The EIA’s Monthly Energy Review came out a couple of days ago. The data is in thousand barrels per day and the last data point is July 2015.

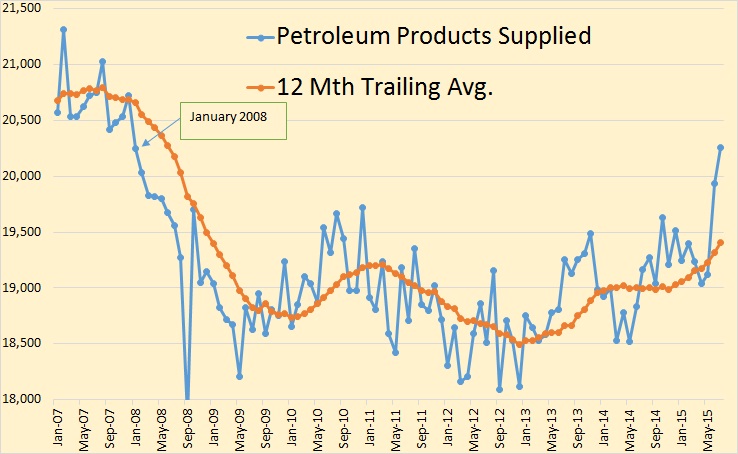

US consumption of total liquids, or as the EIA calls it, petroleum products supplied, reached 20,000,000 barrels per day for the first time since February of 2008.

Something I never noticed before, consumption started to drop in January 2008, seven months before the price, along with world production, started to drop in August 2008. This had to be a price driven decline. Could the current June and July increase in consumption be price driven also?

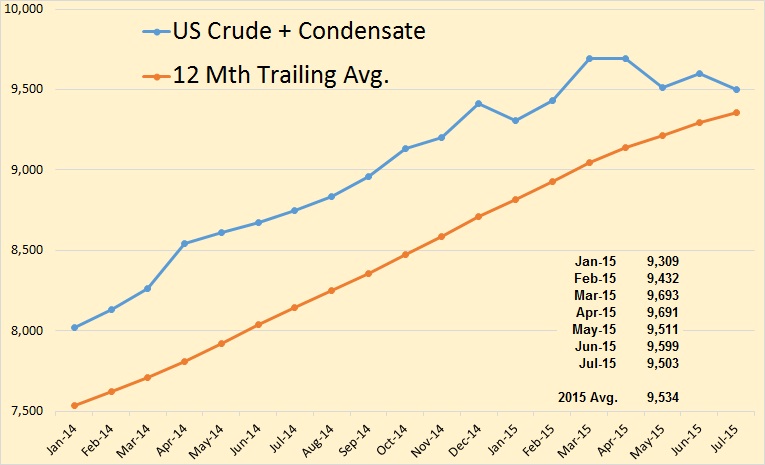

US Production was down 96,000 barrels per day in July to 9,503,000 bpd. That is 190,000 bpd below the March level of 9,693,000 bpd.

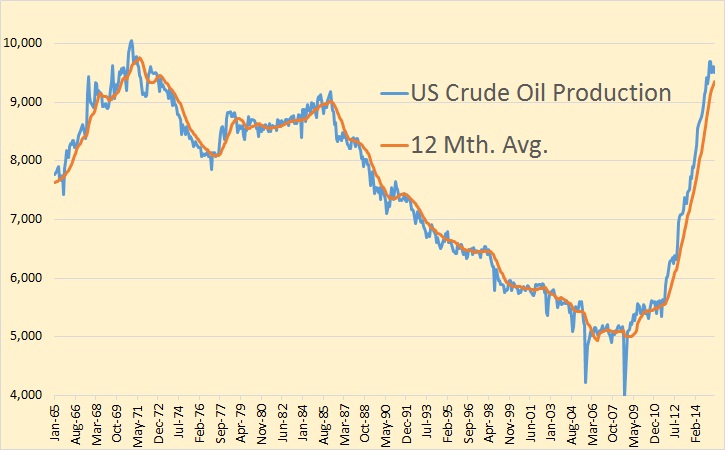

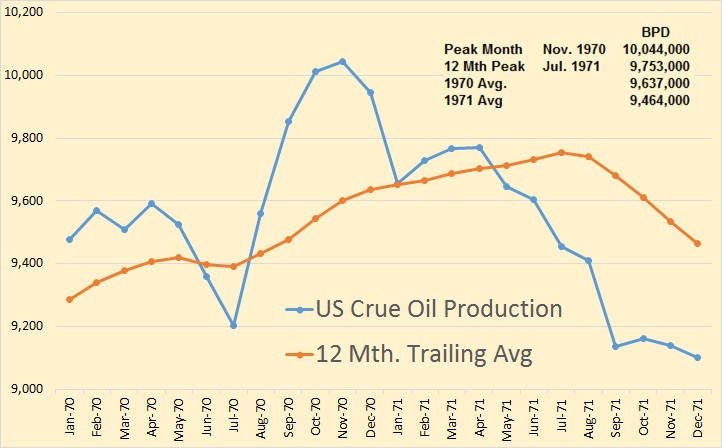

Here is what the last 50 years of US production looks like. The peak was in 1970 or 1971, depending on what you call the peak.

In March 2015 we were still 351,000 barrels per day below the peak month of 10,044,000 bpd in November of 1970. But right now we are headed in the wrong way to break that record. In July we were 541,000 bpd from that record. Right now the 2015 average, January through July, is 9,534,000 bpd. That is 103,000 barrels per day below the 1970 average. But the 2015 average is likely to get smaller as the year plays out.

I have another chapter from Peter Goodchild’s Tumbling Tide: Population, Petroleum, and Systemic Collapse. I really like this book. The author comes closest to matching my sentiments than anyone I have read to date.

Tumbling Tide Chapter 10

The Pollyanna Principle

The problem of explaining peak oil does not hinge on the issue of peak oil as such, but rather on that of “alternative energy.” Most people now have some idea of the concept of peak oil, but it tends to be brushed aside in conversation because of the common incantation: “It doesn’t matter if oil runs out, because by then everything will be converted to [whatever] power.” Humanity’s faith in what might be called the Pollyanna Principle—the belief that everything will work out right in the end—is eternal.

The critical missing information in such a dialogue is that alternative energy will do little to solve the peak oil problem, although very few people are aware of the fact. The Pollyanna Principle, after all, is what gets us through the day. Unfortunately, a quick glance through any standard textbook on world history would show that the principle does not apply to many civilizations that lie buried in the mud. But to point at oil-production charts is to mistake psychological problem for an engineering one; most people do not like to be pushed very far in the direction of the logical.

The main stumbling block, as noted above, is not the fact of the decline in world oil production, but the related fact of the impracticality of alternative energy. Alternative sources of energy do have certain uses, and they always have had, especially in pre-industrial societies. However, it is not possible to use non-hydrocarbon sources of energy to produce the required amount of energy, and in a form that can be (1) stored conveniently, (2) pumped into cars, trucks, ships, and airplanes for the purpose of long-distance transportation of goods and people, (3) converted into a thousand everyday products, from asphalt to pharmaceuticals, and (4) used to run factories—and which costs so little that it can be purchased in large quantities on a daily basis by billions of people.

There is also the question of time. The entire conversion of world industry would have to be done virtually overnight. The peak of world oil production was probably around 2010. The more-important date of peak oil production per capita was 1979.There are approximately 1 billion automobiles and over 7 billion people. Throughout the twentieth century, food production only barely met global needs, and in the last few years it has not even reached that level. In terms of the amount of time available, the switch from hydrocarbon energy to an alternative form of energy would stretch the bounds of even the most fanciful work of science fiction.

But we don’t even know the name of such an “alternative energy.” Every month, the mainstream news media tell us of “the miracle of x power,” but in the following month the x has been replaced by another provider of miracles. And even if that x were named, there would be the immense task of setting such a program in motion on a planet-wide scale—half a century too late do any good.

Contemplating the expense will also take us far into the realms of fantasy. At $10,000 (a fairly arbitrary figure, admittedly, but no real figures exist) per vehicle, replacing the vehicles that are now on the road would cost $10 trillion. The substructure—the ongoing manufacture, transportation, maintenance, and repair—would add much greater expense. The existing furnaces in all the world’s buildings would be obsolete. Countless machines all over the planet would have to be replaced, countless factories redesigned. We would have to replace the asphalt on all the world’s paved roads with a non-hydrocarbon substance. The money and resources simply do not exist. It is perhaps fortunate that there is no politician or business leader who would be willing to initiate such a mad venture.

In actuality, the world of the future will not be crowded. Survival for a few will be possible; survival for a population of billions will not be possible. But very few people have asked the ugly question of exactly how rapid and dramatic reduction of population is going to take place. Voluntarily?

There are two further problems with trying to educate people on these matters. The first is that any discussion of either peak oil or alternative energy requires a scientific frame of mind: an understanding of empirical research and an ability to follow statistics without being misled. A grasp of basic science is essential in order to get balanced perspective on the data and in order to judge between the practical and impractical. The so-called civilized world is still largely the domain of astrology and other forms of superstition. Yet empirical research does not mean “I once saw something-or-other,” and statistics are meaningless unless one understands exactly what is meant by “statistically significant.”

The second of those further problems is that the concepts of peak oil and alternative energy extremely complicated. Although it is possible to reduce those two topics to five hundred words or so, the problem with such a single page explanation is that much of the vital information would be left out. If the document failed to mention every “an/but/or,” the message would almost certainly be lost. If, on the other hand, the document were to be expanded to cover every minute particular, the writer would probably lose track of the average reader, since the text might exceed the latter’s attention span.

The alternative energy problem can also be illuminated by examination of similar dialogues on other topics, especially in cases where science clashes with its opposite. A discussion about creationism, for example, might entail hours of exhausting dialogue, to be terminated when the creationist party raises his head, takes a deep breath, and says; “Well, I believe. . . .” The Conversation has reached a barrier, beyond which no travel is possible. When communication is in such a poor state, there is often little hope that the reader will go so far as to check citations, bibliographies, or further reading lists, or even to do something requiring as little labor as clicking on a hyperlink on a web page.

______________________________________________________________

There has been little data or other news to report lately. And I have been quite busy with little time to devote to the blog. I am in the process of a move to Gulf Breeze Fl. That is on a narrow peninsula between Pensacola and Pensacola Beach Fl. And I still have another week or two before I can get back to my leisurely schedule again. So don’t look for another post for another five to seven days. Well that is unless someone has a guest post they would like to give us.

Saudi Aramco compound goes up in a puff of smoke. Payback?

No, it was just an unfortunate fire in a high rise complex in Khobar.

Fire at Saudi Oil Workers Compound Kills 7, Injures Hundreds

The death toll is now up to 11 and likely to rise further.

One should not look for a conspiracy in everything that happens.

Perhaps. But it is common knowledge that the Houthis have weapons systems that can hit almost anywhere in Saudi Arabia, and in terms of asymmetric operations they are able to hit typical terrorist targets such as government buildings and landmarks to include hotels and infrastructure. At least that is what one ME analyst noted a few months ago. But fires do happen. As do explosions involving sodium cyanide in Chinese warehouses and fires at U.S. military bases in Kanagawa. But far more devastating still are the wildfires that have been ripping through Siberia for weeks now.

Thanks for the post Ron. Greatly appreciated.

Ron, according to BP US production in 2014 surpassed the 1970 peak (C+C+NGL).

Different definitions. BP’s oil production includes crude oil and natural gas liquids

And a few links to recent posts:

Oil Production Vital Statistics August 2015

Iran nuclear deal could pave way to higher output

OPEC’s Gigantic Blunder

This got lost and then reposted end of last post. Iraqi items, but the link (which does not contain all the data) seems pretty good, translator is good, but no ads so will die:

/////////////////////////////////////////////////////////////////////////

Redoing the Iraq stuff. Worth it cuz of the source material:

http://www.iraqinews.com/tag/budget/ the translator has advanced degrees in english lit

Bottom line Dec budget was 100 billion dollars. Since and year to date oil revenues on track to provide 50 billion dollars of influx. Response has been cuts . . . down 32 billion iraq proper and 18 billion for Kirkuk region up north. 45% salary cut for members of parliament.

Lotsa aid coming in. 1.5 Billion loan from IMF, a billion here a billion there from others.

6 million of the pop of 37 million are on govt salaries.

Another item ISIS collected $90 million in June in taxes from region it controls.

Basra Light Assay API 29 Sulphur 3.2% Kerosene 12%, Diesel 21%

Kirkuk Assay API 34.2 Sulphur 2.24% Kerosene 15% Diesel 24%

(the Kurds oil is superior)

Contrast the Libyan El Shahara yardstick

API 43, Sulphur 0.07, Kerosene 19%, Diesel 28% <– quite the anomaly from Jeffrey's chart showing middle distillates collapsing as API grows. This is why Libya oil was and remains such a big deal

“Something I never noticed before, consumption started to drop in January 2008, seven months before the price”

The US recession started in the last quarter of 2007, caused be high oil prices. They contributed, along with accumulated petro-dollar debt, to the financial crisis in 2008/09

22/7/2013

US oil demand peak was in 2007

http://crudeoilpeak.info/us-oil-demand-peak-was-in-2007

Thanks for your update. The more articles one writes, the more updates are needed later….

At one time a few years back I was convinced peak oil would mean the end of life as we know it. I fully recognize that if oil supplies decline abruptly enough , peak CAN wipe us out.

But more recently I have come to believe there really is a possibility of a successful transition – for some of us at least.

The incredibly fast fall in the cost of solar power, and to a lesser extent, wind power, the possibility of large scale coal to liquids production, more efficient ice cars and trucks, electrified autos and light trucks, changes in life styles, etc, etc, ALL taken together indicate that there is at least a DISTINCT POSSIBILITY that SOME PORTION of us can pull thru the peak oil in particular and nonrenewable resource bottle neck in general- while still living pretty decent lives in terms of enjoying modern technologies.

Most of us in my own humble opinion are going to meet unpleasant ends well before the end of this century. Goodchild may turn out to be right and the entire modern day world economy may collapse because it is built on the sands of fossil fuels.

BUT he is wrong, according to a number of capable scientists, when he says a transition to modern renewables based economy is IMPOSSIBLE. No doubt such a transition is going to be an awesomely tough experience even for the people who MIGHT live thru it and come out more or less whole on the other side.

I don’t have a copy of his book and no way to get one quick enough to read it and comment while this key post is fresh, but it is my impression he does not appreciate just how fast things are changing in the field of renewables – and that he does not appreciate how EASILY, in actual fact, we can adapt to fewer fossil fuels once WE MUST ADAPT.

Hardly ANY air travel for instance is really critical to the production of anything at all. A few spare parts and a few key people who are top notch troubleshooters NEED to go by air to solve problems PRONTO-but damned near every airplane in the sky could be permanently grounded without causing any REAL problems except the ones associated with unemployment in industries dependent on air travel.

Gas hog cars and trucks can be outlawed in a matter of DAYS once the necessity of doing so is absolutely obvious to everybody except the owners of the same. Appliances can be manufactured to use half or less of the energy they use today, and then half again. Led lights can be mandated and if another generation of lights use even less energy , the that tech can be mandated too.

CAN’T and WON’T are two different things.

SOME of us are in a favorable position to pull thru-IF we get started pronto. For this reason I say we should all be praying to the god(s) of our choice for Pearl Harbor Wakeup Events.

We DO NOT have to manage a total transition to renewables on any particular time frame. There will be substantial amounts of fossil fuels available to us for many decades to come. IF we can get just half or two thirds of the way within the next three or four decades we can stretch the remaining endowment of fossil fuels some decades beyond that. This gives us two or three generations to change our ways sufficiently to adapt to hardly any fossil fuels at all, but I do not anticipate running so short of coal for centuries that we cannot manufacture and recycle steel and a few other key materials.

IF we choose to manage our collective affairs well and conservatively, we have a good shot at least here in the USA and Canada and a few other places with large remaining endowments of non renewable resources.

We have almost all the high cards in our hands already and life is the sort of poker game where you can hold some and discard some in hopes of getting better ones.

We have the territory. We have the farmland. We have the coal-which if used frugally in the form of liquefied fuel can be used to meet our CRITICAL needs for liquid fuels. We have the military might necessary to defend ourselves , and yes, to keep ESSENTIAL imports flowing our way even if we have to seize them by force.

(Folks who think it cannot be done have the erroneous idea that when the cards are ALL on the table a truly modern army cannot simply WIPE OUT any local people who refuse to play. Just one aircraft carrier flying off fighter bombers armed with neutron bombs could depopulate a a dozen large cities in a few hours.IF we were to devote the output of our herbicide industry to wiping out food production in any given country… barring one able to fight back, and there are only a couple that really COULD… that country would starve in a year. )

We have defensible borders. We can allow in people who will help us survive and keep out those who will not.

Can we succeed? I don’t know.Luck will play a large part either way.There are plenty of things that could go wrong that CAN STOP us from succeeding.

But the transition is at least technically possible.

We have hundreds of millions of tons of recyclable steel in autos alone for instance- three quarters of that could go into towers for wind turbines. We KNOW how to build appliances and cars and furniture and houses that will last for generations. We know how to build net zero energy houses.

WE CAN build fifty times as much pumped hydro storage as we have today- by condemning land suitable for building the necessary reservoirs. This would cost a fortune of course – but we piss away fortunes or a regular basis on sports stadiums and airports and BELCH FIRE XXXL autos and trucks.

We can deliver potatoes to stores rather than potato chips for ten percent of the cost of potato chips in energy.

Above all we can have less kids.

We are having less already with more reductions in birth rates considered virtually guaranteed by most observers. My four grandparents iirc produced between them twelve kids that made it to adulthood. My parents generation cut that by more than half. My generation cut it in half again. The younger women in my extended family hardly ever have more than two kids these days and one is probably closer to the norm than two.

SOME of us are holding a promising hand. All we lack is one more card. If fortune smiles on us and sends us the necessary Pearl Harbor Wake Up Events in sufficient number and sufficiently often, we have a shot.

There are no guarantees but then …. there were never any guarantees.

Don’t get stuck in EGYPT.

But luck can be almost as good as a literal miracle sometimes.

http://www.reuters.com/article/2015/08/30/eni-gas-idUSL5N1150NQ20150830

It appears the Fates have granted the Egyptians a LITTLE peak fossil fuel breathing room.

Well, to replay my standard little lecture, I have found it EASY go get my house totally non-carbon, 100% solar electric, and FAR MORE, NOT LESS, CONVENIENT AND CLEAN.

We heat with PV electricity, we cool with it, we cook with it, we heat our water with it, and we drive our car with it.

And all that cost me LESS, NOT MORE, than the same services my BAU neighbor gets from ff’s.

And a little note on the Leaf. I listen to all the utterly specious, ever more desperate denigrations of EV’s here, and then ask myself “how does that stack up against my own everyday experience with my EV?”

The answer is, not the least like what I see every day. Today my wife and I tooled around to several demonstrations of local off-grid living, did a little shopping at the hardware store for the missing bits of my self-driven hot water circulator, and came home with the range meter reading 60.

Wife does that maybe a couple of times a day, between trips plugs the car into the 3kW charger, and has never had any problems at all.

Like near anybody these days, we can whistle up a gasoline car in a minute for a longer trip.

In the last 12 months, my electricity bill from the coal power company has been zero, except for Dec last, when it was $18.

I am getting close on a wood pyrolyzer that will fuel a generator to give me that bit of extra juice for the cloud periods. This thing puts out wood gas and charcoal. Charcoal is a perfect cooking fuel for when the grid is down– and beautifully smothers the potty poop that eliminates the absolutely absurd conventional flush toilet.

So, my recommendation– JUST DO IT. Or, if not positioned to do it, join a group that does.

PS-There’s a used leaf in today’s newspaper, identical to mine, for $10K.

PPS, Don’t get stuck in Egypt. Park your factory ship in the red sea, bribe the local bandits to use some of their solar sand for copious, near free electricity, make your high quality stuff, and sell it to me. My German kitchen knife is so superior that we never reach for any other.

All true. Just do it.

The Pollyanna disease is contagious. Mac done caught it. Other folks seems to have caught it also. Wimbi, Ronald, and of course there is Nick. Nick is our most vocal Pollyanna. And lets us not leave out Dennis, whom took offense when I said he was “Pollyannish” about a year ago.

But it is only human nature. As Goodchild says, “The Pollyanna Principle, after all, is what gets us through the day.”

And so it goes.

Mr. Patterson, I just think positive in hopes of staving off the inevitable downturn in the use of energy and the power it creates.

Collapse is an evil, wicked, mean and nasty word, not in the argot of the pollyanna lexicon. Chaos is another word that is Verboten. C words don’t fit.

Other than that, I am extremely cynical about what might be the unthinkable, what words can’t describe. Nobody cares to go there, it is frightening. You have to think positive, if it’s pollyannish, so be it.

Nick G sees the good side of an oil-free world, indefatigable and undaunted. Might be in LA LA land, but it helps. har

I have not exactly succumbed to pollyannaish thinking.

Note that I predict most of the human race will be meeting a hard end before the end of this century.

And for what it is worth-I have not PREDICTED that even a Fortress North America WILL survive peak oil in particular and peak natural resources in general.

But I do believe a portion of us yankees and some odds and ends of people in other places have a shot at pulling thru the next century or two at least by husbanding the dregs of fossil fuels, adapting to a low energy life style, and learning and applying a hell of a lot about renewables and conservation.

The population WILL be declining – here in the USA. My rock solid gut feeling is that the borders WILL be closed, by near unanimous agreement among all politicians who wish to REMAIN in office, with only a few very desirable people allowed in. With closed borders we are already below replacement level birth rates unless I am badly mistaken.

And for what we SPEND on imported oil, including the military adventures that make importing it possible, we can mount a war time type effort towards building out renewables and storage.

BAU is a dead man walking even here in the USA.

BUT for the price of one new tricked out F250 I can PERSONALLY with one strong backed helper to assist me , do things to a typical house that will make it only a third as expensive to heat and cool.

That puts the homeowner on a footing where he can afford renewable electricity NOW.

There is an old ragged out GEO METRO sitting out in the edge of the woods that I got dirt cheap, which was RUNNING when I parked it.

I can do a few things to that old car ( not altogether legal) that will make it get over sixty mpg at forty five to fifty mph, and it THAT car could be downsized by HALF and still serve ok to get to work and fetch the beer and groceries. At some point batteries and synthetic oil,probably coal based, can shoulder the transportation load.

IF I were to be a professionally trained engineer, like Wimbi, rather than a technically well educated jack of all trades, I could work near miracles with a few bucks and a few helpers.

Renewables CAN get us thru the next few decades by helping us stretch out the remaining fossil fuels. We will learn a lot during those decades- if we use them wisely- and we will learn from necessity to live well on a quarter of the energy we consume per capita today.

I know better than to predict we WILL act wisely. But there is a nonzero chance we will, and if we do, we have a shot. No guarantees.

Even though I am already old, I am prepared to fort up personally and have already talked to a select handful of people who have standing invitations to fort up with me. None of us believe we will live long enough that forting up will be necessary but we all understand that with bad luck …. even old farts might live to see some VERY interesting times. So… Our tentative plans are just that, tentative, with each of us making such preparations as can be made on a no lose basis.

Owning a large tool set for instance is a no loss proposition.Quality tools generally go up in value rather than down. Skills mastered as a hobby in leisure time MAY be critical later. If never needed, you still have had a good time with the hobby. One of us knows how to make leather after pursuing it as a hobby . . I know how to get the hide off of a cow or a hog.

ALL of us can hit a man in the head at a hundred yards first try with a scoped deer rifle- if necessary and he is foolish enough to stand still for ten seconds or so.

All of us for now at least are able and willing to chop wood and spade up and hoe a cornfield if it comes to that. It could come to that but imo things will not get so bad that forting up will be necessary during my remaining years- not around here at least.

A few years back I enrolled in nursing school hoping to master the basics of one more profession. My plan was to meet a lot of women and and have a good time- academics are very easy for me- and incidentally to get to be as well prepared as possible in the event the shit really does hit the fan. Big troubles with my Mom getting bedridden prevented me from finishing but I did learn most of the critical skills before dropping out to keep her at home instead of spending her last days among strangers in a nursing home.

I am not above breaking into a dental office and stealing a full set of tools so as to be able to properly ( more or less ) extract a tooth- in the event of outright collapse.I know in theory at least how to make opium. Never tried but it looks to be simple enough.I am not afraid to stitch up a bad cut in the event there is nobody around better qualified to do it. I know in theory how to set a broken bone. A couple of the other guys have done it for real.

The point is that I take the possibility of collapse VERY seriously indeed.

I just do not believe collapse will necessarily be universal all across the world.

The last electric light anywhere may wink out eventually, but my belief is that if it does… it will be century or two before it shines its last. At least.

As a matter of the most excellent sort of good luck I already live in one of the very best places in my estimation are for local people to pull thru.

With a little more luck I would be rich. LOL

It is often said that the size of the fight in a dog is more important that the size of the dog in a fight.

Focusing exclusively on bad endings is very bad for one’s morale and happiness.

I have made a conscious decision to enjoy my remaining years as best I can while still being realistic about troubles that may seek me out.

Sticks and stones can break my bones but words such as polly anna run off like water off a ducks back.

I forgot to mention it earlier but ecological collapse could definitely prevent ALL of us from managing a successful transition to renewables. .

Do you consider the technology event “the singularity” ever? We are pretty much at the elbow in exponential growth curve in technology, funny alot of things seem lined up that way also, population, currency, oil depletion, probably lots of other things too.

I believe in tipping points and that we just might reach a point whereby renewables can take the place of fossil fuels–sometime down the future road. But most of us are doomed to perish before that happens. The crisis is almost upon us an not many of us are going to make it into the inadequate supply of renewables lifeboats , in a manner of speaking, in my opinion.

The only reason I believe some of us might make it is that there still remains a substantial endowment of non renewable resources and that those of us who might make it are in possession of those resources all out of proportion to our numbers.

By making it I do not mean merely surviving. There will be people, not so numerous as now by a factor of ten or more, in most places people live now, a century or a thousand years from now.

By making it I mean still having food in stores, grid electricity, basic modern medical care, communications, some minor luxes, functioning water and sewer, a long life expectancy etc.

Cars, if industrial society does survive in pockets, will most likely be extremely rare.Casual air travel non existent. Bicycles and walking the norm except for mass transit and maybe a few electric cars. Cars might eventually become common again but NOT for a LONG time.

Roads cost the US $155 billion dollars per year and that is a shortfall of what is needed to keep everything in good repair. So the cost of keeping the road system operable is similar to the cost of fuel to use it.

We need to find ways to minimize the amount of roads in the US and ways to make the necessary ones less expensive. I am sure a lot of energy is tied up in that $155 billion dollar figure.

Lighter trucks will do it. Or they have to increase the number of wheels to spread the point loads.

Fernando is either dead right or dead wrong, you can bet he never occupies any middle ground and come away a big winner.

He is DEAD RiGHT about the trucks and the highways.

I foresee a time when trucks are MUCH lighter per axle and per square unit of contact patch ( the spot the rubber meets the road) than today.

It is not THAT difficult to build the axles on a truck so they can ” steer ” a bit and so allow the truck to round a corner without brutally scrubbing the tires on the road surface. A lot of trucks have this feature already.

Lowering the per axle weight can be accomplished by regulation alone, but the industry is going to RAISE HELL to prevent it happening, crying and peeing and moaning about the costs and the lost profits.

The solution is to grandfather old trucks for a reasonable period , say thirty years from the date of construction, and then ship any still in good condition to people who don’t yet get it, out of the country.

Given that all truckers will have to comply, none of them will suffer. They all pass their costs along just like other businessmen.

The public in general will suffer a little in the short term because freight rates will go up- but in the long term we will all save a bundle..

Truck drivers as a group are awesomely stupid when it comes to recognizing their own best interests. Lighter and smaller trucks means more trucks and more jobs for drivers, but anybody interested can bet his last can of beans they will not see it that way.

In any case the railroads are going to come back strong for as far out as the eye can see. Even Fernando predicts higher oil prices long term, and trains are about four times as good per ton mile as trucks on fuel.

And trains are vastly better managed these days than in the past due to computerized scheduling and yard management and faster loading and unloading due to using better machinery and methods.

When the first trainload of lettuce was shipped from California by train, in ICEBOX cars, to the Big APPLE it rotted along the way – not because the train was not fast enough, but because it was delayed and delayed and delayed again after that.

Such delays are now history barring accidents or earthquakes or something of that nature.

Intermodal means truck trailers will be driven onto flatbeds on the east coast and hauled to the west coast with three or four guys running the train rather than couple of hundred cowboys driving the trucks.

We will eventually( if Old Man Business As Usual lasts long enough) have intercity rail with grade separated crossings, meaning no accidents, with either the trains or autos and trucks using bridges or under passes.

Then the engineer can put the hammer down and the coal smoke can roll, just like in old western movies movies, if the wind ain’t blowing and the sun is taking a break as well. If renewable juice is available , a computer controlled pure electric locomotive will just mosey off a siding ahead of an oncoming coal fired locomotive and allow it to latch on and the human driving it can bank the fires until such time as the sun goes down or the wind quits blowing.

An average intercity speed of a hundred mph hauling freight will be as easy as pie, no super trains needed, just good well maintained tracks.

It just occurred to me last night that while not intended, letting the roads and bridges fall apart is one way to deal with peak oil.

Where I live, there’s been a lot of expanding and repairing roads. While some of it has been to add express lanes to encourage car pool and bus use, other parts of the work are just to add lanes to busy roads.

Some of us would rather the transportation budget be used for more trains, and that has happened in some places around here, but the focus is still on vehicle transportation.

Unlike my area, it appears that in other parts of the country there is no money to fix the roads. If, of course, you don’t want more cars and trucks moving about, letting the roads fall into disrepair may make economic sense. Why keep pumping money into an infrastructure you may not need in the future?

The trucks do account for significant damage to highways and roads. Road damage from one 18-wheeler is equivalent to 9600 cars. Freeze-Thaw, corrosion, erosion, and large temperature shifts are also culprits.

Fact is we need to get rid of a lot of the roads because even if all trucks were reduced in weight, there would still be significant cost to the public.

Truck weight damage:

http://archive.gao.gov/f0302/109884.pdf

Mac, the answer to the problem isn’t to hunker down and build a wall. Success will only come by bring a sustainable life style to the world before we destroy it. Your fortress will be breeched in time and you will fail. You’re thinking like a Republican. You are starting to see the light of renewables and will see the big picture in time. It wouldn’t be BAU, it could be better. We are all in this together.

“But I do believe a portion of us Yankees and some odds and ends of people in other places have a shot at pulling thru”

Trust me, Yankees are nothing special.

Chief as I see it republican thinking has nothing to do with it but then I ain’t no stinking republican anyway.

I agree with you about the ”sustainable ” thing but to repeat myself I do not have a great deal of hope that we will act wisely and in a timely fashion so as to create a sustainable society. I merely maintain that some portion of us may manage to do so.

I agree that my little( hypothetical for now) fortress MIGHT be breached in the event of things going all the way to hell in a hand basket, but things might also settle down. It might last until some sort of order can be restored, which might take as little as a couple of years or as long as a couple of decades. In any case it would likely enhance the likelihood of my living out my remaining years rather than being murdered for my stash of beans and diesel fuel.

I agree that Yankees are no better men than other men, taken all around, but this does not change the obvious fact that Fate has smiled upon us and dealt us the best hand of any country in the world in a collapse scenario.

Big enough, powerful enough, rich enough, enough people to sustain a more or less closed industrial economy, defensible borders, lots of built out infrastructure already,a tightly allied giant rich and barely populated country next door as big as we are, a population ready to peak and decline if we close the borders, etc.

It is not because we are better men than other men that my country has all these advantages.

It’s just good luck on the part of us yankees.

But I am NOT one to look down on fortune when fortune smiles on me.

I drew four of a kind in the poker game of life. If I had been born rich I would have drawn a royal flush. I am NOT complaining about my luck, no siree!!!!

“Chief as I see it republican thinking has nothing to do with it but then I ain’t no stinking republican anyway.”

The leader of the Republican party wants to start building the fortress with a 1900 mile wall to the south to protect us from Mexico.

“here in the USA. My rock solid gut feeling is that the borders WILL be closed, by near unanimous agreement among all politicians who wish to REMAIN in office, with only a few very desirable people allowed in.”

“We have the territory. We have the farmland. We have the coal-which if used frugally in the form of liquefied fuel can be used to meet our CRITICAL needs for liquid fuels. We have the military might necessary to defend ourselves , and yes, to keep ESSENTIAL imports flowing our way (even if we have to seize them by force). ”

If it walks like a duck, quacks like a duck and looks like a duck. It’s a duck even if it’s wearing a suit and tie.

Who is that “We” in your pocket ? Republicans are clearly the war party. You know which party sings “bomb, bomb, bomb Iran” and who won’t sign on to the current peace agreement with Iran to limit nukes. That don’t have an alternative but war. That right ! It’s Republicans that are always first to point out the war alternative.

“Success will only come by bring a sustainable life style to the world before we destroy it”

I beg to differ. My definition of success is personally not dying in the next famine when humanity goes through the population bottleneck. ‘Saving the world’, as you call it, makes you sound naive.

That’s the spirit…!!

Nancy Polosi and John McCain would be proud….

Actually I don’t think they would be proud. Your point is rather weak. If you would like to spend your days volunteering your time to ‘save the world’ then go ahead. I doubt you will. Your activism in this regard is no doubt limited to trolling the internet with lame comments. I’m focusing my efforts on looking out for number 1. Most people are doomed to die in a global famine within 10 years. There is nothing I can do about that. It’s outside of my influence and therefore outside of my concern. But go ahead, if you have plans to ‘save the world’ I suggest you drop the keyboard warrior shtick and get on with it.

Most people are doomed to die in a global famine within 10 years.

I’m not sure what you mean by “most.” Personally I don’t think “most” people on Earth will be dead within 10 years.

By most I mean something greater than 50%. By mid 2025 is my guess.

Not all people who ‘die in the famine’ will necessarily die of starvation. I suppose some might die from violence and hazardous migration behavior related to competing over access to food, aka fighting for survival. Some who die will be soldiers fighting in wars between states which are fighting over food. Fighting over irrigation is much the same thing. Some who die might be well fed indeed but be killed by enemy soldiers, starving migrants, food riots, stampedes. You name it. I’ll place them all in the same category as ‘die in the famine’ for the sake of argument.

It takes about 2000 kilocalories a day to keep body and soul united. Somewhat more if you are active or live in a cold place. Abstaining from sufficient caloric intake results in death rather soon. First you fight for food. If you do not win the fight for food you die. Perhaps in the fight. Perhaps from starvation. Indeed many may kill themselves. The distinction is moot.

Egypt has about 80 million people with no prospects whatsoever; they’ll be on the move rather soon. The world is at all times about 3 meals away from total anarchy.

The proximal cause of the famine will be peak oil, to-wit decreased net energy flow, and climate change.

Hi Boomer II,

I agree the 3 to 4 billion dead by 2025 scenario is very far fetched.

Now if we assume a nuclear holocaust within 10 years, perhaps such a scenario makes sense, though to be honest I have never looked into the likely outcome of a nuclear World War 3, I imagine it would not be pretty.

…how one pronounces that:

SHtik, or Stik?

Never got the handle of it, though it seems like you indeed do!

shouldn’t you be busy saving the world?

Jimmy, I’m not asking you for your help I assure you. Have a great day and best wishes!

Dear Mac,

-So:…”BAU is a dead man walking even here in the USA.”

-but your:…”old ragged out GEO METRO”…

-will fetch you:…” the beer and groceries”…

-because:…”At some point batteries and synthetic oil,probably coal based, can shoulder the transportation load.”…?

Did I get that correctly?

Boy, you got a pretty good handle on how things work in today’s modern world, don’t you Mac?!?!

I envy your time spent in writing comments, though.

I do indeed!

Be well,

Petro

P.S.: Geo was a piece of crap when new, let alone old and rusty…

P.S.: Geo was a piece of crap when new, let alone old and rusty…

I owned a Suzuki Swift, same car basically. It got 45 mpg and it sure beat walking. It was rear ended by a truck when I stopped at a red light. It was only cosmetic damage but the insurance company totaled it, otherwise I’d still be driving it. It was a great little car.

I have known of some Metros going right on past 300k miles without serious problems but they ARE very prone to rust out. The one I have is badly rusted which is why I got it for next to nothing, the scrap metal price, with the running gear still in great condition.

But I can go three hundred miles south and get one that is mechanically worn out but essentially rust free for peanuts, maybe a couple of hundred bucks. Salt is hardly ever applied to the highways in South Carolina and points south. That will cost me a day and six hundred miles on the old pickup truck. Going that far I will likely get a friend with a newer truck to tow the car home for me. Less gas less likely to break down.

I am not claiming I can survive indefinitely. I do have workable plans to survive for twenty years if the REAPER doesn’t get me sooner. That METRO will if necessary enable me to get around on a TINY gasoline ration. A Volt or LEAF would be better of course.

Swapping out the running gear will take only one day with a helper. Simple little car. Tools and workshop on the premises.

The more likely option is to SELL it to somebody who has one that is NOT rusted out for five times what I paid for it..

As far as having all day to post comments my patient is not having a good day and I am compelled to stick tight. So I will not be out of the sick room except to prepare food and go to the bathroom etc.

Most days I can look in every hour or two and on good days I can take off and check in by phone for four hours..

…good and all Mac, but the question here was not about your GEO!

-The question was about you thinking on one hand that:

”BAU is a dead man walking even here in the USA.”

…yet somehow -on the other hand – you are going to have batteries, synthetic oil, etc, etc, etc, ALL of which are created, made/produced and utterly depend on BAU going full steam ahead!!!

-Now, I understand that these things are difficult (to say the least!) and NOT everybody commenting here and thinking highly of himself and sure about the future comprehends them – and that is why I am pressing this and trying to make you and others pause a little, for what you write/wrote (forgive me for being a bit blunt and forceful here) is quite naive and knowledge lacking!

-I am not trying to be cynical and presumptuous, believe me!

I am trying to be helpful since you (and your progeny) are determined to make it through the impending “bottleneck” , so instead of building wood powered vehicles and using old GEOs, you make more – shall I say – educated choices.

Respectfully,

Petro

I suppose I should be more careful about saying things such as business as usual is a dead man walking.

By that I mean millions of new pickup trucks twice as big every year, more and more airports, cars, malls, subdivisions, people, more and more every thing, etc etc all built on the basis of cheap fossil fuel energy.

Barring the WORST sort of bad luck , we are not going to run out of anything really important ABRUPTLY.

I do not see any real reason why we should run out of oil for instance over such a short time frame that we cannot build some coal to liquids infrastructure. CTL will be expensive, for sure, probably between two and four times the price of crude oil- but that is not so expensive that we anybody except the very poor will starve as a consequence. I have already in my scenarios written off most of humanity ANYWAY.

As the old, current version of business as usual is dieing , a new version, just now emerging, is being born. We have pretty good batteries already, I own a bunch of small ones myself. We will have better ones by far well before oil becomes a critical bottleneck, if oil supplies decline at no more than two or three percent a year. I personally doubt oil will decline faster, and adaptation at that rate is possible- not for everybody, but again I have already written off most everybody ANYWAY.

BAU IS NOT GOING TO BE GOING FULL STEAM AHEAD in the usual old directions when the shit hits the fan. Truly substantial amounts of resources are already being devoted to a new bau paradigm, a new iteration of business as usual.

Any body who has studied history a bit can tell you that countries that seem to be unable to solve even relatively trivial problems for reasons of lack of resources ( mostly tax money ) are able to raise huge armies and put a substantial percentage of their young men to work killing people and burning thru resources such as trucks, guns, aircraft, food, etc at astounding rates.

Sure as hell I know a bunch of people who cannot afford to drive any more but I also know that just about every relatively poor person I know has a car today that gets double the gas mileage a poor mans car got twenty or thirty years ago. Thirty years ago poor guys around here were driving old full size Ford and Chevy trucks.( Today new ones half again bigger get better mileage.) Poor guys are driving OLD compact trucks now almost exclusively- trucks that get DOUBLE the mpg the old full size ones got.

I tossed out all my old incadesent lights years ago in favor of cfl’s and almost all my Cfl’s are now gone in favor of led’s.

Sure I expect to have some synthetic oil- and some ordinary oil too. Not a whole lot, compared to today, but SOME. Enough , certainly, to manage for another decade or two.

IF we get our asses in gear, a hell of a lot can change in a couple of decades.

I will go out on a limb here and predict that a repugnant elephant prez will come out within twelve years and call for hundred mpg cars being mandated the way the state of California has mandated some zero emission cars.

Business as usual as we KNOW it today is a dead man walking. A new generation of business as usual is being born. It may never grow up but it is going to survive infancy at least.

The wind and solar industries are getting close to ready for long pants, and the battery industry is taking some solid food and standing on its own feet but not yet actually WALKING, in a manner of speaking.

I have no progeny. I do have the Metro, and incidentally an old four by four Ford truck, the kind that can be kept running easily, which if time ever permits I intend to convert to a wood gasifier truck- mostly just because I think it will be an interesting way to pass the time out in the garage with old buddies.

Cutting my own fossil fuel energy footprint by half so far has been easy. I can cut it by half again without too much trouble, but at some substantial expense. The money will have to be diverted from other things. Less money for people who make cars and clothing but more for those who make heat pumps and insulation.

Personally I find it naive that people who are doomers think doom is going to arrive in the next few years like a thief in the night. Collapse is headed our way , no doubt about it, and it is already visible on the horizon. COLLAPSE is NOT going to arrive like a thief in the night, but more like a hurricane with nothing else on the news for the last forty eight hours. In the case of collapse the forty eight hours will be more like a decade or two.

SOME of us will most likely pull thru.

It is not unreasonable imo to think that the LARGE majority of people in at least the USA and Canada and a hell of a lot of people in Western Europe and some other places will survive albeit with their living standards falling to subsistence or near subsistence levels.

The USA is not what it once was in terms of unity and grit but otoh these days we still have plenty of resources that can be brought to bear on a wartime footing to stave off outright collapse.

Tell me , how fast do you think oil supplies will fall? Let’s not get too wrapped up with Chinese and Indian peasants all getting cars- anybody who has been paying the LEAST bit of attention knows that will not come to pass, barring miracles on the technology front. I never presume miracles.

How many people in your household? How many could fit in easily ?

IF it were not for overly meddlesome tax and labor laws mucking up my personal range of choices, I would cut a deal with some ugly ( so as not to ever want to take her to bed) but healthy woman in a financial bind to come live with us in exchange for room and board and helping in the house and with Daddy. She could have a full time job and her own car and put almost every DIME she earns, after commuting expenses, in the bank. She could move out any day she pleases. She could go out socializing every other evening. So could I.

But my lawyer tells me to avoid even talking about such an arrangement.

But things change. I may just go ahead and hunt up such a helper anyway. The heat and ac consumption would change not at all, maybe up five percent, ten at the most, electricity for cooking and laundry up a bit , not much. Trips to the store cut by a third at least on a per capita basis for the three of us.

Adaptation is not impossible. I parked our land yacht Buick because I didn’t drive it enough to justify the insurance premiums and tags. Half the people I know are relatively poor and still have two cars when one would do.

If things get really bad within the next ten years I will probably cut a deal with a couple of younger people to come here and live and work as share croppers. They will have a roof over their head and plenty to eat at the very least. If they can find a paid job they can share crop on the side. I will supervise and supply the land, the machinery and the expendables. Too old to actually do much real work anymore..

Since they would not be living inside the same house with me , I can legally work such a deal without having to jump thru IMPOSSIBLE hoops. They pay rent. They work. We keep books together. If there is a profit they share it. In any case they get a very cheap place to live and plenty to eat – if they WORK at growing it.

I read that in places such as San Francisco there are literally tens of thousands of illegally subdivided apartments inside supposed single family residences and garages etc. The authorities are not even making any serious effort to shut them up. Evicting that many people is impossible and trying it would likely mean losing the next election.

Change is already happening and it will accelerate.

Those of us who are thinking and acting have a pretty good shot.

I don’t expect that Metro to be a permanent solution but otoh it may serve ok for five or six years. By then I expect I can afford a ratted out old VOLT or LEAF and to have enough pv of my own to charge it most of the time.

The ONLY reason I do not have pv already is that the cost of it is coming down so fast I am much better off to delay the purchase.

THINK ABOUT THAT FOR A MINUTE.

The cost of small scale pv is coming down so fast I am better off to delay the purchase because I expect to get twice the system for the same money in five years, including all the essential components. Inverters, racks, instrumentation, everything is getting cheaper fast.

The farm house I live in,which I helped build, is mid twentieth century dirt cheap cinderblock.Over the years we have added good windows, lots of insulation up and below, and vinyl siding with insulation outside. Metal roof now too. Barring fire there is no reason that if it is cared for this house will not last a couple of hundred years.

You see what it means to have such houses with a DECLINING population?

Hardly any resources will be needed to build new houses compared to today. We already have plenty of roads, plenty of established grid and water and sewer right of ways etc.

Incidentally I just put in a new well and septic system at a rental that I expect to last a minimum of just about forever in practical terms, a hundred years for the septic system and essentially forever for the well, although it might go dry.

Total cost here, eight thousand bucks. Fifty kWh per month max to run the pump. A hundred bucks a year average maintenance costs long term. Water and sewer in town where I used to live now almost a hundred bucks a month and will be OVER a hundred a month soon.

@ Mac

Too many people down there Mac with guns and expectations. Look at a political map, every state has roads crisscrossing everywhere. If you are doing fine in your area you will have to pony up to someone. Plus, that 1900 mile fence isn’t built yet, and never will be. They going to land mine it too? Drone shoot migrants?

Economic and CC migration will be absolutely huge and will bring every problem with reset/collapse home, regardless of your situation. Imagine a constant “Katrina-like” situation unfolding in several places at the same time. That is what desperate migrations will look like. And Trump fences won’t fix any of that. And no, Mexico won’t pay for the fence.

We are all in this mess together, one way or another. I agree, renewables will help, but also believe Renew won’t replace this incredible ff lifestyle, ever, nor should it. We won’t have EVs tooling around to stores, we will have straggly lines of folks walking and lots of people waiting in lines in towns and cities.

I love Wimbi’s decsriptions of his PV foundation. Alas, I live in a cloudy zone 50+ north and PV is not a viable option. Our family answer is to drive less and less, super insulate, and heat with wood. Grow food. Hydro is for lighting and power tools, but our many power outages in storm season has trained us to live around limits to grid lifestyle.

We’re all going to live simpler and get along with a neighbourhood pulling together, at least in rural situations. Those with set aside wealth tooling around as per BAU will take some pot shots wherever they go, imho. And by potshots I don’t mean ‘tweets’.

From a practical standpoint the best solution is to put four parallel fences, and put dogs between the two inner fences. Anybody caught in the inner fence area can’t say they are there by accident, so they get an automatic 30 days in jail, and a free ride to the border.

Hi Petro,

Maybe you should share your wisdom about what those “educated” choices might be.

Most are arguing that we do not know what the future will be. There are some who think they know that there will be a total collapse of civilization, along the lines of the 1930 to 1945 period only 10 to 100 times worse. Maybe it will be along the lines of the Mad Max series of movies, only with less fuel, or that is my impression. There will be war, famine, no functioning government, general anarchy, and a large decrease in human population due to killing, starvation, disease, lack of medical care, environmental destruction, etc.

I will call this the low income view as World GDP is likely to fall.

On the opposite side of the coin are those that think we can easily replace oil, natural gas and coal with other forms of energy. This would include wind, solar, nuclear, geothermal, hydro, biofuels, wave, and tidal power in conjunction with the declining fossil fuel resource. Also there will be greater energy efficiency, better building and urban design, better transportation options (hybrids, plug-in hydrids, EVs, AVs, busses, rail (including electrified), light rail, and an updated grid with more HVDC transmission. This could be called the high income view.

There are many such as old farmer mac that take an intermediate position between these two extremes. We will call this the medium income view.

It is pretty clear to most that such a transition will be far from easy. Impossible? I doubt it. Easy? Equally doubtful. I would put the odds at a little better than 50/50 that such a transition will occur.

When it begins, how quickly it will proceed is unknown.

Fossil fuel output (in exajoules per year) will likely peak within 10 years and will be apparent to everyone within 15 years. When the reality of energy scarcity is fully realized the pace of change will accelerate and the World may get to work on solutions. Those of us who realize what humanity faces might as well start working on solutions, there is not much point in giving up before we have even tried.

Hi Glen,

Remember that Henny Penny thinks everyone else is Pollyanna.

Back atcha Dennis,

Yep. I have known Henny Penny since I ran across her in the second grade reader. In this neighborhood she usually goes under the alias of Chicken Little.

Pollyanna! Goddam it Ron, there’s a hell of a difference between an air-headed optimist who keeps saying “Things can turn out ok”, and a hard-headed hardware guy who says “ There, I HAVE DONE IT, so quit crying in your warm beer and go do likewise, or, if you insist, go die of stupidity like I think you will and you deserve to do.”

During my R&D days, I had the reputation for showing up at a conference with the THING ITSELF, sitting there running and doing its stuff, when the other guys showed up with megabuck proposals for STUDIES to investigate the POSSIBILITY of doing it.

I think of my granddaughter just off to one of those super- expensive eastern universities, and her dorm room, which looked to me like an overdone palace.

I had gone straight from a shack of a navy barracks to an identical shack of a university dorm, just as filled with ex-GI’s as the barracks had been filled with the same GI’s.

And all this in the sweltering delta with no AC anywhere.

“Try living in the delta without AC”. What a joke! I and millions of others did, and I, for one, am still alive, even if just barely.

To me, the modern generation, including lots of people here, sound like a bunch of wimps, made fat and stupid by a life spent at the swollen titty of the fossil fuel pig.

“…. sound like a bunch of wimps, made fat and stupid by a life spent at the swollen titty of the fossil fuel pig. ”

but they have known no other life ….

forbin

Are you that old wimbi? Came out of WWII?

Yep, lots of us left, some way older than I am.

Vonnegut- “Wars are fought by children.”

Only one close relative left in my family who is a WWII vet.

Wimbi you may not realize it but there are a LOT of us who are VERY fond of you.

“and so it goes”. Great Vonnegut quote. Here is another one – from Tom Wolfe:

“I’ve tried A! I’ve tried B! I’ve tried C! I’ve tried D! Tell me what else I can try!”

The Right Stuff – I have to admit, like Tom’s Edwards AFB’s doomed test pilot, I may be a “Pollyanna”. It happens to engineers and test pilots. Training kicks in. Despite the obviousness of a death-spiral, be it aero or energy, we go through our checklists, re-check the engineering. Try A, try B, try C, even try D, all the way down to augering in. Pollyanna-ish? or coming from a deeper survival instinct? To know that giving up guarantees augering in – the best instinct is to press ahead and try the alphabet soup of options that engineering continues to throw out there. From the first carving of the first wheel, man has been an engineer as well as a mystic. The engineer took us from the wheel to where we are now. Maybe we will auger in, but I’ll be engineering right to the moment of impact. Call it Pollyanna if you want – I prefer Tom Wolfe’s take – The Right Stuff.

Eject, eject, eject!

Not going to improve anything by drilling dirt.

Ron,

There are many people here who recently purchased electric vehicles and PV systems. After experiencing how affordable and convenient such a change is RIGHT NOW, not some magical mystery future, there is an undeniable change in what one believes is possible.

We’re talking about two distinctly different types of people here:

1. People incapable of ever holding a doomer view regardless of evidence.

2. People who held a doomer view, but have seen significant, tangible changes in the affordability and adoption of alternative tech.

Being a doomer regardless of evidence is psychologically identical to being a Polyanna – an inability to change regardless of data.

This is purely in terms of peak oil, and the availability of substitutes in the near future. It is not in regards to the long-term impossibility of growth. Even if human population stabilizes it would not change the fact that our global economic system requires growth to function.

Infinite economic growth is mandatory for a system based on loans and interest. It is also impossible to maintain indefinitely.

That is the ultimate wall that our civilization will ram into.

Developments in the availability and affordability of EVs and PV have allowed me to adopt them myself. As a middle-class American I was able to make that change. In 2008 that was not possible. Even in 2012 that was not possible!

Things are changing faster than many appreciate. It is natural to be skeptical because we’ve encountered such things before. I can tell you. EVs are now real. Affordable solar is now real.

I switched not to save the world with some green machine. I switched because it was financially savvy. I’ve saved money. That was never true before.

“There will be substantial amounts of fossil fuels available to us for many decades to come.”

1. How can you be so sure?

If Ron is right (http://peakoilbarrel.com/peak-oil-right-now/), global oil production will start declining soon. It will be double-squeezed due to the other phenomenon of Export Land Model (https://en.wikipedia.org/wiki/Export_Land_Model). There is also the Energy Trap (http://physics.ucsd.edu/do-the-math/2011/10/the-energy-trap/). I personally think that assumption (MANY decades) way too optimistic. We will not have that “luxury”.

2. To us, or to the U.S.?

When you write “us” I tend to include myself, European, in your “us”. But I guess what you really meant was “you”, the United States, am I right?

Hi Patrick,

If (when) things get really bad, which they surely will, I doubt the U.S. part of “us” will fare well: no better than Europe or Asia. I’d bet places like NZ, New Caledonia and possibly Vietnam will become highly desirable oases; Vietnam owing toughness and self reliance of the population and amazing productivity of the land. The Americas already have the highest murder rate in the world and times are good here (relatively). Of course you already know this.

Hi Doug,

I am sure you appreciate that overpopulation is one of the two key facets of human overshoot. The other is excess consumption of resources per capita.

The more we Yankees manage to kill each other the less problems the rest of us will have eating and staying warm and dry. Sarc light on.

Seriously,

In the event of a mad max scenario which I see as possible but highly unlikely during my lifetime at least, the fact that we have a lot of guns is hardly going to matter at all.

People can murder each other with a piece of pipe very easily. Or just a brick.

If talking about most of ” us ” perishing I mean humanity including a LOT of yankees. If talking about a successful transition I was probably thinking about the USA in particular but some Europeans as well as some people scattered all over the globe have a chance too- maybe not as good as North Americans, but still a shot.

The biggest plus for western Europeans as I see it is that your populations will peak sooner than just about anywhere else and that people there are already inclined to work together. Socialism is a cuss word in the USA but it can be a VERY good thing when it comes to solving really tough problems such as an energy crisis.

You Europeans are sensible enough already to tax the hell out of oil and build and use mass transit.

By many decades I mean at least four or five and maybe as many as ten. WE WASTE most of the oil we burn even NOW- even in Europe, compared to what COULD be in terms of efficient use of it. Ditto natural gas..Ditto even coal when we get right down to it. When I say there will be substantial amounts of oil and other non renewable resources available to ”us” I primarily meant the USA and Canada and maybe a few other places such as Brazil. Russia too. HUGE territory, small population, at no risk of invasion due to being a major nuclear power,etc.

BY going on a wartime economic footing I believe we Yankees can get by on domestic oil plus some synthetic derived from coal and what we can get from Canada etc. The failure to WELCOME Canadian oil of all sorts into the USA is in my opinion one of the DUMBEST mistakes we have made in decades.

Adaptation can happen very fast under wartime conditions and there is little doubt in my mind that once the shit hits the fan hard and steady we yankees will switch over to a wartime footing. This could mean you simply cannot buy a large car or pickup truck NEW for any sum- because none would be manufactured. It could mean having your car confiscated and being jailed for driving over forty mph or buying another drivers gasoline ration to go joy riding. (Driving forty will increase the fuel economy of most cars by a third at least compared to driving seventy.)

It will probably take us yankees another decade just to break the car habit to the extent we can get to seriously building mass transit and setting aside bike lanes on city streets.

There are tens of millions of us yankees living alone or maybe two of us in gigantic houses, by European standards. We can and will double up as a matter of necessity in those cases thereby cutting domestic energy consumption by close to half for that portion of us yankees.

Street cars and subways take a long time but buses can be cranked out in a HURRY.

It appears to me that the vast majority of this forum accepts the fact that the available supply of cheap resources such as petroleum and fresh water have peaked or will do with in the decade. We have built a complex, interdependent economy on these critical resources. The complexity and interdependency means that a a failure or significant reduction in one component will cascade through the entire net work.

There are those who welcome a destruction of business as usual (BAU). Today The Middle East and North Africa are in a state of civil war. Greece, Spain, Italy and Portugal are essentially bankrupt. Africa and Central/ South America are economic basket cases. Japan has been in an economic depression for twenty – twenty five years and China is now showing signs of the ‘Japanese’ syndrome. Central Bank money creation is the only thing that has kept a global economic depression form becoming evident. BAU is being destroyed daily and we are past the tipping point. Even if we suddenly found new sources of cheap energy we would still proceed to global economic collapse.

There are those who think that alternative energy sources (alternative to petroleum) will ‘save the day’. While solar, wind, hydro, nuclear, etc., will mitigate the impact of petroleum deficiencies, political, human nature and economic forces make conversion to those sources difficult to impossible. To date conversion to those sources have been no more than a pimple on a fly’s ass relative to petroleum use. Possibility is not reality!

OFM frequently falls back on a war time economy to ‘save our bacon’. In 1941 we had a population that had been hardened by the great depression. We were for the most part a homogeneous society/culture. People had to be self reliant in order to survive. Today 35% of the US population are on welfare. Another significant number subsist on Social Security and Medicare, both of which will soon be bankrupt. We are a soft, hollowed out, ignorant, society of fat, tatooed, nose ring, meth drenched paper shufflers and baristas.

I am 82 years old. Tonight I will meet with my community emergency preparedness committee. My son-in-law is the leader. Tomorrow I will meet with the community Security leader. Next week I will schedule a meeting with the County Emergency Preparedness Officer. Yesterday I preached at the local community Church. The previous Monday evening at the local Grange meeting, I updated the members on the global economy. All of these meetings result in community preparation for the inevitable economic collapse. In my spare time I teach dwarf fruit tree budding, operate a beef ranch (21 head year round) and maintain the garden/orchard for the family of six households with surplus for the old men and women in the community. I am confident that my rural community will have a good chance of getting through the inevitable ‘bottle neck’ because we are aware and preparing to cope.

I gave up a lucrative career as a senior executive of a global corporation to move my family to this rural valley because I saw in 1994 that the present system was destined to fail. Of course I am ‘talking my book’, but if you expect you and yours to survive the coming collapse you had better plan to cope with an 1890 type existence. That means figure out how you (not Chili) put food on the table and a roof over the table and protect it from the poor souls who out of ignorance or sloth failed to prepare!

There are those who think that alternative energy sources (alternative to petroleum) will ‘save the day’.

They will likely save the day for some people because solar and wind are easier to operate than oil, gas, coal, and nuclear if communities become isolated.

Look, I’m going to die when I get old enough. Nothing is going to save me personally. Similarly, everyone is going to die. Nothing will save any of us from that fate.

If some technologies allow some people to better survive, then those technologies have done their job.

All of us are expendable in the evolution of our species. If some homo sapiens survive to keep the species moving along, that may be a reasonable outcome in the greater scheme of things.

Hi TG,

You are new to me, glad to see your comment. ESPECIALLY THIS EXCERPT.

”OFM frequently falls back on a war time economy to ‘save our bacon’. In 1941 we had a population that had been hardened by the great depression. We were for the most part a homogeneous society/culture. People had to be self reliant in order to survive. Today 35% of the US population are on welfare. Another significant number subsist on Social Security and Medicare, both of which will soon be bankrupt. We are a soft, hollowed out, ignorant, society of fat, tatooed, nose ring, meth drenched paper shufflers and baristas.”

It is in large part because I agree with your assessment of our current society that I am so particular about saying MIGHT and MAYBE and SOME etc when I talk about the possibility of a successful transition to renewable energy. The forties yankee dog was lean and mean,young, with fast reflexes. The current day yankee dog is a lap dog by comparison in most respects, fat, senile, by comparison almost helpless.

Now my own family,what is left of it, is basically not interested in the things you talk about, which is why I will be forting up, if it comes to that, with a few select friends. Forting up is in essence what your plans are all about, only on a community level of course.

IF a couple of relatives show up, I may or may not take them in, it depends on their attitude more than anything else. Most of them only show up now when they want something.Young people have a way of forgetting old folks are alive except on holidays and when they want something. They never lived on the farm. They don’t know anything now except bau jobs and the bau lifestyle. They mostly think I am a cracked old fool for believing in collapse being a real possibility. The neighbors I can best count on to some extent are local church members. They DO believe in collapse but for different reasons.

It is amusing to note that the hard core doomers who hang out here likewise think I am a fool for believing a successful transition to a renewable economy is at least THEORETICALLY possible- but this is a polite forum and we generally do not call each other fools DIRECTLY.

I envy you your confidence your community will pull thru the bottleneck. I am not more than moderately HOPEFUL my little community will survive but we do still have a lot of TOUGH people – compared to most places.

I am wondering what you are doing in order to ensure your community remains peaceful and is NOT going to be overrun by people fleeing other places where life becomes impossible.

OFM said”I am wondering what you are doing in order to ensure your community remains peaceful and is NOT going to be overrun by people fleeing other places where life becomes impossible.”

It will not remain peaceful. However, 15 mile long, one mile wide fertile river valley with minimum access roads that are easily blocked and check pointed. The side ridges are difficult to traverse. We have ham radio communication throughout the valley and drill every other Sunday night to assure that the system works when needed. Security is routinely considered at our regular Community Emergency Action Group meetings. We do not underestimate the risk posed by the desperate.

I like what you say, and admire the things you are doing, very much the same as what I do.

I am quite a bit older than you and grew up during the depression, getting used to more or less universal lack of money and need for self-sufficiency as a natural state of humanity.

Of course I saw all the innovations and almost instantaneous changes of national effort, which was indeed impressive in its speed and depth.

It is true that most people these days are not at all capable of that sort of effective reaction to a major threat, but not a few are. I live in a relatively poverty-burdened appalachian hill country, and around there there are lots of people who have lived their whole life on their own wit and wisdom. They can, for example, make a functional wood gas fueled car like was used by the millions during the big war. Or turn any junk into useful stuff.

Most of my own remaining energy I use to show these folks a lot of great new tech they could make and use but had no chance at all to know about- for example, super good little engines that came out of very high tech space programs but were ignored for other uses that lower tech versions easily could have done

TG

Thanks for your comments. I am interested to hear more about your program. I would like to see something along those lines in our community. Perhaps you can point to some resources that would be of assistance?

Thanks

Walter

The 30 Tcf expected in the Egyptian field is quite large. I think that is between 1/3 and 1/2 of the Marcellus which in now the biggest nat gas producer in our nation.

The 30 TCF is in place gas in a deep water setting. I would use 20 TCF for speculative purposes.

Does not California’s drought lend an opportunity for the electric economy to demonstrate itself?

A state of 40m souls wealthy almost beyond the dreams of Midas, technically superb, highly developed, fertile, but for now with too much sunshine and too little water replenishment. Who knows how long the drought will last – 1yr?, 10yrs?, 100yrs? Its alleviation is by borehole drilling into deeper and deeper connate aquifers. Why do its citizens and legislators not take the bull by the horns and put the Pollyannas centre stage? Ok – there’s always the (pretty high) risk that the winter snows will return, but there’s a significant downside risk of long-term loss of agriculture and downgrading of quality of life.

So use all this insolation to transport and generate fresh water in abundance. Build an infrastructure that supports shipping of water from wet parts of the States/World to offshore California, then to be conveyed by large pipeline into the reservoir system. Massive electric pumps – no problem. Massive current – no problem; PV energy is cheap and abundant. Float an array of Single Point Moorings out to water deep enough to handle 250,000 tonne tankers – same at the other end where the water is coming from. Connect up with 72″ pipelines to the top of the reservoir system.

Temporary shortage of tankers? Build reverse osmosis plants along the coast and complement the water supply into the pipelines. Endless PV power and Li battery storage will provide the muscle.

How much water would stabilise a continuing parched landscape? Let’s say something around the 5 tonnes per day/per person, to include domestic use, industry and agriculture. We’re looking at 200m tonnes per day. That’s about 150 72″ pipes at 4m/sec flow. Increase it as desired to permit pumped downhole replenishment of aquifers (our frac’ing friends can help out here) and make good subsidence in populated areas.

Basic resources are steel, Copper, Lithium, transition metals, plastic insulation and Coulombs. Admittedly on an industrial scale – but hey! What’s in short supply? Commodities are cheap, oil is cheap, PV cells are getting ever cheaper, the Giga Factory can cope with the Li cells, people are available.

Within five years California could be permanently cushioned against ombretrophic failure and we’d all be impressed, if not a few confounded. Then build out to the other water-starved areas of the world, close enough to the sea. Simples!

California agriculture is toast. Using PV to distill or move water would make it much too expensive for crops. There is plenty of water for the urban areas. California agriculture at roughly $18B/yr is over 16% of US agriculture but only one percent of California GDP.

https://www.fieldtomarket.org/report/national-2/PNT_NatReport_Socioeconomic_AgriContributionToNatlAndStateGDP.pdf