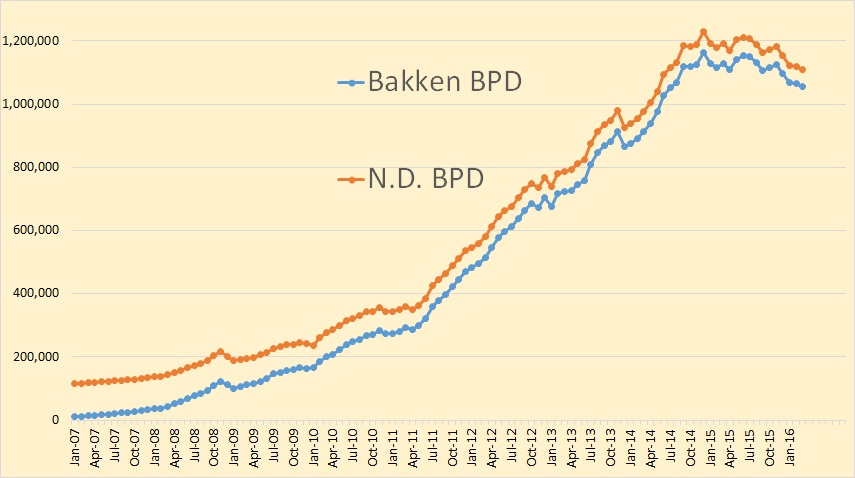

The North Dakota Oil Production Stats are out. North Dakota crude oil production was down just less than 10,000 barrels per day.

Bakken crude oil production was down 7,743 bpd in March while all North Dakota production was down 9,846 barrels per day.

From the Director’s Cut:

Producing Wells

February 13,017

March 13,024 (preliminary) (all-time high was Oct 2015 13,190)

Permitting

February 70 drilling and 1 seismic

March 56 drilling and 4 seismic

April 66 drilling and 0 seismic (all time high was 370 in 10/2012)

ND Sweet Crude Price

February $18.07/barrel

March $26.62/barrel

April $26.87/barrel

Today $33.00/barrel (all-time high was $136.29 7/3/2008)

Rig Count

February 40

March 32

April 29

Today’s rig count is 27 (lowest since July 2005 when it was 27)(all-time high was 218 on 5/29/2012)

Comments:

The drilling rig count fell 8 from February to March, 3 from March to April, and 2 more from April to today. Operators remain committed to running the minimum number of rigs while oil prices remain below $60/barrel WTI. The number of well completions fell from 64(final) in February to 59(preliminary) in March. Oil price weakness is the primary reason for the slow-down and is now anticipated to last into at least the third quarter of this year and perhaps into the second quarter of 2017. There were no significant precipitation events, 4 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations.

Estimated wells waiting on completion services is 920, up 13 from the end of February to the end of March. Estimated inactive well count is 1,523, up 84 from the end of February to the end of March.

Looking at the longer term chart we can see that the increase in production beginning in around 2011 was very steep while the decline has been less dramatic.

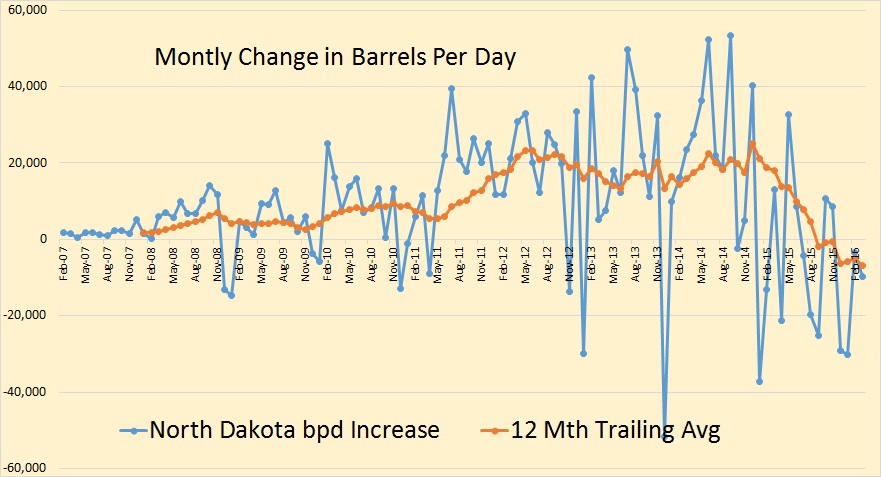

North Dakota change in barrels per day, 12 month trailing average, actually went negative in September of 2015. It is unlikely to go positive for at least two years, if it ever does again.

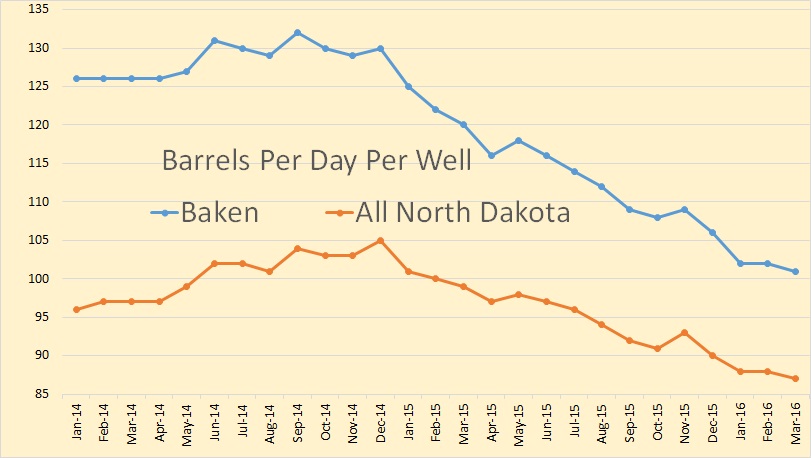

Bakken barrels per day per well now stands at 101 barrels for the Bakken an 87 for North Dakota.

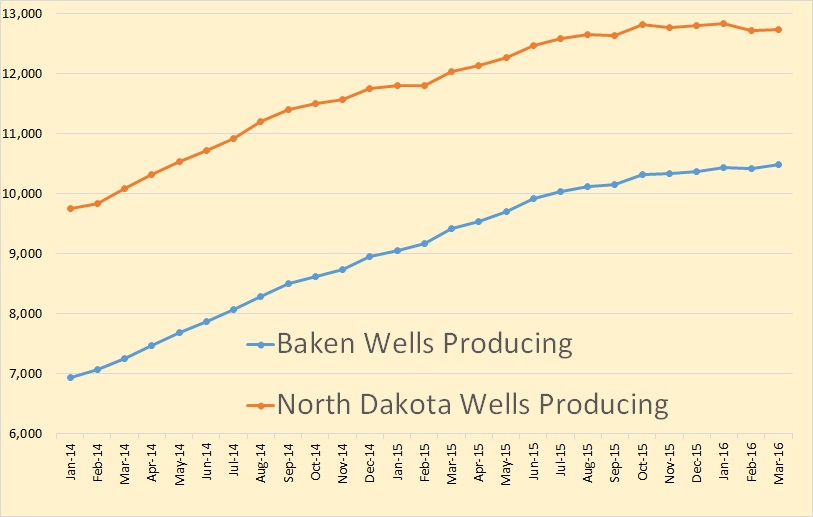

North Dakota Wells Producing has plateaued. North Dakota wells producing in March was actually 83 wells less than it was in October 2015. Of course new wells are added each month but old wells are shut down.

I will just point out that the March also had record gas production, as per the directors cut, even with 10,000 bopd decrease. Continuing the increase in GOR!

The cause?

Choke? or just drilling gassier formations?

Time will tell.

Gas Production

February 48,987,408 MCF = 1,689,221 MCF/day

March 53,002,954 MCF = 1,709,773 MCF/day (preliminary)(NEW all-time high)

Ron. Thank you for continuing to post this data.

Toolpush. Looks like new EPA methane rules require operators to monitor for leaks around wells, tanks, etc twice per year, regardless of volume. High volume/pressure areas, such as compressors, will require four times.

There are rules for drilling and completions. They refer to them as “green completions”.

I suppose the monitoring will cost so much per well, tank etc. I suppose that if wells, tanks, etc are not in compliance, they will need to be or plugged, removed, etc.

The way the EPA release reads, we are going to have to complete surveys on all our wells, and rules regarding existing wells will not be finalized by the Obama Administration, but by his successor’s admin.

Can’t this just be done with sensors as a part of the well’s equipment and be monitored 24/7 as a matter of course?

Paulo. I suppose so. The issue is the cost versus the benefit.

There are over one million active oil and gas wells in the United States. Most have been operated at or near a loss for quite some time.

I presume the majority of these wells release little to no methane individually. As a group, the environmentalists argue, they release a lot and therefore all need to be regulated.

I note that municipal gas distribution systems are exempt from these rules, even though they emit several times more methane, overall, than do upstream operations.

For example, what do you think about each household having to monitor methane emissions 24-7? All households emit a small amount of methane, so therefore should that also be an EPA rule?

I suppose if the cost is too excessive, wells will be plugged.

Just something that will have to be dealt with, and will depend greatly on future oil and gas prices. Wonder how other countries regulate upstream methane emissions?

Shallow

This is the breakdown from 2014. Waiting on the regulations to monitor the other 66% of emissions.

https://www3.epa.gov/climatechange/ghgemissions/gases/ch4.html

In 2014, CH4 accounted for about 10.6% of all U.S. greenhouse gas emissions from human activities…Pound for pound, the comparative impact of CH4 on climate change is more than 25 times greater than CO2 over a 100-year period.

So, 25 times multipled by 10.6% gives about 2.7. That suggests that methane is 2.7 times more important than CO2.

Is that right?

Nick, that is only for US emissions. Globally CH4 has about 1/3 radiative forcing effect of CO2 at the present time. As far as US emissions go, the greenhouse effect of added methane is 2.7 times higher than US added CO2 (much higher over the short term though). But there are much broader ramifications for methane.

Molecule for molecule, methane is at least 20 times stronger greenhouse gas than carbon dioxide, due mostly to the fact that it is dilute and not saturated like CO2. Luckily the absorption band of methane is at 1300 cycles/cm where the earth and atmosphere emit less energy. Unluckily, methane concentration is doubling at a faster rate than CO2. Also unluckily, there is a vaster amount of available methane to can released into the atmosphere than there is CO2 sources. Most of these sources are natural and are temperature sensitive. So raising the temperature is decidedly a very risky venture.

Also keep in mind that the released methane converts to CO2 so the warming does not end with the oxidation of methane.

So basically what methane does is give a very strong greenhouse effect per concentration and then also produces a smaller long term effect from the CO2 it becomes.

Hi NickG,

No CO2 is more important because it persists in the atmosphere for much longer than methane. Problems don’t stop after 100 years, we need to think long term. The focus should be on CO2. See Methane at Real Climate to get the perspective of experts.

Hmmm.

On the other hand, we certainly need to have some kind of time discount: the economy grows, labor productivity grows, technology advances, costs fall.

I wonder how things would look if we assumed that GHG emissions fall to zero in, say, 75 years, than go negative after that?

That would be an interesting model…

Hi Nick,

It is difficult to get GHG emissions very far negative. Lower population may help with land use change and perhaps some low energy process to remove co2 will be developed.

If we assume (realistically) that GHG goes no lower than zero. CO2 remains in the atmosphere for 1000s of years, about half of emissions get removed quickly, the next 40% persists for 10,000 years or more.

This is the reason carbon dioxide is the key greenhouse gas. Water vapor is also important, but this is largely determined by temperature.

Nick, in an ideal world we might get our CO2 output down to a low level, say 10 to 20 percent in 50 to 75 years.

With a growing population, even that is doubtful as coal and natural gas take over from oil. But still possible.

As far as methane output goes, industrial output is only about 1/3 of the amount going into the atmosphere. The rest is from agriculture and natural sources.

Natural sources are on the increase, as will be agricultural sources due to increasing population. So I do not see a decrease in future atmospheric methane with a significant likelihood it will continue to increase even after we get control of fossil fuel outputs.

We need to eat more pork and less beef. Rice is also a huge emitter. The highest methane concentrations are found over India and China.

Dennis,

Why do you think that methane concentrations will go down with time, I see no evidence of that? Methane concentrations are rising, doubling faster than CO2, not falling. Residence time is not a factor as long as the source input is greater than the disassociation rate.

Hi Gone fishing,

I believe it will be determined by natural gas output (which will peak and decline) and by population (which will also peak and decline).

Read David Archer at real climate, I find his arguments convincing, methane is not likely to be a problem.

http://www.realclimate.org/index.php/archives/2014/09/the-story-of-methane-in-our-climate-in-five-pie-charts/

and

http://www.realclimate.org/index.php/archives/2014/08/how-much-methane-came-out-of-that-hole-in-siberia/

The issue isnt really monitoring emissions, this can be done for $100 per site.

The issue is what to do about emissions we know happen. For example, in many jurisdictions we can use natural gas as instrument air. The system releases methane. In some jurisdictions we are regulated and use instrument air.

In some jurisdictions we can put produced water in a tank which releases vapors to the atmosphere, and this water can have dissolved methane. The same applies to condensate tanks, which can be allowed to release gas via the relief valve. In very large facilities we pick up gas and compress it, put it back in the system. But I’ve seen some which allow straight release.

Then there’s the gas we vent from casing annulus. I always give orders to keep the annulus closed, but some operators allow it to vent to help the pump and avoid gas lock.

I could go on naming problem areas I’ve solved simply by spending money or issuing instructions to field managers. Which they like to ignore.

$100 per site per how often? Monthly?

I do note that the rule exempts wells that produce under 300 scf of gas per stock tank barrel.

That may very well exempt quite a few stripped wells and would put the non-gassy ones at a competitive advantage.

It appears to be exempt an operator will need to obtain a certification for each well. That will be a time consuming process, but if it is a one time thing, maybe will not be too bad.

What would be the easiest way to measure gas for wells where there are no gas is not marketed and there are no gas gathering lines.

Continuous monitoring. We can send you a reading every 20 seconds if you have a hard Internet line. Or we send you the signal via a phone card. I have a project for a methane sensor for high school students. The site needs electric power. Thus far the component costs are about $40, but we are building a pilot in a wooden box.

Tool push, the depletion process leads to increasing gas to oil ratio. As pressure drops in the reservoir the reservoir fluid releases gas in increasing amounts (think of it as if it were boiling off as you release pressure in a pressure cooker). The released gas tends to flow easier (has less viscosity), the oil that’s left in the reservoir flows less because it suffers from increased viscosity as it releases gas.

This is a very simple outline of what goes on. The bottom line is that GOR will simply keep increasing, which makes the wells on pump harder to lift. Beyond 1200 GOR or so it’s a real problem.

Fernando,

So do you think the increasing GOR can all be attributed to decreasing pressure due to natural decline? Or do you feel the rate of decreasing pressure is being helped along by cracking open the choke a little bit further than is prudent?

Hi Toolpush,

I know so little about the actual day to day operation of oil wells that you could write it all on a postage stamp with a four inch paint brush, lol.

But it is written in stone that business men in a bad bind for cash invariably do whatever they can to put their hands on that cash, short of robbery, and robbery is pretty damned common.

Survival in the short term trumps all long term considerations whatsoever in the business world.

I have “been there and done that, got the tee shirt” myself a few times, doing altogether the wrong thing from the long term pov in order to survive in the short term.

If cracking the choke a little too far will generate enough additional cash to keep the doors open another week, another month, you can bet your ass and your last can of beans that the choke WILL be cracked.

I am under the impression you are a conventional oil guy, rather than a tight oil guy, but you can tell us something anyway, at least about conventional wells.

How much extra oil could can you get out of a well SHORT TERM by opening up on the choke? I know a precise answer is impossible, but a couple of examples at the high end an the low end will throw some light.

OFM,

I am a great believer in human nature, and realize, as you do, that once people are backed into a corner, normal behavour goes out the window. So getting back to choke and oil production, my gut feeling is that some operators at least, will be running the well for short gain, rather than long term benefits.

Now I am just trying to find the evidence to prove my suspicions. What I am looking for is the newer wells dropping below the older on cumulative production. So time will tell.

As for my back ground. I have always worked offshore, international, and therefore no shale experience. I am also on the drilling side of things. Our intention is the keep the oil below ground. We let other people bring it to surface, though I do get to mix with the production boys at times.

Mostly depletion. Evidently if you lower bottom hole pressure by opening up a choke you can deplete the near well region a bit harder, which increases gas to oil ratio. I’m just going by book learning, I’ve never babysat a newish well with such poor quality rock. I’ve had a couple of really old wells producing from lousy carbonates, but those were put on a clock.

Hi Fernando

What are the units for 1200 GOR?

Cubic feet of gas at standard conditions per barrel of stock tank oil.

So 1.2 MCF/bo is a problem? For all of TX the average GOR is over 2 MCF/bo.

Comparing apples to a fruit stand.

Hi Reno,

My point is simply that currently North Dakota is at about 1500 cubic feet natural gas per barrel of oil produced.

Fernando says this is a problem, I think.

Not sure if it is or isn’t. Increasing gor in an oil reservoir is not good. But I thought you were inferring that Texas was in worse shape. My point was you can’t make that assumption. My only point

I thought maybe the units should be thousands of cubic feet of natural gas per barrel of oil because both Texas and North Dakota are over 1200 cf/bo GOR.

It’s a problem for two reasons: the reservoir loses pressure faster when GOR increases, and , if the well is on pump, the pump efficiency suffers.

If a well makes little water the higher GOR allows it to keep flowing, so that’s lower opex. If it makes 50 % water then as bottom hole pressure drops you got to install a pump or use gas lift. Gas lift is more efficient when GOR is high. But gas lift requires compressors and a surface network.

This is too complex to describe here, but in general a higher GOR, like a higher water cut, can be considered a negative factor. This is more so if gas prices are very low. At $7 per mcf it’s less of a problem.

Hi Fernando,

So the problem is that artificial lift is needed as GOR increases beyond some value (roughly in the ballpark of 1200 cf/b, no doubt this varies depending on water produced, geology, and many other factors I am unaware of). I would think that most wells eventually need artificial lift as they deplete so this is not so much of a “problem”, just the natural course of oil production.

Completion technology gets you more gas (and oil) in the short term. In the longer term geology plays a far more important role on single well life of field economics than completion technology.

0-12 month production is a combination of reservoir and fracture dominated flow. Increases in mean rates are mainly related to advances in completion technology (longer horizontals, > number of stages, reduced spacing between stages, improved proppant technology).

After 12 months, liquid production is reservoir dominated. Decline curves converge to +/- 5 bopd. Geology is the main controlling factor. From 2008 to 2015, the following increases have been observed;

197% increase in 90 day gas only production

46% increase in 90 day oil and gas production

27% increase in 90 day oil only production

10% increase in 90 day income

Extrapolating the 2008 to 2015 curves to 20 years of production, the following changes have been estimated;

6% increase in 20 year income

Break Even oil price lowered from $64 to $60

Conclusion: Completion technology gets you more gas (and oil) in the short term. In the longer term geology plays a far more important role on single well life of field economics than completion technology.

Great comment Ciaran, thanks.

https://www.dmr.nd.gov/oilgas/stats/statisticsvw.asp

6.3% production decline year over year with 1,000+ additional wells

March 2014 to March 2015 production up about 23%

A slow decline in production with 1,000+ wells over the 12 months is to be expected, right?

“Bakken crude oil production was down 7,743,000 bpd in March while all North Dakota production was down 9,846,000 barrels per day.” Extra zeros?

Thanks Greenbub,

Corrected. Should have been 7,743 bpd and 9846 bpd.

A first sight an over 6% year over year decline does not sound very spectacular.

However, in my view it is the dynamics which counts. Since the latest 18 months Bakken production declined at a monthly rate of roughly 2% (see below chart). Should this hold, production will be down by 30% by the end of 2016 (blue arrow in below chart).

We currently see it roughly 30% from the peak of Dec14 by Dec16.

gwalke,

This seems to me a good estimate.

When comparing the 2008/2009 cycle with the current 2014/2018 cycle (see below chart), the 2008/2009 cycle has been quick and dirty, in contrast with the current cycle which is double in length or about 4 years.

The green line is the change in oil price, which leads the red drilling cycle by around 6 months, which in turn leads the blue production cycle by 18 months. As the current cycle is much steeper and longer, the oil price has seen already its through, yet drilling is just about to turn around.

Production will very likely turn around 18 months after drilling has recovered, which is likely not happening before end of this year. So, production cannot recover before two years. This is a lot of time for production declines.

Hi Heinrich,

There is not an 18 month lag between when the well drilling starts and completion unless the DUC inventory is high.

A more likely scenario is that the DUCs will be completed and this will moderate the decline. Then because the DUC inventory has been reduced the lag between the start of drilling and completion of the well will also be reduced, probably to about 6 months so once the rigs get working again the limitation will be the number of fracking crews, we know there is enough equipment to complete wells at a very fast rate, finding workers and training new crews will be the only limitation. I will let the oil pros comment on how quickly crews can be gotten up to speed to resume the pre-crash rate of drilling, my guess would be 24 months at most.

Of course only half that rate or maybe even only one third that rate is needed to stop the decline, but ramping up will require more rigs and more fracking crews.

Dennis,

History tells there is a lag of about 18 months. There are maybe more DUC wells, yet the timing for a restart of drilling is difficult as companies do not know how sustainable any price recovery will be and the start of the recovery will be very tepid.

In addition, the above chart represents total US oil production including Gulf of Mexico (GOM) production. It is especially GOM production which will recover very slowly and will depress the average time of a production recovery.

The recovery will also depend on how long prices will be depressed. In my view Saudi Arabia and also Russia will try to keep prices below USD 50 per barrel as long as possible in order to gain as much market share as possible before prices will go up again.

“It is especially GOM production which will recover very slowly and will depress the average time of a production recovery.”

GoM production continues to increase despite the drop in oil prices

GoM oil production

Source: EIA STEO, May 2016

AlexS,

I do not share your optimism about GOM production.

Roger Blanchard has an excellent article about the same subject and he is pessimistic for GOM production as well:

http://www.resilience.org/stories/2012-02-17/how-reliable-are-us-department-energy-oil-production-forecasts

Heinrich Leopold,

It’s not my optimism. It’s the EIA’s forecast based on oil companies’ project portfolio. These projects were started at times of expensive oil, are now at final stages of development and will not be canceled.

Low oil prices did not affect oil production volumes in the GoM in 2008-09 and 2015-17E, although longer-term prospects may be affected as new projects may be postponed.

Declines in the GoM output in the past several years were due to the accident with BP’s Deepwater Horizon platform (2010) and a temporary moratorium on drilling.

There were also temporary shutdowns of production facilities due to hurricanes Katrina (2005) and Gustav (2008).

Oil production in the GoM, 2005-16 (kb/d)

AlexS,

In above chart about GOM production, you can see that GOM production still grew after the oil price crash in 2008 until 2009. After the peak in 2009 GOM production crashed nearly 700 000 b/d until 2011.

Despite the oil price recovery in 2009, GOM production could not grow again until 2013.

I can therefore see the same scenario for the period 2014-2018: GOM production has peaked in spring 2016 and is set to fall close to 1 mill b/d over the next two years. Any GOM recovery will not happen before 2018 – if any recovery will happen at all. The GOM basin is a very mature play – like the North Sea and will possibly see a terminal decline, especially in the light of new deepwater regulations.

Heinrich Leopold,

Did you read my post above?

If not, I repeat:

Declines in the GoM output in 2010-11 were due to the accident with BP’s Deepwater Horizon platform and a temporary moratorium on drilling.

GOM production has NOT peaked in spring 2016, as several new projects are due on stream in 2016-17 and project started in 2015 are ramping up output.

“In the midst of the downturn, the deepwater GOM perversely continues in a production boom. After falling every year since 2003, Gulf production was 1.4 MMbopd in 2014, and is expected to average 1.61 MMbopd in 2016 and 1.79 MMbopd in 2017, reaching 1.91 MMbopd in December 2017. That will account for about 21% of total, forecast, U.S. crude oil production, according to the Energy Information Administration (EIA).

Contributing to the EIA’s forecasted production growth are 14 deepwater projects: nine that started in 2015, four starting in 2016, and one anticipated to start in 2017. Last year’s additions were Silvertip, Deimos South and West Boreas (Shell); Hadrian South (Exxon Mobil); Lucius (Anadarko); Big Bend and Dantzler (Noble Energy); and Marmlard (LLOG Exploration). EIA had expected LLOG Exploration’s Son of Bluto 2 field to come online in 2017, but the subsea tieback began producing to Delta House in April 2015.

Start-ups this year include Anadarko’s Heidelberg field, which began producing in January. Heidelberg is a truss spar, aimed at reducing development costs. Shell’s Stones field development, which is also due this year, uses the second floating production, storage and offloading (FPSO) vessel in the GOM. The first GOM FPSO was installed by Petrobras and put online in 2012. The other two fields starting production in 2016 are subsea tiebacks—Noble Energy’s Gunflint, and Freeport-McMoRan’s Holstein Deep.

Production from other Delta House tiebacks has been ramping up steadily. Freeport-McMoRan’s (FM O&G) Horn Mountain Deep well, which will be tied back to existing facilities, is expected to begin production during first-half 2017.”

http://www.worldoil.com/magazine/2016/april-2016/features/regional-report-gulf-of-mexico

AlexS,

Sorry for my late answer, I am not checking the site every day.

From above picture I can see that the big chunk of production increase comes from existing fields and not new fields. This is very unlikely to happen. We know by next year what will happen.

Heinrich, the 2015 projects are still ramping up which explains a lot of the increase. The problem will come in 2018 and later when there is a big drop in new projects and deep water projects installed over the last few years come off of their short plateaus.

According to the EIA, before the oil price drop, the average lag between the start of the drilling and well completion in the Bakken was between 4 and 5 months.

AlexS,

Agree with the shale time lag. Yet my chart above is for total US oil production including GOM production. I can actually not say why this time lag exists, yet the numbers tell me there is a time lag of up to 18 months for total US production.

I have made also a chart for the time lag of GOM production and this chart shows a much higher time lag than 18 months for US GOM production. It has been not earlier than 2013 when GOM production recovered from the 2008 oil price crash, which is at least 2 years later than US average production recovery in 2011.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRFP3FM2&f=M

So, this adds up for an average 18 months time lag for US production.

What makes me very pessimistic on US oil production is also the hostile attitude of the US government against its own O&G industry.

http://oilpro.com/post/24429/white-house-issues-final-methane-rules-kicking-og-while-down

Maybe anti-O&G but pro-human? pro-planet? pro-our-grandchildren?

Or pro reserves?

Most people would say that it is good for a country to have large oil reserves. Encouraging companies to pump oil reduces reserves.

Assuming, for the sake of argument, that peak oil is a real thing, a rational government should discourage oil production until the world starts running seriously short of the stuff.

A broken US O&G industry will break also the US economy. How does it feel to be broken and healthy? We will find out soon.

A broken US O&G industry will break also the US economy.

Somebody should have told the “Drill baby, drill!” crowd, “Be careful what you wish for!”

Heinrich Leopold,

What 18-month time lag are you talking about?

Oil prices peaked and started to decline in June 2014. The U.S. oil rig count peaked and started to decline in October 2014 (4-month lag). U.S. Lower 48 states oil production peaked in March 2015 (5-month lag) and total U.S. oil production in April 2015 (6-month lag).

So combined time lag between the peak in prices and peak in production was 9-10 months.

Hi Gwalke,

Thanks. It all depends on the assumptions for wells added in 2016 and your well profile.

Currently my model underestimates actual output by 53 kb/d, but without adjusting the model the output would be 918 kb/d in Dec 2016 or about a 23% decline from actual output in Dec 2014 to the model result in Dec 2016. The “model” peak was in April 2015 at 1158 kb/d, pretty close in magnitude to the actual peak in Dec 2014 (1163 kb/d).

The data from Enno Peters shows 64 well completions in North Dakota in March 2016 (I simply assume all of these are Bakken completions), the model assumes 60 wells per month are completed from May 2016 to Dec 2017, and 62 well completions are assumed in April 2016. Output falls to 886 kb/d in Dec 2017. Chart below.

If we assume that oil prices eventually rise above $80/b in mid 2018 and that the well completion rate rises from 60 per month in June 2018 to 165 completions per month in June 2020, then remains at 165/month until June 2024 and then gradually declines to zero by Nov 2027 we get the scenario below. ERR is 8.5 Gb, about 26,000 total wells are drilled (about 15,000 wells after March 2016) and peak output is 1262 kb/d in Jan 2024. This assumes new well EUR begins to decrease in June 2018 and reaches a maximum annual rate of decrease of 8% 12 months later. EUR decrease is not the same as well decline, it means well productivity decreases as sweet spots become saturated with wells. We do not know when this will start or what the rate of decrease will be, I have guessed at the start date and rate of decrease so that 40,000 wells drilled would be close to the USGS URR estimate from April 2013.

The model is of course likely to be wrong as there are many assumptions, all of which could be wrong.

Hi all,

I updated my model for the well profile from July 2015 to March 2016 using the latest data from Enno Peters (March 2016). The well profile for those months shifted higher, I do not know why. The model now gives a result of 1046 kb/d in March 2016 (1% too low), the model peak in April 2015 is 2.5% higher than the near term peak in March 2015. The scenario below, has 50 wells per month from June 2015 to Dec 2018.

I got that wrong on the near term peak for the ND Bakken/TF, it was June 2015 at 1153 kb/d, the model peak was 2 months earlier in April 2015 at 1158 kb/d, the timing was off a bit and the magnitude was too high by 0.4%. In any case the model is far from perfect, but does a pretty good job considering its simplicity. It is basically well profile multiplied by number of new wells and then add it all up.

The scenario above assumes that the well profile determined from well data for wells starting production from July 2015 to Jan 2016 (611 wells) does not change substantially from April 2016 to Dec 2018. Given the large changes in the well profile from the Jan 2015 to June 2015 well profile to the last half of 2015 ( 12 month cumulative increased from 97 kb to 119 kb), that assumption may not be valid.

If we assumed instead that the well profile shifted back to the Jan-June 2015 well profile starting in April 2016 and that profile was maintained until Dec 2018, then output would fall to 883 kb/d in Dec 2018, assuming 50 new wells per month are added from June 2016 to Dec 2018. Scenario is below and reality may be between this and the previous scenario (if the 50 new wells per month guess is a good one).

Hi Dennis.

Yes, I think we take different (equally valid) approaches to modelling ND. Our approach is to try to work out how many completions there will be per month – I will be the first to admit this is not very accurate but is not a bad ballpark. I’m pleased we come up with similar numbers, it’s a good ‘sanity check’. I would be cautious in assuming that a price rise means a completion increase though, as completions and price don’t correlate very well. LTO is dominated by financing – as they say, give an oil man a dollar and he’ll drill a hole. We might expect more financing to be available at higher prices, but that is not a given.

With the well profile, we have 5 – one for each core county plus “Other”. They are now based on 2015’s data. It is possible 2016 wells will have different profiles. They did increase 14-15, but what is interesting is that the increase was not uniform across counties. McKenzie saw barely any increase. This suggests that tech gains are marginal – you’d expect uniform gains from tech improvement – which also suggests the increases were more to do with geology (“high-grading”).

Ciaran’s comment further up on this is very important – they have been trying to force more production earlier in the well’s life. They have then been claiming to investors that this will increase recovery by ~45%, which is a lie. But it is still important for our purposes because fewer wells are needed to keep production flat. This is a likely reason production beat Helms’ expectations. I would also point out he’s not the greatest production forecaster (nor is it his job to be so, in fairness), and, as we all know, he doesn’t get his completion numbers right.

Thanks Gwalke,

Yes our approach is different as I don’t break down the well profiles by county so your forecast would probably be better. Thanks for the info.

My thinking on well completions increasing is that higher prices will increase profits. Note also there is a lag between the oil price increase and completion increase in the long term model (prices start to increase in 2016 but completions don’t increase until 12 months later, this is a pretty conservative guess imo). Of course my guess may be wrong, I don’t know future prices or how these prices will affect the industry’s decisions. I agree financing will be important, some players such as XTO and Statoil can self finance as their pockets are deep.

Maybe ours is better for the front month – we’re pretty accurate for the next month’s data because of how ND report. Long-term, I would expect your estimate to do better than our long-term forecast.

Hi guys, I have a question that follows from my previous post.

To carry over a quote:

That quoth, the global industrial machine seems to be running now on the EROEI of what? Deep sea/shale oil EROEI? Which is what? 20:1? 15:1?

So my main question is; what might it be, roughly, and what kind of change for EROEI would we guesstimate over what timeframe?

IOW, how soon do you think the global fossil fuel supply might begin to breach, say, an EROEI threshold of 10:1? Also, given price-production-destruction, would it accelerate?

Where’s Jeffrey Brown, by the way?

Presumably, the reason no one uses ERoEI* is that no one has heard of it. I am too busy with my better-than-hopeless projects to go around hyping ERoEI*, regarding which I began my latest attempt to write a clear definitive discussion of sustainability as follows:

It is essential to realize that energy is the life blood of a society. Sustainability amounts to providing a sustainable renewable energy technology, a technology that harvests energy (corrected for entropy) from the sun in real time and that returns more energy than is consumed to install it, operate it, maintain it, maintain its storehouses of natural material capital, prevent or repair environmental damage including aesthetic damage, and support the community that it serves.

If we wish to define a ratio of Energy Returned over Energy Invested (ERoEI*) that will indicate a sustainable alternative energy technology if and only if it is greater than 1.0, we must begin to think of society as a system the purpose of which is to maintain the flow of high-grade renewable energy. Let us begin with a thought experiment … http://eroei.net/sustainability.htm

I’ll get back to your comment later today, Thomas, but a little bit coincidentally, I just came across these shocking numbers that are not even factored in apparently! (Which may make EROEI an even more difficult subject.)

“Caelan why are you such a downer these days?” ~ Aws

No idea.

Caelan ,

I think maybe you need to just quit looking at the worst of the downside possibilities for a few days for the sake of your own enjoyment of life. We only live once, you know.

Hall is a god like figure in my eyes, but his work is still just HIS work, and later estimates of the overall EROEI needed to make energy production and the economy work are more in the range of five to seven to one, for the whole shooting match.

I don’t have any trouble believing wind and solar power can exceed that level over the long term, and even if they can’t, we are building them out NOW using the existing fossil fuel endowment.

So – even if wind and solar prove to be uneconomic over the LONG run, they will still enable us to live ok AND extend the life of our one time endowment of fossil fuels by quite a bit, a generation or two at least.

“Sufficient unto the day are the troubles thereof.”

All these doomer type scenarios fail to take into account the simply ENORMOUS amount of energy we waste these days and the countless ways we can change the way we live so as to live just as well without all that waste.

Furthermore they generally fail to take account of the fact that the population of the world is almost sure to peak and begin to decline within the next couple of generations at the longest, and maybe sooner.

They generally fail to take into account the likely continued fast reduction in the costs of building out and installing wind and solar infrastructure.

Five or ten years ago, I was pretty much a hard core doomer, because I didn’t believe myself that the cost of wind and solar power could ever fall as fast as has happened. I didn’t believe battery technology would advance even a third as fast as it actually has advanced.

I am not complacent, and recognize that there are some VERY tough times ahead of us.

I believe that large portions of the world are likely to experience a die off of the invasive species commonly referred to as the naked ape within this century.

But I also understand that highways last almost forever with maintenance compared to the cost of building new. Houses. even the cheapest sort built in places like the USA to building codes generally last at least a century if they are well maintained. We already have more shopping malls and office buildings, which will also last indefinitely, to last just forever, considering the population is going to peak .

I have worked on machinery since I was a little kid, and the one possession I remember being the proudest of AS a kid was buying my own first reasonably complete set of mechanics tools out of the Sears catalog. It had over four hundred individual tools. I spent a hell of a lot of time divided about equally between looking at the lingerie models and the tools, and I got the tools with my own money when I was fourteen years old. Still got some of them. I never did get one of those models though. LOL.

So even though I am not an engineer, I know a hell of a lot about machinery, appliances, and so forth. There is absolutely no question that an automobile cannot be made to last fifty years, easily, by standardizing the design, and building it in such a way that it is EASILY repaired and reasonably proof against rust. There is no reason a washing machine or refrigerator or electric range should be scrapped in less than fifty years except maybe on the basis of energy effiiency. I have a house full of furniture that will last a couple of centuries, barring fire.

Things are going to be tough, but the situation is NOT hopeless. If you were handy, I would have you over and fill you up to your tonsils with beer and some backyard grilled free range chicken. 😉

“Caelan why are you such a downer these days?” ~ Aws

Caelan, good to see you still have your sense of humour. 🙂

Thing is, Caelan, for many reasons we have to keep on keeping on. BAU sucks, but there has to be some transition worth trying. We all have too many people we love to afford the luxury of not making the effort.

That’s key and you just answered it yourself: BAU sucks, but there has to be some transition worth trying.

If BAU sucks (and not in a good way), then ‘some transition worth trying’ is probably not BAU-based.

At the very least, a BAU-based transition is not a low-power, self-empowering, democratic, or local-community-empowering transition.

Right. If we invest energy that poisons the biosphere to get more energy that does the same, what’s the gain?

On the other hand, if we look in detail, it’s fairly simple to quit the crap, focus on what’s really needed and behold, energy problem cut to maybe 1/10 what it is now, and solar/wind can do that.

Start here, start now, start! Take a look below

http://www.plancurtail.org/

Hi Wimbi,

I am on board!

“All we have to decide is what to do with the time that is given us.”

– Gandalf in The Fellowship of the Ring

Hi OFM,

My favorite part of the Lord of the Rings trilogy is that conversation between Frodo and Gandalf in the mines of Moria.

Another nugget from that conversation, Gandalf says (to Frodo)

Even the very wise cannot see all ends.

Somewhere in the Gandalf is asked why he talks to himself so much.

Gandalf answers that he has the habit of addressing his remarks to the wisest of those present, to save time. As a result, he often ends up talking to himself.

OFM. don’t understand why you think going to solar/wind will be slow and hard. My direct experience was that it was fast and easy, and that’s not just me.

http://thinkprogress.org/climate/2016/05/12/3776728/climate-change-solutions/

You know what a 10kW diesel looks and smells like and how much TLC it takes to keep it going, not to mention its habit of just guzzling gobs of diesel endlessly.

Compare that with 10kW of PV sitting out in the south slope. It just sits there, no noise, no smoke, no fuel, no squeaks for TLC. Just puts out pure power more or less forever. Sure, intermittent, but anybody with farm experience knows full well that everything is, and, for 10,000 yrs, they have coped with it.

I paid for all that by not paying for a pickup. Pain-free.

Hi Wimbi,

Slow and hard are subjective words, and mean different things to different people, and in different contexts.

I think the transition, IF it succeeds, will take not less than fifteen to twenty years, due to the scale of the problem. That’s allowing for a pretty fast rate of growth, in the face of what will be resource shortages, hard times, and opposition from the dug in fossil fuel industries and their allied business interests. People can be slow to change too, due to habit and ignorance.

The hard part is going to come from paying for renewable energy UP FRONT. I would already have a new Volt automobile if I could afford one. I COULD put my hands on one, by doing without something else, say selling some real estate, or making payments.

But my PAID FOR old ice car runs cheap enough that I simply cannot afford to put thirty thousand bucks in a new car.The money is best used elsewhere, spent on things that generate a greater return.

Most people don’t pay for stuff up front. They borrow and pay over time. Interest rates are very low. Those with good credit ratings pay zero interest rates for new cars. PV probably 3% or so.

Well, around here, anyhow, the local bank gives zero interest loans on EV’s, preferably used ones, that cost maybe 1/4 new and are still mechanically like new. And the PV installer will also give zero interest installations.

And, of course, a DIY like me can go out to places like Sun Electronics and pick up oddball PV for 35 cents a watt. And good used inverters too.

Now, just for fun, did you include the cost to the grandkids of the carbon from that cheap old car you have there? Was it still cheap?

Hi Wimbi,

Good to know, I didn’t realize you could get a used car at 0% interest, where I live the loans through the solar installer are about 3%, you might have state incentives where you live, I only get the federal incentive, which would be used for the down payment and the rest of the loan is about 3% over 12 years. I pay about 50 dollars per month for electricity and a PV system would result in a $70/month payment for 12 years, after that the electricity would be free (if there are no net metering rules changes), that would be a simple grid tied system with no backup essentially $20 per month to help reduce carbon or on a kWhr basis it is about 7 cents per kWhr for the first 12 years. I think many people could afford this, but most people think short term, myself included (as I have been think about doing this for a while, but will probably downsize to a smaller home first.)

Once we have the smaller house, PV will be installed with some battery backup.

On the freight and mobility side, Lockheed Martin is not sitting still. Able to lift large loads and access roadless areas much more efficiently than helicopters. Faster than trucks and able to scale up to large freight loads, the hybrid gets lift as it moves forward.

Lockheed Martin – P-791 Hybrid Aircraft

https://www.youtube.com/watch?v=isJRgEu7DQo

Wimbi, one of your site’s short articles suggests that Plug-In Cars Are No Better Than Hybrids. (Do you own a Nissan Leaf? Is it a plug-in or hybrid?)

At any rate, at the end, the article says,

“Even better, share a ride, bike, and walk.”.

I am a long-time acquaintance of Pat Murphy, the author. I talked with him about his not mentioning cars such as mine, an all-electric running, not on the coal-fired grid, but on my own PV. I am asking him to do the same comparison on that combo, including the carbon footprint of the PV. We shall see.

My own crude numbers say the Leaf + PV is very far ahead of all the others.

I also note that all my friends could easily afford to do just what I did and go all-PV for house and car. Nary a one of them has so far, including my highly paid silicon valley son. He’s so deep in his own little universe that he simply does not think about such mundane things as cars.

I agree with his share a ride remark, the obviously better way to go.

Surprised to see you didn’t know a Leaf is all-electric.

I figured the Leaf was, just too tired/occupied to look and confirm. I’ve looked enough this week. lol (Maybe the Leaf-Blower came in a hybrid or Hy-blow™ model.)

So you do have a Nissan Leaf-Blower then? Aha. Now you have to go and justify your ownership. ‘u^

Don’t forget the embedded energy (emergy) of the EV and PV, etc., and the cost and disposal emergy of the ICE’s, batteries over time, mining and realistic figures of that and PV life, BAU/GAU-level roadway maintenance, etc.. Be honest. And then ask yoursef if it would be better to transcend/avert BAU– which all or much of this leads to– and attend more and more to the local scale, the democratic, etc.. I imagine you’re already doing that.

Then share with the neighborhood and/or leave your Leaf-Blower in the parking lot and maybe go out for a walk or a bike ride if you’re not too tired yourself, you rocket scientist, you. ‘u^

Hi Caelan,

Considering your extreme pessimism when it comes to renewables and electric cars, etc, you have just proven that you DON’T EVEN READ THIS ONE FORUM carefully.

The fact that the Nissan Leaf automobile is a battery driven car has been mentioned here HUNDREDS of times.

Wimbi himself has posted about his own Leaf and his own personal pv system fifteen or twenty times at least.

Caelan is just another a good example of an individual’s ideology and personal views blocking out factual evidence that contradicts those views.

If you believe something to be true then why would you waste your time checking the actual facts.

Given the fact that so many of us on this site have been using Wimbi’s all electric Nissan Leaf as an example of how transition is happening already. And we have been doing it for a very long time, just goes to show that most people still aren’t listening!

Of course we know that this is exactly how human nature works. Nothing to see here, move along now, folks!

Hey guys, don’t be silly and grasp at straws or split hairs or whatever.

Part of an interest in the truth means that I might ask questions I’m fairly sure I know the answer to just in case. As already suggested, the Leaf-Blower might come as a hybrid, called the Hy-Blow™. Maybe the company– based in an ostensibly-floundering economy that is Japan, realizes– apparently like the site wimbi mentions– that hybrids are more economical.

Hi Caelan,

When everything is considered, the hybrid is not more economical (if one ignores externalities it might be, but Wimbi chooses to look at the big picture.)

Fair enough, Dennis.

…Hey, Dennis, just a heads up that there are 2 extra copies of this comment that need to be deleted. Thanks!

That goddam wimbi talks too much, he’s a one-note johnny and I’m glad you pointed that out to him.

So, wimbi, quit all that and go back under yer rock, where every one of those good fun widgets need work you aren’t giving them. And, don’t forget the chicken house has a flat tire again.

Ok, fine, same here, I have to get back to my shipping container residence design too.

How many chickens do you have? Anyway, give them a pet for me.

I am almost finished reverse-designing it (3D model off Google 3D warehouse) which means turning all the surfaces into proper solid volumes, after which time as the actual house design will begin.

It’s certainly true that about 70% of the car traffic in America is completely pointless, and could be eliminated by legalizing sensible arrangements like corner stores, garage businesses, etc.

My favorite example of the irrationality of American city planning: Traffic safety people claim that drunk driving is a major cause of traffic accidents.

But most American cities have strict laws dictating that bars must have a minimum number of parking lots per seat, and may not be near the homes of the patrons, but no laws saying they should be near public transportation. So how do you get home?

Americans waste vast quantities of liquid fuel driving around the “Great Triangle” separating their suburbs, their office buildings and their shopping malls. The problem could be solved by simply canning the zoning laws that caused it.

Hi Wimbi,

I left Pat a question:

Your article suggests that a Prius is better than a hybrid.

Have you taken into account the ability of a plug-in to charge when wind and solar production is at their peak, thus

1) changing the mix of electrical generation used by the EV, and

2) incentivizing wind and solar by creating demand where high renewable production lowers power prices?

More mindless blather about “sustainability” and “renewables”.

Instead of designing an economy that sucks up all the worlds crude oil and sends useless junk like solar panels and batteries to the dummies destined for the firing squad, Thomas Wayburn is desperate to be that dummy.

“Don’t shoot me, I’m sustainable!!!”

When are you pseudos going to learn that “renewables” is hydro dams? You’re reenacting the dreamworld of one Vladimir Lenin who in 1920 had the same queer command economy worldview. Nothing has changed in 100 years except now you have 7 billion. Venezuela is not a basket case…its a paradise compared to what you are putting on the blackboard.

Hi Thomas,

Pardon my delay. I glanced at your site briefly and will return to it.

If understood correctly, your fundamental position, at least in a nutshell, is one of human’s leveraging of energy that is in harmony and balance with itself and (in the process, with) the surrounding ecosystem; and that a certain approach, understanding and appreciation of ERoEI (and/or interrelated/underpinning thermodynamic issues surrounding the ‘sociopolitceconomic’) is important in this regard. If so, I agree.

I would add– and with Dennis Coyne’s apparent position in mind, seemingly somewhat at odds for someone with both an economics and physics education– that if we don’t want to take the responsibility to ‘do the math’ or ‘make the analyses’ where those kinds of things are concerned, maybe because it’s too hard or inconvenient, then we might as well abandon most, if not all, our technology (because we don’t have the responsibility to make, manage and use it [beneficially]), and notions that– at least high-energy/BAU-energy and related technology– will ‘save us’.

Hi Caelan,

It is important to do cost benefit analyses where external costs are included. The thermodynamic laws will not be broken so I don’t really concern myself too much with those. So as many engineers would claim and I agree, energy return on energy invested is just not very useful. You are welcome to pursue that, but for it to be useful it needs t look at all energy sources used by society, because it is the EROEI for society as a whole which is the only measure that is useful. I am not going to attempt such an analysis, you can have at it.

Hi Caelan,

The important measure is the EROEI for all energy used by society and it is very hard to measure.

If there is not enough energy its price will rise, so the assumption that price is determined by EROEI is false. The price is determined by supply and demand. Potentially demand for energy will be reduced by efficiency improvements or by a recession, supply of energy will depend on many factors both geological and technological.

I don’t think the EROEI analysis is very helpful, as it is too difficult to measure with any degree of accuracy.

“I don’t think the EROEI analysis is very helpful, as it is too difficult to measure with any degree of accuracy.”

I agree. Furthermore, EROI analyses generally use quantitative data that include production factors but ignore stuff like climate change, air quality, and other environmental qualities which are considered “externalities”. They are (mostly) a useless distraction.

Hi Doug,

You agree with me? One of us is going to need to rethink their position. 🙂

Hell Dennis, I only disagree when you’re wrong. 🙂

Hi Doug,

Good to know. One of us is wrong (at least) when we disagree, probably not he same one every time. 🙂

In many cases we’re both wrong.

That’s not necessarily an issue with ERoEI, but a human/human-system issue/failing.

That’s why some of us call the economic system, the uneconomy:

It boldly, ignorantly and obstinately operates outside of reality, such as via debt/usury (money/the future) and so-called externalities (‘over the shoulder’).

(And that’s probaby why we’re going to get a seneca cliff, incidentally, and why…

photovoltaic PV solar panels may be a ‘short-term huckster’ by Big Oil/Big Energy. Who says Big Oil/Big Government/Big Energy doesn’t own or have a large share/stake in the Gigafactory/PV pie

…with Musk being their posterboy, their ‘logo’, like Colonel Sanders or Ronald MacDonald. Do you think Big Oil didn’t/doesn’t have access to Marion King Hubbert’s work and related peak oil details? Big Oil/Big Energy powers Big Government; Big Oil/Big Energy IS Big Government.)

Any thermodynamic/truly-economic analysis and system worth its salt should take, or at least attempt to take, so-called externalities– present and future– and issues of sustainability and resilience into consideration and into its modus operandi.

But then that’s more democratic. And that’s a problem for elitism.

And as it has been said before, and since we’re on about this, ‘humans are clever but not wise’.

Hi Dennis,

While I ‘know about the problem’, ERoEI is not necessarily about energy price at all, although others may want to make that connection.

My interest in it is more from, say, a ‘civilization/sustainability/thermodynamic/maximum power principle’ perspective.

You may think that an ‘ERoEI analysis’ is not very helpful, but then there are those who may not think that a climate analysis or whatever other complex analysis have you is very helpful either; and others (anyone we know?) who find that an ERoEI or maybe ‘thermodynamic’ analysis somehow threatens their ways of life and/or sacred cows, like electric cars/vehicles (EV’s) and photovoltaic panels (PV’s) that they might own and cherish.

See also.

If anyone (Caelan) hasn’t taken the time to watch Tony Seba presentation- well I just did and suggest you sit down with it and take it in (53min).

https://www.youtube.com/watch?v=Kxryv2XrnqM

If you spend time thinking about EROEI, energy scarcity, innovation, climate change or other associated issues, you will very likely find it good food for thought.

Thinking about PV energy, you could think of the upfront cost as paying for the EROEI upfront (as well as the cost of minerals, manufacturering, etc), and after sometime between perhaps 10-20 years depending on how good the insolation is at your site, you will start to be accumulating an increasing EROEI ratio thereafter. Not sure if I’ve explained that notion well enough, but hope so.

If you don’t live in a sunny locale and the deployment of PV/batteries doesn’t look to have a reasonable payback time period, well just consider that if PV is deployed massively in sunnier areas it will cut into the fossil fuel demand to a degree. This will help will the depletion rate (and prices) overall (elsewhere) to some extent.

Solarcity is offering 5.25% 5yr investment bonds with the funds being using to pay for PV rollout.

https://solarbonds.solarcity.com/b/bond/10183/525-solar-bonds-series-201610-5/

To check on your local insolation potential- here is a good map

http://maps.nrel.gov/prospector

The USA is endowed with very good insolation over about 1/2 its territory.

Build me a HVDC transmission system please.

OK, pardon the non-oil comments. I’m off to explore the Barrow Downs….

Probability Of Bankruptcy Analysis

All the things in our world have an industrial history.

Hey Caelan

On this Monday the largest state in the union got 31% of its daily electricity demand filled by renewable energy.

And it has barely been rolled out yet.

http://content.caiso.com/green/renewrpt/20160516_DailyRenewablesWatch.pdf

Do you live in a cold and shady area?

Hall’s energy analysis of petroleum shows that only twenty percent of the energy gets to the car. Then the car itself is only 20 percent efficient.

So the “real” kinetic energy of a car is actually 0.38 percent of highway speed kinetic energy, which means no harmful accidents actually occur. I am so glad you pointed out how safe we are.

I have been wondering a long time what my speed is “really”.

America does it again!

Perhaps the expression ‘going nowhere fast’ applies here.

repost from the previous thread:

Total oil production in North Dakota Bakken fell to 1057 kb/d in March, a monthly drop of 8 kb/d.

Decline in February-March was only 10 kb/d.

Cumulative decline from December 2014 peak level is 107 kb/d (-9%).

The chart below shows that both the EIA Drilling Productivity Report and the EIA/DrillingInfo monthly LTO production statistics tend to underestimate the resilience of tight oil production, at least in the case of the Bakken. The EIA estimates for February and March will likely be revised upward. I think that even bigger upward revisions will be done for the Eagle Ford.

Bakken oil production statistics: NDIC data vs. the EIA reports (kb/d)

as Shallow Sand pointed out:

“It surprised me that production in ND didn’t fall much when Mr. Helms stated there would be a dramatic drop.”

From an article in Bismarck Tribune:

“Next round of N.D. oil production figures ‘going to be bad,’ Helms says

May 4, 2016

http://bismarcktribune.com/news/state-and-regional/next-round-of-n-d-oil-production-figures-going-to/article_5633c44e-09a9-5d3c-a47c-664f43dfd9cb.html

Early March oil production numbers show that North Dakota will likely drop below 1.1 million barrels per day for the first time since June 2014, the state’s top oil regulator said.

An official update will be released next week, but Director of Mineral Resources Lynn Helms told an oil industry group in Williston he expects to see a “severe” production drop.

“It’s going to be bad,” Helms told the Williston Basin chapter of the American Petroleum Institute Tuesday night.”

In fact, the decline was not as big as was expected and total ND oil production (incl. conventional) in March was 1109 kb/d.

The chart below does not show any acceleration in monthly decline rates:

Year-on-year and month-on-month growth/decline rates in Bakken North Dakota oil production (%)

Might be a slow decline, however, a parabolic increase in the Misery Index was one result after the price bust.

When wells are shut, the lease expires, no longer held by production.

No?

Hi R Walter,

Generally speaking, an OGL that is past its primary term must produce oil and/or gas in “paying quantities” with no cessation of more than xx days (depends on lease language) to continue to be held in effect. There are many ways an operator can handle this situation by producing just a few days a month. An operator can pay a “shut-in gas” royalty to defer a production obligation in certain circumstances. Each situation is different and requires its own analysis.

An operator is not required to show that a well or leasewell is capable of “paying out” it’s cost of the lease, drilling and completion, gathering, treating facilities and so forth.

The important issue is that a well or lease must be capable of producing oil or gas in “paying quantities”.

Generally speaking (in Texas anyway) a lease must generate cash flow in excess of its monthly cost of production. $1 over that monthly cost is sufficient. Naturally, each operator’s cost are different and each lease/well is different.

In my opinion, many wells are “magically” producing just enough oil and gas to generate a marginally positive cash flow. Why you ask? To avoid plugging and abandonment until a greater fool comes along to buy the lease and allow the current operator to get off the hook.

I know of one case where SandRidge Energy (Arena Acquisition) drilled 52 vertical wells in one 640 acre section. Each well is capable of producing 1-2 bbls/day. Payout will never happen and I doubt that production in paying quantities is happening. I also doubt that a greater fool exists to take over this lease

But…… someday someone (perhaps you) will be on the hook to plug and abandon and restore the surface to its original condition.

Thanks for the post Ron.

@Alex,

coming back to your comment at the end of last post:

”

The chart below shows that both the EIA Drilling Productivity Report and the EIA/DrillingInfo monthly LTO production statistics tend to underestimate the resilience of tight oil production, at least in the case of the Bakken. The EIA estimates for February and March will likely be revised upward. I think that even bigger upward revisions will be done for the Eagle Ford.”

The small declines in Feb & March is indeed surprising. Based on the new well count, and on 2015 1H well profiles, I expected declines around 20-25kbo/d. It does appear that the average well that started in the 2nd half of 2015 behaves quite differently, peaking for a few months longer than usual. This is caused for a large part by wells from Burlington, XTO, CLR & QEP. That has messed a bit with my projections, and probably also the EIA. If those wells had behaved more like earlier wells, ND production would be at least 20 kbo/d lower in March.

Questions in my mind now are:

1. How will these “higher for longer” flow rates behave over the next couple of months?

2. Will we see the same behavior in all new wells?

3. Will we see something similar in other basins?

I think you could be right about those upward revisions. To me it shows that there is quite some new uncertainty caused by these changing dynamics.

Enno,

Thanks very much, that’s really surprising.

Perhaps they are using some new completion techniques?

Will try to find something in companies’ presentations.

Hi AlexS and Enno,

Perhaps its just a sharper focus on the sweet spots and only completing the “best” wells has shifted the average well profile over that period.

Great comment, Enno, as ever. It’s important to remember that the EIA’s forecasts seem to generally be very “smooth”, and their models are mostly done at an economic level, meaning they aren’t working from number of wells upwards. This meant they completely missed the beginning of the production decline – their initial forecasts kept on adding ~30kbpd a month to Bakken until April15, for example. Now they are a little to heavy to the downside.

We just did some work on the EIA/IHS report on well costs that came out a little while ago. We suspect that these longer peaking wells may be possible due to lower service costs. Operators have switched to natural sand, and lots of it. Not being an engineer, this is only an educated guess, but the general gist I can gather is that natural sand crushes more easily than artificial ceramic proppant, but is significantly cheaper.

Our assumption on the interests of operators like CLR and WLL is that they currently want to maximise short-term production to boost revenue, and they care significantly less about maximising recovery. Using lots of natural sand fits in with that – though the sand will be crushed more quickly than if artificial proppant will be used, more fractures will be propped open in the short term.

Many of these short term production gains may be given up shortly after any price increase, as the service costs will also rise, and the short term revenue considerations will become less important. That’s the theory we’re working under currently, anyway…

The decline after peak of new wells appears to be significantly steeper than previous years, so when companies claim 40% IP increase = 40% EUR increase, one should be extremely skeptical. By month 7 of production, the average 2014 well had produced 18% more oil than the average 2010 well at the same stage of its life – but by month 26, that difference was down to 7.6%. In month 3, the average 2014 well had produced nearly 9% more than the average 2013 well – by month 26, that was down to 2%. Those are total cumulative oil produced figures, btw.

HAYNES AND BOONE, LLP OIL PATCH BANKRUPTCY MONITOR May 1, 2016

http://www.haynesboone.com/~/media/files/attorney%20publications/2016/energy_bankruptcy_monitor/oil_patch_bankruptcy_20160106.ashx

Hi Ron,

In your opinion will the Saudi’s and Russians be able to significantly ramp further production capacity as they threaten?

I’m not Ron, but this is my view:

Russia is not planning to significantly ramp production capacity.

Energy Minister Novak said today that the country will be able to maintain long-term production levels within the range 525-545 million tons per year (10.5-10.9 mb/d). That’s what Russian officials were saying earlier.

According to the Saudi officials, planned expansion of the Khurais and Shaybah oil fields will only

compensate for falling output at other fields. They claim that the country’s “maximum sustainable output capacity is 12 million barrels per day and the nation’s total capacity is 12.5 million bpd”, but there are no plans to increase capacity and there is no evidence that this capacity really exists.

I think that in reality Saudi Arabia is able to increase crude production from the current 10.2 mb/d to 10.5-10.6 mb/d during the peak season for local demand in the Summer, but not well above those levels.

The Saudis aren’t stupid, they’re good businessmen, and they have sent a lot of younger sons to excellent universities in western countries. So there can be no question they understand that their survival as a prosperous country depends on getting away from oil.

My personal guess is that they are tied up in knots , internally, from the political point of view, so that just getting STARTED on the necessary transition is a hell of a job.

But oil prices will go back up again, barring either a totally bed ridden world economy, or miraculous breakthroughs and growth in alternative energy and electrified transportation, etc.

I am ready to make a substantial bet that within a year of the time oil hits eighty bucks again and stays there for a year that they will announce bidding on contracts to build some giant solar farms. They can do that, and sell the oil they presently burn to run air conditioning at a substantial profit after that.

Solar power is HERE when it comes to oil and places with a good solar resource.

But on the other hand, they have to balance off the big savings on building those solar farms due to the cost of solar power going down year after year against the savings.

I have put off buying a solar system for my place for that very reason. I can’t save enough this year on the juice to offset the cheaper price of buying next year.

If the calculus falls out the same way in other oil exporting countries with hot dry climates, this might mean there will be a couple of million daily barrels or even more available for export than would be the case otherwise.

Incidentally has anybody here run some numbers on how much it would cost them to build and run some coal fired plants in order to conserve oil for export?

You mean the “excellent” universities like Harvard where all they do is concoct ponzi schemes for themselves and recommended to give away heavy manufacturing because it was obsolete? Naturally they preach the Gospel of Solar. The Mighty Solar Cell shall set us free!

Isn’t it obvious by now that The Service Economy Hoax is a code for “We’re broke”?

Or that the Web 2.0 bubble is a continuation of Dot-com fraud?

Idiots gawking all day long at flashing pixels and posting pictures of their dogs?

Would someone please shut down all these useless universities and the educated freeloaders that inhabit them.

Hi Ponzi,

YES, by all means excellent universities such as Harvard, Yale, Princeton, Oxford,MIT, Cal Tech, the University of Chicago, even my own “cow college” land grant university.

Such universities generally have colleges of engineering, physics departments,geology departments, colleges of the life sciences, colleges of agriculture, etc, although judging from your comments it seems you are less than well informed about the existence thereof.

The Gospel of Solar and the Mighty Solar Cell may not set us free, but continued reliance on depleting fossil fuel absolutely guarantees we go back to the horse and mule era.

Production capacity can be ramped with a press conference.

Both Saudi Arabia and Russia are producing flat out. There is no spare capacity in any country in the world except in places like Libya and Nigeria where production is cut by war and civil unrest. Production could be increased in Venezuela if peace and prosperity were to happen there. But that is extremely unlikely.

Iran is ramping up production and will soon be back to pre-sanction levels.

Most of Saudi Arabia’s old fields are in steep decline. They are increasing infill drilling in Khurais and Shaybah in an attempt to compensate for this decline. And for a while they might succeed in doing this, but not for very long.

Hi Ron,

What is the evidence for “steep decline” in the old Saudi fields, there are a few that are certainly declining especially in the northern part of “Ghawar” (which is actually several fields grouped together)? Also how do you define “steep decline”, the average decline is 6.5% with no new wells drilled, so would 6.6% decline be considered “steep”.

As far as I know we have very little data on output from individual Saudi fields, so I would assert that we don’t know what the decline rate is for the old fields in Saudi Arabia.

Dennis, yes 6.5% would definitely be considered steep, especially when it is happening despite massive infill drilling.

I have posted this link many times.

“Saudi Arabia’s Strategic Energy Imitative: Safeguarding Against Supply Disruptions”

8% to almost 2% depletion.

http://www.csis.org/media/csis/events/061109_omsg_presentation1.pdf

Unfortunately the link has since been taken down.

This was a Saudi organization that posted this link in 2006 stating that all Saudi fields had an average natural decline rate of 8% but with their infill drilling program they had gotten the decline rate down to just above 2%. That was 10 years ago.

So do the math. Say a natural decline rate of 8% but with infill drilling… that is pulling the oil out a lot faster… they had gotten the decline rate down to almost 2%. What would the depletion rate have been?

This is from the EIA’s Saudi Arabia country brief. This was posted several years ago but has since been replaced.

One challenge the Saudis face in achieving their strategic vision to add production capacity is that their existing fields experience, reportedly on average, 6 to 8 percent annual “decline rates” (as reported by Platts Oilgram in 2006) in existing fields, meaning that the country needs around 700,000 bbl/d in additional capacity each year just to compensate for natural decline. Decline estimates for Saudi Arabia vary widely, however. The Ministry of Petroleum maintains that decline rates in Saudi Arabia are around 2 percent annually.

Really Dennis, don’t you think that if Saudi fields had a natural decline rate of 8% 10 years ago, but managed to reduce that to 2% by sucking the oil out a lot faster, that the decline rate should be a lot higher today?

Hi Ron,

No not necessarily, and as far as the decline of the nation as a whole, a Hubbert Linearization suggests a URR of 310 Gb and usually the HL results in an underestimate of the eventual URR. At the end of 2014, KSA had cumulative output of 138.5 Gb, and about 142 Gb at the end of 2015.

If we assume the peak is near 50% of eventual URR, that 310 Gb is correct, and output remains at 2014 levels from 2015 to 2019, then the peak would be 2019. Decline from that point would not necessarily be steep, assuming there is adequate demand.

As to whether the decline rate is higher today depends on many factors, I said that I don’t know what the decline rate is, and you can speculate that it is steep, I could also speculate that it is not, but I won’t. We don’t know.

Dennis, Jeesus H. Christ, you have to be joking! A natural decline rate of 8% is what it is, a natural decline rate of 8%. To try to spin that into something else by using Hubbert Linerazation, or whatever, may spin it into something more desirable, but it does not change the facts that all of Saudi’s old fields have a natural decline rate of 8%. End of story. Pumping it all out early will only lead to a Seneca Cliff later on.

Hi Ron

I don’t agree with the 8% natural decline estimate. There have been lower estimates. Probably 6% would be more reasonable.

Dennis, that 8% decline rate was Saudi ARAMCO’s estimate. I know they lie a lot but it is just not like them to lie on the pessimistic side. But when they said they had gotten the decline rate down to almost 2% with infill drilling, now that might have been a lie.

At any rate that “almost 2%” was 10 years ago. There is no way it is still “almost 2%” today.

Oh, one more thing. That 8% was just an average. What they actually said was their fields had a natural decline rate of from 5 to 12%. That would average out to be 8.5% but they rounded it off on the optimistic side.

Also that 5 to 12% was also 10 years ago. With massive infill drilling keeping production high but depletion higher as well, there is no way it is still 5 to 12% today.

But I do understand, you disagree with ARAMCO’s estimate. You think ARAMCO is either lying or totally incompetent. Okay Dennis, I know where you are coming from.

Edit: The decline of the world’s major oil fields

Aging giant fields produce more than half of global oil supply and are already declining as group, Cobb writes. Research suggests that their annual production decline rates are likely to accelerate.

By Kurt Cobb, Guest blogger APRIL 12, 2013

Snip.

5. Now, here’s the key insight from the study. An evaluation of giant fields by date of peak shows that new technologies applied to those fields has kept their production higher for longer only to lead to more rapid declines later. As the world’s giant fields continue to age and more start to decline, we can therefore expect the annual decline in their rate of production to worsen. Land-based and offshore giants that went into decline in the last decade showed annual production declines on average above 10 percent.

What Cobb is saying is that while technologies keep the decline rate low early, it can only increase the decline rate later. Hell, that is just common sense. But then common sense don’t count for much these days.

Dennis, you would not believe 8%. Would you believe 10%?

A Seneca cliff aroundabout now on the world’s largest fields?! 🙁

Hi Ron,

A study by the IEA in 2008 suggested about 3 to 5% decline rates for supergiant fields (URR > 5 Gb).

See

http://www.theoildrum.com/node/4820

I think Sam Foucher’s 2009 scenario may have missed the potential for reserve growth. His scenario had about 62 Mb/d for 2015 and in the comments some thought the scenario was too optimistic. To be honest it looked pretty good to me at at the time. None of us could have foreseen LTO growth at the time, but this only accounts for an extra 5 Mb/d, still leaving us 12 or 13 Mb/d short of actual 2015 output.

There are many different opinions on this that one can find. I don’t know what the output of individual Saudi Fields are, so I cannot determine what the decline rate is, I will leave the speculation to others.

Dennis, I don’t like to speculate and pay little attention to what other’s speculate. But when the Aramco Senior Vice President Abdullah Saif, says their fields have a natural decline rate of 5 to 12 percent, I see no reason to think he was lying.

Of course he also said, a bit later, that via their drilling program, (infill drilling). they had gotten this decline rate down to almost 2 percent, then I believe that also. But that was ten years ago.