The EIA has updated their International Energy Statistics with annual production numbers through 2014 and export data through 2012. Sometimes these stats can be confusing as they include several types of production and exports. But for production I use only “Crude plus Condensate” and for exports I used “Crude Oil Exports” which I assume includes condensate as well.

Also the export data is not exact, just close, because some importers are also exporters. For instance in 2001 the US exported 59,000 barrels per day. In 2012 the US exported 629,000 barrels per day. The exporting of condensate is allowed in the US and since the Shale boom condensate exports have increased quite dramatically because Light Tight Oil is rather top heavy with condensate.

To get exports versus consumption for exporting nations I simply subtracted their exports from their production. The difference was what they consumed. Similar data can be found on the Energy Export Databrowser.

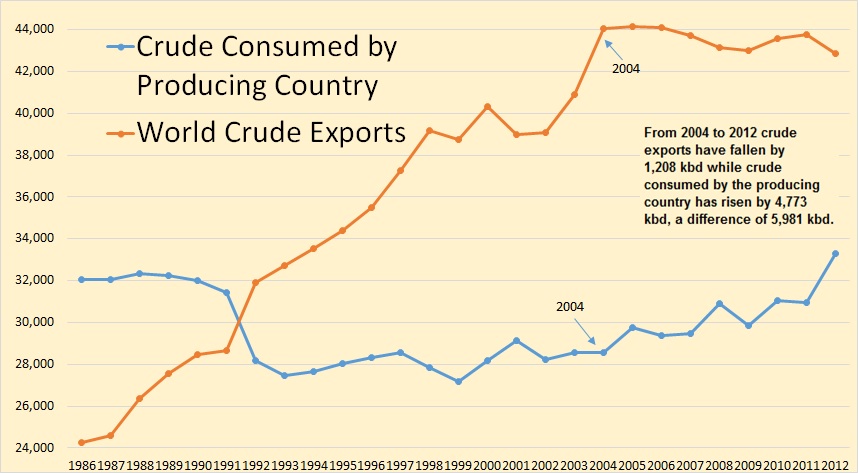

I think the data clearly endorses Jeffrey Brown’s Export Land Model.

In 2012 76,160,000 barrels of C+C were produced per day. Of that 76 million barrels 42,845,000 barrels were exported while the other 33,315,000 barrels was consumed by the producing nations. That is this is oil that was never exported.

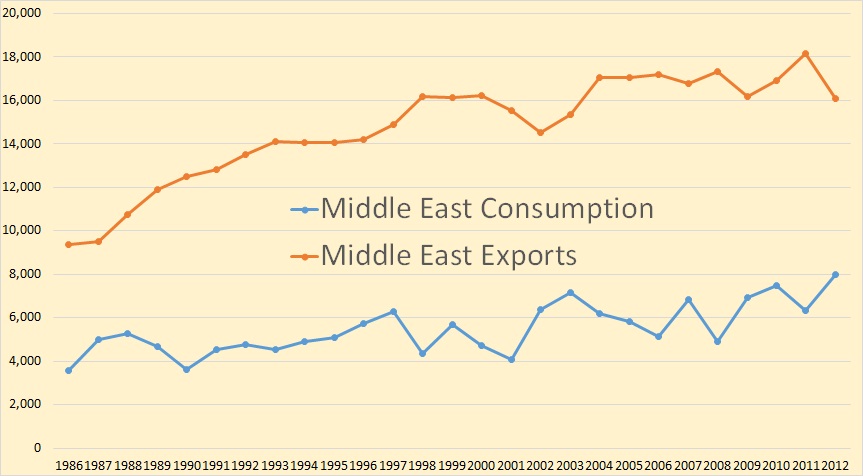

The Middle East is the world’s largest exporting geographical area. However in 2012 their exports dropped by 2,056,000 bpd while their consumption increased by 1,650,000 barrels per day. Obviously some Middle East countries were net importers however it is very likely that all Middle East imported oil was also produced in the Middle East so the above chart should be relatively accurate.

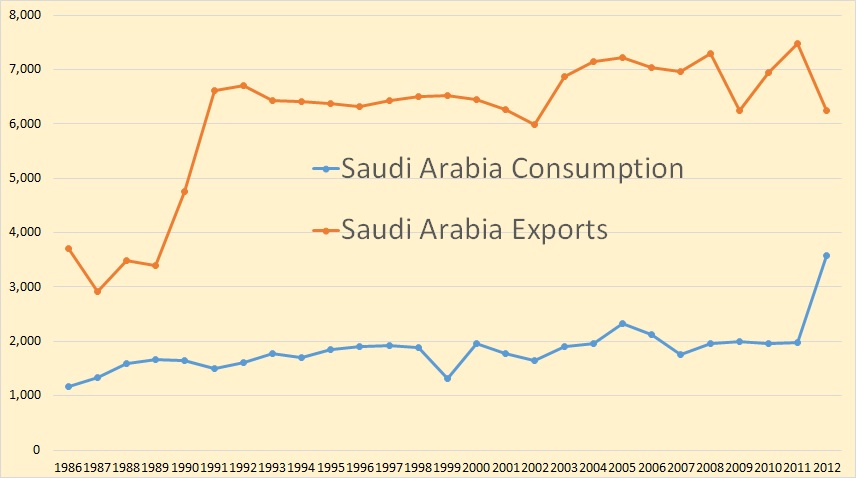

Saudi Arabia is the world’s largest crude oil exporter. The EIA says, in 2012, their exports dropped by 1,227,000 bpd while their consumption increased by 1,600,000 bpd.

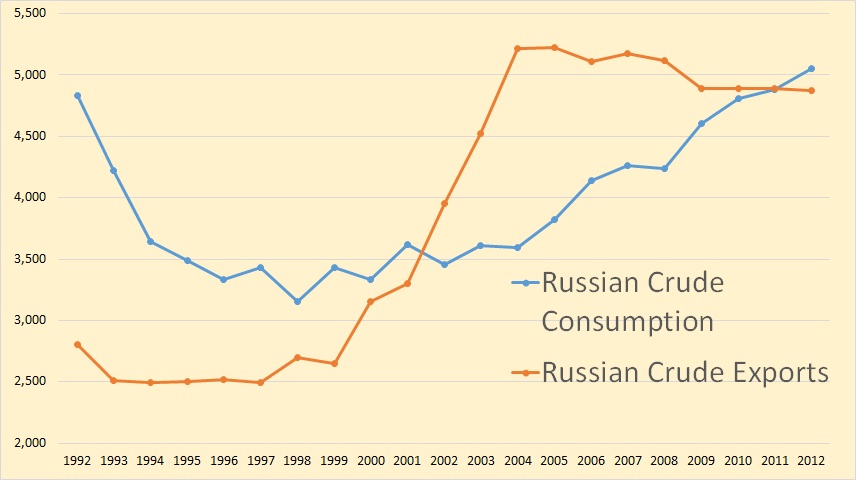

Russia is pretty well tied with Saudi Arabia for the world’s largest producer of crude oil. But in 2011 Saudi exported 2,585,000 barrels per day more than did Russia. But in 2012 that difference dropped to 1,379,000 bpd. Well that is if the EIA’s data is correct.

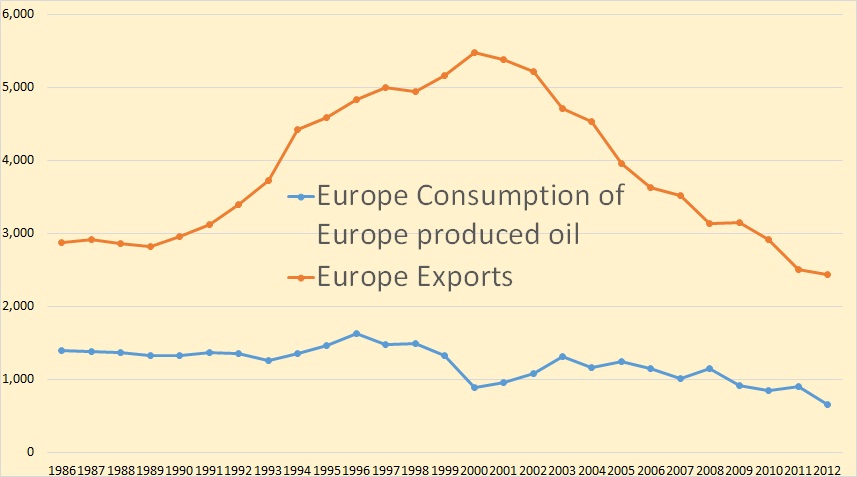

Of course Europe’s exports, of which almost 100 percent if from the North Sea, have been declining since they peaked in 2000. This chart only reflects the European oil that was not exported. It does not reflect total European consumption. Most of European consumption is from imported oil.

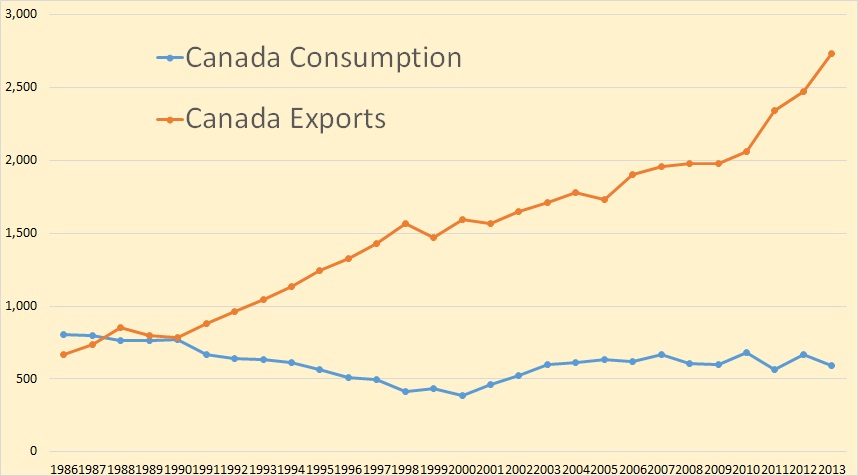

Canada is on of a very few places in the world where exports are increasing.

AAR Reports Rail Traffic Crude Oil Carload Update

The AAR also reported U.S. Class I railroads originated 113,089 carloads of crude oil in the first quarter of 2015, down 17,982 carloads or 13.7 percent from the fourth quarter of 2014.

I did the math. Using an average of 700 barrels per carload that works out to be 879,581 barrels per day in the first quarter 2015, down from 997,279 bpd by rail in the fourth quarter a drop of 117,698 barrels per day. Because the fourth quarter had 92 days as opposed to 90 days in the first quarter, that works out to be 11.8 percent instead of the 13.7 percent stated above. However an 11.8 percent decline in crude oil rail traffic is one hell of a drop in the first quarter.

And it was mostly Bakken Oil! Moving Crude Oil by Rail

North Dakota, and the Bakken region more generally, have accounted for the vast majority of new rail crude oil originations. According to estimates from the North Dakota Pipeline Authority, around 750,000 barrels of crude oil per day were moving out of North Dakota by rail as of mid-2014, equivalent to more than 60 percent of North Dakota’s crude oil production.

Ancient Bacteria Sweat Fuel Under New Mexico’s Desert Sun

Under the desert sun of New Mexico, scientists have engineered ancient bacteria to produce carbon-neutral ethanol using just the sun, waste carbon dioxide and non-potable water. The fuel that results could one day be cheaper than oil. Bloomberg’s Ramy Inocencio reports from outside the oil town of Hobbs.

Alga, in this case cyanobacteria, the most primitive of bacteria, they say, can be turned into ethanol at the rate of 25,000 gallons per acre per year. That works out to be 595 barrels per acre per year. But looking at this operation it looks like a very expensive operation. Please watch this 3 minute 22 second video and give us your opinion in the comments section.

Texas’ oil and gas industry lost 8,300 jobs in April — the most in nearly 30 years

Although oil prices have rebounded about 36 percent in the last month to about $59, many companies are still going through with previously announced plans for layoffs and reduced capital spending this year. That’s affecting job growth in Texas — the nation’s top oil production state — and other states.

The last time Texas lost this many oil and gas jobs was in 1986, with a drop of 9,000 jobs. That was also during the last big oil crisis.

Goldman Sachs sees $45 oil by October

The downturn in activity sparked optimistic sentiment among oil traders that the markets have adjusted, and could be on their way back up.

Not so fast, says Goldman Sachs. The investment bank argues in a new report that not only is the oil rally a bit premature, but that the rally itself will be “self-defeating.” The rally could bring drillers back, but that would merely contribute to a reversal in price gains. More drilling and more production worsen the glut that has not yet been resolved, and prices could be in for a double dip (or triple dip if you count the price declines from February to March 2015).

The Goldman Sachs report says that the problem is not just from a surplus of crude, but also a surplus of capital. Access to cheap finance has allowed production companies to stay in the game and continue to drill new wells. Even companies that have seen their cash flows dry up or have run into liquidity problems have still been able to find investors willing to pony up fresh capital.

Quote of the day. The U.S. is definitely losing its train of thought

Several surprising forces are gathering to take down the Happy Motoring matrix. Peak oil is actually not playing out in the form of too-high gasoline prices, but rather a race between a bankrupt middle class unable to pay the total costs of motoring and an oil industry that can’t make a profit drilling for hard-to-get oil. That scenario is plain to see in the rapid rise and now fall of shale oil.

While browsing on Google News I saw the above quote and thought “Damn, that says it far better than I ever could. That hits the nail squarely on the head.”

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Marketwatch proposes semi-permanent glut:

http://www.marketwatch.com/story/opec-may-condemn-the-world-to-an-oil-glut-for-years-2015-05-22

Sounds like “The Economist” in 1999

Sounds to me like a day out at Belmont.

OilPrice published an article a couple of days ago that concluded just the opposite as what Marketwatch does.

“That’s what makes a horse race,” one of the legendary old oil men used to quip.

OPEC Struggling To Keep Up The Pace In Oil Price War:

Rather than repeating some net export info for the nth time, if anyone has any questions about what I call “Net Export Math,” I would be happy to try to answer.

The original ELM (Export Land Model).

Thank you, Ron, Thank you Jeff!

Jeff, I fully agree that the conclusions of Net Export Math are much more important than, for example, the prediction of the peak. I understand the fact that a country can produce as much oil as it wants, if there is a consumption growing faster than production, the export declines. And when production declines, things look very ugly really fast. There is often only something like a decade between peak production and zero export.

I agree this is the most important aspect of the entire peak oil story.

And that is why I made the statement in the previous Ronpost: hardly no one talks about this absolutely critical piece of information. That might be because these facts and conclusions are sometimes presented in a way that is not easy to interpret.

When I give a peak-oil presentation to the public, I scare them with te aspect of finiteness, I alarm them with EROEI and I finally knock them down with Export Land Model.

You scare them with the aspect of finiteness? Who are they flat earthlings? 🙂

Well, my experience is that most people are indeed pretty close to being the equivalent of flat eartherlings when it comes to basic math and science.

A little food for thought. Disclaimer: my personal view of the world is strongly influenced by a background in the Biosciences. I think of the ELM theory as having immediate consequences for humans as biological organisms.

Exponential population growth is usually followed by logistic population growth.

For practical purposes and to keep things simple, lets just say that oil has been the number one resource responsible for the growth of recent human populations and and also the growth of our current industrial civilization.

Basic physics and biology clearly tell us that continuation of the exponential growth is eventually going to be limited by the availability of resources and waste sinks.

Here are two primers, one on exponential and the other on logistic population growth.

Exponential Growth

https://goo.gl/gIJvqm

Logistic Growth

https://goo.gl/JDw4ga

The take home message for me is that I wouldn’t want to be living in Places like Egypt or Mexico in the near future…

For extra credit you can watch the video on r and K selection…

https://goo.gl/ihdrjf

Hi Jeff

Your work on net exports is vital and gives an insight into what can happen to a country such as the United Kingdom in regards to energy security and balance of trade.

Have you done any work on an import land model?

The United States is an importer and with it’s recent dramatic increase in production it has been able to reduce imports substantially. Those spare imports had to find a new markets and over the last year or so exporters have cut prices in order to keep market share.

Global net exports can go down not just because exporters are using more oil but because importers are producing more. The price of oil tells us that exports are less because importers did not need it all.

Have you ever given a forecast of countries that might lose net exports in the next 5, 10, and 20 years based on your work?

Ron – re: quote of the day. Not just the PO quote, but the entire opinion piece succinctly and accurately summed up our societal predicament regarding our energy and economic present and future. We are the walking dead….we just don’t realize we are already dead.

OT – has the peakoil.com forum been hacked or something? I’ve been getting a 403 Forbidden message whenever I try to log on the past 24 hours. Maybe it’s just me…maybe I’ve been banned because they realize I’m just the typing-dead:)

Yes that is a great article. I am going to save it for further reference and use in the future. The article is by James Howard Kunstler. I have problems with some of his stuff but not this piece.

I am having no problems with PeakOil.com . I don’t think you have been banned because Pops hardly ever bans anyone. Some guys post there as a last resort because they have been banned everywhere else.

” I am going to save it for further reverence “. Funny typo. Be sure to set it up on an oil-barrel alter:)

Fixed it.

Did you mean reference?

Thanks Ron (that was a compliment right?)

PO.com is on a distibuted network (because of past hacks) but sometimes the DNS routers try to send traffic straight to the server, and since the server doesn’t accept calls, you get the Forbidden – It just happened to me yesterday, lol.

Anyway, restart your browser, if that doesn’t work, reboot your machine and then your router/connection/modem.

Sorry for the OT, Ron.

RE: quote of the day – “a bankrupt middle class unable to pay the total costs of motoring.”

Around here, the “bankrupt middle class” [assume a family of 4] seem to spend more money on cell phones, I-pods, internet, video games, Netflix, cable, etc. than they do on gasoline.

The middle class is not bankrupt, but actually expanding worldwide.

Because of efficiency gains, and new technology, energy has become a minor expense.

What has happened is basically the exact opposite of what Peak Oilers have been predicting.

John B,

Sorry for being blunt… that has to be one of the most ignorant things I have ever read. I gather you are not well versed in the concept of the falling EROI.

There seems to be the spreading of a collective brain damage here in the states and abroad.

Steve

(I used to comment on TOD before under the same moniker…more of a lurker now)

He said ‘worldwide’. The middle class is indeed swelling in absolute terms (India and China), it’s just shrinking in the western world.

When I read about PO 4 years ago, my views on everything were colored by PO, now I’ve regained my senses. PO is indeed a problem but not everything is attributable to it. A lot of economic problems in the west today are just issues that are a natural outcome of high wages, over consumption and population decline.

20-30 years ago people in my country could not afford cooking gas and cooked with firewood, now a lot of people use LPG, refrigerator was a luxury in cities, now it’s necessity. The economic growth within my lifetime has been outstanding and all this has been done by just increasing our (India’s) oil consumption from 640k barrels to a measly 3500k barrels.

There is no magic in it, it’s just the sigmoid curve in action and there is more to come. Millions and millions of people in the so called ‘Third World’ will come out of poverty by just providing a little bit of extra energy and investment. To repeat the same in the west would take 10x the investment.

For thousands of years Asia was the centre of the world in terms of economic activity due to it’s favourable geography and climate. I would say what we are seeing is just the reversion to mean.

The economic growth within my lifetime has been outstanding and all this has been done by just increasing our (India’s) oil consumption from 640k barrels to a measly 3500k barrels.

Would it be more productive, then, to channel that oil from wasteful activities in the US (e.g., SUVs for errands) to more basic activities in places like India?

And for that to happen, would the price have to be too high for American consumers, but not so high that consumers in India can’t afford it?

Would it be more productive, then, to channel that oil from wasteful activities in the US (e.g., SUVs for errands) to more basic activities in places like India?

Oh yes, definitely. I filled my car today for the equivalent of 4.4$/gallon and that is not considered expensive here, this is after taking into consideration the fact that our GDP per capita is 1/10th of US in terms of PPP. What does that tell you about the value of oil here ?

In US a gallon of oil represents the difference between an SUV and a sedan, here it represents the difference between a bicycle and a Honda 100cc scooter.

I think when it comes to pricing, developing countries will outbid G7 for oil, simply because it’s so vital to them liter for liter.

I have often pointed out that I can farm far more efficiently with twenty dollar per gallon diesel fuel than I can with animal power.You feed the tractor on days you use it. You feed a horse every day from the day it is born until it dies.

To take this point a bit further- we ( before retiring) used a truck that got about five to six miles per gallon. I could deliver over three hundred bushels of apples per trip to the nearest town in less than an hour round trip, excluding time to load and unload of course.

When my grandfather was a boy, doing a mans work , he left before daylight and got back after dark with a horse drawn wagon making precisely the same trip.The wagon could haul thirty bushels but hardly any more than that due to over working the horses.

So -When you really have a good use for it how much is diesel fuel worth?

FIVE gallons propelled the truck the twenty five miles round trip.

It would take ten or twelve working days to deliver the same truck load using the wagon. The horses would have to be rested no less than every third day, preferably every other day and grain fed every day. Grass and hay don’t get it done when you work a horse hard. It loses weight at an astonishing rate and turns into a bag of bones in less than a month.

People who believe that oil prices are limited by purchasing power are no doubt right so long as a large fraction of all the oil bought is still being wasted.

But once it gets scarce enough that little or none of it IS wasted, it is hard to see a hard upper limit on the price of oil.

MY personal guess is that most likely the upper limit will be determined in the near to mid term, the next two or three decades, by the price of synthetic diesel MANUFACTURED from coal.

Second guess, some little kid someplace will grow up and solve all the problems associated with feeding sewage into one end of a giant processing plant sitting in the desert sun and getting ethanol or some other biofuel- PLUS superb FERTILIZER- out the far end.

All the talk of needing only co2 and sun to make this work is bullshit. There is no escaping the need for other elements – in modest amounts of course , compared to the water and CO2.

Doo Doo and Pee Pee have been PRECIOUS commodities in times past. Barring population collapse they are destined to be VALUABLE commodities once again- rather than a wasted disposal problem.

I say desert because that is where solar energy is most abundant and reliable on a day to day basis but transportation issues will eventually result in such facilities being built near most cities.

Third guess Old Man Business As Usual croaks and the market for oil more or less disappears even while there is still some easy oil left in the ground.

Reality is that the future will be a mixture of all these scenarios plus some electric vehicles etc.

The price will collapse periodically when the economy turns sour and consumers in general have to cut back.But each cycle there will be fewer consumers as opposed to commercial users who can and will pay more. A LOT more.

OFM,

I have often pointed out that I can farm far more efficiently with twenty dollar per gallon diesel fuel than I can with animal power.You feed the tractor on days you use it. You feed a horse every day from the day it is born until it dies.

Indeed. I have a car as well as a scooter, I take out the car only when the scooter won’t suffice, otherwise it’s scooter all the time. I don’t go to the grocery store a km away in a car.

What is the value of oil ? It’s priceless.

To give an example, my mother cooked with firewood for only a very brief period during her childhood and for some months after her marriage and she hated it.

What would I or my mother pay to use gas for cooking ? An arm and a leg, which is definitely more than an American would pay for driving a second car. If it’s price goes up I will use less of it but won’t go back to firewood.

I don’t want to belabor my point but I can’t stress this enough, oil is a magical commodity down here and it’s consumption is going to go up in the next twenty years as millions of people quit firewood and switch to gas. The supply is going to come from West as the empire winds down and wastage is curtailed.

Just to make it clear I still expect the West to be dominant(economically) for the next 15-20 years but the momentum is clearly with Asia.

The marginal value of a litre of oil is huge, the only problem is that you have to be poor at some point in your life to realize it.

Wiseindian, the only reasonable natural gas sources for India are Qatar and Iran. In 20 years India will have to outbid other clients. Given the built in economic inefficiencies we see in the Indian economy and the warm climate I don’t know if most Indians will afford it.

Fernando,

Maybe Turkmenistan along with Qatar and Iran?

Why can’t gas come from Russia via China or Central Asia ? A trans asian alliance if you can call it.

I bet that gas cooking will give way to induction cooktops and PV with a small amount of battery storage.

OFM said “The price will collapse periodically when the economy turns sour and consumers in general have to cut back.”

Darn, what am I going to do? I already cut back. Guess I will have to go off grid and off FF completely (my plan anyway) to ride through this. 🙂

You make a great point about the efficiency of bulk transport. Take a passenger van, 15 mpg. Not good right? Then put eight people in it for a commute, suddenly it’s 120 pmpg. Or a small car at 35 mpg and 4 people, it is 140 pmpg. The more the merrier. So that truck moved a bulk amount in a short period of time and fuel costs were negligible compared to the reduced effort and speed of operation. Reminds me of the logic behind freight trains.

The canals used water, one mule (and a boy) to move large loads, making them efficient and sustainable. However they were slow and could not really increase their rate by much.

Then came the steam locomotive, expensive, inefficient but a high rate of transport and more flexible as to where it could go compared to a canal. No hay or grain needed to feed it just wood or coal and lots of water. Short rest times too.

Everything got faster then. Diesel even faster and cheaper, airplanes even faster.

Population grew faster too. Faster, faster until we run out of …. energy.

Now it’s hurry hurry, damn the costs, find and make more energy, the Red Queen is chasing us or is it the Queen of Hearts?

Luckily I am running in the other direction and so are a number of others.

Wiseindian, it costs a lot to ship Russian gas to China, one would expect the Chinese to consume the gas arriving in China from Russia. A pipeline project to cross from China to India would be enormously expensive.

Synapsid proposes Turkmenistan as a possible supply source, the question in my mind is whether one would try to reach India overland from Turkmenistan. In the end, India is stuck with Iran and Qatar. And that gas will be on demand.

Right now, if I were the Indian government I would be building out all the hydro they can, add nuclear power plants, and distribute pills and provide lots of incentives to cut the birth rate down.

Fernando,

I was thinking Turkmenistan could tie into the pipeline from Iran to Pakistan if it ever gets built if it ever gets continued to India.

If it ever…

Indian govt is already doing all three for last few years.

TFR is actually below 2 in most of the Indian States. A few states are laggards and they are expected to reach TFR of 2.1 in a few years given the massive drop in fertility rates.

Even Bangladesh the eternal poster boy of third world misery has a TFR of 2.2.

wiseindian said:

Only for those who subscribe to the postclassical and neoclassical economists’ use or “price” theory of value.

This theory of value was rejected by all previous economic schools because of what is known as the Paradox of value;

The paradox of value (also known as the diamond–water paradox) is the apparent contradiction that, although water is on the whole more useful, in terms of survival, than diamonds, diamonds command a higher price in the market. The philosopher Adam Smith is often considered to be the classic presenter of this paradox.

There was actually a movie about how it is possible to place so much value upon some precious object that the drive to posess it causes one to self-destruct.

https://www.youtube.com/watch?v=wxN2Mewamj0

I posted a pic down the way:

http://peakoilbarrel.com/world-exports-versus-consumption-the-elm/comment-page-1/#comment-518267

Thanks for quoting me 🙂

Meanwhile, the Economist reports about Venezuela’s repressive regime

http://www.economist.com/news/americas/21647645-not-content-harassing-press-regime-censors-itself-maduros-muzzle?zid=305&ah=417bd5664dc76da5d98af4f7a640fd8a

We read reports about government mismanagement, theft, corruption and increasing poverty

http://www.stabroeknews.com/2015/features/02/08/oil-rich-venezuelas-miracle-record-poverty/

Crime is soaring

http://news.nationalpost.com/news/kidnap-and-murder-on-the-bloody-streets-of-caracas-if-the-families-dont-pay-up-we-eliminate-that-person

Doctors and other professionals are fleeing the country

http://www.ibtimes.com/venezuelas-medical-exodus-result-its-contracting-economy-spurs-fears-national-health-1885490

Don’t get any wild ideas that you might get your grubby hands on our oil in Iran, Iraq or Venezuela.

Our covert ops are working overtime right now, even as we speak, to throw that pinko comuniss fairy Nicolás Maduro out fo office, and install a good democratically elected leader in Venezuela like we got down in Mexico, Peña Nieto.

Did you hear that Maduro is even involved in selling dope to the innocent children of America? And he, along with his buddies the Chinese, don’t even care about global warming? And he’s a socialist! Imagine that! Now there’s a moral reprobate for you if there ever was one.

That great American patriot Richard Nixon showed them comuniss a thing or two back in 1973 when he ordered the CIA to “make Chile’s economy scream.”

And the best thing is our boys down in South America pulled it off without anybody makin’ a fuss about what really happened. In 1970, the CIA’s deputy director of plans wrote in a secret memo: “It is firm and continuing policy that Allende be overthrown by a coup. … It is imperative that these actions be implemented clandestinely and securely so that the USG [the U.S. government] and American hand be well hidden.”

When we finally got our man installed down in Chile, Augusto Pinochet, he rounded up them dirty comuniss pinko fairies in a stadium, who thought they could get away with taking our copper away from us, and snuffed ’em out en masse.

So take that you dirty comuniss fairy pinkos!

It’s just a matter of time before we get that half-breed traitor who isn’t even a true American out of office and put a good ole God-lovin patriot in the White House like Ted Cruz, Marco Rubio or Hillary Clinton. They’ll bomb the smithereens outa Iran and take our oil back in the Persian Gulf.

So don’t be getting any wild notions that you Indians might get your hands on our oil.

Glenn, I take it you think Venezuela’s President Maduro is a victim? The Bolivar hit 429 per dollar this morning, inflation is over 100 %, gasoline is free, the judicial system is broken, over 50% of the population is in poverty, the murder rate is the highest in South America, and you think this isn’t the government’s fault?

Government incompetence and corruption are so extreme they have driven the country over the cliff. Given events in recent weeks I expect oil production to drop about 50,000 to 100,000 bopd per quarter. Furthermore, their production practices are gutting the reservoirs, therefore at least 30 to 40 % of the country’s oil reserves will gave to be written off.

You tell it, Fernando. Whatever happens to those pinko fairies is their own fault.

We gave them comuniss the opportunity to convert to the one true faith, US-style democratic-capitalism, and they refused! Imagine that!

So what can one expect when one refuses to see the light and the way? Why it brings the wrath of the Lord down on one, that’s what. “Make their economy scream,” sayeth saint Nixon.

So don’t you get your pretty little mind in a dither. Obama has already issued

the executive order declaing Venezuela “a national security threat” to the United States, and ordered economic sanctions.

And don’t kid yourself, it isn’t the fact that Venezuela has the world’s largest orange groves that makes it a national security threat to the United States. No, by golly, it’s those vast petroleum resources in the Orinoco basin. After all, without then, what woud happen to our “American way of life”?

Never forget what is written in the

book of Bush: “The American way of life is not up for negotiations. Period.”

Meanwhile, in the real world inhabited by common folk, here’s a post by Daniel with a translation of Leopoldo Lopez calling for a protest next Saturday

http://daniel-venezuela.blogspot.com.es/2015/05/leopoldo-lopez-resistance-repression.html

Things look really grim for Venezuela. I like to give you the exchange rate because it serves as a thermometer of the degree of poverty and desperation in the country. Right now the rate is 420 plus. That means a retiree gets about $20 per month. Professionals are making between $20 and $100 per month. The government is trying to keep skilled labour from fleeing the country by giving them cards they can use to purchase food, but the stores are empty, there are huge lines, and they use a rationing system which only allows an individual to buy by putting their finger in a fingerprint machine. The system, however, is short circuited by corruption, and the food is stolen to be sold openly on the street.

@ Fernando Leanme

On a more serious note, in your mind everything reduces down to a Chiliastic battle between US-style democratic-capitalism vs. communism.

If life were only so simple, so black and white.

Unfortunately, reality is a litte bit more complex than that. The stark reality is that US-style democratic capitalism has no better answers for peak oil and global warming than do those governments of South America inspired by Marxism and/or US-style Progressivism.

Venezuela, Bolivia, Brazil, Argentina and Ecuador all talk the talk when it comes to the extraction game. But they don’t walk the walk. They all see their economic futures tied to the extractive industries, predominately oil and gas.

No better example of this hypocrisy can be found than in the vast chasm which exists between the words and the actions of Ecuador’s left-wing president, Rafael Correa:

During his 15 August TV speech Correa emphasized how many poor Ecuadorians should benefit from ITT exploitation, but made absolutely no mention of those who might be seriously harmed by it.

Top of the list are the indigenous people living in ‘isolation’ (IPI) in Yasuni, who ultimately stand to lose parts of their territory and could be decimated by any form of contact with oil company workers because of their lack of immunological defences.

Why Ecuador’s president is misleading the world on Yasuni-ITT: Rafael Correa has moved to abolish an historic Amazon oil plan, but don’t be fooled by what he claims

Truth be known, both Capitalism and Marxism are ideologies with a humanist, Modernist and Enlightenment pedigree.

As Hannah Arendt notes, “they are twins, only wearing different hats.”

Both ideologies assert the independence of the human will and the capacity of man to make himself the master and possessor of nature.

Both ideologies are materialistic.

Both ideologies assume boundless human material prosperity and endless economic growth.

And both ideologies share the faith of the French Enlightenment that in an “economy of abundance” men would not come in conflict with one another because, presumably, there is no cause for rivalry.

Those, like Arundhati Roy, who do not buy into the capitalism vs. communism two-world theory are aware of the pitfalls of “blackwhite” (George Orwell, 1984) when it comes to dealing with human affairs:

Enter Mahendra Karma, one of the biggest landlords in the region and at the time a member of the Communist Party of India (CPI). In 1990, he rallied a group of mukhias and landlords and started a campaign called the Jan Jagran Abhiyaan (public awakening campaign). Their way of ‘awakening’ the ‘public’ was to form a hunting party of about 300 men to comb the forest, killing people, burning houses and molesting women. The then Madhya Pradesh government—Chhattisgarh had not yet been created—provided police back-up. In Maharashtra, something similar called ‘Democratic Front’ began its assault. People’s War responded to all of this in true People’s War style, by killing a few of the most notorious landlords. In a few months, the Jan Jagran Abhiyaan, the ‘white terror’—Comrade Venu’s term

for it—faded. In 1998, Mahendra Karma, who had by now joined the Congress party, tried to revive the Jan Jagran Abhiyaan.

Walking With The Comrades

Ah, I had thought your comments about the ‘comuniss’ were ‘Poe’ I now see there was indeed more substance hiding behind them.

Poe’s law, named after its author Nathan Poe,[1] is a literary adage which stipulates that, without a clear indicator of an author’s intention, it is often impossible to tell the difference between an expression of sincere extremism and a parody of such extremism.[2] Someone will likely mistake the parody for a genuine article, or vice-versa.[3]

Source Wikipedia

We are seeing something of a great equalization going on which would be noble were it not for our parasite (financial) class which is growing even richer in the process.

A positive aspect of this development is that recognizing the real value of fossil fuels, as well as their true costs creates a more level playing field for alternatives. This means that it becomes more likely that these precious non renewable resources will be used where they are needed most and make the most sense and with as much efficiency as possible.

Asians will outbid Americans in the oil market because they don’t waste as badly as Americans do.

When you hear an American complaining about the high price of gas, what he is really saying is that he can’t afford to waste it any more.

It doesn’t really matter who is richer.

It would be better if oil was freely traded and not subsidized. That might lead to efficient use worldwide.

Actually the middle class is shrinking, especially in the USA. That is their wealth is shrinking and many are entering the poverty class. More and more of the wealth is being concentrated in the hands of the 1%.

The gap between the rich and poor is getting wider.

And I have to agree with Steve.

We’ll never prove it. Data will be obfuscated.

http://www.zerohedge.com/news/2015-05-22/us-department-commerce-officially-jumps-shark-will-double-seasonally-adjust-gdp-data

This is a study showing Q1 GDP consistently below other quarters in recent years. This leads the relevant folks to want to declare that their Q1 seasonal adjustment is too mild. So they will do more of it.

Not clear why Qs 2, 3 and 4 are not declared overly adjusted upwards.

According to this report, the middle class is expanding worldwide.

http://www.oecdobserver.org/news/fullstory.php/aid/3681/An_emerging_middle_class.html

I notice that the report says this.

While the middle class is rapidly expanding in emerging and developing countries, in rich countries it is shrinking and feels incapable of defending the standards of living that have characterised a middle-class lifestyle for centuries.

probably should read it a bit closer…

“The bulk of this growth will come from Asia: by 2030 Asia will represent 66% of the global middle-class population and 59% of middle-class consumption, compared to 28% and 23%, respectively..

…

This middle class is unlike that which became the engine of development in many OECD countries.

…

While the middle class is rapidly expanding in emerging and developing countries, in rich countries it is shrinking and feels incapable of defending the standards of living that have characterised a middle-class lifestyle for centuries. England, Israel and Spain are just a few examples of countries where people take to the streets protesting a situation that for many has become unbearable. Middle and working classes have been carrying too much of the burden of the economic crisis; there has been a shift in wealth and income from them to the wealthier groups of society that is no longer acceptable. The rising expectations of the expanding middle class in developing countries contrast with the stagnating living standards of a shrinking middle class in OECD countries”

I did say WORLDWIDE.

This expansion continues. The size of the “global middle class” will increase from 1.8 billion in 2009 to 3.2 billion by 2020 and 4.9 billion by 2030.

Kunstler’s dribble may sound “catchy”, but a good rule of thumb is that whatever he says, the exact opposite is true.

The size of the “global middle class” will increase from 1.8 billion in 2009 to 3.2 billion by 2020 and 4.9 billion by 2030.

Is that mostly just a numbers game based on population growth?

Well I’m pretty sure I know where Kunstler pulls his numbers out of, but I’d rather not say.

“Worldwide”???

Listen Bud, what happes outside the borders of the good ole US of A don’t matter.

You sound like one of those comuniss to me.

Do you hate America?

You must’ve went to school too long. As Mr. Robichaux advised, “They got plenty communiss in them colleges.”

Glenn,

Are you for real? Commies?? Don’t you realize Commie bashing died years ago.. You’re supposed to hate Al-Qaeda now.

Ron… you got some real live political biggots in here…LOL. Who knew your site would provide entertainment and peak oil analysis.

steve

I think Roy wrote this song just for you, Glenn…

“Let’s Go After the Buddhists” by Roy Zimmerman

https://goo.gl/gPy7Dg

Thanks Fred, I enjoyed that. A cheery tune of things not so cheery.

Glenns heart is in the right place. I respect and admire his sentiments even as I describe them as being unrealistic.

It is ironic if he in a sarcastic comment asks if somebody hates America, given his obvious opinion of Yankee land .

Perhaps this little story will help illustrate how I feel about my country.

Two old democrats are talking over LBJ with another democrat- a younger one who is disillusioned with him and calls him a SOB.

The old guys do not dispute this characterization at all. They simply reply paraphrased ”Yes but he is OUR son of a bitch..”

Life ain’t fair.

Ask any momma rabbit about momma foxes feeding her rabbit babies to baby foxes.

We basically won the competition with other species some thousands of years ago. We have been competing with each other ever since.

My country – often wrong but still my country. My personal welfare and that of my kith an kin depend on it surviving and doing ok.

Not to worry, Steve.

After we get through taking care of the comuniss down in Latin America, we can turn our attention to the rag heads.

Anybody who threatens our national security, anybody who thinks they can terrorize us by taking our oil away from us, is morally reprehensible, and whatever happens to them is their own fault. Never lose sight of the fact that they’re bringing that rain of drones down on themselves by rejecting sure truth.

“My biggest setback was being born white, male, middle class, and a citizen of the United States.”

-Jensen

We can see that problem with the above comments.

Old farmer mac,

On the “He’s an SOB, but he’s our SOB”:

“BUT HE’S OUR SON OF A BITCH”….I’d never thought about this before, but inspired by an offhand comment here I went looking for the origin of the famous “son of a bitch” quote. Here are three contenders:

• Reference.com: It was Roosevelt who made the often-quoted remark about the dictator of Nicaragua, Anastasio Somoza: “Somoza may be a son of a bitch, but he’s our son of a bitch.”

• Dick Morris: FDR’s memorable characterization of Spain’s brutal dictator Francisco Franco: “Sure he’s a son of a bitch, but he’s our son of a bitch.”

• Michael Wood: Rafael Leónidas Trujillo, long-term dictator of the Dominican Republic….The Americans supported him because, as Cordell Hull said, in a phrase since used countless times of other unappealing figures, ‘he was a son of a bitch, but he was our son of a bitch.’

Bottom line: we don’t know who said it, who it was said of, or where it came from.

POLITICAL ANIMAL

There is no doubt in my mind that so far as the YANKEE middle class is concerned, other ” distractions” are responsible for any drop in per capita gasoline consumption- plus increased efficiency of course. In is getting to be almost impossible to buy a CARBURETOR for instance, except by ordering it shipped from a specialty supplier.

One of my neighbors has a brand new CORVETTE that gets BETTER gas mileage than a PINTO I once owned. Just about everybody except the very hard up seems to be spending upwards of a hundred bucks or more on the contents of a little wire or strand of glass coming into their house – a strand so thin it is hard to even see it except in direct sun.

Insurance premiums are costing a LOT of drivers more than gasoline- sometimes as much as five or ten times more if the person lives in some cities and drives only occasionally.

The police in northern Virginia regularly ticket out of state Marylanders for registering their cars in Virginia in order to get a much lower insurance premium.

To the best of my knowledge Maryland cops are keeping an eye peeled for cars with Virginia tags parked too many days in a row in Maryland as well and writing MORE tickets.

Just about every kid I know has a smart phone with a forty bucks and up per month string attached to it.

Driving is no longer the most entertaining and enabling way to spend disposable income. A flashy car is no longer as big a status symbol as it once was in the eyes of young women.

Hardly any young people are able to work on a car anymore. They don’t have a clue as to HOW, and mostly they lack any PLACE to actually do so. The chicken and egg question which comes first electric cars or electric car charging stations applies to tools as well. Investing in tools without knowing how to use them is useless. Learning how without them is impossible. The neighbors and land lord get pissed when they see the hood of a car up.

The car culture in terms of suburbia is alive and well but showing a bit of a pot belly and some gray hair and a sagging chin and some wrinkles.

I don’t know where it will go from here but so long as the middle class has SOME income I am for sure certain that suburbia is not going to die quietly.

Noboby who has sweated to get into his mcmansion with a yard is going to give it up for a smaller generally non existent desirable apartment in town and take a six figure loss as well as start paying rent as opposed to making fixed interest deductible mortgage payments.Rents go up – with inflation and faster in many cases. Mortgages are mostly locked in. Ten years of earnings inflation even without a promotion works wonders on the percentage of income devoted to the house payment.

When gasoline gets to be expensive enough, suburbanites will get rid of their SUBURBANS and buy a VOLT or a Leaf or a TESLA – or even a motor scooter if they can manage the commute that way.A good many will bite the bullet and carpool. Some enterprising folks will start running unlicensed and un advertised scheduled buses – using vans of course. This in essence amounts to a carpool or defacto mass transit where the same person drives every day in exchange for a little cash for a ride.

One of my neighbors back in the thirties once ran such a service – you waited on the side of the road on Saturday morning at eight o’clock and he picked you up and took you to town for a dime – five or six dimes covered his gasoline and he was going anyway. People who actually had a car rode with him quite often to save fifty cents. People adapt WHEN THEY HAVE TO.

The car culture in terms of suburbia is alive and well but showing a bit of a pot belly and some gray hair and a sagging chin and some wrinkles.

Yes, just as we began to associate some cars with old people who wanted to drive around in the equivalent of living room couches, I think we’ll be to associate today’s fuel hogs with old people or rednecks.

I could not access peakoil.com from several kinds of connections from Italy a few weeks ago, with a similar message.

HVACman,

Your computer likely has contracted adware. It’s trying to redirect you somewhere to view an advertisement. It’s something you clicked on that likely caused it. I had same problem a couple months back, ended up having to reinstall windows in order to fix the problem.

I’m not a computer expert but i tried to login to peakoilbarrel one day and got that exact same message. Took two weeks and help to figure it out.

I have had a similar problem for the past few months, I’m not a techie so have no idea what has happened? If anyone knows how to fix this, that would be great.

From what I am gathering demand is increasing more rapidly than various government and economic organizations predicted while supply on a global level is continuing to increase slowly.

As summer hits in Europe and the U.S. demand will increase at a rapid click as years of steady job growth, a more stable political environment (no more shutdowns), and the effects of international QE and interest rate cuts take their effect. Businesses are buying equipment due to ridiculously low interest rates abroad at the same time that demand for just about everything (except oil services and their ancillary manufacturers and suppliers) is growing.

The housing data out of the U.S. this week was feverishly robust. Psychologically we’re at a point where people are eager to buy a home before rates rise. Up until now rates were continually hitting record lows with no potential increase in sight – even though rates were low people perceived that they could hold off without consequence.

The shake up in currency valuations over the last year, culminating in radical adjustments last quarter, would tend to initially reduce demand growth due to the delayed logistical impact of demand shifting from one region to another. With the new currency valuations firmly in place Europe, especially Germany, will begin to see large jumps in demand for its products. Due to the severity of the currency value changes these changes in demand may be significant enough to require large investments in factory and manufacturing growth, which would require a lot of oil.

This is purely my opinion, but is rooted in data and knowledge regarding the effects of currency values on international trade.

In a post a few days ago there was a healthy discussion about China and their “ghost” cities. Some quick digging reveals that these “ghost” cities are, in fact, being populated at a rapid pace. The cities most commonly cited as ghost towns, especially in the famous 60 minutes report, are now surprisingly busy.

Of special interest to all here are videos from 2014 revealing the amount of traffic in these cities. China’s demand for commodities related to building materials is down, and will probably stay down permanently relative to before, but China’s demand for oil will grow rapidly. The mega-cities of China are more than saturated with vehicles, and bicycles as well as public transit are becoming ever more popular, but China’s future is about bringing people into these brand new hubs we previously called “ghost” cities. The videos I have seen of these cities from the past year make it clear that China’s growth in vehicle sales and oil demand will grow at a rate faster than their overall growth of 6-7%.

Global supply may be robust and growing, albeit more slowly now, but demand from the likes of India, China, Japan, Europe, and the U.S. is going to grow very rapidly in this price environment. The markets are so focused on what caused the price decline (supply growth, especially in U.S. tight oil) that they are currently ignoring how quickly demand will rise to meet and exceed that supply. I think data over the coming months will make it clear that global inventories are declining even though supply remains robust.

At some juncture the markets focus will switch from that of supply to demand. Until that time comes oil prices will stay range bound, but will break higher when market mentality shifts.

China ghost cities:

http://blogs.reuters.com/great-debate/2015/04/21/the-myth-of-chinas-ghost-cities/

http://www.theguardian.com/books/2015/may/08/ghost-cities-of-china-wade-shepard-review-planning

http://www.chathamhouse.org/publication/review-china-building-ghost-towns

http://theglobalchronicle.com/5-chinese-ghost-cities-that-came-alive/

Exports, production, wages, and retail sales:

http://www.bloomberg.com/news/articles/2015-05-08/china-exports-decline-in-april-compounding-pressure-on-economy

http://www.scmp.com/business/china-business/article/1247768/wage-growth-slows-respite-bosses

http://www.afr.com/news/economy/trade/china-exports-unexpectedly-decline-20150508-ggww2o

http://www.markiteconomics.com/Survey/PressRelease.mvc/e01f1a716c744d1786b87e2b721c6451

The aggregate of production, exports, wages, and retail sales imply real growth of no more than 3%.

Money supply and state-directed lending:

http://www.reuters.com/article/2015/05/13/china-economy-loans-idUSZZN3EGA0020150513

Money supply is ~200% of GDP and growing at 10-11%.

Productivity and labor force:

http://www.oregonlive.com/playbooks-profits/index.ssf/2015/01/chinas_labor_force_declines_fo.html

China’s labor force is contracting and productivity is not growing, which by one general definition implies no GDP growth. The economy is growing on a net basis only because of state-directed lending to non-productive/unprofitable infrastructure without accurately accounting for depreciation, inventories, etc.

Food and energy imports:

http://www.chinadaily.com.cn/business/2015-03/02/content_19688799.htm

http://www.reuters.com/article/2015/05/08/china-economy-trade-crude-idUSL4N0XY3W620150508

China’s energy and food imports will hereafter be a net drag on the production and export sectors (and thus on productivity and wage growth), cutting China’s growth by as much as 25-30%.

China’s electricity and nat gas consumption:

http://www.chinaknowledge.com/Newswires/NewsDetail.aspx?type=1&cat=INV&NewsID=61047

http://www.chinaknowledge.com/Newswires/NewsDetail.aspx?Cat=INV

China’s electricity and nat gas consumption does not support reported real growth of 6-7% but rather it fits more closely with growth of M2 and wages and retail sales as a share of GDP.

US and Japanese firms’ FDI is now contracting, which is contributing disproportionately to the decline in production and exports.

China is growing much more slowly than is reported and generally believed by the Establishment consensus. Therefore, China is no longer contributing much, if anything, to net growth of global real GDP per capita and “trade” in trade-weighted terms.

You might want to think carefully about end user demand for anything in the context of :

https://research.stlouisfed.org/fred2/series/MEHOINUSA672N

And btw, note that household totals are not growing because of the need of adult children to move back in with parents, as well as elderly grandparents, both categories of which add money to the household and decrease the number of households, and yet there is the graph. The factors combine to be somewhat Apocalyptic.

If one needs a distilled overarching truth . . . the jobs don’t pay. Low interest rates aren’t working. The only source of consumer credit growth in the US are student loans and sub-prime auto loans. Nobody is financing anything else.

Oh and btw:

The housing data out of the U.S. this week was feverishly robust. Psychologically we’re at a point where people are eager to buy a home before rates rise.

Here’s the Existing home sales text from yesterday:

Existing homes sales are not living up to springtime expectations, down 3.3 percent in April to a 5.04 million annual rate which is just below the low-end Econoday forecast. Three of 4 regions show contraction in April with the sharpest decline, minus 6.8 percent, in the South, which is by far the largest housing region.

How exactly is there to be a housing boom with real income in freefall?

Watcher, good points.

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1cd2

At the link above is the differential change rate of real personal income less transfers to personal health care spending, which is decelerating to the rates at which recessions started in late 2000 and late 2007 (and in late 2013 without recession, and in 2005 during Hurricane Katrina).

http://www.bloomberg.com/news/articles/2015-05-22/core-u-s-consumer-prices-rose-in-april-by-most-in-two-years

Health care and housing costs are killing the bottom 80-90% working class and economy overall.

7-8 years ago you could overflow the trolley cart in the grocery store for 100$. These days 2 small plastic bags are sufficient for the same $100.

A hell of a lot of building materials and appliance prices are up very sharply as well over the last few years.

The higher upfront price on appliances is a bargain- if you can pay it and they last. You will get it back in savings on the electricity bill.

I personally keep an eye out for used appliances and put them in the big barn. A used washer running on my own personal cold water disposed of in my own septic system runs for almost nothing. Four or five hundred bucks saved can be put to many good productive uses. Maybe even the solar panels I am going to buy when I finally get around to it.LOL.

Nobody is growing figs commercially here. I will probably put the next five hundred into little fig orchard.Sitting in the house is a sure path to an early death.

In terms of oil demand and employment housing starts are what matters.

http://online.barrons.com/articles/housing-starts-lift-lumber-prices-1432349837

Housing starts were up 20%, building permits up 10%.

Best numbers since 2007.

We can sit here and hold on to our doom and gloom, or we can live in reality where getting to a potentially very bleak future takes time and is interspersed with periods of bright spots.

Let the data tell you what is happening right now instead of coming to conclusions from personal bias and searching for data to fit it.

Brian, I don’t buy the housing data. In fact, housing entered another price bubble in 2012-13 and appears to have begun to roll over in 2014 to date. The traffic and buying intentions heading into the seasonal buying/selling season is not picking up as expected.

Moreover, residential construction as a share of GDP is at a level that is half or less than the average from after WW II to 2005-06. In fact, the net of the lack of growth of gov’t spending to GDP until very recently and the increase in health care (HC) spending as a share of GDP more than cancels out any meager contribution to GDP from residential construction as a share of GDP.

Now with the incipient bust in the energy and energy-related transport sectors, shaping up like that of the early 1980s, will drag significantly on orders, production, employment, and ancillary sectors hereafter going into more challenging YoY comparisons into summer-fall.

Moreover, real incomes of the Millennials after tax, debt service, and HC costs (insurance) are not increasing. They do not have the financial capacity to save and to become lifelong mortgage debtors (“dead pledgers”). They are renting apartments, which is causing rents to rise, which only further ensures that they will not be mortgage debtors for the foreseeable future and that they will have little or no discretionary income.

Lumber prices are certainly up big time. Some local guys are now selling timber on the stump after waiting for years for the right price. I am buying building materials on a regular basis and can confirm that lumber locally is up twenty percent plus over the last year.

Every year suburbia eats tens of thousands more acres that will never again be logged , at least not within the next hundred years.

The Baker Hughes Rig Count is out. Looks like the big decline in the rig count has stopped. Oil rigs down 1.

Offshore in down 5. Down 31 from last year.

This will not effect this or next years production. But after that don’t look to the GOM for any miracles after that.

Remember deep offshore wells decline quickly as well!

is there any sensible explabation why saudi consumption would increase that tapidly on 2012 after such a long time of stability?

As a response to the Arab Spring Saudi Arabia funded massive expansions for various social programs. That could at least partially explain the demand increase.

post 2012

I think that they started up some refinery operations as well as chemical plants, etc. to produce value added products.

Some info that is several years old

Saudi Arabia has announced plans to invest about $46 billion in three of the world’s largest and most ambitious petrochemical projects. These include the $27 billion Ras Tanura integrated refinery and petrochemical project, the $9 billion Saudi Kayan at the Wayback Machine (archived March 15, 2009) petrochemical complex at Jubail Industrial City, and the $10 billion Petro Rabigh refinery upgrade project. Together, the three projects will employ more than 150,000 technicians and engineers working around the clock.[34] Upon completion in 2015–16, the Ras Tanura integrated refinery and petrochemicals project will become the world’s largest petrochemical facility of its kind with a combined production capacity of 11 million tons per year of different petrochemical and chemical products. The products will include ethylene, propylene, aromatics, polyethylene, ethylene oxide, chlorine derivatives, and glycol.[34]

Saudi Arabia had plans to launch six “economic cities” (e.g. King Abdullah Economic City, to be completed by 2020, in an effort to diversify the economy and provide jobs.[35] They are being built at a cost of $60bn (2013)and are “expected to contribute $150bn to the economy”.[36] As of 2013 four cities were being developed.[

Saudi Arabia rewrites its oil game with refining might | Reuters

And also this: Saudi Arabia’s solar-for-oil swap is a ray of hope | Damian Carrington | Environment | The Guardian

No exports of fossil fuels? Crazy talk. I’m still wondering why they just haven’t fuel switched over to NG by now. They have a whole menu of options to reduce internal consumption if so desired; they just have to phase into it, without freaking out their populace.

They have been looking for Nat gas as hard as they can for the last 10 years, and have not found enough. A couple of large sour project came on line. Now they are talk shale. So they are starting to scrape the bottom of the barrel.

“Lexan” Back and Front plates in new 1000V PV Source circuit combiner boxes we are working with are from none other than:

http://www.sabic.com/corporate/en/productsandservices/

“Lexan” – oh no sir, that trademark belongs to ….

*^#& @)$*! – GE sold its plastic division to Sabic,. way back in 2007.

http://www.nytimes.com/2007/05/22/business/22plastics.html

“General Electric agreed yesterday to sell its plastics division for $11.6 billion to the largest public company in Saudi Arabia, the Saudi Basic Industries Corporation. …”

Wow. Shocked that I don’t remember reading/hearing about this, and that it happened 8 years ago now.

New NEC/Insurance/UL listing needs finger safe even in locked electrical panels with disconnects. Panel Air bags requirements soon. . Can’t vaporize those who’s brains are too small to read or understand hazards. Fuel tanks don’t have lockouts. Lower the bar for Darwin awards?

I don’t have a lot of confidence in those numbers when they show a strange diversion like that. I would chalk it up to an error in the EIA’s data.

mazama databrowser shows a smooth relentless ramp up in saudi consumption. No special blips.

The more places they air condition, the more gasoline powered generators they need.

This article claims China’s CO2 emissions have started to decrease. Will this continue?

http://www.vox.com/2015/5/22/8645455/china-emissions-coal-drop

I suspect the Chinese are playing with their emissions figures to help the eu and Obama at the Paris climate talks. The Chinese will be asking for economic aid from rich nations. I understand the UN bureaucracy will be pushing for economic aid to be given to China, India, Venezuela, and other nations.

The slowdown has got to be coming from somewhere.

http://www.climatecentral.org/news/co2-emissions-stabilized-in-2014-18777

Why not? It’s just printed whimsically.

Of course. China is implementing new clean tech like wind, and solar.

For all the talk about a doubling of CO2 levels, this is something that will never happen. It would take 200 years of current CO2 emission increases of 2 PPM/year. I doubt if we’ll see CO2 increases past 2050.

Doubling CO2 is just a model convention, referred to ~280 ppm. That’s 560 ppm. It should be reached sometime within this century, or early next century.

Since CO2 only accounts for about 71% of the radiative forcing from anthropogenic sources the current CO2 equivalent is about 560ppm already.

Between 1990 and 2013 the warming effect on the planet known as “radiative forcing” due to greenhouse gases such as CO2 rose by more than a third (34%).

Radiative forcing from human caused sources is now about 2.8 watts/m2.

In 2012 atmospheric CO2 rose by 2.9 ppm.

Further reading about the CO2 surge from the WMO

https://www.wmo.int/pages/mediacentre/press_releases/pr_1002_en.html

But the net energy imbalance is 0.5 to 0.6 watts/m2. That’s what counts.

What counts is how you understand what that means. Comprehension is key, otherwise it’s just numbers.

Let’s do a little test, now no cheating by looking it up on the internet or having others tell you. This is elementary school stuff.

By looking at a globe or world map how can you tell the tilt of the earth’s axis?

And Fernando must answer first, no helping him.

What it means is that every year the earth’s temperature goes up by a tiny amount. The earth’s surface happens to have oceans, they capture most of this energy. This energy flux into the ocean leads to a slight temperature increase. The system transfers energy down through the water column, and thus, because the heat capacity of the water in the ocean is huge, the overall temperature increase is peanutty.

The climate hysteria bunnies like to convert the energy flux into “Hiroshima equivalents”, which the ignopedists at Sks like to peddle as an app. Propaganda.

As far as I can tell we will hit a crisis point with oil and gas supplies way before the climate gets to be warm enough to be that worrisome. Thus Ron should continue to hammer at the peak oil concept rather than start a “peak temperature” blog.

Ooops, wrong answers. Sorry you get and F.

Hint: you forgot the energy flux into melting ice, evaporating water, soil, rock, vegetation and atmosphere. You also forgot that the ocean measurement is only portional and does not cover the global oceans total area or volume.

I didn’t forget it. This isn’t a climate seminar blog. The ocean heat capacity overwhelms all other factors, since 2004 we can get a pretty decent idea of energy uptake from Argo buoys. The 0.5 to 0.6 watts per m2 figure isn’t debated by most scientists, but some feel it’s a bit lower and I haven’t seen higher estimates. For those who don’t study the subject in detail this is a key number to have in your heads. It’s the higher range of the measured imbalance. No theory, just the facts.

Climate scientists are generally not dumb people John B. Getting a PHD in Physics, Chemistry or Math generally means you have an above average IQ.

And getting a consensus of 97% (or whatever it is ) on anything is almost impossible unless there are really convincing arguments.

If you find holes in their core arguments (like CO2 increasing temperature) there is a potential Nobel Prize available for you if you submit your paper for peer review.

Climate Change is going to wreak havoc on this planet, but it won’t be nuthin compared to ELM peak oil.

standing ovation!!!!

More bait and switch talk. The 97% (which I would include myself) never said anything about “Climate Change” wreaking havoc on this planet.

Interestingly, when Hubbert put forth his peak oil theory, he never said anything about the end of the world. That was Kunstler, and the other nutters with the end of the world nonsense.

Sorry John B. I thought you said you didn’t believe CO2 caused temperature increase in a previous thread.

If I interpreted that incorrectly. I apologize.

The wreak havoc opinion is mine, not the 97%.

If CO2 isn’t increasing past 2050, there is going to be a lot less than 7 billion people on this planet or a miraculous energy transition occurred.

That gives us 35 years to cease all CO2 emissions. Havoc?

Don’t forget the arctic permafrost is melting and degassing methane and CO2 as well!!!! Will that cease by 2050?

last time I checked that isn’t how positive feedback loops work.

thanks!

I try to avoid opinions, and look for facts.

Fact: The current global temp anomaly is exactly the same as it was in 1980.

http://www.drroyspencer.com/wp-content/uploads/UAH_LT_1979_thru_April_2015_v61.png

Fact: The hysteria claimed Arctic sea ice would have been gone by 2014. Reality is quite a different thing.

http://www.dailymail.co.uk/sciencetech/article-2738653/Stunning-satellite-images-summer-ice-cap-thicker-covers-1-7million-square-kilometres-MORE-2-years-ago-despite-Al-Gore-s-prediction-ICE-FREE-now.html

Fact: While it may be true that CO2 absorbs more energy than O or N, it only constitutes .04 % of the atmosphere.

Speaking of classic bait and switch!!!!

I retract my apology (LOL!!!!!!).

Roy Spencer (u can’t be serious)!!!! Arctic not being gone by 2014 means climate scientists are wrong!!!! LOL!!!!

Al Gore isn’t a climate scientist! He is a politician. Climate Scientists aren’t accountable for what he says.

The US Navy, NASA and Climate Scientists agree the arctic is melting. They are the only guys that have the equipment to measure it.

Well, except for Vladimir Putin who is putting troops in the Arctic to protect his Oil resources and China who is trying to get in there as well because their stategists aren’t fools.

Why don’t they listen to Roy Spencer????? Because they aren’t idiots and want to achieve RESULTS. So they listen to scientific consensus.

I am enabling a tiresome conversation. I apologize to those who come to this board to discuss Peak Oil.

Back to the chaos….

Boltzmann Brain.

Al Gore isn’t a climate scientist! They aren’t accountable for what he says.

Or for what you say: “the arctic permafrost is melting”.

So this is exactly my point. Alarmists like to quote the 97%, even though the 97% have never made the Alarmist’s claims.

LOL! John B let’s go have a beer. We can talk about the birds and the bees.

Your a goose. Learned that in Australia.

You just like stirring up stuff for entertainment.

thanks!

“it only constitutes .04 % of the atmosphere”

CO2 makes up 390 ppm (0.039%)* of the atmosphere, how can such a small amount be important? Saying that CO2 is “only a trace gas” is like saying that arsenic is “only” a trace water contaminant. Small amounts of very active substances can cause large effects.

Some Examples of Important Small Amounts:

•He wasn’t driving drunk, he just had a trace of blood alcohol; 800 ppm (0.08%) is the limit in all 50 US states, and limits are lower in most other countries).

•Don’t worry about your iron deficiency, iron is only 4.4 ppm of your body’s atoms (Sterner and Eiser, 2002).

•Ireland isn’t important; it’s only 660 ppm (0.066%) of the world population.

•That ibuprofen pill can’t do you any good; it’s only 3 ppm of your body weight (200 mg in 60 kg person).

•The Earth is insignificant, it’s only 3 ppm of the mass of the solar system.

•Your children can drink that water, it only contains a trace of arsenic (0.01 ppm is the WHO and US EPA limit).

•Ozone is only a trace gas: 0.1 ppm is the exposure limit established by the US National Institute for Occupational Safety and Health. The World Health Organization (WHO) recommends an ozone limit of 0.051 ppm.

•A few parts per million of ink can turn a bucket of water blue. The color is caused by the absorption of the yellow/red colors from sunlight, leaving the blue. Twice as much ink causes a much stronger color, even though the total amount is still only a trace relative to water.

https://www.skepticalscience.com/CO2-trace-gas.htm

“The current global temp anomaly is exactly the same as it was in 1980.”

The current temp anomaly is based upon the 1951-80 baseline, so, no, it’s not the same as 1980

Global surface temperature in 2014 was +0.68°C (~1.2°F) warmer than the 1951-1980 base period in the GISTEMP analysis, making 2014 the warmest year in the period of instrumental data, but the difference from the prior warmest year (2010), less than 0.02°C

http://csas.ei.columbia.edu/2015/01/16/global-temperature-in-2014-and-2015/

Nope, 400 PPM has been reached (and the world didn’t end).

http://research.noaa.gov/News/NewsArchive/LatestNews/TabId/684/ArtMID/1768/ArticleID/11153/Greenhouse-gas-benchmark-reached-.aspx

And the graph I posted is based on an 81 to 2010 average.

http://www.drroyspencer.com/wp-content/uploads/UAH_LT_1979_thru_April_2015_v61.png

That’s right – the same global average temps as 1980.

There is a 30-40 year lag time in the system. The consequences of 400 ppm won’t be realized till 2045-55 time frame.

That is my understanding anyway.

No climate scientists said the world was going to end at 400 ppm. Read the IPCC report.

For a guy that complains about bait and switch you sure are good at it!!!! Psychologists call that projection. Do you watch Fox News?

James Hansen thinks the Greenland Ice Sheet melts at 350 ppm ( I think, something like that). That is one of the consequences.

IMO, the melting of the arctic permafrost and ocean acidification are the big ones. We are destroying our oceans and they are critical for our survival.

Silly guys like John B will probably be long gone by then, so why does he care.

John B,

That’s the 0.04% of the atmosphere that supports all the photosynthesis on the planet, yes?

Good point. In that regard, more CO2 is beneficial.

This is one of those extraordinarily ignorant statements that seem to continuously pop up again and again in denialist circles. To keep it simple, carbon dioxide is often not the limiting factor in the growth of photosynthetic organisms.

This is a pretty good review of the issue:

http://www.skepticalscience.com/co2-plant-food.htm

John B,

My point is that 0.04% of a huge amount of atmosphere is itself a huge amount of CO2. “only” 0.04% sounds like saying that it can’t be important.

Without that 0.04% CO2 the average surface temperature of the planet would be well below freezing.

There may have been some pause in atmospheric warming over the last 20 years, possibly caused by increased SO2 aerosols from Chinese coal fired power plants, but mostly the trend is an illusion due to a very high El Nino (warming) in 1998 and a couple of recent high La Ninas (cooling). However there has been a growing heat gain in the oceans, which might about to be dumped into the atmosphere with this year’s El Nino, which will end the hiatus – the twelve month periods ending in each successive month this year have been progressively the hottest ever recorded.

What can’t be denied though is that the Arctic has continued to warm rapidly – partly because the aerosols aren’t effective in the atmosphere there (maybe Chinese clean tech wouldn’t be such a great idea). Minimum ice volume in September may have dropped by 75% since 1979. This year saw the lowest maximum ice extent (in February/March) ever recorded and looks on course to be the lowest ever extent in September – and, maybe this year, but probably by 2017 the Arctic will be ice free at some point. The California drought is directly attributable to changing circulation patterns caused by the ice loss and was predicted by modeling the phenomena in 2005.

Positive feedback mechanisms are particularly strong in the Arctic – once the ice goes the water can warm above freezing quickly; there will be increase water vapor (the strongest green house gas) forced into the air; the permafrost starts to melt and the organic matter rots quickly releasing more CO2. The big one would be significant release of methane from hydrates (clathrates) in shallow seas in Siberia. If even a small proportion of these (less than 1%) are released then we’d get run away warming as much as >10 degrees Celsius in a few years and, to quote an eminent climatologist, “We are f*cked”; which means not that the happy motoring BAU might be in question but that the human race, and possibly all complex life on earth, is extinguished.

Meanwhile, here’s a plot of worldwide sea ice cover since 1979. These plots are hard to locate in USA government agency sites:

http://notrickszone.com/wp-content/uploads/2015/04/Global-sea-ice-2015_4.gif

The data can be glimpsed in a page like this

http://www.ncdc.noaa.gov/sotc/global-snow/201504

But they don’t dare publish reality: total sea ice extent was 330 thousand square miles higher in April 2015 than the 1981-2010 average.

Are you suggesting there is a mechanism by which high ice coverage in Antarctica prevents runaway warming in the Arctic – I’d be happy to find out there was, but it seems unlikely.

The increased ice area in the south has been explained through increased warming; i.e. higher glacier outflow, especially from Pine Island and Thwaites Glaciers and changing circulation patterns that keep the ice south and close to land where it takes longer to melt. If these glaciers collapse, as seems increasingly likely since 2009, then there will be a step increase in sea ice but I doubt that the streams of refugees from Miami, the Maldives, Bangladesh, Osaka, New Orleans, Boston etc. will be saying thank god climate warming has been disproved.

Antarctica is losing mass big time.

GRACE has measured up to over 300 gigatons/year.

http://www.wunderground.com/climate/facts/antarctica_is_losing_ice_sheet.asp

The PIG is disintegrating before our eyes.

Fernando,

I have already debunked this nonsense and I don’t know why I have to do so again, but I will.

Two points, first, virtually all of the Antarctic sea ice melts during the southern hemisphere summer.

Second, and this is important, fresh water freezes more easily than salt water.

Antarctic sea level rising faster than global rate

A new study of satellite data from the last 19 years reveals that fresh water from melting glaciers has caused the sea level around the coast of Antarctica to rise by 2cm more than the global average of 6cm. Researchers detected the rapid rise in sea-level by studying satellite scans of a region that spans more than a million square kilometers. The melting of the Antarctic ice sheet and the thinning of floating ice shelves has contributed an excess of around 350 gigatonnes of freshwater to the surrounding ocean.

http://www.sciencedaily.com/releases/2014/08/140831150207.htm

The science is not difficult here folks.

I cannot respond to you directly Ron so I am editing my post here.

I did say virtually (for instance compare the maximum ice sheet growth in late winter to the size of the Ross Ice Shelf–virtually is the exact perfect word to use here!) and it should be self-evident that the point is that there is no long term addition and thickening of the Antarctic sea ice that offsets the long term decline and thinning of the Arctic sea ice.

The current extent of Antarctic sea ice, which is nowhere near the maximum extent, can be found here. Note that it dwarfs the Ross Ice Shelf.

http://nsidc.org/arcticseaicenews/

Two points, first, virtually all of the Antarctic sea ice melts during the southern hemisphere summer.

Well that is not quite true.

Ross Ice Shelf

The Ross Ice Shelf is the largest ice shelf of Antarctica (an area of roughly 487,000 square kilometres (188,000 sq mi) and about 800 kilometres (500 mi) across: about the size of France).[1] It is several hundred metres thick. The nearly vertical ice front to the open sea is more than 600 kilometres (370 mi) long, and between 15 and 50 metres (50 and 160 ft) high above the water surface. Ninety percent of the floating ice, however, is below the water surface.

Years, no implications. The earth’s total albedo (the amount of incoming solar light we receive reflected back to space) isn’t changing as a result of sea ice surface coverage. The Arctic loses ice, but Antarctic is gaining an equivalent amount.

I like to point out the way government propaganda distorts reality, and this is a good example. They go through a lot of gyrations to emphasize the Arctic ice cover is shrinking, but they try to disguise the Antarctic ice growth.

The rest of the comments you make are irrelevant to the core issue, which is fairly simple: changes in total ice cover over the last 35 years are zilch. And most people aren’t aware because this fact tends to get buried.