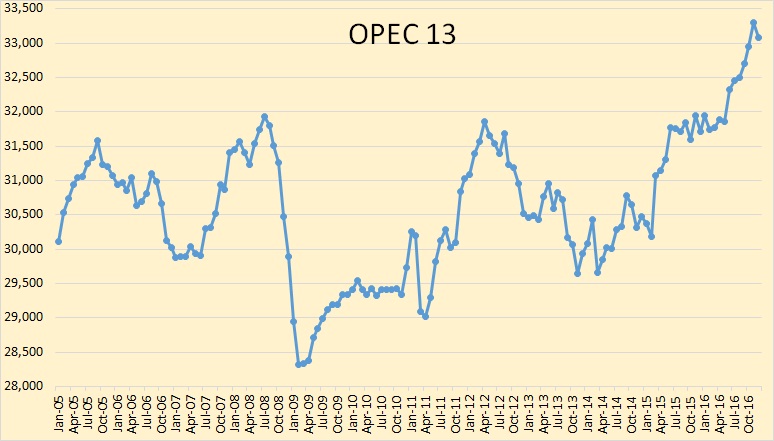

The new January OPEC Monthly Oil Market Report is out with crude only production numbers for December 2016. All charts are in thousand barrels per day.

Indonesia has left OPEC so they are now down to 13 nations. The Indonesia historical data has been removed from the entire OPEC data. Therefore the December data does not reflect any drop due to Indonesia leaving OPEC.

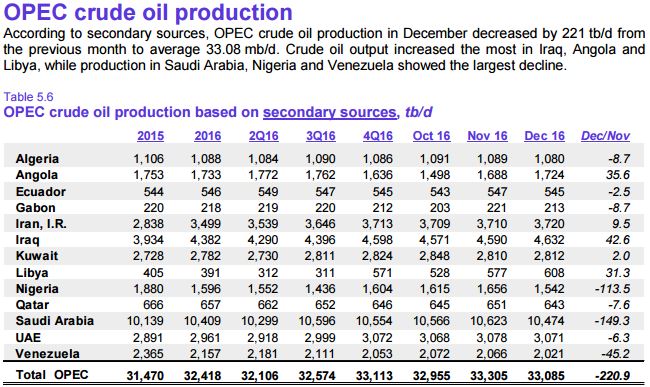

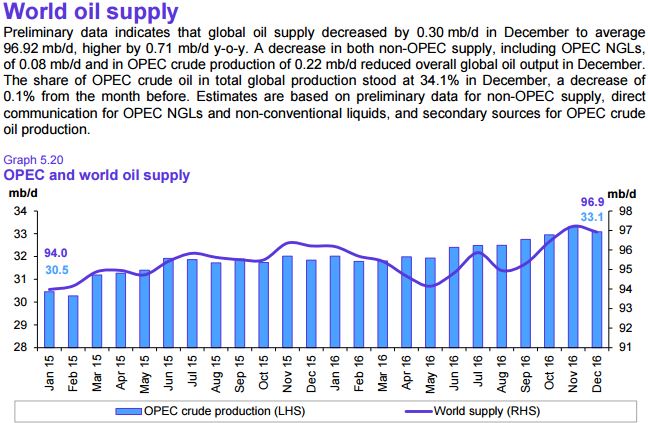

OPEC crude oil production dropped to 33,085,000 bpd in December. That was a drop of 220,900 bpd. However that was after the November production numbers were revised upward by 175,000 bpd. Therefore the drop was only 46,000 bpd from what was reported last month.

Officially, the OPEC agreed to cut production by 1.2 million barrels per day. Those cuts are supposed to kick in in January. But I would not count on their January production numbers being down that much.

OPEC’s December production represents an all time high for the cartel.

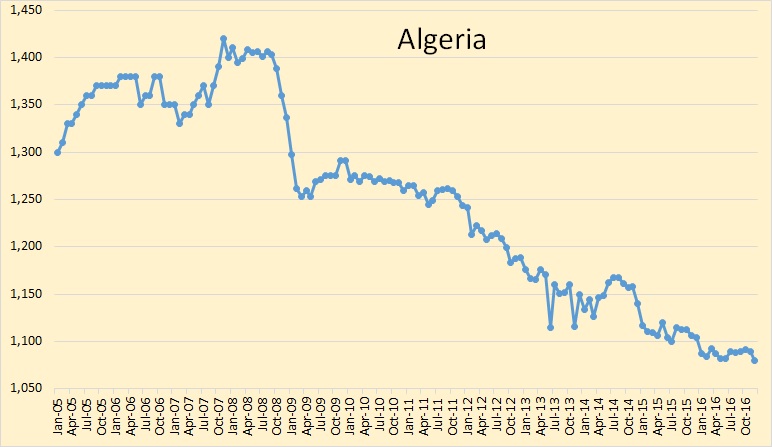

Algeria is in slow decline.

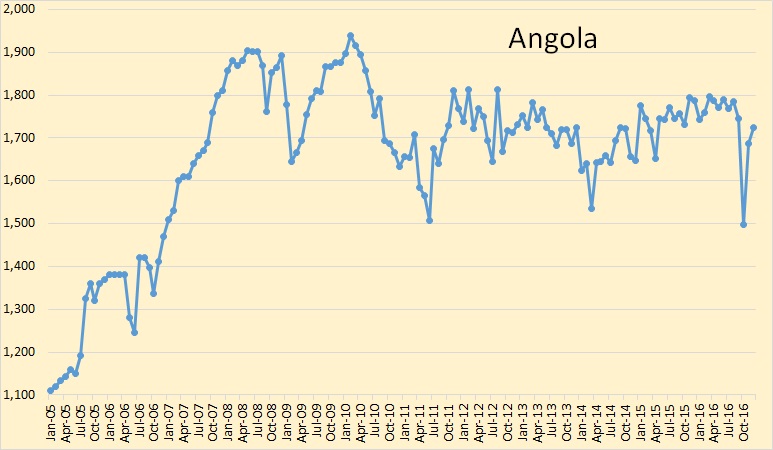

Angola’s production continues to recover from the sudden drop they had in October.

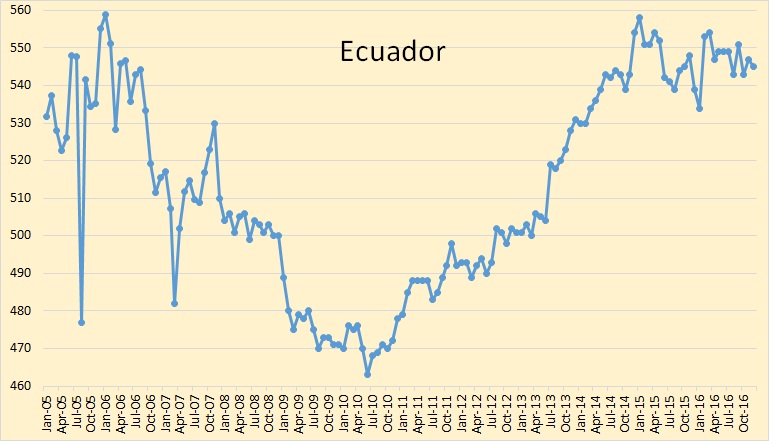

Ecuador seems to be holding steady for the last two years.

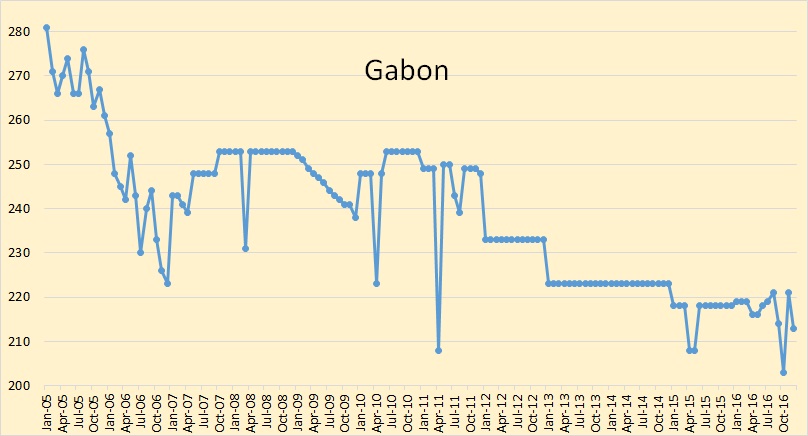

Gabon was added to OPEC a few months ago but their production is so low it will have little effect one way or the other.

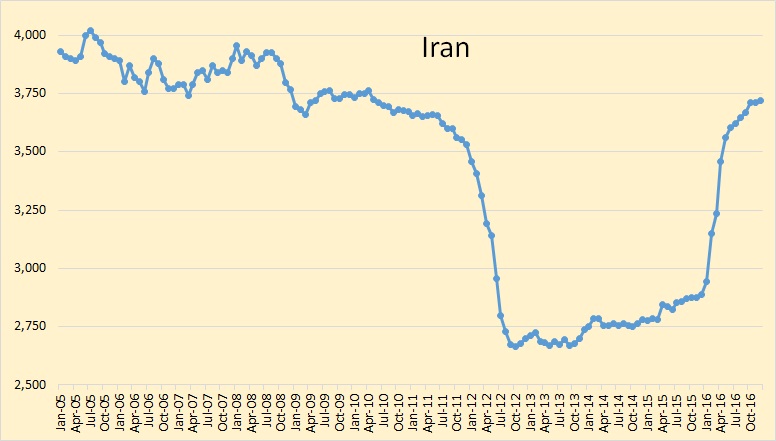

Iran’s increase since sanctions were lifted has slowed to a crawl. There are other problems on the horizon for Iran. They are talking about changing all their oil field contracts to “buy back” contracts. That is they want the option to nationalize all everything. This will likely cause a mass exodus of foreign oil companies from Iran and hit their production considerably.

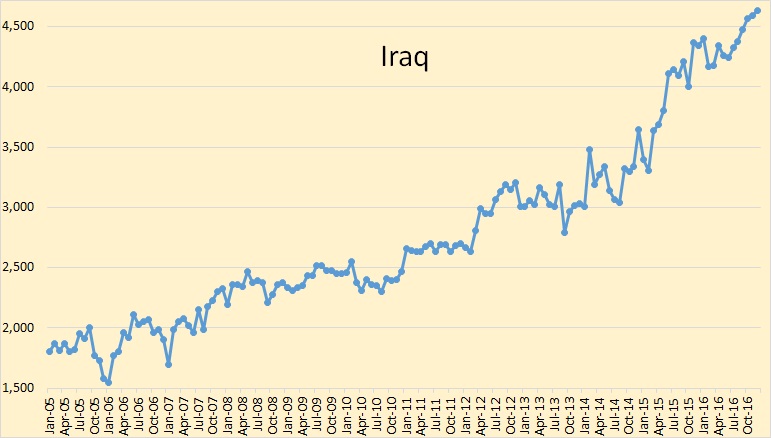

Iraq is the wild card in the plan to cut production. Their production was up 42.6 thousand bpd in December. A lot of analyst doubt Iraq will cut their fair share.

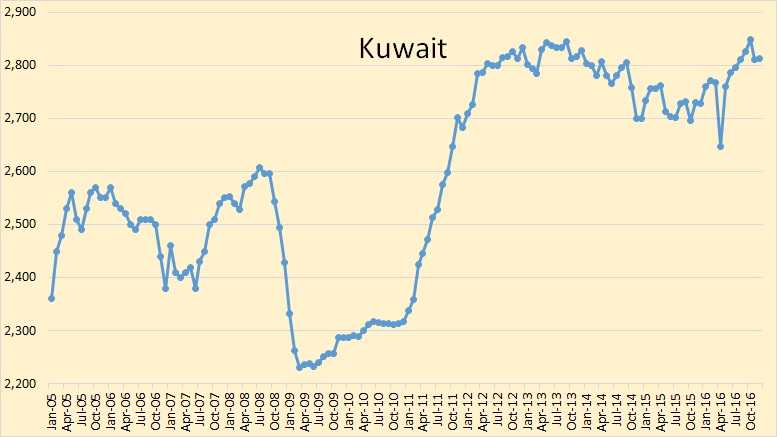

Kuwaiti December production was almost flat from November.

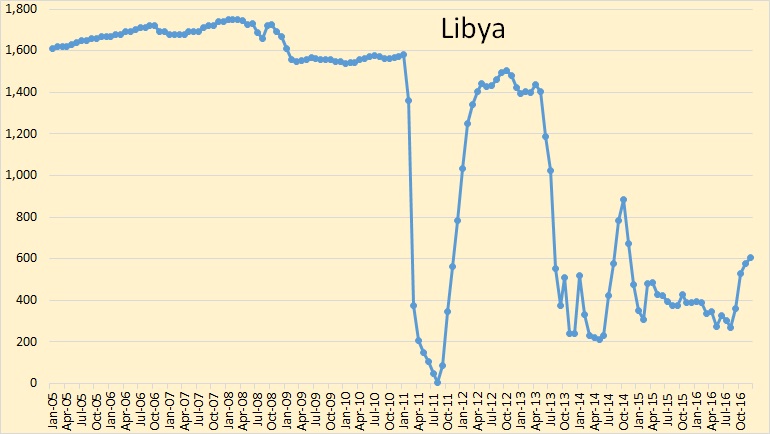

Libya continues to recover but ever so slowly now. No doubt that Libya will say they must cut only from where their full production would have been had they no political problems. I think we can look for Libyan production to continue to increase, or to follow their political fares.

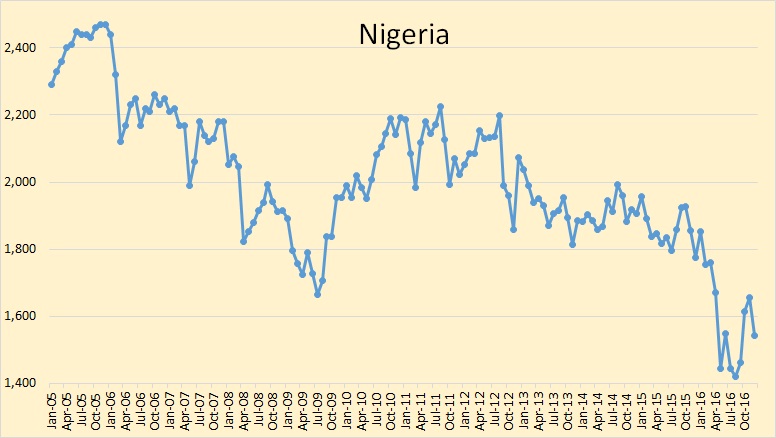

Nigeria took another hit in December. Their production will also follow their political fares. Their January production will depend on how successful they will be in fighting off the rebels rather than any OPEC dictates.

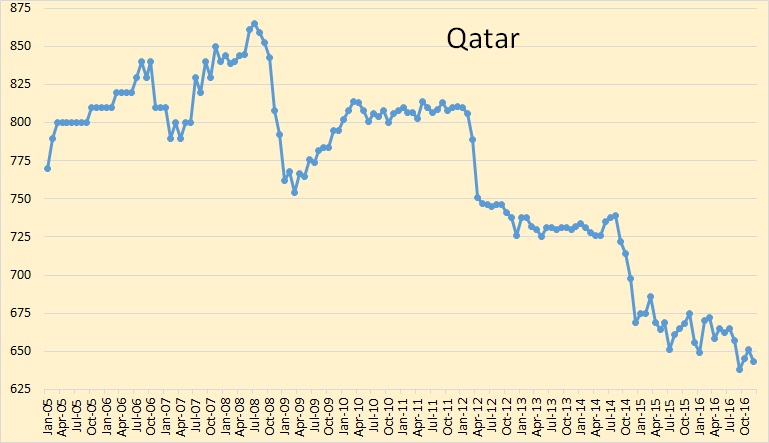

The decline in Qatar’s oil production seems to have slowed since late 2014. But nevertheless their decline continues… and will continue.

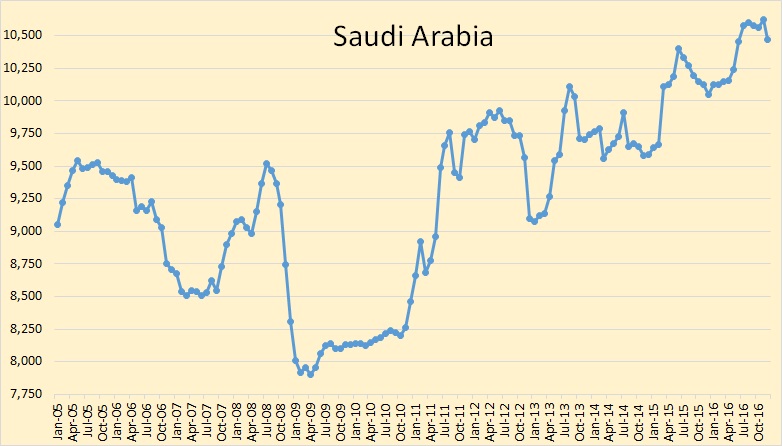

Saudi Arabia’s production was down 149,000 bpd but that was after their November production had been revised upward by 111,000 bpd.

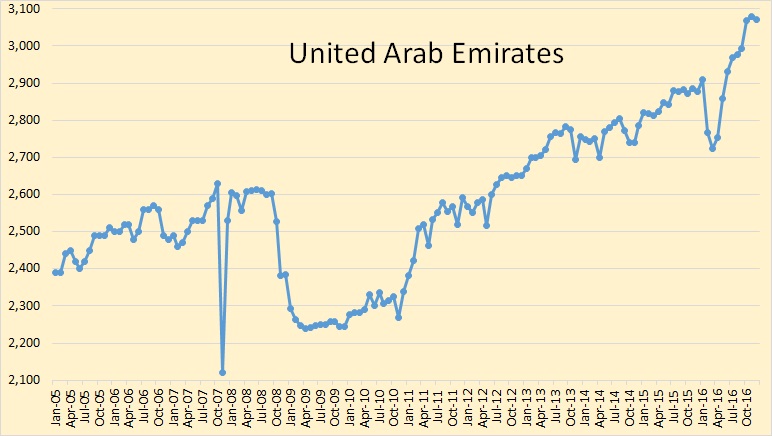

UAE production was down 6,300 bpd in December but that was after their November production had been revised upward by 82,000 bpd.

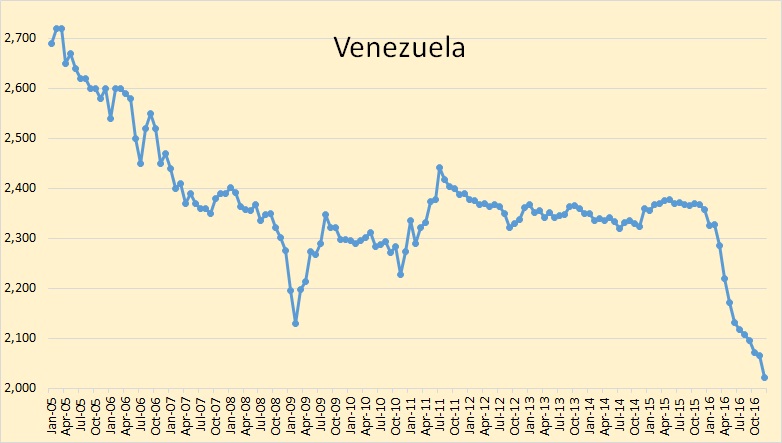

Venezuela took a huge hit in December, down by 45,200 bpd, and that was after their November production had been revised downward by 31,000 bpd. Venezuela has very serious political problems.

World oil supply hit a new high in November but was down in December. The 2016 average is still slightly lower than the 2015 average.

Ron, you might be interested in this:

Global Energy Graphed

The charts here are live, so you can read the data from the underlying data base. Currently have the whole of IEA monthly oil production in there, lots more to come.

Ron,

We are going to have to come to grips with the reality of 3, not 1 or 2, but 3 million bpd more production at a price less than 12 Spring 2014’s since Jan 2015. That surge in output showing unequivocal disinterest in price is undeniable.

something ate the / in 1/2

Watcher, I have no idea what you are talking about. Right now the average 2016 world C+C production is still about 100,000 to 200,000 bpd below the average for 2015. World peak will turn out to be November 2016 and that is about 700,000 bpd higher than the November 2015 peak. But that was due to the recent surge in OPEC production.

Unfortunately the EIA only has data through September. But the last three months of OPEC data will not upset things as much as you assume.

“World peak will turn out to be November 2016 and that is about 700,000 bpd higher than the November 2015 peak. But that was due to the recent surge in OPEC production.”

So peak oil did not occur in 2015.

Also, still possible for yet another higher peak than Nov. 2016 to occur in the future.

And the beat, the rhythm of oil being pumped, just keeps on going…

But peak oil for export was 2005.

No, net exports was higher in 2015. Not by much though.

Hi Jeff,

Where do you see the data for this?

Thanks

BP Statistical Review of World Energy http://www.bp.com/content/dam/bp/excel/energy-economics/statistical-review-2016/bp-statistical-review-of-world-energy-2016-workbook.xlsx

BP provides data for export and consumption so it´s easy to calculate.

See also http://mazamascience.com/OilExport/

Thanks Jeff. Indeed, according to their data the Total World Exports of Oil increased from 52Mbd to 61Mbd from 2005 to 2015.

So, no peak export oil, just yet.

And as you can see from the below chart, it has been all OPEC as far as production increase is concerned.

Ron,

Russia’s C+C output in October-December 2016 was 425 kb/d higher than in the same period of 2015

I understand that Alex, but that is already in the figures thru September. And Russian production for October thru December is only about 100,000 bpd above September. That will not alter the 2016 figures enough to push 2016 world oil production above that of 2015.

So not just OPEC didn’t care about price.

Russia didn’t care either. Well above early 2014 production levels, when price was more than double.

In fairness we could say OPEC’s disinterest in price is mostly Iran and Iraq as the source of the upticks, but Libya is just as much a special case in the other direction, and ditto Nigeria. “Other factors” sort of thing. The numbers are what they are. Production has risen as price fell.

Regardless, btw, even your world C+C chart shows a LOT more production today than May 2014 when the price was more than double today. And your point is valid, most of that is OPEC, but even the non OPEC is higher than Spring 2014.

It just isn’t determinant. That is clearly inescapable. We’ve had more than enough time to see reality.

From end-2014 to end-2016, both OPEC and Russia did care about market share.

That approach may return in 2H 2017 when there will be signs of rebound in US LTO production. Saudi Arabia has already said that output cut agreement may not be prolonged for the second half of the year.

BTW, Russian companies remained profitable and free cash flow positive in 2015-16. Hence, it made sense for them to maximize revenues, earnings and cashflows thru higher volumes.

Am I all alone? Probably. But, with all due respect, I am tired of hearing about market share with a commodity.

To exaggerate the point. It is almost like some wheat farmer in Kansas says that he wants to maintain his market share. Or, maybe more to the point, the largest gold producer in the world saying that they are willing to sell gold at any price in order to maintain their market share.

The oblique point to that point is pretty straightforward — namely the entire Peak Oil concept is about scarcity.

If there is scarcity every producer will have a customer. What can market share possibly mean if there is too little to go around and every drop produced will have a customer?

(As if that is not already true. We have to keep in mind all those buyers out there who have no intention to resell, but rather just want to store it, for going on 3 yrs now)

clueless,

You may be tired, but there were many episodes when oil producers were struggling for market share over the past 35 years (and earlier in the history of the oil industry).

In 2015-16, four large producers have significantly increased oil output and exports: Saudi Arabia, Iraq, Iran, and Russia. Unlike your wheat farmer in Kansas, none of them were producing at loss, and they were trying to partly offset lower prices by higher volumes.

None of them trusted each other; and some of them were (and remain) political rivals in the Middle East. In that situation, if you cut production, others may take your market share, and you will be producing less, while oil prices would remain low.

There were several other countries that increased output thanks to start-up of the projects initiated during the years of high oil prices: Canada, Brazil, Norway, and even U.K.

Market share is a WEAPON in terms of economic warfare. PRICE is a WEAPON in terms of economic warfare.

Countries that hate each others guts and that compete selling oil as exporters can and are obviously in my estimation trying to bleed each other dry, in terms of revenue, in a very real way.

The loser has less power and less influence. We don’t know yet who will give up first and REALLY cut back production.

But we might know, within the next few months.

There’s a lot more to it than just economic warfare, but anybody that denies it plays a major role is naive to say the least.

“Market share” is a euphemism for “cash flow” in this case, I think.

“Russian production for October thru December is only about 100,000 bpd above September.”

Correct.

Hey Watcher I normally get your dark memes right off the bat, but could do with some clarity on this one. Where is this 3mbpd of which you speak?

Ron’s OPEC chart.

There is hysteresis in the response of oil production to price. Oil companies respond to low oil prices by pumping as much oil as they possibly can today (to pay bills) and cutting capex so that production decreases later. The response in production to the current low prices should be apparent in 2020. The hysteresis also occurs with respect to high prices. When prices are high, capex increases, but the increased production is not seen immediately because it takes time to come online. Once online, the production is not cut, even if prices decrease. In fact, low prices tend to increase output from existing wells.

So this hysteresis theory says that when prices are low capex gets low with a later response in production, and . . . because flow is low generates less revenue with the allegedly higher price than it might otherwise.

And if price goes high then you increase capex so that oil flow comes online at the later lower price to earn less money.

Shrewd. You’re selling your reserves for the lowest possible amount of money.

That’s correct. That’s why I don’t think much of these models that use optimization to predict prices.

Shrewd. You’re selling your reserves for the lowest possible amount of money.

If you must have the cash, and just about every oil producer appears to be in dire need of the cash, twenty or thirty bucks net over actual cash cost of production for a barrel in the HAND TODAY is worth over a hundred bucks for a barrel in the five or ten year down the road BUSH.

It may not be shrewd, but it’s not at all hard to understand.

Schinzy is dead on. This sort of oscillation in supply and price, and the reasons for it occurring are covered even in sophomore level economics texts.

The only real difference between the oscillations in oil and in other industries is that the time lags are longer in oil than in most industries.

They are as short as two or three years in my industry, agriculture, in respect to grain.

But in my own specialty, orchards, they are similarly long. It takes tree fruit growers five to ten years to significantly expand production,and once new orchards are established, you must either produce them,or abandon them, there’s hardly any middle ground at all. It’s usually cheaper to produce them, you lose less overall that way, and you can generate a little cash by producing them as well, most of the time.

The time is variable. A 10 well program in the Permian basin may have a one year lag, a large (200,000 BOPD) project in the Ecuadorian jungle can be say five years, a development in the Kara Sea could be say 7 years and reaches plateau in 9 years.

My guess is that outside of LTO, long term projects are cut first. I still think the strongest effects of the current price downturn will be seen between 2020 and 2025. Possibly beyond 2025 if prices do not significantly rise from where they are now.

LTO is the exception and the wild card. I am not convinced that capex cuts in LTO would not have happened even if prices had remained high. Low prices attracted large amounts of fresh capital because investors have been taught to buy low and sell high. Bankruptcies attract investors like flies to a dung pile. Lower earnings on sales may have been made up for with capital inflows. I continue to be amazed at LTO’s capacity to attract capital. We will see how long it continues.

Hmmm. That’s a very interesting guess as to the timing.

We have a secular reduction in demand on the horizon — a very large one. My forecasts are not precise (they could be off by 5 years in either direction) but I’m projecting that circa 2023, secular demand reduction will exceed the natural decline rate of “normal” (not fracked) oil fields.

I think you can all see what happens then.

Someone help me out here? My assumption is that GOM production is under the purview of the BOEM. What BOEM and EIA report as the production from GOM differs drastically. November is incomplete, but the three earlier months has EIA reporting hundreds of thousands barrels a day higher than what the BOEM reports. BOEM data has it trending down, and EIA has it trending up.

So it is not just the November data that is incomplete, but the August, September and October data as well. And of course, the earlier months are more complete than the later months.

Guy, BOEM is kinda like Texas, that is they report the data as it comes in. And if it isn’t in yet, they don’t report it. The EIA, on the other hand, estimates production that has not been reported yet. Eventually, after a few months, the BOEM data will equal the EIA data. Of course the EIA data will be revised as the data comes in. It is usually, but not always, revised downward.

This is BOEM data for new producing leases in GoM. Note that data for Gunflint has just been added, and the profile looks a bit more realistic. I added a few others that had started up as well, including Caesar/Tonga – this had a short blip and then faded away to nothing – there has been no data for about three months so this may come back as as well. All the other data is up to date to October (some for November is available but not all so I haven’t shown it). It is noticeable how early the deep production starts to come off plateau (assuming it has been achieved) – e.g. Lucius is already cutting water in high quantity, Tubular Bells and Son of Bluto 2 are in decline. Also Mars may be starting to blow down gas caps on one or two of the leases so production will decline unless they can balance with new tie backs (I am not aware of any due though).

Everything I have read, so far, indicates a max of 1.4 million a day. That is vs the current 1.6 and upwards reported by EIA. They originally projected a 1.8 for 2017, and have recently moved it down to 1.7.

I think you’re probably about right: BOEM has 413 mmbbls so far this year, which is probably to October for most leases, so giving about 1.36 mmbpd average, but there are some big fields that haven’t fully reported past July like Thunder Horse and St. Malo, and there should be a ramp up of at least 100 kbpd for the last two months. But 1.6 is looking difficult, and the higher projections for next year won’t happen (there is only about 60 kbpd in development, some of which won’t be seen till 2018, and maybe 100 kbpd in continued ramp up, but at least 150 kbpd in decline coming as well.

Thanks, George!

AlexS,

“Is that possible to get similar chart for XTO operation in the Delaware basin

(or NM portion of the Permian; or Permian in general).”

Sure, see below graph.

As you can see, also XTO’s 2015 wells in the Permian seem to follow the 2013 rather closely. Only oil is shown, but the gas part doesn’t seem to be significant (you can see this by changing product to gas).

I got there in 5 steps:

1. Going to my latest US update

2. Browse below to the “Advanced Insights” presentation

3. In the “Operator (current)” selection on the right side, make sure only XTO is checked. You can do this most easily by first clicking “All”, to deselect all operators, and then to scroll down and select XTO (there is also a search function to make it easier). After that click “Apply”, and anywhere on the presentation.

4. To show the wells by years, I changed the “Show wells by” to “Year of first flow”

5. I only checked the Permian basin

Enno, thanks a lot

I wasn’t smart enough to find it myself.

It seems that XTO’s wells in the Permian perform more or less similarly to Bopco’s, although there are significant annual fluctuations.

You’re welcome Alex,

> I wasn’t smart enough to find it myself.

I don’t belief that, and I’ve learned to look different at this: if it’s difficult to find something, that means the design can be improved; the issue is not with the user (well, okay, most of the time!). For now I can’t do much about that, but I can describe the steps needed to answer a particular question, and hope it benefits others as well.

> although there are significant annual fluctuations.

Indeed, I’ve noticed that individual well results vary wildly in all basins, so it’s always good to look at larger samples, before making conclusions. This is also why I’m not so fond of cherry-picking a few wells, as companies sometimes do in their presentations, or certain analysts on other sites. It’s meaningless, as it allows one to proof anything he wants.

“For now I can’t do much about that”

You are doing a herculean work, which requires a big research team.

I am really impressed!

” it’s always good to look at larger samples, before making conclusions.”

I agree. I think a more or less representative sample should include at least several hundred wells.

Huh. 3-year lifespans for wells.

Not worth drilling even at current prices.

FWIW, the latest EIA Weekly Crude Oil Stock report shows the stock level decreasing compared to the 5 year range.

http://www.eia.gov/petroleum/weekly/images/crstuss.gif

Granted, the top of the range is probably 2016 values, but they are still coming together.

Who knows what the rest of the world is doing.

OECD stocks are on 4 month decline, China also down (both from OMR). Based on Jodi data looks like Saudi stocks are on decline as well.

This shows world stocks according to Jodi – hard to see what all the fuss has been about. Note they don’t have every country – e.g. they don’t have China who probably have been increasing storage (I don’t know where OPEC get their data for them). The drop at the end is partly because not all the data is in (they are left as zero entries) but partly because of a real fall in OECD storage as shown in the OMR.

These are Saudi stocks according to Jodi – there has been a decline but it looks to have flattened off a bit. I guess it will accelerate now if they are reducing production, unless they can compensate by reducing internal use (e.g. switching to gas for power – which I think is going to be difficult as their electricity demand is increasing at 8% yearly, or reduce exports).

Colombia production dropped 2.1% to 837 kbpd – the reason (Google translation) is given as “The causes of the decline were operative and of public order, to a lesser extent.”

They are down 15% year on year. Average production for 2016 is 885 kbpd. Hard to see them maintaining a plateau next year.

SA wants a near-term proven history of high production for their Saudi Aramco IPO.

However, the ideal condition for the IPO is higher prices.

The time line of OPEC policy, SA production, and the IPO of Saudi Aramco is sensible from a financial perspective.

Peak oil is a natural process that has a several percent buffer of policy and economics.

The market currenty devalues the power and goal of Saudi Arabia. They desired high production before the IPO (to prove capability), and desire high prices during and after.

As the world’s most trusted source of reserve capacity (whether that trust is valid is another issue) SA has built trust of that capability as prices plunged.

At the very least, the leader of OPEC has tremendous incentive to increase prices as the IPO approaches, and their actions leading to the OPEC cut lend to the idea that they have used their influence to maximize their potential gains (as any sovieirgn entity should do).

To boil it down, SA’s objectives dictate OPEC policy overall. The IPO timing gives incentive, or was even intentionally timed, to coincide with a recent past of increasing production in the face of lower prices WHILE SALSO coinciding with higher current and future prices. If not intentional, cause it is happening, it was tremendous luck.

World liquids supply in 2015-17 (mb/d)

Source: OPEC Monthly Oil Market Report – January 2017

Note: * 2016 = Estimate.

2017 = Forecast, subject to review, following the most recent OPEC – non-OPEC Meetings.

** Data includes Indonesia.

As we can see, according to OPEC estimate, non-OPEC total liquids supply (excluding processing gains) was down 0.72 mb/d in 2016. The biggest declines were in the U.S. (-0.41 mb/d) and China (-0.31 mb/d), followed by Mexico (-0.13 mb/d) and Colombia (-0.12 mb/d).

OPEC total liquids supply increased by 1.11 mb/d, including + 0.95 b/d crude oil (according to secondary sources) and + 0.16 mb/d NGLs, condensate and non-conventional oils.

World liquids supply, excluding processing gains, but including NGLs, biofuels, and other liquids, was up 0.38 mb/d.

Unfortunately, OPEC, IEA and EIA do not provide separate numbers for non-OPEC C+C production in their monthly reports.

IEA OMR is out:

https://www.iea.org/OILMARKETREPORT/OMRPUBLIC/

They have definitely moved from a call on OPEC to a call on shale to meet all future demand growth.

“Whether it be shorter drilling times or larger amounts of oil produced per well, there is no doubt that US shale industry has emerged from the $30/bbl oil world we lived in a year ago much leaner and fitter. The IEA has anticipated for some time that LTO production will increase in 2017, but we are now expecting an even larger increase of 170 kb/d, following a decline of nearly 300 kb/d last year.”

U.S. total C+C+NGLs supply is expected to increase by ~600 kb/d year-on-year in the second half of 2017

Key growth drivers are NGLs and Permian C+C

In the Bakken, year-on-year declines are expected to continue in 1H2017, with flat output in 2H.

Texas Production for November should be out soon. I think the results will show how EIA and IEA are missing that production from Aug to Dec has declined. Not trending up as they suppose. A supposition of 170k per day is way off base, It could level off, but increasing by 170k is not in the cards.

I guess I am not a good palm reader. Texas production just reported, with an implied bump of about 35k a day for November. Everything else shows it should trend down.

Bakken production numbers for November are published. As others may elaborate more on the data, I just want to show the huge structural shift shale oil underwent over the last two years. In below chart producing wells show a yawning gap to actual production. Despite 64 more producing wells in November, production declined. In 2013 just 8000 wells produced the same amount of oil as today. However today 11000 producing wells are needed to produce the same amount. This is 40 % more, which actually increases operating cost by 40% per well. The ‘Red Queen’ effect really kicks in now and makes shale production increasingly unsustainable.

Bakken November statistics have been already discussed.

November production volume is a reversal to mid-2014 levels, not 2013.

8000 Bakken wells that were producing at that time included a much higher percentage of new wells than the current 11000 wells. In 2016, there were much less new well completions than in 2014.

That explains lower output per producing well.

Compared to the wells completed in previous years, new wells in 2016 show slightly higher average IPs. They also show slightly higher decline rates, but in sum we may conclude that average EURs per well are at least not deteriorating. That means that Bakken sweet spots are not yet exhausted. That also means that, with higher drilling and completion activity, Bakken production may rebound.

AlexS,

The percentage of new wells is exactly my point. Call it the law of high numbers. In order to increase production in the Bakken more than 4000 wells per year have to be drilled. At the early stage of the boom 2000 wells (which were then 100% new wells) were enough to increase production by 200 000 bbl/day. Today 2000 new wells ( which are now 20% new wells) just are enough to prevent production falling not more than 200 000 bbl/d. This is a mathematical issue. This will be also the case for the Permian, which is at an earlier stage of the bubble, so that more people can be fooled to invest in. Think of Bakken as a single company. At the early stage it had to invest USD 10 bn (2000 wells x 5 mill) to get 200 000 bbl/d production. Now the Bakken company gets 200 000 bbl/d less despite an investment of USD 10 bn. This is exactly why money is made a the early stage of a bubble, while the late comers are holding the bag. From now on more and more money has to be invested to get out less and less. It does not matter if it is oil or postal stamps, Bakken or Permian. It is the law of the bubble. Anyone who does not understand this will be paying a high price.

Heinrich Leopold,

Output growth (decline) in LTO plays depends not only on the number and productivity of new wells, but also on decline rates of the existing wells.

In general, the older is the stock of existing wells, the slower is average decline rate.

In 2011-2014, when production was increasing at very high rates, the share of new wells (with high decline rates) was increasing, and hence average decline rates were also rising.

Today, the existing stock of bakken wells is older than it was 2 years ago; and hence less new wells would be needed to stabilize production at current levels.

As I expect very slow growth rates for the Bakken from mid-2017 until the end of this decade, the number of new wells needed for this slow growth will be much less than for high growth in 2014.

The chart below from the latest EIA Drilling Productivity Report shows that in absolute terms monthly production declines from existing Bakken wells have peaked at 60 kb/d in early 2015 and have slowed to 51 kb/d now.

“As I expect very slow growth rates for the Bakken from mid-2017 until the end of this decade, the number of new wells needed for this slow growth will be much less than for high growth in 2014.”

But if the older wells continue to decline, how can you say you will need fewer new wells? The older wells are declining, so you’d need new wells to cover those, and then for any growth at all, you’d need more wells to generate a net gain.

Seems like no matter how you want to state it, in an area of declining production the only way to maintain or expand production is to keep drilling more rather than trying to coast along.

‘Permania’ grips the US shale oil industry: “As one respondent to a recent survey for the Federal Reserve Bank of Dallas put it: ‘Permian transactions are approaching price multiples associated with a bubble or a Ponzi scheme’, reminiscent of the property boom of the early 1980s or the technology bubble of the 1990s.”

It’s possible to hold production steady drilling a steady number of wells, even if well quality declines a bit over time. The trick is to have hyperbolic declines, and to stretch well life, so you can avoid having too many wells go off line. The first time I worked on this topic was 1978, so I have a lot of hindsight. Again: got to have hyperbolic declines which reach a very low decline rate (say 7-8%) when they are still commercial and can produce for 20 years. I don’t know if these shale wells do the trick.

Fernando,

Conventional wells decline in the range 5-15 % per year, shale oil and gas wells decline between 30-60% per year – and this is not just for the first year, it is for any following year.

This is the fundamental difference between shale and conventional production: shale can generate production very quickly at low upfront costs. This is why companies boast cost advantages versus conventional production. However, the picture changes completely over time. A well producing 1000 barrels and a decline rate of 50% just produces close to 100 barrels after three years.

If the operating/maintenance cost is around USD 1000 per day and well in the first year – which gives an impressive USD 1 per barrel – the operating costs balloon after three years towards USD 10 per barrel – although they remain the same per well.

“shale oil and gas wells decline between 30-60% per year – and this is not just for the first year, it is for any following year.”

Wrong. Decline rates for shale wells gradually slows ultimately reaching about 7-10% per year

AlexS,

Shale wells decline is slowing down when the wells are very old and down to a trickle.

Somewhere, the steep decline in production per well (from 140barrels per well to 80+ barrels depicted in your own chart) must come from, if not from annual declines. The evidence is now really striking.

Heinrich, these wells I referred to had pronounced hyperbolic decline. First year was about 60% decline, by the sixth year the decline was 10 %. I was trained to direct planning for a drilling program intended to keep production steady at 50,000 BOPD. This was accomplished with two drilling rigs, four completion rigs and some time devoted to gas and injection well drilling and completion. This operation was extremely fine tuned because we had to meet the 50k as a result of an agreement with the government, but there was reluctance to push production higher because we wanted positive cash flow out of that country.

“This is the fundamental difference between shale and conventional production: shale can generate production very quickly at low upfront costs”

How can you add a gazillion tons of sand or ceramic beads and a gazillion gallons of water and miles of laterals, lots of extra steel, etc, additional chemicals, crews and equipment to do the fracking, etc, and pay for all of this extra work and materials for less than you can drill a conventional well ?

Why should a conventional barrel of oil cost MORE than a barrel of shale oil?

Is the typical conventional new well drilled these days producing LESS oil for the first couple of years than a typical tight oil well ? Does the oil from a typical new conventional well sell for LESS than oil from a fracked well ?

AlexS,

Yes the total legacy rate declined, yet there is also lower production. So, the legacy rate as a share of current production is still growing.

Any bubble has a different size and shape. In this case decline rate of wells, geology……. determine the bubble. However, it is difficult to decide when it is time to go out of a bubble. Even Greenspan admitted that it is difficult to see if you are in a bubble and when it is time to act (he did not see the high tech bubble bursting in 2000).

Some bubbles are very shallow and take a long time (the bond bubble lasts now for at least 20 years). However the shale bubble is quite sharp and short. This is what the numbers tell me.

Why does the IEA more rigs and better productivity will increase US LTO when we have data from places like the Bakken showing the decline rates?

The IEA expects recovery in US LTO production to be driven by the Permian.

A slower recovery in the Bakken will follow from mid-2017.

Hasn’t there been some discussion that the Bakken is permanently on the decline because whatever money there is to put into LTO will shift to the Permian?

Bakken oil rig count dropped 9 times from September 2014 highs (198) to May 2016 lows (22). This was the main reason for the drop in oil production.

The recovery in rig count since May 2016 was very slow and uncertain.

Current drilling and completion activity is not sufficient to reverse the declines in production. But year-on-year decline rates have bottomed in 3Q2016 (-17.7% in August) and have slightly improved since then (-12.8% in November).

The IEA expects Bakken output to start increasing on a yearly basis since mid-2017.

Year-on-year change in Bakken oil production

But, as I asked before, is it game over in the Bakken, with the new focus on the Permian?

Texas’s Permian Basin is only U.S. oil-producing region where production will rise – MarketWatch: “The Bakken has suffered from ‘lack of development interest’ since the oil downturn, the Barclays analysts said. ‘Some larger producers in the basin have opted to focus more on other assets in their portfolio, while others are hamstrung by heavy debt burdens, unable to develop their acreage at a normal pace,’ they said.”

U.S. Shale To Put A Firm Cap On Oil Prices | OilPrice.com: “The rest of the shale oil patch will experience declines in production, including Bakken, which will see the greatest decline, at 20,000 bpd; Eagle Ford, where the decline is expected at 3,000 bpd; and Utica, where production is seen to fall by 3,000 bpd. Oil output in Haynesville will see no change in February.”

According to Barclays’ latest survey of global oil and gas companies, North America spending will increase 27% in 2017, after a decline of 38% in 2016.

The strongest growth among LTO plays will likely be seen in the Permian. Bakken and Eagle Ford will lag. As oil prices rise, upstream capex will continue to increase in 2018 and thereafter; and ultimately the tide will lift all boats.

Personally, I think that the rebound in the Bakken will be very slow. Bakken oil production may exceed previous peak (1,164 kb/d in December 2014), but not by much. I strongly disagree with forecasts that Bakken production may reach 2 mb/d. But I also disagree with the view that the Bakken is already in terminal decline.

Hi AlexS,

It will depend in part on the price of oil. If oil prices rise to $120/b the rate of well completion in the Bakken may increase enough to raise output to 1400 kb/d by 2022, but this will require a quick ramp up to 210 well completions per month which must be maintained for 30 months (on average). This very optimistic scenario is presented below, I doubt it will happen, but I have been wrong before (I didn’t think the Bakken would rise to 1100 kb/d by 2014 back in 2012).

Dennis,

In order to reach your goal of 1.4 mill bbl/d for Bakken 200 new wells per month are by far not enough. At 11.000 existing wells, around 400 new wells per month are needed just to stem the yearly production decline of existing wells. So, 600 new wells per month are minimum to reach the goal of 1.4 mill bbl per day.

This means a tripling of capex and substantial operating costs per newly produced barrel compared to the early days of shale producing. I do not think that companies can attract capital for these undertakings, unless the oil price will triple over the next years.

Never underestimate the availability of “dumb money”. It is quite possible that they can attract capital for these loss-making operations.

The smarter CEOs will attract the capital and will not drill the wells, and will then retire to the Cayman Islands with the capital. But I think most of them are religious true-believers in oil drilling.

It appears in 2/2004, Bakken wells hit lowest production level, 186 wells averaged 235 barrels per well per month, or rounded 8 bopd.

Further, in 11/2008, Bakken wells hit highest production level, 834 wells averaged 4,390 barrels per well per month, or rounded 146 bopd.

From 2008 to 2012, bopd per well ranged mostly in the 130s and 140s, with 12/2012 being the last month at 140 bopd or more, with 5,048 wells that month.

November, 2016 shows 10,927 wells averaged 2,694 barrels per well, or 90 bopd per well rounded.

North Dakota puts out a PDF which shows both “Bakken” production by month and “total” state production per month, this is where I pulled these figures, hope I read them right.

I took the following from Enno’s website, shaleprofile.com. Here is how wells with first flow in the following years contributed to 11/2016 production in North Dakota:

2005 127 wells 2,421 bopd 19.06 bopd per well

2006 212 wells 4,726 bopd 22.29 bopd per well

2007 258 wells 8,207 bopd 31.81 bopd per well

2008 514 wells 21,177 bopd 41.20 bopd per well

2009 488 wells 20,930 bopd 42.89 bopd per well

2010 828 wells 34,259 bopd 41.37 bopd per well

2011 1,279 wells 62,587 bopd 48.93 bopd per well

2012 1,849 wells 88,831 bopd 48.04 bopd per well

2013 2,060 wells 124,789 bopd 60.58 bopd per well

2014 2,277 wells 180,045 bopd 79.07 bopd per well

2015 1,535 wells 207,588 bopd 135.24 bopd per well

2016 653 wells 244,840 bopd 374.95 bopd per well

I do think the above illustrates the need for high oil prices early in the well’s life, in order for the well to achieve a payout in a reasonable period of time.

I suspect the majority of wells with first flow since 7/2014 have not and will not reach payout in a reasonable period of time.

US consumers are very thankful that US oil production companies are all willing to drill and complete wells at a loss.

Privately held US producers are not so happy about this, but there are thousands of times more consumers than privately held producers, so the consumers win out.

Only when it is apparent that the vast majority of locations have been put on production in US shale fields will it be profitable to drill and complete shale oil wells in the US. Ironically, there will be few locations left to complete at that point in time.

Most private companies drilling LTO wells stopped in early 2015 because drilling said wells was no longer profitable. OPEC wrongly assumed (as did I) that public companies would do the same, but they did not.

Note, if all ND drilling and completion ceased in 1/2015, ND production in 11/2016 would have been just 547,972 bopd. If that were extrapolated to all US shale fields, per Enno’s website, US production as of 9/2016 would be right at 2 million bopd less, as wells with first flow in 2015 and 2016 contributed just over 2 million bopd.

US producers complain about OPEC and Russia increasing production in 2015-2016. At least they could generate positive cash flow. I presume if US LTO increases dramatically in the first six months of 2017, OPEC and Russia will resume producing at maximum rates, again driving prices below $50 WTI.

This game, however, may very well end up causing an oil super spike at some point, as simultaneous with US LTO hitting a wall, lack of investment in multi-year oil projects will also show up.

Maybe this is why XOM paid so much for Bass Family’s HBP leases. They can bide their time until around 2020, and then cash in on some $150+ barrel oil.

shallow sand,

I think that commercial LTO production in ND portion of the Bakken started in 2006.

Before 2006, daily output for total play was only 2-3 kb/d.

Average daily oil production per well in the Bakken (barrels)

AlexS. I do think Enno’s data includes horizontal Red River formation wells.

Ironically, the Red River wells did produce quite a bit of oil, and per information contained in CLR 10K’s from those periods, the wells cost quite a bit less to drill and complete, as I recall less than $2 million per well. Interesting that CLR has (or at least had) posted on its website 10K for when it was a private company, going back to the late 1990’s.

There were vertical Bakken wells which commenced production in the 1950s, and which continued producing up to 2006 at least.

Further, if one goes back and looks at old ND state information, in the 1998 oil bust, the number of active rigs went to zero.

shallow sand,

there were zero drilling rigs in Montana since November 2015, and 1 or 0 rigs between March and November 2015.

Production in 2016 is declining at an average annual rate of 18-19%

Montana oil production (kb/d)

AlexS,

Well productivity is another sign of the dramatic increase in operating costs in the Bakken. In order to keep production stable, companies should drill at least 4000 new wells per year. However, the contrary is the case: spuds are down to 53 and permits are down to 34, which is a multiyear low.

https://www.dmr.nd.gov/oilgas/stats/2016monthlystats.pdf

The bubble is now deflating fast and I expect a multiyear low for December and January Bakken production.

Heinrich Leopold,

Well productivity, measured as IP (initial production) rates for the wells drilled in 2016 compared with the wells drilled earlier, is slightly higher.

You can see it in Enno Peters’ shaleprofile.com

Both operating and capital costs per well are sharply down, although I admit that this is partly due to cost deflation, and can reverse in future.

Development of LTO plays per se is not a bubble.

The bubble was very high growth rates in 2011-14, which were unsustainable and created a number of imbalances:

– inflated asset prices;

– inflated oil service costs;

– significant and constant outspent of operating cashflow;

– accumulation of large debt;

– supply glut in the global oil market.

Alex

Gotta tell ya, in addition to providing a wealth of relevant data to readers of this site, you also consistently offer concise, accurate explanations as to the ‘why/how’ of events in LTO world.

Muchos gracias for all your input.

De nada, amigo 🙂

AlexS,

What really counts is costs per produced barrel – and not costs per well. As production per well is down, this easily outweights any savings per well. So, I stick to my comment that Bakken costs – per produced barrel – is way up. The bubble deflates.

AlexS,

What really counts is costs per produced barrel. Even lower costs per well – mostly through spacing – cannot outweigh the dramatic decline of production per well. I stick to my point: Bakken production costs ( per produced barrel) are way up and this is why the companies are leaving the Bakken. The bubble deflates at increasing speed. Investors beware.

Continental Resources’ production and cash G&A costs per barrel

AlexS,

CLR is not a pure Bakken play. 60% of its net 1.8 reservoir acres are outside Bakken (Stack Meramec, Scoop Woodford, Scoop Springer, Stack Woodford). These properties are in their early stages and there CLR can play the game again from the beginning. In addition, there seems to be a trend emerging out of the Bakken as companies applied in the December for the first time less permits (34) than

spuds (54). This is a sign that companies draw on their inventories and do not re-invest fresh money. This is also why CLR has better cost data for Bakken as it prepares for the exit.

Yet overall, the cost structure in the Bakken deteriotates. Drilling 2000 new wells since 2015 and losing 200 000 bbl/d production can simply not lead to improved economics.

What “dramatic decline of production per well” are you talking about?

Well performance in the Bakken has been improving.

I think that he was talking about the average per day production of all producing wells, which is thousands of wells, and which will continue to go down.

That enables one to compute how many new wells are needed to stabilize the decline by 12/31/17. If during 2017, one estimates that on December 31 daily ND production from existing wells will be 180,000 bbl/day less than on Jan 1, 2017: then if one estimates that the average daily production from all new wells drilled in 2017 will be 200 bbl/day on 12/31/17, it would tell you that you need 900 new wells in 2017 to end up with the same daily production as at 1/1/2017.

But, it is just math. So, if you only drilled wells in November of 2017, and the new wells were producing and averaging 400 bbl/day on 12/31/17, you would only need 450 new wells.

And, there would be a totally different calculation to answer this question: How many new wells will be needed, ratably by month [or on some other schedule], such that total ND production is the same in 2017 as it was in 2016. That calculation [and the assumptions that it involves] is beyond the scope of this post.

clueless,

That is exactly my point. As this is difficult to calculate for the future, we can take history as a guide.

5 years ago 2000 new wells per year were enough to produce 200 000 bbl/d more. Today 2000 new wells give just a loss of 200 000 bbl/d production. So, we can assume that around 4000 new wells are needed for the Bakken to stay even. To reach the goal of 200 000 bbl/d of production growth at least 6000 new wells per year are needed. For this production growth USD 30 bn are required compared to just USD 10 bn five years ago for the same production growth. So Bakken needs now triple the investment to regain its previous growth.

The reality is that just 500-800 new wells are coming online and the trend is that there are even less wells drilled in the future.

Alex do you really need to stoop so low? Is it just to prove a point? The conversation was about barrels, your chart is also lumping in all the gas. Few would argue that initial production including gas, is going up. Question is how these wells will hold out over the long term.

Any idea how much of this gas would just be flared were it not for regulation against it?

farmboy,

You can visit Enno Peters’ shaleprofile.com.

He is showing similar charts for C+C.

BTW, cost per boe numbers are for total liquids and gas production. It doesn’t matter if the gas is consumed or flared.

AlexS,

You look just at the performance of new wells and “ignore” the huge decline of existing wells.

In order to reach 1,4 mill bbl/ by 2020 (as also Dennis suggests), Bakken has to drill 4.000 new wells, yet also at least 6.000 new wells just to stem the decline in existing wells, which will be swelled by 10.000 to an incredible 21.000 in 2020. That is the big difference now compared to 2009 when the boom started and little decline of existing wells had to be accounted for. This mechanismus will hit also Marcellus, Utica, Permian…. at increasing dynamics.

Despite the improvement in new well performance, the total well performance including existing well performance declines dramatically. This is exactly why I foresee a huge energy crisis over the next few years.

Factoid from here:

http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbblpd_m.htm

Of the US 20 mbpd consumption, middle distillates (kerosene jet fuel and diesel) are about 5.7 mbpd

Given the magical number of 67% of total consumption being transportation, that says 42% of transportation fuel is not gasoline. Probably should throw in residual fuel oil and up to 45%.

Relevant to a past convo about dumbbell assays to synthesize WTI from very heavy and condensate. The resulting mix comforms to WTI parameters, but refiners can’t get any high profit distillates from it, because there isn’t much in it.

Oh btw, the magical number is from 2005ish.

And btw rev 1.0:

http://peakoilbarrel.com/wp-content/uploads/2015/03/5087801.png

distillate content crashes above API 40

Fascinating. I hadn’t spotted this…

So I’m repeatedly running the scenario for after gasoline demand starts really crashing through the floor. (Which is guaranteed to happen sooner or later as cars electrify.) It looks like condensate will become essentially worthless. Very heavy oil will also be quite undesirable. I’m not sure what effect this has on the shrinking oil business at that point…

Condensate will never be essentially worthless. The price of it might well fall off a good bit though.

When it gets cheap enough, and is available in large enough quantity, refiners can build new equipment to convert it into kerosene, jet, diesel fuel, etc, and burn some of it to run the equipment.

And there’s nothing to stop ICE engine manufacturers from building engines designed to run on it, if it’s cheap and expected to stay cheap. Farm equipment manufacturers built machinery to run on the dregs left over from manufacturing gasoline for automobiles for decades.

There are documented instances of farmers just putting a bucket under a leaky pipe at an oil well, when the leak was thin rather than thick crude, and pouring it right in their tractor fuel tank, on a routine basis.

How’s this for a thought. Somebody needs backup power, a lot of it, for a time when the grid is down. They put a million in a big diesel generator, or one that runs on natural gas, if they can count on gas delivery. ( Diesel is easily stored on site in large tanks, so emergency delivery is not an issue.)

That diesel engine can easily be tuned at the factory to run on condensate mixed with a little diesel fuel.

I don’t know how hard it is to store the really light stuff in tanks long term, and evaporation might be a major problem. Or it might not. The ships that haul LNG just burn what boils off in the ship engines, so they don’t lose any significant amounts of LNG during sea transport. The people who might want to store very light oils may be able to find uses for what they would lose to evaporation. My guess is that if you need a lot of electricity, and have free fuel, you can run a generator of your own for no more and maybe less than you can buy the juice from a utility.

I put something on this in the last post but it wasn’t up for long until this one:

“Global oil, gas discoveries drop to 70-year low: Rystad Energy”

http://www.reuters.com/article/us-oil-exploration-idUSKBN1521TA

“Total oil and gas resources found in 2016 reached just more than 6 billion barrels of oil equivalent (boe), … The numbers do not include North American shale resources which have been a key driver in supply growth in recent years. Offshore liquid discoveries, where most major new fields have been found in recent decades, reached 2.3 billion boe last year, 90 percent below 2010 levels. As a result, companies were able on average to replace only 10 percent of their oil and liquid gas reserves last year, …”

Another notable recent development is how any reasonable quality discovery is being immediately fast tracked for development – e.g. ExxonMobil Liza, BP and Eni Mediterranean gas projects, the recent Hurricane discovery in UK, and this year’s Statoil Cape Vulture well (referenced in the article). It doesn’t say much for the other, older projects the companies may have on their books. BP’s announcement today of keeping investment flat through 2018 and emphasising gas as the main growing energy supply may reflect this as well – they have few oil projects left now.

About a year or two ago I was talking with Jeffrey about the avg API gravity of new discoveries. Jeffrey said something like “Avg API gravity has been relentlessly rising with new discoveries this century”.

I know IHS has a database of discoveries, but probably not free. Anyone know where we can get an exact measure of API on new oil? Errr, “oil”.

It was only in the USA that there was an issue with lighter crudes because of the growing ratio of LTO and shale gas condensate in the production mix. It was a possible problem because the USA refinery capacity was built to process a heavier slate. The problem went away when the export ban was lifted so the light oil could be processed elsewhere. Most of the world worries about oil getting heavier. Tapis is still (I think) the highest priced oil and is very light (45 degrees). Before about 2008 the lighter WTI always sold at a premium to Brent.

Lighter fields are easier to produce and have higher sales revenue per barrel so got developed first, all else being equal. Now the heavier oil is left. A lot of the new production from Iraq is heavy – they had to introduce a new crude grade, Basra Heavy, to sell it. Two of the biggest recent discoveries (Brazil pre salt and J. Sverdrup) are medium grade with API around 28. A handful of old discoveries in UK/Norway are still undeveloped as they are heavy oil and weren’t economic even at $100 plus.

https://www.eia.gov/analysis/petroleum/crudetypes/

I would add that, in Saudi Arabia, light crude production at Ghawar field (with API ranging from 33 to 40) is declining and is being replaced with mostly medium crudes from Manifa (26-30.1 API ) and Khurais (around 32 API)

This is partly ofset by super-light crude from Shaybah (42 API).

Iranian crudes from the fields that are ramping up output are also mostly medium and heavy. Iran is also increasing condensate production from South Pars, but condensate is not included in OPEC crude production numbers and is accounted as NGLs.

One exception is Russia, where output of medium crudes from the old fields in Western Siberia is declining; and most of new production consists of lighter crudes. (Therefore, I am currently using 7.33 barrels/ton average conversion rate for Russian oil instead of 7.3).

Meanwhile, in the U.S., the share of ultra-light oil (>45 API) and condensate in total Lower 48 states C+C production (incl. GoM) has slightly declined over the past 2 years

Ultra-light oil (>45 API) and condensate as % of US Lower 48 states C+C production

Good data. That slight downtick would be the Bakken decline.

The overall issue is the need (growing) for diesel. The traditional concept of “easy to refine and therefore more valuable” is stressed by the need for diesel. If there is no diesel in easy to refine oil . . . .

There is also another quirk in the blends. API (or even sulphur or vanadium or metal content) doesn’t tell the whole story. There is a quote I will have to chase down, something like … Libyan oil of the same API gravity as Saudi oil has twice the diesel in it.

stressed as in put under stress

BTW, from the article:

“However, these ‘missing’ discovered volumes in the current years could have an impact on the global supply some 10 years down the line – depending on the investment decisions of the exploration companies.”

Always amusing how this gets said and the conclusion is . . . “Oh! Supply and demand! There will be too little, the price will rise, and then there will be enough tra la tra la!!”

Bullshit. If there’s too little, there is too little for YEARS. It takes that long for this magical investment incentive to fix the problem. The SPRs don’t have years in them.

SOMEONE DOESN’T GET AN ORDER FILLED. And it ain’t the guy who got outbid, because there’s gonna be too little REGARDLESS of bid.

Someone is going to forcibly take it from someone else. How could they not?

Well, the alternative is to simply switch to cheaper, more reliably supplied lternatives to oil.

This has been happening. The switch to NG is well documened. NG isn’t reliably supplied either, though, particularly in Europe.

Now the switch is to electricity, which can be powered by anything including hydro, solar, wind, geothermal, etc.

This is where the permanent demand decline in oil starts: with a desire for energy *security*. The second phase is when the alternatives are simply cheaper than oil, and we’re into the beginning of the second phase already.

thankyou Watcher,

can I ask – is there any public data on the “API’s” of oils held within the SPR ?, and also – is there any data on api’s within the various (private) storage facilities across the USA ?

rgds

Simon

It appears to vary. The SPR inventory quotes X amount of “light, sweet” and Y amount of “heavy, sour”. If they mix them, they get a mini dumbbell in refinery yield.

I recall reading that Cushing is WTI, and if oil coming in is not WTI, things are done to it to make it WTI (add condensate to heavy oil). It’s badly defined.

NYMEX WTI crude contracts are settled in Cushing, OK. That contract is extensively defined. My recollection is that it is multiple pages, but that also includes delivery requirements.

Considering the $ billions of value in those contracts, I believe that NYMEX WTI is well defined.

No, clueless. As recently as 2-3 yrs ago there was talk, covered in a Bloomberg article posted here somewhere, that WTI’s definition was being changed to address the issues of shale influx overwhelming influx from elsewhere.

I’ll do a cursory search, but I seem to always fail searches here It would be bloomberg wti definition

The specifications are on page 1 of the CME Rulebook Chapter 200.

https://www.cmegroup.com/rulebook/NYMEX/2/200.pdf

I put this in the wrong place, so I am reposting it.

‘Permania’ grips the US shale oil industry: “As one respondent to a recent survey for the Federal Reserve Bank of Dallas put it: ‘Permian transactions are approaching price multiples associated with a bubble or a Ponzi scheme’, reminiscent of the property boom of the early 1980s or the technology bubble of the 1990s.”

Boomer II,

It’s worth noting that a fair part of the acreage being bought is being sold by producers like Yates, Bass, and Clayton Williams (which was just acquired by Noble Energy, I believe.) These are names that have been around for decades, often those of families.

I think I read yesterday that the Clayton Williams/Noble deal was an all-stock deal. If so, maybe it’s just a decision to let someone else do the work now. Deals for cash, though, would seem to send a different message, the rat-down-the-hawser kind.

Somebody who knows chip in please?

Exxon’s deal was also stock. Cash only happens if they produce.

I think if oil companies fear their stock prices might go down in the future, they might feel it is best to use some of it to buy leases/acreage while the stock price is high.

Also, if you’re a company that doesn’t have many new discoveries to report, perhaps you want to announce a purchase to keep investors interested.

What Does ExxonMobil’s Permian Basin Deal Mean? – Market Realist

China’s crude oil output will fall 7 percent by 2020 – government

Tue Jan 17, 2017

http://www.reuters.com/article/us-china-energy-idUSKBN15118K

China’s crude oil output is expected to drop by 7 percent by 2020 compared with the previous five-year plan as output from some of the nation’s largest, but oldest, wells falls, while natural gas supplies will rocket by almost two-thirds.

Under a plan covering the period 2016-2020 published by the National Development and Reform Commission (NDRC) on Tuesday, crude output will be around 200 million tonnes by 2020, equivalent to 4 million barrels per day (bpd). That would be down from 215 million tonnes in the 2011-2015 plan.

The drop reflects falling output at aging, high-cost fields as producers scale back production in a lower oil price environment. For the first 11 months of 2016, production was down 6.9 percent at 182.91 million tonnes, just under 4 million bpd.

Consultancy Wood Mackenzie, however, forecasts a decline of nearly 500,000 bpd in Chinese crude oil production over the next four years at 3.5 million to 3.6 million bpd.

“We don’t see any large greenfield oil developments coming stream by 2020. As such, given the maturity and age of the main oil fields … we forecast an ongoing decline in output,” said Angus Rodger, Woodmac’s upstream research director.

Meanwhile, the NDRC said natural gas supply would be 220 billion cubic meters (bcm) by 2020, compared with 134 bcm under the 2012-2015 five-year plan as Beijing prioritizes the sector’s growth.

The government is maintaining an earlier target for shale gas output at 30 bcm, or 13.6 percent of the total.

———————————

Comment: China’s oil production has dropped below 4 mb/d since July 2016

There were 34 permits issued in North Dakota in December. That is the lowest count since July of 2009. The high was 370 in October, 2012. The high yearly average was 250 per month in 2014. Spuds dropped to 53. Rig count, today, is 37. I really don’t see things picking up in the Bakken in 2017. I am betting that December 2017 production will be well below one million barrels per day.

Baker Hughes weekly oil rig count is out.

Total U.S.: + 35

Oil rigs: + 29

Gas rigs: + 6

Oil rigs by major basins:

Permian: +13

Cana Woodford: +9

Williston: +3

Eagle Ford:+2

Niobrara: unchanged

BP predicts “peak oil” will hit between 2025 and 2040/

Broad consensus has suggested “peak oil” the peak oil window will be between the years of 2025 and 2040.

However the report added there was still “considerable uncertainty” surrounding this.

Yes, I would agree that there is still “considerable uncertainty” with that date. Peak oil could come much earlier, possibly as early as 2015.

Personally, the date I’m looking for is not peak oil, but the date at which it becomes permanently unprofitable to drill new oil wells.

This will happen due to reduction in gasoline and diesel demand by electric car substitution, reduction which happens faster than the natural decline rate of the existing fields. This starts the inevitable spiral of shrinkage for the industry as every piece of the supply chain has to shrink. As the supply chain shrinks, economies of scale disappear and competition disappears, causing production costs to rise. In addition, cost of capital skyrockets as equity investors demand higher near-term returns on a shrinking industry than on a growing one, and debt investors consider a shrinking industry much less credit-worthy than a growing one. This reduces profits on existing operations. And the shrinkage continues until a new equilibrium is reached based on jet fuel demand. Which is sufficiently low that it’ll be met by existing fields for a *very* long time — probably until the electric airplanes are ready to fly.

My current projection for this date, which is the end of the oil exploration industry, is 2023, maybe a few years earlier or later. Peak oil might be reached slightly before or slightly after that point. Doesn’t really matter which…

Anyway, the date is basically determined by the rate of electric car factory construction, which is hard to keep an eye on because it’s mostly in China.

As the Bakken bubble bursts at increasing speed, the recent Texas RRC data show that the Texan gas bubble is collapsing spectacurarily (see blow chart) as well. Although data will be revised, total gas production crashed towards 15 bcf/d. This is a beautiful Seneca cliff curve. As gas well completions (blue line at 93 in December) and permits hover around record lows, this trend is very likely to keep on going for a while.

I have speculated that the Exxon deal has more to do with Exxon trying to use its stock to expand its company and to look good to investors than a resounding indication of the company’s faith in the Permian.

Exxon plays catch-up after missing U.S. shale oil boom – Jan. 17, 2017: “Of course, Exxon is a bit more strapped for cash these days. Exxon’s long-term debt has quadrupled to nearly $30 billion even as its profits have tumbled to 17-year lows amid the crash in oil prices.

Exxon’s financial pressure has resulted in the loss of its once-perfect AAA credit rating.

That explains why Exxon is paying for the Permian assets by using the company’s stock.”

Exxon is constantly buying back its shares, and is from time to time using a small part of its huge treasury stock for acquisition. What’s wrong with that?

Nothing.

I’m just speculating that the purchase may be as much, or more, about Exxon’s business decisions than about Exxon’s belief in the future of oil development there.

Another suggestion that the Exxon deal may have to do with more than just acquiring access to oil.

I don’t have any idea how prolific the Permian will be. I’m just thinking of other aspects of this deal.

Exxon and Noble Stoke Permian Passions – Bloomberg Gadfly: “Exxon will also be able to steal some of rival Chevron Corp.’s Permian thunder with investors and possibly offset the fallout from a potential looming writeoff of some of its Canadian oil-sands reserves.”

Russian greenfields production growth, no mention of decline rates on older fields, just the new ones…

Original chart on twitter: https://pbs.twimg.com/media/C2sxX5yXUAEr-ny.jpg

Production cost? Production cost *matters*.

I have wondered if Trump’s appointees with oil and gas ties might, behind the scenes, be preparing for the shift away from fossil fuels and toward renewables. They are insiders and should know what is and isn’t available in terms of oil and gas and coal. I’m wondering if the public line is boom times ahead for the oil industry, but privately they are preparing for a different future.

I’ve posted a few articles about the Exxon purchase, wondering if it signals an investment deal as much or more than it does a future drilling plan.

I thought I’d look for articles about oil companies selling assets. Here’s one of them, from a month ago.

Oil company’s new bet on wind power signals shift in energy investments – Business Insider: “But energy companies are looking for growth in markets that provide more stable returns than oil projects, which have becoming incredibly expensive and risky. Wind provides predictable cash flows for decades, so the return on investment has much less risk than oil and gas projects do.”

Another article about a potential sale, this time Exxon doing the selling. Perhaps the Permian deal is to camouflage Exxon backing away from various oil projects?

Exxon Norway Oil Assets Said to Lure Aker BP, Hitec Interest – Bloomberg: “Billionaire Kjell Inge Rokke’s Aker BP Plc and two private equity-backed companies are in talks to buy stakes in oil fields off Norway from Exxon Mobil Corp. that are valued at about $1 billion, according to people with knowledge of the matter.”

Indonesia, Philippine groups acquire Chevron's $3 billion geothermal assets | Reuters: “Chevron is selling assets, cutting jobs globally and slashing capital spending to save cash in a bid to preserve its dividend amid weak oil prices.”

Royal Dutch Shell PLC saddled with a mountain of debt – Royal Dutch Shell Plc .com: “The Wall Street Journal does not mince its words.

In an article published today, it says that Shell has saddled itself with a mountain of debt as a result of its takeover of the BG Group.

Article author Sarah Kent points out Shell’s debt-to-equity ratio is far higher than its major rivals.

The same concern is expressed in a related Wall Street Journal article: Shell’s New Year Promise: Slimming Down

Although Shell promised to offload $30 billion of assets, it has thus far sold only $5 billion worth.”

Anadarko Petroleum Corproation (APC) To Sell Eagle Ford Assets: “Anadarko Petroleum Corporation (NYSE:APC) has recently announced that it would engage in another round of asset divestitures. This time, the company is selling its Eagle Ford Assets in South Texas.”

a href=”http://www.cnbc.com/2017/01/05/chesapeake-energy-is-not-done-selling-assets-says-ceo-doug-lawler.html”>Chesapeake Energy is not done selling assets, says CEO Doug Lawler: “‘We have 11.3 billion barrels of net recoverable resources across our asset base. … It’s going to be difficult for us to drill and complete all those as fast as what we’d like. We don’t have the capital funding, the cash flow to do it. So we are going to be continuing to look at additional asset sales,’ Lawler told CNBC’s ‘Power Lunch’ on Thursday.”

Here’s the active link to that article.

Chesapeake Energy is not done selling assets, says CEO Doug Lawler

The Exxon sale makes sense as their operated assets are coming to the end of life. They are planning to decommission Jotun, they had a recent drilling program on Balder which should be about finished, and it and Rinhorne will then be in terminal decline. Balder was initially a nightmare project and a lot of the Exxon engineers originally involved were encouraged to move on to opportunities in other companies. It had probably the worst availability record for any FPSO, but since has been extensively revamped so should have a few more years. However maintaining logistics and operator support for two small platforms would not be efficient, and they don’t have anything in UK which they could combine and streamline. They might keep some “operated by others” assets.

Anadarko are wanting money to cover development costs in GoM and probably the sale costs for Freeport Mcmoran. This also makes sense as they have not been very active in the EFS which is in steep decline for their wells, but now have a lot of synergy for new tie backs, and possibly one or two hubs, offshore.

Shell seem to be in a bit of trouble. I think it started when they invested huge sums in the Pearl GTL project and had to neglected investment in more traditional oil production. They had another high impact dry exploration well offshore Canada this week. Iraq didn’t work out – I think they are trying to leave there. I don’t really know what they have that would be easy to sell now, it might have to be a big gas development if they really need the money.

Chesapeake just seem to make things up as they go along.

What I am thinking is this. If you are an oil company and internal research suggests there’s no a path to profitability in the future, you might want to continue to talk up oil in order to sell assets at the highest possible price.

Why get stuck with assets if you think their value will go down over time and the income they generate won’t be as valuable as cash right now? So you make it look like you’ll be in the oil business for the long term, but in private you plan to get out as soon as you can do so.

Again, it’s the Trump administration that makes me wonder about this. It’s possible that Trump’s talk about boom times in oil is just a cover to get the wealthy out of the industry.

I was thinking just the opposite; that Tesla was going to have to make a hybrid gas/electric model in order to be competitive.

Competitive with whom? It’s been estimated that Tesla has received deposits for 400,000 Model 3s.

Getting into hybrids would only serve as a distraction from their main goals.

I think Tesla will likely sell as many EVs as it can make.

I would keep on thinking if I was you…as of now your conclusion as stated “If you are an oil company and internal research suggests there’s no a path to profitability in the future, you might want to continue to talk up oil in order to sell assets at the highest possible price.” show a complete lack of understanding of this business. Maybe you spend some tome thinking about just how little you know.

As a long time industry participate, the exxon deal does not surpriser me at all, and in fact I would have expected it and did. The classic signal the downturn is over or close to it. In commodity business such as the oil and nat gas business you buy assets during times of great stress and sell assets during the mania phase. The business model that looks to be in great danger of any viability is the solar and wind “industries” con job which is held together with lies, hysteria and government largess, which is about to vanish.??

“The classic signal the downturn is over or close to it. In commodity business such as the oil and nat gas business you buy assets during times of great stress and sell assets during the mania phase.”

Did you see the article I posted that says the Permian sales have all the markings of a bubble? So the ones who are selling are smart. The ones who are buying, not so much.

‘Permania’ grips the US shale oil industry: “As one respondent to a recent survey for the Federal Reserve Bank of Dallas put it: ‘Permian transactions are approaching price multiples associated with a bubble or a Ponzi scheme’, reminiscent of the property boom of the early 1980s or the technology bubble of the 1990s.”

This is a really good article about how the Permian may be more about Wall Street than production.

The Permian Bubble Is Underway | Seeking Alpha: “But the biggest issue is valuation. Permian properties are going to be valued very differently if the company has a great return on Wall Street for purchasing the properties in the first place. Drilling and production may become unnecessary, just buy the leases and hold them for appreciation while the market applauds the move. How far this particular valuation scheme goes depends upon market willingness to keep upgrading the value of Permian properties. Right now it appears that some companies have some Herculean assimilation tasks ahead of them. In the case of SM Energy, the market may be approving before any assimilation is done. So there is no confirmation from earnings needed because the deal is a ‘sure thing’.”

“Drilling and production may become unnecessary, just buy the leases and hold them for appreciation while the market applauds the move. ”

This is an even more refined version of the scheme the NG fracking companies used last time around. Last time they drilled, announced first-day production, and sold immediately. Now they are selling before drilling!

The Permian Pitfall: A Race To The Bottom For Tight Oil | OilPrice.com

Article in Reuters explaining the rise in merger and acquisition activity in the oil and gas sector.

Big Oil back on the acquisition trail as outlook brightens

http://www.reuters.com/article/us-oil-m-a-idUSKBN1530OK

The world’s top oil companies are back in acquisition mode, targeting smaller exploration and development firms to boost oil and gas reserves rather than the mega-mergers that followed previous slumps in crude prices.

Since late November, major oil companies have announced 11 deals worth more than $500 million each with a combined value of $31 billion, the clearest sign yet that oil executives are more confident a recovery is underway.

When crude prices collapsed in the second half of 2014, large oil firms slashed spending on exploration and production and offloaded assets to reduce debt so they could cope with lower revenue from oil and gas sales.

But with crude reservoirs declining at a rate of 10 percent a year in some cases, major oil companies are now looking to snap up assets to start growing again and there are plenty of smaller firms burdened with debt looking to sell.

Total acquisitions of oil and gas fields, known as upstream assets, tripled to $31 billion in December from a month earlier, when the Organization of the Petroleum Exporting Countries agreed to cut output for the first time in eight years, according to data from consultancy Energy Market Square.

Deals in the last month of 2016 alone accounted for nearly a quarter of total activity during the year.

The trend continued in January with Total boosting its stake in Uganda’s Lake Albert oil project by snapping up most of Tullow Oil’s (TLW.L) stake for $900 million.

ExxonMobile and Noble Energy (NBL.N) also struck deals worth nearly $10 billion combined for a larger slice of the Permian Basin, the largest U.S. oil field.

While deal making outside the United States almost ground to a halt at the start of 2016, acquisitions in North American shale basins have continued at a steady pace.

In the Permian Basin, for example, the time it takes to produce oil and gas after an initial investment is far quicker and cheaper than developing conventional fields over three to five years.

More deals are likely this year as the large overhang of crude oil in the world that has weighed on the market since 2014 continues to clear and oil prices rise.

“When you can cut capex (capital spending), two-and-a-half to three years later you see production decline and reserves depleting and you have one choice only and that is going after high quality resource,” said Sachin Oza, co-manager with Stephen Williams of the Guinness Global Oil and Gas Exploration Trust.

“If you’ve not spent any time filling your hopper with these opportunities that take five years to build up, there is only one choice: you have to buy them,” said Oza.

Here’s something that suggests BP doesn’t see such a bright future.

BP CEO Won’t Boost Spending, Signaling Caution on Oil Rebound – Bloomberg: “BP Plc boss Bob Dudley is not yet ready to boost spending despite the rebound in oil prices.

The company will keep capital expenditure below $17 billion this year and next, Chief Executive Officer Dudley said in a Bloomberg television interview in Davos, Switzerland. That’s $6 billion lower than 2014, when crude prices first started to slump, showing that the impact of the two-year industry downturn still lingers.”

I see a very robust M&A market the next 2-3 years. The cupboard is empty for the majors. Many will be flush with cash as som megaproject development comes to an end-CVX in particular. And with production falling at the major Chinese oils, I can see the Chinese govt. pushing them to go out and buy reserves. India Oil, Pertamina, Petronas, KNOC, and PTT will be on the hunt as well.

There is still a large number of pre-FID projects that were postponed over the past 2 years and that will likely be re-activated if oil prices continue to rise.

But I agree with you that M&A market will be robust.

There is also a large number of potential asset sellers, particularly shale companies with large debt. They did not want to sell in 2015-16 when assets prices were low, but will be more willing to divest part of their acreage at higher prices in order to improve their balance sheets.

What this forum mostly focuses on is depletion, and to a lesser extent, the price of oil and what that does to production.

There may be M&As that go on for show to reassure investors and are done with little financial risk.