The EIA recently published the February edition of their Short-Term Energy Outlook. If you follow this month to month, and I do, you will notice their prognostications change a little every month. And over several months those small changes can add up to some rather dramatic changes. Nevertheless, below are several charts with their current oil production projections.

The EIA STEO only gives monthly data for total liquids. All C+C data is quarterly and annually. The monthly projected data begins in February 2016. Projections for quarterly and annual data begins January 2016.

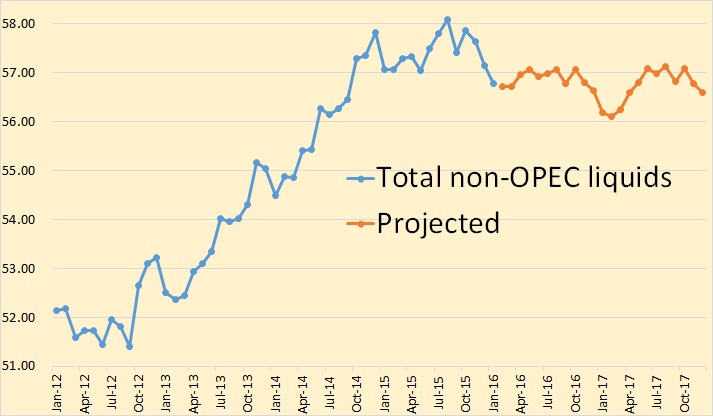

The EIA says Non-OPEC total liquids dropped .5 million barrels per day in December and another .36 mbd in January. But then, other than another short drop in the first quarter of 2017, they see things leveling out for the next two years.

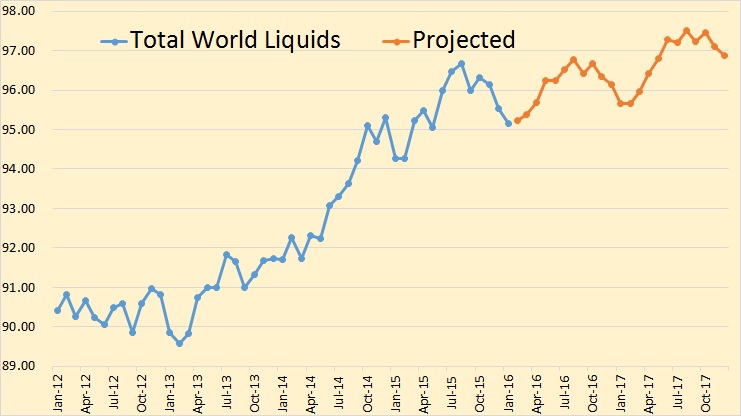

For the total world, the EIA expects far better production numbers than just for Non-OPEC. They expect new highs to be reached in 2016 and again in 2017.

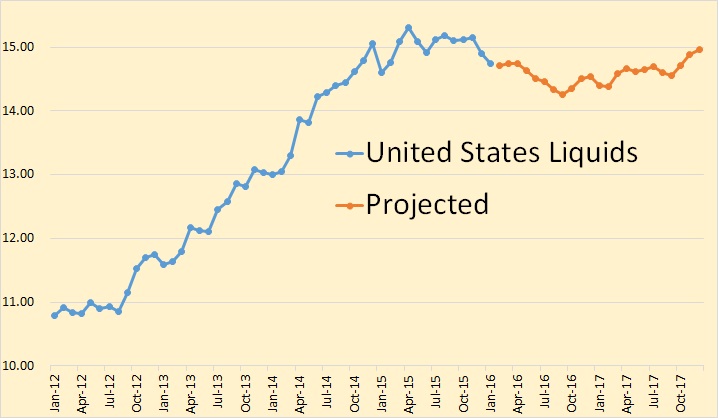

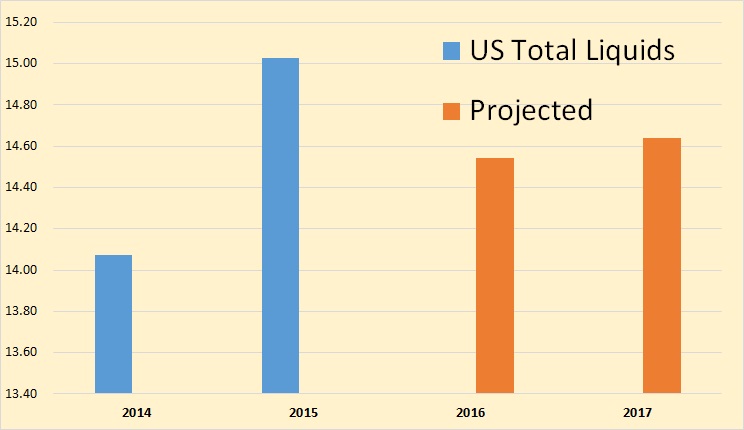

They see US total liquids dropping in 2016 then they begin a slow rise through 2017, but not overtaking the peak in 2015.

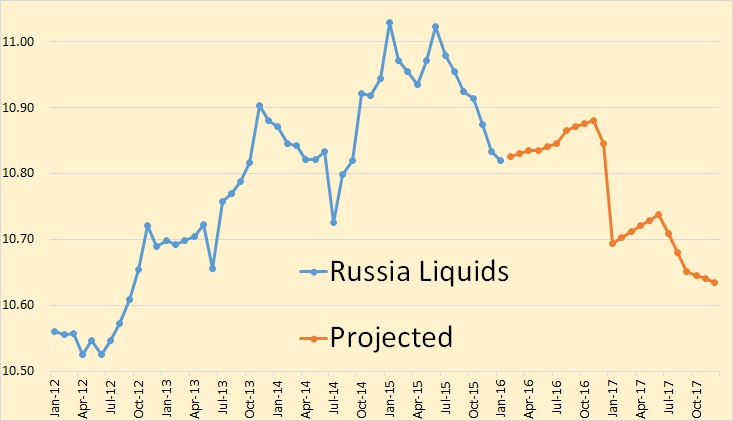

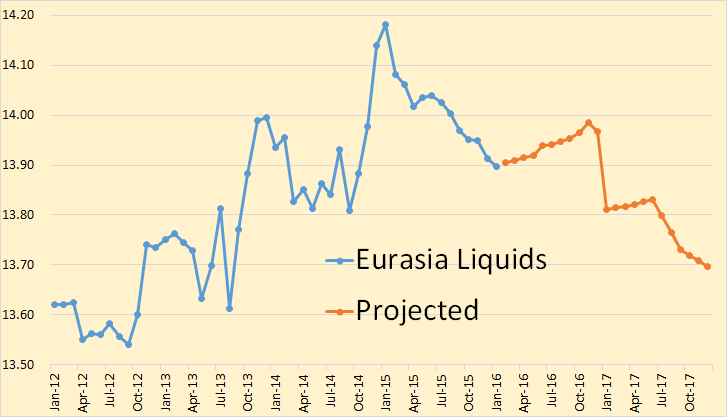

Apparently the EIA thinks Russia has had it. They see a drop in December 2016 then a huge drop in January 2017. I have no idea why. However the scale here makes the decline seem greater than it really is. From January 2015 to December 2017 the decline is only 400,000 barrels per day.

Adding the other FSU nations to the mix, mostly Azerbaijan and Kazakhstan, only exacerbates the decline, making it half a million bpd between January 2015 and December 2017.

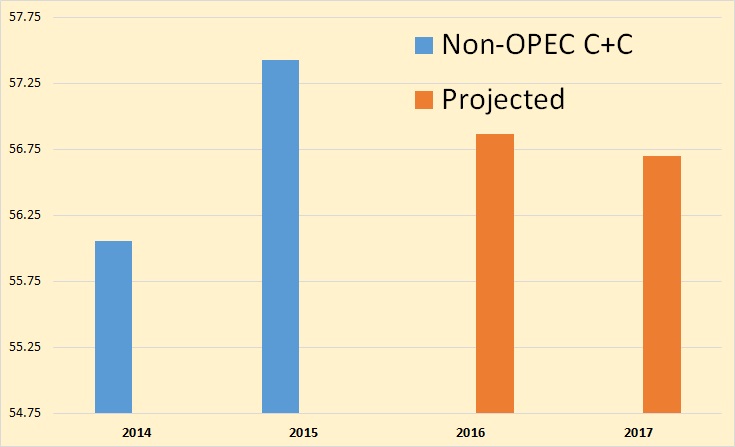

Looking at just Crude + Condensate I think we get a better picture of what the EIA really expects in the next two years. They expect Non-OPEC C+C to drop 580,000 bpd in 2016 and another 170,000 bpd in 2017 for a total of 750,000 bpd over the two years.

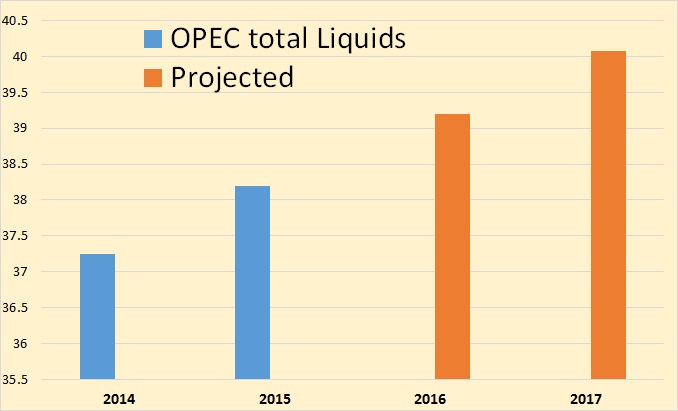

They are expecting far better things out of OPEC however. They have OPEC total liquids up 1,010,000 barrels per day in 2016 and another 870,000 bpd in 2017. They do not project OPEC C+C.

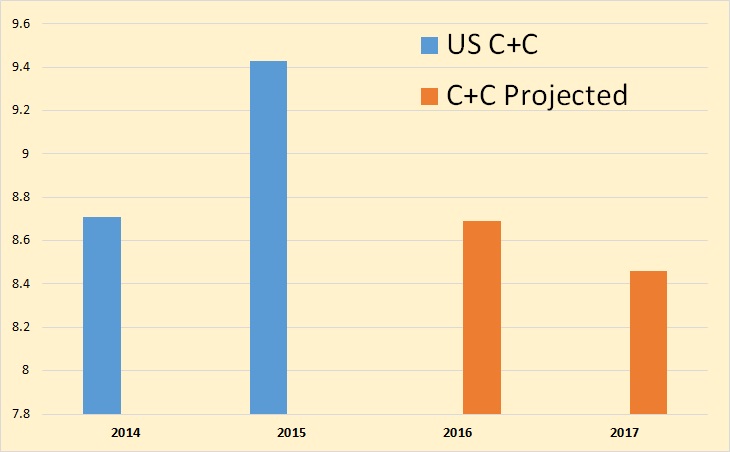

But taking a closer look at their US Projections:

The EIA expects US C+C to drop 740,000 barrels per day in 2016 and another 230,000 bpd in 2017 for a total decline over two years of 970,000 barrels per day.

However they have US total liquids faring much better then just C+C. They have total liquids declining by only 490,000 barrels per day in 2016 and increasing by 100,000 bpd in 2017.

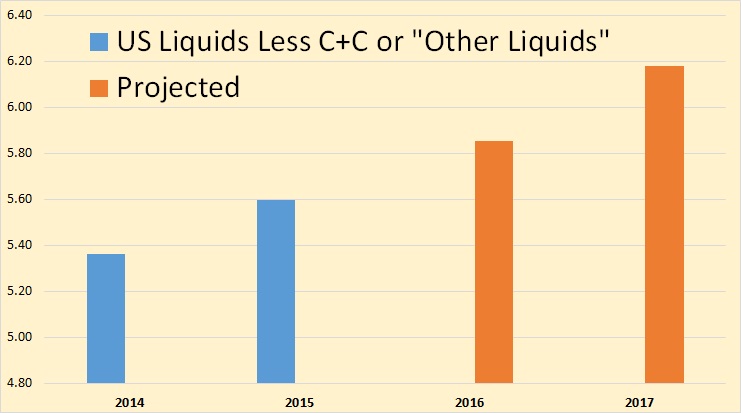

What this means is that US “Other Liquids”, that is NGLs, biofuels and refinery process gain must show a very impressive gains while everything else is going to pot. They show other liquids increasing by 250,000 bpd in 2016 and another 330,000 bpd in 2017.

Most of this increase has to come from NGLs as biofuels are only a minor input and refinery process gain pretty much follows C+C consumption. But…

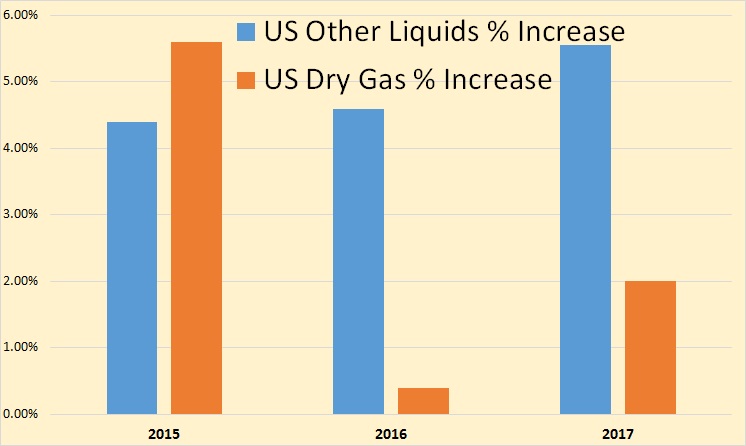

Using their projections for Dry Gas production we find that gas production increased more than other liquids increased in 2015. However they say gas production will increase by only .4 percent in 2016 while other liquids increase by 4.6 percent, and a similar story in 2017 though not quite as dramatic.

Bottom line: I find the EIA’s past production data very accurate. However their projections appear to be pretty lame. This observation is proven out by the fact that those projections are constantly changing. Also, those “Other Liquids” projections seem to make no sense whatsoever. It appears to be mostly a fudge factor.

But the very biggest problem with the EIA’s projections are with OPEC. That is because it is not a projection at all but an estimate of what will be needed to meet world demand. That is they estimate Non-OPEC production, then they estimate world demand, and the difference between the two will be the “Call on OPEC”. That is, they will simply expect OPEC to make up the difference, whatever that difference may be.

Lately however, OPEC seems to be producing a lot more than their call asked them to. That is, they appear to be ignoring their call. And they will likely do likewise when they are expected to produce more to meet demand. They are all currently producing flat out and if there is a call on them to produce more, it will very likely go unanswered. I expect the “Call on OPEC” is a running joke between OPEC nations.

______________________________________________________

Note: I send out an email notice whenever I publish a new post. If you would like to be added to that list then email me at DarwinianOne at gmail.com.

Hi Ron,

First thank you as always for your contribution on such an important topic. So in summary the EIA projections for increased world supply (2nd chart) are to come entirely from OPEC? Is there a country by country prediction for this?

No, the EIA does not publish OPEC country by country future oil production estimates, only OPEC as a whole. I guess the EIA thinks that when they make that “call on OPEC” OPEC will dictate just who puts out all that extra production. 😉

“Just How Accurate Are The EIA’s Predictions?” – has there ever been a statistical analysis of the accuracy of previous predictions? I’d guess the result would be poor. If every poster on this site was asked for a prediction and the results averaged I’d give it about five times more credibility that EIA or IEA.

A question more related to the previous OPEC post: when OPEC give Qatar numbers how is the GTL diesel from Pearl and Oryx recorded (e.g. as crude, as gas, as both or neither)?

The only thing that OPEC counts, in their quota totals, is crude, crude only. Not even condensate is counted. So it does not matter how much of any other product Qatar turns out, that is not counted.

Of course quotas are pretty much a moot point these days. No one pays any attention to them.

George

The EIA itself started doing a retrospective of their AEO (Annual Energy Outlooks) last year.

The report and tables as data files is at:

https://www.eia.gov/forecasts/aeo/retrospective/

The report as one big pdf:

https://www.eia.gov/forecasts/aeo/retrospective/pdf/retrospective.pdf

Hopefully somebody handy with a calculator will try to figure out roughly how much of total world production consists of condensates, natural gas liquids biofuels, etc.

I am not too sure about the comparative energy content of biodiesel and other bio fuel oils, as to their energy content compared to crude, but it takes almost three barrels of ethanol to equal a barrel of crude.

I seem to remember reading that natural gas liquids and condensate contain only about seventy percent of the energy per barrel as crude, about the same as ethanol.

So – with condensate and ngl’s making up an ever larger share of total liquids, the AVERAGE energy content of the total liquid barrel must be declining significantly.

Some people believe that the net energy content of American coal was declining significantly even as the tonnage mined was going up noticeably, a few years back, due to the coal from Wyoming being so much lower quality.

It seems possible that we might have already passed peak net energy from total liquids, and maybe even peak net energy from all fossil fuels combined.

I’m estimating that global crude oil production* was about 69 million bpd in 2005 and 68 million bpd in 2014. I would assume around 69 million bpd for 2015. Global total liquids production was 85 million bpd in 2005 and apparently about 96 million bpd in 2015.

So, I estimate that actual global crude oil production, as a percentage of total liquids, fell from about 81% in 2005 to about 72% in 2015.

In regard to the US, I estimate that actual crude oil as a percentage of total liquids fell from about 57% in 2005 (4.7/8.3) to about 49% in 2015 (7.3/14.8).

*45 API Gravity & Lower Crude Oil

If the collective or average energy content of “other liquids” IS only seventy percent of the energy content per barrel of conventional crude oil, then ten million barrels of conventional are worth about twelve and a half barrels of “other liquids”.

If it turns out that conventional crude HAS hit it’s ultimate upper limit, as indicated by the plateau in production of it, for the last decade, even with the price skyrocketing, then each MILLION new barrels of “other liquids” are will be worth be worth only seven tenths of a million barrels of actual OIL.

Of course the impact will not be quite so bad , in terms of the energy of the total liquid fuel supply, because the total supply already consists of about twenty eight percent “other ” according to JBB’s estimate.

Something tells me net energy per capita per barrel of liquid fuel is in the rear view mirror and receding from view at a steady clip, given the growth of population.

That might not matter as much, except at a moral and humanitarian level, as we think however, because most of the poor people of the world are never going to own and drive automobiles.

But it is reasonable to assume that even the poorest parts of the world will see substantial percentage point increases in oil consumption, so long as oil can be bought at any price, because the less oil you use, the greater the utility of each barrel.

A gallon burnt in a heavy truck delivering food from country side to city is worth twenty or thirty or even forty or fifty bucks, once the truck and the road are in existence, in comparison to the alternative of hauling it with draft animals or human muscle power.

It could turn out that the world wide economy will go downhill FASTER than the available supply of oil, even as high cost producers drop out. If NO new oil is brought into production, the supply will decline at somewhere between four and eight percent annually, according to all the estimates I have seen.

Personally I find it hard to imagine the world wide economy WILL go downhill FASTER than oil supply,barring global level Black Swan events, so I am convinced the price of oil will go up.

This is not to say the economy can’t go downhill faster than oil production in the SHORT term . It might, and so the price of oil might stay low for some time yet, until depletion takes it’s toll.

Oil producers are stubborn bastards, and will give up no faster than they go broke. Some of them can generate some cash for decades yet to come, even at thirty or forty bucks per barrel. If they go broke,due to not being able to pay off loans, whoever buys their wells will buy them cheap enough to continue to produce them.

I will personally gladly pay twenty bucks per gallon, so long as I can get diesel fuel, before I even CONSIDER going back to horses and mules.

Ya feed a car or truck PER MILE you drive it, and a farm tractor PER HOUR you run it. Ya feed draft animals three hundred sixty five days per year. NO CONTEST, unless you CANNOT buy diesel and gasoline at any price.

Mac,

I was chatting with my Norway niece (Nicole/Nikki) this morning and, I recalled, you were asking about the distinction between “oils” and their relative energy value. Remember, I’m 75 now and the grey cells are evaporating rapidly but we had a decent connection so this is (basically) her comment: all errors mine.

She said that any distinction between oil and condensate is artificial and arbitrary. They’re both crude in that compositions are whatever came from the well with no processing other than simple separation. Apparently some oil people simply use five classifications for reservoir fluids: black oil, volatile oil, retrograde gas-condensate, wet gas, and dry gas. And, since most hydrocarbon liquids are close to the (CH2)n formula, the energy content/pound is fairly constant (roughly 17,000 BTU/lb).

Really heavy crudes can be difficult to refine because they’re more likely to be contaminated with sulfur and heavy metals that can poison refinery catalysts, they’re hard to pump, they can leave fouling on the process equipment, and they need more processing (cracking, reforming, alkylation) to produce light fuels (gasoline, diesel, jet fuel). According to her, the bigger concern would be the percentage of heavy industrial gunk which is useful only for big power plants, ships, and industrial furnaces or even road asphalt.

When she got into C12+ hydrocarbons, aromatics, benzene rings, alkenes and branched isomers I got bored and asked about her new boyfriend. Is that any use?

Doug,

This actually is a pretty complex topic.

Please note that while the number of BTUs per unit of weight is equal for condensate and oil, the energy content per unit of volume (barrel) is not. It is approximately 12% lower for condensate (on average). So when you measure total production in volume units not weight units, and most of your production is condensate you inflate the amount of energy extracted. With 50/50 mix of oil and condensate the inflation is around 6%. That means that to get proper comparison with, for example, Europeans data where most production is Brent crude or heavier, you need to multiply US data with factor 0.96 or so to equalize the energy content. That also imply that any claim of world petroleum liquids production glut using volume comparison is unscientific. And any claim about “oil glut” which is less then 1% of total volume of petroleum liquids produced (around 1 Mb/d) is pure propaganda.

As Steve from Virginia aptly noted

http://peakoilbarrel.com/opec-january-production/#comment-559218

Repeating after Steve: “so-called ‘glut’ is simply another finance industry/media narrative”. Or, if you wish, another noble lie in Leo Strauss style. See http://peakoilbarrel.com/collapse-of-shale-gas-production-has-begun/#comment-558479

Looks like the US elite is afraid to go full force into oil conservation mode and was unhappy with “secular stagnation” of the economy. It preferred to drop oil price to solve the problem of “secular stagnation” or at least to postpone the day of reckoning: yet another financial crash which is immanent under neoliberalism, but which might undermine their political power.

Instead, Obama administration adopted Madame de Pompadour “Après nous le deluge” (“after us deluge”) mentality…

Also the mix of refined products you get from the unit of weight of each type of oil is different and you can never get even close in the amount of aviation kerosene and diesel from condensate as from WTI or Brent.

Actually my impression is that the fact that in the USA oil is bought by volume predispose US refineries to heavier oils, as there is more energy content in them and thus they can get more bang from the buck for them.

See Jeffrey Brown’s post about rejection of some blends by US refineries for details.

Hi Doug,

Thanks that is very useful.

Below I show World liquids consumption in Mb/d and Mboe/d using BP data from the Statistical Review of World Energy.

To find Mboe/d I took world consumption in metric tonnes and assumed 7.33 b per metric tonne. Sorry about the typo on the chart, too late to correct.

We hit the peak in World output per capita in 1979.

When she got into C12+ hydrocarbons, aromatics, benzene rings, alkenes and branched isomers I got bored and asked about her new boyfriend. Is that any use?

Well, compared to colliding black holes and gravitational waves, and E=MC^2, organic chemistry is pretty cut and dried… 🙂

Got a small problem with this.

Diesel became used for a reason. Ditto jet fuel. Problems arose that were only solvable by changing to that fuel. There’s a sort of overly glib presumption that energy content for condensate is only down and not zero, applied to . . . not a diesel engine but to the problem addressed by the diesel engine.

The volume/weight thing is a pretty big deal, too. Fuel tank capacity is not defined by weight.

Sorry, but Nicole is wrong. Oil is found as a liquid phase fluid in the reservoir, while condensate is found in the gas phase in the reservoir under static conditions. “Some oil people” isn’t the right description. Petroleum engineers consider the initial conditions and composition of the hydrocarbon system to define how it would behave under different development and operating schemes. These groupings you listed are a very sensible and technically sound system to describe system behavior as the reservoir is produced.

For the non specialist the separation of the crudes by API will do. Use 45 degrees, it seems to do the job. And don’t worry too much about the other details. As we can see, even petroleum engineers can get s bit lost in this area, which is mostly the purview of hard core reservoir engineers and process equipment designers.

Nicole responds: “With respect, the term black oil is particularly imprecise and context-dependent; to a reservoir simulation engineer like me, that means the simplifying assumption that the fluid can be characterized by only two components, one of which can exist in only one phase whose properties we can characterize the other component dissolves in that phase; that phase is black as in “black box”, not color. Usually the non-partitioning phase is the heavy component (separator oil may contain dissolved gas, but the gas phase contains no oil), but it works the other way, too (separator gas can contain condensate vapor, but condensate can dissolve no gas). When it’s applicable, the black-oil assumption saves “lots” of computational effort.”

Thank you Nicole and Doug for the information.

It seems if we are interested in the amount of liquid energy produced in terms of exajoules we would pay attention to the tonnes of liquids produced and just convert to Exajoules.

So for oil consumption data in BP’s Statistical Review of World energy we would focus on the data by weight and use a conversion to Joules (or Exajoules).

One billion metric tonnes of oil equivalent are about 41.87 EJ.

Chart below with World Liquids consumption in Exajoules per year using BP Statistical Review of World Energy 2015.

Nicole left for her bi-monthly platform tour so I’ll say if you stick to weight when doing your rough oil/condensate energy conversions your numbers will be OK. My Proviso: I’m NOT an oil guy. Don’t include NG though, which is mostly methane (22,000 BTU/lb) ????

Thanks Doug,

You know far more than me, just from your conversations with Nicole, and I believe you are also a geophysicist, and have worked in the industry. You may not be up to date on the latest oilfield tech, but you are very knowledgeable nonetheless.

The “liquids” are biofuels, NGL, and C+C in my chart. Methane is not included.

Barrels, BTU’s, mcf, CMO, enough dungpiles ! Save us. Remember http://www.theoildrum.com/node/2320.

Real Energy, as in MT, Calories, EJ would be so clear.

Nicole is still wrong. She answered the point I made with a rather pedantic point which failed to address my comment: the distinction between oil and condensate is whether they are found in the liquid or gas phase in the reservoir. Condensate is found as a gas in the reservoir. The distinction isn’t artificial nor is it arbitrary. She has a bit to learn, probably because she’s too much into her specific experience. Comments in a blog have to teach the audience whenever possible. Hers didn’t.

Right, I’ll suggest she forgo future comments. Nicole lacks confidence in her English anyway so it won’t be difficult to muzzle her.

I disagree.

The important point was energy per unit mass is the same.

In Nicolas view if we are concerned about energy just look at mass produced.

I agree.

Please keep the comments coming Douglas

Fernando knows more than me but not more than your niece.

I am a little puzzled over condensate. If it exists in the gas phase, in the reservoir with, presumably, high pressure, how does it condense to liquid when extracted and the pressure is reduced? I would have expected the reverse. Am I mis-understanding something, confused or just lost the thread?

NAOM

At high pressures, as found in gas reservoirs, things don’t work the same as at atmospheric pressure on the earth’s surface. There is a phenomena known as retrograde condensation where as the pressure is reduced at constant temperature, liquid condenses out of the gas (.e. condensate). If the pressure is further reduced then it will start evaporating again (which is what we are used to seeing).

If the gas is cooled at the same time (which happens naturally when gas is let down in pressure with no heat source present, or if it cools from the hotter reservoir to ambient conditions, say in a pipeline) then there is relatively more liquid formed. In the past condensate was sometimes called drip gas as it dripped out of pipelines from a combination of these effects.

http://www.jmcampbell.com/tip-of-the-month/2007/06/why-do-i-care-about-phase-diagrams/

That was a pretty good explanation. Several years ago I had to explain the way this works to my boss, and I resorted to explaining that a multi component system had molecules bouncing around, and that at high pressure we saw the lighter molecules kicking the heavier ones into the gas phase if they ever decided to settle down into a liquid. It worked.

Thanks, that helps.

NAOM

I posted a long explanation that seems to have got lost so try this:

http://www.jmcampbell.com/tip-of-the-month/2007/06/why-do-i-care-about-phase-diagrams/

because it also hot and will exist as liquid at ambient temperatures.

http://www.naturalhub.com/slweb/defin_oil_and_natural_gas.html

forbin

DougL,

“…asked about her new boyfriend. Is that any use?”

Of course not. Why would I care about her new boyfriend?

I would suggest, as I always do, that if she finds herself putting up with him acting like a jerk, walk away. His problem, not hers.

Synapsid,

Clearly my words are confusing because I wouldn’t expect you or anyone here to give a rat’s ass about Nicole’s boyfriend. OTOH, Nicole is dear to me (like both my Daughters) and her happiness is on my list of life’s concerns. Actually, when I was first working in industry female engineers took a lot of crap from fellow male workers; it’s not like that now. In fact, she once told me that guys on the rigs ALWAYS treat her with utmost respect and I’m sure it’s no different with her new boyfriend, who I met very briefly at Christmas. Besides, I’ve never met a Norwegian woman who’d tolerate much crap, and being married to one for over 40 years, I speak from experience. I apologize for any confusion.

The apology is mine, Doug–I used an invisible yellow smiley face. I do beg pardon.

I don’t try to be annoying. It’s (sigh) a natural talent.

Ahem. Now, about that organic-chemistry comment: At the level of reactions and bonding quantum effects are in play, and cut-and-dried goes out the window and EGO (eyes glazing over) is diminished.

Don’t forget it’s in Norway. The best solution is for her to call the city psych agency to send a team of reeducators who will treat him with kindness and teach him his behavior is his parents’ fault.

This is the sad part Old Farmer Mac. You will not even consider going forward to horses and mules.

I spend a lot of time in Ethiopia, Africa. Humanity and coffee originated here. A large part of their agriculture is still done with oxen plowing the fields. A public taxi in a rural town can still be horse and cart. Donkeys carry cement to many building sites side by side with modern trucks. Those animals are very frugal in their food and water consumption.

And then there are the do-gooders. Those damned NGO’s (charities) that see it as their first mission to buy Toyota Landcruisers to ensure their pompous leaders can be carried in perfect comfort from one five star conference to another to discuss some project in the way waste societies do business. These people are completely blind to the fact that they are destroying what are in all likelihood man’s oldest civilization. Ethiopians are not the ones who build the biggest castles or created the most exquisite art. But they have been around the longest. The skeleton of Lucy is dated at over 3 Million years . That means they know a thing or two about survival.

So you might be forgiven for assuming that people come here to LEARN and see how we could live sustainably. Instead, they introduce “development”. That is of course another term for burning fossil fuels.

Whatever “un-developed” pockets of humanity manage to survive will be among the leaders when oil man finally goes extinct.

This is the sad part Old Farmer Mac. You will not even consider going forward to horses and mules.

I spend a lot of time in Ethiopia, Africa. Humanity and coffee originated here. A large part of their agriculture is still done with oxen plowing the fields. A public taxi in a rural town can still be horse and cart. Donkeys carry cement to many building sites side by side with modern trucks. Those animals are very frugal in their food and water consumption.

And then there are the do-gooders. Those damned NGO’s (charities) that see it as their first mission to buy Toyota Landcruisers to ensure their pompous leaders can be carried in perfect comfort from one five star conference to another to discuss some project in the way waste societies do business. These people are completely blind to the fact that they are destroying what are in all likelihood man’s oldest civilization. Ethiopians are not the ones who build the biggest castles or created the most exquisite art. But they have been around the longest. The skeleton of Lucy is dated at over 3 Million years . That means they know a thing or two about survival.

So you might be forgiven for assuming that people come here to LEARN and see how we could live sustainably. Instead, they introduce “development”. That is of course another term for burning fossil fuels.

Whatever “un-developed” pockets of humanity manage to survive will be among the leaders when oil man finally goes extinct.

I very much sympathize with your view. But, being an incurable R&D engineer, I can’t leave good enough alone. I daydream of a hybrid donkey cart. The donkey pulls the cart, a super simple steam engine in the cart, running on the same fuel as the donkey, boosts the pull in proportion to the donkey pull, result, super strong donkey. Strongest part of donkey does not eat when not working.

Survival. On donkey fuel. Only a few fatal explosions every now and then. (Always some little cost for progress.)

“same fuel as the donkey”

Same as in reused?

😉

NAOM

Ahh. Yep, Donkey – poop – steam.

Like combined cycle. Gas turbine – exhaust – steam.

Donkeysteam. Quick, patent!

Sidney Mike,

I would suggest that whatever Lucy has to say, it applies to all of us, not just to the inhabitants of the Horn of Africa.

I agree with you about the NGOers. How they can act as they do is beyond my comprehension.

Nobody can tell if Australopithecus afarensis was an ancestor species to Homo or not, but in any case we share common ancestors with all Ethiopians since at least the emergence of anatomically modern humans at around “only” 50,000 years ago. We have evolved the same, we have survived the same, our ancestors have probably traveled more and picked some gene varieties from Neanderthals that Ethiopians don’t have, while they retain a bigger share of old sapiens varieties that didn’t make it out of Africa.

“So ‘ere’s ~to~ you, Fuzzy-Wuzzy, at your ‘ome in the Soudan;

You’re a pore benighted ‘eathen but a first-class fightin’ man;”

Well writ, Sydney Mike.

Wimbi, it’s the land that counts, naturally. We cannot afford to lose touch/sight of that in our pursuit of technology and pretty much anything else.

Inasmuch as technology is an enabler, it is also a decoupler/disabler in less-than-wise hands.

Timeless Land

So, if half of the US liquids is condensate, what are the refiners doing with it?

I’m assuming that the condensate is less than octane, so they can’t (easily) make gasoline or diesel or jet fuel or anything heavier out of it.

I know you think there is a lot of condensate in storage, but we don’t have that much storage.

Continued from here…

The State won’t hold without (at least close to) full and mutual ‘coercion’, mutual responsibility and interdependence– like an organism, an ant colony, with no real elites nor inequality/inequability.

But do you know what you then have? An ‘organism’. A ‘trap’.

The moment an element or elements in an organism get out of line (corruption, rebelliousness), the organism is in trouble and can– and does– collapse.

And then it’s back to ‘anarchy’ and much less coercion– dubious, structural or otherwise.

Is that the State you want, Dennis?

See also

Hi Ron, great post and love the blog.

When I look at the world total liquids production chart, it looks like production dropped from about 96.7mmbls/d in summer 2015 to about 95.1mmbbls/d in January – a drop of roughly 1.5 mmbbls/d from peak. Do you think this is accurate? If not, how accurate do you think those numbers are?

Jin

The actual data:

That’s a decline of 1.51 million barrels per day from August to January. I am sure that is not exactly accurate because all the January numbers are not in yet but I would think that it is pretty close. I am not really shocked by those numbers.

I am not really shocked by their projection through the end of 2017 either. But I just flat don’t believe those numbers at all.

Ron. This has probably been covered somewhere else, but are there any major non-opec projects coming online the next months that would account for the significant chnage in slops from historic data to the forecasts?

I haven’t heard of any new projects that would account for such such an increase as the EIA shows. However they have access to a lot more data sources than I. But I believe a lot more projects are being cancelled than are now coming on line.

An interesting WSJ article from late 2015:

WSJ: From Oil Glut to Shortage? Some Say It Could Happen (12/30/15)

The price rout has caused oil companies to cut deeply into investment

http://www.wsj.com/articles/from-oil-glut-to-shortage-some-say-it-could-happen-1451499384

*Awash in total liquids perhaps, but IMO not in actual crude oil

Talk about expensive crude oil . . . .

Based on the WSJ article, global upstream capex was about $1.5 Trillion in 2014 & 2015 combined. I don’t know what the division was between crude oil and gas + associated liquids (condensate & NGL), but it’s plausible that it took about a trillion dollars over a two year period, in order to keep our global crude oil production base approximately stable, at around 68 to 69 million bpd, versus an estimated 69 million bpd in 2005.

If that was solely CAPEX it seems high – assuming 4 mmbpd per year is needed to be bought on line and $70 to $90,000 per bpd average development costs gives $560 to $720 billion. maybe up to $1 to $1.2 trillion with gas developments included. So maybe it includes exploration DRILLEX as well, or costs have gone up a bit (or decline is higher than I’ve assumed). But I think it must include all oil and all natural gas, greenfield and brownfield.

Either the current ongoing cuts, which for me go back to the cancellation of the Voyageur upgrader in May 2013 with about $3 billion write off of sunk costs, are going to have a huge impact over the next five years for oil. Maybe a bit longer for gas as the LNG projects are still coming on line feeding an already large glut.

The cuts in exploration budget will impact as well, but given how little oil in large fields has really been found since Johan Sverdrup in 2010, maybe it’s not such a big deal (the lack of discoveries with or without exploration will of course be a large impact).

Here’s the relevant excerpt from the WSJ article:

You’re right. I was a little off with my math. They were projecting that 2015 + 2016 total global capex (oil and gas + associated liquids) would be about $1.2 Trillion, not $1.5 Trillion. So, then the question is the allocation between crude oil and gas reservoirs.

However, I was correct that Rystad Energy put total global upstream capex at about $1.5 Trillion for 2014 and 2015 combined.

According to the most recent Barclays survey, the primary source of data on global upstream capex, total spending was

$673.2bn in 2014; $520.5bn in 2015 and is projected at $444.4bn in 2016

http://www.oilandgas360.com/ep-capex-first-double-dip-since-86/

Assuming normal base overhead in a development group is 30% that would be $200 billion worldwide, leaving (say) about $500 billion for projects If each average project lasts five years but the main outgoings are in the central four years (the first year is studies, FEED, etc.) then $125 billion of projects are finished each year. To me that and the figures above imply that new project approvals are at best 10% of normal (in 2015 some projects in progress were cancelled and in 2016 the short term projects cancelled in 2014 and 2015 don’t show and therefore don’t need to be cancelled again). This year the same might happen and there would be $60 billion cancelled for 2017.

In my experience it is very difficult to do major projects faster than ‘normal’. You can try but then come start-up, whoops – nothing seems to work properly. And this would be especially true if a lot of the experienced staff were gone (i.e from redundancy or voluntary retirement) and there had been low recruitment of the better graduates.

Therefore in 2019 through to 2023 there will be virtually no new large projects coming on stream, oil or gas – maybe 400 mmbpd per year at best, maybe more if LTO can gear up quickly somehow (which seems to be assumed without any real evidence). If infill drilling gains have been exhausted and the real decline rates from larger fields reveal themselves to be 8 to 10% at the same time, we are really in trouble. Note it won’t just be transport that gets hit, NG poser generation would decline as well.It’s hard to see how it would be possible to f*ck things up for the future much more than we’re doing at the moment.

Somebody please tell me this is wrong.

Three factors to be taken into account:

1/ Projects at final stages of development scheduled for start-up in 2016-17 were not delayed. Projects that started in 2014-15 are ramping up output.

2/ Companies have severely cut exploration capex, but less so development capex. Greenfield projects with long payback period were cancelled or postponed, while less costly and shorter-term brownfield projects in already developed regions with existing infrastructure continue. Infill drilling continues in most regions.

3/ Lower capex partially reflects cost deflation (about 30% from mid-2014 to early 2016 in the U.S., 10-20% in other regions). Capex cuts in local currencies are less than in US$ terms due to massive devaluations in a number of oil exporting countries.

But in general you are correct. The impact of new project delays will be felt by 2020 and in the next decade (see the chart below from WoodMac).

Hi AlexS,

The chart is very interesting, but note that the evaluation was in June 2015 when the average Brent crude spot price was over $60/b.

The same analysis done in Jan 2016 with Brent crude at about $31/b might look somewhat different.

Came across this post at Wood Mac Blog,

http://www.woodmac.com/blog/breaking-the-cycle-cost-efficiency-in-upstream-oil-and-gas/

real costs have risen a lot in the last 10 years.

Chart below.

Note in an attempt to get the chart to post I reduced the resolution, but it is not readable.

Link below to a readable chart

https://drive.google.com/file/d/0B4nArV09d398bkUyOTRwLWhTNGc/view?usp=sharing

Dennis,

The report is dated January 2016

http://www.woodmac.com/analysis/PreFID-2016-USD380bn-capex-deferred

Furthermore, for 2016-17 production volumes, it doesn’t matter how many pre-FID projects are postponed. All those projects were expected to start production several years from now

Hi AlexS,

Thanks. I couldn’t find the article when I went to the WoodMac site.

I misinterpreted the chart without the link to the article.

For large projects the impact of low prices looks minimal before 2020.

Keep in mind there is about 20 Mb/d that WoodMac does not cover (probably smaller producers). Let’s consider the ongoing decline from existing output. If it is 5% per year without ongoing new drilling and maintenance, that is about 4.7 Mb/d of decline that needs to be offset by either new projects that have already been sanctioned or recently started projects that are ramping up. At $30/b we may start to see some decline in output, somewhere between 500 to 1000 kb/d seems realistic to me (change in annual average C+C output from 2015 to 2016.)

I found the following at Wood Mac,

http://www.woodmac.com/analysis/low-oil-prices-halt-production

Chart from link above.

Edit a more recent analysis at link below

http://www.woodmac.com/analysis/Oil-production-still-no-major-shut-ins?filter_sector=1

Hi Ron-

I enjoy reading your articles and all the banter they generate -some more than others 😉

Could you direct me to an analysis of peak us rig count (~1900 Dec 14 – Jan 15) and our most recent production data (or simply your thoughts)? With the rig count at <600 can we expect a similar 3x decline in oil production (I would suspect not, but with $30/barrel vs $90 it could make sense)? Looking at various charts a 2x production decline seems like a reasonable estimate over the next 6-12 mos.

I'm just trying to connect the dots…

US Supreme Court Justice Scalia dead:

http://www.mysanantonio.com/news/us-world/article/Senior-Associate-Justice-Antonin-Scalia-found-6828930.php

There is going to be an epic political fight over his replacement, given how many 5-4 decisions there have been recently (Scalia of course was solidly conservative). Among other things, the Supreme Court issued a stay of any implementation of the EPA’s new rules on power plant emissions:

Greens faced with nightmare scenarios at the Supreme Court

http://thehill.com/policy/energy-environment/269349-greens-faced-with-nightmare-scenario-at-the-supreme-court

And of course, the pro-lifers and pro-choicers are going to go absolutely crazy (or crazier).

The Republicans may try to postpone confirmation of his replacement until next year. (Most analysts seem to be putting the chances of the Senate confirming an Obama nominee this year at pretty much zero.)

It may not be politically correct, but this song rang through Isla Vista when Agnew resigned:

https://www.youtube.com/watch?v=0Yi7AJvzRUA

US Supreme Court Justice Scalia dead:

This is big. It is going to lead to the mother of all battles in the Senate. That is whether to let Obama name a successor to Scalia or hold off a year and let the next president appoint him/her. This will divide the nation and when the dust settles it will tell us in which direction the nation is really headed.

Some people are going to be really shocked at that direction, no matter which way it turns out to be.

I agree Ron— this could turn the tables.

There will be blood in the streets.

The issue for Congress is that if they hold up an Obama nominee that will just drive more Democrats to vote in November.

So the GOP choice is:

– give up the Supreme Court deciding vote now, OR

– desperately cling to their very small hope of stealing the Presidency in November

At the end of the day, the GOP will almost certainly lose both.

At the end of the day, the GOP will almost certainly lose both.

I know it’s strange words coming from an atheist, but… Dear God I hope so. 😉

I have made it clear here that I believe the writing is on the wall ( of the mausoleum, no less ) when it comes to the core of the so called conservative wing of American politics, with the boomers already declining in numbers at a substantial and increasing rate. The boomers parent generation, the WWII generation, is mostly already gone, or in nursing homes.

Younger folks are more liberal by far, across the board, and as the policies of the Koch brothers types, and the megabanks, etc, continue to erode the living standard of working class and middle class people, working class and middle class people will fight back by demanding MORE from government, in the form of health care and so forth.

So – barring Black Swan events favoring the R party, it will and must either fade away, becoming a third party, or move more towards the center.

BUT this does NOT mean, imo at least, that the D party has a lock on the NEXT presidential election, or on congress, either house, NEXT election cycle.

I have already said I will be voting for Bernie if I get the chance.

We are not yet there, but we are headed in the direction of hell, and I can’t see any real hope of reversing course with HRC or any current front running R in the White House.

HRC is very much a conventional politician who is WAY too indebted to the current power elite to really do much, other than run her mouth, about the crimes and criminals on Wall Street. The Trump Chump IS Wall Street.

Sanders has the young people behind him, heart and soul, and while the odds are still against him, he does have a serious shot at getting the nomination.

He ( again imo ) has as good a shot at winning the general election as HRC, and maybe better.

Anybody who mentions racial voting patterns and identifies himself as a conservative is generally accused of racism , but the HRC D faction gets a free pass on this point, and is allowed to claim that blacks will not vote for Bernie. ( unfortunate initials, BS!)

But black people sure as hell aren’t going to vote for Cruz, or Trump. IMO, the black vote for the D’s is perfectly safe, within a couple of percentage points variation, for either candidate. Furthermore tens of millions of working class people, people who aren’t doing so well, may be READY for a socialist flavored message, so long as Bernie is careful not to hit the wrong hot buttons among working class R voters.

It may just be good luck on my part, but I have been sure ( ready to give odds on a bet ) which party would win the White House this close to election time since Nixon’s day.

But THIS time- I don’t have a clue.

The R party is falling apart internally, with the rank and file people who VOTE R sick and tired of the party establishment. Very sick, and very tired.

No further explanation is needed to understand WHY Trump has been able to “crash the ( nomination ) party” without an invitation. Enough of the R rank and file are so desperate for change that the R elite cannot do anything about him, even though that elite hates his guts.

On the OTHER hand, HRC OWNS the D party establishment, and the rebellion is coming from the heart and soul core of the party, namely seriously committed young people.

My opinion, based on a lifetime of personal acquaintances with lots and lots of D voters of all descriptions, is that typical D voters keep their mouths shut, regarding HRC’s negatives, for reasons of party unity. Maybe half of them in total, and eighty or ninety percent of the younger ones, are DEAD TIRED of HRC, and wish she would GO AWAY.

( It is worth mentioning that the typical R voter is equally tired of anybody named BUSH. 😉 )

This explains how OBAMA could literally come out of nowhere nine or ten years ago, and win the nomination. The country, as I see it, was not tired of the D party, but it WAS tired of CLINTONS . ( again my opinion.)

The country NOW, if I am right, is even more tired of her than ever, and she will NOT imo ever light the fires of enthusiasm among D voters the way Bernie can and has already.

On the other hand, the typical hard core R voter hates her guts, and WILL bestir himself or herself to vote AGAINST her, even if not highly motivated to vote FOR who ever the R party nominates.

Let’s face it folks. Charisma counts, and it counts for a hell of a lot. Sanders has it in spades. Trump has it, to some extent, but I don’t know a soul who really looks up to Trump. He’s very popular among the foot soldier R party rank and file, but mainly because he is attacking the establishment.

The R voter might eventually wake up to the fact that Trump IS the establishment, if he gets the nomination. You can bet your last can of beans that the D party will not let anybody FORGET that Trump is part of the elite he is campaigning against.

The younger , smarter, better educated people have already figured out that HRC is part of that elite as well, and want a new day in American politics.

Cultural revolutions are nothing new.

The young people with brains are DONE with the establishment.

We are seeing a cultural revolution born right now, but it may be premature, and Bernie Sanders may crash and burn, and will, if the D party establishment gets its way , by fair means or foul. ( The D party debate schedule says it all for instance. )

The political waters are WAY to muddy imo to predict who will next live in the White House.

Furthermore, there is still plenty of time for shit to happen.

The country wants NEW faces.

I’m sure Bernie Sanders will rescue the democrats.

I wish I were sure. Maybe you are being sarcastic, maybe you have a crystal ball better than mine, maybe you are being humorous.

But both the D and the R parties are capable of shooting off their own toes.

The right personality at the right time , or the WRONG personality, at the wrong time, can determine the course of history, and HAS determined the course of history on occasion in the past.

No Hitler, then no nazis, and possibly no WWII. No Churchill, maybe British morale would not have sufficed to stand up to the nazis.

Lincoln held the Union states together during our Civil War, a job no other man of his time could arguably have managed. No Robert E Lee, the southern states would have collapsed in half the time, for two reasons. One , he was the man everybody looked up to, Jeff Davis was not. The other, he was a genius among generals.

But in the end, the environmental issue trumps (unfortunate word but the right word ) all other issues.

Whether a person believes climate is the KEY environment issue, or just one of the many interlocking environmental issues, anybody who is paying attention must conclude that environmental destruction and degradation are threats to our peace and prosperity and yes, even to our very EXISTENCE.

The R party is not philosophically suited to the task of looking after the environment, and will not, to any greater extent than forced to do so by grassroot pressure, which is unfortunately insufficient.

OFM, well said! Your knowledge of history and human nature are shinning through. Those many years of reading all those history books is paying off. That coupled with your background in reality and science plus wisdom gained through personal experience in dealing with people from all walks of life is also apparent in your comments.

While you may not always be right, none of us is, whenever I read your posts I always come away with the impression that you are a deep and free thinker! It is always a refreshing contrast to the ideological and dogmatic views of those that are so sure that they are right.

We are certainly living in a time of transition and flux the last thing we need is pseudo conservative authoritarians who see the world in stark black and white, getting hold of the reins of power again.

Even if they do, they are too rigidly stuck in their views to be able to hold it, other than by brutal force. And as history has shown us time and time again that never works in the long term.

Cheers!

I was being sarcastic. Bet you one thousand bolivars sanders will be like a democratic deer in front of the republican Mack truck. ?

By the way, did you notice I managed to interview Donald Trump? I did it while I was on my way to serve as mediator between comrade Pope and Kirill.

The Democrats are fools for even listening to Hillary, all she talks about is how good a president she will be. Gets real old, you stop listening. She’s like the creek in Wyoming, Old Woman Creek. Hillary is on her way to a floe. Just one of those things when you get old.

The Democrats are usually always crying wolf and basically never stop. They caterwaul night and day. They should be ruled illegal and disbanded, it would help a lot.

The Republicans are basically all fascists along with the political maverick, Donald Trump.

The back of the pack on the Republican ticket can’t gather 500 people to hear them speak. The quasi Republican Trump seats 10,000 at a rally, not a problem.

If Donald Trump is a fascist, everyone seated in the auditoriums he is filling to the brim must be too. Donald was at Chelsea’s wedding, had a photo op with Hillary and Bill. They were all smiles. Can’t really be much of a Republican, one that can be trusted to toe the party line, that goes without sayin’.

Trump is a prairie fire out there right now.

The Republicans are worried about Trump, he has lots of support.

I’m still going to write in Mickey Mouse, your vote doesn’t really count and you can’t possibly vote for any of the nutjobs on any political party’s ticket, that’s just not going to happen.

After the counting is done, the electoral college meets one day and picks the sucker who is then going to live in fours years of pure hell in the White House.

harumph!

Obama will nominate someone. At the very least it is an essential duty of the Executive Branch to offer a nominee. If he didn’t it would be a serious breach of his essential duties as the President of the United States.

It seems the Senate will reject literally any nominee; the Senate would reject the nominee even if it were a clone of Scalia himself for no reason other than… it’s Obama’s choice!

This will be a huge issue that won’t go away. It will be a prominent issue that will be talked about incessantly in the media until the position is filled, especially because of how well it ties into the other major news story – the election.

Obama should nominate a centrist who is favored by the Old Guard Republicans of the Senate; someone who is a shoe-in for both sides of the aisle.

Rejecting an ideal appointee, which is exactly what would happen, would backfire. As time goes on, and the position remains unfilled the subversive nature of that decision would become undeniable.

Intentionally subverting and damaging a fundamental piece of our democracy; holding the Supreme Court hostage; using the highest court of the U.S. as a political pawn.

It would be, frankly, treasonous to knowingly debilitate the functioning of the Supreme Court if presented a nominee who, under any other circumstances, would be acceptable for both parties. It would be undeniable that they intentionally undermined the functioning of our Justice System, and willfully betrayed our Constitution.

Imagine 11 months of media coverage about this truly unprecedented action. It will become crystal clear that there was no basis whatsoever for leaving a Supreme Court position vacant for an entire year…

That is ONLY if Obama nominates a centrist with an impeccable record of decisions that fall on both sides of the aisle.

Since the nominee will be rejected anyway it would be pointless to nominate whomever his preferred nominee is, and give them the talking point they’re HOPING to create – that it’s all Obama’s fault the position remains unfilled because he nominated someone with a “liberal” record.

Unlike the equally baseless tactic of the government shutdown in 2011 this event would not disappear and the evidence of its absurdity would only grow worse as time goes on, and all of this DURING AN ELECTION YEAR.

Independents who lean Republican would be increasingly worried about how a Republican would make decisions in the White House and lead the country with this radical move front and center on election day.

Democrats who aren’t thrilled with their candidate would be more likely to show up and vote. It would show that the two parties are not “the same” and a Republican President would act vastly differently than a Democrat President – even if it was not their preferred democrat.

McConnell said today the Senate will let the next president pick the next supreme court judge.

For those with a familiarity with US history, the politicsl atmosphere is so similar to the 1850s.

Obama will make a nomination.

This has consequences for McConnell, and the election.

This has consequences for everyone in the election. I dearly hope Obama does make a nomination. It will lead to a showdown. If his nomination is rejected by the republican senate, this will have serious consequences in the November election. It will bring out millions of voters who would have otherwise just stayed at home.

Make no mistake, if the republican senate blocks an Obama nomination, it will lead to a landslide victory for the democrats in November.

Historical all time record for delay in filling a USSC seat is 24 months. 10 months is a non event.

“Discussion: Within hours of the passing of Supreme Court Justice Antonin Scalia, Republican Senate Majority Leader Mitch McConnell vowed to block any replacement nominated by President Barack Obama. Holding a Supreme Court seat vacant for that long would be an unprecedented move since the Civil War.

If it takes the average time for the next president to nominate a Justice and to have them confirmed, the Supreme Court would be one Justice short for 415 days. It has been argued in the past, controversially, that the Senate should refuse to confirm Supreme Court nominees during the final six months of a lame duck presidency, but holding out for eleven months on the basis of the party of the President, rather than the particular nominees, would be a first in U.S. history.

Only one vacancy since the Civil War has lasted longer than 300 days, That was the 391 days between Justice Abe Fortas’s resignation in 1969 and Justice Harry Blackmun’s placement on the court in 1970. That extraordinarily long vacancy was the result of two factors. First, it took President Nixon three months to make a nomination because his first choice declined the offer. Second, the first two nominees were advocates of racial segregation and were rejected by the Senate.”

http://politicsthatwork.com/graphs/supreme-court-vacancies

10 months is a non event.

No one is talking about 10 months. A new president would take office January 20, just over 11 months from now. Then he/she would have to decide who, then send the nomination to the Senate. Then the Senate would have to debate and finally vote. Adding them all up would likely be a lot closer to 20 months than 10.

And as Ghung points out, the all time record, since the Civil War, was just under 13 months, not 24. So if the Senate does wait on a new president, that delay would break the all time record, (since the Civil War). That would be an event, a disgraceful event.

Nah, Congress won’t even be in session most of that time. 10 months is no big deal, especially with them all home campaigning.

Non event.

Really, can you not add? 10 months from now Obama will still be president. As I clearly explained above, it will be closer to 20 months than 10.

If Obama’s nominee is not approved then it will be the longest delay of a supreme court replacement in history.(Since the Civil War.)

How in God’s name is that a non event?

Oh, only one third of senators will be campaigning. And even that one third would not dare miss a vote on a supreme court justice.

The media won’t allow this to be a “non-event”. It’s the biggest story in years; guaranteed to have legs.

History didn’t start 1861. Someone cherry picked that.

Non event. Other things will occupy the front page.

I have often been amused at how people think issues du jour a year ahead will decide voters. In 2008 Obama backstabbed Hillary with fewer votes and maneuvered leftward with steadily decreasing timelines on when he would remove all troops from Iraq. She quoted later times, and the narrative was constructed that the election would be decided by Iraq.

Exit polls surveying what issue was most important to voters said what? The collapsing economy and Lehman.

History didn’t start 1861. Someone cherry picked that.

I really don’t think you know what “cherry picking” really is. If you clearly state that your data starts at a certain point, then that is not cherry picking. Are my charts “cherry picking” because they don’t start when the first barrel was produced?

Non event. Other things will occupy the front page.

Of course other things will occupy the front page. Just what the hell is that supposed to mean? Because the media also reports other news, that makes it a non event? If that be the case then there is no such thing as an “event”.

Exit polls surveying what issue was most important to voters said what? The collapsing economy and Lehman.

No, that is not what the exit polls said at all. Yes, most said the economy was the most important issue but no one said the collapsing economy was the most important. And no one said Lehman, you just made that shit up.

And that was all before Scalia died. Anyway, it was a primary election. It only becomes a really big deal in the battle between Republicans and Democrats. That is in the general election.

I predict this to be the supreme court nominee-

Padmanabhan Srikanth Srinivasan

https://en.wikipedia.org/wiki/Sri_Srinivasan

I predict the White House, Senate, House and the Supreme Court all in the hands of the Democrats by January 2017

Oh is that so? Care to predict which of the 30 Republican-held House seats the Democrats need for a majority will actually flip? Which is to also assume, improbably, that no seats currently held by a Democrat will flip to Republican control.

Here’s something to get you started; https://en.wikipedia.org/wiki/United_States_House_of_Representatives_elections,_2016#Competitive_districts

Maybe when done you can start working on predicting which of the 5 Senate seats the Democrats need for a majority will flip in their direction. Actually you might want to make that 6, since Harry Reid’s seat could easily go Republican.

I doubt that either the House or Senate will flip. However I don’t think Harry Reid’s seat will go Republican. There was a chance that it would before Scalia’s death. But now, not a chance.

Though neither the House or Senate are likely to flip, but many seats will. And a lot more seats will flip to the Democrats than flip to the Republicans, and that will be mostly because of the death of Scalia. However that band of clowns running for President will play no small part in it.

That is unless John Kasich wins the nomination. He is the only non-clown in the group and he scares the hell out of me. He is the only Republican who could win.

Edit: Well, I don’t think Bush is a clown either, but he hasn’t a snowball’s chance in hell.

Assuming the Republicans don’t confirm Obama’s nominee, it will make an “Interesting” election even more interesting. Of course the President always nominates people for the Supreme Court, but the next President would nominate the tie breaking vote for a generally evenly divided Supreme Court (again assuming the GOP controlled Senate fails to confirm). So, it’s a somewhat unusual election in which the control of the Executive Branch, the Legislative Branch and the Supreme Court are all up for grabs.

However, if Obama nominates a moderate who was previously confirmed for a lower level judicial appointment by a majority of Republicans, it will be an acute dilemma for the Republicans.

Agreed, Jeffrey. Centrists, liberals and many independents are tired of what they see as an obstructionist GOP/Congress; the “do nothing” stalemate in Washington. I see a likelihood that a GOP obstruction to an Obama appointment would result in a backlash to the left; more Democrats and left-leaning centrists getting out to vote against ongoing GOP stubbornness to move things along. Acute dilemma for the Republicans indeed.

One of the decisions this court gave us, and Scalia fully supported, was the Citizen’s United debacle; not only unpopular with the left, but generally unpopular with the center-right proletariat as well. This could be used as a wedge going into the general election if an Obama-nominated confirmation doesn’t look likely.

This is my thinking exactly.

The Republicans just gave Obama and the Democrats a huge opportunity.

Nominate a universally acceptable candidate. They reject the nominee, and the media runs with the story of such an unprecedented action until the seat is finally filled next year.

Debilitating the Justice System for blatantly political reasons, and holding the Supreme Court hostage… in an election year at that!

As the months drag on and the position remains unfilled for no reason whatsoever it will backfire TERRIBLY.

I honestly don’t know what McConnell was thinking.

If his thinking was “If we win the election then WE can pick a nominee”, then it is mind-numbingly short-sighted.

This tactic was their only hope of picking the nominee themselves, but it’s impact loses them the election… in which case all they accomplished was to damage the Justice System, and lose an election.

They really didn’t think this through.

Holding the govt hostage with the govt shutdown backfired, so why not double down and hold the Supreme Court hostage!

With the potential nominees they have the Republicans had an uphill battle for attracting independents. This is exactly the thing that would drive independents away. It’s like they WANT to lose the election.

Scalia is being lauded as a strict constitutionalist, but I’ve never been impressed. He generally dismissed checks and balances, either written into the Constitution or implied therein. It seems our two party legislative branch finds these checks inconvenient as well, especially the GOP., obtuse, spoiled by a corrupt campaign finance system, and uncompromising. Their debates are reminding me more and more of old Jerry Springer reruns. Anyway, this all exposes the Democrats as ineffective reactionaries who sell themselves as progressives and reformers. It’s all well designed to leave no room for pragmatism.

We get the government we deserve, eh?

Scalia has never been anything more than a bought and paid for “yes man” for the Republican elite.

1/5 of a presidency and red meat for the Holy Rollers

Jeff Brown Wrote:

“it will make an “Interesting” election even more interesting. ”

Let see if we make it to November first!

Turkish forces attack Syrian and Kurdish positions in northern Syria

http://www.euronews.com/2016/02/14/turkish-forces-attack-syrian-and-kurdish-positions-in-northern-syria/

[We now have a NATO member fighting against Russia]

Just to add more fuel to the fire:

Saudi fighter jets land in Turkey for anti-Daesh fight

http://www.yenisafak.com/en/news/saudi-fighter-jets-land-in-turkey-for-anti-daesh-fight-2412407

Turkey, Saudis threaten ground troops in Syria

http://www.cbsnews.com/news/turkey-saudi-arabia-threaten-ground-troops-syria/

[We likely have WW3 that is currently containined in Syria. I don’t see how this will end well unless there is a Coup or Civil war in Turkey. Currently we have the potential for Russian, Iranian, Turkey, and KSA troops battling it out. The Proxy War in Syria is now evolving into a hot war.]

Turkish PM confirms shelling of Kurdish forces in Syria

http://www.theguardian.com/world/2016/feb/13/turkey-shells-kurdish-forces-in-syria-in-retaliation-for-attack-on-border-posts

“The shelling took place on Saturday after Kurdish fighters, backed by Russian bombing raids, drove Syrian rebels from a former military air base near the Turkish border.”

““We will help our brothers in Aleppo with all means at our disposal. We will take those in need but we will never allow Aleppo to be emptied through an ethnic massacre”

The issue with the death of a Supreme court justice is insignificant to the the escalation in the Middle East.

If the democrats run Sanders and the Republicans run Rubio I bet Rubio wins. He will paint Sanders red.

Fernando, you are really hung up on this “red” thing aren’t you. The red scare is over, except for a tiny few who are still scared shitless about the subject.

Anyway, I think the nominees will be Trump and Clinton.

Seems he has a lot of ‘hang-ups’

I am watching Meet the Press…the Republicans are going to self-immolate on this issue of attempting to refuse to even consider a Supreme Court nominee.

I listened to the various R President candidates talk, and they are off their nuts. Perhaps John Kasich was the least nuts of the lot, but I would still not vote for him.

The fundamental problem with the Republicans is that they refuse to substantively discuss any issues…their mumbo jumbo is nothing but tired old jingoism and sloganeering…constant appeals to fear, ‘the other’ and old white people über alles code-word salads. They are intellectually bankrupt. And Ms. Clinton is a moderate Republican.

Don’t have to refuse. Just go slow.

This is not going to be a big deal.

I voted for Obama to be president for 4 years, not 3. The people elected Obama. There is no reason for delay.

Watcher, on this issue you are just dead wrong. This is one of the biggest deals, in US politics, in this century.

What is at stake is all the progress we have made in the last half century. Civil rights, a woman’s right to choose, homosexual rights, all these things can all be rolled back.

And the absolute worst decision to come out of the supreme court since the Dred Scott decision, Citizens United, needs to be rolled back. That was the decision that allows drug companies, and other large companies, to own their own congressmen. They buy them with their huge campaign contributions. And they vote to keep the money rolling in.

This is the most important supreme court appointment in over half a century. If you think this is not a big deal then you are totally out of touch with reality.

MSNBC on Scalia. Bryan Garner, the famous legal scholar and lexicographer, is the son of one of my Amarillo friends. http://www.msnbc.com/msnbc-news/watch/how-scalia-shaped-conservative-legal-theory-622792771813

Mr. Patterson

I could not agree more re the importance of this passing of Judge Scalia, but I believe the Senate will do exactly as Watcher described in foot shuffling in as non blatant manner as possible (pretty tough to achieve).

In two other quasi-related matters, Judge Ginsburg’s health is especially precarious.

Also, is it just me? Did anyone notice the number of New Yawkers on the stage?

Brooklyn Bernie versus Queens the Donald.

New Yawkers Kagan, Scalia, Ginsburg, Sotomayor (who went to same high school as my sister).

Guyzz are takin’ ovah da joint.

See Republicans for Choice, Republican Majority for Choice and Republicans for Planned Parenthood; all active organizations. https://plannedparenthoodaction.org/get-involved/advisory-boards-and-initiatives/republicans-choice/

but I believe the Senate will do exactly as Watcher described in foot shuffling in as non blatant manner as possible (pretty tough to achieve).

I have no doubt that they will. What I objected to was Watcher saying it is no big deal. Hell, this is the biggest deal, as far as the court goes, in half a century. Or if it is not the biggest deal, it is right up there at the top with the biggest deals.

The importance of this appointment cannot be overestimated. And the political fallout from the fight over the appointment, and the delay by the senate, cannot be overestimated.

This will bring out voters that would have otherwise stayed home. And most of those voters it will bring out are young liberals. The Republicans will rue the day they decided to let this appointment wait for the next president.

Dr. Wilson, I have no doubt that there are some Republicans for choice, or for Planned Parenthood, the vast majority do not.

Which Republican running for president supports a woman’s right to choose?

I rest my case.

Hi Ron,

As usual I agree with you in general, but this is another time I differ as a matter of degree. Citizen United is awful, no doubt about it.

But the Supreme Court, regardless of who the eventual new justice turns out to be, is reluctant to overturn it’s own past decisions.

The odds of recent decisions being reversed in short order are not all that high in my opinion.

But over a period of years……….. You could be right about the direction taken by the SC.

The odds are good there will be at least one more vacancy within the next four years.

But the Supreme Court, regardless of who the eventual new justice turns out to be, is reluctant to overturn it’s own past decisions.

Hey, it happens: 10 Overturned Supreme Court Cases And it will happen in this case, else there is no hope for our country. The House and Senate will be completely owned by Corporate America.

Some decisions are just so outlandish that they demand reversal. It has happened in the past and it will happen again.

I agree with Watcher, in a way: In a fraud-for-a-system that’s the State, it’s kind of an irrelevant detail. Kind of. It’s like talking about the shadows on the wall of Plato’s cave, (rather than the cave, itself, or the ‘shadowmasters’ over the shoulder), even though, of course, you are chained-up/bound to look in that direction.

” ‘Capitalism’ involves the domination… over the working class and it also involves the resistance of workers to that domination in the matrix of social relations that are manifested in political and ideological fields. So that’s class struggle, and it shapes our everyday lives, everything we do. It shapes our taste in music, what we care about, what we wear… It’s ideological domination… The whole society, the way that it exists has been shaped by the economic system that we live under… and in the interests of that class that dominates that system.” ~ Stephanie McMillan

“Behind Boetie’s thinking was the assumption, later spelled out in great detail by David Hume, that states cannot rule by force alone. This is because the agents of government power are always outnumbered by those they rule. To insure compliance with their dictates, it is essential to convince the people that their servitude is somehow in their own interest. They do this by manufacturing ideological systems…” ~ Llewellyn H. Rockwell, Jr.

Clinton is a moderate, but not a Republican. Cut the bullshit.

Right! If one expects to be taken seriously then they should definitely cut the bullshit.

Oh give me a break…

I imagine you both are familiar with this:

https://en.wikipedia.org/wiki/Overton_window

For reasons sake, I was not saying that HRC was LITERALLY a Republican…but her window of political discourse certainly represents what used to be considered expected of a moderate republican. Hell’s fire, people, Bill Clinton’s governance was typical of what used to be expected of a moderate Republican.

I voted for Bill (2x), and for Obama (2x), and I will vote for HRC over any of the brain-dead idiots in the current Republican lineup.

Jumping Jesus on a pogo stick, most political experts acknowledge that Saint Ronald Reagan would be marginalized in today’s Republican Party.

Stop taking everything so literally and shooting from the lip.

Go Read OFM’s rather insightful post on this thread regarding the current political climate wrt establishment vs. non-establishment politicians and consider taking his word on the matter.

Question:

Where does Hillary stand on Citizens United?

Where do Republicans stand on Citizens United?

Where does Hillary stand on Planned Parenthood?

Where do Republicans stand on Planned Parenthood?

Where does Hillary stand on Gay Rights?

Where do Republicans stand on Gay Rights?

And I could go on and on with issue after issue, but you get the point. Sure, you can theorize with your “Overton Window” and say this Democrat was really a Republican and vice versa, but today we identify Democrats and Republicans on where they stand on the issues, not the general demeanor of their past administrations or alliances.

Okay, calling your statement that Hillary is a Moderate Republican bullshit may be a little strong. Perhaps “pure hyperbole” would be a better term.

Among other things, the Supreme Court issued a stay of any implementation of the EPA’s new rules on power plant emissions:

Yes, but the US Navy and Boeing have gone ahead with an interesting zero emissions project. Conservative politicians can’t or don’t want to deal with reality but the US military can and will!

http://goo.gl/48NokK

Navy tests first ‘reversible’ clean energy fuel cell storage system

The fuel cell only needs sunshine and seawater to produce thousands of watts of electricity

Boeing has announced that, after 16 months of development, it has delivered a “reversible” fuel cell for the U.S. Navy that stores energy from renewable sources and generates zero-emissions electricity.

The Solid Oxide Fuel Cell (SOFC) system, which can generate 50 kilowatts (KW) of power, is the largest of its kind and can use electricity from wind or solar power to generate hydrogen gas, which it then compresses and stores.

When power is required, the system operates as a solid oxide fuel cell, consuming the stored hydrogen to produce electricity.

Uhu. This will be very useful for USA Marines setting up fire bases in the Afghan mountains. They can use special bullet proof solar panels. Having the ability to generate 50 kW will be very useful. The military advantage is their ability to use $500 toilet seats and $300,000 50 kW generators.

If it ain’t BAU, you are reflexively against it.

Me? I spend three hours a day trying to overthrow the Cuban dictatorship. And I would also propose boycotting Israeli products if it wasn’t against the law. That’s hardly backing business as usual.

I don’t think they have a lot of seawater in the Afghan mountains but I might be wrong. On the other hand most on the Navy’s ship don’t spend a lot of time there either… They tend to navigate the high seas where, guess what, there is a lot of sun and seawater. Imagine that!

And on another note, made in the USA:

The Ultimate in Off-Grid Transportation: Mini-Fleet-in-a-Box.

Really nice package!

http://ecowatch.com/2016/02/14/mini-fleet-in-a-box/

Hi Fred,

Thanks for the kind words.

It is good that you bring up what the Pentagon is up to, in terms of science and technology.

One of the best ways to get inside the “defenses” of a hard core right winger type is to just introduce him, without ever MENTIONING climate change, peak oil, or any of all that “liberal bullshit”, to things the guys in uniform are doing TODAY so as to be ready TOMORROW to deal with tomorrow’s problems.

When new ideas come to you from people you look up to and trust, they are easily accepted. When they come from the “THEM” side of the “US versus THEM” divide, they are generally dismissed out of hand.

The JOE papers are among the very best. I have not actually succeeded in convincing any hard core redneck high IQ republicans to vote D as the result of their reading them, but I HAVE succeeded in getting some to recognize that that issues such as forced climate change and peak oil are REAL PRESENT DAY ISSUES by leading them to this water.

They drank it without any encouragement, given the source of it. 😉

The guys in uniform are government employees. As such, the bureaucracy forces them to spend money on cockamamie weapons and systems they don’t really care for. Like the Stryker vehicle they sent to Iraq, or the fancy fighters which cost $500 million each.

Yeah, both the JOE’s report and the Bundeswehr’s report on peak oil were excellent reads! The Pseudo Conservative Chickenshit Hawks don’t seem to have a clue as to what may be coming down the pipeline.

They don’t need seawater. The salt is more of a pain in the butt. Unless you want to make chlorine gas, I suppose.

Whatever, Fernando, the point was that sufficient water is more readily available in the ocean than it is the mountains of Afghanistan…

Your comment about salt is irrelevant and it doesn’t affect the production of hydrogen in this system!

The big deals against oil prices are, now, the drop in (the increase) in future demand from 1.6 to 1.2%, per IEA, and the massive amount of oil that Iran is getting to lay out with unknown capital input. Supposedly glutting the market with 1.5 million more barrels with magic, I presume. However, I figure it, the drop in demand seems to indicate only about a 300k to 350k difference.

Ah, the magic of OPEC will prevail, then. Even though to fully ramp up more, Saudi has to drill in the offshore area, which I am sure is NOT $10 barrel cost of production. Iraq has to end their internal strife to gain some traction. Venezuela is sucking wind, badly. Ecuador, while not the massive producer of other OPEC members, currently has only one well drilling from 50 something rigs. It is hard to keep up with the news from every country, and it is clear that neither EIA nor IEA are really putting much effort into real data accumulation. I think OPEC is strapped for production for the next two years, with the exception of the magical production from Iran.