This is a guest post by Political Economist

Nuclear Electricity

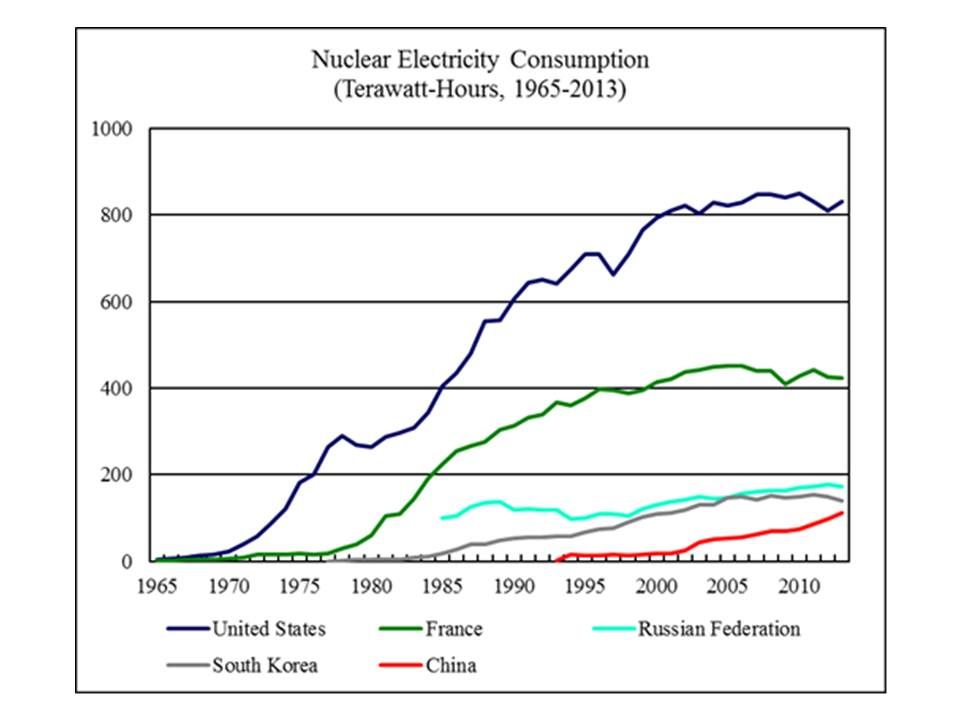

According to BP Statistical Review of World Energy 2014, world consumption of nuclear electricity reached 2,489 terawatt-hours (563 million metric tons of oil-equivalent) in 2013, 0.9 percent higher than world consumption of nuclear electricity in 2012. In 2013, nuclear electricity accounted for 4.4 percent of the world primary energy consumption.

Figure 16 shows nuclear electricity consumption by the world’s five largest nuclear electricity consumers from 1965 to 2013.

According to the World Nuclear Association, as of January 2014, 375 gigawatts of nuclear electric power plants were operative worldwide. 75 gigawatts were under construction, 187 gigawatts were being planned, and 351 gigawatts were being proposed. World Nuclear Association claims that most planned nuclear power plants are expected to operate within 8-10 years. Assuming that in 10 years, all of the currently constructed and planned nuclear power plants become operative, then in average the world will need to build 26 gigawatts of nuclear power plants a year in the next 10 years. In reality, some delays are inevitable.

According to the World Nuclear Association, as of January 2014, 375 gigawatts of nuclear electric power plants were operative worldwide. 75 gigawatts were under construction, 187 gigawatts were being planned, and 351 gigawatts were being proposed. World Nuclear Association claims that most planned nuclear power plants are expected to operate within 8-10 years. Assuming that in 10 years, all of the currently constructed and planned nuclear power plants become operative, then in average the world will need to build 26 gigawatts of nuclear power plants a year in the next 10 years. In reality, some delays are inevitable.

I assume that from 2015 to 2050, the world will build 20 gigawatts of nuclear power plants each year. On the other hand, 2 percent of the existing nuclear generating capacity will retire each year. Under these assumptions, nuclear electricity consumption is projected to rise to 4,648 terawatt-hours (1,052 million metric tons of oil-equivalent) by 2050.

Hydro Electricity

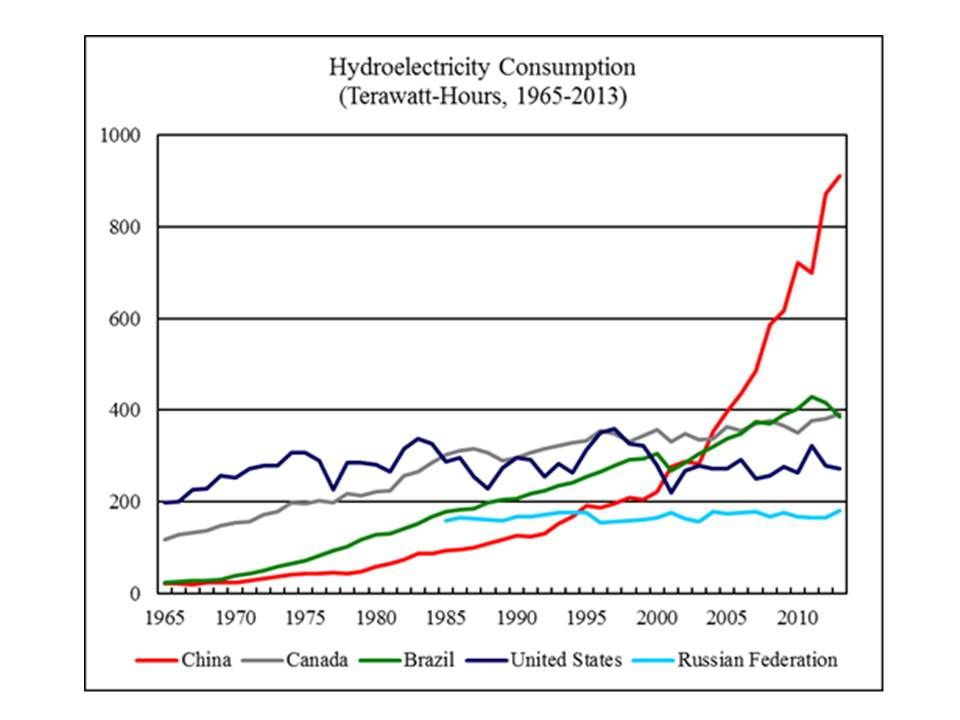

According to BP Statistical Review of World Energy 2014, world consumption of hydroelectricity reached 3,782 terawatt-hours (856 million metric tons of oil-equivalent) in 2013, 2.9 percent higher than world consumption of hydroelectricity in 2012. In 2013, hydroelectricity accounted for 6.7 percent of the world primary energy consumption.

Figure 17 shows hydroelectricity consumption by the world’s five largest consumers of hydroelectricity from 1965 to 2013.

From 2000 to 2013, the average annual growth of world hydroelectricity consumption was about 90 terawatt-hours (20 million metric tons of oil-equivalent). I assume that world hydroelectricity consumption will rise to 880 million metric tons of oil-equivalent in 2014 and will keep growing by 20 million metric tons of oil-equivalent each year from 2015 to 2050.

From 2000 to 2013, the average annual growth of world hydroelectricity consumption was about 90 terawatt-hours (20 million metric tons of oil-equivalent). I assume that world hydroelectricity consumption will rise to 880 million metric tons of oil-equivalent in 2014 and will keep growing by 20 million metric tons of oil-equivalent each year from 2015 to 2050.

Wind Electricity

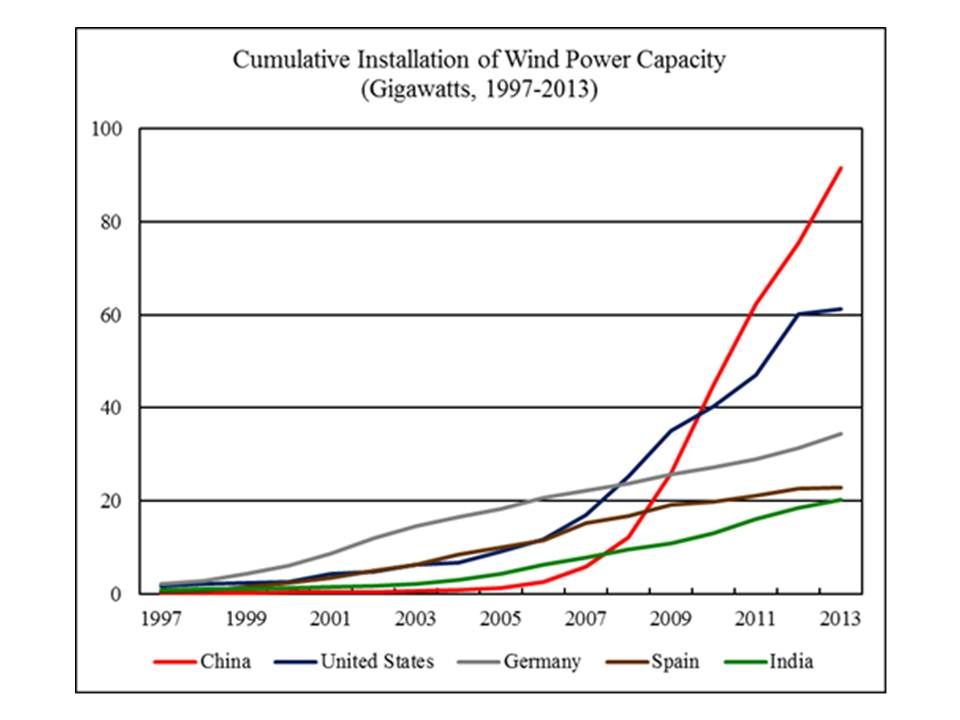

According to BP Statistical Review of World Energy 2014, world consumption of wind electricity reached 628 terawatt-hours (142 million metric tons of oil-equivalent) in 2013, 20.7 percent higher than world consumption of wind electricity in 2012. In 2013, wind electricity consumption accounted for 1.1 percent of the world primary energy consumption.

In 2013, the world cumulative installation of wind power capacity reached 320 gigawatts, 12.4 percent higher than the cumulative installation in 2012. Figure 18 shows the cumulative installation by the world’s five largest installers of wind power capacity from 1997 to 2013.

Wind electricity has grown rapidly. But eventually, the annual installation of wind power capacity will be limited by the availability of grid connection, materials, skilled workers, and other factors. For example, to install 100 gigawatts of wind electricity, it would require the consumption of 10 million metric tons of steel. Beyond a certain threshold, wind electricity may undermine the reliability of electric grid because of intermittency. World total annual installation of all types of electric power capacity is about 300 gigawatts. Only a portion of the annual installation can be committed to the building of renewable power plants.

Wind electricity has grown rapidly. But eventually, the annual installation of wind power capacity will be limited by the availability of grid connection, materials, skilled workers, and other factors. For example, to install 100 gigawatts of wind electricity, it would require the consumption of 10 million metric tons of steel. Beyond a certain threshold, wind electricity may undermine the reliability of electric grid because of intermittency. World total annual installation of all types of electric power capacity is about 300 gigawatts. Only a portion of the annual installation can be committed to the building of renewable power plants.

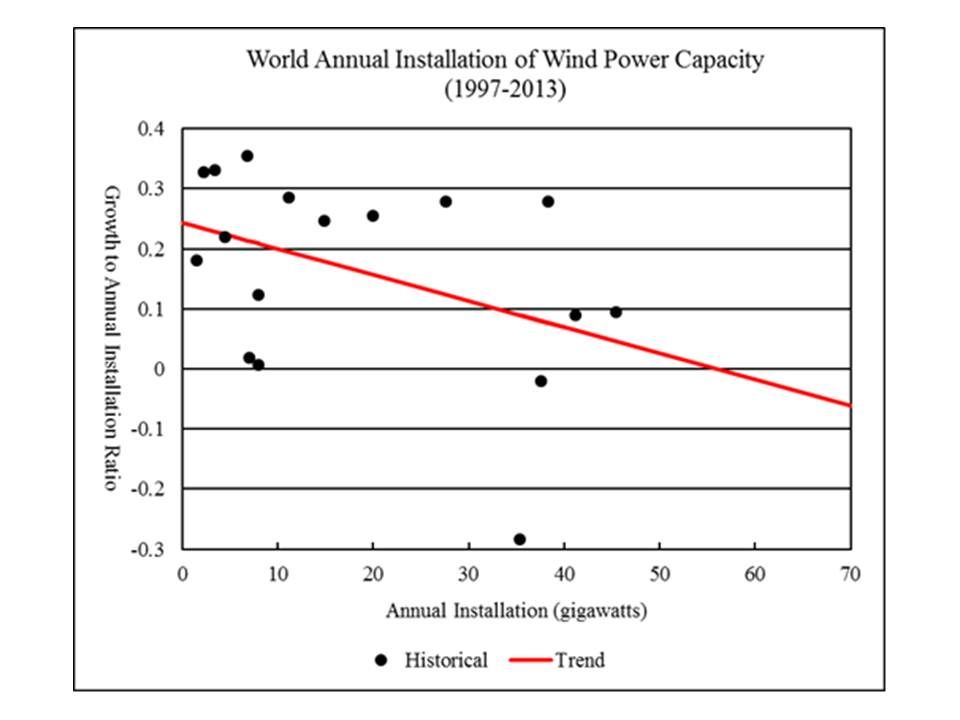

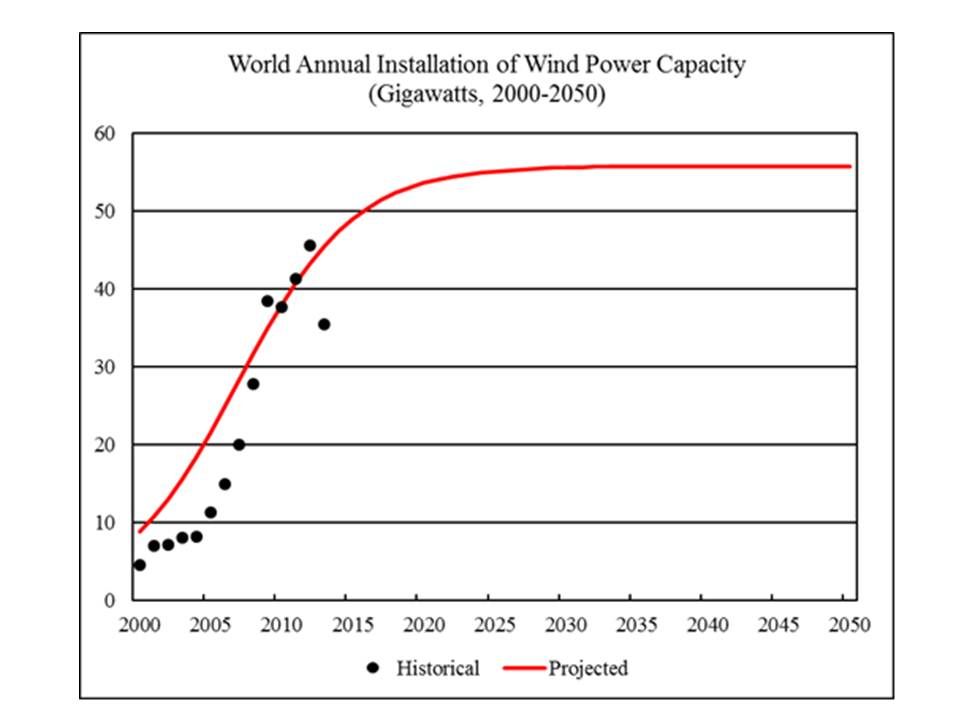

Figure 19 shows the historical relationship between the growth and the level of annual installation of wind power capacity from 1997 to 2013. As the annual installation rises, the growth to level ratio (the growth of annual installation to the level of annual installation) tends to fall. The current trend indicates the long-term “equilibrium” annual installation to be 56 gigawatts. In 2013, the world annual installation of wind power capacity was 35 gigawatts, falling from 46 gigawatts in 2012.

Figure 20 shows the world historical and projected annual installation of wind power capacity.

Figure 20 shows the world historical and projected annual installation of wind power capacity.

The projected annual installations of wind power capacity are used to project the growth of wind electricity consumption from 2014 to 2050 using the following formula:

Annual Growth of Wind Electricity Consumption (Mtoe) = Annual Installation of Wind Power Capacity (GW) * 8.76 * 0.25 / 4.4194

In the above formula, wind power capacity utilization rate is assumed to be 25 percent (the observed world average wind power capacity utilization rate was 22 percent in 2013). The number 8.76 = 8760 / 1000 calculates the electricity to be generated by 1 gigawatt of generating capacity operating year round and converts gigawatt-hours into terawatt hours. The number 4.4194 converts terawatt-hours into million metric tons of oil-equivalent.

Solar Electricity

According to BP Statistical Review of World Energy 2014, world consumption of solar electricity reached 125 terawatt-hours (28 million metric tons of oil-equivalent) in 2013, 33.0 percent higher than world consumption of wind electricity in 2012. In 2013, solar electricity consumption accounted for 0.2 percent of the world primary energy consumption.

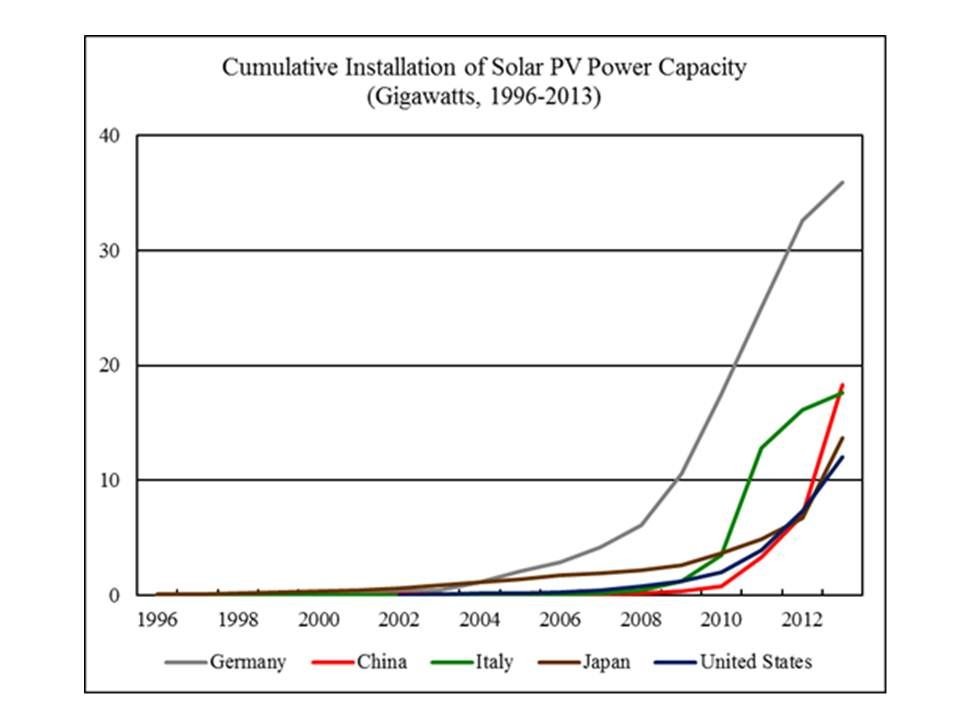

In 2013, the world cumulative installation of solar photovoltaic (PV) power capacity reached 140 gigawatts, 36.8 percent higher than the cumulative installation in 2012. Figure 21 shows the cumulative installation by the world’s five largest installers of solar PV power capacity from 1996 to 2013.

Solar electricity has grown rapidly. But eventually, the annual installation of solar power capacity will be limited by the availability of grid connection, materials, skilled workers, and other factors.

Solar electricity has grown rapidly. But eventually, the annual installation of solar power capacity will be limited by the availability of grid connection, materials, skilled workers, and other factors.

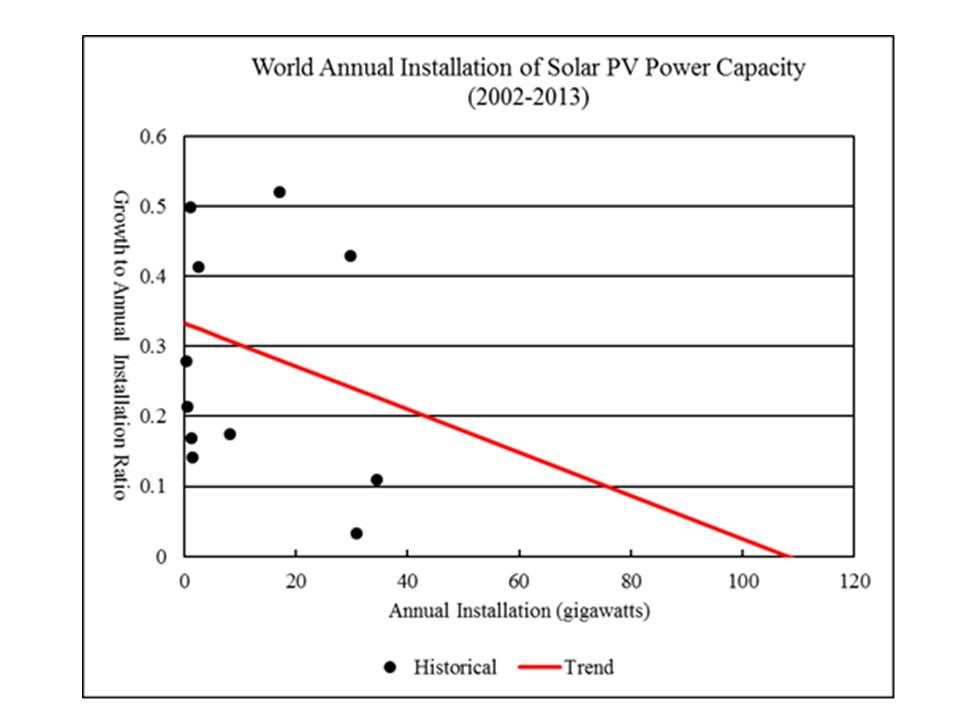

Figure 22 shows the historical relationship between the growth and the level of annual installation of solar photovoltaic power capacity from 2002 to 2013. As the annual installation rises, the growth to level ratio (the growth of annual installation to the level of annual installation) tends to fall. The current trend indicates the long-term “equilibrium” annual installation to be 108 gigawatts. In 2013, the world annual installation of solar photovoltaic power capacity was 35 gigawatts, rising from 31 gigawatts in 2012.

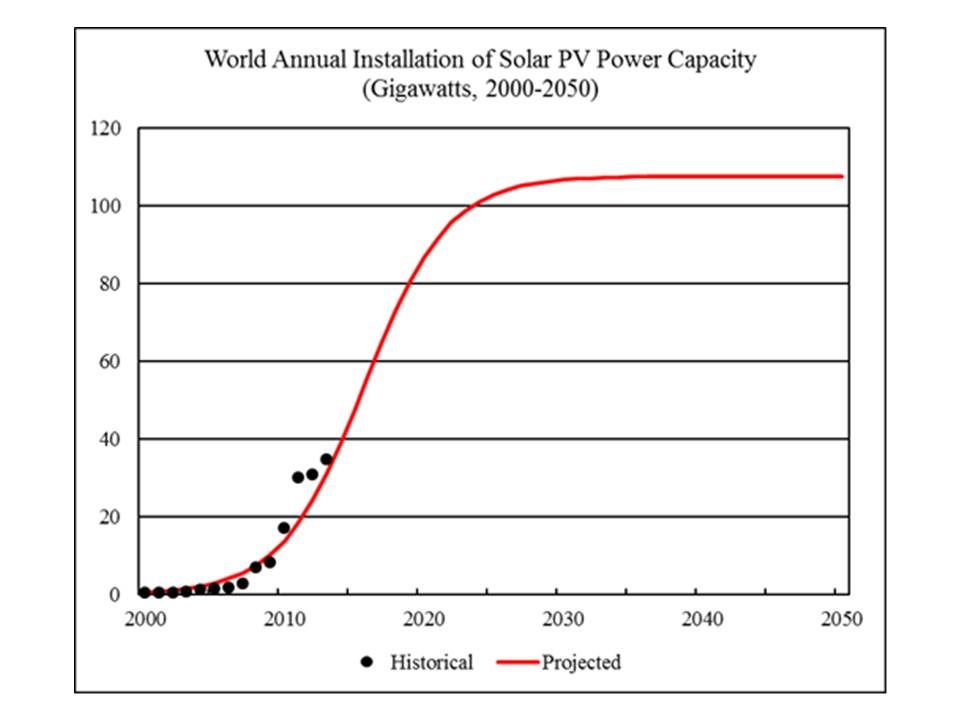

Figure 23 shows the world historical and projected annual installation of solar photovoltaic power capacity.

Figure 23 shows the world historical and projected annual installation of solar photovoltaic power capacity.

The projected annual installations of solar photovoltaic power capacity are used to project the growth of solar electricity consumption from 2014 to 2050 using the following formula:

The projected annual installations of solar photovoltaic power capacity are used to project the growth of solar electricity consumption from 2014 to 2050 using the following formula:

Annual Growth of Solar Electricity Consumption (Mtoe) = Annual Installation of Solar PV Power Capacity (GW) * 8.76 * 0.15 / 4.4194

In the above formula, solar photovoltaic power capacity utilization rate is assumed to be 15 percent (the observed world average solar photovoltaic power capacity utilization rate was 10 percent in 2013). The number 8.76 = 8760 / 1000 calculates the electricity to be generated by 1 gigawatt of generating capacity operating year round and converts gigawatt-hours into terawatt hours. The number 4.4194 converts terawatt-hours into million metric tons of oil-equivalent.

Geothermal, Biomass, and Other Renewables

According to BP Statistical Review of World Energy 2014, world consumption of geothermal, biomass, and other renewable electricity reached 481 terawatt-hours (109 million metric tons of oil-equivalent) in 2013, 7.7 percent higher than in 2012. In 2013, the consumption of geothermal, biomass, and other renewable electricity accounted for 0.9 percent of the world primary energy consumption.

From 2000 to 2013, the average annual growth of world consumption of geothermal, biomass, and other renewable electricity was 4.9 million metric tons of oil-equivalent. I assume that the world consumption of geothermal, biomass, and other renewable electricity will rise to 115 million metric tons of oil-equivalent in 2014 and will grow by 5 million metric tons of oil-equivalent each year from 2015 to 2050.

Biofuels

According to BP Statistical Review of World Energy 2014, world biofuels production reached 65 million metric tons of oil-equivalent (1.3 million barrels of oil-equivalent per day), 6.1 percent higher than world biofuels production in 2012. In 2013, biofuels production accounted for 1.6 percent of the world oil consumption.

From 2000 to 2013, the world biofuels production grew in average by 4.3 million metric tons of oil-equivalent a year. I assume that the world biofuels production will rise to 70 million metric tons of oil-equivalent by 2014 and will rise by 5 million metric tons of oil-equivalent each year from 2015 to 2050.

Iraq: Petrol crisis hits Kurdish region

http://www.youtube.com/watch?feature=player_embedded&v=MiCD5mFwB44

Hi PE,

The error bars on those growth rate projections for wind and solar would be of interest, my guess is that the 95 % confidence interval would be pretty wide.

On the 10 million tons of steel for wind power, that sounds like a lot. It isn’t. In 2012, 1500 million metric tons of steel was produced worldwide, so 10 million metric tons is 0.6% of World output. If wind is overbuilt it can provide up to 90% of output in the Northeast United States. See

http://www.sciencedirect.com/science/article/pii/S0378775312014759

Excerpt from the abstract:

“Our model evaluated over 28 billion combinations of renewables and storage, each tested over 35,040 h (four years) of load and weather data. We find that the least cost solutions yield seemingly-excessive generation capacity—at times, almost three times the electricity needed to meet electrical load. This is because diverse renewable generation and the excess capacity together meet electric load with less storage, lowering total system cost. At 2030 technology costs and with excess electricity displacing natural gas, we find that the electric system can be powered 90%–99.9% of hours entirely on renewable electricity, at costs comparable to today’s—but only if we optimize the mix of generation and storage technologies.”

And from the conclusion:

“At 2008 technology costs, 30% of hours is the lowest-cost mix

we evaluated. At expected 2030 technology costs, the cost minimum

is 90% of hours met entirely by renewables. And 99.9%

of hours, while not the cost-minimum, is lower in cost than today’s

total cost of electricity.”

and

“We find that 90% of hours are covered most cost-effectively by

a system that generates from renewables 180% the electrical energy

needed by load, and 99.9% of hours are covered by generating

almost 290% of need. Only 9e72 h of storage were required to cover

99.9% of hours of load over four years. So much excess generation of

renewables is a new idea, but it is not problematic or inefficient, any

more than it is problematic to build a thermal power plant

requiring fuel input at 250% of the electrical output, as we do today.”

This is off topic but highly relevant to peak oil scenarios.

http://www.nytimes.com/2014/07/01/technology/energy-sector-faces-attacks-from-hackers-in-russia.html?_r=0

Given that modern Russia is somewhat of a fascist police state run in large part by former security types I have no doubt that most information uncovered by the hackers finds its way to Putin and his buddies.

So he probably knows as much or more about peak oil in terms of technical data than anybody else in the world even including for instance the top management of a company such as Exon or Chevron.Those two companies probably don’t know all that much about each other in terms of what they are trying to keep secret.

( This leads to an interesting thought; I wonder how much spying our own government is doing on oil companies. It certainly has the technical ability to do as much as it pleases if it once chooses to do so. If I were a general in charge of defense planning or a top presidential advisor on the national security team I would sure as hell want that sort of raw data available to me rather than having to depend on publicly released documents.)

In the event of a war hot or cold the Russians may have the ability to throw some sand and monkey wrenches into a lot of oil company gearboxes.

At the very least they are probably stealing all the data they can to so as to avoid the expense of doing research and development on their own hook.

They might even be in effect stealing billions of dollars. I have often thought that if I were a simple nurse in a hospital doing drug trials and happened to be helping with the trials I might figure out when a new drug is going to be a block buster and get rich by buying stock in the company.Some trials have been so spectacularly good or bad that they have been stopped very early on. I could short a stock just as easily as buying it.

A Russian mobster with access to the inside data of an oil company that has just hit it big on a new field could buy up the stock well in advance of any public announcement thru front men. Likewise he could short it if test wells prove to be duds.

Given the recent relevations about all the spying on other governments and organizations and individuals foreign and domestic these days in the name of national security I am willing to believe this spying extends into the business of the worlds larger oil companies as a matter of course.

And of course it would be highly compartmentalized and thus might not ever come to light unless we are lucky enough to have another whistle blower such as Snowden.

http://finance.yahoo.com/news/north-dakotas-latest-fracking-problem-232000950.html

Stung by criticism that it has allowed oil producers to flare wells indefinitely, the North Dakota Industrial Commission on June 1 adopted rules requiring that gas-capture plans be submitted for companies to get a new drilling permits. The rules require producers to identify gas-processing plants and proposed connection points for gas lines but don’t affect permits that already had been issued.

The commission, which promotes as well as regulates the drilling industry, on Tuesday is expected to announce measures to limit flaring of existing wells. The federal government also is considering new limits on flaring.

. . .

Flared gas is still subject to royalty. But XTO and Continental haven’t paid either for gas flared at the Wolff or Palmer wells, according to Mr. Kelly, the landowners’ lawyer.

XTO said it doesn’t comment on specific contracts but is working to reduce flaring. Continental declined to comment.

I seem to recall reading, a year ago or more, that in Alberta infrastructure for NG collection must be in place before a drilling permit is granted. Does anyone know if this is the case?

All parties have been put on the same page. They all know if drilling slows, production will fall. Period.

North Dakota doesn’t have any sort of requirement that production rise. Current production should serve the populace just fine.

But the leveraged companies would be looking at an Apocalypse if they are not allowed to drill at maximum speed.

As was mentioned months ago, the choke may tell the tale.

Hi PE,

Edit: the analysis below is incorrect as was pointed out to me (very politely) by political economist. So it is best ignored.

I question the growth to annual installation and whether this trend will be followed after a relatively short period of ramp up (as in the case of wind and solar power).

To test this I looked at the % growth in natural gas consumption vs annual consumption of natural gas in millions of tonnes of oil equivalent over two different periods. First I looked at 1965 to 1985 and the trend points to 1700 million tonnes of oil equivalent at a zero growth rate, then I consider 1965 to 2013 which points to 3700 million tons of oil equivalent at zero growth.

It is not clear that this method leads to reliable results for predicting future growth for wind and solar. See Chart below.

Hi Dennis,

Thank you for your (usually) very thoughtful and critical comments. I agree, that the whole exercise for wind and solar at this stage is rather tentative. R-square is low. For wind it is about 0.2 For solar, it’s in single digit. I can put the starting year at 2008 and get a much better R-square for solar (about 0.3) but then I only have 6 observations and the implied maximum annual installation would be only 50 GW. My hope is that as more and more data are accumulated, in the future we can gradually approach the truth.

That has been said. There are a few points I would like to make.

First, please note that the assumption there will be a maximum annual installation is in fact much more optimistic than the assumption of maximum installed capacity of a renewable resource (which I think is more reasonable in the long run, given the land and resources constraints). I am implicitly assuming no solar or wind power equipment needs to be replaced. The assumption is that solar and wind growth wll eventually become linear but the linear growth can continue indefinitely (which I think in fact it cannot happen).

Second, in the case of wind, annual installation already declined from 45 gigawatts in 2012 to 35 gigawatts in 2013. But I Am assuming in the future it will grow towards 55 gigawatts. We’ll see if I am too optimistic.

Third, I think at least for the next few years, actual observations may continue to pull down the solar trend line. If you look at the solar graph, the growth rate of annual installation (not the growth rate of cumulative installation) needs to be more than 25 percent to pull up the trend line.

Fourth, I think there is a general consensus that wind is subject to much more severe land constraint than solar. See Vaclav Smir’s book, Energy Transitions (Praeger 2010), last chapter. Even at the level of theoretical maximum, only solar can provide more than a fraction of the world’s current energy consumption.

Fifth, on solar, based on Carlos de Castro’s research:

http://www.eis.uva.es/energiasostenible/wp-content/uploads/2011/11/solar-energy-draft.pdf

(I think a revised version of this one is published in Energy Policy)

When ecological and materials limits are taken into account, the global potential is only 2-5 TW (in term of annual flow, not generating capacity). That’s equivalent to about 12,000-30,000 GW of solar generating capacity. In term of electricity output, that is the same output as from 4,000-10,000 GW of conventional thermal power plants or about 80%-200% of the world’s persent electricity generation. But electricity is only about 20% of the world final energy consumption or 40% of the primary energy consumption.

Sixth, the world’s net installation of all types of power plants now is about 250 GW (about 40 percent is in China). So 150 GW from wind and solar would represent 60% of the total net installation. Even if the total net installation doubles by 2050, 150 GW from wind and solar would still represent 30%. If the intermittency constraints cannot be solved by then, 30% is not unreasonable as a limit to wind and solar.

Seventh, yes, world steel production is 1.5 billion tons. But remember, wind and solar installations are new applications and they need to come from the growth of world steel production to not undermine other economic activities. If world steel production grows by 2% a year, the growth would be 30 million tons a year. There is research establishing that each GW of wind and solar consumes about 100,000 tons of steel (actually the research says it will take more than 100,000 tons, I choose to err on the optimistic side). So 150 GW of wind and solar will consume 15 million tons, about half of the annual growth of world steel production. By comparison, a conventional power plant consumes about 50,000 tons of steel for each GW, so the current world annual net installation of all types of power plants consumes about 250 * 0.05 = 12.5 million tons of steel.

I have not yet talked about silver. A GW of solar PV consumes approximately 50 tons of silver. So 100 GW of solar PV would consume 5,000 tons of silver, about 20% of world annual production.

And, by the mid-21st century, can the world steel or silver production keep growing?

One more point. About the natural gas analogy. My approach of assuming maximum annual installation is more like assuming the ANNUAL GROWTH of natural gas consumption will reach the maximum.

So this is more optimistic than assuming that the natural gas CONSUMPTION will reach the maximum.

Also note that in the solar and wind graphs, on the vertical axis, it is not exactly the growth rates of wind or solar annual installation are shown. It is the ratio of growth of annual installation to the current level:

(This year’s annual installation – Last year’s annual installation) / This year’s annual installation

In the long run, it should converge towards the growth rate. But in the short run, the ratios are somewhat lower than the growth rates (and probably imply larger maximum annual installation).

Hi PE,

I took this year’s consumption minus last years consumption divided by this year’s consumption, let’s say output is 10% of capacity and capacity grows from 100 to 200. Installation growth would be 100/200 or 50%, consumption growth (I assume produced electricity is consumed) is 10/20 or 50%.

So the natural gas chart is indeed equivalent to your wind and solar charts.

Edit the above is incorrect, I was mistaken the charts are not equivalent.

Prices will allocate resources, if silver demand goes up so will prices and resources will be allocated appropriately, also as prices increase, more materials will be recycled if supply becomes short. For thermal power plants are you including the steel required for the extraction of fossil fuels in order to run the thermal power plants? What is the research that says thermal plants use less steel than solar?

Hi Dennis, yes, prices allocate resources but there are only certain prices the economy can afford (in fact, what exactly is “price” is almost as complicated in economics as what “mass” is in physics).

Whatever are the prices, one particular activity can only consume a limited proportion of certain resources without seriously undermining other economic activities.

On steel requirement for coal and gas plants (it says the steel requirments are 30,000 tons/GW for gas and about 50,000 tons/GW for coal):

Spath, Pamela L. and Margaret K. Mann. 2000. Life Cycle Assessment of A Natural Gas Combined-Cycle Power Generation System. National Renewable Energy Laboratory, NREL/TP-570-27715. http://www.nrel.gov/docs/fy00osti/27715.pdf.

Spath, Pamela L., Margaret K. Mann, and Dawn R. Kerr. 1999. Life Cycle Assessment of Coal-Fired Power Production. National Renewable Energy Laboratory, NREL/TP-570-25119. http://efile.mpsc.state.mi.us/efile/docs/16077/0065.pdf.

On steel requirment for wind (it says the steel requirement for wind is about 115,000 tons/GW):

Wilburn, David R. 2011. “Wind Energy in the United States and Materials-Required for the Land-Based Wind Turbine Industry from 2010 through 2030.” U.S. Geological Survey, Scientific Investigations Report 2011-5036. http://pubs.usgs.gov/sir/2011/5036/sir2011-5036.pdf.

On steel requirement for solar PV (it says the steel requirement is 83000-145000 tons/GW):

Campbell, Matt. 2008. “The Drivers of the Levelized Cost of Electricity for Utility-Scale Photovoltaics.” SunPower Corporation, http://us.sunpowercorp.com/power-plant/.

Hi Dennis, now continue with the capacity subject.

Please note that the above wind/solar graphs are about ANNUAL INSTALLATION. They are not about CUMULATIVE CAPACITY

Take the BP data as an example. Between 2011 to 2013, the relevant data for solar are as follows:

2011

Cumulative Capacity 71.218 GW

Solar Electricity Consumption: 59.2 TWH

Observed Capacity Utilization Rate: 59.2 / (71.218 * 8760 / 1000) = 9.49%

Annual Installation: 71.218 GW – 41.33 GW = 29.888 GW

(41.33 GW was the cumulative capacity in 2010)

2012

Cumulative Capacity: 102.076 GW

Solar Electricity Consumption: 94.1 TWH

Observed Capacity Utilization Rate: 10.5%

Annual Installation: 102.076 GW – 71.218 GW = 30.858 GW

2013

Cumulative Capacity: 139.637 GW

Solar Electricity Consumption: 124.8 TWH

Observed Capacity Utilization Rate: 10.4%

Annual Installation: 139.637 GW – 102.076 GW = 37.561 GW

My assumption is that annual installation (not cumulative capacity) will reach a maximum equilibrium.

Cumulative Capacity is (roughly) proportional to the annual solar electricity consumption (analogous to your natural gas consumption)

Annual Installation is (roughly) proportional to the annual growth of solar electricity consumption.

The graphs project the annual growth of annual installation again annual installation. So they are more similar to the relationship between the acceleration of natural gas consumption growth and natural gas consumption growth, rather than about the relationship between natural gas consumption growth and natural gas consumption.

I hope that helps to clarify the confusion.

Note that equilibrium annual production together with assumptions about lifetime tell us the equilibrium installed stock.

If windmills last 25 years, 56 GW/year implies a total stock of 1400 GW capacity, 1.4 TW. Likewise, if PV panels last 30 years, 108 GW/year implies a total capacity of 3240 GW, 3.2 TW. As these are total capacity, actual electricity production needs to be derated by the capacity factor and aging losses. For wind, multiply by 0.15; for PV, by 0.067.

I hope that the equilibrium annual production estimates turn out to be too low.

While I agree that the annual production of wind and PV electricity production capacity will tend to a limit, like Dennis, I am sceptical that steel and/or silver availability are at all constraining with the given equilibrium annual production figures.

The annual demand from wind and solar power is likely to be considerably smaller than the expected, and planned-for, increase in annual production of structural steel and steel for motor vehicles between now and 2050. Similar comments apply to consumption of aluminium and of toughened/specialty glass for PV modules and mirrors. I just can’t see constraints on steel production capacity being binding.

If, as in the discussion below, the price of oil jumps by 25% – 30%, and vehicle and structural demand consequently falls and remains below trend, incremental demand from wind and solar power may come as a blessing to steel, glass and aluminium producers.

Silver. De Castro et al. talk about silver in the context of concentrating solar power, most of which is thermal rather than photovoltaic, and which is both very much smaller than PV and growing more slowly. In any event there are several good commercially available substitutes for silver as a reflector, and once there is a big market for reflection and/or the price of silver rises high enough to provide the incentive, more reflective materials will be developed from the existing panoply of lab projects, or new ones. The availability of silver isn’t constraining either.

De Castro’s paper is a useful reminder, though. A simple back-of-the-envelope calculation of likely PV production comes up with 3 TWe (continuous equivalent), and de Castro derates production by 2/3 to allow for aging, dirt, equipment failure, connection losses, etc., giving 2 TWe (ceq). With a derating factor of 0.067, 2 TWe (ceq) means total capacity of 30 TWe. With a 30-year life, that implies equilibrium annual production of 1000 GWe.

Hi Greg, thanks for adding to this discussion.

Again my assumption is that there will be a maximum limit to ANNUAL INSTALLATION, not a maximum limit to annual production of solar or wind.

Although in the long run, a maximum limit to annual production is more reasonable. But in this exercise, I choose to err on the optimistic side. Moreover, I explicitly said I assume there will be no depreciation/replacement requirement for wind or solar. So all installations from now to 2050 are treated as NET Installations. Again, this is an optimistic assumption.

Yes, the future world steel production will be considerably greater than the PV demands. But by how much. Currently the total steel demand by all types of power plant construction is significantly less than 1% of world steel production. How many percents will go to PV?

World steel production in 2013 is already 1.6 billion tons (although the growht rate slows down to 1.9%). About 70% of the world steel production still comes from primary steel, which consumes huge amount of iron ore and coal.

In 2013, the world probably burns about 800 million tons of coal for steel production. In addition, the world produces/consumes almost 3 billion tons of iron ore. World iron ore reserves are 170 billion tons with iron content of 81 billion tons (iron content ratio is 48%).

At the current production rate, iron ore reserves can last less than 60 years.

World iron ore resources are supposed to be more than 800 billion tons with iron content greater than 230 billion tons. Simple calculation suggest that beyond the current iron reserves, iron content ratio among the remaining iron ore resources is likely to be only (230-80)/(800-170) = 24%.

If world steel production grows by 2% a year, and the iron ore and coal consumption grow accordingly, then by 2050, steel production will be 3.2 billion tons, coal burning for stell production alone will be 1.6 billion tons, and iron ore production will rise to 6 billion tons.

World iron reserves will be exhausted by then. If iron ore keeps growing by 2% a year, we are going to exhuast all the remaining iron RESOURCES just a few years after 2100.

In addition to peak oil, there will be peak coal and peak iron. Therefore, there will be peak steel. Therefore, there will be peak wind and peak PV.

Hi PE,

As resources become depleted prices will increase and more steel will be recycled.

Just because most steel is currently primary steel does not mean that it will remain so.

At some point population will peak and growth per capita can continue will much lower rates of growth or even with negative absolute growth.

For example if population declines by 1% per year and growth in World GDP is 0% GDP per capita increases.

In addition, cement can be substituted for steel in many applications (buildings for example) as the price of steel rises, such substitution will occur.

Good Morning PE,

Your arguments make pretty good sense- if I am reading them correctly- on the IF/ THEN basis. If your assumptions hold your arguments probably are good ones.

BUT I seldom see any arguments put forth by economists that I think will hold over a long period of time. The world is not a linear sort of place.People acting in crowds are predictable only in being unpredictable.

There is going to be panic at some point when electricity supplies become intermittent or absurdly expensive simply because of intermittent and absurdly expensive coal and natural gas.

Coal and gas in the ground are not the same thing as DELIVERED – and PAID FOR coal and gas.There are going to be wars and embargoes and national bankruptcies.There may well be resource nationalism that will prevent substantial potential exports of coal and gas and oil.

One potential result of scenarios involving such factors is that there will be a panic based boom in the buildout of wind and solar power.

Electricity is going to eventually – in my estimation at least- be seen as a strategic commodity in terms of national security in many or most parts of the world.

Right now we justify the cost of a coal plant or a nuke by assuming it is going to run continuously many years;whereas we justify the cost of the MIC on the basis of having it there when it is needed and hopefully only needing a tiny bit of it to actually be put to use and only on an occasional basis.

The utilization of our nuclear arsenal has been zero since the end of WWII.Ten percent utilization of solar power and thirty percent utilization of wind power looks pretty good in comparison!!!!!!!!!!!!!!

I believe the solar industry is going to go hog wild eventually for another reason as well.Economic stimulus and social welfare programs are now so thoroughly embedded in our political culture that they are permanent fixtures to the extent anything is permanent in politics.

Times are going to get hard with the growth of population overall, with an aging population on the public dime, and depleting resources of the sort that come out of holes in the ground.

The powers that be in future times are going to be looking for public works programs to partially justify the cost of welfare for skilled and unskilled workers.Millions of them have been put to work in the past building parks and highways. In the future a millions of them will be put to work in the wind and solar industries.In functional terms this means labor costs are largely of no consequence since the labor would be living on tax money even sitting at home getting ready to riot or at least march on the legislature and burn the current governors and presidents/prime ministers/etc in effigy.

Then there is the falling cost of the actual product( pv panels and wind turbines) and the rising value of the electricity it produces in relation to the cost of fossil fired electricity.

I for one cannot believe the price of fossil fuel fired DELIVERED electricity for residential and industrial use is going to go up at less than three or four percent a year in constant money as fossil fuels deplete and the appetite for tax money grows.

My point is this. How much faith can any body reasonably have in economic projections that reach much more than a decade or so into the future??

This is not to say that your work is not of great value in helping create better insights into what the future might hold.

I look forward to your posts with great interest.

Hi Mac, thank you for your criticism of my discipline, which I think is well deserved.

About the value of my projection, the best answers lies in how the energy reality evolves in the future. We’ll find out.

You are most cordially welcome lol.

It is not that you and MOST economists don’ t understand that all their arguments about the future are based on if and then.

The problem is that they know it so well that they seldom if ever bother to mention it and so assume that their readers understand this point too.

The public does generally does not understand anything that doesn’t smack them upside the head like a brick for the most part.

Consequently the public has a powerful tendency to accept such arguments at face value as if they were gilt edged securities.

Hi PE,

Yes I understand, finally!

My confusion was that I was not doing cumulative gas consumption, but the point that I was missing is that the annual output is a function of cumulative capacity, I get it now.

Sorry for the confusion.

The silver constraint only applies concentrated solar power, not to photovoltaics. And even for CSP, aluminum is a substitute.

re de Castro’s paper:

sigh – so much mis-information and dated material…

Silver is currently used for the grid lines and bus bars on most silicon cells,

but a few manufacturers are going with copper over a flash of nickel or very thin silver.

(Copper kills the carrier lifetime in silicon, so one ought not directly contact the two).

Silver usage has in any case declined by about 50% since 2010 due to reformulated pastes and narrower grid lines. (the lines are screen printed or ink-jet printed as a paste, then fired to (a) dissolve the silicon nitride anti-reflective coating and (b) convert the paste into a solid conductor).

de Castro uses old numbers for efficiency, and seems to think that thin film will rule in the future because of cost, so surmises efficiency will never surpass 15%. Well, surprise (to outsiders, not to the silicon PV community), crystalline silicon is beating most all thin-film on cost, and matching First Solar. He uses 20% as the top silicon cell efficiency, but currently SunPower has 20% module efficiencies, Panasonic (nee Sanyo) is close behind, and at the recent IEEE PV Specialists Conference, Panasonic, Sunpower and Sharp all announced cells at or above 25% efficiency, on full area wafers (or essentially so).

So de Castro’s hand-wringing about tellurium limits is non-applicable.

(He can leave that to First Solar 😉

I also found his arguments about land limitations unclear and unconvincing.

If we build a pumped water storage reservoir, we can put (floating?) PV on that too.

He apparently leaves out rooftop PV, but that’s unclear.

The limits to PV are economic, as is, will we have an economy that can afford to do that massive build out (in time)?

My take is take is that’s inversely proportional to the amount of denial of peak oil and climate change.

Hi PE,

You seem to be convinced that my chart above is different from your wind and solar charts so I decided to try to reproduce your chart for solar. I have assumed that you used the BP 2014 data and I understand that the spreadsheet gives cumulative capacity so we need to subtract the previous year to get the annual increase in capacity.

Edit (The following paragraph is not correct ignore please.)

Chart is below and is no different than the Natural Gas Chart which does not use cumulative consumption it uses annual consumption and the growth rate is the increase in annual consumption (similar to the increase in the annual installation) divided by annual consumption.

Hi PE,

I have finally realized my mistake, my apologies. Ignore comment that follows, the analysis is incorrect.

The Solar consumption annual growth is below:

“Annual Growth of Solar Electricity Consumption (Mtoe) = Annual Installation of Solar PV Power Capacity (GW) * 8.76 * 0.15 / 4.4194”

I modified this by using 0.1 in place of 0.15 because the GW consumed divided by GW of capacity increase in 2013 was only 9% so even 10% is optimistic 🙂

Using my modified (more conservative estimate) the maximum growth would be about 20 Mtoe.

A problem with your formula however is that it does not take into account that thermal power plants are not 100% efficient so you need to divide by about 0.4 to account for this (assuming thermal plants are 40% efficient). Note that BP uses 38% efficiency for thermal power plants in its solar and wind consumption statistics in Mtoe. Adjusting your formula we get about a 50 Mtoe annual growth in solar consumption.

Using BP data for solar consumption we get about 70 to 90 Mtoe maximum solar consumption growth, but I still think this method will tend to underestimate potential growth in solar consumption, if natural gas is a guide then this estimate is likely to be a factor of 2 too low. See chart below

Analysis incorrect ignore chart below.

Dennis, I see you’ve already sorted out the confusion about cumulative capacity/annual installation. Great! We agree.

About the BP solar consumption data. Please note that the BP Mtoe data have already converted solar electricity on the basis of “thermal equivalent”.

For example, in 2013, solar elecrtricity consumption is presented as 124.8 TWH or 28.2 Mtoe. 124.8/4.4194 = 28.2

By using the number 4.4194, I am converting solar electricity according to “thermal equivalent”, that is, to make it comparable to thermal power plants with 38% efficiency.

If I want to convert electricity to energy content directly, I want to use 11.63. 124.8/11.63 = 10.7 Mtoe (11.63 * 0.38 = 4.4194)

BP converts wind, hydro, nuclear in a similar way.

Sometimes these “official” institutions cause huge confusions. If you read IEA, they convert nuclear by assuming 33% thermal efficiency, geothermal 10% thermal efficiency, but everything else (hydro, wind, solar) is just converted by electrical energy content.

Iraq Instability And Oil Prices

If just half of Iraqi production ceases:

1.5 million barrels per day of production would be lost. This makes up roughly 1.7% of global crude oil consumption. Econometric modeling suggests that this contraction in oil output would potentially raise oil prices by 45% or about $50 per barrel.

If this were to occur, presumably inflation pressures would mount quickly in the United States. The potential impact on gasoline prices would be a 20% to 25% price increase.

GDP growth in the United States could move toward 0%, threatening a new recession. If the significant upward move in oil prices turns out to be a spike, a recession would probably be averted.

If that is truly the case then this does not bode for the world after Peak Oil. We could expect this kind of supply drop every year after year. This, if this author is just half right, would spell disaster for all the world’s economies.

At any case it is going to be a whole lot worse than even a lot of peak oilers expect.

Given US GDP in Q1 reported in final revision as -2.9% (that’s minus), this person is looking for an improvement in GDP up to, not down to, 0% from an Iraq oil production loss.

Possibly a lot worse…

Not really anything in that paragraph probable and very little correct. Which is pretty typical of that guy. Gold people generally construct all scenarios that somehow evolve to make them kings of their local communities because they had some gold.

Not real clear how that ever happens, but that’s their dream so that is how all their analysis points.

I am not a gold nut myself and never will be. I am convinced that for my remaining years at least that a ton or two of salt in barrels or shotgun ammo or boxes of nails are going to appreciate on average as much as gold and be worth as much or more in a genuine 24 carat crisis pun intended.

But gold still has an extremely powerful hold on the imagination of the world in general and the eastern world in particular.I think eastern governments in particular will continue to hoard it since they seem to believe it represents real power and security.It probably does but not really if you get my drift.

Seasoned burglars know that night lights are for their convenience but they still keep the amateurs away to some extent.Perceptions tend to trump reality in todays upside down world on a lot of occasions- for a while at least. Reality is going to prevail in the end. An ounce of gold cannot buy a non existent barrel of oil or flour.

But the government that has gold – or has fooled the rest of the world into thinking it has it – can probably pass its fiat money for a few more years longer than a government known not to have it.

If currency can be printed at will for oil, then how does EROEI or a petroyuan happening that wrests control from the petrodollar affect/factor into things?

Not at all. It’s paper and imagination defining both.

Only when use of force defines supply or demand do you get accurate measurements of anything. It’s all a matter of people, of whatever nationality, reaching the decision to conserve their oil and not ship it. When that day comes, paper won’t matter.

If you limit the US’– apparently one of, if not the, largest consumers of oil per capita– ability to purchase oil, say, via forcing a petrodollar-to-petroyuan shift, then what?

No difference whatsoever.

Now if you limit the US consumption via interdicting Nigeria tankers enroute Houston and send them to Shanghai, then we’re cooking.

😀

Ok thanks. I’ll keep that in mind.

It used to be that one could get a cheap ride on a freighter in the day. Unsure if its possible now, but maybe an oil freighter is less feasible in any case.

We are still the big dogs especially in terms of blue water navy.I expect that to hold for another twenty years or so.

One reason I really want to see the Keystone built is that once the fecal matter is well and truly in the fan having the keystone instead of Canada having west coast ports for oil means we will not have to intercept tankers headed to China. We can just refuse to load any headed that way when a really hot crisis if it is in our interest to do so.

History ain’t over. China is a rising power and will be challenging for domination of the world if she succeeds in continued growth- which of course is not guaranteed. But we are never again going to be able to face up to her in a conventional war in her own hemisphere and she is fast cementing business relationships with exporters of natural resources that are pretty close in effect to colonialism.

ROCKMAN’s post titled Tieing Oil Up is available here. This blog is not about farming but China is doing the same with agricultural lands and other mineral resources than oil at a blistering pace.

I am not a gold nut but EVENTUALLY things are going to get pretty hairy and China is going to have gold on hand to pay for anything that an exporter will not sell for fiat money or barter for Chinese goods.

China already tops the world in terms of producing all the basic goods needed to fight a conventional war.We don’t have shipyards to build liberty ships any more nor steel mills to make the steel nor even the skilled labor needed to build ships.We can’t even manufacture the heavy beams needed to build bridges any more or the the large pressure vessels needed to build oil refineries and nuclear power plants unless we have regained this ability in the last three or four years.

“I am not a gold nut but EVENTUALLY things are going to get pretty hairy and China is going to have gold on hand to pay for anything that an exporter will not sell for fiat money or barter for Chinese goods.”

In such a situation, an exporter would laugh at being offered shiny metal in return for whatever, probably oil.

There doesn’t have to be a naval confrontation at sea to re-vector tankers. Tankers are pretty easy targets. Even some imagined escort duty of US Navy ships convoying 3rd party tankers doesn’t work if there is merely an attack on one. The cargo is so valuable it must be insured. No insurer would dare do so if there were threats they would be sunk.

What good does it do the Chinese to threaten to sink Houston bound tankers? If they can’t have it, why should they let Houston have it? There would also clearly have been a breakdown in any bidding process by then, because if you HAVE to have it, you print whatever money of whatever denomination you want to file a winning bid. China’s printing press vs the Fed. (Note the yuan does not truly float on the free market, China defines the ratio yuan/dollar, so they can print all they want to equal the needed dollars to file their own winning bid.

It’s not really a contest that works because the world will see that the result is worthless. So that’s why the tanker gets sunk. Just one. That will be the end of insurance.

Watcher,

LOLOL….”An exporter would laugh at being offered a shiny metal…” That has to be the silliest thing you have ever stated. It was a great laugh.

I gather you have no clue of what’s going on during these G-12 meetings…. some of which the U.S. is not included.

A 70% devaluation of the US Dollar is coming. After that takes place… can you come in here and tell that silly shiny metal joke again?

Steve

Now what is the legislation that devalues a dollar 70%? Which party will introduce this legislation? Whose Congress or Parliament decrees this? Will Merkel’s CDU propose this to to their Siemens and Mercedes backers?

Dollars are traded on the FX market, and there is no central bank in the world outside NYC, not a single one, certainly not one in Frankfurt, that would tolerate destruction of Airbus or, for the BOJ, Toyota. The SNB is not going to sit back and watch Hershey’s destroy Nestles.

I disagree about the mechanism by which excess ( printed to cover excessive deficit spending) fiat money works. It does not ever buy goods in and of itself as if it were some sort of magic genies lantern.

SOMEBODY is FOOL ENOUGH to buy most or at least a large portion of the bonds and notes printed by governments large and small.They are exchanging existing money or purchasing power for a PROMISE of MORE money in the future.For the most part they are going to collect both the loaned principle and the interest but the sum of the two is going to be worth only a minor fraction of what they loaned.

The notes or bonds that are held by central banks will eventually be repudiated at the expense of the taxpayers and holders of fiat money in general and probably at a profit to the big banks that are siamesed to the central banks – unless people wise up and start putting bankers in jails instead of penthouses.

Consider a small isolated country with its own precious metal coins.If the king collects all the coins and debases them to the tune of ten percent and puts them all back into circulation prices will rise more or less about that same ten percent according to the econ I was taught back in the dark ages – everything else held equal.

All people and businesses owed money by a government that has allowed it central bank to accumulate bad debts will make the debts good by losing a portion of the purchasing power of whatever money they have or get. This will also include a loss of value of things such as social security checks except when indexed to inflation. (So Social Security itself is not a good example.)

These scenarios are based on the continuation of life more or less as we know it of course. That continuation is not guaranteed by any means.

If you don’t quite understand the rules of some game, maybe it’s not a good idea to be playing it… despite the embedded gun to your head.

Hi Caelan,

If your comment is in reply to my rant about inflation wiping out the value of govt issued paper the people who are buying this paper in my opinion are fully aware of the fact that it is a worse than rotten investment.

But it is not their money that they are spending.It belongs to insurance companies and labor unions and old folks looking for safe investments.

You can safely bet that the managers of such funds as are buying govt paper have only a very small portion of their own assets in this paper- generally just enough to provide some camouflage and a bit of the mine salting effect- as when old time crooks used to put a few nuggets in worthless mines in order to sell them to suckers.

And some buyers are buying in the full knowledge that Uncle Sam’s paper is going to depreciate badly over the next decade or two but there is a defacto tradeoff that is little understood and seldom mentioned.

By holding Uncle’s to be depreciated paper the holders get to shelter under our military umbrella.Given the cost of maintaining a military establishment capable of repelling aggression this is viewed as a bargain by the people holding the paper.

The people of the East have long memories. Given the relative size of China and Japan and China’s current state of economic development what chance would Japan have to survive another half century other than turning herself into a nuclear armed and otherwise fully militarized camp?

The Chinese teach the Rape of Nanking the way we teach Pearl Harbor except there is no PC element in China nor is China hooked on Japanese cars.The Chinese teach it in terms of revenge.

“The petrodollar system also meant that the U.S., the largest consumer of oil in the world, gained the power to buy oil with a currency it can print at will. ~ Wikipedia

Sorry Caelan, but that’s a lot of crap. The US government does not buy crude oil, refineries buy crude and they cannot print money any more than you can. The US Government does not own any refineries. Saying refineries can print money to buy oil is like saying WalMart can print money to buy junk from China.

And the “petrodollar system” has nothing to do with it. Oil is priced in dollars because the world needs some common benchmark in which to measure the price of oil. The so called “petrodollar” is the most overrated thing in the world. It means nothing except status. If the world were to switch tomorrow and start pricing oil in Euros it would mean nothing except a little loss of status for the dollar. But otherwise nothing would change. Any nation can buy oil, today, in any currency it wishes to use because any currency can be changed to dollars in milliseconds on the FOREX.

The idea that oil, on the world market, will ever be listed in Yuan is a joke.

oops, my bad

Oh, I can see it listed that way. But it would not matter if it was. Everything converts. That’s why there is an FX market.

I mentioned above that gold people arrange all their scenarios to make gold dominant. There is a lot of this thinking in the whole KILL THE PETRODOLLAR scenario. Everything in these dreams always is supposed to make gold the decider of who has power and wealth. There is never a path provided for this. It’s just supposed to happen. Everyone is supposed to find themselves in a financial disaster and turn to the guy with gold and elect him king. Very weird.

Ron Wrote:

“The US government does not buy crude oil”

Not to nitpick but just to point this out, The US gov’t does buy crude fill up the SPR as well as sell it from the SPR. Altough the US gov’t is one of the biggest consumer of refined oil products, mostly to support the US military.

“If the world were to switch tomorrow and start pricing oil in Euros it would mean nothing except a little loss of status for the dollar.”

The petro dollar is important for the US. The US has trillions in US Dollars held overseas. In order for any nation to buy oil or even refined oil products they need dollars. If for instance next week, Oil was priced in Euros, Nations would need to acquire Euros to buy oil. The value of the Euro would likely improve as nations acquire or hold Euros to purchase Oil (or refined oil products). Likewise the US dollar would decline as demand would fall, as they sell US dollars to buy Euros. Nations would also be less likely to hold on to dollars in the future.

If the Oil trades were no longer required in US dollars the dollar would also lose it world’s reserve currency status. Its hard to believe that at least some nations holding US dollar would seek to convert there dollar holding into Euros, thus setting off a global event to dump the dollar. Much like when investors get scared during a market correction and cash out stocks at a lost because they fear stock prices will continue to fall. Thus they all rush for the exits at the same time.

“Any nation can buy oil, today, in any currency it wishes to use because any currency can be changed to dollars in milliseconds on the FOREX.”

Unless your currency is junk. Currently Argentina is on the verge of a currency crisis again. It had been setting trades in US dollars since no one wanted Argentina dollars. There are lots of nations that need to hold dollars because its the only way the can pay for imports (not just including energy). FOREX trades also have a conversion premium as the broker handing the trade takes a cut. it cheaper to simply retain Dollars from Exports and use them to pay for imports instead of using FOREX.

“The idea that oil, on the world market, will ever be listed in Yuan is a joke.”

Yes, its probably unlikely that the China will succeed the US with the worlds reserve currency, as China as a credit bubble about 5 times larger than the US did back in 2008. Its Bubble is now in search of a pin.

At this time virtually all nations are trying to weaken their currencies in order to protect their export market. However, lots of countries are setting up bilateral trade agreements to avoid settling trades in US dollars. Currently the direction is moving away from a single currency system and probably into a basket of currencies. The number of bilateral trade agreements grows every year.

It is also disturbing that Oil exporters that announces that it no longer excepting Dollars for Oil seems to get invaded, or destabilized. For instance Iraq and Libya both were attacked by the US shortly after switching Oil Exports to Euros.

The petro dollar is important for the US. The US has trillions in US Dollars held overseas. In order for any nation to buy oil or even refined oil products they need dollars.

Spoken like a man who has never heard of the FOREX, or if he has still has no idea of what it is or how it operates.

TechGuy, no one needs to hoard dollars in order to buy oil. If they have billions in Yuan, Euros, Pounds, or any other currency on earth they can convert it all in dollars in about a millisecond, give or take a few nanoseconds. The petro dollar is important for the US. The US has trillions in US Dollars held overseas. In order for any nation to buy oil or even refined oil products they need dollars. Five trillion dollars per day, in dollars and other currencies changes hands on the FOREX.

Now if you were a Chinese refinery owner with nothing but Yuan in the bank, and wanted to buy half a million barrels of crude, all you would need to do is pick up the phone, or do it electronically, and say “Pay from my account but in dollars.” Your banker would immediately convert your payment into dollars and pay your oil seller.

The FOREX has been around for decades. It is beyond me how anyone still believes that very silly myth that someone needs to hold dollars to buy oil.

Hi Ron,

I don’t think you follow or read my comments entirely, or perhaps I didn’t explain it well. I think your looking at the how refineries and other business that buy crude or refined Petro externally. I am referring at the level of Central banks that settle FOREX trades. I understand that any refinery can convert local currencies into US Dollars in a jiffy, but that not the issue I am trying to convey.

To exchange a currency requires a currency of value or something of value (Oil, Good, grain, etc). In the case of China, They hold about 1 to 1.5 Trillion in US Dollars, so they don’t need to acquire dollars externally. When Chinese Refinery needs to converts Yuan into Dollar, the Chinese Central bank processes the transaction using their enormous stockpile of US dollars.

In the case of Argentina, its a different story since the are net short US dollars and demand for Argentine Pesos on FOREX is non-existent. The Argentina currency is worthless. Argentina has severe shortages for imported goods because the don’t have enough US dollars on hand to pay for the foreign goods they need. A refinery in Argentina can’t just go to FOREX to trade Argentine Pesos for US dollars because nobody wants Argentine Pesos and the Argentina Central Bank isn’t going to give the Refinery any of its few remaining US dollar reserves.

The bottom line is if the Oil is no longer traded in Dollars the US is facing a currency collapse. Demand for dollar will diminish as its no longer needed to settle foreign trades for Petro as well as anything else. Without the US dollar reserve currency status, the US would need to acquire foreign currencies if they can no longer purchase goods using the US dollar. Since the US is a debtor and runs trade deficits in the trillions per year, the US faces a serious problem. Since there are already so many US dollars abroad it very likely that few Central banks are willing acquire more US Dollar for currency exchanges. Since the US is a net importer, its going to be difficult for the US to acquired Foreign currencies from trade. Weak demand for US dollars and the inability to run trade surpluses is going to cause the dollar to collapse.

Hope that clarifies my point. Thanks for reading.

TechGuy, First the term “Petrodollar” and “Reserve Currency” are two entirely different things. I see now that this is where most of the confusion lies. Most people think they are the same thing.

Now there is nothing to keep a nation, like Argentina, from buying oil with their reserve currency, which might be dollars but it also just might be euros. But just because the Argentine Peso is almost worthless does not mean they must hoard dollars. If they think the euro will suffer less from inflation they just might use euros as a currency held in to buy oil. After all, they can convert it into dollars in about one millisecond.

Please see my chart below as to what percentage of the world’s reserve currency is in dollars. It’s about 60% And about 25 to 30% of the world’s reserve currency is euros.

Do you know for sure that Argentina holds dollars instead of euros? But the point is it really makes no difference whatsoever.*

*Except to the Argentina of course. If the euro suffers more inflation than the dollar then they should have held dollars. But if the dollar suffers more from inflation then they would have been better off holding euros to buy their oil with.

Ron Wrote:

“First the term “Petrodollar” and “Reserve Currency” are two entirely different things. I see now that this is where most of the confusion lies. Most people think they are the same thing.”

Different but correlated. The loss of one, is likely to cause the other to fail.

Ron Wrote:

“Do you know for sure that Argentina holds dollars instead of euros? But the point is it really makes no difference whatsoever.*”

You missed my point. whether Argentine holds Dollars or Euros is irrelevent to the point I was trying to explain.

The Argentine Peso isn’t a reserve currency. It needs to source a foriegn currency to settle its imports because no one wants their Peso.

If the Dollar loses it’s status, its going to run into the same problems Argentina does. Nobody is going to want US Dollars if its junk. The US is completely insolvent and must keep interest rates low with ZIRP because it can’t afford to pay its debts. Currently its the reserve currency status (Bretton Woods II) and the Petro-Dollar system that holds up the dollar because it makes up the majority of foriegn trade settlements.

“Please see my chart below as to what percentage of the world’s reserve currency is in dollars. It’s about 60% And about 25 to 30% of the world’s reserve currency is euros.”

http://en.wikipedia.org/wiki/International_use_of_the_US_dollar

61% for the US Dollar, Only 24% for the Euro. The rest of of the other currencies are tiny.

-Ron, Ron, Ron… for a guy who knows oil charts thoroughly, you disappoint me!

I understand Caelan and Watcher getting their info from wikipedia, but you…!

-Sentences like: “…The USgovenment does not buy crude oil, refineries buy crude and they cannot print money any more than you can. The USGovenment does not own any refineries…” are naive at best!

Please, do bear with me for a few seconds and allow me to help. No cynicism, judgement or sarcasm intended!

-USGovmt does not own refineries, but the guys who own the USGOVmT do! They own the FederalReserve which creates the dollar (out of nothing!) and is as federal as fedex is! Indeed!

-Roughly 65% of those $ are held outside Us and most of it is used to pay for oil-gas-coal-energy. If Ms. Merkel et al. did not need US$ to pay Putin for the gas and paid him in euros instead, those $ would come home to roost and you (and I) will not be able to buy bread to eat. The ink and paper on which those $ are printed would be worth far more than the face value!

-The first time we destroyed iraq’s army, but not iraq. When Sadam threatened to sell oil in euros we hang him! The same with Gaddafiof Libya.

-We consume roughly <19 mlb/day and produce roughly <9 mlb/day. None of that oil comes from iraq (and little comes fro the persiangulf for that matter).

-We are there not for their oil. We are there to MAKE SURE they sell it ONLY in US$! The history and economics of why will take way to much time and requires knowledge that frankly speaking you do not possess ( no insult intended! Truly!)

-China and Russia understand well the mechanism and are attacking it. Hence the latest war games in the pacific/south china sea and ukraine and syria. We will (try to) destroy anybody and everybody who threatens the link between $ and oil, or we die ourselves – from hunger!

ThE Only true thing you said in your comment is the Last sentence, but NOT how you understand it!

We WILL NOT see petro-yuan, or any other petro other than US$, for if we do that means 2 things: we become a proud member of 3rd world, or WWIII.

It looks increasingly likely that those who own the govt and the dollar have chosen the second alternative and, if that indeed is the case, we might not see peak oil truly impact us as civilization after all. Sadam did not, but Putin and Xi Jingpin have nukes!

I understand if your reply (or thinking after reading this) might not be "pleasant".

Just trying to help. It seems Your comment is not supported by the same level of abstract thinking as your essays are. To me anyway, but I digress.

Be well,

Petro

I wonder if it’s a touch like this:

You quit trading in governpimp-sanctioned currency and begin trading in some kind of currency that the government doesn’t sanction. Maybe that’s what’s behind Dark Wallet for example.

LOL… Well, Wikipedia does have references that have references that have references… But do you think I only do Wikipedia? Petro Petro Petro…

Still though, the time-constraint built into the average human lifespan does suggest something about informational diminishing returns and priorities.

Sometimes I’d rather go biking than be ball-and-chained to my laptop.

…you missed the point of my comment!

-I was very surprised that a man who writes “The Grand Illusion”, ” Of Fossil Fuels And Human Flash” and similar, not only does not understand the petrodollar concept, but flat out rebuffs people that MAY know (i.e. you and watcher) and tried to enlighten him on the subject (as grossly rough and shortened of an explanation as it may be!). Quoting Charles Hugh Smith and Stephen Lendman (who if you noticed quotes Zerohedge, who quotes Charles Hugh Smith and Jim Willie, who then quote zerohedge again, who quotes…see where I’m going with this?!) is the same as quoting Ron Patterson here. Charles Hugh Smith has a website just like Ron here and his understanding on things is not better than Ron’s (or maybe yours…who knows?) I have a website that caters to the same themes talked here believe it or not, and I suspect you have possibly visited it…if not you other here have.

As far as Jim Willie is concerned the guy talks too much and for an enormously large array of subjects which he rarely thoroughly understands (if at all!). And that is proved by the fact that we will see WWIII before we will see BRICS challenge to the US$ comes to real, viable and practical fruition…which was my whole point I was trying to convey…which proves my point that is not that easy to TRULY and THOROUGHLY understand the petro$ as you and Jim Willie think it is…which makes my point redundant…

No intent of insulting you, or anybody else!

I am sorry for the misunderstanding.

Regarding the last paragraph of your reply, I fail to comprehend it therefore I cannot comment on it.

Be well,

Petro

Hi Petro,

I thought I was embellishing your point, as opposed to missing it.

It is presumed that your other, subsequent, point was about the proverbial echo chamber? Fair enough, although, Zero Hedge is not one person, is it, nor does it self-refer to those two people quoted, does it?

But feel free to offer other references that can be understood by the general population. (I seem to recall your nickname was at one point, hypertexted, so I’ll select it when I get the chance too.)

No one can thoroughly understand ‘everything’– probably more so those who cover a broad topical range– which was part of my point. So let my quotes here from Zero Hedge, CHS, etc., on Ron’s fine site be one form of a call for a better, if not thorough, understanding. Time permitting of course.

Fair enough!

Be well,

Petro

P.S.: I meant “Zerohedge” as a/the “Subject”, not as a/the “Individual(s)/person(s)”.

ZH has a doomsday perspective and hypes sensationalism for traffic, but they are hands down the best source of data underneath headlines of any kind. Lots of worthless comments there, but lots of good comments there.

Petro, Petro, Petro…. I am shocked that anyone in this day and and age has not a frigging clue as to what the FOREX is or how it operates. But I more shocked that people, indeed it seems most people, still hold to that silly myth that people hold dollars in reserve, their reserve currency, in order to buy oil on the international market. That is truly absurd.

No country needs to hold dollars today to buy anything on the international market. A lot of countries do hold dollars to protect their own currency against speculation as explained in the link I posted below.

Again, it is a myth that anyone needs to hold dollars to buy oil. Yes, people all over the world hold dollars but the reason is not because they need it to buy oil.

The dollar is not the only reserve currency. Yes, there are other reserve currencies including the Euro, The Pound Sterling. The reason people and nations hold dollars is not because they need it to buy oil. That is just absurdly silly and it is high time people got rid of this dumb ass myth.

Please, everyone who wishes to know what a reserve currency is and why, read this Forbes article:

The Future of the Dollar as World Reserve Currency

What is a reserve currency? Countries all over the world hold financial reserves, in bonds or money market instruments denominated in some other currency. They also hold gold and Special Drawing Rights issued by the International Monetary Fund. The reserves protect the country’s currency against speculative outflows.

Ron Wrote:

“The reserves protect the country’s currency against speculative outflows.”

Perhaps in a few instances. In the case of China and Japan they, hold them because because it would destroy their export market. The world’s major powers hold back a sea of US dollars. A loss of the the worlds reserve currency would be a death blow to the US dollar.

The only reason why they haven’t dumped them as the major reserve holders would loose a boat load of value and destroy their export market. The dollar system (aka Bretton Woods II) is unsustainable and will fail at some point. Sooner or later someone is going to head for the exit and everyone else will follow to cash out their Dollar reserves just like investors do during a stock market crash. When currencies do collapse its usually happens in a day.

Ron Wrote:

“Again, it is a myth that anyone needs to hold dollars to buy oil. Yes, people all over the world hold dollars but the reason is not because they need it to buy oil.”

Yes, but oil is probably the most importantly traded commodity. It’s hard to believe that if Oil trades are no longer settled in Dollars, that everything else still will be traded in dollars. The loss of the Petro dollar will set off a chain of dominoes.

Lets suppose that Oil is no longer traded in US dollars starting next week and the Euro becomes its replacement (for simplicity). What do you think would happen to the value of the dollar and why? Consider that the US still imports about 7 Mbpd (~$700 million USD per day). Last month the US trade Deficit was $44 Billion. What direction would the cost of Oil go, priced in dollars if the Oil was traded in Euros?

Thanks

A loss of the the worlds reserve currency would be a death blow to the US dollar.

Why would that happen? Please explain what a “death blow” really means. Could I still buy a Whopper at Burger King with a few dollars? I have no idea what you are talking about.

The dollar is only 61% of the world’s reserve currencies. It could and will fluctuate, perhaps 65% in a few years or perhaps 55%. If it went to 35% it would not be a death blow to the US dollar. In fact it would likely mean a great boost to the US balance of trade.

Yes, but oil is probably the most importantly traded commodity. It’s hard to believe that if Oil trades are no longer settled in Dollars, that everything else still will be traded in dollars. The loss of the Petro dollar will set off a chain of dominoes.

Oh please! Everything else is not traded in dollars. And it makes not one whit of difference what currency they are traded in. From my Time Link:

85% of foreign exchange transactions are conducted in dollars; and 45% of all debt securities are dollar denominated.

There is no rule that says anything has to be traded in dollars. Most commodities are priced in dollars. They can all be traded in any currency the traders wish to use. But they are priced in dollars because that is basically the index currency. That is, when the price is given in dollars everyone knows immediately the price in their local currency. It is a convenience and nothing more. There is no international rule that says trades must be “settled” in dollars. 15% of all trades are not in dollars.

If nations decided to trade oil in euros, and they very well could do that, then nothing would happen to the dollar. It would not mean, and could not mean, that oil could not be traded in dollars. It would simply mean that countries would choose to use euros instead. If every European country decided to pay for their oil in euros, and they could get the seller to agree, a barrel of oil would still cost refineries about $110 a barrel, or whatever the going rate happen to be on that day.

The going rate for crude oil on the TOCOM is 68,130 Japanese Yen per Kiloliter (today). Because most of the world trades oil in dollars does not mean that the Japanese cannot trade oil in Yen. It is their choice. It is the choice of any nation what currency they trade oil in.

Ron Wrote:

“Why would that happen? Please explain what a “death blow” really means. Could I still buy a Whopper at Burger King with a few dollars? I have no idea what you are talking about.”

Sure,

The US is by far a net importer and runs annual trade deficits of about $500 Billion per year. For now, the US does not need to settle its debts. In fact the US gov’t benefits from these large trade deficits because exporters simply purchase US bonds with their excess Dollar reserves. So for every dollar in trade deficit the US gets them back to expand their debt.

Imagine if I sold you a car, but you could only pay for half of it. I loan you the money and then give the money back so you use it to buy more stuff.

At some point, high inflation is going to happen, either because the Fed keeps interest rates too low for to long, Prints too much, executes even worse economic policies, or the US is no longer seen as a safe harbor to park capital in. A loss in faith in the dollar will likely cause a collapse in the dollar value. Perhaps a $4 Burger from Burger King today, (BTW: which is only about 7% beef, the rest is filler) may cost $25 after a dollar crisis and continue to increase in price until the dollar stabilizes.

A loss of faith in the US dollar will create a crisis for the US, just like Russia in the 1990s when the Ruble crashed. The week before the Ruble crashed, 1000 Rubles brought a two week vacation. After the crisis, 1000 Rubles couldn’t buy a loaf of bread.

http://en.wikipedia.org/wiki/Economic_history_of_the_Russian_Federation