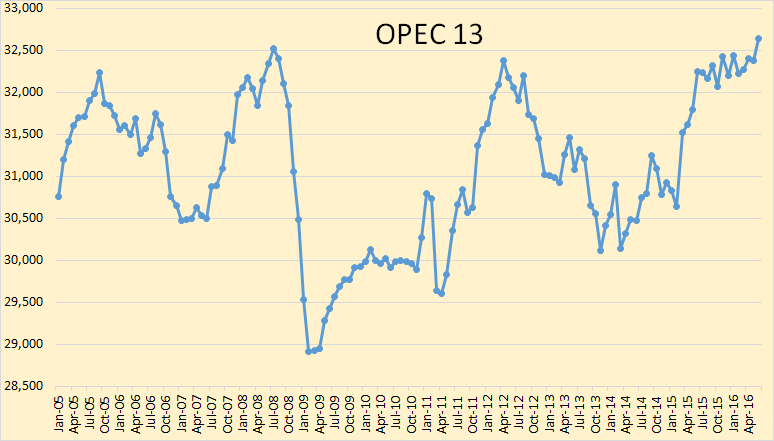

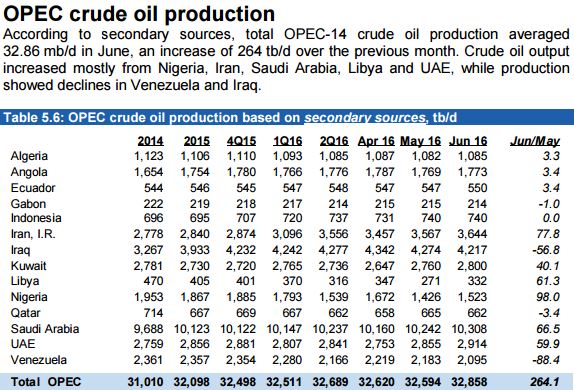

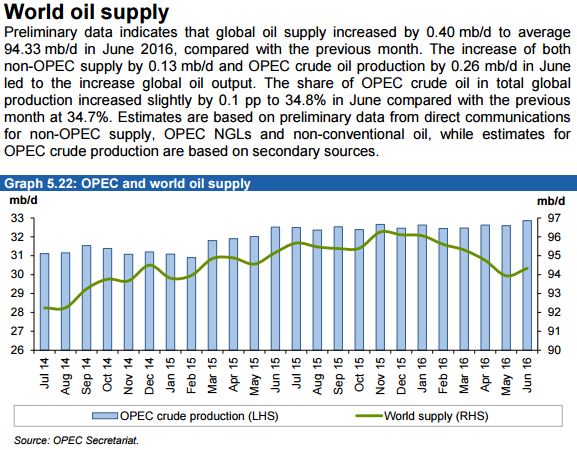

The new OPEC Monthly Oil Market Report is out with crude only production numbers for June 2016. OPEC added Gabon to its member countries this month. But I do not have historical production numbers for Gabon so this report does not include Gabon.

OPEC crude only production reached 32,643,000 barrels per day, (not including Gabon). This was an increase of just over a quarter of million barrels per day. See exact data below.

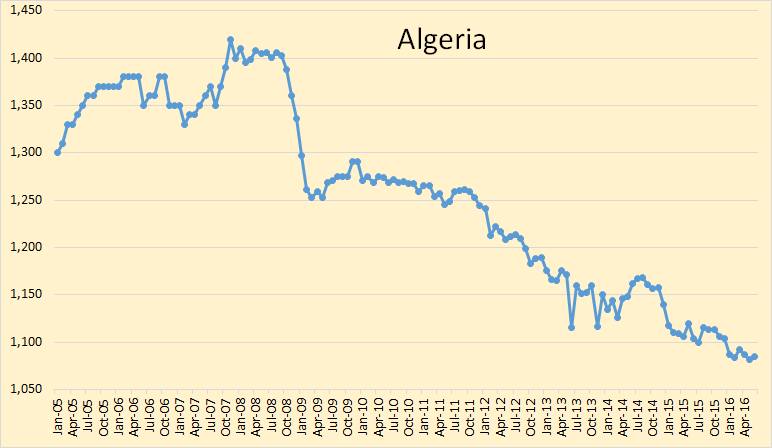

Algeria, slightly up this month but s nevertheless in slow decline.

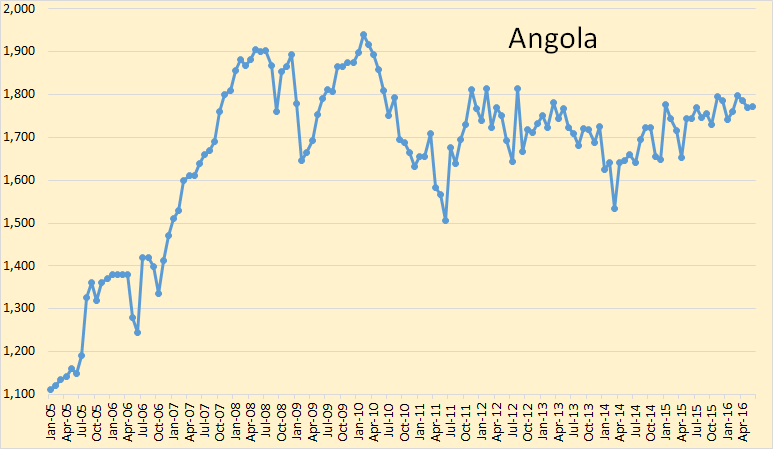

Angola seems to be holding steady.

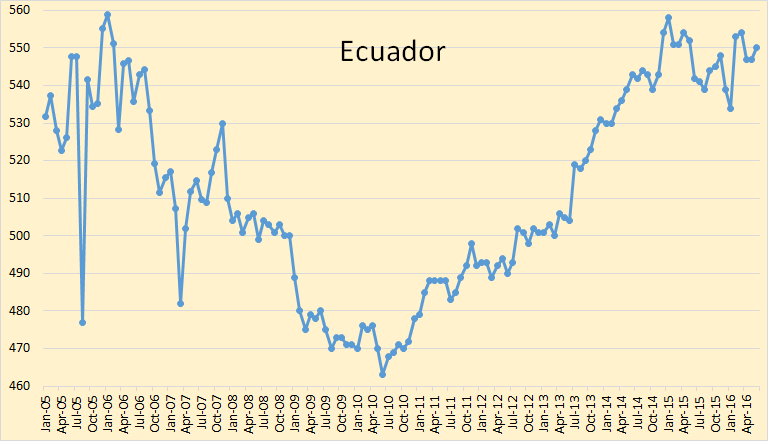

Ecuador is also holding production steady. Ecuador increased its rig count from 2 to 5 in June but that is down from an average of 25 in 2013 and 2014.

Indonesia has reversed its decline in the last year and one half but I don’t see much progress from this point on.

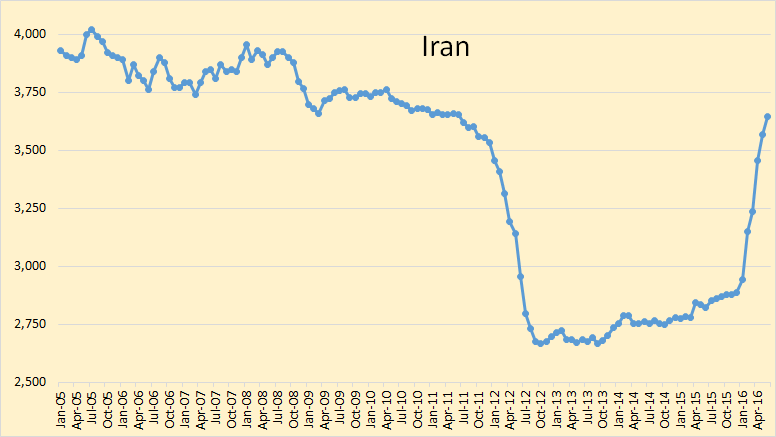

Iran’s increase since sanctions were lifted has slowed. There are other problems on the horizon for Iran. They are talking about changing all their oil field contracts to “buy back” contracts. That is they want the option to nationalize all everything. This will likely cause a mass exodus of foreign oil companies from Iran and hit their production considerably.

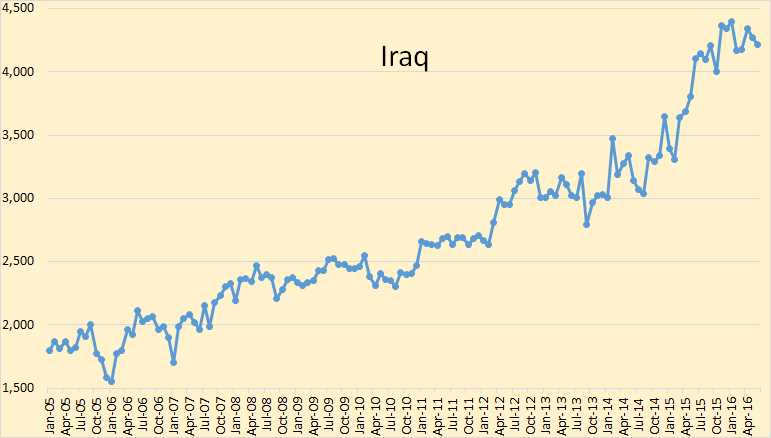

Yes, believe it or not, Iraq has peaked, or at least peaked for the next several years.

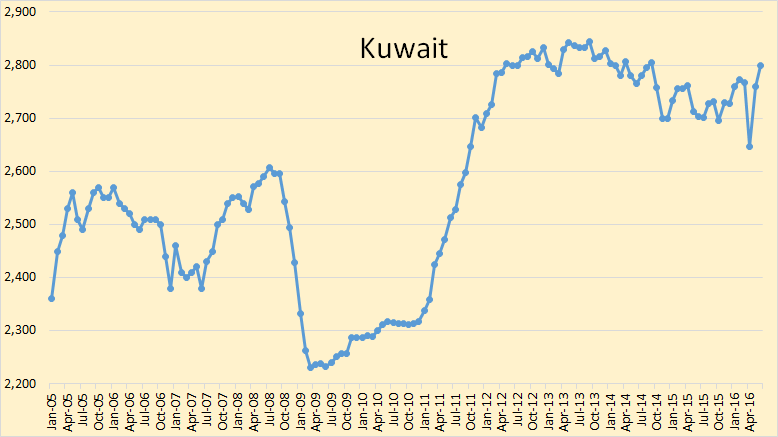

Kuwait has recovered from the problems they had in April. I expect their production to flatten out here with a slight decline over the next few years.

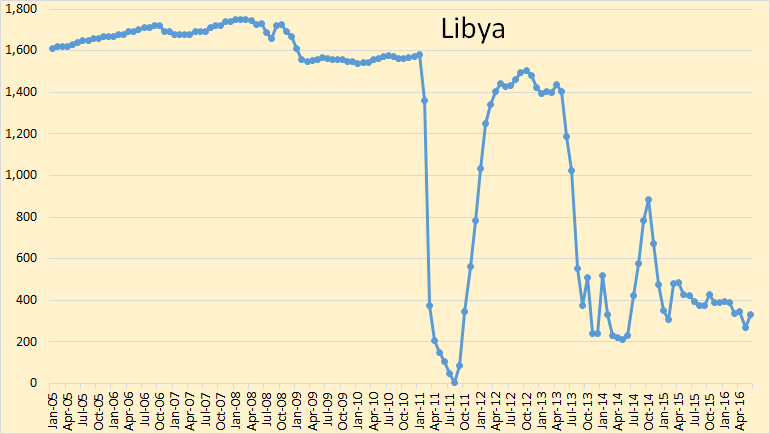

Libya’s problems continue, and will likely continue for a long while yet.

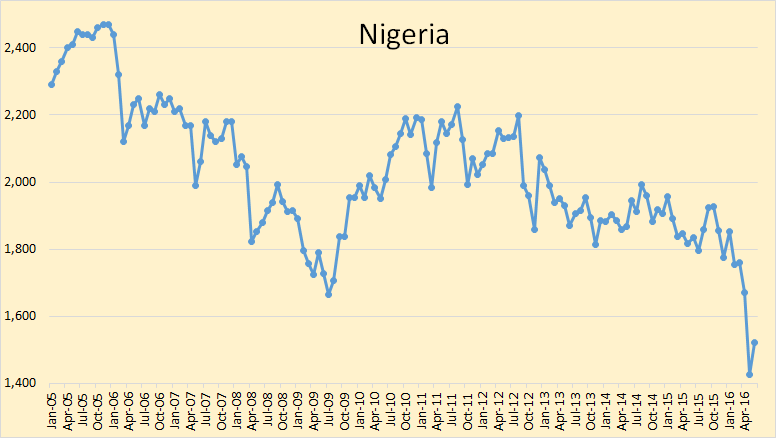

Though Nigeria’s production increased slightly in June their problems with the rebels continue.

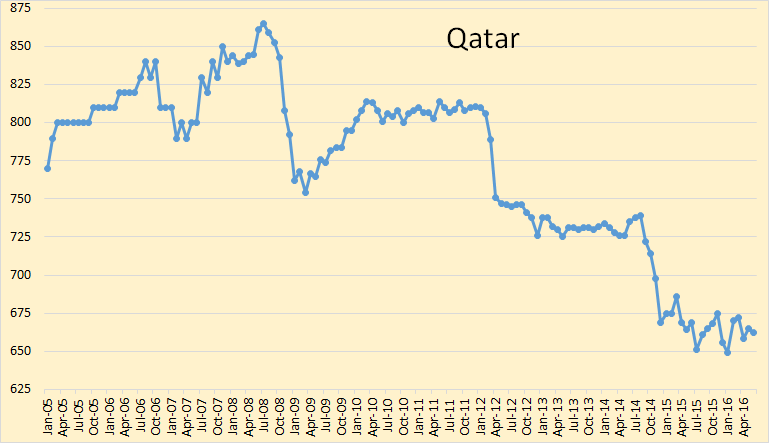

Qatar’s oil production seems to have bottomed out since late 2014.

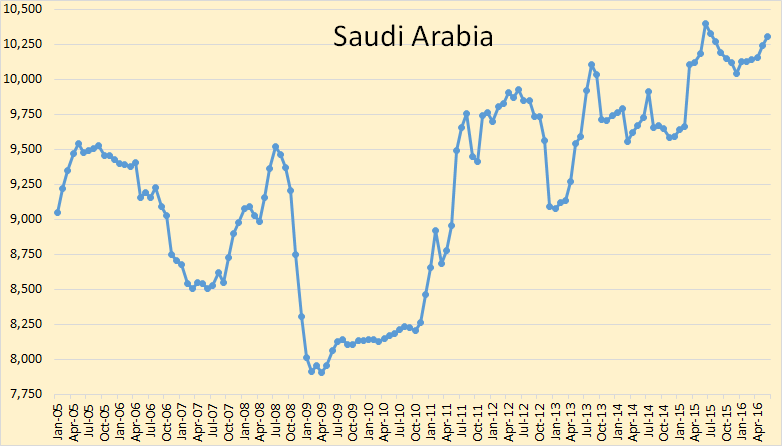

Saudi Arabia peaked, so far, in June 2015 and seems to be holding rather steady since then.

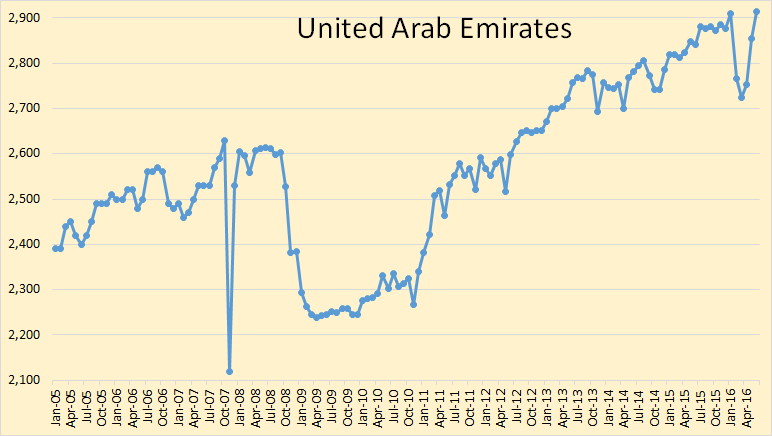

The United Arab Emirates had some problems earlier this year but they seem to have recovered. I think they will hold production steady for a while now.

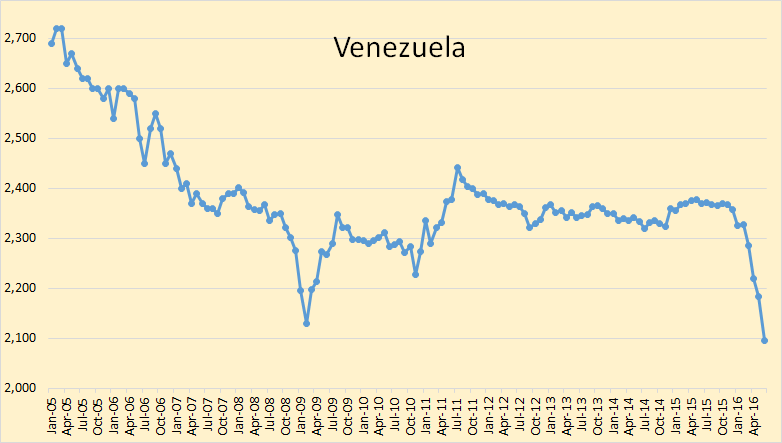

Venezuela’s oil production is dropping much faster than most analysist had predicted. And they, very likely, have a bit to go yet. Many of their workers and contractors are not getting paid. I expect them to be at 1.9 million barrels per day, or lower, very soon.

Though OPEC production reached an all time high in June, world oil production is still down almost 2 million barrels per day since peaking in November 2015.

Recently finished reading Richard Heinberg’s newest book, Our Renewable Future. It is a clear and concise book which lays out with great clarity I felt the opportunities for solar and wind as well as the numerous challenges. One thing is certain, at the global level as well as the national level, there must be discussion as well as clear joint action about the twin realities of peak oil and climate change. Considering that we may have to invest $100 Trillion within a time frame of 20-25 years to mitigate the worst effects of climate change as well as advance our engineering enough to electrify processes such as the manufacture of cement as well as heavy duty equipment related to trailers, mining, farming etc, we must begin to talk more honestly and openly about the coming transition. Just going back and forth between peak oil circle confines isn’t going to help society much at all. The challenge lies in creating a positive vision for a post carbon future which the public hasn’t grasped yet, or maybe is unwilling to.

http://www.abc.net.au/news/2016-06-24/renewable-energy-technology-breakthroughs-needed-says-heinberg/7512840

Considering that we may have to invest $100 Trillion within a time frame of 20-25 years to mitigate the worst effects of climate change as well as advance our engineering enough to electrify processes such as the manufacture of cement as well as heavy duty equipment related to trailers, mining, farming etc, we must begin to talk more honestly and openly about the coming transition.

Indeed! We will have to rethink everything and start a lot of things from absolute scratch. This is the time to go back to the drawing board and reexamine all of our assumptions.

Here is an example of the kind of thinking we will need to be doing more and more.

http://www.ready-for-the-resource-revolution.com/en/bacteria-in-concrete-how-biomimicry-is-inspiring-sustainable-construction/

Hendrik Jonkers, a Dutch microbiologist and finalist in the European Patent Office’s 2015 European Inventors Award, was inspired by the ability of octopuses to regrow lost tentacles, to develop a new cement that could self-repair cracks in a cement structure. To do this, Mark Jonkers included, in the cement, natural bacteria (bacillus pseudofirmus and B. cohnii) capable of producing limestone. Normally dormant, they “wake up” as soon as they come in contact with water and flow into the crack. The limestone creation process then fills in all cracks. Another benefit of this innovation is that the bacteria consume oxygen, thus minimizing internal corrosion in the cement.

For the construction industry, this new material has an essential additional property: its durability. Bacteria can remain dormant for 200 years, which is a real benefit for major civil engineering projects that are difficult to access. This cement, which combines expertise in construction and marine biology, could allow the heavy construction and civil engineering industry to significantly reduce the maintenance costs of bridges, tunnels, and more…

I dont see a need to electrify cement manufacture. There’s a lot of misinformation flying around about global warming which seems to be based on flawed (and poorly documented) carbon cycle processes. As far as I can tell the peak CO2 concentration will be around 630 ppm and then begin a long downward descent to 180 ppm.

Has depletion finally gained the upper hand? My back of the envelope calculation:

Conventional: 78 million barrels at 4% = 3.1 million barrels.

All other: 19 million barrels at 10% = 1.9 million barrels.

Total: 5 million barrels per year

2015 was a year where a lot of projects came online that were developed in previous years. There is less of that this year. So 2 million for this year seem reasonable. Next year will be interesting.

If demand keeps growing, there should be a substantial shortfall, draining storage. The only way to close the fast growing gap is a miraculous recovery of Libya and others that are currently hampered by political unrest.

There are still a lot of projects due this year and next and even into 2018, but not quite enough to make up for the declines. Probably 2.5 to 3.5 mmbpd fall over the three years barring big, unexpected outages. In 2019, 2020 and 2021 there will be dramatic and accelerating falls unless a lot of expensive, and currently delayed, oil developments are fast tracked soon, or a lot of very cheap oil is found somewhere, or in fill drilling ramps up quickly on the big reservoirs. We’ll get to see the truth behind LTO sustainability and flexibility; that and depending on how demand goes, plus the real storage numbers will determine prices and therefore future supply developments. Overall though I agree, I think we will suddenly find ourselves short at some point in the next 5 years, and without many options.

Why would you want to drain storage when you can kill competing consumption with weapons.

Because the people you are trying to kill will then attempt to kill you?

Watcher – I think that Ron “almost” has you pegged. Basically he notes that no one can be that Fu–ing stupid. But, he may be wrong. What in the hell are you talking about when you say “you can kill competing consumption with weapons?” Why would anyone in the supply chain want to kill “CONSUMPTION?”

It’s erroneous to decline “all other” at a fixed rate like you propose.

Output of KSA vs July 2014 at $100+ /b up about 600K bpd. Less than 1/2 price and up 600K bpd.

What’s the latest Russia vs July 2014, Ron? Similar? Probably.

Imagine that. Price didn’t matter.

It’s time lag. Simply said, when prices where at 100$+, everyone had lot’s of money to invest and drilled like mad to get even more oil, explored, developed new fields.

These operations have normally completion times of a few years, so they come alltogether online now. A typically pork circle.

Price does matter – now new projects are delayed or canceled, ready to go into the next round.

Hi Till,

You won’t convince Watcher that price matters, but most of us agree that price matters.

How can anyone possibly deny the effect the price of oil has on the production of oil? The very high price of oil brought on the shale revolution. Oil prices above $80 a barrel caused shale oil production to boom. However shale oil production is just uneconomical at prices below $60 a barrel, or somewhere in that neighborhood.

Dammit, it is as plain as the nose on your face. Price determines production. Does Watcher really deny that simple fact? No, Dennis, you are simply mistaken. Watcher is not so dumb as to deny that simple fact…. Is he???

Watcher has BEEN denying it, as steadily as if somebody were paying him by the word, for as far back as I can remember.

Some people, quite a few actually, believe God looks after their lives for them on an every day basis, and no amount of evidence, good or bad, is enough to shake this conviction.

Watcher apparently believes in some UNIDENTIFIED POWER that keeps oil coming regardless of the price, or perhaps more accurately, keeps it coming even while controlling the price and forcing it down by half or three quarters.

Of course there might be another explanation. Maybe he just enjoys rubbing everybody nose in the apparent failure of the market system in the case of oil.

The explanation is simple enough, in principle. The oil industry is the biggest and slowest moving of all industries, when it comes to NECESSARILY operating on a five to ten year time scale in terms of making production decisions.

Being an orchardist, I am personally quite comfortable with such planning time scales, because my kind of work is planned on a very similar time scale. If I miscalculate , meaning guess, really, what the price of apples will be ten years down the road, and plant too many new trees, I am not just going to take a chainsaw or bulldozer to my orchard because the price collapses. I wait it out, and hopefully OTHER orchardists go broke first. Old trees will be dying, there is depletion in apples, lol.

The production decision making process is triply compounded in difficulty by what we usually forget , because in a forum such as this one, the discussion is centered around BUSINESSMEN out to make a living, folks such as Mike, Shallow Sand, Texas Tea, etc. They make rational decisions, as best they can.

What we forget is that the oil industry is an industry dominated by governments, and governments are notoriously clumsy in managing their business affairs when circumstances demand action.

Politicians, be they Saudi kings or socialist Venezuelans, or right wing dictators or more middle of the road types, are NOT going to do anything to upset their citizens, or piss them off, if it can be avoided. Laying off a few tens of thousands of people is just not DONE until there is NO OTHER choice.

Nobody would notice if we laid off half the people who work in the post office here in the USA. Every body I know , excepting my cousin who is a carrier, and the post master, thinks we could get along JUST FINE delivering the mail three days a week instead of six.

Politicians at the top of the heap are mostly interested in one thing, that thing being to stay in power, and to do that, they play an incredibly complicated, fluid game maintaining the network of supporters who ENABLE them to STAY in power.

Expecting them to act like BUSINESSMEN running a business is naive. As a rule, they will never do anything proactive in order to solve a problem that might just go away by itself. When they DO do something , it is to be expected that the doing will be undertaken much later than it ought to be, and that it will be inadequate to deal with the problem until the problem becomes an existential emergency.

ONCE all the chips are on the table, and it’s literally do or die, or be sent home, out of office and out of power, governments can do some pretty spectacular things, such as mobilize to fight a flat out war.

Things aren’t that bad yet, in the countries dependent on oil revenues,excepting Venezuela. Maduro is actively constructing a police state in hopes of staying in power.

The industry has excess capacity. It took years to build that capacity, and the economy couldn’t absorb the amount of oil coming to market at a hundred bucks, so the price collapsed. The economy IS absorbing the oil coming to market, about the same amount , at about forty bucks.

It will take a WHILE for the excess capacity to dry up.Maybe another year or two, maybe less, maybe longer. If the economy turns sour, it will take longer.If the electric car revolution really comes to pass, on the GRAND SCALE, and very quickly, demand destruction will mean there is so much excess capacity that the price will stay low for a long time.

There is nothing involved in understanding the oil price question that requires more than a basic understanding of supply and demand, plus an additional understanding of the relevant time scales and the nature of GOVERNMENTS as opposed to BUSINESSMEN making decisions.

If businessmen were running the post office, we would have half as many postal employees, lol. Maybe even less.

OTOH, I notice 2 yrs later KSA is producing 600K bpd more oil at less than half the price.

And what is Russia producing now at less than half the price? (asking again since Ron tracks them)

Oh, and more fun, y’all recall the big drilling investment from the majors got cut in Jan 2014?

It`s called delayed effect.

Farmers have generally done the same thing, collectively, when the price of whichever crop they produced crashed.

As an individual guy growing corn, or wheat, or rice, or apples, I cannot produce enough, or cut back far enough, to influence the market price. What I CAN do, is go flat out to produce every possible last bushel, going for the all important marginal dollar that might enable me to survive short term. This is what the SMALLER oil producers are doing, by and large.

While producing flat out individually, and collectively, we make the price crash even lower, and stay in the pits longer, but then this is what drowning men who cannot swim do in the water- try to survive by pushing themselves up by pushing another man under.

The game changes when one (or more) supplier is big enough and rich enough to have pricing power and staying power running at a loss. In that case, the big boy can “sweat” the little fellow , in the words of John D Rockefeller, running him out of business, deliberately.

Now this didn’t take long at all while Rockefeller was running a small local company out back in the early days of big oil, but it can take a hell of a long time when the little guy is a sovereign government, or a giant corporation. I should say that SA and Russia are engaged in BOTH ways, producing flat out to maximize revenues, plus hoping to run some competitors out of the market, at least temporarily.

Folks who aren’t TOO simple minded to think a little also realize there is such a thing as war and politics, and that war can be fought in markets as well as with guns. The USA basically broke the old USSR by making it impossible for that now dead empire to compete with us on building guns, never mind butter, plus encouraging the Saudis to flood the market and deprive the Soviets of oil revenue. Hard core D types will never admit that this is true however, because it is grounds for being kicked out of the party to admit that a Republican has ever succeeded at doing anything at all except creating more and bigger problems.

There is an element of WAR being played out in the oil markets now, and for the last year or two, and it will continue to be important for a while.

Anybody who thinks anybody in DC, excepting oil state congress critters and oil lobbyists, gives a flying fuck about the oil industries problems has a near zero understanding of economic politics. Cheap gasoline is an elixer that is damned good for the OVERALL economy, and as good as a zanax for soothing the nerves of consumers. To expect the Obama administration to do anything to raise the price of oil, when raising it would cost D ‘s elections, is tantamount to insanity. Who can remember this quote? “It’s the economy, stupid”?

Hells bells, the R party rakes the D ‘s over the coals for LOWERING the price of oil by insisting on higher fuel economy standards, lol.

And one last little bit of ranting, and I will lay off for an hour or two , at least, so help me Jesus. This is history we are talking about, not a goddamned thirty minute tv show.

Things that matter take time in real life.

Looking at what Ron has said that the threshold for LTO production is $60, what I find important is that just a few years ago that threshold was in the $80 to $100 range.

Even at today’s prices, $45 to $50 range, we have seen the oil directed rig count, increase over the past few weeks.

This indicates that some of the better plays have a lower threshold.

As we go out in time I would not be surprised that the $60 threshold will move down again.

R DesRoches,

absence of some new technology, I expect we are at the lows of what LTO break-even cost will be for the best LTO plays. As oil prices pick up and balance sheets get better the drilling companies, Fracking co will begin to have some better pricing power and I expect they will use it. So for a time expect break even to stay low but begin to rise “somewhat” as prices move up. I still think $75 WTI is what the best companies in the best plays really need to MAKE MONEY not just break-even in a normal business environment. (lets says 1200 rigs running lower 48 ) I know I would be drilling in the areas I am active at that price, $50 not so much and only with a gun to my head ??

RDR – I am never sure of what anybody said about breakeven, unless it is accompanied by a complete financial statement.

If an oil company has undrilled land in an LTO area, that (1) needs production to “hold” the lease, and/or (2) has bank debt related to its lease acquisition, then: Their breakeven point and perspective is totally different (lower) than if you or I tried to determine our breakeven point if we went someplace, bought acreage and drilled a well.

OTOH, I notice 2 yrs later KSA is producing 600K bpd more oil at less than half the price.

And what is Russia producing now at less than half the price?

Watcher, you cannot measure every barrel produced with the same yard stick.

It cost KSA about $20 a barrel to produce oil, more in some places less in others. Therefore they want to produce every barrel possible in order to meet their budget.

It cost Russia pretty much the same to produce oil from their old fields. But it cost them much more to find new oil and produce it. The price of oil is hitting Russia very hard but will hit them much harder unless the price rises soon.

The low price of oil is killing Venezuela. Their production is dropping. It will drop much further unless the price starts to rise soon.

Almost every barrel being produced cost a different amount to produce. There is a thing called “the margin”. That is what it cost to produce the most expensive barrel of oil being produced. As the price of oil drops, barrels being produced “at the margin” starts to drop off. More expensive oil stops being produced, less expensive oil continues to be produced. Of course there is a delay between the price dropping below the margin and that marginal barrel dropping from production.

Watcher, it is just fucking insane to claim that price has no effect on production. You have to know better than that. Why on earth do you think the number of oil rigs working in North Dakota dropped fro 215 rigs four years ago today, to 30 today? It was because the price of oil dropped and for no other reason. And that decline in the number of rigs is currently having a dramatic effect on oil production in North Dakota.

Hi Watcher,

Prices dropped in June 2014, maybe you mean Jan 2015?

Hi Ron,

It may be that I am misinterpreting Watcher. I have been mistaken in the past and history tends to repeat. 🙂

Dennis, I was just being sarcastic. I know that Watcher really does believe that the price of oil makes no difference. Imagine that! He also believes that money is just a piece of paper.

If you go to any of the big LTO independent oil companies web sites and look at their investor presentations you will find two trends.

First the day to drill wells have come down in the last couple of years, in many cases by over 30%.

Second with bigger fracs and changes in the mix, IPs and EURs have gone up, in many cases above 25%.

What this means is that the break even price of oil has been coming down.

We are starting to see rigs coming back to the patch at oil prices below $50. IMO as the oil prices moves up towards the $60 level the rate of increase in rig counts will also increase.

IPs have gone up due to more proppant and more frack stages, this increases well cost.

I doubt the breakevens have fallen below $75/b for full cycle costs.

Yes they have added more stages with closer spacing, but total well cost to drill and complete have gone down.

According to EOG, 2/3 rds of the lower cost is from sustainable efficiency improvements and the rest is from lower service costs.

According to EOG spud to td has gone down by 43% to 59% (Bakken), and LOE has gone down 30% from $17.02 to $11.86.

At the same time 120 day production rates in 2014 has gone from 10.7 Bbl per foot to 20.9 Bbl in Q1 2016.

Bottom line more oil at lower cost has reduced break even oil price?

Hi R DesRoches,

Well costs went down and then back up as more esoteric well designs have become common. Note that supd costs may have gone down and LOE might also have gone down, but you are leaving out completion costs which is about 2/3 of the capital cost of the well, the decrease in spud cost has been more than offset by increases in completion costs (this includes the fracking). On balance total well cost has probably not decreased much and for the newer designs with more stages (up to 40 or so in the Bakken) and higher amounts of proppant, total well cost has probably increased.

The “lower well cost” presented in the investor presentations is for an older “standard well design”. The newer well designs that have increased the output per well cost an extra 1 or 2 million per well (in the ND Bakken/Three Forks).

What does frac water cost per barrel, or at least a range? How many barrels of water are needed to drill and complete a hz well? How much does trucking the water cost.

I know all this can vary, so just some ranges will do.

Hi R DesRoches.

I took a look at oil rigs operating in the Permian, Bakken and Eagle Ford.

For those 3 plays we have:

Total oil rigs- 213

Horizontal-191

Vertical- 22

Bakken – 28T, 27H

EF- 27T, 26H

Permian-158T, 138H, 74% of oil rigs in the big 3 LTO plays.

Of the 28 oil rigs added since May 27, 2016, 22 were added to the Permian and all were horizontal rigs. The Bakken added 5 horizontal rigs and 1 vertical and the EF 1 vertical rig.

Based on this, Eagle Ford is probably the high cost play, then Bakken, with the Permian perceived as best at the moment of the LTO plays.

Data from Bakker Hughes pivot table.

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-reportsother

“…Imagine that. Price didn’t matter…”

Watcher,

just like you were wrong when you wrote: “…countries with CBs cannot default…”, you are incorrect with this one, as well.

(I clarified that for you here: http://peakoilbarrel.com/petroleum-supply-monthly-texas-cc-estimate-permian-and-eagle-ford/#comment-575038 )

-Not only price does matter, but It is PRECISELY due to the low prices that everybody is producing in a ” …the last big party…” mode, … last oomph, if you will!

All in!

All they can!

….and has little to do with the “delayed effect”…. if there is such a thing.

Be well

Petro

Nexen to lay off 350, releases findings on hydrocracker explosion and pipeline spill

Nexen Energy will lay off about 350 workers from its Long Lake facility, following its release of results of internal investigations into a July 2015 pipeline spill and the January 2016 hydrocracker explosion.

Nexen is based in Alberta but owned by CNOOC, a Chinese company.

New Mexico Oil Tank Fire:

(WPX Energy)

http://earthfirstjournal.org/newswire/2016/07/14/massive-fracking-explosion-in-new-mexico-36-oil-tanks-catch-fire/

Ron is the return of Canadian bbls the big reason for the estimated 400,000 bpd worldwide increase?

Page 51 of the report infers a 700,000 bbl recovery in Canadian production from May to June. Does that sound right to you.

The Canadian National Energy Board predicted Canadian production would increase half a million barrels per day in June.

Hat’s off to Enno for the information he posted refuting Michael Filloon’s claim that Northest Mckenzie wells routinely produce 200,000 to 400,000 bbls oil in the first year. We need more facts, not bs.

http://seekingalpha.com/article/3987709-bakken-update-rig-counts-tell-us-little-horizontal-wells-changed-predict-future-production

It’s amusing to watch the msm dance around avoiding any REAL discussion of why Venezuela is in such real trouble.

http://money.cnn.com/2016/07/12/investing/venezuela-crisis-oil-production-plunges/

The English language media has very uneven coverage. For example, a few days ago Maduro named General Padrino López to a new unconstitutional post. Padrino will boss all ministers as well as the Armed Forces. Giving hm control of the interior ministry gives him control of the dreaded political/secret police, the SEBIN, as well as the national police and national guard.

This cession of power to a general, at a time when the Supreme Court is a mere pawn of the executive and the National Assembly is being ignored blatantly, marks what we could call a self coup. But there’s more, the Cubans are known to be enmeshed in both the military and secret police apparatus. And I have a photo of Padrino López kneeling in front of Fidel Castro. So we could say Venezuela is ruled by a dis functional and corrupt military dictatorship subservient to the Castro family Mafia. All of this is well known to the USA government. Now think through, why is Obama extending a life ring to Raúl Castro, at a time when he’s practically invading Venezuela?

http://www.caracaschronicles.com/2016/07/12/padrinos-move/

Well heck and son of a gun and it’s a real knee slapper, let’s go to the industry bible, shall we?

The BP data released.

Russia production end of 2013 –10.779 mbpd

anddddddddddddd end of 2014 — 10.838 mbpd

anddddddddddddd end of 2015 — 10.980 mbpd

so mid 2014 right around 10.8 mbpd trala trala this is all liquids I think, but let’s not be ever so particular

I’m seeing the top two producers cranking out over 100K bpd MORE at less than 1/2 the price of two full years ago.

Why should price matter when it’s defined in what has been exposed as whimsically defined pieces of printed paper? Think it’s all real? Comfy intellectually with negative interest rates?

“”’Why should price matter when it’s defined in what has been exposed as whimsically defined pieces of printed paper?…” ~ Watcher

Your understanding of those “…whimsically defined pieces of printed paper…” is incorrectly simplistic .

As our world functions today, those “…whimsically defined pieces of printed paper…” make EVERYTHING possible…

….even us having a long distance written conversation.

Be well,

Petro

P.S.: …and to be technically correct, nowadays they are “…whimsically defined concoction of pixels…”

Watcher, doesn’t Russian production reflect the strength of the dollar vs ruble rather than a disassociation from money altogether?

It’s not just Russia. It’s KSA, too. Ron’s numbers lay it out.

It’s Been Two Full Years of price decline. There is no more . . . oh it’s just some transitory effects and we should just wait. Hell, if you wait for anything you’ll eventually see it, and declare that moment verification.

It’s not about some “when”. It’s the area under the curve. All this time it’s not happening, because it’s all gone away since 2009. And it’s never coming back.

It makes sense to me that in the areas where production costs more, production is declining, while where production costs less (Middle East and Russia) production is holding steady to rising.

Let’s see where we end up at end of 2016.

Good point, which AlexS has verified previously.

Why should price matter when it’s defined in what has been exposed as whimsically defined pieces of printed paper?

Only a tiny fraction of all money is in paper printed form. The vast majority of all money is just an electronic entry in a bank somewhere. The form money is in, either in paper notes or as an electronic entry in a bank account, does not change the value of that money. Lots of things can change the value of money, but the fact that it is either printed or in entry form changes nothing.

Russia is seriously hurting because of the low price of oil and Venezuela is dying because of the low price of oil. How can anyone on earth possibly believe that price does not matter?

The low price of oil has a different effect on different producers. In many places the cost of production is still below the price of production. So these folks are producing every barrel possible just to try to stay afloat. But in places where new production cost more than the current price, production is dropping drastically.

You cannot measure every barrel produced with the same ruler. Production costs differ and this difference has a corresponding difference in production.

Watcher,

Russian oil companies are largely shielded from negative effects of low oil prices by:

1) the depreciation of the ruble, which makes oil prices higher in ruble terms and costs lower in dollar terms;

2) the Russian oil tax system, which imposes much higher taxes when oil prices are high and much lower when prices are low.

But Russia is not typical.

In most other countries producers are much more exposed to the price effects

Russian oil production vs. oil price, 2013-16

And KSA up even more?

Production cost differential was true in mid 2014 as well as now.

The price is less than half what it was and two full years have passed. Production is up in the two countries that represent what, a full 25% of the global output.

You guys are contorting yourselves to make an overwhelming reality fit your preconception. These central banks don’t have any idea what trillions upon trillions have done. Hell, Fed governors have explicitly said they don’t.

The “Financial System” is nothing but a bunch of Ponzi Systems.

How else does a small default trigger the collapse (Japan 1997, USA 2008) of the entire interbank market?

Shadow Banks

“Money” Markets

Goldman Sachs appointed central banks

Does that come across as legitimate? And that Shadow Banks are somehow disconnected from the regulated banks? Nonsense.

Short term debt in these “Money” markets is Private Money. Fake Money. Ponzi Money. The Ponzi Operators control the central banks, not the respective governments. Read the new legislation after 2008 where government was cut out of the loop.

Isn’t it funny when their is a run in the Shadow system by the default of a small firm that it PERMANENTLY impairs the ENTIRE real economy.

The definition of Money is More Transactions (Bigger Ponzi) than anybody else. There is nothing real about it because relationship banking disappeared long ago.

Originate a loan, package it, get rid of it, and collect a fee. More loans (transactions), more fees to collect, more power. More subprime = Greater power.

Shale is Subprime Oil.

Hi Watcher,

There’s an old story about a proud dad watching his son in the school marching band. Dad sez his boy is the ONLY one marching to the music, everybody else’s kid is out of step to the music.

Now maybe there is some sort of secret cabal of super rich guys who control the whole world economy, and tell people like Putin and Obama what to do, and when. It could even be that Putin and Obama are the two newest members, lol.

Maybe. 😉

Now I do believe it is possible for a central bank to steer resources, in the form of money , which buys people and concrete and steel, into a given industry. If this happens, then the rest of the economy is deprived of those same resources, in most cases without even realizing it.

But now here is the problem with your argument. Even if a government mandates the production of oil, or any other good or service, by subsidizing it, directly or indirectly, the price of it is still the same.

Sure you can get a few thousand off the price of a new TESLA, or a new pv system, because of subsidies. BUT the TESLA company, and the company that sells you the pv system GET THE FULL PRICE.

The price the seller gets is the TRUE PRICE , the price that determines what can and cannot be profitably produced.

Apparently you just aren’t able to get your head around the facts that price wars happen, that economic warfare is a fact of life, that all businesses can’t react to changes in prices as fast as an independent restaurant operator who can open or close his doors on very short notice.

I have family members who are dead certain that if they broke a leg, God arranged for them to do so, and likewise if they win the lottery. God ordained it.

You aren’t all alone in cherishing a few favorite delusions. 😉

I cherish a few myself, but I try not to advertise them in wide open forums.

It seems to me that when the price of oil drops and one still needs the same amount of income then you have to sell more oil to earn it. Sooooooo price goes down and production goes up so you can afford your budget.

Are you saying Watcher that because price drops KSA should pump less oil? Why ever would they do that? They need money right. They make money selling oil right. Price per barrel goes down so number of barrels being sold needs to go up. Pretty simple stuff I figured.

Absolutely correct.

….at the end of the day, the gross budgetary and debt roll over needs/obligations MUST be met … and that is why EVERY TIME price falls, cheaper/long term conventional producers (as well as the existing non conventional ones that are currently in production!!!!) increase production.

They go on a “fire drill” and produce all they can… until they can, that is!

If prices go lower, expect Russia and KSA (…and Kuwait and a few others…) to increase production – not lower it!

When the production decreases with the prices, is the end of the party and we will have the violent spikes I have mentioned once or twice in the past…

…has little to do with the “delay effect” and “supply-demand”.

You have the accurate grasp of the “glut”, my friend.

Be well,

Petro

That scenario would presume a grand choke that defines level of output, rather than drilling new wells to offset decline rates. The latter is more likely.

The new wells either are or are not free. That is where it has broken.

“As an individual guy growing corn, or wheat, or rice, or apples, I cannot produce enough, or cut back far enough, to influence the market price. What I CAN do, is go flat out to produce every possible last bushel, going for the all important marginal dollar that might enable me to survive short term. ”

In the short term, cash flow trumps just about every other decision during a bad downturn. If you can make your payments, you survive to worry about profits another day. You don’t put tires on the truck, you don’t get your teeth fixed, your kid goes to school in Goodwill clothes, flea market clothes.

Oil producers are in a very similar situation, excepting a few big boys,especially the Saudis, have a lot of cash in the bank to fall back on. Russia is a special case,hard up in some respects, but actually still bringing in a profit due to the low value of the ruble and the Russian tax system.

The Russians and the Saudis cordially wish to see each other in Hell, asap. Putin is in a position now to weather low oil prices. The Saudis are not, after their money in the bank runs short, except for whatever they will be able to borrow.

Petro’s explanation makes the only sense to this situation.

It’s the same with everything. When my wages dropped I did two things; I cut expenses and worked more hours (as needed). Everything had to be paid for. Corporations are no different.

The only thing I never did was expand debt load to pay bills or pretend all is well, (like some Oil Companies do).

Hi Paulo,

In the short term, individual businesses may react by producing more at lower prices. For the market as a whole, if there has not been a big shift in the cost of production for a mature industry, over the long term lower prices will lead to lower output.

Let’s consider the World Oil Market, there are low and high cost producers and over the long term, if prices remain low, oil output will decrease as high cost producers are driven out of business due to lack of profits.

There is a lag between when prices decrease and when output begins to fall due to oil in storage and international and major oil companies taking a long time to adjust their investments.

Claims that there is no delay between oil price movements and oil output are not correct.

The IEA expects non-OPEC liquids output to fall by 800 kb/d in 2016 (June report), this is offset by a rise in OPEC NGLs of 200 kb/d, whether OPEC can increase output from 2015 levels to make up the difference of 600 kb/d is unknown.

A problem with the IEA analysis is that they should report in barrels of oil equivalent or in metric tonnes so that we would know the amount of Energy produced.

It has always seemed strange to me that an agency which purports to report on Energy, wouldn’t use more appropriate units such as Exajoules (EJ) to report energy output.

There seems to be a general assumption that the larger conventional producers can choose to significantly ramp up production when they like, but I doubt that is true. Saudi have just bought on line the Shaybah extension which was a pretty big job to extend production facilities for ‘just’ 250,000 bpd.

Production from a given field may be limited by different parts of the facilities at different times. Typically the limit will be the lowest nameplate capacity between each of: the reservoir / wells; oil processing; produced water handling; associated gas compression; total liquids flow; water (or gas) injection capacity. Overall power availability may also be limiting at some combination of oil/water/gas flow below each one of their individual limits.

Usually in mature fields the wells become limiting. For example as water cut increases not only does the water displace the oil but also, as it is significantly heavier than the oil/gas mix in the wellbore, the overall flow rate declines rapidly. However this need not always be the case. In Saudi I think they design and manage their facilities to keep the production at the oil flow design capacity, which is nominally set to give 2% depletion of the original estimated ultimate reserves per year. To maintain this they maintain excess capacity in the other key facilities. In particular they need to control the water cut by using intelligent wells, expandable liners, and recompletions, or when needed drill new wells higher in the formation. If they lose control of the water cut, which must happen one day (ideally for them it would be the day they flow the last barrel of oil and shut in but that is not going to happen) then the likely limit will be water injection capacity. Water has to be pumped in to maintain pressure to exactly balance the volume pumped out. For the produced water in the oil that is about one for one, for a stock tank barrel of oil it is higher because the oil shrinks as it cools, but mainly because of the gas that is lost. This is ratio is called the formation volume factor and typically is 1.1 to 1.8. Say for a field the water cut is 50% and the FVF is 1.5, this means 2.5 bbls of injection water are needed to give one bbl of oil. I don’t know the Saudi figures but something like that for them means 25 mmbwpd injection (that represents a huge amount of large pipes and pumps, and power – the water isn’t like domestic supply, it has to be at high pressure). It’s not normally economic to build in much spare capacity for the piping systems (but who knows with Saudi). Once water can’t be controlled in horizontal wells the cut increases quickly, if it can’t be handled within the facilities and enough pressure maintenance from injected water supplied then the oil production has to fall (i.e. wells choked back) accordingly.

If at a capacity limit (or limits) increasing production may need new wells, but more than that completely new topsides facilities, anything more than a few tweaks would need at least 2 to 3 years engineering, procurement and construction effort.

Informative comment. Thanks George

Very good overview. I worked with a field set up to handle extra water, but they forgot the water heat capacity requires more heaters. So as water cut climbed we had to use lots of chemicals to get clean oil, until we could install more heaters and heat exchangers. These bottlenecks can be really subtle, so I took to asking for full surface system simulation runs at 90 % field water cut to see where the troubles were bound to pop up.

I think Survivalist and Petro have nailed a very good analysis of the situation. When prices crashed most National Oil Companies and many independent producers tried (and are trying) to produce more to maintain income. The real tragedy comes when prices remain low and production falls like in Venezuela. Lack of investments guarantees that this will happen eventually to most producers, and then once production falls enough we will get very destructive price spikes.

Bingo!

…while indeed initiated by geology, this time “PEAK” shall be by the way – and in the form of low prices…

As I said before:

….more than $65-$75/brl/oil kills economy….less than $60brl/oil kills Shallow and his colleagues…. take your pick….

We have reached our limits…

Let’s keep the party going for a little while longer and enjoy it responsibly.

Be well,

Petro

$60 doesn’t kill us. I have been hoping for a $55-$65 price band, but we are way below that.

We got $44 average for all of 2015, $32 average for first six months of 2016. We are around $5 off WTI.

That’s why break even at $50 is crap. We haven’t been there for 20 months on a sustained basis.

As AlexS notes elsewhere, I’m starting to think $50 breakeven refers to per BOE, which means $70+ WTI.

You “disappoint” me, SS….

As I have mentioned to you numerous times, numbers are illustration and not exact….

I hope you get my point…. but maybe not!

You are fine with $60brl….somebody else is not ….yet, somebody else is ok with $30/brl….. and so on.

As I said numerous time before….we are stuck in this range and going lower….until the party ends.

And you will know the ending by the spikes and shortages….. but by then, is late….too late.

Be well,

Petro

…and SS, when you say : “..$60 doesn’t kill us…”

I wrote “…LESS than $60…”

…just to be correct, you know…

Be well,

Petro

Petro. I understand.

My point is our savior, US LTO, needs a higher price than our 111 year old stripper field.

Which means to me there is a real problem on the horizon.

Petro, we see eye to eye on much these issues, but I do think that the world economy will be able to pay much more for oil than 60$ without crashing. Probably more than $100.

The stuff is too useful, and money will be diverted from other uses to keep buying it.

We’ll see, one way or another….

Hickory,

You cannot simply look at the oil price between 2010 and 2014 and deduce that those prices are sustainable for the World economy. You need to understand the situation under which those prices were made possible at the time. The period 2009-2014 was a time when Chinese debt was growing at unsustainable levels to fuel an oil demand that compensated the demand contraction from an overindebted Europe that could not accept those high oil prices and went into recession and debt crisis. The period 2009-2014 was also a time when central banks engaged in exceptional ZIRP and quantitative easing policies with most countries significantly increasing their public debt.

But there is only one China and all significant economies have now a high level of indebtment so a very rapid growth of debt has become a lot less likely. At the same time ZIRP and quantitative easing policies are a one way avenue of increasing risk, decreasing effect, and extremely difficult return.

The oil price crash has probably delayed the next economic crisis. However the world economy is in no position to assume the oil prices required to guarantee the level of investment required to increase oil production above 2015 levels.

Oil depletion, debt, and low economic growth, will all work to make 2015 the year of Peak Oil. If we enter a period of high oil price volatility due to mismatches between production and demand that will be very destructive both to the economy and to oil production.

Hi Javier,

Possibly $100/b is a problem, but there is a lot of room between $50/b and $100/b. When oil supply decreases, oil price will increase. How much oil prices can increase without damaging the World economy is far from clear.

One can arbitrarily claim $75/b is the magic number that will make the economy crash, nobody knows. There might be a sweet spot between $75/b and $95/b where oil supply can either be maintained or possibly increase slightly and not cause World output to decline. World debt to GDP has been relatively stable since 2010 based on BIS data.

Javier- you (and Petro etc) may be right, and the civil difficulties of Venez and poverty of Moldova may be coming to places far and wide.

I’m thinking that most commerce will still churn on, even if oil is 100$. Maybe just wishful thinking.

Hi Hickory,

I agree. There is very little evidence that oil over $75/b kills the economy, what it has done recently is result in too much oil production relative to demand.

What has changed is that there is no one willing to cut back on output. From 1930-1970, Texas was the World’s swing producer and from 1985-2014 Saudi Arabia fulfilled that role. Now we will see volatility in oil prices unless some new cartel is formed, maybe OPPC (Organization of Petroleum Producing Countries).

US, Norway, UK, Russia, Brazil, and Canada could join the OPEC nations and have a production agreement to control oil prices.

This would never happen, but maybe each nation should regulate output as the RRC once did for Texas, it would help with oil price volatility.

E&P spending is much lower this year than was expected even after the big cuts initially announced. US independents and Canada in particular are hurting. Middle East is the only place holding up.

http://www.ogj.com/articles/2016/07/cowen-global-n-american-e-p-spending-fall-revised-downward.html

“In its midyear E&P spending update, Cowen & Co. now estimates global expenditures to fall 24% compared with a 16% decline in its January survey. The downward revisions were primarily driven by larger spending cuts from North America-focused E&Ps and major international oil companies.

In this update, Cowen & Co. expects US spending to decline 45%, reflecting oil prices of $40/bbl and natural gas prices of $2.50/MMbtu. This was down from a 22% estimate at the time of January’s survey, which was based on $48.5/bbl oil and $2.50/MMbtu gas. Canada spending is expected to fall 33% compared with an earlier estimate of an 18% falloff.

Survey of international spending reveals a 19% decline compared with an initial estimate of 14% in January. The Middle East remains an area of stability while the largest negative revisions come from large IOCs, Latin America, and the Asia Pacific region, excluding China. Latin America is still the weakest region, where spending is expected to decline 30%.

IOCs and independents are projected to have spending declines of 24% this year, while other independents are expected to spend 45% less. This compares with prior decline estimates of 10% and 17%, respectively.”

94.33 million barrels per day and money isn’t a factor. Holy Smoke!

If I have some land and the land has a petroleum deposit, what can be done to extract the oil and probably some natural gas?

The oil will be anywhere from on top of the ground to 10,000 feet deep.

Who do you call? Not Ghostbusters, you will call somebody who drills for oil. Slawson would be a good choice, but Saint Mary’s would also work.

What will it take to have an oil driller come out to the spot to drill a hole 10,000 feet deep? Oranges? Apples? Oil? Money?

Neither one is going to work for free, so you choose one that will do more for less. They both can do the job, so the cost would be a deciding factor. It would be a tough choice, if Saint Mary’s decided to drill for oil pro bono, I would probably choose them. However, Slawson might just pay to drill for oil, so the choice would be obvious, take the money, lease the land for exploration and hope the oil from the well is a gusher at 300k per day.

Slawson is not going to walk away. Drilling for oil is their business. They might offer more to drill for oil and Slawson might drill two for the price of one, and two gushers producing 600,000 barrels per day is definitely going to be better than one. At 40 usd per barrel, you’ll be making 24,000,000 dollars a day, you’ll be able to pay both drillers the costs and they’ll probably deserve a bonus. Both companies will probably offer to drill for more, if the price is right.

After a year of production, you can open a bank account. The banker will be your best friend. The money from oil sales will do a lot of talking.

In any event, no one will walk away with nothing to show for their work. A free lunch won’t be enough, I’m afraid.

You’ll be swimming in gopher gravy like Jed Clampett, so you’ll move to California and the land will be an oil depot. Shipments will be in the bag.

Who will be shipping the oil? You can’t expect the pipeline company to handle the shipments for nothing, and a free lunch won’t be enough, so you’ll have to share some of the proceeds. Warren Buffett won’t ship a single barrel for free, you can’t buy him an ice cream cone, he owns the ice cream store.

Unfortunately, there will be some kind of compensation necessary to keep everybody happy. Money is probably the answer, all interested parties will probably take money.

That’s when you go out and buy a meter. Of course, there needs to be demand for the supply, no demand and you’ll be sitting there with oil and no money. It couldn’t get any worse. Probably won’t happen that way, somebody will want some of that oil. Libya would take it, I’ll bet money on that.

Some info on Libya, looks like they don’t work for free either.

The top exports of Libya are Crude Petroleum ($14.4B), Petroleum Gas ($2.63B), Refined Petroleum ($696M), Gold ($95.4M) and Iron Reductions ($89.1M), using the 1992 revision of the HS (Harmonized System) classification. Its top imports are Refined Petroleum ($2.32B), Cars ($603M), Wheat ($434M), Other Furniture ($282M) and Insulated Wire ($245M).

The top export destinations of Libya are Italy ($5.58B), France ($2.27B), Germany ($2.1B), the Netherlands ($1.39B) and Spain ($1.07B). The top import origins are Italy ($2.93B), China ($2.12B), Turkey ($2.06B), Egypt ($969M) and South Korea ($885M).

http://atlas.media.mit.edu/en/profile/country/lby/

Maybe Egypt is receiving oil from Libya and Libya isn’t telling.

http://atlas.media.mit.edu/en/profile/country/egy/

The IEA’s Oil Market Report is out this morning. The full report is available only to subscribers and will be available to the public in two weeks. But the highlights are now available to everyone. Bold theirs.

Global oil supplies rose by 0.6 mb/d in June to 96 mb/d after outages curbed OPEC and non-OPEC supplies in May. World production was 750 kb/d below last year as higher OPEC output only partially offset non-OPEC declines. Non-OPEC supplies are set to drop by 0.9 mb/d in 2016, to 56.5 mb/d, before rising 0.2 mb/d in 2017.

I wrote a short post in my blog discussing what I think represents “oil production” – crude oil and condensate. I plotted refinery throughput as a proxy of C&C and also BP’s “production” to have a handy reference. I realize we do have storage and other kinks, but I’m simply trying to discern what’s going on at a time when most sources seem to fog the data.

Received an email from a buddy stating, “Chalk one up for you”, (meaning, my prediction on BC LNG)

Shell says final decision to be made end of 2017. I say that is a face-saving statement which really means, ‘no’.

http://globalnews.ca/news/2819984/dark-cloud-over-lng-in-b-c-after-project-delay/?sf30809541=1

‘Dark cloud’ over LNG in B.C. after project delay in Kitimat

globalnews.ca

Premier Christy Clark’s dreams of a booming liquefied natural gas industry in British Columbia were dealt another blow Monday when a Shell-backed venture delayed a final decision indefinitely on a project in Kitimat.

Demand Destruction once the Subprime Autoloan Party wines down?

https://news.slashdot.org/story/16/07/04/2058219/new-cars-are-too-expensive-for-the-typical-family-says-study

In the US – Will it be a choice between Health Care or a Car? Car Sales Bottom in Venezuela

http://www.zerohedge.com/news/2016-07-13/what-happens-car-sales-socialist-utopia

“In the US – Will it be a choice between Health Care or a Car?”

Certainly.

And a choice between a vacation and paying the heating bill,

between paying for kids schooling and a replacement battery pack,

between groceries and the broadband bill.

Cheap energy has allowed us to take just about everything for granted.

Ever done your laundry by hand? How does wool underwear feel? Ever plowed a rocky field with horse?

Ask Caelan. He does all those things.

Hey, Hick’,

I’m ok with you expressing your fantasies about moi semi-publicly.

We could even call it something, like Hickory Dickory. Whaddaya think? ^u^

BTW, have you read Euan’s recent article? It’s pretty good.

I’m trying to repress most of my fantasies. Cheers.

That’s outrageous. A votre sante.

The EIA’s Weekly Petroleum Status Report is out. US C+C production was up 57,000 barrels per day to 8,485,000, Alaska up 71,000 bpd to 411,000 bpd, US Lower 48, including the GOM, was down 14,000 bpd to 8,074,000 barrels per day.

Inventories were down just over 2.5 million barrels to 521,804,000 barrels. I have no idea why prices are down around two bucks today.

two words: trend line?

two more words: price matters, just ask my girlfriends?

IEA news release tanked price.

Diesel and gasoline inventories build. And shouldn’t inventories be declining during summer?

http://www.resilience.org/stories/2016-07-10/gmo-industry-the-dumbest-guys-in-the-room

I am not so sure about that.

Clear and comprehensive labeling ought to be the law, and no mistake.

BUT having said this much, GM crops have the potential to help avoid the worst sort of environmental and humanitarian disasters, and they shouldn’t be outlawed out of hand.

This doesn’t have much to do with oil directly, but it has everything to do with getting thru the next half century or so.

This comment is without me doing any analysis, but does it seem that the IP’s out of the Bakken in the Daily reports are trending towards the “less spectacular”? Lots of sub 1,000, and more than a few sub 500 BO IP.

I created a presentation where I show where oil production from existing shale US wells is heading in the coming years. It only includes the actual & projected production of horizontal wells that started production before 2016.

Excellent work Eno, thanks. I notice that the cumulative production of 2008 and 2009 wells is much higher than other years. Any explanation?

Thanks, the main reason for that is that those were mostly Bakken wells, and Bakken wells are more productive than the ones in other basins.

Enno – Excellent information! I always thought that EOG was the “darling” of the group. But, they having the lowest % of remaining – 36% (64% produced). In that regard, with respect to the production remaining, can you advise “about” how many years of production is represented for an average producer that you note?

Thanks Clueless,

I don’t get your question exactly, can you rephrase? The remaining production is all the production that is still expected from the legacy wells, in the coming 20 years, although most of it will of course be produced early on.

You answered it. Everything in the next 20 years. I was wondering if it was a truncated number of years, like next 5, etc.

Thanks.

I wrote a comment in your blog.

Maybe my imagination has become to active, but I believe the story of the NDA attacking Mobile’s Qua Iboe terminal should be getting more interest. Monday night the NDA announced they had blown up the 300,000 bpd export line. Exxon was quick to deny that an attack had taken place. Someone is lying and it is not clear who.

http://footprint2africa.com/nigeria-militants-exxonmobil-tug-words/

Although it seems almost inconcievable that Exxon would lie about this, there are a couple of things that make you consider the possibility. One is that in May there were reports of a militant strike on the facility, which was denied by Exxon. Shortly after that Exxon reported that a malfunctioning rig had caused damage to the facility, and it was shut down for a short while.

Another is that after the latest attack claimed, Shell reportedly shut in the trans-Niger pipeline, and there have been reports of oil companies evacuating 700 staff.

http://www.vanguardngr.com/2016/07/shell-shuts-trans-niger-pipeline-avengers-strikes/

http://www.news24.com.ng/National/News/militant-attacks-oil-companies-to-evacuate-over-700-staff-from-bayelsa-20160712

It remains unclear what the status is of the Qua Iboe terminal, and other facilities in Nigeria. But it is clear that they have some big problems.

It took a while, but Exxon has decreed force majeure on Qua Iboe. That’s the export terminal they have repeatedly said was not attacked first of this week. 300,000 bpd that will not be exported, for a while

http://www.dallasnews.com/business/headlines/20160715-irving-based-exxon-mobil-halts-shipments-from-nigeria-oil-rises-in-response.ece

Regarding the KSA, it used to get talked about that they were damaging their fields with over pumping salt water. Is this a discredited notion at this point?

I have no idea what you are talking about. I don’t remember any such discussion and I have followed KSA production since about 2001. KSA has used water injection for way over half a century. That is the only way they can keep the pressure up. It does not damage their fields other than normal depletion.

From the wiki page on Saudi oil reserves- “Simmons also argued that the Saudis may have irretrievably damaged their large oil fields by over-pumping salt water into the fields in an effort to maintain the fields’ pressure and boost short-term oil extraction”. It was a theory that I saw regurgitated when KSA was threatening to pump xx millions last year. Thought I saw it here; apologies if not.

Actually the opposite is true, they carefully manage water injection so as not to bypass any oil and, for example, in the past would rest Al Abqaiq field without production to allow the water contact to level out (that field might now be close to exhaustion). They have the best reservoir models in the world and will drill wells just to allow monitoring of the reservoir if needed.

We usually inject salt water. I assume water being injected in Saudi Fields is mostly sea water. As long as the waters are compatible and the water is oxygen and bacteria free then there’s no problem on the “chemistry” side.

Not knowing the detailed well layout and rock description it’s hard for me to speculate with authority. The key in these fields is to pump water to sustain reservoir pressure slightly above the bubble point. Thus it’s possible that an operator could inject too much, in the sense that pressure would be kept a bit too high. This in turn reduces recovery factor a small amount.

By the way, I’ve seen countries where regulations don’t allow fine tuning pressure, and we are forced to operate at a pressure higher than optimum. The guys who wrote those regulations simply didn’t understand the way Mother Nature works.

Thanks for the reply, Fernando.

The price of oil seems pretty darn important. Art Berman had an interview with Chris Martenson on peak prosperity that projects with some 20 Billion barrels of oil have been deferred due to the current low price. That’s a pretty large amount of oil that’s not coming online when required as a result of price.

Not to mention that oil is becoming much harder to find, Steve Kopits at Princeton energy advisors has shown that between 1998-2005 $1.5 Trillion was spent on oil CapEX to increase oil output by 8.4 Mbpd and that from 2005-2013, $4.0 Trillion was spent on CapEx to increase output by just 2.4 Mbpd.

Society is energy constrained and it’s showing up in the economy with crazy effects like NIRP, where $13 Trillion worth of global bonds now yield negative returns from Zero just a few years ago, think about that, paying someone to borrow your money!! Also an economy where young people aren’t getting decent jobs to pay for incredibly overpriced house prices as evidenced by affordability ratios, where populism and extremism is on the rise globally as well as large swathes of society are left out of prosperity. Energy is the ability to do work, without increasing energy supplies society has to fundamentally change.

Energy is the ability to do work, without increasing energy supplies society has to fundamentally change.

As far as I can tell, it is not against any natural laws, for societies around the world to contract, use energy more efficiently and develop technologies that harness energy from sources other than fossil fuels. Yeah, I guess you could say that would be a fundamental change! 🙂

it may not be against any “natural laws” for societies around the world to contract but there is not economic system on earth that will withstand a contraction of any duration.✋it did not have to be this way but it is?

?

…but there is not economic system on earth that will withstand a contraction of any duration.

Since we have been stuck in a growth based economic system for some time now, I certainly understand why most people would think that. However at least in theory, there are other ways of skinning the cat.

http://steadystate.org/discover/definition/

John Stuart Mill, pioneer of economics and gifted philosopher, developed the idea of the steady state economy in the mid-19th century. He believed that after a period of growth, the economy would reach a stationary state, characterized by constant population and stocks of capital. His words eloquently describe the positive nature of such an economic system:

“It is scarcely necessary to remark that a stationary condition of capital and population implies no stationary state of human improvement. There would be as much scope as ever for all kinds of mental culture, and moral and social progress; as much room for improving the Art of Living and much more likelihood of its being improved, when minds cease to be engrossed by the art of getting on.”

A more current and updated attempt at how to achieve a steady state economy is a vision embodied in “The Circular Economy” promoted by the likes of the Ellen MacArthur Foundation.

https://www.ellenmacarthurfoundation.org/circular-economy

Circular Economy

A circular economy is one that is restorative and regenerative by design, and which aims to keep products, components and materials at their highest utility and value at all times, distinguishing between technical and biological cycles.

CIRCULAR ECONOMY OVERVIEW

Today’s linear ‘take, make, dispose’ economic model relies on large quantities of cheap, easily accessible materials and energy, and is a model that is reaching its physical limits…

In any case since we haven’t really seen if a steady state economy can work, we won’t know until we try it. Either because we consciously and deliberately transition to one or because we allow our societies to follow the natural course of events to collapse and we have consequences like dieoff.

And if it doesn’t work, we can always go with Anarchy and Permaculture 🙂

BTW, on a much more serious note, I’m more worried about ecosystems simplification and biodiversity contraction than I am about economic contraction. It seems the Anthropocene’s major contribution thus far has been the ushering in of the 6th mass extinction event.

Hi Fred,

Aside from my thanks for your permaculture promo, (permaculture is essentially anarchic in nature, incidentally), unless your unspoken agenda is to help cull the human herd– which would seem to appeal to Hickory, incidentally– I’m unsure sitting like a lump, and going to an imaginary job, where one again sits like a blob at an office desk in a cubicle (because AI robots are now replacing human manual labor, right?), in a self-crashing car, getting off on Elon Musk, Tony Seba and/or assorted CEO TED Talks and pushing AI-connected buttons on the dashboard console on the way is a good ‘adaptive survival strategy’ in the face of potentially-new pressures of natural selection in a post peak oil world. It just doesn’t seem too forward-thinking– perhaps a bit like the current psuedoeconomy that some of us call the economy. (But maybe I missed a sarcasm tag or winky face or two, haha.)

As I’ve previously mentioned, humans could be considered at least ‘two’ scales; one, the ‘dinosaur-sized’ fossil-fuel-enabled global-industrial-technology-scale footprint; and the other, human-scale, made by our own actual feet. And we both likely know a little bit about what happened to the dinosaurs during the KT Extinction Event. The little ‘dinosaurs’ with the smaller feetprints or clawprints if you will– the birds– of course made it, along with our little ancestors, through this bottleneck.

Therefore, in terms of so-called steady-state economies, I would be inclined to consider them a little in that sense; in looking at some creatures that have survived through an extinction bottleneck or two. It might give us clues into how to do the same, such as with our ‘economies’, such as if we might be able and willing to shrink them down, along with the rest of ourselves, sufficiently small so as to fit them through the next extinction bottleneck. (Which is in part, BTW, why I think permaculture is a far better bet than ‘Suits, Inc.’ technology, which is what appears to be what is creating a looming bottleneck in the first place.)

Let’s break a few hearts:

http://oilprice.com/Energy/Crude-Oil/In-World-Of-50-Oil-Shale-Beats-Deepwater.html

“U.S. shale is the lowest cost option for new oil production and is likely to be more competitive than conventional offshore drilling, according to a new report from Wood Mackenzie.”

That sounds true tt but in the world of $50 oil, I do not think either one, offshore or shale, is profitable.

http://fuelfix.com/blog/2016/07/13/report-cost-cuts-have-helped-texas-shale-drillers-find-profits/

“Worldwide, average oil production costs have fallen by $19 a barrel to $51 a barrel. At least for now, the oil industry has squeezed its production costs down to 2009 levels, and drillers could make a profit extracting 9 million barrels a day over the next decade, a 20 percent increase from the days of $100 oil.

In West Texas, oil companies could make money in the Bone Spring and Wolfcamp tight oil plays with $37 a barrel oil, while their rivals in the Eagle Ford Shale in South Texas could turn a profit at $48 a barrel. The average break-even price in North Dakota’s Bakken Shale is $58 a barrel. In Oklahoma’s Scoop region, it’s $35 a barrel, Wood Mackenzie estimates.”

I think I have mentioned here before, OKLA is happening, and “appears” to be the lost cost LTO play in US. Now that does not mean I know a damn thing about the oil business but it does mean you boys should keep a eye out in the future for considerable production coming out of this area as “development” gets underway.

Considering it is only worth about $10 a barrel to society, they should be happy at $50 a barrel.

Production costs dropped because the industry hit the fan and today there’s contractors, subcontractors, and individuals willing to give bargain prices to survive as long as possible, hoping demand will rise and they can return to being profitable.

Yes, a trillion $ old economy industry can’t cut prices by 50% by “innovation” in a few years. It’s all about subcontractors working for just cashflow to pay interrest on their loans.

When they all resume drillig to these low prices (and in shale all drill in the same few sweatspots with the low $ oil), prices will crash up since there are few workers left to do all this additional work.

Prices are low as long nobody drills…

No kidding. Back in the 1980’s I was a junior supervisor, but I was asked to cut budgets to the bone during the 1985-86 crash. The whole process was incredibly stressful, but we managed to achieve significant cuts by having rather forceful talks with service providers to get cuts. In some cases they had to sit down with unions and their subcontractors, but it seemed to work pretty well after we cancelled a platform painting contract on the spot after they refused to reduce their charges.

As I said.

I don’t know any oil business here, since I sit in Germany, but we have lot’s of industry. And in the last crisis 2007 you could produce for lots less than break even, just to maintain a cashflow. Workers have been on short labor here (It’s a thing from the state to prevent firing, it paid out big time later).

But when the economy picked up prices got higher again. So – you get only the low prices when few people buy – if everyone and his dog would run out drilling new wells these low prices would be history again.

texas,

That break-even bullshit is just nonsense. What is happening in oil industry is debt deflation aka “you have to eat less”. That debt deflation is direct result of debt infused shale development by Wall Street in order to prevent debt deflation in the rest of economy. Wall Street kicked the can of debt deflation in economy for about 10 years with 3 major shale plays in US. That’ all.

OKLA plays maybe will get drilled but they will not make a dime like the rest of shale did not make dime by extracting oil, other than by doing the ponzi type of reselling of leases, companies to a greater fool.

Ves,

you are ignorant, I personally have wells in this trend that will make money, that is working interest that I pay out of pocket money for and get a real after tax return. You should take a little time to learn and then think before you write, or you can continue to show the cyber world just how little you really know about the subjects you write about. decisions decisions…? I have not ask because i do not care but your understanding of the real world seems rather limited, do you profess to know more or have equal or better credentials, education and information, or more access to objective worldwide data within the oil and gas business than Wood Mackenzie? Thats what I thought?

texas said: “Wood Mackenzie?… made of credentials, education and information….”

That is scary.

Why do I need Wood Mackenzie’s interpretation? Reality does not need any interpretation. US oil production is down 1 mil within a year from the peak and folding like cheap wall mart chair, oil price is still in the basement at $46, and shale has outstanding credit card debt of 300 billion. And you are dialling 1 – 800 VISA to finance more drilling of shale in OKLA hoping for different outcome. Priceless, as VISA would say.

Ves,

I now must assume you may have graduated high school, and were in the bottom 1/4 of your class and you may have taken remedial reading. So here is a little help for someone who is just so special.

From the report:

“In West Texas, oil companies could make money in the Bone Spring and Wolfcamp tight oil plays with $37 a barrel oil, while their rivals in the Eagle Ford Shale in South Texas could turn a profit at $48 a barrel. The average break-even price in North Dakota’s Bakken Shale is $58 a barrel. In Oklahoma’s Scoop region, it’s $35 a barrel, Wood Mackenzie estimates.”

Do you see where it said Bakken @$58? This is in North Dakota, not OKLA.

Do you see where it said Eagle Ford @ $48. That is in South Texas. again not in OKLA, Those $$$ numbers were far higher last year.

Now can we name the two biggest LTO fields in the US, stay with me, I know this is hard for you. It is the Bakken and the Eagleford, both on a field wide basis are currently uneconomic and have been for well over 20 months. Most all LTO and conventional production world wide was uneconomic for the 4th 1/4 2015 and the first 1/4 2016, perhaps that explains why production has dropped.

With regard to the economics of my personal business, it will not matter what I say, because you are just plain to ignorant to understand our business. But I will again share, if at such time we see $4.00 nat gas and $75 oil, this play will have risk weighted returns that exceed most of any projects I have been associated with in my 30 years. That includes a number of very prolific trends within the lower 48??

Texas,

You really don’t understand numbers. So let’s leave at that. I will tell you the secret about these reports you religiously read by Wood Mackenzie, Citi, Bloomberg whatever.

Their only purpose is to keep you in a dream. You are dreaming. If you are in oil business today the present is almost a hell. You can endure it only because of the hopes that you have projected into the future. You can live today because of the tomorrow. You are hoping something is going to happen tomorrow, some doors to paradise will open tomorrow. They never open today. And when tomorrow comes, it will not come as tomorrow, it will come as today – but by that time your hope have moved again.

You go on moving ahead of yourself – this is what dreaming means. You are not one with the real, you are somewhere else ( like $4.00 nat gas and $75 oil), moving ahead, jumping ahead. You are dreaming.

Have a nice day.

Hi Texas Tea,

And what has your ROI been so far on these wells after taxes?

Dennis,

I have asked texas the same question few weeks ago and no answer so maybe he is still calculating ROI 🙂

True story: Once I was standing in line for some Korean fast food and guy next to me start talking. “How yu duing?” , “What do yuo do”….. so the guy says “I am investor” for a living .

I said “Cool”. So he starts talking about his investments in real estate, abraka-dabra …so he says: “profit 200% in 2 years, so you can make 100% annually”

And my antennas start beeping right away. The guy was adding the percentages to calculate the profit after 2 years!!! Catastrophe. So he did not even know how to calculate a profit and he was “investor”!!!

If he was making 100% annually then 2*2=4, so he had 4 times more money than in the beginning. 4 times more is 300% and not 200% as he claimed. That was in 2005-6 when RE was “hot” and anyone was RE “investors”, so maybe he is shale investor today 🙂

Hi Texas Tea,

I doubt those quoted costs are full cycle costs in those plays for the average well. They may be based on the fantasy type curves found in investor presentations. When one takes a close look at actual average well output data, the well profiles in investor presentations are usually about a factor of 2 higher than real world results. So the real world full cycle (vs point forward) cost per barrel would be roughly double what you quoted above.

I again wish all would realize that OK resource plays are generally wet gas plays, not oil plays.

Just did a quick search. Found 539 hz wells with first production in OK since 1/1/15.

13 have hit 100,000 cumulative BO or more.

248 have hit 300,000 cumulative mcf gas or more.

It is a wet gas play, just like the Woodford has been for decades. Springer is the only one I would call an oil resource play, I think it is generally agreed to be uneconomic at present prices.

Woodford wells will produce a lot of gas, obtain a premium gas price due to high BTU, and produce little water, so LOE per mcf is low.

I cannot comment on the economics of these wells, but do believe the data, thus far, shows these to be gas. Yes, many have initial high % of liquids, but the liquids disappear quickly.

I think TT has generally agreed with me on these observations.

Again, another quick search, looks like over 1/3 of the OK Woodford wells with first production 1/13 or later have hit 1 million mcf. Also looks like most are producing over 30K mcf per month.

OTOH, most did not produce any oil in the most recent month. The big oil producers currently are for wells less than 12 months old.