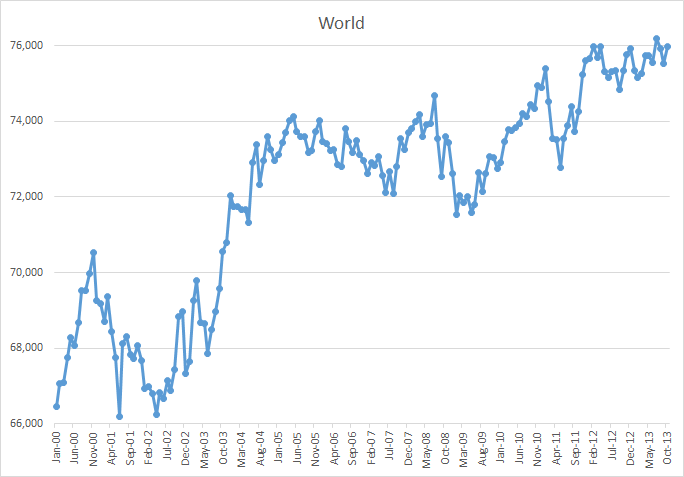

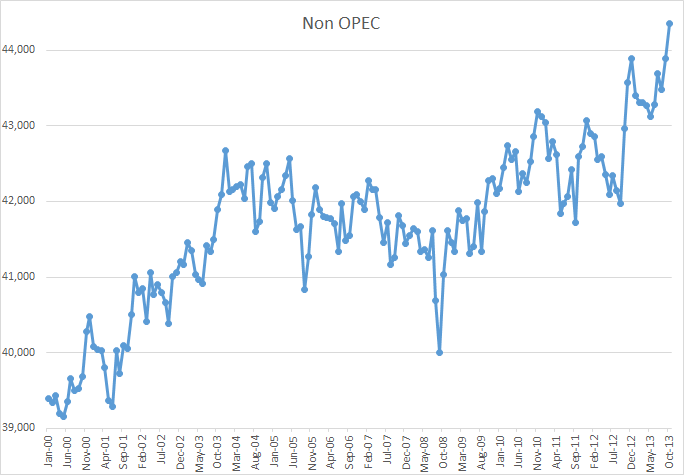

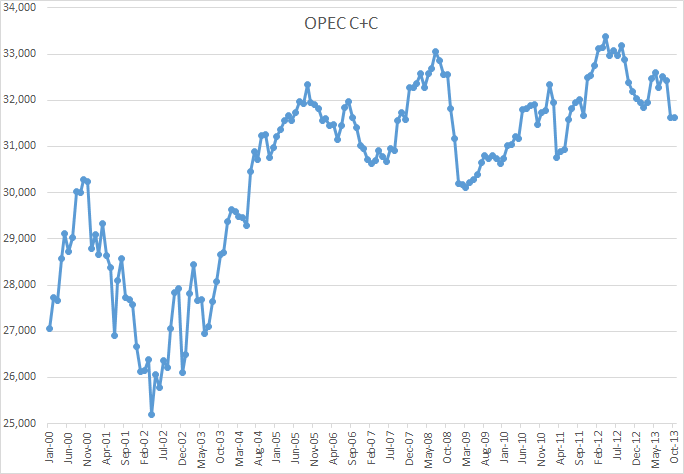

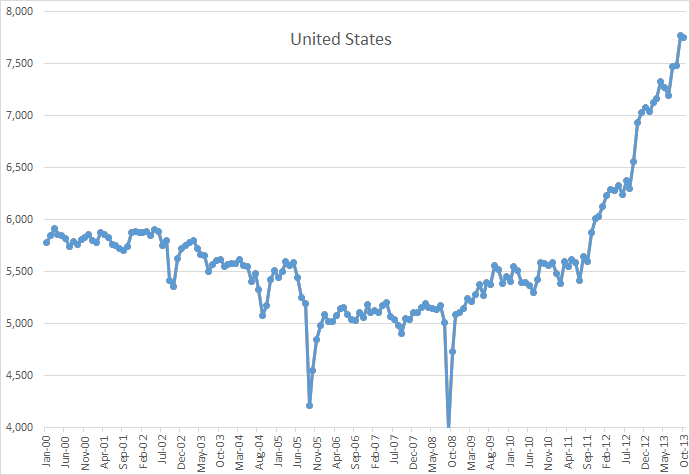

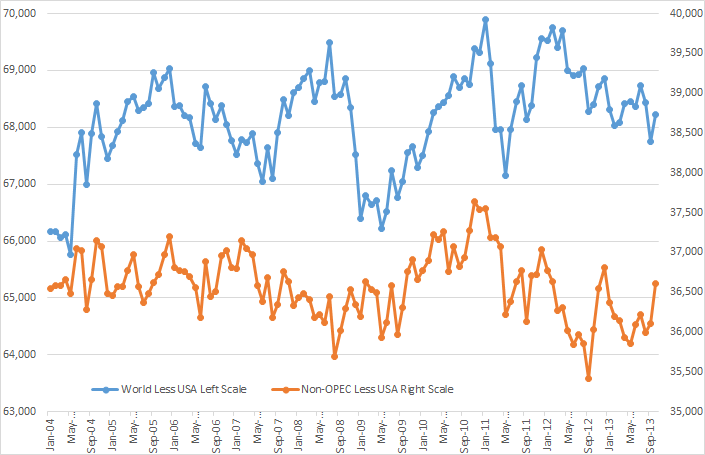

The EIA has updated their International Energy Statistics with the October data. There were some major revisions in the September data. I only track Crude + Condensate so all figures and graphs are for C+C only.

Revisions for September were World, revised down 417 kb/d, Non-OPEC revised down 377 kb/d, Canada revised down 327 kb/d and Brazil revised down 54 kb/d. All other revisions were minor.

After revisions World C+C production was up 454 kb/d, Non-OPEC up 469 kb/d, Canada up 338 kb/d, China up 148 kb/d, Libya up 190 kb/d, Iraq up 150 kb/d, Saudi Arabia was down 300 kb/d and Australia was down 71 kb/d. Lots of other ups and downs but all smaller.

World C+C, average through October for 2013 is up 115 kb/d over the average of 2012.

Non-OPEC average C+C for 2013 through October is up 825 kb/d over 2012.

OPEC C+C average for 2013 through October is down 710 kb/d from the average for 2012.

USA C+C production was down 23 kb/d in October and that was after September production was revised down 18 kb/d. I did have the USA plotted through January based on the weekly data from the EIA but I have removed those last three months because I expect them to be revised downward quite a bit. The last data point here is October where production stood at 7,753,000 barrels per day.

As I have maintained all along it is only the increased LTO production from the USA that is keeping peak oil from being clearly in the rear view mirror.

You can find updated charts of all Non-OPEC nations here: Non-OPEC Charts

Also the page World Oil Production by Geographical Area. Both pages have been updated with the October production numbers.

I just watched the documentary “Ethos” on Netflix but it can also be found here:

Ethos,Top Documentary Films And here:

Woody Harrelson ‘Ethos’ Epic Documentary! Time to Unslave Humanity

It is 1 hour and 8 minutes long. Exactly at the 1 hour mark Woody Harrelson says:

There are some very troubling possible futures for our society. Climate change will displace millions of people and we will hit peak oil in 2015. Thereafter the price of oil will skyrocket. So we will see supply decrease and we will see the prices of food and every basic commodity spiral upwards.

The documentary was made in 2011 and is one of the best I have watched lately. I did not agree with everything in the documentary, only with about 80 percent or so. But it made me feel good to hear people outside outside peak oil groups mention the subject.

This link should really be under the the last key post , the one titled BAKKEN UPDATE.

I am going to put it there with some commentary on it but it is likely most readers won’t see it without this reminder.

http://www.forbes.com/sites/christopherhelman/2014/02/19/will-oxys-divorce-encourage-the-break-up-of-big-oil/

I see US natural gas prices just keep soaring. I guess they are finding that they needed to keep drilling just to stand still, and when all those rigs went off instead to hunt for tight oil, depletion rates meant supply would soon hit problems. Pesky winters eh? There was much talk late year and the year before that of a US natural gas glut that would last 100 years, and having so much gas that export must be opened up. Maybe not so much talk about that now……..

I agree. Maybe I am a little cynical but the cheerleading for cheap natural gas for a century always sounded worse than a carney’s pitch to me.

Meanwhile here is a link to an article about oil in Syria and the prospects for restoring production there.

I think it makes good sense until the last paragraph where the author says that there will not likely be any interest in restoring the country’s oil industry when peace is eventually restored because of good prospects for increased production in nearby countries.

But oil from Iraq or Turkey would be imported and thereby suck foreign exchange as the country could ill afford to spend on oil that could be produced domestically.Furthermore good prospects are hard to come by in recent years and in my opinion there will be plenty of oil companies ready to invest in Syria if and when the country settles down and the investment looks safe from war and nationalization.

Syria can probably get back up to three or four hundred thousand barrels a day from next to nothing once things settle down.That’s not a game changer in terms of the world market but it is more than a drop in the bucket and might be enough to keep the world on the plateau for a few months longer than other wise.

Forgot the link!

http://www.forbes.com/sites/christopherhelman/2014/02/19/report-russia-and-iran-help-assad-prop-up-syrias-collapsing-oil-industry/

USA! The old tired “post-peak basin”…kicking ass and beating the rest of the world’s decline! Never count out the red, white, and blue!

http://www.youtube.com/watch?v=2kv5xzEeTOc

Texas Officials Turn Blind Eye To Fracking Industry’s Toxic Air Emissions

More than 2,400 air emissions permits have been issued in the Eagle Ford without safeguards to limit toxic chemicals breathed in by residents.

David Hasemyer, Ben Wieder and Alan Suderman, Inside Climate News, Feb 18, 2014

I wonder who Rocky would be fighting for…

Return of the Polar Vortex Next Week

Jeff Masters, Wunderblog

Court strikes down Nebraska law that allowed Keystone XL pipeline

By Joe Duggan / World-Herald Bureau

Meet The Family The Tar Sands Industry Wants To Keep Quiet

By Emily Atkin, Climate Progress, on February 18, 2014 at 11:50 am

Let’s give some thought to the average folks who are getting thrown under the Unconventionals’ bus!

NY Times, The Opinion Pages, Room for Debate, Updated February 12, 2014, 7:00 PM

Is Keystone Worth the Fight?

Given the State Department’s recent report, was the pipeline the right issue for environmentalists to get behind?

They’re Right to Stop the Pipeline

J. David Hughes, a geoscientist, is the president of Global Sustainability Research Inc., on Cortes Island, British Columbia.

Presentation suggests intimate relationship between Postmedia and oil industry

Jenny Uechi and Matthew Millar, Vancouver Observer, Posted: Feb 4th, 2014

Dependent Journalism?

I have not yet looked at the links pertaining to the Keystone but I have little reason to expect that there will be anything new in them.

As I see it the whole question is a cat’s ball of yarn but it is not that hard to untangle it.

There is no doubt in my mind that we are looking at catastrophic global warming if we continue on our present path, and there can be no question that as oil goes the tar sands are the worst of all oil resources unless somebody figures out a way to process straight up kerogen shales at a profit.

Looking at the situation strictly from the environmental point of view we need not only to block the exploitation of the tar sands; we need to drastically cut back on the use of fossil fuels across the board and we need to get started in a very big way immediately.

But we aren’t going to voluntarily cut back very much at all on a world wide basis no matter what.

The only significants cutbacks will come as the result of efficiency improvements and end users being priced out of the markets.

Asking people to do without heat , electricity , refrigeration , personal automobiles, and above all jobs is the ultimate political non starter and cutting back just ain’t gonna happen on a voluntary basis.

There is always a bigger envelope that has to be considered and in the case of fossil fuels it is literally our short term survival.

Nobody with a lick of political and economic sense could possibly believe we can make big cuts world wide in fossil fuel consumption.

Any government that attempts such a move in the short to medium would be run out of town on a rail.The best we can hope for is something along the lines of Germany’s long term program and even the Germans are going to be burning a lot of fossil fuels for a long time to come .

SO- We are stuck between the devil and the deep blue sea. Our short term survival depends on the fossil fuels and our long term survival depends on our giving them up.

Some way we either will muddle our way thru, or we won’t.

In my estimation we need to get the oil sands scaled up as fast as possible because unless I am as dumb as a fence post and as lost as a little child alone in the woods , the real world alternatives are worse by a mile.

Now some people will ask with contempt and scorn what could be worse than a runaway greenhouse world and my answer will be a world racked sooner than necessary by economic collapse and resource wars followed by the runaway greenhouse world just the same and probably not more than a year or two later in arriving.

If we don’t mine and burn the tar sands we will be mining and burning just that much more coal and converting a substantial portion of that coal to liquid fuels.

It is my understanding that coal to liquids is an even worse option than tar sands diesel and gasoline.

Economic collapse means the end of any and all major expenditures on scaling up renewable energy and the end of any and all environmental initiatives from cleaning up rivers to protecting endangered species.

Given this reality our best course is to exploit the tar sands, and do all we can to make the best possible use of whatever time the tar sands will buy us.

The choice is not an easy one; the best that can be said about it is that it is probably marginally better than our other possible choices.

If we are very, very lucky the technocopians will prove to be right and renewable energy technologies will evolve to the point they are actually cheaper than fossil fuels in terms of dollars and cents before the fossil fuel situation gets so bad we don’t have fossil fuels enough to make the transition to renewables.

Once the cost of energy really starts getting out of hand the market can and will work some magic and remarkable progress can be made in energy efficiency in a remarkably short time frame compared to todays business as usual atmosphere.

Now about that runaway greenhouse–it is coming and stopping the tar sands isn’t going to stop it nor even slow it down noticeably. But stopping the tar sands might be the straw that breaks our own Yankee economic back later on.

I believe that most of the world is going to be a truly brutal place for humanity within the next few decades for a lot of reasons but I also believe that with luck the US and Canada can pull thru without going back to the dark ages if we play our cards right.

Global warming will probably make the south west uninhabitable and turn the deep south into a tropical hell hole but maybe most of the country will still be livable even if we have to become a nocturnal burrowing species.

Now some people will argue that we won’t have the tar sands when the situation starts getting desperate because the Chinese will have bought up some and contracted for more but that is not the way the world works when nations are dealing with questions of survival.

There is an ocean on either side of North America and nobody is going to come to North America and take away any oil once Uncle Sam’s back is to the wall-at least not within the foreseeable future.

The world’s biggest and most modern military industrial complex does have it’s uses under certain circumstances.

If Keystone doesn’t happen today it will happen tomorrow. If the tar sands are not dug up today they will be dug up tomorrow. If coal is not mined today it will be mined tomorrow. No energy resource will be left untouched when prices get high enough. The public will demand it, the politicians will support it, the corporations will take advantage of it.

To true, mate!

Yes!

WWIII may never be fought and if it is it may not go nuclear on the grand scale.

I am first of all a human being and concerned about the whole world and every living thing in it but reality dictates that we will be competing for the necessities of life as we live it now and oil is one of the necessities.

When the choice is between the USA and her close friends and the rest of the world and all the chips are on the table, I am a Yankee and that’s all there is to it and anybody that doesn’t understand that just doesn’t understand reality.

Trouble is coming on the grand scale sooner or later and it is certain to come before we manage a transition away from oil.

When it arrives we will be far better off here in the United States with the Keystone than without it.

I am not the sort to mindlessly wave the flag and chant USA and NUMBER ONE but we do have enough resourceful people and resources to make a go of it, with a few lucky breaks, regardless of what happens in the rest of the world so long as the environment doesn’ t get so screwed up that an industrial civilization is impossible.

It won’t be happy motoring but hopefully it won’t be preindustrial revolution either.

It does appear to be true that except for LTO we are in decline worldwide. While I find your proposed scenario far more palatable than most , all of the more graceful possibilities merely buy us a bit more time. How long can we stretch this out? Tick…Tock

Mac,

The regular Joe thinks as far ahead as his next pay packet; the average company, to next quarter’s bottom line. Fortunately we have superstars out there with their long view, our politicians. That’s why I don’t despair for the future of my kids and grandchildren. You’re just too dammed negative man.

Fortunately we have superstars out there with their long view, our politicians.

Doug, your forgot to put a smiley face after that statement. Some folks might think you were serious. And I know you don’t want anyone to think you really believe that our politicians are superstars who take the long view. How horrible would it be if they thought you really believed such nonsense? They might send the paddy wagon after you.

Ron,

Honestly, I swear, NEVER in my wildest fantasy, did I imagine that ANYONE would, or could, consider the possibility of politicians being be our savior — or of thinking beyond their next election campaign.

Doug you are not giving politicians enough credit for foresight and long term planning.

I believe that there is good evidence that every once in a while when his seat is safe that one looks as far ahead as he can in an effort to pass the seat along to his personal favorite child or assistant. 😉

The average Joe in 1944 Germany was told that all would soon change for the better…as many of the “leaders” finalized their’ preparations for what was to follow. With many almost starving most still believed! How far down the economic ladder will U.S. Joe of 2014 have to go? No fuel, no electricity, no money or all the way to no food? No Jimmy Carter calls for conservation so as to ease the transition and possibly slow the damage just BAU all the way full speed ahead. The evidence in the way of gov. and industry charts, graphs and reports are not in the least hidden and require only a sixth grade math and reading ability to decipher. Maybe it’s better not to alarm the servants or scare the horses. Anybody have a link to this month’s EIA production numbers for magical flying unicorn urine?

” How far down the economic ladder will U.S. Joe of 2014 have to go? No fuel, no electricity, no money or all the way to no food? ”

Joe Average will be ok in 2014 but I am not too confident about 2044

”Maybe it’s better not to alarm the servants or scare the horses.”

Now there is absolutely no doubt ”that the powers that be ” consider this to be wisdom of the first order.

Alarmed servants and scared horses are extremely hard to manage and it is almost always the best policy from the managers point of view to keep both as happy and as ignorant of any dangers as possible.

Any attempt to do otherwise usually backfires and results in even worse problems–such as the election of Reagan for instance.

Another big decline US natural gas storage, down 250 BCF last week.

Presumably, we should seem some decline in natural gas demand, as power generators who can shift, do shift from gas fired to coal fired plants, but I wonder how much of a factor this is, since so many coal plants have been mothballed or completely shut down.

Also, an offsetting factor would be increased demand for power generation from gas fired plants, due to low water levels in the West, which would affect both hydroelectric plants and perhaps also have a negative impact on the size of cooling ponds.

And we are already seeing some shortages, and sky high prices, at the ends of the distribution system, e.g., Southern California:

http://www.eia.gov/naturalgas/weekly/

In the News:

Reduced inflows strain California natural gas markets

Last Thursday, February 6, the California Independent System Operator (CAISO) issued an alert requesting that customers reduce electricity consumption on that day. The alert was in response to a natural gas shortage at Southern California power plants, but its conservation request applied to all consumers in the state.

Temperatures in San Francisco and Los Angeles averaged 50 and 57 degrees Fahrenheit, respectively, on February 6. Although these temperatures were 9% and 7% below the average for the previous 30 days, they were still well above temperatures in Denver (-8 degrees ) and Seattle (25 degrees ).

Natural gas deliveries to California were reduced by a combination of lower inflows on pipelines carrying in production from the Rockies, and decreased inflows on pipelines taking Canadian production south through the Pacific Northwest. These pipelines extend to California, but colder temperatures in the Pacific Northwest led customers there to take more natural gas off those pipelines, thus leaving less to flow into California. In addition, this led to an increase in spot prices to 10-year highs at many major western hubs. For California, this resulted in:

The PG&E Citygate spot price for natural gas serving northern and central California consumers reaching a 10-year high on February 5 of $24.55 per million British thermal units (MMBtu), versus an average for the previous 30 days of $4.93/MMBtu, according to SNL Energy. Although consumption in the PG&E market area on February 6 rose 29% over its 30-day average to 3.9 billion cubic feet (Bcf), natural gas supplied to PG&E (predominantly pipeline inflows, with some local production) decreased to 1.1 Bcf, 38% below the 30-day average. Bentek Energy reported that storage withdrawals on February 6 totaled 2.8 Bcf, 127% above the 30-day average.

Similarly, the Southern California Border spot price rose to a 10-year high on February 5 to $21.22/MMBtu, versus an average for the previous 30 days of $4.91/MMBtu. Consumption in Southern California rose by 23%, to 3.8 Bcf, while supply (again mainly pipeline inflows) declined by 30% below the 30-day average, to 1.9 Bcf. Storage withdrawals totaled 2.6 Bcf, 131% above the average for the previous 30 days, according to Bentek.

Low inventories led to five consecutive days of operational flow orders on the California Gas Transmission (CGT)pipeline, from February 3 to February 8. This restricted pipeline customers from taking more gas off the pipeline than normal despite the colder temperatures.

Natural gas pipeline inflows to California and the Southwest (Arizona, Nevada, and New Mexico) decreased from both the Pacific Northwest and the Rockies. Much of the gas that flows from the Pacific Northwest into California comes on the Northwest Pipeline. Northwest flows Canadian production from the Westcoast Pipelineto consumers in the Pacific Northwest (Washington, Oregon, and Idaho), as well as to California consumers via its interconnections with CGT in Malin, Oregon, and the Paiute Pipeline on the Idaho-Nevada border. Northwest deliveries at Malin decreased to 0.4 Bcf on February 5, 60% below its 1.0 Bcf/d average for the previous 30 days. Inflows of Rockies production also decreased to Southern California on the Kern River Gas Transmission pipeline and to northern California on the Ruby Pipeline.

I know that most of California, or at least the part of California where the people are, is warm enough that very little residential heating is needed.

But I don’t know how that little is supplied, whether by gas furnaces or resistance electrical heating or perhaps by lp since gas lines do not go every where.

Heat pumps would be extremely efficient but it seems doubtful that the demand for heat would be adequate to justify the cost of a heat pump in a place like SanFrancisco where heat is needed only a few days now and then.

But people who have plenty of money may buy heat pumps after a couple of experiences with curtailed gas deliveries.

How do SanFranciscans heat their houses?

Hillbillies ( like me ) who burn wood and cook with gas or electricity as often as not just turn on the kitchen range when only a little heat is needed.

Per the CPUC – 10 million CA natural gas “customers”. I’m thinking a “customer” is a gas meter, so I’d bet the actual number of residents who rely upon natural gas heat is probably more like 20-25 million of the state’s total 35 million population. Most the the rural areas use propane. Some use kerosene or diesel. Relatively few are all-electric, as electricity in CA is very expensive (though new high efficiency ductless heat pumps are gaining traction in rural areas, as propane/kerosene/diesel is also very expensive)

Nor Cal is from PG&E (Pacific Gas and Electric)

So Cal LA is largely Southern California Gas – a Sempra company

San Diego is heated (on those rare occasions they need heat) by San Diego Gas & Electric

http://www.cpuc.ca.gov/puc/energy/gas/natgasandca.htm

Oh, yes, SF residents use natural gas. They need heat year-round, as some of their coldest weather is in the foggy summer. Many tourists forget to bring jackets/sweaters when they visit SF in the summer and regret it.

Now that I think about it a bit it seems that I remember hearing something about chilly weather in San Francisco in the summer but I had forgotten about it.

So now the question becomes one of which sort of heat is cheaper now and which will be cheaper in the future. I think a really good heat pump will pay off at about three and maybe even four to one at forty degrees or higher temperatures and of course they provide air conditioning and dehumidification too.

Electricity must be expensive indeed to offset such efficiency and additional advantages in favor of gas heat.

It’s a given that the price of both electricity and gas will be going up.I wonder which one will go up the fastest. In most places I would bet that gas will increase in price relative to electricity but given the political situation in California that may not hold true there.

It has been claimed – perhaps incorrectly – that Mark Twain said: “The coldest winter I ever spent was a summer in San Francisco”. Coastal California can be cool in the summer. Inland is a different matter. I recently moved from a natural gas heated house near the ocean to an all electric over 55 compound. Am saving a bundle but that is partially due to an efficient and somewhat smaller design. I too wonder what the gas vs electric future will bring.

It may not be evidence of peak oil but it surely isn’t any evidence to the contrary that Ford is going to build the F150 mostly out of aluminum rather than steel starting this fall.

Now it appears to be the case that Guv’mint Motors has contracted for enough aluminum to build Chevy and GMC pickups out of aluminum too but I wouldn’t personally be too sure about the end use of all the aluminum. Some of it may be used in cars.

http://www.foxnews.com/leisure/2014/02/19/general-motors-reportedely-ready-to-build-aluminum-pickups/

As has been pointed out before, when Chinese buy a new car, it is brand spanking new consumption. When an American buys a new car, chances are an old car somewhere gets junked and isn’t consuming.

So it is the Chinese who are the source of oil pressures. And the Indians. Factoid, just Ford, just one company, sold 935,000 cars in China last year, and not one of them was electric.

China bought 22 million new vehicles last year in total. If we presume 0.0001% of those were electric, we can safely do the math with the number 22 million. 22 million X 20 miles/day at 25 miles/gallon and 42 gallons/barrel = 419K barrels/day of NEW consumption due to the purchase of vehicles. So whatever China’s consumption was in 2012, they added 419K to that. This is more than the total consumption of Greece. The US military on a typical day consumes 380K.

China added that amount last year to their previous totals. And btw, 20 miles driven per day is probably conservative.

Watcher,

I’ve spent a lot of time in China (from Siberian frontier to the Vietnamese border), and can confirm to the truth of your observations. The primary reason, in my opinion, for the explosion (Peter is likely to take a shot at me here) of these car sales boils down to one word, prestige. And, a powerful motivation it is too.

Regarding the question of average miles driven I have no idea. It may be less, or more, than you imagine. I’ve met people whose car never leaves its parking spot; the owners simply take immense pride in possessing the dam things.

Lots of parked cars in US driveways, too. 20 is lower than the US average. Seemed like a reasonable number.

Bottom line: 419K bpd increase. Per year.

It looks as if the railroads and at least some of the companies involved in producing the extra light crudes are taking the possibility of additional accidents very seriously indeed.

It must certainly be the case that some of the caution exercised is the result of fear of lawsuits that could break even a large company but most of it must in my opinion derive from a belief that the supply of LTO is assured for a good long while given that company wide upgraded tank car fleets must be a huge expense.

But the flip side of this coin must be that the railroads are reasonably sure that pipelines from the new LTO fields in the interior will never be built to carry the oil to coastal refineries.

It is likely that pipeline companies aren’t interested because they do not believe the LTO will last long enough to justify the investment.

The older tank cars may still be considered safe enough for heavier crudes or finished products such as diesel fuel.If not I guess they will find their way to Mexico or some other country that is not in a position to pass up a deal on some cheap serviceable tank cars.

http://www.reuters.com/article/2014/02/20/us-bnsf-crude-rail-idUSBREA1J1BE20140220

Pretty sure most of the pipeline controversies are for oil sands oil, not LTO.

”Pretty sure most of the pipeline controversies are for oil sands oil, not LTO.”

Watcher is right about this.

There is not much if any discussion of building pipelines for the transportation of LTO except by a few people who are focused on rail accidents.

They may have enough political influence to get rail safety standards tightened up but nobody in the pipeline industry seems to be interested in building any major new pipelines to move LTO .As noted above the conventional wisdom is that the pipeline companies don’t believe such lines would be profitable.

Some shorter smaller pipelines are obviously being built and near the LTO fields but how many how big and how long I have no idea.

http://www.usnews.com/news/articles/2014/02/19/energy-dept-backs-nations-first-new-nuclear-reactors-in-nearly-30-years

The enviro loonies are convinced that Obama has sold out to the Koch brothers and the republicans are convinced he has sold out to the enviro loonies but it seems to me that he is driving mostly in the middle of the energy road as evidenced by the abuse aimed at him from either side.

I don’t especially enjoy thinking about all the potential accidents that might befall a nuke and the long term disposal of spent fuel is an issue that really may not have a good answer given the political difficulties associated with hot waste.

The technical aspects of spent fuel disposal do not scare me nearly so badly as the thought of a major city not having the juice needed to keep the water and sewer systems up and running and the electric ranges and refrigerators in every house working .

There is a time coming someday when the delivery of coal and or natural gas to generating stations will fail for a day or a month although that time is probably a few decades down the road.

Nukes will still run no matter how bad the weather may be and they will substantially stretch the supply of natural gas which is the key input in the manufacture of nitrate fertilizers and for nitrate fertilizers there are no substitutes .

I try to always look at the forest from the farthest removed vantage point I can manage and I think that given the risks associated with a lack of affordable and reliable base load electricity over the next half century or so we simply cannot afford not to build a new generation of nukes.

I s any regular reader of this blog that believes either oil or natural gas will still be cheap and plentiful in twenty or thirty or forty years?Maybe I am wrong but I am confident that unless the economy really goes to hell in a hand basket that within that time frame we will have accustomed ourselves to driving electric micro mini cars and a nuke can keep them charged up by the tens of thousands .

Could you confirm what c+c is? – crude + condensates ?

Yup

EIA TWIP Propane

EIA TWIP Distillates

Distillate imports are up.

I am following the US weekly crude oil production. The US weekly crude oil production GROWTH appears to have peaked.

The attached graph shows the 52-week moving average of the US weekly crude oil production growth from 52 weeks ago (calculated as the average weekly crude oil production over the last 52 weeks less the average weekly crude oil production over the previous 52 weeks) from 1983 to early 2014

By this measure, after reaching a temporary trough of 101.8 thoudand barrels per day during the week of September 16, 2011, the 52-week production growth had risen virtually uninterruptedly for 117 weeks until it reached the peak of 1241.3 thousand barrels per day for the week of December 13, 2013 (with the exception of a minor dip between January 20 and January 27, 2012 when the 52-week growth fell slightly from 173.7 to 173.4 thousand barrels per day).

There was a short plateau from the week of December 13 to the week of December 27, 2013. From the week of December 27, 2013 to the week of February 14, 2014, the 52-week production growth had declined from 1241.2 to 1216.7 thousand barrels per day. It had declined for each of the past seven weeks with an average weekly decline rate of 3.5 thousand barrels per day. A this rate, it would take 355 weeks or almost seven years from the end of 2013 to see the production growth decline to zero (or the production level peak).

Nevertheless, this may be one of the first indications that the US shale oil boom is entering into a decelerating phase.

On March 21, 2014 – just a month later – the 52 week change of oil growth fell to 1,039 mbd. So the rate of growth has been 200 000 barrels per day lower in just about a month. If this trend is confirmed, oil production in the US is declining once again by the end of this year – and may not go much higher than 8,5 mbp.

This one looks at just the period 2008 to early 2014, making the recent peak in production growth more clear.

Odds seem pretty strong that the weekly figures come from models and not measurements.

Intriguing – I have been watching the ‘rate of change metric’, though only by eye, and it appeared to be slowing just by looking at the official data. How much of a role do you think the weather this year is playing? I know you are in effect doing a year on year comparison, so weather effects should be to a certain effect nullified…….

Yes, this is like doing a year on year comparison. So the weather effect should have been taken care of. You don’t see this deceleration at the beginning of 2013 (in term of year on year comparison)

Yes but hasn’t this been an especially ferocious winter?

We will find out in the coming months to what extent the observed growth decline is strcutural or temporary.

On the other hand, as some commentators have suspected, the weekly production data may be partly based on models and thus do not reflect fully the effects of ferocious weather. In that case, these productions numbers may be revised down as monthly data become available.

I just found an article that explains the legal reasoning behind the much reported recent court decision that will hold up the Keystone for a while longer.

It is based on a regulatory technicality. The governor overstepped his authority in approving a the pipeline route. That authority resides with a state government committee that will have to review and approve the route or else disapprove it which will take some time in either case .Even if they disapprove this route they may still approve an alternative route.

In my opinion the only thing that will actually stop the Keystone being approved -eventually – is that the opposition is able to stall it until either new railroads are built to get the oil thru the bottle neck or until the Canadians build some pipelines of their own east and west to get the oil to market.

My guess for now is that unless some thing changes things in a fundamental way the republicans will be back in charge in DC in 2017 and that if it isn’t approved before then it will be approved in a matter of weeks.

(I make no claims to expertise but I am either very lucky or very good at predicting presidential elections and have gotten all of them right ever since I can remember since I got old enough to vote at least a week before election day.

Of course only about three or maybe four max were expected to be really close and hitting that many by accident is no big deal. IF the democrats win in 2016 it will be because the republicans fumble the ball a couple of times and throw interceptions one after another –again this is assuming that nothing changes in a really big way between now and shortly before election day .

Mac,

As we speak, in Mexico, your President has been lecturing our President (Prime Minister) about global warming, saying that’s why he hasn’t approved the Keystone pipeline; awfully altruistic of him isn’t it?

Not to be cynical, but if it weren’t for of Bakken etc. I suspect your President would, instead, have been lecturing our President (Prime Minister) about being too slow developing the Canadian tar sands.

In fact, I bet that when Bakken etc. tapers off the dialogue will alter as I predict. Meanwhile, tar sands development will slow a little, Canada will build pipelines going east and west and the earth will continue to get warmer – regardless! And Keystone will be built.

What can I say ? 😉

Obama is an American politician and he can be expected to milk every issue for as many vote as he can and he knows that the people in favor of building the Keystone are never ever going to vote for him .

He also knows that the hardcore greens in this country are solidly be hind him but only so long as he keeps throwing them some red meat in the form of not approving the Keystone etc.

I agree with you in principle but my guess is that as soon as he can get away with it meaning after our fall elections Obama will approve the construction . The greenies will never vote republican in 2016 but they might stay home this fall.

If he doesn’t approve the pipeline a republican will and if there is no republican president elected in 2016 then Canada will build pipelines of her own and maybe even sooner.

I am with you. All the way other than that we might come up with somewhat different time scales.

Re: Annual 2013 Saudi net exports

Here are the 2012 EIA data:

(Total petroleum liquids production + other liquids production) – (liquids consumption) = net exports

11.53 – 2.86 = 8.68 mbpd (versus 9.1 mbpd in 2005)

If we take the monthly EIA data for 2013 at face value, Saudi Arabia averaged 11.5 mbpd through October. I estimate that the preliminary annual production number for 2013 will be between 11.5 and 11.6 mbpd. Note that the Saudis are reporting a small decline in crude oil production from 2012 to 2013, and note that their reported increase in crude oil exports for 2013 was the gross number, not the total petroleum liquids net export number.

In any case, if we assume Saudi consumption of about 3.0 mbpd, their 2013 net exports would be 8.5 to 8.6 mbpd. The bottom line is that that since the Saudis themselves are reporting a decline in crude oil production, absent a very significant decline in consumption in 2013, I don’t see how their 2013 net exports could be above 9.1 mbpd (the 2005 rate). In other words, I think it very likely that 2013 was the eighth year in a row that annual Saudi net oil exports were below their 2005 rate of 9.1 mbpd.

Again assuming consumption of 3 mbpd and production of 11.5 to 11.6 mbpd, their ECI Ratio (ratio of production to consumption) for 2013 would be 3.83 to 3.87. Based on the 2005 to 2012 rate of decline in the Saudi ECI ratio, their ECI ratio would be at about 3.84 for 2013.

Incidentally, one interesting aspect of “Net Export Math” is that given a declining ECI ratio, the year over year rate of depletion in remaining CNE (Cumulative Net Exports) tends to accelerate with time.

For example, assuming post-2005 Saudi CNE of about 56 Gb (my estimate), the 2005 to 2006 estimated year over year rate of depletion in remaining post-2005 CNE was 5.7%/year. Assuming 2013 net exports of 8.6 mbpd, their 2012 to 2013 estimated year over year rate of depletion in remaining post-2005 CNE was 9.0%/year, as estimated remaining post-2005 Saudi CNE fell from 35 Gb at the end of 2012 to 32 Gb at the end of 2013.

If we look at a similar time period for the Six Country Case History*, 1995 to 2002, the actual 1995 to 1996 year over year rate of depletion in remaining post-1995 CNE was 19.6%/year. The actual Six Country 2001 to 2002 year over year rate of depletion remaining post-1995 CNE was 46%/year.

This is why I think almost everyone is missing the point about net export declines. When a net exporter might approach zero net exports is pretty much irrelevant, since the biggest volumetric CNE depletions tend to occur early in the net export decline phase. A rough but pretty consistent rule of thumb is that if we look at the time period from peak net exports to zero net exports, about half of post-peak CNE are shipped about one third of the way into the net export decline period.

Globally, I estimate that the year over year rate of depletion in remaining post-2005 Global CNE accelerated from 3%/year for 2005 to 2006 to 3.8%/year for 2011 to 2012. And this is without taking into account the “Chindia Factor.” In effect, I think that we are maintaining something resembling Business As Usual as a result of an accelerating rate of depletion in the remaining volume of Global Net Exports of oil. It’s as if you were maintaing your lifestyle by consuming your remaining savings at an accelerating rate of depletion.

*The six major net exporters, excluding China, that hit or approached zero net exports from 1980 to 2010

Yes indeed, like adding more wells (including horizontals) to existing fields. And, not forgetting “enhanced recovery” (i.e., nitrogen injection at Cantarell) of course. I think “enhanced” is often a euphemism for quicker.

Jeff,

Before you shoot me down I do know that Enhanced Oil Recovery (EOR) refers to techniques for increasing the amount of oil that can be extracted from an oil field, not how fast. When I said sometimes I think EOR is a euphemism for quicker I really meant that sometimes EOR sometimes seems like a euphemism for quicker. Which I realized this one microsecond after pushing the send key and my excuse is that I was still half way through my first cup of coffee. So, in advance, I stand corrected.

Doug, perhaps you, like most of us, should fear ‘peak coffee’ as it is clearly the master resource for cognitive function…

Patrick, My Kiwi connection Down Under (does NZ fit beneath the down under umbrella?). Good to see you’re alive and well. Yes indeed, Peak Coffee, my (our) Nemesis. Judging by the way I scrambled even my second response to Jeff perhaps it’s more properly bullet-in-the-head time – ‘way too late to cancel the coffee routine!

Alive and well and indeed and ‘down under’ although that feels like a rather old fashioned expression these days. A bit quaint.

We are still graciously going along with all you people on the bottom of the world insisting on drawing the map upside down…. (heh)

Otherwise keenly waiting for oil’s next move price wise. Starting to feel some movement in my bones, could it be this year? In order to improve the quality of debate and decisions we really need this issue back on the agenda here. There is a wilful and unhelpful oil abundance meme here, especially in government and official circles, that has filtered down from the shrill noise in our culture’s head office: The US of A.

Wouldn’t it be great if we had more than a binary approach to these issues. It’s either ‘oil for ever’ or ‘none at all’. Currently stuck on the former.

Here’s the always reasonable Tom Whipple hitting the tone well:

http://www.resilience.org/stories/2014-02-21/the-peak-oil-crisis-a-winter-update

Now where’s that coffee….

To infinity and beyond:

Boundless Natural Gas, Boundless Opportunities: Interview with EIA Chief

http://www.nasdaq.com/article/boundless-natural-gas-boundless-opportunities-interview-with-eia-chief-cm328537

Jim Hansen’s splash page for this week’s Master Resource report makes a very illustrative point…

Could natural gas storage really fall below 1,000 Bcf?

To put the natural gas situation in perspective, consider this: EIA forecasts a 2% increase in output from domestic sources this year. A 2% increase would translate to roughly an additional 520 bcf of natural gas coming on line between now and the end of the year. But as you can see from the table below comparing current gas storage volumes to recent five-year averages, that increase in output, assuming it does happens, equates to the current deficit. In other words, the increase in output has already been offset by the severity of this winter, and we’re not through with it yet.

Should this year’s increase in output fall short of the projection, we are certain to start the 2014-2015 heating season with less in the tank than in previous years.

The untold part of the natural gas game-changer narrative is that demand managed to keep pace with the increase in supply, and well on it’s way to overtake it. So, in terms of the supply demand-demand balance, we’re right back where we were in the mid-double-aughts.

Natural Gas Storage Volumes

Winter and early spring comparisons

(in billion cubic feet)

2014 Volume 2014 5 Year Average 2013 5 Year Average 2012 5 Year Average 2011 5 Year Average

Week 0 – 2974 2974

Week 1 – 2817 3207 (-390) 3088 (-271) 3008 (-191) 2917 (-100)

Week 2 – 2530 3048 (-518) 2935 (-405) 2864 (-334) 2797 (-267)

Week 3 – 2423 2868 (-445) 2773 (-350) 2702 (-279) 2674 (-251)

Week 4 – 2185 2706 (-521) 2614 (-429) 2546 (-361) 2536 (-351)

Week 5 – 1923 2541 (-618) 2433 (-510) 2354 (-431) 2365 (-442)

Week 6 – 1693 2390 (-697) 2266 (-573) 2158 (-465) 2202 (-509)

Week 7 – 1443 2184 (-741) 2127 (-683) 1992 (-549) 2063 (-620)

Sources: Energy Information Administration, AmericanOilman.com

Oilsands study confirms tailings found in groundwater, river

Federal study shows water from tailings ponds leaching into Athabasca River

CBC News Posted: Feb 20, 2014 11:59 AM MT Last Updated: Feb 21, 2014 6:51 PM MT

Silence of the Labs

CBC, The Fifth Estate, BROADCAST DATE : Jan 10, 2014

Here’s a link to a story in Scientific American about the Bakken.

It has some very good pictures and more than a few very interesting numbers in it too.

http://www.scientificamerican.com/article/north-dakotas-landscape-energized-photos/

Not Even the Head of Exxon Wants Fracking Operations In His Neighborhood

By Terrence Henry, State Impact, NPR, February 21, 2014 | 10:38 AM

No backyard will go unmolested when all that is left to produce is low EROI fossil fuels!

I wonder how Lee Raymond would have dealt with the matter?

Believe It Or Not, Last Month Was One Of The Hottest Januaries Ever Recorded

By Jeff Spross, Climate Progress, on February 21, 2014 at 12:03 pm