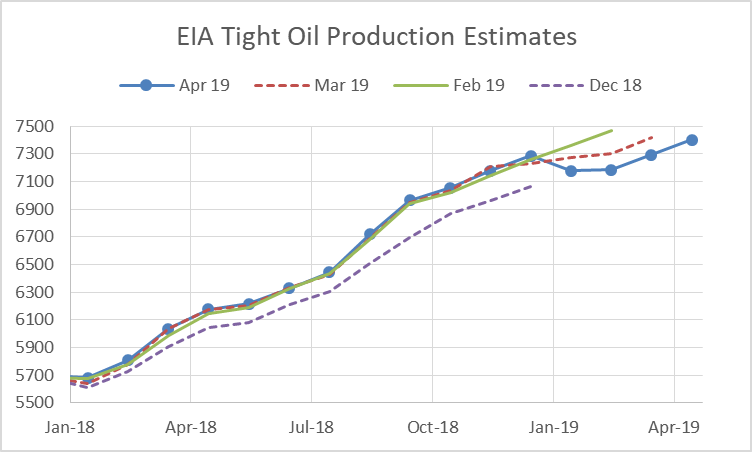

The US Energy Information Administration publishes Tight Oil Production Estimates by Play each month (can be found at link above.) I noticed this month that the estimates seemed different than I remembered so I checked earlier estimates I had saved on my computer. The chart below compares estimates from Dec 2018 to April 2019 (where the last month of data in the estimate is Dec 2018, Feb 2019, March 2019, and April 2019).

As is clear from the chart the February and March estimates have each been revised lower over the past two updates. If this should continue, we might see relatively flat tight oil output for all of 2019.

I have revised my estimate for future US tight oil output to a 400+/-100 kb/d increase in monthly average tight oil output from December 2018 to December 2019.

A set of Permian Basin scenarios with medium oil prices (EIA AEO 2018 reference oil price case) and low oil prices. The Oil price scenarios are shown (plotted on right axis) and the two output scenarios for the Permian Basin.

I noticed the legend is pretty cryptic. The low price-26 Gb is the low price output scenario with a URR of 26 Gb, read from left axis. The med price-58 Gb entry is the med price output scenario with a URR of 58 Gb. Sorry for the poor labelling.

Someone asked me what happens if oil prices are low due to carbon taxes, a fast ramp in electric cars, or a crash in economic output due to GFC2.

Basically we get we get much less Permian output if oil prices rise no higher than $68/b in 2017$ (maximum price of low price scenario, not reached until 2026.)

Dennis,

Amazing work you did. I may understand it as borders of of probable scenarios for both LTO Permian yearly production and WTI (Brent) oil prices. As URR may be somewhere between 26 and 58GB and oil prices (as 5-year averages or so, not on daily basis) will most probably fall between the 2 projected extremes, so someone 30 years from now may find actual LTO Permian production to have been between the 2 limiting curves.

On second thought I have serious doubts. If, on the highest price, the ultimate earnings will be at most 15$/bbl (based on the fat tail of production’s downward trend), on the lowest price the operators will never break even.

Alex Palti,

For the low oil price scenario presented above, you are absolutely correct. If all Permian basin production were treated as one big project run by a single well run oil company (starting in Jan 2010) we can add up cumulative net revenue over time (assuming negative totals are financed at an annual interest rate of 7.4% (nominal interest rate, real interest rate would be 4.9% if we assume 2.5% annual rate of inflation.)

The accumulated debt never gets paid back in the low oil price scenario, it is possible however that some or all of this debt will be written off and the remaining oil could be produced profitably by small efficient producers who know how to produce oil with minimal debt.

Another scenario is that all new well completions cease in 2040 when it becomes clear the Permian project is not viable in the low oil price scenario, from Jan 2041 to the end of the scenario in Dec 2079 only about a half a billion barrels are produced, so ERR is reduced to about 25.5 Gb in that scenario. Also note that I believe the low price scenario is highly unlikely (maybe a 10% probability that oil prices will follow a curve that is that low or lower.) The more likely scenario is higher oil prices, and to me the AEO reference oil price case looks very reasonable (for that scenario I would say the odds are about 50/50 that oil prices will be higher of lower than that scenario.

Chart below shows both oil price cases on right axis and cumulative net revenue in billions of 2017$ for the low oil price scenario is shown on the left axis (note all the numbers are negative on the left axis). Cumulative net revenue is added for every month from Jan 2010 to Dec 2079 and it is assumed there is no debt on Dec 31, 2009 (a simplifying assumption). The cumulative net revenue remains negative every year from 2010 to 2079 and grows to 500 B 2017$ by Dec 2079.

On dwindling reserves and, possibly, higher interest rates, the LTO companies in Permian may fall out of glamour as slow-motion casinos for gambling investors.

Peak Oil Review: 14 May 2019

“Declining well productivity in some [tight oil/shale] plays, despite the application of better technology, is a prelude to what will eventually happen in all plays: production will fall as costs rise. Assuming shale production can grow forever based on ever-improving technology is a mistake—geology will ultimately dictate the costs and quantity of resources that can be recovered.” David Hughes, earth scientist, energy researcher and author of How Long Will the Shale Revolution Last?

Apologies if this article has already been posted.

Coal doesn’t seem to be a cause Trump is saying much about lately. Even oil doesn’t seem to be his focus right now.

Immigration, trade, and wars seem to be what he is pushing at the moment. Other than telling the Saudis to lower oil prices, he hasn’t made energy/fossil fuels a talking point. Has he lost interest or do you think someone has pointed out the unfavorable economics of coal and low oil prices?

Things are happening in Denmark to slow or stop Nordstream 2.

The president directed State to execute this maneuver.

B II, I think the Pres is busy right here at home trying to create a new war to keep him in place while he fights off the Congress. Oil, natural gas and coal will have to wait a bit, they are not enough of a distraction.

What if Trump Refuses To Give Up Power? – Authoritarian America?

https://www.youtube.com/watch?v=SLN_3zN9cOY

Congress Tries To Strip Trump Of War Powers To Prevent Attack On Iran

https://www.youtube.com/watch?v=3JZGD7NBT1Q

Boomer Wrote:

“Coal doesn’t seem to be a cause Trump is saying much about lately. Even oil doesn’t seem to be his focus right now.”

Trump, or at least his war-hawk cabinet seems have a close eye on Venezuela & Iran.

Watcher Wrote:”Things are happening in Denmark to slow or stop Nordstream 2.”

I just had to laugh reading your post after seeing this article:

https://seekingalpha.com/article/4265648-russias-oil-exports-u-s-on-steroids-complicating-opec-deal

Perhaps the US wants to hoard Russian Exports for itself? Makes no sense for the US to block Russia NatGas for Europe, but importing as much Russian Oil as it can get, if its objective is to hurt the Russian economy.

Won’t it be just grand if all the extra Russian Oil US refineries are buying is to sell to China as refined Oil products?

US imports from Russia are 221K bpd. The variance on that number wiggles around an average that appears to be pretty constant since 2015.

I don’t quite know what the point is there, somebody said the president had lost interest in fossil fuels and I pointed out that State was orchestrating maneuvers in Denmark to obstruct Nordstream 2, which is planning to carry fossil fuels.

During the 2016 campaign the point was made that NATO gets funded to defend Europe against Russia, and while NATO is funded to do this, Europe also funds Russia to counter NATO through the purchase of natgas. It’s a legitimate maneuver in establishing a non monetary motivation behind a choice to buy American LNG rather than pipelined Gazprom product. If you can get a buying decision made on the basis of something other than price, you sell American product.

Wow! Dennis, you constantly amaze me with you ability to adapt. I’d pat myself on the head, and feel justified, but your determination is coming from an entirely different set of data, and all I can say is, wow! What I say, has no connection to your train of thought. You are a fritzing genius. Yeah, Texas will be flat, consequently, US will be flat for 2019. But, to be honest, I have no idea after that. Guesses, but nothing tangible.

Now, I can share a little good news I received lately. They completed four more wells on my property, probably 35 to 40 to go. By adding an additional 40% additional length, and more frac stages, etc., they have increased initial output by 50%. EOG has become my forever buddy. And, it’s not even adding in their enhanced production features, yet. An idiot would be the only person who could say that they are not making a substantial profit on these wells.

Direction? There are no further wells being permitted here. They are just making money on some. Enough. I still think EOG is just a step away from being absorbed by a bigger fish, but the idiots who say there is no money being made by shale, are just that, idiots.

It’s here to stay, for awhile. But, I think, collectively, the shale companies are a little more than pissed off, by all the BS. So, the end user is going to have to pay the piper, for this year, at least. No different than OPEC.

I mean, give it a small consideration. If it is extremely limited, they got it, you need it, who the F is in control?

If your production is not up to your estimates, but your net profit is much higher than estimates, who cares?

Small question: With more initial length, they will have much less wells on your property as initial planned.

Anyway, only the total barrels count for the owner, 40 or 80 wells don’t matter.

Another thing for your Permian calculation: I think they now respect the pipeline shortage – when are the new pipelines ready to use? Then they can restart bigger drilling programs.

Interesting 4 more DUC’s compleated and 35-40 more to go on that play. 40 % additional lenght gives more frack stages. According to Schlumberger there is a limit how long longetudial wells can be drilled , and guess if consider over all cost each well related to income during the wells life time , rental of Acre and interest of investment the fundamental remain the same. Oil price now trending down soon WTI below 60 usd/bbl. I believe 2019 will end in a drop for 2019 for us shale , and there will still be oil glut in the market mainly due to weak growth in world market. The last we see is banks that wants out of oil and gaz buisiness , this add huge problems related to rollovers of depth ballons and Companies will come in conflict with covernants that increase uncertainity and lead to new restructuring, bancorupsy.

Not sure what the current pipeline constraints are, pretty sure there is still a shortage of Natural Gas pipeline capacity in Permian Basin. The may still be short on oil pipelines as well.

My wells are in the Eagle Ford. There is no pipeline shortage there. As for the Permian, they do not seem to give a damn about the gas. They burn it, give it away, or pay someone to take it. Total waste.

Guy

Someone asked about Permian pipelines.

Supposed to be available later this year. But, who knows.

Thanks GuyM

I have read the same 2019 to 2020 for oil, for NG I have less info.

Mr. M, productivity is not the same as profitability. EOG’s total return in the Eagle Ford the past decade is NOT something to write home to mama about. COP is starting to make a little money in the liquids rich condensate leg of DeWitt; BHP did not. Nor has Sanchez, Penn, Statoil, CHK, Anadarko, Shell and a multitude of others. Pioneer had to give away their last EF acreage. I looked at EOG wells in Atascosa and in spite of higher productivity and the highest product prices in all shale oil basins, its going to be very close as to whether those wells pay out. EOR has thus far NOT proven economical and has very limited applications due to faulting and bed sealing. I don’t consider myself an “idiot” because I don’t believe the shale oil industry is making money. Shallow, are you an idiot?

Mailbox money tends to make all royalty owners great crusaders for, and big believers in, the shale oil miracle. Not surprising, that.

Mike,

When prices dropped in 2014 I expected a big cutback in tight oil drilling as the venture did not seem profitable at low oil prices. Do you have a rough idea of average well cost lately in the Eagle Ford? If it is $8 million they need $74/bo at the well head for breakeven at 10% discount rate (discounted net revenue over the well’s life equal to well cost is my breakeven calc). Are royalties and taxes the same for oil and natural gas on average? I usually use 33% for oil, not sure if it is the same for natural gas.

$7.5MM is the number, I believe with 18+MM pound frac’s. I use 0.78NRI’s in the EF; ORRI burdens abound. 7% severance and property taxes in Texas. Prices are going down, Dennis. Break’even is fine, if you must; its over used and because it is so ‘qualitative’ most people don’t believe it anymore. Personally I think more people can relate to how many BO a shale well must make to payback full cycle D,C & leasehold costs. I like this because Enno’s data is so easy to use one can then look to see what percentage of wells being drilled will even reach payout. Its simple, and easy, and very tale telling. The EF is racked with debt and the ROI’s on bigger wells are still not sufficient to replace reserves, pay dividends and get out of debt.

Mike,

Sorry for dumb questions but NRI is the percentage left after paying royalties, so in your example 78%, I assume everyone pays the taxes, so for the producer in this example they would pay 7% of the 78% NRI, leaving then with about 72% after paying royalties and taxes. Please correct me if I am confused, anyone, Mike, Shallow Sand or GuyM.

All RI pay severance and property tax; the methodology should be to determine net barrels to the 100% working interest, then deduct severance and ad valorem tax and all other costs from that. A word for the wise, thanks to Aubrey McClendon and the rest of the shale oil industry, since 2011 NO royalty owner has negotiated a lease whereby its royalty is subject to any costs whatsoever. No marketing, nor transportation costs, no nothing. If the WI has had to plop down $500K per well to get 100% of the revenue stream to the market, the RI pays no portion of that. So any stuff you hear from royalty owners about what they receive in the way of nat gas price or nat gas price per MMBTU or NGL’s without processing costs… that is totally irrelevant to well economics. On the other hand, the WI does NOT share hedge benefits with the RI unless there are explicit covenants in the lease that says otherwise, which is rare. For some dumb Lessees that agreed to this sort of stuff, they must PAY the RI the going rate for natural gas to use in gas lift or to run engines for rod lift, so the RI can then get its share of product out of the ground, whereby the WI then has to pay to get it somewhere to sell. I am at the end of my exploration career and do not need to take new leases, thankfully. If one wishes to know why onshore conventional exploration has fallen completely off the cliff the past decade, look no further than how the American shale oil industry has jacked leasehold burdens up 1000%.

One point one percent (1.1%) of the American public is blessed to have RI under shale oil production in America and it has collectively made roughly $780 Bn of revenue, and counting, the past decade, free of all costs, save taxes. The American shale oil phenomena is an amazing redistribution of wealth in America, from printing press to burner tip. If you happen to be in the middle of that you are in high cotton.

Mike.

In our high LOE field 1/8 royalty was what was common when the first leases were signed over 100 years ago. Then, as the gushers blew in, many landowners negotiated 1/6 leases.

When waterfloods were developed after World War II, most of those 1/6 leases were renegotiated back to 1/8 royalty in exchange for the much higher volumes of oil that would be sold.

All through the late 1970s/early 1980s oil boom, 1/8 royalty was still standard.

Only by the advent of shale did we start to see higher fractions.

In fact, we were going to reactivate a lease in 2013 that offset another lease we operated. The problem was the mineral owners all lived in OK and wanted 22.5% royalty with significant cash up front to boot. This was for a few shallow wells drilled in either the late 1950s or early 1980s that would likely have made less than one barrel per well.

Thankfully, we passed. The wells are still sitting there, no equipment, in the state’s orphan well program.

Hi Shallow sand,

I know that producers think in terms of barrels, economists think in terms of cost and revenue.

For simplicity I will assume the tax rate is 2.5% on oil and natural gas, so with 12.5% royalties, the net revenue after royalties and taxes would be 85% of wellhead revenue, of course there would also be operating costs and overhead deducted from this net revenue. If 100 barrels were produced you would have 85 net barrels before operating expenses.

I believe the mistake I made for Mike’s example where 78% NRI is assumed and taxes are about 7% is that these numbers need to be added, so the royalties and taxes would be 22%+7%=29%. So net barrels after royalties and taxes are paid is 71%. If we also assume $13/b for LOE and overhead and an oil price of $50/b we would have take home pay of $22.50/b. The average Eagle Ford well produces about 240 kb over its life, so the total revenue over the well’s life would be 5.4 million dollars (constant dollars). If the well costs $7.5 million, then $50/b does not work. About $62/b pays for the well over its entire life. If we want payout in 60 months, the average Eagle Ford well would pay out in about 60 months at $75/b at the wellhead. Mr. Shellman prefers 36 month payout which for an Eagle Ford well which would require $85/b.

Actual numbers would be a bit different as I have ignored natural gas.

If we include natural gas and assume $2/MCF at the well head, 36 month payout is achieved at $77/bo, and 60 month payout at $67/bo. So 48 month payout would probably be at about $72/bo.

The well would payout after 14 years (end of well life) at $54/bo.

Hi Dennis.

If the NRI is .78 and the average tax rate is 7 percent, the net to 100% working interest would be .7254.

.78*(1.0-0.07)=.78*.93=.7254

Although there may be exceptions, each party usually pays its own share of production or severance taxes.

dclonghorn.

I did it the way you suggested and Mike suggested (perhaps, I was not clear on his message) I was not correct.

I think in dollars rather than barrels.

So $5000 in gross revenue for 100 bo@$50/b, royalties are 22% or $1100 (paid in cash or in barrels), taxes are 7% of gross revenue or $350, that leaves $3550 in net revenue prior to deducting operating expenses and other overhead. 3550/5000=71% and 29% of gross revenue is paid out in royalties and taxes. Or I think that is what Mike was saying. All of this is so obvious to Mike and Shallow sand, they probably don’t understand the question. It’s like asking, is 1+1=2, can you explain?

I finally see my mistake. I was treating it as if the producer pays all the taxes on all of the oil produced. Not so, the owner pays taxes on their 22% share of oil and the WI pays the 7% tax on the 78% share of oil that they get to sell, so yes you are correct.

Mike

To do the economics I need the revenue stream then costs are deducted. I assume when you give me a well cost estimate it includes all costs to handle oil and natural gas production.

When a royalty interest claims they receive x dollars from NG sales per BOE, I assume the WI also receives that price. Then I deduct LOE and G&A expense. Transport costs are also deducted from refinery gate.

In the past I think you have suggested LOE of $13/bo, I assume this is not based on boe. Also not clear if this includes other overhead such as G&A.

One of the real problems with well economics is the fluctuating oil price over the lifetime of the well. On countless wells I have drilled they were economic when we proposed and approved them, economic when we drilled them, and then a swing in oil and gas prices left you with a loss. For instance you could have drilled a well last summer, thought everything would be great, but for the first six months of peak production you got $50 oil, then price rebounds a bit, but your production has fallen as well. In general if a horizontal well does not pay for itself in the first 24 months, it will not be economic, as in the later time between price fluctuations, adding lift, infill drilling and bashing by new wells, drops in production and the cost of capital, you can never make enough to pay back much of the initial investment.

Mike.

I don’t know what to think. Oil is crashing again. A theme is there will be no future demand because of EV’s.

But I am not convinced regarding EV’s yet. I know that is heresy around these parts, but until companies can sell them at a profit, they won’t work. Just like most of the shale wells won’t payout.

My theory is there is coming a day of reckoning, but timing is always tough to predict.

Yes, prices are crashing again. This is the time not to be fooled. Brent backwardation 1-2 month at the highest for years 1.1 dollars and Dubai more than 1.5 dollars per barrel. Deficit globally at least 3mb/d for “normal” oil. Financial market panic to save the day? I don’t think so. The reasonable policy has always been to let the oil price rise so that the market can adjust with bringing more supply and try to substitute the energy form to other types. This crazy action will lead to the volatility in oil prices that in the end is not desired. OPEC just postponed their meeting with likley cut extension to 4th July. Reason; Novak could not make it late June. OPEC+ are clearly pissed off.

This is not going to end well. I think oil prices will overshoot eventually. Already in autumn 2019 is my guess. And 2020 will be a disaster. (don’t listen to me if you want the conventional view)

Price is going to seek a supporting trendline coming off the 2016 lows and 2018 lows. Say a prayer to the oil price Gods and hope it holds. 🙂

Otherwise being long oil isn’t going to work until price reaches a final bottom in the low $20’s

Might get the moonshot of price that some people are looking to happen in 2023 or after when the falling trendline from the all-time highs of 2008 is overtaken. If the supporting trendline off 2016 low holds price might challenge the 2008 trendline a little sooner but not in 2019-2020

One thing you have to understand when oil broke out to it’s all time high most of the way up there was NO technical resistance in the way. There is currently layer upon layer of technical resistance that price has to work through currently just to get where it could possible breakout to the upside. Everytime price gets reject at resistance there is a process it has to go through in order to reach technical support and also clear the technical resistance above that just reject price by moving far enough away from it timewise that it’s no longer resistance.

Shallow Sand Wrote:

“I don’t know what to think. Oil is crashing again.”

Yup, Some how Trump got his wish for lower Oil prices. Of course it on the expectation of a global economic slowdown. But Lower Oil prices enable the US to enforce Iranian sanctions.

Still thinking the US is preparing to go to war with Iran. I think the first step is to cripple the Iranian economy to make it less able to defend itself. Does not matter if the global economy suffers, I am Presuming the primary objective is to take over Iran & VZ before Peak Oil is publically\widely recognized. That said I am some one surprised that the Chinese have taken action to prevent the US take over of VZ & Iran, since China does import Oil from both.

Shallow Wrote:

“My theory is there is coming a day of reckoning, but timing is always tough to predict.”

Yup on both counts. Its like looking at a chess board, at a certain point you can tell who is going to be the winner, but you don’t know exactly the remaining moves will be, and how long the game will go on.

Shallow sand,

I think at some point EVs may cut into demand for oil, but it will be 2040 or 2050 before this occurs. Oil prices headed back up so far today. Memorial Day starts the summer driving season, I imagine oil prices will increase, though much will depend on decisions by OPEC and President Chump.

“I think at some point EVs may cut into demand for oil, but it will be 2040 or 2050 ”

If 30% of the new cars are EVs, they reduce oil demand. This point will be reached between 2025 and 2030 in many larger countries IMHO.

2040 or 2050 really does not make sense.

Ulenspiegel

By cut into demand, I mean that demand falls below available supply and oil prices drop.

Assuming continued 30% growth is likely too optimistic.

I hope you are right but I think you are not correct.

The question is how many internal combustion engines are on the road, not how many are sold.

There are about a billion light vehicles on the road. About 80 new new vehicles million are sold each year, almost all ICEs. They average 14 years before being scrapped. 1 bn / 14 is about 70 million. So 80m – 70m = 10m more ICEs are on the road each year. That is about 1% fleet growth.

Assuming (as many in the industry do right now) that total light vehicle sales have stopped growing, then 10m new EVs a year would be enough to stop the growth of the ICE fleet. 10m vehicles is about 13% of total sales. This seems likely by the late 2020s. Because the ICE fleet is older and bigger, nearly all the cars scrapped in the 2020s will be ICEs.

The current bottleneck for EV growth is battery production. If the market continues with hybrids, which use a lot less liquid fuel but still a little, vehicle demand for oil might fall by 2025. Hydrogen vehicles are another possibility to avoid the battery crunch.

The existing fleet is a huge buffer for the oil industry. My prediction is that new technology will wreak havoc on the car industry in the 2020s, but on current tends the pain won’t be felt in the oil industry until the 2030s.

“The existing fleet is a huge buffer for the oil industry. My prediction is that new technology will wreak havoc on the car industry in the 2020s, but on current tends the pain won’t be felt in the oil industry until the 2030s.”

I see it that way as well.

I have created an EV transition model where first personal vehicles transition to EVs and by 2025 we see the transition begin in the commercial sector.

By 2029 in this scenario we see oil demand fall below my “medium trr and AEO reference oil price scenario” for World oil supply. Chart below shows oil supply (assuming adequate demand at higher oil prices) and demand for oil if the EV transition is very rapid (ramping from 2 million plugin vehicles sold in 2018 to 80 million in 2030).

I suggest 2040 in most cases because I believe this scenario is too optimistic. I revised the scenario with more realistic growth rates and oil demand falls below supply in 2027 (where supply follows my medium 3400 Gb World URR scenario with a peak in output in 2025, from 2025 to 2037 supply is lower than demand suggesting high oil prices to bring the market into balance.

Mike, I apologize to you for the comment. It was not reflective to your positions you have stated in the past. Hence, it was definitely not directed at you. I would be the first to say that independents have had horrible decisions in the past. Shale at 59 a barrel is NOT profitable, overall. It will not stay low, in my estimation. After this year, it will probably never see a price this low, again. Ever. Bubba (the majors) are very interested in shale, because they know this. No matter what the price of oil is, the independents (including EOG) have not shown good management, and are behind the eight ball. They will be bought out, over time, by the majors. The majors see the shale as a long time supply to their refineries, and are not looking to overproduce. The “shale explosion” won’t happen. It was imaginary, anyway, but with the majors moving in, it’s a dream of the past.

I’m not your typical “coupon clipper”. After 30 years as a CPA in banking and taxation, I went back to college and received two MBA’s, one in taxation, and one in Business. Research is not beyond my capabilities.

Guy, we’re good. Your observations here, and your input, are very important; please carry on. I get rocks thrown at me all the time for questioning shale oil economics and the role shale oil will have in our future; folks always believe I am bias because the shale oil industry is hurting me as a small conventional producer. My parade is long over and I aim to work ’till I drop only for fun and for my employees. Truly I care about my country, its stupid energy policies and how this amazing resource we have is being so grossly mismanaged.

I sold my RI stuff in shale years ago and have never looked back. RI ownership in America is truly a gift and I know you know that. You are incredibly lucky to have EOG rowing your boat and I am happy for you; I’ve mapped around your country for Carrizo prospects for years; there are deeper, larger faults associated with the Pleasanton fault complex (shelf margin tectonics) that I hope won’t dissuade EOR in the EF. Watch this next covey of wells closely, how they are drilled, completed and particularly how EOG produces them. They are notorious for gutting stuff from the get go and I worry about what they might be leaving behind. And let us both hope you don’t get a big wad of new production at $50, instead of $65. God Bless Texas !

The Wilcox wells are long lasting and cheap. Just damned hard to find. Good luck.

And some of us are very interested in what you have to say about shale oil and agree with your pov.

I would say that applies to nearly everyone here.

Comments from oil producers are invaluable.

GuyM,

Do you know the cost of the well and how it compares with earlier wells on your property? In other words if you adjust to 2018 $ for both wells and you figure cost per foot or cost per barrel of initial output is the new well cheaper or more expensive. For a lot of wells lately initial production is high, but the wells drop to the level of earlier wells after 18 to 24 months (probably best to do the comparison on an output per lateral foot, so in your case we would expect output of the new well to be at least 40% more than the older wells, the extra 10% (50% increase in initial output) may not last for very long.

At the right price these wells can make money, for the average 2016 Eagle Ford well break even is $59/b at the well head for a $6 million well. A $7 million well needs $67/b at the well head and an $8 million well would need $74/bo at well head.

The average 2016 well had about 18000 fewer cumulative barrels over the first 13 months of production, after that output looks similar (based on shaleprofile.com data), so roughly 18% higher output over the first 13 months for 2017 vs 2016 wells, the 2018 well looks very similar to 2017 wells so far, 2019 too early to tell much. Estimated ultimate recovery (EUR) for the average 2016 well would be about 240 kb and for the 2017 well about 258 kb for Eagle Ford wells.

Scenario for Eagle Ford below using AEO 2018 reference oil price, for the scenario I have only 136 wells per month added over the Oct 2018 to Dec 2025 period, about 153 wells per month were added over the Nov 2017 to Nov 2018 period according to shale profile (I selected Eagle Ford formations only for this count), note that the model is not quite right in that the number of modelled wells is 141 wells per month over the Nov 2017 to Nov 2018 period, part of this may be the way I simplify the model to include the average condensate from gas wells and oil wells in my C+C estimate (in May 2016 the %C/C+C was 81%), I have not updated this figure recently, it may have changed and is making the model a bit inaccurate. Bottom, line the number of wells in the model is too low by about 8.5% from Nov 2017 to Nov 2018 based on the data I have.

Also note that my model only has 15584 Eagle Ford wells completed through Jan 2019, where shaleprofile.com has 20,495 Eagle Ford wells, this suggests that my well profiles may be too high or the method I use for the model needs some adjustment. I may play with this a bit and see if I can improve the model.

No, I don’t know the exact price of the well. EOG quotes prices of less than 5 million, but if you drill down into the finer print, they were using a standard of 5000 ft lateral. These are about 10k ft. So, I’d guess Mike’s estimate of 7.5 would be a good guess. They did not decrease the potential number of wells on our section by the added length, they just added acreage. I am quite aware that you can not project exactly what each well will do over time, each had its own personality. Of course they will drop over the course of 18 to 24 months. Hell, they will drop after one month. Keeping track of individual wells will be much easier than I expected, as being, now, each are allocation wells.

All eight wells DID produce over 120k barrels in the first year. Despite the fact that there was over 3 miles in separation in between what will be the first and the last in line. The best produced over 175k bbls the first year. These come out of the gate far better, so I am using 175k as a conservative estimate. At 61 a barrel, they will make money, at 100, they will make a killing. And, you can quote Enno’s numbers all you want, these are cold hard identifiable numbers, not some convoluted averages.

And, as there have been no new wells permitted for the past two months in Atascosa, I assume there are better places to drill. I agree with Mike, to a point. Most of Atascosa is not profitable, only the far South East part, and my little area in the far, far South West. It is the starting point for the very ill defined Atascosa Trough.

GuyM,

I did not mean to suggest your wells were average. The companies that drill better than average wells will make money, this is a hard feat to accomplish.

There is not a lot of convolution in Enno’s work. I believe he collects the data from the RRC and then presents it, the averages are of the usual sort add up the output from x wells, then divide by x. line up first month with first month, second with second for all wells and we get an average well profile.

Chart below has the Eagle Ford productivity distribution for 2016 and 2017 wells (1561 wells with 24 months of cumulative output), the average 24 month cumulative output is 132 kb, my “model well profile” has 136 kb of output after 24 months.

Your wells will probably make lots of money, but the wells are much better than average, the average well produces 104 kb in the first 12 months, 62% of wells completed produced less than 101 kb over the first 12 months (2016 and 2017 wells, 3280 wells) about 86% of all wells completed in 2016 and 2017 has 170 kb or lower output after 12 months of production. So your wells are in the top 15% and will make money, but the 62% of wells that have less output than average will struggle to make money. I am a big picture person and considering the viability of the Eagle Ford Basin as a whole. If oil prices continue to fall (which I doubt will be the case), the Eagle Ford will struggle.

Congratulations on your wells.

Updated model using $7 million well cost and slightly lower LOE to account for sales of natural gas (which I do not explicitly include in the model). The higher well cost results in less profitable wells, assumed TRR with 48k wells completed is 10 Gb, then economic assumptions are applied reducing total wells completed and economically recoverable resources. Jan 2019 cumulative output is about 3 Gb from Eagle Ford, if the model is followed, 4 Gb of cumulative output in 2021, peak remains March 2015 at cumulative output of 1.3 Gb. A secondary peak occurs in 2019 at about 1223 kb/d for the centered 12 month average.

The scenario above has an error in my spreadsheet so the assumptions of the model are not satisfied. Ignore it.

Updated model below using royalties and taxes at 27.46% and well cost at $7.5 million.

Real Crude is real crude.

https://www.zerohedge.com/news/2019-05-22/luongo-sanctions-are-bitch-us-refiners-importing-russian-oil-mad

When some LTO companies have been somewhat profitable a week ago, now they are in red ink.

It looks like Trumps personal trade war is playing havoc with oil prices, too. I can’t imagine driving has collapsed that much in the beginning of this trade war already.

Todays movement in oil prices is pretty crazy. The detachment between the physical market for oil and the financial market (paper barrels, hedge funds and similar being long shiting their pants maybe) has never been bigger. The physical Brent and also Dubai is getting tighter all the time. The weird thing is that prices for “real” oil in the physical market are way higher than the “face benchmarks” WTI and Brent at the moment. It is no solution to bring oil prices down on “recession fears” in this way. It just has to backfire. When? Well, I don’t know when the general market can be bothered to be informed that we are in a shortage situation.

Well, according to the experts, shale oil is still soaring. Ignorance is sheer bliss.

China has run a trade deficit with the US for decades, while having three times the population who might consume US exports, and do not.

None of the prez’s predecessors did anything about this.

China pegs its yuan. People need to lean back and understand exactly what that means. They buy oil in enormous quantities with a currency whose value they decree. And oil sellers sell it to them.

None of his predecessors did anything about this.

This has nothing to do with socialism or capitalism or any other ism, because those isms are measured/defined by the substance whose value they decree. It’s right there in front of us. They Peg Their Currency.

Time and time again the United States chooses not to declare China to be a currency manipulator. Oil sellers can lean on that and ship 8 million barrels a day to them and get paid by printed pieces of paper that others accept because of course the value is all imaginary anyway.

None of his predecessors did anything about this. They all had decades and they did nothing about this. This is where the manufacturing jobs went from Ohio, Pennsylvania, Wisconsin, and Michigan.

China has run a trade deficit with the US for decades, while having three times the population who might consume US exports, and do not.

It doesn’t matter how large their population is. What matters is the number of Chinese who have disposable income, and that is not as large a number as most people might imagine.

https://www.inkstonenews.com/society/inkstone-index-chinas-middle-class/article/3000635

Inkstone index: China’s middle class

Estimates of the size of China’s middle class vary wildly, with each organization employing a different metric. Even Chinese authorities do not have a uniform definition of the middle class.

For example, the Economist Intelligence Unit says 132 million people now belong to the middle class in China, only accounting for 10% of the population. It uses a totally different measure – annual disposable income of individuals of at least $9,950.

Regardless of the definition, China’s middle class is currently far from the dominant group in the country. (bold mine)

And expanding the middle class is one of the top goals of Chinese policymakers.

Chinese President Xi Jinping has vowed to eradicate poverty and to create a “moderately prosperous” society by 2020 – a year before the 100th anniversary of the founding of the Chinese Communist Party.

Now I’m willing to bet that a trade war with China is not in the best interests of the US. It will ultimately cut heavily into Chinese disposable income, further contracting the potential market for American goods that might have otherwise been exported to China.

Not surprisingly:

Trump’s Alma Mater Disputes Allegations Of Him Graduating Top Of His Class

TURNS OUT, HE DIDN’T EVEN GRADUATE WITH HONORS.

Trump received an economics degree from the Wharton School.

China was a non-factor when the Rust Belt imploded in the 1980s. Their exports were immaterial until the late 1990s. Globalization in general and badly noncompetitive (way too high vs. what was available in the US South or with automation) compensation is what killed the Rust Belt industry.

Similarly, fighting with China won’t do anything to bring back overstaffed, overcompensated low skill labor. Even the Chinese use lots of automation now. They may deliberately over employ because they are communists but the level of tech there and everywhere else is far beyond the old plants.

I’m puzzled. Couldn’t the same be said about the dollar? Trump is spending trillions the US doesn’t have and all the debt is backed by the US economy. If the US economy falters and China’s continues to grow, the dollar will lose a huge amount of value. China will probably stop pegging to the dollar then.

Tldr, who cares if Saudi pegs to the dollar?

Sean Wrote:

“Trump is spending trillions the US doesn’t have and all the debt is backed by the US economy. If the US economy falters and China’s continues to grow, the dollar will lose a huge amount of value.”

US controls a lot of global production (USA, KSA, Iraq, Libya) and has its eyes on Venezuela & Iran. I suspect China is going to to run into problems obtaining the Oil it needs to grow its economy, especially if the the US is able to grab Iran & VZ.

2019-05-23 Shell started production at its giant Appomattox deep water field in the Gulf of Mexico ahead of schedule and below planned cost. It will produce 175,000 boed at its peak.

https://www.shell.us/media/2019-media-releases/shell-starts-production-at-appomattox-in-the-gulf-of-mexico.html

2019-05-23 (Reuters) – Iran’s oil storage on land and at sea is on the rise as U.S. sanctions on exports bite and Tehran battles to keep its aging fields operational and crude flowing, according to data and industry sources.

Iranian oil exports fell in May to 500,000 barrels per day (bpd) or lower, more than half the level seen in April, according to tanker data and industry sources.

Data based on AIS tracking by shipping intelligence platform MarineTraffic showed 16 Iranian tankers, holding some 20 million barrels, were estimated to be used for floating storage after being stationary between two to four weeks.

Analysts have estimated that over 50 percent of Iran’s oil production comes from fields that are over 50 years old with billions of dollars needed to develop additional capacity.

https://www.reuters.com/article/us-iran-oil-storage/iran-stores-more-oil-on-land-and-at-sea-as-exports-slump-idUSKCN1ST1PU

2019-05-23 (Reuters) PDVSA crude and fuel exports have dropped to around 800,000 barrels per day (bpd) so far in May, down from 1.4 million bpd just before sanctions, according to PDVSA’s trade documents and Refinitiv Eikon data.

https://in.reuters.com/article/us-venezuela-oil-tankers-exclusive-idINKCN1ST2AT

Dennis. Do you feel that adoption of EV and the big question marks on how that all unfolds contributes to oil price volatility?

I watch CNBC while eating my bran flakes and listen to Bloomberg while driving. The debate about EV and autonomous driving is often the topic with very much disagreement among the “financial experts.”

Suddenly lease values here have dropped by about $20K per flowing BOPD. Part of that I attribute to the late 2018 crash. But I feel there is something more going on in people’s minds besides that.

Maybe this is just happening in our little corner of the oil patch?

I am beginning to hear fear of 2020 from operators. Who knows what will happen in the elections. Some think a Democrat sweep means we will be shut down immediately by environmentalist leaning politicians.

My view is not that extreme. If anything I sense that EV are not yet affordable in relation to what the manufacturer needs to charge. It has now been 7 years since my neighbor bought his first Tesla. He is on his second. He loves it. He still owns 3 ICE vehicles.

Another doctor recently bought a Model S. So now there are two. I haven’t seen a model 3 here yet.

There is a major expansion being planned at our local oil refinery.

Elon Musk envisions that everyone will lease their robo car out when they aren’t using it. That is one I am having a tough time with. Multitude of issues that arise with that.

So much uncertainty.

I am less interested in how fast EV adoption happens than reduction of oil consumption through whatever means: increased efficiencies of ICE vehicles, recession, less driving, etc.

Boomer II,

It will be all of those things, EVs powered by solar or wind seem like they will be pretty good for the environment. Less driving could be accomplished by a robotaxi service that picks up and drops off several people, reducing the number of vehicles carrying a single passenger, if the average occupancy in a vehicle doubles, fuel use is cut in half.

I’m not sure it’s going to be practical to put a wind turbine on top of a car to run a generator to drive electric motors…maybe it’s better to put a horse on a thread mill to drive a generator, and have that contraption inside a horse trailer you pull with your Tesla?

Posting under influence?

Fernando,

Solar panels on my roof would work. The point is that wind and solar with some hydro and nuclear power can provide at least 80% of electricity and possibly up to 95%.

As costs continue to fall this is likely to be the case by 2040 to 2050 with a transition period between.

Shallow sand,

Elon Musk is very optimistic about how quickly Tesla cars will be able to reach full self driving, my estimate is perhaps by 2030, the “autopilot” features of the Model 3 are pretty cool, but it cannot drive the car as well as I can yet. It does a pretty good job on well marked roads, but where I live those are limited. The Model 3 is about 39.9k for the RWD 240 mile range battery version, before any Federal or state tax rebates. We also own a Toyota Camry Hybrid XLE (older car 2013MY), after driving the Model 3, the Camry seems very inferior, it is my wife’s car, I drive the Model 3 on weekends when we are together and some evenings when we go out after work.

The Model 3 compares favorably to a Honda Accord on 5 year cost of ownership, but keep in mind it is a far nicer car (though not as nice as the Model S).

I don’t think the oil price volatility has much to do with EVs, more to do with trade war, OPEC, Russia and geopolitics.

The robo car thing won’t be happening soon, but as driving AI improves it may be far safer than human drivers, some time in 2035.

When a car can self drive around here it will be ready, I challenge Musk to bring one here and try.

NAOM

Do you think Tesla will be around then?

It appears its stock bubble has burst:

https://www.zerohedge.com/news/2019-05-24/week-finally-burst-tesla-stock-bubble

Yes

There is a scenario where the transition from vast majority ICE cars/trucks to majority EV cars/trucks results in a period of severe disruption to the vehicle manufacturing industry. In a nutshell, people tend to put off a major equipment purchase when they think a more innovative model is just over the horizon.

Its called the Osborne Effect, and the scenario is explained in regard to the auto/truck industry very well in this article. Yes, there is uncertainty as Shallow indicated, and throw this purchasing behavior into the mix.

It looks to be a rough ride for vehicle manufacturers who arn’t very lean, and mean, and on the innovation pathway.

https://cleantechnica.com/2019/02/25/the-osborne-effect-on-the-auto-industry/

The Osborne Effect on the Car Industry-

The grey line is auto sales at current rate of growth.

The Yellow line is a predicted huge dip in sales during the technology transition period from Internal Combustion (orange line) to Electric Vehicle (blue line).

I wouldn’t get hung up on the dates or exact magnitude displayed, rather its the concept that is being portrayed here.

I expect the transition to take longer, but the effect on manufacturers could be huge.

Then add in the effect of cars as a service combined with AI driven vehicles and the normal market growth might flatten and descend too.

True indeed GF.

I was out with a couple guys in their 30’s, and they didn’t even have a plan on how to get back home. No need. Just hail a Lyft vehicle at any moment. In the coming decade that Lyft may be driver-less (and electric).

Yes! It might even fly! 😉

Tesla’s competition aren’t legacy auto manufacturers.

They are disruptive tech companies like https://lilium.com/

BTW, Tesla’s new 147 TFLOPS processor alone should make its stock valuation go through the roof, and it will! Those processors are already going into their production vehicles today. I think looking back from the end of the of the next decade to today will be more like looking back at the horse and buggy age from the end of the last century.

When the AI hears about global heating, it will decide to do one of two things after EV’s take over transport.

1) It will drive around a lot hoping to overheat the planet and get rid of pesky humans.

2) It will lock it’s doors and shut down to save us from ourselves. All transport will get locked down via the internet.

smile, you are being watched

smile, you are being watched

I know and I don’t really care!

You know how to mess with face recognition software? You draw eyes on your butt cheeks and moon it as you walk on your hands! 😉

This Osborne effect on the auto industry is a scenario possibility that I’d rank pretty high. Magnitude and timing certainly unknowable.

In the early stages what would it look like?

Well, surely Calif isn’t Texas, but it is the biggest state in the union, is often a trend setter, and is a big consumer of oil. So it matters.

Over the past year new car sales in Calif dropped of 5.3% [Q1 yr over yr], in the absence of a recession. The third highest selling car in this past year was an electric car (Tesla 3 base model $35,000 according to Edmunds).

If you look at the chart, what is happening in the Calif market looks like 2019. Imagine that.

In a few years I suspect the wind will be stronger in these sails,

with oil prices higher and many more options for electric vehicles available, from Rivian to VW, etc.

As it goes.

These are classic books on how new technology moves from niche to mainstream. Written by Geoffrey Moore.

Crossing the Chasm: Marketing and Selling High-tech Products to Mainstream Customers (1991, revised 1999 and 2014). ISBN 0-06-051712-3

Inside the Tornado: Marketing Strategies from Silicon Valley’s Cutting Edge (1995). ISBN 9780887307652.

The Osborne Effect, or something else like it, seems to be happening in China, the world’s large car market, right now. There was a double digit fall in sales YoY in Q1.

Great comment Shallow,

Nothing keeps one regular like fiber in the morning.

Your asking all the right questions and where do we go from here is the primary reason I visit this site. I manage about three million dollars of family equities. When it was handed to me, it was over weight in energy at about 60% leaning on the down stream side of refineries. One of the reasons it was built this way was because it paid good dividends and there was no viable alternative to oil at the time. Those days are soon to be over if they aren’t already. Everyone loves free markets and capitalism until competition and innovation replaces ones gravy train. I can feel your pain. My mother is 92 years old and there are huge capital gains in most of the oil equites. My hope is that the oil industry equity values hang in there long enough so that when my siblings and myself can unload it at a higher basis value and avoid capital gains then if I sold it now. The nice thing about equities is that with a click of a mouse, their gone.

My guess is that EV’s have had little effect on oil demand to date, but 5 years from now that will not be true. I would also guess that efficiency in new ICE vehicles have a ten fold larger effect on demand to date. My 2016 ICE is about 15 percent more efficient than my 2006 at the same size and weight with 40 percent more horsepower. When the time comes in about 5 years, I plan to buy an BEV.

The Los Angeles basin maybe the best place on earth for EV’s and solar. It has moderate temps, mostly sunny days year round, good latitude, relativity flat (except to get out of the basin), plenty of roofs to mount the solar and air pollution is the biggest down side to quality of life. If it can’t work here, we’re all in big trouble. I’m not sure were you live Shallow, but I had to laugh a little when you say there are now two Tesla’s in your area. There is a good chance that if I drive to the supermarket and back, I will see most likely two or more EV’s and if I go to Costco. There are about 20 Tesla charging stations and sometimes there is a line to get plugged in.

“Some think a Democrat sweep means we will be shut down immediately by environmentalist leaning politicians.”

Really ? I know change is coming and I would suggest a planned transition is much better than sticking ones head in the sand. Leaving stranded assets on the playing field will be much more painful. I’m always looking for a way to reduce my oil exposure. Stay ahead of the game.

Salud

Huntington Beach.

I don’t doubt there are many EV where you are located. Seems like maybe over half are in CA.

Of course I live in flyover country and here there are just two, owned by people not originally from here.

We have had an oil refinery here for over 100 years and it employs a lot of people at very high wages. A lot of people who work there could afford an EV but none drive one.

What I am getting at is that in my personal holding period, which is 10-15 years, oil could be $20 or it could be $200. Heck, during that timeframe it could be both.

It is tough to pay capital gain taxes, but sometimes it isn’t the worst idea. Planned sales over a number of years is a good approach if you are not diversified.

I used to work closely with a trust officer and he was very disciplined. He many times took control of a trust where all or almost all the stock was in one company.

I remember him selling a lot of WaMu stock over a period of years in a trust that had a very low tax basis. There were complaints from the children who would inherit some day. He did a good thing as it turned out, most of it was sold before WaMu failed.

At least I think that it was WaMu. It was one that failed.

I have never seen an all electric car around here. But we have a socialist and communist government so I imagine they’ll be giving subsidies to rich folk to buy electric vehicles, and things will work out for a while until they screw up the economy real bad.

I think the focus here might be too much on EVs and not enough on driving patterns. Everywhere I go in my community and surrounding areas grocery stores and restaurants are offering delivery.

Online shopping has replaced malls in many places. So driving to shop is slipping away.

The population is aging and seniors drive less.

Teens are less interested than they used to be in owning a vehicle or getting a license. In some areas they are using Uber and Lyft instead. It eliminates the various expenses in owning a vehicle.

Boomer,

Most of the gasoline and diesel is used by road transport. It is a problem.

It will be the factors you mention and EVs and self driving vehicles that will solve the peak oil problem.

My point was in response to all the discussions about how many people will buy EVs. It’s as if people think EVs are the only factor in reducing petroleum use.

I see other changes happening now that will likely continue and aren’t dependent on EV adoption. If people decide not to drive as much, it doesn’t matter what vehicles they own. Consumption per capita still goes down.

Boomer II,

I agree, lots of reasons to think as oil prices increase, the use of oil will fall. Some say it can’t be done, but not me.

People who can afford not to will NOT lease their cars out.Most people are rather possessive about such things to begin with, and prefer not to share, even for money.

But millions and millions of people who otherwise CAN’T afford a new car, especially a pricey nice new electric car, WILL share it, because they’re a new generation with new values in regard to material goods.

To them owning a car, if they can rent one cheaply and conveniently anytime, is a bother involving worry and paperwork, at the minimum.

But if owning and renting out a car when it’s not needed turns out to be cheaper than simply renting a car when one IS needed, a lot of them will go that route.

Some people will buy because owning guarantees immediate availability around the clock around the calendar.

Once cars are fully autonomous, most of the worry and legal headaches will go away, and with modern phones, everybody will have a record of exactly what the car looked like at both ends of the rental period. I won’t be surprised if there are even devices built into cars within the next two or three years to detect and measure odors so deodorizing can be charged along with cleaning.

What I don’t like about owning a car are the costs even if I don’t drive it. Ownership fees are high until the car is 10 years old. Insurance premiums took a big jump last year. I have had no claims or tickets, but they still went up by 40 percent. Agents at various companies said it was hail damage in the area, but comprehensive and collision weren’t the costs that jumped. It was liability. If it is related to hail claims, then insurance companies are increasing liability rather than damage on the assumption that it is harder for drivers to drop liability than comprehensive and collision. They are covering their claims for damage via liability hikes.

Once I get to the point where I rarely need to leave town, I will likely get rid of my car and then walk, bike, bus, or Uber my way around. It will likely be cheaper.

Don’t see how EVs will take off when Consumers are struggling with auto loans. I think EVs will remain as a niche market as is now. Consumers will drive less & own fewer vehicles. If Ron is Right and PO happened in 2018, then the global economy is going to start declining in the 2020s. (I think its doomed to decline because of demographics & Debt anyway. PO will just amplify problems).

Don’t see how EVs will take off when Consumers are struggling with auto loans.

Simple! Think transportation as a service. And it will take off and fly, literally! 😉

https://sifted.eu/articles/lilium-flying-car-taxi-service/

… Morgan Stanley estimated in a report last December that the market for autonomous urban aviation mobility (aka self-flying taxis) would be worth $1.5tn by 2040.

Gerber makes it clear that the taxi service idea is central to Lilium.

“We’re not intending to make it a luxury product that only the rich can buy. We want to make it a service that everyone can use,” he says.

Even if you offered him a huge sum, Gerber says he would not sell you an individual plane.

…“We’re not intending to make it a luxury product that only the rich can buy. We want to make it a service that everyone can use.”

But the taxi platform is also about economics.

Morgan Stanley believes the economics of flying taxis could be far more profitable than road-based ride-hailing services like Uber.

They take the example of a 20-mile Uber ride, which takes on average 48 minutes and costs $30. On a busy day one Uber car might do 10 such trips, earning $300 or $75,000 a year. A flying taxi, however, could cover the 20 miles in 12 minutes and earn a small premium for the speed — say $50. It could do 40 such trips a day, earning $2000 or $1.5m a year

$1.5tn by 2040! Think it couldn’t happen?! It’s already in the wings. (Pun intended)

😉

Cheers

I anticipate less driving in the future.

If EVs are what the majority of new vehicles will be, they won’t be niche, but they also may not be purchased the way ICE vehicles have been.

Seniors find they enjoy golf carts in senior communities geared for them. They likely still own their ICE vehicles, but use electric carts for day-to-day transportation.

What I am skeptical about is that vehicle usage will remain the same and all that will change is what is under the hood. I anticipate a major recession/depression before a full change over. On the other hand, the only possible economic boost I see in the future is investing in renewable energy and all that goes with it. It would require investment and jobs. The Green New Deal is rather glib, but I understand the concept. Or think of it as the renewable Manhattan Project.

Boomer Wrote:

“Seniors find they enjoy golf carts in senior communities geared for them. They likely still own their ICE vehicles, but use electric carts for day-to-day transportation.”

LOL! Sorry Golf carts and Mobility scooters don’t count as EVs. But I did have a good laugh! That’s got to been the most creative spin I read in a long time here. Thanks!

Boomer Wrote:

“On the other hand, the only possible economic boost I see in the future is investing in renewable energy and all that goes with it. ”

That’s extremely far fetched, considering the rapid advancing Tsunami of Debt & Demographics. Boomers 55+ now are the majority of workers in energy companies, and they are getting ready for retirement. As I posted power & Oil&Gas companies are panicing since their workforce is getting close to retirement, and they cannot find any younger workers to replace them. I posted this under the last week’s thread.

Boomer Wrote:

“I would say the average family needs multiple vehicles for two reasons: getting back and forth to work and hauling kids around to non-school locations.”

Fertiality rates of the working class in Western nations has collapsed. Don’t need to worry about kids.

https://www.nytimes.com/2019/05/17/us/us-birthrate-decrease.html

” its lowest level in 32 years, according to provisional figures published on Wednesday by the federal government. It said the fertility rate in the United States also fell to a record low.”

I believe its much worse for the Middle Working class, as healthcare costs are insane. A colleague of mine with two kids is spending about $30K on healthcare premiums. The only group that is having kids are those living on welfare. Healthcare premiums are his biggest expense.

I recall that up until the 1970’s Suburbia families just had one car. If it worked back then, it can work in the future. Bottom line, Americans soon won’t be able to afford new vehicles so regardless if they want another vehicle, its going to be off the table.

“Finding ways for people to work at home or get to work without driving is the key to significantly cutting down the need for multiple vehicles in one family.”

Thats already under way. A lot of companies that I work with have a lot of employees that work from home. I work mostly from home too. I see most information based workers (ie Sales, Marketing, finance, IT, etc) working from home and business downsizing office space. Why spend a small fortune to pay for a office building (Heat\AC, electricity, Maintenance, Rent\Mortgage) when your workers can work from home.

There is also the darker side, for Office Workers: Automation. I see a lot of business switching over to automation processes handled by staff. even IT his getting gutted as companies move datacenter services to the cloud. Some of the companies I work now have completely empty datacenters (10K to 20K sqft). The moved everything to the cloud. A lot of manual tasks for Sales, HR, Legal have been shifted over to automation system. Thousands of jobs are getting eliminated. Over the next 10 years about 1/3 of information jobs will get replace by automation: Even in retail, as stores replace cashiers with Ordering Kiosks and self-checkout. Its unlikely that a lot of these people will find steady employment, unless they obtain some advance technical skills in demand.

“LOL! Sorry Golf carts and Mobility scooters don’t count as EVs. But I did have a good laugh! That’s got to been the most creative spin I read in a long time here. Thanks!”

You haven’t been paying attention to anything I have written.

I have said the goal is to reduce driving ICE vehicles. It doesn’t matter if people replace their ICE vehicles as long as they drive their ICE vehicles less.

In senior communities people are using golf carts to get around locally. I said nothing about counting carts as EVs.

You are trying to score points to such an extent you are missing conversations.

I got your message: .

You stated that families will need multiple cars, They won’t because Working class is not having any kids.

You *hoped* that there will be a huge investment in infrastructure, I explain why it was far fetch.

Points? Not interested in the slightest. Use or ignore the information provided.

You said I was including golf carts as EVs. I quoted you.

I never said that. That’s why I said you haven’t been reading my thoughts on EVs. I’m not an EV champion. I don’t care how we reduce dependence on petroleum. EVs will play a role, but so will less driving.

You have confused me with the EV cheerleaders and if you had been carefully reading my posts you would know that.

Sorry then, this was discussion about EV thread and you brought up Golf carts. I think you can see why I made the connection.

Boomer Wrote:

” if you had been carefully reading my posts you would know that.”

I cannot possible keep track of every contributors positions on every topic or post they make. If I post something, Its just information, I am not trying to win at an argument or “gain points”

I would say the average family needs multiple vehicles for two reasons: getting back and forth to work and hauling kids around to non-school locations.

With more people doing their shopping online with delivery, that eliminates the need for vehicles for that.

A few business models are developing to get kids to places without parents. The trips are more expensive than Uber, and the driver selection process is more strict, but if an affordable, safe child transportation option can be found, I know many parents would embrace it. Few parents actually like getting their kids back and forth to practices, beyond-neighborhood play dates, etc.

Finding ways for people to work at home or get to work without driving is the key to significantly cutting down the need for multiple vehicles in one family.

Tech guy,

Those who can afford new cars will buy them or lease. Others will buy used. The 36k Tesla can be purchased currently with rebate it is about 32k. Average price of new vehicle in US is 35k. Cost of ownership is quite a bit lower than comparably priced cars.

In a few years people can buy used Tesla Model 3s.

A 5 year old car will be about 17 to 30k, xepending on battery and features.

Tesla is going bankrupt. If you going to buy a EV, better off going with a company that won’t leave with an expensive brick and does end up killing you when one of the front wheels comes off, or if the battery pack catches fire while parked in your garage. Tesla cannot even afford to restock toilet paper at its facilities. Usually when top management team all quit, its usually a sign of trouble.

Dennis Wrote:

” Average price of new vehicle in US is 35k. Cost of ownership is quite a bit lower than comparably priced cars.”

Does not matter, If you read the article I linked in the early post, or the quoted text it pretty much states that consumers are overextending themselves in debt to purchase vehicles.

Leasing isn’t going to save consumers:

https://www.leaseguide.com/articles/disturbing-new-car-cost-trends/

“Leasing has most of the same costs as buying and financing a new car, which are on the rise”

https://www.cnbc.com/2019/04/17/with-car-leasing-prices-on-the-rise-heres-what-to-do-before-you-sign.html

“a growing number of consumers are balking at buying. Close to half (48%) now think owning or leasing a car is becoming too expensive, compared with 42% in 2015, according to separate research released this week from Cox Automotive.”

As far as buying pre-owned cars: Most people will be holding on to their vehicles until they are junk or the maintenance costs make them un-affordable. I certainly will. Prices on Used car will also soar as demand for them increases as supply becomes tight.

Your views on Tesla are usually off base in every post where you mention them. Toilet paper. A denied myth. Cars catching on fire! Why not also talk about Kia or Hyundai or a slew of others that have fire problems. Why always mention Tesla like they are the only ones that have ever had a car fire. Last I heard the Tesla rate of fires were not higher than ICE vehicles. You seem like you really have an ax to grind with EV’s in general and Tesla specifically.

Some 5 million tonnes of oil were contaminated in April with organic chloride and the dirty crude is now stuck in pipelines in Belarus and further West – in Poland, Germany, Ukraine, Slovakia, Hungary and the Czech Republic.

The sources said it could take months to fully resolve the crisis.

The crude is blocking the 1 million barrels-per-day Druzhba pipeline, shut since late April, and the evacuation of dirty barrels is complicated by the fact that no firm wants to pay for or refine them as organic chloride can damage refining equipment.

https://www.reuters.com/article/us-russia-oil-reverse-exclusive/exclusive-russia-to-pump-dirty-oil-back-from-belarus-sources-idUSKCN1SU0UP?il=0

“Then there’s the mystery of what’s happening to Russia’s crude oil while Druzhba is shut. According to official data, output has barely dropped over the last four weeks, falling from 11.23 million barrels a day in April to 11.15 million barrels a day so far in May. But the country is shipping roughly 1 million barrels a day less than normal, about a tenth of its output.”

https://www.bloomberg.com/amp/news/articles/2019-05-24/russia-s-dirty-oil-crisis-is-worse-than-almost-anyone-predicted?__twitter_impression=true

Only the rich buy Teslas. The left want an extension of price subsidy, but only the green faction of the left. The other traditional faction opposes extending taxpayer money to the rich.

The subsidies aren’t going to extend. And neither will sales.

Watcher, the Model3 is not very expensive and cost will continue to fall, I imagine car manufacturers are pushing for extension of tax subsidies as well, with the exception of Tesla, they will do fine without further subsidies which will expire on Dec 31, 2019. The average selling price for a new vehicle in the US is about 35k, the Tesla Model 3 starts at 40k without subsidies, as Tesla ramps up production and becomes better at manufacturing the cost of the Model 3 will fall, or they may introduce a less expensive car that everyone can afford.

https://www.statista.com/statistics/274927/new-vehicle-average-selling-price-in-the-united-states/

What does start mean? Car and Driver says the $35K car is essentially unavailable, and what is available is north of $41K.

Is there a maintenance plan in place for those vehicles if the company goes bankrupt?

My two girls both have Tesla 3. They are married workers in their 30’s.

They paid mid 30K for theirs, and could have paid the same for something like a Honda Accord, Ford Fusion, Toyota Camry.

Cars for the ‘rich’, says he.

They don’t pay for oil change or petrol.

And yes, they really like the cars.

They will probably not need to ever replace the brake pads and rotors either!

J-T Richards

@JT_Richards

· Dec 26, 2018

Replying to @MMelinot and 2 others

They still use brake pads. The car still stops with friction between pads and rotors. Where there is friction, there is wear. Where there is wear, there is need for replacement parts. They may not need replacement as often (due to some reg. braking), but they need replacement.

Elon Musk

✔

@elonmusk

This is incorrect. Vast majority of vehicle motion is returned to the battery, as the electric motors act like a generator in reverse. Brake pads on a Tesla literally never need to be replaced for lifetime of the car.

Wait a minute.

https://teslamotorsclub.com/tmc/threads/i-thought-we-had-antilock-brakes.121598/

Watcher, even my brother’s Nissan Leaf has regen braking. Hardly ever need to touch the brake pedal. Once in a blue moon emergency braking isn’t going to make a lot of difference in brake maintenance for the entire fleet of EVs during normal use.

No idea. The price can be found at tesla.com.

Price is 41100 including destination charge. The Mercedes C class starts at 41400. That is a car of comparable quality to the Model 3.

Does not matter, Monthly payments are at record highs and auto loan debt is soaring.

https://www.lendingtree.com/auto/debt-statistics/

I think this is at or near the end of line for new vehicle purchases for most americans.

https://www.consumeraffairs.com/news/most-americans-cant-afford-a-new-car-study-finds-062817.html

“Experts cite the rising price of vehicles and the anemic growth of household incomes”

“The main point of this research is to illustrate how Americans are having to overextend themselves to pay for a new car at today’s prices,” said Bankrate.com analyst Claes Bell. “Low- and middle-income households are having to stretch loan terms to six or more years and/or spend huge percentages of their paychecks to afford reliable transportation, and it’s very difficult to get off that hamster wheel of debt once you’re on it.”

“Only the rich buy Teslas.”

And within the next decade, people may say the same about gasoline.

I doubt that I will ever personally own an electric car, considering that I won’t be driving more than another decade or so.

But I won’t be in the least surprised if I have to pay six or eight bucks for gasoline ten years down the road.

But the very happy flip side of that coin, for me, is that as electric cars gain market share, there will be a hell of a lot of ice cars still in excellent condition for sale dirt cheap…. and what I pay out in gasoline is likely to be off set two or three times, even four or five times or more, by the savings on the initial purchase cost of a good used ice car as compared to a new or fairly new electric car.

There are a hell of a lot of people who look at such decisions the same way I do…. basing our decision on the total cost of ownership and operation over an arbitrary number of years, say four or five to ten or even longer.

Some of us take it a step further, and consider the opportunity cost of car ownership money the most important single factor. That’s my personal policy.

I could buy a new car, but the pleasure of owning a nice new car is trivial, to me, compared to the satisfaction and pleasure I get from spending ( what I save on new cars by driving old ones on sweat equity projects) leveraged by doing the work myself.

So the twenty grand my next door neighbor pisses away in depreciation on his new car over the next five years goes into my farm, building a lake, putting in riding trails, bringing it up to a rich folks estate type of landscaping, with private drive shaded by flowering trees, and views from various spots that rival those shown on postcards of New England farm country where people go on vacation just to see the farm communities.

Sorry I don’t know how to rotate this picture, but it’s the view in one direction from a home site I have graded out, and plan on building maybe next year.

In other directions, there are pristine mountain ridges to be seen, and and post card worthy pasture and barn that belong to one of my cousins, across the public road.

Why should I spend my money on cars that depreciate, when I can spend it on things that are beautiful, that last, that can contribute to self sufficiency and sustainability, such as this?

The open field between the house site and stream will be handsomely fenced to keep the deer out of the garden area, which will be about three quarters of an acre. I’ve already planted dogwoods and red maples along my side of the stream, to complement the willow, wild cherry, and walnut trees there already.

Of course if I weren’t into this sort of thing,I could spend what I save by driving an old car on TESLA stock, or the stock of a company that builds wind farms.

Looks very nice, OFM.

If it weren’t for the climate I’d show up on your front porch.

I like the view 🙂

NAOM

Thanks guys,

I posted this to illustrate that there are other things than new cars that can satisfy the ego , laughing out loud, things that APPRECIATE, and that ARE appreciated, even after you are dead and gone

That’s the view toward the public road.

The one toward the mountains is equally good, or even better, unspoiled ( so far ! ) vistas of wooded ridges in the background, with farm scenery in the foreground.

A car is more or less mandatory if you want to live in a place like this, in order to get to your job and so forth. But there’s no real reason it should be a new or expensive car….. other than ego on the owner’s part.

Before too much longer it will be cheaper to summons a selfdriving rental car even in a place like this than it is to own a new car that sits around most of the time.

Electric cars are going to put most of the people who are wedded to the ICE car industry out of business sometime soon, in historical terms.

Hey Mac,

I offered you an invitation last month to come visit me and go fishing. Now I’m offering you a chance to live on the lake. You need a change of scenery. I will make you a deal you can’t refuse and this can be your back yard.

You won’t need to build a pond.