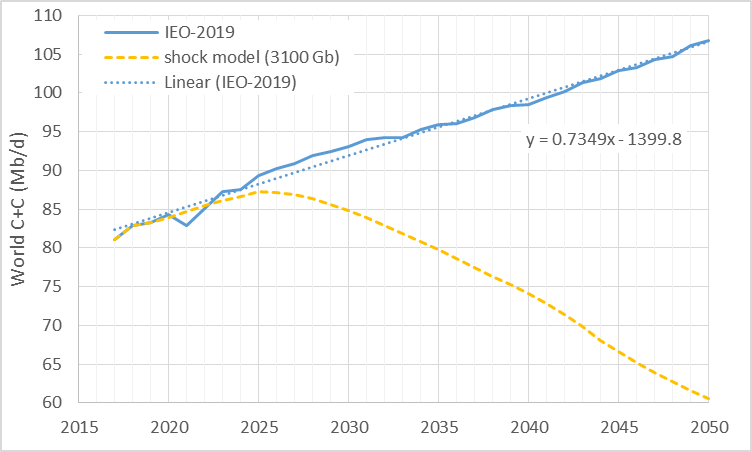

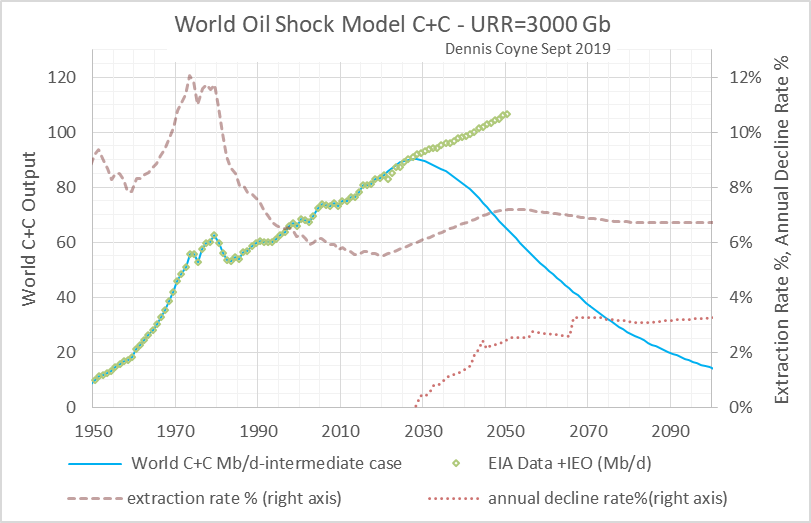

The EIA recently released its International Energy Outlook and it is quite optimistic. In the chart below I compare their estimate for World Crude plus Condensate (C+C) output with an oil shock model with a URR of about 3100 Gb.

The IEO reference scenario shown above (blue line) for World C+C has a trend line with a slope of 735 kb/d from 2017 to 2050, slightly less than the 1982 to 2018 slope for World C+C output’s annual increase of about 800 kb/d. The difference between the IEO C+C output forecast and my more realistic (and perhaps optimistic) shock model estimate is 46 Mb/d in 2050.

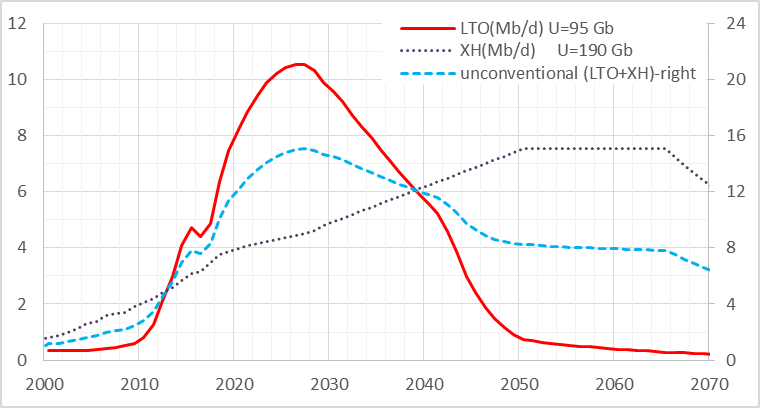

The shock model focuses on conventional C+C output which excludes unconventional oil which I define as the combination of extra heavy oil (API Gravity <10) and tight oil. The economically recoverable resource (ERR) from unconventional oil is 285 Gb in the scenario presented below.

The extra heavy (XH) and tight oil are modelled separately from conventional C+C. The tight (LTO) and XH oil are both read on the left vertical axis and the unconventional oil (sum of LTO and XH) from the right vertical axis. In each of the shock model scenarios presented below the unconventional C+C model output is added to the conventional shock model scenario (three separate cases). I focus on conventional C+C because the bulk of World C+C output consists of conventional C+C about 88% of World C+C in 2018 consisted of conventional C+C.

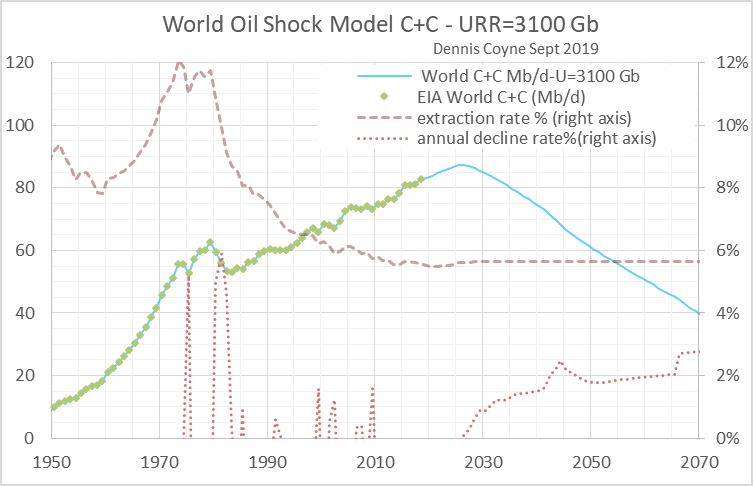

The extraction rate, r is the percentage of proved producing reserves that is produced during the year in gigabarrels (Gb), where r=q/p and q =annual C+C output, and p =proved producing reserves at the end of the previous year. This applies only to conventional proved producing reserves and conventional C+C output as unconventional oil is modelled separately and then added to the conventional C+C model to find the World C+C shock model presented above (as well as the two scenarios presented later). At the end of 2017 p=476 Gb and in 2018 q=26.6 Gb, so r=26.6/476=5.6%. Peak World C+C output for this constant extraction rate model (after 2030) is 87 Mb/d in 2025, URR is 3100 Gb.

The EIA’s IEO seems quite unrealistic, but it would be instructive to see what level of extraction rates would be needed to raise output to the level forecast by the EIA. We will leave the URR assumption at 3100 Gb and assume the unconventional scenario is unchanged from what I have presented already (that scenario is my best guess for a World where Brent oil prices gradually rise to $90/b by 2027 and remain at that level until 2050 and then begin to decline as oil demand gradually is reduced over time.)

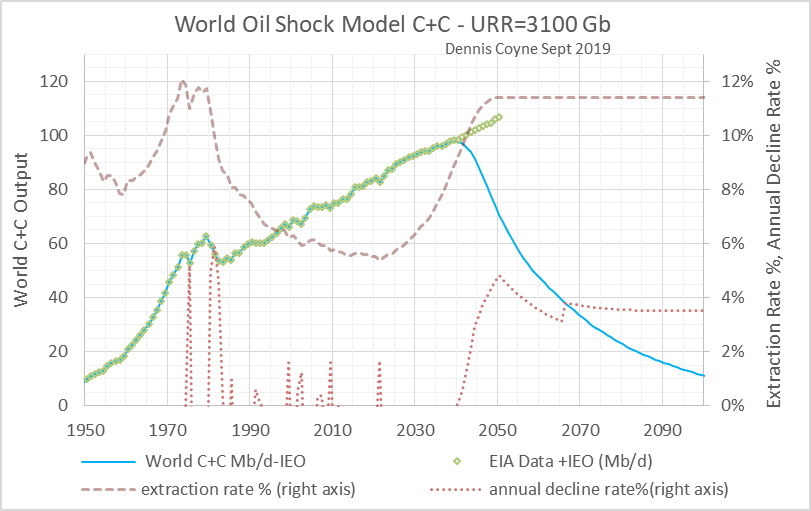

We assume the extraction rate for conventional C+C rises no higher than 12.1% (the maximum from 1950 to 2018 reached in 1973) and that the maximum annual rate of increase in the extraction rate is no more than the 0.38% average annual rate of increase reached during the 1964 to 1973 period, which was the steepest multiyear rise during the 1950-2018 period. Under this set of assumptions, the limit to the rate of increase in the extraction rate (rather than the limit on the maximum extraction rate of 12.1%) limits the shock model from matching the EIA’s IEO over the entire 2019 to 2050 period. The model fails in 2038 where the maximum rise in the extraction rate of 0.38% per year falls short in raising output to the level of the IEO reference case. The extraction rate continues to rise at this maximum rate of 0.38% per year until 2042. The peak is reached in 2039 at 97.8 Mb/d. We assume the extraction rate increases at a gradually slowing rate of increase over the 2043 to 2049 period. From 2050 to the end of the scenario in 2294, the extraction rate is held constant at 11.4%.

The annual decline rates for World C+C output are very high above 4% per year from 2047 to 2055 in this scenario and decline rates remain above 3.5% for all years from 2046 to 2114 except 2061 to 2065.

Note that the point of this scenario is not to show that it is possible, it is to show that unrealistic extraction rates are needed to reach this level of output and that even if it were possible we would face extremely steep decline in C+C output 7 years after the peak was reached in 2039.

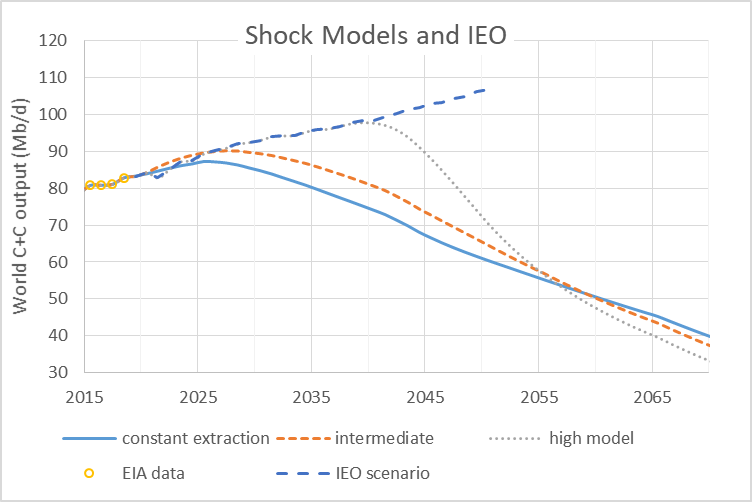

A more realistic intermediate scenario is presented below where the rate of increase in the extraction rate is limited to the rate of decrease in extraction rate experienced from 1990 to 2015 (0.06% per year.)

The scenario above might still be too optimistic, but seems within reason if oil prices are high enough to stimulate adequate investment without crashing the global economy, a difficult knife’s edge to remain balanced upon, making it a low probability scenario (my guess is less than a 1 in 3 chance). Peak is 90 Mb/d in 2027.

The three shock models presented above are presented together in a single chart below (models only) for comparison. I consider the constant extraction rate scenario most likely with about a 50/50 chance the peak will be higher or lower and/or earlier or later. The high scenario (peak output of 97.8 Mb/d) is the least likely (less than a 1 in 50 chance in my opinion that the peak output level will be reached) and the intermediate case is more likely than the high case, but still not very likely with perhaps a 33% probability that the World peak in C+C output will be as high or higher than that scenario (90 Mb/d). Of course, as always, there are an infinite set of possible future World C+C output scenarios so that the odds that any of these scenarios will be precisely correct is approximately zero.

Data for these scenarios are in a spreadsheet.

Interesting. I wonder if Venezuela and Iran will be able to bump up production if they had a regime change or somehow made a deal with Trump?

Also, some new oil coming online in a few individual countries like Argentina, Brazil and Norway. Mostly offshore.

Petroslurp

That is unlikely to change things much.

I would be curious to see, with your model, what URR is necessary for the IEO to be correct.

Thank you for your great work BTW.

Tita

Excellent idea. When I get a chance I can try it with a high urr for both conventional and unconventional C+C, probably around 3700 Gb with 3100 Gb conventional anf 600 Gb unconventional.

The scenario might work in that case but there would be at least an 84% probability that the URR will be lower than that estimate.

Using high URR (F16) case of 3700 Gb with 600 Gb unconventional. I get a peak in 2047 at 103 Gb, again the annual rate of increase in extraction rate is the limiting factor if we assume it cannot rise any faster than the average rate of increase from 1964 to 1973 (0.53% per year in this scenario). Decline is quite steep.

Another high URR scenario (3700 Gb) with extraction rate held constant at 2019 level (where IEO estimate for 2019 is assumed to be correct). Peak year is 2027 at 89.3 Mb/d for this scenario, annual decline rates are far lower than high scenario after the peak.

A final high URR scenario (3700 Gb) with an intermediate extraction rate limited to no higher and annual increase than 0.11% per year (same absolute value as the average annual decrease in extraction rate from 1987 to 2016). Peak is in 2037 at 95.3 Mb/d.

Note that I expect there is about an 84% probability that the World C+C URR will be less than 3700 Gb. The high peak scenario (with a peak in 2047) is low probability, less than 5%, even if URR is 3700 Gb or more. The medium and low cases are more difficult to assign probabilities, but my guess is that they are equally likely if URR proves to be 3700 Gb or more for World C+C.

Thank you.

The IEO is quite optimistic in its predictions. It would require a huge amount of new reserves (600 billions barrels) on top of the 300 billions barrels that we have yet to discover to not even reach their forecast outside unrealistic extraction rate.

Tita,

You’re welcome.

Thank you for the suggestion.

As a “reference case” the IEO scenario is ridiculous in my view even for my high URR case, which has about an 84% probability of being too high an estimate. For my mean estimate for World C+C URR= 3100 Gb it would require an extraction rate of about 25% in 2050 to reach the level of the IEO in 2050.

I wonder how much URR varies by oil price.

Hickory,

There is probably not a big difference in the long run. Maybe 3000 Gb less at very low prices and perhaps 3200 Gb at very high prices. Though higher URR will tend to lead to low prices and the reverse is true at low URR.

So I like the 3100 Gb guess for the long run. I hope it is lower, but that is likely to just be wishful thinking.

Dennis Wrote:

“Maybe 3000 Gb less at very low prices and perhaps 3200 Gb at very high prices.”

The issue I see is that all of the easy oil was produced or is being produced now. Perhaps there really is about 3000 Gb left, but I suspect a lot of it will be too expensive to be produced.

My guess is that when the shale cycle is over, there won’t be a another substitute and we could see high decline rates, much worse than anyone expects.

Recall that between 2005 and ~2013, Oil majors targeted expensive oil projects: Deep water and Arctic, thus I suspect there is really a lot less economically recoverable oil. I don’t Oil prices above $100 bbl would be sustainable. Currently the Global economy can not even normalize interest rates, as we already see global rates starting to fall again back to zero (or negative).

I suspect that during the 2020’s the world will fall into a permanent recession as debt, demographics and peak oil will be a hole too deep to climb out.

TechGuy wrote:

“I suspect that during the 2020’s the world will fall into a permanent recession as debt, demographics and peak oil will be a hole too deep to climb out.“

Not to forget the damages done because of climate change, like droughts, forest fires (intensified by climate change), stronger hurricanes and floodings because of more heavy rainfall.

Possibly the quantity left to extract, the 1800 Gb mentioned by Dennis, is not a very relevant parameter indeed. It is more about the ‘easy oil’ produced in the past and ‘now’, until the year 20 something.

I also guess that oilprices above 100 dollar/b cannot last many years.

Those climate change impacts you list are highly exaggerated. I suggest reading this

https://www.forbes.com/sites/rogerpielke/2019/09/26/its-time-to-get-real-about-the-extreme-scenario-used-to-generate-climate-porn/

Fernando,

I don’t believe in the worst-case scenario’s, like for instance the one from McPherson. And by the way: I didn’t write anything about the extend of damages.

But I don’t have my eyes and ears closed, like some deniers seem to have (or deniers who claim that this climate change is not caused by humans). On the rising number of weather extremes Trump commented: “it’s called weather”. He and many other deniers have own advantages to claim that climate change is not caused by burning fossil fuels or that climate change doesn’t exist at all.

“ Unlike deniers, climate alarmists are not influential

Climate deniers are obviously incredibly influential. Despite their lack of supporting evidence or facts, not only do 28% of Americans continue to believe that global warming is natural and 14% that it’s not even happening, but deniers also dictate Republican Party policy. Republican policymakers constantly invite deniers to testify in congressional hearings, including many of those featured on the Skeptical Science misinformers page.”

https://www.theguardian.com/environment/climate-consensus-97-per-cent/2018/jul/09/there-are-genuine-climate-alarmists-but-theyre-not-in-the-same-league-as-deniers

How much bribe those policymakers will get to invite deniers ?

What rising number of weather extremes, to which extremes are you referring to, and what’s the actual impact?

I ask because most of the climate porno insists on using “weather extremes” as an excuse to scare children out of their wits, but when we look at actual impacts, they are negligible. On the other hand, the alarmists fail to acknowledge there are positive impacts, which mean that at this time climate change has no impact at all on the world economy.

Fernando you are obviously not an ecologist.

Han and Fernando,

Please keep the climate change discussion in the non-petroleum thread.

Thanks.

Tech Guy,

3100 is my F50 estimate for World C+C URR remaining C+C economically recoverable resource is about 1800 Gb as cumulative production is about 1300 Gb.

The URR of 3100 [3000-3200] is a great unknown, IMO.

Who really knows

-at what price oil can the global economy afford to devote to production in the coming decades

-which producing countries will be come semi-permanent failed states, or will be affected by trade barriers, wars, carbon taxing, other other ‘artificial’ restrictions

-which geology will yield more or less oil than predicted, ie Bazhenov

-how fast battery technology will advance and affect the speed of electric transport implementation

So, while 3-3200 URR may be possible, in reality the total harvested may end up being much (much) less. If so, this is unlikely to affect the projections by Dennis over the ten years, and more likely to be seen in the period after the peak becomes ‘visible’.

-how fast battery technology will advance and affect the speed of electric transport implementation

Hickory,

There is another issue that might hamper general acceptance of EV. Yesterday on Dutch tv news was told what happens sometimes after an EV is involved in an accident: the battery pack catches fire and is difficult to extinguish. After extinguished (with a lot of water) it can ignite again. The whole car has to be cooled for days sometimes was said. That means a total-loss for the car, so if that can happen even after a relatively small accident many will wait to switch to an EV I think.

There is already a company in Holland that has special containers to put the car in on the spot of the accident.

So, while 3-3200 URR may be possible, in reality the total harvested may end up being much (much) less. If so, this is unlikely to affect the projections by Dennis over the ten years, and more likely to be seen in the period after the peak becomes ‘visible’.

Yes, for the next ten years it will make not much difference. Past peak the decline rate will count and depends on oilprices and because of the delicate situation the money system is in (very low or negative interest rates, high (consumer) debts) I seriously doubt the world can stand oilprices above $100/b for the time needed to rapidly and definitely leave ICE cars behind us.

Hickory,

I agree. Could be that output is less than 3100 Gb. Doubt it will be less than 2700 Gb and doubt it will be more than 3700 Gb. Perhaps 2.5 % probability URR will be less than 2700 Gb and perhaps 2.5 % probability URR will be more than 3700 Gb.

There is a great deal of uncertainty to be sure.

Dennis

How much oil has been used so far?

Hugo,

1300 Gb of C+C from 1870 to the end of 2018.

So about 1800 Gb left to extract if the 3100 Gb URR estimate is correct.

Hint:

I would not hold your breath

Dennis

2025 give or take a couple of years is a pretty good assumption.

Political problems could bring that forward 2 to 4 years.

Interesting times!

Hugo,

I agree. My guess is about a 68% probability that the peak in the 12 month centered average World C+C output will occur between Jan 2023 and Dec 2027, with roughly a 50% probability it will occur before or after July 1, 2025.

Hugo,

The 2 years makes sense, but 4 years so peak in 2021 or earlier, probably 5% probability or less.

So about 1800 Gb left to extract if the 3100 Gb URR estimate is correct.

What counts above all is the possible speed of extraction and to expect is that the majority of this 1800 Gb will be extracted at low velocity. For example, a field that produces 1 mbd at peak could deliver 0,1-0.2 mbd for a few decades beginning from 5-10 years past peak. For the (economic) consequences of (past) peakoil the quantity 1800 Gb is not very important, but yes important for the theoretical timing of Peak oil.

Han I agree that’s why the low scenario is more plausible.

Trade deal or no trade deal has become a big obstacle for oil price and neither outcome will be good for price of oil. An actual deal would be very US dollar positive. US equities positive. Big negative for government bonds though. Yields would spike. But not enough to bring down equity markets. EUR/USD would sink and USD/JPY would rocket higher on a trade deal. Most of the dollars strengthening would come from the YEN and the EURO on a trade deal with China. Gold and silver would crash if we get a trade deal. Oil might get a knee-jerk reaction higher that last maybe a day or two then it gets sold as dollar strengthening takes hold.

No trade deal is very bad for oil price. Very bad for US equities. Very good for government bonds. YEN and EURO carry trade would unwind which isn’t dollar positive but the dollar carry trade to emerging markets would also be unwinding at same time. When the FED dropped interest rates from 5.25% to 0.25% a lot of dollars were borrowed and they went look for yield elsewhere. A lot of those dollars ended up in China.

I’ve read estimates between 9-10 trillion dollars were borrow and left US shores in search of yield. It’s a huge amount of money that has the potential to unwind driving the dollar higher and would crush oil price along with a bunch of other stuff if it were to ever really start to unwind.

So No trade deal equals dollars leaving China. So they would have a choice to either use their dollars reserves to maintain their peg or watch their currency drop like a rock against the dollar. Which just isn’t going to be very supportive of price of oil. Oil needs calm markets.

Brexit. If there is no deal reached or even a bad deal reached. This is every EURO negative which is very dollar positive. Not good for price of oil.

Kinda looks like the drone attacks on Saudi were a great chance to short oil.

October is shaping up to be a very dark month for oil price. We could be back to the 30’s on WTI by years end depending on how these two things playout.

Guess it’s a good thing that Shale oil comes out of the ground regardless of what price is. Or if there is a profit or not.

This is a big disconnect between what Exxon & the EIA are forecasting with Exxon’s graph here:

I assume that both have a grip on reality. Why such a large disconnect?

Peter EV,

The Exxon forecast for C+C looks far more reasonable than the IEO.

Thank you for the reality check.

I’ve been following Exxon’s View to 2040 for a number of years and it has been very consistent. If anything, I squint and I think I see the “peak” of world supply moving toward 2039.

This is the graph from 2016; three years year to the one above and it shows the “Peak Oil” event in 2005 (Dark Green area) that a number of knowledgeable people were predicting such as Matt Simmons and Ken Deffeyes:

PeterEV,

For the year 2040 Exxon expects about 35 mbd of new conventional crude + condensate to come online. That is a lot, regarding that most giant oilfields are producing many years/decades already. It doesn’t seem impossible though if indeed at least 1800 Gb is left to produce. In any case for that to become reality oilprices must be a lot higher than they are now, because many of that crude oil is not easy and extremely expensive to get (deep water and/or harsh climate, tertiary EOR methods).

The crucial question is: how high can oilprices go before world economy starts to crumble ?

With GM, Ford, Porche, Volvo, Kia, Hyundai, Nissan, etc. etc. all making major plans for electrifying their fleets, it will be interesting to see what effect this has on the price of oil. Steep inroads by EVs could send the price on down to $20/barrel. Battery issues and increases in cost of electricity could send the price above where oil is now.

As you pointed out, the source for increasing oil output to 35mbd requires a lot of major development. Seems the automakers are siding with EVs or at least hedging their bets.

The other thing is that the next graph in this series has as its footnotes:

a) Global oil resources are abundant

b) Oil resource estimates keep rising as technology improves

c) Technology has added tight oil, deepwater, and oil sands resources

d) Less than one-quarter of gloabl oil resources have been produced,

e) Remaining oil resources can provide about 150 years of supply at current demand.

With regard to a) above, USGS said there are about 3 trillion barrels of “oil” in the western US Oil Shales of which about a trillion is produceable. I’m assuming the other 3 trillion is the bitumen in Venezuela, tight oil, deep water, oil sands and other sources that would make up the other 5 trillion of remaining resource.

With regard to d) above, 1 trillion divided by 150 years comes out to 18.26 mbd which is approximately the current demand in the USA.

The Oil Shale in western Colorado will require 2.5 to 3 barrels of water be pumped up over the Continental Divide from sources east of the divide (e.g., Missouri River, Platte, etc.) for every barrel of “oil” that is produced. To produce 5 mbd, up to 15 mbd of water will be needed or about 10 Alaskan Pipelines just to bring water to the source. I’m not sure how much this would add to the cost of a barrel of oil.

Between these footnotes and the footnote from the first set of graphs which says that “Significant investment is needed to offset this natural decline…”, I can see where Exxon is showing a peak around 2040 because the funding might not be there ala the Bakken, etc..

Is the EIA assuming that the investment capital will be there?

PeterEV,

I doubt oil will fall below 40/b before 2050, perhaps it might reach 20/b by 2080 if we find alternatives to fuel water and air transport. At this point it is far from clear that this will occur.

Hi Dennis,

I’d say cheap oil depends on what’s included in the price. If society chooses to internalize the cost of pollution (including GHGs) and supply security, then alternatives to FF for aviation, long distance water freight, seasonal ag, etc will be very competitive by then, even with $40 oil. If not, then…not.

Choices, choices…

Oil price will drop to $20 in 2525, when the use of dilithium crystals to power giant spaceships will allow us to import food and manufactured products from Titan.

Fernando, you should put a smiley face after such comments. A lot of people reading that post may take you seriously and think you are a damn fool. Or even worse, think you are a genus for such great forethought.

Never underestimate the intelligence of a certain percentage of the general public.

Fernando,

My grandfather thought ICEVs would never be a big thing, no need for anything but a horse and buggy.

kind of like you and EVs. 🙂

In 2525, the price of oil will be under $2/bo in 2017$.

In 1917, EVs had 38% market share in the US, today they have 2%. EV technology remains inferior to ICE, and the only reason EVs have any market share at all today is massive government subsidies worldwide. Having said that, and considering the climate hysteria, I expect EVs to capture a growing market share due to continued government support. At some point, once the subsidies are removed, their market share will flatten, if not shrink, when will that be? That depends on how much money governments wish to waste on this folly.

Ivan Kudder,

What do you think happens when World output of C+C peaks in 2025 and oil prices rise to over $150/bo in 2018$?

Perhaps your tune will be different at that point. 🙂

Oh and I disagree on the idea that EV technology is inferior and everyone who I let try my Model 3 agrees.

When was the last time you test drove an EV?

My Model 3 is far superior to my Camry and prices of EVs will fall as more manufacturers get in the game.

I understand some people like the torque of an EV and the bells and whistles of a Tesla, but I don’t think comparing a 54K CAD car (Tesla) to a 26K CAD car (Camry) is a proper comparison. I think you are comparing apples and oranges here.

When I speak of EVs being inferior, I mean a more limited range, very slow re-charge time, high sensitivity to cold and hot weather, and low re-sale value.

I have heard the argument that EVs will get cheaper, but what this argument fails to grasp is that as subsidies are removed, the lower future price of future EVs is going to match the subsidized price of an EV today. This could reduce the burden on the tax payer in terms of subsidy, but of course this wont solve EVs inherent limitations.

I think choosing EVs as a way to fight climate change is the wrong choice, first because EVs have high emissions at the manufacturing stage, and since the electric grid still mainly depend on fossil fuels, EVdriving emissions remains high. I think favoring more efficient ICE cars would have a bigger impact on emissions than an investment in EVs. Outside of the ICE and EV comparison, the real issue we need to consider is the false belief that we can continue with a car culture and fight climate change, I think cities need a fundamental rethink in terms of their transport infrastructure. I’d rather see all the money wasted on EV subsidies go to fund public transport, that would be a far better use for my tax dollars than paying wealthy people thousands of dollars to buy an EV, which does not solve the problem anyways.

Ivan,

I agree, I have driven C class Mercedes as well, and fully loaded, the price is similar to the Tesla Model 3. I was not impressed with the Mercedes relative to the Model 3.

I agree not a fair comparison, but note that with similar features to the Model 3, the Camry V6 XLE is about 35K.

Model 3 low end is about 40K, and likely has similar features to the Camry and probably better acceleration and handling.

Subsidies for Teslas end on Dec 31, 2019 in the US, currently the US subsidy is $1875, the 40K price I quoted assumes zero for the subsidy, so a bit of a price difference, but the Model 3 is a far nicer vehicle.

And don’t forget a minimum of $10k savings in fuel!

As my moniker implies, I do drive EVs, a Tesla and a Bolt. What I see happening is the range increasing, the recharge time decreasing, and the cost per kwh of capacity decreasing. Tesla range is up to 370 miles, Supercharger recharge times have decreased, and companies are on the verge of breaking through the $100/kwh battery cost.

When compared to the history of aviation, I think we are in the 1920’s with respect to EVs and range. Most of the transitioning will begin in the early to mid-2020’s with GM offering electrics in their Cadillac line, Ford offering electric F series pickups and Volvo saying they will be all electric by 2035.

I think the thing to watch is battery development. Honda in conjunction with Cal Tech and NASA are developing a fluoride battery with up to ten times the energy density of current lithium ion batteries.

If all these EV projects take off, what will be left to consume crude oil products?

PeterEV,

With regard to d) less than one quarter is produced, they might refer to OOIP and not URR. Or including all the bitumen that imho never will deliver more than 15-20 mbd

About the future mbd that will be produced it makes sense what TechGuy wrote in this open thread:

“Recall that between 2005 and ~2013, Oil majors targeted expensive oil projects: Deep water and Arctic, thus I suspect there is really a lot less economically recoverable oil.”

Han,

My guess is that the World economy could sustain oil prices at over $120/bo in 2017$ from 2025 to 2035, if IMF projections for real GDP growth are roughly correct. For example the average spending by the World on crude oil from 2010 to 2014 was about 4.35% of World real GDP in 2018 $ at market exchange rates. If we use the IMF’s estimates for World real GDP through 2024 and my medium extraction rate and medium URR scenario and also assume 4.34% of World real GDP can be spent on crude plus condensate without causing a severe recession, then oil prices can rise as high as $137.70/bo in 2018 $ by 2024.

If we further assume that World real GDP continues to grow at 2.5% from 2025 to 2035 and that the 4.34% of World GDP spending on World C+C output can be sustained (demand might falter), then oil prices would rise as high as $196/bo in 2018$ by 2035.

Price scenario assuming medium World URR (3100 Gb) and constant extraction rate using IMF GDP projections and 2.5% real GDP growth from 2025 to 2035 and assuming 4.346% of World real GDP is spent on World C+C output from 2020 to 2035. These would be maximum oil prices assuming demand was as high as potential oil output at these oil prices (oil price may well be lower due to lack of demand at these oil prices).

Dennis

It is not the price of oil that will be the problem. It is that fact that there will not be enough for the global economy to expand.

If I can get diesel, then I can get to work and pay for it. If I cannot get diesel then I cannot get to work and everything falls apart.

At the moment the global economy needs 1.3 million barrels per day extra each year to grow.

Now according to you prediction global oil production will fall by 0.5 million barrels per day after 2027 or so. The decline in production will increase as the last few countries peak and decline.

Somehow growth needs to happen with 2.5 million barrels per day less than the world was used to.

Aviation, marine transport are increasing as people travel more and more goods and food are shipped around the world.

If this reversed, the global economy would tear apart.

Even if every single one of the 100 million vehicles sold each year were all electric the world would still be short of 1 million barrels per day.

And the likelihood of that is small

https://insideevs.com/news/367908/global-ev-sales-in-july-2019/

Those that warned about Peak Oil said the world needed to plan on a grand scale 20 years ahead, not to be seriously affected by peak oil.

Hugo,

As the price rises people drive less, switch to more fuel efficient cars, like hybrids and plugin hybrids or switch to EVs. The move to these types of cars can actually boost economic activity as they need to be built. Likewise for wind, solar, HVDC transmission etc.

Capitalist economies are always in a state of constant change, it is their nature.

Dennis

As I said even if every single car built was electric that would still leave a massive energy gap.

You do not get more efficient than zero consumption for new vehicles.

Imagine global total liquids peaked in 2010. Instead of using 12 million barrels more we would somehow have to get by on 12 million less. A gap of 24 million barrels.

How would things look?

The economy would have to shrink in many sectors, many people would be out of work.

Hugo

We will switch to different energy sources as fossil fuels become expensive.

In your hypothetical scenario prices would have been very different and consumption patterns would be different.

What do you think happens to the efficiency of water and air transport at $200/b, in addition the amount of goods and people moved by air and water will change as prices go up and different mode of travel will be developed. Doesn’t happen overnight. If land transport consumption falls there will be adequate oil supply unti 2070.

In the interim there will be changes I cannot foresee.

Hugo,

You might want to show your calculations. In the US roughly 50% of all oil consumption is for passenger vehicles, and the rest of the world is not so different.

Hugo,

Air and water transport and other uses for oil can become more efficient or there will be substitutes. As oil prices rise there is a great incentive to develop the technology to maximize efficiency, though of course there are physical limits. Eventually we will simply move fewer goods and people and develop more localized economies, moving only those things that are critical to keeping the World economy functioning.

Hugo,

From 1982 to 2018 the average annual increase in World C+C output was about 800 kb/d. Your 1300 kb/d estimate is all liquids, much of which is low energy content NGL and biofuels (about 70% the energy content of the average barrel of C+C). The focus should be on crude plus condensate, that is what the World’s transportation fleet runs on, data can be found at page below.

https://www.eia.gov/beta/international/data/browser/#/?pa=00000000000000000000000000000000002&f=M&c=00000000000000000000000000000000000000000000000001&tl_id=5-M&vo=0&v=T&start=197301&end=201906

Dennis,

I doubt oilprices will rise gradually like in the graph. That’s in theory of course. In real world it probably will be (much) different. For the plateau/ past peak consequences I neither share your optimism, nor the pessimism of Hugo.

However, declining oil production will take the world by surprise.

Largest increase in Exxon’s chart is NGL, which their little blurb mentions is a result of LTO fracking, and that looks rather a lot like they know the liquid that flows is called “oil” in a shaky way.

There is some factors that deside how much oil is possible to exstract economical profittability from a reservoir. Geology is one important element, permability, type of reservoir. In sandstone reservoir oil company. have spent billions of dollars to improve the recoverable persentage by adding chemical, CO2, water injection wells as one problem occour when reservoir pressure drop or at sometimes happen injection wells lost contact with reservoir. Often thoose challanges increase from a certain stage and from this stage often a severe drop in production will occour. Much focus have been on Venezuelas economy and leadership , but from data of producing fields we could see some have about 18% left and this oil is thick like asphalt. The biggest filds in Saudi have about 20% left but this oil is more light but even that will at a certain stage get huge drop in production and hi content of water, chemical that have been injected. I believe both Saudi and US might exsperiance same problem as Venezuela at a certain stage because off geological constraints. Here is some graphs…

https://www.google.com/amp/s/amp.ft.com/content/0f79fba0-7282-3b79-b347-67a5cf4e1957

Freddy

That link is behind a paywall.

Dennis , this page graph 6. If you look at production from 2015 decline increased dramatical. Some link this to drop in oil price, bad management i.e but normaly if that is the truth there will be a change when prices increased. I believe one reason might be the huge drop is related to reservoir has reach a limit even 18-20 % off estimated resourses remain. Think here they use exsperianced data from similar field, structures but geology might be different also one factor might be water injection cause fraction and fragile rock that is weak and make it difficult to maintain the production level.

https://www.csis.org/analysis/venezuelan-drama-14-charts

Freddy

The collapse in Venezuela’s oil production is nothing to do with geology. Geology does not change over night.

Consistent investment and upgrades ensure maximum extraction of the resource and Venezuela has vast reserves.

The psychopath Chavez made the oil company responsible for funding schools and paying the wages of other non oil workers.

He then sacked 20,000 oil workers.

https://qz.com/12984/where-all-of-hugo-chavezs-oil-workers-went/

He then stole the equipment from several companies that had the technology to produce the oil.

https://www.forbes.com/sites/rrapier/2017/05/07/how-venezuela-ruined-its-oil-industry/#577deef7399d

The head of PDVSA was replaced by a general and ignorance and corruption destroyed what was left.

https://www.reuters.com/article/us-venezuela-pdvsa-military-specialrepor/special-report-oil-output-goes-awol-in-venezuela-as-soldiers-run-pdvsa-idUSKCN1OP0RZ

Freddy,

My scenario assumes most of the XH oil comes from Canada until 2030. About 100 Gb assumed for XH for Canada and Venezuela. I have already taken Venezuela into account, I assume by 2030 they will have sorted things out.

Venezuela is going to have a hard time recovering from socialism. The brain drain is accelerating, the current education system is a mess, chaos, lawlessness, and crumbling infrastructure make the country look like Angola after the civil war. And the Cubans hang on, waiting if the Democrats win in 2020 so they can be conceded Venezuela as a colony by a commie like Sanders. It doesn’t look good.

Note to editor- this is foreign influence on domestic politics

Is this tolerated here?

Hint:

Venezuela was going to fall last Dec/Jan according to our right wing friends.

I would look on the analysis with humor——

Maduro isn’t “Venezuela”, he’s a marxist whose wife is known to be ultra corrupt. Both appear to be agents or moles of the Castro family mafia, and together with Cabello and el Aissami run a huge drug traffic network.

Maduro’s regime didn’t collapse as expected because the European Union interfered, and insisted on a dialogue sponsored by Norway, instead of using parallel sanctions on regime capos. Most of these capos, which include high level socialist party officials, senior military, and secret police leaders, have sent their wives, lovers, girlfriends, children, AND BANK ACCOUNTS to Europe. They are seen in the most expensive areas of Madrid, throw lavish parties, and enjoy very good lives with the stolen money as well as money from the drug traffic.

Spain is a heaven for these vermin because the Socialist government gained power thanks to a Parliament vote which required the votes of far left chavista allies such as Podemos and ERC. The socialists have been key influencers on European foreign policy, which also happens to be run by an Italian communist, Federica Mogherini.

The complete turn around of the European Union, coupled to a very weak performance by John Bolton, and the usual lack of intelligence of Venezuelans, has led to the current debacle, in which over 5 million Venezuelans have fled, many of them are now being persecuted and subject to pogroms in Peru and other countries, the country continues to collapse, and the dictatorship has moved to destroy the Amazon jungle at high speed in a search for gold they move through Turkey and African countries.

Earlier in 2019, the Cubans had devised a trap for Trump, they inew Bolton wanted military intervention, and they decided to incite Trump by scaling up human rights abuses. Their idea was to get US troops on the ground, then start killing them during the US presidential election, while at the same time maneuvering inside the US to get either Sanders or Warren elected. They felt having the US bogged down in a mini Iraq war would put a red in the White House.

Trump saw through their trap, avoided intervention, but failed to get European cooperation (the Europeans are keenly interrsted in taking Trump down and setting the table for a weak or a red Democrat, so they share the same goal as the Cubans, Maduro, Russia, and China).

This means Trump is simply going to hunker down, and wait to see if the flow of Venezuelans reaches 7-8 million, there are already serious conflicts and Venezuelans dying in countries receiving the influx, and this should lead to at least Colombia asking the US to create a safe area within Venezuela to set up refugee camps and avoid this mass flight. Trump will agree IF Pelosi agrees, because he doesn’t want this effort to be used by a communist like Sanders to win the election.

Dudes caught in a time warp; off by a few decades.

https://youtu.be/iAHJCPoWCC8

FL- “Political commentary should be in the non-petroleum thread.”

Got it?

Stop with the isms. Money comes from thin air by central banks. Moral measurements about it and philosophies created surrounding it are largely just grad students running out of dissertation topics.

Venezuela is not exporting. They are also not starving. And maybe most important, their oil is being kept in the ground for the grandchildren.

How can that be bad?

The key to being a good communist is to support whatever crimes against humanity and corruption are needed to arrive at the worker’s paradise.

Fernando,

Keep the nonsense conspiracy theories in the non-petroleum thread please. Your commentary on oil focused subjects in the Petroleum thread are welcome.

If you want to converse with socialists you will find more of them on the non-petroleum side.

Yemen rebels claim mass capture of Saudi soldiers in attack

https://www.smh.com.au/world/middle-east/yemen-rebels-claim-mass-capture-of-saudi-soldiers-in-attack-20190929-p52vxw.html

Things are getting interesting:

https://www.moonofalabama.org/2019/09/saudi-arabia-another-defeat-in-yemen-kings-bodyguard-killed.html

Clown prince Mohamed bin Salman may have removed his fathers bodyguard to make it easier for himself to take the throne. The recent Yemeni attack on Saudi oil installation and the defeat of at lest two brigades of Saudi troops must put a lot of pressure of him. MbS is the Defense Minister. He started the war on Yemen. He must fear for his job and position. With the king removed he would become unassailable.

This article says hundreds of Saudi soldiers instead of thousands

http://chinaplus.cri.cn/news/world/10/20190928/359897.html

Is the US weapon export to KSA being debated in the US and if not, is it not time to do so?

US weapons sales are about $200B globally. About $60B to KSA.

Erasing that $60B would be a 10% increase in the US trade deficit.

What would be the point? Russia would be delighted to take that business away. So KSA would send their $60 billion to someone else, get pretty much the same weapons and the US would gain what from this loss of influence?

Is this supposed to be some morality thing where KSA kills people with someone else’s guns? The people are still dead. The difference is the US would lose influence — hmm, let’s use a different word, presence. Russia would gain influence/presence, and there’d be no reduction in the body count.

Or maybe wars would stop if nobody sold weapons to such regimes.

Okie doke. Will you use force to prevent Russia from selling arms? They seek to be a dominant influence in the oil-laden Middle East, too. Doing rather well the past 10 or so years.

I think it is an important ethical discussion and I’m just curious to know what’s on the news. I noticed what Tulsi Gabbard said, but since I don’t follow American news I’m curious if many agree or not. Sorry, I realize this is the wrong thread and I will not comment too much about it on this thread.

https://mobile.twitter.com/tulsigabbard/status/1173723701373591552

Political commentary should be in the non-petroleum thread.

Thanks.

A sheeple awaking? The Rest of the Story: Fracking Oil Carnage and accelerating PetroDollar REJECTION is center to the Repo/Dollar Shortage? Much of the missing/hidden 21 Trillion in the US Budget required for maintenance of the Dollar Standard? EVERYTHING is tied to Oil. The Dollar burning is not going to Stop

———————-

Kirby contends, “I don’t believe President Trump is informed. I do not believe the people around him would dare inform him with the truth because they would be afraid of what he might do in reaction.

https://youtu.be/xAF6_9_WS8g?t=134

Actually this President is the most oil-focused we have had since Jimmy Carter. Even GW Bush, who had an oil background, was less focused.

Saudi border attack

https://twitter.com/Natsecjeff/status/1178294977895522304?s=20

If this keeps up the various Shia militias are gonna march on Riyadh from Iraq and Yemen, and from within KSA. Should make for a total balls-up.

Any one knows at what time EIA will issue the monthly crude production today?

Usually somewhere between 12:00 noon and 2:00 pm, EST.

Freddy

I thought that the EIA would release their US data all at the same time. I usually wait for data from the EIA 914 site. However that data wasn’t released till 3. This is where I get the EIA data for my charts. Learn something new every day.

https://www.eia.gov/dnav/pet/pet_crd_crpdn_adc_mbblpd_m.htm

Thanks Ovi, there is a lot of data out there and I try to learn from this site what is real and trustable…

Argentina news. Vaca Muerta.

Oil output in August, 167000 bpd. Nat gas flow quoted as a 10-year high for Argentina. Don’t remember the number.

Lots of uncertainty with a presumed new Administration coming to power at the end of this month. The new Administration will be more conservative and more pro-business than the last, but that is a general assessment and really all that matters in Argentina is whether or not the decreed price of oil will remain. The IMF labels this a subsidy and the new Administration has been vaguely anti-subsidy (subsidies in general) in a broad sense in their comments.

YPF recently took action that has upset suppliers. They provided notice to the suppliers that dollar contracts will be paid at a peso conversion rate that YPF specified, and the number is 25% under market rates. Some Wall Street analysts ran around in circles and declared that this would shut off support for the efforts in the VM, but to date no suppliers have disappeared from involvement.

As very few of you know, there are three primary credit rating agencies. S&P, Moody’s and Fitch. Fitch is European and they sponsored a recent conference in Argentina to discuss the VM. In response to YPF’s declared currency conversion a couple of suppliers at the conference announced that this would cost them millions of dollars. A Fitch representative noted that it would cost them only dollars off of their projected revenue and not an outright loss. Meaning, merely lower profit and not loss. This raised eyebrows at the conference, both because Fitch would know and should not have mentioned it, and also that the supplier apparently had a 25% minimum margin. There was also talk at the conference about participants in the VM wanting to remain participants even if short-term profit was uncertain. Future potential oil flow and gas flow seems to compel that.

The new Administration-to-be apparently had a representative at the conference who made reassuring noises about support for the VM.

Than the EIA monthly is out .

https://www.eia.gov/petroleum/production/

Seems US oil production declined from 12 082 kbpd to 11 806 kbpd from june 19 to jul 19.

Texas increase 40kbpd or 0.79%.

US decline was 32k in June , 276 k in July and think this reflect the rig count that is still declining together with child well problems , pipeline constraints. If this continue US oil production might fall with more than 1 Mbpd before year end.

Hurricane, Barry I think, is primarily responsible for the decline. The drop and recovery can be seen in the comparison of the weekly and monthly data for the lower 48.

Right,, Barry contributed to the GOM production drop from 1912 in June to 1580 in July. August and September should be back up.

Lower 48 onshore increased 65,000 bopd. Within the rolling plateau range.

june 12082-1912-455-14=9701

july 11806-1580-448-12=9766

Frac spreads were 450 in July (same are as prior month).

Spreads declined to 416 in August and 379 in Sept.

If we look at US L48 conventional that is what has been declining. US tight oil output has been increasing from Feb to August 2019 based on EIA tight oil production estimates by play.

Southlageo,

Would you estimate that output will be back to 1900+/- 50 kb/d for GOM in Aug and Sept?

Yes I would. Also, some time between now and the end of the year I suspect there will be at least one month where 2 mmbo is reached.

SouthLaGeo,

Thank you.

Most of the fall was offshore and Alaska, L48 onshore output increased in July.

Alaska production decreased slightly, by 7kb/d. I usually just take out offshore production to look at the evolution of onshore production, without worrying to much about Alaska which doesn’t change much, only by 40-50 kb/d in the summer.

Yes, LTO production picked up since April. But until now, on a much slower rate than in 2018. But August-September growth suprised everybody last year (+700 kb/d in just two months for onshore production). September-November growth was also a surprise in 2017 (+850 kb/d in 3 months for onshore production).

Will it be the same this year? Rig count is way down, but it may be balanced with an increase in DUC completion. It’s more the “well performance” that is not higher, so I guess we will see an increase, just lower than last year.

Frac spreads are down so DUC completions may not increase. Agree increase will be much lower this year probably about half to one third the increase in 2018.

Horizontal rigs down by 15% or so.

Oklahoma production was up 18,000 to 567,000 bopd. It appears to be kind of a dead cat bounce as Ok was down 58,000 the prior month.

Blowout- Hardcover – October 1, 2019

Corrupted Democracy, Rogue State Russia, and the Richest, Most Destructive Industry on Earth

Big Oil and Gas Versus Democracy—Winner Take All

In 2010, the words “earthquake swarm” entered the lexicon in Oklahoma. That same year, a trove of Michael Jackson memorabilia—including his iconic crystal-encrusted white glove—was sold at auction for over $1 million to a guy who was, officially, just the lowly forestry minister of the tiny nation of Equatorial Guinea. And in 2014, Ukrainian revolutionaries raided the palace of their ousted president and found a zoo of peacocks, gilded toilets, and a floating restaurant modeled after a Spanish galleon. Unlikely as it might seem, there is a thread connecting these events, and Rachel Maddow follows it to its crooked source: the unimaginably lucrative and equally corrupting oil and gas industry.

With her trademark black humor, Maddow takes us on a switchback journey around the globe, revealing the greed and incompetence of Big Oil and Gas along the way, and drawing a surprising conclusion about why the Russian government hacked the 2016 U.S. election. She deftly shows how Russia’s rich reserves of crude have, paradoxically, stunted its growth, forcing Putin to maintain his power by spreading Russia’s rot into its rivals, its neighbors, the West’s most important alliances, and the United States. Chevron, BP, and a host of other industry players get their star turn, most notably ExxonMobil and the deceptively well-behaved Rex Tillerson. The oil and gas industry has weakened democracies in developed and developing countries, fouled oceans and rivers, and propped up authoritarian thieves and killers. But being outraged at it is, according to Maddow, “like being indignant when a lion takes down and eats a gazelle. You can’t really blame the lion. It’s in her nature.”

Blowout is a call to contain the lion: to stop subsidizing the wealthiest businesses on earth, to fight for transparency, and to check the influence of the world’s most destructive industry and its enablers. The stakes have never been higher. As Maddow writes, “Democracy either wins this one or disappears.”

https://www.amazon.com/Blowout-Corrupted-Democracy-Destructive-Industry/dp/0525575472/ref=sr_1_1?crid=1XMB7KOFJ0Y3K&keywords=blowout+rachel+maddow&qid=1569890632&sprefix=blowout%2Caps%2C213&sr=8-1

Maddow’s Blowout is an extremely well written and interesting book. It is somewhat one sided. Rachel does enjoy her pick-up truck and her warm apartment but otherwise ignores the good derived from fossil fuels and minimizes the potential of peak oil deprivation.The late Boone Pickens is not mentioned in the index. I guess that means he is one of the good guys

China says they have achieved the necessary technology to tap what appears to be a pretty big shale oilfield.

Details sparse. It appears to be deeper than the Bakken. There is talk of a well flowing over 700 bpd out to 260 days.

Electric Cars Will not save us.

There are 1,100,000,000 cars in the world and approximately 400,000,000 HGV,s and buses.

Cars use around a third of the 82 million barrels per day produced.

When Peak Oil happens, the world not only will be deprived of the 800,000 barrels of additional C&C it consumes each year, but will have to scramble to save a million barrels per day of falling production.

How will a world with a population increasing by 800 million people in a decade cope?

The global fleet of 6 million electric vehicles save 164,000 barrels per day and the 2 million sold this year will save another 55,000.

Trouble is the number of vehicles sold is 100 million and 98 million of those are ICE vehicles.

Around 50 million vehicles are scrapped each year, meaning an additional 40 million cars and 10 million HGVs on the roads.

With the number of vehicles increasing by 50 million or so, fuel efficiency has limited effect, hence why 40% of new demand is due to road vehicles.

In order to just cope with a decline of 1 million barrels per day each year, the global ICE fleet of cars would have to shrink by 36 million each year. In other words of the 100 million vehicles produced only 14 million could be ICE vehicles. Problem! more HGVs are sold then that each year

http://www.oica.net/category/sales-statistics/

and electric HGVs are 15 years behind electric cars.

https://www.commercialfleet.org/fleet-management/will-electric-trucks-be-in-it-for-the-long-haul

Aviation is predicted in be consuming an additional 4 million barrels per day in the next 15 years. Where on earth will that come from?

The more you look deeply into these issues the more you see a crises looming.

Perhaps it is easier to say oil price rise will fix it. I am pretty sure it won’t.

Cars use around a third of the 82 million barrels per day produced.

That looks low – the US is about 50%. Do you have a source?

Nick,

I thought the U.S is known for its many cars with low MPG.

Many in percentage compared to a lot of other countries, like India and China and a lot of South American, African countries and even a lot or most of European countries. So one third will be correct.

In Curaçao where I live the biggest SUV’s are mostly Ford.

Certainly it doesn’t look good when oil production starts to decline instead of rise. A decline of 1 mbd instead of an increase of 1 mbd per year is a difference of 2 mbd. A lot of possibilities to diminish the use of crude oil, like you wrote many times, but one of the risks is panic. And how will oil exporting countries react ? Are they going to put on ration their own citizens, like happens in KSA now after the drone attack ? And if so, will there follow untenable social unrest, like happened in France already several times ?

Nick

The data is found in many studies, the US is at the top end, but globally oil consumed by cars is 25-28 million barrels per day. A quarter of total liquids or a third of CandC.

https://www.eia.gov/energyexplained/use-of-energy/transportation.php

https://energypolicy.columbia.edu/sites/default/files/pictures/CGEP_Electric%20Vehicles%20and%20Their%20Impact%20on%20Oil%20Demand-Why%20Forecasts%20Differ.pdf

The main point is, once we hit peak oil, every single country will do whatever it can to grab the oil it needs from an ever declining supply.

China’s government will do the obvious tie economic aid to future oil deliveries. It has already done that with several million barrels it gets now.

Even a country like Britain will struggle despite having good public transport, many people cannot get to work without a car.

Even if the world produced 70 million electric cars a year at peak, that would not be enough to cope with the rate of decline. Unless of course aviation and marine transportation decide to stop growing willingly.

Countries will do what they need to in order to secure supplies, the weaker economies will go under, such as Greece and Italy, and the knock-on effects will be felt around the world.

Why Italy and Greece?

It is in Germany where automotive industry is the biggest in the country, and where 80% of transport volume goes by roads.

OneofEU

Simply because Italy’s economy is in a very bad way.

https://www.forbes.com/sites/simonconstable/2019/06/20/doomed-how-theres-no-way-out-of-the-debt-crisis-for-italy/#3ec0676568bb

https://www.aei.org/economics/international-economics/an-italian-debt-crisis-would-be-like-greece-on-steroids/