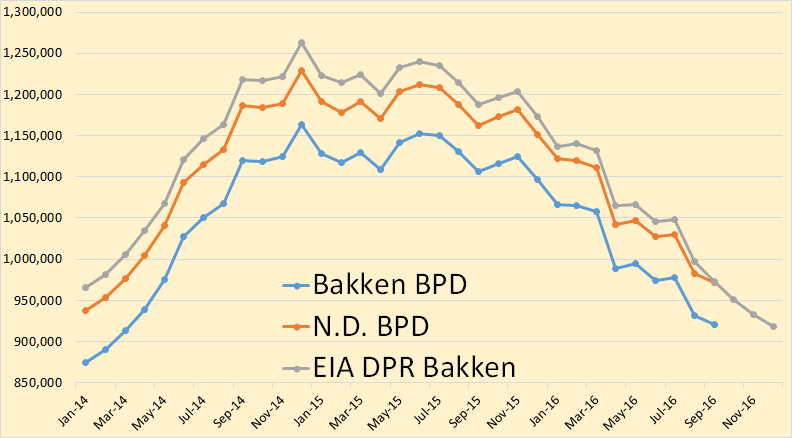

Bakken oil production was down 10,119 barrels per day in September and all North Dakota production was down 10,353 bpd in September.

Bakken production continues to decline though I expect it to level off soon.

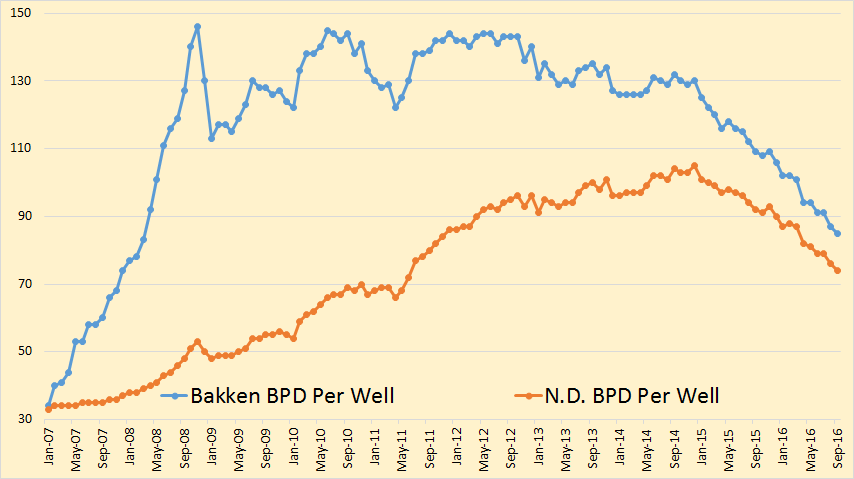

Barrels per day per well continue a steady decline. Bakken bpd per well fell 2 to 85 while all North Dakota bpd per well fell 2 to 74.

From the Director’s Cut

Oil Production

August 30,442,347 barrels = 982,011 barrels/day

September 29,149,737 barrels = 971,658 barrels/day (preliminary)

(all-time high was Dec 2014 at 1,227,483 barrels/day)

920,899 barrels per day or 95% from Bakken and Three Forks

50,759 barrels per day or 5% from legacy conventional pools

Producing Wells

August 13,295

September 13,367 (preliminary)(NEW all-time high)

Permitting

August 99 drilling and 1 seismic

September 63 drilling and 1 seismic

October 82 drilling and 1 seismic (all time high was 370 in 10/2012)

ND Sweet Crude Price

August $33.73/barrel

September $32.98/barrel

October $39.31/barrel

Today $34.75/barrel (all-time high was $136.29 7/3/2008)

Rig Count

August 32

September 34

October 33

Today’s rig count is 38 (all-time high was 218 on 5/29/2012)

Comments:

The drilling rig count increased two from August to September, then decreased one from September to October, and is currently up five from October to today. Operators are shifting from running the minimum number of rigs to incremental increases throughout 2017 as long as oil prices remain below $60/barrel WTI.

The number of well completions rose from 63(final) in August to 71(preliminary) in September. Oil price weakness is the primary reason for the slow-down and is now anticipated to last into the second quarter of 2017.

There was one significant precipitation event, 10 days with wind speeds in excess of 35 mph (too high for completion work), and no days with temperatures below -10F.

Over 98% of drilling now targets the Bakken and Three Forks formations.

Estimated wells waiting on completion2 is 861, down 27 from the end of August to the end of September. Estimated inactive well count3 is 1,514, unchanged from the end of August to the end of September.

Crude oil take away capacity remains dependent on rail deliveries to coastal refineries to remain adequate.

Low oil price associated with lifting of sanctions on Iran, a weak economy in China, and the Brexit are expected to lead to continued low drilling rig count. Utilization rate for rigs capable of 20,000+ feet is 25-30% and for shallow well rigs (7,000 feet or less) 1520%.

Drilling permit activity dropped sharply from August to September then increased from September to October. Operators are maintaining a permit inventory that will accommodate a return to the drilling price point within the next 12 months.

I Can See Clearly Now – Lessons Learned From Five Years Of Crude, Gas And NGL Forecasts

The Shale Revolution changed everything about U.S energy markets, and in the process made forecasting the production and pricing of crude oil, natural gas and NGLs a heck of a lot harder. But we all learn from experience…

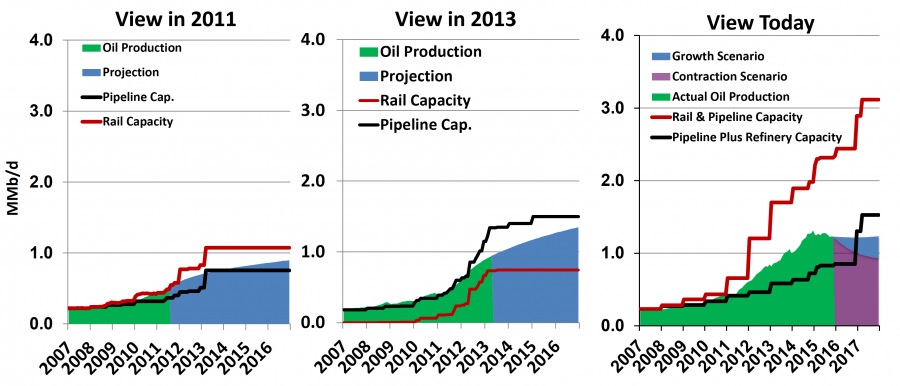

Let’s begin, as we did in our 2013 blog series, with a look at crude oil production in the Bakken. When we look back to the mid-2011 forecast (by Bentek; left graph in Figure 1), crude output in western North Dakota and eastern Montana (green shaded area) had already risen sharply (to ~500 Mb/d in 2011 from ~200 Mb/d in 2007), and the forecast was that Bakken production would climb to ~900 Mb/d in 2016 (blue shaded area). By mid-2011, crude output already had exceeded the play’s pipeline takeaway capacity (black line), and planned pipeline capacity additions were not expected to relieve that constraint until early 2013. As a result, Bakken producers were already adding crude-by-rail (CBR) takeaway capacity (area between black and red lines; ~120 Mb/d as of 2011) as a solution to moving crude to market––and planning to add another 300 Mb/d of CBR capacity by 2013.

Go to the link to read the rest of this article. It is very interesting. As you can see they have the Bakken peaking in December 2014 with the yearly average peaking in 2015. Even their growth scenario levels out thru 2018 and their contraction scenario projects a continue decline.

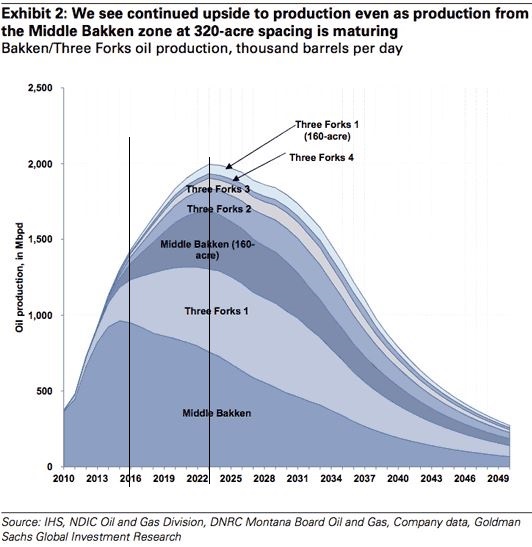

I did not save the link or date for this chart but I am pretty sure it dates from late 2013 or early 2014. They have the Bakken peaking at 2 million bpd in 2023. I inserted the lines to show their peak date and where we should be right now in 2016.. Predicting oil production is a fools game but I sometimes play the fool myself.

China’s Foreign Oil Dependency Nightmare Intensifies

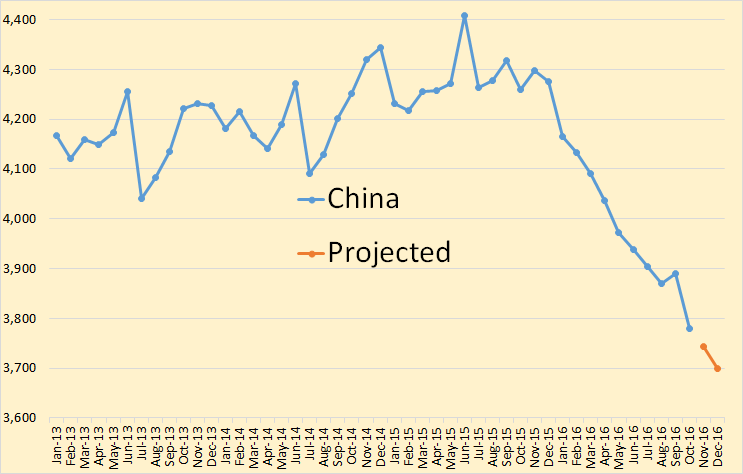

China’s daily crude oil production in October fell to a more than seven-year low , data from the country’s statistics bureau showed on Monday. The development comes as global oil prices are still off from $115/barrel in mid-summer 2014 to now hovering in the mid $40s range amid record high global oil output and historically high oil inventory levels.

Low oil prices have forced China’s state-owned oil majors to trim oil exploration and production activities. Also, contributing to the country’s falling oil output are maturing oil fields and aging infrastructure. However, the scenario will likely remain unchanged until oil prices can find a floor and start trending upward again around $60/barrel giving oil companies an incentive to drill for more oil.

On a daily basis, October production was 3.78 million barrels per day (bpd), the lowest since May 2009, and down from 3.89 million bpd in September.

It looked like, in September, that China’s decline had abated. However their October production put them right back on the track projected by Seeking Alpha in August.

NOTE: The page OPEC Charts has been updated with production numbers for October. If you have comments on that data please post it below, on this post, rather than below that page.

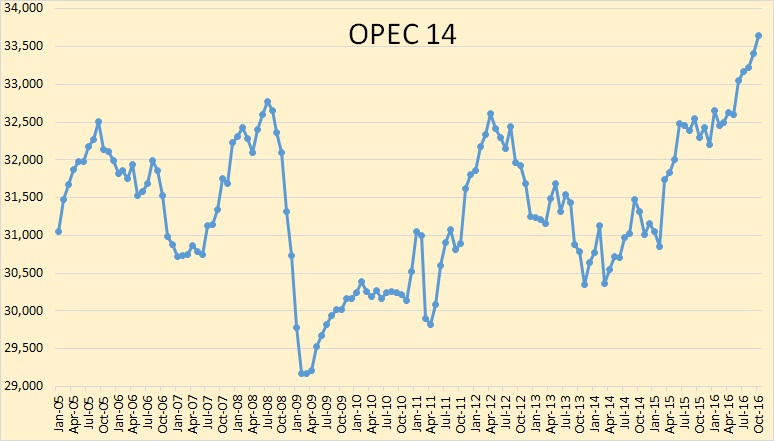

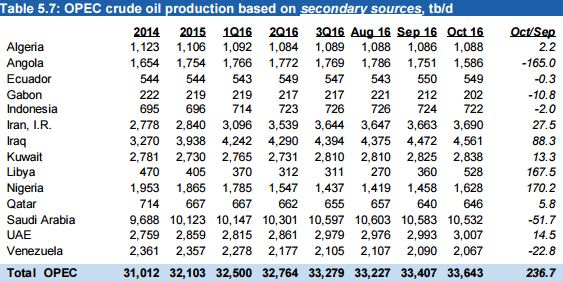

OPEC continues to increase production. How long this can continue I have no idea.

However exactly 100% of the increase this came from the recovery of Libya and Nigeria. Take away their numbers and OPEC production was flat.

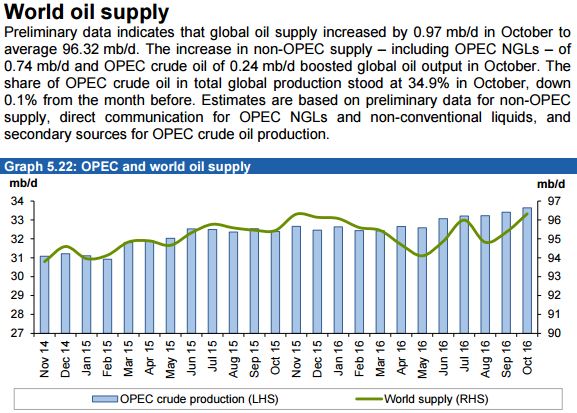

Total world oil supply sits at very near its peak in November 2015. The average for 2016 however is sill well below the average of 2015.

Just a sittin’ here, “riding the slide.”

So far, so good (for me).

😉

I wonder if there will be a sudden stop at the end????

Karl

Hey folks!

Long time no speak.

Quick question that I haven’t seen answered in the last few threads, has the world’s oil output plateaued or peaked yet?

I think the highest I’ve ever seen it is 95 Mb/d, but I admit I don’t recall exactly. Has the peak been hit as expected or has the maximum output increased further since I last paid careful attention?

Thanks!

And now I see that the answer to my question is in this very post so you can all ignore the dumb guy with his stupid question.

Sheesh! Read first, then ask question. Never fails to trip me up. It’s just that simple, but oh no, gotta jump ahead and ask the question first.

Sigh…

21% lower than peak production. Going down at -18% yoy. These are severe numbers. The Trump administration might expecience a rude awakening early 2017.

The new permit numbers will be interesting going forward. 63 new but 28 cancelled and 77 spuds so total open permits are starting to decline.

Bakken Scenario in chart below, 71 wells per month until mid 2017 then gradual increase of 1 well per month to Dec 2018 a more rapid increase of 5 wells per month until reaching 120 wells per month then continued until 2034 with a ramp down of 5 wells per month to zero by Jan 2036. Oil prices gradually rise to 130/b by Aug 2020 in 2016$.

New well EUR starts to gradually decrease in June 2017 and reaches a maximum annual rate of decrease of 4% per year in June 2018. New well EUR in Aug 2016 is 326 kb and is assumed to remain at that level until May 2017.

The problem in using a Hubbert curve is that it was developed for a conventional field, and not a tight oil field like the Bakken, and will have a very different decline curve.

It is also based on the EUR of the field, and it appears that the EUR to generate this curve is only about 10% of the expected EUR according to the EIA for the Bakken.

The Hubbert curve was generated based in full development. In the case of the Bakken drilling was cut by 75% in a very short time so a Hubbert curve will not be a good model for what is happening.

Correction. The Hubbert curve was not developed for anything but as a heuristic with interesting mathematical properties — i.e. Hubbert Linearization

The real physics of decline is described by such models as the Oil Shock model combined with hyperbolic or diffusional decline curves, of which Dennis Coyne has made good use of for describing the Bakken production.

Hi RDR,

A hubbert curve was not used for my scenario. I used the analysis that I first saw by Rune Likvern (the Red Queen series at the Oil Drum) and based on data shared by Enno Peters, developed a well profile based on the actual output data which suggests and average EUR of about 320 kb for the 2010-2015 North Dakota Bakken wells. It is assumed that all wells are average (to simplify the model) and I simply add up the output for all wells completed from 2005 to 2016. The model slightly underestimates output from June 2015 to Sept 2016. How many wells will be completed in the future is a guess, but there have been many estimates of both more wells than I have assumed and fewer wells. Much will depend on future oil prices which are difficult to predict.

If oil prices are higher than I have assumed, output may be higher (more wells may be completed than my scenario) and if oil prices are lower, output will be lower due to a lower completion rate.

In short, no Hubbert model was used for this analysis.

“a Hubbert curve will not be a good model for what is happening.” Apparently it does. It did so for almost 3 years now. And I am sure it will for at least the next couple of months.

Verwimp

I am still following your chart with interest.

As you said in September the data could change and go off course tomorrow, but so far we see … uncanny …

Spring / early summer could get interesting.

Light tight oil has not done a great deal for US economy so far it seems, hence perhaps the Trump administration.

Uncanny, indeed.

Every next datapoint is interesting. Especially during winters. 🙂

Hi Ron Patterson

What do you think about this article*?

*https://www.usgs.gov/news/usgs-estimates-20-billion-barrels-oil-texas-wolfcamp-shale-formation

Well it is shale so the fracking will continue… if the price is right.

thanks Ron, but its 20 GB?

Which was the estimeted of Bakken and Eagle ford at the begining? and what is now reserves?

Hi Caroline,

Bakken median TRR estimate was about 10 Gb for North Dakota Bakken Three Forks by USGS in April 2013.

Proved plus probable (2P) reserves were about 9 Gb at the end of 2014 if we assume probable reserves=proved*0.5. Also 1.2 Gb of oil had been produced at the end of 2014 so this would be a total of 10.2 Gb if all proved plus probable reserves are profitable to produce. Currently cumulative production to date is 1.9 Gb. Since Dec 2007 about 10,700 wells have been completed in the ND Bakken/Three Forks, if we assume the average EUR of those wells is 300 kb, that would be about 3.2 Gb. If we assume the average EUR of future wells is 250 kb, then 27,000 more wells would need to be completed in the future to extract 10 Gb of oil, a total of 37,700 wells completed.

In Drilling Deeper David Hughes estimates about 8 Gb for the Eagle Ford. At the end of 2014 there were about 5.2 Gb of proved reserves and likely 7.8 Gb of proved plus probable reserves in the Eagle ford.

So for the Big three plays this would be a TRR of 10+8+19=37 Gb, maybe another 10 Gb at most for other plays in the US for a total of 47 Gb, if oil prices are high enough ($130/b from 2020-2040). Low oil prices (under $60/b) would cut this estimate in half (possibly more.)

thanks Dennis

Sorry for my english, im from uruguay.

I undersatnd then wolfcamp how much production will have?

20GB not

How much?

How that camp change the usa peak oil, from 2016 Laherrere to.. 20…??

Hi Caroline,

I imagine the Permian Basin might be able to get to 2 Mb/d for a couple of years (maybe in 2021-2023), probably total US LTO would be no more than 4 Mb/d in the most optimistic scenario with high oil prices above $100/b and possibly in the 2020-2025 time frame. Then output will decline slowly over the next 5 to 10 years and more rapidly as Bakken and Eagle Ford run out of room in the sweet spots around 2030 or so. By 2040 total US LTO output will be under 1500 kb/d (possibly well under if oil prices start to fall as the World begins a transition to electric powered transportation).

Hola Caroline,

Su ingles es mucho mejor que mi espanol.

Still think there’s a high possibility of lower price for longer, and the longer, then the greater the switch to electric vehicles will impact on marginal demand, meaning lower for even longer, meaner less capital for exploration and development… und so weiter…. then there’s carbon pricing; which the civilised world will undertake whatever happens in the insane parts…

just saying’

How can the USGS determine that undiscovered resources are technically recoverable?

MattM,

It’s undiscovered within a defined, studied area where the geology is known.

Think of it as the Survey saying to the oil&NG industry “Here’s the geology. If there’s oil there could you get it out with current technology?”

I believe we have to look at the bigger picture in the tight oil plays. Each month the EIA reports on the four largest light tight oil plays in the drilling productivity report.

According to the EIA production for these four plays declined 111 kB/D in aprile 2016.

The decline in production in Sept was down to 60k B/D.

In the Oct report the decline for the month was down to 29 k B/D.

In the current report the decline fell to only 18k B/D.

At the current rate production in the four biggest plays will be growing production in another two to three months. All of this is happening with a rig count about 50% lower that its peak.

One of the reasons to look at these four plays as a group is that many companies have assets in more than one play and are able to shift from play to play based on the highest returns.

It should also be noted that the Permian has higher production from the tight zones than the Bakken and Eagle Ford combined.

These Bakken declines are pretty mild. Awaiting DC for new wells data.

The number of well completions rose from 63(final) in August to 71(preliminary) in September. Oil price weakness is the primary reason for the slow-down and is now anticipated to last into the second quarter of 2017.

Hi Watcher,

Enno Peters has his North Dakota Update for September up. His data says 73 new wells were completed in North Dakota in Sept 2016, probably 72 of these wells were Bakken/Three Forks wells, if we assume 98% of the 33 confidential wells are Bakken/Three Forks wells.

http://shaleprofile.com/index.php/2016/11/17/north-dakota-update-through-september-2016/

I had a look at the proven developed and undeveloped reserves for the major western IOCs and a couple of the larger independents as below. They don’t have as much undeveloped reserve to develop as I had thought, especially for conventional crude. There is only about 17Gb – typically that would only support about 2.3 to 2.8 mmbpd of production. At the moment the companies I looked at have about 2.9 mmbpd worth of projects under construction – they don’t have 100% ownership of all these, a lot is owned by NOCs, but once those projects come on line over the next few years there will be a big bit taken out of the undeveloped part (converted to developed), and that is still not including LTO drilling.

There will be some probable reserves that will be converted to proven, but over years 2013 to 2015 these weren’t that big even as prices were rising. Otherwise new reserves have to come from discoveries (evidently not going well) or purchase (also not that attractive with so many smaller companies loaded up on debt).

ExxonMobil and BP look in the best position (note BP don’t separate out Bitumen from crude so some of their undeveloped might be XXH in Alberta, if not I don’t know where it is; maybe Russia as part of Rosneft JV).

The rules for undeveloped booking include: “Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances, justify a longer time.” However I think this is only really applied to LTO – most conventional projects of any size, especially offshore, have long schedules and their reserves are included no matter what the actual plans are (i.e. ‘justified’).

“ExxonMobil and BP look in the best position (note BP don’t separate out Bitumen from crude so some of their undeveloped might be XXH in Alberta, if not I don’t know where it is; maybe Russia as part of Rosneft JV).”

No, it’s not in Russia

Actually I could have checked better – they state:

“Total proved crude oil reserves held as part of our equity interest in Rosneft is 4,823 million barrels, comprising less than 1 million barrels in Vietnam and Canada, 26 million barrels in Venezuela and 4,797 million barrels in Russia.”

Of the 4,797 they have 1,981 undeveloped. There might be more details elsewhere but their report is about four times longer than anyone else’s so things can be hidden well.

They account a lot of reserves from Rosneft in Russia, but it’s not bitumen.

Probably, Rosneft reserves is Venezuela is bitumen (heavy oil).

Rosneft’s hydrocarbon liquids (oil, condensate, and NGL) reserves as of end 2015 were 24.7 bln bbl (audited by DeGolyer & MacNaughton using the SEC classification).

BP owns 19.75% interest in Rosneft, so BP’s share in Rosneft’s reserves is 4,878 million barrels.

The numbers I am using are rounded, but the result is close to BP’s number of 4,823 million barrels.

Rosneft reserves in Venezuela are mostly in the Petromonagas JV, but I wouldn’t call those “bitumen”. The reservoir produces 8.5 degrees API crude with a fairly decent GOR, and the wells produce using progressive capacity pumps. The best well produced about 2500 BOPD, full pump capacity. The oil is diluted to 18 degrees API and sent to an upgrader.

Rosneft also has several small properties with small reserves, producing medium grade crudes in one block and a 20 API blend from the other. They jv terms stink and they don’t get much for it. They are waiting for Maduro to be removed from power.

Are these numbers after Exxon’s recent write-downs?

Reserves are reported in companies’ annual fillings. So these are the numbers for the end-2015.

Exxon has recently warned that it may write down its reserves due to low oil prices.

The new estimate may appear in 2016 annual report.

A little off topic but still Oil related-

What do you fine folks make of this announcement?

http://www.businessinsider.com/usgs-estimates-20-billion-oil-barrels-in-texas-wolfcamp-shale-formation-2016-11

Game changer? Same old same old? Big nothing?

The USGS link doesn’t work for me so it’s difficult to assess. The key words might be “technical recoverable” in the title. I think they had Bakken at 11 Gb technical recoverable at one time, and that is not looking very likely. Their assessment method for Bakken was pretty simple – pick a well EUR, pick a well spacing, pick total acreage, pick a factor for dry holes – multiply a by c by d and divide by b. There’s a lot of unknowns in that. Still there is almost certainly a lot of oil there – don’t know the price needed for profitability though.

The link works for me.

And there is another one: https://pubs.er.usgs.gov/publication/fs20163092

Abstract:

Using a geology-based assessment methodology, the U.S. Geological Survey assessed technically recoverable mean resources of 20 billion barrels of oil and 16 trillion cubic feet of gas in the Wolfcamp shale in the Midland Basin part of the Permian Basin Province, Texas.

I am a petroleum Geologist drilling wells in the Wolfcamp, the USGS report means nothing. They periodically review basins to assess how much petroleum is there, we have been drilling Horizontal wells in the Wolfcamp for almost a decade, and vertical wells for many decades. Right now there are as many rigs running drilling this rock formation as there are in the rest of the country combined, so it is already baked in to the US production data. This is not like a Saudi Arabia field with a low drill and complete and development cost, it will take many billions of drilling capital to get a small percentage of the oil in place. The big deal is that the area is fairly resilient to low oil prices and will cushion the drop in US production due to lack of investment in other basins.

Thank you, JG ! Straight from the horses mouth, respectfully. The USGS lost all credibility with me as to estimating TRR in the Monterrey Shale in California. It baffles me, after five years of publically discussing unconventional shale oil resources, that modelers, internet analysts and predictors completely ignore economics, debt and finances. Extracting oil is a business; it must make money to succeed. If it does not succeed, all bets are off regarding predictions.

Hi Mike,

The Monterrey shale estimate was by the EIA not the USGS. The EIA had a private consultant do the analysis and it was mostly based on investor presentations, very little geological analysis.

It would be better if the USGS did an economic analysis as they do with coal for the Powder River Basin. They could develop a supply curve based on current costs, but they don’t.

Do you have any idea of the capital cost of the wells (ballpark guess) for a horizontal multifracked well in the Wolfcamp? Would $7 million be about right (a WAG by me)?

On ignoring economics, I show my oil price assumptions. Other financial assumptions for the Bakken are $8 million for capital cost of the well (2016$). OPEX=$9/b, other costs=$5/b, royalty and taxes=29% of gross revenue, $10/b transport cost, and a real discount rate of 7% (10% nominal discount rate assuming 3% inflation).

I do a DCF based on my assumed real oil price curve. Brent oil price rises to $77/b (2016$) by June 2017 and continue to rise at 17% per year until Oct 2020 when the oil price reaches $130/b, it is assumed that average oil prices remain at that level until Dec 2060. The last well is drilled in Dec 2035 and stops producing 25 years later in Dec 2060.

EUR of wells today is assumed to be 321 kb and EUR falls to 160 kb by 2035. The last well drilled only makes $243,000 over the 7% real rate of return, so the 9 Gb scenario is probably too optimistic, it is assumed that any gas sales are used to offset OPEX and other costs, though no natural gas price assumptions have been made to simplify the analysis.

This analysis is based on the analyses that Rune Likvern has done in the past, though his analyses are far superior to my own.

I think when seismic, land, surface and down hole equipment is included, the number is much higher.

With $20-60K per acre being paid, land definitely has to be factored in. Depending on spacing, $1-5 million per well?

Hi Shallow sand,

I am doing the analysis for the Bakken. A lot of the leases are already held and I don’t know that those were the prices paid. Give me a number for total capital cost that makes sense, are you suggesting $10.5 million per well, rather than $8 million? Not hard to do, but all the different assumptions you would like to change would be good so I don’t redo it 5 times.

Mostly I would like to clear up “the number”.

I threw out more than one number, OPEX, other costs, transport costs, royalties and taxes, real discount rate (adjusted for inflation), well cost.

I think you a re talking about well cost as “the number”. I include down hole costs as part of OPEX (think of it as OPEX plus maintenance maybe).

Dennis. The very high acreage numbers are for recent sales in the Permian Basin.

In reading company reports, it seems they state a cost to drill and case the hole, another to complete the well, then add the two for well cost.

This does not include costs incurred prior to the well being drilled, which are not insignificant. Nor does it include costs of down hole and surface equipment, which also are not insignificant.

Land costs are all over the map, and I think Bakken land costs overall are the lowest, because much of the leasing occurred prior to US shale production boom. I think a lot of acreage early on cost in the hundreds per acre. Of course, there was quite a bit of trading around since, so we have to look project by project, unfortunately. For purposes of a model, I think $8 million is probably in the ballpark.

I would not include equipment for the well, initially, as OPEX (LOE is what I prefer to stick with, being US based). The companies do not do that, those costs are included in depreciation, depletion and amortization expense.

Once the well is in production, and failures occur, I include the cost of repairs, including replacement equipment, in LOE. I am not sure that the companies do that, however.

I think the Permian is going to be much tougher to estimate, as there are different producing formations at different depths, whereas the Bakken primarily has two, and the Eagle Ford has 1 or 2.

An example:

QEP paid roughly $60,000 per acre for land in Martin Co., TX. If we assume one drilling unit is 1280 acres (two sections), how many two mile laterals will be drilled in the unit?

1280 acres x $60,000 = $76,800,000.

Assume 440′ spacing, 12 wells per unit.

$76,800,000/12 = $6,400,000 per well.

However, there are claims of up to 8 producing zones in the Permian.

So, 12 x 8 = 96 wells.

$76,800,000 / 96 = $800,000 per well.

Even assuming 96 wells, the cost per well is still significant.

If we assume 96 wells x $7 million to drill, complete and equip, total cost to develop is $.75 BILLION. That is a lot of money for one 1280 acre unit, need to recover a lot of oil and gas to get that to payout.

Hi Shallow sands,

I am neither an oil man nor an accountant, so regardless of what we call it I am assuming natural gas sales (maybe about $3/barrel on average) are used to offset the ongoing costs to operate the well (LOE, OPEX, financial costs, etc), we could add another million to the cost of the well for surface and downhole equipment and land costs. Does an average operating cost over the life of a well of about $17/b ($14/b plus natural gas sales of $3/b of oil produced)seem reasonable? That would be about $5.4 million spent on LOE etc. over the life of the well (assuming 320 kbo produced). Also does the 10% nominal rate of return sound high enough, what number would you use as a cutoff? You use a different method than a DCF and want the well to pay out in 60 months. This would correspond to about a 14% nominal rate of return and an 11% real rate of return (assuming a 3% annual inflation rate.)

“The Monterrey shale estimate was by the EIA not the USGS. The EIA had a private consultant do the analysis and it was mostly based on investor presentations, very little geological analysis.”

Exactly.

USGS’ estimate as of October 2015 is very conservative:

“The Monterey Formation in the deepest parts of California’s San Joaquin Basin contains an estimated mean volumes of 21 million barrels of oil, 27 billion cubic feet of gas, and 1 million barrels of natural gas liquids, according to the first USGS assessment of continuous (unconventional), technically recoverable resources in the Monterey Formation.”

“The volume estimated in the new study is small, compared to previous USGS estimates of conventionally trapped recoverable oil in the Monterey Formation in the San Joaquin Basin. Those earlier estimates were for oil that could come either from producing more Monterey oil from existing fields, or from discovering new conventional resources in the Monterey Formation.”

Previous USGS estimates were for conventional oil:

“In 2003, USGS conducted an assessment of conventional oil and gas in the San Joaquin Basin, estimating a mean of 121 million barrels of oil recoverable from the Monterey. In addition, in 2012, USGS assessed the potential volume of oil that could be added to reserves in the San Joaquin Basin from increasing recovery in existing fields. The results of that study suggested that a mean of about 3 billion barrels of oil might eventually be added to reserves from Monterey reservoirs in conventional traps, mostly from a type of rock in the Monterey called diatomite, which has recently been producing over 20 million barrels of oil per year.”

https://www.usgs.gov/news/usgs-estimates-21-million-barrels-oil-and-27-billion-cubic-feet-gas-monterey-formation-san

I am corrected, RE; USGS and Monterrey. I still don’t believe there is 20G BO in the Wolfcamp. Most increases in PB DUC’s are not wells awaiting frac’s but lower Wolfcamp wells that are TA and awaiting re-drills; that should tell you something. With acreage, infrastructure and water costs in W. Texas, wells cost $8.5-9.0M each. The shale industry won’t admit that, but that’s what I think. What happens to EUR’s and oil prices after April of 2017 is a guess and a waste of time, sorry.

Hi JG,

What is the average cost of drilling and completion (including fracking) for a horizontal Wolfcamp well?

Does the F95 estimate of 11 Gb seem reasonable if oil prices go up to over $80/b (2016 $) and remain above that level on average from 2018 to 2025?

What most interests me are suggestions that there is so much available oil in Wolfcamp and what that will do to oil prices and national policy.

Seems like any announcement of more oil will likely keep prices low. And if they stay low, there’s little reason to open up more areas for oil drilling.

“Their assessment method for Bakken was pretty simple – pick a well EUR, pick a well spacing, pick total acreage, pick a factor for dry holes – multiply a by c by d and divide by b.”

The EIA and others use the same methodology

USGS estimates for average well EUR in Wolfcamp shale look reasonable: 167,ooo barrels in the core areas and much lower in other parts of the formation.

I do not know if the estimated potential production area is too big, or assumed well spacing is too tight.

The key question is what part of these estimated technically recoverable resources are economically viable at $50; $60; $70; $80; $90, $100, etc.

Significant part of resources may never be developed, even if they are technically recoverable.

Keep in mind these USGS estimates are for undiscovered TRR, one needs to add proved reserves times 1.5 to get 2 P reserves and that should be added to UTRR to get TRR. There are roughly 3 Gb of 2P reserves that have been added to Permian reserves since 2011, if we assume most of these are from the Wolfcamp shale (not known) then the TRR would be about 23 Gb. Note that total proved plus probable reserves at the end of 2014 in the Permian was 10.5 Gb (7 Gb proved plus 3.5 GB probable with the assumption that probable=proved/2). I have assumed about 30% of total Permian 2P reserves is in the Wolfcamp shale. That is a WAG.

Note the median estimate is a UTRR of 19 Gb with F95=11.4 Gb and F5=31.4 Gb. So a conservative guess would be a TRR of 13.4 Gb= proved reserves plus F95 estimate. If prices go to $85/b and remain at that level the F95 estimate may become ERR, at $100/b maybe the median is potentially ERR. It will depend how long prices can remain at $100/b before an economic crash, prices are Brent Crude price in 2016$ with various crude spreads assumed to be about where they are now.

Dennis,

where your number for proven reserves in the Permian comes from?

In November 2015, the EIA estimated proven reserves of tight oil in Wolfcamp and Bone Spring formations as of end 2014 at just 722 million barrels.

http://www.eia.gov/naturalgas/crudeoilreserves/

US proved reserves of LTO

Hi Alex S,

I just looked at Permian Basin crude reserves (Districts 7C, 8 and 8A) and assumed the change in reserves from 2011 to 2014 was from the Wolfcamp. I didn’t know about that page for reserves. It is surprising it is that low.

In any case the difference is small relative to the UTRR, it will be interesting to see what the reserves are for year end 2015.

Based on this I would revise my estimate to 20 Gb for URR with a conservative estimate of 12 Gb until we have the data for year end 2015 to be released later this month.

My guess is that the USGS probably already has the 2015 year end reserve data.

Dennis,

The EIA proved reserves estimate for 2015 will be issued this month. I think we will see a significant increase in the number for the Permian basin LTO.

Also note that USGS TRR estimate is only for Wolfcamp.

I can only guess what could be their estimate for the whole Permian tight oil reserves.

But the share of Wolfcamp in the Permian LTO output is only 24% (according to the EIA/DrillingInfo report).

Hi Alex S,

http://www.beg.utexas.edu/resprog/permianbasin/index.htm

At link above they say Permian basin has 30 Gb of oil, so if both estimates are correct the Wolfcamp has 2/3 of remaining resources.

Dennis,

Wolfcamp is a newer play than Bone Spring and Spraberry. That’s why its share in the Permian LTO production is less than in TRR.

Hi AlexS,

That makes sense. I also imagine the USGS focused on the formation with the bulk of the remaining resources. It is conceivable that the 30 Gb estimate is closer to the remaining oil in place and that more like 90% of the TRR is in the Wolfcamp, considering that the F5 estimate is about 30 Gb. That older study from 2005 may be an under estimate of TRR for the Permian, likewise the USGS might have overestimated the UTRR.

AlexS. Another key question, which is price dependent, is how many years will it take to fully develop the reserves?

Hi Shallow sand,

If oil prices go back to $100/b in 2018 as the IEA seems to be concerned about, it could ramp up at the speed of the Eagle Ford (say 2 to 3 years). It will be oil price dependent and perhaps they won’t over do it like in 2011-2014, but who knows, some people don’t learn from past mistakes. If you or Mike were running things it would be done right, but the LTO guys, I don’t know.

shallow sand,

Yes, you are correct. And there are multiple potential production scenarios, depending on the oil prices.

From the USGS press release.

USGS Estimates 20 Billion Barrels of Oil in Texas’ Wolfcamp Shale Formation

“This estimate is for continuous (unconventional) oil, and consists of undiscovered, technically recoverable resources. …

Undiscovered resources are those that are estimated to exist based on geologic knowledge and theory, while technically recoverable resources are those that can be produced using currently available technology and industry practices. Whether or not it is profitable to produce these resources has not been evaluated.”

This is an important way to assess.

If it requires slave labor at gunpoint to get the oil out, then that’s what will happen because you MUST have oil, and a day will soon come when that sort of thing is reqd.

Nice apocalyptic vision of the future you’ve got there!

Whatever happened to the ideals of democracy, capitalism, business, profits, free markets etc…? Don’t worry, no need to answer, that was purely a rhetorical question. I’m quite aware of the realities of the world!

However, not to pour too much sand on your vision, But I have to wonder? Since your potential slaves in 21st century America are already armed to the teeth, they might decide not to just go with the flow. (pun intended) 🙂

Anyways slaves don’t buy cars or too many consumer goods so that might, in and of itself, put a bit of a damper on the raison d’etre, excuse my french, of the oil companies and the very existence of these future slave owners.

because you MUST have oil

Really now?! You know, as time goes by, I’m less and less convinced of that!

Cheers!

This is the mistake most peak-oilers make: thinking that oil is indispensible. You don’t need oil. At some point, it’s cheaper just to carry around some batteries and solar panels.

This follows on from reserve post above (two a couple of comments). In terms of changes over the last three years – there really weren’t anything much dramatic. We’ll see what 2016 brings, especially for ExxonMobil, but it looks like they already knocked a big chunk off of their Bitumen numbers already in 2015.

Note I went through a lot of 20-F and 10-K reports watching the rain fall this morning and copied out the numbers, I’m not guaranteeing I got everything 100%, but I think the general trends are shown.

Note the figures are totals for all nine companies I looked at.

Hmm. C&C reserves are dropping. Bitumen & synthetic reseves dropped, then went up a bit, but will probably drop again.

NG reserves are actually on an upward trend, which is quite different. And this is still in a low-NG-price environment.

IEA WEO is out: http://www.iea.org/newsroom/news/2016/november/world-energy-outlook-2016.html presentation slides, fact sheet and summary are available online (report can be purchased). IEA seems to be _very_ concerned about underinvestment in upstream oil production. Several pages of the report is devoted to this, the title of that section is “mind the gap”. More or less all of the content has been discussed on this website, including the issue with high levels of debt and that this can affect suppliers’ capacity to rebound, and how much demand can be reduced as a result of a stringent carbon cap.

From the fact sheet (available free of charge):

“Another year of low upstream oil investment in 2017 would risk a shortfall in oil production in a few years’ time. The conventional crude oil resources (e.g. excluding tight oil and oil sands) approved for development in 2015 sank to the lowest level since the 1950s, with no sign of a rebound in 2016. If there is no pick-up in 2017, then it becomes increasingly unlikely that demand (as projected in our main scenario) and supply can be matched in the early 2020s without the start of a new boom/bust cycle for the industry”

Presentation 1:09 – Dr. Birol gives his view: “depletion never sleeps”…

I wonder who that paragraph is aimed at. As I indicated above the companies that would be investing in long term conventional projects don’t have a very large inventory of undeveloped reserves (17 Gb as of end of 2015, some of this has gone already this year and more is in development and will come on stream in 2017 and 2018 (and a small amount in later years for approved projects). I’d guess there might only be less than 10 Gb (and this the most expensive to develop) that is currently under appraisal among the major western IOCs and larger independents; allowing for their partnerships with NOCs in a lot of the available projects that could represent 20 to 30 Gb total. That really isn’t very much new supply available, and a large proportion is in complex deep water projects that wouldn’t be ramped up fully until 6 to 7 years after FID (i.e. already too late for 2020). Really the main players need to find new fields with easy developments, but they obviously aren’t, probably never will, and actually aren’t looking very hard at the moment.

My interpretation is that this is IEAs way of saying that it does not look good. Those who can read between the lines get the message. Also, a few years from they will be able to say “see we told you so”.

It’s impossible for IEA to make statements like: “the end of low cost oil will negatively affect economic growth”, “geology is about to beat human ingenuity” etc.

WEO have become more and more bizarre over the years. On the one hand they contain quantitative projections which tell the story politicians wants to hear. On the other hand, the text describes all sorts of reason of why the assumptions are unlikely to hold. Normally, if you don’t believe in your own assumptions you would change them.

Hi,

Here are my updates as usual. GOR declined or stayed flat for all years except 2010 in September. Is it the beginning of a new trend?

Here is the production graph. Not that much has happened. There was a big drop for 2011. 2009 on the other hand saw an increase. Up to the left, which is very hard to see, 2015 continues to follow 2014 which follows 2013 which follows 2012. Will we see 2013 reach 2007 the next few months?

Freddy, these latest years, the IP months are chopped at the top. Any chance of showing those?

The motivation would be to get a look at the alleged spectacular technology advances in the past, oh, 2 yrs.

Its on purpose both because I wanted to zoom in and because the data for first 18 months or so for the method I used above is not very usable. Bellow is the production profile which is better for seeing differences the first 18 months. Above graph is roughly 6 months ahead of the production profile graph.

Excellent.

And I guess we can all see no technological breakthru. 2014’s green line looks superior to first 3 mos 2015.

2016 looks like it declines to the same level about 2.5 mos later, but is clearly a steeper decline at that point and is likely going to intersect 2014’s line probably within the year.

There is zero evidence on that compilation of any technological breakthrough surging output per well in the past 2-3 yrs.

In fact, they damn near all overlay within 2 yrs. No way in hell there is any spectacular EUR improvement.

And . . . in the context of the moment, nope, no evidence of techno breakthrough. But also no evidence of sweetspots first.

I suppose you could contort conclusions and say . . . Yes, the sweetspots were first — with inferior technology, and then as they became less sweet the technological breakthroughs brought output up to look the same.

Too

Much

Coincidence.

It’s all bogus.

clarifying, the techno breakthrus are bogus. They would show in that data if they were real.

And it would be far too much coincidence for techno breakthrus to just happen to increase flow the exact amount lost from exhausting sweet spots.

This suggests the sweetspot theory is also bogus, unless there are 9 years of them, meaning it’s ALL been sweetspots so far. 9 yrs of sweetspots might as well be called just normal rather than sweet.

It is pretty much all bogus, yes, Watcher. With any rudimentary understanding of volumetric calculations of OOIP in a dense shale like the Bakken, there is only X BO along the horizontal lateral that might be “obtained” from stimulation. More sand along a longer lateral does not necessarily translate into greater frac growth (an increase in the radius around the horizontal lateral). Novices in frac technology believe in halo effects, or that more sand equates to higher UR of OOIP per acre foot of exposed reservoir. That is not the case; longer laterals simply expose more acre feet of shale that can be recovered. Recovery factors in shale per acre foot will never exceed 5-6%, IMO, short of any breakthroughs in EOR technology. That will take much higher oil prices.

Its very simple, actually… bigger fracs (that cost lots more money!!) over longer laterals result in higher IP’s and higher ensuing 90 day production results. That generates more cash flow (imperative at the moment) and allows for higher EUR’s that translate into bigger booked reserve assets. More assets means the shale oil industry can borrow more money against those assets. Its a game, and a very obvious one at that. Nobody is breaking new ground or making big strides in greater UR. That’s internet dribble. Freddy is right; everyone in the shale biz is pounding their sweet spots, high grading as they call it, and higher GOR’s are a sure sign of depletion. Moving off those sweet spots into flank areas will be even less economical (if that is possible) and will result in significantly less UR per well. That is what is ridiculous about modeling the future based on X wells per month and trying to determine how much unconventional shale oil can be produced in the US thru 2035. The term, “past performance is not indicative of future results?” We invented that phrase 120 years ago in the oil business.

That, sir, is pretty much the point. I see what looks like about 20% IP increase for the extra stages post 2008/9/10. How could there not be going from 15 stages to 30+?

I see NO magic post peak. They all descend exactly the same way and by 18-20 months every drill year is lined up. That’s actually astounding — given 15 vs 30 stages. There should be more volume draining on day 1 and year 2, but the flow is the same at month 20+ for all drill years. This should kill the profitability on those later wells because 30 stages must cost more.

But profit is not required when you MUST have oil.

You know, that is absolutely insane.

Freddy, is there something going on in the data? How can 30 stage long laterals flow the same at production month 24 as the earlier dated wells at their production month 24 –whose lengths of well were MUCH shorter?

I can only speculate why the curves look like they do. It could be that the newer wells would have produced more than the older wells, but closer well spacing is causing the UR to go down.

I hereby nominate Mike for Dept of Energy Co-Secretary to be served concurrently with Dept of Energy Co-Secretary Harold Hamm.

Thank you, John; but I respectfully refuse. Harold and I don’t see eye to eye on what is best for the American oil industry and besides, the BBQ sucks in DC.

So, Mike, the conclusion is that the frackers are depleting the wells faster (getting more out now, but less later) in order to get cash flow now rather than later?

This matches the scam-the-investors business model which they’ve been using all along, so it doesn’t surprise me. Nice to see confirmation.

Here is the updated yearly decline rate graph. 2010 has seen increased decline rates as I suspected. The curves are currently gathering in the 15%-20% range.

Hi FreddyW,

What is the annual decline rate of the 2007 wells from month 98 to month 117 and how many wells in that sample (it may be too low to tell us much)?

2007 only has 161 wells. So it makes the production curve a bit noisy as you can see above. Current yearly decline rate for 2007 is 7,2% and the average from month 98 to 117 would translate to a 10,3% yearly decline rate. The 2007 curve look quite different from the other curves, so thats why I did not include it.

Hi Freddy W,

Thanks. The 2008 wells were probably refracked so that curve is messed up. If we ignore 2008, 2007 looks fairly similar to the other curves (if we consider the smoothed slope.) I guess one way to do it would be to look at the natural log of monthly output vs month for each year and see where the curve starts to become straight indicating exponential decline. The decline rates of many of the curves look similar through about month 80 (2007, 2009, 2010, 2011) after 2011 (2012, 2013, 2014) decline rates look steeper, maybe poor well quality or super fracking (more frack stages and more proppant) has changed the shape of the decline curve. The shape is definitely different, I am speculating about the possible cause.

2007 had much lower initial production and the long late plateau gives it a low decline rate also. But yes, initial decline rates look similar to the other curves. If you look at the individual 2007 wells then you can see that some of them have similar increases to production as the 2008 wells had during 2014. I have not investigated this in detail, but it could be that those increases are fewer and distributed over a longer time span than 2008 and it is what has caused the plateau. If that is the case, then 2007 may not be different from the others at and we will see increased decline rates in the future.

Regarding natural log plots. Yes it could be good if you want to find a constant exponential decline. But we are not there yet as you can see in above graph.

One good reason why decline rates are increasing is because of the GOR increase. When they pump up the oil so fast that GOR is increasing, then it’s expected that there are some production increases first but higher decline rates later. Perhaps completion techniques have something to do with it also. Well spacing is getting closer and closer also and is definitely close enough in some areas to cause reductions in UR. But I would expect lower inital production rather than higher decline rates from that. But maybe I´m wrong.

Hi FreddyW,

Do you have an estimate of the number of wells completed in North Dakota in September? Does the 71 wells completed estimate by Helms seem correct?

Hi FreddyW,

Ok Enno’s data from NDIC shows 73 well completions in North Dakota in Sept 2016, 33 were confidential wells, if we assume 98% of those were Bakken/TF wells that would be 72 ND Bakken/TF wells completed in Sept 2016.

I have 75 in my data, so about the same. They have increased the number of new wells quite alot the last two months. It looks like the addtional ones mainly comes from the DUC backlog as it increased withouth the rig count going up. But I see that the rig count has gone up now too.

I can’t get any information out of that graph, other than that GOR goes up for every Bakken well over time. Is there a presentation which would make it clearer what you were trying to show?

Not sure if there exists any presentation. But here is a paper on GOR in unconventional reservoirs:

http://petroleum.mines.edu/research/urep/thesis/2.Tuba%20Firincioglu%20PhD%20Dissertation%20Final.pdf

I’ve worked with the author (Tuba Firincioglu), she consulted on a project I was supervising, and she’s a jet plane in this field.

The two subjects are a bit unrelated. Gas to oil ratio goes up because gas comes out of solution as pressure drops, and the gas has lower viscosity.

Tuba’s work was focused on the difference between the lab measured oil-gas mixture performance and what happens in the reservoir, where the fluids are in tiny pores.

The bottom line is that laboratory measurements should be modified to account for rock permeability and pore size/type, fluid viscosity, and the system dynamics (this means in some cases it’s better to pull the wells as hard as possible, which is contrary to conventional wisdom).

One more GOR graph which shows how the distribution has changed over time. The first date is Jan. 2014 just before the price drop and when GOR started to increase significantly. You can see a general movement from lower GOR to higher GOR over time.

Freddy: it’s possible the high GOR wells are hard to produce, and this sets a limit on the overall population GOR. On the other hand it may be a glitch.

I’ve had really bad experience trying to pump high GOR wells, put in smaller tubing and gas lift mandrels, but this only helps if they made over say 50% water. A low water cut high GOR well either flows on its own or it becomes an incredible pain in the butt, with low rates and a lot of slugging.

Ron you say ” Bakken production continues to decline though I expect it to level off soon.”

A few words of wisdom as to the main reasons why it would level off? Price rise?

Hi Pete,

Even though you asked Ron. He might think that the decline in the number of new wells per month may have stabilized at around 71 new wells per month. If that rate of new completions per month stays the same there will still be decline but the rate of decline will be slower. Scenario below shows what would happen with 71 new wells per month from Sept 2016 to June 2017 and then a 1 well per month increase from July 2017 to Dec 2018 (89 new wells per month in Dec 2018).

I am not so convinced that either Texas or the Bakken is finished declining at the current level of completions. There was consistent completions of over 1000 wells in Texas until about October of 2015. Then it dropped to less than half of that. The number of producing wells in Texas peaked in June of this year. Since then, through October, it has decreased by roughly 1000 wells a month. The Texas RRC reports are indicating that they are still plugging more than they are completing.

I remember reading one projection recently for what wells will be doing over time in the Eagle Ford. They ran those projections for a well for over 22 years. Not sure which planet we are talking about, but in Texas an Eagle Ford does well to survive 6 years. They keep referring to an Eagle Ford producing half of what they will in the first two years. In most areas, I would say that it is half in the first year.

The EIA, IEA, Opec, and most pundits have the US shale drilling turning on a dime when the oil price reaches a certain level. If it was at a hundred now, it would still take about two years to significantly increase production, if it ever happens. I am not a big believer that US shale is the new spigot for supply.

Hi Guy,

The wells being shut in are not nearly as important as the number of wells completed because the output volume is so different. So the average well in the Eagle Ford in its second month of production produces about 370 b/d, but the average well at 68 months was producing 10 b/d. So about 37 average wells need to be shut in to offset one average new well completion.

Point is that total well counts are not so important, it is well completions that drive output higher.

Output is falling because fewer wells are being completed. When oil prices rise and profits increase, completions per month will increase and slow the decline rate and eventually raise output if completions are high enough. For the Bakken at an output level of 863 kb/d in Dec 2017 about 79 new wells per month is enough to cause a slight increase in output. My model slightly underestimates Bakken output, for Sept 2016 my model has output at 890 kb/d, about 30 kb/d lower than actual output (3% too low), my well profile may be slightly too low, but I expect eventually new well EUR will start to decrease and my model will start to match actual output better by mid 2017 as sweet spots run out of room for new wells.

Guess I will remember that for the future. The number of producing wells is not important. Kinda like I got pooh poohed when I said the production would drop to over 1 million barrels back in early 2015.

Hi Guy,

Do you agree that the shut in wells tend to be low output wells? So if I shut down 37 of those but complete one well the net change in output is zero.

Likewise if I complete 1000 wells in a year, I could shut down 20,000 stripper wells and the net change in output would be zero, but there would be 19,000 fewer producing wells, if we assume the average output of the 1000 new wells completed was 200 b/d for the year and the stripper wells produced 10 b/d on average.

How much do you expect output to fall in the US by Dec 2017?

Hindsight is 20/20 and lots of people can make lucky guesses. Output did indeed fall by about 1 million barrels per day from April 2015 to July 2016, can you point me to your comment where you predicted this?

Tell us what it will be in August 2017.

I expected the fall in supply would lead to higher prices, I did not expect World output to be as resilient as it has been and I also did not realize how oversupplied the market was in April 2015. In Jan 2015 I expected output would decrease and it increased by 250 kb/d from Jan to April, so I was too pessimistic, from Jan 2015 (which is early 2015) to August 2016 US output has decreased by 635 kb/d.

If you were suggesting World output would fall from Jan 2015 levels by 1 Mb/d, you would also have been incorrect as World C+C output has increased from Feb 2015 to July 2016 by 400 kb/d. If we consider 12 month average output of World C+C, the decline has been 340 kb/d from the 12 month average peak in August 2015 (centered 12 month average).

The dropping numbers are not as much from the wells that produce less than 10 barrels a day, but from those producing greater than 10, but less than 100. The ones producing greater than 100 are remaining at a consistent level over 9000 to 9500. The prediction on one million was as to the US shale only. It is your site, you can search it better than I can,

But then don’t take my word for it. You can find the same information under the Texas RRC site under oil and gas/research and statistics/well distribution tables. Current production for Sep can be found at online research queries/statewide. It is still dropping, and will long term at the current activity level. Production drop for oil, only, is a little over 40k per day barrels, and condensate is lower for September. Proofs in the pudding.

My guess is that you would see a lot more plugging reports, if it were not so expensive to plug a well. At net income levels where they are, I expect they would put that off as long as they could.

Hi Guy,

The Texas data is incomplete. Dean Fantazzini’s estimates are much better than EIA or RRC estimates for the most recent 24 months. Texas C+C is down about 300 kb/d from the peak, Bakken down about 250 kb/d for a total of maybe 600 kb/d for US LTO output. If oil prices remain low your 1 Mb/d estimate might be correct within the next 12 months, in the long term LTO output will fall by much more than 1 Mb/d, but probably not until 2025 to 2030.

Dennis

“Dean Fantazzini’s estimates are much better than EIA or RRC estimates for the most recent 24 months. ”

The credibility of Dean’s methods and calculations has been discussed at length in many prior posts. Many of us believe he has been applying historical correction factors to a data collection system which has changed. As a result his corrected numbers are not accurate. You can believe in them if you want to, but I believe the EIA numbers are much more accurate.

Hi dclonghorn,

The “6 month” estimate uses a correction factor based on the last 6 months of RRC data.

You can believe what you wish of course, time will tell us if Dean’s estimates are better. The EIA estimates are certainly better than the RRC incomplete data, the EIA estimates will be revised upwards eventually.

I guess we will have to wait to see who spits further.

Statistics for North Dakota and the Bakken oil production are perfect, but not for well completions.

From the Director’s Cut:

“The number of well completions rose from 63(final) in August to 71(preliminary) in September”

(North Dakota total)

From the EIA DPR:

The number of well completions declined from 71 in August to 52 in September and rose to 58 in October

(Bakken North Dakota and Montana).

Wells drilled, completed, and DUCs in the Bakken.

Source: EIA DPR, November 2016

Hi Alex S,

I trust the NDIC numbers much more than the EIA numbers which are based on a model. Enno Peters data has 66 completions in August 2016, he has not put up his post for the Sept data yet so I am using the Director’s estimate for now. I agree his estimate is usually off a bit, Enno tends to be spot on for the Bakken data, for Texas he relies on RRC data which is not very good.

Dennis. Someone pointed out Whiting’s Twin Valley field wells being shut in for August.

It appears this was because another 13 wells in the field were recently completed.

It appears that when all 29 wells are returned to full production, this field will be very prolific initially. Therefore, on this one field alone, we could see some impact for the entire state.

Does anyone know if these wells are part of Whiting’s JV? Telling if they had to do that on these strong wells. Bakken just not close to economic.

I also note that average production days per well in for EOG in Parshall was 24. I haven’t looked at some of the other “older” large fields yet, but assume the numbers are similar.

Also, over 3000 Hz wells in ND produced less than 1000 BO in 9/16.

This is just for wells with first production 1/1/07 or later.

Hi Shallow sand,

I agree higher prices will be needed in the Bakken, probably $75/b or more. To be honest I don’t know why they continue to complete wells, but maybe it is a matter of ignoring the sunk costs in wells drilled but not completed and running the numbers based on whether they can pay back the completion costs. Everyone may be hoping the other guys fail and are just trying to pay the bills as best they can, not sure if just stopping altogether is the best strategy.

There is the old adage that when your in a hole, more digging doesn’t help much. 🙂

So my model just assumes continued completions at the August rate for about 12 months with gradually rising prices as the market starts to balance, then a gradual increase in completions as prices continue to rise from July 2017($78/b) to Dec 2018 (from 72 completions to about 90 completions per month 18 months later). At that point oil prices have risen to $97/b and LTO companies are making money. Prices continue to rise to $130/b by Oct 2020 and then remain at that level for 40 years (not likely, but the model is simplistic).

I could easily do a model with no wells completed, but I doubt that will be correct. Suggestions?

Dennis. As we have discussed before, tough to model when there is no way to be accurate regarding the oil price.

I continue to contend that there will be no quick price recovery without an OPEC cut. Further, the US dollar is very important too, as are interest rates.

Hi Shallow sand,

At some point OPEC may not be able to increase output much more and overall World supply will increase less than demand. My guess is that this will occur by mid 2017 and oil prices will rise. OPEC output from Libya an Nigeria has recovered, but this can only go so far, maybe another 1 Mb/d at most. I don’t expect any big increases from other OPEC nations in the near term.

A big guess as to oil prices has to be made to do a model.

I believe my guess is conservative, but maybe oil prices will remain where they are now beyond mid 2017.

I expected World supply to have fallen much more quickly than has been the case at oil prices of $50/b.

” To be honest I don’t know why they continue to complete wells, but maybe it is a matter of ignoring the sunk costs in wells drilled but not completed and running the numbers based on whether they can pay back the completion costs.”

Yep.

Probably to do with how confidential wells are included.

RBN explains EIA methodology:

“EIA does this by using a relatively new dataset—FracFocus.org’s national fracking chemical registry—to identify the completion phase, marked by the first fracking. If a well shows up on the registry, it’s considered completed “

There is an unlikely peak oil related editorial writer hiding in the most unlikely place: a weekly English business paper called Capital Ethiopia. The latest editorial is again putting an excellent perspective on world events. http://capitalethiopia.com/2016/11/15/system-failure/#.WC1ZCvl9600

For the record, I have no interest or connection to this publication other than that of a paying reader.

Wouldn’t it be nice if mainstream publications would sound a bit more like this.

the word oil does not appear anywhere on that.

I’ve lived/worked in several socialist/communist countries, and they share these common traits: they are inefficient, they are unsustainable, they don’t protect the environment, they abuse human rights, they are run by a small caste, they are un democratic, they repress dissent, and they usually evolve into a hybrid fascist-Marxist-capitalist system like we see in China, Vietnam, and is now evolving in Cuba under Raúl Castro.

Thanks all. I thought that the red queen concept meant that there had to be an increase in the rate of completions. So that 71 year-on-year in north Dakota would only stabilise temporarily. Perhaps the loss of sweet spots are being counteracted by the improvements in technology? I’m assuming that even with difficulties of financing there will be a swift increase in completions should the oil price take off, but not sure how sustainable this would be

Hi Pete,

Sometimes I think that once the price of oil is up enough that sellers can hedge the their selling price for two or three years at a profitable level, it will hardly matter what the banks have to say about financing new wells.

At five to ten million apiece, there will probably be plenty of money coming out of various deep pockets to get the well drilling ball rolling again, if the profits look good.

Sometimes the folks who think the industry will not be able to raise money forget that it’s not a scratch job anymore. The land surveys, roads, a good bit of pipeline, housing, leases, etc are already in place, meaning all it takes to get the oil started now is a drill and frack rig.

I don’t know what the price will have to be, but considering that a lot of lease and other money is a sunk cost that can’t be recovered, and will have to be written off, along with the mountain of debts accumulated so far, the price might be lower than a lot of people estimate.

Bankruptcy of old owners results in lowering the price at which an old business makes money for its new owners.

Hi Pete,

The Red Queen effect is that more and more wells need to be completed to increase output. As output decreases fewer wells are needed to maintain output. So at 1000 kb/d output it might require 120 wells to be completed to maintain output (if new well EUR did not eventually decrease), but at 850 kb/d it might require about 78 new wells per month to maintain output.

If decline is hyperbolic, it depends on oil price and input costs. If the decline curve is fairly steady, there will be a number of wells X which increases production a little bit. But I’ve found it’s important to keep old wells producing and then use their jewelry and pipe as part of a rolling materials stock (this lowers new well costs).

It’s a really delicate dance, I’ve found production managers who simply can’t grasp how to run their fields properly to optimize this function. It’s a bit more complicated than making power point slides, which seems to be what modern supervisors are most focused on.

The FED oil production number for October came out yesterday. In below chart the production decline (blue line) is the same as in the previous month, yet the trend is still a massive decline year over year. In my view year over year comparison can show the dynamic of a trend. And it shows clearly that in the current cycle the oil price recovery is – in contrast to the cycle in 2008/9 – very slow and tentative.

The year over year oil price (green line in below chart) actually decreased again year over year and the risk of a double dip in the oil price is growing by the day. Drilling follows very cautiously the oil price in a parallel line (red line in below chart). If there would be really a technological advantage for shale, the red and the green line would not be paralell, but the red line for drilling would rise much stronger. This is actually the case for Middle East drilling, which barely fell during this cycle. This indicates that most Middle East producers still have high margins at the current oil price. Middle East producers – and also Russia – can quite easily cope with an oil price of 40 +/- 10 USD per barrel. This is why I think that the oil price will bounce at the bottom of the barrel within above range for a few years.

There is also something interesting going on with the world economy. The shippers rose exponentionally over the last few days (DRYS up over 1000%). Also the baltic Dry index is up 600% since the beginning of this year. House prices here in London fell – mostly at the high end. Rents for expensives homes are down by up to 36%. Donald Trump has clearly changed something already as it becomes increasingly clear that the dollar hoarders are paying for the infrastructure spending. I am not sure if he understands that he is doing a lot of harm to his own business empire as well.

I expect if that depressing old banker were here he would note that instability is dangerous, and that all the moves in treasuries currency and possibly trade flow create changes of which the results are difficult or impossible to predict

Hi Heinrich,

I can easily understand your assertion that Middle Eastern and Russian oil is profitable at forty bucks.

But if the price is to stay around forty, then it follows that you think that between them, the producers in the Middle East and Russia will be able to supply all the oil the world wants for the next few years.

Am I correct in saying this?

Do you think western producers will continue to pump enough at a loss ( most of them are apparently losing money at forty bucks ) to make up the difference?

If you are willing to venture a guess, when do you think the price will get back into the sixty dollar and up range?

If you think it won’t for a lot of years, is that because you believe the economy is will be that anemic, or because electric cars will substantially reduce demand, or both ? Or maybe you have other reasons ?

oldfarmermac,

The US has thrown the gauntlet to OPEC by claiming to becoming an oil net exporter. This has brought OPEC in a very difficult situation. If they cut – and oil gets to 70 USD per barrel – shale will pick up the slack and produce the amount OPEC has cut within a short period of time. So, OPEC is forced to cut again, until it has lost a lot of market share – and thus also a lot of revenue.

In my view OPEC has no other choice than to produce come hell and water – until something breaks. This could be that many shale companies give up or that for instance Iran is not allowed to export as much as they do, or there is a major conflict in the Middle East, or Saudi Arabia is running out of cash …..

He who has the market share now, will cash in when the oil price rises. And it will rise, yet not until something breaks. This is how business works. This is how Microsoft crushed Apple in the nineties in the PC market – and Apple then crushed Nokia in the smart phone market….

I do not think that Saudi Arabia has the freedom to compromise here – even if they want. If they blink they will be crushed by shale producers. So, the stand-off will go on for a while, at a loose-loose situation for both parties. However this is great luck for consumers as they can enjoy low energy prices for 2 to 3 years.

Dunno about Heinrich, but I strongly believe that electric cars will substantially reduce demand. I also believe that industrial retooling will reduce demand (there’s already been a huge switch to NG). There are other effects: if the price goes high enough, people drive less and take public transportation more. And there’s an overall trend of people moving to downtowns and driving less as a result (which has been going on for decades but is a very slow trend, amounting to tenths of a percent each year). In addition, China’s “oil reserve buildup” propped up the oil market for several years and it has now ended. But I think electric cars are the dominant effect here.

This is tricky to model, but I believe the inherent superiority of electric cars means that demand for electric cars is essentially equal to total demand for cars once upfront price parity is reached in a given market segment. Plug-in hybrids will be part of the market, but it’s documented that typical plug-in-hybrid drivers use electricity almost all the time and gasoline only occasionally.

So I think the primary limiting factor is actually production capacity for plug-in electric cars. This is *extremely* hard to model, but I believe that 5% – 10% of all new cars sold worldwide will be either fully electric or plug-in hybrids in *2018*. Probably closer to 10%. Maybe 15%. This number is dominated by the Chinese market which is going electric *very* fast. The US will lag behind.

If 1/12 of the car fleet is replaced each year and 10% of new cars sold are electric, that’s about .008% of gasoline demand eliminated in 2018. But I see production capacity for electric cars roughly doubling every year after that. I make the assumption that any increase in total car demand is met by additional electric cars (China’s electric car production rate has actually been growing faster than doubling each year). By 2022, the gasoline demand reduction rate from this process alone clearly exceeds the decline rate of the oil fields. The situation will be obvious to enough investors by 2020.

I don’t expect outside investors (as opposed to the money already in ExxonMobil etc.) to pour money into new oil developments until after the oil price goes up, and I don’t expect investors to put money into new oil developments after the situation becomes obvious in 2020. It’ll take a company probably two years to get the oil out and sell it after they do pour the money in. So if the oil price rises in 2017 and the production starts in 2019, this is a pretty short window before the investment dries up in 2020.

I actually think the oil price will climb into the $60+ range in 2017 or 2018 (depending on whether OPEC cuts back now or produces flat-out until they can’t any more) but that the price will be battered back down again as reductions in oil use from the electric car switchover start to become apparent to investors. And I think that’s the final move. The DB report a while back predicted oscillations in the oil price, up as supply ran short, down as demand dropped, up, down, with a final downward move as demand went away.

Hi Nathaneal,

I think your story is roughly correct but too optimistic. Maybe by 2020 5% of new cars sold will be EVs and plugins. About 75 million vehicles sold in 2015 and only about 0.5 million plugins and EVs World Wide. So 5% would be 3.75 million EVs and plugins sold if total vehicle sales (including ICE and electric) remained at 75 million.

If we make the too optimistic assumption that EVs and plugin sales double each year, we be at 4 million in sales by 2018, does that really seem realistic to you?

A more realistic scenario is 40% annual sales growth which gets the market to 10% electric (including PHEV) by 2024 if we assume total vehicle sales growth is 1.5%/year. Even that scenario would be too optimistic in a low oil price scenario.

Dennis,

The 128% growth for Chinese EVs is real. China has actually wanted to get this going since 2000, yet consumers did not catch fire. Yet it seems that EVs are the new cool. And China has a big national interest in this trend.

This is exactly what I want to say: It is possible to spot a trend with the yoy% growth rate – even if the mainstream snubs the low number of actual EVs sold. Of course the growth rate will come down over the years, yet an initial growth rate of 128% tells something. Where there is smoke there is also fire.

A doubling every year means we have 16 mill (or 20%) EVs sold in 2020. Then the World will really wake up and notice. Yet then it is too late for an investment.

EVs will never replace all fossil cars – just like cars did not replace all railways. Yet in urban areas EVs will have a very important role. tThat is pretty sure now.

Hi Heinrich,

I think most cars will be EVs or plugin hybrids in 40 years time.

I do not dispute high growth rates at present, it just becomes very difficult to go from say 2 million cars sold per year to 4 million cars sold per year than from 500,000 to 1 million. Of course this becomes progressively more difficult which is why after the market reaches 1 million EVs and plugins sold per year (probably in 2017) that the growth rate will slow to 40% per year or less by 2019 in my opinion. It will take time for the market to accept EVs and high oil prices and more EVs being sold in the sweet spot of 25 to 30k will help with market acceptance. The cars will need to have 250 miles of range at this price which may become the norm by 2020. Battery prices have been coming down and economies of scale, competition, and innovation will bring prices down more.

I am not offering investment advice, just speculating on how this plays out. Even a 40% growth rate is too optimistic, when they reach 5 million cars sold the growth rate will slow to 20%/year and when they reach 10 million EVs and plugins sold per year the growth rate will slow to 10% per year and that rate might be maintained until they get to 80% of market share, then it might slow to 5% growth until the car makers approach 100% of personal vehicles as EVs or plugin hybrids.

Long haul ground transport will switch to rail and short haul trucks will be plugin hybrids or EVs, but that will happen slowly over the next 45 years.

Dennis,

I have heard the same arguements 30 years ago about the PC market and 10 years ago about the smart phone market. ‘Steve Jobs and Bill Gates were just some nerds and the PC market will be just limted to some special guys.’

The same about the smart phone market. I have then worked in Finland and knew some guys from Nokia. We discussed this and they said ‘smart phones will never take off, because batteries are too weak to support smartphones.’ We know now how this worked out.

I think we are here up to a surprise. China has proven that they can very quickly build up manufacturing capacity, especially as there are no major technological obstacles. Electric motors production can be ramped up very quickly and batteries as well. Also lithium will not be in short supply as most batteries will be recycled.