A Guest Post by George Kaplan

The story here is of a gradual decline in the size and importance of most of these (once) large independents. Their combined reserves and production is not sizeable compared to the super majors and majors but their history may be indicative of what is coming the way of the larger companies. All but one of these companies is American owned. Most have or had holdings in shale or oil sands but many have sold off most of these and chosen to concentrate on a shrinking core business. There is probably a fuller picture to see if their financial performances, such as debt loads or share buy back schemes, were also considered but that’s a bigger job than I’m prepared for or capable of.

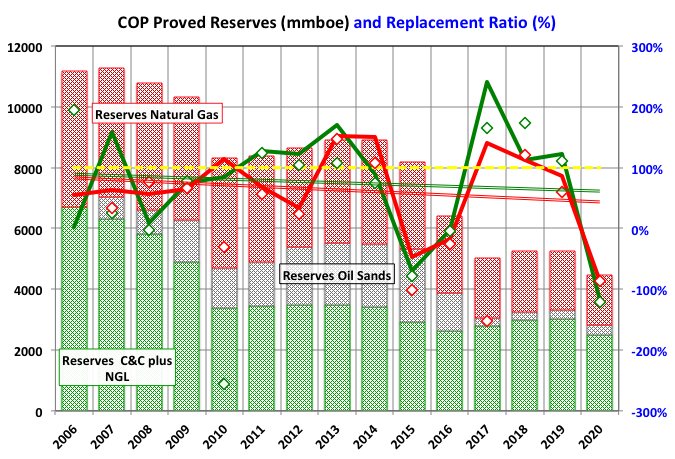

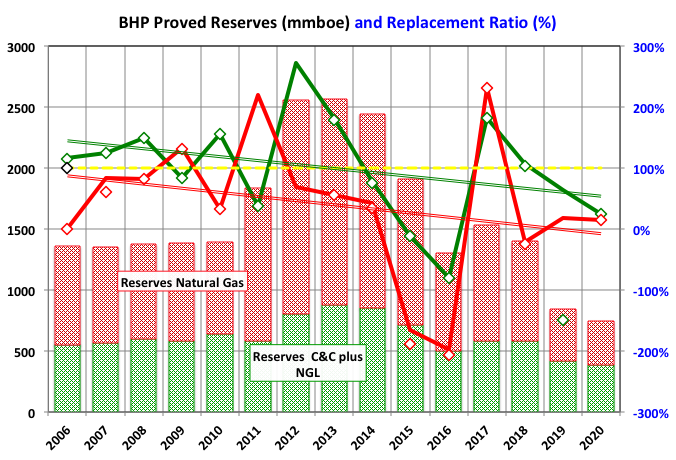

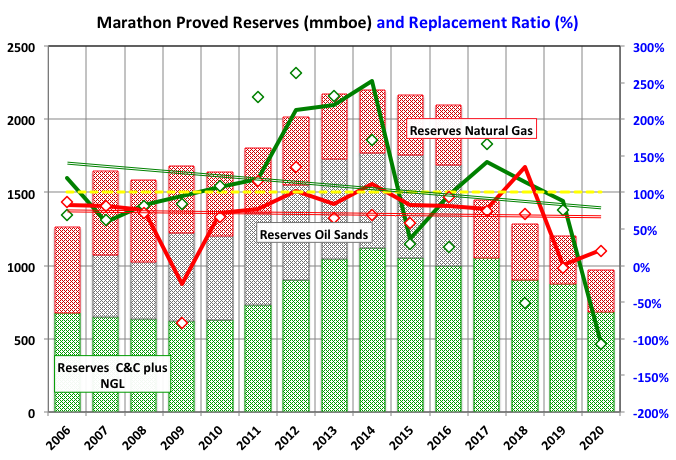

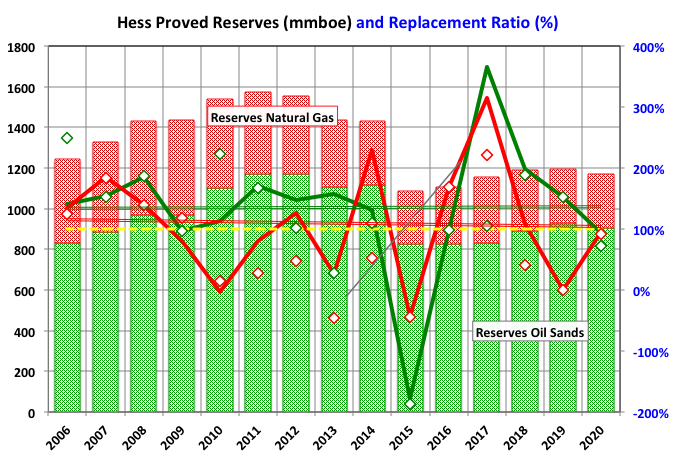

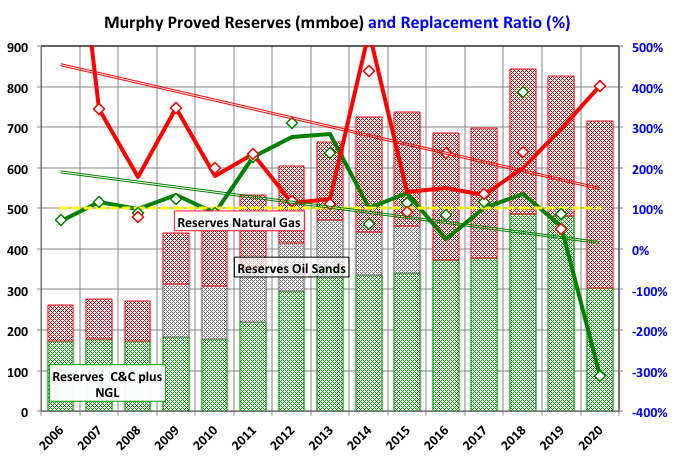

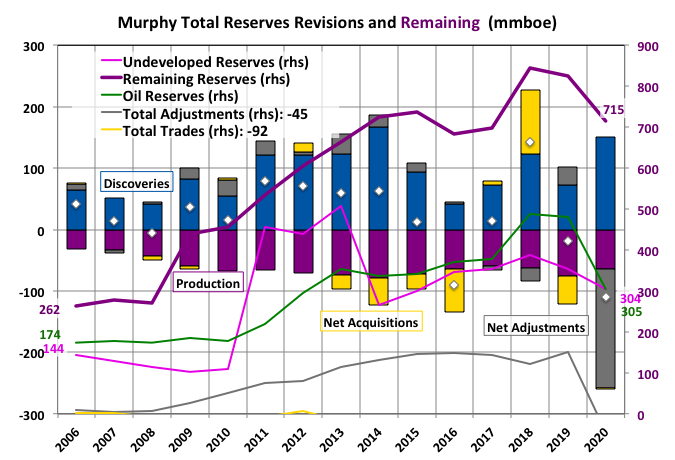

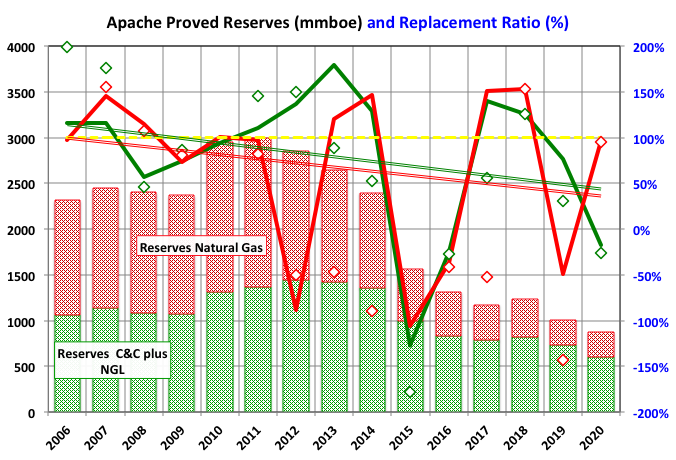

For the reserves charts the right hand axis shows liquid (green) and gas (red) replacement ratio with the organic ratios and their trend lines as solid lines and total ratios, including trades, as diamond markers.

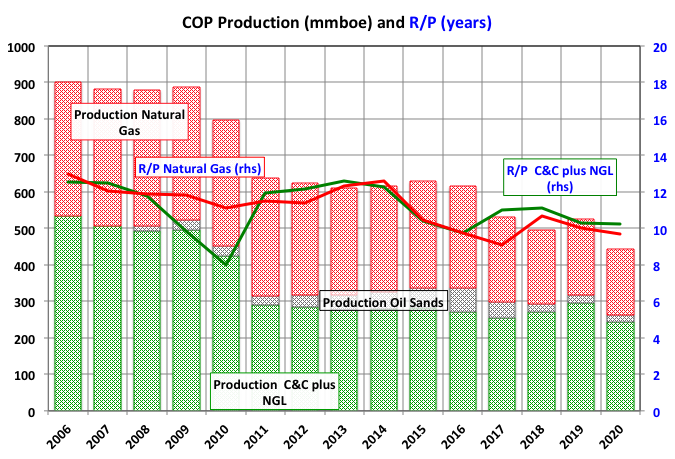

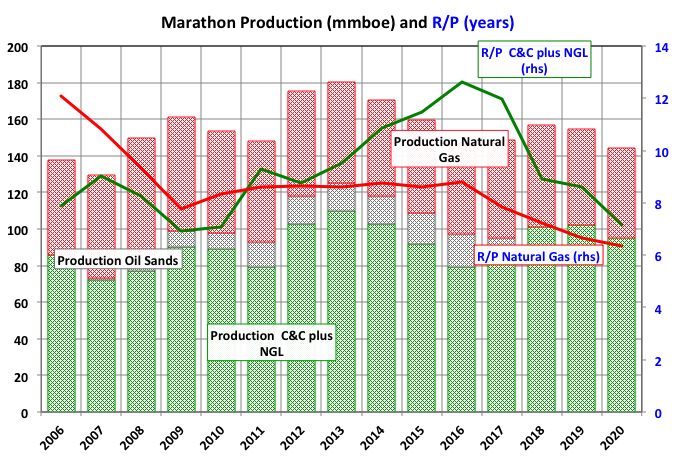

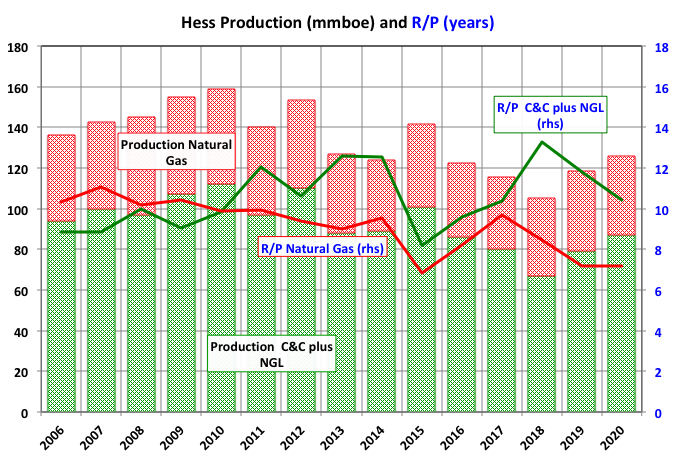

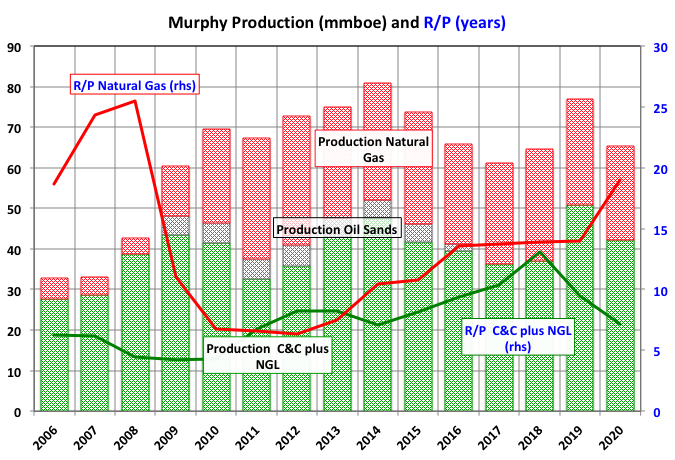

On the the production charts I have not shown R/P for the oil sands production (nor the replacement ratio on the reserves chart) as for the small producers it tends to whizz about all over the place as prices change, but see the future post on Canada and oil sands for some more details.

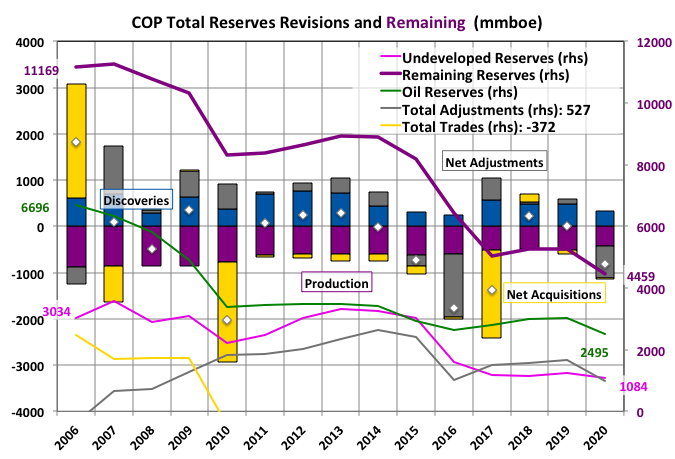

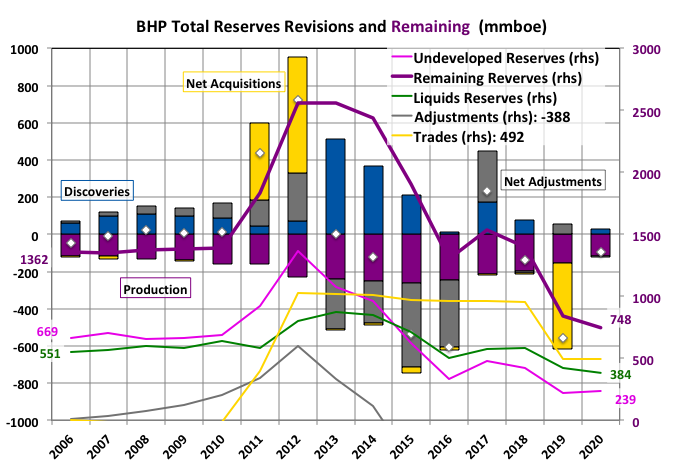

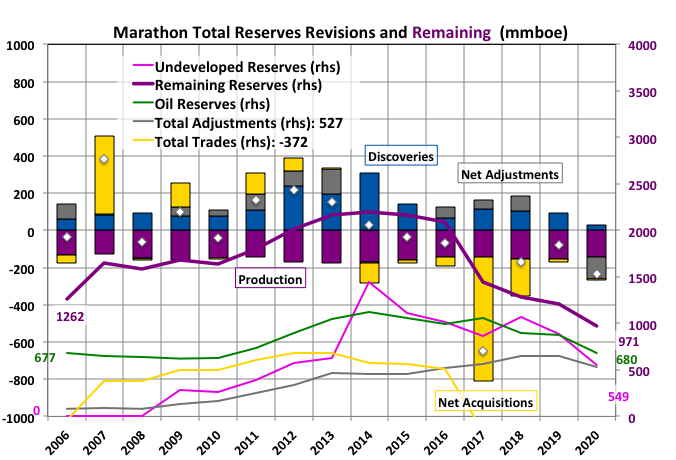

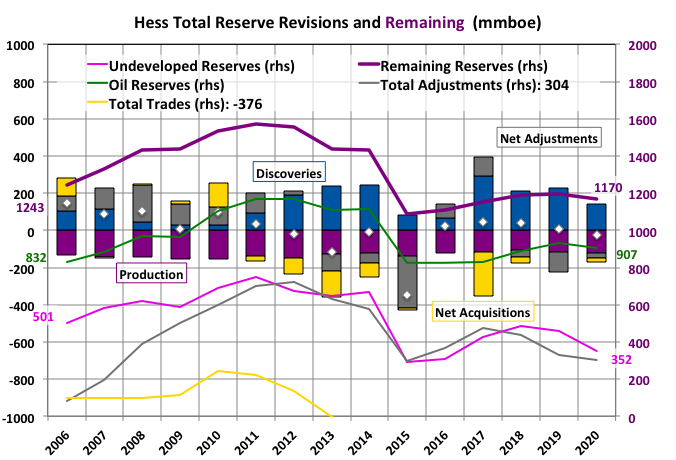

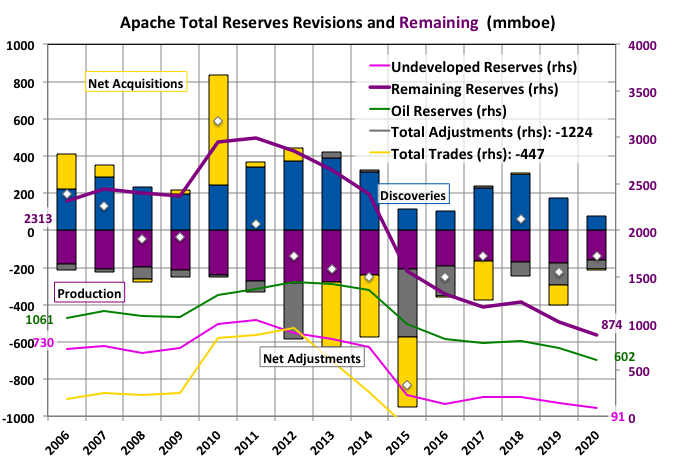

On the revision summary charts I have not shown the cumulative trades (acquisitions/dispositions) or adjustments and revisions if they go negative, as the charts are complicated enough as they are, though really colourful, which is what I mostly go for. However, in such cases, I have shown the final figure in the legend.

ConocoPhilips (COP)

In the last fifteen years, pretty much since its inception in the merger of 2002, COP has lost over half of its reserves, averaged below 100% replacement ratio (and falling) and seen production half. I don’t know when we should stop calling it a ‘large’ independent, but quite soon if these trends continue.

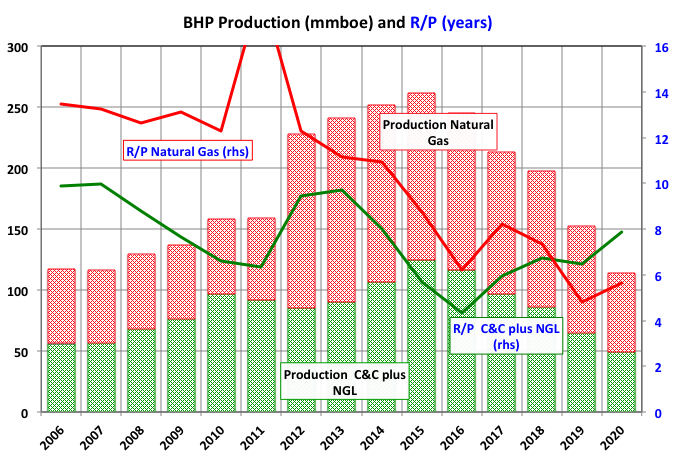

BHP (Broken Hill Proprietary)

BHP has about the fastest relative fall in reserves and production of any company. It has assets in the GoM that still have some life but if current trends continue it will be out of the oil business by 2025, which is just what some activist investors have been pushing for. It sold its shale holdings to BP in 2019, which looks like a prescient move. Note that Australian companies report annual results in August so the impact of the 2020 price drop is not wholly included.

Marathon

Marathon has managed to maintain production but reserves, and hence R/P have been dropping continuously. It sold up in the oil sands in 2016 and discoveries have dried up. I don’t think it has any particular strategy other than gradual contraction. It is a far cry from the player it was last century, and maybe not long for this world.

Hess

Hess has a strong position in Guyana through its association with ExxonMobil, but its USA shale and offshore assets are likely to be coming weaknesses and it might still be looking to sell some off to finance the Guyana developments.

Murphy

Murphy Oil is an exception in this group in that its reserve base has grown, and through discoveries rather than acquisitions. However its production has been falling, and it took a big negative hit last year, which was a continuation of a recent trend of accelerating falls in the reserve replacement ratios.

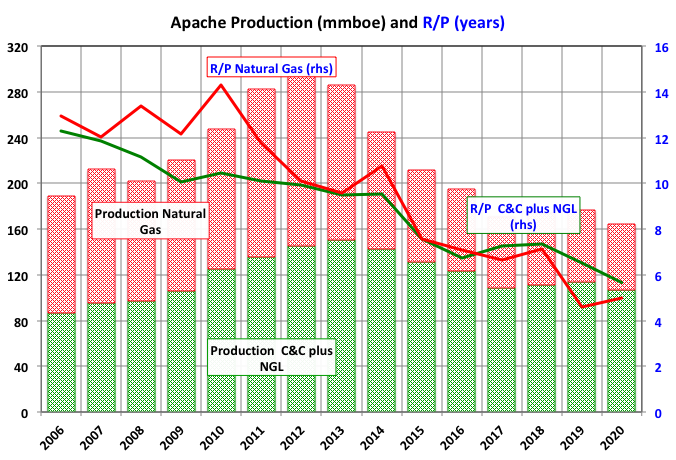

Apache

Apache is fading away and not just from a lack of discoveries and dreadful reservoir performance. It has been actively selling assets over the last decade and has few undeveloped reserves left. I doubt that it can last another five years unless someone is willing to load it with debt.

Off Topic Finish: Evening of Swing Has Been Cancelled

As it becomes more obvious that things are heading south there appear to be a few straws that the rose tinted spectacle sporters increasingly try to cling to. Mostly these come across as rather reductivist, even trite and trivial, and I don’t think they stand up to much consideration.

Probably the most cited is that humanity soon will wake up, en-masse and see (and do – not necessarily the same thing) what’s best for ‘them’, if only we can find the right message (hence god knows how many pie-in-the-sky, head-in-the-sand, thumb-in-bum, let’s-not-frighten-the-children articles, interviews and blogs). There is a strand of philosophy that similarly emphasises a kind of drive for an integrated collective wellbeing as our main goal. I don’t see evidence that this is the main driving force for our behaviour. We evolved to maximize our genetic heritance, why should someone be concerned (at least at instinctive and hormonal levels) at ensuring survival of a global population that contains none of their individual genes – and I don’t think knowing we’re all sixth or seventh cousins would make much difference. We are evolved to gain reproductive advantages however we can. Often this involves status displays, which at the moment means consumerism taking over the world even as we trash it. We are evolved for tit-for-tat response and so will sacrifice our wellbeing in order to stick it to someone else (whether for good reasons of fairness or bad ones of selfishness) or to help someone in need (let’s ignore the question of whether altruism exists only because it makes us generate some feel good hormones or sends out desirable signals, and is therefore never wholly objective). We are evolved to tolerate a certain level of psychopaths who seem disproportionally to attain positions where they can do untold damage without any guilt or feeling of responsibility – maybe they were beneficial overall in the right circumstances, e.g. war and revolution, but not so useful if the aim is to avoid those things..

People also cite the rapid response to the Covid pandemic and how we all stayed at home and reduced our fuel use, which therefore means it must be simple to fix the climate crisis (rarely mentioning the other predicaments we face) in the same way. The lockdown has not been voluntarily and was only tolerated as it was seen as temporary – actually turning into a rolling temporality with growing discontent as it progressed. Most grudgingly accepted it initially, but not voluntarily, fewer as time went on and, with rare exceptions, just wanted (still want at the time of writing in mid May) things to go back as they were or more so, forgetting the unpleasant things that the lockdown had eased such as pollution and having to meet your workmates in person, and eager to unleash a debt fuelled rebound in environmental trashing. Anyway this is often cherry picking particular aspects: it was not particularly successful by some measures – it flattened the curve as intended, but didn’t prevent the second, third and fourth waves and might have promoted the generation of new strains; and it showed up many of our vulnerabilities and fragilities.

The fall of communism is another sometimes cited example of how fast change can happen, but to me shows the exact opposite: it took forty years of cold war pressure from the most powerful alliance ever seen, on a system in which most of the population were already in favour of change, and even then it needed a couple of happy accidents to kick things off.

The overpopulation problem is either ignored or addressed by the argument that if all women are educated correctly then birth rates will fall, which is undoubtedly correct but is now starting to sound trite. Really women should be allowed to be educated, just as men, as an end in itself not just because ‘we’ have decided it would be a good thing for the planet. For either gender the number of immediate descendants is inversely correlated to education level, with PhDs having the fewest – should we therefore commit to seven years tertiary education for everyone to save the planet? That’s not going to happen so what level do ‘we’ decide is adequate?

Leaving that aside, this hope concerning population limitation has some issues. Historically, although Iran may have been an exception, it has taken two generations to make a demographic transition so that birth rates decline after death rates have fallen. And it is within those two generations where the large bulge in population growth occurs, and is typically sustained. There may be a decline slow in native populations, but is often maintained through migration, Japan being an obvious exception. We need solutions in terms of a decade or two not two or three generations.

Wealth creation has been the actual ultimate cause, women’s education is a consequence of this just as improved health and longevity are, although it is difficult to completely separate causes from correlations. A full solution doesn’t rely just on education; women must be given empowerment throughout society, not just the right to learn. Additionally any and all methods of birth control, including abortion, need to be freely available, plus some minimum form of social security so that a reasonable old age can be expected without relying entirely on family support. Although it is wrapped up in convoluted religious claptrap and right to life arguments (sidelining any acknowledgement of women’s rights) I think opposition to birth control comes down to a simple evolutionary one: babies have the fathers genes to pass on, the mother doesn’t. It is more apparent with abortion because the chance that a fetus is going to reach reproductive age is much higher than that of an egg-sperm pair on their first blind date. Even if successfully introduced, and there’s not much to show since Bush junior stopped the targeted US international programs as soon as he was elected, such initiatives will be some of the earliest to be expunged if and when societal collapse really gets rolling.

Part of the added choice that education allows is that of expending more resources on ensuring that a greater proportion of offspring survive to reproductive age. Therefore overall consumption of the resultant smaller population would increase on a per-capita basis and probably overall too. More importantly women are only half of the equation, certain men (and more so in times of hardship) will choose the easy option of having as many descendants as possible so that, even if fewer survive overall as a result, their proportion in the remaining population still increases. Denial of women’s rights, however covert and tacit, fits right in with this strategy.

As if by common consent the developed world doesn’t mention overpopulation and the undeveloped world keeps quiet about overconsumption, which is often dismissed as the easiest problem for us to solve, almost not worthy of discussion. Conspicuous consumption is partly fitness and status signaling as an aspect of sexual selection. In this context for the less viable partners, i.e. the poorer, such signalling must come at a higher relative cost to the signaller to be reliable – it then indicates fitness despite a handicap. For the wealthier it just says ‘look at me’. Either way the more conspicuously consumptive the better. Therefore the fact that ‘we don’t need all this stuff’ is the whole point of having it, even, or maybe especially, for the least well off. A peacock without a flashy tail would have a less fraught and longer life, however completely sexless (but maybe he could take-up a nice hobby) and without any direct descendants. Trying to deliberately alter inherent behaviour such as this, however quickly or slowly, is a the errand of a fool (or extreme narcissist). What can quickly change is how the consumption is represented, e.g. a possible move from goods to experiences at the moment, although the evidence for that still seems anecdotal to me, but to think we could direct such a change rather than watch it emerge organically, as fashions do, is arrogant idiocy.

Runaway consumerism in the last couple of generations is the result of this drive being coupled with continuous energy surplus and an advertising machine that has figured out all the best ways of manipulation whilst being presented with the perfect platforms for their deployment in the Internet and social media. Of course it’s a lot more complicated than this with effects from support for descendants, dominance signalling, conflict resolution, self-image issues, intuitive fitness, cheating, exaptation etc., probably more so than we will ever be able to discover, which is one reason why all the reductive, sound bite, ‘we know best’ solutions have no chance of working as they are proposed.

A particularly risible expression of optimism is that we can evolve culturally quickly and change our stance on these problems with a neat pirouette or two. As well as having some troubling social Darwinism overtones this is just wrong. Superficial things like fashions might change relatively quickly but deep behaviours and attitudes don’t. Short of violent revolutions, which always leave the majority worse off initially, established institutions, customs and social norms change glacially slowly (actually slower now that all the glaciers have accelerated so much). A particular impediment is when out-group cooperation is required, possibly the most important aspect for addressing our various quandaries. As with most things social media and the Internet will have opposite effects to those expected or hoped for and will promote groupthink over individual enterprise, further entrench set ideas, and stultify any routes to progress. As we get further from our environment of evolutionary adaption as extended, egalitarian family groups of hunter-gatherers and occasional farmers it should be less of a surprise that our personal and collective responses become unpredictable and contrary. All of which is irrelevant in current situation because, even if we can change our attitudes rapidly, there’s nothing to be done in the time available. Our starting point and momentum along a BAU trajectory are too much to overcome.

Rarely do any of the silver bullet answers ever mention possible obstacles such as the actions of bad actors seeking short-term personal gains. The actions of the various denier groups has shown that even if reality cannot be avoided for ever its recognition can be severely delayed. In our recent civilisation sweet spot malevolent forces could be somewhat accommodated within the growth paradigm without doing too much immediate, relative damage – psychopaths as CEOs for instance – or controlled by state agency. As things breakdown those avenues will be hampered and the bad actors will have bigger detrimental impacts, as I think we’ve been seeing for at least ten years, but possibly as far as back to the financialisation manias of the eighties. Implementation of globally beneficial changes will be ever more problematic.

The ultimate hope is geo-engineering. We can evidently alter the climate without trying but to think we can steward it is the ultimate hubris. I think if we try climate engineering, which we undoubtedly will once the trillion dollars of East Coast beach front getaways start going under, then we deserve everything we get.

To a first approximation energy use in extraction processes is inversely proportional to the original concentration, so that handling 400ppm concentrations would take a couple of orders of magnitude moew energy or more and/or more processing equipment than 4%. Hence scrubbing CO2 from the atmosphere is extremely energy and resource intense even if it could be made to work. It’s why so much of the earth has to be covered in forests and the oceans teeming with plankton, even given the huge amount of energy we get from the sun, just to maintain the previous balance we had, still less make up for our profligacy. If fossil fuels power the extraction it is kind of self-defeating, if renewables then we’ll need twice as much or more ‘stuff’ as we otherwise would (and all those open cast copper mines, tailings run offs, illegal Coltan diggings needed to supply the raw materials, assuming enough even exists, are oh so aesthetically pleasing and HSE friendly – not, except in Edward Burtynsky photographs).

> should we therefore commit to seven years tertiary education for everyone to save the planet?

Ignoring the hyperbole, this raises an interesting question: In light of the steady increase in labor productivity, what will people do all day when they are no longer needed on the assembly line, or sitting behind the wheel of a truck? Maybe education isn’t as much an imposition and a waste of time and resources as you imply.

I did not imply education is an imposition or a waste, what i said was it can’t and won’t be used primarily as a primary means of population control. The proportion of population that don’t go on to tertiary education (about half in UK) have no interest in education and would have left school earlier if allowed. Most that continue do so to get a qualification and improve their job prospects. The emphasis is increasingly on results rather than means. Most would prefer shorter and less debt producing routes to the same end. Some goto higher levels for he lifestyle or out of ennui, with no interest in the academic side.

Few go to university to experience education for the sake of it. Maybe more numbers than in the past but a much lower proportion. Few can afford it for one thing – there has o be at least a nominal promise that the future (discounted) rewards will exceed the near term costs. Who do you suggest pays for all this given that nobody, except the shrinking numbers of super oligarchs and kleptocrats, is going to be earning direct money in the world you seem to envisage?

You don’t get paid much and may have some crappy offices as a PhD candidate and teaching assistant but you get to play with some really expensive toys. For me it was mosttly cutting edge computing power and a huge and power hungry optical analysis machine (nowadays easily fitted in an iphone I expect, but as an aesthetic – and educational – experience I think I’d prefer what I used). I actually did most of my education just because I enjoyed it without much thought for the end result, but when it became a chore I left, mid way into the PhD. Luckily I had the choice, in your future it looks like there would no such option so you’d have students who were education slaves as well as debt slaves. A recipe for revolution, which I think would be the best outcome.

A lot of a PhD student’s time is not strictly about learning – there are teaching and admin duties, and you can get a lot of free time ( many chose to take part time jobs – not an option in your future I think, so do you propose that the candidates spend such time teaching each other unnecessary stuff that they barely understand themselves in the first place.

PhD education implies a growth based society – things have to be getting bigger and better and build on previous work. Many programs involve commercial entities and are funded for gain. It can be highly competitive – for many it is just a long term selection process for professorship, it’s not happy-clappy self-sustaining education for the sake of it, low cost, pseudo ashram. Your proposal sounds even less like that and more like some forceable re-education camps in communist China.

Huh? I don’t recall proposing anything.

As the Auschwitz Museum pointed out to Marjorie Taylor Greene, comparing anything you don’t like to totalitarianism is a “sad symptom of moral and intellectual decline.” It also disrespects the victims. If that’s all you can come up with then fine.

Anyway, tertiary education isn’t the solution to high birth rates, primary education is.

https://ourworldindata.org/grapher/womens-educational-attainment-vs-fertility

That would be my proposal. I’m Looking forward to over-the-top condemnations of the evils of teaching children to read and write.

If primary education is mandatory- at least a government prescribed curriculum- then it’s, in a sense, ideological and/or intellectual kidnapping of children.

Parents do not need rationalizations on how and what their children are to be taught.

For a little foundational mortar to what I am talking about I would suggest that we consider what has been in the news lately from Canada WRT a boarding school in Kamloops British Columbia.

Thanks George,

Both stimulating and illuminating.

I know this is the oil thread, but in response to the off topic rant I would like to say that there are two very low cost reversible contraception methods available. One for men and one for women:

For women, the sympto-thermal method (my daughter is a big fan):

https://www.factsaboutfertility.org/wp-content/uploads/2014/09/SymptoThermalPEH.pdf

For men I only know of a French website:

http://boulocho.free.fr/

“boulocho” has the same French pronunciation as “boules au chaud” which roughly means “warm balls”. This method of contraception consists of wearing underwear designed to keep testicles warm enough to kill sperm. The design is simple enough that with minor sowing skills one can transform standard underwear into sperm killers.

Both methods of contraception require investment of time rather than money. My daughter claims that the time investment for women in the sympto-thermal method is both rewarding and empowering because of the self awareness acquired.

Preferable to bouloblur anyway.

Biden Admin proposing elimination of IDC expensing and percentage depletion, among other tax preferences.

Elimination of IDC expensing will affect US shale.

Percentage depletion only affects small producers. We can make it without percentage depletion. Will just result in us paying more income tax. But lower 48 onshore conventional production in US is below 2 million barrels per day and slowly falling. Hopefully we will be permitted to continue to produce oil for the many uses of it besides light transport.

As long as Biden doesn’t try to sell these as “Big Oil Tax breaks” I’m not going to complain.

I think elimination of these tax preference items will lower US production, which will increase oil prices. US is historically the only major producer that has desired low oil prices. That is because we are still a net importer of crude oil.

Now that Trump is gone, it appears US also is not too concerned about oil prices.

What a turnaround from this time, last year. We had just reactivated our wells at the end of May, 2020, after oil had went negative on April 20.

Yesterday WTI closed around $69.50.

President Biden could turn out to be very good for small conventional lower 48 onshore producers. He just needs to recognize that our oil is still needed, and will still be needed for decades.

I will keep beating my drum. Stripper well oil is small footprint. Existing source. Very low methane emissions from upstream operations. Employs the highest number of persons per BO. Employs largely rural populace. Owned by small business. Family owned. Pays a lot in local taxes. Is very low decline. Predictable. Uses the smallest amount of materials, such as plastics and steel. I can go on, but won’t.

Stripper well doesn’t need “tax breaks” either, if it is afforded a strong, stable oil price. In my view, $60-70 WTI won’t kill the consumer.

But, I heard on Bloomberg radio yesterday that the Reddit investors are beginning to pour into oil and grains. So, worried about volatility.

Only about 1/5-1/6 of voters in the very rural counties (25K or less in population) votes for Biden. Yet his policies appear to be a boon for those populations.

Here’s to $5+ corn, $14+ soybeans, $6+ wheat, $6+ milo and $65+ WTI! Keeping prices there would really solidify a part of the US that is really struggling.

I suspect I might be the only person still posting here that lives in an oil and grain producing region. There just aren’t many of us left.

Labor will be our huge problem. Maybe strong and stable commodity prices could bring some people back, or keep some of our young people here?

Thank goodness for the people from Mexico and Central America. Without them, rural USA would be in really big trouble.

Thanks Shallow sand,

I appreciate your perspective and think there are very few here that do not feel the same way.

Dennis.

I will add, if rural is in big trouble, I believe the entire USA is in big trouble.

I have never seen the labor shortages that I am seeing today in my community.

I know there are many efforts to radically change how our country’s food supply is produced. But, like energy transition, those will take decades.

It is not attractive to most to live in rural locations. Very, very difficult psychological and emotional transition for those that try to move from urban/suburban to rural. I have seen it first hand. We cannot keep doctors for that reason, for example. There are almost no attorneys here under the age of 60. Management of our factories has mostly been moved, because it can be due to technology, and because management doesn’t want to live here.

Most in the factories here are being hired in at $16-19 per hour, and will be over $20 soon after. Most work at least 10 hours of overtime a week.

But we have a very high percentage of young adults in the rural areas struggling with hard drug dependency. Meth is the big one, and it is easier for a 20 year old to get meth than to get a beer in most rural areas.

Our country needs to do so much better across the board on hard drug dependency. One of the many reasons being to fill all of these job openings. Of course, there are more important ones than that.

I bet if hard drug dependency was completely eliminated, over 90% of child abuse and neglect court cases would also be wiped out. That is the most important reason we need to do better.

I think that a great part of the trouble you are observing is due to the scarceness of population associated with extended farms. In my corner of France, a wealthy organic farmer has 50 ha and is working hard with his wife to sell on markets crude products (legumes, chicken and parts of it, eggs) and elaborated products (flour, bread, oil, pates…). They are selling them on two public markets, one in my town (4500 inhabitants, 5 kms from their farm) and in an other (30.000 inhabitants, 20 kms from thei farm). I think the lack of middle-sized towns and of the associated market of urban inhabitants is the origine of the lack available people to carry out the different fonctions which would be needed to attract people. And of course, there is a lack of public will to organise the management of your territory. We have a lot of them : sradedet, scot, plu, pdu…

1) their farm

2)We have a lot of territorial management plan : Sraddet (Schéma Régional d’Aménagement, de Développement Durable et d’Égalité des Territoires) whose general goals are fixed by the law, the SCOT (Schéma de COhérence Territoriale), the PLU (Plan Local d’Urbanisme), the PDU (Plan de Déplacement Urbain). The regions have also to establish a SRCAE (Schéma Régional Climat Air Energie) and the departement under have a PCAET (Plan Climat Air Energie Territorial) to establish along the paths of the SRCAE. These two components are designed for the fight against the climate change and are part of the strategy of the French government in this respect. The goal of all this is to make live the different territories and this is a concern for French state.

With respect to drug problems, I recommend Johan Hari: Chasing the Scream. If you don’t have time to read the book, watch the Ted Talk:

https://www.ted.com/talks/johann_hari_everything_you_think_you_know_about_addiction_is_wrong

Actually we know how to solve drug problems. Iceland did it. They went from the European country with the highest adolescent drug abuse rate to the European country with the lowest in 20 years. First you have to understand addiction, as Hari says, it’s more about social bonding and trauma than chemical dependency. Then you just use common sense. The war on drugs is probably the best way to make drug problems endemic in society. See

https://mosaicscience.com/story/iceland-prevent-teen-substance-abuse/

Portugal’s decriminalization of drugs has also been very positive. They are not interested in going back to the war on drugs.

Be wary of Hari’s oft cited work: https://slatestarcodex.com/2017/10/25/against-rat-park/

I did not know about the controversy surrounding rat park.

However understanding drug addiction goes beyond one experiment. Data based policy is always better. Data indicates that the war on drugs has been a phenomenal failure and there is no reason to expect it will become more effective in the future. Iceland used data to reduce their drug abuse problem. They had addicts fill out surveys. In 20 years they changed the culture from a drug culture to one in which human connections did not use drugs. An abused child has a 400% greater chance of becoming an addict later in life than a child who has not been abused.

Dr. Goran Maté has done a lot of work with addiction. See

https://bioneers.org/dr-gabor-mate-toxic-culture-bioneers/

A film is being released next week on his work:

https://thewisdomoftrauma.com/

I agree. I otherwise am more than happy for gov’ts to focus on working to combat social strife through data than via ideologically based solutions that ignore human behaviour. It’s more that I recall the Kurzgesagt video on YouTube that covered this topic and didn’t put as much nuance in the reading of those materials as it should.

The War on Drugs has very obviously been a foolhardy approach that caused more harm than good. And the definition of madness would be to continue to execute it.

Didn’t mean to steer the oil board to drug issues. Sorry about that. Just pointing out IMO it is one reason for labor shortages, as COVID lock down led to an increase in hard drug use in my community. As many oil service companies where I am are small businesses, many of those that are drug dependent (mostly male) wind up seeking work in the oilfield here at some point or another. This is because small businesses many times do not have stringent drug testing policies nor do they do extensive background checks. We have lost personnel to drug dependency issues several times.

One story I commonly relate. We suspected an employee was abusing meth. He went from solid worker to always late, never completing assigned tasks. Field foreman told him one day to ride with him. Field foreman drove straight to occupational health clinic. Told employee he needed to submit a urine specimen. Employee got out of the truck and took off walking down the highway. Never came back. Had to mail him his last paycheck. He has since went to prison. His daughter has since been arrested for meth possession. All a shame, good people if the drug issues were removed.

Drug dependency is a very complex problem with no easy answers. Better to be further discussed on non-oil board, if there is interest in doing so.

Shallow sand,

I am always happy to hear your comments, always worth listening to, don’t worry about which thread, if you think it is relevant, it is.

Chemotherapy

I just saw a pretty good Australian film called ‘Babyteeth’ that’s in large part about drug and social/family issues the context of a young woman with cancer.

The film examines and challenges the sociocultural hypocrisies and difficulties ostensibly inherent in the legalities of and access to assorted drugs that people in different socioeconomic strata use to cope with their assorted issues.

For example, the ‘street drug addict” is placed in context with the psychiatrist who can prescribe his own and wife’s drugs and with their daughter’s own cancer treatment.

Just to stay at the oil field – Meth addiction and overtime work goes hand in hand.

Meth and it’s derivates was the drug of the 50s in Germany during rebuilding from the war (Pervitin, Weckamin). They have been legal until the 70s.

It’s the easy way first – just take it and you can work longer. Want to drive a truck 16 hours? Just throw a few Pervitins. Side effects and addiction come later. And the unclean stuff from the black market kills people faster.

Great read – “Blitzed: Drugs in the Third Reich.” Like Oil, Fuel for War … Battlefield game-changer till it fried the troops nervous system. Burnout a factor the failure later in Russia. https://www.amazon.com/Blitzed-Drugs-Third-Norman-Ohler/dp/1328663795

Not sure what the answer is on drugs.

Better opportunity, better education, perhaps medical care for all as in most developed nations (which I assume includes drug rehab) might be solutions.

The pandemic has put a lot of stress on society and may have increased drug abuse, perhaps as the pandemic recedes things may improve.

Unclear. Have things become much worse of late as far as labor shortage.

Sometimes an increase in wages could lead to people moving to the area.

Some like rural life, some do not.

I live in Oregon, which all drugs are legal in small amounts.

Addiction has not increased. I’m continually finding things I didn’t know I have which makes this law very good.

Don’t even drink alcohol now——–

https://apnews.com/article/oregon-decriminalize-drug-possession-6843f93c3d55212e0ffbdd8b93be9196

“Today, the first domino of our cruel and inhumane war on drugs has fallen, setting off what we expect to be a cascade of other efforts centering health over criminalization”

Thank you, SS, from a UK reader who works in the O&G engineering business.

Your posts are very informative. Worrying, and with the colour of local knowledge.

Common sense has gone adrift, along with even short-term stability.

“Thank goodness for the people from Mexico and Central America. Without them, rural USA would be in really big trouble.”

Yes, and it is a very important thing to publicly acknowledge.

I raise the possible future scenario where certain countries will be competing for immigrants, actively recruiting and incentivizing them.

Mr Kaplan , your off topic is above my pay scale so no comment . On the oil companies ,would it be safe for me to say that ” they are skating on thin ice ” . Tks for your work which complements your last post on the ” minnows” . All add to our knowledge about “peak oil” . Merci .

Exxon already making changes.

https://www.bloomberg.com/news/articles/2021-05-31/exxon-exits-oil-exploration-prospect-in-ghana-after-seismic-work?sref=0zdlLqkP

Saudi Arabia Says It is No Longer An Oil Producing Country

When Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman announced that Saudi Arabia was no longer an oil-producing country, he likely didn’t mean literally.

“Saudi Arabia is no longer an oil country, it’s an energy-producing country,” the Energy Minister told S&P Global Platts this week.

Saudi Arabia has high green ambitions that include gas production, renewables, and hydrogen.

“I urge the world to accept this as a reality. We are going to be winners of all these activities.

Saudi Arabia will surely benefit from the green transition. While the Exxons, Chevrons, and Shells of the world are busy doing climate activists’ bidding in the boardroom and courtroom, NOCs–particularly in various OPEC nations–are all-too-eager to take advantage of what will surely be increased oil prices.

Already Saudi Arabia has raised its official selling price for the month of July to Asia.

But that doesn’t stop Saudi Arabia from pursuing its green ambitions–the Saudi Green Initiative–while funding those green ambitions through oil sales. Saudi Arabia plans to generate 50% of its energy from renewables by 2030, in part to reduce its dependence on oil. In 2017, renewables made up just 0.02% of the overall energy share in Saudi Arabia.

Saudi sees the handwriting on the wall. They know damn well that their high production numbers are limited, even if the rest of the world does not. I think they are actually hoping for a green transition and they hope to be a part of it. After all, what choice do they have?

” they hope to be a part of it. After all, what choice do they have?”

yes, and the same applies to us. its a matter of pace and the effort applied.

Crazy talk from the Saudis. How the hell is a completely oil dependent country, both for their income and survival in an arid desert, going to transition into renewables in just 8.5 years? Essentially it’s an admission that they’ve peaked for good,

Ron,

I have been following your posts for a while now. Thank you for sharing your knowledge.

You seem to be certain that the Saudis themselves can see the end of high production in their oil fields. I understand that all the super-giants in Saudi are very, very old and that Aramco is doing all sorts of things to keep production up and that is expected for old fields, even these super giants. However, we also haven’t seen Cantarell type field declines from the Saudi super giants yet, or rather we don’t know of any.

I can’t understand why you believe Saudis are near their maxiumum production capacity and from here on their production is going to decline (rather sharply?). Nothing that I read in Aramco’s annual report gave me that feeling. But I also understand that they will not divulge bad numbers.

In short, please can you share your views on Saudi future production and the reasons?

Many thanks

However, we also haven’t seen Cantarell type field declines from the Saudi super giants yet, or rather we don’t know of any.

Saudi announced in 2006, 15 years ago, that Abqaiq, (pronounced Abb-kay) was 74% depleted and Ghawar was almost 50% depleted; Saudi Arabia’s Strategic Energy Initiative

They claimed, in 2006, that all Saudi was only 29% depleted. But that was a blatant falsehood. Ghawar, at that time, was about 60 to 70% depleted and all Saudi was well past the 50% mark. Around 2000, Their decline rate was about 8% per year but they, around that time, initiated an enormous infill drilling program that got their decline rate down to almost 2%:

• Without “maintain potential” drilling to make up for production,

Saudi oil fields would have a natural decline rate of a hypothetical

8%. As Saudi Aramco has an extensive drilling program with a

budget running in the billions of dollars, this decline is mitigated to

a number close to 2%.

The Saudi author of this piece then confuses decline rates with depletion rates:

• These depletion rates are well below industry averages, due

primarily to enhanced recovery technologies and successful

“maintain potential” drilling operations.

What anyone should realize is that when you decrease decline rates, by pumping the oil out faster, you increase the depletion rates. They began creaming the top of their fields, staying above the rising water, about 20 years ago. Really, what the hell would one expect to be happening by now?

Saudi, in their IPO a few years ago, said production from Ghawar was 3.8 million barrels per day. For the world’s largest field, that is a Cantrell-style decline rate. Remember, the smaller the field, the faster the natural decline rate. And they have admitted that they brought old mothballed fields of Khoreis, Shaybah, and Munifa online, at massive expense, to make up for the decline in their older fields. However, they have no more mothballed fields.

I spent 5 years in Saudi and my son just retired from ARAMCO a couple of years ago after spending about 23 years there. You must understand that exaggeration is part of their way of life. They do it and they expect everyone else to do it. They will never admit that their total production is in steep decline. No, Khoreis, Shaybah, and Munifa are not in decline but their combined output is only around 2.5 million barrels per day.

Very many thanks Ron.This is super.

Saudi has also been claiming that their proven reserves of oil are about 267bn bbl for the last, what 20-30 years now, notwithstanding the 3bn bbl they take out every year! Must be magic!

Cantarell is now at a bit more than 100kbpd down from 2.2mmbpd in the early 2000s. If any of the Saudi super-giants, especially Ghawar, are following that trend, it’s going to make an impact. And it’s a question of ‘when’ rather than ‘if’.

There is also a rumour that their war in Yemen was because they wanted to get their hands on the oil in the rub al-khali because they don’t have much left within their territories. Apparently, there’s a lot of oil in the empty quarter and they don’t want to share that with Yemen.

I agree with your judgment – exaggeration is a part of their culture in much the same way that every shopkeeper there expects you to bargain because prices are also exaggerated. You can barely trust the financials of Western companies, so can’t take the Saudis at their word.

Very many thanks again for your comments. Your opinion informed by your experience is worth its weight in gold (or should I say bitcoin! :-)!

Since 2005 they have averaged producing 3.43 billion barrels per year, crude only. That comes to about 55 billion since the beginning of 2005. If you count total liquids it would be well over 60 billion.

But as you say, they have “magic oil”. For every barrel they pump out of the ground, another barrel magically appears to replace it.

Saudis are having to issue bonds to pay their dividend. I believe Exxon and some of the other majors are doing likewise. Not sure how this could possibly be a sustainable business model…

https://www.aljazeera.com/economy/2021/6/9/saudi-aramco-to-sell-6b-of-dollar-denominated-islamic-bonds

WTI Punched a $70 ticket sometime after 6:00 PM EST, June 6, 2021. The last time this happened was Oct 16, 2018, $71.92 before falling below $70 the next day.

WTI at $70 is probably still bearable. Higher numbers dramatically increase chances of the recession (actually the USA is in secular stagnation since 2008).

Today I read the EROEI of solar is around 0.8 outside of deserts. A recent paper by Ferroni and Hopkirk estimated an EROI=0.8 for PV in Switzerland. https://www.sciencedirect.com/science/article/pii/S0301421516307066

You need EROEI around 7 for the source of energy to be economically viable. Wind barely makes it, but solar, outside of deserts does not.

Another interesting figure is that the energy density ( KW/kg ) of lithium batteries is approximately 100 times less then energy density of diesel (gas has slightly lower energy density; kerosene approximately the same).

A subcompact car with a 10-gallon gas tank can store the energy equivalent of 7 Teslas, 15 Nissan Leafs or 23 Chevy Volts, according to industry sources.

” interesting figure is that the energy density ( KW/kg ) of lithium batteries is approximately 100 times less then energy density of diesel ”

but don’t forget the energy in the diesel is about 30% efficient converting into work while the battery is over 90% efficent doing work – so comparing energy “stored” in compact cars and teslas etc is either pretty useless or pretty misleading

But your post is also misleading and leaves the reader with the impression that you’re little more than an EV propagandist. Even at 30% efficiency for diesel, there is still 100/3 = 33.3x more energy available than a comparably sized lithium battery. That huge difference is far and anyway superior to anything a battery will ever do, ever. It will never be matched by any electrochemical storage scheme. So there is that.

Indeed. The advantages EVs have come from efficiency in weight reduction (aside from the battery pack) and aerodynamics, along with electric motors being super simple and efficient. But in terms of raw energy density, you cannot beat chemical fuels, and there really isn’t anything that threatens this by virtue of the chemistry.

Batteries, for all their advantages in simplicity, are never going to be lighter and more energy dense. Lithium is just about the best there is in terms of weight to energy ratio, something quite key for a moving vehicle.

Mike,

Electrical engines proved to be viable for small cars and delivery trucks with short ranges. No question about it. But that does not mean they are optimal. This is just a fashion partially fueled by people who missed their STEM classes 😉

I think natural gas is currently a viable competitor to EV and is IMHO a much better feat.

First of all charging efficiency of lithium battery is only 80%.

That’s true that electrical motor is more efficient, but when you have a transmission using multiple gears most of this difference is lost.

Also you overestimated the efficiency of the tandem lithium battery — electrical motor, as it includes converter with efficiency less then 90% and a lithium battery has its own internal resistance which increases with age and also lead to losses. 0.8*0.8*0.9=0.57. BTW modern diesel engines efficiency is about 43%-44%, based on 2013-2014 certified engines.

Moreover the efficiency of lithium battery in winter is dismal. And not only because at low temperatures is simply does not work well and its capacity is less. A lot of energy is consumed by the cabin heater. IMHO driving EV in severe winter is dangerous not withstanding short trips to nearby sky resort that some make on their Tesla 3 🙂

The average US car goes 0.74 miles on a kWh of gasoline. Many Teslas and the Hyundai Kona (among others) go 4.0 miles per kWh.

Cost per mile is $0.12 for gasoline, $0.06 for California EV, $0.03 for average EV.

Likbez.

Switzerland has poorer solar input than any place in the lower 48, even pacific northwest coastal, so its a lame site to use as a yardstick.

I know people who do 100% of their driving miles with solar from the roof, at lower cost than your miles.

And they didn’t check the EROEI figures before or after the purchase of equipment.

The solar is already paid off for them, and they’ve got 2 to 4 more decades of electricity coming from that system.

And I know people who have driven across the entire country with no liquid fuel tank-nothing for energy storage in their EV but lithium. And the acceleration of their car will pin you deep in your seat if they aren’t careful with the pedal.

Hey- look on the bright side- every mile that solar/electric vehicles travel is just another mile of gasoline left for you.

Hickory, how many of those solar panels were subsidized by government? A lot of them. And what’s more, even though early adopters charged their Teslas from those subsidized panels, did that somehow change the EREOI from 0.8? How is the rest of society going to benefit if all the early opportunists managed to get cheap cells at an artificially low price, that actually were fantastically expensive in real terms regarding the cheap energy (at the time) that was used to make them?

And so what if they drove across the country in electric power??? WTF? What does that prove? Was there actually anything productive generated by this hugely energy intensive self-interested activity? No, there was not. It was nothing more than a display of self indulgence, and an excessive one at that.

MikeS.

“The Energy Payback Time of PV systems is dependent on the geographical location: PV systems in Northern Europe need around 1.5 years to balance the input energy, while PV systems in the South equal their energy input after 1 year and less,”

https://www.ise.fraunhofer.de/content/dam/ise/de/documents/publications/studies/Photovoltaics-Report.pdf

After 25 years modern panels still have between 82-93% peak capacity output.

In regard to the feasibility of lithium batteries- I was pointing out that they work well enough (are dense enough) to get the job done. Its not a complicated idea. Likebz referenced diesel energy density. Thats very good, but in case you haven’t been keeping up- peak crude oil is upon us, so time to adapt. Past time actually.

Bottomline- both solar energy and electric vehicles are viable systems for transportation. And that is nice considering the world faces peak oil supply.

Some people would prefer to witness the countries economy crash and burn as peak oil becomes a reality. I guess they think they would make more money for the short term. Others would like to see the country gradually deploy other ways to get around.

If nothing else, this scenario will lead to a radical reshaping of how we as a species go about doing logistics. If the pandemic hasn’t called into question the application of JIT logistics for all industries, then the loss of cheap diesel certainly will. Even if long haul electric trucks become a thing, it will require a different approach to matters.

Cars are otherwise a solved issue with EVs. There’s nothing that an ICE can really offer over an EV. Trucking and heavy industry is another matter, and that’s where problems will be. Frankly, I welcome this uprooting of a paradigm that has no resilience built in whatsoever.

You are both funny and superficial.

There is no question that “electric vehicles are viable systems for transportation. ” that’s true since 1940th I think. Just think about electric trains and diesel-electric trains :-). Also as compact cars they are viable in temperate climate (Leaf, Tesla, etc) and possibly in big cities and corresponding metropolitan areas.

Like in war this is the question of strategy. Wrong strategy usually leads to defeat. I think the current EV fashion driven by people who missed their STEM classes is counterproductive and probably harmful.

It might well lead to problems in the near future. You should never put all eggs into one basket. Lightweight and emotion-driven arguments like your above just does not make the cut, if we are taking about the strategy.

Some interesting questions are

1. If we reached “plato oil” stage (I think so), then how long it will last before Seneca cliff? 10 year, 50 years, 100 years ? That’s a big difference.

2. Will we get fusion energy driven energy generation or not.

3. Will neoliberalism be replaced in the USA by some other social system, because neoliberalism (and connected with it imperial tendencies (“Full Spectrum Domination” doctrine), and the corresponding level of military expenses — money that should be allocated toward the energy transition are simply waited on maintaining and expanding of the empire) can’t reform itself and probably will drive this country off the economic cliff, or to the WWIII (with even worse results).

Delusions Made To Order:

Fossil Fuel Extenders & Morphing Narratives

Unsure about Hickory’s implied personal/anecdotal statistics there (that we should take on good faith?), but in any case, the number of instances I used to note of pseudo-renewable energies referred to as ‘fossil fuel extenders’ seem to have essentially dried up.

Maybe it’s a bit like that ‘morphing C-19 narrative’.

Over the years here at POB, we’ve argued the issue almost to death. Feel free to consult the archives… provided they haven’t been ‘conveniently’ edited of course. ‘u^

Likbez , I will make an effort to answer your 3 questions .

1. Peak oil was /is 2018 . Plateau will be 5 years . Why ? The parameter is exportable oil production and not total oil production . ELM is a bitch .

2 . Nuclear fusion . Not going to happen . It is like the horizon . We can see it but we can’t reach it .

3 . USA situation . I am least qualified to comment as I am in Europe , but still the safest is that the current political system cannot continue for long especially when I look at it with the lenses of resource availability . There are no volunteers for starvation . What will replace this ? I don’t know .

P.S :Your sentence “Like in war this is the question of strategy. Wrong strategy usually leads to defeat. ” I am going to be using this . Hope you don’t have a copyright on this . 🙂

“Igor Sechin, the head of Russian oil major Rosneft (ROSN.MM), said on Saturday the world was facing an acute oil shortage in the long-term due to underinvestment amid a drive for alternative energy, while demand for oil continued to rise.”

Indeed.

The USA government exists exactly for the purpose not to allow acute oil shortage 😉

Good luck with that

“ Saudi sees the handwriting on the wall. They know damn well that their high production numbers are limited, even if the rest of the world does not. ”

Yep. Think about it…every barrel they displace from (what I assume is) highly subsidized domestic consumption, is a “new “ barrel for export—a new revenue stream. That is, since they don’t have the reserves to meet the anticipated future OPEC call, these additional export barrels are essentially “free money” (after pay-out on the so-called renewable energy investments)… i.e., they do no defer any otherwise producible oil. Hence, expect SA to be a “world leader” in so called renewable energy…of course, done in the name of a greener world for us all. 😉

What the Saudis are saying reminds me of the name change of “Statoil” to “Equinor” in 2018. The company was to become a energy company formost, and they have done exactly that becoming very involved in offshore wind power development. And in the forefront of floating wind power at greater depths. A lot of western oil companies have stressed lately that they now try to be energy companies, not only oil/gas companies. There are a lot of things that can be done to mitigate problems due to declining oil production. When it comes to SA, they can start using natural gas from Ghawar or Qatar to replace fuel oil for power generation during especially summer. During winter they could export hydrogen based on natural gas to elsewhere (Germany? I read an agreement was reached between SA and Germany regarding hydrogen). They could also start with solar panels on roof tops combined with a batteries in e.g. electric cars to bring down the absurdly high oil consumption per capita in SA, along with trying to electrify more of the economy. And by doing this still have much oil to export for some years despite declining production. Much like we in Norway try to do, transition in high speed to an electrified economy. And thereby make it easier for both producers and importers of fossil fuels to live with a declining production.

1) About hydrogen production and solar panels, French scientists of the CEA worked out an electrolyser with a 99% energetic yield in 2014. The CEA of Grenoble established a joint-venture with Schlumberger New Energy, Vinci Construction, Vicat and the AREC Occitanie (Agence Régionale Energie Climat) called Genvia with the direction assumed by the former director of the CEA Liten. The factory will be built near Bézier and will produce the electrolysers. 2) The CEA Liten worked out HIT solar panels and the process to build them. The HIT solar panels of the CEA have the most effective yield of electricity production in this category (25%). They are in a partnership with Enel Green Power to build them in Sicilia. With these two elements, the Saudis, with their desertic lands and the abundant sunshine they have, could produce important quantities of hydrogen.

There are a lot of things that can be done to mitigate problems due to declining oil production. When it comes to SA, they can start using natural gas from Ghawar or Qatar to replace fuel oil for power generation during especially summer.

Okay, first point: Qatar has plenty of natural gas. The problem is they are in a feud with Saudi and they do not trade with each other:

Saudi Arabia, Bahrain, the United Arab Emirates and Egypt severed diplomatic ties with Qatar in mid-2017 after accusing the country of supporting terrorism. Qatar has repeatedly denied the accusations. The boycotting countries, known as the Arab quartet, also cited political differences with Qatar over Iran and the Muslim Brotherhood.

Second point: Saudi does not have nearly enough natural gas to power their own power plants and desalination plants:

Saudi Arabia wants to buy tons of American natural gas

New York CNN Business —

Saudi Arabia has placed a huge bet on American natural gas.

In a sign of shifting energy fortunes, Saudi Aramco announced a mega preliminary agreement on Wednesday to buy 5 million tons of liquefied natural gas per year from a Port Arthur, Texas export project that’s under development.

If completed, the purchase from San Diego-based Sempra Energy (SRE) would be one of the largest LNG deals ever signed, according to consulting firm Wood Mackenzie.

But this may change. Saudi is desperate for natural gas and this has led them to try to make amends with Qatar:

Arab countries agree to end years-long feud with Qatar that divided Gulf

Updated 4:08 PM ET, Tue January 5, 2021

(CNN)Saudi Arabia and its Arab allies agreed on Tuesday to restore diplomatic relations with Qatar and restart flights to and from the country, ending a three-year boycott of the tiny gas-rich nation.

Saudi Arabia, Bahrain, the United Arab Emirates and Egypt severed diplomatic ties with Qatar in mid-2017 after accusing the country of supporting terrorism. Qatar has repeatedly denied the accusations.

The boycotting countries, known as the Arab quartet, also cited political differences with Qatar over Iran and the Muslim Brotherhood. Doha, unlike its Gulf neighbors, has friendly relations with Tehran, supported the Muslim Brotherhood in Egypt and has hosted groups affiliated with the Islamist group.

Qatar’s only land border — which it shares with Saudi Arabia — was sealed shut. Boycotting countries closed their airspace to Qatar, and nearby Bahrain and the UAE closed their maritime borders to ships carrying the Qatari flag.

Fantastic Ron. Too many people practising truth by assertion and liar’s bluff / wishful thinking. They won’t change, but you persuade others whom are genuinely seeking the truth and can distinguish between evidence supported logic and security blanket speculation.

As was previously linked to on POB, (https://www.sciencedirect.com/journal/petroleum-exploration-and-development/vol/44/issue/6 , p. 1024) south Ghwar was pumping 60% water seemingly c 2008.

SA is going to end badly, as too will fever dreams that don’t realise that their electric transition is a mirage – largely it’s all fossil fuels in disguise and totally parasitic on upon the peak energy infrastructure of previous and current fossil fuel excess calories.

We may have an Electric Middle Ages (Ugo Bardi), but unless a new energy source AT LEAST as energy dense and net positive as FF is discovered like yesterday then this lovely wealth Blip we all enjoyed is going away.

“Electric Middle Ages “- use that time wisely. Lighten your load.

Second point: Saudi does not have nearly enough natural gas to power their own power plants and desalination plants. OK, why they didn’t invest money as Morocco did with their different Noor installations? The three Noor installations are producing together 1,45 TWh of electricity annualy. And when the project will be finished, the cost will be around 2,5 billions dollars.

What is Noor? Had to Google it. OK, it’s solar. Excellent. Agreed, why haven’t the Saudis done this already?

OK, why they didn’t invest money as Morocco did with their different Noor installations?

Okay, thanks to John for telling me what a Noor installation was. However, I am not a Saudi and have no idea why they do not invest in solar energy.

Here is the description of the Ouarzazate solar power station with Noor 1, Noor 2, Noor 3 and Noor 4. https://en.wikipedia.org/wiki/Ouarzazate_Solar_Power_Station

Roger that.

Thanks a lot George. I appreciate your data rich posts as well as your “off topic finish”.

All the best,

Excellent post George, as usual.

Mr. Kaplan,

Thank you for this post. This is truly astonishing when you consider that 20 years ago COP was Conoco and Phillips. 2 large integrated majors who pioneered the Deep Water Gulf of Mexico Tension Leg Platform and the North Sea, respectively.

John S

Prices for Oil have continued to rise.

From Oil price at 4 PM June 9, 2021

From Mike S , the truth and nothing but the truth .

https://www.oilystuffblog.com/single-post/zombie-fish

Peter Schiff predicts $100 WTI this year, and $150 next. Someone tell Art Berman!.

https://www.youtube.com/watch?v=OQnoQIM76YY

If he is correct, and he just might be correct, it will be because the world finally realizes that peak oil is in the rearview mirror.

Ron,

All that is needed for oil prices to increase is that demand grows faster than supply, peak oil is likely in the future rather than the past, my current expectation in 2027+/-2 for peak C plus C 12 month centered average output at a level of 85+/-1 Mb/d.

Dennis,

If oil prices go to $90 a barrel, every nation on earth will be producing flat out. Then $100, then $125, then $150? And you think that could possibly happen before we hit peak oil?

Oil prices will spike after peak oil. The glut happened when the world was producing the most oil. Why on earth would one expect higher prices at a time when every nation is producing more oil than ever before? That would far more likely be a time of a glut and low prices. Prices will see their highest spike after the peak, when supply can no longer meet demand.

Ron,

I agree the spike will likely occur after the peak, but spikes happen when at some time (call it t) demand is greater than supply ay some lower price ( call it p). Whether the output of crude plus condensate is at its maximum level (over a sustained period like the 12 month average) at time=t is a separate question. That might occur during a period of low prices (a glut of oil supply) or high oil prices (where there is a shortage of oil supply that is inadequate for demand at a lower oil price).

The 2018 peak in C plus C output (the centered 12 month average output) peak of 83157 kb/d in November 2018 will likely be surpassed by 2024 with a smaller chance this might occur by as early as 2023 or as late as 2025. I would put the chances that World output of C plus C (centered 12 month average) will be greater than 83157 kb/d by December of 2025 at greater than 3 in 4 and roughly even odds that it a new peak (again defined as centered 12 month average) in C plus C will occur by July 2024.

Dennis,

I have thoroughly analyzed world production over the last few years. 40% of world oil production is produced by the USA, Saudi Arabia, and Russia. I believe all three of these countries have peaked. The other 60% is produced by countries other than these three declined by over two million barrels per day before the pandemic.

Nuff said.

I have also analyzed World production over the past 15 years or so, and come to a different conclusion. World output of crude plus condensate is likely to peak in the 2025 to 2030 time frame, I would put the odd that 2018 will be the peak when we look back in 2030 as less than 1 in 10 odds.

Time will tell, as always.

Ron,

Where did you get the data for your chart below -world ex-US, Russia and Saudi? It would be great to get hold of the data. Thanks!

It seems that this group was already 2mmbpd below its undulating peak before the pandemic struck – the result of both depletion/lack of exploration success and the general reduction in O&G capex since 2015. Future prospects for this group in terms of oil production look bleak for the same set of reasons (a) no exploration success/exploration budget, and (b) even more cuts in development and maintenance capex after the pandemic.

I believe at most, this group of countries can produce at a level 2mmbpd below pre-pandemic levels which is 4mmbpd below its peak in 2017/18. When this group’s production declined by 2mmbpd, it was more than made up by US Shale. Shale also also contributed another 2mmbpd in demand increase over the same period.

Now Shale’s ability to offset supply declines from the rest of the world (ex-US, Rus, Saudi) is shot to pieces. I doubt it will even offset it’s own decline and go back to Nov-19 levels. As Harold Hamm commented “shale has drilled the heart out of the watermelon”.

Dennis, you talk of a peak in 2025-30, where will all this oil come from? Surely not from exploration success over the last 15 years because that has been sorta absent. Russia has been clear about its lack of potential supply growth. Iran, Iraq (a bit doubtful) and UAE – yes there will be some growth but not enough to offset the declines from this group and shale – even if you don’t believe in further demand growth (which I do). If you believe all this is going to come from the Saudis, you surely believe them more than Ron and I do.

Please can you split out the sources of additional supply in your model? It will help all of us understand where you are coming from.

For a new oil peak to occur so much must go right it’s almost like flipping a nickel and having it land on its side. Political instability in producing countries must remain subdued (Nigeria, Iraq, etc); tight oil has to ramp all the way back up with the attendant batch of financial suckers willing to toss their money in a hole in the ground; Saudis/Russians must not be past peak; no new pandemics or financial crises or random wars in the Middle East; etc.

Is it possible? Maybe. Is it likely? No it is not.

To elaborate a bit, think of peak oil in actuarial terms. Will the patient still be alive in year x, say 2028. Then assign reasonable odds to each of the factors that might lead to death, and tally them up. So, for instance, over the next seven years, will Iraq still be a coherent state? Say you think there’s a 97% chance, or 0.97. Make a list of all the things that could cause another peak in oil from happening again, and assign them a probability. Then multiple all the probabilities together and see if you think the patient will still be alive. It’s all guesswork of course, but at least it allows a framework for thinking about whether or not it’s reasonable to assume there will be another peak in output, as Dennis insists. I think you’ll find that you have to make A LOT of rosy assumptions to your predictions in order to get a better than 50% chance that there will be a new peak (i.e., the patient will still be alive later this decade).

Where did you get the data for your chart below -world ex-US, Russia and Saudi? It would be great to get hold of the data. Thanks!

Go here: https://www.eia.gov/international/overview/world?src=

Then click: Data

Then click: Petroleum and Other Liquids

Then click: Monthly petroleum and other liquids production

That will get you the last five months in windows format. To get the data all the way back to the early 70s, mouse over: Download Options. Then I click on: Export CVS (table). That will download the data to Excel. But you must then save it as an “Excel Workbook” or it will be jibberish the next time you open the file.

If you don’t have Excel then I think it will still open in “read-only” format. Or you can try one of the other two formats offered. I have no idea what that will get you.

We can all think of many reasons why producing countries may fail to keep oil levels up this decade.

There is one big reason why many could have an incentive to go all out on production-

and that is higher price, of course.

I wouldn’t be surprised to see price well over $100 in the next few years.

Then we will get the real test of productive capacity (with Iran policy being the biggest unknown).

A question will remain- how high, and how long will oil prices have go up, in order to spur new basin development, and exploration, exploration attempts?

Many, many thanks Ron!

Much appreciated!

Not sure if this is Peter Schiff, but the site below also expects high future oil prices.

https://longforecast.com/oil-price-today-forecast-2017-2018-2019-2020-2021-brent-wti

Saudi Arabia And Russia Warn Of Major Oil Supply Crunch

Environmentalists and activist shareholders intensified pressure on large public oil firms to align their businesses with a net-zero scenario, while some of the international majors acknowledged they have a part to play in the energy transition.

But the leaders of the OPEC+ group, Saudi Arabia and Russia, will continue to invest in oil and gas because, they say, the world will still need those resources for decades, despite the growing push against fossil fuels and investment in new supply.

Chronic underinvestment in oil and gas supply while operational oilfields mature would lead to a supply crunch and a spike in oil prices down the road, analysts and Big Oil top executives such as TotalEnergies’ Patrick Pouyanné say.

Appologies if this has already been posted.

From your link: BP’s chief executive Bernard Looney wrote that forecasts of much lower investments in oil and gas were “in many ways consistent with our approach – to reduce our oil and gas production by 40% in the next decade.

Snip.

In Russia, the chief executive of the largest Russian oil producer, state-controlled Rosneft, warned that underinvestment in oil is setting the stage for a severe deficit in supply.

Yes, oil production will be falling and oil prices will be rising. Anyone with half a brain can see that. But it will have to happen before the world will be able to see what is right now as plain as the nose on their face. Their worldview keeps them from seeing the very blatantly obvious. Ideology will obviously alwayse trump common sense.

It’s looking more and more like peak oil is here right now.

Nah, peak oil was in 2018.

I am hoping that peak oil becomes a low price event as predicted by Schinzy and the actuary lady rather than a high price event as seems to be expected by accepted economic theory. Lower prices would be a lower impact event and would do less immediate damage to the the environment than a high price engendered feeding frenzy. Given the apparent direct link from oil prices to food prices to social unrest I would prefer to see some pension plans downgraded (admittedly not mine anymore as I disinvested some years ago) and the rich west having not quite as long, expansive and conspicuously consumptive retirement years (do bucket lists really matter other than a status check off, and are 3 or 4 extra years of dementia addled living really worth it?) rather than pictures of children with swollen stomachs, fear filled eyes and fly blown faces; or those rows of tiny body bags that photographers really like to capture.

George, peak oil is in the past and it was a low-priced event. I was not aware that economic theory predicted peak oil to be a high-priced event. The point is no one realizes, or did realize, that the peak had been reached. High prices only happen when there is a scarcity of oil. At the peak, it is far more likely that there will be a glut of oil, as it was.

“Ideology will obviously alwayse trump common sense.“

So true ;).

On 05/07/21 the US 10year chart formed a hammer candlestick on daily chart within a consolidation pattern. Which suggested higher yields coming. Well little over a month later price broke below the bottom of that candlestick which suggest that the bond market doesn’t believe the inflation we have seen is here to stay. Yield headed lower.

The inflation we have had seems to be supply side due to covid. If inflation is at peak which bond market is suggesting. Oil price might not have much more room to run higher. And I’d take it a step further and say price inflation due to a weaker dollar is starting to real hurt places like China and they are going to act by tightening monetary policy. You think this would be positive for the yuan and push the dollar even lower. But when you tightening monetary policy credit contracts and economic activity contracts.

I do expect oil price to rollover and head back to $50-$55 might happen from a slightly higher price from here because of lag time between when bond market signals rollover in inflation back into deflation and when prices start reacting to this.

This isn’t your history bond market.

Inflation doesn’t really matters, what only matters is the one big question: “How much bonds does the one market member with unlimited funds buy?”.

And the time the FED was able to rise more than .25% is in the rear mirror – when they hike now, inflation or not, all these zombie companies and zombie banks will fail and no lawyer in the world will be able to clean up the chaos after all these insolvency filings.

They have to talk the way out of this inflation. They have to talk until it stops, or longer. They can’t hike. They can perhaps hike again when most of the debt is inflated away – a period with 10+% inflation and 1% bond interrest.

And yes, they can buy litterally any bond dumped onto the market – shown this in March last year when they stopped the corona crash in an action of one week.

I think most non-investment-banks are zombies at the moment, and more than 20% of all companies. They all will fail in less than 1 year when we would have realistic interrest rates. On the dirty end, this would mean 10%+ for all this junk out there – even mighty EXXON will be downgraded to B fast.

In old times the FED rates would be more than 5% now with these inflation numbers. Nobody can pay this these days.

And now in the USA – look for how much social justice and social security laws you’ll get. The FED has to provide cover for all of them.

We in Europe will do this, too. New green deal, new CO2 taxes, better social security – the ECB already has said they will swallow everything dumped on the market.

So, oil 100$ the next years – but some kind of strange dollars buying less then they used to.

Just my 2 cents.

Eulen , your 2cents = 1 Dollar . Everything you say is correct . Weird is the only word for what is happening in the financial world . I was in my first year of college when Paul Volcker hiked interest rates into double digits so I have a benchmark to measure against . This is not going to end well . Take care .

From

https://longforecast.com/oil-price-today-forecast-2017-2018-2019-2020-2021-brent-wti

better resolution at link above, a very different oil price forecast from HHH. Over $100/bo for Brent by the end of 2021.

This is nonsense. They have Brent crude oil prices peaking, so far, in March 2025 at $164.11. And they have WTI peaking the same month at $132.55, $32.56 lower. There is no way the spread could be that large. Also, they have natural gas prices dropping over the same period. Just who the hell are these “Longforcast.com” people?

Disregard anything with “forecast” in the title. They don’t have a time machine, and extrapolation is a horrible metric with dynamic markets as complex as the energy ones.

Might as well show me the tea leaves or goat entrails and tell me the price on 11 June 2027.

Dennis Gartman is still considered a commodities expert.

He infamously said in 2016 that WTI would never be above $44 again in his lifetime. He is still alive last I knew.

Since I have owned working interests in oil wells (1997) I have sold oil for a low of $8 and a high of $140 per barrel. 6/14 oil sold for $99.25 per barrel. 4/20 oil sold for $15.40 per barrel.

Predicting oil prices is impossible.

About the only oil price prediction I have had right so far is that if Biden won, oil prices would rebound. Of course, we can argue about why that is, and if there is even any connection.

There are still no drilling rigs running in the field we operate in. There are still hundreds of production wells shut in. There are still less than 10 workover rigs running in our field. The largest operator still has a help wanted sign up in front of its office. We finally found one summer worker, he is still in high school, but thankfully covered by our workers comp. He cannot drive our trucks, and is limited to painting, mowing, weed control, digging with a shovel, cleaning the shops and pump houses and other tasks like those. That’s ok, because we need that, but not being able to drive is a pain. But auto ins won’t allow anyone under 21 to be covered.

As always, your observations are much appreciated.

Yea Ron i agree with Kleiber, I wouldn’t take anything on that site too seriously.

The IEA is now starting to sound warnings about supply. Last week they were telling the oil companies to stop exploring and to move toward a renewable energy future.

IEA: OPEC needs to increase supply to keep global oil markets adequately supplied

In its monthly oil report, the International Energy Agency (IEA) has said that global oil demand is set to return to pre-pandemic levels by the end of 2022, rising by 5.4 million bpd in 2021 and by a further 3.1 million bpd next year. The OECD accounts for 1.3 million bpd of 2022 growth while non-OECD countries contribute 1.8 million bpd. Jet and kerosene demand will see the largest increase ( 1.5 million bpd year-on-year), followed by gasoline ( 660 000 bpd year-on-year) and gasoil/diesel ( 520 000 bpd year-on-year).

World oil supply is expected to grow at a faster rate in 2022, with the US driving gains of 1.6 million bpd from producers outside the OPEC alliance. That leaves room for OPEC to boost crude oil production by 1.4 million bpd above its July 2021-March 2022 target to meet demand growth. In 2021, oil output from non-OPEC is set to rise 710 000 bpd, while total oil supply from OPEC could increase by 800 000 bpd if the bloc sticks with its existing policy.

https://www.iea.org/reports/oil-market-report-june-2021

https://www.oilfieldtechnology.com/special-reports/11062021/iea-opec-needs-to-increase-supply-to-keep-global-oil-markets-adequately-supplied/

(IEA) has said that global oil demand is set to return to pre-pandemic levels by the end of 2022, rising by 5.4 million bpd in 2021 and by a further 3.1 million bpd next year.

That comes to about 500,000 barrels per day monthly increase, every month until the end of 2022. I really don’t believe that is going to happen. No doubt most nations can increase production somewhat, but returning to pre-pandemic levels will be a herculean task for most of them.

Thats not quite what they (IEA) said Ovi-

“Last week they were telling the oil companies to stop exploring and to move toward a renewable energy future.”

The more more accurate summary would be-

“Last week they were telling the oil companies to stop exploring [and producing in new basins if net carbon zero by 2050 is the goal].”