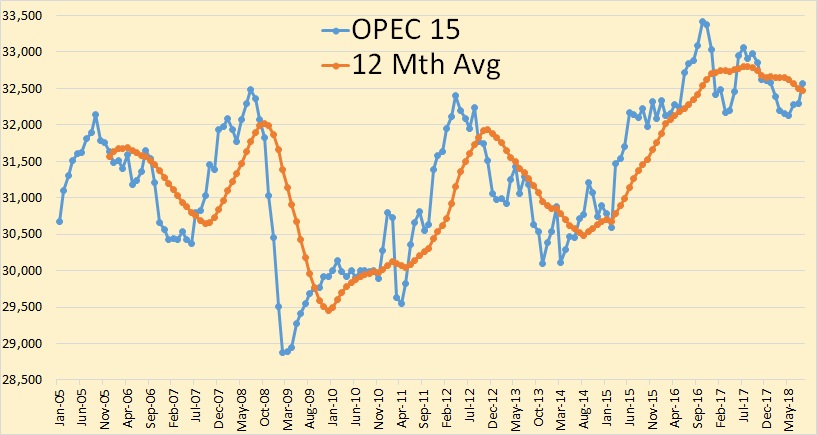

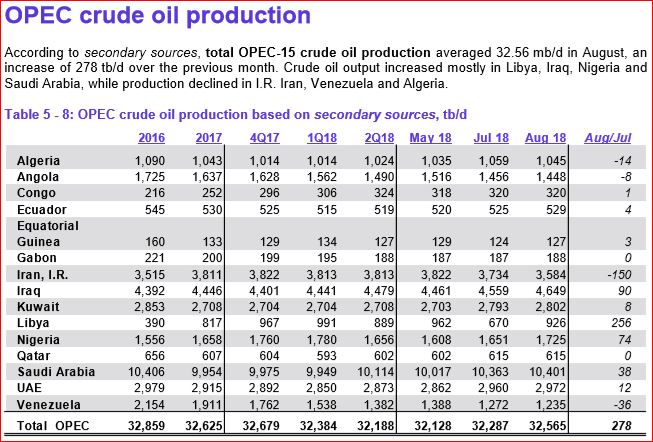

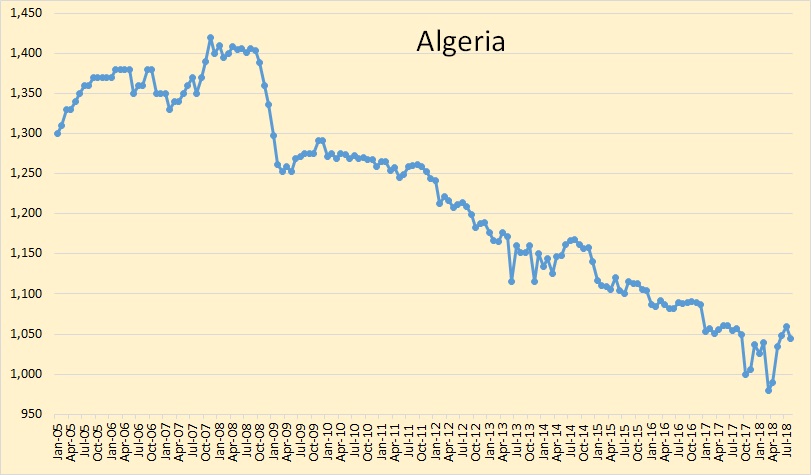

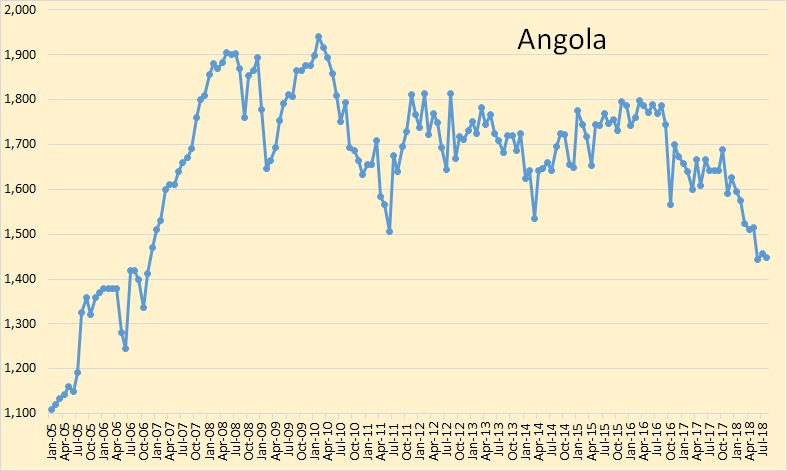

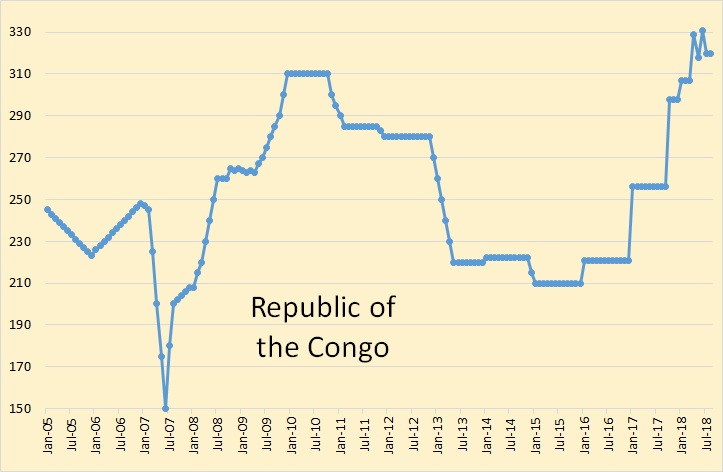

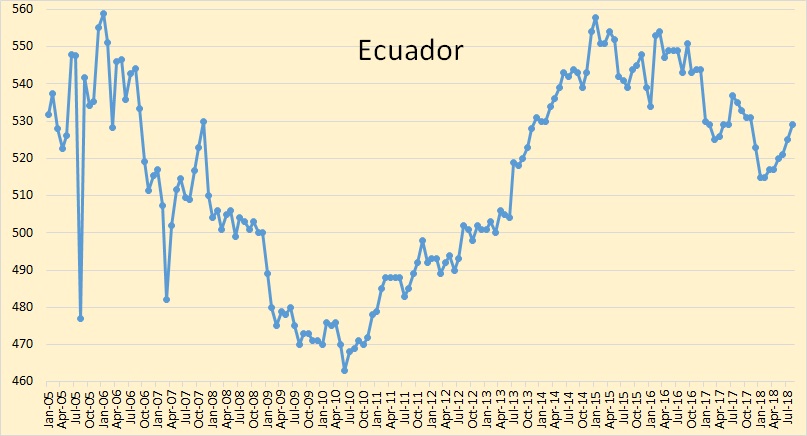

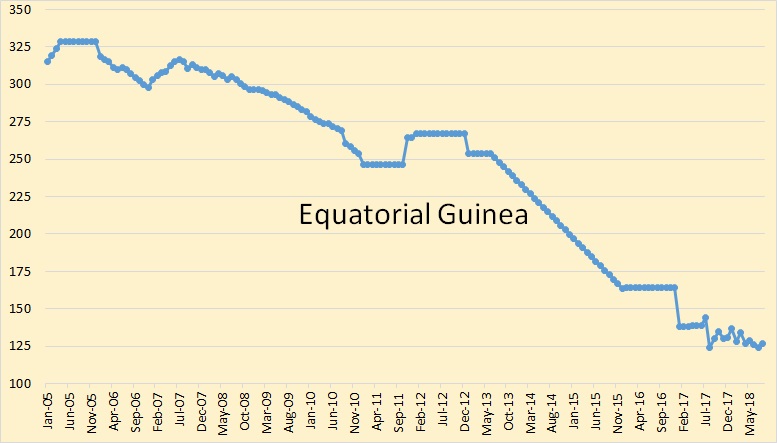

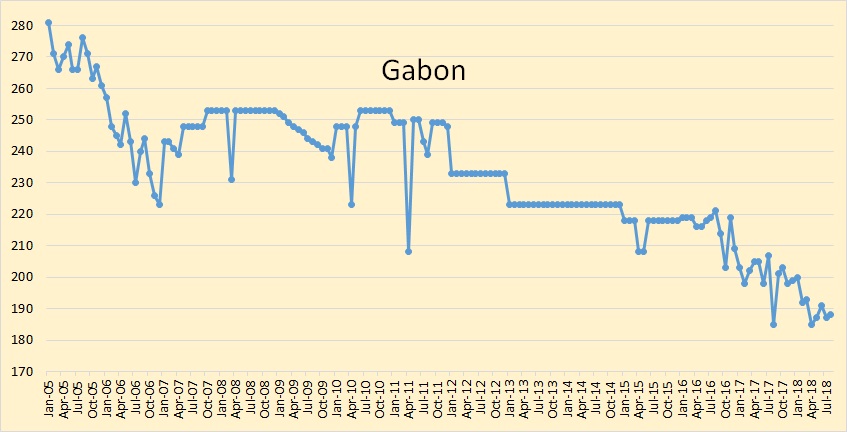

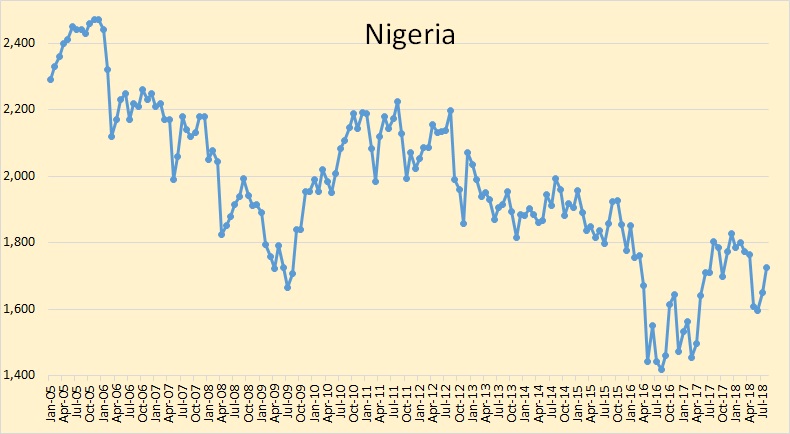

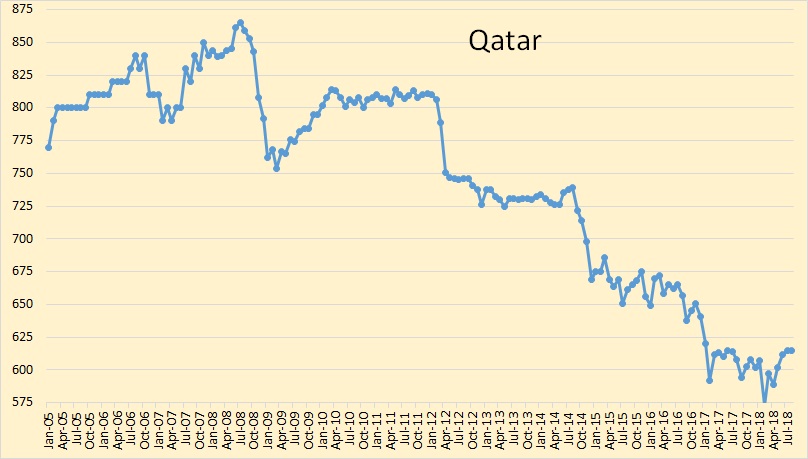

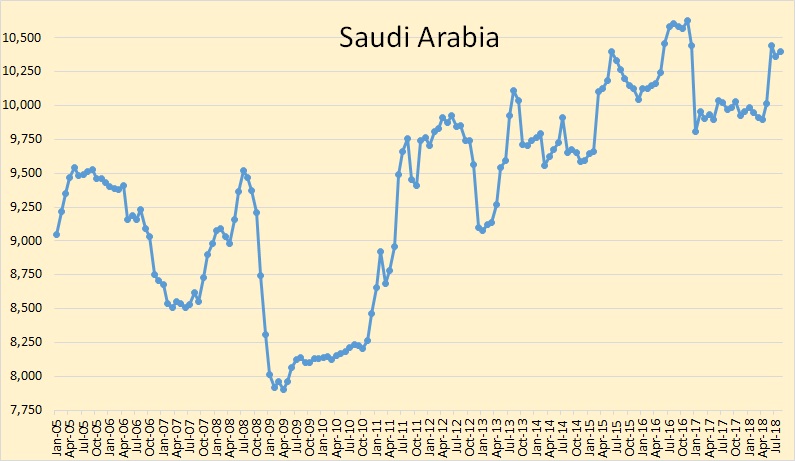

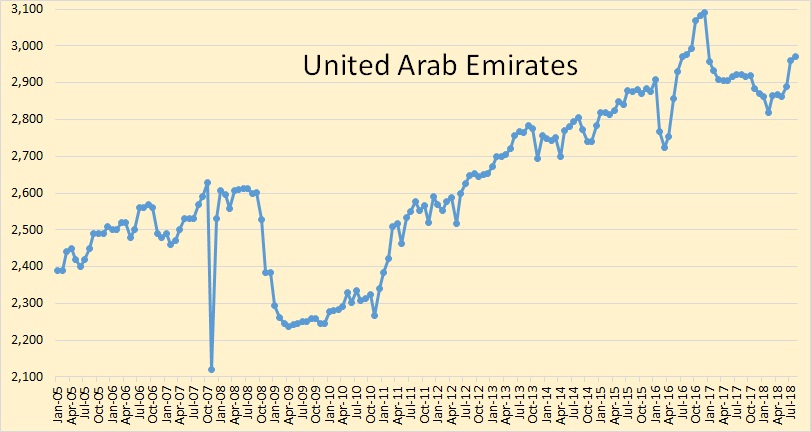

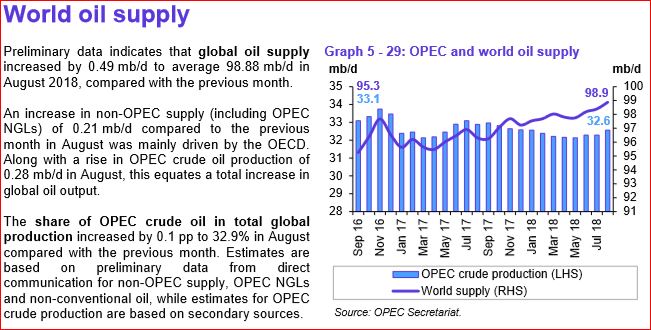

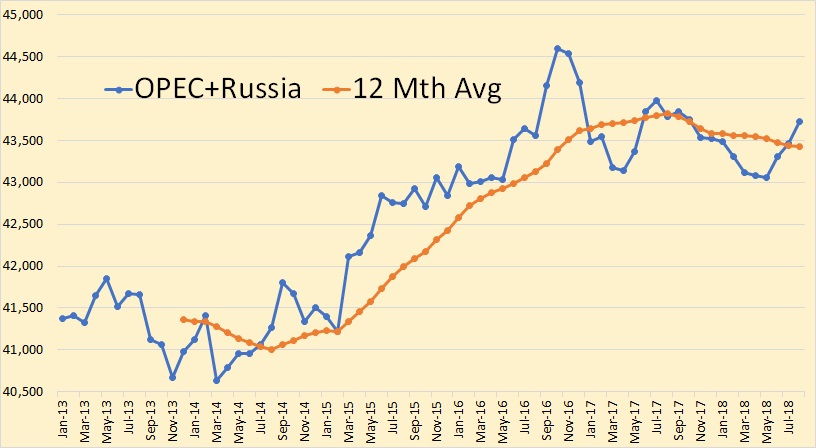

Data for the OPEC charts below are from the OPEC Monthly Oil Market Report. All OPEC data are through August 2018 and in thousand barrels per day.

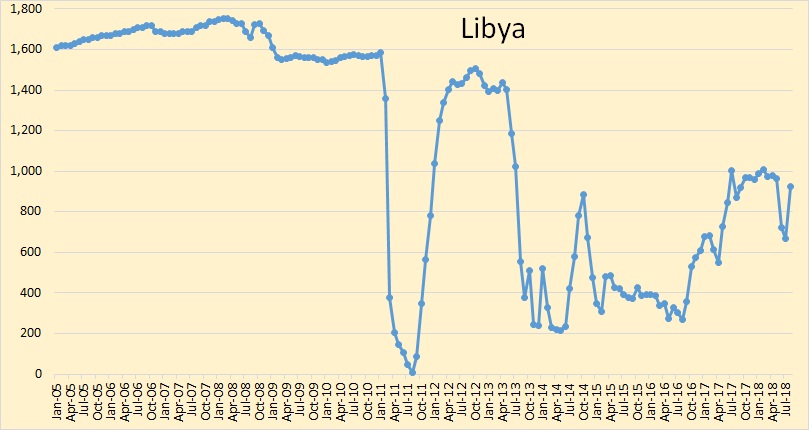

OPEC 15 crude only production was up 278,000 barrels per day in August to 32,565,000 bpd. Most of that increase was Libya, up 256,000 bpd.

July OPEC production was revised down 38,000 barrels per day.

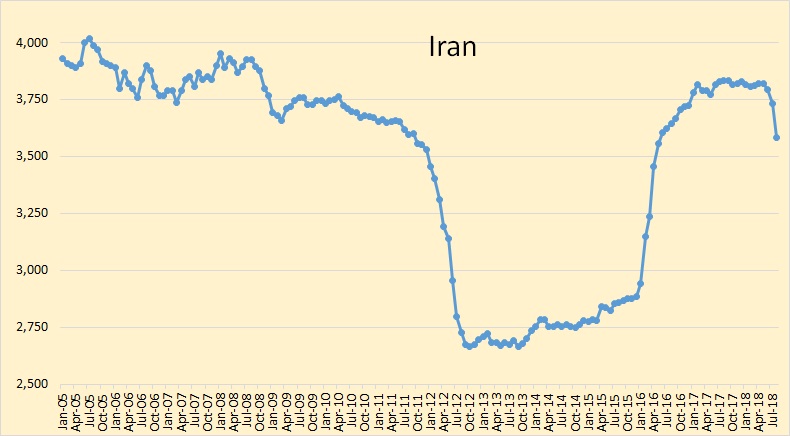

Sanctions are beginning to have an affect on Iranian production.

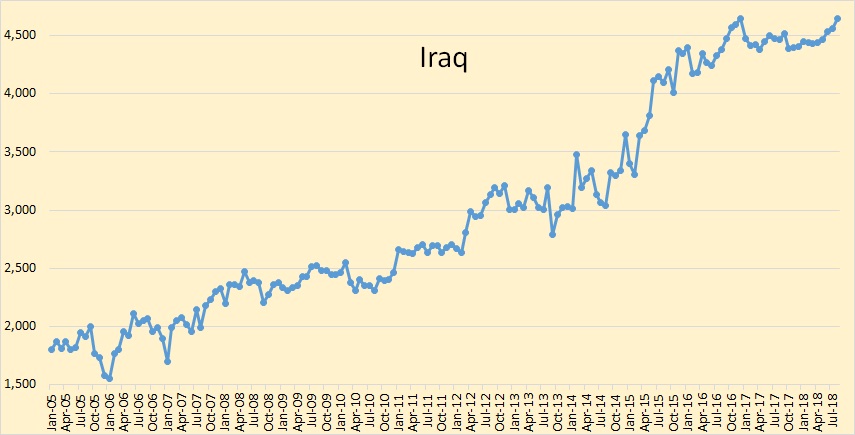

Iraq reached a new high in August, but just barely. They had 4,649,000 bpd. Their previous high was 4,642,000 bpd in December 2016.

Libya was the big gainer in August, up 256,000 bpd to 926,000 bpd. They are still fighting rebels however. They will likely be down slightly in September.

I think Saudi Arabia will hold pretty close to this level for awhile now.

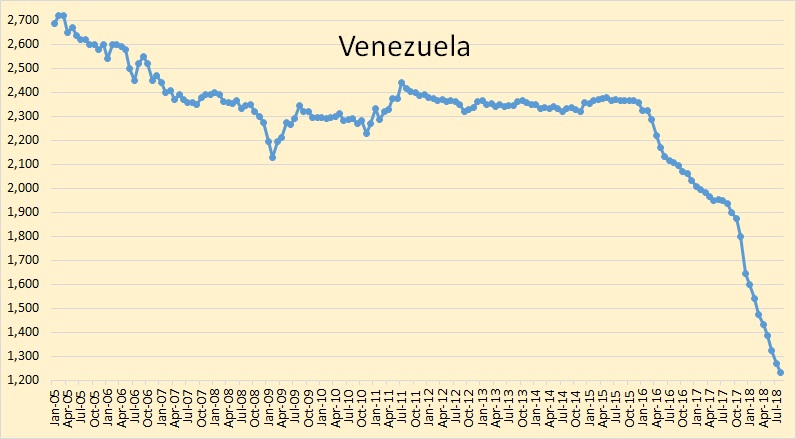

Venezuela’s decline continues. They are now over 1,100,000 barrels per day from their average in 2015.

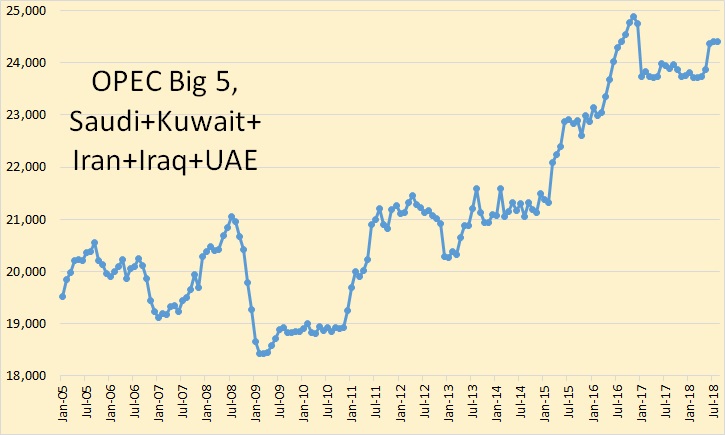

No change in OPEC big 5 output this week. The decline in Iran was offset by slight gains from the other 4. But I look for declines in the big five in the next few months because of Iranian sanctions.

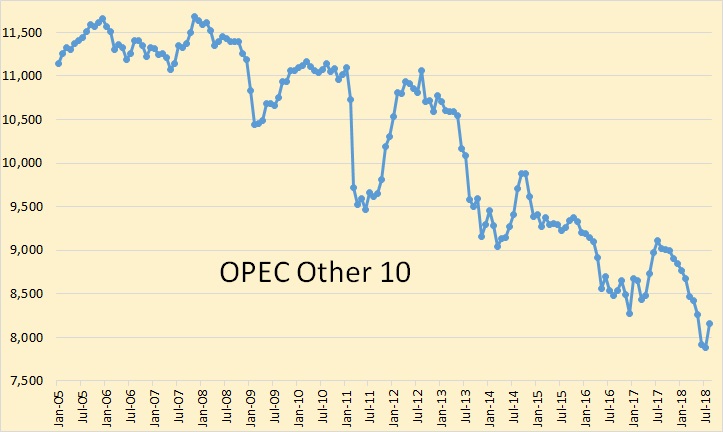

The OPEC Other 10 was up in August because of Libya. But the decline will continue.

There was no increase in Russian production in August but OPEC did have an Increase. It is my opinion that both OPEC and Russia will level out for a few months then start a slight decline.

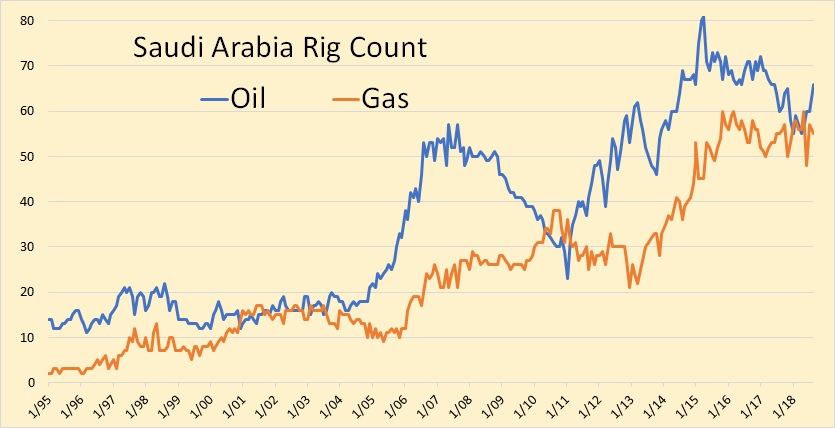

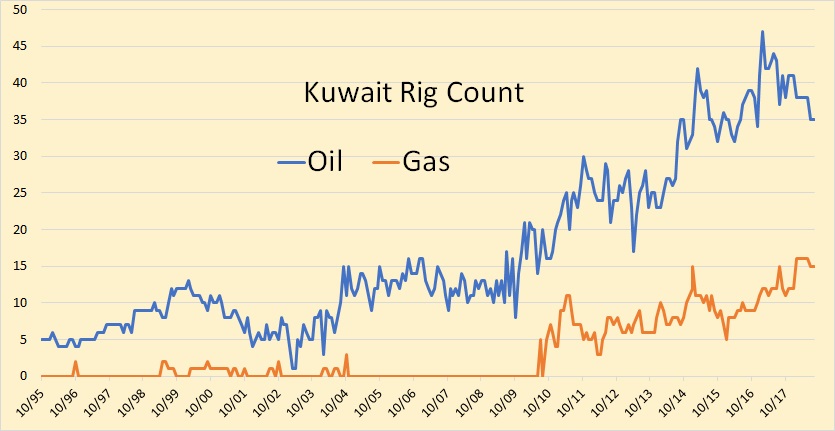

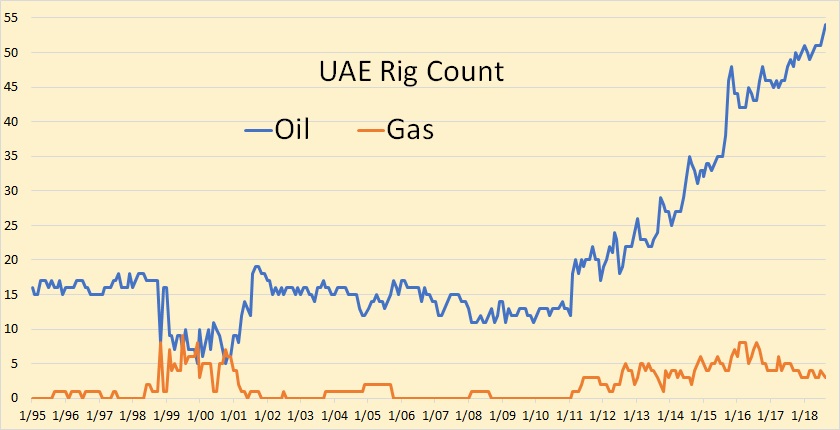

The three charts below are from Baker Hughes and the data are through August 2018. The Baker Hughes Iran and Iraq rig counts are incomplete and therefore not included.

Saudi began its massive infill drilling program in 2006. They tapered off in 2009 and 2010. It is likely that the big increase that began in 2011 was mostly for the Khurais and Manifa projects. The oil rig count was 66 in August.

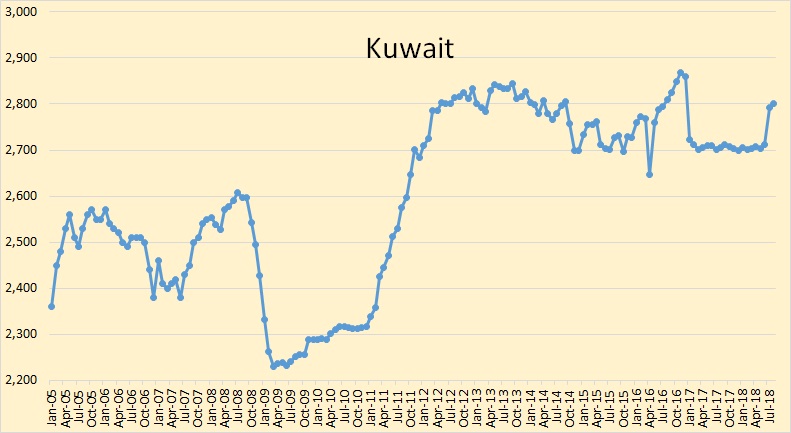

Kuwait’s oil rig count went from an average of 11 in 2009 to over 40 in 2017. The August count was 35.

The UAE rig count, (Abu Dhabi+Dubai), went from an average of around 13 in 2010 to over 50 today. The count was 54 in August.

From Oil and Gas Journal 05/08/2000

Horizontal wells find varied applications in Saudi fields

King Saud University, Riyadh Horizontal-well applications in Saudi Arabia have many objectives, such as controlling oil and gas coning in relatively thin remaining columns, improving waterflood sweep efficiency, improving productivity rates from thin and tight reservoirs, and saving development costs. At yearend 1999, about 200 horizontal wells had been drilled in Saudi oil fields. Horizontal wells are recognized as one of the most important technical advances in the oil and gas industry in the last 20 years. At first, the industry considered this technology to be an exotic way of drill…

And that’s all I could read of the article without a subscription to Oil and Gas Journal. But that’s enough. We know that in 1999, Saudi oil columns were getting thin and that they had a serious coning problem.

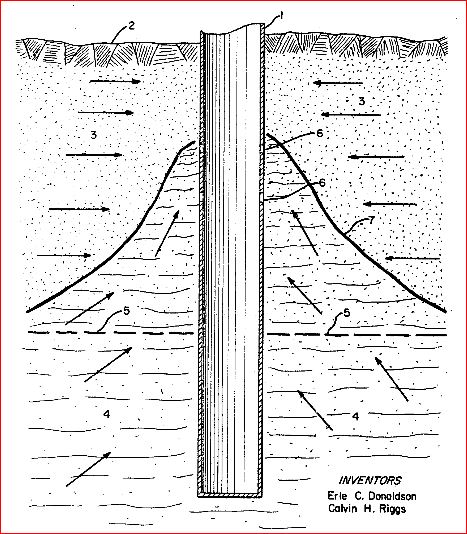

Above: Verticle oil well water coning.

They began combatting the problem by drilling Horizontal wells with laterals right along the top of the reservoir. They had, at that time, about 200 such wells. But 200 wells is not very many wells. They would need a lot more.

The below was posted by Stuart Staniford on April 7, 2007 on The Oil Drum.

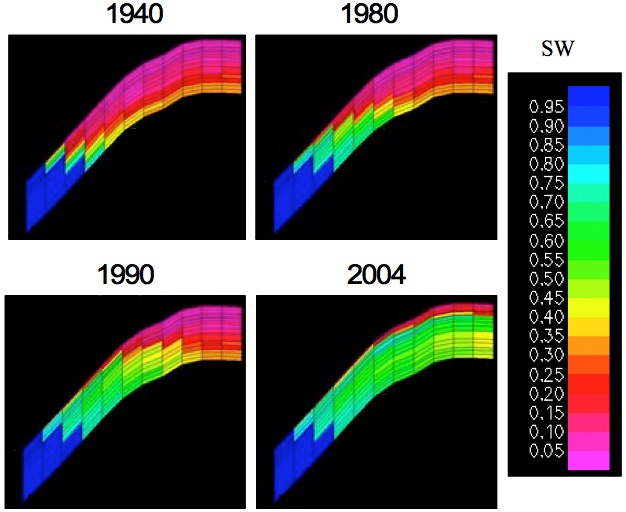

Western flank cross section of North ‘Ain Dar. Source: Figure 9 of Alhuthali et al, Society of Petroleum Engineers Paper #93439, March 2005.

The legend on the right is percent water. It is very hard to read, especially if, like me, one has defective color vision. But the 2004 image is not nearly as bad as it looks. If you go halfway down the column, from the top, you still have less than 50 percent water. So in 2004, there was still a lot of oil left in the Ain Dar section of Ghawar. But you can understand that the vertical wells were starting to pull up a lot of water. In fact, the water intrusion was so bad that all Saudi fields, at that time, had an average decline rate of about 8 percent. But not to worry Saudi had a solution.

Other Ghawar fields, Shedgum and Uthmaniyah, show similar profiles as Ain Dar.

I published most of the following in March 2014. The Ravensworth link had already been removed when I published this piece. However, the Saudi Arabia’s Center for Strategic and International Studies link was valid at the time but since been removed. The “International Business Publications” link still works but this publication is updated annually and the version with the quote below is no longer available. However, it is a Saudi publication and is still interesting.

Ravensworth.org published the following in 2006:

One challenge for the Saudis in achieving this objective is that their existing fields sustain 5 percent-12 percent annual “decline rates,” (according to Aramco Senior Vice President Abdullah Saif, as reported in Petroleum Intelligence Weekly and the International Oil Daily) meaning that the country needs around 500,000-1 million bbl/d in new capacity each year just to compensate.

That quote by Abdullah Saif was widely circulated. and in 2007 International Business Publications published this on page 144:

One challenge for Saudi in achieving their strategic vision to add production capacity is that their existing fields sustain, on average, 6 to 8 percent annual “decline rates” (as reported by Platts Oilgram) in their existing fields, meaning that the country needs around 700,000 bbl/d in additional capacity each year just to compensate for natural decline.

However, in 2006 Saudi Arabia’s Center for Strategic and International Studies claims they have gotten this decline rate down to almost 2%.

Without “maintain potential” drilling to make up for production, Saudi oil fields would have a natural decline rate of a hypothetical 8%. As Saudi Aramco has an extensive drilling program with a budget running in the billions of dollars, this decline is mitigated to a number close to 2%.

The drilling program they are talking about is those horizontal wells placed at the very top of the reservoir. Now imagine, that with all those brand new horizontal wells sucking the oil right off the top of the reservoir, they still had a decline rate of over 2%! Of course, that was in 2006, 12 years ago. And just what might that decline rate be today?

We have the following quote from the Aramco CEO in the Annual Review 2017, published August 17, 2018, bold mine.

Notwithstanding an improved market picture, the oil industry’s preparedness for the future remains in question as the sector has lost an estimated $1 trillion in planned investment since the market downturn began. The situation becomes more disconcerting when seen in the light of global demand growing at the rate of 1 to 1.5 million barrels per day annually, and maturing oil fields around the world exhibiting steepening natural declines that must also be offset by continuing Investment in the industry.

Khalid A. Al-Falih, Aramco Chairman of the Board of Directors.

Then we have this, bold mine:

Saudi Aramco Signs Deal With Baker Hughes To Boost Offshore Oil Production

Marjan is the first of three major offshore field expansions that Saudi Arabia plans. The other two will be for the Zuluf and Berri offshore fields, which currently have capacity of 800,000 bpd and 200,000 bpd, respectively, S&P Global Platts data shows.

The three major offshore expansion plans are expected to add 1 million bpd of production capacity by 2023. This could offset declining production from aging fields in Saudi Arabia, which continues to be viewed as the swing oil producer in the global market.

These three fields are themselves very old and mature oil fields. Berri was discovered in 1964, Zuluf in 1965, and Marjan in 1967. And all three have been online since. Saudi has discovered several new fields but they are all tiny little things that will add little to Saudi’s production capacity. So they must turn to more infill drilling in their old offshore fields to try to keep production flat.

Saudi’s last major discovery, Sahybah, was discovered in 1968 but did not go online until 1998 due to its very remote location. Khurais and Manifa were both discovered in 1957 and produced for many years before being mothballed because of low production and other problems. But both were brought out of mothballs due to declining production in their other fields. Massive water injection was used to increase reservoir pressure. There are no more supergiants to be discovered in Saudi Arabia and no more old giants to be brought out of mothballs and put back online.

Conclusion: I believe Saudi Arabia can keep producing at, or close to, current levels for a few more years. That is if more infill drilling in their old offshore fields can compensate for declining production in their old onshore fields. But don’t look for increased production from them if demand and prices increase in the future. They will, very likely, only try to keep production level, as long as they possibly can.

So, the world should not expect them to make up the over 2 million a day we will be short next year?

Be interesting to see how the Iran sanctions finally unravel.

Hubbert linearization works for phase 1 (OIP1?) straight drilling? Phase 2 (OIP2?) horizontal sweep drilling hubber linearization resets to new curve… Phase 3 (OIP2+) has yet another steeper decline hubbert line. Saudi has all fields in all phases. However Gehwar and the most productive piece historically must be in last 10% of its oil (phase 3).. World flexibility to consumption is near zero…excepting Trump’s pulling down of overseas currencies (aka no gold std over there as to much issues)…so if Gehwar goes off line (5M/day) I seriously doubt other ‘sulfer fields’ can compensate…

World flexibility to consumption is near zero…excepting Trump’s pulling down of overseas currencies (aka no gold std over there as to much issues)…so if Gehwar goes off line (5M/day) I seriously doubt other ‘sulfer fields’ can compensate…

No worries! /sarc

In 2010, global crude oil demand was 86.4 million barrels per day. In 2018, it is expected to increase to approximately 99 million barrels per day. * This statistic was assembled from several IEA Oil Market Reports. All figures are annual averages and include biofuels.

Supply will always meet demand! Right?! And another 83 million humans added to the planet every year.

“The definition of insanity is doing the same thing over and over again and expecting different results”

Albert Einstein

Fred,

If “demand” is consumption of oil rather than “desired consumption”, then supply (that is production today as well as yesterday’s production that is stored as inventory) will indeed meet demand (consumption). One cannot consume something that does not exist. Supply=demand is a tautology.

Also market theory is about price setting. Economic statements about supply and demand always refer to the amount of money that changes hands, not about the quantity of goods. So for example, when the price fell from $100 to $30 a few years back, and demand quantity barely budged, demand fell by 70% — by definition.

Trying to apply statements about demand you thought you understood in economics 101 for jocks and engineers 40 years ago to demand quantity usually just leads to confusion.

Alimbiquated,

I disagree, you are talking about revenue, demand is shorthand for quantity of demand and supply is short for quantity of supply.

Also note that the price of the product is the same on both the buyer and seller side, so in your example the revenue collected by the seller also falls by 70% and supply is still equal to demand.

Those shorthands are all very well Dennis, but crucially, you cannot expect standard economic equations to apply to them.

I’m not just being pedantic about terminology. Calling demand quantity demand makes sense. But supply quantity and demand quantity aren’t the economic values of supply and demand, so the laws of economics do not apply to them. The law of supply and demand applies (unsurprisingly) to supply and demand, not supply quantity and demand quantity.

I am also fine with people saying “Green tea gives me lots of energy”, but that doesn’t mean I think there are a lot of calories in green tea.

[Edited for clarity]

Alimbiquated,

Why does the market price adjust? What is it that becomes scarce? It is the specific goods consumed and produced that economics is all about. It is the study of the allocation of scarce resources to meet the needs of society. Money is just a mechanism through which the exchange of goods is facilitated.

Also note that there is no “value” in economic theory today, we have no measure of value, the price is just a price, an amount of money that is exchanged for a good.

The “value” of that good is different for every consumer and cannot be objectively measured, value is subjective, it cannot be measured any better than a beautiful sunset.

Also as we are talking about a good produced (supply) and consumed (demand), as they are exchanged at some price P then the revenue (price times quantity) exchanged between buyer and seller will be equal, because the quantities are equal.

Economics is about both price and quantity and supply (short for quantity of supply) and demand (quantity of demand). This applies from Econ 101 to Walrasian microeconomics studied at the graduate level.

Yes, I do know that, Dennis! 😉

However I was thinking desired demand/consumption. That is where I think the rubber will actually hit the road. But the world is all transitioning to flying EVs so none of us will actually have to worry about it…

Cheers!

Fred,

Desired consumption is pretty much always higher than available supply, for goods that are produced and sold for profit. When this is not the case prices would be zero and there is little incentive to produce the good in question.

No doubt you knew that too, but some people don’t know economics.

When this is not the case prices would be zero and there is little incentive to produce the good in question.

Yes! Under the current global capitalist economic model that would indeed be correct!

However, from the dawn of agriculture and throughout the entire history of human civilization, up until about the 17th century, when modern capitalism emerged, humanity had somehow managed to produce goods and survive.

I strongly suspect that when we finally end, this already failed, collective economic experiment, we may again find alternative incentives to produce goods and services beyond the ‘Profit Motive’.

I realize. that the 50 or so individuals who currently hold as much wealth and assets as about the 3.5 billion poorer half of the world’s population, will probably disagree with me.

However as history has taught us many times, when there are gross injustices the oppressed eventually come up with revolutions and ingenious devices such as guillotines… 😉

Cheers!

It’s simple, people that work together and cooperate live a higher quality of life. People who take care of their own just because they exist also lead a higher quality of life.

That becomes noticeable quickly.

Hi Fred,

So do you prefer feudalism or slavery?

😉

Very good point! And right on the money, too!

The current form of capitalism is in many ways similar to a form of indentured slavery or a form of serfdom as in Feudalism, only with some minor superficial tweaks. You can’t get a title to another human being these days, but you can, for all practical purposes cause them to be indebted for life.

Obviously I prefer none of the above! I also do not think that any recent economic models will work all that well going forward.

Whether or not people freak out when hearing the label ‘Socialism’ applied to system by which to run a civil society is irrelevant and an unfortunate persistent consequence of brainwashing of the general population, especially in the US.

But I sincerely believe that some form of liberal Social Democratic form of government and an economic system that recognizes resource limits and the absurdity of pushing the myth of ‘GROWTH’ might be a start in the right direction.

Not holding my breath and so far I have seen no indication that sanity will prevail and as far as I can tell, time is quickly running out to prevent a collapse of civilization. At which point most of these arguments will be pretty much moot!

Cheers!

Fred,

The social democratic form of government is just a variation on global capitalism, it is simply a well regulated market capitalist system.

So far experiments with a Marxist type system have tended to lead to more problems and have generally required repressive regimes.

I am not saying a better system is not needed, simply pointing out that such a system has not yet been discovered.

So far a well regulated (where government intervention to solve problems of positive and negative externalities is encouraged) market capitalist system is the best system that exists, in my opinion.

Even though sometimes the leaders that are elected are suboptimal.

Democracy is a terrible political system, but better than any other system by far.

The social democratic form of government is just a variation on global capitalism, it is simply a well regulated market capitalist system.

Yes, but what I’m proposing is a hybrid system that takes into account limits to growth while creating social safety nets which are sorely lacking in the US. Such as universal health care, free university education, and a recognition of the fact that due to technological disruption ‘JOBs’ as we have defined them up until now, may be a thing of the past. So we need a system that finds ways to support citizens both financially and allows them to maintain a sense of purpose and dignity in life.

While it may at one time have done so, the current capitalist system in the US, no longer does any of the above, for the majority of its citizens. That is not a sustainable system.

Hi Fred,

That is clearly up to the citizens of the nation.

Plenty of nations with democratically elected governments have moved in the direction you suggest, mostly European nations.

The US can follow their lead or languish in a nineteenth century political system. Its up to the citizens to choose. Lately we have moving further into the past, perhaps a depression will move us forward or further backwards, maybe we’ll get to feudalism yet. 🙂

European nations are not all using the same system. Eastern europeans who suffered under communist rule tend to shy away from socialist practices, while Western European nations have divided into unsustainable messes like we see in Greece, Italy and Spain. Others, like Sweden are moving away from Socialism. And others are out to lunch, worry about their sun tans, have their streets full of garbage and beggars, like France.

People always get confused with the concept of demand, because it expresses several things.

Demand always refers to the present and the future. Once the purchased is made (and the product is not returned) demand becomes realized and equals consumption. Yet there is confusion because many people talk about past demand when they should talk about sales. Fred talks about demand in 2010. That is consumption or sales, not demand.

Demand can only be estimated statistically and is very dependent on the price. It is subject to a large uncertainty and gross errors that have brought down important companies.

If I want to buy the newest Play Station but I think it is too expensive and would buy it if it was $50 cheaper, I am demand at a lower price point only. Sony will eventually lower the price to reach me.

If I want the latest iPhone just launched at its price but there are not enough units and I can’t get one, I am unrealized demand and very bad for the company as I can go to the competition if the wait is too long.

In the case of oil there is very little storage for the amount of stuff we use, so the industry makes a great effort to produce only what is going to be sold and keep it in the ground otherwise. Production and consumption match rather well, but small deviations have a disproportionate effect on price.

In the case of oil, as the price is negotiated during the sale, there is no unsatisfied demand. Everybody that wants oil and can pay the price will get it. The problem is the part of the demand that becomes potential demand at a lower price as the price increases. The potential demand at a previous lower price translates into economic activity decrease somewhere.

When economists and experts talk about how much oil demand will grow next year, they are making a statistical guess at a certain price point. If prices are rising demand will increase less than if they are stable or decreasing. We shouldn’t put too much faith on that data.

If production turns out to be higher than demand, stores fill and price goes down (see 2014). If production turns out to be lower than demand, stores empty and price goes up (right now). The buffer to prevent huge swings in price used to be OPEC spare capacity. In the 21st C OPEC spare capacity has been unable to buffer mismatches between supply and demand. It is one more of the signs that we have reached terminal state and Peak Oil is upon us.

http://www.energyeconomist.com/a6257783p/world/outlook/graphs/clopspar.gif

Carlos,

In short, the quantity of demand at any time t is dependent on the price of the product at time t, generally a lower price ceteris paribus will result in a higher quantity of demand relative to some higher price and vice versa.

That is generally correct, Dennis. But in the case of oil there are two important inelasticities that result in a certain lack of linearity.

One is that oil is absolutely required and cannot be substituted in most cases. In response to a price variation the demand is relatively inelastic. If the price increases, businesses will continue buying oil products until they can’t, while people might drive less. If the price decreases, consumption will not increase much until the economy expands and uses more oil.

The second inelasticity is due to the long time required to increase oil production in response to increased consumption and high prices. This gap between the price signal and the increase in production used to be dealt with spare capacity. If not we get very destructive price swings.

Carlos, what percent of oil consumption is inelastic? I ask this knowing there is no accurate answer, but this is a source of uncertainty in the whole equation.

Some consumption can be dropped with ease, and other as a last resort. Some consumption is frivolous, and other critical. Some cultures have much less fat baked in their consumption cake, and others very much so.

An associated question relates to time. How much time does a consuming entity have to adapt to price increases?

I don’t know. My guess based on consumption reduction in EU countries during the debt crisis is that very little oil consumption can be reduced before causing economic contraction. People with two cars can choose the one with higher mileage and it is a factor when buying a new car. When it comes to the decision of not going to places, we must think that there is a whole industry of recreation, leisure and tourism that suffers from that. So discretionary usage is also economically important.

A consuming entity tries to pass the cost increase to customers. If it is not in position to do so it will try to optimize operations and cut other expenses. Labor costs are one of the obvious places for cutting. The relationship between gasoline prices and unemployment is very clear.

https://1.bp.blogspot.com/-ZPx1wURlDTM/UHLSVnCewGI/AAAAAAAAGXY/rIcD3I3ygMc/s1600/US-UE-rate-and-real-motor-gasoline-prices-2-yrs-later-1976-sept-2012.png

Carlos,

In the short term we might have perfectly inelastic demand, not so over the long term, consider 1980s oil demand.

My guess for the USA is that, over 10 yrs, a 1/3 drop in oil supply could be absorbed by the economy without depression. Certain sectors would suffer severely, and others would do just fine. People would make some big adjustments, but things would roll on. Would be a different story if it happened in 1 yr.

I’m not nearly as optimistic that this kind of restriction in supply could be swallowed by Japan, since they already run a fairly tight ship, and need to keep consuming in order to earn their income (export goods).

if Gehwar goes off line (5M/day) I seriously doubt other ‘sulfer fields’ can compensate…

Ghawar is not one field, it is five. It is highly unlikely that all five would ever go offline at the same time. And I doubt that Ghawar has produced 5 million barrels per day in years. 3 Mbpd would be my guess.

For the North ‘Ain Dar graphic.

It looks like they damaged their field in the 2000s somewhat, the water mixing up with the oil. But still lots of oil in, when you can produce this mix, with the horizontal technic.

Wonderful presentation of the current situation in OPEC oil especially KSA!

As most readers here know, USA light tight is fighting headwinds to increase its production. Should OPEC lose around 1 million bpd from Iran the world oil balance deficit would increase dangerously.

The situation in KSA cannot be accurately determined because of a lack of hard data. However, as Ron has described above the information available indicates that KSA is at or near an overall decline in its production. Whether that decline will be a gentle 2% per annum or a senica cliff 10 %+ like Cantrall is the big question.

In the past when they haven’t been bringing new developments on it’s looked to be around 5% – e.g. late 2015 and late 2102, the trend (from only three points, but so what this is just a blog) is about that since June.

The number of rigs drilling for oil is only half what it was at it’s peak.

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rigcountsintl

Once all these rigs are back working I am sure they will find lots of oil like they did in 2014.

https://www.cambridgenetwork.co.uk/news/no-sign-of-peak-oil/

This detailed analysis shows how much oil and gas there is. Plenty

The maximum oil rig count in Saudi Arabia was 81, it is now 66.

The maximum oil rig count in Kuwait was 47, it is now 35.

The maximum oil rig count in the UAE was 54, it is now 54.

The maximum international oil rig count was 1080, it is now 792, 288 rigs below peak. Also, the number of working rigs does not determine how much oil is found. Most of those rigs are engaged in infill drilling, they are not wildcats just punching the ground trying to find oil.

Your detailed analysis is the BP Energy Outlook, a publication that just takes OPEC’s word for how much oil they have left in the ground. OPEC tells bigger lies than Donald Trump.

Sorry John, you haven’t a fucking clue as to what the hell you are talking about.

Here is someone that does have a clue – CEO of Schlumberger:

http://www.northamericanshalemagazine.com/articles/2497/schlumberger-ceo-can-u-s-shale-meet-future-global-oil-demand

“The short-term investment focus adopted since 2014 offers a finite set of opportunities over a limited period of time, and this period is now clearly coming to an end as seen by accelerating decline rates in many countries around the world,” Kibsgaard pointed out.

BAU won’t get it done – no quick fixes, ‘new shale revolution’ or ‘reserve production’ to get us through – my interest is mostly how we (as a society and culture) will react as constraints on the resource ‘haves’ and ‘have nots’ set in.

Went through Irma in South Florida last Fall – and in general order was maintained – but really only out of Gas for about 3 days – and was more of a shock type shortage. A very slow decline of world supply will hit those who can’t pay for it most – and maybe wake up enough through higher prices to begin planning for what will be the greatest energy transition that must take place!

Thanks, Captjohn, that is a very interesting read. Some people in the oil business really do know what’s going on.

Question: Is there any reason that BP, an oil company would publish optimistic bullshit while Schlumberger, a service company, would tell it like it is?

Because service companies dont know. Usually operators lie to them so that they can’t share proprietary data with other operators.

What the fuck are you talking about? What operators? Service companies are upstream people. Oil companies are mostly downstream people. When you say “operators”, just who are you talking about?

service companies do not operate wells. They may have WI in some international projects where they have access to data to generate reserve reports, but they do not operate wells. In those instances where they do not have a WI and outside of the data they collect when completing a well, they have no more info than anyone else.

I was referring to the incentive. Why would oil companies have the incentive to paint an optimistic picture of the future of oil production when service companies seem to have no such incentive.

Also, an operator of an oil well is just someone who controls the valves and pumps with instructions from headquarters. They would have no idea about anything. Unless you are talking about the owner of an oil well?

Don’t ask me why these pubcos do what they do. I am in the business and you can read the balance sheets like I do. NOne of it makes sense unless you are trying to squeeze out a 15% return using other peoples money, but even that is suspect. So your guess is as good as mine.

ETA: Producing a commodity with price swings as wild as Oil and Gas hoping to get a 15% return on your money is INSANE.

Operator is going to have ALL of the data. Production, tests, logs, etc, so they would know as much if not more in some instances than the non op WI, even if they have no interest in the well. That is my experience.

Fair enough. Thanks for the info.

The big oil companies are selling a story of long term stability to their investors, partly so they can justify the long term investments needed for the mega-projects where they get most of their oil and cashflow (some of those see no net return for many years). They only need to sell themselves to their investors, not their customers who just buy the cheapest or most convenient, be it crude to refineries or petrol to motorists.

The service companies live more year to year – they get hired to help develop and drill a field and then their workload drops a lot except for some well servicing during operation. Schlumberger is selling itself to its customers (the ‘operators’ who are the E&P companies) and investors as the go to guy for the next couple of years as activity tries to pick up but faces increasing issues as the easy (and now not so easy but still OK-ish) oil goes away.

Schlumberger is not a typical service provider to the producers, although that is a large portion of their business. Since their purchase of Cameron International and other oilfield manufacturing companies, they have been providing facility engineering and fabrication services to the oil producers worldwide.

In point of fact, Schlumberger does have the information that the producers have, and then some. They use those numbers as a basis for facility engineering, and as such are arguably in a better position to interpret them than the producer as of late.

I’ve regularly read the BP annual report, and have come to regard it as little more than a curiosity. Schlumberger, Shell and Total have a firmer grip on the world oil situation, based on my read of their CEO’s comments. However that may be confirmation bias on my part. We shall see….

Libya and Nigeria more likely to go down than up from here to the end of the year and probably drag down overall OPEC numbers with them. First cargo from Egina (200 kbpd nameplate) will be in early January. Angola looks like it might be in trouble. Sonangol were predicting possible 10 to 20%+ decline rates for the on-line FPSOs from about 2023, but it might be happening a few years early, and their only new production was from EOR type projects as far as I could see, none of which have been announced, plus a couple of small tie-backs.

Fantastic report, as usual.

I remember Matthew Simmons saying that when Saudi peaks, the world peaks.

Mr.Simmons likely never considered the productive wonders of a cash flow negative oil boom aka USA LTO sarc/

I wonder how many more cash flow negative oil booms the world can endure, and how long USA LTO will last. While we’re at it, I wonder how the pension funds invested in USA LTO are gonna do for their members once the rats under the floorboards get flushed out.

Buckle your chin strap. Within a few to several years we’ll perhaps know better how this is gonna shake out. George Kaplan and Dennis Coyne had some future production charts in the comments of last post. By my rough eyeball and memory, I think George Kaplan had future production down to about 40 million barrels a day by 2050 (see link below). Dennis, ever the optimist ;), had us down to about 50 million barrels a day by 2050 (see Mr. Coynes comments in response to George). Either way, those alive in 2050 are gonna be living in a very different world!

http://peakoilbarrel.com/eias-latest-usa-world-oil-production-data/#comment-651548

Survivalist,

A lot depends on how much oil can be extracted. George Kaplan’s scenario looks to be roughly a URR of 2400 Gb if the 2020 to 2063 trend continues in future years (it is roughly straight line decline over that period so I just extended the line to zero and estimated URR. It is more likely, in my view that URR will be about 3060 Gb (including 260 Gb of extra heavy and LTO oil), that’s about midway between a pessimistic HL scenario(2600 GB) and optimistic USGS scenario (3000 Gb) for conventional oil.

Also higher rates of extraction could keep production a bit higher maybe 64 Mb/d in 2050, it will depend on the length of Great Depression 2 in 2030. Of course I think that might only last 4-5 years, being an optimist. 🙂

I haven’t worked it out but I’d guess the ultimate recovery is more than your estimate. First, as I said before, the XH production is based on long cycle projects, so it would have a fat tail extending beyond when most of the conventional oil is exhausted (there are a few reasons for that but one is that it needs upgraders and those are not built with excess capacity). Second, as I said twice before, Laherrere has about 180 Gb of “rest of the world” reserves that I didn’t include as I don’t know what they represent – if they are undiscovered oil then at current rates it will take about 40 years to find them, or if the recent trend for declining discoveries holds then forever.

And that is the last I am going to write – or read – on that Laherrere paper. It was just a comment on a blog, not an article in Nature or the Times or even a letter to either of those, or even a letter to the local free advertising paper. I wrote it most for my own interest, writing things out help clarify ideas, but I rarely do more than a cursory proofread. Most people who bothered to look at it would have read a couple of sentences and skimmed the rest, a very few might have got more out of it. It didn’t change anything fundamental. If somebody was going to write another comment they wrote exactly what they were going to write anyway.

Thanks George,

Well I appreciate your attempt as it made me read the Laherrere paper more closely. When I skimmed through the first time, I missed the fact that he revised his earlier OPEC (excluding extra heavy Orinoco oil) estimates to 200 Gb less than earlier papers (from 1300 Gb URR to 1100 Gb URR), there does seem to be 200 Gb missing from his URR estimate which is about 2200 Gb for C+C less extra heavy for the 35 nations he analyzed and about 200 Gb for extra heavy oil for a World total URR of 2400 Gb (about what your scenario has).

I had focused on his World C+C less extra heavy oil estimate near the start of the paper (2600 Gb) and then added the 200 Gb of extra heavy oil from the table at the end of the paper. From these two estimates there is 2800-2400 =400 Gb of missing oil when the two estimates are compared.

An HL on C+C-XH-LTO for 1993-2016 gives a URR estimate of about 2440 Gb. USGS has about 3000 Gb, average 2700 Gb for URR of C+C-XH-LTO

Survivalist

It won’t take to 2050 to see a different world. Just a small fall in supply has effects well out of proportion to the nominal cash value of the oil lost. Cheap flights would disappear, trade would plummet, GDPs shrink – the books have to balance one way or another (see recent paper on impact on trade, I think by Barclays, and works by Hall and Kummel). The biggest impact might be food prices, they could easily double and more short term, then the few billion who spend half their income on food suddenly have to spend it all. Turmoil would ensue and likely knock more oil supply off line. There was a paper about Sweden I think – from memory (don’t quote me) a rapid fall by a quarter of the oil available leads to collapse and by a half to complete loss of civilization.

At the same time the declining cheap and efficient energy would hamper efforts to address the other big ticket, long term issues: rising population, evolutionary inevitable aspirations – “poor man wanna be rich, rich man wanna be king, and a king ain’t satisfied till he rules everything” (of course); declining levels in some of the big aquifers (a few are getting to the point where the basic pump designs don’t work, the replacements needed are much more expensive and much more energy intensive); declining soil loss (at current rate all the soil on sloped arable land will be gone in 50 years – that’s a third – and most of the rest in another 50); and of course climate change related extreme weather. This year we’ve had record heat waves, wild fires, typhoons and (soon) hurricanes plus droughts etc. Soon those will be weekly events (we’re not far off now) but on top of that we will be having two or three extreme extreme-weather events per year. More and more of the oil will be going simply to triage on these (but the patient will get worse anyway). At some point countries will cease to be liberal democracies, the USA seems to be leading the way there, and say what you like about liberal democracies they have never declared war on each other, dictatorships on the other hand …

People will say oh we just need to do this, that or the other – but there is no “just” about any of it, and especially as oil disappears: ignoring the externalities there is absolutely no better real energy source imaginable by some way, especially the cheap stuff we used to have.

You of course know all this and are preparing much better than me, I do not much more than appease my conscience by not flying and hardly ever riding in a car, but I think I’m getting to the “acceptance” stage and pretty much missed out on depression (no physical symptoms anyway).

… [end of rant].

If I remember correctly someone once asked Matt Simmons how best to prepare for peak oil. His response was “be over 50”.

And that was , what, about 15 yrs ago? So make it 65 now.

I tend to agree with you George. Only a small decrease a short time after peak, and the realization that it’s not going back up, will likely open a lot of people’s eyes to the fact that almost every stock and equity is overvalued (come to understand that anticipated future growth will not be realized). I plan to hunker down and catch up on my reading while the dust settles, and I’m thinking there’ll be a lot of dust. I’ll send you a map. Password is ‘I think I’m with the band’.

I find this to be also an interesting take on the future of oil

Fracking (Tight Oil) delays Peak Oil by some years

https://aleklett.wordpress.com/2017/04/16/fracking-tight-oil-forskjuter-peak-oil-med-nagra-ar/

MudGod,

I remember Matthew Simmons arguing the decline in Saudi output is imminent. Eventually he will be correct, Laherrere estimates about 300 to 350 Gb of URR for KSA, call it 325 Gb. A hubbert linearization gives a result of about 320 Gb for URR with cumulative output through the end of 2017 at 150 Gb, that leaves about 170 Gb to be produced.

It is far from clear what future output from KSA will look like. Laherrere expects decline will be between 2%(350 Gb URR) and 3.5%(300Gb URR) per year after 2040 for KSA.

Hi Ron,

Awesome post as always, would you be able to fit nbr of drill rigs Into the same chart as production figures also for your three charts. Perhaps it would make the picture even more clear.

I will do that next post.

EIA confirms the stock draw reported by API yesterday. US is now below 400mb for first time since feb 2015 but the trend now is down.

Ron, when oil reservoirs have very low initial water saturation (that is, very high initial oil saturation), the rocks are oil wet, and this reduces recovery factor under waterflood or water drive. This leads to a recovery factor of say 40% for an oil wet rock, and 55 to 60% for a water wet rock with almost identical oil quality (I’m generalizing).

Fernando,

Which applies to KSA? Water wet or oil wet rocks?

Dennis, the four cross sections from a model shown in the post tell me the top of that reservoir ought to be oil wet, because oil saturation is shown to be so low. This depends on the oil, the water, rock properties, column height, etc. I assume some Saudi fields have large oil columns, the oil is swelled by temperature and solution gas, and the rocks can be oil wetted. But i really dont know. My point is that if you see a field with 10% initial water saturation, then the high water cut point could be say 50% water saturation of the rocks. That reduces oil from 90% to 50% saturation, so the recovery at that point is 4/9. Ron indicated he thought that field could have much more oil but if the saturations were so low near the top, it should be oil wet (but im not sure). We can of course pump wells to really high water cuts and this yields a much higher recovery factor. But that requires cheap gas to generate electricity so we can pump huge amounts of water

Some years ago someone posted (elsewhere) a description of oil to water ratio and concluded that disaster was about to befall all of society because the ratio was something like 90% water and 10% oil in what was being produced. My recall is this was a conventional well and I think it was Saudi Arabia.

Soon after, someone who knew about such things pointed out that 90/10 ratios are very common and suggested nothing about incipient disaster.

Ron

Although I have been lurking on your website for years, this is my first port.

I have been trying to follow Saudi oil production upgrades for years. This is the best summary I have seen.

I know they have one field with too high vanadium content to sell to other refineries, so they built a refinery to handle the large vanadium crude.

Also I know they had a heavy oil field that they could not sell all of the production because no other refineries could take all they could produce. Therefore, they built a refinery just for this very heavy crude.

Do you have updates on these two projects?

Manifa has very heavy oil and is also continued with vanadium. It is online now and producing about 900,000 barrels per day.

Manifa Project

I don’t know of another Saudi field that has a heavy oil problem.

Mike had some posts on the last thread about someone buying an 1180 acre State of New Mexico lease for about 100 million. There is a seeking alpha article about the great deal Matador Pet got in the last New Mexico auction snagging 8400 acres for only 387 million.

https://seekingalpha.com/news/3389832-matador-resources-buys-new-mexico-acreage-oil-gas-lease-sale

So people think that oil production next year will not meet demand. Of course consumption will equal production, but demand will be higher, and we won’t be belabor this further because the point here is a question above — how does society react too insufficient oil?

The question is never analyzed in a particular way. It’s usually evaluated from the consumer’s perspective. Who does what to get the oil they need. We can imagine they bid higher, we can imagine that day seize the oil enroute to someone else, and we can imagine a magical agreement on the part of everyone to stop all economic activity not involved in food production/distribution to reduce global consumption.

What seldom is described is the decision making process within the leadership of oil producers and exporters. It seems clear that a sudden awareness of insufficiency would yield leadership meetings making decisions not about how to distribute more oil to customers, but rather how to keep the oil for future generations of the producing country, without getting invaded and destroyed.

One would think that the optimal strategy for a country that has oil is to ally itself with a military power that can deter invasion by some other military power, without having the ally’s troops actually present on the territory. Or perhaps more effective would be investing in the necessary explosives or nuclear material for one’s own oil fields, and inform potential invaders that the oil will remain the property of the country whose geography covers it, or the fields will be contaminated for hundreds of years to deny them to anyone else.

Clearly this is the optimal path for an oil producer and not seeking some technology that can allow them to drain the resources of future generations more rapidly now.

So people think that oil production next year will not meet demand. Of course consumption will equal production, but demand will be higher,…

Watcher, I assume you think demand is what people want. But there is no way to measure what people want but can’t afford. So “demand” in that sense has no meaning whatsoever. So what happens is the price of gasoline, or whatever, rises or falls until supply equals demand. As prices rise, demand falls and as prices fall, demand rises because people can now afford it. Therefore demand always equals consumption. Demand is what people buy at the price they can afford. I wish we had a word for what people want but even if we did there would be no way to measure it. A poll perhaps? 😉

Ron,

I answered that above

http://peakoilbarrel.com/opec-august-production-data-2/#comment-651890

Estimating demand is essential for a company and can determine its survival. Demand is dependent on price, so demand estimates are essential for deciding the price of a product. The curves for price and demand cross at a point that maximizes income.

Demand is estimated statistically (polls sometimes), with models, and expert forecast. It has a large uncertainty.

That is potential demand at a lower price point. It is estimated in the same way. Companies decide to lower their prices with hopes to realize that lower-price demand.

Exactly. Demand becomes consumption when realized, so it only makes sense to talk about demand in the future or the present (due to lack of real-time data). It doesn’t make sense to talk about past demand, because it becomes consumption or sales.

There is a numerical measure for how much people want gasoline, regardless of price.

It is the length of the line of cars at the gas station in the 1970s. Demand was measured in 100s of feet. Price somewhat doesn’t matter. If you can’t afford it, you put it on a credit card and then default.

Put it on the credit card and not pay it. Because, it was de fault of the company to give it to you in the first place.

The length of the queue is an interesting metric by which to measure the want that people have for an item. Nice one. I’m gonna use that. Reminds me of my Dad’s old story about lining up for a week to buy tickets to see The Beatles.

When you are lining up to buy tickets to see the Beatles it might be called a ‘Want’ or a ‘Desire’. However, when it is the line at the soup kitchen it becomes ‘Hunger’ or ‘Desperation’!

And that queue can sometimes feel like a hundred miles…

I remember that—-

It was eye opening.

The bigger issue is people, Business, & gov’ts servicing their debt. If the cost of energy increases, it make it more difficult to service their debt. Recall that Oil prices peaked at $147 right before the beginning of the 2008/2009 economic crisis. Since then 2008 Debt continued to soar as companies & gov’ts piled on more debt. Debt is promise on future production. Borrow now and pay it back over time.

I recall the presentation Steven Kopits did about 4 or 5 years ago that stated Oil production was well below demand. I think real global oil demand was projected to be about 120mmbd back in 2012-2013 (sorry don’t recall the actual figures).

I think the bigger factor is how steep the declines will be. Presumably all of the super giants are in the same shape and likely heavily relied on horizontal drilling to offset natural decline rates. Presuming as the oil column shrinks in the decline rates will rapidly accelerate. Most of the Artic\Deep water projects were cancelled back in 2014\2015, and I believe most of those projects would take about 7 years to complete and need between Oil at $120 to $150/bbl (in 2012 dollars) to be economical. I am not sure the world can sustainably afford $120+ oil, especially considering the amount of new debt that has been added in the past 10 years.

Ron Wrote:

” I wish we had a word for what people want but even if we did there would be no way to measure it”

Perhaps the word “Gluttony” or the phase “Business As Usual”. People don’t like change, especially when the result, is a decrease in living standards.

Being willing to pay more for oil may change who gets it. But it will not alter the fact that someone who wants oil will not get it. That will be a ripple of market information which will travel around the world pretty quick, I should imagine!

There is always somebody who wants oil but cannot afford it.

This is unlikely to change in the next 30 to 40 years.

The vast majority in almost all the places in the world would like to use more oil but their income is not enough so they end up doing with less. That includes me. Who doesn’t want a bigger faster newer lawn mower, truck, or tractor? What person would not prefer the latest iphone etc. ? or going on vacation, eating out at high end steakhouses? The main reason they can’t is because it would take more and cheaper oil for them to be able to afford it. Else they can only try to take it away from someone else? The peak in global oil production/person happened back in 1979, not because folks were tired of using it all but due to the laws of physics coming into play.

So there are two ‘classes’ of ‘peak oil’. One class is where oil supply is constrained by price (throwing more money at production sees an increase in production), the second class is where oil supply is constrained by physical availability at any price (wave more money at production, but production cannot increase).

In the first case (price constrained) normal market behaviour will apply – folk pay more (if they can afford it) to get more.

But in the second case (resource constrained), it does not matter how much is offered, there is simply no more oil to be had.

With the prevailing declining yields and declining discoveries, are we not in the transition between these two states – moving from price constrained to resource constrained? And once we get well into resource constrained, the price a buyer can pay will determine who gets the remaining available oil, and no amount of screeching and dollar-bill-waving by those who have missed out will improve the supply situation for them.

The second case is my main interest. And I think we are already there. We wouldn’t be looking at LTO and oil sands if there were cheaper options.

LTO decline rates should make the issue more obvious when there are fewer places to drill new wells.

LTO decline rate would be no problem by a conventional / state possessed oil company.

They would have a field with tight oil, and then just equip let’s say 20 fracking / drilling teams and start to produce through their field in 30 or 50 years. They would have a slow decline by starting at the best location and getting to the worse one, while increasing experience / technic during the years to compensate a bit.

You have a pretty good argument except for the “30 or 50 years” part. That’s where the wheels fell off your go-cart. Just how large would the tight oil reservoir have to be to keep 20 drilling and fracking units for 30 to 50 years? And if you assume other oil companies are in that same reservoir doing the same thing? They are going to cover a lot of acreage very fast.

Adam Ash,

It matters very little. At any time t the available supply is limited and the market price will determine who gets what is available. Those willing to pay more than others will get the oil. When we reach a point where no more oil can be supplied at price P, there might always be some more oil that could be at some higher price P’, it is simply a matter of oil prices reaching the point that there are substitutes that can replace the use of oil in some uses. Today the biggest use for oil is transport and electricity and natural gas may soon replace a lot of this use, especially as oil becomes scarce and prices increase.

At $100 to $120/b the transition to EVs could be quite rapid, maybe taking 20 to 25 years to replace 90% of new ICEV sales and then another 15 years for most of the fleet to be replaced as old cars are scrapped. So by 2055 most land transport uses for oil will be eliminated.

The higher oil prices rise, the more incentive there will be to switch to cheaper EVs, even natural gas will probably not be able to compete with EVs as Natural Gas will also peak (2030 to 2035) and prices will rise. It will probably be unwise to spend a lot of money for Natural gas fueling infrastructure, though perhaps it might work for long haul trucking, rail seems a more sensible option.

Adam Ash Wrote:

“So there are two ‘classes’ of ‘peak oil’. One class is where oil supply is constrained by price (throwing more money at production sees an increase in production), the second class is where oil supply is constrained by physical availability at any price (wave more money at production, but production cannot increase)”

Consider this way:

There is already a huge shortage of $10/bbl oil, and a massive glut of $300/bbl oil. There is always shortage resources. Price is just a system that balances demand with supply.

Adam Ash Wrote:

“But in the second case (resource constrained), it does not matter how much is offered, there is simply no more oil to be had… no amount of screeching and dollar-bill-waving by those who have missed out will improve the supply situation for them.”

Not exactly. People that can only afford $50/bbl Oil get out priced by people willing to pay $100/bbl. Supply shifts to the people that can afford the hire price at the expense of people that cannot afford the higher cost. Higher prices will lead to new production, even if has a Negative EROEI (ie tar sands using cheap NatGas).

In an ideal world, higher prices lead to less energy waste (flying, recreation boating) and better efficiency (more energy efficient buildings & vehicles). But I am not sure that will be the case in our world.

The first to suffer from high energy prices will be the people living in poor nations. Recall back in 2008-2014 we had the Arab spring when people could afford the food costs, and started mass riots and overthrough gov’ts. This will return when Oil prices climb back up.

Its possible that the world make continue to experience price swings, as global demand struction decreases demand. For instance in July 2008 Oil was at $147/bbl but by Jan 2009 it was about $30/bbl. I doubt we will see such large price swings, but I also doubt that Oil will continuously move up without any price corrections.

Realistically we are in deflation driven global economy as the excessive debt applies deflationary force to the economy. However central banks counter deflation with artificially low interest rates and currency printing (ie Quantitive Easing). My guess is that industrialized nation gov’t will become increasing dependent on QE and other gimmicks that lead to high inflation\stagnation.

IEA OMR sept: https://www.iea.org/oilmarketreport/omrpublic/

OECD stocks are up but IEA forecast a decline in 4Q18.

“OECD commercial stocks rose 7.9 mb in July to 2 824 mb, only the fourth monthly increase in the last year. Stocks have been stable in a narrow range since March. Preliminary data for August point to significant inventory builds in Japan and the US, and a fall in Europe.”

“Even before we factor in any further fall in exports from Venezuela or Iran, record global refinery runs are expected to result in a crude stock draw of 0.5 mb/d in 4Q18. Any draw will be from a basis of relative tightness: in the OECD, stocks at end-July were 50 million barrels below the five-year average.”

They are still misreading US production, courtesy of the EIA. “Stellar?”. And, I really have a hard time understanding where they are coming from, because they deal in “liquids”. They are saying a 1.7 increase in liquids in 2018, and a 1.2 increase in 2019. On an average basis, oil may increase .6 for 2018, and .5 for 2019. Even EIA is at .7 for 2018, now. Where do the other one million in liquids come from??? Condensate is included in EIA and my figures, and I seriously doubt that LPG makes up the difference. Actually, from EIA it could make up .55 million of the difference, but half a million of phantom liquids is..where?

https://www.eia.gov/outlooks/steo/report/us_oil.php

Guym,

From 1982 to 2017 the average annual increase in C+C consumption has been about 800 kb/d each year. Better in my opinion to focus on C+C rather than “all liquids”, so if this rate of increase in consumption were to continue, then at 600 kb/d we would be 200 kb/d short (and that would come from inventory)

I’m reading the IEA report above. They deal in liquids, and it is better to concentrate on oil and condensate, but they don’t. And, yes, whatever amount they are off, will come out of inventory. An additional subtraction from their estimate of .5 million draw. Next year, we get to increase that draw dramatically.

OPEC reports non-OPEC increases to be 2.02 million for 2018, and that is reported this month. They report oil and condensate. It won’t get close. There may be some offset in demand calculations. If they are off this much on supply, their demand calculations have to come from what they get shooting darts.

Iea pretty useless because they oly have all liquids forecasts. eia is better as they have crude forecasts in aeo. Steo also not very good.

Actually its the EIA’s IEO (International Energy Outlook) from 2017 that’s useful and has a C+C projection through 2050. The projection is pretty reasonable through 2026, after that there is a rapid increase to 100 Mb/d in 2050 from 83 Mb/d in 2026, about a 700 kb/d annual increase for 24 years, after a 280 kb/d annual increase in output from 2017 to 2026.

The projection for 2027 to 2050 is not realistic in my view, but the 280 kb/d annual increase in output from 2018 to 2026 seems reasonable.

Would the real Dennis Coyne please stand up? Really Dennis if that’s some trolling you this is going to get effing confusing round here. Can’t you block the SOB

Hi Duanex,

That is me. My best guess is about World C+C at about 85 Mb/d in 2025, pretty close to the EIA’s IEO 2017 in 2025. I can create a very optimistic scenario that gets to 90 Mb/d in 2040 with very high extraction rates, but I don’t consider that a very likely scenario. The EIA’s IEO 2017 reaching 100 Mb/d of C+C output in 2050 is just not going to happen, maybe 1% probability at most.

From Kjell Aleklett in a link above:

“In 2003 the International Energy Agency (IEA) predicted that oil production (not including fracking) would reach over 120 million barrels per day (Mb/d) in 2030.

In 2015 oil production by fracking was around 4 Mb/d and there has also been an increase in natural gas liquids production through fracking.

The IEA’s current prediction for 2030 has been reduced from 120 Mb/d to 98 Mb/d despite the increased production from fracking. At the same time, the IEA in its World Energy Outlook 2016 report has warned that production may be significantly lower in 2025 due to insufficient investment.”

This is testimony to two important facts:

– How bad are future oil production predictions.

– After the unexpected addition of tight oil from fracking the predicted increase in production from 2000 to 2030 has dropped by 50% (from 45 to 23 Mbpd), and is expected to be reduced further. If anybody needs evidence that Peak Oil is approaching fast, there it is. Predictions of production increase even by the most optimistic organisms are eroding fast.

A little bit up in the comments for this thread…but, it is a point to make that OECD stocks increased 7.9 mb in July. What is much more important and difficult to measure is the inventory globally. If we have a 10-40 million draw in Chinese inventory in July/August as is plausible due to a variety of sources and maybe 30-10 million barrels of draw in KSA with close partners inventory for July/August…then the picture didn’t change that much as we were lead to believe. The first figure before the “-” is July, the second for Aug; all guesses of course. It is very difficult to push the botton to increase oil production, and therefore it is also very difficult to increase worldwide inventories after a prolonged investment drought as we have seen.

For Progressive music lovers, like me: https://m.youtube.com/watch?v=gJuxREA6AwA

From 2016

Saudi Arabia’s oil reserves: how big are they really? Kemp

https://www.reuters.com/article/us-saudi-oil-kemp/saudi-arabias-oil-reserves-how-big-are-they-really-kemp-idUSKCN0ZL1X6

Over the years there has been various speculation of how KSA defines reserves:

ya, per article, probable redefined as proven. maybe

there was a time when it was suggested KSA was defining reserves as what was originally there, ignoring production since 1960 or whatever.

there was even a suggestion that the oil/water mix coming up was being used to redefine original rock porosity, which would redefine reserves

Here is what you need to know about reserves: No one has any incentive to tell you the truth about them. How could KSA benefit by telling anyone the truth? If they were going to shut down 100% in the next 3 years, they absolutely would not tell anyone. That would just be begging to be invaded by someone who needs most of what’s left and has no reason to share.

So don’t expect that you’ll ever know KSA reserves. Why should you?

Actually, I’m not really very bothered about knowing their reserves. What I’d really like to know though is when they’re gonna peak, and how steep the decline will be after that. I guess I think it’ll give me an edge lol

Does anybody here think that KSA will mirror China in post peak proportions?

Here’s an article with a good chart on China.

http://peakoilbarrel.com/eias-latest-usa-world-oil-production-data/

Are there any good case studies that might give insight into KSA’s peak production profile?

Personally I think KSA is acting desperate. The anti corruption drive was just a big shakedown, they’re in Yemen for oil, gas (not much), ports close to Oman in what used to be called South Yemen, and maybe a pipeline to one of them ports that gets them to the ocean on the other side of Iran’s straits. Lots of other nonsense with their neighbours too. KSA is train wrecking, and I don’t think it’s all just some generational thing.

There’s been a couple of articles recently, from pretty sober and credible sources, saying that MbS might be gone next year. He lives mostly on his yacht with armed guards now. All his schemes have pretty much turned to dust one after the other: the Yemeni war is costing about $5 billion a month, his father has turned against him (my interpretation would be that someone else has taken over as having the the king’s ear now, as he’s got some sort of dementia so probably doesn’t do much original thinking), the attempt to distract attention with anti-Qatar sentiment isn’t working, the Ritz-Carlton extortion episode is backfiring even though it got him some ready money, Sunni-Shia issues still bubbling.

GeorgeK,

Sort of related: Saudi Arabia is buying Israel’s Iron Dome missile-defense system and Israel has offered to share intelligence on Iran with the Saudis. This according to an article at Reuters quoted at Oil-Price/ASPO under Peak Oil News.

I’m expecting next to see pigs in my silver maple.

Hanging out on a yacht is bad form for a man with such motivated & creative enemies. Obviously he and his security entourage have not heard of the late Lord Mountbatten, or The Rainbow Warrior.. A few limpet mines and he’s old news.

EIA Weekly U.S. Ending Stocks to Friday 7th September

Crude oil down -5.3 million barrels to 396 (green dot on the chart)

Oil products up +10.9

Overall total, up +5.6

Natural Gas: Propane & NGPLs up +3.7

Chart showing EU and US crude oil inventories, monthly: https://pbs.twimg.com/media/Dm_zjpTX0AAMhjq.jpg

A weekly measure of international inventories

Crude oil & products: https://pbs.twimg.com/media/Dm_0vELX4AAdLHB.jpg

Products: https://pbs.twimg.com/media/Dm_0NuEX0AAsPo0.jpg

Japan to the 8th of September, the date on the chart is the report date.

Japanese inventories usually peak in October

https://pbs.twimg.com/media/Dm_1ZfjW4AAelJl.jpg

Gas To Liquids (GTL) 200 barrel per day plant suspends operations

“The Board of ENVIA Energy (ENVIA) has decided to suspend operations at the Oklahoma City gas-to-liquids plant and to undertake a review of strategic alternatives in order to preserve the value inherent in the facility.

The ENVIA plant uses Velocys Fischer-Tropsch technology to produce premium wax, diesel and naphtha. …”

http://www.greencarcongress.com/2018/09/20180913-envia.html

A lot of GTL news at http://www.greencarcongress.com under the Gas-to-Liquids tag.

And most of it is plans for studies, or announcements of suspension of efforts.

GTL doesn’t seem likely to be a major player anytime soon, if ever.

Does anyone have an opinion on Extraction Oil and Gas? XOG.

I am wondering if they think they will survive or if they are in the business to make what they can now before debt catches up to them.

From above . . . when you have to have something, you put it on a credit card and default . . .

https://www.zerohedge.com/news/2018-09-13/china-offers-venezuela-5-billion-loan-support-ideological-ally-maduro

China won’t care. Why should they?

The Venezuelan National Assembly issued a statement (which was distributed to all foreign embassies) which says the National Comptroller is illegitimate and that all financial transactions, including loans, are illegal and will not be honored when the Maduro regime falls.

There’s a battle raging in the US between factions which focus mostly on US elections or providing cover so that Maduro can survive. They focus so much on Syria, Russia and israeli issues they don’t pay much attention to what goes on in Venezuela.

Meanwhile, the Supreme Court in exile, Luisa Ortega (the exiled State Prosecutor), Ledezma (the Caracas mayor who escaped from house arrest), Julio Borges (former National Assembly president who fled after being threatened by Maduro) are working quietly to set up a government in exile. This requires several steps which have to be followed as per the constitution. The decision point for President Trump will come in about 90 to 120 days (it should be closer to 90). This decision diesnt involve military or any of the violent means being discussed. But it could lead to Maduro’s defeat.

Blurb says his term is 6 yrs. Election was this year. But I suppose folks can declare they won’t honor that, either.

The article announcing the loan said that Venezuela had failed to make payments on present loans. It did not point out that payments are frozen by banking sanctions. Payments to China or Russia won’t be.

https://tradingeconomics.com/venezuela/government-debt-to-gdp

That’s an interesting chart. Debt to GDP is now about 23%. Banks discovered pretty early in the financial universe that they cannot collect interest from an entity that doesn’t borrow money from them. They tend to be not pleased about it.

(US debt to GDP is over 100%)

Just scrolled through some articles. An amusing one said this: China has loaned Venezuela $50 Billion since 2008. Lots of verbage about the horrors of it all and the collapse of this or that. Somewhat later in the article, near the end of it “Venezuela has repaid much of the debt to China with oil. About $20 Billion is outstanding.” Maybe that oil is in exile now.

Then there’s this:

More than 2.3 million Venezuelans out of a total population of around 32 million have left the country during the past four years, according to the NGO CARE.

So that’s what, 600K/yr? Now there’s not much doubt that some returned, no? And beyond returnees, immigration to Venezuela seemed to be 1 million per year as of 2014. There was a blurb out there throwing racism on the matter, that those leaving were light skinned and those arriving were from China and Haiti. Quite many from China.

Venezuela law apparently provides free healthcare for anyone in the country, regardless of nationality.

Regardless, the quoted population for 2018 is 32.5 million. That’s from UN data. 2017 31.97 million. Growth rate 1.26% (US is sub 1%)

Enough reality!

Wasn’t Maduro to be gone

23 years ago?MSM brings such sharp analysis—–

Hightrekker Wrote:

“Wasn’t Maduro to be gone 2 3 years ago?”

Usually when a gov’t is mismanage as badly as Venzuaela, it gets overthrown. VZ is just a quirk that it hasn’t resulted in a Coup or civil war. Recall that Civil wars & Coup’s are very common in Latin America.

Sooner or later Moe will be forced out or killed. Its just a matter of time.

Watcher wrote:

“Venezuela law apparently provides free healthcare for anyone in the country, regardless of nationality. ”

Kind of pointless when there are no drugs, medical equipment, or sufficient HCPs available. Free Healthcare in VZ is like putting a sign next to an empty Gas can that says “Free Fuel!”

Someone once said “One can tell a lot of lies speaking only the truth”.

One can tell even more lies quoting only true statistics.

But the reality is that my neighbour Venezuela currently is a complete chaos.

You would know more than me–

I was in Colombia for quite a while, and in Argentina for a shorter time, but not in Venezuela.

Many comrades were there for years.

But the reality is that my neighbour Venezuela currently is a complete chaos.

Don’t worry Jair Bolsonaro, will keep the great Brazilian march for order and progress right on track! Then he can expand it throughout the rest of South America…/sarc!

Right wing, left wing they are just opposite sides of the same worthless wooden nickle! Brazilian Ultra Nationalism and a wish for going back to failed policies of the past won’t work and they are a path to future chaos in Brazil as well.

Hopefully there are some sane Brazilians left who will stand up against this stupidity!

I guess China figures the Monroe Doctrine only applies to Europeans. Money grows on keyboards, I’ll be more impressed when China “sells” them advanced air, not just L-15’s and K-8’s.

https://www.nytimes.com/1984/11/08/world/us-warns-soviet-it-won-t-tolerate-mig-s-in-nicaragua.html

The elections held in 2018 are considered illegitimate because they were called by an illegitimate “constitutional assembly”. About 42 countries have already declared they consider that assembly and the spurious election to be illegitimate.

The steps being taken by the democratic firces are intended to lead to the creation of an alternate executive which can be recognized by other nations. This process takes time, but the international community has signaled they consider the Supreme Court in exile, Luisa Ortega, and the National Assembly to be the only legitimate powers.

The flow of refugees has increased steeply as hunger and despair increase, so the numbers by now probably exceed 3 million.

I talk to Venezuelans in exile as well as those inside, and I sense they wait to see if the US rescues them. But i keep explaining that they wont get help until the transitional government is formed and requests help. I also indicated to resistance leaders that its important to have a roster of young men who are in exile and have served in the military or worked as policemen or as private security guards. The idea is to recruit 20 thousand volunteers to form a national army, which would have civilian control from a Minister of Defense in exile. I know the shape of the Venezuelan military and the country. So all those 20 thousand would need is for the US to take out the Chavista air assets and provide air support with drones, a few B52s and C130 gunships.

Great, another US backed overthrow in Latin America. It usually leads to such positive outcomes.

The procedure we would follow isn’t an “overthrow”, because the legitimate executive would be the transitional givernment in exile. This givernment would declare that Maduro et al are posers who carried out a coup, ask help to arm 20 thousand venezuelan volunteers who would proceed to take a portion of Venezuela with USA air cover. Once this territory is liberated the legitimate venezuelan government would recruit an additional 100,000 volunteers and expand the territory it controls. The ultimate aim is to have an army with 500,000 soldiers and make sure the maduristas either surrender, run away to Cuba, or get killed. Its a legal solution, its gradual, works like a steam roller. And you can go tell them this is what’s coming down their throats. Maybe they’ll realize this is an end game they arent going to win, and run away to Cuba.

I should add this strategy doesnt require UN or other international approval, because it would be a government and people asking for help to get rid of a plague. We would make sure the liberated areas are kept under strict control to avoid popular lynchings of maduristas, secret police, colectivos and other gangsters who have been propping up the regime. The bad ones would be jailed, tried under Venezuelan law and serve time as required.

“Once this territory is liberated[confiscated] the [psuedo]-legitimate venezuelan government[regime] would recruit an additional 100,000 volunteers [death squads]”

two of the many ways to tell a story.

Hickory,

Yes, terrorist or freedom fighter is just a matter of who wins.

From the British perspective, the Sons of Liberty were terrorists.

Do the actions of Maduro seem legitimate to you?

How about Stalin?

Indeed Dennis.

Maduro legit? I don’t see how you have a legit leader in a country with so much manipulation of the process, from coup to press suppression etc.

On the other hand, how does a leadership installed by outside forces call itself legit?

Failed state isn’t easy to fix.

I sure wouldn’t trust anyone with such an authoritarian affinity to be involved in decision making regarding governance.

The main bodies creating the transitional government would be the Supreme Court judges who were named by the National Assembly with the required supermajority vote. The National Assembly at the time was the only legitimate body, thus it transferred its legitimacy to the judges.

The judges fled because as soon as they were named Mafuro ordered their arrest. The ones in exile are the ones who got away.

The State Prisecutor was also named and approved according to the constitution. She fled when she feared for her life after Maduro’s illegitimate assembly said they were replacing her (a power they lack given their illegitimacy).

My sense is that english speaking leftists we see on social media and writing comments include hard core regime supporters who would say or do anything to see their red genocidals tyrants rule and destroy nations in the name of “social justice”.

Hickory,

It would seem that removing a dictator by democratic means is difficult without some kind of revolution or military coup. In the case of Venezuela some government in exile which attempts to remove a dictator by force, might be the only viable option. I have never been to Venezuela so I don’t know the situation first hand.

Thats a dangerous game Dennis. Better make sure you have a very big majority of the population on your side. Else you can get situations like VietNam and Iraq. Is Brazil, Columbia, Chile, Argentina clamoring for this path? Does China, The EU and Russia concur?

Hickory,

Probably right, UN action might be better, though that usually accomplishes very little.

Weapons and advisory support and possibly air cover would seem to make sense as standing by and watching things fall apart as Obama did with Syria seems a poor policy.

I don’t ever expect much from the UN, other than discussion. They are not set up to actually do anything.

And I don’t trust the USA to get much right in the world. Picking winners and losers is not something we do well at all.

I have no trust for the right or left wingers. That leaves only 27 people in Venezuela., and they are wise enough to just shut up and work on surviving.

Once again, what do the other countries in S. America want?

Lastly, some people would say that the only way to fix a failed state is through an authoritarian process. They could be correct, I suppose. Hard to find that with good intent, especially when you throw in the lure of petrodollars.

https://mobile.reuters.com/article/amp/idUSL1N1TM1VJ