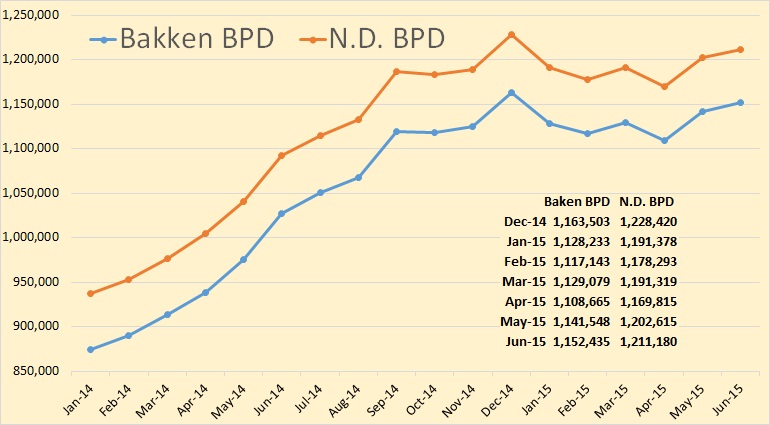

The Bakken Production Statistics and the ND Production Statistics with June production numbers has been published.

Bakken production was up by 10,887 barrels per day to 1,152,455 BPD while all North Dakota production was up by 8,565 barrels per day to 1,211,180 BPD. Bakken production is still 11,068 bpd below their December high while all North Dakota production is still 17,240 bpd below their December high.

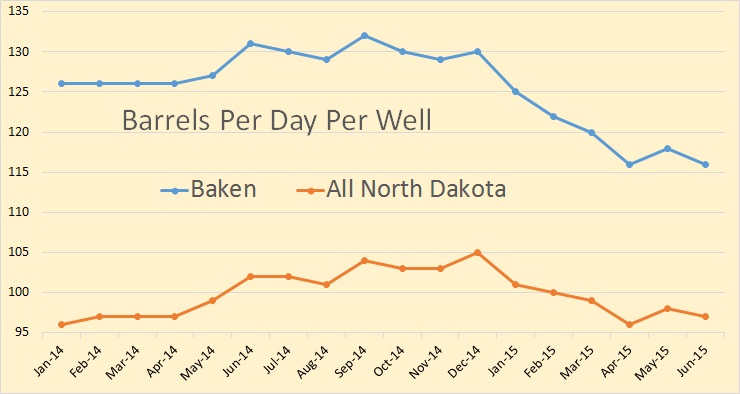

Bakken barrels per day per well dropped by 2 to 116 and all North Dakota barrels per day per well dropped by 1 to 97.

From the Director’s Cut, bold mine.

May Producing Wells = 12,679

June Producing Wells = 12,864 (preliminary)(NEW all-time high)

May Permitting: 150 drilling and 0 seismic

June Permitting: 192 drilling and 0 seismic

July Permitting: 233 drilling and 1 seismic (all time high was 370 in 10/2012)

May Sweet Crude Price = $44.70/barrel

June Sweet Crude Price = $47.73/barrel

July Sweet Crude Price = $39.41/barrel

Today’s Sweet Crude Price1 = $28.50/barrel (lowest since December 2008)(all-time high was $136.29 7/3/2008)

May rig count 83

June rig count 78

The drilling rig count dropped 5 from May to June, 5 more from June to July, and remains unchanged this month. Operators are now committed to running fewer rigs than their planned 2015 minimum as drill times and efficiencies continue to improve and oil prices continue to fall. This has resulted in a current active drilling rig count that remains 5 to 10 rigs below what was operators indicated would be their 2015 average if oil price remained below $65/barrel. The number of well completions rose sharply from 116(final) in May to 149(preliminary) in June as a large number of NC status wells reached the 1 year deadline for completion, or TA approval. Renewed oil price weakness anticipated to last well into next year is by far the main reason for the continued slow-down. There was one significant precipitation event in the Williston area and a separate one in the Minot area, 5 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

At the end of June there were an estimated 848 wells waiting on completion services, 60 less than at the end of May. The current rig count plus NC well inventory is sufficient to maintain 1.2 million barrels of oil per day for 24 months.

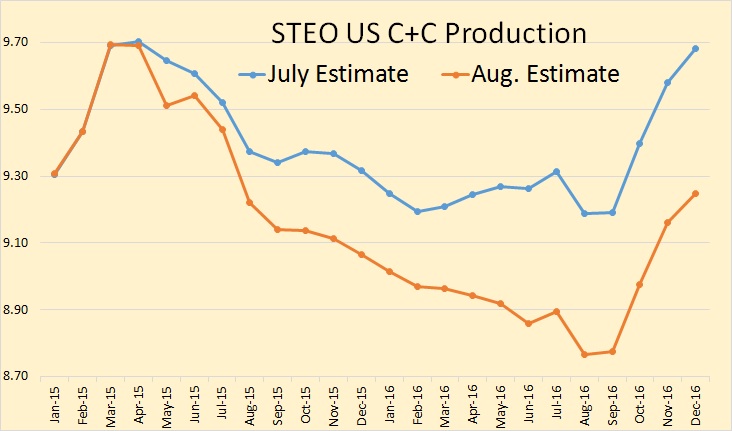

This does not jive with the EIA’s latest predictions for US production through 2016, data below.

The EIA’s Short Term Energy Outlook came out a few days ago. There was one big surprise.

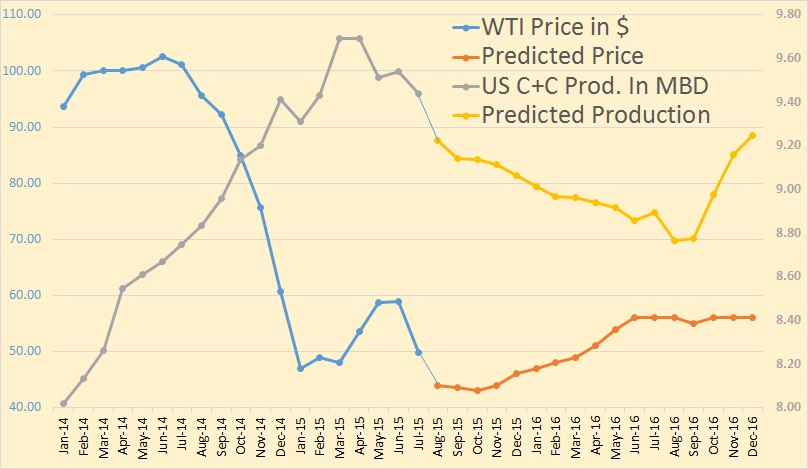

The EIA has, quite dramatically, downgraded its future US production expectations. The average C+C production, for the of 2015, had been revised downward by only 120,000 bpd but the average production for 2016 has been revised down by 360,000 bpd. The largest change, in future expectations, was December 2016 which has been revised down by 430,000 barrels per day.

The EIA predicts the decline continues through the third quarter of 2016 then production will start to surge upward again. I have no idea why they think this will happen as they are expecting no such increase in the price of oil.

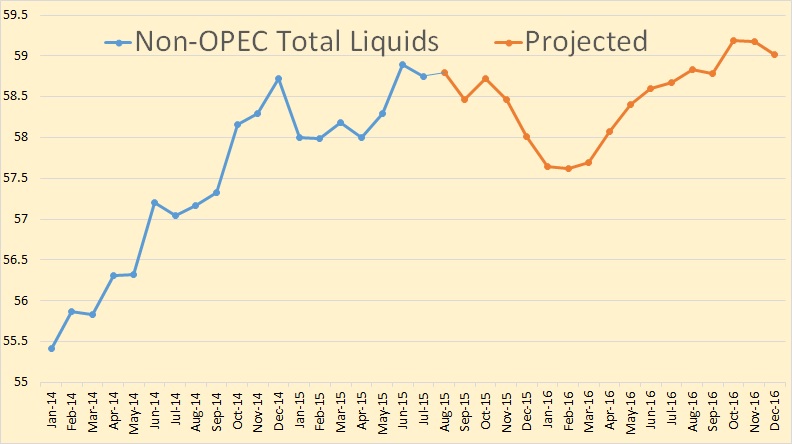

The EIA does not think 2015 will be the peak as far as non-OPEC total liquids are concerned. They have 2014 non-OPEC total liquids averaging 58.38 million barrels per day and have 2016 total liquids averaging 58.48 million barrels per day. Well that’s this month’s projection anyway.

This chart is Total Liquids, not C+C like the two charts above it. While the EIA lowered its 2016 average US C+C expectations by 360,000 bpd they only lowered their Total Liquids averaged expected production by 330,000 bpd. But that does not mean they lowered World or Non-OPEC Total Liquids or by the same amount.

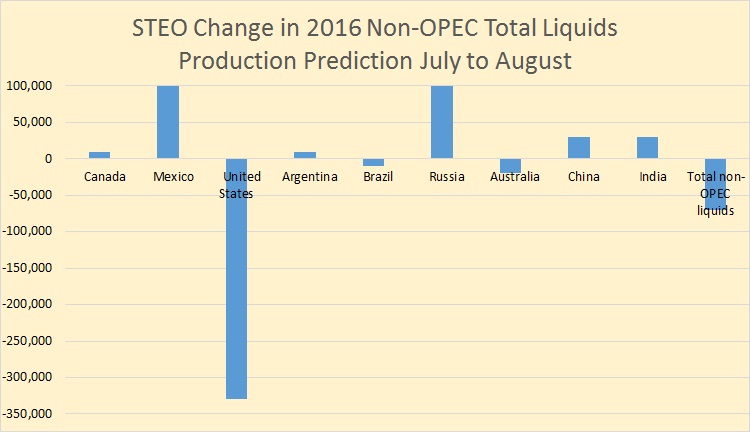

The above chart shows all changes in the EIA’s Total Liquids predictions from the July STEO to the August STEO. Only the nations in the chart above had any changes July to August. They increased their Total Liquids prediction for Mexico and Russia by 100,000 each and decreased their total Non-OPEC Total Liquids prediction by 70,000.

All this just shows that the EIA can, rather dramatically, change their outlook for oil production, for any nation, from month to month. Who knows what their outlook next month might look like?

My point is not to knock the EIA for their changing predictions but to point out that we should not put too much value in them because they are mostly just wild ass guesses, subject to change from month to month.

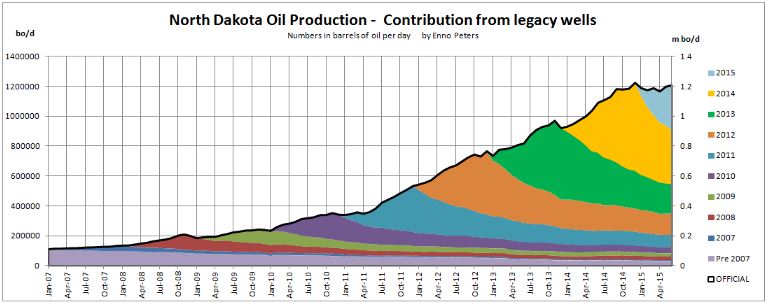

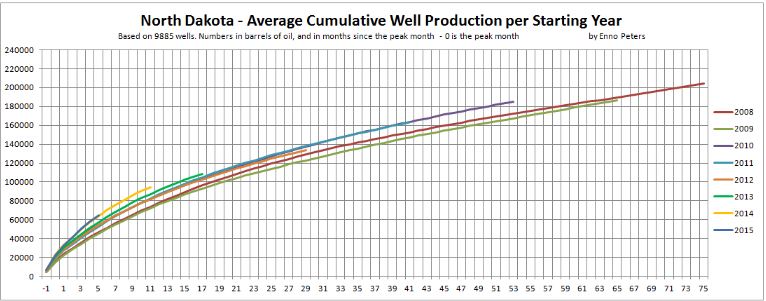

All the following text and graphs were posted by Enno Peters:

I have updated several charts, and will mostly let them speak for themselves.

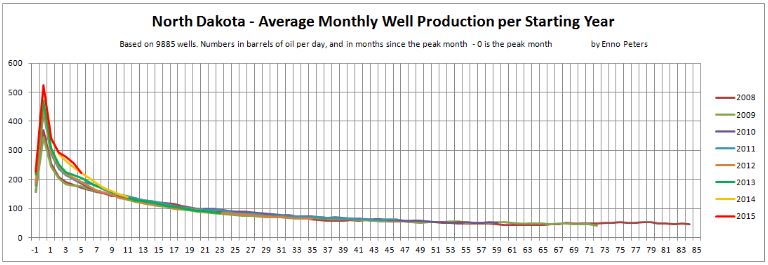

Lynn Helms mentioned during the last webinar that wells starting in May 2015 produced about 25% better than wells starting in May 2014. I can’t find support for this in the data:

The most important improvement during the last years was a (slight) increase in initial production, while production after a year of operation is trending remarkably similar with earlier years.

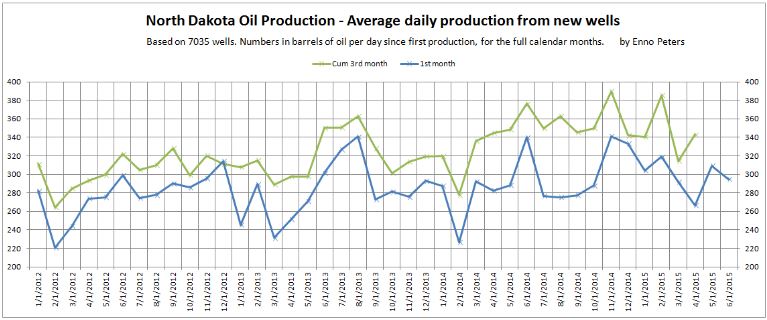

In the following graph we can see the average production for new wells, for the full calendar month (as no accurate information is available regarding the number of producing days). The blue line shows the average production during the 1st month of production, while the green line shows the average production during the first 3 months of production. This graph shows more clearly that 2014 wells produce initially a bit more than 2013 wells, but from 2014 onwards there has been no significant improvement any further. This is surprising, as some high grading effects since the price drop should be visible by now.

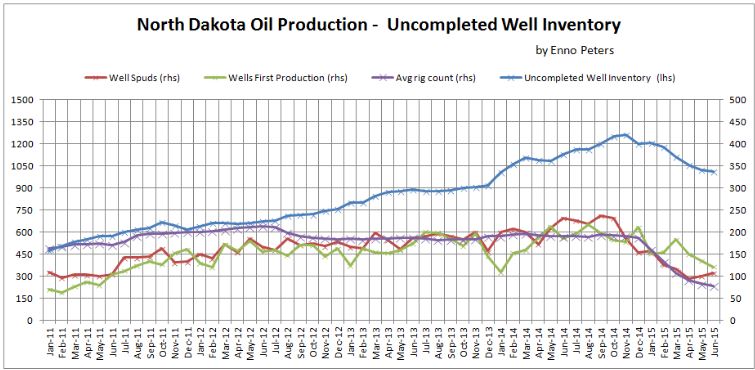

The following chart shows the new number of well spuds (red), and wells starting production (green), per month. Also the average rig count per month is shown (purple), which tracks well with the number of wells spud. Only recently the number of new wells spud per rig is going up, probably because better rigs/crews are still working, and because of improved operations due to fewer rigs. The blue line tracks the wells that are spudded, but not yet producing (=uncompleted wells). Maybe not all of these spudded wells will be completed, but so far their status does not indicate otherwise. This uncompleted well inventory includes normally a working inventory of about 4-5 times the wells spudded in a month (the typical lead time from spud to production). Therefore, I estimate that about 450-550 wells from this inventory are in excess of a normal inventory, and may have to come on line in the coming year.

Note : the completion numbers from the Director’s cut are highly unreliable, as can be seen by comparing them from the Director’s cut with the numbers from the annual statistics report. A much more reliable way is to use the number of wells having first production, which historically (comparing them with the annual statistics reports) also tracks the actual completed wells very closely.

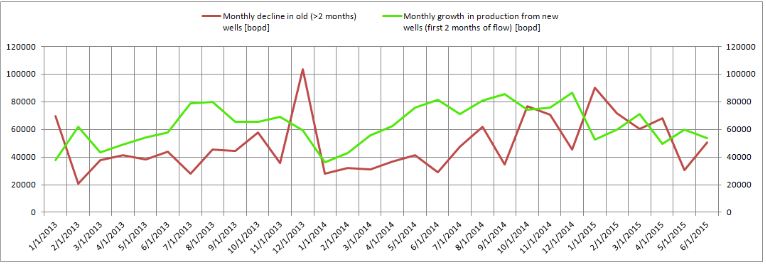

The following graph shows the monthly contribution to the overall oil production in ND from new wells (growth during first 2 months of production), and the decline in older wells (> 2 months). The difference is the monthly growth/decline in total ND oil output. A small difference with the actual numbers is caused by service wells and wells not individually reported. What this chart shows is that after May (in which there was quite a large growth in production ), the growth in June has almost stopped, due to less growth from new wells, and more decline from old wells.

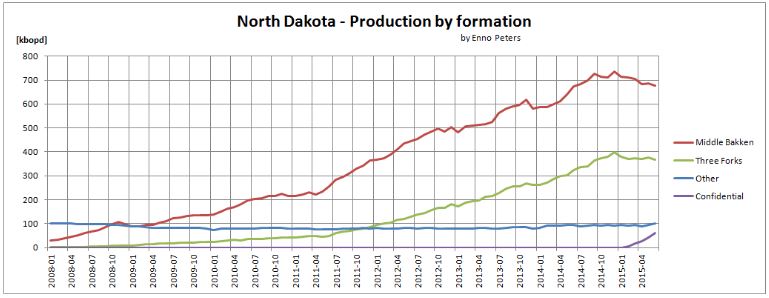

The following graph shows that oil production from the Middle Bakken formation peaked in December. I belief it is likely that this will proof to be the final peak, as the absolute number of new Middle Bakken wells already peaked in 2012, and recently the ratio of Three Forks wells vs Middle Bakken wells is going up. This is important as, historically, Three Forks wells produced on average about 15% less than Middle Bakken wells, and the Middle Bakken formation has been the major driver behind ND production so far.

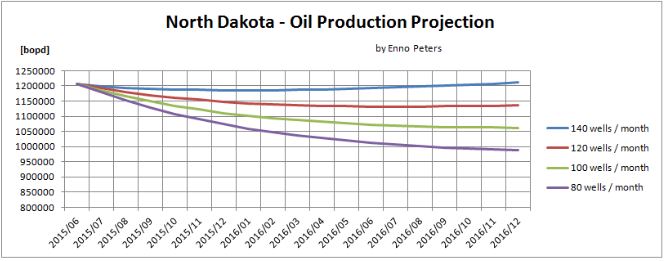

Finally, a projection of what kind of oil production can be expected from North Dakota, based on 4 different scenarios, shown by the number of new wells per month, from July onwards until end of next year. Currently about 100 wells are spudded per month, and in the current price environment I find it hard to belief that wells are drilled without plans to complete them. This number may drop, but there is still an inventory of not completed wells. Therefore, I think the most likely projection is between the green and blue line, at least for the coming 6 months, which means that by year end ND should produce between 1.1 and 1.2 million bpd.

___________________________________________________________

Note: If you would like to receive an email notice when I publish a new post, then email me at DarwinianOne at gmail.com .

Don’t they have to put in something optimistic somewhere in their projections or be forced to admit the future of oil doesn’t look so good?

ND June report is bearish for oil prices, as if any further bad news were needed. Flat production through June, 2017 will be financially bad for all US producers.

Note current posted price of $28.50 is the lowest since 2008.

It appears rig count in ND has stabilized at about 72-75. I think CLR and WLL both indicated they may pull a couple each.

Just too much backlog, plus too many rigs still running.

I know where we will be at with another 24 months of realized oil prices in the high 30s.

Where will the Bakken drillers be financially?

Well put on in June (we will assume it is a good one, cost just $7.5 million, including all equipment, and 100% gross working interest, 80% net working interest. Further assume differential is just $8. Also assume gas is $2)

182,500 gross oil barrels sold, 182,500 gross gas sales.

182,500 x .80 x $34 =$4,964,000.00

182,500 x .80 x 2.00= $292,000.00

Less:

Severance taxes = $525,600.00

OPEX at $6.00 BOE= $1,021,998.00

G &A at $2.00 BOE = $340,666.00

Pre tax and pre interest net $3,367,736.00

Assume 1/2 financed with cash flow from other operations, 1/2 financed from debt at 5%.

Interest expense = $375,000.00

Deficit after two years, exclusive of income taxes.

$3,367,736.00 – $375,000.00 = $2,992,736.00

$7,500,000.00 – $2,992,736.00 = $4,507,264.00

I will bet I am painting a very rosy scenario. It is likely far worse for most wells and companies.

The state of ND really needs to relax the one year completion rule and possibly limit both drilling and completions. I think it would be in their citizens best interests at this point in time.

That, or pray for an OPEC cut.

Thanks for this very helpful math exercise. What percentage of the total lifecycle production do you figure comes in the first 2 years? I presume a hefty majority given the decline curves.

Really do not know what an accurate EUR is for Bakken. Companies say 775-800K BOE. On this site I read 350-450K BOE.

Keep in mind, those EUR assume well life of 30-50 years.

I think the guys here who are on top of things are showing 190K to 220K oil first 60 months. So I have set forth a very strong well.

I think first five years is most relevant. After that, will be lucky to sell more than 15-20K BOE per year. OPEX likely to range between $15-$60 per barrel of oil.

This is a real cluster, isn’t it?

Distribution of crude oil EURs in North Dakota Bakken (kbbl/well)

Source: EIA Annual Energy Outlook 2014

Thanks AlexS. I knew I was being very generous.

Pretty bad when a top 10% well is an economic train wreck.

Shallow, look at the graph showing oil, water, and gas within the post. It shows gas continuing to increase, water seems to be increasing as well. This is a reasonable behavior for a depletion drive in a very low permeability dual porosity system.

If we move forward in time individual wells will tend to have increasing water cut which may eventually remain steady, but gas to oil ratio should increase to such a high level that pumping the well becomes very problematic (the pump starts compressing gas an overheats or locks). There are solutions but they don’t come cheap and there’s nothing we can do to keep rates up. Wells like this just seem to come down to 5 to 20 BOPD and are a hassle to produce.

I’m pretty sure most of you know this problem, and I was wondering if there’s something new over the horizon. I’m afraid that a low productivity well like this will just have to be shut in periodically to allow fluid build up. The implication is a very low marginal rate for a long time.

This means somebody ought to get their behind in gear and explain to North Dakota state authorities they really shouldn’t be ordering well abandonments for marginal wells. Once oil prices increase these wells maybe can be milked slowly.

Fernando. The big problem will be handling the produced water economically.

Elm Coulee field in Eastern Montana was developed primarily between 2004-2007. The wells there produced like you describe, 5-30 barrels of oil per day. The wells in Elm Coulee tend to produce very little water, 1-5 barrels per day. Therefore water disposal does not appear to be a big issue.

In ND Bakken, it appears that produced water rates in older wells tend to be higher, and more variable. There appear to be few wells tied into salt water disposal wells by way of piping. Therefore most produced water is truck hauled, which is not cost effective if oil prices are low. For example, a well producing 600 barrels of oil and 2000 barrels of water, per month, which is truck hauled, has a tough time at $28 oil prices.

Of course, the tough part will be paying for down hole failures on these wells. It appears pulling the rods and changing the pump costs $30K and pulling the tubing adds another $40K, so $70K to repair a tubing leak. These prices may come down, but I am sure 10,000′ wells get expensive.

I think economics for a 20 bopd ND Bakken well could look like this, assuming 20 mcf gas is sold, $34 oil price, $2 gas price, .80 net revenue interest (NRI)

Oil sales. 5,840 x $34 = $198,560

Gas sales 5,840 x $2 = $11,680

OPEX (excluding down hole failures) $120,000

Down hole failures 80,000

Severance taxes 21,024

G&A 42,048

Loss (pre interest). $52,829

Of course, if oil goes back to $80, this well can be very profitable.

It depends greatly on down hole failure rates. None or one per year, maybe ok. More than two will make things tough.

The question, of course, is how do companies pay billions of principal plus interest off the backs of these wells.

Furthermore, at the present strip, these wells have no PV10 value unless one just plugs in $6 per BOE for OPEX. I’d like to see the engineering at year end on these wells.

Fernando, thank you. I hope your post is not lost in obscurity. Please see my remarks to Enno down hole about increasing GOR.

I have suggested many times in the past here on POB that I am suspicious of shale oil EUR tails and that much of that suspicion has to do with the practical problems associated with producing low fluid entry, high GOR wells on rod lift at 9000 feet TMD 20 degrees from vertical. It is a nightmare. You have to have done that sort of thing to know how much of a nightmare. It will be interesting to see if it can even be done, period.

If WOR continues to increase in these Bakken wells then it becomes an economic nightmare and very oil price sensitive as to how long those wells can go before reaching economic limits.

As these wells get older, operating expenses will go up and oil prices will have to be much higher than they are now to avoid economic limits. If 70% of the well’s total UR is recovered within 5 years, the remaining 30% is questionable to me. That creates a real big, fat question mark on equity and just what there is to “sell” to be able to get out a bind. Or who might want to buy the stuff. To quote Fernando, this is all very un yahooey.

Fernando’s post is a perfect example of how difficult it is to analyze data, or model data, or make predictions about the future without understanding what is actually going on in the field.

Mike

Mike,

Congratulations: you got your Blue back.

Things will only get better!

Syn, it’s not a promotion, I assure you. Actually, its weird; it gets blue above $42.00 a barrel and black below $41.67. I probably ought to be worried, now that you mention it.

Mike

It looks like 120-130 barrels of oil in the first 24 months. So if we plug in 130K barrels of oil and adjust down severance taxes accordingly, after 24 months in the above example, the operator is still behind $5,792,464.00.

A significant portion of the water increase is due to the more frequent use of slickwater fracs. Whereas 80k/100k barrels of water was common in the past, newer completions regularly use 200k/400k barrels, and even after the flow back, this elevated amount of water re surfaces.

Since the stabilization policies were implemented in the Bakken a few months ago, the removed volatile components both reduced the amount of ‘oil’ and added to the ‘gas’ figures.

Where are the NGL removed from the oil? The last time I worked in the USA we stabilized at a plant, fed the stabilizer overhead to a plant where the C2 plus was reported as NGL. We kept separate NGL reserves. The difference between oil as found in the reservoir and the stabilized crude was the oil formation volume factor.

Does North Dakota keep a separate NGL record the operators use to estimate royalties and other taxes?

Fernando

Your questions just prompted me to do a lot of digging as I have not been keeping too close a watch on this stuff the past several months. What I found (subject, perhaps, to some error) …

Big distinction between ‘conditioning’ (which is what is happening) and ‘stabilization’.

Process is occurring on site or nearby centralized storage area.

Only 7% (hard to believe) of a Bakken wells do not yet have gas gathering lines.

Oneok is the big dog in the area with gathering lines, takeaways, and processing plants.

Oneok started ethane recovery in June and now transports over 100,000 barrels a day of NGLs from the Bakken. (That number seems extremely high, but Oneok stated the number should increase to 105,000 bbls by year end.

Oneok is connecting several hundreds of new Bakken wells to their gathering system on an ongoing basis.

Although I looked, I could find no distinction regarding NGLs either in a financial context nor production categorization.

If the numbers are truly that large (1.6 Bcfd gas, 100k bbls NGLs, some separate description will likely be forthcoming.

The #s sound ok for rich gas. I find 7 % of wells to lack gas connections to be borderline criminal. As I mentioned before, North Dakota seems to be run below the lowest standards I’ve seen in over 15 years. That place is like the USSR or the old Middle East when it comes to gas handling and facilities layouts.

The state of North Dakota seems to have a very yahooey government. They need to tour Angola, Gabon, and Azerbaijan to get an idea of how to keep their chaos in better shape.

The beauty of democracy and bureaucracy is gridlock.Gridlock keeps things from changing very fast.This is probably good over time and on average- but not so good when the ship of state is headed directly for the rocks at full throttle.

Then it’s almost every body in the bureaucracy working feverishly to preserve his little bit of turf with only a handful of guys trying to reverse engines.

There is a saying in secretary land- businesses run in spite of management, rather than because of it.

Rock man on the other forum used to say they should all have just copied texans’ regs from start to finish

Were states companies ND could have just hired away a few top folks for a few tens of millions and presumably saved their t citizens multiples of that

The EIA’s prediction for Mexico is pretty wild, given that PEMEX says their crude production for June averaged only 2.247 million BOPD, and on July 31 PEMEX lowered its production forecast this year to 2.288 million bpd from 2.4 million bpd.

So PEMEX is revising downward, while the EIA is revising upward.

Maybe the EIA is counting on all that massive new private foreign investment in the indudustry that Hillary Clinton promised if Mexico would change its laws so as to allow for private investment in the business?

Given that the first lease sale was a total bust, it looks like all Mexico’s gonna wind up with is what the little boy shot at.

I keep seeing the EIA as a politically driven entity. Most USA government agencies should be considered suspect when it comes to forecasts. And this goes no matter who is in power.

Have you seen any sign that private forecasts (e.g., BP) are any better??

By now it should be pretty obvious to all that the price of oil is politically driven, and has very little to do with all that silly mythology about “free markets” that Adam Smith dreamed up over two centuries ago.

It’s been that way since FDR signed the Connally Hot Oil Act on February 22, 1935. For almost four decades after that, the U.S. government set the price of oil. It did this by limiting the supply of oil so that the forces of supply and demand would act to keep the price of oil up.

Then, sometime in the 70s the U.S. reached peak conventional (read “cheap”) oil. After that the baton passed to Saudi Arabia, and the Saudi government has set oil prices since.

Politics, in other words, and not markets have determined oil prices for the past 80 years.

This political power to set oil prices, however, is not absolute. Volcker demonstrated that, by raising interest rates to almost 20%, he could engineer a prolonged worldwide recession. This caused more destruction of oil demand than the Saudis could cut supply. The Saudis finally threw in the towell, opened the valves, and flooded the world with oil, precipating the oil price crash of the 1980s.

Saudi Arabia will continue to have great political power to control world oil prices until it too reaches peak conventonal oil.

Then oil pricing will enter a completely new paradigm.

Paul Volker

fixed

By now it should be pretty obvious to all that the price of oil is politically driven, and has very little to do with all that silly mythology about “free markets” that Adam Smith dreamed up over two centuries ago.

With all due respect Glenn, I don’t believe you know what the hell you are talking about. The price of oil can be manipulated if and only if you can manipulate supply or demand. Of course OPEC could alter supply and drive the price up. But how does one manipulate demand? Yes, the Fed does have some control over interest rates but that affects everything from beans to automobiles, not just oil. No one in their right mind should suggest that the Fed changes interest rates just to manipulate the price of oil.

People are always spouting off about the government manipulating the price of oil but no one has yet explained how they can do that? Well they have given no explanation that makes any sense anyway.

Suppose there were excise taxes or tarrifs.

And looks to me pretty clear that Argentina’s government defines their price of oil. They aren’t the only subsidy out there either.

You’re somewhat backed into a corner here. There is nothing sacred or pure about a man made substance — money.

how does one manipulate demand?

The US eliminated about 10M bpd in demand by creating fuel efficiency standards (CAFE).

The US kickstarted hybrids with the PNGV program in the 90’s. The California CARB did the same for EVs soon after.

It doesn’t happen overnight, but consumption can be reduced. In the long-term, it can and should be eliminated.

“Yes, the Fed does have some control over interest rates but that affects everything from beans to automobiles, not just oil. No one in their right mind should suggest that the Fed changes interest rates just to manipulate the price of oil.”

They don’t do it because of oil specifically. But the purpose of ZIRP (zero interest rate policy) is to distort the price mechanism to create the illusion of abundance. Interest is the price of money. Money is the claim on future resources and real capital. When you set the interest rate to zero, you are effectively communicating to the market that the price of money is zero, therefore that there is an infinite amount of future resources and real capital to claim. And the result is quite predictable, you get a frantic wave of “investment” into any kind of bullshit that can generate even the slightest financial profit. And if it doesn’t, just borrow more money at zero price and buy more steel, machines, water and all the other stuff you need to drill more. Why not, when the market now thinks all of those things are infinite and therefore free. And now the economy is eating itself from the inside, wasting away decades of accumulated capital and the last reserves of resources, because someone artificially set the price of all those things at zero.

And the result is quite predictable, you get a frantic wave of “investment” into any kind of bullshit that can generate even the slightest financial profit. And if it doesn’t, just borrow more money at zero price and buy more steel, machines, water and all the other stuff you need to drill more.

If only that were true. That’s what the Fed was hoping, but it hasn’t turned out that way. Sure, there’s some stupid investing going on, but not enough, or we wouldn’t be seeing zero inflation.

Nick G,

That’s correct. The Fed has cut the Fed Funds rate to just a tad over 0% for the past 7 years and has implemented quantitative easing, but to no avail.

The private sector is still not lending/borrowing.

I hardly believe that mal-investment, however, is the way out of our economic malaise.

I made a typo on the title of that graph. It should read:

“Total Private Credit Market Debt Outstanding (tens of trillions of dollars) & Federal Funds Rate (%)”

The fact is that the fed has acted out of desperation because the political system is broken. The logical the sane way to increase demand at the zero lower bound is infra structure spending (and any idiot who suggests that the crumbling infrastructure in this country isn’t in need of immediate attention needs to be institutionalized), yet this obsessive crazy focus on public debt at a time when it is private debt that is the problem and the government could never borrow money cheaper is most destructive impulse, the dumbest possible response ever foisted on a gullible public.

Sadly, it’s not stupidity, it’s a deliberate strategy to cripple democratic government, on the part of the wealthy who want to maximize their power.

It’s called “starving the beast”, and it includes deliberately creating large deficits with massive tax cuts, and then using the deficits as an excuse for cutting spending on regulatory agencies, benefits, anything except corporate welfare and the military (which are pretty close to the same, it’s true).

Nick G,

As Galbraith explains:

Consistent with Fisher’s formula…was a terrible possibility. It was that the supply of money could not be increased. The largest part of the supply of money, as by now will be adequately understood, is deposits in banks. If business is sufficiently bad, profit prospects sufficiently dim, gloom sufficiently deep, businessmen may not borrow money. Then no deposits are created, no money comes into existence. The banks can be provided with cash for reserves by purchases of government securities (or agency-issued securities in the case of QE) by the Federal Reserve Banks from the banks of their customers. This cash will then lie fallow in the banks. Without borrowing and deposit creation there is no effect on prices or through prices on production. This, it now developed, was not a hypothetical possiblity but one that was intensely miserably real.

Galbraith is like most other professionals who know every damned last little detail about the SYSTEM they specialize in as it is currently organized and regulated- but apparently NOTHING about the BIGGER picture.

Economists tend to be like that more so than any other sort of professional imo.

They can’t imagine any sort of monetary system other than a central bank of some sort operating under the rules they are familiar with, with the banks being able to loan out money they do not actually HAVE.

OR MAYBE I should say they ARE capable of thinking outside their conventional box but simply refuse to do so and maintain that their box is the only one possible.

There is no reason at all that the government – Congress and the executive – cannot do away with the current system and create a new one.

The government could for instance simply print some greenbacks – WITHOUT ANY BANKING involved except plain old clerical bookkeeping – and declare them legal tender. Such money could circulate just as well as checks and in fact could be held in bank vaults to be used to redeem checks anytime somebody wanted to do so.

I have NOT claimed such a system would WORK very well- there are plenty of reasons it would not. But the system we have now does not work so awfully well either- does it?

The government could actually print dollars -physical dollars on paper- and use them to pay for all or most government purchases and services in instead of collecting taxes and spending the taxes.

The biggest temptation would be to print too much- but sometimes existing banks create too much money. No REAL difference there, other than who is in the drivers seat.

I could take as this legitimate cash to a bank and deposit it and write checks against it- and the checks could circulate without most of the people writing and cashing them ever actually asking for actual physical dollars.

The supply of dollars could be as large as deemed necessary.

There is nothing fundamentally sacred about fractional reserve banking and lending – although many people tend to think of it as holy writ.

OFM,

I think that’s right.

But one has to remember that Daddy Galbraith (he has a son who is also a famous economist) operated in the Keynsian tradition, and the reality is that Keynsians, despite all the charges to the opposite, came to save capitalism, not destroy it.

A monetary system which you describe, whereby the government just prints money and spends it into circulation, is advocated by some, but not all, of the various monetary reform movements. Most are still very much entrenched in banking school teachings, but a few are not.

But would such a system — where the preponderance of the money creation power resides in the state and not the private sector — still be capitalism?

Some assert that those who have the money creation power have the most powerful positions in a society. I tend to agree, at least when it comes to the modern societies in which we now live.

Is it democratic, or moral, to give an institution like the Fed, which operates completely in darkness and in the interest of only a select few, this inordinate power over society?

Strummer,

What you’re saying is strictly true if an economy were operating at or near max capacity. But it’s not. That’s why we aren’t seeing runaway inflation.

The real resource crunch will be obvious when inflation spikes up and not before.

Strummer,

Plenty of BS jobs with added word “consultant” in description, car traffic bumper to bumper, everybody on cell phones looking busy, circling like ants whole day with occasional work of separating white copy invoice from the yellow but nothing to show at the end of the day. That is economy in the 0% environment.

Fly fishing tour for 2 hours for 4 people is $600! I beg your pardon? Yup. How is the business? Meh. Turn around, see no line up. I am thinking let’s try this supply & demand thing. Can we make a deal? Nope. There is a cluster of 6-7 fly fishing shops in 2-3 miles radius. Same price everywhere and no budging on a price and no customers in sight. These guys are like mini fly fishing cartel 🙂 The only thing I am wondering how long this supply of funny money will last.

This peculiarity of sticky prices is something that puzzles me.

I am in the process of making a decision to clean up thirty acres of overgrown and forested land to convert it to pasture and hay- the preferred sort of old geezer farming around my parts, much less labor intensive and lower pressure compared to orchards.

The local guys hiring out dozers and tracked front loaders have been raising their prices ( supposedly on the basis of their own costs going up !!! for fuel and parts) for the last eight to ten years and are now charging a hundred bucks an hour or so. They were charging eighty two years ago.

It is damned near impossible to explain to one of them that ten thousand dollars in hand today is better than maybe twelve thousand in hand three or four or five years from now, the extra two thousand being hopefully gained by business picking up.

They seem to think that my only choice is to pay THEIR price or just abandon the job.

But as Nick and others point out,I DO have options.

At the moment the most likely one seems to be to just buy an old track loader of my own and hope it runs for thirty days without a major breakdown. The odds of that are actually pretty good if I am a very careful buyer. At the end of a months work I can sell the machine- if it is still running- for about what I paid, maybe more.

Running a dozer thru the woods knocking down trees is great fun if you have male redneck streak as wide as mine. Plus I get to show those acquaintances who accuse me of being a whale loving tree hugging commie democrat video of my mad maniac grin as I knock down the trees with nasty black smoke rolling out the exhaust. 😉

The women will gasp with indignation- but later on a couple of them will maybe seek me out given my demonstration of male prowess knocking down trees. Women’s mid brains aren’t any better than mens. DOUBLE 😉

Instead of dude ranching with horses and trout I can maybe open a dude ranch specializing in the white collar customers who buy Harley Davidson motorcycles by the millions getting their rocks off running a dozer. Say TWO hundred bucks an hour, they can knock down some trees in the way ANYWAY. OR just dig a hole and fill it up again.

This business works very well for some Nascar outfits. Take a ride in a detuned but genuine race car for a couple of hundred bucks or actually DRIVE it for a few laps for a few hundred more.

The big picture looks REALLY bad but I am not going to run short of beans and cornmeal so long as I am able to get around.

Ron,

How can one manipulate oil demand?

The best book I’ve found that explains how monetary policy works is John Kenneth Galbraith’s Money: Whence It Came, Where It Went.

“The miracle of money creation by a bank, as John Law showed in 1617, could stimulate industry and trade,” Galbraith explains.

And conversely, a tight monetary policy has the opposite effect, dampening industry and trade.

And this is not controversial. I know of no economic school of thought that disputes this.

Now granted, as Irving Fischer discovered, there are times when banks stop lending and a liberal monetary policy will not get them to lending again, or people to borrowing again, and the economy remains in the doldrums despite a loose monetary policy.

However, I know of no historical instance where a sufficiently tight monetary policy did not slow the economy. And if the economic policy is tight enough, such as Volcker’s was in 1979, 1980 and 1981, it can drive the economy into recession.

I have no idea if breaking the back of Saudi Arabia was one of Volcker’s motives. He certainly had other targets, like labor, and the destruction of oil demand could have been collateral damage.

I do know, however, that the demand for oil is inextricably tied to overall economic activity. If overall economic activity declines, then there is going to be demand destruction for oil.

This is very elementary economic theory, none of which is all that controversial.

And to put those almost 20% interest rates into historical perspective.

Volker’s target was inflation. End of story. Its not complicated.

That is why the crazy fear of inflation now is just that. Crazy. Volker proved that the Fed always has the power to crush inflation. It will cause collateral damage. But the Fed can crush inflation by raising interest rates.

Oh I think Volcker had a few more deamons he wanted to slay other than just inflation. Life’s not so unidimensional as that, and Volcker had a plethora of goals he wanted to acomplish.

For instance, what about Volcker’s jihad on labor?

As Volcker told the New York Times: “The standard of living of the average American has to decline… I don’t think you can escape that.”

In 1981 as the recession was reaching new depths and many in Congress were calling for relief, Volcker again explained to obedient lawmakers the utility of his artificial economic disaster: “in an economy like ours with wages and salaries accounting for two-thirds of all costs, sustaining progress [in price reduction] will need to be reflected in moderation of growth of nominal wages. The general indexes of worker compensation still show relatively little improvement [towards the goal of lowering wages].”

According to Harrison and Bluestone,

the deep recession did precisely what it was designed to do. With more than ten million people unemployed in 1982 it was impossible for organized labor to maintain wage standards let alone raise them. Reductions in wages rippled from one industry to the next and from the center of the country outward. The real average weekly wage fell more than 8 percent between 1979 and 1982, and failed to recover at all in the next five years. Essentially with wage growth arrested by unemployment, what growth occurred during the Reagan period rebounded mostly to the profits side of the capital-labor ledger.

I do know, however, that the demand for oil is inextricably tied to overall economic activity. If overall economic activity declines, then there is going to be demand destruction for oil.

But cheaper oil should also stimulate those industries that use more oil. Up to a point. If the economy tanks, overall consumption should go down, which would reduce oil demand.

Seems to me that controlling the price of oil through the economy or controlling the economy through the price of oil is too complicated to be the best approach stimulate or dampen economic activity. The price of oil may go up or down as a result, but I can’t see too many policy makers using oil itself to control the economy.

Glenn, here you are talking about the entire economy, not just the price of oil. You are talking about the stock market, the inflation rate, the housing market, the commercial real estate market, the currency market, the price of hogs and pork bellies and everything else that has any connection to the state of the economy.

I am talking about manipulating the price of oil by manipulating demand. If you want to include everything else in the whole world wide economy in your “manipulating strategy” then you are working with a mile wide brush to paint a bicycle.

I ain’t buying it and it should be obvious why.

Well Ron, certainly Volcker had a number of deamons he was trying to slay.

But I can’t for the life of me figure out why you rule out the possibility that the high price of oil might be one of them.

When these powerful people like Volcker operate — and the Fed president is undoubtedly is one of the most powerful men in the world — they operate with purpose. They operate with intent. And they didn’t come riding into town yesterday on the back of a hay wagon.

So, to begin with, lowering the price of oil from $38 to $14 a barrel struck a mighty blow against inflation.

But more importantly than that, geopolitical considerations may have played a significant role.

As the NY Times reported today in ‘Oil prices: What’s behind the drop’: “Dropping oil prices in the 1980s did help bring down the Soviet Union, after all.”

http://www.nytimes.com/interactive/2015/business/energy-environment/oil-prices.html?_r=0

When the Saudis finally did completely throw in the towel in 1985, the collapse of oil prices cost the Soviet Union $20 billion a year in the following years, which in those days wasn’t pocket change.

Here’s how Michael Reagan put it:

“Oil was the only thing the Soviets had in the 1980s that anyone in the rest of the world wanted to buy, besides ICBMs and H-bombs, and they weren’t for sale.

“Lower oil prices devalued the ruble, causing the USSR to go bankrupt, which led to perestroika and Mikhail Gorbachev and the collapse of the Soviet Empire.”

http://www.politifact.com/punditfact/statements/2014/mar/13/michael-reagan/ronald-reagans-son-says-his-father-got-saudis-pump/

And here’s how Wikipedia explains it:

The dramatic drop of the price of oil in 1985 and 1986 profoundly influenced actions of the Soviet leadership….

The USSR’s trade gap progressively emptied the coffers of the union, leading to eventual bankruptcy. The Soviet Union finally collapsed in 1991….

US President Reagan also actively hindered the Soviet Union’s ability to sell natural gas to Europe whilst simultaneously actively working to keep gas prices low, which kept the price of Soviet oil low and further starved the Soviet Union of foreign capital. This “long-term strategic offensive,” which “contrasts with the essentially reactive and defensive strategy of “containment”, accelerated the fall of the Soviet Union by encouraging it to overextend its economic base.

https://en.wikipedia.org/wiki/History_of_the_Soviet_Union_(1982%E2%80%9391)

Well Ron, certainly Volcker had a number of deamons he was tryig to slay.

But I can’t for the life of me figure out why you rule out the possibility that the high price of oil might be one of them.

When these powerful people like Volcker operate — and the Fed president is undoubtedly is one of the most powerful men in the world — they operate with purpose. They operate with intent. And they didn’t come riding into town yesterday on the back of a hay wagon.

So, to begin with, lowering the price of oil from $40 to $10 a barrel struck a mighty blow against inflation.

But more importantly than that, geopolitical considerations may have played a significant role.

As the NY Times reported today in ‘Oil prices: What’s behind the drop’: “Dropping oil prices in the 1980s did help bring down the Soviet Union, after all.”

http://www.nytimes.com/interactive/2015/business/energy-environment/oil-prices.html?_r=0

When the Saudis threw in the towel in 1986, the collapse of oil prices cost the Soviet Union $20 billion a year in the following years, which in those days wasn’t pocket change.

Here’s how Michael Reagan put it:

“Oil was the only thing the Soviets had in the 1980s that anyone in the rest of the world wanted to buy, besides ICBMs and H-bombs, and they weren’t for sale.

“Lower oil prices devalued the ruble, causing the USSR to go bankrupt, which led to perestroika and Mikhail Gorbachev and the collapse of the Soviet Empire.”

http://www.politifact.com/punditfact/statements/2014/mar/13/michael-reagan/ronald-reagans-son-says-his-father-got-saudis-pump/

And here’s how Wikipedia explains it:

The dramatic drop of the price of oil in 1985 and 1986 profoundly influenced actions of the Soviet leadership….

The USSR’s trade gap progressively emptied the coffers of the union, leading to eventual bankruptcy. The Soviet Union finally collapsed in 1991….

US President Reagan also actively hindered the Soviet Union’s ability to sell natural gas to Europe whilst simultaneously actively working to keep gas prices low, which kept the price of Soviet oil low and further starved the Soviet Union of foreign capital. This “long-term strategic offensive,” which “contrasts with the essentially reactive and defensive strategy of “containment”, accelerated the fall of the Soviet Union by encouraging it to overextend its economic base.

https://en.wikipedia.org/wiki/History_of_the_Soviet_Union_(1982%E2%80%9391)

Volcker had a number of deamons he was tryig to slay.

But I can’t for the life of me figure out why you rule out the possibility that the high price of oil might be one of them.

Glenn, of course Volcker would have liked to control a lot of prices. The only goddamn thing he had control over was the Fed. He could finagle interest rates and the money supply. Every Fed chairman since its creation has done that. That, by no stretch of the imagination, can be considered “manipulating” the oil market.

Ron,

If US policymakers 1979-1989 would have been interested in taming inflation across the board, then they would have implemented a contractionary fiscal policy to go along with the contractionary monetary policy.

But they didn’t.

Instead they implemented an expansionary fiscal policy at the same time they implemented a contractionary monetary policy, racking up a mountain of public debt as a consequence. Despite all the hype and extravagant “inflation fighter” claims to the contrary, these were no “hard money” men. They were spendthrifts to the extreme, at least when it came to spending money on the sectors of the economy they favored.

How do you explain this?

It’s pretty obvious that policymakers intended for certain sectors of the economy — like labor, manufacturing, and the oil and gas sector — to pay the price of bringing inflation under control, while other sectors were spared.

If this were not the case, then how do you explain the regulatory forebearance policymakers showered on the S&L industry between 1979 and 1989, and then the subsequent bailout of the S&L sector in 1989-1992?

How do you explain the relief package the Fed crafted in 1982-92 to avoid the domino effect from the Mexican, Argentenian and Brazilian debt crisis from befalling U.S. banks?

How do you explain the $4 billion Fed, treasury, and FDIC rescue package of Continental Illionois Bank in 1984?

How do you explain the Fed’s discount window bailouts of 350 weak banks in the late 1980s?

“Finance became the chosen sector of the U.S. economy — the one that would be protected and promoted,” Kevin Phillips concluded in Bad Money. “Manufacturing would receive no such help.”

The 1980s was the time when the US began making the transition from industrial capitalism to finance capitalism, and it was no accident.

Glenn, you’ve got to be kidding. I don’t need to explain any of that shit. None of this has anything to do with your assertions that the fed could and does manipulate the price of oil. Can you show that all this was done to manipulate the price of oil. Of course not, that would be a totally absurd claim. That means your whole argument is totally absurd.

Ron,

Of course you have to “explain that shit,” at least if you want to have any sort of coherent theory as to how all this data you generate fits into the larger economic and political scheme of things.

The amount the US spent on importing oil plummeted by a whopping 63% from 1980 to 1986, from $62 billion to $22.7 billion.

And yet both the federal budget defict and the trade deficit shot into the blue empyrean. The trade deficit increased by over 600% between 1980 and 1987!

Those are not the policies of policymakers interested in controlling inflation.

Where did all that money go?

.

And we see something very similar happening now, though not to the same degree as in the 1980s.

The amount the U.S. spends on imported oil, due to both the decline in quantity and price of imprted oil, has plummeted by 70% , from a high of $31.2 billion in June 2011 to $9.5 billion in February 2015.

And yet, the U.S. trade deficit has not experienced a similar decline.

How does one explain this?

The $20 billion a month the U.S. is saving on oil imports is just being used to import other stuff.

Why would policymakers allow this? Why would they not implement policies which encourage that $20 billion per month in oil savings to be used to buy domestically produced goods?

the U.S. trade deficit has not experienced a similar decline.

Extend your chart further back in time. I think that will make it clear: trade deficits tend to grow during economic recoveries. If that’s not happening this time…falling oil imports is a sensible explanation.

Nick G,

Do you believe that running a trade deficit — as long as the capital flows used to pay for it are denominated in a sovereign currency controlled by the sovereign — is a good thing? And I acknowledge that some schools of dissident economic thought, such as MMT, as well as our current crop of orthodox economists, believe this.

And such a belief does have its own logic. After all, a nation is receiving something for essentially nothing. It is receiving material goods produced by another country for a commitment to pay at some future date, and when that future date arrives the nation always has the option to pay with more fiat money — more promises to pay sometime in the future — which itself can create with a few entries on a keyboard. Such a system allows a nation to consume more than it produces. It sounds like a great deal, no?

The problem with such a system is that it destroys the productive might of the nation.

Creditor nations like China and Germany reject the logic. They believe that the priority should be to build the productive might of the nation, not the financial might. As Joseph Chamberlain put it to a group of English bankers towards the end of the 19th century: “Are you entirely beyond anxiety as to the permanence of your great position? Banking is not the creator of our prosperity, but is the creation of it.”

The US first ran a trade deficit in 1971, and has pretty consistently ran one ever since. Do you believe this is a good thing?

I agree: exporting currency causes Dutch Disease.

But, we were talking about a narrower question: is a declining oil deficit causing a decline in the wider deficit, all else being equal? It looks likely to me.

Ron,

In response to your question — “Can you show that all this was done to manipulate the price of oil?” — what I can show you is that it has been known for a long time that, when the US implements a tight monetary policy, commodity prices go down.

This has been common knowlege amongst economists for a long time. And as far as I know is not at all controversial, as the conclusion is grounded not only in theory but in a considerable amount of empirical data as well.

For instance, in an article recently published by three IMF economists, they state that

And if we go look up Frenkel’s article, we see that he in turn refers to articles published in the 1970s.

http://www.hks.harvard.edu/fs/jfrankel/overshootingmodel.pdf

So what evidence do we have that US policymakers deliberately manipulated the price of oil down in the 1980s?

1) A motive to manipulate the price of oil down,

2) The means to do so, and

3) The testimonies of any number of actors at the time (and a like number of historians) who assert that the US policymakers did indeed manipulate oil prices lower.

Concomitantly policymakers threw lifelines to those sectors of the economy they considered to be important and which they knew their monetary policy would also devastate (e.g., finance, defence, the wealthy, etc.) while allowing manufacturing, domesitic oil and gas producers and labor to sink.

Nick G,

I’m still trying to get my head around the role oil plays and how it interacts in the bigger economic and political scheme of things.

It’s complex.

Here’s what John K. Galbraith had to say about oil in the 1970s and its impact on the larger US economy:

In the autumn of 1973 came the Yom Kippur war, the oil embargo and a very large increase in petroleum prices. These were widely blamed by the Administration economists, among others, for the inflation. Around three-fourths of the price of 1973 occurred before the war and before the oil prices went up appreciably….

Everywhere the higher oil price was considered highly inflationary; in the United States it served invaluably as an exercise for official inadequacy in the control of inflation. In fact, it was deflationary. Especially in the Arab countries but also in Iran and elsewhere, the revenues accruing from the higher prices were far greater than could immediately be spent for either consumers’ or investment goods. So they accumulated in unspent balances. Thus they represented a withdrawl from current purchasing power not different in immediate effect from that of levying a large sales tax on petroleum or its products. The effect, increasingly evident as 1974 passed, was the predictable effect of fiscal astringency. As demand faded, prices in competitive markets — those for food, commodities, services — began to weaken. Prices subject to corporate market power continued to rise. So did unemployment. The oil-producing countries had provided the industrial countries with a surrogate tax increase. Its effect, like any general or monetary action against inflation, was to increase unemployment well before acting to arrest inflation.

So if what Galbraith is saying is true, then under the same circumstances falling oil prices should have the opposite effect: the same as fiscal stimulus. But, as Galbraith explains it, this would only happen if the revenues accruing from the higher prices were not immediately being spent for either consumers’ or investment goods.

Was that the case in the 2010-2014 period of high oil prices? What do the dollar holdings of various governments around the world look like during this period?

This is a classic case of market “friction”. When things change, markets take time to react. That lag causes problems for the economy.

When prices rose in 2004-2008 most of the increase in revenues for oil exporters did indeed get spent. And now that revenues are falling, those governments are still spending: they’re drawing down savings. This should stimulate the world economy, all else being equal. One of the things that needs to stay equal is spending in oil importing countries, including government and consumer spending. Oil importers need to not do “austerity”, and consumers need to spend the oil “dividend”.

Please anyone who quotes Michael Reagan as an authority destroys their credibility.

Is that sort of ad hominem attack what passes for argumentation these days?

Don’t you think a more legitimate argument would be to attack the message, and not the messenger?

”Please anyone who quotes Michael Reagan as an authority destroys their credibility.”

There is a distinction to be made between being an authority and being a witness to authority and history.

I mention the laws of physics often but I am not a physicist and I quote history often but I am not a historian- except the armchair amateur variety.

The quote is pretty much dead on. The old soviets were dependent on oil revenue and had almost nothing else to sell. The bombs were not for sale.

There was a somewhat sudden and unexpected glut of oil on the market with the price falling dramatically.

Was RR responsible ? Personally I believe he worked to that end, along with the Saudis.

The commies certainly had a very hard time making ends meet without the oil revenue.

Most political observers accept this basic outline, excepting perhaps a few hard core leftish leaning folks who will forever refuse to admit RR ever succeeded in ANYTHING at all , even tying his own shoelaces.

Hi Glen,

More likely those Soviets saw the writing on the wall little bit ahead than the rest. You have to remember that they know what is available in terms of resources at least in their backyard. And that is pretty big backyard. They pulled their horses, throw the satellites to the wolfs, regroup and short 23 years after we have different picture.

Europe’s periphery is energy and financially getting starved and debt rot is getting closer to the core, North Sea Oil is terminal decline, Canada & US are counterfeiting $50 to get $20 of oil with shale & oil sands as that one guy said. That is logical way of looking in review mirror. Other explanations with “opening the oil flood gates and bankrupting” is Hollywood type of simplistic way at looking at things.

Then how would you describe this?

Glenn,

Nobody is disputing that SA increased production. What I am saying is that price of oil itself did not bankrupt country. What caused the hardships is “keeping up with the Joneses” aka: flying to Cosmos, war adventures, supporting satellite states,…once that is removed they are pretty much sustainable, for now. So it was their rational decision to dismantle money draining structure.

Ves,

So let me get this straight.

Are you arguing that depriving Russia of oil revenues, through engineering lower oil prices, was not part of the Reagan strategy?

Are you arguing that the 70% drop in oil prices between 1980 and 1986-89 was not one of the principle causes of Russia going bankrupt?

Glenn,

What I am arguing is that Russia is in better spot now than it was in the 80’s. If you want to thank Reagan for that than that is okay with me. In this world everything is relative and sometimes things turn out different than what we expect.

Bakken honchos mapped out to drill out 70.000 wells, but everything got stalled I think at 10k. Who is bankrupting them? I would argue mostly themselves. Is this good or bad? Who knows? It could be good for conventional players wherever they are in few years. That is the paradox of life.

Ves,

I agree that Russia is in far better shape these days. This is not 1979-1989, and after what the US did in the 1980s much of the world swore “Never again” and has taken measures to prevent such a thing from ever happening again.

Therefore, I’m not convinced by the claims that U.S. policymakers are maneuvering for a repeat of the 1980s.

Nevertheless, I’m pretty convinced that US policymakers want low oil prices. They seem to be intent upon talking oil prices down, and lose no opportunity to do so. Why? I’m not at all sure. Maybe in a decade or two we will find out what the method behind their madness was.

It also appears that both Saudi Arabia and Russia want low oil prices. Why? Each surely has its own reasons. But we at this moment, just as is the case with the US government, can only speculate as to what those reasons might be.

I am with RON in this little dogfight.

OF COURSE markets can be manipulated. OF course money can be tight or loose. Of course cartels exist. Of course regulations can be put in place to reduce or stimulate demand.

But at the end of the day all these ” Of courses” apply just as much to a truck load of apples or lumber or steel or beer as they do to oil.

When it comes to the basics of supply and demand you are either a seller or a buyer..

You either sell for the going price or you buy for the going price. If consumption starts picking up while production remains stagnant, that price will start going up. If consumption starts falling, with production constant, the price will start downward until balance is restored.

It’s as simple as that.

People tend to forget that classical economic theory is taught in the VERY FIRST course at university as a THEORITICAL SPECIAL CASE – a SNAPSHOT of a market for a given good or service- with all factors FIXED ( Everything else HELD EQUAL) for purposes of the discussion of supply and demand EXCEPT production and consumption. In the raw original theory demand IS DEFINED as equal to consumption- this being the instantaneous special case. The word in general use has morphed into a something different.

ALL THE MANIPULATIONS of the markets mentioned by the naysayers certainly DO affect production and certainly DO affect consumption.

But in the end, consumption matches production and the price moves to keep the two in approximate balance.

Consumption, production , and price are conjoined triplets and CANNOT be separated except by playing word games.

The word ”demand” is one of the words in English that brings on endless misunderstandings. It ought to be banished except in context of describing factors AFFECTING consumption. DEMAND as the word is typically used trips up ninety nine point nine percent of the public.

CONSUMPTION is a meaningful word that is reasonably easy to quantify. It equals production plus or minus storage and draw down. Demand as the word is used MAY mean consumption but it may also be a xxxxing abstraction that includes endless abstractions such as future expectations.

Some people will argue that a subsidy reduces prices.

BULLSHIT except as a special case. Nick may have the taxable income needed to get the subsidy provided for a LEAF. I am not broke, I have a FEW assets worth enough I am not in any danger of ever missing a meal , lol, but no current taxable income. Nissan gets the same price but Nick and I pay a DIFFERENT price? Then price has no mathematical or logical meaning.

A subsidy may reduce the PERCEIVED or purchase price the INDIVIDUAL CUSTOMER pays for a new LEAF or VOLT or TESLA but the TRUE or REAL PRICE remains the xxxxing same.

The price paid by the COLLECTIVE CUSTOMER, the individual PLUS the taxpayer, the REAL price , remains the same.

NIssan’s price equals the collective purchasers price.

Logical absurdity disappears, words mean something again. Math is ALWAYS logical.

A subsidy just shifts part of the price onto the back of the government which provides said subsidy. All taxpayers (Taxes are FUNGIBLE .) are tapped to contribute to the true price , as reflected by what the PRODUCER sells for, which remains the same.

IF the PRICE is DIFFERENT at any given moment in respect the buyer and seller, then PRICE is a contradiction in terms, a term without a definition.

It is a logical absurdity to say that Nissan sells a LEAF for thirty thousand but that Nick buys it for twenty four(?) , if discussing price supply and demand in basic theoretical terms.

( Folks who have studied economics more recently or at a higher level may use different terminology but I have never seen any of this overall argument refuted in understandable terms. )

If I were getting paid to make this argument I would organize it better. 😉

no current taxable income. Nissan gets the same price but Nick and I pay a DIFFERENT price?

Not really. Get a lease, and you get the value of the tax credit. If you want to own the car at the end of the lease, then you can buy it for the residual value. If the new Leafs have gotten way better, just let the lease expire and then you can buy the used Leaf for the current (lower) resale value, or you can just lease the new one.

The government is still paying part of the REAL COLLECTIVE price, funneling it thru the leasing company to NISSAN.

The car still costs ALL OF US COLLECTIVELY what I pay plus the government contribution even if leased.

IF government could provide goods and services for free there would be no need for taxes.

I know you don’t buy new cars, but I wanted to clarify for those that do, that you don’t need to have taxable income to get the value of the tax credit as a buyer.

As far as leasing goes: it seems to me that leasing it is pretty much the same as buying, except that you have more flexibility: you can choose whether not to buy the second half of the car at the end of the lease.

Mac,

Google Pigovian taxes and subsidies.

Old Farmer, you talk about price as if it is real. Cost is real. Price is a means to shift money around. How about the real cost of oil that runs that ICE. Include the cost of oil wars, pollution, disease, death, and the huge bill coming up from global warming inducing climate change. I bet the fuel would then cost 5 to 10 times what the car cost. Also include the cost of not reducing oil use because of the oil consumer funded media denial campaign and lobbying that goes on to make people believe using the stuff is just fine.

You talk about the poor taxpayers paying to subsidize something that will help solve a problem. Instead of subsidizing their own demise.

Just like public works, subsidies are supposed to aid the public, not suck it dry and leave it to rot when the oil runs low.

MZ, I am pretty much in agreement with you as far as your first paragraph goes, in the broadest terms. Nick is right about oil being dirty and extremely costly and we need to get away from it asap.

But we must part ways when it comes to price being ” a means to shift money around”.

We could argue forever about the meaning of such an ambigious definition.

My whole argument above was to prove exactly what you are saying, that price does not mean anything unless we know who is paying.

A goddamned Leaf does not cost twenty four K if government kicks in another five or six K.

In casual conversation price and cost are usually interchangeable. In a purely technical discussion hardly any laymen know the distinctions between basic economic terms. I used to know most of the more elementary ones.

We are not far apart at all, maybe not on the same line but on the same page or at least in the same chapter.

OFM, price is the money exchanged in a single transaction. Price is set to move the goods or services and make some profit (although that is sometimes debatable). Too high a price and the transaction does not occur, too low and the goods or services eventually cease to be provided by that business or person.

Cost is the overall cost in money, time, effort.and an assortment of non-monetary states, occurrences and qualities both present and future. It is not just the cost to the individual that is making the transaction but to society and the environment in general. Cost is the total effect of a transaction or group of transactions.

We do not live in a vacuum or on an isolated island, everything we do has costs. These are balanced against benefits and if viewed in a wide enough scope should ripple benefits across the society and environment as well as the individual.

Taking smaller subsets all the way down to the level of just price is a self-centered hedonistic narrow-minded set of actions that may have short term benefits for the individual and the business but will have uncontrolled effects upon the greater system, often negative.

To make it simple, price is the small narrow view, cost is the big inclusive view.

Such as “What was the price of the car?”

or “What are the real costs of that car”.

Possibly, those first 13 years of education should spend a little time explaining the difference and defining our duties to society and the world. Most education seems to be centered around the three R’s and a minor amount of discipline. Very little to do with actually having people learn how to think and act responsibly through realization of what those actions will really cause in the larger picture.

Leaf does not cost twenty four K if government kicks in another five or six K.

Leaf dealers don’t get the credit. They just get the very roughly $30k.

At $30k (in other words, not including the credit) the Leaf is the cheapest thing on the road. With the credit (and credits from a few states), it’s insanely cheap.

see

http://www.edmunds.com/nissan/leaf/2014/st-200674102/cost-to-own/

I have read that US CPI is around 4% if the the formula used to calculate it is from Volcker era. Is it true ?

Re-defining inflation saves government billions every year. The use of hedonic pricing can understate real inflation by a long shot.

Watcher touches on this subject a lot. The re-defining of things to make ones objectives possible.

If the Fed is able to show that inflation is well below 2% it can use it as an excuse to print and hold interest rates down for as long and as low as they want to.

Inflation is too low. Not too high. http://www.bloomberg.com/news/articles/2014-11-14/fed-inflation-optimism-defied-by-lower-consumer-outlook

BP has apparently figured out how to manipulate the NG market:

BP Plc faces millions of dollars in penalties and surrendered profits after a Federal Energy Regulatory Commission judge concluded Thursday that the natural gas producer manipulated markets in Texas in 2008.

http://www.bloomberg.com/news/articles/2015-08-13/bp-manipulated-natural-gas-market-in-houston-ferc-judge-says

Yes, and this was just a year removed from BP being convicted of manipulating the propane market. It seems to be a fairly well known “secret” the extent to which commodities can be manipulated. It all started when he money center banks became heavily involved in hedging commodities – prior to their involvement, of course, only actual buyers and producers of said commodity were allowed to hedge.

“By now it should be pretty obvious to all that the price of oil is politically driven … “

It is the customer who sets the price of oil. As long as he (she) can borrow the price is stable or increases. As the customer falls insolvent — in Greece, China, Japan, Brazil, Canada, USA — he (she) cannot borrow and there is no bid.

The more the drillers borrow the more the customers must also borrow to repay (the drillers’ debts). This is a gigantic problem because the drillers’ can only borrow at the expense of the customers!

Say what you like about finite oil supply: at any given time there is a finite amount of credit, this is divided between customer and driller (with the parson’s share going to the lenders themselves). The more the driller borrows the less funds remain for the customer.

That’s why prices are low and declining. Customers have been bankrupted by their oil suppliers.

We start with who we are as a species, and with such outgrowth manifestations as symbolic language; the making of spears; and money…

That we are even having these arguments is testament to increasing overcomplexity and undercontrol.

Zero interest rates do this… The fed does that… Money means this… BoJ did that… Yes they did… No they didn’t… Well not exactly…

Little islands in a large archipelago on a vast sea…

Thanks, Ron

It is clear that the increase in the Bakken oil production in May and June was due to WTI hovering around $60/bbl.

There were more wells completed than spudded.

Note that Bentek said that June production was higher both in the Bakken and EFS.

Not sure about July, but August production should be lower

I also noticed that the Bakken wellhead/WTI spread has widened again in July

The EIA DPR team apparently decided to be more conservative in their estimates, and they were wrong again.

North Dakota DMR (Bakken ND) vs. EIA Drilling Productivity Report (Bakken ND + Montana) production data (kb/d)

U.S. shale firms turn to private equity as market funding tails off

“A torrent of $44 billion in high-yield debt and share sales in the first half of this year has slowed to a trickle with oil now at just above $42 a barrel, 30 percent below its June levels and 60 percent down from June 2014, and a more pessimistic view taking hold that global oversupply could keep oil cheap for years.

The number of high-yield bond and share issues has tumbled more than two-thirds from levels seen in May, Thomson Reuters data show.”

http://www.reuters.com/article/2015/08/14/us-oil-usa-financing-idUSKCN0QJ0BH20150814

From the article:

“It didn’t solve people’s problems, so now when you roll to 2016 …there will be an opportunity for private equity-backed companies with plenty of capital in place to go out and start buying.”

But will some of those assets be worth buying even at reduced prices?

Ya this theory would be stating that the reason the wells can’t make money is too much was paid for the lease.

That’s not the cost that makes them uneconomic.

“My point is not to knock the EIA for their changing predictions but to point out that we should not put too much value in them because they are mostly just wild ass guesses, subject to change from month to month.”

They lie about inflation, money supply, job numbers, debt ceiling etc etc.

They WILL lie about future oil production. That’s why i come over here in the first place, to see what really happens!

Yep.

Hear No Evil, See No Evil, Speak No Evil.

The EIA is a branch of the Department of Energy which means the workers are government employees. But they have nothing to do with job numbers, inflation, the debt ceiling or anything else outside the energy department.

The EIA may be guilty of being overly optimistic at times or overly pessimistic at other times. I see no reason to believe that they lie however. I think they are doing the best job they can with the budget they have.

Hanlon’s razor: Never attribute to malice that which can be adequately explained by stupidity.

I would change that a little: Never attribute to malice that which can be adequately explained by ignorance. Ignorance has a somewhat different meaning than stupidity. We are all ignorant of the future and our guesses about tomorrow are usually off by a country mile. But our missed guesses do not make us stupid, and they certainly do not make us guilty of malice

Yeah, way too many people involved in government for some non systemic conspiracy to maintain. No one goes to work every day intending to lie as their mission.

The way this is or will play is via definitions. All those folks doing their sophisticated counting of this or that will count something with a new definition just the way they counted things with the old definition. Doesn’t have to have a whole agency of liars. Just requires someone in some meeting to make a strong case for a redefinition. That would start the ball rolling.

WTI itself was changed about a year ago. Never did get the specifics on that. Just the Bloomberg article saying it was about to happen to deal with the influx of LTO to Cushing.

Watcher says: “No one goes to work every day intending to lie as their mission.” Clueless says: “Unless they are going to fill out an expense report that day.”

I’ve done energy (future electricity demand) forecasting for a government agency before.

There may be some parallels with peak oil forecasting.

No one had an agenda. No one wanted to be wrong.

There was a legacy algorithm that was used to do the forecast. You can’t just willy nilly change it because you felt you had a better idea. It had been used for years.

It was the algorithm that was approved.

After the initial cuts of the results were produced, they were sent to the local managers of the areas you had produced the forecasts for and they provided their feedback., which may or may not get incorporated into the forecast.

Sometimes the data you were given was absolute shit…missing records and you had to compensate.

By that time, the deadline was fast approaching and you were scrambling to just get the damn report produced!!!! and you knew it wasn’t 100% perfect.

I suspect the EIA and other groups due their constraints are wiping the sweat off their faces after the report get produced. Then it’s time for the next one.

BTW, on our team that produced the report only 1 guy understood electrical engineering, the rest were software guys.

my 2 cents.

“No one had an agenda. No one wanted to be wrong.”

VERY CLOSE but not a ringer 😉

Everybody had at least a two item agenda. One finish the report.

TWO do not turn in a report that makes the boss who approved previous reports or may have actually written them personally look foolish.

Bringers of bad news or composers of such reports are seldom actually SHOT in western countries these days but they are often banished to the unemployment office or transferred to Podunk to be in charge of cleaning the toilets – PERSONALLY.

Good point, Mac!

Yes, everyone has an agenda, likes getting paid, going home at night to eat a hot meal with their kids and watching internet porn…lol!

I’ve worked in forecasting in a number of industries (never oil) and I have never met a single person who generated a report based on their poilitical views. In fact, how could you program that into software?

At the pion level that I am at, guys just want to do their job, go home to their family and feel good about themselves.

Maybe at the higher ranks the political stuff gets thrown in, and I agree at private companies things will get changed if it doesn’t align with an executives view of things (have seen that). But that executive has to pay for that and wear the risk that decision creates.

The guys doing the grunt work ( data management, analytical modeling, reporting, etc) are usually in it for the right reasons.

Remember, the executives can’t produce the reports. They can only express if they like them or not. How do you express someone’s opinion in software code without getting caught?

The reports are produced by software (maybe excel on simpler ones).

To change the outcome of a report, you need to get the guy who created the report (software programmer) to change it or manipulate the input data the created the outcome.

That’s tough to do without exposing yourself to fraud.

In government, they do audits, including data audits. You have to explain why the number in your spreadsheet is different from what is in the source system.

Not as easy as it sounds. Conspiracy theorists be damned.

thanks!

I know nothing at all about the nuts and bolts of hands on programming but I do know and understand the principle garbage in garbage out.

SOMEBODY generally has the power to decide what goes in and that determines what comes out.

The best place to look for hanky panky is in the selection of the data you are TOLD to use.