By Ovi

All of the Crude plus Condensate (C + C) production data for the US state charts comes from the EIAʼs Petroleum Supply monthly PSM which provides updated information up to November 2023.

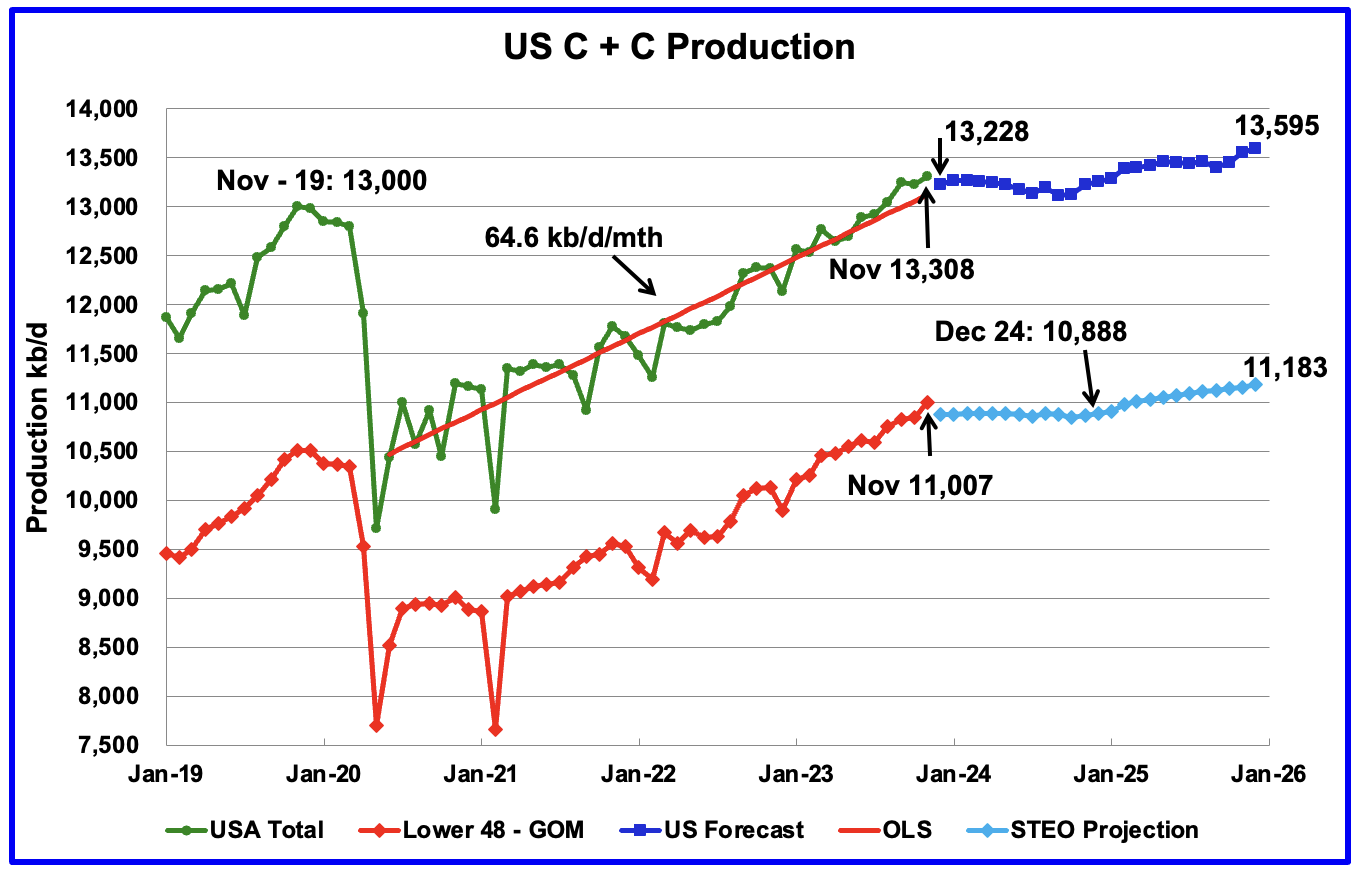

U.S. November oil production increased by 84 kb/d to 13,308 kb/d, a new record high. The increase was primarily due to increases in Texas and New Mexico offset by a decrease in the GOM. Note that October production was revised down from 13,248 kb/d to 13,224 kb/d.

The dark blue graph, taken from the January 2023 STEO, is the forecast for U.S. oil production from December 2023 to December 2025. Output for December 2025 is expected to reach 13,595 kb/d.

The red OLS line from June 2020 to October 2023 indicates a monthly production growth rate of 64.6 kb/d/mth or 775 kb/d/yr. Clearly the growth rate going forward into 2024, shown by the dark blue graph, is flat and significantly lower than seen in the previous June 2020 to November 2023 time period. From November 2023 to December 2024, production is expected to drop by 119 kb/d.

While overall US oil production increased by 84 kb/d, the Onshore L48 had a production increase of 160 kb/d to 11,007 kb/d in November.

The light blue graph is the STEO’s projection for output to December 2025 for the Onshore L48. From November 2023 to December 2025, production is expected to increase by 176 kb/d to 11,183 kb/d. Production for most of 2024 in the Onshore L48 will be essentially flat.

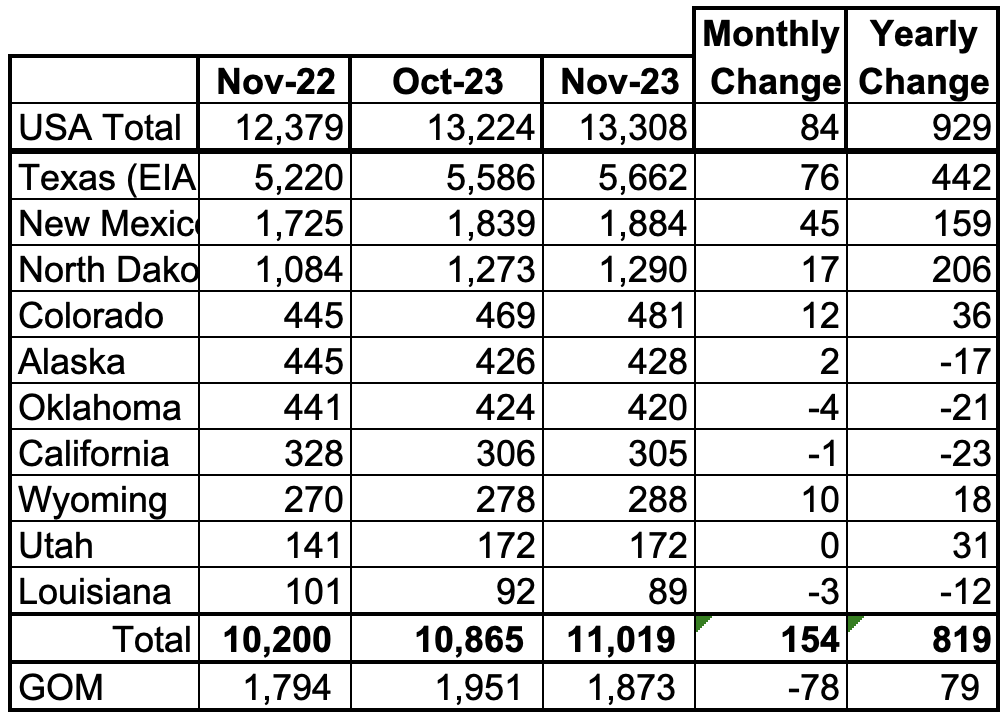

Oil Production Ranked by State

Listed above are the 10 US states with the largest oil production along with the Gulf of Mexico. These 10 states accounted for 82.8% of all U.S. oil production out of a total production of 13,308 kb/d in November 2023.

On a YoY basis, US production increased by 929 kb/d with the majority, 807 kb/d coming from Texas, New Mexico and North Dakota. GOM production dropped by 78 kb/d MoM while YOY it is up 79 kb/d.

Note that on a YOY basis, three of the smaller producing states have increased production, Colorado, Wyoming and Utah.

State Oil Production Charts

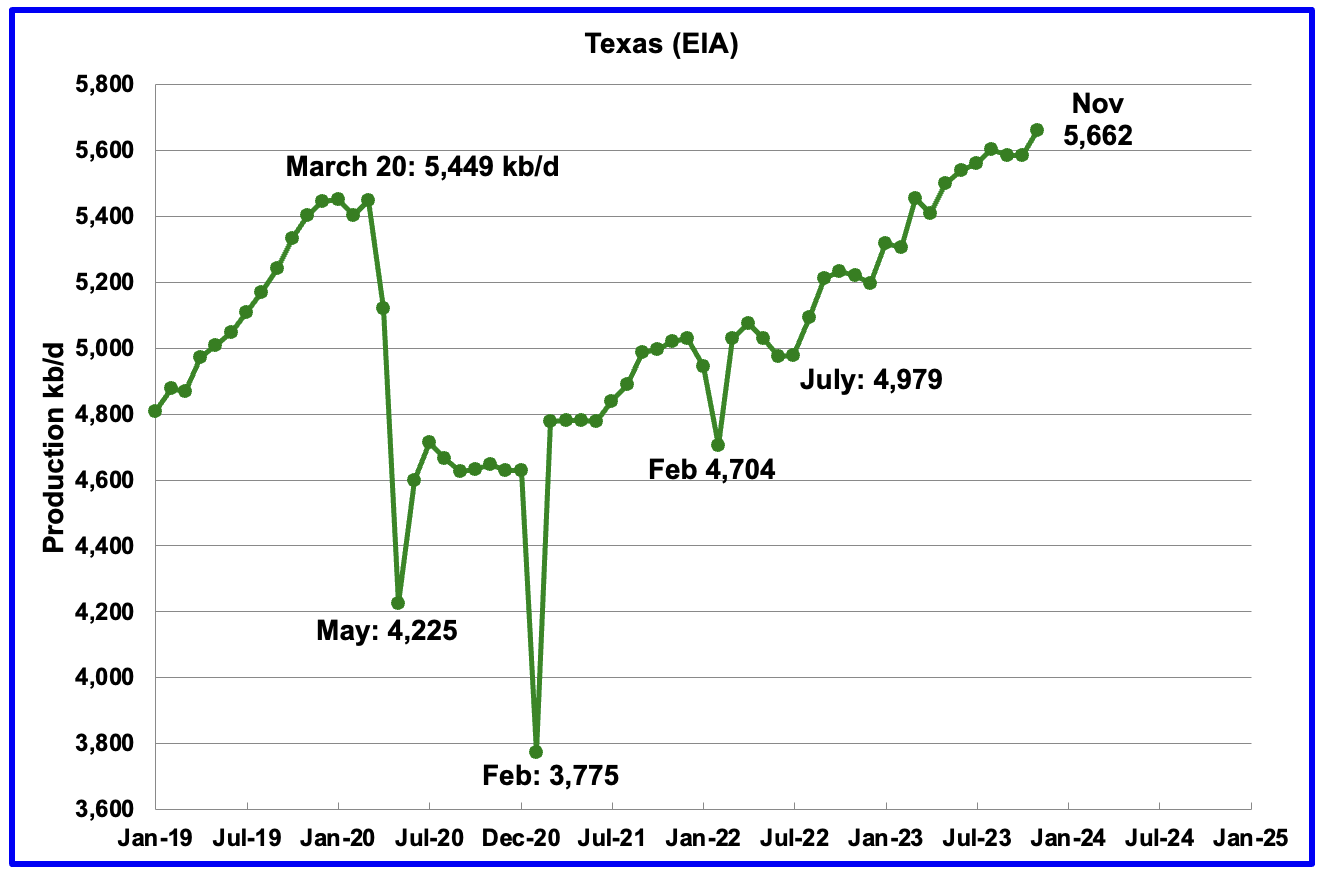

Texas production increased by 76 kb/d in November to 5,662 kb/d. However, relative to October’s production reported last month, 5,607 kb/d, November output was up by 55 kb/d.

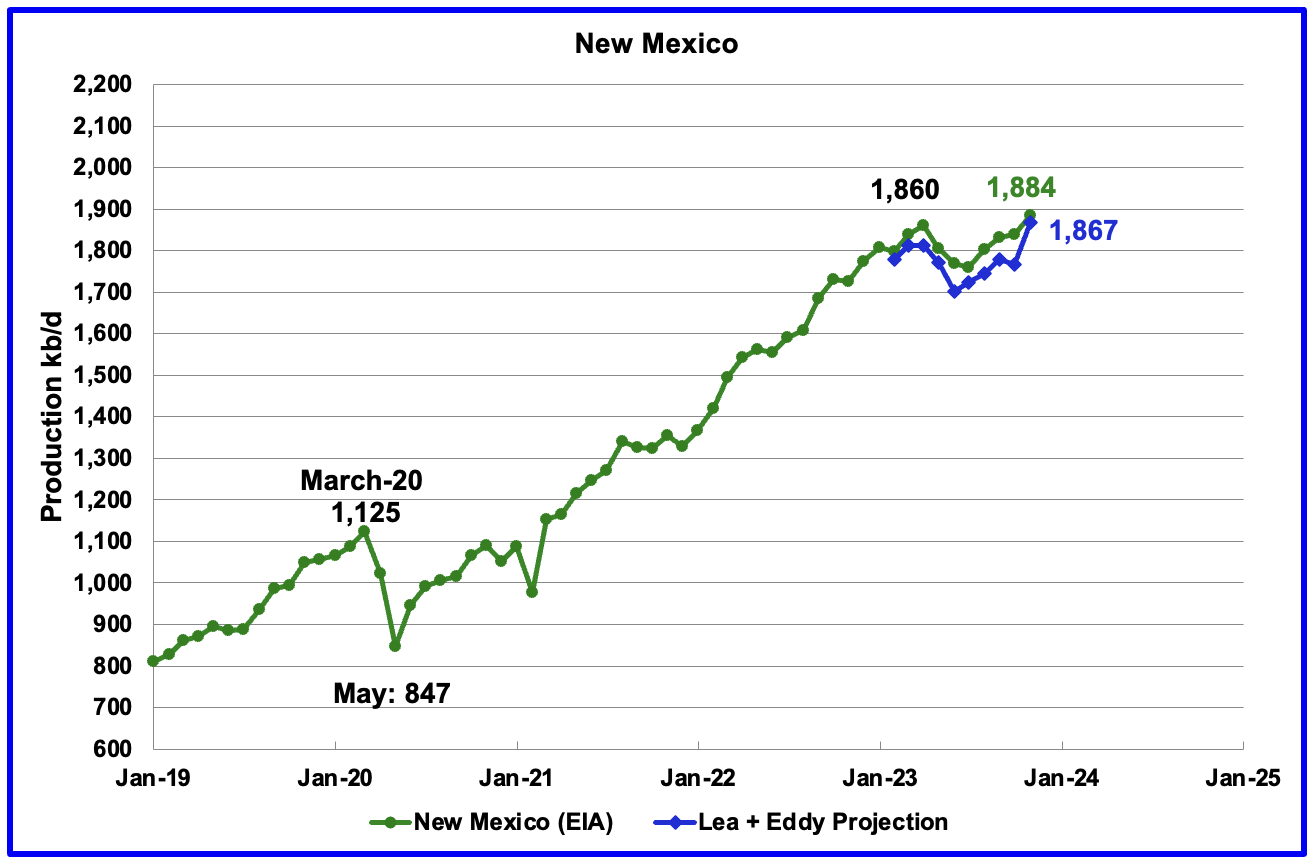

New Mexico’s November production rose by 45 kb/d to 1,884 kb/d.

The blue graph is a production projection for Lea plus Eddy counties. The projection used the difference between November and October production data provided by the New Mexico Oil Conservation Division.

The combined output from Lea and Eddy counties in November increased by 101 kb/d. It is interesting to note that the Lea + Eddy production trend is similar to the EIA’s except for October.

More production information from these two counties is reviewed in the special Permian section further down.

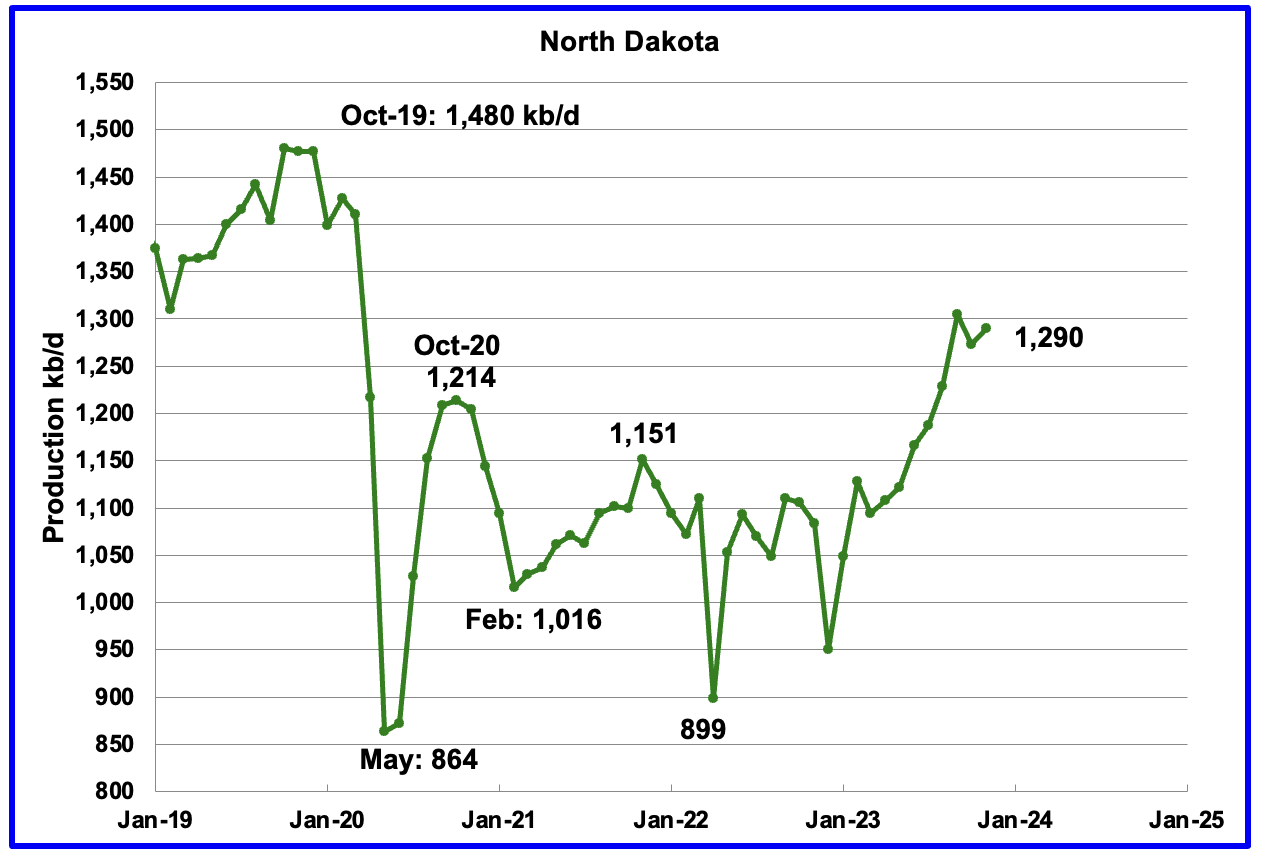

November’s output increased by 17 kb/d to 1,290 kb/d.

According to this source, production growth for October was lower due to October bad weather. The bad weather extended into November and may account for the small 17 kb/d November increase.

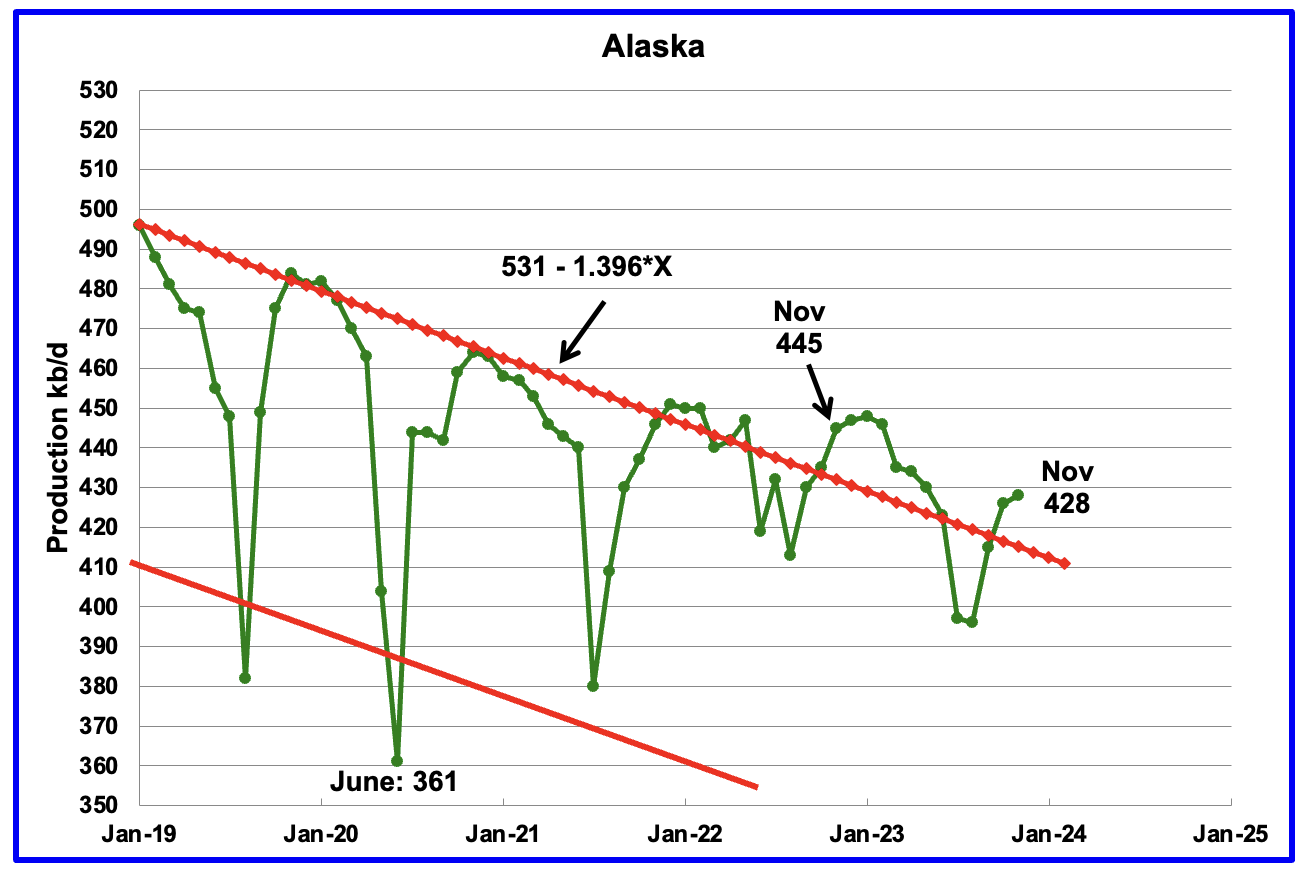

Alaskaʼs November output increased by 2 kb/d to 428 kb/d. Production YoY is down by 17 kb/d. The EIA weekly petroleum report continues to show January Alaska production is in the 425 kb/d to 435 kb/d range.

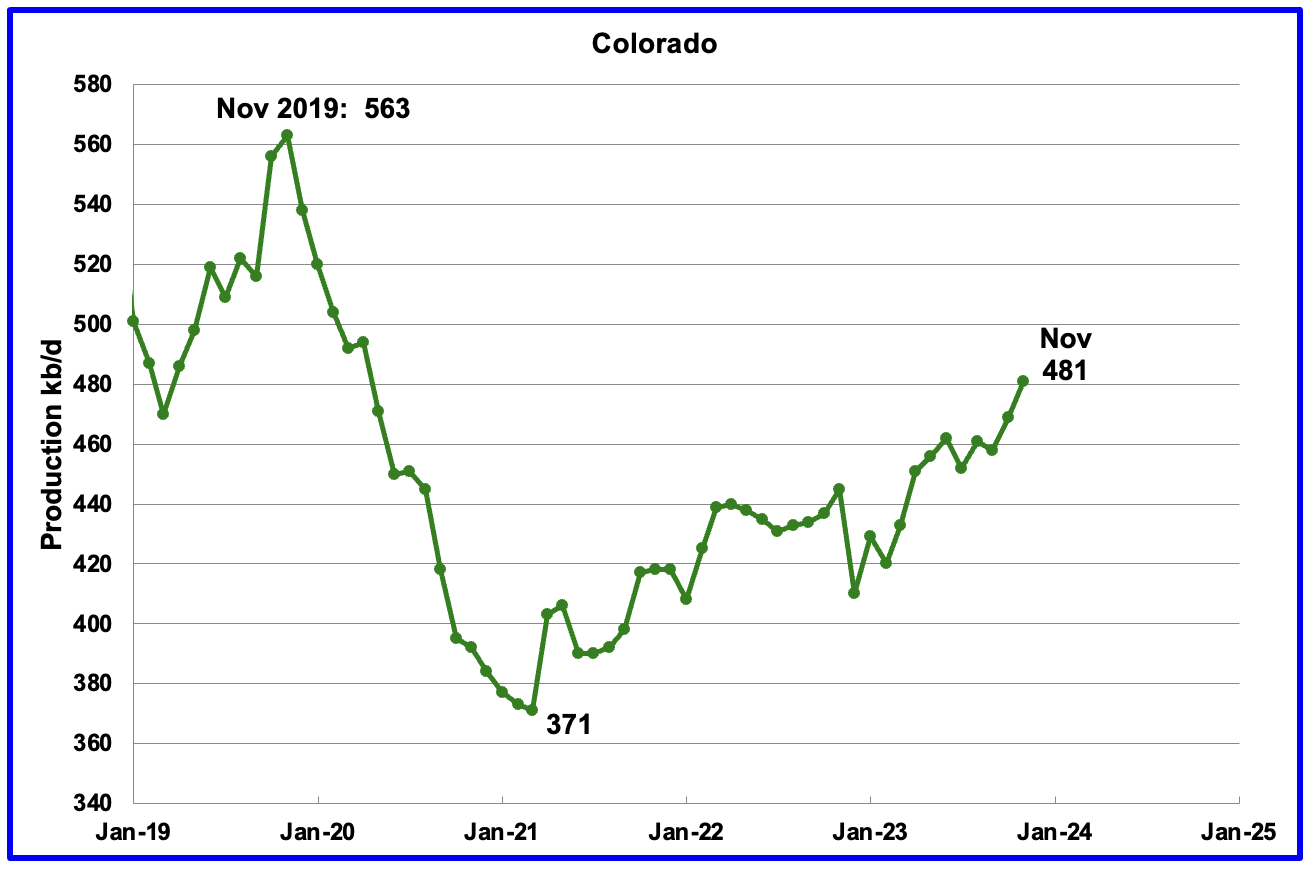

Coloradoʼs November production increased by 12 kb/d to 481 kb/d. Colorado has moved ahead of Alaska to become the 4th largest oil producing state.

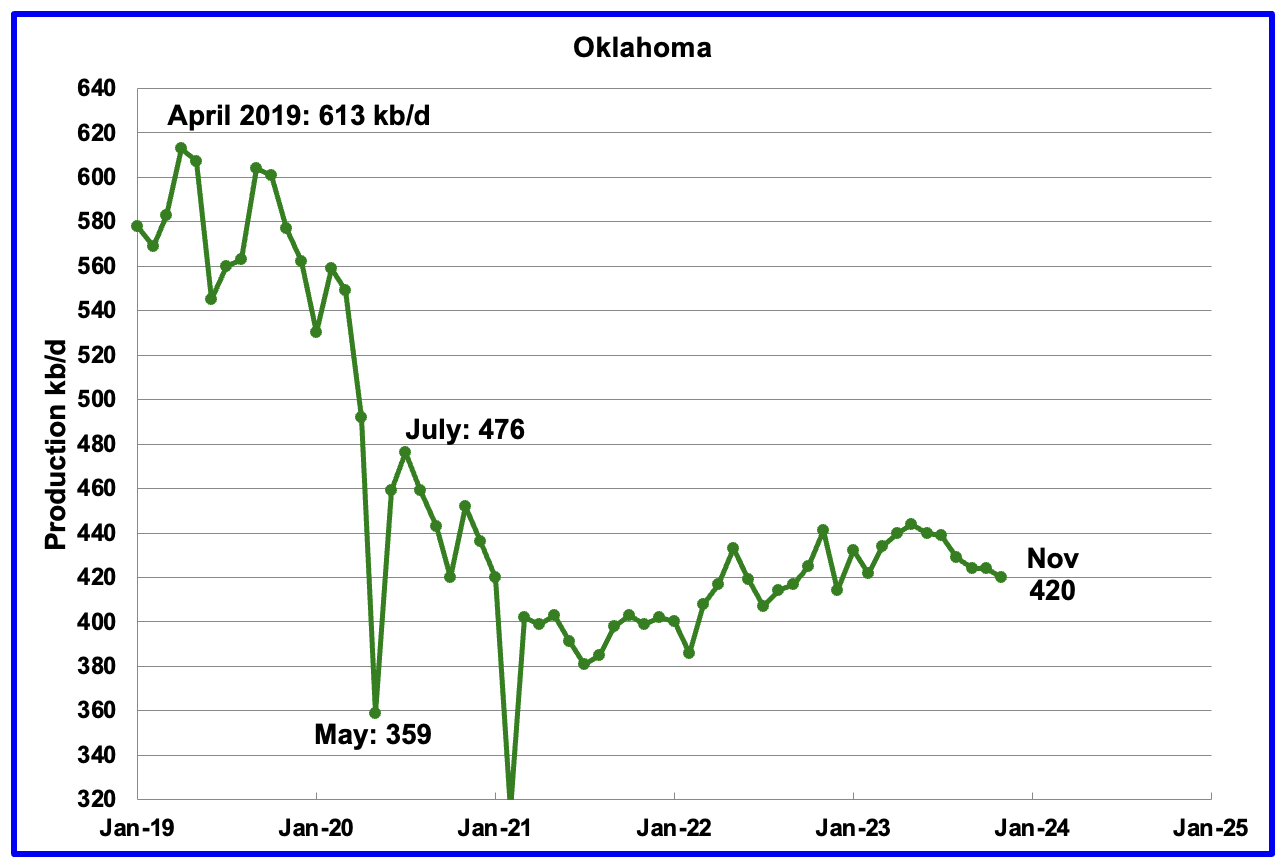

Oklahoma’s output in November decreased by 4 kb/d to 420 kb/d. Production remains 56 kb/d below the post pandemic July 2020 high of 476 kb/d. Output may have entered plateau/declining phase.

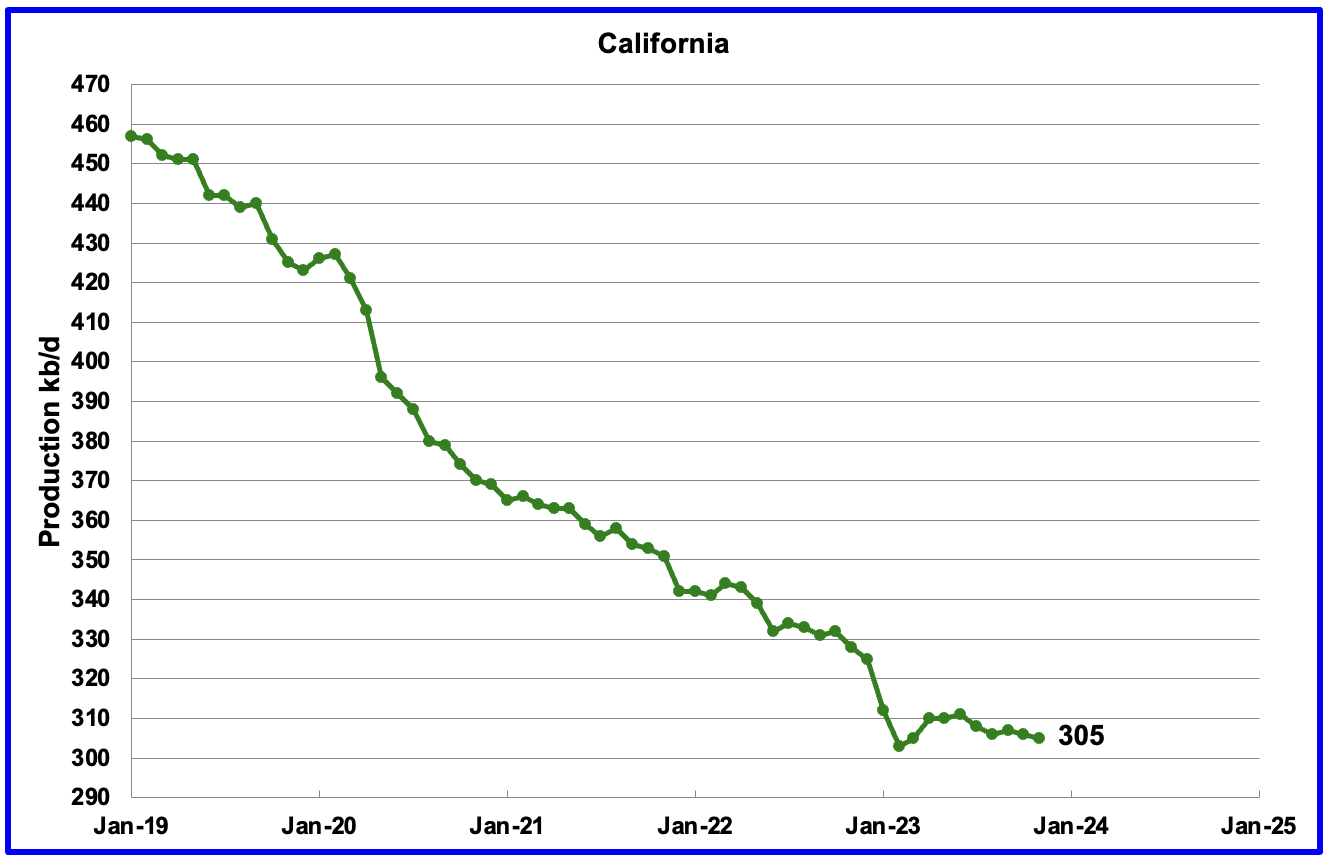

Californiaʼs November production declined 1 kb/d to 305 kb/d.

According to this Article, “The two largest U.S. oil producers, Exxon Mobil and Chevron will formally disclose a combined $5 billion write down of California assets when they report fourth-quarter results.”

“Exxon Mobil last year exited onshore production in the state, ending a 25-year-long partnership with Shell PLC when they sold their joint-venture properties.

Chevron will also take charges of about $2.5 billion tied to its California assets. It is staying but bitterly contesting state regulations on its oil producing and refining operations in the state, where it was born 145 years ago as Pacific Coast Oil Co.

California’s energy policies are “making it a difficult place to invest,” even for renewable fuels, a Chevron executive said this month. The company pumps oil from fields developed 100 years ago but has cut spending in the state by “hundreds of millions of dollars since 2022,” the executive said.”

It is not clear if this action by Exxon and Chevron will accelerate/change the production decline rate in California.

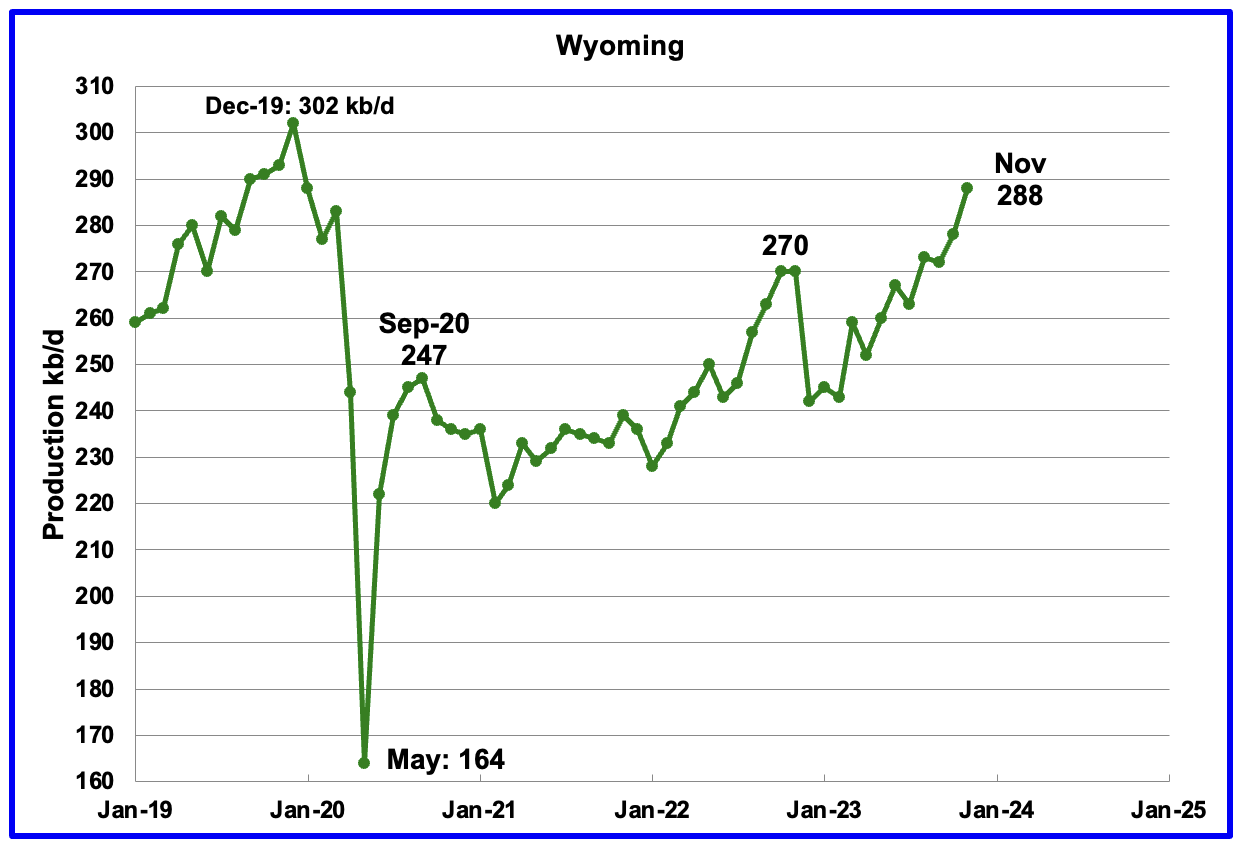

Wyoming’s oil production has been rebounding since March 2023. November’s oil production rose to 288 kb/d, a post pandemic record high.

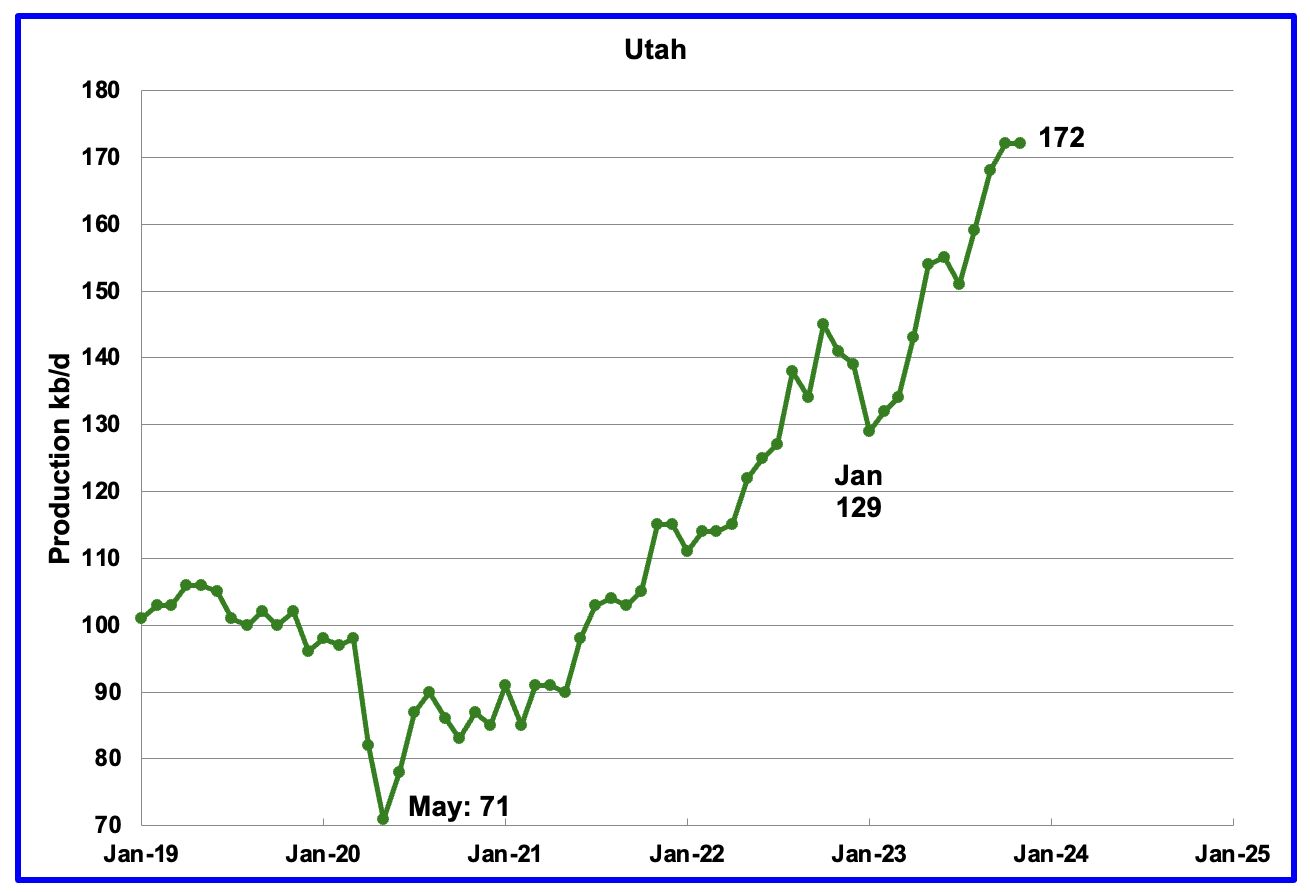

November’s production was unchanged at 172 kb/d. For the first 4 months of 2023, Utah had 7 rigs operating. Since May the number of operational rigs has bounced between 8 and 9, which may account for the increased production.

The increased production since February has come from the Uinta basin.

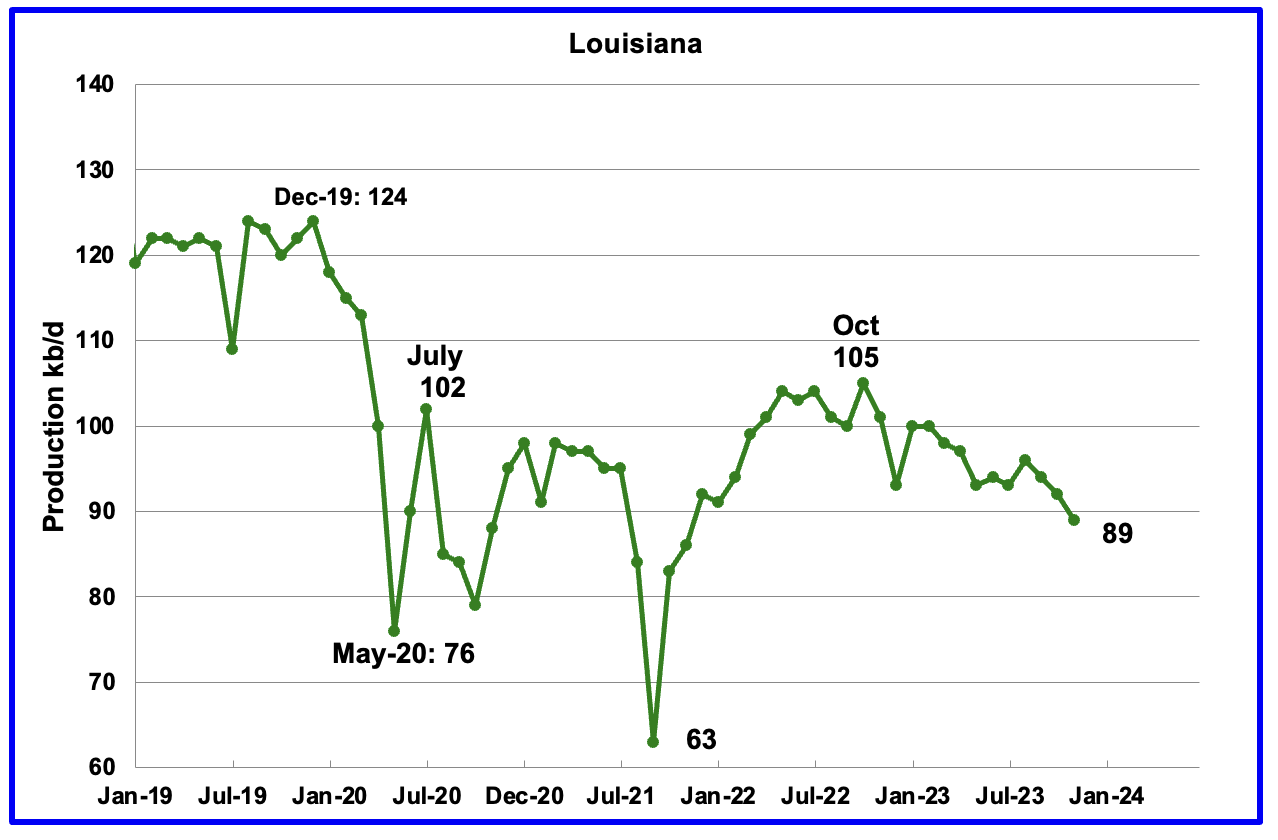

Louisiana’s output entered into a slow decline phase in October 2022. November’s production decreased by 3 kb/d to 89 kb/d and is 16 kb/d lower than the recent October 2022 high.

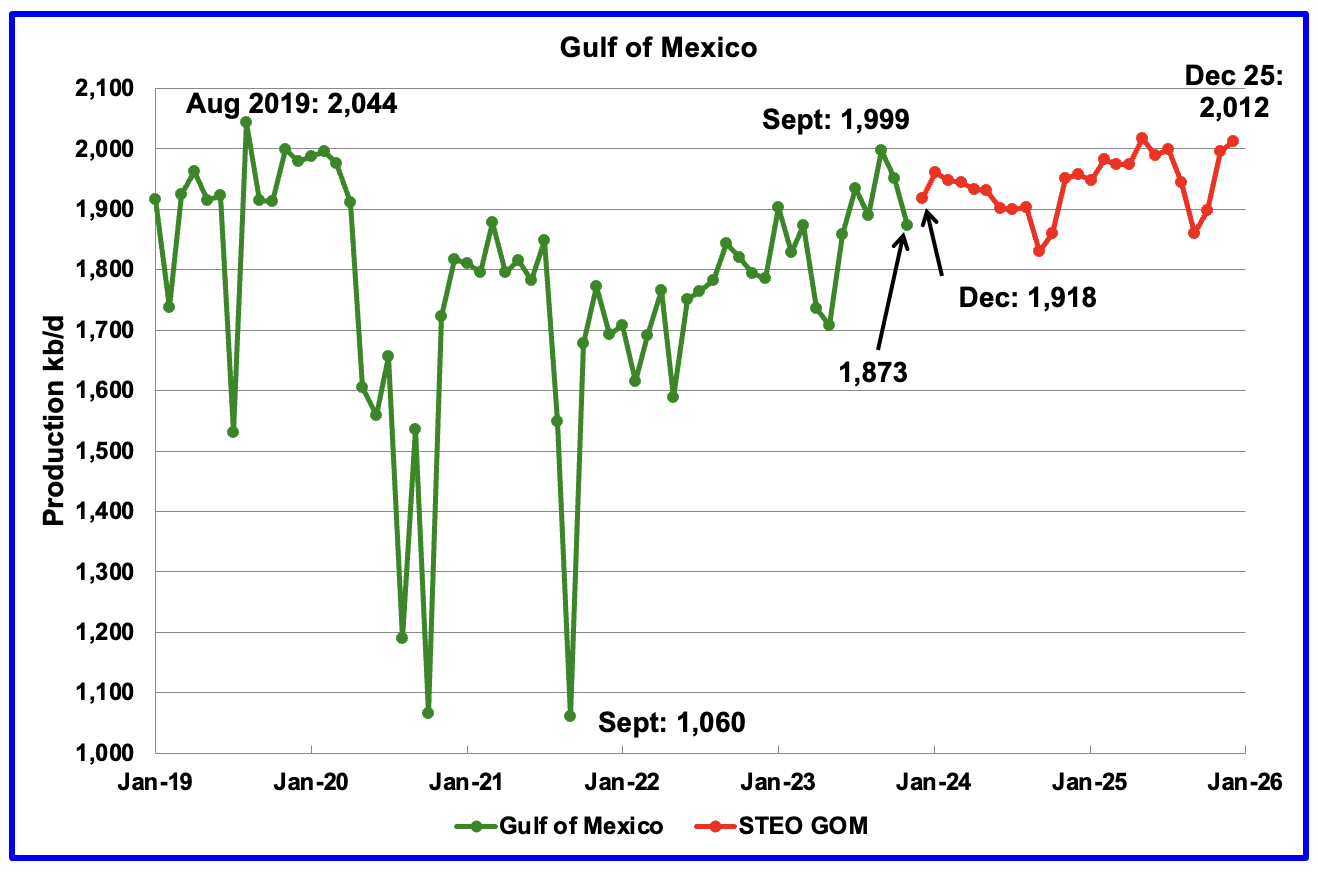

GOM production decreased by 78 kb/d in November to 1,873 kb/d but is expected to rebound in December by 45 kb/d to 1,918 kb/d.

The January 2024 STEO projection for the GOM output has been added to this chart. It projects that over the next 24 months production will increase to 2,012 kb/d in December 2025.

It is not known if the GOM decline shown after January 2024 is related to a combination of extensive maintenance and a general decline of wells. Also disappointing production from some highly touted wells could be an issue according to this source.

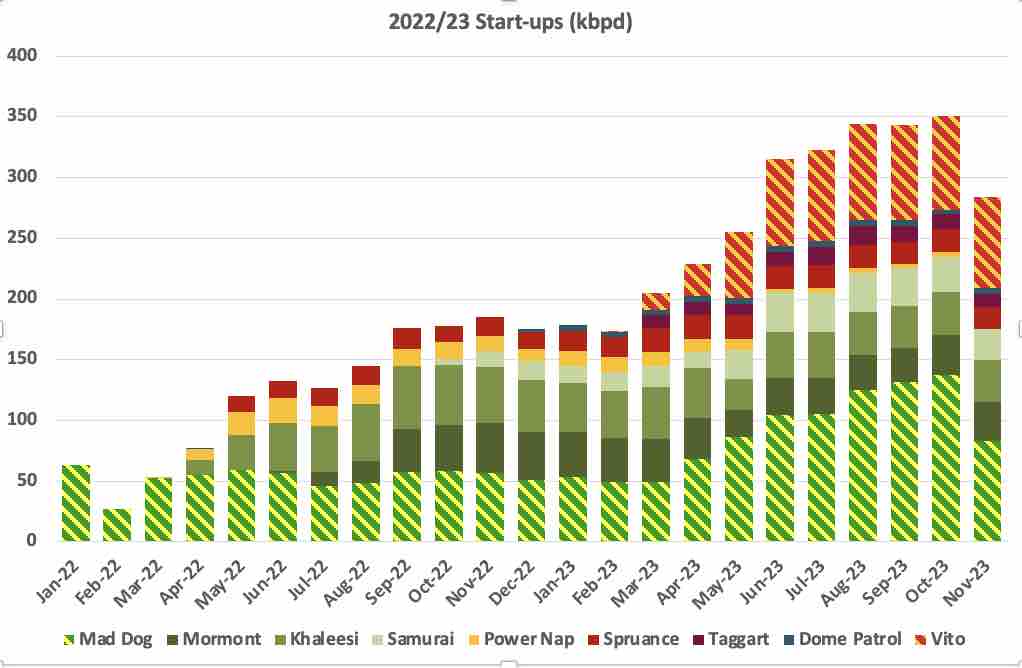

George Kaplan has provided the following chart and comment regarding production from GOM startups that began in 2022/23.

All except the two smallest of the recent leases added for GOM had lower production in November, with Mad Dog having several days of turnaround. I’m not sure if Mad Dog has the potential to increase above its previous maximum and Vito should hold a plateau for a couple of years, but all the others look to be now in decline. Water cut in Taggart is rising very quickly and it is also impacting Spruance and Khaleesi. Of the new leases expected Rydberg is some months late, no news on Whale (also now late wrt original Shell announcement at time of FID) or Shenzi North yet. The Main Pass pipeline seems to be still out, so about 70 kbpd offline.

A Different Perspective on US Oil Production

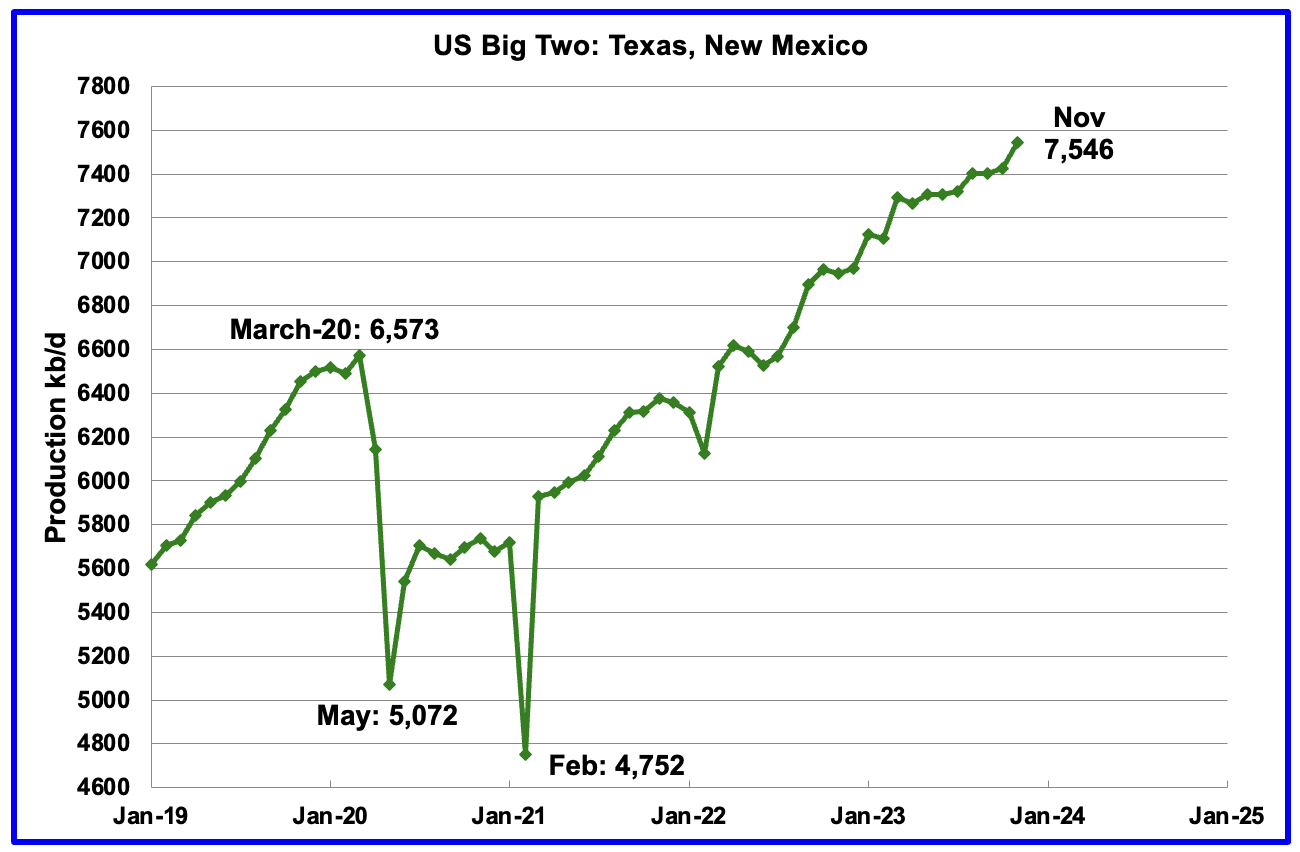

The Big Two states’ combined oil output for Texas and New Mexico.

November’s production in the Big Two states increased by a combined 121 kb/d to 7,546 kb/d with Texas adding 76 kb/d while New Mexico added 45 kb/d.

Oil production by The Rest

November’s production in The Rest increased by 39 kb/d to 3,420 kb/d. The main contributors to the increase were North Dakota 17 kb/d, Colorado 12 kb/d and Wyoming 10 kb/d.

The main takeaway from The Rest chart is that current production is 632 kb/d below the high of October 2019 and this appears to be a permanent loss that will never be recovered.

The On-Shore lower 48 W/O the big three, Texas, New Mexico and North Dakota, shows a slow rising trend from the low of January 2022. November’s production increased by 22 kb/d to 2,171 kb/d. The majority came from Colorado, 12 kb/d and Wyoming 10 kb/d. Production from these states has just exceeded the post covid production high of 2,158 kb/d in July 2020.

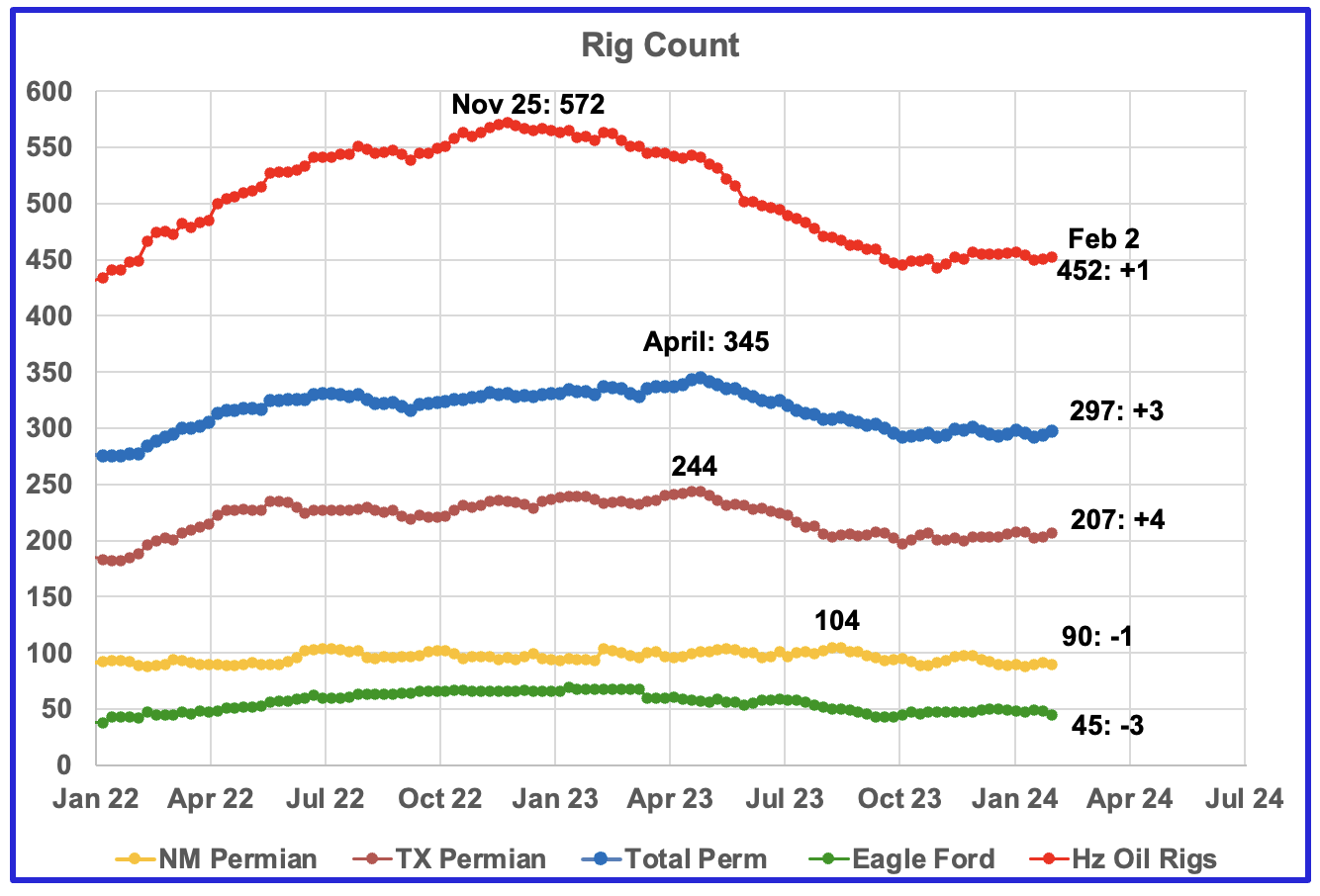

Rig report for week ending February 2

– US Hz oil rigs increased by 1 to 452. The rig count has been close to 450 since the beginning of October.

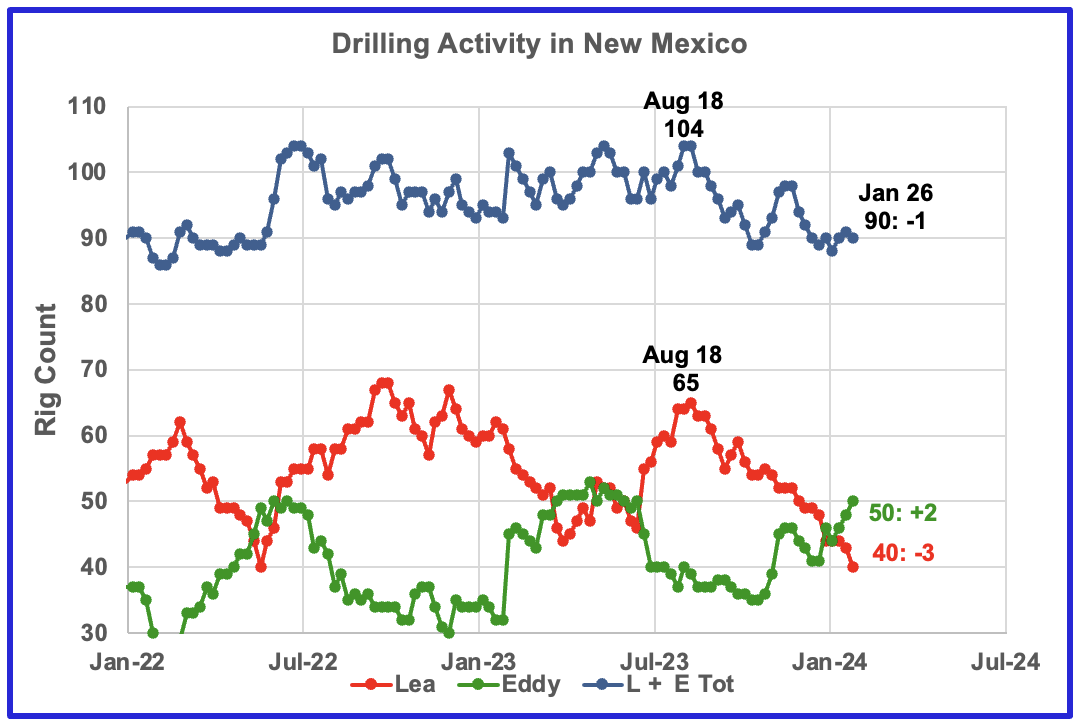

– Permian rigs were up 3 to 297. Texas Permian was up 4 to 207 while NM was down 1 to 90. In New Mexico, Lea county was down 4 to 40 while Eddy added 2 to 50.

– Eagle Ford dropped 3 to 45.

– NG Hz rigs declined by 2 to 105 (not shown)

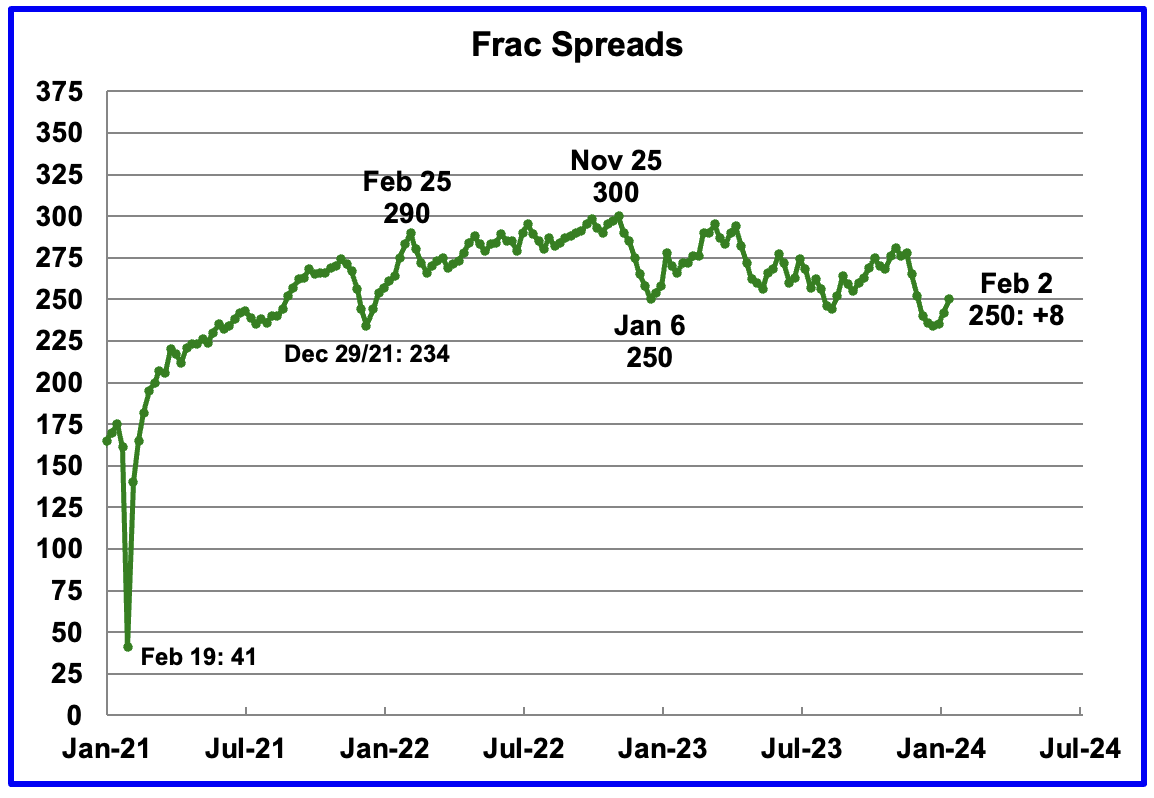

Frac Spread Count for Week ending February 2

The frac spread count was up 8 to 250 and up 16 from the previous low of 234 on December 29, 2021. How high will the Frac count go in 2024?

Permian Basin Report by Main Counties and Districts

This special monthly Permian section was recently added to the US report because of a range of views on whether Permian production will continue to grow or will peak over the next year or two. The issue was brought into focus recently by the Goehring and Rozencwajg Report which indicated that a few of the biggest Permian oil producing counties were close to peaking or past peak. Also comments by posters on this site have similar beliefs from hands on experience.

This section will focus on the four largest oil producing counties in the Permian, Lea, Eddy, Midland and Martin. It will track the oil and natural gas production and the associated Gas Oil Ratio (GOR) on a monthly basis. The data is taken from the state’s government agencies for Texas and New Mexico. Typically the data for the latest two or three months is not complete and is revised upward as companies submit their updated information. Note the natural gas production shown in the charts that is used to calculate the GOR is the gas coming from both the gas and oil wells.

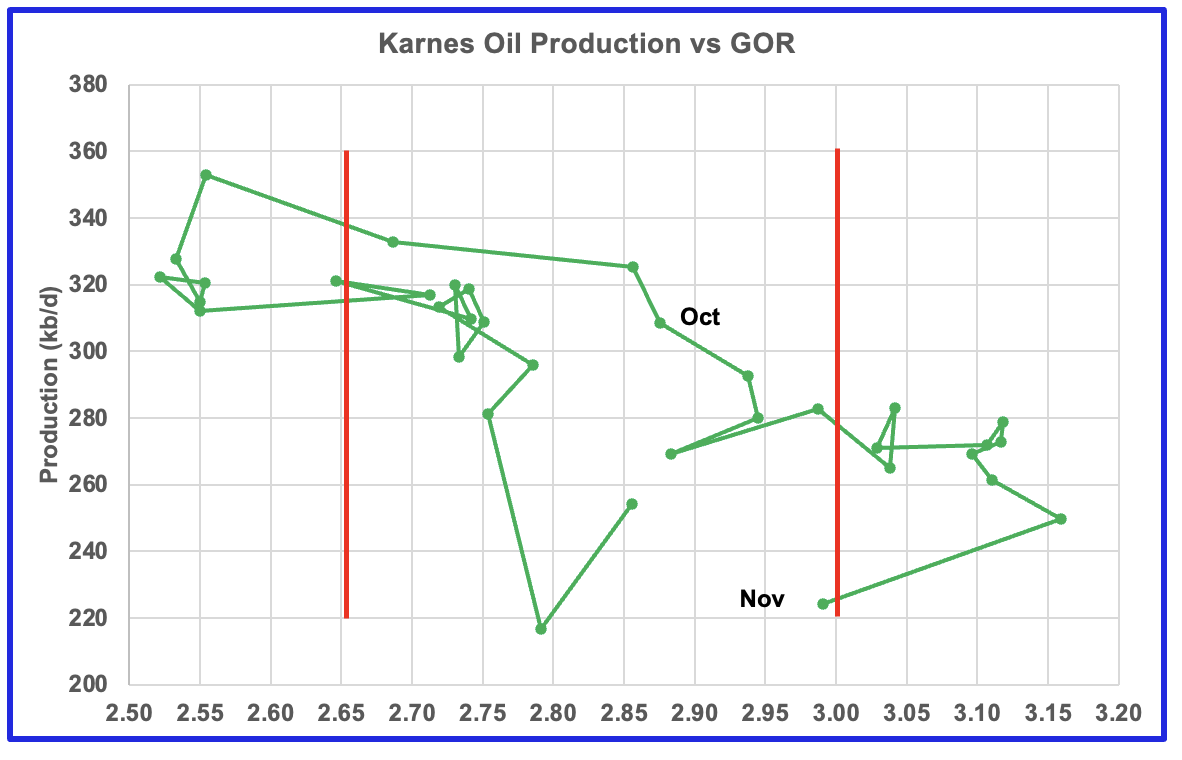

Of particular interest will be the charts which plot oil production vs GOR for a county to see if a particular characteristic develops that indicates the field is close to entering the bubble point phase. While the GOR metric is best suited for characterizing individual wells, counties with closely spaced horizontal wells may display a behaviour similar to individual wells due to pressure cross talking . For further information on the bubble point and GOR, there are a few good thoughts on the intricacies of the GOR in an earlier POB comment. Also check this EIA topic on GOR.

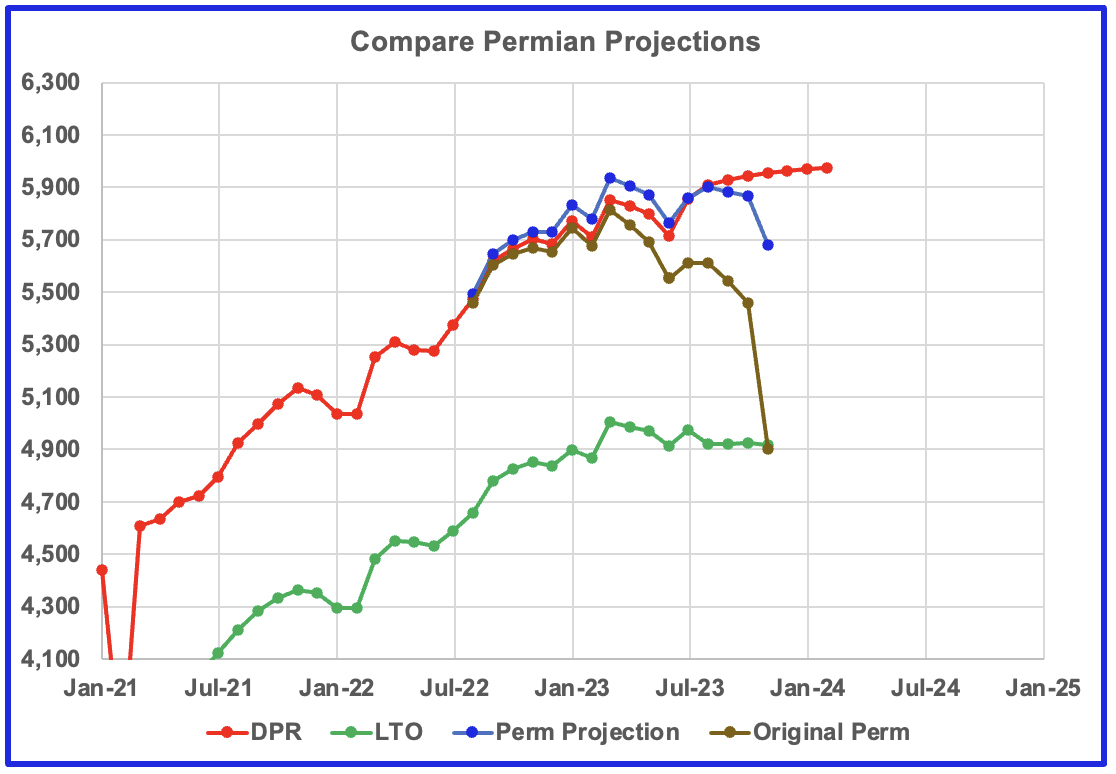

This chart shows four oil production graphs for the Permian basin updated to November and to February for the DPR. The gap between the DPR and LTO projections is there because the DPR projection includes both LTO oil along with oil from conventional wells in the basins that it covers.

The red and green graphs show oil production as published by the EIA’s DPR and the LTO offices. Comparing the two, it appears that the LTO office believes Permian LTO production is currently in a plateau phase while the DPR office continues to show a small increase in growth before plateauing. The blue marker is a projection. The brown chart is the sum of Permian production data from the Texas RRC and the New Mexico Oil Conservation Division. The big November drop is due to a larger than typical monthly production drop in the RRC data.

The blue graph only uses two months of production data from New Mexico OCD and the Texas RRC, October and November, to make its November projection. The blue graph is similar to the DPR and LTO graphs in the sense that it is also indicating that Permian production may be entering a plateau phase.

New Mexico Permian

Over the past six months drilling activity in Lea county has fallen each month. For the week ending February 2, the rig count in Lea dropped by three while Eddy added two. Since the middle of August, the Lea county rig count has dropped from 65 rigs to 40 rigs in Januuary 2024. At the same time November production in Lea county increased by 59 kb/d, see next chart.

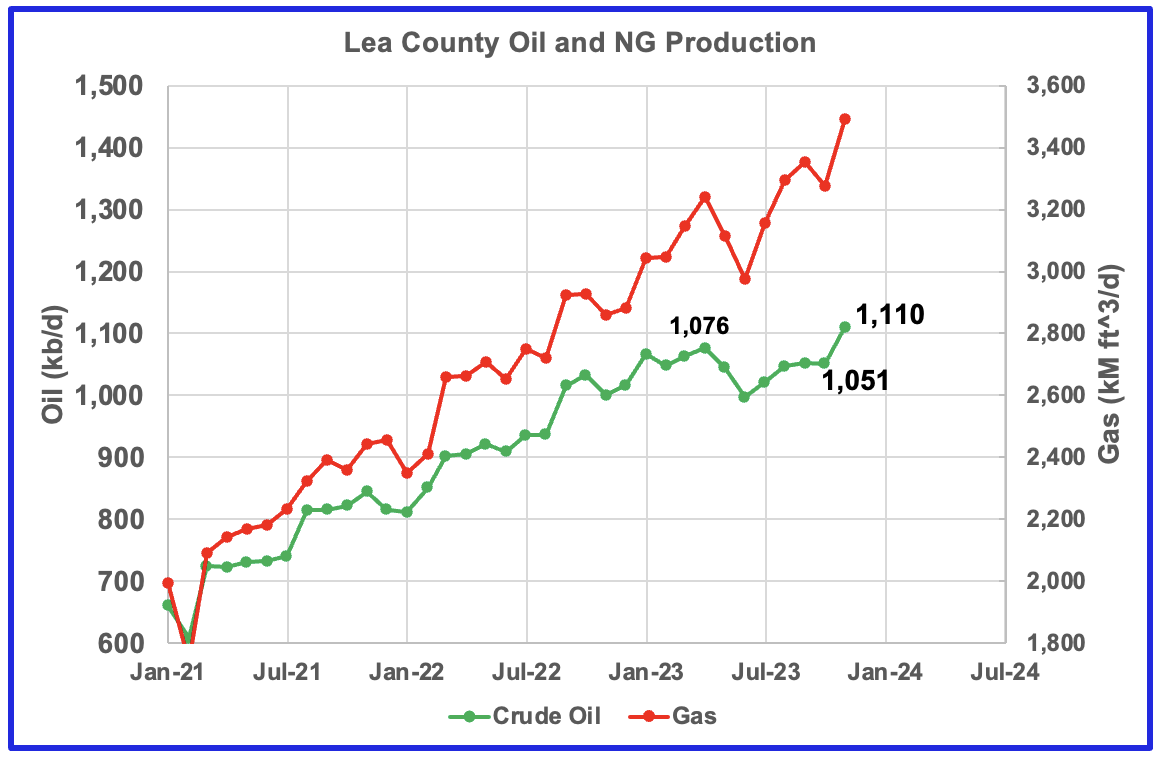

From June 2023 to September 2023 NG production rose faster than oil production in Lea county. However November saw both record NG and oil production and the GOR stayed in the same range as the past three months, see next chart.

November oil production increased by 59 kb/d to a record 1,110 kb/d even though the rig count dropped by 25 rigs since August 18. Assuming the average spud to production time is 6 months, that implies a small number of new wells could have started producing in 4 to 5 months. In other words, the November production increase must be associated with a number of June 2023 drilled wells coming online in November. That being the case, the production increase in Lea could increase for another month before starting to decline, assuming that production should follow the dropping rig count, delayed by 4 to 8 months.

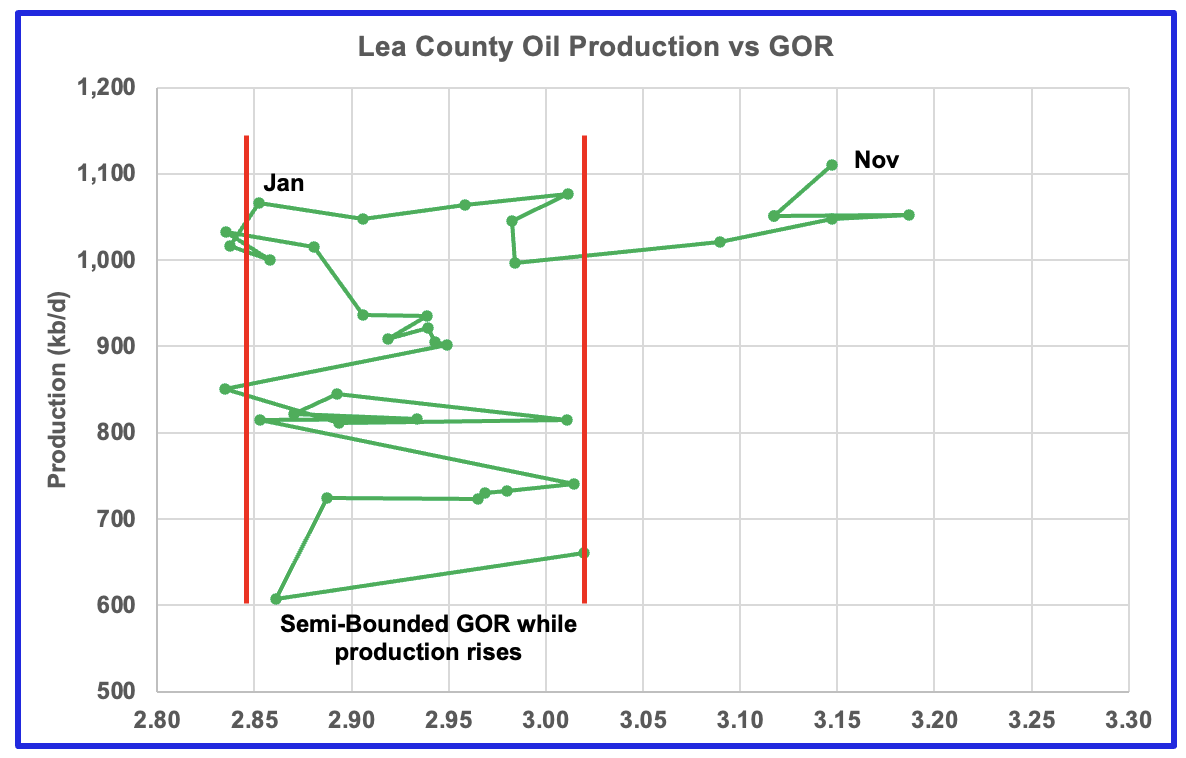

After much zigging and zagging, oil production in Lea county stabilized above 1,000 kb/d. The GOR and oil production both increased in January 2023. November oil production in Lea county hit a new high of 1,110 kb/d. The data for the last four months, August to November, is incomplete and will be updated over the next few months.

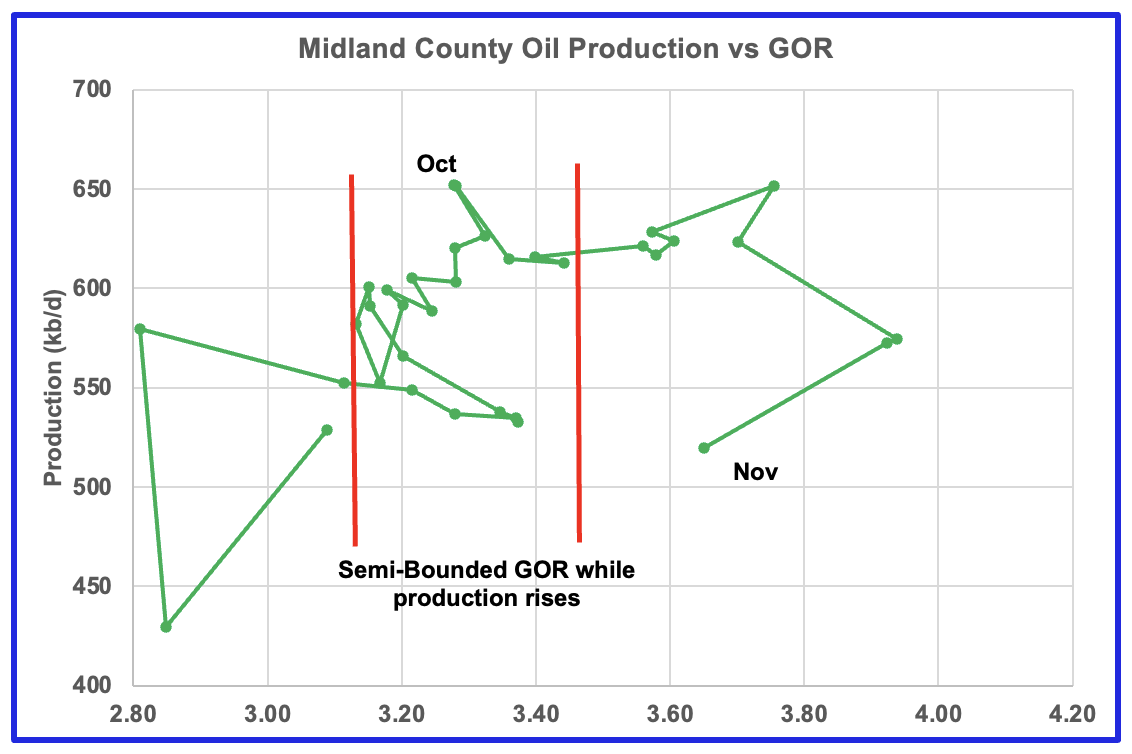

This zigging and zagging GOR pattern within a semi-bounded GOR while oil production increases to some stable level and then moves out to a higher GOR to the right has shown up in a number of counties. See an additional two cases below. While this is the fifth month in which Lea county has registered a GOR outside the semi-bounded GOR range, the November trend has changed since both production and the GOR have increased. As noted above the increase must be related to the significant increase in drilling that started in mid June.

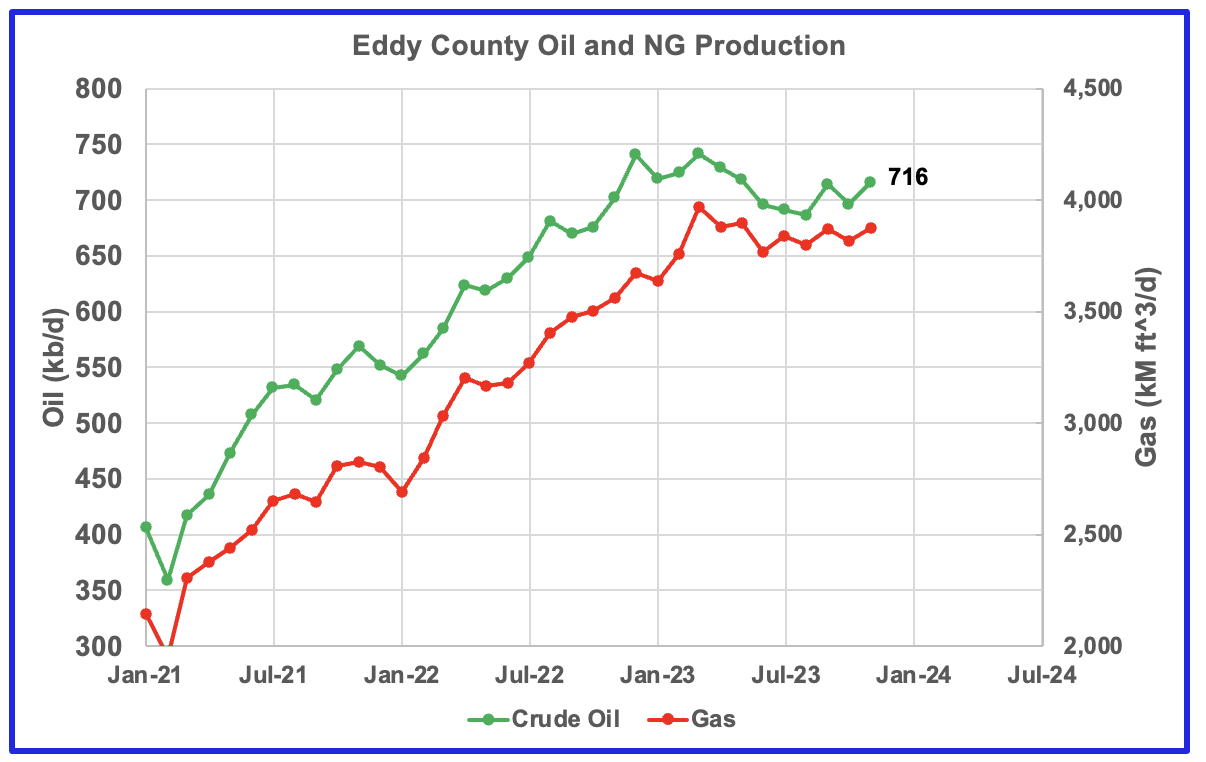

Eddy county oil production is showing early signs that it is in a plateau phase. November production was 716 kb/d.

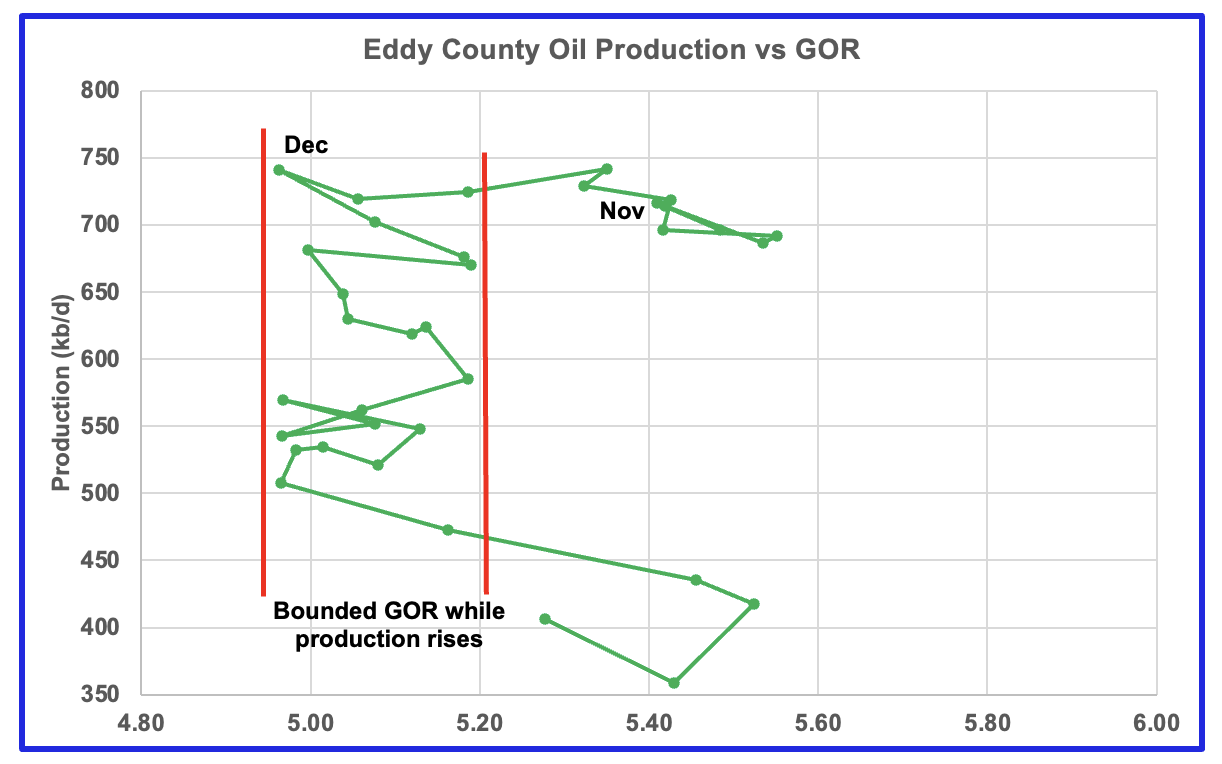

The Eddy county GOR pattern is similar to Lea county except that Eddy broke out from the semi bounded range earlier and for a longer period while oil production has been bouncing around the 700 kb/d level.

Texas Permian

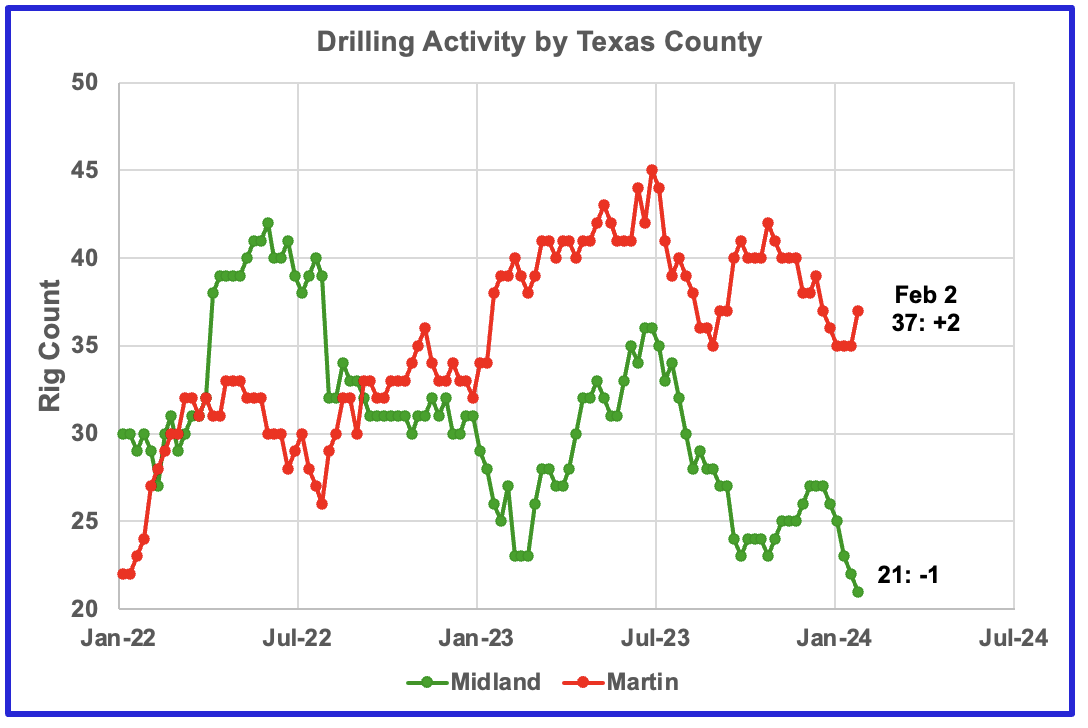

During December 2023 drilling activity started to decrease in both counties and continued into January. However the rig count increased in Martin county in early February.

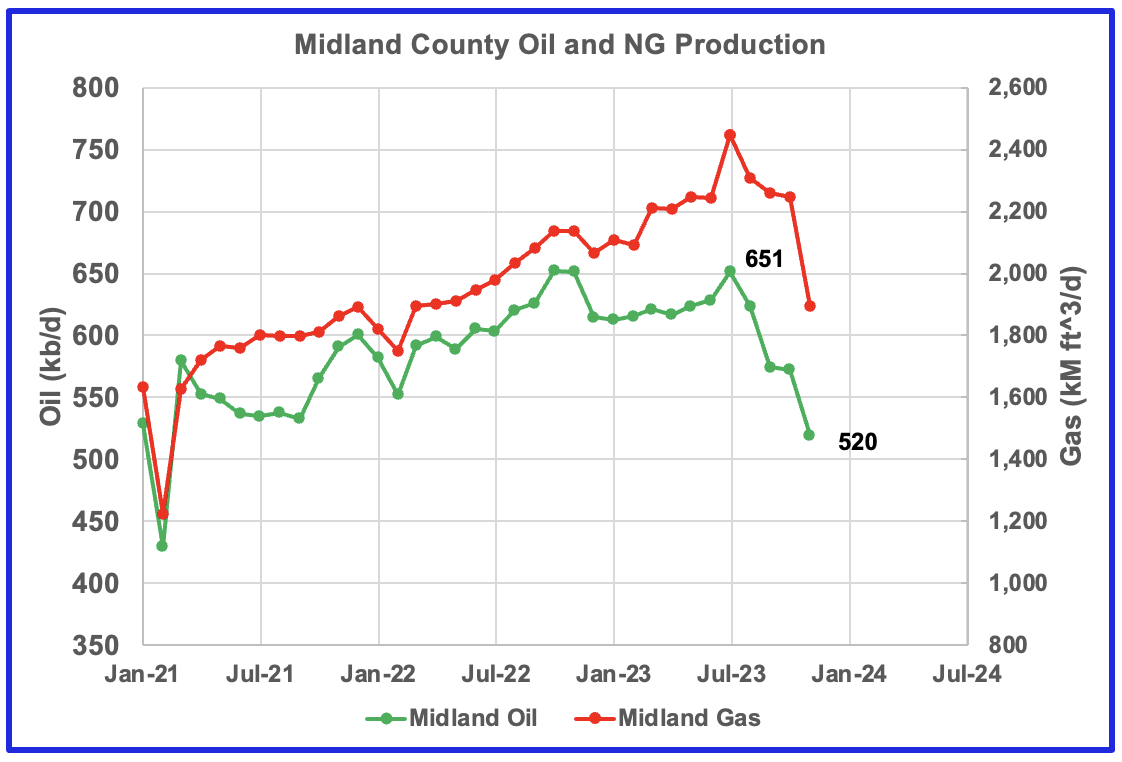

Both natural gas and oil production are dropping in Midland county. November Oil production has dropped by 131 kb/d to 520 kb/d since July 2023.

Comparing the drop in production with the rig count, one could speculate that the drilling peak in June 2022 could account for the July 2023 oil production peak. Note the sharp drop in the rig count at the end of July 2022 which could explain the rapid drop in Midland production that started in July 2023.

Oil production is dropping and the GOR is increasing. It appears that Midland has entered the bubble point phase?

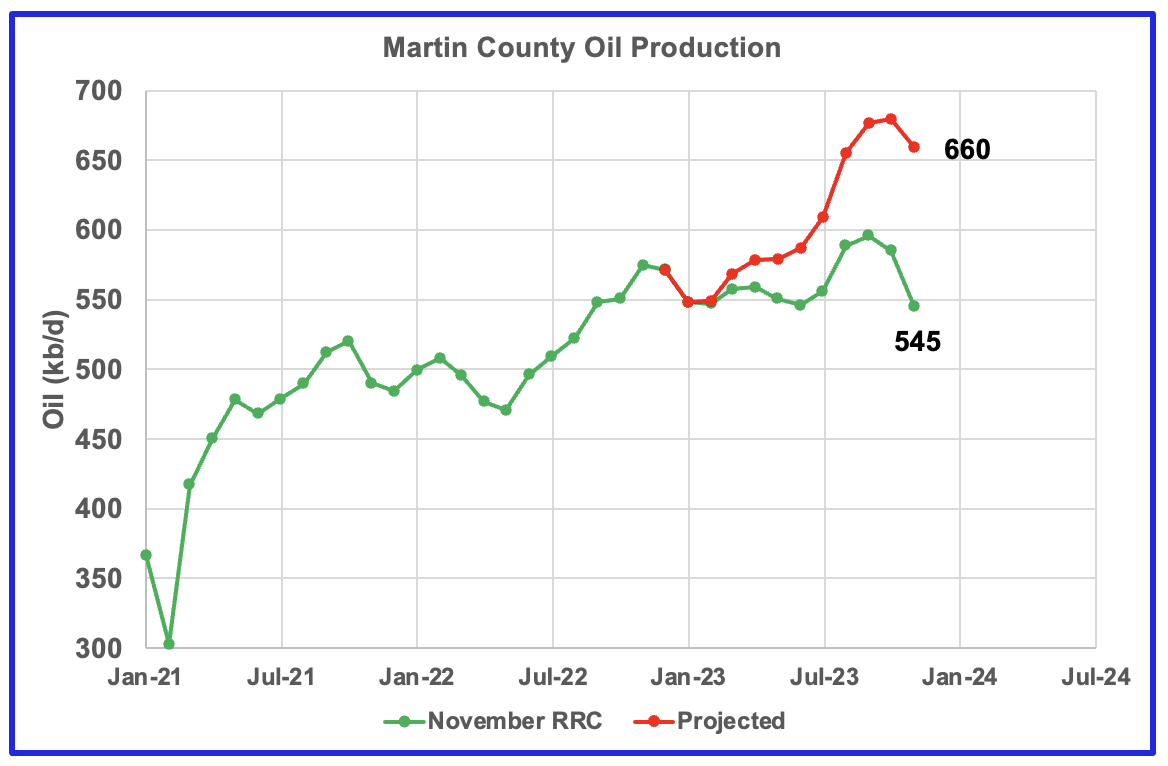

The chart shows the RRC oil production for Martin County along with how the RRC could be reporting November 2023 production about one year from now.

The red line is a production forecast which the Texas RRC will be reporting for Martin county about one year from now as drillers report additional updated production information. This projection is based on a methodology that used October and November production data and will be re-estimated next month.

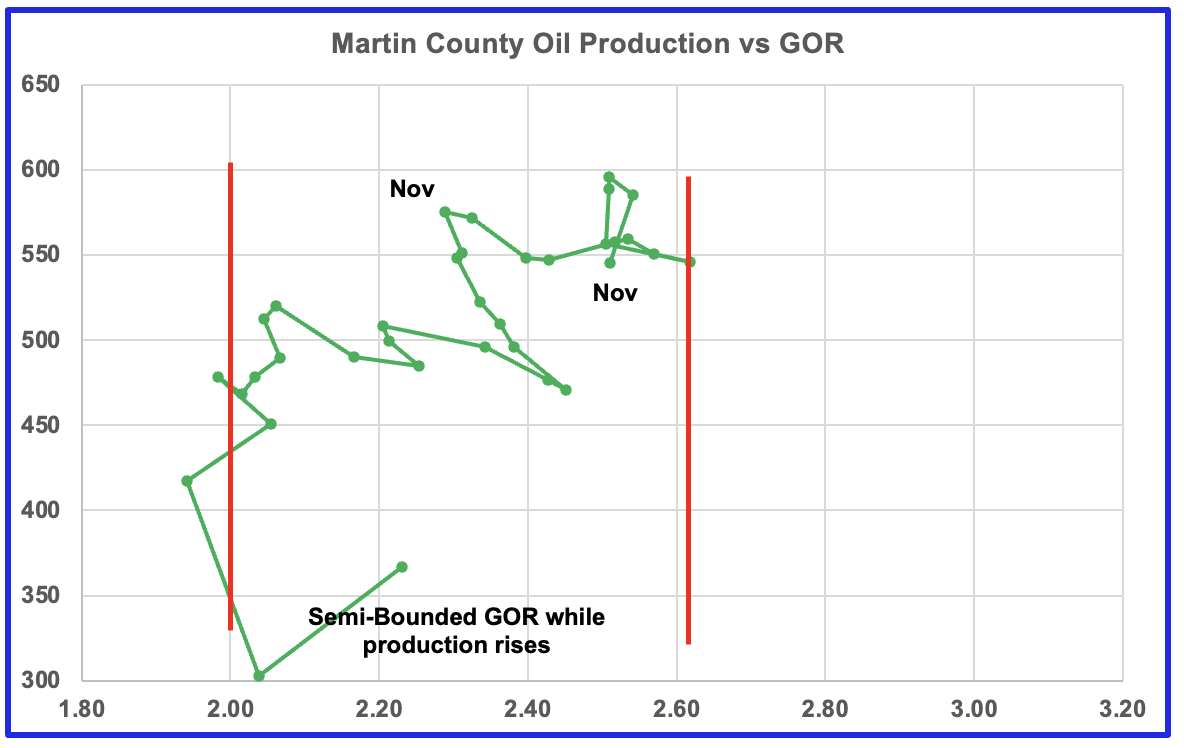

Martin county’s production and GOR continue to stay within the semi bounded range and near peak production. Martin county has the lowest GOR of these four counties at a GOR of 2.51. Martin may not be at the bubble point that results in a dropping oil production trend.

Three of the four oil production vs GOR charts above are exhibiting characteristics indicating that three of the largest oil producing counties in the Permian are in the bubble point phase and are close to or past their peak? Not clear as to what is happening in Martin County.

The production data reported by the RRC this month appears to be a little more under reported than previous months. While there are other indicators pointing to an upcoming peak in Permian oil production, such as the declining rig count, a few more months of data is required.

Eagle Ford Basin Largest County

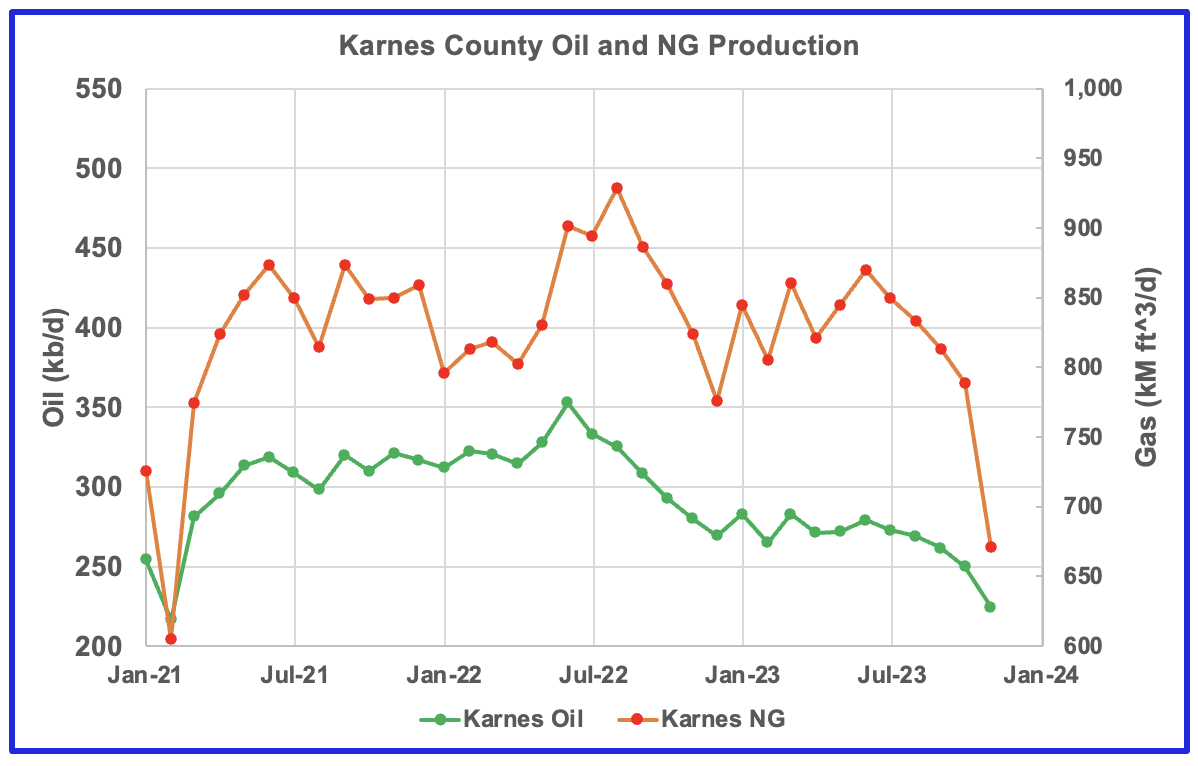

Karnes county is the biggest oil producing county in the Eagle Ford basin and is ranked as the seventh largest oil producing county in Texas. Both oil and gas production are falling in Karnes county and both are down close to 30% from the peak.

This is the GOR vs oil production chart for Karnes county but the GOR is still within its typical range while both oil production and GOR are dropping. This may indicate that Karnes county wells never entered the bubble point phase and weren’t very gassy to start with. Karnes county ranks fifteen in Texas natural gas production.

Drilling Productivity Report

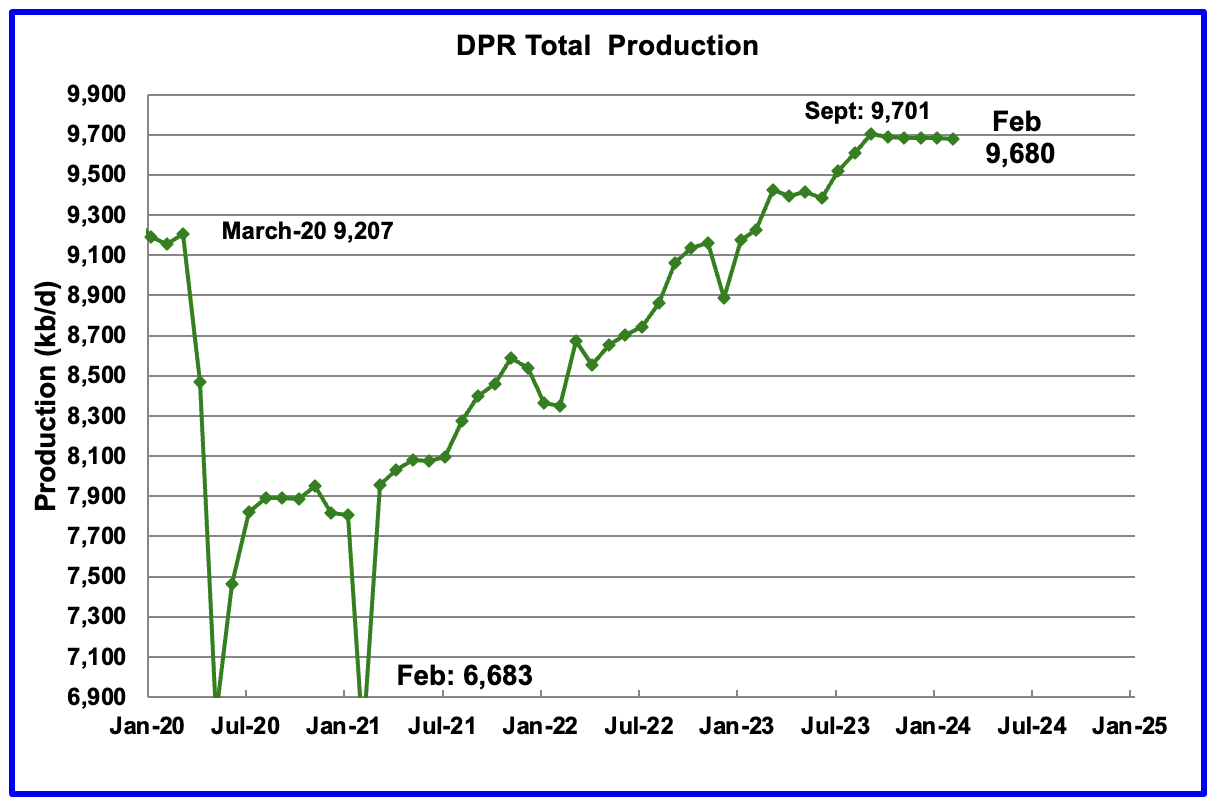

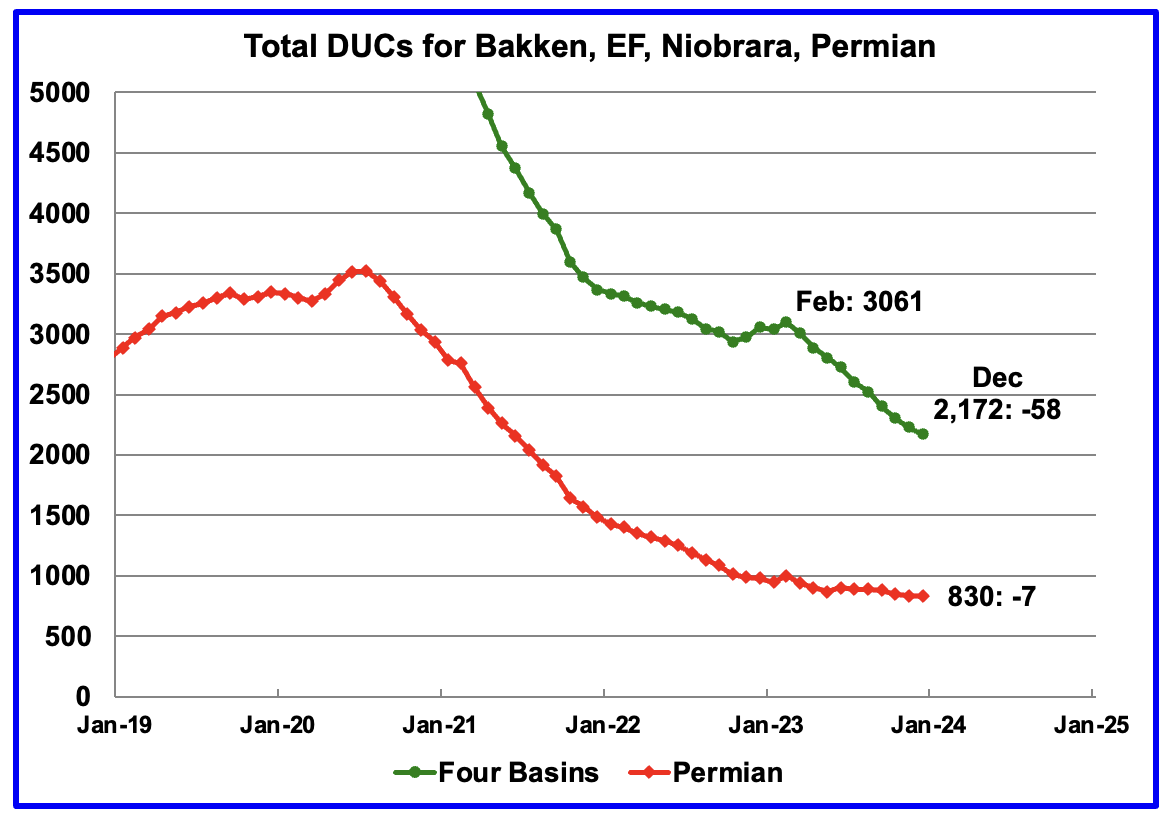

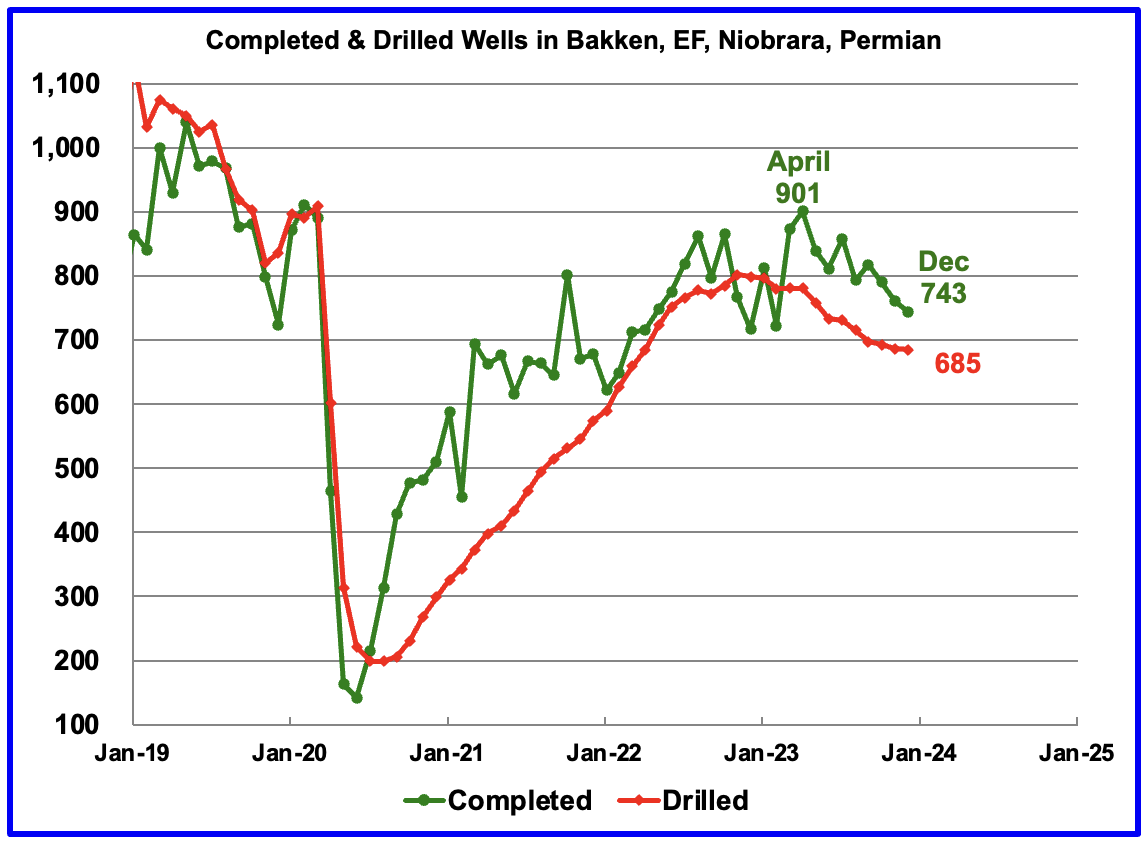

The Drilling Productivity Report (DPR) uses recent data on the total number of drilling rigs in operation along with estimates of drilling productivity and estimated changes in production from existing oil wells to provide estimated changes in oil production for the principal tight oil regions. The January DPR report forecasts production to February 2024 and the following charts are updated to February 2024. The DUC charts and Drilled Wells charts are updated to December 2023.

Above is the total oil production projected to February 2024 for the 7 DPR basins that the EIA tracks. Note that DPR production includes both LTO oil and oil from conventional wells.

The DPR is projecting that oil output for February 2024 will decrease by 1 kb/d to 9,680 kb/d.

While DPR production has been essentially flat since September, the February report also made a downward revision to its previous production forecast. For January, DPR production was revised down by 11 kb/d to 9,681 kb/d. Previous revisions over the past few months were upward.

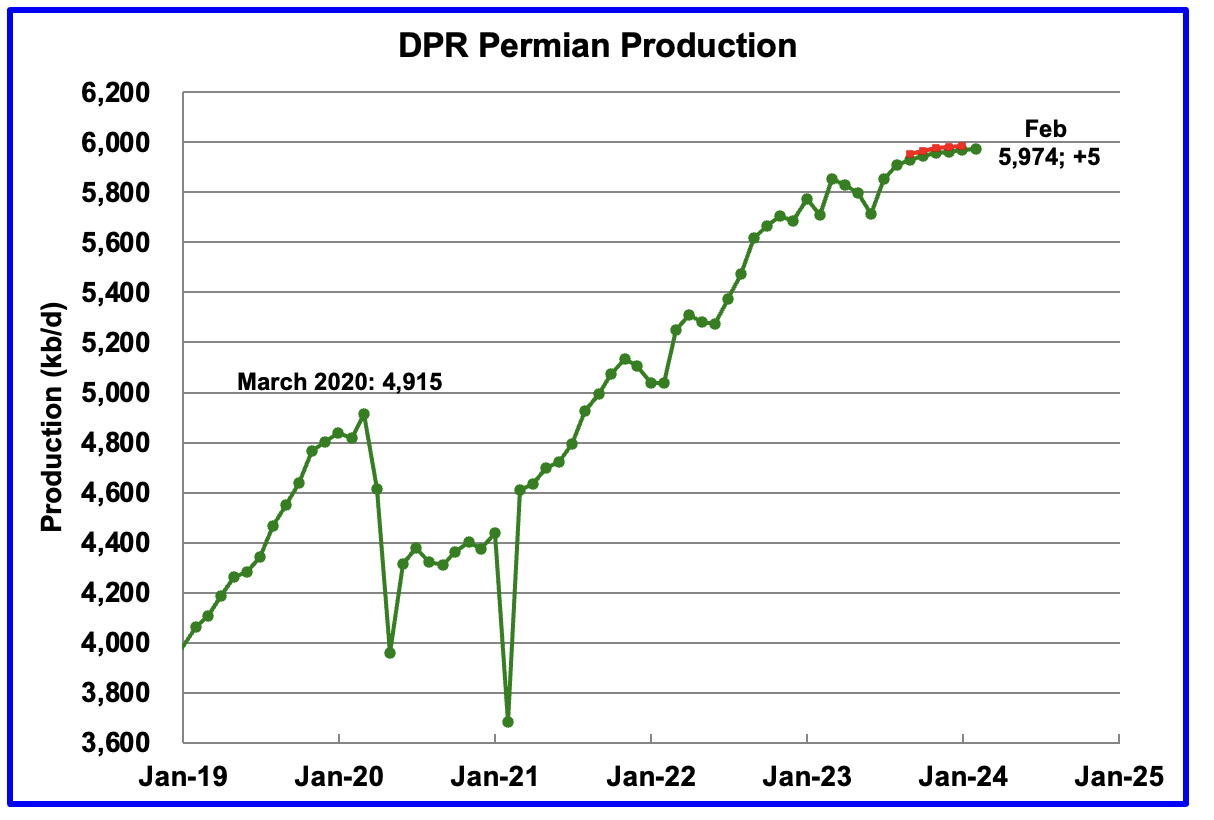

According to the EIA’s January DPR report, Permian output will continue its slow rise in February. It is expected to increase by 5 kb/d to 5,974 kb/d. The last five months of production data clearly show a dropping trend in monthly production growth.

The red markers show the DPR’s previous December forecast. For January, Permian production was lowered by 17 kb/d from 5,986 kb/d to 5,969 kb/d.

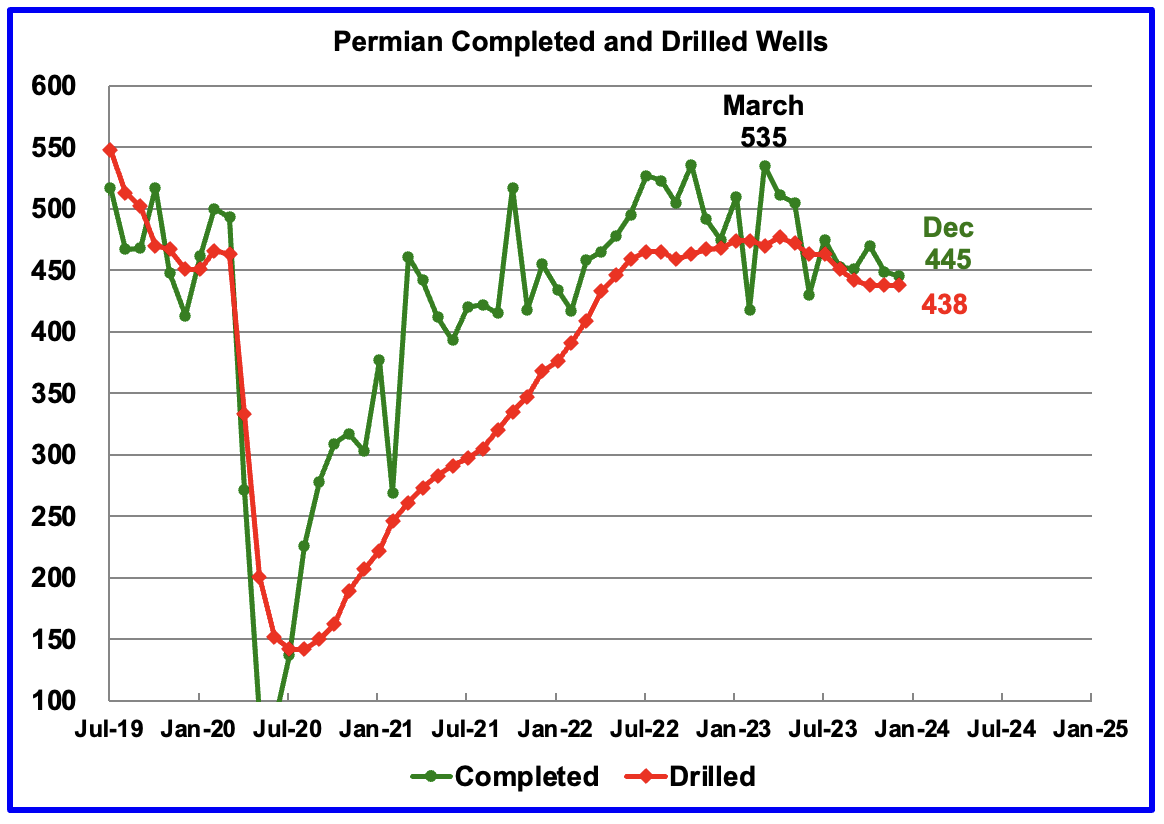

During December, 438 wells were drilled and 445 were completed in the Permian. (Note that December is the latest month for DUC information). The completed wells added 410 kb/d to December’s output for an average of 922 b/d/well. The overall decline was 403 kb/d which resulted in a net increase to Permian output in December of 6.5 kb/d. Of the 445 completed wells in December 438 were required to offset the decline. Those extra 7 completed wells producing at 922 b/d resulted in the 6.5 kb/d increase in December.

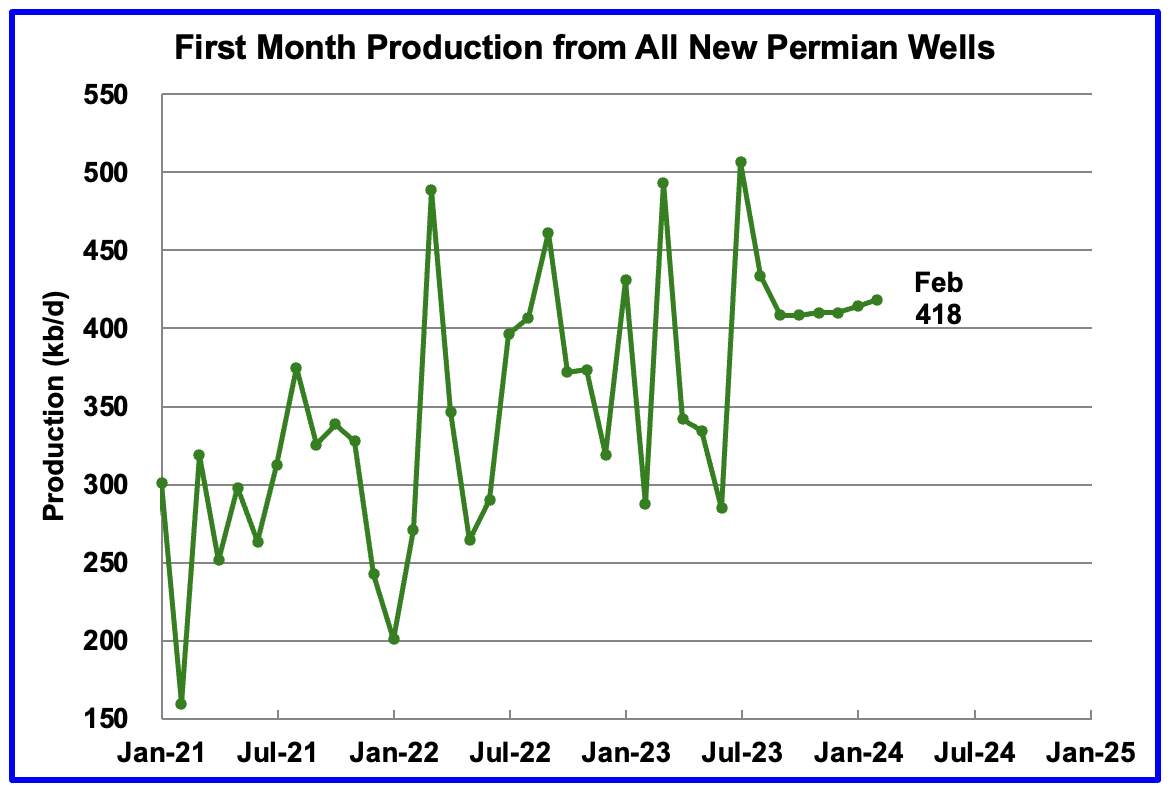

This chart shows the average first month total production from Permian wells tracked on a monthly basis. The total monthly production from the newest Permian wells in February is expected to be 418 kb/d, 4 kb/d higher than January.

Recall that this production of 418 kb/d is offset by a decline of 413 kb/d for a net overall output increase in the Permian basin of 5 kb/d, the smallest recent monthly increase. This all hints at slowing production growth in the Permian.

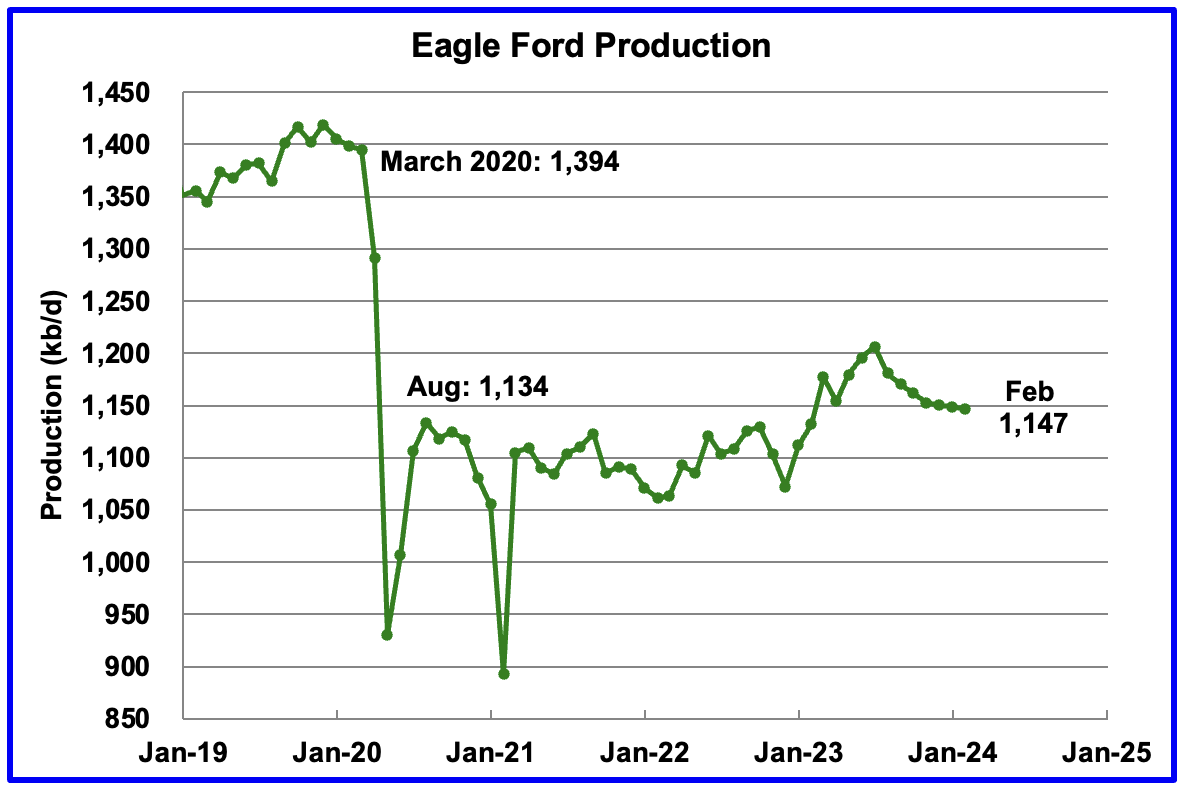

Output in the Eagle Ford basin has been in a downtrend since August. The DPR’s January’s forecast projects February output to decrease by 2 kb/d to 1,147 kb/d. The Eagle Ford’s output for January was not revised in the February report.

At the beginning of the year 2023, 68 rigs were operating in the Eagle Ford basin. The rig count began to drop in mid March 2023 to 60 and slowly dropped further to 47 in November 2023. Since late October 2023 the Eagle Ford rig count has been close to 48 ± 2 rigs.

The DPR forecasts Bakken output in February will be 1,303 kb/d, 1 kb/d Lower than January. February 2024 production is now projected to be 58 kb/d higher than the post pandemic peak of 1,245 kb/d in October 2020.

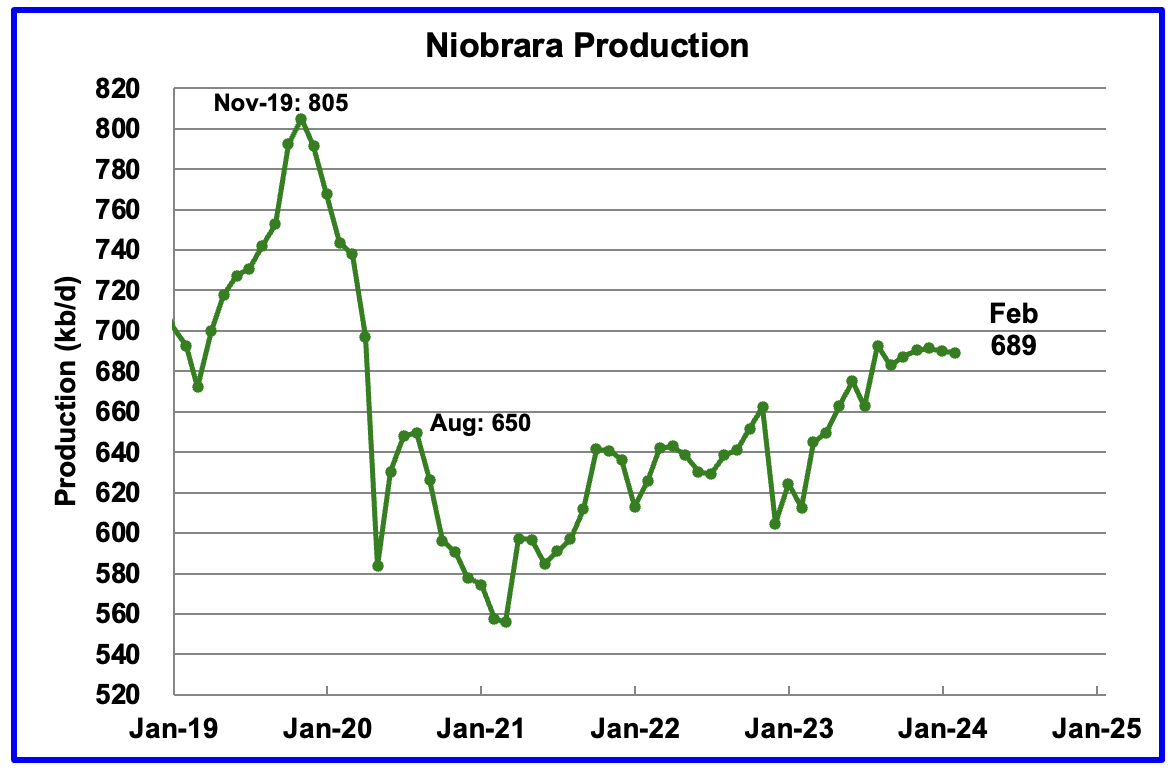

Output growth in the Niobrara continues to slow. February’s output decreased by 1 kb/d to 649 kb/d.

Production increased starting in January 2023 due to the addition of rigs into the basin but stabilized at 16 ± 1 rigs in March and April. However while from August to December, the rig count has held steady at 14, January has seen the rig count drop by 2 to 12. The drop in production has been slowed by the increased use of DUCs, 29 in December. See next section.

DUCs and Drilled Wells

The number of DUCs available for completion in the Permian and the four major DPR oil basins has fallen every month since July 2020. December DUCs decreased by 58 to 2,172. The average DUC decline rate since March has been 89 DUCs/mth but appears to be slowing. Of the 58 DUC decrease in December, 29 came from the Niobrara. The average DUC decline rate over the past 6 months in the Niobrara has been 29 DUCs per month. Without this high completion rate, the production drop shown in the Niobrara chart would have been higher.

In these 4 basins, 743 wells were completed while 685 were drilled. Both drilled wells and completions are down from higher levels in early 2023.

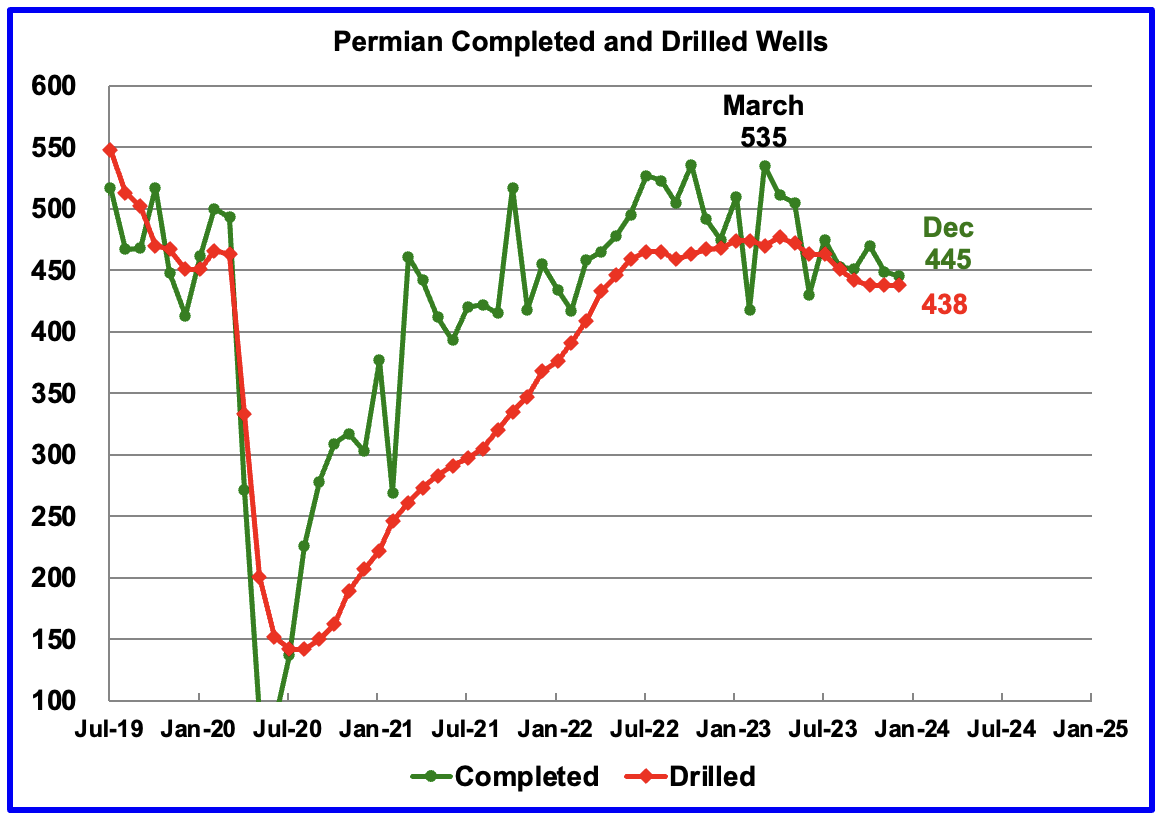

In the Permian, the monthly completion and drilling rates have been slowing since the March 2023 high of 535 rigs.

In December 2023, 445 wells were completed while 438 new wells were drilled. The gap between completed and drilled wells in the Permian is now very small compared to late 2022 and early 2023. Regardless, it is those extra completions that increase Permian production.

A discussion last month on this board overwhelmingly decided that a more realistic DUC count for the Permian would be closer to under 100. That being the case, the 830 being reported by the DPR, if correct, must include a significant number of dead DUCs that will never be completed. An indicator of true number of viable DUCs in the Permian may be gleaned from the recent monthly completion rate.

- August: 2

- September 9

- October 32

- November 11

- December 7

While October is showing 32 DUCs were used, the original post on October completions reported 11. The 32 appears to be an outlier and data revision is being used to accommodate the current data.

Good stuff, thanks Ovi.

Thanks Greenhub

Much appreciated.

I second that!

Peak Oil 20 years of wrong predictions.

http://www.energycrisis.com/campbell/

Quote “ Britain faces the prospect of closed filling stations” That was from 2006.

Obviously Campbell and many others were wrong, the knowledge they had was simply deficient. The price of oil in real terms is lower than it was in 2005, so Lynch was correct.

This year in the U.K. electric car sales is predicted to hit over 300,000 units. One new car in six will not use any petrol or diesel.

https://brokernews.co.uk/will-electric-car-sales-hit-the-22-zev-mandate-requirement-in-2024/

It is a bit sad that some people have invested so much time and emotional effort into something that may actually not matter.

Charles

Actually it does matter and has mattered. You make a good point that oil prices are lower than peaks in 2005-2008. And what happened in 2008? Have we forgotten? Then what happened in 2014? When QE ended what happened? Then 2020 COVID19 what happened? The US added two Saudi Arabia’s worth of oil and gas production in the last 15 years if the world was well supplied it would have crushed the market and tanked the price. But didn’t instead it got mopped up by the global industry and it still wasn’t enough to tame prices. So brilliant minds emptied the SPR. The biggest mistake that peak oil has made is to believe in traditional economics that scarcity will drive up prices. It simply doesn’t work that way. There is an upper boundary on energy prices that when met people disconnect. Mistaking price for supply is a fatal flaw. What you’re suggesting is demand destruction because of EVs.

Well here’s a reality check on the economics of EVs

https://www.reuters.com/business/autos-transportation/hertz-sell-about-20000-evs-us-fleet-2024-01-11/

But you’re going to get your chance to prove your theory this year as shale rolls over and people start protesting the unaffordable prices.

Sorry I forgot that’s already happening in France and Germany. I also forgot the diesel shortage in Russia last year.

What you’re discounting is the economy has tank globally that’s why demand is down not EVs . The economy has tanked because there isn’t enough surplus energy to maintain affordability. A good poster child is Germany who’s in the process of de industrialization. It’s already happened in the UK and it will start happening here.

Nailed it.

JT

The price of oil was higher for far longer in 2011,2012 and 2013 before US tight oil flooded the market and the global economy did very well.

Those who think oil price at $100 is expensive should think a lot about what you get from a barrel and how much is wasted moving around 6litre engines with one person inside.

Why do Americans use 20 barrels per year when Europeans use 8 or 9? This is just blatant wastefulness. Chinese use less than three barrels of oil a year.

Has the global economy tanked? A 2.6% growth is not tanking.

Personally I think global oil production will peak in 2028 and prices will start to rise a year or two before. How much really depends on EV sales and global oil decline rate.

https://www.ev-volumes.com/

I think peak oil will hit the poorer half of the world the hardest, but the richest quarter will not even notice.

Well summarized JT. As I often say, unless oil prices drop back to their pre-70’s oil crisis level, and stay there for years while the economy expands, then we know that ‘demand’ is being curtailed by the high (energy) cost of supply.

“some people have invested so much time and emotional effort into something that may actually not matter”

Unfortunately, it matters a hell of lot and will continue to do so indefinitely.

Its going to take a very long time for population to go into global decline mode, a long time for the global ICE light vehicle fleet to be primarily electric, a hell of a long time for cargo transport by land, sea and air to require less liquid fuel, a long time for industrial machinery in mining/construction/materials to wean off liquid fuels, etc.

In the meantime there is depletion, and if prices are low there will be large stranded fossil fuel deposits left in the ground. Add to that the significant chance of geopolitical disruptions to supply such as failed states (ex Libya), trade restrictions (ex Venezuela), and outright conflict (ex Houtis)….a fascinating book could be written on this subject, and the future updates of it will be wild.

You have all the ingredients lined up on the counter for huge petrol shortages in many parts of the world over the rest of the century, despite the new ability to replace some of the oil consumption with electrification of transport and commercial operations.

The race in on to learn to live with less liquid fuel, in fact it started decades ago and many people are still not even lined up at the starting gate.

Hickory

The more I read about aquifer depletion and overuse of rivers and land no longer able to produce food. I am sure that deaths rates will increase considerably before the decade is out.

A study done on the carrying capacity of the world determined that the 60 million people who die each year would have to double by 2030 in orders for the rest to have enough food. Like peak oil; peak water, peak soil and peak fish will mean fewer and fewer people will have enough.

Peak oil is the least of our problems.

https://www.theworldcounts.com/challenges/planet-earth/freshwater/deaths-from-dirty-water

https://siwi.org/latest/water-crisis-india-everything-need-know/

Charles

It so easy to look at the past and say “Campbell and many others were wrong, the knowledge they had was simply deficient”. No their knowledge of what happens to oil fields was not deficient.

What Campbell and other experts and no one else knew in the early 2000s was that the US was on the verge of creating an oil basin almost equivalent to Ghawar. Around 2005, US oil drillers and companies were experimenting with and transferring gas fracturing technology to oil fracturing in the shale oil fields in Texas.

In 2010, the IEA stated that peak conventional oil occurred in 2006. It is not clear if this statement was an indication that there was going to be another peak due to heavy oil from Canada and Venezuela or they had a clue that something incredible was about to change in US production.

In the attached chart, note how US decline slowed in 2007 and 2008 as US production hit its low at 5,000 kb/d in 2008 and then began to rise.

Imagine where the world would be today without those extra 7,000 kb/d to 8,000 kb/d that the US has added to world supply.

Yes there was reason to worry about Peakoil and am glad those specialists were there to warn everybody. Toyota bought into those Peakoil concerns and started working on EVs and that is why they were first with their Prius in 1997, laying the ground work for today’s EV technology and the transition to EVs.

Looking at the US chart, one must ask when will the downside of that sharp rise start, possibly two years from now? Then what.

I’d have more respect for being wrong, if they admitted it. And did retrospectives. Instead they hide from it. That shows me more of an advocate, than an analyst.

Anonymous

I am surprised that you are not aware that Campbell, Deffeyes and Simmons have all left this earth.

Have we reached peak peakers? Are they being depleted, faster than the discovery rate of new peakers? I keed, I keed. (Although not entirely–looking at the Peak Oil fad, it seems to have crested about 2010ish. TOD and ASPO shutting down c. 2013, shows something.)

But to be serious. Nothing stopped them from addressing their predictions prior to death. Except for Simmons-he died suddenly. The other two had a chance to see that they had been too peaker-ish. Yet did not write analytical post-mortems (pun not intended).

Also, of course, many other peakers are still alive. Yet instead of addressing past articles and what they got right/wrong and how they’ve changed going forward as a result…we just seem to get (a) radio silence or (b) can kicked down the road (like an apocalyptic Church that revises the date of the Rapture). A very few seem to revisit their past commentary. AND to revise their methods. I’d put Rapier and Coyne in that camp. But a lot of the rest don’t. Even a “light peaker” like James Hamilton (UCSD) never really revisited his “hundred dollars here to stay” article from 2014. Or the raft of peak oil by state analyses that he did in the early 2010s.

Anonymous, All that matters is the formulation of the depletion analysis. As with any other mature scientific discipline, the mathematical model is the starting point.

https://chat.openai.com/share/67814c20-7c42-40ec-a2e0-06ff1bf8b732

And all of them had time to learn, before their deaths, how and why they were wrong. Did they provide the rest of us with that information before their demise?

I am most interested in Colin, because he was predicting global peak in 1990 or so, and went on to do it again. And again, if memory serves. After multiple cycles of “oopsy” he must surely have mentioned somewhere along the line why he kept screwing the pooch and admitted that anything else he claimed be dismissed immediately upon publication? Rather than what actually happened, which is that the “gee aren’t you are a sucker” count of enthusiasts continued to grow.

Ovi

Most of the experts who predicted peak oil around 2005 worked in times when oil was $20 to $30 a barrel.

They badly underestimated the resources that $100 oil would release, many also believed that the global economy would be crippled by oil prices over $100. As it turns out the higher oil price did not affect the economy, this is because every barrel of oil used produces 20 times the gdp it costs to get out of the ground.

In the next few years we will see exactly what higher prices can do, including how much spare capacity OPEC has. We will also see if electric cars reduce demand globally or just in countries that use over 8 barrels per person. Will India consumption continue to increase to 5 or 6 barrels per person at that very low consumption rate India will need 20 million barrels per day.

How much oil will each of the additional 500 million people use in 2030.

I liked this graph from the other thread – it’s all about shale – and that stuff depletes like crazy.

rgds

WP

And that one is as of 2018.

What does one look like as of the end of 2023?

Alaska looks like it is close to done.

I remember reading on “The Oil Drum” they had to shut down their main pipeline if the flow rate got too low.

Whatever happened to that?

Andre The Giant

As best I can recall, I think they had to add another Heated Section along the line to prevent the oil from getting too viscous/thick as it cooled during the winter.

Laherrere data added:

Laherre has a habit of underestimating shale. Why would you believe one more “about to peak and drop massively” report from him?

Here he is in 2014, predicting ultimate recovery of 2.5B from the Bakken, with a 2014 peak.

http://aspofrance.viabloga.com/files/JL_Bakken2014.pdf

Bakken has massively outperformed Laherre’s prediction. His curves predict ND Bakken to be doing ~20,000 bopd as of NOV2023. It’s well over 1,200,000 instead! And note this was AFTER he knew about tight oil. So, he can’t claim it came out of nowhere like a meteor. This was just him being a peak oiler, using Hubbert linearization (blech!) and talking down shale.

Why should I believe Laherre now? Why has he not written an article to discuss why his method failed earlier and how he has adjusted to avoid similar mistakes. And not just resetting the “world is ending” tape by kicking the can to next year…but actually changing his method itself?

Bakken is really amazing in 2023, almost up 30% at 1.3Million BOPD!

This 30% can not be compared even by Permian! TX+NM could barely match the 300KBOPD increase!

This has to be explained by something — Drilling in the high TOC shales opened up new frontiers?

Many oil men were underestimating not the shale but the financials tricks that were produced to finance the Bonanza.

I think the curve is put there not to be believed but to provide an alternative story. Dennis Coyne’s production bulge is still a peak, and a story too.

They are both stories, I think the future will confirm and infirm which one was true in retrospective.

The Bakken is still down 13% from its all time high in late 2019. Still, a very impression gain in 2023 followed by a stall in production and a forecast that the stall continues.

the other side of this cliff will scream downward soon.

No on the tight oil cliff LTO. Too much human innovation, energy and creativity targeting some of the best petro rock on the planet in a reasonably friendly operational environment. No cliff, but more of a long, drifting wind down over 80 years… as my C-Ball predicts.

That Laherre data chart is unrealistic on the tight oil decline in my opinion.

I think even with zero new completions, that the Laherre tight cliff is unrealistic. Just taking existing production and looking at base decline. Yes, the newest generation drops the fastest. But older wells drop slower. And the new ones become old ones over time.

I suspect Laherre is in love with symmetrical Hubbert curves and doesn’t even really calculate a base decline, which is more of a long exponential/hyperbolic tail. No reason for it to mirror the build. Certainly that’s a main issue with his bad Bakken prediction.

When you see Laherre making basic errors like that, it’s one more reason to be very wary of him on world URR. It’s Dunning Kruger land. He doesn’t realize his limitations. In all likelihood, he’s making errors and in the pessimistic direction on other URR calculations. Like he’s done with tight oil.

Alternatively, it might matter. Just not in the way folks have been claiming in the modern era, beginning with Colin Campbell predicting global peak around 1990.

There are some topics that would get me kicked out of peak oil websites for just mentioning, in particular the 1979 global peak, and the idea that the world grew the economy for the following 15 years (about how long it took for the 1979 global peak to be knocked off by the next) and there was no zombie apocalypse or end times Rapture nonsense that was often speculated about back then.

And I do not view it as sad to have invested time in the topic, I could argue that knowing logically the faults and problems with the idea in real time (and while mentioning any of them got me banned from internet websites speculating on the right amount of gold, guns and ammo to collect), arguably they made my career into something substantially more than it would have been otherwise.

So no remorse on investing the time at all, and emotion has nothing to do with it. Just science that shit up and work the problem.

Unfortunately, the EIA is now doing Hedonic adjustments just like the U.S. Govt with inflation.

The U.S. didnt reach a new record in C & C production in NOV 2023, because its now adding ~700,000 bd of mostly NGLs and misc oil as a new supply called, Transfers To Crude Oil Supply.

So, unless we are now calling NGLs, oil, U.S. Crude & Condensate oil production plateaued in mid 2023

Steve

Uh, no. They are not. (Classic peak oiler cope mechanism…blame it on NGLs. Seen it so many times before. And usually from people that don’t even know the details of the EIA website.)

Steve

It is not clear to me that the EIA has changed their definition of C + C. In their weekly Petroleum report they created another box to try minimize the variation and size of their adjustment factor. They have just taken oil from one box and put it into another box. No new oil has been added.

Attached is the weekly production from September 29 to December 8. They are essentially flat and there is no 700 kb/d bump. The first weekly report that contained the new Transfer box was the November 17 report and it transferred 720 kb/d but production was constant. See second table.

A clip from the November 17/2023 Weekly Petroleum report

Ovi,

Tom Loughrey of FLOW brought the Transfers to Crude Oil Supply to my attention on Twitter. He gets the credit.

Regardless, the EIA explains the new adjustment here: https://www3.eia.gov/petroleum/supply/weekly/wpsr_notice_11132023.php

I was corresponding with Tom about this because all of a sudden in July, production started trending higher, significantly.

The EIA states in that update, that Transfers To Crude Oil Supply includes unfinishef oils and NGLs which are blended into the C&C supply.

Tom and I believe the majority of the Transfers To Crude Oil Supply are NGLs.

Again… the EIA make this quite clear. I am surprised you all here at the POB didnt know about it.

Steve

The transfers explains the crude input to refineries, shortfall. The crude production is off of the 914 and is just from 3 phase separators. Transfers doesn’t affect the production number. Just explains where the extra barrels going into refineries are from.

Mike Shellman also does a great post on the same subject matter of U.S. OIL ADJUSTMENTS.

THE UGLY TRUTH: https://www.oilystuff.com/single-post/the-ugly-truth?

steve

Steve, HFIR (the blogger that Mike reposted) is a noted permabull from Seeking Alpha. Every year he has said price would overperform and that US production would underperform. A few times, he’s been right. But overall for last decade or so, he’s been dramatically wrong.

Note also, that he heavily touted CRC, a very high leveraged, and thus high beta conventional California producer. It went bankrupt.

Everyone has bad calls and good calls. But HFIR is much more bad than good. Also, EIA has clarified how the adjustment factor works several times…and HFIR just refuses to learn.

Steve

As best as I can figure out, here it is straight from the horses mouth, the STEO. I hadn’t noticed but transfers have been added to the STEO back to 2022.

First off, let’s put things in perspective. NGPLs are typically in the 6,000 kb/d range. The current transfers are in 700 kb/d range and are about to drop into the 500 kb/d range, so expected to drop to less than 10% shortly.

In the attached chart, the data has been taken from the January STEO. Going back to April 2022, transfers were 419 kb/d and definitely increased C plus C. In November 2023, the transfers added 717 kb/d, so the increase in NG production is increasing US C plus C. However one could also argue that the EIA has just created a new box out of old data.

The breaks in the graphs start in January 2024 and reflect the STEO forecast.

I am sending the spreadsheet to Dennis to see if he can post the data somewhere in the cloud.

Ovi,

You can add any spreadsheet to peakoilbarrel.com as a media file and then post a link to the file in the comments.

Link to Ovi’s spreadsheet below

https://peakoilbarrel.com/wp-content/uploads/2024/02/Transfers.xlsx

Steve

Looks like you did not visit the OPEC post. Adjustments were discussed there and in some previous posts.

Ovi, of course EIA didn’t change their definition. This whole “must be counting NGLS” came out from the peakers in 2017 also…when US outperformed. And then it just crushed everyone in oblivion in 2018 and the NGL conspiracy theorists gave up and moved on.

I made a video about the change of API density, NGL or wet gas in the shale oil and fluid production.

https://youtu.be/2hxyNIhxmnQ

I compared Bakken with Permian as well as the Appalachian wet gas & condensate production.

Thanks for putting that up!

rgds

WP

1 of x:

Great information, and a lot of work. As always, Ovi.

Confession, I actually blank out a little after the 914 discussion. DPR and LTO reports interest me less. I do appreciate the rig/frack count, though.

Would love to have gas and API, and even NGL coverage, also. There’s stuff going on.

Anonymous

Thanks. Much appreciated. Read only what interests you.

With your extensive knowledge, could we have your thoughts on plunging rigs in Lea and Martin and rising production.

I haven’t looked, thought about it. Just haven’t zoomed in on those (arguably important!) counties. You’ve been tracking those much more than I have.

Also, I assume you were teasing me with some Scandinavian humor. In case you weren’t. I don’t have deep expertise or industry experience. I’m just another civilian riffraff commenter, consuming Internet content.

EDIT: OK, just looked at that part of the report. A few thoughts.

1. I think the overall trend is of Permian rigs dropping from the JUL to now. The difference between Midland and Martin is not significant, if you’re looking at last 6 months (not last few weeks.) Lea is also down a fair amount.

2. Eddy is the one that looks different, with rigs hanging in there, unlike the other three. Not sure why. Maybe it is more core of the core? Maybe actions of specific operator affecting things (XOM or even OXY are less price responsive than small independents. Elephants don’t dither.) I really don’t know…just brainstorming.

3. As far as the general rig reduction…wonder if that is just a WTI price response, mostly?

4. Production can still increase even while rigs drop. For one thing, there’s a 6 month or so delay to frack and put on line wells. For another thing, just because rigs dropped, doesn’t mean they dropped below maintenance level. Consider if 100 rigs are running in an area and 40 are needed to maintain. You can drop a lot of rigs before, you actually drop below maintenance. It can be pretty nonlinear, given high grading. Have seen this in the Bakken.

5. I would be a little wary of production county data trending using state data. TX (and to a lesser extent NM) are noteworthy for lags in production reports. So, you’ll tend to see spurious drops in most recent months, if you use the state’s county data.

I’m Italian.

Hmm. Ever been to Gaeta? I did a few weeks military time there. Loved it!

https://en.wikipedia.org/wiki/Gaeta

2 of x:

The US production is fascinating. But not that surprising. For anyone who has been following since 2012 (12 years ago!) Not surprised to see US up production in a $70 price regime.

It’s not going gang busters. But still. We added almost a million bopd last year. And are at a current record.

Outperformed the EIA and people that thought we’d grow. And definitely spanked those who said US would never get back to 13! (Something the “world is post peak” types should think about…)

That doesn’t mean there are not headwinds.

(1) Price is always a concern. And if SA opens the taps (and they got them…don’t kid yerself), they can crash price.

(2) Regulatory regime always gets worse. The country is moving to the left and has been since the 30s, really. Yes, there are oscillations, but that is the mega trend. Biden administratioon does not want high prices before the election. But their hearts are in crushing oil, not helping it. After 2024 victory (and I think they will win…Trump is an idiot), they will be more free to go hard core greenie. And sink their shanks into oil industry.

(3) It’s harder to grow after growth. Rystad had an excellent discussion of this. (The converse of this is ALSO TRUE…it’s easier to grow/maintain after a decline.) Basically, even with zero change in well profile or increase rate, the problem is that the amount of new production increases after growth. So your base decline hits worse.

(4) We are starting to run out of resource. Yes, I’m a cornie and saying it. Not running out as fast as the anti shale Berman types think. That’s why wrong so often over the years (they are biased). Still, looking at things that are down the middle, like Enno’s work, you see it. I DO still see growth in the Permian. But we are moving to a lower growth regime, at least.

(5) Weather. January is going to be brutal. In ND especially. But rest of US also. And the ND stuff…some goes off line and doesn’t come back until May. All that said…watch out peakers…don’t assume weather is a meta trend. You have fallen for that banana in the tail pipe several times before.

——-

All of those headwinds noted, I still think the STEO is too timid. Didn’t predict the growth to date. If prices stay constant, or even go with the strip (slight decline, not a crash), I expect us to hit 14s in 2024 (not even 2025). There’s just too much momentum in the system. Look forward to some strange 914 results with the weather a couple months from now. Then weather recovery. And 14+ by ~NOV2024 (reported end of JAN2025).

3 of X:

Ovi, Ohio was actually the tenth strongest state in the last 914. Very tentatively. And just for the last month. And very light oil. All that said, look at the latest 914. It passed LA.

No big issue and your choice on what to do. I remember you had KS at one time and cut it. Not sure if OH is sustainably in top 10. But…any way you cut it…it was top 10 last month. Look at the data!

Anonymous

Need to keep an eye on Ohio. Definitely going in the opposite direction than Louisiana.

Great chart. Thanks.

Hi Ovi,

Louisiana is green and Ohio is red maybe? I guess you could do top 11 perhaps, as they are so close.

Dennis

Easy to do. Getting tired today sorting out adjustments. Forgot to add legend. Time to quit.

Ovi thanks for all you do. I would be happy to post that spreadsheet when you have a chance to send it.

Dennis

Already sent. Forgot to include it in the first email.

Ovi,

Can you resend? I am not finding it in my email.

4 of x:

TX is massive. Bigger than Canada, Iran, Iraq, China. Well behind Russia, SA, or rest of US. But still…massive. It’s going to be fun watching them pass 6 MM bopd (price crash excluded) in 2024.

Paging Jim Hamilton! So much for ‘experts say it will never pass its old peak’. So much for ‘places tend not to pass old peaks’. (Something that was sometimes wrong even in 2012, when you said it. Look at Canada for instance.)

Go Tejas! (sauce)

5 of x:

I love NM. Another state that broke its records. (Paging UCSD professor Jim Hamilton! Time to redo your state by state paper!) It’s like UK or Norway…on its own!

Yeah…there’s headwinds. Only two counties. Democrats. Etc. Etc. Still…they keep on trucking. Still a very pretty girl in the Juarez lineup (you had to be there to understand).

Anonymous

Those dropping rigs counts in NM and Texas, will start to show up in 9 to 12 months as production peaks and declines.

The drillers must be seeing something that is making them leave Lea, Midland and Martin counties. Is it low pressure? What else can they see when they are finished drilling?

Ovi,

Perhaps they have decided to wait for higher oil and gas prices and asre simply biding their time. Also possible that they have become more efficient over time and can drill more wells with fewer rigs, I don’t think the EIA has the best data on this, Novilabs may be far better, though updates are not as frequent as they once were. Though we are lucky they provide so much information for free.

Thank you Enno Peters.

Dennis,

both are probably true.

Wells per rig per month have gone up substantially, not only because of improvements, but because they drill more wells per pad, which speeds things up. Cube development. Some pads are 15-20 wells.

Ovi,

If we assume 1.5 wells are drilled per rig we can use rig counts with a 6 month lag to estimate completion rates (the 1.5 wells per rig is based on historic spuds from Novilabs and rig counts from Baker Hughes for Permian Basin), this can be input int my Permian model for completion rate to estimate future Permian output, it assumes no change in DUC count.

Dennis

Oil price could be a factor in Texas since June 2023 was the low point for oil prices. However by mid August WTI prices were back over $80/b and NM’s rig count started to drop in mid August. See chart.

Adding in a delay time into your program is an interesting thought. However It would not answer the more pressing question of whether the Permian is close to peaking, say within a year from now as many believe, or three years from now that your model predicts.

I have asked Dr Google for his thoughts on information that is brought back from the drill bit. Interesting paper. Found this comment interesting.

“Drilling Dynamics. The aim of drilling-dynamics measurement is to make drilling the well more efficient and to minimize nonproductive time (NPT). Approximately 75% of all lost-time incidents of more than 6 hours are caused by drilling-mechanics failures.[3] Therefore, extensive effort is made to ensure that the drilling-mechanics information acquired is converted to a format usable by the driller and that usable data are provided to the rig floor.

The most frequently measured downhole drilling-mechanics parameters are downhole mud pressures (PWD), WOB (Weight on Bit), torque on bit, shock, temperature, and caliper. Formation testing while drilling (FTWD) provides key formation pressures for drilling optimization. The data provided by these measurements are intended to enable informed, timely decisions by the drilling staff and thereby improve drilling efficiency. The two main causes of NPT are hole problems (addressed by hydraulics measurement and wellbore-integrity measurement) and drillstring and tool failure (addressed by drillstring-integrity measurement).”

So there is lot of good info coming back to the drilling crew. I assume that with a lot of experience they can tell if the area being drilled is good or bad. It would be good to hear from Mike S, LTO or anyone else with drilling knowledge.

https://petrowiki.spe.org/PEH:Drilling-Data_Acquisition

Ovi,

The peak will depend on completion rates and the rate that new well productivity changes over time. Below is a guess I made in December 2018 shortly after the USGS released its Delaware Basin undiscovered TRR mean estimate of roughly 60 Gb in November 2018. I have filled in EIA data from late 2018 to 2023 that was not available when the estimate was made.

This was a case of an estimate that was too optimistic, but note that in December 2018 few knew about the upcoming Global pandemic and the disruption that would cause to the oil market.

Dennis

I think it is a damn good estimate considering that it was done in 2018.

When doing forecasts, the important thing to get right is the TREND, not the actual numbers. The trend in this chart is very good. It is climbing and starting to roll over in 2024. What could one ask for more from a 2018 projection.

Permian production at the beginning of 2024 is close to 5,900 kb/d. Your projection for beginning 2024 is 6,500 kb/d, a 10% error on the high side, many wish they could get that close.

Bottom line, this is an amazing projection.

“Bottom line, this is an amazing projection.”

Absolutely.

Ovi and Hickory,

When you create a lot of scenarios, some may be close to correct. This scenario was done just after I presented a poster at the AGU with Paul Pukite in December 2018. This was just after the USGS released its Delaware Basin assessment and I needed to re do the scenarios I presented in my poster as a result. Link below to abstract

https://agu.confex.com/agu/fm18/meetingapp.cgi/Paper/446221

e poster at link below

https://agu.confex.com/agu/fm18/mediafile/Handout/Paper446221/permian%20basin%20tight%20oil.pdf

A more recent set of scenarios below, the medium scenario is my best guess, the low scenario has falling completion rates starting in July 2024, the medium scenario has completion rate remaining about the same as the June 2024 level which is based on rig counts in December 2023 with completion rate assumed to reflect drilling rates 6 months earlier, after June 2024 it is just a guess. The high scenario assumes completioj rate gradually rises to 550 wells per month by 2028 and remains at that level until 2036 than rapidly falls. All 3 scenarios assume new well productivity falls after Dec 2022, with the annual rate of decrease at about 4% in 2023 and falling more at higher completion rates and less at lower completion rates.

The main difference seems to be the amount. That’s what interests me and wish you would discuss it more. The exact shape/time of curve seems kind of not so important, nor do I think you can predict it, really.

Also, the last two curves are very similar, not worth the third scenario.

Lastly, it’s interesting to me how you always assume worse productivity after a time…I remember you doing that 10 years ago…didn’t work out how you planned…was too negative.

Anonymous,

Yes I was wrong on productivity decreasing in 2012, I have been very transparent about that, recently new well productivity has been decreasing, over the 2021 to 2023 period in particular and especially when we normalize for lateral length. The 4% annual decline is an assumption based on well productivity decline from 2021 to 2022. I assume constant lateral length at average 2022 levels in my model. There is a given volume of prospective rock in productive formations, increased lateral length increases the volume of prospective rock used per well.

I agree predicting the exact path of the future output curve is difficult (impossible in fact)..

The difference in URR between the low and high scenarios is due to fewer wells being completed in the low scenario (101k total wells completed) vs the high scenario (133.6k total wells completed). Note that higher completion rates in the high scenario results in more well productivity decline. The low scenario assumes oil and natural gas prices fall due to lack of demand where the high scenario assumes prices are high due to robust demand for oil and natural gas. The medium scenario assumes oil and natural gas prices remain roughly where they are today until 2035 and then demand starts to fall leading to gradually falling oil and natural gas prices which leads to fewer prospective resources being profitable to develop.

Chart for normalized well productivity for Permian Basin average well 2015 to 2022.

From 2019 to 2022 the average annual rate of decrease in average Permian basin normalized well productivity was about 4%.

1. If you have an area-based model, normalizing by lateral length makes sense. Yes, you chew up more rock. At a second order, there is probably some beneficial financial impact of the longer laterals, making more marginal rock economic (thus a higher total resource). I’ve made this point with Enno, before. Again…I’m not against normalizing. Actually think it’s first order the right thing to do.

2. But regardless, doesn’t your model just have a total resource (area under the curve) which is assumed? So, your assumptions on well productivity are just going to tweak the speed of drawing down the tank (I guess extending it), not really affecting total resource.

3. If your model is just number of completions, times production, I’d think you’d want to keep it un-normalized. So maybe you really should assume they draw the tank down a little quicker.

Anonymous,

The well profile changes yearly based on the data, so for any given year output is well profile convolved with completions. The URR is based on TRR and economics,( prices, costs, etc). I start with mean TRR estimate from USGS, but if we look at the details, about 25 Gb of the resource is very low productivity rock that is unlikely to ever be developed.

So the 50 Gb estimate takes this into account. The better benches of the USGS estimate are the ones I focus on. Perhaps if oil prices are $200/bo or more in 2024$ some of the 25 Gb of low productivity rock will be viable, but I remain skeptical.

6 of X:

ND is interesting. Headwinds from weather/remoteness/takeaway. And the flaring restrictions. And the maturity of the play.

All that said, it’s a very rich are. The middle Bakken has some thin bed conventional properties. And there’s several prospective areas in the Three Forks.

Bakken has been written off several times before by Berman and the like. And they were wrong.

My take is a miserable winter…but then recovery going well into summer. And finish the year up slightly year over year. (Price caveat of course.)

they are drilling the high TOC shale, i.e. lower Bakken and even upper Bakken

Results seem to be good — this broke the previous paradigm that shale oil can not be produced from high TOC shale.

The mainstream give 3 death penalties to high TOC shale:

1. they have oil but adsorbed or dissolved in TOC kerogens, and can not be produced

2. they have zero porosity, conventional porosity reading all give close to zero readings

3. they have low maturity, using unreliable but dominating benchmark Tmax, most high TOC shale reads immature so no oil has been generated yet.

There is also a lot of re-fracking activity in the Bakken.

7 of x:

CO is interesting. Definitely headwinds with maturity and regulation environment. So fascinating to see it up slightly. Really don’t follow it that much, so not sure if a blip or what.

Do you know of any article or reports discussing this?

8 of X:

AK definitely in decline, but starting to depart from the peaker band. Would do even better if the Feds would let people drill and explore more.

9 of 9:

No comments OK and Cali.

Interesting to see WY bumping up like that.

UT also fascinating with its relatively high level lately (despite headwinds from Fed land controls and wax shipping issues).

LA is boring. (one more reason to cover OH.)

No comments FGOM.

Sheng, regarding your video:

https://youtu.be/2hxyNIhxmnQ

It’s interesting, but:

1. I don’t think there’s any reason to connect refinery run API to crude production in TX. They are pretty different industries, well separated by geography. And there’s a lot of import/export.

2. The seasonal variation in NGLs has to do with the vapor pressure at different temperatures at the surface (three phase separator). In the summer, it’s hotter, pentanes plus have a higher vapor pressure, and thus more progress into the wet gas stream (and get sorted out at the gas processing plant). In winter, less of that happens. While it is possible that’s related to what happens over time in a black oil reservoir, it seems pretty different. You’ve got a variation more of pressure than temp in the reservoir and over longer times, not seasonal. And you have a changing composition downhole. So, all in all, you really need to prove they are the same thing. Otherwise, it almost looks as if you are confusing the two different phenomena.

3. The one part of your discussion I liked most was making the point that Midland oil is close to 40. So any progressive change to lower the API will look like a lot of shift to 30s versus 40s. In Bakken, we’d see less since the starting API was 42.

4. However, I don’t see why we only saw phenomena (3) last year. We been doing shale for a long time now. Why this year?

5. Also, even if (3) is occurring, I don’t see how you can say the average API is getting lighter. It may not be shifting dramatically (was at a knife edge before), but it is going down in API.

Anonymous,

Thanks for the detailed comments and advices!

here are my comments to your points:

#1. ” refinery run API to crude production in TX” — I am also kinda puzzled by this, I am using this link here to do the 5 fluids crude production API in TX,

https://www.eia.gov/dnav/pet/pet_crd_api_adc_mbblpd_m.htm

not this here that relates to refinery input, which I used for “Average API” in TX,

https://www.eia.gov/dnav/pet/pet_pnp_crq_dcu_nus_m.htm

but, when I looked into North Dakota “Average API” in PADD2,it is indeed dominated by imports from Canada, see:

https://www.eia.gov/todayinenergy/detail.php?id=4890

my thoughts are:

the PADD2 is the major import source, and PADD3 (TX) is dominated by TX shale oil. There is 0.1API increase, which certainly can not explain if 900K BOPD lower shift 10 API or even 5API, so this is in bulk consistent with the 5-fluids’ classic API change, Black Oil API down, but Volatile and Condensate API up. My guess is that there are lots of much lighter crude exported from PADD3, so they are not shown in this refinery input API average. If counted, the average will be even more obviously lighter.

#2. Yes, you are right — I am trying to explain the annual oscillation is wellhead T driven, and the last 3-year up trend is reservoir P driven.

#3. thanks, but I also want emphasize the “900K BOPD shift in past 3 years” size, which is huge, and this small shift consistent with GOR shootup in the past 3 years.

#4. but I am confused by “I don’t see why we only saw phenomena (3) last year. We been doing shale for a long time now. Why this year?” — this year the API30 in TX is surpassing API 40 in TX, but it has been on the up trend, especially the past 3 years, which is consistent with GOR shootup in the past 3 years.

#5. I believe overall it is getting much lighter than “0.1API lighter” I shown here for TX refinery input as I explained above in #1. But the BO part is getting a little heavier, and this caused a big confusion in EIA news report making outsiders believe US shale oil is getting obviously heavier, while others like Mike believe it is a clickbait or EIA inaccurate account.

great work, OVI!

I have a question here if the trend is peak already reached, and rigs going down in Permian, why news reads that the top producers, Chevron and Exxon are both planning to increase production?

Sheng WU

Thanks.

That same question popped into my mind when I read the XOM and CVX comments. Attached is an article that provides some clues. I think most of the growth is through acquisitions. The other point to note is that they have a plan. Plans don’t always work out.

“Darren Woods, Exxon’s chairman and CEO, said the company is planning to grow Permian volumes up to about 650,000 boe/d during 2024.”

“Chevron’s Chairman and CEO Mike Wirth said the company is starting the year in the Permian with 12 rigs and three frac crews.

“Looking to the year ahead, our program is back-end loaded as we plan to continue to build our DUC inventory before adding an additional completion crew in the second half of the year,” Wirth said during Chevron’s Feb. 2 earnings call.

Chevron plans to exit 2024 with its Permian production at an average 900,000 boe/d; The company still aims to achieve Permian production of 1 MMboe/d in 2025.”

Here are four different perspectives.

– The first chart in the post (STEO) says US production will grow by close to 350 kb/d by end 2025.

– OPEC says LTO production will rise by 400 kb/d each year over the next two years. 2023: 8.3 Mb/d. 2025: 9.1 Mb/d. Most from the Permian.

– XOM and CVX are both aiming for continued production increase.

– Many of us on POB think LTO will peak in about a year from now.

Room for a lot of good discussion and entertainment.

https://finance.yahoo.com/news/exxon-chevron-tapping-permian-output-131200022.html#:~:text=Exxon aims to organically boost,Resources—another top Permian producer.&text=After closing the Pioneer deal,to about 1.3 MMboe/d.

Ovi,

Good points. One thing I would add: when they say increase in boe, we have to keep in mind that with rising GORs and rising light NGLs the boe will keep going up even if oil stays flat…

Ovi and Dennis,

Not sure if you’re familiar with the work of Dr. Dean Fantazzini: Ovi’s fellow Italian and fellow Texas RRC modeler.

https://sites.google.com/site/deanfantazzini/nowcasting-texas-rrc-oil-and-gas-data-ongoing-project?authuser=0

Dr. Fantazzini has developed a simple, but in my view robust, methodology, where he has derived correction factors for T to T-24 months, from averaging correction data.

I am lifting here from Dr. Fantozzini his latest correction model, which he just posted on Twitter.

What you can see here is that:

1. in 2022 EIA was underestimating TX production, something that Dennis also noted, and that underestimation is now pretty much fixed, as RRC data will likely not change much.

2. In the past 6 months or so, EIA is overestimating TX production, based on Fantazzini’s correction, something that Ovi’s model also showed.

Coincidentally, this switch from underestimation to overestimation coincides with the switch of the Adjustment Factor from positive to negative, giving credence to the idea that the Adjustment reflects mostly a Production error.

So we have now several angles that are suggesting that the PSM is currently slightly overestimating production, after underestimating it before. You have the, let’s call it, the Italian RRC Correction Mafia (Dr. Fantazzini and Ovi). Then you have that HFIR online personality, who has his own proprietary production estimates and claims that they track Production+Adjustment much better than Production alone. Then you have the Enverus/EIA data that got published on Friday, showing that production has been going down since September in the shale basins that they track (https://www.eia.gov/energyexplained/oil-and-petroleum-products/images/u.s.tight_oil_production.jpg)

So taken altogether, I am getting sold on the notion that the PSM numbers are a bit inflated….

Kdimitrov

Thanks for the link. When I first came up with the idea of trying to correct the monthly data from Tx and NM about five months back and shared it with Dennis, he indicated that it sounded similar to the methodology Dr. Fantozzini used.

In reading the link you provided. The basic idea is the same. Here are the a few of the small differences. I use the difference for the last three years of data. I agree those first months are small corrections. However for November the onshore Texas data for 2021 was lower than October and it had a massive impact on the results. See first chart in Permian Basin section. I think there was something wrong with the Tx data and just noted “The big November drop is due to a larger than typical monthly production drop in the RRC data.”

The other issue is whether to average the monthly increments or just use the last two months of data. I don’t have enough data at this point to make a decision. Currently I am just using the last two months of data. However I would note that it is more difficult to pick up a new trend by using longer averages. I prefer three and six month averages.

Check the NM chart. See how well it matched.

Fantazzini has been doing this for a long time. It might have had utility prior to the 914, but doesn’t have much now. If you look at EIA 914, it has a very strong match to eventual state data. Dennis has posted it several times. Dr. Fanta has nothing like that to show for his own work, to show it is better.

Also, Fanta even massively hedges his bets by using different scenarios with different lag amounts…such that very different amounts are predicted. Which doesn’t show much confidence in his own method.

The Fanta stuff used to get posted here, but eventually stopped. I guess he’s still carrying on out of inertia. But I really fail to see the point, when EIA is doing direct bottoms up surveying of 90% of production.

Also, I can remember times when he was wrong in the past and looked (unsuccessfully) for excuses. Like the massive increases of late 2017…that had skeptics looking for NGL excuses (see I said, we’ve heard that song before). And guess what…when all the final data came out, the massive growth of late 2017 was correct. And got even more massive in 2018. And eventually the “EIA must be cheating” crowd gave up and accepted what was going on.

The collateral issue at the small and mid sized banks hasn’t been fixed. With the end of the FED’s BTFP all the collateral issues come back front and center.

These small and mid sized banks do not have the collateral to borrow from primary credit or the discount window as it was once called. Nor can they afford the >4% interest rate on these loans to keep them solvent.

And if they had the collateral they would just borrow the funds to remain liquid from REPO instead of using primary credit.

I should also add that just because interest rates go back to zero doesn’t fix the commercial real estate in places like San Francisco or Atlanta where the vacancy is something like 30%. Lower interest rates aren’t going to fix this.

Banking crisis likely comes back with a vengeance in 2024.

I won’t be surprised at all to see WTI in the $50-$60 range by mid year.

https://www.msn.com/en-gb/news/world/oil-refinery-in-southern-russia-ablaze-news-agencies-quote-officials/ar-BB1he1Kb

one of Russia’s largest oil refineries hit by Ukranian drones.

Dethreading for WHUK:

As a scientist, it’s important to adjust based on results. And I’m not even saying to throw everything out, either. I understand the (sometimes correct) appeal of retaining a model, even when outliers argue against it, or a pesky test goes the wrong way. Still, one ought to at least address these contrary data points and at least consider adjusting. If you were looking at (I donno, physics of complex materials), I would say the same thing. You can’t be so wedded to a particular model, that you don’t consider revising it when results don’t follow plan. And…oil exploration and development is a WAY more complex system with way more unknowns than temp-resistivity plots of complex materials. Full of messy economics, technology development, exploration, regulation, etc.

For one thing, with Dennis, it’s easy to look at his articles from ten years ago and see how much they underperformed. Maybe he’ll cite EIA also (although I think he’s been more negative than them…basing his work on USGS bottoms up quantities and Laherre amounts). But in any case, even if “the other guy was wrong”, he still needs to address why his model failed. And at a time, when shale was very much already on the scene. Not like an asteroid landing or something.

At the end of the day, I really think the Dennis Coyne stuff is a bunch of spaghetti traces where what really matters is his reservoir amount estimate. It’s basically Hubbert style work, but with some fancy model (probably too fancy and a false analogy from physics to economics) on how that resource gets exhausted over time. But I really respect Hubbert more than Coyne, since Hubbert makes the point that what really matters is the area under the curve. That you could have many different development scenarios…shark fin or gaussian or even multiple peaks…but area under the curve is constrained. With that in mind, what really matters is not the specific spaghetti, but the resource estimate. If you used some too conservative Laherre or USGS or Hubbert number, you’ll end up with egg on face when we find more, when we figure out how to move more marginal rock to productive rock (and the mining industry has a LONG history of doing this…look at copper mining). But in any case what really matters is the resource estimate. That should be 80% of the discussion…not the spaghetti and the fancy physics words.

I have to admit to not following all the mathematics and physics justification of the shock model. I do have a slight BS-smelling concern based on hearing a bunch of fancy words from physics, being used to judge the evolution of production in what is really an economic/engineering area. I sometimes see people toss around fancy words physics stuff in technical stock analysis (which is pseudoscience). But again, it’s just a sniff…and I haven’t bothered following down the rabbit hole of pulling out my thermal physics textbooks.

https://www.physicsforums.com/threads/discover-the-top-graduate-textbook-for-thermal-physics-studies.293234/

I mean just because individual wells have some transport processes going on (and pretty complicated ones, with different rock, phases changing, shifts when putting the rod pump on, etc.) is no reason that the overall progress of development should be modeled on some fancy word transport equation. I mean baseball involves Newtonian scale kinematics…but if someone came up with predictive equations for mass phenomena (at the season performance level) in baseball, it would similarly not make sense. The ballistics don’t apply to mass statistical phenomena, they apply to predicting what path a ball takes.

P.s. “Mature scientific discipline” for oil production prediction? You really ought to look at physical scientific areas that are much more mature, for comparison. Production prediction is night and day from “mature”. Much more like economic forecasting.

Gotta admit, I never saw shale production reaching this level, and I assume it will continue to surprise.

At some point in the future, it will quit growing, and then start dropping.

But it has literally saved our bacon. I have kids, nieces and nephews and I sincerely hope shale holds up long enough to get us to the energy transition where we just don’t need as much oil.

Listened to Mike Wirth on Bloomberg this evening and he kept hitting on the term discipline when discussing upstream industry CAPEX. Music to my ears.

Awful lot of undrilled territory offshore and in Africa, etc. Is there anything there? So very hard to put an ultimate recovery number out there. Plus technology, ultimate is a long time. Now we say 3000 gigabarrels. But in 50 years, that is possibly ultimate too. 50 years and $500 per barrel. What do we find? What do we recover? I think about the peace river area. Baytex and Obsidian are recovering cold flow heavy oil…..they are getting 6% of OOIP.

IN 50 years is that remaining 94% still going to be there? Or will some form of thermal or solvent recovery get 50%? Ultimate is a verylong time.

C185

$500.00 oil isn’t possible because it’s unaffordable. Unless of course minimum wage goes to $150.00 per hour.

To illustrate dewatering coal mines in the UK in the 1800s was done with coal fired steam powered pumps. Essentially the energy was free in that it never left the mine and entered the coal market so it was not a cost on the mines balance sheet. However eventually all those Victorian mines were shut in because the coal energy required to run the steam pumps exceeded the market value of the surplus energy harvested at the mine and could no longer cover cost of labor which was essentially food for the miners even with a company store. The system was shut in. Not because there was no coal, there remains as much in the UK today’s ever harvested it just is no longer ore quality. Which means there is no way to mine for it from an energy perspective. And remember that includes feeding the miners.

Oil is no different only vastly more complex and much larger. However it will suffer the same effects of depletion as any mining industry has. Only quicker because of its function as the master energy source unlocks heavily depleted mineral mines and agricultural mines (ie farms) that will not be operational without oil powered equipment. That’s why we’re already seeing shortages protests bankruptcies migration and a host of other problems. Today’s $80.00 is the new $500.00 it doesn’t work.

So when we talk of $500.00 oil are we also accepting $30.00 milk? $30.00 eggs $500,000.00 -$1,000,000 cars? $150.00 minimum wage? Could that happen? That’s hyperinflation it has happened but does it keep the lights on?

Why?

JT. If your observation that higher priced oil will be left in the ground due to lack of affordability is indeed true, consider that this is reflection of the basic principle of population overshoot. Collectively, the population of the world has far overgrown what it can afford on a long time frame basis (sustained economic performance) in the absence of limited or one-time extraordinary inputs such as- affordable fossil, mechanization of labor, industrialization, debt based financing, globalization of supply chains, for example.

Can we downsize population and economic expectations in a deliberate gradual manner?

I see no recipe for that, no matter what the political or economic system.

50 years….50 years ago, 1973, crude oil was $3, on its way to todays $70. Is $500 in 50 years such a stretch? 50 years ago no one saw the wolfcamp as produceable. Certainly even Hubbert did not forsee shales producing oil. So in 50 years there will be nonew technology? Just project your curves.