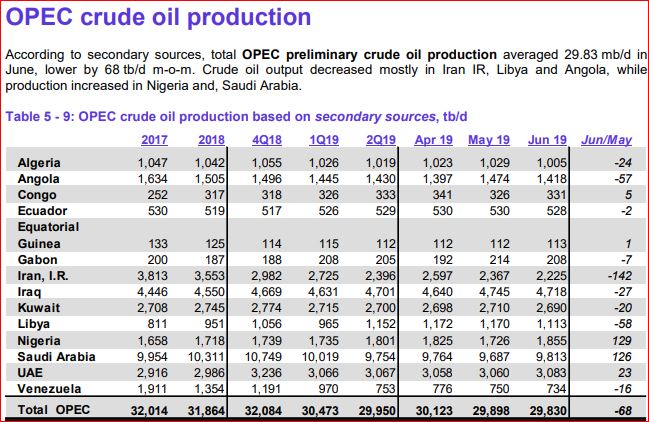

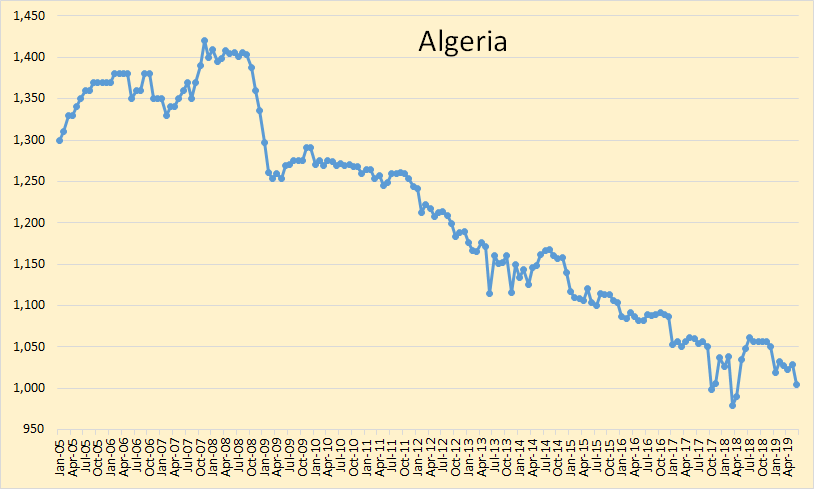

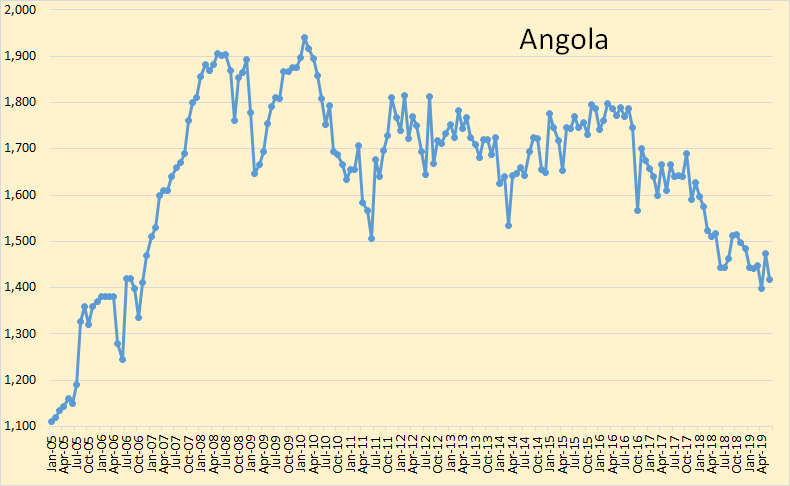

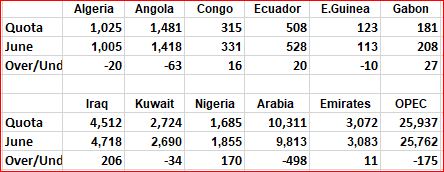

The following June OPEC data is based on the latest July OPEM Monthly Oil Market Report and is in thousand barrels per day.

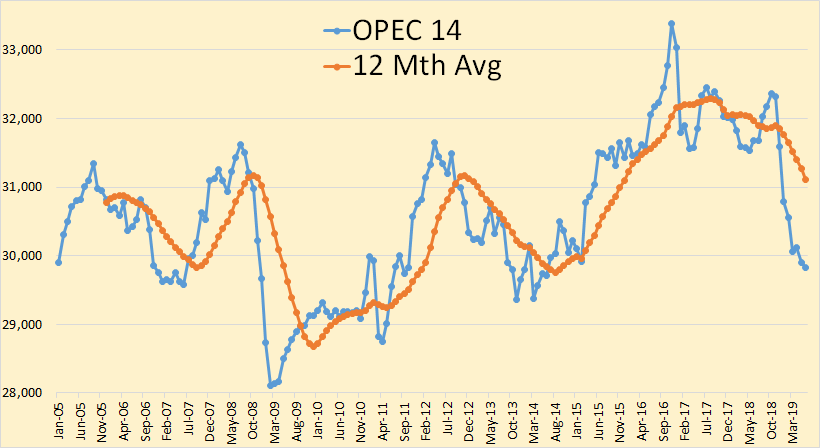

OPEC 14 crude only production was down 68,000 barrels per day in June.

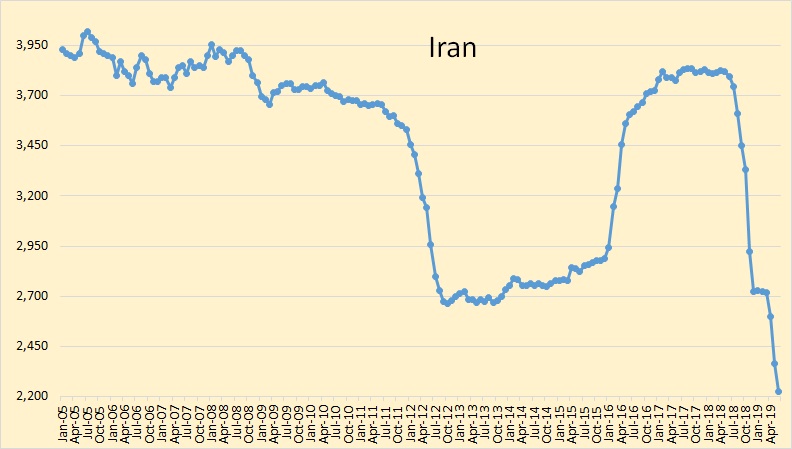

Iran continues to decline, down 142,000 barrels per day in June.

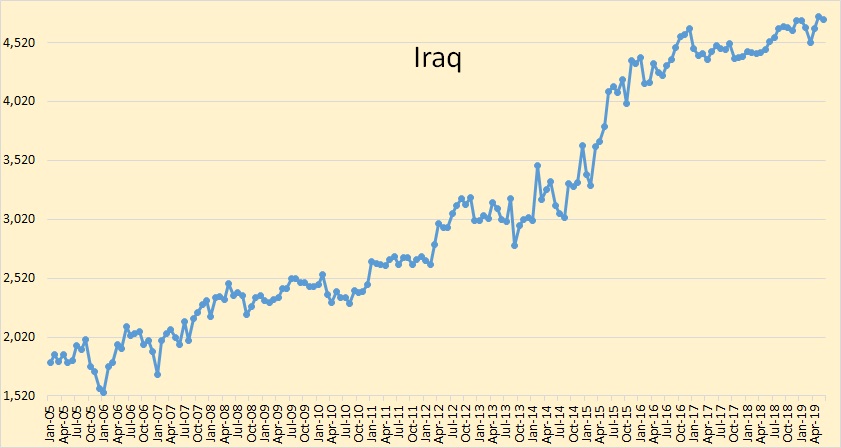

Iraq is still pretending quotas do not exist.

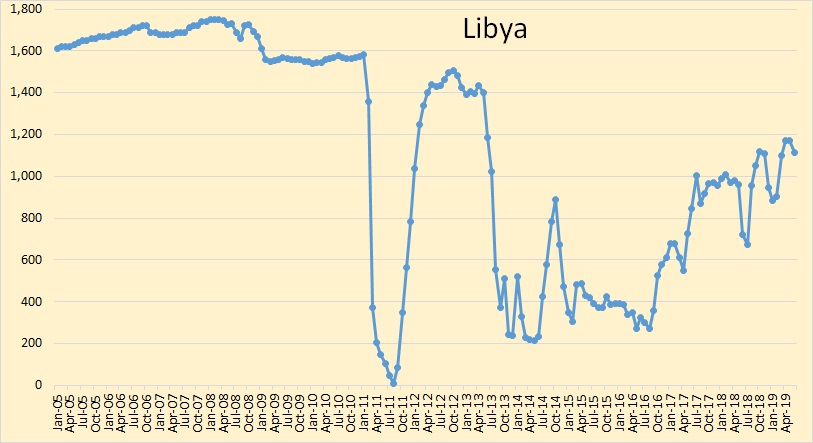

I think the rebels are only having a slight effect on Libyan production. They appear to be producing at near maximum possible production even if there were no rebel problem.

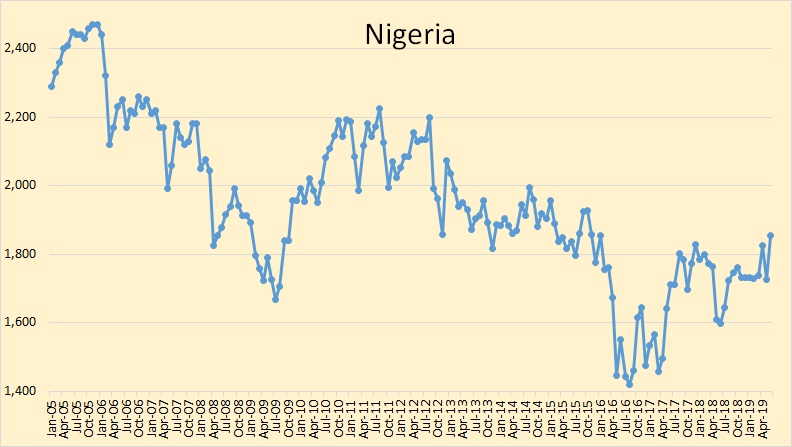

Though Nigerian production was up 129,000 barrels per day in June, I think they are well past their peak and are now in slow decline.

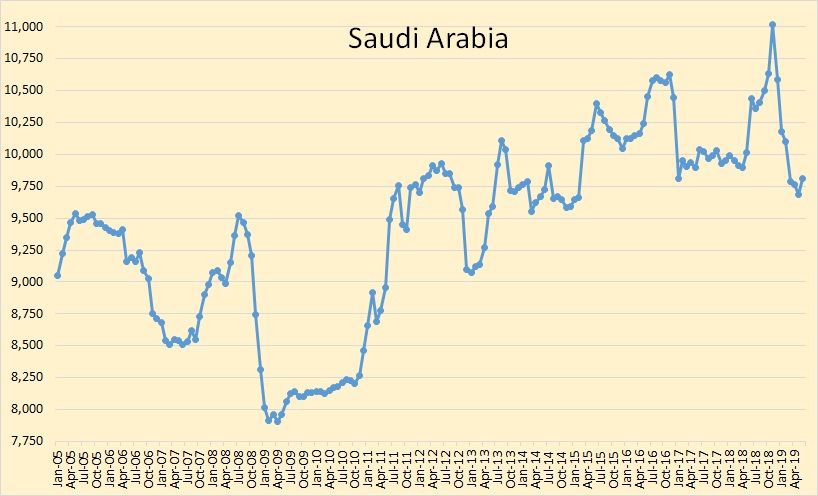

Saudi Arabia, though their production was up 126,000 barrels per day in June, is still producing half a million barrels per day below their quota.

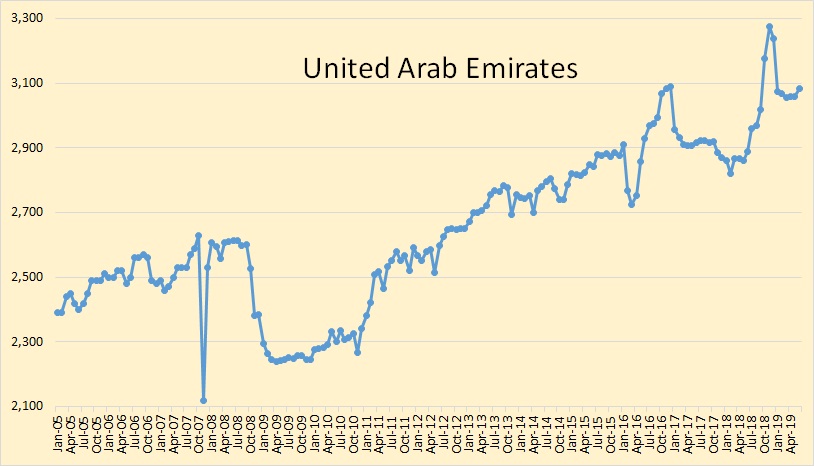

The UAE is holding steady at just over three million barrels per day.

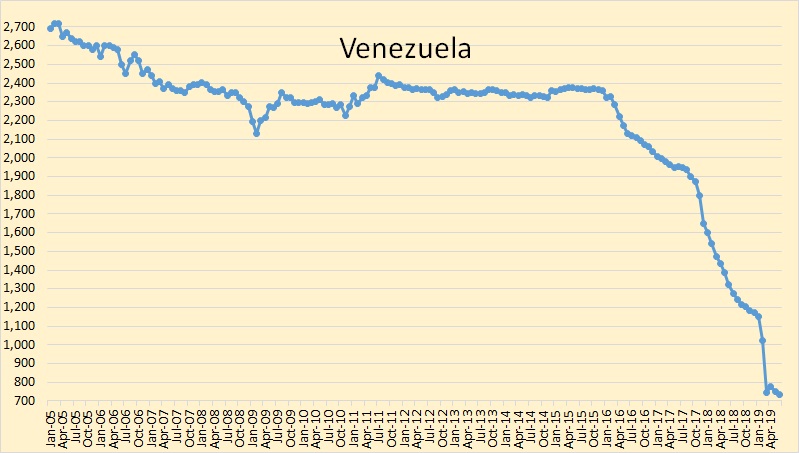

Venezuela seems to have bottomed out at just over 700,000 barrels per day. Venezuela averaged almost 3,000,000 barrels per day in 2001, the first year I have records of their production.

Iraq, Libya, and Venezuela are exempt from quotas. Iraq is not exempt, they are just ignoring their quota and producing flat out.

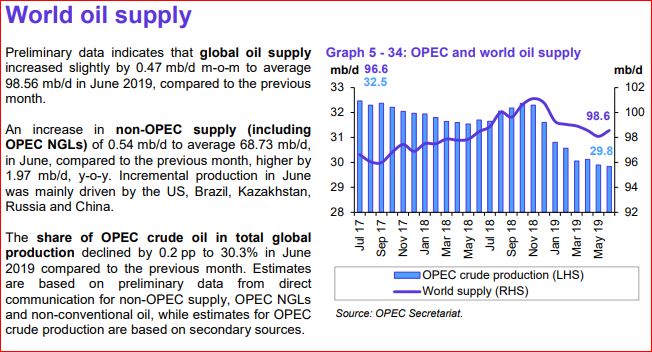

I think OPEC’s estimate of world liquids production for June is just a tad optimistic.

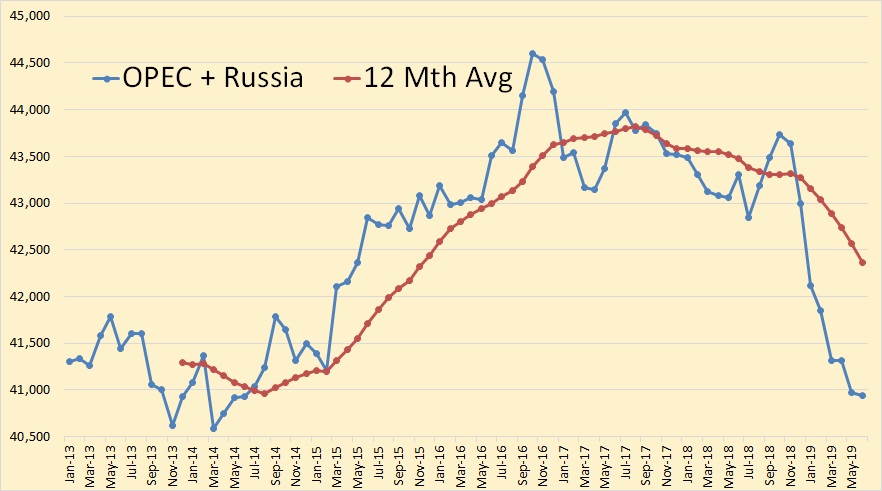

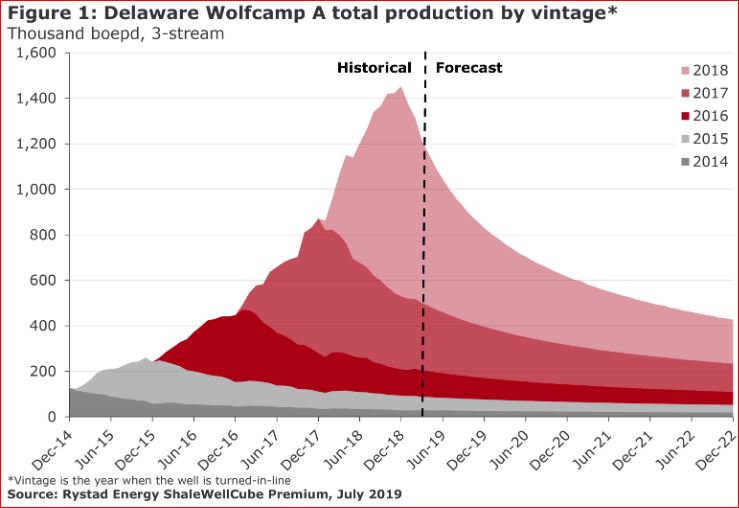

Rystad Energy Shale Newsletter

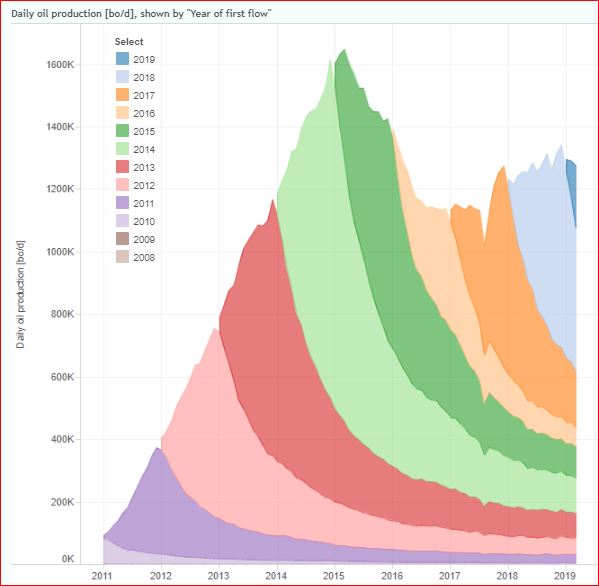

In a previous commentary, we focused on the profitability of modern shale wells across the Wolfcamp A zone. This time, we are analyzing historical vintages of Wolfcamp A wells from 2014 to 2018. Figure 1 shows a historical three-stream production profile for these vintages from ShaleWellCube, along with the forecast for future periods. The combined output from all five vintages peaked at 1.452 million barrels of oil equivalent per day (boepd) in December 2018 and it is expected to decline to 420,000 boepd by December 2022.

The above chart shows only production prior to 2019. The interesting thing about this chart is that it shows Delaware Wolfcamp production, prior to 2019, declining by 600,000 by December 2019. That’s how much it needs to produce in 2019 just to stay even.

Enno Peters’ Eagle Ford update through March

Very interesting chart on the Wolfcamp A. It’s the main driver for growth in the Permian. It’s definitely not the only shale or oil source in the Permian, but definitely the one with the highest expected growth. They have a B, C and D, but they get less productive and with more gas, the lower you go. No surprise on the EF.

GuyM,

You should read the Rystad piece, based on their analysis the IRR of the average 2016 Permian Wolfcamp A well is 24% and for the average 2017 well about 27%, and for 2018 drops to 20% due to the recent fall in oil prices.

See this chart that shows how average 2018 wells IRR will change with different oil and natural gas prices (NGL assumed to be 33% of crude price).

I’m a little bit suspicious of Rystad because they tilt bullish consistently, and I’m specifically suspicious because only 10% of the shale companies operating int he US have positive free cash flows.

If these wells were really spitting out mid to high double digit IRR’s then these companies would be rolling in cash.

They are not.

Despite saying “fully burdened” multiple times, it wasn’t until I got to the very last paragraph of the report where I found this:

++++++++++

“While the economics of recent vintages in the most prospective US liquid basin remain exceptionally robust, we should note that these ATAX IRRs still do not correspond to fully-burdened returns.

For a complete picture, we also need to take into account land cost, where the variability between early and late entrants is expected to be significant. We aim to tackle this assumption in a forthcoming analysis.”

+++++++

Oh.

They left out land costs. You know, one of the largest line-item expenses there is.

Put those back and these wells are negative I will bet you. And that’s a decidedly “bearish tilting” discovery.

Yeah, the “singers” leave off land cost, road cost, earth moving equipment, tanks, and pipelines, which can easily add up to a couple of million more per well.

Thanks Chris

I missed that. For some basins there might be a 10% IRR at 65 per barrel for the average new well over its productive life for all costs including land.

Howdy from a hot S. Texas, Chris. IRR is a bad financial metric for the shale oil biz; its easily manipulated, much like break’even prices. And generally speaking it’s the same folks always doing the manipulating. The IEA and the EIA are Rystad, DI and IHS’s biggest clients. Good news sells, bad news, not. As George says, it’s not a lie if you believe it.

ROI’s on CAPEX have always been an important, and overlooked key to the failed shale oil business model. The possibility (often based on exaggerated EUR’s to begin with) of earning $13MM undiscounted cash flow on a $8.5MM dollar investment, over 15-20 years, no less, was never conducive to staying out of debt to grow. And current 165% ROI’s on the very BEST of wells are not now conducive to paying interest, reserve replacement and ultimately, we hope, deleveraging debt. It simply does not work. The “models” that predict growth, and debt reduction, short of $85 oil prices, sustained for many consecutive years, are ridiculous. By year end ’19 we’ll see how ridiculous.

The American shale oil phenomena (not to be confused with the American oil industry) is a textbook example of “non-profit capitalism.” From printing press to Central Banks to lenders to shale companies, the end result is suppose to benefit the American consumer at the pump and burner tip and is a great redistribution of wealth in our nation. But it’s the people in the middle that are making the killing, the lawyers that put the deals together, the banks that get the yields, the CEO’s that make the +$20MM annual compensation packages while their EPS suck…the royalty owners getting the free money, they are the big winners. And none of those folks want to see it end. EVER. They could care less about 2 BCFPD of associated gas being flared, or all the LTO getting exported at $20 discounts to Brent, or ground water levels in Reeves County…they love the shale thing because it makes them money. And they all do whatever they can to make sure people believe it’s a miracle, a revolution; a game changer.

Phftttttt.

The real oil business, the real America, works on profit. Debt is for pussies, for weenie-necks, for dads who do not care what sort of life they leave for their kids.

Keep up the good work, buddy!

Yeah, $85 and above would work for some, not all. $65 would work for a lot less of them, and $55 is pretty much a sucking action for cash on almost all. And as a royalty owner, I would much prefer them not to drill until $85. But, royalty owners do not run the damn companies. Faulting them is like laughing at the homeless. I have about 30, or more, wells that can be drilled on my lease, and I have a tiny ownership. Do you think I am happy with $55 to $60 drilling on it, you are wrong. It’s about the last hope in life I have, and I am happy with wasting it??? GD, I am 70, but not that senile, yet. Ok, I may be an exception, but, at least, you could say some, or maybe even a lot. Otherwise, it’s discrimination, which for you, I would not guess. But, all royalty owners, is like downgrading the homeless. Most, do not have a clue they could have had steaks, instead of mush.

I am “discriminating” against greed and in any way I can trying to draw attention to the need to conserve America’s remaining resources. Continuous 120 day drilling commitments in MOST oil and gas leases, term assignments and/or farmouts has led to over drilling, increased GOR and potential loss of BHP and recovery rates. It’s also led to excessive flaring and the waste of associated gas, overproduction, much lower product prices… and more debt. If operators (Lessees/Assignees) do not comply with these continuous drilling provisions they typically lose acreage they’ve paid thousands of dollars per acre to lease.

I am a royalty owner and consider it one of America’s great privileges. By proper management of my minerals I have ensured my family will benefit from them for many, many decades. Onerous drilling to earn provisions, however, are part of why the shale oil and shale phenomena in America is, essentially, out of control and on a mission to drain the last of our country’s hydrocarbon resources as fast as borrowed capital will allow. If your leases do not contain Pugh clauses and drilling commitments then ignore my observations and goodonya.

I guess I see a different picture of most royalty owners than you, and I will just concentrate on the EF, as that’s where I am. Most of the EF was leased up by around 2009, far before public knowledge of the field. Ours was originally with Cheatapeak for about $800 a net acre. The common way to lease it, was through third party land men, who would lie with impunity. The standard story was, if you don’t lease it, with our lease, you may not get anything if they find oil. In return for signing their lease, as is, was a generous quarter, rather than the usual eighth. I knew the rest was BS, but a quarter sounded pretty good. The continuous drilling clause in that, was so weak to be non-existent. No Pugh clause. That was standard. I actually did not sign with Cheatapeake, nor EOG, but the lease wording was basically the same. My guess, is the vast majority of mineral right owners were given the same deal. Maybe not the majority of land, but certainly the number of signers. Most of the Permian was leased many years ago, with an eighth, or less. Chevron actually owns 100% on a lot, and so does Oxy, no doubt. Exxon’s acquisition of the Bass families’ holdings in the Delaware span 4 decades. EOG’s entry into the Delaware was through purchase of Yates. I believe the picture you are painting of royalty owners is distorted, for most. With, at least, the big holders, the number of wells is determined by the company. Not the lease. And most of the rest have very little capex to complete with.

There are so many mineral owners in so many different situations that it is difficult to paint all with a broad brush.

However, management of shale weren’t playing with their own money, and so what happened happened.

If we could just not keep having these quick drops like Q4 2018 and Q2 2019.

I think that it will be interesting to see what happens to all of the sub 10 BOPD shale wells. Better hope no down hole failures. Pretty hard to pay 8 figure pay packages to management on the backs of those. Lol.

I think all investors need to think about what happens when these companies start to run out of shale locations and have falling production.

Just go to shaleprofile.com and run some calculations on 2014-2016 wells in the various shale basins.

By the time you subtract 25% royalty, then severance, LOE, G & A, it’s apparent that the majority of the wells cannot payout in a reasonable time. 3-5 years.

I guess in early 2015 those of us in the conventional upstream arena were saying this. Vertical wells fell off a cliff. But shale wells (with OPM) kept on trucking.

And the stories told about break evens, which we knew were fraudulent, have proven such.

It is not necessary I “distort” the truth or generalize the role greedy mineral owners have in the overdrilling and premature depletion of America’s shale oil resources; the evidence is in every courthouse in every county in every shale oil basin in America. Google it, or better yet, go research public records yourself, as I often have to do. It is abysmal, the requirements made of Lessees, Assignees and Farmoutees to develop those shale oil resources, regardless of price, or pressure preservation or common sense. It is very much part of the problem the shale industry faces. They, and the regulatory agencies that protect them, may have brought it on themselves when they changed applicable field rules…nevertheless the big winner in all of this shale gig is the American royalty owner, RI and ORRI combined. I estimate to the tune of about $800 billion in free money the past decade. Those are just the facts, as painful as they may be.

As a side note, the Texas DPS reports 30 people have been killed on Texas oilfield roads in July so far…all in a hurry to deplete America’s last remaining hydrocarbon resources, flare its associated gas, and export the shit to Korea.

I give up. Communication is at a firewall, here. Ok, the royalty owners are the problem. I will no longer reply to any more of your tirades.

Mike.

I’m not familiar with Texas shale leases nor who the mineral owners tend to be, so I am not qualified to comment as I did.

Where I am, several royalty companies have bought fractional interests in active leases and also where production is inactive.

During the high prices we tried to lease a tract offsetting us, which had been abandoned. The wells are in the state plugging fund. The mineral owners are from a shale state, and they wanted a large royalty, much larger than had been granted here. Plus cash upfront. Plus wanted us to drill the two remaining locations within a certain time or forfeit them (which made no sense given the lease boundaries, etc. So we passed. It has sat abandoned for several more years, Wells haven’t been plugged either.

However, we have reactivated several leases from 1990s to present, and we are working on two more small ones that offset us right now. In each case the mineral owners have been relatively easy to work with.

I ballpark that we have produced over 50K BO from those reclamation projects. With royalties from 1/6 to 1/8, I’d say those that worked with us have fared pretty well.

I guess maybe when you aren’t operating near shale things are a lot easier.

Hi Mike,

I would think the smart companies would not agree to those requirements for a lease. It is a strange way of doing business, at least the way you lay it out. What percentage of shale leases would you guess have such onerous terms?

Hi Mike.

This is a whole different topic: Kayross (I haven’t heard of them) are quoted on Rigzone today as saying that Permian CAPEX data for 2018 have been underreported by some $4.1 billion. They quote Andrew Gould: Average production costs have been underestimated and production per well overestimated. He says that current shale-oil production is substantially more water- and sand- intensive than commonly believed.

Kayross: Sand and water intensity in Permian tight-oil production in 2018 is 23% higher than previously recorded, with sand demand underestimated by 9.2 billion pounds and water by 12.5 billion gallons.

Is this something you’ve come across?

I am having difficulty resolving the discrepancy between the declining production in Wolfcamp A chart above with the attached chart using EIA data the two rising Permian basins, Wolfcamp and Sprayberry. For May, the EIA is showing production of 1.36 Mb/d for Wolfcamp and no sign of rolling over. The linear fit indicates a production increase of 34,200 kb/d/mth.

I always have trouble reconciling EIA data.

Ovi

The chart shows output by year wells completed. So it answers the question what would output look like if no wells were completed after Dec 2018.

Not a very realistic scenario.

Thanks Dennis

What I missed was that there was no 2019 production shown on the chart. I just notice that the 1200 kb/d was lower than the latest EIA LTO data.

Ovi,

I think the chart shows Delaware Wofcamp only where EIA data lumps midland and Delaware wolfcamp formation together, so I expect the numbers would be different.

I can’t take my eyes off of these charts as they unfold in real time. In the last year I am back to watching every post and comment like a hawk. If this weren’t so ridiculously important, I would say I have an addiction problem and need to get help!

Bloomberg news article: “Frackers still don’t seem to realize their glory days are behind them”

https://twitter.com/StuartLWallace/status/1149104114501971968

Thanks Paul,

Chart below from that Bloomberg piece suggests that without all the external capital, US tight oil output would be only about 2 Mb/d instead of 7.5 Mb/d in May 2019. We might see relatively flat growth going forward, much will depend on future oil prices (low prices might result in decline, medium prices, flat output and high prices a small increase, perhaps to 9 Mb/d or so.

Agree, and I don’t think price increases will dent that much for awhile.

GuyM,

Yes probably 3 to 6 month lag between price increase and completion increase and majors may choose to develop more slowly so I expect if there is an increase in tight oil output it will be a much smaller rate of increase than 2017-2018 (where the annual rate of increase was about 1300 kb/d), I expect more like 400 to 500 kb/d annual rates of increase from 2020 to 2022 (on average) and then slower rates from 2023 to 2025 (maybe 200 to 300 kb/d on average). Peak will be 2025+/-1 year with gradually increasing rates of decline.

May be a longer lag. The completion crews may be dropping like a rock, again. They have to permit and drill first, and completions may be a bit sluggish to appear after that. And the funding to do that, is seriously in question, now.

GuyM,

Majors have plenty of money and they may choose to expand output if prices are right. Chevron can deal with lower oil prices and still make money, XTO not in as good a position on NRI.

Wow!

https://www.bloomberg.com/amp/news/articles/2019-07-12/cracks-show-in-the-permian-s-promise-as-shale-producers-retrench

Even EOG. Flat, at best. One could expect more rig count drops soon. Because, this does not reflect the multitude of smaller companies that make up a good portion of production.

This can be used for reference to the article for perspective.

https://www.rrc.state.tx.us/media/50413/top32producers2018.pdf

Oxy is actually three of those companies, now. Both the Oxies and Anadarko.

Up In Smoke

North American oil producers burned to through 187 billion of cash since 2012

Are these the same people who complain about government subsidies for renewable energy? Or scoff at those who dare suggest we need an all out World War II like effort to transition away from all fossil fuel use as quickly as humanly possible?

Inquiring minds would like to know!

Market Summary > Tesla Inc

NASDAQ: TSLA

243.11 USD +4.51 (1.89%)

Market Summary > EOG Resources Inc

NYSE: EOG

90.61 USD USD −0.22 (0.24%)

Jul 12, 9:58 AM EDT

Cheers!

Be sure to let us know when Musk’s vanity project pays a dividend.

https://ycharts.com/companies/TSLA/eps_ttm

https://www.nytimes.com/2019/05/02/business/tesla-stock-fundraising.html

Elon Musk and America’s Toxic Cult of the CEO

“If you have a reckless CEO who can’t be fired because it would hurt the company, then you don’t really have a company; you have a cult.”

https://newrepublic.com/article/151479/elon-musk-americas-toxic-cult-ceo

It’s not about Musk, it’s about the hypocrisy of the fossil fuel advocates who can’t see the berms in their own eyes but call out the splinters in the eyes of others.

WARNING This comment is in part a political rant.

It’s relevant here because electric cars have as much to do with peak oil as geology itself, in political and economic terms.

Sometimes in the eyes of the public, or certain segments of the people, the man and the party, or the man and the company, or even the man and the country, are pretty much one and the same.

It disgusts me to think of Trump as the man and my country, but that’s pretty much the case, in terms of public perceptions of who and what the USA is all about these days, in the eyes of people from other countries. In the eyes of his FOLLOWERS here in this country, as THEY see things, he is all about what the country IS or at least SHOULD BE.

Political revolutions require charismatic leaders, if they are to succeed. Like it or not, as contemptible and physically repulsive as he is, Trump is as attractive to his followers as the most beautiful woman in Holly Wood is to an eighteen year old farm boy who isn’t getting any except from his plain but faithful girl Minnie Fingers.

Economic and technical revolutions can and do come about MUCH sooner, and mature MUCH faster, if there are charismatic leaders.

The leader’s charisma may well be FAR AND AWAY more important than his actual personal leadership and technical skills, so long as the leader makes sure he has a highly competent and dedicated management team.

Trump’ s REAL team is competent, as evidenced by the fact that his REAL friends are getting what they want, namely lower taxes on business and big incomes, looser or not existent environmental legislation and regulations, judges who will toe THEIR line, etc. Nothing else REALLY counts, from HIS pov. All the rest is either show or distraction or a joke. Trump is president of this country because as ugly and repulsive as he IS, he has charisma by the TON, so far as his FOLLOWERS, the foot soldier voters of the R party, are concerned.

Personally I believe that Elon Musk has more personal charisma than anybody else on the planet, in terms of inspiring followers in the high tech industries, now that Steve Jobs and a couple of other such visionary guys are history.

Musk IS Tesla, and Tesla IS Musk. He has by the force of his personality held the electric tech true believers together and kept them faithful to the dream. They bought Tesla’s sight unseen because he inspired them to do so. They put money into the company based on their belief that he would succeed where everybody else has failed in breaking into the auto industry from startup status for going on a century now.

AND so far as I can determine, from reading anything relating to him personally I have run across, he has world class brains and leadership skills as well, as evidenced by his work, his technical vision, and his ability to hire a hog’s share of the best and brightest people in fields related to the electric automobile industry, heavy construction industry, and space industry.

It’s true he has over the last year or two developed a habit of shooting his mouth off unnecessarily at some considerable expense to himself and maybe to the company as well, but anybody that expects perfection in human beings has a rude awakening coming.

It’s also true that he’s been lucky. Some famous political leader, maybe Napoleon, once said SEND ME LUCKY GENERALS.

Musk IS Tesla, in my estimation. The company wouldn’t exist without him. It wouldn’t be the world’s leading company in the electric car industry, and the likeliest leader in the electric trucking industry, and additionally the leader in the space launch industry as well.

Tesla may well have a substantial lead in the autonomous car industry as well, but that remains to be seen. Tesla, or Musk, also seems to be years ahead of everybody else in the future of the inner city transportation industry, given that the Boring Company is NOT actually boring at all.

The Boring Company is admirably positioned to build the future equivalent of subways, and years ahead in the tech that will be used to build them, and I would put money into Tesla to be part of that new industry, except I don’t have any.

Call TESLA a cult if you want.

Some people consider Christianity a cult, and Christianity meets all the usual requirements of the definition, except for size.

Christianity is TOO BIG and TOO INFLUENTIAL, and has been, for over a thousand years, to be properly referred to as a cult.

A week or two ago, some of my hard core nit wit Trump supporting friends and relatives were gloating over the prospect of Tesla going bankrupt, because they only selectively listen to what they WANT to hear. This week they’re totally uninterested in electric cars.

My guess is that the electric car industry is at least five to ten years closer to maturity than it would be without Tesla and Musk.

That five or ten years might be the difference between a successful transition to a post peak oil economy and a crash and burn transition.

Some highly successful but very poorly educated southern general of the Civil War era, when asked the secret of his success, said it was paraphrased, getting thar fustest with the mostest.

Thanks GuyM,

Very nice piece with a bunch of good charts and info. The last two sentences sum it up nicely.

Such measures mean the U.S. will continue to see shale production, but the explosive surges of the past may be over, according to Janus’s Barrett.

“U.S. production in absolute terms will continue to grow,” he said. “But the pace of production increases will slow.”

This assessment concurs with your views quite well, you have been saying this for at least 6 months, I think.

Lol, it’s my opinion, but everyone has one, just like a part of the anatomy everyone else has.

GuyM,

When looking at new drill oil completions for Jan-June in both 2018 and 2019 the numbers are nearly the same, for the Permian in particular the new drill completions for the past 2 months have been higher than the rate of the past 12 months, also the trailing 3 month average new drill oil completion rate is higher than the rate for the past 12 months and also higher than the average completion rate in 2018. It will be interesting to see output levels for the tight oil from the Permian basin in June 2019.

Interesting thing happening in the world of Chinese oil consumption.

First of all, one has to understand the narrative — which is “the trade war will slow Chinese GDP and reduce its oil consumption”.

Chinese 2018 oil consumption was 13.5 mbpd, an increase over 2017 of 5.3%. Domestic oil production fell 1.3% 2018 vs 2017 and is now at 3.8 mbpd.

2019 first half — crude imports to China (the above numbers are all liquids so the arithmetic requires thought) grew to 9.87 mbpd. This is an 8.8% increase.

Scrambling then begins to align with preconceived narrative.

1) Legit scramble is the 1.3% fall in production. That would indeed require more import. So the 8.8% might become 7.5% — still jaw dropping and try not to laugh at EVs.

2) Semi legit scramble is examination of refinery status. If a refinery is down desperate folks leap to declare the imported oil is not “consumed”. Stored instead. Then one digs into the numbers.

3) Exports of fuels is up 13%. But the numbers are small. 13% isn’t a huge number of barrels. Total exports are about 1.4 mbpd, and that’s after the 13%, so growth in exports is only 170K bpd. And 170K / 13.5 mbd (total consumption) is only 1.2%.

And so, sports fans, Chinese consumption is enroute to a 6-7% growth year. That will put it at 14.5 mbpd.

It’s relentless and it will kill Americans someday unless it is stopped. By force.

” Chinese consumption is enroute to a 6-7% growth year….It’s relentless’

I’ll leave other to respond to the call for war, if they so choose.

But I will say that the USA would be wise to have no plan to import oil from beyond this hemisphere, because others, including China, will be consuming all that is available from Africa and Asia.

There will come a time when EV’s look brilliant. To some they already do.

Are they consuming oil or stockpiling it?

Again, the numbers matter. 1 million bpd for half a year is 180 million barrels. Their spr capacity is five hundred million and the last data available says it’s 410 million filled. That was for late 2018.

You can’t just imagine that you have a hundred million barrels of storage lying around that you chose not to have already filled. The whole storage meme globally is analysts making a guess about oil price, throwing together meaningless explanation and hoping the coin flip comes up in their favor so that they have ammunition for their next pay raise negotiation.

Hi Watcher,

Where do you get your info on Chinese storage capacity and such?

Sometime back,quite a while back, I posted comments to the effect that I thought the Chinese were admirably positioned to build lots of storage capacity, considering that they had the money, manpower and industrial capacity to do so, and that the economy was slow at that time. However, due to a lack of research skills, or maybe secrecy on their part, I couldn’t find much in the way of information on their storage, actual or planned.

So … If they built this hypothetical storage capacity, and put a gazillion barrels of oil in it, when oil was thirty or forty bucks…….. Well, they have made out like bandits.

I strongly suspect that they believe that no matter how much oil they have in storage, it will never be too much,as THEY see things, considering that between depletion and world wide economic growth, the price is apt to go up fast enough that they earn a respectable return on their investment in stored oil…… barring a major economic crash.

And having a huge oil reserve has to be a major national security issue for them, considering their need to import such a large percentage of their consumption.

Personally I think our own leadership is as dumb as a fence post for not having a SPR four or five times as big. It’s impossible to say how long it might be before lost export capacity could be restored if a hot war breaks out anywhere in the Middle East.

Interestingly Trump has the opposite opinion and is selling as much SPR as allowed….

Arctic sea route opens for the summer with first Yamal LNG cargo

https://www.reuters.com/article/russia-arctic-lng-idUSL8N246304

Anyone have any thoughts on why Iran is sinking so much lower than the previous round of sanctions? It looked like they had stabilized at a similar plateau earlier in the year but now they’re spiraling down again.

Could be anything. Iran has quit reporting to OPEC. Who knows where it really is. They are, naturally cheating all they can. No doubt, some elements in Iraq are helping, and Russia or China will not disclose anything. We have sanctions on Russia, and a trade war with China. Quien sabe?

Cheating?

What does cheating mean? This production number is way under the OPEC allowed quota.

This was covered here years ago. Look at a map of Iran and look up at their northern border. Oil shipments don’t have to go through the Persian Gulf. We had a great analysis here of how many small tankers go back and forth on the Caspian Sea. Pretty easy to mix Iranian crude with crude from other countries up there.

Yeah, poor choice of words.

https://bakerhughesrigcount.gcs-web.com/static-files/850b7922-b3d5-451f-9e70-364e8a4a17ce

Rig count. Down. Where the heck is Energy News??

Permian down 6, Eagle Ford down 5. Permian down 8% YOY, and EF down over 18% YOY. Total Texas down almost 14% YOY. As of the end of June, Texas completions for oil down almost 13% YOY. Getting close to that magical flat zone, Dennis.

GuyM,

Consider rig counts in early 2018 and note that the annual rate of increase in tight oil output in 2018 was 1800 kb/d. Rigs may need to fall quite a bit to result in flat tight oil output. Much depends on the number of fracking crews and the data is harder to find on that.

Oh, it’s up some. I don’t expect flat to really occur for a few months.

GuyM,

Are you expecting that oil prices will decrease? I think a continued slow increase is likely (annual rate of increase of 400 kb/d) at current oil price level or higher.

No, not decrease, but in this craziness they could. Up and down very slow increase like current. But that is Wag, for sure.

agree with that assessment, or my wag is similar to yours.

Dennis,

We can also see from the DUC data (eia) is that there is more completion than wells drilled currently. Completions are at a higher level than 2018, around 1’400 wells per months between March and June 2019, vs 1’300 in the same period in 2018. But they have to tap in the DUC wells to reach this level of completions, and DUC wells may not be as productive as freshly drilled wells.

I think it is pretty hard to guess the growth of the US production for 2019…

Agreed

The latest SRSrocco is quite interesting.

FINANCE COSTS ARE KILLING THE SHALE INDUSTRY

All true. Interesting that he picked Anadarko to comment on. Pending vote by shareholders for Oxy takeover. WAG is Shell will wind up with Oxy. Follow the stories on the Oxy jet. But, that is basically why the smaller companies will have little capex for drilling. They can’t borrow, and no cash flow.

From Rigzone , Permian is slowing down.

https://www.rigzone.com/news/wire/permian_shale_boom_slowing_down-12-jul-2019-159292-article/

I believe from this very soon US tight oil production will peak and the decline will be huge. The world is not able to face this as there will be lack of oil. Perhaps Mr. President should give some aid as the investors could at least get back some of their investment.

The July EIA Drilling Productivity Report is released in a couple of days. We’ll see what it says about the Permian.

https://www.eia.gov/petroleum/drilling/

https://www.eia.gov/petroleum/drilling/pdf/permian.pdf

Tony,

Took a look at DPR from July 15, 2019 and the trend for US tight oil for the past 12 months is an annual rate of increase of 712 kb/d. For the past 5 months the annual rate of increase is a bit higher at 800 kb/d. The DPR is often on the optimistic side, so I still like my earlier estimate of 600+/-200 kb/d for the annual increase for US tight oil output in 2019.

Another article on Permian slowing down

https://finance.yahoo.com/news/shale-boom-permian-slowing-down-100000463.html

An understatement.

https://seekingalpha.com/amp/article/4274378-oil-and-gas-capital-flowing

Interesting. Marshall Islands would follow US, along with Panama. Bunch of Iranian tankers without a flag country.

https://mobile.reuters.com/article/amp/idUSKCN1U72DS

The early season hurricane in the GOM is going to put a major dent in US July crude output. Around 60% of production is shut-in and will be that way for around a week. This storm is weak but so sprawling there is a huge area of the Gulf flying helicopters is dangerous

Not the Big One for the industry, New Orleans or Houston by any means. Still, Gulf is hot and favorable for storms this year.

The weird part, is that it started forming over the US, and then went to the GOM.

I’m more than a little anxious about this week. Both the Dow and S@p500 have a broadening pattern or some people call it a megaphone pattern sitting on top of them. Both are touching the upper boundaries at close on friday. Like to the pip touching. On monthly chart both have a massive amount of what is known as classical bearish divergence.

Meaning price is making higher highs while the oscillator is making lower lows. RSI (Relative Strength Index) is the oscillator i use most often. Possible end of current uptrend for US equities. The set up could be the possible end to the up trend from 2009. Meaning the all time high is in and it isn’t going any higher. Which is why i’m more than a little anxious to see what happens.

Dollar index. If you use the RSI and look at the dates of 09/17/2018 – 01/28/2019 – and – 06/24/2019. The RSI is making lower lows while price is making higher highs. This is what is known as hidden bullish divergence. Meaning dollar index is likely going a lot higher just judging by it’s structure.

10 year likely hit a low. and will work it’s way back to 3%

Trendline resistance on WTI chart coming off the 2018 highs back in last october comes in at just tad above $62. So some pretty strong resistance should be met there and price should hit it this week as it’s not but maybe $1.50 away from current price.

You do know this is not an investment blog?

And you presumably do know the United States owes about 22 trillion dollars, and each 1% on that is 220 billion?

The FED buying bonds could not possibly have a more compelling reason than that.

Don’t give a crap if this is an investment blog or not watcher. If that top on US equities plays out like they normally do. Your going to see a sea of red on monthly charts.

Go compare any time period where there is a lot of red on monthly charts of US equities and you’ll see WTI and Brent didn’t do very well at all.

I don’t come on here and post my damn charts. And i’m not going to. I’m just giving an opinion on where price is ahead. Dennis gives his opinion about price everytime he does a chart because a lot of his assumptions are based on higher prices coming.

Knowing what i know about global pensions funds. And Dennis is projecting peak oil around mid 2020’s. The Mother of all financial crisis is coming. Between now and 2030.

But keep telling yourself The FED and other central banks can abort a bad ending with unlimited money. People who believe that truly don’t understand how money works. Also why monetary policy should have never been used in response to 2008-2009. We should have ate our peas then.

What FED should do is set rates at 7% and keep them there and let all the chips fall wherever they do. That won’t go over too well though. But what the FED doesn’t tell everybody is when they do cut rates they can’t ever really raise them back up. How negative can rates really go? That is the question. When the price of money can no longer go any lower the game they are playing is over.

Europe and Japan are a lot closer to endgame than the FED is by the way.

You need to understand what a bad ending is. You don’t seem to know.

A bad ending is not when lines on a screen go down. It’s not when asset price numbers decline by 50 or 60 or 70%.

A bad ending . . . a collapse . . . an implosion . . . all the favorite words for this sort of thing, equates to 75-85% global population decline over a period of 12-24 months. You don’t have that, you don’t have a big deal. You get loud talk and hands waving over the heads of guys in suits. You don’t get more graves dug. Only graves matter. The rest is pretense.

If deaths are threatened because non-physical numbers on a screen have a value, then declare the numbers changed. By decree. You think an equity smash down 80% and hints of deaths occur, you think we can’t have a govt decree that all trades of that day or recent days are now cancelled — you think voters with 401Ks would oppose that? There would be no opposition other than shorts, and suspending court funding to hear any such lawsuits is another item that would see no opposition.

A peak in oil production, assuming oil is defined exactly the same way it was defined at all historical parts of its curve, also isn’t all that determinant of big body counts. It only becomes so if demand (not consumption) continues its relentless spike upwards. If people want it, if they desperately want it or need it, then unavailability and lowered consumption gets you body counts, either from mushroom clouds or starvation.

None of which has to have anything to do with squiggly lines on Wall Street graphs.

You need to learn how to keep score. The score is kept in dead bodies, not dollars.

Land ≠ Money

Kid: “Dad? Why are there rich people?”

Dad: “What do you mean by rich? You mean like in spirit?”

Kid: “No-o-o-o-o… Like they have lots of big houses and cars and money!”

Dad: “Ohhh, you mean those kinds. Well, you see, sweetie, our society allows some people to make more money than other people, working no harder than anyone else. Society then allows those with more money to acquire more land than others. Over time, this creates the dynamic for most, if not all, problems we have in society today, like landlessness, homelessness, poverty, social unrest, war and collapse.”

Kid: “Why does society allow that?!”

Dad: “Corruption. Society uses force to uphold undemocratic, unethical laws that say that one person with more money can have more land than another with less money.”

Kid: “Why can’t we stop that!?”

Dad: “Corruption again: This setup is upheld by people with guns and weapons, or access to them, like police, security guards and military people– people (among many others) who often don’t understand this basic and very simple immoral core of our society.”

Kid: ” ? ”

Dad: “Ya; ? “

Japan has demonstrated that when it comes to economics there is no end game. As Watcher often says a pretend system can be manipulated any way you want. Geology can’t. On a side not I have visited Japan every summer for 20 years and I take note of change and it is fair to say the infrastructure is falling apart. Simply not enough workers to keep up even with endless money supply.

HHH, I don’t usually agree with your analysis or conclusions, but I enjoy reading them and feel they help me sort through things. Confirmation bias is something we can all get trapped by if we don’t continue to look at things from different perspectives. This applies to the peak oil question as well as investments.

One of the other common bias is that most on this board and many energy investors over weigh the effect of North American production and inventory. Thankfully Ron keeps reminding us about the rest of the world with posts as above. There are a bunch of countries struggling to maintain production, and a surprise could come from anywhere. Political, economic or resource depletion could all trigger drops.

HHH,

You are correct that low oil prices will result in lower output. I have explored the case for tight oil where oil prices never rise above $70/b for Brent oil in 2017$.

The chart below summarizes my best guess cases for US tight oil for two oil price cases shown on right axis. If oil price is lower than the “low oil price scenario”, then output would be lower if no other model assumptions are modified (well costs, land costs, OPEX, transport cost, taxes, royalties, discount rate, interest rate, etc).

An economic crash will undoubtedly reduce demand for oil, I do not think I can predict future economic output any better than I can predict future oil prices.

So I simply assume IMF estimates of future economic growth will be roughly correct (this often proves in practice to be a poor assumption.)

Note that the $70/bo oil price is based on comments at oilprice.com where a prominent member believes oil prices are likely to remain at $70/b in the medium term (about 5 years), I simply extended that assumption to see the effect on tight oil output.

Hi there Triple H (HHH)

“Knowing what i know about global pensions funds. And Dennis is projecting peak oil around mid 2020’s. The Mother of all financial crisis is coming. Between now and 2030.”

Interesting comment you made there. I’d be very interested to know more about your knowledge and opinions. Wold you ever consider a guest post on this fine blog, (if they let you haha)? I’d like to read more of what you have to say, and why, if that interests you.

Thanks for the interesting comments you bring here.

I have disagreed with some of you about the likelihood of a traditional war.

I think this is the future. It is much cheaper for countries to launch.

https://www.politico.com/story/2019/07/13/trump-cybersecurity-defense-1415650

“No Energy store holds enough Energy to extract, collect and utilise an equal amount of the total Energy it stores.

No energy system can produce sum useful energy in excess of the total energy put into constructing it. EVs, too!

This universal law is applicable to all energy systems – the sun, nuclear fission and fusion, wind, solar, hydro, galaxies and you name it.

Humans have never managed and will never manage to extract, collect and utilise one unit of excess Energy expanding less than one unit of Energy – all along.

All forms of power production humans have today are gold-grade fossil fuels derivatives.

This includes shale oil and gas.

Energy, like time, only flows from past to future” (The Fifth Law).

ROFL, great comedy! Thanks.

“No energy system can produce sum useful energy in excess of the total energy put into constructing it”

Sorry to say you are wrong, especially since you so carefully selected your brand name, advertising and website.

Simply, you forgot about plants, here on planet earth.

Imagine how much more energy one acorn turned to oak can collect, store and distribute over 300 years, than it carried into life.

In this real world.

Oh, and the sun doesn’t count in this equation.

Lets be clear.

Its in a different system. Out there.

Despite reading here for years, today i post my first comment. FRED contains a wealth of information, for example data for car sales, displayed below.

https://assets.wallstreet-online.de/_media/1591/board/20190713210220-uscarsaless190713.png

This image demonstrates the influence of current oil prices on consumer behaviour.

It is not possible to extrapolate this curve in such away that it combines higher oil prices and a flourishing car industry.

What is D and F. Are the sales monthly? Pls provide some commentary or a few words from the WSJ

Domestic and Foreign Autos, data from:

https://fred.stlouisfed.org/series/LAUTONSA

Because the high variation of sales numbers, a 12 month average is used for the y-axis.

The x-axis is C+C production per day from EIA, times WTI cost per barrel, averaged per month.

https://www.eia.gov/beta/international/data/browser/#/?pa=0000000000000000000000000000000000vg&f=M&c=00000000000000000000000000000000000000000000000001&tl_id=5-M&vs=INTL.53-1-WORL-TBPD.M&vo=0&v=T&start=199401&end=201903

Because EIA has about three months delay, the last three months are from OPEC MOMR, with a correction factor.

None of that makes sense. China alone buys about 24 million cars per year. Your vertical axis says the US domestic and foreign sold 450K cars last year. Correct number for vehicles is about 16 million.

You might also want to look into FRED’s definition of car. Sales are over 2:1 SUVs / light trucks now.

Sorry, i missed the light truck numbers. Sales are per month, but averaged about the last 12 months. Including light trucks, the graph is very different, and much less dramatic.

https://oilprice.com/Energy/Energy-General/IEA-Huge-Oil-Glut-Coming-In-2020.html

As long as this BS continues, oil prices will stay low. More BKs and mergers, and flat shale output. Because, it’s now official, big oil determines Permian output. Which will not be recognized much until 2020. Because, the elevator do not go to upper floors. I wasn’t going to call it until an Oxy takeover by a major, but I can finish the sentence with the words we have. Final conclusion will have to wait for the official autopsy, but the doc needs to be smart enough to know that the patient died. May be quite smelly by then.

GuyM,

As Mr Cunningham points out in the end of that piece, the forecasts for US tight oil growth are probably wrong as completion rates are likely to slow down. It is possible that growth rates in tight oil output might increase if oil prices rise. One problem with some of these forecasts is they look at total stock levels rather than crude, light distillates, middle distillates, and fuel oil. There may be quite a bit of growth in “other products”, such as NGL, but those products are less important and supply is relatively amply (they are mostly a byproduct of oil and natural gas production and with the exception of pentane-plus are less important for fuel supply for transportation).

In addition a lot of pipelines are being built and some of the increased “stocks” are used to fill those pipes, a better measure is days of forward demand and by that measure OECD commercial stocks have been flat since 2018Q2 at about 60 days. There has been no “huge” surge in stocks since 3Q2018 when days of forward supply increased from 58 to 60 days for OECD commercial stocks.

Eventually the market will get this right when the 2Q2019 OECD estimates come in in August or Sept, they may well have decreased from 1Q2019 levels as US tight oil output may continue its rate of increase at only one fifth the 2018 rate of increase (2018 annual rate of increase 1800 kb/d, past 7 months the annual rate of increase was 340 kb/d).

Perhaps by 2020 the market may realize that oil supply is short.

Attached is a chart that compares the DPR monthly production predictions for the Permian basin with the actual production increases as reported in the DPR. The EIA has just issued the July report.

As can be seen, the production volatility between Jan 17 and Jan 19 is very high. This indicates that they didn’t have access to good data from many drillers. However, It appears that something has changed as of Jan 19.

The variability has decreased and the actual production numbers appear closer to the predictions. More significantly since May, the monthly increases have been closer to 40 kb/d with the August prediction being 34 kb/d. In early 2018, their monthly predictions were closer to 80 kb/d and nowhere near the actuals.

For all of the LTO basins, the DPR predicts an increase for August of just 49 kb/d. If true, it is not clear to me how OPEC and the IEA are seeing US production increases of 1.5 Mb/d to 1.7 Mb/d for 2020 unless there is a significant increase in drilling activity. At this time all of the indicators are in the other direction

Not a big fan of the DPR. Apples, Oranges Times bananas yield ???

The whole point of the post is to show that maybe they finally got their act together. They are certainly doing better than OPEC and the IEA.

Ovi,

I agree the DPR is better than in the past, it would be better if they modelled rigs in separate categories vertical oil, vertical gas, horizontal oil, and horizontal gas, but in any case it is better than a few years ago. Agree it is better than OPEC and IEA estimates of all liquids output, a number that was never very useful.

Yes, granted, they are. Even the usually strange weekly is within reason. Over, but within reason. I take their monthlies as very close to reality. Their projections ain’t so realistic, just justified numerically.

GuyM,

The AEO 2019 tight oil predictions are not bad through 2026 or so, after that I agree they are not very good at all.

Ovi,

They may be using YOY comparisons and the fast growth of 2018 makes those impressive. They might also be expecting some increase in GOM output as their are a number of projects close to completion or currently being ramped up. SouthLaGeo has better information on this. I think he expects perhaps a 300 kb/d increase in GOM output from Dec 2018 to Dec 2019, this still would be far below the OPEC and IEA estimates for US C+C increase which I agree are too high by at least a factor of 2.

Another problem with both IEA and OPEC estimates is they focus on all liquids output, so perhaps much of this increase that they expect is NGL from associated gas and Appalachian Natural Gas output.

The international statistics are not very useful, except the EIA’s statistics which focus on C+C, unfortunately the EIA statistics are reported very late, with the most recent update only through March 2019.

https://www.marketwatch.com/amp/story/guid/1D0C8511-8ECD-484F-9286-7F5B84A284A8

Odd one. But, Carrizo is in the EF, and Callon in the Permian. Combined Texas production about the size of Anadarko or Apache.

This won’t make the papers like Callon and Carrizo but it is very interesting nonetheless.

Natural Gas Partners (NGP) a private equity group based in Fort Worth has started rolling up the Permian companies it has funded.

Bluestone Natural Resources, Bravo Natural Resources and Blackbeard will combine, The surviving company will be Blackbeard who has offices in Midland and Fort Worth. Bravo and Bluestone people will be working themselves out of the picture over the next month or so.

Last year, NGP started rolling up its Oklahoma companies to sell primarily because it recognized that real liability exists from SWD induced earthquake damage in the SCOOP/STACK and MERGE plays. And also because the plays suck.

It’s a big deal. They are also invested in Centennial, and many others. 20 billion in investments, and they are starting to shrink.

Callon is offering a 25% premium in an all-stock acquisition, based on Friday’s closing prices. But it’s the absolute price that tells the real story. Carrizo is selling out for $13.12 a share, getting it back to where it traded just less than three months ago – and way below the $23 level where it sold a slug of new shares last August. If Callon is engaging in some bottom-fishing, Carrizo is nonetheless grabbing eagerly at hook, line and sinker.

Carrizo’s decision to sell with its stock trading close to its lowest levels in a decade is the salient fact here. It is being paid with stock and its shareholders will own 46% of the enlarged Callon, so they can participate in any gains once the deal is done. They’re better off not looking too closely at their screens on Monday, though: Callon’s stock slumped by as much as 17% Monday morning, wiping out the implied premium.

https://finance.yahoo.com/news/shale-frackers-decision-sell-says-150950126.html

https://oilprice.com/Energy/Energy-General/Shale-Investors-Fear-Bloodbath-As-Earnings-Season-Kicks-Off.html

Ok, the more I read his stuff, the more I understand the more where he is coming from. You have to read his last paragraph.

Four months, Dennis. Price will waver slightly to the upside, before reality sets in. Discounting, even slightly the shale myths is going to take time, and harder numbers. Investors grasp it now. Oil traders and paper traders in oil are a hard nut to crack, because all they believe in is EIA, opec, and IEA. Which will be the last group to get it.

GuyM.

Similar deal in grain trade.

Lots of Ag professors at major universities study grain trade. I listen to some of their podcasts. This is what they say in unison.

Right now the US corn and soybean crop is not looking good. But the funds do not so crop tours, talk to farmers, fly drones over fields, etc. So as long as USDA says all is well, grain prices stay low.

USDA estimated 91.7 million acres of corn planted most recently. None of the Ag professors believe the number, nor do the various independent traders I listen to. But the funds went with it and corn sold off limit down.

That’s a very close comparison. Very interesting.

So as long as USDA says all is well, grain prices stay low.

https://www.axios.com/trump-administration-moving-hundreds-usda-scientists-dc-kansas-city-c53e4520-c37c-4a40-8770-51a584b3d183.html

Trump administration moving hundreds of USDA scientists from D.C. to Kansas City

Details: ERS jobs remaining in D.C. mostly belong to “administrative staff, analysts who perform market outlook estimates and those who collect data,” according to internal documents reviewed by the Union of Concerned Scientists. Their analysis showed that “[e]conomists and other ERS researchers who make conclusions from that data are likely to be reassigned to Kansas City” — but the USDA disputes that.

May you live in interesting times! (Chinese Curse)

WJ Clinton moved the toxic wizards of the FDA to Arkansas. The Elephant in the Room is the unfunded/unacknowledged $40 Trillion (?) Liability for Gov Mules. Get them out of DC for Resiliency.

Both were (and are) corporate whores–

The proletariat can argue who is the worst—

Clinton is a bit brighter, but the Fat Guy is not hampered by any moral decisions.

They guy in the White House is Trump and whether or not he accepts responsibility is irrelevant, the buck stops at his desk. What Clinton did or did not do is water under an old and very rickety bridge. As much of a slimeball as Clinton may have been, at least he understood that certain policy decisions have consequences for the welfare of the entire planet and he wasn’t hell bent on deliberately blowing things up just for the sake of doing so.

The fact of the matter is that the Trump administration doesn’t want the truth about a lot of what the USDA scientists are reporting out of the bag. A lot of it isn’t good news!

Furthermore this was a blatant move to silence them!

https://news.vice.com/en_us/article/evy9ew/usda-scientists-are-quitting-in-droves-thats-really-bad-news-for-climate-research

The researchers’ union anticipates, after an unofficial count, that as many as 80 percent of the employees are planning to quit rather than move, and that will disrupt entire fields of study, ranging from honeybee pollination patterns to how crop prices fluctuate with changes in consumer demand. Their positions will take years to fill, if USDA staff recruits new hires at all.

“Toto, we are not in Kansas anymore!”

One wicked witch down one more to go!

Cheers!

“As much of a slimeball as Clinton may have been, at least he understood that certain policy decisions have consequences for the welfare of the entire planet and he wasn’t hell bent on deliberately blowing things up just for the sake of doing so.”

I’ll disagree vigorously on that one. Clinton repealed Glass-Steagal doing immeasurable damage to the entire middle and upper middle classes. We’re going to be eating the losses from that overt move towards financialization for the rest of everybody’s lives on this board, and several generations past that.

Without the resources to re-build or construct anew, very little can be done compared to had we been prudent instead.

That’s just one example. Clinton was awful. So was Bush. Obama too. Now Trump. See the pattern?

It’s almost as if the president is a meaningless distraction and there’s an embedded state function that chugs along courtesy of the several million non-elected federal employees.

That’s just one example. Clinton was awful. So was Bush. Obama too. Now Trump. See the pattern?

Yes, I do see a pattern! Clinton, Bush and Obama really awful for Americans and I do take your point about Clinton specifically. I’ve never been a fan!

Now Trump is a real danger to the entire planet. I also get the distraction bit and consider Trump to be a puppet but The planet is going to hell in a hand basket and Trump happens to be the figurehead stoking the fires! I consider the damage he is doing to American prestige on the international stage to be off the charts.

In the 1930’s Populism, Fascism and Ultra Nationalism led to WWII with profound consequences for Europe and the world. In the 2030’s it might literally lead to the end of industrial civilization and the extinction of most life.

To be clear, my personal view is that the ‘Global Economy’ is a subsidiary of Ecosystems Inc. Your views may differ.

Cheers!

“The researchers’ union anticipates, after an unofficial count, that as many as 80 percent of the employees are planning to quit rather than move, and that will disrupt entire fields of study, ranging from honeybee pollination patterns to how crop prices fluctuate with changes in consumer demand. Their positions will take years to fill, if USDA staff recruits new hires at all.”

Clasical big business move. Want to downsize? Move business to a far away place, people leave, you haven’t laid people off, blame it on natural wastage.

NAOM

GuyM,

Do you mean that it will take 4 months for the oil price to start to increase as the traders remove their heads from uncomfortable places?

Mostly, yeah.

Is Bakken directors cut overdue?

https://www.chron.com/business/energy/amp/Icahn-takes-another-shot-at-Oxy-Anadarko-fiasco-14044142.php

Per Icahn, he wants a buyer for Oxy. But, I don’t think that differs much from management’s goals. The benefit for mgt would probably be less under him, and no doubt, a different buyer.

Neither one is anywhere near healthy, but it combined size may make it more attractive for a merger, buy, or whatever.

https://www.bloomberg.com/amp/opinion/articles/2019-07-15/callon-petroleum-buying-carrizo-oil-gas-reveals-fracker-woes

Interesting read – 2020 looks to be a big consolidation year for shale. The wheat is getting separated from the chaff, as big banks don’t appear to be interested in loaning to smaller tight oil cos that haven’t ponied up. Specifically, EOG, Pioneer, Chevron, and Exxon look set to come out on top and possibly be the only players of any significance in shale, likely by the end of 2020.

https://oilprice.com/Energy/Energy-General/Shale-Investors-Fear-Bloodbath-As-Earnings-Season-Kicks-Off.html

Oh, don’t forget about ConocoPhillips and Shell. Shell is looking to be a bigger player. And the other top 32? Who knows.

Suppose there’s a subsidy. Then what?

Suppose oil supplies are unlimited. Or that BEVs fall to half their current price level, or that subsidies for BEVs continue.

Many different suppositions could be made.

North Dakota has published their May directors cut. May prelim is 1393284 up 799 from the revised April of 1392485.

They have 91 (revised) completions in April and 94 (preliminary) in May. EIA has 129 in April and 126 in May. And EIA has a lot less DUCs than the directors cut. Where is the difference??

Toby,

EIA includes Montana and North Dakota in their Bakken estimate so that is part of the difference, where can completions be found at the EIA?

Bakken/TF was basically flat, a change of less than 1 kb/d and at 1337 kb/d well below the peak of 1347 kb/d in Jan 2019.

https://www.dmr.nd.gov/oilgas/stats/historicalbakkenoilstats.pdf

https://www.eia.gov/petroleum/drilling/#tabs-summary-3

There is an Excel file “DUC data” where completions are listed by month. More than 30 completions a month in Montana seems to be weigh too high…

Thanks Toby,

The alternative explanation is that the EIA data is not very good, for North Dakota Bakken tight oil completions your best bet is shaleprofile.com

https://shaleprofile.com/2019/06/19/north-dakota-update-through-april-2019/

Looks like it might be 30 completions per month in Montana, or the EIA estimate is just not very good.

And how do 700 DUCs in the Bakken (EIA) compare to 985 DUCs in NoDak alone according to the directors cut? I think that´s just guesses. A little more than 90 completions in NoDak sounds reasonable to because more completions should have resulted in more production growth. It Looks like NoDak Needs around 90 new wells a month just to hold production flat.

Toby,

No idea on the DUCs, often the EIA data is model based and not very good. As I said, shaleprofile.com data is very good, the best free data available, in my opinion.

Enno Peters does an excellent job.

They have activity in Montana, but 30 is not close to likely. EOG is up there, but not much in 2019 plans.

GuyM,

In my opinion where there are errors are probably in the DPR. I have no clue what the completion rate is in Montana.

Looking at Montana data from the state of Montana there were only about 3.4 horizontal oil wells per month completed in Montana in 2018.

For all oil wells completed in 2018 it was about 4 per month in 2018 in Montana.

http://www.bogc.dnrc.mt.gov/WebApps/DataMiner/Wells/WellCompletions.aspx

North Dakota Monthly Oil Production Statistics through May, 2019.

Yeah, that looks pretty flat. Gonna stay that way, or down a tad.

GuyM,

I agree, at the present oil price level. If they go up output may rise and if oil prices fall output may go down. Much depends on the price of oil which is muy dificil to predict.

And again, as usual, no evidence of that. Look at the chart. Extend it back to 2014. Oil’s price has varied a great deal over the last five years, but clearly mostly way down from 2014. No sign of it in the production chart. It’s relentlessly upwards. Didn’t care what the price was.

And that’s the end of the analysis. The presumption of price being determinant only has to fail once to be proven invalid. There’s the chart and we know the price has varied all over the place. It’s certainly far down from 2014, but guess what. Bakken production is not.

Game over. Hypothesis fails. Stop pretending.

Just take the supply with OPM from Investors and retirement fonds as benchmark.

While not at positive cashflow – no space left on the credit card no drilling.

That’s why investor sentiment is important now – are they still buying the bonds and the stocks to get new money?

Oil price is important too – because it determines how much additional capital they need.

In the past that was no problem – if you have limitless credit on your card you can shop limitless.

Watcher,

Depend how much price falls. Output of tight oil decreased from March 2015 to Sept 2016, primarily due to oil prices decreasing. The increase in price over the 2016 to 2018 period led to rising tight oil output. Changes in costs to produce oil as plays are better understood (Permian basin tight oil mostly during 2015 to 2018 period) and output per well increased is a complicating factor. Not only price determines output, things are never as simple as you assume.

Meaningless gobbledygook. Repeat after me. You only have to fail once for a hypothesis to be rendered invalid.

Don’t equivocate about costs and then pretend that your hypothesis is intact. If price does not determine production and something else does, then price does not determine production.

And don’t wave hands over head and try to make a case for it being a special case. Not more than a few months ago we talked about another occasion where price clearly and absolutely did not determine production in any way whatsoever, throughout the early 1940s. Price didn’t determine production and supply and demand did not determine price. End of theory. Find another.

Put the silliness away. It is normal for other factors to determine these things. It is abnormal for something like price to be the major issue.

One failure ends a theory. We know of many. The theory is ended.

Watcher,

Your math skills seem to be limited to equations with a single independent variable.

The world seems to be quite a bit more complex than that.

Costs are not fixed, and there are multiple different formations in both tight oil and throughout the World at different stages of development.

I am pretty sure an oil pro would tell you that the price of oil will affect their decisions on whether to develop a well or not, but once the process reaches a certain point the project will likely go forward and the oil may be produced because sometimes (perhaps always) shutting in the well will do damage, rates of production might be reduced in a low price environment.

For each well drilled and every project considered the economics will be unique, but for any single decision the price of oil will be one of many variables that will affect the final decision.

This is not a hypothesis, it is a fact, though I will defer to Shallow Sand or Mike Shellman who actually have made these decisions for many years and know far more than me.

I think the discussion was the 30s not the 40s during the Great Depression (ended in 1939),

you seem to not understand what demand is.

It is not the desire for a good, it is desire backed up by money to make the purchase.

Pretty basic stuff. You also don’t seem to get that supply and demand determine the price of a good and either curve can shift for a multitude of reasons, you can call it hand waving, I call it reality, things change always, it is the only constant.

Money Versus Gun

You and I are at a pool of oil that, in its entirety, both of us somehow needs badly/very soon for our survival (let’s say for a few salads) but only one of us can have it because it is not big enough for another…

There’s someone, completely unarmed, who claims it, standing along with us who’s willing to offer it to the one with the most money…

You have lots of money and are also completely unarmed, and the price is affordable to you. I have no money, but a gun…

Who likely gets the pool of oil?

Marx And Ethics

“Marx also argues that in a developed exchange economy, money replaces need as the mediator between human beings and the object. If I have a real need or talent, but no money, the need or talent may well remain unrealized and even may appear unreal and imaginary. On the other hand, if I have money but no true talent or need, I can easily realize my slightest whim. Thus, money distorts reality; it turns essential reality into an unreal dream, and mere whims into reality.”

Two quarters of land with copious amounts of sand sold for 20 million dollars. Far more value in the sand than 20 million dollars paid for the two quarters of land.

The sand will be used for fracking Bakken wells.

Expect the Bakken to begin to produce more oil, not less.

The numbers don’t lie.

Bakken might increase a bit more, much will depend on the future trend in well productivity, I expect the average new well EUR in the Bakken/Three Forks will eventually start to decrease, perhaps we will see evidence of this by 2020. Once this starts it will relentlessly decrease and output will decrease as well completion rates may decrease due to lack of profit. Depends in part on oil prices, if oil prices rise enough to make the wells profitable, then flat output might be maintained for a couple of years, but by 2024 under any reasonable oil price scenario, Bakken/Three Forks output will start to decline.

Watcher,

Did you look at the chart? It only goes back to May 2016. Oil prices have mostly been trending higher from May 2016 to Oct 2018.

In fact the ND output was pretty flat from May 2016 to July 2017 and then tracked up with oil prices from July 2017 to Oct 2018, the fall in prices after oct 2018 then led to flat ND output, often there is a lag between prices and output as it takes time to drill and complete a well, typical lag is about 6 months.

tight oil output and WTI oil price (nominal)

That shows no correlation between investment decisions and output. Extremely low prices slowed it down but didn’t stop it despite any wells being drilled then being money losers. And it started soaring again at $50, which we now also know is an unprofitable price.

It hasn’t been economically driven at all until now.

As I’ve written above, now as formula:

(Nr_of_new_wells) = ( (Oilprice)*(NrOfBarrelspumped) + (NewDumpMoney) ) / (CostPerWell)

A high oilprice can increase wells – or new dump money. To maintain production at sinking oil prices the amount of dump money has to be increased – so more staff doing flashy Powerpoints are needed.

In this model the paying of dividends is not included – when the oilprice rises enough to not needing OPM anymore, production is increased relentless until it is limited again by OPM.

Propoly,

Lower prices reduces profits ceteris paribus, and higher oil prices raises them.

There is a lag between price changes and production changes of 4 to 6 months. Also output per well improves as the nature of newer plays becomes better understood.

So we would not expect perfect correlation in a complex relationship where multiple variables are changing.

“The issue is that to complete more wells, you need to spend more capex. And to spend more capex, you need to spend outside of your cash flow. This requires shale producers to access the capital market, which is no longer available even for the leanest of producers. In addition, investor pressure on disciplined capex spending means less capex, not more.

This combined with the increasing treadmill effect will be the ultimate drag on US shale production. This doesn’t mean US shale production won’t grow this year, but it means that when it does stop growing, it will do it in a blink of an eye and catch the world off guard.”

https://seekingalpha.com/article/4275164-shale-oil-well-productivity-stalls-putting-growth-estimates-risk

It won’t come close to that for 2019. Otherwise, the overall graph is more realistic, than in the past.

Striking is that it has been essentially stagnant for almost a year. All but certain that will prove out over the next couple months. Remains to be seen if this is a coincidence between particularly bad winter, mediocre prices and growing cutbacks in funding. Or if this level is at or slightly beyond the sustainable max in the real world.

Very interesting graph. If flat when still manage to compleate DUC to 60% of a cost of a new well than there should soon be a decline if oil price remains at 50 range WTI. I guess the Companies already know what DUCs gives the lowest break even price and highest cash flow, that they might first compleate. In the mean time some increased activity and investment is ongoing offshore where it seems some fields have suitable profit with brent 50 usd/bbl , but this new oil that might come 3-5 years from now cant replace the drop in US shale as a consequence of changed incestors strategy , first they need to show profittable Buisiness to get access to funds.

No, they don’t Freddy, and that’s the core reality.

This is society’s lifeblood that we’re talking about. You will never allow yourself to die, literally die, because of a substance created from thin air by central banks. If these people have to have access to funds to make the lifeblood of civilization flow then access will be provided, regardless of profit.

It won’t make any difference. You can’t fight entropy with printed money. The entropy of the oil we get is increasing. It is less concentrated, less usable, and requires more energy to obtain and transform.

If you print the money what it means is that a larger share of the economy is dedicated to obtain the oil (even if we don’t notice), and as a result the economy performs worse and society becomes more fragile. That path leads to a sudden simplification, also known as collapse, as per Joseph Tainter.

I think rationing would make more sense. So much of oil goes to non-essential uses. People don’t “have to have” oil to make trips to the grocery store in SUVs. A country doesn’t have to print money to keep that oil flowing.

Pretty amazing to see all these hypotheses regarding the plateauing in Bakken production with little (no?) mention of the largest, most proximate reason being the limits on gas flaring.

Helms has only mentioned it about a gazillion times.

For folks who track any of the real world events occurring in western North Dakota, the owners of DAPL are planning on increasing capacity from current 570 000 bbld to 1.1 million bbld.

There are 2 other proposed takeaway pipes targeting the PRB, Bakken, and DJ regions for sourcing with ultimate capacity in the 300,000 bbld range.

And, again, for those looking at real world events, the ongoing advances in completion/production (especially flowback) techniques should recognize that tier 1 acreage is actually growing.

A great many of these techniques bode well for the future wave of refracs.

As an aside, the Liberty Resources EOR project is continuing.

Collaborating agency NETL posts ongoing status reports.

Hi Coffeeguyzz,

I agree there is no peak in Bakken oil production yet. Looking at total production of Liberty wells I have to say that this might be the reason why they have no more rig running in NoDak. There are several wells from 2017 that haven´t made 50 thausand barrels. Wells from january 2018 are below 150 thausand Barrels. There is indeed tier 1 acreage left to drill, but it is not operated by Liberty.

Toby

No doubt that Liberty owns somewhat marginal rock.

When they (Liberty I) bailed out of the Bakken in 2013, it was clear, at least in hindsight, that they preferred to get the money upfront rather than spend decades slogging it out in a fiercely competitive, capital intensive industry.

When they re-entered the Bakken a year later with Riverstone’s financial resources backing them, Chris Wright and his team set about – on this somewhat fringe acreage – to develop cutting edge fracturing/completion/producing protocols that might lead to industry wide productivity gains.

The spinoff Liberty Oilfield Services has earned perhaps the industry’s highest regards for fracturing expertise.

(An unidentified – to me – completion company recently came all the way across country from North Dakota to Tioga county, PA, and fractured 3 wells on the Kinnan pad.

Operator SWEPI (Shell) has declared that these wells are their best performing AB wells to date).

So, all in all, looking at Liberty’s production alone might obfuscate, somewhat, the “bigger” goals of this outfit.

Coffee,

I don’t pay much attention to the AB.

Why are these 3 wells better than any other well in the area?

Has SWEPI, disclosed any info other than IP ?

How long have these wells produced? What are SWEPI’s future plans for this pad and the area around it? How many wells are planned for the rest of this year?

John

These Kinnan wells were said to be the best SWEPI wells by a local on a Pennsylvania landowners site – gomarcellusdotcom – who, apparently, got that info from a Shell press release.

These are not better, currently, that the Painter 2H, which has 5.3 Bcf with 234 days online.

The Painter is now owned by Montage Resources and is, I believe, over 14,000 lateral length.

The 3 Kinnan wells – 21/23/25 – has produced just over 2 Bcf each with 141 days online.

They are all currently (May report … came out the other day) flowing at 15.6 MM cfd on restricted choke.

I am unaware of precisely why SWEPI would describe these Kinnan as their best, but they follow a multi year long pattern of SWEPI bringing on 3 wells at a time, same pad, and flowing on restricted choke until line pressure is reached.

At 15+ MMcfd at the 5 month mark, these wells surpass previous wells’ production.

There have been rumors that SWEPI may suspend AB operations, but their CEO is on record as being very bullish with unconventional operations.

They currently have almost 1,000 permits on about 250 pad sites.