OPEC just published its December Monthly Oil Market Report with their crude only production numbers for November.

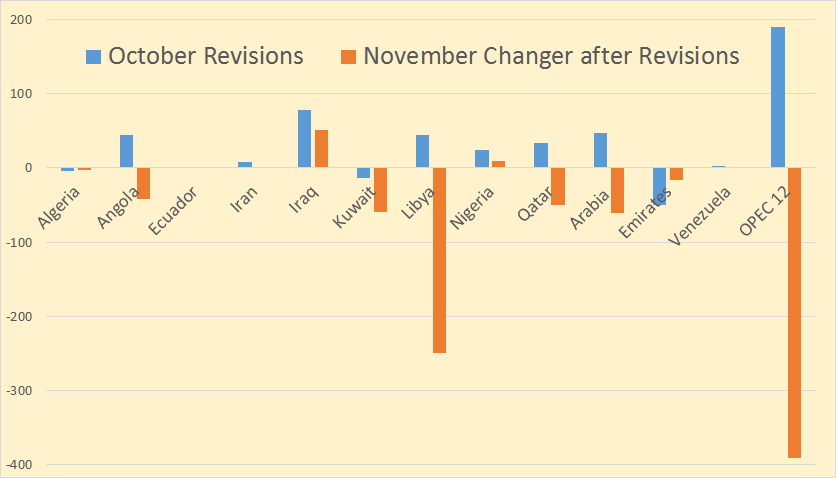

Total OPEC crude only production was down 390,000 barrels per day but that was after October production was revised up by 190,000 bpd. After revisions only Iraq and Nigeria showed any increase in November.

The data for all charts below is in thousand barrels per day and is through November 2014.

OPEC crude only production stands at 30,053,000 barrels per day.

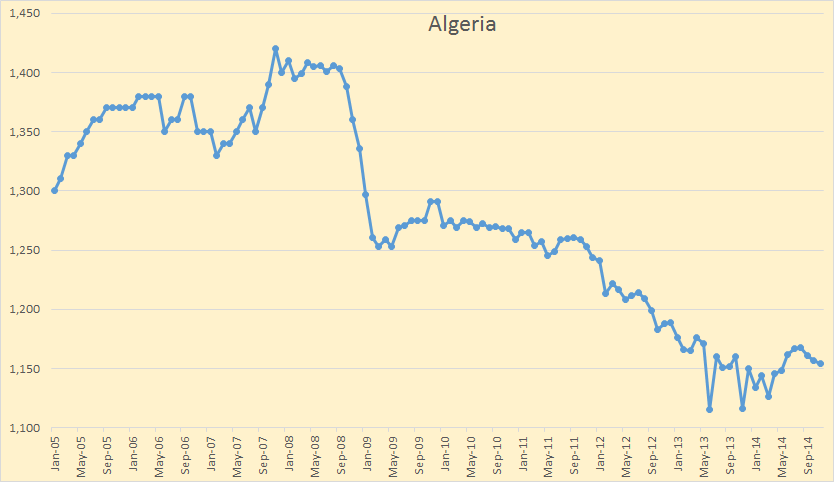

Algeria started a slow decline in 2011 but seems to have reached a plateau in 2013.

Angola has been on a bumpy plateau for about 4 years now.

Ecuador began to increase production in 2011 and after about a 70,000 bpd increase seems to have reached a peak.

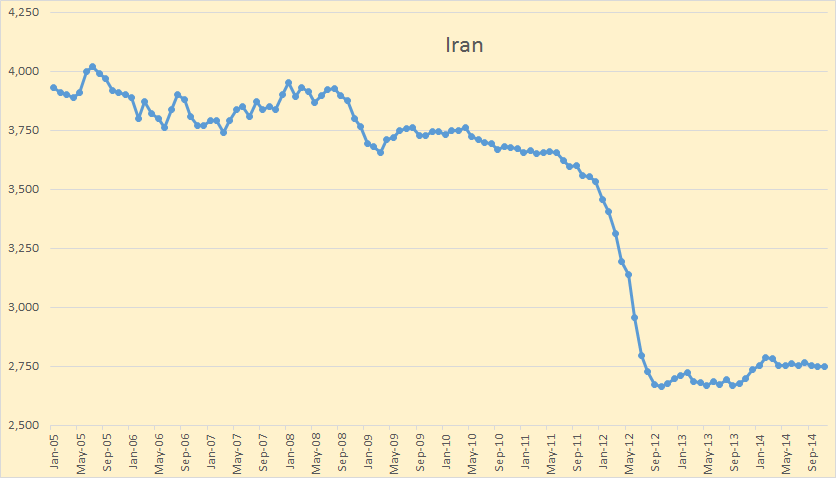

Nothing very exciting is happening in Iran. Production is holding at 2,750,000 bpd and holding.

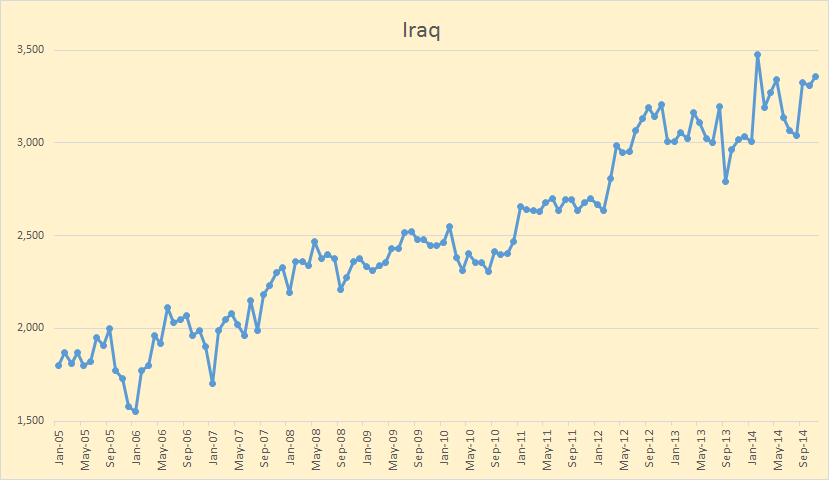

Iraqi production is holding steady despite ISIS intrusion.

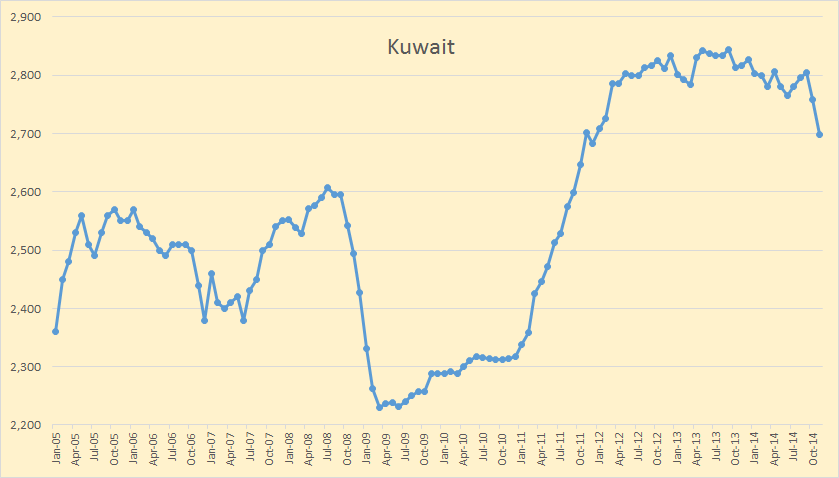

Project Kuwait, Kuwait’s infill drilling program increased production by about 240,000 bpd above their 2008 peak but it seems declines have caught up with them and their production seems to be in decline.

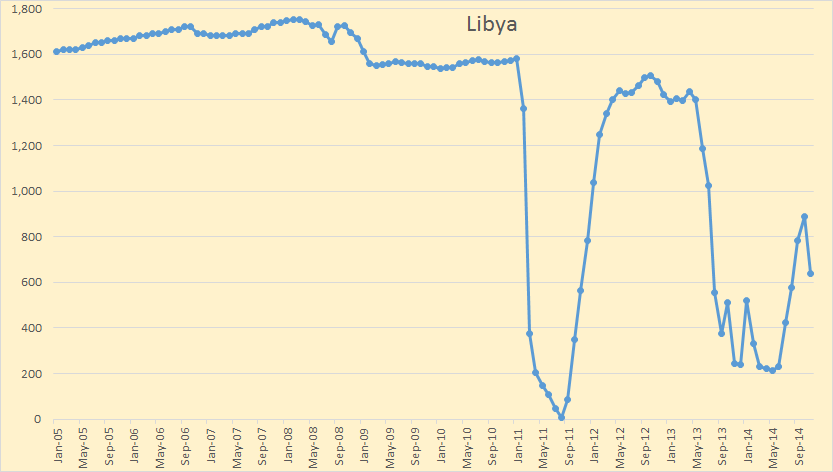

The largest November decline was in Libya. They were down 249,000 bpd in November.

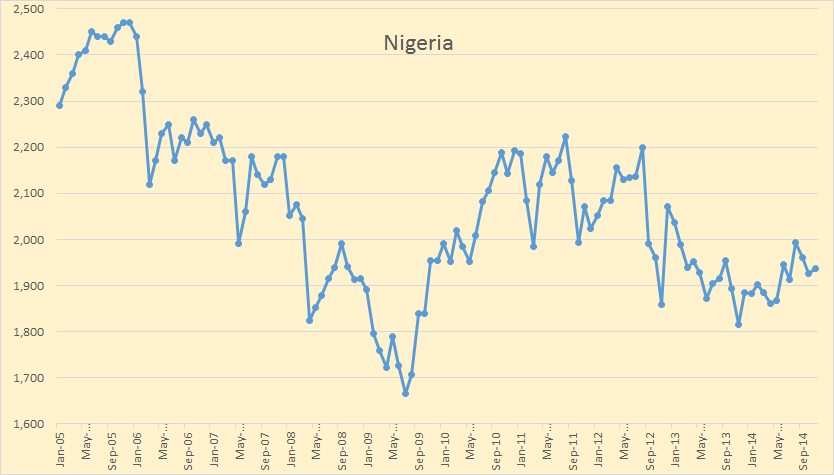

Nigerian production seems to be holding relative steady for the past couple of years.

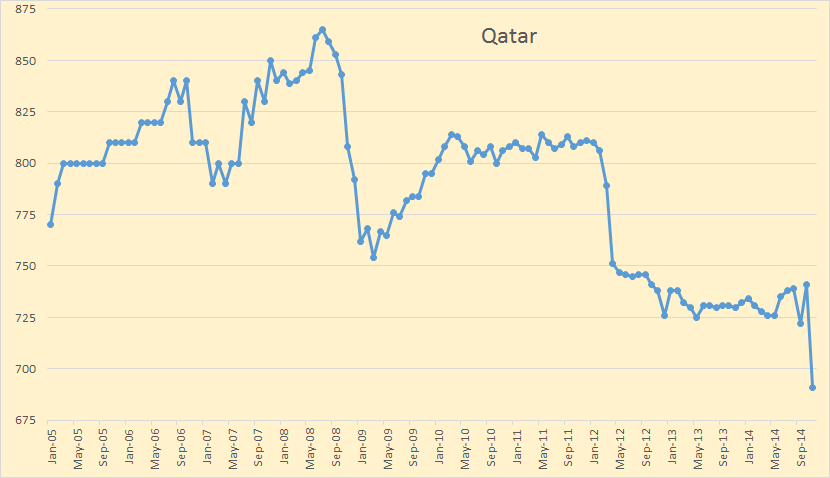

I don’t know what’s going on in Qatar but something seems to be happening. Their production dropped by 50,000 bpd in November and that’s a lot for them.

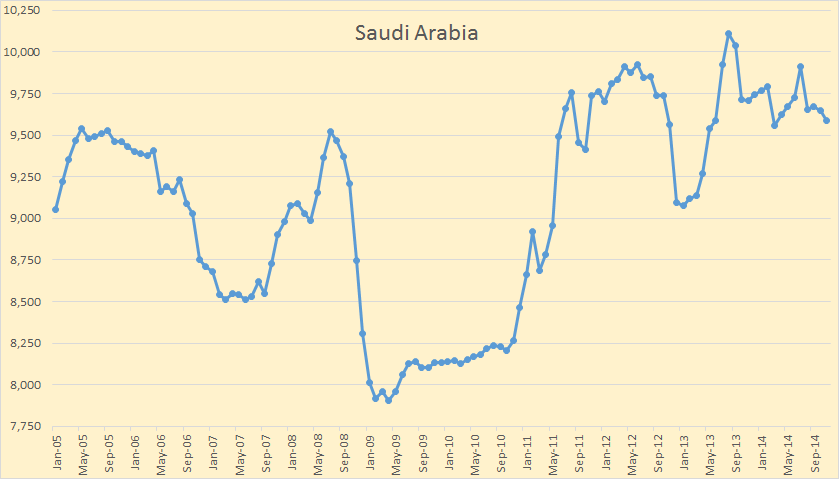

Saudi production fell slightly in November, down 50,000 bpd but that was after October production was revised up by 47,000 bpd.

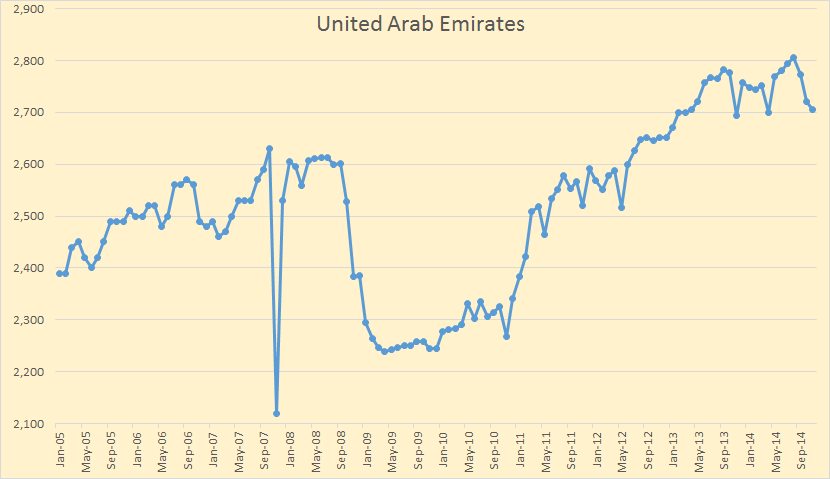

The United Arab Emirates had a similar program as did Kuwait but now appear to have peaked and started a slight decline. They are down about 100,000 bpd since their peak 4 months ago.

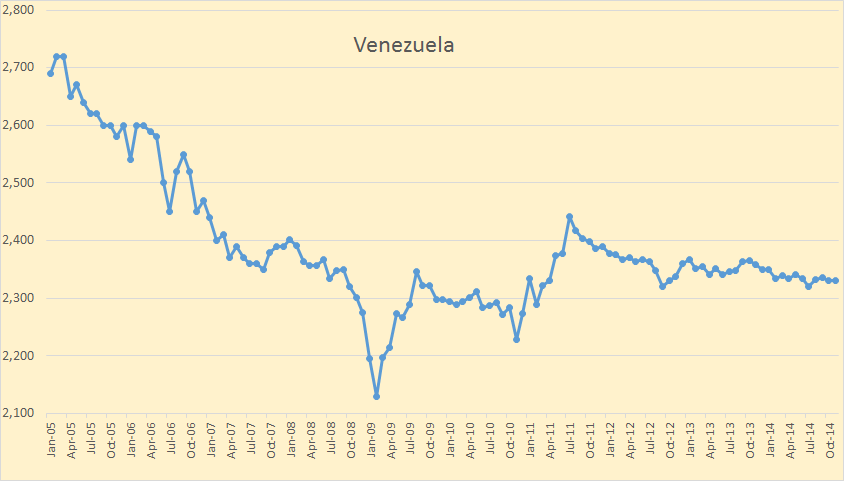

Venezuela’s production has leveled out at about 2,330,000 bpd. This is a little surprising giving that their conventional fields are very mature and require heavy investment to maintain current production levels. I have been unable to locate Venezuela’s bitumen production vs. conventional oil production but I believe bitumen or extra heavy production to be somewhere under half a million bpd.

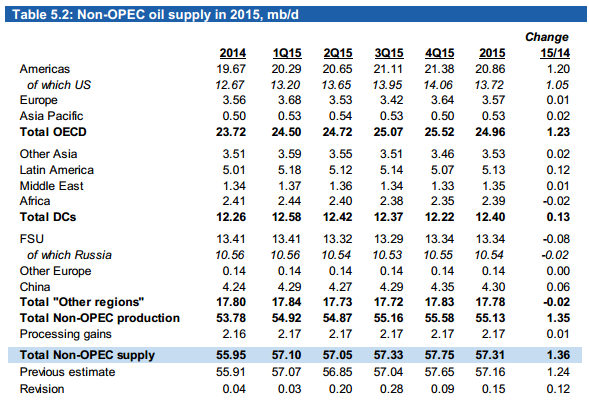

The OPEC MOMR has an opinion of what non-OPEC will produce next year. They believe non-OPEC production will be up 1.36 million barrels per day with the bulk of that increase coming from the US and Canada. That prediction is Total Liquids, not C+C.

In other news the EIA published their Short-Term Energy Outlook Monday. They are predicting that US total liquids will be up next year by 990,000 barrels per day and Canadian total liquids to be u 110,000 bpd. They are predicting non-OPEC total liquids to be up 840,000 bpd. That means they expect non-OPEC liquids, outside US and Canada to be down 260,000 barrels per day.

This one is very important:

Limits to Growth was right. New research shows we’re nearing collapse

The 1972 book Limits to Growth, which predicted our civilisation would probably collapse some time this century, has been criticised as doomsday fantasy since it was published. Back in 2002, self-styled environmental expert Bjorn Lomborg consigned it to the “dustbin of history”.

It doesn’t belong there. Research from the University of Melbourne has found the book’s forecasts are accurate, 40 years on. If we continue to track in line with the book’s scenario, expect the early stages of global collapse to start appearing soon.

I was on Doomstead Diner TV Sunday. I gave a very muddled performance however.

Seeking Alpha has started picking up some of my blogs. They have published three so far.

Note: I send an email notice when I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com.

Thanks Ron, interesting to see Kuwait and Qatar both cutting production. And the Libyan renaissance seems to be dying. And I see the EIA must have a good batch of weed.

The OPEC Conundrum

Oil price wars – who blinks first?

The second post by Roger Andrews

Here in Aberdeen a massacre is in progress 🙁

You came close to independence, the funding for which would have been . . . low priced oil. That was dodging a bullet.

Yeh, tell me about it. But its not over. The UK political land scape appears to be in process of a generational overhaul. The referendum ended up being as much about social depravation as independence. And the socially deprived are abandoning their traditional Labour party to join the Nationalists in droves.

UK general election in May 2015 and another Scottish election in a couple of years. We have far too many layers of representation.

Is Cameron at any risk in May?

Consensus among those who do the numbers seems to be ‘yes’, but it is hard to call. Probably 5o/50 he wins or loses. Even a ‘win’ could mean he still needs a partner party to govern with a majority, just like now, and perhaps will not be able to raise one. Ukip the populist crowd would not be an ideal partner.

It has become a competition of the least unpopular. I believe Cameron will win a majority. Libe Dems have become unvotable because of alliance with Tories. Labour have become unvotable because of legacy from illegal wars and unpopular leader. Enter UKIP, straight talking, beer swilling with a sensible energy policy.

So UK membership in the EU is not long for this world. That may be the UKIP’s price?

I have always been pro-Europe and pro-European. But I am increasingly disillusioned with the dictators in Brussels.

it is because concept “pro Europe” that was sold to the masses is delusion in itself. I mean even Hollywood after Rocky 6 sequence can not “sell” the same thing over and over.

Another hung parliament seems most likely at the moment, though Cameron will be praying he can take credit for any stimulus from the low oil price so he can continue his economic rhetoric.

One company I know has just announced 28% staff cuts from early New Year and are already planning a phase 2 of cuts. BP are already cutting jobs. Budgets are being slashed. Local press announced 10,000s jobs expected to go.

Major projects already committed will go ahead. But vast amounts of non-essential drilling and maintenance will get shelved.

Its definitely a bad time to be looking for work in Aberdeen.

And a little further to the east.

BP WEIGHS FUTURE OF AGING NORWAY FIELDS AS OIL SLUMP FORCES CUTS

http://readingeagle.com/ap/article/bp-weighs-future-of-aging-norway-fields-as-oil-slump-forces-cuts

“As oil prices keep falling, BP Plc is among Norwegian oil producers taking a hard look at whether to kill off aging offshore fields earlier than planned because squeezing out the last barrels might not be worth it.”

BP is run by beancounters. They are really good at firing people around the end of the year. An excellent way to pick up professionals is to budget them for the second quarter. This allows you to interview and pick up hand picked cast offs from large multinationals. The best candidates are usually short and squat, and don’t know how to make a good power point slide.

Another slaughterhouse today in the oil markets. 4%+ on both WTI and Brent.

Inelasticity cuts both ways with this stuff. Sure you have to buy what you need, but you don’t buy any more than you need. Hence having a glut despite the marginal producers needing $100+ to extract.

Regex posted a note at the end of the last Ronpost comment thread laying out LLC organization from a Bakken producer. LLCs of course are to allow people to walk away from debt without exposing their other assets.

Regex the rest of that presentation was, as you well know, hype and it was hype prepared at probably $70/b. It’s now $60/b. Seriously, how do you cut rig count by 40% and say you’re going to increase oil production 5%? Oh yes, because now, unlike before, you’re going to drill better rock.

Note: If you have posted an important comment on a previous post please feel free to re-post it on the most recent post.

This is not the oil drum and I don’t have silly rules like Leanan did.

Okie doke, will go get it.

Well, no I won’t. Mike rebutted and it will get long.

Wait I’ll put it at the bottom. It’s a good item and Mike has good rebuttal.

The dollar is flat today so oil is moving with bad economic news.

The real danger here is what we’ve been discussing — shale’s proportion of national GDP is much more than can be known because the sheer recency of it would escape the in-place economic metrics. This has death spiral potential. If shale starts to die, so does GDP, and thus consumption, and the price falls even more.

If you’re Russia that can get oil for its people at $8/b, you are sitting pretty. They will power their tractors and their trucks bringing food to Moscow. The Saudis will start buying food for oil. A bushel for a barrel, in 1970s parlance.

BTW with Bakken sweet at $44/b, even wacko Kudlow is facing suicide watch.

I happen to work in the Bakken. Heard today CLR, Hess and others are stacking out rigs. Heard of 10 so far that will be stacked out upon well completion.

It had to come.

Any news on frac spreads? I would assume they will keep going longer, but laying a few off would be a good price management tool, for some good discounts.

Mildly off topic question, but when is the price of oil going to shoot back up? For my own present financial well being, oil prices being higher rather than lower is necessary.

Alternatively, when will the world’s economic activity take off in response to the juicing of the economy provided by lower oil prices? This would help me out some too, though rather less directly.

I’m hoping that these low oil priced don’t last much longer than a year. I have no idea of when, where, what or how long any price might arise though. But I’d prefer higher prices.

Pls send your note to the Russian embassy. Maybe they’ll care. Or not.

Further, if there enough of you, you can get government or Fed stimulus send to the shale industry. Yet another mechanism for that.

Why so sarcastic? Did you sleep well last night?

No. Maybe tonight, if Singapore doesn’t log in at $57/b.

Why so sarcastic? Did you sleep well last night?

Correlation is not causation…if there were a direct ratio between Watcher,s sleep and his sarcasm, I’m pretty sure he wouldn’t sleep at all. : )

-Lloyd

Depends if this is just a production glut or if the glut is as big as it is (and staying as big as it is) because global demand is that weak. The former can work out real fast once production gets in line with demand. The latter…not so much.

I personally lean the latter. Quite a bit of bad global economic news and all other commodities are also in the tank.

I personally lean the latter. Quite a bit of bad global economic news and all other commodities are also in the tank.

There’s a lot that can be cut back. People can drive less. They can fly less. They can buy less. There’s a lot of non-essential oil use in the world.

If you kill a lot of people, then their use isn’t essential, either.

If you kill a lot of people, then their use isn’t essential, either.

Yes. Wipe out a lot of people, either intentionally, neglect, or some other fashion, then what resources are left might be enough to support the people who are left.

Some of you expect collapse to hit everyone and every system equally. But I think some areas and some populations will be hit harder.

Hi Boomer,

I completely agree with you. In fact I have argued here in other posts that the world is in the early stages of collapse. Collapse is not necessarily a binary event, and it does not necessarily have to be global.

Of course eventually societal strain may result in a sudden transition to a new state, but at this point we are in the midst of a managed collapse.

Best,

Tom

Hit them before they hit you.

Why would there be non-essential oil?

If there is, does this imply that people are just frivolous with their use?

What mechanism would trigger not using non-essential oil?

Price? Isn’t the general consensus that high prices hurt economies?

People that can afford to use non-essential oil if it is high priced will probably use it anyway.

A wealthy person does not need to own a high priced car with low mpg, but they buy them anyway. Is this non-essential?

Great efficiencies and scaling back consumption.

Perhaps you don’t get a car and you walk, bike, or take public transportation.

Instead of a 2000 square foot house you live in a 1000 square foot house.

There is a lot of room to cut consumption. People waste a lot. Food, fuel, electronic devices, toys, etc.

There are quite a few people realizing they can get by with less. And what they don’t use doesn’t automatically get used by someone else.

I meant to say: create efficiencies, and scale back consumption.

What mechanism would trigger not using non-essential oil?

Tribalism?

Also poor urban planning. The federal government has spent vast sums in the last 70 years gutting urban America.

@Wet One

nobody knows.

real anecdote from last week end of the year meetings:

Oil company: “We have done budgets for 2015, but we cannot tell you how big the budget is ( I guess it is classified like in Bond movies 🙂 )”

Our service company: Okey????

Oil company: The reason we cannot tell you is because probably it will change (read: get chopped) in January.

Our service company: Okey????

So now there is conundrum: keep employees, lay off employees, buy or not buy equipment, buy Christmas presents or not buy Christmas present…in one word we are like “deer in headlights” 🙂

The budget gets chopped in March. But we do get warnings. Many years ago I proposed changes to our budget approval process. I think it was a pretty good idea, but it never went anywhere (I was surrounded by Harvard types).

I could take 1 to 3 years for oil to return to the $90 level. But then again our leveraged Ponzi debt economy could come spiraling down. We could be looking at Great Depression II. Anyone who gives you an estimate is just guessing.

Oh there will be some graphs appearing soon that will posture themselves to be something more grandiose than a guess, so don’t you worry.

hahaha. No doubt

Hi Watcher,

All scenarios are guesses. The price of oil makes a huge difference to oil output over the long term, recently some grandiose scenarios have appeared with different oil price scenarios. In the chart below I compare the EIA’s 2014 Annual Energy Outlook (AEO) oil price scenarios for Brent crude in 2014 $ with the two recent oil price scenarios I have created.

It would be interesting to hear what you(and others) think oil prices will be (0 to infinity would cover it, but not be very bold, though it would likely be correct) over the next 15 years.

I would go with “DC high” as the most likely.

Thanks Fernando.

If some other, rate of increase seems more reasonable, please suggest. DC high is 3.6% annual rate.

Thanks Fernando,

The DC high scenario aimed for AEO ref price in 2030 and has a 3.66% annual oil price increase from 2015 to 2040.

I think maybe a 3% annual rate of increase, which would take prices from $67 in 2015 to $140 in 2040 might be more reasonable. The DC low is about a 1.2% annual increase in oil prices, another alternative would be a DCmedium case of maybe a 2.5% annual rate of increase ($124/b in 2040 in 2014$).

forgot my name in above, sorry

I’m not that much of an expert. That DC High is a bit lower than the OPEC 2012 vintage price forecast. The report had estimated a much usa lower horizontal well cost. I think it compensated for this with a higher financing cost. Time will tell.

Ahh, there’s one.

On one hand, non-OPEC supply is still increasing and projected to increase in 2015. On the other hand, OPEC said they will not decrease their production. Other point consumption in H1 one year is lower than consumption on H2 the previous year.

Unless something happen in early 2015 (central banks, subsidies…) I think US oil production would start to decrease in Q2 2015. Indeed, the number of drilling permits has fallen by 37% in November. If the number of permits fall again in December, US production will definitely decrease in Q2.

Many shale oil companies have a moving break-even from $90 in May to $70 to $40 and continuing to decrease apparently. I think they are going right to the wall.

I am not sure we will have a peak in 2015, but there are many trends to think it will be 2015. Increase in oil price should help to maintain a plateau or have a smooth decline (at the beginning).

I think we will have a scenario similar as the 2008 price peak: low oil prices will decrease production while consumption will go up because of low oil prices. At some point in H2 2015 or H2 2016, production will be lower than consumption, oil will sky rocket followed by a new (or deeper) economic crisis.

Moving prediction… 2015 will probably be historical regarding to oil production.

The following article is also putting things in perspective (pro-european think-tank).

The oil industry crisis

It all depends on FED policy. If the benefits of a lower oil price do not outweigh the damage on shale and ancillary industries and the high yield bond market, the dollar will go lower. In my view we had already this week a reversal as the dollar fell despite lower oil. It looks like it is in the best interest for the US economy to have a high oil price rather than have a strong dollar. This is a considerable policy change from past decades. A lower dollar will for sure ignite higher growth and eventually also stabilise the oil price.

The reason prices have fallen is because customers are bankrupt, not just in the US but around the world. The credit system is broken and customers can no longer afford to borrow-to-bid the price of crude. Meanwhile, those with access to funds will not bid in their place. Elites understand that you cannot spend your way to wealth!

Will prices go up? Yes and no. In real terms the cost to extract each new barrel of oil is greater than the one it replaces so the replacement barrel will be more expensive or it won’t be sold. In nominal terms, prices can’t go up. In our economy there are two agents or segments: drillers and their customers. They compete against each other (and their lenders) for funds. One segment’s purchasing power can only increase at the expense of other’s. While there hasn’t been an out-and-out shortage of petroleum there has been shortage enough to adversely affect the customers’ solvency. The drillers have borrowed hundreds of billion$: they need the loans, otherwise there is no petroleum.

The customers also need the same funds because sales to customers is what retires these billion$ (trillion$) of driller loans.

When funds flow to drillers = more of a debt burden falls upon customers leading to insolvency. That is underway right now. Should more funds flow to customers = the drillers are starved of funds and customers fail anyway due to fuel constraints. Our blessed ‘energy revolution’ was a gigantic diversion of funds from customers to drillers by way of finance, PR and (hopeful) policy. Now customers are broke and cannot afford to retire the drillers’ loans. Next up: finance ‘difficulties’ as banks choke on the billion$ of bad loans. That means more monetary easing = more diversion of funds away from customers this time to the bankers = lower fuel prices in a vicious cycle.

Whatever occurs, glut or shortage, the customer takes it in the neck which strands the drillers.

Fundamental issue: a supported price is one where oil use is productive, that is, offers a real (not borrowed) return. Guess what? There is almost no real return to our use of petroleum! The car cannot be paid for by driving it, neither can the roads, the fuel supply/distribution or massive governments. What pays is debt and now the credit system is broken. That is what the price decline is saying: banking and finance have reached the point of diminished returns.

Instead of useful but difficult voluntary conservation we now get to experience ‘Conservation by Other Means’. Whoo boy it’s going to really hurt.

🙂

The reason prices have fallen is because customers are bankrupt, not just in the US but around the world. The credit system is broken and customers can no longer afford to borrow-to-bid the price of crude.

People used to be willing to borrow on the assumption that their incomes will rise enough in the future to be able to pay off their debt. They may be realizing that may no longer be the case.

They borrow to go to college. Maybe they get jobs when they get out. Maybe they don’t. But they are paying off debt.

They used to borrow to buy a house on the assumption that appreciation would more than cover the loan. They may still be the case in a few markets, but not everywhere.

These days, what is there that consumers can buy now and pay off later with increased income? Very little. If they are conservative about their purchases, that is as it should be.

Any industry that depends on consumer spending as got to factor in a reluctance to spend. And any industry that depends on business spending has to factor in that businesses may not be investing in their own businesses because consumers are conservative.

There really isn’t a lot on the horizon to suggest a boom.

Hi Boomer II,

Your assessment is correct in developed countries. There is much less excessive consumption in developing countries, so there may be continued growth there.

Also there could potentially be a boom in spending on replacements for fossil fuel, or if not a boom, at least increased spending on alternatives (wind, solar, geothermal, and nuclear energy and rail, light rail, better windows and doors, more insulation, heat pumps, and maybe a few plug-in hybrids and EVs.

Also there could potentially be a boom in spending on replacements for fossil fuel, or if not a boom, at least increased spending on alternatives (wind, solar, geothermal, and nuclear energy and rail, light rail, better windows and doors, more insulation, heat pumps, and maybe a few plug-in hybrids and EVs.

I think there could be a boom in alternative energy wherever it is installed. Yes, in this country it would need to be financed via debt, but I think it would boost the economy enough to cover that debt.

As for developing countries, yes alternative energy should automatically improve their economies. If they have no energy or expensive energy, putting in something that is solar powered should pay for itself.

” The car cannot be paid for by driving….. ” Yes it can. Cars are used driving to work and generate income over the lifetime of the car more than a car is worth.

Energy and resources are the only real capital we have. Killing that capital does not create more capital. Income gained with help of burning fuel in a car is probably spent on burning more capital.

Labor and human ingenuity are the only real resources we have.

As a follow up to my last question, will world oil production actually increase during this time of low prices or is this the end of last kick the growth in oil production will ever get? I.e., is it all downhill from here?

I know it’s all speculation at this point, but low prices will shut off investment taps and the endless march of depletion will continue. It’s weird that it would end this way, heralded by low oil prices, but I suppose the world is full of surprises.

Here’s how it plays:

You got geology. If there is no oil in rock, you can’t get it no matter what you do.

You got EREOI. It may take more effort to get the oil than the oil could fuel, and this is supposed to magically be measured by money.

You got money, that pays for effort and the output is sold for money and if it’s less than what you paid for the effort, you won’t continue. Unless:

You have central banks and starvation fearing governments, who will redefine money and make that oil come out of the ground regardless of EREOI (measured by money) because it would be profoundly immoral to let their people starve when they could get oil out, and obfuscate all problems associated with it via money created from thin air.

Oil’s price fall correlates almost to the day with a global spike in the dollar vs other currencies. It is credible that this has been orchestrated and supply and demand are not definitive determining price in a world where 4 trillion dollars were created from nothingness since 2009.

The oil price, like gold before it is ABSOLUTELY being manipulated – probably to stimulate the global economy!

If one believes that the price of oil is manipulated then it would behoove them to explain exactly how this is done.

By monetary policy – the FED can influence the yield curve – a steep curve drives a currency lower. A lower dollar will for sure bring the oil price up and vice versa. Will hurt a strong dollar and low oil price the US economy now? The huge collapse of shale companies and the implosion of the high yield market seems to confirm this view. I am expecting a much lower dollar quite soon.

I think the mechanism of oil price suppression is easy enough and could work.

(1) We talk behind the scenes with Saudi Arabia and, while noting an already obvious trend in weakening demand and steady supplies, ask them to not cut production at their next few OPEC meetings.

(2) Next, talk behind the scenes with your favorite bankster allies and ask them to help move oil down either directly by shorting oil futures or indirectly be not taking long positions. Also tell them to be sure to whisper to US producers that oil may be going down and now would be an excellent time to hedge (i.e. go short the futures).

(3)Once that ball gets rolling downhill, just sit back and watch the pressure build on your enemies.

We know that the US futures market is the playground of price manipulators so it’s not at all difficult to imagine them doing the same thing with oil, especially if there’s official backing.

The thing about “”markets”” now is that with the heavy presence of lightening fast computers dominating the quote and liquidity structures, all you have to do is set a trend in a given direction and they’ll do the rest of the heavy lifting for you.

(1) We talk behind the scenes with Saudi Arabia and, while noting an already obvious trend in weakening demand and steady supplies, ask them to not cut production at their next few OPEC meetings.

Well that would be controlling supply! Yes that would work but you are dreaming if you think “we”, whomever we are, could actually talk to to the Saudi King or Princes who dictate Saudi oil policy.

(2) Next, talk behind the scenes with your favorite bankster allies and ask them to help move oil down either directly by shorting oil futures or indirectly be not taking long positions. Also tell them to be sure to whisper to US producers that oil may be going down and now would be an excellent time to hedge (i.e. go short the futures).

You must be joking. For starters my bankster don’t trade futures and few do. Most banks don’t even allow naked trades in derivatives. That would be considered gambling with depositors money. Banks simply don’t allow that. Virtually all institutional trading in futures is done by 1. ETFs, 2. Speculative Funds, and 3. Hedgers. It would be impossible to “talk” to these people and get them do follow your wishes. They are trying to make money not do the bidding of someone who wishes to see oil prices fall.

We know that the US futures market is the playground of price manipulators so it’s not at all difficult to imagine them doing the same thing with oil, especially if there’s official backing.

No, we do not know that at all. But you are correct in one respect, it is not at all difficult to imagine them doing that. But that’s exactly where it is, all in your imagination.

People who make claims of futures market manipulation have no idea just how hard this would be to accomplish. “Talking to bankers and hedgers”? Give me a break. They are going to listen to you or me? The very first thing they would do is ask you: “Who are you to give me financial advice?”

The Hunt Brothers tried to manipulate the silver futures market and it cost them billions.

Yeah. I’ve been actively trading in futures for a very long time, and I can tell you beyond a shadow of a doubt that these markets are now very much in the hands of price manipulators.

I’m not sure why you are being so vehement on the matter, so certain, it speaks of a belief system perhaps that you are holding rather than an opinion based on facts.

I can show you tape after tape of various price moves made int eh futures market that have nothing at all to do with legitimate price discovery and everything to do with moving prices for the sake of moving prices.

It’s just how these markets work now. The structure began to break down in 2007 and by 2008 we had a new emergent market structure.

To move these markets around now is simply a matter of applying a little bit of leverage in the right spot.

For example, the favorite playground to move the S&P is not in the cash market…that’s where the final effects show up.

The initiating spot is in the VIX and emini futures…

We also know that central banks have direct accounts with the CME.

And we know that various banks, yes *banks*, have been active manipulators of aluminum, FOREX, Gold, LIBOR…all things that you would claim are ‘too big’ to manipulate but apparently not.

I watch and participate and study these markets every single day and I have tons of facts to back up these points. I save data constantly.

It’s not really as hard to accomplish as you seem to think. In fact it happens pretty much every day.

What seems to get missed is that in 2008 the TBTF banks and the investment banks were merged or in the case of Goldman an investment bank was turned into a regular bank virtually over night. The markets haven’t been the same since. You now have investment banks with virtually unlimited firepower, soon to be backed up by tax payers again, playing in every liquid market available.

It’s just how these markets work now. The structure began to break down in 2007 and by 2008 we had a new emergent market structure.

For consumers, does any of this matter anymore? Seems like wealth creation primarily benefits those who are already very wealthy. A two-tiered system where the wealthy get more wealthy and everyone else gets by as best they can.

Sure, oil prices could go down for awhile, but if consumers are smart, they no longer make plans based on what are likely temporary price declines.

Does the economy for the average person have anything to do with the economy of the wealthy these days? Seems like two totally separate worlds. And the only time they affect each other is when there is another crash. So the consumer gets hurt when it falls apart and doesn’t really benefit with it booms.

And we know that various banks, yes *banks*, have been active manipulators of aluminum, FOREX, Gold, LIBOR…all things that you would claim are ‘too big’ to manipulate but apparently not.

LIBOR? Now you are mixing apples and oranges. Banks do control interest rates, or at least partially so. I have no doubt that banks do try to control interest rates. That is not the futures market.

However five trillion dollars, in various currencies, changes hands every day on the FOREX. No one bank has enough money to manipulate the FOREX.

If you have the facts that various futures on commodities, including oil, are being manipulated, you need to tell us exactly what those facts are.

You mentioned talking to the Saudis, bankers and hedgers. I just don’t see that as actually working and certainly not “manipulating the market”.

I never imagined you as a conspiracy theorist Chris. I am shocked.

Rumors swirl every day on and off the futures trading floor. These sometimes do cause sudden swings in the market. But such moves are always short lived. Only supply and demand can affect the actual long term price trend in the price of oil.

Of course if you could talk to Saudi oil minister Ali Ibrahim al-Naimi and convince him to cut supply that would definitely work. But neither Iran or Venezuela had much success in doing that but if you could….

Uh oh.

Do I believe that smart people make plans and hide them from time to time? Yes.

So I believe that money and power are great reasons to hide one’s plans and motives from public view?

Yep. Guilty as charged.

It is how the world has always been and always will be.

“I never imagined you as a conspiracy theorist Chris. I am shocked.”

This conversation is now over.

“According to him, the dystopia of the Wachowski Brothers’ Matrix trilogy is already here: the technological-industrial ‘machine’ is already running the world, a world where individual humans are but insignificant little cogs with barely any autonomy. No single human being – neither the most powerful politician, nor the most powerful businessman – has the power to rein in the system. They necessarily have to follow the inexorable logic of what has been unleashed.”

~ G Sampath on John Zerzan

Just go and think about it for awhile over a nice bourbon and then see how you feel. ^u’

Let the yeasts worry about their wastes.

I view this with interest.

Ron, the other day I offended you by mentioning that Chris’s video on ocean acidification was a travesty, because it opens with unsubstantiated claims about pesticides and monarchs, “compounds” and obesity rates, things that someone with a PhD in “neurotoxicology” should know better than to say, claims that totally undermine the veracity of the video.

There are people who aggrandize themselves by getting people wrapped up in narratives of conspiracy and doom, and who don’t care about facts.

In 2009 I dropped out of the peak oil scene because it became clear to me that there were a whole lot of cranks in the field that were pulling the wool over the eyes of us who are purely lay observers–the Savinars, Rupperts, and others.

I think you need to consider that this Mr. Martenson might be another such crank.

I am very, very skeptical about who I listen to about peak oil anymore. Just one or two slip-ups, and I tune them out.

Mike

Greetings, Mike, the lurker,

This whole dystem is the ‘world pulled over our eyes’. It’s a religion. Ridiculous and overcomplicated and no one really knows their Bibles, but very sinister at the same time because it imposes itself on the planet.

It even tortures and witch-hunts like the good ol’ days. Ah, enlightenment, progress…

By the way, speaking of price discovery, I just discovered that the price of oil is too expensive for everyone. =)

Father MacIntyre hath spoken.

And now back to our regularly-scheduled program…

What say you, Father Watcher, from the Land of Dems, bonds, shorts, OPEC, NoDak, percentages, and K-Street?

Ah, never mind. ‘u^

Happy belated Halloween.

Another point: the FED (and ECB) is running out of assets to monetize. Buying too many treasuries, like Japan almost monetizing all .gov debt, is not an option. FED and other cb’s are already in stocks. Maybe US shale is something to ‘monetize’. Or ‘they’ are crushing emerging markets for abandoning the dollar.

Don’t underestimate the influance of finance and politics. There are no markets. There’s just the FED & friends.

Saoedi Arabia not lowering production is weird.

‘They’ are looking for assets to monetize, and foremost; a reason to monetize imho.

Saoedi Arabia not lowering production is weird.

Why? Isn’t it just as weird that Russia does not lower production? Or anyone else for that matter?

The running out of assets narrative was pretty thin from day one. If you want to monetize something and there aren’t enough of them, just pay more for what there is.

It would be odd for the Saudis to cut production when the prices fall. They have bills to pay as well.

I am with Ron ninety nine percent of the way.

I do believe that oil prices can be and may be manipulated to a small extent OVER THE SHORT TERM.

But if a given speculator buys oil today because it is cheap- physical oil that actually goes into storage- that has the effect of raising the price TODAY while depressing the price on the day he sells it.

This sort of game is a wash.

Now it is possible that a Ronald Reagan can make a deal from a position of strength with a close ally such as the Saudi royal family and maybe talk them into glutting the market and fxxxing up the old USSR economy while pouring the coal onto the star wars fires and maybe breaking the old USSR’s political and economic back.

Opinions vary as to whether this actually happened. If it did it was because other circumstances fell into place and helped set the stage. No liberal I know believes it happened but just about every conservative I know believes it did.

( No liberal a year or two ago believed in conservative predictions of cheap gasoline either. Lol. Neither did I.)

But times are different now. The leadership is different in both countries.Circumstances are very different indeed.

Recently our leadership has been rubbing the Saudi collective nose in cultural shit-from THEIR pov. Women in charge of the state department. Advocating policies such as freely practiced abortion. Gay rights.

This stuff is ok on the home front and ok with me but only a damned fool could possibly believe it does not matter at a VERY deep level over in Sand Country.

My opinion is that the current price collapse is a natural consequence of production holding up better than expected with the economy being weaker that expected along with fast increasing efficiency in cars etc.

Oil is probably the most price inelastic important commodity in the world. A minor surplus thus means a price collapse and a minor shortage thus means a price spike.

A BIG collapse and a big spike.

Now the Saudis may be cooperating IN PART with CM’s scenario but mostly maintaining production for other more important reasons of their own. One would be to maintain market share. Another to put a hurting on our tight oil industry. A third- and the most important of all in my opinion- is to force the smaller hangers on in OPEC to understand that if they want a production cut they are REALLY going to have to play fair and do some cutting themselves -that the Saudis are not going to keep on toting the load for them.

You just cannot force the price of a given commodity down -or up- very much or very long unless you can control the supply reaching the market.

The average guy filling up his gas tank cares not a flying XXXX at a rolling donut what the FUTURE wholesale price of oil is going to be next year.

And the producers and the refiners and the shippers and the retailers are supplying this average guy TODAY – not next year.IF he ain’t buying then they ain’t selling.

IF they ain’t selling then they have to cut the price to a point the end user buys whatever IS produced.P.E. R. I.O.D

I don”t know how much crude goes into long term storage but my guess is that it is much less than one percent. Probably less than a tenth of a percent. Leaving it in the ground is probably a lot cheaper.

NEXT YEAR has almost NOTHING to do with the price of oil at the pump TODAY.

The future price of corn means very little to a farmer with corn to sell today. Now if it is high he may choose to hedge now and grow more next year- but that is NEXT year.He can hold some of his his corn if he wants to- it is after all already harvested and he most likely owns a storage facility adequate to hold a good bit which would otherwise be empty and unused anyway.

If he doesn’t sell today that helps raise the price today but depresses it when he sells his carry over next year.

Now a big buyer with money to pay well in advance and pay the storage costs may be buying today when corn is cheap in expectations of higher prices next year of course.

But that is still a wash over a years time.

Now as to whether the OVERALL economy can be manipulated by bankers and politicians- the answer to this question is undoubtedly yes – in the very broadest terms.

But so far as I can see the current low interest rate that made the tight oil boom possible was not set with the tight oil industry in mind.

NOBODY in his right mind believes that the bankers of the world have been conspiring for the last decade to run up oil prices.

The current policy of the worlds central bankers has certainly not been put into place with the intention of bringing on a recession or depression -QUITE the contrary.

It was set with the ENTIRE economy in mind unless I am badly mistaken – with perhaps the banking and investment industries being a little more equal than the rest of us – Animal Farm style.

As Ron said there is not a snowballs chance on red hot stove that anybody in Washington could convince anybody in Venezuela- or Russia- to cut or increase oil production to further American foreign or economic policy.

We ain’t got no friends in them places to put it as bluntly as possible in my local vernacular.

The truth of the matter is that the Saudis themselves would disown us in a skinny minute except for the fact that they are afraid to do so. Without us to keep them on their throne with our political and military clout they would be refugees by now.They probably would all have either fled or dead and unable to flee forty or fifty years ago.

We are an imperial power without any question but we practice a much softer brand of imperialism than any other top dog country has in the past and the Saudis know it.

They have no desire to align themselves with the Russians or Chinese for this reason- but they are not powerful enough and will never be powerful enough to go it alone. So they stick with us as their best choice.

But the fact that a hypothetical woman who has recently gotten thoroughly disgusted with you is still living with you is NOT an indication she will be eager to do whatever you want her to anymore-even if she would enjoy it.

The Saudis will cooperate with us to the extent they have to from here on out rather than because they view us as real friends.

We were never their REAL friends in any case, in the sense we are friends with for example the Aussies.

Being a nation built on a different cultural and religious foundation has always ruled that out.The First Five Books are not enough.

That hypothetical woman can either leave or kick you out. Over here at least. Over there the men do all the kicking.

Maybe for some folks who don’t quite understand my arguments about current consumption and prices in relation to EXPECTED or PREDICTED future prices I should elaborate a little more.

You can buy a house today based on the expectation of the price going up next year and thereby making a profit. If lots of people buy houses for this reason then it will without a doubt result in house prices going up NOW.

But rents are based on CURRENT DEMAND. A few people might sign leases now hoping to avoid rent increases next year but rental leases of houses are usually for a year only so guess what- next year the landlord will raise the rent unless you negotiated a two year lease.

People may think oil is going up again and bid up the price of oil STILL IN THE GROUND- by bidding up oil company stocks. I would myself if I had any money.

But the price of oil in the ground to be extracted next year or ten years from now has no more to do with the price of oil today than next years housing market has to do with TODAY’s rental rates.

Next year may be a boom or bust year for apple growers. This years price-TODAYS price – is determined by current supply and current demand.Apples don’t keep. Houses do but a months rent not collected is lost forever. So rent money is a perishable too.

Oil keeps – in the ground. But todays price is determined by todays supply and todays demand.

Todays supply AIN’T IN THE GROUND. IT is already in tank farms and pipelines and the tanks at service stations and in your car.

The oil being pumped out of the ground today will reach the end user weeks or months from now.But the buyers of it are already scaling back because their inventories are piling up on them. Service stations cut their orders,local wholesalers cut their orders, regional wholesalers cut their orders . refineries cut production ,-all the way back to the well owner until the supply matches consumption at every level.

This process may take a while to play out – not less than a few weeks and more likely a few months. Inventories along the way will go up or down to accommodate the process of finding the new equilibrium price and supply.

I know most of the regulars here understand this stuff without it being spoon fed but there are always newbies and hopefully some kids who are new to the nature of markets.

EXPERTS are the last people to get it when the fundamental nature of the game is changing.

People who believe in conventional banking practices for instance cannot conceive of the executive and congress writing a whole new set of banking laws.

Conventional farmers cannot conceive of being unable to buy fertilizer or pesticides.

Conventional economists mostly cannot conceive of a world without endless growth- at least as a possibility.

CM is at least unconventional enough that he understands some physics and biology.

BUT I am waiting- along with Ron- for an explanation of the way our government is herding the cats of the oil industry.

Herding cats is basically impossible imo.

Mac,

You mention that you are apple orchard grower. Do you sometimes shake your trees to see which apples are ripe for falling? I did that when I was kid at my grandpa farm. Maybe somebody is “shaking” the “oil orchard trees” to see who is ripe for “falling”.

I am not saying that is the case. I have no idea and I don’t particularly care to know because it will not help me in any way in my day to day life. All I was saying I try to keep my mind open, as Buddhist would say to have “beginners mind”, and then I would see a glimpse of reality from the fog of delusions.

For the time being, the US dollar is the world reserve currency. If the value of that reserve is intentionally manipulated, then all prices of all goods and services are, to some extent, manipulated.

The Fed explicitly targets 2% inflation, and this necessarily perturbs all other prices, however they may ramify through an impenetrably and wildly complex world.

The Fed has also willfully monetized fraudulent debt instruments, and has openly targeted asset prices by design, to alter behavior, regardless of the fact that they can not predict what that behavior will be. The Fed and treasury are hardly alone in this sort of conduct.

If the goal is “growth”, and that is explicitly stated, the finite nature of the “real” world must eventually doom this enterprise. The question seems to me to be a matter of timing.

It all depends on who’s growth your talking about. Currently, Wall Street and the Fed only directly control 25% of the world economy so from their perspective there is still a lot of growth potential even in a finite world.

Wow, this has the same feeling I get when an old car keeps falling apart, I fix it and soon more falls apart and more patches are needed. The end result is inevitable and the timeline ends when I no longer want to put up with the amount of trouble and monetary losses.

To be watching a civilization where the old tried and true is acting like an old car on it’s last legs while a whole new way of doing things, new materials are being formed, new energy sources are all banging on the door to be let in and taken seriously; is just amazing to me. So much manipulation, so much desperation and so many changes. Still the major choice is the dead end system that got us here. Absolutely crazy and strange. Life is emulating the stage at this point. Way too much drama for the results.

For me, lately the question has been do I want to keep an old car and not drive it or do I want to get a new car and not drive it. So far, I’ve been keeping the old car and patching it as needed.

Allen. What you say is what I think. What to do?

My own personal decision is to do what I do, thermal machines, in a way that might be good for all of us little furry critters scurrying around in the understory trying to avoid being trampled by the dinosaur in its death struggle.

We know that when all the thrashing around has quieted down, it’s our turn.

So, PV is near miraculous, just a sheet of glass that puts out real watts than can charge your car and/or fry you to death. But, in the last three weeks, couldn’t do diddely since no sun, so what it needs is a booster to get over such events. Like a wood pyrolyzer/air engine.

And, of course, I can’t begin to make a new PV out in my workshop.

The pyrolyzer works just fine, and I can’t understand that they aren’t already on the market to replace the much inferior conventional wood stoves, one of which is heating my back as I speak.

The thermocompressor looks great on my sketch, as well as on my son’s simulation.

Like you say, energy banging on the door.

You guys here who spend serious time recording the dinosaur’s death struggle, should take a break now and then and look at all the good new stuff ready to be born which you could be supporting right now instead.

Hi Wimbi,

Do you have a website or blog so folks can see what your up to?

You are welcome to post stuff at my blog (very low traffic though), if Ron likes it and thinks it’s relevant to peak fossil fuels, he would likely post it at POB where lots of people will see it.

My blog is at link below,

http://oilpeakclimate.blogspot.com/

just contact me there, if interested.

My daughter, in a university, has some students putting some of my stuff on the web, where anybody can grab it and run off anywhere. They are waiting my finished dwgs with dimensions and McMaster-Carr numbers.

Will let Ya’all know.

As a follow up to my last question, will world oil production actually increase during this time of low prices or is this the end of last kick the growth in oil production will ever get?

It is far more likely that oil production will decrease during times of low prices. Prices dictate supply and demand. Low prices usually drive supply lower.

But the last half of your question is what is called a non-sequitur. It does not follow that if production goes down… or up… that this means that this is the end of the last kick to the growth in oil production we will ever get. Low prices is likely a kick down in oil production. But there could be future increases in prices that will encourage higher oil production. Whether they will be successful or not remains to be seen.

You know, Ron, hmmm, there could be serious calendar issues in this.

If you shut down drilling via low price for years, the global decline rates take the output down. Then if you get a price rise, there should be a point where restarted drilling can never get you back to previous levels. It would be somewhat different than the frantic drilling concept being unable to offset declines.

It would be accumulated declines added up (down) by the calender can never be undone even with restored drilling before geology simply runs out.

Watcher, Ron is clearly correct saying oil production will decrease during times of significantly low prices. But, the depletion of “easy oil” reserves will continue (or even increase); leaving (expensive) “harder oil” for the future. Meaning, if (when) you get a price rise, there should be a point where restarted drilling can never get you back to previous levels (your precise point). But it’s all a question of timing. A brief drop in oil prices is simply a convenience for consumers and a (big) inconvenience for producers. The above argument comes into effect in a relatively long low price cycle, in my opinion. Face it, per my niece’s comment in the previous post, production is already being deferred in “expensive” off shore oil Norwegian fields. These fields will be reactivated in the future but add even more pressure on future prices.

Douglas, best point in your para that the easy oil decline is the hardest to replace. I’ve suggested hysteresis in shale price . . . a different price for industry destruction — far lower — than required for industry restart. You’ve just said the same thing, but even for conventional.

The easy oil depletes, the harder oil also depletes, but this raises the average restart price.

And . . . no, given shale’s hyper fast everything (70% of Bakken production from wells less than 20 months old) this cycle doesn’t have to be long and slow. Take the price down, maybe only for 6 months of so, smash the industry, fill the court dockets with lawsuits of one party against another, raise the price, really high, and you STILL can’t restart because everyone is paying lawyers.

Russia, if they did this, are geniuses.

Russian oil fields have a lot of high water cut wells. As it turns out many of these wells stop producing oil if they are shut in. This means russian producers have a conflict. They would love to close the high water cut producers to cut costs, but that’s dangerous. I don’t know what they are doing at this time. But this is a very touchy and complex technical and economic problem.

If you look past currency, and think in terms of “having enough to feed our people”, the water cut issues diminish in importance.

A fave theme here is “how do you do irreparable harm to an oil field”. The shut-in-can’t-be fixed scenario has been mentioned. In the context of Libya. Shrug.

When is the last time global oil production/consumption moved more than 5% in a year, regardless of the direction of price?

even in “high price” (clearly an anchoring phenomenon) environment globally we’re blowing though 30bn bbls or so.

We need that stuff you know……

Rgds

WP

(p.s. I think using a logon/pswd is a good idea)

Never fear, high prices are here: OPEC slashes oil production estimate; crude slumps again

So, in the wake of their next meeting? Or however this works usually. Maybe the news itself will do the trick? Or prices won’t rise at all, given what bulls the shale drillers are. Will be interesting to see the dynamics at work here.

Venezuela “predicts” an emergency OPEC meeting early next year. That’s about 2 weeks after release of the schedule for the next meeting specified to be June.

I agree with you Ron. I see that I phrased my question poorly. What I was really asking is as follows:

“will world oil production actually increase during this time of low prices or is this the end of [the] last kick [at] the growth in [the highest rate of] oil production will ever get?”

Or in other words, will this time period be “Peak Oil” because the confluence of factors that lead to increases in the highest rate of oil production, vs. the factors which work in the opposite direction, permanently be on the side of lower and lower possible maximum output? I.e. geological, financial, political, economical and other factors will never come together in such a way that the maximal rate of oil production will never again be higher than it was in the past?

Oil production rates will go up and down under the influence of whatever factors are at play at the particular time in question. But has the maximum rate of production been reached, never again to be surpassed?

Keep baiting, ouette won, and you’ll get your answer. Tons, in fact. And by simple random chance, one of those answers will be approximately “right,” And it will be selected and highlighted as a “correct prediction” out of the lot of stinkers. I’m placing my money on don’t know squat, which is of course the correct answer, and I run from those who claim otherwise.

haha the Elaine Garzarelli approach. If you got 1000 stock analysts flipping a coin 100 times, one of them is going to get heads 100 times.

That analyst will be declared the most skilled coin flipper.

I more or less failed statistics, but I am going to guess, math free, that to get 100 flips all heads you would have to start with an analyst population that would not comfortably fit in the confines of the world, possibly of the solar system.

Or have a crooked one in your initial sample, which to be fair is higher odds

You know, I ***KNEW*** someone would complain about the numbers. haha

The point is the concept. Lots of people are predicting every day and someone is going to be right and get declared highly skilled.

haha the Elaine Garzarelli approach. If you got 1000 stock analysts flipping a coin 100 times, one of them is going to get heads 100 times.

Damn Watcher, you should know better than that. The odds against 100 heads in a row is 7.89E-31. That is an extremely tiny, tiny number.

Nod.

Easy to roughly estimate using the following fact: Two to the tenth (1024) is roughly ten to the third(1000).

The chances of heads n times in a row are roughly one in two to the nth, or using the fact roughly ten to the -n/3.

”You got EREOI. It may take more effort to get the oil than the oil could fuel, and this is supposed to magically be measured by money.”

I must disagree. I am sure you understand what you are talking about but I think you got in a hurry and should have looked twice before pressing the post comment key. This is a mistake I make often myself. Else I just don’t understand – a frequent failing on my part too.

Energy returned on energy invested is measured in energy not money and while this is a limiting condition under some circumstances it is not very important under other conditions such as RIGHT NOW – not for the short to medium term..

It is obviously impossible to use oil to extract oil if it takes two barrels of oil to get one barrel out of the ground.

BUT if you use twice as much energy from natural gas and coal that sell for four times LESS on an energy content basis you may well be able to make an economic or monetary profit while experiencing a losing EROEI.

Gas and coal are plentiful and very cheap at the moment compared to RECENT oil prices so for the moment EROEI as it relates to oil is not very important.

But it WILL BE IMPORTANT – VERY IMPORTANT INDEED- later on when coal and gas are also in short supply along with oil.

I expect oil and coal prices to gradually converge with oil prices on an an energy equivalent basis. This is going to take a long time to come about but the only thing that oil is really better for is transportation. And as oil gets to be ever more expensive over time the market will move transportation away from oil.

It occurs to me that Model T Ford back when it first hit the road probably cost as much in terms of earning power as an electric car today. In other words what I am saying is that a man in the same profession- assuming that profession still exists -probably had to spend as many days pay back then for a new Model T as his great grandson doing the same work- say accounting – has to spend to buy a Chevy Volt or a Leaf- or maybe even a TESLA..

If the economy doesn’t crash and prevent it then electric cars are going to eventually take nearly all the market for passenger cars imo. Wind and sun are free and coal is going to be plentiful for a long time and electricity is going to be available.

I don’t think anybody acquainted with the industry is saying the same thing about oil – that it will stay cheap- unless he has an ulterior motive of some sort.

The interesting thing about the Model T, is that Ford wanted them to run on Ethanol, in order to provide income to America’s farmers. He was swayed by the oil companies.

With regards to electric cars, the numbers have been doubling for the past 3 years, and planned production would have them double again next year. If this rate of increase continues, there will be over 1 billion electric cars on the road in 2025. So even if oil production declines by 25% in 2025 (as suggested in the video), the decline in demand would more than make up for it.

Not bad. The overall point was the difficulty of finding the end point of Energy Invested measure (the trucks that haul the oil, the heat that formed the metal that made the truck, the shoes on the driver’s feet, etc) and how money became the metric that avoids the difficult input calculation.

But one of your sub points is legit, that the form of Energy Invested might be nat gas (it certainly is for Suncor’s oil sands operations) rather than oil, but in a macro entropy perspective you still can’t do that very long, and no, the solar guys don’t need to jump in and say they are going to pump oil with solar powered drillbits. That’s not happening and isn’t going to at 745 watts per horsepower.

Where your point goes is just deeper into the complexity morass of how do you measure energy input. The world decided to do it with money. But money gets printed whimsically now so it would be nice to have another metric.

Well , ahem, wells come in various kinds and most of them are deep subjects lol…..

I lack the proper words to describe why money IS a fairly decent metric but I will try anyway. IF I buy a bulldozer and pay a quarter million for it then it has less than a quarter million worth of energy embedded in it. The fuel is apt to be the biggest variable expense – more than the operators wages. The operators commuting energy expenditure is probably exceeds his food energy expenditure which probably exceeds the energy expenditure involved in his shoes.

In other words the farther you get from the bullseye of eroei then the less the small things matter.So if you have a reasonable estimate of energy involving the big things you should have a reasonable estimate of eroei with the understanding that the true eroei is somewhat but not much higher.

Of course there is the flip side of the coin to consider- the entire economy consists of a lot of small things in the aggregate.

My work boots are a very small part of my energy input as a farmer given that I sometimes used to use up to a hundred gallons of fuel a day.. But the three piece suits worn by lawyers are a much bigger part of the energy budget of a law office.I doubt the average lawyer uses over a gallon or two of fuel a day running his law practice unless he lives out in the boonies.

In my estimation money can and will continue to be printed until it is essentially worthless at some future time. For now it works a lot better than nothing as a measure of energy intensity.

Ron, can you get the Regex post and Mike’s rebuttal. It has a graph in it and I’ll fail.

Regex Wald posted on another thread:

Oasis has announced their preliminary 2015 capex plans — the first “big” Bakken producer to do so up to this point.

Planned capex is $750-850 million in 2015, or about half of what will be spent in 2014. The 16 rigs they have been leasing all this year (incidentally, only Continental and Hess have been running more rigs in the Bakken during 2014) will be whittled down to 6 by the end of March as they concentrate all drilling to the company’s best acreage, in north-central McKenzie County. In spite of this, they still expect a 5-10% increase in year-over-year production by the end of 2015.

If you’re into such things, they have posted a new investor presentation to coincide with the 2015 capex announcement. For obvious reasons, more focus is placed on costs in this presentation compared to previous presentations.

The stock is down more than 75% over the past 5 months, and, so far, today’s announcement has not yet helped.

BTW, Watcher: Oasis is one of the public Bakken companies that has all its wells and related assets organized into an LLC. To be exact, “Oasis Petroleum North America, LLC.” Hess is another notable Bakken driller that also does this. Their LLC is “Hess Bakken Investments II, LLC.”

Mike replied:

This LLC thing is ridiculous; as was mentioned in this link, Oasis is the 3rd most active driller in the Bakken. Hess is the 2nd most active, both are large, semi-integrated public companies. They are also LLC’s, so what? There seems to be two implications regarding this LLC issue, one being that any company carrying those initials behind it can simply walk away from its debts and leave everyone else holding the bag. That’s bunk. Ask a lawyer.

Two, the issue with LLC’s is that there are thousands of them operating shale wells, that LLC’s drill the majority (?) of shale wells and when they all walk, the shale industry will die immediately. That’s bunk too. The implication is, I think, that there are lots of mom and pop companies able to drill 10 million dollar wells that will go belly up because of oil prices. Shale oil is a big boy’s game that is played with big money.

The only way to resolve this “fear” is to define what constitutes a small shale oil company and what constitutes a big shale oil company. Then a lot of time has to be wasted listing all the shale companies in the Bakken and judge them as small, or big. Y’all can do that, then decide who is the flight risk.

By the way, make sure that you are comparing apples to apples, operators to operators and not operators to service companies. There are indeed lots of mom and pop LLCs providing services to the shale oil industry, so what again?

Thanks, Ron. It is a good offering and a good rebuttal.

Mike, if putting LLC behind a company name doesn’t mean they shield their external assets from internal risk, then exactly what would you think Limited Liability Company means?

And also, if there is no such shield, why would they endure the legal costs of arranging such a business architecture?

It doesn’t have to imply . . . “evil”. A company that doesn’t protect its shareholders’ assets with such an arrangement is not performing fiduciary duty pretty much at all. They would be irresponsible if they didn’t arrange things so that they can walk away with impunity.

BTW I don’t think LLC existed more than 20 yrs ago. A tad new.

Definition of a Limited Liability Company or LLC

Like a corporation, a limited liability company or “LLC”, is a separate and distinct legal entity. This means that an LLC can obtain a tax identification number, open a bank account and do business, all under its own name. The primary advantage of an LLC is that its owners, known as members, have “limited liability”, meaning that, under most circumstances, they are not personally liable for the debts and liabilities of the LLC. For example, if an LLC is forced into bankruptcy, then, absent special circumstances, the members will not be required to pay the LLC’s debts with their own money. If the assets of the LLC are not enough to cover the debts and liabilities, the creditors generally cannot look to the members, managers or officers for recovery.

All it means is that the executives or owners of a company are not personally responsible for the debts of the company. Of course if the stock goes to zero then their stock holdings in that company go to zero. But the debitors cannot go after other assetts the owners may hold. Company property is fair game however. If there are buildings, real estate or equipment owned by the company, they can go after that.

In Mike’s defense, I think he is rebutting my past semi hyperbole about who the drillers are and most particularly to what extent they have a long term perspective rather than being house flippers.

Pardon the Mike Tyson quote, but “everyone has a plan until they get punched in the mouth.”

LLCs will fold like cheap lawn furniture if they see a threat. And they should.

Thank you, Ron. I understand the LLC theory as to how it pertains to shareholders and personal liability to principles in public companies; I have been in business for myself way too long (I should have got out of the stinkin’ oil business in June!). In the case of mom and pop LLC’s I am still under the belief that personal guarantees are very necessary and we both know how litigious a world we live in these days; nobody is totally off the hook for nothing anymore. Liability was not my beef anyway.

Look, I think that with declining oil prices and the shale oil industry being in deep doo-doo, the peak oil community has moved up in prestige, so to speak. Your blog, I believe, is at the head of the class. I just want us to be careful about predicting the exact time of death of the shale oil industry least we’ll be just as guilty as it has been.

The oil business is like Texas weather, if you don’t like it just hold on a minute, it’ll change.

Thank you again for the good work.

Mike

Mike, I knew you knew exactly what LLC meant. My post was in response to Watcher’s post.

Watcher, I am occasionally confused by some of your statements and if I am again, I stand corrected. In the context you were using LLC’s it seemed to me you were implying a crafty way for business in general, in this case the shale oil business, to skate off into the sunset leaving boatloads of debt behind with no liability whatsoever. I don’t think that is the way it works. Its limited liability, not no liability. How does GE loan 400 million dollars to Shale R Us, LLC and not expect to get paid back? And, by the by, I think that LLC’s are now old enough to be getting holes blown in them not too infrequently these days by good lawyers.

Liability issues aside, the more relevant part of our debate, for me anyway, is the notion that the shale oil industry is going to implode tomorrow because “thousands” of LLC’s will just walk away from unprofitable wells. Not service companies, or man camp landlords, or caterers, operators. You have said precisely that. I stand by my belief that the vast majority of wells being drilled in the two primary shale plays are by large, partially integrated public companies who cannot simply disappear in the dark of night.

We are two months into a precipitous drop in crude oil prices. I think it is way to soon to be burying shale oil companies in mass graves. This bust is a shale oil bust, not an oil industry bust; I know you know that. The world is not coming to an end. I do not believe that LLC’s will fold up like lawn chairs, as you say, maybe that is the American way now days, I don’t know. Its not my way.

Lets see how it shakes out and not get in such a damn hurry to bury those guys. We’ll know soon enough. You know what I do for a living; what do you do, please?

Mike

I’m nobody, Mike. I’m gonna stay that way.

I was never anybody to start with.

IIRC you have mentioned one or another snooty mba program here in the not so distant past.

And you certainly seem to know a lot about the ins and out of business on an ongoing day to day ”this is what is happening right now basis”. Not many people know so much unless it is part of a job.. Time counts and you obviously spend a lot of time poking in less than well illuminated corners.

Fess up.

I expect you are involved in some way hands on in the oil or broader energy business – maybe not greasy hands with calluses but hands on in the sense of buying and selling securities maybe.

“implying a crafty way for business in general, in this case the shale oil business, to skate off into the sunset leaving boatloads of debt behind with no liability whatsoever. I don’t think that is the way it works. Its limited liability, not no liability. How does GE loan 400 million dollars to Shale R Us, LLC and not expect to get paid back? ”

Well, bad example hahahaa GE was bailed out. Their loan department damn near cost Jeff Inmelt his job.

But your real point is what it is. Nobody lends money if they don’t expect to be paid back. Well, maybe. That IS what interest rates determine, or used to before the arrival of swaps. Now it’s interest rates and swap premiums that measure risk, and — as we’ve been digressing to now and then — if you’re TBTF you don’t have to do any of that crap. You just have to spend money on Congressional campaign donations to be sure you get your piece of the bailout because you’re, altogether now, Too Big To Fail.

GE was.

Risk of default is in every loan made for anything. The loan approval guys are going to get an end of year bonus for ‘bringing in more business’ so if they can just get a few loan payments collected by last Christmas, they get their bonus. Then, if they don’t believe their own booming economy propaganda, they retire to spend more time with their families or they move on to “other opportunities” before the default hits.

This is all somewhat moot in a world of bailouts, and as has been posted, the MSM is already floating that trial balloon. And come on, we didn’t really think the world had gotten back to pre-2008 normal, did we?

Having been involved in some LLCs, I can tell you banks get small operators to give personal guarantees. Large corporations are smarter than this. Unless lenders can prove fraudulent conveyance (very difficult) the lenders are on the hook with no recourse.

Mike, I’d bet Watcher was a spook. I think those guys (and gals) have their brains rewired so they can never again reveal the fact they actually exist: They become virtual people. Whatever, Ron’s Blog wouldn’t be the same without him. Better maybe but not the same. 🙂

To not use an LLC for an venture which potentially creates huge liabilities would be crazy.

If you own a couple of rental properties you most likely will put each of them in a separate LLC in case a tenant who slips and falls sues you, even if s/he was awarded 50mm for a broken arm by some jury which had a bad day. Your damages will be limited to whatever assets the LLC has instead of everything you own. That is not “crafty”, that is common sense. In a way it is a protection against the ridiculous US legal system.

Rgds

WP

Thanks, pardner; I’ll remember the advice about LLC’s.

One of my rules:

Never do business with spooks or family guys.

I just posted up above that I think he is an active trader or energy business man of some sort. Spook fits better.

This might explain his tendency to believe in conspiracies right left up down center and anywhere else …

It is not that I myself don’t believe in markets being manipulated. I do. Sometimes. Often in fact.

BUT NOT EVERY TIME day after day.

Some things just happen. Like for instance a weak economy interacting with a steady or maybe slightly rising oil supply to result in a price crash.

Nobody has to deliberately do something in concert with anybody else for such things as the recent oil price crash to happen.

Maybe I was one of those tree huggers that drove spikes in so when the chainsaw hit the spike the saw would fly back and cut off an arm.

That would be really green.

Good try but lol on that one Watcher.

You have never run a chainsaw obviously enough if you think a spike in a tree will result in the logger getting hurt- if he hits a spike it just dulls the cutting chain on his hand held saw.

(Farmers either redneck or university trained or combo like me know about such things since we frequently run our saws into all sorts of stuff embedded in trees. Kids nail horseshoes to trees, dog chains get left around them , fences get nailed to trees, etc and all this stuff is inside the tree eventually as the wood grows OVER it.)

Now when a conventional circular saw four or five feet or larger in diameter turning a couple of thousand rpm hits a horse shoe – or a spike- at the mill – shrapnel flies and expensive repairs are necessary.People DO get hurt sometimes.Used to anyway. Larger mills nowadays have metal detectors.

I just recently logged a couple of dozen nice poplars leaving the first six feet on the stump given that the mill operator is adamant about not buying such logs.

Send a log to a local mill with a horseshoe in it and the mill owner will never buy from you again.These particular trees were all on the acre or so around an old house where kids lived for at least half a century.So the stumps are are all very tall stumps.I bought the old place to fix it up and left some trees for shade of course.

Incidentally circle saws are pretty much obsolete these days, having been replaced with band saws which make less sawdust and thus more lumber.. But a spike in a log still means a potentially dangerous breakdown and an expensive repair.

Mike,

Here in the UK it certainly looks like an oil industry bust. We’ve a lot of tired and expensive fields, and a lot of people selling expensive deepwater services. There’s lots of redundancies being made at the moment.

Hi, Mr. Taylor; its amazing how quickly and emotionally people are reacting to this oil price thing, isn’t it?

I read recently the most fascinating little tale of Americans developing a little oil field in Sherwood Forrest during WWII. Man, it was great! What a secret that was, and how well the secret was kept from the Germans. They had no rig lights for fear of Germans seeing them. Those American roughnecks were there for years developing that field and could never even write home to tell their families where they were!

I like to remind people who yak about shale oil technology and horizontal laterals, how long the oil business has been doing that sort of thing. And my favorite example is extended reach wells drilled there off the British mainland, what is that field called? Man, those guys get way out there, something like 7 miles. Incredible technology, 20 years old.

Mike

Mike,

It’s certainly surprising how fast some firms are reacting, but a lot of the exploration companies were already feeling the pinch at $100/bbl, since majors already wanted to cut capex. It’s a worrying time. I certainly won’t be spending my Christmas bonus this year!