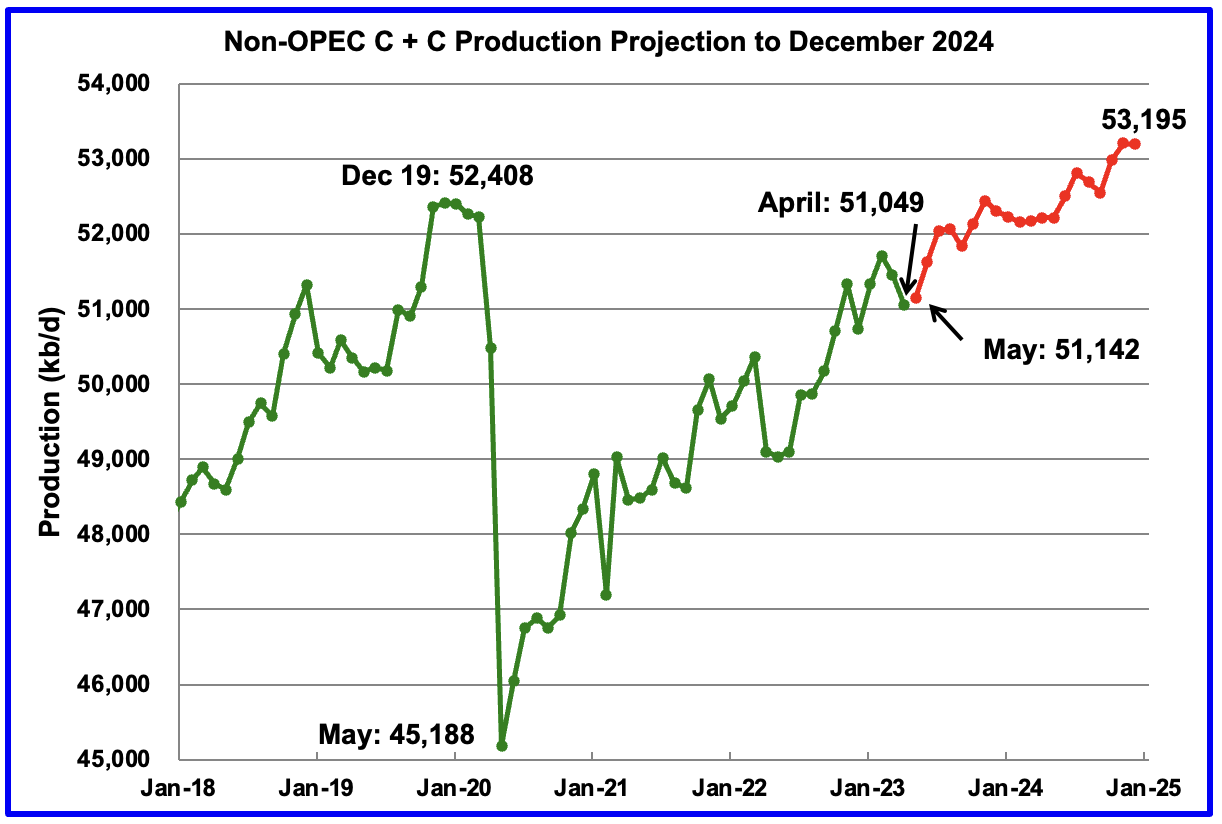

April Non-OPEC oil production dropped by 407 kb/d to 51,049 kb/d. The largest decreases came from Canada, US and Russia.

Using data from the August 2023 STEO, a projection for Non-OPEC oil output was made for the period May 2023 to December 2024. (Red graph). Output is expected to reach 53,195 kb/d in December 2024, which is 787 kb/d higher than the December 2019 peak of 52,408 kb/d.

From May 2023 to December 2024, oil production in Non-OPEC countries is expected to increase by 2,053 kb/d, a seemingly unrealistic forecast. According to the STEO, the major contributors to the increase are expected to be the US, close to 600 kb/d and Canada close to 700 kb/d, both estimates considered to be on the high side.

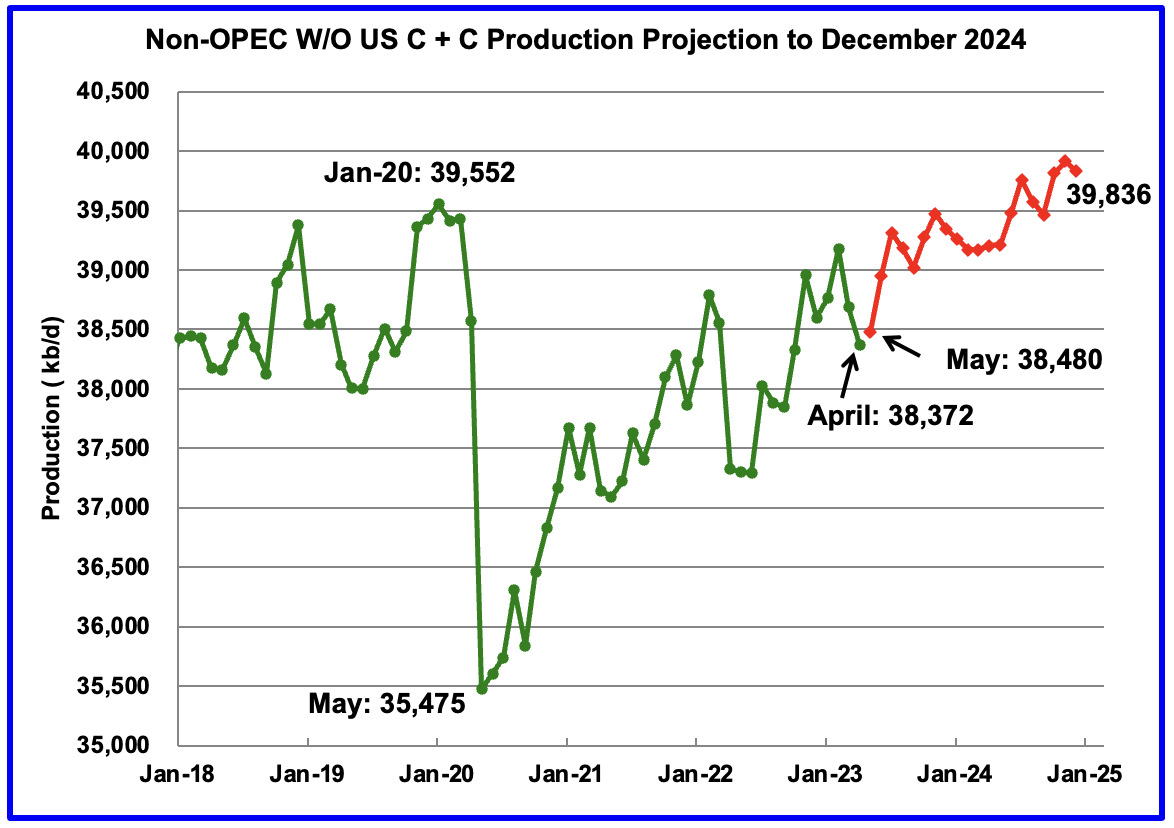

April Non-OPEC W/O US production dropped by 314 kb/d to 38,372 kb/d. May production is projected to increase by 108 kb/d.

From May 2023 to December 2024, production in Non-OPEC countries W/O the US is expected to increase by 1,356 kb/d.

Note that December 2024 output exceeds the pre-covid high of 39,552 kb/d in January 2020 by 284 kb/d.

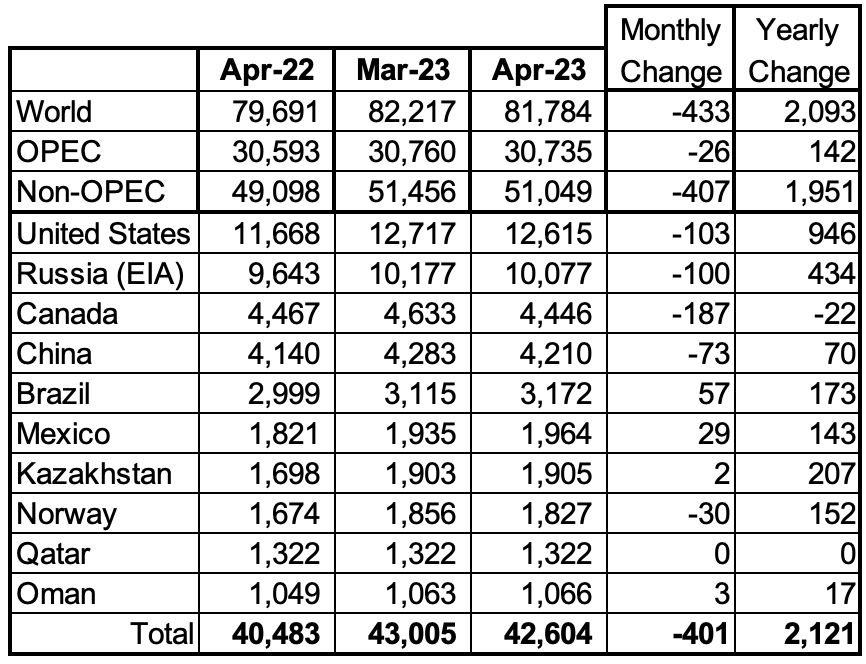

Non-OPEC Oil Production Ranked by Country

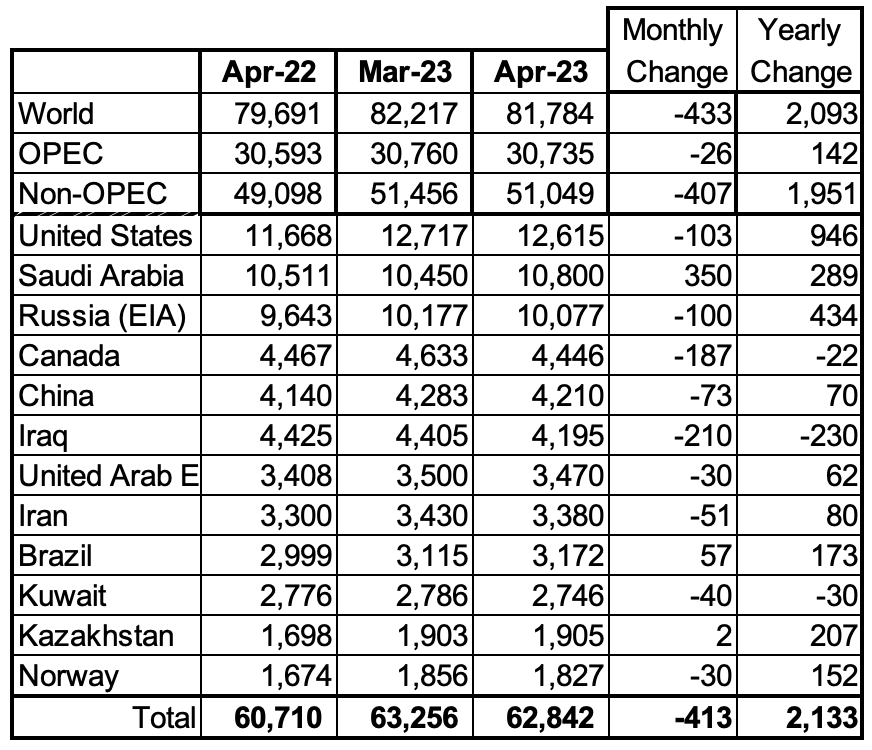

Listed above are the World’s 10 largest Non-OPEC producers. The criteria for inclusion in the table is that all of the countries produce more than 1,000 kb/d.

April’s production drop for these ten Non-OPEC countries was 401 kb/d while as a whole the Non-OPEC countries saw a production decrease of 407 kb/d. The top 4 producers had a combined output drop of 463 kb/d.

In April 2023, these 10 countries produced 83.5% of Non-OPEC oil production.

OPEC’s C + C production decreased by 26 kb/d in April while YoY it increased by 142 kb/d. World MoM production decreased by 433 kb/d while YoY output increased by 2,093 kb/d.

Non-OPEC Oil Production Charts

The EIA reported that Brazil’s production increased by 57 kb/d in April to 3,172 kb/d.

Brazil’s National Petroleum Association (BNPA) reported that output in May and June increased and that June increased by 166 kb/d to 3,367 kb/d mainly due to new project start-ups, a new record high, red markers.

Much of Brazil’s upcoming 2023 production growth of close to 100 kb/d will come from the highly productive pre-salt fields. From April 2022 to April 2023, production from the pre-salt fields increased by 173 kb/d.

According to the April 2023 IEA Oil Market Report: “We forecast supply to reach a new record high of 3.42 mb/d this year, up 300 kb/d y-o-y, as platform maintenance returns to normal scheduling and five additional FPSOs come online.“

According to the August OPEC MOMR: “Two new FPSOs started production during May, with Petrobras pumping the first oil from the FPSO Anna Nery installed at the Marlim complex in the offshore Campos Basin. According to Petrobras, the Buzios subsalt fields also received its fifth production unit, with the FPSO Almirante Barroso. Petrobras’ oil output fell by around 0.6% in the 2Q23 y-o-y due to losses from maintenance, in addition to the natural decline of mature oil fields and some asset sales. However, the crude oil output is expected to be supported by offshore start-ups announced at the beginning of the year.”

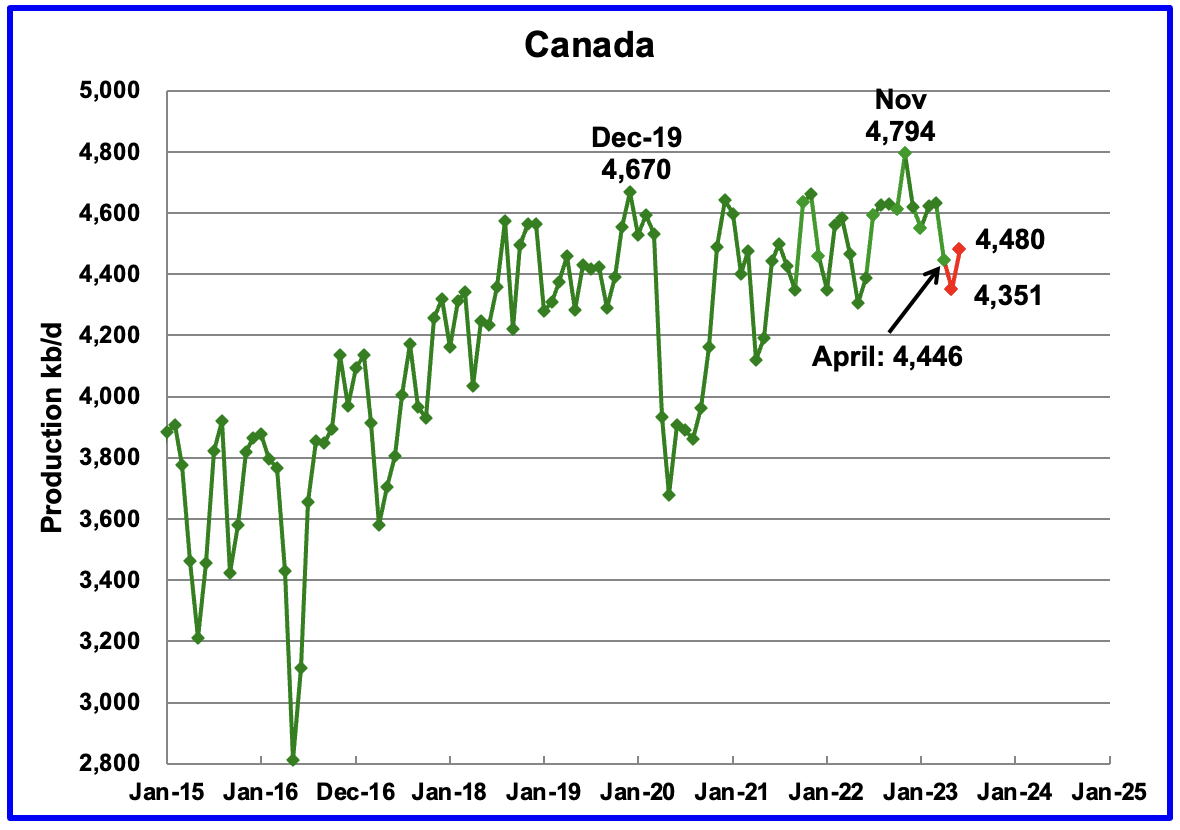

According to the EIA, Canada’s production declined by 187 kb/d in April to 4,446 kb/d. The May drop to 4,351 kb/d, along with April’s was due to significant maintenance at the oil sands mines and upgraders. The STEO is forecasting a production rebound in June to 4,480 kb/d.

According to the OPEC July MOMR : “Scheduled maintenance programmes during 2Q23 and 3Q23 are expected to soften output. It is the oil sands that are projected to be the main driver of Canada’s production through to the end of the year, driven by Kearl debottlenecking and CNRL (Canadian Natural Resources) Horizon optimization. Additionally, the Terra Nova Floating Production Storage and Offloading unit (FPSO) is expected to restart production in mid-2023.

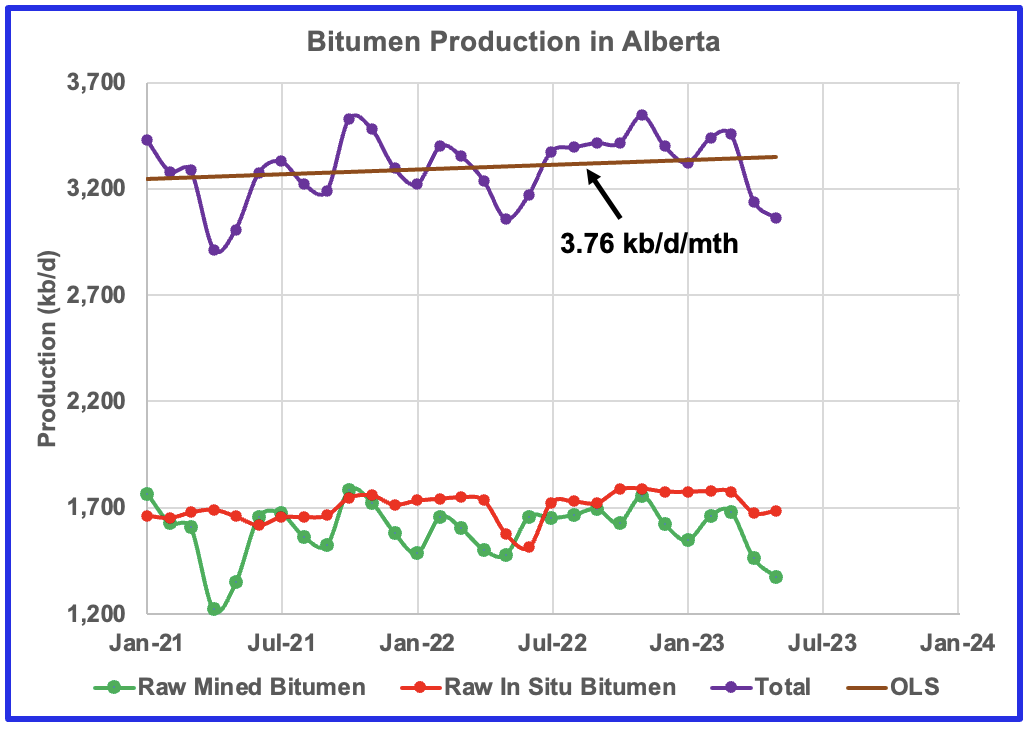

This chart shows the post pandemic trend in bitumen production in Alberta and the data is provided by the Canada Energy Regulator. Production in April and May 2023 was affected by severe weather and plant maintenance. On average, total production has been increasing at a rate of 3.76 kb/d/mth, brown OLS. Looking at the two different extraction methods, it appears that In Situ is slowly increasing while mined bitumen is holding steady.

According to the OPEC August MOMR report: Crude bitumen production output fell m-o-m by 259 tb/d, and synthetic crude declined m-o-m by 125 tb/d. Taken together, crude bitumen and synthetic crude production dropped by 384 tb/d to 2.5 mb/d.

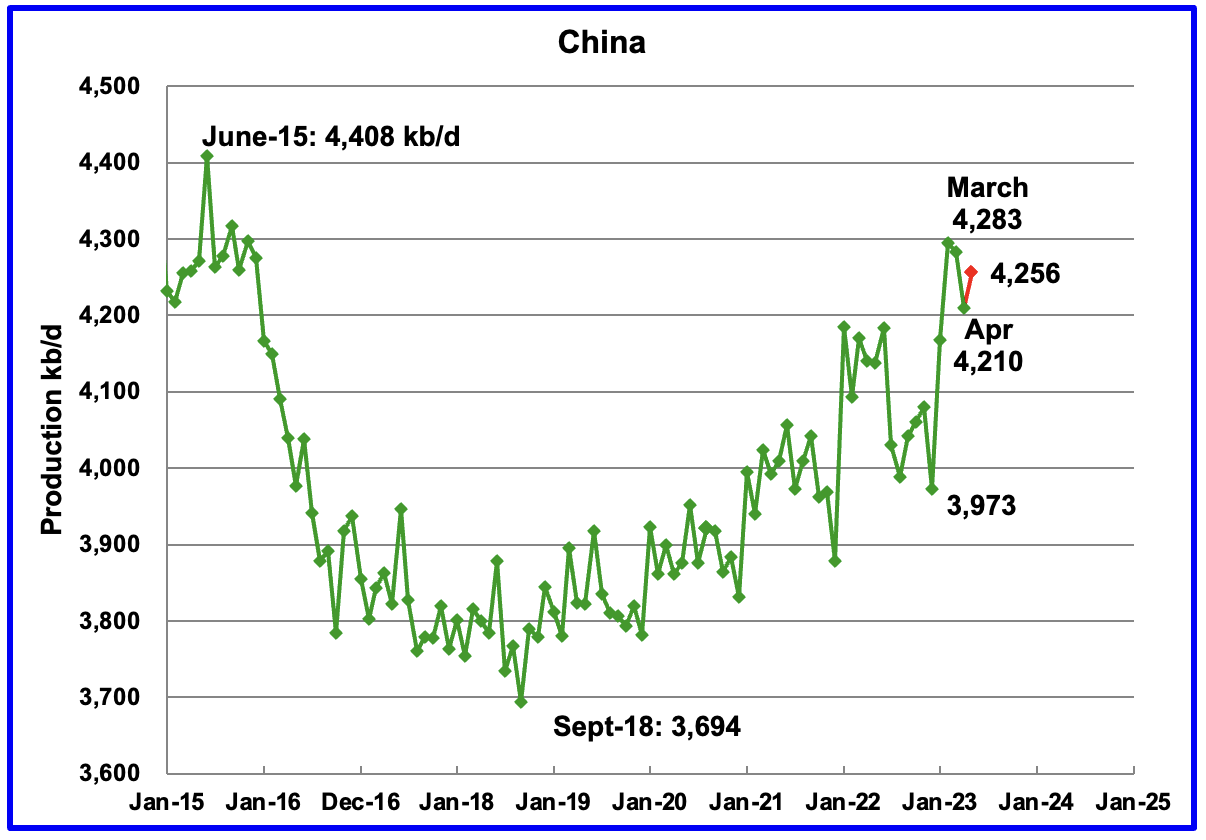

The EIA reported China oil output in April dropped by 73 kb/d to 4,210 kb/d.

The China National Bureau of Statistics reported that production during May increased to 4,256 kb/d.

While China’s production growth has risen steady since 2018, it may be approaching its post pandemic high.

According to the OPEC July MOMR: “Natural decline rates are expected to be offset by additional growth through more infill wells and EOR projects amid efforts by state-owned oil companies to safeguard energy supplies.

For 2024, Chinese liquid production is expected to remain steady y-o-y and is forecast to average 4.6 m/d. For next year, Liuhua 11-1, Shayan and Liuhua 4-1 (redevelopment) are planned to come on stream under CNOOC and PetroChina. At the same time, the main ramp-ups are expected from the Changqing, Kenli 10-2, Wushi 17-2 and Kenli 6-4.”

According to this source: From the low point in 2018 to the peak in 2023, China has added more than 600,000 barrels a day of extra production – more crude than some OPEC+ nations generate daily. Pumping about 4.3 million barrels a day now, China is again the world’s fifth-largest oil producer, only behind the US, Saudi Arabia, Russia and Canada, and ahead of Iraq.

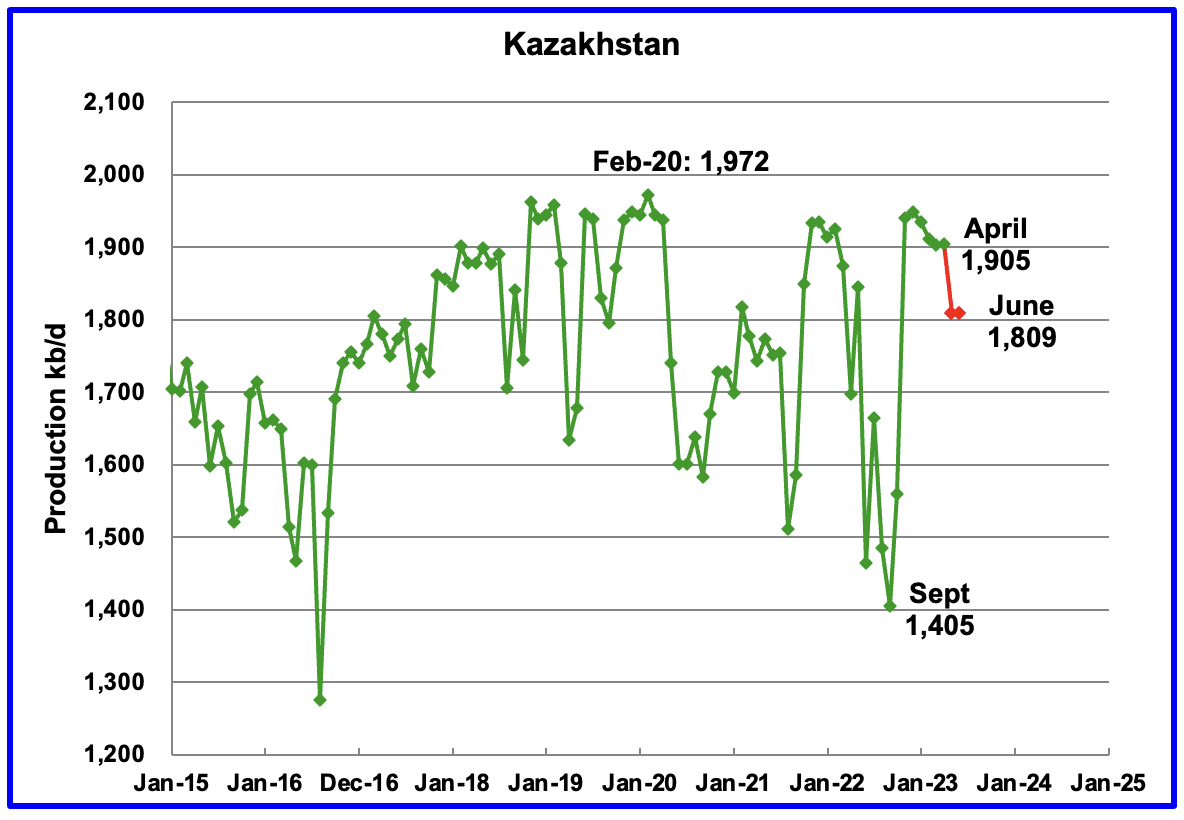

According to the EIA, Kazakhstan’s output increased by 2 kb/d in April to 1,905 kb/d. The STEO is forecasting a production drop to 1,809 kb/d in May and holding steady in June at 1,809 kb/d.

Mexico’s production in April was 1,964 kb/d an increase of 29 kb/d over March. Output dropped to 1,959 kb/d in May and June, according to Pemex.

Mexico has recently revised its definition of condensate. This has resulted in the EIA adding an extra 60 kb/d, on average, to the Pemex report. The red markers include the additional 60 kb/d.

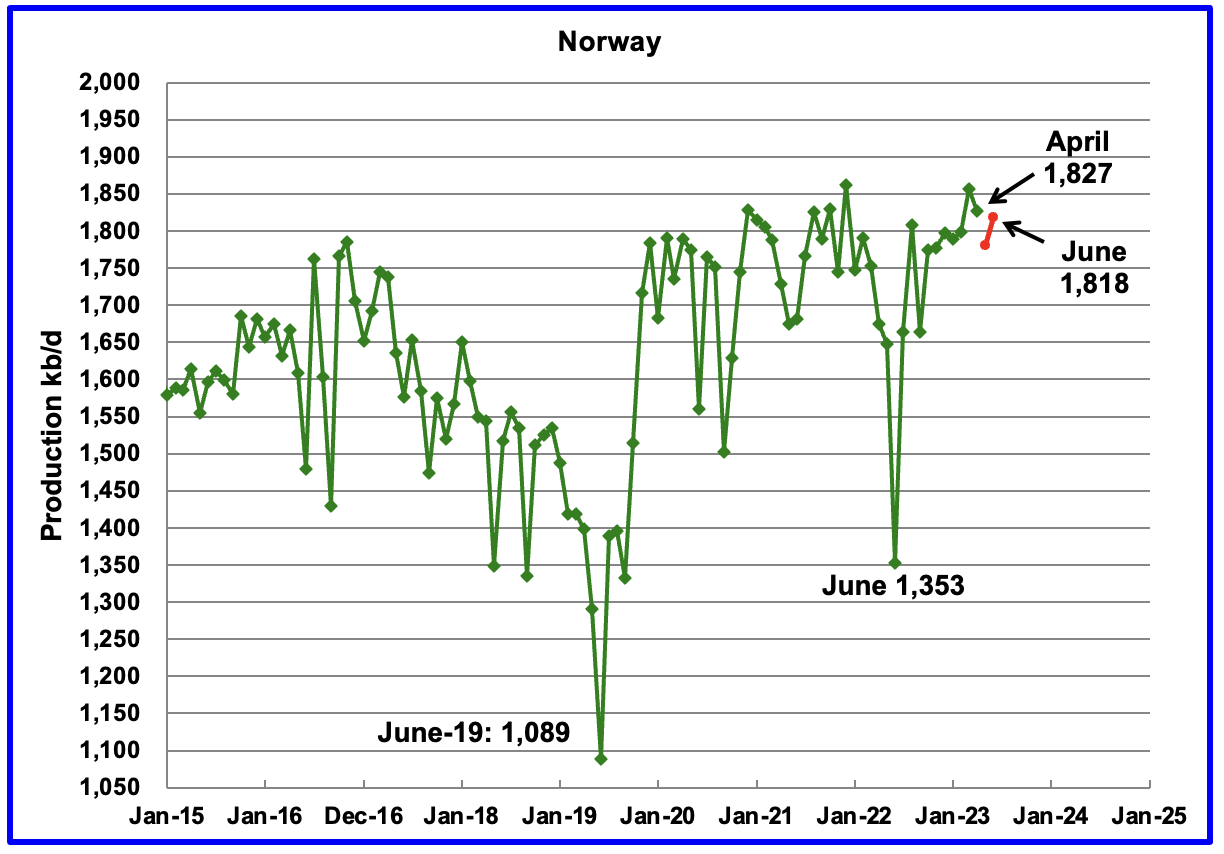

The EIA reported Norway’s April’s production to be 1,827 kb/d. The Norway Petroleum Directorate (NPD) reported that May’s production dropped to 1,781 kb/d and then rebounded to 1,818 kb/d in June. (Red markers).

According to the NPD : “Oil production in June was 0.6 percent more than the NPD’s forecast and 0.5 percent lower than the forecast so far this year.”

According to this source: “The North Sea’s biggest oil field Johan Sverdrup now has the capacity to produce as much as 755,000 b/d of crude.”

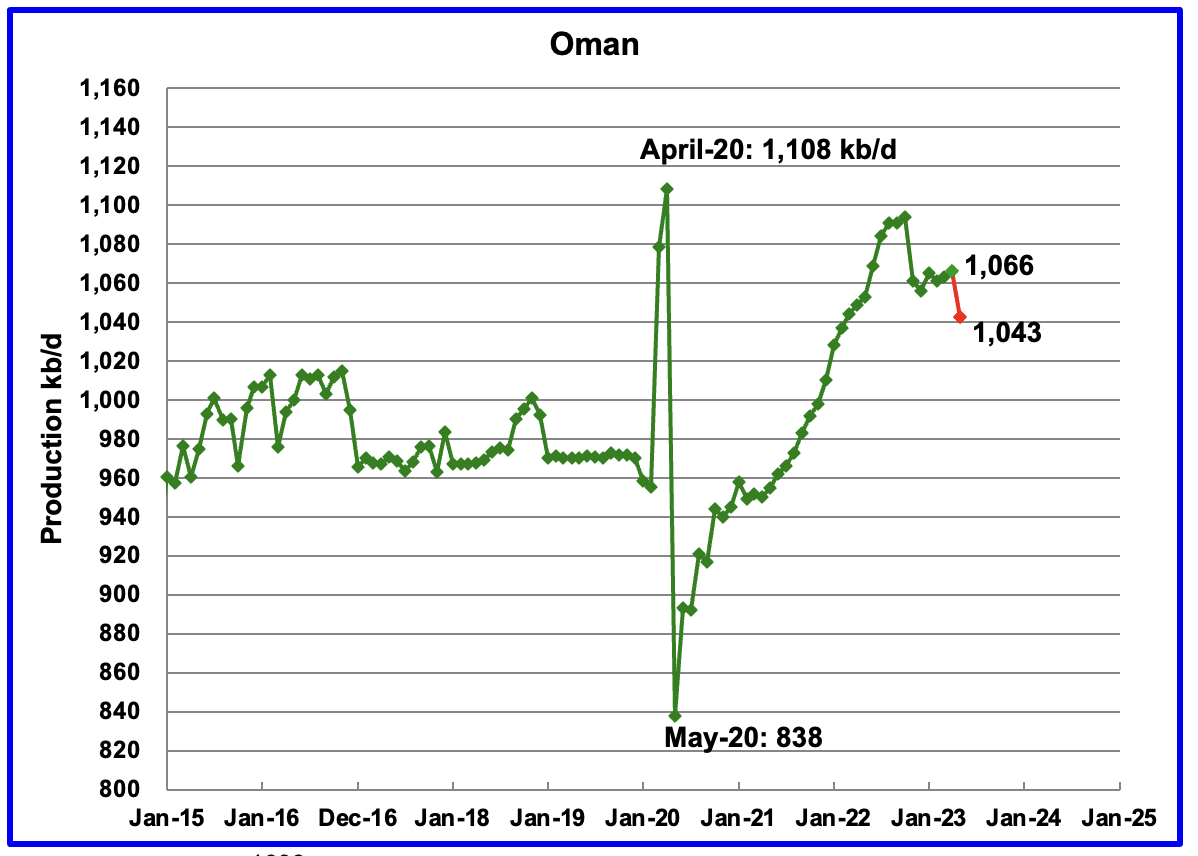

Oman’s production has risen very consistently since the low of May 2020. Oman’s April output was essentially flat but dropped to 1,043 kb/d in May.

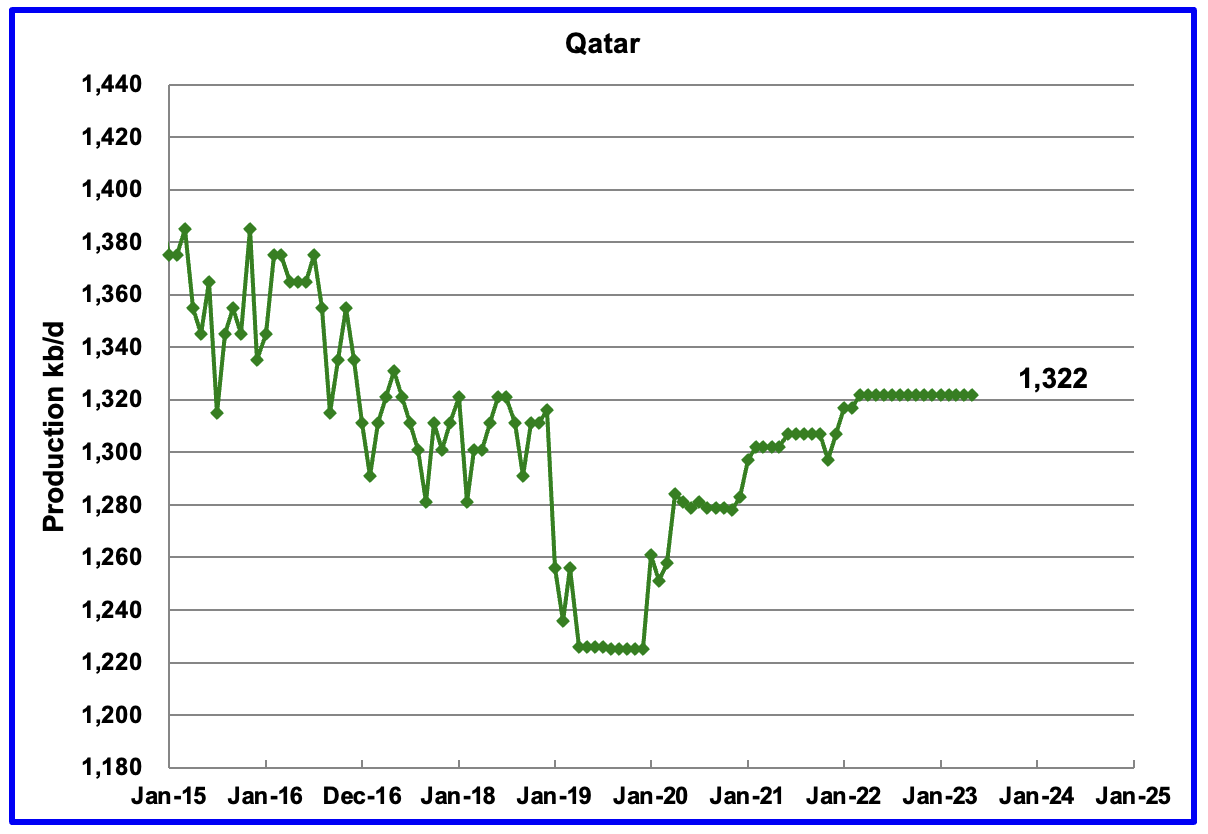

Qatar’s April’s output was unchanged at 1,322 kb/d, possibly due to lack of updated information.

The EIA reported Russia’s April production was 10,077 kb/d. Using data from the August STEO report, Russian output is expected to drop to 9,901 kb/d in May 2023.

Using data from Argus Media, Russian production, as previously reported by the Energy Ministry, was estimated for April and May. For April and May, Argus reported that Russian production of crude was 9,730 kb/d and 9,500 kb/d, respectively. May production is available here. Using information from this S & P Global article, Russian condensate production is close to 8% of crude production. Adding the 8% to the crude production for April and May results in C + C production of 10,508 kb/d and 10,260 kb/d, respectively.

“Vienna — Russia’s condensate production averaged 833,000 b/d in November, energy minister Alexander Novak said Friday.

Stripping the November figure out from Russia’s previously reported oil output data shows that crude production was 10.41 million b/d in the month.

Russia is seeking to exclude its condensate volumes from its production quota under a supply cut agreement with OPEC and nine other allies, which the coalition will attempt to finalize Friday in Vienna.”

In the past when information was directly available from the Russian Ministry of Energy, the difference between the Russian Ministry and EIA was 404 kb/d higher. Comparing the two independent estimates above, Russian April output is 431 kb/d higher while May is 359 kb/d higher. Use of the Argus data provides production rates reasonably consistent with the EIA estimates.

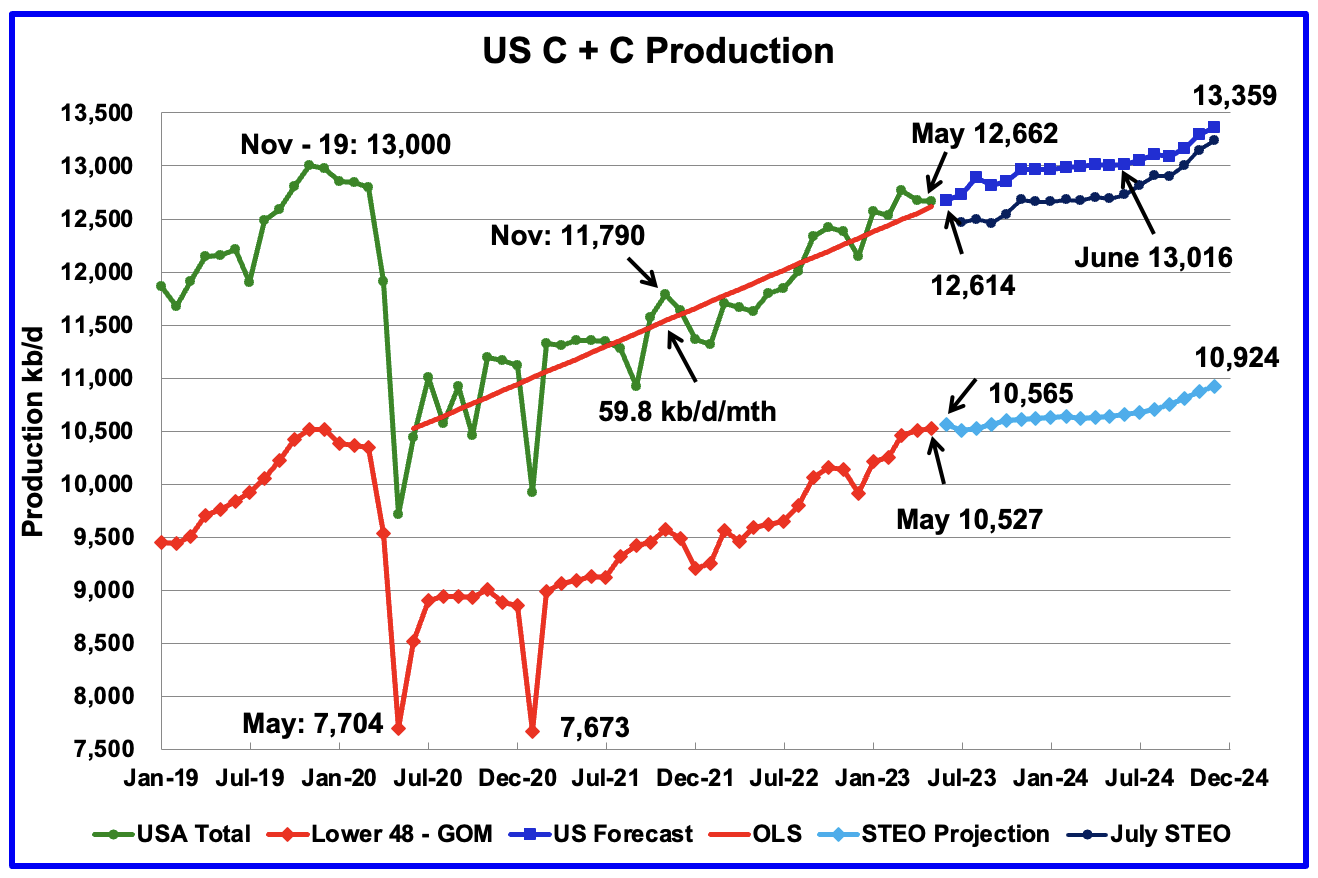

U.S. May oil production decreased by 15 kb/d to 12,662 kb/d, a small change, primarily due to the upward revision of April output from 12,615 kb/d to 12,677 kb/d.

The dark blue graph, taken from the August 2023 STEO, is the forecast for U.S. oil production from June 2023 to December 2024. Output for December 2024 is expected to be 13,359 kb/d which is 359 kb/d higher than the November 2019 peak of 13,000 kb/d. Note the difference between the August and July STEO forecasts for US oil production. The August forecast is between 125 kb/d and 350 kb/d higher than reported in the July STEO forecast.

While overall US oil production decreased by 15 kb/d in May, the Onshore L48 had a production increase of 19 kb/d to 10,527 kb/d. The light blue graph is the STEO projection for output to December 2024 for the Onshore L48.

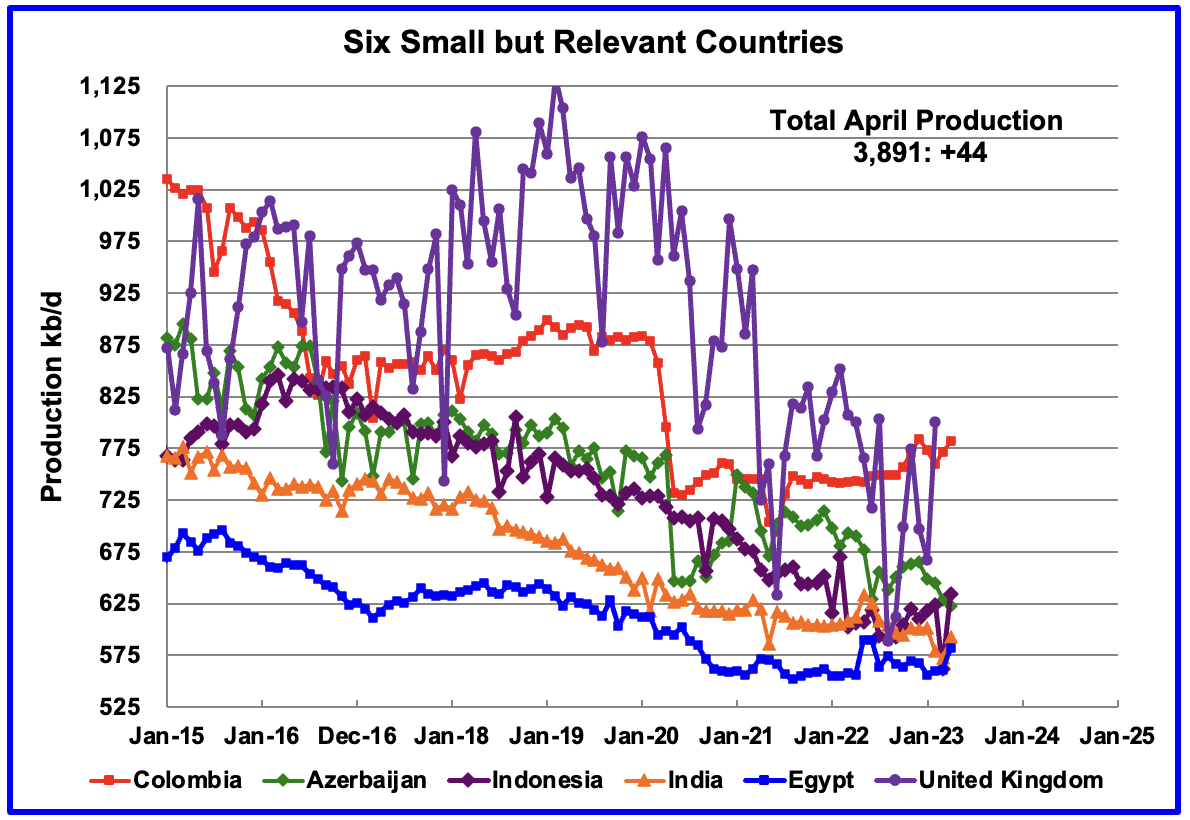

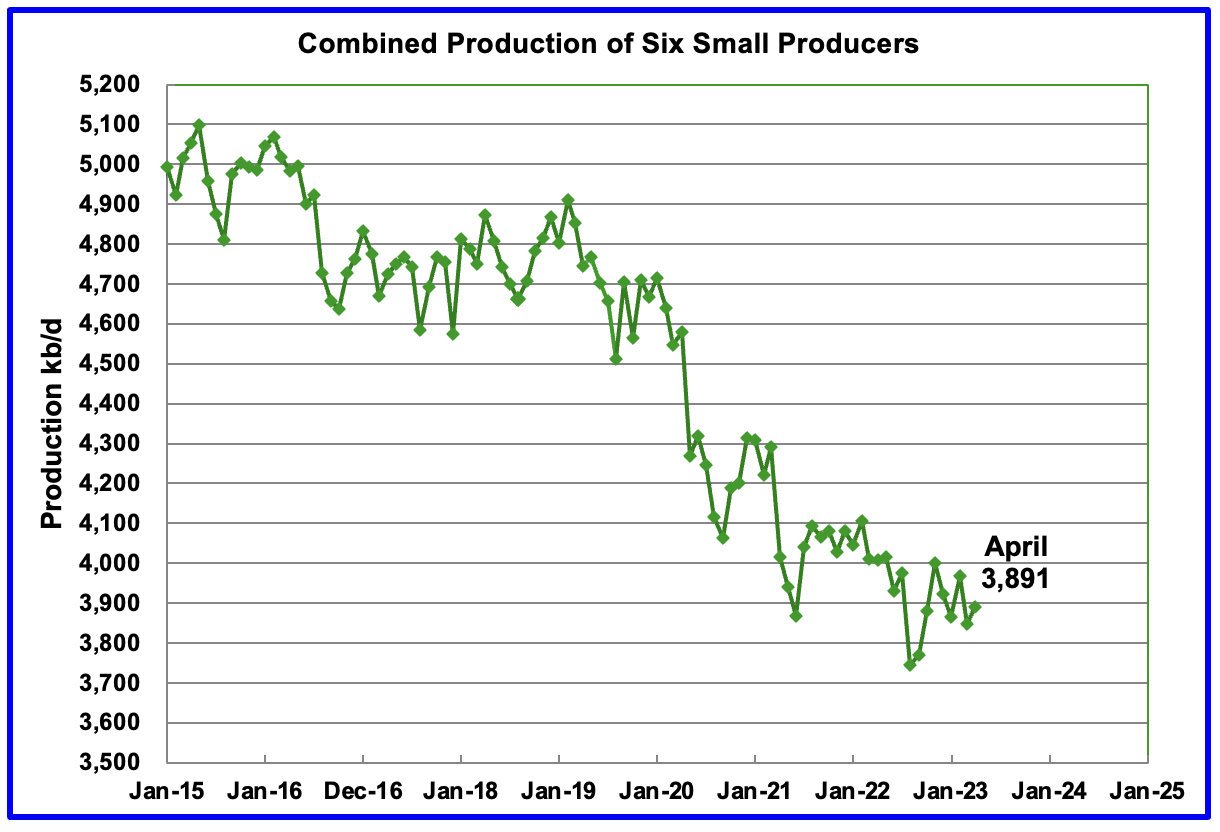

These six countries complete the list of Non-OPEC countries with annual production between 500 kb/d and 1,000 kb/d. Note that the UK has been added to this list since its production has been below 1,000 kb/d since 2020.

Their combined April production was 3,891 kb/d, up 44 kb/d from March.

The overall output from the above six countries has been in a slow steady decline since 2014 and appears to have accelerated after 2019.

World Oil Production Ranked by Country

Above are listed the World’s 12th largest oil producers. In January 2022, these 12 countries produced 76.8% of the world’s oil. On a MoM basis, production decreased by 413 kb/d while on a YoY basis, production increased by 2,133 kb/d.

World oil production decreased by 433 kb/d in April. The largest decreases came from Iraq, 210 kb/d and Canada, 187 kb/d while Saudi Arabia added 350 kb/d.

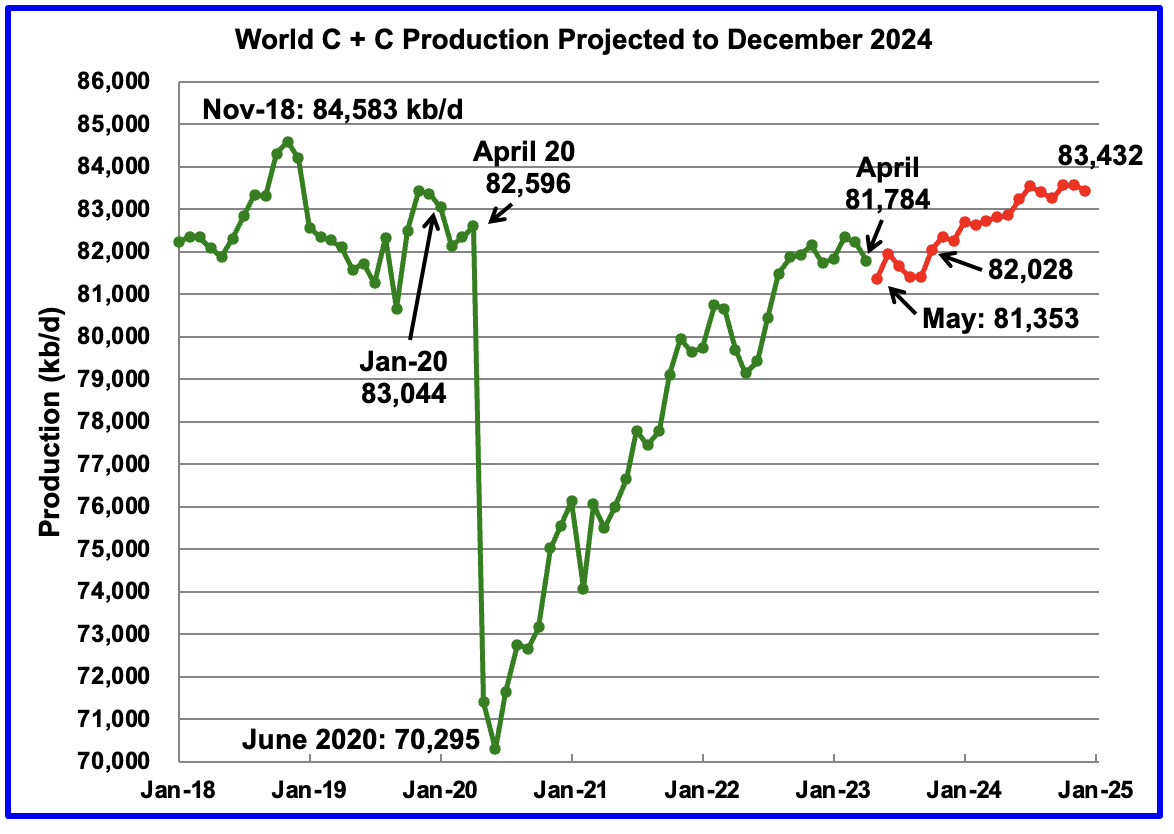

World Oil Production Projection

World oil production in April decreased by 433 kb/d to 81,784 kb/d.(Green graph).

This chart also projects World C + C production out to December 2024. It uses the August 2023 STEO report along with the International Energy Statistics to make the projection. (Red markers).

The red graph forecasts that World crude production in December 2024 will be 83,432 kb/d and is 1,151 kb/d lower than the November 2018 peak. Note the large increase to 82,028 kb/d in October 2023. This could be due to Saudi Arabia reversing part of its September 2023 1,000 kb/d cut.

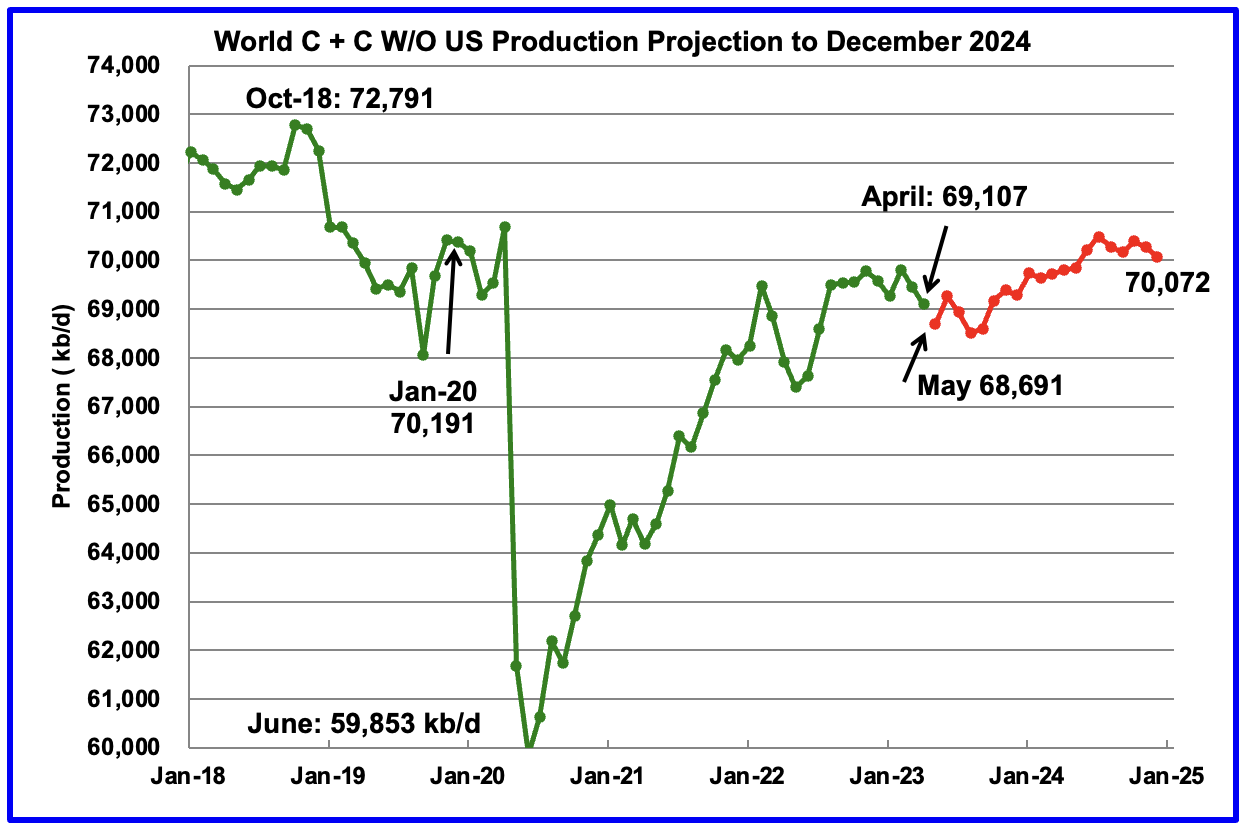

World without the US oil output in April decreased by 340 kb/d to 69,107 kb/d. May’s output is expected to decrease by close to another 416 kb/d to 68,691 kb/d. December 2024 output of 70,072 kb/d is 2,719 kb/d lower than October 2018 output of 72,791 kb/d.

World oil production W/O the U.S. from April 2022 to December 2024 is forecast to increase by a total of 965 kb/d.

I don’t understand how production continues to slide and the pundits say demand is up? Why isn’t the market tighter. I have come to the conclusion that the market information is a best guess and no one really has a handle on the real supply and demand numbers except in the rear view mirror after the official production numbers are reported usually 3 months later than the production month.

I would expect the market to tighten if demand is up as claimed and Saudi and Russia have cut back 1.5 million barrels a day.

I am concerned about the underlying debt bubble in commercial and residential real estate. When that bubble bursts, and now also one trillion dollars of high interest credit card debt goes unpaid, I think this fall may be very difficult and if WTI oil prices do not stay up above $80 WTI for a lengthy period, oil production in the United States will continue to fall.

I am long term bullish on oil prices and now mostly natural gas but the short term looks a little scary.

LTO Survivor

I think when people say demand is up, I think that they are referring to US Supply and Demand. Below is a table that compares the average product supplied, a proxy for demand, over the past 4 weeks compared to last year. As you can see, the YoY demand for the main products gasoline, jet fuel and distillate are up.

Note that total demand is close to 20,700 kb/d. Not shown in the table is input to refineries, which is close to 16,600 kb/d. That gap is made up by exporting and importing product and crude, primarily from Europe and Canada.

On a world basis, I agree OPEC and the EIA are guesstimating with respect to supply and demand. I think Iran is supplying more than OPEC is reporting. It was not until SA cut production by 1 Mb/d in July that WTI firmed up in late June from $68/b to $83/b today. I think that is sufficient evidence that up to end June supply was greater than demand. The smart money got in early at the end of June in anticipation of the SA cut.

The full EIA table can be obtained here: https://ir.eia.gov/wpsr/overview.pdf

See WTI Chart below.

WTI Chart

Why is there a need for a 50 days and 200 day MA, I think a 5 day MA would make sense to smoothen a bit the graph but 50 and 200 days MA,?

Svaya

While the 50 and 200 day MAs are smoothing processes, their intent is to get a better idea of the underlying trend in a particular product. These averages are primarily used by stock traders to look at the medium and longer term price trend of a stock. They are also used by commodity traders.

With the 50 and 200 day MA, traders look for two particular events, The death cross and the golden cross. When the 50 day MA crosses the 200 day MA on the down side, it is known as the death cross and is a signal to sell. On the other hand when the 50 day MA crosses the 200 day moving average on the upside, it is known as the golden cross, a signal to buy.

The current price trend of WTI indicates that the golden cross event could occur in the week of August 21 to 25.

For better info try Google.

https://www.investors.com/how-to-invest/investors-corner/moving-averages-provide-effective-tool-for-your-trading/

Oh, I see, I don’t believe in trading and speculation…

Svaya,

You may not believe in trading and speculation and I also do not participate in this as it seems like gambling. Nonetheless trading and speculation does seem to effect prices in the short term, in the long term only actual supply and demand matter. The visibility of both supply and demand are not very good in the present, only looking back several months can these be judged, to look at the present one looks at trading and speculation on paper markets to get an idea what those traders think is happening with the knowledge that they are often incorrect so it is a very rough guide to where future prices might go.

China’s total imports from Russia fell 8%. Trade data out of China has be beyond ugly. China and India have both been refining a lot of Russian oil and exporting those refined products. Mainly to Europe. So at least part of Chinese and India demand is actually just European demand.

Money supply growth in US has shrunk 8 months in a row. -10% growth for the last 3 months in a row. Only other time this has happened was in The Great Depression.

Rising oil prices in an economy with a contracting money supply. Something is going to break.

Money can be cheap but hard to get when banks become unwilling to lend. We can have interest rates at zero but banks can still be unwilling to lend.

Have to watch bank credit. Loans and leases. Which currently aren’t really growing but also not really contracting yet either. So I’d say you have to look at both bank credit and the M2 money supply.

My whole $25 oil is based on the credit spigots being turned off for a period of time.

Based on Eurodollar credit being turned off for a period of time.

“My whole $25 oil is based on the credit spigots being turned off for a period of time.”

Put your right arm in, take your right arm out. Put your right arm in, and you shake it all about. Do the Hokey Pokey and you turn yourself around, that’s what it’s all about!

HHH, what is your take on deflation scenario in China in the long term, say the next 5 years?

I don’t see it getting any better. I don’t think investment led stimulus like what they did in the wake of 2008 is going to bring back their internal demand because in large part their internal demand depends on demographics. Which they can’t change. We are 40 years from the adoption of one child policy. They can’t undo the demographic damage that has been done.

So China is very dependent, more so now than ever on external demand. Which imports from both the US and Europe are down over 20% which has the knock on effect of less China imports of raw materials.

So unless demand is fixed in the US and Europe. China is facing decades of deflation much like what Japan has gone through.

Or China massively reArms. Vast military spending might do the trick to stimulate domestic demand. Not a good outcome for the US or Taiwan.

External demand would go to zero if they attempted an invasion of Taiwan. Not saying it won’t happen. Because as their economic situation continues to deteriorate with no end in sight. They might just consider an invasion.

Use to land 182’s with balloon tires and stall kits on the Chandeliers in Louisiana. Fish all day, clean fish to ten, then take off the beach in the dark back to Houston.

The US has drained its SPR to half, much of that went to China, as does way too damn much of the 1.5 G BO of Permian exports every year. Our inventories in the US are at an all time low; China, on the other hand, has nearly 950MM BO in its SPR’s and enough JP4 to fly its military jets for a year, full out. In the US we are relying on 10 months of lag time from a Wolfcamp spud in Martin County to JP4. We can fly for four months with fuel on hand. Anybody can Google all this, by the way, easily.

US tight oil exports are smart, uh? Good for our nation’s energy security. Our country is governed by imbeciles, blue, red alike.

Thanks HHH for you thoughts on China’s economy.

perhaps we live in alternate universes.

Production is down because of the joint Saudi production cuts.

Demand: “The IEA estimated that global oil demand hit a record 103 million barrels per day in June and could scale another peak this month. Meanwhile, output cuts from Saudi Arabia and Russia set the stage for a sharp decline in inventories over the rest of 2023, which IEA said could drive oil prices even higher.”

As inventories drop to an 8 year low the only thing that will drop oil prices is a repeat of the great financial crises. Possible yes, probable not so sure. Gonna keep dancing with the one I brought… WTI oil to $90.

https://www.rigzone.com/news/wire/iea_says_global_oil_demand_hits_record_and_prices_may_climb-11-aug-2023-173640-article/

https://ia902602.us.archive.org/2/items/oil-exports.-34odt-1/Oil%20exports.75odt%20%281%29.pdf

SECTION 1: The material in the original edition ……. 10

A simple explanation of oil geologist Jeffrey J. Brown’s “Export Land Model”……………………………………………..11

Sweden may be without diesel to import as early as during 2025-2026, or 2027 at the latest, according to my numerous

calculations. In 2027 the world has only an estimated 380 000 barrels of diesel exports to share, which China and India very quickly will consume, while the world had over 6,4 million barrels of diesel exports to share in 2005, when oil exports and diesel exports peaked.

*********

Is this possible?

I can’t see it since rationing would be in full force.

Do you or anyone else know why Brown has dropped out of sight and doesn’t comment anymore?

(I know a retired Professor of Geology who wrote papers on PO in the nineties who now refuses to talk because “it is too late.”)

Perfectly credible especially as Sweden is shuttering refining capacity. The EU is especially exposed because they have effectively shut of Russian crude and have only partially replaced the 3 million b/d. Meanwhile China and India have bought Russian crude at deep discounts and sold finished products (jet and diesel ) back to the EU. Worse still the EU is squeezing refineries over carbon emissions. This is not a new story. By the end of this decade there will be no spare crude capacity anywhere. Demand is growing in India and Asia and this will consume the entire export quantity , especially when you look at the Chinese petchem build out, which is colossal. Forget KSA. They have been quitely entering into jv’s, especially in Asia, that will consume KSA exports. In effect it is captive leaving very little for other destinations. When US LTO declines, which will be sooner rather than later, that will have a huge iimpact. China and the EU will lose some of their crude supply and there will be a stampede which the Chinese will win. Even the US could be grubbing about to find suitable barrels. Happy days.

Carnot, you wrote an exceptionally good summary of the world crude oil situation in about one-tenth the words that I would have used.

To emphasize a massive sea change, it would appear that the Saudi-U.S. relationship has been more or less severed, and they have partnered up with China to become the petrochemical purveyor to the world.

The U.S. LTO boom will devolve into a natural gas and condensates story. In truth, the Delaware part of the Permian–the main growth part–is already more condensates, as the API frequently floats above 50.

The recent work of Lars, posted on reddit, had only one response at r/peakoil to anyone wanting to make something of Lars the forest man.

This was it:

“It took a little bit to get to the text of the work, and I was able to read some of it. However, early on it became obvious that it might suffer from a very serious flaw. I wonder if the author did due diligence on his supposedly famous source of the math he then applied to create his idea?”

I think the comment was aimed at anyone using the ELM, not just forest people who might not be familiar with the difference between world famous and just peak oil infamous.

Reservegrowthrulz,

I have read that longer horizontal laterals for tight oil wells will tend to have lower EUR when normalized for lateral length. Is this correct as far as you know when all else is held equal (two wells drilled nearby in a core area of the same formation, one with a 5000 foot lateral and the other with a 10,000 foot lateral)? In the example given we would expect the shorter horizontal would have a higher EUR per foot of lateral assuming similar frack stages per foot and proppant per foot etc.

Some of the possible reasons fro reduced EUR with increased lateral length are covered in post below.

https://www.oilystuffblog.com/single-post/death-by-eur

Excerpt from Mr. Shellman’s post linked above:

And one more thing from an old operator of a half century, please…longer laterals seem great at first, then they are not so great.

Once induced frac energy poops out and those longer lateral have to go on artificial lift, like gas lift, ESP, or even rod lift, things change drastically. It is impossible to create enough pressure drop (delta) at a cluster of perforations 2.5 miles away with artificial lift. Back perforations toward the toe of a long lateral stop contributing to the well after induced energy poops out; those propped up fractures then close and in the end offer very little in the EUR of things. 15,000 foot laterals create monster IP 6 and 12 month production stats, then start dropping like a rock and end up being 8,000 foot laterals before you know it.

A tight oil operator gets a bigger bang for his buck with a longer lateral, cash flow is quicker and maybe, but not for sure, the well gets to pay out faster. All good for a company, maybe not so good for our country.

Longer laterals probably reduce recovery rates of OIP. Perforated stages at the heel of lateral may recover 10% of oil in place in the SRV (stimulated container) but those stages toward the toe will struggle to have 5% RR of OIP. Will those back stages in a long lateral ever be re-drilled to recover that oil left behind? Hell no. Its lost forever.

When studying the Barnett some decade and a half ago, what was noticeable about longer lateral lengths was production per foot of lateral length decreased, all other factors being equal. Never looked for oil. However, as I discovered later on, it was that number of stages mattered far more in terms of performance than lateral length. And industry response was then to increase frac stage density, and interestingly to overdo it. Per cluster performance declined, even as initial production continued to increase. To run that one to ground required some specific information, it was on the Bakken, and I haven’t been able to get that quality of information since 2012. When I boiled it down to a nice chart and sent it off to the head of reservoir engineering, they admitted that there was a limit to decreasing frac cluster spacing. My question had been why, in light of what could be found in their data, didn’t they optimize around the cluster spacing that was obvious, save some money. The answer revealed that there was more to it than a decision from the head of reservoir engineering. I found out why later.

So my answer is there is more to it than just lateral length, and the information to prove it again is beyond my ability to get without a large company providing it in order to learn things.

I find it interesting that in your quote propped fractures are closing for some reason, per. Mr Shellman. Because only increased reservoir pressure from a frack job moves it? Hardly. His reasoning doesn’t work in terms of differential pressure as it still the prime mover, toe or heel, pre and post fracture treatment. Create the differential in only the heel, or all along the well bore, and unless something has blocked the wellbore proper, sooner or later that differential will be pulling on every open perforation. Might the toe always be operating with a larger pressure differential at the sand face? Sure. So what. Might there ultimately be more oil left in the pore volume closer to the toe? Sure. So what. None of this by itself does anything to crush proppant anywhere, unless someone wants to argue that when reservoir pressure is reduced far enough below initial reservoir pressure that something happens related to the rock matrix itself, or proppant suddenly can’t prop. But that wasn’t the claim, reservoir pressure reducing below original reservoir pressure was. So when reservoir pressure of 5000# is in the rock (down from 6000# post frac), and the wellbore pressure at the toe is 3000#….proppant decides to stop…propping? Really?

So no, I’ve never heard this idea before. I haven’t ever seen his claim in a journal anywhere either. To be honest I am not as interested in the single well performance issues bandied about by the folks doing the work nowadays, there is more interesting tidbits in the application of statistics to a plethora of data compared to the bad old days. Ask him if he has any references, it would interesting to see any data about folks studying this or science articles, or really even claiming it and explain how they deduced it. If someone has the physics explanation I can build a routine to search every well in the Permian looking for it to see if it matters.

to RGRZ:

The fact is that no one cares about incremental engineering improvements. All that’s important is order of magnitude estimates of what the expectation is. An interesting recent tweet by a chemical engineering professor who does fundamental research in catalysis:

So to someone like RGRZ, wondering about fundamental limitations and proposing the why and how some behavior comes about through a hypothesis is not their agenda. They just want to squeeze the last bit of efficiency they can out of the situation they are dealt with.

Paul’s quote:

“They just want to squeeze the last bit of efficiency they can out of the situation they are dealt with.”

Those of us not retired have every interest in doing what we enjoy doing until it is time to retire. Efficiency doesn’t have anything to do with it from my perspective.

RGRZ said:

“Efficiency doesn’t have anything to do with it from my perspective.”

Missed completely my point. Plus efficiency is in terms of business/economic efficiency, as engineering as a job is typically part of a business.

Ask us if we care whether a 2% improvement in recovery of a typical Permian well is going to matter in the long-term estimate of peak oil? But it may be important for a business willing to pay for an engineer to devise such a strategy. Or they may not care either and save the engineering money and tap it out as a matter of convenience, not caring about extra return. Because that is always happening as well,

I never used the term proppant crushing to describe fracture closure at toes. Perforated stages toward a toe close, or partially close for a number of reasons, most of which have to do with eventual reduced liquids conductivity to the well bore. Half the time they sand-up and are not washed out.

No way is pressure differential great enough from AF to “pull equally on all stages,” or at all stages 3 miles away toward the toe.

Using liquids as the flow regime, not gas (?!) longer laterals is a grossly inefficient way of recovering oil in place. If tight oil were profitable to extract >3:1 ROI, that sector would not use longer laterals, or frac designs for front loading cash flow.

Longer laterals is about money and “efficiency” of money spent v. money returned, not maximizing recovery of our country’s remaining hydrocarbon resources.

So what, he says? Well, another mile of rock as been exposed, poorly treated, and recovery rates are way less than 10% of OOIP. The oil in that rock is stranded, locked up. No longer available. Gone. That’s what. Take all that out of the USGS TRR resource estimates and chunk it in the dumpster.

Mike,

Is AF Artificial Lift?

From:

No way is pressure differential great enough from AF to “pull equally on all stages,” or at all stages 3 miles away toward the toe.

If AF means artificial lift from a pump of some sort, then this statement above seems reasonable based on my understanding of fluid mechanics. Just making sure I am getting it correctly, thanks.

Thanks for the information.

AI, yes; not AF. Because toe stages in ultra long wells rarely get stimulated to their potential, IMO they are the first to begin pressure depletion, which then in turn requires those back stages to require higher delta p than front ones when induced and natural energy is depleted.

Walk out the front door of your house, take a 3 mile walk down a straight street and think of homes on both sides of the street as frac stages. You have to manage those homes at the END of the street from YOUR home. It cannot effectively be done.

I have no idea where the proppant crushing issue came up, not me. BTW, 2022 had the highest percentage of 15K ft. laterals in the Permian but that was still <14% of total (Enverus).

Thanks to everyone downhole who said nice things.

Thanks Mike.

I always appreciate learnibg from a pro.

I am not a pro, Dennis; just somebody in a good position in life to want to help and make people understand, and trust in, my industry more. Thanks.

“Take all that out of the USGS TRR resource estimates and chunk it in the dumpster.”

Resource estimates of the USGS don’t ever include economics. They once told an AAPG conference in Long Beach that their reserve growth estimates for the LA Basin presumed that a tsunami comes in, wipes out LA, the land is sold to oil companies, and they can do anything they want with it to increase oil production for whatever price it takes.

The USGS also understands, and I’m paraphrasing one of their quite smart scientists here, that all known or even supposed and undiscovered oil and gas accumulations are 100% technical recoverable. And they are quite correct, even if normal folk or good ol’ boys can’t for a second understand the economics of why.

Mike S,

In my opinion you are the definition of an oil industry professional.

Thank you for all the knowledge you have shared at Peak Oil Barrel and Your Oily Stuff Blog.

It is appreciated more than you know.

Thank you, Dennis, that is a very kind thing to say to me. I am grateful.

I am also relieved beyond words that according to the growth guy the 85 plus % of oil in place in tight oil basins that we are stranding, because of pressure depletion, is still “technically recoverable.” We can keep drilling the Permian forever; we don’t need CAPEX, or normal people, or good ‘ol boys, we just need more engineers. I feel lots better.

Thanks again, Dennis.

Reservegrowthrulz,

Data from the Bakken would be more useful especially if it is oil focused.

My understanding is that fluid flow along a pipe will be affected by a pressure drop along the length of the pipe. Eventually these wells are placed on artificial lift and we would expect based on fluid mechanics that a longer lateral would have lower flow near the toe of the lateral due to frictional losses along the pipe and a lower pressure differential when on artificial lift due to these frictional losses. There is likely a limit to the size of the pumps providing the artificial lift and even if we are not near those limits (I am not familiar with the technology or costs) there is no doubt an optimum pressure target at the heel of the lateral which cannot be maintained along the length of the lateral due to physical principles.

In any case my expectation is that even for wells with similar frac cluster spacing along the lateral in similar quality rock (in terms of barrels of oil per cubic meter of rock, porosity, and ability to fracture the rock properly) that a 5000 foot lateral well will have higher EUR per 1000 feet of lateral than a 10 thousand or 15 thousand foot lateral well. Thus the move to longer lateral lengths designed using optimal industry practice will tend to reduce EUR per well when normalized for a 10 thousand foot well.

Thus we would expect normalized EUR should be falling and it should not be a surprise given that average lateral lengths have been increasing. To me it is surprising that the drop in EUR per foot of lateral has been relatively small from 2016 to 2020 in the Permian basin, only about 1.2% per year.

Most Bakken wells go on lift equipment within months. You can usually see the profile in the production data when the equipment goes in. Hell, any shale well I ever did in vertical wells received equipment early and then went on some form of backside pressure control.

In either case, I can pretty easily carve up lateral lengths and productivity metrics across the Bakken, at the well level in one form or fashion, I’ll check sometime just to see which way things lean. But that isn’t where the real questions reside, that is just interesting data tidbits along the way.

Reservegrowthrulz,

Yes there are many metrics that are important such as the mass of proppant used per foot of lateral, the number of frack stages per 1000 feet of lateral, and lateral length. I have some data on average annual lateral length in the Permian Basin and average annual EUR for the Permian, but I do not have the other data. Since 2016 EUR normalized to 10 thousand feet in the Permian basin has been decreasing as lateral length has been increasing (data from 2016 to 2021, too early for a good EUR estimate after 2021). For every 1000 foot increase in lateral length normalized EUR has decreased at about 1.6% on average over this period. Changes in frack stages per lateral foot and amount of proppant used per foot may confound this result, but I do not have that data.

If lateral length, proppant use, and frack stage density stabilize at some optimum level we might see EUR stabilize as has been roughly the case in the Bakken/Three Forks.

Lots of interesting questions but I do not have access to the data needed for more detailed analysis.

@Mike

Just buy some excavators and dig it out in south african diamond pit mine style – you’ll get every barrel.

Technical recoverable…

Not economic at oil prices under 2000$ or so….

Or frac with nitro glycerine instead of water and lift the surrounding up and down by a few 100 feet at every “boom”. I think some russians even thought of fracking with nuclear bombs in the 70s.

Just kidding.

Ovi, stellar job as always on this.

Before too long Argentina will warrant being included on the list of small but relevant countries as it gradually builds up the infrastructure to increase Vaca Muerta production.

Here is one take on that- https://oilprice.com/Energy/Crude-Oil/Will-Argentina-Reach-Its-1-Million-Bpd-Oil-Production-Goal.html

Hickory

Thanks

Attached is a chart for Argentina and you can see the effects of Vaca Muerta coming on line. I think it will be a while before it gets to 1 Mb/d, 7 to 10 years. From the info below it looks like a growth rate of between 50kb/d/yr to 75 kb/d/yr is a reasonable expectation.

This company states: “Pampa Energía, the fifth-biggest natural gas producer in Argentina, plans to invest $200 million in an oil pilot project in the Vaca Muerta shale play with a goal of reaching 200,000 b/d in production in the next few years, helping to diversify its gas-strong upstream business, company executives said Aug. 10.”

https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/natural-gas/081023-argentinas-pampa-to-invest-200-mil-in-vaca-muerta-shale-oil-pilot

Here is another link: https://www.reuters.com/business/energy/argentinas-neuquen-hits-oil-export-record-with-vaca-muerta-boost-2023-08-10/

Russia’s currency collapse is a cause of concern. Could potentially have a Soviet Union like collapse. Which in theory could take most or all of their oil exports offline.

You would think Russia learned something from 1991, but did the US learned something?

HHH you are now is fantasy land. Russia is not going to collapse. So which horse are you riding now? Oil to $25 or Russian production going to go off line(not going to happen)

You sure about that? It did happen before. Their currency has lost what 62% ish of its value against pretty much every currency that matters. This is over about the last 12 months.

What exactly is going to stop their currency from crashing further. Last week it was falling 2-3% a day.

If your a business in Russia how do you cope with that?

Russia ran out of dollars to defend the value of their currency.

They even dipped into their sovereign wealth fund to get dollars previously to defend their currency shortly after invading Ukraine.

It wouldn’t surprise me at all if they experience a degree of hyperinflation that brings down the government.

Heck go look at the value of the Ruble against the Chinese yuan and India Rupee. Selling oil to them in their currencies isn’t helping matters.

“What exactly is going to stop their currency from crashing further”?

The elimination of Putin, the end of Russian aggression on Ukraine and Russian reformations for all the loss and damage to Ukraine. Than Russia can return to the International economic system. Russia can pay for the reformations from their wealth of natural resources.

That’s what it’s all about !

*****

OTHER WORDS FOR HOKEY

1 corny, maudlin, melodramatic, cloying, goopy, mushy

2 fake, false, artificial, counterfeit, sham, spurious

Does pokey mean slow?

adjective,pok·i·er, pok·i·est. Informal. moving or acting slowly or ineffectively; slow; dull: poky drivers.

https://www.youtube.com/watch?v=Zh2PalZFs0g

And by the way, just admit you were wrong about $25 (in March), because it’s making you look Hokey.

Ruble is down another 2 almost 3% today and it’s still early.

HHH , disagree with your assessment of Russia . This is 2023 and not 1993 . A lot has changed .

I follow Alexander Mercurius on Russian matters since late 90’s . This is his view .

It now suits Russia that the Ruble is falling against USD and EURO. Russia is doing a ‘dirty float’ to manipulate its value. Russia was not importing last year, oil prices were high, Russia was in recession and was recovering from sanctions, so a strong Ruble made sense to lower inflation and the Ruble became very strong which stabilised the financial system and did not affect the budget.

Russian economy is now surging, there are signs of overheating, imports are risings, export revenues are falling, as oil prices fell, as Russia had been pumping with discounts to secure share of the market. Now, fall in energy revenues mean a sharp fall in trade surplus and the current account in Q2 2023, and Russia will not allow the current account to go into deficit.

So, Russia is now cutting oil production, with Saudis that is raising oil prices, and grain deal is gone which places Russia in a strong position for grain exports, so more Rubles will be got from oil by allowing value of Ruble to fall and food exports are more competitive, produced cheaply in Rubles and sold abroad in other currencies.

So, trade surplus will strengthen and current account will rebound in Q3/ 4, imports will be choked off which will lower heat in the economy (interest rates are also raised) and the budget is strengthened as more receipts are got from oil and food exports. The budget is likely to return to balance or a small surplus in Q4.

So, it suits Russia to allow the Ruble to temporarily fall, will not much harm domestic economy, small rise in inflation, which is very low now and Russia has room to let it happen. Russia has done this before, and will do it again. It has handled the situation with exports and with oil revenues, with grain, and with Ruble with accustomed skill.

See the full video . Starts to explain the Ruble devaluation at 9 min ,

https://www.youtube.com/watch?v=JLCKMmxSRTs

Agree. Russia is uniquely able to be self reliant – not by choice, of course! But it runs a highly fiscally conservative domestic economy, the envy of all conservative economists.

Capital exports are tightly controlled, the domestic ruble is doing fine but as wages have increased and domestic manufacture is still catching up there are a lot of imports, causing ruble outflow to ‘friendly countries’ (prob. mainly China). So the Central bank – Govt owned – raises interest rates to such a level that some of the exuberant consumer spending is sucked out of the domestic economy. The governor has a predisposition to do it in one blow, and to overshoot.

Oil ad gas exports are carefully managed to try to adequately meet global demand, but at a price that both suits all OPEC, and doesn’t dampening the global economy.

And Russia relies far, far, less on forex markets, all of which is invisible to the west. It does over the counter govt to govt forex deals with China and India, increasingly uses bilateral trade.

The west scrapes data from SWIFT, and, guess what – Russia has been blocked from SWIFT…so some of Russia’s foreign exchange arrangements are now a black box to the west.

https://www.lauriemeadows.info/conflict_security/Beware-the-Ides-of-March.html#Bilateral_trade_using_domestic_and_friendly_nation_currencies

Thanks Laurie . I have bookmarked your blog for further reading .

Laurie,

That is an excellent perspective.

Thanks for posting.

Wow. Laurie’s blog has a very extended discussion of US & European sanctions on Russia, and not one mention of Ukraine!

Nick G , ” and not one mention of Ukraine! ” . Yeah , because Ukraine is a patsy . The golden rule ” If on the poker table you don’t know who is the patsy , then you are it ” . However there is no solution for some since

” not one mention of Ukraine! ” . Yeah , because Ukraine is a patsy .”

But she doesn’t say that. She doesn’t mention it at all. I’d argue that it is a highly unrealistic argument, that is impossible to defend. Which is why she doesn’t even try.

I don’t mind if someone wants to present the Russian point of view. I don’t mind if they agree with Russia, though I don’t think that’s realistic. But not even mentioning the primary claim of “the West” is a very strong sign of propaganda and misinformation.

HHH

IGNORED

08/03/2023 at 6:57 am

In Europe France, they already just in last 12 months have lost 48% of their foreign currency reserves. We are talking mainly dollars here.

Even though they are under a shared currency they still have to have dollars to operate on a global scale. And they have lost almost half their dollars in just 12 months. So don’t let the value of EUR/USD fool you. France is running out of dollars fast.

Running out of purchasing power fast.

France is paying for some gas in Chinese yuan because they don’t have a choice because they don’t have and can’t get the dollars needed to pay for it in dollars. ”

Now read this and understand the problem of collateral that HHH talks about . Connect the dots . Geo politics will define 2023 .

https://tomluongo.me/2023/08/07/france-niger-five-basis-points-continue-change-world/

Ron discovered this site in June/July this year when they came out with a worldwide reserves in 1P ,2 P form by Rystad . This is the latest submitting on the site . Mind blowing . Had to pour an extra shot to balance myself . Don’t forget the comments section .

https://futurocienciaficcionymatrix.blogspot.com/2023/08/sensaciones-en-la-evolucion-del.html

Is there an english version of the page ?

Mike , when I visit the site , Google translate window pops up and it translates from Spanish to English effortlessly .

It seem we have some problem 😉 by the way, i have data about oil production for each major saudi arabia oil fields but i don’t know how to put many graphics in a comment (and even one since it just fail every time i try) so if someone can help it could be greatly appreciated.

Convert them to gif or jpeg less than 60k (or maybe 50).

I use a cutoff of 55 kB, typically jpg works. I copy and paste into a spreadsheet and then use the save function which allows me to reduce image size and type (gif, jpg, or png) when I save the image. There are other ways to do this, but basically you need to reduce image resolution to get the filesize under 55 kB.

thank you very much

Also post one picture per comment.

Ovi,

Thanks for the report and data. I find it incredible that the top 3 oil producers account for ~ 41% of the worlds C+C production. It’s probably been like this for a while but god damn thats pretty centralised.

Iron Mike

Excellent observation. It deserves its own graph.

Thanks Ovi for the chart. One of the 3 falling over will cause a significant decline in production, which will cause prices to shoot up.

Iron Mike

Attached are the rest. Difficult to believe that April 2023 is almost 4,000 kb/d lower than November 2016.

Ovi,

And ~ 5000kb/d from the 2020 slump. I think its statistically okay to say that the plateau (if we are in one) is between the 43000 and 52000 for world – top 3 producers.

Iron Mike

Agreed

Iron Mike,

I would put the plateau at 48 to 51 kb/d for World less Big 3. I would call the 2020 to 2023 period a pandemic anomoly. I focus on the 12 month average, single month peaks are not important by themselves imho.

Dennis,

I disagree. Firstly in my opinion that’s not a plateau. It’s far too narrow and can just be considered as noise as far as the data goes. Plateau should be much more wider to account for noise, seasonalities (if any exist) and also error margin.

I agree the pandemic is an anamoly, but we live in a world in which anamolies do occur. So ignoring them is at ones peril. Geological peak oil and subsequent declines will be considered as anamolies since it occurs only once, but that anamoly will change the trajectory of everything after the fact.

Essentially you and I have different perspectives on the future. You see the world as BAU, I see the world in a transition period where BAU is getting rockier and eventually in the near future it will be disrupted more often than it did in the past.

Iron Mike,

I guess we define plateau differently.

https://www.merriam-webster.com/dictionary/plateau

If we look at 12 month averages and use plus or minus 1 standard deviation away from median (49.5 Mb/d) we get 47.4 to 51.6 Mb/d for 12 month average of World less big 3 from 2015 to most recent 12 month average.

I agree anomolies will occur, but the pandemic was quite unusual in its severity. Doubtful we will see something like that in the next 50 years. As to geologic decline, that is expected and will define the down slope beyond any plateau that might occur.

For World output the plateau is about 78.7 Mb/d to 83.7 Mb/d when we throw out outliers from April 2020 to Sept 2021. The plateau starts around Aug 2014 for centered 12 month average World C plus C output and my expectation is that aside for the pandemic period, the plateau for the centered 12 month average of World C plus C will continue until August of 2033, about 19 years (roughly 17.5 years excluding pandemic period).

Dennis,

So according to your definition, if world – big 3 goes above or below your plateau, what is that data defined as, a new high which means the previous data points was not a plateau, or a new low which gives the impression of terminal decline ?

The band is way too narrow in my opinion. Oil is a geopolicitical commodity which deserve a much wider plateau. We can agree to disagree.

Iron Mike,

To me it makes more sense to look at the World as a whole, historical data, plus my scenario of future output suggests the plateau I have suggested, hey we can make it 10 standard deviations if that makes you happy, but I think 1 to two does the job just fine.

For World ouput we could take a longer period such as Jan 2004 to April 2023 and use that data and two times the interquartile range to define a plateau at the median of 76523 kb/d with a lower bound of 62526 kb/d and an upper bound of 90521 kb/d, this would cover the period from August 1995 to December 2042 for my Shock Model, a period of about 47 years, quite a long plateau. This is about /-18% of the median. We could define a narrower range of median plus or minus the interquartile range which would be 69.5 to 83.5 Mb/d with median at 76.5 Mb/d and would cover March 2003 to August 2039 for data up to April 2023 and my model after 2022, so a shorter 36 year plateau in that case.

There are an infinite number of ways the plateau might be defined, Hickory’s plateau looks reasonable to me, or we could make it plus or minus 5, 10, 15, or whatever percent some one wishes. I doubt output rises much above 85 Mb/d.

Isn’t the first peak in oil prices an indicator of when global production hit the plateau? In 2008 oil hit ~$100 and in 90s it was about $17 on average…

Also, the global rig count hit a similar peak beginning in ~2007 of more than 3,000 rigs. The last time rig count was above 3,000 was in 2014. In 2022, rigs were only ~1,750…

Production peaked in 2018…I would call that a ~10 year plateau, but if you remove US tight oil it’s an even shorter plateau…

The reason we are all talking about this is the plateau phase ended in ~2020 and we have clearly entered the decline phase…

See OPEC+ trend:

Plateau, +/- 4%, starting in 2014

Thats what I see.

Hickory,

Thats a pretty good assessment.

Seneca cliff soon.

My guess

I have no idea about decline rates or cliffs, although I share Iron M’s and others concerns that instability in global relations and nations internal machinations will interfere with global oil production and exports.

Hickory,

I share that concern, though I expect the transition to electric transport might help reduce demand for oil enough to alleviate the situation. Likewise the transition to wind, solar, hydro and other non fossil fuel sources of electricity and to heat pumps for space and water heating will reduce the need for natural gas and coal.

For me climate change is a bigger concern, but reduction of fossil fuel use will help reduce carbon emissions and developing processes to remove carbon from the atmosphere in the production of cement and perhaps utilizing excess power in the future in synthetic fuel processes to remove some carbon and perhaps capture of carbon when utilizing those fuels might help. Reforestation projects might also help to reduce atmospheric carbon. All of this will be a struggle and success is far from assured, the best we can do is try harder to accomplish the feat of reducing environmental destruction as much as possible. Reduced human population will also help.

Now that promoted Victoria “F the EU” Nuland has been traveling to Africa to deal with the Niger disturbance, how will that affect extraction in Nigeria et al? Inquiring minds would like to know…

Edit: ELM is a most important issue, I surely hope Norway isn´t draining Johan S and Troll too fast, would like some hydrocarbons from there, for my kids at least.

Laplander , the Niger issue . ECOWAS ( NATO in Africa ) was Nigeria , Chad , Mali and Niger . Chad and Mali have declared they will not attack Niger . The Nigerian President asked the parliament to send troops across the border . The parliament refused . After the Russia – Africa summit this has now become a ” white imperialist ” issue . No African politician will risk being seen as a tool of the countries that had enslaved them . Geopolitics will be the theme of 2023 . As to Norway , sorry to disappoint they will pump all they can and as fast as they can . If they curtail supply then the EU collapses . Norway is the only dependable source of energy now since the Russian sanctions .

Aug 11 Rig and Frac Report

Rigs continue to move out of the Texas Permian and into the NM Permian.

– Overall US rigs down 1

– Texas down 4, Tx Permian down 3, EF down 2

– NM up 3 to 105 to where it was in July 2022

– Total Permian is unchanged at 308.

NG was down 5 to 108.

Frac Count Up 5

Some Assistance Here… Locating Jeffery Brown

Anyhow know of how to contact Jeffery Brown of the Land Export Model. I read Lars Larsen’s new 102 Page PDF on the subject, but I would like to make my own calculations and charts.

Does anyone have any contact info for Jeffery Brown?

Thanks… steve

Bring ROCKMAN back too!! (From the Oil Drum)

His MADOR speculation ( Mutually Assured Distribution of Resources ) is my vote for where things are heading.

USA and China form a symbiotic relationship where energy and supply chains are guaranteed,

to avoid blowing each other up.

Is exactly where I think things are going.

This shows STEO estimates from January and August for GoM together with BOEM reported production. I don’t think I have ever seen an STEO number that has underestimated actual production over the last five years. For this year overestimation has so far been about 100 to 150kbpd each month. The more the under production is the more the estimates in subsequent months seem to be increased, as if the main ting is to match a preset running average. The STEO is not a continually adjusted bottom up analysis. It seems to use a set annual pattern, with a dip for hurricane season as the most noticeable feature, which is moved up and down each month and with minor adjustments made (maybe quarterly but I’m not sure).

Just in .

Lot’s of Zombie companies anyway, they lived only on cheap energy and even more cheap credit.

Having to roll a bond or getting a new credit frame is the end then for companies earning litterally nothing even in good times. The 0 interrest years from QE breeded them in mass.

Banks in Europe have a lot of negative yielding bonds on their balance sheet from years of negative interest rates.

All the issues banks are facing in the US are bigger in Europe. It’s just not talked about as much.

It’s a matter of time not if banks go bust and interest rates are back negative in Europe and at zero in US. None of which will be positive for demand in general and oil prices in particular.

And no the FEDS idea of a bailout isn’t fixing the problem in the US. These banks can’t pay the FED back. There is no exit.

Banks instead of lending into the economy are going to buy government bonds. Which you’ll see a bunch of hedge funds go bust on their treasury shorts.

Volatility is going to pickup in a big way and it won’t be good for risky assets or oil prices.

HHH , is correct . Watch the step down . As far as Europe is concerned all the banks are ” dead man walking ” . How many UBS can be bailed out ?

https://mishtalk.com/economics/moodys-downgrades-10-small-to-mid-size-banks-6-more-under-review/

Deposits are going to continue flowing out of the small and mid sized banks into money market funds or even government bonds now as banks can’t compete with the higher rate of interest.

And you know in theory they should be able to borrow back the funds that are leaving in wholesale lending markets. But they don’t have good enough collateral. Or collateral that the big banks will accept. Or it’s so costly for them in wholesale lending markets it’s not worth it.

It’s literally going to be thousands of banks that shut their doors.

Now the problem that creates for the economy is new loan origination goes to next to nothing. I think CRE will likely take a 50% haircut in value over next few years. And pension funds are highly invested in CRE because it never goes down in value. Well until it does.

When property values fall what does that do to local government tax receipts?

If your long oil right now you’re basically picking up dimes and nickels in front of a steamroller. Better have a good exit plan because CTA positioning is near max long. And when the algorithms start taking profits. Prices head down again.

HHH” If your long oil right now you’re basically picking up dimes and nickels in front of a steamroller.” this from someone who has been short oil for a year now! its getting clearer by the day you do not pay any attention to the market fundamentals at all, but only to the select macro issues which support your previous positions. BROKEN CLOCK at best. WORLD WIDE RECORD OIL DEMDAND I guess you did not see that coming😎

Well both China’s and India’s imports from Russia are down big. China was down 8%. Maybe you should re-examine demand being an all time highs and going higher.

And Russia energy is selling at a discount and still imports from China fell 8%

HokeyHokeyHokey check this out:

ECONOMY Visualizing the $105 Trillion World Economy in One Chart Published 3 days ago on August 9, 2023

By Pallavi R

Visualizing the $105 Trillion World Economy in One Chart

By the end of 2023, the world economy is expected to have a gross domestic product (GDP) of $105 trillion, or $5 trillion higher than the year before, according to the latest International Monetary Fund (IMF) projections from its 2023 World Economic Outlook report.

In nominal terms, that’s a 5.3% increase in global GDP. In inflation-adjusted terms, that would be a 2.8% increase.

https://www.visualcapitalist.com/visualizing-the-105-trillion-world-economy-in-one-chart/

Turn yourself around, that’s what it’s all about!

Netherlands is now officially in recession .

https://www.reuters.com/markets/europe/dutch-economy-enters-recession-inflation-bites-2023-08-16/

Mike S is not taking any prisoners . Cutting thru the BS >

https://www.oilystuffblog.com/forumstuff/forum-stuff/everybody-s-pants-are-on-fire-now?origin=notification

Permian Basin well profiles from 2016 to 2020 normalized to 10 thousand foot lateral length. Cumulative output in barrels from month of first flow.

501,647 489,667 484,951 484,243 484,319

above is EUR in barrels of oil (natural gas and NGL output is not included in these EUR estimates, they are C plus C only) at 161 months for 2016, 2017, 2018, 2019, and 2020 average Permian basin well normalized to 10 thousand feet. Over the 2016 to 2019 period average well productivity per 10k feet of lateral decreased at an average rate of 1.2% per year.

The increased average lateral length may be causing this drop in EUR, average lateral lenght for Permian basin wells increased from about 6900 feet in 2016 to 9000 feet in 2020, by 2022 the average lateral length was about 10 thousand feet (Jan through September data only) see link below for lateral lengths.

https://www.eia.gov/todayinenergy/detail.php?id=54079

In my view it is a bit too soon to make a good estimate for EUR for 2021 or 2022 average wells as we do not have a long enough period of data to make a decent estimate.

MIKE S the very definition of BS. How anyone pays attention to someone who missed the biggest oil and gas development story of the late 50 years is beyond me. I suppose being wrong all the time is like a badge of honor here at POB. That being the case we can make Mike honorary general of the BOP.

Mike was right about a few thing the SPR, decrease of productivity, among others things, what about you what have you been able to achieve besides projecting?

Svaya,

I agree, Mike Shellman is great, I have learned much from him. He is a straight shooter and calls it as he sees it.

Mr Shellman does not fell the need to brag if he makes a correct prediction. Some might say that predicting higher oil prices when they are low is a pretty safe bet and is what most at POB have been predicting, including Ovi, Ron, me and many others.

There are those who toot their own horn for no apparent reason, Mr Shellman is not in that group.

+1

2% higher and +850,000 bpd are not even close to the same. Can’t TT2 see that incongruity?

Dennis

Above there was this tantilzing comment.

FRENCHFRIES

08/11/2023 at 5:52 pm

It seem we have some problem 😉 by the way, i have data about oil production for each major saudi arabia oil fields but i don’t know how to put many graphics in.

Could you email him to see what SA graphs he has.

He can email peakoilbarrel at gmail, if he wants.

Dennis

The IEA agrees with Argus that Iran was producing 3,040 kb/d of crude in July. The OPEC MOMR has Iran July output at 2,828 kb/d, up +68 kb/d from June, up 130 kb/d from May and up 260 kb/d from Q4-22. Sounds like the MOMR is trying to slow walk the steady increasing Iranian production up to 3,000 kb/d. The current gap between OPEC and Argus/IEA is 212 kb/d.

I heard a reporter saying that the US is turning a blind eye to the increasing Iranian production

Ovi,

EIA STEO has Iran’s output similar to the OPEC secondary sources estimate. In the grand scheme, 200 kb/d is not a huge difference. Also the IEA has other OPEC nations with higher output with the total estimate for July OPEC 13 crude output about 550 kb/d higher than the OPEC MOMR estimate. As to which is correct, unknown, the estimates are preliminary and often revised. Probably a best guess would be the average of the two estimates (IEA OMR and OPEC MOMR) which for July OPEC13 crude is about 27585 kb/d, this is about 275 kb/d higher than the OPEC MOMR estimate.

Dennis

Quite a big discrepancy with UAE. They were one of the big objectors to cutting in July and that is what made SA go at it alone.

Now it makes more sense for the price weakness from late April to late June. While I believed there was a 500 kb/d oversupply, I was thinking it was due to Iran. Now it is clear that it was a combination of Iran and UAE.

It will be interesting to see if SA keeps it cut into October and whether the exit will be in two 500 kb/d increases spread over few months.

I don’t post in this thread very often, but I usually read it.

It’s looking to me as if there’s a real if only minor possibility that the electric vehicles industries and renewable energy industries may actually continue to grow fast enough that when oil and gas production do peak ( anytime from now to maybe another four or five years) that a lack of oil won’t crash the world economy.

I’m interested in hearing what the guys over here who seldom if ever post in the other thread have to say about this possibility.

You can read this avoiding the pay wall by logging into your google account.

It’s amazing how fast renewables and electric vehicles production are growing , with the potential for accelerating growth for years to come.

https://www.nytimes.com/interactive/2023/08/12/climate/clean-energy-us-fossil-fuels.html?utm_source=newsshowcase&utm_medium=gnews&utm_campaign=CDAQtIThq4Cetut1GLzV17HCvY6onQEqDwgAKgcICjCO64oDMJavPA&utm_content=rundown&gaa_at=g&gaa_n=AfHvTEsE2eLUUYg3C17e92eXRz96iGSZqD8BNTSPxrnh6YEPktb4ZSUQ7Lw49CqCS2BFax13TD5H4VxJB7AnLf7xuaG3&gaa_ts=64d91535&gaa_sig=I516GbJ5kW29_esElKusgrWzWaK_N1nNj0oaCv7B7GauuqegEWN9QmbvMwlb951L8qklAQEhSBqLEDt0zSma6w%3D%3D

Looking at growth rates can be misleading, one has to look at absolute numbers, which may not be as impressive.

Iron Mike,

Oil output grew at about 7% annually from 1933 to 1973, growth was limited by demand. For renewable energy the demand already exists, there are not any demand constraints only the limits on how fast capacity can be expanded to replace coal and natural gas so growth might continue at 25% per year which can add up fast. Let’s say growth averages 15% for 20 years for Wind and solar power output. In 2022 Wind and solar consumption were about 32 EJ (Stat Review of World Energy), if average growth for the next 20 years is 15% per year for combined wind and solar consumption, then 2042 output from wind and solar would be 524 EJ. This is more than fossil fuel consumption in 2022 (494 EJ). As prices for EVs continue to fall (as is likely with inventory piling up on dealer lots) and people become more familiar with EVs and the expanding charging network making EVs more and more convenient, EVs may quickly replace ICEVs just as the ICEV replaced the horse 100 years ago.

There are ~4 million EVs in US to date. Even with considerable growth thru 2030, that’s still only around 15% drop in fuel demand…maybe if people drive/fly less we can get a more significant drop in demand…

Kengeo,

Worldwide plugin sales(EVs and plugin hybrids) have been growing at about 42% per year from 2012 to 2021 on average, if sales continue to grow at 35% per year for 9 years, then all new car sales will be plugins by 2031 and the light duty ICEV fleet will be half the current size by 2036, if heavy duty vehicles follow the light duty vehicle trend and electrify 10 years later oil demand for land transport falls by 20 Mb/d by 2037 and by 40 Mb/d by 2049.

Dennis –

Not sure how well that lines up with mines/mineral availability.

How long do you think EV sales could continue 35% annual growth rate?

Already seems like it’s slowing down? If 2022 total car sales were ~13 million and EVs were ~7% of that, EV sales growth will have to slow down soon if it’s going to be 100% of total sales in 2030 (which it likely will not). Cybertruck and Rivian will likely make a major impact and could become ~4-5 million/year in time…prob. take 10-15 years for that to happen…

But the take home is that we are not talking about a significant change in oil demand any time soon, maybe by 2035 if growth went perfectly?

A catalyst moment is likely coming very soon, economy is on a slow path to recession and is going to get a huge kick in the rear from oil price spike coming soon. Oil prices likely to increase by 5% per month for next year or so, peaking in second half of 2024 above $200 per barrel.

Kengeo….look outside the US to get a clearer view of EV sales and trajectory. Its a global industry with rapid change still in early stages.

And it will really ramp up if we get into a clearly visible and significant oil supply/demand imbalance on the shortage side of the equation.

Kengeo,

If sales growth for plugins is 35% per year for 9 years, then 100% of new light duty vehicle sales would be plugin vehicles, after that growth would proceed at whatever rate new vehicle sales grow over time. If self driving cars get widespread approval in the interrim, new vehicle sales might crash as only on fourth as many light duty vehicles will be needed and nearly all light duty vehicle travel miles will be in self driving EV robotaxis. Most consumers will no longer choose to own their on vehicle. This will rapidly accelerate the transition to electricly powered transport.

Hello Dennis, I know we have debated this before, so I won’t repeat the detail… have you found any new data or surveys to support the notion that self-driving vehicles will displace private vehicle ownership? I still do not see it as a trend for the reasonably foreseeable future. Self-driving will likely mostly just erode the human driving Uber/Lyft ride-share fleet in my opinion.

Evidence is seen in the continued trend of increasing private vehicle ownership data in the US even while Uber and Lyft thrived:

https://www.forbes.com/advisor/car-insurance/car-ownership-statistics/

Will try to find better data than Forbes, but their source appears to be DOT, etc…

If humans wanted to drop their private owned vehicle, they would have already started to do so with Rideshare having been around for almost 15 years. Whether it’s a human driving Uber or a robo Uber car, they both provide the same service. So, if human driving Ubers have not been able to erode private vehicle ownership, why would the self-driving vehicle make a difference?

I still believe strongly that humans will continue to follow the same lifestyle pattern that owning your own vehicle is vitally important and a strong priority for a broad spectrum of reasons.

AV’s will certainly have their place and contribute, but private vehicles will remain much as it is today. Of course, this is coming from a guy with a five car household! It may be six soon if I can find a vintage 87 suburban in good shape.

Gungalonga

Uber and Lyft are modestly improved versions of an existing thing: taxis. They’re slightly cheaper, and perhaps more importantly they circumvent local limitations on the number of drivers.

Autonomous driving offers the possibility of dramatically lower costs. That’s the difference.

Robo taxis . 10 robotaxis paralyze the highway system . ROFL .

https://www.theverge.com/2023/8/15/23831170/robotaxi-cpuc-sf-waymo-cruise-traffic-halt

To build out on Dennis’s comment: There are several factors affecting the car market. We are already seeing falling ICE sales in China, and in the US used market: we are probably reaching the point where people want BEV’s and are unwilling to tie themselves to an ICE car for 10 years (or facing the drastic reduction in resale value when the market for them has died). This is my position, actually: I’m trying to eke 2 or 3 more years out of a 2007 Yaris to be in a position buy the promised small Tesla.

The other factor is Full Self Driving, or autonomous, vehicles. I’ve seen videos of the current version of Tesla FSD (11.4.6) in action, and I think that it is far closer (within 2 years) than I thought a year ago (when I didn’t believe it was close at all).

I think these two developments will upend the car market and probably the global economy. If our society has FSD, and/or Robotaxis, we will need fewer cars and fewer parking spots. A car that drives itself, and is safer than when a human drives it, is an entirely new value proposition, especially for an aging population. It will become impossible to sell cars that don’t have it. Tesla is already in discussion to license FSD to one of the big legacy auto makers; my guess is that by 2032, most new cars will be BEV’s with Tesla FSD.

Nick,

On the relative cost savings between human driven ride share and autonomous… I don’t think it will be significant enough to make much of a difference on the decision to also own a private car or not.

Maybe you have better hard numbers, but to me, the cost of owning your own car is significantly higher than the cost to only use the current options of taxi/Uber/Lyft/mass transit. Yet, these significantly cheaper options have not slowed down the growing ownership of private cars. Why, because humans often do things inspired by emotion, passion, vanity and desire regardless of the financial logic.

When we use Uber in our family, it generally averages around $6-$15 a ride. Often, we split that cost with friends. While this isn’t everyone’s experience and style of use, it is already a cheap and smart option, yet we all still own private cars. Autonomous ride share would almost have to be free to start people thinking of ditching their personal vehicle and that’s a stretch. Personally, I don’t think AV vehicles will be much cheaper to use than current human driven ride share. Yes, you drop the human driver cost which is big, but that human driver also generally paid out of their own pocket to maintain and manage their own ride share vehicle… the AV vehicle company would need to charge enough to cover humans managing them and all the infrastructure and maintenance. So, I think the expectation that AV vehicle ride share cost would be dramatically lower than human driven is a stretch. Even if it is, it isn’t likely to be an influence on mass abandonment of private owned vehicles.

Owning private vehicles is a very personal experience… emotion, desire and individual necessity has much to with it. A person’s unique expression, need of style, color, requirements and performance all go into the experience of owning a big machine that you control and that is waiting for you with all your gear, settings, equipment, kids, dogs, etc.

No tradesman, hunter, car enthusiast, fisherman, person with kids, person with kids that play sports, etc, etc, etc. would likely ditch their private car/truck just to gain the slight possible cost savings of human ride share over autonomous… the AV vehicle would also not fit many of their daily life requirements.

Continued growth in privately owned vehicles despite many existing cheaper daily transportation options has proven this. AV’s will be used, but will make little to no difference with human desire and necessity to also own private vehicles in my expectation. They will coexist.

Gungalonga,

AVs may reduce the need for families to need two cars. Also kids older than 14 or 15 could go to sports etc using AVs, younger children might still ride in parents car. For sportsmen, they could request specific AVs if needed. The costs will be far cheaper than you imagine, when total cost of ownership is compared with use of AVs. The very wealthy will still own private vehicles, just as the very wealthy still ride horses in some cases.

For 99% of the human population private car ownership will become a thing of the past, kind of like the horse and buggy.

I think Nick is right that the difference is far lower costs for AVs vs Uber/Lyft operated by humans. The cost of a service matters. Why do you think ICEVs replaced horses, it was faster and cheaper. For AVs the main thing is that they will be cheaper, but they will also be safer.

To GUNGAGALONGA at08/17/2023 at 11:38 am:

Whether it’s a human driving Uber or a robo Uber car, they both provide the same service.

It’s not the same thing. Because you are not paying a human’s salary to drive, the cost to run a Robotaxi, and in turn the cost to the passenger, will be much lower than an Uber or a conventional taxi. There are a variety of other costs-cleaning, for instance- but if you have FSD, your total costs will be dramatically lower.

Hello Dennis,

On kids 14-15 riding robo AV, maybe some… but I like to participate in practices, etc with my boys and like to drive us with all their various gear. Also, those same kids will be chomping at the bit for their own car when they turn 16! It’s a huge independent moment and expression of style for a 16 year old to get a car and be free. My first car which was an old 1976 Pontiac with vinyl seats and no AC… tough to peel your skin off in the summer… but I loved it, it was mine to use when and how I wanted and had my cool bumper stickers and fuzzy dice hanging large.

For our events, and most people I know, we also bring lots of gear and big coolers to our sports, camping hunting/fishing events. Much of this gear usually stays in the car to save time loading and unloading. Not really convenient to load and unload an AV robo taxi multiple times every time I want to go somewhere. Also, we are usually tight on time in my family, so waiting for a human Uber or AV is never really a convenient option when time is tight and even unscheduled. I certainly wouldn’t ever give up my independence, freedom and convenience to move through the universe… I would look for other areas of life to save money.