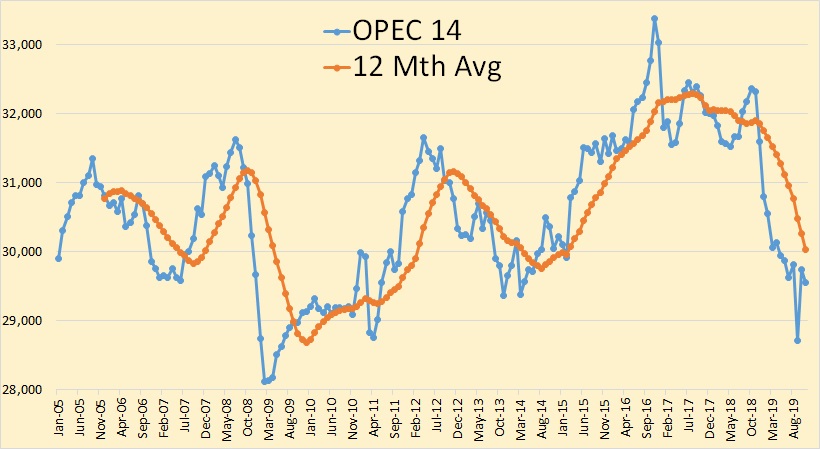

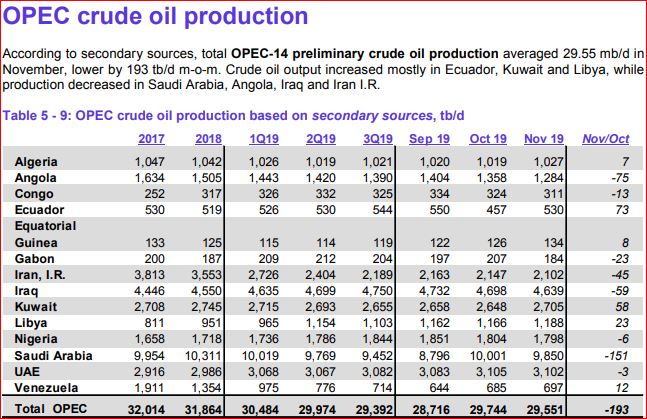

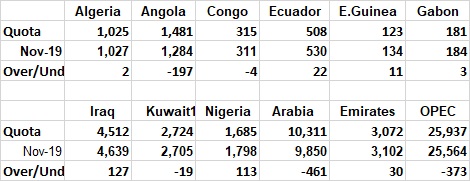

The OPEC data for the charts below are from the OPEC Monthly Oil Market Report.

and is thousand barrels per day.

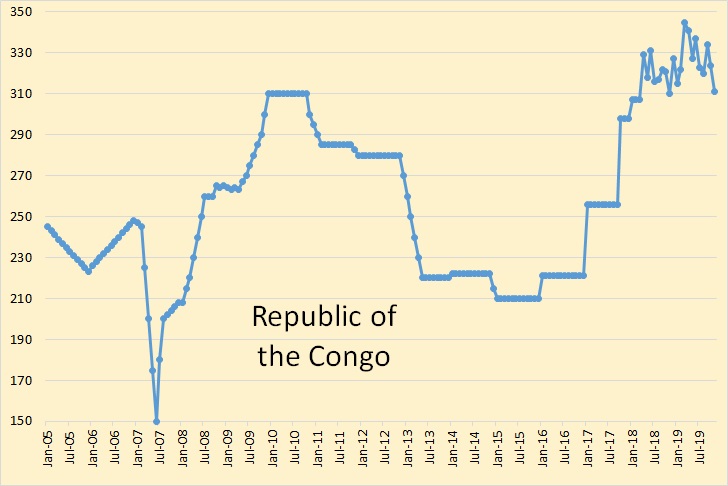

OPEC 14 was down 193,000 barrels per day in November but that was after October production had been revised up by 94,000 bpd.

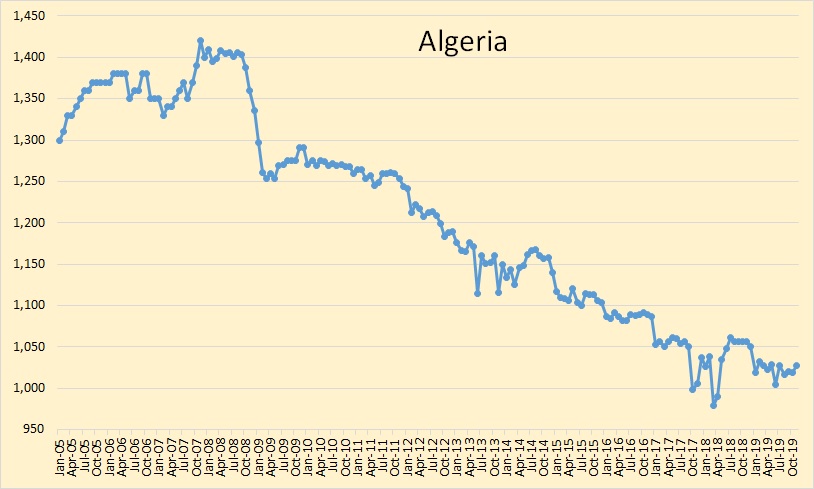

Algeria slightly increased production in November. Nevertheless, they are in a slow decline.

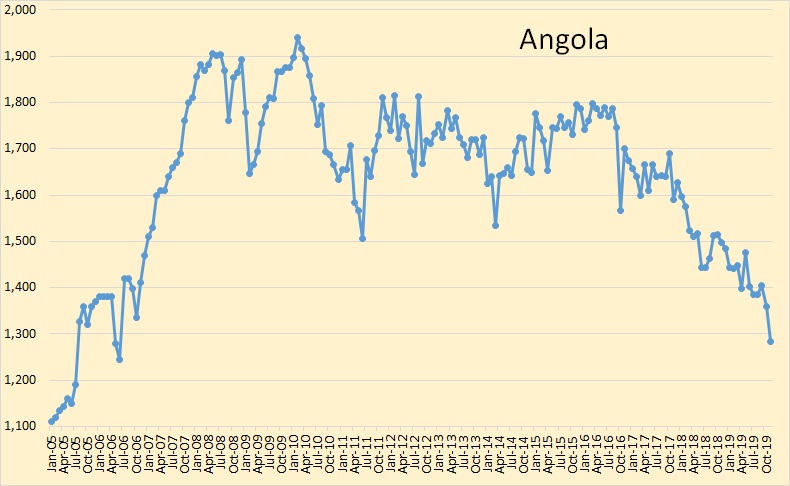

Angola took a hit in November, down 75,000 barrels per day. They are now 197,000 barrels per day below their quota.

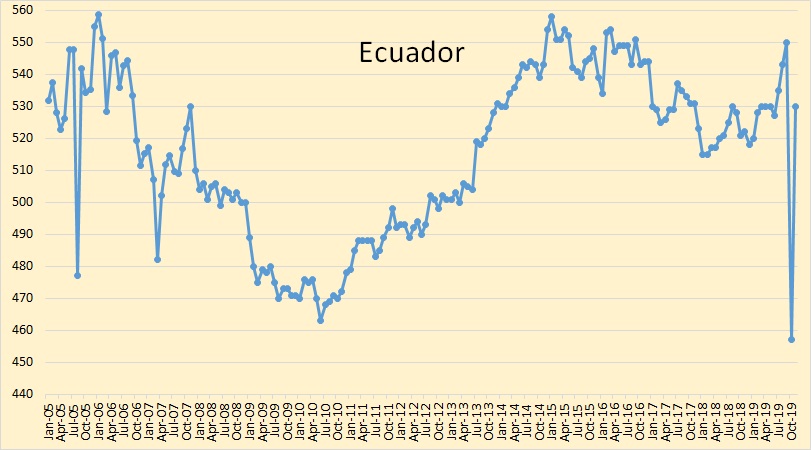

Ecuador recovered from the huge hit they took in October but are still down 20,000 barrels per day from September. Ecuador will be leaving OPEC at the end of December.

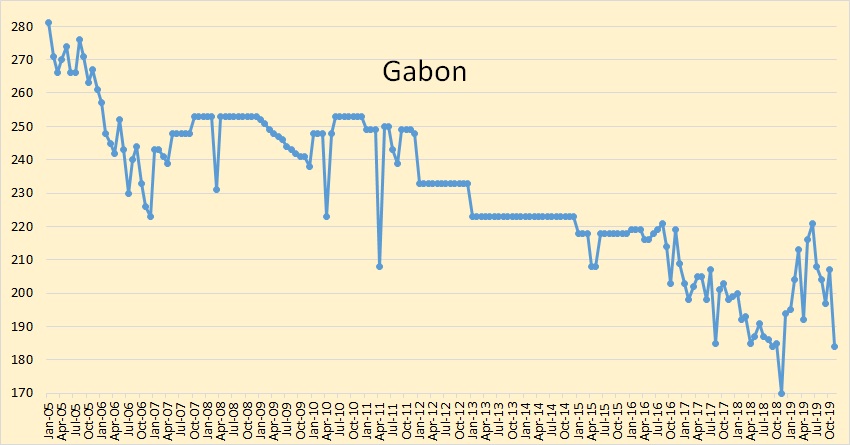

Gabon was down 23,000 bpd in November. Big hit for such a small producer.

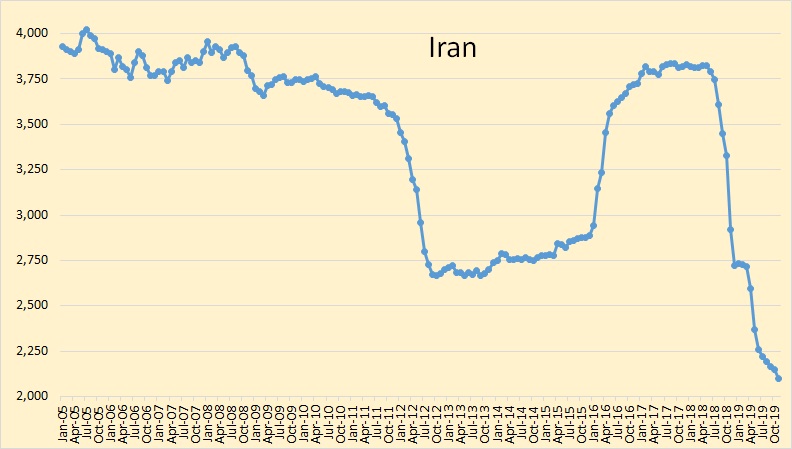

Iranian production was down another 45,000 bpd in November. I don’t understand why sanctions is hitting so much harder this time than the sanctions that began in 2011.

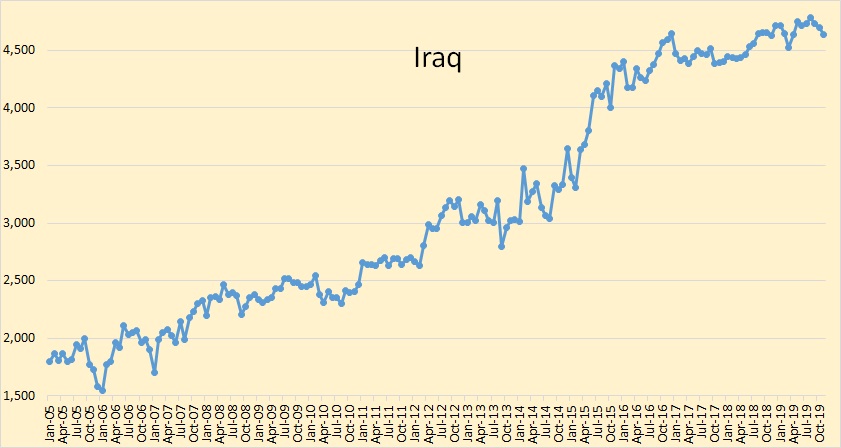

Iraqi production was down 59,000 bpd in November. However, I think they are still producing flat out, or very nearly so. Iraq is producing 127,000 bpd above their quota. In other words they are ignoring their quota.

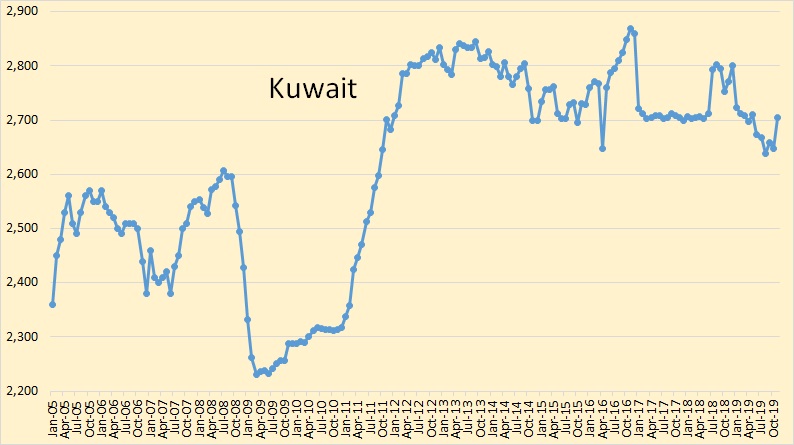

Kuwaiti production was up 58,000 bpd in November. However, their October production was revised down 26,000 bpd.

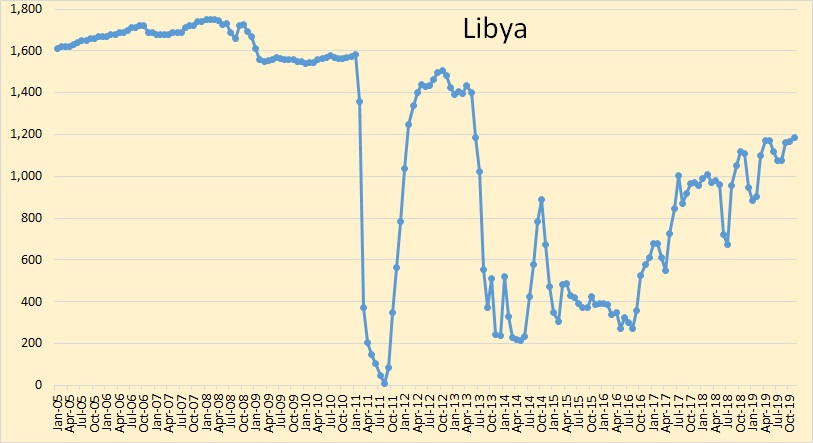

Libya, like Iran and Venezuela, are exempt from quotas. They are exempt because of conflict in the area. However, I doubt if they could produce much more with no conflict.

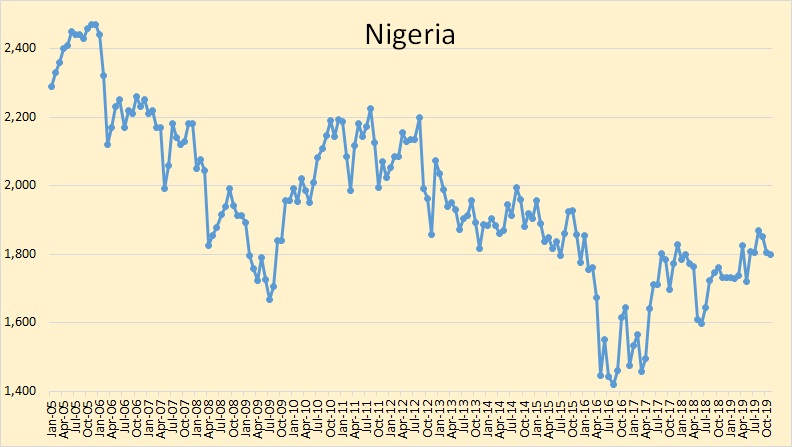

Nigeria, like Iraq, is ignoring its quota. They are producing 113 bpd above their quota.

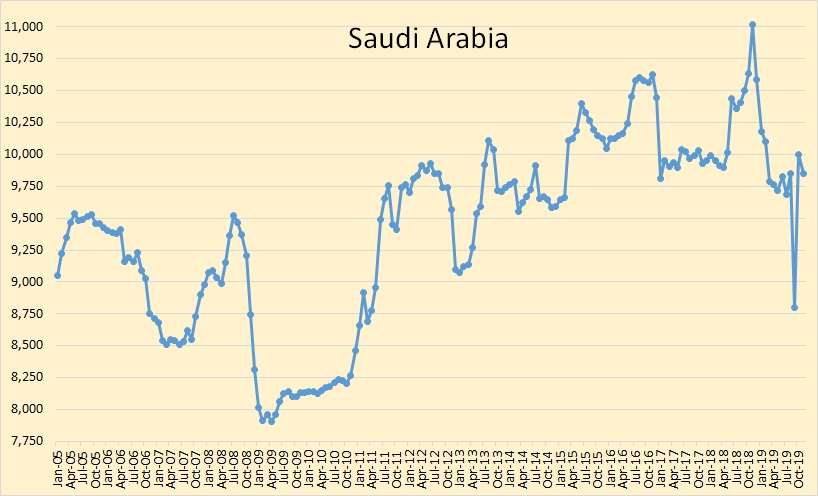

Saudi production was down 151,000 bpd in November to 9,850,000 bpd. However, their October production was revised upward by 111,000 bpd to 10,001,000 bpd. Saudi, in November, produced 461,000 barrels per day below their quota.

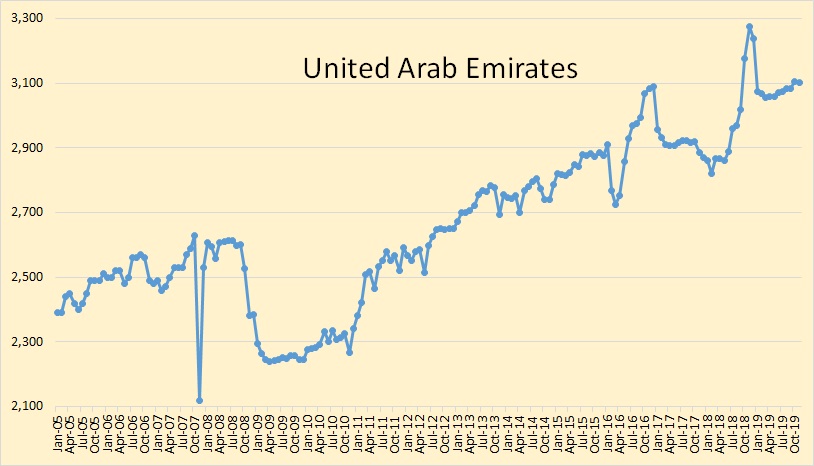

UAE production is holding steady. They are 30,000 bpd above their quota.

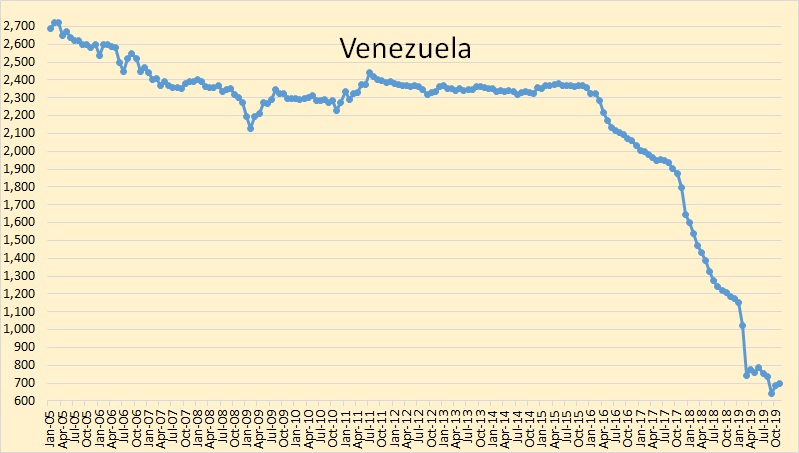

Venezuela seems to have bottomed out at just under 700,000 barrels per day.

Here we have production versus quotas. The “OPEC” column excludes the three countries not subject to quotas.

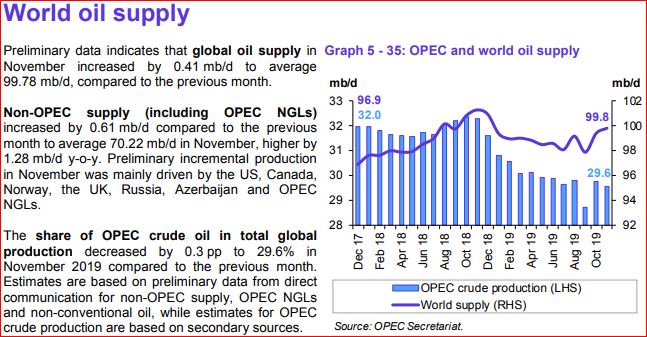

This is the OPEC Secretariat’s opinion of world total liquids production. I am not sure how accurate it is.

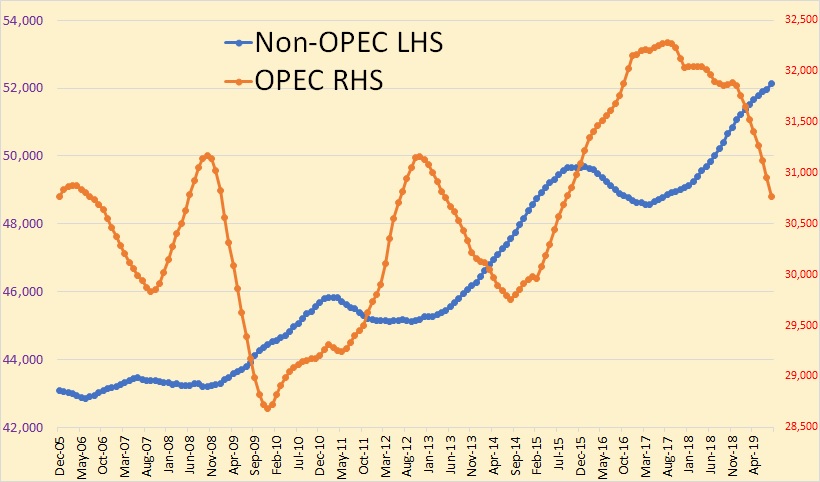

As of December 2005, Non-OPEC 12 month average stood at 43,099,000 barrels per day. In August 2019 that 12-month average stood at 52,127,000 barrels per day, an increase of 9,028,000 barrels per day. As of December 2005, OPEC Production 12-month average stood at 30,769,000 barrels per day. By August 2019 that 12-month average stood at 30,766,000 barrels per day, a decline of 3,000 barrels per day.

Note: August is the last month I have World data for. The OPEC 12 month average in December of this year will be down about another 875,000 bpd.

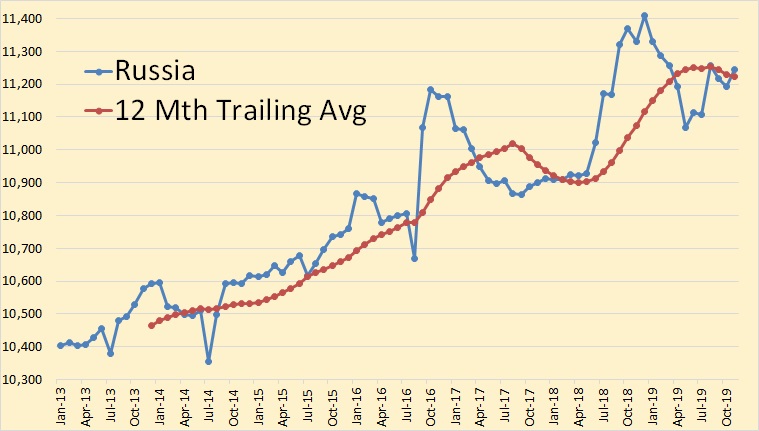

Russia through November 2029. This is Russia Ministery data using 7.33 barrels per ton.

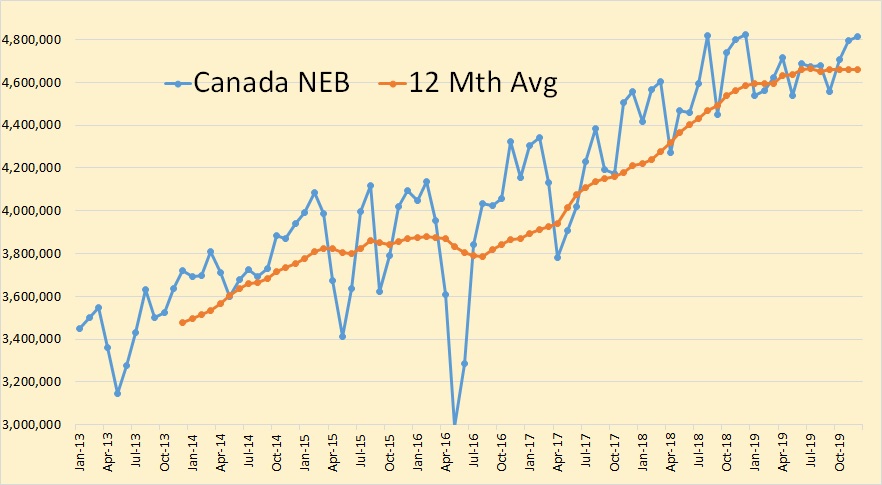

Canadian production through December 2019 according to the Canadian National Energy Board. All 2019 is a projection but only the last three months are subject to any serious revision.

Any credence to the story around Iran producing more than they are reporting to Opec?

Iran has stopped reporting production to the OPEC Secretariat. What you see here is what several sources estimate as their production. The OPEC MOMR looks at them all and makes a “best guess” estimate or their production. They refer to these reports as “secondary sources”. They do this with all other OPEC countries as well. It is just an estimate and yes, it could be off by several thousand barrels per day.

Can’t it be they produce full out and are smuggling it with transponder off tankers and other tricks?

I doubt seriously that they are producing flat out. But they are trying to evade sanctions with every means they have. An article from this past May:

Iran to sell oil in ‘grey market’ as US tightens sanctions

Iran has mobilised all its resources to sell oil in a “grey market”, a top official said, after the United States told buyers of Iranian oil – including China, India and Turkey – to stop purchases or face sanctions.

Amir Hossein Zamaninia, Iran’s deputy oil minister, told state media on Sunday that Iran will continue to export oil despite the US sanctions, which he said were neither just nor legitimate.

You will need to read the full article to get the whole story. But it will give you new insight on how these sanctions work, and how they are supposed to work.

The issue is probably finding buyers, sure some is for sure sold that way but they probably cant sell millions of barrels per day under the radar to buyers willing to eat the added risk. Witch will lead to filling up storage witch leads to lowering production.

The smuggled oil probably have a hefty discount also, so there will be loss in income even in the imaginary case they manage to smuggle all the difference.

There are also rumors that some of their oil is being exported thru Iraq.

FYI to you newer folks. Iran has a path of export seldom talked about anymore. It was on the radar screen in the Obama years but not so much now.

Namely, look at the map. There are many tankers on the Caspian. Iran oil is easily mixed at receipt point on the Russia coast of the Caspian. Russia can sell the mixture and reimburse Iran.

If you do a search for Iran pipelines, there are maps showing access to the Caspian sea.

All five of the countries bordering the Caspian have fleets of tankers. Oil can move out of Iran.

Neka oil terminal, on the Caspian, was once reported to be in the process of developing a loading capacity of 1.5 million bpd by 2016. I would imagine there’s likely an addition to the Caspian swap program going on. As well as refining Central Asian crude, existing infrastructure at Neka could facilitate exports, with Russia buying highly discounted Iranian crude. Iraq is also likely involved in numerous swap schemes with Iran.

https://www.transport-exhibitions.com/Market-Insights/Iran/Archive/A-guide-to-Iran’s-oil-exporting-ports

What is the explanation that Non-OPEC produces more than OPEC, but OPEC has 70% of world reserves? Although this might have been the case in the early history of oil production, I would think that this should not be the case near the peak. If I recall correctly, Campbell thought that OPEC’s stated reserves are actually the estimated ultimates for each OPEC country?

No, no, no, OPEC has almost 80% of World oil reserves:

OPEC Share of World Oil Reserves, 2018

Well, 79.4% to be exact Some people really believe that unbelievable crap. Well hell, there are still people who believe the earth is flat and that the sun revolves around the earth. So why should we be surprised? Some people will believe anything.

I would like to think that most people on this list know that OPEC quoted reserves is pure bullshit.

Hey, we have a president who lies every time he tweets. And sometimes he tweets 200 times a day. And perhaps 45% of the nation believes him. The capacity of humans to believe the absurd is unbounded.

Anyway if IEA and EIA projections are made on the basis of OPEC claimed reserves, we have a serious problem.

“there are still people who believe the earth is flat” if it only were so, for as Al Bartlett pointed out in his New Flat Earth Society

https://www.albartlett.org/articles/art1998jan.html

“The flat earth removes all the need for worry about limits”

Still, what would you and Dennis estimate of reserves be based on actual production rates.

Well, I have always stated, on this blog as well as The Oil Drum, that every nation produces what oil they can produce. Production must have some relation to reserves.

The normal R/P ratio is around 20. That doesn’t mean a nation with an R/P ratio of 20 will run out of oil in 20 years. Because as their production declines, their R/P ratio will still hold at about 20 because they are producing less oil therefore their reserves will go further. So an R/P ratio of about 20 is the norm for normal size conventional fields.

For giant and supergiant fields the R/P ratio would be greater and for smaller fields, as well as shale fields, the R/P ratio would be smaller.

If a giant or supergiant field is nearing the end of its life, but infill drilling, creaming the top of the reservoir, this will throw a monkey wrench into their R/P ratio. While in its prime, the field may have had an R/P ration of 40 or even greater, its R/P ratio while being creamed will be much smaller, less than 20.

Using OPEC’s reserves data for both OPEC and Non-OPEC, OPEC has an R/P of 109 while Non-OPEC has an R/P ratio of about 12. That OPEC number is absurd beyond belief.

Ron,

According to Hubbert methodology, at the peak production the number of years to exhaust the reserve is N = 2/a in which “a” is the intrinsic growth rate

dQ/dt=a Q (1-Q/Q_0)

From Laherrere’s reports for world peak, this is between 0.04 and 0.05. This means that the R/P ratio is between 40 and 50 at the peak. Thus if we say that 1/2 of the reserves are left at the peak and we take Laherre’s URR = 2500, this gives R/P=1250/35=36 years. These are ball park figures, but suggest that R/P ~ 20 is low. These numbers are for the entire world and for example for North Sea at its peak Hubbert’s analysis gave a = 0.12, so R/P=2/0.12=16.6, and this illustrates the fact that smaller fields are closer to your number R/P=20.

If we exclude the heavy oil then OPEC’s share is close to the 70% I suggested. How does this square its share of the production numbers for the world. This was my original question. I would like to read what the thoughts of other posters are on this as well.

Seppo,

OPEC’s 2P conventional reserves are about 575 Gb and non-OPEC 2P conventional reserves are roughly 512 Gb. Note that there is likely to be some future discoveries and reserve growth (these combined is called cumulative discovery). We are likely to reach the 50% point of conventional URR by 2023, if my 2800 Gb estimate is correct, if it is 2500 Gb for conventional URR (a 2018 Laherrere estimate was 2600 to 3000 Gb) we are past 50%.

Seppo,

OPEC “proved” conventional reserves ( excludes Orinoco) are likely to be 3P reserves.

The best reserve number to use is 2P reserves as there is roughly 50% probability reserves will be higher or lower than that estimate.

For UK where we have 1P, and 2P estimates the 2P/1P ratio is 1.7 from 1975 to 2016. Note that OPEC has chosen to develop resources more slowly to prevent oversupply. We would expect some difference in R/P when comparing OPEC with ROW.

Yes, Dennis, you are likely correct in that assessment. However, OPEC post those figures to actually represent the difference between OPEC reserves and Non-OPEC reserves. The “P” they are implying must apply to both sides of that statement, Non-OPEC as well as OPEC. They should not quote 3P for OPEC and still use 2P for Non-OPEC. That means OPEC is either totally ignorant or deliberately lying.

It is comforting to know that you really doubt those OPEC numbers. However, I still believe it is a gross overestimate even if they are quoting 3P reserves.

Ron,

I know you think it is far less than they say because you believe reserve estimates should be fixed. A look at US reserves over time suggests that reserve estimates get revised higher over time as prices increase and as the development of resources increases knowledge and leads to better estimates of resources.

This happens in the US and it also happens in OPEC, it just is far less transparent in the case of OPEC.

Basically we do not have a good estimate of OPEC reserves, we are left with a wide range of guesses.

https://aspofrance.files.wordpress.com/2018/10/35cooilforecast-oct.pdf

On page 134 of document linked above (Oct 2018) Jean Laherrere has an estimate of about 570 Gb for OPEC 2P conventional reserves (excluding 96 Gb of Orinoco reserves).

Typically Mr. Laherrere’s estimates are conservative.

Mr Laherrere’s estimate for World conventional remaining 2P C+C reserves in Oct 2018 was 1296 Gb, with a URR of about 2600 Gb. My best guess estimate is for World conventional C+C URR is a bit higher at 2800 Gb.

Dennis, you are seriously mistaken here. I very well know what the word “estimate” means. By definition, an estimate cannot be fixed. Otherwise, it wouldn’t be an estimate.

However, reserves are fixed. Estimates of oil company reserves, of oil companies traded on the NYSE, are and almost must be, very conservative. That is if oil companies err, they must err on the conservative side. Otherwise, they are in trouble with the SEC.

National oil companies, or companies not traded on any exchange, are under no such obligation. They can simply declare their reserves to be whatever they desire them to be. And, that is exactly what OPEC nations do, especially since it reserves, at least partially, determine what their quota should be. And also, prestige is something that matters greatly in the Middle East. The more reserves one has the greater the respect they believe they deserve.

Dennis, reserves that are simply “declared” by the company possessing them, have no basis in reality. Especially, especially if the nation declaring their reserves have an ulterior motive for exaggerating them.

Yes, yes, yes, Middle East reserves are nothing more than an estimate. But they are far more likely to be an overestimate than an underestimate.

But then overestimated reserves can still grow. All the countries possessing them have to do is declare that they have grown.

Mr Laherrere’s estimate for World conventional remaining 2P C+C reserves in Oct 2018 was 1296 Gb, with a URR of about 2600 Gb.

Dennis, that means that 50% of conventional world C+C reserves have gone, according to Laherrere.

If OPEC 2P conventional remaining reserves are 570 Gb, they have almost 50% of world conventional C+C remaining, although they (almost) never were producing flat out from their oilfields in production, according to you (and many others ?). With Iraq being one of the few countries that certainly for many years had fields in production that didn’t produce at max. capacity. From this 2P numbers must be concluded that OPEC is exaggerating their reserves indeed, as pointed out many times by Ron. A few decades ago the decision was that each country from OPEC was allowed to produce quantities of crude oil according to their published reserves. We know what happened then.

3P reserve numbers cannot be characterised as educated guessing, because you wrote:

The best reserve number to use is 2P reserves as there is roughly 50% probability reserves will be higher or lower than that estimate.

If world conventional C+C remaining is less than 2P, then the world could soon have a big problem, regarding production decline percentages (unless crude oilprices go very high, which world economy cannot bear (bear market).

By the way, the estimates of the quantity of crude oil extracted since the year 1850 vary considerably.

In an article published in 2015 can be read:

In 2008, two chemists from the Hungarian Academy of Sciences theorized that less than 100 billion tonnes of crude oil was produced since 1850 and the annual rate of production is around 700 million barrels. However, John Jones from the University of Aberdeen’s School of Engineering recently debunked this estimation. Jones pointed out that Istvan Lakatos and Julianna Lakatos-Szabo – the two chemists behind the dubious estimations – gave no references for their estimation and the actual figure is much higher.

Doesn’t make the projections more easy.

Han,

See section 3b of

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3866387/

Gives Oil Resource estimates, note that they use “all liquids” for cumulative output.

I use EIA data for 1960-2019

see link below for 1960-1972 data.

http://don.geddis.org/bets/peakoil/eia-doe-1960-2006.html

Data for 1973 to 2018 can be found at EIA.

Earlier data is from

https://cdiac.ess-dive.lbl.gov/trends/emis/tre_glob_2013.html

Multiply tonnes of Carbon emissions from liquid fossil fuel by 1.2745 to get tonnes of oil, then multiply by 7.33 to get barrels of oil for data from 1870 to 1959.

Most liquid fossil fuel before 1960 was C+C so this is a fairly good approximation.

I get about 1335 Gb of conventional fossil fuel at the end of 2018 when extra heavy oil and tight oil are excluded. About 30 Gb of cumulative unconventional C+C has been produced from 1965 to 2018.

The data is far from perfect, but this is what I use.

Ron,

If we take the BP OPEC conventional reserves of 979 Gb (we will assume this is 3P) and compare Laherrere’s estimate of 570 Gb (that is a 2P estimate), we get 3P/2P=1.7, very similar to the 3P/2P ratio for UK reserves. In short, I do not think the OPEC reserves are grossly overestimated from a 3P reserve perspective.

For conventional OPEC reserves we would have 1P=335 Gb, 2P=570 Gb, and 3P=979 Gb. For non-OPEC less oil sands we would have 1P=324 Gb and 2P=550 Gb using BP data at the end of 2017. Higher oil prices in the future are likely to lead to some discoveries as well as reserve growth, about 380 Gb for my best guess scenario.

Higher oil prices in the future are likely to lead to some discoveries as well as reserve growth, about 380 Gb for my best guess scenario.

Dennis,

So reserve growth would be more than conventional 1P OPEC reserves now (335 Gb)

Han,

The 380 Gb is “cumulative discovery” which is the combination of new discoveries and reserve growth from 2018 to 2400. This is my best guess, actual might be 200 Gb more or less.

Rig counts among OPEC countries mirrors US tight shale count. Reflects collapsing net-energy return.

Refined products (gasoline and diesel) are consumed to drill and deliver crude. However they are produced, distilled and measured elsewhere at the refinery, not the well where they are used.

These refined products are sold/purchased in an open market, mostly by private companies and contractors, and so are not tracted by any agency. The amount of refined diesel required to drill is not published, and so we have no idea how soon that consumed oil exceeds produced oil. That simple ratio is the most critical value in the entire world. And we have no idea.

Pioneer & ExxonMobil Pumping Out A Lot More NatGas In The Permian

According to the data from Shaleprofile, not including some unreported wells in Q3 2019, both Pioneer and ExxonMobil now producing a lot more NatGas.

Pioneer Q4 2018 to Q3 2019 Permian Production Increase

OIL = +25,161 bopd (54%)

GAS = +21,080 boepd (46%)

ExxonMobil Q4 2018 to Q3 2019 Permian Production Increase

OIL = +35,190 bopd (50.4%)

GAS = +34,623 boepd (49.6%)

ExxonMobil’s total 69,813 boepd production increase in the Permian for the first three quarters of 2019, without a few wells reporting, about half is NatGas.

LOL

No wonder Chevron is writing down $10-$11 billion in assets, mainly Shale Gas Assets in the Marcellus.

Watch for 2020 for the U.S. Shale Industry to start to disintegrate. A Little Birdie told me.

Steve

EOG Permian Q4 2018 to Q3 2019 Production Increase

OIL = +17,123 bopd (48%)

GAS = +18,247 boepd (52%)

While there are some wells not yet reported, I don’t believe it will change the overall Oil-Gas percentages.

What a FRICKEN MESS… LOL.

Steve

“What a FRICKEN MESS… LOL.”

Steve, you really are the only person I know that spews economic ignorance and laughs at himself in this own private conversation.

The tight shale play has turned the worlds oil market supply from shortage to excess for the last 5 years. It’s cut the price of oil and NG in half for the last 5 years compared from the previous 3 years prior. It has doubled the U.S. oil production and cut it’s imports to record 50 years lows. It’s lowered the cost of transportation fuels to everyone in the world and created millions of new jobs here in America. It’s the major factor inflation is almost non existent. The industry is suffering current pain from it’s own overwhelming success.

What’s your “FRICKEN” problem ? Poor gold sales. Because your a “MESS”. Exxon and Chevron are enormous multinational companies that are managed not for the next quarterly report, but for decades into the future. The current world surplus is not going to last forever and swing back to shortage. Pay attention.

The jokes on you, “LOL”

LOL,

Steve

HB, yes of course tight shale oil will last forever and ever. It will never peak. And those tight oil jobs will also last forever and ever. Yes, we are living in the golden age…. and it will last forever and ever.

So What’s the “FRICKEN” problem with those folks like Steve and Ron who think this golden age will one day come to an end?

“oil will last forever and ever. It will never peak.”

“golden age…. and it will last forever and ever”

Ron, nothing in my comment deserve those sarcastic references. You don’t dispute any of the facts of my current view. I clearly finish my statement with:

“The current world surplus is not going to last forever and swing back to shortage”

I my life time, I would say there has been two swings to an era of shortage. The first would be from the early 70’s to the mid 80’s. Basically from peak U.S. to Alaska online and CAFE standards kicking in. The second era of shortage being early after the turn of the century to the oil price collapse in late 2014. A good example of long term price increase stimulating production and balancing markets. Plus, a viable EV alternate to oil in the future.

BTW, the U.S.A. is at record low unemployment and Laker tickets start at about $250 a pop in the rafters.

I clearly finish my statement with:“The current world surplus is not going to last forever and swing back to shortage”

Yes, and I’m not sure I understand it as it seems to undercut everything you’ve said before it. Steve indicates that the “fricken mess” is about to come, I think (“Watch for 2020 for the U.S. Shale Industry to start to disintegrate”), so your comment then shows some agreement…?

Ron, nothing in my comment deserve those sarcastic references.

Right, and nothing in Steve’s post deserved this sarcastic remark.

What’s your “FRICKEN” problem ?

You are wearing rose-colored glasses man. That is your fricking problem. But that is okay, those glasses are all the rage these days. Almost everyone has a pair. But when you talk down to people who are not wearing them, it really pisses me off.

“when you talk down to people”

Ron, being you seem to understand the language of SRSrocco. Here is my response for you:

http://peakoilbarrel.com/opec-november-production-data-2/#comment-693444

Let me know what it means.

“You are wearing rose-colored glasses”

Not at all. I’m completely aware oil isn’t a infinite resource. It’s a commodity that is priced in the moment. That can take at times a decade of major amounts of capex to move the supply needle upwards. You understand overshoot. The market will swing back towards balance and miss it’s target again. I can assure you of that. That’s the nature of capitalism. Enjoy the good times while they last.

HB. The problem with shale is that it is expensive oil, despite what companies such as XOM and CVX put out publicly. However, it has a big advantage in that it is onshore, USA.

I think part of the reason that XOM, CVX, COP, MRO and other companies with worldwide operations keep at it is because it is onshore lower 48.

I remember when everything that these companies were doing was international. It required employees to live in some less than desirable places. Recall the stories I have related here about employees of these companies having less than 24 hours to leave Libya, or being herded out of the office in Venezuela at gunpoint.

Working offshore can’t be a picnic. Also, the liability is great, see BP’s disaster.

The management and employees want shale to work very badly. And it does at a high enough oil price. Unfortunately, the price hasn’t been there since 2014. But they keep making stuff up because they don’t want to be sent back to the Middle East and other tough places, or work offshore deepwater.

But what has been bad for the companies has been great for consumers. I can’t believe how much Bernie and Elizabeth ignore the benefit shale has been to the US economy.

What would have happened without US going from less than 5 million BOPD to almost 13 million in eleven years? I suspect a lot of bad things.

My primary beef is that the companies lie about what price they need for shale to work and completed too many wells when prices were low.

I think maybe shale is finally figuring out they need above my preferred $55-65 WTI price band. We have been slightly below that and it appears things are really slowing down.

Good points SSand.

And I have to agree that most ‘progressive’ voters don’t want to acknowledge the dramatic economic benefit that shale oil production has had on the economy. The decade long (and longer) extension on peak oil has been a huge gift to the ‘business as usual’/perpetual growth stance of the country (and world).

Has this grace period been used wisely?

Hickory,

I think it could be argued that a more gradual development of the resource would have been better for both the oil industry and the US economy, the US economy was doing fine when oil was at $100/bo, and higher oil prices would have spurred growth in other industries, wind, solar, EVs, plugin hybrids which are going to be needed for a successful transition. The low oil prices brought about by a development of the tight oil resource that was too rapid was overall a net negative for the US economy, we are way behind were we would have been in moving forward as oil resources deplete, the low oil prices will rapidly give way to a very high oil prices and all the people that have bought large vehicles because oil prices were low may regret their buying decision.

Note that I am not claiming tight oil should not be produced, but I would agree with Mr. Shellman that we may have shot ourselves in the foot.

https://www.oilystuffblog.com/single-post/Thrust-Fault-Reverse-Fault-OPECs-Fault

“The low oil prices brought about by a development of the tight oil resource that was too rapid was overall a net negative for the US economy”

Interesting perspective.

I certainly think that for long term stability and growth of the country, and the lower 48 oil and gas industry, a much slower pace of development would have been healthier.

This hyper-caffinated growth in tight oil we have seen over the past 8-9 years is a result of lack of a coherent policy, and a national culture of massively obese debt financing. (even if Paul Krugman thinks the debt is OK).

“the dramatic economic benefit that shale oil production has had on the [US] economy.”

I am affraid on this blog most of the expressed views do not look outside the US. The mayor difference the shale oil production boom has made, was not visible in the US, I believe. The US has reduced its dependency on foreign oil, which was a good thing to keep business-as-usual going in the US, not more then that. But that foreign oil, that used to be shipped to the US, kept flowing too. It goes to China now (most of it). China has showed the world it has the capacity to import that amount of oil. With the word ‘capacity’ I’m not talking about seaport infrastructure, I’m talking about becoming a global economic and political superpower. I do not believe the US will ever, after the shale boom, regain the capacity to import such amounts of foreign oil. The US should have used shale to compensate for the declining conventional domestic production only, so it could keep importing huge amounts of foreign oil. The foreign oil would have stayed out of reach of China.

It would be in the US national interest to import less oil.

It could do so very easily by reducing consumption for low value, unimportant uses like commuting in single occupancy SUVs: about 50% of US oil consumption is for passenger vehicles, at an average of less than 23MPG and an average occupancy of only 1.2 people.

Raise the average MPG to 46 and raise average occupancy to 1.8, and you could reduce US oil consumption overall by about 6M Bopd.

“It would be in the US national interest to import less oil.”

It wouldn’t. It could, but it isn’t. Because someone else is importing it now. They are not burning it in SUVs. They are powering their industry!

Do we have any reports showing how Chinese oil consumption is allocated between industry, passenger transportation, freight, etc.?

Shallow, I’m going to guess shale needs a little more than your preferred price band for a financially fit industry. Once a commodity is in an over supplied market. It becomes a fight for market share and the big boys don’t like giving up that. Think back to the response of Saudi Arabia a few years ago. They doubled down and it became a blood bath.

Small fish like yourself can’t do much more than to hunker down and weather the storm. Hopefully during the good times you weren’t out popping $1000 bottles of champagne. Because those guys are the first to go down when the going gets tuff.

I agree with you that there are signs of financial discipline that seem to be on the rise of late. I hope to see a stronger price market for 2020. But I won’t count my chickens until the fat lady sings. This is probably the best time to buy industry assets when everyone is turned off and burned out on the idea. The market will turn around.

https://oilprice.com/Energy/Crude-Oil/IEA-An-Oil-Glut-Is-Inevitable-In-2020.html

IEA is calling for a glut in 2020. Perhaps oil price will take a bit of a dive.

I’m expecting a continuing firming in price from here into the driving season and refinery turn up. With a collapse going into the election. I’m pretty sure the Russians and Saudi’s will back their man.

“I’m pretty sure the Russians and Saudi’s will back their man.” ~ HB

Israel too I would suppose

The glut forecast by IEA depends on strong growth in US tight oil forecast by IEA of 1000 kb/d in 2020. IHS forecast is for 440 kb/d growth in US tight oil in 2020, if IHS is correct there will be no glut in 2020, currently the days of forward supply for OECD petroleum stocks is below the 5 year average, the trade deal recently announced might lead to stronger demand growth than forecast by the IEA, the combined effects of more demand and less supply might lead to higher oil prices.

The IEA is almost always too optimistic in its forecasts, unlike me who tends to underestimate future output, despite my reputation as an optimist, generally my oil forecasts (unless I specifically state that the forecast is intentionally optimistic to try to match some unrealistic forecast by others) that are my “best guess” scenarios have always been less than actual output.

HB. I have used leases developed in our field in the past ten years to demonstrate that shale is high cost. Again, rule of thumb the cost of a conventional well in our field is approximately 1/100 of a shale oil well ($70K range v $7 million range).

Here are some examples with production through 10/31/19:

8 producers 4 injection wells. Cumulative BO 83,466. YTD BO 2,085. First production 4/2003.

10 producers 4 injection wells. Cumulative BO 116,065. YTD BO 2089. First production 9/2005.

10 producers 4 injection wells. Cumulative Bo 55,595. YTD BO 3,023. First production 3/2006.

4 producers 1 injection well. Cumulative BO 37,418. YTD BO 1,289. First production 8/2008.

8 producers 3 injection wells. Cumulative BO 42,494. YTD BO 2,328. First production 10/2008.

4 producers 1 injection well. Cumulative BO 19,216. YTD BO 1,220. First production 12/2010.

8 producers 3 injection wells. Cumulative BO 46,463. YTD BO 1,877. First production 8/2011.

4 producers 2 injection wells. Cumulative BO 10,700. YTD BO 634. First production 10/2011.

8 producers 3 injection wells. Cumulative 59,592 BO. YTD 4,956 BO. First production 11/2011.

1 producer. Water disposed of in adjoining lease. Cumulative BO 7,872. YTD BO 444 BO. First production 5/2012.

8 producers 3 injection wells. Cumulative 56,500 BO. YTD 3,858 BO. First production 6/2012.

4 producers 1 injection well. Cumulative BO 11,758. YTD BO 1,457. First production 6/2013.

2 producers. Water disposed of on adjoining lease. Cumulative 3,524 BO. YTD BO 393. First production 11/2013.

6 producers Two injection wells. Cumulative 25,988 BO. YTD 3,233 BO. First production 9/2014.

Figure in anywhere from $60K-80K to drill, complete and equip each well including electric, flow and/or injection lines. Figure another $20-30K for a tank battery.

Assume anywhere from 12.5 to 20 percent royalty.

Of course, some projects do better than others. But compare this to shaleprofile.com wells.

There was very little drilling in our field from 1987 to 2003. There has been very little since 2015. Century plus year old stripper field.

Shale is expensive oil.

There have also been many reclamation projects in our field during 2005-2014 of abandoned wells wherein the producers went bust in the 1990s, with 1998 being a knockout blow.

We took over 2 wells drilled in the 1950s they were abandoned in 1998. We just had to equip them and build a new tank battery. We also took over three wells also drilled in the 1950s where we had to do the same, plus plug the injection well and convert one producer to an injector. These work well at $55-65 WTI also.

I can also point to many projects developed in our field in the 1980s where cumulative per well has topped 40K BO to date.

Conventional oil is a much better deal than shale usually when you can find it. And also when you aren’t trying to pay for 8 figure CEO pay, skyscrapers and jets out of it.

Shale just has the scale. Huge scale. Worldwide game changing size.

Shallow, I can’t thank you enough. Alot to digest here. My first glance gave me the feeling shale drilling dollars are about half as productive. Maybe you have a better number.

When a new field is drilled, is it always under pressure without the cost of lifting it from the hole? Then once the pressure is exhausted it becomes a stripper?

A lot of the Huntington Beach field lays under the ocean. There is over a mile long row of wells along the shoreline. I’m assuming they go horizontal under the ocean. Only a few wells have lift Jacks. Can strippers wells go horizontal?

There isn’t enough down hole pressure here for natural flow. Everything goes on pumping unit immediately and injection wells are also drilled at the same time as production wells.

To put into perspective, the field was originally drilled over 100 years ago. Waterflood was initiated on a large scale right after WW2. Many wells were plugged in the late 1960s-early 1970s when oil prices were low. The field was redrilled in the late 1970s – early 1980s. Little activity after 1986, until prices took off during the Iraq War.

For example, we operate a lease that was originally drilled in the 1950s. It was plugged out in 1972. In 1979-81, all of the plugged wells were drilled out (casing had not been pulled). New injection wells were drilled.

Cumulative from 9 producing wells since 1979 is over 140K BO with production currently at 5.5 BOPD. It is difficult to tell what these wells produced from 1953-1972, because they were part of a larger unitized waterflood project. Our guess is around 200-250K BO during that time frame.

Only a small company would be interested in 9 wells making 5.5 BOPD, but they have been economic even during the worst part of 2016 (barely during Q1 – 2016).

There haven’t been HZ wells drilled in the shallow zones (1,500’ and below). However, there has been some success with 1,800’-5,000’ TVD hz wells. Not sure of the economics.

There has been success with slick water fracks in deeper vertical wells also.

Correction. Project discussed above was not economic Q1 2016.

Had not included overhead, which is primarily labor. Labor is usually the major expense with stripper wells.

Great comment, SS.

Thanks Greenbub.

Yes great comment by shallow sand.

They all are, but a ton of info in that last one.

You sound angry HB.

I imagine the cornucopian gang will respond poorly to their future hopes… er I mean ‘predictions’ not coming to fruition.

Contributions from research on anger and cognitive dissonance to understanding the motivational functions of asymmetrical frontal brain activity.

https://www.ncbi.nlm.nih.gov/m/pubmed/15130525/

Not at all. Mowed the yard this morning and headed for the gym in a few minutes. It’s another beautiful sunny day here. Probably spend the evening downtown watching the game over a drink.

Life is good and set up to be better as the price of oil rises.

And you ?

Nah, you sound quite cantankerous, perhaps childish even, re: SRS’ POV

Me- I can’t complain

Life is good

Gonna get a BJ later

“Egotists have a strong tendency to talk about themselves in a self-promoting fashion, and they may well be arrogant and boastful with a grandiose sense of their own importance.”

https://en.m.wikipedia.org/wiki/Egotism

Good for you, don’t tell the wife

Price of oil is headed south HB. Temporary dollar weakness is over. You can go look and see the turn in every single currency pair. Particularly the Euro against the dollar and the chinese yuan against the dollar. But you can see it everywhere. In all currency pairs against the dollar. Take a second and actually go pull up these charts and look at them.

Now when the dollar index breaks above 100.00 Let me know where the price of oil is. Dollar index is at 97.10 at the moment. It’s fell off around 200 points since October. Allowing a rebound in the price of oil.

This whole idea of high price oil leading to a switch over to EV’s is so off base from what reality is going to be.

I’m just telling you what the price action is saying. What the actual market is saying. What people with actual money in the market are doing.

Oh one other thing. Make sure your looking at a candlestick chart not a line chart on the daily chart. Otherwise you might just miss what i’m talking about.

Getting price right or really close to right isn’t that hard. You just got to tune out the talking heads. Telling you opec cuts this and shale production will be this by such and such date. Tune out opinions and watch the price action.

HHH correct if I am wrong, but I thought earlier in the year you said that oil would be $20 by now?

that was before the super-predictable thing happened – Fed reversed tightening. But many “in the biz” apparently don’t think the Fed is going far enough, and so will create a dollar rise anyway – it just delayed it by a number of months. HHH might have a different answer, but this is one possible snarky one.

Permian Drillers Are Struggling To Keep Output Flat

Newer wells in the Permian see their oil and gas production declining much faster than older wells, and operators will need to drill a large number of wells just to keep current production levels, an IHS Markit analysis showed on Thursday.

IHS Markit has analyzed what it calls the “base decline” rate, calculating the actual or expected production of all the operating wells at the start of the year and tracking their cumulative decline by the end of the year. Over the past decade, the base decline rate of the more than 150,000 producing oil and gas wells in the Permian has “increased dramatically,” according to the analysis.

https://oilprice.com/Energy/Energy-General/Permian-Drillers-Are-Struggling-To-Keep-Output-Flat.html

LOL,

Steve

Through oct 2019 Permian output has continued to increase. Seems the death of tight oil has been grossly exaggerated. 😉

Yes, when subjective terms such as “increased dramatically” are used, take it with a grain of salt. Nothing beats tracking the data and plotting the trends on a chart to get a quantitative number.

Chart below based on the EIA estimate of Permian tight oil from Jan 2018 to October 2019.

Permian is sum of Wolfcamp, Bonespring and Spraberry colums in spreadsheet at page linked below see “tight oil production estimates by play”

https://www.eia.gov/petroleum/data.php

I am just not seeing the dramatic slowdown in Permian basin output, perhaps it is the rose tint in my eyeglasses. 🙂

Completion rate in Permian basin averaged about 490 wells completed per month from Jan 2018 to Oct 2019 and the annual rate of increase in the completion rate was about 49 new wells per year (about a 10% annual rate of increase.) For the first 9 months of 2019 the average completion rate in the Permian basin tight oil plays has been 510 new wells per month and for the past few months the rate has been 550 new wells per month.

Scenario below is based on a simple model with well profiles developed using data from https://shaleprofile.com/. The scenario assumes the Sept/Oct 2019 Permian basin completion rate of 550 new wells per month continues from November 2019 to May 2035.

The scenario is quite conservative as higher oil prices in the future are likely to lead to an increased completion rate in the Permian basin, it is also assumed that new well EUR will start to decrease in Jan 2019 and by May 2035 the average new well EUR has decreased to 75% of the Dec 2018 average new well EUR in the scenario presented. The URR for the scenario is about 55 Gb.

Hi Dennis, The graph you show doesn’t have a dramatic slowdown. Yet. Consider that the Baker Hughes rig count for the Permian has declined as follows:

486 on 12/14/18

454 on 3/29/19

441 on 6/28/19

414 on 9/27/19

399 on 12/13/19

There is a large lag between the time a rig is drilling and when a well reaches peak production. One approximation is to use 6 months as an average. We all know that due to the rapid declines shale wells have, a large effort is needed just to maintain production. I don’t know how many rigs are needed just to maintain permian production, but my guess would be that we are nearing that level today, if so your graph will be moving toward flat over the next six months or so.

Meanwhile, Scoop, Stack, Bakken, Eagle Ford, and Niobara as well as conventional production are all going to be challenged to maintain current production. I still expect lower 48 onshore to begin declining with the November 19 monthly report.

dclonghorn,

It seems that from Dec 2018 to April 2018 the fall in the rig count had little effect on the completion rate (if the EIA estimate of Permian completions is correct), over that period the rig count fell, by roughly 36 (interpolating on the data in your comment) while completion rate increased by 27 (519 to 546). Possibly this was due to more DUCs being completed, we have seen a bump in oil prices of late, this may lead to higher rig counts.

So far US tight oil output has been more resilient than I expected, perhaps rigs are being utilized more efficiently, if you are from Texas (as your name implies) you would know better than me. I am just looking at the output data and completion data, the completion rate has increased at about 50 per year, the scenario assumes that falls to zero, perhaps that will occur at current rig count levels. At some point rig counts may increase as oil prices rise. We will have to wait for the data.

Hi Dennis, I have seen some reports that DUCs have been falling both overall and in the Permian. The effect of the fall is to partially offset the declining rig count, at least as long as DUC count keeps falling. There appears to be quite a few DUCs left although some folks say a lot of them are “dead ducks” because they are bad holes, or exist as bungled paperwork. I don’t know how much excess DUC inventory there is, but from reading quarterly press releases, it seems that the excess inventory is probably thinning out pretty quickly.

One of the other factors that I believe has helped maintain the growth rate of Permian production recently is the completion of some oil and gas pipeline projects in August and September. These projects increase takeaway and decrease the cost of takeaway, which results in a production bump in the areas affected. Additional pipelines are under construction although the recent completions seem to have solved much of the current takeaway issue.

Yes, I am from Texas and was in the oil and gas biz some time ago, now I just observe. From what I can tell, the industry continues to become more effective in many ways, although the big productivity gains seem to be over for now.

Thanks DC I agree a combination of more DUCs and greater efficiency of operating rigs might explain continued Permian output growth.

I expect the rate of growth will be lower due to the fall in rigs and frack spreads. May show up in output data in a month or too, typically there is a seasonal slowdown in winter, though perhaps less so in Permian basin than Williston.

Have looked at the Chevron specifiers. No evidence they are backing away from Vaca Muerta.

Further, Total has sent some money there.

Chevron will regret its Vaca Muerta Shale Investments.

It is amazing to see seemingly intelligent people throw money away into the neverending Shale Energy Pit.

We will look back ten years from now and wonder how completely insane it was to believe in the Shale Energy Ponzi Scheme.

steve

Only if one believes the world will transform to a carbon free energy system to save plant earth soon

LOL,

steve

The economy is decarbonizing, slowly, but not to save the world, and maybe not in time to save the world.

The reason for the decarbonization of the energy and transportation sectors is that carbon based energy can only be accessed by first collecting and then burning carbon rich materials, and then making use of the hot (fluid) liquid or gas collected from that fire to produce mechanical energy.

This is a Rube Goldberg solution that has served mankind well for centuries, but it makes less and less sense as methods of directly harvesting ambient energy improve.

Just as word processors replaced typewriters, electronic readers replaced dead tree media, and chip storage replaced scratchy LPs, wind and solar are replacing fossil fuel. Nobody tried to save the world from typewriters. They vanished because the technology was no longer up to date.

Put another way, cheap oil isn’t much of a defense against EVs. Oil gets sold because there are vehicles on the road that burn it, just like hay used to b big business in the horse drawn era.

Car makers are going to dramatically slow or stop manufacturing combustion engine vehicles in the next few years. It’s already happening. New ICEs are too expensive to design, and new IC vehicles are too expensive to build.

Fleet sales will switch first. The main effect of that in the short term will be to worsen the already doubtful business model for developing new engines. So ICEV innovation will fall behind EV innovation.

Americans think they will be immune because Americans love gas guzzlers. But what Americans really love is what there corporate overlords command them to love on TV. Rmmbr when very American household watched I Love Lucy, and GM used the ads to tell Americans that those stupid fins on Cadillacs we (get this) “beautiful”? Some people still believe that. People were shocked by the lack of fins, paint, and other doodads on the Tesla truck. Trucks are supposed to “look tough”.

So what does corporate America want? Short term profits to please the bankers. Just look at the Boing 737 MAX saga to see what lengths corporate America will go to avoid development costs. Detroit is piling into EVs now because it cuts development costs. Stay tuned for the ads explaining to you why after decades of worshiping gas guzzlers, you suddenly don’t like them any more.

You may not be aware that the price of oil in Argentina is not the same as the price of oil elsewhere in the world.

Production numbers for Norwegian oil and gas for November are out:

https://www.npd.no/en/facts/news/Production-figures/2019/production-figures-november-2019/

Growing towards 2 Mbpd for November as the new 2.2 to 3.2 Bn barrel Johan Sverdrup oil field comes online. The field is expected to produce 440 000 bpd next year, and peak at 660 000 bpd by 2023. The field is planned to produce for at least 40 years.

Also interesting is that Norway’s oil output is 216 kb/d higher than forecast.

Well Johan Sverdrup is already at 350000+ boepd, that is a lot sooner then expected so there is your 200 difference.

Norway peaked years ago at 3 mbpd (around 2010). Is it really news that one of the last offshore bonanzas has managed an inconsequential production bump? All the way past 2 mbpd.

Nobody has suggested Norway will reach a new peak. The decline rate will be reduced for a few years and then will continue.

It happened with the UK when Buzzard came online

Price of oil does have problem that will play out over next 6-8 months. Without a trade war and Brexit hanging over markets. There isn’t a whole lot of reason to be holding government bonds which yield next to nothing or less than nothing in some cases. Fed is buying bills so Repo market won’t implode into another 2008. Only problem is they need to be buying coupons or treasuries also. They are buying some treasuries but it’s not near enough to hold interest rates down. Yields on debt are going to rise without something like a trade war holding them down. That is a problem if your long oil.

Keep an eye on 10 year US treasuries. If they become just a little less liquid and yields rise as i believe they will. These OPEC cuts aren’t going to mean as much as some might think.

Some people believe ‘the market’ for crude oil is a fair and effective arbiter of the industry supply and demand.

But if we step back an inch or two, we all can see it has been a severely broken mechanism during this up phase in oil.

For example, there has been long lags between market signals of shortage or surplus.

Disruptive policies and mechanisms such as tariffs, embargo’s, and sanctions, trade bloc quotas, military coups and popular revolutions, socialist agendas, industry lobbying, multinational corporate McCarthyism, and massively obese debt financing, are all examples of forces that have trumped an efficient and transparent oil market.

And yet, the problems with the oil market during this time of upslope will look placid in retrospect, as we enter the time beyond peak.

I see no reason why it won’t turn into a mad chaotic scramble.

We had a small hint of what this can look like in the last mid-century. The USA responded to military expansionism of Japan by enacting an oil embargo against them. The response was Pearl Harbor. This is just one example of many.

How long before Iran lashes out in response to their restricted access to the market?

People generally don’t respond very calmly to involuntary restriction on food, or energy, or access to the markets for these things.

The new US defense bill, agreed on by both parties, includes sanctions on executives of companies involved in the completion of Nordstream 2. This is companies involved in laying the remaining pipe, and also companies involved in the infrastructure around the arrival point.

This could include arrest of the executives of those companies, who might travel to the United States. One of the companies is Royal Dutch Shell, who have 80,000 employees in the United States.

So much for the “Free Market”.

The EIA has just released the data for US Oil and Gas proven reserves for 2018.

Table 1. U.S. proved reserves, and reserves changes, 2017–18

They say US C+C proven reserves total 47.1 billion barrels. Assuming our average C+C production is 12 million barrels per day that puts our reserves to production ratio at 10.75. That is a real shocker. I thought it would be much higher than that. Check my math. The data is in thousand barrels.

Daily production 12,000

Days per Year 365.25

Annual Prod.. 4,383,000

Proven Reserves 47,100,000

R/P ratio…… 10.75

Ron,

Your arithmetic looks spot on. Last year the R/P was 10.64. Not sure why you are surprised, I am guessing you thought it would have fallen rather than increased, note that in 2009 SEC rules were changed so that reserves are based on a different price than 2008 and earlier, see article below.

https://www.stout.com/en/insights/article/understanding-sec-oil-and-gas-reserve-reporting/

2019=$55.65/bo

2018=$65.66/bo

2017=$51.03/bo

all based on EIA spot price for WTI for first day of each month from Jan to Dec.

Prices used for SEC oil reserve calculations were pretty high in 2018 relative to 2017 ($14.63/bo higher) which may have bumped up reserve estimates for year end 2018.

Dennis, I am not surprised that it increased. They said they found 7.2 billion barrels of new oil, in the Permian I assume. I have my doubts but for the time being, I will take their word for it. My surprise was that it was so low. I had just assumed the US R/P ratio would be somewhere around 20.

Interesting article by HFI Research yesterday, making the case for the start of a multi year bull market for oil.

https://seekingalpha.com/article/4312385-oil-things-are-starting-to-look-brighter

Also lots of Goldman Sachs charts, with the one below showing a peak plateau from 2022 to 2025. The legend is missing 3 shale plays. The bottom dark blue is Delaware (Permian), Midland (Permian) above and Bakken, the grey.

My own guess is US shale oil will peak in 2021.

This Goldman Sachs chart from the same HFI article above shows a US shale oil peak in 2023, followed by a decline to 2050.

The chart says Big 4 but should be Big 6. The dark green is STACK/SCOOP and light green, Marcellus.

If so, output will not drop below current production levels for 20 more years!

I’d be curious to see if they had production estimate for US nat gas as well .

Note that these charts are “liquids production”, which would include NGL. A better estimate would look at C+C, but NGL output from “big four basins” might not be that great. The scenario above looks reasonable through about 2027 (if NGL output is not significant), decline from 2027 is likely to be steeper, my best guess scenario (all US tight oil) has a peak in 2025 around 10 Mb/d and output falls to about 5.4 Mb/d in 2040 and to under 1 Mb/d by 2050, so the Goldman Sachs scenario seems optimistic. My best guess scenario for all US tight oil has a URR of 89 Gb. Permian, Bakken, and Eagle Ford about 75 Gb, peak for these 3 basins (equivalent to big 4 above) for my scenario is 8.7 Mb/d in 2025, output falls to 4.5 Mb/d in 2040 and to 600 kb/d in 2050.

NGL’s go to the refinery and market just like the rest of shale oil liquids don’t they?

If so, it makes sense to keep them in the same bucket for projection purposes, no?

Hickory,

NGL is a very small input to refineries, mostly it is used either as a heat source (propane and other bottled gases) and as an industrial input for petrochemicals (mostly plastic and synthetic fibers). As the product that is likely to be constrained is liquid fuel (and here I will refer to fuel that is a liquid at 1 atmosphere of pressure and 20 C).

So no, I would disagree that bottled gas should be lumped together with Crude plus condensate, it is crude plus condensate that is the major input that produced gasoline, diesel, home heating oil, jet fuel, residual fuel (used in ships and industrial boilers), and kerosene.

Most of the rest of the “petroleum products” are by products that we have found a use for, but are less important in my view.

Interesting article on seeking alpha about why Opec can now push up the price without starting a third shale boom.

https://seekingalpha.com/article/4310727-analysis-why-opec-can-push-up-price-and-not-risk-third-shale-boom

The basic premise is that productivity per completion has stalled, and there is no longer a huge overhang of cheap frac spreads keeping the frac market oversupplied.

dclonghorn,

Your article goes into a lot of depth. I noticed these statements:

“The main driver of Legacy Loss is Total Production, which is logical.

In Permian, higher Initial Production (IPt) increased legacy loss, probably because new wells deplete faster than old wells”

New wells depleting fasting than old wells partly explains why the monthly legacy loss keeps increasing from month to month. It’s not close to 600kbd/month, according to EIA DPR.

The chart below from the article shows Jan 2015 as Peak Shale No 1 as legacy loss was above new monthly shale production. The author says when “red line gets above new monthly initial production then that’s Peak Shale No 2”, which might happen as soon as early 2020. This is shown by the dashed line “IPt minus Legacy Loss” reaching zero, which means Peak Shale No 2. The author says that this could happen if WTI stays at $55.

It’s not close to 600kbd/month, according to EIA DPR.

I think you meant: “It’s now close to 600kbd/month, according to the EIA DPR.” I added the total legacy decline, from the DPR, for all seven basins for December. Totals below.

(274,421) Permian

(55,430) Niobrara

(1,282) Haynesville

(120,388) Eagle Ford

(74,415) Bakken

(7,654) Appalachia

(45,027) Anadarko

(578,616) Sum

I find it very interesting that total production of new oil peaked in mid 2018 and is now in decline while legacy decline continues to increase.

A lot of people fail to realize that this is a race with the Red Queen. They will have to produce almost 600,000 barrels per day of new oil in December just to stay in the same place. That is a herculean task.

Ron

Both Tony and I posted projected DPR data for December in an earlier post showing the closeness of production and decline. Production only exceeds decline by 48.2 kb/d in December. Essentially decline consumes 92% of new production. I think you had previously put a chart/info showing how decline was eating a significant portion of new production.

Ovi,

Another way to do legacy decline and new well increase is to use shale profile ( https://shaleprofile.com ) data for maximum well output in 2016, 2017, 2018, and 2019 and then used DUC data for Bakken, Eagle Ford, Permian, and Niobrara (coincides with the shaleprofile areas covered.)

From shaleprofile well quality tab (maximum per year)

2016, 523.1 b/d

2017, 582 b/d

2018, 642.9 b/d

2019, 683.8 b/d

https://shaleprofile.com/2019/12/03/us-update-through-august-2019/

This chart gives a different story from DPR.

Note that if we consider only data from Jan 2018 to Oct 2019, the legacy decline and new well increase cross in mid 2024. Note that I doubt such an extrapolation would be accurate.

Dennis

I don’t have access to Enno’s data and cannot comment. I have comment further down.

Ovi,

For shaleprofile data see well quality tab at

https://shaleprofile.com/2019/12/03/us-update-through-august-2019/

I just picked the maximum output from the well profiles for 2016, 2017, 2018, and 2019.

Then I used completion data from the EIA DPR page see right column of page below (DUC data has completion data as well). The Niobrara, Bakken, Eagle Ford, and Permian data was used for completions as that lines up best with the shale profile US data.

https://www.eia.gov/petroleum/drilling/

All of this data is publicly available.

Also you need the tight oil data from page below, see “tight oil production estimates by play” excel link at page linked below.

https://www.eia.gov/petroleum/data.php

So new well production is completions times max well output, total production increase from monthly difference in “tight oil production estimates by play” (or monthly delta tight oil output) and legacy decline is new well increase minus tight oil output monthly production change (delta output).

My guess is that this estimate will be far better than the DPR estimate.

Ron,

You’re right I meant “now close to 600 kbd/month”. Maybe it will be 600 kbd/month in the next EIA DPR on Dec 16.

https://www.eia.gov/petroleum/drilling/

Yes it is a race with the Red Queen and the monthly legacy decline rate keeps increasing linearly, month to month.

Ron,

I think you might mean the change in total production peaked in 2018. Over that period the completion rate was rising rapidly in the Permian basin. It is expected that the rate of increase will slow down.

How fast this slow down happens will depend in part on the price of oil.

Dennis, what actually peaked in mid-2018 was barrels per day of new oil. That’s what I meant to imply and that’s what happened. If you read my post again, you will see that is exactly what I said. I am not a fool Dennis, I know that the total amount of shale oil has continued to increase. Yes, that new oil kept the total production increasing but increasing at a lower rate.

What this means is that the total production of shale oil will soon start to decline. That is the bane of shale oil that most folks simply don’t understand. The legacy decline rate of shale oil is about 12 times that of a conventional field. That is, a shale basin declines at about 6% per month while a conventional reservoir declines at 6% per year or less.

Therefore barrels of new oil must continue to increase because the decline rate is applied to the entire basin, not just new wells. Of course the newer the well, the greater the decline.

Nevertheless, unless monthly new oil increases the legacy decline rate will soon equal new production rate and the production of the basin will flatten out. That does not mean it will decrease, it will flatten. The peak will have been reached.

Bottom line. If the rate of new oil peaks then the total peak must be only 12 to 24 months away. When the legacy decline equals barrels per day of new oil, then you have a peak plateau. And when barrels per day of new oil falls below the legacy decline rate, that will be the start of shale oil decline.

Ron,

Sorry, I missed the “new”. Legacy production change does not always decrease (or increase in absolute value). As fewer wells are completed the legacy production decrease gets smaller (absolute value). See DPR data for legacy production change from 2015 to 2017 to convince yourself of this fact. Basically when completion rate stops increasing the legacy decline rate gets smaller in magnitude (absolute value).

Eventually the US tight oil output level will stop increasing, but not until 2024 at the earliest and possibly as late as 2026.

The belief that peak output is 12 to 24 months after peak “new oil” depends on the assumption that legacy production decline maintains a steady slope, this is not generally the case, the slope will change as the completion rate changes, when completion rate is unchanged (held steady) the slope of legacy production change quickly approaches zero.

Dennis, new production went from about 500 kb/d in the middle of 2017 to about 650 kb/d in the next year or so. It is now around 610 kb/d. I expect it to keep dropping and apparently you do not. However, I believe it will be around 500 kb/d by the end of 2020.

Of course, legacy decline will decline also. Buy it will lag new oil decline. That’s exactly what happened in 2014-2015. Look at the chart Dennis, there is no reason that legacy decline will not lag this time exactly as it did before.

If new oil declines then overall production will decline also, with some lag time. Why, in the name of Posiden, or whatever God you happen to worship, would you expect it not to do so. 😉

Hi Ron,

It depends on the relative rates. Note that it is not that I expect it will not occur, just not in 12 to 24 months.

From March 2015 to March 2016 the US tight oil completion rate (Bakken, Eagle Ford, Permian, and Niobrara) fell from 1063 to 429, today the completion rate is about 1059 (similar to March 2015) do you expect the completion rate will fall to 429 in the next 5 years? I certainly do not. I use models that match history very well, USGS TRR estimates and economic assumptions based on what I have learned from industry professionals like Shallow sand, Mike Shellman, and others (http://theoildrum.com/node/9506). The models suggest that if the completion rate gradually rises through about 2026, then tight oil output peaks around 2025. After 2026 the completion rate flattens then gradually declines as gradually falling EUR makes completing new wells less profitable as sweet spots run out of room.

I have no opinion on God. Some things are beyond our understanding.

The models suggest that if the completion rate gradually rises through about 2026,…

And you actually believe that completion rates will gradually rise through 2026? Rigs are being retired and frack spreads are being sold for scrap. But the model suggests that completion rates will rise?

I just don’t understand what planet you are living on Dennis.

Ron,

No the model assumes nothing about completion rates. So far completion rates have risen since 2016. It maybe that the rate of increase slows (I assume as much), but with oil prices rising completion rates are likely to continue to rise in my opinion.

Even if completion rates are flat (I doubt they will fall before 2026) output continues to rise until at least 2023.

As I often suggest, higher oil prices will tend to lead to higher completion rates, the more slowly tight oil output rises, the higher oil prices are likely to be.

completion rates average about a 180 well annual increase in completion rate form Jan 2016 to Oct 2019. The best guess scenario has completion rate increasing at an average annual rate of 42 wells per year. That is 4 times slower than the past 3.75 years. A pretty conservative scenario in my opinion.

One of the comments from the above referenced article seems to be from one of the principals at primary vision, they know a lot about the fracking biz.

mjohnson1

Comments4 | + Follow

Supply is gonna be tighter in 2020, we wrote a note a few weeks back: Roughly 10,000,000 horsepower of equipment has been subjected to weakened demand, field rotation, unplanned maintenance, consolidation, moved abroad, sold off for parts, or been deemed unusable in the last 18 months.

Matt – Primary Vision

08 Dec 2019, 04:09 PMReply4Lik

I have no personal knowledge of it, but it makes sense that with high fluid pressures, abrasive sand, and strong chemicals frack units should wear out more rapidly compared to say a drilling rig. With completion costs around 70 percent of well cost the lack of cheap pumping horsepower may be a harbinger of increasing well costs. How much is 10 million horsepower? I think that equates to around 180 spreads. If that comment is close to correct, we may not have much cushion left. How does Halliburton spell pricing power?

As most everyone who is watching the shale biz knows, one of the major reasons it has been able to persist is the continued reduction of the cost to produce a barrel of shale oil. When costs to drill and complete wells quit declining it messes up the model even for the top producers. Add in parent/ child well issues, tier 1 locations mostly developed, and Wall Street wanting a return on investment.

These statements are from this Oct 30 2019 article.

https://www.rigzone.com/news/wire/frackers_scrap_idled_equipment_amid_shale_drilling_downturn-30-oct-2019-160198-article/

1 With almost half of U.S. fracking firepower expected to be sitting idle within weeks, shale specialists including Patterson-UTI Energy Inc. and RPC Inc. are retiring truck-mounted pumping units and other equipment used to shatter oil-soaked shale rock.

2 Estimates for total U.S. fracking capacity vary but Bank of America Merrill Lynch puts the figure at almost 25 million horsepower. Just 13 million of that is forecast to still be at work during the final months of this year, down from 17 million during the second quarter of 2018, according to Bank of America’s Chase Mulvehill.

3 About 2.2 million horsepower, or roughly 10% of industry capacity, already has been earmarked for the scrap heap, according to Scott Gruber, an analyst at Citigroup Inc.

The more aware I become of these shale oil indicators, the more I guess that US shale oil could peak in March 2020.

Tony,

Keep in mind that trends often change over time.

If you are correct about a 2020 peak in tight oil, it is likely to be temporary, peak will be 2024 to 2026 with 2025 my best guess.

And what, Dennis? How, pray tell, will 17 million horsepower -and other infrastructure including manpower – magically re-appear in 2020 and inflate another peak? With existing shale finances in the tank, $300 billion of already accumulated and un-repayable debt, and Wall Street financiers demanding repayment on their investments, your prognostication for a rebound has a tinge of ‘wildly unrealistic’ about it.

ExxonMoble boe per day is 2.25 millon and has a market value of $300 billion. The tight oil shale play over the last decade has increased production 7 million bpd. Is $300 billion of debt really out of line? Do you have CFO experience with a multi-billion dollar company?

In the trucking industry the major freight companies running 24/7 turn their tractor fleet over on a 5 year rotation receiving 20 cents on the dollar at retirement. Ready mix trucks are turned over after 10 years rotation at 20 cents or less on the dollar running 12/5. When the business environment is good. It’s easy to delay retirement a little to meet demand. When times are difficult, the old trucks sit in the yard and can be stripped for parts.

I have to question your hair on fire comment. Do you know the life expectancy of a drilling rig for a large corporation ? The related article is talking about retiring 10 percent. That’s a 10 year rotation. Maybe replacement is just cost efficient verses down time. The big boys don’t work on the same time frame as the little guy.

HB. $300 billion divided by 7 million comes to over $42,000 per barrel of debt. IMO that is a high level of debt unless oil prices recover to 2011-14 levels.

Only the best oil production is selling for that in our part of the world and that is production with a decline rate of 3% per year or less.

Regarding XOM, keep in mind that includes not just the upstream, but the midstream and down stream, both of which are substantial.

XOM also has substantial international upstream assets which are generating substantial cash flow at $60s Brent.

Shallow, XOM has a chemical business too.

OXY spun off CRC with $6 billion in debt and 150k boe in late 2014. Based on $100 oil. $40,000 per barrel of debt. They get Brent pricing.

Is shale expensive? I don’t know. But, it cost $100 plus to replace it on the open market(2011 to 2014). At 7 million bod, that’s a lot of jobs here and keeping the money in house(U.S.).

Cheap market oil is keeping inflation in check and the economy rolling. Long term, I expect the price of oil to increase as markets balance reflecting production costs. Iran,

Libya and Venezuela are all wild cards on the supply side.

I also believe CRC is a $100 stock with firm $100 Brent and the shale play is based on that pricing too.

HB. CRC has generally good assets in not such a good location. CRC was saddled with too much debt, the max reasonable at $100 Brent.

CRC isn’t a bad one to gamble on. Better than the lottery.

But make sure you can stand to lose it all too.

Mr Sutherland,

Perhaps there will be a temporary peak in US tight oil output (or an inflection point where the output curve flattens) in 2020 or 2021. Can you predict what might happen to the price of oil if that occurs? Do you think oil prices are likely to rise or fall?

What happens to tight oil profitability if oil prices should rise (will it be higher or lower)?

What are tight oil producers likely to do in the face of higher profits?

The average annual rate of increase in the US tight oil well completion rate was 265 wells aver the Jan 2016 to June 2018 period. The annual rate of increase in the tight oil well completion was 90 wells from July 2018 to November 2019. The scenario below is based on a “Red Queen” type model (see http://theoildrum.com/node/9506) and well profiles based on the Arps hyperbolic model fitted to data from https://shaleprofile.com (thank you Enno Peters).

The average annual increase in the tight oil well completion rate for this scenario is 23 wells over the Dec 2019 to Jan 2025 period. In my view the scenario is quite conservative, it assumes Brent oil prices (2018$) gradually rise from $65/bo in Dec 2019 to $90/bo in Jan 2027 (a linear increase of about $3.57/year in 2018$.) After reaching $90/bo it is assumed oil prices remain $90/bo until 2037 and then gradually fall to $40/bo by 2067 and then remain at $40/b until 2079 (end of scenario). Peak for this scenario is 2025 at 9.73 Mb/d, URR is 86 Gb.

Last thing, most people here think my “best guess” scenarios are wildly or outrageously optimistic, but historically they have either been close to correct (not often though) or too pessimistic (nearly every time). The scenario presented here is actually a bit lower than my best guess which is about 10.2 Mb/d in 2025 with a URR of about 88 Gb. In other words I expect the scenario presented here will be low, I would guess about a 60% probability US tight oil output will peak at a higher level than this scenario.

I very much agree, and I don’t know why this is not a more mainstream view. A limited amount of frack spreads going into the winter can only mean production will suffer. The oil price lives its own life, but if the market really is misinformed (strong suspicion)…the ketchup effect will come in 2020. I really think the investment cycle in oil should have started in 2018/19. But when just about everyone try to demonify oil as an investment, then that scenario has to wait until 2020 as far as I am concerned. Not sure the physical market can withstand it longer than that.

The interesting part is what happens if/when oil prices go up. What is the response from shale oil?

kolbeinh,

I expect an increase in oil prices will lead to a higher completion rate and higher tight oil output. There is typically a 4 to 6 month lag between the move in oil prices and a response in the completion rate. So if the current oil price move is sustained we might see the rate of increase in tight oil output increase in the April to June 2020 time frame.

https://www.rystadenergy.com/newsevents/news/newsletters/UsArchive/shale-newsletter-dec-2019/

In this article from December 2019 Rystad have studied the break even cost of the biggest Shale field in US. Seems from this break even price have been stabile since 2014 and is now aprox. 45 usd each barrels. I believe if this is true the operators manage to offset the impact of fewer sweet spots Thiere 1 or what is emention in Reports as Thiere 6 wells that had break even price 18 usd with increased drilling productivity and lately we have seen more use off DUCs. I also believe Capital cost like interest and vallons are not including. If profit where 10 usd each barrels I believe 3 of 4 Companies in US shale would not deliver red inc on the bottom line 3Q 2019. Interesting to read others view of this report… espesialy from pepole that have grown up in this Shale Buisiness and are a part of it every day. Another question , think it was SS that emention the production pipe could get hole in the production section that could lead to pressure drop and is a very exspensive issue to repear that could dammage all profit of that well. I am interesting in this issue, what cause thoose whole, is it tear from oilflow that carry with back propant? How can this be repeared. ?

https://seekingalpha.com/article/4293580-wrights-law-continues-drive-shale-breakeven-costs-lower

Here is another article regarding breake even price US shale. Seems from this there was a change in profit in 2019.

Thanks Freddy. Another good article here about Wright’s Law and EV battery prices…

>> Moore’s Law Isn’t Dead: It’s Wrong – Long Live Wright’s Law <<

https://ark-invest.com/research/wrights-law-2

Yes, it isn’t time that drives price reduction, it’s number of units produced. That is why the “Crossing the Chasm” strategy works when new products are introduced. First you target early adopter niches with a relatively expensive product, und then the price falls thanks to the sales to those customers. That allows you to address niches that require lower prices, and the cycle repeats.

Or you can start with a lower price, if you can afford to subsidize the product until it reaches scale. This has been popular with Japanese companies, e.g., Toyota and the Prius.

OT:

1900 — German physicist Max Planck publishes his groundbreaking study of the effect of radiation on a “blackbody” substance, & the quantum theory of modern physics lives.

Interesting analyze from Seeking Alpha.

https://static.seekingalpha.com/uploads/2019/12/13/5006891-1576233676424615_origin.png

This shows the peak in US shale was in 2018 and from now the increase yoy will be lower. I strongly believe their estimate regarding offshore discoveries is true, lots off wells that was very promising was drilled in 2019 and was dry or not economical to develop. Equinor is now drilling a very promising deep water well in Brazil with huge potential , but even with a good result it takes 5 – 10 years to build out. We might need to relay on Opec , Saudi if they have spar capacity left…

Freddy,

Again 2018 was the peak rate of increase in shale output, different from a peak in output. The slope of the output curve will change over time. When the slope is zero we have reached a maximum, minimum, or inflection point.