EIA begins monthly survey-based reporting of U.S. crude oil production

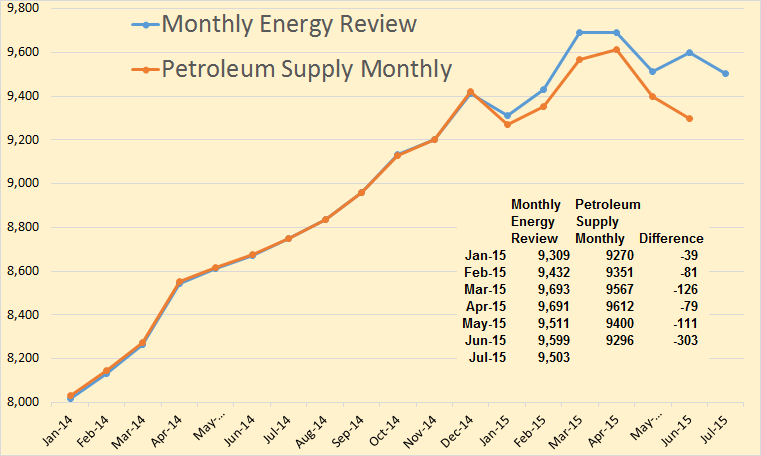

With the release of today’s Petroleum Supply Monthly, EIA is incorporating the first survey-based reporting of monthly U.S. crude oil production statistics. Today’s Petroleum Supply Monthly includes estimates for June 2015 crude oil production using new survey data for 13 states and the federal Gulf of Mexico, and revises figures previously reported for January through May 2015.

From the EIA’s Monthly Crude Oil and Natural Gas Production webpage.

Beginning with the June 2015 data, EIA is providing estimates for crude oil production (including lease condensate) based on data from the EIA-914 survey. Survey-based monthly production estimates starting with January 2015 are provided for Arkansas, California, Colorado, Kansas, Louisiana, Montana, New Mexico, North Dakota, Ohio, Pennsylvania, Texas, Utah, Wyoming, and the Federal Gulf of Mexico. For two states covered by the EIA-914—Oklahoma and West Virginia—and all remaining oil-producing states and areas not individually covered by the EIA-914, production estimates are based on the previous methodology (using lagged state data). When EIA completes its validation of Oklahoma and West Virginia data, estimates for these states will also be based on EIA-914 data. For all states and areas, production data prior to 2015 are estimates published in the Petroleum Supply Monthly. Later in 2015, EIA will report monthly crude oil production by API gravity category for the individually-surveyed EIA-914 states.

This is great news for those of us who have been complaining for years about the EIA’s poor and misleading data collection methods.

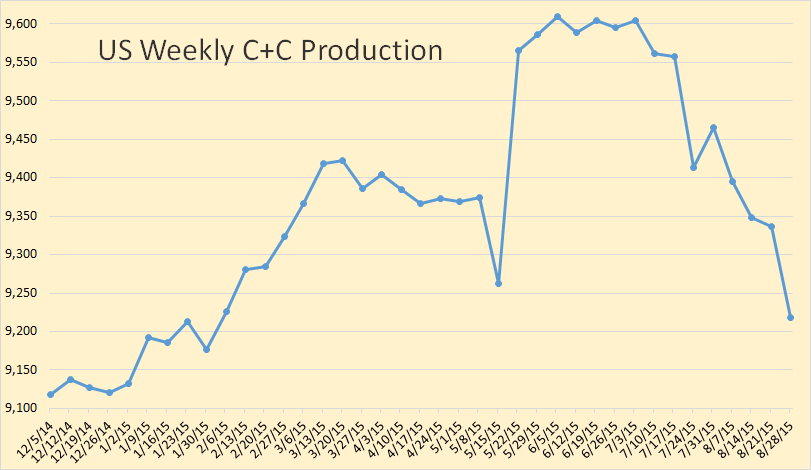

June C+C production, according to the Monthly Energy Review, was almost 9.6 million barrels per day. But the Petroleum Supply Monthly cuts that by 303,000 bpd. And they have production dropping by 316,000 barrels per day in the last two months, May and June.

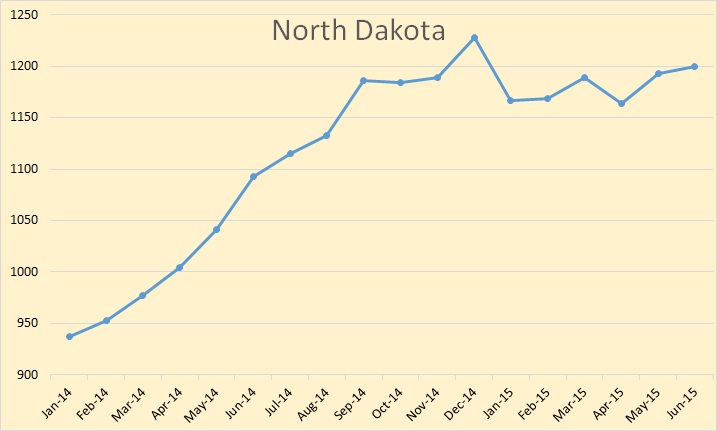

The Petroleum Supply Monthly reports the exact same data for North Dakota as the NDIC reports in their data release.

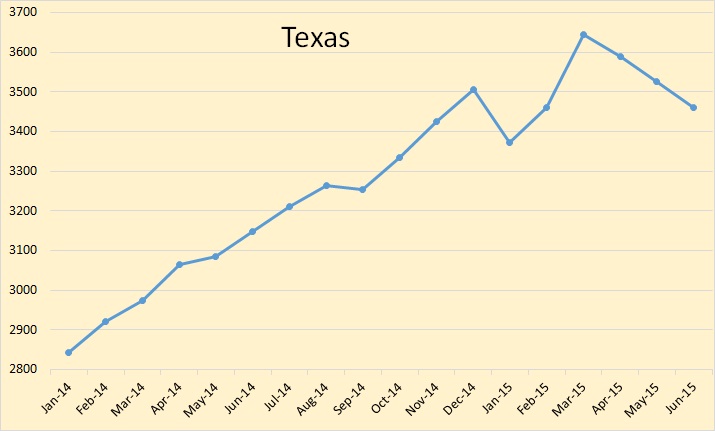

Texas peaked in March at 3,644,000 barrels per day but has since dropped by 184,000 bpd to 3,460,000 bpf.

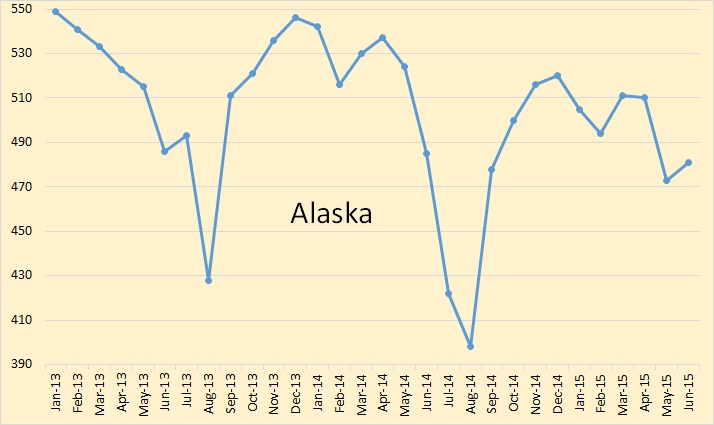

The oil price decline has had little effect on Alaska production. They just continue their sure but steady decline.

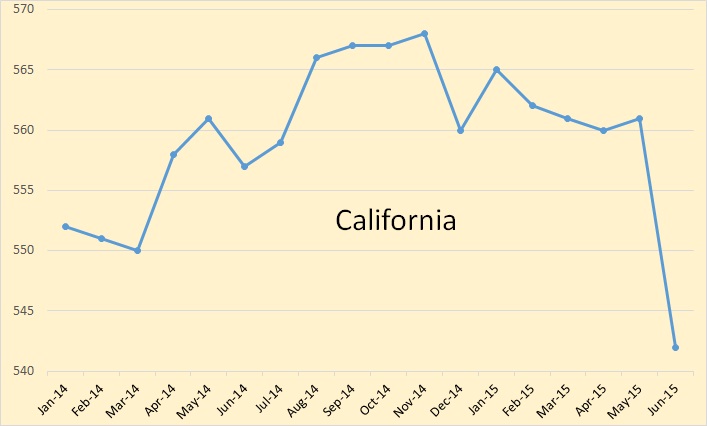

California dropped by 19,000 bpd in June.

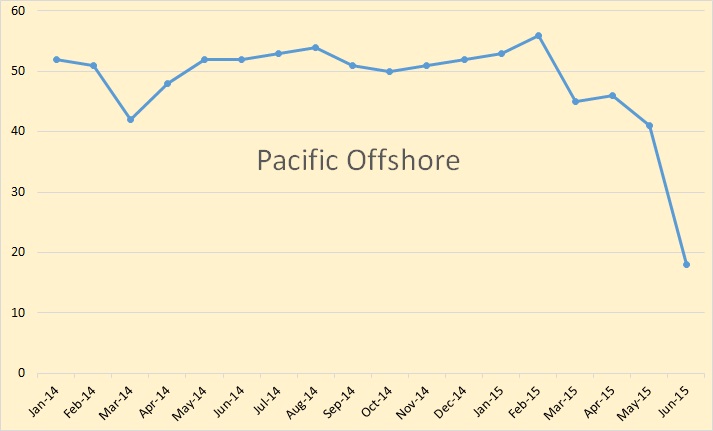

Pacific Offshore is down to 18,000 barrels per day.

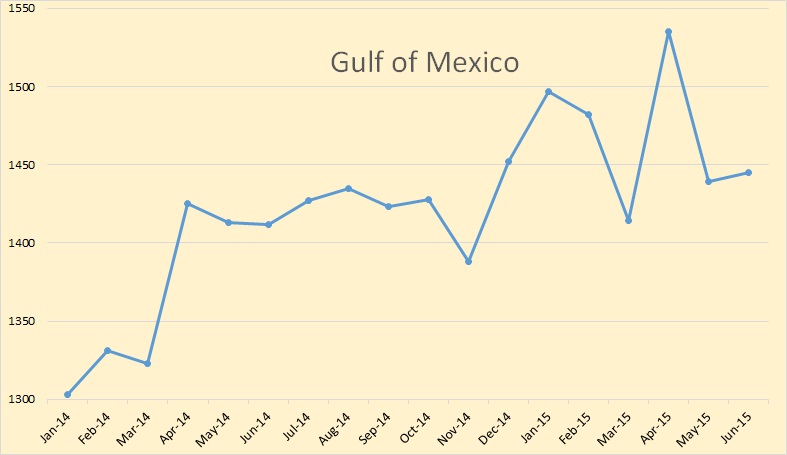

The Gulf of Mexico is trending slightly upward.

New Mexico, who’s production come partially from the Permian, was bucking the trend through April but has since dropped 16,000 barrels per day to 421,000 bpd.

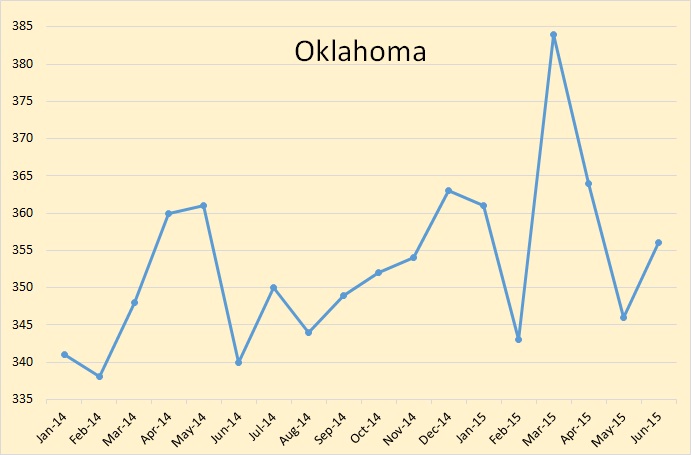

Oklahoma is not yet part of the new survey method but this estimate is likely very close. They seem to be holding their own despite the price collapse.

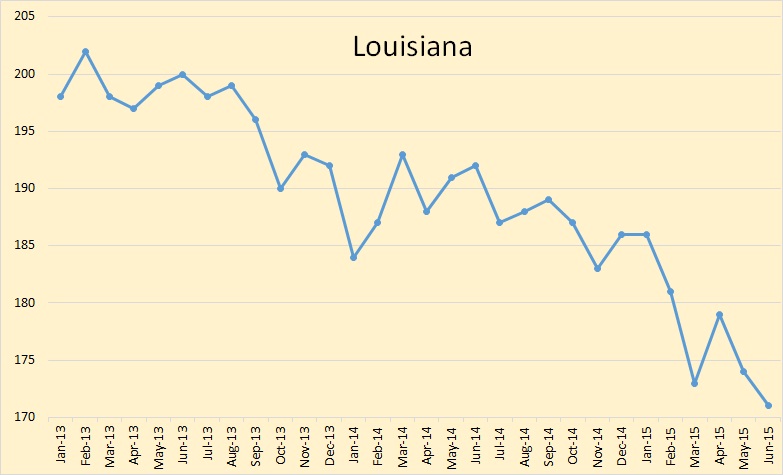

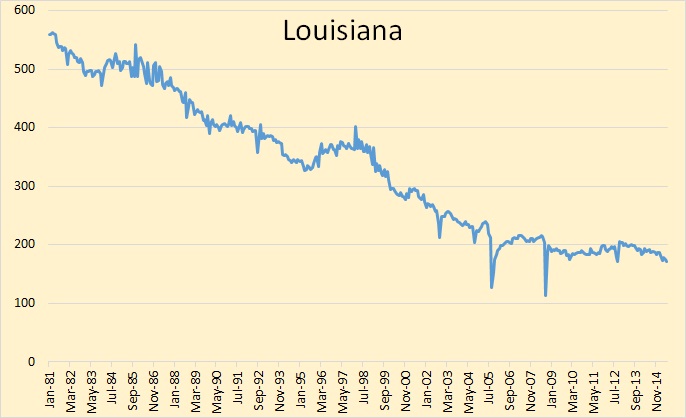

Louisiana continues its natural decline.

Louisiana once produced 560,000 barrels per day but what happened to Louisiana eventually happens to all producing states and nations.

US production was down 119,000 bpd last week. However only 19,000 of that was the lower 48. Alaska was down 100,000 bpd. That was likely due to their usual summer maintenance. The EIA says US C+C production for week ending 8/28/15 was 9,218,000 barrels per day. That is approximately one million barrels per day less than either Saudi Arabia or Russia is producing.

Iraqi Oil Output Declining as of 2018 in Morgan Stanley’s View

Iraq’s crude production will start to decline in 2018 because of a slowdown in investment due to lower oil prices and a costly war on Islamist militants, according to Morgan Stanley.

OPEC’s second-largest crude producer will pump 4.18 million barrels a day in 2017, with output then falling to 4.132 million in 2018 and to 4.127 million by 2020, Haythem Rashed, a Morgan Stanley analyst in London, said in a Sept. 2 report. The bank had previously forecast rising output every year to 4.6 million barrels by 2020.

Iraq’s production has climbed 1 million barrels a day by July from a year earlier, becoming the strongest contributor to global supply, Morgan Stanley said. The removal of export constraints in the south, increased pipeline capacity in the semi-autonomous Kurdish region and the separation of heavy and light crude streams all contributed to growth, according to the report.

“With these infrastructure and crude marketing tailwinds now largely played out, we see limited prospects for further production growth,” Rashed said in the report.

Iraq was one of great hopes for cornucopian crowd. Leonardo Maugeri has Iraq at 7.6 million barrels per day in 2020. They are at 4 mbd today and I don’t expect them to ever reach 5 mbd.

Thanks Ron.

I can’t seem to do a new comment.

Hello Energy Experts,

I’m running for the most powerful office in the land and need your help. It’s not easy communicating with most of Americans about Climate Change and Energy policy. So I’m here trying to put together a 10 point policy list for my stump speeches. On what needs to done to save the country and world from a dismal future. Each point needs to simple, short and understandable. You know, something like “Drill Baby Drill” or “Carbon Tax”. Then a short paragraph telling me what you mean by it.

Each one of you don’t need to give me 10 phrases. Just one good one from each of you would be fantastic. I’m looking forward to hearing this groups 10 best ideas to save the plant and future humans from themselves.

Thank you

“Let’s all congeal around oil”.

“Clean energy to create well paying jobs”.

It’s a very slick message, it gets traction with watermelons, union labor, the oil and gas industry, republicans, democrats, the military industrial complex, the Israel Lobby, farmers, Hollywood, the solar power lobby, the wind lobby, the ethanol lobby, and retirees.

“Hike, Bike or EV’s by 2030”

“Panels on roof and an EV in every garage”

“Transform the Transportation Industry by 2030”

“Let’s stop cooking ourselves”

Outlaw the production of fossil fuel dependent personal transportation vehicles by 2030.

FUCK OFF AND HUG A TREE

Dear Presidential Candidate,

Before running for the most powerful office in the land and trying your hand at saving humans from themselves, you might want to take a refresher course in basic writing skills.

Either that, or hire a competent copy writer and editor…

Just sayin!

Is anyone else having problems doing a new comment?

I couldn’t the other day.

It was saying something like “can’t find the link/page/contents/…”

But I just went back to the home page, reloaded,

the went down the link to the article, reloaded, then was able to post a new comment.

From their short term energy outlook page:

“EIA estimates total U.S. crude oil production declined by 100,000 barrels per day (b/d) in July compared with June. Production is expected to continue decreasing through mid-2016 before growth resumes late in 2016. Projected U.S. crude oil production averages 9.4 million b/d in 2015 and 9.0 million b/d in 2016, 0.1 million b/d and 0.4 million b/d lower, respectively, than in July’s STEO. ”

“Before growth resumes” assumes they will have to have much more completions in order to offset the decline rates. If it keeps declining at this rate, production by December will be around 8.8 million, so how is the average going to work out to be 9.4 million for 2015?? Ouiji board answer, no doubt. Unless oil gets over 70, what is going to cause oil companies to expand capex to increase production to stop the drop??

Although, I was off on timing due to the use of hedges (which will soon expire), I still see production dropping from Dec high of over 9400k to close to a million.

Head scratch.

Survey? So they are going to ask entities with incentive to under report how much their production is? Are there penalties for inaccuracy? If so, fine. If not . . . …

Why isn’t this metered, at least to the states?

So they are going to ask entities with incentive to under report how much their production is?

Why would states have an incentive to under report? Eventually that’s where the EIA have always gotten their data. They always report, after the final data has finally come in, exactly what the states report. Now they are just going to ask them a lot earlier. They are going to ask each state what they think their production was for the latest month, or the month two months previous to the date they are asking. That is in August they asked for the June production estimate. By then each state should have a pretty good idea what their production was for that month.

I can think of no reason any state would under report. What did you have in mind?

I thought they were surveying companies, not states. Eliminates the point.

They were directly surveying companies, not state agencies.

About 450 largest producers accounting for at least 85% of total production in each of the named states.

Hi AlexS,

Nice summary, I could not have done better. Did you notice how the EIA estimates are now less than the DI data? The DI data reflects data from the RRC (including the “pending file”) and will always tend to be a little on the low side as there is always some unreported output for recent months. The EIA estimate should never be lower than the DI data and that is the case for January and February. For Texas the Jan and Feb survey data is about 89% of the DI data for all Texas. If we assume the March through June survey data is a similar percentage of actual output then we get a higher (and better) estimate of Texas C+C output.

Dennis,

I do not have access to the DI data, but DI numbers quoted by the EIA are below EIA’s own new estimate for Dec14 and March-May15, and only slightly higher for January-February.

The EIA’s new estimate methodology is clearly not perfect, and actual numbers can be lower or higher.

I am sure that DI’s numbers are not 100% correct as well

I encourage everyone to read about the new methodology at the EIA web page.

It looks to me like they are now underestimating Texas output. My estimate, based on the survey data and the Drilling info data is the following from Jan through June 2015 (TX C+C in kb/d.) The first two points are the drilling info data for Jan and Feb and the following 4 assumes the survey data times 1.138 is the best estimate. The drilling info data is an average of 13.8% higher than the survey data for Jan and Feb and I assume this ratio remains the same for March through June (companies surveyed produce 87.9% of TX C+C output).

3384

3482

3679

3645

3596

3529

No problem with a new comment.

Comparison of new and old methodologies. The case of Texas

The % should remain at 88.2% for all months.

Some time this week, when downloading an EIA report, I was asked to take a little survey and I did. They asked what percentage of petroleum products were foreign-sourced, and two of the multiple-choices were “27%” and “39%”. I answered 39%, though in my opinion it’s higher than that.

They said the correct answer was “27%”. Then asked for comments. I accused them of intellectual dishonesty, and, as an example used “refinery gain”. If 45% of the refinery inputs are foreign-sourced, then 45% of the “refinery gains” should also be marked as foreign-sourced. Further, if 45% of the diesel used in the agricultural segment produced ‘biodiesel’ is ultimately foreign-sourced, then (probably) about 20% of the ‘biodiesel’ should be marked foreign-sourced.

I then concluded the comment by stating that I need **accuracy** in these reports, not cheerleading.

Reason for the anecdote: Perhaps they’re catching some flack?? And hoping to reduce it?

In a comment on 09/02/2015 at 1:58 pm, in response to Mike announcing that he will no longer be participating in these discussions, I made reference to this survey. In composing that comment I went to the EIA web site to copy their mission statement which is when I was presented with the survey. Here’s what I wrote about it in my comment:

Edit:When I went to the EIA web site to copy their mission statement, up pops a user survey! Boy, did I give them a piece of my mind! One question asked about the percentage of US oil consumption that was imported and when I guessed right, the response was “Congratulations, you got it right! How did you know the answer?” So, I proceeded to tell them about this awesome web site and all the awesome analysis of their data that goes on around here! ? I actually told them that EIA staffers might learn a thing or two from this site!

My reasoning for choosing 27% instead of 39% was that prior to the surge in production from fracking, the US was importing about one third of it’s oil consumption. The surge had reduced the level of imports so, the new figure could not be 39%, it would have to be the lower of the two, 27%. The other choices were way out there, like 5% and some other entirely unrealistic figure!

Oops! Major brain fart! Prior to the surge in production the US imported two thirds of production, not one third!

According to Jeff’s 09/04/2015 at 7:34 am post below, the one that starts with “All glory is fleeting”, “The EIA shows that US C+C production was 5.0 MMBPD in 2008. Let’s assume that the current estimate of 9.6 MMBPD in US C+C production in April, 2015 is correct.” In his 09/04/2015 at 9:53 am post further down he posts:

Late August US net crude oil imports (four week running average data, MMBPD):

2008: 10.1

.

.

2014: 7.3

2015: 7.1

That would make 2008 crude imports two thirds of 2008 imports + production and using the EIA’s 2014 figure for crude oil production of 8.7 MMBPD, along with the late August 2014 figure above, 7.3 MMBPD, 2014 imports would be 45% of imports + production!

However, according to a web page in the FAQ section of the EIA’s web site:

How much petroleum does the United States import and from where?

The United States imported approximately 9 million barrels per day (MMbbl/d) of petroleum in 2014 from about 80 countries. Petroleum includes crude oil, natural gas plant liquids, liquefied refinery gases, refined petroleum products such as gasoline and diesel fuel, and biofuels, including ethanol and biodiesel. In 2014, about 80% of gross petroleum imports were crude oil, and about 44% of the crude oil that was processed in U.S. refineries was imported.

The United States exported about 4 MMbbl/d of crude oil and petroleum products in 2014, resulting in net imports (imports minus exports) of about 5 MMbbl/d in 2014. Net imports accounted for 27% of the petroleum consumed in the United States, the lowest annual average since 1985.

I guess if you can define petroleum any damned way you want to, you can get any number you want to! Now I’m even more confused than ever!

A good portion of those foreign imports are exported as product. The net import after subtracting exports (which include refinery gain) is about 5 million bpd.

Aha! Thanks for pointing that out. I was just looking at raw domestic extraction (~9.3) and the usual import (~7.3) and could not imagine how that worked out to 27%.

But I still think that foreign sourced crude should be tracked through refinery gain and biodiesel. As a thought experiment, imagine that all imports were halted. If biodiesel is *really* domestic production, then the halt in imports should have no impact on biodiesel production. But we all know that’s not true. Similarly, if ‘refinery gain’ was *really* domestic production, the halt in imports should also have no impact on *that*. But we also know *that* to be untrue.

net imports = crude imports + product imports – crude exports – product exports

The refinery gain comes from splitting up molecules and adding hydrogen. The hydrogen is sourced from USA produced methane. Also, we have to consider which molecules are split and turned into lighter molecules. I suspect the foreign cruces have a higher content of “splittable” molecules, which means they “swell” more than the light domestic crudes and condensates. This topic is so complex I would keep refinery gain in a separate column.

Why does this blog believe that Iran and Iraq are anywhere near their full potential? If Iraq could increase its oil production so much under horrific conditions and Iran can maintain it under full spectrum sanctions, then one can imagine their true potential. In my view, this is the reason why the West is so obsessed with these countries. The same must apply to Russia and to a lesser extent Kazakhstan. Those two countries can also boost their production in the future. If Russia was anywhere near her peak in relation to oil output, then the West would be much less inclined to keep provoking the country with the world’s largest nuclear arsenal. There is a reason behind everything.

Stavros, no one is saying Iran or Iraq could not produce what they are currently producing.

As far as Iran goes, they deserve no medal for producing under sanctions. Sanctions only cover a very small part of their oil production. So I have no idea what you are talking about there.

Iraq!!! Iraq said they could and would produce 12 million barrels per day. That is pure bullshit. They will not produce half that amount. They are producing 4 million barrels per day, about one third what they said, back in 2009, of what they said they would produce. I said back then that they would produce about 4 million barrels per day but never reach 5 million barrels per day. I am standing by that prediction. Of course I could be wrong. I have been wrong before. But 12 million barrels per day, or even 10 million barrels per day, or even 8 million barrels per day. I have been wrong but never that wrong. That is nothing but bullshit that only a bullshitter himself would believe.

I remember a 17 mbpd prediction from an Iraqi oil minister, and by 2015, and only about 6 yrs ago.

The Russia thing is probably the core issue of oil. If the US Fed funneled lenders can lend money to loss generating shale operations, then lower paid Russian oil workers should generate less of a ruble denominated loss for their shale ops, when they get around to them. They could get quite a flow out of that B. shale if it doesn’t matter what it costs.

The old economic vs geologic peak issue.

when they get around to them.

Russia is unlikely to ever “get around to them” when any company has to pay 60% of revenue on every barrel lifted.

http://www.bloomberg.com/news/articles/2015-01-05/russian-shale-beating-u-s-is-ongc-s-last-bet-corporate-india

I have been wondering why other countries have not succeeded in working with shale. However, with Russia the reason is obvious. They seem to have much more oily shale than the US. So this might just require a change in Russian law to free up another 5 billion barrels plus per day in new capacity.

I think this passage from the Bloomberg article pretty much tells the story:

Russia can develop its shale oil resources even without foreign partners, Interfax reported Dec. 29, citing Lukoil President Vagit Alekperov. The development is not profitable at current oil prices, Interfax reported in the interview.

The Russian government apparently took a look at shale oil and decided it wasn’t feasible to produce at $100 a barrel or less.

This does not mean, however, that it believes oil will always be at $100 or less, or that it is willing to give those reserves away to the transnational oil companies the way Mexico is.

Glenn, that is not my reading. The tax rates seem to assume a very low extraction cost such that a tax of 60% of revenue is reasonable. The drilling and fracking costs must be subtracted from the taxed amounts for shale resources to be cost effectively developed. My guess is that much of this massive shale resource could be developed right now with American technology if the tax rates and structure resulted in American level taxes and fees.

A few years ago I googled up some charts from the Iraqis them selves. Those 10 or so million barrels of oil is supposed to come from south Iraq. This is part of the same geological trend that produces the bulk of Irans oil. Look at the amount of oil they produce, and you get a hint of the maximum potential of that field. Beeing no expert I need margins to not be wrong, so I said they will never be above 6 million barrels. It simply is not possible to squeeze out that amount oil from those rocks. Unless the Iraqis know something the Iranians don’t.

According to Cheney’s Energy Task Force, convened by president George W. Bush in 2001 during his second week in office, this largely unexplored area of Iraq held oil fields which had the potential to double Iraq’s oil reserves.

To my knowledge, the area still remains unexplored.

Check to see how much oil is produced on the Saudi side of the border.

Cheney turned out to be a dishonest jerk.

You mean Cheney would be more appropriately described as a member of the War Party than the Oil Lobby?

Sometimes it gets to be just too difficult to tell the difference between the two.

Cheney is that thing that sat on top of a tower looking like an evil eye in the lord of the rings.

Stavros, it depends on how one defines full potential. I think Russia is at full potential at 10 million BOPD. Producing a higher rate is bad for Russia. As regards Iraq, I wouldn’t take it higher than 4 million BOPD. I feel Iran would do better at 4 million BOPD as well. Anything higher is counterproductive.

Let me ask you, what is your background?

Ha! Morgan Stanley predict production down to the nearest 10,000bpd in 5 years time and expect to be taken seriously?

I want to do a fossil fuel post. Earlier in this year I supported Ron’s projection that we would have an intermediate term peak in oil production at least in the US this year. I had near zero expertise in this field but it seemed to be of significant importance for our civilization. I came here because Ron Patterson seemed to be by far the single person best nurturing a rational evidence based evaluation of what is going on with this issue. I think all of us should have an immense sense of gratitude for Ron’s efforts. He is a treasure for all of humanity in his eclectic use of data from many sources to present an understanding that seems to be better than any other single source. The many people who come here from around the world is confirmation of this shared understanding.

My support for a short to intermediate term peak was due in large part to the projections from the EIA such as their Drilling Productivity Report. I fully included natural gas in my understanding of this peak production assumption. Well we have learned that the EIA is quite inaccurate in many ways. I was astonished to learn that the EIA could not accurately include the Baker Hughes drilling rig counts even when they are very public and the EIA is explicitly asserting that they are using that data. This recent post highlights how wrong they have been in the past.

The energy content of US natural gas production is well in excess of our oil production. The roughly 72bcf/d of dry natural gas is equal to about 12m barrels of oil per day (given 6,000 cf equal to one barrel). Obviously the natural gas liquids from gas production would substantially add to this energy inequality. Well we may be looking at a massive increase in gas production to a much higher level.

Bentek is a highly respected market analysis organization. Consider the following quotes attributed to Bentek in one article:

http://powersource.post-gazette.com/powersource/companies/2015/09/01/Marcellus-Shale-to-become-a-net-exporter-of-natural-gas-this-year/stories/201509010013

“The Marcellus reached a record high of 20.4 Bcf/d on Aug. 24”. “There are about 2,300 wells in the inventory, representing about 14 Bcf/d of trapped production.” “In November, infrastructure projects should bring about 3.9 Bcf/d of new capacity to the Northeast, with production forecasted to grow about 3.4 Bcf/d at that time”.

This will be a 5% increase in relatively short order. If we cannot export this production it will result in a further massive decline in pricing for natural gas. Obviously there is the capacity for much greater increases in production in subsequent years. In terms of total fossil fuel energy content, oil and gas may continue to produce new annual records for a good number of upcoming years. The apparent short term decline in oil output does not seem to be enough for the US to post a decline in total oil and gas energy produced.

I want to do a fossil fuel post.

Have at it. Send it to me and if it fits what this blog is about I will post it. But remember I like a lot of graphs.

If we cannot export this production it will result in a further massive decline in pricing for natural gas.

There is no law that prevents export of natural gas. But currently we don’t have any LNG plants to liquefy natural gas for shipment. And there are none in the planning stage as far as I know. So I just don’t think it is going to happen.

Ron, I don’t see that my modest expertise could approach the quality required for a top line post on your wonderful blog. I just wanted to have a modest FF post here in the comment stream. I came here for the fossil fuel expertise. Since I have a much greater lay understanding of global warming and renewable energy it has been excessively easy for me to join the digressions from FF. We do need a strong focus on what is happening with fossil fuels.

Yes, there is not LNG export capacity in place at this time. However, there are plants with nameplate capacity for 9Bcf/d under construction (completion this decade) with the first one coming on-line in a few months with another several Bcf/d in 2016. We also have a substantial increase in pipeline export facilities into Mexico. If Bentek is right the supply will still be far above these incremental export options.

Further replying to Jeffrey:

David Hughes in his Drilling Deeper report says of the Marcellus, “The first-year decline rate is 32%, which is on the low end of field decline rates observed for shale plays.” This would suggest a one year field decline of only 6.5 Bcf/d, much less than your 8 Bcf/d. Beyond that I recall that Ohio is reporting a 160% increase year over year in production. The Utica formation is physically more massive than the Marcellus. I have great respect for what Hughes did with his report but he totally ignored the impact of the Utica. It was an insignificant formation in his opinion when he did his research and a year later this can be seen as a massive mistake.

My expectation is Louisiana and some other areas can be expected to have a year over year decline. However, I see a very low chance that that those declines will equal the massive increases that some see in the American northeast. Don’t forget that many drillers have been getting less than $1 in the northeast for their gas when Henry Hub was over $2.50. What is going to happen when these monster formations have enough takeaway so that drillers can get near the gas prices at Henry Hub? Not all gas drillers in the US will be happy. However, my expectation is that the drillers in the Marcellus and Utica can be extremely happy for years to come.

“Much” less?

In any case, I was referencing the EIA’s estimates in regard to the Marcellus. As of August, 2015, their estimate for the annualized legacy decline from existing production is 8.3 BCF/day per year:

http://www.eia.gov/petroleum/drilling/pdf/marcellus.pdf

Excerpt from my comment below:

With an underlying gross decline rate of about 24%/year, the US needs about 17 BCF/day of new production per year, just to offset the declines from existing production. Note that this volume of gas–that the US needs just to offset declines from existing wells–exceeds the dry gas production levels of every country in the world, except for the US and Russia. In other words, in order to maintain current gas production, we need to put on line–every year–more gas production than Canada, or Norway, or Iran, or Qater, etc.

Incidentally, a volumetric annualized decline of 6.5 BCF/day from just existing Marcellus wells would exceed the volume of all of Mexico’s 2014 dry natural gas production, and it would exceed the 2014 gas production from every country in the Americas, except for Canada the US.

Jeffrey, you cannot multiply a monthly legacy decline by 12 to get an annualized field decline rate. That is not how things work. I will stand with David Hughes and his field decline rate. Subsequent declines in a given well will almost always be somewhat less than a prior month’s decline rate. Mr. Hughes’ calculations of annual field decline rates take this into consideration. The 1.5 Bcf/d difference in our calculation may seem small. However, in terms of price impact such a difference is major. Also, the comparison with other countries is irrelevant. We have two massive resources in the American northeast and a very robust capacity to make use of them. If we want to be realistic we need to accept reality as it is.

Thanks for explaining that. After 36 years in the oil and gas business, now I finally understand the difference between hyperbolic and exponential decline rates.

Of course, that’s irrelevant to the point I was making.

At stable production levels, if existing Marcellus wells are declining at about 0.7 BCF/day per month (the EIA’s number), how much new gas did operators have to add in 12 months in order to maintain production?

Jeffrey, I semi-agree that our difference in calculating the field decline rate does not obviate the large amount of new capacity that must come on-line. The point that I was making reflected the Bentec analysis. If they are right obviously we are talking about massive additions to total capacity. Are they right? Do you have any evidence that they are not right? If we have over 16Bcf/d when the producers are getting extremely little, what will happen when they can get a price closer to Henry Hub?

I presume that you know that the new capacity produced with a rig in a month of drilling in these two regions is greater than in any other shale formation. The only one that is close is Haynesville which is way beyond its 2011 peak production. Utica has just started to ramp up. As I pointed out the Utica is more massive than the Marcellus and it currently is just a bit over 2.5 Bcf/d. The potential for further increases in from these two formations seem to be massive.

I have read that there are actually 40 planned pipeline projects over the next five years. The total incremental takeaway capacity can be close to double what currently exists. Why would people build that capacity if they do not think people will use it? I think the Bentec analysis seems to be quite plausible. If you have evidence against their claims please present it.

To be clear here, any disagreement that we may have about the incremental production needed to balance the field decline rates seems to be beside the point. The drilling rigs that were there can return quickly. They are increasing in productivity at a rate that suggests these fields are not in any decline. The implications for pricing delivered to the producers is that there could be a massive increase in effort to deliver a more lucrative product.

Let me add that David Hughes projected peak production from the Marcellus in 2018. A few months ago he revisited his analysis and confirmed that expectation. Mr. Hughes is a firm supporter of the theory that we will be seeing a peak in oil and gas production. He just does not see in coming now from the evidence he sees.

Don,

“Re: Mr Hughes does not see it coming now from the evidence he sees”

Where has Mr Hughes expressed that opinion?

I am Ron’s “special or most dense” blog participant and sometimes needs a little extra help.

Please don’t consider yourself to be dense. The community that comes here does so to increase our understanding concerning energy. I am delighted to share any information that I have and my sense is that others here would be likewise delighted to share their information and sources.

David Hughes published his 300+ page masterpiece, Drilling Deeper,on the Post carbon web site.

http://www.postcarbon.org/wp-content/uploads/2014/10/Drilling-Deeper_FULL.pdf

His analysis of the Marcellus starts on page 259. He did reconfirm his analysis of the Marcellus earlier this year. I will find that reference if you wish but it is not substantively different than his 2014 treatment.

Don, the “shale” well decline rates are hyperbolic. This means the total field decline depends on the cumulative production each well has achieved. Plus we have to consider the well design, whether it’s on choke (they usually are), and equipment / pipeline restrictions.

I have in my head the architecture for a program which can estimate the decline in production capacity for a large well population. To get it to work, I need about 4000 man hours. When it’s done, I need confidential data from all producers. And when that great opus cranks up, the production capacity decline rate it predicts for the Marcellus will have plus/minus 10 % error bars. I guess.

Fernando, my guess is that you are quite right about the chokes. If I owned wells and were getting less than $1 for my product I would have a massively restricted choke on my wells. Many of the wells might be opened up significantly when higher prices for their product become available. My support for David Hughes’ field decline rate is contingent on all other things being equal. We may be going into a future where things will be massively changing in these two major formations.

Choking is used to increase the flowing bottom hole pressures and reduce condensate banking around the fracture face.

It’s also used to reduce wellhead flowing tubing pressure and allow the use of a reasonable wall thickness for the flowline and other downstream equipment. Sometimes flow has to be reduced to avoid exceeding erosion limits. And sometimes it’s done to cool the flow down and allow better condensate recovery.

There are quite a few reasons when I think of it. But it’s also useful to set well production to meet the buyers’ call, save gas reserves for later, etc. (it gets complicated).

I hardly know where to start.

The notion that there is currently 14Bcf/d of trapped production in the Marcellus is absurd. I’m not sure what exactly the number is, but it should be in the range 2-5, and it is rapidly decreasing.

The 2,300 number of wells spud but not productive is mentioned as if it was something unusual. In fact, this number was over 3,000 in 2012, and hasn’t been this low since 2011.

Ramp-up of a new pipeline or a new pipeline expansion isn’t a step function increase. It’s more of a slow process of de-bottlenecking proceeding backwards from the main pipeline. See here for details on the REX reversal which as nominally been at 1.8 Bcf/d for some time but is still pumping out only around 1.4 Bcf/d. As it ramps up, we keep setting new Marcellus production highs by very tiny amounts.

Those numbers from David Hughes are old. The Marcellus field decline rate has been increasing rapidly, due to both an increase within the same regions and a shift in activity from the NE dry to SW wet area. The EIA Drilling Productivity Report gives field decline numbers, although inexplicably they refuse to provide the actual numbers but only give the results after they are smoothed by an undisclosed smoothing algorithm. Just take the “Legacy Production Change” and divide by the previous month’s production and you have the monthly decline rate, which is currently running around 4% per month, or around 38% annually.

I took a look at the PA production numbers from Susquehanna County, which is the deepest core of the NE dry area. The decline is fairly slow for the first six months or so, and then becomes almost exponential, at around 30% annually, with very little sign of any kind of hyperbolic slowing. I’m guessing the initial slow decline is a result of extensive formation damage due to injected water, which gradually dissipates somewhat. In any event, with a hyperbolic decline curve, a decrease in drilling would lead to a decrease of the decline rate, not the increase which we observe. The same type of effect is seen with the very young “Utica” region, where the decline rate is rapidly increasing, but still only 2% monthly.

The EIA’s “Utica Region” and “Marcellus Region” don’t seem refer to wells in the Utica and wells in the Marcellus. Rather, EIA “Utica” appears to refer to Utica and Marcellus in Ohio, while “Marcellus” appears to refer to Utiaca and Marcellus in PA and MD.

The more sane of the companies in the Marcellus and Utica are receiving much more than local spot prices even without hedges, because they have arranged for firm transport commitments for most of their production. This does not include CHK.

We currently don’t have enough production to satisfy demand without interannual storage draws, except with an unusually warm winter. Increased transport out of the Marcellus region will help, but we currently don’t have nearly enough investment to keep production steady, let alone increase it. As transport from the Marcellus to NYC and the Northeast increases, we’ll see increased seasonality of demand in the depressed price region. The initial response isn’t to from depressed prices to Henry Hub prices all the time, but only in winter, which still doesn’t leave a good price environment.

Eventually, of course, the price will have to increase, and drillers will respond to the price increase. For the moment this is delayed because of the myth of the tidal wave of stranded Marcellus gas at current drilling levels. Lease holders in the western Woodford and northern Haynesville seem to want to satisfy Held by Production requirements if the price goes up a bit. Maybe CHK will drill that oil fairway Utica stuff that nobody else seems to think is worth that much. Maybe we’ll see infill in the core SW or NE Marcellus. I just know that this current gas investment level won’t be enough.

Slow early life decline can also be caused by the fact that the producing formation is restricted by the completion tubulars, and the well choke. Sometimes the well choke has to be used because the separator won’t handle the initial well capacity. This is the reason why gas well decline rates aren’t possible to pin down with a simple decline curve analysis.

Yes, a choke could cause that as well, but it seems to be unrelated to IP and I thought these wells in particular were quite low in total liquids.

Blaine

Thanks for taking the time to post this info.

Why would a choke setting be unrelated to the initial potential you see in public records? In some jurisdictions we do a multi rate test and use that data to estimate an “absolute open flow” (AOF). But the production records you see (the monthly production, or the well test) are usually the result of producing a gas well with a choke.

Old gas wells may not have a choke, but in new wells it’s highly unusual not to use one. There’s also the choking or restriction caused by well tubulars. Quite often, especially if the operator is looking long term, the well is completed with a smaller tubing size to optimize lift later in well life. This means a well will not be flowing at full capacity early in life. This in turn reduces the decline rate.

And this is why estimating the decline rates for large gas well populations is so hard to accomplish.

Thank you Fernando. I was thinking that this logically had to be the case. However, without the hands on expertise I did not want to say so. There are gas wells 2.5 miles deep, producing pressures of over 9,000 pounds per square inch. With that much weight on top of the formation it is almost logically certain that we would find such pressures. It would be insane to install take away pipes that were ten time stronger than the ones now actually required in the field. The costs to get the gas away would skyrocket.

Blaine,

Thanks so much for your long and thoughtful sharing of your perspective. I regarded the Bentek claims as outliers that either demonstrated substantial and continuing new high in net petroleum energy production for the US or claims that needed to be debunked. It is good to see an attempt at debunking them. I very much was looking to find expertise from others that could fill in my massive ignorance about this field.

However, I do have a range of questions in response to your various claims. David Hughes had over 4 Mcf/d per well for the first 12 months of production for a new well in Pennsylvania at the end of 2013. His graph suggested per well production was continuously increasing. In fact the graph had only 3 Mcf/d for 2012. The EIA Drilling Productivity Report does not report production by well. As you know they report new production by drilling rig. However, their 3,220 figure per rig at the beginning of 2012 is now 8,350 per rig. This is a rather furious rate of increase in productivity over recent years. If we use the obviously archaic (2013) per well data from Mr. Hughes and multiply this by the 2,300 wells not currently producing that would suggest 9.2 Bcf/d. Given modest assumptions about probable per well improvements, this does imply that Bentek’s 14 Bcf/d could be quite realistic. I would appreciate any data that you have to document your suggestion that the actual number “should be in the range 2-5.”

I am sure that you have heard that well decline rates can be radically reduced in later years. Mr. Hughes had a very low 8% per year decline rate in the Marcellus for wells after the first three years. Can I ask you where you got the data showing that wells in Susquehanna after the first six months “becomes almost exponential, at around 30% annually, with very little sign of any kind of hyperbolic slowing.” The suggestion that there is no slowing in later years would seem to be radically different than than any other field on our planet. I look forward to your data documenting this claim.

I was a bit stunned by this claim:

“The EIA’s “Utica Region” and “Marcellus Region” don’t seem refer to wells in the Utica and wells in the Marcellus. Rather, EIA “Utica” appears to refer to Utica and Marcellus in Ohio, while “Marcellus” appears to refer to Utiaca and Marcellus in PA and MD.”

EIA has been less than competent in many ways. However, can you present evidence that they are not actually reporting production from the Utica and Marcellus formations as they claim. Also to my knowledge Maryland has yet to allow any shale based drilling at all. Did you mean to refer to West Virginia? My recollection is that there are massive year over year increases in some WV counties.

I fully accept what Fernando has been saying about choking wells back. That is a wild card in any predictions about future field decline rates. However, an increase in field decline rates may correlate with substantial increases in actual field production because of more attractive pricing for producers. We will see about that. In the meantime, let’s figure what is happening now and in the immediate future.

By the way, I am reading the Bentek claim as predicting an additional 3.4 Bcf/d to apply to November of 2017, not this year. It can take a long time to fully integrate these new pipeline projects.

Mr. Wharton

The site Marcellusgasdotorg contains comprehensive production data on all 6 1/2 thousand producing unconventional wells in Pennsylvania, in addition to the near 15,000 total that have already been permitted.

To substantially augment the report from Bentek, the University of West Virginia just released a report on the Utica. This work was a compilation of data emanating from a dozen or so sources … governmental, educational, private industry. Exceptionally informative. They feel the technically recoverable amount will be about 800 Tcf, comparable to the Marcellus in their estimation.

An additional data source is the release this past May by Wrightstone Energy on the shallower Upper Devonian formations. They feel there is over 30 Tcf recoverable in the southwest portion alone.

To put these numbers in some context, the hype surrounding ENI’s Mediterranean find claimed an amount of 30 Tcf.

I know little about gas. But this discussion brings up an issue I have pointed out regarding oil.

Should otherwise productive wells with good casing be plugged merely due to low commodity prices?

I know that state regulations and lease terms require this. But should this be rethought?

Most mineral owners want production now, low prices or not. Did have one who told us recently if we wanted to shut wells down (not a waterflood) he was ok and would sign an agreement. Ironically, it is one of the very low cost leases.

I have seen several conventional gas leases for sale in the last couple years, low decline but losing money badly. Removing the state/contract issues, should those all be plugged, or is that a waste.

Thousands of wells have been plugged within a 30 mile radius of us over the years. Many needed to be for casing issues. However, many good ones were plugged due to 1990s oil price issues. 2010-2014 several of those areas were redrilled, at major expense. Seems like a waste to me.

Would appreciate comments about this issue. I agree there should be solid regulation of temporarily abandoned wells which would include surface and mineral owner protections.

Shallow

I’ve been getting a good education about some of that by occasionally checking in on some sites that cater to mineral rights owners. Go Marcellus shale dotcom is one, the EF also has one. The Bakken has had a few come and go.

The temperament of the people seems to be all over the place, as is the treatment/ethics (or lack) of the various companies.

But to address your curiosity about lessees’ flexibility in down times, it sure seems as if they collectively would be. Some may be greedy, but the majority may postpone payment now if it meant jepordizing future income.

Good luck.

Thanks coffee. I have seen the Marcellusgas site. it seems to be largely very detailed data. For our purposes we would need global aggregates in a form that could be used to abstract a more general understanding. I had also seen the WV report but I had not seen the Wrightstone Energy one. Your comment seem in general supportive of the Bentek projections.

I have another question that can only be answered by professionals who understand drilling. Obviously there are over 7,000 producing well in the Marcellus with most of them physically above the Utica. Is is possible to go back and extend those wells into the lower formation? The Utica at it deepest goes down 3 miles. It might not be cost effective to drill to that depth for a new well. However, the incremental depth beyond an existing well would be much less. I am profoundly ignorant of what might be possible with that. My guess is that there might be a similar issue with Bakken/Three Forks configuration.

The Marcellus is expected to produce 120 TCF by 2040 in Drilling Deeper according to the most likely scenario. David Hughes models a 20% annual decrease when the wells reach the exponential phase of their decline. probably after year 5 (though this is a guess by me, I will defer to the oil experts as to when the typical terminal decline rate begins for the average gas well.)

Note that the URR will be higher than 120 TCF as drilling and production will continue beyond 2040. It is expected that another 30,000 wells will be drilled after 2040 in Hughes’ most likely scenario (63,000 total wells and 32,000 wells by 2040) see pages 276-280 od Drilling Deeper.

Chart for Marcellus scenarios by Hughes.

Thank you Dennis. This analysis is an excellent analysis from the early 2014 perspective. The major problem with it that I see now is that it may underestimate the rate of technological change. The changes just over the last several years have been ferocious in the extreme. I am now hearing of automated technology where a single person manages the drilling of five wells from a single iPhone. That is not mainstream now but units working on such futures are rapidly adding to workers and revenue. The 3,220 cf added per rig per month at the beginning of 2012 is now 8,350 cf per rig. That is over 2.5 times the productivity in less than four years. I don’t think Hughes adequately took the rate of technological change into consideration. I don’t know if it can adequately be taken into consideration. Does anyone have any view about how the Hughes analysis would be changed if we had a coherent expectation about what the technology might be?

A single person can “manage” 10 rigs with a radio and a portable computer if the rig supervisors and personnel are very skilled. You know, it all depends on what you mean by managers. I’ve been in drilling ops where the managers couldn’t tell a bit from a pup.

Hi Don

The increase in rig productivity may reduce cost but does not increase trr.

Probably 200 TCF urr is optimistic through 2060.

Dennis, obviously a large part of natural gas in the Marcellus formation will be left there in large part because it will be too expensive to get it out. 200 TCF URR is an good optimistic guesstimate of what might be extracted by 2060. However, cost is a big variable. There is talk about rigs that can walk to a new location or self-assemble. Other are talking about total automation. It is a bit hard even to imagine what they mean by that.

Fernando, I fully understand that it is possible for a “manager” to have little knowledge or involvement with the operation. However, the particular case that I referenced presumed real time data in the deep hole with control over what happened with the bit. That is pretty hands on. Apparently there is an accepted protocol in place for getting info from deep in the hole.

It’s kind of rediculous that the data is not reported on a per well basis in the first place, since the rig is usually not a large fraction of the costs. They might as reasonably report per ton of sand to give a downward trend.

Average wells drilled per rig in the Marcellus area was very nearly 2.0 was of Jan-March 2015. You can divide the 8,350 Mcf/d by 2.0 to get 4,175 Mcf/d IP average, which isn’t much different from what Hughes had. Multiplying by this 2,300 does in fact give a result close to that quoted.

My objection wasn’t that the number is wrong, but that it but that it isn’t a good representation of trapped production as I would define it. There are always quite a lot of wells under development, even in areas without transportation bottlenecks. Unless they’ve taken them out specially, this number includes around 450 shut-in wells. The companies don’t have money budgeted to develop these wells with any kind of rapidity. If you’re going to include wells that they don’t presently have money to complete, why not include drilling permits too? My 2-5 Mcf/d was just a hand-waving estimate of the amount of actual capacity that could be deliverable on relatively short notice in the absence of trunk pipeline congestion, based on observed price/demand response.

My estimate 30% annually was from random sampling of initially high IP wells in Susquehanna using the publicly available PA DEP data. Admittedly a more comprehensive survey would be preferable, and it would be nice to have pressure and choke data, but that data is not generally available. It did seem to be rather consistent, however. I was mostly looking at wells starting production 2011 and later. The earlier wells which were not as tightly packed do seem to have had slower decline curves.

By no slowing, I meant no slowing of the exponential decline rate in these wells which are after all only around 4 years old. A hyperbolic decline rate would be slower. Since an exponential decline is one of the commonly used exact diffusion solutions, I’m not sure why this should be seen as exceptional. Perhaps some hyperbolic slowing of the decline rate will be evident later.

Re: EIA regions: Read the product description. They are presenting data by region and never claim that it is by formation. You just assumed that was what they meant. I should have said all production from the appropriate counties, for Marcellus in PA, NY, MD, and WV, and yes, of course PA and WV would be much larger than NY and MD.

It’s kind of rediculous that the data is not reported on a per well basis in the first place, since the rig is usually not a large fraction of the costs. Average wells drilled per rig in the Marcellus area was very nearly 2.0 was of Jan-March 2015. You can divide the 8,350 Mcf/d by 2.0 to get 4,175 Mcf/d IP average, which isn’t much different from what Hughes had. Multiplying by this 2,300 does in fact give a result close to that quoted.

My objection wasn’t that the number is wrong, but that it but that it isn’t a good representation of trapped production as I would define it. There are always quite a lot of wells under development, even in areas without transporation bottlenecks. Unless the’ve taken them out specially, this number includes around 450 shut-in wells. The companies don’t have money budgeted to develop these wells with any kind of rapidity. My 2-5 Mcf/d was just a hand-waving estimate of the amount of actual capacity that could be deliverable on relatively short notice in the absence of trunk pipelien congestion, based on observed price/demand response.

My estimate 30% annually was from random sampling of initially high IP wells in Susquehanna using the publicly available PA DEP data. Admittedly a more comprehensive survey would be preferable, and it would be nice to have pressure and choke data, but that data is not generally available. It did seem to be rather consistent, however. I was mostly looking at wells starting production 2011 and later. The earlier wells which were not as tightly packed do soom to have had slower decline curves.

By no slowing, I meant no slowing of the exponential decline rate in these wells which are after all only around 4 years old. A hyperbolic decline rate would be slower. Since an exponential decline is one of the commonly used exact diffusion solutions, I’m not sure why this should be seen as exceptional. Perhaps some hyperbolic slowing of the decline rate will be evident later.

Re: EIA regions: Read the product description. They are presenting data by region and never claim that it is by formation. You just assumed that was what they meant. I should have said all production from the appropriate counties, for Marcellus in PA, NY, MD, and WV, and yes, of course PA and WV would be much larger than NY and MD.

From Bloomberg

“Houston-based Cheniere Energy Inc. plans to ship its first LNG cargo in December from Sabine Pass on the U.S. Gulf Coast, marking the start of a wave of projects forecast to turn the nation into a major gas exporter. More than 50 applications have been filed to ship gas from the U.S.”

Note the stock symbol for this company on the NYSE is LNG.

Ovi, I expect that relatively few of the 50 will actually be built. LNG prices have crashed. The plants that have been approved with construction actually started are likely to go to completion. Most of the nameplate capacity on them is already contracted for with long term contracts and are thus relatively safe investments. That does not mean that the LNG will actually be exported. However, it does mean that fees will be paid if the companies who have contracted for the LNG don’t take it. As I see this market, anyone that builds a LNG export facility will be crazy to do it without long term contracts to take the product. The world-wide capacity is likely to much exceed the demand. Frankly, I think the LNG importers would be crazy at this point to sign a long term contract. The spot market is likely to be dirt cheap.

If memory serves, the EIA put the annual decline from existing wells in the Marcellus somewhere on the order of about 8 BCF/day per year.

An Interesting Gas Play Case History

The Haynesville Shale Gas Play, which covers part of both Texas and Louisiana, is an interesting case history. Following is a chart showing the monthly production versus the rig count. Note the significant time lag, a little more than a year, between the beginning of the decline in the rig count (late 2010) and the beginning of the decline in production (early 2012). Also, note that that there was about a three year gap between the beginning of the late 2010 decline in the rig count and the end of the steep production decline (late 2013):

http://i1095.photobucket.com/albums/i475/westexas/Haynesville-rig-count-and-natural-gas-production1_zpsb1n95tiz.jpg

In any case, the decline in production from the Haynesville Play contributed to the observed 20%/year exponential rate of decline in marketed gas production from Louisiana from 2012 to 2014 (dry gas production for 2014 not yet available). Note that this was the net rate of decline in gas production, after new wells were put on line (for both conventional and unconventional production). The gross underlying decline rate from existing wells in 2012 and 2013 in Louisiana was even higher than 20%/year.

The Louisiana data provide strong support for the Citi Research estimate that this gross underlying rate of decline in existing US gas production is on the order of about 24%/year (again, gross being the rate of decline, before new wells are added).

With an underlying gross decline rate of about 24%/year, the US needs about 17 BCF/day of new production per year, just to offset the declines from existing production. Note that this volume of gas–that the US needs just to offset declines from existing wells–exceeds the dry gas production levels of every country in the world, except for the US and Russia. In other words, in order to maintain current gas production, we need to put on line–every year–more gas production than Canada, or Norway, or Iran, or Qater, etc.

Don,

Natural gas production in the US is actually in a sharp decline since December 2014 (production over 74 bcf/d) towards 72 bcf/d this week. Despite FERC, REX…. pipelines reversed and coming online, production did not increase nor pricing changed very much. Although the record production of Marcellus seems to be impressive, Marcellus stagnates since the last few months , just touching the record with a marginal production increase for one day and then falling back below 20 bcf/d again. This goes on now for months. The US is still a net importer of natgas and imports are strongly on the rise over this summer (imports from Canada up over 25% from last year in some weeks). It would be first a good showing if net imports can be reduced before talking about exports. The next few months will show, if the predictions of a huge production increase will become true. So far this has not been the case. Alaska for instance went down in June by 2bcf/d from April. In my assessment we will see an extreme natural gas shortage this winter.

I agree. It looks like gas production is declining 0.2% week over week. I expect the declines to increase as the fracklog is being worked off and the decline in rig counts from earlier in the year kick in more. I also think the EIA will readjust their numbers soon. LNG to Sabine will actually begin flowing in October or November with first LNG shipped in Dec. More capital will be taken out of the system next month with borrowing bases redetermined and companies just going flat out broke. A lot of companies are producing gas that shouldn’t be-SFY, PVA, SD, HK, XCO etc. There are numerous private equity backed companies in trouble as well that you just don’t read about because they are private.

Heinrich, I hope you are right. However, I assume that you are familiar with Bentec and their reputation. Note that that I am not assuming any personal expertise here. Frankly, given the record of EIA, it seems reasonable to play our confidence in the more highly respected private analysts. Also consider that there is massive work still to be done to integrate pipeline investments into the actual field flow.

CARACAS, Sept 1 (Reuters) – Venezuela and China have signed a deal for a $5 billion loan….

Venezuela has borrowed $50 billion from China through an oil-for-loans agreement….

That financing has been especially crucial for Caracas since last year’s oil market rout, which aggravated the country’s severe economic crisis. – See more at: http://www.rigzone.com/news/oil_gas/a/140403/Maduro_China_Signs_Off_on_5B_Loan_to_Boost_Venezuela_Oil_Output#sthash.jrzikk22.dpuf

$50 billion is the total of what they have borrowed in the past to be paid back in oil. The current loan is $5 billion.

A source at Venezuelan state-run oil company PDVSA told Reuters in March that China was set to extend a “special” $5 billion loan that would likely stipulate hiring Chinese companies to boost output in the company’s mature oil fields.

Venezuela has borrowed $50 billion from China through an oil-for-loans agreement created by late socialist leader Hugo Chavez in 2007, which has helped Chinese companies expand into Venezuelan markets amid chronic shortages of consumer goods there.

Well according to this article in Deutsche Wirtschafts Nachrichten, it appears to be the second installment of a deal Maduro and Xi Jiping cut earlier this year.

http://deutsche-wirtschafts-nachrichten.de/2015/03/21/gegen-usa-china-gibt-venezuela-milliarden-kredit/

The article is in German, but here’s an English translation:

In the coming months China will lend Venezuela, which faces bankruptcy, ten billion dollars. These funds are part of a bilateral agreement. For China it’s a way to quench its energy needs, while the US continues its confrontational line with Venezuela.

Venezuela is under the threat of soverign default. In providing two five-billion dollar loans, China has become an important partner for the struggling country. The first part of the loan is the joint Chinese-Venezuelan Fund, and will be directed into major projects, CNBC reported. The agreement will be signed later this month. China extended the terms of the loan to five years, giving Venezuela more breathing room, as the terms are typically limited to three years.

The second part of the loan will be used in the oil industry. China will support investments in oil fields, intended to help Venezuelan oil company PDVSA increase production, the official said. Ninety-six percent of Venezuela’s foreign exchange revenue comes from the export of raw materials.

The recent fall in oil prices is one contributor to the financial pressure on Venezuela. Interest rates on bonds have risen again. Venezuelan President Nicolás Maduro claimed the US is responsible for the fall in oil prices late last year. “Are you aware that an oil war rages?” said Maduro on Monday in a broadcast speech to businessmen. “This war has one goal – to destroy Russia.” In addition, it is also directed against Venezuela “to destroy our revolution and bring about a collapse of the economy.”

In March Obama called Venezuela a threat to the US national security. Domestically Maduro is under pressure. There were regularly scheduled demonstrations against the government of the country last year. In February 2015, a 14-year-old died in protests. Last week there were protests in Caracas again.

Venezuela is extremely lucrative for China’s investment interests. This is the country with the highest oil reserves in general, and China’s energy demand will increase with the increasing rural-urban migration in the coming years. China has already given Venezuela $45 billion in exchange for oil and fuel.

With the new loans for Venezuela, China finds itself in opposition to the United States. It was only in February that China promised loans to Russia to support Moscow in a similar fashion.

The loans are intended to generate business for Chinese companies, and allow them to import Chinese laborers not protected by Venezuelan Union rules.

The terms require Pdvsa to ship crude at heavily discounted prices, my sources say the payments this year involved shipping about 400,000 BOPD at heavy discounts, and that new loans were in a sense intended to keep the $50 billion topped off.

Chinese moves in Venezuela are a form of colonization. The new agreement includes setting up centers to teach mandarin to Venezuelans. Also, the Venezuelan army sent soldiers to Beijing to participate in the Chinese military parade celebrating the end of WWII.

Another tidbit: Colombia has filed criminal charges against Maduro for the ethnic cleansing of Colombians. The papers were turned into the international criminal court last night. I don’t expect much to come from this action. The only thing I think will make the Maduro regime collapse, in spite of Chinese efforts to prop it up, is to put pressure on the Castro family dictatorship. The Castros have placed over 30 thousand Cubans in Venezuela, many of them in the security services and the Venezuelan military. This allows them to have the means to stop Venezuelans from trying to force Maduro and his clique out of power.

Latin America for the past five centuries has been a chessboard upon which the world’s great hegemonic empires — Spain, Holland, France, Britain, the United States — have played their imperial games.

The perfect example of this is Mexico. For over 500 years its people have never had a state which represented them. Porfirio Díaz summed it up succinctly: “Pobre de México, tan lejos de Dios y tan cerca de los Estados Unidos.” (Poor Mexico, so far from God and so close to the United States.)

Now China and Russia are joining the fray.

Russia isn’t really into it other than to have a card to play as it reacts to USA pressure around its borders.

The USA for the most part isn’t into that “fray” in Latam.

China on the other hand has a very transparent mercantilist imperial policy. And they are very willing to encourage dictatorships, human rights abuses, corruption, etc. China is a throwback. I see them as an agent for evil.

Fernando Leanme says:

The USA for the most part isn’t into that “fray” in Latam.

Fernando, I don’t know what planet you live on, but it surely isn’t planet Earth.

With everything going on in Guatemala as we speak — with the people of that country struggling to wiggle out from under the imperial jack boot of the United States — statements like yours show you have completely departed from factual reality.

Good grief man, Guatemala’s president (that is up until a couple of days ago) was on the friggin’ CIA payroll back in the 80s when he conducted his genocides and mass murders.

Your view that the US’s shit don’t stink, or the even more fact-free view that it is not even involved in Latin America, defies all reality and all common sense.

Heck, at least old farmer mac attempts to construct a moral and intellectual defense for US aggression, and doesn’t just bury his head in the sand and depart completely from factual reality.

These headlines pretty much tell the story:

“In Guatemala, Protests Threaten to Unseat President, a U.S.-Backed General Implicated in Mass Murder”

http://www.democracynow.org/2015/8/24/in_guatemala_protests_threaten_to_unseat

“Guatemala President Faces Arrest as Business Interests and U.S. Scramble to Contain Uprising”

http://www.democracynow.org/2015/8/27/uprising_in_guatemala_could_anti_corruption

“Is Guatemala’s President Going to Jail? Legislature Strips Pérez Molina of Immunity After Protests”

http://www.democracynow.org/2015/9/2/is_guatemalas_president_going_to_jail

“Guatemalan President Resigns in ‘Huge Victory’ for Popular Uprising”

http://www.democracynow.org/2015/9/3/guatemalan_president_resigns_in_huge_victory

“Allan Nairn: U.S. Backers of Guatemalan Death Squads Should Be Jailed Alongside Ex-President”

http://www.democracynow.org/2015/9/4/allan_nairn_us_backers_of_guatemalan

Glenn, in fairness to Fernando, he is unlikely to accept Democracy Now as a fair and balanced view of Latin America. Also, the 1980s are a long time back and hardly represent current American priorities. We have pivoted toward Asia and we have much greater concerns about the Mideast and a newly bellicose Russia. I just do not see Guatemala as a great priority and my guess is that American governmental observers are not greatly engaged with this minor but passionate response to reprehensible corruption. If a corrupt leader goes to jail and new elections occur, my guess is that our State Department will adequately happy.

It is hard for me to believe that I am supporting Fernando. However, I do agree with him that America is not much concerned about the fray here.

Most politilogues from Latin America, I do believe, would agree that the US’s failures and embroilments in other parts of the world drew the US’s attention away from Latin America. This gave various progressive governments in Latin American breathing room, something they probably would not have had if the US had not had its hands full in other parts of the world.

Hugo Chávez came to power in Venezuela in 1998, Néstor Kirchner in Argentina and Luiz Lula da Silva in Brazil in 2003, Evo Morales in Bolivia and Tabaré Vázquez in Uruguay in 2005, and Rafael Correa in Ecuador in 2007. All of these are “progressive” governments which are united in their defiance of the Washington Consensus.

To claim though, as Fernando does, that the “The USA for the most part isn’t into that ‘fray’ in Latam,” is quite the exaggeration, and flies in the face of all reality and all common sense, at least for anyone with a rudimentary knowledge of what is going on in Latin America.

Also I noticed you attacked the messenger — Democracy Now — and not the message.

Notwithstanding this distraction, the bottom line is that there is more than ample evidence, from any number of credible sources, to demonstrate that the United States is still involved in Latin America, and not in a minor way.

Whether the US is successful in turning back the tide in Latin America, however, is an open question.

I would imagine some of you here may have heard of the U.S. Southern Command. Perhaps also the School of the Americas? A lot of you are old enough to remember being taught about the Monroe Doctrine.

It is true that U.S. interests are spread thin around the World. We need to engage in Africa to combat radical Islam (and also aggressive mercantilism by China)…we need to pivot to the Pacific (contain China)…wait, we need to check Russia’s adventurism in Ukraine. Be all that as it may, we will always have core equities in the rest of the Western Hemisphere. Our involvement in Central and SouthAm affairs is usually much broader spectrum and subtle than blatant military actions. Notice I said ‘blatant’. Certain aspects of the U.S. military specialize in executing key operations that are quite discreet.

I tend to view political (including low-vis mil ops) as a symptom/sideshow of overpopulation and resource depletion.

Jesus. I lived in Venezuela for a decade. Helped manage huge assets. Had access to intelligence you have no idea exists. And you come back quoting democracy now dot org about Guaremala to teach me about Venezuela?

These personal anecdotes, however, do nothing to counter the overwhelming amount of evidence on record which demonstrates that the United States is still very much “in the fray” in Latin America.

Glenn, I told you that Fernando would be unlikely to accept Democracy Now as a fair and balanced view of Latin America. I hate to say I told you so but that is what I said. Personally I treasure Democracy Now. On many issues I am a quite liberal. Also I have no doubt that we are doing some things that would not look good from that liberal perspective. I think you do understand my central point that the US government cares very much less about such things compared our focus decades ago. Beyond that the impact that we do have as a government is far less likely to be definitive. The people of Guatemala have spoken and I don’t see that anything our government does will change that outcome. And yes that does mean that America is much less concerned “about the fray down there.” Obviously our government is still engaged to some extent. However, if you were to talk with high level management in the State Department privately I think it is quite likely that they would voice a view similar to what Fernando and I are saying here. If they are on a LATAM desk they would likely be less than happy about that situation.

Glenn, you present nothing relevant to Venezuela worth a single bean.

Those populists you listed are completely irrelevant to a discussion as to whether the USA is in a “fray” in Venezuela. But I guess once one guess bitten by the red bug and turns into a red zombie there’s no sound argument one can use. ?

EIA has not been costing us lunch money. They have been costing us real money. And the CPA guy above mentioned that the EIA expects production to accelerate in late 16. How? Is Disneyland coming to the oil patch? On what is this claim based? Does anybody know?

The EIA expects oil production in the GoM to increase by 290 kb/d from May 2015 to December 2016 as a result of new project start-ups (presumably non-affected by low oil prices).

Crude + condensate production in the Lower 48 states is expected to decline by 810 kb/d between May 2015 and June 2016 (from 7.63 to 6.82 mb/d) and then slightly increase in 2H16 to 7.07mb/d in December 2016 due to higher oil prices.

Note that the IEA recently revised downward its historical numbers for the U.S. oil production, so their forecast in September STEO should also be lower.

U.S. oil production and WTI spot price forecast: EIA STEO August 2015

AlexS. I just do not see why WTI in the high 50s would cause a large number of rigs to return to the EFS or Bakken. I cannot figure out why there are more than a handful there now.

I know I have beaten this to death, but we are high cost and we have been taken out to the wood shed. However, when I compare us to shale, the cost is even higher.

I’ll pick on HK again. They have 40K BOEPD and did an agreed default, reducing their debt from $3.5 to $3.1 billion. They claim their bank operating line of credit will be remain as is, at $850 million, despite the default and despite that unsecured debt is trading for 30 cents on the dollar. So apparently banks are going to allow them to drill wells that cost $7-8 million, will make 200K+/- in 60 months, with oil in the $30s and gas under $2 in the field.

Let’s equate all of this to a small producer who is 1/1000 the size of HK.

ABC Oil Company has 40 BOEPD. They had $3.5 million of debt, but defaulted on part, and therefore it is reduced to $3.1 million. Their production will generate about $250K of income the next 12 months, and will be down to 26 BOEPD in 12 months without further drilling. The interest expense on the $3.1 million will be $300,000 annually if principal is not reduced.

ABC wants the bank to loan it $850K so it can drill 11 wells that will produce 2,000 or so barrels of oil each from now till the end of 2020.

Now why would a bank loan anything to ABC, let alone for them to drill more?

I do not understand how the Office of the Comptroller of the Currency would not write up a bank that loaned a part of $850 million to a shale company who has just defaulted on $400 million of loan principal, that will have at least three times the $$ of long term debt as PDP PV10 and is going to use the funds not to pay down 13% interest third lien bonds, but is instead going to use the $850 million to drill more wells that will not come close to payout in 60 months.

I cannot understand how things have gotten so far from reality, especially as we are just 7 years removed from the exact same debacle in the US housing industry.

Rant over.

Shallow, I suspect that the people who preside over these affair are psychopaths or something. I recall asking questions about the nature of the participants over at TOD because of our ability to sift through the BS presented by the media and understand the concepts involved in Peak Oil.

It seems that most of us who participate here on this blog are of a certain rare personality type (INTP/INTJ?) while Wall Street types are generally not. It strikes me that there are some people who just cannot see “the writing on the wall” simply because it interferes with their preferred world view while, most of us find it difficult to blindly engage in folly because, we cannot bring ourselves to ignore “the writing on the wall”.

I dunno. What is it about most of us here that makes it possible for us to understand Peak Oil and limits to growth when there appear to be vastly more people who cannot wrap their heads around these concepts and even vastly more who just plumb don’t give a shit?

I’m concerned, for example, that modern civilization has disrupted so many natural cycles and introduced so many strange and wonderful 😉 new compounds to environment that we are fouling our nest so to speak. I see the Sargassum seaweed problem currently being experienced in the Caribbean, as natures response to more CO2, more nutrients and more warmth in the sea water. I find it somewhat disturbing and think that humanity had better try to help nature restore balance, by putting this biomass (seaweed) back on land from whence the nutrients and carbon originated that, are causing the problem to begin with. I guess that makes me probably about one in a million!

You see, we will never understand how that stuff works because we just cannot think like them and they will never be able to explain anything to us because, they just cannot think like us. We will get up in the morning and ponder about what is going to happen when the “chickens come home to roost” and they will get up and think about how much money they are going to earn (personally) so that they can buy that new SUV or boat or take that next vacation to Cancun (or at least somewhere that doesn’t have that awful, stinky, seaweed nuisance!).

Like you, I suppose, many of us here “cannot understand how things have gotten so far from reality”.

I’m concerned, for example, that modern civilization has disrupted so many natural cycles and introduced so many strange and wonderful new compounds to environment that we are fouling our nest so to speak.

THE PROBLEMS WITH WASTE