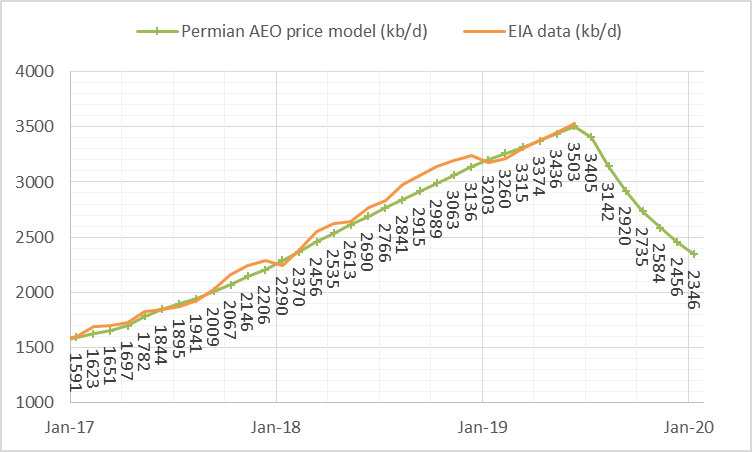

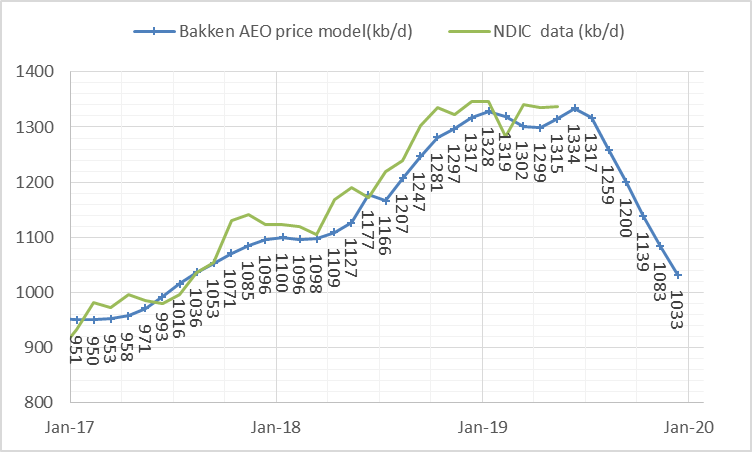

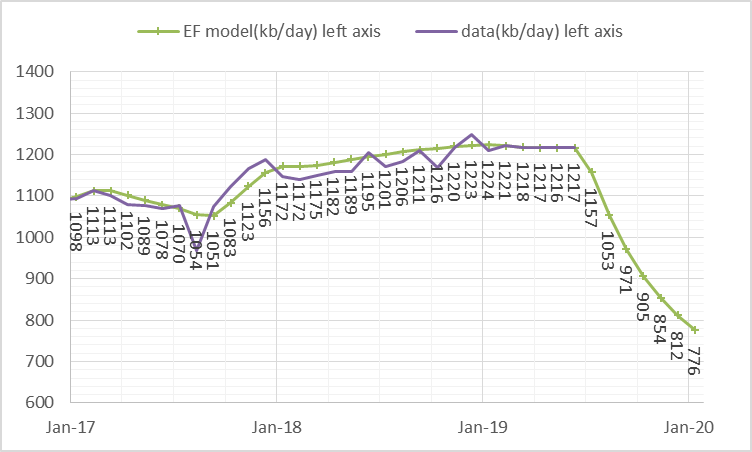

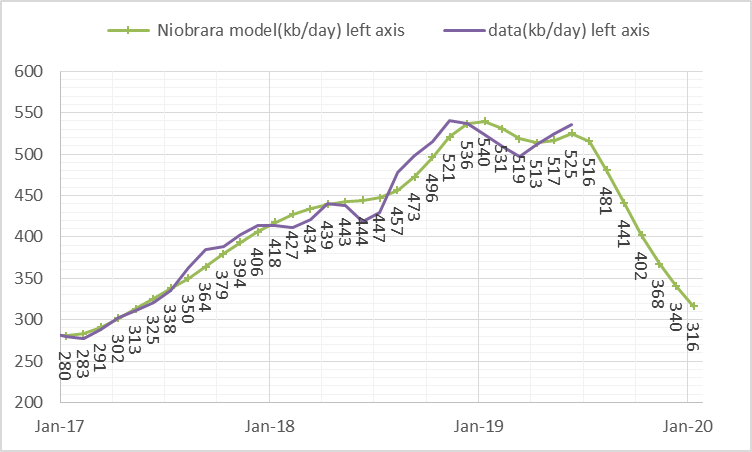

US tight oil legacy decline can be estimated by assuming no future tight oil completions in the various US tight oil basins. The charts below illustrate such an estimate for the Permian, North Dakota Bakken/Three Forks, Eagle Ford, Niobrara, and other tight oil basins (not included in the previous 4 tight oil basins).

Permian legacy decline is 3405 minus 3142 or 263 kb/d.

North Dakota Bakken/Three Forks legacy decline is 60 kb/d.

Eagle Ford legacy decline is 104 kb/d.

Niobrara legacy decline is 37 kb/d.

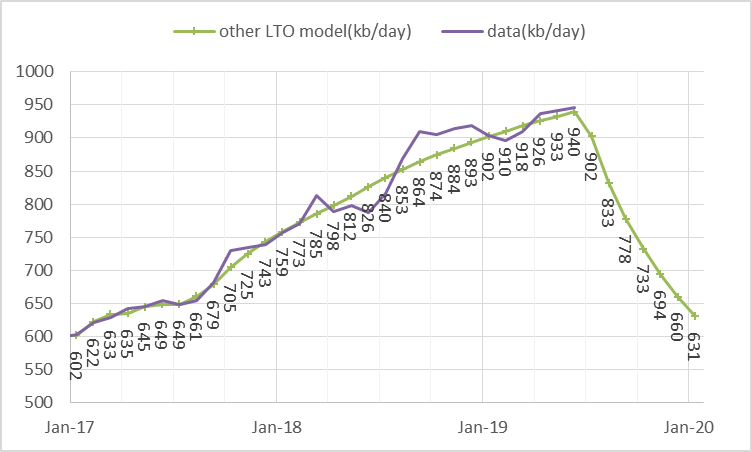

For “other LTO plays”, which is all other tight oil besides Permian, ND Bakken/TF, Eagle Ford, and Niobrara, the legacy decline is 69 kb/d.

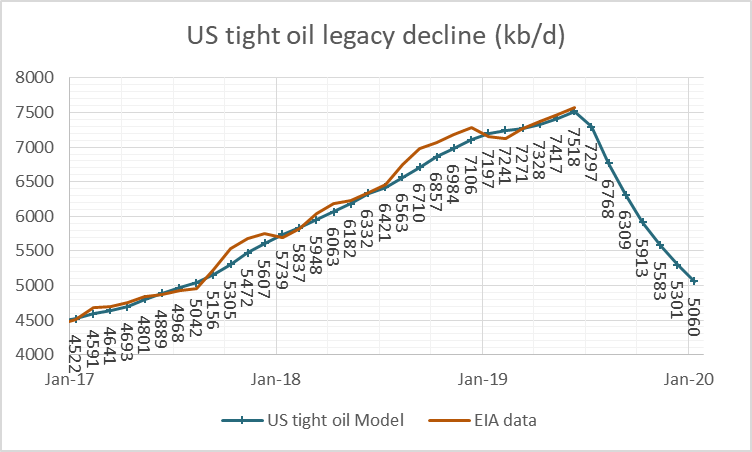

For different plays the timing of the maximum legacy decline rate occurs in different months due to differences in well profiles and completion rates over time. The chart below is simply the sum of the 5 models presented above.

US tight oil=Permian + ND Bakken/TF + Eagle Ford + Niobrara + other LTO.

For US tight oil the estimated legacy decline is 530 kb/d in August 2019. For each scenario above we have assumed no wells are completed after June 2019, for the North Dakota Bakken Three Forks we have assumed both the number of completions and output is the same in June 2019 as in May 2019, June completions for all plays are estimated to roughly match model output with the EIA June estimate.

The average maximum output of US tight oil wells in the first quarter of 2019 was 689 bo/d based on data from shaleprofile.com. The number of wells which need to be completed to keep tight oil output from decreasing is 530,000/689=769 wells competed per month. In 2018 the average monthly completion rate was 979 wells per month (also based on data from shaleprofile.com).

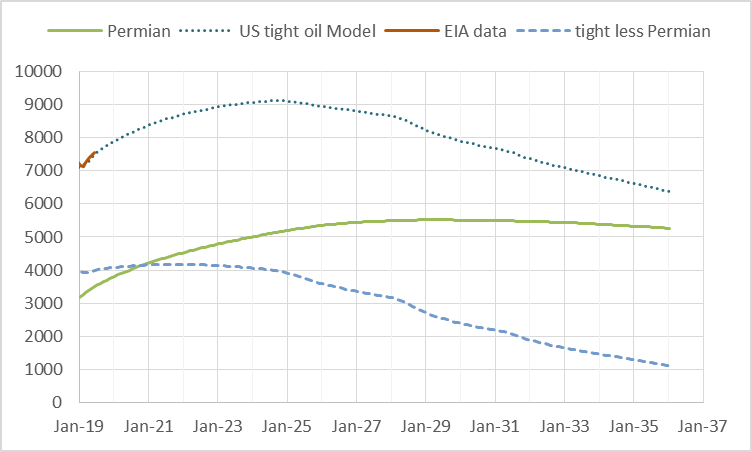

A simple scenario for tight oil output can be created by assuming the average completion rate of the past 6 months is maintained in all tight oil plays until profitability requires a decrease in the completion rate (the AEO 2018 reference oil price scenario is assumed). The chart below shows all US tight oil output, Permian basin output, and US tight oil minus Permian basin output.

Most of the increase in US tight oil output from 2020 to 2025 comes from Permian basin tight oil, after Sept 2024 the decreases in tight oil plays excluding the Permian basin are larger than the increases in the Permian basin so that overall US tight oil output peaks at 9.1 Mb/d in August 2024 for this scenario.

Note that the scenario presented below is conservative and I would expect that rising oil prices over the 2020 to 2024 period may lead to an increase in the number of tight oil well completions, especially in the Permian basin and perhaps in other tight oil plays as well.

Either a higher peak in tight oil output might be reached (perhaps as high as 11 Mb/d) or higher Permian completion rates after 2024 could lead to a plateau scenario where the 9.1 Mb/d peak in 2024 is maintained for a few years. It is not possible to predict which of these might be more likely, my guess is a slightly higher and later peak of perhaps 10 Mb/d in late 2025 or early 2026 is more likely than presented in the scenario below.

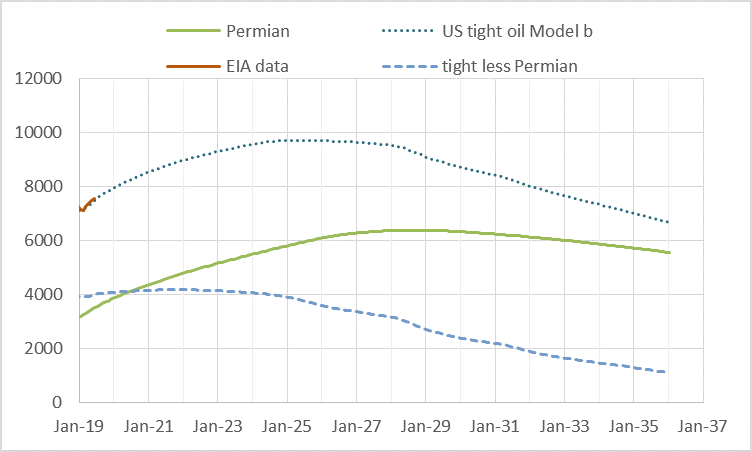

Scenario below changes only the Permian scenario with a higher completion rate rising from 478 tight oil wells completed in July 2019 to 550 wells completed in Dec 2025 and then the completion rate gradually decreases to 453 wells in Jan 2036. The previous scenario had Permian completion rate at 456 wells completed every month from July 2019 to June 2037. The difference between the two scenarios is fairly small with the second scenario having a higher and later peak of 9.7 Mb/d and the peak moving to March 2025 (6 months later).

This scenario remains fairly conservative, but in my view is more likely than the first scenario presented. The URR of this scenario from Jan 2010 to April 2053 is 93 Gb, with 63 Gb from Permian, 10 Gb from both Eagle Ford and ND Bakken, and another 10 Gb from all other tight oil plays in the US (Niobrara about 4.5 Gb). Lower oil prices would reduce the URR and higher oil prices than I have assumed might increase the URR, the likely range is 83 to 103 Gb. From June 2006 to June 2019 about 14 Gb of tight oil has been produced.

Hello Dennis. I posted this at the end of the comments in Ron’s previous entry of 20190712, but it bears repeating here for your examination given the subject matter.

In short, it appears to me your charts above overestimate actual reserves by 20% or more, due to shale operator under-reporting of drilling/fracking operations.

‘Permian Producers Underreport Fracking Activity’

https://oilprice.com/Energy/Crude-Oil/Permian-Producers-Underreport-Fracking-Activity.html

Per Ron’s reporting, peak oil was 2018-2019. I think closer to 2018…

Mr Sutherland

See recent comments at shaleprofile.com Mr Peters and Mr Shellman disagree with that report, as do I. As far as peak we will have to wait a few years. There have been several peaks in the past. I maintain my estimate of a 2025 peak with a 50% probability it will fall between 2023 and 2027, roughly a 25% chance it will occur before 2023 and also a 25% chance it will occur after 2027.

That is my wag.

Could you give us the link to where Enno disagrees with the Kayrros report of 23/7/2019?

https://www.kayrros.com/media

As an actual oil and gas operator in Texas I would like to address this Kayrros fake news thing so folks can move on to more important things regarding the financial plight of the US shale oil industry and whether it is sustainable in the future.

It is not possible to fabricate production from wells that do not exist in Texas, nor New Mexico. Oil production must be reported to to the Texas Railroad Commission the month it moves across a lease line and that production must be assigned to a specific well, with a TRRC ID number, or in the absence of an ID number, by virtue of a drilling permit number and placed in a temporary “pending” file awaiting an actual TRRC ID number. ALL of that is of public record. To receive authority to move oil off premise the TRRC knows exactly how the oil from that well was extracted and the exact completion details. Fracfocus is a data sell company; nobody reports completions to Fracfocus. Kayrros, like Fracfocus, is a data sell company and it has gotten a lot of mileage out of this fake news. It does not know how to do research, is relying on Fracfocus and partial data submitted to the EIA via 914’s and is otherwise out to lunch on this entire story. How one makes these allegations via satellite imagery, and algo’s, and not do proper homework at the TRRC, is absurd. But, it worked quite well and now everybody knows of Kayrros. The allegations made about missing costs are simply implied by virtue of imaginary, missing wells.

None of this can happen in the real world, and in spite of the dumb dookey said by some, here, if it did it would all be VERY illegal. Stealing oil from mineral owners in Texas is a hangin’ offense.

Nobody has been a bigger critic of the shale oil business model and fabricated, grossly exaggerated EUR’s the past six years than I have. This story, however, is garbage. A far more important, more relevant story was done by the WSJ six months ago regarding shale oil and gas EUR’s. That story is proving itself spot on, daily, and has far more reaching effects on America’s hydrocarbon future than this Kayrros crap.

Thanks Mike.

The link to the discussion at shaleprofile.com is below

https://shaleprofile.com/2019/07/22/north-dakota-update-through-may-2019/

scroll down to comments, though Mike has covered this well above.

Thank you Mike.

The Fayetteville gas field shows a similar graph on Enno’s Shaleprofile. By 2015 almost all of the dry gas capex shifted out of the Fayetteville to other basins such as Marcellus, and Haynesville. As a result production plummeted for 2-3 years, and then the rate of decline slowed. That graph is based on actual history rather than projections.

Thanks dclonghorn,

My first 6 charts in the post are theoretical. If well completions stopped all at once it might be a proper forecast. Perhaps there was a crash in natural gas prices which caused the compltiin rate to drop to zero quickly in the Fayetteville play.

16/12/2017

Shale gas revolution did not last long for BHP – the Fayetteville story

http://crudeoilpeak.info/shale-gas-revolution-did-not-last-long-for-bhp-the-fayetteville-story

Dennis,

EIA DPR has legacy declines of:

Bakken: 73

EF: 117

Permian: 268

You and EIA DPR have very similiar estimates. Well done!

Enno Peters has said that the legacy decline changes all the time, I agree.

We would have to compare my estimates to the June DPR for a proper comparison.

Dennis,

Of course the legacy declines change all the time, but not drastically from month to month. And fair enough, we can compare the June EIA DPR numbers with yours, but it doesn’t change the point very much:

Bakken: 70

EF: 118

Permian: 263

Tom,

I am surprised the DPR matches my estimate, in the past the difference was pretty large, perhaps their model and mine has improved over time. I agree if the completion rate stays relatively stable (no big jumps higher or lower) the legacy decline won’t change a lot from month to month.

Dennis, thank you for sharing your model. If I understand your numbers well, there is only 1.6m barrels of growth left in US shale fields combined between today and 2024? If so, US shale annual growth rate is set to slowdown materially by the early 2020s; this will have a material impact on oil prices.

Joseph,

You are welcome.

Note that the scenarios presented are quite conservative. There are two scenarios, the first assumes that the average level of tight oil well completions remains unchanged from 2019 to 2024 and then begins to decrease (that scenario peaks at 9.1 Mb/d about 1.6 Mb/d higher than June 2019). The second scenario is also pretty conservative and peaks at 10 Mb/d in 2025. Note that the rate of tight oil well completions rose by about 500 per year over the mid 2016 to mid 2018 period, if we even see half that rate of increase in the future (an increase in the rate that tight oil wells are completed of about 250 per year) we might see tight oil output reach 11 Mb/d in 2025. A higher peak would likely lead to steeper decline after the peak.

The 10 Mb/d peak scenario seems most likely to me, but despite the claims by many that my scenarios are too optimistic, in most of my past scenarios my guesses tend to underestimate actual output, so it may be that reality will show that the 11 Mb/d estimate is correct. We will have to wait until 2025 to know for sure.

Very good estimate, based on current and past. I still think there is a good possibility of big oil taking over a larger segment of the Permian. How much of a future increase could be determined by how fast their future US usage could be expanded. Slowing growth and extending the tail. That, though, is still just sheer speculation. Have to go with yours, at this point.

Extending the tail, would be beneficial to the US, if and when peak oil hits.

GuyM,

Thanks.

I would think the lower of the two estimates would be consistent with a slow down in growth rates, essentially the tight oil completion rate for the entire US tight oil industry increased at an annual rate of 520 wells each year from June 2016 to Sept 2018, that is from 408 tight oil wells completed in June 2016 to 1576 wells completed in Sept 2018, the average monthly completions over this period was 1067 tight oil completions per month. From Sept 2018 to June 2019 the annual increase in completions slowed to 13.5 per year, a decrease of a factor of 38. The first scenario with the tight oil peak of 8.9 Mb/d in 2024 has no increase in the completion rate from July 2019 to June 2024, which might be consistent with majors increasing their completions at the rate that the poorly performing independents decrease their completions so that over all the rate of completions remains relatively fixed at about 4% below the June 2019 completion rate.

Much will depend on the future price of oil, which of course is unknown. My guess is that a slow down in the rate of increase in completions (as in first scenario) is likely to lead to relatively high oil prices, that in turn is likely to lead to a higher completion rate (as in the second scenario).

That is my wag in any case, very low odds it will be correct as the possibilities are essentially infinite.

What is the CAPEX required for 9 Mb/d and for 10 Mb/d? Cash flows? What will happen if there is another credit crunch? How long will Wall St play this game?

Thanks for your decline scenarios. Yes, there were a couple of important peaks in the past. The 2005 peak for example caused the financial crisis, responded to by lowering interest rates and quantitative easing – which financed the shale oil boom, albeit at $100-110/barrel for 3 years, not what George Bush and Dick Cheney had in mind.

16/3/2013

Iraq war and its aftermath failed to stop the beginning of peak oil in 2005

http://crudeoilpeak.info/iraq-war-and-its-aftermath-failed-to-stop-the-beginning-of-peak-oil-in-2005

The debt created by QE could well bring the world into a recession. Therefore, I would like to see your decline scenario amended as follows:

(a) include DUCs

(b) limited CAPEX available

(d) for next 5 years

Thanks

The Financial crises was not caused by oil prices.

It was caused by banks selling hundreds of billions worth of loans to people who could not make the repayments. The derivatives constructed on the back of these fake loans ripped right through the financial sector.

https://www.thebalance.com/subprime-mortgage-crisis-effect-and-timeline-3305745

When peak oil happens, you will know about it, because it’s impact will be greater than the sub prime fiasco.

While economic crises respond to multiple causes, oil price shocks are commonly associated to economic crises. The 2008 oil price shock may not have been the underlying cause of the GFC, but it was responsible for making the financial shenanigans unsustainable, acting as the trigger for the crisis. The 2008 oil price shock was the consequence of the 2005 peak in conventional oil.

The economy needs a cheap energy input and is particularly sensible to oil prices. However the economy can tolerate higher prices as long as it is expanding its debt, which is equivalent to bring wealth from the future to expend now, paying for expensive energy while expanding the economy. It is not unreasonable to think that the increase in oil price after the 2005 peak in conventional oil was a fire below the credit expansion that resulted in the GFC. A credit expansion at the expense of those that could not repay the debt under any circumstance, and could only service it for as long as the economy expanded vigorously. We must also take notice that the recovery after the GFC and the high oil prices afterwards were sustained by the phenomenal credit expansion of China, the biggest fastest one taking place in the world economy ever.

So yes, I think peak oil had a lot to do with the GFC, constituting a good test of what a peak oil crisis might be, only that after peak oil a full recovery after each crisis should not take place.

Carlos

Perhaps the American economy needs cheap oil, because it uses so much of it. However other countries use a fraction of the oil and achieve very high standards of living, Per capita oil consumption in Europe is half that of the United States and Europe is larger than the United States.

If the United States cut it’s over consumption to match other developed countries it would not need any imports and very little shale oil also.

“If the United States cut it’s over consumption to match other developed countries it would not need any imports and very little shale oil also.”

True, but could have, should have 40 years ago. Little bit late to the party now.

What will happen next is a rationale that says we have to exploit the oil that we have now to power the technology that will help find alternatives.

What we should be doing now, at this late date, is using as much oil and gas pedal to the metal, building out the wind and solar power industries, and building out the electric car and truck industries.

Every million barrels burnt in the process of building these industries now, while oil is still cheap, will save us millions of barrels later on. How many I can’t say, but it will for sure be a multiple of the number of barrels needed to build and operate a battery factory.

Ditto a solar farm and natural gas. The electricity generated by the farm will displace a multiple of the quantity gas that would otherwise be burnt to generate electricity.

I tell my redneck Trumpster acquaintances that every electric car on the road means that more and cheaper gasoline for THEM.

They aren’t too dumb to understand THIS argument, lol.

I tell something similar to idiots who blow the horn at me when I ride my bicycle and I catch up with them at the next traffic light. The fact that I drive a bicycle instead of a car makes the gas price lower for them.

What may do in the US economy is a combination of higher oil prices, plus higher healthcare costs, plus higher education costs, plus higher housing costs.

James Hamilton wrote in his April 2009 research:

Causes and Consequences of the Oil Shock of 2007-08

“Whereas historical oil price shocks were primarily caused by physical disruptions of supply, the price run-up of 2007-08 was caused by strong demand confronting stagnating world production….. Eventually, the declines in income and house prices set mortgage delinquency rates beyond a threshold at which the overall solvency of the financial system itself came to be questioned, and the modest recession of 2007:Q4-2008:Q3 turned into a ferocious downturn in 2008:Q4.”

http://econweb.ucsd.edu/~jhamilto/Hamilton_oil_shock_08.pdf

Matt,

Financial problems were the cause of the crisis, not the price of oil. High oil prices from 2011 to 2014 (averaging 105/b in 2017 $ over the period) coincided with World real GDP growth of around 3%.

Matt,

I disagree that the 2005 peak caused the financial crisis, that is far from clear. The proximate cause of the financial crisis was poor regulation of the financial industry.

For tight oil, the move of the majors into the sphere will provide plenty of capital, their pockets are very deep.

The scenarios use a discounted cash flow analysis to determine if any particular well will have a present value of discounted net revenue over the life of the well equal to the capital cost of the well, a nominal annual discount rate of 10% is used in the analysis and an interest rate of 7.5% (nominal annual rate assuming 2.5% annual rate of inflation). For the Permian basin a real well cost of 9.5 million in 2017$ is assumed.

Global financial crises are not very common, since 1875 there have been 2 (Great Depression and GFC), I don’ think we can predict when the next GFC (or Great Depression 2, aka GD2) will occur, but statistically the frequency over the 133 years from 1875 to 2008 was one every 66 years or so. Maybe in 2074, though my wag would be 2030+/-2. In this case the final peak in World C+C output in 2023-2027 is likely (greater than 50% probability in my view) to lead to either GFC2 or GD2, it will depend partly on if the World adopts a fiscal austerity posture (as in Great Depression) or a more enlightened Keynesian policy approach (where recovery from the crisis may be relatively quick). Monetary policy is not the appropriate response to a financial crisis as the zero lower bound in interest rates is like pushing on a string.

Bush and Cheney knew about the approaching 2005 peak. That’s why they invaded Iraq. See my post further up. If they had warned the banks to be prudent with investing in car and therefore oil dependent suburbia (subprime mortgages) the 2007 recession in the US might not have morphed into the financial crisis. Have you read Hamilton’s paper? It was written 10 years ago and should be common knowledge.

Matt,

Yes I have read it, I think the focus on only the US in his analysis limits its usefulness. High oil prices were not likely to have been the cause of GFC, other factors were far more important in my view.

Dennis said- “The proximate cause of the financial crisis was poor regulation of the financial industry”

Exactly. It was repeal of the Glass-Steagal act in the late 1990’s, which had been designed after the Bank failures of the great Depression era, that set up the country for the financial fiasco (failed gambles) of 2008-9.

Sure peak oil (pre-fracking) and trillions spent on frivolous things like Cheneys war were not helpful, but not the cause.

And Glass-Steagal was cancelled under Clinton.

The pump worked for a while, but late stage capitalism corrected the delusion.

Yep, courtesy of Newt Gingrich and Phil Gramm.

Yep—

“I disagree that the 2005 peak caused the financial crisis, that is far from clear. The proximate cause of the financial crisis was poor regulation of the financial industry.

…

statistically the frequency over the 133 years from 1875 to 2008 was one every 66 years or so.”

So you think that globalization and financialization don’t affect those odds?

When looking at the GFC people react as the blind people touching different parts of the elephant. Deregulation was important, oil stagnation and price hike was too. There was also a housing bubble in many countries that is commonly blamed. In an environment of increasing oil prices and low interest rates safe investments underperform. Deregulation and easy lending leads to riskier high yield investments. Asset inflation adds fuel to the bubble. Let’s remember that deregulation was specific to the US. The EU didn’t deregulate. Banks got overexposed in a risk-friendly environment. An oil price spike spoiled the party.

“High oil prices from 2011 to 2014 (averaging 105/b in 2017 $ over the period) coincided with World real GDP growth of around 3%.”

That’s because China and other Asian countries experimented a huge debt expansion. Debt expansions are a big boost to the economy. High oil prices from 2011 to 2014 triggered the European debt crises that almost killed the EU. Several countries had to be rescued. Unlike China, Europe had already a big debt and many countries could not expand it to finance expensive oil. Their oil consumption went down while their GDP growth turned negative.

Carlos,

The problems in the EU were much bigger than high oil prices, a system where nations do not have control over their own money supply makes policy options quite limited, when this is coupled by nonsense such as fiscal austerity in a time of economic crisis, it leads to a prolonged economic down turn.

The problems in the EU in response to the GFC were primarily a problem caused by bad economic policy.

A properly regulated financial system can function quite well, problems arise when free market fundamentalists become the primary advisors to those in power.

The deregulation in the US and poor financial practices throughout the World led to the financial crisis.

Note that I expect the odds have indeed changed and expect the next financial crisis will occur in 25 years rather than the 63 year period which seemed to prevail from 1875 to 2008.

Also note that the time from the 1929 crash and the 2008 GFC was about 79 years and between the long depression and 1929 was only 54 years. The World become more globalized and access to credit become more widespread during the second period, but the time between crises increased rather than decreased.

So your hypothesis that severe economic crises will become more frequent is not supported by historical evidence. Of course the sample is very small and things can change.

High oil prices from 2011 to 2014 were a direct result of FED’s QE put under the entire market. That never happens if QE 1,2 and 3 don’t happen. There lies the rub. They do another massive round of QE at any point in time in the future oil prices are going back to their 2011 to 2014 prices. The FED absolutely knows this.

Question is if your a central banker do you pull the trigger on the next round of QE knowing it brings collapse of the very bubble your trying to keep inflated. Or do you allow bubble to deflate by choosing not to expand it. What they want to do is jawbone market up by holding the carrot out for the rabbit to chase. Without ever having to let the rabbit get the carrot. That way they don’t have to unleash the kraken that brings $100+ oil with it.

But just as a thought exercise. Say oil reached $100-110 all on it’s on. Would there be the option on the table to do QE when oil prices were already that high. The answer is no. Oil prices will never be allowed to go back to the 2011-2014 averages not even close. Markets aren’t free markets.

The next round of QE will happen when oil prices are low. Debts and deficits just keep growing. My guess is $20 ish WTI. But watch trendline support. It could very well coincide with when price reaches trendline support. Which would take $20 Wti off the table.

HHH,

If supply is short and consumption is more than output so that stocks decrease at any price P, then prices will be “allowed ” to uncrease to a level that consumption matches production.

Central banks cannot print crude.

the permian would disagree with you. it’s not much different from a planned economy – where things are produced for the benefit of society even when done at an economic loss (i.e. no excess profit to be wrung for capital inputs and labor).

But if there is more demand than supply, something has to determine who gets it. One way is to let the price rise until some users drop out, or until people across the board use less. Or rationing could be used.

So demand has to be controlled in some fashion when everyone’s wants can’t be met. Oil could be free, but if there isn’t enough to go around, some mechanism needs to be determined to distribute a limited supply.

twocats,

If prices are too low Permian output will stop increasing.

This will become apparent in 2020 unless oil prices rise and will be especially apparent if oil prices fall.

Note that my scenarios all assume gradually rising oil prices through 2037.

“If prices are too low Permian output will stop increasing.”

There are scenarios where the oil might continue to be produced.

1. The price stays low, but the government underwrites the costs.

2. Oil producers are ordered to produce by the government. Extreme, yes. But production wouldn’t be dependent upon the price of oil.

3. Oil companies are nationalized and tax dollars are used to keep them running.

The idea that oil production is entirely dependent on oil prices doesn’t acknowledge that oil production could be subsidized or be taken by force.

I personally don’t think oil production will be maintained at any cost. I think reducing demand is more likely. But there are scenarios where oil production is decoupled from price.

More likely: The economy goes into recession. Trump gets voted out. Oil production crashes as the credit dries up. The Republicans spend the next decade blaming the crash on “government regulation”.

Boomer,

I mostly consider scenarios that may actually happen. If there is a Great Depression 2, the scenarios you posit may come to pass, up to 2030 it is doubtful there will be another Great Depression, after that it is a coin flip in my view.

I think the wheels will come off before 2030. Other than a massive push to convert the world to renewables, I see nothing on the horizon to keep the global economy perking along.

I see multiple problems — natural disasters, lack of water, debt, trade disruptions, rising healthcare and housing and education costs in the US — that will hit at the same time and generate an overall crisis situation.

But at the same time, I don’t see the US government interceding by law or force to keep oil prices artificially low. I think there will be multiple awarenesses that it isn’t a good idea to keep this declining industry propped up. Investors are already of that mindset.

Boomer,

There are multiple problems, however the likelihood that all problems will reach a critical point simultaneously is infinitesimal in my opinion.

Water shortage is solved by higher prices for water rising costs for healthcare, and education can be solved by adopting innovations already put in place in Europe, natural disasters will continue to occur as they always have. The problems will be addressed one by one as best we can, again as has been attempted in the past. Solutions are likely to lead to new problems, rinse repeat.

Dennis, I am not nearly as optimistic as you. On the other hand, I am not as apocalyptic as some here. I fall somewhere in the middle.

The world I grew up expecting as a child of the 1950s and 1960s is already gone. I feel like I am living through one of the major turning points in human history: the foreseeable end of the fossil fuel age, the end of the American Empire (not that that is bad), the lessening of global cooperation, impactful climate change, etc.

I mean, what is different now is the number of people on the planet and what they consume. Nothing in human history is comparable.

I think the collective stresses will hit and will hit hard. I don’t expect WWIII but I do expect trust between countries and their willingness to trade and cooperate will decline. For that matter, I think the US is already in the midst of a psychological civil war. I don’t see it improving and the result, I think, will hurt us economically.

Boomer,

I think it might be helpful to remember that oil is no longer needed. Truly, it’s expensive, polluting and risky compared to renewables and electrification.

What we’re seeing is not limits to growth. What we’re seeing is a classic conflict between a legacy industry and a new industry. It’s a very old story which has been repeated many times in history. The US civil war was in part the same thing: a conflict between the old (agriculture) and the new (manufacturing). The old was trying to preserve it’s privileges with tariffs, and the new was trying to break free.

The obsolete legacy FF industry is willing to fight a scorched-earth fight, crippling democracy and throwing the environment overboard, all in the name of profits. They’re fighting to preserve their subsidies (mostly indirect in the form of non-enforcement of pollution controls) and protect their right to burn all of their reserves.

Eventually, it will lose, decisively.

Let’s try to make that happen sooner…

Nick G,

I am sorry but i completely disagree with your premise.

If oil is no longer needed, then why does the oil consumption of the world keep increasing.

Why in 2018, the most profitable company in the world aramco?

I am sorry i respectfully completely disagree. What you are saying is in complete conflict with what’s actually going on in the real world.

Nick G. Converting the world to renewables is the one development I believe could deliver an economic boost. But I see Trump moving toward a totalitarian government. I don’t trust that he and his administration will do anything to point us toward the future. I see more along the lines of us being a declining world power than a beacon of hope.

How to you think we are going to fare for the next six years, especially if he gets re-elected?

I’m not focusing on whether or not we will survive without oil. I am more concerned with right wing politics around the world. I mean, look at the various religious and racial conflicts around the world. They don’t make economic sense, yet they continue for hundreds of years.

Tribalism seems to triumph over cooperation far too often.

As for citing the past Civil War, it was a war, with death and destruction. It wasn’t an easy transition from one economic system to another. And I’m not sure we have yet brought the South into the larger US economy. Some are still fighting that war.

Iron Mike,

That’s a good question that deserves a long answer. It’s at the heart of the multi-trillion dollar conflict between FF and it’s competitors.

I agree that in the very short term we’re dependent on oil. But we could kick the habit fairly quickly, and we ought to.

So, let me ask: do you agree that climate change is a very serious risk? Do you agree that the US has spent trillions on oil wars in the last 35 years? Do you believe that oil shocks have caused trillions in damage to the world economy in the past, and could do so in the future?

And, do you agree that most transportation and HVAC could be electrified?

Boomer,

I also foresee many problems. I believe humans may muddle through. Eventually population will peak and fall and fossil fuel use will do the same.

Many of the most pessimistic climate change scenarios rely on estimates of fossil fuel URR that are not realistic. Much needs to be learned on climate change and faster action moving away from fossil fuels is needed. I am not optimistic that will occur, higher prices for fossil fuel and lower prices for alternatives will help, but may not be enough.

tough times ahead for sure, our thinking may not be all that different.

igh oil prices from 2011 to 2014 were a direct result of FED’s QE put under the entire market.

There’s no mystery here: QE helped the economy recover, and the recovery created demand for oil.

They do another massive round of QE at any point in time in the future oil prices are going back to their 2011 to 2014 prices. The FED absolutely knows this.

No, they really don’t know that. That’s because it makes no sense.

Actual, real economic activity creates demand for oil, not some mysterious QE magic. If the economy slows down the Fed might reduce interest rates, or do more QE. But that will only support oil prices indirectly, by stimulating the economy.

Lets look at where yields on 10 year Germany bund are. Just a tick or two away from where ECB benchmark rate is at. Either yields got to rise on the 10 year or ECB has to do a rate cut so there will be a spread where banks can make money lending money. Benchmark rate is -0.40% Germany’s 10 year is at -0.38% How low do you believe they can cut interest rates and still have a functioning economy? Europe’s banks are about to get slaughtered here.

The US 10 year currently at 2.08% US benchmark rate 2.75% Either 10 year yields rise above benchmark rate or recession will be here soon. FED will be cutting rates.

There is actually a dollar short here even with all the mess in Europe. That might give oil price a boost at least for a little while.

FED has room to cut and ECB really doesn’t. ECB might have a rate cut or two left in them but it won’t be by much. Yields on long dated government bonds are becoming a huge problem as they go negative. Yet if they were to rise very much that would also be a huge problem. FED cutting short-term rates should also stepping yields on the US 10 year which will put some upward pressure on yields elsewhere like Germany so ECB won’t have to cut rates by much to create a spread where banks can make money.

If we had any real economic activity bursting, yields would be rising. Mountain of unpayable debt sitting on top of everything preventing real economic activity from taking place.

All we have is central bank distortions. That is why stock prices and bond prices and real estate prices are nowhere near what the economic fundamentals say they should be. Who knows where Oil price would be if real price discovery were allowed to happen.

If we ever get real inflation as in oil shock inflation. Central Banks can’t raise rates to stop it. High oil prices are indeed a threat to the bubble everything that was created in the wake of 2008-2009.

How are you relating that to oil prices?

All right, you’ve edited your comment to add an answer to my question above, in your last 2 paragraphs.

Except…it still makes no sense. Sure, asset prices are higher than they would be without the central banks buying assets. But how does that relate to oil prices??

As far as oil shock inflation goes…central banks weren’t born yesterday. They’ve put enormous thought and analysis into this question (look up the research at the St. Louis Fed, for instance), and decided that oil shock inflation is pretty sharply limited to oil products (in other words, it’s not true that oil shock inflation causes general price inflation) and they’ve specifically excluded the prices of energy products from the “core” inflation index that they rely on for policy decisions.

This is, in fact, a change in policy from 40 years ago. The Volcker ultra-high interest rate regime circa 1979 was more related to inflation expectations that started during Vietnam and the Burns Fed loose money regime than it was related to oil, but it was partially a response to oil shock inflation. And…the Fed has changed it’s policies since. They’re no longer worried about the impact on the general CPI of price increases of energy products.

So, no: high oil prices are not a threat to the economic recovery, at least in the form of inflation, or CB responses to inflation.

Matt,

I did a quick analysis of Permian Basin only with a modified oil price scenario with a maximum oil price of $100b reached in late 2036, oil prices then decline slowly starting in 2038 (I have assumed high oil prices result in substitution by EVs and greater efficiency in oil use leading to demand to fall below supply by 2037). Capex is well cost ($10 million per well) times wells completed (456 per month) and net revenue deducts capex, opex, royalties, taxes, and transport cost from total revenue.

The basin becomes cash flow positive by early 2020 in this scenario.

Matt,

Chart below shows cumulative net revenue in billions of 2017$ on left axis and Permian basin output in kb/d on right axis. This uses the modified oil price scenario I described in the comment above (Brent oil price in 2017 $ falls to $87.46/bo by the end of 2050 vs original AEO scenario with oil price at $113.79 at the end of 2050).

Note that the cumulative net revenue deducts interest at a real annual rate of 5%/year for negative cumulative totals. The analysis starts in Jan 2010, cumulative net revenue is assumed to be zero on Dec 31, 2009 for the Permian basin. The debt level has reached 124 billion in 2017 $ by the end of 2018 in the modelled scenario.

The Permian basin tight oil industry becomes debt free by 2026 and cumulative net revenue reaches 690 billion in 2017$ by 2040.

This scenario corresponds with the 9 Mb/d US tight oil peak scenario with the peak in 2024. The URR of the Permian scenario is about 50 Gb, and for the entire US tight oil scenario the URR is about 78 Gb for this modified oil price scenario. The peak is unchanged, but the tail falls off more quickly after 2040.

Oil price scenario (Modified AEO 2018 reference case) used in scenario above.

So brent prices from 2019-2040+ never go below $55. Big call, but lets see what happens.

Iron Mike,

Note that the EIA’s AEO 2018 reference oil price case is the basis for this scenario. I modified it by not allowing oil price to rise above $100/bo, the AEO 2018 case continues to rise to $113/b by 2050, roughly following the slope from 2025 to 2035 all the way to 2050. Chart with that case below and modified case (AEO mod) for comparison.

https://www.rigzone.com/news/wire/shale_drillings_worst_yet_to_come-25-jul-2019-159409-article/?amp

Drilling and fracking is set to decline further for 2019.

GuyM,

That article focuses on rigs, this may just be a matter of too many rigs being activated when oil prices were $70/bo back in Oct 2018, now companies are scaling back due to lower oil prices and demand for capital discipline. A 10% decline in rig count can be offset by a 10% increase in rig efficiency, companies keep their A teams working and these guys are the most productive in the field.

I asked earlier if there is data on the number of frack crews working, a search pulls up very little information, at least through June 2019, tight oil output continues to increase.

No, but the company has both rigs and frac crews. Both are suffering in the article. Little data on fracking. You have to read between the lines, a lot. No hard data, but my guess completions are starting to suffer, too. Hard data will only be apparent if July’s completions for July, posted in the second week by RRC, show significant reductions, which is my guess. Wags abound, but are not hard data.

GuyM,

It is always a guessing game. I look at the decrease in rigs that occurred over the 2015 to 2016 period, what occurred in that case was that the number of wells drilled per rig increased as rig count decreased, I believe in this case the same may occur. Through June the data shows that the completion rate in Texas for new drill oil completions the level in June 2019 was roughly the same as the average for the first 6 months of 2018 (596 vs 601). Certainly there were a lot fewer completions in June 2019 vs June 2018. If the completion rate remains about where it is, output will continue to increase. My calculations suggest the new drill oil completion rate can drop another 17% (from 600 to 500) and flat output will be maintained.

Er, flat output is not what everyone and their dog is betting on. Articles like these are real, and include comments from the CEOs and are reported by credible reporting like from rigzone. I ignore the BS articles like from some “expert” “research” company that reports that a thousand wells were not reported to the RRC in 2018. While, it supports a lot of my guesses in the direction of the Permian, it’s too far fetched to consider. It ain’t real, this looks real.

Dennis

Congrats on your excellent model. August DPR decline is 560 vs your 530. Darn good. I think that the article that Guy refers to requires further analysis since I think they are correct in their outlook, possibly for another reason.

Attached is a chart of the DPR total decline rates for all of the basins starting Jan 18. As can be seen, it is virtually linear. The decline rate increases at a rate of 7.51 kb/d/mth. By next July at this rate, the decline rate will be close to 650 kb/d/mth. I think it will be slightly less than that since there is a hint of deceleration in the data.

In a response in the last post you stated “With 637 b/d for maximum output for the average US well from Jan 2018 to March 2019, this suggests 509,000/637=799 wells needed for flat output.”

If we now change 509,000 to 620,000 for next July, (lowered it by 30 to reflect your lower estimate), that suggests 620,000/637 =973 new wells per month are needed for flat output. Sounds like the gerbil wheel is spinning really fast.

This suggests to me, along with other info, that LTO production could be peaking within the next 12 to 18 months.

I agree with Mike and others, that it is impossible to under report completions by a thousand wells a year in Texas, especially.

Completions in District eight are definitely declining in July, however. My count to the 26th is down 50 over June. If the Permian is going down, most shale completions are probably down.

Ovi,

Note that average well output may increase as capital moves to the most productive basin (permian currently). The model I have presented here combines results from 5 models and a very conservative competion scenario such as the one I have presented will result in either a flat or decreasing legacy decline rate.

Take a look at legscy decline from 2015 to 2017 in the DPR. Legacy decline rate does not always increase.

It would probably be better long term on productivity, although that is in constant change as they drill new child wells. But, from my reading of Texas completions, the initial from the EF is still ahead. I dislike the DPR, but it confirms the EF and the Bakken have initial higher outputs. Which drop faster than historical Permian production, but that is a new field that keeps changing over time. So far, unless RRC data can be proven wrong, I will go with that. Actually, I think the difference is decreasing over time.

GuyM,

Shaleprofile.com gets its data from the state agencies (RRC, NDIC, New Mexico, etc). If you look at 2018 wells for the various tight oil plays you will see Bakken 662 kb/d max, Eagle Ford 604 kb/d max, and Permian basin 730 kb/d max, in each case this is for the average well that strared producing in 2018.

In my opinion Enno Peters data at shaleprofile,com is the place to find what is happening in the tight oil plays in the US, great data on shale gas as well.

Dennis

Clearly the level of drilling affects the legacy decline rate. Attached is the same chart starting in Jan 2017. You can see how the decline rate started to increase as the drilling activity increased in 2017 and the price of oil got back into the 50s and touched 60 by the end of the year. The earlier chart only started in 2018 because that was when the linear portion began. I am not saying that the linear trend will continue because the drilling activity required would be too intense and contrary to what many are saying. My expectation is that the decline rate to will start to roll off shortly and possibly peak before year end.

Okay, two things affect the legacy decline. (Rate?) Are you talking volume or percentage per month? The more oil you have to decline, the higher the volume of oil that will decline. Also, newer wells decline at a much higher rate, (percentage) than do older wells.

If drilling stops then the volume of oil and the percentage will both decline. You will have less oil to decline and the wells will continue to age and their monthly percentage of decline will decrease.

Hey guys, this ain’t rocket science.

Ron

The chart is showing volume decline rate of 560 kb/d/mth for July. If drilling activity would continue at the current rate, the decline rate would continue to increase monthly by close to 7.5 kb/d. However, with drilling activity slowing it should start to roll over shortly.

I agree. As I said, it ain’t rocket science.

The other point is to see the decline rate roll over from linearity. I think that will be a clearer indication the drillers are getting the message to slow their drilling and to find a more financially sustainable drilling program.

Ovi,

For my conservative scenario for the Permian basin with 456 wells completed each month from July 2019 to June 2020 the legacy decline rate rises to 275 kb/d in Aug 2020 from a rate of 262 kb/d in Aug 2019, by Aug 2021 legacy decline is 283 kb/d. So with a flat completion rate the legacy decline does gradually increase by about 3.6% per year for the Permian basin.

Aug 2025 legacy decline 295 kb/d, but finally in Aug 2027 legacy decline rate decreases to 288 kb/d.

Note that for other basins such as Eagle Ford and North Dakota Bakken/Three Forks the completion rate decreases before 2025 so legacy decline rate decreases as well. For the Permian scenario the completion rate remains at 456 oil wells per month from July 2019 to Jan 2028 even in a low oil price scenario where oil prices rise to only $70/b in 2017$.

Dennis

I am a bit confused at this point with all of the info and models and perhaps you can explain where the difference occurs. Your model and the DPR are almost in perfect agreement regarding the Permian decline rate for August 2019, 262 kb/d vs DPR of 268 kb/d.

However, from the data provided above from your model, the increase in the monthly decline rate, i.e. acceleration, from August 2019 to August 2020 is close to 1 kb/d/mth. However when I plot the decline rate of the Permian, using the DPR data, from Jan 18 to Aug 19, the decline data is increasing virtually linearly at a rate of 4.684 kb/d/mth.

Is this difference in the accelerating decline rate due to a decrease in the number of wells drilled going forward from August 2019? Also does your model show a higher acceleration rate from Jan 19 to August 20 than the 1 kb/d/mth from July 2019 to June 2020?

Ovi,

Yes, my scenario assumes the number of wells completed per month remains fixed from July 2019 to Dec 2025. From Jan 2017 to July 2019 the completion rate was increasing. see chart.

Dennis

Thanks. That’s quite a significant change in slope starting about now.

Ovi,

Yes, note the change in slope for the completion rate, many claim that the rate will be different going forward, my scenario simply assumes the completion rate remains constant at the average level from Jan 2019 to June 2019 (456 new horizontal oil completions in the Permian basin each month) for the foreseeable future (until 2027), that assumption causes the change in slope for the legacy decline rate.

GuyM believes that the completion rate will decrease. If he is correct the legacy decline rate might be flat or even decrease, it would depend upon the rate of decrease.

I think my scenario is about as low as it will go unless we see GFC2, I am also often wrong, just ask my wife. 🙂

Asking wife is no fair.

she speaks the truth, though I do not always hear.

Only 6 out 22 exploration wells yielded in discovery in H1/2019. worst performance in norway since 2008

From my email box, no link, sorry.

Energy an Capital

The Curious Case of Iran’s Missing Oil

Keith Kohl Photo By Keith Kohl

Written Jul. 26, 2019

Extraordinary feats of magic are taking place right under our noses.

And the magician pulling off these incredible tricks would make David Copperfield scratch his head in amazement.

First, I want you to take a look at the Sino Energy 1, a Hong Kong-flagged oil tanker:

From a size perspective, the Sino Energy 1 isn’t the largest crude tanker at sea.

Built in 1999, she measures roughly 182 meters in length and can carry nearly 50,000 tonnes at full capacity.

Now pay attention, and don’t blink… or you might miss it.

One minute the Sino was gliding through the waters of the Persian Gulf. The tanker was sitting high in the water, suggesting that its cargo hold was empty.

Then, suddenly, it vanished, right into thin air.

In fact, this captain-turned-magician was so good that he made the Sino disappear for nearly a week.

But what really made this vanishing act so special was the fact that after it reappeared a week later, the Sino was full to the brim with crude oil.

Quite the curious case, indeed.

Although I’m never one to spoil a good magic act, all it took the Sino’s captain to pull off this trick was a little flip of the switch.

It’s called the Automatic Identification System, or AIS for short.

Back in 1974, an international maritime treaty was enacted called the International Convention for the Safety of Life at Sea.

The fifth chapter of this treaty lays out the guidelines regarding the safety of navigation. More specifically, Regulation 19 of this chapter requires ship-borne navigational systems and equipment.

That’s where the AIS comes into play; it gives everyone the basic information, including its identity, type, position, course, speed, navigational status, etc.

The signal is automatically sent from a transponder onboard, so it not only lets the owner keep track of the ship’s whereabouts, but it also helps prevent everyone from hitting each other.

Every oil tanker on the planet has one.

And that’s how, with a small bit of sleight-of-hand, the captain of the Sino Energy 1 was able to pull off his magic.

However, the question you should be asking is, “WHY did he turn off his AIS?”

Fortunately, that answer is much easier to answer.

Tanker Wars

Why is oil sitting under $60 today?

Well, one reason is because despite the geopolitical chaos taking place in the Strait of Hormuz — from tanker seizures to the Royal Navy frigates now escorting UK-flagged ships through the area — Iranian oil is still making its way to the international market.

These oil tankers are essentially “going dark” to skirt U.S. sanctions placed on Iran’s oil industry.

It’s an effective way for tankers to slip quietly through the Strait of Hormuz, fill up their hold with Iranian crude, then slink back out and unload their cargo elsewhere.

And the Sino’s captain isn’t the only one with this trick up his sleeve. Since U.S. sanctions have gone into effect, dozens of tankers have gone dark, smuggling millions of barrels of Iranian oil out of the area.

But let’s not fool ourselves here; we know exactly where most of this oil is going: China.

It’s not a coincidence that today, the Sino Energy 1 is sailing at a comfortable 13.4 knots in the Eastern China Sea.

What do you think will happen when this party trick doesn’t work anymore?

It turns out President Trump isn’t going to look the other way. This week, the U.S. placed economic sanctions on Zhuhai Zhenrong Ltd., a state-owned Chinese company, as well as its CEO for violating sanctions and buying Iranian crude.

The question now is whether this zero-tolerance policy will deter future tankers from making the same move.

Perhaps.

It’s not as if those buyers don’t have options.

Both Russia and the Saudis are already stealing some of that market share from Iran.

That includes China, too.

Saudi Arabia exported 40% more oil to China in April than it did the previous year.

And soon there will be even more oil making its way to China, and it’ll come from a very unlikely source.

We’ll dive right into that next week.

Until next time,

Keith Kohl

Ellen Wald of the Atlantic Council

https://www.atlanticcouncil.org/about/experts/list/ellen-wald

says Iran needs to export 1.5 mb/d to balance the budget and 720 Kb/d absolute minimum in survival mode

https://www.bloomberg.com/news/videos/2019-07-26/-bloomberg-commodities-edge-full-show-07-25-2019-video

Details are here:

….But, in the last revision of the budget, a new field is added to the external revenue sources table, which has escaped the eyes of many financial analysts. Additional petroleum export revenue equivalent to $1.7 billion is projected as “Crude oil delivery to real or juridical persons” i.e. petroleum sales through private entities on the open international market. Hence, the expected petroleum export revenue to support the government’s budget becomes $25.7 billion, which—considering that the Iranian government has assumed a crude oil price of $54 per barrel—translates to a crude oil export quantity of approximately 1.5 million barrels per day (bpd).

….

By applying the lessons from the previous sanctions period, implementing saving plans, increasing non-oil exports, enacting financial reforms, currency controls and managing the NDF and foreign reserves, Iran can probably manage with a minimum petroleum export revenue of around $17 billion a year, equivalent to 720,000 bpd. That would allow the country to keep its head above water and the population to survive until the next US presidential election.

https://www.atlanticcouncil.org/blogs/iransource/iran-s-crude-oil-exports-what-minimum-is-enough-to-stay-afloat

Iran, if Europe wants to skip sanctions it just sends in vessels to help out. A manufacturing recession has started and most banks have bonds at negative rates. Us stay home means Israelis have to deal with pope and catholic based oil regeme

Y’all pretty much have 2008 wrong. Go read about Blythe Masters and her invention in 1994. Glass Steagal not involved in this. Whether in force or repealed would not have mattered. Blythe created a product that was not covered. So it didn’t matter if it was repealed or not, it was already being dodged — and it was being dodged in a systemically destroying way that left all parties unwilling to deal with any counterparties in 2008 since their exposure could not be known. Had nothing to do with politics. No one was to blame — other than Blythe maybe.

And yes, there are negative rate bonds all over the world, which I have pointed out before. What do you conclude from this? Generally people will conclude something like this:

Oh blah blah Europe is not the US and blah blah they aren’t competent there and blah blah blah blah well, I got my own problems and whatever is going on must be complex and I just don’t have the time to get into it.

What they should conclude is why be surprised? Money is created from thin air by central banks and there is no obligation whatsoever that it behave in accordance with any calculation or expectation or rationale whatsoever. View all things through the prism of oil, not money, or you will understand nothing.

According to Richard Werner, central banks don’t create money out of thin air, but commercial banks do, for instance when one gets a loan to buy a house, the bank will create that money from thin air. Well to be exact he says central banks produce only 3% of the money supply, 97% is produced by commercial banks ‘out of nothing’ to be exact.

https://econpapers.repec.org/article/eeefinana/v_3a36_3ay_3a2014_3ai_3ac_3ap_3a1-19.htm

Likely a difference without distinction, given fractional reserve regulations being controlled at the federal level. It’s also rather US centric and that cannot make any sense in a world with a pegged yuan created by the PBOC. And there is the more recent reality of US QE magnitude reaching nearly 25% of GDP, and that’s a GDP somewhat credit defined.

So the concept is maybe some sort of granularity in meaning without changing conclusions — the value derives only from collective imagination and not any physical laws of nature.

Cool find, though.

https://seekingalpha.com/article/4276539-shale-oil-production-growth-disappointment-real-risk-h2-2019

An understatement, but some are beginning to get it.

Well researched article which states that US shale production will grow only a small amount in 2019H2 which means that “US oil production as a whole has flatlined for the rest of the year”.

The attached image shows Rystad’s data tracker indicating a drop-off in wells fracked in the US.

https://static.seekingalpha.com/uploads/2019/6/30/5006891-15619305466757216_origin.png

Howdy all.

I’ve gone down a bit of a rabbit hole on the photosynthetic yield from the prior thread. There’s a lot more to it than I first suspected.

Meanwhile, here’s my latest piece on taking crazy pills: https://www.peakprosperity.com/overdosing-on-crazy-pills/

When the oil dwindles, we humans really just don’t have a plan. Not one that operates at scale. Not one that maintains an ultra-complex, just-in-time economic system. Not one that knows how to feed people at great distances on ruined soils.

“Growth for the sake of growth is the ideology of a cancer cell.” ~ Edward Abbey

Wish I could be more optimistic in these times, but it seems that I read too much.

This link from Chris Martenson’s website is MUST reading. Water is now depleting as fast as oil in some critical locations.

https://www.peakprosperity.com/forum-topic/pissing-away-our-supergiant-fossil-water-aquifer-the-ogallala/

This link from Chris Martenson’s website is MUST reading. Water is now depleting as fast as oil in some critical locations.

Goddammit, I have been thrashing that straw for over a decade. But now that Chris Martenson has said it, that makes it legitimate?

The water tables are falling all over the world, not just in critical locations. They are falling by meters per year in India and China. They are falling in the Ogallala Aquifer in the USA. We are running out of water to irrigate the food producing areas of the World.

Okay, you have just been informed that the world is being destroyed by human activity. And you just got that news? I told you that ten years ago. But now you are surprised? You are shocked? Well…. welcome to the world of the informed.

I. grew up in the Texas Panhandle. I recall hearing about the falling Ogallala Aquifer about 50 years ago.

But it’s much worse in India and China. Indian farmers are committing suicide at an alarming rate because they can no longer irrigate their crops. Whole cities depend on water being trucked in because all wells are dry.

In China, the Yellow River no longer reaches the sea for much of the year. The Gobi desert is marching toward Bejing.

And the good ole US of A is turning away or incarcerating starving Guatemalan farmers and their families who can no longer eat because of drought.

If it took 50 years to deplete something that took 12000 years to accumulate you wouldn’t be a dumb ass and be looking at your watch would you?

Hi Ron,

I don’t remember ever disagreeing with you about the water problem, lol.

As a matter of fact, I seldom ever disagree with you about any resource related question, although I do believe we might not be QUITE as bad off as you do, in respect to such resources.

I no longer believe industrial civilization IS NECESSARILY doomed to disappear. I believe now that some people in some parts of the world do actually have a fair to decent change of pulling thru the coming crash and bottle neck and continuing to maintain an industrial civilization. I’m not maintaining there WILL be such survivors. I’m just saying there MIGHT be.

A few years back I was a hard core doomer, like you. I changed my mind because the renewable energy industries have proven they do at least have the POTENTIAL to shoulder the load currently carried by fossil fuels, assuming we also drastically change the way we use energy, and the way we live, and that the human population crashes regionally or world wide. I believe a series of regional crashes are FAR more likely than one big planetary crash, barring a flat out WWIII.

No , I’m not shocked about the water issue, lol.

I’ve probably been thinking about resource depletion as long as just about anybody other than professional scientists, considering that I’m a farmer and at least reasonably well informed. I have posted numerous links about resource depletion over the years, here and elsewhere.

And I occasionally post newer ones about the same, because the newer ones generally contain new details, and are often read by people who didn’t see or have forgotten the older ones.

Most people who are aware of the water problem DON’T yet know that it’s already beyond critical for lots of farmers in the mid west, and that a hell of a lot of them have been forced out already, or forced to give up irrigation and return to dry farming , as a result of the fast depletion of the Oglalla.

But if they read the link, they will know.

I hope you are enjoying your adventure out west. I’m beginning to wonder if I will outlive my old Daddy. I’ll be eighty if he makes the century mark, and there’s a good chance he will, so I may never, considering my CHRISTIAN culture, be free to take off again myself. HONOR THY FATHER AND MOTHER, you see.This means ACTIVELY. No nursing home for my old Daddy, not so long as I am physically or financially able to care for him otherwise.

I understand very well your beliefs in respect to religion, and totally agree about the science, etc.

But I really do wish you and some others would tone down the anti religious rhetoric, because it doesn’t help AT ALL, politically, and politics are the determining factor in getting rid of Trump and company, establishing sensible environmental regulations and policies, etc.

Do I intend to imply that other people, who are not Christians, don’t look after their aged parents? Not at all. I am saying that people who take their religious culture seriously are far more likely to do so. Virtually every one of my university class mates I am still in contact pay nearly no attention at all to religion, other than maybe getting married and buried at the old family church, assuming they still live someplace near it.

And nearly all of them have put their elders in nursing homes. In my community, most of us are somewhat serious about Jesus, and the majority of us who are so inclined keep our elders home with us until the last possible minute.

Religions have survival value. That’s why they persist. You are scientifically literate,and should admit it.

Of course I’m perfectly willing to admit that a well run democracy should and to a very real extent DOES provide for the elderly, and actually advocate society as a whole doing so. It would be hard for me to handle the load if it weren’t for Medicare and social security, etc, and impossible in the event of major medical problems.

None of this is to say that we should be so stupid as to nominate somebody like HRC, who was the MOST DISTRUSTED and LEAST LIKED nationally prominent Democrat in the USA, which is MORE than ample explanation why she lost to Trump, as bad as he was and is. She was and is a girl scout, compared to him…… but she was simply not the candidate with the best chance of winning. She was an old line machine type politician at a time when the core of BOTH parties was absolutely determined to SEE SOME CHANGE.

The D’s nominated more of the same. The R’s did all they could to keep Trump out, but he won the nomination anyway, and then because of the Electoral College the White House as well.

The epitaph of her campaign , in the last analysis, will read, “I’m with her……I guess.”

Lets hope the D’s nominate somebody with some charisma, somebody without a miles long baggage train, real or imagined, and somebody who appeals to both the professional classes as well as the working classes. They can and will win if they nominate such a candidate.

If they nominate somebody too far to the left, as the public perceives them, the R’s may win again.

But I really do wish you and some others would tone down the anti-religious rhetoric, because it doesn’t help AT ALL, …

What do you mean by “it doesn’t help at all”??? It makes me feel one hell of a lot better. 😉

Seriously, I will not tone it down. I will continue to rail against religion until I draw my last breath. Religion has been responsible for most of the wars. It was the sole reason for the Inquisition. It was responsible for the Crusades. It was responsible for 9/11. Evangelicals are the reason we have an idiot in the White House today.

Religion poisons everything.

Religion poisons everything

And not being able to mention this, is just a toxic meme protecting itself.

Emphasizing anti religious convictions does not do much to increase the leftish leaning liberal voting tally. The D’s need to understand that their core is with them, and does not need it’s butt kissed, because the D core will NEVER vote R. What the D’s need to do is put more emphasis on the problems of working class people, who INCLUDE women and minorities, etc.

It’s not good, in political terms, to emphasize points that do more to motivate the enemy than one’s own troops.

Emphasizing anti religious convictions does not do much to increase the leftish leaning liberal voting tally.

Mac, I really don’t give a flying fuck about increasing the leftish leaning liberal voting tally. That is not my goal in life. I have a different goal.

Hi again Ron,

I strongly urge you to do whatever you can, and everybody else LIKEWISE, to do whatever HE can, within reason, to increase the number of leftish liberalish voters, and reduce the number of right leaning conservatively oriented voters, supposing you REALLY give a damn about the environment and the future of any younger relatives.

does not do much to increase the leftish leaning liberal voting tally

You really need to look a little deeper– that is only one of many outcomes- and of little use.

Pepsi or Pepsi Lite is not a option

“Religion is an insult to human dignity. With or without it you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion.” ~ Steven Weinberg

Caring for my 86 year old mother at home, thank you for the lecture, and I don’t an imaginary blond blue eyed Arabian death defying three in one spirit god to get me to do it.

This is a bit off topic but the issue raised some questions.

We know the Ogallala Aquifer water is being pumped out more than replenished. But how can it be replenished?

We have four major dams along the Missouri, stretching from North Dakota southward to the Nebraska/South Dakota border. What would it take to filter that water and pump it into the aquifer at various spots.

One of the things to consider is that Exxon Mobil in their annual energy outlook: A View to 2040, says we have 1 trillion barrels of oil that we know we can produce over the next 150 years to meet current demand. That works out to 18.26 MBOD; which means its just USA demand.

Where is this “oil”. They don’t say but I suspect that part of it (or most of it) is the Shale Oil formations in Western Colorado and Utah. USGS says we have a lot more of that there.

The problem is that it needs about 2.5 to 3 barrels of water to produce something that will go through a pipeline to a refinery. To produce 5 MBOD, there needs to be up to 15 million barrels of water per day. It’s not going to come from the Colorado River. It has to come from east of the Continental Divide.

The Alaskan Pipeline, in its heyday, pumped a little over 1.5 MBOD. So in effect, there would need to be up to 36 Alaskan Pipelines to provide for 18 MBOD from the Shale Oil formations.

If Exxon is contemplating this any part of this scenarion, why not filter and send a portion of that water south to the Ogallala area and pump it into the aquafier? In this article, https://www.scientificamerican.com/article/the-ogallala-aquifer/ I didn’t see any mention of pumping water from the Missouri into the aquifer. Not sure why. I did see where T Boone Pickens was talking about a 624 mile water pipeline to pump water from the Texas Panhandle part of the aquifer to Dallas and costing $2.1 billion.

Thanks for the comment, and this clarification for casual readers

Remember that there’s a difference between “shale oil” and “oil shale”. The former is what is found in NoDak and Texas, while the latter is Colo and Utah, is non-fracked and will probably take enormous amounts of water to exploit. From what I understand, it takes heat to remove the shale oil from the oil shale and one way to do that is through superheated steam.

https://en.wikipedia.org/wiki/Shale_oil_extraction

Thank you for the correction. The terms are easily confused as in Exhibit A above and the attached JPG listing the feedstock as oil shale and the product as shale oil. It can get confusing in a hurry for neophytes like myself.

I was reading in wiki that it would take from 1 to 10 barrels of water after the extraction. However, in a report on a oil shale extraction pilot project, Shell was trying various heating methods to get the hydrocarbons to flow as you mentioned above. The Shell project manager was saying something on the order of 2.5 to 3 barrels was needed to process the extract into something that would flow in a pipeline with hopes of getting that water usage number down. I don’t have a reference for this later claim.

OFM Thanks for the link. I’ve been thoroughly enjoying the presentation by Walter Jehne https://youtu.be/123y7jDdbfY that was posted by ezlxq1949 in response to the initial post. These concepts are critical if we have any intention of turning our climate around. Even though fossil fuels will continue to be burned as fast as humanly possible we really can cool our planet by changing the ways we manage our landscapes.

From your article:

This is why I’m strictly apolitical. It matters not to me whether it would have been Trump or Clinton in the White House. Either/both would have been similarly defective leaders.

Wild bee species critical to pollination on the decline

EPA restores broad use of pesticide opposed by beekeepers

Yeah, that’s exactly what Hillary would have done.

Please, give me a break. It matters whom we have in the White House, it matters a lot. We have a blooming idiot for a president who calls himself “an extremely stable genus”. He behaves like a 12 year old schoolyard bully. He is an embarrassment to all Americans.

So the US is an NET NG Exporter for the 1st time in Decades for 2018 and perhaps 2019. With

Utility conversions to NG and projections in this Post, seems like this is complete Loco loco, If there is a Fractions of 1% NG Shortage for Centralized Power Generation things could get U G L Y 16/20 milliseconds Later. Talk about JIT Logistics Chain! What A MAD MAD MAD World. https://www.utilitydive.com/news/ferc-creates-lng-export-division-following-spike-in-development-applicatio/559493/

LT

September price for LNG in JKM (Asia) market is $4.25/ mmbtu delivered.

If that statement was made a few years back, it would understandably be deemed insane.

Henry Hub, as of this posting, is $2.15/mmbtu.

The just-christened FSRU, ‘Galleon’ will soon be positioned off Port Kembla, Australia and will provide 70% of the gas needs for New South Wales. (Victoria’s Crib Point will get its own FSRU – Esperanza – shortly).

Galleon will be supplied by Cheneire.

When people realize that the world’s largest LNG exporter – Oz – is getting supply from the USA, heads are gonna explode.

You have this wrong. Cheneire Marketing International is the company that has the contract to position and manage the S. Korean built FSRU offshore Australia and to establish it ready to function in support of an AIE project (Australian Industrial Energy) to supply that region with LNG.

In fact, AIE has the contract to provide gas to this customer in January 2021. Cheniere is responsible for getting the FSRU positioned and prepared to support that date. The articles I saw said the gas comes from AIE and Cheniere is just some personnel manning the FSRU.

Watcher

Re-read the few releases describing these events.

AIE is the developer of the Port Kembla LNG terminal and has a contract to supply gas to the Aussie distributor Energy Australia.

The owner of the just-built Galleon is the Norwegian outfit Hoegh.

Hoegh signed the 18 month long contract with Cheniere to ensure the ship will be onsite starting this September.

Cheneire is in the business of liquefying and selling LNG.

At the moment – with the future status to be determined post January 1, 2021 – Cheniere will supply the fuel ongoing to the AIE run Port Kembla terminal.

Replace oil?

1. Goggle search on Russian moth antigravity and see victor’s new car

Replaces oil, a plasma vortex based physics

2) fusion , European type conserves fuel little embrittlement, lasts long time. Replaces coal nuclear electric power

3) environments cleans itself if farm oceans

Blurb. A tractor needs 1 to 1.5 horsepower to pull 1 inch of plow width. Plow blades are 16 inches apart.

You can crunch up the numbers from there.

Or maybe not. Here’s the crunch:

If the plow attachment for a tractor is 57 feet wide, and the tractor is of properly chosen horsepower, it will do 32 acres per hour at nominal speed. The acres per hour requirement is about completing a large farm (>1000 acres) before planting season expires. And the reason why diesel is dominant and electric inconceivable is this — the properly chosen horsepower for a 57 foot wide plow attachment is 425 Hp.

31 hours to plow 1000 acres with that guy. Pretty pricey equipment. If you go smaller you see this:

21 foot plow will do 12 acres per hour. Tractor power required to get the speed for that number is 310 horsepower. 84 hours to do 1000 acres. You can see how the horsepower value is non linear for speed and therefore labor costs will go up.

745 watts per horsepower. The 310 Hp tractor will be 231 Kw of muscle to do that speed. 84 hours day and night — 19,404 KW-hrs. Let’s put 10 Tesla batteries on it at 100 KW-Hrs/battery. That will be 19 battery recharges required, overnight to fully refill at reasonable 240VAC and amperage levels you can find on a farm. The batteries will weigh 12000 pounds. (At 8 hrs to recharge, that’s 152 hours. Nearly twice the time to do the actual work)

(speed and power numbers from here:

https://farm-energy.extension.org/match-implement-size-to-tractor-to-save-fuel/

)

That, for some reason reminds me of the old Ronald Walters posts. (har)

Don’t know what that means. I do know that says you won’t feed 7 billion with electric tractors.

He used to do a lot of math. Meant it in a good way.

Use electric traction engines fed from an overhead down 1 side of the field. No need for tractors running all over the soil and ruining it.

NAOM

There are a lot of ways to replace oil for tractors. Just one example would be corn ethanol:

Corn takes about 3.5 gallons of diesel per acre, year round, to produce (a range of 2 to 5, with no-till at the low end). An acre of corn can produce the equivalent of about 320 gallons diesel (160 bushels per acre, 2.8 gallons of ethanol per bushel and .7 gallons of diesel per gallon of ethanol), so that’s roughly 1% of corn production needed to power tractors.

Corn ethanol would make a lot more sense for tractors than for light passenger vehicles.

https://pubs.ext.vt.edu/content/dam/pubs_ext_vt_edu/442/442-073/442-073_pdf.pdf

Seems like an easier solution would find ways to reduce oil consumption for other forms of transportation and save what is left for tractors and such.

Well, it’s kind’ve a theoretical question, as we have a ways to go before we’re faced with the question of getting to zero oil consumption.

I suspect that children 50 years from now will be astonished that we ever did something so odd as to burn black and dirty fossil fuels. To them it will seem similar to living in caves.

On the other hand…